SmartFlow connects all Vaki Smart Pumps, Graders and Counters for full overview and control of the fish handling system.

To find out how SmartFlow can revolutionise your business, contact your MSD Animal Health account manager.

SmartFlow connects all Vaki Smart Pumps, Graders and Counters for full overview and control of the fish handling system.

To find out how SmartFlow can revolutionise your business, contact your MSD Animal Health account manager.

THE town of St Andrews is used to welcoming visitors from all over the world, and last month it hosted another big event.

This time, though, it was not a golf tournament that drew an international crowd to Scotland but the Responsible Seafood Summit, co-hosted by the Global Seafood Alliance and Seafood Scotland.

The summit covered a host of topics on the theme of sustainable seafood, covering catch fishing and aquaculture, and provided a unique forum for the exchange of ideas, experiences and insights. Fish Farmer’s report on the summit appears in this issue.

Oban, on Scotland’s west coast, was the venue for the Association of Scottish Shellfish Growers’ annual conference and this too was an opportunity to talk about the challenges and opportunities for the shellfish farming sector, and you can also read about that in the November magazine.

Also in this issue, we look at a report that outlines how an initiative to kick-start sea farming in Wales could potentially prove to be a huge boost to the “blue economy”.

Sandy Neil reviews the arguments presented to the ongoing follow-up inquiry into the salmon industry by the Scottish Parliament’s Rural Affairs and Islands Committee.

Vince McDonagh reports on the troubling levels of sea lice now being encountered in Norway’s northern waters; and on concerns over the lack of growth for the aquaculture sector in the European Union.

Dr Martin Jaffa reacts sceptically to a poll that suggests consumers are ready to pay more for fish produced to higher welfare standards; and Nick Joy reflects on a UK Budget that included some bad news for small businesses.

We also have a report from the latest Aqua Agenda webinar hosted by Fish Farmer, on Land Based Strategy. Our expert panel comprised Thue Holm of Aquafounders Capital, Trond Schaug-Pettersen of Salmon Evolution and Paul Howes, Manager at the Centre for Sustainable Aquatic Research, University of Swansea. Don’t forget to sign up for our next webinar, on Technology, Remote Monitoring and Artificial Intelligence, which takes place on 19 February – see the UK News section for details.

Best wishes Robert Outram

Meet the team

Editorial advisory board: Steve Bracken, Hervé Migaud, Jim Treasurer, Chris Mitchell and Jason Cleaversmith

Editor: Robert Outram

Designer: Andrew Balahura

Commercial Manager: Janice Johnston

o nston s armerma a ine om

O ce Administrator: Fiona Robertson

ro ertson s armerma a ine om

Publisher: lister Benne

@fishfarmermagazine

@fishfarmermag

www.fishfarmermagazine.com

Fish Farmer Volume 47, number 11

Contact us

Tel: +44(0)131 551 1000

Fax: +44(0)131 551 7901

Email: editor s armerma a ine om

Head o ce: e ial li a ons, e es ar , 496 Ferry Road, Edinburgh EH5 2DL

Subscrip�ons address: Fish Farmer ma a ine s s ri ons, arners ro li a ons l , e Mal n s, est treet, Bo rne, Lincolnshire PE10 9PH

Tel: +44(0)177 839 2014

K subscrip�ons: £75 a year

RO subscrip�ons: £95 a year including postage all air mail

Tavish

THE Scottish salmon industry’s woes last year have been highlighted in official statistics that show farmed Atlantic salmon production fell by more than 18,000 tonnes in 2023 to 150,949, a year on year decline of 11%.

The Scottish Government’s Scottish Fish Farm Production Survey 2023 also shows that the total number of smolts produced in 2023 decreased by 3.6 million (7%) to 51.5 million.

The publication details statistics on the employment and production from cottish fish farms. t is structured to follow industry trends within the farmed Atlantic salmon, rainbow trout and other species sectors.

n 2023, the total number of staff directly employed in salmon production was 1,480 staff, a decrease of 28 staff compared with 2022. The staffing figures refer to production of Atlantic salmon in seawater and do not include staff involved with processing or marketing activities.

The picture was more positive for rainbow trout. Production in this sector increased by 6% in 2023 to 9,258 tonnes.

This is the highest level of rainbow trout production recorded in Scotland.

Brown and sea trout production decreased to 16 tonnes in 2023.

Meanwhile, Scotland’s salmon industry has reported the best September survival rate for Scottish salmon since 2020. ew figures published in October revealed a 98.18% survival rate on farms in September, which is historically the most challenging month for salmon in the sea.

which has created better conditions for salmon, but industry body Salmon Scotland has also stressed the importance of the resources invested in fish health over the past few years, including £975m spent since 2018 in freshwater treatment vessels, investment in research, a reduction in the time that farm-raised salmon spend at sea, as well as staff training and improved monitoring systems to help farmers respond to natural challenges such as ellyfish blooms and warming seawater. Salmon Scotland says the situation has transformed significantly since then, with production up 15 in the first half of 2024 (to 86,600 tonnes from around 75,000 tonnes) compared to the same period last year.

Tavish Scott, chief executive of Salmon Scotland, said: “Scottish salmon farmers provide the highest standards anywhere in the world for the animals in their care, and have invested £1bn in fish health and welfare since 2018.

The percentage of mortalities was around half the rate recorded in September last year, when warm sea temperatures in the autumn led to micro ellyfish blooms which can harm fish. fter two very challenging years, survival rates in 2024 have been consistently high, reaching 99.03% in June.

2024 saw a cooler, wetter summer

“And while no farmer wants to lose any animal, the care our farmers provide means that survival rates for farm-raised salmon – which spend up to 18 months in the sea – are dramatically higher than their wild cousins.

t is testament to the dedication of farmers that survival rates on Scottish salmon farms are now at the highest level since 2020.”

Look out for more details from the Fish Farm Production Survey in the Fish Farmer Yearbook, published next month.

THE Scottish Seaweed Company was a winner in two categories in the Scotland Food & Drink Excellence Awards, which were held on 9 October.

Two products in the company’s Shore range of snacks were declared best in class: its Peking Duck Seaweed Chips were named Healthier Choice Product of the Year, while Shore Sweet Sriracha Seaweed Chips won in the Snacks and Accompaniments category.

The overall winner on the night as Scottish Product of the Year was another seafood offering, the Fishwife Pie from Carnoustie-based restaurant and piemaker WeeCOOK, known for its unique blend of traditional and modern Scottish cuisine. Judges praised the brand’s award-winning pies and dedication to utilising

seafood sourced from local waters, such as Arbroath smokies, Shetland mussels, and North Sea haddock.

Hosted by TV personality Simon Rimmer, host of Channel 4’s Sunday Brunch, the awards ceremony in Glasgow was attended by 500 people from across the food and drink industry.

Ashley Connolly, Local Buying Manager for Scotland at headline sponsor Asda, headed up the judging panel for the tasted product categories. She said: "This year’s judging was one of the toughest yet, with so many exceptional products on offer – a true reflection of the outstanding quality across the industry. Congratulations once more to all the winners, who really stood out in an incredibly competitive field."

A STEEL signing event on 7 November has marked the e innin o t e final p ase o construction or a ne sustaina le a uaculture researc acilit at t e niversit o Stirlin

e ational uaculture ec nolo an nnovation u is inten e to rive t e s a ition to e a orl lea er in o ern a uaculture practice

isitin politicians an senior universit lea ers si ne t e steel structure an a pla ue ic ill e un in a ter it opens ne t sprin

e state-o -t e-art acilit is un e a invest ent t e overn ent t rou t e Stirlin an Clack annans ire Cit e ion eal as ell as a ol son oun ation rant ill e ull inte rate into t e universit s orlreno ne nstitute o uaculture o ic inclu es a lar escale arine acilit at ac ri anis in int re an a res ater acilit at uckie urn near enn

Pro essor Sir err cCor ac Principal an ice-C ancellor o t e niversit o Stirlin sai e ne ational uaculture ec nolo an nnovation u ill create t e s lea in innovation co unit or sustaina le a uatic oo pro uction an position innovation an pro uctivit at t e ore ront o one o t e orl s astest ro in sectors

e acilit is also t e catal st or t e creation o a ran e o i value skille o s an trainin opportunities in t e lue econo space

Secretar o State or Scotlan an urra P sai elco e t e pro ress ein a e to eliver t is pioneerin a uaculture pro ect acke overn ent un in - part o our co it ent to t e Stirlin an Clack annans ire Cit e ion eal - it is a reat e a ple o colla oration to fin innovative solutions or oostin pro uctivit creatin o s an i provin sustaina ilit in t e sector in Scotlan an e on

