CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Hatton-Brown Publishers, Inc.

Street Address: 225 Hanrick Street

Montgomery, AL 36104-3317

Mailing Address: P.O. Box 2268 Montgomery, AL 36102-2268 Telephone: 334.834.1170 FAX: 334.834.4525

Publisher: David H. Ramsey Chief Operating Officer: Dianne C. Sullivan

Editor-in-Chief: Rich Donnell

Senior Editor: Dan Shell

Senior Editor: David Abbott Senior Editor: Jessica Johnson

Publisher/Editor Emeritus: David (DK) Knight

Art Director/Prod. Manager: Cindy Segrest Ad Production Coordinator: Patti Campbell

Circulation Director: Rhonda Thomas

Online Content/Marketing: Jacqlyn Kirkland

Classified Advertising: Bridget DeVane • 334.699.7837 800.669.5613 • bdevane7@hotmail.com

Advertising Sales Representatives: Southern USA

Randy Reagor

P.O. Box 2268 Montgomery, AL 36102-2268 904.393.7968 • FAX: 334.834.4525 E-mail: reagor@bellsouth.net

Midwest USA, Eastern Canada

John Simmons 32 Foster Cres. Whitby, Ontario, Canada L1R 1W1 905.666.0258 • FAX: 905.666.0778

E-mail: jsimmons@idirect.com

Western USA, Western Canada

Tim Shaddick 4056 West 10th Avenue Vancouver BC Canada V6L 1Z1 604.910.1826 • FAX: 604.264.1367

E-mail: twshaddick@gmail.com Kevin Cook 604.619.1777

E-mail: lordkevincook@gmail.com

International

Murray Brett

58 Aldea de las Cuevas, Buzon 60 03759 Benidoleig (Alicante), Spain Tel: +34 96 640 4165 • + 34 96 640 4048

E-mail: murray.brett@abasol.net

corporate industrial woodlands

in the U.S. All non-qualified U.S. Subscriptions are $55 annually: $65 in Canada; $95 (Airmail) in all other countries (U.S. Funds). Single copies, $5 each; special issues, $20 (U.S. funds). Subscription Inquiries— TOLL-FREE: 800-6695613; Fax 888-611-4525. Go to www.timberprocessing.com and click on the subscribe button to subscribe/renew via the web. All advertisements for Timber Processing magazine are accepted and published by Hatton-Brown Publishers, Inc. with the understanding that the advertiser and/or advertising agency are authorized to publish the entire contents and subject matter thereof. The advertiser and/or advertising agency will defend, indemnify and hold any claims or lawsuits for libel violations or right of privacy or publicity, plagiarism, copyright or trademark infringement and any other claims or lawsuits that may arise out of publication of such advertisement. Hatton-Brown Publishers, Inc. neither endorse nor makes any representation or guarantee as to the quality of goods and services advertised in Timber Processing. Hatton-Brown Publishers, Inc. reserves the right to reject any advertisement which it deems inappropriate. Copyright ® 2022. All rights reserved. Reproduction in whole or part without written permission is prohibited. Periodicals postage paid at Montgomery, Ala. and at additional mailing offices. Printed in U.S.A.

Please send address changes to Timber Processing, P.O. Box 2419, Montgomery, Alabama 36102-2419

