Upon your first day at Guaranteed Rate, each loan officer will be assigned and greeted by a dedicated Onboarding Account Manager. Your Onboarding Account Manager (OAM) will be your main point of contact while you find your way around Marketing at GR. They will be able to act as liaisons between you and other teams in Marketing along with other departments at GR.

Your OAM will assist with:

• Formatting your headshot

• Reviewing/optimizing your biography

• Getting your Spanish Certification to use Spanish marketing material (if applicable)

As a new loan officer, you will need to:

• Submit your New Hire Marketing Survey

• Join our weekly Welcome Calls

• Submit your database for upload in our Permitted Marketing Data Upload form

Once you are licensed to originate with Guaranteed Rate, it’s time to make it known that you’re now with GR. Your OAM will help you:

• Order business cards

• Activate your website, application, and mobile app

• Announcing to your network that you’ve joined GR through email, social media, and postcards

It will take some time to settle in; that’s why your Onboarding Account Manager is here to support all your marketing needs and initiatives for up to 60 days. Your OAM will be available to help learn how to navigate our systems and tools, aid in design projects, sponsorships, and more.

As your initial needs wind down, you’ll be introduced to our Marketing Team

• Providing guidance on best practices, inviting agents to Agent Advantage, locating assets, and troubleshooting issues.

• Understand marketing allowances and reimbursement policy

• Learn about our marketing platforms and how to access them: RAC (Basic or Pro), Mortgage Coach, Monitor Base, Yelp, Adwerx, GR Social, Your Marketing Account Manager, Your Events Coordinator, and Guaranteed Goods Store

How do I ask for help?

New employees, and managers helping new employees, can reach the Onboarding team at Marketing@rate.com.

Your Marketing Account Manager will be your main point of contact to support marketing requests or general marketing questions. They also act as the liaison between loan officers and all other teams in Marketing. Email marketing@rate.com for assistance.

How will my Marketing Account Manager help me?

• Assist in finding existing targeted marketing assets

• Help facilitate assets requests through our Workfront platform for:

• Ads

• Billboards

• Flyers

• Social Media

• Presentations

• Emails

• Signage

• Assist with locating Red Arrow Connect (“RAC”) assets

• Act as a liaison to the entire Marketing Department

• Update loan officer and branch webpages

• Facilitate reviews and approvals for sponsorships/ads

Red Arrow Connect (“RAC”) is our CRM and Marketing platform, providing centralized data and multimedia marketing tools to reach your network across all channels and applications. RAC’s client management and communication features will drive growth and build customers for life.

Red Arrow Connect Tools & Features : CRM

Our customer relationship management (“CRM”) is integrated with Encompass and Optimal Blue to ensure your borrower, agent and loan data is centralized and up-to-date with little-to-no data entry necessary.

Auto-campaigns

Email and direct mail campaigns—just set it and forget it, to stay in front of leads, clients and referral partners!

Print Marketing

Pre-approved and customizable print ready flyers, direct mail postcards, EDDM postcards, business & greeting cards, brochures, PowerPoint presentations and more.

Web Marketing

Pre-approved and customizable social media posts for Twitter, Facebook, LinkedIn and Instagram, including videos ready to post directly to your integrated social media outlets.

Email Campaigns

Pre-approved and customizable email templates that are simple to send out to your database.

Pricing :

Basic: FREE - Pro: $165/Month

Additional Help & Questions :

Email redarrowconnect@rate.com or visit the Hub

On demand webpages built to co-brand with real estate agents and integrated with MLS to highlight property listings.

These landing pages serve as great solutions for event or open house registrations, or lead generation for digital marketing campaigns.

Integrated with our Agent Advantage platform, you can co-market with real estate agents on print, email and other digital assets while also offering agents a free CRM for their own use.

Video platform that allows for selfie-style or screen recorded videos to be embedded in email and sent to any contacts in your CRM. Personalized messages are a great way to keep you face-to-face with your database.

Automated campaigns including various trigger & milestone-based touch points across multiple channels and mediums.

