When you’ve been in business for as long as we have at UFG Insurance, you understand what matters most to your customers. For us, it’s our commitment to delivering deep underwriting expertise with the personal relationships and responsive service our partners and policyholders have come to expect and appreciate from UFG.

Think UFG for new business opportunities today — we deliver what matters most. ufginsurance.com

Connect, engage and thrive with your IIAW membership. Get the full experience of an IIAW membership from enriching events, invaluable resources, dedicated advocacy and much more.

6-11 PAGES:

INSURANCE BARTENDER..................................................6-7

Empowering Your Agency: Leverage Exclusive Tools and Resources

INSURCON.................................................................................12-17

Last Chance to Register for our 125th Anniversary Celebration: InsurCon2024 on May 15-16 at Lambeau Field!

FROM THE ARCHIVES..........................................................19-21

Agents Flock to Minocqua (Originally Published March 2007)

PERSONAL LINES....................................................................22-23

E&O Risk Management Strategies to Strengthen Client Bonds in 2024

RISKY BUSINESS......................................................................24

When Life Gets Stressful, Have a Plan

COMMERCIAL LINES............................................................26-27

Biggest Product Liability Payouts: How Agents Can Ensure Clients Have Adequate Coverage

MARKETING............................................................................28-29

Mastering Customer Communication: Unlock Success With Email Automation

APRIL CE SCHEDULE..............................................................31

725 John Nolen Drive

Madison, Wisconsin 53713

Phone: (608) 256-4429

Fax: (608) 256-0170

www.iiaw.com

President:

Mike Ansay | Ansay & Associates

President-Elect:

Joanne Lukas Szymaszek | Risk Strategies Company

Secretary-Treasurer:

Dan Lau | Robertson Ryan Insurance

Chairman of the Board:

Nick Arnoldy | Marshfield Insurance Agency, Inc.

State National Director:

Steve Leitch | Leitch Insurance

Janel Bazan | Avid Risk Solutions/Assured Partners

Beth DeLaForest | Aspire Insurance Group, Inc.

Mike Harrison | R&R Insurance Services, Inc.

Jason Knockel | Kunkel & Associates, Inc.

Aaron Marsh | Marsh Insurance Services, Inc.

Andrea Nelson | Unisource Insurance Associates, LLC

Brad Reitzner | M3 Insurance Solutions

IIAW Staff

Matt Banaszynski | Chief Executive Officer 608.256.4429 • matt@iiaw.com

Mallory Cornell | Vice President 608.210.2975 • mallory@iiaw.com

Kim Kramp | Accounting Supervisor 608.210.2976 • kim@iiaw.com

Trisha Ours | Director of Insurance Services 608.210.2973 • trisha@iiaw.com

Evan Leitch | Agency Solutions Advisor

608.210.2971

• evan@iiaw.com

Jeff Thiel | Director of Agency Success 608.256.4429 • jeff@iiaw.com

Andrea Michelz | Education & Membership Engagement Coordinator 608.210.2972 • andrea@iiaw.com

Diana Banaszynski | Events Coordinator and HR Business Partner 608.256.4429 • diana@iiaw.com

Ali Smeester | Accounting Specialist 608.256.4429 • ali@iiaw.com

Wisconsin Independent Agent is the official magazine of the Independent Insurance Agents of Wisconsin (IIAW) and is published monthly by IIAW 725 John Nolen Drive, Madison WI 53713. Phone: 608.256.4429. IIAW does not necessarily endorse any of the companies advertising in publication or the views of the writers. IIAW reserves the right, in its sole discretion, to reject advertising that does not meet IIAW qualifications or which may detract from its business, professional or ethical standards. © 2024

For information on advertising, contact info@iiaw.com.

FOR WISCONSIN EMPLOYERS

Offering specialized safety and claims resources for employers of all types and sizes

With over $56,000,000 of written premium in Wisconsin, SFM’s position as a leading monoline workers’ compensation carrier continues to grow.

SFM’s full-service Wisconsin operation consists of underwriting, claims management, loss prevention, medical case management and premium audit.

“We insure employers in a broad range of industries, from the smallest of small startups to large, complex businesses and everything in between,” said Vice President of Regional Business Nick Marino. “We’re proud to have developed a reputation as a leader in workers’ compensation insurance in Wisconsin.”

Marino credits the company’s 2023 94% premium retention and 95% policyholder retention rates to SFM’s flexible underwriting, proactive claims management and collaborative loss prevention service.

“Workers’ compensation is all we do, so we have to offer a superior policyholder and agent experience,” Marino said.

SFM writes businesses across a wide range of industries, and we offer specialized services for health care, trucking and manufacturing.

• Senior living and supportive care: We serve employers of all types and sizes including nursing homes, assisted living facilities, group homes, home health agencies and hospitals. Statistics show health care workers are at high risk for injuries due to moving and lifting patients, so we have two Wisconsin-based loss prevention representatives certified in safe patient handling to help employers prevent these types of injuries.

• Trucking: We serve trucking industry employers of all sizes including local, intermediate and long haul. Trucking can be a hazardous industry, so our safety team has compiled an array of best practices and safety resources specific to our trucking industry customers.

• Manufacturing: For manufacturing customers, we offer expertise in ergonomics to prevent injuries. We have a loss prevention representative certified in ergonomics, and we use artificial intelligence technology to help our customers pinpoint injury risks and correct them.

Despite Wisconsin’s ongoing softening work comp rate environment, SFM continues to experience growth.

“Our team is 100% based in Wisconsin – and it makes a difference,” said Marino, who has been leading the Wisconsin team for nearly 18 years.

We also recognize that many employers need coverage in multiple states, so we are now licensed in 34 states.

Our primary focus continues to be the upper Midwest, but we recognize that many of our customers have collateral operations and remote employees across the country.

You can learn more about SFM and how to partner with us at sfmic.com/agents.

SFM is excited to be a growing presence in Wisconsin, and we look forward to seeing continued growth together with our agency partners.

“Our team is 100% based in

— and it makes a difference.” WISCONSIN

In the fast-paced and ever-evolving landscape of insurance, independent insurance agencies face numerous challenges—from staying abreast of technological advancements to navigating regulatory changes. In Wisconsin and across the United States, aligning with leveraging your membership in the Independent Insurance Agents of Wisconsin (IIAW) and the Independent Insurance Agents and Brokers of America (IIABA) isn't just advantageous; it's vital to your business. Membership in these organizations and harnessing the power of technology, particularly through platforms like Catalyit, independent insurance agencies can unlock a plethora of benefits, empowering them to thrive in an increasingly competitive market.

