SHOP EXECUTIVE OUTLOOK 2025

Guiding shops through the uncertain year ahead

BUILD YOUR SHOP TO BE HOW YOU WANT IT

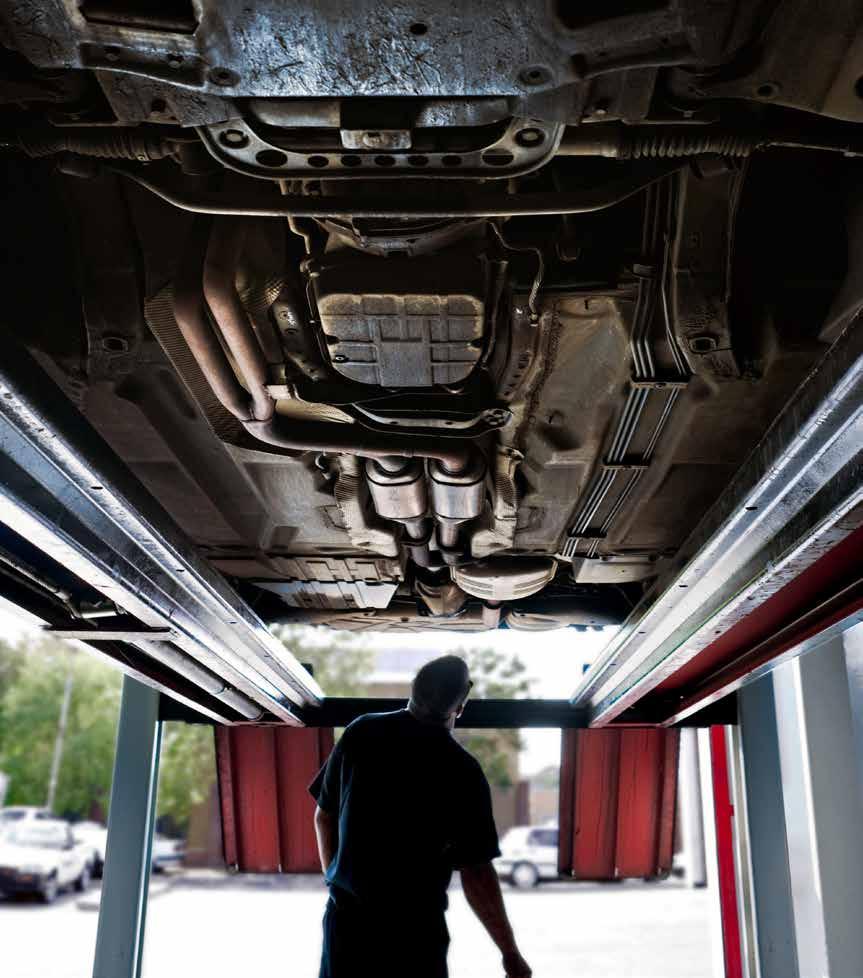

HEADWINDS AWAIT AFTERMARKET SHOPS

A BETTER WAY FOR YOUNG TECHNICIANS

Guiding shops through the uncertain year ahead

BUILD YOUR SHOP TO BE HOW YOU WANT IT

HEADWINDS AWAIT AFTERMARKET SHOPS

A BETTER WAY FOR YOUNG TECHNICIANS

We cover:

• Technical articles, how-to guides

• Newest government and private sector news

• New product alerts

• Vehicle innovations, and what’s coming to your shop

• Consumer habits and what to expect from your customers

• And much more!

BY ZAKARI KRIEGER, VP, PRIME CARCARE, FIX NETWORK

THE YEAR 2024 was a transformative one for Prime CarCare, the retail division of Fix Network Canada. We executed on transformative goals in both our mechanical and auto glass sectors, reinforcing our position as a leader in the automotive aftermarket. As we look ahead to 2025, our focus remains on driving innovation, integrating services, and ensuring that our franchise partners have the tools they need to thrive in an evolving industry.

One of our key strategic priorities for 2025 is the continued expansion of auto glass services, particularly through the integration of NOVUS Glass into mechanical service locations. As vehicle technology advances, windshields are no longer just glass—they are crucial safety components requiring precise repair, replacement, and calibration. Fix Network is tackling this shift by deepening vendor relationships and strengthening franchise support with ADAS calibration sourcing, setup, and support services that expand our calibration capabilities to enhance service efficiency and profitability.

NOVUS Glass has already seen remarkable growth, achieving doubledigit expansion in 2024. Our comprehensive approach—including best-inclass training and operational support—positions us as the preferred partner for aftermarket mechanical service entrepreneurs. Franchisees like R&S Auto in the GTA, who have built a strong reputation over three decades in mechanical and collision repair, successfully integrated auto glass services into their operations. By bringing glass services in-house, they have improved customer retention and unlocked new revenue streams.

Glendale Motors in Ancaster is another testament to this approach. The business recently expanded its service offerings with the launch of NOVUS Glass Ancaster, complementing its existing NAPA Auto Pro mechanical services, Tirecraft tire and lube service, and car wash facilities. This type of service integration is exactly what Fix Network envisions—a seamless, onestop solution for customers that strengthens business potential for franchisees.

Collision Industry Innovation: The "Shop of the Future"

At Fix Network, we continue to redefine the collision repair landscape

with our "Shop of the Future" model—integrating auto glass, ADAS calibration, and mechanical services within collision centres. This initiative is designed to streamline operations, reduce cycle times, and create a superior customer experience. Fix Auto Fort McMurray is a shining example of this vision in action, with owner Johnny Soleas recently acquiring the industry-leading Hunter Ultimate ADAS system within his mechanical service centre. This addition further enhances his facility’s calibration capabilities and repair services as he prepares to open a new NOVUS Glass location, serving the retail market in Fort McMurray and bringing all external sublet services in-house to support his collision centre.

“We’re not just a collision centre anymore,” says Johnny. “We’re an automotive repair facility—handling everything from diagnostics and mechanical work to ADAS calibration and windshield repair and replacement. By eliminating sublets, controlling quality, and diversifying our services, we’re setting a new benchmark for efficiency and customer experience.”

In 2024, Speedy Auto Service underwent a major digital transformation, implementing a fully cloud-based POS system to optimize operations. This platform is the foundation for our 2025 strategy, which includes leveraging data analytics and seamless access to OEM parts through OEC RepairLink. These tools will allow franchisees to streamline supply chains, simplify ordering, and increase profitability in an increasingly complex repair landscape.

As we move into 2025, our vision for the Fix Network mechanical and autoglass business in Canada is clear: embrace digital transformation, enhance partnerships, and integrate services to create a stronger, more efficient network. With the industry evolving rapidly, we must remain agile— leveraging technology and strategic growth to empower our franchise partners while keeping them at the forefront of emerging innovations, including the role of AI in enhancing customer experiences.

