Certain job markets can be treacherous. They can make shipwreck of even the most skilled candidate’s career You need a seasoned hand to guide your career safely to the next professional port. Accounting Principals and Parker + Lynch are the experts in financial recruitment and placement We have a deep understanding of local job markets, salary trends and the broader business climate. Aligning top talent with quality companies is what we do We know you’ll never stop until you reach your destination. We can help you get there. Contact us today.

Wdesk is the leading cloud pla orm for repor ng, compliance, and dat a management.

Ensure the accurac y of your data—input a single dat a point to distribute to all your relevant reports and documents—and automa cally eliminate manual errors.

Over 2,80 0 organiza ons use our award-winning solu ons to modernize work across the enterprise.

Here are just a few of the areas Wdesk c an help:

• SEC filings

• Performance and management reports

• Quarterly and annual reports

Gain efficiency in your financial and management repor ng processes with Wdesk. To learn more, visit workiva.com/repor ng

When I began my career with the Illinois CPA Society in late 1 9 9 8 , t h e O u t l o o k e m a i l p l a t f o r m h a d o n l y r e c e n t l y b e e n launched as part of Office 97, and our email system consisted of three CompuServe email accounts Fast-forward to today, and it’s crazy to think about how far we’ve come so quickly

While we now often complain about the amount of email we get, can you imagine communicating or working without it going back to just pens, paper, and what’s now referred to as snail mail? If I had told you in 1990 that you’d do most of your holiday shopping online in 2017, you would have simply asked, “What’s online?”

Now we live and work in a world where we’re online, and often o n c a l l , 2 4 / 7 a n d f a c i n g c h a n g e l i k e w e ’ v e n e v e r s e e n b e f o r e C o n s i d e r j u s t b l o c k c h a i n t e c h n o l o g y, w h i c h i s h e r e t o d a y a n d revolutionizing the way transactions are completed as you read t h i s I t ’s a l s o e s t i m a t e d t h a t 4 9 p e rc e n t o f a l l w o r k c o u l d eventually be automated with technology, and advanced robotic process automation (RPA) and artificial intelligence (AI) have the p o t e n t i a l t o a u t o m a t e o r e l i m i n a t e u p t o 4 0 p e rc e n t o f b a s i c accounting work by 2020

Technology will continue to advance at an ever-increasing rate, just as it always has, and we simply need to adapt Recently, I spoke about blockchain technology at a Chapter meeting, only to receive feedback along the lines of “that’s never going to happen ” Did you ever think that you’d be able to surf the internet, buy anyt h i n g , m a n a g e y o u r f i n a n c e s , w a t c h a n d m a k e m o v i e s , s e n d

emails, make calls, and much more, from a device the size of an index card? Again, most of you would have thought that’s crazy Yet, the iPhone, first released just a decade ago, has helped revolutionize the way we work and interact with the world around us, and most of us go into the shakes if we leave our houses without our smartphones.

So, what do we do about things like blockchain, RPA, and AI? Embrace it, learn it, and play with it More than any other time in the history of our profession, CPAs have an opportunity to move away from repetitive transactional tasks and focus on providing meaningful insight and analysis to clients and coworkers

Thirty years ago, people looked at Lotus and Excel and said, “So what ” Today, we look at those tools and can’t imagine life without them. This time is no different. The successful CPAs of tomorrow will be those who view technology as an opportunity, embrace it, and capitalize on it

Technology can drive us crazy, but we can’t live without it The pace of change is ever-increasing, but we embrace it. It seems i m p o s s i b l e t o k e e p u p , b u t w e d o E v e r y n e w t e c h n o l o g y s t i r s some fear and angst among us, but we overcome it And the Illinois CPA Society will be here for you every step of the way, providing the information and education you need to succeed today and tomorrow Technology isn’t our enemy, it’s our answer

{Follow Todd on Twitter @Todd ICPAS} {Watch Todd’s CEO Video Series on YouTube}

Technology isn’t your enemy it ’ s your answer.

The velocity of change in the accounting profession has never been greater Join Lisa Har tkopf, CPA , Chair of the ICPAS Board of Director s and Todd Shapiro, ICPAS President & CEO, for an engaging conver sation on how we can thr ive in a world of disruption

Town Hall Forums are a great oppor tunity for you to interact with the Society's leadership and your peers as you discuss the power ful issues facing the profession.

all prog rams:

CPE: 1 5 Credit Hour s Cost : FREE Complimentar y breakfast or lunch included. REGISTRATION

Please call 800.993.0 407 or visit www.icpas.org.

ILLINOIS CPA SOCIET Y

550 W Jackson Boulevard, Suite 900, Chicago, IL 60661 www.icpas.org

Publisher/President & CEO

Todd Shapiro

Editor Derrick Lilly

Creative Director

Gene Levitan

Photography

Jay Rubinic + Derrick Lilly

Circulation

John McQuillan

Chairperson

Lisa Hartkopf, CPA | Ernst & Young LLP

Vice Chairperson

Rosaria Cammarata, CPA, CGMA | Mattersight Corporation

Secretar y

Geoffrey J Harlow, CPA | Kessler Orlean Silver & Co , PC

Treasurer

Kevin V Wydra, CPA | Crowe Horwath LLP

Immediate Past Chairperson

Scott D Steffens, CPA | Grant Thornton LLP

Christopher F Beaulieu, CPA, MST | CliftonLarsonAllen LLP

Michael D Bedell, Ph D | Northeastern Illinois University

Terry A Bishop, CPA | Sikich LLP

Brian J Blaha, CPA | Wipfli LLP

Jon S Davis, CPA | University of Illinois

Stephen R Ferrara, CPA | BDO USA LLP

Jonathan W Hauser, CPA | KPMG LLP

Anne M Kohler, CPA, CGMA | The Mpower Group

Dorri C McWhorter, CPA, CGMA, CITP | YWCA Metropolitan Chicago

Thomas B Murtagh, CPA, JD | BKD LLP

Elizabeth S Pittelkow, CPA, CGMA, CITP | ArrowStream Inc

Maria de J Prado, CPA | Prado & Renteria CPAs

Stella Marie Santos, CPA | Adelfia LLC

Andrea K Urban, CPA | ThoughtWorks Inc

BACK ISSUES + REPRINTS

Back issues may be available Articles may be reproduced with permission

Please send requests to lillyd@icpas org

Want to reach 24,000 accounting and finance professionals? Advertising in INSIGHT and with the Illinois CPA Society gives you access to Illinois’ largest financial community Contact Mike Walker at mike@rwwcompany com

INSIGHT is the magazine of the Illinois CPA Society Statements or articles of opinion appearing in INSIGHT are not necessarily the views of the Illinois CPA Society The materials and information contained within INSIGHT are offered as information only and not as practice, financial, accounting, legal or other professional advice Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication It is INSIGHT’s policy not to knowingly accept advertising that discriminates on the basis of race, religion, sex, age or origin The Illinois CPA Society reserves the right to reject paid advertising that does not meet INSIGHT’s qualifications or that may detract from its professional and ethical standards The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within INSIGHT, and makes no representation or warranties about the products or services they may provide or their accuracy or claims The Illinois CPA Society does not guarantee delivery dates for INSIGHT The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delays in delivering INSIGHT INSIGHT (ISSN-1053-8542) is published four times a year, in Spring, Summer, Fall, and Winter, by the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA, 312 993 0407 Copyright © 2017 No part of the contents may be reproduced by any means without the written consent of INSIGHT Send requests to the address above Periodicals postage paid at Chicago, IL and at additional mailing offices POSTMASTER: Send address changes to: INSIGHT, Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA

“Folks want to save, know they should, but they are overwhelmed by convoluted options, complex tools, and financial jilting-jargon. How can we fix this?” – Ken

FisherCountry Financial has new data showing just how financially strapped our compatriots are: Almost one in five Americans (19 percent) wouldn’t be able to pay their bills within one month of losing their jobs and that figure jumps to 37 percent for those earning less than $30,000 per year

Exacerbating the situation, Bankrate com found that 24 percent of Americans have no savings set aside in case of emergency and 60 percent wouldn’t be able to cover an unexpected $500 expense

