Report from the TriNations 2024 event

A different approach to raising salmon

Find out what can it do for aquaculture

West Africa: unethical source of aquafeed?

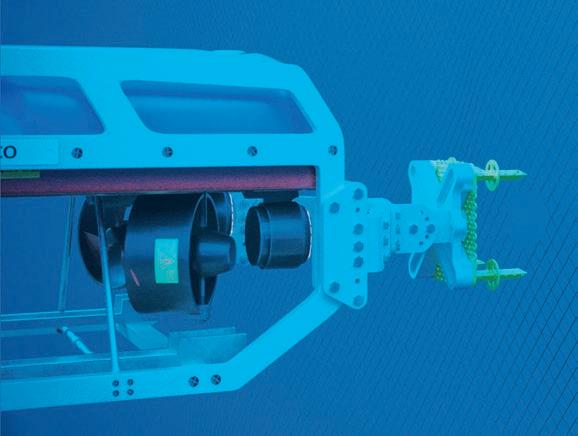

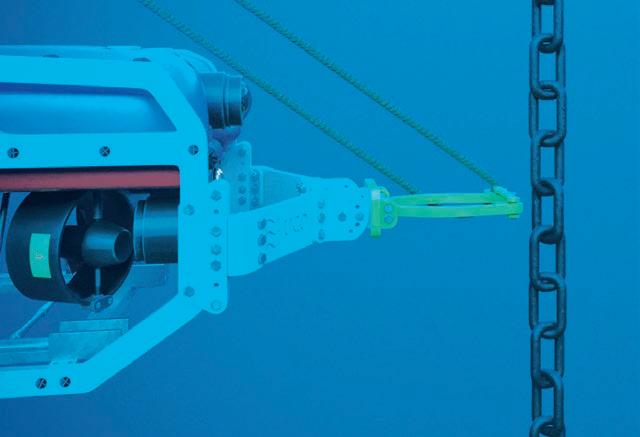

Combines a fully independent ROV (multiple ROV platforms can be utilised) with our patented mort collection system. Powered by an inspection class ROV, this system is very manoeuvrable and able to cope with challenging environments. The ROV can be detached and used to undertake inspection work or other underwater tasks with our range of tools, such as net repairs, rope cutting or attaching.

This in-house designed mort collector is powered by water jets, making it robust, simple to operate and the more cost effective method for mort removal. There is limited moving parts, resulting in low maintenance and this system too can cope with the harshest environments found in salmon and trout farms.

Both systems come with a variety of collection basket sizes.

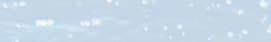

Our F90 basket has a 90 litre capacity, which can be used for the recovery of small fish such as sea bass and sea bream farmed in the Mediterranean Sea or even be used to collect salmon smolts or juvenile fish.

The F600 basket (600 litre capacity) can be used for harvest sized salmon and trout and can even be used to collect brood stock. The F440, is our standard size and provides a good balance of footprint and capacity.

The NetFix repair system uses a patch to cover small holes in fish pens. Deployed with an ROV following an inspection, the temporary patch can be placed easily, ensuring full containment of your stock.

Our range of tools can be used to turn your ROV into a more useful underwater tool, with the ability to loop ropes, attach a carabiner hook or cut ropes. The tools fit into the same frame used for the NetFix repair system.

HANGE is pretty much a constant these days, but sometimes it takes effect in a particularly dramatic form. Just like that, the UK has a new government.

What does it all mean for aquaculture? It’s safe bet that fish farming will feature pretty low on new PM Keir Starmer’s priorities, but even so the Labour government’s strategic aims will have an impact, from a willingness to improve relations with our European neighbours and the UK’s devolved governments to a commitment to clean up Britain’s waterways and coastlines. Our article on the new political scene suggests what’s next.

And as Salmon Scotland’s Tavish Scott writes in his column this month, the salmon industry is taking its message not only to a new UK leadership but to a (relatively) new First Minister in Scotland.

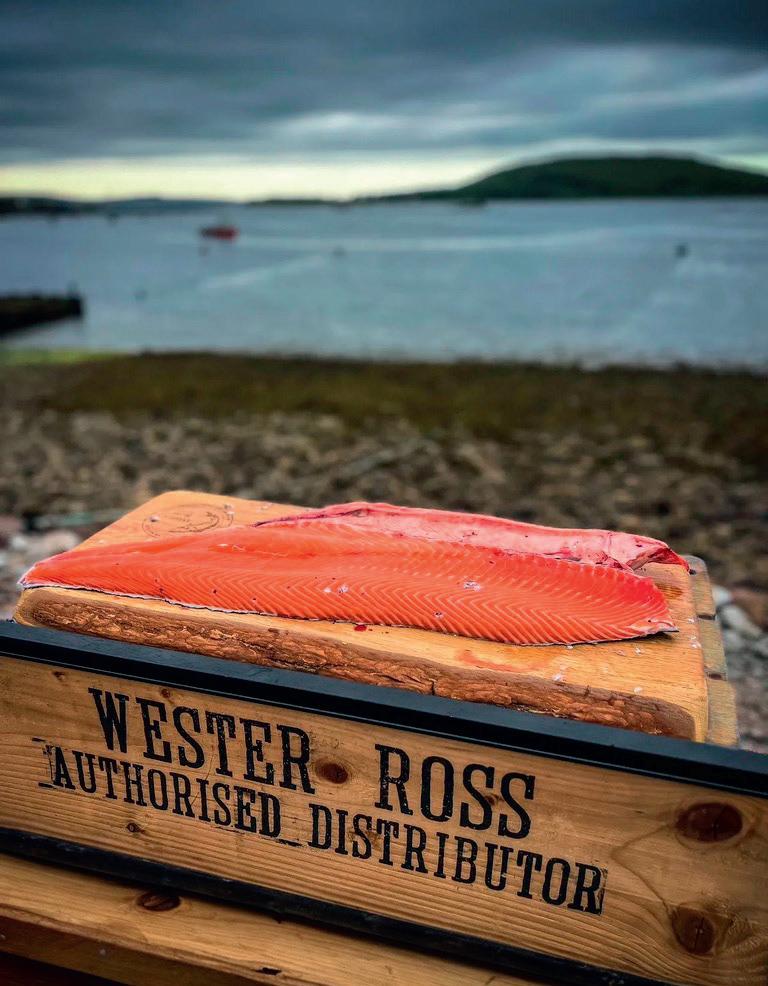

For Wester Ross Fisheries, change came suddenly two years ago when it emerged that the company, formerly one of Scotland’s few remaining independent salmon farmers, had been acquired by Mowi, the world’s biggest player in this industry.

Wester Ross has a very distinctive approach to rearing salmon, with smaller pens and hand feeding wherever possible. There was a lot of speculation, therefore, over how the Wester Ross way might change under Mowi’s ownership.

Fish Farmer visited Wester Ross to ask that question – you can see what we found out in our cover story this month.

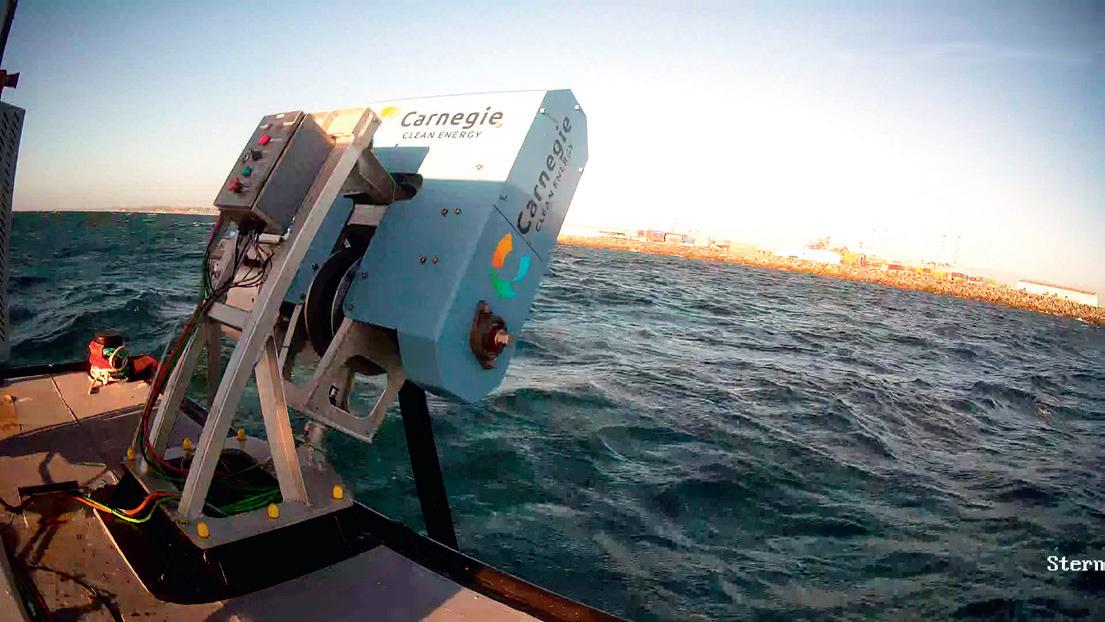

Meanwhile, the August issue also features Sandy Neil’s article on “green energy” and how it could be deployed effectively in aquaculture. Vince McDonagh examines the impact (so far) of Norway’s “salmon tax” and at a couple of projects that are setting out to find out more about the jellyfish threat; and Nick Joy looks back at a quarter-century for Loch Duart, the business he co-founded.