Pro essor Si on ac en ie ea o t e nstitute o uaculture sai ur vision is to tackle lo al pro le s o oo

Above: Steel signing at NATIH: (L-R) Councillor Gerry McGarvey, Depute Leader of Stirling Council; Professor Simon MacKenzie, Head of the Institute of Aquaculture, University of Stirling; Professor Sir Gerry McCormac, Principal and Vice-Chancellor, University of Stirling; Eileen chofield, hief Operating Officer and niversity ecretary avid airns, Regional Managing Director, Robertson Construction Central East

securit un er an sustaina ilit t rou a uaculture e ne ational uaculture ec nolo an nnovation u ill elp us uil on our international reputation or orl -class researc teac in tec nolo ical innovation an consultanc in a uaculture supportin ro t in t e pro uction o a uatic oo or u an consu ption contri utin to lo al oo securit ile re ucin t e i pact on natural resources ill inclu e ei t separate te perature-controlle res ater S recirculatin a uaculture s ste s units capa le o operatin in a ran e ro C to C s ell as acilitatin researc it ill ean ore opportunities or un er ra uates an post- ra uate stu ents to et an s-on e perience an or colla oration it lar e an s all partners in t e private sector

THE next edition of leading trade show Aquaculture UK is moving to Glasgow, it has been announced.

The organisers, Diversified Communications, said the show, which has been held in the Highland resort of Aviemore for many years, will take place at the SEC, Glasgow, (pictured) on June 16 and 17, 2026. The 2026 Aquaculture Awards are scheduled for the night of June 16, 2026.

Diversified said: “For many years, Aviemore and, in particular, the Macdonald Resort, has been a wonderful host, providing a unique and memorable experience for everyone who has attended the show.”

However, with planned building development taking place on the land Aquaculture UK occupies, an alternative long-term base had to be found for the biennial exhibition and conference.

The company said the overriding feedback received from both exhibitors and visitors in post-event surveys was that Glasgow offers the best location.

The case for Glasgow, Scotland’s biggest city, is that it boasts a wider range of accommodation and improved transport links, making it more accessible for national and international attendees and providing scope for the event to scale up further in future.

The past two editions in the Scottish Highlands have been stretched to capacity due to the increasing demand for exhibition space and attendance at the popular Awards Dinner. As a result, relocating to a bigger venue has become inevitable for the events continued success and future growth.

Aquaculture UK Director, Cheri Arvonio, said: “This decision hasn’t been made lightly.We deeply value our time in Aviemore and are hugely grateful for the warm hospitality and beautiful surroundings that have helped make Aquaculture UK what it is today.

“However, with no guarantee of availability in Aviemore, the move to Glasgow offers an exciting opportunity to welcome more participants, provide an even more enriching experience and strengthen collaboration within the global aquaculture community. The relocation has also allowed us to secure the prestigious Hilton Hotel to host the Aquaculture Awards. Offering a stunning backdrop, the larger venue will accommodate the huge demand for places to join the industry’s most important celebration.”

For more information about Aquaculture UK 2026 see the event’s web page aquacultureuk.com. The 2025 Aquaculture Awards, which will be a stand-alone event, will take place on Thursday 19 June 2025 at the Macdonald Drumossie Hotel, Inverness.

TRADE marketing body Seafood cotland has been confirmed as a partner for the Michelin Guide Awards Ceremony Great Britain & Ireland 2025. The event will be held in Kelvingrove Art Gallery and Museum, Glasgow, pictured) on 10 February 2025. The bid to

host the ceremony came from a joint partnership between Glasgow Life and Scotland Food & Drink, of which Seafood Scotland is a key member. Seafood Scotland said the event will be a great showcase for the best of the country’s produce.

TINY Fish, the business created to find value in small smolts that are not selected for grow-out, had a second win in two weeks when it was named Best Start Up at the Highlands & Islands Food & Drink Awards on 1 November (pictured are co-founders Jarl van den Berg and Teresa Garzon, centre of photo). The awards were held in Inverness. Tiny was also winner of the Aquaculture Innovation Award at the Responsible Seafood Summit, at St Andrews, on 22 October.

For more on the Aquaculture Innovation Award, see page 61 of this issue.

ar i hael ele te as A hair a

FOLLOWING the UK General Election, MPs the All-Party Parliamentary Group on isheries met for the first time in the new Parliament. The officers elected to the

were: Alistair Carmichael, Liberal Democrat MP for Orkney and Shetland as Chair of the group, alongside Labour’s Melanie Onn, MP for Great Grimsby and Cleethorpes as Co-Chair, Aberdeenshire North and Moray East MP and SNP spokesperson on Defra, Seamus Logan as Vice-Chair, and Bridlington and The Wolds Conservative MP Charlie Dewhirst as Treasurer.

MOWI Scotland enjoyed one of its best periods for at least two ears it profits u pin al ost et een ul an Septe er t is ear

e ivision ic as een attlin iolo ical issues over t e past e uarters pro uce an operational or profit o a ainst a ear a o

Scotlan recor e a arvest o tonnes an increase o al ost tonnes

e operational per kilo as per k up ro

n prices an volu e evelop ent o i sai ac ieve prices ere o n ear-over- ear alt ou t e ere a ove t e re erence in t e uarter ue to a contract s are o

e ualit as oo an arvest ei ts i prove ro Q e volu e ui ance or is tonnes tonnes i er t an

e Scottis report sai Cost ecrease ro t e co para le uarter on t e ack o t e o n ar tren in ee prices an i er survival rates co ine it i er avera e ei ts

Pro uction ortalit ee conversion rate an arvest ei ts all i prove ro t e co para le uarter

Sea te peratures ave een lo er t an in Q an t e seasonal c allen es associate it al ae an ell fis ave een less o an issue t is ear

roup- i e o i as poste a recor Q revenue fi ure o n n is outstan in per or ance as translate into an operational profit or o

Above: Mowi, Loch Hourn

C a sters and Loch Fyne Oysters, two ke ran s in t e ssociate Sea oo s roup ave een reco nise or t eir oo practices t e uaculture

Ste ar s ip Council o ac ieve certification un er t e SC stan ar s oreca e a sters picture as re uire to eet strin ent re uire ents re ar in environ ental an social i pact

Meanwhile, Loch Fyne Oysters as een certifie un er t e SC s C ain o custo criteria is certification eans t at pro ucts can no e tracke transparentl ro t e source to t e final custo er ictor est ana in

irector at ssociate Seafoods, which also owns ol en S ell ussels sai ur SC accre itation is a si nificant ilestone or oreca e a sters e ope our ar in practices not onl support t e ealt o local ecos ste s ut also contri ute to t e lon -ter sustaina ilit o t e in ustr it oreca e a ein an environ entall an ecolo icall si nificant location our accre itation ol s particular i portance

COOKE Scotland saw its sales rise by 17% last year, but any ope o i prove profits ro that were cancelled out by higher production costs.

These included increased material and labour costs, which were the main challenges in what was an e ceptionall in ationar ear

The company said turnover last year totalled £217m, but pointe out t at t e volu es sol ere relativel at it t e higher revenues mainly due to record salmon prices last year.

While sales were up by 17%, the cost of producing those sales rose by 25% to £165m.

et profit a ter ta ell ro in to £21.2m last year. Much of the reason for this was down to high interest rates which adversely affected both businesses and consumers throughout most of last year.

Cooke said the higher interest rates cost the company an extra in plus an a itional in orei n e c an e costs

It also said the increase in raw material and utility costs would have an impact on the cost of feed purchased through the group company, Northeast Nutrition Scotland Ltd, adding that feed is one of its main costs.

Cooke Aquaculture Scotland – now rebranded as “Cooke Scotlan as esta lis e in a ter Cooke ac uire a series of seawater and freshwater assets in Orkney, Shetland and the UK mainland. A year later it strengthened its Scottish operations with the acquisition of salmon farming operations in Yell, Shetland.

FISH Farmer is partnering with aquaculture technology business Krucial to co-host the next webinar in our Aqua Agenda series: Technology, Remote Monitoring and Artificial Intelligence.

The webinar takes place on Wednesday 19 February 2025, 11.30am-12.30pm (UK time).

Our expert panel will be discussing the use of IT to remotely monitor fish behaviour, oxygen, water temperature, feed usage and health and safety issues. How has artificial intelligence (AI) assisted fish farming operations and what technological advances does the future hold?