What’s interesting about America’s savings crisis is that it spans the population Last year, a Federal Reserve study on the economic wellbeing of U S households found that spending equaled or exceeded annual income for individuals earning less than $40,000 (69 percent), $40,000 to $100,000 (44 percent), and more than $100,000 (32 percent) It’s no wonder why consumer debt is spiking to record levels

Federal Reserve data released earlier this year shows U S consumers are carrying balances totalling more than $1 trillion on their credit cards, up 6 2 percent from a year ago and the highest amount since our time of financial crisis in January 2009 This is in addition to the more than $1 trillion in auto loan debt Americans are saddled with, and student loan debt has nearly tripled in the last decade to over $1 4 trillion

The bottom line is that too many of us are making the costly mistake of spending too much and not saving enough That said, it’s highly likely that many of your clients, prospective clients, and even friends and family may have large amounts of debt and little to no savings set aside And this is where you come in

“CPAs skilled at organizing financial information and wrestling with the most complex set of laws, regulations, and filing requirements in the world the Internal Revenue Code (this may only be a slight exaggeration) have an important role to play in combating our savings and debt crises,” says James Sullivan, CPA, PFS, Illinois CPA Society member and board member of Consumer Debt Counselors Inc

Sullivan says the need for financial counseling and guidance is unprecedented, and CPAs are the perfect candidates to provide it, both as a public service and as a business development tool. “With an overwhelming need and the right tools, CPAs can take advantage of a growing practice development opportunity by delivering a valuable service to Illinois students and families,” he adds

As respected business advisors and finance experts, CPAs are perfectly positioned to advance financial literacy and planning in their communities Are you ready to help make a difference in someone ’ s financial future?

Over the years, your living expenses may have increased Could your current life insurance benefits:

• Help your family maintain their lifestyle?

• Pay for your kids’ college education?

• Allow your spouse to retire comfortably?

It’s always a struggle to lose someone you love. But your family’s emotional struggles don’t need to be compounded by financial problems

That’s why the Group 10-Year Level Term Life Insurance Plan is made available to ICPAS members.* This valuable insurance program offers:

• Your choice of benefit amounts up to $250,000.

• Rates that are locked in for 10 full years.

• Benefit amounts remain steady for the 10-year coverage period. There are no age reductions.

The multi-government Electric Vehicle Initiative set a goal for 30 percent market share for battery power cars, buses, trucks, and vans by 2030. Electric vehicles now represent just 0.2 percent of total light-duty vehicles.

[International Energy Agency]

Tesla’s eccentric CEO Elon Musk wins the limelight for autonomous and electric vehicles (EVs) here in the U S , but his luxury EVs aren’t the only ones revving up the automotive and tech industries In fact, gasoline and diesel-fueled automobiles could become things of our past pretty fast, thanks to China.

Touting the largest auto market in the world, China joins Britain, France, and India as the latest global powerhouse to announce its intent to ban sales of traditional gasoline and diesel-fueled automobiles

Britain and France both pledged to invest billions in electric infrastructure and halt sales of traditional automobiles by 2040, and India plans to sell only electric cars by the end of the next decade And while China hasn’t yet set its timetable the country already accounts for more than 40 percent of EVs worldwide its plan to transition to fully electric vehicles stands to disrupt the global transportation and petroleum industries, among others.

China has been providing billions of dollars in research subsidies for electric development and incentives to buyers, but a new quota system will require its automakers to steadily transition production exclusively to EVs, pressuring them to step up development of electric technology China has also ordered state-owned power companies to speed up charging station

installations to increase the appeal of EVs and help curb oil imports and environmental issues

International automakers are already taking note Volvo Cars, owned by China's Geely Holding Group, plans to make electric cars in China for global sale starting in 2019; Mercedes Benz will offer electric versions of all its models by 2022; Honda announced at this year ’ s Frankfurt Motor Show that it’ll offer electric versions of all new models launched in Europe from now on; and General Motors, Volkswagen, Nissan, and others are exploring or forming joint ventures with Chinese partners to develop and manufacture EVs in China

These moves could leave the U S as the last major stronghold for automobiles powered by gasoline and other fossil fuels considering the U S federal government hasn’t yet gone so far to support EVs. Incentives for EVs come in the form of tax breaks up to $7,500 for consumers Some states, including Illinois, also offer tax credits, rebates, grants, loans, and other tax and fee reductions to encourage sales of electric and hybrid vehicles

Whether the U S emerges as a true leader in EVs remains to be seen, but the technology stands to disrupt not only several important industries around the globe but also our lives. If the pace of technological advancement continues accelerating as it has, it’s likely we’ll all be “driving” autonomous EVs much sooner than we ever thought and accounting for them

The benefits reach far and wide when CPAs create a culture of giving back.

By Eric ScottMost job descriptions for accounting and financial positions don’t include a bullet point about taking time to make the world a better place. But while catching a tax calculation error or explaining a financing strategy may earn congratulations or save a company’s bottom line, more CPAs are taking on the task of saving their communities one cause at a time.

For the last eight years, the Illinois CPA Society has held its annual CPA Day of Service, which has significantly grown in size and recognition during its short history. In September of 2016, a record number of more than 1,350 CPA Day of Service volunteers teamed up at events across Illinois, helping with everything from building homes and community gardens to packaging food for families in need

For those who choose to roll up their sleeves and volunteer during the annual CPA Day of Service, it’s a great opportunity to do something meaningful for people outside of their workplaces But for many others in the profession, giving back stretches well beyond a single day of service

“It’s a priority for our firm We take it further than just writing a check,” says Leslie Finn, director of marketing and recruiting at Deerfield, Ill CPA firm Warady & Davis LLP With a large not-for-profit client base, Finn says her firm of about 100 staffers has a charitable-minded focus; volunteerism and community support is a core value something staffers know when they walk in the door on day one.

“It’s ingrained in our culture We talk about it at orientation, and it’s part of our hiring process It’s communicated frequently throughout the year,” Finn explains. “We encourage everyone to get involved with associations and boards that interest them.”

In fact, Warady & Davis has its own charitable committee where employees have a direct voice in the causes they’d like to support as well as the overall charitable theme for the year The staff then works in teams to support these causes even during tax season Last year ’s theme focused on honoring veterans, and many firm staffers took part in CPA Day of Service projects at Edward Hines Jr Veterans Administration Hospital near Maywood, Ill. This year ’s firm theme centers on health and wellness. Warady & Davis staffers even step up to assist their own not-for-profit clients on tight budgets

“People generally care about each other here and the clients,” Finn says. “You serve the clients better when you enjoy what you’re doing ”

In similar fashion, Wipfli CPAs and Consultants ingrains a yearround focus on volunteering and giving back. The entire firm was honored with the Time and Talent Public Service Volunteerism Award at the Illinois CPA Society’s Leadership Recognition Dinner last June more than 100 area staffers participated in local CPA Day of Service activities, and about an equal number of associates from its Rockford, Freeport, Sterling, Dixon, and Mendota offices volunteered their time at local park districts and other not-for-profit organizations.

“It’s easy to say one day a year we’re going to donate our time, but Wipfli takes great pride in giving back to our community,” says Gary Shutan, Wipfli’s geographic market leader for the Chicago market. “We have a great response from a lot of our associates and partners It’s part of the culture here, giving back to our communities and helping others that aren’t as fortunate ”

From small CPA firms to very large practices and corporate finance departments, those dedicated to their professions seem equally

dedicated to serving their communities. And for some in large companies, taking the time for group volunteer projects also leads to valuable networking and team-building opportunities

“I met someone I would never have spoken with if she hadn’t volunteered,” says Chris Roberts, an accounting manager with Exelon in Warrenville, Ill “It’s nice to get out of the office You’re doing it for a good cause and meeting others makes it a win-win.”

For last year ’s CPA Day of Service, Roberts organized a team to assemble and pack meals for needy families at Feed My Starving Children in Aurora, Ill. And while he’s experienced in rounding up colleagues to give back to their community, Roberts says his colleagues really don’t need much encouragement when it comes to volunteering.