FEATURES

CONTACT MANAGEMENT

PRINT MARKETING

SOCIAL MEDIA & WEB MARKETING

CO-MARKETING

OFFICE 365 INTEGRATION

REFI OPPORTUNITIES IDENTIFICATION

DIRECT & AUTOMATED EMAILS

CO-BRANDED DIRECT EMAILS

CUSTOM EMAIL TEMPLATES

ADVANCED EMAIL STATISTICS

LOAN STATUS TEXTING

CUSTOM LEAD CAPTURE APPS

FOCUSED VIEW

MORTGAGE COACH

TASK MANAGEMENT

AUTOMATED LEAD SOURCES

CUSTOMER INTELLIGENCE ALERTS

JOURNEY LEAD NUTURING

DRIP EMAIL CAMPAIGNS

ACTION PLANS

BOMBBOMB VIDEO

CUSTOMIZED FOCUS VIEWS

CONSUMER PROPERTY LISTING ALERTS

Agents across the country trust us to help them close loans quickly and grow their business. Our real estate agent platform, Agent Advantage, provides quick mobile and desktop access to your referral partners’ favorite Guaranteed Rate tools. It also allows agents to watch top agent coaching videos, co-brand marketing materials, share leads through a free CRM, refer leads to our originators, receive email and text messages about loan milestones and more!

Benefits of Agent Advantage :

• Access to a free CRM platform (“Total Expert”)

• Create co-branded marketing collateral

• Seamlessly connects agents, originators and their clients

• Loan Status Monitor provides real-time status updates on transactions

• Never miss a pre-approval with the GR Mobile Loan App

• Calculators with real-time rates

• Our proprietary data center, GR Research, helps clients get to know the specific details about the demographics, real estate trends and amenities in a local market or neighborhood

Helpful Guides :

These resources are helpful to inform agents and originators when using the Agent Advantage platform. They both contain instructions on how to sign up as well as more details on the tools listed above.

• Agent Advantage Overview

• LO to Agent Presentation

Additional Help & Questions :

If you need additional help, email agents@rate.com or reach out to your designated Marketing Account Manager

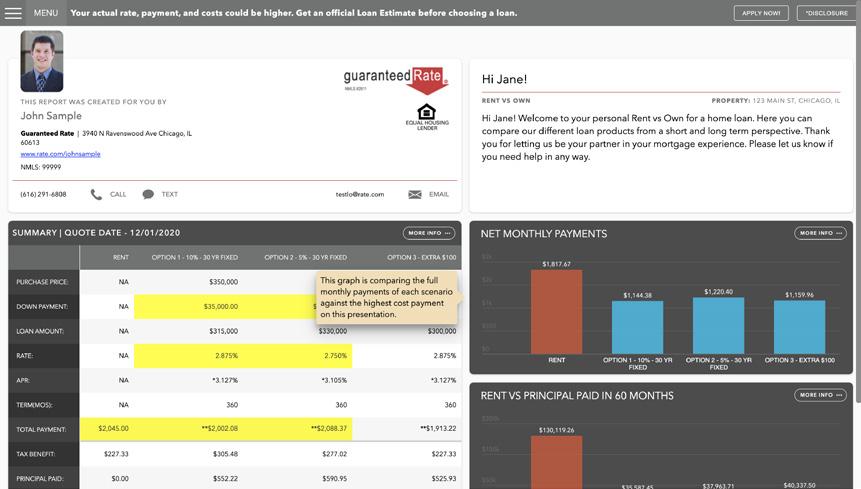

Create home loan strategies and virtual presentations that provide expert loan advice and improve pipeline conversion while increasing your productivity. Joining the Mortgage Coach community will allow you to convert your borrowers more predictably and profitably and gives you access to great coaching tips from top originators nationally that use the tool.

Benefits of Mortgage Coach :

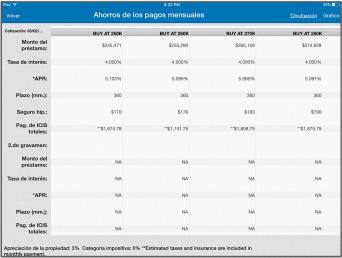

We’ve integrated Mortgage Coach with our pricing and fee engines so you can seamlessly create Total Cost Analysis reports that educate borrowers on loan options with side-by-side comparisons. Advise your clients like never before with Mortgage Coach’s clear and interactive visuals that include intuitive charts, graphs and even video explanations to further personalize the presentation.