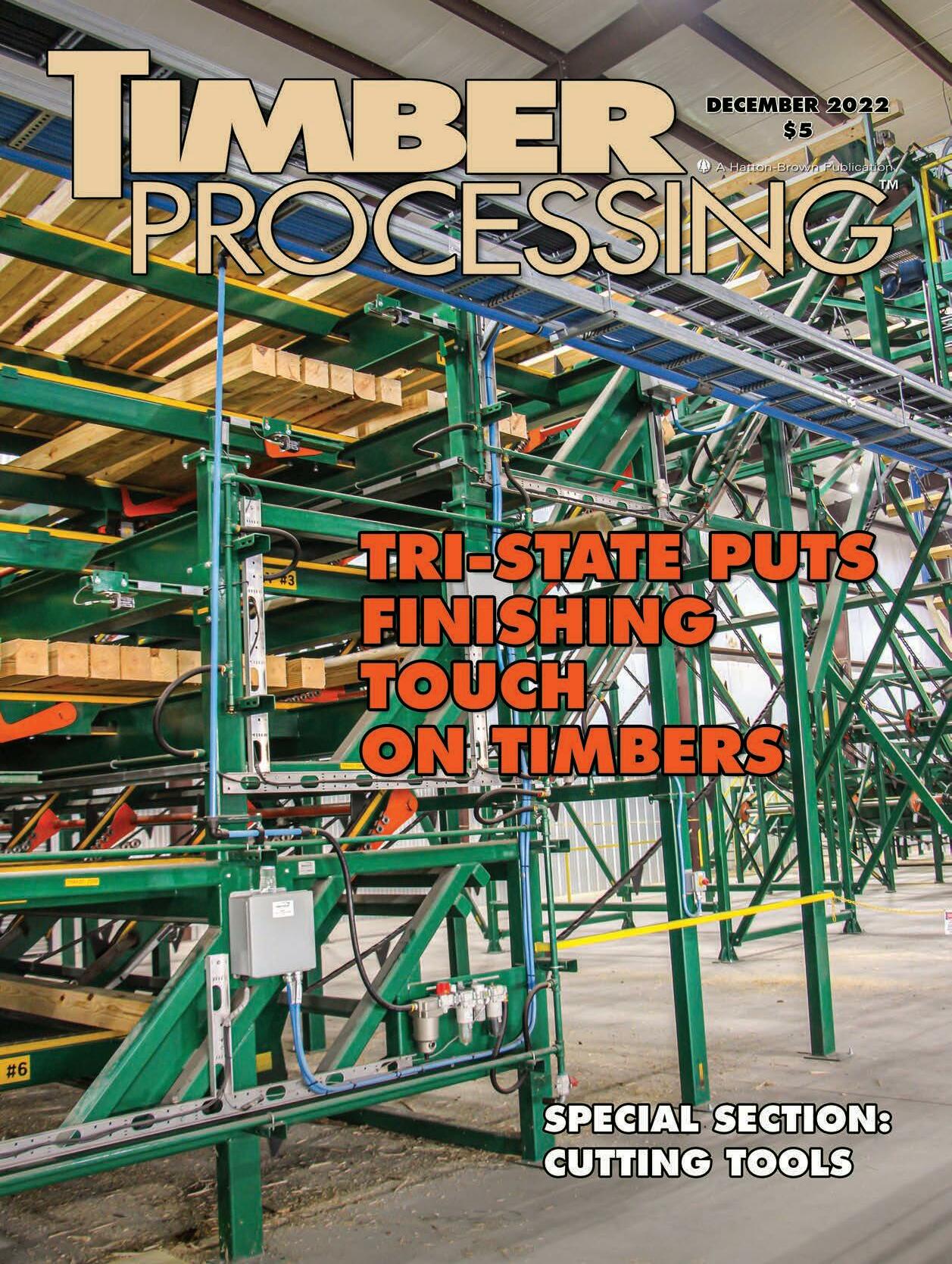

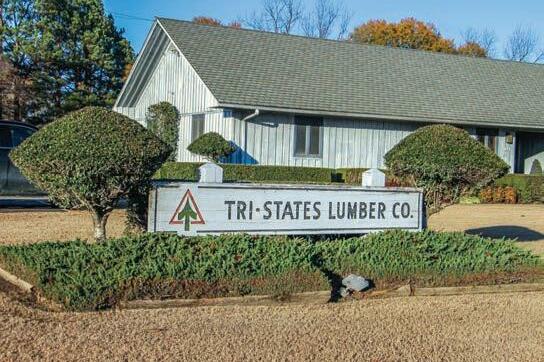

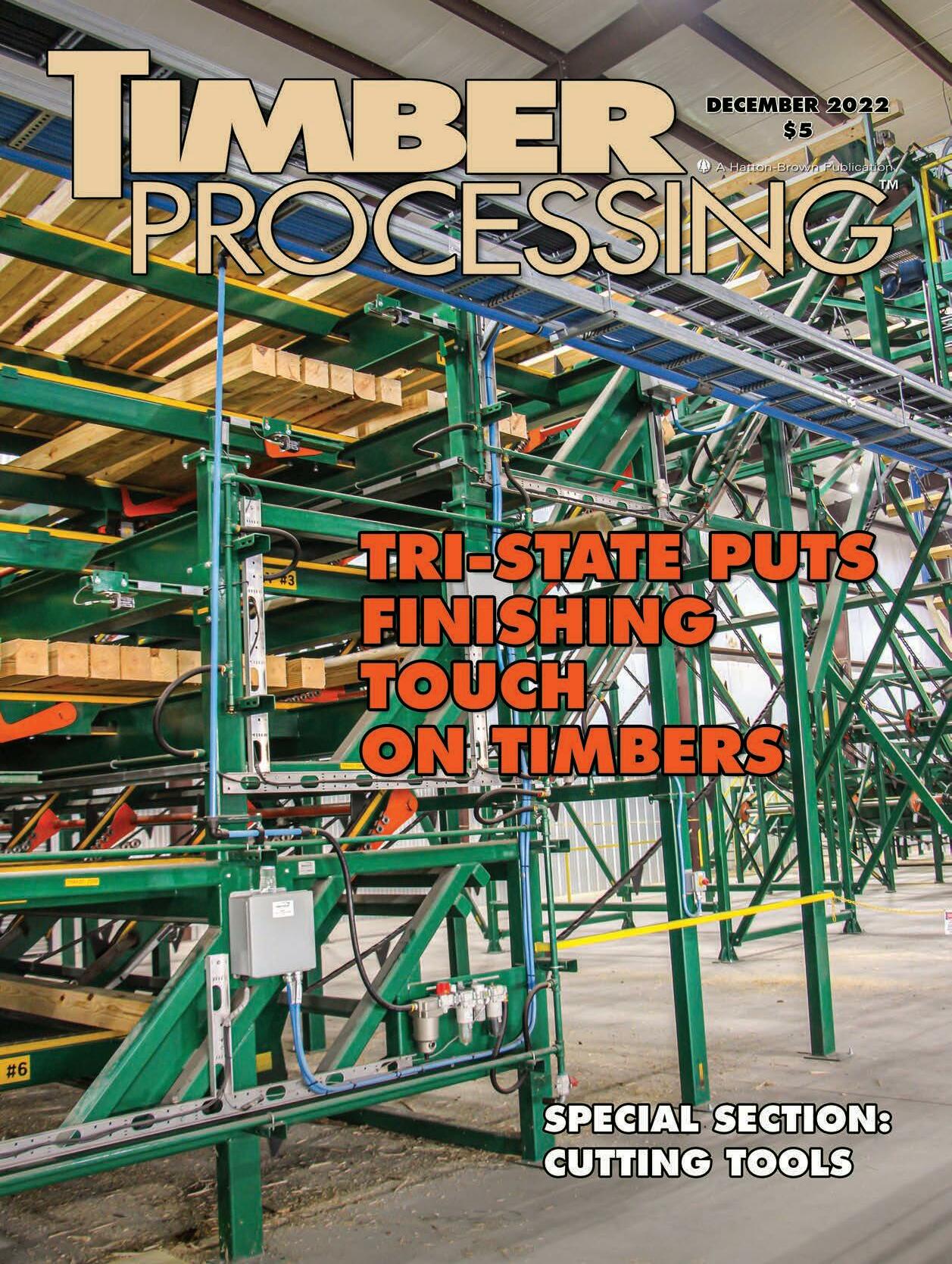

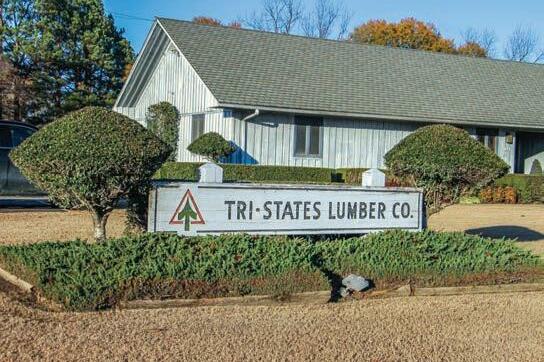

Volume 47 • Number 11 • December 2022 Founded in 1976 • Our 491st Consecutive Issue NEWSFEED Arizona Operation Re-Brands Again COVER: Tri-State Lumber of Homan Industries starts up a new timbers planer mill at its multi-faceted wood products manufacturing site in Fulton, Miss. Story begins on PAGE 10. (Jessica Johnson photo) 6 TRI-STATE LUMBER Planer Mill Investment Takes Shape 10 CUTTING TOOLS Several Suppliers Offer Latest Technologies 20 FILING ROOM TIPS Don’t Take Anything For Granted 16 IMPORTANCE OF ROUNDWOOD Environmental Benefits Shouldn’t Be Overlooked 26 AT LARGE New Officers Named For SFPA 38 MACHINERY ROW USNR Gains Sawmill Order In Chile 40 Renew or subscribe on the web: www.timberprocessing.com A Hatton-Brown Publication VISIT OUR WEBSITE:www.timberprocessing.com Timber Processing (ISSN 0885-906X, USPS 395-850) is published 11 times annually (monthly except Jan./Feb.) by Hatton-Brown Publishers, Inc., 225 Hanrick St., Montgomery, AL 36104. Subscription Information—TP is free to qualified owners, operators, managers, purchasing agents, supervisors, foremen and

plants,

Other Hatton-Brown publications: Timber Harvesting • Southern Loggin’ Times Wood Bioenergy • Panel World • Power Equipment Trade

Circulation CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

other key personnel at sawmills, pallet plants, chip mills, treating plants, specialty

lumber finishing operations,

officials and machinery manufacturers and distributors

Postmaster:

Member Verified Audit

THEISSUES FILLED WITH ACTION ON MANY FRONTS

Rich Donnell

Editor-in-Chief

2022 left us with softened lumber prices, declining housing starts, and rising interest rates. Nobody was complaining too loudly, given the astronomical surge in lumber prices in the spring of 2022 that everyone enjoyed, and the corresponding surge in housing starts. There remained activity in the building markets at year’s end, but there was shuffling around with lumber production curtailments, while new greenfield or recently upgraded mills became anxious to see what they could do. You might say it was a mixed bag of goods heading into the new year.

Before we totally bid 2022 adieu, here were some developments as covered in the pages of this magazine:

Timber Processing named Eric Schooler, CEO of Collins, as its 34th annual Person of the Year.

—North Carolina lumberman J. Wilson Jones, Jr. died at age 87.

—Canfor purchased Millar Western Forest Products.

—Neiman named Steve Henson as CEO.

—Spencer Forest Products began construction of a sawmill near Forks, Wash.

—Southern Forest Products Assn. announced it was moving its sawmill expo from Atlanta to Nashville in 2023.

—Sierra Pacific Industries named Todd Payne as president and GM.

—Oregon-based Freres Lumber celebrated its 100th year.

—Claw Forestry Services announced it was building a southern yellow pine sawmill in Gloster, Miss.

—85% of U.S. softwood lumbermen responding to TP’s annual Sawmill Operations & Capital Expenditure Survey in April forecasted their business situation for 2022-2023 as excellent or good, as did 75% of U.S. hardwood lumbermen.

—Canfor continued with construction of a SYP sawmill in DeRidder, La.

—George Weyerhaeuser Sr., who served as president and CEO of his greatgrandfather’s namesake company, died at age 95.

—BID Group purchased Smith Sawmill Service.

—PalletOne, Inc. purchased 50% of Dempsey Wood Products.

—Paper Excellence purchased Montreal-based Resolute Forest Products.

—Teal Jones Group continued construction of a SYP sawmill near Plain Dealing, La.

—USNR acquired Timber Automation.

—Canfor announced plans to build a SYP sawmill north of Mobile, Ala.

—Tahoe Forest Products began building a sawmill near Carson City, Nev.

—Wood Fiber Group changed its name to Burton Mill Solutions.

—Hancock Lumber acquired Madison Lumber of Madison, NH.

—Western Forest Products named Steven Hofer as president and CEO.

—After cancellation in 2020 due to the pandemic, Timber Processing & Energy Expo returned to Portland, Ore. and drew more than 1,200 non-exhibitor attendees from more than 110 wood products producer companies, while showcasing 170 equipment exhibitors manned by 900 of their representatives.

—Roseburg continued construction of a SYP sawmill in Weldon, NC.

Meanwhile during 2022, Timber Processing editors again took to the field and visited: Pyramid Mountain Lumber, Seely Lake, Mont.; Pleasant River Lumber, Dover-Foxcroft, Maine; Mt. Hood Forest Products, Odell, Ore.; Vicksburg Forest Products, Vicksburg, Miss.; Georgia-Pacific, Diboll, Texas; Biewer Lumber, Winona, Miss.; Roseburg, Dillard, Ore.; Neiman, Gilchrist, Ore.; Price Sawmill, Piedmont, Mo.; Tri-State Lumber, Fulton, Miss.

Contact Rich Donnell, ph: 334-834-1170; fax 334-834-4525; e-mail: rich@hattonbrown.com

TP

10 16 20 26

TIMBER PROCESSING ■ DECEMBER 2022 ■ 5 CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

ARIZONA OPERATION CHANGES NAME

Arizona-based NewLife Forest Products has rebranded itself as Restoration Forest Products, LLC (RFOR). In addition to the name change, the company announced changes to its senior leadership team.

“The new name more accurately represents what we do,” comments Ted Dergousoff, CEO of Restoration Forest Products, LLC. “Our partners, customers and communities can still expect to see the same passion, diligence and commitment towards our mission of restoring the health of our forests, preventing wildfires and producing world-class lumber and building products. We are excited to lead the way in creating a sustainable model for forest restoration.”

With the rebranding, RFOR introduces additions to its senior leadership team, including:

l Neil Calhoun as Chief Financial Officer. Calhoun brings more than 40 years of experience in the manufacturing industries both domestically and internationally.

l George Stedeford as Senior Vice

President, Forest Operations. He will focus on forest operations as the company builds out its harvesting and restoration efforts.

l Bob Banchero as Senior Vice President, Sawmill Operations. Banchero will oversee the sawmills and engineered wood products. Banchero has 40 years in the lumber industry, demonstrating on several occasions the ability to manage multi-sawmill divisions in the U.S. and Canada.

The company is implementing sawmill and engineered wood products manufacturing at its plant Bellemont, Ariz., while also increasing forest restoration work in service of its Forest Service stewardship contract to thin and treat more than 300,000 acres at risk of wildfire on the Kaibab, Coconino, Apache-Sitgreaves and Tonto national forests.

Forest Service awarded the contract in 2013 to Good Earth Power, which became NewLife Forest Products. The company had initially planned a greenfield sawmill at a site in Williams, Ariz., but switched to Bellemont after a large former paper products finishing

industrial building became available. The company reports it has tripled the size of its forest restoration operations.

ROANOKE VALLEY LUMBER PROGRESSES

Roseburg’s newest sawmill operations site, Roanoke Valley Lumber in Weldon, NC, is now dotted with new buildings and concrete pads awaiting the equipment that will turn trees into high-quality dimensional lumber for the company’s growing customer base in the Southeastern U.S.

Recent developments include:

l Foundation poured for the debarker l Foundation and building installed for the kilns

l Foundation and building installed for truck loading area

The Roanoke Valley Lumber team has accepted delivery of some key pieces of equipment, and undergone essential training prior to construction completion. Hiring for leadership and technical roles continues, with hourly recruitment kicking off in early 2023.

NEWSFEED 6 ■ DECEMBER 2022 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

WESTERVELT ANNOUNCES CADE WARNER AS COO

The Westervelt Co. recently promoted Cade Warner to Chief Operating Officer, effective January 1. He has been the chief sustainability officer.

Warner becomes responsible for the five business operations of The Westervelt Co.: Forest Resources, Wood Products, Ecological Services, Real Estate and New Zealand, and Business Development and Information Services. He now works closely with President and CEO Brian Luoma in overseeing operations and implementing the strategic plan of The Westervelt Co.

EAGLE PURCHASES LUMBER

OPERATION

Eagle Forest Products is purchasing the lumber manufacturing plant of Family Pallet Lumber in Tangent, Ore. This purchase was expected to close by year end and will result in a significant increase in production at the facility going forward.

John Peaslee, previously with Idaho Timber, will be the General Manager of Manufacturing Operations for Eagle Forest in Tangent.

Eagle Forest Products is a lumber manufacturing and marketing company with manufacturing operations in Tangent and Roseburg, Ore.; Greenleaf, Wis.; Magnolia, Ark.; and Piedmont, Ala. The company also has sales and distribution operations in Eagle, Idaho; Montgomery, Texas; and Chesapeake, Va.

WEYERHAEUSER, UNION COME TO AGREEMENT

In late October, after a 48-day strike, Weyerhaeuser reported the resolution of a work stoppage involving members of the International Assn. of Machinists and Aerospace Workers union in Oregon and Washington. Weyerhaeuser has approximately 1,200 employees who are members of IAM, including employees in the company’s Wood Products and Timberlands organizations, and the approval of the new contract has resulted in the restoration of

operations at all sites.

The workers had walked out in mid September after they turned down an offer from Weyerhaeuser.

The new agreement covers 1,192 workers at four sawmills, two log export facilities, two statewide log truck operations, and seven logging camps. They’re members of four woodworker locals of the International Assn. of Machinists.

The agreement reportedly raises wages 14% over four years, starting with a 5.5% increase retroactive to June 1.Union members reportedly made a concession in that for the first time they’ll be paying a portion of health insurance premiums directly from their paychecks.

The agreement includes a $3,000 signing bonus and increases the pay premium for working swing, graveyard and weekend shifts. It adds a second week of paid vacation to workers in their first three years on the job (it rises gradually to five weeks a year in year 20).

The work stoppage reportedly caused 860,000 tons of logs not harvested, and 230 million board feet of lumber not milled.

NEWSFEED 8 ■ DECEMBER 2022 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

SMALL, BUT

MIGHTY

By Jessica Johnson

As more and more green-

mills are finding themselves having to get creative to keep up. Some are upgrading equipment, some are selling out, and some are just treading water. But for Tri-State Lumber, part of the Homan Industries family of companies that have been operating in Fulton for 56 years, the answer to competing against the megamills is simple: Don’t!

Larry Homan, a sage at 80 yearsyoung, says those companies don’t ask him what to do, or give him any control over what they do; so, why take cues from them? Instead, Tri-State stays in its lane, focusing on what it has done well for the last five decades–high quality, treated southern yellow pine backed by good customer service. “We have maintained this philosophy for a long time: Control what

He adds that while the mill he has built from the ground up is fairly small, producing 50MMBF annually, being a specialty mill that cuts only timbers, with the value-added bonus of the ability to cut, kiln dry, surface, spray with antimold solution and then treat, has led the company to a strong balance sheet for decades. “Our niche is timbers. We know our place. And we’re going to try to be the best little mill around.”

