TAKE CENTER STAGE UNDER

NOW THAT PRESIDENT DONALD TRUMP AND FELLOW REPUBLICANS CONTROL ALL LEVERS OF GOVERNMENT, THE FOCUS IS ON HIGH NET WORTH CLIENTS PAGE 12

NOW THAT PRESIDENT DONALD TRUMP AND FELLOW REPUBLICANS CONTROL ALL LEVERS OF GOVERNMENT, THE FOCUS IS ON HIGH NET WORTH CLIENTS PAGE 12

Find out how you can make 8% + 4% + 4% + 4% = MORE than 20% your clients’ retirement with a no-fee 21.5% bonus

What retirement needs are you solving for? Accumulation? Income?

See why it matters — page 17.

Scan the QR code to learn more

Designed

One equity-only index

Three straightforward triggered strategies 7, 10 and 20-year guarantee periods

Index crediting parameters guaranteed throughout the specified period

Visit lad.americannational.com for

information or to run a quote.

6 Hitting the accelerator on annuities

From her start as an intern to heading product development, Alison Reed discusses her unique career at Jackson National Life.

24 More than luck

By Susan Rupe

Kevin Tostado took a chance on making an Emmy-winning documentary about the game of Monopoly. Now he helps his clients rely on more than luck to attain financial security.

By John Hilton

High net worth clients are the clear winners of the new administration’s strategy. What advisors must know.

38 The power of ‘no’: Turning passive enrollment into active decisions By Tom Smith

30 How partnering with a CPA firm boosted my life insurance practice

By Steven J. Spector

What you should know if you think this is the right move for you.

34 Choosing the scenic route: Why diversification matters

By Lori Seaton

Diversifying within an annuity helps clients stay on course no matter what surprises the market brings their way.

How brokers can drive engagement in employee benefit decisions.

42 Retirement challenges differ regionally By Ayo Mseka

Attitudes and actions regarding retirement vary, depending on where investors live.

44 Conquering self-sabotage and shushing negative self-talk By Casey Cunningham

Ways to master your mental foundation and build mental resilience.

46 Premium financing: A two-edged sword? By Doug Bailey

Premium financing can be a valuable tool — if used correctly.

As an insurance advisor, you know the importance of true sales support that helps you grow your business and serve clients better. At Redhawk, we understand and couldn’t take this more seriously.

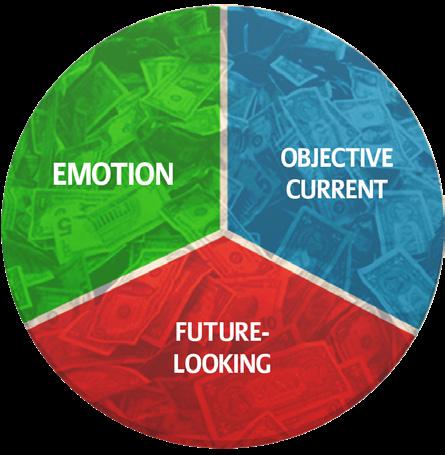

That’s why we created Risk-Guard™—a game-changing strategy designed to help you close more deals and drive better financial outcomes for mid to high-net-worth clients.

It’s a results-driven approach that focuses on three critical areas:

✔ Increase Retirement Income

✔ Reduce Investment Costs

✔ Lower Investment Risk

Thousands have already experienced the benefits of Redhawk and Risk-Guard— now it’s your turn. Elevate your client relationships and close more deals.

We don’t just offer tools and strategies—we empower you with unmatched flexibility, elite support , and exceptional value, all with no hidden fees or platform markups. We’re here to ensure you reach new heights, with a dedicated team supporting you every step of the way.

Scan the code to download your Risk-Guard™ Overview today!

In conjunction with this month’s feature on serving the high net worth market, I’ve assembled some interesting and offbeat ways to meet HNW prospects, all taken from articles published on InsuranceNewsNet.com.

I looked for suggestions that were a little different and might give you some new perspective on developing your prospect list. I’d love to hear back from our readers on unique ways you’ve met and cultivated high net worth clients. If you have an original strategy for meeting HNW prospects, please email me with your suggestion at editor@InsuranceNewsNet.com and include “HNW” in the subject line.

Here are 13 strategies.

1. Participate in luxury sports activities

Involvement in sports like golf, tennis or sailing offers informal environments to meet affluent enthusiasts.

2. Join exclusive social clubs

Becoming a member of prestigious social clubs allows you to mingle with affluent individuals in relaxed settings, fostering genuine relationships.

3. Attend high-end charity events

Participating in upscale charity galas and

fundraisers provides opportunities to network with philanthropically inclined HNW individuals.

4. Engage in art and cultural circles

Frequenting art exhibitions, museums and cultural events can connect you with patrons and collectors who value the arts.

5. Network through philanthropy

Many HNW individuals are involved in charitable activities. Participating in or supporting philanthropic events allows you to connect over shared values and causes.

6. Offer specialized services

Providing tailored solutions, such as estate planning or tax optimization, can attract HNW clients seeking expertise beyond standard financial services. Demonstrating a deep understanding of complex financial needs sets you apart.

7. Collaborate with other professionals

Building relationships with attorneys, accountants and other advisors who serve HNW clients can lead to referrals. A network of trusted professionals enhances your credibility. (Check out “How partnering with a CPA firm boosted my life

8. Volunteer for nonprofit boards

Serving on boards of reputable nonprofits aligns you with community leaders and HNW donors.

9. Engage in travel circles

Affluent individuals often have a passion for travel. Sharing experiences or participating in luxury travel clubs can create common ground.

10. Participate in high-profile organizations

Joining organizations that attract affluent individuals provides a platform to meet potential clients. These settings offer regular events and meetings, creating opportunities for meaningful interactions. Tiger21 and Young President’s Organization, for example, sometimes allow financial advisors to join as affiliate members or to participate as guest speakers.

11. Join investment clubs

Participate in clubs or groups focused on investment opportunities, which attract members interested in wealth growth.

12. Offer pro bono services to startups

Assist emerging entrepreneurs who may become affluent to build relationships early in their success journeys.

13. Participate in wine or culinary societies

Affluent individuals often appreciate fine dining and wine; joining these societies can provide networking opportunities.

John Forcucci Editor-in-chief

Correction: In last month's issue, in the article "Whatever happened to DEI?," a quote was incorrectly attributed to Vanessa Matsis-McCready, associate general counsel and vice president of HR services at Engage PEO. The quote should have been attributed to Michelle Smith-Cotto, assistant general counsel and HR consultant with Engage PEO.

The U.S. economy showed momentum in early 2025 de spite lingering uncertainty in the wake of the November elections. The Conference Board gave an optimistic out look for the economy this year but cautioned that tainty about tariffs and immigration could weigh heavily on that outlook as the year progresses.

Conference Board economists predicted strong momen tum in the economy, as consumers are willing to spend.

President Donald Trump’s tariff plan would cut the growth of U.S. gross domestic product while swelling inflation, said Yelena Shulyatyeva, senior economist. The effects of these tariffs, Shulyatyeva said, would be a drop of nearly 1 percentage point in U.S. GDP over the next four quarters, while raising inflation by 0.6 percentage point during that same period.

GDP growth is predicted to be about 1% for 2025, which could be problematic, Shulyatyeva said. At that rate, GDP growth could go into the negative range by year’s end, she noted.

In a bid to do what he says will lower property insurance costs, a California lawmaker has filed a bill to make oil and gas companies accountable for climate change-related natural disasters. Called the Affordable Insurance and Climate Recovery Act, the law, if enacted, would allow victims of natural disasters to sue fossil fuel companies for damages.

