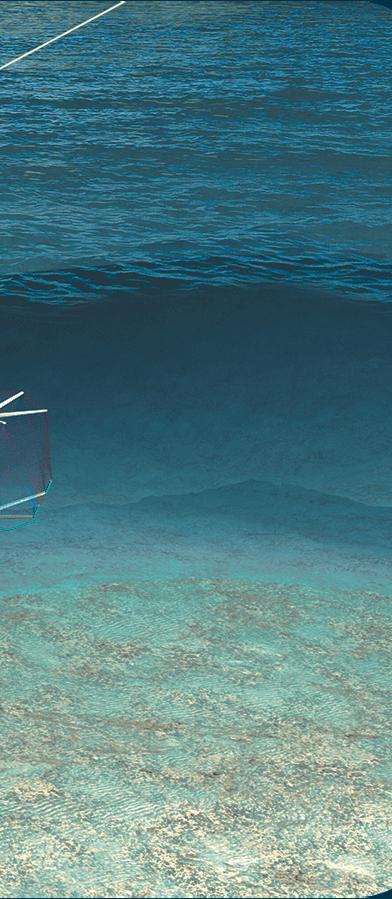

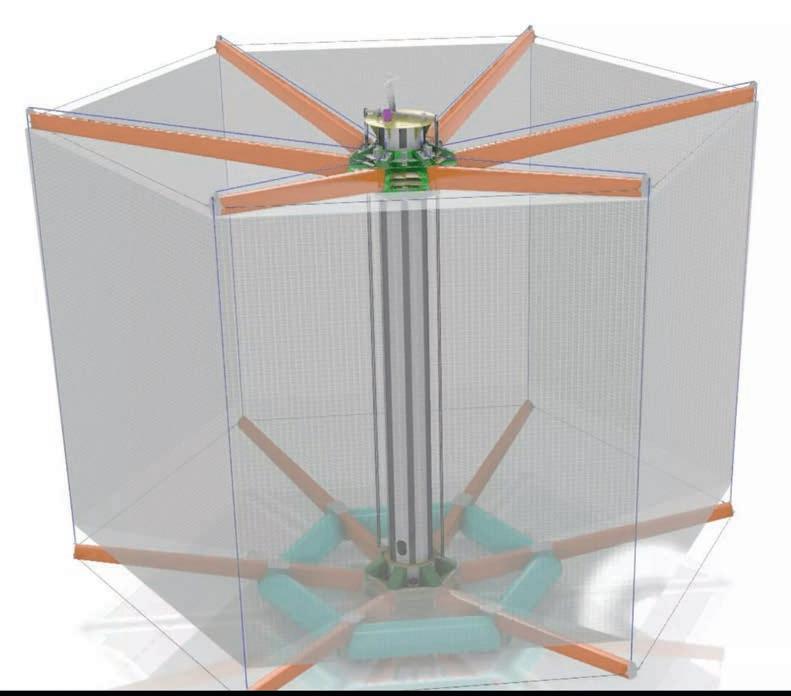

Subfarm’s vision for submersible pens

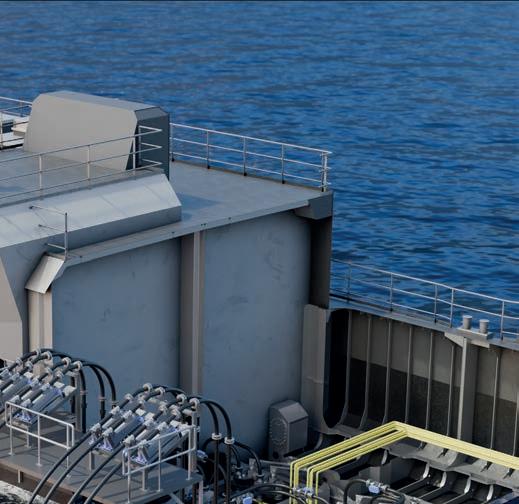

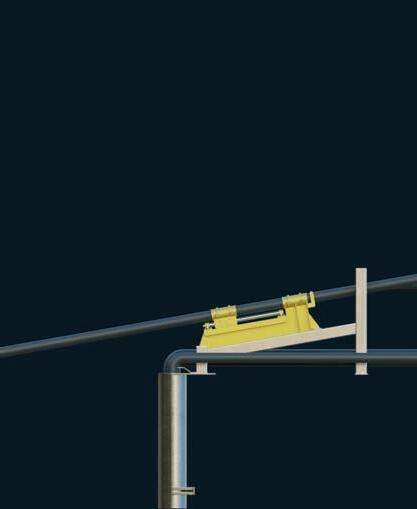

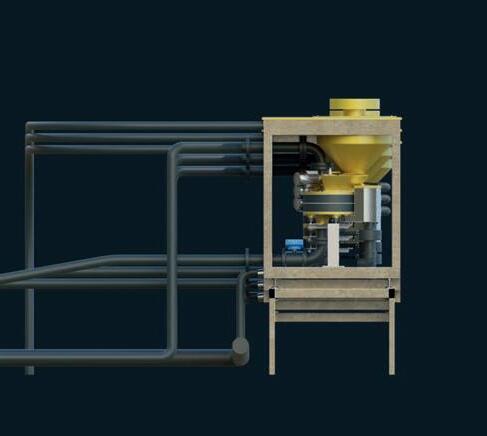

Bring confidence to your net cleaning job, with the most reliable pump on the market.

NLB’s high-pressure water jet pumps are proven reliable for offshore and onshore net cleaning. Engineered specifically for the aquaculture market, they withstand the harsh conditions of open seas, foul weather, and salt corrosion, all while delivering the same performance and durability NLB has been recognized for since 1971. Our units also offer a compatible interface with the industry’s leading head cleaning systems.

NLB will go the extra mile to make the switch easy for you. Contact us today to discuss your options!

HE UK is, at the time of writing, in the throes of a general election campaign, the timing of which seems to have taken everybody by surprise (not least the party that called it).

Even ahead of that announcement, however, elected politicians have been taking an interest in our sector. At Aquaculture UK in Aviemore, the country’s biggest event for the sector, the show was opened by Scotland’s Employment and Investment Minister, Tom Arthur, and we also saw a visit from Scottish Labour Leader Anas Sarwar.

A week later, the Blue Food Innovation Summit in London was addressed by Lord Benyon, Minister of State for Climate, Environment and Energy in the UK Government. You can read full reports on both these events in this issue.

All three elected representatives made it clear they see aquaculture as critically important, both for the economy and for food security, but their support is not a blank cheque. Tom Arthur made it clear that the development of aquaculture in Scotland must be sustainable and also take account of local communities, while Lord Benyon acknowledged the criticisms of salmon farming’s record and stressed: “More needs to be done.”

Meanwhile the Scottish Parliament’s follow-up inquiry into salmon farming has just started, and it is clear that the industry will need to have some good answers ready. As speakers at both Aquaculture UK and the Blue Food Innovation Summit stressed, the fish farming industry not only needs to continue to improve its sustainability – it will need to get better at telling its story.

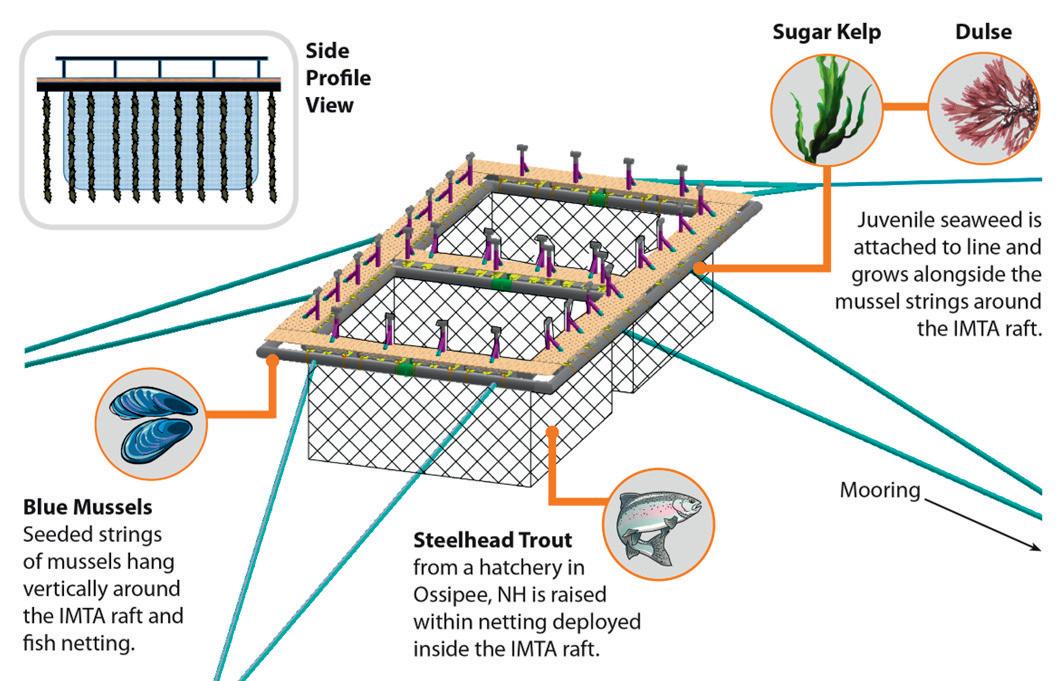

Also in this issue, Julia Hollister explains why there is increasing interest, in the United States, in an integrated approach that brings together seaweed with other forms of aquaculture, whether shellfish or finfish.