The company’s revolutionary communications technology means that even operations in remote locations such as offshore fish farms, where cellular connections are unreliable or nonexistent, can be digitally linked.

For aquaculture, Connected Seafarm from Krucial has been developed as the answer to unreliable cellular connectivity, blindspots and power outages, allowing users to digitise every site in their aquaculture operation with ease, no matter how remote.

Krucial co-founder and Chief Technology Officer Kevin Quillien will be joining us to share his insights into the impact of technology on aquaculture.

Krucial’s mission is “to make digital transformation achievable for all, no matter the location or situation”.

Save the date: 19 February 2025!

To register for this free webinar, simply go online to bit.ly/3CgKdc2.

A SEAFOOD cooperative representing Scottish shellfish producers was named as Supplier of the Year in the Marine Stewardship Council awards, held recently in Plymouth.

Scottish Shellfish Marketing Group (SSMG) won the coveted title of MSC Supplier of the Year, an award for which it was nominated by its customers, in recognition of the organisation’s commitment to responsible sourcing.

The MSC and ASC UK 2024 Awards were held jointly and sponsored by Seafood Scotland, Plymouth Gin and Plymouth City Council.

The ASC awards saw accolades for Fish Said Fred, Sainsbury’s and Lyons Seafood.

SSMG mussel farms have been MSC accredited for more than 12 years.This year SSMG was also the first producer to be accredited ASC certification for Scottish farmed Pacific oysters.

Derek Sharp, Commercial Manager, Scottish Shellfish, said, “We’re really proud that SSMG won Supplier of the Year especially as this award was nominated by our customers. It was great to be able to celebrate with them and share in our success.”

Scottish Shellfish Marketing Group is a co-operative with 15

members, supplying MSC Mussels to supermarkets and foodservice operators throughout the UK and promoting the nutritional and taste benefits of eating Scottish seafood. The winners of the MSC awards, in full, were:

MSC UK Supermarket of the Year: Gold –Sainsbury’s; Silver – Iceland; and Bronze – Lidl

MSC UK Retail Supplier of the Year – Scottish Shellfish Marketing Group

MSC UK Seafood Brand of the Year – Princes

UK Online Brand of the Year – Ocado

MSC UK Marketing Champion of the Year – Lidl.

MSC UK Marketing Campaign of the Year - Birds Eye & Iceland, for Big Sea Savings

MSC UK Foodservice Supplier of the Year – Brakes and M&JSysco companies

MSC UK Foodservice Champion of the Year 2024 – Lussmanns

MSC UK Ocean Leadership Award 2024 – Cornish Sardine

Management Association

MSC UK Fishing Hero of the Year 2024 - Ian Syvret, Jersey

Lobster Fishery

MSC UK Newcomer of the Year 2024 – Crosta & Mollica.

A COMMITTEE of MSPs in the Scottish Parliament has warned that the scientific work that underpins fisheries policy could be adversely affected by underfunding, especially for the Marine Directorate’s research facilities.

The Rural Affairs and Islands (RAI) Committee has written to Mairi Gougeon, Cabinet Secretary for Rural Affairs, Land Reform and Islands, following its review of the

Marine Directorate budget, as part of its Pre Budget Review.

Committee members visited the Directorate’s Science Laboratory in Aberdeen (pictured) as part of its review. In the letter, RAI Convener Finlay Carson says: “It was clear that the staff we met were dedicated and professional...the condition of the marine laboratories estate, however, was far from ideal as a result of recent weather events and the age and condition of some buildings, and members were concerned about the impact the condition of the laboratory facilities was having on scientists’ ability to work as effectively as possible. For example, samples need to be stored at an appropriate temperature and scientists need to have a dedicated and sufficient work space.”

One building previously used by the

TWO directors have stepped down from the board of marine technology business OTAQ, as part of an initiative to save money at the company.

Harald Rotsch has stepped down from the board but will continue to act as Chief Technology Officer in a non-board capacity, while Sarah Stoten has resigned her position as NonExecutive Director, both as of 31 October.

In a statement, OTAQ said: “Both Harald and Sarah have voluntarily resigned their positions in recognition of the costcutting measures already implemented by the company, measures which they view appropriate to extend to all levels.

“While Harald will remain with the company, Sarah has kindly offered to support a smooth transition. It is the board’s view that it will retain the expertise needed to service the nearterm needs of the group, best positioning OTAQ for long-term success and

Directorate was currently empty because it had been found to contain asbestos, while another had been damaged by Storm Arwen in 2021 and has still not been repaired.

RAI Convener Finlay Carson told Fish Farmer: “We were quite shocked at the working conditions the Directorate staff were facing.” Overall, the committee found, funding levels have declined following the formation of Marine Scotland in 2009 from £75.5m in 200910 (£108.3m real terms) to £45.8m in 2016-17 (£58.5m real terms).

At the committee’s hearings, a number of experts expressed concern that the high reputation of marine science in Scotland was being undermined by funding cuts and by a focus on compliance work over research.

The committee says it will return to this issue when the 2025-26 budget is published.

maintaining suitable corporate governance.”

OTAQ reported an operating loss of £422,000 for the first half of this year.The Scottish Government’s decision to impose a de facto moratorium on acoustic deterrent devices (ADDs) was a blow for the company’s Sealfence offering, but with new product lines such as the Live Plankton Analysis System (LPAS) and the investment in shrimp biomass business Minnowtech, OTAQ sees opportunities to develop other markets.

Phil Newby, Chief Executive Officer, commented: “I would like to sincerely thank both Harry and Sarah for their valuable contributions to OTAQ during their tenure on the board.We are pleased that Harry will continue in his current role and we will retain his extensive expertise and industry knowledge within OTAQ. I also extend our best wishes to Sarah in her future endeavours and thank her for continued support as we transition to a leaner business and establish a solid platform from which we can then grow."

THE Oyster Restoration Company is to donate native oyster spat to support the restoration of marine ecosystems in Scotland’s Cromarty Firth.

The project takes the form of a partnership with “rewilding” campaign organisation Mossy Earth, as part of the latter’s Donate and Collaborate Initiative.

Mossy Earth is looking to reintroduce native oysters and enhance sea rass ea o s in t e firt s surroun in t e lack sle ere once widespread reefs are now considered absent.

European Native oysters (Ostrea edulis) are vital to maintaining the health and biodiversity of marine ecosystems, acting as natural ater filters an creatin a itats t at support a variet o arine li e o ever ue to actors suc as overfis in a itat loss and disease, native oyster populations have plummeted by more than 95% in the last century. Mossy Earth’s Cromarty Seascape project aims to help reverse these losses by restoring oyster reefs in the Cromarty Firth and re-establishing this keystone species in its natural environment.

BIOMAR UK has become the first feed mill in the UK to gain certification under the Aquaculture Stewardship Council’s new feed standard.

The ASC said certification for BioMar’s Grangemouth facility –which produces feed for salmon and trout – marks a significant milestone for the company but also for the progress of the entire UK farmed seafood industry towards more responsible practices.

Salmon and trout farms in the region and beyond are now able to obtain ASC compliant feed from BioMar UK.

It is only the second feed mill to attain ASC Feed Certification in Europe and, the ASC said, will play a pivotal role in ensuring more responsible production of feed for the Scottish salmon industry, where transparency, responsibility and traceability are increasingly important.

Rob Wilson, BioMar UK Business Unit Director, said:

“Achieving ASC Feed Certification at our Grangemouth facility marks an important step for BioMar UK. This milestone highlights our commitment to leading the charge in responsible aquaculture practices.

“By providing ASC compliant feed, we are not only supporting local salmon and trout farmers but also helping to ensure that the UK aquaculture industry continues to meet the growing demand for ethical and transparent seafood production.”

ASC certified farms have until October 2025 to change their feed supply to be ASC compliant – in other words, to use only feed produced by certified mills.

EUROPE’S shellfish industry has the potential to solve many ey policy challenges but the industry itself is in crisis .That was the warning last wee from the uropean ollusc roducers ssociation ( ), which held its first event in the uropean arliament in trasbourg.

The uropean ollusc roducers ssociation ( ) brings together national or regional associations and bodies representing mollusc producers within the uropean nion and the .

ith members from si uropean countries pain, rance, the nited ingdom, the etherlands, taly and reland the represents 0 of the companies or operators involved in the production and mar eting of shellfish in urope.The is currently chaired by ddy isseeuw from the etherland roducers ssociation.

