The age of dark factories has arrived that offer more productivity with less consumption. With +1000 turnkey projects in 120 countries, Alapala is one step ahead of the era...

56

COMPANY FEATURE - LA BOULANGERIE BY VUPES

Reviving French Tradition with Transparency in Dubai’s Bakery Scene

26

STARTUP FEATURE - ANCHOR FOODS

Anchor Organic Foods’ mission to transform Kenyan flour industry with sweet potatoes

54

BAKER'S CORNER - AVUGWI SIMON

Avugwi Simon, a bakery technologist at Nas Airport Services, talks about Blending Art, Science, and Innovation in Modern Bakery

FOUNDER & PUBLISHER

Francis Juma

SENIOR EDITOR

Martha Kuria

EDITOR

Wangari Kamau

EDITOR

Yegon Kipngetich

BUSINESS DEVELOPMENT

DIRECTOR

Virginia Nyoro

BUSINESS DEVELOPMENT ASSOCIATE

Vivian Kebabe

HEAD OF DESIGN

Clare Ngode

ACCOUNTS

Jonah Sambai

Published By: FW Africa

P.O. Box 1874-00621, Nairobi Kenya

Tel: +254725 343932

Email: info@fwafrica.net

Company Website: www.fwafrica.net

www.foodbusinessafrica.com

www.millingmea.com

www.foodandhospitalitymea.com

www.dairybusinessafrica.com

www.freshproducemea.com

Sustainable Packaging Middle East & Africa is published 4 times a year by FW Africa. Reproduction of the whole or any part of the contents without written permission from the editor is prohibited. All information is published in good faith. While care is taken to prevent inaccuracies, the publishers accept no liability for any errors or omissions or for the consequences of any action taken on the basis of information published.

www.foodsafetyafrica.net www.healthcaremea.com www.ceobusinessafrica.com

The grains and milling industry remains the cornerstone of global food security

As 2024 draws to a close, it’s a perfect moment to pause and reflect on a year that’s been nothing short of remarkable for the grains, baking, and food industries. This year, we’ve witnessed incredible resilience, bold innovations, and global shifts shaping the way we produce, process, and consume food. In this 11th edition of Milling Middle East & Africa (MMEA), we bring you a collection of stories that capture the heart of this dynamic year while offering a glimpse into what lies ahead.

This year, Dubai truly became the heartbeat of the food and beverage sector. It wasn’t just about hosting global events like Gulfood or the IAOM Middle East & Africa Conference— it was about the energy, the innovation, and the way the city continues to bring the world together.

Our feature story on La Boulangerie by Vulpes in Dubai dives into this energy, showcasing the inspiring journey of Didier and Adam Schneider, the father-son team who’ve redefined Dubai’s bakery scene. Their story is a testament to how Dubai’s multicultural audience pushes boundaries, inspiring bakers and food producers to blend international trends with local flavors.

We’ve also seen exciting shifts in what people eat and why. Health and sustainability have moved from niche concerns to major drivers of change. We spoke to Anchor Organic Foods in Kenya, which is leading the way. It is transforming traditional staples by incorporating sweet potatoes into flours, a win-win story that’s reshaping the Kenyan food landscape.

But it hasn’t been an easy year for everyone. In Zimbabwe, the 2023/2024 growing season brought harsh realities, with the worst drought in 40 years fueled by El Niño. The impact has been devastating—drastic drops in maize production and a rise in food insecurity have led the government to declare a State of Disaster. As we focus on Zimbabwe for this issue,

it’s a stark reminder of how interconnected climate and food security are and the urgent need for action.

Also, in this issue, we highlight the tech revolution in grain sorting. What used to be tedious and error-prone grain sorting technologies have now become a marvel of precision and efficiency thanks to cutting-edge advancements. These innovations are raising the bar for quality and safety in food production, and we’re excited to share how these developments are changing the game for everyone involved in the supply chain.

Looking back at the 34th IAOM Middle East & Africa Conference and Expo held this November, it’s clear that the industry is laser-focused on sustainability and smarter ways to mill and process grains. It was inspiring to see the ideas and innovations that came to life at the event. If you missed it, don’t worry—we’ve captured the highlights for you.

We’re also keeping a close eye on Uganda, a country stepping boldly onto the global stage by joining BRICS. This move opens new opportunities for trade and development, and with Uganda gearing up to host the AFMASS Food Manufacturing Expo from February 11 to 13, 2025, it’s an exciting time to explore what the future holds for this rising star.

We hope you find this edition informative and inspiring as we collectively work towards a more resilient and sustainable future for the milling sector.

From all of us at Milling Middle East & Africa Magazine, we wish you a joyful holiday season and a bright, successful start to 2025!

Stay informed. Stay inspired.

Martha Kuria Senior Editor, MMEA

www.afmass.com/grains-expo

UGANDA & GREAT LAKES REGION EDITION

Kampala, Uganda - Feb 11-13, 2025

www.ug.afmass.com/grains-expo

KENYA & EASTERN AFRICA EDITION

Nairobi, Kenya - July 2-4, 2025

NIGERIA & WESTERN AFRICA EDITION

Lagos, Nigeria - October 14-16, 2025

www.west.afmass.com/grains-expo

SAUDI ARABIA – Olam Group, a Singapore-based global food and agribusiness leader, has confirmed preliminary discussions with the Saudi Agricultural and Livestock Investment Co. (SALIC) regarding a potential sale of its agribusiness unit, Olam Agri.

SALIC, fully owned by Saudi Arabia’s Public Investment Fund (PIF), submitted a nonbinding offer that caused Olam's shares to surge by 17%.

SALIC currently holds a 35.43% stake in Olam Agri, following a US$1.24 billion investment in 2022 that valued the business at approximately US$3.5 billion. This aligns with Saudi Arabia’s Vision 2030 initiative to enhance food security by reducing import dependency and strengthening supply chains. Olam Agri, a leading supplier of grains, oilseeds, animal feed, rice, and edible oils, reported over US$23 billion in revenue in 2023, with operations spanning more than 30 countries.

Olam has been restructuring its portfolio in recent years, aiming to unlock value through strategic initiatives. It announced plans for an IPO and demerger of its food ingredients and agricultural units in 2021. However, market volatility delayed these plans. Analysts speculate that a successful sale to SALIC could replace the need for an IPO and potentially eliminate plans to list Olam Agri on the Saudi Exchange.

A sale would also align with growing Gulf state investments in agribusiness to secure food supplies regionally. For Olam, the transaction could generate significant capital, allowing the company to focus on its other core unit, Olam Food Ingredients, which supplies commodities like cocoa, coffee, and spices globally. The company has reaffirmed its flexibility in strategic decisions, stating that it will continue monitoring market conditions to guide its IPO plans for its food ingredients and agri-business segments.

Bühler’s African Milling School introduces new Apprentice Feed Miller Program for 2025

KENYA – The Bühler Group’s African Milling School (AMS) in Ruiru, Kenya, is launching its Apprentice Feed Miller Program on March 3, 2025.

The program aims to address skill gaps in Africa’s feed milling industry by offering comprehensive training for professionals in feed manufacturing and related sectors.

Since 2015, AMS has been a leader in milling education, training over 1,200 professionals. Its facilities include a fully operational milling plant, analytical labs, and modern classrooms, providing a complete learning environment.

The 16-week online preparatory phase covers foundational concepts such as cereal science, basic math, mechanical conveying, and electrical engineering. This is followed by 8 weeks of hands-on on-campus training at AMS’s Ruiru campus. The on-campus phase includes plant maintenance, pellet quality testing, steam rack operations, and advanced automation using PLCs. Specialized modules include size reduction, mixing theory, pest control, and food safety, with practical experience on machinery like hammermills and pellet presses.

The program is designed to help participants optimize production plants, reduce downtimes, and improve pellet quality and animal nutrition.

AMS is addressing challenges in Africa’s feed milling sector, such as post-harvest losses, energy inefficiencies, and reliance on imports, by focusing on local crop utilization, sustainability, and technological innovation. Graduates will be prepared to implement cost-saving measures and improve production efficiency.

This initiative is part of Bühler’s commitment to supporting Africa’s food systems by promoting resilience and sustainability. By focusing on locally available crops like millet, sorghum, and pulses, the program also aims to enhance food security and unlock market opportunities for value-added products.

For more information, contact AMS at ams.nairobi@ buhlergroup.com.

SOUTH AFRICA – Premier Group, a South African food producer, has posted a 32.4% growth in its half-year interim profit boosted by cost-saving initiatives in a challenging operating environment.

Operating profit rose 17.3% to 945 million rand (US$52M), benefiting from the suspension of load-shedding, which improved operations in key categories.