Nicki Holmyard reports from the Shellfish Association of Great Britain’s annual conference; Eugene Gerden gives an update on China’s aquaculture aspirations; and Vince McDonagh describes how the debate in Iceland over new fish farming regulations is going.

Dr Martin Jaffa critiques a new and not entirely even-handed podcast on the future of wild salmon, and Nick Joy argues that public servants are all too easily swayed by activists.

I hope there is something for everyone this month!

Best wishes

Robert Outram

Meet the team

Editorial advisory board: Steve Bracken, Hervé Migaud, Jim Treasurer, Chris Mitchell and Jason Cleaversmith

Editor: Robert Outram

Designer: Andrew Balahura

Commercial Manager: Janice Johnston jjohnston@fishfarmermagazine.com

Office Administrator: Fiona Robertson frobertson@fishfarmermagazine.com

Publisher: Alister Benne�

@fishfarmermagazine

www.fishfarmermagazine.com

Fish Farmer Volume 47, number 06

Contact us

Tel: +44(0)131 551 1000

Fax: +44(0)131 551 7901

Email: editor@fishfarmermagazine.com

Head office: Special Publica�ons, Fe�es Park, 496 Ferry Road, Edinburgh EH5 2DL

Subscrip�ons address: Fish Farmer magazine subscrip�ons, Warners Group Publica�ons plc, The Mal�ngs, West Street, Bourne, Lincolnshire PE10 9PH

Tel: +44(0)177 839 2014

UK subscrip�ons: £75 a year

ROW subscrip�ons: £95 a year including postage – all air mail

28-29

30-36

Tavish

Nicki

40-41

42-44

THE follow-up inquiry into salmon farming in Scotland got underway earlier this month with what amounted to the case for the prosecution, as well as evidence from academics and non-governmental organisations.

The Scottish Parliament’s Rural Affairs and Islands (RAI) Committee held its first evidence-taking session, with input from nongovernmental organisations and academics. The RAI Committee is following up on progress since the last Holyrood inquiry into the industry, in 2018. It heard from two campaigning organisations which – to varying degrees – oppose salmon farming. Responding to the question of whether an industry supporting more than 1,500 jobs and worth £760m to the economy should be welcomed, Rachel Mulrenan, Scotland Director of conservation group WildFish, said: “We obviously recognise the need for high quality, future-proof jobs on the west coast of the Highlands and Islands, and that’s beyond dispute, but we do not think at WildFish that salmon farming has a place in this future.”

is against salmon farming.

John Aitchison of the Coastal Communities Network said: “All jobs are important [but] jobs don’t depend on how the salmon farming is done. If salmon farming was done better, jobs would still be there.”

He added that automation and consolidation into larger farm sites means that increased volume of fish produced does not equate to more jobs and noted that the figure for the benefits of salmon farming do not include environmental and other costs.

Sarah Evans, Aquaculture Policy Officer with the Marine Conservation Society said MCS “does not take a position” on the economic question, but she said the MCS supports the idea that the industry needs a “social licence” in the communities in which it operates.

She said: “There can be a place for salmon in Scotland’s future, but there needs to be changes before it can grow.”

is getting better, but he added that the industry needs to do more to provide meaningful mortality data.

The committee also heard from academics in the field: Dr Annette Boerlage, Research Fellow in Aquatic Epidemiology, School of Veterinary Medicine, Scotland’s Rural College; Professor Simon MacKenzie, Head of the Institute of Aquaculture, University of Stirling; Professor Sam Martin, Director of Research, School of Biological Sciences, University of Aberdeen; Dr Helena Reinardy, Lecturer and Teaching Fellow, Scottish Association for Marine Science; and Professor Lynne Sneddon, Chair in Zoophysiology, Department of Biological and Environmental Sciences, University of Gothenburg.

She said salmon farming accounting for only a very small proportion of new jobs created in the region over the last three decades.

Mulrenan added that WildFish is not opposed to all forms of aquaculture but

Sean Black, Senior Scientific Officer for Aquaculture, Royal Society for the Prevention of Cruelty to Animals, said from the RSPCA point of view, knowledge about fish biology is improving and fish welfare

Professor Sneddon, who has carried out extensive research into the capacity of fish to feel pain, said current lice treatments, particularly the thermolicer process, cause the fish pain and distress. She said they also make the fish more vulnerable to other biological challenges. Aberdeen’s Sam Martin said that treatments could be problematic for fish that were already subject to other health issues, but he did not concede that the treatments themselves were demonstrably harmful.

The next session, planned for 12 June as this issue goes to press, will hear evidence regarding farmed fish health and from the Scottish Environment Protection Agency.

INDEPENDENT salmon farmer Loch Duart will continue its partnership with a local conservation organisation for another three years, it has been announced.

Loch Duart, based in the north-west of Scotland, has been working with the West Sutherland Fisheries Trust (WSFT), which has acted as an independent monitor and auditor of Loch Duart’s fish health data.

WSFT is an independent charity, established in 1996 and based in northwest Scotland.The trust monitors wild fish populations and advises on the management of rivers and lochs in the area.WSFT biologists visit four different Loch Duart farm sites each month to independently audit weekly fish health checks, including sea lice counts, and environmental and biological conditions. These audits provide Loch Duart with an unparalleled level of transparency in fish health data reporting, the company said, while also encouraging positive dialogue between the salmon farm and the fisheries trust.

Beth Osborne, Loch Duart’s Fish Health Manager, commented: “This is a unique partnership and one that both Loch Duart and the West Sutherland Fisheries Trust are proud of.We encourage others in the sector to look at what we’ve been doing and consider similar partnerships”.

She added: “It’s important that Loch Duart works with the trust because it gives us transparency of our data as a whole, both from the wild stocks as well as the fish farm. It helps the local environment, the local people and all of the local stakeholders. If everything’s healthy in the area and we’ve shared as much information as possible, then everybody benefits.”

Loch Duart’s working relationship with WSFT goes back to 1999, the year the salmon farm was founded.The verification partnership, which began in 2021, grants WSFT unprecedented access to Loch Duart's sites.

The company said: “This ensures continued transparency in fish health data reporting and upholds the company's commitment to doing things the ‘Loch Duart way’.”

Dr Shona Marshall, Senior Fisheries Biologist for the trust, said: "Our auditing of sea lice counts has been ongoing for three years and has proved to be a success.We are pleased to extend this partnership with Loch Duart Salmon. Working closely with Loch Duart has given a good understanding of the farm practices, their issues, and solutions.The care shown by the staff towards their fish and their willingness to discuss issues for both farmed and wild fish in an open manner is welcomed. I’m not aware of any other trust that has the access that I have here " Loch Duart supports WSFT with net sweeps and training in sea lice and gill health identification for wild fish.The two organisations also work together to form an environmental management plan, supporting the local area.

SCOTTISH Sea Farms has teamed up with seaweed growing venture Atlantic Garden, in a scheme that combines salmon and kelp farming on Loch Spelve, in the Sound of Mull.

The aim of the year-long pilot is to enrich and replenish the marine environment, feeding into the company’s work to minimise any impact from its farming activities.

The farm, which had been fallowed, was chosen as a suitable testing ground in the collaboration between Scottish Sea Farms and businessman and writer Guy Grieve, who ran the Ethical Shellfish Company from Mull and now, through his company Atlantic Garden, plans to produce commercial quantities of sugar kelp, to be used in garden compost.

The seaweed lines, installed last October, produced encouraging growth over the winter, and this month four 90m pens will be stocked with salmon.

Scottish Sea Farms Head of Sustainability and Development Anne Anderson said: “Seaweed is so beneficial in so many ways for the marine environment. As a plant, it absorbs carbon dioxide, while releasing oxygen. It’s a bit like planting trees to offset your carbon footprint.

“And some of the organic nutrients, nitrogen and phosphorous, from salmon farming are absorbed to help nourish the kelp. It will be interesting to see if we get more seaweed growth once we put the

Scottish Sea Farms sought permission from Crown Estate Scotland for the trial, and talks are now underway to amend the farming lease to cultivate seaweed longer term.

In Loch Spelve, Area Support Manager for Mull Andrew MacLeannan worked with Grieve and Mull-based Inverlussa Marine Services to install four 750m of seaweed lines (a total of 3km), seeded by Dutch supplier Hortimare, and tied the lines to the raised salmon pen grid.

“We plan to stock the farm with 7kg fish, from Fishnish in the Sound of Mull, so this will only be a four or five-month cycle, not the full 18 months,” he said.

“Loch Spelve is sheltered so ideal for seaweed, which doesn’t like strong currents, but the environmental conditions have been challenging for salmon production in the past, particularly for gill health."

Grieve wanted to start producing seaweed at scale in Scotland to complement the seaweed gathered from harbours.

“One of the key points about farmed seaweed is you get a very clean product whereas when you gather it you have to remove plastic,” he said.

“I had fished out of Loch Spelve for 12 years and it struck me as immediately obvious that the best partners for this should be someone like Scottish Sea Farms, for the simple reason that for decades they have been working at sea, through thick and thin,

and through every kind of weather."

Guy Grieve plans to keep the crop in the water until the summer to harvest as much biomass as possible, up to 30 tonnes, all being well.

