PAGES 20-21

How

As you think about financial security, you may be looking for ways to grow your long-term wealth safely and with certainty. Ibexis’ fixed annuity products are complemented by fixed returns, easy-to-understand crediting strategies and flexible payout options tailored to your financial goals.

Learn more at ibexis.com

Qualified Lead Generation

Proven Sales Process

Professional Support This is Simplicity.

38 Unlocking the power of FIAs in a secure retirement plan

By Jim PoolmanMore consumers are likely to consider a fixed indexed annuity once its benefits are explained to them.

42 Brokers step up to help address rising health care costs

By Kim Buckey

Employers and their workers rely more on the broker’s expertise as they attempt to rein in higher costs.

Two elite companies offer their unique perspectives on product, process and

future

By Susan Rupe

46 Estate planning in a down economy

By Sabine Franco

By Sabine Franco

Downward economic trends can negatively impact even the most carefully planned investment strategies.

48 Advisors face 4 digital challenges

By Dennis Winkler

and Yasir Andrabi

How advisors can quickly adopt change and adopt digital transformation.

50 Knocking at the door

Martha Hart and Erika Williams By John HiltonA look at the National Council of Insurance Legislators and its niche role in the regulatory system.

reserved. Reproduction or use without permission of editorial or graphic content in any manner is strictly prohibited. How to Reach Us: You may , send your letter to 150 Corporate Center Drive, Suite 200, Camp Hill, PA 17011, fax 866.381.8630 or call 717.441.9357. Reprints: Copyright permission can be obtained through reprints@insurancenewsnet.com. Editorial Inquiries: You may e-mail editor@insurancenewsnet.com or call 717.441.9357, ext. 117. Advertising Inquiries: To access www.innmediakit.comor call 717.441.9357, Ext. 125, for a sales representative. Postmaster: Send address changes to InsuranceNewsNet Magazine, 150 Corporate Center Drive, Suite 200, Camp Hill, PA 17011. Please allow four weeks for completion of changes. Legal Disclaimer: This publication contains general financial information. It should not be relied upon as a substitute for professional financial or legal advice. We make every effort to offer accurate information, but errors may occur due to the nature of the subject matter and our interpretation of any laws and regulations involved. We provide this information as is, without warranties of any kind, either express or implied. InsuranceNewsNet shall not be liable regardless of the cause or duration for any errors, inaccuracies, omissions or other defects in, or untimeliness or inauthenticity of, the information published herein. Address Corrections: Update your address at insurancenewsnetmagazine.com

2023

s the insurance industry continues to evolve, it’s becoming increasingly important for agents and professionals to stay competitive. With new technology, changing customer needs and evolving marketing strategies, the industry is constantly in flux. As we enter the summer months, the time is right to review some strategies that agents and other insurance professionals can use to stay ahead of the game and succeed in a changing market.

In today’s digital age, it’s essential for insurance agents to embrace technology in order to stay competitive. By leveraging technology — especially the most recent quantum leaps in generative AI, such as ChatGPT and Bard — agents can streamline processes, improve the customer experience, and gain a competitive edge. Check out Publisher Paul Feldman’s interview of Shelly Palmer in this issue (pg. 6) for some great insights into the importance of adopting this powerful new tool, and what is at risk if you ignore AI and leave it to your competition.

At the same time, insurtech is simplifying tasks that previously were slow and cumbersome. For example, agents can use online platforms to simplify the insurance application process, or chatbots to provide customers with instant support. While adopting new technology can be challenging, it’s essential for staying relevant in a rapidly changing market.

Another key strategy for staying competitive in the insurance industry is personalizing the customer experience. By using data analytics, agents can gain insights into customers’ needs and preferences and tailor their insurance solutions accordingly. This can lead to improved customer satisfaction and increased retention rates. For example, agents can offer personalized insurance packages that are customized to each customer’s unique needs and budget.

Another important way to stay competitive is to be proactive with marketing efforts. This means leveraging social media, email marketing and other digital channels to reach potential customers. By developing targeted marketing campaigns, agents can attract new business and retain existing customers. Although marketing can be a challenge for agents with limited budgets, there are many cost-effective strategies that can be used to drive results.

It’s critical for insurance agents to stay attuned to changing customer needs and expectations. This also means being aware of changing preferences among baby boomers, millennials, Generation Z, etc. As the insurance industry continues to evolve, customers are looking not only for new products and services that meet their evolving needs but also at ways to comfortably obtain them. By staying ahead of the curve and offering innovative solutions, agents can differentiate themselves from the competition and build long-term customer loyalty.

As the business becomes more complex, ongoing additional regulation also will continue to become more complex. Whether it’s regulating life insurance illustrations or implementing guidelines for index-linked variable annuities, financial services oversight will be a constantly moving target and will require constant monitoring by those in this industry to remain in compliance.

As experts in risk management, the insurance industry has a unique responsibility to address the risks associated with climate change. We have covered some of these efforts, including a coalition that has

been started to examine some of the solutions that the insurance industry can bring to the table. This includes not only managing the risks associated with extreme weather events but also taking proactive steps to mitigate the root causes of the problem. We expect to see more efforts by the insurance industry — which has a lot to lose but also a lot to gain by addressing this issue.

The insurance industry has changed radically from the staid, unchanging days of yore. Staying competitive in the industry today — whether you work for a small agency or a large carrier — requires a combination of technology, personalization, marketing, adaptability, and especially an eye toward tackling new and emerging challenges. The need for change will be ongoing, and competitive pressure will only increase. If you haven’t made addressing the need for change and evolution part of your normal routine, the time to start is now.

John Forcucci Editor-in-chief

Read about what one state’s leadership is doing to address its property insurance crisis, why Medicare Advantage plans’ profitability is attracting Washington’s attention and how a major overhaul of life insurance illustration regulation is coming in the future.

labor market,” Salka said. “It’s really heartening to see that so many of them recognize life insurance as a piece of their overall financial puzzle.”

Millennials are most concerned about burial and final expenses, with that being cited as a major reason why they have life insurance by 52% of millennials, while only 35% of Gen Z cited it. The second largest reason for millennials is that their employer gave it to them.

Millennials were the most likely to buy life insurance this year because of the pandemic, with 44% saying so; the younger Gen Zers lagged way behind at 24%; Gen X, 31%; and boomers, a mere 17%.