“The office is extremely supportive of being active in the community, and Exelon encourages its people to get involved. It’s definitely part of our culture,” he says, pointing out that there’s a volunteer calendar on the company’s intranet where employees can easily join upcoming volunteer opportunities “Our volunteer calendar is the center of the buzz. It just starts with the culture and word of mouth ”

In describing Exelon’s recently wrapped-up giving campaign, Roberts highlights that Exelon and the Exelon Foundation donated more than $46 million to charitable causes in 2016, and Exelon employees contributed more than 171,000 volunteer hours

Even for those with few dollars or hours to give, the impacts stretch far and wide Samantha Newmark is a 22-year-old accounting student at Bradley University in Peoria, Ill. who’s set to graduate with both her bachelor ’s and master ’s degrees in accounting Cramming

classes and late-night studying into a five-year program is enough of a load for any college student, but Newmark still finds time for giving a growing trend among the younger generations entering the business world with hopes of working for a cause they care about.

As a member and chapter leader of Beta Alpha Psi, an international honor organization for accounting, finance, and information systems students, Newmark arranged for about 15 of her Bradley classmates to volunteer at a nearby camp for kids from lowerincome families during last year ’s CPA Day of Service, helping to clean up facilities around the camp, including a play area where she says it was a big thrill to ride down the camp’s huge slide when they were done While the tasks were fairly simple, Newmark says her team’s efforts had a huge impact on both the camp’s staff and everyone involved

“It’s definitely more satisfying than getting an ‘A’ in class It’s so rewarding being there for other people and that it means so much to them,” she says “It really opens a door to the real world ”

When asked if volunteerism and giving back were important qualities for future employment, Newmark made it clear that it’s definitely a key factor. “It’s essential for any employer to have that responsibility; giving back is something that’s really important to me ”

The desire to volunteer time and give back for the greater good is an increasingly common bond among firms, corporations, schools, and individuals today, and the efforts impact far more than just the communities being served a culture of caring is good for us all.

Finn sums it up best: “It just brings people closer together when working side-by-side in an effort that brings about the greater good It creates a certain kind of energy and connection among firm members There’s no better way to help yourself than to help others ”

You don’t have to be one of the Big Four to deploy the latest tech tools in your firm

By Ryan Watson, CPA

By Ryan Watson, CPA

Much has been made about artificial intelligence (AI) in the media, both for its promise of efficiency and also for the risks it poses to a variety of industries, including accounting

Just this past summer, our article, “Accounting for AI,” highlighted IBM Watson’s big debut into our space and the near-term implications it will have on our profession at large That dialogue, though, at least so far, has primarily centered on enterprise executions of AI, like KPMG and H&R Block leveraging Watson to deploy custom AI solutions to their business challenges And while that’s exciting for teams at those firms, what’s a small or regional accounting, tax, or advisory firm to do without the resources of in-house developers and data scientists?

Fortunately, as AI becomes mainstream, the opportunities to leverage it to automate work and deliver better client service are increasing daily. In fact, it’s likely your firm is already benefiting from AI and machine learning.

Here are three AI and machine learning technologies any size firm can start using right now

Image recognition is being used by firms of all sizes to automate everything from tax workflows to accounts payable and receivable sometimes without them even realizing it. Popular apps like Hubdoc, Receipt Bank, and Expensify are all examples off-the-shelf web and mobile apps that are saving accountants and their clients from hours of manually processing transactions and expenses, but did you know these are all powered by image recognition and machine learning algorithms?

Financial document capture apps like the ones mentioned use an optical character recognition (OCR) process to scan paper bills, files, receipts, and statements, read the data, and interpret and digitize it. Using expense reporting as an example, data entry is as simple as having your client snap a photo of a receipt with their smartphone and the information is automatically extracted and populated in the client’s accounting platform, like QuickBooks or Xero OCR is already employed in many facets of our everyday lives, including the tollbooths many of us pass through each day OCR technology is what’s behind the automatic license plate recognition system that charges our I-Pass accounts when we forget our transponders at home

Hubdoc employs an extra layer of human quality assurance to certify the correct information is extracted by its technology, but it still means no data entry or filing for you or your client What’s exciting about this, besides the time-savings and convenience, is that we’re really just getting started on our AI journey.

“Leveraging mature technologies, like OCR, and some manual quality assurance, we’ve been able to streamline the bill and receipt capture process for our customers But this just scratches the surface of what we think we’re capable of,” says Hubdoc CoCEO Jamie Shulman. “As we start to truly take advantage of AI and machine learning, our goal is to make the end-to-end expense management and bill payment process truly automated and instantaneous.”

This is a technology that’s easy to tip-toe into. You can start with automating a single workflow, like accounts payable Working within the comforts of your clients, select the right tool, perhaps Hubdoc, and integrate it with a digital general ledger and, if

applicable, a bill payments suite. From here, Hubdoc can sync with vendor portals to automatically ingest all bills for payment or receive them through email or standard uploads The image recognition software will automatically identify the date, vendor, amount, and after some training by the firm and client, the account code It’s really easier than you’d think

Receiving recommendations from some form of AI may sound hyper-futuristic, but when you consider the following examples, you’ll see there’s a common thread here: AI and machine learning systems are already part of our personal and professional lives.

When Netflix recommends what you should watch next, it’s based on algorithms that pull from the taste graph of their entire global subscriber base, taking into consideration what’s available by region and similarities between content and user behavior this is a recommendation engine driven by machine learning

Similarly, accounting software companies are implementing machine learning systems within their platforms to help prevent and correct user mistakes Take cloud-based accounting software provider Xero for instance; coming off of an intensive, year-long project where developers looked at the mental processes users go through, they’ve built a machine learning model that learns user invoice coding behaviors and mistakes, and then notes the corrections accountants and bookkeepers make in order to automatically offer recommendations and corrections as users work within the system in the future.

Xero’s machine learning system, already available to users, improves with use, meaning it “learns” as you’re feeding it data And have you ever noticed how your smartphone tries to predict the next word of your text message, or how Google seems to know the search term you’re trying to put it? The point is, you’re already benefitting from recommendation engines, and they’re only going to become better and more prevalent. The more you seek out the tools deploying this technology, the easier your tasks will become

Do we have any Iron Man fans here? Have you ever imagined having your very own J.A.R.V.I.S. to organize your life? Apple’s Siri and Amazon’s Alexa are starts, but full-fledged AI personal assistants may be closer than you think. While smart assistants aren’t quite capable of toasting your bread yet, they can organize the myriad of appointments and requests for meetings that pile into your inbox

Smart assistants use natural language processing (NLP), a technology that enables software to understand the actions and language of humans NLP gives smart assistants the ability to not only interpret the language but to understand the intent behind it Smart assistants can also learn the unique preferences of the user, such as their preferences for meeting length or location

Amy Ingram, for example, is a smart assistant developed by x ai, or an AI personal assistant who schedules meetings on your behalf in an intelligent and human-like manner The beauty of Amy is that it’s easily integrated into your workflow by CC’ing “her” into your emails Amy then reads the emails and communicates directly with the contact on your behalf, arranging meetings and appointments based on your personal schedule and preferences of times, locations, and meeting types. The most significant benefits of Amy are her efficiency, human-like capabilities, and ability to respond in a thoughtful and intelligent manner people actually think she’s a real person Talk to her like a real-life assistant and the magic of her AI takes over.

We don’t have to tell you that your business deals with a lot of data. But businesses today do need to be reminded that this data is only useful if it’s monitored and leveraged for strategic decision-making and effective risk management

The truth is that you’re already a big data user; you just need to embrace it. If you’re a user of Facebook, Google, payment processors Stripe or PayPal, or any of the other platforms mentioned in this article, for instance, you’re contributing to our evolving big data ecosystem, helping to plant the seeds of future AI advancement. This data serves as the foundation upon which AI and machine learning models are built, refined, and reinvented

For example, Facebook utilizes insights from its big data to provide targeted advertising based on a consumer ’s preferences. PayPal leverages data from its closed-loop network to improve customer experiences and detect and prevent payment fraud And Stripe utilizes data to analyze and identify patterns of suspicious activity in payments on its network to safeguard your transactions Hubdoc, Xero, and Google are all building big data architectures that will automate more of our business workflows in the future

The point is that you don’t have to be one of the Big Four to take advantage of big technologies AI, machine learning, and big data are all around us The earlier we all embrace change and begin employing the tech tools available to us, the better we’ll be positioned to be firms of the future

Ryan Watson, CPA is a founder and principal of tech-savvy accounting firm Upsourced Accounting and Xero’s Midwest ambassador. He can be reached at rwatson@upsourcedaccounting com

Attracting and retaining women business owners as clients is key to sustaining your practice.