“We should get 8-10 kilos per metre of seeded line but this is a pilot so we don’t know what to expect yet. I look forward to what we learn from this trial and what our next steps will be.”

Atlantic Garden is donating 20p from every bag of seaweed compost it sells to the Scottish Coastal Clean-up.

CROWN Estate Scotland has appointed Hamish Macdonell as the organisation’s Head of Corporate Affairs. He was previously Director of Strategic Engagement with trade body Salmon Scotland, and he is a former Scottish Political Editor

with The Times.

Hamish Macdonell said: “I am delighted to be joining Crown Estate Scotland as the organisation’s new Head of Corporate Affairs. As a former Director of Salmon Scotland, I understand the role salmon farming plays and the relationship that exists between aquaculture companies and Crown Estate Scotland.

“I look forward to working with a terrific team at Crown Estate Scotland for the benefit of rural and coastal communities all over the country.”

HAULIER Ferguson Transport & Shipping has taken delivery of a batch of new trucks and trailers for live fish transport, as part of its long-standing relationship with salmon producer Mowi Scotland. Ferguson will operate the trucks in Mowi’s livery. Two top of the range Euro 6 low emission Volvo Trucks

in Mowi colours have already joined the fleet, as well as 10 new Crossland fish tanker trailers. A further four tractor units will be delivered in the coming months to transport fresh Mowi salmon and the full fleet is expected to be delivered by the manufacturers over the next 12 months.

A NORWEGIAN salmon farmer who played a key role in helping to build the industry in Scotland has died, aged 60. During the 1990s

Inge Midtbø was Chief Executive at Lighthouse of Scotland Ltd, which farmed in the Hebrides and west coast of Scotland. The business was later to become The Scottish Salmon Company, now Bakkafrost Scotland. Midtbø returned to Norway in 1997, helping to develop Nordic Halibut. He was more recent Chairman of seafood processing business

P.Stave AS.

THE Cooke Seafood group is this month celebrating ten years of aquaculture in the UK with a change of name. The company said it is very proud that the business is now a decade old and of what has been achieved.

Cooke Aquaculture Scotland was established in 2014 as part of the global company’s strategy to achieve success through acquisitions and organic growth to meet an increasing market demand for healthy, fresh seafood. The company will from now on adopt the shorter name of "Cooke Scotland".

Colin Blair, Managing Director of Cooke Scotland, said: “Ten years this month, the Cooke family acquired the successful seawater and freshwater assets in Orkney, Shetland and UK mainland before building on its Scottish operations.

“I take great pride in what we have accomplished as one of the leading producers of world-renowned Scottish salmon and the largest producer of organic Scottish salmon.”

In the past decade, Cooke Scotland has tripled its organic production and increased general production and supply to its loyal customers. The company has harvested and shipped over 52 million fresh farmed salmon to more than 16 different countries worldwide and continues to grow responsibly and sustainably by maintaining consistently high standards.

The company said: “As one of the largest employers in the Scottish Northern Isles, and with over 380 staff who dedicate the time, care and resources to rearing the finest Scottish salmon, the company works hard to generate shared prosperity by playing an intrinsic part of the communities in which its employees live and work.

“Since 2018, Cooke Scotland has donated over £700,000 through the Cooke Community Benefit Fund to a variety of local-led events, activities, groups and community projects throughout Scotland and the Northern Isles, and in the north of England.

“Cooke’s local investment has had particularly positive reallife impacts in the Northern Isles including supporting local businesses and jobs, maintaining local populations, sustaining the uptake of local schools, ferries and shops; and created ongoing operational spending with local businesses.”

Cooke said a key milestone was the establishment of Northeast Nutrition Scotland in Invergordon to locally produce feed in-house for Cooke’s UK operations.

“Cooke Scotland has also bolstered its workforce recruitment and is having great success with staff training and development – including effective results in the areas of husbandry and fish welfare,” it added.

MARINE technology business OTAQ is planning to raise between £1.5m and £2m through an issue of convertible loan notes.

The announcement came alongside the company’s latest trading update, which reports an “encouraging” first quarter for 2024, with revenues up 19% year on year.

OTAQ expects that the final figure for trading in the year to 31 December 2023 will be slightly ahead of previous estimates, with revenues of not less than £4.4m (2022: £4.0m).

The company anticipates that its EBITDA loss will be down to £311,000 (2022: £331k). The latest estimate for the loss is some £66k higher than previous guidance, however, due to “certain non-recurring items”.

OTAQ is proposing to conduct a fundraising by way of a conditional placing of convertible loan notes to raise net proceeds of up to £2m, with a minimum raise of £1.5m.

The convertible loan notes will be redeemable after three years with a cash coupon of 10 per cent per annum. The notes will be convertible into OTAQ ordinary shares of one penny each at a price of 3.0 pence per share.

The placing will be subject to approval by shareholders at the next annual general meeting.

Phil Newby, Chief Executive Officer of OTAQ, said: “The board acknowledges with satisfaction the company's progress, especially the favourable market conditions in the offshore sector, where OTAQ is strategically positioned to pursue emerging global growth prospects for its OceanSense, Eagle IP, and subsea electrical connector and penetrator solutions.

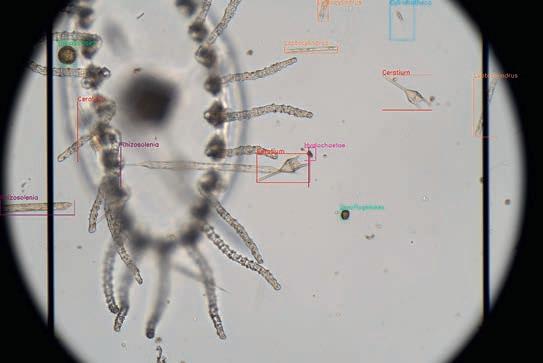

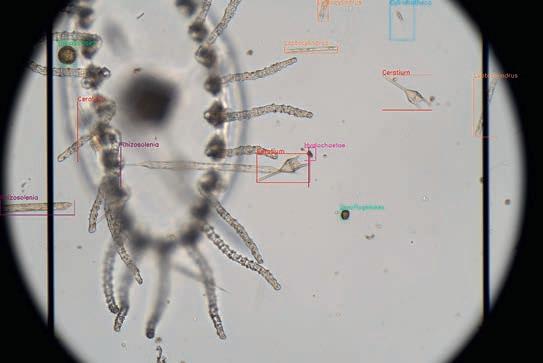

“Given the anticipated improvement in reported revenue for 2023 and the favourable start to 2024, the board remains confident in its current growth strategy. The recent commercial launch of LPAS [Live Plankton Analysis System] marks a significant milestone for the company, one that we are poised to develop throughout the remainder of 2024 and beyond.”

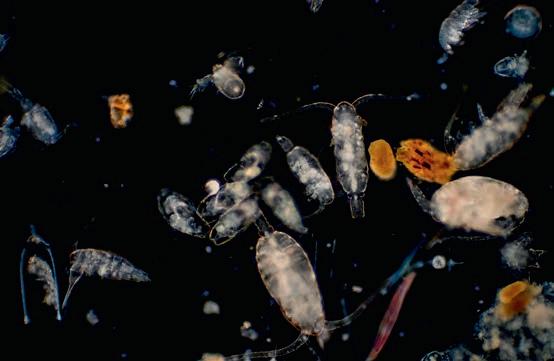

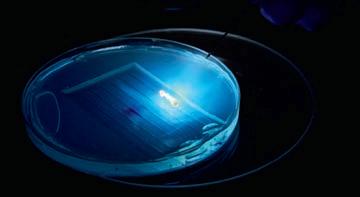

OTAQ’s LPAS, which is designed to detect harmful algal blooms, was launched at the Aquaculture UK trade show in Aviemore. The system has completed trials successfully after four years in development.

The company also said its sonar shrimp system, developed for Minnowtech LLC, is now gaining traction in its target markets. OTAQ has also identified further new customer interest in its Sealfence acoustic deterrent device (ADD) solution from salmon farmers in several major salmon production regions, having sold 19 Sealfence units into these core target markets in the first quarter – although regulators in Scotland have still not come to a decision on ADDs.

A £4.6m fund, aimed at bringing academia and industry together to tackle key challenges facing UK aquaculture, is being made available.

Researchers and their industrial partners working in sustainable aquaculture are set to benefit from a share of this new Biotechnology and Biological Sciences Research Council (BBSRC) investment.

The Sustainable Aquaculture Partnerships for Innovation fund will support 10 projects designed to address specific issues facing British aquaculture, including disease prevention and animal welfare.

All funded projects include at least one partner from industry who will contribute at least 10% cash or in-kind to the full economic cost of the project.

Among the funded projects is a 24-month consortium, which will help to address the health and welfare impact of plankton on aquaculture by using:

• novel imaging approaches

• artificial intelligence

• mathematical models

• real-time web-based reporting

The project has applicability to a diverse range of areas and international applications and could benefit the shellfish aquaculture industry.

Elsewhere, researchers will explore how regulating exposure to light can help tackle some of the challenges posed by infectious diseases on salmon farms.

Previous research underpinning the project has shown that juvenile trout exposed to continuous light were less resistant to skin parasites.

Another project will bring together a large consortium of seaweed producers from around the UK, Sweden and Norway to research ways to boost red seaweed cultivation.

