S this month’s issue of Fish Farmer goes to press, we can say for sure that the UK will have a new Fisheries Minister. Mark Spencer, the previous incumbent, failed to retain his Sherwood Forest seat at the General Election, and the government he was a part of has made way for another.

What that might mean for aquaculture in the UK is less clear, and the sector is probably pretty low on the “to do” list for the incoming Prime Minister. We do know that Labour, in its manifesto, promised to champion “Brand Scotland” internationally and that it specifically mentioned Scottish salmon as part of that brand.

Labour has also pledged to reduce the barriers to trade with the European Union, which have been a major irritant for UK finfish and shellfish farmers. This won’t be a quick process, however. Change is coming, but what it means for this sector has yet to be seen.

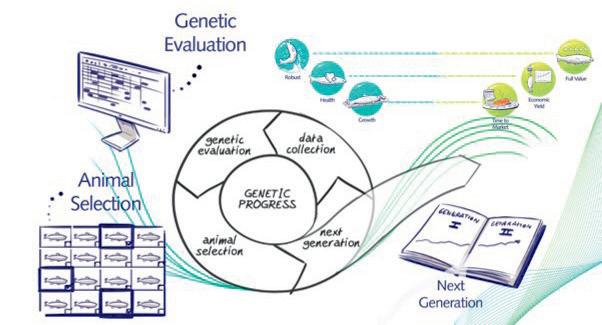

Meanwhile, in this issue we look at how gene editing – rebranded as “precision breeding” – might be used in aquaculture. This is one issue where Labour and the Conservatives seem to be broadly on the same page, although the Scottish Government is still opposed to this technology entering the commercial space.

Sandy Neil reports on efforts to reinstate the hyperbaric chamber at Dunstaffnage, a key medical resource for diving emergencies.

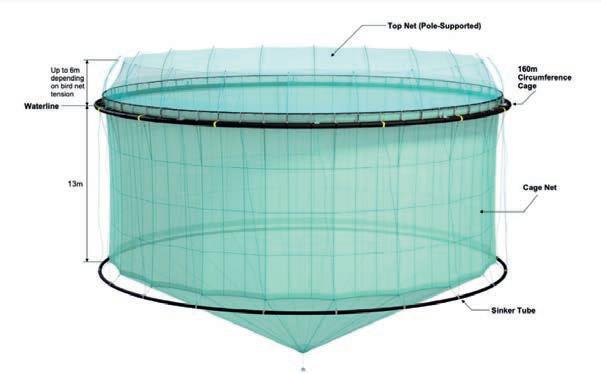

Vince McDonagh reports on progress across different salmon farming nations towards offshore farming, a move which promises to solve some problems but comes with challenges of its own.

This issue also includes a profile of Vertical Oceans, the company that is looking to change the way shrimp is farmed with a solution that, they say, could work anywhere.

We report on bipartisan moves in the USA to encourage more aquaculture and close the country’s seafood import gap; and on the Irish Government’s plans for sustainable growth in the sector.

Finally, we preview the European Aquaculture Society/World Aquaculture Society conference coming up in Copenhagen next month, and Dr Martin Jaffa considers how consolidation has affected the fish farming industry.

Best wishes Robert Outram

Meet the team

Editorial advisory board: Steve Bracken, Hervé Migaud, Jim Treasurer, Chris Mitchell and Jason Cleaversmith

Editor: Robert Outram

Designer: Andrew Balahura

Commercial Manager: Janice Johnston jjohnston@fishfarmermagazine.com

Office Administrator: Fiona Robertson frobertson@fishfarmermagazine.com

Publisher: Alister Benne�

@fishfarmermagazine

www.fishfarmermagazine.com

Fish Farmer Volume 47, number 07

Contact us

Tel: +44(0)131 551 1000

Fax: +44(0)131 551 7901

Email: editor@fishfarmermagazine.com

Head office: Special Publica�ons, Fe�es Park, 496 Ferry Road, Edinburgh EH5 2DL

Subscrip�ons address: Fish Farmer magazine subscrip�ons, Warners Group Publica�ons plc, The Mal�ngs, West Street, Bourne, Lincolnshire PE10 9PH

Tel: +44(0)177 839 2014

UK subscrip�ons: £75 a year

ROW subscrip�ons: £95 a year including postage – all air mail

Tavish

Nicki

Sandy

Sandy

OTTER Ferry Seafish has been awarded nearly £50,000 to work with Argyll wild fisheries experts to develop a groundbreaking gene bank which could help save threatened wild salmon populations.

The grant for the fish farm and research centre, based at Tighnabruaich on the west coast of Scotland, is one of seven major environmental projects being supported by Scotland’s salmon farmers to help save iconic wild salmon and sea trout.

Almost £140,000 has been granted to organisations this year through Salmon Scotland’s Wild Fisheries Fund to address long-term species decline. The fund is part of a £1.5m commitment from the salmon industry.

The initial four-year project is being developed in partnership with the Argyll Fisheries Trust and the River Ruel Improvement Association.

Organisers hope the project will not only help stock several regional rivers but also become a “blueprint”, paving the way for a wider "genetic insurance" network of banks across the country.

Alastair Barge, Otter Ferry’s managing director, said: “We are very excited to be part of this new initiative funded by the Salmon Scotland Wild Fisheries Fund.

“The project combines the knowledge and expertise of the wild fishery sector with the control provided by our

dedicated staff and versatile aquaculture facilities.

“Working together with the Argyll Fisheries Trust and the River Ruel Improvement Association, we aim to preserve the genetic integrity of the river’s salmon population while giving it a real chance for rapid recovery in the future.”

Preserving the river environment

A separate scheme to tackle erosion on the Ruel, improving the habitat through tree planting and fencing, has received £10,000, marking a third year of funding.

The five other projects awarded funds this year are:

• Ayrshire Rivers Trust – £17,026 to

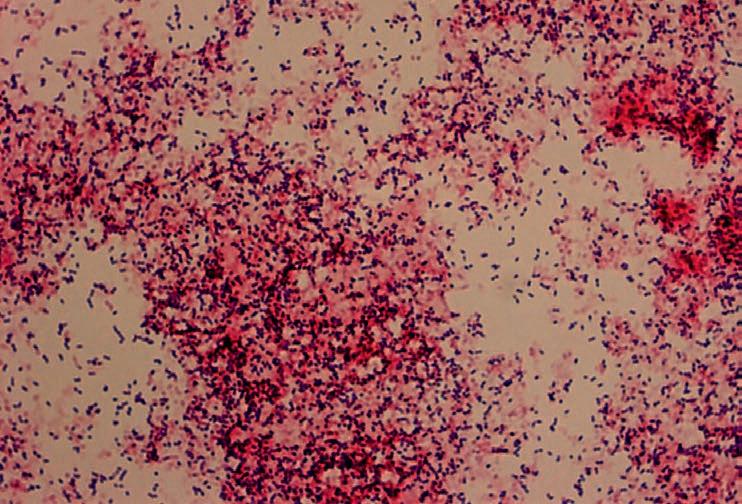

ACTION to control sea lice numbers on Scottish fish farms has been successful, partly driven by the new requirement to report lice numbers on a weekly basis.

That is the verdict of Charles Allan, group leader of the Scottish Government’s Fish Health Inspectorate (FHI), in the evidence he gave to the Scottish Parliament’s Rural Affairs and Islands (RAI) Committee.

He said: “I think the sea lice situation on farms in Scotland has changed significantly… we have seen sea lice numbers come down on farm. In the last year we have offered no enforcement notices.”

undertake a restoration project that will aim to address riverbank erosion at the Mauchline Burn.

• Galloway Fisheries Trust – £22,697 to reduce acidity in the River Bladnoch using 700 tonnes of crushed scallop shells on forestry roads and feeder burns, improving the ecosystem.

• Uig Lodge Lettings – £10,000 for improvements to the Fhorsa River on the Isle of Lewis, focusing on enhancing spawning areas, reshaping channels, clearing vegetation and helping salmon move more easily.

• Urras Oighreachd Chàrlabhaigh (Carloway Estate Trust) – £6,305 for fishing surveying, analysis, and spawning bed improvements on the Carloway River on the Isle of Lewis.

• River Eachaig Fishery Syndicate –£24,376 for habitat improvements in Argyll, including riverbank strengthening, fencing, rhododendron control, and flood damage repairs.