By Kristine Blenkhorn RodriguezMarshall Field built a successful retail business on one primary principle: “Give the lady what she wants ” He knew his target market and catered specifically to women’s shopping needs The accounting and finance industry should take a page out of Field’s handbook

Harvard Business Review called out the financial services industry as the least sympathetic to women’s needs just a few years ago, their financial needs particularly as business owners mystifyingly ignored As the number of women-owned businesses grows exponentially, however, a dynamic and diverse market awaits the accounting and finance professionals who can serve up the specialized financial advising it seeks.

There are now more than 11 3 million women-owned businesses in the U S , meaning women own about 38 percent of the country’s businesses, says The 2016 State of Women-Owned Businesses Report, a summary of business trends commissioned by American Express OPEN. These

firms employ an estimated eight percent of the nation’s private sector workforce and generate over $1 6 trillion in annual revenues

What’s more, between 2007 and 2016, the number of womenowned businesses increased by 45 percent fully five times faster than the national average among all businesses and revenues among women-owned businesses have increased by 35 percent since 2007, 30 percent higher than the national average. All told, between 2007 and 2016, women created 3 5 million new businesses, of which 78 percent are owned by women of color.

If all that isn’t impressive enough, the McKinsey Global Institute report, “The Power of Parity: How Advancing Women’s Equality can Add $12 Trillion to Global Growth,” suggests “a ‘full potential’ scenario, in which women play an identical role in labor markets to that of men, as much as $28 trillion, or 26 percent, could be added to global annual GDP by 2025.”

In other words, knowing what women business owners look for in their financial services providers is more important than ever With that in mind, we offer this insight from some of Illinois’ own women entrepreneurs.

With six out of 10 women investing their personal finances into their businesses, the stakes are high. Being personally invested in the business creates a different vibe than a venture capitalbacked operation.

Krista Goral, owner of the Chicago-based custom dress business MeasureMake, likes to work with professionals who’ve experienced the “blood and muscle” of a business “Not only do I want to know the person on the other side of the table, but they also should know what building a business and creating your own opportunities takes ”

Goral’s desires are fairly typical A recent study by Accenture states that women want financial advice based on their life journeys

Take Renee Pollino, owner of My Half of the Sky, an L3C coffee shop focused on helping the disadvantaged in Wheaton, Ill., for instance “As not only a woman, but a Hispanic woman,” she says, “I believe it's important to give opportunity to not only women, but to those who often are not given opportunity ”

In other words, talk journeys and milestones, not just numbers and products

With previous experience in the banking business, Goral feels financially savvy But she also says it makes her choosier as in, don’t overcomplicate things; get to a solution faster.

“Men want to throw a lot of potentially helpful products and solutions at me But we get bogged down It’s too many choices, not all of which fit my business Women tend to listen, pare it down to a few reasonable solutions and, in general, make it less complicated,” she explains

Goral’s goal of keeping her business and finances simple isn’t unusual, according to a recent Betterment study that analyzed the accounts of 60,000 investors, 25 percent of them women The findings: Women signed into their accounts almost half as frequently as men and changed their asset allocations 20 percent less frequently It’s about finding what works, and sticking with it.

Women love their businesses, but many women express distaste for the financial side, due in large part to insulting experiences.

“I dumped an accountant like a hot potato when he sounded like he was parenting me financially rather than explaining my options and advising,” confides Jordan Holwell, owner of Higher Energy Massage Therapy in Naperville, Ill

Accounting and finance professionals take note: Business and financial advising should come without condescension

“Most of your life, you hear about the bias, but I guess I never believed it until I experienced it,” Pollino says, explaining her experiences as a victim of assumptions about her financial and business expertise

“Two years before the launch of My Half of the Sky, I went to a local bank to discuss financing options The woman president met with me for 20 minutes and seemed excited about what I wanted to do. She gave me a name and number of a contact that she insisted would be of great help to me,” she explains “When I called the person, I discovered it was a professor at the local community college who offers a one-day class on how to write a business plan She hadn’t even seen my business plan She made huge assumptions about me. That’s just one of many bad experiences.”

Pollino’s experience was echoed by a good portion of our interviewees. Some remember a time when they were asked for their husbands’ financials just to rent space for their businesses While most women aren’t treated as second-class citizens so openly anymore, many still struggle to secure financial backing and advising

Listen, listen, listen then listen some more. Communication skills trump gender among most of our interviewees.

Take Joyce Clarkson, co-owner of The Dinner Club in La Grange Park, Ill., who started working with one female accountant because she thought a woman would bring stellar communication and listening skills “I was wrong,” she admits

“After working together for some time, my frustration level was through the roof I could ask this CPA the same question 10 times in 10 different ways ‘How will this affect my taxes? Is this a wise move?’ and she couldn’t give me a clear answer. Communication is critical for me,” Clarkson says, explaining that it’s important to her business decisions to have somebody that can clearly advise without providing a lot of immaterial or impertinent information

Clarkson ultimately turned to another firm to meet her needs; the owner is male, but her day-to-day contact is female “It’s not the gender,” she says “It’s the communication style that matters They listen They advise And then they continue to listen ”

For years, women business owners have struggled with an advisory model built for men But, women are a growing force in the entrepreneurial world with very specific wants and requests In short, making sure your firm is tailoring services to female clients is crucial to remaining a viable enterprise moving forward

“Whether I’m right or not, I just feel women CPAs have my best interests at heart,” Holwell says “But, show me someone who gives me that feeling man or woman and I’m all in.”

Becoming a balanced leader is central to succeeding in life and business.

By Jay Scherer

By Jay Scherer

How do you lead? How do you know if you’re an effective leader? Do you have a leadership philosophy? In my 20 years of experience as an executive coach, I’ve found these to be difficult questions to answer for most charged with leading a team, a department, or an entire organization

The challenge for all leaders is that being able to articulate the kind of leader you want to be and being able to consistently deliver on that promise is exactly what’s needed to drive your success and the success of your team

When you’re responsible for managing or supervising people, you’re getting paid to lead And as a paid leadership professional, you’re also responsible for being a student of leadership, seeking out the secrets of what great leaders do But getting there isn’t easy when there’s a new leadership theory of the month, month after month I can’t even keep up and it’s my field of study.

Just try Googling “leadership theories”; you’ll get something like 5 4 million results It’s no surprise that much of this information is reduced to background noise; it’s no surprise that you might not know where to start or which theory is appropriate in your own situation. So, it’s also no surprise that you also may not be leading as well as you could or should Thankfully, you can lead better, day in and day out.

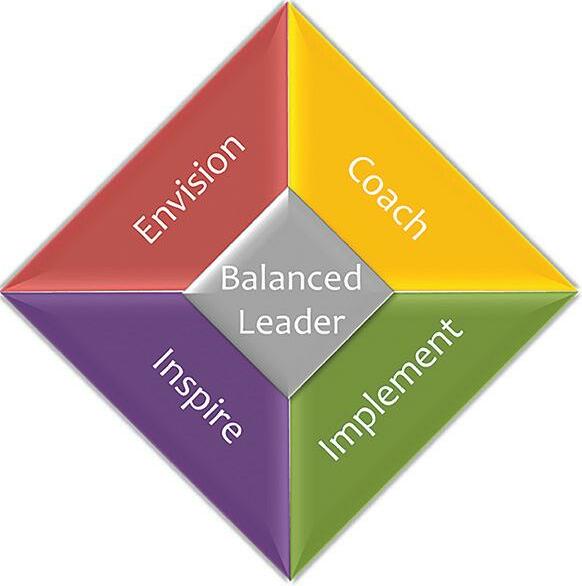

The framework below represents next generation thinking the thinking of a balanced leader resulting in contemporary, simple, practical, and very usable leadership practices

Sometimes, before you look to the future, it’s best to look to the past Even though changes in people, markets, and technology are driving changes in how leaders “need” to lead today, I believe every leader can better their chance of achieving superior results if he or she balances four timeless leadership traits and practices:

In other words, reasonably implementing these practices ensures you’ll be on the path to effective, balanced leadership

O f c o u r s e , o n e k e y t o i m p l e m e n t a t i o n i s f i g u r i n g o u t j u s t h o w much time you’re currently spending on each area if any I often encourage the leaders I work with to track their time for a week or two, using their calendars and color-coded entries to illustrate how much time is spent on each leadership trait and practice

With a better understanding of where your time is being spent, you can make the necessary adjustments to get the right balance But what is the “right” balance?

