CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

HATTON-BROWN PUBLISHERS, INC.

Street Address: 225 Hanrick Street

Montgomery, AL 36104-3317

Mailing Address: P.O. Box 2268

Montgomery, AL 36102-2268

Telephone (334) 834-1170

Fax 334-834-4525

Publisher David H. Ramsey

Chief Operating Officer

Dianne C. Sullivan

Editor-in-Chief Rich Donnell

Managing Editor Dan Shell

Senior Editor David Abbott

Senior Editor Jessica Johnson

Publisher/Editor Emeritus

David (DK) Knight

Art Director/Prod. Mgr. Cindy Segrest

Ad Production Coord Patti Campbell

Circulation Director Rhonda Thomas

Online Content/Marketing Jacqlyn Kirkland

ADVERTISING SALES REPRESENTATIVES

SOUTHERN USA

Randy Reagor

(904) 393-7968 • Fax: (334) 834-4525

E-mail: reagor@bellsouth.net

MIDWEST USA, EASTERN CANADA

John Simmons (905) 666-0258

E-mail: jsimmons@idirect.com

WESTERN USA, WESTERN CANADA

Tim Shaddick (604) 910-1826 • Fax: (604) 264-1367

E-mail: twshaddick@gmail.com

Kevin Cook (604) 619-1777

E-mail: lordkevincook@gmail.com

INTERNATIONAL

Murray Brett

+34 96 640 4165 • + 34 96 640 4048

E-mail: murray.brett@abasol.net

CLASSIFIED ADVERTISING

Bridget DeVane 334-699-7837 bdevane7@hotmail.com

Timber Harvesting & Forest Operations (ISSN 2154-2333) is published 6 times annually (January/February, March/April, May/June, July/August, September/October, November/ December issues are combined) by Hatton-Brown Publishers, Inc., 225 Hanrick St., Montgomery, AL 36104. Subscriptions are free to U.S. logging, pulpwood and chipping contractors and their supervisors; managers and supervisors of corporate-owned harvesting operations; wood suppliers; timber buyers; businesses involved in land grooming and/or land clearing, wood refuse grinding and right-of-way maintenance; wood procurement and land management officials; industrial forestry purchasing agents; wholesale and retail forest equipment representatives and forest/logging association personnel. All non-qualified U.S. subscriptions are $50 annually; $60 in Canada; $95 (airmail) in all other countries (U.S. funds). Single copies, $5 each; special issues, $20 (U.S. funds). Subscription Inquiries—TOLL-FREE 800-669-5613; Fax 888-611-4525. Go to www.timber harvesting.com and click on the subscribe button to subscribe/renew via the web. All advertisements for Timber Harvesting & Forest Operations are accepted and published by Hatton-Brown Publishers, Inc. with the understanding that the advertiser and/or advertising agency are authorized to publish the entire contents and subject matter thereof. The advertiser and/or advertising agency will defend, indemnify and hold Hatton-Brown Publishers, Inc. harmless from and against any loss, expenses, or other liability resulting from any claims or lawsuits for libel violations or right of privacy or publicity, plagiarism, copyright or trademark infringement and any other claims or lawsuits that may arise out of publication of such advertisement. Hatton-Brown Publishers, Inc. neither endorses nor makes any representation or guarantee as to the quality of goods and services advertised in Timber Harvesting & Forest Operations. Copyright ® 2023.

POSTMASTER: Send address changes to

TIMBER HARVESTING & FOREST OPERATIONS

P.O. Box 2419, Montgomery, AL 36102-2419

All rights reserved. Reproduction in whole or in part without written permission is prohibited. Periodicals postage paid at Montgomery, Ala. and at additional mailing offices. Printed in USA. A Hatton-Brown Publication Foremost Authority For Professional Loggers Browse, subscribe or renew: www.timberharvesting.com Vol. 71, No. 4: Issue 699 July/August 2023 In this year’s Timber Harvesting Logger Survey, loggers across the country report they are facing growing challenges to profitability and business viability. Article begins on PAGE 12. (Patrick Dunning photo, design by Shelley Smith) MyTake __________________________________________________ 4 Newslines ________________________________________________ 6 Innovation Way _________________________________________ 27 THExchange ____________________________________________ 28 Select Cuts 30 Ad Index _______________________________________________ 30 Other Hatton-Brown Publications: Southern Loggin’ Times • Wood Bioenergy Timber Processing • Panel World • Power Equipment Trade OurCover OurFeatures OurDepartments Loader Technology Latest Models As We See It Loggers Making Money For Mills Equipment World Suppliers Making News 24 21 22 Baker Land and Cattle Diverse Operation Succeeds 10 CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Resource’?

As Survey Emphasizes Business Issues

Gathering up the results for this year’s Timber Harvesting Logger Survey, and reading the comments that go with each question is always one ofthe editors’favorites parts of the survey report process. We repeatedly ask our readers to“Raise Your Voice” in responding to the survey, and once you add up all the comments we have well over 300 deep (and some not so deep) logger thoughts on a wide variety of topics.

One thing really stood out, and I guess it’s a good thing that even with the fading gray hair I can still be shocked at some industry practices: The logger who noted that an acquaintance in procurement told him that when they really want more logs procurement officials may cut their logging rates,knowing that logging contractors will haveto work harder and deliver more wood to the mill just to maintain their operating and cash flow positions.

Now no one’s gonnaaccuse me of being an economist, but I dimly remember that in general if someone has a demand for more of something, the best way to get it is to pay more. That a mill can apparently get more ofwhat it demands by paying less is highly illustrative of the position that many logging contractorsfind themselves in.

Knowing the pressures that loggers are under, knowing what has to happen to burp out an extra 2-4-6-8 loads a day, can organizations pursuingsuch“pay less for more”policies only be viewed as adversarial at best?

Again, I’m no expert and some may say a procurement organization may actually pay more for more loads at a lower rate—but let’s not kid ourselves here.Markets may come and go, rates upand down, but operating costs go one way and have only accelerated the past few years as the survey shows. Being the “cost reduction link” in the forest products supply chain, the logging and log trucking industry “can break even for only so long,” one respondent emphasizes. Meanwhile, the old“make it up with more production”

remedy is a false cure at best, one logger says.

Years ago during the Iraq War everyone’s favorite U.S. Defense Secretary, Donald Rumsfeld,made the offhand comment that U.S. troops were a “fungible resource” like water or maybe even diapers: just use them up and go get some more when you need more. The TH Logger Survey comments show that’s the attitude some wood-consuming organizations have—yet the survey results show nothing can be further from the truth considering the pressure logging contractors are under. Let’s hear what the loggers have to say for themselves:

“The logging industry manages a

cern. “We are not getting compensation for what we do. If logging is going to survive we have to get trucking in line with competition. The big flooring factories can pay a driver a hundred thousand a year and their insurance is peanuts compared to ours,”says Georgia logger Arnold Hooley, who echoes many loggers who commented that the issues facing log trucking that make operations difficult.

“The price of everything goes up but the price we are paid for logs never seems to keep up,” says Tom Walker of Connecticut. “As loggers buy more and more expensive equipment to try to produce more they put themselves in a position where they cannot afford to stop working.”

Walker believes that for too long,“Mills and brokers beat into the heads of loggers that the key to success is big production. This mentality is great for them as they get cheap raw materials. A better approach is to limit production and maximize profits on each log through marketing. This is our wood. We should be telling the mills, brokers etc. what the cost is. Not the other way around. If they don’t pay they don’t get.”

renewable resource and if done correctly the resource can be managed to provide fiber and jobs forever,” commentsCalifornialogger Myles Anderson, a former American Loggers Council board member. “In order to keep businesses alive in this industry we need common sense regulation that helps the industry sustain a workforce so that the forest can be managed and not burnt to the ground.”

Anderson believes that one reason thelogging industry continues to be labeled as one of the most dangerous in America “because the industry is continually trying to train new employees.”

He adds that“The reduction in available work days from regulation, weather, mill quotas, urban sprawl and a host of other issues impacting rural America is where logging takes place impacts our ability to keep highly trained employees to do this job.”

Getting paid enough in the current operating environment is a big con-

The uncertainty is leading some toreassess what in the past would have been an easy decision. “I would like to pass the business down to my son and grandson, but I now am encouraging them to pursue other careers,” says Louisiana logger Keith Chenevert. “I don’t see how logging will be sustainable for the long term with the cost of everything we use being so high and the cut and haul rates so low.”

Correction

The photo and cutline on page 13 in the May-June issue “Pellham Cutting: Quality Creates Work Demand,” contained an identification error, wrongly implying the inset photo was Greg Pellham’s son Blake. Instead, the photo was of Pellham Cutting Inc. siderod Andy Lovegren. Timber Harvesting regrets the error.

4 JULY/AUGUST 2023 TIMBER HARVESTING & FOREST OPERATIONS

SHELL

Take

DAN

My

‘Fungible

Not Loggers,

Markets may come and go, rates up and down, but operating costs go one way and have only accelerated the past few years as the survey shows.

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Pulp-Paper-Container Market Undergoing Big Changes

Pulp, paper and containerboard producers are undergoing a shift in infrastructure and product focus that’s resulting in big impacts to fiber demand and currently hitting loggers hard in the procurement areas surrounding such wood consuming facilities. The changes are reflected in the 2023 TH Logger Survey results and also popping up in various news reports and industry newsletters.

The pulp and paper segment is continuing to adjust to declines in demand for publishing paper and other print media as more people work from home. There’s also been a drop in demand for shipping and packaging paper products, reversing the skyrocketing demand for packaging at the height of the COVID pandemic when traditional retailers were closed, leading to a boom in online shopping.

A comprehensive report in Fastmarkets RISI’s early June North American Woodfiber & Biomass Markets by Chris Lyddan notes that across 30 pulp-paper industry sites since 2020, outright closures and displacement through expansion that’s utilizing mostly recycled fiber have had a huge impact:

“Altogether, an estimated six million tons of finished product, perhaps 20 million tons of chips, has so far shut either permanently or indefinitely across nearly 30 mill sites, large and small, recycled and virgin,” he says.

