Creating new reefs for native oysters

Farming warm water prawns in a cold climate

How is the sector faring?

Free from PFAS chemicals Free from microplastics

Slalåmveien 1, NO-1410 Kolbotn, Norway Ph.: +47 66 80 82 15 - post@netkem.no

05.12.2023 Fish Farmer Magazine for 2024

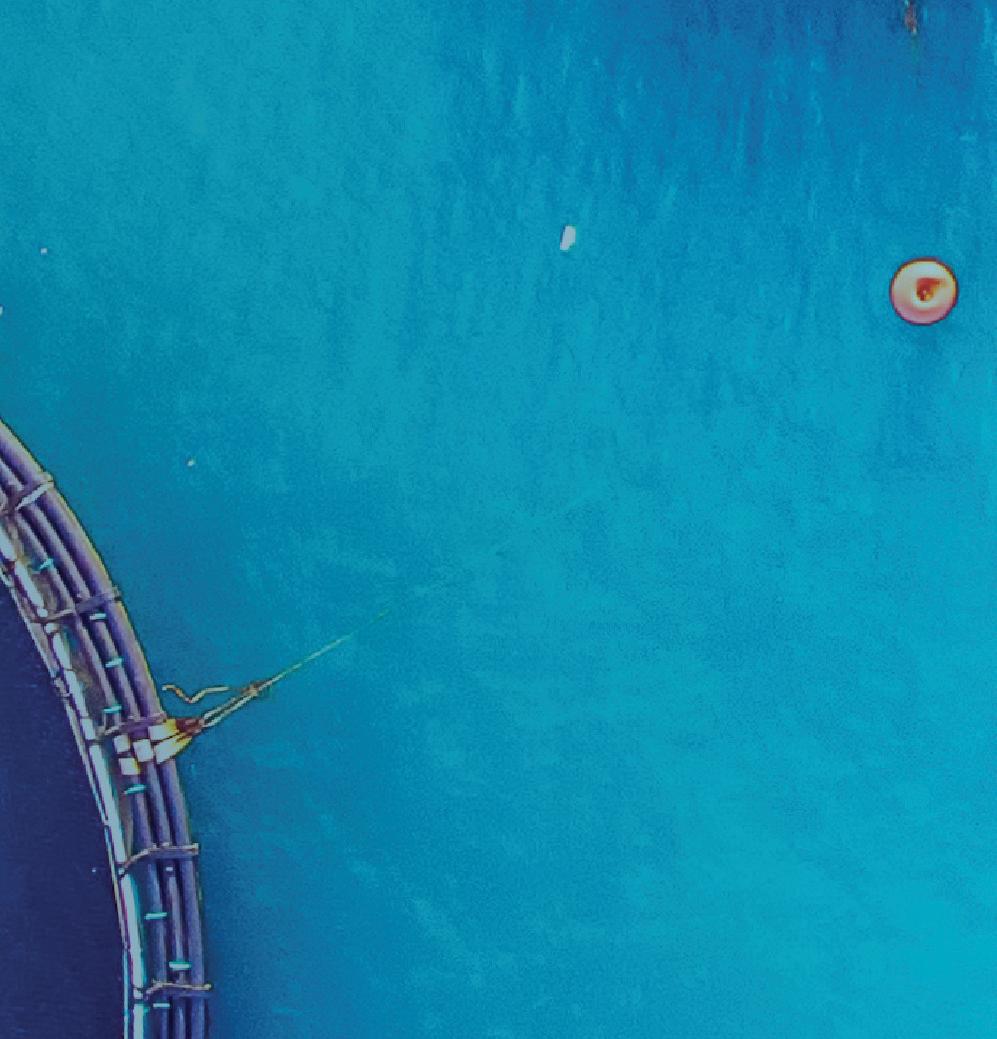

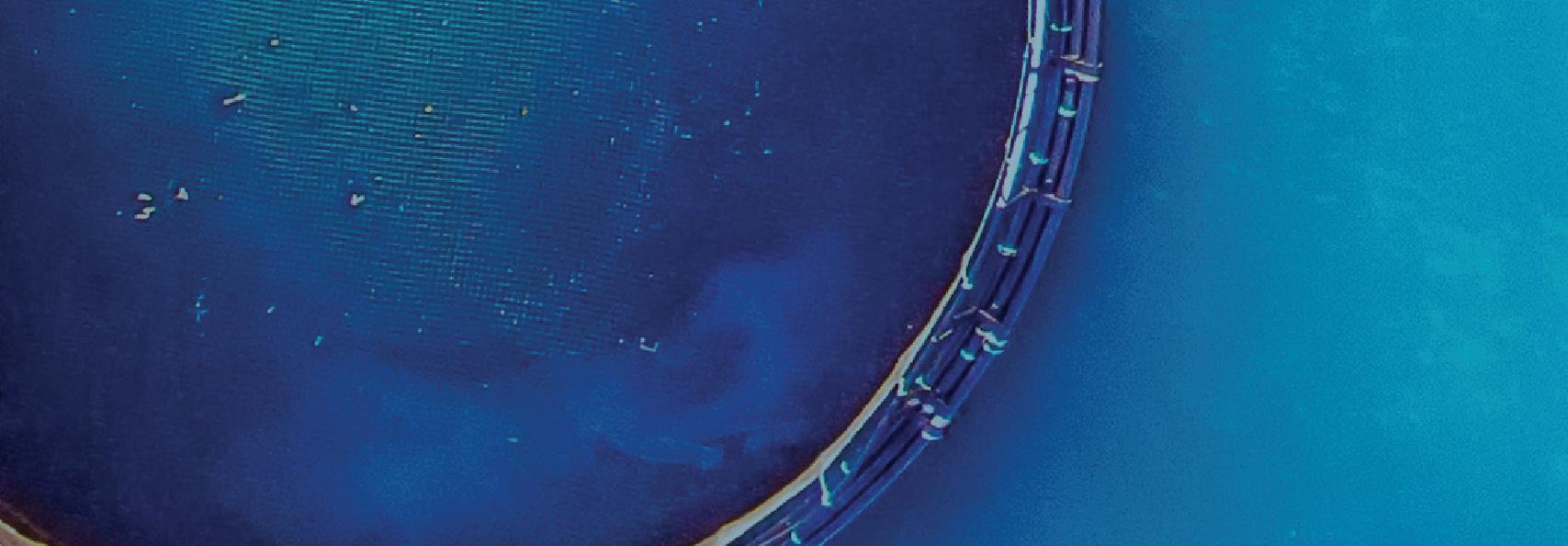

THIS month, Fish Farmer looks at a broad spectrum of the aquaculture sector, ranging from shrimp and oysters to salmon and trout. Our cover image depicts a boat laden with scallop shells, part of a project to recreate oyster reefs in the North Sea using “cultch”, hard organic material that acts as the perfect surface for native oyster spat to settle on and grow.

By using scallop and oyster shells from the seafood industry, not only is this ideal example of the circular economy helping to restore endangered native oyster populations, but it is also reducing the amount of waste going to landfill.

Also in this issue we look at some of the projects underway to create a European shrimp industry. Farming the world’s favourite tropical shrimp – L.vannamei, better known to UK consumers as “king prawn” – in a cold climate presents many challenges, not least in terms of energy costs, but there are already ventures taking shape that suggest that a sustainable, premium supply of fresh shrimp on our doorstep could be a reality soon.

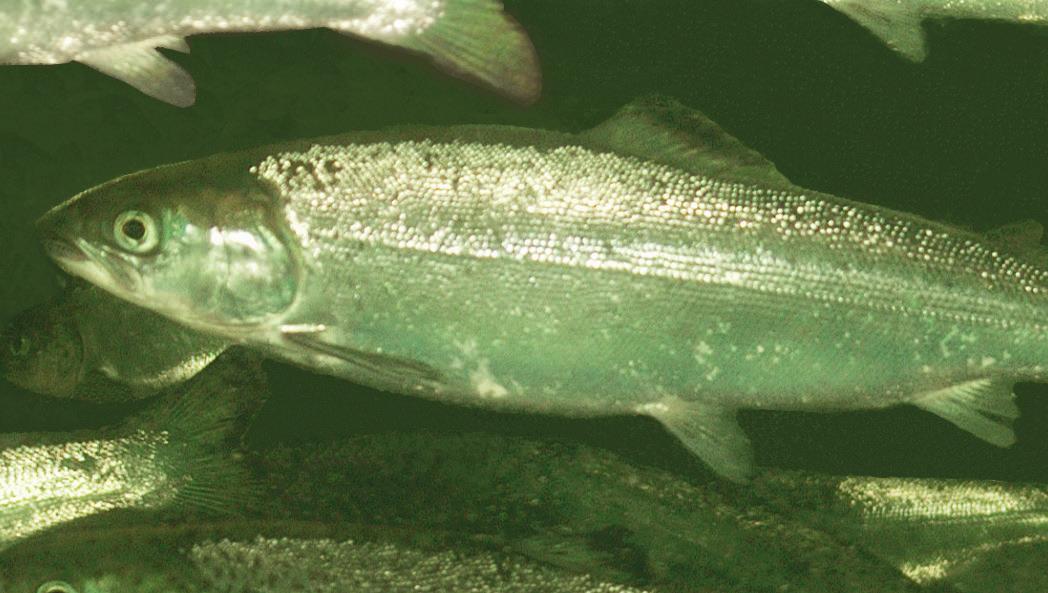

Our review of the trout industry internationally finds plenty of optimism among the producers of this arguably undervalued salmonid. Trout is in many ways a more robust fish than salmon, and at its best easily stands comparison with its rival, Atlantic salmon.

