Demystifying IUL

Illustrations

No Ivy League degree required.

How one IUL is staying ahead of the proposed regulation curve. p.11

No Ivy League degree required.

How one IUL is staying ahead of the proposed regulation curve. p.11

As your clients work hard to prepare for their financial future and build the life they want, you can help them fuel their possibilities faster. And yours, too.

Introducing the Transamerica Financial Choice IUL SM , designed to help make more possible.

LIVE PROSPEROUSLY

More accumulation potential means more opportunity

LIVE BROADLY

Industry-leading foreign national program to grow your client base

LIVE CONFIDENTLY

Leverage strategic sales support and business-building expertise

With the tax-advantaged Transamerica Financial Choice IUL SM , the tools to expand your business are at hand.

A rising tide

By Susan Rupe Industry professionalshelp lift others in their communities by helping them improve their financial literacy skills.

18 Protecting the castle

By Susan Rupe Brian Cardenwants to help his clients build a castle of wealth and then create a moat to protect it.

LIFE

24 Ask the right questions, find the right coverage

By Howard SharfmanHow to get all the information you need to provide clients with the best solution.

6 Volunteering for success

Jeff Chernoff, NAIFA’s Young Advisor Team Leader of the Year for 2022, found success through his passion for giving back. In this interview with Publisher Paul Feldman, Chernoff describes how his community involvement helped grow his business.

28 Does pessimism really suppress annuity sales?

By Steven A. Morelli

By Steven A. Morelli

A negative outlook regarding life expectancy may be correlated with other factors that impact the decision to buy annuities.

INSURANCE & FINANCIAL MEDIA NE TWORK

PUBLISHER Paul Feldman

EDITOR-IN-CHIEF John Forcucci

MANAGING EDITOR Susan Rupe

SENIOR EDITOR John Hilton

VP, SALES & MARKETING Susan Chieca

31 Keeping five generations of workers happy with their benefits

By John ThorntonToday’s multigenerational workforce demands a fresh look at benefits.

36

Helping clients navigate difficult estate-planning conversations

By Ben BeshearWhen an advisor holds a client accountable, it helps ensure their legacy will be carried out smoothly.

38 The how and when of texting clients

By Tom SheahanStay compliant while communicating with clients.

40 States maintain iron grip on insurance regulation

By John HiltonThe issues surrounding state insurance commissioners and the differences between elected and appointed systems.

INSURANCE & FINANCIAL MEDIA NETWORK

150 Corporate Center Drive • Suite 200 • Camp Hill, PA 17011 717.441.9357 www.InsuranceNewsNet.com

CREATIVE DIRECTOR Jacob Haas

GRAPHIC DESIGNER Shawn McMillion

SENIOR CONTENT STRATEGIST Lori Fogle

EMAIL & DIGITAL MARKETING SPECIALIST Megan Kofmehl TRAFFIC COORDINATOR Sorayah Talarek

MEDIA OPERATIONS DIRECTOR Ashley McHugh

NATIONAL SALES DIRECTOR Sarah Allewelt

NATIONAL ACCOUNT DIRECTOR Brian Henderson

NATIONAL ACCOUNT DIRECTOR Tobi Schneier

DATABASE ADMINISTRATOR Sapana Shah

STAFF ACCOUNTANT Katie Turner

Copyright 2023 Insurance & Financial Media Network. All rights reserved. Reproduction or use without permission of editorial or graphic content in any manner is strictly prohibited. How to Reach Us: You may e-mail editor@insurancenewsnet.com, send your letter to 150 Corporate Center Drive, Suite 200, Camp Hill, PA 17011, fax 866.381.8630 or call 717.441.9357. Reprints: Copyright permission can be obtained through InsuranceNewsNet at 717.441.9357, Ext. 125, or reprints@insurancenewsnet.com. Editorial Inquiries: You may e-mail editor@insurancenewsnet.com or call 717.441.9357, ext. 117. Advertising Inquiries: To access InsuranceNewsNet Magazine’s online media kit, go to www.innmediakit.comor call 717.441.9357, Ext. 125, for a sales representative. Postmaster: Send address changes to InsuranceNewsNet Magazine, 150 Corporate Center Drive, Suite 200, Camp Hill, PA 17011. Please allow four weeks for completion of changes. Legal Disclaimer: This publication contains general financial information. It should not be relied upon as a substitute for professional financial or legal advice. We make every effort to offer accurate information, but errors may occur due to the nature of the subject matter and our interpretation of any laws and regulations involved. We provide this information as is, without warranties of any kind, either express or implied. InsuranceNewsNet shall not be liable regardless of the cause or duration for any errors, inaccuracies, omissions or other defects in, or untimeliness or inauthenticity of, the information published herein. Address Corrections: Update your address at insurancenewsnetmagazine.com

According to the most recent available Federal Reserve SCF data, the average retirement savings for Americans who are between the ages of 65 and 69 is $206,819. The highest average was among those 55-59 years old at $223,493. According to the Government Accountability Office, however, only about half of households age 55 or older have any retirement savings. About a third have no defined benefit plan or retirement savings, and about 20% have a defined benefit plan but no retirement savings. The remaining 52% have some retirement savings.

Those numbers are alarming.

There are some signs of hope, however. A recent BlackRock study found that Generation Z workers, ages 18-25, are saving an average of 14% of their income. So one might assume that financial literacy is improving among the younger generations. Among the older generations — millennials, Generation X and baby boomers — the average is 12%.

However, with nearly half the population having little or no retirement savings, there is definitely a shortfall when it comes to financial literacy.

A savvy advisor I recently had a conversation with suggested that financial literacy education should start in middle school. My wife, Lisa, is a middle school engineering teacher. If we’re teaching engineering in middle school, why not financial literacy? The advisor went on to say that in terms of retirement planning, even people who work in other aspects of the financial industry are not educated in what is needed to plan for their financial future and retirement. It’s a different set of skills.

About one-fourth of non-retirees have no retirement savings at all, according to the Federal Reserve. And only about one-third of non-retirees believe their saving plan is on track. And the breakdown by race/ethnicity shows an even greater disparity.

While 42% of white people believe their retirement savings is on track, that

percentage drops to 23% for Blacks and 22% for Hispanics. And while 80% of whites have at least some retirement savings, that percentage drops to 63% for Blacks and 58% for Hispanics. (See chart.) So there is

of advice that the public needs in order to become financially literate.

also a disparity in financial literacy across racial and ethnic groups, and, in fact, a more intense need for financial literacy.

While it’s alarming that only 40% of those ages 45-59 believe their retirement savings are on track, according to the Federal Reserve, it’s also alarming that only 34% of those ages 30-44 believe they are on track. As we know, the earlier people start saving for retirement, the greater chance they have at meeting their retirement savings goals.

Obviously, improved financial literacy is better for all: those who are managing their budgets and planning effectively for retirement, and for the financial advisor community, since improved literacy would provide a greater pool of the public seeking financial assistance.

It’s also clear that there is a large percentage of the public in the middle-aged demographic who need financial advice and help steering their retirement planning onto a better course. For them, the need is more urgent.

I noticed recently that Schwab MoneyWise has a feature on its site called “Ask Carrie.” Certified financial planner Carrie Schwab-Pomerantz offers the kind

She does so in a format that we’ve all come to recognize and be comfortable with — the advice column — and which doesn’t reek of making an overt sales pitch, but only offers sound advice. This type of approach is one of many possible methods of addressing the need for financial literacy. There is no right or wrong way, but more outreach is needed. There are many ways to connect — through advice columns or blogs on your website, a regular podcast, newsletters — maybe even offering a seminar at your local high school. Letting the public know that you are there to offer help and advice is a crucial step in helping to turn the tide and improve financial literacy.

As we strive to broaden the voices in the magazine, we are working to expand the number of professional associations providing useful information and discussion for our readers.

With this issue, we welcome the Financial Planning Association to our pages with their first article, “Pro bono financial planning benefits society and advisors,” which takes a look at how offering your time and guidance can make you a better financial planner. FPA is the leading membership organization for Certified Financial Planner professionals and those engaged in the financial planning process, and we know the association will add to the valuable discussions and provide actionable information for our readers.

Welcome to FPA!

