Hancocks extensive premium Gin portfolio boasts fine brands from around the world including England, Ireland, Scotland, the Netherlands, France, Italy, Japan, Australia and New Zealand.

PAIR WITH THE PREMIUM EAST IMPERIAL RANGE, PROUDLY MADE IN NEW

ZEALAND.

Victoria Wells Editor – Drinksbiz victoria@drinksbiz.co.nz

ZEALAND.

Victoria Wells Editor – Drinksbiz victoria@drinksbiz.co.nz

WELL, THAT was a bit of a whirlwind start to 2023.

I think most of us were just hoping for a summer with no lockdowns or other sudden surprises, and with locals and tourists out and about enjoying the sunshine and spending up large. You know, a proper summer.

Instead, Jacinda Ardern got back from holiday and swiped left on continuing to lead the country and then Chris Hipkins was less than a week into the job before he found himself dealing with catastrophic weather events in the central and upper North Island.

As I write, we’re still in the grips of it as hundreds of homes and businesses try to clean up after the torrential rain of recent days. (They could tell us there’s a swarm of locusts coming next and it probably wouldn’t surprise anyone.)

Change is certainly the one constant in these unpredictable times.

From a drinks industry point of view, some of the biggest changes continue to come in the no/low category, and our feature in this issue looks at recent research that tracks this sector’s trajectory

perception of flavour, aroma and texture to figure out if a certain consumer profile will like a new food or drink, providing instant insights and massively reducing market testing time.

2022 Invivo X SJP Sauvignon Blanc

and just how fast it is expected to grow over the next few years (see page 16). The other news that caught my eye while putting this issue together is a New York company that has combined artificial intelligence with the world's largest sensory database to develop an AI that can predict consumer preferences when it comes to new food and beverage products (see page 21). Essentially, the AI has been built to model human sensory

It comes hot on the heels of the AI-powered chatbot ChatGPT, which is already making waves globally for its incredible potential and this is all no doubt the tip of the iceberg when it comes to what we’ll see AI do in the future. Maybe one that keeps an eye out for locusts would be useful.

Enjoy the issue, Victoria.

Partly because I’m an SJP fangirl from WAY back, but mainly because this is a simply delicious, intensely fruity wine. (Pg 26)

Sprig + Fern Summer Chill Hazy

It might not have felt like summer at times, but this new offering from Nelson brewers Sprig + Fern transports you straight to the back deck with a sea view and a smell of barbceue in the air. (Pg 40)

Scapegrace Uncommon Japanese Yuzu Lemon Vodka

This limited edition release from New Zealand distillery Scapegrace heroes the distinctive yuzu fruit from Japan, as grown in Horowhenua by Neville and Junko Chun. A bright, refreshing and deliciously citrus twist on a classic vodka. (Pg 52)

They could tell us there’s a swarm of locusts coming next and it probably wouldn’t surprise anyone.

PUBLISHER

Karen Boult karen@boult.co.nz

+64 21 320 663

EDITOR

Victoria Wells victoria@drinksbiz.co.nz

+64 27 575 9021

DESIGNER

Lewis Hurst lewis@hurstmedia.nz

+64 21 146 6404 hurstmedia.nz

ADVERTISING

Roger Pierce advertising@drinksbiz.co.nz

+64 274 335 354

drinksbiz.co.nz

Associate Member (NZ)

Drinksbiz is published every second month by Trade Media Limited. The contents of Drinksbiz are copyright and may not be reproduced in any form without the written permission of the publisher.

Please address all editorial, subscription and advertising enquiries to Trade Media Limited, P O Box 37745, Parnell, Auckland.

FEBRUARY

Saturday 11 February

Marlborough Wine & Food Festival

New Zealand’s longest-running wine and food festival returns for 2023 at Renwick Domain. marlboroughwinefestival.com

Friday 17 – Saturday 18 February

Wairarapa Wines Harvest Festival –Carterton

A celebration of Wairarapa wines, with top wineries from around the region. To be held at ‘The Cliffs’ on the banks of the Ruamahunga River. wairarapaharvestfestival.co.nz

MARCH

Thursday 2 – Sunday 5 March

Indulge Festival – Auckland

A new four-day festival showcasing New Zealand food, wine, design and music. To be held around Auckland’s Silo Park, Wynyard Point and Jellicoe Harbour. indulgeauckland.co.nz

Saturday 4 – Sunday 5 March

DramFest – Christchurch

New Zealand’s largest whisky education and tasting festival is set to take place following the COVID postponement of the 2022 event. dramfest.co.nz

Saturday 4 March

Kegkoura – Kaikōura

KaikŌura craft brewery Emporium Brewing host the region's very own craft brewing festival. Tickets available from the website. emporiumbrewing.co.nz/kegkoura

Saturday 4 March

Marchfest – Nelson

The 15th annual Marchfest will showcase a wide range of craft beer from the Tasman region and around New Zealand. To be held at Founders Park. marchfest.com

Saturday 11 March

Wildfoods Festival – Hokitika

The iconic Wildfoods Festival returns to Hokitika for 2023 with wild food, a live music line-up including Sir Dave Dobbyn and a partnership with Garage Project. wildfoods.co.nz

Saturday 11 – Sunday 12 March

Gindulgence – Christchurch

A selection of some of New Zealand’s leading gin distillers at Ilam Homestead, with gin, cocktail and tonic masterclasses. gindulgence.co.nz

APRIL

Saturday 1 April

Harvest Hawke’s Bay Food & Wine Festival

A new food and wine event to be held riverside on Tuki Tuki Road in Hawke’s Bay. Sixteen wineries and eight eateries will showcase their wine and food at this day-long event. harvesthawkesbay.com

MAY

Saturday 6 – Sunday 7 May

The Great NZ Food Show – Hamilton

A two-day consumer show of food, beverage and culinary products to be held at Claudelands in Hamilton. Exhibitor details available on the website. greatnzfoodshow.com

Friday 26 – Sunday 28 May

The Food Show – Wellington

The country’s largest consumer culinary event returns to Wellington over three days at Sky Stadium. Exhibitor details available on the website. foodshow.co.nz

Note: While event details were correct at time of print, we recommend checking individual event websites for the latest updates.

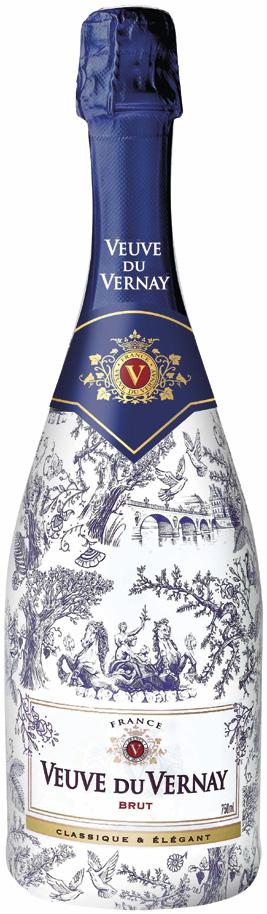

SPARKLING WINE brand Veuve du Vernay has a long and successful legacy in New Zealand – since arriving here in 1997 it has built a loyal consumer following to become the country’s number one French sparkling wine1

A long-term partnership with local distributor EuroVintage has seen the international brand become the go-to sparkling for New Zealand consumers seeking an authentically French experience, but it is far from resting on its laurels.

“We are a French brand, but we are rooted in New Zealand,” says Xavier Pignel-Dupont, the APAC Managing Director for Castel Group, which owns Veuve du Vernay. “We have a long story with Kiwis, and a long story with EuroVintage too. When you have such a long partnership it means that together we are really building into the long-term.”

This long-term vision includes plans this year to increase consumer and brand awareness through digital campaigns, a new local consumer website, in-store activity and highlighting innovative NPD elements across the range.

The Veuve du Vernay range of sparkling wines is made in the famed French wine region of Burgundy and was founded in the 1960s by winemaker Robert Charmat. He named his wines for a widow in the town of Vernay who helped his father during his own early winemaking days. ‘Veuve’ in French means ‘widow’.

Veuve du Vernay is made by the renowned house of Patriarche, which is owned by Castel Group, the largest producer of French wines. It is sold in 70 markets around the world and is a top performing French sparkling wine in the U.S. and number one in New Zealand.

Here, the Veuve du Vernay range includes a Brut, Brut Rosé, Ice, Ice Rosé, and a recently released 0% alcohol expression.

As Veuve du Vernay builds on its growth in New Zealand it is drawing on research commissioned by Castel Group to better understand the Kiwi sparkling wine consumer.

“We wanted to understand more about shopper motivation and the key brand attributes that consumers found important when choosing Veuve du Vernay,” explains Kerry Wheeler, GM Sales and Marketing at EuroVintage.

Carried out by Sapien Research in mid-2022, the Sparkling Wine Consumer Analysis2 revealed that Veuve Du Vernay buyers are more likely to have a higher income, buy sparkling wine more frequently than other sparkling wine buyers and they associate the brand with a wide variety of occasions – both casual and celebratory.

The research also showed that Veuve Du Vernay stands out within the sparkling category because of its French/ international connection, which gives it a feeling of exclusivity and elegance.

“These brand associations provide a key point of difference for Veuve Du Vernay versus other sparkling wine brands, and are closer to champagne brands, but at a much more affordable price,” says Wheeler.

She says Veuve du Vernay’s French heritage came through strongly in its appeal for consumers. “It was one of

the key driving factors as to why people really love the brand. It has that French authenticity and elegance.”

Xavier Pignel-Dupont says the research has confirmed exactly what the brand is seeking to convey. “The fact that Kiwi consumers like that Veuve du Vernay is French and find it to be elegant and sophisticated is our point of difference from local sparkling and sparkling from Australia. It makes Veuve du Vernay distinctive and unique.”