The presented its manifesto for the sustainable development of the uropean shellfish sector, which among other things calls for the space allocated to shellfish farming to be tripled and for improvements in water uality.

The manifesto s last point calls for the creation of an ommon uaculture olicy setting binding ob ectives and measurable development indicators as the only way to reverse the downward trend in production and unloc the full potential of the s shellfish sector.

The mollusc producers are calling for the strict implementation of the environmental regulations related to wastewater treatments and water management, for political support for the sector s development, and for the valorisation and compensation of the ecosystem services provided by the sector.

profession that contributes to the ob ectives of food autonomy. sector of activity that creates obs. ey player in the sustainability of our environment, acting as nitrogen sin s or a means to combat coastal erosion, e plained rench ember of the uropean arliament sabelle e allennec who was hosting the trasbourg event

The ambitions of the uropean nion for a uaculture are as bold as they are necessary, declared ddy isseeuw, resident, in his speech.

e added The envisions a future where sustainable a uaculture plays a pivotal role in food security, environmental sustainability and economic resilience. nfortunately, the reality on the ground is very different. ot only the sector is not growing we are decreasing year after year.

ollusc production is the largest segment of a uaculture in the , with an annual production of over 500 million tonnes. t uropean level, the shellfish production sector represents an annual production worth €11 0m ( £ 1m) and more than 50 of a uaculture production. owever, this ey player in the a uaculture industry has been in steady decline for 20 years.

JAPAN’S Mitsubishi Corporation has bought into the Finnish aquaculture technology company Finnforel.

Mitsubishi, a large conglomerate with a range of industrial interests, already owns the salmon farming group Cermaq, which operates in Norway, Chile, Scotland and Canada. The amount it has invested in Finnforel has not been disclosed.

Finnforel is an innovative agritech company, focused on farming rainbow trout in what it says is a sustainable way. It has pioneered a comprehensive concept which encompasses the entire value chain—from advanced selective breeding programmes to its feed, farming, processing, packaging and branding of its fish products.

Finnforel said the aim of the Mitsubishi investment is to secure “a sustainable, efficient, and environmentally friendly way to produce fish locally which will offer also significant benefits to food security”.

Finnforel’s strategy is built around its unique Gigafactory concept, which integrates environmentally friendly fish farming and processing under one roof, delivering industrialscale production with maximum efficiency and sustainability.

The announcement explained:

“Through this investment from Mitsubishi Corporation, Finnforel will develop their farming of rainbow trout, which is a suitable coldwater fish species for recirculating aquaculture systems (RAS).

“These systems employ advanced biofiltration to allow control of all essential environmental factors and ensure stable, safe and clean indoor

conditions, while efficiently recirculating and reusing water within a closed system, ensuring zero biowaste and minimum wastewater.

“The usage of recirculating aquaculture systems facilitates year-round fish production, irrespective of environmental conditions.”

Finnforel’s Gigafactory concept also covers processing and packaging of consumer fish products onsite.

Its solution allows it to minimise the number of parties involved in the logistic chain and cut transportation time.

“This will naturally guarantee ultimate freshness of fish products delivered to consumers and lowers the cost,” the company added.

The concept also supports local food systems and reduces the carbon footprint associated with long-distance transport, Finnforel said.

Pekka A Viljakainen, Co-Founder and Chief Executive Officer of Finnforel Group, said: “I believe that in future, RAS will play a crucial role in enhancing food security by enabling efficient, sustainable, and reliable production of fish where excess nutrition and waste will not end up in the seas. That is why we developed our Finnforel Gigafactory with 0% waste policy, to be implemented where the consumers are. We are very proud to have Mitsubishi, with its global distribution channels, talent and resources, to support Finnforel’s journey.”

BAKKAFROST has unveiled weaker than expected third quarter results. Meanwhile, the company’s Scottish arm continues to ake a loss ut t e latest fi ures s o its recover is continuin

C e in aco sen sai luntl t at e as not satisfie it t e roup s results t is uarter e aroese-o ne sal on ar er announce a lo er roup or operational profit or t e ul to Septe er perio o 173 million Danish kroner (£19m) compared with DKK 269m (£30m) 12 months earlier.

Bakkafrost Scotland produced revenues of DKK 317m (£35m) up ro in Q last ear e operatin loss or EBIT was almost halved – down from minus DKK 263 million (-£29m) to minus 138m (- £15m ) this time.

The Faroe Islands produced revenues of DKK 1,420 million (£159m) down from DKK 1,628m (£182m) last year an a lo er operational or profit of DKK 310m (£34m) which was DKK 232m or £26m lower than Q3 2023.

C aco sen tol s are ol ers t at the results were mainly impacted by low salmon prices and the continued aftere ects o t e eneral strike in t e aroe Islands in May, as well as an unplanned cull forced by a disease issue at one of its sites.

He said: “The strike in May combined with the unplanned harvest of A-19

i pacte ne ativel our a ilit to a apt to arket nee s to optimise market value for our products.”

ut e stresse it as not all loo n t e aroe slan s e ave seen ver oo iolo ical per or ance is is evi ent in t e stron ro t lo ortalit an increase arvest ei ts

“Our hatcheries have also delivered excellent operational results ena lin us to increase our s olt trans er e pectations for this year, with further increases planned for next year.”

urnin to Scotlan aco sen sai ur e-riskin strate as worked. Exceptional mortalities have reduced by more than 80% co pare to last ear arvest ei ts ave increase an sea lice levels are at an all-time low - just like in the Faroes.

Regin Jacobsen

e are akin stea pro ress in ra pin up pro uction at the Applecross hatchery to produce lar e i - ualit s olt an e pect start trans er o s olt in Q

Hereafter, we expect to only transfer i - ualit s olt a ove

e a e o aintain a stron co petitive position e are prioritisin cost ana e ent an ali nin our capacity with operational needs. In line with this, we have implemented several cost-savin easures an capacit a ust ents in Scotlan inclu in t e closure o t e processin acilit at ar ank in ul e ull e ects o these measures were not visible in Q3.”

THE third edition of the international aquaculture industry show, Aquafuture Spain, will take place from May 20 to 22, 2025, at the IFEVI exhibition centre in Vigo, in the north-west of Spain’s Atlantic coast. After two successful editions in Silleda, next year’s event looks set to be bigger than ever, with the confirmation of 1 0 e hibitors, a 20 growth compared to the previous edition, with seven months to go before it takes place. Aquafuture Spain is the only aquaculture show in Spain and the second largest in Europe. For more information, go online to aquafuturespain.com.

OLE-Eirik Lerøy, Mowi’s longserving Chairman, is stepping down from the board of the salmon farming giant after more than 15 years. His successor

will be shipping executive Ørjan Svanevik. Ole-Eirik Lerøy (pictured) joined the company in 2009 when it was known as Marine Harvest. Over the last 15 years, the business now known as Mowi has developed into the world’s largest producer of Atlantic salmon with a turnover of €5.5 billion (£4.6bn).

John Fredriksen, Mowi’s largest shareholder, said: “Ole-Eirik is a true industry veteran... we highly appreciate his contributions over the past 15 years.”

Communities receive record £331m from salmon fund

THE Norwegian seafood sector produced its best ever export results in October – with salmon continuing to dominate and also netting the highest ever value.

The total for the month was O 1 .5bn (£1.3bn) 5 or NOK 914m (£64m) up on 12 months ago.

Christian Chramer, CEO of the Norwegian Seafood Council, said: “Never before has seafood been exported for a higher value in a single month.

“The reason is primarily an exceptionally strong mackerel export that we have not seen the likes of. It alone accounts for almost the entire increase in value in October.” So far this year, Norway has exported NOK 143.1bn (£10bn) worth of seafood. This is an increase of O 1. bn, (£100m) or 1 compared to the same period last year.

Measured in US dollars, the value is unchanged, while in euros the e port value was 1 lower.

CEO Chramer added: “The economic development in the markets appears to be moving in a positive direction, with record low

unemployment, real wage growth and prospects for increasing household consumption in the EU. “These are factors that increase purchasing power and thus the willingness to pay for Norwegian seafood.”

As usual, salmon continues to dominate the Norwegian seafood scene with exports of the popular pin fish hitting a new pea during October.

Trends also appear to be changing with a continued marked growth in the sale of salmon fillets last month.

The country’s salmon farmers sold 144,761 tonnes worth O 12bn (£ 2m) last month. The value was up by NOK 133 million (£ m) with a 10 growth in volume. Poland, the US and the Netherlands were the main salmon markets.