Jon Gibb, co-ordinator of the Salmon Scotland Wild Fisheries Fund, commented: “The wild fisheries fund provides a rare and exceptional opportunity for rural and coastal communities to access vital funds aimed at improving their local rivers and lochs... wild salmon are currently facing a deep and dire crisis, and the aquaculture sector can play a crucial role in reducing their decline.”

Scan here to see the video

He was giving evidence in the second session of the RAI Committee, which is reviewing the Scottish salmon industry, following a previous inquiry which reported in 2018.

Allan said the level of six sea lice per fish, which was previously the statutory level for mandatory intervention, had been exceeded only once in the last reporting year. Asked whether sea lice numbers had gone down, he replied: “Yes – that’s borne out by the data… and almost never do we see the clinical results of infection.”

Arguing that the management of sea lice in farmed fish populations in Scotland had improved, he stressed that the role of the FHI is not only to enforce penalties but to encourage continuous improvement.

He said: “If I have to apply the stick, I would see myself, as a regulator, having failed.”

SCOTTISH salmon exports in the first four months of this year were up more than a third by value, according to HMRC figures. The data, analysed by industry body Salmon Scotland, shows that the value of salmon exports was up by £65m to £250m, a 36% increase on the same period last year.

On a rolling 12-month basis, the figure was £645m, representing the highest level in five years and an 11% increase compared with the previous year’s £581m. Salmon exports achieved their highest sales value since 2019.

Exports were also up by 35% in volume terms. In the first four months of the year, 26,000 tonnes of Scottish salmon were exported to more than 40 countries, enough for more than 100 million meals.

Salmon Scotland said that if current growth continues, 2024 could set a record for international sales.

Tavish Scott, chief executive of Salmon Scotland, said: “The reputational and economic value of Scottish salmon is immense, as reflected in these latest export figures showing a significant increase in global demand for our healthy, nutritious fish."

The EU continues to be the key destination for Scotland’s salmon exports, accounting for £153m worth of the total between January and April this year.

Sales to the bloc have soared by £53m, while

volume was up by 51% to almost 17,000 tonnes.

France remains the single largest market for Scottish salmon, with sales of £143m.

Elsewhere, exports beyond the EU increased 14% to £97m, with almost one in five salmon exported heading to the US (£56m, representing a year-on-year increase of 13%).

FARMED mussel production in Scotland reached a record level in 2023, while there was a slight fall in the volume of farmed king scallops and oysters.

The figures come from the Scottish Shellfish Farm Production Survey 2023. The survey was compiled for the Scottish Government from returns provided by shellfish producers.

The figures for 2023 show that Scotland produced 10,300 tonnes of farmed common mussels, the largest amount ever recorded and representing an increase of 13%. The number of common mussel producing sites with sufficient spat settlement for production purposes decreased, however, from 88 to 54.

The vast majority of mussel production is based in Shetland, which accounts for around 84% by tonnage.

Pacific oyster production decreased by 4%

during 2023 in tonnage terms, while there was an increase in the production of native oyster from 109,000 to 111,000 shells in 2023. Native oyster production is now back to the levels seen in 2019 after the serious slump which occured in 2021.

During 2023, 3.9 million Pacific oyster shells were produced for human consumption. Almost half came from the Highland region and just under 34% from Strathclyde.

There was a decrease in king scallop production since 2022, from 39,000 to 24,000 shells. Queen scallop information was not reported this year due to the low levels of production and producers.

The financial value of farmed shellfish production was also up. The Scottish shellfish farming sector is estimated to be worth approximately £14.1m at first sale value, an

increase of 36% on the 2022 value.

Employment levels decreased by 4% from the previous year, with 246 full-time, parttime and casual staff being employed in the industry during 2023.

The survey also reports on shellfish health issues. During 2023, 133 out of 294 licensed shellfish production sites were inspected as part of a risk based surveillance programme. Movement restrictions remain in place for the presence of Bonamia ostreae at Loch Sunart and the Dornoch Firth in Highland region, West Loch Tarbert and Lynn of Lorne, Loch Creran and Loch Etive in Strathclyde region. Great Britain remains free of the shellfish diseases bonamiasis, marteiliasis and OsHV-1 µvar, with the exception of specific compartments under movement restrictions.

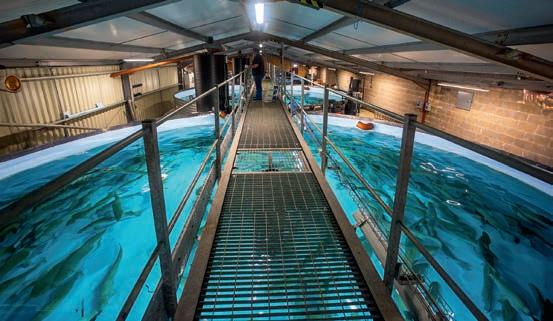

MEMBERS of the newly formed Young Aquaculture Society (YAS) visited Scottish Sea Farms’ west

coast facilities for a deep dive into how farmed salmon are raised.

The day-long visit took in a tour of the Scottish Sea Farms (SSF) Barcaldine Hatchery near Oban, a Q&A session with the company’s Head of Sustainability and Development, Anne Anderson, the SSF farm at Charlotte’s Bay and the processing and packing facility at South Shian.

A SCOTTISH Sea Farms processing supervisor has won the inaugural Emerging Talent award at the M&S Select Farm Awards 2024. Nicole McAleer saw off competition from other leading food producers to scoop the prize, one of five awarded in

celebration of the M&S supply chain in Scotland. She is pictured, left, receving her award.

The Emerging Talent award, open to anyone aged 35 and under, champions those who are positive role models, making an exceptional contribution to their sector.

McAleer joined the salmon producer over four years ago as a Trainee Processing Supervisor at South Shian near Oban before progressing to her current position and is believed to be one of only two women in the Scottish sector to perform such a role – the other is also working within Scottish Sea Farms.

AS part of the Aqua Agenda series, Fish Farmer will be hosting a free webinar on Wednesday 21 August, on the topic of Recruitment and Diversity. We’ll be looking at how fish farming and seafood businesses can ensure they continue recruiting successfully and what is being done to encourage young people into this field.

Our panel of experts includes: Dr Liz Barron-Majerik MBE,

NEIL Manchester, the Managing Director of Kames Fish Farming who died in May last year, was commemorated with a weekend of fundraising and celebrations in June that brought in more than £4,000 for local causes.

Director of Lantra Scotland; Donald Waring, Learning and Development Manager, Mowi; Jillian Couto-Phoenix, Head of Skills and Talent at the Sustainable Aquaculture Innovation Centre (SAIC); and Jeni Adamson, Industry Engagement Manager with Seafood Scotland. The webinar takes place between 11.30am and 12.30pm on Wednesday 21 August. To register, scan the QR code below.

The company invited current and former staff members, and Neil Manchester’s family, to take part in a Memorial Challenge set up using the sports app, Strava. Kames committed to donating £1 for every mile covered by cycling, walking and swimming. Together the participants covered more than 2,900 miles.

On the Saturday Kames hosted a hog roast along with clay pigeon shooting – an activity Neil Manchester loved.

Together with the JustGiving page set up for the event, just over £4,650 was raised.

The Craignish Community Company, which supports first responders, was the main recipient with £1,500 ringfenced and the rest of the money being split between rural emergency charities near the Kames sites, including the Kilmelford Fire Service and First Responders being two others.

Kames Marketing and Communications manager Cate Cannon, whose husband Andrew Cannon is now Managing Director and whose father-in-law, Stuart, founded the company, said: “First Responders are local volunteers who can be at the emergency scene before the ambulance arrives – bearing in mind that ambulances can easily take an hour to reach rural parts, so they are really important to rural communities. They need funding for training and kit. They came out to Neil within minutes of his collapse and tried to resuscitate him, so his wife was keen to support them.”

THE long-time partner of a Mowi Scotland employee has expressed “disappointment” over the findings of a Fatal Accident Inquiry (FAI) into his death.

Clive Hendry was an Assistant Farm Manager with Mowi, at the Ardintoul farm on the south side of Loch Alsh.

On 18 February 2020, he was disembarking from a workboat, the Beinn na Caillich, onto the farm’s SeaCap feed barge, and became trapped between the barge and the workboat. Although a colleague attempted to rescue him, he slipped out of his life jacket and into the sea. He was recovered, lifeless a few minutes later.

Key marine safety bodies were not represented, she said, the court’s online video application was unreliable at times and not all the evidence was presented. For example, previous accidents, including eight involving crushing injuries, had not been taken into consideration.