The company, known for brands like Mister Sweet and Manhattan, invested in high-volume bakeries and modern equipment to enhance quality and reduce production costs. Premier's revenue increased by 3.7%, reaching 9.7 billion rand (US$539.38 million), despite challenges such as high interest rates and commodity volatility.

The group, which competes with Tiger Brands, Pioneer Food, and RCL Foods, acquired a 30% stake in Goldkeys International in June to expand into the rice market.

Kobus Gertenbach, the Group’s CEO emphasized

BIOTECHNOLOGY

diversification, stating that Premier is already a major player in its current categories and can’t pursue further acquisitions in those areas without competitive issues.

That means it “can’t really buy someone else (in those categories) without creating some competitive issues,” he said.

Since 2011, Premier has invested over R6 billion to diversify from milling and bakery to sugar confectionery and home & personal care, acquiring brands like Super C, Mister Sweet, Manhattan, and Lil-lets. It expanded its bakery portfolio through acquisitions in the Eastern and Western Cape and grew its African presence, adding bakery, milling, and beverage operations in Eswatini, and milling, biscuits, animal feeds, and pasta in Mozambique.

Premier operates 13 bakeries, 7 wheat mills, and 3 maize mills, producing a wide range of products across Southern Africa. Its products are distributed through 28 depots in South Africa, Eswatini, Mozambique, and Lesotho, with a Lil-lets office in the UK serving global markets.

KENYA – Kenya’s move to adopt genetically modified organisms (GMOs) has advanced after the High Court dismissed petitions challenging the government’s 2022 decision to lift a 10-year ban on GMO cultivation and importation.

In a ruling on November 7, 2024, Justice Lawrence Mugambi upheld an earlier judgment from the Environment and Land Court, which found no evidence that GMOs harm human health or the environment. The decision confirmed that Kenya’s regulations under the Biosafety Act, overseen by the National Biosafety Authority (NBA), ensure safe GMO handling and cultivation.

This ruling signals a major step in Kenya’s embrace of biotechnology, aligning the country with other African nations like South Africa, Nigeria, Ethiopia, and Sudan, where GM crops have led to higher yields, reduced pest damage, and lower production costs. The decision comes as Kenya faces significant food insecurity, with 3.2 million people in arid and semi-arid regions experiencing food shortages. Advocates for GMOs argue that drought-tolerant maize, pest-resistant cotton, and virus-resistant cassava could improve crop production and help alleviate hunger.

Opponents, including attorney Paul Mwangi, raised concerns about the lack of public participation in the decisionmaking process and the potential loss of indigenous seed varieties. They also warned that the commercialization of patented GMO seeds could harm small-scale farmers. However,

the court emphasized that the lifting of the ban was done in accordance with legal procedures, and that safety measures were in place to protect public health and the environment.

The NBA has reported that seven GM crops, including cotton, maize, and cassava, are currently undergoing trials. These developments suggest that GMOs could play a key role in boosting food security and agricultural sustainability in Kenya. Experts like Prof. Richard Oduor from the Kenya University Biotech Consortium highlighted the potential for GMOs to enhance crop yields and support farmers.

SRI LANKA - Sri Lanka is facing rising poultry feed costs, driven by strict import controls and taxes on maize, resulting in high egg and meat prices in a nation already struggling with child malnutrition.

The government’s policy favors domestic maize farmers but critics argue it disproportionately benefits large producers and intermediaries, dubbed the “maize mafia,” harming smallscale poultry farmers and consumers.

To protect local maize production, the government has imposed a 25-rupee-per-kilo import tax and a restrictive licensing system that limits maize imports. This system allows license holders to control prices even when imports are allowed.

Minister Vijitha Herath explained that while Sri Lanka has permitted 300,000 tonnes of maize imports this year due to low Yala season harvests, the quota-based system keeps prices high. Domestic maize costs around 160 rupees per kilo (US$547 per tonne), much higher than the import price of 110

rupees per kilo (US$376 per tonne).

High feed prices burden small and medium poultry farmers, who lack affordable maize access and the means to import it directly. Import licenses drive up demand, increasing prices in neighboring countries like Pakistan, traditionally Sri Lanka’s cheapest maize supplier. The Pakistani price of maize is around US$255 per tonne (75 rupees per kilo), making the import tax a 30% barrier.

To help small poultry producers, Minister Herath stated the government is working to connect them with importers for cheaper wheat as an alternative feed. “We will continue importing maize until domestic production increases, but we aim to lower maize prices,” he added.

Sri Lanka’s focus on import substitution limits its ability to import food affordably and export competitively, while the special commodity levy and VAT on processed poultry hinder maize exports, making them uncompetitive globally.

WEST AFRICA – According to the Food and Agriculture Organization (FAO), cereal production in the region is projected to fall to 73.7 million tonnes in 2023, a decrease of 700,000 tonnes from the previous year.

This decline is attributed to rainfall deficits during the critical growing season, affecting key producers such as Côte d'Ivoire, Benin, Ghana, and Togo, while flooding in the Sahel and Nigeria has further exacerbated crop losses. In Nigeria, the region's largest cereal producer, drought and flooding have also hampered production, with cereal yields expected to be below average in 2024.

This decline in domestic production is expected to worsen food insecurity, with the FAO forecasting that up to 49.5 million people in West Africa may face acute food shortages by 2024, particularly during the lean season. Economic pressures such as inflation, currency devaluation, and high input costs are further compounding the issue, making nutritious diets unaffordable for many. A surge in food prices is also expected in 2025, driven by reduced domestic output, rising export demands, and logistics costs. Key crops such as maize, soybean, and sorghum are projected to see significant price increases, placing additional strain on Nigeria’s food security.

In response to these challenges, the African Development Fund (AfDB) has approved a US$99.16 million financing package to enhance regional rice value chains in West

Africa. The Resilient Regional Rice Value Chain Development Project (RC-RVCDP) aims to achieve rice self-sufficiency in the region by 2030. The project focuses on improving rice production through modernized irrigation systems, climatesmart seeds, and better processing units, while promoting regional collaboration. The Gambia and Guinea-Bissau are among the primary beneficiaries, with a particular emphasis on empowering women and youth through skills training and financial inclusion. This initiative represents a crucial step toward addressing food insecurity and strengthening the region’s agricultural resilience.

FEBRUARY 11-13, 2025 | KAMPALA, UGANDA

No.1 Trade Shows for Food Service, Hospitality & Travel Industry in Africa

AFRICA - According to the 2024 OECD-FAO Agricultural Outlook report, Africa is expected to account for 41% of global rice imports by 2033, totaling over 26 million tonnes annually.

Rice is the second most cultivated cereal and third most consumed crop on the continent. Despite efforts to boost production, local output remains insufficient.

Currently, Africa imports around 17 million tonnes annually, 32% of global imports, to meet rising demand driven by population growth and dietary shifts. Per capita rice consumption is projected to grow from 25.1 kg in 2023 to 28.5 kg by 2033, the second-fastest increase globally.

Africa’s population is expected to reach 1.69 billion by 2030, placing pressure on local production systems that cannot keep up with demand. As a result, reliance on international markets will increase. In West Africa, the main production and consumption area, Nigeria is expected to nearly double its rice imports by 2033 to 4 million tonnes, almost matching China’s projected imports.

While some analysts believe Africa can become selfsufficient, opportunities exist in West Africa to boost production, such as expanding irrigation. Currently, 80% of rice production relies on rainfall, but irrigation could improve yields. In Nigeria, about 4.2 million hectares are cultivable, yet only 17% is irrigated. Senegal’s USDA estimates show 240,000 hectares with irrigation potential, with yields up to 7 tonnes per hectare compared to just 2 tonnes from rainfed areas. Mali has nearly 2.2 million hectares suitable for irrigation, though only 36% is exploited.

To address this, ECOWAS announced a ten-year, US$19 billion strategy in October 2023 to support rice production, including interventions in storage, processing, fertilizers, and seeds.

ZIMBABWE – Zimbabwe’s wheat harvest for 2024 is set to achieve historic highs, with 428,000 tonnes already delivered to Grain Marketing Board (GMB) depots from 90,000 hectares harvested.

The projected total harvest by season’s end is expected to reach 600,000 tonnes, meeting Zimbabwe’s national consumption needs and opening up opportunities for export. This achievement represents the highest yield since Zimbabwe began commercial wheat production, marking a significant step toward reducing dependency on wheat imports.

Lands, Agriculture, Fisheries, Water, and Rural Development Permanent Secretary Professor Obert Jiri emphasized the importance of increasing domestic wheat output to ensure national food security. He urged farmers to take advantage of sunny weather to continue harvesting, as recent rains have increased moisture levels in wheat fields, particularly in Mashonaland provinces, which contribute heavily to the crop. Excess moisture poses a risk to wheat quality, prompting the government’s call for swift action during dry spells to protect the harvest.

