P OLICY

WINTER 2022

What a great first couple of months as chairman.

I had the pleasure of attending the Big “I” Fall Leadership Conference in Niagara Falls. It was reassuring to see the gears working on a national level with all our agencies in mind. More importantly our Oklahoma Young Agents and Shania Slavick were both recognized for their efforts and achievements for winning the “Outstanding Young Agent’s Meeting Award” for their 2021 conference and “Liaison of the Year Award.”

There was a little bittersweet moment when IIABA CEO and President Bob Rusbuldt announced his retirement after 37 years with the IIABA. He has overseen many major Big “I” initiatives, including the inception of Big “I” Markets, InsurBanc, Trusted Choice® and the creation of Big “I” Hires.

I want to take a minute and encourage you to engage with BIGiOK. My time with my fellow board members over the years has really kept me from falling into a rut. I know we all read how beneficial networking is, but until you put it to task you will greatly underestimate the truth in it. There are many ways you and your staff can be engaged and reap the benefits of networking. Our Young Agents group has many events across the state like the YA Happy Hours, lunch bunches and conferences. For people new to the insurance industry, it’s easy to feel like you’re on your own. By getting them out to these events, they will feed off one another and understand

that they are facing the same hurtles as other agencies.

The Big “I” Oklahoma has many events throughout the year. Our conferences and trade shows put agents and company representative together in one place. If you’re like our agency, throughout the year the question will be said out loud: “I wonder who would write a..?” The answer to that question is at our conference. The nation’s top companies come together to help inform and encourage you and your staff to not only write business but also know where to put it. I can attest to specific moments that were turning points for me. Many of those moments were at BIGiOK events.

With that said, we are currently planning the 2023 BIGiOK Annual Conference in Branson, Missouri, April 2021 at Big Cedar Lodge. This will be an amazing conference! I encourage all of you to register as early as possible, as the room block will fill up fast. We will have an excellent lineup of speakers; networking activities such as shooting clays, fishing, golf, etc.; a chuck wagon dinner; partner showcase; and more! So, be on the lookout for more information coming soon. It could be a turning point for you and your agency. n

For 75 years, Mid-Continent Group has been committed to providing specialty commercial insurance and surety products for the oil and gas industry. Our specialized expertise and entrepreneurial, relationship-driven approach has allowed us to offer solutions which address the unique needs of our agents and insureds.

We distinguish our Workers’ Compensation coverage by providing value-added services before, during, and after a claim.

Upfront loss control measures Responsive claims handling Facilitation of quality medical care (when an accident does occur)

We’ve been successfully protecting our policyholders and their employees since 1983.

Browse all of our products at www.guard.com.

Happy holidays to everyone!! It seems like we were just celebrating summer and fall –and now it’s winter! We’ve had SUCH a busy fall around here!

In September, we attended the IIABA Fall Leadership Conference, where our Young Agents were awarded the Outstanding Meeting award and our own Shania Slavick was named Young Agent Liaison of the Year. Our YA Committee is working HARD to create community within our Association and industry. If you know of someone who should be involved, please contact us –there’s room for more!

As we close out 2022, we’ve been able to get back to some sort of “normal.” We had an outstanding 115th Anniversary Conference in May at the OKC Omni and had a record crowd. We also have gotten back to in-person classes in the building; however, the benefit of virtual is still available to all of our members: Katie Finch and Shania keep it all moving.

Our Agency Opportunities Department is booming and there’s more to come! If you are interested in Consulting Services for your staff or agency strategic planning, we can do it. Sara Bradshaw Ray is now Kolbe Certified and can give you and your business insight for those that you are hiring or already on staff.

Our website is new in 2022. It’s cleaner and brighter, but mostly easier to navigate than ever before. Jerry Rappe’ has done an incredible job

in our Communications Department, doing everything from working on podcasts with our Young Agents to making sure we get our weekly video out. He has so many great ideas, and I can’t wait to see what he has in store for 2023.

Our “For Profit” Department is as busy as ever. Jeanette Madrid and Cindy Munden work tirelessly with our workers’ comp program (and Cindy still handles Farm & Ranch and Umbrella!). Cari Senefsky and her team are doing a great job with our E&O Program, which has changed over the past few years.

And of course, Josh Reasnor, our COO, keeps all the plates spinning to make sure we’re on task. Honestly, I can’t ask for a better staff to make YOUR Association the best it can be!

Also, in this holiday season of thankfulness, I can’t sign off without mentioning the wonderful Board of Directors that I work with. I’m not sure any state has a better support system than the BigIOK Board. They care about this Association and the needs of its members. They are willing to step up to make our agencies better. I truly appreciate their forward thinking and support.

To all of you, I was to wish you a Merry Christmas and a happy 2023. It goes by fast, doesn’t it? n

“And now, welcome the new year. Full of things that have never been.”

- Rainer Maria Wilke Johnson, CISR, CIC BIGiOK PRESIDENT/CHIEF EXECUTIVE OFFICER

Maintaining a safe workplace shouldn’t be a daunting task. Protecting the workforce is what we do at Summit, and we’re here to help every step of the way.

summitholdings.com

Policies are underwritten by Bridgefield Casualty Insurance Company and Bridgefield Employers Insurance Company, authorized insurers in AL, AR, FL, GA, IN, KY, LA, MS, NC, OK, SC, TN, TX and VA; Retailers Casualty Insurance Company, authorized in AL, AR, LA, MS, OK and TX. ©2021 Summit Consulting LLC (DBA Summit, the people who know workers’ comp LLC), PO Box 988, Lakeland, FL 33802. All rights reserved.