Lockhart said the FAI’s failure to make recommendations – the published determination only provides “opinions” and “conclusions” – meant that lessons from the tragic accident had not been learned.

She said: “I feel this will happen again… nothing has changed.”

Sheriff Gary Aitken of Inverness Sheriff Court, said: “There are precautions which could reasonably have been taken that might realistically have resulted in the death, or accident resulting in the death, being avoided… there should have been a specific risk assessment for the transfer of personnel from large workboats such as the Beinn na Caillich to floating structures such as the SeaCap. Secondly, and following on from such a risk assessment, there should have been a safe system of work for such transfers. As a minimum, such a system of work should have required that the vessel be stationary during transfer and mandate that personnel should only embark or disembark from the vessel when signalled by the master of the vessel that they are satisfied that it is safe to do so.”

In May last year Mowi, which pled guilty at Inverness Sheriff Court to a number of health and safety breaches, was fined £800,000 and ordered to pay a victim surcharge of £60,000.

Catriona Lockhart, Hendry’s partner for 28 years, felt the court case had not addressed the underlying causes of the accident and campaigned for an FAI to be opened – but she now feels let down by the process and its outcome.

Catriona Lockhart said of the inquiry, which was conducted online: “It was just a farce.”

BAKKAFROST Scotland has reported a much improved second quarter harvest for this year.The operation produced 11,400 tonnes against 7,300 tonnes for the same April to June period last year.

The development reflects the continuing improvement at its Scottish division which is now getting on top of earlier biological problems.

The Faroe Islands Q2 harvest was 10,200 tonnes against 8,700 tonnes last year, but the figure would have been higher had it not been for a general workers’ strike across the islands during the period.There was, more or less, no seafood processing taking place in the Faroes for up to a month.Truck drivers were also involved in the strike.

The company’s Faroese operations were also affected by an infectious salmon anaemia (ISA) outbreak at the end of May.

Bakkafrost Q2 feed sales remained largely unchanged at 32,900 tonnes.

The full Q2 2024 report will be released on 26 August.

The determination also criticises lax practice regarding life jackets and man overboard training, issues which Mowi says it has now addressed, as well as improving the company's procedures for safe transfer.

Mowi’s Head of Health and Safety, David Filshie, told the Oban Times: "Mowi extends its deepest sympathies to the family, friends, and colleagues of Clive Hendry, who tragically lost his life on February 18, 2020. The findings of the Fatal Accident Inquiry highlight shortcomings in our safety management system which were immediately rectified after the accident. Since the accident, we chose to recognise guilt and focus on improvements and maintaining the highest possible standards for our safety management systems.”

ICELANDIC fish farming company

Laxey has been granted a licence to grow up to 7,000 tonnes of salmon and rainbow trout in a land-based facility at Viðlagafjörður in the Westman Islands, on the country’s south coast.

The company says this is a new operating licence which was submitted to the authorities earlier this year.

Laxey is building a 32,000 tonne a year fish farm for salmon in a flowthrough system. It is expected the project could create about 100 jobs in the Westman Islands region, also known as Vestmannaeyjar.

The smolt-station is located in Farahan and will use a recirculating aquaculture system (RAS). In the

grow-out facility clean seawater is pumped up through the station and cleaned before being returned to the sea. A place has been chosen in Viðlagafjara on Heimaey.

The company says the sea temperatures around the Westman Islands are generally very favourable which is important for a good growth rate and good operating results.

The project appears to be progressing well. A month ago Laxey said it had completed the first grading and transfers between the RAS systems. This had involved a great deal of planning and preparation, the company said.

Two weeks later batch two was transferred from the hatchery to RAS

1. This was the second time that its staff performed this transfer, but this time it was twice as big as the last one with 600,000 fry being transferred between systems.

It said the operation was well prepared which resulted in a safe and efficient transfer. The next batch will arrive this month which will comprise 900.000 salmon ova.

Last week the first grow out tank was erected, having been assembled in less than four days. In total, there will be eight tanks erected this summer and autumn. The tanks are designed by A-Consult, which is also in charge of the installation.

A MAJOR salmon permit auction in Norway in June has netted the government more than five billion krone – or almost £400m.

A large part of the proceeds, which will be paid out later this year, will go to coastal farming communities.

Most of Norway’s largest salmon farmers came away with sizeable volumes, but the biggest buyer was Japanese-owned company Cermaq, which paid more than a billion krone (£74m) for 3,360 tonnes of permitted biomass. Close behind was the combined deep sea fishing and aquaculture company Holmøy Havbruk AS which bought 2,770 tonnes for just over NOK 900,000 (£67m)

buying 2,704 tonnes and 2,274 tonnes respectively. The privately-owned business Nordlaks purchased just over 1,000 tonnes.

In total 17,300 tonnes was successfully sold off for almost NOK 5.3 billion.

Mowi and SalMar also went in big,

Fisheries and Oceans Minister Marianne Sivertsen Næss said:

“New permits in areas with a good environmental situation facilitate further growth in the aquaculture industry.

“I am happy that many players have taken part in the auction, and that there has been a great willingness to bid. This shows that there is a great demand for breeding permits.”

She added: “The farming industry is valuable for Norway. It contributes to sustainable food production, jobs and activity along the entire coast, and is a mainstay in many local communities.”

Just over 50% of the proceeds (around £200m) will be distributed to municipalities and county councils along the coast through the Norwegian aquaculture fund.

DESPITE record revenues and high salmon prices last year, the north Norwegian salmon farmer Nordlaks was left with greatly reduced profits.

The company is firmly blaming higher taxes for the slump in its profitability in 2023.

Nordlaks had a turnover of NOK 4.82bn (£360m) in 2023, representing an increase of NOK 372m (almost £28m) from the previous year. This was mainly due to higher prices and a weaker krone, which increased the value of its foreign earnings.

But the company’s taxes increased by 162% compared with 2022, which means the company will have a total tax bill of NOK 701m (£52m) on last year’s accounts.

Profit after tax was NOK 560m (£42m) – down by NOK 469m (£35m) in 2022.

Chief Executive Eirik Welde said the consequences of a significantly larger share of the profit going to tax meant that planned investments are being delayed.

“That means fewer new jobs and fewer assignments for the supplier industry,“ he added.

Nordlaks’ own production of salmon dropped from 54,000 tonnes in 2022 to 45,000 tonnes in 2023.

CEO Welde said: “It has been a challenging year. We have had attacks by pearl moths [jellyfish], a high incidence of lice due to the hot summer and winter sores.

“That’s not how we want it to be and when it comes to lice and winter sores, we work purposefully with lice lasers and vaccine development.”

On a brighter note, Nordlaks said it has had great success with the use of lasers against salmon lice.

He added: “We avoided lice removal which stresses the fish, which is both good fish welfare and provides better quality for our customers.

“I would also like to commend all our talented employees, who work hard every single day to solve the problems that arise. It is thanks to them that Nordlaks is the company we are today.”

Winter sores have been a major problem in the aquaculture industry for several years, but now all the fish at Nordlaks will be vaccinated with a new type of vaccine this coming winter.

Welde said: “We have tested a new vaccine which has shown good results so far. We therefore believe that the winter of 24/25 will be better when it comes to this problem.”

NORWAY has signed a free trade deal with Chile which is expected to open up business opportunities between the world’s two largest Atlantic salmon farming companies. The agreement was conducted by EFTA (the European Free Trade Association) and also includes Iceland, another important

aquaculture country, as well as Switzerland and Liechtenstein. Norwegian companies such as Mowi already have a sizeable stake in Chile’s fish farming industry, but this agreement, which replaces an earlier 20-year old deal should make further investment much easier, said the Norwegian Ministry of Trade and Fisheries.

KRILL harvesting company Aker BioMarine has entered into an agreement with the US buyout fund American Industrial Partners to sell ownership in its feed ingredients business. The deal is based on an enterprise valuation of US $590m (£463m). The acquiring party will be a newly established company, as yet unnamed, owned 60% by American Industrial Partners and 40% by Aker Capital. The move follows a strategic review announced in February, and is intended to allow Aker BioMarine to focus on its human health and nutrition businesses.

SALMON producer Mowi has taken delivery of a new feed barge with a silo capacity of 1,000 tonnes. The barge, provided by GroAqua, will operate in one of Mowi’s farming sites in the Faroe Islands. With 16 feeding lines, the 39 by 13 metre feed barge is

intended to optimise feeding by having one feeding line per cage, feeding the whole farming site simultaneously. Set up for remote operations, the barge is built for high-energy sites with, the ability to withstand significant wave heights of HS 5.5m.

