We are living in unprecedented times.

Pandemics, wars, and environmental disasters are all happening in quick succession, disrupting food supply chains and causing food security problems in magnitudes never before experienced in our beloved continent, Africa. I’m strongly convinced better days are behind us and things can only get worse from here.

Rainfed agriculture and other 19thcentury methods of production may have served us in the past, but I’m afraid, they won’t be effective today nor will they produce enough food needed to feed our future population which is projected to almost double in the next three decades. Commitment from leaders to end hunger in their respective countries has mostly ended up being empty rhetoric with few concrete steps taken to achieve food security. Our lack of working food systems left us exposed when the war in Ukraine disrupted the global food supply chain and exacerbated food security problems in Africa. Its ironic we in Africa, who control 60% of all the arable land in the world, depended on a country 50 times smaller than us for food. In a normal functioning society, Africa should be the

world’s food basket and not the largest receiver of food aid, a situation in which it finds itself currently.

Climate change is further complicating our food security situation. In East Africa, millions of people are going hungry each day as the region battles its worst drought in four decades. The situation is different but equally devastating in West Africa. Heavy downpour in Nigeria is causing the worst flooding in at least a decade, damaging crops in large areas of farmland across the country. Weathermen project such extreme weather conditions of high

rainfall succeeded by extended dry periods to become even more frequent in the future. All these are a sign that its finally time for Africa to do a complete overhaul of its food production system to give it the best shot at achieving Sustainable Development Goal 2 on Zero Hunger by 2030.

There is no shortage of examples that Africa could borrow from in its quest to become food secure. Israel, Egypt, Saudi Arabia, and Qatar have all significantly raised their food production despite operating conditions far worse than what Africa experiences. Despite being smaller than Rwanda, Israel in 2018 produced 42 million tonnes of agricultural produce including oilseeds and pulses, fruits and vegetables, cereals and grains, commercial crops, and roots and tubers. How much more we could produce in a much better climate and vast land is mind-boggling. The potential is there, what is lacking is concrete steps toward transforming our agricultural systems but as a matter of necessity, the time for action is now, we either change or perish.

Paul Ongeto, Lead Editor, FW Africa.

Paul Ongeto, Lead Editor, FW Africa.

Carcass

jowl

What makes the Art of European Meat? It’s that exceptional combination of Craftsmanship, Food Safety and Tailor-Made Service. And that’s what the Belgian meat suppliers truly master. As one of Europe’s leading meat producers and exporters, they turn their expertise into an art form. Up to you to savor it.

Find your Belgian meat master at artofmeat.eu

Hindquarter

Hindquarter

34 New Product Innovations:

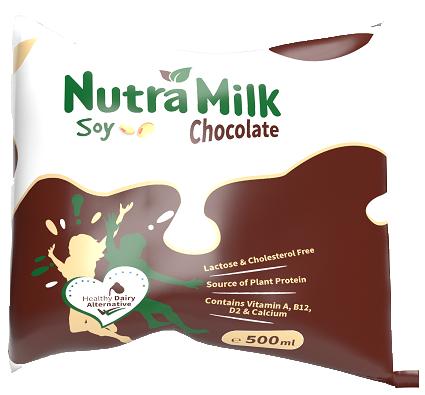

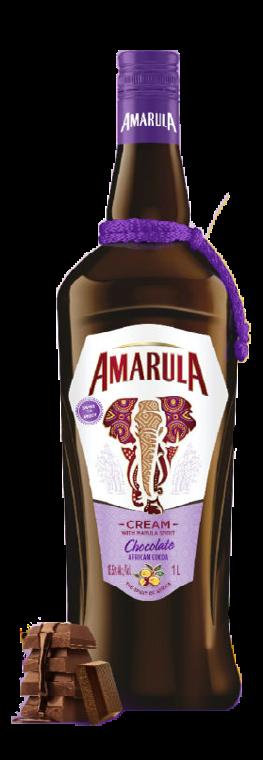

Bakex Millers Limited: Ungano Blended AllPurpose Flour | Libstar Holdings: Goldcrest honey | Woolworths: New Tea Infusions | Kenya Breweries Ltd: Rockshore Tropical Lager | 260 Brands: Nutra Milk | Distell Group: Amarula Chocolate

43 Ghanaian dairy industry: The sleeping giant in need of a small nudge

47 African Beverage Company of the Year 2022: Distell Group is our pick, as the wines and spirits major innovates and grows globally

60 Want to keep diabetes at bay? Research shows that a diet rich in these foods can help you achieve your goal

28

• Zambia’s leading alternative protein maker 260 brands receives US$5m from Norfund

• Consortium of African investors to establish regional cold-storage platform

• Ghanaian cocoa processing company Niche Cocoa ventures abroad

• Constellation Brands divests part of its mainstream and premium wine portfolio to The Wine Group

• Kenya lifts 10-year GMO cultivation and importation ban

• Exeo Capital acquires Vital Health Foods extending its investment in functional, convenience foods

• Julius Berger marks entry into the food sector with launch of new cashew processing plant

• Britannia Industries acquires Britania Foods, buys controlling stake in Kenafric Biscuits

• Heineken Vietnam opens Southeast Asia’s largest and fastest brewery

• Fan Milk Ghana demonstrates sustainability commitment through US$6.8m green project

• Plastic packaging, recycling specialist ALPLA opens new production hub in South Africa

• Jumia deploys use of drones in Ghana to streamline logistic operations, cut emissions

• Royal DSM develops Delvo Plant Go enzyme to enhance efficiency of oat milk manufacturing

• IFF opens innovation hub in Singapore to fast-track innovation in Asia

• GEA launches water-saving dealcoholization system for beer

• Rubix Foods establishes Florida innovation center to offer tailor-made solutions to customers

• Givaudan opens Consumer & Sensory Insights center in South Africa

• Kerry develops cost-effective alternative to natural stabilizers used in ice cream production

Our commitment to our customers to continue our local knowledge and insights included Senegal amongst other countries in 2022. The Senegalese culinary heritage is inspired by a combination of ancient local tradition, and North African, Portuguese, and French flair.

The Senegal study relied on a holistic approach aiming at unravelling the consumer’s cooking habits, with a focus on the most popular seasonings and daily cooked savoury dishes. Apart from basic staple ingredients it was also a goal for MANE to gain insights into the way culinary aids are chosen by consumers and then used in everyday dishes. What are the drivers or liking and what are user’s expectations?

The main learnings pertaining seasonings are that the foundation flavours should contain tonalities like garlic, bayleaf, ginger, vinegar, parsley, lemon juice and black pepper. Furthermore the usage of local dried mollusks and fishes enhance the taste of the most popular dishes such as the Thiebou djeune the acclaimed national dish.

In addition to this wide range of seasonings, stock cubes and powders stand as key ingredients. They supply to their dish a special, different/exclusive flavour not possible to obtain from any other spices or herbs. Consumers feedback show preference for the versatile

flavours ‘classic’, ‘arôme’ and ‘spices’, but we found difference in usage between age groups and regions. The analysis of the aromatic profiles of the products reveals the signatures of some brands and local specifics: for instance, in Senegal, the garlic note is predominant in many tablets and powders.

Broths are another important stage of food preparation used in various ways, according to needs, but mainly in the many spice mixes such as Nokoss, Roff and Marinade prepared to make the dishes tasty. The culinary quality of broths is top of mind for the local cooks and chefs

Based on these rich insights, MANE’s teams tailor dedicated solutions to fit with local tastes and help their clients develop innovative products in line with consumers’ expectations. We also enhance this rich information further with tasting sessions with consumers to understand drivers of preference.

CONTACT US:

MANE Ghana, Sansiro-Lizzy Complex, Plot 200-217, Cotton Street,East Legon Accra Ghana

Contact: +233 30 254 1934

MANE Kenya, Delta Court, Watermark Business Park, Ndege Road, Karen, Nairobi

Contact: +254 715 542 327

MANE South Africa, 25 Bertie Avenue, Epping Industria 2, Cape Town

Contact: +27 21 534 4422

EDITORIAL

Paul Ongeto | Catherine Wanjiku |

Abel Ndeda

ADVERTISING & SUBSCRIPTION

Jonah Sambai | Virginia Nyoro

DESIGN & LAYOUT

Clare Ngode

PUBLISHED BY: FW Africa

P.O. Box 1874-00621, Nairobi Kenya Tel: +254 20 8155022, +254725 343932 Email: info@fwafrica.net Company Website: www.fwafrica.net

Food Business Africa (ISSN 23073535) is published 6 times a year by FW Africa. Reproduction of the whole or any part of the contents without written permission from the editor is prohibited. All information is published in good faith. While care is taken to prevent inaccuracies, the publishers accept no liability for any errors or omissions or for the consequences of any action taken on the basis of information published.