In today's digital age, technology plays a pivotal role in shaping the insurance industry. From customer relationship management (CRM) systems to advanced analytics tools and artificial intelligence, technology has revolutionized how insurance agencies operate and interact with clients. By being a member in the IIABA and IIAW, independent

agencies gain access to cutting-edge technology solutions and thought leadership through Catalyit. The platforms highlighted on Catalyit help agencies streamline processes, enhance productivity, and improve client experiences, allowing them to stay ahead of the curve and remain competitive in a rapidly evolving market landscape. Catalyit helps identify which solution is right for your agency and pairs you with one of their consultants to assist you on your journey.

Data-driven decision-making is no longer a luxury but a necessity in the insurance industry. Through IIABA and IIAW, independent agencies gain access to valuable data analytics tools and resources that enable them to derive actionable insights from their data. By harnessing the power of data, agencies can identify market trends, anticipate customer needs, and optimize their business strategies for maximum impact.

In addition to technological advancements, membership in IIABA and IIAW provides

independent agencies with a powerful voice in advocacy efforts. These organizations advocate for policies that support the interests of independent agents and their clients, ensuring a fair and competitive regulatory environment. By aligning with IIABA and IIAW, agencies contribute to shaping the future of the insurance industry, advocating for policies that promote innovation, consumer protection, and market stability.

Membership in the IIAW signals a commitment to professionalism, ethical conduct, and excellence in the insurance industry. This affiliation enhances your agency's credibility and reputation, instilling confidence in clients, prospects, and business partners alike. By associating with a reputable organization known for upholding high standards and promoting best practices, your agency sets itself apart as a trusted advisor and partner in meeting clients' insurance needs.

This enhanced credibility can translate into stronger client relationships, increased referrals, and sustained business growth over the long term.

Membership in the Independent Insurance Agents of Wisconsin is not just a choice—it's strategically imperative for the success and longevity of your insurance agency. From gaining access to unparalleled industry expertise and networking opportunities to advocating for favorable policies and accessing exclusive resources, the benefits of joining the IIAW are plentiful. By aligning with the IIAW, your agency positions itself for sustained success and growth in Wisconsin's dynamic insurance market.

Get the most out of your membership! Don’t hesitate to reach out to me and learn more about how the IIAW can help your agency grow and succeed in 2024.

> Matt Banaszynski, CEO, IIAW

> Matt Banaszynski, CEO, IIAW

Cheers, this month's recipe is a great cocktail for late spring! Cheers to our fantastic members who have made our Association what it is!

For the syrup

• 1/4 c. granulated sugar

• 1/4 c. water

• 1/2 c. blueberries

• Zest of 1/2 lime

For the margarita

• 2 tbsp. sugar

• 2 tbsp. salt

• 1 lemon, cut into wedges

• 8 oz. tequila

• 4 oz. triple sec

• 1 cup lemonade

• ice

1. In a medium saucepan over medium heat, combine sugar and water and stir until sugar has dissolved. Add blueberries and lime zest and bring mixture to a boil. Reduce heat and simmer mixture until blueberries have burst, about 5 minutes.

2. Remove from heat and let cool for 10 minutes, then strain mixture into a clean jar. Let cool completely.

3. On a small plate, stir together sugar and salt. Rim each glass with a lemon wedge, then dip in sugar salt mixture.

4. Divide tequila, triple sec and lemonade between 4 glasses. Fill each glass with ice, top with blueberry syrup and garnish with a lemon wedge.

Our evaluation leads you to the exact resources you’ll need to achieve your business goals. Scan the QR code in the bottom corner or visit this link to take the evaluation:

https://su.vc/iiaw

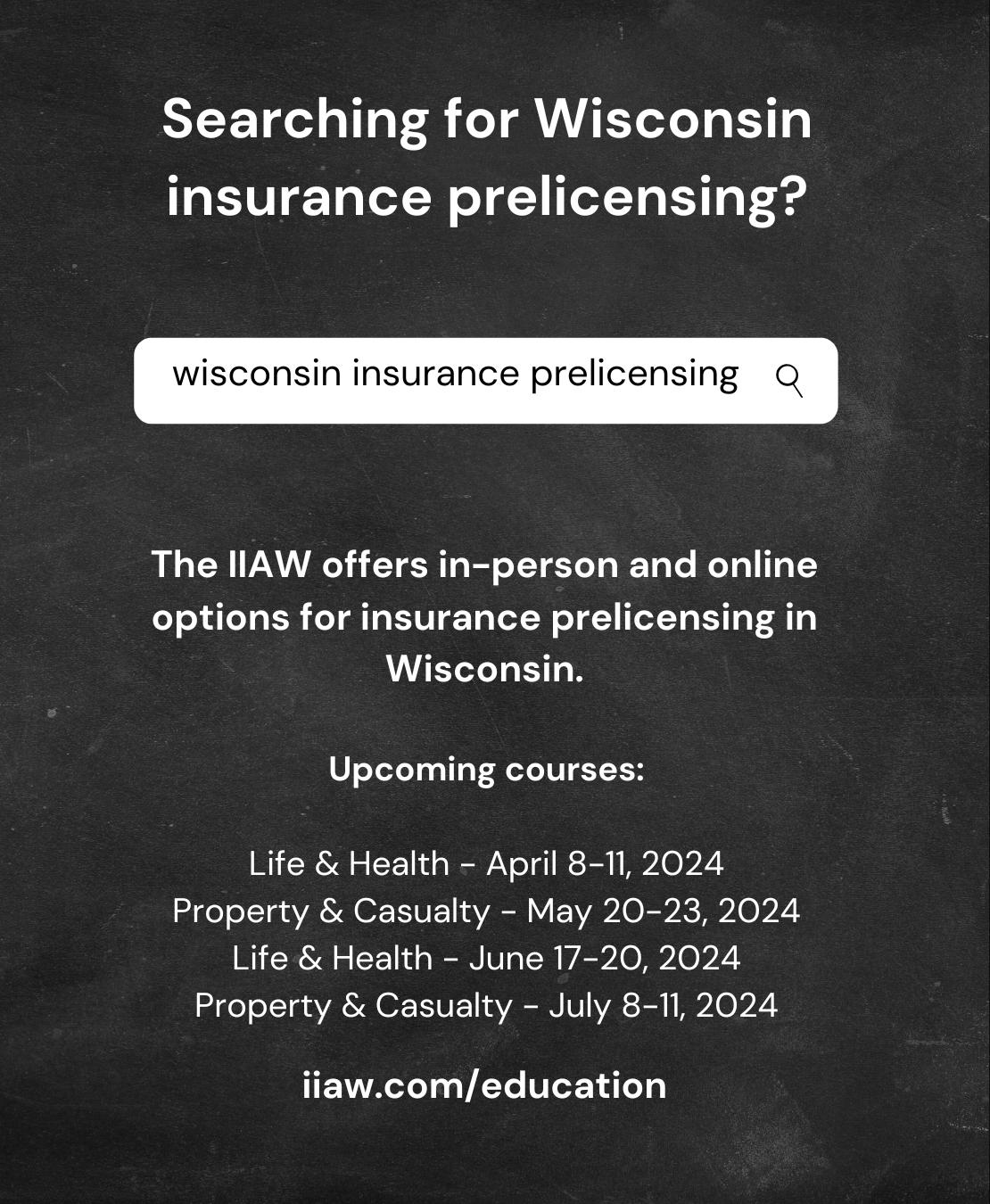

The IIAW is your leader in insurance CE, prelicensing and employee training. Join us and other agents at our annual convention and other events throughout the year.

An IIAW membership entitles you to exclusive products and consultative services. We offer E&O, Data breach, EPLI and Association Health Plan for Wisconsin independent insurance agents.

The IIAW and InsurPac, our state and national Political Action Committees, ensure our industry is present and heard in Wisconsin and Washington D.C.

We offer technology, operational, accounting and human resources support to meet the needs of your agency.

An IIAW membership maps out benefits to navigate your agency toward success. Members receive access to Trusted Choice for a full suite of tools and resources for your agency to use in its own marketing. Plus, members receive our publications and marketing guides through our knowledge center.

Agency Solutions - Free Evaluations

Operational Reviews

Workflow Mapping

Technology Evaluation

Financial Evaluation

Strategic Evaluation

Communications

WI Independent Agent Magazine (Monthly Publication)

Big I Buzz (Weekly E-Newsletter)

Interest Area Newsletters (Monthly) - Personal Lines, Commercial Lines, Employee Benefits and Industry Relations & Operations

IIAW Publications (Industry Research, Marketing Guides, Quarterly, Compensation Report & Annual Marketshare Reports, etc.)

Education

Prelicensing

Online & Classroom CE

Employee Training with

Emerging Leaders

Professional Development

Networking Events

Opportunity to Attend National Leadership Conferences

Events

Annual Convention (InsurCon)

Networking Events

Government Affairs

Political Advocacy at the State & National Level

News & Updates

Legal Briefs and Guidance

Free Quarterly Consultation

Services

Agency Accounting Services

Agency Operational Consulting

Agency Technology Consulting

HR Consulting

Virtual Operational Improvement Reviews

Task Forces & Councils

3 Virtual Meetings Per Year

Free CE Credits

Networking Opportunities

Technology

Cybersecurity Compliance Bundle

Catalyit (Full Access Subscription)

WAHVE - Talent Solution

Marketing

Branding

Young

The IIAW is here to help with all your agency accounting needs.

•Day-to-Day Bookkeeping

•Payroll Processing

• Direct & Agency Bill Reconciliations

• Financial Statement Preparation

• Annual Budget Preparation

• Work With Your External Accountants For Tax and Auditing Needs

Our services are best fit for agencies lacking financial acumen on staff, agencies with mature staff looking forward to retiring and agencies looking for additional bookkeeping knowledge and support.

Our team of dedicated agency accounting specialists are ready to assist you!

Kim Kramp Agency Supervisor kim@iiaw.com

Ali Smeester Agency Accounting Specialist ali@iiaw.com

Ali Smeester Agency Accounting Specialist ali@iiaw.com

Matt

No matter where you are in your insurance journey, the Big “I” is ready to help. Expand your knowledge, build your book of business, maximize your marketing or cultivate an agency team that thrives in any market. Independent agencies at more than 25,000 locations lean on the Big “I.”

How can we help you?

IT’S TIME TO TAKE THE NEXT STEP, THE BIG “I” HAS YOUR BACK independentagent.com

INSURCON2024 • MAY 15-16, 2024 • LAMBEAU FIELD, GREEN BAY

WEDNESDAY, MAY 15TH

10:30AM-12:30PM

Champions Club Room

Aaron Popkey, Green Bay Packers

Margeaux Giles, Irys

*This event is open to agency personnel and those receiving a special invite.* Limited space available on a first-come, first-serve basis.

1PM-4PM

Johnsonville Tailgate Village

4:30PM-9PM

Johnsonville Tailgate Village

Mallory Cornell, IIAW Vice President

Matt LaFleur, Packers Head Coach

THURSDAY, MAY 16TH

8:15AM-9:00AM

Legends Club Room

9:10AM-10:10AM

Legends Club Room

10:20AM-11:20AM

Mary Hosmer, Paul Leitch, Darrel Zaleski and Marc Petersen

WISCONSIN CEO PERSPECTIVES

Melissa Winter, Acuity

Rob Jacques, West Bend

Heather Boyer, Society

Alan Ogilvie, Church Mutual

Legends Club Room RISK MANAGEMENT PANEL

Local Green Bay Leaders of Risk and Crisis Management

11:30AM-12:30PM

Legends Club Room

12PM-1:30PM

Pre-Function Area

12:30PM-3:30PM

North Balcony and Pre-Function Area

5PM-6PM

Atrium Floor

6PM-9PM

Atrium Floor

CEO PANEL

Bob Brandon, Penn National Lisa Earnest, Progressive Kevin Leidwinger, UFG

GOURMET LUNCH

EXHIBITOR SHOWCASE

COCKTAIL RECEPTION HONORING IIAW PAST PRESIDENTS

Open to Everyone

EVENING CELEBRATION

Charles Woodson, Former NFL

Defensive MVP, Heisman Trophy Winner and ESPN Analyst

Our exclusive Agency Appreciation Luncheon is a gathering dedicated to recognizing our valued agency personnel and esteemed invitees. Hear how the Packers prepare for the 2025 Draft, their marketing strategy and how they respond to challenging events from Green Bay Packers Director of Public Affairs, Aaron Popkey. We’ll also feature a fast-paced CEO Q&A with Irys Founder and CEO, Margeau Giles, moderated by President Mike Ansay.

