ANNUAL SHOP SURVEY

Jobber News is Canada’s longest-established publication serving the distribution segment of the Canadian automotive aftermarket. It is specifically directed to warehouse distributors, wholesalers, machine shops, and national accounts.

Publisher | Peter Bulmer (585) 653-6768

peter@turnkey.media

Managing Editor | Adam Malik (647) 988-3800 adam@turnkey.media

Associate Editor | Derek Clouthier

Contributing Writer | Kumar Saha, Zakari Krieger

Creative Director | Samantha Jackson

Video / Audio Engineer | Ashley Mikalauskas, Nicholas Paddison

Sales |

Peter Bulmer, (585) 653-6768 peterb@turnkey.media

Delon Rashid, (416) 459-0063 delon@turnkey.media

Circulation | Delon Rashid, (416) 459-0063 delon@turnkey.media

Production | Tracy Stone tracy@turnkey.media

Jobber News is published by Turnkey Media Solutions Inc. All rights reserved. Printed in Canada. The contents of this publication may not be reproduced or transmitted in any form, either in part or full, including photocopying and recording, without the written consent of the copyright owner. Nor may any part of this publication be stored in a retrieval system of any nature without prior consent.

Canada Post Canadian Publications Mail Sales Product Agreement No. 43734062

“Return Postage Guaranteed” Send change of address notices, undeliverable copies and subscription orders to: Circulation Dept., Jobber News, 48 Lumsden Crescent, Whitby, ON, L1R 1G5

Jobber News Magazine (ISSN#0021-7050) is published six times per year by Turnkey Media Solutions Inc., 48 Lumsden Crescent, Whitby, ON, L1R 1G5

From time to time we make our subscription list available to select companies and organizations whose product or service may interest you. If you do not wish your contact information to be made available, please contact us.

NAVIGATING QUALITY AND AVAILABILITY DEMANDS

The automotive aftermarket can be a complex industry. As change waves move through, they are being marked by evolving demands for quality and availability.

This dynamic landscape was vividly illustrated in the findings from the Jobber News Annual Shop Survey, which polled shop leaders to gauge their shifting priorities over the last year.

The survey results revealed a significant shift in concerns from parts availability to the integral role of relationships and quality. Just two years ago, availability dominated the landscape with nearly 94 percent of respondents citing it as their top concern. Last year, this number dropped to about 85 per cent, suggesting a gradual adjustment to inventory improvements as the impacts of the pandemic eased.

However, these statistics barely scratch the surface of a deeper narrative unfolding within the industry.

A closer look at the responses illuminates a crucial insight: While availability is improving, the relentless pursuit of quality has surged as a top shop priority. Quality was a recurring theme throughout the survey. Keep in mind, respondents weren’t directly asked about quality concerns — they raised the issue themselves.

This shift underscores a critical reality: Shops are increasingly willing to overlook higher costs if it means gaining access to available high-quality auto parts and components.

There's been visible improvement in inventory management as the aforementioned pressures ease. Yet, there’s a growing insistence on quality that goes beyond mere availability. Shops expressed a clear preference for reliable parts that ensure efficiency and reduce the frequency of returns and warranty claims, emphasizing the adage that "time is money." High-quality parts enable shops to maintain operational flow and customer satisfaction, crucial for business sustainability.

Jobbers play a key role here. They must leverage their relationships with suppliers to advocate for enhanced product quality. The direct feedback from shops highlights a critical gap in the supply chain — quality assurance. Suppliers must take heed and rigorously examine quality.

Jobbers, positioned uniquely between suppliers and shops, have a pivotal role in communicating these demands and ensuring that suppliers are held accountable for their part in the industry's ecosystem.

Moreover, the survey highlights an undercurrent of dissatisfaction with how relationships and service levels are managed. The interaction between jobbers and shops, pivotal to aftermarket success, appears strained by issues beyond logistical efficiencies. Shops report a desire for deeper, more knowledgeable engagements from jobbers who understand their specific needs and can offer tailored solutions. They rely on their jobber’s expertise. If they feel that’s lacking, they’re moving on.

The call for enhanced service levels speaks to a fundamental need for expertise and customer care in every interaction. Knowledgeable staff who can provide accurate information and think outside the box are not just preferred; they are necessary for the health of these business relationships.

President & Managing Partner | Delon Rashid

Head of Sales & Managing Partner | Peter Bulmer

Corporate Office

48 Lumsden Crescent, Whitby, ON, L1R 1G5

0021-7050

As the automotive aftermarket navigates these transformative times, it is crucial that all stakeholders — jobbers, suppliers, and shops — embrace a unified approach to quality and service.

Adam Malik Managing Editor, Jobber News

We

WHY THESE PROS DON’T LIKE FLAT RATE PAY

Flat-rate technicians have been forced to cut corners and oversell because their focus is on their paychecks, not quality service. And they wonder why our industry has a bad reputation.

Bob

Paff, Automotive Service Business NetworkA lot of folks in the industry aren't big fans of flat rate pay. Basically, it doesn't work well unless you're at a dealership doing the same kind of easy work every day. Using a flat-rate system can give the wrong impression about the whole trade. If you're running a shop that works on different types of cars and does various jobs, relying solely on flat-rate pay is a problem. It's time to consider pay systems that are steady, include bonuses for good work, and connect with how well the company is doing financially. The owners need training to get this right—to understand how to manage their shops well. The shops that figure this out are the ones where good techs want to work.

Carlo Sabucco, Sil’s Auto Care CentreWHAT YOU CAN’T DO AFTER YOU’VE QUOTED A CUSTOMER

I disagree with this sentiment. We’re not salesmen. We provide a needed service. A little empathy and reassuring that the job is necessary, the car is worth the investment, and a brief explanation of the repair being more financially feasible than other alternatives — i.e. replacing the car, or ignoring the problem and making it worse, is what I believe customers are looking for. Not a hard close. If the work is really necessary, and our price is fair, there should be no salesmanship needed. And in today's market of never-ending appointments, I honestly do not have time to argue if someone is just trying to save a nickel. You’re never going to please those people. Charge your inspection fee and move along to the person beating down the door for service.

Geoff Walton, Grant Street GarageWHY MOBILE REPAIR IS OUTPACING DIFM

We have a mobile service, but in most cases, the vehicle has to come to the shop anyway for the repairs due to a variety of conditions including of the difficulty of doing the repair on-site. The job, in these cases, has to be put on a lift to remove/replace the necessary parts/components in order to access them. I agree that many repairs/procedures can be done mobily, but major or challenging ones are more efficiently done in the shop.

Glen Hayward, Good Works Auto Repair

Here in Ontario, you can’t find enough skilled help in a shop, let alone doing mobile repairs out in the cold, snow, rain etc. I can see how some of the mobile programmers and diag guys do it, but they usually come to a warm shop to do the work in. The mobile tire change people? Not a fan either. Consumers should have their vehicle done in a proper garage or shop setting so critical mistakes are not made out freezing in the snow in somebody's driveway.

