EDITORIAL STAFF

Iam truly honored to be writing my first article as chairman. It doesn’t seem long ago that Denise [Johnson] approached me at conference and asked if I was interested in joining the board. To be honest, I remember seeing her across the convention hall as she pointed at me and said, “YOU!” singling me out like I got caught doing something I wasn’t supposed to! Now that I think back, maybe she was telling me I was going to serve on the board and not asking. My answer would have been yes either way.

Outside of attending several conferences, my first interaction with the BIGiOK was when our agency was facing multiple issues around how the state of Oklahoma is involved in insurance. I had told our story to a few people, and it was just not going anywhere. Someone suggested that I reach out to our Association. I had reached out to Scott Cornelius a couple times and found him to be extremely helpful. I knew Denise was related to Scott, so I was sure that apple didn’t fall far from the tree. Well, this was an understatement. Immediately I could tell how she approached agencies who reach out to the Association, and she was of vital assistance when I needed it. Everyone needs to understand that our Association has positioned itself

to serve its members. The work done by the BIGIOK teams and the board members from the past has produced an Association ready to react and serve.

It was at this point, I knew the importance of our Association. Over the last four years serving on the board, I have come to appreciate how intentional our Association is. The board meetings, while jovial at times, carries a very serious undertone of intensity to serve our members. Whether you employ two people or 300, the utmost consideration is there. I am coming in as chair behind Stewart Berrong. Stewart thrived in this leadership role and seeing his vision for our Association was great to be a part of over the last year. People often take the approach of holding the line and not losing ground during hard times, but Stewart saw his term as an opportunity to keep pushing us forward – and as a result, we have ended up in probably the best position our Association has ever been in.

In general, for insurance agencies, I don’t think there could be a better time for our industry as a whole. I have always gauged the market by how hard it is to grow our agency. There has been a significant growth of new businesses, and for the most part, fortunately, our existing insureds have been propped up through the pandemic with relief money.

But over the years I have come to learn that opportunities are only good if they can be capitalized on. This is where the BIGiOK is a valued partner. Utilizing Big I Hires to find a qualified workforce or engaging “Agency Opportunities” with Sara Bradshaw Ray are great ways to find solutions to streamline your agency.

I strongly suggest you run your agency through the Agency Assessment on the BIGIOK website. It will identify a library of resources indicated in the assessment results that would be helpful to your agency. Making sure your agency is taking full advantage of these resources will only help to grow and strengthen your knowledge base and that of your team’s, which makes all of us better agents. This, in turn, helps clients. The better we are at what we do, the better we can serve our clients.

As I think about what I would like to see happen over the next year, my mind goes right to our Young Agents group. I think to staff agencies and competing in developing the online marketplace;

we must invest in our pipeline of talent. We need to share our stories and let it be known that, no matter what you’re interested in, there is a possibility to get involved in those industries through insurance.

This is my story: I have always had an interest in Emergency Services. Our agency (The Burrows Agency) works hand-in-hand with fire, EMS and first responder agencies, and it is such a rewarding career, I don’t even think of it as a job. At no point did I ever think I could be highly involved in that community through insurance.

Our Association has many opportunities for our new agents. My favorite is Future Insurance Leaders of Oklahoma (FILO), an opportunity provided by BIGiOK to expand the knowledge and exposure of young insurance leaders in Oklahoma. We have courses for CISR, CISR Elite, CIC and CRM accreditations to take their knowledge to the next level. I feel this is an exciting time in our industry and I look forward to the year and serving our members. We have a great future ahead. n

With roots dating back to 1947, we have navigated other periods of uncertainty and various economic cycles. EST. 1947

For 75 years, Mid-Continent Group has been committed to providing specialty commercial insurance and surety products for the construction industry. Our specialized expertise and entrepreneurial, relationship-driven approach has allowed us to offer solutions which address the unique needs of our agents and insureds.

Policies are underwritten by Mid-Continent Casualty Company, an authorized insurer in all states except AK and NY; Mid-Continent Assurance Company, an authorized insurer in CA, CT, DE, HI, ID, LA, ME, MA, MO, NE, NV, NH, NJ, ND, OH, OK, PA, RI, TX, VT, VA, WV, WI and the D.C.; and Oklahoma Surety Company, an authorized insurer in AR, KS, LA, OK, TX and OH. © 2022 Mid-Continent Casualty Company, 1437 S. Boulder, Suite 200, Tulsa, OK 74119. All rights reserved. 5606-MCG (1/22)

We’ve made it through the hot summer and now we’re heading into fall… golden leaves, football, hayrides – all the “normal” things. Fall for us means it’s time to ramp up our many programs that assist in making our members better! Some of the things you need to note are:

•

The YA conference will be held Oct. 4-5 in Tulsa at the Tulsa Club. If you’re a Young Agent – you’ll want to be there. We have some incredible speakers and the networking in the industry is better than ever! If you’re in management in your agency, send your Young Agents! You’re not going to find a better way for them to learn the industry and get to know those involved in the industry.

• Agency Opportunities!

We encourage everyone in your agency to take advantage of the Agency Assessments (www. BIGiOK.com/AgencyOpps). If you want to find out how to make your agency better and the products and services provided to you as a Big “I” member, take advantage of these six FREE Assessments – Strategic Assessment, Technology Assessment, Marketing Assessment, Financial Assessment, Operational Assessment and Equipping Assessment.

• MyNetwork is in full swing! This is a facilitated Mastermind program to sharpen your professional skills not only in the industry but in leadership. We have programs nationwide and

Johnson, CISR, CIC BIGiOK PRESIDENT/CHIEF EXECUTIVE OFFICER

still growing. Take advantage of these incredible groups – it’ll make you a better professional! www.MyNetworkINS.com

• Check out our new and improved website!

I think you’ll find it easier to use and navigate. www.BIGiOK.com

I’m so thrilled with the feature article with our new Chairman Jerrad Coots. Jerrad has been an inspiration for me for many years and has taught me a lot about navigating through the legislative world of insurance. He and Kory are part of their family business – The Burrows Agency. They bring with them an innovative energy to the Association. It’s going to be a great year working with him and our new board.