This record harvest is seen as reinforcing Zimbabwe’s goal of food self-sufficiency and fostering a more resilient agricultural sector. Key government-backed initiatives, such as the Presidential Winter Wheat Scheme, the Agro-Yield Initiative, and the Belarus Farm Mechanisation Scheme, have been instrumental in this success. The collaboration with private players, who expanded wheat cultivation on an additional 25,000 hectares, has also been crucial to achieving this year’s results.

Zimbabwe’s wheat sector has benefited from strategic planning and investment aimed at reducing reliance on imports. Last year, the country imported approximately 40,000 tonnes of wheat, a cost authorities aim to minimize moving forward. By boosting domestic production, Zimbabwe can potentially stabilize local flour prices, strengthening food security and the economy. The increased yield could enable Zimbabwe to become a wheat supplier to neighboring countries in the Southern African region.

The Grain Millers Association of Zimbabwe acknowledged the long-term benefits of this achievement, including a reduction in the nation’s import bill and the stabilization of local flour prices, further enhancing economic resilience. The successful harvest is expected to contribute to food selfsufficiency and stability in the sector, positioning Zimbabwe as a more self-reliant and export-ready player in the regional wheat market.

MALAWI – The Malawian Agricultural Development and Marketing Corporation (Admarc) is set to establish a maize flour milling plant, a strategic move that could significantly improve its profitability and stabilize Malawi’s grain markets.

The corporation had extended the bidding deadline for the supply, installation, and commissioning of the plant to October 22, 2024, as it seeks international partners for the project. This marks Admarc’s return to flour milling after nearly two decades, following the 2003 sale of its previous mill, Grain and Milling Company Limited, to the Bakhresa Group.

Admarc spokesperson Theresa Chapulapula confirmed the plan to establish the new milling facility but refrained from commenting on the investment scale or the business model. Experts view this as a timely decision to revitalize Admarc’s operations. Tamani Nkhono-Mvula, an Admarc board member and agriculture policy expert, pointed out that while private sector partners might be initially cautious due to Admarc’s past financial struggles, a successful milling venture could encourage similar projects across Malawi.

This move aligns with Admarc’s ongoing structural reforms aimed at enhancing its competitiveness and sustainability. Leonard Chimwaza, an agricultural extension expert, praised

Admarc's shift toward value addition, which he believes is essential for the corporation's long-term sustainability. For too long, Admarc focused on social services, limiting its profitability. Agricultural economist Zachary Kasomekera noted that Admarc’s entry into flour milling could stabilize grain prices, a key factor in ensuring food security. He emphasized that Admarc's role in controlling price volatility could lead to more affordable flour for Malawians, especially during market disruptions, benefiting consumers and strengthening the agricultural sector.

USA – Ardent Mills LLC, the largest flour milling company in the United States, has announced the closure of its Mankato, Minnesota flour mill, citing challenging market conditions.

Milling operations will wind down, with production set to cease by mid-January 2025. The Mankato mill, the smallest of Ardent Mills’ three Minnesota facilities, has a daily capacity of 9,900 cwts, compared to 26,760 cwts at Hastings and 16,000 cwts at Lake City.

"This was a tough decision," said an Ardent Mills spokesperson, emphasizing ongoing pressures in the milling

industry. The Mankato mill, with roots dating back to the late 1870s, became part of Ardent Mills in 2014 after passing through various ownerships. Currently employing 44 people, the mill produces a variety of flours sourced from hard and soft wheat across the US and Canada. Employees will be offered relocation opportunities. Customers of the Mankato facility will be supplied from other Ardent Mills locations.

The closure reflects broader financial challenges for Ardent Mills. According to Conagra Brands, which owns a 44% stake, the company’s first-quarter 2025 results revealed diminished market volatility and lower volume trends. Ardent Mills' earnings for the period dropped 18%, from US$35.5 million to US$29.1 million, mirroring a decline in industry-wide profitability. Ardent Mills' profits have eroded from a high of US$49.2 million in fiscal 2023 to just US$22 million in fiscal 2022.

Despite these challenges, Ardent Mills remains focused on strategic expansions, such as the recent addition of 9,500 cwts of daily capacity at its Commerce City, Colorado, facility. Conagra's leadership remains optimistic, with CEO Sean Connolly noting, “I am proud of our team for delivering another quarter of strong margin recovery."

UAE - Invictus Investment Company, a leading agro-food enterprise listed on the Abu Dhabi Stock Exchange (ADX), has announced plans to acquire a prominent flour mill business in Mozambique.

This acquisition is a significant step in the company’s strategy to expand its footprint across Africa, aligning with its vision to become an integrated agro-food enterprise while strengthening its operations in both the Middle East and Africa.

Amir Daoud Abdellatif, CEO of Invictus Investment, stated that the acquisition, pending regulatory approval, is a key part of the company’s long-term strategy to grow its agro-food business in “high-potential African markets” and to “build on operational capabilities in the midstream and downstream segments.” Financial details of the deal remain undisclosed.

“This acquisition represents a key milestone in our growth

strategy,” a company spokesperson remarked, emphasizing the importance of establishing a presence in Mozambique to meet the rising demand for food products across Africa while promoting sustainable agricultural practices.

This move follows Invictus's earlier acquisition of a 60% stake in Moroccan grain trading company Graderco, a firm with significant market presence in Morocco and revenues exceeding AED 1.5 billion (US$410 million) in 2023. Graderco imports, stores, and trades millions of metric tonnes of grain annually.

With AED 8.1 billion (US$2.2B) in revenues and 5.37 million metric tonnes in commodity transactions in 2023, Invictus continues to expand. Earlier this year, the company announced plans to invest US$272 million in acquisitions and joint ventures to boost its MENA and African operations.

TURKEY – Turkey’s largest flour producer, Ulusoy Un, has acquired an 85% stake in Italian pasta maker Pastificio Mediterranea for nearly US$5.76 million from Spain’s Cerealto Group.

This deal strengthens Ulusoy Un’s international presence through one of Italy’s historic pasta brands.

Founded in 1908 in Silvano d’Orba, Pastificio Mediterranea is renowned for its high-quality, traditionally produced pasta. The company gained global recognition in the 1950s and 60s with the Moccagatta brand and expanded internationally. It pioneered automated pasta pressing in 1936 and upgraded to a state-of-the-art plant in 2003.

The Moccagatta family will remain involved, preserving their expertise and legacy. Ulusoy Un aims to tap into the premium pasta market, leveraging its raw material resources and global network.

“We will contribute to Pastificio’s growth and further expand its geographical coverage through our group’s supply capabilities and customer network,” said Eren Günhan Ulusoy, Chairperson of Ulusoy Un.

Marco Ferraroni, General Manager of Pastificio Mediterranea, expressed confidence in the partnership, stating, “We are confident that together we will take our company to the next level.”

This acquisition is part of Ulusoy Un’s expansion strategy,

following its purchase of a 12.65% stake in U.S.-based bread maker Rudi’s earlier this year. Global demand for premium pasta is rising, driven by consumer interest in artisanal offerings.

The milestone comes at a time when Türkiye’s pasta industry is thriving, ranking second globally in production and export. In the first eight months of 2024, Türkiye exported 984,000 tons of pasta, reaching 166 countries, including South America, Africa, and Japan. Aykut Göymen, President of the Turkish Pasta Industry Association, highlighted the country's growing role in the global pasta market.

Bühler launches state-of-theart grain innovation center in Switzerland

SWITZERLAND - Bühler, the Swiss technology leader, has launched its innovative Grain Innovation Center (GIC) in Uzwil, a state-of-the-art application center designed to advance grain processing.

The facility, which opened on October 28, aims to support food and animal nutrition industries by enhancing their processes, addressing market demands, and maintaining competitiveness.

The GIC, part of Bühler’s network of Application & Training Centers (ATCs), integrates the latest technologies to foster collaborative innovation. “The Grain Innovation Center is the newest expansion of Bühler’s ATC network, covering everything from raw materials to diverse finished products,” said Johannes Wick, CEO of Grains & Food at Bühler. “We are providing our customers with the flexibility they need to address industry challenges and innovate, helping them revolutionize their markets,” he added.

The global milling industry is undergoing a transformation, driven by factors like raw material variability, energy efficiency needs, and evolving safety and consumer demands. To address these challenges, Bühler designed the GIC to integrate automation, IoT, data analytics, and sustainable practices.

Spanning 2,000 square meters across five stories, the GIC is equipped with over 70 advanced pieces of equipment. Customers can conduct trials for food and feed applications, explore solutions in grain cleaning, optical sorting, grinding, protein shifting, and hygienization, and test a range of raw materials. The center also supports trials for non-food bulk materials, enhancing its versatility.