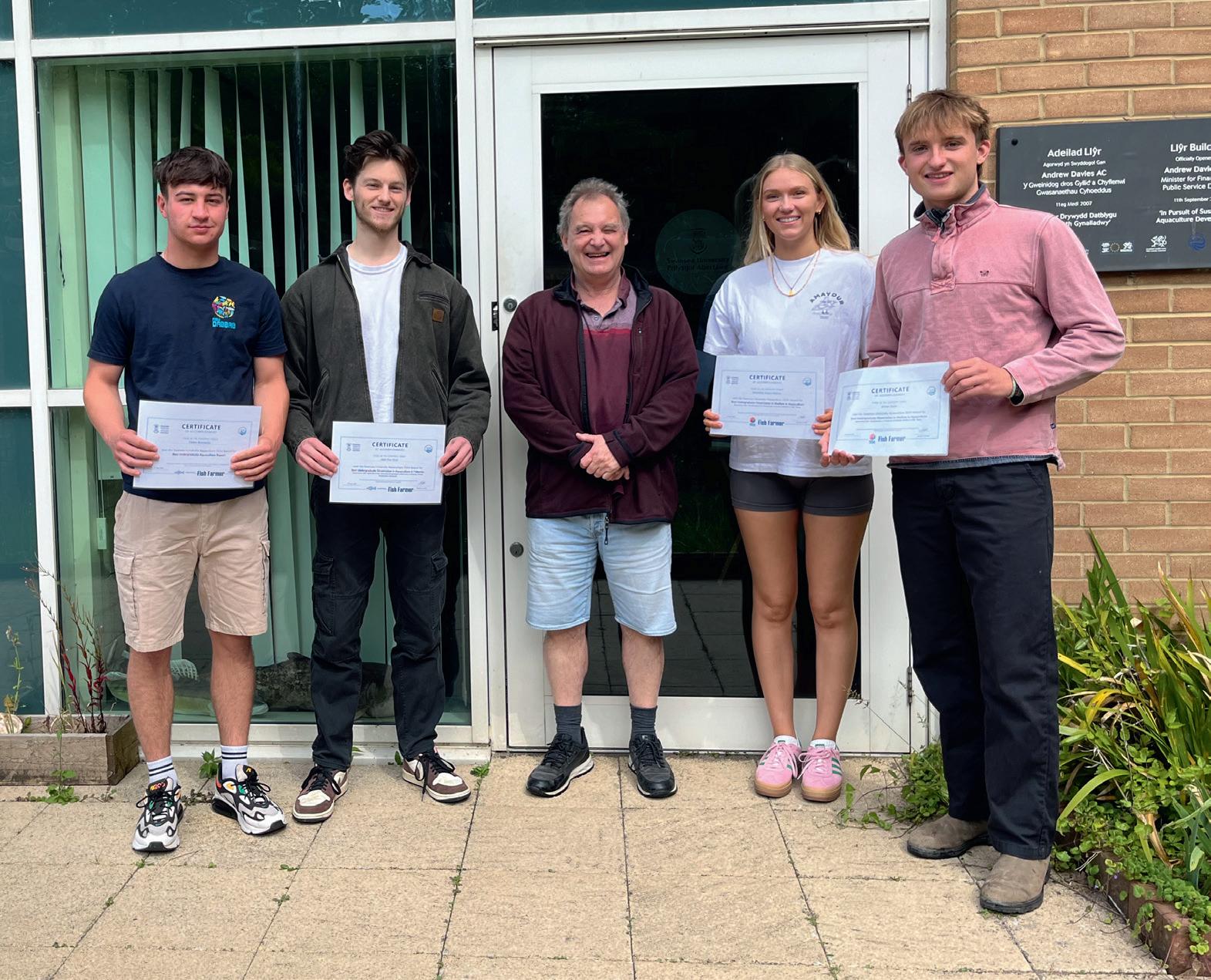

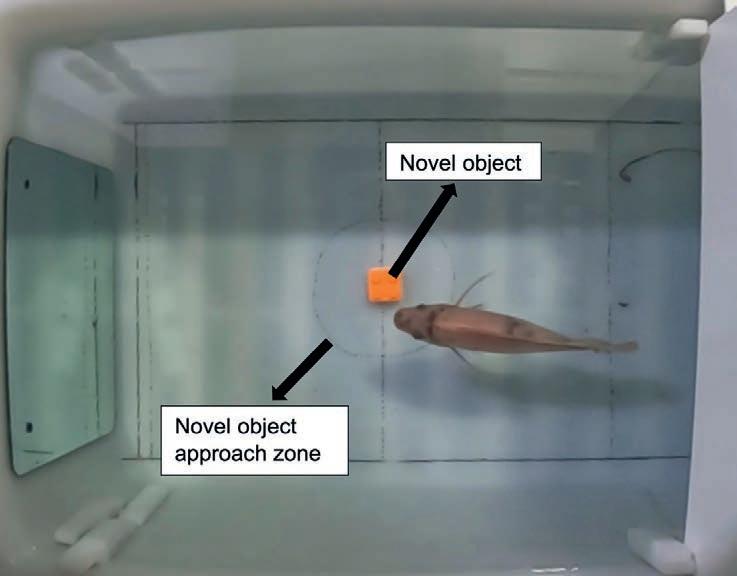

It’s not all salmon – we also focus on a study showing how shrimp farming can benefit from a combined approach including seaweed and shellfish, and on the winning student projects at the University of Swansea, which raise interesting questions for tilapia and shrimp welfare.

Read all this and more in our packed August issue!

Best wishes Robert Outram

Meet the team

Editorial advisory board: Steve Bracken, Hervé Migaud, Jim Treasurer, Chris Mitchell and Jason Cleaversmith

Editor: Robert Outram

Designer: Andrew Balahura

Commercial Manager: Janice Johnston ohnston fishfarmermaga ine com

Office Administrator: Fiona Robertson frobertson fishfarmermaga ine com

Publisher: lister Benne

@fishfarmermagazine

www.fishfarmermagazine.com

Fish Farmer Volume 47, number 08

Contact us

Tel: +44(0)131 551 1000

Fax: +44(0)131 551 7901

Email: editor fishfarmermaga ine com

Head office: Special ublica�ons Fe es ark 496 Ferry Road, Edinburgh EH5 2DL

Subscrip�ons address: Fish Farmer maga ine subscrip�ons arners roup ublica�ons plc The al�ngs est Street Bourne Lincolnshire PE10 9PH

Tel: +44(0)177 839 2014

UK subscrip�ons: £75 a year OW subscrip�ons: £95 a year including postage all air mail

Nicki

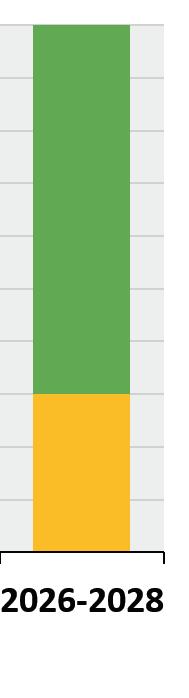

THE Scottish Government has defended its decision to allow a four-year implementation period for new regulations which will reduce the permitted limits for a key sea lice treatment. Environmental campaigners have expressed concern that the new limits will not be imposed sooner.

reduce the number of treatments that can be made in a cycle.

The consultation on a new environmental quality standard (EQS) for emamectin benzoate (EmBz), marketed commercially as Slice, ran from April to July last year. The EQS will see the limit of 763 nanograms (ng)/kg of sediment wet weight reduced to 272ng/kg dry weight.

“Emamectin benzoate is persistent in the environment, breaking down slowly, therefore, to avoid exceeding the environmental standard, sufficient breakdown is necessary before more can be accommodated or increased waste capture is required.”

The Scottish Environment Protection Agency (SEPA) said that tighter limits were being introduced following scientific evidence that EmBz is harmful to crustaceans in the areas it is used, as well as the sea lice which it targets.

Views in the consultation ranged from resistance on the part of some producers, and scepticism over the scientific basis for the change, to calls from environmental lobby groups for a complete ban.

While the new limits for EmBz are already being applied to applications for new or increased discharges, the Scottish Government stated: “Taking into account sector concerns and the need to safeguard the environment, Scottish Ministers will direct SEPA to implement the EQS within a 48-month timeframe.”

The statement went on: “Scottish Government acknowledges that the application of the new EQS is likely to

The time allowed to implement the change acknowledges concerns that fish farmers will need to change their lice treatment plans, especially for younger, smaller fish that will less easily withstand handling in mechanical or freshwater treatments.

The grace period was not universally welcomed, however. John Aitchison, Chair of the Friends of the Sound of Jura, posted on X (formerly Twitter): “By 2028, the Scottish Government will have allowed salmon farms to discharge the pesticide emamectin benzoate into the sea for 12 years, at levels that it knew were killing wild crustaceans far away from the farms. Scottish Ministers should be ashamed.”

Peter Pollard, Head of Ecology at the Scottish Environment Protection Agency, said: “As Scotland’s principal environmental regulator, we’re clear in our role around safeguarding our marine environment.The development of the new environmental standard for emamectin benzoate (EmBz) in marine sediments was led by the UK Technical Advisory Group.

“The standard was derived following

internationally agreed methodology for setting environmental standards and using the best available scientific evidence on the toxicity of the medicine to aquatic life.We remain confident in the approach undertaken by UKTAG and the Scottish Government, which is led by scientific evidence and understanding in accordance with a procedure set in law and EU-wide guidance.

“SEPA have been applying the new environmental standard when determining applications for proposed new, or increased, discharges of EmBz since March 2023. This updated interim environmental safety limits that we had been applying since 2017 to regulate all proposed new, or increased, discharges of EmBz.

“Following Scottish Government’s decision on the application of the new environmental standard to all discharges, including those authorised prior to our application of interim safety limits in 2017, we have begun work to calculate updated licence conditions. These will reduce the quantities of EmBz that can be discharged and enable the progressive recovery of the environment from the effects of past discharges. We will ensure these new conditions come into force, and are complied with, in accordance with the timetable set by Scottish Government.”

Dr Iain Berrill, Head of Technical at industry body Salmon Scotland, said: “Scotland’s salmon farmers take their responsibilities to the environment very seriously and provide world-leading standards of animal health and welfare that are independently verified by government and third-party certification bodies.

“We have engaged fully in the process to establish a scientifically robust standard which is based on the most up-to-date and rigorous evidence available, adheres to European guidelines, and includes a high margin of safety to protect the marine environment.”

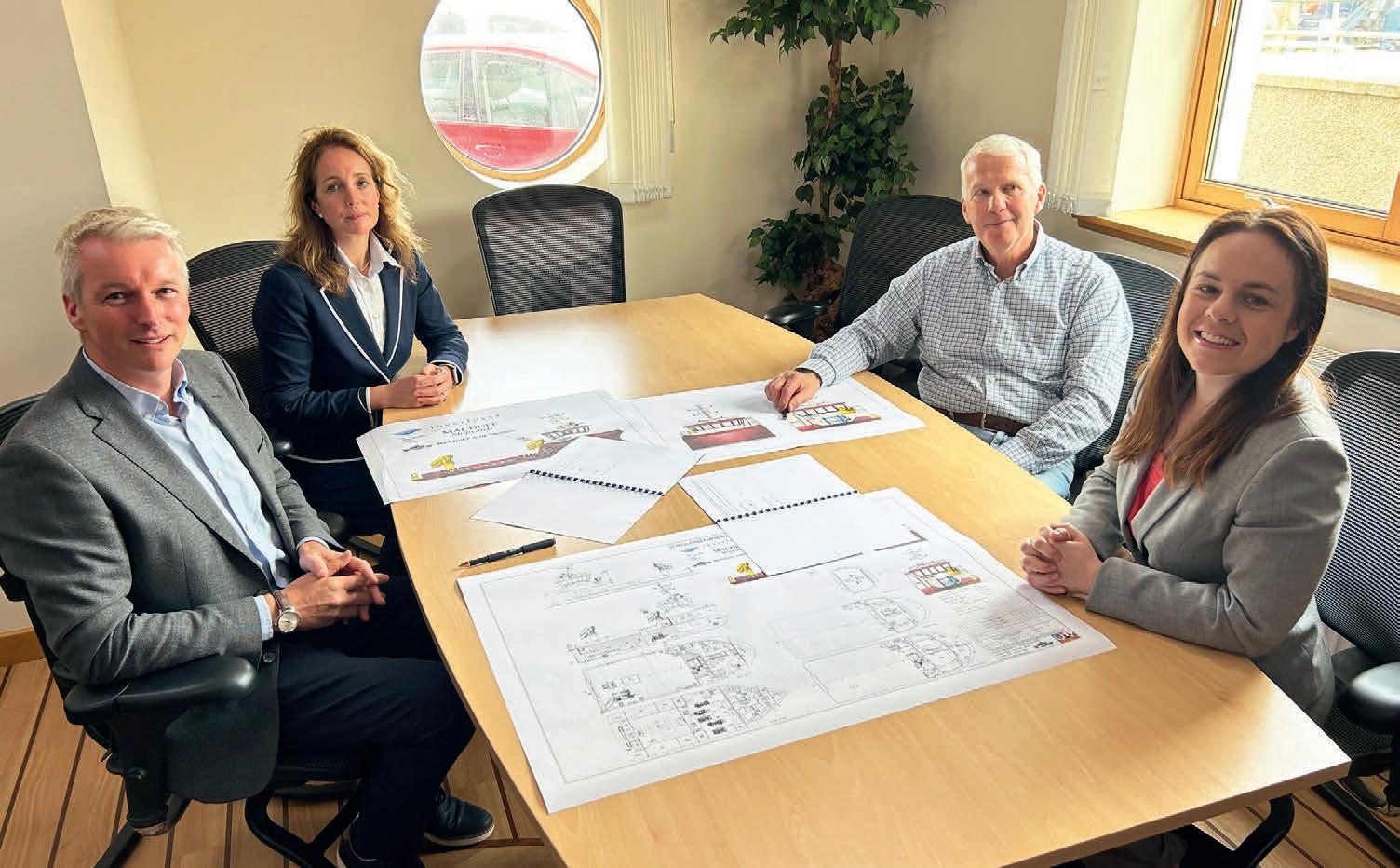

THE first of five fully refurbished Sea-Cap barges (pictured below) has been delivered to Mowi Scotland at Loch Etive.