Policies are underwritten by Bridgefield Casualty Insurance Company and Bridgefield Employers Insurance Company, authorized insurers in AL, AR, FL, GA, IN, KY, LA, MS, NC, OK, SC, TN, TX and VA; Retailers Casualty Insurance Company, authorized in AL, AR, LA, MS, OK and TX. ©2021 Summit Consulting LLC (DBA Summit, the people who know workers’ comp LLC), PO Box 988, Lakeland, FL 33802. All rights reserved.

OKPac is BIGiOK’s state political action committee. It provides financial support for state elected officials who will provide support for or have shown support of issues affecting the insurance industry and to those who share our business philosophies. Only individuals or partnerships can make contributions to OKPac. Under Oklahoma law, OKPac can accept no contributions from corporations.

Wes Becknell

Stewart Berrong

Travis Brown

Debbie Burton

Jeff Burton

Jerrad Coots

Vicky Courtney

Scott Dull

David Eaton

Eitzen Family Trust

Vaughn Graham C. Ross Harris Donald Hass Michael Hood

Denise Johnson

Mark Long

Bruce Magill

Pat Mandeville

Mark McPherson

Brandy Mullins

Sara Bradshaw Ray

Kathy Reeser

Michael Ross

Daniel Somers

Joe Strunk

Belynda Tayar Thrive Insurance Scott Wiedemann

InsurPac is IIABA’s national political action committee. It pools the voluntary and individual financial contributions of thousands of independent insurance agents to help elect candidates to Congress who share IIABA’s business philosophies. InsurPac is the largest property-casualty insurance industry PAC in the country.

Wes Becknell

Stewart Berrong

Travis Brown

Debbie Burton

Jeff Burton

Vicky Courtney

John “Jed” Dillingham

Timothy “Tim” Driskill

Michael Scott Dull

Philip Eitzen Chris Floyd Allen Giblet

Vaughn Graham, Jr. Vaughn Graham, Sr. C. Ross Harris

Tony Holmes

Clayton Howell Denise Johnson

Mark Long

R. Bruce Magill

Patrick Mandeville

Kelly Miller

Thomas Perrault*

Kathy Reeser

Arthur Drew Rickets T.J. Riley Gary Rosenhamer

Michael Ross

Jane Seals

Daniel Somers

Michael Somers

Joe Strunk

Belynda Tayar

Kevin Wellfare

The 2022 “Be the Solution” Young Agent’s Conference that was held Oct. 4 and 5 in Tulsa was a huge success! Over 40 first-time attendees participated, and engagement was fantastic. The conference provided excellent networking opportunities and the ability to learn from some of the industry’s top leaders. The event was truly a valuable experience for all who attended.

The Conference Bowling Tournament at Dust Bowl Lanes was a great success! We put together randomized teams of agents and company representatives so that attendees had the opportunity to network outside of their inner circles with new faces! Everyone showed up in force and had a blast. The atmosphere was electric, and the competition was fierce.

During the lunch hour we were provided a great opportunity to hear from Beth Miller, Brandon Tatum and David Carothers, as a group panel, about some of the pressing issues affecting our industry. It was insightful to hear their perspectives on topics like the

future of the workforce, the role of technology in our industry and the impact of global economic forces. Carothers, our keynote speaker, hosted a live podcast during the conference. He provided updates on what happened at the conference, as well as interviews with some of the young agent’s committee. This is a great opportunity for young agents to get the latest information on what’s happening in the industry and to hear from some of the top leaders in the field. Make sure to check out the episode “Big I Oklahoma” on the “Power Producers Podcast”.

The insurance industry has long been dominated by men, but women are slowly starting to make their mark. According to a recent study, women now make up nearly one-third of the insurance workforce. And while that number is still relatively small, it represents a significant increase from just a few years ago. Photo 23 provides a image featuring a powerful moment where one of the speakers requested all the women in the room to stand up and be recognized, which accounted for half of the attendees at our conference. n

CHAIRMAN

TREASURER

BIGiOK is the largest insurance trade association in Oklahoma. With more than 475 independent insurance agencies, we represent nearly 3,000 independent insurance agents and their employees and more than 100 company members. BIGiOK member agencies range in size from one person to some of the largest agencies in the region.

Founded in 1906 as the Oklahoma Association of Local Fire Insurance Agents, BIGiOK is a result of the consolidation of the Independent Insurance Agents of Oklahoma, Inc. (IIAO) and the Oklahoma Association of Professional Insurance Agents (OAPIA) on Jan. 1, 1992.

BIGiOK policy is set by a board of directors elected at the annual conference. Policy is implemented by a professional staff located in Oklahoma City. BIGiOK’s

As the new voice of the independent agents of Oklahoma, BIGiOK promotes and provides education, legislative advocacy, innovative concepts and practical solutions, and community and career opportunities.

mission is carried out through a variety of programs designed to enhance the business of independent insurance agencies.

BIGiOK is an active advocate on behalf of independent agents before legislative, regulatory and judicial groups in Oklahoma and at the federal level.

BIGiOK is affiliated at the national level with the Independent Insurance Agents and Brokers of America with offices in Alexandria, Virginia, and Washington, D.C.

BIGiOK is an excellent source of information through POLICY magazine, published quarterly, and the Oklahoma Agent, a monthly newsletter of time-sensitive material for its members.

As long as baby boomers have owned independent insurance agencies, they’ve heard a drumbeat on succession planning from merger and acquisition consultants, financial advisories and bankers: “Do not wait. Get an agency valuation. Create a written perpetuation strategy. Give yourself a five-to seven-year runway to stage an orderly exit. You’ll thank us later.”

Do principals listen? Some do. But most wait.

Waiting can bring uncertainty and chaos. And Exhibit A is Avery Moore, now president and CEO of ECI Insurance in Piedmont, Oklahoma. After an emotional ride, at age 32, Moore took ownership of the agency last year.

The agency is a family legacy for Moore. Her grandfather, Earnie Cornelius, returned from the Korean War and founded ECI in 1964. Back then, Piedmont was a town of 5,000. He said he wanted to be a big fish in a small pond, Moore says. Today, it’s a bedroom community for Oklahoma City and the county is growing fast.