Closures just announced this year include WestRock at North Charleston, SC; Pactiv Evergreen at Canton, NC; Cascades in Niagra Falls, NY; and Graphic Packaging in Tama, Iowa. And those closures don’t count the unscheduled downtime, reduced operations and indefinite closures such as NP Paper in Rumford and Old Towne, Maine and IP’s three straight quarters marked by unscheduled downtime. PCA’s announcement in May it was closing its Wallula, Wash. paper and corrugated packaging plant until later in the year is also a big hit, as the facility is a large destination market for many Northwest Intermountain chip producers.

In the Lake States region high inventories and lowered demand have mills taking downtime and cutting back on production, some taking away fuel bonuses as diesel prices have eased. Lyddan cites sources such as a Michigan procurement manager who says they haven’t bought open market wood since March, are currently running at about 50% and taking in less than 25% of what they normally buy. There’s also a Wisconsin logger who believes that after the current downturn, combined with inflation hitting almost all operating costs, the region could see “a different world, with a lot of logging capacity gone.”

Canada Fires Hit Mills, Loggers, Big Acreage

What’s being called Canada’s worst-ever spring fire season has torched 9.9 million acres as mills and loggers across the country take extensive downtime while thousands have been evacuated and drifting smoke has blanketed the Northeast U.S. Blazes have affected forest operations in British Columbia, Alberta and Quebec and forceddowntime at dozens of facilities and restricted timber harvesting activities, say officials

with the Forest Products Association of Canada (FPAC). For example, Resolute Forest Products closed four Quebec sawmills temporarily, and Chantiers Chibougamau was forced to temporarily shut its Nordic Kraft pulp mill in Lebel-sur-Quevillon, Quebec.

A recent Reuters news story noted that the closures have affected lumber prices, since Canada is the world’s second-largest softwood lumber producer and reported thatChicago lumber futures for July delivery have climbed 7% since June 1.

Hood Rebuilding Plywood Plant In Mississippi

Hood Industries announced plans to invest more than $200 million to build a plywood manufacturing facility in Beaumont, Miss. and create 265 direct jobs. The announcement was part of a groundbreaking event at Beaumont held May 4, and it comes 40 years after Hood Industries took over operations at Beaumont Plywood in 1983.

The new facility will operate at twice the capacity of the previous facility, which was made inoperable by

NewsLines 6 JULY/AUGUST 2023 TIMBER HARVESTING & FOREST OPERATIONS

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

For loggers in some markets, fewer loads of pulpwood are leaving the landing this year thanks to paper industry changes.

a tornado on April 17, 2022. Construction will begin this summer, and manufacturing will commence in early 2025. Hood Industries plans to fill the jobs over the next four years.

Hood Industries is a mix of wood manufacturing and distribution operations that also includes a plywood manufacturing plant in Wiggins, Miss. and four sawmills in Waynesboro and Silver Creek, Miss., Bogalusa, La. and Metcalfe, Ga., and 15 wood products distribution operations.

Huber OSB Plant Lands In Mississippi

Huber Engineered Woods appears to be looking at building its sixth OSB plant in Shuqualak, Miss. in Noxubee County. In March, the U.S. Army Corps of Engineers and the Mississippi Dept. of Environmental Quality released a joint public notice for Huber’s application for a permit pursuant to the Clean Water Act, and in May MDEQ released a Large Construction Notice of Intent under the Large Construction General Permit applied for by Huber at Shuqualak.

Huber had planned to build its sixth OSB plant in Cohasset, Minn., but after experiencing constant entanglements in the process from governing authorities, including a Minnesota Court of Appeals decision that would have caused further delay in the construction of a $440 million plant, Huber opted to pull out of the project and begin looking elsewhere.

Huber operates OSB facilities in Maine, Georgia, Virginia, Tennessee and Oklahoma.

CM Biomass Adds To Pellets Roster

Jackson Pellets, LLC held a ribbon cutting March 22 at its new wood pellet manufacturing plant at the Jackson Port, Alabama. Todd Bush, CEO of CM Biomass North America, the parent company of Jackson Pellets, told the group that the Jackson plant is the crown jewel of all the facilities he’s been a part of.

The mill represents a $21 million investment and is expected to employ 45 to 50.

CM Biomass, a company based in Denmark, has 10 other facilities in the U.S. Bush said that everything

they have learned from building other facilities has been applied at Jackson in building the mill from the ground up. He said that the product manufactured in Jackson will go to Mobile as does product from other facilities in Mississippi, Tennessee and Alabama.

Roseburg Announces Major Investment

Roseburg Forest Products, which announced in April a $700 million investment over the next four years to expand operations in southern Oregon, including a $450 million MDF plant in Dillard, Ore., has selected Siempelkamp as the primary supplier of the MDF plant, including a 10 ft. x 42.1 m ContiRoll continuous press.

The companies noted that in 1969 Siempelkamp supplied Roseburg Lumber with its very first compositepanel press line.

Roseburg’s Oregon investment, which also includes a component manufacturing center at Dillard, and upgrades to existing plants in Douglas and Coos counties, is considered to be the largest known manufacturing investment in rural Oregon and one of the largest private capital investments in the state’s history.

The remaining $200 million of the investment will go toward improvements and significant upgrades at the plywood plant in Riddle, Ore., including two new lathe lines and a new hardwood plywood line; and a new dryer at the plywood plant in Coquille, Ore.

“These operations are all key parts of our integrated platform in Oregon, starting with our timberlands, and including our primary processing plants making lumber and plywood, as well as our secondary plants that use wood residuals like sawdust and chips to make value-added products such as MDF, ensuring the full utilization of our precious timber resource,” Roseburg’s Director of Government Affairs Eric Geyer says.

Asia Global Pellet Share Is Growing

While worldwide trade of pellets remained roughly unchanged yearover-year in 2022 from 2021, Asia has increased its global share of wood

pellet imports to a record 32%, according to a recent report in WoodMarket Pricesat ResourceWise.

The report notes that Asia, represented by Japan and South Korea primarily, has continued to grow import volumes at the expense of European buyers and its share of import volume is up from only 18% five years ago. The upward trend is expected to continue, and the report projects Japan will be the fastest-growing market in the world in the next 5-10 years.

The growth in Asian pellet demand bodes well for Northwest loggers: Increased pellet shipment growth is likely to be supplied by Pacific Northwest and Canadian fiber producers. The report notes that after shipping almost all their collective production to Europe, Southern U.S. pellet producers shipped 10% of their volume to Asia in first quarter 2023.

AZ Project Released, Yet Costs Affect Health Projects

According to Apache Sitgreaves Forest Supervisor Rob Lever, the U.S. Fish and Wildlife Service has finally released a biological opinion, that will let the 92,000-acre Black River thinning project move forward. But it will likely take months for the Forest Service (FS) to prepare and release the individual sales.

The project is considered critical to improve forest health and maintain habitat for several sensitive species. FS officials note that thousands of acres in the project area have so much fuel loading that two-thirds of the entire area is likely to carry a high-intensity crown fire.

The project release is good news for the region, but otherwise Arizona’s forest managers and forest industry continue to struggle with lack of markets for the biomass produced by forest health projects as the state has only one major biomass market.

Forest managers are seeking to expedite forest health projects in lieu of finding a single-source contractor for millions of acres under the 4 Forests Restoration Initiative, but the lack of markets and now inflationary pressures are biting into contractors’ production and expansion plans.

NewsLines Foremost Authority For Professional Loggers JULY/AUGUST 2023 7 CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Court Rejects Ban of Aerial Retardant on Forest Fires

The U.S. District Court in Montana ruled in May that the Forest Service may continue using aerial fire retardant while it pursues a Clean Water Act permit from the U.S. Environmental Protection Agency. The ruling comes in a suit filed by a preservationist litigant seeking to enjoin nationwide agency use of aerial forest firefighting retardant.

This decision is a victory for rural communities and forest stakeholders who manage and produce sustainable forests. The environmentalist lawsuit to stop firefighting may garner public notoriety, but it comes at the expense of good forestry and rural forest communities.

Great Lakes Logging Expo: Pre-Show Activity Brisk

Registration is ongoing and booth space is still available for the 2023 Great Lakes Logging & Heavy Equipment Expo at the U.P. State Fairgrounds in Escanaba, Mich. from September 7-9.

The 77th Great Lakes Logging & Heavy Equipment Expo features a kickoff event co-sponsored by Ponsse on September 9 that includes a silent auction, and a $20 fee covers admission for all three days while children under 18 get in free. Call 715-304-2871 to register; visit gltpa.org

Foremost Authority For Professional Loggers JULY/AUGUST 2023 9 NewsLines CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

As We (ALC) See It

Loggers, Truckers Provide Critical Landowner-Mill Connection

By Scott Dane

By Scott Dane

All aspects of the timber industry supply chain are vital. None can exist without the other. But the weakest link is the logging and trucking sector. Logging and trucking have become very capital-intensive elements of the forest products industry, with the most labor challenges and the tightest returns on investment. Trucking is getting increasingly more difficult with regulations, driver shortages, inflationary expenses and insurance and maintenance becoming cost prohibitive. The price of a new truck is nearly $200,000.

A review of publicly traded forest products manufacturers and landowners reveals strong, if not record, returns on investment over the past few years. Although forest product prices have fallen dramatically compared to the record prices, large forest products companies have posted strong stock value increases over the past couple

of years. Two of the largest companies have reported stock price increases of two to five times 2022 prices. These companies have also reported annual net earnings of over $1 billion.

Landowners, including Real Estate Investment Trusts (REITs) and industrial landowners (mills), have initial investment costs, but minimal annual costs. The return on investment for landowners, particularly REITs and industrial landowners, has been consistently positive, with an annual percentage increase in value of 25% over the past three years. Large industrial landowners have experienced similar increases in the value of their timberlands.