Automotive Group Director | Nickisha Rashid (647) 355-7416

nickisha@turnkey.media

Publisher | Peter Bulmer (585) 653-6768 peter@turnkey.media

Managing Editor | Adam Malik (647) 988-3800 adam@turnkey.media

Associate Editor | Derek Clouthier

Contributing Writers | Zakari Krieger, Erin Vaughan, Mark Tirbany

Creative Director | Samantha Jackson

Video / Audio Engineer | Ashley Mikalauskas, Nicholas Paddison

Sales | Peter Bulmer, (585) 653-6768 peterb@turnkey.media

Delon Rashid, (416) 459-0063 delon@turnkey.media

Nickisha Rashid, (647) 355-7416 nickisha@turnkey.media

Circulation | Delon Rashid, (416) 459-0063 delon@turnkey.media

Production | Tracy Stone tracy@turnkey.media

CARS magazine is published by Turnkey Media Solutions Inc. All rights reserved. Printed in Canada. The contents of this publication may not be reproduced or transmitted in any form, either in part or full, including photocopying and recording, without the written consent of the copyright owner. Nor may any part of this publication be stored in a retrieval system of any nature without prior consent.

Canada Post Canadian Publications Mail Sales Product Agreement No. 43734062

“Return Postage Guaranteed” Send change of address notices, undeliverable copies and subscription orders to: Circulation Dept., CARS magazine, 48 Lumsden Crescent, Whitby, ON, L1R 1G5

CARS magazine (ISSN# 2368-9129) is published six times per year by Turnkey Media Solutions Inc., 48 Lumsden Crescent, Whitby, ON, L1R 1G5

From time to time we make our subscription list available to select companies and organizations whose product or service may interest you. If you do not wish your contact information to be made available, please contact us.

he year ahead is going to be one that will keep shop owners busy. The next 12 months pretty much have the making for a little bit of everything to happen. Economic rollercoaster, greater technological advancement, shifting consumer behaviours. Certainly, plenty of challenges — but also opportunities, with a focus on maintaining resilience and driving growth.

Inflation has eased but Canadians still aren’t out of the woods. They’re being cautious with their money. As noted during a recent event with automotive dealers, Canadians who can afford to save are saving. Those who can’t are spending on what they need to.

So when it comes to buying a new vehicle, the thought of doing so is generally out of the question for many. As DesRosiers Automotive Consultants noted in a recent report, 2024’s new vehicle sales were nearly 200,000 units below sales in 2017 even though the population has increased by almost five million people.

So that suggests people are choosing to fix their car. Well, yes — when they have to. Instead of coming in for preventive maintenance, they’re waiting for a significant breakdown to occur.

"We know that with lower-income households especially, there's maintenance deferral that goes on during economic times like we're in. We've seen it in the past, and we're seeing it now," said Nathan Shipley, executive director and industry analyst with Circana’s automotive aftermarket practice at AAPEX in the fall.

The used market was called “a horror story” by Daniel Ross from Canadian Black Book at the fall's Talk Auto conference. A lack of supply and high prices are making the market unstable.

And prices — from new and used vehicles to replacement parts — are only expected to rise if the threat of tariffs from our neighbours to the south comes through. At the time of writing, a pause was put in place so uncertainty continues to await us.

Workforce development remains a pressing issue. The skilled labour shortage continues to impact the industry, necessitating innovative hiring and retention strategies. Partnerships with trade schools, apprenticeships and in-house career development programs are vital for building a robust talent pipeline. Succession planning is also becoming increasingly important as a significant portion of the workforce approaches retirement.

As leaders explain in this edition of the CARS Executive Outlook, this is a time for the auto care sector to come together. Collaboration is a must, they urge, as there’s strength in numbers to come up with strategies and best practices to benefit each other and the customers you serve.

As the industry moves forward, adapting to changing market conditions and embracing new opportunities will be crucial for success. A focus on collaboration, innovation and adaptability allows players in the automotive aftermarket to navigate the complexities of the current economic climate and position itself for growth in the year ahead.

President & Managing Partner | Delon Rashid Head of Sales & Managing Partner | Peter Bulmer

Corporate Office

48 Lumsden Crescent, Whitby, ON, L1R 1G5

The insights and strategies shared by industry leaders provide a comprehensive roadmap for thriving in this sector. It won’t be easy — it never is — but there is a way to make it better.

Adam Malik Managing Editor, CARS

ISSN 2368-9129 Online 2368-9137

We want to hear from you about anything you read in CARS magazine. Send your email to adam@turnkey.media

I had installed air conditioning in the shop about 15 years ago. It is discouraging that the industry is just realizing that we should treat our technicians the best we can. The install cost was likely recouped in 1 week of good productivity. Sadly, customers often reacted like we must have money to burn because the ‘whole’ shop was comfortable. As if us grease monkeys didn’t deserve it. I often had a vehicle outside with the hood open to appear open.

Ron Finney, Finney’s Auto Service

We installed AC 2 years ago in Central Virginia. It was 105 degrees f in the parking lot. AC full tilt was 85-88 in the shop but no humidity. Even though it would be hot for a home it was pleasant for working. We also have three oil burners for heat in the winter. Worth every Penny. Many shops have neither heat nor AC for their employees.

Stephen Konyndyk, Endurance Auto Repair

I believe this stigma exists mainly with the people supposedly guiding this generation, not the kids themselves. From what I can see with my own kids and their friends, there seems to be a reckoning coming against the educrats telling all of our kids they need a university diploma to be successful. Fortunately for the kids who pursue these industries in the future, the competition level will be low and the profits will be high. It’s not going to be hard to eat every other kids’ lunch who have learned nothing in the way of real world skills.

Geoff Walton, Grant Street Garage

There is no question there is stigma of the trades, with the automotive industry representing the worst of all trades. We lure young individuals into our trade by representing a cool persona of performance, racing, restoration and new technology only for them to find out later that it is not as glamorous as they were made to believe . We do not need to find solutions of attracting the next victim to this industry. What we need to do, is show the people that have taken the leap of fate that this can be a very lucrative career choice, for the right type of person. To survive in this industry you have to be able to deal with disappointment, failure, anxiety and problem solve the unknown. You need to have an insatiable desire to prove yourself to everyone.

Rob Nurse, Bob Nurse Motors

I don’t understand why people are embracing a technology that takes away any thought processes we may have. This will only make people be less analytical and not be able to learn.

Bob Ward, The Auto Guys

Wow, I knew this was coming years ago. If you look at the economic indicators from product sales through product jobbers and distributors, the numbers will not coincide with the reduced growth from our traditional automotive aftermarket results. This is due to an increase in imported brands. Don’t get me wrong. I am not against market competition. What I see as a source of this downturn is the complacency of our home-grown manufacturers in not nurturing their commercial customer markets, driving them to find alternatives. This is not new. The problem has been building upon itself for years and we’ve lost too many as a result. How many more manufacturers will have to sell out or die before the reality sinks in?

Bob Paff, Automotive Service Business Network

I agree with most of this article, except for the part where you specify the situation where they’re at another shop and are calling around for prices. 99 times out of 100, that is definitely not the customer we want. We don’t sell on price. I already know I won’t be the cheapest, so why bother?

Geoff Walton, Grant Street Garage

When the Ontario government started the Drive Clean program in 1999, they made concessions for maximum cost of repair, actually defeating the entire purpose to get smog producers off the road. I was on the focus group at the time. I said then and say it now: Not everyone can afford an automobile they are costly and require maintenance. Most people don’t even budget for vehicle maintenance.

