Tax policy is changing, Social Security is going up and proposed legislation would help Americans save much more for retirement.

Many of these policy changes can be traced to one overarching concern: INFLATION.

MDRT’s

Tax policy is changing, Social Security is going up and proposed legislation would help Americans save much more for retirement.

Many of these policy changes can be traced to one overarching concern: INFLATION.

MDRT’s

Discover stats, approaches and tools that insurance and financial advisors need to stay at the forefront of what matters to today’s consumers.

Plus, see where you stand from a client’s perspective, and find out how the financial advisors of today are connecting with their clients better than ever.

Go to PAGE 5 to get a peek at some of the results of this survey, including:

• What tool 75% of Americans say is extremely important for their advisor to use

• Technology 65% of Gen X advisors use that’s likely to become a mainstream medium

• How to get access to ALL the original research from MDRT’s survey

• Insights on topics that could affect how you do business in 2023

MDRT is a preeminent global association with a rich 95-year history of setting the highest standards when it comes to ethics, knowledge, service and productivity. The esteemed members of MDRT are committed to aiming higher and achieving more.

Let the mentorship of the world’s leading life insurance and financial services professionals and the industry’s most robust collection of resources inside MDRT help you capitalize on trends you’ll discover in the infographic to anticipate your clients’ needs and better serve them.

By joining MDRT, you’ll learn how to improve productivity and run your business more efficiently as well as be inspired to reach the next level of professional success.

See what’s most important to consumers and clients today. GET A PEEK AT EYE-OPENING STATS ON PAGE 5!

Grab your copy of the MDRT Fintech and Advisor Survey and discover how it can help you grow your business.

At MassMutual Ascend, we go above and beyond for your customers. By providing transparent annuity products and putting service above all else, we make the impossible feel possible and pave the way for brighter financial futures.

Take your customers to the future they want.

MassMutualAscend.com

Products issued by MassMutual Ascend Life Insurance Company (Cincinnati, OH), a wholly owned subsidiary of Massachusetts Mutual Life Insurance Company (MassMutual).

© 2022 MassMutual Ascend Life Insurance Company, Cincinnati, OH 45202. All rights reserved. MassMutualAscend.com

Bryon Holz believes an advisor’s passion should be his brand. Read more about what the incoming president of the National Association of Insurance and Financial Advisors has to say about the association and his views on the industry in this interview with Publisher Paul Feldman. IN THE FIELD

By Susan

By John Hilton

By Susan

By John Hilton

30 Annuities cast a light when things seem dim

ByJim Poolman

Rising interest rates may sound like music to the ears of investors who are debating whether to add an annuity to their retirement portfolios.

34 Help clients understand rising long-term care costs

ByKen Latus

Discuss what is needed practically and financially to avoid unexpected burdens.

38 What millennials need to know about Social Security

By Ron Mastrogiovanni

It’s not too early for younger clients to begin thinking about how their future benefits will impact their retirement.

40 Finding success with center-ofinfluence marketing

By Ayo Mseka

Patience is the key to forming good alliances. IN

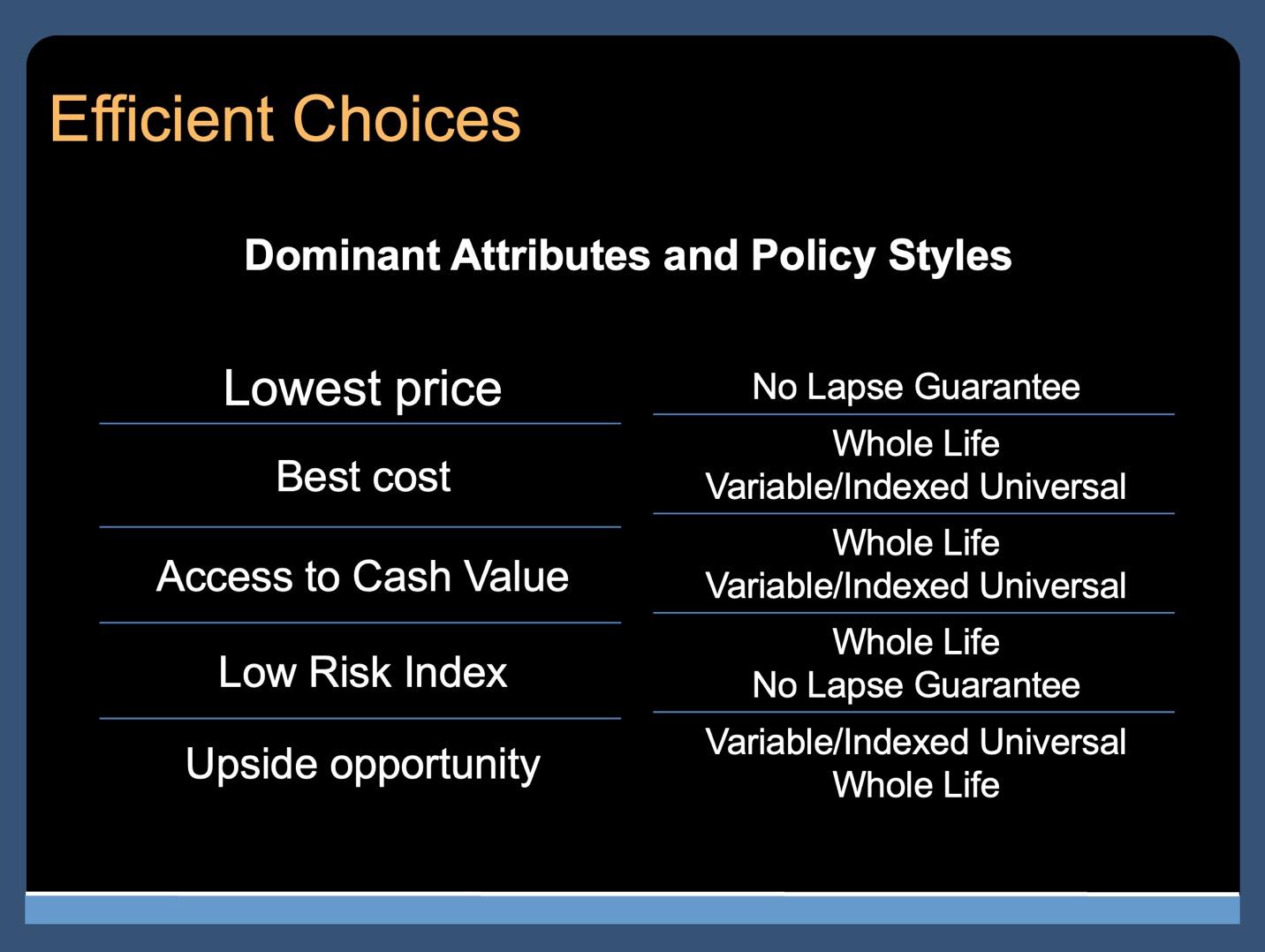

KNOW 42 The increasing demands for standards of care in the sale of life insurance.

By Richard M. Weber

What’s next in the general evolution of insurance products? Back to the basics!

e-mail editor@insurancenewsnet.com or call 717.441.9357, ext. 117. Advertising Inquiries: To access InsuranceNewsNet Magazine’s online media kit, go to www.innmediakit.com or call 717.441.9357, Ext. 125, for a sales representative. Postmaster: Send address changes to InsuranceNewsNet Magazine, 150 Corporate Center Drive, Suite 200, Camp Hill, PA 17011. Please allow four weeks for completion of changes. Legal Disclaimer: This publication contains general financial information. It should not be relied upon as a substitute for professional financial or legal advice. We make every effort to offer accurate information, but errors may occur due to the nature of the subject matter and our interpretation of any laws and regulations involved. We provide this information as is, without warranties of any kind, either express or implied. InsuranceNewsNet shall not be liable regardless of the cause or duration for any errors, inaccuracies, omissions or other defects in, or untimeliness or inauthenticity of, the information published herein. Address Corrections: Update your address at insurancenewsnetmagazine.com

The Federal Reserve Bank of New York recently analyzed data from the American Time Use Survey and found that, as a country, we are saving a combined 60 million hours of per day of commuting time by working from home. The COVID-19 pandemic dramatically changed how Americans are spending their time, including where and how we work. Recent statistics show that about 15% of full-time employees are working from home full time while about 30% are working in hybrid situations.

So, what do these statistics mean to agents and financial advisors? More time. More time to meet with clients. More time to prospect. More time to keep up with training and understanding the many new products arriving on the scene.

In a recent conversation with InsuranceNewsNet, industry icon Harry Hoopis pointed to this silver lining of having more time to meet with clients as one of the most important changes for the business in recent years. Harry — with an amazing career at Northwestern Mutual hiring and managing a large and success ful workforce — believes maximizing meetings with clients is one of the essen tial components of success for agents and financial advisors.

This is not the first time we’ve heard this. And we’re hearing it more and more often. Many advisors and agents have be gun to realize that:

1. Many Americans — including older Americans — use video conferencing software frequently and have become more comfortable doing so.

