CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Hatton-Brown Publishers, Inc.

Street Address: 225 Hanrick Street

Montgomery, AL 36104-3317

Mailing Address: P.O. Box 2268

Montgomery, AL 36102-2268

Telephone: 334.834.1170

FAX: 334.834.4525

Publisher: David H. Ramsey

Chief Operating Officer: Dianne C. Sullivan

Editor-in-Chief: Rich Donnell

Senior Editor: Dan Shell

Senior Editor: David Abbott

Senior Editor: Jessica Johnson

Publisher/Editor Emeritus: David (DK) Knight

Art Director/Prod. Manager: Cindy Segrest

Ad Production Coordinator: Patti Campbell

Circulation Director: Rhonda Thomas

Online Content/Marketing: Jacqlyn Kirkland

Classified Advertising:

Bridget DeVane • 334.699.7837

800.669.5613 • bdevane7@hotmail.com

Advertising Sales Representatives:

Southern USA

Randy Reagor

P.O. Box 2268

Montgomery, AL 36102-2268

904.393.7968 • FAX: 334.834.4525

E-mail: reagor@bellsouth.net

Midwest USA, Eastern Canada

John Simmons

29 Bugelli Drive

Whitby, Ontario, Canada L1R 3B7

905.666.0258

E-mail: jsimmons@idirect.com

Western USA, Western Canada

Tim Shaddick

4056 West 10th Avenue

Vancouver BC Canada V6L 1Z1

604.910.1826 • FAX: 604.264.1367

E-mail: twshaddick@gmail.com

Kevin Cook

604.619.1777

E-mail: lordkevincook@gmail.com

International Murray Brett

58 Aldea de las Cuevas, Buzon 60

03759 Benidoleig (Alicante), Spain

Tel: +34 96 640 4165 • + 34 96 640 4048

E-mail: murray.brett@abasol.net

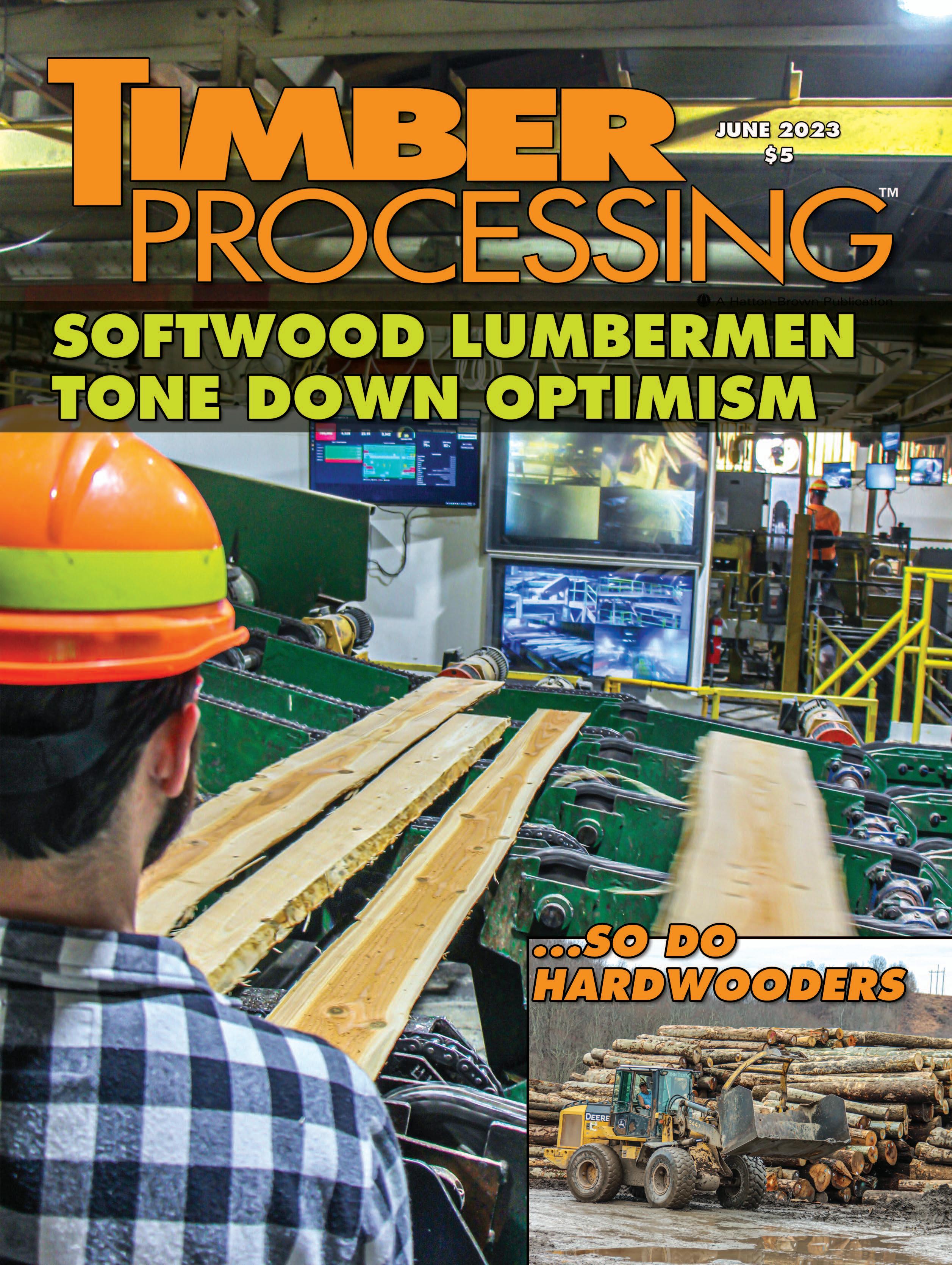

COVER: U.S.

Timber Processing (ISSN 0885-906X, USPS 395-850) is published 11 times annually (monthly except Jan./Feb.) by Hatton-Brown Publishers, Inc., 225 Hanrick St., Montgomery, AL 36104. Subscription Information—TP is free to qualified owners, operators, managers, purchasing agents, supervisors, foremen and other key personnel at sawmills, pallet plants, chip mills, treating plants, specialty plants, lumber finishing operations, corporate industrial woodlands officials and machinery manufacturers and distributors in the U.S. All non-qualified U.S. Subscriptions are $55 annually: $65 in Canada; $95 (Airmail) in all other countries (U.S. Funds). Single copies, $5 each; special issues, $20 (U.S. funds). Subscription Inquiries— TOLL-FREE: 800-6695613; Fax 888-611-4525. Go to www.timberprocessing.com and click on the subscribe button to subscribe/renew via the web. All advertisements for Timber Processing magazine are accepted and published by Hatton-Brown Publishers, Inc. with the understanding that the advertiser and/or advertising agency are authorized to publish the entire contents and subject matter thereof. The advertiser and/or advertising agency will defend, indemnify and hold any claims or lawsuits for libel violations or right of privacy or publicity, plagiarism, copyright or trademark infringement and any other claims or lawsuits that may arise out of publication of such advertisement. Hatton-Brown Publishers, Inc. neither endorse nor makes any representation or guarantee as to the quality of goods and services advertised in Timber Processing. Hatton-Brown Publishers, Inc. reserves the right to reject any advertisement which it deems inappropriate. Copyright ® 2023. All rights reserved. Reproduction in whole or part without written permission is prohibited. Periodicals postage paid at Montgomery, Ala. and at additional mailing offices. Printed in U.S.A.

Postmaster: Please send address changes to Timber Processing, P.O. Box 2419, Montgomery, Alabama 36102-2419

Other Hatton-Brown publications: Timber Harvesting • Southern Loggin’ Times Wood Bioenergy • Panel World • Power Equipment Trade

Volume 48 • Number 5 • June 2023 Founded in 1976 • Our 496th Consecutive Issue ISSUES

Does The Survey Really Tell Us?

lumbermen aren’t as spry as they were a year ago, but they aren’t battening down the hatches yet either. PAGES 16-56. (Dan Shell and David Abbott photos) 5 NEWSFEED Hood Stepping Up At Beaumont 6 HARDWOOD SURVEY Gearing Up For Possible Slowdown 42 SOFTWOOD SURVEY Tapping The Brakes A Little 16 AT LARGE Master Lumbermen Are Recognized 58 MAIN EVENTS SFPA Expo Comes Into Focus 70 AD LINK Advertisers Contact Information 70 Renew or subscribe on the web: www.timberprocessing.com A Hatton-Brown Publication VISIT OUR WEBSITE:www.timberprocessing.com

What

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Rich Donnell Editor-in-Chief

MAYBE

THE MARKETS WILL SURPRISE US ONCE AGAIN

If you didn’t notice it on the cover, your eyes are getting as bad as mine, but yes this is our annual U.S. Sawmill Operations and Capital Expenditure survey report. It doesn’t pretend to be as precise as a presidential election poll, and there’s no figuring for margin of error here, but it is a solid indicator of what U.S. lumbermen are feeling— where in the mill they’ve been spending their money, where they plan to spend it, and how much. Sprinkle in a few comments on markets and mill operations, as many lumbermen did, and one starts to get a clear picture—at this point in time.

That last clarifier—at this point in time—is key. The survey is e-mailed in April, and the reports on the results as shown in this issue were written in the second week of May. Now of course, as you read this, we are into the month of June.