Considering that the younger generations want coverage, why aren’t they getting it? Largely because they don’t know a lot about it.

by Steven A. MorelliThe memory of the dark, scary days of the COVID-19 pandemic might be fading, but the lessons are apparently imprinted on younger generations, especially single mothers, who have an appreciation for mortality and life insurance, according to the latest LIMRA/Life Happens Insurance Barometer.

Although a record-high percentage of consumers (39%) say they intend to buy life insurance in the next year, younger people are driving the demand, with 50% of millennial and 44% of Gen Z respondents wanting coverage, according to the survey.

Alison Salka, head of LIMRA research, said the 10th annual survey

showed a growing pool of younger people wanting life insurance.

“Younger generations, the millennials and Gen Z, are really starting to see the need,” Salka said. “It really presents an opportunity for the industry. … The majority of Gen Z is interested in life insurance. Only 40% of Gen Z told us that they own life insurance and about half of them report a need gap.”

The pandemic is likely to have instilled that awareness of mortality and the need for life insurance in younger people because it was a defining moment in their development.

“You have these younger people who are coming of age after or during a pandemic, during a volatile, interesting

The main reason millennials didn’t have it yet was because 38% said they thought it was too expensive. Of course, being young, they could find inexpensive term coverage, but another reason they didn’t have insurance is that they had not gotten around to finding out about it — that was the leading reason for Gen Z, with 37% citing that reason while 27% of millennials selected that.

The other reasons stemmed from not having the information they need, such as whether they can qualify for coverage.

Read the full story online: https://bit.ly/younglife23

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at stevenamorelli@gmail.com.

By John Hilton

By John Hilton

Inflation and rising interest rates. Regulatory pressure and market volatility. These unique economic conditions might force insurers to abandon small life insurance product policies.

“When I talk to some of my peers out there, they’re suggesting that small policies are going to be tougher and tougher to deal with,” said Steve Cox, head of life and combination products for Life Innovators, an independent product development company.

The trends in life insurance product development were the subject of a pair of sessions at this year’s LIMRA Life Insurance and Annuity Conference. Cox joined a panel titled “Impact of the Current Economic Environment on Life Insurance and Annuities.”

Some insurers might set minimum life policies as high as $250,000, Cox said. “I think it’s hard to say you’re serving middle

America when you do that,” he added.

Inflation is a double whammy for insurers, the panel noted. Although inflation declined for nine straight months, down to 5% in March, it is still well above the Federal Reserve target of 2%. Furthermore, economists say the pain to the household budget is going to be felt for some time to come.

“Certainly there’s a challenge for small policies,” said Elizabeth Dietrich, chief actuary for Prudential Retirement Strategies. “Compared to what else people are spending money on, do they have enough left in their discretionary income to put money aside for some of these other things?”

The life insurance industry is not taking advantage of the increased awareness that accompanied the COVID-19 pandemic, Cox insisted. According to the 2022 Insurance Barometer Study, one in three U.S. adults (31%) say they are more likely to purchase life insurance because of the pandemic.

A federal investigation found that Prudential Insurance Co. improperly denied more than 200 claims made on its group life insurance policies from 2017 to 2020, the Department of Labor announced.

The DOL reached a settlement with Prudential that prohibits the insurer from denying a beneficiary’s claim based on the lack of evidence of insurability when premiums were collected for more than three months.

“This egregious practice left grieving families without the life insurance for which their loved ones had paid, in some cases, for many years,” explained Solicitor of Labor Seema Nanda in a news release.

“Essentially, in many instances, participants were paying premiums for life

insurance policies that never existed,” Nanda added in a conference call with journalists.

The Prudential policies that should have been paid total between $3 million and $7 million, DOL officials said. Parallel investigations have found that other life insurers also engaged in similar practices, the DOL said.

It is on the employer to ensure that employees complete the process to meet insurability, DOL officials said, but Prudential also had a responsibility to make sure that had taken place.

Prudential Financial has advised the department that they will voluntarily reprocess denied claims dating back to June 2019 and provide benefits for the claims previously denied based solely on lack of

Technology helps smooth delivery of life insurance, Cox noted.

“What we can do as product people to build something to take advantage of that heightened awareness,” he added. “In so many ways consumers are demanding [automation]… We’re going to be really challenged to meet those needs.”

Read the full story online: https://bit.ly/life250k

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at john.hilton@innfeedback.com. Follow him on Twitter @INNJohnH.

The insurer sent the following statement to InsuranceNewsNet:

“Constructive engagement with our regulators is an important component of doing business the right way, which is foundational to our approach to delivering for our customers, while fulfilling our regulatory obligations. We have worked with the Department of Labor to resolve this matter. We are addressing this with supplemental group life insurance customers that are impacted and providing clear guidance to our customers regarding the responsibilities for maintaining evidence of insurability.”

Read the full story online: https://bit.ly/prulife23

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at john.hilton @innfeedback.com. Follow him on Twitter @INNJohnH.

Generative AI, says Shelly Palmer, is a turning point in technology: “If you are not terrified by this … if you’re not excited beyond anything you’ve ever seen before, you don’t know enough about it.”

An interview with Shelly Palmer by Paul Feldman, Publisher

helly Palmer believes that if you invest a little time in learning how to use generative AI in your business, your staff will immediately become 5% to 25% more productive. Palmer is professor of advanced media in residence at the Newhouse School of Public Communications at Syracuse University and CEO of The Palmer Group.

Named LinkedIn’s Top Voice in Technology, Palmer covers tech and business for Good Day New York and is a regular commentator on CNN. His latest book, Blockchain — Cryptocurrency, NFTs & Smart Contracts: An executive guide to the world of decentralized finance, is an Amazon No. 1 Best Seller. Palmer spends a lot of his time learning about generative AI, following its lightning-fast evolution, and providing insights and practical advice to the Fortune 500 business world. The insurance and financial services industries are already using AI to some extent. Generative AI, though, has just changed the stakes. In this interview with InsuranceNewsNet Publisher Paul Feldman, Palmer warns that you must adopt generative AI as a tool, or your business may quickly fall behind — and maybe even perish.

Paul Feldman: What do you think life insurance agents and financial advisors should know about AI? Should they fear it?

Shelly Palmer: I think anybody with half a brain should be scared out of their wits. If you’re not scared out of your wits, you don’t know enough about it. That said, AI is here to stay. There was a time before generative AI hit the consumer zeitgeist. And a time after. It’s like there was a time before the internet. And a time after. There was a time before generative AI. And a time afterward. This technology is so deep, so pervasive and so capable that those

who use it best will have an immense early competitive advantage.