2. The amount of time spent not driving to meet clients can be directly translated into additional meetings.

3. Some of those additional hours of found time are also useful for increasing pros pecting and training.

Many advisors have begun to shift their schedules online to maximize their appointments. More available hours also

translate into providing more time slots for clients, making it easier for a client to fit a meeting into their tight schedule. Combining a more flexible schedule with superefficient online scheduling apps like Calendly allows clients to easily and quickly find and sign up for an open meet ing slot without phone calls or emails or using advisor or staff time. This ensures that the advisor’s meeting schedule is maximized by removing scheduling bot tlenecks and inefficient use of time, in creasing their prospects of success.

As we approach the new year, there have been increasing calls for the insurance industry to “reset the narrative.” This is something we’ve heard from industry observers and analysts through the course of the year.

For example, Karl Hersch, Deloitte’s U.S. insurance leader, described the in dustry as being at a post-pandemic inflec tion point that marked a time for change — and resetting the narrative. Specifically, he pointed to increasing investments in technology, building industry talent and focusing on culture.

Hersch reminded us of what the in dustry does for “all the other industries out there.” Without the insurance indus try, he said, there’s no rebuilding of bro ken buildings, there are no cruise ships floating on the ocean, and there are no human beings driving cars. None of that is possible without insurance supporting those industries.

This provides a powerful way to look at the industry in a new or refreshed light. And maybe it provides a powerful frame work for attracting new talent.

The need to attract new talent — the best talent — is widely seen as a major goal for the industry. That talent is need ed to provide the innovation required for the industry’s future success, especially after workforces have been buffeted by the great resignation and the great retirement.

Insurers are working to reinvent the workplace in order to attract new tal ent. Part of that objective is focusing on the workplace culture, especially when it comes to increasing diversity and creating a remote/hybrid work environment that has become the norm for about half the work ing population following the pandemic.

Technological innovation also is key to improving the consumer experience, help ing provide products and services with the speed and efficiency that we’ve become accustomed to in our dealings with most industries.

Committing to address the talent gap, enable technological advancement, and enhance workplace culture and diversity are the goals the industry must priori tize. Resetting the narrative to spotlight the great importance of the industry and the opportunities that lay ahead as these goals are achieved will help ensure future success.

John Forcucci Editor-in-chiefHoo boy, glad I'm not stuck in traffic!

Lock in a guaranteed 7.20% interest rate on the income base for up to 10 years with the fixed rate Lifetime Income Rider.1

Cater to your client’s specific needs with a variety of crediting strategies and indices to choose from.

Accumulate in the annuity on a tax-deferred basis, interest credited will not be taxed until it is removed from the annuity.

1) Lifetime Income Rider index credit is calculated differently than base contract indexed strategies and does not impact the base contract’s Annuity Value. There are fees for these riders. Any excess withdrawals will decrease the income base and will require the income payment to be recalculated, resulting in lower income payments. A full surrender will terminate the contract and lifetime income rider payments. You may not take a partial or excess withdrawal that would result in an annuity value of $2,000 or less. ASIA PLUS Surrender Charge Schedules: 7 year: 7%, 6%, 5%, 4%, 3%, 2%, 1%, 0%; 10 year: 10%, 9%, 8%, 7%, 6%, 5%, 4%, 3%, 2%, 1%, 0%; California 9 year: 9%, 8%, 7%, 6%, 5%, 4%, 3%, 2%, 1%, 0%. A Market Value Adjustment may apply. Waivers are not available in all states. Form Series FPIA19; LIR19 (Forms may vary by state, Idaho forms ICC19 Form FPIA19 and ICC19 Form LIR19). The contract and riders may not be available in all states. See Policy for details and limitations. American National Insurance Company, Galveston, Texas.

[Editor’s Note: These are some of the major stories to which we are devoting ongoing coverage on InsuranceNewsNet.com.]

Planning for retirement has never been more challenging than it is today. With inflation at a 40-year high, talk of reces sion and workers facing a retirement that could last more than 30 years, the ques tion is: Does the 4% rule still make sense?

A panel of financial experts discussed the challenges of retirement planning today and whether those challenges have made the 4% rule obsolete. David Lau, founder and CEO of DPL Financial Partners, teamed up with David Blanchett, adjunct professor of wealth management at The American College, for a webinar that looked at the 4% rule in today’s planning environment.

The 4% rule is a rule of thumb that suggests retirees can safely withdraw the amount equal to 4% of their savings during the year they retire and then ad just for inflation each subsequent year for 30 years. But the panelists said that tra ditionally “safe withdrawal” rule doesn’t necessarily work in today’s environment.

“There is no way to describe how awful this year has been” in looking at the per formance of various asset classes through

the third quarter of 2022, Blanchett said.

He noted that bonds can no longer provide reliable income as they once did. In addition, retiring in a down market can derail a retirement plan, putting a retiree at risk of depleting their portfo lio while still needing income. Anxiety about running out of money during re tirement can lead retirees to underspend their retirement savings.

Read the full story online: bit.ly/4percent2022

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents’ association and was an award-win ning newspaper reporter and editor. Contact her at Susan.Rupe@innfeedback.com. Follow her on Twitter @INNsusan.

profit goals elusive. Investors prefer that insurers sell off lines that lag behind in profitability.

One of the historic problems with selling off a piece of an insurance com pany is that it requires every policy holder’s signature.

by John HiltonInsurance deals are set to rise dramat ically, according to the 2022 Global Insurance Run-Off Survey released last month by PwC.

Ninety-seven percent of respondents predict similar or greater levels of deal activity in North America going forward, the survey found. PwC projects the glob al non-life run-off market at $960 billion, up from $790 billion in 2019.

“I think we will see deal numbers rise and much larger deals being done, espe cially in the U.S.,” said Andrew Ward, partner, liability restructuring, PwC UK.

Insurance business transfer deals represent one path to getting a deal done, but states have been slow to adopt the corresponding laws to make those deals possible.

The insurance industry has strug gled for decades with how to handle discontinued blocks of business. The Association of Insurance & Reinsurance Run-Off Companies (AIRROC) formed in 2004 to give insurers a forum for ad dressing the issues.

Insurers are especially keen these days to move on from old books of business, as ultralow interest rates continue to make

Nevertheless, the appetite for deals re mains high, Carolyn Fahey, executive di rector of AIRROC, said in the PwC report.

“The legacy sector is creative and vi brant,” she said. “There are appetites for every type of deal size and tools that can work for any situation.”

Read the full story online: bit.ly/transferlaws2022

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at john.hilton@innfeedback.com. Follow him on Twitter @INNJohnH.

Figuring out whether the 4% rule still makes sense and why states are slow to adopt business transfer laws.

MDRT’s 29 Essential Facts

To Know

Personal interaction is one of many reasons clients choose to work with a human advisor instead of a roboadvisor. And while they may not want to put their entire financial life in the hands of a bot, that doesn’t mean they don’t expect human advisors to use technology. In fact, responses from the MDRT Fintech and Advisor Survey found it’s highly important that advisors do so.

Follow along as we demystify advisors’ fintech usage according to clients, as well as advisors’ reported use of technology.

Consider this your guide to understanding and exceeding your clients’ expectations.

In their recent survey, MDRT discovered clients’ tech expectations. Additionally, the survey explored the gap between those expectations and what clients believe their advisor uses.

51% of Americans say it’s extremely or very import ant for human advisors to use tools like email, social media, instant messaging, webinars and videos to increase communication.

Only 35% of clients report their advisor doing so.

75% of Americans say it’s either extremely important or very important for human advi sors to use cybersecurity tools like password managers or two-factor authentication (2FA). Only 35% of human advisors’ cli ents report that their advisor uses such tools.

As technology becomes more of a requirement for doing business today, MDRT, along with other professional organizations, urges members to adopt fintech in their practice. Whether it’s something as simple as an online appointment scheduler or as complex as artificial intelligence, these technology solutions help automate some of your daily work so you can spend your time on higher-value tasks.

54% of survey respondents stated they use social media like Facebook or LinkedIn to communicate with their clients.

• 65% of Generation X advisors.

• 60% of millennial and Generation Z advisors.

• 27% of baby boomer advisors.

52% of survey respondents reported using an email or e-newsletter program, to communicate with their clients.

• 63% of Generation X advisors.

• 52% of millennial and Generation Z advisors.

• 35% of baby boomer advisors.

• Advisors of color (63%).

• White advisors (49%).

44% of survey respondents indicated they communicate with clients using instant messaging platforms like WhatsApp or Telegram.

• Generation X (56%).

• Millennials and Generation Z (42%).

• Baby boomers (27%).

This is just a glimpse of what you'll find in the full report! To download a wealth of additional insights from MDRT’s latest research, visit www.2022MDRTreport.com

55% of Americans find usage of fi nancial modeling software extremely or very important.

51% of clients report their human advisor uses this technology.

44% of Americans find that online schedulers are extremely or very important.

40% of clients say their human advi sor uses such platforms.

42% of Americans say the use of platforms like Zoom or Microsoft Teams for hosting virtual meetings is extremely or very important.

22% of survey respondents stated they use a password man ager, like LastPass or 1Password.

• 30% of Generation X advisors.

• 23% of millennial and Generation Z advisors.

• 11% of baby boomer advisors.

• Male advisors (27%) were also more likely than female advisors (14%) to use password managers.

