for the future?

NFP’s Technology Alliance is revolutionizing the construction and infrastructure industry.

Navigate the complex landscape of construction risks with a tech stack tailored to your enterprise and project-speci c developments. Access a powerful advisory team harnessing the power of emerging technology risk controls driven by project management software, reality capture and the Internet of Things (IoT).

•

•

•

•

By harnessing the power of technology risk controls you will better identify and mitigate project risks, reduce insurance rates and deductibles, and boost safety, e ciency and productivity. Step into the next generation of construction risk management, today.

4 Comment Summertime Snapshots and Pool-side Reading

6 K PMG/CCA REPORT Adoption of Technology

Between late 2022 and March of this year, KPMG surveyed 275 Canadian companies in the construction sector to produce the KPMG 2023 Construction Industry Digital Maturity report in collaboration with the Canadian Construction Association.

According to the research, two thirds of construction companies say the pandemic prompted them to make new investments in technology. Most organizations today feel they must adapt their digital strategy to succeed in the new market landscape.

14 BUILDFORCE CANADA REPORT Construction Labour

BuildForce Canada, a national industry-led organization committed to working with the construction industry to provide information and resources to assist with its management of workforce requirements, released its Construction and Maintenance Looking Forward report earlier this year. Using its Labour Market Information (LMI) system that tracks 34 trades and occupations, along with industry consultation, the organization presents an assessment of construction labour markets in Canada for 2023 through 2032.

22 PROCORE REPORT How We Build Now – Canada

In early 2023, Procore partnered with Censuswide to survey 502 construction industry stakeholders in Canada across owners, general contractors and subcontractors. Questions provided to the participants were focused on market conditions, top challenges, digital transformation and technology adoption. Using that data, Procore has created How We Build Now – Canada, a look at the technology and industry trends that are shaping Canadian construction in 2023.

Want the full editions of these reports?

Simply scan the QR Code at the end of each section to access the full version.

Summertime snapshots and pool-side reading

In June, Environment and Climate Change Canada issued a seasonal outlook calling for a hotter than usual summer, with above-normal temperatures expected for most parts of the country right through until September. So, in addition to harbouring thoughts about ways to keep cool in the heat, the team at On-Site got thinking that it might be an idea to provide our readers with some beach or pool-side reading, hence the development of our first bonus Special Edition.

While our regular features and columnists will return in the fall, this special summer issue is entirely dedicated to key industry reports about the construction sector in Canada – the kind of reading material that’s perfect to tuck into a bag as you jet off on vacation or head to the pool for some fun in the sun.

As we share these three major reports, we would like to thank the organizations who have graciously provided their respective documents. Procore, KPMG, the Canadian Construction Association and BuildForce Canada do great work gathering insights for the industry, and we appreciate their support and permission to share their latest data in our pages.

While you and your company are likely paying attention to how market conditions, digital transformation and technology adoption are impacting your company this year, the data collected by these organizations illustrates how the industry is collectively facing challenges.

It is worth noting that, much like the Reader’s Digest magazines that often find their way to cottages and summer homes, the reports presented here are condensed versions. The full documents include additional tables, graphics and sections. As such, I encourage you to use the QR codes at the end of each section to access the original documents.

And don’t forget, there are also many other reports, studies and reviews that the team at On-Site shares throughout the year, so make sure to keep your subscription current. Our weekly newsletter is a great source of news between each magazine. As of our October edition, we will be back to our usual presentation of industry news, statistics and information.

Until next time, enjoy the read, as well as the pool or beach, or wherever you spend the dog days of summer.

www.on-sitemag.com

READER SERVICE

Print and digital subscription inquiries or changes, please contact Angelita Potal

Email: apotal@annexbusinessmedia.com

Tel: (416) 510-5113

Fax: (416) 510-6875

Mail: 111 Gordon Baker Road, Suite 400, Toronto, ON M2H 3R1

PUBLISHER | Peter Leonard (416) 510-6847 pLeonard@on-sitemag.com

EDITOR | Adam Freill (416) 510-6821 afreill@annexbusinessmedia.com

MEDIA DESIGNER | Lisa Zambri lzambri@annexbusinessmedia.com

ASSOCIATE PUBLISHER | David Skene (416) 510-6884 dskene@on-sitemag.com

ACCOUNT COORDINATOR | Kim Rossiter (416) 510-6794 krossiter@on-sitemag.com

AUDIENCE DEVELOPMENT MANAGER | Urszula Grzyb (416) 510-5180 ugrzyb@annexbusinessmedia.com

PRESIDENT/COO | Scott Jamieson sjamieson@annexbusinessmedia.com

Established in 1957, On-Site is published by Annex Business Media

111 Gordon Baker Road, Suite 400, Toronto, ON M2H 3R1 Publications Mail Agreement No. 40065710

ISSN: 1910-118X (Print)

ISSN 2371-8544 (Online)

SUBSCRIPTION RATES Canada $49.50 per year, United States $113.00 per year, Other foreign $136.50, Single Copy Canada $13.50. On-Site is published 7 times per year except for occasional combined, expanded or premium issues, which count as two subscription issues. Occasionally, On-Site will mail information on behalf of industry-related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above.

Annex Business Media Privacy Officer privacy@annexbusinessmedia.com

Tel: 800-668-2374

Content copyright ©2023 by Annex Business Media may not be reprinted without permission.

On-Site receives unsolicited materials (including letters to the editor, press releases, promotional items and images) from time to time. On-Site, its affiliates and assignees may use, reproduce, publish, re-publish, distribute, store and archive such unsolicited submissions in whole or in part in any form or medium whatsoever, without compensation of any sort.

DISCLAIMER This publication is for informational purposes only The content and “expert” advice presented are not intended as a substitute for informed professional engineering advice. You should not act on information contained in this publication without seeking specific advice from qualified engineering professionals.

Adam Freill / Editor afreill@annexbusinessmedia.comSubs paid. Waivers in place. Let’s rock.

GCPay keeps work flowing, so you can finish on schedule and on budget.

Move away from tedious manual subcontractor payments, and put an end to headaches. Easily manage contracts and meet deadlines. Guarantee lien waivers are present and error free. Stop back and forth emails with automatic and custom waiver generation. All with ERP integrations with platforms like Viewpoint, CMIC, and Sage.

Help your entire team complete more projects—smoothly.

Stay in the flow.

GCPay.com

CUE CONSTRUCTION 4.0:

MAKE-OR BREAK TIME

KPMG 2023 Construction Industry Digital Maturity survey takes an in-depth look at technology adoption in Canada’s construction industry.

The past few years have been, to say the least, challenging for the construction industry. The pandemic, supply chain disruptions, labour shortages, and the surge in material costs disrupted lives and business activity. In response to these challenges, many construction companies came to realize that investments in technology were needed to respond to the new market realities, and improve productivity, workflow inefficiencies, and worker safety.

According to research gathered by KPMG in collaboration with the Canadian Construction Association (CCA) for the 2023 KPMG Construction Industry Digital Maturity survey, two thirds of construction companies say the pandemic prompted them to make “moderate” to “great or

considerable” new investments in technology. Most organizations today feel they must adapt their digital strategy to succeed in the new market landscape.

Although only 13 per cent of respondents feel that their company has realized full integration across their value chain from supplier to customer, and 59 per cent feel they are partially integrated, more than eight in 10 companies believe that disruptive technologies can generate savings and efficiencies and make them more competitive.