Martin Jaffa examines sentinel cages, one of the ways used to gather evidence on sea lice populations and finds the science to be wanting.

Salmon Scotland’s Tavish Scott reflects on lessons from a visit to the Faroes, and Nick Joy expresses some scepticism over the rush to RAS production.

Meanwhile, we also feature the embattled salmon industry in British Columbia and a restocking scheme in Washington state, in the USA, involving a helicopter airlift.

Finally we also look at two aquaculture projects in the UK that have run into opposition: the plan for a RAS salmon farm in Grimsby and an ambitious seaweed farming project off the coast of Cornwall.

Best wishes Robert Outram

Editorial advisory board: Steve Bracken, Hervé Migaud, Jim Treasurer, Chris Mitchell and Jason Cleaversmith

Editor: Robert Outram

Designer: Andrew Balahura

Commercial Manager: Janice Johnston

ohnston shfarmermaga ine com

ce Administrator: Fiona Robertson frobertson shfarmermaga ine com

Publisher: lister enne

@fishfarmermagazine

www.fishfarmermagazine.com

Fish Farmer Volume 47, number 10

Contact us

Tel: +44(0)131 551 1000

Fax: +44(0)131 551 7901

Email: editor shfarmermaga ine com

Head o ce: Special ublica�ons e es ark 496 Ferry Road, Edinburgh EH5 2DL

Subscriptions address: Fish Farmer maga ine subscrip�ons arners roup ublica�ons plc The Mal�ngs est Street ourne Lincolnshire PE10 9PH

Tel: +44(0)177 839 2014

subscriptions: £75 a year

subscriptions: £95 a year including postage all air mail

Tavish

Nicki

‘No cover-up’,

committee is told

A HEARING held as part of the Scottish Parliament’s inquiry into the salmon farming industry on 2 October was dominated by arguments over an alleged “cover-up” ahead of the MSPs’ visit to a fish farm in the previous month.

The Rural Affairs and Islands Committee of the Scottish Parliament is following up on a previous report, in 2008, on the salmon industry. As part of the inquiry, members of the committee visited a Scottish Sea Farms site at Dunstaffnage, near Oban on Scotland’s west coast, on 23 September.

Later that week, campaigning group Animal Equality UK released video footage which, it said, showed dead fish being removed from the pen in the early morning, ahead of the MSPs’ visit. Animal Equality UK Executive Director Abigail Penny said the removal of dead fish “morts” indicated that the salmon industry wants to “hide the truth” about mortality in farms.

She argued: “We urge the committee to see the industry for what it truly is: deceptive and deadly.”

At yesterday’s committee hearing, MSPs quizzed representatives of the salmon industry about the issue.

Dr Ralph Bickerdike, Head of Fish Health at Scottish Sea Farms, stressed that the morts removal that had been

filmed was a routine e ercise carried out at pens regardless of whether any external visitors were expected.

The pen concerned was one of seven that had been treated with fresh water and a certain number of mortalities could be foreseen. The numbers at the pen concerned were not out of line with typical outcomes, he added.

He stressed: “There was no attempt whatever to cover up.”

The industry’s arguments were supported by the Fish Health Inspectorate (FHI), which in a letter to the committee said that reported mortality levels at the Dunstaffnage site did not appear to be above that which would need to be reported.

a recognised aspect of animal husbandry.”

Tavish Scott, Chief Executive of Salmon Scotland, said: “This committee and our sector have been subject to a deliberate, orchestrated and coordinated campaign by antisalmon farming extreme activists, aided and abetted by some in the media. This is another deliberate attempt to derail the committee’s focus on what has changed in the Scottish salmon industry since 2008.”

The letter also stated: “The FHI would consider that this procedure would be consistent with the mortality removal procedures on Scottish aquaculture farm sites.”

The FHI stressed: “Whilst any mortality is regrettable and should be minimised, where possible, it is

Later in the meeting, Scott clashed with Conservative MSP Edward Mountain, who suggested that Scott had put him under undue pressure to take a less critical attitude to the salmon industry. Mountain quoted from a conversation Scott had not known was being recorded, but the committee’s Convener Finlay Carson ruled this topic was not relevant to that morning’s hearing. As this issue went to press, Cabinet Secretary for Rural Affairs Mairi Gougeon was due to give her evidence on the industry on 9 October.

NEW restrictions on the use of the in-feed sea lice treatment Slice will impede salmon farmers’ efforts to contro arasites fish farmers ha e arne . he cottish o ernment has re ce the amount of emamectin benzoate, known commercially as Slice, that can be administered, fo o ing a cons tation on a ne en ironmenta a it stan ar .

implementation period is too long, the salmon sector has estione the scientific asis for ma ing the changes in the first ace.

cottish ea arms ea of staina i it an e e o ment nne n erson sai the ha een set so o to rotect a fresh ater s ecies et ice is fe to the fish in a marine en ironment.

“What is the likelihood, if you think about the places where we’re farming, of a sediment which has emamectin benzoate resent in it fin ing its a to a fresh ater ar ae he ho e sector s a erage se of emamectin enzoate has een g ann a o er the ast fi e ears a sma amo nt of me icine se to treat arge n m ers of fish. he sea e area of im act is er sma so the ris is sma . his an the a sence of a i e ath a to the sensiti e fresh ater rece tor rea estions the j stification for hat is in rea terms, a freshwater standard being imposed within the marine en ironment.

he re ise rom te concerns that the treatment is harmful to crustaceans, has been applied since March 2023 to new or increased consents t no the cottish o ernment has irecte the cottish n ironment rotection genc to im ement the re ise stan ar so that a farms i ha e to com ithin months. hi e en ironmenta cam aigners sa the fo r ear

cottish ea arms ea of eterinar er ices onnie o tar sai ets on t ant to e eft itho t ice in their me icina too o . e commente ice which has been around for 25 years, is such an im ortant art of o r ice contro rogramme. We tend to prescribe it in the post-transfer to sea stage to try to delay and control the sett ement of j eni e Lepeophtheirus ice. t s a so er im ortant in managing the seasona in of Caligus lice that come from i fish an can ca se s en more se ere ice amage to arger fish. t s n i e e ha e eno gh consent to se it in those fish n er the ne r es an that orries me.

f o ant to see higher s r i a rates then on t ta e a a a ita me icine that s orts s r i a .

SALMON farmer Bakkafrost Scotland has been granted a licence for a treatment system to turn fish waste into fertiliser.

The pyrolysis unit, which turns organic sludge into inert biochar, will be based at Bakkafrost’s hatchery at Applecross.

The company said it was an important step in establishing its “circular economy” credentials.

The licence for the pyroliser was granted by the Scottish Environment Protection Agency.

The surplus is a by-product of the wastewater treatment process in the hatchery’s recirculating aquaculture system (RAS) facility. It consists of organic and inorganic solids held in water. The process dries the sludge and turns it into inert biochar which is used as a fertiliser and soil improver, refining the structure and water retention in soils. This process also “locks away” carbon permanently.

In the first stage, hatchery sludge, roughly 97% water, is treated by going through a filter belt. The water content is reduced to about 80% and the dry matter content is increased to about 20%.

The next stage requires the licence as it incorporates a pyrolysis unit which dries sludge at about 300°C, generating sludge pellets. These are then heated to 700°C without the presence of oxygen during a pyrolysis process. Heat is effectively absorbed and repurposed inside the system, increasing total energy efficiency. The end product is a biochar which is a material with a high stable carbon content.

Ian Laister, Managing Director, Bakkafrost Scotland, said: “In a RAS facility, substantial quantities of unused ‘waste’ materials are generated, which must be separated from the water

circulating back to the fish.

“Traditionally, that material has been considered waste, but technological advancements have opened the door to a more sustainable management process and that must be good news for helping protect our environment.

“All of this is very much in line with Bakkafrost Scotland’s sustainability goals and supports building a circular economy from farm to fork.”

Bakkafrost Scotland’s ambition for its RAS facilities is to reduce waste by 90 per cent, to use 100 per cent sustainable power and to reduce the water used in the process by 90 per cent. Hydro, solar, recycled material, and heat recovery systems will be used to reduce impact on the environment.

RSPCA Assured suspended three Scottish salmon farms from its animal welfare scheme, following allegations of animal cruelty.

Activists from campaigning group Animal Equality presented RSPCA Assured with drone footage showing that fish had been removed from the water for longer than the maximum 15 seconds allowed, causing them distress and risking suffocation.

The three farms are all on Scotland’s west coast: Loch Alsh, operated by Mowi; Fiunary, Sound of Mull, operated by Scottish Sea Farms; and Bakkafrost’s Ardcastle farm on Loch Fyne.

Animal Equality said: “In over a dozen incidents across the fourmonth period, salmon appearing to show signs of consciousness are left out of water for over one minute; one fish appears to suffocate for over three minutes. These instances of asphyxiation far surpass the RSPCA’s 15 second maximum allowance.”

The drone films also captured other instances of apparent abuse such as live fish thrashing in cages and salmon kicked along the deck of a boat. The incidents appeared to involve unwell fish that had been removed from the pen in order to be humanely despatched.

Abigail Penny, Executive Director of Animal Equality UK, said: “Here we have proof of over a dozen fish desperately struggling in their final moments of life – it begs the question: what else happens when no-one is watching? No industry of this scale, causing mass suffering to millions of animals each year, should ever be left to its own devices and, evidently, the Scottish farmed salmon industry needs far greater scrutiny.”