Bruce Eccles, Eccles Auto Service

AS CONSUMERS WEIGH AFFORDABILITY and convenience, independent shops are gaining momentum, according to a new report.

Canadian vehicle owners are increasingly turning to independent automotive repair shops for maintenance and repairs, according to findings from the Roland Berger Automotive Aftermarket Pulse 2024 report. The shift reflects a broader trend across several regions as costconscious consumers seek alternatives to original equipment manufacturer (OEM) service channels.

The report, released in late 2024, highlighted that 65 per cent of Canadian respondents prefer independent shops, citing shorter wait times and lower prices compared to OEM service providers. This aligns with a North American trend where independent shops are capturing a larger market share.

Independent shops have established a reputation for competitive pricing and reliability among consumers, the report noted. However, challenges remain as the industry faces increasing demands from electric vehicle owners and advancing technologies like ADAS (advanced driver assistance systems).

In Canada, 65 per cent of respondents prefer independent shops, higher than the global average. The choice is motivated by affordability and convenience, underscoring the importance of maintaining competitive pricing and quick service turnaround.

THE CANADIAN AUTO CARE SECTOR remains resilient despite economic challenges, according to the latest insights from AIA Canada.

The Outlook Study, Edition 2024-2025 noted that growth in the automotive aftermarket will be driven by consumer demand for cost-effective services, the expansion of EV infrastructure and regulatory support for independent repair businesses.

The report analyzed the state of the Canadian auto care sector and provided insights into economic trends, employment and consumer behaviour.

Under the theme of Resilience in the face of economic uncertainty, it urged industry players to embrace technological advancements and workforce development to thrive in the evolving automotive landscape.

Under economic overview, AIA Canada reported that the Canadian auto care sector has rebounded strongly since the COVID-19 downturn. In those years and coming out of it, core auto care businesses have expanded, driving the industry to a record high economic output of $43.9 billion

The outlook also looked at how much Canadians drove, noting significant fluctuations over the last several years.

After peaking in the third quarter of 2022, vehicle kilometres travelled have steadily declined. The study noted that pandemic

FAST & RELIABLE SERVICE

PREFERRED PRICING

TECHNICAL TIPS FROM INDUSTRY LEADING EXPERTS

restrictions, fuel costs and remote work trends have influenced this.

The full report, which includes full market trends and forecasts, is available for free to download only for AIA Canada members.

THE CANADIAN LIGHT VEHICLE market saw a significant rebound in 2024, with overall sales reaching an estimated 1.86 million units.

That’s an 8.2 per cent increase from the 1.72 million units sold in 2023, according to DesRosiers Automotive Consultants.

However, Andrew King, managing partner at DesRosiers, called for caution despite the optimistic numbers.

“While we would never take a gain of 8.2 per cent for granted, the market remains approximately 180,000 units below its 2017 high, despite a Canadian population that has increased from 36.7 [million] to 41.5 million people over that time.”

The year began with exceptionally strong sales in January and February, which DesRosiers credited to pent-up demand as consumers were finally able to purchase vehicles they had been waiting for. While the middle months of the year caused concern, the fourth quarter also saw robust sales. Quebec was highlighted as a leading province as consumers rushed to buy zero-emission vehicles (ZEVs) before provincial incentives were reduced.

Several key market dynamics stood out over the past year for the consultancy. The growth of SUVs led to a new record for light truck share, with passenger cars falling to only 13.4 per cent of total sales. Compact and subcompact SUVs dominated the market. The luxury segment underperformed in 2024 due to affordability issues.

WITH MILLENNIALS HITTING their mid40s at the top end, the Automotive Industries Association of Canada looked at how this age group views vehicle maintenance and repair.

Its latest Consumer Behaviour Series report, Understanding Millennial Canadian vehicle owners, shed light on the behaviours, attitudes and preferences of millennial vehicle owners, those aged 25-44. It explored evolving trends in vehicle maintenance, repair habits and the integration of emerging technologies such as electric vehicles and telematics.

Millennials display a divided approach to vehicle care, with some feeling confident about maintenance while others express helplessness at the service counter — 36 per cent of them said they “feel helpless bringing their vehicle in for maintenance and repair” while 57 per cent said that they are very or somewhat knowledgeable when it comes to vehicle maintenance and repair.

Most Millennials will go to either the dealer or an ASP, when choosing between one or the other, the dealer came out ahead. And when asked who performs the work better, 37 per cent said dealers; 32 per cent said they’re both equal and 31 per cent choose independents.

The report further explored the growing trend of online shopping and where they prefer

to shop — many conduct research online before visiting physical stores. It looked at EV ownership among Millennials and where they prefer to have their vehicles serviced.

WHILE THERE WAS A MODEST increase in employment in the automotive sector as a whole, performance varies across different sectors. But it was good news for those in the aftermarket, according to DesRosiers Automotive Consultants, including setting new records.

Employment in the motor vehicle manufacturing industry decreased by 1.8 per cent compared to October 2023, bringing the total to 35,900. Similarly, the parts and accessories manufacturing sector saw a decline of 5.5 per cent, reducing employment to 69,300.

In contrast, the aftermarket sector showed positive growth across the board. Employment in automotive parts and accessories stores rose by 2 per cent to reach 45,000, setting a new record for the industry. The automotive repair and maintenance industry also hit recordbreaking levels, with employment surpassing 123,000.

Automobile dealers, the largest segment of automotive employment, saw a 2.4 per cent increase over October 2023, reaching 159,100. Despite this growth, the numbers remain below pre-pandemic levels.

“The performance of the aftermarket sectors in generating employment was remarkable in 2024,” said Andrew King, DesRosiers managing partner. “Parts and accessories stores, and repair facilities both hit all-time records, generating jobs for Canadians from coast to coast to coast.”

NEARLY THREE-QUARTERS OF CANADIAN drivers (73 per cent) believe that extreme winter weather, fuelled by Canada’s changing climate, has made winter tires more critical than ever

According to a recent survey by the Tire and Rubber Association of Canada (TRAC), winter tire adoption has climbed to 78 per cent nationwide, up 10 points since 2016. Outside of Quebec, where winter tires are mandatory, usage has reached 73 per cent.

While adoption continues to grow, financial pressures are prompting hesitation among some drivers. Nearly one-third (30 per cent) of respondents say they are less likely to invest in winter tires due to rising living costs. However, a strong majority — 83 per cent — view winter tires as a vital safety investment despite economic challenges.

“We all see the impact of climate change and the increasing frequency of severe winter weather,” says Carol Hochu, president and CEO of TRAC. “The good news is more drivers are equipping their vehicles with winter tires and are better prepared for winter motoring. Despite financial concerns, 79 per cent believe winter tires have saved them from a potentially hazardous driving situation.”

THERE ARE TOO MANY CHALLENGES in the way for fuel cell electric vehicles to become a viable option for consumers, according to aftermarket experts.