John Forcucci Editor-in-chief

• Band 1: $5,000–99,999 • No Bonus

• Band 2: $100,000–249,999 • 10 bps Bonus3

• Band 3: $250,000+ • 25 bps Bonus3

1) For the Duration of the Interest Rate Guarantee Period as stated on the contract’s data section. Rates subject to change for new issues at any time. All interest rates are declared as annual effective rates of interest. Interest is credited to your annuity daily on a compound basis assuming a 365-day year. 2) All waivers may not be available in all states. However, any increase in the value of the annuity contract will be taxable as ordinary income, as would any withdrawals from a qualified contract. 3) For initial premiums of $100,000 or more, add 0.10% for the duration of the Interest Rate Guarantee Period as stated in the contract’s data section; add an extra 0.25% for $250k+. Form Series: MYG20. (Forms may vary by state). CA Form: MYG16(04). For Agent Use Only; Not for Distribution or Use with Consumers. Not FDIC/NCUA insured | Not a deposit | Not insured by any federal government agency | No bank/CU guarantee | May lose value

The Newsweek Logo itself is the intellectual property of Newsweek and all other rights are reserved. American National Group, LLC is the corporate parent of the American National companies, which include American National Insurance Company and its insurance affiliates. American National Insurance Company, founded in 1905 and headquartered in Galveston, Texas, is licensed to conduct business in all states except New York. In New York, business is conducted by American National Life Insurance Company of New York, Glenmont, New York. Each company is financially responsible for only the products and services it issues.

This fixed deferred annuity offers several guarantee periods to lock in a competitive accumulation interest rate for the period selected.1

Read up about fiduciary rule setbacks and why older Americans are extending their careers and have unexpected wealth.

[Editor’s note: These are some of the major stories to which we are devoting ongoing coverage on InsuranceNewsNet.com.]

Institute, 401(k) plans hold $6.3 trillion in assets as of Sept. 30, 2022, on behalf of about 60 million active participants and millions of former employees and retirees. When recipients retire and the money is “rolled” out of those plans, many advisors earn a commission.

Regulators consider that a conflict of interest and want to expand the definition of fiduciary. The fiduciary standard is based on the “five-part test” established in 1975, in which one of the prongs is whether the advisor and client are in an “ongoing relationship.” In order to satisfy that prong, the DOL claims a one-time rollover contains the expectation of future advice rendered.

The judge was not buying it.

“While an offer to provide future advice may, as the Department suggests, be the beginning of a relationship, that relationship is inherently divorced from the ERISA-governed plan,” she wrote. “Because any provision of future advice occurs at a time when the assets are no longer plan assets, it is not captured by the ‘regular basis’ analysis.”

by John HiltonThe Department of Labor is determined to extend fiduciary duty to sales of financial products paid with retirement plan dollars. A new rule is expected sometime this year.

But the DOL suffered a significant setback when a federal district court judge in Florida struck down a portion of guidance issued in 2021 that expanded the definition of a retirement plan fiduciary.

As of press deadline, the DOL had not officially appealed the decision.

The American Securities Association filed the lawsuit shortly after the DOL’s investment advice rule took effect in February 2022.

Judge Virginia M. Hernandez Covington ruled that a portion of the department’s FAQ guidance illegally widened its regulatory lane and failed to comply with the agency’s own regulations.

The ruling is the latest setback for the DOL in its bid to extend fiduciary duty to advisors who handle “rollover” planning. According to the Investment Company

Created by the Trump administration, the Investment Advice Rule has two main parts: a new prohibited transaction exemption allowing advisors to provide conflicted advice for commissions and a reinstatement of the fivepart test to determine what constitutes investment advice.

The Biden administration allowed the investment advice rule to take effect Feb. 16, 2021, while the DOL began work on a new definition of fiduciary.

Whatever the reasoning, it is clear that more older people are remaining at work or returning, with the greatest growth coming from those 55 and older. In 2000, only 19% of those between 65 and 74 were working, a percentage expected to grow to 32% by 2030.

by Steven A. MorelliMore older Americans are claiming they relish the opportunity to continue working. But do they really?

A third of people between 65 and 74 and 12% of people over 74 expect to still be working by 2030, according to a study.

More workers are expecting to extend their work lives, and they might be tricking themselves into believing that they want to do it rather than having to do it, according to findings from the survey report “Employment Extenders: A (labor) force to be reckoned with” from Voya Cares and Easterseals.

Most “employment extenders” said they want to work longer, but most of them also say they have not saved enough for retirement, with a majority having less than $500,000 in savings. The survey polled 1,062 of what the researchers called employment extenders — half 50 and older who previously retired but are currently working, the other half at least 65 and planning to work past retirement age.

Only 43% said they were working to cover current or future expenses, but nearly all (92%) older workers said they needed or wanted more money for retirement. Needing the money was No. 8 of the reasons most cited for working past retirement age. Simply being able to work was No. 1.

by Steven A. Morelli

by Steven A. Morelli

Are older Americans holding more wealth than generally thought? If the Census Bureau data is correct, it’s true.

The Census Bureau found that the population overall had higher income and slightly less poverty than previously thought, thanks to a new analysis project, the National Experimental Wellbeing Statistics, or NEWS. The bureau is correcting survey data for a more accurate measure by linking the survey, the decennial census and commercial data to remove errors and bias in income and poverty estimates.

The project found that in 2018, median household income was 6.3% higher than in survey estimates, and poverty was 1.1 percentage points lower.

But older Americans were faring far better. For those 65 and older, household

income was 27.5% higher and poverty was 3.3% lower.

The previous estimates were spot on for those under 65, with median household income showing a slight difference of -0.1% in the corrected data. But for the 65-and-older group, household income was $55,610 versus $43,700, a 27.3% difference.

The next age group down fared better as well. For those 55-64, the correction showed $72,430 versus $68,950, a 5% difference. The change below that was statistically insignificant.

Older people were less impoverished as well. For all ages overall, the poverty rate

“Of no surprise, this lack of confidence correlates to the amount Employment Extenders have in retirement savings,” according to the report. “As many as 60% say they have less than $500,000 in savings, including all investments, savings accounts, pension plan/defined benefit plans, employer-sponsored retirement plans (e.g., 401(k), 403(b), 457) and IRAs or Roth IRAs. And three-in-10 admit to less than $100,000 in savings.”

Perhaps the most concerning theme in the survey results was how few are preparing for the likely financial or physical challenges ahead of them.

Read the full story online: bit.ly/oldwork23

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents association. Steve can be reached at stevenamorelli@gmail.com.

was 1.1% lower. That might not sound like much, but it represents a 9.4% decrease in the number of people in poverty. For people over 64, poverty was much lower, with a 3.3% decrease in the poverty rate, representing a 34.1% drop in the number of people in poverty.

There was no decline for Black people, people with disabilities, children, those with some college education, and Midwest and rural residents.

The rich were even richer than estimated in the share of income, but only at the very top, which by now seems familiar for the modern American economy. The top 5% fared better, but the groups directly below did not see a similar lift.

Read the full story online: bit.ly/olderwealth23

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents association. Steve can be reached at stevenamorelli@gmail.com.

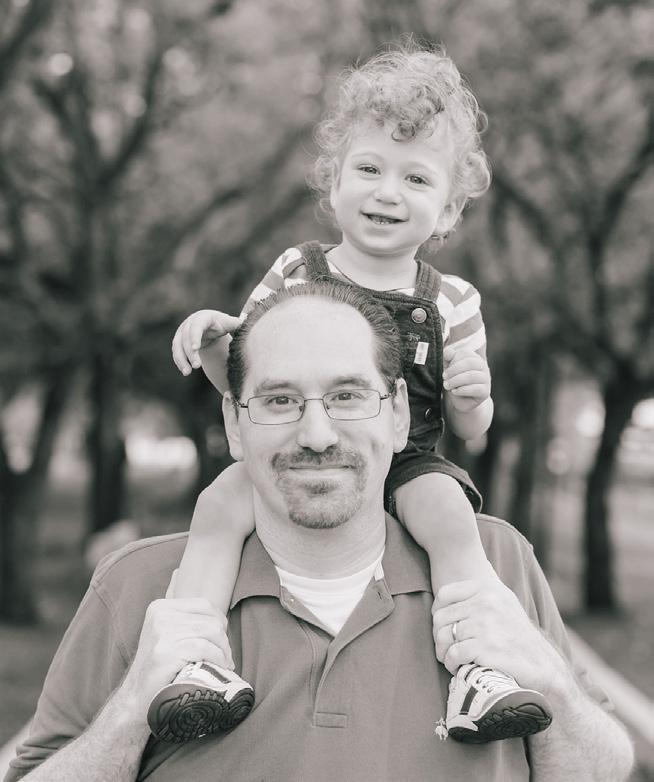

Third-generation financial advisor and member of National Association of Insurance and Financial Advisors Jeff Chernoff says he owes his success to his family roots in the business, what he has learned through being an association member, and his passion for giving back through his volunteerism and mentorship.