An RSPCA Assured spokesperson said: “We have launched an immediate investigation into these allegations and suspended membership of the three farms from the RSPCA Assured scheme, pending further investigation. This means they cannot currently market or sell any products under the RSPCA Assured label.

“As our inquiries are ongoing, we are unable to comment further at this time.

“Animal welfare is our absolute priority and we always take any complaints of poor welfare extremely seriously. We would urge anyone with any concerns about the welfare of animals on an RSPCA Assured certified farm to contact us straight away, without delay, so that we can immediately investigate and address any welfare issues as a priority.”

Scottish Sea Farms’ Head of Fish Health and Welfare, Dr Ralph Bickerdike, said: “Last month, we identified unacceptable lapses in best husbandry practice at one of our farms, following which we took immediate remedial action.

“This included issuing further guidance on how best to humanely cull poorly fish without delay; guidance that we issued cross-company in August to ensure all farms conform to best practice, at all times.

“To make doubly sure that this strict protocol is understood and upheld, our fish health team is also delivering and supervising additional refresher training in each of our farming regions.”

Scottish Sea Farms confirmed that its other farms continue to be members of the RSPCA Assured scheme.

SALMON ro cer o i cot an has transferre the first of its post smolts from Loch Etive to the company’s farm off the isle of Muck, on Scotland’s west coast.

o i sai the mo e as a significant mi estone . he och Etive sites were acquired by Mowi as part of its purchase of the fish farming assets of a nfresh in . he ha re io s een used to grow trout, but Mowi has repurposed them to grow post smolt salmon in conditions that, the company hopes, will make the transition from fresh to sa t ater more s staina e for the fish. Previously, individual sites at Loch Etive were fallowed at different times but Mowi’s new production plan includes six-month growth cycles to enable farms to synchronise fallow (empty) periods thro gho t the ho e och s stem. his rea in ro ction combined with the loch’s naturally brackish waters has helped to maintain a low sea lice population in Loch Etive, since sea lice do not o rish in con itions of o sa init .

ea ing a o t the ost smo t transfer en a fie

o i arming cot an re an aroes an t antic ana a sai he ost smo t sa mon ere in e ce ent con ition. am proud of everything we have achieved so far at Loch Etive which is pioneering best practice in aquaculture.

“Not only are we proving that there is a sustainable alternative to land-based post smolt production, we are also using new sea lice modelling to achieve greater monitoring and control of sea lice, combined with a new approach to fallowing, all of which is resulting in hea th ost smo ts rea to contin e gro ing at sea.

sa mon are feared to have escaped from a fish farm in orthern re an . he e artment of gric t re Environment and Rural Affairs is carrying out an investigation into the incident.

he a arm as raise on n a e tem er after a tear in a salmon cage at a site in enarm o nt ntrim.

Glenarm Organic Salmon is Northern Ireland’s only salmon farm, but the company has so far declined to comment.

Local anglers are already reporting the discovery of escaped salmon in the area.

ar o ston hairman of the Ulster Angling Federation, to e s in orthern Ireland that there was a danger that the escaped salmon will mix with the wild population. he ro ince has a re ati e sma so i fish farming sector and escape incidents on this scale are generally rare. he e artment of Agriculture, Environment and Rural Affairs said a report was made on the Sunday evening that “...a rip in the net of a farmed salmon cage had een i entifie at the site in enarm .

ORGANIC Sea Harvest has been given the go-ahead to create a ne fish farm off the coast of e j st a fe ee s after an ear ier attem t ha een t rne o n.

h anning committee ha ear ier ref se a ications for ne farms at a ma een an o igarr es ite anning officers recommen ing a ro a

he com an sai at the time it as isa ointe the ecision an o re ect on hat f rther action it nee e to rocee .

t ointe o t that the com an ha een farming sa mon in north east e since hen ermission for an initia t o cage gro s at n ertote an nacnoc as grante the anning committee. t a so sai it farms to some of the strictest organic standards in the world with accreditation from se era ea ing organisations.

n amen e a ication as asse to the f co nci ith officers recommen ing a ro a for a ma een t not o igarr .

rganic ea ar est ha re ce the n m er of cages from its initia ro osa s to i sa mon cages near o igarr an another at a ma een.

hose co nci ors ho o ose the ans agree that the roject co ring socia an economic enefits to e t sai the ere not consi ere s fficient to o t eigh the a erse is a an coasta im act on the s ecia a ities of the s ecia an sca e area.

ea ing to e s e ac nnes of rganic ea ar est sai e i ha e to re ect on to a in artic ar some of the comments that ere ma e mem ers. e ossi nee to re ert to some of hat as state

Organic Sea Harvest was established in ith the ision of fi ing a ga in the organic sa mon mar et.

t is a so the first ne

in e en ent o ne an o erate

sa mon farm in cot an for se era eca es going against the tren foc sing so e on raising organic sa mon.

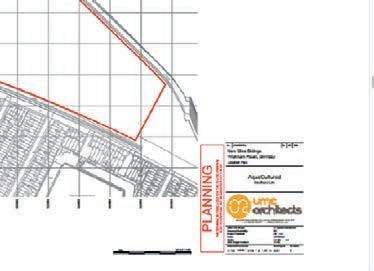

PLANS to build an £80m-plus landbased salmon farm in Grimsby face an extra hurdle following a High Court decision to grant a judicial review of the local authority’s planning decision in favour of the project.

The case was brought by the organisation Animal Equality UK, which has questioned the decision by North East Lincolnshire (Grimsby and Cleethorpes) Council, which granted permission for the project almost a year ago.

nima a it i arg e that the co nci s anning officers misdirected their committee by ruling that animal welfare concerns could not be considered as material factors in the decision-making process.

The company behind the project, AquaCultured Seafood, plans to produce up to 5,000 tones of Atlantic salmon for the UK

market within the next three to four years, in a recirculating aquaculture system (RAS) facility (pictured). Animal Equality is opposed to salmon farming whether on land or on coasts and fjords. It said: “In a bid to stop the construction of the site – put forward by start-up firm a t re eafoo t – Animal Equality now intends to argue in court that the committee’s decision to permit the site’s construction was unlawful, with committee members being told they could not take into account animal welfare.

“As a result, we believe that the highly likely catastrophic and irre ersi e anima e fare ramifications ere not inc e within their decision-making process.”

See special report, page 42.

JULY’S UK General Election saw many new faces elected to the Westminster Parliament – and in September several of them joined industry body Salmon Scotland at a breakfast briefing.

The event was hosted by Western Isles MP Torcuil Crichton, and it brought together several new politicians as well as long-serving MPs.

Those attending the breakfast event on Wednesday included Salmon Scotland Chief Executive Tavish Scott and representatives of member companies.

The MPs heard that Scottish salmon is the UK’s largest food export, with international sales increasing by 41 per cent in the first half of 2024, driven by substantial growth in the Asian and American markets and generating £431 million in value over the six months alone.

Around 12,500 jobs are reliant on the sector, with supply chain roles in every part of Scotland.

Salmon is also highly nutritious and has one of the lowest carbon footprints of any protein production.

Torcuil Crichton, MP for Na h-Eileanan an Iar, said: “Scottish salmon is due a boom in the next decade as global demand for good, low carbon and nutritious food grows.

“The challenge is to accommodate the expansion of farming while ensuring that communities reap the benefit of jobs and added value from this great Scottish product.”

Tavish Scott, Chief Executive of trade body Salmon Scotland, added: “It was great to be joined by so many of Scotland’s newest MPs and have the opportunity to highlight the

impact our sector has in each of the nation’s 57 constituencies.

“MPs were able to meet with representatives from Scottish salmon producer companies and learn about the thousands of supply chain companies which contribute to the sector’s success.”

the com an sa s.

Not only were colleagues helping clear debris from coastlines across Shetland, Orkney and the Scottish mainland, but each participating team was also awarded a £100 Heart of the Community donation for the local cause of their choice.This year’s event, which ran from Friday 20 to Sunday 29 September, was the company’s biggest yet with 16 beach cleans registered.

Kishorn Farm Manager Iain Flack said he and his team had a vested interest in protecting the coastal environment and were looking forward to working with other volunteers to help keep the shoreline pristine.

He explained: “It’s not a question of engaging with the local community, we are part of the local community.The majority of the farm team live in and around the area so it’s only natural that we want to look after it. The more of us locally who pitch in, the bigger the difference we’ll make.”

Scottish Sea Farms Heart of the Community Coordinator Jessica Taylor-McKaig said: “Our farm teams are involved in beach cleans throughout the year... but the Great British Beach Clean is great for enlisting the support of colleagues from across the wider company.”

PLANS to extend marine planning zones in Scottish waters have been put out to public consultation.

ish an she fish farms re ire anning ermission o t to 12 nautical miles, however local authority responsibilities for anning contro s c rrent on e ten to three na tica miles. Under new proposals, the marine planning zones will be extended.

he cottish o ernment arg es that c arif ing res onsi i ities an e ten ing the imits for oca anning a thorities creates the otentia for ne sites to ring in more in estment an jo s artic ar for is an an coasta communities.

nno ations in techno og mean that a ac t re sites can no e ocate f rther from the shore the o ernment sa s adding that these developments have the potential to reduce the en ironmenta im act of marine farming essening interactions ith i sa moni s an s orting farme fish hea th an e fare.

The 12-week consultation runs until 11 December and the document Extending Marine Planning Zones can be accessed online.