November 08-10, 2022

Gulfood Manufacturing Dubai, UAE

Focus: Food & Beverages https://www.gulfoodmanufacturing.com/

November 08-10, 2022

ISM Middle East Dubai, UAE

Focus: Snacks & Confectionery https://www.ism-me.com/

November 09-12, 2022

SIAL InterFOOD Jakarta, Indonesia

Focus: Food & Beverages https://sialinterfood.com/

November 20-22, 2022

Hi & Fi Asia-China Shanghai, China

Focus: Food & Beverages https://www.figlobal.com/china/en/home. html

November 21-23, 2022

Agritech East Africa

Dar es Salaam, Tanzania Focus: Agriculture https://www.agritecheastafrica.com/

November 23-25, 2022

Pacprocess India Mumbai, India

Focus: Processing & Packing https://www.pacprocess-india.com/

November 24-27, 2022

OIC Halal Expo

Bakırköy, Turkey

Focus: Food & Beverages https://www.helalexpo.com.tr/en/

November 24-27, 2022

SIAB Expo Maroc

Casablanca, Morocco

Focus: Food & Beverages https://siabexpo.com/en/

November 29-December 01, 2022

Agrofood West Africa Accra, Ghana

Focus: Food & Beverages https://www.agrofood-westafrica.com/

November 30-01 December, 2022

Plant Based World Expo Europe London, UK

Focus: Alternative foods https://www.plantbasedworldeurope.com/

December 01-03, 2022

Smart Cold Chain Expo Hyderabad, India

Focus: Cold Chain https://smartcoldchainexpo.com/

December 05-07, 2022

Food Africa Cairo Cairo, Egypt

Focus: Food & Beverages https://www.foodafrica-expo.com/

December 05-09, 2022

World Coffee and Tea Expo Lagos, Nigeria

Focus: Tea & Coffee https://www.worldcoffeetea.com/

December 07-09, 2022

Drink Technology India Mumbai, India Focus: beverage, dairy and liquid food https://www.drinktechnology-india.com/ en/

December 07-09, 2022

SIAL China Shanghai, China Focus: Food & Beverages https://www.sialchina.com/

December 13-15, 2022

Middle East Natural and Organic Products Expo Dubai, UAE

Focus: Food & Beverage https://organicandnatural.com/

January 24-26, 2023

International Production & Processing Expo Atlanta, USA

Focus: Food & Beverages

https://www.ippexpo.org/

February 08-10, 2023

Fruit Logistica Berlin, Germany Focus: Fruits https://www.fruitlogistica.com/en/

March 15-16, 2023

Global Dairy Innovation Congress MENA

Dubai, UAE Focus: Dairy http://www.szwgroup.com/global-dairyinnovation-congress-mena/

March 20-22, 2023

IFE - International Food & Drink Event

London, UK Focus: Beverage https://www.ife.co.uk/

March 28, 2023

Africa Food Sustainability Summit Nairobi, Kenya Focus: Sustainability https://www.foodbusinessafrica.com/ future/

March 30-01 April, 2023

AFMASS Food Expo Nairobi, Kenya Focus: Food & Beverage https://www.afmass.com/

March 31, 2023

AFMASS Youth Summit

AFMASS Food Expo Nairobi, Kenya

Focus: Food & Beverage https://www.afmass.com/

March 31, 2023

Africa Food Industry Excellence Awards

AFMASS Food Expo Nairobi, Kenya

Focus: Food & Beverage https://www.afmass.com/

Connect with us

Food Business Africa Magazine

Follow Us Foodbizafrica Follow Us Foodbizafrica

Like Food Business Africa Magazine

Processing and packaging solutions for stock cubes, processed cheese, butter, margarine, yoghurt and UHT beverages.

IMA supports the international Food and Dairy market with the best platforms and machines now available to satisfy industry needs, consistently providing tailored technologies for the processing and packaging of soft and pressed stock cubes, as well as cream cheese, yoghurt, yeast and so on, managing the entire food chain, from dosing and wrapping to end-of-line. Make the most, with us.

ASHISH PANDE Country Head, Olam Agri, Nigeria

ESSAM EL-MADDAH HR & General Secretary Director, Danone Egypt & North East Africa

JUSTIN ARCHER COO East Africa & Group Head of Sustainability, Sucafina SA

CLAUDIA CASTELLANOS Managing Director, Black Mamba

JOACHIM WESTERWELD Executive Chairman, Bio Food Products

MILLICENT A. ADOBOE Co-Founder, Achiever Foods Ghana

CAESAR ASIYO Chief Development Officer, Victory Farms

SAINT-FRANCIS TOHLANG Corporate Affairs Director, Nestle East & Southern Africa

NICO ROOZEN Honorary President, Solidaridad Network

ROZY RANA Managing Director, Dormans Coffee

GAURAV VJ CEO, 260 Brands

BRETT THOMPSON Co-Founder & CEO, Mzansi Meat

ASHISH PANDE Country Head, Olam Agri, Nigeria

ESSAM EL-MADDAH HR & General Secretary Director, Danone Egypt & North East Africa

JUSTIN ARCHER COO East Africa & Group Head of Sustainability, Sucafina SA

CLAUDIA CASTELLANOS Managing Director, Black Mamba

JOACHIM WESTERWELD Executive Chairman, Bio Food Products

MILLICENT A. ADOBOE Co-Founder, Achiever Foods Ghana

CAESAR ASIYO Chief Development Officer, Victory Farms

SAINT-FRANCIS TOHLANG Corporate Affairs Director, Nestle East & Southern Africa

NICO ROOZEN Honorary President, Solidaridad Network

ROZY RANA Managing Director, Dormans Coffee

GAURAV VJ CEO, 260 Brands

BRETT THOMPSON Co-Founder & CEO, Mzansi Meat

ZAMBIA – 260 Brands has received a US$5m investment from the Norwegian Investment Fund, Norfund,

www.FoodBusinessAfrica.com

to finance its expansion into soymilk production.

Celebrating its Silver jubilee in September this year, the consumer goods company that manufactures, markets, and distributes products mainly based on maize and soy, launched the country’s first plantbased milk dubbed Nutramilk, made from locally sourced soybean.

The capital from Norfund will finance an investment in a turnkey

soymilk production facility with an annual production capacity of 9.6 million liters.

The unit is set to utilize the UHT technology and aseptic packing that allows for a long shelf life of the products in ambient temperatures, an important factor for sales and distribution in Zambia, where the coldchain infrastructure does not allow for the availability of such beverage’s country-wide.

NIGERIA – Ganic Foods Limited, a Nigeria-based agro-food processing company, has received a US$38 million Dual Tranche Export Development Facility from the African Export-Import Bank (Afreximbank).

The deal is designed to support Ganic in the construction of a Palm Kernel Expellers plant, a Soybean Solvent Extraction Plant, as well as a Vegetable Oils Refinery– all located within an area of over 50,000 square

In financing the project, which is tagged at a total cost of N27 billion (US$62m), Afreximbank shows its support for the development of a local substitute for imported edible oil, reducing Nigeria's dependence on imported and, in some cases, smuggled edible oils.

This reduced exposure to imports will insulate Nigeria from the recent pricing volatility of edible oils on international markets triggered by the war in Ukraine.

GHANA – Ghana’s largest private cocoa processing company, Niche Cocoa, is seeking to expand its footprint through an investment in a manufacturing facility in Wisconsin, USA.

Under the investment, Niche is leasing an existing 44,000-squarefoot building where they will hire 24 employees to process approximately 1,200 containers of Ghana-imported cocoa cake each year.

The raw materials will be turned into cocoa powder, finished

chocolate, and cocoa liquor which will be sold to other manufacturing facilities undertaking the processing of chocolate, ice cream, and baked foods.

The project will be the largest food and beverage investment by an Africa-based company in US history and the largest Ghana foreign direct investment ever in Wisconsin.

To ensure the success of the project, Niche Cocoa is partnering with The Omanhene Cocoa Bean Company, a Milwaukee-based company that

pioneered the production of worldclass, single-origin, bean-to-bar chocolate manufactured in Ghana.

Ganic Foods clinches US$38m from Afreximbank for establishment of edible oil processing facilitiesmeters at Odofin-Oke Village, along Shagamu-Abeokuta Expressway, Ogun State, Nigeria.

AFRICA – Ifria Cold Chain Development Company, a newly established platform providing end-to-end cold chain solution and transportation services, is eyeing a US$9.4m equity investment from IFC to support development of its cold chain business in North and West Africa.

SOUTH AFRICA – African Infrastructure Investment Managers (AIIM), one of South Africa’s largest infrastructure-focused private equity fund managers, has led a consortium of investors including Bauta Logistics and Mokobela Shakati (Pty) Ltd, to establish a cold chain logistics platform dubbed Commercial Cold Holdings (CCH).

logistics (TCL) infrastructure.

To this end, CCH would focus on acquiring and developing facilities with strategic physical locations and/ or integration with market-leading food producers, wholesalers, and retailers.

To kick-start its investment plan, the consortium has entered an R760 million (US$42.8m) deal with Africa's largest fishing group, Oceana, for its commercial cold storage (CCS) unit, with the transaction subject to regulatory approval.