Cornelius’ son, Scott Cornelius, later took over the firm along with his sister Denise Johnson, Moore’s mother. Decades later, there was the next generation to consider: Moore and her cousin were in line for ownership.

Moore was skeptical about insurance as a career at first but fell in love with it while working at another independent agency. In 2014, she bought her mom’s book—Johnson is now CEO of Big I Oklahoma—and started producing.

“Being family owned has been an incredible source of pride for our family,” Moore says. “It was always understood that I would take over the agency with my cousin. But there was nothing in writing. My uncle [Scott Cornelius] said, ‘Nothing is going to happen to me, and I’ll retire when I’m 67—and you guys can take it over.’”

Moore joined a local women’s executive group. When she presented what she thought were her major business issues, the group pushed back with a bigger problem.“

They said, ‘The problem you’re presenting is not the problem. There is nothing actually tying you to the agency. There is no buy/sell agreement,’” Moore recounts.

The issue wasn’t on Moore’s radar. “It was the first time I heard the terms ‘buy/sell’ and ‘first right of refusal,’” she says. “With our family, everything had just sort of worked out. Nothing bad had ever happened in the past. When I heard that from the group, I had to have a conversation with my uncle.”

Moore asked her uncle for a written agreement, but he was reluctant. “He felt like I was trying to push him out—but I was trying to protect my work,” she says.

The conversation continued for four years. They finally signed in May 2020. The plan called for Cornelius to retire at age 67. Moore and her cousin had first right of refusal on the agency’s book. They would be 50-50 owners. The purchase price would be 1.5 times the

commission value—perhaps half of what ECI Insurance might fetch in the open market. In addition, Cornelius would fund a 15-year note at a 4% interest rate.

Why an owner-financed loan? Cornelius was uninsurable, Moore explains. He had been treated for skin cancer in years past, so his retirement plan was the value in the agency’s book.

In sum, Cornelius offered Moore the same deal his dad offered him. “He wanted to give us the same opportunity,” Moore says. “He was an incredibly generous person.”

Indeed, such a low sale price and attractive financing terms are typical in family succession plans. Owners seek to continue the local brand, customer loyalty and family agency legacy, which in the case of ECI Insurance is a legacy spanning seven decades.

Moore’s uncle’s generous terms never came to pass. There would be no 15-year loan window. In early 2021, he suddenly passed away from cancer. The family was forced into finding another way to keep the agency in the family.

Two days after the funeral, Moore and her family sat down with lawyers. “It was the worst-case scenario,” she relates. “My aunt was grieving the loss of the love of her life. Attentions on business got lost along the way. I was negotiating the best benefit for myself... but to do that in the middle of grief... I wouldn’t want anyone to have to go through that.”

Moore said the succession plan wasn’t clear on a transition in the event of a sudden death—or how to treat contingency income, profit sharing or customer fees in agency revenue.

Meanwhile, the agency team needed attention. “It took five months of me trying to hold on to my employees,”Moore says. “It felt like ‘Top Gun’—trying to hold on and pull out of a nosedive just to keep the team and business going.” Cornelius had hired two staffers a few weeks before he died.

In April 2021, Moore began to seek financing to buy out her cousin’s first right of refusal and assume ownership of the entire firm. Her agency friends gave her names of bankers for loans. “Our financial health was incredibly good,” she says. “I was so confident walking into that first bank.”

For collateral, the banker asked about ECI’s hard assets. He wasn’t as interested in commission revenue or customer lists. After the fourth failed meeting, Moore sat on the curb outside the bank and cried.

“I said, ‘I don’t know how I’m going to do this,’” she says. “For a female entrepreneur like me, there was so much head trash going on at the beginning: Can I do this? Can I lead my team? Will they follow me? Can I make it successful? All the doubts were going on in my head that I can’t do it. But I told myself I am taking this opportunity.”

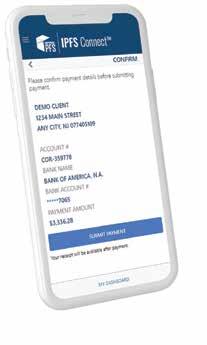

Moore approached a total of eight banks. It was a “no” from all. Finally, taking her mom’s advice, Moore called InsurBanc.

Scott Freiday, division director at InsurBanc, told Moore he had helped other agencies transition through an unexpected death of a principal. And he thought he could help ECI Insurance.

In fact, Freiday relates, “All of the agency’s credit metrics were solid. It was a third-generation owner, a strong, well-established agency, a great market, and an excellent book of business. We could do all the financing they were looking for, including buying out the cousin and establishing a line of credit.”

“[Moore] was well experienced and clearly capable of running the agency,” Freiday says. “Avery spent a significant amount of time working at the agency. It was clear she was the one to take over. She had the experience and the mentorship there.”

The InsurBanc deal closed in 30 days, and the agency was now wholly owned by Moore. Looking back, she is still amazed. “I had just turned 32 and I’m borrowing millions of dollars,” Moore says. “I don’t know many 32-year-olds who can borrow millions of dollars.”

“InsurBanc is like the Oprah Winfrey of lending—they’ve got lots of wisdom,” she says. “They do all our banking. They’re literally almost an extension of our agency because now we have a banking relationship. We didn’t have that with our local bank.”

A year after the sale, the firm is doing well, with 15 employees. Last year the firm grew commission revenue by 11.5% and year-to-date gross revenue for 2022 is up 18%. Moore says she’s joining an agency cluster to generate more growth. The book is more diversified as well, including life and health products.

“I have an incredible team,” Moore says. “We didn’t lose a single employee during all of that. That was one of my biggest fears. Those are the people I show up for every day.”