Seafood Council analyst Paul T andahl said The growth in fillet exports is a trend we have seen throughout the year. It must be seen in the context of increased processing capacity in Norway.”

He added: “In October, the USA was the biggest growth market for both fresh and fro en fillets.

NORWAY’S Aquaculture Fund looks set to pay out NOK 4.7bn – £331m – this year to coastal communities. The payment is the largest since the fund was set up and is due to the exceptional prices paid at auction for fish farming licences. Fisheries and Oceans Minister Marianne Sivertsen Næss (pictured) said the coalition government was also ensuring that the host local authority areas should receive a larger share of the value creation from the fish farming industry. She added: “The government has always said that the host municipalities should come out better after we introduced land rent tax on aquaculture. The result is that the municipalities get more money to offer welfare services for their residents.”

SAMHERJI, celan s lar est fis in an a uaculture co pan is to start ork on its ne sal on lan ar t is ont e ne s as isclose t e co pan s C air an al vin orsteinsson at a eloitte ariti e in ustr event t is eek e escri e t e pro ect at e k anes near t e celan ic capital e k avik as t e roup s i est sin le pro ect e s ovel cere on or t e first p ase o t e fis ar ic ill e uilt over a nu er o sta es ill take place on ove er

e ar ic receive roa support ro pu lic in t e area last ear is e pecte to eventuall pro uce tonnes o fis a ear t ill also create at least ull ti e o s e c air an sai t at sal on consu ption aroun t e orl as ro in an t is as presentin e citin opportunities e see t at our custo ers ant a i e ran e o sal on pro ucts an sal on as no eco e t e i est pro uct in ost countries

e total invest ent ic inclu es a ne po er plant is t ou t to e ell over

ICELANDIC salmon farming company Arnarlax has been told that its licence to farm 10,000 tonnes of sterile salmon in Isafjord has been revoked.

The reason given by the Icelandic Environmental and Natural Resources Board of Appeal was that MAST, the Icelandic Food and Veterinary Authority, failed to provide a “comprehensive, weighted assessment of the potential risk of the spread of fish diseases and parasites” before issuing the licences.

The ruling is a big setback for Arnarlax, which is the production division of Icelandic Salmon and which in turn is majority owned by the Norwegian salmon farmer SalMar.

Arnarlax CEO Bjørn Hembre said that as a consequence, the licence,

which was originally awarded on 14 June this year, has been revoked.The Board of Appeal also addressed the issue of maritime safety.

He added: “This [decision] is unfortunate but will not affect our long-term guidance for production of fertile salmon on current licences. We are now going over the ruling and will work with MAST on the next steps.”

Arnarlax said that according to the ruling, such assessment of potential risk is a necessary precondition for licences in areas where the distance between fish farming sites is less than five ilometres.

The Board of Appeal also addressed maritime safety issues concerning one of the three sites. Arnarlax will work with authorities and MAST on these matters and perform the necessary assessment in order for the licence to be reissued.

The company added: “Icelandic Salmon want to emphasise that no fish farming operations have started in Ísafjarðardjúp and therefore, the ruling will have no effect on current operations or guidance.”

NORWEGIAN salmon farmer Måsøval issued a results warning ahead of its third quarter report due later this month.

It has blamed biological issues and most notably high salmon lice levels, which is currently affecting several companies, for the problem.

It is also reducing its harvest guidance for this year from 26,500 to 27,500 tonnes down to 24,700 to 25,700 tonnes.

Måsøval says the operational result is weaker than expected by the market and preliminary estimates by analysts covering the company’s share.

The statement added: “Although Måsøval does not provide financial guiding apart from harvest volume and a general indication of cost development, the company finds a notification is required as it is deemed as inside information in the view of the company and a profit warning is warranted to ensure investors are well informed.

“Operational results are weaker due to accelerated harvesting of two sites with ISA [infectious salmon anaemia], at Måøydraga and Espnestaren.”

Måsøval said challenging logistics and more expensive harvesting of salmon with ISA, in addition to low average weights resulted in high costs and low prices for harvested volume.

The harvesting of the sites with ISA (Måøydraga and Espnestaren) was finalised during the quarter.

The statement continued: “Sales and processing segment had a negative effect on the operational results due to one-time costs in order to make the new harvesting plant TL52 operational.

“The plant was operational from September 3 2024, and had a faster ramp up of volume than expected. The company has also experienced substantially higher sea lice pressure, compared to what is seasonally normal in the region, and what was expected at the time of the Q2 presentation.

“More treatments of sea lice have hampered production resulting in a negative revision of harvest guiding for 2024.“

Måsøval said it is still finalising its Q3 report, which is expected on 19 November.

NORDIC Halibut has reported third quarter sales prices for its premium farmed fish up 11 year-on-year, continuing the rise seen earlier this year.

In its Q3 (July to September) operational update, the company said the increase was consistent across size categories compared to the same quarter last year and demonstrates the strong demand for halibut and willingness to pay for quality farmed halibut.

In Q3 2024, it achieved an average sales price of 1 3 O g O (head on, gutted), or around £11. 5.

Nordic Halibut is based in Averøy, central

Norway. It also achieved an increase in average harvest weights, to . g O compared to 3 2023 s average of .3 g O .

Nordic Halibut is prioritising the harvest of smaller individuals to optimise the size distribution of the existing biomass with the ambition to increase average harvest weight over time.This cull of smaller fish is e pected to lead to further improvements in price achievement.

Total revenue for 3 202 amounted to O 1 m (£1.2m) with harvest volumes reaching 10 tonnes O .

It added: “The strategy to harvest smaller individuals to prioritise the growth and e ibility of the biomass at sea is yielding strong results.

This is demonstrated by a 1 biomass growth during the quarter, net of harvest compared to Q2 2024. Including the harvested amount, this represents total production at sea of 21 of outstanding biomass during the uarter.

“This focus aligns with the commercial strategy aimed at increasing harvest weights in future periods to respond to mar et signals. The overarching objective remains to optimise the utilisation of available biomass, even if it entails potential impacts on short-term harvest volumes.”

NORWAY’S rapidly growing cod farming industry has received its first dedicated wellboat. Watched by several hundred people, leading cod farming company Ode “christened” the Ronja Ode at its anse aia head uarters in the centre of Ålesund in October.

The event mar ed the beginning of a uni ue collaboration between the two local companies, Ode and the wellboat company Sølvtrans. Ronja Ode (pictured) is the world s first dedicated wellboat for transporting farmed cod and represents a significant step forward in the development of the cod farming industry.

The companies said this partnership demonstrates how local companies from the unnm re region are leading the global mar et for aquaculture solutions.

Ode O Ola valheim said This collaboration between Sølvtrans and Ode is a great example of how local companies along

the coast are world leaders in aquaculture and a uaculture solutions, wor ing closely together to achieve their goals.

“Ronja Ode, as the first wellboat dedicated to cod, will be an excellent addition to our integrated value chain. “

Christian Remøy, Head of Cod Operations at Sølvtrans, shared the excitement. He said: “Sølvtrans is very pleased that two local companies, Ode and Sølvtrans, have started a long and important collaboration in the transport of farmed cod.

“We see cod farming as an innovative and future-oriented industry. The crew and shipping company have wor ed hard over the past si months to prepare the world s first dedicated wellboat for cod. “

He added: “Sølvtrans hopes Ronja Ode will ma e a significant contribution to Ode delivering a top uality product to the mar et.

A LARGE number of people at the companies behind the “Egg” close contain ent fis ar s ste look set to lose t eir o s

So e involve in t e also kno n as ett s ste are ein a e re un ant ile ot ers are likel to e stoo o n at least te poraril at ot t e or e ian tec nolo co pan vu an t e pro uction co pan er e o positt ccor in to t e local ne spaper Bergens Tidende, t e ointl operate usinesses e plo ust over people Cato n oun er an eneral ana er o vu tol t e paper t at sales a not reac e e pectations e co pan a ope to sell t o etts t is ear to t e sal on ar in sector eac o etres capacit at as not appene an investors appear to e currentl sittin on t e ence e on its i pressive appearance t e ett as aile as a reakt rou in t e fi t a ainst sal on lice an in ections e pro ect as first unveile ore t an nine ears a o it t e clai t at it ill elp fis el are

e ca e takes in ater ro the bottom of the structure and pumps it out through the top e environ ent an pro uction can e controlle

o i as one o t e earl investors but it has since sold its interest in t e pro ect

LARGE bluefin tuna brea ing into salmon cages have been causing serious disruption at a number of orwegian fish farms.

hile the problem is not on the same scale or of the same severity as ellyfish attac s, the tuna also nown in orway as mac erel sturgeon have nevertheless created uite a headache and a lot of e tra wor for the affected farms. our incidents were recorded during October and at least three more in the preceding few months. owi was one company affected while the farming company ulefis spent at least four days trying to free a 3 ilo ( 0lbs) tuna.They finally succeeded than s to help from

divers and underwater vehicles. ome of these fish are particularly large and powerful, often the si e of a small shar .They can cause a lot of damaged as they try to brea into the cages.