The playing field will ultimately level because those who are not good at this will perish. Not languish — perish. And those who are good at it will fight it out. Ultimately, the AIs are going to be fighting it out, but that’s for later in the story.

There are a couple of different ways to look at this. The first way to look at it is that throughout history, productivity has been the key driver of economic success. The more productive you are, the more economically successful you are. It’s that simple.

In, let’s say, about 45 minutes, I could train everybody who sits in front of a terminal in your entire organization to properly prompt the commercial-grade version of ChatGPT Plus. At the end of that 45 minutes, every single person who was in that seminar would be between 5% and 25% more productive. That will directly equate to the bottom line. You’re going to make more money, create more value, grow your business.

Feldman: What are some examples of how AI could make a business more productive?

Palmer: Let’s say I have three Excel spreadsheets. The first one starts off with first name in the first column, then last name in the second column, then company, then title, then email. And the second sheet starts off company title, email, last name, first name. And the third sheet starts off company title, first name, last name, email. And you need to make that into one spreadsheet. Ten seconds after putting that request into any of the GPT engines, you get out the file you want in CSV format.

So, something that took you 20 minutes, or took your admin 20 minutes, now takes 10 seconds. You have 20 minutes of paid time back. What will you do with it?

You have a meeting on Zoom. Somebody is taking notes. They’re going to summarize that meeting.

They’re going to have action items in bullet points. There is probably a solid 30 minutes of someone’s time plus the 45 minutes of the meeting. In the world we live in now, that transcript comes out of Zoom, goes directly into GPT-4, comes out of an autonomous agent, fully finished, in an email sitting in a draft folder for you to approve and send out.

What was 20, 30, 40 minutes of somebody’s time is now a couple of seconds and your approval. How many times would that be replicated throughout

your organization or throughout the business world?

On the high end of the spectrum, we go from conversational AI clients like ChatGPT and like Bard, like the interface on Bing, which actually sits over GPT-3 or GPT-4, and OpenAI through Microsoft. We go to what’s known as autonomous agents. Autonomous agents are scripted AI models. Their job is to run as many different AI models as they need to accomplish your goal. So rather than learn to break a problem down into

individual tasks so that you can ask ChatGPT to do your work one task at a time, instead, with an autonomous agent, you set your goal.

So, let’s pretend we’re researching something. We’re going to research pet insurance, and what we’re going to do is we’re going to say, “What are the top five most pet insurance-friendly dog breeds, and why would I want to recommend them to my clients? Which breeds live the longest? Which live the healthiest lives? Make me a table and cite your sources.”

The goal of doing that in a chat client will take you 10 or 15 minutes to work through all the parts of the problem. And the big chat clients, the commercial ones, have only read the internet up to 2021, so you don’t have current information. With an autonomous agent like Auto-GPT, Godmode, AgentGPT and hundreds of others that have been coming out — there’s literally an app a day coming out across the whole landscape — you give it a goal, and the goal would be “Please do comprehensive research on the five most family-friendly dogs that I can recommend to my clients with the best breeders in the area.” That’s all you’d tell it.

It would go out to the internet, it would cite its sources, it would go to the American Kennel Club, it would go wherever it has to go, it would show you its entire process. The agent would do it all for you. You’d walk away, go get a cup of coffee, and when you came back, the research all would be there.

Now, that’s going out to the internet. Another way you could use an agent would be to say, “I want a comprehensive summary of all of the policies and programs I presented to and sold to my clients this year, for a year-end summary. I also want to know what they were closest to on my pipeline and what I need

to do to get them over the goal line.” That’s the goal for the agent.

That’s a couple of days of research with you and an assistant — or a trip to the coffee machine and back for an autonomous agent. That’s the kind of productivity we’re talking about. To say nothing of the generative tools that would allow you to build the PowerPoints from scratch based on demographic knowledge or knowledge from your customer relationship management system.

you train AI to help you — maybe even when you’re not there with the client directly?

Palmer: That’s the ultimate end of this. We’re working on this for almost every client — some kind of autonomous agent that is going to do all this work. At that point, it is your employee; it’s truly a co-worker in your agency or in your company. That requires a feedback loop mechanism that does not exist, al-

So, there isn’t any area of the insurance business that won’t be impacted by this. Strategies for actuaries, strategies for mitigation of risk — down the list. Playbooks and program lists and operations manuals for your clients, compliance manuals, compliance checklists.

Any process where you ever sat down to enumerate any workflow for internal or external use will be done faster, cheaper, more efficiently, more productively by these tools. There is literally nothing in the insurance business other than taking someone out to lunch this won’t do better than you will.

Feldman: I think one of the things that has become big in the insurance industry is a program such as Copytalk. Advisors and agents are either recording their client conversations or they’re recording their notes. They’re in their car, they call it up, and that’s generating a text summary.

Our average reader has about 200 or 300 clients. Some have 5,000 clients and more. They’re doing all these presentations and conversations and transcribing them for compliance purposes. How do

though the people at OpenAI have said they’re working on ChatGPT for business and GPT-4 for business, and that will include a mechanism for uploading your own data sets.

Feldman: What are some ways an insurance agent or financial advisor could best use this in their practice today?

Palmer: I think first off, productivity increases. The second thing is you can get good at automating some processes that used to take a lot of time. If you wanted to do a compare and contrast for clients, these are tools that do those kinds of analysis extremely well and lay out their thought processes.

To automate sales pitches, to automate any kind of go-to-market materials, or to take the go-to-market material that your big carriers are giving you and turn it into something that’s customized for clients based on the CRM — I think that’s really the magic here.

Feldman: Let’s say you have financial advisors and insurance agents who have consistently held seminars. If they’re doing two or three a week, and they do it for five or six years — or

Any process where you ever sat down to enumerate any workflow for internal or external use will be done faster, cheaper, more efficiently, more productively by these tools.

whatever that period is — could AI tell them what their conversion rates are, what their closing ratio was? Maybe tell them when the optimal time is to follow up, what’s the best email to send? With CRMs today, you collect a lot of data, but a lot of people aren’t utilizing that data, aren’t making it actionable.

Palmer: You’re 100% right. We collect data, but you need to make it actionable. Most people do not have the tools to make the data actionable. The way that most people would use Salesforce or a CRM system like HubSpot when they’re talking to someone is they would see their last notes: “How was your trip to Bali with your wife?” and “So last time we were talking about cyber insurance, where’d you guys land on that?” That’s how you would use it, and you might go back a little bit further or review some of the policies they already have. You might even farm it a little bit for some metadata to send a bulk email, but that’s not the same as pulling real insights from the data that you collect.