Kerry Wheeler says the brand’s 200ml format is likely a significant driver when it comes to Veuve du Vernay fans enjoying the wine more regularly on a casual basis, rather than just at special occasions. “The three packs of 200ml really provide that flexibility, so you don’t have to open a whole bottle,” she says.

Innovative style

Although a familiar name on New Zealand shelves, Veuve du Vernay creates fresh appeal with a range of limited-edition bottle wraps that highlight its New Zealand connection and French roots.

“To be a leader, to gain new consumers and to gain a new generation we need

to bring surprise,” explains PignelDupont. “We need to bring new temptations. Why would you buy the same bottle every day? Let the new generation discover Veuve du Vernay as well.”

These stylish wraps have included a New Zealand flag design as well as a Toile de Jouy design (right), the pattern made famous by Marie Antoinette at Versailles, in pink and blue to reference the wine’s French heritage.

A new pohutukawa wrap will also be released in late 2023 for the festive season.

A particularly striking release is a temperature sensitive wrap for the Veuve du Vernay Ice Rosé (750ml), in which the label’s design evolves as the temperature changes and reaches its ideal serving point.

The Veuve du Vernay 0% sparkling wine is also easily recognisable on shelf with a distinctive bright blue label and is expected to perform well as demand grows quickly for lo/no alcohol options in New Zealand.

With this enhanced understanding of the New Zealand market, Kerry Wheeler says they are putting Veuve du Vernay “front and centre” for sparkling wine consumers.

The coming months will see more investment in social media and the launch of a new consumer website, as well as increased ranging in-store, print and digital mailers, and media support.

“Our expectation and goal is to keep the [market] leadership,” says Xavier Pignel-Dupont. “We have a strong position in the market and now we are increasing our investment for above the line to continue to bring awareness and create more content for the brand. And this will definitely help our retailers.”

1 IRI NZ Grocery market data MAT 01.01.23

2 Research source: Sapien Research, Sparkling Wine Consumer Analysis, April 2022

• Veuve du Vernay Brut (3 x 200ml pack, 750ml, 1.5L magnum)

• Veuve du Vernay Brut Rosé (3 x 200ml pack, 750ml, 1.5L magnum)

• Veuve du Vernay Ice (3 x 200ml pack, 750ml)

• Veuve du Vernay Ice Rosé (3 x 200ml pack, 750ml)

• Veuve du Vernay Zero Alcohol Free (750ml)

Veuve du Vernay is priced from RRP $18.99.

Veuve du Vernay is distributed exclusively in New Zealand by EuroVintage

“The fact that Kiwi consumers like that Veuve du Vernay is French and find it to be elegant and sophisticated is our point of difference from local sparkling, and sparkling from Australia.”

- Xavier Pignel-Dupont, Castel Group.

THE DRINKSBIZ team was greatly saddened to learn of the passing of respected drinks writer and Drinksbiz columnist Dominic Roskrow in late 2022. He died in England after a short illness in November. He was 61.

Tributes flowed from around the international whisky industry following news of his death.

Dominic had been the spirits columnist for Drinksbiz for more than a decade, offering insightful commentary on whisky

AN ANNUAL survey of New Zealanders’ drinking habits has found that more than half of those surveyed tried a low alcohol drink in 2022 – up 9% on the previous year.

The research for the NZ Alcohol Beverages Council (NZABC) was conducted by Curia and surveyed 1250 people across New Zealand.

The NZABC says that its annual survey aims to understand New Zealanders’ views on how alcohol is perceived across a number of issues. One set of questions asked what respondents were drinking and how they drank overall.

The results showed that 56% of those surveyed tried a low alcohol drink in 2022, up 9% on 2021, while 69% had tried a ‘premium’ drink, up 13% from 2021.

The research also found that of those who had tried a premium wine, beer or spirit, 45% consumed it more slowly.

“The trend of going ‘no and lo’ and ‘sipping and savouring’ your drinks appears to be cementing itself into the way we drink,” says NZABC Deputy Chair, Robert Brewer. “This means we are actively choosing to slow down when we drink and, for others, it’s about choosing a lower alcohol option.

“Drinking higher strength options more slowly and/or choosing lower alcohol options are great trends and mirror the overall decline in drinking over the last couple of decades,” added Brewer.

“We’re drinking approximately 25% less per capita than we did in the early 80s and we’re drinking less harmfully as well. However, there is still a lot of work to be done to better understand and then accelerate the changes we are beginning to see in our drinking culture.”

and the wider global spirits industry in each issue. A drinks writer for more than 30 years, Dominic was a highly regarded figure in the whisky world, having edited several whisky publications including Whisky Magazine, The Spirits Business, and Whisky Quarterly. He also wrote more than 15 drinks books and, with Gavin D. Smith,

was tasked with revising and updating Michael Jackson’s Complete Guide to Single Malt Scotch (7th edition, 2015).

Dominic was regarded as an authority on and staunch supporter of New World whiskies. In mid-2021 he launched an online magazine, Stills Crazy, dedicated to celebrating the best of New World whisky. He had also created an awards programme, the New Wizards Awards, to recognise independent whisky producers and bottlers from around the world.

New Zealand held a very special place in Dom’s heart, and he was a huge fan of the All Blacks, having been to the All Blacks XV v Barbarians game in London shortly before his death.

His contributions to the pages of Drinksbiz will be very much missed by the team.

NEW ZEALAND’S largest independent spirits brand, Scapegrace, has announced an ongoing partnership with independent music company LOOP that will align it with leading and upcoming New Zealand artists and music.

It says the LOOP partnership will enable Scapegrace to showcase its RTD range across popular music festivals, providing an opportunity to sample product en-masse to a wide audience, nationally.

The initial summer events included three L.A.B festivals in Tauranga, Hastings and Whangarei and three Summer Thieves shows in Waihi Beach, Hamilton and Leigh.

Scapegrace co-founder and marketing director Mark Neal says, “We could not be more excited about this partnership between two leading New Zealand brands, both creatives in their own right. The partnership with LOOP provides Scapegrace the opportunity to create a canvas for both brands to creatively collaborate on music, entertainment and cross-promotional activity over the summer.”

Mikee Tucker, Founder of LOOP says they’re thrilled to be partnering with Scapegrace. “The core driver of our business has always been around forming meaningful relationships with Kiwi-owned innovators, and this partnership is exactly that.”

NEW ZEALAND Winegrowers has launched its new global brand platform – New Zealand Wine, Altogether Unique –designed to highlight the very best of the New Zealand wine industry.

It is New Zealand Winegrowers’ first brand refresh since 2006, and the new visual identity is rolling out across global markets.

“With global activity returning to ‘normal’, it’s more competitive than ever to have the voice of the New Zealand Wine brand heard, and a clear premium brand message is essential,” says Charlotte Read, General Manager Marketing, New Zealand Winegrowers. “Creating a compelling brand positioning for New Zealand Wine is important as we seek to engage and motivate evolving wine drinking audiences.”

New Zealand Winegrowers worked alongside creative agency Many Minds to incorporate the latest consumer insights, define its brand essence and create an accompanying new visual identity.

“The combination of New Zealand’s location, people, and climate is simply magic. There is nothing else like it on earth,” says Mike O’Sullivan, Creative Director, Many Minds.

“There were key words that came back from the insights, like our people, nature, and purity, which formed the foundation pillars of the New Zealand Wine essence of purity, innovation, and care.”

New Zealand Winegrowers says that the origins of the three circular forms in the logo represent these three unique selling points. These three circular shapes were further crafted into more geometric organic forms reminiscent of fronds on a grapevine but rendered in a more bespoke

and timeless style. It says the result is a highly contemporary mark, unique to New Zealand, that gives New Zealand Wine a more distinct visual presence on the world stage.

A short storytelling video featuring Kiwi actor and winemaker Sir Sam Neill (Two Paddocks) also aims to create an emotional connection to New Zealand wine.

“This storytelling asset will tell the foundational story of New Zealand wine through the lens of the key pillars of purity, innovation, and care – aspects that make New Zealand wine and the New Zealand wine industry, so unique and special,” says Charlotte Read.

WEST

craft

Reefton Distilling Co. has partnered with independent spirits distributor Iconic Beverages to launch nationally in Australia. Iconic Beverages will distribute its multi-award-winning flagship product Little Biddy Gin in the Classic and Pink expressions.

Reefton Distilling Co. founder and chief executive, Patsy Bass, says they’re thrilled with the new partnership. “We’re incredibly excited to expand our reach and capability in Australia through Iconic Beverages. Their commitment to brand building, and strong network both on- and off-premise, make

QUEENSTOWN HOSPITALITY software

business Loaded is launching its global campaign, following the raising of $3.25 million via a combination of equity and debt, with an initial entry into Australia planned for early 2023.

Loaded is an SAAS-based (Software as a Service) hospitality management platform, which helps hospitality businesses monitor and manage their revenue, labour, inventory and budgeting from one place. It was founded by hospitality entrepreneurs James Arnott and Richard McLeod, who started hospitality company Cook Brothers Bars in 2004, which today has 13 hospitality outlets across New Zealand.

Loaded CEO Richard McLeod says that crossing the Tasman is the first step in expanding globally and the expectation is that this will happen rapidly once market traction is achieved in Australia. “With 900 customers at home who have demonstrated significant profitability and efficiency improvements when adopting Loaded and very few competitors in the market globally – we’re pretty excited about the opportunity ahead,” says McLeod.

Invest South, a local investment fund, is the major participant in the capital raise and will also appoint a director to the board of Loaded.