The path to getting there is where it gets interesting. Homan believes that for dimension lumber, the future is in crosslaminated timber (CLT). But the market will always have a demand for timbers, so in order to keep up with that demand, Tri-State needed to upgrade its facility in a major way. The first major upgrades

FULTON, Miss.

Compared to current new sawmills, TriState Lumber’s production numbers come in small, but its timbers are anything but. Tri-State’s niche is timbers with the ability to dry, fully dress and treat them. CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

something he is not particularly proud of. But, he knows and understands how valuable technology can be for a mill, so Homan is working to find solutions that fit his needs and budget.

While Homan might not be leading edge with technology, he does re-invest in the facility he loves so much. “We knew that our planer was a problem; we knew our drying was a problem. We can’t go out and build a 350MMBF mega-mill. So we are going to do what we can do and pay for. We are going to continue to do that. We’re just trying to do better every day, a little bit at a time.”

PROJECTS

For many, first comes a sawmill, then comes a treating plant then comes a distribution channel. Larry Homan did it in reverse. He says he had a vision of the direction he wanted to go in, it just came together differently. “We had to do it piecemeal—still are. This is a familyowned business. This is a business we’ve put a lot of time into and we’re proud of,” he reiterates.

Homan started in 1967 as a wholesale distributor of spruce shipped from British Columbia by rail, serving predominately the mobile home manufacturing market that dominated northwest Alabama-north-

gas-fired kiln, followed by a treating plant and a remanufacturing plant. The mill sought to capitalize on the kiln-dried after treating (KDAT) market that was making waves.

As demand for KDAT waned, it was time for Homan to pivot again, expanding into another new market and adding a planer mill to the register. Though the planer had some challenges in the first few years. Homan was buying rough green lumber from small local vendors— where quality and sizing was inconsis-

With the installation of a VAB autograder in the planer mill, Tri-State has consistently seen more than 40% of dressed lumber being stamped #1 grade.

The complete planer mill rebuild represents a $10 million capital investment in the future, owner Larry Homan says.

PROCESSING ■ DECEMBER 2022 ■ 11

TIMBER

The mill cuts 50MMBF annually.

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

planer out and replacing it with new equipment, including optimizing the merchandizer with an InoTech system. Those changes brought production increases (to 50MMBF annually) that demanded a new Nyle gas-fired kiln in 2018, bringing the kiln total to four.

As Homan went through the mill relieving pressure points and increasing capacity, other parts of the facility were becoming obsolete—namely the planer mill—a sore spot in the facility that was incredibly labor intensive with many safety concerns.

NEW PLANER MILL

Homan says it was an easy “yes.” A lot of site prep had to be completed, but from the time the project was greenlighted with signed contracts to commissioning was just under two years. Completed in 2022, the entire team is very happy with the outcome—reducing labor needs dramatically and with increased automation the need for touching the lumber was eliminated.

Investing $10 million, Tri-State enlisted the help of PLC USA to handle the construction and engineering of the project. PLC USA ultimately chose InoTech to manufacture the tilt hoist, stick recovery and planer infeed table. The planer itself is a Yates American A20-12 with servo-motor positioning system. A VAB linear auto-grading system from Timber Automation was installed after the planer. Behind the auto grader is a Kop-Coat double ring moldicide spray system. InoTech also supplied the trim saws, sixtray sort system, and auto stacker. Z-Tech systems provided the grade mark printer

the process.

Homan says one of the biggest positive changes the new equipment in the planer mill brought was verification of their in-house grading. Previously, timbers were hand stamped, and graders were trained to be ultra-conservative with what was stamped #1. With the automatic grader Tri-State is seeing an uptick in #1 production, with consistently greater than 40% being marked #1. Not trying to crowd the grade is something Homan appreciated when he was a distributor working with other mills, and when the time came to train his own graders, he went on the conservative, high side, too. “We don’t regret tough grading,” he adds. TriState does not pull #1 lumber. Instead, a true #2 and better grade, with grade stamp #1 is left in the packages.

Homan says while future plans aren’t set past continuing to run the mill as best as it is able, the planer mill was essential for further expansion. “We had to get that piece of infrastructure in place to plan for the future.”

Earlier in 2022, a wet deck was in-

MILL FLOW

Tri-State Lumber is 100% focused on timbers, 4x4, 4x6, 6x6, 6x8, 8x8, made in lengths up to 32 ft. Homan recognizes there isn’t a great demand for that length of timber, but he figures if he is going to be in the specialty timbers business, he’s got to be able to service the extremes.

All logs are purchased at the gate, with the specification of 14 in. butt and 6 in. top. Tri-State does not cut sideboards, since the mill uses a chipping canter. All chips coming off the canter are sold mainly to nearby paper mill.

The primary breakdown uses a new Nicholson debarker. InoTech provided the bulk of the equipment in the sawmill, including merchandizer, conveyor, conveying equipment, and dual scanners. From the primary breakdown line, cants on sticks move to one of the four batch kilns.

PHILOSOPHY

Homan says the company likes being ultra-conservative, with a strong balance sheet and no debt. “If you pay as

place for continued investment and growth.

12 ■ DECEMBER 2022 ■ TIMBER PROCESSING

An automatic strapper from Samuel gives packs a clean look.

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Part of the investment to prepare for the planer mill rebuild, Tri-State lumber added a Nyle gas-fired batch kiln to its lineup in 2018.

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

weather the recessions better. Can’t say when, but guaranteed to have recessions,” the industry veteran says. But despite all of the challenges he’s faced, he says he really does love the lumber business. He cites the other mills he did business with as a distributor as those he modeled himself after when he was just starting out.

“When I started out I didn’t have two nickels to rub together. I didn’t have a choice, I had to grow into this,” he explains, adding that without having great employees throughout the years the company would be nothing.

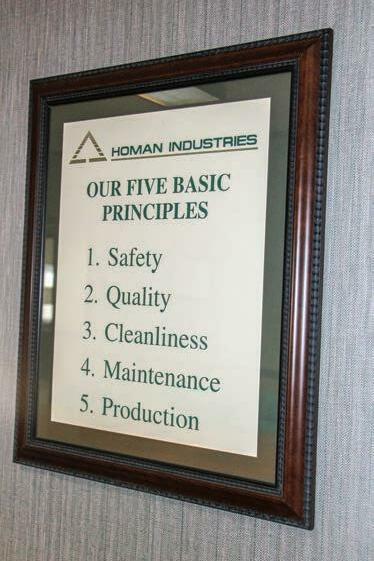

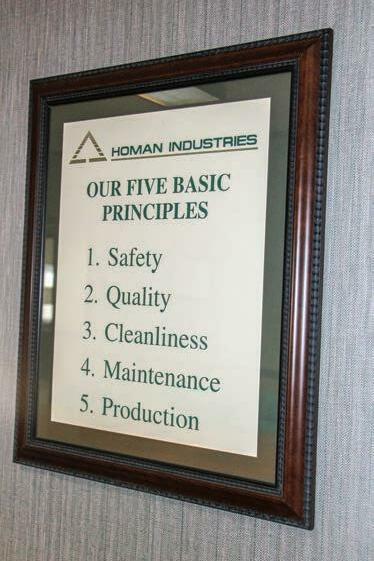

The company operates under five principles that Homan calls the guiding lights. On the surface they appear simple enough: safety, quality, cleanliness, maintenance, production. But the way Homan looks at them is anything but.

“When we say safety, we don’t just mean you leave here with all the fingers and toes you brought in. We mean safety in checks and balances in everything throughout our business,” he says of the way the company operates putting emphasis on safe work in all areas. He says that obviously quality means making a good piece of lumber—but also in making sure the company does things in a high-quality way with quality people in the mill, quality customers and quality vendors.

To him, cleanliness extends beyond the dust on the floor, to making sure the company has clean dealings and is transparent in how it operates. Just like with maintenance—going beyond oiling the machines to maintaining good relationships with employees, suppliers and customers.

“If we do those four things,” Homan says, “The fifth one, production (and profit) will be a product of those four things. You’ll see it.”

14 ■ DECEMBER 2022 ■ TIMBER PROCESSING

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

TP

Over the course of 56 years the footprint in Fulton has grown significantly.

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

DON’T EXPECT, INSPECT!

By Dave Purinton

At the Simonds International Tech Center for Saw Filer Vocational Training we utilize a number of slogans or phrases to encourage students to remember to focus on the fundamentals. One of those phrases is “Don’t Expect, Inspect!”

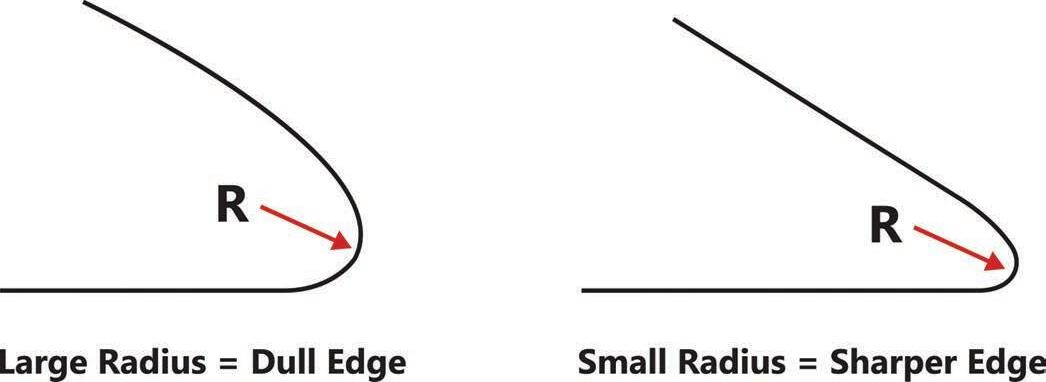

Simply loading a saw blade onto a CNC or conventional sharpening machine and pushing the button is no assurance that you will take off a sharp, ready to run blade. The proper amount of material removal from the top, face and gullet of each saw tooth is one critical element for an uninterrupted run in the saw box. Too little material removal and you will return a dull saw blade to

service or one prone to gullet cracks. Remove an excess of material and you run the risk of damaging the blade by burning the saw tips and gullet, needlessly high abrasive costs, and premature retipping or swaging.

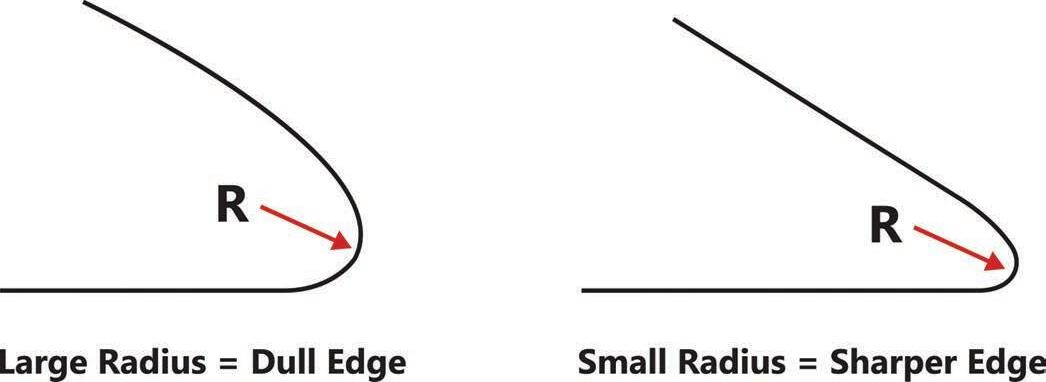

So how does one quickly check that a saw blade queued up for its next production cycle is properly sharpened for the intended run time? One technique is to take a critical look at the cutting edge of those blades that have been classified as Ready-to-Run. Use a penlight for this quick visual inspection. Check the saws out as if you or your team did not put them up. Inspect it as if you had not reconditioned it. The cutting edge of a sharp saw blade will not reflect light. If you observe a reflection on the cutting edge of the blade, that is an indication the edge still has a radius or flat on it. (See photo at left.) To get a feel for this technique, inspect your blades after their run and prior to reconditioning them. This can help the learning with just how much material must be removed from the saw blade to get it sharp enough to properly function at the mill.