We train the AI, but the AI is training us. Once you start to get familiar with the kinds of insights that you can gather, you’re going to collect different data because it will help you do better.

Feldman: It’s amazing how in the last six months, the whole world has changed, and that’s just from a consumer perspective.

Palmer: We haven’t even started to talk about the way they’ll use this for advertising, and building custom ads, and social selling. So, if you tend to use the internet, if you tend to use social media, if you are someone who advertises on Twitter or LinkedIn or Facebook or Instagram or Snapchat, you can use it to build out these programs. It also does a really nice job of responding. You can give it a range of responses, and you can have it automate the responses if you want to keep active on Twitter or LinkedIn. There’s just no end to how you can use this.

People at Adobe just came out with Firefly. I would say within just a few months, Midjourney will have an application programming interface, and it will handle text better.

And Canva already has incorporated some AI into their social art tools. So right now, for someone who runs an agency, go look at Canva and see how you could automate your news items that you put into LinkedIn or Facebook stories or Instagram stories or in a carousel.

Firefly ultimately will be the Adobe answer to that, which will be the higher-end, more robust version, although Firefly is amazing. There’s a video company called Runway, which does browser-based video editing. It’s spectacular. If you were doing production artwork and promotional materials, there’s a world of these tools out there.

There’s a website called Futurepedia.io. I believe they have created the largest, most comprehensive database of emerging AI tools. They haven’t had a chance to vet them all, so you go there at your own risk. What I do like about Futurepedia, though, is that it is a comprehensive list. You can go there and see what’s new.

You need to use this every day in your business. You also must go to their terms of service and check the box that says they’re not allowed to look at your information for quality assurance purposes, so that it is protected. The best thing you can do is reach out to their sales department, get a commercial API for your business, and build your own chat client or your own interface sitting above GPT-4. And the reason for that is that then, by contractual agreement, they can’t look at your data, so your data becomes your own.

Privacy and security are important here, but for every purpose that most people would use ChatGPT Plus, you can just go check, “You can’t use my data for quality assurance.” And then your data is yours.

These models don’t learn from you. They don’t remember; they have no memory. You will keep a separate chat for each individual thing you’re doing. So, client A gets their own chat, client B gets their own chat. It’s costly because those chats get longer. The model, because it has no memory, must read it every time. So, the best practice is to have an individual chat for each task that you’re trying to accomplish or each client individually.

Feldman: One of the things that’s an issue right now is what are called AI hallucinations. Hallucinations are when AI will literally just make something up. Is that just something we must accept for now and make sure we verify everything? Will AI get beyond the hallucinations at some point?

Palmer: It’s a great question it’s an important question. There are several different solutions. The main solution is you must bring a lot of subject matter expertise to both the input and the output. The better you are at your job providing input, the better ChatGPT will be at helping you do your job.

Second, this concept of embedding and context injection — creating your own database that restricts what the model will use as input — will help curb hallucinations dramatically. Third, human beings have to understand that the conversational AI interface was specifically built to trick you into believing you’re talking to a human, and so people immediately fall into that trap.

The evolutionarily stable way for human beings to interact with one another is called the “default to trust.” The default to trust is that until you prove yourself not to be trustworthy, I’m going to trust you.

The only evolutionary stable strategy for human beings to interact with large language models and artificial intelligence is a default to distrust of the machine. You must immediately assume 100% of what you’re reading is nonsense, and if anything feels like nonsense, you ask about it.

Feldman: So how do we get better at that? Everything that you do should be reviewed if you’re going to use ChatGPT. Content creation is one thing that is very important for insurance agents and financial advisors. So how much of it do we trust? How much do we verify?

Palmer: If you bring more expertise to it, you will get more out of it. But even if you don’t bring anything to it, you’re still going to get something out of it. The hallucinations problem isn’t going away anytime soon. Nobody really understands why that is. There’ll be some guardrails put up there. This is early days.

If you go to shellypalmer.com and subscribe to our newsletter, we will try to stay on top of it. But more

importantly, you need to stay on top of it however you can. And there are lots of newsletters out there. There are plenty of videos on YouTube. There’s a lot of reading to be done. Nobody wants to have to learn something new every 15 minutes, but right now, you must learn something new every 15 minutes.

You must do this, because if you get this wrong, someone’s going to basically be able to take your business away from you.

Feldman: It’s either you surf it or you get crushed by the wave.

Palmer: Yes.

Feldman: Where are we going to be in one year from now with AI?

Palmer: No idea. What I do know is that there will be a catastrophic AI event sometime in the next 12 months. I don’t know what it’s going to be. Stock market crash, airliner forced down by misinformation,

something horrifying. It’ll get in front of Congress, and we’ll have a little come-to-Jesus moment, and that’s going to sober everybody up. That’s my prediction. Something terrible is going to happen because no one knows — we’re literally standing knee-deep in gasoline and we’re playing with matches, and I have no idea where this is going.

If you are not terrified by this, you don’t know enough about it. If you’re not excited beyond anything you’ve ever seen before, you don’t know enough about it. Those are just two emotions that generally don’t come together at the same time.

Maybe the only other time I’ve ever felt this way was only for a few seconds. I was honored and lucky enough to jump out of an airplane with the Golden Knights, which is the Army’s crack tandem skydiving team. And they took me up to 10,000 feet, and they strapped me to a young man I entrusted my life to. The two of us, strapped together, jumped out of the airplane.

I had never been more thrilled and more terrified at the same exact time in my life. That first 15 seconds — when you are just falling through the air from 10,000 feet, abject terror and you could taste the adrenaline in your mouth — that’s how I go to work every day now.

That’s my prediction. Something terrible is going to happen because no one knows — we’re literally standing knee-deep in gasoline and we’re playing with matches, and I have no idea where this is going.Yep, you guessed it. Midjourney, again.

•

•

•

•

Insurers are showing hiring optimism, as 67% of them have plans to increase their staff during the next 12 months, driven by the property/casualty segment at 69%. In addition, 79% of companies expect to grow revenue during the next 12 months. This is according to a study by The Jacobson Group and Ward, part of Aon plc.

In addition, 93% of life/health companies expect an increase in revenue, and 50% of the companies stated that change in market share will drive their expected revenue changes. Thirty-five percent also cited pricing factors.