Vinnie Klimkosz, Vinnie’s Mr. FixitTHE TECHNICIAN SHORTAGE MAY BE WORSE THAN YOU THINK

As someone who works as a technician, I have to say I cannot blame people for going into the white-collar fields. Yes, right out of school I was making more money than my college-educated counterparts, but as the years have gone on most if not all of them are making 50-100% more than me.

In addition to compensation, there is a clear cultural difference. Office workers are treated as professionals (generally) and have comfortable working environments, work from home partially and do not have to spend a dime of their own money (yes I am talking about the $100-$300 weekly tool payments I had for years) to complete the job.

We can talk all day about vehicles being big computers and having all sorts of technology, but at the end of the day, you have to be equally interested in getting dirty, hurt, bleeding and working on things that were not designed to be easily serviceable and are incredibly frustrating.

Moving jobs consistently and working my way into management was the only way I was able to feel respected, treated as a professional, and not in pain at the end of a work week.

Not everyone is cut out to be a manager or sit at a desk all day, but there are certainly more lucrative trades that do not require as many different skill sets or capital to get started.

JustinFlannery, automotive service technician

HOW AI CAN MAKE YOU A BETTER TECHNICIAN

I feel all AI will do is make people lazy and not think any more. Technicians need to be challenged and those that are true diagnostic techs will not use AI. With all this technology we are being trained to not think which is wrong on so many levels. I look at how techs are using diagnostic websites to do their work for them. When they do this, they don’t learn anything. They just want to get the job done and move on to the next one as fast as possible (flat rate).

Bob Ward, The Auto Guys

Scan the QR code for the latest and more in-depth news

TOP INDUSTRY AWARDS HANDED OUT

THE AUTOMOTIVE INDUSTRIES ASSOCIATION OF CANADA has announced the winners of two of its highest honours for 2024.

Bill Hay has been named the Distinguished Service Award winner. Young Professionals in the Auto care sector (YPA) Young Leader of the Year Award went to Patrick Verriet.

The winners were announced ahead of AIA Canada’s National Conference where both were officially presented the award.

The Distinguished Service Award is the highest honour from AIA Canada. Hay is a well-known figure in the Canadian auto care industry.

This award acknowledges an individual member’s exceptional service and leadership that have significantly advanced the industry’s growth and development across Canada.

Hay is currently the president of The E.R.I. Group.

The Young Leader of the Year distinguishes a youthful industry leader exemplifying innovation, leadership, and an unwavering commitment to the auto care sector. Patrick Verriet served as chair of the YPA Committee and is the business development manager for Canada at Mann+Hummel.

UNI-SELECT ACQUIRES

B.C.’S GILBERT

GILBERT SUPPLY COMPANY is now part of Uni-Select, expanding the company’s presence in British Columbia. Started in 1982, Gilbert has expanded to five locations with 70

employees, which Uni-Select’s announcement pointed out as “the backbone of its success.” Uni-Select highlighted the distributor’s growth as a family-owned company, becoming known for its topnotch customer service and ties to the community.

“From the outset, our interactions with Uni-Select and Bumper to Bumper have been characterized by profound mutual respect and a spirit of collaboration. This partnership feels like a natural progression, promising a bright and prosperous future for our teams and the communities we serve,” said Trevor Gilbert, president of Gilbert Supply Company.

Its locations are in Vernon, Kamloops, Merritt, Salmon Arm and Armstrong. The company offers automotive and industrial parts and services.

“We’re thrilled to begin this new venture, merging the heritage of a respected family business with our corporation’s reach,” said Émilie Gaudet, president and chief operating officer of UniSelect. “This acquisition is more than a business transaction; it represents a blending of mutual values and visions, aimed at elevating our service quality and community involvement to new levels.”

Gilbert acquired two locations in the region from West-Can Auto Parts in 2019. The Vernon, Kamloops and Merritt locations were rebranded as Bumper to Bumper locations at that time

CANADIANS LETTING MAINTENANCE SLIDE

CANADIAN VEHICLE OWNERS are continuing to ignore oil change needs, updated research has found.

The Automotive Industries Association of Canada released its latest look at consumer behaviour. It sheds light on where Canadian vehicle owners are deficient in their knowledge and where opportunities are for the automotive aftermarket.

Free for members, it examines the habits of Canadians across various segments such as age, income, region and type of vehicles they own. The report is $199 for non-members.

The report, Canadian vehicle owner’s attitudes towards maintenance and repair, shows that Canadians put oil changes at the top of the list of services they are letting slide. It’s followed by checking oil and a trio of tire related needs: Changing them, checking wear and checking pressure.

About 2,000 Canadians were surveyed in March 2023. They said they spent almost $400 on maintenance plus about another $650 on repairs.

CANADIANS WITH EVS DRIVE MORE THAN ICE DRIVERS

ACCORDING TO S&P GLOBAL MOBILITY’S analysis of the vehicle types that put up the most kilometres on the odometer, diesel and natural gas top the list while electrics came third, ahead of traditional gas-powered vehicles.

Battery electrics in Canada travelled more than 19,000 km in 2023. Plug-in hybrids were just behind that total by a little more than 1,000 km. Traditional internal combustion engine vehicles travelled about 16,600 km.

Both diesel and compressed natural gas vehicles travelled about 21,000 km last year, largely due to the fact most vehicles equipped with these propulsion systems are fleets and last-mile delivery vehicles.

“Typically Class 2, Class 3 trucks — they’re vans, they may be used for commercial work, last-mile delivery. And so they’re naturally going to get more kilometres per year,” explained Todd Campau, aftermarket practice leader at S&P Global Mobility.

Still, these numbers show that when consumers buy an EV, they’re not letting it sit parked in their driveways or garages.

“But definitely as you start to think about how can we move people toward electric vehicles, one of the things that we

clearly have found is that when people do make that shift, those vehicles are getting used very similarly to what their non-electric counterparts were,” Campau said.

AUTO INDUSTRY PRICES RISING

WHETHER IT’S NEW vehicles, used ones or auto parts, prices across various categories of the automotive industry rose throughout 2023.

New vehicles saw prices jump 3.4 per cent, according to the

Consumer Price Index. Used vehicles had a more modest increase, up 0.3 per cent last year. According to DesRosiers Automotive Consultants, this represents a decrease in the rate of price increases for vehicles compared to the significant rises over the previous two years.

On the vehicle maintenance and repair side, service and replacement parts jumped 5.3 per cent and 5.8 per cent, respectively.

“While not the increases we saw at the ends of 2021 and 2022, the auto industry — much like the market at large — continued to see persistent growth in CPI as of December 2023, with the costs of owning a vehicle still rising noticeably,” observed Andrew King, managing partner at DesRosiers.

CANADIANS SLAM R2R ‘SCARE TACTICS’

THE CANADIAN REPAIR COALITION (CanRepair), a collective comprising individuals, businesses, educators, and not-for-profits, including the auto care sector, recently challenged manufacturers’ arguments against sharing repair data.