As you know, the BigiOK staff is here to assist you with any need you may have. They are all hardworking and want the best for you. Always feel free to contact them with any questions or thoughts you might have. Our goal is to make your Agency Better! And of course, you can always contact me directly at denise.johnson@BigiOK.com.

Profound Thought: It is better to a have a great team than a team of greats. n

Maintaining a safe workplace shouldn’t be a daunting task. Protecting the workforce is what we do at Summit, and we’re here to help every step of the way.

summitholdings.com

Policies are underwritten by Bridgefield Casualty Insurance Company and Bridgefield Employers Insurance Company, authorized insurers in AL, AR, FL, GA, IN, KY, LA, MS, NC, OK, SC, TN, TX and VA; Retailers Casualty Insurance Company, authorized in AL, AR, LA, MS, OK and TX. ©2021 Summit Consulting LLC (DBA Summit, the people who know workers’ comp LLC), PO Box 988, Lakeland, FL 33802. All rights reserved.

Policies are underwritten by Bridgefield Casualty Insurance Company and Bridgefield Employers Insurance Company, authorized insurers in AL, AR, FL, GA, IN, KY, LA, MS, NC, OK, SC, TN, TX and VA; Retailers Casualty Insurance Company, authorized in AL, AR, LA, MS, OK and TX. ©2021 Summit Consulting LLC (DBA Summit, the people who know workers’ comp LLC), PO Box 988, Lakeland, FL 33802. All rights reserved.

OkPAC is BIGiOK’s political action committee. It provides financial support for state elected officials who will provide support for or have shown support of issues affecting the insurance industry and to those who share our business philosophies. Only individuals or partnerships can make contributions to OkPAC. Under Oklahoma law, OkPAC can accept no contributions from corporations.

Jeff Burton Vicky Courtney

Scott Dull David Eaton

Eitzen Family Trust C. Ross HarrisDonald Hass Michael Hood Denise Johnson Mark Long

Bruce Magill

Pat Mandeville Mike Mosley Sara Bradshaw Ray

Kathy Reeser

Michael Ross

Daniel Somers

Joe Strunk

Belynda Tayar

Thrive Insurance Scott Wiedemann

InsurPac is IIABA’s political action committee. It pools the voluntary and individual financial contributions of thousands of independent insurance agents to help elect candidates to Congress who share IIABA’s business philosophies. InsurPac is the largest propertycasualty insurance industry PAC in the country.

Contributions as of 07/12/2022. Only gifts of $100 or more are listed, except for Young Agents, whose contributions of any amount are listed. Young Agents are denoted with an asterisk.

Is your name not on the list? Use the contributor’s statement on the back of this page to donate.

Independent Insurance Agents of Oklahoma P.O. Box 13490 | Oklahoma City, OK 73113 P: (405) 840-4426 | F: (405) 840-4450 | info@bigiok.com

By making a contribution to OkPac, you are investing in the future of independent insurance agents across Oklahoma. Please note: All contributions must be made by PERSONAL check or PERSONAL credit card. Company or Agency accounts cannot be used.

Name: Agency: Occupation: Address: City: State: ZIP: Phone: Email:

Count me in! I want to INSURE MY FUTURE with a personal contribution to OkPac at the following level/amount: (select one)

$5,000 - Millenium Level

$2,500 - Platinum Level $1,000 - Centennial Level $500 - Gold Level

$250 - Pioneer Level $150 - Founders Level $100 - Young Agent Level Other: $______

I am including a PERSONAL check made payable at OkPac. I will submit payment online via https://okpac.epaypolicy.com

National Support: I want to INSURE MY FUTURE on a national level with a personal contribution to InsurPac in the amount of: $________ I am including a separate personal check made out to InsurPac. Please process my credit card. (Note: Card information may not be provided for OkPac.)

Credit Card Number: ____________________________________ Expiration Date: _______ Name on Card: ______________________________________________ CVV: __________

Contributions or gifts to InsurPac and OkPac are not deductible as charitable contributions for purposes of federal income tax. Federal and State law require IIABA and BIG I OK to use our best efforts to collect and report the name, mailing address, occupation and name of employer for each individual. Your contribution should be considered strictly voluntary Any corporate contributions are prohibited.

Declaration: The contribution listed above was freely and voluntarily given by me from my personal property. I have not, directly or indirectly, been compensated or reimbursed for the contribution listed above.

Signature: Date:

CHAIRMAN

Jerrad Coots

Burrows Agency

Claremore

Vicky Courtney

Ricketts Fennell & Assoc.

Tulsa

STATE DIRECTOR

Chris S. Floyd, CRM, CIC

Brown & Brown Insurance Pryor

DIRECTOR at LARGE

Scott Dull

Omega Insurance Agency

Choctaw

COMPANY LIAISON

Rebecca Easton CompRisk Management Inc.

CHAIRMAN-ELECT

Vaughn Graham Jr., CIC

Rich & Cartmill Inc.

Oklahoma City

SECRETARY

Kathy Reeser

VIP Insurance

Edmond

Stewart L. Berrong, CRM, CIC

Ed Berrong Insurance Agency

Edmond

DIRECTOR at LARGE

Ryan Teubner

Rich & Cartmill, Inc.

Oklahoma City

As the new voice of the independent agents of Oklahoma, BIGiOK promotes and provides education, legislative advocacy, innovative concepts and practical solutions, and community and career opportunities.

DIRECTOR at LARGE

Rob Piearcy

Arnett Insurance Agency Durant

COMPANY LIAISON

Meredith Cole Graham-Rogers Inc.

Bartlesville

BIGiOK is the largest insurance trade association in Oklahoma. With more than 475 independent insurance agencies, we represent nearly 3,000 independent insurance agents and their employees and more than 100 company members. BIGiOK member agencies range in size from one person to some of the largest agencies in the region.

Founded in 1906 as the Oklahoma Association of Local Fire Insurance Agents, BIGiOK is a result of the consolidation of the Independent Insurance Agents of Oklahoma, Inc. (IIAO) and the Oklahoma Association of Professional Insurance Agents (OAPIA) on Jan. 1, 1992.