In recognition of his work, Chernoff was named NAIFA’s Young Advisor Team Leader of the Year for 2022. Vice president of his family’s Tampa-based Insurance and Trust, Chernoff is also president-elect of NAIFA-Florida and is past president of NAIFA-Tampa Bay. He has mentored dozens of young professionals in recent years.

Chernoff’s leadership activities, however, extend beyond NAIFA. He serves on the board of the Tampa Bay Chamber of Commerce and is vice president of Partners in Network, which links professionals in order to facilitate referral-based business growth. He also serves on cultural boards, such as the board of the Stageworks Theatre in Tampa. This volunteerism not only provides a way to give back, but it also provides an opportunity to build his professional network.

Chernoff credits NAIFA for helping him make the transition into the insurance business from his earlier career in higher education, and he credits association-sponsored trainings for helping set him on the path to success.

Speaking with InsuranceNewsNet publisher Paul Feldman, Chernoff describes how volunteerism inspires him and why “we’ve always done it this way” no longer holds true.

Paul Feldman: Congratulations on being the Young Advisor Team Leader of the Year. Tell me about that. What does that mean to you?

Jeff Chernoff: I was overwhelmed when I found out. I joined NAIFA in March 2011, the same month that I got licensed. Like many leaders in our association, I started off by getting involved in what was then called a local association, now a chapter. Through the chapter, there were opportunities for state involvement. I kept showing up and kept asking, “How

can I help?” For me, it felt like a true recognition of all the efforts that I’ve been doing for the past 12 years.

Feldman: You’ve been actively involved. What are some of the lessons you’ve learned from your fellow advisors and the people you’ve been mentoring?

Chernoff: Don’t be afraid to put yourself out there. But if you are asking to assist, make sure that you do whatever it is that you say you’re going to do.

There are a lot of people who volunteer but never do anything, never make any sort of a positive impact. The people who do make that positive impact stand out. Which led me to leadership opportunities.

Feldman: What are some hard questions you faced or that you’ve asked as you’ve worked with the organization?

Chernoff: One of the questions that I ask a lot is: “Why are we doing this?” I don’t want to hear, “Well, we’ve always done it that way.” Just because we’ve done something the same way doesn’t mean that’s how we need to do it now. We need to come up with new ideas; we need to improve our association.

One of the things NAIFA says is, “Youth is the future. Young advisors are the future.” I’m always quick to point out, “No, we are not the future. We are the now.” I think the average NAIFA member is in their 50s — that’s not a great look for us when we are trying to attract a wider audience. We, as an association, should work to bring in younger pe ople.

Feldman: What do you think NAIFA could do or should do as an organization to inspire younger people to enter the field or become NAIFA members?

Chernoff: You would never go to a doctor who wasn’t part of the American Medical Association. You would never go to a lawyer who wasn’t part of the American Bar Association. Why would you consult someone about financial services who wasn’t part of that professional association?

NAIFA is reaching out, going to colleges and universities, and reaching out to people in risk management and finance

and encouraging them to get involved. The association will hold its diversity symposium in May for the seventh or eighth year. NAIFA recognizes they need to get younger, they need to appeal to a broader audience. But it’s like turning a battleship around. You have to go five miles in the wrong direction before you can actually turn around.

Feldman: I think a lot of people join organizations and just expect magic to happen. I truly believe associations are about getting involved. What did you learn early in your career when you got involved?

Chernoff: What I learned is that I’m not the typical young professional. I’m involved with mentoring a lot of young professionals, and the conversation that I hear over and over is, “Oh, I went to one or two meetings. I didn’t get anything out of it.” In addition to being a member

Chernoff: My grandfather worked for MetLife from 1959 to 1981 and then retired. In our family — including both sides — there’s something like 15 family members who have worked in insurance or financial services.

My father’s oldest brother, my uncle, he worked in it for a short time. My aunt worked in it on the administration side. She met her now husband, my uncle, at MetLife. We had a cousin who became a financial advisor. Ironically enough, my uncle worked in claims for Travelers for 40 years. I’ve always been around the business, but it was never something that I considered.

I remember my father started our company when I was 3 years old. He was working six days a week. He would come home for dinner and then, a lot of times, after we went to bed, he would go out for evening appointments, networking or

of the national organization, I currently serve as president of NAIFA-Florida. I’ve been speaking about the need to create micro volunteerism. We have to create opportunities for young professionals, people who are just getting into the business, and make them feel as though they have a voice. And make sure that their voice is heard.

It took me 12 years to become president of my state. That is an incredibly long time. We, as an association, must do better and must provide those impactful opportunities immediately.

Feldman: You are third generation in the business, like I am. How did that influence

whatnot. I remember on school holidays and weekends, we would come in and do things around the office, like filing. I was very much around the business. At that point, though, I never even considered going into the industry.

Then, my wife got a job at the University of South Florida in May 2010. Florida was still being impacted by the recession. If you’re looking to work in higher education and there’s not a lot of public funding available, you’re going to have difficulty getting a job.

My father said, “Look, you’re here. Come in, see what you think. No pressure.” Within three months, I got my customer service representative license and

was on the path to becoming a licensed agent. I haven’t looked back.

Feldman: You were about 30 when you got your license, so you had a little bit of a career before you got into the business.

Chernoff: Yes. My previous career was working in higher education, managing residence halls. After I came into the business, my father said, “One of the reasons I wanted to start a company is that if either one of my kids wanted to come into this business, it was available for them.” He was always willing to allow us to pursue our dreams or pursue what we felt was going to be best for us. He was just excited that I had shown any interest in it at all.

Feldman: Did your family members inspire you to join and be active in NAIFA?

Chernoff: My father definitely did. I’m assuming my grandfather was in the association; at that point in time, though, it was the National Association of Life Underwriters. When you contracted with MetLife, one of your onboarding forms was signing your NALU application. My father was the one who gave me my NAIFA application. He said, “Fill this out. You need to be a member of your professional association.” He was the one who encouraged me to make my first political action committee contribution and said, “Give $50. It won’t hurt you much, but it’ll

make all the difference in the world.” He also gave me the gift of knowing the value of advocacy.

Feldman: Tell us a little about your practice.

Chernoff: We’re a multiline agency. We specialize in working with business owners on their personal lines insurance. We also work with them on their business needs for life insurance and disability income insurance, and then we also work with them on their investments.

Our market is business owners and particularly small-business owners and their key executives. We do a lot in the group retirement space. We do financial planning.

We’re a small business. We’re made up of four agents, two of whom sell life insurance and financial investments — which is what I do — and then two of them who are strictly property and casualty. We do a lot in the third-party money

manager space and working with clients on the wealth management side.

Feldman: How do you do your marketing and sales? I know you said you do a lot of networking. I think that’s a missed opportunity for anybody who sells locally.

Chernoff: I’m involved with the Tampa Bay Chamber of Commerce. I’ve served on their board for several years. I mentor their young professionals. I’m a past chair of that program.

Actively participating is important. I tell people, “When you get involved in something, truly get involved. Don’t just show up. Don’t just pay membership dues simply to say, ‘I’m a member’ or ‘I’m doing this for a resume line.’ But rather, show up, volunteer, donate your time, donate an hour a month. If you can donate more, great.”

What often ends up happening is that the people you work with come to you and say, “Hey, I have this insurance issue or I have this financial services issue. Is this something that you might be able to help me with?” I get between 30% and 40% of my business from the Tampa Bay Chamber of Commerce.