The move is part of a project to reduce the number of farms from four to three while ensuring that all operations and the visual appearance of the sites meets the highest standards.

Three barges will be used in Loch Etive and will feed remotely from the shore base, reducing marine traffic on the loch and vessel emissions, while two barges will be available for Mowi’s operations in Ireland.

Mowi said that the upcycling of redundant concrete barge hulls into low profile energy-efficient hybrid barges will provide sustainability benefits and cost savings of around £4m relative to purchasing new feed barges.

A consultation exercise was held with residents in the Loch Etive area. The sites have been part of Mowi since it acquired them from Dawnfresh in 2022.

Area Manager Clara MacGhee said: “Upon consultation to gauge the views of the communities surrounding Loch Etive, residents were largely supportive of the changes to lower profile equipment and hybrid battery barges.”

Some, however, said that farming operations could be tidier, so this shift is an important step to reduce the impact on the surrounding area, she added.

Dougie Gibson, who is a specialist in vessel and barge engineering, said: “The refurbishment and re-use of these redundant barges is a great use of resources with a positive outcome for the environment. All five barges have been fitted with sound proofing and designed to lessen the height and visual profile, reducing emissions and noise.”

Stewart Graham, Gael Force Group Managing Director, commented: “With the advances in technology and barges now being able to be remotely operated from feed control centres, it became clear that there was a potential large sustainability and economic upside to upcycling the barges... it is a superb example of low environmental impact and low-cost repurposing of an existing asset which, due to the hybrid system fitted, will now also run with very significant energy savings too and we congratulate Mowi for its vision and commitment to this ongoing upcycling project.”

Harvest has seen its application to open two new marine farms off Skye knocked back for a second time.

The company, which raises organic salmon certified by the Soil Association, is looking to operate two sites at Flodigarry and Balmaqueen, on the north-east coast of Skye. It says the expansion is necessary because its two existing farms at Culnacnoc and Invertote, also on the Skye coast, are by themselves not economically viable. Previously, applications for larger farms on the same proposed sites were rejected because their presence would, Highland Council ruled, spoil the visual amenity of the area.The sites are overlooked by footpaths although these are not heavily used. This time, planning officers had recommended the planning applications be approved, but they were overruled by a majority vote in the North Planning Applications Committee.

At the time of writing, the company was believed to be considering its next steps.

AQUACULTURE services business Inverlussa has acquired its rst e t e esse ic s een ren e Isaac McKinnon i e r in it s n r ucer i n t e est c st f c t n

n er uss re er tes r ts f r t e s n in ustr n t e iti n f t e c n s rst e t i rin its t t fleet t

The Isaac McKinnon icture ri t s en t f n

e c cit f 3 t s re tte n u r e t t e s

e i r in r ere it s ri in ui t

en i s n n er uss s n in irect r s i is is er e citin ti e f r t e c n es ite it ein n tur r ressi n fr ur current er ti ns it is sti i ste f r r f r us

n er uss ins er s nu er f se e t er t rs e c n s s it s re recruite e erience cre int e r es n u s i e s e f its current r f rce

in t t e future t e s n t ttr ct ne t ent int t e in ustr i t eir recent nn unce ets i r r e

ri r t t in fleet

n er uss s s c issi ne ne ri r t fr

c uff i r s e ne ri iese e ectric r t

i e etres n n er te it cre f si t i

e e ui e it u r e cr ne c cities n ec e ui ent

inc u in r er t in n e ut inc es esi ne t ift n t e ects suc s fee r es is s eci ise e ui ent i en nce t e r s s n f r rin ri

n in c i ities n net iftin c cit

nten e t ser ice r er sites er tin in ee er re e se n re te ffs re c ti ns t e esse s esi n e sises nce se ee in c i ities t r i e st e tf r in r u se s

t i s fe ture e ensuite c ins it si ni c nt f cus n n ise re ucti n es eci en c n uctin ur er ti ns t en nce cre c f rt n i in c n iti ns r

c t n s e ut irst inister te r es e c e t e nn unce ent s s e itnesse t e c ntr ct si nin t c uff r ur

e s i n er uss s test esse i rin re i u it

s t c t n i e rnessin reen tec n ies t su rt ur net er iti ns

t is cruci t t e c ntinue t e r ce inn ti n in u cu ture r ctices s t t t e sect r c n ec e resi ient t t e ressin c en es se c i te c n e

eafish launches sur e on ear end-o -li e issues

SEAFISH, the public body which supports the UK seafood industry, has launched endof-life fishing and aquaculture gear surveys to help minimise waste and encourage greater recycling. Seafish’s researchers

will interview supply chain stakeholders to glean important insights, including where gear is manufactured and assembled, the types of materials used, the average lifespan and what happens once the gear reaches the end of its useable life. Seafish has invited anyone involved in fish or aquaculture, or with expertise on this issues, to take part in the survey by contacting . survey seafish.co.uk and Seafish researchers will be visiting sites around the in August and September.

TH- AST Scotland-based engineering specialist Brimmond has reported a increase in turnover for the - financial year.The company saw revenues hit . m, far exceeding its target of m.

The business has won a number of high-value contracts across multiple sectors, including a five-year service contract with British Antarctic Survey BAS for crane servicing and engineering support on the oyal esearch Ship S Sir David Attenborough.The company’s largest service contract to date will see Brimmond become the main hydraulic contractor for refit periods, working across the ship’s osyth and Harwich bases.

I’S Inchmore Hatchery, south of Inverness, is undergoing a major transformation into a unique visitor experience. The Scottish visitor centre will showcase how the industry is helping to feed an everincreasing world population in a sustainable way, continually adapting and evolving to

improve itself and the end product. reative agency Dynams are leading the project, developing a concept that will appeal to key stakeholders including politicians, investors, buyers customers, community groups and those interested in careers in the industry. The transformation makes use of bold static graphics and unique sensory displays, as well as interactive digital touchscreens featuring a series of short films that delve deeper into the owi story.

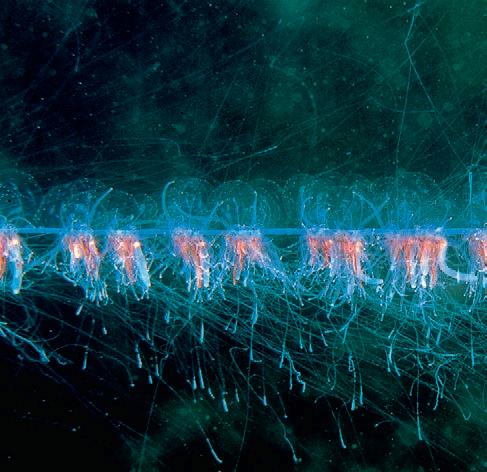

A CONSORTIUM of researchers from Scotland, Norway and the Faroe Islands are working on a project aimed at creating a better model for the dispersion of sea lice in water.

The project, known as SAVED – Sustainable Aquaculture: Validating Ectoparasite Dispersal (Models) – recently received a funding boost from the Sustainable Aquaculture Innovation Centre (SAIC).The aim is to create a new system to validate the results of existing dispersion models.

Project partners include the University of Strathclyde; Mowi Scotland; Scottish Sea Farms; Bakkafrost Scotland; the Scottish Government’s Marine Directorate; the Norwegian Institute of Marine Research; Firum, Aquaculture Research Station of the Faroes,The NW Edge, and Scottish Environment Protection Agency (SEPA), as an observer.

Sea lice modelling has become a key element in planning consent f r s f r s in uris icti ns i e r n re recent Scotland.There is no universal consensus, however, regarding whether the models currently used to predict sea lice dispersion reflect re it in t e rine en ir n ent

A variety of dispersal modelling tools are already available. However, each model works with a different set of underlying assumptions, meaning they tend to return different results. A new, universally accepted tool for cross-comparison between models and data could lead to a more robust, standardised approach to model evaluation, the researchers say, leading to more accurate predictions of tenti ris t i s

SCOTTISH-based Seaweed nter rises is r isin n nce t build the UK’s largest multispecies seaweed processing hub – and has rolled out a new brand identity for its products.

The company’s new brand is “House of Seaweed” and its plan is to unlock the European bottleneck curtailing growth by stabilising seaweed at scale and producing quality bulk ingredients. Its plans include development to be the UK’s rst u ti se ee r cess r accredited under the BRCGS food safety standard scheme and able to handle any seaweed species by enhancing production capabilities and supporting its own journey to net zero targets.

Pete Higgins, Co-Founder and CEO of House of Seaweed, commented: “We are thrilled to unveil House of Seaweed, a name that embodies our commitment to excellence,

sustainability, and innovation. ur ne i entit reflects n celebrates the brilliance of the raw material we work with and tells the story of who we are, what we do, and the future impact we hope to have.

“We are driven by the environmental and societal impact we can make through our hero ingredient, together as a team alongside our partners, suppliers and customers."

In August last year, Seaweed Enterprises acquired the assets of Fife-based Mara Seaweed.

AQUACULTURE

features prominently in a new report setting out research priorities for the UK’s animal-based food sector.

Governmentsupported body the UK AgriTech Centre has published a report, Livestock and Aquaculture Innovation: Shaping the Next Ten Years, based on input from more than 150 stakeholders in the livestock and aquaculture industries.

The Agri-Tech Centre was created in April this year with core funding from Innovate UK, following the merger of three existing Agri-Tech Centres. The report sets out 11 thematic priorities, which all fall within the Agri-Tech Centre’s strategic themes.The 11 priorities are:

• Animal Health

• Animal Welfare

• Food Safety, Quality and Nutritional Content

• Climate-Smart Solutions

• Productivity

• Optimised Diets

• Ecosystems and Biodiversity Improvement

• Optimised Land Performance

• Optimised System

• Data Asset

• Technology

Phil Bicknell, UK Agri-Tech Centre CEO, said: “Agri-tech inn ti n s si ni c nt potential to support sustainable and resilient livestock and aquaculture systems, but to do so, we must get ahead of the curve and anticipate tomorrow’s challenges today."

MOWI has reported a second quarter trading EBIT or operational profit of €230m (£195m) with Scotland continuing to improve. This is slightly lower than what some analysts had been forecasting, however.