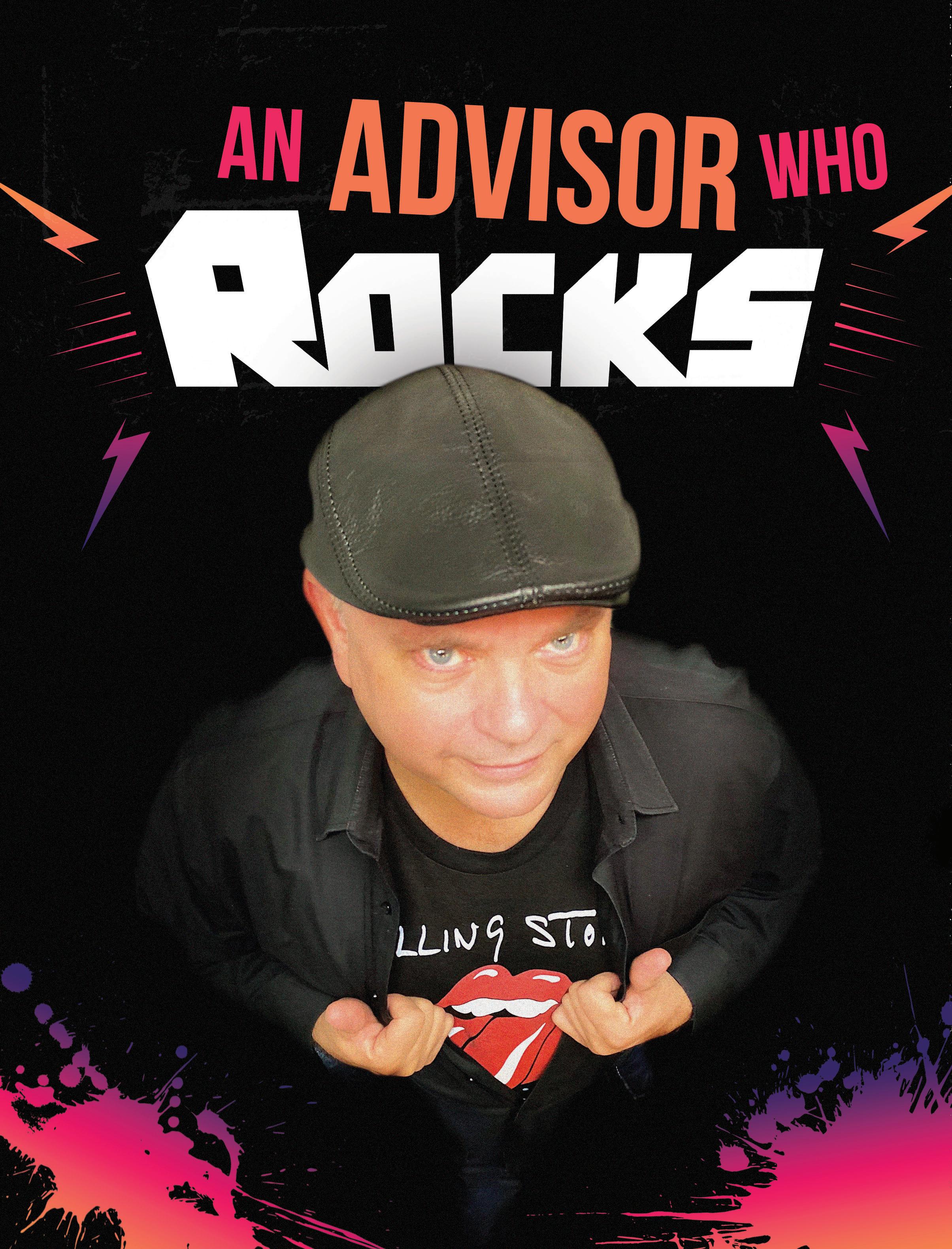

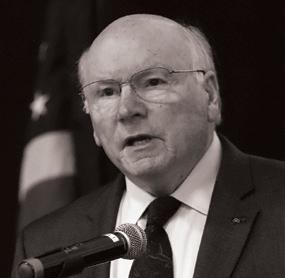

Why NAIFA President-elect Bryon Holz believes NAIFA’s role is more important than ever, and every advisor’s passion should be their brand.

Bryon Holz built a long and substantial career providing investments and insurance to successful individuals and business owners throughout the Southeast.

Although he had a humble start in the business, he eventually earned life mem bership in Million Dollar Round Table. Today, he regularly speaks to audiences around the country — and around the world — while continuing to lead his prac tice, Bryon Holz & Associates of Brandon, Fla., which he founded in 1983. In 2023, he will take on a new role — president of the National Association of Insurance and Financial Advisors.

His speaking engagements most recent ly have taken him to Australia. “Wherever I travel in any state or any country or place I go, I always find something amaz ing to enjoy and appreciate wherever that is, whether it’s a house of worship or it’s a vineyard or a winery or whatever it is,” he said. “I think that some describe that as a sense of wonder, as almost a childlike sense of wonder. But I think that if we nev er lose that, then life is full of great things to enjoy and appreciate.”

A graduate and presidential scholar of the University of Tampa, he finds his pro fessional education never ends, and he has obtained numerous designations and cer tifications over the years. Holz is known for his love of music — his Twitter handle is @BryonHolzROCKS — and is also an avid photographer who shares his hobby through his social media. “I don’t know how many guitars I have, but it’s one of my problems. I have a lot of friends in music, and it’s certainly something I love.”

As Holz prepares to take on the leader ship of NAIFA, he shares his thoughts both about the role and the future of the orga nization, as well as the success he has had, while offering lessons and advice learned over the course of his career.

Paul Feldman: You have had such an incredible career in the insurance indus try, nearly 40 years. How did you get in the industry?

Bryon Holz: It was pretty much by acci dent. I kind of fell into it. My family moved out from the Chicago suburbs in the ear ly ’70s, when I was still in middle school. We moved from a large metropolitan

area into a relatively rural area in West Central Florida. There wasn’t a lot to do, so I became very involved in extracurric ular activities at school. One of the indi viduals I got close to was my high school biology teacher. He started working with teachers and educators while I was still in high school, helping them with 403(b) s, tax-sheltered annuities and retirement planning. He did so well that soon he quit teaching and did that fulltime.

I always did well in school, and I was the first one in my family to go to college. I had a full scholarship — a presidential schol arship — to the University of Tampa as a business student. I knew I wanted to work in business. At my college graduation, my former high school biology teacher asked me what I was going to do, and I really didn’t know. There was a recession going on. He said, “Why don’t you come work with me until you get your real job?” Now, 39 years later, I’m still looking for a real job.

We started working with educators back then and, of course, did a lot with 403(b)s and retirement. But we quickly went to other areas of life insurance, mutual funds and retirement planning. For the last 39 years, most of my focus has been on re tirement planning. I always think of the NAIFA logo, which is the symbol of help ing our clients should they live too long, die too soon, or become too sick or hurt to work. Holistic financial planning and risk management are what I’ve done through out all these years.

Feldman: You’ll be assuming the presidency of NAIFA next year. How did you get involved with NAIFA, and where do you see yourself taking the association?

Holz: I had a mentor early in my career who invited me to attend a local NAIFA meeting, saying, “If you’re going to be a professional, you need to be a member.” So I became a member. I quickly found out the importance of affiliating with fellow professionals — we were in competition, but we supported each other and really lifted each other. All of my best sales ideas, all of my best practice management ideas, have come from others.

NAIFA has always been important to me throughout the years, whether it’s on the local level, state level or, of course, on the national level. Any time I get togeth er with NAIFA friends, I always learn

something. Whenever I speak — and I’ve been all around this country, speaking and sharing with NAIFA members and fellow professionals — I always get something out of that. There’s that synergy, and that’s so strong with the National Association of Insurance and Financial Advisors.

Feldman: As a practicing advisor, you’ve had agents who have entered your practice. How do you integrate them into the system, nurture them and help them grow?

Holz: One of the greatest challenges of our profession right now is replenishing our selves, filling up the bench. Where are the new professionals coming from? There are two sides to this. On one side are identifying and encouraging them and bringing them into the profession. Some years ago, my firm had intern programs for educators, for college students and for people from other professions who wanted to try a new profes sion. Those are pretty much gone now.

The traditional agency system is not what it used to be. NAIFA, for example, has a future leaders program that we’ve de veloped in various colleges and universities around the country. We need to reach into our communities and work with Women in Insurance and Financial Services, the National African American Insurance Association, and the Latin American Association of Insurance Agencies, and make sure that we’re growing NAIFA’s Young Advisor Team.

While on the one side we need individu als who can come into the industry, on the other side is the advocacy role of NAIFA — regulation, Congress and legislatures across all 50 states to make sure that we can continue to serve Middle America. Unfortunately, our profession has been reg ulated in so many ways that we’re almost at risk of not being able to serve the majority of clients. It’s getting to the point where if you don’t have a quarter of a million dollars in investable assets, no one wants to talk to you or no one can talk to you because of the way things are being regulated.