“I miss Scott every day,” Moore continues. “We talk about him all the time. My uncle and I were incredibly close. He was my mentor. At least once a week I still try to text him.”

“Sales is so easy compared with agency ownership and management,” she adds. n

van Aartrijk is principal at insurance branding firm Aartrijk.

1) Bring it up. “I loved my uncle, but we avoided the hard conversation” about a written succession plan, Moore says. Be clear, too, about what happens in the event of a serious illness or death.

2) Get your personal finances in order. Living above your means can dissuade bankers from loaning you money. “Set yourself up for financial success,” Moore says, noting her only significant personal debt was a home mortgage while she was looking for a loan. “I cannot stress being financially sound enough.”

3) Go to experts. “I would do things so differently today,” Moore says, reflecting on the string of failed meetings with Main Street banks. “Go to a lawyer who understands independent agencies. I would have my own lawyer review the buy/sell.” She notes that she wishes she had started with InsurBanc for a succession loan versus leaning on local bankers who discounted the value of her agency’s book.

4) Start early. At least five years is a smart runway to start putting together a perpetuation plan. Staging an owner’s exit can begin the process of gradually transferring ownership to the next generation of agency principals while providing economic benefits to all parties and building agency value, says Scott Freiday, InsurBanc division director.

5) Ask about financing options. Internal perpetuations are an excellent way to continue an agency’s legacy. “Creative financing solutions are available to work with agency principals to structure lending terms to meet their tax strategies,” Freiday notes. “Some agency principals may look for a combination of cash at closing and holding a note payable over time that earns interest and provides income during retirement.”—PvA

Market trends. Added revenue streams. Acquisition opportunities. Access to additional markets. The road of independence is tough – but worth it.

At Keystone, we understand what keeps you up at night. We always have our eyes open to provide our community of like-minded agents with the resources, expertise, and relationships that matter in today’s industry. We work tirelessly so you can focus on leading your business with confidence – not sleeplessness.

That’s how independence works better together.

December 1: CISR Agency Operations

December 2: CISR Insuring Personal Residential Property

December 9: Episode 4: Free Friday Ethics Webinar

JANUARY 2023

January 13: Episode 4: Free Friday Ethics Webinar

FEBRUARY 2023

February 10: Episode 4: Free Friday Ethics Webinar

February 14: CISR Agency Operations

February 15: CIC Insuring Company Operations

February 17: CISR Insuring Commercial Property

MARCH 2023

March 10: Episode 4: Free Friday Ethics Webinar

March 21: Commercial Casualty 1

March 22: CIC Commercial Casualty

March 24: CISR Commercial Casualty 2

2023

April 5: James K. Ruble Graduate Seminar Webinar **

April 14: Episode 4: Free Friday Ethics Webinar

April 26: CISR Insuring Personal Auto Exposures Webinar **

April 27: CISR Insuring Personal Residential Property Webinar **

MAY 2023

May 12: Episode 4: Free Friday Ethics Webinar

May 16: CISR Life & Health Essentials

May 17: CIC Personal Lines

May 19: CISR Other Personal Lines Solutions

JUNE 2023

June 7: CISR Elements of Risk Management Webinar **

June 16: Episode 4: Free Friday Ethics Webinar

June 21: CIC Agency Management

** NOTE: ONLINE ONLY CLASSES

Fall of 2022 was a great time to get involved in Young Agents. We’ve got a great group in this state and are not planning to slow down.

In the weeks leading up to our own 2022 YA conference, more than a dozen young agents, company reps and spouses represented Big I Oklahoma at the National Young Agents Leadership Institute in Niagara Falls.

Between all the wonderful networking, keynote speeches and meals, Oklahoma was highlighted at the awards ceremony. Not only was our own Shania Slavick presented with the prestigious 2022 State Liaison of the Year award, but Oklahoma was also recognized for its October 2021 Young Agents Conference with its Young Agent Meeting of the Year Award!

Winning that award for our 2020 virtual conference and then again for our 2021 conference in Oklahoma City was reassuring for our committee, proving that we were ready for a great 2022 YA conference in Tulsa. And let me tell you: if you did not attend, you missed an incredible experience.

The 2022 “Be the Solution” Young Agents Conference in Tulsa this past October was one for the books. With a record high 120+ registered attendees, roughly 60% being agents and more than 40 first-time attendees, the one-anda-half-day event was high energy.

“Be the Solution” was all about challenging ourselves – a challenge to be more than what we have been. With keynotes titled “Leading for the Future,” “Coaching & Mentoring for Professional Success,” “Understanding the Modern Insurance Buyer” and “Building an Internal Sales Process,” there were many hours of practical advice on creating solutions inside the insurance organizations we all represent.

I stand by my promise in my previous Policy magazine article. Oklahoma agents, CSRs and company reps 40 years or younger, or those with five years or less experience in insurance, have the unique opportunity to engage with people and ideas that are raising the bar in our space. They can learn from passionate experts who will

teach them as much as they can. The CE credit is merely a fringe benefit.

Yet, I have heard many speakers say it before: most people will do nothing with what they learned at the conference. Now is the time for implementing change. And for those who step up to the challenge, may the words of Arnold Bennett be a constant reminder: “Any change, even a change for the better, is always accompanied by drawbacks and discomforts.”

Go Be the Solution. n

As we walked away from the IIABA (Independent Insurance Agents & Brokers) fall conference held in Niagara, New York, in September this year, many of us as Big I board members had to ponder what the future of this great Association would look like with the upcoming leader changes.

A new chairperson! Well, that happens each year and we have some of the best peers in the country vying for the position, and it is always filled with great talent and wisdom of those who have traveled in the same industry shoes, if not at least similar, that the rest of us have traveled. The chairperson has historically always been a huge asset for the Association, as they are generally vetted heavily by 50 board members before they make it into the cogs of executive leadership.