In contrast, it is obvious at times that the large manufacturer or landowner is unconcerned about paying a service contractor (logger) to harvest raw materials at rates that keep the contractor sustainable and their crews making a sustainable family wage. Too often, the large company succeeds in leveraging the smaller logging service contractor to harvest at unsustainably low margins. Why have the smaller service contractor

loggers and truckers not experienced the same gains as the larger companies in the forest industry?

According to Forisk Timber REIT (FTR) Weekly, timber REITs as a sector realized a value increase/return of 25.09% based on appreciation and 30.12% on a total returns basis in 2021. These “snapshots” of timberland investment returns demonstrate an attractive return on investment for REITs and industrial landowners. However, many smaller private landowners have not seen comparable returns on their timberland investments.

There is nothing wrong with segments in the supply chain being profitable. In fact, they all should be profitable. It is the only way that the timber and forest products industry will be sustainable.

However, there is a major discrepancy between the return on investment of the landowner and mill compared to the logging and trucking sector. The logging sector invests millions of dollars in equipment that does not increase in value but instead continually depreciates in value. It is similar for the timber trucking industry.

Employment within the logging industry has steadily declined on average 2% per year. The infrastructure is eroding. A prior survey found that half of the logging companies in the U.S. operated at a break-even or loss, while the greatest percentage of profitable logging companies operated at a 1%3% profit margin. In most instances, the price paid for delivered wood has not kept pace with inflation over the past 10 years, while all costs (fuel, labor, equipment, insurance) have increased more rapidly than the Consumer Price Index (CPI) inflation rate.

Many forest landowners and mills subscribe to forest certification programs that require specific training and practices of the logger. Much of the implementation and expense of achieving these initiatives is primarily borne by the logger in the name of sustainability, without any tangible benefit offsetting their cost, realizing any market gain, or stability. Sustainability is important for the future of the forests and the timber industry, with certification programs emphasizing “Sustainable Supply Chains.”

We do not see the same landowner or mill focus on the sustainability of the logging and trucking suppliers.

10 JULY/AUGUST 2023 TIMBER HARVESTING & FOREST OPERATIONS

Dane

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Sustainability and products certifications, which include a significant effort and investment on the part of logging contractors, mean premium prices and new markets for forest products manufacturers—and an additional cost for loggers.

A discrepancy in the “certification criteria” is the requirement to “use written agreements for the purchase of raw material.” While this may be practiced between landowners and procurement entities, it is only figuratively practiced between loggers and facilities. Under these type “agreements” volume and price can and are changed at the discretion of the facility. There are few if any, “binding” agreements between loggers and end users. This limits long-term investment security and business practices.

Current standards have demonstrated a failure to ensure that sufficient attention to supply chain sustainability exists and is maintained across all sectors of the timber and forest products industry.

Certification programs must include logging sector sustainability requirements if they are legitimately concerned about the long-term sustainability of healthy forests. Incorporating “fair trade” verifiable

requirements for the service contractors in the certification process will fill a gap in the current sustainability criteria of forest and product certification programs.

Without the logger and trucker, the landowners cannot harvest their timber

and realize the return on their investment. Without wood, the forest products industry cannot produce the products that generate income and profit. But, as has been demonstrated, the chain must be strengthened to ensure this link does not continue to weaken and eventually break. Without the logging and trucking sector, there would be no supply-chain connection between the forests and forest products mills.

Certification programs are the thread that stitches these sectors together. Certification programs need to ensure that all sectors of the timber and forest industry supply-chain are considered essential components to meet sustainability and certification objectives. Otherwise, forest sustainability will fail across all sectors, and “certification” programs will have proven ineffective in ensuring healthy, sustainable forest management.

This article was originally written for the Louisiana Loggers Council & Louisiana Forestry Assn.

Foremost Authority For Professional Loggers JULY/AUGUST 2023 11

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

The Master Logger Program is one way loggers have developed a program that certifies sustainability and environmental awareness.

Logger Survey Results Show

‘New Normal’ Not Sustainable

DANShell

Designing the logger survey, our loosely followed process at TH is to do a straightforward contractor profile kind of survey every other odd year, then try to find an issue or specific area to drill into in the survey and swap out some questions on the even years.

During the past several surveys the pandemic has taken up a lot of survey space, and this is the first survey since 2019 that doesn’t have a specific pandemic question. This is also a basic contractor profile survey year.

So in this 2023 Logger Survey Report, we decided to look at it as a “before” and “after” situation comparing business conditions and survey results from 2019 before the pandemic hit in early 2020 to now—a depressing new normal in many ways. Along the way, there’s been unprecedented forest products prices and soaring inflation, 12 JULY/AUGUST 2023

TIMBER HARVESTING & FOREST OPERATIONS

Inflation and labor issues now combine with reduced log and fiber demand to further reduce contractor profitability.

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Foremost Authority For Professional Loggers JULY/AUGUST 2023 13 CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

pandemic dynamics leading to labor issues and much more.

In spring 2019, despite a tariff war with China that was roiling log export markets, the forest products industry

was on a general upswing, still recovering from the Great Recession of 2008-9. But since then, with the pandemic impacts beginning in spring 2020, lots of uncertainty has been in-

jected into the logging industry and supply chain as loggers have been hammered with rising operating costs and labor instability.

Meanwhile, the past few years it’s

14 JULY/AUGUST 2023 TIMBER HARVESTING & FOREST OPERATIONS CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

been more of the same around the country as loggers struggle with challenges such as ongoing public lands access and overall regulations out West, major closures and realignment in the pulp, paper and container sector with mill closures in the Carolinas,

Florida, Maine and Louisiana. And weather events can quickly turn into huge business challenges as hurricanes, fires and even overly warm winters continue to create risk and hardship around the country.

Not to get too proverbial here, but

the silver lining in the old saying of being “lucky” to live and operate in “interesting times” certainly wears thin after a while. So this survey report will do a lot of comparisons to just four years ago, to highlight the changes wrought by unprecedented economic events and pandemic dynamics. In doing so, we spotted several interesting data points.

Downsizing Trend—Logging is definitely a small business industry: The average number of employees reported by loggers responding in 2023 is nine.

On a related question that looks at company size in terms of logging crews, there’s definitely been some downsizing in the ranks since before the pandemic. In 2019, 53% of loggers reported they ran only one crew. Now, more than two-thirds (68%) say they run only one. The 23% of loggers who reported running two crews in 2019 is now 18% in 2023.

The downsizing is also reflected in two answers on a cost-cutting question deeper in the 2023 survey: During the past two years, 12% of loggers say they’ve downsized in response to operating conditions. That includes 10% who say they’ve eliminated one crew

16 JULY/AUGUST 2023 TIMBER HARVESTING & FOREST OPERATIONS CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

and 2% who have cut two or more crews from their operations.

The 2023 survey asked: Has your company expanded, remained about the same or downsized in the past two years? More than half (61%) say their operations have stayed roughly the same, while 10% report expanding and 28% report downsizing.

While an industry run by small businesses, logging is also quite capital intensive: 44% of loggers report total logging business investment of

more than $1 million, including 7% at more than $5 million.

Profitability Elusive—For years a concern among loggers is the annual ROI on all that investment in equipment, personnel and supplies. Asked to estimate their pre-tax profit percentage for the prior year (2022), this year’s survey shows that more than a third of those who responded said they either broke even (17%) or lost money (21%). When 38% of the companies critical to the supply chain aren’t profitable, that’s

a major cause for worry.

It’s interesting to look at the results from 2019 before the pandemic, as all the answers from four years ago slid downward as loggers have trended toward lower profitability: The group that reported pre-tax margins of 10% or more four years ago was 24% smaller this year; and the group reporting margins from 4% to 9% four years ago was 44% smaller this year. Meanwhile, the number of loggers reporting margins of 3% or less or outright unprofitability has increased 22% since the pre-pandemic 2019 TH Logger Survey.

As one logger who commented on the survey said, “You can break even for only just so long.”

The responses from four years ago compared to now are striking when loggers were asked to rate their company’s financial health.

As with the pre-tax margin question, the responses to the same question all moved negatively during the past four years until now, when half as many loggers rate their financial health as “very good” (6%) in 2023 compared to the 13% who said so in 2019.

Likewise, 21% of loggers in 2023 rated their company’s health as “poor”

18 JULY/AUGUST 2023 TIMBER HARVESTING & FOREST OPERATIONS CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

(16%) or “very poor” (5%), compared to only 6% who said poor or very poor back in 2019. Meanwhile, in 2023 30% of loggers rate their business health as “good” while 44% say “fair.”

“The cost of equipment, insurance, labor, fuel, and nearly every other necessary component has skyrocketed, but not the rates that loggers receive,” commented Justin Everheart of JEM Forestry in Bonners Ferry, Id. “If we want to bring young blood into the industry offering full benefits has to be doable and the money has to come from somewhere. The industry has to shift and loggers need to be viewed as a priority making sure they can make a decent living running an operation and offer one to their crews.”

Operating Challenges—Sadly, one thing that hasn’t changed in four years since the 2019 Logger Survey is that loggers across the country (63%) rank Insurance as the heaviest impact business challenge they currently face, same as 2019, when 69% of loggers said so.

In 2023, the top three heavy impact business challenges ranked by loggers include Limited Markets, cited by 50%, and Labor Issues, cited by 47% of loggers. (In 2019 the top three heavy impact issues were Insurance, Trucking/DOT issues and Weather.)

Labor concerns, of course, have risen to the fore for all personnel from entry level to truck drivers and equipment operators, and the number of loggers citing limited markets cer-

tainly reflects the multiple pulp-paper mill closures and realignments around the country along with reduced log buying for many mills due to markets and lumber prices.

Heavy impact business issues cited by 40% of more include Load Quotas (45%), Trucking-DOT Regs (44%) and Compensation (43%). Weather was cited as top heavy impact business chal-

Foremost Authority For Professional Loggers JULY/AUGUST 2023 19 CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

lenge by 27% of loggers, Debt was tops for 26% of loggers, Equipment Downtime was the biggest challenge for 24%, while 23% cited timber availability-cost. Environmental Compliance and Product Separations were big impact issues for 15% and 11%, respectively.