I serve on probably four or five different committees. That’s in addition to the things I do with NAIFA. I’m currently chair of our leadership Tampa Alumni Association, which is made up of 550 members. I do quite a bit because I’m passionate. What’s interesting about my prior career is that it taught me the importance of service. It taught me the importance of giving back. When I changed careers and went into insurance, that’s what I missed. So, by volunteering my time, I found a way to be involved and to mentor and make a positive impact on my community.

Feldman: What advice would you have for a person who is new to the business? What are some of the easy first steps they can take to network and create business for themselves?

Chernoff: That’s one of the ways I benefited from joining NAIFA. I’ll tell you how I became involved with the chamber of commerce. My father told me early in my career that I was a terrible manager who didn’t know how to train people. But, he said, there are NAIFA classes you should consider taking called the LUTCF, the Life Underwriter Training Charter Fellow program.

The very first course I took was on prospecting. There was a line in the textbook that said, “You should consider joining your local chamber of commerce.” I took the book’s advice. I showed up and I said, “Hi, I want to get involved. What can I do?” It was as simple as that.

NAIFA has the professional development resources that will be needed. They’ll help you figure out the type of professional you want to be.

Feldman: One of the courses you teach is NAIFA’s Leadership in Life Institute. Tell me a little bit about that, what you got out of it and how it helped your business.

Chernoff: I went through the course in 2014. My father said, “You should get more involved with NAIFA. This is something that will serve as a door opener for you to get involved.” What LILI is meant to do is to help people grow professionally, grow personally, be a better family person and be more successful in sales. Those are the four premises. The course is designed to help challenge your way of thinking and make you a better leader. That’s what it did for me. When the opportunity came for me to moderate the course, I said, “I would love to do that. It’s something that I’m very passionate about.” As a moderator, I serve as someone to provide perspective, challenge opinions appropriately and help people taking the course grow as people and as professionals.

Feldman: How do you work with agents who are not really sure this industry is right for them? What

are some ways of keeping people engaged?

Chernoff: The reality is that, yes, the start of your career can be really tough. The first two to five years are the hardest. If you can get over that hump, eventually you build enough credibility that people start to work with you and you build a positive reputation.

If I were sitting across from someone right now who was thinking about exiting the business, the first question that I would ask them is why they got involved in the first place. Why did they choose to join this profession? Have they had the opportunity to see a death claim paid and what sort of impact that had on that family or on those loved ones? Until they’ve experienced it, they really don’t know the value of what it is that we do.

I was 10 years into my career when I paid my first death claim, and I saw the value. It’s something that has been very, very impactful.

Being part of a professional group can help even if you’ve been in the business for a while. For example, the past 10 Young Advisor Team Leaders of the Year meet on a monthly basis, almost like a study group. Even though I’ve been in the business for a long period of time, I can have a down day. We’re told “no” more often than we’re told “yes.” That can be debilitating psychologically. Last month, I was having a down day. I was really kind of disappointed about something, and those two hours in the monthly team leader meeting inspired me. It really lifted me up.

Feldman: Napoleon Hill talked about the power of a “mastermind” group, and that is a big benefit with NAIFA. Some people feel like masterminding with people in your local market is feeding their competition, but you haven’t found that to be true?

Chernoff: Absolutely without question. They must have an “abundance mentality.” For example, the Tampa Bay media market is made up of 3 million households. How many policies am I going to sell in my lifetime? It’s certainly not going to be 3 million. I don’t need to sell 3 million. I need to sell one or two a week. I think the first part of it is helping people switch from a mentality of scarcity to a

mindset of abundance.

I’m very fortunate in that most of the people I’ve interacted with, including those with NAIFA, very much have an abundance mentality. They want to help you. The evidence proves members of NAIFA make more money than those who are not in NAIFA. I think part of that has to do not only with the abundance mentality but also with the resources that NAIFA provides to those in our profession.

Feldman: What benefits can someone who has been in the business a long time get from joining NAIFA?

Chernoff: Most of our members join NAIFA for one of three reasons. No. 1, advocacy. No. 2, the ability to share ideas and to learn from other people. Our industry, for better or for worse, hasn’t changed that much in 40 or 50 years. A good sales idea from 50 years ago, a lot of times, still works today.

No. 3: People join because they want to belong to a group of like-minded professionals who want to be ethical, who want to do the right thing. I think NAIFA appeals to all of our industry in those different ways.

NAIFA is being much more intentional in terms of making sure that there are benefits of value for members.

For example, three years ago, there was an advanced planning session, a half-day workshop. At that session, I learned a defined benefit plan can contain life insurance.

As part of the defined benefit plan, the premium becomes tax deductible because the policy is held in a trust and the death benefit is tax deductible. Well, 95% of my clientele are business owners or they’re key executives.

A light bulb went on and it revolutionized my business. I spent the time necessary growing that part of our business. That’s when we started our group retirement division. All that came from what I learned from NAIFA.

And I learned the importance of how to prospect by joining your local chamber of commerce. About 30% to 40% of my business comes from that. I don’t think the average industry member knows all the things that NAIFA offers. I wouldn’t be here if it weren’t for NAIFA.

Is the U.S. in a recession? “It’s probably the top question of the day,” said Dana Peterson, chief economist at The Conference Board, at a recent webinar.

If the U.S. is in a recession, “it’s probably starting right now,” she said. She presented some data pointing to a recession starting either in the first quarter or early in the second quarter of 2023. Leading indicators have fallen well into negative territory, she said. A current reading of those indicators suggests a recession may already be here.

Recession warning signals “have been flashing red since March 2022,” Peterson said. She noted that the six-month rate of leading economic indicators fell below 4% at that time. The diffusion index has been below 50 since January 2022. These two factors suggest what Peterson described as “a shallow recession.”

If the U.S. is in recession, Peterson said, she doesn’t anticipate deterioration in the labor market. She predicted a modest increase in the unemployment rate, which would level off toward the end of 2023.

Forget the image of an older person living on cat food in retirement. Older Americans may be doing better financially than the U.S. Census thought they were, according to a new analysis the agency recently released. The Census Bureau found that the population overall had higher income and slightly less poverty than previously thought.

An analysis found that in 2018, median household income was 6.3% higher than in survey estimates, and poverty was 1.1 percentage points lower. But older Americans were faring far better. For those 65 and older, household income was 27.5% higher and poverty was 3.3% lower.

Even if seniors were doing better than expected in 2018, they had a tough time during the pandemic. Teresa Ghilarducci, an economics professor at the New School who studies retirement policy, said the skyrocketing rate of early retirement will set older Americans, especially poorer people with fewer resources, back economically.

Income tax season is winding down, and people are worried that higher inflation and interest rates will take a chomp out of their refund check. They also fear their tax refund will be smaller than usual and delayed.

This year, more people are paying down debt and are a tad anxious that the refunds are not going to have the impact that they are hoping for, according to a Bankrate survey. In fact, worry is the key term this year, with only 31% of respondents saying they were not worried about their refund.

Bankrate respondents’ worry that refunds will be down is justified. Refund amounts were down 11.3% compared with last year, according to the IRA.

In perhaps a sign of where Americans are financially, a substantial proportion of respondents to the Bankrate survey said the refund is important, with 75% saying it is at least somewhat important to their financial situation.

Wells Fargo agreed to pay $300 million in cash as part of a settlement with shareholders, addressing a federal class-action lawsuit filed in 2018. The Construction Laborers Pension Trust for Southern California led the class-action lawsuit brought on behalf of an estimated “hundreds of thousands” of investors. The settlement also involves former Wells Fargo chief executive Timothy Sloan.

The plaintiffs claimed they were damaged by the bank when they purchased or acquired Wells Fargo’s common stock during the class-action period of Nov. 3, 2016, to Aug. 3, 2017.

According to the settlement, the plaintiffs “alleged that during that period, [Wells Fargo] made materially false or misleading statements” in violation of federal securities law. Those statements “caused the price of Wells Fargo stock to trade at artificially inflated prices.”

We are adopting too high a level of risk by using all our financial capacity to fund programs we would like to have but cut taxes at the same time.