Our new chairperson, John Costello from New York, will no doubt be another great chair for our Association. John has held numerous positions at both the state and national level for the Big “I.” He is former chairman of the Independent Insurance Agents & Brokers of New York, past president of the Independent Insurance Agents of Monroe County and was the 1995 Monroe County Insurance Professional of the Year. He formerly served on the Big “I” Board of Directors and chaired the Big “I” Finance Committee. He was elected to the Big “I” Executive Committee in 2016.

A new president and CEO for the IIABA! Well, this is the biggest news I have regarding our leadership changes. Bob Rusbuldt announced during our board meetings at the conference that he will be retiring his position as president and CEO of the IIABA. Bob is the longest tenured Big I top executive and had provided 23 years of incredible service to our organizations. He leaves the Big I in a great position after many years of contributions to making the Independent Agency system better for all those who serve in this space.

The new president and CEO was selected by the IIABA Executive Committee and was announced as well during the fall board meeting. Charles Symington will begin his term on Sept. 1, 2023. Charles is the current senior vice president of external, industry and government affairs. He has his own story and has made major contributions to the Big I as a top-level executive. He has severed in many capacities as a Big I executive since 2004. He is very well known and respected on Capitol Hill and is an undeniable best choice for this position.

Although change is constant and our leadership is changing, the future is bright for the Big I! n

National Security has provided competitive, affordable insurance to policyholders for 75 years. We also provide our agents with competitive commissions, excellent customer service and experienced company adjusters.

As a Southeastern based regional company, National Security prides itself on fast, efficient service from a friendly small town company. Our agent website provides fast quotes, online policy issuance, and real-time policy information. Find out more about our products by calling 1-800798-2294 or visiting nationalsecuritygroup.com

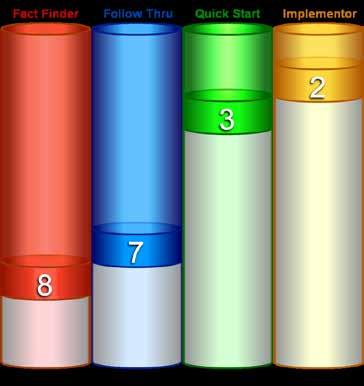

For decades,our industry has been fascinated with various forms of testing, generally used as a part of the hiring process. Even as an agency brat, I wasn’t immune from being asked to take the generally accepted insurance industry profile as a part of my professional entry into the business back in the late ’80s. Most would have just assumed that my genealogy and vast experience typing multipage, carbon-paper fire policies and filing those dreaded rainbowcolored expiration forms was a clear indication that I was certainly cut out for the business!

Fast forward 10 years or so when I began to delve into the Meyers-Briggs and DiSC personality assessments, which did nothing but feed my fascination with what makes people tick and how that played out as a young manager, at home and even in the cul de sac. There were so many days I could have kicked myself for dropping Psychology 1113, not once but three times, during college because the class schedule just never fit with the rest of my plans for the semester.

Since entering the consulting world, I’ve used industry skills testing as well as tools like Meyers-Briggs and DiSC to support my clients in their hiring decisions, culture assessment and strategic planning. While all these resources can be a great help in both hiring and management considerations, it still felt like

something being left out of the mix, but I could never put my finger on what was missing.

Many recognize that technical and industry skills testing is best for measuring the acuity of the cognitive portion of the brain. Likewise, personality assessments like MeyersBriggs, DiSC, Enneagram and the like all measure the affective part of our brain, which provide indicators of our feelings, preferences and tendencies.

When I hit my 50s, I realized the impact of my decades-old work style began to affect my ability to crunch numbers or write the detailed comparative into the wee hours of the morning as compared to my 20s, 30s and 40s. I was also sensitized to how stressors could send me spiraling into my Meyers-Briggs “grip” where the various elements of my personality trend toward the extreme. Then I discovered another part of the mind that I had no idea even existed, much less that it isn’t affected by age, race, even gender.

What’s left you might ask? The part of the mind where our doing is centered. Why we do what we do, how we do what we do, even how much time we spend doing what we do when we’re free to be ourselves – the conative part of the mind and how we achieve success with less stress and more joy.

For more than a few decades, the work of theorist Kathy Kolbe has transformed how we understand human performance. By identifying

the conative, instinctual talents within each of us, The Kolbe System™ has provided an integrated, powerful and practical theory to improve productive and predict success in our work.

The Kolbe A™ Index, the only assessment in the behavioral profiling world that measures the conative part of the mind, has been a part of the BIGiOK staff management and board of directors strategic planning process for several years.

I even took a Kolbe A™ Index when I was helping with some strategic reorganization a few years ago, but I wasn’t bitten by the Kolbe bug until I went through the Kolbe Certification™ course and testing this last summer! Suffice it to say...I’m hooked! Not only am I intrigued by the relevance of this work, I’m also convinced this is the missing link to what we’ve been doing when we stop short with the skills and personality testing we have traditionally used in our hiring. I am convinced that conative assessment will provide that valuable data we need to retain and develop our top talent, not to mention planning for agency transitions in ownership and succession!

You’ll be hearing much, much more over the coming months about the Kolbe A™Index and how you can leverage these and other team tactic studies in your organization. n

• The Hanover Insurance Group

• AmTrust North America

• ICW Group

• Berkshire Hathaway GUARD Insurance Company

• Pie Insurance

• Hawksoft, Inc.

• AF Group

• Columbia Insurance Group

• Philadelphia Insurance Companies

• Burns & Wilcox

• Producers XL

• Stonetrust Workers’ Compensation

• Equity Insurance Company

• Taber Brokerage

• ePayPolicy

• Jencap Insurance Services

• Normandy Insurance Company

• RT Specialty

• Central Insurance

• Risk Placement Services, Inc.

• AndDone-Quivit

• Southwest Risk, LP

• Markel

• Patriot National Underwriters, Inc.