In 2011, I helped conduct a survey of a select group of 75 senior leaders that asked how much time they actually spend on each of the four areas We found that Implement (35 percent of time) led t h e w a y, f o l l o w e d c l o s e l y b y I n s p i r e ( 2 9 p e rc e n t o f t i m e ) , a n d E n v i s i o n ( 2 1 p e rc e n t o f t i m e ) a n d C o a c h ( 1 5 p e rc e n t o f t i m e ) rounded out the balance

What’s interesting about the results is that when we asked if this was the appropriate amount of time to spend in each area, the responses centered on the belief that leaders should spend considerably more time on the long-term items (Envision and Coach) As a rule of thumb, I believe the more senior your role, the more time you should spend on Envision and Coach I’d also encourage you to ask your superior how much time he or she thinks you should be spending on each leadership practice.

Envision. Great leaders spend time building strategies and plans in anticipation of the short-, mid-, and long-term implications of the o v e r a l l m i s s i o n , v i s i o n , a n d i n i t i a t i v e s o f t h e b u s i n e s s T h i s requires leaders to fully understand their businesses, envision the future, build strategy, and innovate.

Inspire. Great leaders focus on getting others to buy in and commit to a course of action When inspired and engaged, people willingly give discretionary effort This requires leaders to foster commitment, engage people, build relationships, and promote teamwork.

Implement. Great leaders are great leaders because they get things done. They align their teams with their organizations’ goals and make sure they’re all heading in the right direction, executing on plans and strategies This requires leaders to have the ability to organize, establish priorities, instill accountability, and drive results.

Coach. Great leaders ensure sustainability of their enterprises by focusing on developing the talent around them This requires leaders to know how to assess people, build teams, and maximize the potential of each individual through coaching and more.

Too often leaders get caught up in business tasks when a balance between tasks and the human side of business is what actually m a x i m i z e s e f f e c t i v e n e s s . T h e p o i n t o f t h e f o u r t i m e l e s s t r a i t s and practices above is that they seamlessly achieve balance by focusing on both short- and long-term impacts, and both people and performance.

Inspire and Implement, for instance, are practices that support an organization in achieving near term results On the other hand, Envision and Coach are practices that support an organization in creating and delivering on a long-term vision and strategy, and in developing people and the organization for a sustainable future Envision and Implement are task-focused while Inspire and Coach are people-focused.

In short, you have to find the balance that’s right for you and your team. But, armed with this insight you can then build a plan for each day and week about the percent of time you should spend on each of the four practice quadrants Some days you may spend n o t i m e i n o n e q u a d r a n t d e p e n d i n g o n t h a t d a y ’s f o c u s , b u t I believe you’ll need to spend some time in all four quadrants each week if you’re truly focused on becoming a balanced leader

Following this strategy, one leader I worked with, the U S presid e n t o f a g l o b a l e n t e r p r i s e , q u i c k l y r e a l i z e d t h a t h i s e x e c u t i v e team meetings were only focused on the long term the team had a n e x e c u t i o n g a p . T h i s l e a d e r i s n o w w o r k i n g o n c l o s i n g t h a t g a p , u s i n g a n o v e l “ B a l a n c e d L e a d e r S c o r e c a r d ” t o g u i d e h i s team’s areas of focus

In addition to figuring out where you need to spend your time, i t ’s i m p o r t a n t t o c o n d u c t a n h o n e s t s e l f - a s s e s s m e n t o f y o u r effectiveness in each leadership area In which of the four areas are you most comfortable? Least comfortable? It’s probably true that where you’re most comfortable is where you’re most effective. On the flipside, where you’re least comfortable is where you’re most likely less effective

I e n c o u r a g e y o u t o w o r k t o u n d e r s t a n d w h a t y o u c a n d o t o enhance the skills you’re least comfortable in, but also consider how to leverage your stronger skills

Becoming a great leader is an ongoing process one deserving of many trials and errors but this basic approach provides a way to put together and implement a plan that focuses you on becoming a better, balanced leader, today

Jay Scherer is the president of Chicago-based Scherer Executive Advisors, a specialized coaching firm with deep experience helping executives achieve business objectives and career goals Jay can be contacted at jay@schererexecutiveadvisors com

A TWO -DAY PROFESSIONAL DEVELOPMENT COURSE

16 CPE Credits | Field of Accounting

November 7-8

Deloitte O ffice | 111 S Wacker Drive | Chicago, IL

www.financialexecutives.org/events

Join FEI as we provide prac ticing professionals with the exper tise and k nowledge they need to excel in their roles as preparers or reviewers of SEC filings.

Par ticipants will learn the rules of the road, explore the filing requirements and required forms, discover disclosure best prac tices, and gain insight from experienced SEC repor ting professionals.

SEC Required Forms: 10-K , 10- Q, and 8-K and the prox y statement

Applicable rules and regulations

Disclosure guidelines including MD&A best prac tices

SEC hot topics: non- GAAP repor ting, revenue recognition, the statement of cash flows, segments, and contingencies

Geared toward the prac ticing professional direc tly or indirec tly responsible for SEC repor ting within an organization I f you are a CFO, controller, assistant controller, SEC repor ting manager or other professional wanting to learn more about SEC repor ting, this t wo- day course is intended to give you the foundation you’ll need to succeed in your current role SPON

www.financialexecutives.org/events

By Mark J Gilbert, CPA/PFS

By Mark J Gilbert, CPA/PFS

While the best planning starts with a new tax year and cont i n u e s t h r o u g h o u t i t , t h o s e o f u s w h o s l a c k e d o f f c a n s t i l l r e a p some year-end tax reduction rewards The final quarter of the cale n d a r y e a r i s a g o o d t i m e t o t u r n y o u r a t t e n t i o n t o s o m e l a s tminute

Here are some of the areas that I believe are especially important to focus on.

Inflation is back on the rise, but inflation-adjusted benefits and provisions have only risen slightly less than one percent over their 2016 levels Still, you should be aware of using the increases to your benefit when reviewing income amounts qualifying for the standard deduction, alternative minimum tax (AMT) exemption, earned income tax credit (EITC or EIC), foreign earned income exclusion, and the estate and gift tax exclusion In addition, be sure to check the IRS’ guidelines; income limits have increased for the tax rate schedule, the limit on itemized deductions, AMT applicability, and the lifetime learning credit.

To the dismay of some of you, the 2017 tax year has seen several specific deductions change or disappear altogether.

Beginning in 2017, taxpayers age 65 and older are subject to an adjusted gross income (AGI) threshold of 10 percent, up from 7 5 percent Let’s say you have an AGI of $50,000 You’ll now need to have medical expenses of at least $5,000 to deduct the costs, and even then, you can only deduct the amount exceeding $5,000 Therefore, if you’re older than 65, you could consider accelerating medical procedures and payments into 2017 unless it’s clear that you won’t exceed the new, higher threshold.

Unfortunately for taxpayers carrying private mortgage insurance (PMI), the premiums are no longer tax-deductible If you needed another reason to eliminate costly PMI payments, here it is

A l s o b e g i n n i n g i n 2 0 1 7 , m o r t g a g e d e b t t h a t ’s f o rg i v e n b y a lender in a short sale or foreclosure is no longer excluded from the taxpayer ’s taxable income Any taxpayer in this situation could be facing a large tax payment in April 2018 and may want to explore ways to soften the blow, like making estimated tax payments in 2017, if possible.

Student loan debt is plaguing the nation and it just became a little more painful for some The tuition and fees deduction of up to $4,000 in qualified education expenses for the taxpayer or eligible dependent was eliminated for tax years beginning with 2017.

Most of the energy-efficiency tax credits expired at the end of 2016

Going forward, solar energy systems are the only energy-saving and renewable energy sources eligible for a federal tax credit, which is equivalent to 30 percent of the purchase price through 2019, 26 percent through 2020, and 22 percent through 2021

Despite some popular tax deductions being eliminated, there are still several ways to actively manage or reduce your income tax bill Below are a few that I often recommend

Automatic payroll deductions deposited into your self-managed or employer-sponsored retirement plans, like a 401(k), 403(b), SAR-SEP, SIMPLE IRA, etc , defer your taxable income and lower your tax bill I advise contributing as much as you can afford to, but do consider contribution limits The $18,000 limit ($12,500 for SIMPLE plans) is an aggregate annual limit by person, not by plan. So, if you work for more than one employer or have more than one account type, monitor and adjust your overall contributions to avoid exceeding the limits.