Earn 3 Ethics CE credits during Mallory’s Less Risk. More Reward. E&O Risk Management course. This course will be full of storytelling, statistics and E&O risk mitigation tips and it is premium credit approved by Swiss Re.

Gear up for an exciting tailgate party, featuring an exclusive Meet and Greet with Packers Head Coach, Matt LaFleur, an exhilarating cornhole tournament, tailgate games and dinner!

We’ll engage in insightful discussions with our four esteemed former presidents of the IIAW, delving into their experiences and perspectives on the industry’s evolution.

Gain unique perspectives from top CEOs who lead companies within the state. Discover how these local leaders navigate emerging trends, address challenges and implement innovative strategies to shape the future of Wisconsin’s insurance industry.

Join us as we listen to local leaders in risk management and crisis management and how they mitigate their exposures. Hear how professionals plan for Packer game day events and other potential hazards that face the city and events in Green Bay.

Gain valuable insights into the insurance industry’s future trajectory from top CEOs in our CEO Panel, as they discuss emerging trends, challenges and innovative strategies shaping the landscape.

Join us for a gourmet lunch prior to our Exhibitor Showcase.

Network and connect during our Exhibitor Showcase on the North Balcony, overlooking the Lambeau Field Atrium. Agency attendees can win big prizes from Super Door Prizes and by playing Blackout Bingo.

Join us for a cocktail hour preceding the evening’s celebration as we set the stage for a spectacular night with a photo opportunity overlooking Lambeau Field.

Our Evening Celebration will feature aceremony honoring this years award winners, and we’ll pay tribute to outgoing West Bend CEO, Kevin Steiner, and Church Mutual CEO, Rich Poirier, as they receive the IIAW E.J. Tapping Award. Charles Symington, IIABA CEO will lead a presentation, and we’ll enjoy a delicious dinner as we journey through the rich history of the IIAW over the last 125 years. Charles Woodson will lead a keynote presentation that promises to leave a lasting impact. Cap off the night with an exclusive Meet & Greet session, offering the chance to connect with Woodson.

Enjoy your Guided Lambeau Field Stadium Tours and Hall of Fame Tours (included w/ registration) during this time!

8:15 TO 9 A.M. ON THURSDAY, MAY 16TH

We’ll engage in insightful discussions with our four esteemed former presidents of the IIAW Board of Directors, delving into their experiences and perspectives on the industry’s evolution.

MARY HOSMER

Served as President 1991-1992

PAUL LEITCH

Served as President 1997-1998

DARREL ZALESKI

Served as President 2020-2021

MARC PETERSEN

Served as President 2021-2022

9:10 TO 10:10 A.M.

Gain unique perspectives from top CEOs who lead companies within the state. Discover how these local leaders navigate emerging trends, address challenges and implement innovative strategies to shape the future of Wisconsin’s insurance industry.

10:20 to 11:20 A.M. ON THURSDAY, MAY 16TH

Listen to local leaders in risk management and crisis management on how they mitigate their exposures. Hear how professionals plan for Packer game day events and other potential hazards that face the city and events in Green Bay.

INSURCON2024 • MAY 15-16., 2024 •

11:30 A.M. TO 12:30 P.M. ON THURSDAY, MAY 16TH

Gain valuable insights into the insurance industry’s future trajectory from top CEOs in our CEO Panel, as they discuss emerging trends, challenges and innovative strategies.

TAPPING LIFETIME ACHIEVEMENT AWARD RECIPIENTS

6 P.M. TO 9 P.M. ON THURSDAY, MAY 16TH

During our Evening Celebration, we’ll pay tribute to outgoing West Bend CEO, Kevin Steiner and Church Mutual CEO, Rich Poirier, as they receive the prestigious IIAW E.J. Tapping Lifetime Achievement Award. This award is named after the IIAW’s founder, E.J. Tapping, who was known as an unrelenting advocate of insurance agents and who believed the Association and its members should work in the public’s best interest by holding themselves to the highest ethical standards while working to insure the American dream.

AGENCY APPRECIATION LUNCHEON CEO PANEL

10:30 A.M. TO 12:3O P.M. ON WEDNESDAY, MAY 15TH

Agency personnel and those receiving a special invite can join this fast-paced CEO Q&A with Irys Founder and CEO, Margeaux Giles, moderated by IIAW President Mike Ansay.

Experience a Packers Tailgate Like Never Before

When You Join Us For Our Johnsonville Tailgate Party

Celebrate our monumental 125th anniversary at the heart of the action - Lambeau Field’s Johnsonville Tailgate Village on Wednesday, May 15th. Get ready to meet Green Bay Packers Head Coach Matt LaFleur, compete in a cornhole tournament, enjoy our DJ for the evening and an excellent dinner.

Schedule for the evening:

• 4:30PM to 6:30PM Meet and Greet, Sponsored by Irys

• 7PM-9PM Dinner, Cornhole Tournament, Tailgate Games and DJ

NOW: IIAW.COM/INSURCON

Former NFL Defensive MVP, Heisman Trophy Winner and ESPN Analyst

Charles Woodson is an 18year NFL veteran, former NFL Defensive MVP and Heisman Trophy winner. He is a Super Bowl champion, nine-time Pro Bowl defensive back and was inducted into the Pro Football Hall of Fame in 2021.

A champion both on and off the field, Charles has also formed the Charles Woodson foundation, providing scholarships to incoming students at the University of Michigan in need of financial aid. Additionally, Charles has pledged over $2 million to the University of Michigan C.S. Mott Children’s Hospital and established the Charles Woodson Clinical Research Initiative to support critical research projects that show promise of significant improvements in kids’ quality of life and longevity.

Woodson is also an oenophile who developed an interest in wine while playing football for the first time in Oakland, near the Napa Valley. He partnered with O’Neill Vintners to develop a signature wine label, “Charles Woodson’s Intercept.”

Don’t miss out on hearing Charles’ Keynote Presentation, concluding our Evening Entertainment on Thursday, May 16th. Following his presentation, you’ll be able to take home a bottle of his wine or whiskey (included with your registration) and there will also be a photo opportunity with Charles led by a professional photographer.

Scan the QR Code to see Charles’ message to InsurCon2024 attendees!

West Bend has a long history of writing workers’ compensation insurance. Our underwriters are knowledgeable and experienced. Our loss control reps have the expertise and tools to help keep employees safe. And our claims practices are the best in class.

From Main Street-type businesses to specialty businesses like food trucks, West Bend has the experience and expertise to protect businesses of many kinds and many sizes. We want to write all of your workers’ compensation business, small to large!