The primary reason companies plan to increase staff during the next 12 months is an expected increase in business volume, the survey said. More than two-thirds of companies (37%) listed this as the primary reason to hire, followed by areas being understaffed.

In addition to these plans for growth, 10% of companies are planning to decrease their number of employees. When it comes to reductions in headcount, 8% of companies report that reorganization will be the primary reason for this activity during the next 12 months.

Nearly half (42%) of all advisors expect the impending recession to be short and shallow, beginning and easing gradually, while under a quarter (23%) expect a significant and prolonged market downturn marked by stagflation and instability.

Is this a financial crisis? Four in 10 investors said they think so in a recent Nationwide Advisor Authority study. Three in 10 (30%) believe the U.S. is approaching one, and only 36% are confident that they will survive the next financial crisis despite living through many prior episodes.

Survey respondents say financial crises feel more like an inevitability than a possibility. One-fifth (20%) of investors expect to face two more financial crises in their lifetime, and nearly half (43%) expect to face three or more. In addition, many are worried that their finances will not survive the next market downturn, with nearly 4 in 10 (39%) investors indicating that after living through a previous crisis, they are more nervous about their ability to protect their finances.

As investors across older generations rely on previous lessons learned, many are bracing in anticipation of an economic downturn. For example, 38% of Gen X and 29% of baby boomer investors expect a prolonged period of severe downturn marked by stagflation and instability. What’s more, they don’t expect this to be the last crisis they live through. Twothirds (65%) of Gen X and almost half of baby boomers (48%) expect to live through at least two more financial crises in their lifetimes.

‘UNREGULATED

Singer and megastar Taylor Swift decided to “shake it off” when offered the opportunity to endorse FTX. Swift is the lone celebrity pursued by disgraced cryptocurrency developer Sam Bankman-Fried who asked the right questions about FTX, an attorney suing SBF said.

“[She] actually asked that, ‘Can you tell me that these are not unregistered securities?’” Florida attorney Adam Moskowitz said. Moskowitz filed a November

class-action lawsuit against SBF and the roll call of celebrities who endorsed FTX, including Tom Brady, Gisele Bundchen, Shaquille O’Neal and Larry David. He said Swift was the only celebrity who bothered with due diligence when presented with their FTX sponsorship offer.

As for Swift, we can only guess that she is saying, “We are never ever getting back together” regarding lending her celebrity status to FTX, and she is probably glad she won’t have to cry “Look what you made me do” in the future.

Nearly two-thirds of Americans (65%) say no to raising the retirement age for those who are currently in their 20s, according to a poll by Data for Progress. Increasing the retirement age is one idea that has been floated as a way to keep Social Security solvent.

A closer breakdown of that figure showed opposition extended beyond party lines for respondents, as 72% of Democrat-identifying respondents and 59% of Republicanidentifying respondents also said it was “unfair” and “unrealistic” to expect younger Americans to work into their 70s. Sixty-five percent of respondents who identified as independents or third-party voters also said the same.

Less than 10% of Americans polled said they supported raising the full retirement age above 67, the current threshold for those born since 1960, with only 5% of Democrat-identifying respondents and 9% of Republican-identifying respondents backing the move.

If the 24% cut in Social Security benefits under current law goes into effect, it will double the rate of poverty among the elderly.

— Sen. Bill Cassidy, R-La.

The share of households reporting that it has become harder to obtain credit today than it was a year ago rose to its highest level since at least 2013.Sales/marketing. Product management. Operations. Actuarial. Source: The Jacobson Group and Ward Source: Nationwide Advisor Authority study

Grow your agency

• Customized targeted recruiting plan, agent recruiting leads, onsite and virtual open house recruiting events.

High-touch personal attention

• Producers enjoy direct access to underwriters and sales support teams.

Elevate your agency with customized training

• Advanced and business markets, sales concepts, case design, and support staff assistance team.

Exceptional regional team to support your agency

• Annual business planning and monitoring, onsite training, team-building events

Full suite of products to help you stand out from the crowd

• Innovative term insurance to age 85.

• Outstanding return-of-premium products.

• Streamlined indexed universal life insurance design.

• Unique ability to add a commissionable policy enhancement that allows the policyowner to customize the way the death benefit is paid out

• Founded in 1895, a producer-focused Company with fourth generation family leadership that has great financials and no debt.

For information about a vested independent contract with Kansas City Life Insurance Company, call Tom Morgan, Vice President, Agencies, 855-277-2090, or visit join.kclife.com.

Annuity sales are smashing all historic records as consumers flock to protection products. But game-changing federal regulation looms.

By John HiltonAnnuity sellers are sitting atop a mountain of goodness.

Nearly all product lines are selling strong or boast a positive outlook, and successful technology adoption is proceeding with alacrity. States coast to coast are adopting the industry-favored best-interest sales rules.

It’s all contributing to sales so strong that calling them simply “record breaking” almost undersells the market heat — more like record shattering. Firstquarter annuity sales totaled $92.9 billion, a 47% increase from the prior year, according to LIMRA’s U.S. Individual Annuity Sales Survey.

That follows sales of $310.6 billion in 2022, a 22% increase from 2021 results and 17% higher than the record set in 2008.

rule forced the industry into a costly revamp of sales practices. It also swung many more potential annuity sales into the unsuitable category.

And the bottom line suffered. In 2017, annuity sales plunged to $204 billion, the sales nadir of the past decade.

Jim Szostek is vice president and deputy, retirement security for the American Council of Life Insurers.

“Fiduciary-only advisors generally require account holders to invest at least $100,000 up front,” Szostek said. “It is also worth noting that fiduciaries charge a fee for advice, generally on an ongoing basis based on assets under management. This works for those with significant assets.

“But it doesn’t work for most working-class families who are most likely to benefit from income guarantees in retirement through an annuity.”

deferred annuities and indexed annuities, which shield owners from the volatility of stocks and bonds.

Even a solid rebound for equities this year — the S&P was up nearly 7% as this issue went to press — is doing little to subdue the desire for protection annuities.

“Market conditions continue to drive investor demand for annuities,” said Todd Giesing, assistant vice president, LIMRA Annuity Research. “Every major fixed annuity product line experienced at least double-digit year-over-year growth.”

Demand for annuities is so strong, many carriers are having trouble keeping up. Industry social media chatter is buzzing with talk of annuity applications delayed for weeks.