The U.S. stock market’s rally during the first half of 2017 may make charitable contributions an appealing tax-reduction strategy. In fact, instead of selling investments to raise cash for making a charitable contribution, investors could consider donating shares of stocks, mutual funds, and other securities that have appreciated in value Why would you want to do this? You’ll avoid paying capital gains tax on the appreciation of the investments, and you’ll be entitled to a charitable contribution deduct

charity you want to support can accept in-kind transfers of the investments you wish to donate Since these types of transactions can take several days or longer to complete, it’s best to not wait until late in December to do this

mutual funds will make robust distributions of capital gains this year, generating a tax liability for anyone holding them in a taxable investment account If you’re a mutual fund investor, I recommend familiarizing yourself with their estimates of capital gains distributions before year-end. If you find that your investment funds are generating meaningful gains, consider adjusting y

capital gains tax coming your way If you wish to sell your appreciated mutual fund shares ahead of the capital gains distributions to capture the higher share price, know that the sale itself will also generate capital gains tax Here’s where the practice of tax-loss selling, the strategy of selling your losing securities to offset any realized capital gains, becomes an effective tool for reducing taxes throughout the tax year.

With meaningful tax reform remaining elusive, I believe 2017 will end up being a year in which traditional tax planning, which typically focuses on deferring income and accelerating deductions and losses, remains a prudent course of action for taxpayers Only time will tell, but only you can make your money work harder start thinking ahead.

An active Illinois CPA Society member, Mark J Gilbert, CPA/PFS heralds more than 25 years of accounting, finance, and personal financial planning experience as a principal at Reason Financial Advisors Inc Mark can be reached at mgilbert@reasonfinancial com

You’ve spent a lifetime making business decisions based on numbers putting invaluable time, money, and effort into growing your firm into a practice you’re proud of This has been your livelihood But you’re getting older, family and health is becoming more important, and the pace of change in the industry is getting to be a bit too much But, you just don’t know how to leave or how to let go, and the stress and confusion is gnawing away at you. Well, you’re not alone.

Despite spending much of their lives making practical and strategic business decisions, it’s common for owners and partners of small and mid-size CPA firms to succumb to emotional stress and decision making when they start thinking about how to exit the businesses and careers they’ve spent their lives building Emotions run high, and the stakes run higher.

“There’s a common misperception that succession planning means giving up autonomy, independence, and money. But that isn’t necessarily true,” says Lon Goforth, vice president of Prosperitas Advisors LLC, a consulting firm that provides merger, acquisition, transition, and succession services

There’s no shortage of horror stories and myths associated with succession planning, Goforth says, but when thoughtfully developed and implemented, succession plans can provide financial rewards and maintain the legacy that owners and partners worked so hard to create

But an effective plan requires early awareness and management of fear, uncertainty, anxiety, sadness, and other emotional and financial burdens that commonly arise when professionals contemplate retirement and the prospects of merging, selling, or handing off the reins of their firms

Here are some of the pitfalls to think about.

When it’s time for aging CPA firm owners and par tners to cash in or step down, recognizing and managing emotional stress is key to leaving with the upper hand.

Starting the process early is the biggest key to a successful transition Unfortunately, many “owners and partners of firms wait way too long before they even start thinking about an exit strategy,” says Dominic Cingoranelli, executive vice president of Consulting Services for Succession Institute “They let decades go by without thinking about it, and then suddenly they feel a sense of urgency and anxiety to get something done, and their emotions and expectations are all over the place ”

In the 2016 PCPS/Succession Institute Succession Survey of CPA firms, Succession Institute found fewer than 10 percent of solo and sole practitioner respondents had practice continuation agreements in place. In other words, the vast majority of such firms don’t make succession planning a priority They have no backup should something happen to them before they’re ready to sell their practice

“There’s not as much thought put into retirement now,” cautions Peter Fontaine, founder and managing partner of Chicago-based NewGate Law, a provider of legal and risk management services to accounting firms. “People say they love what they do, and they think they’re going to work forever But the reality is that they’re going to get older,” he says, noting that those who fail to plan ahead often suffer the consequences.

“Even if you’re just starting up, you have to be thinking about who you’re going to bring in to run the firm when you’re ready to leave,” Fontaine continues. “Owners and partners who come to us at age 65 won’t have the best options available They won’t achieve the transition of clients they would’ve wanted or the most favorable transaction terms. So many people rely on a buy-out as a retirement plan, but you have to put plans in place early for that to happen If you want to retire at 65, start modeling your plan at 55 Give yourself a 10-year runway to get things in place ”

For many, a 10-year deferment isn’t an option at this point, but whatever the case, Goforth encourages the transitioning of responsibilities and client relationships over time to allow for the emotional realities to set in, pointing to the fact that those who quickly sell and walk away are those who are most susceptible to what he refers to as post-partum feelings

“With so many baby boomers retiring in the next few years, there are going to be a lot of firms in play,” Cingoranelli stresses, noting that acquirers can afford to be picky Succession Institute’s survey found that 40 percent of single-owner firm respondents are planning on retiring in the next five years Among multi-owner firms, one-in-six with less than eight full-time personnel will be considering merging upstream

In other words, the firms that spend time refining their succession plans and practices improving the client base, upgrading technology, and streamlining workflows and processes will be more attractive in a market that could begin softening for sellers

Cingoranelli also advises owners and partners to invest in their people: “A lot of clients come to us saying they need to get out because they’re working more and enjoying it less That’s a common sign that they haven’t developed the people below them ”

But developing junior staff requires commitment, too It’s not easy to relate to or develop the people in those roles when it has been 20, 30, or 40 years since you were in that same position it requires major behavioral changes to be a coach or mentor, in addition to energy, time, and resources

Most firms also don’t establish a solid path to partnership, according to Goforth “People don’t realize that it takes one-and-a-half to two full-time equivalents to replace a partner. And it can take 18 to 24 months before people even begin to understand the requirements of a partner,” he explains “If two partners are leaving within a few years of each other, it puts a tremendous amount of pressure on other staff ”

Because many small firms don’t properly groom their staff, they often miss opportunities for internal succession. “We talk with clients who initially think they don’t have anyone up to the task of replacing a partner, but often we can find someone who would be if he or she could just get some training,” Cingoranelli says “That shortsightedness is a shame, because the idea that you’re going to be able to hire in experienced people to make the practice better is a myth That’s why the smart money is to put your energy into developing your own people. Building up a cadre of strong people gives you options and creates added value ”

“Numbers don’t do deals, people do. Successful deals are built on the ability of people to have a like vision, even if they’re going in dif ferent directions.”

Exploring every option and creating added value is especially important for those looking to cash in their chips so is a healthy sense of reality

According to Cingoranelli, many CPAs expect to sell at a higher price and for more favorable terms than what the market is offering. And firm owners and partners often overestimate the amount of money available for an internal buy-out, Goforth adds “A lot of times when we put pencil to paper, the numbers don’t work out the way they thought they would There isn’t always plenty of money,” he says This in itself can create further stressors

“When people give themselves too rich a retirement, the staff left behind can’t afford the package that was set up, especially if multiple partners retire around the same time,” Fontaine explains “That’s when we see young people leave and take clients with them Bad succession planning can create a really unworkable structure ”

Whether working through a potential internal or external deal, owners and partners should carefully and strategically consider all of the opportunities and downsides “The financials are important, but you have to make decisions based on more than that,” Goforth says, adding that transactions fail because people didn’t ask enough questions or take the time to thoroughly review all aspects of the deal

“Most firms don’t have any clue how much work goes into a successful deal Too often, the parties involved have lunch, go over numbers, shake hands, and then go back to business as usual Or they make a decision based on whom they like Those are recipes for failure,” Goforth cautions “You have to take the time to talk about staff, timing, responsibilities, and the emotions involved for the successor and the retiree Numbers don’t do deals, people do Successful deals are built on the ability of people to have a like vision, even if they’re going in different directions ”

When negotiating terms of a deal agreement, owners also need to think about their own transition Finding ways to stay engaged can help ease the emotional burden of retirement But at some point, partners have to come to terms with knowing that their top-dog role won’t last forever

“People like the status quo, and panic sets in when they need to give up control Some people literally can’t let go, and in many cases they come up with excuses to avoid doing a deal Then when they die or are sidelined by a health issue, their inability to have made decisions creates confusion and extra work for staff or spouses,” Goforth explains “People don’t understand how much stress and work it causes for others when they don’t have plans in place. You have to think about what’s best for your clients and your staff ”

Cingoranelli also notes that paying a partner retirement benefits while he or she continues to manage client relationships is not a good practice “Until they’ve transitioned the relationships, your firm can’t really count on the clients staying after the retired partner has been paid and actually leaves.”