The world’s largest Atlantic salmon farmer produced a total harvest of 110,500 tonnes, 3,000 tonnes higher than a year ago.

The Scottish harvest was 19,500 tonnes against 18,000 tonnes last year. The Scotland EBIT per kg was slightly lower at €2.20 (£1.88), but it was the second highest in the group.

Mowi said the operational EBIT for the group was approximately €230m (£197m) in Q2 2024. The blended farming cost was €5.84 (£4.99) per kg in the quarter which represented an improvement of €0.21 (£0.17) per kg from €6.05 (£6.15) per kg in the first quarter.

The harvest breakdown in gutted weight equivalents is as follows:

• Farming Norway 59,500 tonnes

• Farming Scotland 19,500 tonnes

• Farming Chile 14,500 tonnes

• Farming Canada 9,500 tonnes

• Farming Ireland 3,500 tonnes

• Farming Faroes 2,500 tonnes

• Farming Iceland 1,500 tonnes (Arctic Fish)

Total 110,500 tonnes

The operational EBIT in consumer products was €25m (£21m) while the operational EBITDA in feed was €11m (£9m).

The reported financial net interest-bearing debt (NIBD) for the group was approximately €1.88bn (£1.6bn) at the end of the quarter (excluding IFRS 16 effects).

created to detect harmful plankton has analysed around 38 million i es in its rst e r f er ti n t

s f r site in et n e in t t uses a combination of lasers and cameras to detect and photograph microscopic, single-celled phytoplankton in the water, before uploading data for specialist analysis, detection and monitoring. It was deployed by a research team from UHI partners Scottish Association f r rine cience n Shetland, with help from Scottish Sea r s ic er tes t e e ee

s f r in et n t is t e rst ti e

t t n s een e e t r in s f r n ere in ur e

t n t n re critic rt f t e ce n ec s ste ut en t e re c r e nu ers r s t e c n cre te t ins ic re n er us t u ns e tin s e s t t e s r e

t e e s c n s e r fu t f r e s n t n because of the toxins but because they use up dissolved oxygen in

the area, creating a health problem. ince enterin t e ter t e ee in s rin t e s photographed phytoplankton around t e c c t inute inter s n s re i enti e tren s in t e presence of phytoplankton from more than 38 million images taken so far.Thanks to funding from the Sustainable Aquaculture Innovation entre rese rc ers e observations will help them to better understand seasonal trends in harmful phytoplankton blooms. r ect e er r f eit i s n f s i t is n t ri us if cu t to predict when an algal bloom will occur, given the various environmental factors involved in its formation.The more warning e c n i e s n s e s f r ers t e etter t e c nce t e have of mitigating the impact.

it t e e e irtu t n ist n ut r un t e clock, identifying potential risks before a scientist has even looked down a microscope."

SEAFOOD consumption in Britain is continuing to decline, a new survey by the industry body Seafish has found. Cost inflation, which reached its peak last year, is one of the main reasons, but the study says other factors are also in play.

The report says that seafood consumption in the UK fell 22% between 2006 and 2022, but post-Covid the decline has accelerated,

and is now equivalent to a fall of 30% every 10 years.

Seafood retail sales have fallen by 13.6% since the peak in 2021. For foodservice, servings of seafood remain flat, hovering around 20% lower than before the pandemic. Servings are down 18% compared with 2019.

There are a few positives such as farmed fish (presumably salmon) and convenience meals, but the overall picture is not great.

Seafish says: “As with other parts of the food sector, the seafood industry is facing severe challenges but also the prospect of substantial opportunity.

“We’re exploring how seafood consumption in the UK is changing and how key drivers are generating opportunities and threats now and into the future. “

The Fish as Food review concludes that in the wider world, major changes are afoot, driven by economic and food security prospects, and climate change.Major changes are underway in food expectations with possible changes in production.

“Seafood could struggle under tough conditions in the next five years,” it warns.

The review continues: “There are immediate challenges such as inflation, costof-living, and the Russia - Ukraine conflict. These challenges, and others, could lead to significant structural change for the industry.

“However, in the face of these changes, seafood has a window of opportunity.

Seafood’s position in the market will be strengthened if it is promoted as a highquality protein that is value for money."

WORK is underway to recover a Scottish Sea Farms landing craft that sank in July.

The Julie-Anne was at its mooring at the Fiunary salmon farm, in the Sound of Mull off Scotland’s west coast when the incident occurred.

So far there is no clear explanation of why the boat, which had no-one on board at the time, sank. At the time this magazine went to press, it was hoped that the deployment of a larger salvage vessel u succee in refl tin t e JulieAnne. When the incident occurred, Scottish Sea farms immediately n ti e t e riti e n st u r enc rine n ineers

ertif in ut rit

c ttis n ir n ent r tecti n enc n rine cci ent Investigation Branch.

n t e ice f t e t e c n s en iste t e assistance of environmental services specialists Briggs Marine. s es ers n f r t e c ttis n ir n ent r tecti n enc s i t t e ti e recei e re rts f sunken vessel at a Scottish Sea Farms site near Fiunary from the coastguard and operator on Thursday 4 July.

e er t r ce s in t e ter t c nt in n potential pollution and prevent dispersal, and divers have been monitoring the vessel to check for and plug leaks.While a small fuel leakage was initially observed, this has been contained and no further pollution has been recorded.The operator will continue to apply mitigation measures before the vessel is recovered.

"Members of the public can report environmental impacts online at sepa. org.uk/report.”

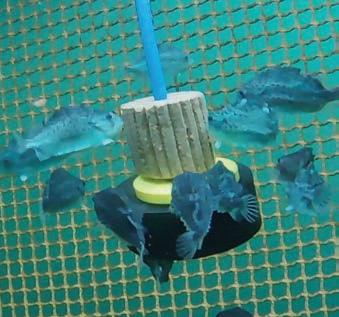

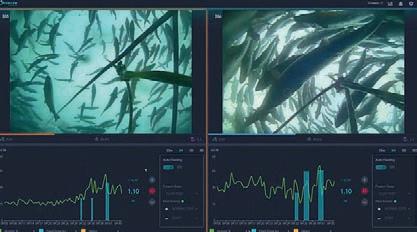

AKVA group has taken full ownership of the UK aquaculture related rti ci inte i ence business Observe Technologies.

AKVA, the world’s largest supplier of aquaculture solutions and services, has had a one-third stake in the business since February 2021.

Based in southern England, Observe Technologies has sold rti ci inte i ence fee in s uti ns t re t n s f r sites r i e

Knut Nesse, CEO of AKVA, said: “The acquisition of 100% shares in ser e is f re t str te ic i rt nce t n i furt er e e n c e ent ur i it fferin s t t e r et

Following the transaction, AKVA will be the sole shareholder of Observe and own 100% of the shares.

e ini u urc se rice f r t e f t e s res f s rt een sett e c s c nsi er ti n n rt

f se ers cre it t t i e sett e in inst ents t e i over the next three years.

n iti n c nsi er ti n n e rn ut u t i u t t urc se rice f i e i if cert in c n iti ns re et

Loch Duart Ltd saw a big drop in profits for the year to 31 March 2024 – but the company says this reflects the cost of its plans for growth.

Turnover for the Scottish-based company was £43.08m (2023: £52.5m) and operating profit was down to £1.29m from the previous year’s £4.67m.

The company’s accounting profit was £710,457 compared with £3.39m in 2023. The company said in its annual report that this was an anticipated decrease “…as a consequence of the plan to revise site structures in support of future growth”.

Interest payable and similar expenses went up to £284,585

(2023: £157,944). Group net assets were also up, from £38.3m in 2023 to £46.7m this year.

Directors’ remuneration was up to £786,687 (2023: £513,722) and the highest paid director received £320,404 not including pension contributions.

The directors said: “Focus on the year has been addressing the increasing biological challenges created by raising water temperatures and the company’s approach to farming, particularly farm size, allows it to apply less intensive solutions which put less strain on fish.

• Boats and Barges - Net Zero

• Careers in Aquaculture

• EAS/WAS Aqua 2024 Review

• Seafarming

• Landbased Farming & Hatcheries

• Shellfish

• Processing News

• Featured Species

For more information on opportunities for advertising with editorial content around these subjects please contact: Janice Johnston 0044 (0) 131 551 7925

nst n s f r er ine c

Copy deadline - Friday 30 August

“The company continues to work on increasing production through new sites and to develop the potential of existing sites. Investments in infrastructure and operational capacity were made during the year and following the year end.”

Loch Duart is also “exploring” the potential for reopening operations in Canada. The company had planned to open three salmon farming sites in Canada more than 10 years ago, but its proposals were blocked by the Canadian government.

Post your vacancy on s f r er ine c

Contact Janice Johnston 0044 (0) 131 551 7925

nst n s f r er ine c for only £225 (+vat) per job posting.

NORWAY’S farmed salmon are less pink than they used to be – and this could partly be due to sea lice treatments.

These are among the conclusions of a study by ofima, the orwegian food research institute.

The findings are based on questionnaires answered by orwegian industry actors in , data on fillet colour from commercial productions between and , and from ofima’s D licences. H

orwegian Seafood esearch und has funded the study, which has been carried out by ofima Senior Scientist Trine Ytrestøyl and her colleagues.

“There is a high degree of correlation between what the fish farmers report in the questionnaire and what we observe affecting pigmentation in the data analysis, so there is reason to believe it provides a realistic picture of the situation, says Ytrestøyl.

Historical data show that the colour intensity of orwegian salmon has decreased somewhat from to , with a slight increase after this period.There is also more variation in fillet colour now than in the past, which supports the results of the questionnaire: some fish farmers struggle more with pigmentation than others.

The researchers believe the investigation reveals the negative effect that repeated mechanical delousing has on fillet colour.This effect has not been documented before and could be caused by several factors. It may be due to increased consumption of an antioxidant

like astaxanthin when the fish are stressed.

However, it could also be that reduced feed intake results in lower slaughter weight, which is of great importance in relation to fillet colour. If fish are slaughtered at a lower weight to avoid more delousing, this will have a further negative effect on colour.

Almost all respondents had taken measures to improve pigmentation. There is more astaxanthin in the feed (50-70 mg per kg) than before and some fish farmers also have more of the omega- fatty acids A and DHA as well as vitamins in the feed.

Ytrestøyl explains: “This has had a positive effect, but it is expensive, and we have tried to find out what leads to inadequate pigmentation.

There are seasonal variations in pigmentation, and this can be taken into account when planning production.Very rapid growth resulted in poorer pigmentation, while the colour increased with greater slaughter weight.There was also a clear negative effect from many mechanical delousing treatments.

This has not been shown before, although it has been mentioned as a possible cause of poor fillet colour. hat surprised the scientists was the significant difference in colour at slaughter between suppliers of hatchery fish.

ow, they are looking to investigate this further to determine what impact the hatchery phase has on pigmentation levels when the fish are slaughtered.

AN explosion in the oxygen supply has led to the death of around 200,000 hatchery fish at a farming facility in Norway. The regional newspaper Bladet Vesterålen

reports that Trond Geir Reinsnes, the owner of the Sigerfjord Fisk site, described the incident as a “nightmare”. The company, which is based in the Sortland

region, is Norway’s largest supplier of Arctic char and also farms some trout.