BIGiOK policy is set by a board of directors elected at the annual conference. Policy is implemented by a professional staff located in Oklahoma City. BIGiOK’s

YAC CHAIRMAN

Ryan Smith

Smith & Sons Insurance Agency Lawton

mission is carried out through a variety of programs designed to enhance the business of independent insurance agencies.

BIGiOK is an active advocate on behalf of independent agents before legislative, regulatory and judicial groups in Oklahoma and at the federal level.

BIGiOK is affiliated at the national level with the Independent Insurance Agents and Brokers of America with offices in Alexandria, Virginia, and Washington, D.C.

BIGiOK is an excellent source of information through POLICY magazine, published quarterly, and the Oklahoma Agent, a monthly newsletter of time-sensitive material for its members.

Tom Cooper, Attorney at Law PIGNATO, COOPER, KOLKER & ROBERSON, P.C.

Change is not a four-letter word, but sometimes our reaction to it is! Prior to 2001, the law applicable to non-competition and nonsolicitation agreements in Oklahoma was equal parts vague and unpredictable. The law as applied in the real world seemed to be fundamentally incompatible with the statutory law as originally written. Although the applicable law was better defined just over two decades ago, some recent experiences of mine have led me to conclude that some agencies (and perhaps their legal counsel) have not fully stayed in step with the changes.

Let’s start with the law as written in the Oklahoma statutes. The core statute, which has been on the books since 1910, provides very simply that, subject to very limited exceptions, “every contract by which anyone is restrained from exercising a lawful profession, trade, or business of any kind . . . is to that extent void.” (The exceptions understandably address the sale of the goodwill of a business, as well as the dissolution of a partnership. In those instances, the parties can legally agree to various restrictions, including the prohibition of competition within a certain, defined geographical region, limited to the county where the business was located and all “contiguous” counties.)

When I first dealt with this issue in the early ‘90s, I found that the Oklahoma cases in which our appellate courts had interpreted the abovereferenced statutes had, over the years, developed a sizeable exception to the

“every such contract is void” statute. In a nutshell, at that point in time, the law was that only “unreasonable” restraints of trade were void, and that the “every such contract is void” statute was not really an absolute prohibition of all restrictions. The courts determined that, as long as a restriction was “reasonable” with regard to the type of activities embraced, the duration of the limitation, and the geographical area covered, a restraint of trade could be upheld. Because the “reasonableness” of restrictions was of course dependent on the particular facts of a particular case, no hard and fast rule was (or could have been) developed. This rather fuzzy standard remained the law in Oklahoma until 2001, when the Legislature amended our statutory scheme in an effort to provide some degree of structure to this area of the law. The Legislature’s motive was legitimate, but the end result fell short of supplying employers with much standing to prohibit a former employee’s conduct. The statutory language is sufficiently succinct – not to mention important – that it can and should be repeated in full here:

A person who makes an agreement with an employer, whether in writing or verbally, not to compete with the employer after the employment relationship has been terminated, shall be permitted to engage in the same business as that conducted by the former employer or in a similar business as that conducted by the

former employer as long as the former employee does not directly solicit the sale of goods, services or a combination of goods and services from the established customers of the former employer.

It is as simple as that; any provision in a contract that is in “conflict” with the above language “shall be void and unenforceable.” The few cases that have come out after the 2001 amendment have for the most part construed the new language strictly. That is, a written prohibition against the “direct” solicitation of customers of the former employer is acceptable, while a written prohibition against the “indirect” solicitation of customers of the former employer cannot legally be prohibited by the former employer.

Despite the fact that we are now over two decades post-change, I continue to see “Producer Agreements,” “Agent Agreements” and similar such contracts between agencies and its individual producers which rely upon the law as it existed prior to the 2001 amendment. I suppose the tendency to cling to outdated language is somewhat understandable in that these types of contracts tend to get passed down from generation to generation within an agency. Plus, it is not unreasonable for a nonlawyer employer to assume that it should have a decent degree of protection against competition by a former employee. But the harsh reality is that an Oklahoma employer can prohibit a former employee from only the direct solicitation of the sale of goods or services from

persons/entities who are already established customers of the former employer. And, if the non-competition agreement does not fall in line with existing Oklahoma law, the former employer runs the risk that the court will find the entire agreement void, and refuse to try to “rewrite” it so that it complies with the law.

I’ll leave agency owners with a bit of good news, though. The 2001 amendment also added a section which provides that a contract prohibiting an employee, or even an independent contractor, of a business from soliciting –directly or indirectly, as well as actively or inactively – the employees or independent contractors of said business to become employees or independent contractors of another person or business will not be construed as a “restraint of trade.” So, while the law allows only narrow restrictions on a former employee with regard to competing with the former employer, the law does not frown upon, and in fact explicitly endorses, a contract which prohibits a former employee from trying to steal/solicit the employees of the former employer.

Tom Cooper is a partner in the Edmond-based civil litigation firm of Robertson, Kolker, Cooper P.C. He began his career as an attorney in 1993. Since 1999, he has focused his practice on E & O defense and insurance coverage disputes. He has been a regular contributor to the POLICY for well over a decade and is a frequent speaker at insurance agent seminars.

Market trends. Added revenue streams. Acquisition opportunities. Access to additional markets. The road of independence is tough – but worth it.

At Keystone, we understand what keeps you up at night. We always have our eyes open to provide our community of like-minded agents with the resources, expertise, and relationships that matter in today’s industry. We work tirelessly so you can focus on leading your business with confidence – not sleeplessness.

That’s how independence works better together.

Young and new insurance professionals across our state, and even our nation, are the most valuable group for the future of our industry. It is an honor to speak for the Big I Oklahoma’s Young Agents over the next year.

Perhaps we have met, or we will soon, but I’d like to quickly introduce myself and let you in on the stance our committee is taking over the next year or more.

From Lawton, Oklahoma, I am vice president at Smith & Sons Insurance Agency and am a fourthgeneration owner. For the elders among us, you may have known my forefathers, Walter Smith, Wayne Smith, Clark Smith and Jeff Smith. In July 2022, I stepped up to serve as chair of the Young Agents committee, a seat that many inspiring professionals have held before me. It is a true privilege to serve the Big I of Oklahoma like they all did in their time.