“We obviously had a ton of volume coming through in protection-focused annuity product,” Giesing explained. “And that was simply a distraction. We’re

$

Source: Secure Retirement Institute, Preliminary U.S. Individual Annuity Sales Survey, First Quarter 2023

But faint as they might be, there are potential storm clouds lingering on the horizon.

The Department of Labor is expected to publish a new fiduciary rule by the end of 2023, a rule change that would likely upend annuity sales practices. It’s the second attempt by the DOL to extend a fiduciary duty to annuity sales and other retirement fund transactions.

Finalized in 2016, the first fiduciary

The S&P 500 stock tracking index firmly turned bearish last June. Since the start of 2022, the index is down 14%. Combined with other skittish economic indicators, such as rampant inflation and recession talk, retirement investors fled the market in fear.

Protection-focused annuities is where they ended up parking their money — products like fixed-rate

hearing from the industry that there have been backlogs and that insurance companies had to quickly expand their headcount in new business processing to be able to handle the volume.”

Many insurers are quickly pivoting to technology to help process applications faster. During Prudential’s first-quarter earnings call last month, Chairman and CEO Charlie Lowrey noted “a significant increase” in sales of fixed annuities.

He credited technology, in part, for the boost.

For example, a majority of annuities applications are now submitted with electronic signature, Lowrey added, “which has reduced processing time by several days and improved our environmental impact.”

Historically, the stock market gains over time and the bulls will eventually run again. The Dow Jones Industrial Average gained a modest 1% through the first four months of 2023. LIMRA is predicting slow and steady growth in equities through 2028.

to downside risk and provide the opportunity for growth, usually through a market index.

RILA products offer more growth potential than fixed annuities, but less potential return and less risk than variable annuities.

Introduced in 2010 by AXA Equitable Life Insurance Co., now known as Equitable, it took some time for RILAs to catch on. Sales topped $11 billion in 2018, and carriers rushed products to market to catch the RILA trend.

or to start to see some share get diluted from top carriers. We’ve seen a little bit of that, but for the number of carriers that have come into the market and you’re still seeing exponential growth? It’s almost unprecedented.”

RILA contract premium increased 11.4% in 2021, and White noted that 61% of RILA premium is money new to the industry — in other words, not funds swapped from an existing annuity.

In response, annuity buyers will surely turn away from protection-centered products such as fixed-rate deferred. LIMRA forecasts about a 30% decline in this category, but Giesing noted that even with the projected decline, those are still historically strong sales.

But that decline does not mean the selling party has to end. If the industry has proven anything, it’s that annuity manufacturers have a product for all seasons.

In good market times, that product is registered indexed-linked annuities. Also known as structured or buffered annuities, RILAs are a tax-deferred longterm savings option that limit exposure

Today, there are 17 carriers offering RILAs and more than $41 billion in annual sales. Transamerica, Global Atlantic and Sammons all brought new RILA versions to the market in 2022.

With interest rates climbing higher seemingly each time the Federal Reserve meets — the Fed hiked its benchmark borrowing rate again in May to a target range of 5% to 5.25%, a rate not seen since 2007 — RILA sales growth was expected to halt.

That has not happened.

In fact, RILA sales expanded by 6% from 2021 to 2022, said Sutton White, head of annuity product for Life Innovators.

“We’re still seeing growth, even as we’re seeing new carriers [introduce RILAs],” White pointed out. “You would expect to see growth potential flatline

The RILA Act awaits President Joe Biden’s signature and could further boost sales. The bill would lower barriers to retirement income products by requiring the Securities and Exchange Commission to revise rules regarding developing and offering certain annuity products, including RILAs.

If signed into law, the bill will direct the SEC to create a new form to replace the forms annuity issuers currently are required to use when filing RILAs with the commission. These forms require the disclosure of financial information in line with GAAP, as well as other extensive information that is irrelevant for prospective annuity purchasers, industry lobbyists say.

Most notable is the S-1 form, filed with the SEC. The number of carriers offering

RILAs could double if the RILA Act becomes law and they are not required to file the more cumbersome S-1 form, White predicted.

Furthermore, talks with the Interstate Insurance Product Regulation Commission to add RILAs are nearing a successful conclusion, White said.

Created by the National Association of Insurance Commissioners in 2002, the interstate insurance compact reviews and approves (or disapproves) individual and group annuity, life insurance, disability income, and long-term care insurance products.

account into a stream of periodic payments. VAs grew wildly popular while the stock market regained strength in the years after the 2008-09 economic crisis.

Sales were too good.

Eventually, carriers became nervous about the amount of VA guarantees on their books, Giesing noted, and adopted different strategies to counter that risk.

The lone Debbie Downer in this whole rosy scenario is the looming fiduciary rule. DOL officials are notoriously tight-lipped about rules in progress and could not be reached for comment.

However, industry lobbyists feel good about having a precedent set by the 5th U.S. Circuit Court of Appeals in 2018, when a 2-1 ruling tossed out the fiduciary rule published by the Obama-era DOL.

“Carriers started to say, ‘Okay, we want to balance out our annuity portfolios and our annuity sales,’” he said. “So they started diversifying, offering products without guaranteed living benefits or looking at other product lines and putting an emphasis” on other annuity categories.

11.4%

“RILA is not in the compact currently,” White explained. “So not only do you have to go through the arduous process of filing Form S-1, but you also then have to do a state-by-state filing of the final product, which ‘tedious’ doesn’t even begin to describe because there’s not really a lot of consistency [from state to state].”

Variable annuities were once the prettiest products on the shelf. At their 2011 peak, VA sales topped $156 billion, the majority of them with guaranteed living benefits.

Traditional VAs include an investment account that may grow on a tax-deferred basis and include certain insurance features, such as the ability to turn an

Source: LIMRA SRI, 2022: A Deeper Dive into Registered Index Annuities

VA sales plummeted steadily, registering just $61.8 billion in 2022, the lowest full-year sales since 1995. Traditional VA sales were $12.9 billion in the first quarter of 2023, down 30% from first-quarter 2022 results.

But Giesing and LIMRA say VAs still have a place in the market. LIMRA forecasts call for a gradual uptick in VA sales to the $80 billion range by 2027. At $198,000, the average new contract premium for VAs with guaranteed living benefits is very high.

“Very lucrative and one of the highest average commission premiums for contracts,” Giesing noted.

Since then, the Trump administration published the investment advice rule, a surprisingly strong effort. The department was immediately sued twice over a portion of guidance issued in 2021 that expanded the definition of a retirement plan fiduciary.