This will include the use of:

• novel culturing strategies

• hatchery technology

• contamination control, microbiome engineering

• predatory microorganisms for disease control

Dr Lee Beniston, Associate Director of Industry Partnerships and Collaborative R&D at BBSRC, said: “Advances in aquaculture technology and innovative approaches have enormous potential to provide the UK, and the world, with a more sustainable, diverse and healthy

source of nutrition.

“This will support ambitions in areas such as food security through to the health of the nation.”

The project partners include key players in the sector such as Scottish Sea Farms, Bakkafrost, Mowi and Salmon Scotland.

Other organisations, such as the University of Stirling’s Institute of Aquaculture, where scientists will work with industry partners on three of the 10 projects funded by BBSRC investment, are involved.

Professor Simon MacKenzie, Head of the Institute of Aquaculture at the University of Stirling, will lead a project aimed at improving gill health in Atlantic salmon, a partnership with PatoGen and Bakkafrost.

Fellow Dr Adam Brooker will lead a team working with Bakkafrost and Garrett Brothers to improve fish welfare in salmon aquaculture using on-demand, electricpowered aeration.

Professor Dr Monica Betancort will head up a project to research the use of camelina omega-3 oil for optimal heart and gill health, in partnership with Biomar.

AQUACULTURE UK, the country’s biggest trade show for the industry, packed a full programme into two days at Aviemore over 14 and 15 May.

The show saw visitors and exhibitors from across the UK and much further afield, with national pavilions for the first time representing Canada, Chile and Ireland. The occasion also gave leading politicians an opportunity to voice their support for the industry. Opening the event, the SNP’s Employment and Investment Minister, Tom Arthur, praised the industry’s contribution to Scotland’s economy, concluding: “We see a bright future for aquaculture.”

Scottish Labour leader Anas Sarwar also attended

the show, meeting producers and suppliers, and addressing the AGM of industry body Salmon Scotland, which was being held alongside the show and conference. He

described the sector as a key part of “Brand Scotland”.

The conference had a full programme with speaker panels covering a range of topics from genetics to the

parallel challenges faced by fish farmers in Scotland and Canada.

This year’s trade show also saw a number of product launches from companies large and small, from Gael Force’s new reinforced pen to a new remotely operated vehicle (ROV) dedicated to mort collection.

Aquaculture UK was also the venue for the Aquaculture Awards, with among others, a special achievement award for Gilpin Bradley, the former Managing Director with Wester Ross Fisheries.

Read our full report on Aquaculture UK, starting on page 30 of this issue.

See Fish Farmer’s video of the show highlights online at bit.ly/AquaUK24vid.

RESEARCH organisation the Sustainable Aquaculture Innovation Centre (SAIC) has secured new funding to continue its support of fish health research and development.

The agreed package means SAIC will need to focus its efforts more narrowly –and this has left the voluntary organisation Women in Scottish Aquaculture (WiSA), which SAIC has supported and helped to set up, looking for a new host.

Last year the Scottish Funding Council (SFC), which funds a huge range of educational and research institutions across Scotland, previously SAIC’s chief source of finance, announced that it was ceasing its support for the aquaculture body, much to the disappointment of the industry.

The new £1.5m package, made up of £500,000 from the Scottish Government’s Marine Fund Scotland and £1m of transitional funding from the Scottish Funding Council (SFC), will allow SAIC to build on its work over the past decade and sharpen the innovation centre’s focus on driving positive health and welfare outcomes for farmed fish.

For WiSA, however, the search is now on for another supporter.WiSA carries out a range of activities, including mentoring programmes, the WiSA Awards, events and training, and online knowledge-sharing.

Up until now, SAIC has administered WiSA, using in-house expertise and staff time, with financial support from industry and government.

In a flier issued at the Aquaculture UK conference,WiSA said: “WiSA is looking for a new host organisation to fund or fundraise in order to administer and deliver our key initiatives alongside our advisory group. If you share our vision and passion, then please come and speak with us about how you can help make sure WiSA continues to exist.”

Via a video address at the conference, Mairi Gougeon, Cabinet Secretary for Rural Affairs, Land Reform and Islands, underlined her appreciation for WiSA’s work and said the Scottish Government is committed to working with it in future, although that pledge came without any guarantee of funding.

SAIC has now launched a new funding call for businesses and higher education institutions for projects exclusively focussed on finfish health and welfare.The deadline for applications is 19 June 2024. A minimum of £800,000 in funding is available to applicants, with an emphasis on gill health, the mitigation of challenges potentially arising from climate change, such as harmful algal blooms and micro-

jellyfish, and emerging issues affecting fish health. SAIC is particularly keen to receive proposals focussed on potential preventative techniques and technologies for these areas.

David Gregory, Chair of SAIC, said: “The funding provided by the Scottish Government and SFC will allow SAIC’s vital work to continue.The model of combining funding from the sector and government, which has underpinned our work over the past decade, is now very well established and has delivered a broad range of positive outcomes in aquaculture.

“SAIC’s more concentrated remit is aligned to the sector’s priorities, and we look forward to fostering greater collaboration on R&D projects to tackle the most pressing health and welfare challenges faced by the fish farming community.”

SHETLAND Islands Council has given its approval to Scottish Sea Farms’ proposed offshore salmon farm at Billy Baa.

The move is part of a strategy of modernising and consolidating the company’s estate in Shetland into fewer but larger farms.

Four existing consents to farm in the more sheltered, shallower waters of Sandsound Voe – Brei Geo Inshore (1,209 tonnes), Brei Geo Offshore (2,635 tonnes), Sandsound Voe (100 tonnes) and Sandsound Bixter (1,000 tonnes) – will be surrendered.

In their place will be one new farm, Billy Baa (4,091 tonnes), sited slightly further offshore where, the company says, hydrodynamic modelling found there to be even better growing conditions, but without any increase to overall environmental load. The proposed farm comprises nine 160

metre salmon pens and one 120 metre pen, secured by a 125 metre mooring grid and with a surface area of 19,480m2.

Commenting on the news, Scottish Sea Farms’ Head of Sustainability and Development Anne Anderson said: “By combining four smaller consents into one location, equipped with fewer but larger pens, we’re seeking to maximise water exchange and oxygen levels – two key factors supporting fish growth – in and around the farm.

“It will also be a more efficient approach to farming this stretch of Scalloway’s waters, enabling the team to concentrate their time, skill and resources in one location, further boosting fish health, welfare and survival.”

anything; the planning and consenting process is there for a reason.

“Should we be successful, however, we would hope to be in a position to be stocking Billy Baa in 2026.”

As part of its rolling programme of farm modernisations and consolidations, Scottish Sea Farms has a second proposed development, Fish Holm in Yell Sound, under consideration by Shetland Islands Council.

The next step for the company is to secure the SEPA (Scottish Environment Protection Agency) CAR licence which, if awarded, will set permitted levels on fish volumes and veterinary medicines.

“Our policy has always been to secure the relevant approvals and licences first, before ordering the farm infrastructure or assigning fish,” said Anderson. “We don’t assume

This is one of two planning notifications (the other by fellow salmon grower Mowi in the Highlands and Islands region) that are helping to trial the new, streamlined licensing and consenting process for salmon farms introduced following the recommendations of the Griggs Report.

Under the new process, local authority planners and SEPA work together to review submissions in consultation with key stakeholders, rather than each body consider the applications separately as currently happens.

THE Icelandic salmon farmer Ice Fish Farm has changed its name – and its shares can now be traded on Iceland’s market for aspiring companies.

The development marks a significant step-up for the business, which is backed by the Norwegian salmon company Måsøval.

The company, which has a market value of ISK 44bn (£250m), will now be officially known on the Icelandic stock market as “Kaldvík AS”. The company’s affiliated shares will trade on the Nasdaq First North Growth Market in Reykjavik, appearing as KLDVK. It is already listed on Oslo’s Euronext Growth Market.

The Ice Fish Farm move follows in

the footsteps of Arnarlax, another Icelandic fish farmer, which was listed on the Icelandic First North Market eight months ago. This market is often seen as a stepping stone for companies aspiring to list on the main stock exchange.

At the Capital Markets Day ceremony, Kaldvík chairman Asle Rønning spoke of the growth of the business in recent years from a small operation. He said when the business launched in 2016, it had just 30 to 40 employees. Today it now has a staff close to 200 “in our fantastic team”, he said.

Ice Fish Farm, which has a near 44,000 tonnes maximum allowable

biomass, underwent refinancing with a major equity increase last year.

The chairman said the company was proud to be involved in salmon farming even though some people were saying those taking part in the industry should be ashamed.

While the industry needed to continue to improve on welfare, Rønning said he was proud of the industry, reminding his audience that salmon aquaculture produced far less CO2 gases than pig or chicken farming, and it was also generating sustainable jobs in Iceland’s rural areas.

Guðmundur Gíslason, CEO of Kaldvík, said the company’s registration in Iceland was a logical and natural development, given all that was happening in the country.

He had earlier explained the thinking behind the listing move: “As the operations of Ice Fish Farm take place exclusively in Iceland, a dual listing on First North Iceland is a natural and logical next step for the company. Since listing on Euronext Growth Oslo in 2020, we have significantly grown the business and become the leading aquaculture entity in the east fjords of Iceland. Combined with the fact that we have experienced an increased interest in Ice Fish Farm by Icelandic investors, and a significant part of the company ‘s shares are currently held by Icelandic investors, we believe now is the right time to pursue a dual listing.”