Reinsnes said: “Mostly these things are a false alarm, but I saw that it concerned a cone that adds oxygen to the water. Then I became more worried, a mistake there is almost a disaster.

“Most of the fish were lost due to a lack of oxygen, although the rescue effort managed to save half the fry.”

The paper reports that one of the cones that produces pressurised oxygen had exploded. This meant the fish did not get enough oxygen-rich water.

Reinsnes said that losing almost a third of the 650,000 fish at the facility was not a total crisis, saying that the situation would have been worse if there had been fewer hatchlings. They would have been ready for slaughter in two years’ time.

The incident is now being investigated and he told the newspaper that the company would be seeking compensation. The CEO said that the company now has around 450,000 fish left from that generation which should lead to the production of around 320 tonnes.

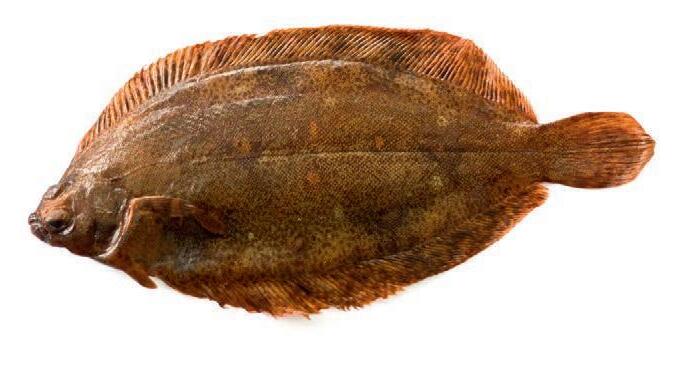

FISH farming now accounts for more than a third of all fresh cod being exported from Norway.

While Norwegian aquaculture news continues to be in te s n n tr ut ite s f r in is t in on a growing importance, the latest information from the Norwegian Seafood Council shows.

In July Norway exported 2,384 tonnes of fresh cod to a value of NOK 137m (almost £10m).

While overseas sales of trawler-caught fresh cod have been declining (the volume fell by 19% last month), farmed cod exports have been rising at an impressive rate.

n u t e t t s u t t nnes n it s set to go on rising.

The value of farmed cod exports rose by 185% to NOK 58m i e t t ure is sti er s en set inst s n it s s t t ite s u cu ture is in its r

Farmed cod is popular because supplies are guaranteed un i e i c u t c ic is ften su ect t e t er related interruptions, especially in winter.

r ts fr c f r in re in e usi e e er e recently reported losses of NOK 93m (£6.6m) last year, mainly due to the cost of large-scale investment in future growth. The company is still in a build-up phase, where investments in biomass growth are greater than income.

It said the build-up phase will continue this year before the c n st rts t ener te siti e c s fl t r s t e end of next year.

The Seafood Council says that while most of Norway’s wild c is e rte t en r t e et er n s is n t e largest destination country for farmed cod.

t f t ese estin ti ns re tr nsit r ets st f t e s es n fr t e et er n s t t e r e fres r ets e se ere in ur e t s e s n r cesse

i in st i re n e f n st t t e e f Council, said: “The decline in the export of fresh cod is expected, with lower quotas resulting in fewer landings and a lower volume.

t t e s e ti e e see t t t e e rt f f r e c is stable at approximately 1,000 tonnes per month.”

Norway’s largest wild cod source, the Barents Sea, is expected to see substantially reduced quotas next year.

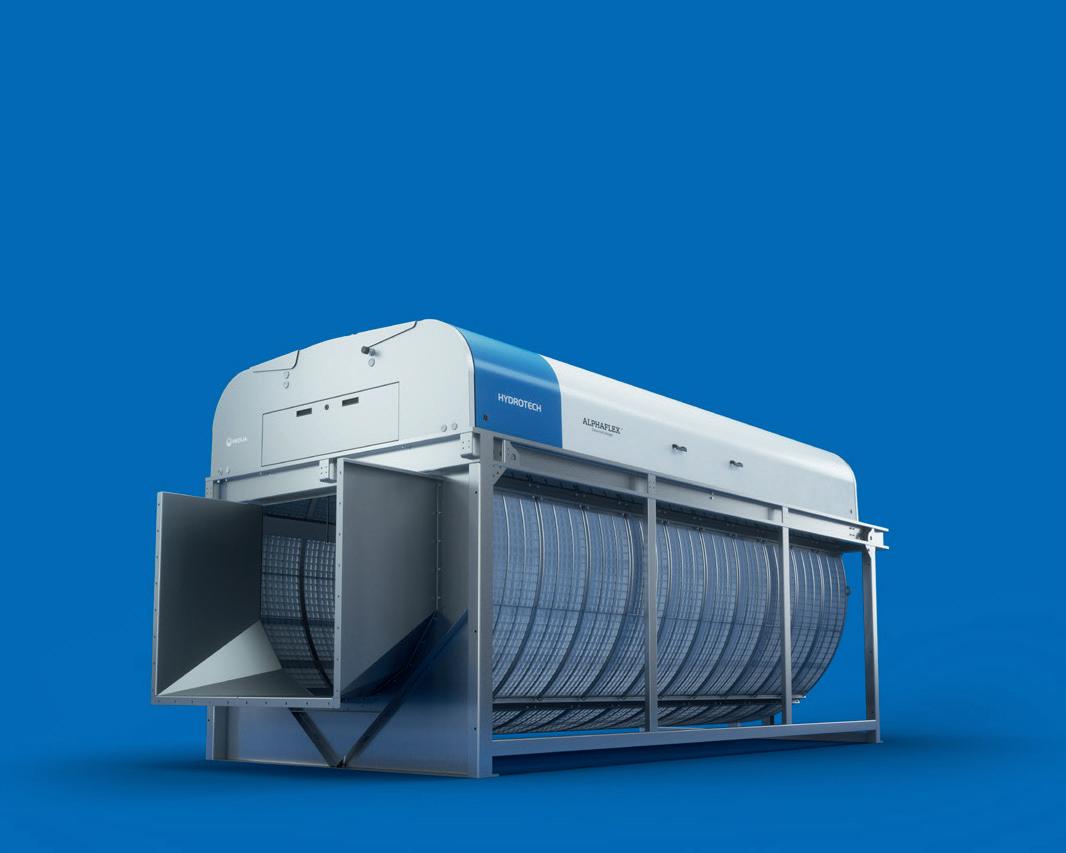

The Hydrotech Drum Filter Value series focuses on reduced maintenance, increased component quality and simplified operation – all to give your plant maximum filtration performance at a minimum operational cost.

Contact us!

Call +46 (0)40 42 95 30 or visit www.hydrotech.se

• Fish Cage Nets

– Nylon & HDPE

• Predator Solutions

• Net Service Plant

• Antifoulant

• Net interface system

• Net recycling routes

• Supplier of LIFT-UP

THE restaurant at the Salmon Eye aquaculture display centre in Norway has been voted by TimeMagazine as one of the best places in the world to visit. The futuristic oating centre is in the heart of Hardangerfjord in south-

west Norway and opened two years ago. The project is the brainchild of the fish farming company Eide Fjordbruk. It has been a passion project for the brothers Sondre and Erlend Eide, the third generation in the family’s aquaculture business.

ATLANTIC krill harvesting company Aker BioMarine has unveiled a 6% increase in its second quarter revenues to US $94m (£73m). Adjusted BITDA or operating profit increased by year on year to S $29m (£22m). Aker BioMarine announced in July that it has entered into an agreement with the US buyout fund American Industrial Partners to sell ownership in its feed ingredients business. The deal is based on an enterprise valuation of S m m . The acquiring party will be a newly established company, as yet unnamed, owned by American Industrial artners and by Aker apital.

INFECTIOUS salmon anaemia is suspected at a SalMar location in Norway, in what appears to be a growing number of cases across the country this year. The Norwegian Food Safety Authority said the location is in Trondelag County and is operated by Salmar Oppdrett AS and Salmar Farming

AS. The authority said it was planning an immediate inspection of the plant to take follow-up samples so that the Veterinary Institute can possibly confirm the disease. Restrictions were been imposed on the site, including a ban on moving fish, ova and milk without special permission.

NORWAY-based fish farm cage manufacturer FiiZK is selling its lice skirt production business to Iceland’s Hampidjan Group.

Under the agreement, Hampidjan will take over FiiZK Protection AS, the lice skirt business, which is located at Valsneset in Ørland municipality, north-west of Trondheim, Norway. The lice skirt business delivered revenue of approximately million . m in .

“Ecomerden” and Starfish . In addition, the company has recently launched “FiiZK FlekZii Cage”, which is a semi-closed cage solution that aims to reduce lice infestation.

FiiZK Group’s largest shareholders are Nekkar ASA (39%) and BEWI Invest (41%).

FiiZK Protection AS is a leader in the production and sale of salmon lice skirts for the aquaculture sector and has about market share in Norway. Following the sale, the number of employees in the company will be around , located primarily at Valsneset.

The parties have agreed to not disclose the financial details of the transaction, which is expected to be completed next month (September). FiiZK Protection AS will be renamed following the completion of the transaction.

FiiZK said the sale is part of a streamlining of its business. In future the intention is to focus on “unconventional” farming methods including closed and semi-closed cages for fish farming. The first step of this strategy was announced on 26 June, when FiiZK announced the sale of FiiZK Digital AS to seafood investor Bluefront.

The new approach includes FiiZK’s new closed cage, “Protectus”, which is based on the best solutions from the company’s three previous models: “Certus”,

“The aquaculture industry is increasingly recognising the biological and commercial benefits that closed and semi-closed cages bring. To date, FiiZK’s cage products have successfully completed more than production cycles, demonstrating strong fish growth and no problems with lice and escapes. We aim to build on this success,” said Jan Erik Kvingedal, Managing Director of FiiZK.

The FiiZK Mjåtveit facility

The FiiZK Protection AS facility at Mjåtveit, outside Bergen, West Norway, is not part of the transaction. This business, which manufactures technical textiles including canvas for closed and semi-closed fish cages, will be transferred to the FiiZK group company FiiZK Industries AS prior to execution of the share purchase.

Approximately people are employed at the Mjåtveit facility.

“Our facility at Mjåtveit plays a key role in manufacturing materials for our semi-closed and closed fish cages. eeping this business therefore supports FiiZK’s strategic direction,” said Ole Falk Hansen, chairman of FiiZK and CEO of Nekkar ASA.

NORWEGIAN seafood exports to Britain last month, including salmon, showed the highest increase in value, the Norwegian Seafood Council has reported.

Overall, July seafood exports were worth NOK 13 billion (around £900,000) which was 6% higher on the same month last year, mainly due to a continuing decline in the value of the krone.

Seafood Council Managing Director Christian Chramer said: “The reason behind the increase in the export value for July is a weakened Norwegian krone against both the euro and the dollar.

“We see that a fairly sharp price drop for salmon was compensated by an increase in volume, and in the end it is the currency that gives value increase.”

The British market saw the greatest increase in value, with an increase in export value of NOK 381 million (£26m), or 64% compared to the same month last year.

The export volume to the UK ended at 19,092 tonnes, which is 117% higher than the same month last year.

Victoria Braathen, the Seafood Council’s UK Envoy, said: “A large increase in July harmonises well with total exports to

Great Britain so far this year, which show a value increase of 8% in Norwegian krone and a volume increase of 12%.