The attac s appear to come mainly from the species nown as eastern mac erel sturgeon which spawn in the editerranean.

The veterinary authorities say there has been an increase in the number of tuna moving into orwegian waters during the late summer and early autumn months, where they gra e intensively in the coastal waters in which the farms are located.

The authorities say that overall, more and more tuna are being observed over large areas from the orth ea right up to the southern tip of valbard.

The orwegian irectorate of isheries has issued a guidance list to salmon companies on how to handle the tuna if they do get into a cage, including the advice that entry holes must be repaired as soon as possible once the tuna is out.

A GROUP of activists in Australia have failed to stop the large Woolworth retail chain in Australia selling Tasmanian salmon.

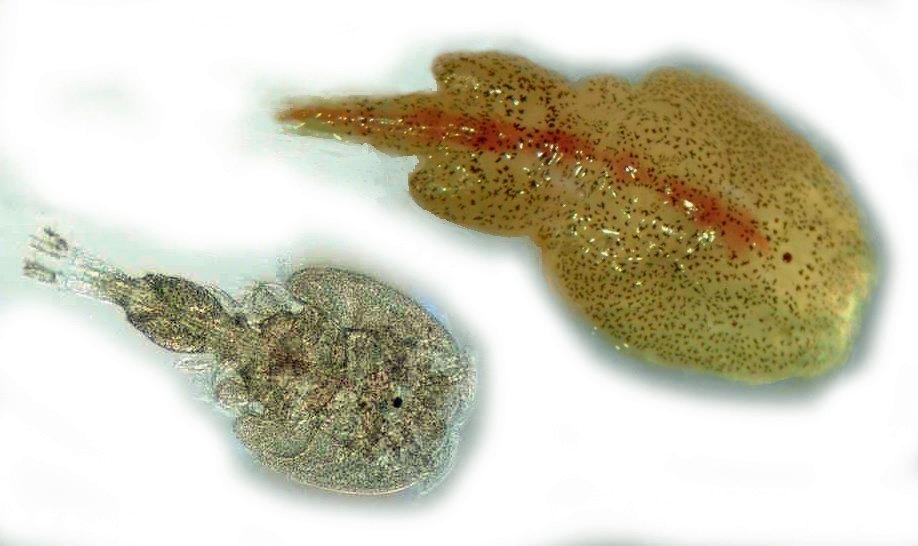

They claim that salmon farming practices in Tasmania’s Macquarie Harbour are threatening the rare Maugean skate which now only exists in that area.

Marine biologists estimate that fewer than 200 of the skate remain and their future existence as a species remains in serious doubt.

The campaign is being led by a group of 120 marine activists who say that salmon farming is a major threat to the future existence of this prehistoric fish. hareholders at the oolworth annual general meeting in ydney were asked to vote on a resolution calling on the company to no longer sell salmon from the harbour from next year, but they rejected the demand – at least for the time being.

company. It did, however, take the name from the original company, which had not been registered in Australia at the time.

oolworth roup chairman cott Perkins told the AGM the company was waiting for the results of government studies before making a further decision about sourcing farmed salmon from Macquarie Harbour, which produces about 10,000 tons of salmon a year.

owever, a ban on salmon fishing has not been totally ruled out by the retailer.

Despite its name, the Woolworth shops have no historical connection with the famous FW Woolworth store chain that once operated in the and UK. The similarly named Woolworths supermarkets in Australia (and later New Zealand) are operated by a separate

“The unsustainability of supply from Macquarie Harbour is a matter we’re taking very seriously,” he said.

The condition of this rare skate species is currently being assessed by the Australian federal government.

Last week the industry body, almon Tasmania, e pressed concern that ustralia s Threatened pecies

Conservation Committee had been granted an extension to 30 October 2025 to come up with its recommendations on the Macquarie Harbour issue. This means that the future of the Tasmanian salmon industry will not be decided until after Australia’s next federal elections.

u e artin, O, almon Tasmania, said: “We are frustrated but not surprised by this outcome.

There has now been a ood of scientific evidence presented to the Threatened pecies onservation Committee showing the situation for the skate is very different to some of the initial advice they had been reviewing.

“Macquarie Harbour is the healthiest it’s been in over a decade and the captive breeding programme is proving an early success. On top of that, the population sampling that informed that committee’s initial thinking has now been proven to be very awed.

“Everyone is determined to secure the future of the Maugean skate, but decisions must be grounded in accurate information on the population numbers and the many potential reasons for the species’ long term decline.”

THE Ecuador site of aquafeed group BioMar has achieved certification under the Aquaculture Stewardship Council’s new international Feed Standard.

Located in Guayaquil, BioMar’s facility produces highquality shrimp feed. The company said that achieving ASC Feed certification is a key part of BioMar’s broader strategy of sustainable innovation and strengthens its role as a trusted provider of ASC compliant feed.

Henrik Aarestrup, Vice President for Latin America, Shrimp & Hatchery, at BioMar Group, commented: “Our goal is to provide shrimp farmers with the tools they need to succeed in a rapidly evolving industry. With this certification, our customers can be confident that they are using feed that meets the highest global standards for sustainability, helping them to secure their position in a fast-growing market.”

He added: “For us, this certification goes beyond meeting a standard. It’s part of our broader commitment to supporting the entire shrimp aquaculture value chain. By investing in innovation, sustainability and collaboration, we aim to help farmers achieve long-term success while ensuring that seafood production is ethical, transparent and sustainable.”

ASC CEO Chris Ninnes said, “Our ASC Feed Standard establishes an essential and unique benchmark for feed production and BioMar’s certification in Ecuador is a welcome development towards greater transparency,

traceability and impact measurement in the feed industry. We congratulate them on this achievement and their ongoing commitment to more responsible feed.

“With the first feed mills celebrating ASC certification in January 2024, we started a journey to drive positive change in the feed industry. There is still much more progress to be made, but with the commitment of the seafood farming sector and the entire value chain, we now have over 30 feed mills either certified or in assessment. That collaborative effort will truly transform global aquatic feed production towards greater responsibility.”

ASC-certified farms have until October 2025 to ensure their feed supply is ASC compliant. The use of ASC compliant feed is necessary for ASC certified farms to continue meeting the ASC Farm Standard and retain their certification.

farm loo s set to be built in the heart of anada with official help and approval.

The anitoba provincial government has promised support for the apphire prings nc rctic char a uaculture and processing facility near oc wood unicipality, north of innipeg.

apphire prings, which is ust four years old,says the 1 5m (£ 0.5m) pro ect will create at least 100 obs plus 120 indirect obs and would help boost the local economy.

t would also be anada s most central land fish farm, with most other facilities in ritish olumbia or on the east coast.The pro ect will also be anada s largest rctic char facility.

The anitoba state has also said it is financially supporting the plan with a loan of around 10m (£5.5m).

The province s Trade and atural esources inister amie oses and

griculture inister on ostyshyn both said the facility will contribute to anitoba s economy.

amie oses highlighted the government s commitment to ob creation and economic growth, emphasising that the facility will e pand opportunities in anitoba while producing sustainable food.

The facility, located at the former site of the epartment of isheries and Oceans oc wood perimental ish atchery, will be anada s largest rctic char facility and aims to position anitoba as a leader in the industry.

en lair, O of apphire prings nc, e pressed gratitude for the province s support and outlined the company s goal of becoming a leader in sustainable a uaculture.

e stressed the pro ect s role in supporting the local economy and meeting the rising demand for healthy, sustainable protein sources.

industry coalition tronger merica Through eafood ( T ) has e pressed its strong support for the ational eafood trategy mplementation lan released by O isheries.

The plan highlights the importance of increasing sustainable a uaculture production as part of a broader strategy to strengthen the seafood industry.