NORWAY exported seafood worth NOK 14bn (just over £1bn) last month, largely thanks to increased volumes of salmon and trout.

This new May record, which also includes volume growth, represents an increase of 8% by value on the same month last year.

Christian Chramer, the Norwegian Seafood Council’s CEO, said that in the first four months of this year, the Norwegian krone was weaker than the corresponding months last year, which raised export prices measured in Norwegian krone. That has now changed.

“In May, the Norwegian krone strengthened, and thus there was no positive currency effect last month,” he added.

“Despite that, the value of Norwegian

seafood exports has never been higher in a month of May before.

“Although there are challenging economic times for many consumers, Norwegian seafood is still a highly sought-after food item.”

Exports to three EU countries –Spain (up 19%), Portugal (up 22%) and the Netherlands (up 15%) – saw the greatest growth.

So far this year, Norway has exported seafood worth NOK 68.5bn (£5bn), 2% higher than the corresponding period in 2023.

Salmon remains by far Norway’s most important species exceeding NOK 10bn (£740m) in May.

Chramer said there was growth in salmon for the first time this year and it was also an historic month for trout with the value the highest it has ever

been in a single month.

Farmed trout exports totalled 5,561 tonnes and were worth NOK 587m (£43m) representing a value increase of 65% on a year ago. The volume growth, year on year, was 83%.

Salmon exports totalled 82,662 tonnes (up 2%) and the NOK 10bn value represented growth of 8% on May last year.

THE last few weeks have seen a worrying number of cases of the infectious salmon anaemia (ISA) virus reported in Norway – and now also in the Faroes.

In late May, Måsøval said ISA was suspected at one of its salmon farming sites in Norway.

The news came just days after the company announced buoyant 2024 first quarter results.

Måsøval disclosed the unwelcome development in an Oslo Stock Exchange announcement, saying: “Strict measures have been implemented to contain the virus and prevent further spread. Måsøval will harvest the site to reduce biological risk. Fish on site numbers are 396,000 with an average weight of 5.6 kg WFE [whole fish equivalent].

“The site was originally planned to be fully harvested in week 26, thus the change in harvest plan will have limited effect on volumes and cost and is expected to have little effect on price achievement.”

The news was the latest in an increasing number of suspected and confirmed ISA cases in Norway.The virus is not dangerous to humans but can devastate fish stocks.

ISA was also confirmed in the far north of Norway. Nordlaks Havbruk AS received positive test results for the disease in its farm at Sandnes Øst in Hadsel municipality. Nordlaks Havbruk director Bjarne Johansen said: “This is a situation we take very seriously. Our highest priority is to protect the health of our fish and minimise the risk of spread.

“The fish at the Sandnes Øst location will be slaughtered as quickly as possible and we are working closely with the Norwegian Food Safety Authority on further work.”

The Norwegian Food Safety Authority was notified of suspicions on 16 May when the test results arrived. Following routine procedures, a restriction zone was created to prevent, limit and combat the spread of the disease.

The disease was also detected at a Sjøtroll Havbruk site in the Vestland region and a suspected case was reported at a SalMar location at the beginning of May.

ISA reaches the Faroes

Bakkafrost last month confirmed an ISA outbreak in the Faroe Islands, the first instance of the disease in that jurisdiction for a long time.

The virus was found at two Bakkafrost pens at the company’s farming site A-19 Vágur.The full site has a million fish in total, with an average weight of 2.6 kg.

Bakkafrost said: “Strict measures have been implemented to contain the virus and prevent further spread.

“The two affected pens will be harvested out immediately and the full site will be harvested out within two months, in line with Faroese regulation.

“Consequently, estimates show that harvest volumes for 2024 will be reduced with 2,000-3,000 tonnes gutted weight by the accelerated harvest of the entire farming site A-19 Vágur.”

Salmon says its Arctic project is on track

LAND-based fish farmer Andfjord Salmon has said its development in the north of Norway is going well.

Releasing its first quarter report, the company, which recently completed a capital raising of NOK 350m (£25m), reports that its build out programme at Kvalnes on the island of Andøya in the Arctic archipelago of Vesterålen is progressing as planned.

The pool pit excavation was completed ahead of schedule, and the harbour area and waterways workstreams are on track, the company said. The facility will operate as a flow-through system using seawater.

Post-smolt production is underway with a high survival rate at 97.5%.

Andfjord Salmon says a report on the site by food research institution Nofima has concluded that fish welfare and health in the first production cycle have been good.

The company says its policy of co-operation with other industry

players is proving positive for economic development in the region. Agreement has been reached with Eidsfjord Sjøfarm/ Holmøy Havbruk (part of Holmøy Group) whereby Andfjord Salmon will farm post-smolt for a select number of nearby ocean-based farming locations as part of upcoming production cycles.

The initial production plan has been approved by relevant authorities, while there are ongoing discussions with additional local conventional fish farmers regarding partnering.

The company is planning for a harvest of around 40,000 tonnes between next year and 2030.

Benchmark hires sales chief for Iceland

AQUACULTURE biotech

business Benchmark has appointed Sverre Vormedal as the company’s Sales and

Technical Manager for Iceland and the Faroe Islands. Prior to joining Benchmark, he served as Biological Controller at Arnarlax, the Icelandic farming company.

His previous experience includes work in service boats, fish farms, sales logistics, and quality management throughout the industry. Vormedal has lived in Reykjavik, Iceland, since May 2021 and will work out of Benchmark’s office in Hafnarfjördur, Iceland.

Thousands of Icelanders sign petition against net-pen farming

MORE than 46,000 people have signed a petition calling on the Icelandic government to outlaw open net-pen salmon farming in the country’s fjords. The poll has the backing of Icelandic sport fishing groups. The campaign took on new momentum last autumn following a serious escape at an Arctic Fish facility in the Westfjords. It has since become even more of a political hot potato now that Iceland’s new aquaculture bill, setting out a long-term strategy for fish farming, is currently being debated by parliament.

The petition was started several months ago and includes signatures from foreigners and Icelandic nationals. It was delivered to the Ministry of Food which had been handling the ongoing aquaculture bill, but that responsibility has now been taken over by the Icelandic Economic and Social Committee (see Iceland feature, page 58).

SALMON farming veteran

Paul Birger Torgnes has been honoured by the Federation of European Aquaculture Producers (FEAP) in recognition of a career

A LARGE bonus is being offered for the recapture of farmed salmon that escaped from a Lerøy Seafood facility in Norway.

The company is offering anglers NOK 700 or around £52 per salmon – one of the highest rewards so far for such an event.

More than 8,000 fish escaped from the Lerøy farm in the Hitra municipality over a week ago.The original escape figure was more than 14,000 but that estimate was later reduced.

The incident was made worse by the revelation that many of the fish were infected by bacterial kidney disease (BKD).

The news journal Børsen reports that former professional footballer Vegard Heggem has been negotiating with Lerøy on behalf of anglers.

Børsen says he and the river managers will receive the NOK 700 bounty for anglers who catch each escaped fish caught in rivers around the area.

They will have to be confirmed as farmed salmon following submission. Heggem, a former Liverpool FC and

Norwegian international right back, now retired, said the figure was only fair and reasonable.

It also said the rivers affected are some of the best wild salmon fishing rivers in the country.

Heggem told Børsen: “We have experienced escapes in the past, but never with infection from this rare disease [BKD).

“The phone calls are pouring in from people and fishermen who are genuinely concerned.The timing is absolutely disastrous, now just before the start of fishing on 1 June,” said Heggem to Børsen.

Lerøy has apologised for the incident, saying it is working purposefully to ensure as many fish as possible are returned and to ensure such an incident will never happen again.

weight in the same quarter last year.

The EBIT or operational profit was NOK 120m (£8.8m) compared to just NOK 36m (£2.6m) 12 months ago.

that goes back to the early days of the industry in the 1980s. Torgnes was announced as the recipient of the FEAP Award for 2024 at the organisation’s annual general meeting in Istanbul.

Paul Birg-er Torgnes has been involved in salmon farming in Norway as well as in Chile, UK and other countries over the last few decades. He is still active in his family-owned company, producing salmon in Norway, and has also been involved in farming other species, such as sea bass and sea bream in Turkey.

THE large central Norwegian salmon farmer Måsøval has reported a strong first quarter performance, despite encountering some of the problems that have hit a number of producers.

The company battled against jellyfish, winter storms and cold sea temperatures during the period, but its teams battled these well, the company said.

Måsøval recorded revenues of NOK 402m (almost £30m) in the first quarter, harvesting 3,606 tonnes gross weight.

These figures compare to NOK 237m (£17m) and a harvest of 1,994 tonnes gross

CEO Helge Kvalvik said: “During the quarter, the group not only harvested more salmon than guided [estimated], but also exited the quarter with a high biomass with harvest-ready fish.

“Cost position improved significantly in the quarter, positioning us for a strong Q2.

“Results are, however, somewhat hampered by low price achievement due to downgrading.”

He added: “We have intensified our work on fish health to improve the quality within the entire value chain.”

Måsøval said losses in the sales and processing department due to nonrecurring events overshadow a strong operational quarter.

NORWAY’S aquaculture employers have reached a pay agreement with the country’s fish feed and fishmeal workers. A settlement with fish farm staff, however, is going to mediation.

The feed sector settlement includes increases in the minimum wage, and overtime and shift pay rates for staff.