The GIC is part of Bühler’s broader Uzwil-based ATC hub, which includes several specialized centers and a new Milling Academy. Rudolf Hofer, Head of the GIC, stated, “Through strategic partnerships and comprehensive material flow management, we’ve created a unique innovation ecosystem.” This hub supports Bühler’s mission to drive sustainable innovation and talent development in the grain processing industry.

The Andersons, Inc., secures longterm lease at Port Houston

USA - The Andersons, Inc., a major player in the grain and fertilizer trade, has signed a long-term lease at Port Houston to expand its export operations for soybean meal and other bulk grains.

This agreement, announced on October 24, marks a significant enhancement to the company’s facilities, allowing it to meet the growing demand for soybean meal in international markets.

As part of the expansion, The Andersons is implementing key upgrades to boost logistical efficiency, including adding rail-based unloading access for soybean meal. This new addition will streamline the unloading of unit trains directly at the export point, reducing handling times and transportation costs, especially as domestic soybean crushing rates continue to rise.

“The long-term agreement and expansion at Port Houston allow us to meet growing global demand and provide seamless delivery of product to high-demand export markets,” said Bill Krueger, president and CEO of The Andersons. “By collaborating with our railroad partners, we’re poised to meet increased renewable fuel demands while optimizing logistics through direct rail access at the Texas Gulf,” he added.

The company’s Houston facility currently supports annual grain exports exceeding two million tonnes, with storage capacity of 6.3 million bushels. This expansion will add storage for up to 22,000 tonnes of soybean meal, further highlighting The Andersons’ commitment to high-volume grain exports. Additional upgrades include a modernized conveyance system and a new ship-loading tower to improve loading speed and efficiency.

Port Houston’s Chief Operating Officer, Tom Heidt, stressed the partnership's importance in advancing regional and national economic goals. “This agreement reflects Port Houston’s strategic role in supporting America’s green economy,” he said, noting its impact on job growth both locally and in key agricultural regions.

KENYA - IMCD Group, a global leader in specialty chemicals and ingredients, has made a significant advancement in East Africa’s food innovation landscape with the inauguration of its new Food and Nutrition Applications Laboratory in Nairobi, Kenya.

According to the company, the facility provides a dynamic platform for the creation and optimization of formulations across various market segments, including beverages, bakery, dairy, confectionery, snacks, and savory foods.

Located in Kenya’s capital, the lab acts as a hub for coinnovation, bringing together IMCD’s customers, suppliers, and technical experts to address the evolving needs of consumers in Kenya and the broader East African region. “This significant investment by our company will definitely support the development of innovation concepts that shall inspire future menus and products,” said Faisal Abdi, General Manager of IMCD’s East Africa business.

East Africa’s growing urbanization and rising middle class are shaping consumer preferences, fueling innovation in food and beverage sectors. “These have led to the growth of formal retail and food delivery services in the region,” Abdi added. At the lab’s launch event, customers and suppliers explored diverse product innovations tailored to local tastes.

George Olan’g, IMCD’s Food & Nutrition Business Unit

SUSTAINABILITY

Manager, emphasized the lab’s role in setting new standards for food production and quality in East Africa. “We are making a significant leap in enhancing food innovation across Kenya and the broader East African region,” he said.

The Nairobi lab, part of IMCD’s global network, integrates technical services and specialized expertise, offering advanced sensory analysis and application testing. This supports companies in improving product appeal, stability, and shelf life, driving innovation while fostering resilience and sustainability in East Africa’s food industry.

ITALY - Viterra Ltd., a leading agricultural company based in Rotterdam, Netherlands, has announced a strategic partnership with xFarm Technologies SA to enhance sustainable farming practices.

The collaboration, unveiled at the Agri Data Green Summit on October 23, will initially roll out in Italy, with plans to expand to other European countries.

This initiative focuses on supporting farmers in adopting carbon measurement methodologies and regenerative agricultural practices. The partnership will introduce two complementary programs for both existing and new Viterra farmer-customers. Participating farmers will gain access to Viterra Sustainable Farming, a farm management information system (FMIS) developed by xFarm Technologies. This innovative platform is designed to streamline operations while promoting sustainable farming practices.

Key features of the FMIS include the ability to calculate greenhouse gas emissions, monitor acidification, assess

eutrophication levels, and evaluate net water consumption— critical metrics for modern farming sustainability.

In addition to the FMIS, Viterra will launch its Regenerative Agriculture Program to assist farmers in transitioning to regenerative methods that focus on low-carbon crop production.

Stefano Predebon, Viterra’s global head of carbon trading, emphasized the importance of the initiative, saying, “Together with xFarm Technologies, we want to provide our farmers with the best-in-class tools and much-needed incentives to build a resilient, sustainable, and future-proof supply chain. This is an important step in the fight against climate change and to support farmers’ livelihoods.”

xFarm Technologies, based in Manno, Switzerland, is committed to digitizing the agri-food sector. Giovanni Causapruno, the company’s sales director for Europe, noted that the partnership would not only reduce environmental impact but also create significant value for farmers.

SAUDI ARABIA - CESCO, a leading designer and manufacturer of grain handling, storage, and processing solutions, has successfully completed the Factory Acceptance Test (FAT) for a high-capacity bagging line system as part of its project with United Feed Company (UFC) in Saudi Arabia.

The FAT, conducted on October 31 at CESCO’s sub-supplier site, marks a key milestone in the project’s progress.

The completed FAT demonstrated the system’s ability to operate across four parallel lines, each capable of bagging up to 1,000 bags per hour, each weighing 50 kg. Rigorous testing focused on sewing speed, cutting precision, ink printing functionality, and belt conveying efficiency, ensuring the equipment met UFC’s operational and safety standards.

A second round of testing will take place at UFC’s site in Saudi Arabia after installation, where the system will be evaluated under real-world conditions using actual products. Shipment to Saudi Arabia is scheduled for mid-November, with installation and on-site testing following as planned.

Martino Celeghini, CEO of CESCO, commented, “Achieving this milestone demonstrates our commitment to timely execution and high quality for our partners.” He added, “Our collaboration with UFC supports Saudi Arabia’s agricultural sector and aligns with the country’s food security goals. We

look forward to completing the project on schedule.”

This high-capacity bagging system is part of a larger grain storage and handling facility that CESCO is building for UFC, a prominent player in Saudi Arabia’s food industry. The facility, designed for efficiency and scalability, will become a key resource for the country’s poultry and livestock sectors, supporting its food security initiatives.

NORTH AMERICA - ADM, a global leader in innovative solutions from nature, has announced the rollout of its Digital Grain Elevator’s FOB Ag Logistics Platform at multiple grain origination locations across the United States and Canada, with plans for further expansions throughout North America.

This platform serves as an all-in-one mobile tool designed to streamline grain delivery logistics, offering digital dispatch capabilities, real-time tracking, and an invoicing system that eliminates the need for traditional paperwork.

According to ADM, the platform allows producers and carriers to quickly request trucks and receive real-time updates on delivery locations and expected arrival times. "The successful implementation of this technology across a broad part of our North American footprint is already helping us work with our partners to simplify and streamline the work we do together," said Alicia Ralston, ADM’s vice president of digital transformation.

Currently active in ADM’s eastern regions, including Decatur, Illinois; Toledo, Ohio; and Evansville, Indiana, the platform aims to improve efficiency by expediting delivery timelines and enhancing invoicing accuracy.

ADM continues its collaboration with Farmer Business Network (FBN) through the Gradable platform, supporting over 12 million enrolled acres. This initiative enables farmers to document regenerative practices and add verifiable value to grain through sustainable certifications and carbon metrics.

Aaron Secrest, CEO of Digital Grain Elevator, Inc., highlighted that “simplifying dispatch, tracking shipments, digital ticket integration, and automated invoicing” represents a significant advancement in agricultural transportation.

Recently, ADM and FBN formed a joint venture to expand the Gradable platform, enhancing digital technology in sustainable farming and making it easier for farmers and buyers to engage in eco-friendly practices.

ITALY - Milling equipment supplier Alapros Makina has successfully commissioned a state-of-the-art flour mill for the Casillo Group in Monfalcone, Italy, marking a significant milestone in the modernization of flour milling technology.

The new facility, with a capacity of 300 tons per day (tpd), integrates advanced engineering and modern technologies to enhance efficiency and product quality. During the commissioning process, representatives from Alapros Makina, including their engineering team, worked closely with Francesco Casillo, CEO of the Casillo Group. Together, they conducted thorough inspections and evaluations to ensure the facility met stringent performance and quality benchmarks. The assessments confirmed that the mill achieved its operational targets and exemplified Alapros’ commitment to customer satisfaction and engineering excellence.