I think that’s a significant challenge. It’s hard to get someone in the business to hit the ground running if they have to hit such large goals and targets to stay in business. The great news is that when we are able to sit down with our regulators, members of Congress and legislators in all

50 states, as only NAIFA can, they recog nize what we do helps all of society. What we do as professionals is the solution, it’s not the problem.

Advocacy is one of the things that makes NAIFA not only so strong and im portant but makes serving with them so important.

Feldman: Let’s talk about your busi ness. You have talked about offering sensational client service, and I think that’s important for our industry. It’s a good message. Can you tell us a little about that?

Holz: Several years ago, I realized that we’re educators. We primarily depend upon the effectiveness of our communication with our clients and prospects to be able to serve them. How successful we are depends upon how well we can communicate and motivate our clients to take action to solve the challenges that may be present in their lives. I learned years ago that in order to strengthen your message, it’s best to appeal to as many senses as possible, whether it’s sight, sound, taste, touch, smell.

I started with some simple things that I learned from mentors — a stick of chew ing gum in birthday cards to our clients

I have a great passion for music. That’s a great way to brand myself and our practic es. That’s a great way to involve and engage more senses.

Feldman: You also do wine tastings. How do you generate business through wine tasting?

Holz: Well again, that’s all about the senses. It’s just a chance to enjoy and celebrate. We don’t sell anything through these events, but we do try to talk about how different vintages are better from different places in different areas and different regions. It’s the same thing with asset allocation.

Some years bonds might do well, some years international stocks or domestic blue-chip stocks might do well. It’s the same with wine. We have that story to tell, but at the end of the day, it’s just an op portunity to connect with our clients and prospects — and introduce ourselves and invite their referrals to do business with us as well.

Feldman: Let’s talk more about this. Let’s say someone wants to host a wine tasting for their practice. How do you do that? What does your format look like? How do you market it?

wine region’s going to produce the best grapes or the best wine. And that it’s the same thing with investments — there are ups and downs. I don’t do the presentation about the wine. I leave that to professionals.

We have a wine shop nearby and they have a great classroom, and we’ve used that several times. We have a winery and a vine yard that we’ve used as well. I don’t personal ly talk about the wines, and I try not to even talk about the message as well. I usually try and bring a product sponsor, a partner, in and talk about that message as well.

My goal, my role is to be the ambassador. It’s to be the relationship builder. I don’t pick stocks for my clients. I don’t pick is sues for my clients. My goal is to help them find out where they need to be and connect them with the products and services that best meet their needs. It’s the same way with these wine tastings. I wouldn’t do well leading it personally — especially after the third glass or third tasting!

Feldman: I want to come back to regulation. What do you see as the most significant regulation issues that agents should be concerned with and support ing NAIFA on?

Holz: Right now, there are really two pri mary issues that I see. The first one is that agents and reps are able to serve Middle America — that regulation doesn’t price out Middle America, middle-income con sumers and others. We all need an advisor. That’s our greatest challenge.

and their children, for example. We host ice cream socials. We do intergeneration al marketing to all of our clients to bring their children, their grandchildren, their great-grandchildren, their parents, their grandparents — and anything that we do clientwise, we always try and get as many senses involved as possible.

Holz: We’ll invite clients who we know enjoy wine, and we’ll invite them to bring a friend. The main thing we’ll use it for is to introduce referrals to our practice and to help our existing clients feel good about what we do — especially now with the vola tility in the market. And it allows us to reit erate the message that every year a certain

Our second one is being able to serve as an independent advisor. I think that’s a serious issue that’s coming up in a lot of different states and one we need to be aware of so that they can continue to be independent to provide that service. We’re concerned about duty of care, of course. The SECURE Act, saving our seniors. Being able to use annuities in retirement planning is really important. Seeing the agent and the rep as the enemy first is an issue that we’re vigilant on. NAIFA has ad vocated for agents, making sure that we’re able to do our job and help people. That’s the most important thing we’re doing right now — and we’ve done it for more than a century.

Feldman: What are some things agents should be doing right now that they’re not doing? What advice and tips can

you give to agents to help them be more successful?

Holz: First, they should join NAIFA. Right now, I think it’s important for them to align themselves with resources that can support them in their practice, resources like NAIFA’s centers of excellence and our Advanced Practice Center, Limited and Extended Care Center, and finding plac es that can truly help them with the best thought leaders in the industry. I think that in the last few years, especially with COVID-19, they don’t realize that these resources exist.

I think the most important thing for our reps is to recognize that we’re stronger to gether — we need each other.

So many of us are working with our cli ents virtually and through the phone and through email and online. That’s great, but what we need to also keep in mind is that nothing replaces the role of the agent. We have indications that might suggest the con trary, like automatic sign-ups for 401(k)s, but no one’s going to take care of them as well as an advisor can.

We need to make sure that we’re posi tioning ourselves in our communities to truly be the trusted advisor. Unfortunately, there’s a lot of division right now in our country and in the world. “They” are the enemy. It’s us against them. That saddens me so much. What we do at NAIFA is pur ple. It’s not red, it’s not blue.

Our clients and our fellow citizens, our communities, they’re sick from this. They’ve got shell shock from all of this. They need professionals who can be the voice of reason. The more we recognize that as agents and reps and members, I think the better we’re going to be.

Feldman: As an advisor, how do you deal with somebody whose beliefs may be so different from yours? How do you manage that?

Holz: My faith is very important to me, of course, and my family. I always try and see it from the individual’s point of view and perspective. Even if we may not agree on something, I still see that they need help. I see where they’re going, and I recognize the need for them to get there. I help them to get there. I always try to have empathy. What can I do to make things better?

Feldman: One of the things you de scribed earlier was that some of your best ideas come from others. What are some of the best tips and advice that you can share with our readers?

Holz: Virtual client service. Working with our clients virtually rather than in person in advance of the pandemic, which has been huge. I thought you had to be at their kitchen table or they had to be in my office. That’s been a game changer for me.

Also, hire a scheduler. Your time is your most valuable asset as an advisor. I started having someone schedule my time about four or five years ago, and it has been a game changer for our practice. We have more meetings with our clients. We’re more in touch with them. We do more for them. We’ve been more successful. Our production has increased.