It slammed them for “hiding behind scare tactics to restrict repair data for local shops and car owners.”

Amid rising automotive thefts linked to organized crime, CanRepair criticized manufacturers for using security concerns as a pretext to limit access to repair information for local shops and car owners. The coalition further called out manufacturers for ‘deflection, denial and distortion’ for connecting right to repair efforts with the growth in car thefts.

“Claims from vehicle manufacturers that allowing the right to repair will perpetuate car thefts and work against their efforts to keep vehicle systems secure are reflective of a revolving strategy of deflection, denial and distortion, rather than addressing the root causes of

vulnerabilities,” it statement said.

The group argued that if access to vehicle data for independent technicians poses a security threat, it reflects a foundational lapse in the vehicle’s design. By shifting the focus to external factors, manufacturers sidestep their responsibility in ensuring product security, the group observed.

AMERICAN RIGHT TO REPAIR EFFORTS GET BOOST

ATE brake fluids

Today’s ESC, ABS, and ADAS systems require brake fluids with specific viscosity, texture, boiling point, and pressure behavior.

ATE offers exactly the right brake fluid for each vehicle’s requirements, so you can be sure that brake systems will function as designed.

Commission (FTC) submitted their backing to the U.S Copyright Office, endorsing MEMA Aftermarket Suppliers’ call for an exemption to the Digital Millennium Copyright Act (DMCA).

This proposed change would allow vehicle owners to access and share their car’s telematics data with third-party repair services.

The DOJ and FTC agreed that allowing consumers to view and share their vehicle’s telematics data presents minimal risk to copyright holders and does not elevate cybersecurity threats

Engineered Like No Other.

This stance aligns with MEMA Aftermarket Suppliers’ argument that the modern automotive repair industry, increasingly reliant on software, should not restrict vehicle owners’ choices due to data access limitations.

The agencies emphasized that the existing barriers on noncopyrightable telematics data could unfairly limit competition in the market. This could prevent vehicle owners from sharing crucial operational data with independent parts manufacturers and repair services, creating a “competitively harmful bottleneck.”

DRIVERS CONCERNED ABOUT VEHICLE DATA SHARING

MOST DRIVERS WOULD buy a car with less technology to protect their privacy, a study has found.

A recent survey report by Kaspersky reported that seven in 10 (72 per cent) of drivers are uncomfortable with automakers sharing their personal data with third parties. The report, Is my car spying on me? reflects growing concerns about privacy and data security in the era of connected cars.

Despite the allure of modern vehicles equipped with advanced technology, sensors, apps and infotainment systems, the report found that most drivers are wary of how their data is used.

The survey of 2,000 U.S. drivers in November 2023 showed that 87 per cent of participants believe automakers should be obligated to delete their data upon request. Additionally, only 28 per cent of respondents claimed to have some understanding of the kind of data collected by their vehicles.

The findings come as the global automotive aftermarket wrestles with automakers and governments to enact a legislated right to repair solution, citing that automakers will have too much control over information that should be owned by consumers.

The trend of connected cars has not only improved comfort and convenience but also opened new revenue streams for car manufacturers through subscription services based on in-car technology.

However, this technological advancement has raised significant privacy concerns. A Mozilla report gave the auto industry poor ratings for privacy, highlighting that many car companies’ data policies allow them to share consumer data with third parties. Kaspersky noted that this not only creates privacy issues but also poses a security risk, as consumer data becomes increasingly vulnerable to leaks or theft

IMPACT

OF BRIDGE COLLAPSE ON VEHICLE SUPPLY

THE COLLAPSE OF THE Francis Scott Key Bridge last month, and the subsequent closure of the Port of Baltimore, introduces a new challenge to the automotive supply chain, particularly affecting vehicle imports.

But ratings agency DBRS Morningstar isn’t concerned about its long-term effect on new vehicle supply, just as dealers were faring better in the area.

The bridge collapse poses a temporary hurdle for the automotive sector especially in terms of vehicle imports through the Port of Baltimore, it determined in a commentary released last week. However, the industry’s preparedness, coupled with strategic supply chain management practices developed in response to previous crises, leaved the industry positioned well to manage the current challenge effectively.

“Despite representing another strain in the automotive supply chain, given the moderate scale and limited geographic scope of the Bridge Collapse/Port closure, we expect the affected OEMs to readily absorb any resulting impact,” said Robert Streda, senior vice president of diversified industries at Morningstar DBRS.

Despite the Port of Baltimore’s significance as a major hub for passenger cars and light trucks —facilitating over 847,000 vehicle movements in 2023 — the automotive sector is anticipated to manage the disruptions smoothly. The port accounted for approximately 11 per cent of U.S. automotive imports last year, a manageable fraction in the broader context of the nation’s automotive import activities which are distributed across multiple ports, the agency said.

VEHLO ACQUIRES SHOP-WARE

VEHLO, AN AUTOMOTIVE aftermarket software and financial software company, announced it acquired ShopWare, a cloud-based management platform designed for

Andy McMillian has been promoted to vice president of national sales at Lucas Oil. He will direct sales operations across the United States and Canada.

Deidra Colvin is the new chief revenue and strategy officer at Lucas Oil. She will oversee revenue operations and pinpoint growth opportunities.

Lucas Oil promoted Shane Burns to senior vice president of global sales, responsible for broadening distribution networks and product availability worldwide.

Vehlo announced Josh Weis as its new chief executive officer. He succeeds Michelle Fischer, who will transition to chair on the company’s board of directors.

Dan Lucas has been appointed as vice president of sales at Clore Automotive. He will build on key goals of sustainable growth and high customer satisfaction.

independent automotive repair shops.

The company plans to add Shop-Ware’s technology to its other product offerings. Its brand offerings include Shop Boss, Autoshop Solutions, 360 Payments and more. Shop-Ware offers an interface for customer communication to add to a shop’s service quality and customer satisfaction.

Shop-Ware was founded in 2013 by Carolyn Coquillette out of her own San Francisco repair shop to meet the growing demand for transparency and efficiency in the repair process.

“From brand equity to technical leadership, I am very proud of Shop-Ware and everything we’ve accomplished to reach this incredible milestone,” she said in a statement.

Coquillette will join Vehlo’s aftermarket leadership team.

NEW COUNCIL FOR SUPPLIER CEOS

MEMA AFTERMARKET SUPPLIERS has announced the creation of the Aftermarket Suppliers CEO Council.

This new council is designed to be an exclusive forum for chief executives from various sectors of the automotive industry, including automotive, commercial vehicle and remanufacturing.

In an announcement, the group noted that the council is part of MEMA’s commitment to providing high-value networking opportunities, something members often cite as one of the key benefits of their membership. These platforms are designed enable industry leaders to engage in meaningful discussions on topics that impact their businesses and the sector at large.

Stats that put the North American automotive aftermarket into perspective

$58,000

The Ford Mustang GT saw a 41.5% price increase over the last 10 years when adjusted for inflation. It cost $31,000 in 2013.