— Joseph Kasputys, CEO at Economic Ventures

U.S. payroll growth has topped estimates for 10 straight months in the longest streak in decades.

Transamerica Financial Choice IULSM launches amid new regulatory guidance for IUL products to align illustrated growth with actual yields.

Index universal life (IUL) is a popular tool for consumers to gain financial protection, growth potential through index accounts linked to major market indexes, downside protection1, and supplemental income through policy withdrawals and loans2

The first IUL product was launched by Transamerica on January 6, 1996, and the product line has continued to expand and evolve to become one of the most popular forms of permanent life insurance today. In 2021, over 30 carriers sold a combined $3.5 billion of index universal life, according to LIMRA. As more consumers have taken interest in IULs, there has been a growing need for illustrations that more clearly communicate the features, benefits, and value of the product while showing realistic projections of potential policy performance.

Regulators began to address the need for greater consumer education and uniformity in IUL illustrations across the life industry with the introduction of Actuarial Guideline 49 (AG49) in August 2015. AG49 provided guidance to carriers in determining maximum illustrated credited rates while also placing limits on policy loan leverage in illustrations.

As the industry continues to innovate in this space with new index account offerings such as volatilitycontrol funds (VCFs), many carriers illustrate these new features under very different parameters. This makes it difficult for consumers to compare one carrier’s policy to another on an “apples-to-apples” basis.

As an example, the same carrier may offer a VCF with a lower participation rate and an annual persistency credit while also offering the same VCF with no bonus and a higher participation rate as an account option. Under current AG49 regulations, the illustrated bonus on the VCF isn’t subject to maximum illustrated rate limitations and may be much larger than other index accounts such as the S&P 500® index. These differences can lead to more confusion and greater complexity among consumers trying to select the best product for them.

To bring greater transparency and consistency to the IUL market, Transamerica has taken a different approach with the launch of Transamerica Financial Choice IUL (FCIUL). FCIUL features five index accounts that are designed to give consumers greater choice and flexibility in how they choose to allocate their cash values over time. The index accounts offer exposure to small-mid cap, large cap, and global equity indexes while also giving customers the option to choose from higher cap rate options in exchange for a 1% annualized fee. Transamerica also offers an index account option featuring an uncapped participation rate strategy with an annual volatility target of 5%. The current 200% participation rate means any positive index return will receive interest at a rate that is double that amount.

FCIUL is also one of the few products in the market to offer a persistency credit3 that has no restrictions on how the policy’s cash values are allocated. This allows for consistent illustrations across all index account options, making it easier for consumers to evaluate the product on its features rather than solely on how it illustrates with a particular index account. The persistency credit, currently at 0.6%, begins the later of the policy’s 10th anniversary or attained age 60. The credit provides an additional boost to cash values that customers may access for supplemental income in the future.

The NAIC has proposed another update to AG49 that will eliminate the discrepancies in illustrated performance between benchmark indexes like the S&P 500 and non-benchmark indexes like VCFs to bring further clarity and uniformity to IUL illustrations. Transamerica’s FCIUL was built in anticipation of these upcoming regulatory changes, which will help consumers make more informed comparisons when deciding which product best suits their needs.

TPIU10IC-0322, or #TPIU1000-0322. Form numbers may vary by jurisdiction. Not available in New York.

1 Guarantees are based on the claims-paying ability of the issuing insurance company.

2 Loans, withdrawals, and death benefit accelerations will reduce the policy value and death benefit. Provided the policy is not and does not become a modified endowment contract (MEC), 1) withdrawals are tax-free to the extent that they do not exceed the policy basis (generally, premiums paid less withdrawals) and 2) policy loans are tax-free as long as the policy remains in force. If the policy is surrendered or lapses, the amount of the policy loan will be considered a distribution from the policy and will be taxable to the extent that such loan plus other distributions at that time exceed the policy basis.

3 The Persistency Credit is a non-guaranteed, discretionary credit that may or may not be paid.

2716036

Learn more at transamerica.com/FCIULToolkit

For Financial Professional Use. Not for Use With the Public. Life insurance products are issued by Transamerica Life Insurance Company, Cedar Rapids, IA. All products may not be available in all jurisdictions. Policy Form #ICC22

How advisors are boosting their communities by helping their members raise their financial literacy skills.

By Susan Rupe

By Susan Rupe

Ana Stringfellow wants to keep young people and their families from making some of the same mistakes she made when she was fresh out of high school and new to the workforce.

Stringfellow is a financial advisor with Edward Jones in St. Louis. But she was a recent high school graduate, beginning her first “real” job at Ford Motor Co., when her mother gave her some advice that puzzled her.

“She said to me, ‘Go to Labor Relations and start putting money in your 401(k).’ I said, ‘OK, well, what is a 401(k)?’ And she said, ‘Don’t worry about it; just do what I told you to do.’ She couldn’t articulate what a 401(k) is, but she knew I needed to do it.”

Stringfellow is one example of how financial professionals give of their time and knowledge to help provide people in their communities with the financial literacy knowledge they need to lift themselves to financial independence.

She speaks of her own experience as a young adult in the working world as her inspiration for helping others learn more about money.

The Ford plant where she worked for 12 years closed down, and she received what she called “a substantial buyout” in addition to the money she had in her 401(k).

“Because I had seen Warren Buffett on TV a few times, I thought I was an investment guru,” she laughed. “I invested the money, but I made every mistake imaginable. I took some of the money and put it into something I didn’t know, which turned out to be a real estate investment trust, which I now know was really stupid. And I lost a lot of money. I said, ‘If God ever puts me in a position to have that much money at one time again, I’d never make the same mistake twice.’”

She eventually became a financial advisor and set out to share her knowledge.

Stringfellow volunteers to teach financial literacy classes at St. Louis Community College and in four high schools in the city. She also is one of several financial advisors who work with the 314 Project, partnering with the Urban League to teach money management skills to students and parents.

“One financial advisor works with the students, and another financial advisor works with the adults,” she explained. “We teach them about financial literacy, and then we bring students and adults together at the end so that they can help hold one another accountable. It’s not only about giving the information to the students or giving the information to the parents — it’s giving the information to the family so they can change the trajectory of their life.”

In her sessions, she covers budgeting, paying for expenses and “the differences between wants and needs.”

“We not only discuss how you make a budget, but we also go through the budget and ask, ‘These things that you’re purchasing — is that a want or a need? Is this something you can’t live without?’” she said. “I want to make them understand that something that may be a want, maybe they can scale it back. We help them figure out how much is going out? How much are you bringing in? How can we adjust those figures so that they come closer to one another?”

She uses name-brand sneakers as a way of differentiating between wants and needs.

“I know that students feel they need them. And I know they need to cover their feet with something. But it doesn’t necessarily have to be with a $150 pair of shoes.”

Stringfellow said she covers different methods of money management, such as the avalanche method of paying off debt or the 50/20/30 rule that states 50% of your income should go toward bills, 20% should go toward discretionary spending and 30% should go into savings.

She estimates she has worked with about 25 families and 60 individuals in her financial literacy education sessions.

“I know that there are people who will have a better life trajectory for themselves or their children or even their grandchildren because of their interactions with me,” she said.

Joseph Chalom goes into his local schools — not to lecture about financial literacy but to begin a discussion aimed at empowering students to take financial control over their lives.

Chalom is president of Retirement Council Inc. in Coral Springs, Fla., and he volunteers with Invest, which describes itself as an insurance education program for future leaders.

“I’m really trying to spark engagement,” he said. “I also want the students to engage in a conversation with their parents about what they are or aren’t doing.”

Chalom said he recognizes that the high schoolers he works with “are at the age where a lot of them think that adults — especially their parents — don’t know anything.

“But when this information comes from a third party, they think, ‘Maybe my mother or father does know something.’ And maybe the student could bring something back to the home that might help empower their parents to take a second look at their own financial planning or their own legacy plan. If we don’t focus our energies toward students who are willing to soak in this information and create brighter financial futures for themselves and generations to come, we’ve got a real problem.”

Chalom said sometimes the students surprise him with their questions. He recalled a recent session in which a discussion about beneficiaries led to a lively discussion on life insurance.