To ease the transition following a deal, Goforth often advises clients to consider inclusions for continuing to work for a determined amount of time “A lot of people worry about being out of a job and not being valuable By staying around for two to three years, then reducing your time, clients can continue to see you but also get to know the people who will be succeeding you. Most partners aren’t going to get pushed out as soon as the ink on the deal is dry ”

All things considered, planning your exit well in advance is the best way to ensure a smooth transition that leaves you at peace when the time comes to fold, move aside, or make room for those who will follow and carry on your legacy “There’s not going to be a cure for aging,” Fontaine concludes. “You need to think about what your firm is today and what you want it to be in the future ”

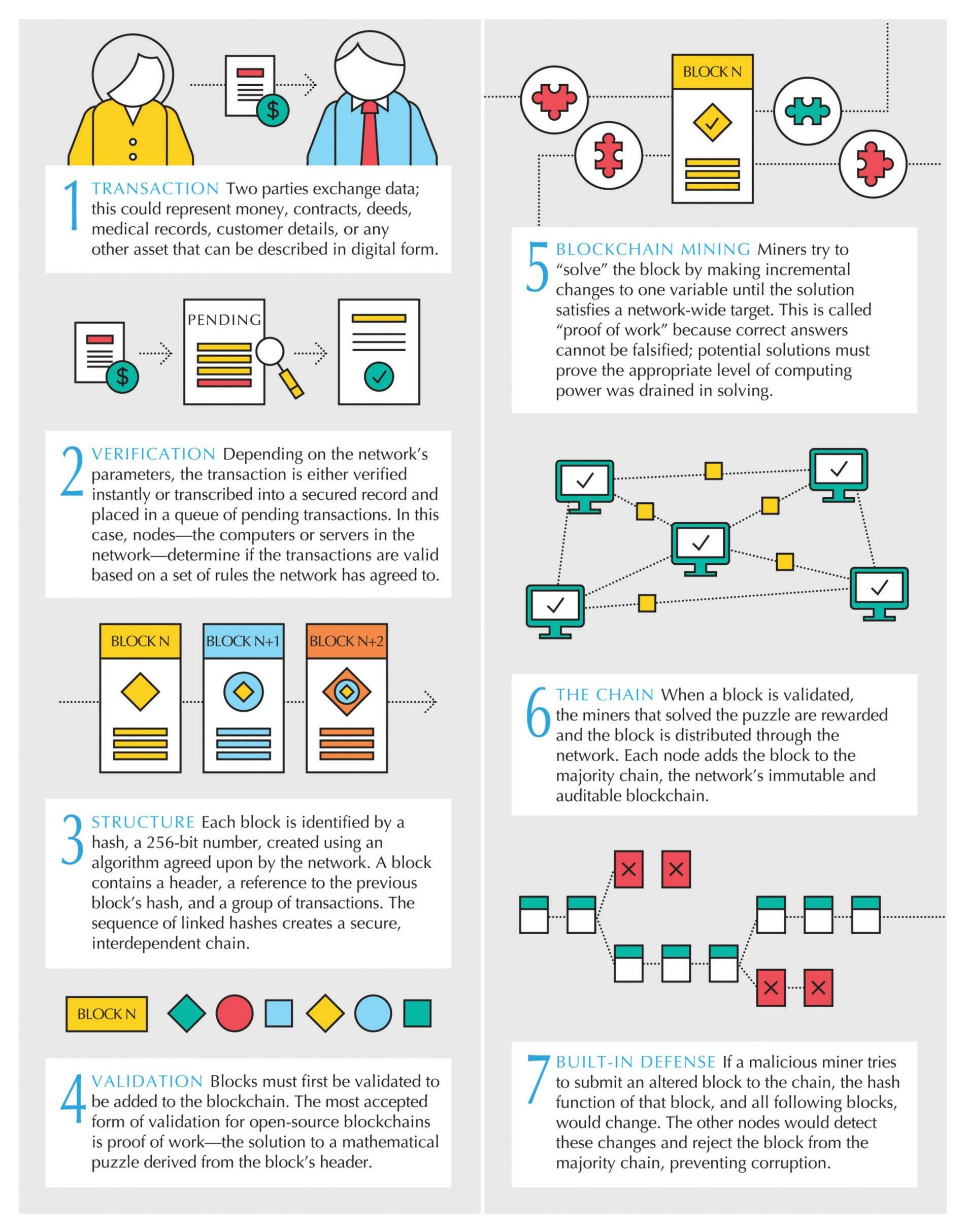

Consider a technology that could make traditional reconciliation obsolete a cloud-based, crowdsourced digital ledger where every transaction is recorded and verified by users in real time based on an honor system between all participants

Now, consider this technology is rooted in the alternate currency movement aka cryptocurrency with all the requisite concerns about security, access, and trust that go with it Could the accounting and finance industry possibly adopt such a technology?

Welcome to the blockchain discussion

In case you haven’t heard, and you wouldn’t be the only one a recent Deloitte survey indicated that about 40 percent of senior U.S. executives haven’t blockchain technology is sparking an operations revolution in practically every industry on the planet The race is on to adapt the open-source, live entry-and-verification technology behind the soaring cryptocurrencies Bitcoin and Ether to streamline recordkeeping and business transactions in disciplines spanning from cross-border financial transactions to supply chain management

In the simplest terms, a blockchain is a distributed digital ledger that records and executes transactions without the need of a middleman And it’s all based in what many in the accounting and finance profession still consider the ultimate cultural and operational challenge “accounting in the cloud,” explains Lamont Black, assistant professor of finance at DePaul University - Chicago “Blockchain is really good at recording a value and putting a timestamp on it Instead of everyone having their own files, they can go to one location where everyone can agree on that shared information, allowing it to be used centrally ”

Deloitte’s definition goes deeper: “[Blockchain] is a distributed ledger that provides a way for information to be recorded and shared by a community ” Every member of this community maintains their own records, but “all members must validate any updates collectively.” And we’re

not just talking about numbers. “The information could represent transactions, contracts, assets, identities, or practically anything else that can be described in digital form. Entries are permanent, transparent, and searchable, which makes it possible for community members to view transaction histories in their entirety,” the firm explains.

And here’s where the name comes in According to Deloitte’s explanation, each update is a new “block” added to the end of the “chain ” A central protocol is established to determine how “new edits or entries are initiated, validated, recorded, and distributed With blockchain, cryptology replaces third-party intermediaries as the keeper of trust, with all blockchain participants running complex algorithms to certify the integrity of the whole ”

Who knows what the future holds for this technology, but today, a blockchain looks like a conventional database just one that moves and changes in real time “It records all processes, tasks, and payments and digitally stamps them It basically does what human intermediaries do now, but without the potential for human error or tampering,” explains W. Brooke Elliott, professor of accountancy and department head at the University of Illinois at Urbana-Champaign. “It’s protected from any type of tampering or revision.”

Deloitte is just one of many organizations exploring and developing new ways to implement blockchain technology Another Big Four member, PwC, is investing heavily in resources to develop blockchain applications and services Powerhouse names like Goldman Sachs, IBM, Intel, J P Morgan Chase, Morgan Stanley, and Wal-Mart are just a few others forming their own blockchain R&D collaborations

Deloitte recently opened a global blockchain lab to develop applications for the technology According to Deloitte’s New Jersey-based audit partner Will Bible, the development of blockchain technology benefits from a vibrant global, opensource community. “We’re seeing small groups of entrepreneurs building their own solutions, with software communities putting out their own platforms,” Bible

explains This open-source collaboration means blockchain’s development won’t necessarily be led by the computer and software industry though how it’s commercialized remains to be seen

The decentralized computing network Ethereum, for instance, has emerged as the latest platform of choice for commercial blockchain development, with some calling it “a more flexible and developerfriendly alternative to Bitcoin with its native cryptocurrency, Ether.”