CCS is a leading cold storage provider in Southern Africa, offering primary temperature-controlled storage and handling services of mainly perishable products on behalf of major manufacturers, exporters, and importers for over 50 years.

“Anchoring CCH’s strategy with such an established player is crucial for the platform’s regional expansion.

Damilola Agbaje, AIIM Investment DirectorThe partners seek to establish a pan-African cold storage platform in a bid to ensure food security in the region by beefing up sub-Saharan Africa’s capacity for temperature-controlled

“New market entries will leverage CCS’s technical expertise and operational track record to secure strategic customer relationships,” said AIIM Investment Director Damilola Agbaje.

Up to 70% of CCS through-put will come from staple foods, critical for domestic food security, facilitating a continuous supply of staple foods.

Ifria is an integrated cold chain development company operating in franchise, license, or directly- cold chain logistics assets, ranging from added value cold storage/logistic warehouses for perishable products in industrial zones to first mile cold chain at the production/farm level in North and West African markets.

Its existing asset is a refrigerated warehouse facility providing storage and other value-added services for perishable food products in the port of Tanger Med in Morocco.

The IFC funding will be channelled towards supporting Ifria’s first round of investments in Morocco and Senegal between 2022 and 2024.

Some of its pipelined projects in Morocco include the acquisition an existing TCL facility in Casablanca with an initial size of 10,000 pallets position, and the development of a new TCL facility in Ouled Teima, located in the vicinity of Agadir with an initial proposed size of 5,000 pallets position.

In Senegal Ifria readies development of a new TCL facility in the industrial zone of Diamniadio in the vicinity of Dakar with an initial size of 5,000 pallets position, alongside the construction of a new TCL facility to be located in the port of Dakar with an initial proposed size of 5,000 pallets position.

NEW MARKET ENTRIES WILL LEVERAGE CCS' TECHNICAL EXPERTISE AND SECURE OPERATIONAL TRACK RECORD TO SECURE STRATEGIC CUSTOMER RELATIONSHIPS

Cold chain solution provider Ifria to receive IFC financing to spearhead growth

TUNISIA – Tunisia’s fully-integrated producer and global exporter of olive oil, CHO Company, has bid farewell to one of its investors Gulf Capital, a leading thematic Private Equity firm investing across the Middle East and Southeast Asia.

Gulf Capital successfully parted ways with the olive oil producer after realizing over 15% IRR on the growth capital investment.

During the partnership period, CHO Group expanded its production facilities and grew its local and global footprint through local acquisitions,

backward vertical integration, and building global export markets.

As a result, the company grew its revenues by circa 33%. It also doubled the number of countries it exported products, extending its reach to a record 50 countries across North America, Europe, Asia, and Africa while maintaining doubledigit EBITDA margins.

Gulf Capital’s and other investors’ participation also encouraged CHO Group to launch notable diversity initiatives, even at the board level.

Today, women represent 25% of the company’s top management and 45% of the full-time workforce, up from a low percentage a few years ago.

US – Constellation Brands, one of America’s largest beer suppliers, has decided to divest a portion of its mainstream and premium wine portfolio to its peer, The Wine Group.

The labels included in the deal were Cooper & Thief, Crafters Union, The Dreaming Tree, Monkey Bay, 7 Moons, and Charles Smith Wines.

The decision to sell the wine portfolio builds on the company’s efforts to establish a bold and innovative, higher-end wine and spirits portfolio with distinctive brands

and products, delivering exceptional consumer experiences.

Robert Hanson, EVP & President of the wine and spirits division stated: “Over the past three years, we reshaped ourselves into a higherend wine and spirits division with intentional, strategic mainstream plays and are moving our business towards becoming a leading global Premium/ Fine Wine & Craft Spirits portfolio.”

This transaction will enable us to focus and shift our portfolio towards the higher end, positioning ourselves to continue delivering industry-leading growth and shareholder value with the right portfolio for our ambitions. In turn, The Wine Group is acquiring great brands that complement its current strategy of continuing to build a premium wine portfolio.”

Constellation Brands divests part of its mainstream and premium wine portfolio to The Wine Group

THE WINE GROUP IS ACQUIRING GREAT BRANDS THAT COMPLIMENT ITS CURRENT STRATEGY OF CONTINUING TO BUILD A PREMIUM WINE PORTFOLIORobert Hanson, Constellation Brands EVP & President of the Wine and Spirit Division

EASTERN AFRICA – Flow Equity, a high-impact poultry business targeting underserved rural households in Eastern Africa, has raised a combined US$14 million funding round to grow its operations across the region.

Flow Equity operates in Ethiopia via its investment in EthioChicken and Rwanda and Uganda via its subsidiary Uzima Chicken.

The company's primary product is high-yielding day-old chicks (DOC), sold in a package including feed and vaccines to its network of trained agents.

The agents grow the chicks for a month to produce healthy, vaccinated pullets and cockerels that are then sold to smallholder farmers.

MOROCCO – Barry Callebaut Group has established its first local production footprint in Morocco and subsequently on the African continent.

Attelli, which is part of the French COFRAPEX Group, specializes in

catering, food distribution, and retail in Morocco and neighboring countries.

Other than taking over the manufacturing assets of the Casablanca-based company, the two parties have entered into a long-term supply agreement for compound from Attelli.

This partnership allows Barry Callebaut better cater to local demands and accelerate its expansion in the region.

The chocolate maker has been operating across the continent through distribution partners and has been supporting chefs and artisans to develop their talent and skills at its Chocolate Academy Centers located in Morocco and South Africa.

KENYA — The Kenyan government has lifted its ban on Genetically Modified Crops in the country after 10 years of suspension.

Their world-renowned breeds produce 3–4 times more eggs in comparison to local chickens and reach over 2kg in three months in the village environment, representing at least a 3x gain in productivity for smallholder farmers.

Its inclusive distribution model and proven breeds enable Flow Equity to meet the fast-growing demand for protein among the mass market at the bottom of the pyramid.

In Ethiopia, EthioChicken was launched in 2010 and has become an industry leader selling over 25 million chickens per year.

Kenya has been reluctant to approve the import or planting of genetically modified food crops since November 2012, amid an ongoing debate about the safety of GMO crops, which have been lauded for their advantages, including resistance to drought, pests, and higher yields.

The decision by Cabinet will permit farmers to cultivate and import food crops and animal feeds that have been genetically enhanced through biotechnology.

In a meeting Chaired by President William Ruto in State House Nairobi, the cabinet reached the decision in accordance with the recommendation of the Task Force to Review Matters Relating to Genetically Modified Foods and Food Safety, and in fidelity with the guidelines of the National Biosafety Authority on all applicable

international treaties including the Cartagena Protocol on Biosafety (CPB).

The cabinet considered a broad array of proposals touching on climate change adaptation, reducing Kenya’s reliance on rain-fed agriculture by increasing irrigation, planting diverse and drought-resistant crops, and the implementation of early warning and response mechanisms.

Poultry investor Flow Equity clinches US$14m funding for expansion across Africa

KENYA — Britannia Industries, India’s largest bakery firm, has acquired a 51% stake in Kenafric Biscuits, a subsidiary of Kenya-based manufacturing conglomerate Kenafric Group.

The move will help the Asian company set up a manufacturing base and expand sales in the African markets.

In a filing with the Bombay Stock Exchange, Britannia Industries noted the deal was instigated by its subsidiary Britannia and Associates (Dubai) for INR92m (US$1.1m).

Concurrently, in partnership with Kenafric Biscuits, Britannia Industries Limited took full control of Catalyst Capital-backed Britania Foods Ltd., as well as Catalyst Britania Brands Ltd in a US$20 million transaction that also involved acquiring property and a plant.

“Four years ago, during our centenary celebrations, we reiterated our vision of becoming a Total Global Foods company.

“Our new manufacturing base in Kenya will open doors to tapping into the potential of East Africa, a region that holds immense promise,” said Annu Gupta, CEO of International Business at Britannia

Britannia has been looking to add capacity in Africa, where governments want to expand their industries and reduce imports of products that can be made locally.

The company recently set up contract-packing facilities in Egypt and Uganda, and has been considering ventures in Kenya and Nigeria.

VIETNAM – Heineken Vietnam has the Ba Ria Vung Tau brewery, which has become the region’s largest after multiple expansions over the last five years.

Covering an area of 40 hectares in My Xuan A Industrial Zone, Phu My – Ba Ria Vung Tau, was acquired by Heineken in 2017 and increased its capacity 36 times over the last five years, boasts of an annual capacity of 11 million hectoliters.

To a large extent, the Vung Tau brewery has automated operations in the beer-making process from raw material delivery, brewing, and filtration to delivery for packing: ‘making it the most productive Heineken brewery in the world.

Its packaging area only needs 5 technicians for each of the two lines with speeds up to 130,000 cans/hour.