Another area in the filing room that can lead to unnecessary saw changes or short blade life is at the other end of the spectrum from CNC machining and automated equipment. Even those fancy CNC and automated blade reconditioning machines also have wear parts that require monitoring! Here, too, the maintenance record

must be maintained and easily accessible for review when things “don’t go right.”

Here we are talking about basic hand tools. Saw hammers, straight edges, tension gauges, stretcher roll components, and even leveling blocks are all wear parts. (See above photo.) One challenge with maintaining hand tools is the wear can be very gradual. A filer may even subconsciously adapt to the tool wear—and cause him or herself extra work in the process. Each of these hand tools should be inspected on a recurring basis. And like changing the oil in your vehicles, the inspection dates should be recorded in a log.

If one cannot remember the last time the hand tools were inspected, that is likely a good sign that task is overdue. Logbooks are also useful for sharing the inspection frequency with others in the department. One technique for a visual inspection of the tension gauge or straight edge is to observe the light pattern either on a saw blade or leveling block. Then rotate the tool 180 degrees and observe the

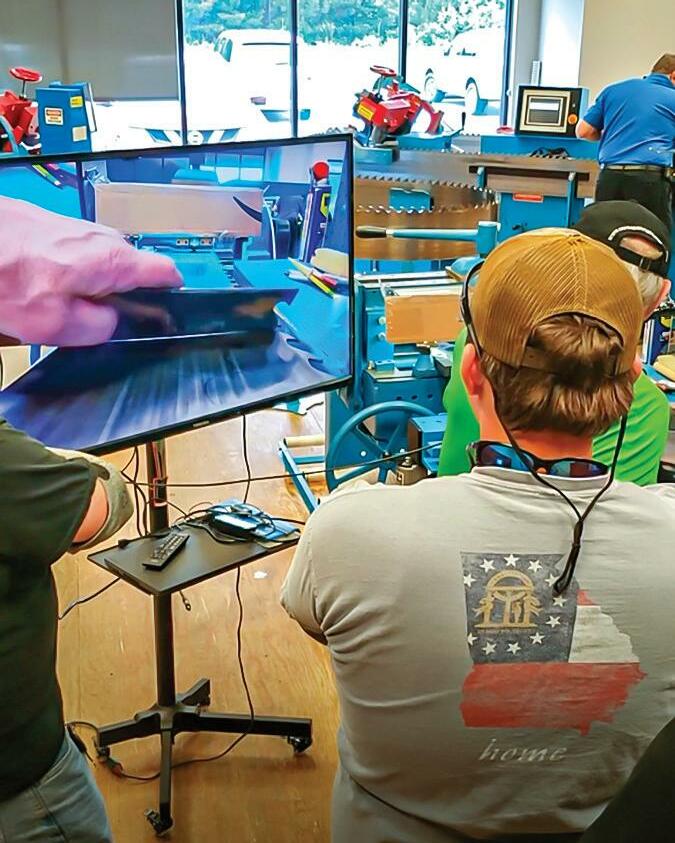

Foundational saw filing skills in an age of CNC and automation 16 ■ DECEMBER 2022 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

exact same spot. The look should be identical. If the shape of the light varies, it is time to take the next step and check your gauge against the inspection gauge.

The “inspection gauges” are not used in daily saw maintenance. These straight edges and tension gauge tools can be like a friendly port in a storm of frustration in

the filing room. If your saws are not behaving like you “expect,” it may be time to “inspect” the tools you are using to perform the blade reconditioning task and ensure that are not causing you more work than they are performing. A relatively minor investment in these tools could be recovered in helping prevent even a few

unscheduled saw changes.

Following some tried and true maintenance techniques and record keeping can be your calm in the storm of a difficult day. T P

David Purinton is VP Marketing at Burton Mills Solutions. E-mail: dave.purinton@ burtonmill.com.

18 ■ DECEMBER 2022 ■ TIMBER PROCESSING

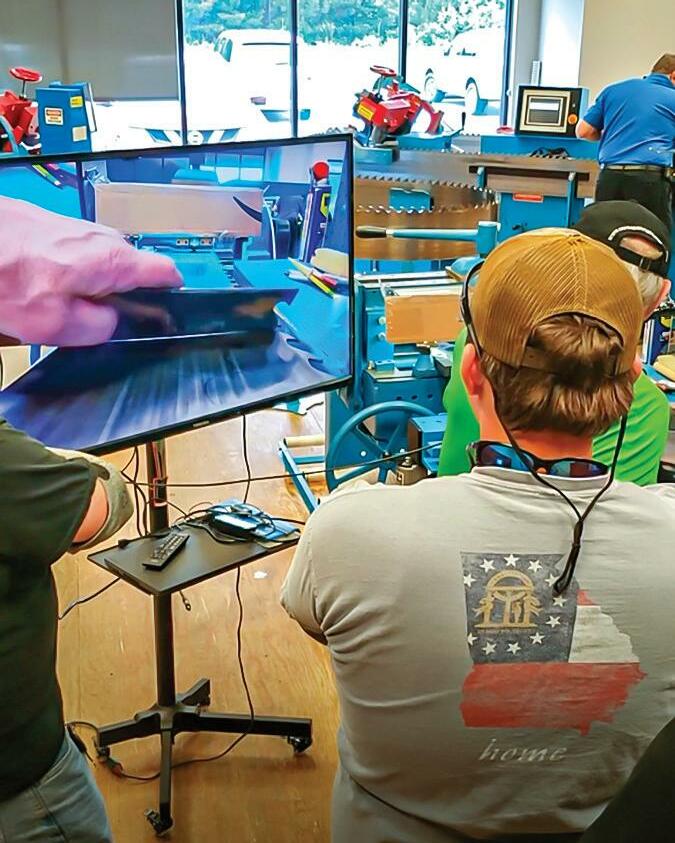

Benching on the big screen

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Is band saw really ready to run?

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CUTTINGTOOLS

ANDRITZ

The Andritz TurnKnife is a high-quality knife system that, due to its special design and manufacturing precision, produces chips of the best quality over a long period of time. The system is based on an easily manageable knife with two edges.

Produced from the highest quality alloy chromium steel, the knives are specially treated during manufacturing to provide a much longer edge life than conventional knives. The TurnKnife has a double-edge and is reversible which eliminates knife grinding. The patented shape design ensures precise and consistent knife location to maximize chipping performance.

Upgrading a chipper with the TurnKnife system improves chip quality and chipper performance with excellent economics.

BID GROUP

Long hours of research and development have led BID to create the most advanced disposable knife. From steel composition to ease of maintenance, no detail has been overlooked. We designed the Comact BLADE to be the toughest blade on the market with excellent resistance to abrasion and impact.

Offering fast and accurate blade positioning with its unique clamping design, our cutting tool system produces quality surface finish, leading to superior grading and full-length boards. Furthermore, the cleaning time of the contact surfaces is reduced.

With their unrivaled know-how, BID representatives are committed to work with you on-site, ensuring our systems meet and exceed the demanding requirements of a modern sawmill. Support is fast and responsive, and offered 24/7.

As opposed to competitors, BID is an OEM and manufacturing expert. We know knives, but we also know the equipment being used and have the expertise to find the cause of the issues quickly, if any.

Contact your BID representative today to learn more about our cutting tool system.

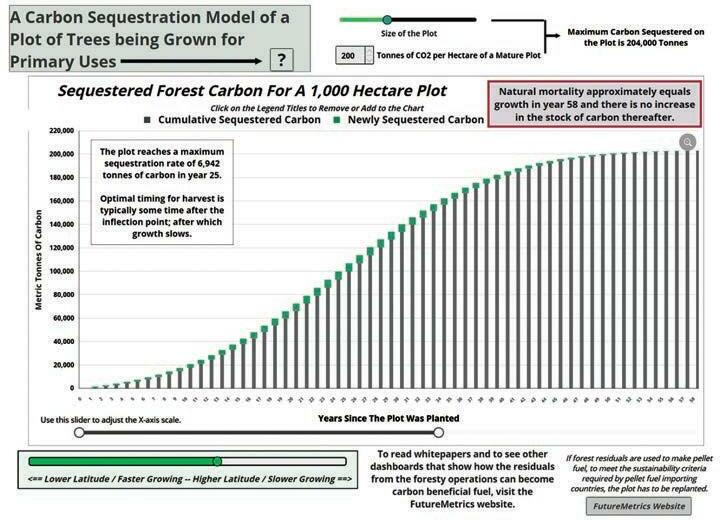

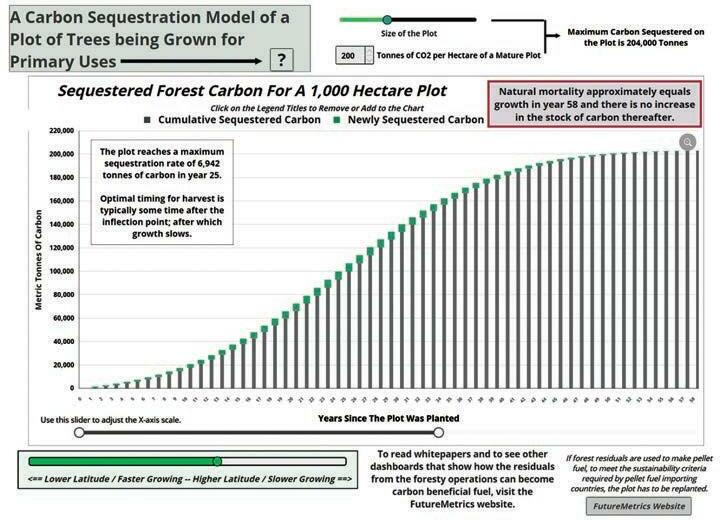

COLONIAL SAW

Colonial Saw, Inc., a leading distributor of advanced saw and knife grinding machinery, offers a hi-tech solution for sharpening a high volume of carbide saw blades. Sawmills, lumber manufacturers, and grinding and sharpening shops will benefit from its robot loading system that enables unattended and overnight grinding at a surprisingly affordable price.

The Premium-Loader, an 8-axis grinding machine, is built by global pioneer ABM Grinding Technologies. This new generation machine minimizes human labor with a robot and probing system, allowing for true unattended processing with superb accuracy and superior finish grind quality.

“We have several customers telling us being able to run Premium-Loader overnight with no personnel delivers dramatic productivity increases and boosts the bottom line,” says Dave Rakauskas, Vice President of Colonial Saw.

“Adding this machine allows our guys to program all our round saws in the morning and focus on bands, benching, and knife grinding the rest of the day. Colonial Saw’s service has been excellent, and we’re very happy we stepped up to this level of automation in our filing room,” says Andy, filing room

EDITOR’S NOTE: The following companies submitted these editorial profiles and images to complement their advertisements placed elsewhere in this issue. Please refer to those advertisements for web site and contact information. All statements and claims are attributable to the companies.

Andritz TurnKnife longer edge life

High-performance cutting tool system designed by BID.

20 ■ DECEMBER 2022 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Colonial Saw offers robotic saw service center.

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CUTTINGTOOLS

manager for Lampe & Malphrus Lumber.

“We’ve done 60,000 blades on our ABM robot in the first three years. We have 10 robotic grinders here and the ABM Premium runs as much or more than any of them,” says Mike Morette of Sharp Tool in Hudson, Mass.