“Beyond a positive development for salmon and trout, the other growth is in ue t t e e rt f s e n s i

She added: “Frozen whole cod has an overall volume growth of 3% and continues to take a larger share of Norwegian exports.

e is si ni c nt r et f r Norwegian haddock. It is positive to see a clear increase for both frozen and fresh whole haddock for the market in July.”

The continuing devaluation of the krone

AN alert was sounded for a suspected outbreak of bacterial kidney disease (BKD) at a site in the Norwegian south-west region of Møre and Romsdal.

BKD is a serious problem for salmon farmers and can lead to heavy mortality among both farmed and wild salmon with outbreaks resulting in major financial losses.

The potential infection was found at a location where Hofseth Sea Farming and Ewos Innovation

cultivate salmon and rainbow trout.

Anyone who travels in the area and carries out activities related to fish farming will now have to show the necessary care so that the spread of any disease can be avoided.

Facilities in the area must have a particular focus on BKD at all health checks. It is important to prevent further spread between facilities or to wild fish through fish, equipment and boats.

led to a return of an increase in the value of salmon.

Norway exported 107,442 tonnes of salmon during July to a value of NOK 9.6 billion (£675,000) in July – a 3% rise in value and a 13% increase in volume. Poland, the Netherlands and the United States were the main markets for salmon.

Germany had the largest increase in value in July, with an increase in export value of NOK 142 million (£10m), or 46%.

The increase in the popularity of farmed trout continues with the July value increasing by 36% to NOK 698 million (£49m) and the volume up by 38% to just over 8,000 tonnes.

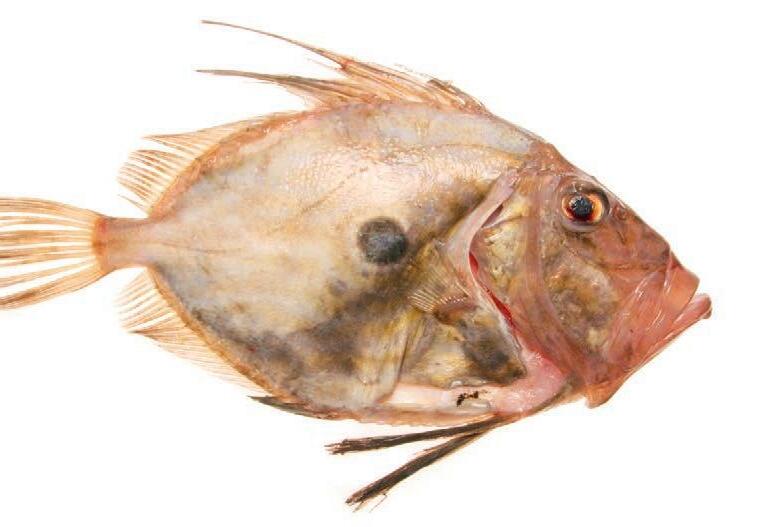

WHITE fish farmer Nordic Halibut has reported earnings of almost NOK 20 million (£1.43m) during the second quarter this year, thanks to the willingness of buyers in Britain and elsewhere to pay high prices for this popular prime fish – even at smaller sizes.

The company, based in western Norway, says the April to June period demonstrated a sustained upward trend in sales prices. Increases were realised for halibut sold in the 1-3 kg category, with a 12% rise in the 3-5 kg category, with a 14% price increase, and the 5-7 kg category, with a 5% price increase, compared to the same period in 2023.

Nordic Halibut said: “This trend demonstrates the strong willingness to pay and established high price levels for quality farmed halibut products in high-end markets even for smaller sizes exported to the United Kingdom and the EU.”

As planned, the company experienced a decline in harvest weight, averaging 4.5 kg (4.1 kg HOG), compared to Q2 2023’s average harvest weight of 5.2 kg (4.7 kg HOG).

Reduction in average harvest weight resulted in an average sales price of 153 NOK/kg in Q2 2024, reflecting a year-onyear (YoY) decrease of 1.2%.

Total revenue for Q2 amounted to NOK 19.1 million (£1.3m), with harvest volumes reaching 140 tonnes (125 tonnes HOG).

Nordic Halibut said it expects increased volumes and higher average harvest weights in the second part of this year. It also remains confident in its pricing strategy and market positioning.

Its growth plan is to expand production volumes to 4,500 tonnes (HOG) by 2026 and to 10,350 tonnes by 2031.

FARMED salmon has jumped into second place in the list of Iceland’s most valuable seafood exports, the latest official figures show. But it is still running a long way behind cod.

Salmon exports are now worth ISK 37bn m and the figure is rising fast year on year as Iceland’s aquaculture sector expands. This is the highest figure so far recorded. od, by comparison, almost all of it wild caught, earned the country IS bn m , says the industry organisation adar (also known as the Association of Iceland ompanies in the aritime Industry . Radar said that salmon is now expected to remain in second place for some years to come as there was no other fish species likely to challenge that position. The adar figures

are based on exports for the first five months of this year which show that the export value of salmon on its own accounted for of the export value of fish and of the value of all products, both seafood and industrial.

BI D Aquaculture, the Danish company specialising in design and start-up services for land-based fish farms, is reported to have filed for bankruptcy.

The company said in a statement on riday that there was no basis for further operation and would therefore be submitting a winding up petition.

It had taken a hit during the pandemic and this was followed up by the kraine ar.

Billund’s Chairman Jon Refsnes said the decision was taken with deep regret , adding there was no real alternative.

CEO Kristoffer Lund added that Billund had had good operations over the past year. But there had been too many challenges from previous activities, which made it difficult to find sufficient capital for further operations.

Despite good operational progress, the company’s efforts to secure its capital needs were ultimately hampered by disputes from

before the changes.

Based on this, the board concluded that there is no basis for further operation. fforts will now be made to find the best possible solutions for all employees, customers and creditors.

Billund was born in Denmark as an offshoot of an eel producer, but was founded in , back when AS was a practically unknown technology. It became a pioneer in the development of sustainable aquaculture all over the world.

In the s, the company ramped up its activities in Taiwan, Korea, Thailand and China due to the eel production boom.

This lasted for around seven years before moving into the salmon sector through a recirculation fish farm in hile.

ith offices in Denmark, hile and Australia, Billund Aquaculture then became a pioneer in the development of RAS technology worldwide.

THE company behind an ambitious seaweed farm in the North Sea says it will be the world’s first offshore facility of its kind on a commercial scale.

North Sea Farmers plans to open a seaweed farm this autumn, co-located with the Hollandse Kust Zuid (HKZ) wind farm, about 18 kilometres off the coast of Scheveningen in the orth Sea. HKZ is owned by Vattenfall, BASF, and Allianz, and consists of 139 turbines. It generates electricity equivalent to the typical consumption of 1.5 million Dutch households.

orth Sea arm , created by orth Sea armers with funding from Ama on’s ight ow limate und, is a oating farm located between wind turbines where seaweed cultivation can be tested and improved. Scientific research will also be conducted on site into the potential of seaweed farms to capture carbon.

By locating the farm in previously empty space between turbines, the company says, the project will be able to expand seaweed cultivation in the otherwise heavily used waters of the orth Sea.

There is more than enough space in the current and future planned wind farms in the North Sea, North Sea Farmers estimates, to scale up production to one million tons of fresh seaweed per year by 2040. This is expected to contribute to the capture and avoidance of millions of tons of 2.

The project will be led by North Sea Farmers (NSF) and executed by a consortium of scientific researchers and partners from the seaweed industry. The expectation is that the seaweed farm will be operational by the end of this year. The consortium hopes that North Sea Farm will serve as a replicable commercial model for offshore seaweed cultivation worldwide.

orth Sea arm is thus intended to be the catalyst for scaling up the seaweed sector. hen complete, the farm will span five hectares, and is expected to produce at least , kg of fresh seaweed in the first year. This seaweed will be processed into inspiring applications for Europe.

ef Brouwers, eneral anager of orth Sea armers, said e are particularly pleased to receive the world’s first permit for a seaweed farm within a wind farm. Hollandse Kust Zuid is one of the newest wind farms in the orth Sea and at the same time relatively close to the coast, about two hours’ sailing. e hope that, with this project, people will become further convinced of the scaling opportunities of seaweed in the North Sea, but also of other forms of co-use such as solar, wave energy and nature restoration.

The scientific consortium includes researchers from lymouth arine aboratory , Deltares, and Silvestrum limate Associates, seaweed extract manufacturer Algaia, project developer Simply Blue roup, and maritime contractors Van ord and Doggerland ffshore.

MORE than 100 stakeholders have already signed up to SalMar’s Salmon Living Lab project since its launch a few months ago, Frode Arntsen, Executive Director of the salmon giant, has disclosed.

Speaking at a Norwegian Seafood Council conference in Bergen recently, Arntsen said the project will contribute to providing healthier and more sustainable seafood.

SalMar, in collaboration with Cargill, announced the NOK 500m (£35m) plan back in March. The Living Lab will foster a collaborative approach across the salmon industry to tackle biological issues.

The conference was told that while global demand for salmon had increased in the last three to four years, production in Norway had stagnated.

Arntsen said: “Salmon production has become a high-tech industry that

has succeeded with a number of good solutions and brought us forward.

“There are, however, other factors that have developed in the wrong direction. The feed factor, the proportion of damaged fish and the mortality rate have increased.

“Now is the time to acknowledge the challenges and increase knowledge about salmon biology,” he added.

SalMar launched the Salmon Living Lab initiative to help increase that knowledge.

Arntsen said: “The Living Lab will close knowledge gaps, search for new insights and attract partners with leading industry expertise. ow we are working to find out how to organise ourselves.”

Some of the results will be public, while some will be more companyspecific, he explained.