The DOL wants most of all to extend fiduciary duty to advisors who handle “rollover” planning. According to the Investment Company Institute, 401(k) plans hold $6.3 trillion in assets as of Sept. 30, 2022, on behalf of about 60 million active participants and millions of former employees and retirees. When recipients retire and the money is “rolled” out of those plans, many advisors earn a commission.

Regulators consider that a conflict of interest and want it to be considered fiduciary advice. The fiduciary standard is based on the “five-part test” established

in 1975, in which one of the prongs is whether the advisor and client are in an “ongoing relationship.” In order to satisfy that prong, the DOL claims a one-time rollover contains the expectation of future advice rendered.

A federal district court judge in Florida struck down the guidance in a February ruling that has been appealed by the DOL.

Judge Virginia M. Hernandez Covington ruled that a portion of the department’s frequently asked questions guidance illegally widened its regulatory lane and failed to comply with the agency’s own regulations.

“While an offer to provide future

advice may, as the Department suggests, be the beginning of a relationship, that relationship is inherently divorced from the ERISA-governed plan,” she wrote. “Because any provision of future advice occurs at a time when the assets are no longer plan assets, it is not captured by the ‘regular basis’ analysis.”

So, we wait.

In April, Washington and Wyoming became the 35th and 36th states to adopt the NAIC best-interest standard for annuity sales and recommendations. States have swiftly responded to lobbying efforts that ramped up following the 2020 model adoption by insurance commissioners.

It mirrors the best-interest regulation adopted by the SEC in 2019 for broker-dealers and registered representatives.

“A best-interest standard is better,” Szostek said. “It protects consumers without making making access impossible for working-class Americans.”

InsuranceNewsNet

Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at john.hilton@innfeedback. com. Follow him on Twitter @INNJohnH.

In this year’s Annuity Awareness Month Thought Leadership Series, great minds from two elite companies offer their perspective on product, process, and the future of an everchanging annuity marketplace.

Harnessing AI for fixed indexed annuities: A new era of opportunities

by IbexisPAGE 20

The evolution and advantages of custom indices with Adam Politzer, Senior VP

and Chief Product Officer,Athene PAGE 22

Artificial intelligence-enabled indexes have the potential to revolutionize the way we think about investing in indexed annuities.

Leveraging AI and machine learning indexes offers dynamic, adaptive and data-driven investment strategies that differ from traditional indexes in key ways, such as asset selection, weighting, rebalancing, adaptability and data analysis.

While traditional indexes still have a place in fixed indexed annuities, AI-enabled indexes make an excellent complement. In this article, we’ll explore the benefits and demystify the use of AI in an index.

The power of AI lies in its ability to process vast amounts of information to make data-driven decisions. Because it can analyze data at lightning speed, AI offers significant advantages over traditional human analysis. It can sift through years of a company’s financials, for example, much faster than an analyst could, allowing quicker and more accurate decision-making.

AI can interpret news and market dynamics and analyze other factors to make real-time investment decisions with the latest information, solidifying it as an invaluable tool for managing investments.

Additionally, AI eliminates factors like emotion that can greatly affect investment decisions, often leading to suboptimal results. This helps ensure a greater likelihood of investment choices that are based on data and objective analysis.

While the power of AI is unquestionable when it comes to analyzing vast amounts of data to make data-driven decisions on a monthly, weekly or daily basis — like whether to shift in and out of global equities, gold, bonds or exchange-traded funds — AI does have limitations. It may not always be able to interpret nuances of human behavior or unprecedented events and their impact on the markets. In light of that, it’s important to view AI as a tool that can assist in investment decision-making rather than as a replacement for humans. By combining human expertise and AI-powered analysis, we can achieve better investment outcomes that reflect the best of both worlds. And as more carriers begin using AI-enabled indexes, we drive innovation and make our industry more efficient.

Back in the heyday of variable annuities, everyone talked about “rider wars” and which company was going to have

the best living benefit or income benefit. Today, it’s a battle of the indexes. As a way to adapt to changes in the economy, changes in interest rates and the volatility of the markets, indexed annuities have evolved since the early days of using only standard S&P indexes. Now investors have access to an array of indexes with different methodologies, criteria and volatility controls, opening a wide range of investment strategies that previously were inaccessible.

“As we continue to face financial uncertainties, AI will undoubtedly play an increasingly important role in helping investors succeed in complex markets.”

AI-powered indexes represent the next step in this evolution.

AI indexes have the ability to quickly adapt to ongoing market changes and optimize returns, potentially outperforming traditional, rules-based indexes set by human analysts. During the pandemic, AI-enabled indexes proved their worth by quickly adapting investment strategies, minimizing losses and capitalizing on opportunities that human analysts might have missed. For instance, one AI index invested in Moderna after interpreting a press release about its COVID-19 vaccine development and invested in Campbell Soup Company based on buying behavior during historical events such as the pandemic.

With a rules-based index, the index is constructed and maintained in accordance with a set of rules, whereas an AI index is designed to learn from and adapt to market changes. It’s not limited by fixed rules or predetermined parameters, which allows it to pivot and optimize returns more efficiently.

As we continue to face financial uncertainties, AI will undoubtedly play an increasingly important role in helping investors succeed in complex markets.

— Ryan Lex, Ibexis chief distribution officer

While we can tout the benefits of using artificial intelligence, a major misconception about AI is that it’s a “black box.” The good news is that carriers like Ibexis are making an AI index more of a “glass box,” providing transparency by enabling producers to understand why AI is making certain decisions to reallocate.

This eliminates the fear of the unknown and empowers producers and their clients to capitalize on the opportunities AI affords.

To be on the cutting edge of the AI revolution in insurance and financial services, partnering with established carriers and index partners that have demonstrated a strong commitment to innovation and technology is essential. These partners make ideal collaborators for exploring the potential of AI in fixed indexed annuities, as they have the expertise to handle the complexities of the technology and develop new investment strategies that fully leverage its capabilities.

Additionally, as AI continues to improve itself through machine learning, it will play an increasingly important role in shaping the future of the index market. By being transparent, carriers like Ibexis hope to stimulate awareness of and interest in indexes that can provide investors with even greater opportunities for diversification, optimized returns and risk management, now and into the future.

Leveraging AI’s analytical capabilities to make better portfolio allocation decisions in an index and help investors make more predictable decisions over time potentially leads to smoother returns and improved risk management.