Like efforts to make weapons manufacturers liable for gun-related crimes or tobacco companies responsible for smoking-related illnesses, the bill claims that oil and gas corporations have long been aware of the environmental risks associated with their products and have misled the public about these dangers.

The increasing frequency and severity of climate disasters have sent insurance

prices skyrocketing across California and have pushed many families into the state’s insurer of last resort, the FAIR Plan. From 2018 to 2022, California had the largest number of average acres burned annually and the most residences destroyed due to wildfires of any state in the United States. The preliminary assessment of damages from the Palisades fire is more than $250 billion.

A new administration in Washington continues to add uncertainty to the broader macro environment, so this year insurers must be strategically flexible. That was the word from Conning as the research company gave its outlook for the coming year.

Insurers must remain adaptable to seize emerging opportunities, as several key trends will shape the 2025 insurance

When people think about tariffs, they typically think about goods they might get from somewhere else. Many times, we don’t think about services like car insurance.”

Matt Brannon, Insurify

landscape. Scott Hawkins, head of insurance research for Conning, listed four forces that will drive the insurance industry this year: economic growth, insurance regulation, growth of artificial intelligence and shifts in reinsurance

Insurers are focusing on efficiency for the coming year, said Alan Dobbins, Conning’s director of insurance research. Carriers are increasing automation, streamlining operations and continuing to find opportunities to reduce costs — whether through increased use of artificial intelligence or reduced staff.

Stubborn inflation and high prices are causing headaches for the average American. But those who are well off keep on spending.

Moody’s Analytics said that households earning $250,000 or more annually — about 10% of the population — account for nearly half of all spending. High earners increased their spending by 12% between 2023 and 2024.

In addition, the net worth of the top 20% of earners has risen by more than $35 trillion, or 45%, since the end of 2019, according to the Federal Reserve. Net worth grew at a similar rate for everyone else, but it translated to a lot less money — an increase of $14 trillion for the bottom 80%.

From her start as an intern to heading product development, Alison Reed discusses her unique career at Jackson National Life, and how she is helping to accelerate the future of annuities.

An interview with Paul Feldman, publisher

“Iwas finishing my last two quarters of graduate school, and I needed an internship. I applied and got an internship at Jackson.” That opportunity began a 23-year trajectory that eventually led to Alison Reed’s becoming chief operating officer of Jackson National Life Distributors — Jackson’s marketing and distribution business — and then, in December 2024, chief product development and strategy execution officer.

In her new position, Reed is leading the way for one of the industry’s top annuity sellers to develop new products, product strategy and cutting-edge technology. “At

Jackson, we fully believe in freedom of choice,” Reed said, adding, “and the product solutions are not one size fits all ... so the consumer is getting exactly what they need at that right level of cost.”

In this interview with InsuranceNewsNet Publisher Paul Feldman, Reed discusses her unique path at Jackson and what she hopes to accomplish in the future.

Paul Feldman: Congratulations on the new position as chief product development and strategy execution officer. Can you tell me a little bit more about what you plan to do in that position and what you want to accomplish?

Alison Reed: I can start by giving maybe a little background on my career progression at Jackson into this position, and then also take a little deeper dive into the position and my responsibilities. I have a unique background at Jackson, where I started in 2002 as an intern. That was 23 years ago.

I’ve grown through multiple roles into senior-level management positions and now as chief product development and strategy execution officer. Throughout my career at Jackson, I’ve generally had some level of participation in Jackson’s product portfolio. But as Jackson became an independent company in 2021, the focus on strategy has become more important and

critical to the organization.

Within this role, I oversee Jackson’s product solutions group. That includes our product strategy team. The product strategy team also covers competitive insights and intelligence of the industry and other carriers. That team also oversees the product management team, which is handling our existing product portfolio.

Within that team, they manage our existing portfolio as well as enhancements and changes to any of our existing products on the platform, both currently marketed and nonmarketed products. That team also is responsible for all product illustrations.

The other team I oversee is called distribution technology and execution. That team is responsible for all our product launches, bringing the products to market once they have been approved by Jackson’s product development working group. This team also is in charge of our distribution technology portfolio. They ensure that all the technological needs are met for our wholesalers, internal and external, and make sure we’re most efficient and effective in the field through use of technology.

Feldman: Tell me how you got into the business in the first place. This started as an internship. At the time, did you think this would become your long-term career?

Reed: Definitely not — I didn’t foresee it. Jackson is a company of growth and innovation, which excited me. I have been touching product throughout my term at Jackson. I started in more of a due diligence role for the company and their broker-dealer network, reviewing and approving products for sale by their financial advisors. And that eventually expanded into becoming the manager of the variable annuity product portfolio.

That was in 2008, which was a very interesting time in the market, going into 2009 with the financial crisis. But from there, I realized Jackson had priced the products the right way. They had a disciplined approach, and we came out on the other side of the financial crisis as a leader in the industry and the annuity industry.

Jackson has just been a great company to work for in terms of their support, the stretch opportunities that they’ve provided me, not only in product and strategy

areas but also other areas of the company, as well as support through any life changes that have occurred for me in my 23 years with the company.

I serve and participate in a Jackson mentorship program for associates. I also am a leader of the Empower Business Resource Associate group, which is a group focused on women in business and women specifically at Jackson in the growth stage of their careers. I participate in career pathing and career workshops for our associates as well. So I certainly try to give back to all the associates at Jackson based on my unique career and progression that I’ve been fortunate to have in the firm.

Feldman: It sounds like an amazing journey. What do you hope to accomplish going forward?

Reed: There are a few things that we want to focus on in the future for Jackson. One is to speed up our work with our current products and channels. We have a diversified product portfolio, and we continue to want to grow in those products. We also want to do more in our current partnerships.

Jackson primarily distributes through their traditional broker-dealer channel. However, we are expanding into the registered investment advisor channel as well. And in December 2024, we announced a partnership with Chase in which we will distribute our RILA product going forward.

Another big aspect of my role is continuing to diversify our product portfolio, as well as new relationships and other channels. With new product opportunities, we want to continue to expand into the defined contribution space and codevelop with different plan sponsors or asset managers and bring protected retirement solutions to market, whether they are inplan solutions or out-of-plan solutions.

We’re also researching the contingent deferred annuity area, which is essentially a stand-alone benefit guarantee. It’s unbundling traditional VA with living benefits and focusing on that income solution as a wrapper for more traditional investment options.

And then the final area with my role is in technology — digital transformation and making the overall experience for advisors and consumers more seamless and integrated.

Feldman: Let’s go back to the defined benefits area because we’re hearing a lot about that. Can you talk about why it’s such an important area to expand into at this point?

Reed: A couple of reasons. I think what’s really opened the door is SECURE 2.0. That certainly opened the door for broader conversations.

Jackson has a lot of great partnerships through our variable annuity products with a lot of asset managers that are interested in expanding into this space. So with their expertise and our expertise and protected retirement solutions, it makes for a natural partnership.

At the same time, we’ve also seen the number of people with pension plans — defined benefit plans — decrease significantly. There’s also uncertainty about Social Security and having that as an income stream in retirement. So being able to partner to provide some sort of guaranteed income stream in retirement for plan participants is so critical for the industry going forward. And we feel there’s a lot of opportunity, both in plan and out of plan for different rollover solutions too.

Feldman: Jackson has made a big pivot into registered index-linked annuities, which is another hot area. Could you tell me about where you hope to take that product line?

Reed: Jackson launched its first RILA product in 2021. Since then, we’ve had two successful product launches in RILA and now are offering Market Link Pro II, which is our product in the industry.