Why do I point this out? Let’s go back to April 2020, when this survey was conducted. The coronavirus was coming on, and there was tremendous uncertainty. As a result, when U.S. softwood and hardwood lumbermen were asked what their forecast was for their lumber business for 2020-2021, only 27% said excellent (2%) or good (25%), while 39% said fair and 34% said poor or very poor.

After a brief standstill, the lumber markets took off and lumber prices went so high that saying they broke all previous records doesn’t do justice to just how high they went. In other words, the majority of lumbermen got it wrong, but who knew?

So it was no surprise that in the following year’s survey, conducted in April 2021, a whopping 92% of lumbermen expected their lumber business for 20212022 to be excellent (46%) or good (46%), while only 5% said fair and only 3% said poor or very poor. This time they got it right.

The enthusiasm waned a tad the following year, as did markets, but still 81% of the lumbermen said 2022-2023 would be excellent (16%) or good (65%), while 15% forecasted fair and 4% said poor or very poor. Again, right on.

So here we are now, and given the expected softening of the markets following the last two years (it couldn’t last forever), along with higher interest rates and inflation, 35% of softwood and hardwood lumbermen combined expected their lumber business to be excellent (1%) or good (34%) in 2023-2024, while 55% said fair and 10% said poor or very poor. The outlook isn’t as muddled as it was as the pandemic came on in spring 2020, but it’s fairly comparable. And really the most striking comparison is with the 2021-2022 outlook, when 92% said excellent or good, of which 46% said excellent, while today it’s only 35% excellent or good for 2023-2024, of which only 1% said excellent.

It will be interesting come next April 2024 to see what transpired in the lumber business the remainder of this year and into next year. As recent history has taught us, who knows?

As usual we present separate reports on the softwood and hardwood survey results in this issue, with the softwood report beginning on page 16 and the hardwood report starting on page 42. To those who completed the survey, thanks for taking the time.

5 16 42 58 THEISSUES

TP Contact Rich Donnell, ph: 334-834-1170; fax 334-834-4525; e-mail: rich@hattonbrown.com TIMBER PROCESSING ■ JUNE 2023 ■ 5 CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

HOOD PLANS NEW PLYWOOD MILL

Hood Industries announced plans to invest more than $200 million to build a plywood manufacturing facility in Beaumont, Miss. and create 265 direct jobs. The announcement was part of a groundbreaking event at Beaumont held May 4, and it comes 40 years after Hood Industries took over operations at Beaumont Plywood in 1983.

The new facility will operate at twice the capacity of the previous facility, which was made inoperable by a tornado on April 17, 2022. Construction will begin this summer, and manufacturing will commence in early 2025. Hood Industries plans to fill the jobs over the next four years.

“The mill has been one of the cornerstones of our company because of the support

received from the community of Beaumont, Perry County and surrounding areas and the hard work of our excellent employees,” commented Warren Hood, Owner and CEO, Hood Companies. “We are excited to be able to rebuild the facility into one of the most modern plywood plants in North America.”

Mississippi Development Authority is providing assistance for infrastructure improvements and site development. AccelerateMS is providing a Mississippi Works grant to support the critical training needs of Hood Industries and will support the company’s long-term workforce goals and objectives for this project. Perry County and the town of Beaumont also are assisting with the project.

“After a devastating tornado shut this plant down, some would have left. But not this team, and not this company,”

added Gov. Tate Reeves. “Today’s groundbreaking is the launch of an incredible comeback story. This $200 million investment will bring 265 good-paying jobs to Beaumont and Perry County and have a tremendous impact on the local community. I congratulate Hood Industries on this exciting day and thank them for their enduring commitment to our state.”

Hood Industries is a mix of wood manufacturing and distribution operations that includes a plywood manufacturing plant in Wiggins, Miss. and four sawmills in Waynesboro and Silver Creek, Miss., Bogalusa, La. and Metcalfe, Ga., and 15 wood products distribution operations.

Hood resumed plywood operations at Beaumont after the previous owner, Weyerhaeuser, had shut it down in 1982 during a recession. Weyerhaeuser had purchased it in

1979 from Delta Industries, which built the plant as Delta Pine Plywood in 1971.

Parallel to the starting of operations at Beaumont in the 1980s, Hood also began plywood operations at Wiggins, Miss., which Hood continues to operate today.

SIERRA PACIFIC IS BIG ON WINDOWS

Sierra Pacific Windows, a division of Sierra Pacific Industries, is expanding its roots in high-end window and door production by unveiling plans for a manufacturing campus in Phenix City, Ala. following the acquisition of 610,000 sq. ft. of manufacturing and warehousing space that’s located on 113 acres, once home to a textiles plant.

The added space will allow Sierra Pacific Windows to increase its produc-

NEWS

6 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

FEED

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

tion capacity and more efficiently respond to nationwide customer demand for its wood and vinyl products that has grown ten-fold in the last decade. Products manufactured will mirror what is produced at the company’s existing California and Wisconsin locations

“This expansion of our windows manufacturing capacity is a reflection of our confidence that customers value the distinctive product quality and service associated with Sierra Pacific Windows,” says Sierra Pacific Industries CEO Mark Emmerson. “Our unique seedto-window approach starts by planting trees that take at least 50 years to mature. We always take a long-term, sustainable view to business. We also pride ourselves on being a place our employees feel valued for their contributions and stay for long careers.”

“The attractiveness of Al-

abama as the right location for our company to advance is undeniable,” adds Sierra Pacific Windows President Tom Takach. “We wanted a location that gives us the room to grow and expand. With our significant and rapidly growing demand for our windows and doors, locating in Phenix City is an obvious choice, from easy access to transportation corridors to the skilled labor forces in the greater Russell County area.”

The 610,000 sq. ft. building is just the beginning of the company’s investment in Phenix City. New equipment is already on order and fasttracked to outfit the greenfield build of Sierra Pacific’s most high-tech window and door plant to-date. Combined with the company’s existing locations in California and Wisconsin, the addition of the new facilities brings Sierra Pacific to a milestone of more than 2

million combined sq. ft. of manufacturing space for its Window division.

The company credits local municipal and elected officials as being instrumental in drawing their attention to the area. The Phenix City region and the State of Alabama were a supportive force that furthered Sierra Pacific Windows confidence in putting down roots in this region for their Eastern U.S. windows manufacturing operations.

SPI is a third-generation, family-owned forest products company based in Anderson, Calif. The company owns and manages more than 2.4 million acres of timberland in California, Washington and Oregon. Along with being a windows manufacturer, it is one of the largest U.S. lumber and millwork producers including 18 sawmills and eight biomass-fueled cogeneration power plants.

WARNER WILL TAKE OVER FOR LUOMA

The Westervelt Company announced that President and CEO Brian Luoma will retire at the end of 2023, and current COO Cade Warner will succeed him.

Luoma joined Westervelt in 2017, and his tenure has been marked by growth of the company, most notably the expansion of the lumber business through the construction of a new lumber mill in Thomasville, Ala.

Warner was recently appointed to the Board of Directors. He joined Westervelt in 2017 and has held roles in

8 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

NEWSFEED

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

strategy and planning, sustainability and continuous improvement.

“We have been working toward this transition for some time, and both Brian and Cade have created an opportunity for a seamless shift in leadership,” says Rob Taylor, Chairman of the Board. “Brian has done an excellent job leading the company, especially during the uncertainty of the pandemic years, and we appreciate his dedication to growing the company and the capability of our employees. We are eager to welcome Cade to the Board and into his new role. His experience and passion for this industry will be essential in continuing to guide the growth of the company.”

Luoma comments, “When I joined Westervelt, I found a company loaded with talent. I am very proud of everything we accomplished as a team, particularly the continued de-

velopment of our people and their relentless commitment to our customers and the quality of our products and services. Throughout the remainder of this year, Cade and I will continue to work closely together as we transition leadership. Sustainability has been a core value for Westervelt for more than a century, and it will continue to expand under Cade’s leadership. I am very excited to see what the future holds for Cade and the next generation of leaders at The Westervelt Company.”

CANFOR TOUTS FUNDAMENTALS

Canfor Corp. reported a first quarter adjusted operating loss of $146 million, noting that strong earnings from the company’s European operations and more modest earnings from its U.S. South operations

were outweighed by continued pricing pressure on its Western Canadian operations.

The company reported an operating loss of $208.5 million for the first quarter of 2023, but after adjusting for certain one-time items, including a $62.1 million inventory write-down in the current period, the company’s operating loss was $146.4 million for the first quarter, a $17.4 million improvement compared to an adjusted operating loss of $163.8 million for the fourth quarter of 2022. These results reflected improved pulp and paper segment results, offset in part by a decline in lumber segment earnings.

President and CEO Don Kayne commented, “This was another challenging quarter for our lumber business. Strong earnings from our European operations and more modest earnings from our U.S. South operations were overshadowed

by ongoing weakness in Western spruce/pine/fir lumber pricing, which resulted in further temporary capacity reductions across our Western Canadian sawmills. In addition, we announced and began implementing a restructuring of our British Columbian lumber operations to better align manufacturing capacity with the available long-term fiber supply.”