Designed to meet the increasing demand for automation by today’s circular saw manufacturing and mill filing rooms, the Premium-Loader offers vast range of production capacity for round saw blades. It delivers a high ease-of-use factor with a user-friendly control system, web camera monitoring, live error notification and a familiar Windows platform. Shops will also appreciate its compact footprint and efficient power consumption. Any shop grinding 250 or more blades per week should seriously consider this ma chine. A detailed cost justification is available by request.

HANCHETT MFG.

Hanchett Mfg. Inc was established in 1889 and continues to produce conventional filing room equipment and tools for sawmills around the world. From our Model 410 and 414 band saw sharpeners to our stretchers, swages and shapers and back gauges, we can provide the tools that you need. For the users of inserted bit saws we have the industry standard Jockey Grinder, anvils and swages available.

We are also a major manufacturer of precision knife grinders for mills from coast to coast. Our Challenger and HAN models are found in any first class mill in the country. All of our equipment is made in Big Rapids, Mich. using American made parts.

Our equipment is sold by the top mill supply companies. Contact your favorite representative for help with Hanchett products.

OLESON SAW TECHNOLOGY

Oleson Saw and Iseli are pleased to announce the Iseli BNA100 Fully Automatic Stellite tipping machine for equipping saw teeth by a plasma welding technique. The BNA100 is the next generation of the Vollmer GPA and has many of the same mechanical operations but features a new Iseli controller. The BNA100 can use Stellite rod, Stellite wire spool or HSS wire spool. It can be seen in operation on you tube here: https://www.youtube.com/watch?v=oD-7s1jRSEc.

The BNA100 is capable of Stellite tipping band and circular saws. The Iseli BNA100 is extremely well built to hold up to the challenging day to day operations of a sawmill application. Plasma welding with inert gas guarantees a strong and homogeneous fusion between the stellite and saw. Tipping and annealing are both done with a single machine using the integrated annealing station.

Iseli is known for their Swiss Precision in their full line of saw filing equipment including CNC full-flood band saw sharpeners, automatic swaging and shaping machines, the RZ1 CNC auto bench and CNC oscillating dual side grinders.

22 ■ DECEMBER 2022 ■ TIMBER PROCESSING

Hanchett builds on solid foundation.

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Iseli BNA100 Plasma Stellite tipping machine

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

VOLLMER

The brand new grinding machines CS 860 (for tooth faces and tops) and CSF 860 (for tooth sides) from Vollmer are designed for machining carbide-tipped circular saw blades with diameters up to 860 mm (34 in.) in a single clamping operation.

Thanks to uniform and intuitive operation, users can learn how to program the machine in no time. Innovative measuring equipment, handling systems for unmanned machining, as well as networked data exchange via a standard IoT Gateway, automate the production processes for carbide-tipped circular saw blades with various tooth geometries.

Automation for lights out unmanned machining is possible with the Vollmer ND handling systems which can combine up to three grinding machines and can be equipped with up to 650 saw blades.

Smart grinding wheel management and operator error prevention could save your company valuable resources. The machines automatically detect the newly inserted saw teeth and machine them to size in an oscillating manner. The feed pawl registers broken teeth in order to prevent the grinding wheels from breaking and also determines the tooth pitch without having to enter it manually.

The duo of sharpening machines—CS and CSF 860—are used in companies that require carbide-tipped circular saw blades for the cutting of wood, metal or composite materials. Tool manufacturers can use the Vollmer machines to automate the production of large volumes and sharpening services are able to flexibly machine circular saws from different manufacturers and types. Sawmills, contract sawmills, furniture manufacturers and producers of plate materials use the grinding machines to resharpen carbide-tipped circular saw blades in-house quickly and efficiently.

“In wood and metal processing, the carbide-tipped circular saw is indispensable as one of the main cutting tools; furthermore, thanks to their properties, they can often be resharpened multiple times,” says Jürgen Hauger, CEO of the Vollmer Group. “With our CS 860 and CSF 860, we are offering two grinding machines that are not only easy to use, but which can also be used by our customers to reduce the total costs for sawing performance and in addition, conserve resources.”

WILLIAMS & WHITE

The Williams & White Hammerhead 3000 auto bench is an all-inone band saw processing center designed to automatically tension and level a band saw with ease. Standout features include: an easy saw load system featuring hide-away clamps, independent rigid tension and level heads, intuitive touch screen control with teach functionality, and a full light curtain safety system.

The precision measuring systems for level, tension and back allow the Hammerhead 3000 to efficiently work the band saw to exacting specifications.

24 ■ DECEMBER 2022 ■ TIMBER PROCESSING

CUTTINGTOOLS

The new Vollmer CS 860 and CSF 860 grinding machines for carbide-tipped circular saws

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Williams & White Hammerhead 3000 auto bench

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

ROUND WOOD ABOUT

By William Strauss

By William Strauss

There has been high-level discussion from some government policymakers in the EU (European Union) about restricting the use of “roundwood” as feedstock for pellet fuel. (Roundwood typically references the part of the stem of a tree that is not sawn into lumber.)

While the spirit of the policymaking exercise is properly grounded as a tactic to disallow deforestation and encourage the most efficient use of a renewing resource, a blanket exclusion of “roundwood” is misguided. This paper attempts to explain why. This paper also discusses the dynamics of forest growth and carbon sequestration.

First, there is no place for permanent deforestation anywhere in the forest products industry. The foundational and abso-

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Do we really want to exclude all roundwood from being used to make pellet fuel, given the integration of forest dynamics, wood-based products, and carbon sequestration?

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

lutely necessary condition that underpins the definition of wood as a renewableresource is that the stock of trees in a managed forest must remain constant or growing.

(A managed forest is essentially a tree farm with many plots in many stages of the growth cycle. Each plot regrows after every harvest. At the landscape level, across many plots, the new growth equals or exceeds the removals of mature trees and thus the net stock of wood and sequestered carbon, on a contemporaneous basis, is not depleted.)

This is both good for the environment and good for business. For owners of sawmills, pulp and paper mills, pellet mills, and other capital cost intensive factories that rely on a constant flow of logs and chips, matching their annual feedstock demand to the ability of the regional managed forests to supply wood is essential to the business model. It would make no sense for the investors of hundreds of millions of dollars to expect to deplete the project’s essential raw material and face cost pressure due to increasing scarcity and risk financial failure. Wood pellet exporters operate under these same constraints and have the added oversight of having to have independent certification that their raw material sources are sustainably managed.

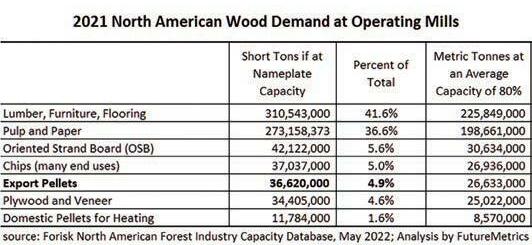

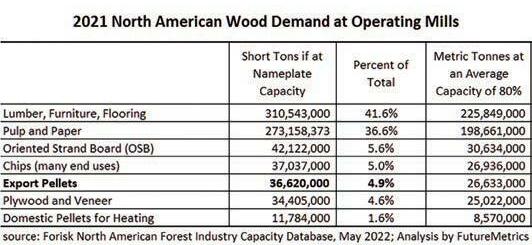

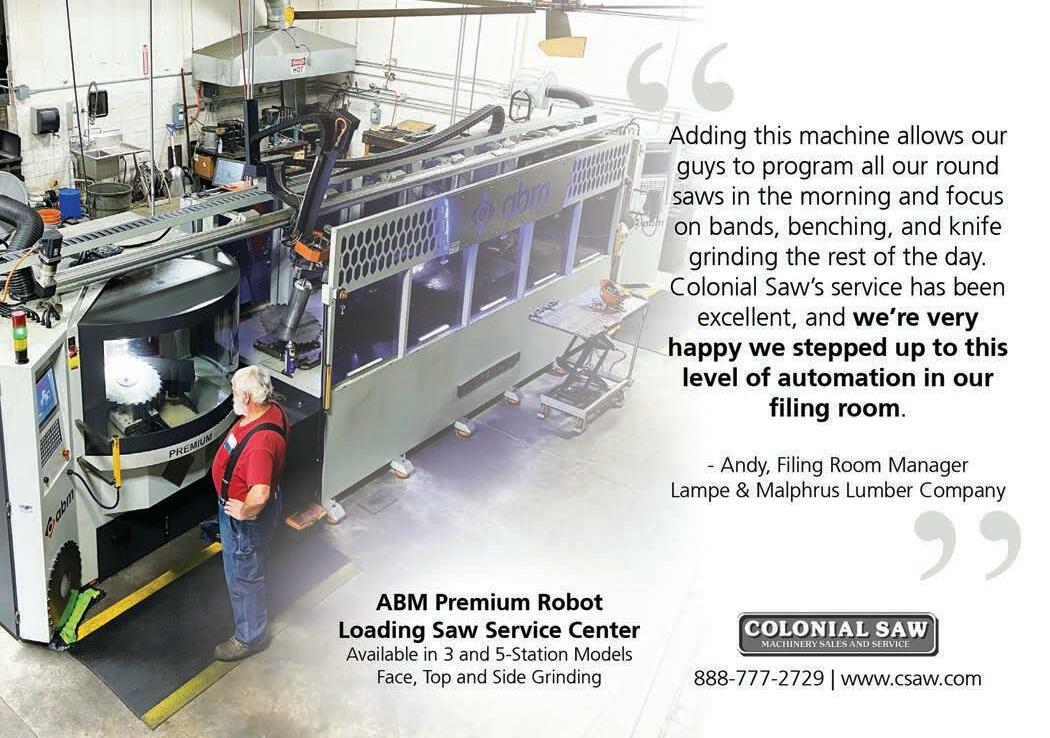

There are nearly 1,500 operating mills in North America (U.S. and Canada) that use wood as their primary input. North America’s managed forests supply hundreds of millions of metric tons per year for the production of products that many of us take for granted. Table 1 shows the estimated annual demand by industry segment.

It should be noted that lumber production produces significant quantities of residual byproducts that are often used as feedstock in the other listed wood products sectors. Thus, the total annual demand is not the sum of the individual demands since there is spillover of byproducts.

Table 1

When debarking a round sawlog and making it into square lumber, there are slabs, chips, sawdust and shavings from the planer that are produced as byproducts of the sawmilling operations. Depending on the size of the trees and whether it is hardwood or softwood, yields vary.

A typical breakdown of residual production is shown in Table 2. Every log will be different and differing species will also result is different residual amounts. The types of equipment used in the sawmill will also impact residual production versus lumber production. This table illustrates one potential outcome.

Table 2

The data suggests that sawmilling byproducts in North America probably exceeds 80 million metric tons per year. (Forisk North American Forest Industry Capacity Database, May 2022, and data from various sources about sawmill productivity)

Also note in Table 1 that the pellet export sector’s use of woody feedstock is a small proportion of the total. The ratio of sawmill residuals to roundwood used in pellet factories in North America varies widely from 0% to 100%. But since some proportion of an estimated 26.6 million tons per year of wood demand by the export pellet mills is from residuals, the demand for roundwood for export pellet production in North America is significantly less than 26.6 million tons per year.

What does make its way to pellet mills in the form of roundwood is the residuals from the harvests that are unsuitable for higher value use or are not marketable in the region of the harvest.

The highest value of a newly harvested tree is the sawlog portion. The working forest’s landowner has every incentive to maximize their profit from the harvest by maximizing the production of sawlogs. Using sawlogs for purposes other than making lumber almost never happens.