The topic of hydrogen-powered vehicles for mass market use came up during a pair of discussions at the recent Worldpac Supplier and Training Expo. While generally acknowledging that FCEVs are superior to battery electric vehicles, hydrogen has many more obstacles for reaching the mass market than BEVs.

“It’s practical,” said Isaac Rodell, manager for Worldpac Training Institute’s alternative fuels training program, of FCEVs. “Your energy efficiency is there and you’re no longer restricted by just the battery range. You can refuel the vehicle [and] continue on your trip without having to wait for long charge times.”

But the problem is infrastructure, he noted during a meeting with media members at the event. A main selling point of BEVs is that vehicle owners can charge at home and not always rely

on charging stations. With hydrogen you have to rely on a station for refuelling — and that infrastructure isn’t readily available now and there are not enough FCEVs out there to justify building many.

Instead, hydrogen looks to be a better option for fleet applications and heavy-duty than consumer vehicles, said Luke Murray, an instructor and curriculum developer with the Worldpac Training Institute (WTI).

“That’s always been my vision of hydrogen fuel cell technology: Container ships, cruise ships, trains. That’s where it makes sense,” he said. “They’re going to be in port for a long time — fill it up. Why put diesel in there? Your ports — your trains and your ships are all coming in the same place — that’s where you get your hydrogen. They’re all next to the water, which is where most of our hydrogen is stored.”

Stats that put the North American automotive aftermarket into perspective

49%

Most Canadian drivers find it easy to understand dashboard warning lights, while 21 per cent admitted they found them confusing.

86.6% 86.6%

Light trucks are dominating new vehicle sales in Canada, leaving just 13.4 per cent of the market to passenger cars.

DesRosiers Automotive Consultants

The number of current vehicle owners now driving some form of electric or hybrid car, including traditional hybrids, fully electric vehicles and plug-in hybrids.

1.72 1.72 MILLION

60% 60%

Canada saw an 8% increase in vehicle sales in 2024 compared to the previous year. GM led the market with sales with more than 294,000 units sold.

DesRosiers Autmotive Consultants

1.3

There was a slight uptick in visits to aftermarket shops in the last year, from 1.2. Dealership visits remained steady at 1.6 visits per year.

J.D. Power

1

Only one partial automation system received an “acceptable” rating, two were deemed “marginal,” and the majority, 11 systems, were classified as “poor.”

Insurance Institute for Highway Safety

CARS will regularly feature automotive schools across Canada. In this issue, we learn more about Durham College If you’d like your school featured, reach out to adam@turnkey.media.

Name of school:

City:

Head of program:

Oshawa and Whitby, Ontario

Ralph Ruffo, program coordinator

Tell us about your school. What do you offer? How many students do you have?

With campuses in Oshawa and Whitby, Durham College (DC) offers 145-plus programs including 11 apprenticeship programs to more than 13,700 full-time post-secondary and 2,300 apprenticeship students.

Our Whitby Campus has been home to our Faculty of Skilled Trades and Apprenticeship for more than 30 years and additions in recent years include the W. Galen Weston Centre for Food, the Ontario Power Generation Centre for Skilled Trades and Technology and the recently-opened Vanhaverbeke Family EV Training Centre.

DC’s skilled trades programs include our Automotive Technician – Service and Management (Motive Power Technician) program with more than 100 students enrolled annually and launching in 2025, the Electric Vehicle Drive Technician program.

DC’s learning environment includes access to cutting-edge training simulators and new model training vehicles as well as state-ofthe-art diagnostic equipment. Small classes are taught by industry professionals familiar with the latest technology who can support

hands-on learning in our auto shops and EV labs.

We focus on entrepreneurship and customer service, offering access to a broad range of careers within the auto sector and our automotive yechnician co-op stream further enhances industry training.

The Electric Drive Vehicle Technician Ontario college diploma program is one of only two offered in the province and prepares students to enter the in-demand field of clean transport — the fastest growing industry in Canada’s clean energy sector.

This is a fantastic time for students to pursue a skilled trade in the auto sector. They are entering an evolving and challenging industry where advancements in technology include driver assist, electric vehicles and autonomous vehicles. The introduction of artificial intelligence is reshaping transportation with vehicle-to-vehicle communication. It’s a high-demand, recession-proof industry with growing wages and upward mobility.

At Durham College, we proudly integrate evolving technology into our curriculum and connect students to faculty who help them develop the problem-solving skills necessary to tackle future challenges in this exciting and changing industry.

Student Aftermarket Day

November 20, 2024

Barrie, Ontario

The auto care sector was the focus of the day for students of the Automotive Business School of Canada. It was the annual Student Aftermarket Day event at Georgian College in Barrie, Ontario, where the next generation of future automotive professionals got to learn more about the opportunities the auto care sector has to offer. A trade show and networking event was available for student to meet and learn about careers in the industry. The day is hosted by the Young Professionals in the Auto Care Sector, the under45 professional networking arm of AIA Canada.

Build your shop business to run the way you want it to run — but don’t let it run you // By

Erin Vaughan

In this month’s column, I’d like to address a comment that was made in the October issue of CARS regarding my advice on how to run a shop.

I’m not here to tell anyone what they must do in their business; you started your business because you wanted to do it your way. If your way works for you and you’re happy, please continue doing things your way. What I’m here to do is simply provide an alternative option to “the way it’s always been done.”

My advice is for shop owners who are struggling to be profitable, are unhappy with the amount of time they spend in their business and are unable to see a future where retirement is a possibility.

You can work 14 hours a day, seven days a week for 15 years and this could provide you with enough income to pay your bills, pay yourself and put some money away for retirement. But what was the trade-off?

It’s also for techs who would love to own their own business but are not interested in the life that most shop owners live: Working extremely long hours, feeling financial stress and missing out on having a personal life.

If you love this amazing industry but you’re struggling to make it work for you, I’m here to tell you that there is a way to provide great service, employ awesome people, make a great living for yourself, spend quality time with the people you love and have a saleable business when you’re ready to retire.

You can work 14 hours a day, seven days a week for 15 years and this could provide you with enough income to pay your bills, pay yourself and put some money away for retirement. But what was the trade-off? Time with your kids; time with your friends; your marriage; your health?

Much like the commenter, I wore all the hats for a long time: service advisor, technician, manager, accountant and marketer.

Despite participating in management training for the majority of those years and being told that the owner needed to work on the business, I still worked in it — a lot.

What I found is that I couldn’t do everything well, so all areas suffered — including my personal life. I lost friends, missed out on time with my family and, at one point, I almost lost my marriage. At times, I hated my business. It had taken so much from me and I couldn’t see a way out.

Once I stepped back from day-to-day operations to work on my business, my life started to become much more balanced. Yes, I still work a lot but it’s work I enjoy doing: Strategic planning, marketing and leading my team.

I work on my business every day; tweaking systems and processes to improve shop efficiency, shop culture and client service. The way I look at it, if we don’t continue learning, growing and improving, we’ll fall behind as the world changes. Just like vehicle technology changes every year, so do the way clients interact with us and the way employees want to be treated.

My business isn’t perfect and it never will be — that’s not a realistic expectation. However, just like I keep learning and growing, so do my employees. And we will continue to provide the best service we can to our clients, regardless of what changes come in the future.