With a total of 4 canning lines, Vung Tau factory can produce 12

million cans of beer a day, the fastest canning line of all Heineken breweries worldwide.

The brewery is also considered the innovation hub for Heineken Vietnam. Since 2015, it has introduced seven new products to the Vietnamese market: including Strongbow cider, Tiger Platinum and Heineken 0.0.

WITH A TOTAL OF 4 CANNING LINES, VUNG TAU FACTORY CAN PRODUCE 12 MILLION CANS OF BEER A DAY, THE FASTEST CANNING LINE OF ALL HEINEKEN BREWERIES WORLDWIDE

Heineken Vietnam opens Southeast Asia’s largest and fastest breweryREGULATORY AFFAIRS

AUSTRALIA – Beverage contract manufacturer Refresco is expanding its global footprint with an agreement to purchase one of Australia’s leading manufacturers of non-alcoholic beverages, Tru Blu Beverages Pty Ltd. (“Tru Blu Beverages”).

The deal which is subject to regulatory approval, creates a new platform for Refresco, in line with its strategic promise, to expand into a third continent – both organically and through acquisitions.

CEO Refresco, Hans Roelofs, commented: “Today’s announcement is a testament to our proven Buy & Build a strategy. We started with one factory in Europe just over two decades ago and steadily built a diversified, pan-European platform. Only six years ago, we took our first step into North America.

“We now operate over 70 manufacturing sites globally, with just about half of those located across North America and the rest throughout Europe, offering a full range of beverage solutions to a broad customer base.”

Meanwhile, Refresco has also agreed to acquire alcoholic beverage manufacturer Avandis from Lucas Bols N.V. and De Kuyper Royal Distillers.

Roelofs said this acquisition is a step change in expanding our offering to customers in the alcohol category and complements the existing hard liquor capabilities in Europe.

SPAIN - Nestlé has revealed plans of investing EUR100m (US$97m) in one of its largest coffee factories, based in Spain, over the next three years to make the factory even more competitive from a portfolio point of view.

The Nespresso owner will use the investment to increase its production capacity of instant coffee and coffee capsules at the factory in Girona, Catalonia, and invest in technology to improve sustainability and logistics.

The Girona factory already serves the domestic market and exports “significant volumes” to Europe, America, Asia, Africa, and Oceania.

Nestlé said: “The investment will allow us to focus on the production

and filling of soluble coffee based on spray dry technology and the production of coffee capsules in line with the growth of the market.

The announcement follows Nestlé’s investment in Asia and Americas coffee markets earlier this year when it opened its second coffee plant in Mexico in a project that cost US$340m and created 1,200 jobs.

Meanwhile, Seattle’s Best Coffee brand is set to become part of Nestlé after the Swiss company entered into a deal with its parent company Starbucks.

The transaction is subject to respective Board and customary regulatory approvals and is expected to close by end of this year.

Nestlé’s noted that this transaction is part of its focus on driving sustained profitable growth in the coffee category and strengthens the Global Coffee Alliance by allowing both companies to focus on their core strengths.

Nestlé to invest US$97m in Spanish coffee factory, acquires coffee brand from Starbucks

THE INVESTMENT WILL ALLOW US TO FOCUS ON THE PRODUCTION AND FILLING OF SOLUBLE COFFEE BASED ON THE SPRAY TECHNOLOGY AND THE PRODUCTION OF COFFEE CAPSULES

Nestle

GHANA – Fan Milk Ghana, a subsidiary of multinational foodproducts corporation Danone, has inaugurated three green projects at its North Industrial Area Plant in Accra.

Established at a total cost of seven million Euros (US$6.8m), the wastewater treatment plant, biomass boiler, and solar power installations, demonstrate Danone’s ‘One Planet One Health’ vision and reinforce the company’s leadership in sustainability in Ghana and globally.

The wastewater treatment plant will ensure that only clean water from the factory is discharged into the environment, accelerating the regeneration and sustenance of the Odaw River to promote other forms of life for river bodies.

Meanwhile, the solar power installations at the Industrial area factory, offices, and the various regional distribution centers, are in

pursuance of the company’s global strategy of reducing dependency on conventional energy sources and increasing the use of renewable energies.

With the new biomass boiler, FanMilk will now switch from using diesel as its fuel source to a multi-fuel system that uses palm kernel shells or wooden chips to cater to the factory’s steaming requirement of 1,800kg/h.

Group, has merged its five previous facilities in South Africa under one roof, at the newly opened production site in Lanseria, near Johannesburg, established at a total cost of US$50m.

The new premise, termed as the company’s new sub-Saharan Africa headquarters, features 35,000m² of covered production, administration, and storage space.

It also has a further 12,500m² of space for future expansion, as well as 30,000m² of roof area equipped with solar panels.

Opened after two years since construction work began, the new plant will manufacture around 3.5 billion pieces will every year.

GHANA – Jumia, the leading e-commerce platform in Africa, has partnered with Zipline, the world's largest instant delivery service, to deploy on-demand drone delivery for e-commerce in Ghana, with plans to expand the service to Nigeria and Côte d'Ivoire.

The collaboration will integrate Zipline's automated, on-demand delivery system with Jumia's existing distribution network to enable

customers to receive instant, ondemand delivery of the products they purchase when and where they want them to be delivered.

“Using the latest instant logistics technology will allow Jumia to offer our consumers on-demand delivery of the products they need – instantly.

"This will support Jumia's commitment to sustainability and innovation, and provide muchneeded access to rural and remote areas where conventional delivery services have challenges," said Apoorva Kumar, EVP and Group COO of Jumia.

The drones deployed in Ghana have a maximum payload of 11.8 liters or 6.6 lbs (3 kgs), meaning that only a few select products will be delivered through the service.

Jumia deploys use of drones in Ghana to streamline logisticSOUTH AFRICA – Austrian plastic packaging and recycling firm ALPLA

THE WASTE WATER PLANT WILL ENSURE THAT ONLY CLEAN WATER FROM THE FACTORY IS DISCHARGED INTO THE ENVIRONMENT

Benin as of July 1, 2022. It now has the mandate to produce and market all the products of its brands available in the country, including Coca-Cola, Fanta, Sprite, and Schweppes, among others.

The new capital investment will fund the setting up of a processing line for soft drinks with a capacity of 385,000 hectolitres per year, which will rise to 730,000 hectolitres from the 5th year.

BENIN – The newly established Coca-Cola Donga Bottling Company SA (CCDBC) in Benin has inked a contractual loan agreement with the West African Development Bank (BOAD) to the tune of FCFA 20 billion (US$30m).

The capital investment will be

channelled towards the establishment and operationalization of a processing complex and a can manufacturing line by CCDBC in the Seme-Podji industrial zone in Benin.

Coca-Cola Donga Bottling Company was designated as the bottler of The Coca-Cola Company in

In addition, it will have a mineral water processing line with an average of 7,300 hectolitres and a 64 million can per year manufacturing unit, which will be extended to 200 million cans from the 4th year.

The establishment of the can manufacturing unit, the first of its kind in the West African Economic and Monetary Union (WAEMU) area, will meet the demand of brewers in the region for this type of packaging.

KENYA – Kerry Group has partnered with the Irish humanitarian organisation Concern Worldwide to improve the lives of 46,000 Kenyans in the Tana River region, by providing access to climate-smart agricultural practices.

In Tana River County, 62% of the population live below the poverty line and most rely on agriculture for their livelihoods. Many of the farmers are focused on livestock farming, but climate change has led to water insecurity and pasture deterioration, causing death and declines in livestock productivity, thereby wiping household income and food security.

The county is however, one of the major producers of mango in Kenya. Kerry in partnership with Concern, have identified an opportunity to tackle these challenges in the Tana

River, which has 200,000 mango trees growing along its banks through the Agricultural Livelihoods Improving Value Chains and the Environment (ALIVE) project.

Under the four-year project, the parties will collaborate to improve food security, boost household income and reduce malnutrition levels by training farmers, as well as providing access to climate resilient seeds and opening new areas for agricultural production and irrigation.

With financial support from Kerry, and using river water for irrigation, the project will create a regional value chain for mango production to benefit female growers, creating a new income stream for their families.

Participants will receive training on post-harvest handling, support for mango processing at community level

and the introduction of post-harvest processing machines.

Ajay Sharma, Kerry’s East Africa General Manager said, “The ALIVE project with Concern will create longterm value for smallholder farmers, by farming the land once again to support themselves, their families and the community. I’m delighted that Kerry is investing in creating long term value in Kenya.”

Farmers will also be empowered to interact with markets, with an aim to improve household incomes by 20% annually, forming farmer-producer cooperatives and establishing relationships with regional processors and traders. Concern’s Director of International Programmes, Carol Morgan said.

Kerry partners with Concern Worldwide to establish mango value chain in Tana River, Kenya

NETHERLANDS – Royal DSM, a global science-based company in Nutrition, Health, and Bioscience, has developed Delvo Plant Go, a novel enzyme that can improve oat milk production efficiency by reducing hydrolysis time by 30%, thus saving on energy.