Proactive

Reach out to past borrowers for mortgage reviews and update t hem on refinance opportunities

Integrated

Connected to Encompass, Optimal Blue, GR Pull Fees and Red A rrow Connect

Types of Presentations :

• Simple loan comparisons to current loan vs. multiple new options

Automation

Get alerts when borrowers view the Total Cost Analysis

RateWatch

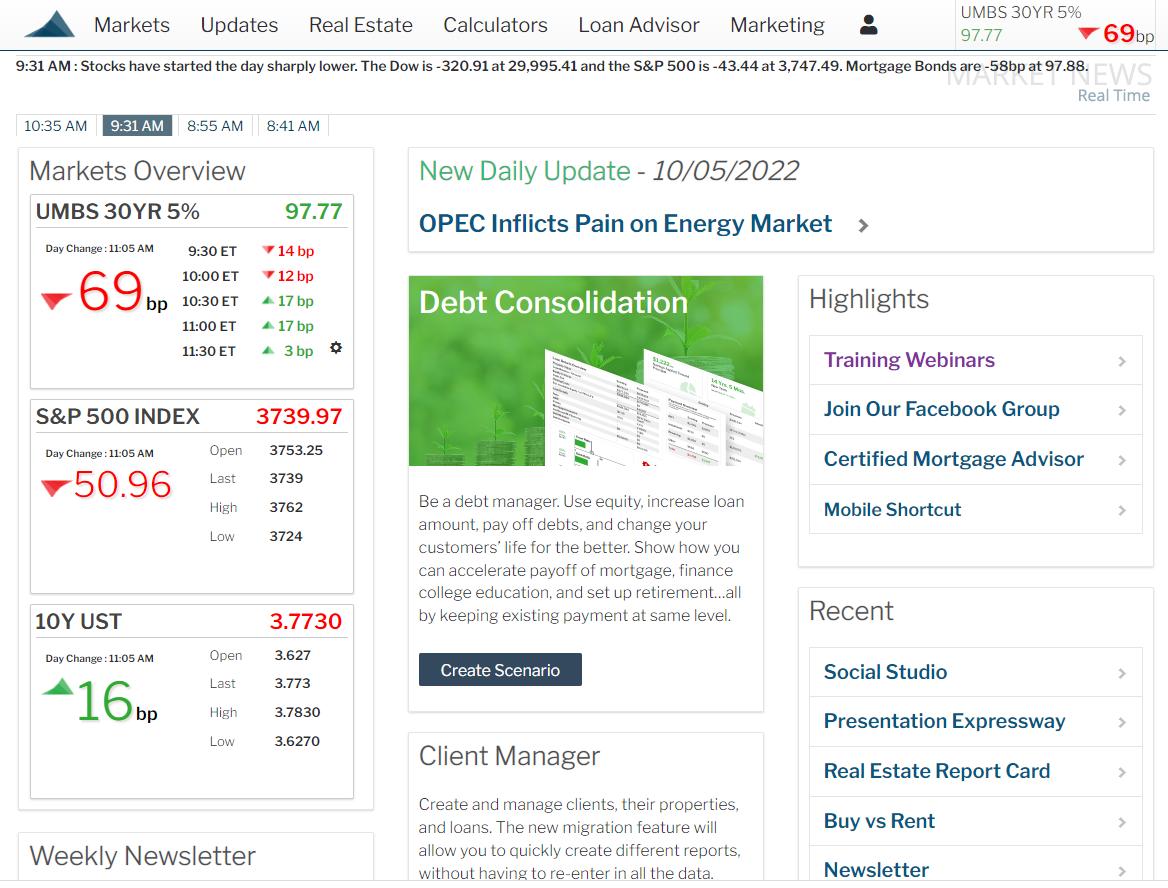

This MBS monitoring tool deploys the latest interactive charting technology to ensure clear delivery of up-to-the-minute market movements. Never miss key market movements with real-time alerts!

• You can record and append a video explanation, highlight before sending and interact with the borrower within the presentation in real time

• Outline short term and long-term financial benefits

Pricing

Guaranteed Rate Price: $65/month

Additional Help & Questions :

Email mortgagecoach@rate.com Learn more on the Hub

RateWatch:

As a mortgage loan officer, you want to be there for your customers at every stage of their homeownership journey. But it will not happen if you let them slip away. This is why you need MonitorBase, a customer retention tool providing real time alerts when past clients are in the market or eligible to refinance or purchase. MonitorBase proactively puts you in front of your borrowers before they move forward with another lender! Loan officers that use this system fund 1 in 31 alerts, whereas those that do not use it funds 1 in 115 alerts.