By Adam Malik

Complex challenges and constant manoeuvring — that’s what the following year has in store for automotive aftermarket service shops in Canada, according to leading experts in the mechanical repair sector.

The landscape for the year ahead looks to be shaped by economic fluctuations, technological advancements and evolving consumer behaviours. Industry leaders are preparing for a year marked by both challenges and opportunities, with a focus on maintaining resilience and driving growth.

Economic conditions remain a significant concern. Although inflation in Canada has eased since its peak in 2022, expectations have stayed high, leading to cautious spending throughout 2024. High interest rates have further influenced consumer behaviour, prompting many to prioritize maintaining and repairing their existing vehicles over purchasing new or even used ones.

Indeed, it’s becoming prohibitively troublesome to replace your vehicle these days. Costs remain high on the new side and supply in the used market is … well, let’s have Daniel Ross from Canadian Black Book describe it.

“The used supply is, I'd say, a horror story,” he said during the Talk Auto Conference in the late fall of 2024. “We started with a poor sales outlook the last four years. We're looking at poor used supply the next four years.”

But it's not like customers may be running over to repair shops.

“We're seeing maintenance deferral, especially among lower-income households," said Nathan Shipley, executive director and industry analyst with Circana’s automotive aftermarket practice. "Oil changes, AC system recharges, wiper blades, and tires are among the items consumers are delaying."

And even when they do come, don’t expect them to be looking for top-shelf items. Shipley further noted a trend of “buying down,” which means a customer who may have bought a premium or mid-grade product line is looking for a downgrade to better fit their budget.

"We know that with lower-income households especially, there's maintenance deferral that goes on during economic times like we're in. We've seen it in the past, and we're seeing it now," Shipley said.

Political uncertainty adds another layer of complexity. As the time of writing, trade tariffs placed by the United States on Canadian and Mexican products had been delayed but were still very much on the table. Such tariffs are expected to raise the cost of parts and repairs, putting additional strain on consumer budgets.

Technological advancements are rapidly transforming the industry. The rise of electric vehicles and the increasing complexity of modern vehicles require ongoing investment in advanced diagnostic tools and training.

How do shop owners keep pace? Collaboration amongst your peers and operational excellence were key strategies noted by leaders for 2025. They emphasize the importance of cooperation among repair shops and suppliers to share insights and best practices. This would help foster resilience and innovation, enabling businesses to navigate economic pressures more effectively.

We asked 10 industry leaders three questions: How will the economy impact customer behaviour in 2025 compared to 2024? What role is technology playing in repair shops these days and how can shops use it effectively? And what could impact business the most this year — is there one key opportunity or challenge awaiting shop owners?

In alphabetical order, here’s what they told us…

WITH STABLE ECONOMIC growth and high interest rates, consumers will focus on maintaining their current vehicles, boosting demand for affordable, highquality repairs.

Shop owners need to promote preventive maintenance. Educate customers on cost-saving measures like regular checkups. Offer value deals, such as loyalty programs or bundled service discounts for budget-conscious customers. They also need to prepare for EV demand. Research incentives and invest in tools and parts for EV maintenance.

Technology is critical for efficiency and trust. Advanced diagnostics, EV tools, CRM systems, and management solutions are driving change. So upgrade diagnostic tools by investing in equipment for modern vehicle issues. Leverage CRM systems — streamline scheduling, invoicing, and follow-ups for better customer experiences. Train for EV servicing by enrolling technicians in EV-specific programs to remain competitive.

Adopt management coaching. Engage in coaching to develop leadership skills and improve team efficiency, ensuring smooth integration of new technology. You opportunity is the growing EV market. It offers a chance to attract new customers. The challenge will be the skilled labor shortage. This requires innovative hiring and retention strategies.

So focus on recruitment. Partner with trade schools and offer apprenticeships to build a talent pipeline. Invest in staff retention by providing training, competitive wages, and a positive work environment. Diversify your services — expand offerings to include EV repairs, tire services and fleet maintenance.

Fill in your skills gaps. Stop using the excuse that you don’t know how to do something, from marketing to CRM. Fill your team with these skills or learn them yourself. Don’t get left behind

"Increasing uncertainty will probably be the number one challenge as we see changes in monetary, trade and tariffs."

"

Fill in your skills gaps. Stop using the excuse that

you don’t know how to do something, from marketing to CRM."

WHILE INFLATION IN CANADA has eased since 2022, consumer inflation expectations remained elevated, leading to reduced spending through 2024. If we find ourselves in a trade war with the U.S., we will likely see an actual increase in inflation which will again contribute to reduced spending. A low Canadian dollar could also contribute to increased costs for repairs but also add to more domestic travel in the summer months.

Everyday repair and maintenance such as brake service and tire changes will increasingly require the use of diagnostic tools for safe and complete repair. Like computers, they require regular software updates to remain effective and safe and shops must include this as part of the maintenance tools.

E-commerce also continues to be a key element for shops success. More customers are expecting to be able to book service online, receive an online condition report with pictures explaining the repairs needed on their vehicle and interact via email or text messages. Shops need to be able to provide these services while ensuring cybersecurity for the information of their customers.

Increasing uncertainty will probably be the No. 1 challenge as we see changes in monetary, trade and tariffs. But at the same time, the fundamentals of the auto care sector remain strong and will provide opportunities for consolidation as more people and shops choose to retire and sell their businesses.

AS WE ENTER 2025, the automotive aftermarket faces evolving challenges and opportunities. Repair shop owners must remain agile and leverage operational excellence, digital strategies, and data-driven insights to thrive in this shifting landscape.

In 2024, repair shops grappled with rising costs and cautious consumers amid economic uncertainties. These pressures persist in 2025, emphasizing the need for cost management and productivity improvements to safeguard margins. Streamlined workflows, resource optimization, and staff training are crucial to delivering a seamless and transparent customer experience.

Nearly half of all consumers discover repair shops through online searches, underscoring the critical role of a robust digital strategy. Tools like Google Analytics and Search Console, and collaboration with digital marketing firms help businesses enhance their online presence and capture measurable returns.

Collaboration among repair shops, suppliers and technology providers is vital in 2025. Sharing insights and best practices fosters resilience. We support this with free resources like digital audits and Google search trends for tire and automotive services, empowering businesses to adapt and grow.

Success in 2025 hinges on operational excellence, digital tools and embracing emerging technologies. Remaining customer-focused and innovative is essential in a market rewarding agility and foresight.

"The automotive service industry is at a crossroads. While change is inevitable, apathy among some shop owners and technicians poses significant risks."

"Collaboration among repair shops, suppliers and technology providers is vital in 2025. Sharing insights and best practices fosters resilience."

WITH ECONOMIC UNCERTAINTY in 2025, rising prices for parts and new vehicles could impact customer behaviour in two ways: Delaying nonessential repairs or shifting to preventative maintenance to avoid costly future repairs. Shops must be transparent, explaining price increases and offering solutions like flexible payment plans to retain customers.