As of third quarter of 2024, we were a top 5 player in the industry, and RILA is approaching about a third of our product portfolio. So, it’s been very successful, and I attribute that to a few things. One, the uniqueness of our product offering. We have several unique features when compared to other products in the industry, including a unique crediting methodology. We also provide choice for the consumer in offering three different terms, five different index options and different crediting methods as well.

We’ve also come to market with an award-winning digital marketing tool that allows advisors to easily illustrate some of the outcomes with our RILA

product solution. When you combine that with our large distribution force and relationships in the industry, the combination of all of that has resulted in a lot of great success for Jackson and the RILA product. In addition, we launched a living benefit guarantee on our RILA product in the fall of 2024. This is an optional benefit. It can be elected after issue, which is unique to the industry. We also were able to expand our RILA offering in the state of New York. New York had some regulations that prevented many carriers from entering that state. We were able to expand, and we have seen a lot of success with our product offering in the state of New York.

Feldman: Customization and offering all these options and riders are very important now for consumers. Why are these gaining such importance?

Reed: At Jackson, we fully believe in freedom of choice. And the product solutions are not one size fits all. We offer choice — whether it’s in living benefit features, index options, fund options on our VA — and then offer that at a corresponding charge. So the consumer is getting exactly what they need at that right level of cost.

Feldman: Let’s talk about annuities and their importance in the current landscape. We have about 10,000 Americans hitting age 65 every day. People are living longer and worried about having their assets last. Add to that fluctuating interest rates and the inflation threat. Where do you see the annuity market going, and how is Jackson adapting?

Reed: The trend in the industry has been growth. It has been record growth. That’s being driven by spread product offerings with fixed indexed annuity and fixed annuity as well as RILA growth. But we also saw trends last year with monthover-month growth in traditional variable annuities as well, which I think is a positive sign given the market environment. At Jackson, we feel fortunate and excited to be a player in this growing industry environment with a lot of new and innovative solutions coming out across the marketplace. It’s really diversity and choice for the advisor and the consumer. We offer traditional variable annuities. We’ve been a

large player in that space. Our flagship product is called Perspective II. That product offers a very robust investment platform that isn’t restricted when a consumer elects a living benefit guarantee.

We feel that it’s very important to allow that growth. And to the point that consumers are feeling they’ve undersaved and are worried about retirement, we feel this variable annuity that offers access to investments that participate in the market and allows for growth is so important for that type of investor because it allows for step-ups and growth and guaranteed retirement income.

Within that product, too, we were the first to offer a living benefit guarantee, called FLEX DB, which offers both a guaranteed income solution as well as legacy protection. That’s been one of Jackson’s most popular living benefit guarantees. We believe that’s important for consumers who desire both income and legacy protection. And we also offer a unique flex net benefit that offers enhanced income and periods of market growth.

The product that we offer is an investment-only variable annuity called Elite Access. This product offers an even more robust investment platform of traditional and nontraditional investments, some of which are exclusive to Jackson. We have expanded this product into some protection options as well with an optional return of premium death benefit.

In the fall, we added a guaranteed minimum accumulation benefit, or a GMAB, called Principal Guard. That guarantees full principal protection over specified terms. With assets and volatility in the market, we believe this is a great solution for those consumers as well.

And then, of course, our RILA product too. It’s a great product for some upside potential but also offers partial downside protection through buffers and floors. It allows the consumer to participate in market upsides but also have some downside protection. And we believe it’s another good solution for advisors to discuss with their clients, based on their needs.

Feldman: I know that Jackson won some awards for its digital ecosystem. Could you talk about how important that type of functionality is and how important it is to your growth?

Reed: Providing an end-to-end advisor and consumer experience has been an important strategic initiative for Jackson. We’ve invested a lot into that advisor experience and in adding digital tools for the advisors to access. It’s been important for our existing advisors, but it’s also been an important solution for attracting new advisors to Jackson.

The tools enable them to show some quick outcomes and they can quickly follow through with an introduction to a wholesaler, et cetera. So the full complete digital ecosystem has been such an important aspect of Jackson’s strategic growth, and it will continue to be an important focus for Jackson going forward.

Feldman: Is that your major focus for increasing distribution? What are the other areas for a distribution growth?

Reed: Certainly the digital ecosystem is a focus. I would also say our initiatives to diversify into new products and new channels are also areas of focus. We believe the advisory and the RIA channel are an opportunity for growth at Jackson. At Jackson, we offer advisory versions of our variable annuity product, our investment-only product, our RILA product and our FIA product.

We also offer a specific advisory solution for the RIA channel. So that is a big area of focus of growth, as we have seen more advisors transitioning from the traditional broker-dealer channel into the dually registered and then into the RIA channel. Supporting that advisor through that transition and journey through different product options is important for Jackson.

We also want to support advisors through better integration of annuity products into wealth management platforms. Part of the digital transformation strategic initiative for Jackson has been to enable us to better integrate annuity solutions into wealth management platforms — not only the product solutions, but also how we better integrate annuities as an option into financial planning and wealth planning tools so that an advisor can illustrate to consumers easily that a portfolio with an annuity can have a better end outcome than a portfolio without an annuity. So Jackson has taken a big leadership role in working with

different fintech companies on helping to achieve those goals.

Feldman: Let’s talk about what you’re doing with mentoring women in the company. There aren’t a whole lot of women in this industry. It sounds like Jackson’s really focused on this.

Reed: Jackson offers a lot of different career opportunities based on your career paths and objectives. For me personally, my journey has been more home office focused, as it allows me to stay closer to home, have a family and have a good work-life balance.

We have many female external wholesalers who have had very successful careers within Jackson, and we try to mentor newer female associates in the organization on different career path opportunities that they may want to explore based on their goals and objectives.

I am the executive sponsor of the Empower Network, which is what we call a BRAG, which is a Business Resource Associate Group within Jackson. We have many of these based on different desires of our associates. But it’s probably one of the largest organizations at Jackson that really focuses on women and bringing women together to talk about career opportunities.

We just wrapped up our national sales meeting for all the distribution companies. We had some breakout sessions for wholesaling in terms of how certain women have made wholesaling work for their long-term career and balance that work-life family aspect as well.

Feldman: We see so much of the wealth in the country falling to women as they outlive their husbands. How are you trying to make an impact with that demographic?

Reed: We do have some female-focused marketing campaigns that we leverage with certain advisor groups that want to expand their practice into focusing more on that female consumer given some of the dynamics that you mentioned. And that’s another reason why we feel some of the products that we offer — such as the variable annuity with lifetime income guarantees and the variable annuity with lifetime income plus legacy protection

— are such important products. Women are outliving their husbands, and we are providing that comfort that they will have income for life and also some legacy protection that they can then pass it on to their beneficiaries.

Feldman: Jackson has award-winning illustration software. Illustrations have been a problem for a lot of carriers and regulators. How does the industry do a better job of illustrations?

Reed: There are two aspects to this. We’ve seen a lot of success and continuing relationships into existing advisors as well as expanding into new advisors. They can see some outcomes and what the product can do. And Jackson’s working on expanding that, not only with RILAs, but also with our whole product portfolio.

An existing advisor or a new advisor can come in and answer some questions and then determine what product path they may want to explore based on certain needs of their consumers. In terms of actual product illustrations, which Jackson offers behind our login screen, those are much more in depth and take into account much more complex scenarios, where you can illustrate withdrawals, growth, different portfolios, hypotheticals, and it’s much more robust than some of these digital tools that we’ve introduced. Because of some of the challenges we’ve seen in the industry, we’ve taken a very conservative approach to the build-out of our illustration software.