Other local private investors have also invested directly and through the Mainland Angel Investors network.

Loaded has also attracted support in the form of a $1.25 million loan from MBIE through the Queenstown Economic

them a natural fit for our team.”

The news comes just months after Reefton Distilling Co. opened its new distillery on the edge of Reefton, with bottling and warehousing on site.

Iconic Beverages Brand Manager Andy Kelly says they are excited to bring Reefton Distilling Co. to Australian consumers. “When the Reefton Distilling Co. team approached us to launch Little Biddy in Australia we were thrilled. Their exceptional range of spirits is backed by an iconic and authentic story, and we can’t wait to build on their success to date.”

A NEW food, wine and design festival is coming to Auckland’s waterfront in March, with some of the country’s leading wineries set to take part.

Indulge will be held at Auckland’s Wynyard Point and Jellicoe Harbour over four days from 2-5 March, 2023 and feature renowned chefs, designers and restaurateurs, along with a range of New Zealand wineries.

Indulge has been created by the team behind the popular Urban Polo events in New Zealand and Singapore.

Transformation and Resilience Fund (QET Fund) which is administered by Kānoa – Regional Economic Development & Investment Unit.

“The support from MBIE on top of the significant equity raise means that we are in a position to invest further in building our product and development team almost entirely in Queenstown, which is important to us as a company founded by born and bred Queenstowners,” says McLeod.

Loaded was originally developed as a central management system for Cook Brothers Bars, which famously purchased the Captain Cook Tavern in Dunedin when Loaded founders Richard McLeod and James Arnott, both of Queenstown, were in their fourth year as university students.

Urban Events Managing Director, Simon Wilson, says he is delighted to have so many quality brands involved, with wineries such as Bannockburn’s Akarua, Blenheim’s te Pā and Waiheke’s Cable Bay among those confirmed already.

Other winery exhibitors include Two Rivers, Akarua, Hunting Lodge, Villa Maria, Waitiri Creek, The Uncommon NZ, Cable Bay, 495 Wine Direct and Mawhitipana Ridge Estate, with organisers saying more will be announced.

Indulge is expected to host around 20,000 people over the four days and has been created in partnership with NZME and is supported by Tourism New Zealand and Auckland Unlimited. indulgeauckland.co.nz

AN ORGANISATION dedicated to helping new and existing craft distilleries to thrive and grow has crossed the Tasman to launch in New Zealand.

The Distillers Institute (TDI) began in Australia in April 2020 and offers a training course covering key areas of running a distillery business, from a vision and business plan, to financing, marketing, distribution, customs requirements and more.

TDI has now launched its course in New Zealand with craft spirits advocate Marcel Thompson (author of Still Magic and Gin Ventures) as its local lead. It has also been supported by Distilled Spirits Aotearoa and industry figures Rob Auld of Southland’s Auld Distillery and Patsy Bass of Reefton Distilling Co.

Anne Gigney is one of the five founders and is the Director of the Tasmanian Whisky Academy, a Board member of the Institute of Brewing and Distilling (APac)

and advocate for education in Australia’s distilling industry.

Gigney says that The Distillers Institute was established in Australia to help aspiring and existing distillers to successfully start and grow their distilling or spirits business, with the goal of building a compliant and robust distillery business that will withstand the test of time.

She says the time is right to bring TDI’s course to New Zealand given the fast-growing craft spirits industry here. “Having been here in Australia to see what the early years and fails look like, we know it will make

a big difference,” says Gigney. “It’s about making great decisions right at the outset so you know where you are now, where you’ll be in a year and where you’ll be in 10. Our goal is to futureproof those folk heading into the industry.”

The Planning your Successful New Zealand Distillery course is tailored for the New Zealand market, including links to all Customs NZ requirements and others.

Gigney says that New Zealand students will also join the TDI distilling community, which has more than 440 students, primarily in Australia, and gives access to a monthly Masterclass webinar showcasing distillers and suppliers from Australia and New Zealand with the goal to build capacity and reach within the industry. thedistillersinstitute.co.nz

HOSPITALITY NZ says that the refusal by Government to put chefs on its immigration Green List will hurt hospitality businesses and customers.

The government announced in December that it will expand the Green List settings to make it faster and easier for more workers in the healthcare, education and construction sectors to access the work to residence pathway in New Zealand.

Hospitality NZ CEO Julie White says they are “beyond frustrated” to see that

chefs have been left off the immigration Green List. “We asked for them to be included on the list as a bare minimum, but this was shut down by the Government, saying they can already come in. But they have totally missed the point. The global shortage of skilled staff means we need more competitive and attractive immigration settings.

“Chefs are allowed to work in New Zealand, but they have to uproot their life to settle in a country where there is no certainty of residency,

versus Australia, where there is automatic residency. All we asked for is competitive policy settings that at least give us a chance of attracting people.”

She says that hard-hit hospitality and accommodation venues will miss out on desperately needed business over the summer high season thanks to the Government refusing to change immigration settings for chefs and other much needed hospitality roles. “Hospitality and accommodation businesses are telling us they will have to

continue cutting opening and restaurant hours, and days, and refuse accommodation bookings over the summer because they won’t have enough staff. This is an ongoing disaster for many businesses on top of the struggles of the past two years,” says White.

The Government had said that the Green List settings will be reviewed again in mid-2023 and new Prime Minister Chris Hipkins indicated to business leaders in late January that he wouldn’t rule out changes to the immigration settings.

(RTD) products grow by more than +7% in volume across those 10 key global markets in 2022 and is forecasting consumption to increase by a third by 2026, spearheaded by growth of no-alcohol products.

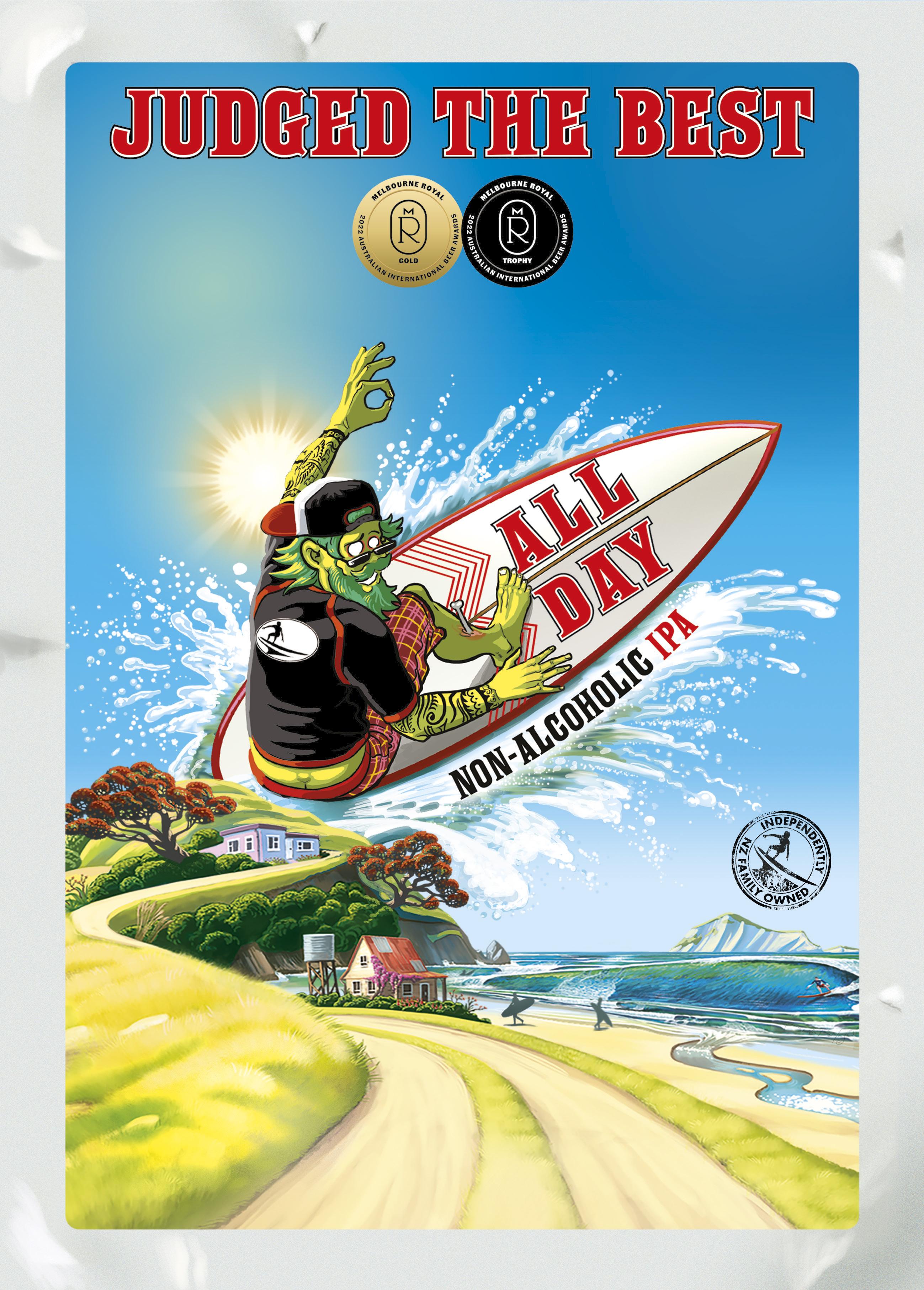

THE RAPID rise of the no/low alcohol category in New Zealand has been increasingly evident over the past couple of years with a greater range of local and imported products, dedicated retail space in-store and online, and increased mainstream media coverage of the growing no/low consumer shift.