“We spent several minutes talking about what a beneficiary is — a primary beneficiary, a contingent beneficiary — and I asked, ‘What if this happened?’ and we did a little bit of role-play. I said I have a million-dollar life insurance policy, and I’m making particular students the primary beneficiary, and as soon as I said ‘million-dollar,’ everyone started asking questions. Could there be more than one beneficiary? Could there be an ultimate beneficiary? Could you leave the money to charity? I was excited about the conversation because that indicated to me there was genuine interest in learning more about life insurance.”

He also discusses using credit responsibly and prioritizing needs over wants.

One issue that Chalom said he wants to impress upon the students is “that the

“If we don’t focus our energies toward students who are willing to soak in this information and create brighter financial futures for themselves and generations to come, we’ve got a real problem.”

JOSEPH CHALOM

concept of planning and goal setting is scalable. It’s transferable to everything in your life, everything from testing, preparing for a test to education planning to planning for retirement. It’s the same concept. You can’t wait to the last minute to do it. You have to plan ahead, and you have to set goals, and you have to prioritize those goals.”

Chalom said that when he was younger, “no one shared the information that I’m sharing with others.

“If they had, it would have saved me some grief. I learned this the hard way. And if people can’t take what they know and help empower others, then I think that’s pretty sad.”

Stoy Hall spends much of his volunteer time partnering with various nonprofit organizations in the Des Moines, Iowa, community to promote a greater understanding of financial issues. He said his goal is “to have an open dialogue, an open conversation from tip to tail, whatever they want to learn.

“I want to direct people and have deep conversations with people. And I find that in the majority of those conversations, no matter what I speak about, I bring up a money mindset.”

Hall is founder and CEO of Black Mammoth in West Des Moines, Iowa. He also has a weekly newsletter and a regular podcast in which he discusses having a money mindset.

“In my conversations, I ask everyone, ‘What is your relationship with money? Is it negative? Is it positive?’”

Money is tied with emotions, Hall said.

“The reason we don’t learn about money or the reason we don’t have money, all of that will stem down to some type of an emotional decision at some point, whether that’s trauma from your childhood, trauma from work, trauma from being an adult, etc.,” he said. “I have found those people who are successful have been able to turn that negative relationship with money into a positive, and that has allowed them to reach the goals that they want to achieve. It has nothing to do with a dollar figure. It has everything to do with what’s in their mind. That’s the overall theme of everything I talk

about. And then I’ll get into the nittygritties within.”

Hall said when he talks to people about financial literacy, there is one question they want him to answer.

“All people want to know is, ‘Am I good? Am I on the right path?’

“They want to understand what they’re doing with their dollar every day, and every time they get a paycheck. Is there a path and a structure to it? Or are they out here, just willy-nilly throwing money around? And then after you answer that for them, you can start to talk to them about things like 401(k)s, a Roth IRA, how to sign up for health insurance.”

Hall said the most difficult thing about discussing financial literacy is getting people to open up to an uncomfortable conversation about money. “At that point, people will break down, they’ll cry, they’ll bring out emotions and trauma that are deeply rooted. And that all has to happen before they can get into the nitty-gritty of products and details and concepts.”

He said he believes financial literacy education is crucial to helping bridge the economic divide in the U.S.

“The wealthy have the means to get that education, but they also have had something passed down to them — whether that’s knowledge or money or whatever. The first-generation wealth builders, myself included, never had that. We didn’t learn from our parents, and we got nothing from school. Then by the time we get out on our own, we think it’s too expensive to hire a planner because we don’t have any assets or we have $100,000 in student loans.”

Hall said those who need financial literacy education often find they must fight for it.

“I believe that fight isn’t about the knowledge of products or concepts. The fight is deeply rooted in their mental health. And no one really talks about that as much. But if we can help fix that issue, or at least improve it, everything else kind of opens up for itself.”

Financial literacy education isn’t limited to young people. It’s for people at every stage of their lives.

That’s the message Elvin Turner wants to convey. Turner is president of Turner Consulting in Hartford, Conn., and he is

“People will break down, they’ll cry, they’ll bring out emotions and trauma that are deeply rooted. And that all has to happen before they can get into the nitty-gritty of products and details and concepts.”

STOY HALL

the founder, president and CEO of Take Charge Total Wellness Foundation.

After four years as a pilot program of the Society of Financial Service Professionals, the Take Charge Total Wellness Foundation was launched in 2020. Its mission is to increase the financial and health literacy and well-being of multiple generations of people in minority and other underserved communities.

The foundation brings together professionals from multiple disciplines to work alongside people in their communities to improve the financial and health literacy of those who are underserved. These professionals conduct community forums as well as online discussions.

“We work in communities where people don’t typically see insurance agents, investment advisors, lawyers, accountants — they’re not really part of that network. And I go into these communities, primarily in churches, and hold financial literacy sessions on a range of topics that are important to the people who live there,” Turner said.

Turner travels about 20 times a year to places such as Philadelphia; Waterbury, Conn., and Oakland, Calif., to speak to community members as part of his work with the foundation.

The foundation has a multigenerational focus, he said. “We believe that if each family member across generations adopts sound financial and health disciplines, the fortunes of entire families can be transformed. This enhances individual and collective quality of life and profoundly impacts the family legacy.”

Turner said the foundation reaches families and individuals who are in one of four distinctive life stages.

1. Teens seeking to attend college. Turner said the program teaches teens that attending a “name” school is less important than whether the school is a good fit for the student.

2. Young adults starting jobs and buying homes. The program teaches that the pursuit of material goods, travel and work/life balance is important: but young adults also must build an inventory of skills and wisdom that’s transferable to the jobs emerging in a turbulent economy.

3. Middle-ages people and their families and individuals in the highest earning years of their lives. The program teaches them to create a financial and insurance safety net that will keep them whole through the inevitable challenges of life.

4. Senior citizens. The program teaches them about security with dignity, using accumulated resources and relationships to continue their lifestyles into their retirement years.

No matter the life stage of someone who seeks financial knowledge, people of all ages have a few challenges in common, Turner said. The first challenge is lack of trust.

“Part of what I do with these seminars is build trust between the people in these communities and people in the financial services industry,” he said. “That’s a huge barrier for many people and it’s the reason why they never will seek help. So, I focus on creating a level of trust, and I believe it’s important to treat people respectfully.”

The fear of not having enough money to be able to plan is another challenge, Turner said.

“People ask, ‘Do I have enough to start the plan?’ The answer is, ‘Yes, you do.’ You may not be one of the superrich, but you have many of the same issues that they do. So getting people to engage with you because they know they have enough to start to plan is a challenge.”

The third challenge, Turner said, is helping people answer the question, how much is enough?

“Many people don’t plan because they can never get to that number,” he said. “So they focus on accumulating, and they think, when I get enough, I’ll start planning. But it doesn’t happen.

“Our goal is to help people overcome these challenges and not be afraid to plan.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents’ association and was an award-winning newspaper reporter and editor. Contact her at Susan.Rupe@innfeedback. com. Follow her on Twitter @INNsusan.

“Part of what I do with these seminars is build trust between the people in these communities and people in the financial services industry. That’s a huge barrier for many people, and it’s the reason why they never will seek help.”

ELVIN TURNER

As you think about financial security, you may be looking for ways to grow your long-term wealth safely and with certainty. Ibexis’ fixed annuity products are complemented by fixed returns, easy-to-understand crediting strategies and flexible payout options tailored to your financial goals.