371,559

It was a record-breaking year for the Canadian International AutoShow with its highest attendance numbers ever, topping 2018’s high by almost 13,000 people.

Canadian International AutoShow

129,034

The Vancouver International Auto Show set a new attendance record for its five-day event, the first after a four-year hiatus. It set a single day attendance record of 39,823 guests.

Vancouver International Auto Show

37 POINTS

The index score for consumer automated vehicle readiness dropped two points from 2022 and is now down five points since 2021.

J.D. Power 2023 U.S. Mobility Confidence Index (MCI) Study

217%

Canadian employers are turning to apprentices with a massive increase year-over-year. They’re also investing in upskilling and training their existing staff.

Peninsula Group

49%

Almost half of Manitobans drive almost every day. Another 33% drive 4-6 days a week. In Ontario, 42% drive every day..

CAA

88%

The majority of Canadians are concerns about speeding in residential areas. However, 22% admit to the behaviour.

11.7%

The Ford Mustang GT saw a 41.5% price increase over the last 10 years when adjusted for inflation. It cost $31,000 in 2013.

CAA

Rerev

ZEVs — battery electrics and plug-in hybrids — grew nearly three points in 2023 over the year before. 77.6% of new vehicle registrations were ICE vehicles, down from 84.1%.

69%

A Baby Boomer is most likely to get vehicle issues taken care of right away. 41% of Gen Zers said the same, but 38% would do it when convenient

2023 MarketWatch Generational Car Care Survey

On the Road

Lordco Auto Parts 34th Annual Trade Show

April 3-4, 2024

Vancouver, B.C.

Under the theme of “Honouring Our History. Celebrating our Future,” Lordco Auto Parts marked 50 years in business during its 34th annual trade show at the PNE grounds in Vancouver. With more than 15,000 attendees registered, the halls of the PNE Coliseum and Agridome were packed with Lordco customers. In addition to checking out the latest offerings in tools, equipment, parts and components, attendees were also able to take advantage of special deals from more than 400 vendors that were available only while at the show.

IS PRICING READY FOR ARTIFICIAL INTELLIGENCE?

Reliable data will be the biggest barrier in AI adoption for parts pricing

By Kumar SahaThese days, it is hard to escape artificial intelligence (AI). From search bars to Facebook, AI tools are being increasingly integrated into our daily lives and activities.

Parts pricing — or any pricing for that matter — is not immune to AI. The topic often comes up in my conversations with clients. One client even pointed out that they have started to use AI in their pricing decisions. Since AI applications are at a nascent stage across most organizations, I was curious about how this company was using AI in their pricing decisions. On more probing, it was clear that they were not using AI at all. They were automating some processes and actions, which they conflated with AI implementation.

True AI — one that can provide generative decisions and actions based on complex variables — is still far from reality in pricing action. Large retail companies are now beginning to explore the possibilities of AI in their revenue growth strategy. But it is still early days.

As far as I know, AI has yet to meaningfully penetrate the realm of parts pricing. But where does the practice stand today? How can professionals adopt AI in their tool kit? What will be the ROI?

The state of AI in parts pricing

Today, at its best, aftersales pricing actions hover between rulesbased pricing and quasi-automation, the latter generally actioned through pricing software. At its worst, there is no strategy with outcomes determined by experience, instinct and Excel. Shockingly, the latter makes up most of the industry and is rampant even among large-sized companies.

Retailers are the furthest ahead in the game. They are utilizing some of the advanced automation tools that good software can offer. Their pricing actions are driven by multiple factors: Economic, customer, financial, competitive and volumetric. But the outcomes are still driven by rules created by pricing teams.

In other words, a price change is still dependent on logic developed, built and altered by human input.

In a true AI environment, pricing action will be autonomous and self-sustaining. The tool/software will be learning, correcting and optimizing itself along the way without human intervention.

Here’s an example: Currently, pricing professionals put caps on price increases and decreases in their rule sets to ensure

that prices do not go beyond a certain threshold that could potentially undermine competitiveness and margin targets. These caps must be tweaked periodically to ensure alignment with market requirements. AI would eliminate the need for these manual adjustments. It will automatically consider the business imperatives acquired through training models and adjust these thresholds on its own.

Using AI in parts pricing

AI opens up various possibilities for pricing strategy. Even with automation, custom pricing for individual parts in a portfolio is nearly impossible. AI will enable companies to target the individual nuances of each SKU and price those products accordingly to maximize not just revenue, but also customer value. For instance, certain high-moving SKUs can be autonomously monitored for seasonality, competition and economy. The prices for these SKUs can be reliably adjusted when one or more of these factors change without human intervention.

Similar things can be done in another context. If a supplier or retailer has ‘good, better, best’ portfolio, AI can be set up to selfadjust, while keeping the relative price distance between these products required to maintain value perception. Companies can also automatically price according to sales channels.

AI can also help users implement automatic geo-pricing — that is, creating specific prices based on region, city or postal codes. Some U.S. parts retailers have already begun to action them but, as AI improves, these actions will become more dynamic, leveraging factors such as real-time demand and inventory.

Benefits and costs

The key benefits of AI are self-evident. The most critical one is the ability to find micro-opportunities that are mostly likely missed by both manual analysis and automation. Another key advantage would be predictive analysis. Current tools rely on historical data to guide decisions. Of course, complex statistics are used to make forecasts, but they’re limited by human and software capabilities. AI will allow companies to anticipate price changes and take actions automatically.

While there is little doubt about the ROI of AI, many companies may balk at costs. First, there is the cost of technology. Companies such as Microsoft and Google have already made waves with their decisions to charge business-to-business customers for their AI tools. When pricing software companies start fully integrating into their products, costs will go up.

But the AI bill does not end there. AI specialists are in high demand and are extremely expensive to hire. While user companies will not lead large AI teams, they will still need professionals who have a strong knowledge of implementing and running AI tools. AI will also require data — tons of it. Companies can also expect their information costs to soar in their AI journey.

But these investments will be critical, as they will separate the winners from the losers.

Kumar Saha

Kumar Saha

Kumar Saha is Vice President (U.S.)/managing director (Canada) of global automotive data firm Eucon. He has been advising the North American automotive industry for over a decade and is a frequent conference speaker and media commentator. He is based out of Toronto.

“YOU NEED IT, WE’VE GOT IT ” . THAT’S NAPA KNOW-HOW .

Over 500,000 vehicle parts and products in inventory, all ready for delivery: that’s over 500,000 good reasons to make us your number one partner. napacanada.com

QUALITY CONTROL

Quality is top of mind for auto repair and service shops in our annual survey. That includes a quality relationship with their jobber. But the degrading quality of parts has them concerned

Many companies across various sectors will boast about why they offer the best service, focusing on the quality of the products they sell.

But if you were to ask shop owners, they might suggest that the automotive aftermarket is falling behind in this area.