During these wild days of hardening markets, a constant flow of new technologies to learn about, and countless new carrier and brokerage partnership opportunities, it is an exciting time to be involved in the world of independent insurance. But our industry stereotypes precede us in the talent pool.

There is an urgency in the industry to bring in talented young people, whether from other industries, the armed forces or straight from college or high school. At our 2021 Young Agents Conference, Alyssa Bouchard, VP of industry engagement at Gamma Iota Sigma, shared a brilliant presentation about what college students and graduates are considering when contemplating a career in insurance. The top four decision drivers for students/graduates when considering places to work were “future growth,” “training,” “culture” and “compensation.”

This is where the Big I comes into play for your new and young employees. While there are resources available to help with each of those factors, you have the opportunity to actively lean into what the Young Agents group has to offer.

Here is my commitment to you: the Young Agents committee will continue to find ways to host engaging

Ryan Smith YOUNG AGENTS COMMITTEE CHAIRMAN

events that enhance the young and new professionals in our space. I fully believe that a young person who is involved in the industry outside of their normal dayto-day obligations is more likely to excel in their work for their employer. By attending, participating and engaging in our Young Agent events and discussions, your young employee will make more ties in the industry, find inspiration to achieve more and grow. Their growth and fulfillment in their work will attract others in their networks to our industry, and likely your organization.

What I ask of you, Mr. or Mrs. Industry Veteran: support the Young Agent events by introducing your new and young employees to our group. Let them have a day and a half for the annual Young Agents Conference (Oct. 4-5 in Tulsa). Help them register for our regular Webinar Series. Support their interest in becoming a Future Insurance Leader of Oklahoma. Help them find a mentor and an accountability group in the industry that will push them to reach bigger goals. Maybe most importantly, get their feedback on how the insurance industry can better attract and support other young people.

The more engaged and passionate young people we have to represent us, the more opportunities for bringing in new young talent to our industry. I look forward to discussing this with you at the next Big I event, and with your young colleagues at the next Young Agent event. n

Did you know? Independent Agents place 35.7 % of all personal lines – up from the two previous years, according to the Big I 2020 Market Share Report. Also, Captive agents/carriers lost 4% of the market share from 2017 to 2019, according to the report. This might surprise many, but it’s a great indication that the IA is still very relevant in the personal lines space.

Did you know? Independent Agents place 84.5% of all commercial lines. That means a vast majority of all commercial lines is handled by Independent Agents and Brokers across the country, just like you. Not Captive Agents or Direct Writers. Also, the trend of IAs placing commercial lines continues to strengthen with marginal but growing market share.

The Big I Market Share report is supported by AM Best data, which is the most credible in the industry regarding insurance carrier placement. This

credible information provides us clear indication of the strength and direction of the Independent Agent and Broker. I’m not a math whiz, but I would say the Correlation Coefficient indicates a positive direction of the Independent Agent according to this data.

Independent Agents and Brokers are strong and are growing market share as they play a vital role in the risk and insurance space for their customers.

The Big I provides very valuable information to its members. The Market Share Report is just one of many publications that are available and free to you as a Big I member. For full details of the Market Share Report from the IIABA / BIG I, go to IIABA.NET. n

WE ALL WANT A PIECE OF IT, AND WE ARE CURIOUS WHO OWNS IT

Chris Floyd, CIC, CRM STATE

Independent Agents and Brokers are strong and are growing market share as they play a vital role in the risk and insurance space for their customers.

National Security has provided competitive, affordable insurance to policyholders for 75 years. We also provide our agents with competitive commissions, excellent customer service and experienced company adjusters.

As a Southeastern based regional company, National Security prides itself on fast, efficient service from a friendly small town company. Our agent website provides fast quotes, online policy issuance, and real-time policy information. Find out more about our products by calling 1-800798-2294 or visiting nationalsecuritygroup.com

Elba, Alabama

Elba, Alabama

Our nation is seeing the impact in nearly every industry. COVID earlyretirement packages left many in the airlines industry with 25% fewer pilots than their daily routes required. In addition to the airlines industry, a USA Today study revealed a staggering number of other industries – including the insurance industry, as well as health care, manufacturing, accounting and engineering – with large shares of workers approaching retirement age in the next five years.

The insurance industry has been warned about the ever-growing “Graying Out” of our ranks for nearly a decade, but few have really gotten serious about addressing it. In 2023 alone, it’s estimated that close to 20% of our industry employees will be exchanging their office keys for condos in the Keys. Think about what that statistic looks like in your own office. Then consider the staggering number of people required to fill that void and the fact that they most likely will be walking into our offices as neophytes ready to assume entry-level roles and ill-equipped to deal with the complex issues of risk management, the unique nuances of individualized protection portfolios and the everevolving dynamics of our tops-turvy marketplace.

Completely apart from the graying issue is the “Great Resignation.” We’ve all read about it and likely even experienced it as the term “post-COVID” began to make its way into our conversations. While the term may sound like the title of a dystvopian novel, it’s a term used to describe a predicted mass exodus of employees from the workforce. And while it would also be easy to say, “Well, that’s not happening in my office,” and move on to the next thing on your calendar, the cold hard truth is that it’s happening in nearly all of our offices, not just the restaurants where you wait 45 minutes to be seated, then discover only half of the tables filled.

The great news is that we don’t have to get caught on our heels! We have the opportunity to change the trajectory of the statistics if we step up and invest in our next generation in more ways than just the basics of our “first-week-on-thejob” industry orientation videos and prelicensing courses.

We’ve mentioned this in previous articles, but it begs the reminder that the COVID-19 pandemic has reoriented workers who are asking: Why do I do what I do? What am I good at? and How can I thrive? Employee-growth-centric leaders and managers are delving into the answers to these questions with their agency team members to understand what energizes

are all kinds of articles about flexibility and benefits, but the intangibles may be even more impactful. Employees who trust their leadership, who feel valued, and who believe that they are contributing and growing are the employees who are going to thrive in our industry going forward.

them, where their passions are and how they can help them thrive in our industry. Never underestimate implicit messaging that accompanies the investment you make in your people. It is a strong indicator that you value them, you appreciate them, and you see what they can bring to your organization.