28 ■ DECEMBER 2022 ■ TIMBER PROCESSING

➤ 30 CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

It is not possible to make lumber from the whole tree. However, it is possible to use those lower value non-sawlog clean harvest residuals for making paper, cardboard, tissue, OSB, and

pellets. (Clean “white” chips are from debarked roundwood and also are mostly devoid of dirt.) Export pellet producers can tolerate some bark in the mix as well.

Of those potential users, the pellet producers have the most restricted ability to pay. (The offtake agreements between the pellet producers and the buyers sets the prices. There is a ceiling on the pellet fuel prices that buyers can afford to pay based on their revenue from power sales. That ceiling flows back through the supply chain and limits the price that pellet producers can charge for the pellets. The markets for pulp and OSB usually allow those producers to have the ability to pay a higher price for their wood than pellet producers.)

In other words, if there is a pulp mill or OSB mill in the same wood basket as a pellet mill, the pulp and OSB mills can afford to pay a higher price for their chips and roundwood than pellet mills. Pellet mills should not be sited near those types of mills.

Bottom line is that pellet mills are bottom feeders! They take what is left over that no one else wants.

If no other buyers exist that are willing to pay a higher price for the lower value parts of the tree, the pellet fuel factory takes

30 ■ DECEMBER 2022 ■ TIMBER PROCESSING 28 ➤ CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

much of what is left over from a harvest; a harvest that was motivated by sawlog sales. Similarly, if there are no other buyers willing to pay a higher price for the sawmill byproducts, they take those as well. (Distance from the harvest site or the sawmill to the end user matters. Longer distances [more diesel fuel] add significant cost to the delivered feedstock. Longer distance also increases the carbon footprint of the material.)

Managed forest plots are also often thinned at some point early in their growth cycle. The removal of relatively young trees that are diseased, not growing straight, or are too close to other healthier trees improves the crop in general. Those thinnings are typically not suitable for a sawmill but can be suitable for pulp and paper mills or OSB mills, and, if there are no other buyers willing to pay a higher price, are suitable for pellet mills.

To suggest that all roundwood be excluded from pellet feedstock entirely misses the dynamics of how forests are managed, the costs of transporting roundwood longer distances, and how the different parts of a tree can be used for different products.

Pellet producers perform a valuable service by offering a market for residuals that otherwise would rot, perhaps be burned in slash piles, or may have to be landfilled.

l The wood pellet industry ensures that not only 100% of the harvested tree is utilized, but that the whole tree is processed to extract its highest value, with quality logs heading to the sawmill, “and then lower quality logs can go to chips or to other residual uses such as wood pellets.”

(Excerpted from “Power of Pellets: Responsible Sourcing” by Gordon Murray)

SEQUESTRATION

NGOs and policymakers are rightly concerned about the sustainability of forests and the highest and best use of those valuable renewing resources. While some acknowledge that forests can be sustainably managed and that there is a responsible use for some roundwood as feedstock for pellet fuel, some also question any harvest because, they say, it removes a valuable carbon sink.

As noted at the beginning of this paper, permanent deforestation cannot be supported in any way for the production of any product (lumber, furniture, paper, pellets, etc.). If the annual net growth of new wood across the landscape is being reduced by poor or non-existent forest management in any region, those logs should be subject to intense scrutiny and likely

32 ■ DECEMBER 2022 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

deemed not in compliance.

But, as was noted earlier, mills that use wood depend on a steady long-term supply and relatively stable prices. That means that they have to match their demand to the ability of the region around them to provide continuous supply without the risk of scarcity. In other words, the growth of new wood has to be equal to or exceed the removals.

If the value added to the sawlogs is local and the sawmills are capital intensive and not portable, then there is every incentive for the mills to support responsible forest

management. This certainly describes most of the industry in North America and in many other areas of the world.

A corollary to the “growth equaling or exceeding removals” condition is that the stock of carbon held across the forest landscape will not be depleted. (FutureMetrics has several papers discussing this concept.)

But what about just leaving the forests, including managed working forests, alone and letting them continue to soak up carbon?

The problem with that argument is that

forests do not continue to soak up carbon forever. At some point, a forest will reach a growth equilibrium. Essentially, the morality rate will equal the growth rate and the quantity of wood (and carbon) will reach a limit.

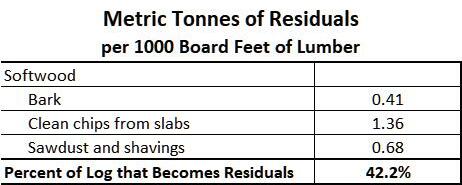

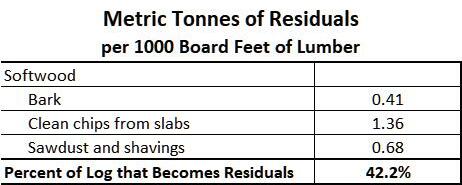

The image on page 30 illustrates this. The image is from a new interactive dashboard crated by FutureMetrics that allows the user to experiment with some basic inputs to the growth model. The model is based on a typical S-curve growth function. Different species, geographies, etc. will create growth curves that are not so mathematically perfect. But the pattern in reality is no different than the model: Early growth in the stock of wood (and thus carbon) accelerates as young trees grow. Early growth is more rapid than later growth. Eventually the net stock reaches a nogrowth equilibrium.

The chart shows the carbon sequestration dynamics over time of a plot. The size of the plot can be changed but in general it is small enough to be considered one of many plots in a larger landscape.

The dashboard settings as shown result in a maximum sequestration rate in year 25 (this can be changed when live by using the green colored slider in the bottom left that changes the growth rate). As the plot approaches its maximum density, the rate of conversion of CO2 to carbohydrates declines. Around year 58, the plot hits its limit. Leaving this plot alone after year 58 does nothing in terms of increasing the amount of carbon that is sequestered.

For a managed forest, the decision to harvest will likely be after the inflection point but well before the zero-growth milestone. At some point, the low growth rate no longer supports waiting any longer to convert the resource into sawlogs and other types of woody feedstocks. Some may say that the harvest of that plot creates a carbon debt that will take decades to repay. This argument does not add up empirically if the plot is one of many in the larger forest landscape.

Across the larger landscape the relevant constraint is that the net growth has to equal or exceed the removals. Across multiple plots, trees are in many stages of their growth cycles. All of them are absorbing carbon. If the net absorption of the untouched younger plots equals (or exceeds) what is removed in the harvested plot, there is no depletion of the net stock of carbon held in the forest and thus no carbon debt.

For example, if the harvested plot holds 200,000 tonnes of carbon but the forest at large absorbs 200,000 tonnes within a

34 ■ DECEMBER 2022 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

time period that is less than the time until the next plot is harvested, then there is essentially no depletion of carbon. Are these numbers plausible?

British Columbia (BC), Canada, is one of several major wood growing regions in North America. Most of the forests in BC are owned and managed by the government (about 95%). BC, after careful analysis by government foresters, sets a maximum annual allowable cut (AAC) that is always less than the annual new growth. The AAC in BC equates to more than 100,000 tonnes of

wood every day (a total of about 50 million cubic yards per year). So, using the dashboard example, new growth in BC completely replaces the removal from 1000 hectares in a matter of days.

This is in stark contrast to the carbon debt proponents who say that it takes many decades to repay.

The state of Georgia in the U.S. has 21,979,000 acres (8,894,000 hectares) of private forestland that supports about 185 sawmills, pulp and paper mills, pellet mills, and other wood-based manufacturing. Those mills receive a continuous sup-

ply of raw materials, and many have been for many decades. That is only possible if the managed forestland produces as much (or more) new wood on a daily basis as is removed on a daily basis.

In forests that are professionally managed to produce a continuous supply of raw materials, the net stock of wood in the forest is not shrinking and therefore there is no carbon debt from a harvest.

CONCLUSION

Anyone who uses tissue (most of us do at least once a day!), has furniture made from wood, who lives in a building with wooden components and wooden cabinets, gets packages from online retailers, walks on wooden floors, and reads books is supporting the harvest of trees. Different parts of the tree become different goods that most of us take for granted.

The market provides very strong price signals that define the cascade of uses. And, as this paper has shown, there are some parts of a harvest or of sawlogs left over that have no higher or better use other than to become feedstock for pellet fuel. Some of those parts are stem sections or large branch sections that are “roundwood.”

Policy stipulations about roundwood that result in increasing the proportion of the tree that has no commercial value, and is thus wasted, is certainly not the intent of policymakers or enlightened NGOs.

The carbon benefits of forests are noncontroversial. And, as this paper has shown, the resource, if managed as it should be (and is in many locations), can be used without depleting the sequestered carbon.

Given that much of the harvest becomes long-lived wooden materials, the working forest is a conduit to semi-permanent sequestration. The fuel pellets that are produced from the leftovers from the declining value adding cascade of uses, some from sawmill residuals and some from forest residuals in the form of roundwood, contribute significantly to the generation of renewable carbon beneficial energy and heat.

The continuous turnover of working forests combined with an environmentally and economically motivated full use of the harvested tree and its byproducts is the foundation for the carbon beneficial pellet industry. Rational policy should not change that. T P

(William Strauss, PhD, is President of FutureMetrics. Visit futuremetrics.info. Multiple papers, many with live, interactive dashboards, are available.)

36 ■ DECEMBER 2022 ■ TIMBER PROCESSING CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

SFPA Elects 2022-2023 Officers

Southern Forest Products Assn. (SFPA) elected its new officers during the board of directors session at the association’s annual meeting October 21 in Nashville. The 2022-23 SFPA officers are Chairman of the Board, Mark Richardson, The Westervelt Co.; Vice Chairman of the Board, Rich Mills, Hood Industries, Inc.; Treasurer, Pino Pucci, LaSalle Lumber Co.; Immediate Past Chair, Will Lampe, Lampe & Malphrus Lumber Co. SFPA also gave a big note of thanks to outgoing board officer and immediate past chair Craig Forbes of Weyerhaeuser. Left to right, Pino Pucci, Mark Richardson, Rich Mills, Will Lampe, and Eric Gee, SFPA executive director.

ATLARGE 38 ■ DECEMBER 2022 ■ TIMBER PROCESSING

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

KDS Partners With New York Blower

KDS Windsor and The New York Blower Co. (NYB) are opening a manufacturing facility in Philadelphia, Miss. as a joint venture.

KDS currently has a plant in Hendersonville, NC, but decided to expand due to increased demand. This new facility will manufacture new kilns, and provide service and replacement parts for existing kilns, ventilation systems and fans.

With the new facility in Mississippi, both companies will be able to increase manufacturing capability, diversify their labor force, and gain greater accessibility into Texas and the Southeast. This allows for quicker service, decreased lead times and less costly freight.

The building in Philadelphia has 150,000 sq. ft. of indoor space, and 100,000 paved sq. ft. of outdoor storage. The outdoor storage space will serve KDS especially well as they assemble kiln components prior to shipment. The building includes significant overhead lifting capacity, furnished office space,

and a recently upgraded power supply. Its layout meets the needs for both KDS and NYB with the opportunity for future expansion by both companies.

John King Chains Wins MHEA Award

John King Chains won the Supplier of the Year accolade at the annual Materials

within the materials handling industry is a fantastic achievement. We thank our customers, suppliers, partners and all our employers for making this possible.”

John King Chains Group is a fifth-generation family-owned business, with the head office and principal manufacturing in Great Britain, along with operations in Africa, Asia Pacific, Central Europe, North America, and South America.

The company currently focuses on the design and manufacturing of chains, sprockets and associated products; laser, fabrication, manufacturing, welding and machining; site services (installation and servicing); project management; and conveyors and systems.