Ben Rutten, Global Business Manager, Milk & Plant-based Dairy Alternatives at DSM, stated: “The enzyme solution can be incorporated into existing manufacturing processes and removes the need for the oat solution to be heated and maintained at 70°C for liquefication, then cooled and maintained at 50°C for saccharification.”

With Delvo Plant Go, manufacturers can carry out the whole hydrolysis process in a single step, at a temperature of 60°C – reducing the total time from three to two hours.”

He added that the improvements result in increased capacity or reduced costs – something that is particularly important given the current volatility in the energy market.

Delvo Plant Go, part of the company’s enzyme portfolio, has been specifically designed for oat-based drinks manufacture and cannot be used for developing other dairy milk alternatives.

This enzyme is particularly important to manufacturers who have to carefully choose the right enzyme or enzyme combinations to not adversely affect beverage traits such as viscosity, mouthfeel, and flavor in oat beverages.

SINGAPORE – IFF, a manufacturer of ingredients for the food, beverage, health, biosciences, and scent markets is expanding its footprint in the Asian region with a new Innovation Center in Singapore.

The Innovation Center in the nation’s premier biomedical research hub, integrates the technologies, capabilities, and expertise of all four business divisions: Nourish, Health & Biosciences, Scent and Pharma Solutions.

The 11,000 sqm facility, IFF’s largest in the region, features more than ten creation, design, and analytical laboratories, a collaboration studio, and culinary and demo kitchens, providing customers with full sensory capabilities to support each stage of the process from ideation through commercialization.

The hub has one of the biggest dairy processing pilot plants in Southeast Asia, replicating large-scale industrial production processes.

The center also houses IFF’s global innovation center for fabric care powders and personal wash, the largest scent evaluation facility worldwide, and is the first IFF location to support all scent product

categories.

Ramon Brentan, IFF Singapore Innovation Center site leader and vice president, Greater Asia regional general manager, Scent, IFF said: “In this integrated space, we will unlock cross-divisional synergies, fasttracking innovation and accelerating new growth opportunities.

The opening follows IFF’s newly operational Singapore Flexiblend plant in Tuas and marks the latest in the company’s nearly US$30 million investment into Singapore.

Royal DSM develops Delvo Plant Go enzyme to enhance efficiency of oat milk

beer with the goal of reducing water in production,” said Ralf Scheibner, filtration expert at GEA.

“Due to its lower volume, it has a higher alcohol content and can thus serve as a base for alcoholic mixed drinks and trendy beverages, such as hard seltzer, or can be reused.”

While initially designed for the dealcoholization of beer down to 0%, the system is equally used for other non-alcoholic beverages, such as 0% cider.

GERMANY – GEA has launched a new dealcoholization system monikered GEA AromaPlus PRO that can save 66% to 100% of freshwater consumption in non-alcoholic beer production processes.

The reverse osmosis technology allows for a cleaner separation of water and alcohol from the “crucial” ingredients that give the aroma, color, and turbidity to beer.

The German corporation added that this new tech not only allows for the saving of fresh water but

also allows the use of the remaining alcohol from the dealcoholization or diafiltration as a valuable by-product.

The specially developed reverse osmosis membrane is very selective for ethanol, allowing brewers to filter alcohol at lower temperatures.

This helps save time, energy costs and preserve the flavor, allowing breweries to skip the step of restoring the flavors after the alcohol has been removed.

“Our latest filtration system combines the trend towards 0.0%

Ralf Scheibner, Filtration expert at GEAopened two new Food & Nutrition (F&N) application laboratories in Morocco and South Africa to expand its footprint in Africa.

The labs’ inauguration follows the opening of a similar facility in Egypt mid-this year, further enabling the Azelis team to provide even more innovative and technical support to customers throughout the entire MEA region.

will primarily focus on dairy, fruit preparations, baking, and beverages, complementing the many other Azelis F&N laboratories across EMEA and worldwide.

AFRICA

Azelis has

While fully equipped to service various food segments, these application laboratories

Chris Sacy, Managing Director Azelis MEA, said, “The opening of two new Food & Nutrition application laboratories is a significant move in the market, supporting our drive for innovation, and further improving the technical service we provide to customers.”

OUR LATEST FILTRATION SYSTEM COMBINES THE TREND TOWARDS 0.0% WITH THE GOAL OF REDUCING WATER IN PRODUCTION

DENMARK – The Danish ingredients supplier, Chr. Hansen has reported a ‘solid’ financial performance, delivering a total revenue of €1.21bn (US$1.19bn), marking 13% growth for the year ending 31 August 2022, despite a ‘volatile’ macroeconomic and geopolitical environment.

The company’s Organic growth was 9% in 2021/22, 7% of which was driven by volume growth, while the implementation of price increases –to reflect inflationary pressures – can

be attributed to 2% of total organic growth, which the company reports had a favorable impact in the second half of the year.

However, organic growth was negatively impacted by Russia, where Chr. Hansen scaled down operations, explained CFO Lise Mortensen. Following Russia’s invasion of Ukraine, the challenges ‘intensified’ and Chr. Hansen decided to reduce its activities in Russia to basic food ingredients only.

Lisa explained that the company supports the very basic products within food and health, adding that its work in Russia is not implicated in sanctions. She noted that the Danish ingredient supplier has decided not to disrupt very basic food chains to feed the civil population of Russia.

SOUTH AFRICA – Swiss multinational flavor and fragrance manufacturer, Givaudan has opened a new Consumer & Sensory Insights (CSI) center at its production facility in Johannesburg, South Africa.

The CSI center, which is its first in Africa, will provide an interactive space for an expert panel to taste, smell and otherwise experience new flavors of food and beverages developed by the company, reports Engineering News.

The food ingredients maker prides itself on creating consumer-centric food experiences by leveraging unique and local consumer and sensory understanding in every step of its food development journey.

At its Tulisa Park facility, food scientists are among the employees that manufacture flavoring extracts, syrups, powders, and related products

for the food and beverage industry.

Givaudan's commercial head for trade and wellbeing in the South Asia, Middle East, and Africa region Antoine Khalil says it is crucial to comprehend the multimodal aspects of food and beverage experiences and translate them into multifaceted product solutions for customers and consumers.

At its Tulisa Park facility, Givaudan develops savory and sweet goods, beverages, and dairy flavors. Its expert tasting panel comprises 14 South Africans, who rate and describe samples according to Givaudan’s sensory language, called Sense It. The panel uses science-based methodologies to profile ingredients or products, according to taste, flavor, texture, color, and other attributes.

The CSI was designed with special sensory software to run live data analysis, while panelists feed in their evaluations. The center includes an area for sample preparation, fully equipped booths for product testing, and a multipurpose meeting area for discussions.

With its South African CSI, Givaudan aims to strengthen its local flavor development capacity and complement the work of the other CSIs globally.

Givaudan opens Consumer & Sensory Insights center in South Africa to boost local capacity

Chr. Hansen overcomes tough business environment to record 13% growth in full year revenues

SWEDEN – Swedish manufacturing equipment supplier Atlas Copco has expanded its presence in Poland through the acquisition of locallybased compressed air distributor, Vector.

Based in the Polish city of Tarnowo Podgórne, Vector is a privately owned company with 23 employees that serves a wide range of industrial companies in the country.

Atlas Copco noted that the acquisition will see it gain more knowledge and expertise in the

sale, installation, and service of compressed air systems.

On the purchase of the firm, Vagner Rego, Business Area President Compressor Technique, said, “Vector has a strong market recognition in the Polish market, and great expertise. The acquisition will enable us to strengthen our presence in the area.”

Atlas Copco has confirmed that Vector will become part of the Service division within the Compressor Technique Business Area.

The Swedish equipment maker has been aggressive in its acquisition strategy in Q3 of its current financial year, scooping up 11 new businesses, bringing the number of companies that have joined the Group so far this year to 21.

IRELAND – Kerry Group has developed Sherex Supreme, a costeffective alternative to locust bean gum (LBG), the natural stabilizer used by ice cream makers to increase viscosity and prevent ice and lactose crystals from forming in hard-pack ice cream.

The product is comprised of LBG, guar gum, and mono- and diglycerides of fatty acids – ingredients that are already present on many ice cream labels, meaning there would be limited to no impact on labeling.

Sherex Supreme is reportedly derived from splitting and milling the seeds of carob trees functioning as a natural plant-based emulsifier and gelling agent and requires minimal processing, meeting requirements for clean labeling.

Tricia Hayes, Kerry’s global senior director – emulsifiers, texture systems, and gum acacia, explained: “Kerry’s Sherex Supreme is a texture system that delivers the creamy mouthfeel, good aeration, desired viscosity and controlled meltdown that consumers expect from ice cream while offering up to 50% cost savings versus standard texture systems.”

Kerry claims it tested the new texture system’s performance on premium, budget, and standard hard-pack ice creams, where Sherex provided the taste and texture attributes of traditional ice cream.