SAMHERJI, Iceland’s largest seafood business, saw increased revenue in 2023 but its net earnings fell by 39% thanks to restructuring which saw the disposal of some of its operations.The operating profit was €54m.

The company, which is engaged in both aquaculture and conventional fishing, sold its European and North American operations at the start of 2023 to Baldvin Thorsteinsson, the son of the CEO,Thorsteinn Már Baldvinsson.

Overall, Samherji said it had a successful year in aquaculture, fishing and processing and products sales. Revenue totalled €419m (£353.4m) in 2023, marking a 10% increase in product sales revenue from the previous year.

EBITDA (earnings before interest, tax, depreciation and amortisation) was up from €69.9m to €74.6m (£63m) for 2023, but net earnings, after adjusting for the loss of discontinued operations, totalled €58.7m (£49.5m), down from €101.2m (£85.3m) in 2022.

“Core operations” were stronger than in 2022, the company said, with increases in revenue and earnings before depreciation and financial items. Considerable changes have been made to the balance sheet in recent years and 2023 was the first full operating year in which the group’s activities spanned only fishing, fish farming, processing and selling marine products.The actual decline in profits year-on-year was partly down to the effects of restructuring in 2022.

The company’s largest investment during the year involved expanding the land-based fish farming facility in Öxarfjördur, north eastern Iceland, through the subsidiary Samherji Fish

Farming, which has more than two decades of experience in land-based aquaculture.

The investment for expanding the facility in Öxarfjördur amounted to €27m (£23m).The facility is expected to produce around 3,000 tonnes of salmon annually.

The company said the knowledge and experience gained from operating this facility will be utilised in Samherji Fish Farming’s proposed land-based salmon farm in the Reykjanes Peninsula (in southwest Iceland).

CEO Thorsteinn Már Baldvinsson, said: “Samherji’s operations performed well last year, and the company’s finances are strong, as the annual financial statements clearly show.

“During the year, we faced various challenges, and the company’s employees deserve praise for solving them with resourcefulness and diligence.”

Samherji sells almost all its products in foreign markets, where interest rates have spiked due to increased inflation.Wars have also had a major impact on international trade. In such situations, solid business relationships and strong sales networks prove their importance.

He added: “Forces of nature reminded us of their power in the second half of the year when seismic activity began in Reykjanes, forcing the residents of the town of Grindavík to leave their homes.

“This sequence of events had direct and indirect effects on the operations of Samherji Fish Farming. We celebrated Samherji’s 40th anniversary in its current form in 2023, and I can only be optimistic about the future.”

LAND-BASED fish farmer Gigante Salmon successfully raised at least NOK 225 million (£16.6m) in a new share issue in Oslo last month.

The deal was completed through the issue of 34.6 million shares at an average price of NOK 6.50 per share.

Gigante Salmon, which is based in northern Norway, said in a Stock Exchange announcement that it plans to use the net proceeds to fund the company’s projected investment and working capital needs for the construction and operation of the land-based salmon farming site on Lille Indre Rosøy in Rødøy municipality (also known as the “Rødøy facility”) as well as for general corporate purposes.

It continued: “The company is pleased to announce that the book-building for the private placement has been successfully completed.

“On the back of strong investor demand, the company decided to increase the size of the private placement from NOK 200 million to NOK 225 million in gross proceeds through the allocation of

34,615,384 new shares.”

The company is building one of Norway’s most advanced RAS (recirculating aquaculture system) facilities. The development phase is now moving towards conclusion and production is expected to get underway later this year.

in particular because the private placement enables the company to secure equity financing to accommodate the company’s funding requirements for construction of the Rødøy facility on a short timeline.

The Gigante Salmon statement added: “The board is of the view that it will be in the common interest of the company and its shareholders to raise equity through a private placement,

FISH farming giant SalMar may have been hit by a second outbreak of infectious salmon anaemia in less than a month, it is feared.

The Norwegian Food Safety Authority is reporting that a suspected outbreak has been detected at a site in Frøya municipality. The site is owned by SalMar although the fish is owned by Refsnes Laks, in which SalMar has a major stake.

The Food Safety Authority said: “Salmar Oppdrett AS notified the Norwegian Food Safety Authority on 14 June of suspected ILA at site 33737 Olausskjæret [on the central Norwegian coast near Trondheim]. The suspicion is

based on the results of a PCR analysis carried out after sampling at the site.”

The Authority said it is planning an immediate inspection of the plant to take follow-up samples which will be sent to the Norwegian Veterinary Institute, in order to confirm whether the disease is ISA.

ISA has since been confirmed at a SalMar location in Alta municipality, following suspicions based on PCR samples taken at the end of May.

Around the same time possible ISA was detected at a Mowi site in Trondelag county and a suspected case at a Måsøval site was also confirmed.

“Further, a private placement will reduce execution and completion risk, as it enables the company to raise equity efficiently and in a timely manner, with a lower discount to the current trading price, at a lower cost and with a significantly reduced completion risk compared to a rights issue.”

Earlier this year, Gigante changed its CEO, appointing Kjell Lorentsen to replace Helge Albertsen, after it emerged that construction costs at the Rødøy plant were running far above the initial estimate.

Above: Kjell Lorentsen

A POTENTIALLY damaging strike in the Norwegian aquaculture industry was averted late last night.

The employer group Seafood Norway and the trade union organisation Fellesforbundet (“Joint Federation”) have reached a deal much earlier than most people thought. The talks were widely expected to go on into today.

The lead negotiators were Christian Justnes for Fellesforbundet and Geir Ove Ystmark for Seafood Norway, with Torkjel Nesheim as mediator.

Christian Justnes said he was well satisfied with the result which gave extra purchasing power to his members along with other so far unspecified benefits.

There will be relief among companies that a deal has been reached as a strike would have meant a serious setback for the industry at a time when it is facing other pressures including higher costs and taxes and falling salmon prices.

More than 200 fish farms along the Norwegian coast, mostly belonging to the big names in the industry, would have been affected.

Some of the key details include a general pay increase of seven kroner (around 60p) per hour, a NOK 15.77 (£1.10p) increase per hour in the minimum wage rate and a skilled worker allowance increase of NOK 6 (45p) per hour.

Christian Justnes added: “We are happy that we have put in place an agreement that ensures increased purchasing power for our members.

“We have received a significant increase in both the minimum wage, on-call allowance and skilled worker allowance. In this way, we lift both the lowest paid and reward competence.

“We have also put in place very important changes within HSE and on-call arrangements, which will mean a lot for the everyday working life of our members.”

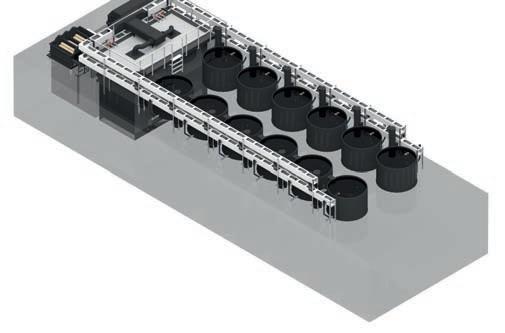

THE land based company Salmon Evolution has this week signed a deal to start building the second phase of its Indre Harøy project.

The agreement is with the flow through, hybrid and RAS technology company Artec Aqua and the construction firm Hent AS.

Earlier in June, Salmon Evolution completed the private placement of NOK 365 million (£27m) and an increase in bank facilities with NOK 675 million (approximately £50m).

It said: “The company has taken the final investment decision for Indre Harøy phase 2 and has accordingly signed an agreement with Artec Aqua and Hent, in which the phase 2 grow-out project moves into the construction phase.”

“Mobilisation will commence shortly, with planned construction start during Q3 2024. In parallel the company is proceeding with the planning and engineering for the additional tank capacity.

“As previously communicated no final decisions or agreements are entered into for this part of the phase 2 project.”

Salmon Evolution CEO Trond Håkon Schaug-Pettersen said: “We are now creating

a foundation for substantial profitable growth, and with phase 2 in full operation we will have a strong cash-flow generating platform with significant annual investment capacity.”

Located on Norway’s west coast, Salmon Evolution describes itself as the global leader within land-based salmon farming with a clear roadmap for 100,000 tonnes HOG annual production capacity.

NORWAY’S salmon farmers could be facing further legal action on top of the price fixing claims from UK retailers, consumers and the European Commission, it emerged yesterday.