T commends O isheries for prioritising sustainable a uaculture production as a ey component of its ational eafood trategy, said rue anta inters, ampaign anager of T . This plan outlines critical steps that the agency is ta ing to support growth of an merican a uaculture sector, which includes a focus on developing an efficient, predictable, timely and science based regulatory framewor for offshore fish farming in federal waters. ntil a clear and efficient regulatory permitting process is put in place, the will continue to miss out on the significant economic, environmental and food security benefits that offshore a uaculture would provide.

ey goals outlined in O s ational eafood trategy mplementation lan include

• cceleratin pro ress on i ple entin an e ficient pre icta le ti el an science- ase re ulator ra e ork or arine a uaculture by providing continued e pertise and coordination for the permitting of prospective a uaculture operations, and leading the identification of uaculture Opportunity reas ( O s), or areas that are deemed ideal for fish farms.

• Continuin to invest in a uaculture science This includes by conducting a uaculture studies to provide science based advice and tools to minimise potential negative effects of marine a uaculture operations on the environment and to support sustainable industry development.

The plan identifies four pilot initiatives around which O aims activate and enhance partnerships to tac le cross cutting issues.These initiatives include efforts to bolster industry resilience in the ulf of e ico and outh tlantic shrimp fishery support revitalisation of the port of ort Orford, Oregon increase climate resilience in highly migratory species fisheries and support las a s seafood sector resilience.

SENIOR figures in ew ealand s a uaculture industry are warning that red tape and lac of access to ey areas of the coastline are seriously hindering growth.

oncerns over bureaucracy and other issues were e pressed at the recent uaculture ew ealand conference in elson, at which the view was e pressed that it is becoming increasingly difficult to get access to the sea.

ing almon hief ecutive arl

arrington said that while opportunities to e pand the a uaculture sector were huge, only 0.01 of the country s large marine economic estate was currently being farmed.

ccording to adio ew ealand ( ) he maintained s a nation, we have made it incredibly difficult to gain access to farm the sea.

e said the company s lue ndeavour pro ect to farm salmon in the oo trait was the poster child for this, having ta en nine years and m (£ .2m) to get through the consenting process.

arrington reminded his audience that the

industry generated 0m (£355m) revenue each year from the farming of mussel, salmon and oysters (three uarters of which was e port earnings) which was but a drop in the ocean of the potential .

e went on almon generates a return 1 ,000 times greater than sheep and beef per surface hectare.

nfortunately the salmon sector s production has moved diddly s uat in the last 10 years. said lue ndeavour is e pected to be a

ma or contributor to the industry s 3bn (£1. bn) goal, where it is hoped 10,000 tonnes of salmon will be produced at the 12 hectare farm each year. t should be worth an estimated 350m (£1 3m) in e port earnings, which would more than double the company s current production.

ts pilot farm, made up of two 55 metre diameter pens, is e pected to be operational from the middle of ne t year, with salmon to be harvested from 2030.

arrington said the government had ta en steps to reduce regulatory hurdles and he presented inister for Oceans and isheries hane ones with the ing almon ommercial Thin ing elt which is awarded to an individual showing outstanding grit, ingenuity in cutting costs or creating value for our company .

e said the minister s wor had already saved the company close to 2m (£ 3 ,000) and avoided the diversion of significant resources and energy ust to maintain its current rights to operate.

ealand s aroa ing almon has become the first ing salmon producer globally to adopt the innovative lue mpact feed programme developed by io ar.

This initiative supplements wild caught fish in its formulations with cultivated algal oil, fish trimmings and insect meal.

The new approach, io ar said, significantly reduces the impact on wild fish stoc s while utilising clean, sustainable sources of Omega 3 to produce the healthiest fish possible.

s an early adopter of this technology, aroa almon trialled the algal oil, achieving outstanding results with their salmon that led to them winning the eafood uture daptation award in 2023. uilding on this success, the company s partnership with io ar now includes using novel ingredients li e insect meal and fish trimmings sourced from pelagic fish in their feed.

This initiative will see aroa ing almon become a net positive fish producer, committed to lowering its carbon footprint while incorporating regenerative and circular feed ingredients.

aroa ing almon is a 100 ew ealand owned partnership that includes gāti orou, Ōnu u unanga the indigenous mana moana (or guardians) of aroa arbour and the founding ates amily.

The company says its operations are based on intergenerational sustainability, aiming to provide local employment and healthy seafood for today and the future.

TILAPIA producer Regal Springs, salmon farmer Cermaq and retail giants Marks & Spencer and Albert Heijn were among the winners at the Good Farm Animal Welfare Awards (GFAWA) in Paris last month.

e a ar s oste not- or-profit or anisation Co passion in World Farming, recognised 49 winners from over 15 countries for their leadership in improving farm animal welfare and promoting more sustainable supply chains.

uncan ates, founder and managing partner of aroa ing almon, said hen first started farming salmon in aroa arbour, almost four decades ago, the feed ingredients essentially relied on wild caught fish as the raw material, and we fed up to 3 g of wild fish to grow 1 g of farmed salmon. learly, this wasn t a sustainable practice. ith the introduction of lue mpact, we at aroa ing almon have started our ourney to become a positive fish protein producer, a far cry from those days long ago and a testament to our ongoing aspiration to become a truly sustainable food producer.

SOME uncertainty in the aquafeed industry has been relieved with the announcement that eru s ne t fishing season will start on 1 ovember, with a quota of just over 2.5 million tonnes.

The announcement was made at the annual conference of the marine ingredients organisation O, held in isbon over 21 23 October. eru accounts for around 20 of global fishmeal supply in an average year, so the latest announcement will have an impact on the world a uafeed mar et.

The O conference gathered a record number of 530 delegates from 3 countries.

lose to 30 spea ers discussed feed ingredient strategies for the future, supply and demand for marine ingredients, feed ingredients industry beyond fishmeal and fish oil, and e plored the role which marine ingredients play in human health.

e all recognise that uality feed leads to uality food, and that s the foundation of everything we do O s irector eneral, etter ohannessen, noted. long with this contribution comes great responsibility. e must measure our impacts both environmentally and socially using science bac ed framewor s to trac progress. e ve seen e citing e amples of innovation and ambitious efforts already ta ing shape across the industry .

He added that the industry understands that its social licence to operate is essential. arning and maintaining this re uires collaboration and investment in fishery sustainability, which were ey themes throughout the conference.

Swiss-based Regal Springs received the inaugural Aquaculture nnovation ar or its co it ent to fis el are s a lo al leader in tilapia production in Indonesia, Honduras and Mexico, Regal Springs was recognised not only for its social and health initiatives that support local communities but also for its ongoing investment in research and development to promote responsible ar in practices e al Sprin s as t e first tilapia pro ucer to research, develop and implement humane electrical stunning et o s specificall or tilapia no applie across its entire production process.

Albert Heijn, the largest supermarket in the Netherlands, received a Special Recognition Award for establishing an innovative collaboration across its entire supply chain - including feed suppliers, farmers, processors, and retailers - to improve shrimp welfare.The company has effectively eliminated the practice of eyestalk ablation – used to increase egg production in breeding shrimp – reduced the stocking density and introduced electrical stunning before slaughter. Its partnership with the Shrimp Welfare Project has been instrumental in developing humane stunning solutions and setting industry standards.

A Special Recognition Award for Innovation was also awarded to British retailer Marks & Spencer. In partnership with shrimp producers and supported by FAI Farms, M&S has developed a comprehensive protocol to monitor the health and welfare of shrimp throughout its supply chain.

Salmon producer Cermaq received a Special Recognition Award for its commitment to humane stunning methods for salmon. It is the second-largest Atlantic salmon producer to adopt a global humane slaughter policy – following Mowi ASA’s commitment in 2022 – which applies to all their farms and operations in Norway, C ile an Cana a enefitin over illion sal on annuall

Dr Tracey Jones, Global Director for Food Business, Compassion in World Farming, concluded: “The geographical diversity, range o species an t e vast nu er o ani als set to enefit ro this year’s award winners are truly remarkable... it’s particularly encouraging to see innovation in aquaculture being recognised this year. Aquaculture species are sentient beings and their welfare is just as important as that of land animals. Recognition of their specific nee s is eco in ore i el ackno le e

AKVA group looks set to land the supply contract to build a planned new smolt facility for Cermaq Chile.

It is thought that Billund would get the supply deal, but the company ceased trading in the summer.

The AKVA group is the world’s largest supplier of solutions and services to the aquaculture industry.

In a brief announcement to the Oslo Stock Exchange, AKVA said: “AKVA group ASA is pleased to announce that a Letter of Intent has been awarded from Cermaq Chile SA related to a RAS contract for the new smolt facility in the Los Lagos region in Chile.