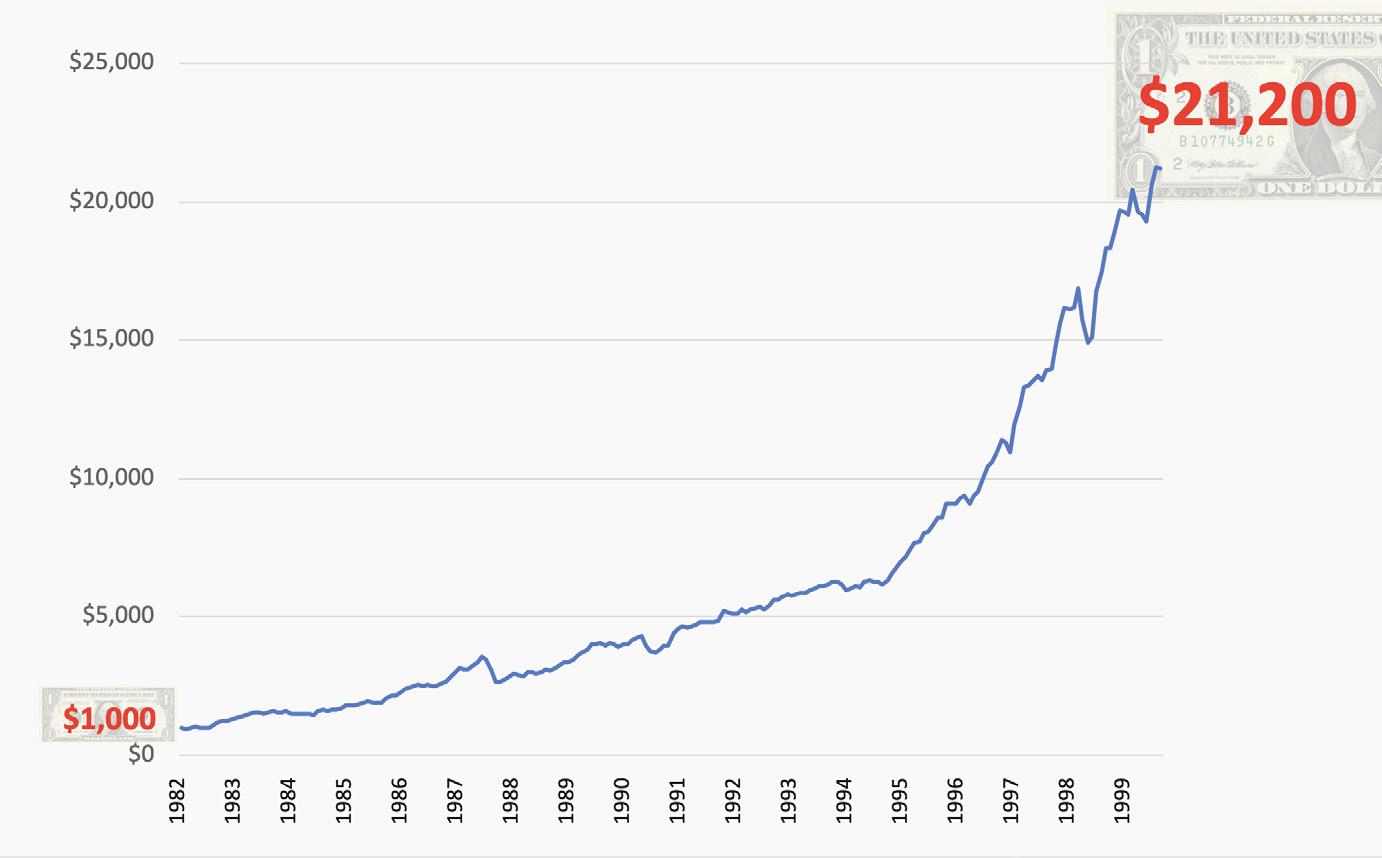

Another thing I’d emphasize is story telling, which is so important in what we do as well. We’ve developed several stories. They’re not our own, of course. We’ve sto len them. For example, the story about the young man who saved the princess’s life. The young man saves the life of the prin cess, and the king is so grateful for saving his daughter’s life that he offers to give the young man a million-dollar reward. The young man, being a smart young man says, “Instead of the million dollars, why not just give me a grain of rice, doubled each day for a month?” The king thinks, “Sure, I’ll give him the rice.” But he didn’t realize that at the end of the month, the young man would end up with the entire kingdom’s rice production. That tells the story about the power of compound interest. Stories are great to use in our practice. People can remember and identify with them.

I think the most important thing I’ve learned as a professional is to be in touch with your clients — to touch them regular ly, to send out the emails, to send out the snail mail, to have events, do the birthday cards to everyone in the household — to just reach out and touch them regularly. Don’t be afraid to reach out when times are tough like they are now with the economy and with the markets.

We are very active in social media, and we really have a very well-planned-out ap proach and calendar to our social media program. We make sure that we have days in the week when we do fun things that align with our brand. Whether it’s about

rock stars — in my case, classic rock, be cause we target baby boomers — you need to mix it up. We’re very careful to do that, and it’s very calculated, and we found great success in our response to it. Has it gotten business for us? I know it has.

Another thing is our branding. Everyone who’s in our business, every rep, every agent, can brand themselves. I use music as my brand. If you’re a golfer, you can brand yourself with golf. Brand yourself and you’ll have a stronger identity with your clients and prospects, and it makes a difference.

Feldman: How would you recommend somebody create their own brand? How do you really drive brand?

Holz: Once you identify what your pas sion is, you can share that with others and others can relate to it. If it’s cooking, hold cooking classes at the local kitchens. Just make sure that you’re open to all the differ ent ways that you can share those passions with your clients. Don’t think “Well, this will be corny.” Go all in and make sure that you have fun doing it.

If it’s authentic and it’s truly you, that’s what it’s all about. I think that’s the most freeing thing that I’ve done in my profes sion, is recognize what I am and who I am and what I like. In my case, it’s music. Then just be open and free about it, and people will say, “Yeah, that’s Bryon. He’s the music guy, but he’s also a financial advisor.” Dig deep, open up and go for it.

Feldman: What is NAIFA doing to make sure it remains relevant?

Holz: In addition to advocating for our members, NAIFA is partnering with more companies than ever before. So not un like how advisors may brand themselves, NAIFA is branding ourselves in ways that we can attract and serve more advisors and agents than ever before. I think that’s really important.

What is insurance? It’s taking a small amount of something and putting it togeth er with something much larger to manage that risk. Well, that defines NAIFA — tak ing one person at a time, adding them into something bigger to strengthen who we are and what we do as professionals. That’s why I’m so excited and humbled to be the incom ing NAIFA president, to be a part of that.

The Fed’s aim is to slow the economy, and a recent Nationwide Agency Forward survey showed that small businesses are already feeling it. The poll showed that 70% of small-business owners expect a recession in the next six months. But most owners are not prepared for it, with only 37% saying they are ready to ride out a recession, the same percentage of consumers who say they are prepared.

Inflation is the business owners’ top concern (61%), while supply chain dis ruptions still are vexing businesses, with 41% saying they are a problem. The third top concern, at 35%, was rising interest rates.

Only 42% of business owners said that business conditions were good, and 9% said they were excellent; 34% said conditions were fair, and 14% said they were poor. Four in 10 owners (39%) said revenue dropped somewhat or a lot over the past six months, with only 3% saying it increased a lot; only 34% expect an increase of any kind in the next six months.

The survey showed that small-business owners have been responding to the slowing already, with 58% having looked for ways to reduce expenses in the past months and another 24% looking to do so in the next six months. They have already dipped into their own savings, with 38% saying they have done so and another 16% expecting to dip into their own money.

There is light at the end of the infla tion tunnel, said Mark Zandi of Moody’s Analytics, who predicted U.S. inflation will be cut in half within six months. Zandi’s prediction hinged on several fac tors, though, including oil prices staying at current levels, supply chain problems let ting up and vehicle prices coming down. Overall, Zandi believes the Federal Reserve’s policy tightening is put ting the economy on the right track. He predicts high prices should re cede enough to prevent a recession.

He expects the Fed to pause hikes around the 4.5% or 4.75% level this winter.

Thanks to the increase in online banking and the COVID-19 pandemic, the num ber of Americans who are “unbanked” hit a new low in 2021.

A new report from the Federal Deposit Insurance Corp. found that 4.5% of Americans — representing approximately 5.9 million households — were without a bank account in 2021. That’s the lowest level since the FDIC started tracking the data in 2009 and down from 5.4% of Americans in the 2019 survey data. What did the pan demic have to do with the increase in bank ac counts? States and the federal gov ernment distributed trillions of dollars in stimulus to Americans

after COVID-19 shut down the U.S. economy in March 2020. The benefit programs largely required that recipients have a bank account in order to send the funds quickly to those impacted. During that time, consumers opened bank ac counts to access these funds quickly and securely, the FDIC said.

Let the buyer beware when it comes to bitcoin trad ing. More than half of the reported trading volume on 157 cryp to exchange sites is misrepresented or fake, according to a study pub lished in Forbes magazine.

Forbes estimated the global daily bitcoin volume for the industry was $128 billion on June 14. That is 51% less than the $262 billion one would get by taking the sum of self-reported volume from multiple sources, the study said.

The study said the biggest problems come from a lack of regulation, noting that the least regulated exchanges account for $89 billion of bitcoin volume while claim ing to make $217 billion. Experts point to wash trading, the act of selling an asset to yourself in an attempt to inflate the value of that asset, as the reason for the discrep ancy in value.

With interest rate hikes, a lag effect on prices can take six to 12 months.

Helping your clients choose their Medicare supplement carrier is one of the most important things you do. That means picking the right carrier the first time. Since plans are standardized, how can carriers differentiate themselves to customers? While price matters, so does peace of mind.

As the nation’s number two carrier for Medicare supplement, Mutual of Omaha offers:

• Confidence. We’ve been in the market for more than 55 years and, as a carrier with a national presence, we hold more than 1.4 million policies in force. Clients can rest easy with us.

• Outstanding service. For you, this means direct access to underwriters and a dedicated sales support staff. For clients, we deliver on our promise to pay, anniversary rating, competitive rates and up to a 12% household discount.

• Brand awareness. Our recognized name among Medicare-eligible clients means your customers know us. You don’t have to sell us.

For producer use only. Not for use with the general public.

Plans that make a difference!

• Check out our competitive prices and savings on Plan N

• High-Deductible Plan G available

This rating is the 2nd highest of 16.*

A.M. BEST

This rating is the 5th highest of 21.*

MOODY’S INVESTORS SERVICE

Strong

This rating is the 5th highest of 21.*

S&P GLOBAL

*as of 10/1/22

For clients who are looking to make the right Medicare supplement decision, look no further than Mutual of Omaha.

Contact your marketer or visit mutualofomaha.com/ sales-professionals.

Tax policy is changing, Social Security is going up and proposed legislation would help Americans save much more for retirement.

Many of these policy changes can be traced to one overarching concern: inflation.

BY JOHN HILTON

BY JOHN HILTON

The headlines on 2023 tax and retirement policy changes are not quite as big as President Joe Biden had hoped, but one issue — inflation — is is driving significant developments that advi sors will want to address with clients.

It’s not all bad news, either.

Inflation proved stubborn throughout 2022, despite the Federal Reserve’s best efforts. The year is ending with inflation affecting nearly all aspects of the U.S. economy.

The Fed hiked interest rates five times in 2022 and was expected to push through a sixth increase in November. A year that began with the fed funds rate at 0.25% to 0.50% will end with the rate at 3% to 3.25%.

The inflation fallout is being felt across all age groups and has massive ramifica tions for retirement planning.

While the rate hikes might succeed in bringing inflation back to the Fed’s 2% target, it might also cool the jobs mar ket. The unemployment rate could rise as high as 6% next year, according to a recent Deutsche Bank forecast.

Likewise, rate hikes could throw the economy into a recession in 2023, say executives such as Goldman Sachs CEO David Solomon and JPMorgan Chase Copresident Daniel Pinto.

Although that news is certainly bad for clients, they are getting some correspond ing good news in the form of inflationary adjustments to both tax filing rules and Social Security.