The employer organisation Seafood Norway said: “We included new provisions in the collective agreement regarding, among other things, local negotiations, right to breastfeeding leave and text on dyslexia-friendly workplaces.”

“The protocol also contains text regarding salaries for meetings in collaboration committees for the industry.”

While there is relief that a settlement has been reached with this important group of workers, the employers remain at a stand-off with fish farm workers and there is talk in Norway –although no more than that at this stage – of possible strike action.

Seafood Norway said: “There

was a breakdown in the negotiations between Seafood Norway and the Norwegian Confederation of Fisheries (trade unions) regarding the Aquaculture Agreement following negotiations on 22-24 May.”

The settlement now goes to mediation and at the time of writing, this was due to take place on 13 and 14 June.

However, Seafood Norway is preparing the ground for possible action with advice to members which says: “We remind you that if employees cannot be employed as a result of a strike in their own company, a conditional lay-off notice must be given with 14 days’ notice.

“This is recommended to be done in the event of a breach in negotiations and subsequent mediation.”

WHITE fish farming company

Nordic Halibut says it is well positioned to achieve its target in two years’ time of 4,500 tonnes (HOG), and on track to reach 10,350 tonnes by 2031.

Presenting this year’s first quarter results, Nordic Halibut said it harvested 150 tonnes (135 tonnes HOG) with an average weight of 4.9kg during the period and registering an average price of NOK 163 (almost £12) per kg.

The company also achieved a superior quality rate on 99.7%, but reduced revenues of NOK 22m (£1.6m).

In a highly important strategic move, the company said it aims to release one million fish into the sea annually until the new infrastructure is completed by 2027.

In line with expectations, the EBITDA came out at a loss of NOK 8.4m (£617,000) and the financial loss for the period was NOK 22.3m (£1.6m) in total.

Nordic Halibut said in its Q1 report that it had experienced a slight decline in achieved price during the period, but compared to the fiscal year 2023 (161 NOK per kg) there was an increase.

Lower harvest weights and reduced export share to the US market explained the decrease in price level between quarters.

The report adds: “This emphasises the importance of the company’s strategy to maximise larger-sized harvests to achieve better price realisation.The price development signals market trends for premium seafood products.”

LEADING cod farmer Norcod is gradually clawing its way into profit, the company’s latest figures suggest.

The Norwegian business saw its losses reduced by almost half during the first three months of 2024.

The operating loss before biomass adjustments was NOK 47.9m (£3.5m) against a loss of NOK 88m (£6.5m) over the same period a year ago.

Norcod slaughtered 2,765 tonnes (round weight) during the period at a production cost of NOK 39.75 (£2.90) per kg.

Norcod said net growth during the quarter was 1,586 tonnes, amid heavy investment in biomass and a satisfactory feed conversion rate, and stable and predictable mortality.

:

In fact, according to official statistics, Norcod’s share of total export volume of harvested cod from Norway during the quarter was 65%, and at the end of the period, it held 50% of the farmed cod biomass volume.

At the start of this year Norcod secured a new contract with a Chinese customer “at favourable market prices”, and now says it plans to strengthen its market position in China this year.

Norcod said its key tasks going forward are: “Firstly, a continued vigilant focus on cod biology and fine tuning of the feeding regime, the production processes, and the utilisation of production capacity.

“Secondly, stepping up efforts to develop the market and positioning our product in a premium niche category.”

The Hydrotech Drum Filter Value series focuses on reduced maintenance, increased component quality and simplified operation – all to give your plant maximum filtration performance at a minimum operational cost.

MOWI has decided not to appeal against the court decision which rejected its claim over Norway’s “salmon tax”.

In April the district court in Hordaland threw out the salmon giant’s lawsuit against the tax, also known as the “ground rent” or “resource rent” tax. Mowi CEO Ivan Vindheim has been the industry’s strongest critic against the tax.

The company has claimed that the legislation is unfair, discriminatory and contrary to the rules of the European Economic Area (EEA) of which Norway is a member.

The company has decided not to continue down this route. However, another approach may be on the cards.

According to the business news site e.24, Mowi has accepted that the decision of the Storting (the Norwegian Parliament) cannot be challenged on a general basis.

It added that the government’s Attorney General, Fredrik Sejersted, was waiting to see if the company will take a different legal approach.

“In our view, it is obvious that the ground rent tax is fully compatible both with the Constitution, EEA law and the ECHR,” Sejersted said.

The tax was voted in by parliament a year ago although the rate was cut from the government’s original proposal of 40% to a compromise of 25%.

Norway’s national broadcaster NRK said the state believes that Mowi must wait until it has a concrete tax decision to complain about, and that there is no basis for taking legal action against a decision from the Storting.

Mowi believes that the case in the district court was of a purely procedural nature to determine when a case about the legality of the penalty claim in the new ground rent model can be tried. The company has said it may yet proceed with a lawsuit.

Finance Minister Trygve Vedum, who introduced the salmon tax, said Mowi’s decision was good for the company and the industry.

The Conservative Party, which is currently riding high in the polls, and its right-wing ally the Progress Party have said they will scrap the tax if elected next year.

Mowi may yet have to wait for that eventuality before the issue is finally sorted out.

NORWEGIAN and Canadian salmon farmer Grieg Seafood has reported a near £7m drop in operating profits for 2023.

They were pushed down in large part by serious biological problems in Finnmark, which included the Spiro parasite and jellyfish attacks These, together with low sea temperatures, affected mortality, fish health, welfare and quality.

Grieg produced a 2023 harvest of 21,075 tonnes, up by around 5,700 tonnes on 2022.

The operational EBIT was NOK 292m (£21.4m) compared with NOK 385m (£28m) in Q1 last year. The operational EBIT per kilo was NOK 13.8 against NOK 25.1 in 2023.

The group expects a 2024 harvest of 81,000 tonnes.

It was not all bad news from Norway with Rogaland delivering its second best quarterly results.

And the company’s Canadian operations saw the successfully completed harvest of the first generation in Newfoundland, with a high share of superior quality fish.

Grieg CEO Andreas Kvame said: “The underlying biology is improving in all of our farming regions. Our Finnmark operations were affected by historical biological challenges,

including the Spiro parasite and string jellyfish. “Coupled with low seawater temperatures, the challenges impacted survival, fish health, welfare and quality. I am not satisfied with the fish welfare situation during the quarter.”

He said Grieg continued to implement a variety of improvement measures, including a new vaccine against winter ulcers, a UV filter against Spiro and sea lice treatment capacity with improved welfare.

“We are also making changes to our production planning and reducing biological risk as our post-smolt strategy is gradually rolled out in our regions. Because of our long production cycles, it takes time to see the results of our measures.”

THE salmon giant Cermaq is expanding its Norwegian business with the purchase of the family-owned company Ballangen Sjøfarm.

Based in the north of the country, Ballangen Sjøfarm employs around 50 people and produces 10,000 tonnes of salmon a year.

Otto Bakke, one of the founders, said that after 13 years of co-operation with Cermaq, he was sure this was the best solution.

Cermaq, which is owned by the Japanese industrial giant Mitsubishi, already has a stake in the business.

Ballangen Sjøfarm currently has three owners; Ballangen Holding, Ballangen Utvikling and Cermaq. The latter two will be the owners going forward. Cermaq will be the majority owner with the exact share of equity to be clarified later.

The company was started in 2001 and Otto Bakke said it was important it should continue to be an important cornerstone and safe workplace for the community where it is based.

“We have been concerned that Ballangen Sjøfarm’s employees and operations should continue and continue to be developed,” said Otto Bakke.

“This is included as part of the agreement. Ballangen Sjøfarm will thus be able to face the future even more solidly.”

The company name and administration will be maintained in Ballangen and the purchase will not entail any changes for the company’s 50 employees.

“Having cooperation with Cermaq since 2011 has been a great advantage, which operations and results clearly show. Therefore, we are confident that the future looks bright for employees and the company’s further

development,” said the chairman of Ballangen Holding, Svein Bakke.

In the joint operation since 2011, Ballangen Sjøfarm has been responsible for the dayto-day operations at sea, while Cermaq has been responsible for smolt, slaughter, processing and sales in addition to operational support for lice treatments. Service operations, and accounting and financial services have also been part of this. The companies are therefore well acquainted with each other.

Cermaq Norway CEO Knut Ellekjær said: “We are both humbled and proud to be the preferred buyer of one of the country’s best-run farming companies with 50 skilled employees. As the owner of locations in small coastal communities in Nordland and Finnmark, we know how important Ballangen Sjøfarm is to the people who live there and the ripple effects this creates.

“We will strengthen this with great faith in increased activity for the company going forward,” Ellekjær added.

TWO ultra-modern vessels have been commissioned for the Norwegian feed transport company Fjordfrende, which is jointly owned by Skretting and Cargill.

The boats are due to be delivered in 2026 and will have a hybrid dieselelectric propulsion system with a large battery pack, as well as engines that will be able to run exclusively on biodiesel.

The cost for both ships is estimated at NOK 950m – or just over £70m.

The contract has gone to the Norwegian company Eidsvaag although it is understood the vessels will be built in Bilbao, Spain.

In 2019 Skretting and Cargill decided to co-operate on the transport of fish feed in Norway.

Instead of ships with two separate names sailing close to each other on the same routes, they agreed to collaborate on transport under the name Fjordfrende with their feed moved by the same vessels.