:

• Attracting and acquiring a new customer costs 5 times more t han retaining an existing one

• Increasing customer retention rates by 5% boost profits by 25% to 95%, according to research done by Frederick Reichheld of Bain & Company

• Research by Gartner indicates that 65% of a company’s revenue comes from existing customers, and it costs five times more to attract a new customer than to keep an existing one satisfied

:

• Proactively connect with past clients regarding current loan opportunities

• Ability to see when past clients may be ready for a new loan so you can reach out before other lenders do

• Great tool to prevent early payoffs

• Convert previously denied loans into new, funded loans with alerts that borrower’s credit has improved

• Inquiry: Get an alert within 24 hours of a past client’s credit being pulled by another lender

• Predictive: An algorithm predicts when someone is preparing their credit for a new loan

• Pre-Mover: Receive alerts when there is a change in MLS status of a property

• Migration: Alerts sent when a previously denied borrower’s credit improves to a qualifying level

• Opt-in

• Borrower’s information is automatically uploaded to MonitorBase

• No PII or SSN is added only name, address and contact info

• Daily alerts sent to your email, text or both

• Access full alerts on MonitorBase dashboard

• Firm Offers sent to borrower via email

• Please note: You are NOT allowed to share this data with referral partners because it is credit data

Pricing :

Unlimited - $135/month

Pay Per Alert - $4.50 per alert

:

Email monitorbase@rate.com. Learn more on the Hub

The value of Yelp for Business is pretty simple: when consumers are looking to find trusted local businesses, they look at what other people have to say. Yelp provides consumers with relevant local business and services that they need and has the added benefit of customer reviews to build deeper confidence.

With unmatched local business information, photos and review content, Yelp provides a one-stop local platform for consumers to discover, connect and transact with local businesses of all sizes by making it easy to request a quote, find directions, call directly, or book a consultation.

178 M+

UNIQUE MONTHLY VISITORS

34M

ANNUAL REAL ESTATE CATEGORY SEARCHES

Benefits of Paid Partnership with Yelp :

• Paid partnership unlocks Yext + Yelp integration

• Monitor and respond to Yelp reviews within Yext

• Remove competitor advertising on your listing

• Increase your reach, visibility and leads from Yelp

Enhanced Profiles:

• A free Yelp listing shows competitor ads; upgrading removes competitor ads

• Customization of your listing

• Call tracking and pixel implementation:

• Example of free listing: Waltham, MA

• Example of upgraded listing: Jason Evans

Pricing :

Enhanced Profile Cost: $25/month - Cost-per-Click Ad Budgets: Varies

Additional Help & Questions :

Email marketing@rate.com or learn more on the Hub

4.6M

MONTHLY MORTGAGE SEARCHES & PAGE VIEWS

Cost-per-click (“CPC”) Advertising :

45% CONSUMERS CHECK YELP BEFORE A VISIT

• Yelp ads will show to Yelp visitors who are local to you and are looking at your competitors Yelp profiles.

• CPC Advertisers in the mortgage category have an average increase of 989% in Profile Page Views and 1.900% in secondary actions

• Secondary actions include Calls, Clicks to Websites, Clicks to Directions

Best Practices :

• On average, the spends depend on the market, in a high populated city, you should be spending more than in a rural location

• Enroll in a CPC and Enhanced Profiles for the best ROI

Birdeye is an online reputation management and customer experience platform designed to help Loan Officers monitor and manage their online reputation and reviews from a variety of sources such as Google, Facebook and others. The platform allows our Loan Officers to collect and respond to customer feedback in real-time, solicit surveys, track and analyze online reviews and convert insights into customer feedback.

• Centralized Review Management: Birdeye aggregates reviews from popular platforms into one unified dashboard, saving you time and effort in monitoring your online reputation. You can view and respond to reviews from platforms like Google, Facebook and more, all in one place.

• Optional Automated Review Solicitation Via RAC: Birdeye is fully integrated with Red Arrow Connect and the system will automatically solicit reviews for you. This will increase the frequency of positive feedback and enhance your online reputation.

• Auto-Response for Reviews: Birdeye simplifies the process of responding to reviews by giving you access to pre-made response templates that will automatically reply to your reviews, saving you time and enhancing your overall customer experience.

• Social Sharing: Birdeye allows you to share customer reviews on your social Auto Review Share allows you to effortlessly promote your reviews each week.

Adwerx was selected as Guaranteed Rate’s digital advertising platform. The platform provides automated retargeting for all licensed VPs, as well as targeted digital ad campaigns personalized to the loan officer.