We work closely with the regulators, specifically FINRA, in obtaining approvals for all our registered and nonregistered illustrations to make sure that we’re taking a balanced approach and illustrating these products to the consumer. They are complex, and we believe the consumer must understand the different and various outcomes that could play into those illustrations.

Jackson has taken a leadership role in working with industry groups to determine how we can improve the overall illustration experience for the end consumer, because there’s a point where it gets to be too much information for that consumer to digest. And we want to make sure that we’re providing that balanced

view, but also not overstating or making things too complex so that it’s too much for them. That’s why I think digital tools that are more high level in nature have been such a success story for Jackson.

Feldman: What can we do as an industry to better educate on the importance of annuities — such as what portfolio outcomes are with annuities versus without annuities? There are some advisors who don’t necessarily believe in annuities. How can the industry address that?

Reed: I completely agree that education will be the key. I think annuities have had a stigma in the past that they’re too expensive, with high commissions, that they tend to lock up your money.

And I think the industry has changed significantly for the better in terms of flexibility of the products, lower costs of the products, providing unique features to that end consumer that traditional investments, mutual funds, exchange-traded funds, et cetera cannot provide. Yet some advisors still do have some issues with the products. I think it’s up to Jackson and the industry to help better educate through our distribution partnerships but also through our asset management partners.

Because of Jackson’s large variable annuity block of business, we have lots of very strong relationships with top asset managers in the industry, whether it’s BlackRock or T. Rowe Price or American Funds. They, along with many other asset managers, have been very supportive in helping us to try to get that message out to advisors.

More of those asset managers are releasing their own independent studies on this aspect. And I think the more information about annuities that can come from others in the industry — not just annuity companies — the more open advisors who have not offered annuities in the past will be to seeing these products as solutions.

Like this article or any other? Take advantage of our award-winning journalism, licensure and reprint options. Find out more at innreprints.com.

by John Bultema, President & CEO, Columbus Life and Lafayette Life Insurance Companies

Are you up for a challenge in 2025? And as important, do you have a choice?

Independent insurance agents face a formidable task in guiding clients to trusted carriers, ones which can be counted upon to help safeguard hard-earned legacies.

Financial strategy has grown increasingly complex amid fluctuating financial markets and erratic economic conditions. For nearly the last decade, financial markets and the global economy have marked both unprecedented highs and catastrophic lows. And in the process, economists have found their expectations repeatedly upended in either direction. The sole point where experts seem to regularly converge is that what’s coming next in terms of the economy at large is unknowable.

The insurance industry is no exception. The past decade has brought surges of new business to our industry as well as unfortunate casualties in carriers experiencing weakening levels of capital, a few even so far as to requiring rehabilitation by their departments of insurance. Newcomers to our business — those perhaps more focused on shortterm investor profits than long-term policyholder benefits — meanwhile have emerged to begin acquiring a number of carriers.

Against this backdrop, it’s more important than ever for agents to consider the financial strength and performance record of their insurance partner in order to provide clients with a greater sense of security.

Western & Southern Financial Group offers independent agents a family of companies carrying some of the industry’s strongest ratings. Together they provide a comprehensive portfolio of key life insurance products for independent agents.

Independent agents benefit from three critical life insurance product lines provided by Columbus Life, Lafayette Life, and Gerber Life, all strengthened and secured by their common heritage with Western & Southern. Drawing on a legacy dating to 1888, Western & Southern today stands as one of the strongest mutually held insurance groups in the world. Our individual brands help provide assurance bolstered by our parent organization’s phenomenal capital-to-asset ratio of 14.9%2, one that far surpasses the aver-

age of the 15 largest publicly traded life insurers doing business in the U.S. Our enterprise now serves some 6.4 million clients, policyholders and account owners and in 2023 (as 2024 numbers are still being finalized) we paid $7.4 billion in total claims, benefits and dividends.

Yet each brand stands uniquely positioned to bring independent agents advantages for their own businesses.

Columbus Life, founded in 1906, specializes in indexed universal life insurance as well as offering term life and fixed indexed annuities. We offer a portfolio of products ranging from IULs for individuals and survivorships, traditional or rapid-issue underwriting. While many carriers focus on overly optimistic projections, “Real Life” is the rule here. Columbus Life prioritizes transparency and realistic outcomes, ensuring agents don’t need to revisit policies burdened by unmet expectations.

Timeless values guide modern design at Lafayette Life. Here whole life insurance stands foremost. We offer some eight individual whole life policies and we prize an unbroken histo-

ry of paying dividends since the company’s 1905 inception.3 Lafayette Life’s portfolio also includes term life and fixed indexed annuities. Our variety of base policies and riders equip agents with a versatile toolbox for modern life, one ready to be tailored to individual needs and as necessary adapted to changing requirements. When life calls for new plans, our policies offer non-direct recognition loans for access to cash value. All life insurance products at Lafayette Life (as well as Columbus Life) automatically include our accelerated death benefit rider for eligible clients, providing competitive benefits to be used for any reason in the event of a claim. We are also home to Lafayette Life Retirement Services. It offers an experienced, responsive single shop for qualified retirement plan sales and administration, helping agents grow their business by serving other small business owners.

Finally, consider Gerber Life. Famously known for providing juvenile coverage direct to the consumer, it also offers independent agents guaranteed issue life coverage for older individuals. For more than half a century, Gerber Life has been dedicated to providing everyday families with access to life insurance coverage under one of America’s most recognizable brands. Clients and agents alike appreciate a quick, simple application with no exams or complex questions. Guaranteeing coverage for individuals aged 50 and older, it helps provide financial relief for final expenses, medical bills and outstanding debts. The confidence inspired by Gerber Life’s widely recognized identity is further enhanced by the strength of our parent enterprise, conservatively managed to better assure delivery of its more than $65 billion of life insurance in force.4

Life insurance is complicated. The products and concepts are unfamiliar to most consumers. Agents meanwhile are under enormous pressure to stay current as expert resources while managing their business as well.

Success-minded agents can streamline their business model by partnering with a carrier equipped to provide as much as possible under one roof. Recognized and respected issuers — Columbus Life, Lafayette Life and Gerber Life — each possess unique product portfolio strengths. Yet all are unified under the shared financial wherewithal and operational proficiency of Western & Southern. Moreover, other units specializing in investments, real estate and institutional markets provide enhanced diversification that in turn helps Western & Southern better weather economic downturns and ultimately serves as added ballast for its life insurance obligations. This time-proven business pro-

file should give agents confidence that they’ll never need to apologize for representing our products and their issuers.

As President and CEO of Columbus Life and Lafayette Life, I’m proud we encourage direct access for independent agents to our Home Office teams, including Underwriting, New Business and executive leadership. Together our operations function as a cohesive team with the common goal of an exceptional customer experience. Moreover, we offer shared services such as our Advanced Markets professionals to support complex planning and sales — providing complimentary resources from industry specialists for an agent’s own practice. And because each agent’s business is unique and valuable, our sales teams deliver world-class service in helping agents excel.

If you’re an independent agent yet to work with any of our solutions, then I encourage you to learn more about how we can better support your business. We understand the challenges confronting independent agents. Come work with a company with which you can build a long-term relationship, a company that provides solutions where you won’t have to explain unmet or unexpected outcomes. As time marches forward in this unknowable world, we want to provide you and your clients with as much stability as we can. Doing so helps make you more productive and better able to serve more clients. Allow us to help you soon.