Lumber segment results were primarily driven by a moderate decline in most North American benchmark lumber market prices, with the average North American Random Lengths Western SPF 2x4 2&Btr price and the average southern yellow pine East 2x6 #2 price both down 6% quarterover-quarter. These factors were offset in part by slightly higher market pricing in Europe. In addition, the current quarter reflected moderately

NEWSFEED 10 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

NEWSFEED

higher production and shipment volumes across all three lumber operating regions, primarily due to increased operating days in the U.S. South and Europe, as well as reduced market-related temporary downtime in Western Canada.

North American lumber market conditions remained under pressure through most of the first quarter of 2023. Residential construction activity was in line with the previous quarter but con-

tinued to be impacted by housing affordability constraints stemming from persistent inflationary cost pressures and high interest rates. These ongoing housing sector challenges more than offset slightly improved demand in the repair and remodeling sector and led to a decline in most North American U.S.dollar benchmark lumber prices in the current quarter.

Offshore lumber demand and pricing to

Asian markets experienced continued weakness in the first quarter of 2023, most notably in Japan and Korea, due to the combined impact of high inflation and interest rates as well as elevated lumber inventory levels in those regions. In China, despite the introduction of government stimulus measures early in the current period aimed at reviving the domestic economy, lumber demand and pricing continued to be negatively impacted by high inventory levels in that region.

In Europe, and to a greater extent the United Kingdom, lumber demand and pricing experienced a modest improvement through the first quarter of 2023, reflecting a slight uptick in residential construction activity combined with restricted supply from Russia and Belarus.

Looking ahead, the company expects global lumber market conditions to face continued challenges through the second quarter of 2023 as general economic uncertainty accompanied by affordability pressures are projected to continue to weigh on demand. Notwithstanding these headwinds, in the longer term, underlying global lumber market fundamentals are forecast to be solid, principally reflecting strong demographic trends, consistent demand driven by an aging housing stock and low inventories of new homes. Demand in the repair and remodeling sector is anticipated to be strong through the second quarter of 2023, despite inflationary pressures, due to an aged housing stock and seasonal factors.

Results in the second quarter of 2023 will also reflect the impact on production and shipments of the permanent closure of the company’s Chetwynd sawmill and pellet plant, as well as the temporary closure of its Houston sawmill.

In the U.S. South, the construction of the company’s greenfield sawmill in DeRidder, La. is progressing well and its ramp-up in production is anticipated to commence in the second quarter of 2023 and continue through the balance of the year.

WEST FRASER SEES POSITIVE TRENDS

West Fraser Timber Co. Ltd. reported first quarter sales of $1.627 billion and earnings of negative $42 million, First quarter Adjusted EBITDA was $58 million.

The lumber segment Adjusted EBITDA was $0 million, while the North

12 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

America

Engineered Wood

Products segment Adjusted EBITDA was $31 million, including $15 million of inventory write-downs. Europe Engineered Wood Products segment Adjusted EBITDA was $20 million

“In the first quarter of 2023, we faced challenging demand markets due in part to seasonal effects as well as higher mortgage rates that continued to moderate new home construction activity in the U.S., comments

Ray Ferris, West Fraser President & CEO.

“Our Lumber and North America EWP businesses were most impacted by these factors. As in the prior quarter, the product and geographic diversification of our European Engineered Wood Panels and Pulp & Paper segments provided positive EBITDA contributions that helped to offset some of the weakness in North American residential construction markets.”

Ferris says West Fraser is diligently

managing through the market cycle and will continue to operate with financial discipline as it leverages a strong balance sheet to reinvest in operations and return capital to shareholders.

“Importantly, our financial flexibility allows us to continue our core strategy of being a low-cost producer of wood building products while also positioning us to capitalize on opportunities as the demand environment becomes more favorable over the medium and longer term.”

Several key trends that have served as positive drivers in recent years are expected to continue to support medium- and longer-term demand for new home construction in North America, the company stated, adding that over the medium term it expects an aging housing stock and greater entrenchment of work-from-home flexibility will help to offset near-term headwinds and spur repair and renovation spending that supports lumber, plywood and OSB demand. Over the longer term, growing market penetration of mass timber in industrial and commercial applications is also expected to become a more significant source of demand growth for wood building products in North America.

The seasonally adjusted annualized rate of U.S. housing starts was 1.42 million units in March 2023, with permits issued of 1.41 million units, according to the U.S. Census Bureau. While there have been near-term headwinds to new home construction, owing in large part to the recent upward reset in interest rates and the impact on housing affordability, unemployment remains relatively low in the U.S. and central bankers across North America and Europe have indicated that the current rate hiking cycle may be nearing an end, the company stated. However, demand for new home construction and wood building products may decline in the near term should the broader economy slow or interest rates remain elevated or increase further than currently expected, impacting consumer sentiment and housing affordability.

The demand for European products is expected to remain robust over the longer term as use of OSB as an alternative to plywood grows. Further, an aging housing stock supports longterm repair and renovation spending and additional demand for wood building products, according to the company.

NEWSFEED 14 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

OUTLOOK

ones.

What a difference a year makes! Remember last year at about this time, when U.S. softwood lumbermen were very positive, based on Timber Processing’s annual Sawmill Operations & Capital Expenditure Survey?

At the time, 85% of the lumbermen who responded to the survey forecasted their business situation for the remainder of 2022 and 2023 as excellent (19%) or good (66%); that was down slightly from the year before, when 92% felt excellent or good for 2021 and 2022.

But remember when the pandemic hit, just as this annual survey was being conducted, and only 33% said excellent or good for the remainder of 2020 and 2021. Obviously not many forecasted the super-record-breaking lumber prices and the rebound of the housing market, which would occur over the next twoplus years.

But as of today, many softwood lumbermen have again adopted a lukewarm stance, if that. According to the results of the most recent annual survey, 42% of the softwood lumbermen forecasted excellent or good for the remainder of 2023 and 2024, and of that only 2% said ex-

16 ■ JUNE 2023 ■ TIMBER PROCESSING

MIXED

Rich Donnell

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

U.S. softwood lumbermen aren’t as upbeat as a year ago, but they’re still upgrading their mills, and maybe building new

TIMBER PROCESSING ■ JUNE 2023 ■ 17 CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

18 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

20 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

22 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

24 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

26 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

cellent while the remaining 40% said good.

Nearly half (49%) of the respondents forecasted 2023-2024 as fair, compared to 11% a year ago, while 9% said poor, compared to 3% a year ago.

“Not as good as the previous couple of years. Headwinds for sure until interest rates drop,” commented Timothy Biewer, principal of Biewer Lumber, which operates two new sawmills in the South and several mills in Michigan and Wisconsin.

“This is going to be a challenging year economically. In my opinion the traditional economic indicators are not necessarily correct,” said T. Furman Brodie, VP, Charles Ingram Lumber of South Carolina. “The economy is feeling the after-effects of the pandemic, and the traditional indicators don’t necessarily function correctly. The regulatory environment is becoming oppressive.”

“The lumber market appears to be fairly slow, with prices hitting a bottom in the first quarter,” added Trott Hunt, chairman, Hunt Forest Products of Louisiana. “Our business is good, shipments are moving and we are running at capacity.”

“The country is a mess and the lumber

markets will be flat,” stated James Quinn, chairman and CEO, White Mountain Apache Timber Co. of Arizona.

The 23-question survey was e-mail blasted in April to sawmill management subscribers of Timber Processing. It drew responses from representatives of

approximately 175 U.S. softwood lumber sawmills. Responses came from owners, presidents, vice presidents, general managers, regional managers, other executives, plant managers and supervisory personnel.

55% of the mills produced mostly 2 in. lumber, with 18% more focused on 1 in. lumber and a significant number producing timbers.

22% of the mills produced at least 200MMBF in 2022, with 3% topping 350MMBF. 18% produced 100200MMBF, while 19% came in at 50100MMBF, 14% at 25-50MMBF, and 5% at 10-25MMBF. Their expected production in 2023 increases on the high end, with 24% now producing more than 200MMBF, followed by 13% at 100200MMBF, 24% at 50-100MMBF, 14% at 25-50MMBF and 4% at 10-25MMBF.

Several questions dealt with capacity and downtime: 44% said they produced at 90-100% of capacity in 2022, with 29% coming in at 80-90%, 16% at 7080%. For 2023, they forecasted a similar 44% at 90-100%, a little higher in the 80-90% range at 32%, and 11% at 7080%.

As for downtime in 2023 compared to 2022, 43% said about the same, while 30% said more in 2023 and 27% said less.

CAPITAL PROJECTS

The better markets of the past two years apparently prompted softwood lumbermen to make improvements to their operations, as the survey indicated that 78% of the respondents completed at

28 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

least one capital project in the past year. The survey provided a list of 45 machinery and technology project areas and asked lumbermen to select the ones they had completed.

The big winner was dry kilns/controls, picked by 28% of the lumbermen. Maintenance work as usual received expenditure, as 26% selected it.

Next in line was log scanning/optimization, 18%, followed by wheel loaders, downstream sawing (gang/edger /trimmer) and lumber handling forklifts, each selected by 16% of the lumbermen.

Green end sorting/stacking, filing room equipment, chippers/hammermills/screens, and fire prevention each received 15%.

Rounding out the double digit selections were log feeders (13%), log loaders (12%), downstream scanning/optimization (12%), and dust control, trucking, boilers, extended length infeeds and log merchandising cutup, each receiving 10% of the responses.