“AKVA will start with engineering and site work during Q4 2024.The value of the contract linked to the Letter of Intent is approximately €30m (£25m).The final contract is expected to be awarded from Cermaq during Q4 2024.”

Mitsubishi-owned Cermaq said earlier this year that the project,

called Nueva PCC, near the city of Paragua, will be one of its most important in the region.

It will have a production capacity of 14 million smolts per year. Cermaq Chile said the second stage of the PCC (Post-Larval Capture and Cultivation) farm will be called Canal de Chacao Fish Farm.

The fully automated project, which will be the company’s largest in Chile, includes cutting-edge technology in all its production phases, will allow the complete fish cycle to be carried out in fresh water, producing smolts from eyed eggs, with a minimum average weight of 150 grammes.

Singapore-based Barramundi Group has been given a form of insolvency protection while the company attempts to carry out financial reconstruction.

On 11 October, the fish farming group made an application to the High Court of Singapore for a “Moratorium Order” which would give it a period of six months’ protection against a winding-up order or the appointment of external administrators.

The court agreed to grant four months.

The Moratorium will also protect Barramundi against any “execution, distress or other legal process against any property of the company” unless sanctioned by the court. Barramundi, which is listed on the Oslo Børs, said: “The company requires the reliefs provided by the Moratorium Order to protect it from creditor enforcement action, while giving it breathing space to carry on negotiations for a restructuring and compromise of its debts with its creditors.”

It also announced that the group has obtained a bridging loan of SGD 400,000 (£234,000) from a shareholder. The loan, the company said, will help to finalise restructuring plans.

In September, Barramundi announced that it would be embarking on a financial reconstruction programme with the help of its financial advisor, KordaMentha Pte Ltd.

Last year the group’s Australian farms were placed into administration after ambitious expansion plans had to be abandoned. The Australian operations were subsequently sold to Tassal, a Cooke subsidiary. Barramundi is now planning to invest in sea farming, and a RAS (recirculating aquaculture system) site, in Brunei.

Meanwhile the Oslo Børs has placed the Barramundi Group in what it calls the “Recovery Box”, reserved for those companies “subject to circumstances that make pricing of the securities particularly uncertain”.

Above: (L-R) Daði Pálsson, Managing Director of Laxey; Karl Ásgeirsson, Sales Manager at Baader Iceland; and Kristmann Kristmannsson, Project Manager for Processing and Procurement in Laxey.

ICELANDIC fish farming company Laxey and Baader in Iceland have entered into an agreement for the delivery of processing equipment for Laxey’s landbased farmed salmon plant, currently under construction.

Laxey is building a new fish farm in the Westfjords region which is planned to have a production capacity of 32,000 tonnes by 2031.

For Laxey, the partnership with German-based Baader is important in

securing equipment and production technology, which the fish farmer said will support its plans for high-quality products for the global market.

Kristmann Kristmannsson, Project Manager for Processing and Procurement, said: “We are excited about this partnership with Baader, which is at the forefront of technology solutions for the marine industry.

“This agreement can lay the foundation for a successful

collaboration, and we expect that this will be the beginning of a successful relationship that will contribute to promoting the Icelandic land farming industry.”

Karl Ásgeirsson, Baader’s Sales Manager in Iceland, added: “We are proud to participate in this important project with Laxey. Our equipment will ensure that they can meet the strict demands made for quality in production in the international market.”

Laxey said Baader, a German-based global company developing and manufacturing equipment for salmon processing, is known for solutions designed with production quality and animal welfare in mind. This approach, the company said, makes Baader a good partner for Laxey which focuses on responsible food production while meeting the demands of customers around the world.

“We expect that this will be the beginning of a successful relationship ”

BEWI, a leading provider of food and seafood packaging components, is set to merge its traded food packaging business with STOK Emballage (“STOK”), forming a combined Northern European packaging solutions group.

BEWI will receive a cash consideration of €20m (£16.7m) in addition to an ownership position in the combined entity of around 15%.

Christian Bekken, CEO with BEWI, said: “Partnering with STOK presents a unique opportunity to further expand the traded food packaging business with a highly capable partner.”

BEWI’s traded food packaging business currently has net sales of approximately €75m (£62.5m).

The business has a solid position within seafood and food packaging in Norway and Iceland, with a particular focus on the seafood industry.

STOK is a leading value-added distributor of protective packaging in Denmark and Greenland and provides a one -stop solution of packaging products, machinery, logistics services, and regulatory and compliance advice.

The company has strategically located warehouses in Denmark, Greenland and Norway. The complementary combination of BEWI’s traded food packaging business and STOK creates a leading packaging distributor across Denmark, Norway, Iceland and Greenland.

STOK had sales last year of €113m (£94.2m). The new combined company will have annual sales of close to €190m

(£158.4m) and a clear strategy for further growth, said the announcement.

Christian Bekken added: “STOK is an ideal partner for our traded packaging business, and we are truly looking forward to joining forces with their team of industry experts.

“They have an impressive track record of profitable growth over several years, and their broad and diverse product portfolio complements ours very well, creating a strong potential for synergies and further growth opportunities.”

AN agreement has been reached for the purchase of the assets of the Icelandic seafood processing equipment company Skaginn 3X, which filed for bankruptcy in the summer.

A group of investors with the firm KAPP, another Icelandic technology company, will buy all the equipment and liquid assets of the Skaginn estate in Akranes.

Skaginn 3X was a well-known name in the world of seafood processing and aquaculture equipment, but it filed for bankruptcy four months ago after Baader, its German parent company since 2021, failed to turn the business around.

More than 120 staff were laid off despite attempts to save the company. Now a new company, KAPP Skaginn, has been created to move the operation forward.

Iceland’s salmon and fish processing industries are expanding

at an impressive pace and the new owners see an opportunity for Skaginn, which is majority-owned by Skaginn ehf. It will also look outside Iceland for business.

Freyr Friðriksson, KAPP’s CEO and largest shareholder, said that it could be challenging to re-hire staff but he was optimistic about the company’s future despite the fact that the market was not easy.

He said: “The market here at home and abroad is difficult, but we are certain that there are opportunities and we just have to approach them.”

He said the new operation was confident that the past knowledge and experience of staff with the previous operation along with goodwill from previous customers will prove a strong asset.

The deal is subject to approval from Iceland’s Competition Authority but the aim is to restart operations next month.

NORWEGIAN researchers are working on possible ways to eliminate Listeria food poisoning bacteria in salmon and trout.

Listeriamonocytogenesis a commonly occurring organism in the environment and it is very hard to eliminate. The DeList project, underway at Norwegian food research institution Nofima, is looking to see whether dipping a fish fillet in a bacteria-killing substance could safely reduce the threat of contamination.

Senior Researcher Tone Mari Rode, who leads the DeList research project, said: “In our experiments, we’ve used several methods that aren’t yet approved by Norwegian authorities. That’s the nature of research. If you don’t try new methods, you won’t know what works and what doesn’t.”

In the experiments, brown trout is first exposed to Listeria, then dipped in various treatment baths to determine what can remove or reduce the bacteria.

“We’ve used acetic acid, low pH, and antimicrobial – bacteria-inhibiting – substances. Nisin, which is approved in Norway for use in dairy products, is one of them,” explains Tone Mari Rode.

The project is funded by the Norwegian Seafood Research Fund, FHF.

A DISPUTE has broken out between Norway’s salmon industry and the na�onal broadcaster NRK over claims that some of its employees are developing asthma through their work.

NRK has highlighted research findings from a study carried out on workers at St Olav’s Hospital in Trondheim.

The broadcaster said reports from the hospital showed that a number of people, some of them immigrant workers, were suffering from “salmon asthma”.

One woman was so ill she thought she was having a heart a�ack. Others found themselves unable to go to work.

Doctors are con�nuing with the study, but some have described the development as “frightening” with more pa�ents appearing at clinics.

A lot of water is used in fish processing plants, leading to �ny droplets forming which the workers breath in – and this could be part of the problem, researchers suggest.

But the salmon industry employer organisa�on Seafood Norway said that an incorrect image is being portrayed. NRK chose not to say that around 15% of all asthma cases among adults can be caused by exposure in different workplaces and it does not have to involve the salmon industry.

Seafood Norway CEO Geir Ove Ystmark said: “For those who are affected by work-related asthma, it is of course sad to hear.

The aquaculture industry has par�cipated in projects related to this and to look at what can be done to prevent people from ge�ng asthma.”

Research also shows that the salmon industry could be no more exposed to this than other industries.