• Prime Insurance Company

• The Hartford

• Skyward Specialty Insurance

• Med James, Inc.

• Treaty Oak General Agency

• Iroquois Group

• BPN, Inc.

• Red River Roofing and Construction

• Farmers Alliance Mutual Insurance Co.

• Keystone

• Amerisafe

• WORKS24

• Main Street America

• Equipment Insurance International

• Applied Systems/EZLynx

• EMPLOYERS

• Openly Insurance, Inc

• UFG Insurance

• Old Republic Surety Company

• Foresight

• Smart Choice

• Gainsco Auto Insurance

• Traders Insurance Company

• Pennsylvania Lumbermens Mutual Insurance Company

• Specialty Insurance Managers of Oklahoma

• Cornerstone National Insurance

• Chris-Leef General Agency, Inc

• National General, an Allstate Company

• Swyfft

During the COVID-19 Public Health Emergency, the Centers for Medicare & Medicaid Services temporarily allowed Medicaid members who no longer qualified for Medicaid coverage to continue receiving benefits. With the PHE predicted to end in the coming months, members who are no longer eligible for SoonerCare will lose their coverage. These members will receive a letter notifying them of the date their coverage will end. They will receive another notification 45 days before their coverage ends and another 10 days before.

During the PHE, states that received a 6.2 percentage point increase in federal funding for Medicaid were forbidden from disenrolling beneficiaries from the safety-net program. That resulted in enrollment in Medicaid and the Children’s Health Insurance Program swelling by 24%. When the PHE ends in January 2023, millions of people enrolled in Medicaid will have their eligibility redetermined, triggering a high risk of coverage loss for individuals due to eligibility reasons. In Oklahoma, approximately 200,000 will be disenrolled in Medicaid. Many of these people will be eligible for other sources of coverage, such as subsidized plans in the Affordable Care Act Marketplace.

The Oklahoma Insurance Department is partnering with the Oklahoma Healthcare Authority to ensure eligible members remain enrolled or successfully transition to other coverage. To help minimize gaps in

coverage, the OID and OHCA are providing information on insurance options for Oklahomans who no longer qualify for continued coverage. Health insurance options to maintain coverage include:

• Employer-Based Group Health Insurance

• Individual Health Insurance Coverage through ACA Marketplace

• Affordable: Low-cost monthly premiums when federal subsidies are applied

• Comprehensive: Plans cover prescription drugs, doctor visits, urgent care, hospital visits and more.

• Spousal Coverage

All SoonerCare members need to make sure all their information is up to date before the PHE ends. If not, members may be at risk of losing SoonerCare for you and your family. Some information that may need to be updated could include:

• Household income

• Contact information (address, phone number, etc.)

• Number of people living in your household

• Missing documents

Members can update their information online at www.mysoonercare.org or by calling the SoonerCare helpline at (800) 987-7767. They can also contact the OID Consumer Assistance at (405) 521-2991 or visit online at www.oid.ok.gov/PHE n

The IIABA National Conference is always a great opportunity to network and learn from insurance professionals from all over the country. This year’s conference in Niagara Falls, New York, was no exception! We’re excited to announce that Shania Slavick won the 2022 Young Agents State Liaison of the Year Award. This award is a testament to her dedication to the insurance industry and her commitment to serving Oklahoma’s young insurance professionals. In addition, the Oklahoma Young Agents Committee won the 2022 Outstanding Young Agents Meeting Award for the Annual Conference. This award is a recognition of the hard work our committee puts into planning and executing our annual event. We’re proud to be recognized at the national level and we’ll continue working hard to provide value for our members. If you’re not already a member of the BIGiOK, which provides membership to Oklahoma Young Agents, we encourage you to join us! We offer educational opportunities, networking events and discounts on products and services that can help you in your career. That’s why BIGiOK is the best place for young insurance professionals in Oklahoma!

Midcontinent, CompSource Mutual and Insurica were all listed on The Journal Record’s list of 44 companies selected as the 2022 Best Places to Work in Oklahoma.

The Journal Record and the Best Companies Group have teamed up for the sixth year to honor Oklahoma businesses and organizations excelling in creating quality workplaces. Companies are selected based on employee interviews plus workplace policies, practices and demographics.

Midcontinent was listed small/medium category (25-249 U.S. employees) category while the others were listed to the large category (250 or more U.S. employees).

The 2022 Best Places to Work event was held Nov. 17 at the National Cowboy & Western Heritage Museum in Oklahoma City.

This has become an all too familiar story.

An agency owner reached out several weeks ago and asked me to meet with him and the owner of an agency in his town that he was looking to purchase. They had been talking for several years. They had a handshake agreement that someday he will buy the agency when the time is right. Those conversations were consistent over time, but had never turned into any action. The selling agency owner was now in his early 80s, but the time didn’t seem right just yet. Until it was.

Some serious health issues caused the conversation between the two owners to change from someday into a reality. I was introduced to the selling agency owner, and together with the buyer we went through what to expect in the valuation process. He was charming, funny and full of stories. It was obvious that the last thing he wanted to talk about was his career in insurance coming to an end. Instead, he preferred to reminisce about his favorite clients, brag about his amazing staff and tell me the story of how he started in this incredible industry of ours. Our 30-minute call tripled in length, but I didn’t mind at all. I loved getting to know him, and honestly, I loved listening to his stories.

As our call came to an end, we agreed that the completing the valuation was the next logical step. The seller expressed concern about letting his staff know he was contemplating selling, so he asked that I mail him the proposal and confidentiality agreement and send the data sheets that were required for the valuation in an email that does not mention the purpose. He planned on confiding in his office manager, as she would need to help him complete the information. The proposal was sent, agreement was signed and the data sheets were emailed. We were on our way.