This latest threat comes from the country’s anglers and sports fishing groups who were faced with the closure of 33 salmon rivers earlier this week, mostly in the south of Norway.

The government has banned salmon fishing in these rivers because it is worried by the low level of wild salmon

stocks. It is possible that normal fishing activity will not be resumed until at least next year.

So far, most of the rivers in the north of the country have escaped action.

Now the sports groups are threatening to sue salmon farming companies, claiming they are largely responsible for the situation.

Geir Moholdt, Chairman of the sports fishing organisation Gaula Elveierlag told the national broadcaster NRK that his members want the farming companies

to recognise the serious consequences they have inflicted on the wild salmon stocks in Norway.

He said lice, fish escapes and infections were the biggest threat to wild salmon stocks and the companies had to take responsibility for this.

Moholdt said fishermen “were shocked by such a brutal decision” but recognised there were so few wild salmon in some of the rivers, there was very little left to fish for.

He argues that it is now time for the aquaculture industry to bring in closed cages.

In response, the employers’ group Seafood Norway said low wild salmon stocks were happening in countries or areas where there is no salmon farming, citing Sweden and eastern Scotland as two examples.

THE Norwegian seafood export boom which has been making headlines for the past few years has ground to a halt.

Figures from the country’s Seafood Council show that overseas sales in the first six months of this year totalled NOK 80.6 billion (£6bn) but fell by NOK 1.6 billion (£118m) or 2% on the same period last year. Poor June sales were the main factor.

The Seafood Council put a brave face on the news, saying that although there was no growth in value during the first half of this year, it still represents the second highest figure recorded in terms of value. Only 2023 was better.

CEO Christian Chramer said: “A weak Norwegian krone and high prices for cod and salmon boosted value in the first five months of the year. However, the growth stopped in June, which is largely driven by falling salmon prices.”

Fisheries and Oceans Minister Marianne Sivertsen Næss added: “Despite the downturn, the seafood industry is delivering strong figures with the second-best half-year figures ever.

“Nevertheless, weakened purchasing power in key markets, lower export volumes and increased competition from other seafood nations is something we must take very seriously.”

Chramer said salmon still accounts for 70% of the total value of Norwegian seafood exports, so when the price of fresh whole salmon fell by as much as NOK 31 (per kg) in June compared with the previous month, it had a major impact on the total value. Salmon grew in value for 36 consecutive months before stalling in March this year. In the first half of the year, the value fell by NOK 1.8 billion (£133m), or 3%, compared

with the same period in 2023.

Chramer added: “The situation was demanding in the first half of the year. Biological challenges resulted in lower harvesting volumes and a change in product composition towards more fillets.

“In June, global competition from other producer countries also increased, which had a negative impact on prices. The battle for salmon customers has now really intensified.”

We’ll be looking at how sh farming and seafood businesses can ensure they continue recruiting successfully in what can be a di cult market for employers looking for the right talent. The panel will also discuss what is being done to encourage young people into this eld. And we’ll be asking how the industry can become more diverse and o er more opportunities for women and minorities.

THE Canadian federal government’s decision to ban open net fish farming in British Columbia by June 2029 has been met with dismay and anger by the industry.

Many fear the decision will cost hundreds of jobs and set back the aquaculture industry in the province for years. It could all but wipe out much of Canada’s farmed salmon production.

The government said salmon aquaculture licences will be renewed for five years with stricter conditions, effective from 1 July 2024. After this date only marine or land based closed containment systems will be considered for new licences.

Fisheries Minister Diane Lebouthillier has outlined a transition to closedcontainment salmon farm operations and said she would allow aquaculture farms to renew their licences in a “responsible, realistic and achievable” way.

Grieg Seafood said that based on the announcement the company was suspending investment in BC and would await a draft transition plan to assess further action.

Grieg pointed out that the decision only

applied to British Columbia and had no implications for its operations in Newfoundland.

Tim Kennedy, CEO of the Canadian Aquaculture Industry Alliance, said the government objective was unreasonable because there was no scientific basis to the decision.

He added: “The objective is irresponsible because it threatens 5,000 highly paid and skilled jobs in coastal British Columbia (500 of these jobs held by Indigenous people) during a time of economic stagnation.”

The alliance said over 95% of Canada’s salmon production comes from salmon farms in ocean pens in British Columbia.

The BC Salmon Farmers Association has said an analysis showed the province could

lose up to CA $1.2 billion in economic activity annually if the licences are not renewed.

First Nations groups are divided on the issue, with some supporting a ban but with others calling for it to continue because they depend on it for their livelihoods.

The influential Canadian seafood website Sea West News said the ban has triggered a fierce backlash, adding it has made a mockery of pledges with the First Nations.

Sea West News added: “Denying the science of its fisheries experts that show the marine operations pose less than a minimal risk to wild stocks and bowing to the demands of activists to get their votes, the government’s decision is being described as irresponsible, unrealistic and unreasonable.

“It also makes a mockery of the Liberals’ promise to deliver science-based decisions regarding the future of salmon farming in BC and walks back on the pledge of economic reconciliation with First Nations.”

Mowi described the decision as unfortunate, saying it had been made despite its efforts to pave the way for future sustainable growth and employment.

A NEW global seafood certification system for small scale fishers and their communities is out for consultation.

Community Catch has been tailored to the needs of small scale fisheries, and is based on international standards for sustainability, labour rights and fair trade principles.

The initiative seeks to address a fundamental problem faced by smaller fishers, who can find that compliance with established certification schemes is too expensive.

Community Catch has released its draft bespoke seafood certification scheme for a 60-day public consultation, due to close on 29 August 2024.

The consultation period gives stakeholders and interested bodies the opportunity to comment on the content and relevance of the standard and evaluation process.

Comments from the consultation will be used to inform a revised draft, which will itself be opened for a further 30-day consultation period. It is expected that the scheme will officially launch on the market later this year.

Based on the FAO Code of Conduct for Responsible Fisheries and FAO Voluntary Guidelines for Securing

Sustainable Small-Scale Fisheries, the new social and environmental standard also aligns with the ISEAL Credibility Principles and the Global Sustainable Seafood Initiative (GSSI) Global Benchmarking Tool for seafood certification schemes. It also incorporates relevant aspects of the International Labour Organisation (ILO) convention on work in the fishing sector and the Ethical Trading Initiative (ETI) base code.

The standard includes all forms of fisheries and species, including multi-gear and multi-species, and it provides recognition of those that are demonstrably moving towards the standard.

Dr Andrew Hough, a director of the organisation, said: “We are very proud of what we have developed, and believe that for small-scale fisheries, it offers a cost-effective alternative to other global certification schemes. In particular, the new certification scheme will enable fishing communities to connect to markets that were previously inaccessible.”

For more information go online to communitycatch.org/consultation

PROXIMAR Seafood has pre-sold at least a third of expected annual production for this year from its new land-based salmon farm in Japan.

The company, which is putting the finishing touches to its RAS (recirculating aquaculture system) facility near Mount Fuji, had a standing biomass of 360 tonnes at the end of Q2 (June), more than tripling the 112 tonnes at the end of the first quarter.

Proximar said the first sales agreement has been reached, securing a fixed price per kilogram for a larger part of the harvested volumes for 2024.

The price achievement was in line with its expectations and benchmark, and it also reflected a price premium compared to the cost of imported Atlantic salmon from Norway.

The sales agreement is expected to cover approximately one third of the expected harvesting volumes for this year.

CEO Joachim Nielsen said in an Oslo Stock Exchange message: “We are very pleased to see the positive development in our biomass continuing through the second quarter of 2024.

“The water quality remains good which again is reflected in our growth curves. We continue to see low natural mortality.”

He added: “Our first batch is above 3.25 kg on average, and we remain on track for first harvest in September. We continue to do sample testing for quality and taste, and both internal and external feedback is very positive.”

Proximar’s targeted long-term harvest level is 5,300 tonnes (HOG) per year in Phase 1.

Left: Joachim Nielsen

EARTH Ocean Farms, the Mexican company focused on regenerative aquaculture, has a new brand identity: “Totoaba Santomar”.

This will be the consumer-facing brand for its main product, farmed totoaba (Totoaba macdonaldi).

Earth Ocean Farms (EOF) is based in Baja California, Mexico and raises totoaba, red snapper and oysters in the Sea of Cortez. Totoaba is a native Mexican species which EOF is marketing as a premium seafood product.

EOF stresses the sustainability and traceability of its fish, with a unique QR code for each individual, which certifies and provides transparency about its origin and harvest.