Visit www.WesternSouthernBrands.com to contact Columbus Life, Gerber Life, or Lafayette Life and learn more.

1 LIMRA, U.S. Retail Individual Life Insurance Sales Reports (Annualized Premium) as of 12/31/23.

2 As of 12/31/24.

3 Dividends are not guaranteed and may be changed by the company at any time.

4 As of 12/31/23.

Life insurance products are not bank products, are not a deposit, are not insured by the FDIC, nor any other federal entity, have no bank guarantee, and may lose value.

Payment of the benefits under the contract is the obligation of, and is backed by, the product issuer. Columbus Life Insurance Company and The Lafayette Life Insurance Company are domiciled in Cincinnati, OH and operate in DC and all states except NY. Gerber Life Insurance Company is domiciled in White Plains, NY and operates in DC and all states. Gerber Life Insurance is a trademark used under license from Société des Produits Nestlé S.A. and Gerber Products Company.

NOW THAT PRESIDENT DONALD TRUMP AND FELLOW REPUBLICANS CONTROL ALL LEVERS OF GOVERNMENT, THE FOCUS IS ON HIGH NET WORTH CLIENTS

BY JOHN HILTON

Advisors in the high net worth space are doing much more than maintenance with clients in 2025. Or at least they should be.

With President Donald Trump back in power, literally everything is on the table when it comes to tax cuts, new laws, repealing laws and or favorable regulation. The Trump administration efficiency assessment of the federal government was well underway as this issue went to press.

The new administration delivered bombshell results on a near-daily basis and high net worth clients are the clear winners of the overall strategy.

With department heads and key lieutenants still being confirmed into March, much of the Trump administration

provisions temporary to limit the 10-year revenue cost of the TCJA to the amount authorized in the Congressional Budget Resolution ($1.5 trillion).

Also, lawmakers had to comply with Senate budget rules under the process used to pass the tax act and bypass the Senate filibuster, which required no increase in the federal budget deficit after the 10th year.

In short, Congress needs to act to extend the TCJA, and that creates an opening to cut taxes further.

“We must make permanent the 2017 Tax Cuts and Jobs Act and implement new pro-growth policies to reduce the tax burden on American manufacturers, service workers and seniors,” Treasury Secretary Scott Bessent told lawmakers during his confirmation hearing.

blueprint remains under wraps. The first major showdown over the federal budget came with a mid-March deadline and will impact everything to come.

What is known is that Trump and Republicans who control the House of Representatives and the Senate are all in agreement on another round of tax cuts with a likely price tag in the trillions. Trump is eager to extend and build on his signature accomplishment: The Tax Cuts and Jobs Act of 2017.

The TCJA was the most significant tax reform since the Tax Reform Act of 1986, which lowered the top tax rate for ordinary income from 50% to 28% and raised the bottom tax rate from 11% to 15%.

But unlike the 1986 tax bill, the TCJA changes were limited to a decade. Congress chose to make the individual

Extending the 2017 tax law “is the single most important issue of the day,” he added. Letting the law expire would unleash a $4 trillion tax hike that could crush the U.S. economy, Bessent maintained.

At press time, Republicans were working to advance a budget blueprint reflecting Trump’s desire to slash taxes and spending in tandem.

The plan provides for up to $4.5 trillion in tax cuts and a $4 trillion increase in the debt limit so the U.S. can continue financing its bills. The budget plan also directs a variety of House committees to cut spending by at least $1.5 trillion while stating that the goal is to reduce spending by $2 trillion over 10 years, the Associated Press reported.

We must make permanent the 2017 Tax Cuts and Jobs Act and implement new pro-growth policies to reduce the tax burden on American manufacturers, service workers and seniors.

– Treasury Secretary Scott Bessent

The tax cuts are being offset by massive potential cuts to social services, particularly Medicaid. Democrats naturally oppose tax cuts as handouts to “billionaire donors and wealthy corporations,” as House Speaker Hakeem Jeffries put it, but have few options to oppose the plan.

One important thing to watch for in the final package is whether the new round of tax cuts will be temporary or permanent.

Part and parcel with general tax cuts is the fate of the estate tax. The estate tax has long been a target of conservative lawmakers, who call it the “death tax.”

The TCJA more than doubled the maximum that families can give their beneficiaries without incurring federal gift or estate taxes. This applies to gifts made either while alive or as part of an estate.

The gift and estate tax exemption is adjusted annually for inflation and was $13.61 million for a single person in 2024. Unless Congress acts to extend the current language, the estate tax will revert to 2017 levels, or about $7 million.

As partner of Socium Advisors, Michelle Magner handles tax issues and many other financial concerns for high net worth clients. Socium is a national firm with plenty of resources, including a dedicated estate planning lawyer, to aid in financial planning.

“The tax management piece really impacts our clients in several different ways,” Magner said. “How we manage assets, how we’re planning for liquidation events, what types of strategies we can implement throughout a particular tax

year to help or alleviate the burden. But then there’s also the longer-term piece of the estate tax and the types of insurance products that can really help to minimize or mitigate that tax liability in the end.”

The insurance industry was among the biggest beneficiaries of the TCJA. The corporate tax rate reduction from 35% to 21%, a part of the act that was already made permanent, was a major benefit for insurers, as it directly boosted their aftertax profits.

Companies like Allstate, Chubb and UnitedHealth experienced higher profitability since they retain much of their earnings in taxable investments. Higher

earnings allow those insurers to return more to shareholders, but also invest in much-needed technology like artificial intelligence tools.

But interest rates are a second key part of that profitability equation. Insurers, and high net worth investors, make money when interest rates are higher.

On that issue, Trump has been stymied by Federal Reserve Chair Jerome Powell. The central bank doesn’t “need to be in a hurry” to resume its interest rate cutting campaign, Powell has said, noting officials reduced the rate significantly last year and the economy remains sturdy.

After hiking its key interest rate to a 23-year high of 5.25% to 5.5% in 2022 and 2023 to tame a pandemic-induced inflation surge, the Fed cut the rate by a full percentage point by late in 2024, citing slowing consumer price increases.

The inflation rate edged up early in 2025, which makes the interest rate hikes Trump and wealthy investors want more unlikely in the short term.

Private placement life insurance is an option that can make sense for high net worth clients in a scenario of swirling uncertainty, said Michael Ashley Schulman, partner at and chief investment officer for Running Point Capital Advisors, a multifamily office.

A PPLI policy is structured as a private contract between the insurer and the

investor. This arrangement allows the investor to “wrap” a new bespoke investment portfolio within the life insurance policy, thereby delaying taxes on income and capital gain accumulation while potentially minimizing estate tax liability at the end, Schulman explained.

PPLI investments can include opportunities not available in traditional life insurance policies, such as private credit, real estate debt, hedge funds, private equity, insurance-directed funds and publicly traded securities.

PPLI is a strong tool for advisors in estate planning for wealthy clients, more so if stepped-up basis is eliminated at the federal level, Schulman said. It offers high net worth individuals “an efficient mechanism for wealth transfer in an evolving tax environment,” he said.

Stepped-up basis is a tax rule that adjusts the value of an inherited asset to its fair market value at the time of the original owner’s death.

“By combining the tax advantages of life insurance with customized investment flexibility, PPLI provides sophisticated investors a powerful tool for long-term tax optimization while maintaining access to investment growth through policy loans, removal of basis, and other permitted features,” Schulman said.

Sen. Ron Wyden, D-Ore., is a relentless critic of PPLI. He introduced a bill in December to reclassify and tax the strategy.