The Monfalcone flour mill stands as a testament to innovation in the milling sector, designed to be a model of high efficiency and quality. “This plant will breathe new life into the sector,” stated an Alapros representative, emphasizing the transformative impact of this project.

The Casillo Group, a leader in the global food industry, specializes in processing and distributing durum wheat, with 14 milling facilities across Italy. Founded in 1958 by Vincenzo Casillo, the company has evolved significantly and continues to innovate under the leadership of his sons, including Francesco Casillo. The group remains committed to quality and sustainability.

The decision to partner with Alapros was driven by their reputation for excellence in milling technology. According to the Casillo Group, the collaboration aims to enhance competitiveness by leveraging cutting-edge production methods and sustainable practices, ultimately increasing production capacity and improving product quality to meet growing consumer demand.

AUSTRALIA - Australia’s ASX-listed agribusiness, GrainCorp, reported a crushing of 540,000 tonnes (t) of canola seed in the 2024 financial year (FY24), an increase from 496,000t in FY23.

This achievement, however, came amid a challenging financial landscape, with a notable decline in overall performance. Underlying earnings before interest, taxes, depreciation, and amortisation (EBITDA) fell 53%, dropping to US$268 million from US$565 million in FY23. The underlying net profit after tax (NPAT) also experienced a near 70% decrease, falling from US$250 million in FY23 to US$77 million in FY24.

GrainCorp’s Managing Director and CEO, Robert Spurway, attributed the lower earnings to “challenging global market conditions and variable crop production,” though he praised the company’s “discipline in operational performance and effective cost management” in navigating these challenges.

Total grain handled dropped significantly, with volumes declining to 28 million tonnes (Mt) from 37.4Mt in FY23. Export volumes decreased from 8.3Mt to 5.6Mt, and domestic outloads fell from 6.4Mt to 5.9Mt. Chief Financial Officer Ian Morrison pointed to drier conditions in Queensland and northern New South Wales (NSW) as contributors to the lower production, although above-average conditions in southern NSW and Victoria helped offset some losses.

Despite these difficulties, GrainCorp’s agri-energy segment saw growth, increasing by 28,000t to 379,000t, driven by demand for tallow and used cooking oil.

Looking ahead, Spurway expressed optimism regarding the winter crop harvest and ongoing demand, despite pressure on margins. “As the year plays out, inevitably demand will continue to grow,” he stated.

BY MARTHA KURIA

In response to the global surge in demand for nutritious, gluten-free food alternatives, Kenya’s Anchor Organic Foods is pioneering a unique approach to flour production by utilizing indigenous crops. Speaking to Milling Middle East & Africa Magazine, Austin Kearby, Co-founder and Operational Manager at Anchor Foods, shared insights into how the company strives to deliver nutrient-dense, gluten-free alternatives grounded in locally sourced sweet potatoes.

Founded in 2019 by Purity Nyamu and Austin Kearby, Anchor Organic Foods embarked on a mission to support Kenyan communities by creating economic opportunities and addressing nutritional challenges through indigenous food resources. The COVID-19 pandemic brought global attention to the fragility of food supply chains, prompting consumers to seek healthier, local, and nutrient-dense food options. Recognizing this shift, Anchor Organic Foods seized the opportunity to showcase Kenya’s abundant sweet potato crop in an innovative way, transforming it into a shelf-stable, nutrient-rich flour that serves as a sustainable, gluten-free alternative to conventional flours.

Purity and Austin were driven not only to serve health-conscious consumers but also to address the challenges faced by Kenyan sweet potato farmers. Traditionally, farmers encounter difficulties in marketing their produce, often selling at low prices or suffering from high post-harvest spoilage. Sweet potatoes are particularly vulnerable, with a short shelf life that increases the risk of spoilage during transport and storage. Witnessing these issues firsthand, Nyamu, equipped with a background in finance, business management, and leadership roles, sought a solution that would create a reliable income stream for farmers while addressing post-harvest losses.

The answer was to convert sweet potatoes into a long-lasting flour, high in fiber and vitamins, that aligns with consumer preferences for gluten-free, sustainably sourced products. By transforming sweet potatoes into a shelf-

stable product, Anchor Organic Foods provides farmers with new revenue opportunities and helps alleviate nutritional deficits in Kenya. Austin shared, “We’re proud that our product supports healthier diets and creates sustainable income for local farmers.”

THE FLOUR’S HIGH NUTRIENT DENSITY HAS MADE IT A POPULAR CHOICE AMONG LOCAL NUTRITION PROGRAMS, PARTICULARLY FOR COMBATING MALNUTRITION.

Anchor Organic Foods’ flagship product, sweet potato flour, is rich in fiber, vitamins, and minerals, making it an ideal choice for healthconscious consumers and those with gluten intolerance. Unlike conventional corn or wheat flours, sweet potato flour boasts a higher nutritional profile, providing essential nutrients that address childhood malnutrition.

The flour’s high nutrient density has made it a popular choice among local nutrition programs, particularly for combating malnutrition. One of Anchor Organic Foods’ key partners, a local nutrition organization, recently began incorporating sweet potato flour into meals for underweight children with promising results. Austin says, “For those facing malnutrition, especially children, it provides essential nutrients that aid in healthy weight gain.”

Unlike traditional use, Anchor Foods employs a unique processing technique by chopping sweet potato tubers without peeling, preserving maximum nutrition. “Sweet potato skins are safe to eat and rich in fiber, antioxidants, and

other nutrients that support gut health, enhance satiety, and prevent chronic disease,” he added. To cater to diverse dietary needs, the company also developed products like Uji (porridge) and Ugali blends. These mixes retain the natural benefits of sweet potato flour, gaining popularity among parents seeking wholesome meal options. As Austin explains, “Parents and nutritionists alike are seeing the value in a natural, glutenfree product that’s easy to incorporate into daily meals.”

Establishing Anchor Foods was no small feat. Purity Nyamu spearheaded research into sweet potato flour production, undergoing training at the Kenya Industrial Research and Development Institute (KIRDI) to refine the process. With Kenya Bureau of Standards (KEBS) certification, Anchor’s flour products are now available on healthy store shelves, expanding consumer access to this innovative, indigenous flour.

The company’s mission is clear: establishing a sustainable business that balances profitability with social and environmental impact. This commitment, known as the “quadruple bottom line” approach, centers not only on financial gain but also on creating positive social, environmental,

and health outcomes.

While the company’s mission is clear, challenges remain. Anchor Organic Foods has not yet automated its operations, and high power consumption costs weigh on production. Austin shared that labor and power account for nearly twothirds of their revenue, impacting the company’s production capacity.

Currently, the company relies on local millers to process sweet potato flour, as building an in-house milling operation would require substantial investment. This reliance on outsourced milling complicates the maintenance of strict gluten-free standards, as not all facilities are equipped with allergen management protocols. Austin envisions a future where Anchor Organic Foods operates its own milling facility, enabling them to enhance quality control and meet rising consumer demand.

Anchor Organic Foods’ production capacity is limited by its drying process, with a weekly output of approximately 60 kilograms of flour. The company is exploring investment options to expand its drying and milling capabilities, allowing it to scale operations and access broader markets. Additionally, the company is working on a solar power project to reduce operational costs and carbon emissions. Anchor is also exploring partnerships with certified organic farmers and seeks organic certification for its products, reinforcing its commitment to sustainability.

A key part of Anchor Organic Foods’ mission is educating consumers on the benefits of sweet potato flour and glutenfree products. Austin highlighted, “Consumers are becoming more health-conscious, but understanding how to incorporate products like sweet potato flour into everyday meals is essential.” To address this, Anchor participates in farmers’ markets, food exhibitions, and community events, conducting taste tests and providing educational materials. Additionally, they maintain an active social media presence, particularly on Instagram, to share recipes, nutritional benefits, and product insights, building consumer awareness and trust.

As a small player in a market dominated by large producers, Anchor’s strategy is to emphasize quality over quantity, building its brand around nutritional value and local impact for consumers who prioritize health-oriented products.

Anchor Organic Foods has forged partnerships with local clinics and feeding programs to address malnutrition in vulnerable communities. One notable collaboration involves a clinic in Tana River, which incorporates sweet potato flour into meals for malnourished children. These partnerships

are crucial to the company’s vision of making a meaningful impact in the health and nutrition sector, particularly among populations that face food insecurity and limited access to nutritious foods.

Through targeted feeding initiatives and health programs, Anchor Organic Foods aims to create a sustainable business model that prioritizes community welfare and contributes to Kenya’s broader goals of improved public health and food security.