SHEREX SUPREME IS A TEXTURE SYSTEM THAT DELIVERS THE CREAMY MOUTHFEEL, GOOD AERATION, DESIRED VISCOSITY AND CONTROLLED MELTDOWN THAT CONSUMERS EXPECT

Tricia Hayes, Kerry Global Senior Director, Emulsifiers, texture systems, and gum acacia

SOUTH AFRICA – Libstar, one of South Africa’s leading Consumer Packaged Goods (CPG) manufacturers and distributors, has named its current group CFO Charl de Villiers as its new CEO, effective 1 January 2023.

The appointment follows the announcement of the retirement of the company’s CEO and Co-founder Andries van Rensburg, at the end of the year.

Andries co-founded Libstar in 2005 with the vision of building a valueadded consumer goods business.

Pegged to take over the helm, Charl will continue to drive the repositioning of the group’s portfolio towards a higher-growth and valueadded food portfolio, as well as the growth of its categories and channels through both organic expansion and acquisitions.

Charl is a Chartered Accountant and LLB graduate, with a unique combination of legal and financial qualifications, which provides a breadth of technical competence, strategic problem-solving skills, and attention to detail.

KENYA – Copia Global, the fastgrowing B2C e-Commerce platform operating in East Africa, has promoted its Chief Financial Officer (CFO) for the Kenya division, Dominic Dimba to Managing Director of the East Africa region.

Dominic will take on his new role, having amassed over 20 years in strategic, financial, strategic, and business development roles on three continents.

He will oversee the operating and financial performance of Copia Kenya and Uganda businesses, and drive profitability through growth, margin improvement, and unit cost optimization.

Alongside his appointment, Copia Global has named Caren Robb as its new Global Chief Financial Officer and Mike King to take over the role of Chief Technology Officer.

Caren Robb brings on board over 20 years of experience, leading teams across thirty countries, specializing in finance, governance, risk, analytics, corporate affairs, transformation, and strategy for the retail and financial services sectors.

KENYA – Multinational drinks maker, Diageo, has appointed Kenya Breweries Limited’s current Managing Director Mr. John Musunga, to be the CEO of Guinness Nigeria PLC, with effect from 1st November 2022.

Mr. Musunga, a seasoned leader with local and international leadership experience, joined KBL 19 months ago following the promotion of Ms. Jane Karuku as the new Group Managing Director for the company's parent company, East African Breweries PLC, in 2020.

Prior to joining the maker of Tusker Lager, he had a highly successful career at GSK, working at senior levels in Eastern Africa, Southern Africa, and Europe.

Mr. Musunga will take over the helm of Guinness Nigeria from Mr. Baker Magunda who headed the company since 2018.

Before joining the Nigerian business, he was Managing Director of Diageo Ethiopia and the Indian Ocean Markets.

Libstar promotes its current CFO Charl de Villiers to CEO position

Copia Global deepens focus on regional growth with new executive appointments

KENYA – Kenyan agriculture digitalinsurance startup, Pula, has announced the appointment of Michael Joseph, the former Safaricom PLC Chairman, and CEO, as the new Chairman of its Board effective September 19.

Pula is an agricultural insurance and technology company that designs and delivers innovative agricultural insurance and digital products to smallholder farmers.

Michael is famously known as the founding CEO of Kenya’s giant telco Safaricom PLC, which he took from a subscriber base of 1800 to 14 million in just 10 years.

He is currently the Chairman of Kenya Airways board of directors and also doubles up as the Chair of the MPESA Foundation Academy. In addition, Michael holds several executive roles in the larger Vodafone group.

SOUTH AFRICA – Africa’s largest fishing company, Oceana Group, has appointed Zafar Mahomed, the former Chief Financial Officer (CFO) of Cell C and McDonald's SA, as its new financial head effective November 1. Mahomed will take over from interim CFO Ralph Buddle, who has been filling in since February 2021 after the suspension and eventual firing of Hajra Karrim from the company for “gross negligence”.

He will officially assume office as its CFO and executive director of its board from 1 February 2023, to allow for a smooth transition and handover.

The new appointee has more than 25 years of experience in finance and business across major multinational and listed companies as well as worldwide brands in multiple industries ranging from manufacturing to retail, financial services, real estate, and property, food, medical devices, hospitality, mining equipment, and FMCG.

He has vast experience, and a proven track record in the telecommunications, food franchise; and furniture retail industries.

SOUTH AFRICA – Food giant Nestlé has appointed Nicole Roos as Managing Director for the East and Southern Africa Region (ESAR).

To be based in Johannesburg, South Africa, Roos becomes the first female head of the region.

She takes over from Bruno Olierhoek, whose term ends on 31 October 2022.

Olierhoek is set to take up a new assignment in due course, having served as Chairman and Managing Director of the region since 2018.

Roos is currently the Business Executive Officer (BEO) for Coffee and Beverages for ESAR. She started her career at Nestlé in 2002 and has had an illustrious journey since.

Michael Joseph lends his expertise to Kenyan insurtech startup Pula, to lead its board

Nestlé appoints Nicole Roos as first female MD for East & Southern Africa region

Fishing giant Oceana appoints Zafar Mahomed as Chief Financial Officer

Bakex Millers has expanded its existing wheat flour range with the launch of Ungano all-purpose flour, a 50:50 blend of whole meal and white flour. Bakex positions the affordably priced flour packaged in 2Kg paper bags, as "the exemplary choice for making mouth-watering and scrumptious donuts, biscuits, mandazis, KDF, chapati, and naan," among other popular Kenyan wheat flour-based meals.

bakex.co.ke

South Africa-based food and beverage giant Libstar has expanded its Goldcrest honey range of honey to include Lemon & Ginger to help soothe the symptoms of colds and sinus infections, Chilli which assists in boosting immunity, and Lavender & Chamomile, known to relieve nausea and reduce anxiety and stress. The honey range comes in 225g easy squeeze bottles and is available at leading stores in South Africa.

www.libstar.co.za

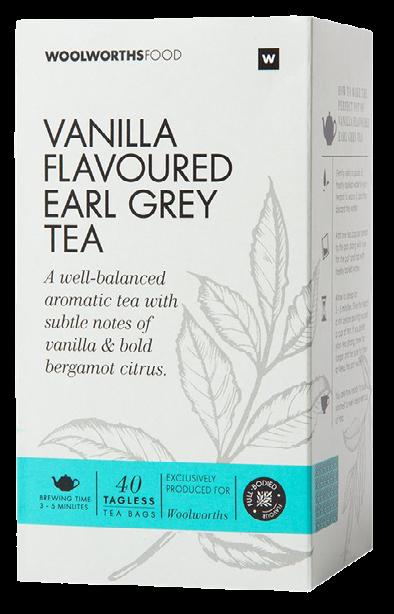

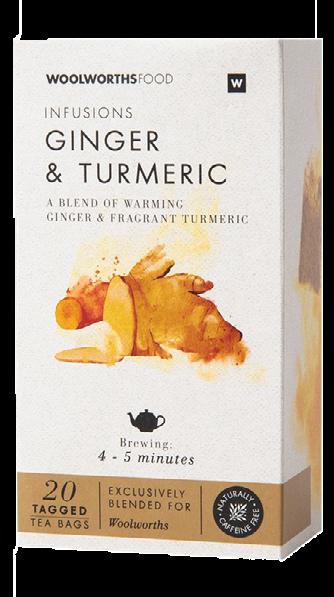

South Africa-based retailer Woolworths has introduced a new range of teas “that take infusion to the next level.” Produced in partnership with Cape Herb & Spice, the range includes pleasantly sweet and tart Blueberry; fragrant Ginger & Turmeric as well as the traditional Vanilla with a bold bergamot twist.

www.woolworths.co.za

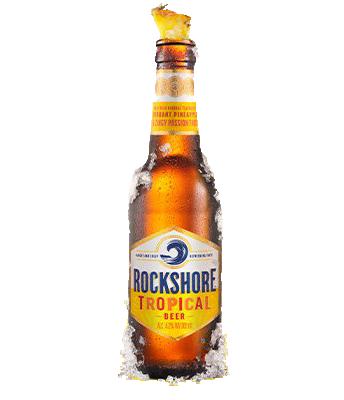

Kenya Breweries Ltd (KBL) has launched a new fruit-infused beer targeting light drinkers. Monikered Rockshore Tropical, the new drink is infused with natural tropical African fruit flavors like pineapple and passion fruit and has an Alcohol by Volume (ABV) of 4.2%. Packaged in a long-neck bottle, the beer will soon be rolled out in bars and restaurants country-wide.

www.eabl.com

260 Brands, a consumer goods manufacturer based in Zambia, has marked its silver jubilee with the launch of the country’s first plant-based milk dubbed Nutramilk. The new product is made from locally sourced soybean and is processed with UHT technology and aseptically packed to ensure it has a longer shelf life without the need for refrigeration. Nutramilk powered by Vitamin A, 12, D2, and Calcium comes in plain, chocolate, and strawberry flavors.

www.260brands.com

South African drinks firm Distell has launched the new chocolate-flavored Amarula liqueur, a blend of marula fruit and sustainably sourced African cocoa beans. Bottled at 15.5% ABV, Amarula Chocolate is available in 700ml, 750ml, and oneliter formats. The expression is recommended served chilled over ice, in a cocktail, added to coffee, or in a milkshake with vanilla ice cream and chocolate sprinkles.

www.distell.co.za

Building a sustainable coffee ecosystem by roasting at sourceBy Paul Ongeto

There are few things as universal as the love of a steaming hot cup of coffee. Walking into the factory of African Coffee Roasters (ACR), the flowery and fruity fragrance of the roasting coffee hit my nostrils and it finally dawned on me why millions of people around the world can’t get enough of this beverage, it’s simply irresistible. My love for tea was quickly put into question as my nose buds bathed in the distinct and pleasant aroma. Our hosts welcomed us to a wonderfully brewed black cup of coffee, and when in Rome, I had to do as Romans do, enjoy my cup without sugar. Slightly bitter at the first sip, but the beauty of the drink started emerging in the third and fourth sips when the once subtle fruity and nutty flavors became more prominent. I was hooked and quickly broke off my relationship with tea, at least for the moment.