A year ago, Wyden released a report calling PPLI a tax shelter for the ultra-wealthy. The report, which characterizes PPLI as a “buy, borrow, die” tax shelter, is highly critical of the uses and tax advantages afforded to the purchasers of such products that are not available to the less affluent.

With Republicans in full control of the federal government, PPLI appears safe from further regulation for the time being.

Van Carlson is the founder and chief executive officer of SRA 831(b) Admin, an Eagle, Idaho-based firm that helps high net worth clients set up micro-captive insurance arrangements.

The micro-captive concept was introduced in 1986 under Section 831(b) of the Internal Revenue Code. Similar to how the 401(k) tax code allows an employer to set aside tax-deferred dollars for

retirement, the 831(b) tax code allows a business to set aside tax-deferred dollars to cover under- or uninsured risks.

It can help a high net worth business owner eliminate a lot of risk and stress from their business, Carlson said. SRA is the largest manager of 831(b) plans in the country and began in 2008.

With the COVID-19 outbreak not long in the rearview mirror, many wealthy business owners know how quickly unexpected disruptions can arise, Carlson noted. The forced 2020 shutdown left many business owners fruitlessly appealing to their insurers for business interruption coverage.

“If you relied on PPP or ERC, or any government programs to keep your business afloat during those times, what are you doing differently about it today?” he said. “Because I don’t know if we can rely on the government next time, nor should we rely on the government next time.”

The IRS views micro-captive insurance arrangements with significant scrutiny, as some have been used for abusive tax avoidance schemes rather than legitimate risk management. That is just a reason for lawmakers to “clean it up” and make it a stronger and normal business practice, Carlson said.

The micro-captive concept is pretty simple. A business owner establishes a captive insurance company owned by the business or its affiliates. The captive provides insurance coverage for risks that may not be adequately covered by traditional insurance policies.

The operating business pays premiums to the captive, and captive insurers that collect $2.9 million or less in annual premiums (as of 2023) do not pay federal income taxes on premium income—only on investment income.

“You are retaining risk on your books, and you just don’t know it until something happens,” Carlson said. “And I think COVID-19 is a good example of that.”

InsuranceNewsNet

Senior Editor John

Hilton covered business and other beats in more than 20 years of daily journalism. John can be reached at john.hilton@innfeedback.com. Follow him on X @INNJohnH.

If you relied on PPP or ERC, or any government programs to keep your business afloat during those times, what are you doing different about it today? Because I don’t know if we can rely on the government next time, nor should we rely on the government next time.

– Van Carlson, founder and CEO of SRA 831(b) Admin

Premium finance solutions and wealth management are top of mind for affluent clients and the businesses that serve them. Read up on the latest from trusted partners and finacial leaders in our special sponsored section.

The key to retirements success — solving for the right needs by EquiTrust Life Insurance Company

PAGE 17

The most important word in annuities is TRUST by American Equity Investment Life Insurance Company

PAGE 18

The Advanced Markets Playbook: Strategies to boost your practice and drive results with Andrew Rinn of Sammons Financial Group

PAGE 20

Bridging the gap: Expanding the high net worth market by Kimberly Duke of LIDP

PAGE 22

Differentiating your high net worth service model in a democratized wealth management landscape by Jeff Wick of Cambridge Investment Research Inc.

PAGE 23

Clients in the accumulation or income phase of retirement? It matters when you’re building a smart strategy for the future.

Picture your clients — the people, not just the names. The goals and aspirations. If you were to ask 10 people what retirement means to them and if they’re ready, you’d get 10 different answers.

The truth is retirement isn’t one-size-fits-all. One client may have decades to prep and plan, while another may be just a few years away, or even on the cusp of retirement. Their goals and time horizons are poles apart, but a wellcrafted strategy is essential to helping them turn their retirement dreams into reality.

Accumulation vs. income phases

As you approach each client, are you considering where they are in their retirement journey? If you’re not identifying them by their accumulation vs. income needs, you may be missing the mark.

How do the phases line up?

Accumulation

During the accumulation phase, individuals focus on saving money for retirement while employed, allowing their funds to grow over time through contributions and market gains.

In the income phase of retirement, individuals focus on managing various income sources to maintain financial stability and pursue their goals after leaving the workforce.

Meeting your clients’ unique needs starts with recognizing their stage in the funnel. Fixed index annuities (FIAs) come in all shapes and sizes, providing solutions for any stage of retirement. The key is to work with carriers who offer FIAs specifically designed for particular retirement phases, such as accumulation-focused FIAs and incomefocused FIAs.

Accumulation-focused FIAs help clients build savings now, while they’re in the workforce and envisioning

the future. These products offer ways to accelerate earnings, like premium bonuses and/or accumulation value bonuses, higher credited rates and guaranteed accumulation value benefits.

On the other hand, income-focused FIAs offer features that prepare the client for income distributions, such as income benefit riders (IBRs). IBRs help them secure guaranteed lifetime income, and may offer other advantages such as spousal continuation and the ability to boost income withdrawals in the event of a chronic illness.

Learn more about solving for your clients’ needs based on their retirement phase with a focused product suite. Call us at 866-598-3694 or email Sales.Support@EquiTrust.com today!

Trust is the foundation of any successful relationship. Those in the financial services industry know that when individuals place their financial security in the hands of an insurance company, they seek the assurance that promises will be kept. But trust isn’t built overnight, it’s earned through consistent actions that reinforce reliability. Strengthening trust goes beyond client relationships — it includes partnering with trusted carriers that accelerate your business.

Annuities are valuable financial tools that offer opportunities for growth, protection against market risk, and dependable sources of retirement income. With a wide range of annuity options designed for different goals, they often come with various features and riders to navigate. Regardless of the specific product, clients entrust their savings into these solutions, making trust in their provider essential. Several key factors contribute to building and maintaining that trust:

• Financial Stability – Consumers need assurance that the carrier will fulfill obligations, even decades later.

• Transparency – Annuity products can appear complex, making clear and honest communication crucial in fostering confidence.

• Service & Support – The way a company interacts with policyholders can reinforce — or erode — trust over time.

• Regulatory Compliance & Ethics – A strong ethical foundation reassures policyholders that their interests come first.

Selecting the right annuity provider is about much more than product features — it’s about safeguarding your reputation for long-term success. While financial professionals recognize the importance of credibility, it’s also important to realize how much a provider’s reputation can influence various aspects of their practice. A trusted insurance carrier may offer far-reaching benefits, including:

• Increased Sales Confidence – Financial professionals may feel more confident in their recommendations when they trust the carrier’s reliability.

• Faster Sales Cycle – A strong reputation may ease objections to help shorten the sales cycle, while responsive support can contribute to faster, more confident decisions.

• Higher Client Retention – When clients trust their provider, they may be less likely to surrender policies, which can lead to more stable commissions and stronger relationships.

• Lower Compliance Risk – A reputable carrier tends to prioritize ethical practices and transparency, which can help reduce compliance challenges.

• L ong-Term Growth – Partnering with a trusted brand can enhance your credibility, helping to generate more referrals, repeat business, and sales growth.

Establishing trust in annuities requires more than just promises; it demands ethical practices, financial strength, and customer satisfaction. Recently, Newsweek recognized American Equity Investment Life Insurance Company as the #1 Most Trustworthy Company in Insurance.1

This ranking was based on an independent survey of over 70,000 participants evaluating companies across 23 industries on trust in advertising, fairness to employees, and overall reliability. Industry recognition like this underscores the importance of upholding high standards across the board.

Exceptional customer support is vital to building trust. When David Noble founded American Equity in 1995, he felt that many companies had drifted from the core principals of service and relationships. So, he built American Equity on a commitment to service and strong partnerships.