What is the objective of digital advertising through Adwerx?

• Increase VP production through automation of online advertising

• Increase brand awareness for each individual VP and Guaranteed Rate

• Allow VPs to stay in front of their sphere of influence to drive more referrals

• Increase online engagement by ensuring that each person that visits a VP page is followed by that VP’s personal branding ad across mobile devices, Facebook, Instagram and premium websites such as WSJ, NYT, ESPN and BBC

What exactly does the platform provide?

• Automated retargeting ads for your personal brand: Each consumer visiting your VP page will be automatically retargeted. Your ads will appear on Facebook and Instagram, as well as top websites and apps (e.g. CNN, ESPN, NYTimes.com). Provided to you by Guaranteed Rate at no charge automatically.

• Access to easily spin up your own custom audience ad campaigns: These additional ad campaigns include targeted audiences based on geotargeting and behavioral activity. We compile an audience of users within the geo-fenced area whose online behavior suggests an interests in mortgage services (ReFi calculators, visiting mortgage sites etc), custom list uploads, Red Arrow Connect database, increased retargeting budgets and streaming TV commercials.

• Analytics & reporting: The Adwerx portal provides a dashboard with number of impressions and results of each of your ad campaigns.

• Stream into the homes of your top zip codes: Streaming commercials gets your name into the living room of your target audience without the challenges of traditional TV advertising. TV commercials can be displayed on all streaming TV platforms including: DirectTV, Hulu, The Weather Channel, FOX, Pluto, ESPN, CNN, Comedy Central, ABC, TubiTV, NBC, Apple TV, HGTV and Sony Crackle.

How do I access my account?

Visit rate.adwerx.com and click “Log in” at the top right corner. Then select “Quick log in with your company” and that will prompt you to access via single sign on (“Okta”).

Pricing:

Contact an Adwerx representative for a consultation.

Adwerx Help & Support:

Learn more on the Hub

The Adwerx Customer Success Team can be reached through these channels: Website Portal: rate.adwerx.com

Adwerx Dedicated Phone Support Line: (888) 387-0487

Adwerx Dedicated Support Email: rate@adwerx.com

For single sign on issues, please email Guaranteed Rate’s TechSquad. For other questions, email marketing@rate.com

We have a whole team dedicated to boosting your social media engagement with clients and partners—past, present and future!

Benefits of RateSocial:

• Three Facebook Business Page posts and Two LinkedIn posts per week that dynamically link to your contact information are automatically published to your accounts

• Get access to exclusive new social media content before anyone else

• Increased activity on your social channels and greater visibility amongst your followers

• Great way to engage with millennials and first-time homebuyers

Types of Posts

• Educational info for customers about the homebuying process

• Posts that highlight Guaranteed Rate in the news

• Original content from the Knowledge Center on rate.com

• Home improvement tips and tricks

Sign Up for RateSocial:

• Costs $60/month

• Fill out this Subscription Form

• Once your form has been received, the team will follow up with a credential form to gain access to your social media accounts and initiate automated posting

Additional Help & Questions:

For more information, email GRSocial@rate.com or visit the GRSocial Intranet Page

MBS Highway is an industry-leading platform that provides loan officers with tools and content to help you stay on top of the market, build stronger referral relationships and build better trust with your customers and prospects. Memberships provide access to daily market update videos from industry expert Barry Habib, market alerts for the best time to lock, real estate analysis and marketing tools and access to an evolving library of video scripts and weekly industry newsletters.

Daily coaching video and market updates from Barry Habib:

• Keeps VPs informed on the latest market trends and insights

• Simplifies what is happening with the market

• Enables VPs to help customers navigate the home buying or refinance process

Presentation Expressway and Social Studio:

• VPs can present with ease using PowerPoint slides and video tutorials created by Barry Habib

• New presentations and scripts are uploaded monthly and quarterly

• Ability to easily create social media videos using pre-created scripts and a teleprompter feature

Insider content:

• A plethora of proprietary market tools

• Examples include: The Kiplinger Letter by Knight Kiplinger, By the Number$ by Michael Higley, and Real Estate data and charts

• Access to a shareable weekly newsletter in RAC

Financial calculators and tools:

• Various efficient financial calculators and tools are available for a variety of scenarios, helping homebuyers make decisions with confidence

• Easy-to-understand analyses to show potential buyers the value of homeownership

• Snapshot of market conditions and financial opportunity in any MSA, county or ZIP code

Pricing:

Exclusive MBS Highway Membership - $75/month

Additional Help & Questions:

Email MBSHighway@rate.com. Learn more on the Hub

Homebot delivers a “financial dashboard for the home” that tracks home equity and presents a personalized finance strategy for each client. Loan officers utilize this experience for instant engagement with their database and to maintain trusted-advisor-for-life client relationships. The platform can also be co-sponsored/co-branded for Realtor partners and their clients, offering a great way for lenders to expand their sphere while giving real estate agents the home finance content and support to supercharge their client-for-life strategy.