Now, new research from IWSR Drinks Market Analysis, the global leader in alcohol data and analysis, shows that this growth is only set to gather pace.

Its newly released IWSR No- and LowAlcohol Strategic Study examined 10 focus markets (Australia, Brazil, Canada, France, Germany, Japan, South Africa, Spain, the United Kingdom and the United States), and found the market value of no/ low alcohol products in 2022 surpassed USD$11 billion, up from USD$8 billion in 2018.

It reports that increasing consumer demand saw no- and low-alcohol beer/ cider, wine, spirits, and ready-to-drink

IWSR says that the pace of growth of the no/low-alcohol category is expected to surpass that of the last four years, with forecast volume CAGR of +7%, 2022-26, compared to +5%, 2018-22.

No-alcohol will spearhead this growth, expected to account for over 90% of the forecast total category volume growth.

“The dynamic no/low-alcohol category presents opportunities for incremental sales growth as consumers are recruited from drinks categories such as soft drinks and water. Brand owners have an opportunity to recruit non-drinkers of alcohol,” comments Susie Goldspink, Head

The steady growth of the no-low movement around the world is set to continue apace, as new research from IWSR Drinks Market Analysis reveals…

of No- and Low-Alcohol, IWSR Drinks Market Analysis.

“As more people opt to avoid alcohol on certain occasions – or abstain from it altogether – no-alcohol is steadily increasing its share of the no/ low category.”

Following the December 2022 release of the IWSR No- and Low- Alcohol Strategic Study, IWSR Drinks Market Analysis has reported the following key points:

No-alcohol products spearhead overall category growth

No-alcohol volumes grew 9% in 2022, increasing their share of the overall no/ low-alcohol space in the world’s 10 leading no/low markets to 70%, up from 65% in 2018.

“No-alcohol is growing faster than lowalcohol in most markets,” says Goldspink.

“The countries where this does not apply, such as Japan and Brazil, are earlystage low-alcohol markets with a small volume base.”

Improved taste, production techniques, and a diversification of consumption occasions are driving no-alcohol’s dominance over low-alcohol in many markets. IWSR expects no-alcohol volumes to grow at a compound annual growth rate (CAGR) of +9% between 2022 and 2026.

The maturity of the no/low-alcohol category varies widely by market.

Germany, the world’s largest and most mature no/low-alcohol market, will see relatively slow growth due to beer market maturity and lack of innovation.

Meanwhile, more dynamic growth will come from markets including Australia, Canada and the US, which will all see double digit volume compound annual growth rates, 2022-26. The world’s most valuable no/low-alcohol markets are Germany, Japan, Spain, the US, and the UK.

No-alcohol beer/cider will contribute nearly 70% of the overall no/low-alcohol growth between 2022 and 2026. Almost all of the no-alcohol RTD growth will come from the US and Japan, whereas no-alcohol wine growth is expected to be more fragmented, but positive, across markets. No-alcohol spirits will see some of the more dynamic growth, as brand owners invest in innovation, and products are given more space by retailers and the on-trade.

Low-alcohol is expected to grow at a 2% volume CAGR, 2022-26, with much growth driven by the low-alcohol beer and wine categories. The US is the dominant driver of low-alcohol wine, with early seeds of innovation and traction in others.

No/low consumers are maturing at a global level, with Millennials the largest age group.

Switching between alcohol and no/low is common, both in the same occasion and between different ones. 78% of consumers of no/low products also

No-alcohol beer/cider will contribute nearly 70% of the overall no/low-alcohol growth between 2022 and 2026. – IWSR Drinks Market Analysis

drink full-strength alcohol; the largest subset (41% of no/low consumers) are classified as ‘substituters’, who choose no/ low products when avoiding alcohol on certain occasions.

However, ‘abstainers’, who refrain from drinking alcohol altogether, account for 18% of no/low consumers, and their numbers are rising in most markets, with younger legal-drinking-aged consumers at the fore. The ‘abstainers’ group has changed most in size in the past year, with nine out of 10 markets seeing an increase.

says Goldspink. “Pair this with the rise of functional beverages – often containing ‘mood-enhancing’ adaptogens or nootropics – and the result is a strong outlook for no-alcohol.”

Consumers

As no/low products permeate a wider variety of occasions – low-alcohol often in low-key social settings, no-alcohol alone or unwinding with a partner at home –newer recruits to no/low are increasing their frequency of consumption.

With people motivated to drink no/low by lifestyle, rather than necessity, growth is now being driven both by recruitment of new consumers and by greater participation. Daytime consumption of both no- and low-alcohol has increased this year, signalling potential for the category to expand beyond alcoholreplacement occasions.

“This pattern of avoiding alcohol on certain occasions or altogether is driving no- over low- alcohol growth,”

The biggest challenge facing the no/low category is one of availability: in many markets, no/low products lack visibility in the mainstream on-trade; among retailers, there is often confusion about where they should be displayed – in the beer/wine/ spirits aisle, among soft drinks, or on their own. In both channels, the choice of products is often limited.

Cost has become less of a barrier for non-consumers of no/low-alcohol, dropping from 14% in 2021 to 7% in 2022. Despite the cost-of-living crisis, cost as a barrier to purchase currently remains unchanged among those who do consume no/low drinks. Where no/low is established, prices are similar to equivalent full-strength alcohol categories.

Product innovation focuses on packaging, flavour, and functional benefits While many NPD approaches so far involve modification of ABV (alcohol by volume), some producers are focusing on innovation in packaging, functional benefits, and flavour, to broaden the options available to consumers and to allow brands to keep consumers within their portfolios.

Examples of these include sliding ABV scales and multipacks, the use of botanicals to create more intense flavour, and the introduction of spirit alternatives across a wider range of categories, such as aperitifs, dark spirits, and agave.

There are also signs of increasing product focus on functional benefits, such as added nootropics, vitamins, and adaptogens, with product messaging shifting from the absence of alcohol to flavour and other benefits. Some mixer brands are also broadening their range to offer products that can be enjoyed without a spirit or spirit alternative.

Find out more at IWSR Drinks Market Analysis – theiwsr.com

Switching between alcohol and no/low is common, both in the same occasion and between different ones.KELSEY CHANCE / UNSPLASH

FRENCH SPECIALIST glass company

Saverglass has created new bottle variations that are enhanced by engraving. These offer customisations that take the design and characteristics of the bottles to the next level and emphasise the elegance and personality of each model.

faithfully reinvents the Bordeaux style – is irresistible.

Unique character

These innovations in the world of wine make it possible to offer new, revisited designs with strong character, and ideal versions for a limited series that complements existing models.

Whilst the Bordelaise ICON is admired for its aristocratic elegance, this new variant – which masterfully and

The name ‘Duomo’ is suggestive of the flamboyant domes of the Italian Renaissance, and reawakens traditional lines with shoulders adorned with a magnificent set of horizontal stripes. This elegant vision contrasts with the simplicity of the bottle’s body, perfectly suited for customising with decorations or a label.

The Duomo models, and their Bourgogne-style sister Zebra models, are aimed at estates looking for evermore sophisticated bottles, where etched designs reinforce the already assertive character of the Bourgogne Vin Grand Cru and Bordelaise ICON bottles.

With these models, Saverglass offers an ideal container for limited series or special cuvées that will catch the eye of consumers, either on the shelves or at the best restaurants.

Etched to enhance

Originally from the world of perfumery, the use of etching to enhance silhouettes is now an essential part of premiumisation for both spirit and wine bottles, providing even more sophistication.

Perfectly mastered by Saverglass, engraving allows extremely precise, fine and delicate ornaments to be created, with well-defined contours beautifully carved in the glass.

Engraving is skilfully applied on the Bordelaise and Burgundy shapes, which are an iconic part of the Saverglass wine collection, completely transforming them by delicately chiselling ridged patterns into the glass.

Find out more about the ranges from SAVERGLASS 09 522 2990 saverglass.com

Whilst the Bordelaise ICON is admired for its almost aristocratic elegance, this new variant is irresistible. Suggestive of the flamboyant domes of the Italian Renaissance, DUOMO reawakens traditional lines with shoulders adorned with a magnificent set of horizontal stripes.

With these models, Saverglass offers an ideal container for limited series or special cuvées that will catch the eye of consumers, either on the shelves or at the best restaurants.

IWSR DRINKS Market Analysis has released preliminary 2022 data across the total beverage alcohol industry in the US that shows all major categories – beer, cider, wine, spirits, and ready-to-drink (RTDs) – posted growth across premiumplus price tiers.*

It says that while total volumes of wine (-2%), beer (-2%) and cider (-4%) all declined in 2022, the premium-and- above segments of each grew: wine (+6%), beer (+4%) and cider (+11%). Total spirits volumes were up +2%, with premium+ up +13%, while RTDs showed moderate gains at less than +1% with premium+ up +38%.

High-income drinkers, earning over $150,000, were especially secure, and across all demographics, Millennials show more confidence than older drinkers. IWSR consumer data shows consumer spending and purchasing volume were up in 2022 vs 2021 in most tracked categories.

It says that despite industry-wide price increases, premiumisation (or trading up to higher-priced, often higher-quality products) is still driving all segments of beverage alcohol.

IWSR Drinks Market Analysis says that premiumisation is occurring most notably in spirits. Overall, 33% of Americans said they had spent US$50 or more on a bottle of alcohol in 2022, against just 24% in 2021. Furthermore, six in 10 online shoppers say they spend more on alcohol online than in-store.

“Another area where premiumisation is proving to be a key factor driving volume is at-home consumption,” says Brandy Rand, Chief Strategy Officer, IWSR Drinks Market Analysis. “With a vast majority of Americans consuming alcohol at home, 46% say they are likely to treat themselves to better quality drinks there, which is also beneficial for wine and beer.”