Anchor Organic Foods aspires to become a cornerstone of Kenya’s nutritional and sustainable food landscape. Over the next five years, the founders envision scaling production, creating full-time employment opportunities, and expanding partnerships with farmers to enhance local economic stability. According to Austin, the company was founded with the intention to “help underprivileged Kenyans,” providing unskilled labor jobs and creating new opportunities for those in need. Currently, the company has four employees and works with small-scale farmers across Kenya. However, as Austin stated that they are also looking forward to incorporating farmers growing indigenous grains such as finger millet across Kenya in a mission to contribute to a healthier, more resilient food system in Kenya.

BY MARTHA KURIA

Zimbabwe, nestled in Southern Africa between the Zambezi and Limpopo Rivers, boasts a population of 16,724,546 as of October 2024, according to Worldometer's analysis of the latest United Nations data. The nation's economy leans heavily on agriculture, which contributes 17% to its GDP and employs 60% to 70% of its workforce. Agricultural performance stands as a pivotal factor influencing rural livelihood resilience and poverty levels, as highlighted by the Food and Agriculture

Organization (FAO) of the United Nations. With 4,130,000 hectares of arable land, a quarter of which is cultivated using animal and manual draught power, maize remains the dominant crop, although there's a growing emphasis on diversifying production with crops like wheat, sorghum, and millet to bolster food security initiatives.

WORST DROUGHT IN 40 YEARS

Climate change poses a significant threat to Zimbabwe’s grain sector, with erratic rainfall

patterns and prolonged droughts becoming increasingly common. The country faced its worst drought in 40 years during the 2023/2024 growing season, primarily driven by the El Niño weather phenomenon. This climatic event triggered a dry spell across southern Africa, drastically impacting crop yields.

President Emmerson Mnangagwa reported that over 900,000 hectares (ha) of maize have been devastated by the drought, out of an estimated 1.8 million hectares planted. This significant loss has severely compromised food security, compelling the Zimbabwean government to declare a “State of Disaster” in April 2024. In his address, President Mnangagwa emphasized the urgent need for approximately US$2 billion in aid to provide life-saving assistance to affected communities. According to the World Food Programme (WFP), more than 5.3 million people in Zimbabwe are projected to face food insecurity in 2024, a dramatic increase from previous years.

Maize remains Zimbabwe’s principal grain, with the country consuming an estimated 2.2 million metric tons annually; 1.8 million tons for food and 400,000 tons for livestock feed. Although sugarcane is the most produced crop in the country, maize production plays a crucial role

in the nation’s food security and agricultural economy. However, the sector is dominated by smallholder farmers, over 90% of whom rely heavily on rainfall due to limited access to irrigation technologies. This makes maize production extremely vulnerable to climate variability.

Zimbabwe’s maize production for the 202425 marketing year (May 2024 to April 2025) is forecast to fall by a staggering 60% due to severe drought conditions linked to the El Niño weather phenomenon. According to the U.S. Department of Agriculture's Foreign Agricultural Service (FAS), maize production is projected to drop to 635,000 tonnes, a significant decline from the 1.5 million tonnes harvested in the previous season.

In the 2023/24 summer cropping season, Zimbabwe’s cereal production was predicted to drop by 65% to 800,000 tonnes from 2.3 million tonnes in the previous season. This sharp decline was primarily attributed to the El Niño-induced drought. Obert Jiri, the Permanent Secretary of the Ministry of Lands, Agriculture, Water, Fisheries, and Rural Development, confirmed that most dry-land maize and traditional grains were a complete write-off. For maize, FAS data forecasted to fall 70%, reaching its lowest level in almost a decade at 696,116 tonnes, compared to the 2.3 million tonnes produced the previous year.

In previous years, maize production has been

highly volatile. For instance, in the 2022/23 season, maize production plummeted by 43%, down to 1.5 million tonnes from a bumper harvest in 2021/22, when the country produced 2.7 million metric tons. This instability led the Zimbabwean government to lift a maize import ban in 2022, which had been in place since May 2021 following a near-record harvest.

According to recent estimates announced by the Ministry of Agriculture in May 2024, Zimbabwe’s maize harvest is expected to fall 70%, its lowest level in nearly a decade, after drought decimated crops. In its outlook report, the Ministry projects that maize production would stand at 696,116 tonnes at the end of the 2023/2024 campaign which will end next July, down from the 2.3 million tonnes that was estimated for 2023. The predicted stock, in addition, would represent a drop of 36% compared to the forecasts of 1.1 million tonnes made last December and 50% compared to the harvest of 1.4 million tonnes achieved during the previous campaign.

This would be the smallest harvest since 2016, 8 years ago, when Zimbabwe produced just 512,000 tonnes.

After enjoying the status of a surplus producer of corn, Zimbabwe has become a net food importer over the past 20 years. For the 2024-

25 marketing year, it is estimated that Zimbabwe will need to import at least 1 million tonnes of maize to meet domestic demand. The government has issued over 651 import permits, allowing private companies to procure at least 3.2 million tonnes of maize, well above the nation’s annual consumption needs of 2.2 million tonnes. This large import volume highlights the urgency of the crisis. In addition to food maize, the demand for feed corn is expected to increase to 350,000 metric tonnes for the 2024-25 marketing year, as the country struggles to meet both human and livestock consumption needs

As maize production falters, the GMB struggles to maintain its strategic reserves, putting the country's food security at risk. If the government aims to restore its strategic reserves to the mandated 500,000 tonnes, this figure could rise to 1.5 million tonnes.

Zimbabwe’s Grain Marketing Board (GMB) is mandated to maintain a minimum strategic reserve of 500,000 tonnes of grain, with maize comprising the bulk of this reserve. However, the FAS report warns that carry-over stocks could plummet to just 150,000 tonnes in the 2024-25 season, a dangerously low level for a country that faces ongoing food insecurity. The 2023/24 marketing year saw maize production estimated at 1.5 million metric tons, reflecting only a modest 5% increase from the previous year, primarily due to favorable rainfall in the northern regions. Still, this fell far short of the country’s annual maize

demand, creating a deficit of nearly 700,000 tonnes.

Zimbabwe’s reliance on maize imports is growing, particularly from neighboring South Africa, which enjoyed a record maize surplus in the 2023/24 season, exporting over 3 million metric tons. However, persistent drought conditions, economic instability, and rising input costs make it increasingly challenging for Zimbabwe to bridge this gap.

Zimbabwe, once known as Africa's breadbasket, is now grappling with a severe corn shortage that has forced it to look beyond its borders for supplies. Historically, the country relied on neighboring South Africa and Zambia for corn imports. In Marketing Year (MY) 2023/24, Zimbabwe imported nearly 640,000 metric tonnes (MT) of corn from South Africa. However, drought across the southern African region has tightened supplies, creating a challenging situation for MY 2024/25.

South Africa, a key supplier, has seen its corn output drop by almost 20% due to the drought. Zambia, another traditional exporter, is also struggling to meet domestic demand and is set to import at least 1.0 million metric tonnes (MMT) of corn, further straining the regional supply. As the availability of corn decreases across the region, the competition for limited supplies intensifies.

In response to the crisis, Zimbabwe recently received a donation of 1,000 MT of maize from Rwanda, providing some relief. However, the

nation faces ongoing challenges in securing enough corn to meet its demand. The country plans to turn to global markets to compensate for regional shortages, with potential imports from countries like Brazil, Russia, Argentina, and the United States.

Although Zimbabwe permits genetically engineered (GE) corn imports, strict regulations require that these shipments undergo quarantine before being processed into cornmeal, a staple food in the country. The Zimbabwean government is facilitating these imports in partnership with private millers.

Due to the tight supply, consumption patterns are also expected to shift. Human consumption of corn is forecast to decline by 6% to 1.5 MMT, driven by reduced availability and rising prices. However, demand for feed corn in the livestock sector is projected to increase. The sector's consumption could rise to 350,000 MT as Zimbabwe seeks to sustain its national cattle herd and support the expanding broiler production industry, which grew by 9% in 2023.

In response, Zimbabwe is taking steps to improve its grain storage infrastructure, which is managed by the GMB. Plans are in place to expand storage capacity by 750,000 MT over the next three years. This expansion aims to enhance food security and safeguard against future supply disruptions, allowing the country better to manage shocks in the global and regional grain markets. WITH AN ANNUAL DOMESTIC WHEAT CONSUMPTION OF 360,000 TONNES, THE YEAR'S PRODUCTION SURPLUS OF 108,000 TONNES GRANTED ZIMBABWE SELFSUFFICIENCY

Zimbabwe has achieved a significant milestone in its agricultural sector by surpassing self-sufficiency in wheat production. According to the Rural Agricultural Advisory Services, the 2023 wheat harvest reached 468,000 tonnes, marking a 25% year-on-year increase. With an annual domestic wheat consumption of 360,000 tonnes, the year's production surplus of 108,000 tonnes granted Zimbabwe self-sufficiency status to enter the export market in the 2023/2024 season.