“This is all about doing more with less,” says Jordan Thomson, a senior manager within KPMG’s Global Infrastructure Advisory group. “There is an amazing level of demand for infrastructure from all sectors that is facing a constrained construction

industry and increasing costs. New technologies will help us bridge the gap and deliver more projects more efficiently.”

The decisions that construction companies make today have never been more important, for they will determine how well their organizations will be able to weather the unexpected and seize the coming opportunities.

When KPMG conducted its first version of the survey in 2020, digital and technological maturity in the construction industry was “fairly low.” The 2023 survey reveals the industry has made headway, but more needs to be done. COVID-19 hastened many digital journeys: Over two thirds (67 per cent) of respondents say the pandemic spurred new investment in, or assessment of, new technologies for their business. Of

the 67 per cent, nearly a third (32 per cent) say the pandemic influenced them to a “great” and “considerable” extent, while 35 per cent say it had influenced them to “a moderate extent.”

Compared to 2020, companies are now shifting more investment dollars into technologies to support project management, project execution, and bid development.

“Technology can help the construction industry address Canada’s housing and infrastructure challenges,” explains Tom Rothfischer, partner, and national industry leader for building, construction, and real estate at KPMG in Canada. “Digital tools, if used smartly, save time and money, reduce waste, and improve worker safety and productivity. In short, they help get projects done on time or ahead of schedule and on budget.”

INDUSTRY OUTLOOK

The industry has tremendous growth potential across the industrial, commercial, institutional, and civil construction sectors, in part fuelled by housing demand, needed maintenance and repairs, government investments, and the transition to the green economy.

In Ontario alone, where the construction industry contributes 7.7 per cent to the provincial economy, construction projects in public transportation, nuclear refurbishment, and other infrastructure and institutional projects will contribute to the growth in non-residential construction, according to StatsCan.

However, the industry is divided in its outlook for the next five years, despite the anticipated need for infrastructure asset replacement and repair, renewable energy projects, and new residential housing.

In the near term, the construction industry is buckling in for a possible recession. Over two-thirds (67 per cent) of construction companies expect an economic downturn in the next 12 months, with a nearly 50-50 split in expectations on whether it will be shallow or deep.

Just over half (54 per cent) believe the downturn will be mild and short-

lived, lasting one or two quarters at most. Forty-six per cent anticipate a more prolonged recession.

Either way, the prospect of a possible recession has not deterred their digital transformation plans.

Nearly seven in 10 survey respondents (69 per cent) who expect a recession are currently either accelerating their digital transformation strategies (60 per cent) or staying the course on their digitalization timetables (40 per cent).

Fewer than a third (31 per cent) are pausing or reprioritizing their digital plans largely to cut their operating expenses and alleviate economic stresses.

investment in projects will flow to the rest of the industry.

HITTING THE LABOUR WALL

The construction industry must find a way to do more with less.

The pandemic hastened the industry’s impending retirement crisis, prompting older workers to retire early and contributing to a tightening in the labour market. As many as 62,000 jobs nationwide currently need to be filled, estimates the CCA, and approximately 156,000 workers are expected to retire by 2028, according to BuildForce Canada.

While 42 per cent of respondents to the 2023 Construction Industry Digital Maturity survey are significantly or somewhat more optimistic about the sector’s five-year outlook, a third are significantly or somewhat more pessimistic; and a quarter are neutral.

Owners and suppliers have a more optimistic view of the future than general contractors, subcontractors, and consultants like architects, engineers, etc. Nearly half of owners (49 per cent) and two thirds of suppliers (66 per cent) have a significantly or somewhat optimistic five-year industry outlook, compared to only 37 per cent of general contractors, 29 per cent of subcontractors, and 31 per cent of engineers, architects, etc.

KPMG notes the high level of optimism with owners is important, as they represent the first link in the construction value chain. Their optimism suggests continued

As it stands today, the industry can’t keep up with today’s labour force requirements. Nine in 10 companies said that they are currently experiencing a labour shortage. That jumps to 94 per cent in Québec. Almost as many – 86 per cent nationally –say that the labour crunch is impacting their ability to bid on projects and/or meet project deadlines. In Québec, 94 per cent are also struggling to bid on new work and/or their projects are behind schedule. As many as 90 per cent of B.C. construction companies say their projects are also being impacted. Technology offers ways for companies to weather the scarcity of labour. Eighty-six per cent of the companies surveyed – and again 94 per cent in Québec – say that they are considering prefabrication, modularization and innovative new tools and machinery to improve their efficiency and address the labour shortage. Nearly nine in 10 (89 per cent) agree that “better project management tools, that is, analytics, building information modelling (BIM), digital twins, etc., make labour more effective and help address shortages.”

The KPMG poll also finds that 91 per cent of construction companies across Canada believe the education system needs to be “much more flexible” to allow young people to pursue the trades. In Québec, that figure jumps sharply to 97 per cent.

The industry realizes that it’s not attracting the talent it needs and it can’t entirely rely on immigration to fill the gap. While education is one lever, technology

Technology can help the construction industry address Canada’s housing and infrastructure challenges.”

ADOPTION OF TECHNOLOGY

them decide if a project is worth bidding on, its cost and contingencies.

Big data has made a “great or considerable” positive impact for 40 per cent of the companies currently using it. However, 46 per cent say the extent to which it’s impacted their organization has been moderate or slight, and the remaining 14 per cent say it hasn’t significantly impacted their organization at all.

This begs the question as to the quality of the data that’s collected and fed into AI applications, and whether big data has in fact been truly understood or implemented.

is another. In the world of modern construction, technology can help to attract young workers who have grown up in a digitally interconnected technological world and want to make an impact in the greening of industry.

TECHNOLOGY ADOPTION: WHAT’S IN YOUR TOOLKIT?

The construction companies surveyed by KPMG intend to invest significantly in technology and digital transformation.

BIG DATA

You can’t digitally transform your organization without a fundamental data transformation. In an industry run on slim profit margins, companies that have a

better handle on their data and can trust its veracity and quality will stand a far greater chance of delivering projects on or ahead of time, on or below budget, and delivering superior returns compared to their competitors.

Big data can reduce project costs and timelines, identify safety issues and material wastage, improve sustainability, and increase efficiency. Globally, many construction companies are using realtime, cloud-powered analytics of large and unstructured datasets.

Through predictive analytics, machine learning (ML) and artificial intelligence (AI), companies are better able to analyze historical material, time, personnel spend, and evaluate a project’s risk profile to help

Only 42 per cent of respondents have designed and implemented cloud computing to connect data sources and share information across project teams, and 42 per cent say their organization’s systems and processes are integrated to a “great or considerable extent.” Just 36 per cent say their corporate functions and internal departments share data effectively and as many as six in 10 (61 per cent) acknowledge that they are experiencing “significant issues” with data siloing.

Less than half (45 per cent) of survey respondents say they are using “data analytics effectively to make business decisions” and another 29 per cent leverage data analytics to a “moderate extent.” Fewer than half (only 44 per cent) use online document management or data repository tools with their clients and project teams to a “great or considerable extent.” About a third (34 per cent) are using ML and automation “to a great or considerable extent” on administration-type processes.

DEMAND-DRIVEN SUPPLY CHAIN

Demand-driven supply chain (DDSC) integrates links along the supply chain to anticipate demand and enable faster and more cost-effective delivery of materials and services. It requires visibility and transparency in the supply chain. While DDSC has been leveraged for years in the manufacturing industry, the pandemic highlighted the importance of active supply chain management in the construction sector.

Investments in new technologies intersect with DDSC to enhance supply chain management accuracy and effectiveness.