Not far behind were log merchandising scanning, debarkers, metal detectors, log canter breakdown, profiling machinery, chipper heads, planer mill strapping/stacking and conveyers, each receiving 9%.

A followup question asked softwood lumbermen how much new capital expenditure in machinery and systems their mills had allocated or committed to for 2023 and 2024.

More than half, 53%, said at least $1 million. Breaking that down further, 3% said $50-$75 million, 1% said $20-$30 million, 3% said $20-$30 million, 3% said $15-$20 million, 4% said $8-$10 million, 10% said $5-$8 million, 9% said $3-$5 million, 8% said $2-$3 million, and 12% said $1-$2 million.

Where are they spending this money in the mill this year and next year?

38% of the lumbermen are putting ex-

30 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

32 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

penditure into maintenance. The leading “vote-getter” in actual equipment expenditure was lumber handling forklifts with 31%. It was followed by dry kilns/controls with 28%, debarkers at 25%, log yard handling and downstream sawing each with 24%, dust control at 23%, planer mill sorting/stacking at 21%.

Other machinery and systems that were selected by at least 10% of the lumbermen included: fire prevention, conveyors, chipper/hammermills/screens, log merchandising cutup, wheel loaders, green end sorting/stacking, boilers, filing room equipment, trucking, data collection systems, log scanning/optimization, log merchandising scanning, metal detectors, automated lumber graders, planer mill strapping/stacking, log canter breakdown, downstream scanning/optimization, log cranes, mill information software, log loaders, circle saw sharpeners, and tipping equipment.

In other words, softwood lumbermen are “spreading their wealth” around.

MILLS & MARKETS

Several questions addressed new sawmill construction, and 13% indicated their company had started up a new sawmill that was built basically from the ground up in the past two years.

12% of the lumbermen said they are currently building a new sawmill, while 10% said they are seriously considering it, and 15% said it’s a possibility.

While visions of new sawmills may be dancing in their heads, their existing operations are encountering several conditions of note? The survey provided a list of a half dozen such conditions and asked lumbermen to select any that apply: 70% selected labor shortage, followed by “can’t get parts on time” with 59%, supply

34 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

chain disruptions, 45%, vendors are backed up, 33%, and log supply issues, 32%.

A random question asked the lumbermen if their mills are working to reduce the use of hydraulic systems: 18% said yes, giving it lots of attention, while 34% said some attention, and 48% said no, not really.

Another at large question was about the cross-laminated or mass timber market and lumbermen interest in it: 3% said they were selling a significant amount into CLT, 13% said they were selling a little bit but would like to sell more, 11%

said they were selling a little bit but don’t expect much growth, 15% said they are not currently selling any CLT lumber but would like to get into that market, and 58% said they don’t plan to get into the CLT market.

The survey ended with two openended questions. One was what are lumbermen’s biggest concerns with regard to keeping their mills running efficiently:

“Lack of skilled trades labor. We plan to continue to develop our team and grow from within to fill future and present needs in these areas,” commented

Duane Clemons, mill manager, Woodgrain Independence in Virginia, which actually produces both softwood and hardwood lumber.

“Employee turnover, and training replacements,” said Philip Latos, technical and engineering director, Weyerhaeuser.

“Labor shortage, insurance costs rising, utility costs and fuel costs increasing,” added Jennifer Durant, CEO of Gurney’s Saw Mill of Massachusetts. Other comments included:

l “Downtime and maintenance”

l “We have constant labor shortages.

36 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

38 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Not a lot of turnover but a constant need of consistency in coming in to work!”

l “High costs, in particular raw material”

l “Legal environment”

l “Lead times are a challenge on replacing old equipment.”

l “Cash”

The final question invited lumbermen to address how they foresee lumber markets, their business situation and the “general state of things.”

“Hard to project, but we have made significant improvements that are coming on line now,” said Robert Jordan IV, principal of Jordan Lumber based in North Carolina.

“Rough 2023 and 2024. Long term very positive,” said Charles McRae, owner of Rex Lumber based in Florida.

“We expect some improvement in the 2nd quarter, and a little bit better in the 3rd quarter, but overall not any significant improvement,” added Todd Johnson, president, Pyramid Mountain Lumber of Montana.

“Overall ok. I think the SYP grade lumber market will continue to get oversaturated in the SE USA,” said Bradley Tuminello, president of Southern Packaging of Louisiana.

“The general outlook is still negative due to rising interest rates and slowdown in housing. We are also seeing significant volume that is being imported from European markets,” said Tommy Stansell, COO of Vicksburg Forest Products in Mississippi.

“Our log costs are completely out of touch with the current market. Mills in our area are dropping shifts and taking extra downtime. 2023 will see a supply/ demand correction in our log markets and costs need to be reduced enough to sustain low lumber prices,” observed Jason Brochu, co-president of Pleasant River Lumber in Maine.

Other comments included:

l “2023 will be a tough year with reduced lumber consumption across the board. Anticipate improving and favorable conditions 2024-2026.”

l “We think it should be steady.”

l “Expect 2019 levels of profitability for 2023-2024”

l “It feels like a more normal market similar to pre-pandemic where winter/spring showed reduced demand. However, it feels good out there and demand is still strong.”

l “Economy will enter a lagging market, correction period that is similar to 2007-2009.”

l “Lumber markets will eventually stabilize when interest rates stop rising.”

TP 40 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

TOUGHER GETTING

By Rich Donnell

By Rich Donnell

American hardwood lumbermen are considerably more skeptical over their lumber business situation for 2023-2024. Only 22% forecasted their business during this year and next as good or excellent, compared to 75% who said likewise a year ago in TP’s annual U.S. Sawmill Operations & Capital Expenditure Survey, and 88% who said the same two years ago.

In fact, no lumberman who responded to the survey expected it to be excellent, while 22% said good, 67% said fair, 8% poor and 3% forecasted very poor. Compare those numbers to a year ago when 13% said excellent, 62% said good, 21% at fair, 3% said poor and 2% forecasted very poor.

The current lack of optimism is actually more in line with how hardwood lumbermen felt three years ago in spring 2020 with the uncertainties of the pandemic rolling in, when only 18% forecasted their business as excellent or good. A whopping 45% forecasted it as poor back then, much more dramatic than now, though most of the doomsayers were proven wrong in the next year.

“Extremely difficult situation,” com-

42 ■ JUNE 2023 ■ TIMBER PROCESSING

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Market conditions are getting tougher and many hardwood lumbermen are having to toughen up for the challenge.

TIMBER PROCESSING ■ JUNE 2023 ■ 43 CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

mented James Pierce, president of Pierce Lumber in Iowa. “Hardwood lumber prices are down over 50% for most species since 2020. Private landowners are not willing to sell timber at depressed pricing. Chinese logs buyers are buying walnut and white oak logs at prices that are higher than the dry lumber is selling for yet have freight and processing costs to make them into lumber. This country needs to stop allowing logs to be sold to the Chinese. Domestic markets are weak. Mill capacity is too high for these markets. Not encouraging.”

“Lumber sales should be steady, but with very little profit margin,” said Jamie Peters, procurement manager at North Country Lumber in Wisconsin. “Overall outlook for this fiscal year is fairly gloomy, but we’ll stay fairly busy moving most of our products and struggle to move others at times.”

However, Lance Ramsey, manager at Yazoo Lumber in Mississippi, bucked the negative trend, adding simply, “Good year predicted.”

The 23-question survey was e-mail blasted in April to sawmill personnel subscribers of Timber Processing. It drew responses from representatives of approximately 55 U.S. hardwood sawmills. Nearly half of the responses came from owners, with the remainder mostly presidents, vice presidents, general managers, other executives, plant managers and supervisory personnel.

More than two-thirds of those mills produced mostly 1 in. lumber and furniture grade lumber, and a good portion produced timbers. Several mills produced about evenly between hardwood and softwood lumber.

Almost 60% of the mills produced less than 10MMBF annually in 2022, while 10% produced 10-15MMBF, 15% at 1525MMBF, 10% at 25-50MMBF and 6% more than 50MMBF. The percentages are similar for their expected annual production in 2023, though there’s a slight uptick to 8% at more than 50MMBF.

A few questions dealt with capacity and downtime: 34% said they produced at 90-100% capacity in 2022, with 23% coming in at 80-90%, 20% between 6080%, and a troubled 23% at less than 50%.

Those numbers look a little better for expected production versus capacity in 2023, with 38% expecting to produce 90100% of capacity, 21% at 80-90%, 23% between 60-80% and 18% at less than 50%.

As for downtime in 2023 compared to 2022, almost half said it will be about the same, while 36% expected less in 2023

44 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Which conditions are your operation encountering?

and 15% forecasted more downtime this year.

One question addressed several “conditions” their mills may be encountering, and asked the lumbermen to select any and all that applied. Labor shortage led the with a whopping 64% of lumbermen checking it, followed by “can’t get parts on time” at 44%, log supply issues at 38%, supply chain issues and lumber shipment issues each at 28%, while “vendors are backed up” was picked by

23%. Another choice was conditions “pretty much as usual,” which was selected by 23%.

CAPITAL PROJECTS

A key part of the survey address capital expenditure projects, and two-thirds of the hardwood lumbermen said they had completed at least one such project in the past year. The survey provided a list of 45 machinery and technology pro-

ject areas and asked lumbermen to select the ones they had completed.