By Adam MalikThe Jobber News Annual Shop Survey was sent out to readers of this magazine’s sister publication CARS to find out what has changed in the opinions of shop leaders over the last 12 months as some level of normalcy and consistency has settled into the industry.

Two years ago, availability was by far the top concern with it being highlighted in nearly 94 per cent of responses. Last year, it dropped to the mid-80s per cent range.

The narrative over those two years focused on the importance of relationships and its relegation to the back

burner in 2022 before it returned as a top-three factor of importance.

Inventory seems to have improved but one thing is for certain — if you want to be a first-call jobber, having products in stock will be your bread and butter.

However, this alone can’t guarantee success. From the responses we received from shop leaders, it's clear they expect more than just availability — price and quality are equally crucial.

Indeed, following availability, quality was the most frequently mentioned factor when respondents had the chance to comment.

Moreover, some are willing to overlook price concerns if their jobber provides high-quality auto parts and components.

“Having a relationship where my needs are prioritized and high-quality parts are available is worth way more to me than a few dollars of savings on parts,” one respondent wrote. “I sell time, which means I need good parts in a reasonable amount of time, so I can keep my techs moving and not have to do a bunch of warranty work.”

Indeed, this type of comment was common throughout responses. By having quality products, shops can’t use their time effectively. There is less worry about comebacks if they know what is being installed on the customers’ cars is a quality part.

“We want to be able to order our parts online and have quality parts available at a reasonable price,” observed one responder. “We want the parts quickly to keep jobs moving and the program system is just an added bonus.”

Availability

The survey was modified a touch from years past. Rather than being asked to pick all of the top reasons they consider when they call a jobber, they were asked to list the top one and then separately list other factors.

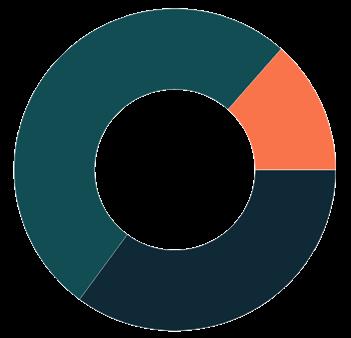

Availability/inventory reigned supreme on both counts. About 45 per cent picked that as their top reason with relationship trailing well behind at 26 per cent. Price rounded out the top three at 11 per cent.

When asked to pick the other factors, availability was selected by 65 per cent of respondents with price much closer at 58 per cent. Relationship placed third at 46 per cent.

Naturally, shops want their jobber to have every part readily available so they can get the work for the vehicle sitting in their shop completed. Easier said than done, it appears in some cases.

“We need parts today,” one respondent said, simply.

“We need availability and prompt delivery at a competitive price,” another said.

“You can't sell/install what you don't have,” read another response. “And if the supplier is 'difficult' then 'everything' is difficult. If inventory and relationship is good, all of the other factors

mentioned can be worked out.”

One respondent outlined the importance to getting parts delivered to their shop quickly.

“We want to be able to get the job done as soon as possible to limit inconvenience,” they wrote. “We want prices to be competitive. We like to look up parts ourselves to make sure that we can ensure accuracy. I like to buy from people that care about succeeding (us and them).”

If a jobber can’t recognize the importance of a shop’s time, then the partnership is not worth having, outlined one response.

“I would like a jobber to be able to get me the proper parts, good brand selection and stand behind legitimate issues,” they added, before noting a common complaint that has been around for a long time.

“I also don't want clients to tell me (and prove it) that they can get the same part at the same or lower price. All my time, as well as that of the jobber, has been lost/wasted and, therefore, lost revenue.”

Relationships

The shop-jobber relationship may be one the most dynamic ones going. Few, if any, industries can say they can call a store, order a part and have it show up the same day, even within an hour.

But that doesn’t mean shops are dancing through fields of rainbows and lollipops over their relationship with their jobber. There are key issues they say often need to be addressed to enhance service levels.

“A knowledgeable counterperson and someone who can think out of the box is important,” explained one respondent. “Relationships help with preferences to brands.”

Another complained about the lack of specialized local knowledge. They would rather have someone with boots on the ground telling them what they need, rather than someone in an office who may be in another part of the country.

“The level of top-down corporate management is staggering,” they lamented. “They should put more faith in their local managers to decide what is and isn't viable to stock locally. They know us better than anyone.”

For some, price isn’t as important when they know they have a solid relationship with their jobber. “Price is not always important as long as they have the parts. And intelligent counter employees are often few and far between,” one said.

On the topic of counter staff, even though talent options are limited, shops don’t have time to waste with someone who isn’t interested in the business.

“If you have a counterperson that does not know anything about vehicles, then that makes that business worthless. Then they should leave us as clients to look up our own parts by opening up their catalogues to us,” one respondent said.

They then went on to explain their frustrating

process: “So many times I am looking for a certain part and know that they should have a listing. But the counterman has no clue where to look. Then I need to source a different shop that gives me a part number, then reach back out to the same person I originally spoke with but now giving a part number, who then does in fact have inventory for the original search.

“This leaves an enormous concern from these so-called questionable suppliers.”

Why they leave

Shops are pretty consistent with their reasonings for why they give up their first-call jobber. The top two most common phrases used to describe their desire to leave were product availability and quality of products.

One put the issue squarely on the shoulders of the counterperson.

“Counterperson ignorance. No other reason. Total ignorance of my time and time spent trying to get them to understand what I am looking for,” they complained.

They called on jobbers to be more thorough in their hiring practices to make sure they’re qualified to handle the job.

“Then add some training also. Don't hire someone and leave him to answer calls knowing this individual knows absolutely nothing about the job,” they added. “That tells me this jobber has no interest in helping a clientele that took years to build up.”

Another hammered home issue on pricing, saying their jobber refused to believe their competitor was selling the same parts for less. And when confronted with data, brushed them aside.

Here’s what they told us: “Steadfastly refused to believe that their competition was considerably less than they were on identical parts, even after printing off months of proof, given to the rep to show the branch and regional reps. They cherry-picked one or two they were slightly better on and called it done. But just flat-out refused to believe they were on average 25-30 per cent higher cost.”

Which of the following factors is MOST IMPORTANT in terms of your decision to make a jobber your first call?

What other factors are important in terms of your decision to make a jobber your first call ?

From how many jobbers do you typically purchase in a given month?

WE ASKED:

What percentage of products you purchase from your firstcall jobber versus other sources (other jobbers, car dealers, other sources)?

“If you could give any piece of advice to aftermarket jobbers about how to keep you, their customer, happy, what would it be?”

THEY ANSWERED:

Stop selling parts to people off the street. I would 100% choose a supplier who refused to sell to retail customers.

Access to the parts/vehicle look-up and inventory and to order directly from that portal similar to online (some may do this), plus a decent part number reference portal to be able to cross reference or find current pricing.

Having online parts ordering that shows local stock is very helpful.

The jobbers combat the OEM's with some fantastic warranties. However, I don't care how great the warranty is if we have to use it frequently. Or at all. Once is too many times. Factory parts fit right the first time, every time, and very rarely fail, increasing our productivity.