Easier said than done? Not really! Employers who are winning the battle against the Great Resignation and neutralizing the massive “Graying Out” trend of our industry are those who are going beyond the basics and investing in the professional growth and development of their employees, especially the next generation.

There are all kinds of articles about flexibility and benefits, but the intangibles may be even more impactful. Employees who trust their leadership, who feel valued, and who believe that they are contributing and growing are the employees who are going to thrive in our industry going forward.

There are all kinds of examples outside our industry of employers who are investing in their teams with workshops, coaching and dashboardbased resources that deliver and quantify the value of their investment and outcome in their teams. A great example right here in our home state is un-sung

hero, BIGiOK President and CEO Denise Johnson. Forward-thinking and ever aware of the extraordinary need to grow our next generation, Denise made sure our 2021-22 BIGiOK Young Agents Committee had the opportunity to participate in a MyNetwork facilitated mastermind group designed to connect them as a team but also grow them as future leaders in our state and our industry.

Originally established in 2015 to meet the needs of female leaders in the insurance space, MyNetwork has now expanded to include mixed gender groups of leaders, managers and producers. These high-impact groups, led by seasoned professional facilitators, are catalysts for neutralizing the current trajectory of retirement and resignation. To learn more about how BIGiOK can help you leverage MyNetwork to grow your own organization visit our independent website, www.MyNetworkINS.com

Bill Gates captured the essence of this entire article when he said, “As we look ahead into the next century, leaders will be those who empower others.” This is how we address “The Gray.” Let’s be leaders! n

There

• The Hanover Insurance Group

• AmTrust North America

• ICW Group

• Berkshire Hathaway GUARD Insurance Company

• Pie Insurance

• Hawksoft, Inc.

• AF Group

• Columbia Insurance Group

• Philadelphia Insurance Companies

• Burns & Wilcox

• Producers XL

• Stonetrust Workers’ Compensation

• Equity Insurance Company

• Taber Brokerage

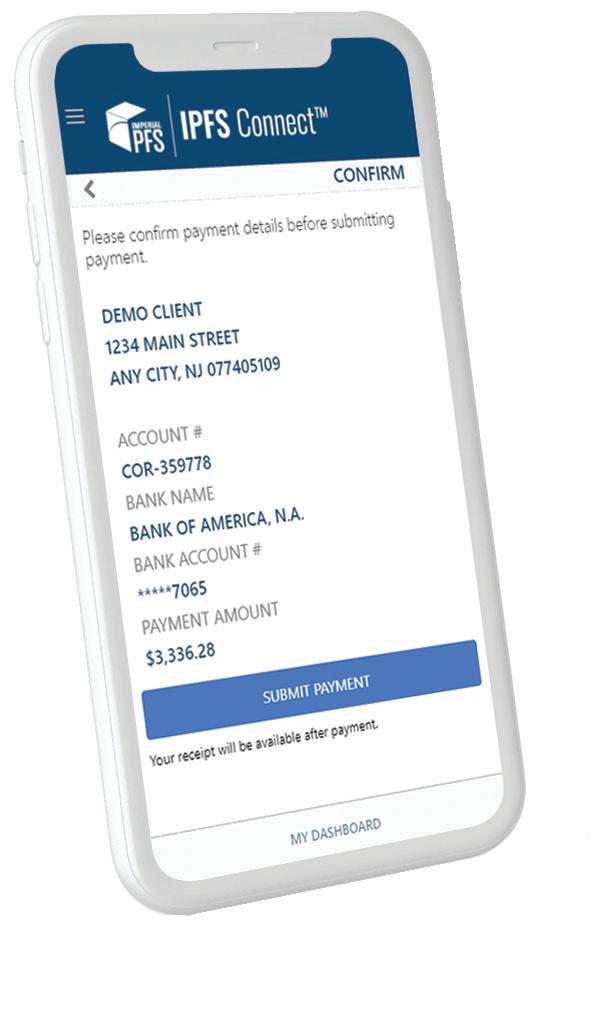

• ePayPolicy

• Jencap Insurance Services

• Normandy Insurance Company

• RT Specialty

• Central Insurance

• Risk Placement Services, Inc.

• AndDone-Quivit

• Southwest Risk, LP

• Markel

• Patriot National Underwriters, Inc.

• Prime Insurance Company

• The Hartford

• Skyward Specialty Insurance

• Med James, Inc.

• Treaty Oak General Agency

• Iroquois Group

• BPN, Inc.

• Red River Roofing and Construction

• Farmers Alliance Mutual Insurance Co.

• Keystone

• Amerisafe

• WORKS24

• Main Street America

• Equipment Insurance International

• Applied Systems/EZLynx

• EMPLOYERS

• Openly Insurance, Inc

• UFG Insurance

• Old Republic Surety Company

• Foresight

• Smart Choice

• Gainsco Auto Insurance

• Traders Insurance Company

• Pennsylvania Lumbermens Mutual Insurance Company

• Specialty Insurance Managers of Oklahoma

• Cornerstone National Insurance

• Chris-Leef General Agency, Inc

• National General, an Allstate Company

• Swyfft

Recovering from a cyberattack can be costly and timeconsuming. With the increase in the number and cost of cyberattacks, more companies understand the importance of cyber insurance. According to The National Association of Insurance Commissioners, the number of written

consumer information and continue effective operations.

In 2021, NAIC formed a new Innovation, Cybersecurity, and Technology (H) Committee to address the insurance implications of emerging technologies and cybersecurity. This will be an ongoing opportunity for state insurance regulators to discuss and coordinate efforts regarding innovation, cybersecurity and privacy.

cyber insurance policies in force increased by 21.3% from 2019 to 2020.