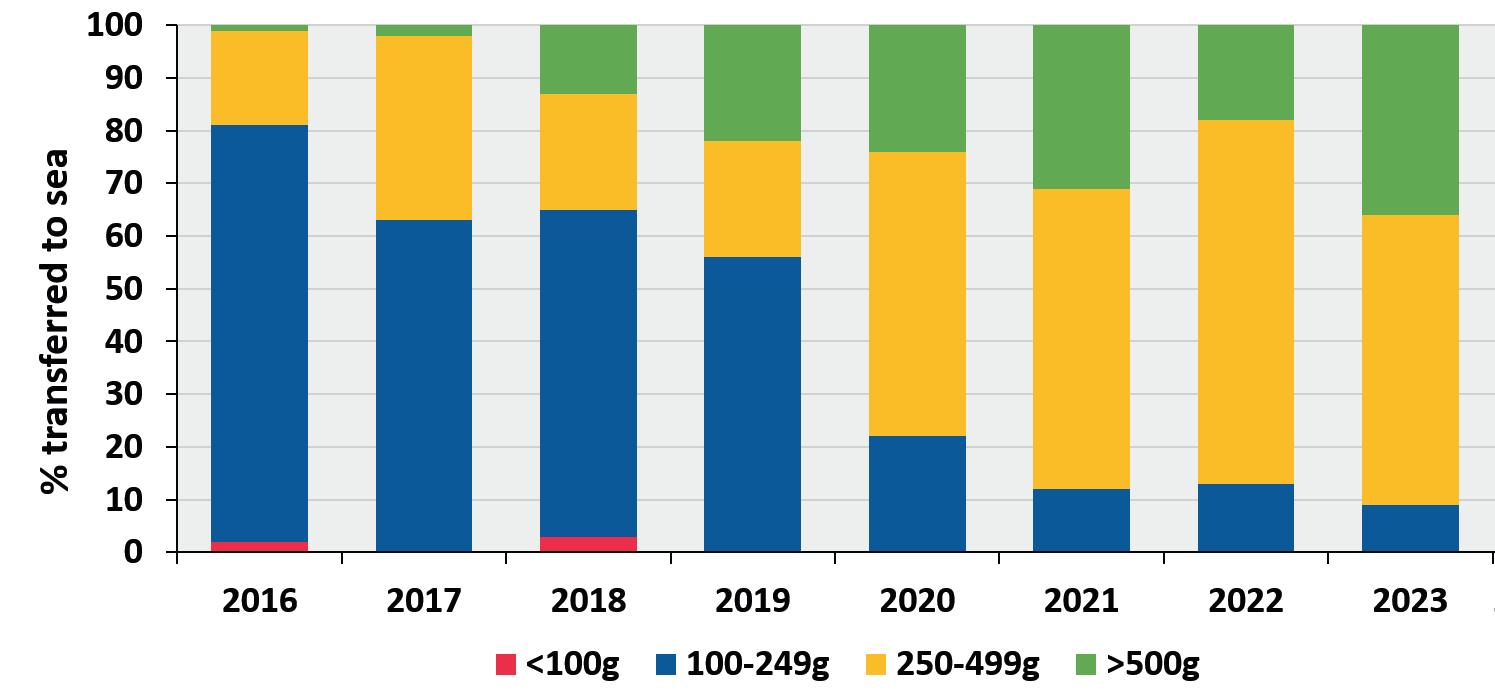

BIOFISH says it has entered into an agreement with a recognised industry player for the delivery of approximately 170,000 –180,000 post-smolt of 250-300 grams.

The contract has been secured under market terms, with delivery scheduled for the second half of September.

Biofish CEO Sondre Hagerup Johnsrud said: “This agreement is another recognition of our solid track record of consistently delivering robust, high-quality smolt and post-smolt to satisfied customers.

“The agreement is with a new customer to BioFish and includes an intention between the parties to develop a long-term collaboration.”

This is Biofish’s second major deal

in just over a month. Back in June the company secured an agreement, also with a recognised industry player, for the delivery of between 170,000 and 180,000 post-smolt of 500 grams.

The company has a post-smolt RAS production facility in Ljones close to the Hardangerfjord on the west coast of Norway. Almost 40% of Norwegian fish farming sites are located within one day of transport.

Biofish, which was established in 2016, said in its annual report a few weeks ago that last year had seen the delivery of 450 tonnes of smolt and post-smolt with a strong biological performance. It also reported revenues of NOK 48m (£3.5m), more than double that of 2022.

THE integrated salmon farming company Hofseth Aqua is facing the prospect of a heavy fine following the accidental death of an employee just over a year ago.

A 25-year-old man, Perry Emil Johansen, died in an explosion in June last year at a company site in Sunnmøre in western Norway.

Now the Norwegian Labour Inspection Authority has ruled that the company breached the Working Environment Act on several matters at a silage plant, which it says, had a number of weaknesses. These included a lack of risk assessment and training on matters such as explosion hazards.

Hofseth Aqua says it has worked to correct these deviations and is co-operating with the Norwegian Occupational Safety and Health Administration.

The company has accepted responsibility, saying it has fully cooperated with the various authorities and has worked to correct any issues.

The public prosecutor has already imposed a corporate penalty of NOK 4m (£287,000) on the company, but further penalties including compensation, are expected.

Hofseth Aqua said: “We think it is absolutely terrible that this accident

happened at our facility and have done everything we can to ensure that nothing similar happens again.

“It is important for us to use the experience from the tragic incident to increase knowledge about this throughout the industry,”

LAND-based fish farmer The ingfish ompany saw its sales volume leap by more than a third, year on year, in the second quarter of this year.

In its latest trading update, the company, which is listed on the slo Stock xchange, said revenue for was up by to . m . m . m, or . m . The volume sold was up to tonnes tons .

Standing biomass doubled to , tonnes tons . et biomass growth was tonnes tonnes and the company also recorded strong harvest volume growth of to tonnes tonnes evenue per kg was . . per kg . . per kg .

The ingfish ompany produces yellowtail kingfish in a AS recirculating aquaculture systems facility in eeland, etherlands, and is also moving ahead with a second site in aine, in the S.

The latest update states This growth is a result of focused efforts to penetrate key markets and expand into new territories, driving our revenue to . million, a increase from . The additional investment in commercial activities has begun to yield results, resulting in market growth

for The ingfish ompany’s main product yellowtail kingfish, in the professional and retail sectors.

The biological performance of the farm was impressive, with the biomass growth in the quarter being tons. ompared to , the standing biomass more than

doubled to , tons at the end of , . ith the AS systems functioning optimally, the company continues to prove its capability in producing high-quality fish in a reliable, consistent, and sustainable manner.

The company will release its interim and H financial results on September.

THE former Chief Executive and Co-founder of the Icelandic salmon company Arnarlax has been appointed as General Manager of Grieg Seafood’s new processing plant at Gardermoen, near Oslo.

Kristian B. Matthiasson brings a wealth of experience to the new role, said the company.

His more recent experience as the managing director of Leines Seafood, a processing company that primarily produced frozen portions for the supermarket chain Aldi, has equipped him with the necessary skills and knowledge to lead our upcoming processing plant at Gardermoen, it added.

In this pivotal role, the company said Matthiasson will develop Grieg’s organisation and optimise operations to drive excellence.

Grieg said: “Focusing on strategic goals, he

will be a crucial catalyst for identifying and implementing initiatives to contribute to our factory’s success.”

Matthiasson said: “I look forward to starting as General Manager at Grieg’s stateof-the-art processing plant at Gardermoen.

“The production of salmon has always been close to my heart, and I look forward to becoming part of the Grieg family.

“At the new factory in Gardermoen, we should have every opportunity to produce safe and high-quality products in a sustainable, efficient, and reliable manner. There is much to be done before we receive our first fish in the fall of 2025, and I am excited to take on this work.”

Matthiasson started Arnarlax with his father, Matthias Gardarsson, in 2014 before stepping back some five years later. Arnarlax was acquired and is now part of the SalMar group.

The Gardermoen VAP (value added processing) centre is set to commence operations in the autumn of 2025, marking a significant milestone for Grieg Seafood, the company said.

its commitment to bringing the value chain closer to the end consumer and enhancing Grieg Seafood’s value creation.

Grieg’s Chief Commercial Officer, Erik Holvik, said: “I am thrilled that Kristian, with his extensive expertise and valuable experience in the seafood industry, will be a crucial player in our VAP project.

“His leadership and vision will be instrumental in the project’s success, and we are excited to have him on board.

The company said it plans to establish the processing factory in a new and energyefficient facility at the airport. It will have an annual processing capacity of 10,000 – 12,000 tonnes (HOG equivalent), with an option of increasing the capacity to 20,000 tonnes if needed at a later stage.

The project will create up to 60 new jobs at the plant.

Grieg said expanding its processing capacity is a testament to

The location makes it possible to process Grieg Seafood’s salmon from its Northern region Finnmark as well as its Southern region in Norway, Rogaland. It is optimally placed, Grieg said, for smooth logistics to the markets by truck, boat, train or air freight.

SALMON farmers in British Columbia have expressed disappointment and concern after being told that a draft Transition Framework from the Canadian Department of Fisheries and Oceans (DFO) has been delayed.

Salmon farming licence holders were informed of the delay at the end of July. No new release date was announced.

However, the licence holders were told the delay could push the release into next month.

Brian Kingzett, Executive Director of the BC Salmon Farmers Association, said: “The rural coastal communities and employees who rely on salmon farming have been in a constant state of uncertainty since 2019 when the transition commitment was first announced.

He added: “The ongoing delays and decisions made by the federal government continue to cause concern and stress on these families and

communities as they do not know what the future holds for them.

The association says that “the unrealistic timeline for full transition announced by the Department of Fisheries and Oceans Canada (DFO) in June undermines the federal government’s commitment to sciencebased decision-making, restoration of wild salmon populations, support for UNDRIP and rural coastal communities, growth of Canada’s blue economy,

increased food security, and support for young Canadians.

Kingzett added: “Our sector has worked tirelessly over the past few years and submitted thousands of pages of documentation to the federal government to show our commitment to this process.

“The federal government knew that the five-year timeline to transition to closed containment or land-based was unrealistic, and the delay in releasing the draft Transition Framework will further inhibit our sector’s ability to meet the already demanding timeline set by D .

The association said that despite this ongoing challenge, the sector will persist in fighting for its communities and finding a responsible, realistic and achievable path forward, concluding: “The BC salmon farmers remain hopeful the federal government’s draft Transition Framework will provide that opportunity.

A MEMBER of the US House of Representatives has brought forward legislation aimed at slamming the brakes on the growth of offshore fish farming.

Mary Sattler Peltola, an Alaskan Democrat, is seeking to ensure that no applications for offshore fish farms in US Federal waters are approved without the explicit authorisation of Congress.

Her bill, the Domestic Seafood Production Act (DSPA), would also encourage research on the effects of finfish aquaculture on the ecosystem and potential offshore locations “that may be least impactful to the marine environment and commercially important fish stocks”.

NOAA (the National Oceanic and Atmospheric Administration) would be barred from awarding financial assistance of any kind for the purposes of facilitating offshore aquaculture.

The document explaining the bill refers to “floating factory farms” and states: “Industrial offshore fish farming causes ecological and economic harm to our coastal communities.”

The legislation would also seek to boost local employment opportunities by ensuring that processing seafood in US waters is carried out in the United States and overseas. Currently, much of America’s catch is processed in

countries like China where labour is cheaper.

She said: “In Alaska, so many communities rely on fish and seafood production both for subsistence and goodpaying jobs. My bill would support our local fishing and maritime communities while strengthening our domestic seafood supply chain.”

Congress is currently considering bipartisan legislation which is intended to encourage the development of offshore aquaculture, in order to make the United States more selfsufficient in seafood.

SALMONES Camanchaca, one of Chile’s largest salmon farming companies, slaughtered 11,643 tonnes of Atlantic salmon in the second quarter of this year – almost double the figure for the same period last year.

The Q2 figure for 2022 was just 6,400 tonnes.

The average weight of harvested fish increased from 4.4 kilos in the first three months of this year to five kilos in Q2, while the ex-cage cost decreased to US $4.99 (£3.90) per kg from US $5.28 (£4.14) per kg in the first quarter.

Sales in Q2 2024 totalled approximately 11,000 tons of Atlantic salmon and 2,100 tons of coho. The coho inventory was reduced by approximately 50% by the end of Q2 compared to the end of the first quarter in 2024.

Salmones Camanchaca estimates a total harvest of between 46,000 and 48,000 tons of Atlantic salmon for 2024, up from 44,100 tonnes in 2023.

For coho, the company projects a harvest of 4,000 to 5,000 tons, compared to 11,400 tons in 2023.

The company, which employs almost 2,000 people, currently has its main overseas markets in the United States and Mexico.

LAND-based salmon farmer Nordic Aqua Partners has said it expects to lose around 190 tonnes in the current quarter after detecting a high concentration of the off- avour compound geosmin at its Chinese facility.