If there was an area to which they could improve I guess it would be price related. Our techs are often more cost aware than our customers in some cases. They often question why our go-to jobber is significantly higher than their competition.

Availability is key, lack of stock and constantly having to wait for parts that are not stocked locally are a massive issue that disrupts work flow and causes a snowball effect down the line of later jobs.

We are all trying to keep up with the fast rate that technology is moving. The jobbers that aren't online will lose out. I think that a good conversation between jobbers and what would be helpful to their business and the independents might prove useful.

Knowledgeable counter staff. Realistic delivery promises. Try to assist in making all involved in this process to make a profit and maintain integrity.

Offer training. Have good counter staff. I like to be treated like a member of their organization. Don’t sell wholesale to people off the street it makes us, repair facilities, look bad when we charge more than the customer can buy it for from the same company.

So this shop walked away from the relationship because of the frustrating experience, pointing the blame on the jobber becoming part of a larger entity.

“Too bad because we loved dealing with the rep and the branch. Great people, working under corporate myopia. This happened when they merged and became the largest jobber in North America,” they said. “Years later, we still price-check them on a regular basis but nothing has changed. They miss out on a share of my annual $400k-550k parts purchases”

Who you gonna call?

It seems these grievances are impacting how many options shops are adding to their list of calls for parts.

Last year, 41 per cent of respondents said they contact just one or two jobbers for all their needs every month. That number is down to 35 per cent. Half of respondents said they’re calling three or four different jobbers per month. About 10 per cent are reaching out to five or six stores.

What percentage of products do you purchase from new car dealers?

However, shops have not increased their reliance on dealers, compared to last year. Nearly half (46 per cent) said about one in 10 products they order are from dealers; 37 per cent said they get 11-25 per cent of product for dealers. Combined, 83 per cent said they get upwards of a quarter of their products from dealers.

That’s more or less in line with last year when 84 per cent said so.

Stiil, shops said they’re turning to dealers in part because of product availability and also quality.

“Slightly more due to availability and reliability of the parts,” one respondent said when asked if they were increasing their orders from dealers.

“Not sure of percentage but the increase has come from a complete lack of quality in many aftermarket parts,” noted a respondent.

Dealers are also being more competitively priced, one response noted. “Availability — some parts are not available from jobbers, parts that work. More and more aftermarket parts have too many failures,” they added.

One specifically pointed out oxygen sensors as an issue in the aftermarket. “Aftermarket just cant get it right. Have to continually price shop with dealer parts because a lot of times dealer prices are less than the aftermarket,” they said. “Unfortunately, you have to do what is best for the customer even if it means I lose my margins.”

Another complained about quality as a reason for turning more to the dealer for parts.

“I’ve been in business for 40 years and I am seeing too much white-boxing happening in the aftermarket,” they wrote. “Checking prices, dealerships are still in line and sometimes cheaper and better quality.”

Another respondent pointed out their frustration with their local jobber. The dealer is more of a one-stop-shop and seems to

Has the proportion of parts you buy from new car dealers increased or decreased in the last year?

have a better grasp on their needs than the jobber.

“No sense in getting frustrated from a local jobber with no knowledge and getting wrong parts and wrong estimates,” they said. “I just resort to dealer purchasing. Chances are one-stop-shop with proper estimates.”

Online ordering

It’s a tale of two ends of the spectrum when it comes to online ordering by shops. Just more than half (51.4 per cent) of respondents said they order at least 70 per cent of their products online. Drilling deeper, 20 per cent say they each do 80-90 per cent and 90-100 per cent of their orders online.

The exact same number, 20 per cent, say less than 10 per cent of their ordering is done online.

So there are equal numbers of those doing almost all their parts orders online as there are doing almost none.

What do shops enjoy about ordering online? It seems to come down to the ease.

“Minimal issues with online ordering,” said one.

“Online ordering is the best. You have control of your order and are eliminating the counter person who may not understand your query or order requirements,” highlighted another.

Another noted that they know exactly what they need, better than the jobber store’s staff, so they go ahead and order it themselves and avoid the middle man, so to speak.

“We definitely order more online each year over year. We can order directly through our software (which saves a step). It works for efficiency and record keeping but not if you have product or technical questions,” noted one response.

“Online ordering is pretty good. Idle chit chat wastes time. They could do better by identifying quality of the parts listed,” observed a respondent.

On a percentage basis, how many products do you order online?

10-19

For one shop, the owner has their techs order the parts so the onus is on them to get it right.

“I like someone to be accountable if the parts are not correct. My technicians do not want to make a mistake,” they wrote.

One respondent noted that they order online begrudgingly. “Not happy about online ordering but at times looking after the client is more important than the opinion of the jobbers,” they said. “The jobber could pay more attention to what we are working on and what we are ordering. We know what we want. We don’t rely on the jobber to know.”

It’s not a perfect system and there is room for much improvement. In particular, accurate on-hands numbers as well as a way to track the progress of the order are top requests of shops.

“The biggest issues is lack of communication if there is a problem with a parts availability. And also the lack of information pertaining to where parts are. Information is key, any jobber should know this,” one answer read.

“Sometimes the sites are not very accurate with in-stock, and/ or availability. Real-time updates are important,” noted another.

“Jobbers are doing a decent job but sometimes stock of parts is an issue,” stressed one response.

Inflation challenges

Inflation hasn’t been kind to general consumers and those shopping in the autmotive aftermarket are no exception.

According to DesRosiers Automotive Consultants, vehicle maintenance and repair saw prices increase in 2023. Service and replacement parts jumped 5.3 per cent and 5.8 per cent, respectively.

For the most parts, shops are navigating as best they can. Most customers seem to expect the increased prices. Some shops note that low prices are certainly not the way to go in this business.

Which development do you expect to have the biggest impact on your business in the next year?

“Low price is not an advantage,” one respondent noted. “Customers want quality, installers want proper fit — not junk.”

Another respondent agreed. “Cost vs. quality is more important. First time fixed should be the priority so even the economy parts need better quality control.”

“We are very clear to customers that cheaper parts are not always the best choice,” echoed another.

But for the most part, shops are keeping their margins the same and passing on the higher costs to customers.

“Prices go up, up, up but we have to pass it on to the customer. They understand that it is the current economic situation that we are all in. Inflation has not impacted the parts we order. We continue to purchase what we (our customers) need. We try to always by ‘value’ (good quality at a fair price). The jobbers meet our needs and generally do a fantastic job of it,” one respondent said.

Another also noted the helpfulness of their jobber.

Consumers and all of us understand that prices on everything have gone up. As an independent shop, we need to make sure that we are current with our prices to stay in business. Our jobber sales reps help. I will not sacrifice quality over price,” the said.

But it’s hard to justify price increases when suppliers are not keeping up with quality, one respondent pointed out.