“Starting in January, average Social Security benefits will rise by more than $140 a month,” said Lyle Solomon, principal attorney at Oak View Law Group in Auburn, Calif. “Social Security payouts will increase, while Medicare premiums will decrease, giving seniors more breathing room and peace of mind.”

Social Security and Supplemental Security Income benefits for approximately 70 million Americans will increase 8.7% in 2023 in a historic cost-of-living adjustment.

But that is far from the only change on the way in 2023.

While Biden did not get many of the tax code changes he campaigned on — thanks to a sharply divided Congress — there is still plenty new to review with clients.

For starters, in October, the IRS un veiled higher federal income tax brackets and standard deduc tions for 2023. The agency also boosted the income thresholds for each bracket, with the new limits apply ing to 2023 for tax returns filed in 2024.

“We’re seeing a much larger increase in the standard deduction than was originally forecast,” said Rob Burnette, CEO, finan cial advisor and professional tax preparer at Outlook Financial Center in Troy, Ohio. “We’re going to see deductions change. For example, the gift tax exclusion projected to be $15,000 is going to be $16,000. That

qualifying taxpayers who have three or more qualifying children, up from $6,935 for tax year 2022.

» For tax year 2023, the monthly limitation for the qualified transportation fringe benefit and the monthly limitation for qualified parking increases to $300, up $20 from the limit for 2022.

» For the taxable years beginning in 2023, the dollar limitation for employee salary reductions for contributions to health flexible spending arrangements in creases to $3,050. For cafeteria plans that permit the carryover of unused amounts, the maximum carryover amount is $610, an increase of $40.

Another tax change — the sunset of the expanded child tax credit — could be saved by Congress in its December “lameduck” session. The credit was significantly

2022 2023

means you can give $16,000 to someone and not have to pay gift tax because whoever re ceives it doesn’t pay any income tax on it.”

Some other important tax filing changes announced by the IRS include:

» The alternative minimum tax exemption amount for tax year 2023 is $81,300 and begins to phase out at $578,150 (for married couples filing jointly, $126,500, and phasing out at $1,156,300). The 2022 ex emption amount was $75,900 and phasing out at $539,900 ($118,100 and $1,079,800, respectively, for married couples).

» The tax year 2023 maximum earned income tax credit amount is $7,430 for

expanded in 2021 by the American Rescue Plan so families could receive up to $3,600 per child under 6 and $3,000 for those ages 6 to 17. But the changes were made for just one year and will be reduced back to $2,000 per child in 2023 unless Congress acts.

“I don’t know if there’s a lot of partisan pushback from Republicans on a child tax credit,” Burnette said. “So that’s something that likely could probably [pass Congress].”

One tax that Biden very much wanted to change is the estate tax. Biden’s 2020 plat form called for returning estate tax to the “historical norm.” The 2017 tax bill signed by President Donald Trump doubled the

Source: IRS

$11,000 or less

$11,001 to $44,725

$44,726 to $95,375

$95,376 to $182,100

$182,101 to $231,250

$231,251 to $578,125

$578,126 or more

amount that individuals can pass on before the 40% estate and gift tax kicks in. In 2022, that number is $12.06 million.

Early on in his administration, Biden proposed a new plan that left the estate tax threshold alone but eliminated the “stepup” in basis.

The step-up in basis is a provision in tax law that relates to how assets — such as stocks, bonds or real estate — are valued and taxed after their owner dies. Currently, stepped-up basis allows the value of an as set to be adjusted to reflect the asset’s value at the time that the owner dies rather than the value when it was originally purchased.

Capital gains are taxed when a capital asset is sold for a profit. For example, if shares of corporate stock were purchased for $100,000 and sold 10 years later for $200,000, the $100,000 profit would be considered a capital gain. However, if the owner of a capital asset were to die and bequeath it to someone, the basis of the asset would be adjusted to “step up” to the asset’s current value.

The administration asserted elimi nating the step-up basis could generate as much as $100 billion over a decade. Biden’s 2022 budget again proposed elim ination of the step-up provision, but his estate tax proposals have yet to gain any traction in Congress.

Even if the estate tax remains unchanged,

10% of taxable income

$1,100 plus 12% of amount over $11,000

$5,147 plus 22% of amount over $44,725

$16,290 plus 24% of amount over $95,375

$37,104 plus 32% of amount over $182,100

$52,832 plus 35% of amount over $231,250

$174,238.25 plus 37% of amount over $578,125

advisors of high net worth clients need to plan for the future. The current estate and gift tax exemption is scheduled to end on the last day of 2025. After that, the exemp tion amount will drop back down to the prior law’s $5 million cap, which, when ad justed for inflation, is expected to be about $6.2 million.

In addition, the 40% maximum gift and estate tax rate is set to increase to 45% in 2026. It’s something advisors should keep a close eye on, Burnette said.

“If we’re looking at President Biden and another Democratic Congress, I look for them to accelerate that [estate tax] sunset provision,” he said, “and then jack up ev erybody’s taxes and change all the deduc tions and stuff like that.”

Persistent IRS pleas for more funding from Congress finally paid off this summer, when Democrats added $80 billion for the agency to the Inflation Reduction Act.

Fortified with a new funding stream, the IRS is making plans to clear a mas sive backlog of unprocessed tax returns, upgrade technology that is decades out of date and hire more auditors. As a result, what have been a very low audit rate and a correspondingly high possibility of getting away with an imperfect tax return are like ly to change.

Francine J. Lipman is a professor of law with expertise in tax issues for the University of Nevada, Las Vegas. Anyone wishing to get tax planning advice might be too late, she said.

“We’re just now get ting done with 2021 tax compliance,” she said during a late-October interview. “Tax professionals have learned to be more professional with their clients, mean ing get engagement letters, get retainers, charge what you’re worth and not tolerate last-minute looky-loos who are trying to shop around.

“I think clients need to be aware of that and respect their CPAs and tax profession als and start talking to them now.”

There are some areas where moving parts require a CPA or a tax-focused ad visor to help clients maximize their bot tom line, Lipman explained. For example, a capital gain rate of 15% applies if your taxable income is more than $40,400 for singles or more than $80,800 for a married couple filing jointly.

“It’s interesting because there’s an in terplay between the capital gains tax rates and Social Security,” Lipman said. “You could trigger some stock sales and have a capital gain that is in the 0% tax bracket,

Source: IRS

Taxable income

Taxes owed

$22,000 or less 10% of taxable income

$22,001 to $89,450 $2,200 plus 12% of amount over $22,000

$89,451 to $190,750 $10,294 plus 22% of amount over $89,450 $190,751 to $364,200 $32,580 plus 24% of amount over $190,750

$364,201 to $462,500 $74,208 plus 24% of amount over $364,201 $462,501 to $693,750 $105,664 plus 35% of amount over $462,500

$693,751 or more $186,601.50 plus 37% of amount over $693,750

but that might cause some of your Social Security to be taxed as ordinary income.”

In other IRS news, the agency an nounced the largest-ever increase in con tribution limits on 401(k) plans and other federal savings programs.

The amount individuals can contrib ute to 401(k) plans will rise to $22,500 in 2023 from $20,500 in 2022. The same increase applies to 403(b) plans, most 457 plans and the federal government’s Thrift Savings Plan.

The catch-up contribution limit for em ployees 50 and over will go from $6,500 in 2022 to $7,500 in 2023. The increase means participants can contribute a total of up to $30,000 starting in 2023 — a $3,000 boost from 2022.

The $7,500 catch-up contribution limit applies to anyone who turns 50 or older in 2023.

Catch-up provisions provide an op portunity for workers 50 and older to contribute more to their retirement sav ings and especially helps those who ha ven’t been able to contribute maximum amounts in the past. The pretax contri butions also let taxpayers reduce taxable income even further.

“Because all the limits have gone up, it allows folks who are already putting in the maximum amounts to save more and get the tax benefits,” said Evan Press, financial

professional with Equitable. “Given infla tion has been so high, it’s important for peo ple to save what they can. When it comes time to take money out of these vehicles in retirement, they will need more income to keep up with this higher inflation.”

medical and health services not covered by Medicare Part A.

Medicare Part B premiums, deductibles and coinsurance rates are determined according to the Social Security Act. They normally do not go down, explained Jim Silbernagel, creator and host of Real Wealth, an online radio program for in surance and financial professionals.

Press Silbernagel

Those 401(k) opportunities in con junction with planned Social Security increases give clients a double-barreled approach to boosting retirement dollars. On average, Social Security benefits will increase by more than $140 per month starting in January, the Social Security Administration estimated.

Likewise, recipients are coming out ahead with a decrease in Medicare Part B premiums. The standard monthly premi um for Medicare Part B enrollees will be $164.90 for 2023, a decrease of $5.20 from $170.10 in 2022. The annual deductible for all Medicare Part B beneficiaries is $226 in 2023, a decrease of $7 from the annual deductible of $233 in 2022.

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other

“Typically, the [Social Security] rais es that we’ve been getting have been taken away by the increased premiums in Medicare,” he said. “It’s kind of an unusual situation, where they’re actually getting to keep the raise.”