This achievement follows Zimbabwe's first self-sufficiency in wheat production in 2022, a milestone that set the stage for the current surplus.

For the 2023/2024 marketing year, Zimbabwean farmers planted a remarkable 121,769 hectares of wheat, representing a 34% increase from the previous year and surpassing the government's target of 120,000 hectares. This expansion solidifies the country's ability to exceed its domestic consumption needs and bolster the production and sales of wheat-based foods. The pure irrigated wheat crop, essential to mitigating the effects of the El Niño-induced drought, is projected to yield over 600,000 tonnes, far beyond the nation's annual requirement of 360,000 tonnes. This harvest sets a new record since wheat production began in the country in 1966.

The Zimbabwean government and its Rural Agricultural Advisory Services have been closely monitoring these developments. The government has incentivized wheat farmers with a planning price of US$ 440 per tonne, encouraging them to exceed the initial hectarage target of 120,000 hectares. Despite these successes, Zimbabwe still faces challenges in producing enough durum wheat, which is essential for the pasta, biscuit, and bakery industries.

Despite a rise in wheat production in Zimbabwe, the quality remains insufficient for bread production, forcing the nation to continue importing wheat. For the past two decades, Zimbabwe has blended imported wheat, mainly from Russia, Canada, and Australia, with locally grown wheat to produce high-quality bread flour.

Currently, Zimbabwe imports around 30% of its hard wheat needs to achieve the desired flour blend. According to the Grain Millers Association of Zimbabwe (GMAZ), whose members produce 98% of the country’s flour, the imported wheat is essential for achieving the quality required for bread production. This import strategy is vital for maintaining bread quality, as local wheat alone cannot meet the necessary standards.

Tafadzwa Musarara, GMAZ Chairman, commented in a 2023 report, “The quality of our local wheat is good compared to regional wheat, and it's performing well in producing biscuits and other products. However, for bread, we must mix varieties to produce durable, high-quality loaves.” The National Bakers Association of Zimbabwe has identified the ideal blend as 70% local wheat and 30% imported wheat for optimal bread production.

However, Zimbabwe has reported a 17% reduction in durum wheat imports in the first half of 2024, further highlighting its commitment to self-sufficiency. According to the Zimbabwe National Statistics Agency (ZimStats), the value of unmilled durum wheat imports dropped from USD 65.4 million in the first half of 2023 to USD 48.3 million during the same period in 2024. This decrease is a direct result of the government's focused approach to increase local wheat production and

reduce reliance on foreign markets.

The government is exploring the commercial production of durum wheat. Dr. Dumisani Kutywayo, Chief Director of the Department of Research and Specialist Services (DRSS), noted that previous efforts to commercialize durum wheat varieties were hampered by low demand. However, the recent increase in imports suggest a shift in demand due to local production of pasta, biscuits and other products.

Therefore, the Crop Breeding Institute (CBI) is poised to revisit the issue of durum wheat commercialization. “There have to be takers of the varieties,” Dr. Kutywayo emphasized.

The flour milling sector in Zimbabwe consists of approximately 40 milling companies, with a total milling capacity estimated at around 900,000 metric tons annually. Despite this capacity, the country consumes approximately 300,000 metric tons of flour annually, indicating a significant surplus potential. Among these products, maize meal dominates the market, accounting for over 60% of total flour consumption. The average per capita flour consumption in Zimbabwe is estimated at 21 kg per year.

Dominated by four major players, such as National Foods Holdings Ltd., Blue Ribbon Foods, Ashanti Milling, and Proton Bakeries, these giant companies benefit from economies of scale, advanced milling technologies, and strategic marketing initiatives, contributing to nearly 70% of the country's flour production. On the other hand, smaller milling operations exist alongside these industry giants, often catering to niche markets and offering specialised products.

However, the industry faces substantial hurdles, primarily due to hyperinflation, which has severely impacted input costs and overall profitability. According to the World Bank, Zimbabwe has experienced one of the highest inflation rates globally, adversely affecting the agricultural and manufacturing sectors. As a result, many milling companies struggle to sustain operations amid rising costs and diminished consumer purchasing power.

MILLET: RESILIENT GRAINS IN A CHANGING CLIMATE

Sorghum and millet are traditional grains that have gained renewed attention in Zimbabwe due to their resilience to drought and poor soils. In May 2023, the government came up with measures to increase the hectarage under small grains under climate-proofing strategy to attain national self-sufficiency in food. Nationally sorghum, pearl and finger millet production has been on upward trend with total production rising from 76 362 tonnes in 2019 to 280 956 in 2023. Provision of agroinputs under the new agro-ecological zone mapping in the 2022/23 agriculture season resulted in a 45 percent increase in production from 194 097 tonnes in 2021/22 season to 280 956 tonnes in the 2022/23 season. These grains are critical in the country’s strategy to build climate resilience in agriculture. The government, in collaboration with development partners, has promoted the cultivation of these crops, particularly in arid and semi-arid regions where maize production is less viable. MMEA

• Reach the key decision makers in Africa & Middle East grains and milling industry with one magazine

• Milling Middle East & Africa is the only magazine focused on the grains industry in the region

• The magazine is available in both print and digital format, providing our advertisers with a regional and worldwide audience

• We offer more than just the magazine - we also offer digital advertising, organise industry events and webinars AVAILABLE

TPioneering Innovation, Sustainability, and Tech for a Smarter Milling Future

BY MARTHA KURIA

he 34th IAOM Middle East & Africa (MEA) Conference and Expo, held from November 10–13, 2024, at the Dubai World Trade Centre, solidified its reputation as the premier event for the global flour milling and grain processing industries. With over 800 professionals from 50+ countries, this year’s gathering showcased cutting-edge innovations, provided valuable industry insights, and fostered meaningful connections across the milling and grain sector.

Did you miss this year’s event? Don’t worry - Milling Middle East & Africa Magazine captured every moment to ensure you stay informed.

The conference began with an inspiring address from Essa Al Ghurair, Chairman of Essa Al Ghurair Investments, who set the tone by unveiling the IAOM Milling App. This

innovative tool, designed to assist millers in overcoming operational challenges with real-time support and resources, highlighted the event’s commitment to advancing the industry through digital transformation.

The conference featured impactful keynote speakers, beginning with Dr. Hischam ElAgamy, Executive Director at IMD, who captivated the audience with his session, “Megatrends Shaping the Business Landscape in an Uncertain World.” His deep dive into global economic and technological trends gave attendees actionable strategies to navigate market complexities.

Daniel Basse, President of AgResource Co., provided a comprehensive review of the global wheat market for the 2024/2025 season. His analysis of shifting geopolitics, supply-demand dynamics, and economic factors impacting grain prices was crucial for industry stakeholders to understand

upcoming challenges and opportunities.

A major theme of IAOM MEA 2024 was innovation, particularly in sustainable milling practices and technological advancements. Andreas Hummel from Wingmen Group GmbH explored energy-saving opportunities in milling operations, emphasizing the need for sustainable practices that enhance profitability.

In the educational sphere, Dr. Secil Uzel from Alapala Academy and Priscilla Bakalian from Bühler’s African Milling School discussed the growing importance of bridging theoretical knowledge with practical application in mill management. They stressed the critical role of training in preparing future millers to handle the industry's evolving demands.

The conference also spotlighted the role of technology in shaping milling operations. Bühler Group’s Marcel Scherrer discussed how milling technology innovations drive efficiency and adaptability, while Sven Mattutat from Mühlenchemie introduced the innovative CousZym product, responding to the growing global demand for couscous.

A standout session moderated by Dan Basse addressed the implications of Turkey’s wheat import ban on regional trade. Experts, including Dr. Eren Günhan Ulusoy and Nicolas

Tsikhlakis, analyzed how such a policy shift would impact wheat pricing and availability, offering strategies for millers to navigate potential disruptions in the supply chain.

The expo floor was buzzing with activity as nearly 180 exhibitors showcased the latest products and solutions transforming the milling sector. One of the most exciting innovations was Bühler Group’s unveiling of the CHRONOS OMP-2090 B, a fully automated bagging station optimized for non-free-flowing products like flour. This new technology promises to enhance accuracy, labor cost savings, and overall operational efficiency, exemplifying the kind of automation that will define the future of milling.

Other notable exhibitors, including Alapala Group, Tanis Milling Technologies, and Omas Industries, presented advanced milling equipment, storage solutions, and AI-driven applications to improve efficiency and address the sector’s challenges in food security and sustainability.

Networking events were a central feature of IAOM MEA 2024. The Welcome Reception and Traders' Cocktail Dinner provided a relaxed atmosphere for attendees to exchange ideas and forge valuable connections. Sponsors played an integral role in making these events possible. Bühler, Mühlenchemie, and SEFAR sponsored the Welcome Reception, while Cargill, INVIVO, The Andersons, and Viterra supported the Traders’ Cocktail Dinner.