My introduction to ACR’s coffee was with a world-class quality product and Jacob Elsborg, the Chief Executive Officer, couldn’t wish it was any other way. The coffee I had drunk is

part of a batch that is processed from green coffee sourced from all over Eastern Africa. “We also buy a little bit of green coffee from Latin America to have a broader variety," Elsborg adds. At the facility, the beans are roasted into different products from what the CEO describes as ordinary coffee to high-end specialty coffee and everything in between. “We pack ground coffee, we pack whole bean coffee, we also pack capsules here at ACR. Everything you see on the supermarket shelves, we can produce here,” he says. About 120 different coffee products come from the facility, mostly private labels for different supermarkets and other B2B customers.

Production of the different coffee products is reliant on different coffee processing machines installed at the roastery, the vacuum packing machine being the latest. Patrick Oboge, the Head of Production at ACR notes that the machine, sourced from Italy, is one of the most efficient machines in the company’s portfolio. “It has the capacity of producing 35 units every minute. So this means that every day for a two-eight hour operating shift, we can produce 16,800 kilos in a day.” Oboge highlights that the machine is part of

a production process that is comprised of two roasters with a combined capacity of 10 tonnes per day, and 5 different packaging lines that can package up to 32 tonnes of coffee in a day.

A small bummer for coffee lovers here in Kenya is that ACR operates in an Export Processing Zone and is therefore obligated by law to export more than 80% of its production. ACR’s customers are mainly in northern Europe with Denmark, Finland, and Holland being its largest buyers. “But we also have customers in Saudi Arabia, Rwanda, Nigeria and a little bit here in Kenya,” Elsborg reveals.

Normally, coffee roasters are located near their markets, which are predominantly in Europe, North America and Asia. This means coffee is usually exported in its green (raw) form in a long, complicated supply chain that can include unnecessary actors who end up capturing more of the coffee’s value than the farmers do. ACR differentiates itself from other players by ensuring that the roasting is done close to where the coffee beans are grown. “We are changing the narrative by adding value locally,” reveals Jane Kamau, the Sustainability and Compliance Manager at ACR. “We keep

more than 50% of the retail value in Kenya. This helps equalize the trade balance for the region, strengthen the economy, stabilize the local currency, and secure income opportunities for a broad range of local suppliers.”

The sourcing program however entails an elaborate process to ensure only highquality, ethically certified coffee beans reach the factory. Stephen E. Vick, Head of green coffee procurement, quality control, and coffee product development, reveals to us that every single lot of green coffee that ACR purchases is subjected to several tests including screen size, moisture content, water activity, density, and of course, flavor. Prior to shipment, a 350 gram pre-shipment sample is sent that is meant to represent the entire lot of coffee (up to 19,200KG). What arrives at ACR’s warehouse must match the physical and sensorial characteristics of this sample.

BUILDING A SUSTAINABLE BUSINESS Quality control is just a standard procedure to ensure the quality of the final product is guaranteed. ACR’s core strength is on building a sustainable coffee value chain. This is the sole reason why the company was established in the first place almost seven years ago. Farmers have been at the core of

WE DO THE GROUND COFFEE, WE DO THE WHOLE BEAN COFFEE, WE ALSO DO THE CAPSULES HERE. EVERYTHING YOU SEE ON SUPERMARKET SHELVES, WE CAN PRODUCE

THE TEAM BEHIND THE HIGH QUALITY COFFEE PRODUCTS FROM AFRICAN COFFEE ROASTERS

By Catherine Wanjiku

By Catherine Wanjiku

When you think of Ghana, the first thing that crosses your mind is the vast land of cocoa plantations with clustered cocoa pods full of valuable cocoa beans. However, in recent years, the West African country has turned its focus on industrial development, which has been a significant source of economic growth for the country, a trend that continued in 2020 and 2021 despite widespread disruptions associated with the Covid-19 pandemic. The

sector accounts for a large portion of both employment and exports, underscoring its importance as the government seeks to bolster value-added activities' contribution to the economy and attract investment into emerging segments.

One of the promising sectors in the country is the dairy segment, which had an estimated Retail Sale Price (RSP) value of about US$350 million in 2021. According to a report by Fitch Solutions, the sector will see significant growth over the medium term (2022-2026), aided by growing real disposable incomes, demand for dairy

products, investments, and infrastructural development mainly spearheaded by the government. With disposable incomes projected to rise by 9.0% to US$5,420 between now and 2026, Ghanaian food spending over the forecasted period is set at a growth of 13.2% five-year

fresh milk. Some of the popular dairy products up for sale include fat-filled milk powder FFMP, a full range of UHT milk (full cream, semi-skimmed, and skimmed), whey dried milk powder, full cream evaporated milk, unsweetened milk, sweetened condensed milk, tea creamers, infant formulas, flavored milk drinks, yogurt, ice cream, and cheese.

Most of these products are derived from reconstituted milk which is mostly imported, as domestic production of fresh milk is under developed and represents an insignificant share, less than one percent of the total dairy market value, according to USDA in a GAIN report. Lower milk production is due to numerous factors, including poor demand, limited supply, issues with cold chain logistics, and erratic electricity supply, leading to fresh milk consumption being limited to some cattle-rearing communities.

With recent economic development, the market landscape is changing. The presence of supermarkets and the advent of malls, more modern market structures, and improved cold chain logistics are creating a conducive environment for fresh milk sales to thrive. Furthermore, the growth of the expatriate community and a booming tourism industry before the Covid-19 pandemic increased the demand for fresh milk in the major cities.

Nature Farms Ghana Limited, the leading supplier of domestically sourced fresh milk, is readying for the boom in the market, with USAID highlighting that the company has identified additional sources of fresh milk supply for the processing plant. The company plans to expand production capacity from the current 7,000L to 50,000L per day, starting from a modest target of 10,000L per day

CAGR, with dairy spending expected to provide the highest growth by an annual average of 20%. The acceleration in dairy spending highlights a trend of both westernization and greater formalization of the Ghanaian food sector, coupled with logistical capabilities, such as better roads making transporting goods easier, and better refrigeration capabilities, among other developments. In 2022, Fitch Solutions forecasts a CAGR of 21.1% for total dairy spending, growing from US$748.8 million in 2022 to US$1.4 billion by 2026.

A stroll through the market reveals an evident absence of

by the end of 2022. However, with the average yield of milk from a cow being three liters per day, there is a likelihood of the firm operating under capacity should the expansion vision materialize.

The limited domestic milk production forces Ghana to turn to the importation of dairy products. In 2021, Ghana imported milk products worth US$127 million, a growth of 30% over the preceding year's value of US$97 million. Some of these products include milk, cream, powdered milk, buttermilk, curdled milk, yogurt, kephir, cheese, and curd. The final value of these products is high as they attract an import duty ranging from 20% to 50% of the CIF value. In addition to this, imports generally attract additional charges at the ports including, National Health Insurance Levy, Import Excise Duty, African Union Levy, ECOWAS Levy, and Processing fee, among others. These additional charges coupled with other import restrictions, and low milk supply, have limited the number of

investments channeled into the sector by both local and foreign investors. However, the Ghanaian government through the launch of projects such as the one district one factory initiative to increase local food production and processing to meet local demand, create jobs, and reduce reliance on imports, is expected to spur growth even in the dairy sector.