Regardless of the platform, “blockchain is the real innovation of Bitcoin,” Black says. “This technology can be applied.”

There’s no clear answer as to how widely blockchain technology will be applied, or how it will impact accounting, finance, and tax professionals yet For now, blockchain awareness is simply “important for CPAs at all levels,” says Len Steinmetz, director, Financial Services Advisory at Grant Thornton

“It’s not generally expected that blockchain will become the de-facto transactional standard at all levels of the economy,” Steinmetz says, pointing to current predictions that the early adopters will be “top-tier financial corporations, asset managers, and other large economic enterprises,” including “retail banking transactors, payment system processors (SWIFT already has a blockchain product in beta), swap and other trading platforms.”

He adds, “For mid-tier firms, we’re probably looking at a three-to-five-year horizon where small businesses will likely be the last to adopt or may not adopt outright, instead using platforms that use blockchain technology ‘under the covers ’”

This means CPAs and other finance professionals have some time to immerse themselves in the technology and learn about its best implementations especially if they want to stay relevant to their organizations and clients

In other words, accountants and auditors won’t be tossed out on the street, but now is a good time to educate Deloitte’s Bible says traditional accounting support roles are likely to switch from reconciliation to analysis. This technology will automate many job functions, but also “create opportunities for analytics,” Bible notes, and firms will obviously be looking for job candidates with the latest technical skills

Take traditional double-entry bookkeeping, for instance According to Steinmetz, accounting reconciliation typically depends on independent auditors to verify entries and validate financial information Depending on the design of the blockchain system, once data is entered, it’s subject to an immediate verification process that refines or completely eliminates this manual job function

“Blockchain addresses these concerns by, first, distributing identical copies of the ledger to each member in the network (so everyone has the same view into the transaction at the same time); second,

identifying ownership and transfer of ownership; and third, cryptographically securing the ledger and each transaction in a managed and immutable way,” Steinmetz explains

Then consider triple-entry bookkeeping and momentum accounting Blockchain is seen as a potential modern driver of these proposed alternative accountancy systems, which not only focus on the traditional process of recording debits and credits, but also monitor and note real-time changes in balances

The blockchain future means “the accountant and auditor function would deal less with the mundane and more with truly complex transactions [It’s a future] where today’s CPAs will make significant value-add contributions,” Steinmetz adds

The blockchain future can also potentially change accounting coursework worldwide Steinmetz thinks training will have to change in two key ways: Accounting majors will need a “firm grounding” in “distributed ledger technology, cryptography, security, and operation of trusted and trustless networks.” Plus, they’ll need to build “a good understanding of the coming world of blockchain or ‘triple-entry’ accounting ”

DePaul University and the University of Illinois are among many institutions responding to these developing technologies with increasing levels of computer science coursework

“When I moved to Chicago in 2013, I was teaching money and banking I was talking about how technology is changing the [finance] space Even then, my students wanted to know about Bitcoin and the technology behind it,” Black says “Today, the school is developing a blockchain curriculum that involves more conversation with faculty in computer science.”

At the University of Illinois, Elliott just led a major undergraduate curriculum revision in the College of Business to build analytics and other technologyrelated courses into its core “We’ve always produced accounting professionals with a solid understanding of accounting fundamentals and an ability to communicate well with colleagues and clients, but now we’re investing to produce accounting professionals who also have a competency in data analytics and emerging technologies,” she says. “In our masters programs in accountancy, we’re launching a data analytics concentration where students will have the ability to build a core competency in analytics and apply these skills to develop solutions to problems identified in the accounting discipline ”

As for what the future holds for these students and the profession, Elliott says don’t believe everything you read

“I don’t believe it’s the end of the audit industry by any means, as has been referenced in several popular press articles,” she says “As long as there’s estimation in financial reports, and there always will be, then technology alone cannot substitute the value [we] provide.”

Blockchain allows for the secure management of a shared ledger, where transactions are verified and stored on a network without a governing central authority Blockchains can come in different configurations, ranging from public, open-source networks to private blockchains that require explicit permission to read or write Computer science and advanced mathematics (in the form of cryptographic hash functions) are what make blockchains tick, not just enabling transactions but also protecting a blockchain's integrity and anonymity

Technology is advancing at an accelerating pace, bringing a truly seamless global marketplace ever closer to our horizon Imagine business and trade, financial and professional services, and more, all available and accessible 24/7 to an interconnected global population, unbound from borders and currencies Now imagine what that means for accounting and finance professionals and their educations

These forces are driving significant evolution in the accounting industry, pressing accounting firms to rethink their needs and services, and inspiring the development and transformation of human capital.

In response, Illinois colleges and universities must rise to the challenge of preparing the accountants of the future by reimagining their curriculums to ensure that tomorrow’s accounting and finance graduates can keep driving the profession forward.

It’s widely predicted that technologies such as artificial intelligence, blockchain, and advanced robotics will take over the majority of basic accounting work While some portend that this could eventually eliminate the roles of many accountants and auditors, others believe that these technologies will simply free these highly skilled professionals from mundane and repetitive manual tasks, empowering them to focus on business-critical advising and guidance, problem solving, and strategic planning

“The ability to only be a gate keeper of historical results will be greatly diminished and replaced by technology,” explains Maurie Richie, a human resources generalist at the CPA firm of Ostrow

Reisin Berk & Abrams Ltd “It’s very important for young accountants to not only be able to produce financial statements, tax returns, and an audit, compilation, or review, but they must also be able to analyze, manipulate, and organize larger volumes of data and provide meaningful interpretations of the information that’s collected ”

Expanding on that thought, Thomas Walker, Illinois office managing partner of accounting and advisory firm Baker Tilly, says “the workforce of the future will need a different set of competencies and skills, with a greater emphasis on complex problem solving and creative thinking ”

In fact, today’s accounting firms are already ratcheting up their expectations and demands, seeking only the best and brightest graduates and experienced talent that exudes technical aptitude for big data, data analytics, and business intelligence and the interpersonal skills to be well-spoken and present analytical findings

It’s a challenging mix to find, and a challenging transition to make for those accustomed to accounting being a back office function The demand for more strategic, more visible accountants is definitely on the rise, says Timm Bellazzini, CPA, partner at professional services firm Sikich LLP.

“Clients expect their accountants to be business strategists today,” Bellazzini explains, meaning what’s learned in the classroom needs to immediately apply to the challenges businesses and clients face

To best position students to meet the demands of firms, Richie believes that more emphasis needs to be placed on problemsolving and data-manipulation skills, explaining that “stressing more of an information technology component and skill set within the accounting degree will make graduates more valuable and capable to make a difference.”

Making a difference is what matters as the growing emphasis on data drives change in the presentation of financial information “For example, advances in information science allow risk assurance professionals to analyze millions or billions of transaction files to detect flaws in a company’s internal control system, or to design systems to better protect assets or financial information,” explains Brad Cripe, assistant department chair and Gaylen and Joanne Larson professor of accountancy at Northern Illinois University (NIU) Cripe also points to the trend of using larger and larger amounts of data to analyze the impact of current and future regulations on taxable income and global financial income As the profession deals with the confluence of globalization, economic and tax reform, and the use of enormous data sets to answer questions and solve problems, he says the next generation of accountants needs to be wellrounded in both accounting and economic theory and have strong data-processing and presentation skills.

“Ultimately, at Northern Illinois University, we hope that our graduates can see beyond the current problems to identify the larger implications facing society Governments are balancing the need to be competitive within the global economy while simultaneously facing base erosion and transfer pricing issues Accountants are uniquely qualified to help both governments, taxpayers, and other users of financial information,” Cripe explains “In this economy, the successful accountant asks the question that no one else thought to ask, and as a result, moves the process forward in a way that wouldn’t have been otherwise possible ”

To ensure their accounting graduates are positioned for success, NIU has adjusted its undergraduate and graduate curricula in response to the accounting community.