When you select West Bend for your valued customers, you can rest assured you made the right choice. After all, we are the best remedy for workers’ compensation.

To find an agent near you, visit thesilverlining.com.

As agents and risk managers face a new year with continuing hard market challenges, the first quarter of 2024 is an excellent time to discuss the financial, property or operational changes with your clients that may impact their insurance coverages.

A recent survey from Trusted Choice® found that nearly 70% of Americans are currently reviewing their coverages and 45% are doing so due to rate increases. However, you can solidify your relationship with clients by helping them understand the current market and providing them the coverage they need at the price they need.

Communicating with your clients via email or letter is essential, but you can also reach out via social media campaigns. This allows you to educate clients about the hard market and how their own risk exposures can reduce liability for your clients' organizations. Additionally, documented outreach on problem coverage areas, such as underinsurance, can help your agency avoid an errors & omissions claim.

Crucially, at a time when agencies are feeling the squeeze from increasing operational costs due to inflation and companies cutting commissions, solidifying relationships will help retain clients and protect income.

With consumers experiencing steep rate increases even nonrenewals, discussing higher deductibles with your personal lines clients is a good approach, especially with high net-worth clients where assuming more risk is realistic.

However, it pays to educate your clients with a more modest property or auto portfolio about the potential benefits of a higher deductible. The benefits include a lower premium and the ability to avoid reporting a loss that may impact their renewal.

With up to 40% of E&O claims filed against personal lines policies, it's important to frequently remind your personal lines clients of changing exposures:

1) Life events. These events include marriage, divorce, the birth or adoption of a child, or a new youthful driver in the family. When it comes to aging, consider the need for a referral to a life and health agent for disability or other coverages such as a cancer supplement.

2) Insurance-to-value ratio pressures. Home renovations, such as a kitchen remodel or the addition of another living unit, should trigger a coverage reevaluation. Agents should explore their clients' needs for higher limits for additional living expenses with lengthier renovations given supply chain and contractor availability, as well as higher law and ordinance limits.

3) Acquisition of valuables. This includes jewelry, art or guns that may belong on a separate schedule due to limitations in the homeowners personal property coverage.

It's best to ask the carriers to run any replacement cost estimates and insist that the insureds pick the level of coverage given the information you furnish.

However, always suggest the insured consult an appraiser or contractor for the best replacement cost estimate.

4) Operating an in-home business. This can create both general and professional liability exposures, as well as the need to insure office equipment, such as computers or other items.

5) Exploring potential rate reductions. Identify additional safeguards, such as low mileage forms on seldom-driven vehicles, burglar alarm installations, or other risk-reduction techniques that can reduce the risk and lower rates.

6) The need for higher limits. Highlight risks that can require higher liability limits or an umbrella policy for all insureds.

Receiving an annual update helps to prevent negligence allegations and builds stronger ties with your insureds.

For your commercial lines clients, the first quarter is a great time to examine the past year's performance and any changes. Changes can not only create differences in payroll and sales information, which are crucial in the rating process, but can also create uninsured exposures.

Here are some key topics to clarify with your commercial clients:

1) Changes to payroll or sales data. During the pandemic, many contractors' and vendors' sales numbers and payroll increased dramatically. However, as COVID-19 restrictions eased, many business owners saw reductions in these numbers, leading to an impact on premiums. As business owners face a 2023 tax season, reviewing their prior year's financials can mean adjustments to their coverages.

2) Updating vehicles and scheduled property. Are all schedules current, and are current values adequate to repair or replace that equipment?

3) Loss runs. Offer any risk management assistance based on this data. Discuss open lagging claims or provide an update on problematic or potentially overreserved claims. On closed claims, watch for missed subrogation opportunities, such as a non-chargeable auto accident with recovery potential.

4) Significant changes. These changes can include adding or removing a partner, venturing into new areas of products or services, such as a handyperson who now replaces roofs, or a new endeavor not covered by a general liability policy, such as offering consultations.

5) Response to increasing litigation. Remind your commercial clients of the importance of coverages they may need such as employment practices liability, pollution liability, or active assailant coverage. As society changes, business owners face increasing risks of litigation and new and improved coverages emerge to protect them.

6) Coverage limits. Review potentially problematic coverage limits, such as liability limits, business income limits and umbrella limits.

A vital practice for all agents is documenting these conversations. If you offer a coverage, such as additional coverage for assault & battery for a tavern, and the insured rejects that coverage, ask your insured to sign a form declining the offer. While an email of a coverage declination or rejection will help defend you if needed, it's a best practice to obtain the insured's signature on a form before you implement a coverage change, notify an insured about coinsurance issues, or change the policy to higher deductibles.

Agents never want to face a negligence allegation where your insured asserts that you “didn't offer that coverage" or that they “never requested that coverage change."

Some insurance experts suggest the market may soften slightly in 2024 in response to carriers' rate increases to the historic market conditions. However, whether 2024 softens or, in some lines, hardens, the more you communicate with your clients, the stronger your relationship with them.

Nancy Germond, Executive Director

Lately, the IIAW has received a number of questions from agencies and there is a common theme: “Can I do this?” In the scenario I’m referencing, “this” is typically an extra service that an agency is considering providing or a new workflow to help create efficiency. While every operation may vary, one thing remains the same. The change would be much easier with a standardized process from the start!

Consistency: Standardized procedures ensure that tasks are completed consistently every time. This consistency helps maintain quality across the agency's operations, from processing claims to handling customer inquiries.

Efficiency: Having standardized procedures streamlines workflows, making them more efficient. Employees know exactly what steps to follow for each task, reducing the time and effort required. This is especially true in situations where the agent is being asked for something outside of their typical duties. Example: The procedure includes standard language to notify the client of the normal timeline and steps when obtaining a homeowners quote. They can then send the proof of insurance to their mortgage lender. In this situation, the client knows they will be sending the proof of insurance to the lender, and helps minimize the number of times the agency is asked to do this on their behalf! This efficiency can lead to cost savings and improved productivity.

Compliance: Insurance agencies are subject to various regulations and industry standards. Standardized procedures help ensure compliance with these regulations by clearly outlining the

steps needed to adhere to legal requirements.

Training and Onboarding: Standardized procedures serve as valuable training resources for new employees. They provide a clear roadmap for new hires, helping them quickly understand their roles and responsibilities within the agency.

Risk Management: Insurance agencies can better identify and mitigate risks by standardizing procedures. Clear guidelines help minimize errors and omissions and reduce the likelihood of costly mistakes.