With such challenges out there, a poor compensation structure only makes things worse. Looking at the past two years, 20% of loggers report rate increases (16%) or fewer quotas-more loads (4%). However, twice as many—40%—loggers report either rate reductions (10%) or tighter load quotas (30%) during the past two years.

“It is very hard right now. Finding additional crews to increase production is almost impossible. The only way to consistently profit is to increase production. And as soon as you’re able to, quotas begin,” says TJ Shafer of Forest Sales in Manning, Tex.

With labor such a challenge these days, loggers were asked what they do to attract and retain employees, and 77% said ensure a competitive pay rate, followed by 50% who provide production bonuses. Paid vacations and regular raises were cited by 39% and 33% of loggers, respectively.

Only one in four loggers who responded—25%—say they offer health insurance, which is a key benefit to maintaining a stable workforce. Another 7% of loggers say they offer profit-sharing plans.

Labor issues drew a big share of the comments across several questions, ranging from the humorous—They won’t work because they can’t smoke weed at fire camp—to multiple touching comments about the desire to offer more and better packages for employees but the money is just not there, especially for health insurance.

And of course 90% of loggers said “No” when asked if they felt good about being able to find employees to replace those who leave or retire.

Equipment, Technology—Taking a look at loggers’ equipment maintenance and repair practices, the survey shows 87% of loggers report they handle routine maintenance and repairs within their organizations, and 43% of

those who responded said they maintain a shop to help them do so. Another 43% said they maintain at least one service truck-trailer to help with repairs and maintenance, and 18% of loggers said they employ at least one full-time mechanic. Meanwhile, 24% of loggers say they pay a dealership or independent mechanic to handle routine service work.

Logging is also very consumable intensive, and 25%of loggers report they spend more than $200,000 annually in parts, supplies, tires, maintenance and repair (not fuel). That includes 8% who say they spend more than half a million annually. Meanwhile, 56% of loggers say they spend $100,000 or less on parts supplies and maintenance. Another 19% say they spend between $100,000-$200,000 annually.

Noting that equipment is becoming

cating the public about logging-forestry (21%), and showing examples of your work (19%).

Compared to just four years ago, this year’s results show much higher usage rates. For example, in 2019 only 8% of loggers said they used the Internet to find employees, while only 9% said they used it to find timber to harvest.

Judging by the number of loggers who skipped the question in 2023 and the 7% who answered “other,” there’s evidently a stubborn minority continuing to avoid the Internet and computers in general. The best comment?

“You cannot run a competitive business without knowledge of the electronic age. No longer should a contractor say I hate or don’t understand a computer. From bidding sales to mapping and bookkeeping, you have to use the Internet. You cannot just say, ‘I leave that to my wife.’”

Looking Ahead—While the future always remains uncertain, there’s not a lot of optimism out there for what the next two years holds: In 2023, only 14% of loggers expect overall log and pulpwood demand in their area to improve in the next two years, while

more technologically advanced and with performance and production data logs and analytics, built-in GPS systems and more, the survey asked loggers about using such features, and 56% reported they don’t run equipment with such features. Of the 44% who have such features on their machines, 20% don’t use the technology at all, 18% says they take advantage of certain key metrics but not all, and 6% say they try to take advantage of all data generated.

Responding to the 2023 TH Logger Survey, 70% of loggers from around the country say buying and selling equipment is their most frequent use of the Internet and social media in their businesses. The next most popular use is learning how other loggers and truckers resolve mechanical issues, say 40% of loggers. Not surprisingly, finding employees is the third-most popular use, cited by 30% of loggers.

Other top uses by loggers include finding timber to harvest (22%), edu-

more than a third (34%) expect demand to diminish somewhat. Some 52% said they expect demand to remain about the same.

Results from the same question four years ago show a big shift in logger optimism, as back then more than 30% were expecting demand to improve in their markets over the next two years, while only 13% were expecting reduced demand.

Asked to gauge their likely logging future during the next five years, it’s interesting that loggers responded in almost equal groups, each more than 30%: In 2023, 36% of loggers say they plan to remain fully engaged and growth- and opportunity-oriented business stance the next five years, while 33% say they’ll stay in the business but not with expansion or growth in mind. Meanwhile, it’s got to be worrisome that roughly a third of those who responded (32%) say they will likely exit the logging industry in the next five years.

20 JULY/AUGUST 2023 TIMBER HARVESTING & FOREST OPERATIONS

TH

“If we want to bring young blood into the industry offering full benefits has to be doable and the money has to come from somewhere.”

— Justin Everheart, Idaho logger

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

“You cannot run a competitive business without knowledge of the electronic age. You cannot just say, ‘I leave that to my wife.’” —Colorado logger