Public Finance Minister Ivan McKee said: “These proposals rogress o r ision for staina e ac t re commitment to e ore the reg ator frame or e on three na tica miles and to support innovation. Our proposals could boost the marine fish an she fish farming in str ith more o ort nit for e e o ment an se of ne techno ogies whilst ensuring consistency in roles and responsibilities and ro st assessment of e e o ment ro osa s.

“Protecting Scotland’s marine environment is crucial and supports marine industries. Developments must balance environmental impact alongside the economic opportunities. he enefits to coasta an is an comm nities co e significant an these comm nities in artic ar are encouraged to share their views.”

nforma cons tation has a rea ta en ace ith the oca anning a thorities a ac t re gro on ention of cottish oca thorities ea s of anning cot an o a ac t re reg ators a mon cot an ssociation of cottish he fish ro ers an ritish ro t Association.

tension of the marine anning zones o e carrie o t means of an affirmati e cottish tat tor nstr ment to amen he o n an o ntr anning arine ish arming cot an r er .

Hatch something new and watch your profits grow.

• Higher densities for higher pro ts

• High Market Value

• Low maturation, high survivability, triploid, disease-free

• Available 4 times/year: Oct, Jan, Apr, July

• Special 1st time trial pricing available Please email for more information

Helping you feed the world.

DANISH family-owned fish farming group Aqua ri has entered into a partnership with the van der Wees family, which is now the company’s ma ority shareholder of Aqua ri.

The two families said they share “a common ambition to consolidate and e pand the over 00-year-old company”. Aqua ri was founded by Anders riess in lyng re, enmark, in 00. enning riess and his cousin orten riess are the fourth generation of riess at the helm.

The company’s core business is the farming, processing and sales of trout,

trout caviar and fresh ander also known as pike-perch .

Aqua ri has a total of facilities in enmark, both on land and at sea. ports account for of the company’s business, with key markets including the Nordic countries, apan, ermany, kraine and the A. Aqua ri employs more than 00 employees, all in enmark.

nder the deal, the riess family will retain “a significant shareholding”, and enning and orten riess, who have led the company for the past 0 years, will continue in the management team,

working closely with the new , Ale andre van der Wees.

The van der Wees family is a rench entrepreneurial family with roots in retail.

Ale andre van der Wees said “ y family and I are proud to partner with the riess family, who, over the past years, have developed a beautiful company that provides high quality products and a great place to work I am particularly e cited to oin the team of e perts that make up Aqua ri, and I look forward to continuing to learn about the company through its operations and alongside industry specialists.”

enning riess said the new ownership marks the end of a thorough search for the right strategic partner.

e said “We have been looking for a partner to help us develop and grow Aqua ri for some time. ut we have also allowed ourselves to be picky and take the time needed.We first met Ale andre in 0 , and the ties that we have bound with the van der Wees family through the past five years have convinced us that they are the perfect partner. ur families share the same values and have a mutual and long-term ambition to develop Aqua ri, which is e tremely important to us.”

LAND-based fish farmer The Kingfish Company has signed an agreement with aquaculture supplier VAQ AS for the development and preliminary engineering of Phase III of its yellowtail kingfish farming facility in Zeeland, Netherlands.

The project involves a significant expansion of The Kingfish Company’s existing production facilities. The company has previously completed two construction phases in Kats, Zeeland, and already delivers high-quality yellowtail kingfish to the European market. The agreement with VAQ covers process and engineering services for planning a third facility at the site. Deliverables include the design of production facilities, RAS (recirculating aquaculture system) design, and relevant support systems with process and flow diagrams, as well as wastewater treatment.

The preliminary project began in early September and is expected to be completed by the end of 2024. The results will form the basis for The Kingfish Company’s final investment decision.

Vincent Erenst, CEO of The Kingfish Company, said: “This partnership marks a pivotal step towards scaling our sustainable aquaculture operations and continuing our commitment to delivering premium quality yellowtail kingfish using environmentally friendly practices. We look forward to working closely with VAQ AS to drive innovation and sustainability in the aquaculture industry.”

Above: Team photo from the signing ceremony ack ean- harles alette T , elipe squivel A enior ro ect ngineer , Tilla ygard oltermann A ept anager rocess iology , ram ohaan T ead of perations , Wesley arrant T ead lectrical ngineer , uibert ornelisse T Technical pecialist , hristiaan de Wet T ead of esign ngineering ront ondre idalen A , incent renst T

Sondre Høidalen, Managing Director of VAQ AS, commented: “We are very pleased to have won this exciting assignment in a highly competitive environment and look forward to expanding our experience from building complete salmon farming facilities to include a new fish species for us in collaboration with The Kingfish Company.”

ARCTIC-based salmon farmer Nordlaks has purchased a large site for its proposed new smolt facility.The company said the project will create 50 direct jobs and around 100 ancillary employment opportunities.

or a s confirme the mo e after signing a ea ith arsta Municipality for 70 acres of land at Rødskjær. It will be company’s fourth and largest smolt facility to date.

ec ti e irector ri e e sai f e manage to achie e hat e ant here at s j r it i ha e major ri e effects. here co e to jo s here an for e er jo e manage to create in Nordlaks, it leads to at least two more in other industries. In other words, it means up to 150 jobs, work for oca s iers an e en more hea th sa mon.

e a e e are no signing one of the argest an most important agreements of all time with a business operator. It is wonderful news that Nordlaks is approaching the realisation of its am itio s ans for s j r.

arsta har o r an arsta m nici a it are joint e e o ing commercia areas an a har o r on s j r ocate in the middle of northern Norway – and in the middle of the most populous region in the country.

his sho s the o er of the oca o nershi e ha e in the a ac t re in str in the region sai ari nne sa a or of arsta m nici a it .

s j r is a so seen as an attracti e siness area for sea ase in stries for the entire oga an region.

he a ac t re in str is e ecte to ma e a significant ro ortion of the e e o ments that i ta e ace on s j r in the coming years.The industrial area is expected to attract ne com anies an in estments an strengthen the region s economic foundation.

or a s a rea has significant acti it in the m nici a it ith three smo t faci ities in the area. he atest one i ho se se era mi ion fish.

The project will be in the billions (krone) range and will make it possible for Nordlaks to allow the salmon/smolt to grow larger on land before they are released into the sea.Traditionally, the salmon/smolt has been 150-200 grams when released into the

sea, while so-called large smolt is between 500 grams and one kilo.

or a s erations irector i in je ing sai allowing the salmon to grow larger on land, we reduce the time the sa mon i e in the sea. his re ces the ris of isease an the sa mon is ess e ose to ice. t sim ro i es etter fish e fare. o achie e this e nee more smo t faci ities. hat is h Rødskjær is important for Nordlaks, in addition to the fact that it i create man jo s oca .

nother a antage of a shorter time in the sea is that it i e ossi e to ha e greater ro ction in e isting faci ities. n other or s je ing sai there is etter ti isation of the ocations that are already in use today.

rigina the an as to acres of an t the roject was scaled down to 70 acres.

e e sai e en e a ing mi ion [around £5m] in tax last year, an increase of 164% from the re io s ear. hen o r in estment ca ita is so significant re ce there are of co rse conse ences t e are sti er ha to ta e a ste for ar in rea ising this roject.

NORWEGIAN seafood exports continued their record run in September, totalling NOK 11.6bn (£828m) – an increase of 6% by value on the same month last year. The volume, at 141,600 tonnes, represents a rise of 9%.

It was also a strong quarter (July to September) for salmon, which now accounts for 70% of all seafood sold, with 372,442 tonnes sold at a value of NOK 31.8bn (almost £2.3bn).

Seafood Norway said the quarterly value increased by NOK 997m (£71m) or 3% in value and 8% in volume on Q3 a year ago.

As usual Poland and Denmark, which have large salmon processing sectors, along with the United States, were the largest markets.

Seafood Council analyst Paul T Aandahl said growth in Germany, particularly in home consumption, has been particularly strong.

He added: “At the same time, the consumer price is falling compared to the same period last year. This strengthens the competitiveness of salmon compared to other proteins.”

Farmed trout exports also did particularly well with a record 25,033 tonnes sold during the quarter at a value of NOK 2bn (£144m). The value increased by 24% and the volume was up by 34% .

All Norwegian seafood exports hit a Q3 record of NOK 44.1bn (£3.15bn) which was 5% higher than Q3 12 months ago.

Seafood Council CEO Christian Chramer said: “Thanks to a historically high export value in September, we have put behind us the best third quarter ever.

“This time there is, so to speak, no currency effect from a weak Norwegian krone, since we are comparing with the same period last year.

“There were high volumes for salmon, trout, mackerel and prawns which drive up the export value.”

Aquaculture also appears to be compensating for reductions in fishing catch quotas, most notably for cod and haddock.

TONE ellesvik pictured has been appointed as ales anager at Norwegian cod farmer de. he brings over 0 years of e perience in the seafood industry, with e pertise in the sales and marketing of whitefish. ellesvik was previously ales irector at Nordic roup and has previously served as ales irector at companies such as omstein and Terra eafood. de, one of the country’s leading cod farmers, currently operates five sea facilities and has its own hatchery.

THE slo government has persuaded ra il to fully open its market to Norwegian seafood, most notably salmon. nder the agreement, Norway’s ood afety Authority can issue health certificates for aquaculture products e ported to ra il. The health certificate covers all species and products from aquaculture, from fillets to whole, gutted fish and all forms of preservation, including smoked products. owever, farms that have suspected or proven I A or pancreatic disease will not be included.