Other key insights from IWSR include: Spirits category has 25th straight year of volume gain

Long-term premiumisation of spirits has boosted the category with evident crossover in RTDs as pre-mixed cocktails and spirit-based RTDs gain ground.

Total whisky category volumes (up +3% in 2022 vs 2021), surpassed vodka

(less than +1% growth in 2022 vs 2021) last year for the first time in almost two decades. US whiskey holds the largest share of total whisky volumes, as well as percentage growth (+4%), with value increases led by bourbon which increased by +8%.

Agave spirits contributed US$1.6bn to the spirits industry in 2022. This growth accounted for 70% of the overall volume growth and 65% of overall value growth of total US spirits.

straight years of volume gains but saw a much lower growth rate than in previous years, (+1%) in 2022, as malt-based hard seltzers slow down. Spirit-based RTDs, hard teas and FABs show momentum however and premiumisation is evident across the RTD category as value increased by +6%.

Sparkling wine achieves 21st consecutive year of volume and value gains While sparkling wine sees continued growth, the total wine category declined by volume for the second straight year, decreasing -2% in 2022 vs 2021. From a value perspective, total wine posted modest growth (+1%). Still wine continues to drag down overall wine performance (-3%) as declines in the standard-andbelow segment were unable to be offset by advances occurring in the premiumand-above tiers.

Within still wine, a strengthening trend of health and wellness is bringing awareness to the no- and low- alcohol subsegments. In other wine segments, rice wine/sake (+3%) and flavoured wine (+8%) performed well. Rice wine/sake benefited from a return to the on-premise, while flavoured wines attract younger LDA consumers drawn to flavour, a halo effect from the RTD category.

Though no/low products are a mere 1% volume share of total beverage alcohol in the US, the category’s growth rate was +15% in 2022. No/low-alcohol wine and beer hold the largest share, both in volume and value.

Also notable in 2022 - tequila surpassed US whiskey by value to become the second most valuable spirits subcategory in the US. Tequila alone is set to overtake vodka in 2023 to become the industry leader by value.

Traditional spirits are expected to overtake traditional beer as the share of servings leader for the first time in modern history this year. This means on a drink-by-drink basis, more Americans will drink traditional spirits.

While total beer continues to recover from pandemic losses, imports (led by Mexican beer) showed positive volume gains at +4%. Domestic beer commands a 79% volume share of total beer and struggles from long-term decline, weighing down overall beer performance.

The RTD category (which includes all alcohol bases) was able to post seven

Channel dynamics point to strengthening on-trade recovery

Usual channel dynamics were severely disrupted by Covid-19, with ecommerce and brick and mortar off-trade sales benefitting from on-trade restrictions. Near-term corrections will see the picture stabilise over the next five years. Ecommerce share was up +1% in 2022, at a much more moderate performance than pandemic highs. On-premise recovery is evident with the channel up +24%, and with a full return to pre-pandemic volumes expected in 2023. Half of consumers expect their on-trade drinking to remain the same, although many are watching what they spend and reducing the frequency of visits.

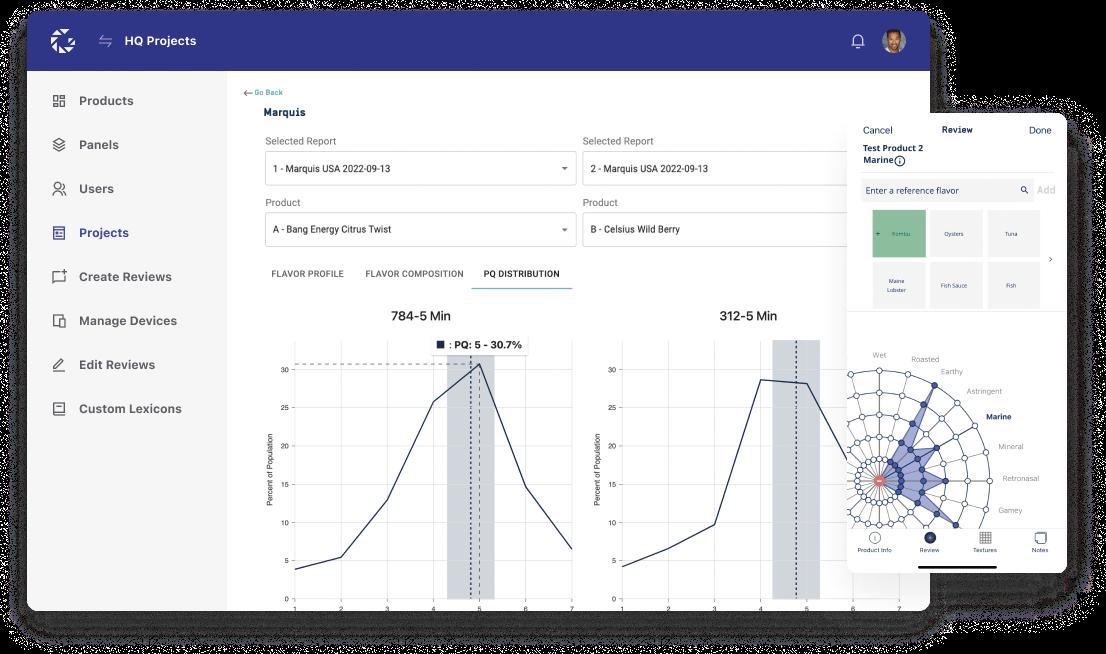

GASTROGRAPH AI – the first artificial intelligence solution designed specifically for predictive product development in the food and beverage industry – has announced the commercial launch of SensoryLink, the company’s new Platform as a Service (PaaS) and its recent capital raise.

The US$7 million capital raise included both existing and new investors, including Cornes Technology, Leawood Venture Capital, BASF, and the Sony Innovation Fund, among others, and will help support the global commercial launch of the SensoryLink platform.

The Gastrograph AI machine learning platform efficiently models human sensory perception of flavour, aroma, and texture to understand consumer preferences for multiple targeted demographic segments and provides market and formulation insights that drive brand success for major global CPG firms.

“We provide actionable insights to the global food and beverage industry across multiple geographies and demographic segments for a wide variety of products,” said David Purdy, Chief Executive Officer.

“These customised predictions are delivered with high-resolution analysis that enables major food and beverage companies to access real-time consumer preference information to make quicker, more informed decisions.”

Purdy says that Gastrograph AI delivers full cycle capabilities, from curated data collection via its mobile app to leveraging revolutionary algorithms and a proprietary database, to deliver highly accurate and detailed predictions of flavour, aroma, and texture preferences.

Gastrograph AI’s founder and Chief Scientist, Jason Cohen, says that they have assembled the world’s largest sensory database, covering over 30 countries, and can combine this with their proprietary algorithms to deliver critical insights for over one billion distinct consumer profiles. “Now the food and beverage industry can test products and gain market insights in weeks, rather than months, to identify unique product profiles, evolving consumer preferences, and product optimisation opportunities.”

WAIHEKE DISTILLING Co. has launched its new artisan Gin & Tonic RTD.

Spirit of Waiheke Artisan G&T is anchored on the craft distillery’s signature gin, which embodies the land, wind and sea. The contemporary dry gin is distilled with botanicals, kelp and citrus and paired with an island-inspired tonic.

The premium RTD is 7% ABV and presented in a 250ml slim can with a

striking black and white illustration.

Waiheke Distilling Co., which opened in early 2021, says the new RTD is an exciting and convenient way to introduce its artisan products to a broader range of discerning customers.

Spirit of Waiheke Artisan G&T is available in 250ml singles at RRP $12.50 and 4-packs at RRP $48 Waiheke Distilling Co.

NEW ZEALAND beverage company

Zangria has launched a new flavour for summer, releasing Zangria Pineapple, Mango & NZ Wine.

Zangria is designed to be a unique New Zealand take on a traditional sangria and the new release is made with an applegrape ‘fruit wine’, which is blended from Marlborough wine grapes and Hawke’s Bay apples. It is then combined with real pineapple and mango fruit juice before a final top up of lightly sparkling water.

The new release joins the original Marlborough Rosé, Watermelon and Berries flavour, which launched last summer.

Zangria founders Bonnie Shum and Mitch Wiffin say their goal is to continue to push the boundaries of the traditional wine and RTD category, injecting their creativity into the brand’s taste and branding thanks to their combined backgrounds in the wine industry and advertising.

Zangria is batch brewed and contains no added sugar or artificial sweeteners. Each can contains under 5.5 grams of fruit sugars. At 4.8% ABV, Zangria is classified

as a fruit wine and its founders say it is a great substitute for a low-alcohol wine or a full-strength RTD.

• Zangria Pineapple, Mango & NZ Wine 330ml 6-pack RRP $19.99

• Zangria Rosé, Watermelon and Berries 330ml 6-pack RRP $19.99 and 10-pack RRP $29.99.

Zangria

AFTER WINNING four golds at the 2022 NZ Artisan Awards, Marcus Walker of Alice Hard Brewed Tea has his sights set on expansion around New Zealand.

Alice Hard Brewed Tea launched in July 2021 and Walker says he is working to keep up with demand for his sparkling alcoholic iced tea following the Gold Medal wins at the Artisan Awards for each of the four flavours (5% ABV) entered:

• Green Tea – Lime & Marigold

• Herbal Tea – Hibiscus, Rosehip & Apple

• Rooibos Tea – Orange & Lemon Peel

• Black Tea – Strawberry & Vanilla

The teas are made from a large pot of sweetened tea that is allowed to cool before champagne yeast is added. The yeast converts the sugars, leaving a dry sparkling iced tea with residual sugar levels from 0.1g/100ml.