David Wadsworth, Managing Director, adds, “It is fantastic to achieve such a prestigious award and one that confirms that our continual reinvestment into best manufacturing equipment and tech-

MACHINERYROW 40 ■ DECEMBER 2022 ■ TIMBER PROCESSING ➤

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

45

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

02/22 NORTH AMERICA ■ United States ■ Canada ■ North Carolina ■ Georgia ■ Ontario Manufactures Kiln-Dried 4/4 Red and White Oak, Poplar, Ash and Cypress Contact: Linwood Truitt Phone (912) 253-9000 / Fax: (912) 375-9541 linwood.truitt@beasleyforestproducts.com Pallet components, X-ties, Timbers and Crane Mats Contact: Ray Turner Phone (912) 253-9001 / Fax: (912) 375-9541 ray.turner@beasleyforestproducts.com Beasley Forest Products, Inc. P.O. Box 788 Hazlehurst, GA 31539 beasleyforestproducts.com WANT TO GET YOUR AD IN OUR NEXT MARKETPLACE? Call or email Melissa McKenzie 334-834-1170 melissa@hattonbrown.com WOOD PRODUCTS MARKETPLACE We produce quality 4/4 - 8/4 Appalachian hardwoods • Red Oak, White Oak, Poplar • Green Lumber: Air Dried, Kiln Dried Timbers & Crossties • Hickory, Sycamore, Beech, Gum & Elm • Custom Cut Timbers: Long lengths and wide widths Sales/Service: 336-746-5419 336-746-6177 (Fax) • www.kepleyfrank.us Buyers & Wholesalers Next closing: January 5, 2023 ■ Kentucky ■ Minnesota HAROLD WHITE LUMBER, INC. MANUFACTUREROFFINEAPPALACHIANHARDWOODS (606) 784-7573 • Fax: (606) 784-2624 www.haroldwhitelumber.com Ray White Domestic & Export Sales rwhite@haroldwhitelumber.com Cell: (606) 462-0318 Green & Kiln Dried, On-Site Export Prep & Loading Complete millworks facility, molding, milling & fingerjoint line STACKING STICKS FOR SALE AIR-O-FLOW profiled & FLAT sticks available Imported & Domestic DHM Company - Troy, TN 38260 731-446-4069 Fax: 707-982-7689 email: kelvin@kilnsticks.com www.KILNSTICKS.com ■ Tennessee WANT TO GET YOUR AD IN OUR NEXT MARKETPLACE? Call or email Melissa McKenzie 334-834-1170 melissa@hattonbrown.com CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Top Wood Jobs

niques over the years was the right decision. We are pleased to also inform our clients that we have further exciting plans in the pipeline and one we aim to announce to the industry in early 2023!”

Carbotech Names Southern U.S. Manager

Matthew Phillips is joining Carbotech Group as Account Manager – U.S. South. His expertise will allow him to provide outstanding guidance and help customers with their projects and their needs to improve their processes.

Phillips will represent Carbotech and Autolog products.

Chile’s Foraction Orders

Sawmill From USNR

USNR has received an order for a complete sawmilling system from Chilean company, Foraction Chile. This highly advanced production line is designed to process Radiata Pine and will be installed

at a greenfield site in the Los Rios region about 800 km south of Santiago.

The scope of the contract ranges from the debarker/log sorter optimizer through the log breakdown equipment, finishing with the trim/sort/stack line. This project marks one of USNR’s most comprehensive undertakings outside of North America and Europe.

The saw line will be a European-style Merry-Go-Round line that has proven to be very successful in Chile throughout the years. The primary sawing machines will be Sawmaster 1600 band saws arranged in a quad configuration. In this iteration of USNR’s ever-evolving Merry-Go-Round concept, there will be an additional chipper canter and a Circular Saw 700 gang saw.

The saw line will be backed up by a Catech XT edger optimizer line. The edger will be equipped with an additional twinblade split saw for maximum versatility.

A 45-bin green sorting and stacking line completes USNR’s portion of the project. Main components in the sorting line include a Revolver Lug Loader,

Multi-Track Fence, and a multi-saw trimmer. The stacker line features a catching lug tier-forming table in front of USNR’s Low-Profile Stacker with an overhead tier management system to ensure maximum productivity.

In addition to the equipment supplied by USNR, USNR’s partner in Chile, Solecia, will be responsible for supplying the log sorting line, log infeed equipment, and residual handling equipment.

SmartMill Breaks Into Eurozone

SmartMill confirmed the signing of a new contract that includes the sale and installation of the Smart Trim system to Ante-Holz GmbH of Germany.

The company is currently in discussions with other mills in Europe as it expands global operations.

The Smart Trim combines three pieces of equipment in one: a lug loader, a positioning system and a multi-saw trimmer. The result of this technology is the capability

lengths.

TIMBER PROCESSING ■ DECEMBER 2022 ■ 45

MACHINERYROW Call Toll-Free: 1-800-669-5613 LUMBERWORKS LUMBERWORKS Recruiting Services Executive – Managerial – Technical - Sales JOHN GANDEE & ASSOCIATES, INC Contingency or Retained Search Depending on Circumstances / Needs “Your Success Is Our Business” Serving the Wood Products and Building Materials Industries For more than 26 years. 512-795-4244 Call or Email me anytime! john@johngandee.com www.johngandee.com Austin, Texas 3220 3802 Importers and Distributors of Tropical Hardwood Kiln Sticks

lowest cost per cycle”

Industries

GREENWOOD KILN STICKS Importers and Distributors of Tropical Hardwood Kiln Sticks

lowest cost per cycle”

greenwoodimportsllc@gmail.com

127 EMPLOYMENTOPPORTUNITIES

to produce infinite lumber

“The

GW

www.gwi.us.com Dennis Krueger Jackie Paolo 866-771-5040 866-504-9095 greenwoodimportsllc@gmail.com jackie@gwi.us.com

“The

GW Industries www.gwi.us.com Dennis Krueger Jackie Paolo 866-771-5040

jackie@gwi.us.com

and Staffing George Meek

PROFESSIONAL SERVICES 13519 1615 BAND SAW CLEANING MACHINE Brand New Construction VISIT: metalhealthmachinery.com 803-307-8773 13837 40 ➤ CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

Recruiting

geo@TopWoodJobs.com www.TopWoodJobs.com (360) 263-3371 3779

MAINEVENTS

JANUARY

10-11—Missouri Forest Products Assn. winter meeting, Courtyard by Marriott, Jefferson City, Mo. Call 573-634-3252; visit moforest.org.

FEBRUARY

6-8—Indiana Hardwood Lumbermen’s Assn. Convention & Exposition, Indianapolis Downtown Marriott, Indianapolis, Ind. Call 317-288-0008; visit ihla.org.

22-26— Appalachian Hardwood Manufacturers annual meeting, Ponte Vedra Inn & Club, Ponte Vedra, Fla. Call 336885-8315; visit appalachianhardwood.org.

MARCH

1-2—Ohio Forestry Assn./Ohio Tree Farm annual meeting, Marriott Northwest, Dublin, Ohio. Call 614-497-9580; visit ohioforest.org.

2-5—Delhiwood 2023, India Expo Centre & Mart, Greater Noida, India. Call+91-80-4250 5000; visit delhi-wood.com.

8-10—2023 SLMA & SFPA Spring Meeting & Expo, Hyatt Regency Savannah, Savannah, Ga. Call 504-443-4464; visit slma.org.

17—OptiSaw 2023, Hotel Le Concorde & Restos Plaisirs Group, Quebec City, QC, Canada. Visit optisaw.com.

22-24—Hardwood Manufacturers Association's National Conference and Expo, JW Marriott Nashville, Nashville, Tenn. Call 412-244-0440; visit hmamembers.org.

28-30—Kentucky Forest Industries Assn. annual meeting, Embassy Suites, Lexington, Ky. Call 502-695-3979; visit kfia.org.

29-31—International Wood Products Assn. 67th World of Wood Convention, Hyatt Regency, Savannah, Ga. Call 703820-6696; visit iwpawood.org.

APRIL

3-5—American Wood Protection Assn. annual meeting, Loews Ventana Canyon Hotel, Tucson, Ariz. Call 205-733-4077; visit awpa.com.

16-18—Western Wood Products Assn. annual meeting, Embassy Suites PDX - Portland Airport, Portland Ore. Call 503224-3930; visit wwpa.org.

MAY

15-19—Ligna: World Fair For The Forestry And Wood Industries, Hannover Exhibition Center, Hannover, Germany. Call +49 511 89-0; fax +49 511 89-32626; visit ligna.de.

19-20—Northeastern Forest Products Equipment Expo (Loggers’ Expo), Cross Insurance Center, Bangor, Maine. Call 315369-3078; visit northernlogger.com.

JUNE

9-10— PA Timber Show, Russell E. Larson Agricultural Research Center, Pennsylvania Furnace, Penn. Call 814-8632873; visit agsci.psu.edu/timber.

10-13—Assn. of Consulting Foresters of America annual conference, The Graduate Eugene Hotel, Eugene, Ore. Call 703548-0990; visit acf-foresters.org.

AUGUST

23-25-SFPA Forest Products Machinery & Equipment Expo, Music City Center, Nashville, Tenn. Call 504-443-4464; visit sfpaexpo.com.

Listings are submitted months in advance. Always verify dates and locations with contacts prior to making plans to attend.

A

D

L

I

N

K

This issue of Timber Processing is brought to you in part by the following companies, which will gladly supply additional information about their products.

ADVERTISER

PG.NO. PH.NO.