FOR the first time, more than half the fresh cod e ported from Norway last month was farmed. Two months ago the ratio was a third, which demonstrates the impressive growth in this still relatively young branch of aquaculture. The total eptember fresh cod e port figure was , 00 tonnes and worth N

THE giant ortuguese supermarket and food group er nimo artins Agro-Alimentar

A has purchased two million shares in the Norwegian landbased salmon producer Andf ord almon for an estimated N 60m . m , adding to the retailer’s e isting stake in the company.

The shares were bought from Andf ord oldings A at a price of N 0 each.

er nimo artins AgroAlimentar A A is a company closely associated with Antonio errano, who has been a member of Andf ord’s board of directors since 0 and is also of A. e is a former ortuguese inister of Agriculture and isheries.

Andf ord olding is a company associated with ounder and oard ember oy ernt ettersen, who said he was happy at the purchase as A had played a key role at board level in Andf ord’s success.

The deal makes up a little under three per cent of the outstanding shares in Andf ord almon, but it does reflect the gradual but increasing overseas interest in Norwegian salmon businesses.

ocated on the island of And ya in the Arctic archipelago of ester len, Norway, Andf ord almon has developed an innovative aquaculture system for the shore-based farming of Atlantic salmon, based on its patented fl ow-through technology.

er nimo artins AgroAlimentar A was created in 0 to safeguard the ability of ortuguese food retail companies to supply themselves directly with strategic products, ensuring food security and availability. It operates several hundred food stores in ortugal, oland and in olombia, outh America.

A operates in four principal business areas dairy, agriculture, aquaculture, and fruits and vegetables.

In aquaculture A started to produce sea bass in ines through eaculture in 0 6, followed later by the production of sea bream in adeira in partnership with a local company. In 0 , eaculture was granted licences to build from scratch offshore aquaculture units in the Algarve to produce sea bream and sea bass.

million 6. m . While volumes were slightly down, the value rose by with of that total coming from Norway’s cod farms. eafood ouncil

Analyst Thomas akobsen said this is the first time that cod farm production has overtaken the trawler catch in the fresh category.

SOME of Norway’s largest salmon companies are in for an anxious time as they await the European Commission’s ne t mo e o er a ege rice fi ing. three a hearing in Brussels with the EU’s competition authorities came to a c ose on e tem er.

If found guilty, the salmon producers face the prospect of eing fine to of their ann a g o a t rno er. n the case of o i ase on its sa es this co tota m aro n m an for a ar it co e to m.

However, it is unusual for the EU to impose maximum ena ties in s ch cases.

It is not known how long the companies will have to wait, t it co e se era ee s. simi ar a egation in the United States has already been settled, costing the salmon farmers m m s an a itiona m . m to c ose ana ian c aims. he sett ement i not inc e an a mission that the com anies ere at fa t. It was thought then that the EU, which takes a strong stand against cartels of any kind, might also settle but that has not ha ene .

he si com anies ha e a strong enie the a egations hich go ac a most fi e ears to hen the as sti art of the . t the time in estigators rai e some of the cottish offices of or egian o ne com anies. he com anies ha ear ier een gi en ermission to st the EU investigation documents, allowing them time to is te an thing the containe . his has no een fo o e up by the hearing last month, which was held behind closed oors.

he sa mon com anies are a so facing a simi ar c aim of aro n m from se era of ritain s ea ing retai ers as e as a c ass action s it re resenting cons mers t if they are cleared by the EU those claims would become har er to s stain.

THE jellyfish scourge which cost Norwegian salmon companies millions of krone last winter may be on the way back.

The Norwegian Institute of Marine Research, through its Jellysafe project, says there have been increased sightings of the “perlesnormanet” jellyfish – also known as string or barbed jellyfish – and estimated numbers are now running at the same level as last year.

So far, however, no salmon farmers have reported any losses from this growing and serious problem.

Jellyfish attacks adversely affected almost every major salmon company in Norway last year – and some in Scotland – leading to the premature deaths of millions of salmon.

Some colonies were up to 30 metres long, but when broken up they got into the cages, killing the fish.

Jellysafe said the number of weekly Apolemia uvaria observations continues to increase in a pattern similar to the autumn last year.

A cluster of Apolemia was observed in salmon farming area PO3 near Bergen.

The institute has been carrying out research on how much of the damage and huge cost of last winter can be prevented. It says that the industry may be able to help. Jellysafe is invitingfish farmers to participate in a discussion forum to share experiences, get quick access to results and help the project to continuously come up with solutions that will prevent major damage in the cage.

The institute also wants samples from along the coast, so it can see if there are genetic differences between the various groups and those from last year, and it has offered to send out sampling kits.

FAROESE fish farmer akkafrost has reported a significantly higher third quarter harvest, with its cotland arm showing a marked improvement.

The aroe Islands produced ,600 tonnes, a rise of , 00 tonnes on the same period months ago.

The harvest in akkafrost cotland, which is now recovering from various biological issues, totalled , 00 tonnes against , 00 tonnes in 0 . All harvest volumes are provided in head-on gutted equivalents.

eed sales in 0 were , 00 tonnes with the group’s feed subsidiary avsbr n sourcing 0,000 tonnes of raw materials in the three months uly to eptember.

esults during the previous quarter were badly affected by a month-long general strike which almost paralysed commercial activity on the aroe Islands.

The stoppage proved costly for akkafrost because the harvest had to be delayed until after the dispute was settled which was also a period when salmon prices dropped sharply.

akkafrost has since highlighted ma or

progress in cotland, resulting in increased revenues and profits.

It said in August that an early harvest policy and sourcing smolts from its own in-house production had helped to achieve ma or improvements.

The company added “ ne key element of this strategy is to harvest around 0- of the planned total harvest volume for 0 during and , ahead of which tends to bring more biological challenges in cotland.”

The full third quarter report, when more details on strategy should become known, will be released on November.

T e port value of Icelandic farmed fish has reached more than 0m I . billion during the first seven months of 0 , according to the latest official figures.

tatistics Iceland said most of this was due to higher salmon sales, which are now starting to rival other northern hemisphere salmon producing countries. Iceland’s salmon e ports between anuary and uly this year totalled I . bn almost m , higher than in the same period in 0 .

The growth in salmon farming over the past few years is little short of phenomenal. In the past seven years they have increased tenfold to I . bn in 0 . They fell somewhat last year, due to a number of farming facilities being out of action for various operational reasons.

Icelandic salmon companies have been stepping up production this year and a

number of new salmon farm pro ects are currently underway, suggesting that e ports will continue to increase at pace.

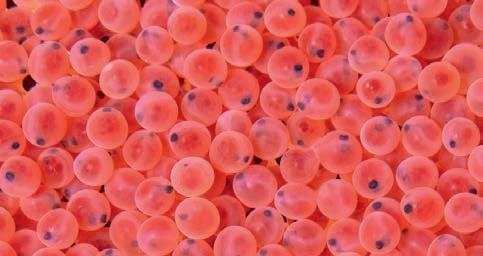

There was a slight reduction in Arctic char a form of trout sales during the first half of this year which totalled m. tatistics Iceland said it was a similar story for the high tech product fertilised salmon ova, which was worth around I billion . m .

In fact the pace of Iceland’s farmed fish e ports accelerated even further during August, for which figures have ust been published. They were worth I . bn around m , an increase of 60 on a year ago.

Iceland’s salmon output generally speeds up during the high summer months, but there is no doubt that the country’s salmon sector is now becoming a force to be reckoned with.

NORWAY has secured an agreement to sell more seafood into the European Union.

The agreement, which will greatly help Norway’s salmon producers, was reached through the EEA (European Economic Area) which also involves Iceland, another important seafood supplier.

The EU bloc is Norway’s largest salmon buying area with Denmark, the Netherlands, Poland and France the main markets.

Norway’s Fisheries and Oceans Minister, Marianne Sivertsen Næss, said the deal provides higher duty free quotas and export opportunities for Norwegian products, both fisheries an a ac t re.

Negotiations to agree on the next period of EEA-EU trade relations formally began in June 2022. In June this year, the agreement was approved by the Council of the EU, which represents the member states.The agreement will now be submitted to the Storting, Norway’s parliament, for approval.

he minister sai fi e roce res for enacting the agreement mean that it will take a few months before the industry can start using the duty-free quotas.

he sai e are in ia og e ith the to fin a so tion that helps the industry to draw on the duty-free quotas as soon as possible.This is something Norway has worked for all along.”

However, it may still take some months before the seafood industry is able to activate the new export quotas.

UP to 10,000 salmon in northern Norway have reportedly been killed by poison gas.

The regional newspaper Lofotposten said the incident took place at Eidisholmen outside tamsund.The fish had an average weight of around two kilos. The gas is reported to be hydrogen sulphide, sometimes called sewer gas. It is colourless and known for its pungent “rotten egg” odour at low concentrations. It is e tremely flammable and highly toxic and can occur naturally under certain conditions.

According to Lofotposten, the incident affected a site owned by Isqueen, a local family-owned

salmon farming company.

Isqueen was quoted as saying the problem first became apparent earlier this month when gas bubbles, smelling of rotten eggs, were observed.

Production manager Henrik Svendsen told the newspaper that the deaths are believed to have been caused by the period of unusually high summer temperatures.There have also been unusually calm seas, and a reduced water flow in the facility. The company has informed the Norwegian Food Safety Authority.

Isqueen AS is run by the Svendsen family and was previously known by the name of Lofoten Polarlaks.

NORWEGIAN fish farmer

almon volution is moving decisively toward a full year harvest target close to ,000 tonnes, according to the company’s latest market update.

The company operates a landbased salmon farm, using a hybrid flow-through system, at Indre ar y on the Norwegian coast.