This, they said, would limit fishing traffic and reduce greenhouse transmission by at least a fifth.

The first new vessel is to be completed in the first half of 2026 and the other in the second half of that year.

Fjordfrende has now been operational for almost five years.

DESPITE a series of challenges this winter, the Lerøy Seafood Group has announced better than expected 2024 first quarter results.

Lerøy, which also owns one of Norway’s largest white fish trawler fleets, produced an operational EBIT or operational profit of NOK 842m (£62m).

This is down from NOK 989m (£73m) in Q1 last year, but the outcome is far better than what was being predicted.

CEO Henning Beltestad said: “We have had a good quarter in aquaculture with strong biological development.

“In light of very cold sea

temperatures, our fish grow well. It is also very pleasing to note a significant improvement in biology and earnings in Scottish Sea Farms (in which Leroy owns a half share with SalMar).”

Lerøy generated a Q1 operating income of NOK 7,110m (£522m), up from NOK 6,791m (£494m) a year ago.

Beltestad said the group’s downstream business (VAP S&D) generated an operational operating profit of NOK 176m (£13m) in the first quarter. This, he explained, had been driven by operational improvements, high capacity utilisation in Norway and increased product prices.

He added: “With our fully integrated value chain, we have an advantageous position with high processing capacity in Norway, which we have utilised well in the quarter.”

The CEO concluded: “We have good momentum.”

THE Japanese aquaculture company

Soul of Japan has secured a huge 33 billion yen loan (£165m) to develop and build a RAS salmon facility in the country.

Soul of Japan (SOJ) said the RAS (recirculating aquaculture system) facility, currently under construction, will be Asia’s largest land-based salmon farm. It will stretch over 135,000 square metres and have a capacity to

produce 10,000 tonnes of Atlantic salmon.

The Tsu plant will be bigger than the Mount Fuji project led by the Norwegian company Proximar Seafood, and reflects Japan’s growing ambition to become a leading producer of Atlantic salmon. Proximar is now close to achieving its first commercial harvest.

SOJ is working with Pure Salmon

Technology, which will be providing the advanced RAS system for the plant.

The loan is from Sumitomo Mitsui Banking Corporation (SMBC) and the transaction is being supported by 8F Asset Management, an asset manager of private equity funds that also owns the Pure Salmon Group.

The SOJ project will be built at Tsu City in central Japan, close to the large city of Nagoya.

Erol Emed, CEO of Soul of Japan, said: “This debt financing allows us to accelerate our growth and contribute to Japan’s food security while minimising our environmental footprint. We are committed to delivering high-quality, locally produced salmon to consumers.”

Karim Ghannam, Chief Investment Officer at 8F Asset Management, said: “We are excited to work with SMBC, the banking group and the management teams of SOJ and Pure Salmon to facilitate this transaction that recognises the importance of sustainable aquaculture and its positive impact on Japan’s economy and the environment.”

A GROWING global middle class and an ageing world population looking to eat healthy food are driving Atlantic salmon consumption, the industry giant Mowi says in its 2024 Salmon Farming Industry Handbook.

It also warns, however, that the industry is reaching the limits of growth unless there are significant improvements in production technology and fish health.

Mowi’s annual review of salmon farming is a yearly attempt to give a clear picture of the sector, how it operates, its challenges and the worldwide benefits it brings.

The handbook reveals that the supply of Atlantic salmon has increased by 527% since 1995 (annual growth of 7%). The annual growth in the period 2013-2023 was 3%.

Mowi said it expects future growth from 2023 to 2028 to remain relatively stable, however, at 2%, as the industry has reached a production level where biological boundaries are being pushed.

The handbook says: “Future growth can no longer be driven only by the industry and regulators as measures are implemented to reduce its biological footprint.

“This requires progress in technology, development of improved pharmaceutical products, implementation of nonpharmaceutical techniques, improved industry regulations and intercompany cooperation.”

It says: “The industry is a good fit with the global macro

trends, as Atlantic salmon is a healthy, resource-efficient and climate-friendly product produced in the sea.

“The global population is growing, resulting in increased global demand for food. The world’s population is expected to grow to almost 10 billion by 2050.

“The health benefits of seafood are increasingly being promoted by global health authorities. The EAT-Lancet Commission recommends increased consumption of fish, dry beans and nuts as sustainable, healthy protein sources.”

Highlighting salmon’s now well-known omega-3 health benefits, the handbook says that wild fish stocks were now more or less fully exploited.

“The middle class is growing in large emerging markets, allowing more people to eat different, and more nutritious, protein rich foods, such as fish, meat and eggs.

“Consumption of high-quality proteins is expected to increase,” the publication says.

It points out that climate change is the greatest environmental challenge the world has ever faced.

“Soil erosion is a growing issue for food production, challenging the world to investigate new ways of feeding the population.

“Concerns about climate change are influencing dietary choices. Increased consumption of fish can reduce global GHG emissions and improve human health.”

NORDIC Aquafarms has launched a legal action against a local authority in Maine, USA, in an effort to keep its plans for a large landbased salmon farm on the US east coast alive.

The company is asking the Maine Superior Court to reverse a decision by the City of Belfast, Maine, which has had the effect of denying Nordic Aquafarms access to a vital area of intertidal mud flats on Penobscot Bay, required for the farm’s outflow pipes.

After a long dispute over ownership of the area, the city initially brought an “eminent domain” action enabling it to seize the land in question and enable the fish farm to go ahead.

Following a vocal campaign by environmental groups, the city reversed that decision, and Nordic Aquafarms is now challenging the change of policy.

The proposed RAS (recirculating aquaculture system) salmon farm is estimated to represent a capital investment of at least $500m (£383m). Nordic Aquafarms has faced numerous legal challenges over its proposals, but this is the first lawsuit the company has initiated.

“Having the Superior Court determine Nordic’s rights following the council vote is an important part of the development process, and Nordic is committed to seeing it through,” the company’s Spokesperson Jacki Cassida said.

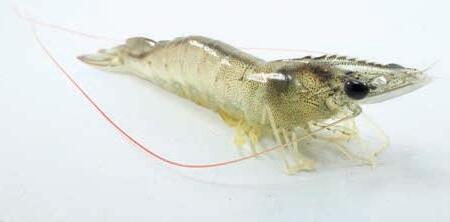

AQUACULTURE production in Queensland, Australia, saw an impressive 17% increase by value in 2022/23, thanks largely to shrimp farming.

The annual Ross Lobegeiger report, published by the Queensland Government, shows that aquaculture production in the north-eastern Australian state was worth AU $263.2m (£137m) in 2022/23, up from AU $224.7m (£117m) in 2021/22. Over 24 years the industry has grown at an average of 7.1% per annum.

Production by volume was 13,528 tonnes, up 3.9% on 2021/22. The numbers employed in aquaculture fell from 889 to 855.

The mainstays of the industry are prawn (shrimp) and barramundi, also known as Asian sea bass. Prawn production accounted for just over 80% by value, and barramundi around 14%. Other freshwater fish, including silver perch (Bidyanus bidyanus), jade perch (Scortum barcoo), and Murray cod (Maccullochella peelii peelii), represented less than 2%.

Regionally, the biggest share of production is concentrated around Mackay:

• Mackay AU $161m (£84m)

• Cairns AU $51m (£27m)

• Gold Coast AU $23m (£12m)

Prawn production grew 12.6% in 2022–23.

Mark Furner, Minister for Agricultural Industry Development and Fisheries and Minister for Rural Communities in Queensland, said: “The Queensland Government’s support for the aquaculture industry has helped to make it one of Queensland‘s fastest-growing primary industries.”

LAND-based start-up Katahdin Salmon has received a $5m (£3.9m) grant for remediation of its proposed recirculating aquaculture system (RAS) plant in Maine, in the north-eastern United States.

The company is also rebranding as “Great Northern Salmon”.

Marianne Naess, CEO of Great Northern Salmon, said: “Katahdin Salmon has been a good name for the initial development phases in Maine. Now that the company is entering into a new phase, it is the right time to transition to a name that reflects the developments of the company and the way forward but that still ties the company to the local community.”

The remediation grant, for the US Environmental Protection Agency (EPA), will be used to ensure the plant, based on the site of an old paper mill, is free of pollution from its former industrial use. The grant was awarded to the company’s development partner

Our Katahdin for the remediation of the project site in collaboration with Katahdin Salmon. This grant comes in addition to $1m (£787m) in funding from the Maine Department of Economic and Community Development for the same purpose.

Our Katahdin is a volunteerdriven not-for-profit organisation working to promote community and economic development in the Katahdin region.

The Millinocket facility will be located on the 1400-acre property that belonged to the Great Northern Paper Company which permanently closed in 2008. When the Millinocket Mill opened in 1900, it was the world´s largest paper mill. It was the first paper mill to

have an on-site hydro generation and distribution facility.

Nofitech selected for RAS design

The RAS system for the plant will be designed by Norwegian business Nofitech.

Dean Guest, Head of RAS Technology at Great Northern Salmon, said: “It became clear as soon as we started exploring future collaboration that we see things the same way and that Nofitech has a design that is compatible with our bioplan. Nofitech´s reputation for delivering on expectations for cost, performance, and schedule... was also an important factor.”

Contractors from across the country have shown interest in the remediation project, which will be managed by Sevee & Maher Engineering. The contractor is expected to be selected within the next few months with a remediation starting later this summer.