A W Stiles Contractors 38 931.668.8768

Andritz Iggesund Tools 2 813.855.6902

Arkansas Economic Development Comm 13 800.275.2672

Automation & Electronics USA 14 704.200.2350

BID Group 48 843.563.7070

Burton Mill Solutions 3 800.426.6226

Calibre Equipment 43 +64 21 586 453

California Saw & Knife Works 38 415.861.0644

Carbotech-Autolog 8 819.252.2273

Ceratizit S.A. 30 +352 31 20 85 1

Colonial Saw 35 888.777.2729

Cone Omega 31 229.228.9213

Corley Manufacturing 35 423.698.0284

Down River Cryogenics 32 866.616.1405

Esterer WD GmbH 29 +49 8671 503 0

FiberPro 28 501.463.9876

G F Smith 6 971.865.2981

Hanchett Manufacturing 37 800.454.7463

Holtec USA 7 800.346.5832

Industrial Autolube International 18 403.754.3646

Ledinek Engineering 33 +386 2 61300 51

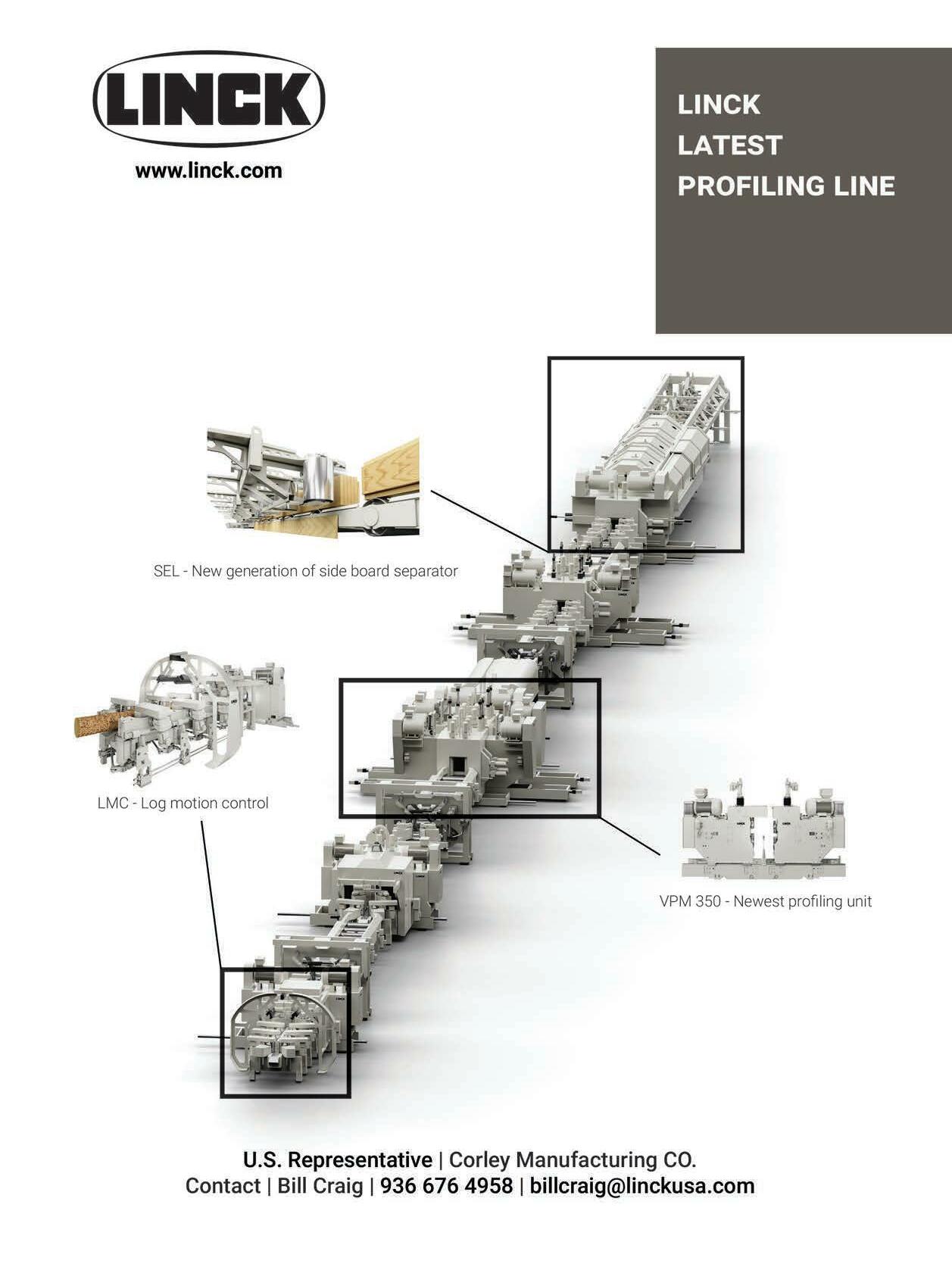

Linck 39 936.676.4958

Linden Fabricating 38,40 250.561.1181

Mebor 41 +386 4 510 3200

Metal Detectors 31 541.345.7454

MiCROTEC 15 541.753.5111

Mid-South Engineering 40 501.321.2276

Nelson Bros Engineering 37 888.623.2882

Oleson Saw Technology 23 800.256.8259

Opticom Tech 30 800.578.1853

Premier Bandwheel 18 604.591.2080

Real Performance Machinery 25 843.900.9494

Sering Sawmill Machinery 32 360.687.2667

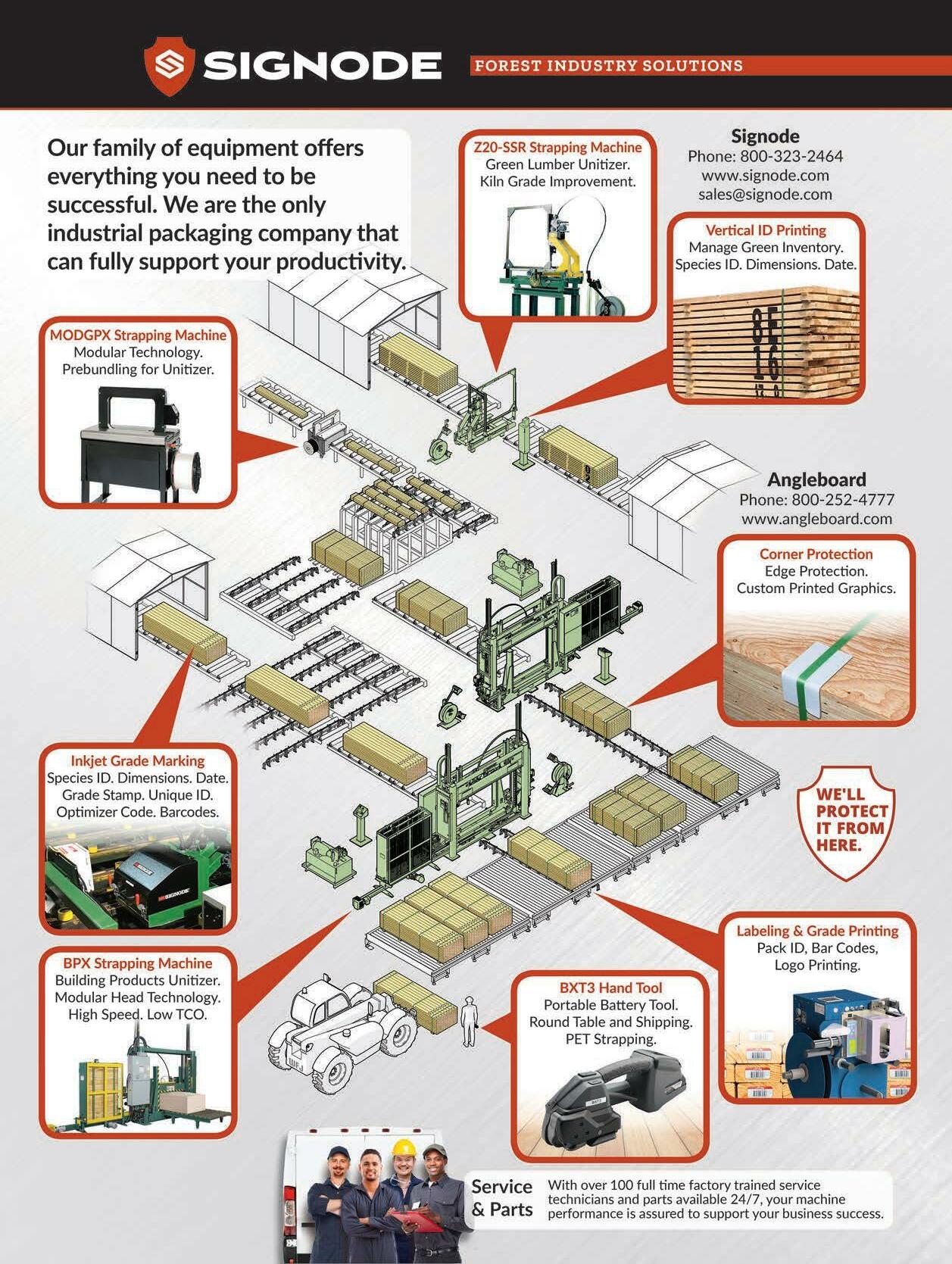

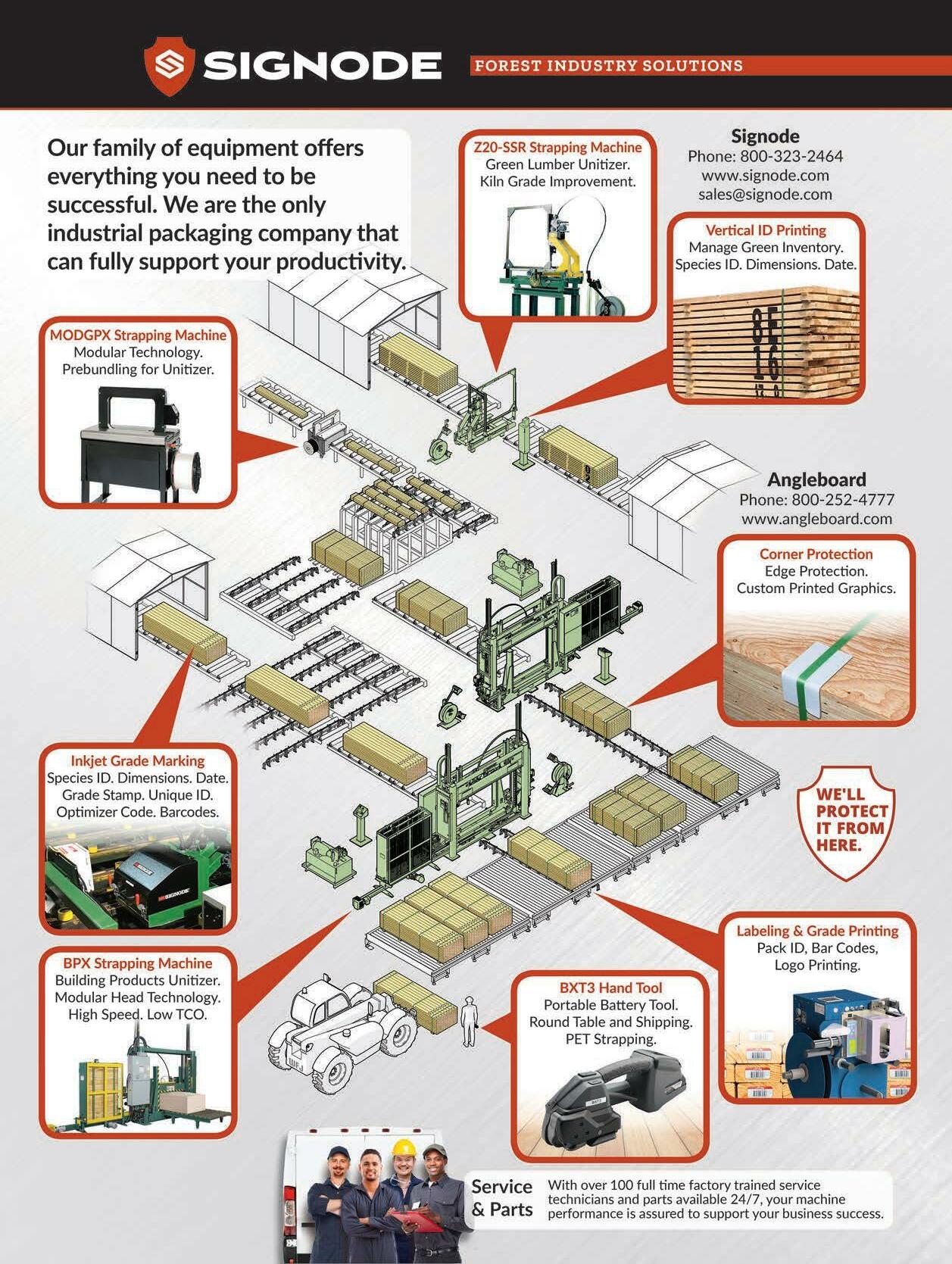

Signode 17 800.323.2464

Smith Sawmill Services 47 800.598.6344

T S Manufacturing 36 705.324.3762

Telco Sensors 21 800.253.0111

USNR 34 800.289.8767

Vecoplan 42 336.252.4824

Vollmer of America 19 412.278.0655

Williams & White Equipment 9 888.293.2268

Wood-Mizer 42 866.477.9268

46 ■ DECEMBER 2022 ■ TIMBER PROCESSING

●

●

●

is a free service for advertisers and readers. The

liability for errors or omissions.

●

●

ADLINK

publisher assumes no

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

CLICK HERE IF YOU HAVE NOT ALREADY OPTED IN!

By William Strauss

By William Strauss