In an era of uncertainty and with so many devices scattered throughout enterprise networks, insurers face digital risks in their daily operations, as do all firms in the financial sector. Insurers receive a lot of personal and financial information from both policyholders and claimants. Our industry must keep pace with security demands to protect

At the Oklahoma Insurance Department, we also recognize that cybersecurity is one of the most important topics for the insurance industry and businesses today. We are committed to adopting new defensive tools to educate our employees about their information security responsibilities for keeping the state of Oklahoma secure. We understand that most attacks are successful due to “individual error” within the organization. We are focused on training our team and implementing security processes to help protect the confidentiality, integrity and availability of state data.

However, cyber insurance alone is not a perfect solution. Companies that have cyber insurance still need to practice data security training regularly. In addition, cyberattacks are constantly

I believe organizations should bring together human resources, legal and IT teams to emphasize the importance of cybersecurity in the workplace. Whether by accident or not, many employees are still the biggest cause of cyberattacks, according to the 2019 the Cost of Cybercrime Study.

evolving as hackers develop new methods and find new targets. The rapid evolution of these new hacking strategies makes it difficult for insurers to assess the true risk of potential losses and expenses. Therefore, it is important to train and educate employees to think and act with security in mind rather than respond after a cybercrime.

I believe organizations should bring together human resources, legal and IT teams to emphasize the importance of cybersecurity in the workplace. Whether by accident or not, many employees are still the biggest cause of cyberattacks, according to the 2019 the Cost of Cybercrime Study.

As counteracting internal threats is still one of the biggest challenges facing businesses, greater emphasis should be placed on preventing people-based attacks. Also, adopt data loss prevention technologies and tools such as cloud services to help reduce the cost of cybercrime. Organizations should invest in enabling security technologies to reduce costs and enhance recovery efforts.

Cyber insurance is a small but growing market. As cyberattacks become more frequent and damaging, insurers need to provide cyber coverage that protects people from these emerging risks. As the cyber insurance industry faces challenges with a lack of historical data and the ability to predict the future of cyber risk, insurers and policyholders need to agree on contracts and ensure a clear understanding of what is covered.

Discuss with your insurance agent what policy would best fit your company’s needs and ask

questions about your policy. Make sure your policy includes coverage for data breaches and cyberattacks on your data held by vendors and other third parties. Also, consider whether your cyber insurance provider will defend you in a lawsuit or regulatory investigation: Look for “duty to defend” wording.

Moreover, security should be a core competency across organizations, whether they have cyber insurance or not. Companies must invest in the education and training of their employees to increase cybersecurity awareness and mitigate cyber risk. Organizations should work closely with their partners to jointly protect and defend their operations. By enhancing security controls and strengthening their cyber programs, there’s a better chance of securing a policy with more attractive rates and coverage.

As regulators, we will also work hard to develop new ways to monitor this evolving market and protect consumers from these threats. Cyber insurance is certainly one of the fastest-growing sectors of our industry. To keep pace with this growth, we will continue to support our employees to be competent and security-centric by providing new technologies and educational resources.

Now, more than ever, we all need to do our part to build cyber resilience from the inside out. When consumers, insurers and regulators all work together, I believe we can find better ways to manage digital risk and better cyber security practices. n

In Oklahoma and all over, independent insurance agencies have long struggled with the adoption and implementation of technology in today’s digital world. Far from recognizing tech as an I.T. function of backroom servers and computer systems, a successful tech strategy is the sign of a future-focused agency.

But, what does a digital strategy look like for independent insurance agencies? How do they evaluate and incorporate foundational tech tools, like an agency management system? What emerging tools, like mobile apps and chatbots, are they prepared for? And, most importantly, how do they successfully onboard these new technologies to turn a profit?

For decades, technology has been one of the biggest pain points for the independent agency system, predominately composed of small-to-midsize businesses. Their size, limited staff, and fear of risk have been a sticking point in allowing for advancements in the area of tech.

When it comes to technology, independent agents can no longer just sit back and “wait and see.” The pandemic forced much of the world into a remote environment heavily reliant upon technology, consumers now demand businesses be more technologically savvy, and competition from direct and captive agents leveraging technology is intensive. Agents need to step up, but how do they start?

Enter Catalyit.

In October 2021, the independent agency system gained its biggest tech advocate. Backed by renowned tech leader Steve Anderson and seven Big “I” state associations, the single greatest technology resource for the industry was born.

Catalyit knows tech. But not just any tech. They have assembled a team of insurance industry tech leaders who

specialize in key areas that feed the Catalyit resource online and enable the Catalyit experience for subscribers. Coined the Catalyit Success Journey™, the platform takes its members along a personalized technology roadmap that changes and evolves as the agency changes and evolves. Their Baseline, Better, Best, and Beyond benchmarks guide agencies through areas of technology to help them move from research to successful implementation. Catalyit is all the tech guidance an agency needs in one place.

While Catalyit is a full technology emersion experience for independent agents, offering one-on-one consulting, training courses, articles and a discussion board, it’s the guides and reviews that set it apart.

Catalyit Guides and Reviews curate solution providers across 20+ categories that exist to make independent agencies run more effectively and efficiently. Each guide contains a topline overview why that category is critical for today’s agency, five points of consideration when selecting a provider, and Catalyit’s take on the implementation and adoption of that specific technology, as well as ratings and reviews for the service providers listed. Certain categories, AMS and Personal Lines Quoting Systems for example, take it one step further and show a high-level comparison chart of vendors to help make the selection process that much easier.

Catalyit provides two levels of service to independent insurance agents: a free Basic Subscription and a Full Access Plan. Both journeys begin at the same starting point – the Catalyit Tech Assessment, which will now be a part of Agency Opportunities Assessment series at BIGiOK, walks the user through five groups of multiple-choice questions to give the agency and the Catalyit team insight as to how much, or how little, technology the agency currently has in place.

Upon completion of the assessment, the agent will receive a comprehensive report with a personalized technology road map. As part of the upgraded plan, Full Access subscribers will also receive a complimentary 30-minute phone consultation with a Catalyit expert to review their results and create a plan for the future.

“We set out to give the industry something it has never seen before,” said Steve Anderson, Catalyit co-founder and CEO. “This platform is more than just another technology resource. By leveraging all the components and opportunities housed on the site, agencies can thrive in ways they will not on their own.”