Sean DeWitt, President of Our Katahdin, said: “We are delighted to announce that we have been awarded a $5 million grant from the US Environmental Protection Agency (EPA). The grant will play a crucial role in remediating 26 acres of the former mill site’s wastewater lagoon. This EPA-funded project will clear the way for Great Northern Salmon’s (formerly Katahdin Salmon) aquaculture project which has secured major project permits and is scheduled to begin construction in 2025.”

Great Northern Salmon, formerly Katahdin, is a venture of Xcelerate Aqua, which was founded by Marianne Naess and Erik Heim, who left Nordic Aquafarms in 2022.

US-based aquaculture genetics specialist the Center for Aquaculture Technologies (CAT) is spinning out its Canadian subsidiary into a separate business.

CAT said the move was “part of a strategic alignment to optimise technical specialisation”.

Center for Aquaculture Technologies Canada (CATC) will operate as an independent company, although both will remain part of the portfolio of CAT’s parent, Cuna del Mar. The US and Canadian arms will continue to collaborate while operating under separate governance and management structures.

CAT, headquartered in San Diego, California, will maintain its focus on advancements in the aquaculture genetics sector. CAT houses state-of-the-art genotyping laboratories and a team of genomics and bioinformatics experts, capable of developing custom genetic tools for any aquatic species.

As well as its breeding expertise, the company also advises on genetic improvement programmes, ranging from mass selection and genetic diversity management to advanced

techniques like genomic selection.

Meanwhile, CATC, a contract research organisation with GMP (good manufacturing practice) release capabilities, will continue to operate its facilities in Souris and Victoria, Prince Edward Island, Canada. CATC will retain focus on health and nutrition research for aquatic animals, supported by diagnostic services and a commercial-scale feed extruder.

John Buchanan, CEO of CAT, commented: “The realignment empowers CAT to pursue innovation in genetic improvement with singleness of purpose and strategic focus. We are excited about the opportunities in bringing our genome editing technologies to commercial impact while honouring environmental stewardship. We have a world-class team in all genetics disciplines, are committed to client success, and are excited about the future.This will also allow CATC to pursue strategic initiatives in health and nutrition with agility and allow both teams to focus on innovation.”

The senior management and frontline teams for both organisations will remain in place, CAT said.

Newly appointed CEO of CATC, Myrna Gillis, added: “The realignment presents us with a unique opportunity to deepen our expertise in health, nutrition, diagnostics and specialty feed production while forging new pathways for research and development. We are excited about the prospects this brings and are committed to driving meaningful contributions to the growth of the aquaculture sector. We also express thanks to our founder John Buchanan for his vision and leadership, and for the initiative in charting the exciting new direction for both organisations. Look for additional updates from us soon.”

Gillis has been overseeing the focus on health and nutrition since November 2023.

A COURT in Chile has lifted the bankruptcy order made against struggling salmon company Nova Austral.

Previously, the chief judge of Porvenir in Pablo Aceituno had ordered the opening of a bankruptcy liquidation process, requesting the Superintendence of Insolvency and Re-entrepreneurship to nominate a liquidator. The resolution also set out the background of the three main creditors.

It appears that two creditors, feed producer Nutreco and another creditor, smolt supplier Salmonera Dalcahue Limitada, were unhappy with the terms of the reconstruction deal for Nova Austral reached in January.

It was another creditor, however - reportedly Cargill’s feed subsidiary EWOS - which applied for the bankruptcy order to be overturned.

Recent financial reports show that Nova Austral’s losses almost trebled last year despite much higher revenues. Its accounts for 2023 show pre-tax

losses of just over $US 144m (£128m) against $49.9m (£44m) in 2022.

Nova Austral, which employs more than 3,000 people, says in its annual report that this situation is a fundamental consequence of the substantial drop in the company’s production levels, due to the revocation of three aquaculture concessions carried out by the environmental authority (SMA) starting in 2022. These were reversed in the first instance by the environmental court during the month of January 2024. The company also cites the financial costs associated with the issuance of the bond in Norway.

Despite this Nova Austral remains reasonably positive about the future. It says in its 2023 annual report that its sales come from a highly diversified client portfolio, where clients are economically and geographically dispersed in countries with low sovereign risk rates (mainly the United States and in the European Union).

EXCITEMENT is growing at Proximar Seafood which is closing in on the first harvest of Atlantic salmon at its new site near Mount Fuji, Japan. Reporting its 2024 first quarter results, the company is expecting to achieve this significant goal in September.

It also will make history by becoming the first producer of Atlantic salmon in Japan.

CEO Joachim Nielsen said everything is on track supported by favourable biological

conditions, stable water quality and good fish health.

The operational activities are increasing in the post-smolt grow-out (PSG) building as planned.

The second module of the PSG will be put into operation during Q2, with the remaining two to follow in H2 this year.

The targeted long-term harvest level for Proximar is 5,300 tonnes (HOG) per year in Phase 1, with a gradual ramp-up from the first harvest.

Estimated harvest volumes for 2024 and 2025 combined are expected to be around 4,700 tonnes (HOG).

Proximar said the 2024 target harvest volume will be communicated closer to first harvest announcement.

Standing biomass at the end of the quarter was

111.9 metric tonnes, up from 39.8 metric tonnes at the end of Q4 2023. By mid-May the biomass was 188 tonnes.

CEO Nielsen added: “We are pleased to see the standing biomass increase at pace, whilst the growth of the fish remains according to expectations.”

Proximar said the first quarter highlights included:

• Fish stock growth, with total biomass at 111.9 metric tonnes by the end of Q1 2024

• Increased operational activity in the postsmolt grow-out building, now with multiple batches in production

• Raising NOK 165m (around £12m) in a private placement and repair offering

• Extending the repayment date for the JA Mitsui Leasing (JAML) loan until December 2025.

THE European Parliament has decided to press ahead with a potentially controversial change to the regulations around smoked salmon processing.

Objections had been raised by the processing sector but they were rejected by the Strasbourg-based parliament.

The new regulations centre on part of the production system known as the “stiffening process”.

The changes were first proposed by

the European Commission and adopted by the parliament last week despite mounting concerns.

The European Parliament believes that the planned changes will greatly improve food safety and cut waste.

Stiffening involves reducing the ambient temperature of fresh salmon to between minus four and minus 14 degrees centigrade after it has been filleted and smoked to help protect against Listeria-type bacteria. And

NOMAD Foods Limited has announced the appointment of Ruben Baldew as Chief Financial Officer, effective June 17, 2024. Baldew will succeed Samy Zekhout, who is leaving his position to explore new opportunities outside of Nomad Foods.

Zekhout’s contribution was praised by Stéfan Descheemaeker, Nomad Foods’ Chief Executive Officer, who said the CFO will remain with the company until July 31, 2024, to assist in the orderly transition of his duties.

Baldew joins Nomad Foods with over 20 years of global consumer products experience, most recently as CFO of Accell Group from November 2018 until October 2023.

Prior to Accell Group, Mr Baldew spent over 15 years at Unilever in various finance roles with broad, international experience in the Netherlands, Belgium, Switzerland and Thailand.

there have been a number of salmon Listeria outbreaks in Europe over the past year.

But the industry fears it will cost many jobs especially in large salmon processing countries such as Poland and Denmark.

The Polish Association of Fish Processors (PSPR) has already expressed serious concerns, especially around the time involved in stiffening.

It is concerned that despite serious concerns by the industry, the parliament has now gone ahead without taking them into account.

With an output of more than 200,000 tonnes and a value of over £1 billion, Poland is by far Europe’s largest smoked salmon processor.

A spokeswoman for the association said the change will add complications and reduce the time involved in stiffening to 96 hours.

Until now there has been no time limit for keeping salmon at the stiffening temperature before slicing.

“The change will add complications ”

Nomad is the company behind several iconic seafood brands including Findus, Birds Eye and Iglo, the largest frozen fish brand in Austria.

Earlier in May Nomad reported Q1 results with revenue up 1.1% to €784m (£667m), but adjusted EBITDA down 16.4% to €122m (£104m).

CEO Descheemaeker said the business had seen a “solid start to the year” with tangible progress on key growth objectives.

Nomad maintains its full year guidance, expecting to deliver revenue growth of 3%4%, adjusted EBITDA growth of 4%-6%, and adjusted EPS of €1.75-€1.80.

SEAFOOD is continuing to provide a significant contribution to the performance of the Hilton Food Group.

The group’s principal UK seafood operations, which include farmed and wild caught fish, are based in Grimsby where its production centre supplies the UK retail and food service trade.

In a first quarter update, Hilton said trading was in line with the board’s expectations with volume and sales ahead of the same period last year.

In UK & Ireland, both volume and revenue are ahead of last year, benefiting from a strong Easter trading period as well as slowing inflation and good growth in Ireland, while the momentum of the UK (Grimsby) Seafood turnaround continues.

In Europe, the core meat and easier meals business continues to perform well, with volume and revenue ahead of last year.

The update added: “In APAC, as expected there has been more normalised volume growth from our three facilities in Australia and our food park in New Zealand, following strong growth in 2023, with revenue seeing some impact from changes in mix and deflation.

“We continue to build our long-term partnership with Walmart in Canada and remain on track for the 2027 launch of our multi-protein

ICELAND Seafood Interna�onal (ISI) has reported a good start to 2024 a�er a difficult �me last year. It expects to see sales volumes increasing as salmon prices fall.