Pablo Konietzko, CEO of Santomar, said: “This new brand represents an important step towards generating a healthy ocean, helping to restore endemic species, and promoting economic growth in our region. Santomar is the name that defines our identity today, a wise choice, as it honours and shows the deep respect we

Above: Totoaba Santomar

have for our sea, its species, and its people.”

The brand name combines the Spanish words for “saint” and “sea”, and the company’s new slogan is “Sit mare gloria” (“glory to the sea”).

The company says its meticulous processes, ensuring absolute traceability, from the handling of broodstock to the production of juvenile totoabas, guarantee optimal conditions for their breeding, making them available 52 weeks of the year.

Santomar collaborates with research centres, government agencies, other organisations, and fishermen on conservation, reconstruction of fisheries and new aquaculture production techniques.

THE former Center for Aquaculture Technologies (CAT) subsidiary in Canada has rebranded as “Onda”. Formerly known as CATC, Onda is a contract research organisation focused on aquaculture. The new name comes from the

Latin word for “wave”. Onda will maintain alignment with its sister company CAT, and continue to be an integral part of the Cuna del Mar portfolio. While operating under separate governance and management structures, both companies say they remain focused on collaboration and delivering high-quality, industry leading service standards.

PLENARY speakers have been confirmed for the Latin American Aquaculture Congress, taking place in Medellin, Colombia this September. They are Dr Benjamin Le Frentz of the US Department of Agriculture, Nélida Rodriguez Osorio of the Universidad de la Republica in Uruguay and Marcela Salazar, Scientific Director of Benchmark Genetics in Colombia.

The Aquaculture in Latin America Congress combines LACQUA 2024, The VIII Latin American Conference On Native Fish Farming And The XI Colombian Congress On Aquaculture. It takes place over September 24-27, 2024, at the Plaza Mayor Convention Centre.

GRIEG Seafood has appointed a new regional Director of Operations for its Newfoundland business.

Elizabeth Barlow, who takes over at Grieg Seafood Newfoundland on 8 July, comes with nearly 30 years of operational and management experience in the aquaculture industry and government.

Grieg CEO Andreas Kvame said: “Elizabeth has extensive operational and management experience spanning from biology and salmon farming to governmental roles in the Province of Newfoundland and Labrador.

AUSTRALIAN salmon company Huon Aquaculture is expanding its Tasmanian farm at a cost of AUS $110 million (£78m)

The project will include a new recirculating aquaculture (RAS) system at its Whale Point facility in Tasmania.

Salmon farming has become something of a controversial issue among certain groups in Tasmania during the past year over claims that it is damaging the environment, but the investment has been widely welcomed in the state.

The project is expected to create at least 150 construction jobs and a number of extra company jobs in the Port Huon area. It should be fully operational within three years.

Huon CEO Henry Batista said the expansion would allow the company to grow larger fish on land.

This in turn would mean that fish going into the sea will be larger and would need to spend less time in open waters.

“Huon salmon already spend most of their lifecycle on land and this expansion strengthens our land-based farming capabilities,” the CEO added.

“This investment will also further improve water use at Whale Point, increasing the amount of water recycled in the RAS to 99%.”

CEO Batista added that the project would enable the company to use existing land and offshore marine sites.

GRIEG Seafood’s salmon farming operations in British Columbia were hit by a “low oxygen event” in May which affected fish health and led to a rise in sea lice levels, the company has reported.

Grieg said: “In May 2024, Grieg Seafood BC experienced a low dissolved oxygen event in Nootka Sound.This is a naturally occurring event which can affect the health and welfare of our salmon. At the same time as the low oxygen event, harmful plankton in the area also impacted some of our fish.

“Due to these adverse environmental conditions and in order to preserve the welfare of our salmon, we were unable to handle and perform sea lice treatments during this time, resulting in higher-than-normal sea lice counts for a short period of time.”

The company stressed that its operations have throughout the

event maintained compliance with both DFO’s regulations and third-party certifier Aquaculture Standards Council (ASC) through the use of its Integrated Pest Management Strategy.

The company added: “We were also able to draw upon the broader industry agreement to share mitigation resources, utilising mechanical and freshwater treatment vessels to treat multiple farms in the area as quickly as possible.”

AQUABOUNTY Technologies has finally sold its land-based farm in Albany, Indiana after putting it on the market earlier this year.

The US $9.5m (£7.5m) cash deal also includes some equipment from the company’s Ohio site.

The buyer is the Wisconsin company Superior Fresh which, unusually, combines salmon farming with growing organic leafy greens such as lettuce.

AquaBounty announced in February that it was putting the Indiana farm up for sale, to raise capital, describing the move as a difficult decision.

In May the company reported a 2024 first quarter net loss of US $11.2m (£8.8m) against $6.5m (£5.1m) in Q1 2023. Costs for AquaBounty’s farm in

Pioneer, Ohio – currently under construction – have increased dramatically, adding to the company’s need for capital.

It is thought that part of the proceeds will be used to reduce a long term loan. The sale is expected to be completed over the next few weeks.

AquaBounty has developed a strain of genetically modified (GM) Atlantic salmon, under the brand name AquAdvantage.

In contrast, Superior Fresh is clear that its salmon are non-GM and the company does not even allow GM ingredients in its feed.

The company’s salmon are grown on land using freshwater tanks in what is an almost closed system, with 99.9% of water treated and recycled within the facility.

The fish waste is put to good use through a nutrient recycling process. Using a microbial biome that mineralises the waste and releases its nutrients, the waste is repurposed and is used as fertiliser for vegetables.

THE first 2024 anchovy season in Peru’s north-central fishing zone ended in June with more than 98% of the quota fulfilled, the marine ingredients organisation IFFO reports.

IFFO said this was a very positive sign for the fishing and feed sectors, considering that Peru accounts for around one-fifth of global fishmeal supply in an average year. A second fishing season will take place later in the year, based on independently set quotas taking into account the size of the biomass.

In Peru’s southern fishing zone, the season ended with slightly more than 10% of the first season’s quota landed. A new quota has been announced for the second

season, beginning on 1 July 2024.

In the first five months of 2024, cumulative fishmeal production in the countries analysed in IFFO’s report (Peru, Chile, Denmark / Norway, Iceland / North Atlantic, USA, African countries, Spain) increased by 40% compared to the same period in 2023. The significant year-on-year increase of the Peruvian supply was the main factor behind such a positive trend. When it comes to fish oil, cumulative output through May 2024 was approximately 10.8% higher year-over-year, again driven by the increased supply from Peru. All other regions analysed in this report showed a decline in their supplies of fish oil in comparison to the first months of the year 2023. Aquafeed production in the first half of the year 2024 remains below the amount reported during the same period in 2023. IFFO expects that reduced aquaculture activity in the first five months of 2024 might further weaken the demand for feed ingredients.

A GROUP of representatives from award-winning fish and chip shops in the UK have been visiting Norway on a study trip, courtesy of the Norwegian Seafood Council.

The 2024 National Fish and Chip Award winners were accompanied by the Norwegian Institute of Marine Research and the Norwegian Directorate of Fisheries, and several media representatives from both the UK and Norway.

Also on the trip were representatives

of Winners were also joined by the National Federation of Fish Friers (NFFF), organisers of the National Fish & Chip Awards.

The three-day trip took in Ålesund, including a voyage on board one of Norway’s largest Frozen at Sea vessels, Østerfjord and a visit to Ellingsøy, the northernmost island in Ålesund, which gave the winners an opportunity to visit Brødrene Sperre, one of Norway’s leading producers of frozen at sea whitefish.

Victoria Braathen, Norwegian Seafood Council UK Director, said: “It’s been an absolute pleasure and truly inspiring to host the winners of the 2024 National Fish and Chip Awards on this educational study trip to Norway for knowledge sharing and networking.

“It’s of great value to us to celebrate the successes of this incredible sector and we believe that by offering operators a chance to experience first-hand just where their fish comes from, and the lengths the Norwegian seafood industry is going to ensure the future of sustainable fishing, we’re developing a joint understanding of the role of sustainable seafood in fish & chips and building partnerships for the future.”

“We’re developing a joint understanding of the role of sustainable seafood ”

A GROUP representing British consumers is pressing ahead with a claim for compensation from Norwegian salmon farmers over alleged price fixing – and it has put a figure on it.