Customer Satisfaction: Consistent and efficient processes contribute to a positive customer experience. Customers who receive timely and accurate service are more likely to be satisfied with the agency's performance and may even become loyal clients.

Standardized procedures are essential for ensuring smooth operations, reducing risks, and delivering high-quality service in the insurance industry. If your agency would like help developing workflows or updating current processes, please reach out to Mallory, mallory@iiaw.com. We have full operational reviews available for E&O premium credits, or we can assist with one-off questions or provide templates to use within your agency.

> Mallory Cornell, Vice President, IIAW

> Mallory Cornell, Vice President, IIAW

When consumers are hurt or killed as a result of a problem with a product, they have legal rights under product liability law that governs these situations and dictates when and how victims can make a case for compensation.

Today, there are many well-known examples of product liability cases, from the hot coffee case against McDonald's, said to be the most debated product liability case in American history, to the case against tobacco giant Philip Morris that resulted in the payment of $28 billion in punitive damages to lung cancer sufferer Betty Bullock of Missouri in 2002.

“Over the last 10 to 15 years there has been an explosion in product liability cases," says Gary Grindle, executive vice president, Amwins Brokerage. “I think a lot of it has to do with social inflation where people are now just looking for someone with a deep pocket to pay when somebody's injured irrespective of clear negligence."

Since 2018, there have been numerous product liability cases that have resulted in the payment of billions of dollars to claimants. Some recent cases include the claim against Monsanto and Bayer in relation to the popular weed killer, Roundup, which contains cancercausing glyphosate; Johnson & Johnson's talc products which allegedly contain traces of toxic asbestos; and the Hoffmann-LaRoche's acne drug Accutane, which failed to warn of possible gastrointestinal side-effects.

More recently, in November 2023, a federal judge allowed the majority of claims to move forward in litigation that asserts chemical hair relaxer products made by L'Oreal USA, Revlon and others allegedly cause cancer and other injuries.

These are just some of the high-profile, wide-ranging product liability lawsuits that are currently making headlines because of the impact they have had on plaintiffs' lives and the monetary amounts involved.

“These types of claims have changed the market by showing that every party in the supply chain needs to be aware of the inherent risk of a product or process as well as risks assumed contractually," says Amy Gilmore, vice president, casualty underwriting performance for excess & surplus/specialty and commercial lines, Nationwide. “It is important to understand the reach of the product, distribution, longevity of product in the market, and potential hazard to ensure each party in the supply chain is covered adequately."

This is evident in the recent L'Oreal USA, Revlon filing where several smaller cosmetics companies, including some based in India, are named in the lawsuits.

In the product recall world, “the Tylenol incident was essentially the seminal industry event," says Scott Crump, assistant vice president, manufacturing and mercantile strategic business units, Selective Insurance. “While it wasn't the largest in history, it's still one of the largest from a dollar standpoint."

In September 1982, Johnson & Johnson made a voluntary recall of its best-selling product, Extra-Strength Tylenol, when seven people died from taking Tylenol that was laced with cyanide. The incident cost the company between $100 and $150 million.

“There are several things to consider when ensuring adequate product liability protection for clients," says Peter Burns, head of large and complex casualty solutions, The Hartford.

Here are four things to remember:

1) Understand the risks your clients face. “By understanding your client's product list and where they are manufactured, you can be prepared to defend against strict product liability and negligence, including design defects, manufacturing defects, marketing defects and improper warnings," Burns says. “Businesses that import products may bear sole responsibility and be held accountable for safety requirements, industry or government standards, proper safety warnings and labels. Understanding the legal theories of liability can help your client know the risks they face."

2) Review contracts clients have in place. An agent should “be aware of contractual requirements and ensure appropriate hold harmless agreements are in place so that suppliers and partners are responsible for their own negligence in the case of a claim," Burns says.

3) Offer risk mitigation options. “Help clients document retention and a written product safety program that reflects legal requirements and creates a story of the development of the product to show evidence that a business took sufficient measures to make a product safe," Burns explains.

4) Communicate what is coming down the pike. In 2024, “some product liability cases that we foresee

coming down the pike include 'forever chemicals,' such as perfluoroalkyl or polyfluoroalkyl substances (PFAS); societal product claims, including social media, obesity, environmental impacts, infant formula, gun manufacturers and retail sellers; and COVID-19 vaccination efficacy," says Terry Bolin, vice president, casualty claims for excess & surplus/specialty and commercial lines, Nationwide.

While product liability claims have primarily been related to tangible products, litigation has recently been brought in California against Meta Platforms Inc's Instagram and Facebook, ByteDance Ltd's TikTok and other social media platforms alleging that these sites set out to hook young users, leading to addiction and poor mental health outcomes, including eating disorders, self-harm, depression and suicidal thoughts.

“Communicating emerging issues so that insureds know what to expect and why is important," Burns adds. “As well as helping them understand how quality control measures are critical to product accounts and help protect them."

This article was originally featured on iamagazine.com in March 2024.

> Olivia Overman, IA Content EditorWe distinguish our Workers’ Compensation coverage by providing value-added services before, during, and after a claim.

Responsive claims handling

Facilitation of quality medical care (when an accident does occur)

We’ve been successfully protecting our policyholders and their employees since 1983.

Effective communication is the cornerstone of any successful insurance agency. Email remains a powerful tool for not only educating and informing customers but also establishing loyalty and confidence.

Email can be used to help your customers better understand the value of their coverage, foster a positive relationship with you as their insurance agent, and ultimately, contribute to long-term customer retention and satisfaction.

However, keeping up with the volume of emails needed to achieve this can overwhelm an agency, which means it is crucial to leverage email automation to streamline your communications strategy. In this guide, we’ll delve into the world of email automation, exploring both the “how to” and “when to use it” aspects to help you harness its potential and drive remarkable results.

Email automation involves sending emails to a predefined list of recipients based on certain triggers or schedules. It allows an agency to reach its audience at the right time with relevant content, nurture leads, and guide customers through the customer journey. Here’s how to get started.

The first step in leveraging the power of this automation is selecting the right email marketing platform. Look for systems offering robust automation and sequencing capabilities. Leading platforms such as Mailchimp, HubSpot, Constant Contact and ActiveCampaign provide a range of automated features, including drip campaigns, segmentation and personalization.

If you already have invested in an agency management system, contact your provider. What do they offer for automated email? Can they provide additional guidance? What features are you not using?