Anderson leads a team of experts, united by the strength of 100-year-old organizations, to remove the roadblocks that are preventing insurance agencies from advancing their internal technology capabilities. Catalyit boasts it’s passionate about two things – independent insurance agents and technology – serving agents of any size, no matter where they are on the technology spectrum.

“This is a resource every independent agency can get behind,” states Lisa Lounsbury, co-founder and president of Catalyit. “No matter how advanced an agency’s digital strategy may be at present, with new products and opportunities hitting the market every day, it’s impossible to keep up. Our team is 100% focused on staying abreast of trends and needs for the IA system, removing that stress from the agency floor.”

We’re excited to announce the integration of a new BIGiOK member benefit called Catalyit coming to Oklahoma in October. This new addition to the Agency Opportunity

Assessments will give you even more insights into how to grow your business. Beginning in October, all BIGiOK members will be automatically set up as basic members, but at any time you have the option of upgrading to full access, which unlocks all content, training, guides, reviews, newsletters, community and more for their entire team. If you’re not already familiar with Catalyit, be sure to check out their website for an overview of what they do. We think you’ll be impressed with what they have to offer!

By Jerri Culpepper

By Jerri Culpepper

Incoming BIGiOK chairman

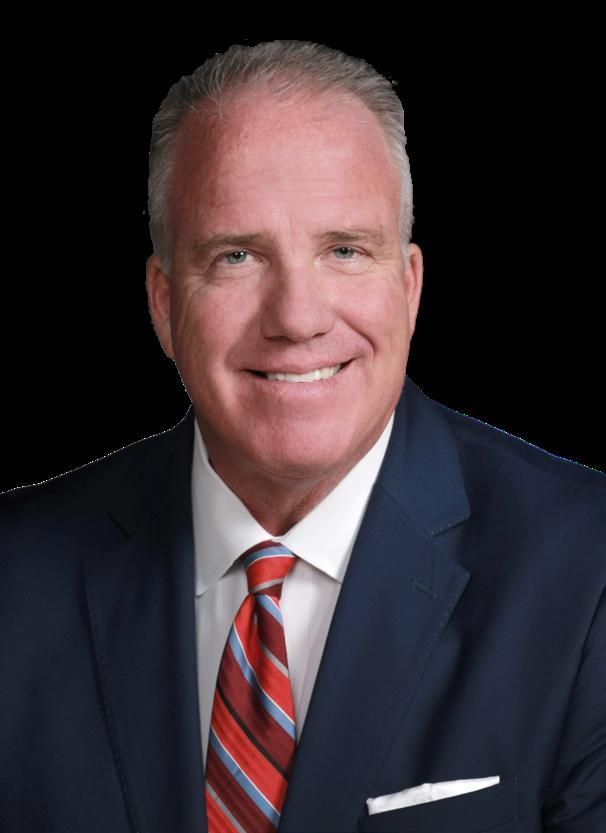

Jerrad Van Coots, today a risk and marketing specialist at The Burrows Agency (www.vfisok.com/) – which he describes as “the greatest job in insurance” – describes himself as a “working man from the start.”

The Norman native’s first “job” reveals a budding entrepreneur: “re-selling” tickets at University of Oklahoma football games.

“I was about 12 or 13. My buddy would walk one way around the stadium right by the gates; people would just give kids tickets as they go in. He would pass them off to me and I would sell them. It was one of the greatest times in my life,” Jerrad recalled. We used the money to play video games at The Quarter House on campus and ate a lot of cheese fries.

“OU fans will know what I am talking about,” he quipped.

After graduating from Norman High School, Jerrad headed straight out into to the workforce so he could “get right into living life,” as he puts it.

He worked is way up to being manager of an auto glass company that was contracted my General Motors to replace glass in

vehicles that had already been through the assembly line. That career ending abruptly with the closing of GM in Oklahoma City.

“It was by first real reality check about life and careers,” Jerrad recalled. “I was all in and on my way with an amazing career; to have that pulled out from under me was tough, but it prepared me for the harder parts of life at a young age”

His first job in the field of insurance was with a private investigation company, Winston Service, which conducted all types of private investigative work but specialized in Workers’ Compensation investigations.

“Your days start very early. We have no idea when someone is going to leave their house. So, starting surveillance at 4 or 5 a.m. is quite normal,” he said. “Some days the individuals leave early and act in a way not even close to what they are claiming. Some days they don’t leave at all. Those are very long days.”

Owner Robert Cox served as a mentor “both professionally and spiritually to me,” Jerrad said, noting that the way he conducted his business with genuineness and integrity continues to guide him.

“The skills I learned at Winston Services were instrumental in me being hired by Walmart to do internal investigations for embezzlement and forensic-style auditing,” he said. “I had the opportunity to learn investigative interviewing and interrogation techniques.”

In 2012, Jerrad began working at The Burrows Agency, headquartered in Claremore, alongside his wife, agency director Kory Burrows Coots, who represents the third generation of her family to work in the insurance field, and her father, agency president Dave Burrows. Kory’s grandfather,

John Harvey Burrows, worked as an independent insurance agent for 57 years. He purchased Viles & Burrows Agency, which became The Burrows Agency in 1975. Today, Jerrad spends most of his time working with Oklahoma’s fire and EMS community. The Burrows Agency is the state’s largest provider of insurance to the emergency services community.

“I feel like I have the greatest job in insurance; serving those who serve others in the manner that emergency service workers do is very fulfilling. I hope other insurance agents think of the insurance they write is as fulfilling as I do,” he said.

Jerrad said his greatest career success to date is, by far, his acceptance by the emergency service community.

“The fire and EMS community is an amazing group of people. On a daily basis, they do heroic things. So, imagine handling claims around situations where people have risked their lives or were involved in impossible situations. You must try and respond from a claim’s stance with the same level of intensity. We respond to them the same way they respond for everyone else. Trust me, they don’t expect anything less,” he stated.