Learn more at ibexis.com

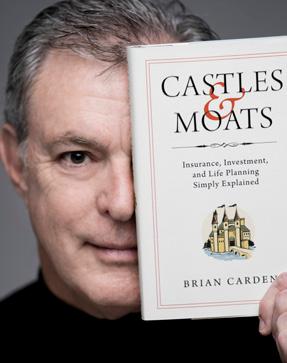

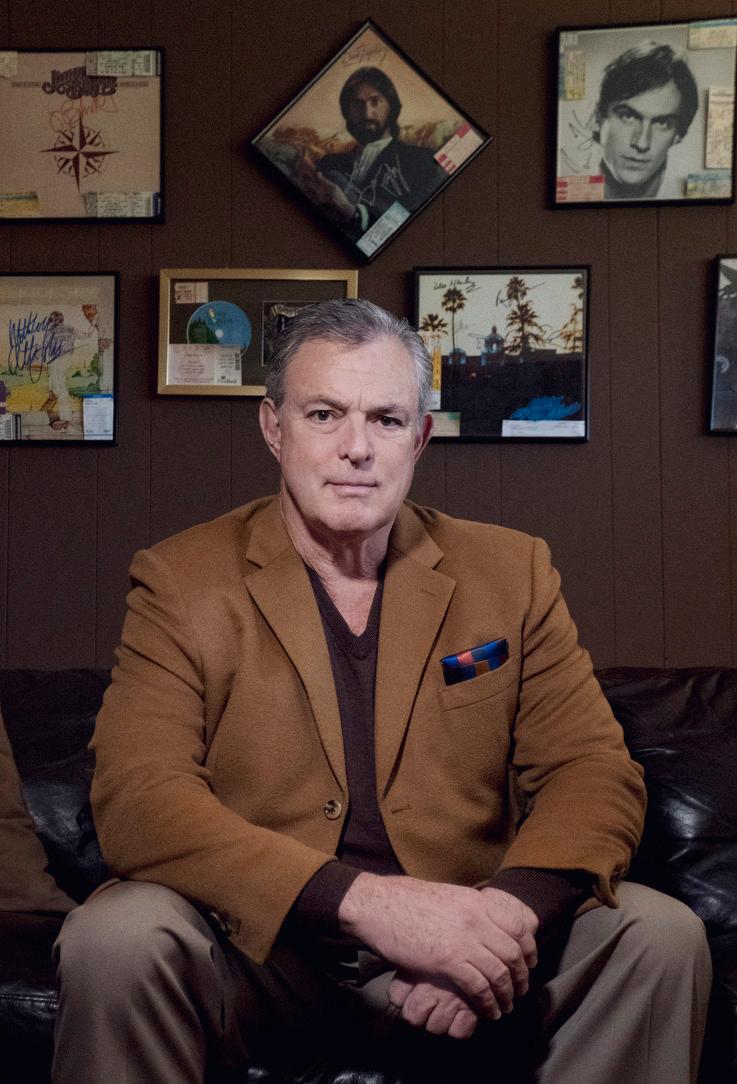

BRIAN CARDEN helps his clients guard what is most important to them.

By Susan RupeBrian Carden was fresh out of college, working in a department store, when a flyer on his apartment door set him on a completely different path.

The flyer was from a recruiter who was looking for people interested in launching an insurance career with John Alden Life. Carden contacted the recruiter and embarked on an insurance and financial services journey that has lasted 40 years.

Carden is based in Brentwood, Tenn., and is an advisor affiliated with Madison Avenue Securities. He said he views his career as a calling to serve and views himself as a “professional explainer.” He also is an avid blogger, writing about “things that make you go hmmm,” and he published a book, “Castles & Moats,” in 2022.

But his early days in the insurance business were mainly spent on the telephone. “I was making a minimum of 40 connected calls a day to insurance agents to market my one-to-15-employee small group health plan,” he recalled.

He eventually moved on to Safeco Insurance, where he learned about annuities and 401(k) plans. He moved into the retail side of the business, where he traveled throughout an eight-state territory.

“Safeco also had a huge network of property and casualty agencies,” he recalled. “I called on them and asked them who else I should talk to.”

At that time, the Internal Revenue Code Section 72(t) began allowing penalty-

“I spent nights in North Carolina in the furniture factories. I did workshops with companies like R.J. Reynolds. At that time, North Carolina was flush with big manufacturing plants that needed to get people off their staff. And they offered that early retirement program. So I was the guy from out of town who came in and led the workshop for the advisors.”

Carden eventually became tired of the road, and someone he met through his local professional association asked him whether he would consider opening his own agency. He opened a Nationwide agency in the Nashville area, and his business took off.

“I jumped at it. I was good at it. I enjoyed it. And I learned how to ask good questions,” he said.

Carden said a friend gave him some advice that stuck with him. “He said, ‘Don’t waste your time calling on people; call on people who will refer you people.’” He focused on serving people who were buying homes in his community, and he called on real estate agents, lenders and attorneys for referrals.

But after a while, Carden believed he already had done as much as he could do with his agency, so he sought another change.

A bank hired him to be a small-business 401(k) specialist, but a general agent for what was then known as Connecticut Mutual approached him about coming to work for him. It was a turning point in

mentality didn’t work at all. And I started to fail miserably.”

Carden said a friend in the agency introduced him to the Sandler Selling System, which is a seven-step consultative selling approach. The goal is to establish an open dialogue to build trust and understand the prospect’s pain points, budget and decision-making process. Then, the seller can either disqualify the buyer or guide them to the right solution.

“I dug in until I mastered it, and I still use it today,” he said. “It taught me how to conduct an interview, how to get answers, how to find out if the person I’m talking to is the decision maker, how to set expectations and how to lead people to where they say, ‘I want to work with you.’”

Opportunities can crop up in the most unlikely places, as Carden discovered when he was part of a group touring Greece on vacation. He met a woman in the group who had spent about 20 years working for some of the major securities firms in the U.S. She told Carden she dreamed of opening a boutique firm, and Carden told her he was thinking about opening his own practice.

A few months after returning to the U.S., the two reconnected and decided to move forward with their professional dreams. “She is the securities brains of the operation, and I am more on the insurance side,” he said.

The practice continues to grow, with Carden affiliating with a Medicare practice in an effort to serve another set of client needs.

Carden said the most difficult part of being independent is “motivating yourself to stay disciplined to go and see people.”

But being independent has many advantages as well.

free early withdrawals from 401(k) plans and individual retirement accounts under certain circumstances. This enabled people to retire prior to reaching age 59½ while avoiding a 10% penalty on their retirement plan withdrawals. Carden said Safeco was one of the early adopters of the 72(t) plan, and he spent much of his time explaining it to workers in large manufacturing facilities in his territory.

Carden’s career.

“When I was a wholesaler, I was the master of ‘show up and throw up,’” he recalled. “You know, ‘Here’s my product, here’s why it beats the competition. Here are the features and benefits. Here’s the commission. I’d love to work with you.’ And that was pretty much it.

“Now I am sitting down with my peers, my friends here at home, and that

“I love the fact that I am very agnostic when it comes to product. I work with a lot of BGAs and FMOs in different areas. And if I get, for example, someone who is a business owner, and he needs a large amount of life insurance for a business loan. And let’s say he has some health issues. I can pick up the phone, call my BGA and say, ‘This is who I have. What will be the best fit?’ And I let them do the due diligence, and I present their recommendation to the prospect.”

“I think it’s important that other people understand my life experiences. Because I don’t want them to go through that.”

planning for the future.

Some of his personal experiences tie into the insurance world.

When he was about a week away from his 50th birthday, he was in a head-on collision that destroyed his car but left him unhurt. “I could have been a quadriplegic,” he said. Carden said he sometimes shows photos of his wrecked car to prospects and gets them thinking about whether they have planned sufficiently in case the unexpected happens to them.

He also tells stories of the time his family was sued because of a freak backyard fireworks accident, or the time his aunt and uncle and their children were killed in a plane crash. That makes people think about possibility of liability or the importance of contingent beneficiaries.

“I think it’s important that other people understand my life experiences. Because I don’t want them to go through that,” he said.

Carden tied together his thoughts from his blog posts and other writing, along with his industry knowledge, to publish the book “Castles & Moats.” The idea for the title came from his days in property/ casualty insurance. Your home is your “castle,” and insurance is the “moat” that protects your castle.

In the same fashion, he said, someone’s wealth also can be their castle. He wants to help people “build their glimmering castle of wealth and surround it with a moat of protection.”

Carden wrote his first blog post about 20 years ago, and the subject was his father.

“Mom let him read it, and he called me and said, ‘Son, I appreciate you writing about me. But is that going to get you any business?’ That’s just the way he thought about it.”

Carden said that as he traveled to conferences or attended workshops or wholesalers meetings, he would be hit by what he called “an aha moment.”

“I thought, ‘I can spin that,’” he said. “And so that’s how the blog got started.”