Technology is rapidly transforming the industry. With the rise of EVs, shops must stay current with training and invest in proper diagnostic tools. The growing complexity of vehicles makes ongoing training essential. Neglecting this risks losing business to competitors better equipped for advanced diagnostics and repairs. Collaboration among AARO members to share expertise and tools can help address these challenges.

The automotive service industry is at a crossroads. While change is inevitable, apathy among some shop owners and technicians poses significant risks. Reluctance to embrace new government initiatives, pursue training or engage with industry associations hinders progress.

AARO is committed to supporting members, but the first step must come from within the industry. By participating in programs, pursuing training and getting involved with AARO, shop owners and technicians can directly influence the industry’s future while strengthening their businesses. Together, we can overcome challenges and build a stronger, more innovative automotive service and repair sector.

IN 2025, ECONOMIC PRESSURES are driving consumers to be more costconscious as inflationary conditions continue to increase the cost of everyday life. Although this is negatively affecting many industries, the automotive aftermarket repair industry remains resilient and offers consumers more affordable vehicle repair and maintenance options compared to OEM franchise dealers.

Technology continues to revolutionize our shops, enabling us to provide customers with services and experiences that meet their expectations. It has enhanced our communication and marketing strategies, allowing us to grow our business and reinvest in new, advanced tools and training. This ensures our teams can meet the demands of the constantly changing technologies in vehicles today.

This year will present many challenges with the noise of shifting political landscapes, increased cost of living and the negative effects these changes may have on many, including our teams. It is important that we seize the opportunity to foster a positive culture within our businesses so our team members can see a path to growth and stability. As long as there are vehicles on the road, the aftermarket will always thrive.

By staying adaptable, embracing technological advancements and supporting our teams, we can navigate the challenges of 2025 and continue to succeed.

"Technology continues to revolutionize our shops, enabling us to provide customers with services and experiences that meet their expectations."

"Along with the opportunity to expand product portfolios in this category, the aftermarket industry should be prepared to service an aging car count."

THE GEOPOLITICAL LANDSCAPE is poised to have a significant, but unknown impact on business this year. An unpredictable economy, combined with the cumulative effect of inflation, will see consumers spending cautiously and keeping their vehicles longer. This will have a tier-down effect on consumer goods, including tires, meaning higher demand for quality value brands over premium offerings. Along with the opportunity to expand product portfolios in this category, the aftermarket industry should be prepared to service an aging car count.

Technology will continue to play a critical role for repair shops in 2025, especially where it can improve customer experience. From online ordering to drop-off and pick-up services, customers want choice when it comes to in-person vs. digital interactions.

While not yet table stakes, savvy shops are educating themselves in new vehicle technology, including advance driving assistance systems (ADAS) and electric vehicles. As manufacturers hold vehicle usage data closer, shops are feeling increased pressure to invest in the tools and subscriptions to access it. Memberships in associations like the Automotive Industry Association of Canada, which advocates for the aftermarket to access OEM data on behalf of consumers, are valuable in this shifting landscape.

Our industry’s human resources challenge is also evolving. Where recruitment has been top-of-mind for years, our attention is now turning to succession planning for a retiring population. Home-grown solutions like mentorship programs and management training will lend a competitive advantage, as will in-house career development programs, ownership opportunities and strong partnerships with polytechnics and organizations that promote trades.

MANY CONSUMERS PLAN TO take on more debt this year to cope with rising costs and half feel they’re within $200 of being unable to cover monthly bills, according to the MNP Consumer Debt Index. In 2025, economic pressures are expected to dampen consumer confidence, influencing their willingness — and ability — to authorize auto repairs. Geopolitical tensions have added to consumer concerns.

Shops may see an increase in "Failure to Authorize" scenarios. Emphasizing value, safety and convenience will be crucial in aligning with customers' financial concerns. The rising cost of living will push Canadians to rethink their spending. Many will face tough decisions, like whether to repair their car, buy a new one or let it sit.

Staffing remains another critical challenge. Losing a key team member can disrupt customer service and hurt financial performance. Prioritizing recruitment, training and retaining of skilled employees will be vital.

Technology is more crucial than ever in today’s repair shops. From online discovery and first contact to appointment booking, transparent quotes (with photos), authorization and payment, seamless systems enhance the customer experience. These processes have become essential for staying competitive and building customer loyalty. On the repair side, advanced diagnostic tools and support are widely available. Shops should partner with providers that offer ongoing updates, relevant training and strong support.

Whether it’s improving the customer experience or using better tools for repairs, staying up to date with the latest tech is key. A game-changer is artificial intelligence. It has the potential to improve both diagnostics and customer service. It could power bots that handle phone calls, offering better, more consistent responses. These bots are already being used today.

"Shops may see an increase in "Failure to Authorize" scenarios. Emphasizing value, safety and convenience will be crucial in aligning with customers' financial concerns."

"Rather than focus on preventive maintenance, consumers are waiting for a major catastrophe to happen before getting their cars fixed."

THERE ARE CONCERNS ABOUT the impact of the current economic conditions on customer behavior in 2025 compared to the previous year. High interest rates are causing customers to be more cautious with their spending, leading them to focus on repairing their existing vehicles rather than purchasing new ones.

However, they’re not repairing them the same way they used to. The average invoice amount for repairs has increased significantly, from around $200 to more than $1,000 because customers are delaying maintenance and only addressing major issues when they arise. Rather than focus on preventive maintenance, consumers are waiting for a major catastrophe to happen before getting their cars fixed.

Repair shops these days are facing the challenge of staying up to date with rapidly evolving technology in the automotive aftermarket. Despite efforts to provide ongoing training for staff, we often struggle to keep pace with the technological advancements. This has led to situations where technicians are not fully prepared to handle complex diagnostic issues, causing additional stress and challenges. Plus, the cost of equipment and staying on top of updates is costly. Where does that money come from? That’s a challenge for shops.

Between the economic climate and constant technological changes, repair shops need to adapt their strategies, invest in the right equipment and training and find ways to effectively serve their customers in this evolving landscape.

THE AUTO REPAIR INDUSTRY and shop owners have no choice but to evolve or dissolve to adapt and combat the economic uncertainty ahead in 2025. While 2024 was a year of new car supply chain recovery, what seems to be setting 2025 apart already is the renewed focus on payment options, strong value and customer service being sought after by most drivers. Ways to pay will continue to be an area of growth, as higher demands will be put on auto repair shops to offer consumer credit options, easy monthly payment plans and affordable financing to help manage rising repair costs.

Building trust and creating convenience through technology is the successful path toward empowering consumers. Advanced tools and technology can effectively set a shop apart and ahead of the pack, from simply updating your in-store image to improving how service advisors communicate (by text, social media, chat, email or phone) with each customer’s preference. The expectation is that modern vehicles should be repaired and maintained by modern shops and expertly trained staff.

Future-proofing your business is a constant challenge, as vehicles continue to increase in complexity, and we all strive for every shop to maintain efficiency and profitability. Offering service expertise for all makes and models is always a key to acquiring new business. We’re seeing a strong need to invest in both the training and the equipment necessary to do so, from repairs and maintenance on hybrids and EVs to advanced driver assistance systems calibrations found on almost every vehicle these days.