• Engage clients with personalized financial dashboards Homebot’s award-winning dashboards deliver custom, actionable insights through the entire homeownership lifecycle to your clients and prospects. With an average 50% monthly engagement rate, Homebot ensures you remain top-of-mind.

• Empower clients to refinance or purchase at the right time: Automatically educate and alert clients when they should consider refinancing, or if they have enough equity to get some cash or to purchase an investment property.

• Maximize your agent relationships: Inviting agents to join you on Homebot is a great way to quickly grow your reach, obtain new leads and strengthen your relationships with the agents in your network.

• Load all of your clients automatically with the RAC journey: Manual uploading your database is no longer necessary. Get setup on Homebot easily by automatically loading your clients from a unique Homebot group using our Total Expert Integration.

Pricing:

• H omebot Subscription - $195/Month includes a 500 client capacity

• $25 for additional client blocks of 100

• $10 co-sponsorship fees per agent

Email Homebot@rate.com. Learn more at the Homebot Hub Page

Clients today expect—and depend on—accurate, official answers when making big decisions.

Yext Search Experience Cloud platform puts you in control of your business facts online. It provides official, accurate, up-to-date answers to consumer questions across the internet. Starting on your own webpage, then extending across search engines, voice assistants, maps, apps and chatbots, Yext safeguards you against misinformation and ensures only truth is spread online.

Benefits of Yext:

• Fully optimized VP & branch webpages

• Central platform to manage YOUR digital footprint

• Listing standardization

Yext Best Practices:

• Verify your info is correct on your Yext Dashboard

• Enhanced local SEO and search discoverability

• Answers search functionality

• Check your name, social media links and other critical info to make sure everything is accurate

• Regularly update your Listings with contemporary information, branch or team photos, new team updates, events, etc.

• Regularly post on your social media pages

• This data is critical in learning which social and/or listing channels are driving the most traffic to your website. Prioritize posting and optimization to the pages that are working for you

Learn more on the Hub

For support, contact your dedicated Guaranteed Rate Marketing Account Manager or email marketing@rate.com or Yext White Glove Service team via the contact info below: Email support-guaranteedrate@yext.com or call (844) 830-2285

We have a whole team dedicated to boosting your social media engagement with clients and partners—past, present and future!

What can I choose from?

• Red Arrow Connect ($165)

• MonitorBase ($135)

• Mortgage Coach ($65)

• GR Social ($60)

• Yelp ($25)

• MBS Highway ($75)

FAQs:

Do I have to opt in if I’m happy with my elections?

Yes. We ask that you opt-in just once to ensure you understand the costs associated with each service. In addition, many new services are available we want to make sure you are aware of !

Can I use my marketing budget if I have one?

Yes! If you have a marketing allowance, you are eligible to use this. Any overage, however, will be deducted from your commission.

Will I be billed monthly or quarterly?

Your marketing subscriptions will be billed on a monthly basis.

Learn more on the Hub

Events and Broker Opens are a terrific way to build and strengthen relationships that in turn drive sales. They also provide a way to show off your personal side, your style, hobbies, and shared interests with your network—keeping your name in the forefront of their mind.

Events Best Practices:

Agent Outreach

Reach out to agents or referral partners without having it be too salesy.

Reconnect

Helps you reconnect with agents or referral partners that you have not spoken to in some time.

Exposure

Keep your name current and at the top of peoples’ minds.

Personal Touch and Authenticity

You are able to get to know clients or referral partners personally and authentically, outside of a business/mortgage transaction.

Generate Leads

You are able to grow your database with all of the attendees of the event.

The events team helps you through every step of your event!

Event assistance is offered for Loan Officer that achieved President’s Club and Chairman’s Circle from the previous year.