The brand name was inspired by the classic Lewis Carroll story of Alice’s encounter with the Mad Hatter at his tea party in Wonderland, and the logo of four rabbits comes from a set of porcelain rabbits that Marcus Walker’s grandmother had.

The four Alice Hard Brewed Tea flavours are 5% ABV and available in four packs or a ‘Mixed Tea Collection’.

Alice Hard Brewed Tea

It’s festival season and alcohol licensing lawyer

Pervinder Kaur has some useful tips on what to know about applying for a special licence…

MY FIANCÉ and I went out on a date night recently. It was an amazing evening here in Ōtautahi Christchurch. The riverside eateries were buzzing with energy. Everybody looked so happy to be out and enjoying the warmer weather in this part of the world.

We Kiwis look forward to the summer season each year. Whether it is culture, sport, food and wine, or all of the above, there is something for everyone to enjoy. Summer is also the time when many festivals, functions, and other special events are underway. Whether the event is small or large-scale, if you plan to sell alcohol at an event or provide alcohol at no charge but where there is an entry fee, then you are required to have a special licence in place.

Examples of events that generally require special licences are sporting events, concerts, farmers’ markets and fairs, and any private gatherings where alcohol is being sold or supplied for a fee or donation.

What is a special licence?

A special licence allows the sale or supply of alcohol at certain events. The Sale and Supply of Alcohol Act 2012 (Act) has introduced two different types of special licence: the on-site special licence and the off-site special licence.

The on-site special licence allows the sale or supply of alcohol at the event, whereas the off-site special licence allows the sale or supply of alcohol that will be taken away and consumed at another place. The type of licence your event requires will depend on when (and where) guests are consuming alcohol.

Most councils require applications for a special licence to be filed at least 20 working days before the event. However, you should aim to apply even earlier to help ensure it is processed in time. If you wish to apply for several events on one application, these events must be linked in some way, such as a series of related meetings or a series of related match dates for a club’s sports season.

circumstances where it would be more appropriate to issue a full permanent licence or where it would be appropriate for a licensee to seek a variation to existing licence hours (s 41). It is recommended to seek expert legal advice if you’re unsure whether your event would meet the criteria required under the Act.

What hours apply to special licences?

A special licence can allow the sale or supply of alcohol at any time of day or night. However, the district licensing committee may set certain hours as a condition of the licence. Remember, unlike other on-licences, there is no additional drink-up time allowed outside the hours the special licence is granted for.

Who reports on applications?

What is an ‘event’?

“Event” is defined in the Act as including “…an occasion and a gathering, and any series of events” (s 5). It is generally expected that an applicant for a special licence can articulate the nature and date of any event or series of events as part of the application process (Re New Zealand Police LLA 454/94). This is necessary so the relevant district licensing committee (DLC) can establish whether the application simply expands upon business as usual or is instead a bona fide separate event.

The law now explicitly prohibits a special licence from being issued in

Applications are referred to the Police, Licensing Inspector and Medical Officer of Health for consideration. They may require further details or want to meet you about your application. Any opposition must be founded on the Act’s criteria for the issue of special licences (ss 142 and 143) including: the object of the Act, the applicant’s suitability, its staff, systems and training, any relevant local alcohol policy, and the design and layout of the premises where the event will be held. It is vital for the success of the application that it is carefully drafted and includes sufficient information for the DLC to enable it to grant the application. Don’t be afraid to seek expert advice. It will save you money and effort in the long run and you will have time to focus on the actual event.

It is vital for the success of the special licence application that it is carefully drafted and includes sufficient information.

The 2022 harvest was the biggest ever for Sauvignon Blanc in New Zealand, and the wines are punching above their weight in quality too, says Joelle Thomson.

Sauvignon Blanc

RRP $18.99

Giesen

Purity is dialled up in this aromatically focused, tropical and citrus expression of Sauvignon Blanc. It’s made from grapes grown in the Wairau Valley, Marlborough’s large sea of vines devoted largely to this singularly successful white grape variety. 17.5/20

RRP $18.99

Beverage Brothers

Punchy, pure and powerful. The 2022 Pā Road Sauvignon is packed with fresh flavours of thyme, gooseberries and lemon zest, making it a great dry white to pair with fresh seafood. The wine is a blend of Marlborough grapes, with just over half from the Redwood Hills Vineyard in the windswept Awatere Valley, while 46% are grown in the Wairau Valley, which adds riper tropical fruit aromas. 17.5/20

Sauvignon Blanc

RRP $19.99

Giesen

‘Uncharted’ is an apt name for this dry, flinty and lime-zesty expression of Sauvignon Blanc from the Awatere Valley. This area lies south of Blenheim and is cooler, windier and edgier in climate, with diverse terraced vineyards that provide a range of flavour profiles ranging from crisp acidity through to tomato stalk and pronounced citrus flavours. Really good drinking and great value. 18/20

2022

Sauvignon Blanc

RRP $19.99

EuroVintage

Hunter’s intensely aromatic Sauvignon Blanc rocks crisp, refreshing acidity with succulent lemongrass aromas and seductive flavours of ripe citrus zest, crunchy green apples and passionfruit. Its medium body suits a light chilling, which accentuates its dry style and long finish. This vintage has a very modest 11.8% ABV; light by most modern standards and a lovely characteristic for summer drinking. Certified vegan wine. 17.5/20

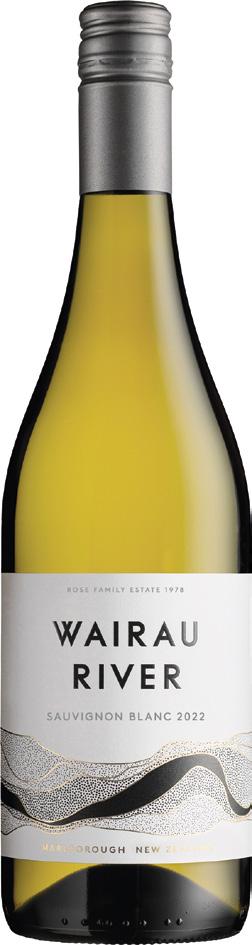

2022 Wairau River

Sauvignon Blanc

RRP $19.99

Federal Merchants

A warm, dry ripening season in 2022 created beautiful conditions for high quality, super-concentrated flavours in this succulent Sauvignon Blanc. A zingy, zesty and deliciously fresh wine, offering excellent value. 17.5/20

2021 Clos Henri Petit Clos

Sauvignon Blanc

RRP $21.99

Maison Vauron

Ten generations of winemaking in the village of Sancerre in the Loire Valley led the Bourgeois family to New Zealand in 1999 where they expanded their Sauvignon Blanc production, starting with this humbly priced, deliciously tasty wine. Classic cool temperature fermentation in stainless steel retains freshness, and this wine’s complex creamy flavours come from three months on lees (yeast cells), which adds depth, balance and body. Distinctly drier in style than many Marlborough Sauvignons. All grapes at Clos Henri’s vineyards in Marlborough are certified organic too. 17.5/20

‘Uncharted’ is an apt name for Giesen’s dry, flinty and lime-zesty expression from the Awatere Valley.

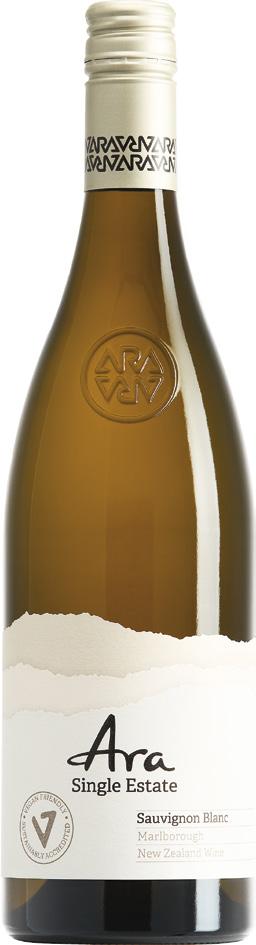

Sauvignon Blanc

RRP $21.99

EuroVintage

Channel your inner fashionista with a sip of this soft, smooth and subtle Sauvignon Blanc with its bold aromatic intensity, light body, intense flavours and lingering finish. Skin contact, French barriques and larger oak hogsheads bring structure, complexity and richness of flavour to this fruitforward wine. Superb value for money as well as being a fun brand. 17.5/20

Sauvignon Blanc

RRP $21.99

Marisco

This wine has delicious depth of flavour with rich, fruity appeal, but a totally dry taste carrying citrus, ripe melon and fresh green herb aromas. It delivers outstanding concentration and a next-level taste, without the price tag to match. A fabulous wine for drinking now and over the next two years. 18.5/20

RRP $21.99

Marisco

This lively new vintage of Leefield Sauvignon Blanc is driven by the fruitforward appeal of passionfruit, classic Marlborough Sauvignon gooseberry aromas and a support structure of succulent acidity. It’s a vibrant dry white wine with delicious length of flavour and great drinking, offering great value. 17.5/20

Sauvignon Blanc

RRP $21.99

Whitehaven Wines

A great vintage for Whitehaven Wines in Marlborough. This is another outstanding expression of ripe, concentrated fruity flavours with a dry appeal in every succulent sip. Drinks beautifully now with its ripe tropical notes of pineapple, green mango, melon and passionfruit. Impressive. 18.5/20

RRP $22.99

Mora

Mora means ‘to pause’ in Latin and that’s certainly what this wine made me do by shining a fresh new light on Central Otago Sauvignon Blanc. It has a medium body, dry, flinty freshness and a smooth, soft texture that comes from three months lees ageing. This builds structure and adds a creamy note to the wine with its flavours of guava, fresh herbs, hints of passionfruit and zesty, vibrant palate. 17.5/20

2022 SOHO Stella

Sauvignon Blanc

RRP $22.99

SOHO

SOHO Stella Sauvignon Blanc is inspired by the uber-stylish designer Stella McCartney. The wine lives up to her name with suave depth of flavour and succulent tropical notes dialled up high in this refreshing, zesty, dry wine with its long finish.