Two weeks later, first thing Monday morning, I received a call from the buyer. I answered with a chipper “Good morning” and was met with an unexpected somber voice. He fumbled his words and struggled to share the news that the seller’s health had taken a turn for the worse; he was hospitalized a few days ago and passed away the previous evening. Then there was silence.

I cannot even begin to tell you how much I dread this kind of call. My heart sank, and you could tell his heart was breaking as well. We both were quiet for what seemed like forever. I broke the silence with a question: “Tell me what I can do to help?” He then shared his

thoughts and plan to help the seller’s widow navigate the next days, weeks and months. She is now faced with taking care of the affairs for an agency she has never been a part of and had no idea where to begin. When something like this happens, the focus goes from planning to “rescue.” Worse than that, someone who is mourning the loss of the greatest love of their life is forced to make decisions that they have no experience handling. They are forced to think about details and logistics that are in many cases completely foreign.

We started discussing things like:

Who has the logins and ability to access the carrier portals? How do we ensure that we keep the appointments in place and take care of the customers? Who has the logins to the accounting system, bank

accounts? Is there any life insurance? Does someone know how to run payroll? What do we tell the staff? Clients? Carriers? How do we reassure the staff?

It is completely overwhelming. The business that was a lifetime of work and the main source of income in their retirement is now in jeopardy.

The reality is for many agency owners the time will never be right, and sadly they will put planning for the transition of their agency off until there is no time left.

This can happen to anyone at any age.

You do not have to exit your agency to have a plan. The time is always right to make a plan.

For more information about planning for your agency please visit www.agency-focus.com or contact Carey Wallace at Carey@agency-focus.com. n

Over the past 14 years, Carey Wallace has worked with hundreds of agencies, helping them understand their agency’s value and turn that knowledge into an actionable plan for their agency’s future. Carey is a Certified Exit Planning Advisor and provides a variety of consulting services through the company she founded, Agency Focus, LLC

BIGiOK was saddened to hear of the death of former IIAO Chairman Bill Livermon. A former INSURICA colleague, Bill grew up in an insurance family, having worked alongside his father, C. H. “Slim” Livermon, at Livermon Insurance Agency Inc. from 1967 to 1988 in Oklahoma City.

After his father passed, Bill joined Commercial Insurance Services and was with them through INSURICA’s purchase of CIS in 2004. He was then with INSURICA until September 2014.

Bill served as chairman of the Independent Insurance Agents of Oklahoma (as was his father before him) in 2005 and also served as chairman of the Oklahoma City Association. He also served on the board of Crime Stoppers and on the board with the YMCA for 25 years. His most recent and rewarding and enjoyable role was serving as a liaison at the OU Health Stephenson Cancer Center.

“Inside Buyers? Outside buyers? Become familiar with all the facts before you decide on which direction to take your agency. Scott Freiday, SVP and division director at InsurBanc, will help you understand how “inside” and “outside” buyers differ and assess what the differences mean to your agency.“

By Scott Friday InsurBanc, SVP and Division DirectorIndependent agency sale transactions are continuing at a strong pace in 2022. Organic growth rates and profitability are booming, according to Reagan Consulting. Those financial drivers continue to steer agency merger-and-acquisition prices upward.

In this environment, some agency principals are looking for a game plan to sell their firm, whether to an outside buyer (such as a strategic investor or a private-equity investor) or an inside buyer (through an agency perpetuation — continuing the independent agency as it exists but with new leadership).

Agency principals may perceive an outside sale as more lucrative than a perpetuation. But is an internal offer really worth less than an external? An internal offer to perpetuate an agency can be as appealing as an external sale or even more so. Here’s a look at why.

While the financial terms of the sale are always a top consideration, the price tag is only one of the key considerations for an agency owner. Some of the others typically are:

• The selling owner’s role in the agency after the sale.

• The timeline for the transaction (especially for the selling owner).

Agency owners looking to sell who look at the price tags of other merger-and-acquisition transactions in the marketplace are in essence starting at the finish line. Instead of doing that, it’s productive to start by looking at goals for 1) the owner and 2) the future of the agency.

Those aspirations provide a guiding light through the sometimes-complicated process of deciding upon an

agency sale or perpetuation transaction. Questions to ask include: Do I want to continue working or retire outright? What responsibility, if any, do I want to take after I sell to a third party or perpetuate my agency to an internal buyer?

While any potential buyer covets the potential growth and profitability of a target agency, a handy way to categorize agency buyers is to divide them into inside buyers and outside buyers.

Internal buyers are those already working within an agency, and usually become owners through the principal’s decision to perpetuate. Commonly, inside buyers are family members and/or producers or other key employees working at the agency.

External buyers come in a couple variations. First is the private equity (“PE”) buyer, who is not necessarily familiar to an agency owner but is attracted by the agency’s financial performance, growth prospects and/or market share. Some PE buyers acquire an agency to merge its operations into another. In fact, some sellers perceive that PE buyers are making “book of business purchases.” It’s often true, though, that PE buyers want the seller involved after the sale to run that book of business, continue to manage results or take on a sales role.

A second type of outside buyer is the strategic buyer. Possibly already known to the owner, he or she might be a peer from a nearby geographic area or even the same city. Like a perpetuation buyer, a strategic buyer is likely to carry on an acquired agency’s operations as they are. However, it’s also possible the strategic buyer might want to change the name of the agency, consolidate operations or make other changes. Strategic buyers might be less likely to want a selling owner to remain on, since these buyers are involved in the agency business already and might not need the support that a perpetuation buyer might want.

A sale to a third-party buyer may seem to have the highest number at first look. But there could be nonfinancial factors at play. A private-equity buyer, for example, might fold the agency into another. This may mean the agency location may close, employee arrangements may change, agency branding may shift, and so on. An external buyer also might feel less obliged to continue the agency’s community involvement. A selling principal needs to consider those factors in light of the goals he or she has set.