“It has to be noted that even ‘good’ name brands of the past have had a sharply noticeable increase in defective or poor fitting products over the last decade. Too many parts manufacturers are trading on their good name/solid reputations delivering poor product,” they said.

This is pushing shops to look at dealers for parts.

“Because we always want to sell only quality, hence we have to deal primarily in OEM parts. The aftermarket has failed miserably on the quality score,” they warned.

NOW YOU HAVE IT: TRANSIT’S RECIPE FOR SUCCESS

For half a century, Transit has experienced exceptional growth with a singular focus: creating value for jobber stores.

To achieve this, Stephan Guay, president of Transit, knew the key was to engage directly in the field. He and his team talked to countermen and business owners daily to understand their challenges, a practice he continues to prioritize. He quickly realized that the success of his company hinged on excelling in three specific areas, which became the fundamental pillars of Transit: more speed, more selection, and more support.

With these pillars as a guiding framework, Transit has gained the confidence and direction necessary to unveil its new slogan: “Now You Have It.”

“We had never taken the time to stop and articulate what sets us apart – our identity,” says Guay. “Our goal was to convey to our customers who we are and what we stand for. Now, it’s easier to explain what Transit is about using the three pillars and the slogan.”

THE TRANSIT ADVANTAGE

Transit offers a unique combination of speed, selection, and support to ensure customers receive the quality products they need quickly and efficiently.

"Endless slowdowns are the enemy of jobber stores because if they can't get the parts quickly enough, it impacts the operations of repair shops and the satisfaction of customers whose cars are on the lift. That's why we invest massively in technology and logistics to always be faster," says Guay. "However, selection and support, which complete our three pillars, are also crucial to our customers' success. More selection means comprehensive coverage, defect-free products, and competitive pricing. As for support, it involves offering a dedicated account manager who understands your business, maintaining a quality sales team for faceto-face meetings, and investing time to visit repair shops with customers to gain valuable firsthand insights into their needs."

Transit has another massive advantage: it manufactures what it sells. From development to quality control, everything is managed by the Transit team.

"If there is an issue, we control the entire supply chain,” says Guay. “This is an undeniable advantage.”

HUMBLE BEGINNINGS

Getting to this point took some time for Transit, as Guay explains. "I've been in the industry for 30 years. I started working with my dad and was the only employee. We had one warehouse, which was actually a barn."

Transit now operates a main 150,000 sq. ft semi-automated distribution centre located in Levis, Que., and it has seven other warehouses in Ontario and extending to Newfoundland, making it the largest auto parts distributor in Eastern Canada.

Maintaining close working relationships with customers has been the company’s primary approach since 1971, a core value Transit has consistently upheld. Today, Transit remains committed to nurturing strong ties with its business partners.

COMMITMENT TO EXCELLENCE

"The mindset behind 'Now You Have It' is that it’s a continuous way to be better," says Guay.

Transit welcomes customer feedback and goes beyond merely listening. It uses the Net Promoter Score (NPS) to measure customer satisfaction and loyalty, with their score ranking among the highest in the distribution industry.

"In every survey we send out, we carefully consider and address any feedback that can improve our services and customer experience. By prioritizing the success and satisfaction of our customers, we build loyalty, achieve our business goals, and distinguish ourselves from competitors," Guay explains.

Transit's commitment to its customers extends beyond business sales. For Transit, the well-being of its customers is of utmost importance.

“It’s not just about auto parts. I had a customer who was looking for someone to help in HR, and I put my HR team on it to resolve his issue,” says Guay. “If my customers are successful and free from distractions, they are going to sell more parts, and everybody wins.”

Now you have it, and Transit certainly does too.

ENHANCING THE OVERALL CUSTOMER EXPERIENCE

By Zakari Krieger

By Zakari Krieger

In the automotive parts aftermarket, success hinges on understanding relationships beyond just product knowledge, emphasizing customer health and experience

In the fast-paced world of automotive parts aftermarket, staying ahead means more than just knowing your inventory inside and out. It's about understanding the intricate dance between suppliers, shop owners, and consumers – a dance that's often overlooked in the rush to educate on the latest products and technologies.

As someone who has spent considerable time organizing and participating in parts training evenings, I've come to question the true impact of these efforts as a strategic sales tactic. While educating clients on the technical aspects of products is important, it often fails to address the underlying relationship dynamics that can make or break a business, evolving past that transactional relationship.

Reflecting on my experience running a national retail network, I've come to appreciate the paramount importance of customer health. It's a timeless principle, yet one that is sometimes overshadowed by the relentless pursuit of product knowledge.

Jobbers looking to grow their businesses would do well to shift their focus towards enhancing the overall customer experience. This means investing in marketing strategies, understanding key performance indicators (KPIs), and most importantly, nurturing the relationship between shop owners and their clientele.

Ultimately, being a jobber means that our relationship with the

shops is transactional. However, for years, we focused on organizing coaching performance groups for our clients as a proxy for the type of services a network would provide focusing on building profitability and operational performance. The shops would meet monthly, and we would come in at some point during the meeting for a short update on some product or business-related updates.

This created quite an effective bridge with product-related communication. However, this was done in a setting where such a topic wasn’t the main focus.

The shops had the obligation monthly to pull their numbers from their operating system and do inputs into a centralized file based on some of the core KPIs, that shops can use to pull value levers within the business.

Some key focuses include inspections performed, average estimates and labour hours billed. Additionally, the shops would focus on more quantitative items like shop image, customer service and coaching service advisors for performance and customer experience.

Ultimately, the health of the jobber is the health of the shop, thus creating an environment and relationship past selling parts and honing in on supporting the shop in a different way was a key focus to our success with our clients as a jobber.

"In today's landscape, it's not just about selling parts — it's about fostering an environment where customers feel valued and supported throughout their automotive journey."

In today's landscape, it's not just about selling parts — it's about fostering an environment where customers feel valued and supported throughout their automotive journey. This entails offering personalized solutions, providing expert guidance, and going above and beyond to ensure satisfaction at every turn.

I firmly believe that by prioritizing the health of the customer, jobbers can unlock new avenues for growth and success. By coaching their clients on broader business strategies and helping them optimize their operations, jobbers can position themselves as invaluable partners in the quest for excellence.

Ultimately, the success of a parts store hinges not just on the quality of its products, but on the strength of its relationships. This example highlights the transformative power of prioritizing customer health and relationship-building in the automotive parts industry. By focusing on enhancing the overall customer experience and fostering meaningful connections with clients, jobbers and shop owners alike can unlock new opportunities for growth and success in an increasingly competitive market.

We’re making a difference

Woodington Lake Golf Club

Tottenham, Ontario (40 Mins from TO Pearson Airport)

Mark your calendars for the 49th Annual Shad’s R&R Golf Tournament on Thursday, June 13th. All proceeds to Muscular Dystrophy Canada.

START TIME 10:00am SHARP!!