THE DOER’S DREAM

0% Financing Select models only

Booth K341

The Utility Expo Kentucky Exposition Center Louisville, KY

Sept 26th- 28th

See the Hyundai difference yourself at your local dealer or hceamericas.com.

ADOPTION OF TECHNOLOGY

Based on the survey findings, the key business case for robotics is worker health and safety, followed by schedule efficiency and productivity. This is aligned with the manufacturing sector, where automotive companies have already invested in such tools as exoskeletons to improve workplace and worker safety.

BLOCKCHAIN AND SMART CONTRACTS

Almost six in 10 companies surveyed plan to introduce, or are in discussions to implement, smart contracts built on blockchain technology, finds the research.

BIM AND DIGITAL TWINS

Building Information Modelling (BIM) uses 3D modelling to digitally render construction designs and analyze construction phases and site logistics, increasing both efficiency and productivity by providing a central repository for project data, providing critical project data spanning design criteria, materials, construction, cost, and warranty and operation documentation.

About a third (34 per cent) of respondents to the 2023 KPMG Construction Industry Digital Maturity survey say they are experienced “to a great or considerable extent” with BIM and digital twin technologies and the application of these two technologies in project delivery, while 28 per cent are experienced to a “moderate extent.”

ROBOTICS AND AUTOMATION

When asked the extent to which the surveyed companies are using robotics, such as drones, exoskeletons and collaborative robotics, nearly a third (32 per cent) say to a “great or considerable extent,” and a quarter (25 per cent) to “a moderate extent.” Sixteen per cent are using them “a little” and 28 per cent aren’t using robotics at all.

While the survey shows an increasing focus on robotics and automation, the survey authors believe this focus is primarily on investing in lower-cost technology, like drones. Expected payback times are getting shorter though, with most respondents (63 per cent) stating an expected payback time of less than three years for their technological investments, which is a shorter timeframe than when companies were surveyed three years ago.

The objective is to improve transparency, accountability, and traceability. It’s a single source of truth covering all aspects of a construction project, and as such, can also deter fraud by eliminating suspicious and duplicate transactions. Information on purchased materials can be visible on the blockchain, including production and quality certificates.

INTERNET OF THINGS SENSORS

Canadian construction companies have various reasons for investing in wearables and Internet of Things (IoT) sensors, including to improve productivity, planning, estimating, sustainability and/or health and safety.

The survey finds that only 56 per cent have invested to a “great or considerable extent” (34 per cent) and to “a moderate extent” (22 per cent). Twenty per cent have invested “a little” and a quarter have not invested at all.

IoT sensors can cover a broad array of

ADOPTION OF TECHNOLOGY

attributes including water, temperature, air quality and particulate counts to fire risks, the structural integrity of a building, monitoring proper curing and quality of concrete and more IoT sensors are immensely valuable on construction sites to detect and mitigate risks like water pipes freezing and potentially bursting in the winter.

Accordingly, IoT sensors offer an interesting value proposition to insurance companies which can use sensors to better understand and mitigate risk by requesting that construction companies deploy IoT technology to detect, mitigate and control risks and thereby reducing project risk, insurance claims and litigation.

CYBER RISK MANAGEMENT

The benefits of technology and digital connectivity are not without their risks. From ransomware to spear phishing and distributed denial of service (DDoS) attacks, cyberattacks in Canada are on the rise. No industry is immune.

Yet, fewer than four in 10 companies (38 per cent) surveyed for the KPMG 2023 Construction Industry Digital Maturity

survey have implemented cybersecurity tools and technologies.

Only about a third (32 per cent) have definitive plans to implement cybersecurity technologies over the next three years and 17 per cent have put it on the table for discussion to implement. The remaining 13 per cent admit they have no plans to implement cybersecurity tools. No wonder then that over half (56 per cent) of those surveyed aren’t confident that their IT world is secure.

Six in 10 companies (62 per cent) also acknowledge their “flow-down” cyber compliance requirements or specifications to their suppliers could be clearer or better articulated.

As companies leverage technologies, such as robotics to assist in builds, drones to monitor worksites, and sensors and connected devices to operate smart buildings, they generate, collect, and store vast quantities of data. Cybercriminals are looking for vulnerabilities or ways in to steal personnel, account or financial records, architectural and engineering designs, intellectual property data, or confidential

or sensitive project information, or to gain control of critical infrastructure.

Cyber breaches can result in both financial and reputational loss and could jeopardize work on future projects. While three quarters (76 per cent) are greatly, considerably, or moderately concerned about privacy breaches and potential risks associated with private data, over half (54 per cent) acknowledged that they have not fully considered the risks of using digital technologies nor quantified the financial risks.

Cybersecurity starts with awareness and identification, assessment, prevention and defence, and response. Increasingly, cybersecurity-related provisions are being included in construction projects and tailored to specific project needs and risks.

Do the terms of your supply and construction contracts cover cyber risks, provide early warning regimes, indemnification, or restrict the storage of data? Are there measures stipulating that sensitive information be destroyed or returned when the contract ends? Are security frameworks, testing and audit procedures in place?

THE CONNECTED SITE

Projects create an enormous amount of valuable information. BIM and digital twin technology provide the ability to combine and integrate technology across the project team to develop a unified data model which will be what defines the construction landscape in the 21st century. We call it the “Connected Site.”

GETTING THE RIGHT PEOPLE AT THE TABLE

Are construction companies investing in the right technologies? Who makes the investment decisions? How supportive of technology use are your project teams and skilled trades? And how well is change management being communicated throughout the organization?

The unwillingness to change established ways of working is typically the biggest barrier for wider adoption of technology. This is particularly true in the construction industry. A successful digital strategy starts with board and executive sponsorship. But only 44 per cent of the companies surveyed say that top management assigns a “great” or “considerable” significance to digital transformation.

Department heads – those closest to identifying the organization’s needs and limitations – will need to play a larger

role in guiding their organization’s digital maturity. They will also need to review their workforce capabilities. Forty-four per cent of companies surveyed say that digital transformation will require hiring new talent within their organization to a “great” and “considerable” extent and another 33 per cent say it will require hiring new talent to a “moderate” extent. Are there opportunities to reskill or upskill employees on various technologies? How effectively is your organization recruiting data scientists and technologists?

On the upside, there’s excitement in the air over change. Approximately eight in 10 companies say their project teams, workforce, and back-office teams are considerably or moderately “excited about and supportive of new technologies.”

THE NEXT 3 TO 5

In the 2020 edition of the report, KPMG

posed the question, “Can you afford to wait?” The ensuing three years proved that companies can’t afford to wait.

The industry now recognizes that they must modernize or be left behind. The next three to five years could well be a “make or break” timeframe for many companies.

The authors of the 2023 KPMG report list several strategies to encourage the investment and use of technology in construction. These include:

• Developing an enterprise-wide strategy and tracking progress;

• Identifying business outcomes that intrinsically link technology to the business’s overall objectives;

• Building motivation and develop a change management plan;

• Attracting and retaining talent; and

• Partnering with trusted advisers.

Between late 2022 and March of this year, KPMG interviewed and surveyed 275 Canadian companies in the construction sector to produce the KPMG 2023 Construction Industry Digital Maturity report in collaboration with the Canadian Construction Association. On-Site Magazine would like to thank KPMG’s Tom Rothfischer and Jordan Thomson, and Mary Van Buren of CCA, for their work in bringing this research to our industry. To download a copy of the report, please scan the QR Code.