It reported a third quarter output of 6 0 tonnes head on, gutted taking the 0 second half total to around , 00 tonnes and the full year to appro imately ,000 tonnes.

almon volution said it had had good biomass build-up during the quarter, with steady improvement in the daily growth rates and continued strong results on key parameters such as feed conversion ratio, mortality and superior grade share.

price realisation of N per kg . .

The report said the 6 0-tonne harvest had a superior grade share of , and an all-in

The average weight of . kg was up by 0 from the second quarter this year. The standing biomass had reached , tonnes

by the end of last month.

“The biomass production is steadily improving at Indre ar y, with a wide range of initiatives ongoing to take out the full growth potential”, Trond kon chaug- ettersen said.

e added “The standing biomass is close to record levels going into , which together with a further increase in e pected harvest weights, makes us well positioned to capitalise on the e pected price rebound.”

A few months ago almon volution signed a deal to start building the second phase of its Indre ar y pro ect.

The agreement was with the flow-through, hybrid and A technology company Artec Aqua and the construction firm ent A . With capital now in place through a private placement of equity, construction work is e pected to start this autumn on phase .

THE world’s largest producer of Atlantic salmon has spelled out a strategy to cement its leading position in the industry in the coming years.

The Mowi group’s plan is to grow production volume by 100,000 tonnes as well as making cost “improvements” of €300m-€400m (£250m-£333m). Mowi is also considering moving to other methods of salmon farming in addition to coastal operations.

CEO Ivan Vindheim (pictured, at the group’s Capital Markets Day presentation in September) said: “After reaching a milestone 500,000 tonnes of salmon harvested in 2024, we are now looking ahead to the next milestone of 600,000 tonnes which we aim to fulfil in 2029.

“We will achieve this through better utilisation of licence capacity, while also improving productivity and biological performance of existing production through our investment in post-smolt.” Furthermore, he added, Mowi is planning an ambitious cost improvement programme, building on a drive launched in 2018, which has led to €300m (£252m) in savings through 1,700 different initiatives.

He said Mowi’s strategy is built on three pillars – volume growth, competitive costs and sustainability. The company has grown from producing 375,000 tonnes of salmon in 2018 to an expected

500,000 tonnes in 2024. Now Mowi plans to continue that trend.

“We have grown faster than the rest of the industry in recent years, and our goal is to continue to do so in the future. By releasing more smolt and increasing our use of post-smolt we will be able to harvest 600,000 tonnes of salmon in 2029, thereby reinforcing our position as the world’s top producer of Atlantic salmon,” Vindheim added.

In addition to the company’s post-smolt venture and the improvements in biological performance that it brings, Mowi’s digitalisation and automation strategy is also central to the company’s plans.

“We launched Mowi 4.0 in 2021 and since then have invested heavily in a range of measures to introduce greater efficiency and automation across our value chain. We are already seeing the positive impact this has had on sustainability, productivity and cost reduction, and we expect to reap further benefits in the years to come,” Vindheim said.

Continued growth in Mowi’s farming operations will in turn lead to growth in its two other divisions,namely consumer products and feed. “The rest of the supply chain will grow in line with farming going forward. To produce more salmon we need more feed, and more salmon means more raw material for our 20 secondary processing plants around the world,” the CEO added.

The company estimates revenue growth of 7-8% per year over the next five years, resulting in revenue of €8.5bn (£7.1) in 2029, compared with €5.5bn (£4.6bn) in 2023.

Mowi’s focus has been and will continue to be sea-based salmon farming and related technology, Vindheim stressed. He said, however, that the company is nonetheless closely observing developments in other technologies and is prepared to adopt new technologies as and when the time is right and they show themselves to be profitable.

The company said it is also looking to grow through selective acquisitions, provided they fit into the company’s operational strategy.

CHARLES Høstlund, the former head of Norway Royal Salmon (NRS), has been appointed as CEO of Nordic Aquafarms, the land-based fish farmer.

He had been chairman of Nordic Aquafarms and his elevation follows the departure of the previous CEO, Bernt Olav Røttingsnes, who had earlier indicated he wanted to step o n after si ears in ost. Høstlund is a highly e erience fish farm executive, who helped to build NRS into a leading salmon company which at one time had exciting offshore am itions.

we are now in a phase where the focus will be on successfully farming yellowtail ingfish an e are sure that Charles is the right person to lead the group in this hase.

He also thanked the outgoing CEO Bernt Røttingsnes, who will continue to carry out work for the company in future, for his contribution to or ic afarms.

Charles Høstlund said:

“I know the group and the employees well after several ears on the oar .

The Hydrotech Drum Filter Value series focuses on reduced maintenance, increased component quality and simplified operation – all to give your plant maximum filtration performance at a minimum operational cost.

It was later to become part of the integrated seafood group NTS, which as then o ght a ar.

Nordic Aquafarms said Høstlund will add valuable expertise to the company in the phase the company is now entering, with the aim of becoming the leading a er in e o tai ingfish farming.

Nordic Aquafarms Board Member Haakon Aschehoug said: “We are very pleased that Charles Høstlund is ta ing o er as . fter several years of developing our land-based facilities in Norway and Denmark,

“The company has three well-functioning landbased facilities for breeding e o tai ingfish an controls the entire value chain from broodstock to sale, which makes us well equipped to develop the group to become the leading player in the production and sale of e o tai ingfish.

Nordic Aquafarms has an impressive yellowtail ingfish ortfo io ith a hatchery with its own broodstock in BedstedThy, Denmark, and growth facilities in Hanstholm, Denmark, and in re ri sta . he gro is also working to launch a facility for the production of e o tai ingfish in re a a ifornia.

Contact us!

Call +46 (0)40 42 95 30 or visit www.hydrotech.se

PROXIMAR eafood has sold the first salmon from its ount u i facility straight into the apanese market. This achievement for the company also marks the first harvest in apan of domestically produced farmed salmon. oachim Nielsen, of ro imar eafood, declared “The completion of the first commercial harvest is marking an operational and commercial pivotal milestone.

“ ro imar is the only supplier of domestically produced Atlantic salmon in apan, years ahead of competition.”

e added “We have since ctober 0 proven great production capabilities and fish growth, and I am now immensely proud to see all the hard work from our e cellent team being commercially validated through the first harvest.”

There was strong interest in the sale with the fish fetching attractive prices. The harvested salmon averaged kg head on, gutted with 00 superior quality, and ro imar confirmed the price achievement aligned with the company’s e pectations

of premium prices compared to the import price to apan of Norwegian Atlantic salmon. Nielsen said “ ur Atlantic salmon shows high quality and based on the feedback from our partners and others, I am confident that we are providing apanese consumers with a longed-for local product with unparalleled freshness.

“The harvested fish will be shipped to customers in the reater Tokyo region. This was a trial harvest of appro imately . tonnes, to confirm that all equipment and processes work smoothly. ro imar plans to initiate daily harvesting in late ctober.”

ro imar is also releasing a new brand name and logo “ u i Atlantic almon”. This trademark will be used to build ro imar’s brand in apan and Asia, positioning the company as the market leader of apanese-produced Atlantic salmon to Asian consumers.

“ ount u i is an iconic landmark in apan, and the area is known for high quality water resources. The location of ro imar at the foot of ount u i is believed to have a positive value in terms of marketing and branding, not only in apan but also in the entire Asian region,” Nielsen said.

NORDIC Aqua Partners, the Norwegian company operating a land-based salmon farm in China, has raised the equivalent of another £25m in capital.

Nordic Aqua Partners produces salmon at Ningbo near Gaotang in eastern China and successfully completed its first harvest six months ago, with the first operational harvest of 523 tonnes following a few weeks later.

But in late July the company was forced into a surprise cull after detecting a high concentration of the off-flavour compound geosmin, which is harmless to both fish and humans but can affect the taste of the salmon.

On 26 September, Nordic Aqua Partners confirmed the issue of 4.676 million shares at a price of NOK 75 (£5.39) which brought in a total of NOK 350m (£25m).

The company said: “The net proceeds from the private placement will be used to, together with indicative debt financing and cash on hand, (i) to fully fund the estimated Stage 2 build out, (ii) to repay short-term debt facility, (iii) for Geosmin improvement capex, (iv) towards working capital build up and (v) for general corporate purposes.”

Nordic Aqua is actively focusing on building market

distribution and brand exposure in the current phase. It is particularly prioritising the establishment and development of lasting customer relationships in important premium segments, in order to optimise the value achievement of its premium product, Nordic PureAtlantic.

Located in Ningbo, China, Nordic Aqua describes itself as the first local producer of truly sustainable and super-fresh Atlantic salmon to the Chinese market.

SALMON production is forecast to grow by 3.5-4.0% in 2025, resulting in a slight decline in spot prices for the full year, according to the latest research from market research firm ontali.

This growth, the firm says, is driven largely by a recovery in Norwegian and uropean productivity.The difference in price achievement between the first and second half of 2025 is expected to be around €3 per kg (£2.53).

In terms of volume for 0 , Norway’s will increase by at least 0,000 tonnes Whole ish quivalent W and the rest of urope by at least ,000 tonnes W , the ontali forecast predicts.

This pro ection for 0 comes on top of an increase in harvest volumes for 0 o for aroe Islands, Iceland, Norway, and the . emand from high-value food-service segments such as sushi restaurants in urope, North America, and Asia hina and ong ong has recovered strongly following the ovid- pandemic and continues to support high prices in the first half of 0 .

owever, the regulatory regime ma imum allowable biomass and sea temperatures will determine final production levels. loser to 60 of global volume is e pected to be harvested and sold in the second half of 0 , with retail as the primary end-sales channel to consumers. or producers, value growth in 0 is anticipated to be driven by increased volumes, particularly through retail promotions and campaigns for farmed salmon, rather than higher spot prices.