Four other significant changes to Social Security are coming in 2023:

» An increase in the wage cap. In 2022, the wage cap is set at $147,000 and earnings beyond that point aren’t taxed for Social Security purposes. Next year, the wage cap is rising to $160,200, which means higher earners could see their Social Security tax burden rise substantially.

The Social Security tax rate on earnings is 12.4%. Self-employed workers pay all of it, while employees split the bill with their employers. So, the 2023 Social Security tax

Source: Social Security Administration

burden for those earning $160,200 or more is $19,864.80.

» Rising Social Security “work credits.”

Forty lifetime work credits are needed to receive Social Security benefits, of which a maximum of four can be earned annu ally. In 2022, a work credit was granted for each $1,510 in earned income. In 2023, that figure is rising to $1,640, according to the Social Security Fact Sheet.

» Rising maximum payout. The maximum payout at full retirement age is rising sharply. Following a $197-a-month increase in 2022 to $3,345, lifetime high earners will see the maximum benefit at full retirement age jump $282 per month to $3,627.

Only 2% of workers hit the thresholds to claim the full benefit, the biggest being 35 years of earning at or above the Social Security cap.

» Increasing income thresholds.

Social Security penalizes early claimants (ages 62-66) by withholding some benefits above an earnings amount. In 2022, $1 in benefits is withheld for every $2 in earned income above $19,560. For early filers who hit their full retirement age in 2022, $1 in benefits can be withheld for every $3 in earned income above $51,960.

In 2023, those figures are increasing to $21,240 and $56,520 before any withhold ing begins. Claimants of full retirement age can earn an unlimited amount with no reduction in benefits.

A lot will change in Washington before the calendar turns to 2023. Despite the out come of the midterm elections (which took place after this issue went to press), many of the priorities for the financial services industry are somewhat bipartisan.

One such example is the Securing a Strong Retirement Act of 2022, known informally as SECURE 2.0. It passed the House on March 29 with overwhelming support (414-5).

The Senate followed up with two differ ent versions, the Retirement Improvement and Savings Enhancement to Supplement Health Investments for the Nest Egg Act (RISE & SHINE Act) and the Enhancing American Retirement Now Act (EARN Act), which together will form the Senate’s Secure Act 2.0 package.

While the House and Senate versions differ in the details, both would expand retirement savings for workers. For older workers, the plans would accelerate catchup contributions to retirement plans.

Currently, those over 50 years old can contribute an extra $6,500 annual ly. Both bills would increase that limit to $10,000 beginning in 2024, with the House bill applying the new limit only to those who are ages 62, 63 or 64, while the Senate version would be for ages 60, 61, 62 or 63.

Additionally, both would require that any catch-up contributions for those over age 50 be made as Roth contributions and would allow employees to have employer matching contributions made as Roth contributions.

For IRA catch-up contributions, cur rently at $1,000, both bills would index the limit to inflation, though the start date is different for each.

When it comes to taking money out of a pretax retirement plan, both versions would delay the first required minimum distribution year to age 75, though the House bill phases in the change, while the Senate bill goes directly to 75.

The expectation is some form of SECURE 2.0 will be sent to Biden by the end of the year, much as the original SECURE Act was passed in late 2019 and signed by Trump. SECURE 2.0 will provide some options for Americans to work lon ger, if they can, and make greater contribu tions to their retirement, Silbernagel said.

“That’s something we as advisors really need to be talking to clients about,” he said. “I think one mistake a lot of advisors that are asset gatherers make is they see those 401(k)s and rollover opportunities, and they want clients to retire so they can cap ture that money.

“But I think you serve your clients much better by making sure they’re in a good po sition and having a little patience because there’ll be more of the retirement accounts to roll over if we do a good job of counsel ing our clients.”

InsuranceNewsNet

Senior Editor John Hilton has covered business and oth er beats in more than 20 years of daily journalism. John may be reached at john. hilton@innfeedback.com. Follow him on Twitter @INNJohnH.

We’ve surveyed the industry to find ONE Individual, Carrier, IMO/ BGA, Technology or Product that is disrupting the status quo and shaping the future of the insurance industry.

Premium financing: Still a viable option in today’s rising interest rate environment with Todd Petit, Jeremy Conover, and Austin Bichler of Allianz Life Insurance Company of North America PAGE 18

How Allianz maintains 2,000 premium finance policies, demonstrating outstanding persistency while continuing to bring in new, high-quality premium finance business — even in a volatile market environment.

Allianz Life Insurance Company of North America (Allianz) continues to be one of the leaders in pre mium financing, with a stringent vetting process and a team approach to this advanced markets solution for high net worth clients.

While rising interest rate headwinds and volatile markets have some asking whether premium finance is still a good idea today, ask Advanced Markets or Product Development at Allianz and you will learn that for specific situations, premi um finance is viable.

Allianz believes it’s important to fully understand the ins and outs of premium financing in order to make an informed decision about whether the time is right and whether you have the right candidate for this type of transaction.

Allianz’s diligent assessment and al lowance of premium finance cases has enabled them to facilitate many success ful transactions over the years.

“While there is an abundance of op portunity in premium finance, there are only certain scenarios that make the cut at Allianz,” says Todd Petit, Head of Advanced Markets, Allianz.

“Prior to any conversation about premium finance, the first step is to establish the need for life insurance. Sec ond is to determine how the client will pay for that needed life insurance. If the client has a better use of their assets or income, such as retaining those funds in their investments or perhaps their business, then a discussion can be had as to whether borrowing money from a third-party institution is an option,” says Jeremy Conover, Director of the Advanced Markets team that exclusively handles premium financing for Allianz.

The typical candidate for traditional premium financing programs is a high net worth client. In an emerging market, hybrid premium financing life insurance is purchased for the death benefit as well as the cash value, which can be used to supplement retirement income through policy loans and withdrawals.1

In both designs, the candidates should be people who un derstand and appreciate the potential advantages/risks of us ing leverage.

“To give a hypothetical example, imagine you have a real es tate client who needs $10 million of life insurance for estate planning strategies. This coverage will require $250,000 per year in life insurance premiums, which the client is willing to pay using funds they have accumulated in a brokerage ac count. You discover the client has $4 million in that brokerage account and it has been earning 10%. As the agent, you let the client know that one way they could pay the $250,000 in life insurance premiums is with money from that brokerage ac count. However, instead of forfeiting the 10% earnings on that money, they could borrow it from a third party — where they may pay less than 10% in interest while keeping that $250,000 in their brokerage account working for them,” says Conover.

“Clients who are typically interested in utilizing premium financing want to retain their capital,” Conover adds. “Rath er than pay large life insurance premiums, they find it more attractive to borrow the funds from a bank and pay the loan interest, which is typically less than life insurance premiums. They may also be interested in premium financing if they are purchasing life insurance for estate planning purposes where the individual is running up against gift tax limitations.”

Premium financing is a complicated transaction with multiple parties involved: insured, owner (if different), agent, vendor, bank and insurer. Without the right partners, things can easily go awry.

“A key role in a premium finance transaction is the premi um finance vendor tasked with ensuring the loan and pol icy performance are both monitored and that communica tion flows between all parties so the program stays on track. Taking action to make changes within the policy is also an important component of ongoing management of a premium finance policy. From refinancing or paying off the bank loan, to changing policy features or allocations, making changes when needed will help ensure the client’s objectives are still being met. Allianz has a strict vetting process for vendors and requires any agent we work with to have an approved premium finance vendor involved. This helps ensure client satisfaction over what is typically a 30-plus-year transaction,” says Petit.

“Because Allianz is willing to sacrifice top-line growth for quality premium finance cases, we’ve been able to yield

strong results and policies, upholding a 98% renewal rate on premium-financed policies,”2 says Petit.

“Whether a premium finance case works out well is often dependent on how it’s positioned from the start,” says Austin Bichler, Head of Life Insurance Product Development. “Alli anz takes a strong stance in opposition to the way premium finance is sometimes sold — as ‘free insurance’ or a ‘more affordable option.’ Problems also arise when realistic expectations aren’t communicated from the beginning, or risks are not explained properly.”

Premium finance is a long-term transaction, so if not monitored fre quently, it can lead to complaints.

This ongoing management of premi um finance transactions is paramount, as many factors can change as time goes on, such as loan expenses, interest rates, policy performance, loan qualification, loan exit plans and more — any of which has the potential to cause problems if not monitored and reacted to.

Petit says, “These issues can be avoided with alignment between the parties involved, which is why Allianz places such emphasis on selecting a vendor that meets specific cri teria: they’re committed to this business over the long term and adequately staffed to actively manage policies for the next 30+ years as well as handle the annual renewal process. Be cause vendors are making financial projections sometimes 30 years into the future, Allianz requires they make conservative projections when designing coverage in order to set realistic expectations and then evaluate risks and benefits each year.”

Allianz requires agents to not only go through their premi um finance training program before writing any business but also work with one of the carrier’s vetted premium finance vendors that administer these plans and provide the customer with stress test examples.

“The requirement of stress tests is a key Allianz differen tiator that has the life insurance policy illustrated at various crediting rates to demonstrate the variability of policy earn ings. Additionally, we require that loan interest rates in future years be modeled using rates we provide and not some arbi trary number, again to demonstrate variability of the loan inter est. The entire goal of this process is to create transparency to the customer around the items that move in their program and how variability can impact their desired results,” says Conover.