A quarter of the lumbermen spent money on maintenance related projects, while wheel loaders and log carriages each came in at 17% of the lumbermen for completed projects. Next was dry kilns/ controls at 14%, followed by log loaders and bandmill headrig each at 11%. A significant 8% completed downstream sawing (gang/edger/trimmer) projects and an equal number updated downstream scan-

46 ■ JUNE 2023 ■ TIMBER PROCESSING

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

48 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

50 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

52 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

ning/optimization. 8% also completed filing room equipment projects.

A group of machinery areas were all selected by 6% of the lumbermen, including log yard handling, bandmill resaw, green sorting/stacking, planer mill

sorting/stacking, lumber handling forklifts and trucking.

As far as the dollar amount of capital expenditure in machinery and systems their mills have allocated or committed to for the remainder of this year and 2024, an

54 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

impressive 19% said at least $1 million (8% at $1-$2 million, 8% at $2-$3 million and 3% at $3-$4 million). 10% came in at $500,000 to $1 million, 5% at $400,000$500,000, and 18% at $100,000$300,000.

Where are they spending their money? Maintenance led the way with 36% of the responses, but the top machinery selection was debarkers with 28%. Dry kilns/controls and green end sorting/stacking each came in with 20%. Log yard handling equipment was next with 19%, followed by wheel loaders and log carriages each with 17%.

Downstream sawing (gang/edger/trimmer), planer mill sorting/stacking and trucking each received 14% of the lumbermen. Log loaders, downstream scanning, data collection systems and dust control each received 11%. Next highest projects were metal detectors, boilers and filing room equipment each with 8%.

An operational question addressed hydraulic systems and if their mills were working to reduce the use of hydraulics. The vast majority, 82%, said not really, while 18% were giving it some or lots of attention.

A few questions touched on new sawmill construction, and 6% said they had started up a new sawmill in the past two years, and 3% said they’re building

TIMBER PROCESSING ■ JUNE 2023 ■ 55 CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

one now, while 8% said they’re giving it a little thought for the near future.

Only 6% said they’re selling a little bit of lumber into the cross-laminated or mass timber market, but 14% said they would like to get into that market. The vast majority don’t plan on pursuing it.

An open-ended question asked lumbermen what their biggest concerns were with regard to keeping their mills running efficiently.

“Log supply and the cost of obtaining enough logs to keep running efficiently. Labor is always in question as well to keep the mill running at its full capacity,” added Jamie Peters, procurement manager at North Country Lumber in Wisconsin.

Other comments included:

l “Downtime and maintenance”

l “Logs at fair price”

l “Price of labor, logs and lumber”

l “Staffing and general maintenance of equipment”

l “Labor and increasing operating cost”

l “Labor and equipment availability”

As to how they foresee lumber markets and the “general state of things”:

“Month to month hoping lumber prices get higher and diesel lower. Need to figure solutions to labor,” said Jason Carden, regional procurement manager, New River Hardwoods in Tennessee.

Other comments:

l “Hopeful”

l “Tough but we’ll get through it.”

l “General state of things to come is that there will very probably be a recession in the near future.”

l “KD lumber prices are too low for the

56 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

WWPA Recognizes Latest Master Lumbermen

Five veteran lumber industry professionals were added to the Western Wood Products Assn. Master Lumberman roster on April 17 during the 2023 Annual Meeting in Portland, Ore. Quality Standards Director Pete Austin presented the awards at the Industry Luncheon and noted the Master Lumberman award is a prestigious honor with only 436 individuals receiving the award since the program was introduced.

The five new Master Lumbermen are: Gilbert Antone, Yakama Forest Products; Gerardo Garcia, SDS Lumber LLC; Darin J.Pace, WWPA Inspector; Jesus (Jesse) Roman, WWPA Inspector; and Kevin Szabados, Hampton Lumber Mills.

To qualify for the award, candidates must be Certified Graders for at least 20 years, have extensive experience in lumber manufacturing, hold supervisory responsibilities and must be nominated by their companies. Nominations for the 2024 Master Lumberman awards are due by November 30, 2023. For more information contact Dyanne Martin in Quality Standards at dmartin@wwpa.org.

In addition to the Master Lumberman awards, three Western mills were honored for outstanding safety records at their operations. The Chairman’s Safety Awards were presented by WWPA Second Vice Chairman Troy Little.

Chairman’s Awards for best five-year safety records (2018-2022) in three cate-

gories based on mill size were presented to Hampton Lumber Mills, Willamina, Ore.; Interfor U.S. Inc., Longview, Wash.; Boise Cascade Co., Kettle Falls, Wash.

Best one-year lowest incidence rate safety records (2022) were recognized with the District Awards:

—District 1: Interfor U.S. Inc., Longview, Wash.

—District 2: Interfor U.S., Inc., Molalla, Ore.

—District 3: Woodgrain Lumber, LaGrande, Ore.

—District 4: Montrose Forest Products, Montrose, Col.

—District 5: Boise Cascade Co., Kettle Falls, Wash.

Each year WWPA identifies individual certified graders with high grading proficiency over a year-long performance schedule and provides this information to participating mills. The association recognizes that such achievements reflect a commitment the entire mill made to improve the quality of the lumber produced. This is the foundation for the WWPA Hi-Q Mill Awards. The 2022 Hi-Q Mills recognized at the meeting include:

Stimson Lumber, Priest River, Id.; Stimson Lumber, Plummer, Id.; Idaho Forest Group, Moyie Springs, Id.; Stimson Lumber, St. Maries, Id.; Western Forest Products US, Vancouver, Wash.; Stimson Lumber, Tillamook, Ore.; Swanson Group Manufacturing,

ATLARGE

At the WWPA Master Lumberman ceremony, left to right, Pete Austin (WWPA Director of Quality Standards), new Master Lumbermen Gerardo Garcia, Gilbert Antone, Kevin Szabados, Darin Pace, Jesus (Jesse) Roman, along with Ray Barbee (WWPA President) (Photo courtesy Taras & Alla)

58 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Roseburg, Ore.; Willamina Lumber, Willamina, Ore.; Hampton Lumber Mills, Darrington, Wash.; Interfor U.S., Longview, Wash.; Sierra Pacific Industries, Shelton, Wash.; Sun Mountain Lumber, Deer Lodge, Mont.

Wooden Turbines Will Use LVL

Modvion’s wind turbine towers are built with engineered wood products. Replacing steel and concrete with wood—when possible—is a hyper intelligent way to make wind power almost free from carbon emissions.

Swedish wood technology company, Modvion, and the Finnish wood product company, Metsä Wood, have an agreement for Metsä Wood to supply laminated veneer lumber (LVL) for Modvion’s wooden wind turbine towers.

“Building renewable energy with renewable materials can enable net-zero energy production from wind,” says Pär Hallgren, Head of Procurement at Modvion. “Metsä Wood is an important partner in our journey to become a leading supplier of the next generation of sustainable wind turbine towers, which will also make us potentially one of the largest buyers of LVL.”

The material is essential for the design as its strength-to-weight ratio results in lighter towers with less need for expensive reinforcements.

“Kerto LVL enables high material efficiency thus making it ideal for sustainable construction. Modvion’s design and application is a great example of its versatility,” says Henrik Söderström, SVP, Sales and Marketing at Metsä Wood.

Along with the technical benefits of LVL, it also enables radical reductions in emissions. According to a lifecycle analysis conducted by the Swedish research institute RISE, a wooden wind turbine tower reduces emissions by 90% when compared to a steel tower of the same height and load. Considering that wood is also storing carbon, the

TIMBER PROCESSING ■ JUNE 2023 ■ 59

ATLARGE

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

tower becomes carbon negative, since it is binding more CO2 than it emits during manufacturing. To ensure maximum carbon storage, Modvion plans to reuse the wood material after the wind turbine tower is decommissioned.

“The volumes of wood needed for a Modvion tower is between 300-1200 cubic meters depending on the height and load. That means an LVL carbon storage capacity between 240- 950 tonnes CO2 per tower,” says Hallgren.

Modvion’s next milestone is building its first commercial wind turbine tower during 2023. The wooden tower will be installed with a 2 MW wind turbine on top and stand at 150 m total height, including the blades. Metsä Wood is the supplier of the LVL for this project.

Cypress Group Elects Lewis, Beasley

Southern Cypress Manufacturers Assn. elected officers for 2023 at the association’s Annual Meeting on March 22 in Nashville, Tenn.

Cassie Lewis, Turn Bull Lumber Co.,

Elizabethtown, NC, was elected SCMA President. Lewis joined Turn Bull Lumber in 2011, working her way through the accounting and logistics departments, before joining the sales team in 2015. She now serves as the company’s account manager, and is responsible for all sales, as well as managing the green and kiln-dried inventories.

Truss Beasley, Beasley Forest Products (BFP), Hazlehurst, Ga., was elected SCMA Vice President. He joined BFP in 2014 and is currently serving as vice president of business development for the Beasley Group sawmills and flooring plants. Beasley earned a Bachelor of Finance and a Master of Business Administration from Georgia Southern University.