When assessing marketing automation providers, consider factors like ease of use, integration with your existing tools, scalability and customer support. Many platforms offer free trials. Test a few to see which one works best for you.

Before diving into email automation, analyze your business goals and customer journey. Identify key touchpoints where automated emails can add value, such as welcoming new customers, guiding them through the onboarding process, re-engaging dormant leads, or nurturing prospects with educational content.

Consider creating a flowchart of your customers’ journeys to map out potential automation points. This will help you visualize the sequence of emails and the triggers required to deliver a seamless and relevant experience.

Example: When David Anderson, owner of a small Midwest agency, analyzed data from customer engagement, he found many were dropping off after receiving a quote. To nurture these prospects, he implemented an automated drip campaign to highlight the value of working with him by providing loss control tips and the benefits of coverage options. This led to a significant increase in quote conversions.

Now that you have the foundation in place, let’s explore the practical “how to” aspects of email automation.

One of the most impactful applications of email automation and data analytics in the insurance industry is segmentation. By categorizing customers into specific groups based on factors like age, location, coverage type and claims history, agents can tailor their communication and services to better meet the unique needs of each segment.

Example: Tina Davenport, an auto insurance agent near San Diego, segmented her customer database by commercial auto and personal auto. Business customers received a quarterly newsletter featuring fleet management tips. Personal auto customers received a monthly safe driving bulletin that included seasonal driving tips and distracted driving statistics. This targeted approach strengthened customer relationships, improving customer retention and profitability.

Also, try at least two different subject lines for your emails. This is called “A/B testing,” which means you can send the same email but with different subject lines. Or the same subject line but with different body copy. Have some fun with this. You’ll build a knowledge base about action words or calls-to-action that perform better in generating responses. The more you test, the more you’ll understand what works for you.

A drip campaign is a series of emails sent automatically to customers or prospects at designated points over a predetermined interval of time. Use it as a strategic tool to build lasting relationships. It is highly effective for nurturing leads and guiding them through the sales funnel. The best drip campaigns contain engaging content that gradually build trust and showcase the value of your products or services.

An example drip campaign for your agency could be a four-part email series for new customers, introducing them to your brand story, sharing loyalty testimonials, offering a newsletter subscription and, finally, preparing them for their policy renewal.

Example: Peter Garcia, an independent agent from Albuquerque, New Mexico, used a drip campaign to educate his potential customers about the complexities of commercial business insurance. Over the course of a month, he sent a series of emails featuring different coverage options, case studies and success stories, leading to an increase in inquiries and policy purchases.

Not surprisingly, personalized emails with tailored recommendations and content resonate more with recipients and drive higher engagement rates. That’s why it is important to leverage data from your customer relationship management (CRM) or agency management system to include the recipient’s name, location and past interactions with your firm.

Email automation isn’t just about streamlining your workflow. It is about delivering timely and relevant messages to your audience. Here are some scenarios where email automation can be a game changer:

Keep your customers informed and engaged by sending monthly newsletters with updates on your products, services or insights about your customers’ industries or personal insurance situations. Use automation to schedule these newsletters ahead of time, ensuring consistent communication even during busy periods.

Example: Cheryl Browne and her partner, Trudi Campbell, both seasoned agents from New Orleans, send out a monthly newsletter to their customers with updates on new coverage options, safety tips and seasonal advice (like hurricane preparedness during storm season), creating an ongoing dialogue and building trust.

Welcome new customers with a well-crafted series of emails that introduces them to your brand and values. The automated series should provide valuable content, showcase your services and remind customers to update their insurance policies, if applicable.

As an independent insurance agent in Davenport, Iowa, Robert Miller sends a personalized welcome to each new potential customer. The recipient receives a valuable, easy to read eBook that delves into understanding insurance terms and coverages.

Use email automation to re-engage prospects who haven’t interacted with your emails or bought coverage. Craft compelling messages that remind them of the value you offer and entice them to act and engage.

When Martha Walker from Wichita, Kansas, joined her family’s independent agency, she wanted to contact former customers of the agency. To do so, she initiated a series of personalized emails spotlighting the agency’s local presence and community involvement—along with an invitation to stop by their booth at the town’s Saturday farmers’ market for a chance to win a gift card supporting local businesses.

Email automation is a dynamic tool that can revolutionize your agency’s communication strategy. By choosing the right marketing automation system, assessing your business goals and implementing effective automation techniques, you can create personalized, timely and engaging email campaigns that drive meaningful interactions with your audience.

Whether you’re sending monthly newsletters, welcoming new customers or re-engaging dormant leads, email automation empowers you to connect with your audience in a way that drives results and nurtures lasting relationships.

Take the plunge into the world of email automation and unlock the true potential of your agency’s communication strategy.

This article was originally featured on trustedchoice.com.

In 1919, A group of Pennsylvania farmers founded Penn National Insurance to provide affordable workers’ compensation insurance.

Today, Penn National Insurance sells property-casualty insurance in 12 states by partnering with more than 1,200 independent agency operations. In 2012, we affiliated with Wisconsin-based, Partners Mutual Insurance Company. As one company, we bring the personal attention and local focus of a regional carrier, along with the quality of products and services of national carriers.

Interested in partnering with a thriving insurance carrier with superior customer experience? We are looking for seselect commercial lines-oriented agencies in Wisconsin.

Contact:

Vicki Lentz

262-432-3420

vlentz@pnat.com

Contact:

Clayton Zogata

715-383-5454

czogata@pnat.com

We help people feel secure and make life better when bad things happen

• Strong financial performance and A.M. Best Financial Strength Rating of A (Excellent) Positive Outlook

• Expanded Commercial Lines products and services with competitive pricing and comprehensive coverages to help our agents grow profitably

• Comprehensive Personal Lines product offerings, including Homeowners Equipment Breakdown and additional protection plans

• State-of-the-art quoting, processing and self-service tools, making it easier and faster to meet your customers’ needs

• Local, experienced underwriting, claims and management staff

Neenah, WI (2/27/24) - SECURA Insurance published its 2023 annual report sharing details about the company’s financial results, corporate projects, and company culture.

“As a mutual company, financial performance isn't the only way we measure success,” said Garth Wicinsky, SECURA President & CEO. "Delivering on our promise to our policyholders, building positive relationships with our independent agents who sell our products, and continuing to be rated a Great Place to Work by our associates are all important factors in our success."

In 2023, SECURA grew direct written premium to $1.1 billion and its agency partners produced $141 million in new business.