Outside the office, Jerrad enjoys spending time with wife of 14 years and their daughters, Kohen and Vanna. They especially enjoy family movie nights, which they hold one to three times a week. The family has two poodles, Maddie and Shadow, and a cat. Additionally, the older daughter, Kohen, has a chameleon named Sherman.

Noting that he loves playing the drums and even has a dedicated room for it in the house, Jerrad kids that he tries “to ruin everyone’s peace at least once a day.”

2021 photo showing a scene from Killers of the Flower Moon starring Martin Scorsese, Leonardo DiCaprio and Robert De Niro. Incoming chairman Jerrad Van Coots (wearing hat and with sideburns) and his wife, Kory, had an opportunity to serve as extras for the film.

copyright 2021 Tulsa World

Jerrad Van Coots’s family, from left, daughter Kohen, wife Kory and daughter Vanna.

Jerrad is active in the community. He is a past board member of the Heritage Hills Golf Club and the Claremore Collective and a current board member of the Claremore Soccer Club, the Oklahoma State Firefighters Museum and, of course, BIGiOK.

“Due to the nature of our business, I serve as an advisor to countless emergency services across the state,” he said, adding with a smile, “When I say advisor, I mean anything from legislative work to flipping burgers at a fundraiser. Support your local emergency services!”

And just recently, Jerrad and his wife had a once-in-alifetime opportunity.

“My wife and I were recently cast in the movie Killers of the Flower Moon. I got to work side-by-side with Martin Scorsese, Leonardo DiCaprio and Robert De Niro,” he said.

Given his obvious passion for and pride in his current line of work, as well as his fulfilling life outside the office, it’s obvious that Jerrad took the right path, which started years ago as an enterprising football ticket scalper. n

Q. As the incoming chairman, what are your top goals for the Association?

A. My top goals are going to be around ensuring we are serving our members in the way they need it. In any organization, you have to identify your strengths and weaknesses. Then you must have a grasp on the capability of your team. With Denise [Johnson] and the staff at BIGiOK, our possibilities are endless. … We have had an amazing run of past chairmen and board members. Our Association is positioned so well legislatively and educationally, and we have the best company partners in the country. I just have to keep our eye on the prize, and it will be a great year.

Q. What do you see as the Association’s greatest challenges in the coming decade?

A. Just recently I was in Bugtussle, Oklahoma, at a rural fire department. I was putting my hands on the property I was insuring. I was fielding questions and telling stories of our agency and our history serving the fire service. The board meeting was at 7 p.m. on a Tuesday. Most of the members of the department are coming straight from work. It’s hot and the people are obviously tired. I was ecstatic to be there, I was ecstatic to be talking insurance. Whether it’s insure tech or a pandemic, the push to automate insurance or for it to be handled remote is prevalent in our world. What we must determine as insurance agents is, are we the problem? Are we pulling back from getting personal with our insureds? The generations before us considered their insureds as family who have put trust in them. The loss of this relationship is the greatest threat to our Association and our industry. It creates the vacuum that paves the way for a different solution.

Q. What do you see as the Association’s greatest strength?

A. Our greatest strength is that we are in Oklahoma. We value one another. We value an eyeto-eye handshake. We have a strong membership of

the most respected people from communities across the state. Another strength is my generation is being handed an industry that is planted in the most fertile soil, that has been worked and prepared. We still have those individuals involved today and we are still benefiting from their leadership. We should be leaning into these guys and gals for inspiration and wisdom.

A. Life has changed dramatically in a short time. The competition for people’s attention is now the name of the game. We are in a constant secondby-second fight for someone’s attention. People unfortunately have to prioritize where they focus their attention. I was at presentation recently. Half of the people attending probably sent 100 emails, responded to 100 text messages and paid two bills during the presentation. The paradox of holding relationships close and personal might not be done standing next to them anymore. I personally reject this notion. The microwave was so convenient when it came out. TV dinners were to be the future of cooking. It didn’t take long to figure out, ease and convenience doesn’t mean edible food, and it won’t mean good insurance. As an Association, we have to prepare our members by keeping our culture of agent representation vital.

Q. How would you describe your leadership style?

A. Trust but verify. This is only because of the staff we have here at our office. Honestly, it’s probably just “trust” right now. We are all professionals and know what needs to be done. I have always seen our staff as equals. I always share my mindset or how I’m seeing different situations. If you present an idea well, they latch onto it. I’m not into giving orders or just telling people what to do. I have put a lot of trust into our team. I surround myself with people who will make me better. I am inspired every time I walk into the office.

Congratulations to Dillingham Insurance (www. dillinghaminsurance.com/), headquartered in Enid, recipient of the Southwest regional MarshBerry’s MAX Performer Award!

The MarshBerry MAX Performer Award is a mark of distinction given to independent agencies with

impressive financials, operational excellence, and world-class client service. The national winner will be announced in October.

Watch the regional winner video announcement: https://hubs.ly/Q01f5N-70 n

The Young Agents’ lunch bunch at Hideaway in Stillwater had an excellent turnout! We were thrilled to see so many new faces, and we’re looking forward to seeing everyone again at our next event. We hope you’ll join us for a fun and casual lunch where you can meet new people and catch up with old friends. Upcoming Young Agents’ Happy Hours: Up Down; Tulsa, 4-6 p.m. Sept. 7, In the Raw VU; and Ardmore, 4-6 p.m., The Dew Drop.

We love to spotlight our BIGiOK agency members. They are an incredibly talented and hardworking group of individuals who share our commitment to excellence. We are proud to have them as part of our Association.

Be a Newsmaker | What’s happening in your organization? Celebrating an anniversary, opening a new branch, or have a staff member who has received an outstanding award? Send us your news, along with a photo and your logo, so we can recognize those achievements in our POLICY magazine. Please email info@BIGiOK.com if you have questions.

We are excited to announce the release of the Oklahoma Young Agents Show podcast which is avail able on Apple Podcast, Amazon Music, Spotify and BIGiOK.com/YA. The aim of the podcast is to engage, educate and expand the horizons for Young Independent Agents in Oklahoma, by presenting quick interviews of leaders in our space. The show is designed to provide listeners with valuable information about the insurance industry for new agents, as well as to create a community for young insurance professionals in Oklahoma.