He originally penned his thoughts for a local newspaper. It was in the days before Facebook and other social media became

prime means of communication.

“I would find things that appealed to me, things that I think are taught incorrectly, like the whole ‘buy term, invest the difference’ mentality. Or when you see these auto insurance ads on TV that are basically pushing price and telling you you should only buy what you need. And I’m saying, ‘No, I walked away from a head-on collision. Let me tell you what you need.’”

Carden’s favorite blog topics relate to his family and personal experiences. He writes about the people in his life, about his favorite sports teams and his favorite activities — golf being a big one. And he ties those topics to some aspect of

Carden said he not only is the book’s author, but also its “explainer.” He aims to help consumers understand, prioritize, organize, strategize and stress-test each financial product or strategy to help create a more favorable outcome.

His writing is another way for him to connect with clients, he said. “People recognize that I’m here, but I have a heart. And family is important to who I am.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents’ association and was an award-winning newspaper reporter and editor. Contact her at Susan.Rupe@innfeedback.com. Follow her on Twitter @INNsusan.

Carden says he wants to help people

“build their glimmering castle of wealth and surround it with a moat of protection.”

By offering a level of protection and growth opportunities along the way, a Shield annuity can help bring the retirement your clients have imagined within reach. All with the simplicity you’ve come to expect from Brighthouse Financial ® .

Find out how a Shield annuity can help clients reach their retirement goals – all with no annual fees.1

1 Withdrawals may be subject to withdrawal charges.

Scan the QR code to learn more.

This is not an offering of any securities for sale in New York. This communication refers to Brighthouse Shield ® Level Select 6-Year Annuity, Brighthouse Shield ® Level Select 3-Year Annuity, and Brighthouse Shield ® Level Select Advisory Annuity, collectively referred to as “Shield ® Level annuities” or “Shield ® annuities.” These products are index-linked annuities issued by, with product guarantees solely the responsibility of, Brighthouse Life Insurance Company, Charlotte, NC 28277, on Policy Form L-22494 (09/12)-AV (“Brighthouse Financial”). Shield Level annuities are distributed by Brighthouse Securities, LLC (member FINRA). All are Brighthouse Financial affi liated companies. Shield Level annuities have charges, termination provisions, and terms for keeping them in force. Please contact your fi nancial professional for complete details. Product availability and features may vary by state or fi rm. Brighthouse Financial ® and its design are registered trademarks of Brighthouse Financial, Inc. and/or its affi liates.

Shield Level annuities are registered with the SEC. Before you invest, you should read the prospectus in the registration statement and other documents Brighthouse Life Insurance Company has fi led for more complete information about the company and the product. You may obtain these documents for free by visiting EDGAR on the SEC website at www.sec.gov. You may also request a prospectus from your fi nancial professional or directly from Brighthouse Financial at (888) 243-1932 or brighthousefi nancial.com.

Consumers love indexed life, a love affair that remained strong in the fourth quarter of 2022, according to Wink’s Sales & Market Report. Total 2022 indexed life sales hit $2.7 billion, an increase of 10.9%. This was both a record-setting quarter and a record-setting year for indexed life sales, Wink reported.

Non-variable universal life sales also showed an upswing in sales in 2022, ending the year at $3.1 billion, an increase of 5.9% over the prior year.

Fixed universal life sales were another story, though, with total 2022 fixed UL sales at $425.3 million, a decline of 17.9%. Universal life had a challenging year in 2022, with Sheryl J. Moore, CEO of both Moore Market Intelligence and Wink Inc., reporting “Universal life sales are likely the lowest they have been since the product was developed nearly 45 years ago. There definitely needs to be some new innovation in the market if carriers want to revive the product line.”

Whole life sales didn’t fare well in 2022 either, with total sales for the year at $4.5 billion, a decline of 5.7%.

After the 2008-09 finan cial crisis, interest rates fell to near zero and dozens of life insurers boosted costs for longtime policyholders, seeking to improve results as their investment income fell. Now these insurers are giving partial refunds to tens of thousands of these customers to settle a wave of lawsuits spurred by the increases, The Wall Street Journal reports.

The higher charges spurred lawsuits that alleged breach of contract and other wrongdoing. Insurers say their actions were in line with policy provisions allowing increases up to specified maximums.

Approximately 43,000 refund checks totaling $69 million were issued in recent weeks to Voya Financial policyholders. Lincoln National and Genworth also reached recent settlements in lawsuits over higher insurance bills.

It’s difficult enough to bring advisors into the business; keeping them in the business is even harder.

DID

High turnover rates among those new to sales positions in the industry are an ongoing challenge. LIMRA research shows that in 2020, only 15% of financial professionals in agency systems that recruit mainly inexperienced individuals remained with their hiring companies after four years. In fact, the majority of those left within their first two years in the business.

When asked how to address this issue, field and home office leaders identified five factors that have the greatest influence:

1. Early sales activity (a fast start).

2. A strong selection process prior to hiring financial professionals.

3. Joint fieldwork.

4. Quality of sales training.

5. Mentoring.

African American insurance agents are also leaving the industry at a rapid clip, prompting calls by industry leaders to take steps to address this issue and enhance diversity, equity and inclusion among professionals serving the industry.

“The Next Steps on the Journey,” a survey report recently released by Marsh and the National African American Insurance Association, found that most participants said that lack of promotions or

advancement is the most significant barrier to retention (75%). This was followed by lack of growth opportunities (70%) and lack of mentorship (68%).

Owning life insurance is one way Black Americans can improve their sense of financial security. According to the 2022 Insurance Barometer Study, 68% of Black Americans who own life insurance feel financially secure, compared with just 47% of uninsured Black Americans.

Historically, Black Americans’ life insurance ownership rate has been above the rate for the general population. In 2022, 55% of Black Americans reported owning life insurance, which is higher than the national average (50%). Yet 48% of Black Americans — representing 21 million adults — say they need (or need more) life insurance coverage, which indicates a substantial coverage gap in the Black American community.

Despite the fact that Black Americans reported higher levels of financial concerns, LIMRA research also showed a higher intent to purchase life insurance. Sixty percent of uninsured Black Americans intended to purchase life insurance, compared with just 37% of the general population.

More than 100 million Americans said, ‘We want to buy your product; sell me life insurance.

— Joe Templin, advisor and author of Becoming an Introduction MachineBrooks Tingle was named CEO of John Hancock.

Grow your agency

• Customized targeted recruiting plan, agent recruiting leads, onsite and virtual open house recruiting events.

High-touch personal attention

• Producers enjoy direct access to underwriters and sales support teams.

Elevate your agency with customized training

• Advanced and business markets, sales concepts, case design, and support staff assistance team.

Exceptional regional team to support your agency

• Annual business planning and monitoring, onsite training, team-building events.

Full suite of products to help you stand out from the crowd

• Innovative term insurance to age 85.

• Outstanding return-of-premium products.

• Streamlined indexed universal life insurance design.

• Unique ability to add a commissionable policy enhancement that allows the policyowner to customize the way the death benefit is paid out

Stability

• Founded in 1895, a producer-focused Company with fourth generation family leadership that has great financials and no debt.

For information about a vested independent contract with Kansas City Life Insurance Company, call Tom Morgan, Vice President, Agencies, 855-277-2090, or visit join.kclife.com.

You may be surprised at what motivates people to buy life insurance coverage.

By Howard SharfmanRegardless of how well you know your clients or believe that you understand what they want, some of their comments and motivations still may surprise you. That’s why asking the right questions is critical to ensuring that you have all the information required to provide them with the best solutions.

Ultimately, information in equals information out. Many upper-level executives in many industries erroneously believe they can diagnose any problem simply sitting at their desk. The reality for insurance and financial professionals is that we all must obtain accurate information directly from the client because every person, and every set of facts, is unique.

My firm recently conducted a client survey that included the question “Why did you buy life insurance?” One of the respondents, a retired doctor with no

reasonable liabilities, stated that his key motivation was asset protection. I could have given you 20 reasons why I thought he should own a policy, and asset protection wouldn’t have been on the list. Yet that was his hot-button issue. The survey reinforced to me how crucial it is to ask clients what is most important to them — since those answers can be quite unexpected.