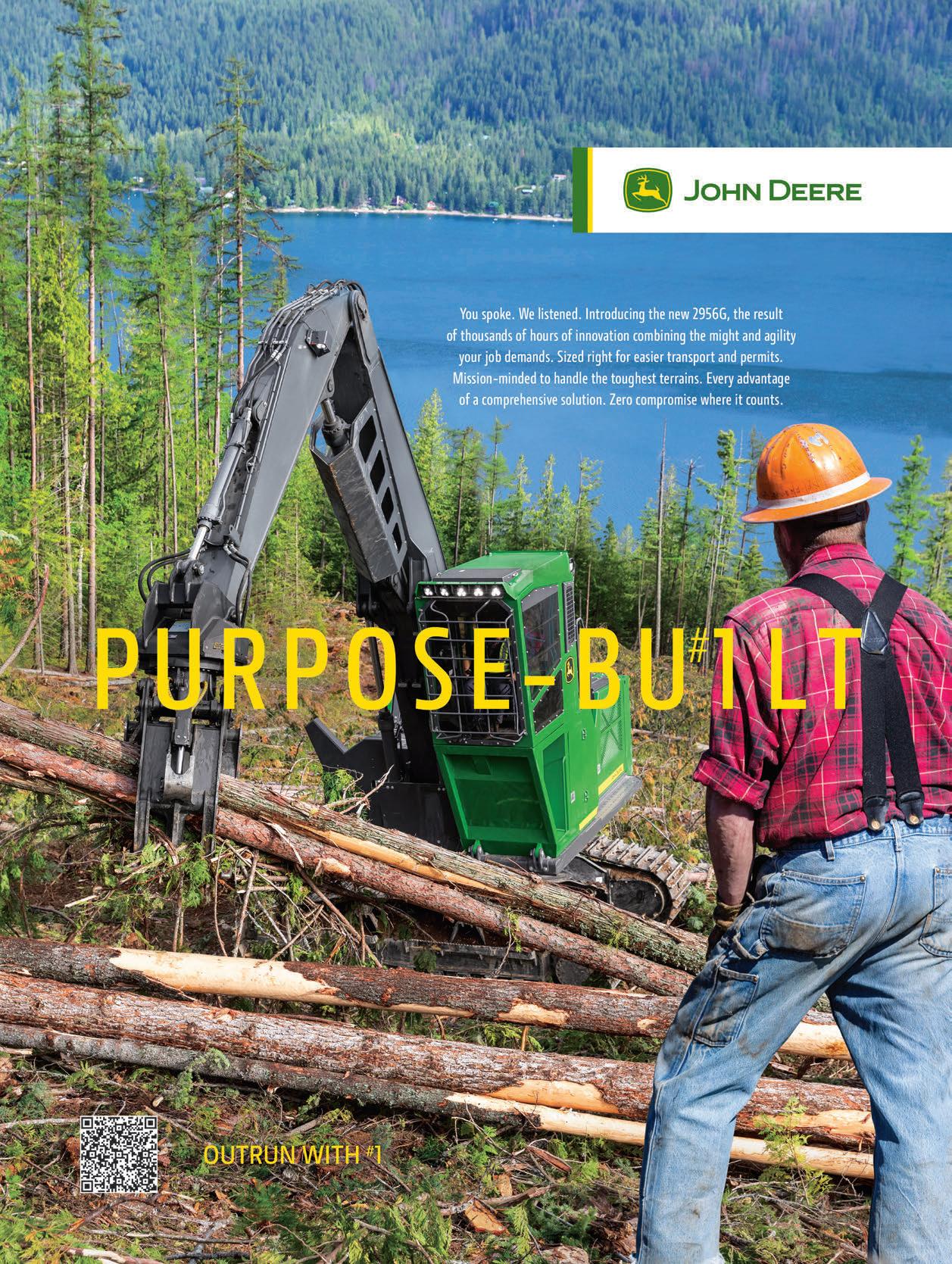

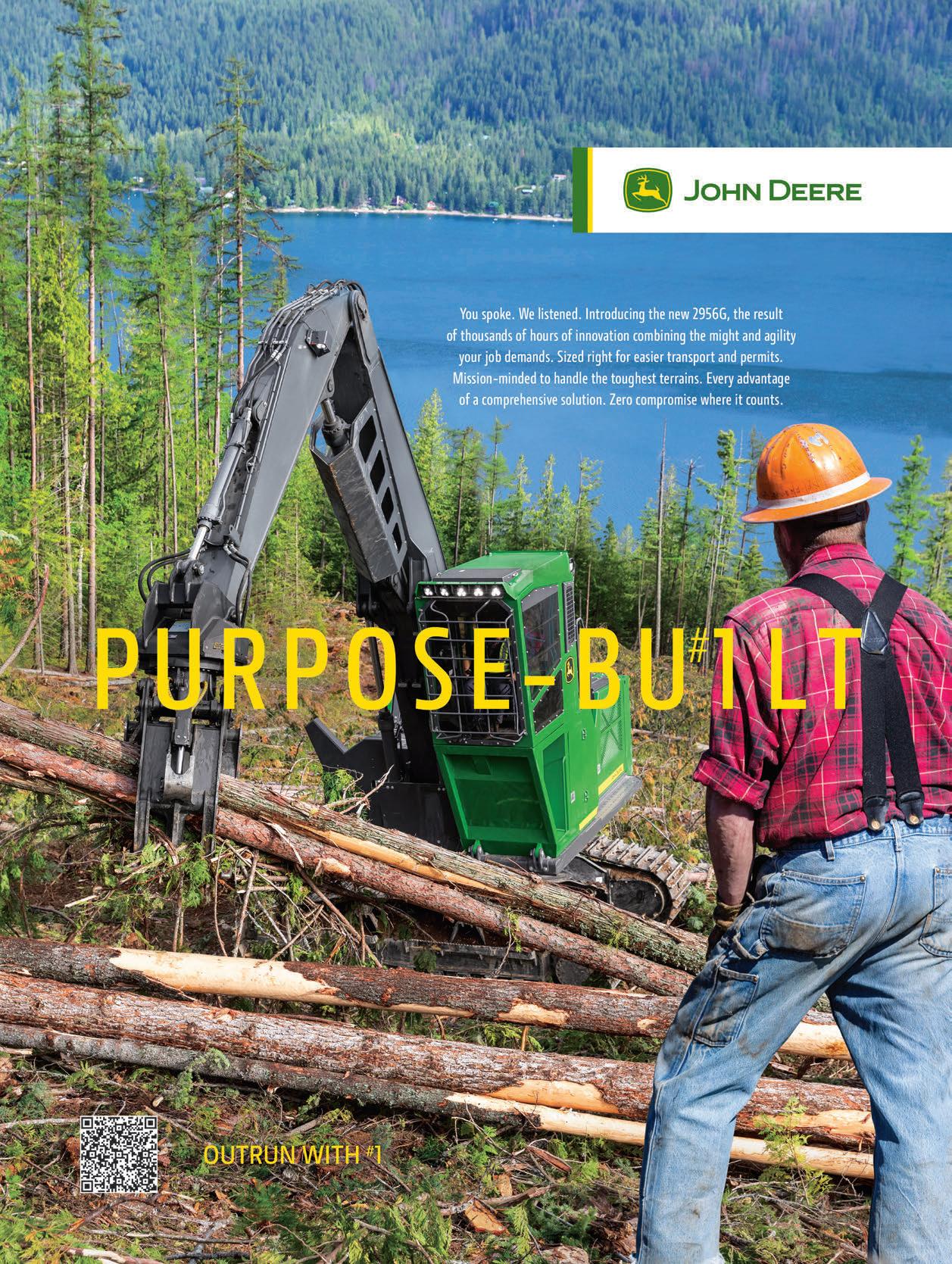

Deere 2956G Crawler Log Loader

Earlier this year, John Deere introduced the new 2956G: An ideal solution for customers looking for a machine that provides the best combination of engine horsepower and hydraulics capability, while maintaining a machine weight of less than 90,000 lbs.

Aimed to help ease transportation, the 2956G crawler log loader features an overall shipping width of less than 11'6" to go with the lower operating weight. As machine weights and widths increase, so do costs associated with transportation. The design on the 2956G also helps save on costs relating to transport due to its less restrictive transportation requirements. In addition, the new mounting of the log deflector adds additional strength to the right-front corner of the machine and the new, clean, and simple design of the hood profile, aligned with counterweight, helps to enhance debris shedding.

The 2956G crawler log loader machine features excellent power and hydraulic flow that significantly boost loading capability, speed, and capacity to run the Waratah 624. Also, customers looking to increase efficiency in roadside processing can expect improved productivity when running the Waratah 624 head as compared to the 2654G.

Visibility enhancements have also been prioritized in the design of the new 2956G. Enabling additional visibility to the right track, as well as reduce overall impact, the RH front corner log deflector has been strategically moved to the back on the machine to improve operator visibility. A rear-view camera, light and JDLink antennas have been integrated into the counterweight for additional protection. Visit johndeere.com/forestry