CONSTRUCTION AND MAINTENANCE

LOOKING FORWARD

BuildForce Canada’s Assessment of Construction Labour Markets from 2023 to 2032.

Construction is one of Canada’s largest industrial sectors. In 2022, total construction industry employment exceeded 1.5 million Canadians, or approximately one of every 13 working Canadians. As a whole, the industry accounts for seven per cent of Canada’s GDP. It is made up mostly of small businesses, with approximately 60 per cent of industry firms classified as micro businesses consisting of fewer than five employees.

As with many sectors of the economy, the construction industry has emerged from the COVID-19 pandemic in a strong

position, but with the additional challenge of recruiting from a shrinking labour force.

Labour Force Survey data from Statistics Canada shows employment grew by 101,400 workers (seven per cent) in 2022, while the labour force grew by 85,200 workers (5.5 per cent). The inability of the labour force to grow as quickly as employment helped to bring the construction industry’s average unemployment rate down from six per cent in 2021 to 4.7 per cent in 2022. The national construction unemployment rate reached a low of 2.4 per cent in July 2022, its lowest-recorded rate since 1976.

Total construction industry employment increased in 2022 on the strength of elevated investment levels in new-home construction, public-sector institutional buildings, and public-transit systems. This rapid rise in construction demands created tighter labour market conditions throughout most of the year.

Provinces such as Ontario, British Columbia, Quebec, Nova Scotia, and Prince Edward Island were particularly impacted, as investment levels were high in both residential and non-residential segments.

These additional construction demands

created recruitment challenges for many employers, both in the residential and non-residential sectors. Labour market pressures in the residential sector should ease in 2023 and 2024, as the rapid rise in interest rates recorded in 2022 has moderated demands for new homes. Renovation and maintenance demands, however, are expected to grow almost continuously through the forecast period.

In the non-residential sector, labour market demands are unlikely to ease until the middle years of the forecast period, given the high volume of large projects underway in most regions of the country.

NATIONAL CONSTRUCTION FORECAST OVERVIEW (2023 TO 2032)

While less impacted than other sectors of the economy, construction continues to recover from the lingering effects of the emergency measures introduced to control the spread of COVID-19. Although temporary, these measures not only impacted industry training, but also forced some older workers to leave the workforce to deal with pandemic-related family obligations. The slow return of these older workers to the labour force contributed to tighter labour markets in 2021 and the early part of 2022.

Strong demand for construction services created market conditions in which employment demands for much of the year outstripped the capacity of the labour force to keep pace with growth, leading to lower overall industry unemployment rates across most of the country.

Construction investment has increased dramatically since the pandemic, with governments at all levels investing heavily in infrastructure as a tool to stimulate the economy. In 2022, combined residential and non-residential construction investment increased by three per cent over 2021’s record high.

Residential investment levels were driven by record-low interest rates in the first half of the year and a growing demand for housing that was spurred by low rental vacancy rates in many cities and high levels of immigration. The non-residential sector benefited from stronger levels of public-sec-

tor investment in healthcare, utilities, transportation, and public transit, as well as robust levels of private-sector investment.

Overall investment in the residential sector was up two per cent from 2021 levels, while investment in the non-residential sector added four per cent. BuildForce Canada forecasts construction investment to contract in 2023 and 2024 as higher interest rates cool the country’s strong housing market, and as a number of key non-residential mega-projects conclude.

Total construction investment is poised to contract by four per cent in 2023, with demand reductions of eight per cent in the residential sector and one per cent in the non-residential sector. The contraction is brief, however. By 2032, total investment is expected to grow slightly, up one per cent compared to 2022 levels.

Continued investment growth lifted construction employment in the 34 trades and occupations tracked in the BuildForce Canada LMI model to above 1.16 million workers in 2022, an increase of five per cent compared to 2021. The residential and non-residential sectors both added workers.

As construction investment contracts into 2023, total employment is expected to decline. A loss of four per cent of the residential-sector workforce will more than offset further growth of just above 1.5 per cent in the non-residential sector to create an overall contraction of one per cent.

These diverging trends continue into 2024, before growth resumes in both sectors in the medium term and remains mostly unchanged through the long term. By 2032, overall employment is expected to add one per cent, as a gain of four per cent in the non-residential sector more than offsets a loss of one per cent in the residential sector.

Although employment is expected to record only modest increases over the 10-year forecast period, labour force management will be challenging. Industry retirements are expected to reach their highest levels in the near term as large numbers of workers from the baby boomer generation exit the industry.

Construction demands will require the industry’s labour force to expand by 54,100

workers over the forecast period. When this demand growth is added to the 245,100 individuals expected to retire during this period – approximately 20 per cent of the 2022 labour force – the overall industry recruitment requirement rises to 299,200 workers by 2032.

Although the industry is expected to recruit approximately 237,800 new-entrant workers under the age of 30 during this period to help offset some of this requirement, even at these heightened levels of recruitment, the industry is likely to be short 61,400 workers by 2032.

NON-RESIDENTIAL INVESTMENT

Since the onset of the pandemic, nonresidential construction investment has been supported by a series of major projects across the industrial, commercial, and institutional (ICI) and engineering-construction sectors. These were deployed as tools to stimulate the economy, and in response to growing population demands.

After rising by almost 10 per cent in 2021, non-residential construction investment increased again in 2022 – by just over four per cent, with both the ICI and engineering-construction sectors growing.

Activity in the engineering-construction sector has grown since 2020 on the strength of major transit, utility, and roads, highways, and bridges projects in Ontario, British Columbia, Quebec, Nova Scotia, and Prince Edward Island. As several of these projects conclude in the near term, investment cycles down. By 2032, engineering investment contracts by eight per cent compared to elevated 2022 levels.

Investment in the ICI sector has been on a steady growth curve since 2017. Levels have increased in every province, supported by major education and healthcare projects, as well as across the commercial and industrial sectors. The outlook for the sector calls for a series of increases across the forecast period, with investment ending the decade 14 per cent above 2022 levels.

Growth is particularly strong in the commercial sector, where investment increases annually to 2032, adding 26 per cent over 2022 levels. Gains in the

Comprehensive Lineup

Complete your fleet with loaders, graders & more from Brandt – in stock & ready to rumble!

Technology Leaders

Pressure “keeping up”? Brandt gets it. With 15+ years in construction tech we’ll help you get it right.

24/7/365 Support

With Brandt you get 100+ equipment service locations, mobile techs & the parts you need, pronto!

industrial sector (10 per cent) and the institutional sector (six per cent) are less pronounced.

NON-RESIDENTIAL EMPLOYMENT

Employment in the non-residential sector added nearly 24,000 workers in 2022, rising by four per cent over 2021 levels. Employment is poised to grow continuously between 2023 and 2027, rising to above pre-pandemic levels and a forecast peak of more than 602,900 workers (five per cent above 2022) by 2027. Growth will be greatest in provinces with strong engineering construction and institutional demands.

Between 2022 and 2026, employment will increase by more than 26,000 workers before declining slightly through most of the remaining forecast years. By 2032, non-residential employment is expected to increase by 21,600 workers – a four per cent rise over 2022 levels.

Note that the widespread conversion of ICI buildings to the greater use of electricity for heating and cooling is excluded from this report, as these efforts are still in their early phases and have had only minor impacts on

overall construction labour markets. As these efforts accelerate, they will be added to future BuildForce Canada outlook reports.

NON-RESIDENTIAL LABOUR FORCE

Rising demands across the non-residential sector will require the labour force to increase by some 42,100 workers across the forecast period. Over the same period, an estimated 120,800 workers are expected to retire, bringing recruitment requirements to 162,900.