An issue with outside buyers, often with PE deals, is the “earnout component” in the sale. These earnouts are payments triggered if the seller helps the agency hit financial targets after the sale.

Those targets can be ambitious to hit. So, while PE deals might sound initially like big-dollar transactions, an

outside observer might not really know how that earnout affects the price the seller gets. (Keep in mind that any agency merger-and-acquisition information available through word of mouth is usually incomplete.)

For owners thinking about an agency perpetuation, it’s vital to discuss those ambitions with potential buyers as early as possible. This can help uncover how much interest they have in being future agency owners. Having those conversations can clarify what’s possible. Perpetuation deals, as with any transaction, also involve a transition for the selling owner. Both the seller’s role and the transaction timeline are important here. The selling owner might take a role as a mentor, produce business, work as a consultant, and/or take other responsibilities while the new owners work into to their new roles. That transition role likely would be specified in the purchase agreement.

Staged perpetuations (those that take place over several years through two or more steps) can be appealing to owners who want to get out of the agency gradually. They can result in prices equivalent to or even more than an external sale by cashing in on a portion of ownership now and building shareholder value as the agency grows. Those shares could be worth more down the road and the principal continues to benefit from the agency’s cash flow while remaining a partial owner.

But owners who want to exit the business quickly might be more amenable to selling to a third party with no involvement after the sale. However, owners who make an outside sale without setting a plan for their career after selling their agency sometimes want to get back into the agency business after a couple of years — having experienced “seller’s remorse.”

For any agency sale, it can help to think of the owner’s role in terms of his or her “runway”: The principal may be taking off by selling the agency, but if they haven’t decided fully on a destination they might not be satisfied with where they land.

One other consideration for any agency owner is the tax treatment of the sale. For instance, a staged perpetuation can allow the owner to receive sale proceeds staggered over a period of years, which can be attractive not just for tax reasons but also financial reasons.

Whatever thoughts an agency owner has today about a future sale or perpetuation, the strongest advice I give to anyone is to take a broad view of the three factors: financial terms, the selling owner’s role after the sale, and the transaction timeline. n

Originally published: Aug. 3, 2022, at https://www.insurancejournal.com/ news/national/2022/08/03/678569.htm

The Independent Insurance Agents & Brokers of America (the Big “I”) has announced that Bob Rusbuldt, Big “I” president and CEO, will retire next year. The Big “I” Executive Committee named Charles Symington, senior vice president for external, industry and government affairs, as his successor starting on Sept. 1 of next year.

Bob joined the association in 1986 and was named CEO in 2001 after leading the government affairs department at the Big “I” for many years. He has overseen many major Big “I” initiatives, including the inception of Big “I” Markets, a market access program for agent members; the formation of BIRC, a reinsurance company, and InsurBanc, a bank catering to independent insurance agencies’ needs; the implementation of a marketing brand for members, Trusted Choice®, and the consumer-facing agent locator and company, TrustedChoice.com; the creation of Big “I” Hires, a national hiring resource for the independent agency channel; and the establishment of the Trusted Choice Disaster Relief Fund and COVID-19 Relief Fund for member agencies in need, among other notable innovations.

Bob recently steered the Big “I” through the challenge of the coronavirus pandemic and also the celebration of the association’s 125th anniversary.

During his time at the Big “I,” Bob was named a “Top 25 Living Legend of Insurance” by PropertyCasualty360.com and earlier this year, he was recognized by Insurance Business magazine among the world’s top insurance leaders on its Global 100 list. In addition to leading the Big “I,” Bob serves on a number of boards, including as chairman of the TrustedChoice.com board.

The Independent Insurance Agents & Brokers of America is proud to announce the selection of the 2022 Big “I” Best Practices Agencies. On behalf of the entire IIABA, we congratulate the following Oklahoma BIGiOK member agencies who have achieved this level of excellence:

• Berrong Insurance Agency, Weatherford

• ECI Insurance, Piedmont

• INSURICA, Oklahoma City

• Professional Insurors Agency, Oklahoma City

Out of 48 states, 282 agencies have achieved this level of excellence. To be eligible for consideration, each agency submitted extensive financial and operational data that was then reviewed by an independent panel. The agencies selected represent the highest performers based on their growth and operational excellence.

The IIABA Best Practices Study has been conducted annually since 1993 and is recognized as the gold standard for benchmarking and best practices in the insurance industry.

For more information about the Best Practices Study, please visit www.independentagent.com/BestPractices.

Marisue Elias-Newman, Esq., assistant vice president of regulatory affairs at Berkshire Hathaway GUARD Insurance Companies, was recently elected chairperson for the National Workers’ Compensation Reinsurance Association Board of Directors at its 2022 annual meeting.

The NWCRA is a contractual reinsurance pooling mechanism among participating carriers that provides an arrangement to comply with the state statutes and the Workers’ Compensation insurance plans for assigned risk business. Marisue, who was elected to the NWCRA board in 2019, oversees the Berkshire Hathaway Guard’s residual market activities, licensing and governmental relations.

In September, the Tulsa Regional Chamber recognized seven local organizations at the Tulsa Small Business Summit & Awards. Among the honorees was Tedford Insurance, which was honored as the Family-Owned Small Business of the Year. The chamber’s Small Business Awards recognize Tulsa-area companies for their resilience, innovation and dedication to the local community. Nominees went through an application process judged by chamber of commerce professionals from outside the region.

View the presentation on YouTube.

After 50 years in the insurance industry, Deb Altman is retiring from her position as vice president and producer at Loftis & Wetzel Insurance. She began her career working for Bob Medley, and she has been with Loftis & Wetzel for the last 35 years. Altman has been an invaluable member of the Loftis & Wetzel team, and her knowledge and experience will be sorely missed. We would like to thank her for her dedicated service over the years and wish her all the best in retirement.