In an increasing interest rate environment, setting expecta tions is important. To give clients a complete understand ing, stress tests must be done to show what the future po tentially looks like given the economic environment, and

evaluated on a yearly basis for continued effectiveness. “It’s important to recognize that there will be times when premium finance works and times when it doesn’t,” says Con over. “There are going to be periods when clients don’t earn that 10% from our earlier example. Instead, the client might only earn 2% one year, and the loan interest could be higher than what they’re earning in that brokerage account. Howev er, reviewing these plans on an annual basis and continuing to monitor and make adjustments helps defend against poten tial pitfalls.”

“Allianz didn’t procure 2,000 premium finance policies by saying yes to every case that came through the door. The number, size and persistency of premium finance policies on the books is a testament to the agents we choose to work with, the specific requirements set forth and the vendors we’ve vet ted. We strongly believe not everyone is a candidate for pre mium finance, and the strategy is not the starting point for a conversation,” says Petit.

When one is choosing the type of insurance product that may be suitable for a premium finance strategy, there are options. The estimated breakdown by type puts IUL as the majority in most cases, whole life being used in a little more than a quar ter of cases and the remainder using universal life.

Bichler says, “Allianz focuses on accumulation IUL and takes into consideration what could be effective in a premium finance situation when creating our products. This includes the accumulation potential, the fee structure, the unique indi ces, flexibility and other benefits.”

If your clients are considering premium financing, Allianz and their approved vendors can provide support in executing these transactions. While there may be some headwinds cur rently, working with the right partner can help ensure that such headwinds will be accounted for. As Petit says, “If your house crumbles, it’s because you built a straw house. Allianz can help you build a stronger support system for your premium finance cases that can help them weather volatile market conditions.”

To learn more about how Allianz products and services can help support the premium financing conversation through volatile market conditions, visit https://bit.ly/allianzpf or for specialized support, contact Jeremy Conover at 949-351-2542.

Clients considering a premium financing strategy should consult with a financial professional to ensure they understand the potential benefits and risks as well as their tax advisor and attorney to discuss their specific situation.

1 Policy loans and withdrawals will reduce the available cash value and death benefit and may cause the policy to lapse, or affect guarantees against lapse. Withdrawals in excess of premiums paid will be subject to ordinary income tax. Additional premium payments may be required to keep the policy in force. In the event of a lapse, outstanding policy loans in excess of unrecovered cost basis will be subject to ordinary income tax. If a policy is a modified endowment contract (MEC), policy loans and withdrawals will be taxable as ordinary income to the extent there are earnings in the policy. If any of these features are exercised prior to age 59½ on a MEC, a 10% federal additional tax may be imposed. Tax laws are subject to change and you should consult a tax professional.

2 Internal Allianz statistic as of 6/2022. Number of lapses/deaths compared to number of years a policy has crossed over an anniversary. Guarantees are backed solely by the financial strength and claims-paying ability of Allianz Life Insurance Company of North America.

Products are issued by Allianz Life Insurance Company of North America, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297.

Odyssey is another name for a long, com plicated journey that often is undertaken in pursuit of a goal.

It’s the name Anna Maasel gave to the wealth management firm she founded Odyssey Private Wealth in Maumee, Ohio — as tribute to the journey she made to overcome the financial abuse that left her tens of thousands of dollars in debt. Now she wants to help her clients on their own journeys toward financial freedom and a comfortable retirement.

Her private odyssey began during a physically abusive first marriage, which led to her spending eight years fighting for custody of her children during her divorce. A few years later, she married her second husband and said she was hit with a devas tating surprise shortly after their wedding.

“Two weeks after we were married, I tried to use my credit card to buy a plane ticket. But my card was declined, and I didn’t understand why,” she recalled. “Up to that point, I had a perfect credit score, and I never really carried much of a credit card balance. And I hadn’t even used this particular card before.”

When she called her card issuer, Maasel was shocked to learn that her new credit card already had been charged up to its $10,000 limit. Checking further into the issue, she discovered charges to home im provement stores for purchases her new husband had made without her knowledge.

And the news got worse.

Maasel soon learned her new husband had charged up her other credit cards as well, and she was about $40,000 in debt.

“At the time, I was working for a school district and was making $14 an hour,” she recalled. “I knew that getting out of that kind of debt would be insurmountable.”

Maasel said she had spent years pay ing for attorneys fees and counseling fees from her abusive first marriage. This credit card debt knocked her down financially again. She and her husband filed for bankruptcy, and she hoped for a fresh start. But during the bankruptcy proceedings she discovered that their combined debt was more than $100,000 — and that she was pregnant.

But things eventually turned around. Maasel said she worked her way into a

better-paying job and her finances im proved enough that she was able to ob tain a credit card again. She was even thinking about applying for a mortgage on a new home. However, it didn’t take long for Maasel’s situation to spiral downward again.

“He did it to me again,” she said. “He took my credit card and maxed it out.” She filed for divorce.

“The fun never ends when you have this situation with fraud and abuse,” she said.

Maasel said she met with a financial advi sor at one point during her second mar riage and was interested in joining the pro fession. But it wasn’t the right time for her to do it.

“I needed to find a job that would enable me to earn a better living and to be able to better myself,” she said. “But at the time, I was the breadwinner for my family, and I didn’t want to be in a situation where I had to depend on commissions.”

Maasel met her current husband, Aaron, in 2019 and married him a year later. Aaron is the founder of Voyageur Advisory Group, also located in Maumee.

Private Wealth, which is the securities piece of our company.”

She and her husband not only blend ed their businesses, but they also have a blended family of eight children. Maasel said her family keeps her busy, but she also finds time to paddleboard and do some other fitness-related activities.

Maasel said she and her husband main ly work with retirees.

“My husband also is an attorney, and we do a lot of trust work for clients,” she said. “And when clients do their trust work, they fund their trust. That leads them to doing a lot of financial services business with us. They may choose annuities or in dexed universal life policies, or they may do some generational planning with dif ferent insurance products.”

Maasel said an average client is around 65 years old, either retired or close to re tiring. “I would say our average client has a net worth of between $1 million and $2 million. But we have clients who have a net worth of maybe only a quarter-million dollars and some who are closer to $5 mil lion in net worth.”

As her practice grows, Maasel said, she wants to serve more female clients.

“When I met my current husband and found out he was working in the financial industry, I thought it was really cool be cause I always wanted to have an oppor tunity to get into that profession and build myself in a way that I knew I was capable of,” she said.

Maasel works with Voyageur in addi tion to running Odyssey.

“I work with him on the insurance side, as I have an insurance license,” she said. “But I recently obtained my securities li cense, so I have my own business, Odyssey

busi ness a little bit more and serve more wom en in general,” she said. “Starting next year, we’re going to lean toward offering some woman-centered seminars on topics that empower them.”

to build that piece of

Maasel said one of her goals is to broad en her practice’s base to serve women of all ages — not only those who are of re tirement age.

want to give them the ability to think ahead and think about how they can plan

“We do serve some single women, and I would like

our

“I

My husband also is an attorney, and we do a lot of trust work for clients.

And when clients do their trust work, they fund their trust. That leads them to doing a lot of financial services business with us.

I can speak from a woman’s perspective. Sometimes women get intimidated by the man in the room and they look to anoth er woman for comfort. So I definitely pick up on that.”

Some female clients, she said, feel a sense of privacy around their finances.

“They don’t know who to trust. So they’re not going to divulge their finan cial information for fear of being taken advantage of.

“I do see some embarrassment and shame among women who are widowed and whose husbands always took care of the financial issues, and now they are faced with taking care of them. They feel embarrassed about their lack of knowl edge. And I see some women who are more independent and they’ve dealt with finances themselves.

“They have a little bit of reluctance to al low someone else to take over. But I would say overall that women are embarrassed and feel a lack of competence over their finances. They’re not sure what to do or who to trust.”

Maasel said she plans to offer some workshops and other events to teach wom en about their finances. “I even thought about developing an online course geared toward women so if they’re too embar rassed to come in person, they can still sit behind a computer screen and learn,” she said, “and then they might feel comfort able enough to start asking questions and having a conversation.”

for their future — whether it’s the longterm goal of retirement or how they will pay for their kids to go to college,” she said.

Maasel said her experience in overcom ing financial abuse provided her with tools that she uses to work with her clients.

“I would say empathy is the No. 1 thing that I came away with that applies to my practice,” she said.

“I think I have the strength of intuitive ness and empathy that men don’t neces sarily have,” she said.

“I’m very good at picking up on subtle, nonverbal cues. I can see when someone’s getting lost in our discussion that there’s an emotional piece they are struggling with. I’ll say to them, ‘You’re kind of quiet; tell me what you’re thinking here.’ Then

we stop the conversation and move it from being more educational and talking about how annuities work, for example, and move into, ‘Wait a second here. What are you feeling here? There’s something going on in your mind that you’re not saying out loud.’ I’m good at digging into those types of things.”

Maasel said she believes women, es pecially single women, often don’t trust themselves to make the right financial decisions.