Based on historical trends, and supplemented by the industry’s ongoing career-promotion efforts, an estimated 130,000 workers under the age of 30 are expected to join the non-residential construction sector. However, without additional recruitment efforts, the industry may be short as many as 32,900 workers by 2032.

Addressing peak demands through interprovincial mobility may be challenging. With many provinces reporting higher or sustained levels of construction activity, in the non-residential sector in particular, there may not be strong incentive for workers to relocate.

Competition for workers will be most

intense in British Columbia and Ontario, where many major projects are planned and underway, and where labour markets are already tight.

BUILDING A SUSTAINABLE LABOUR FORCE

Employment growth in 2022 was widespread, though younger workers made up a larger share of employment gains. The increased participation among youth in the industry is a positive signal. Not only does it reverse a decades-old trend of contracting numbers of workers in the sector, but it also suggests that efforts to attract more young people into careers are bearing fruit.

These efforts will be increasingly important over the forecast period, particularly as Canada’s population ages and the youth population declines. These demographic shifts will contribute to tighter labour markets, as labour force participation by older workers is much lower than that of their younger counterparts.

LABOUR FORCE DIVERSIFICATION: UNDER-REPRESENTED GROUPS

The share of younger Canadians available to enter the labour force has been in decline for several years. As the baby boomer generation of workers commences retirement over the next decade, the competition for younger workers will be intense.

To mitigate the impact of this demographic shift, the construction industry must diversify its recruitment. The industry must increase recruitment of individuals from groups traditionally under-represented in the current construction labour force, including women, Indigenous People, and newcomers.

In 2022, there were approximately 199,600 women employed in Canada’s construction industry, of which 27 per cent worked on site, directly on construction projects, while the remaining 73 per cent worked off site, primarily in administrative and management-related occupations. Of the 1.16 million on-site tradespeople employed across the 34 trades and occupations tracked by BuildForce Canada, women made up five per cent.

The estimated 53,900 tradeswomen in Canada are represented across all sectors

Ambitious Projects.

of construction, but given the nature of construction work, women account for a higher share of total tradespeople (five per cent) in residential construction. The top five trades and occupations in which women tend to be employed are trade helpers and labourers (18 per cent of all tradeswomen), construction managers (15 per cent), painters and decorators (14 per cent), contractors and supervisors (eight per cent), and carpenters (seven per cent).

The Indigenous population is the fastest growing population in Canada and therefore also presents recruitment opportunities for Canada’s construction industry. In 2021, Indigenous People accounted for 5.1 per cent of Canada’s construction labour force. This share is notably higher than the share of Indigenous workers represented in the overall labour force. The share of Indigenous People in the labour force across all industries has been growing at a faster pace than construction over the past five years.

Canada’s construction industry may also leverage newcomers (immigrants) over the forecast period to meet labour requirements. Due to the declining natural rates of population growth, immigrants are the primary source of labour force growth in Canada. Immigrants have been playing an increasingly important role in replenishing the workforce, with the share of immigrants in the workforce increasing from 21 per cent in 2011 to 27 per cent in 2021.

Canada has been successful in attracting and integrating immigrants into the labour force; however, immigrants remain under-represented in the construction indus-

try. The construction labour force share of immigrants was 18 per cent in 2021, which is notably lower than the share in the overall labour force.

CONCLUSIONS AND IMPLICATIONS

The 2023–2032 BuildForce Canada

Construction and Maintenance Looking Forward forecast sees construction employment continuing to grow as the sector maintains its post-pandemic growth curve. In the short term, growth will be constrained somewhat by a reduction in residential investment created by higher interest rates. Activity in the non-residential sector, meanwhile, remains on a steady upward trend in most provinces. By 2032, overall employment is expected to increase by one per cent from 2022 levels.

Non-residential employment enters the forecast supported by a broad range of major institutional and engineering-construction projects across the country. These include public transit works in Ontario and Quebec; utilities in British Columbia and Ontario; mining in Ontario and Saskatchewan; roads, highways, and bridges in British Columbia, Nova Scotia, Ontario, and Quebec; and

healthcare facilities in Nova Scotia, Quebec, Ontario, and British Columbia.

Non-residential employment is anticipated to rise to a peak around 602,900 workers in 2027 (and to above pre-pandemic levels by 2026), before declining modestly through the remainder of the forecast period. By 2032, employment is expected to increase by 21,600 workers – a four per cent rise over 2022 levels.

Meeting peak demands will be challenged by limited provincial mobility. Many provinces are already experiencing high or sustained levels of construction activity, giving workers no strong incentives to relocate in the near term. Labour market challenges are complicated by the retirement of an estimated 245,100 workers, or 20 per cent of the 2022 workforce. This represents a significant loss of skills and experience that is unmatched by new workers.

The task of attracting new workers to construction may become further complicated as other industries face similar challenges related to replacing an aging labour force. Meeting near- and long-term demand requirements will require a combination of industry strategies.

BuildForce Canada is a national, industry-led organization committed to working with the construction industry to provide information and resources to assist with its management of workforce requirements. Its mandate is to provide accurate and timely labour market information to advance the needs of the entire construction industry to develop a highly skilled labour force that will support the future needs of Canada’s construction industry. To access the full construction labour report, please scan the QR Code.

The Worldwide Leader in Concrete Paving Technology

GOMACO offers the full range of concrete slipform pavers, curb and gutter machines, trimmers, placer/spreaders, texture/ cure machines and bridge/canal finishing equipment. GOMACO equipment features our exclusive and proprietary G+® control system, created in-house by our software engineers from the wants and needs of contractors paving in the field. At the heart of GOMACO equipment is our passion for concrete and our commitment to our customers. We look forward to visiting with you about your upcoming paving projects and your concrete paving equipment needs. Our worldwide distributor network and our corporate team always stand ready to serve and assist you.

HOW WE BUILD NOWCANADA PROCORE:

A look at the technology and industry trends shaping Canadian construction in 2023.

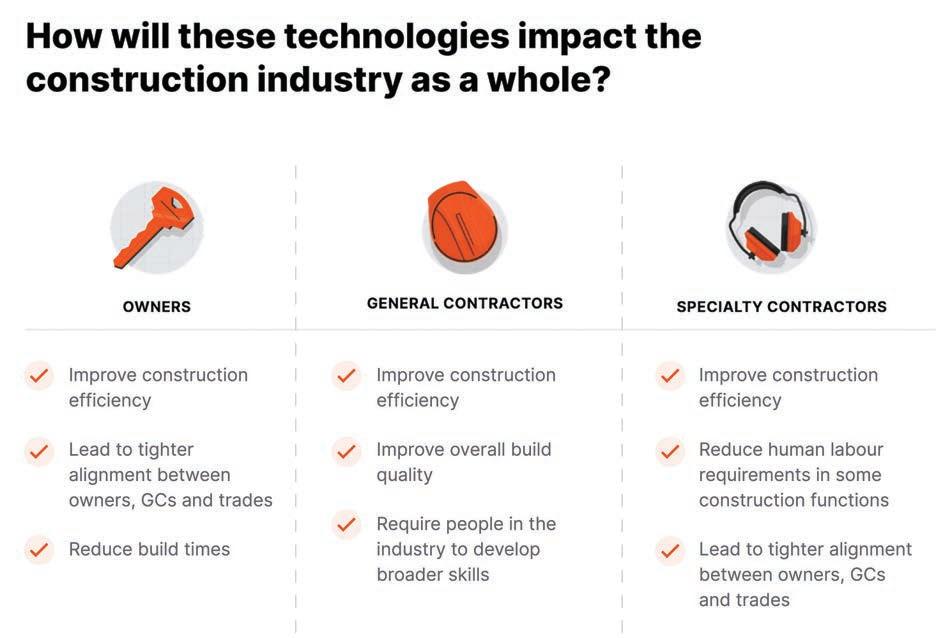

In early 2023, Procore partnered with Censuswide to survey 502 construction industry stakeholders in Canada across owners, general contractors and subcontractors. Questions provided to the participants were focused on market conditions, top challenges, digital transformation and technology adoption.