In addition to financial growth, SECURA offered more than 17,500 hours of continuing education credits to its agency partners through in-person courses, webinars, and ondemand videos. The company also offered performance development opportunities to its associates, with 291 exams taken through The Institutes Knowledge Group and 42 associates completing the company’s Foundational Leadership Program.

To view the full 2023 annual report, visit secura.net/annualreport. For career opportunities, visit secura.net/careers.

| SECURA Insurance, headquartered in Neenah, Wis., is a regional group of property-casualty insurance companies operating in 13 states. Approximately 550 independent insurance agencies represent the group, which provides a broad range of competitive commercial, agribusiness, farm, nonprofit, and special events products. SECURA Insurance is known for providing exceptional service to its agents and policyholders since 1900, and is rated A (Excellent) by A.M. Best for its excellent ability to meet policyholder obligations.

It is a Ward’s Top 50 company for outstanding results in financial performance and consistency over a five-year period, and it is a certified Great Place to Work. Visit www. secura.net to learn more.

Sheboygan, WI (3/5/24) - Acuity is the top-ranked Wisconsin-domiciled carrier in the 2024 CRASH Network Insurer Report Card, which puts Acuity among the top 6 insurers nationwide in the report’s Honor Roll. Acuity is also ranked #1 in the 6-state Great Lakes Region, consisting of Minnesota, Wisconsin, Michigan, Illinois, Indiana, and Ohio.

CRASH Network surveyed over 1,000 collision repair shops across the country for its 2024 Insurer Report Card. Shops were asked to grade the claims service of insurance companies based on one question: How well does this insurer’s claims handling policies, attitude, and payment practices ensure quality repairs and customer service for motorists?

According to CRASH Network, Acuity has personnel that are better trained, more experienced, and/or quicker to respond than other insurers. Acuity also has claims processes that are more efficient and payment practices that are more reasonable than other companies and is also more willing to pay for quality parts and original equipment manufacturer (OEM) repair procedures. Surveyed shops said the best insurance companies don’t pressure them to cut corners or install lower-quality parts to save money and aren’t adding more administrative steps to slow down the repair and claims process.

“We truly care for our customers, and it shows in the claims service we deliver. Being recognized again by CRASH Network proves that customers can count on Acuity when accidents happen,” said Melissa Winter, Acuity President.

The report card also revealed that many insurers earning the highest grades from repair shops are regional insurance companies that “do not spend billions of dollars per year on advertising.” In fact, none of the 10 largest auto insurers in the country scored higher than a C+ grade, and none were ranked in the top 50 insurers.

Acuity Insurance, headquartered in Sheboygan, Wisconsin, insures nearly 150,000 businesses, including nearly 350,000 commercial vehicles, and more than 550,000 homes and private passenger autos across 31 states. Rated A+ by AM Best and S&P, Acuity employs more than 1,600 people.

West Bend, WI (3/12/24) - In a significant leadership transition, West Bend Insurance Company is pleased to announce the promotion of Rob Jacques to Chief Executive Officer (CEO). Jacques, who has dedicated over 24 years to the company, also currently holds the position as President an appointment he’s held since 2022 where he represented the Commercial Enterprise division as a senior officer. In his expanded role as President and CEO, Jacques is set to guide West Bend's corporate strategies and operating principles into a new era.

Jacques steps into the shoes of Kevin Steiner, who’s been at the helm as CEO since 2009, marking a period of substantial growth and success for the company. Under Steiner's stewardship, West Bend not only fortified its position in the market, but he’s also left an indelible mark the community and the insurance industry.

Reflecting on the transition, Jacques expressed deep appreciation for Steiner's mentorship and leadership. "Working alongside Kevin has been an extraordinary journey. His profound impact on our company, community, and the insurance sector at large is truly remarkable," said Jacques. He further emphasized his commitment to the company's core values, stating, "With the support of our exceptional team of officers and leaders, I am eager to continue fostering strong relationships with our agency partners and caring for our dedicated team of over 1,600 associates."

West Bend Insurance Company, with a storied history spanning 130 years, has been a cornerstone in providing comprehensive insurance solutions to business owners, homeowners, and auto owners. The company boasts a broad portfolio of property and casualty coverage across 14 states and offers Surety coverage nationwide.

As Jacques assumes leadership, West Bend stands on the cusp of a promising future, building on a legacy of excellence and a commitment to its partners and associates. The entire West Bend family looks forward to supporting Jacques in his new role as he steers the company towards continued success and innovation.

Fond du Lac, WI (3/13/24) - Society Insurance elected Sherman Brown of Chicago, Ill. as a director at its Annual Meeting of Policyholders on March 11, 2024.

Brown is executive vice president of business services at the National Restaurant Association, which is the world’s largest foodservice trade organization. He is charged with overseeing business strategy, marketing, sales and daily operations for the company’s products and services business – including the ServSafe program, which more than 20 million foodservice workers have completed. Brown earned a bachelor’s degree in finance from Howard University and a master of business administration (MBA) degree from Clark Atlanta University.

“We are thrilled to add Sherman Brown to Society’s board of directors,” said Heather Boyer, Society Insurance president & CEO. “His executive experience at the National Restaurant Association and his time at Walt Disney Parks & Resorts, in the United States and internationally, provide invaluable insight into the hospitality industry that we specialize in insuring across our nine states.”

“Sherman guides the work of 200+ employees to serve more than 40,000 members of the National Restaurant Association, including partnerships with 52 state restaurant associations,” said Kim Sponem, chair of Society’s board of directors. “He’s been instrumental in strengthening operations, developing talent, advancing business vitality and driving knowledge and collaboration. Sherman’s strategic leadership skills are a great addition to the diverse experience on the Society Insurance board of directors.”

Society’s board congratulated Thomas Gross on his retirement from the board of directors. Gross served for 27 years.

In addition to Brown, Boyer and Sponem, Society’s board of directors includes JoAnn Cotter, John Duwell, Susan Finco, Nancy Hernandez, Linda Newberry-Ferguson and Rick Parks.

| Headquartered in Fond du Lac, Wis., Society Insurance has been a leading niche insurance carrier since 1915. Society focuses on the small details that make a big difference to its policyholders while offering top-notch insurance coverage, service and competitive pricing to businesses in Wisconsin, Illinois, Indiana, Iowa, Minnesota, Tennessee, Colorado, Georgia and Texas.

At Western National Insurance, nice is what’s guided us for over 100 years. And we’re just getting started.

Western National Insurance. The power of nice.

www.wnins.com