Here is how we can help:

• Help generate ideas for the event you are wanting to host

• Design unique event invitations to send to your guests

• Research venues and help make arrangements

How to plan an event:

• Reach out to events@rate.com or your Regional Events Coordinator

• Complete the National Events Request Form

• Send out invitations & promote your event on social media

• Set up your RSVP and guest registration tracking site

• Work with GRSocial (if you are a member) on promoting the event on social media

• Provide you with tricks and tools on how to host a great event

• Show up to the event and follow-up after on social media and with the attendees

• Attend our training listed on the Events Resource center page

Additional Event Resources: Events Resource Center Page

“The Point” is our in-house creative team of professional designers, copywriters, editors, photographers and videographers—who are responsible for conceiving, developing and executing impactful cross-channel marketing assets. The Point is here to serve all your marketing needs!

Cross-channel marketing assets include:

• Advertisements

• Emails

• Print (brochures, flyers, postcards)

• Signage

• Billboards

• Social Media

How to get custom marketing assets:

• Landing Pages

• Digital Banner Ads

• Blogs

• Videos

• Photography

• Motion Graphics

If you are interested in custom work with the creative team, reach out to your Marketing Account Manager or email marketing@rate.com

Pricing:

Creative hours are billed at rate of $85 per hour. This scope of work is based upon the media specifications and creative brief included therein. Any alterations to these specifications or significant directional changes to this creative brief could result in additional charges.

Our e-commerce store for all Guaranteed Rate employees, Guaranteed Goods is the place to purchase branded promotional items. Items for purchase range from custom and personalized goods made to order, to large bulk orders of available products. With hundreds of items to choose from, the Guaranteed Goods store has much to offer. From the all new Black Arrow Collection featuring exclusive higher-end items, to our home goods and technology selections, our store has something for everyone.

The Guaranteed Goods store offers deeply discounted pricing and easy-to-use ordering platform so you can show off the Guaranteed Rate brand, and even personalize items with your own information and style.

Benefits of Guaranteed Goods:

• Competitive prices for premium products

• Personalized items available

• Bulk orders available

• Seasonal and closing gifts available

• We only accept payments via cost centers (marketing budgets)

Helpful Guide:

Guaranteed Goods Store Navigation

Be sure to check out our line of items for Spanish-speaking customers

Our Gifting Program is an automated closing gift campaign that will send gifts directly to clients approximately 2–3 weeks after their loan has been funded. To sign up, just select your gift and which borrowers you want to send to (Refinance, Purchase or Both). We’ll do the rest of the work from there! Check out the available gifting options below.

Gifting Program Sign-Up: Email giftingprogram@rate.com

We’re committed to making our mortgage process more efficient for all parties involved and ensuring that our diverse communities receive the great customer service we’re known for, regardless of English proficiency. While we have some general Spanish marketing available for all Loan Officers to use, there’s so much more you can do if you’re Spanish certified.

Benefits of Getting Approved:

• Gain access to over 100 pages of Spanish marketing assets and business cards in Red Arrow Connect

• Include “Se habla Español” and disclaimer to email signature and VP webpage

• Receive permission to feature Spanish testimonials from the customer satisfaction survey on VP webpage

How to Get Approved:

• Review the Becoming Language Certified procedure and submit your request

• Review the Foreign Language Communications Policy

Additional Help & Questions: For questions, email LEPCompliance@rate.com

We have a host of additional elements, from flyers and social posts to magazine and radio ads in several languages, including Russian, Chinese, Vietnamese and Korean.

Guaranteed Goods

Gifting Program

MonitorBase Intranet Page

MonitorBase Login

GRSocial

GRSocial Sign-Up Form

Spanish Marketing

Events

Yext Overview

Yelp

Adwerx Overview

Agent Advantage

Mortgage Coach Overview

Marketing Intranet Page

MBS Highway Overview

Red Arrow Connect Overview

Birdeye Overview

Homebot Overview

Marketing Subscriptions

Marketing Platforms

Marketing Support

General Marketing Inquiries: marketing@rate.com

CRM/Marketing: redarrowconnect@rate.com

Events: events@rate.com

New Hire: newhiremarketing@rate.com

Promo: promo@rate.com

Agent: agents@rate.com

Marketing Platform Questions (including subscriptions): marketingplatform@rate.com

Yext (webpages, listings, etc.): yext@guaranteedrate.com

Adwerx: adwerx@rate.com

Mortgage Coach: mortgagecoach@rate.com

MBS Highway: mbshighway@rate.com