HOW WE BUILD NOW

Construction is both inspiring confidence and driving new opportunities across the industry. We’ve seen massive strides in both digital and cultural transformation, spurred on by new technologies arriving every day and talented people who are building for the future. In Canada, changes in construc-

tion are happening across all regions with an ever-improved focus on delivering the best projects.

In the Canadian construction market, confidence levels in the industry are high. Despite challenges, there is significant digital transformation underway, led by owners. As construction management platforms start to become more and more ubiquitous, the industry is noticing the benefits of a single source of truth for all their project and workforce data.

BUSINESS SENTIMENT AND 12-MONTH OUTLOOK

Strong industry confidence is consistent across business types and sizes.

Like much of the world, Canada is experiencing the repercussions of the pandemic. Canada’s GDP growth from late 2021 to late 2022 has been the highest of the G7 countries and the economy is now 2.7 per cent bigger than it was before COVID-19. However, like other developed countries, Canada has been experiencing high inflation, rising interest rates and slowing growth.

The consensus among economists is that Canada’s economy will expand by just 0.3 per cent in 2023, with growth improving to 1.5 per cent in 2024. This means that in 2023, Canada is experiencing economic stagnation. Despite these statistics, it is heartening to see the construction industry express cautious optimism as it

looks to consolidate and build on post-pandemic progress.

Nine in 10 survey respondents say they are confident about market conditions over the next 12 months. Some of this confidence rests on multiple large infrastructure projects currently underway or in the pipeline. The government’s “Investing in Canada” program – estimated to be worth $180 billion over the next decade – will see upgrades in public transportation, ongoing nuclear refurbishments and new wastewater projects. To date, 85,000 projects across all sectors have been approved, with a total value of $131 billion.

Canada’s green building strategy will also generate many work opportunities for the construction sector. The housing sector will grow too as the country adjusts to a large immigration influx and ongoing population growth from January 2022 to January 2023. This was the first 12-month period in Canadian history where population grew by over 1 million, the highest annual population growth rate since 1957.

Owners are more conservative about construction outlook than general contrac-

tors and subcontractors. More than seven in 10 subcontractors and general contractors (72 per cent) expect the number and value of projects completed by their organization to increase in the next 12 months, compared to 65 per cent of owners.

Organizations involved in civil and infrastructure, energy and utilities are more likely to be confident about an increase in the number of projects completed by their organization in the next 12 months compared to organizations involved in single-family residential, education and healthcare.

Throughout the year, numerous civil contractors will be tendering for new projects and hitting key milestones on mega schemes, such as the Metrolinx/IO – Ontario Line subway, British Columbia’s (B.C.) Site C Clean Energy scheme and the Bruce Power generating station refurbishment.

PROJECTS AND COMPLETIONS

Of the respondents who report working in the residential sector, just 43 per cent expect to build more housing units in 2023 than they did in 2022, though this does vary across the regions. Over half of respondents from

B.C. and Alberta who work in the residential sector expect to build and deliver fewer housing units in 2023 compared to 2022.

• 55 per cent of respondents from Alberta who work in the residential sector expect to build and deliver fewer housing units in 2023 compared to 2022.

• 51 per cent of respondents from B.C. who work in the residential sector expect to build and deliver fewer housing units in 2023 compared to 2022.

• 60 per cent of respondents from Ontario who work in the residential sector expect to build and deliver more housing units in 2023.

Companies in Ontario are more positive in their outlook than their counterparts in B.C., Alberta and Quebec. Just under eight in 10 respondents in Ontario (78 per cent) expect an increase in the number of projects over the next 12 months. This sentiment drops to 69 per cent for Quebec and 60 per cent for B.C.

Similarly, 80 per cent of respondents from Ontario expect an increase in the value

of projects over the next 12 months. This number falls to 67 per cent for Alberta and 61 per cent for Quebec.

NAVIGATING TOP CHALLENGES ON THE HORIZON

Performance remains a cause for concern with nearly half of all projects going over budget and over schedule.

As an industry, construction has inherent challenges that can inhibit peak performance. The sheer complexity of many projects is one factor. Cost-inflation’s impact on materials and labour is another. In a nutshell, the operating environment for construction is constantly in flux.

Organizations in B.C. are likely to see slightly better performance than their counterparts. Respondents there said that, on an

average, 40 per cent of their projects went over budget compared with 48 per cent in Ontario, 50 per cent in Alberta and 51 per cent in Quebec.

In terms of schedule, respondents from Quebec again report slightly worse performance with over 52 per cent of their projects going over schedule as compared to 51 per cent in Alberta, 47 per cent in Ontario and 45 per cent in B.C.

BUILDING SUSTAINABLY

Tackling climate change and becoming more sustainable are some of the construction industry’s top challenges over the next few decades. This will involve increasing the resilience of the nation’s infrastructure, improved use of recycled building materials, installing sustainable energy systems and

the repurposing rather than demolition of existing buildings.

A way to minimize the amount of rework is also required — high levels of waste are currently a major impediment to improving sustainability. A data-driven transformation in construction, drawing on new technologies like prefabrication, AI and robotics, will be the catalyst for change.

The Canadian government has committed the country to achieving net-zero emissions by 2050, combined with an even more ambitious target of reducing emissions by 40 to 50 per cent by the end of this decade.

As the construction industry is responsible for around eight per cent of Canada’s total greenhouse gas emissions, the sector is well-placed to make a major contribution to meeting these targets by reducing its annual carbon dioxide emissions.

One in two owners (50 per cent) and nearly half of general contractors (48 per cent) and subcontractors (47 per cent) report having started to focus on strategies like prefabrication and improved material selection to reduce the carbon footprint of projects, and 41 per cent of all respondents are either tracking or plan to start tracking carbon emissions on their projects within the next 12 months.

That said, 31 per cent of respondents

report that sustainability is not a key issue for them on their projects.

Rework is the bane of sustainability, but it is rife in the construction sector. Poor quality work is not the only factor creating such alarming levels of wastage. Improper planning, coordination issues and scope changes all impact these statistics.

With so much rework pushing projects over schedule and budgets, thereby degrading construction’s overall performance, contractors are keenly assessing technology’s potential to offer a transformative solution to these systemic problems. This is exemplified by the impact technology has on productivity and profitability, as covered later in the report.

ADVANCED MATERIAL PURCHASING AND LOCALIZED SUPPLY CHAINS

With inflation running at 6.8 per cent in the Canadian economy in 2022, construction input costs also rose – sometimes even more sharply because of specific supply chain issues. Material price pressures are being felt right across the construction sector.

Just over a third of general contractors (34 per cent) and 32 per cent of subcontractors, report being unable to pass materials price increases onto owners, which has eaten into their margins. That said, it seems many contractors have been able to pass on these rising costs as 30 per cent of owners report higher project costs driven by materials pricing inflation.