18.5/20

Sauvignon Blanc

RRP $23.99

Astrolabe

One of New Zealand’s classic great whites made from a blend of grapes grown in Marlborough and rocking rich, ripe, tropical fruity vibes with flavours of passionfruit, guava, pineapple and ripe pear. These are beautifully tempered with vibrant freshness and a light zingy touch.

18/20

2021

Sauvignon Blanc

RRP $24.99

Urlar

A dry, flinty and downright delicious

Sauvignon Blanc made by winemaker

Jannine Rickards of Urlar Estate in Gladstone in the central Wairarapa. This outstanding wine has bold flavours of freshly picked herbs and notes of tomato leaf, balanced by a creamy barrel ferment smoothness and subtle hints of tropical fruit with a lingering, succulent finish.

18.5/20

2022

Sauvignon Blanc

RRP $24.99

Forrest Wines

This wine is next-level thanks to Beth Forrest’s winemaking philosophy of enhancing Sauvignon Blanc’s tropical flavours and then reining them in with a touch of salty je ne sais quoi. Green herbs, floral aromas and a slightly salty hint all carry the ripe aromas of fruit in beautiful balance. Certified vegan wine. 18.5/20

Blanc

RRP $24.99

EuroVintage

This aptly named Sauvignon Blanc is a left-field take on this country’s most produced wine. In this example, it is lightly bubbly, thanks to the wine being bottled while it’s still fermenting and sealed with a crown seal to retain the CO2 that is produced naturally during fermentation. This accounts for the wine’s light sparkling style, which was traditionally referred to as pétillant naturel by the French and is now widely abbreviated to ‘pet nat’. It’s also cloudy, as the yeast cells from the fermentation remain in the bottle, adding savoury flavour notes. This is a tasty, dry Sauvignon that works beautifully on a hot day, served lightly chilled. 17.5/20

RRP $25.99

Vintners

A top Martinborough Sauvignon Blanc with fresh, flinty, herb and tropical fruit aromas from the cool climate sub region of the majestic Te Muna Valley, situated seven kilometres from Martinborough village. Stony vineyards are planted on river terraces and the region’s cool nights add distinctive freshness to the grapes’ natural acidity in each sip of this lively dry wine. 18.5/20

SAUVIGNON BLANC is the largest volume wine made and grape planted commercially in New Zealand. This made the 2022 vintage an incredibly important one for this country as it was 20% bigger than the previous largest harvest in 2020, and was also 47% up on the small volume year of 2021. This grape and the wine it makes are not only commercially successful, but are also producing higher quality wines than ever before, thanks to hard work on the part of winemakers to coax the best out of it. This is why wines such as Greywacke Wild Sauvignon and Dog Point Section 94 are thriving, alongside other examples made with barrel fermentation, ageing or both.

Paddock Sauvignon Blanc

RRP $25.99

Vintners

This is one of Marlborough’s top expressions of Sauvignon Blanc. It has outstanding zesty freshness, complex tropical and herbaceous flavours, depth, and great length for superb drinking. It may have higher natural acidity than a Chardonnay, but this wine works well in place of one. Drinks well now and can improve in depth of flavour for up to five years. 18.5/20

2021

RRP $26.99

Mineral

Sunshine and smoothness in a glass thanks to hot days and cool nights in Marlborough, along with 45% of the grapes in this wine being fermented in large, old French oak. This provides creamy notes with a barrel ferment quality and character, not unlike a Chardonnay but with more distinctive tropical flavours here and a long finish. 18.5/20

2022

Sauvignon Blanc

RRP $27.99

Astrolabe

Distinctive and delicious with smooth, nutty aromas and a fresh herbal taste balanced by succulent Sauvignon Blanc acidity, which is enhanced by the cool climate on the coast at Kēkerengū where the grapes in this wine are grown. This area provides higher acidity with its colder nights and this in turn gives the wine its lingering flavours and character. 18.5/20

2022 Big Sky Martinborough

Sauvignon Blanc

RRP $27.99

Big Sky Wines

One of the Wairarapa’s most deliciously succulent and bone-dry whites with fabulous flinty flavours and a dry style. This outstanding Sauvignon Blanc is made by Jeremy Corban and Katherine Jacobs at Big Sky Wines in the stunning Te Muna Valley in Martinborough. They give this wine a little time on lees postfermentation, in old oak, which builds texture. 18.5/20

Sauvignon Blanc

RRP $28

Whitehaven Wines

This wine is named for the late co-founder of Whitehaven Wines, Greg White. The winery is now run by his wife and daughter. This wine is made with grapes grown entirely in the Awatere Valley, south of Blenheim. Here, the cooler nights tend to preserve noticeably higher acidity and more citrus flavours in the wines, which comes through here as lemongrass, basil and lime in a wine with a lingering fresh finish. 18.5/20

RRP $29.99

AONZ Fine Wine

Blanc

A complex, dry, super-succulent Sauvignon Blanc from the great North Canterbury wine region – one of the most unsung areas in New Zealand’s wine industry. This wine has concentrated deep and rich flavours of ripe passionfruit combined with creamy textures and a long finish. A great white that is dry, expressively Kiwi in taste and sings of the South Island’s potential for outstanding white wines. 18.5/20

RRP $29 - $30

Hancocks

This weighty, interesting and complex Sauvignon Blanc tastes of citrus zestiness and tropical notes of guava. It is made from grapes grown on the Woolshed Vineyard on Loveblock Farm. This vineyard is situated in the lower Dashwood area of the Awatere Valley, south of Blenheim. Hand- and machine-harvested grapes are fermented separately with wild yeasts in a range of vessels including stainless tanks, a concrete egg and old French oak barrels. 17.5/20

Sauvignon Blanc

RRP $29.99

Negociants

This is one of Martinborough’s most sought-after Sauvignon Blancs thanks to its succulent citrusy notes and subtle suggestions of tropical scents, which lead into a wine with pineapple and mango flavours balanced by freshness and a lingering finish. 17.5/20

2021 Te Mata Cape Crest

Sauvignon Blanc

RRP $33.99

EuroVintage

Te Mata Estate is a pioneer of dry white Bordeaux-inspired blends of Sauvignon Blanc and Semillon, in this case also incorporating a smidgeon of the littleknown Sauvignon Gris grape, which is a distinct grape variety in its own right, rather than a blend, despite its name. This wine is bone-dry and has complex flavours of full-bodied, creamy, barrel-derived smoothness, sitting comfortably alongside tropical notes and fresh herb aromas.

18.5/20

2022 Cambridge Road Bianco

RRP $34.99

Cambridge Road

Sauvignon Blanc, Chardonnay and Pinot Gris all rub shoulders in this dry white blend, which was made by fermenting the grapes in large format (860 litre) older French oak barrels with wild yeasts. It’s a complex wine with a light to medium body and a lingering finish. Savoury notes, creamy texture and softness all make this a superb summer white. It was bottled with minimal sulphur dioxide at 10 parts per million. 17.5/20

Te Mata Estate is a pioneer of dry white Bordeauxinspired blends of Sauvignon Blanc and Semillon.

2021 Jules Taylor OTQ Limited

Release Sauvignon Blanc

RRP $35

Hancocks

OTQ is a smooth, medium-bodied Sauvignon Blanc that began as a smallscale passion project for winemaker Jules Taylor, hence the name ‘On The Quiet’. It has softness and a rich, fuller-bodied style than most Sauvignons, which makes this wine appealing to all white wine lovers. A little time on lees adds impressive complexity. 17.5/20

2020 Pegasus Bay North

Canterbury Sauvignon Blanc

RRP $35.99

EuroVintage

This maverick take on a dry white Bordeaux blend has superb complexity aligned with freshness. A wide spectrum of fruit flavours, from green plums to ripe limes and passionfruit, are enhanced by savoury lees influence and outstanding acidity. The 70% Sauvignon Blanc in the blend provides bright tropical fruit flavours with 30% Semillon in the support role, bringing creaminess and body. This wine is always aged for a year prior to release, allowing integration and further complexity to develop. It is a beautiful drink now and can age for up to a decade, improving over that time. 19/20

2022 Huntress Waikoa

Sauvignon Blanc

RRP $36.99

Huntress Wines

‘Waikoa’ translates from Māori as ‘happy waters’ and is winemaker Jannine Rickards’ take on a skin contact white made entirely from Sauvignon Blanc. Fresh citrus flavours and lively acidity are both enhanced by a grippiness that comes from the phenolic influence of extended grape skin contact. This adds a layer of complexity to the freshness of the wine, which was bottled with minimal sulphur dioxide. 18.5/20

RRP $38.99

Negociants

Some wines are made big, and others find their own way there, such as this perfectly named Wild Sauvignon from winemaker Kevin Judd. Aromas of vanilla and lemon zest lead into a dry, full-bodied wine with savoury notes of oatmeal and cedar and a crisp, lingering, intense finish. I love this great style, which is made from a combination of hand- and machine-picked grapes all fermented in French oak, with a small percentage being new. The wine’s name refers to the wild yeasts used for fermentation and while lees stirring adds body, it was used judiciously for a subtle influence, which comes through in this outstanding expression of Sauvignon. 19/20

2019 Pegasus Bay Finale

Sauvignon Blanc Semillon

RRP $44.99

EuroVintage

Two years in oak adds depth and stunningly savoury complexity to this highly viscous, botrytis-influenced blend of Sauvignon Blanc and Semillon. A luscious, honeyed sweet white that is full-bodied with amazing depth of concentration and a long zesty finish. 19/20

2017 Dog Point Section 94

Sauvignon Blanc

RRP $45

Red & White Cellar

Complex, dry and full-bodied with structure and flavour to burn. This great white is made from Sauvignon Blanc grapes grown on Section 94, a distinct area of Sauvignon Blanc vines on one of Marlborough’s oldest vineyard sites. It’s named after the original Lands and Survey maps of early New Zealand and its flavours span a greater spectrum of deliciousness than most Sauvignons: from white floral notes through to green apple aromas, oatmeal and sourdough. 18.5/20

For distributor details see the Distributor Index on page 68.