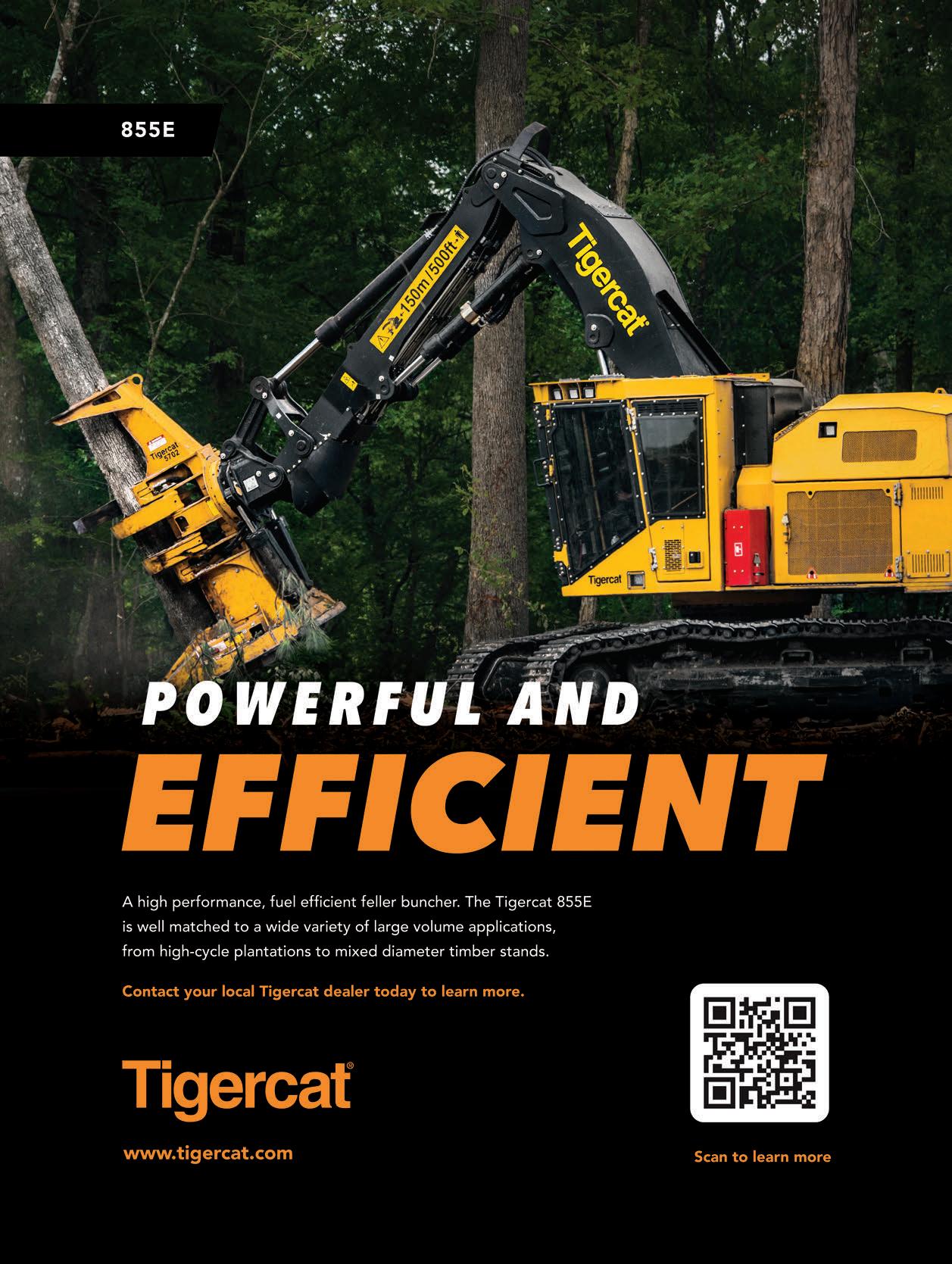

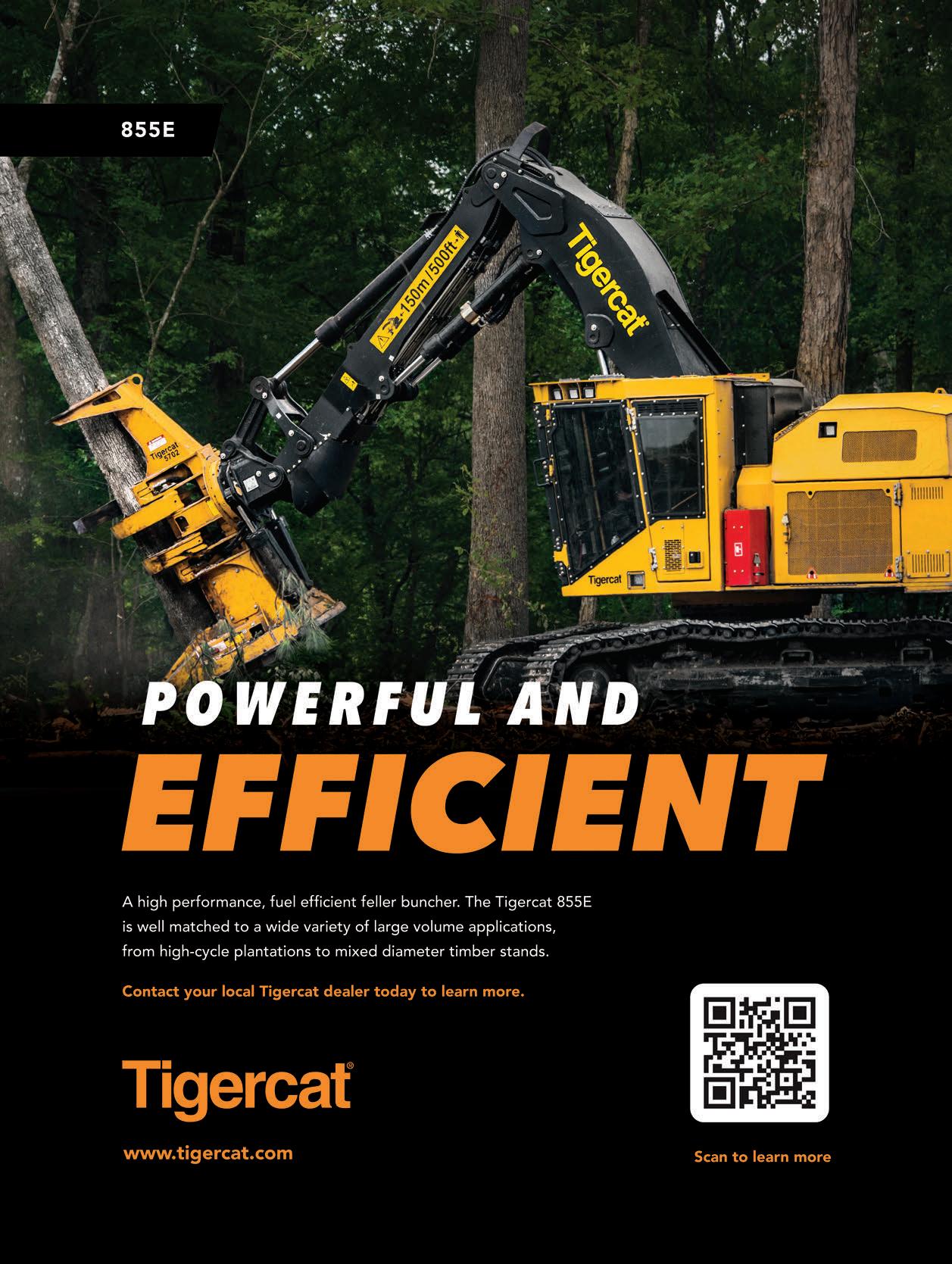

Tigercat 865 Purpose-Built Loader

The Tigercat 865 is a purpose-built logger designed for loading and processing applications. The 865 combines power, efficiency and serviceability into a true multi-purpose forestry carrier. The 865 is a 71,000 lbs. carrier that offers many advantages over excavator conversions, such as higher cooling capacity, a better operating environment, stronger undercarriage components and extremely efficient and task-optimized hydraulic circuits. The result is higher production, uptime and fuel efficiency for lower operating cost per ton. The Tigercat FPT N67 engine delivers 165 kW (221 HP) at 1,900 RPM.

The 865 shares a common platform with the 850 processor and can be configured as a loader with boom options for various grapple styles including bunching, power clam and butt-n-top grapples, as well as grapple saws. Equipped with a live heel boom, along with the optional pull-through delimber and bar saw slasher hydraulic package, the 865 can be configured as a high-performance merchandising loader. This package is well suited to typical southern US full-tree harvesting systems.

The 865 can also be configured as a high capacity roadside processor, capable of running large harvesting heads in demanding duty cycles. Dual swing drives provide ample torque and speed for high-performance loading or processing. The high cab improves performance and operator visibility in high decking applications.

865 features the common high-rise cab from Tigercat’s logger lineup. The large ergonomically designed cab is quiet and climate controlled for maximum operator comfort. A full-length front window, and additional floor windows provide superior visibility with clear sightlines. LED lighting and the rearVIEW camera system further augment operator visibility. Visit tigercat.com

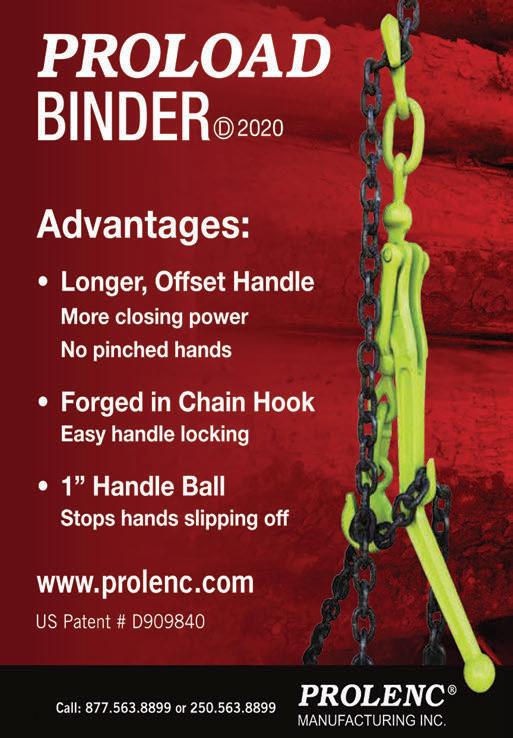

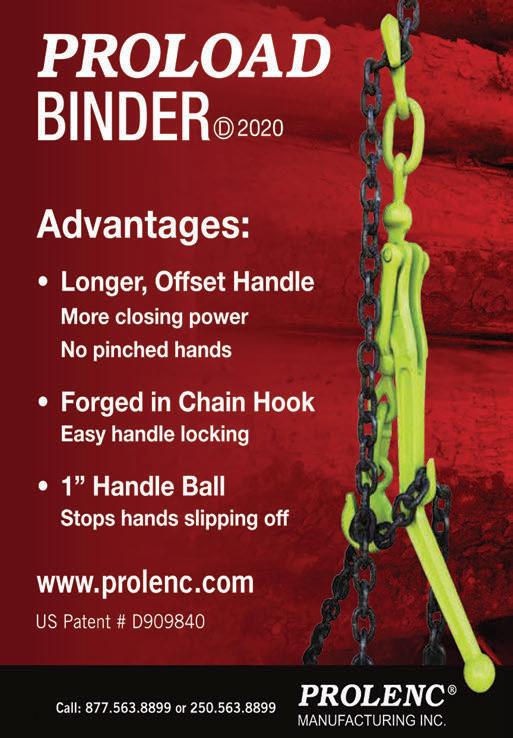

Prolenc Log Load Binder

ProLenc’s innovative log Load Binders feature a longer, offset, forged handle for more leverage when closing and will not snap closed on the hand as straight handles are prone to do.When open their geometry allows handle to stand upright when attaching to the chain on a log bundle wrapper. A 1" round ball on the end of the handle stops hands and wet gloves from slipping off when closing.The forged in chain hook enables easy, positive locking of the handle eliminating the traditional method of wrapping the chain around the handle or using a separate wire restraint.

The Prolenc new, patent pending 250 series Brake Link is designed to integrate with 5 to 8 ton class rotators offered by Finnrotor, Baltrotor and others in this class weight class and features Prolenc’s unique, simple, tapered friction sleeve design. Externally mounted and integrated on the link, it offers easy access for periodic tension adjustments and serviceability. The link is single or double dampening and also available as individual units to adapt to the wide variety of linkages and crane tips available worldwide. Ideal for smaller thinning harvesters and free swinging biomass heads as well as loading grapples the 250 series allows Prolenc to now offer a full complement of brake links and dampeners for all attachments up to 2,000 Kgs or 4,400 lbs. Visit prolenc.com

LoaderTech

Foremost Authority For Professional Loggers JULY/AUGUST 2023 21 CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Baker’s Diverse Operation Hauls Multiple Products

DAVIDAbbott

MALVERN, Ark.

Though his company may be named Baker Land and Cattle, Cody Baker, 27, says these days his business is in the woods, not the pastures. Baker and his dad, Kevin, 52, don’t actually run cattle anymore, but they did for a long time, and in fact that’s how they got into logging.

Clearing 140 acres right after high school, aiming to use it for pasture, Cody bought some old logging equipment and did the work himself but soon realized he really enjoyed the logging, and decided to try more of it. Nine years have passed and he’s still in timber.

Operations

Cody also didn’t really set out to have an outfit quite so big: On a single crew, the Bakers run two loaders, two skidders and a cutter, with multiple backups. “We were sort of forced into getting as big as we are,” the younger Baker explains. “When we first started we had trouble with quotas. We were small so we were the first ones they wouldn’t let haul.” Now they haul a minimum 15 daily loads, often getting closer to 20. (The day before TH vis-

ited in early March, they hauled 22).

“We have to have 75-80 loads a week just to survive right now, the way we are set up,” Kevin says. “Rain won’t let you get more than that in the winter and in the summer mill quotas won’t let you get more, so you can only increase production so much.” Trucks make four or five trips each per day, which is possible because the mills are within 50 miles. “With fuel as high as it is there is no money in hauling long distances,” Kevin continues.

They have six trucks (mostly Macks with Kenworth and Western Star in the mix) and 10 trailers (Pitts, Magnolia, Viking), but don’t run them all full-time. “Finding drivers is the biggest problem we face,” Cody says. “I think it’s everybody’s problem.”

In the woods, both main loaders are Prentice machines, a 384 and a 2484C, bought used from Stribling Equipment. Both use CSI delimbers and buck saws.

Two Tigercat skidders, a 630 on

duals (28L back, 30.5 front) and a 625 bogie, came from MidSouth Equipment in Caddo Valley, along with a 726D feller-buncher.

Cody keeps spares of everything: two extra loaders, a John Deere skidder and another Tigercat skidder. He has a Tigercat 845 track cutter reserved to run in very wet conditions. He also still has, and occasionally still runs, his first cutter, a Hydro- Ax; Weiler can still provide the parts to keep it running.

The Baker team also has a Morbark clean flail chipper, but not in the woods. “A few yeas ago we tried to split it up into two crews with inwoods chipping on one job, but truck-

Baker’s one large high-capacity crew gets the loads out while conditions and quotas are good.

22 JULY/AUGUST 2023 TIMBER HARVESTING & FOREST OPERATIONS CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Cody Baker, left, and father Kevin make a good team.

ing was such a problem that we couldn’t keep both jobs going, so I parked the chipper,” Cody explains. Now once or twice a year, the Evergreen Packaging paper in Pine Bluff hires him to chip on their wood yard. “I normally shut my log crew down when we do that; my help out here goes up there and we chip 24 hours a day, six or seven days a week, for three months this year. It takes all of my help and I hire some temporary help while we’re up there.” He has Peerless chip vans to haul from wood yard to the mill a few miles away.

Land

Kevin secures a lot of the timber that Cody buys for the crew, relying on his years of experience and connections in the region. “Once you survive the first 10 years you start getting the repeat business and then you don’t have to look for timber as much any more; it just comes to you,” Kevin notes.