Supply chain problems are impacting respondents to a different extent across the country. Quebec-based respondents report the highest impact, with 41 per cent reporting significant delays due to supply chain

issues, compared to 35 per cent respondents from Ontario and just 25 per cent of respondents in B.C.

To counter price fluctuations, shortages and other supply chain problems, general contractors (52 per cent) and subcontractors (46 per cent) are considering or have considered advanced purchasing of materials.

Strengthening ties with local supply chains is another strategy being pursued by contractors looking to reduce input costs. More than four in 10 general contractors (41 per cent) have started to look at more local material suppliers, and 46 per cent of subcontractors are doing the same. Nearly half of owners (49 per cent) also report developing stronger links with local suppliers.

RED TAPE IS A BARRIER

More than a quarter of respondents (26 per cent) say delays in obtaining construction permit approvals and associated red tape are hampering the competitiveness of the Canadian construction industry.

For example, it now takes nearly 250 days to obtain a building permit—three times longer than in the U.S., and ranking Canada 34 out of 35 OECD countries in building permission times.

As well as speeding up construction permits, the government also needs to address problems with health and safety in the sector, say respondents. Construction has always been a potentially hazardous occupation, with an average of 20.2 fatalities per 100,000 workers each year in Canada and many serious injuries incurred.

Federal, provincial and territorial safety associations are working hard to reduce these numbers, but respondents feel more

needs to be done to minimize and outlaw bad practices. Around one third of respondents feel the government should introduce regulations to improve quality and safety standards in the construction industry.

With regard to other regulations, top of mind for 40 per cent of respondents are ISO standards like ISO 9001, ISO 19650, ISO 45001 and ISO 16739. These are followed by sustainability certifications like LEED, ZCB, IREE and TRUE and health and safety related certifications like COR.

OPTIMIZING DELIVERY OF FINANCIAL SERVICES

Improving insurance and payment processes is a necessity. Over half of respondents feel the industry can do a better job of using existing data to simplify the way payments and insurance are managed.

Prompt payment legislation was introduced in Ontario in 2019. Alberta and Saskatchewan have followed suit and other provinces are considering doing the same.

However, there is still clear dissatisfaction with the way the systems are working as 52 per cent of subcontractors report having experienced cash flow problems arising from delayed payments. General contractors are also affected.

These delays can be catastrophic for subcontractors, who pay for materials and labour before being paid themselves for their project work. Many go out of business while waiting to be paid what they are owed.

This can impact a subcontractor’s risk profile, which means banks are often reluctant to lend to them. The difficulty of obtaining finance to keep afloat while awaiting payment means many subcontractors use non-traditional lending sources, which

may expose them to greater risks and higher interest rates.

Nearly half of the subcontractors surveyed (48 per cent) reported experiencing trouble obtaining approval for financing from traditional lending institutions. Owners face a different set of payment-related problems with almost four in 10 (39 per cent) reporting that invoiced amounts do not match the amount of work completed.

Nearly four in 10 respondents (37 per cent) report frustration with the time it takes to get construction insurance quotes. They say that, on average, 11 per cent of their total project costs are attributable to insurance-related expenses.

DIGITAL TRANSFORMATION

Owners lead the construction industry when it comes to digital transformation, with 28 per cent considering themselves to be a digital-first business and another 47 per cent stating they are well on their way to adopting digital formats and workflows.

This compares with around one in six general contractors (17 per cent) and about one in five subcontractors (19 per cent) who consider themselves to be a digital-first business. Around a quarter of general contractors (26 per cent) are either just starting out or

have not yet started their journey towards digital transformation. Subcontractors lag slightly further behind, with 31 per cent either just starting out or not yet started towards digital transformation.

Alberta leads the way when it comes to digital transformation with 82 per cent of businesses reporting themselves as either a digital first business or one that’s well on the way to adopting digital formats and workflows. B.C. and Quebec lag with around 33 per cent of respondents reporting either just starting out or not having started towards digital transformation.

THE IMPACT OF ECONOMIC VOLATILITY ON DIGITAL TRANSFORMATION

Economic and industry volatility has been prompting businesses to seek greater efficiencies through digital transformation. Three in 10 respondents (30 per cent) reported that they need new technology that will help drive operational efficiencies and cost controls.

This volatility is also prompting a fresh re-evaluation of companies’ technology, with many companies carrying out financial audits and effectiveness-testing of their current systems. Nearly one quarter (24 per cent) said they feel they need to start

looking at existing technology to understand what’s working and what’s not. A similar number (23 per cent) want to consolidate their investments in tech.

Just over one in five respondents (21 per cent) report they need to scale back plans for evaluation and rollout for new tech. All this could potentially lead to reduced tolerance for poorly adopted tools and solutions that are leveraged by siloed teams to solve smaller point problems.

Non-digital workflows are not a thing of the past. Around one quarter of respondents (23 per cent to 28 per cent, depending on the workflow) still use paper-based records or non-digital processes as part of their workflows, but technology is a key performance enabler.

When asked what is most likely to improve productivity in their organization, respondents cite upskilling employees, reducing time spent on manual admin tasks and adopting tech to make teams more efficient.

Asked what is most likely to improve their profitability, respondents list maintaining an inventory of commonly used materials to manage price fluctuations, simplifying existing tech and processes, and adopting tech to make teams more efficient. It’s clear

The leader in sustainable air solutions

Atlas Copco’s range of e-air compressors provides a sustainable option for any application. See why E-Air fits your business, saves you money, and reduces your overall fleet emissions.

7 Benefits of

that technology is seen as offering the ability to act as a common lever that can raise productivity and profitability.

REAL-TIME INFORMATION AND IMPROVED COLLABORATION

Almost half of respondents feel the industry must embrace greater collaboration (including virtually) among stakeholders (owners, developers, general contractors, subcontractors, engineers and consultants) in projects.

Owners report enhanced security, improved employee experience and improved decision making on current and future projects as the top benefits they expect by investing in capturing, integrating and standardizing data from different parts of their business.

General contractors report improved visibility, reduced costs and improved decision-making on current and future projects as the top benefits of investing in capturing, integrating and standardizing data from different parts of their business.

Subcontractors report increased productivity, better regulatory compliance,

enhanced security and reduced costs as the top benefits they expect by investing in capturing, integrating and standardizing data from different parts of their business.

The industry realizes the value of data, yet how accessible is this data and how is it being utilized to deliver the kind of benefits the industry expects it to deliver?

When asked about the time spent just searching for data or information, respondents reported spending 17 per cent of their time on a typical project searching for data or information – clearly a significant amount of time to invest in low productivity tasks.

DATA MATURITY

The level of data maturity varies by company size when it comes to general contractors and subcontractors (builders), with small businesses more likely to be at Level 1. Around three in 10 respondents from these small builders (29 per cent) reported being at Level 1, compared to just 19 per cent from mid-size businesses and eight per cent from large enterprises. Large builders are by far the most data mature,

with 51 per cent at Level 3 or 4.

Overall, half of respondents consider themselves at Level 2 in their use of data. About one fifth (21 per cent) are Level 1, where much of their data exists in spreadsheets and on paper. Just 25 per cent report having highly data-driven decision making, made possible by dedicated data teams at Level 3. Only four per cent are at Level 4, gaining insights from data that they consider to be of significant value to their business. Large businesses are by far the most data mature, with 51 per cent at Level 3 or 4.

CONSTRUCTION TECHNOLOGIES ON THE HORIZON

Respondents rate construction management platforms, clean technologies involving green, sustainable or innovative materials, and next generation BIM as the top technologies that will drive change in the construction industry over the next three years.