The action, filed at the specialist UK Competition Appeal Tribunal, seeks redress of as much as £382m in compensation for consumers who bought certain farmed Atlantic salmon products from UK grocery retailers between October 2015 and May 2019. Some of the biggest names in salmon farming are being sued, including Mowi, SalMar, Lerøy, Scottish Sea Farms and Grieg.

and at various meetings and “working dinners”. It is claimed that this was cartel behaviour and a breach of competition laws.

The claim was lodged by Waterside Class Ltd, a company established to pursue the claim. It said the defendants unlawfully colluded to increase global prices for farmed Atlantic salmon, leading to increases of up to 20% in the prices paid by consumers.

According to Waterside, the six defendants worked together to increase the price of farmed Atlantic salmon through various methods, according to the claim. The defendants are accused of manipulating benchmark prices for Norwegian Atlantic salmon by using related entities to purchase salmon at inflated prices, and unlawfully exchanging commercially sensitive information about the price and volumes of sales of farmed Atlantic salmon. Senior executives at rival companies allegedly planned to rig prices via email correspondence,

According to the claim, this unlawful overcharging of consumers continued until 31 May 2019, shortly after the European Commission raided the offices of various salmon farmers as part of a major investigation into price-fixing in February 2019. In January 2024, the Commission expressed its preliminary view that various Norwegian companies had indeed colluded to fix short-term farmed Atlantic salmon prices in Europe between 2011 and 2019.

Waterside’s sole director and representative, Anne Heal, was previously the Director of Regulatory Affairs at BT. She said: “By bringing this collective action, I want to give a voice to affected consumers across the UK, and see them properly compensated for their losses. I also want to bring attention to market practices which harm consumers, and hold the defendant companies to account for their alleged wrongdoing.”

Meanwhile, UK retailers themselves are also pressing a claim for compensation.

Price fixing allegations in the United States and Canada were settled out of court last year.

The companies concerned have strenuously denied allegations of price fixing in both the EU and North America.

THE global alternative investment platform Slate Asset Management has acquired the World Seafood Center in Oslo for a figure close to £100m.

The Center is a state of the art new-build refrigeration and distribution facility, based at a logistics hub near Oslo’s main airport. The purchase figure is NOK 1.3bn (£95.4m).

Slate said the acquisition adds to its portfolio of essential real estate assets in Europe.

Explaining the reason for its move, the company added that seafood is the second largest industry in Norway with a growing export volume benefitting from strong demographic tailwinds, that are driving high demand in the region for industrial space for the seafood industry.

The World Seafood Center is a 55,000 square metre facility strategically located in the rapidly developing Gardermoen region within Oslo Airport City with immediate access to main transport networks to Europe and the overseas markets in Asia and America. Salmon would almost certainly be the principal species going through the facility, and one of the Center’s largest tenants is the salmon giant Mowi.

The property is let to some of the largest seafood tenants in the world

MOWI, the world’s largest supplier of farm-raised salmon, has started produc�on at its new combined slaughterhouse and processing plant at Jøsnøya in Norway’s Hitra region. It has a produc�on capacity of 100,000 metric tons – enough to process around a third of Mowi’s produc�on in Norway – and it replaces Mowi’s factory at Ulvan.

The new plant consists of a produc�on building with administra�on and technical wing, a seawater sta�on, cleaning and by-product building and a floa�ng pier.

The new processing plant at Hitra will receive fish from sea harvest vessels only. Mowi Norway is now using four sea harvest vessels to supply its

processing plants, and the South Region in Norway is already fully based on this technology.

Building on this experience, Mowi intends to increase the capacity of these vessels and, in the long term, subs�tute wellboat transport with sea harvest vessels which represent an improvement in fish welfare.

Speaking about the new facility at the groundbreaking back in in 2022, Olaf Skjærvik, director of Mowi Mid Region, described the new plant as: “…a state-of-theart factory built for the future.”

Code IT, already a supplier to Mowi in 16 countries, provided key so�ware for the new plant from its CodeIT Enterprise™ range, including labelling and tracking modules, scanner systems and weighing systems.

under long lease terms indexed to inflation, which are expected to provide stable and resilient cash flows.

The facility derives 100% of its energy supply from green and renewable sources and is equipped with robotics and artificial intelligence technologies, which further contribute to its high levels of operating and energy efficiency.

“We are pleased to be increasing our exposure to European essential real estate with the acquisition of this premier cold storage and distribution facility,” said Sven Vollenbruch, Managing Director at Slate.

He added: “The World Seafood Center has established itself as a critical part of the food supply chain globally, providing consumers across Europe, America, and Asia with access to high-quality Norwegian seafood.

“As global demand for sustainable seafood continues to grow, we look forward to working together with the leading tenants at the World Seafood Center to further enhance the quality, efficiency, and resiliency of this facility, ensuring it remains a major seafood export hub for years to come.”

KLAUS Nielsen is stepping down as CEO of Danish seafood processor Espersen after nearly 25 years in the role. His successor is Tino Bendix, who will take over as CEO both of Espersen and its parent company, INSEPA, on 5 August.

Espersen’s headquarters are in Denmark but also runs the former UK operation of Iceland Seafood International, based in Grimsby, which it acquired in August last year.

In total, Nielsen has been at the company for 37 years.

Tino Bendix is currently CEO of Kruuse, a supplier of veterinary equipment, and has experience at management positions in a number of companies across the food and fast-moving consumer goods sectors.

Paying tribute to the outgoing Chief Executive, Chair of the Board Flemming Enevoldsen said: “I have cherished our close cooperation which has been strengthened during recent years of international turmoil including the pandemic, the war in Ukraine, our exit from Russia and the very volatile inflationary business environment.”

He added: “I am pleased to welcome Tino Bendix as our new CEO. Tino was selected amongst a strong field of candidates in a thorough process, and I am confident that his personality, international background, and strong food industry experience compile the right fit for Espersen.”

Consolidation in the salmon sector is based on hard economic realities, argues

THE salmon sector in Norway appears to be embarking on a journey that Scottish producers took many years ago –the journey of evolving from being an industry of many producers to just a handful.

I have heard many explanations of what happened, including claims that the Scottish industry was acquired by Norwegian owners to avoid the supposed constraints of Norwegian regulation. In fact, what happened to the industry was entirely predictable.

At the end of the 1980s, Highlands & Islands Enterprise set out a view of how they perceived a future Scottish aquaculture sector might look. They believed that the sector would consist of producers of a wide range of different fish and shellfish species. However, this model never materialised, and instead it was the salmon industry that dominated the sector for many years to come. Why salmon led the field was simply down to its similarity to the poultry sector.

Chicken used to be expensive and a real treat. In post-war Britain, investment was made in food production and consequently chicken became much more widely available to consumers.

The problem for producers was that there was only a small part of the market prepared to pay a high price for this “special treat”. If the market was to expand then the price had to reflect the higher demand.

I always use the analogy of Rolls Royce cars and the question that if they were produced in the same numbers as the Ford Fiesta, would consumers still be prepared to pay £330,000? The answer is no – Ford Fiestas used to sell in the large volumes they did because they were priced at £19,000.

This is what happened to chicken. The producers were growing more and more chickens and such large scale production meant that the costs decreased, along with the profit margins. The

larger farms continued to be profitable, however, because whilst the margin on each bird was low, they were producing many more chickens. BBC’s Countryfile has just discussed this issue, pointing out that 80% of UK pig production is in the hands of 30 businesses, whilst 75% of UK chicken production is accounted for by just three companies.

The same process applies to salmon farming. Overnight, in the late 1980s, the salmon industry evolved from a low volume industry to one of high volumes. This change also meant that high margins became much lower. The industry faced a choice: cut back production and recreate salmon as a luxury treat, or expand production, making salmon an everyday food choice. We know which route the industry chose.

The problem for farmers was that the loss of margin needed to be addressed, and this was best achieved by cutting costs. Feed was one of the highest costs for the farmer, and to get a more favourable price it needed to be bought in larger quantities, to benefit from economies of scale. Bigger businesses could cut costs more easily than smaller ones. Even the smallest of businesses can compete, however, if they can become highly specialised and find a way charge a premium price for their product.

This is what happened in Scotland in the late 1980s and early 1990s. The 180 or so farms that were pioneers in the early days of the sector realised that the days of charging high prices for their fish were numbered, and that competing in future would be extremely challenging.

Whilst some promote the narrative that foreign owners came looking for farms to buy, the reality was that it was Scottish owners who were keen to sell. Over the subsequent years, the ownership of the

Scottish industry changed, with fewer but much larger businesses. Today there are just six finfish farming companies operating in Scotland and whilst the critics complain that most owners come from overseas, the reality was that the industry was never really all in Scottish ownership. The first pioneers were Anglo-Dutch.