In early March, the Bakers and their team were working an upland site with a breathtaking view, a 280-acre mature pine clear-cut for the PotlatchDeltic mill in Ola. This job was a little outside their normal territory, an hour and a half from home base, but a mill closure forced them to widen their net. “Plus in wet weather the hills are better to work in,” Cody adds. And the weather has been particularly wet of late. “It takes about a day for the job to dry out after a big rain, and then it rains again. But it’s not killing us too bad; we’re making it.”

The Bakers do often cut PotlatchDeltic tracts in winter months just because the ones back home are better suited for summer harvests. With the mill shutting down in Malvern, though, Cody is unsure if they will have to make some changes, seek

some new markets or spend more of the year working farther from home.

“We hauled 90% of our wood to that mill (in Malvern),” he points out.

Along with PotlatchDeltic, Baker trucks haul to several mills: Hixson Lumber Co. in Magnolia, Southern Chips, Inc. in Perry, Green Bay Packaging, West Fraser in Leola, Highland Pellets and Evergreen Packaging in Pine Bluff, Anthony Timberlands at Malvern, Wilson Brothers Lumber in Rison, and Sorrell’s Sawmill in Sparkman.

Challenging Times

“We are not against growing, but it is hard to plan on the future when everything is as bad as what it is now,” Cody says. “Interest rates are double what they were a year ago. Equipment costs more but still wears out just as fast. My trucks are old; a 2007 is an old truck now. But we keep them dependable and legal. I couldn’t imagine having to try to make new truck payments on top of it all. I don’t see how others do it.”

His dad agrees. “You’re better off to buy an old truck, spend $20-30,000 to rebuild it and roll it out,” he advises.

Still, Cody acknowledges, that’s part of the trouble in keeping drivers. “One of the biggest problems we face is not having new trucks. We have a real good woods crew but we constantly lose drivers. They will swap to drive a newer truck even for less pay. But I can’t justify the expense of a brand new truck and put it in the conditions we work in.”

No surprise, the biggest expense in the last year has been diesel, Kevin says. The weekly fuel bill is around double what it was a year ago, and as he notes, they weren’t making a huge profit back then, so how can they absorb that cost increase?

And it’s not just diesel prices, Cody

stresses: inflation has all operating expenses up 25% or more across the board, and parts availability remains limited. “I had an older machine that was parked for three months waiting on replacement parts,” he says. “It’s a good time to have used equipment for spares. We had to part out one truck this summer just to keep the other trucks going.”

At this point, the focus is less on thriving and more on just surviving till the situation improves. “We are buying time now, hoping we can last till it gets better,” Cody says. “I think things will get better but I think we’re two years out. We will lose some money here and there just to keep busy, because we have an exceptional woods crew and I would hate to lose them.” He figures he’ll need those men when the economy turns around.

“It is a hard life,” Kevin admits. “We leave home at 4 a.m. and get back home between 9 and 10 at night.” The elder Baker got married and had kids young, he’s never worked for anyone else and he says he’s had an exceptionally good life. The work is hard, but he counts it a blessing and a privilege. “Look at this view!” he advises of the high elevation job the Baker crew was working in early March. “Not many people get to enjoy this view from their work all day every day. Loggers don’t have to be pried to get out of bed and don’t hate going to work.” In fact, he notes, loggers often can’t wait to get back to it. They’re not workaholics, they’re just proof of the old axiom: if you love what you do you’ll never work a day in your life. “People do this because they love it,” Kevin believes. “It’s got to be in your heart and soul or you won’t make it.” TH

This is an abridged version of an article that ran in April 2023 Southern Loggin’ Times.

Foremost Authority For Professional Loggers JULY/AUGUST 2023 23 CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Bogie skidder handles big loads in tough conditions while older cutter, right, extends its operating life with a rebuilt motor.

Swedish Forestry Expo Looks Good

Organizers of the first Swedish Forestry Expo reported a wonderful fair week at Solvalla in Stockholm, Sweden, with great weather, positive visitors and exhibitors, interesting seminars and even a visit from H.R.H. Crown Princess Victoria of Sweden.In total, 10,247 visitors came, representing 57 different countries, who observed more than 150 exhibits.“We have been eagerly waiting to organize Swedish Forestry Expo, and what a success it turned out to be,” comments

Anton Erlandsson, Swedish Forestry Expo Exhibition Manager.

“We, as organizers, are very pleased with the event, and the atmosphere on-site and afterwards has been very positive. Our goal has been to create a more specialized meeting place for the professional forestry industry, and we truly feel that we have succeeded. Besides exceeding our original visitor goal, also with the right type of visitors, which is incredibly exciting.”

DC Equipment Buys Madill Brand, Assets

Renowned logging equipment brand Madill has been acquired by New Zealand-based DC Equipment as the steep slope harvesting specialist seeks to integrate its new generation cable logging systems with Madill’s time-tested equipment and designs. Nicholson Mfg., a long-time sawmill debarker manufacturer, had owned Madill since 2011.

Interestingly, DC Equipment founder and ownerDale Ewers, a New Zealand logger, says he’s dreamed of owning a Madill yarder

since childhood.“Madill is known for its durability, ability to perform and longevity—and those strong equipment

features align with our current brand, Falcon,” he says.

Ewers believes adding the Madill brand and intellectual property under DC Equipment’s manufacturing umbrella helps achieve the company’s mission of “creating a safer and more productive steepslope logging industry throughout the world.”

The acquisition also opens up potential benefits to other industries, and he sees the move as astepping stone to not only helping the forest industry progress but also providing

EquipmentWorld 24 JULY/AUGUST 2023 TIMBER HARVESTING & FOREST OPERATIONS

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Madill at OLC in the ’90s

customers with solutions they need.

“We’re not here to be the biggest manufacturer; we’re here to provide the best solution for our customers,” Ewers says, adding there’s no plan to reinvent Madill products outside of integrating some of DC Equipment’s current and future technology and innovations.“There’s history, heritage and a heck of a lot of customer loyalty there that needs to be recognized,” he adds.

A brand in business more than 100 years, Madill has produced more than 3,000 yarders during that time. DC Equipment officials emphasize that current Madill customers can still receive parts and servicing through their current channels, and updates on the Madill acquisition will be posted on DC Equipment’s and Madill’s website and social media.

DC Equipment is an early pioneer in steep slope systems, manufacturing its Falcon products that include motorized grapple carriages, winch assist machines, yarders and camera systems since 2010. The company claims more than amillion operational hours across theproduct lines with zero harm. In North America, ModernMachinery represents the Falcon brand in the U.S., and Great West Equipment in Canada.

Ewers says hestarted DC Equipment to mechanize and de-risk the steep slope logging environment, and the acquisition of Madill is another big step toward that goal. He sees a future that includes developing more integrated solutions, by leveraging automation and data capture and working totransition to lower emission machines.

Quebec Receives First Of Three Logset Hybrids

many questions related to hybrid technology and the benefits around such hedge cutting machinery. All requests were answered by the team of LN machinerie, which is the Logset dealer in Quebec.

Logset former Chairman of the Board, Tapio Nikkanen, commented, “I am today honored to present to you after four years of project work the first Logset 12H Hybrid in Quebec. The different people contributing and involved in this project did outstanding work facing and managing various hurdles along the way and I would like to thank them explicitly.”

Caribou Purchases StumpGeek Software

Logset officials announced that the government of Quebec is moving forward with three hybrid machines for lower emissions, costs and more efficient forest harvesting. The first delivery of the Logset 12H Hybrid was officially announced by the Minister of Natural Resources and Forests of Quebec, Madame Maite Blanchette Vezina during Conseil De L’Industrie Forestiere Du Quebec (CIFQ).

After the official announcement by the Minister and with great anticipation, she was looking forward to sitting in the driver’s seat of the Logset 12H Hybrid which was parked outside the congress hall.

Members of the CIFQ and guests of the congress joined the minister and gathered around the machine for

Caribou Software, a forestry software company that services more than 300 timber companies across North America, announced its acquisition of the StumpGeek forestry software system to extend its product offering to smaller logging contractors and sawmills.

“Over the years, we’ve spoken to many, many logging contractors and small sawmills who move 10 to 30 loads a week and need a simple way to pay trucking subs and ensure they are receiving payment for all their loads, but they don’t need the full capabilities of our Logger’s Edge and Cutting Edge systems,” says Teresa Hannah, President and Co-Founder of Caribou. “StumpGeek allows us to assist those smaller, simpler companies at a price point that works for their budget.”

The StumpGeek product was designed by Wesley Bushor, a logging

EquipmentWorld Foremost Authority For Professional Loggers JULY/AUGUST 2023 25 CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

contractor in Wisconsin, who wanted a better system than the interlinked spreadsheet he had developed over his 30 years of harvesting timber to keep up with his own logging business. He partnered with a professional software developer, and the two of them first launched StumpGeek into the market in 2015. StumpGeek’s existing client base is mostly centered in the Midwest, but it also encompasses companies in Arkansas, Maine, New Hampshire, Oregon, West Virginia and Mississippi.

In addition to tracking production volumes, revenue and payments associated with load tickets, StumpGeek also has a “Work Log” for tracking things like truck mileage, fuel costs, road-building hours, and other types of non-load-based work. It even has a “Money Log” that serves as an electronic checkbook.

Caribou Software has been providing critical data management and job costing software solutions for the forestry industry for more than 15 years.

International Names Waters Top Dealer

International Truck announced Mississippi-based Waters Group as the 2022 North American Truck Dealer of the Year. The award recognizes the top International Truck dealer for commitment to provide industry-leading uptime and unparalleled performance in customer satisfaction, annual sales, service and community involvement.

David Waters and Vaughan Waters were in attendance to accept the award. “Waters Group has a customer-first mindset that Navistar values in our dealers and they have forged phenomenal relationships with local fleets, resulting in notable sales numbers,” says Jeff Felix, group vice president, Dealer Sales and Operations. “Because of their rich legacy, community involvement and family-oriented business model, we are proud to have them as one of the many successful dealerships in our vast dealer network.”