RRP $44.99

Negociants

Ox Hardy Wines is a wine company with a long legacy inspired by Thomas Hardy, who planted some of the first vines in South Australia in 1891. Today, the business is run by his descendants, including Andrew Hardy (aka “Ox”), who makes this dark and delicious spicy Shiraz. It’s made with grapes grown in Blewitt Springs in McLaren Vale, south of Adelaide, where sea breezes cool the vines, adding balance to its bold fruit power. It was aged for 18 months in oak and bottled with minimal filtration.

17.5/20

RRP $24.99

Vintners NZ

The silly season may be done and dusted, but wine lovers need good quality, affordable bubbles on a regular basis. Enter Villa Sandi Prosecco, one of my favourites for its consistency, freshness and light body, all of which make it a deliciously appealing aperitif with white fruit flavours and great balance. Love the 11% ABV too. 17.5/20

Pinot Noir

RRP $54.99

Caro’s Wines

The Doctors Flat Vineyard in Bannockburn always creates one of the most full-bodied expressions of the Pinot Noir grape. Firm, deep in colour and with robust but smooth tannins, this wine is from a site that is possibly the highest altitude vineyard in Bannockburn. It results in Pinots with spicy, staunch textural qualities in their youth, which evolve over time into complex, rewardingly delicious wines. 18.5/20

Martinborough

RRP $39.99

Cambridge Road

Wild yeasts, a portion of carbonic maceration and ripe fruit from Hawke’s Bay all make this a beautiful expression of the Syrah grape thanks to sensitive winemaking by Martinborough winemaker Lance Redgwell, who purchased grapes from Stonecroft Vineyard to make this wine. It has textural interest and a medium body, which gives it fabulous balance and a lovely long, flavoursome finish. 18.5/20

RRP $116.99

Mondillo Wines

Silky smooth, fleshy Pinot Noir from Dom Mondillo, who describes the 2019 Bendigo growing season as cool in spring and leading to great flavour concentration in the grapes grown that year. This wine tastes ripe and rich with a superb silky texture that leads you back in for sip after sip. Deliciously seductive. 18.5/20

Ox Hardy Wines is a wine company with a long legacy inspired by Thomas Hardy, who planted some of the first vines in South Australia in 1891.

Decanter World Wine Awards 2022 – Gold Medal

NZIWS 2021 – Trophy for Champion Pinot Noir

NZIWS 2021 – Gold Medal

NZIWS 2022 – Gold Medal

IWC – Trophy for Champion Red Wine

IWC – Trophy Champion Central Otago Pinot Noir

IWC – Gold 96 Points

A CENTURY is a long time for a human life, but it’s not a long stretch for a fine wine brand, which can take at least a couple of decades to build brand awareness.

This is exactly what Nigel Greening and Blair Walter from Felton Road Winery have been doing extremely successfully for the past quarter century. So successfully, in fact, that it may seem surprising to know that Felton Road Wines is only 25 years old and, for the first time in 15 years, the team has launched its first new single vineyard Pinot Noir.

That new wine is MacMuir Pinot Noir, named for the vineyard of the same name on Felton Road, which is situated alongside the better-known Calvert Vineyard. The new wine was launched at the 25th anniversary of Felton Road Wines, in October last year.

A handful of wine writers were invited to the winery’s home in Bannockburn, Central Otago, to taste a selection of Felton Road’s old and new wines, focusing mainly on single vineyard Pinot Noirs from Block 5, Cornish Point, the Calvert Vineyard, the new MacMuir and also the Bannockburn blend: a wine made from grapes grown on nearly all of these different blocks of land around the winery and along Felton Road.

This is a dramatic corner of countryside. Gold mining sluicings define the landscape as much as the mountainous majesty of the arid surrounds. Lush green vines struggle to find their footing in the craggy dry rocks and the variation of the land’s aspect to the sun, wind

and its elevation all bring depth and a meaningful expression to the term ‘single vineyard’ wines.

Felton Road winemaker Blair Walter produces 100% biodynamically certified wines, meaning that all the grapes are grown without any chemicals and that the land is farmed in a sustainable fashion, with all waste recycled back into the property.

In a broad sense, the term ‘single vineyard wine’ has, I believe, been overused, often in a meaningless fashion; in a similar way to the buzz around the term ‘craft beer’. Both terms can fall victim to marketing hype and don’t always carry as much mana as I would like to see; speaking as one who is asked to critique these products.

But in the case of Felton Road, the wines do speak of a sense of place, even though these single sites sit right next to each other, in some cases. The two wines that speak to me of place more than any others, at least this early in their lives, are the 2021 Felton Road Calvert Pinot Noir and the 2021 Felton Road MacMuir Pinot Noir. Incredible differences are apparent, from their aromas to the body, structure and feel of these two wines in the mouth and also the taste of the fruit.

It’s still early days for New Zealand’s young wine industry but a lot has happened at Felton over the past 25 years, not least climate change and the profoundly positive impact that has had on the wines, says Blair Walter. But that’s another story.

This first vintage of MacMuir Pinot Noir comes from the single vineyard site in Bannockburn of the same name. This wine has a superb fragrance of red berries, plum jam and elegant florals, which sits in a full-bodied silky Pinot Noir with enormous depth and complex spicy flavours. It drinks beautifully now and will keep for the long haul in a cool, temperature-stable cellar.

THE PREMIUM Liquor Co. has launched its latest venture with the opening of Shed 530 Estate – a winery, vineyard and cellar door in Hawke’s Bay.

Previously Moana Park Estate, Shed 530 Estate produces its own signature Shed 530 label from grapes grown in small, estate-operated vineyards across Hawke’s Bay, with its own boutique Chardonnay made on-site.

The new winery is helmed by Chief Winemaker Kel Dixon, who takes over from winemaker John Hancock.

A Hawke’s Bay local, Dixon’s winemaking experience has seen him produce over 30 vintages across Hawke’s Bay, Marlborough, Canterbury and in the south of France. Dixon says he’s

excited to take up the new role. “I’m thrilled to use all my years of experience in winemaking to support a winery with a real vision for the future in a region I’m passionate about.”

The estate is nestled in the Dartmoor Valley and overlooks an historic woolshed and established vines that date back 30 years.

Shed 530 Estate’s cellar door offers its own wine selection as well as boutique gin options, cocktails and local beers alongside a range of small plates and platters using locally sourced ingredients, such as cheeses from Hohepa Dairy and Origin Earth.

shed530.com

INNOVATIVE AND multi-award-winning Invivo has launched a new bubbly range in New Zealand: Invivo X Unity – made for celebrating everyday moments all year round.

Featuring a gorgeous Prosecco DOC and perfectly pink Prosecco Rosé DOC, Invivo X Unity is made for celebrating everyday moments all year.

Like adding some glam to an outfit with a handbag or turning a Friday night-in into a party, Unity elevates an ordinary drinking occasion into something that sparkles. Whether you’re glowing up to go out on the weekend or watching the Eurovision Song Contest at home, Unity will bring the glam to your glass for this, and every occasion.

Invivo X Unity is also the Official Prosecco of the Eurovision Song Contest and will be showcased at the world’s biggest musical gathering in 2023 in the UK. Enjoyed by the contestants throughout the contest, Invivo X Unity brings together the ultimate party wine with the ultimate party!

Invivo X Unity Prosecco Rosé D.O.C

A beautiful pale pink drop with a glimmer of fine bubbles. Strawberries shine through on the nose, with a hint of tropical flowers coming through. This crisp Prosecco Rosé has perfectly balanced acidity. Douze points!

Invivo X Unity Prosecco

A beautifully crisp Prosecco with notes of citrus and white flowers on the nose. Green apple and orange and lemon flavours fill the palate from the first sip in this well-balanced bubbly What better way to elevate any night. Saluti!

MISSION ESTATE Winery was awarded New Zealand’s only Syrah Masters medal in the 2022 Global Syrah Masters for its 2019 Mission Huchet Syrah from the Gimblett Gravels in Hawke’s Bay.

The competition is run by The Drinks Business magazine with wines from old and new world regions tasted blind by a judging panel of Masters of Wine, Master Sommeliers and senior wine buyers. To win a Master award a Syrah must be judged “an outstanding example of its type, showing impeccable winemaking”.

Just six Masters medals were awarded: one for Mission and five for Barossa wineries. The very limited Huchet wines are described as “the ultimate expression of winemaking at Mission”. RRP $150.

Mission EstateCHURCH ROAD Chief Winemaker Chris Scott has been named New Zealand Winemaker of the Year for the fifth time at the annual Winestate Wine of the Year Awards.

It is also the third consecutive win for Scott, who has now won the title in 2013, 2016, 2020, 2021 and 2022.

Pernod Ricard Winemakers NZ, which owns Church Road, was named New Zealand Wine Company of the Year for the second year in a row.