This emphasis on construction management platforms as a key lever for change is also visible when it comes to adoption. Well over half of respondents (56 per cent)

are either currently using (29 per cent) or plan to adopt (27 per cent) a construction management platform over the next year.

Next generation BIM and AI/ML are the two technologies that are most likely to take the longest time to be adopted throughout the sector, with 42 per cent of respondents stating that they are neither currently using nor planning to adopt these technologies within the next 12 months.

Half of general contractors (50 per cent) and just over half of owners (51 per cent) say they prefer an integrated solution, compared to just 35 per cent of subcontractors. Just over half of all respondents in B.C. (52 per cent) and Alberta (55 per cent) and half in Ontario (50 per cent) prefer point solutions or individual software that meets specific needs.

Of the respondents who reported preferring an individual solution, the top three reasons for doing so are:

• Less likelihood of impacting other business systems.

• Access to specialized expertise from the technology provider.

• Faster or easier implementation.

A RAPIDLY EVOLVING LABOUR MARKETPLACE

Labour and productivity are top of mind for respondents. Canada has a well-documented labour shortage and construction, which according to Statistics Canada employs 1.5 million people across the country, has been particularly badly hit.

In 2022, on average, there were around 80,000 job vacancies in the sector each quarter, all of them proving difficult to fill. Some provinces are hit worse than others, placing even more pressure on their local construction scene. Skills shortages also drive wage growth, which forces up building costs.

The situation may well worsen as approximately 124,300 workers (20 per cent of the 2022 construction workforce) are expected to retire by 2032, according to BuildForce Canada.

The ongoing labour shortage could leave the Canadian construction 61,400 workers short by 2032.

The loss of so much experience and knowledge is a significant concern, and is exacerbated by construction’s perennial

struggle to attract sufficient numbers of new entrants.

Staff and skills shortages have a knock-on effect on all aspects of company performance. They damage productivity and profitability, create work backlogs, and make it harder to maintain a safe working environment onsite.

In fact, 29 per cent of respondents to the survey have been unable to take on more projects in the past three to six months as a result of the labour crisis.

As they leave opportunity on the table, it’s no surprise that labour markets are a major concern for organizations. Respondents consider hiring and retaining skilled labour as one of the top challenges they face over the next 12 months.

One reason for this shortfall could be other industries holding greater attraction for new employees when compared to construction. That seems to be true for 27 per cent of respondents who agree that it is hard for construction to compete with other industries for good employees.

With businesses struggling to recruit, employers are vying for the best talent within

a limited pool. Just over a quarter of respondents (27 per cent) agree that there is too much competition in construction for talent.

The problem could worsen. Just over three in 10 respondents (32 per cent) fear that some of their most experienced people will retire within the next few years and take valuable knowledge with them.

Fostering workforce wellbeing through an inclusive, diverse and safe environment can help fight labour challenges. Opening up the industry to a more diverse range of people will help increase the pool of available talent and ease the labour challenges. Organizations recognize this, with 38 per cent of respondents saying they need to improve diversity and inclusion in construction workplaces to attract women, minorities and historically underrepresented groups.

In fact, just over four in 10 respondents (41 per cent) have a diversity and inclusion policy in place with another 45 per cent planning to implement one in the next 12 months.

On average, 24 per cent of the executive staff and leadership at responding organizations is female. Subcontractors have the worst ratio when it comes to having female members on staff. Just 22 per cent of executive staff at subcontractors are female, compared with around 25 per cent at owners and general contractors. Subcontractors similarly report the lowest numbers of women across trade and site staff.

Organizations are also focused on improving the wellbeing of their workforce. Over four in 10 respondents (41 per cent) report having a wellness and mental health practice or policy in place to reduce the likelihood of burnout. Forty-six per cent plan to implement a process in the next 12 months.

Despite some fundamental labour challenges, respondents say they are optimistic about the future. Nearly eight in 10 (79 per cent) are confident they will have enough people to meet their organizational needs over the next 12 months. A further 80 per cent report confidence that their workforce will have the necessary skills to meet demand over the next 12 months.

Increased use of technology, like construction management platforms, can

help teams attract and upskill traditionally underrepresented groups in construction through streamlined training, certifications and better managed schedules. Additionally, construction management platforms help organizations increase the safety of their jobsites through reporting and standardizing safety procedures. Increasing the physical and mental safety of jobsites is just one way to make construction a more attractive career for novice workers.

PROJECT MANAGEMENT SKILLS IN DEMAND

With regard to skills, respondents consider data analytics, project management, commercial/ financial management and trade skills as the top skills that are likely to be in demand in the construction industry over the next 12 months.

Organizations are preparing their workforces for these new demands. More than 40 per cent of respondents (44 per cent) say they currently have employee training programs in place for upskilling and reskilling, and 42 per cent are planning to implement one in the next 12 months.

5 STEPS FORWARD

How can you and your organization take action on these learnings? Here are five ways to work towards a better business based on the findings in this report:

01 Leverage technology to drive performance, productivity and profitability

With 48 per cent of respondents reporting their projects go over budget and over schedule, it’s critical to find ways to deliver better outcomes across projects. By helping to standardize processes, reduce barriers to collaboration and improve information flow,

technology can have a direct impact on an organization’s bottom line.

02 Minimize rework for a sustainable future

As builders focus on sustainable development, one area of potential wastage that stands out is rework. As 27 per cent of total project time is spent on rework, reducing this can have significant sustainability impact. Early and improved collaboration between all key stakeholders can be a good way to get started.

03 Eliminate data siloes to unlock data-driven insights

Currently, 17 per cent of time on a typical project is spent searching for data. Often, this information is inaccessibly located in silos. Having a single source of truth that removes accessibility barriers can improve decision-making and reduce time spent on low-value tasks.

04 Proactively manage financial risk to avoid surprises

Risk data generated by construction technology platforms are currently not evaluated in risk decisions. Over half of respondents feel the industry can improve the way they leverage data to simplify payments and improve the way contractors view insurance.

05 Leverage construction management platforms for competitive advantage

Respondents consider construction management platforms to be one of the top technologies that will drive change over the next three years. It’s no wonder, then, that many owners, general contractors, and subcontractors already have or plan to implement such a platform within their own business to stay ahead.

The information presented in this special Reports Edition of On-Site Magazine is a snapshot of the current construction climate in Canada, based on Procore’s How We Build Now - Canada report. To see more about how business owners, general contractors and subcontractors feel about the industry today, scan the QR Code to access the full version of the Procore study.

On-Site’s 40 Under 40 Virtual Symposium 2023

MENTORSHIP The Building Blocks of Success

Please join us online Thursday Sept 28 at 1pm ET for this CAREER BUILDING OPPORTUNITY!

Session One: Join recent honourees from On-Site’s 40 Under 40 Canadian Construction Professionals recognition program as they discuss the mentoring that they received on their way to achieving their successes in the construction world.

• What worked for them?

• What didn’t?

• What would they like to see?

• How can you become a mentor?

Session Two: Representatives from Canadian mega-contractors EllisDon and Pomerleau join our second panel and will discuss their mentorship programs and opportunities along with successes they’ve witnessed.

Th e right p aver f or ev er y ap plic atio n

WORLD TESTED. CONTRACTOR APPROVED: As the global leader in paving technology, we‘ve seen just about everything there is to see. In every climate, every condition, every twist, turn and terrain. And we put that world of experience in your hands, so you can experience exceptional performance and results at every phase of the paving process

ww w.wi rtge n .co m