"Building trust and creating convenience through technology is the successful path toward empowering consumers."

"The biggest business factor is your business culture. Happy staff builds great success. If you fail at this, everything else falls short of expectations."

THIS YEAR WILL BRING economic changes that may influence customer behaviour in the automotive industry. Changes like U.S.-Canada trade tariffs may increase the cost of parts and availability. Cost of living and housing affordability, EV adoption efforts may slow or increase, and political change can alter customers’ confidence. Then there’s always the question of, “Is there a recession or not?” All these factors play a part in customers’ behaviour. Many people say that 2024 was a tough year for them. This makes 2025 an opportunity to have a better year.

This is where customer experience comes into play. Customer experience is always the best factor to focus on, especially when customers are cautious with their hard-earned money. Using automated CRM technologies to save time so to focus on listening, connecting and ensuring the best possible experiences are being produced for your customer and business team. Getting the most out of your management software to help you manage workflow and vehicle inspections so that management can spend time training and coaching staff to function at the best possible level achievable in support of quality work and effective communications that contribute to the customer experience goals of your team.

The biggest business factor is your business culture. Happy staff builds great success. If you fail at this, everything else falls short of expectations. Build a happy team so you blow your customers’ minds with how much knowledge you have. That will benefit their ability to make good choices for their transportation needs and personal financial considerations.

The Mini-Ductor Venom HP is the highest powered Mini-Ductor at 1800 watts. This handheld induction heater generates high-frequency magnetic fields to produce a flameless heat™ that releases ferrous metal from rust, corrosion and thread lock compounds.

APPLICATIONS:

> Seized Lugnuts

> Fuel Tank Straps

> Exhaust Manifold Bolts

> Suspension

The mechanical automotive service market in Canada faced significant challenges in 2024 and appears poised for continued turbulence as we head into 2025.

Reflecting on the macroeconomic environment in 2024, the start of 2024 saw mechanical retail service locations performing well. Inflationary pressures were weaning and consumer confidence remained relatively steady, as reflected in the Consumer Price Index (CPI). However, by the second quarter, disinflationary trends began to emerge as the Bank of Canada maintained tight monetary policy to combat the lingering effects of high inflation.

Historically, the automotive service industry demonstrates an inverse relationship with economic conditions: In prosperous times, new vehicle sales increase, reducing the average vehicle age and lease/finance turnovers, which dampens service revenue growth. However, this cycle has been atypical.

The sustained period of tight monetary policy and higher interest rates, compared to the past decade, presented a mixed landscape. While OEM sales showed signs of recovery, consumers grappled with the dual challenges of elevated vehicle prices stemming from inflation and increased borrowing costs. As consumer confidence waned, many found it difficult to bear the costs of non-discretionary vehicle maintenance.

Publicly traded companies in the service sector mirrored these struggles. For example, Monro, Inc., one of the largest aftermarket service chains in the U.S., reported a 6.4 per cent year-over-year revenue decline in its regulatory filings in the second quarter of last year. Although the U.S. economic environment differs from Canada’s, it serves as a benchmark while highlighting unique Canadian complexities, including currency fluctuations, a weakening dollar, taxation pressures,

housing affordability challenges, and labor trends.

Looking ahead to 2025, political uncertainty in Canada will likely continue to influence the sector. Key concerns include how the Canadian government navigates the economic landscape, the implications of U.S. trade tariffs and the ongoing weakness of the Canadian dollar.

While the U.S. Federal Reserve appears to be pausing its tightening monetary policy, Canadian consumers remain under strain. Economic indicators suggest Canada may ease monetary conditions, which could widen the bond yield disparity with the U.S., further weakening the Canadian dollar. For a sector reliant on imports from the U.S., this currency weakness will exacerbate cost pressures, ultimately affecting consumer purchasing power.

From a parts perspective, I see automotive service providers needing to focus on product choices and building incredible service experiences and trust with their customers to drive success.

Many shops take a cookie-cutter approach, but drivers will need to include significant investments into deep customer interactions including community events, local sponsorships, customer education events and marketing to continually drive new customers to the shop.

Meanwhile, providers will have to ensure the optimization of operational functions at the counter to close opportunities when presented at the shop.

Despite these challenges, the automotive service market remains a diverse and resilient industry. Segments such as collision and autoglass, which often rely on insurance-paid components, have seen growth opportunities, particularly with the evolution of advanced driver assistance systems (ADAS). These technologies represent a beacon of hope for revenue growth within the service sector.

For service providers, the path forward lies in adapting to changing market dynamics and focusing on operational efficiency.

Key areas for improvement include:

■ Performance coaching and training: Equip service providers with the tools and knowledge to improve efficiency and profitability.

■ Customer experience enhancement: Differentiate through superior service and create loyalty among vehicle owners.

■ Exploring untapped segments: Unlock profitable opportunities in areas like auto-glass and ADAS services.

From my experience — spanning service operations to overseeing multi-faceted auto service chains across the country — the narrative with customers must evolve. Service providers must drive customer experience, encourage investment, and embrace innovation. This includes adapting to the technological demands of modern vehicles and their owners.

The future will see a reduction in the number of service shops as the industry continues to consolidate and adapt to rising costs in training, personnel and overhead. There is going to be a significant compression in consumers to bear the threshold of maintenance services and increase the pressure on automotive service locations to become more creative and navigate these rising cost and consumer spending pressures.

If you’re in the market for a replacement aligner, or if you’re exploring ADAS calibration, invest in the scalable, future-proof system that’s setting the new industry standard. For the cost of a typical single-purpose alignment machine, the Autel IA900 delivers advanced diagnostics, digital vehicle inspection, stateof-the-art wheel alignment, and step-by-step ADAS calibration instructions – all in a single investment, system, and workflow.

Mark Tirbany

I’ve been part of the automotive and transportation industry world since I was young. The pandemic provided an opportunity for me to return to school and, shortly after, I took a leap and opened my own mobile repair business, focusing on both diesel and automotive services.

Although I’m relatively new to the industry, having launched my company just three years ago, I've noticed an unsettling trend: Many new techs and a few older ones appear jaded and a bit sour of their current employment throughout the entire industry. There are many great technicians better than me who feel stuck.

The few standout techs that do excel often go unnoticed and are

usually underpaid. I am by no means the best tech, but I did find myself trapped in this same situation. There had to be a better option. Many of these talented technicians find themselves trapped in what I call the “pizza party corporations” — large companies that offer superficial perks, like a slice of pizza, a handshake and a pat on the back for being great. Meanwhile, some of these large corporate

24_014615_CARS_FEB_CN Mod: December 30, 2024 10:35 AM Print: 01/08/25 page 1 v2.5

companies reap record profits. It’s a formula that leaves talented techs feeling undervalued and frustrated. All too often, that frustration seeps into their attitudes and work.

To those techs who feel stuck, disillusioned, and underappreciated: There’s another way. Don’t let bitterness take hold. Instead, focus on getting better — the mobile business model is the solution.