If you would like to become a sponsor or make a donation to SHAD’s R&R For the Kids, please contact one of our board members directly. Shad’s Board of Directors

Chairman Brad Shaddick brad.shaddick@outlook.com

• Kristine Brown KBrown@wakefieldcanada.ca

• Luc Champagne luc.champagne@autosphere.ca

• Andrew Connor aconnor@dormanproducts.com

• Mike Fazackerley mike.fazackerley@matthewscott.com

• Charlie Grant cgrant@gbsales.com

• Patricia Lazzarotto patricia.lazzarotto@firstbrandsgroup.com

• Mark Potts mpotts@driv.com

• Malcolm Sissmore malcolm@sissmore.com

• Scott Stone Scott@promaxauto.com

• Jeff Van de Sande jvandesande@uapinc.com

• Sean Williams swilliams@uniselect.com

• Cameron Young cameron.young@ca.bosch.com

• Jason Yurchak jasony@worldpac.com

On the Road

MEMA Aftermarket Suppliers Vision Conference

April 9-10, 2024

Dearborn, Michigan

The MEMA Aftermarket Suppliers Vision Conference in Detroit brought in top aftermarket minds to examine the issues facing industry suppliers. From political tensions to electric vehicles to artificial intelligence and more, attendees made up mostly of industry executives left with fresh insights — and connections thanks to networking events. The event opened with a networking reception at The Henry Ford Museum of American Innovation and the full conference began the next day.

BAYWATCH

TAKE A LOOK AT THE NEWEST PRODUCTS

LED WORK LIGHTS

A new line of Philips Xperion 3000 LED work lights is available. The Xperion 3000 Pen eco is powered by three AAA batteries. The “Pillar” is a hand-held work light. The Xperion 3000 “Slim” is a hand-held light. The Xperion 3000 “Zoom” resembles a flashlight but features a tilting light. The Xperion 3000 “Line” is an inspection light. The Xperion 3000 “Pocket” is a palm-sized lamp with two output modes. The Xperion 3000 “Headlamp” is a wearable headband work light with two light sources and three output modes. The Xperion 3000 “Flood” is a projector work light with three output modes. It can also be used as a power bank to run other devices. The Xperion 3000 “Penlight” is handy spotlight for tight spaces. www.lumileds.com

HotSpot_April_JN_QuarterPageAd.pdf 1 2024-03-08 5:12:21 PM

KNOCK SENSORS

Continental has added eight new part numbers to its OEM Knock Sensors line. The additions provide application coverage for some of the most popular domestic, European and Asian makes and models on the road today. The expanded line covers Chrysler, Dodge, Ford, Infiniti, Jeep, Lincoln, Mercedes-Benz, Mercury, Nissan, and Ram models ranging from 2000 to 2023. The new sensors provide coverage for 28,814,500 vehicles in operation (VIO) in the United States and 2,438,395 vehicles in Canada.

www.continentalaftermarket.com

RUST REMOVER

CRC Industries has introduced a new onequart canister size for its Evapo-Rust brand of rust remover. It will hit shelves in February 2024. A dip basket has been integrated into the canister, so users don’t have to pour the product out into a separate container – they can remove rust right in the canister. The one-quart size is ideal for small tools, nuts and bolts, garden tools, and other jobs around the garage and home.

www.crcindustries.com

DIESEL AFTERTREATMENT INJECTORS

Continental has introduced a new Diesel Aftertreatment Injector part number. The injector provides application coverage for Ram truck models 2500, 3500, 4500, and 5500 from model years 2013-2023. It’s the first part of its kind that Continental has offered to the aftermarket. Continental’s Diesel Aftertreatment Injector provides application coverage for 78,033 vehicles-in-operation (VIO) in Canada and 997,714 VIO in the United States.

www.continentalaftermarket.com

TRIPLE FANS

Continental has a new line of triple fans consisting of six part numbers arriving in 2024. The announcement provides application coverage for the Cadillac Escalade, Chevrolet Silverado, and GMC Denali, Sierra and Yukon. With the six part numbers that will be released, Continental Triple Fans will provide application for several million vehicles in operation. www.continentalaftermarket.com

The Philips OlfaPure 7300 is a new an appcontrolled, car aroma diffuser that allows drivers and passengers to relax, stay alert, reduce motion sickness or simply refresh the air inside their vehicle. The diffuser holds up to four different scent cartridges at a time, allowing users to customize their preferred aroma to improve their driving experience and mood. Users can choose from an array of 10 different fragrances including three ‘functional’ scents and seven ‘mood’ scents. It is designed to fit in most console cup holders and is USB powered and Bluetooth connected.

www.lumileds.com

CAR-TOONS

BAYWATCH

GDI CLEANING UPGRADE

CRC Industries introduced an improved version of the CRC GDI Service Pack with a newly reformulated version of the CRC GDI IVD Intake Valve and Turbo Cleaner. The CRC GDI Service Pack includes the CRC GDI IVD Intake Valve and Turbo Cleaner, CRC Mass Air Flow Sensor Cleaner, CRC Throttle Body and Air-Intake Cleaner, and CRC 1 Tank Power Renew. All products in the service pack are also available individually. Combined, the products help clean and optimize the performance of MAF sensors, throttle bodies, intake valves, fuel injectors, spark plugs and combustion chambers.

www.crcindustries.com

OFF-ROAD LIGHTING

Continental announced the NightViu premium lighting line of professional driving and working lights will be made available to consumer markets including off-road enthusiasts, recreational vehicles (RV), and marine. These were originally designed for use on construction, mining and off-highway equipment. They are built to withstand extreme temperatures, vibration, dust, and moisture. The lights feature advanced LED technology that provides excellent lighting performance and exceptional energy efficiency. NightViu Driving Lights provide a focused beam of light for long-distance illumination. www.continentalaftermarket.com

» Access to over 25,000+ quality auto parts and 1,850+ accessories

» Order precision of 99.8%

» Availability rate of 97%

» Defect rate of 1.3%

» Orders ready in 20 minutes

» Same-day shipping until 3 p.m.

» Quick and easy online ordering

» Entry to 25+ trusted brands

BRAKE PADS

BRAKE PADS

COATED ROTORS

& WHEEL BEARINGS PREMIUM BRAKE PADS 100% MADE IN CANADA

& STEERING

MOUNTS & ASSEMBLIES

SEMI-METALLIC BRAKE PADS

% NEW CALIPERS

SPORT PERFORMANCE BRAKE ROTORS

& COILS

Brake Rotors and Drums

Brake Pads and Shoes

Brake Calipers

Hub Bearings

CV Axles

Chassis Parts

Complete Strut Assembly

Shock Absorbers

Strut mounts

Radiators

Water Pumps

Steering Pumps and Racks and Pinions

Steering Gears

Starters and Alternators

Batteries

Oil Pans

Fuel Pumps

Wiper Blades

Ignition Parts and Coils

Fuel lines

Exhaust Parts, Universal Converter, and Flex Pipes

Misc Automotive Parts

939 Warden Ave Scarborough ON M1L 4C5 Info@hotspotAutoparts.com | www.hotspotautoparts.com