Since then, American Equity has invested heavily in its customer support infrastructure to ensure that financial professionals and contract owners receive timely, knowledgeable assistance.

To strengthen relationships, regional teams of internal and external wholesalers work closely with financial professionals to provide local support. For those requiring a higher level of assistance, a dedicated Concierge Service team delivers specialized business support, ensuring that their financial professional partners have the tailored solutions they need to succeed.

Operational efficiency is just as critical. Processing service requests quickly and issuing contracts within 24-48 hours, when in good order, are top priorities. American Equity’s streamlined processing is reflected in MyApp™, an advanced eApp system designed to eliminate errors and accelerate contract issuance. The system features a built-in pre-suitability tool called EZ Suit™.

Together, these innovations have resulted in a less than 1% NIGO rate, less than 8% suitability review rate, and a 42% faster completion time than paper applications.

Further technology investments provide 24/7 access to product information, policy details and self-service capabilities through secure customer portals. Customer feedback is continuously gathered to refine products and services — ensuring that evolving needs are met.

From its earliest days, American Equity has championed integrity as a fundamental value. Mr. Noble instilled what he called the ‘mother-in-law principle’—meaning if he couldn’t explain a product clearly enough for his mother-in-law to understand, then it wasn’t something he would sell to anyone. This core value remains in place today under the leadership of American Equity’s current CEO, Jeff Lorenzen, who worked closely with the founder and has carried forward the same commitment to transparency.

Over the past three decades, American Equity has built a reputation as a carrier that puts people first and has grown to become a leading provider of fixed index annuities. This reputation is underscored by

American Equity’s ‘A’ (Excellent) Rating from AM Best, reflecting its strong financial position and ongoing commitment to stability.2

“At American Equity, trust isn’t just a goal, it’s a foundational commitment to our partners, our customers and our employees. It’s always been the philosophy at American Equity, that people are our greatest asset, and when we value our team members that translates into strong relationships with our financial partners and a willingness to go above and beyond for our customers.”

— Jeff Lorenzen, CEO

In an industry where trust is paramount, providers with strong financial practices and high customer service standards stand out. American Equity, with its decades-long reputation and industry recognition, serves as an example of what it means to be a trusted carrier. As the industry evolves, transparency, reliability, and ethical business practices will remain the benchmarks of success

Start building a future of trust with American Equity today by visiting american-equity.com/agent-resources to learn more.

1 Source: newsweek.com/rankings/worlds-most-trustworthy-companies-2024

2 A.M. Best has assigned American Equity an “A” (Excellent) rating, reflecting their current opinion of American Equity’s financial strength and its ability to meet its ongoing contractual obligations relative to the norms of the life/health insurance industry. A.M. Best utilizes 15 rating categories ranging from A++ to F. An “A” rating from A.M. Best is its third highest rating. For the latest rating, access www.ambest.com. Rating effective 11/27/2024.

The life division at Sammons® Financial Group, comprised of Midland National and North American, has always supported policies in the advanced sales space. In 2022, after a year of record sales, a desire to offer even more to agents and their high-net-worth or business clientele led to the strategic build out of a full Advanced Markets department. When the time came to hire its leader, one name rose to the top.

For more than two decades, Andrew Rinn has been at the forefront of Advanced Markets, shaping strategies that empower financial professionals and drive industry growth. In just a few years, Andrew has built a premier team, drawing from his extensive experience to innovate and elevate how Advanced Market teams operate.

But his journey into the financial services industry was anything but conventional.

Growing up in a large family of 11 children, many of whom pursued careers in financial services, Rinn initially resisted following the same path. However, a nudge from a sibling in Human Resources led him to an Advanced Markets position that would ignite his passion for the industry. Though he didn’t secure the role immediately, his determination led him to earn multiple designations, including CLU, ChFC, and CFP, eventually landing the job. “Persistence and continuous learning have been the hallmarks of my career,” he said.

Rinn’s leadership philosophy is deeply influenced by his diverse experiences. As an athlete, he developed a competitive, achiever mindset that has carried over into his professional life. His early missteps, such as producing overly complex reports, taught him the value of simplicity. He recalls an incident where a 23-page report on Charitable Remainder Trusts was condensed into a one-pager that ultimately closed a major deal. “Simplicity is the ultimate sophistication,” Leonardo da Vinci once said, and Rinn reflects on how this lesson became a cornerstone of his approach.

In his current role, Rinn has been instrumental in transforming the Advanced Markets team into a proactive, industry-leading unit to serve financial professionals at both Midland National® Life Insurance Company and North American Company for Life and Health Insurance ®. His vision extends beyond traditional roles, emphasizing collaboration with internal and external partners. The team’s tagline, “Individual and Business Solutions Made Simple,” reflects this ethos, distilling complex strategies into five core questions that agents can easily engage with.

One of Rinn’s most significant innovations is the shift from reactive technical support to proactive partnerships. “We don’t wait for the phone to ring anymore; we’re actively partnering with financial professionals to help them grow their businesses,” he said. Initiatives like their targeted coaching programs for their internal and external sale teams equips and empowers them to provide more valuable

guidance and resources to actively support financial professionals in growing their practices. Continuous learning is a priority, with an emphasis on professional designations, industry memberships, and thought leadership activities that keep the team at the forefront of industry trends.

What truly sets Midland National and North American apart is their culture of collaboration and a “Yes, we can” mindset. As part of an employee-owner culture, everyone is invested in each company’s success, fostering a shared commitment to excellence. This culture extends to strategic partnerships that help enhance the value proposition for clients.

Clients

don’t

want

to be lec-

tured to; they want to engage in a conversation where they are equal partners. If you can simplify the complex, they’ll be a better advocate for their own financial plan, and for you as a trusted partner.

A prime example is the collaboration with Marshall & Stevens, a leading provider of business valuation services. Recognizing the limitations of a do-it-yourself approach, Rinn championed an external partnership model that adds credibility and efficiency to business transition planning. “We decided to turn that apple cart upside down by creating an external partnership approach rather than having Advanced Markets masquerade as valuation experts,” he said.

Marshall & Stevens offers independent Calculations of Value based on the IRS Fair Market Value standard, streamlining the planning and underwriting process. This partnership not only enhances the agent’s role as a trusted resource but also helps ensure clients receive high-quality, objective valuations.

Looking ahead, Rinn is focused on expanding the Midland National and North American footprint in the high-net-worth and business owner markets. Premium finance and executive benefit planning are key growth areas, supported by advanced metrics that shift from reactive to predictive marketing. By identifying trends and creating targeted strategies, the Advanced Markets team is poised to meet the evolving needs of modern clients.

Rinn’s advice for those looking to build or improve an Advanced Markets practice is straightforward: “Focus on simplicity, execution, and genuine partnerships. Metrics matter, but it’s the relationships that drive success.”

He emphasized that it’s not just about the information you deliver. It’s how you engage your clients and make them feel understood that will empower them to explore advanced strategies. “Clients don’t want to be lectured to; they want to engage in a conversation where they are equal partners. If you can simplify the complex, they’ll be a better advocate for their own financial plan, and for you as a trusted partner.”

This philosophy underscores the importance of a unified approach when working with Advanced Markets. “You’re not just working with Advanced Markets; you’re working with product, underwriting, legal—the point is, we coordinate our efforts to give a first-class experience for our financial professionals,” Rinn said. In today’s landscape, clients have more, not less, need to solve their estate, business, and executive benefit challenges. Often, these needs can only be addressed through advanced planning with life insurance, making the collaboration across teams even more critical.