Red Rock Project Has New Owner

Lakeview RNG, a wholly owned subsidiary of NEXT Renewable Fuels, has acquired assets associated with the Red Rock Biofuels development in Lakeview, Ore. and is commencing a redevelopment

60 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

ATLARGE

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

plan focused on completing construction of certain aspects of the site while replacing or enhancing others. When completed, the Lakeview RNG facility is expected to be capable of converting forest waste into renewable natural gas (RNG) and clean hydrogen.

The Red Rock Biofuels facility and property was headed to auction, following the recording of a notice of default and foreclosure as placed by the lender and trustee. The default was due to the failure to pay principal and interest on certain Economic Development Revenue Bonds issued by the state of Oregon. The total default amount was nearly $355 million.

Red Rock Biofuels was founded as a sustainable aviation fuel (SAF) operation in 2011, and was being built to produce drop-in fuels from woody biomass and manufacture approximately 20 million (US) gallons (≈ 75.7 million liters) per year of low-carbon intensity renewable biofuels. The facility finally broke ground in summer 2018 but remained incomplete.

“Acquiring the Lake County clean fuels infrastructure is another advancement in our mission to decarbonize the transportation industry and produce low carbon fuels at scale,” says Christopher Efird, CEO and Chairperson of NEXT. “This acquisition represents a major step toward our clean fuel production capabilities and pathways to meet growing demand for clean fuels along the West Coast of the United States while helping to address the critical concern of forest health.”

Lakeview RNG will process wood waste and turn it into a low-carbon gaseous fuel.

Lakeview RNG has evaluated the potential feedstock supply in Oregon and determined that all of its wood waste needs could come from within 150 miles of the facility.

NEXT is also currently permitting and developing a 50,000 barrel-per-day/750 million gallon-per-year Renewable Diesel (RD)/Sustainable Aviation Fuel (SAF) refinery at Port Westward on the Columbia River outside Clatskanie, Ore.

CM Biomass Adds To Pellets Lineup

Jackson Pellets, LLC held a ribbon cutting March 22 at its new wood pellet manufacturing plant at the Jackson Port, Alabama. Todd Bush, CEO of

62 ■ JUNE 2023 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

ATLARGE

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CM Biomass North America, the parent company of Jackson Pellets, told the group that the Jackson plant is the crown jewel of all the facilities he’s been a part of.

The mill represents a $21 million investment and is expected to employ 45 to 50.

CM Biomass, a company based in Denmark, has 10 other facilities in the U.S. Bush said that everything they have learned from building other facilities has been applied at Jackson in building the mill from the ground up. He said that the product manufactured in Jackson will go to Mobile as does product from other facilities in Mississippi, Tennessee and Alabama.

CM Biomass reports that its North American production facilities are primarily supplied with byproducts from the sawmilling industry, but it also developed a facility in Douglas, Ga. that converts peanut hulls. The company lists the following facilities: Huntsville, Texas; Douglas, Ga.; Ideal, Ga.; Effingham, SC; Brookhaven, Miss.; Jackson, Ala.; Quitman, Miss.; Jasper, Tenn.; Crosville, Ala.; Fruitdale, Ala.

CM Biomass Partners was founded in 2009 as a response to the European Union’s increased demand for sustainable green energy solutions and the EU RED 2020 targets. Since the beginning, the company has benefitted from the close connection to the CM group with its many years of experience within commodity trading, shipping, warehousing and wood pellet bagging. In the meantime, helping suppliers meet sustainability requirements has also become an important and fast-growing task.

Today, they trade more than 3,600,000 MT of wood pellets per year, which makes them one of the largest independent wood pellet trading companies in the world.

CM Biomass Partners employs around 225 in Denmark, Sweden, Germany, UK, Holland, Italy, Latvia, Russia, Singapore, Vietnam and the U.S.

In 2021 United Shipping & Trading Co. acquired a majority stake in CM Biomass.

Airex Energy Completes $38M Funding Round

Canada-based biomass carbonization technology provider Airex Energy Inc. announced it has concluded a Series B funding round valued at CA$38 mil-

lion, which Airex Energy states will fast-track its growth initiatives, including a Québec biochar project tying in with its partnership with France-based environmental quality developer, Suez, which aims to significantly boost biochar production in Europe and North America by 2035.

Led by Canada-headed “cleantech” venture capital and impact investor Cycle Capital Management, the most re-

cent round welcomed the FTQ Fonds de solidarité, which joined the syndicate of existing investors including Investissement Québec, Desjardins-Innovatech, Export Development Canada (EDC), and Cycle Capital.

With proprietary technology Airex Energy produces biochar, which sequesters carbon in the ground and in other materials; biocarbon, which is used to produce green steel and other

TIMBER PROCESSING ■ JUNE 2023 ■ 65 ATLARGE CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

metals; and biocoal, an environmentally friendly fuel and coal replacement.

“From the outset, we have been convinced of decarbonization’s potential, particularly in polluting industries, as well as of Airex’s patented technology. As we get ready to launch the largescale commercialization of biochar and biocoal, we look forward to contributing to Airex’s growth, alongside Airex’s team, strategic partners such as Suez, and renowned investors like the Fonds de solidarité FTQ, Investissement Québec and Desjardins,” notes AndréeLise Méthot, Founder and Managing Partner of Cycle Capital.

“We are proud to count on the support of recognized local investors. Their backing is a wonderful acknowledgment of our shared sustainable development ambitions, as well as a sign of confidence. Thanks to our one-of-akind technology, we are poised to become a leader in the area of innovative and environmentally friendly decarbonization solutions both inside and outside Canada,” adds Michel Gagnon, CEO of Airex Energy.

Coming In The July Issue

Byproducts Processing Chippers—Hogs—Hammermills— Silos—Conveyors

ATLARGE 66 ■ JUNE 2023 ■ TIMBER PROCESSING

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

02/23 NORTH AMERICA ■ United States ■ Canada ■ North Carolina ■ Georgia ■ Ontario Manufactures Kiln-Dried 4/4 Red and White Oak, Poplar, Ash and Cypress Contact: Linwood Truitt Phone (912) 253-9000 / Fax: (912) 375-9541 linwood.truitt@beasleyforestproducts.com Pallet components, X-ties, Timbers and Crane Mats Contact: Ray Turner Phone (912) 253-9001 / Fax: (912) 375-9541 ray.turner@beasleyforestproducts.com Beasley Forest Products, Inc. P.O. Box 788 Hazlehurst, GA 31539 beasleyforestproducts.com WANT TO GET YOUR AD IN OUR NEXT MARKETPLACE? Call or email Melissa McKenzie 334-834-1170 melissa@hattonbrown.com WOOD PRODUCTS MARKETPLACE We produce quality 4/4 - 8/4 Appalachian hardwoods • Red Oak, White Oak, Poplar • Green Lumber: Air Dried, Kiln Dried Timbers & Crossties • Hickory, Sycamore, Beech, Gum & Elm • Custom Cut Timbers: Long lengths and wide widths Sales/Service: 336-746-5419 336-746-6177 (Fax) • www.kepleyfrank.us Buyers & Wholesalers Next closing: July 6, 2023 ■ Kentucky ■ Minnesota HAROLD WHITE LUMBER, INC. MANUFACTUREROFFINEAPPALACHIANHARDWOODS (606) 784-7573 • Fax: (606) 784-2624 www.haroldwhitelumber.com Ray White Domestic & Export Sales rwhite@haroldwhitelumber.com Cell: (606) 462-0318 Green & Kiln Dried, On-Site Export Prep & Loading Complete millworks facility, molding, milling & fingerjoint line STACKING STICKS FOR SALE AIR-O-FLOW profiled & FLAT sticks available Imported & Domestic DHM Company - Troy, TN 38260 731-446-4069 Fax: 707-982-7689 email: kelvin@kilnsticks.com www.KILNSTICKS.com ■ Tennessee WANT TO GET YOUR AD IN OUR NEXT MARKETPLACE? Call or email Melissa McKenzie 334-834-1170 melissa@hattonbrown.com CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Call Toll-Free: 1-800-669-5613 TIMBER PROCESSING ■ JUNE 2023 ■ 69 Recruiting Services Executive – Managerial – Technical - Sales JOHN GANDEE & ASSOCIATES, INC Contingency or Retained Search Depending on Circumstances / Needs “Your Success Is Our Business” Serving the Wood Products and Building Materials Industries For more than 26 years. 512-795-4244 Call or Email me anytime! john@johngandee.com www.johngandee.com Austin, Texas 3220 Top Wood Jobs Recruiting and Staffing George Meek geo@TopWoodJobs.com www.TopWoodJobs.com (360) 263-3371 3779 1615 EMPLOYMENT OPPORTUNITIES Importers and Distributors of Tropical Hardwood Kiln Sticks

lowest cost per cycle” GW Industries www.gwi.us.com Dennis Krueger Jackie Paolo 866-771-5040 866-504-9095 greenwoodimportsllc@gmail.com jackie@gwi.us.com GREENWOOD KILN STICKS Importers and Distributors of Tropical Hardwood Kiln Sticks “The lowest cost per cycle” GW Industries www.gwi.us.com Dennis Krueger Jackie Paolo 866-771-5040 866-504-9095 greenwoodimportsllc@gmail.com jackie@gwi.us.com 127 LUMBER

13877 EMPLOYMENT OPPORTUNITIES CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

“The

WORKS

MAINEVENTS

JUNE

9-10— PA Timber Show, Russell E. Larson Agricultural Research Center, Pennsylvania Furnace, Penn. Call 814-8632873; visit agsci.psu.edu/timber.