THE big Chilean salmon farmer Nova Austral, which fought back from the brink of bankruptcy earlier this year, is continuing to remain positive.

Publishing its 2024 second quarter report, the company said that although prices experienced a downward trend in the April to June period, they were still expected to remain higher than the general market due to contracts that had been agreed earlier.

evenues were down by to . m 0. m due to a smaller harvest but the gross loss however fell by 00,000 to . m . m .

Nova Austral’s Trim prices at the end of June 2024 were 6 above the rner Barry prices. Urner Barry is a renowned business publisher which specialises in accurate and unbiased reporting of food related market information.

uring the period, ,000 smolts were delivered, with ,000 of them stocked in Nova Austral sites and 330,000 sold to third parties.

The company said there were no extraordinary mortality incidents experienced during the last months.

The company had six farm sites operating and planning to stock three more farm sites before the end of the year.

On sales, the company said it was continuing to focus on value added products, with the United States and Europe expected to remain its main ob ective markets. It said the strategic focus will be on fresh products and frozen portions.

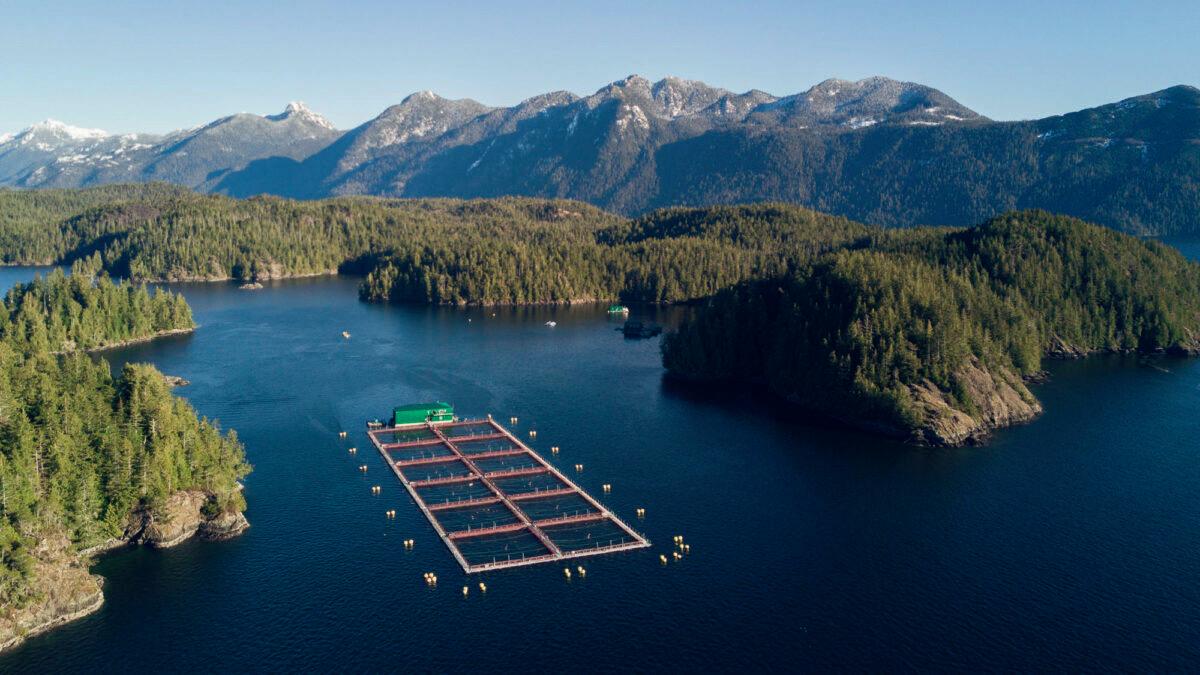

A salmon and a rare breed of skate can co-exist around Tasmania, new data has shown.

Last year there were calls to the authorities for aquaculture on Australia’s southern island province to be scaled back due to fears about the future of the Maugean skate.

But the latest information is that the Maugean skate population has not only stabilised but there are as many uveniles in acquarie arbour now as there was 0 years ago.

The highly respected Institute for Marine and Antarctic Studies research found that the population of the skate stabilised in 0 , with no overall further decline in the three years since.

It also found an increased presence of young Maugean skates back to 0 levels, and labelled the findings a “positive sign” and a “ray of hope” for the future of the skate.

Salmon Tasmania CEO Luke Martin said the new IMAS research, coming on top of other data indicating water conditions had recovered to the best levels in over

a decade, confirmed it would be a very unreasonable response by the ederal nvironment inister Tanya Plibersek to consider shutting down salmon aquaculture in Macquarie Harbour.

“As an industry we have never shied away from concerns about the Maugean skate, and indeed we have invested heavily in the scientific research and analysis that is now shaping the conservation response to ensure the future of the species in Macquarie Harbour.

“We have also consistently said we expect all regulatory decisions made about our industry’s presence in the harbour to be based on science, and not political agendas, or in response to pressure from single-minded activist groups.”

e continued “Today, we have further science that confirms the Maugean skate population stabilised three years ago and that the number of uveniles is at a decade high,” Luke Martin said.

“This follows science from the independent EPA last week

Above: Fish farm, Macquarie Harbour, Tasmania

that showed the oxygenation of acquarie arbour is the best it’s been in more than a decade.

“The science irrefutably shows that the skate and the harbour are on the improve, all while salmon aquaculture continues.

“It confirms the adaptive management approach adopted by regulators, with the full cooperation of our industry, is working and can

continue to support an industry presence in the harbour that is so critically important to the economic and social wellbeing of the local community. “

artin added “We also e pect other stakeholders in Macquarie Harbour, particularly Hydro Tasmania, to step up and share responsibility for the long-term management of the harbour.”

anuary to uly 0 , cumulative fishmeal production increased by almost 6

compared with the same period in 0 , according to the latest update from the marine ingredients organisation I . This, I said, was due to a significant year-on-year increase of the eruvian supply after a productive first fishing season of 0 in the North- entre of eru. ish oil’s global cumulative output through uly 0 was appro imately 0 higher year-on-year.

a iet a ese fish far s estro e as t hoo agi ta es its toll

Typhoon agi, as it has been called, swept through parts of southern Asia in recent days tearing up aquaculture and fishing facilities. The damage is estimated to be at least 0m m with some businesses likely to find it difficult to recover. According to local reports many small fish

farming businesses have been left with little but a great deal of debt, with their livestock and facilities all but wiped out. ietnam’s eputy inister of Agriculture and ural evelopment hung uc Tien said the storm has had a severe impact on aquaculture and livestock farming.

COOKE eafood’s A division is celebrating 0 years of aquaculture operations in the state of aine. The group has more than 00 employees in the east coast state which is now arguably the most important salmon farming area in the .

roup lenn ooke said “We have many long-term employees who have been with us from the start, and we thank them for their dedication and are grateful to all those who have oined us over the years to grow a sustainable local business.”

THE anadian ederal overnment has finally published its transition plans to end open pen farming in ritish olumbia.

The move comes almost five years since the government first said it would formulate a transition policy. It then said in une that a scheme was on its way but that it was further delayed.

The plan outlines how the government intends to move forward with support for irst Nations, communities and workers that depend on the industry.

It says its aim is to make ritish olumbia a world leader in “innovative and clean aquaculture technology”.

The ttawa government has come under strong criticism from the industry and some irst Nations groups who want traditional salmon farming to remain.

ther irst Nations groups support the government, claiming that open pen farming is a threat to wild salmon on which they depend.

The almon armers Association, which represents more than 60 businesses, said at the weekend it had received the draft transition framework and would now take the necessary time to review it.

Its statement continued “ ur sector has submitted thousands of pages of documentation to the federal government to show its commitment to this process, and our hope is that these efforts are reflected in the draft transition framework.

“ owever, we continue to stress that the timeline for the transition to closed containment by 0 is unrealistic, unachievable and risks significant negative impacts on our sector and the communities that depend on it.

“We remain committed to evolving responsibly in partnership and or agreement with irst Nations in whose territories we operate to enhance wild salmon recovery efforts, support self-determination and the path of reconciliation with irst Nations, reduce any potential risks from farming, foster economic growth in rural and coastal communities, drive technological innovation and development, and build a thriving lue conomy in .”

It added “We will have more to say in the coming days as we review the draft transition framework in more detail.”

FLORIDA-based salmon farmer

Atlantic Sapphire has reported a much brighter picture for production during the third quarter of this year.

The company processed 1,300 tonnes against 365 tonnes during the July to September period 12 months ago when temperaturerelated challenges resulted in slower growth.

Atlantic Sapphire said that the harvest weight had increased during the quarter, as the standing biomass had been adapted to the current, more limited feeding capacity during the quarter.

During Q3, the statement said, biological development progressed favourably with stable water quality and temperatures, low mortalities, and increased harvest weight throughout the quarter following the operational measures taken to

increase harvest size.

The realised average harvest weight was 1.42 kg (head on, gutted) in July, and 1.55 kg (HOG) in August, and 2.19 kg (HOG) in September.

Atlantic Sapphire expects further increased average harvest weight in the fourth quarter this year.

CEO John Andreassen said in the company’s annual report that the first part of a “challenging” year had been focused on resetting the biofilters, which he described as “an enormous task” as the company had to continue fish farming at the same time.