Actors in the Ghanaian dairy industry are led by Nestlé Ghana Limited which distributes various dairy products including popular powdered milk brands NIDO, New NIDO FortiGrow, and IDEAL. The company also supplies evaporated milk and is the largest distributor of Lactogen and Nan Infant Formula. On the ice cream and frozen dairy products, Fan Milk Plc relishes its Ghanaian consumers with brands such as FanYogo, FanChoco, FanIce, GoSlo, FanMaxx, SuperYogo, and FanVanille. The market is also graced by one of Africa's leading producers of powdered milk brands Promasidor, supplying Cowbell Milk powder,

Cowbell chocolate, Le Berbère, Loya Forvita Milk, Loya Full cream milk, Miksi fat-filled milk powder, and Mixwell fat-filled milk powder.

Meanwhile, Friesland Campina West Africa Limited has also been a major dairy industry player in Ghana for so many years, with the company’s name overshadowed by its iconic and popular Peak brand, which boasts a range of milk and cream products. From full cream evaporated milk, variants of UHT milk, and sweetened condensed milk, to reconstituted powdered milk, the brand enjoys enviable consumer loyalty. Arla Foods Limited Ghana is another major food manufacturing company in the dairy

business in Ghana. Their product categories comprise milk (powdered & liquid), butter, and cheese. Among the company’s popular brands is the DANO range of UHT milk, which is in demand among the rapidly growing middle class in urban areas. Their supplies also include butter and cheese from value-added brands like Arla and Lurpak.

The dairy market in Ghana is dotted with a wide range of products. However, within the segment, yogurt is set to be the outperformer in the medium term 2022-2026, as Ghanaians' demand for drinking yogurts is expected to skyrocket due to their affordability and convenience. Fitch Solutions forecasts yogurt spending to increase from US$89 million in 2022 to US$417.2 million in 2026.

The increased demand for yogurt will largely be driven by a westernization of Ghanaian consumption choices but also due to their greater accessibility and the fact that yogurt is often seen as an affordable protein substitute. Drinkable yogurts have also grown significantly in popularity amongst Ghanaian consumers and are often marketed as a high protein, low sugar, on-the-go drink. Companies such as FanMilk have far deeper offerings in the drinkable yogurt and ice-cream categories compared to traditional dairy products such as milk and butter. Emigoh Ghana, a large food and beverage company, has a subsidiary, Yomi Yoghurt, solely dedicated to the production of yogurt products.

Meanwhile, USDA also highlights that the Ghanaian dairy market presents bright prospects for suppliers of fat-filled milk powder (FFMP), despite the recent growth in demand for non-dairy creamers due to their health and wellness tag. Some industry analysts hold the view that growth in demand for non-dairy creamers by health-conscious consumers will eventually pose a substantial threat to the market share of powdered milk. However, this assertion is not credible because non-dairy creamers are mostly patronized by

coffee and tea drinkers who constitute only a fraction of powdered milk consumers.

It is sad that in a market where dairy products enjoy an RSP value of about US$350 million, local production only accounts for 1%. Millions of hard-earned foreign exchange could be saved if the country raised the local share even to at least 50% of total demand. The country is not lacking in arable land, about 4.7 million hectares were considered arable in 2018, and neither is it lacking in water as the country receives about 31 to 85 inches of rainfall in a year. What could be lacking as stated above is local investments in high-yielding dairy cows, cold-chain infrastructure, milk processing capacities, and strong government policies that favor local production while at the same time discouraging exports.

Ghana could borrow a leaf from Nigeria, which also suffers from over-reliance on imports for its dairy needs, on how to build up its local capacities. Under its backward integration program, Nigeria is making some progress toward local dairy production with private entities partnering with the state to drive self-sufficiency in milk production. One of Nigeria’s noteworthy strategies is availing of arable land to the processing companies for dairy cattle farming and importation of improved cattle breeds from abroad to

ensure the production of ample and quality milk.

Probably the best examples are in East Africa where local production accounts for between 80 and 90 percent of demand. For instance, Kenya which has long protected its local dairies with tariffs, today accounts for 12% of the 49 billion liters produced in Africa. The country's sector also gives direct employment to over 500,000 people and indirectly to 700,000 people. That is what Ghana stands out to gain if concerted efforts are pumped into the dairy sector by both public and private sector players

rinks are indisputably the perfect companion for any occasion. From the clicking of whisky glasses to the popping of wine bottles, and the sipping of cocktails, one can never run out of options when in need of something to quench their thirst. These drinks have to come from somewhere, and in Africa, the

Distell Group is one of the companies ensuring your glass always has something indulging, whenever you want to celebrate. With roots in South Africa and a global reach, Distell Group has set itself apart as the leading producer and marketer of a diverse portfolio of award-winning alcoholic brands in Africa, that have been meticulously crafted to fit all occasions. Having on its books some of the

most loved and appreciated brands across the world such as Amarula, Hunter’s Dry, Nederburg, and Viceroy, among others, Distell combines rich provenance, authenticity,

peer in the beverage industry on the continent, and it is our honor to present it to you, our readers, as the 2022 African Beverage Company of the Year.

Since its inception in 2000, following the merger of Stellenbosch Farmers' Winery and Distillers Corporation in a deal worth R515.2m (US$28.1m), Distell has been focusing on the production and marketing of wines, spirits, ciders, and other ready-to-drink (RTD) beverages, with a mission to enhance memorable moments and inspire responsible enjoyment, while enriching the lives of its stakeholders. The merger of the two entities, which are accredited for the development of the liquor industry in South Africa, gave Distell a stable ground to kick-start its operations.

A year later after the merger, Distell Group's shares began trading on the Johannesburg Stock Exchange on 19 March 2001 under the symbol DST which later changed to DGHL after the company's restructuring and formation of a new entity Distell Group Holdings Limited in 2018.

and diversity that cuts across the whole continuum from everyday enjoyment to occasional luxury indulging. For this reason and many more, Distell Group stands tall among its

Having operated for more than two decades, Distell has tremendously grown, from earning revenue of R4.6 billion (US$254m) at its inception to more than octupling its topline earnings to R34.1 billion (US$1.89 billion) in its 2022 full year. As of October 2022, Distell Group had a market cap of US$2.14 billion. The bullish performance is accredited to continuous investments in the growth of its operations,

strategic partnership across the continent and the world over, launch of innovative world-class brands, and having an unwavering commitment to its shareholders and community at large.

The drinks maker boasts of having over 300 products under different brands, both directly and indirectly owned. Its local production is undertaken at its fully-owned wineries, i.e., Nederburg, Adam Tas, J. C. Le Roux, and Durbanville Hills. Distell also operates six distilleries in its home market, i.e., Worcester, Goudini, Van Ryn's – Stellenbosch, WellingtonJames Sedgwick Distillery, and Monis, Paarl, alongside its other blending and packaging facilities in Gqeberha, Springs, and Wadeville.

Under its leading category - wine, Distell picks grapes from vineyards that are some of the finest in the region and crafts them into wines of great complexity in its cellars. Its portfolio features South Africa's best-known and loved wines such as Nederburg, Drostdy-Hof, Paarl Perle, Durbanville Hills, Fleur du Cap, J.C. Le Roux, Sedgwick's - South Africa's first and original old brown, Two Oceans, 4th Street, Allesverlonen, Autumn Harvest, Overmeer, Cape Portrait, Zonnebloem, and Pongrácz.

In a bid to drive convenience, customer satisfaction, and value for money, Distell leverages trendy packaging for a number of its wine brands such as Bag in Box packaging for the Two Oceans, 4th street, and Overmeer wines.

Meanwhile, its maturing spirits category offers smooth and refined brandies such as Viceroy, Richelieu, Van Ryn's, and Klipdrift; alongside double mature whisky brands such as Three ships (South Africa's first whisky brand), Scottish Leader, and Bain's Cape Mountain tagged as South Africa's first single grain whisky. The spirits banner also constitutes the playful and colorful Count Pushkin vodka, and the globally awarded

velvety cream liqueur Amarula which is sold in over 100 countries.

Its fast-growing category – Ciders and Ready to Drink - offers real refreshment from brands such as Hunter's cider, Savanna cider, Esprit fruit-flavored drink, Bernini sparkling spritzer, Vitafit Aday sparkling apple juice, Extreme Energy apple ale and Vawter seltzer (Africa's first hard seltzer launched in 2021).

Through its Venture Business, Distell has continued to grow its core premium spirits brands, debuting new variants of the Amarula drink, including the plant-based cream liqueur made with the African marula

fruit and coconut milk as its base. The South African company has also debuted Amarula African gin, Amarula Ethiopian coffee and Amarula chocolate made using sustainably sourced African cocoa.

Its cider portfolio has also welcomed the addition of Hunter's red apple to Hunter's Dry, Chilled Non-Alcoholic, Gold, Hard Lemon, and Export variants. Savanna Chilled Chilli - the world's first spicy cider, Savanna Jean, and Savanna Loco - SA's first tequila-flavored cider were also recently launched, joining the existing range of Savanna Dry, Angry Lemon, Light, and Non-Alcoholic.

The South African drinks major also seeks to expand its product offering to CBD-infused drinks following the acquisition of a 20% stake in RETHINK CBD brand formulated by Releaf Pharmaceuticals in 2020.