At its core, Rinn’s approach reflects a belief that Advanced Markets is an indispensable partner for financial professionals seeking to elevate their practices. “Leverage the expertise and resources available through Midland National and North American. You might be pleasantly surprised at how transformative it can be,” he said.

The views and opinions expressed are Andrew Rinn’s views and opinions as an individual and do not reflect the views and opinions of

Improve your client’s financial outcomes and strengthen your competitve market position

By Kimberly Duke, CMO and SVP of Growth at LIDP

In the current financial landscape, the desire to build wealth and secure a prosperous future is a universal aspiration, especially among average wage earners who fund their financial futures with fewer resources. While high-net-worth individuals (HNWIs) enjoy the benefits of extensive investments, the working-class demographic is increasingly searching for effective pathways to enhance their financial situations and prepare for a stable retirement. One of the most promising strategies for achieving these goals is through annuities, which can be a pivotal tool in wealth accumulation and financial security.

Kimberly Duke

Annuities come in various forms: fixed, variable, indexed annuities, and hybrid, each catering to different risk tolerances and financial objectives. For average wage earners, investing in annuities is a means to safeguard against market volatility and accumulate wealth over time. This is where financial advisors and agents play a crucial role. Their expertise helps individuals understand the nuances of annuity products, guiding them in selecting options that best align with their financial objectives.

That said, the financial advisory landscape is constantly evolving, driven by changing consumer expectations and technology advancements. In today’s digital age, clients demand more than just transactional interactions; they seek personalized, insightful guidance that caters to their unique financial situations. To thrive in this environment, advisors must embrace technology and leverage it to enhance their service offerings. An effective technological ecosystem includes educational tools, sophisticated business systems for product comparisons, comprehensive customer relationship management (CRM) systems, and advanced data analytics tools. These elements collectively contribute to creating a seamless and informative experience for clients.

Interactive tools, informative videos, and online seminars can demystify annuities, clarifying how they work and their potential benefits. Advisors can use these resources

to empower clients, fostering a greater understanding of how annuities fit into their overall financial strategy. Plus, with various annuity products available, advisors need robust comparison tools to help clients evaluate options effectively. Technology solutions that enable clients to visualize different scenarios, returns, and costs associated with various annuities can lead to more informed decision-making. And then once a client invests in a product, advisors need to fuel that relationship. Advanced CRM systems allow for personalized communication, providing insights into client preferences, past interactions, and financial goals. By maintaining detailed profiles of clients, advisors can tailor their recommendations, ensuring that clients receive solutions that best fit their individual needs. It takes an ecosystem of technology for success.

Data analytics can also be leveraged to enable advisors to provide more informed recommendations to their clients. Advisors can gain insights that inform their strategies by analyzing market trends, consumer behavior, and product performance. This competitive edge allows advisors to cater to changing client demands, positioning them as trusted experts in the field.

Successful advisors understand that selling annuities isn’t merely a transaction; it’s about building lasting relationships. When advisors have the proper technology and tools available to provide a strategic, education-focused approach highlighting the potential for wealth accumulation, it will appeal to the average wage earner. Helping clients to realize their dreams of becoming high-net-worth individuals, ultimately improving their clients’ lives, and solidifiying their company’s competitive market position.

For over 44 years, LIDP Consulting Services has focused on creating longterm, strategic partnerships with our clients. We bring technology and business expertise together in a single policy admin system tailored to handle the complexities of the L&A industry. Our combination of advanced business logic and modern, scalable technologies, provides an unmatched policy administration experience. To learn more go to www.lidp.com.

By Jeff Wick, Vice President, Client Solutions, Cambridge Investment Research, Inc.

Shifting demographics among both financial professionals and investors, and advancements in technology and product platforms are transforming the wealth management landscape. In our vibrant industry, the only constant is that there will always be something driving change. As financial professionals and their firms continually work to adapt in the current environment while also positioning themselves for future success, is the key to thriving in an evolving industry simply getting back to the basic strategies that have served high-net-worth (HNW) clients for decades?

Yes, there are lower barriers to entry to many of the products and services that were previously the sole domain of the wealthy, from a stronger middle-market appetite for alternatives to growing expectations among retail clients for the same holistic support and service previously reserved for multi-family offices. Financial professionals cannot be faulted for seeking out fresh ways to create and deliver exclusive client experiences to attract and retain their most lucrative client segments.

In wealth management, we’ve made “elite” services more accessible to meet the demands of the broader mass affluent client base. However, by addressing the needs of one client segment, we’ve created a void in another, leaving the question of how to deliver the exclusivity HNW clients want, while also fulfilling their fundamental wealth and asset management needs.

To a large degree, products alone will no longer satisfy the demand for elite status this group desires. Successfully serving them will require integrating products with services that are more precisely attuned to what the HNW and ultra-high-net-worth (UHNW) segments want to achieve both in the near-term and for future generations.

More Cowbell

Personalization at scale looks to be a primary benefit of AI-driven productivity enhancements. Consequently, the hyper-personalization HNW clients demand requires more: more resources, more outside-the-box creativity, and more tailored solutions that target the specific needs of individual clients and their families. Much of what used to be a value-add is now the new standard. Attracting and retaining HNW clients is both an art and a science that combines soft solutions with platforms and products to create an unparalleled service experience.

For example, at Cambridge, our Private Client Solutions offering includes outsourced, personal CFO services –a concierge-level solution that’s unique in our space. Through a partnership with Hero CFO, we provide financial professionals’ HNW clients with personal CFO services to oversee their family’s financial management, including customized support such as household bookkeeping, electronic bill payments, and budget preparation. After all, if you are a family that has $50 million, $100 million or more in assets, why wouldn’t you manage your family the same way you would your business? These clients need to know where the money is going, and how their family money is managed.

They also need to help prepare the next generation for when those assets eventually change hands. Effectively working with multiple generations within HNW and UHNW families is central to developing an enduring client relationship. The ability to respect, incorporate, and build upon different perspectives, expectations, needs, and values is crucial to successfully managing these households.

There is no one answer to attracting and retaining HNW and UHNW clients across generations. Rather, it requires a customized, fully-integrated combination of products and services that reinforce the next-level exclusivity and tailoring that these clients desire. As personalization becomes more ubiquitous, financial professionals will need to hone in on catering to the wants and needs of HNW individuals to differentiate their services from the masses.

Going back to basics and consistently delivering on fundamentals is the foundation of a value-add relationship. Access to specialized products and services that demonstrate a deep understanding of a client’s goals, as well as an end-to-end service model – one where, as their trusted financial professional, you are the first person they think to call when a life event unfolds – is the type of relationship today’s HNW client expects, and the key to maintaining these relationships for years to come. Member FINRA/SIPC

Kevin Tostado uses his skills developed as an Emmy-winning filmmaker to help clients achieve their financial dreams.

By Susan Rupe

Step into any insurance professional’s office and you’re likely to see a display of the awards they have received over the course of their career. Sales awards, industry honors, certificates from their professional associations — you can find them hanging on the walls or arranged on a shelf.

But not many professionals in the insurance business can boast of winning an Emmy Award. Kevin Tostado is perhaps the only one.

Tostado is a Financial Adviser in San Diego, Calif. offering investment advisory services through Eagle Strategies LLC, a Registered Investment Adviser and a Registered Representative offering securities through NYLIFE Securities LLC. Eagle Strategies and NYLIFE Securities are New York Life Companies. But he also is the owner of Tostie Productions, an Emmy Award-winning, high-definition production company that he founded 21 years ago. Tostie Productions’ mission is to make innovative films and videos that inspire, provoke and entertain their audience.