IAOM MEA 2024 also honored the outstanding contributions of individuals in the milling industry. Muhammad Islam Ali of

Kenya’s Mombasa Maize Millers was named Regional Leader for 2024, while Abdel Moniem Salem of Essa Al Ghurair Investments LLC received the prestigious Miller of the Year award. These accolades underscored the commitment and innovation driving the sector forward.

As the curtain closed, the focus shifted to next year’s event, which will be held in Jeddah, Saudi Arabia. The event left participants inspired and energized, ready to tackle the challenges and opportunities facing the milling industry. With a continued focus on innovation, collaboration, and education, IAOM MEA remains at the forefront of shaping the future of milling.

The event was made possible through the generous support of key sponsors and partners. Many thanks to SOLARIS Commodities for being the Platinum Sponsor, demonstrating its leadership and commitment to advancing the milling industry. The U.S. Wheat Associates played a pivotal role as the Education Partner, shaping the educational content of the conference.

Supporting the event as a Silver Sponsor, Midstar, a global agricultural commodity trading business with a presence in Dubai, ensured all conference attendees were catered for their lunch for the three days, and Al Ghurair Foods supported as a Silver Sponsor. Additional Bronze Sponsors included Alapala, Grain Corp, Aston Foods and Food Ingredients, and IFFCO Group. Intercereales provided essential event materials, while the Rusgrain Union partnered as an official association partner.

THANK YOU!

10 - 13 NOVEMBER 2024,

BY WANGARI KAMAU

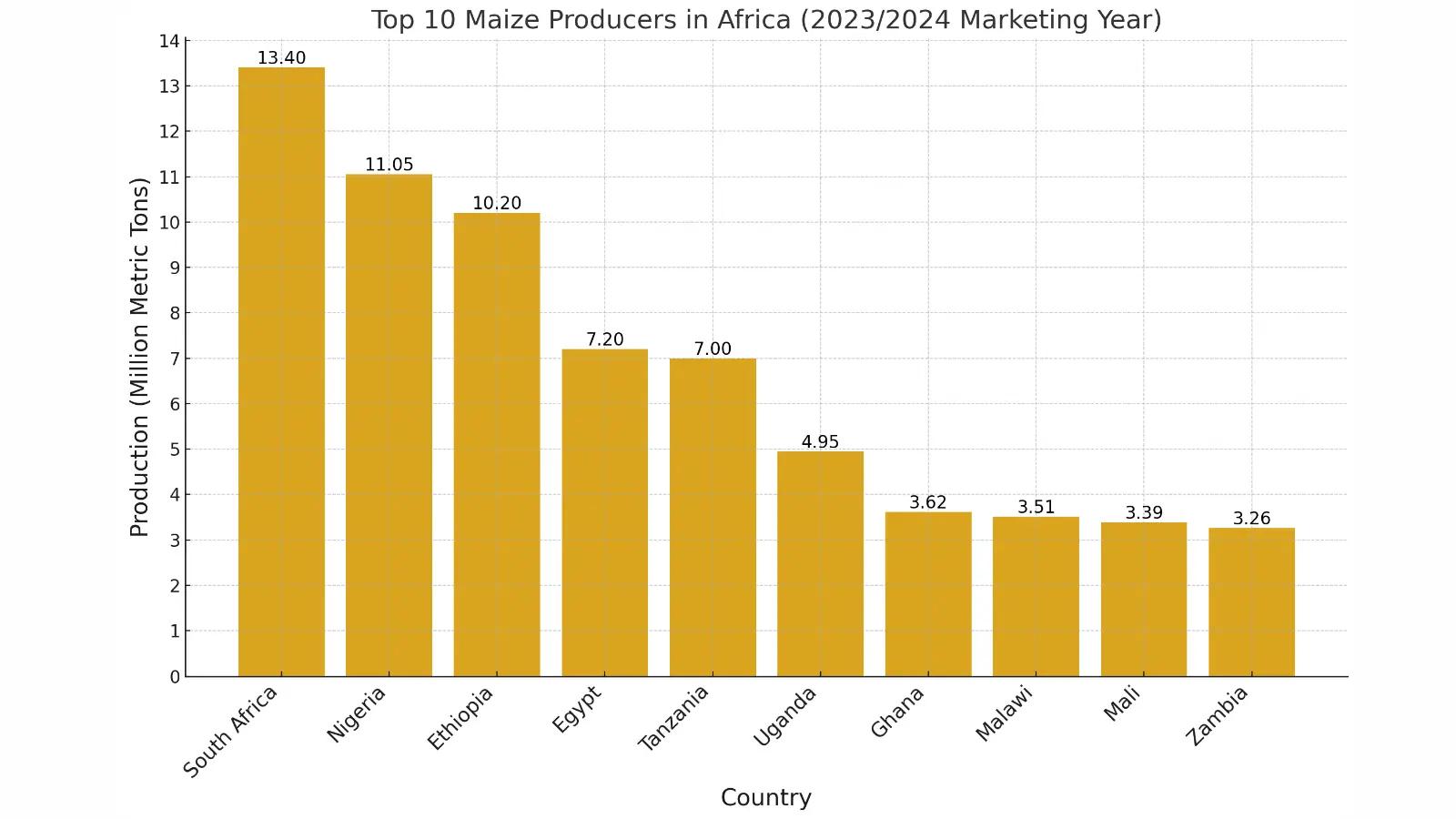

Maize accounts for roughly 24% of the continent's arable land. Despite its pivotal role in food security and animal feed, Africa contributes just 7.5% of global maize production. This disparity highlights the continent's struggle with low yields, averaging only 2.1 tons per hectare—far below the global average of 5.8 tons and starkly contrasting to the United States’ 11 tons per hectare.

In the 2023/2024 marketing year, Africa's maize production reached nearly 91 million metric tons, reflecting strong demand for human consumption and animal feed. However, as reported by Statista, this was a slight decline from the 93 million metric tons achieved the previous year. Projections for the 2024/2025 marketing year anticipate a further decrease to 88 million metric tons, driven by persistent challenges such as climate change, pest outbreaks, and limited access to advanced farming technologies. Economically, Africa’s maize market is poised for remarkable growth. According to Mordor Intelligence, the market’s value is expected to rise from USD 38.8 billion in 2023 to USD 53.66 billion by 2028, reflecting a compound annual growth rate (CAGR) of 6.7%.

Southern Africa, led by South Africa, faced a turbulent 2023/2024 marketing year due to severe drought, slashing production to 13.4 million metric tons—the lowest in five years. This caused local corn prices to surge, especially for white corn. Despite this, South Africa plans to rebound to 17 million metric tons in 2024/2025 by expanding planting to 3.15 million hectares. Exports remain a priority, with 2 million metric tons

expected in 2023/2024, mainly to neighbouring countries affected by maize shortages. In Malawi, erratic weather and pests slightly reduced output to 3.51 million metric tons. Internal issues, including grain hoarding, have driven maize prices up to US$24.85 per 50-kilogram bag—the highest in the region.

In East Africa, Ethiopia sustained maize production at 10.2 million metric tons in 2023/2024, aided by government initiatives and investments in farming infrastructure, despite climate challenges. Uganda’s production rose to 4.95 million metric tons, edging closer to the symbolic 5-million-ton mark. Tanzania stood out with 7 million metric tons in 2023/2024, bolstered by expanded planting areas and solid regional trade agreements with Zambia and the Democratic Republic of

Congo. Kenya increased production to 3.2 million metric tons, yet still relies on imports to meet its 3.9 million metric tons annual demand.

In West Africa, Nigeria, the region’s largest producer, saw production fall to 11.05 million metric tons in 2023/2024, with minimal recovery expected in 2024/2025 due to climate stress. Despite modest growth, Ghana faces threats from drought and pests, potentially pulling production down to 2.3 million metric tons.

In North Africa, Egypt is the region’s top producer, with most maize going to feed production. Despite battling high temperatures and pests, the country maintained its maize output at 7.2 million metric tons in 2023/2024. However, challenges remain for the 2024/2025 season as efforts to modernise agricultural systems continue to prioritise efficiency and climate resilience.

Maize is the backbone of diets and feed production, pivotal in food security and the continent’s agricultural economy. From forming the foundation of daily meals to fueling livestock and aquaculture growth, maize sustains millions of lives and livelihoods. However, as demand rises, production, storage, and distribution challenges threaten its ability to meet growing needs of people and animals.

For human consumption, maize remains indispensable across Africa, feeding over 300 million Africans daily. White maize, preferred for its milder taste, dominates consumption, particularly in Southern and East Africa. Rapid urbanisation has spurred demand for processed maize products, such as