10-13—Assn. of Consulting Foresters of America annual conference, The Graduate Eugene Hotel, Eugene, Ore. Call 703548-0990; visit acf-foresters.org.

JULY

23-26— Walnut Council annual meeting, TBD, Columbia, Mo. Call 765-583-3501; visit walnutcouncil.org.

25-28— AWFS Fair, Las Vegas Convention Center, Las Vegas, Nev. Call 224-563-3761; visit awfsfair.org.

28-30— Georgia Forestry Assn. Annual Conference, Jekyll Island Convention Center, Jekyll Island, Ga. Call 478-992-8110; visit gfagrow.org.

AUGUST

23-25— SFPA Forest Products Machinery & Equipment Expo, Music City Center, Nashville, Tenn. Call 504-443-4464; visit sfpaexpo.com.

29-31—Florida Forestry Assn. annual meeting, Sandestin Golf & Beach Resort, Miramar Beach, Fla. Call 850-222-5646; visit flforest.org.

29-31—Louisiana Forestry Assn. annual meeting, Golden Nugget Hotel & Casino Resort, Lake Charles, La. Call 318443-2558; visit laforestry.com.

SEPTEMBER

5-8—Tennessee Forestry Assn. annual meeting, Marriott Cool Springs, Franklin, Tenn. Call 615-883-3832; visit tnforestry.com.

7-9—Great Lakes Logging & Heavy Equipment Expo, UP State Fairground, Escanaba, Mich. Call 715-282-5828; visit gltpa.org.

10-12—Alabama Forestry Assn. annual meeting, Orange Beach, Ala. Call 334-265-8733; visit alaforestry.org.

15-16—Kentucky Wood Expo, Masterson Station Park, Lexington, Ky. Call 502-695-3979; visit kfia.org.

17-21—American Wood Protection Assn. Technical Committee meeting, Le Meridien Downtown Denver, Denver, Colo. Call 205-733-4077; visit awpa.com.

20-22—Northeastern Lumber Manufacturers Assn. annual meeting, Samoset Resort on the Ocean, Rockland, Maine. Call 207-829-6901; visit nelma.org.

26-28—Arkansas Forestry Assn. annual meeting, Oaklawn Hotel & Spa, Hot Springs, Ark. Call 501-374-2441; visit arkforests.org.

27-29—North Carolina Forestry Assn. annual meeting, Biltmore Estate, Asheville, NC. Call 800-231-7723; visit ncforestry.org.

OCTOBER

4-6—National Hardwood Lumber Assn. Annual Convention & Exhibit Showcase, Omni Louisville Hotel, Louisville, Ky. Call 901-377-1818; visit nhla.com.

Listings are submitted months in advance. Always verify dates and locations with contacts prior to making plans to attend.

This issue of Timber Processing is brought to you in part by the following companies, which will gladly supply additional information about their products.