NEW Zealand is planning to move into commercial kingfish farming as part of a plan to further develop its growing aquaculture sector.

The southern hemisphere country is already a major producer of salmon but it sees this high value white flesh species, which is becoming increasingly popular in Europe and the US, as an important addition.

The research body NIWA (National Institute of Water and Atmospheric Research) says such a move is now a reality for the country.

The kingfish are grown at NIWA’s state-of-the-art land-based farm, which was officially opened last month.

The facility at NIWA’s Northland Aquaculture Centre in Ruakākā, North Island, has been designed to demonstrate the commercial viability of landbased aquaculture, and it can produce up to 600 tonnes of kingfish each year.

NIWA’s Chief Executive, John Morgan, said the farm introduces a new species to help New Zealand meet the huge global demand for seafood, and it will help the industry reach its ambitious target of NZ $3bn (£1.4bn) by 2035.

The RAS is a joint venture by NIWA and the Northland Regional Council, which constructed the premises that are leased to NIWA, and it represents a significant investment in North Island’s economy.

INDUSTRY body Scotland Food & Drink has revealed the finalists for its pilot Bookable Food and Drink Experiences training programme.

The companies involved include a shellfish farmer, Caledonian Oyster Co, and two seafood suppliers: Isle of Bute Smokehouse and The Tobermory Fish Company.

The programme, designed to help Scottish producers make their experiences more easily discoverable and bookable for both international and domestic tourists, has been oversubscribed, attracting far more than the 50 businesses initially sought and reflecting the growing awareness among Scotland’s food and drink businesses of the crucial role tourism plays in their future growth and success.

Participants will benefit from tailored workshops and expert-led training that will help them capitalise on Scotland’s booming tourism sector, which continues to thrive as both a domestic and international destination.

A group of 50 businesses have been selected for the first round of training. Each of these businesses will participate in a series of workshops, networking events and one-on-one mentoring aimed at refining their tourist offerings and making them more accessible.

Led by Scotland Food & Drink on behalf of the food tourism leadership group, which includes VisitScotland, the Scottish Government and the Scottish Tourism Alliance, the programme builds on insights from the national tourism organisation’s Scotland Visitor Survey 2023, which revealed that nearly half

(46%) of visitors engage in food and drink activities during their stay, with nearly a fifth (19%) of long-haul travellers specifically choosing Scotland for its culinary offerings.

Fiona Richmond, Head of Regional Food at Scotland Food & Drink, commented: “We are absolutely thrilled with the overwhelming response from businesses across Scotland. The level of interest truly highlights how integral food and drink tourism is to the future of our local businesses. This programme is designed to provide them with the tools, training and confidence to enhance their offerings, reach new audiences, and help build Scotland’s reputation as a must-visit destination for food and drink lovers.”

Sally Swinbanks, from Tobermory Fish, added: “This is an invaluable opportunity for us to not only develop our offerings but also to connect with like-minded businesses and share ideas.

“As Scotland continues to grow as a tourism hotspot, both domestically and internationally, it’s crucial that we understand how to tailor our services to meet the needs and expectations of visitors, particularly in the food and drink sector.”

“We are absolutely thrilled with the overwhelming response ”

SALMON producer Mowi has denied that its Scottish processing plant was responsible for an apparent pollution incident in the River Lochy, near Fort William.

On 29 September, local people noticed what appeared to be blood and fish scales, as well as a number of dead fish, in the river, coming from a waste pipe at the Lochyside flood defences.

BBC News quoted activist Jamie Moyes, who campaigns with the group Abolish Salmon Farming, as saying the incident was “nothing new” and locals see blood in the river “all the time”.

Mowi’s processing plant at Blar Mhor is situated nearby. The company has responded in a statement that declared: “Mowi has undertaken its own investigation into the incident at the River Lochy where local people reported a red discharge. Mowi is confident that the discharge did not come from its facility at the Blar Mhor Industrial Estate.

“Mowi has checked all its operating procedures as well as the effluent system and CCTV. The effluent is cleaned onsite by a water treatment process that removes contaminants from water. Following this process, the effluent is only discharged to the Scottish Water treatment works at Caol Point.

“Mowi is not the only business which processes this type of

material on the Blar Mhor Industrial Estate but is the only one regulated by SEPA under IPPC regulations.”

The Scottish Environment Protection Agency and Scottish Water are investigating the incident and Mowi said the company would co-operate with the authorities in that process.

CENSEA , a Captain Fresh group company, has announced the appointment of Peter Schonman as National Culinary Director, a newly created role designed to spearhead innovation and new product development within the company.

Peter Schonman joins CenSea with a diverse and accomplished career in the culinary field, most recently serving as Corporate Executive Chef and Sales Manager at Pasta Montana.

He spearheaded culinary ideation, menu development and educational support, significantly contributing to the company’s year-over-year sales growth and earning Pasta Montana a place among Sysco Canada’s “Top 10 Suppliers of the Year” for two consecutive years. Prior to Pasta Montana, Peter was Director of Culinary Innovation at Anova Food (a subsidiary of Bumble Bee Foods).

CenSea is one of the largest importers and distributors of frozen seafood in the US. Early this year, the 60-plus-yearold company was acquired by Captain Fresh, a tech-led vertically integrated global powerhouse of seafood brands.

JAPANESE seafood conglomerate Hanwa Kogyo has taken a controlling stake in seafood processor Marugo Fukuyama Suisan. Marugo, based in Wakkanai City, Hokkaido, Japan, freezes and processes seafood caught in northern Hokkaido, such as scallops, salmon, hairy crabs and giant octopus. Scallops make up the biggest proportion of its business.

Its latest recorded accounts, for 2023, show revenue of JPY 3.8bn (about £19m)

Hanwa Kogyo now owns 80% of Marugo Fukuyama Suisan.

Hanwa said: “By incorporating Fukuyama Suisan into our food division, we believe that we will be able to strengthen the processing capabilities that are the strengths of our existing group companies and further promote sales to overseas markets such as North America and ASEAN, thereby creating synergy effects throughout the food division.”

IHAVE always been sure that it was unnecessary for Scottish Ministers to appoint a regulator to manage sea lice. As the weeks go by, I am also increasingly convinced that the appointment of SEPA to this role was a major mistake. Having watched their efforts from the outset, I firmly believe that SEPA have little understanding of sea lice and the interactions with wild fish. I suspect that SEPA have simply listened to a narrative promoted by Scottish Government scientists based on mathematical modelling and have adopted the narrative as their approach to regulation but, critically, without any real understanding of what it means.

Dr Martin Jaffa argues that the methods being used to estimate sea lice numbers are expensive – and unreliable

world. If sentinel cages were such a good method for predicting sea lice infestation, then why have they not been in regular use?

The last time they were employed in Scotland was over 10 years ago and over a period of three years, these sentinel cages did not provide a shred of evidence that modelled infective sea lice larvae caused any threat to wild salmon during the key migration window. This has not deterred SEPA from pursuing this approach.

The regulation is based on a sea lice dispersal model which assumes that sea lice found on farms will produce millions of infective larvae which are dispersed away from the farm, infesting all the fish they subsequently encounter. Unfortunately, they have been unable to validate their model because so far no-one has ever found the clouds of sea lice larvae predicted by their or anyone else’s sea lice dispersal model. Instead, the salmon industry is to be regulated based on the outcome of a theoretical model.

The Scottish Government has collected masses of data on wild salmon and sea trout since the beginnings of the salmon farming industry. This data provides clear evidence that salmon farming is not the reason why wild salmon and sea trout numbers have collapsed. SEPA are not interested in this data because of their failure to understand such interactions.

SEPA plan to validate their model by using sentinel cages. However, sentinel cages will never validate the model because the infective stages that the model predicts do not exist in the real

Sentinel cages are small, enclosed net pens which are stocked with up to 50 farmed salmon smolts and left tethered to the seabed in key locations. After a prescribed length of time, the cages are recovered and the numbers of lice on each fish counted. If sea lice are found on the fish, then the presence of a salmon farm is blamed even though the infective lice larvae have never been recovered in large numbers from the surrounding seas. The possibility that any lice are the result of transfer from passing wild fish is dismissed out of hand because the model says otherwise.

Back in March, SEPA’s Head of Ecology, Peter Pollard, had told the audience at the Fisheries Management Scotland Conference: “We now have got a grant funding arrangement with the Institute of Marine Research [IMR] in Norway, and they will be working alongside us on the sentinel cage work.”

This leads to the obvious question: why does SEPA need to work with IMR on sentinel cages? Certainly, Marine Directorate scientists have used sentinel cages previously, with the biggest study running for three years from 2011 to 2013 in Loch Linnhe. The data from that study was used in the more recent SPILLS project involving scientists from the Marine Directorate, Scottish Association of Marine Science and from some salmon farming companies. If sentinel cages were considered such a key indicator of lice infestation, why were they not deployed as part of the SPILLS project especially as the project concerned salmon parasite interactions?

Turning to Norway, IMR still uses sentinel cages as part of the Traffic Light System assessment but interestingly not across all 13 Production Areas (POs). In fact, last year, it deployed sentinel cages in just two of the POs, which suggests that their value is extremely limited. If sentinel cages were considered a key part of the assessment process, then surely IMR would deploy them in every PO, and it doesn’t. The most effort it has employed to utilise sentinel cages was in 2017 and 2018 when they were installed in seven out of the 13 POs but by 2020, the number was reduced to just one. For the last three years, IMR has deployed sentinel cages in two of the POs but not always the same two. IMR clearly does not consider sentinel cages to be an integral part of the assessment process, yet SEPA does.