I have slowly been gaining traction in the industry, particularly on the mobile repair and security system side. There are also lucrative and fulfilling opportunities in all areas of the industry. I’ve had the privilege of helping many of my peers and associates launch their own niche mobile operations — whether in mobile detailing, diagnostics, repairs, specialty parts, you name it.

What sets a mobile business apart is exceptional communication and the ability to deliver outstanding service. While my services may not be inexpensive — often rivalling the rates of major OEMs — the experience I provide is second to none.

The key advantage of running a mobile business is that the revenue goes directly to you. But — and a big one — is that freedom comes with much responsibility. You're not just a technician — you’re also a service advisor, parts technician, payroll manager, ambassador and accountant. You’re responsible for the successes, but also for the inevitable challenges that come with running your own show.

Building a successful mobile business isn't without its hurdles. There will be times when things go wrong — and they do go wrong. You need to take responsibility, even when circumstances are beyond your control. Often, this means absorbing the cost of a mistake or sacrificing your own time to make things right. However, the most important asset in this business is your reputation. Your name and

the quality of your work will define your success.

This business requires more than just technical expertise. You need to be a skilled communicator, professional and possess high emotional intelligence to understand and meet customer needs. You must be driven to continuously improve, honing your skills every day.

There is a mind set of “there are no problems, only solutions” that you need. You can’t start a mobile business and be a “mickey mouse” technician; you need to be 10 times better than all of your competition. Not knowing everything in our industry is fine but you need to know how to compile and obtain information to find a solution.

With the busy lives of customers, commercial and otherwise, I have found they genuinely appreciate the services my business offers. I have not had one unhappy mobile repair customer nor have any vehicle I have installed a security system for been stolen.

‘Fix it right the first time’ — anyone can do what I’m doing, but the key is to do it right and do it quick. In that order. We are in the service industry. Great service should always come first.

To the next generation of automotive techs, know that there is an alternative to the corporate grind. The path of a mobile business is not without its challenges. It offers the opportunity to take control of your career, earn the respect and compensation you deserve directly from your customers, and avoid the frustrations that often come with working in a traditional rigid corporate setting.

The new Top Tec 6310 0W-20 from Liqui Moly is a new motor oil that meets the requirements for Stellantis brand vehicles. Designed primarily for petrol, petrol/hybrid and diesel engines in specific 2018 and newer models, this oil is designed for engines needing the PSA B71 2010 specification.

Mahle Aftermarket launched TechPro 2 and Brain Bee Connex 2, featuring a redesigned interface for easier use and a compact VCI connector with DoIP for advanced diagnostics. These tools simplify diagnostics with intuitive navigation, video tutorials, and a Smart Scan function for detailed fault code analysis. They're compatible with the Mahle Cyber Security Pass, ensuring access to encrypted data, with customizable licenses and updates for current users.

www.servicesolutions.mahle.com

Air Lift Company introduces new air spring kits for the 20232024 Ford F-350 4WD DRW, including LoadLifter 5000-series, LoadLifter 7500 XL Ultimate, and Air Lift ProSeries kits. These kits enhance vehicle suspension, eliminate squat, and improve towing and hauling safety and comfort. Options range from the LoadLifter 5000 with 5,000 lbs. capacity to the LoadLifter 7500 XL Ultimate with 7,500 lbs. capacity.

Setting the standard for quality, durability & performance.

Schaeffler delivers durable, precision parts for efficient, cost-saving repairs. Backed by REPXPERT support, we help shops ensure reliable vehicle performance. www.vls.schaeffler.us

Dayco has introduced three new synchronous belt drive products for the North American industrial market, emphasizing significant energy and cost savings. Launched in early April, these belts cater to a range of industrial applications with options categorized into good, better, and best. The HT Power Belts are ideal for general use with their durability and temperature stability from -4°F to 212°F. The HT Power Plus Belts suit high-load needs, while the HT Power Carbon Belts excel in extreme conditions, handling temperatures from -22°F to 266°F, perfect for tough environments.

www.dayco.com

ZF Aftermarket expanded its lineup, introducing 33 new part numbers for Sachs Continuous Damping Control (CDC) shock absorbers. This release boosts coverage to approximately 1.6 million passenger vehicles in the U.S. and Canada, a more than 70% increase in ZF's CDC offerings, due to growing demand for advanced damping technology. The parts are designed for a variety of vehicle models, including BMW and Audi. www.zf.com

Dana’s new Spicer Select Constant Velocity (CV) joint repair kits are designed to optimize the repair of a vehicle's drive shaft by replacing the CV joint instead of the entire drive shaft. Replacing the CV joint rather than the complete driveshaft streamlines the driveshaft repair process, saving time and money. The repair kits include a high-quality constant velocity joint, hardware, and grease. The application-specific design ensures dependability and an exact fit. Coverage is available for popular vehicle models, including Jeep Grand Cherokee and Wrangler JK models. www.DanaAftermarket.com

NRS Brakes announced the launch of Brake Pad X, which it says is the lightest brake pad in the world. Available to order now for Tesla vehicles and engineered by NRS Brakes, the new addition features a composite BIMETAL of aluminum and stainless-steel backplate, powered by the award-winning NUCAP Retention System (NRS). www.nrsbrakes.com

Dana Incorporated has launched The Ultimate Dana 60® rear semi-float axles, providing a direct-fit, bolt-in upgrade for Jeep® owners. These new axles offer the benefits of the full-float design, such as Spicer® nickel chromoly steel axle shafts and Spicer ring and pinion gearing, while being lighter and compatible with the vehicle’s factory five-lug hubs. This semi-float option allows Jeep owners to reuse existing wheels and brakes, avoiding the cost of an eight-bolt system overhaul..

www.DanaProParts.com

Atrium Solutions has launched Orbit, an artificial intelligence technology designed to enhance efficiency for commercial tire dealers. This innovation automates the delivery receipt process within tire manufacturers' portals, significantly reducing the need for manual data entry and addressing the common challenge of extensive paperwork. Orbit minimizes human involvement in routine tasks, thereby boosting operational speed, efficiency, and agility. This allows dealers to focus more on delivering exceptional service and maintaining streamlined operations. www.atrium.app

Philips has expanded its Ultinon Drive 5000 series to include eight models of LED lightbars. Available in 10”, 20”, and 30” single and double row versions, and 40” and 50” double row configurations, these lightbars are designed for demanding off-road use. They feature scratch-resistant polycarbonate lenses, waterproof DT electrical connections, and corrosion-free stainless steel mounting brackets. Rated IP68/IP69K for water and dust resistance and IK07 for impact resistance, they offer illumination patterns from 426 to 833 yards. The lightbars are designed to avoid electrical interference with vehicle functions. www.lumileds.com

Schumacher Electric Corporation has relaunched its DSR Pro Series jump starters, now available under the model numbers DSR165, DSR166, DSR167, DSR168, and DSR168/G. These highperformance jump starters, featuring internal chargers with peak amps ranging from 2200 to 4400, are designed for portability and efficiency. The units can be recharged using any extension cord, making them ideal for professional use with bay drop cords. Available at professional tool suppliers, these jump starters save time and money by enhancing operational efficiency in automotive shops. www.schumacherelectric.com