The pattern of consolidation seen in the chicken sector did not just focus on production. There was also a move towards processing the finished product for the retail sector. The salmon industry has taken a long time to follow this example but companies like Mowi now produce both branded and own label consumer products.

The question now is: why is such

consolidation now on the agenda in Norway? The answer is that back in 1972, Parliament proposed that it was undesirable to have large facilities that affect the character of the sector. Salmon farming was seen as an extension of fishing and agriculture and initially ownership was restricted to a single licence. Today, there are almost 100 farming companies in Norway of which 17 account for 80% of the volume.

Can this structure still survive the pressure to change? Some of the smaller companies cooperate to obtain the economies of scale but these owners face competition, not only from other Norwegian producers but also in an international marketplace.

According to Dag Sletmo of DNB Seafood, it is those farmers that are stuck in the middle between the smallest and largest operators who are struggling with lower margins and profits. Thus, the much slower pace of change experienced in Norway may speed up so that Norwegian production looks more like that of Scotland – or Chile, where just 11 companies account for 80% of production.

A consolidated industry means that companies are better served to maintain much tighter control over their costs and thus ensure that they can supply a wide range of diversified products across the retail sector every day of the year. Salmon is such a versatile protein that the opportunities are endless, but these could never be met if the industry structure in Scotland had remained as 180 separate small businesses.

Salmon Scotland chief executive Tavish Scott highlights the work being done to protect Scotland’s iconic wild salmon

CAPTAIN James T Kirk: it is a name from one’s youth, depending on age.

Or if one is the same age as my kids, a baffled look along the lines of “gosh Dad, you are old.”

In the classic sci-fi series Star Trek, Kirk promised to boldly go where no man has gone before. The actor William Shatner, a Canadian, has just done that.

In response to the Canadian federal government’s appalling decision to ban salmon farming sea pens in British Columbia, Shatner has released a foul-mouthed rant on social media attacking, in Anglo-Saxon terms, the salmon sector – and, by definition, the thousands of Canadians who work in it.

Unfortunately, the Trudeau government has taken a decision based on politics, not science or jobs.

The Canadian Liberals currently have MPs in Vancouver and other affluent areas in BC – but the party is way behind in the opinion polls and an election is looming.

As with all political parties in trouble (see the Conservatives in the UK today or Labour after the 2015 defeat), they are appealing to their political base. But this political decision risks jobs and livelihoods and will hurt coastal communities the most.

Trudeau’s Liberals have encouraged rich, fashionable antisalmon farming activists to use recognisable faces to attack the sector in this foul-mouthed manner.

Of course, Shatner is quite entitled to make his point.

He is extremely rich and doesn’t want for anything in life, and people will make up their own mind on his motivations.

But what is unacceptable is the language used. People going to work in any walk of life do not deserve abuse whether they be a former Hollywood A-lister or a hardworking Canadian fish farmer.

Yet Shatner and co have called open house on the men and women of the BC sector.

I hope that normal Canadians will see this for what it is: rich egos dictating what the working man or women should think.

What this brings home back here in Scotland is the need for our sector to work hand and glove with local communities.

Our member companies run fantastic local initiatives to support the communities where they are based, recognising the importance of being good neighbours.

And as a sector, we arrange initiatives such as Salmon Scotland’s Wild Fisheries Fund.

Almost £1400,000 has been granted to organisations across the country this year from the fund to help save iconic wild salmon and sea trout.

The fund is part of a £1.5 million

People going to work in any walk of life do not deserve abuse

commitment from Scotland’s salmon farmers to support the conservation, restoration, and sustainable management of wild fish numbers.

Galloway Fisheries Trust has received £22,700 to tackle high acidity levels threatening fish numbers on the River Bladnoch; Tighnabruaich-based Otter Ferry Seafish has been awarded £49,404 to work with Argyll wild fisheries experts to develop a gene bank to boost threatened salmon populations; and community landowners Urras Oighreachd Chàrlabhaigh (Carloway Estate Trust) and Uig Lodge Lettings have each received grants.

Scotland’s salmon farmers are determined to find solutions, engaging constructively with the wild fish sector and taking meaningful action to save wild salmon.

We actively contribute to reversing this decline by supporting community-led projects to restore our rivers and lochs, making a positive global impact.

I doubt Shatner is aware of this vital work which is taking place.

But we will certainly make sure that MSPs are aware of it when the Scottish Parliament Rural Affairs and Islands committee meets with the sector following the summer recess.

To date, the committee has heard from a number of witnesses, including activist groups determined to spread misinformation and shut us down.

I look forward to providing factual information to MSPs in the autumn.

One of the issues that has repeatedly come up has been the issue of declining wild salmon numbers.

MSP Elena Whitham asked if environment regulator SEPA had “identified any evidence of significant harm to wild salmon from farmed salmon sites”.

I was pleased that Lin Bunten, Chief Operating Officer for Regulation, Business and Environment with SEPA, responded to

the committee: “I am not aware of a direct link between farmed salmon and wild salmon per se.”

The latest data from the Scottish Government shows that catches of wild salmon are the lowest ever since records began in 1952.

But since 2010, the decline of wild salmon catches from rivers on Scotland’s east coast – hundreds of miles from the nearest salmon farm – is at exactly the same rate as the declines from rivers within the salmon farming heartland.

If salmon farms were responsible for the decline in wild fish numbers, then surely the rate of decline would be seen to a much greater extent on the west coast?

The fact that the figures show that isn’t the case is an inconvenient truth for the anti-salmon activists here at home, and the celebrities in Canada.

When I think back to the adventures of Captain Kirk, boldly going where no one had gone before, I recall just how many intergalactic scrapes the crew of the Starship Enterprise got into.

Leadership was required, yes, but vitally so was teamwork and collaboration.

It is collaboration that is key to reversing the decline in wild salmon numbers, and Shatner and his friends would do well to remember that.

Tavish Scott is Chief Executive, Salmon Scotland.

ILOVE oysters, and really miss having oyster farmers for neighbours! In my local fishmongers, No 3 oysters are sold for £1.50 each, making them an expensive treat. In restaurants, they are even more expensive because someone else is doing the work of opening them. I recently forked out more than £40 for half a dozen with a glass of champagne, and whilst they were delicious, I couldn’t help thinking about the several years of nurturing, back-breaking bag turning and grading the oyster farmer had gone through to receive a fraction of the final selling price.

On a recent trip to France, I was able to buy a box of 24 oysters for less than €18 (£15.30) – which is less than half the price in the UK, and far more affordable! On another occasion, I enjoyed three oysters and a glass of white wine for just €6 (£5.10).

However, the oyster industries on each side of the English Channel are vastly different in scale. The UK is very much the poor relation when it comes to shellfish aquaculture, yet with a positive political and regulatory environment, it could achieve far greater things.

Production in the EU was just under 98,000 tonnes in 2020, and France accounted for 80,796 tonnes of this. The UK, by comparison, produces around 3,000 tonnes per year.

According to EUMOFA, the European Market Observatory for Fisheries and Aquaculture, French production was stable between 2011 and 2020, apart from a sharp decrease in 2015 due to significant mortalities.

of oysters in 2020. According to France AgriMer, the national body promoting seafood and agricultural products, home consumption of oysters in that year was 22,925 tonnes, leaving much to be enjoyed in restaurants and cafés. Christmas is the most popular time to eat oysters, and more are eaten in December than at any other time of the year.

Large-scale retail and outdoor markets accounted for 80% of the sales volume in 2020 and oyster producers travel for many

France is the main intra-EU oyster exporter, selling 10,035 tonnes in 2020, worth more than €66.5 million (£56.5 million). It is also the main importer from its neighbours, bringing in 6,541 tonnes worth €36 million (£30.6 million) that year.

To match its prowess in production, France boasts the largest apparent consumption, with consumers enjoying 76,000 tonnes

I tried to tell her that these were the tastiest bits!

hours to sell their product inland at local markets. I enjoyed chatting to several producers in the markets about the trials and tribulations of their industry.

Oyster production

Oyster spat in France may be produced in a hatchery or collected from the wild, where the larvae settle naturally on submerged chalked tiles or plastic discs threaded onto poles. Hatcheries allow for more control over the quality and characteristics of oyster spat and produce single seed, whereas wild spat is generally clumped together and needs to be separated before ongrowing in bag and trestle or floating systems.