70 ■ JUNE 2023 ■ TIMBER PROCESSING

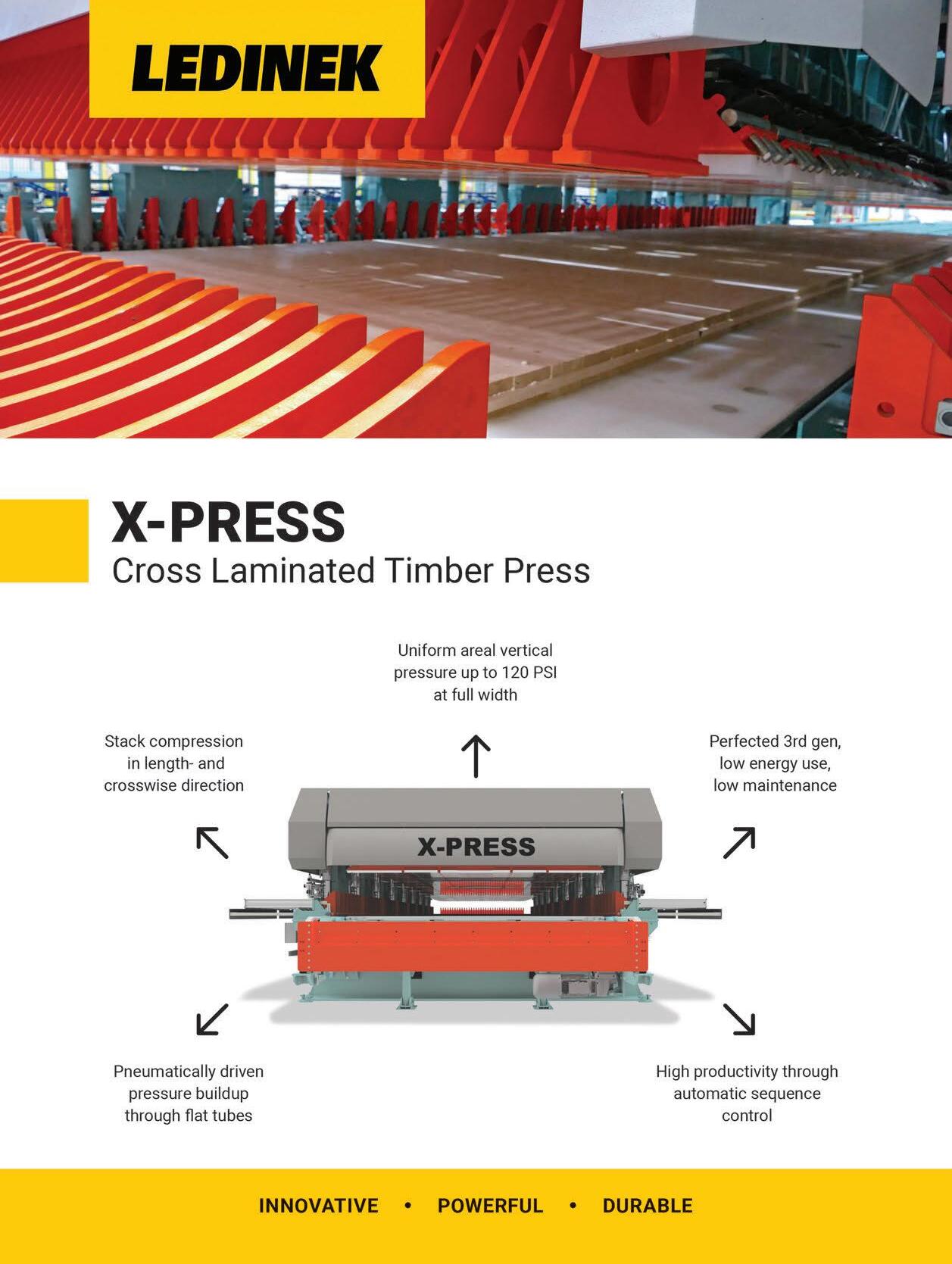

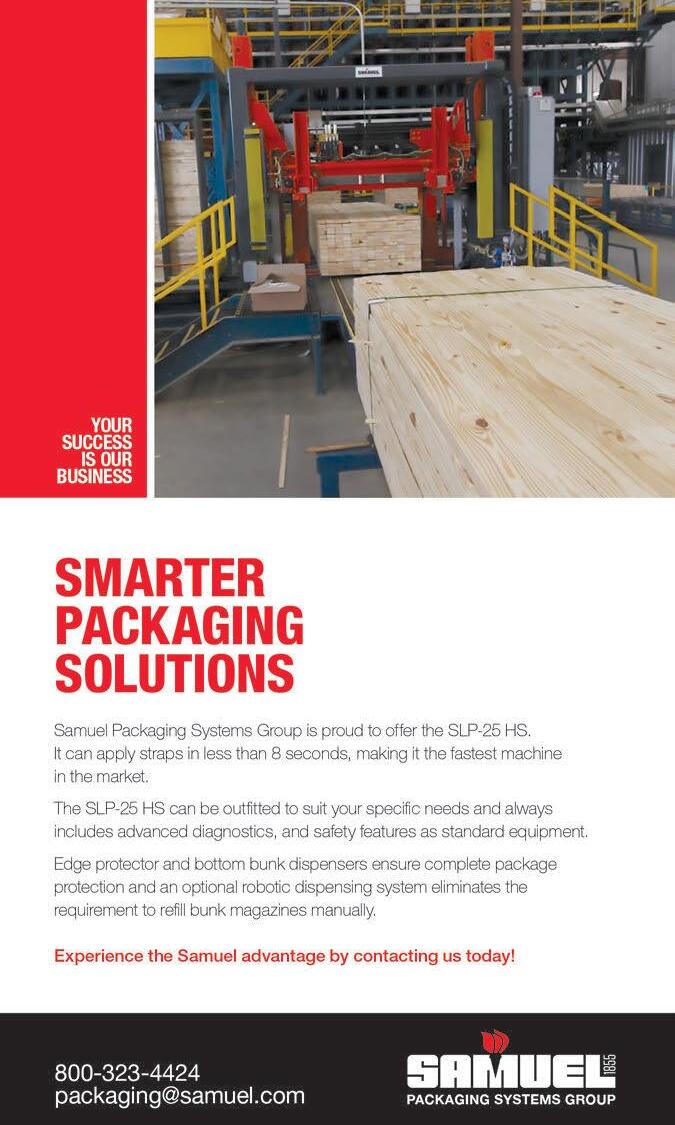

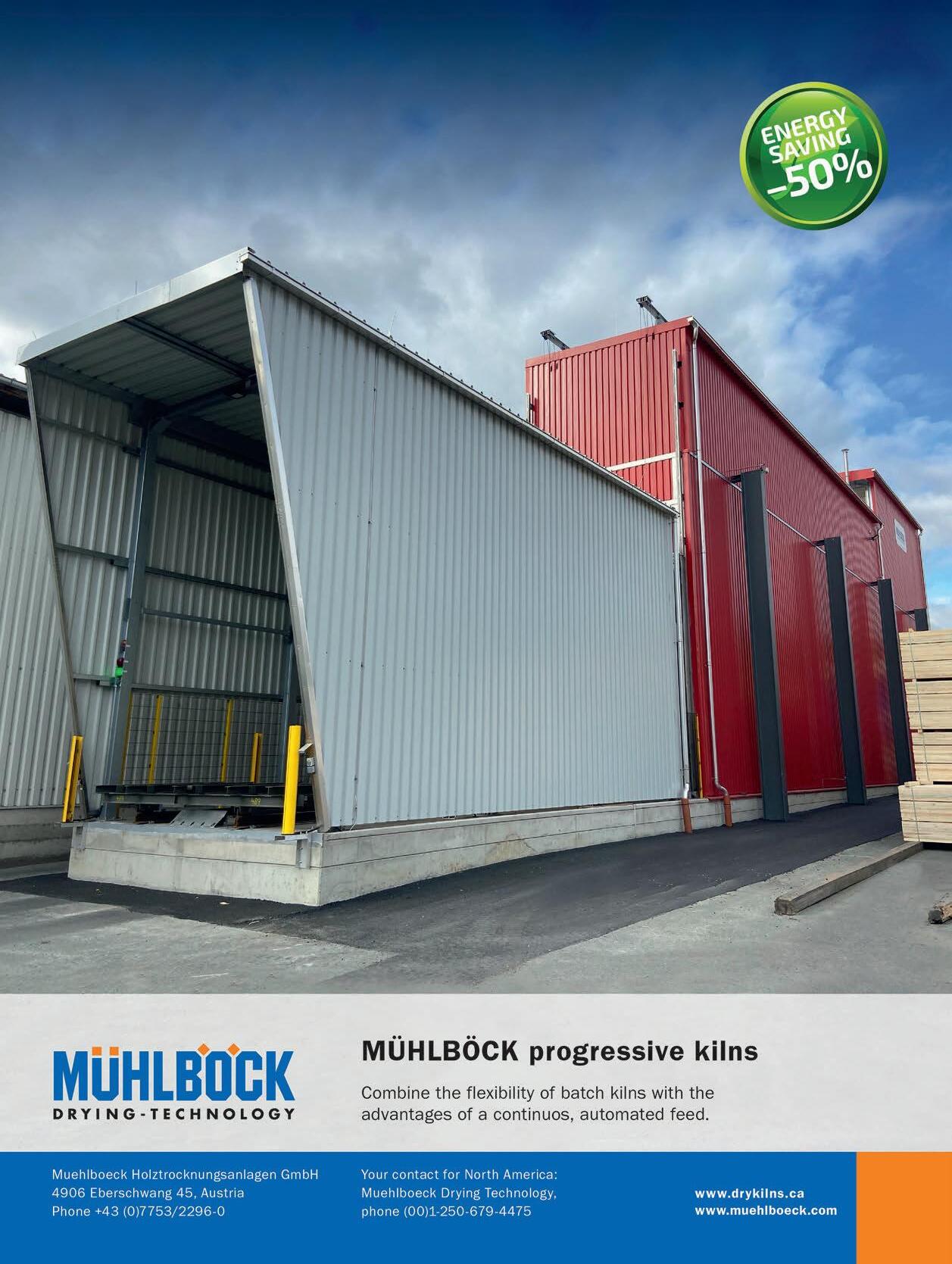

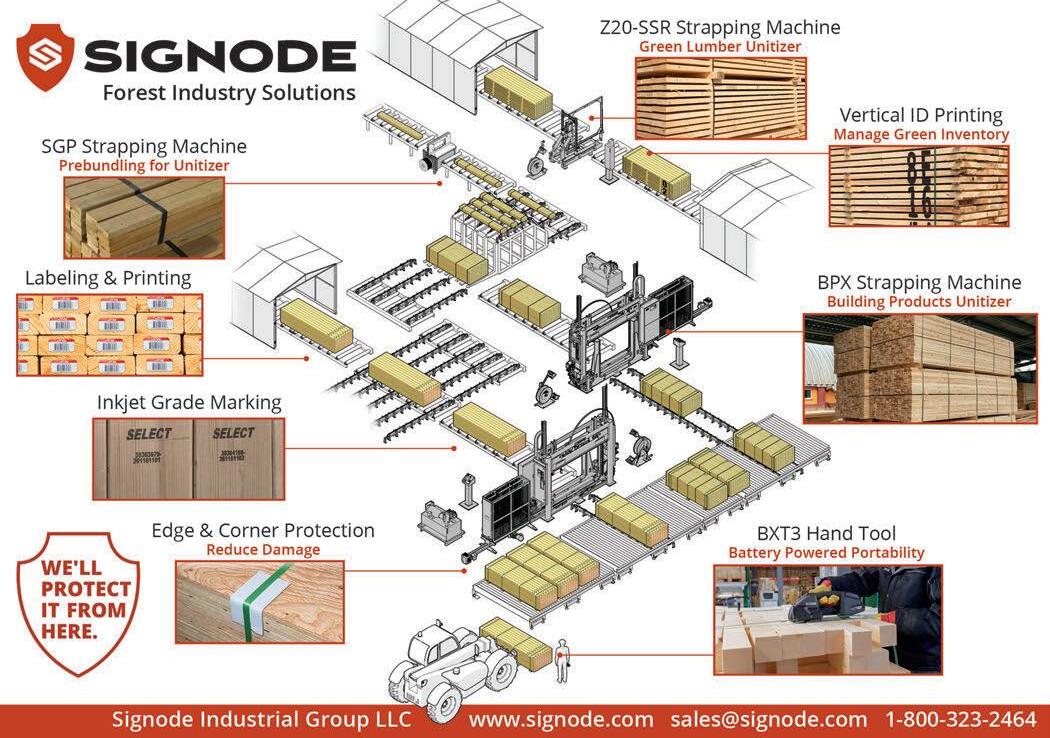

A ● D ● L ● I ● N ● K ADLINK is a free service for advertisers and readers. The publisher assumes no liability for errors or omissions. A W Stiles Contractors 67 931.668.8768 Andritz Iggesund Tools 2 813.855.6902 Arxada 9 678.627.2000 Automation & Electronics USA 14 704.200.2350 BID Group 72 843.563.7070 Biolube 59 260.414.9633 Brunner Hildebrand 61 615.469.0745 Burton Mill Solutions 3 800.426.6226 Calibre Equipment 63 +64 21 586 453 Carbotech-Autolog 34 819.362.6317 Cleereman Industries 56 715.674.2700 Cone Omega 64 229.228.9213 Cooper Machine 21 478.252.5885 Corley Manufacturing 8 423.698.0284 Down River Cryogenics 60 866.616.1405 Esterer WD GmbH 33 +49 8671 503 0 EXPO 2023 67 504.443.4464 FiberPro 58 501.463.9876 Finnos 10 +358.09.455.2553 Fulghum Industries 59 800.841.5980 G F Smith 6 971.865.2981 Halco Software Systems 60 604.731.9311 Hogue Industries 13 503.656.5100 Holtec USA 7 800.346.5832 Industrial Autolube International62 403.754.3646 JoeScan 62 360.993.0069 John King Chains 53 +44 1977 681 910 Ledinek Engineering 39 +386 2 61300 51 Legna Software 64 800.278.1098 Linck 51 936.676.4958 Linden Fabricating 66 250.561.1181 Mebor 49 +386 4 510 3200 Metal Detectors 26 541.345.7454 MiCROTEC 23 541.753.5111 Mid-South Engineering 67 501.321.2276 Minda Industrieanlagen GmbH 54 828.313.0092 Muhlbock Holztrocknungsanlagen41 +43 7753 2296 0 Nelson Bros Engineering 45 888.623.2882 Oleson Saw Technology 31 800.256.8259 Opticom Tech 30 800.578.1853 Rawlings Manufacturing 20 866.762.9327 Real Performance Machinery 71 843.900.9494 Samuel Coding & Labeling Group12 800.667.1264 Samuel Packaging Systems Group 40 800.323.4424 Sennebogen 25 704.347.4910 Sering Sawmill Machinery 28 360.687.2667 Sicam Systems 36 604.584.7151 Signode 45 800.323.2464 SII Dry Kilns 15 800.545.6379 Springer Maschinenfabrik GmbH47 +43 4268 2581 0 Superior Solutions 60 870.310.6722 T S Manufacturing 35 705.324.3762 Telco Sensors 19 800.253.0111 Terex Deutschland Gmbh 27 +49 0 7253 84 0 USNR 11,65 800.289.8767 Valutec 29 +46 0 910 879 50 Vecoplan 37 336.252.4824

ADVERTISER PG.NO. PH.NO.

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!