Waters Group operates seven locations and employs more than 300 . The

Waters family acquired the International franchise in 1938 when Ray Waters Sr. founded the company in Columbus, Miss. Now 85 years later, the company is family owned by third and fourth generation family members: Mike, ML, and David Waters and their sons Michael, Josh, and Vaughan Waters, respectively.

“A core goal of our company and a stated Waters family value is to achieve B.O.B. Excellence (best of the best) in all we do,” says David Waters. “This is a goal we set for each and every team member throughout our company. This was a tremendous team effort by all our employees and vendor partners that has allowed the Waters Group to be recognized. Most importantly, we appreciate our customers having faith and trust in us to serve their transportation needs.”

In 2022, Waters Group delivered more than 500 units to customers, sold nearly $21 million in parts, and all dealer locations received “Prestige Standards” certification for customer service.

EquipmentWorld 26 JULY/AUGUST 2023 TIMBER HARVESTING & FOREST OPERATIONS CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Ponsse Looks Ahead To Fossil-Free Steel

SSAB and Ponsse Plc have joined forces in a partnership in which SSAB will deliver fossil-free steel to Ponsse gradually beginning in 2026. This partnership will further solidify Ponsse’s position as a provider of sustainable forest machines and bring SSAB closer to its goal of establishing a fossil-free value chain.

“Our products and services will play a crucial role in assisting our customers in achieving their climate objectives during the transition to a low-carbon economy. Our Ponsse EV1 forwarder concept with completely electric drive and our partnership with SSAB regarding fossil-free steels will lead our development towards carbon neutral forestry,” says Juha Inberg, Chief R&D and Technology Officer, Ponsse Plc.

SSAB aims to deliver fossil-free steel to the market at a commercial scale during 2026 and to largely eliminate carbon dioxide emissions from its operations in around 2030. SSAB works with iron ore producer LKAB and energy company Vattenfall as part of the HYBRIT initiative to develop a value chain for fossil-free iron- and steelmaking, replacing the coking coal traditionally used for iron ore-based steelmaking with fossil-free electricity and hydrogen. This process virtually eliminates carbon dioxide-emissions in steel production.

Husqvarna Group

Names Hajman CEO

Board of Husqvarna Group has appointed Pavel Hajman as permanent Group CEO.Pavel has been acting CEO since December 2022, following a career of more than 30 years in leading positions within and outside Husqvarna Group.

Hajman has been a part of the Group Management team since 2014 and has a history within Husqvarna Group as president for Husqvarna Forest & Garden, SVP Operations Development and SVP IT.Prior to joining Husqvarna Group, Pavel held various leading positions within Seco Tools and Assa Abloy in Europe and Asia.

Air Burner’s CharBoss

InnovationWay

After a successful debut at the University of Idaho Experimental Forest in January 2023 and a biochar production demonstration in Harrisonburg, Va., the world’s first mobile onsite biochar production system is ready tackle even the most challenging, most demanding jobs with no grinding, hauling, or permanent facilities. Visit airburners.com.

CharBoss, the world’s first mobile onsite biochar production system, has arrived. Air Burners partnered with the USDA Forest Service to boost the environmentally-friendly technology while adding power and speed to the new self-contained CharBoss. The fully assembled above-ground air curtain burner system is an advanced pollution-control device scientifically proven to eliminate wood waste 40x faster than open burning and significantly reduces particulate matter, like black carbon smoke, to help mitigate climate change.

CharBoss accepts whole trees, logs, root balls, slash piles, invasive shrubs, and other unwanted biomass debris. It burns 1 ton per hour, leaving behind 20% biochar, a valuable carbon-rich residual to sell or return to the soil. The towable CharBoss is ideal for hard-to-reach remote areas, like forest thinning, land clearing, and disaster cleanup (recovery).

Rottne E-Cabin

The new E-Cabin from Rottne is a testament to innovative engineering, where an outstanding cabin has become even better, with a focus on enhanced ergonomics and functionality. Integrated screens on the control panels and additional buttons on the joysticks make the work environment more flexible and efficient. Beneath the panels lies a completely new control system that complies with all laws, standards, and regulations. Visit rottne.com.

EquipmentWorld Foremost Authority For Professional Loggers JULY/AUGUST 2023 27

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

24 Hour Ad Placement Service: 1-800-669-5613 28 JULY/AUGUST 2023 TIMBER HARVESTING & FOREST OPERATIONS TH Exchange EUREKA! EUREKA! EUREKA! OWNERS HAVE OVER 30 YEARS COMBINED EXPERIENCE! We can save you money on Saw Teeth. Hundreds of satisfied customers. Rebuilt Exchange or New. We specialize in rebuilding Koehring 2000, Hurricana, Hydro Ax split teeth and all other brands. Call Jimmy or Niel Mitchell. Quantity Discounts! EUREKA SAW TOOTH CO., INC. 4275 Moores Ferry Rd. • Skippers, Virginia 23879 PH./FAX (day) 1-434-634-9836 or Night/Weekends • 1-434-634-9185 NOW ACCEPTING CREDIT CARDS 7180 1926 2583 2687 2687 CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Foremost Authority For Professional Loggers Ω JULY/AUGUST 2023 29 24 Hour Ad Placement Service: 1-800-669-5613 TH Exchange 2687 5078 CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Oregon State Gets $1 Mil To Study Mass Timber, Fire

Oregon’s U.S. Senators Ron Wyden and Jeff Merkley recently announced that Oregon State University will receive $1 million from the U.S. Dept. of Agriculture to study the effects of fire on mass timber products to determine sustainability fortheirincreaseduse in new construction.

Noting that Oregon is a leader in modernizing and engineering wood products, Wyden said he was excited that “Oregon State has earned these funds to further study how mass timber performs in real time so that we can keep firefighters safe while also increasing adoption of this resilient, innovative wood product. And I’ll keep fighting for similar investments in Oregon to support these valuable new sources for jobs, affordable housing and building materials.”

Building code officials and fire marshals often present concerns that mass timber may be too combustible for use in new construction due to lack of data on how mass timber responds to fire. Oregon State will use the funds to study how mass timber decays in fire

and how much carbon is emitted during a fire in order to develop solutions for firefighter safety in mass timber buildings and providing the first data related to carbon emissions for a structure. Studying the effects of fire on mass timber structures may be able to alleviate barriers of using mass timber throughout the U.S.

USDA Announces Wood Utilization, Innovation Grants

The U.S. Department of Agriculture (USDA) recently announced the investment of more than $43 million to expand innovative uses of wood, including as a construction material in commercial buildings, as an energy source, and in manufacturing and processing input for wood products used in framing homes, making paper products and more.

These funds are being invested in 123 projects nationwide throughCommunity Wood Grants and Wood Innovations Grants. These are longstanding Forest Service grant programs that promote innovation in wood products and renewable wood energy economies. Since 2015, the Wood Innova-

AdLink

Listings are submitted months in advance. Always verify dates and locations with contacts prior to making plans to attend.

July 13—The Warnell Logging Cost Analysis Course, Alabama Forestry Commission, Montgomery Ala. Visit conted.warnell.uga.edu/courses/lca_2023.

July 28-30—Georgia Forestry Assn. Annual Conference, Jekyll Island, Ga. Call 478-992-8110; visit gfagrow.org.

August 11-12—Southwest Forest Products Expo, Hot Springs Convention Center, Hot Springs, Ark. Call 501224-2232; visit arkloggers.com.

August 23-25—Forest Products Machinery &Equipment Expo, Music City Center, Nashville, Tenn. Call 504-4434464; visit sfpaexpo.com.

August 29-31— Louisiana Forestry Assn. annual meeting, Golden Nugget Hotel & Casino Resort, Lake Charles, La. Call 318-443-2558; visit laforestry.com.

August 29-31— Florida Forestry Assn. Annual Meeting &Trade Show, Sandestin Golf & Beach Resort, Miramar Beach, Fla. Call 850-222-5646; visit floridaforest.org.

tions and Community Wood Grant programs have provided more than $93 million to 381 recipients to support wood products and wood energy projects.

According to Agriculture Secretary Tom Vilsack, “By building more sustainably, we are able to address the ongoing wildfire crisis and lower risks to our communities, while also creating new markets for the excess and hazardous wood we need to remove from our fire-prone western landscapes and creating jobs and wealth in rural communities along the way.”

This

Easy

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

30 JULY/AUGUST 2023 TIMBER HARVESTING & FOREST OPERATIONS ADLINK is a free service for advertisers and readers. The publisher assumes no liability for errors or omissions. Air Burners 17 772.220.7303 BKT USA 9 888.660.0662 John Deere Forestry 5 800.503.3373 Forest Chain 27 800.288.0887 Great Lakes Timber Professionals Assn. 31 715.304.2861 Mid-South Forestry Equipment Show 15 601.354.4936 Olofsfors 8 519.754.2190 Pacific Logging Congress 26 360.832.1745 Ponsse North America 2 715.369.4833 Prolenc Manufacturing 9 877.563.8899 Southwest Forest Products Expo 8 501.224.2232 Tigercat Industries 32 519.753.2000 Western Trailer 25 888.344.2539 White Mountain 11 800.439.9073

issue

HARVESTING is

to

in

by

Funded proposals under these USDA grant programs expand and retrofit wood energy systems and wood products manufacturing facilities and develop markets for innovative uses of mass timber and renewable wood energy. Projects also help to restore healthy forests and reduce wildfire risk, protecting communities, infrastructure and resources while curbing climate change. Grant recipients include for-profit entities, state and local governments, tribes, school districts, community-based non-profit organizations, institutions of higher education, and special purpose districts. Access to current advertisers! http://www.timberharvesting.com/advertiser-index/

of TIMBER

brought

you

part

the

following companies, which will gladly supply additional information about their products.

EventsMemo

SelectCuts

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

By Scott Dane

By Scott Dane