Although it is harmless to both fish and humans, geosmin, which is a naturally occurring compound, can, in elevated concentrations, negatively affect the taste of the fish.

Detection of off- avour was discovered at the company’s ingbo production facility. Nordic Aqua artners said the problem was due to the overloading of the purging unit.

A specialist team had identified the root causes and was implementing both immediate and long-term solutions to prevent future occurrences, including enhancing the water filtration and management processes.

Andreas Thorud, anaging Director at ordic Aqua ingbo , said ur Atlantic salmon has, since its launch in April, received very good feedback in the market

However, following recent quality checks, elevated levels of geosmin were identified in specific production sections.

As a result, the affected salmon, metric tonnes, heads on gutted, will not be sold for human consumption but thus at a substantially lower price.

He added ordic Aqua does not compromise on quality and we relentlessly seek premium development of land-based salmon farming, and learning and minor surprises is a part of such development.

TH second half of this year promises better times for aquaculture producers worldwide, with rising consumer demand and falling feed costs.That’s the positive picture presented in the latest report from abobank’s research arm.

Global aquaculture update 2H 2024 says that demand for salmon and shrimp will begin to improve in the second half of , thanks to the recovery of Western economies.

eed costs are anticipated to decrease, thanks to a rebound in fish meal supply, providing a silver lining for the sector, the report says.

According to orjan ikolik, Senior lobal Seafood Specialist for abo esearch, the salmon market continues to face a tight supply, with prices expected to remain high through the latter half of . Seasonal patterns will in uence pricing, but the overall trend suggests that costs will stay above average.

orway and Scotland are poised for a supply recovery, although this remains tentative due to unresolved biological issues.The S and Asia are experiencing depressed demand, which has not allowed prices to offset the high costs resulting from weak biological performance. However, the anticipated reduction in feed costs should offer some relief to producers.

Another factor driving demand is the falling relative cost of salmon compared with other animal protein options, the report says.

Shrimp industry: tentative recovery with lower feed costs

In the shrimp sector, there are indications of a turnaround, particularly in estern markets where demand and prices are gradually increasing as in ation eases, said ikolik.

The industry is set to benefit from lower farming costs due to improved fish meal

supply. However, the recovery remains fragile, with hinese import demand expected to decline.The positive supply growth from cuador, India and Vietnam could potentially lead to an oversupply, casting doubt on the possibility of a price recovery in the second half of .The depressed profitability of shrimp farming continues to favour large, sophisticated operations, leading to increased industry consolidation.

Fishmeal prices to soften as supply increases

The key factor affecting aquafeed prices has been eru’s anchovy harvest. The first half of marked the end of a year-long l i o season part of the natural climate cycle in the acific which greatly reduced the anchoveta biomass and thus eruvian fishmeal and fish oil production.

By April , the report says, climatic conditions had normalised and the anchovy fisheries once again saw a high biomass, allowing the eruvian fishing regulators to grant a normal quota of , m tonnes.The subsequent catch rate and a high fish oil yield underlined a successful first season. xpectations, abobank says, are that in a i a conditions will develop, further cooling ocean waters, which is beneficial for the anchoveta biomass. The report adds onsequently, we expect that the second eruvian fishing season, starting in ovember , will be equally strong as the first. In addition, this should allow fishmeal prices to continue to correct, especially since the ratio with soybean meal remains high even after the recent price drops.

ven an expected reduction in fishmeal supply in urope in H should not materially alter the outlook for normalised fishmeal and fish oil supply globally in H , abobank says.

hi o u on trac or fish arm ro ect

JAPAN’S Shikoku Railway Company (trading as JR Shikoku) is to begin launching a trial land-based salmon project in

the Kumamoto Prefecture. The company operates non-rail businesses such as hotels and property and says that salmon farming is now an activity which shows considerable promise. The company says it is installing a number of tanks on its premises to cultivate king salmon juveniles. It will eventually select a permanent location, and plans to set up three main commercial operational sites.

in fish aine ro ect asses another obstacle

THE ingfish ompany has overcome a major hurdle against opponents trying to prevent the company building a yellowtail facility in Maine on the US East Coast. A group called Protect Downeast has in the past launched several appeals against the granting of municipal permits for the project. But the latest appeal attempt, held before aine’s Business and onsumer ourt, ended with the rejection of all the group’s arguments. The court found in favour of the town of onesport and ingfish aine and upheld the permits issued by the Planning Board.

government signs hosting a reement or uaculture rica

PREPARATIONS for the upcoming 3rd Annual International Conference and Exposition of the African Chapter of the World Aquaculture Society (AFRAQ2024) were given a boost last week following signature of the hosting agreement by the National Institute of Marine Sciences and Technologies (INSTM), on behalf of the Ministry of Agriculture, Water Resources and Fisheries, Tunisia. This special gesture means the Government of Tunisia and its associated institutions are fully committed to collaborate with WAS in ensuring smooth organisation of the event. AFRAQ24 takes place in Hammamet, Tunisia, on 19-22 November. Conference details will be updated on the event page on www.was.org/Meeting/ code/AFRAQ24.

THE Lerøy Seafood Group has announced a strategic investment in the US biotech company Salmonics.

The terms of the investment remain undisclosed, but the announcement said it will support Salmonics’ continued growth and cutting edge biotechnology, which uses fish blood to create healthcare products.

Based in Maine, in the north-eastern United States, Salmonics develops and markets innovative re-agents and biomedical products from the blood of salmon and other fish species.

It transforms this by-product into a valuable resource for research, and veterinary and human health applications.

Salmonics says its proteins and re-agents support a wide range of applications, including regenerative medicine, cell proliferation, clotting, wound care and pain treatment.

Henning Beltestad, CEO of Lerøy, said: “We are excited and pleased to support the work Salmonics has undertaken to advance cutting-edge biotechnological solutions utilising farmed fish, increasing value and meeting our sustainable development goals.

This investment re ects our commitment to innovative solutions that enhance the efficiency and potential of the seafood value chain while delivering positive benefits to healthcare.

er y’s investment marks a significant milestone for Salmonics, providing the company with the resources to accelerate its product development and market reach.

Cem Giray, President and CEO of Salmonics, said: “This collaboration between Salmonics and Lerøy will usher in new opportunities to expand the use of our fish blood-based biomedical products into the biotechnology and pharmaceutical space globally.

“Lerøy’s expertise and commitment to sustainability align perfectly with our mission to transform aquaculture and fisheries by-products into valuable biotechnology, pharmaceutical and research resources to improve patient care and outcomes while potentially lowering healthcare costs with a net positive environmental impact.

A COMPANY dedicated to restorative aquaculture through “ranching” sea urchins has announced deals with a major capital investor and the owners of one of Japan’s leading sushi chains.

Urchinomics was created to address the problem of growing urchin populations, which are turning kelp forests into “urchin barrens”. Its solution is to remove the urchins and farm them in less problematic locations.

Uni, often known as sea urchin “roe” although it is actually the urchin’s reproductive organs rather than eggs, is a particularly popular product.

Verdant Bloom, the parent company of Urchinomics, signed an agreement with Japanese shipping and logistics group NYK which will see NYK investing an undisclosed amount of capital in the aquaculture business.

Urchinomics

has also announced a collaboration deal with Food & Life Companies Ltd, which operates more than 1,100 restaurants under the brands “Sushiro,” “Kyotaru,” “Sushi Misaki,” and “Sugitama” in nine countries and regions, including Japan.

The partnership aims to create a stable supply of highquality, domestically farmed sea urchins, while contributing to the conservation of blue carbon ecosystems.

Koichi Mizutome, President and CEO of Food & Life, said: “Through collaboration with Urchinomics, I hope we will be able to establish planned manufacture and a secure stable procurement base of sea urchins... also I have high hopes to cause positive effects of restoring kelp forests, through the effective use of natural resources by utilising barren urchins, which have been difficult to consume as food.”

A SINGAPORE company has developed a vaccine which it believes can successfully combat a deadly disease.

The company, UVAXX, a leader in autogenous vaccines and a subsidiary of the Barramundi Group, said the development had been carried out in conjunction with the Agency For Science Technology and Research in Singapore. UVAXX has described the breakthrough against SDDV, which can cause serious losses, as a potential game-changer for the sector.

SDDV causes fish to shed scales, develop lesions and suffer major mortalities. The vaccine is a formulation designed to protect fish from SDDV. It is also known as scale drop disease virus and can kill up to 70% of a pen of Asian sea bass, or barramundi.

By combining specific parts of the virus known as epitopes that trigger immune responses, the vaccine aims to strengthen the fish’s natural defences against the virus.

Dr Sunita Awate, Research Director, UVAXX, said: “Through our 12 years of experience working with farmers to provide veterinary services and fish health solutions, we have witnessed first-hand the severity and devastation caused by SDDV. Asian sea bass farmers across the region need and want a solution. Having an efficacious SDDV vaccine can lead to a paradigm shift in aquaculture disease management, from a reactive to preventative approach, and transform farm production unit economics.”

Singapore-based newspaper the Straits Times said the development brings renewed hope for farming Asian sea bass, with the survivability rate of the fish, if infected, up by around 75%.

THE Leader of Comhairle nan Eilean Siar, the Western Isles Council, has expressed frustration that employees and the community were not alerted earlier over plans to shut down a Bakkafrost processing plant.

Faroes-owned Bakkafrost Scotland has extensive salmon farming operations in the Western Isles, but in July it announced that its processing plant and harvest station in Stornoway, Isle of Lewis, are likely to be mothballed for a period of time because there will not be enough production to sustain them.

The company said it would be consulting with the staff at the Marybank processing plant in Stornoway over redundancy proposals. Staff working on the company’s fish farms in the region are not thought to be affected. The sites affected are the processing facility, in Stornoway’s Marybank industrial estate, and the harvest station at Arnish.

The company said that there would be very little requirement for harvesting or processing over the next 18 months in its operations in the north of Scotland.

A spokesperson for Bakkafrost Scotland

said: “I can confirm we are considering a temporary, but extended, closure of our facilities at Marybank and Arnish in Stornoway, affecting around 80 jobs.

“As our communicated plans, the business has harvested the majority of our production in the first part of the year and there will be minimal harvesting activity over the next 18 months in the North, this is due to stocking timing and locations.

“Our board has been forced to consider extremely difficult scenarios in order to futureproof the business and secure our remaining staff across Scotland. One of the scenarios proposed is that we close the Arnish Harvest Station and the Marybank Processing Facility, for an extended period.

“We intend to start a period of collective consultation with those potentially affected and hope to complete this over the coming weeks.”

Output from the company’s Southern sites will continue to be processed at the Cairndow facility.

Representatives from Comhairle nan Eilean Siar met on 11 July with Ian Laister, Bakkafrost Managing Director for Scotland, and sought assurances from Bakkafrost on its plans for the impacted employees, the future of its operations in the Western Isles and the reasons for its decision.

Cllr Paul Steele, Leader of Comhairle nan Eilean Siar, said: “Our primary concern following this announcement is the wellbeing of the employees impacted by this decision and their families. Comhairle nan Eilean Siar will work alongside Skills Development Scotland and partners through the PACE programme to ensure employability support is available to all those impacted. This decision will also have a significant impact on local businesses who provided services to Bakkafrost.