AI can play a crucial role in providing smoother returns in indexed annuities by determining and predicting appropriate volatility targets for indexes. With the industry trending toward increased volatility targets — ranging from 7% to 12% on some products — AI’s ability to process and analyze historical data can help set more accurate targets that better reflect market conditions and investor expectations.

AI also can be employed to develop and manage a dynamic allocation strategy within the indexed annuity. By continually analyzing multiple asset classes, such as stocks, bonds and commodities, it can determine the optimal allocation mix that maximizes returns while managing risk.

Jim Simons — a pioneer in using AI and machine learning to make more informed trading decisions in real time, generating market-beating returns and growing a multibillion-dollar company as a result — serves as a powerful example of the vast impact AI can have on the financial industry. While not everyone can expect the same level of success, Simons’ achievements demonstrate the incredible potential of AI.

Carriers like Ibexis and others, and their index partners, have extensive resources and proven track records of success, which makes them well positioned to drive the future of AI-powered indexes and shape the investment landscape for years to come.

As the financial industry continues to evolve, we’ll likely continue to see a variety of indexes enter the market and a growing interest in AI-enabled indexes. This competition is healthy, driving innovation and encouraging the development of more advanced investment strategies. That said, even with an increasing reliance on AI, humans will continue to play a crucial role in setting up the structure of AI indexes, ensuring the technology is guided by expert knowledge and experience.

The age of AI is here, and we must embrace it. The future of our industry is dependent on those willing to seize this new opportunity. It’s why we have to stay informed about industry trends and recognize the importance of collaboration between human expertise and AI capabilities. This combination acts as an advanced and sophisticated tool in our toolbelt. It’s one we can use to better navigate the complexities of the financial world and make more-informed decisions that help clients achieve their financial goals.

“To be on the cutting edge of the AI revolution in insurance and financial services, partnering with established carriers and index partners that have demonstrated a strong commitment to innovation and technology is essential.” — Ryan Lex, Ibexis chief distribution officer

Custom indices are gaining in popularity as a means of helping clients meet their financial goals. Athene, a leading provider of fixed indexed annuities, is at the forefront of this trend with its innovative custom index solutions.

In this interview, Adam Politzer, senior vice president and chief product officer, speaks to INN about what makes custom indices so effective at providing clients with value and protection from market downside.

INN: Can you set the stage by explaining what custom indices are and how they differ from benchmark indices like the S&P 500®?

Politzer: When we talk about custom indices, we’re referring to a specialized type of index designed to work within a fixed indexed annuity (FIA). While most people are familiar with benchmark indices like the S&P 500®, a custom index is tailored to track a specific investment style and typically includes exposure to a range of asset categories such as equities, bonds and commodities. One important distinction of custom indices is they’re entirely rules-based, which means performance is mathematically driven as opposed to people-driven, so generally more accurate in terms of what’s happening in the market.

INN: What inspired Athene’s use of custom indices, and what’s changed in recent years that you see as a benefit to clients?

Politzer: The inspiration for using custom indices in FIAs came from the limitations of traditional point-to-point caps on the S&P 500®, which offered decreasing growth potential as rates fell. Custom indices were introduced to meet the need for higher growth potential. Since then, there's been an extraordinary amount of innovation.

Unlike the S&P 500®, custom indices were designed to provide more consistency and predictability, making it possible to offer better rates and an improved experience. Moreover, custom indices allow for greater diversification, exposing clients to a broader range of asset classes. Additionally, our custom indices are built on fundamental principles that aim to maximize growth potential for the amount of risk taken, which differs from the S&P 500®’s purpose of tracking the 500 largest companies.

These factors combined have led to the creation of better financial products, including the current generation of FIAs.

INN: Some financial professionals may be skeptical of the accumulation potential shown for custom indices. How do you respond to this concern, and what strategies are used to optimize growth while minimizing risk?

Politzer: It can certainly be difficult to keep track of the various components of the many custom indices in the marketplace today as well as understand how those components are valuable to clients, which is why education is so important. Custom indices are primarily designed to provide protection from market downside.

All of the underlying components are familiar benchmarks or investable products with plenty of liquidity. These underlying components have been around for years, and because the indices are fully rules-based, we’re able to show how these indices would have performed prior to them being in existence.

While our custom indices show strong performance when tested retroactively, we believe they are designed to work prospectively as well because they are built on strong academic principles, like diversification, which hundreds of years of data has proven effective.

INN: To anyone who believes custom indices are inherently complex and not as transparent as benchmark indices, what would you say, and what steps have been taken to improve transparency and understanding of these indices?

Politzer: We understand custom indices can be complex, but we firmly believe they create value for clients. To improve transparency and understanding, we’ve worked with The Index Standard® to focus on 122 years of custom indices research (Athene.com/INN-IndexResearch) to both explain how they work and would have performed in various market conditions.

As more complex indices enter the market, it’s important to ensure they’re built on sound financial principles and not just designed to perform well in a historical backtest. At Athene, we make sure everything we introduce into an index makes academic sense and is built on solid principles. The volatility control features on our indices allow for greater stability and predictability of the index’s performance. For example, one of our index’s volatility control is balanced every hour. This results in better pricing and interest credits for clients.

INN: Since protection from market risk is intrinsic to a FIA, what role does volatility control play in a custom index?

Politzer: Firstly, it allows us to offer greater participation rates, often in excess of 100%, without a cap.

This is because volatility controlled indices are easier to hedge because they result in a smoother performing index. Secondly, volatility control helps to ensure more consistency in renewal rates, as we can be more confident in the cost of these options and offer clients consistent participation rates at renewal.

While some financial professionals may initially question the need for volatility control in a principal-protected product, we believe it plays a critical role in optimizing growth potential and reducing risk.

INN: Can you talk to us about the volatility target on a custom index compared to the volatility of the S&P 500®?

Politzer: When it comes to the total value we provide our clients, we allocate the same option budget regardless of the index strategy. The native volatility of the S&P 500®, which people may be familiar with, is usually around 20%. If we have a 3% option budget, we may be able to offer 50% exposure to that index on a given day.

However, if we add a volatility control with a target of 5%, which is a quarter of the volatility of the S&P 500®, we could potentially offer participation rates that are four times as high. This means the total value of the product

almost every economic environment. Our expertise in curating the best set of index solutions and having a wide selection of indices allows clients to take advantage of the diversification we offer. By spreading money across these index strategies, clients are more likely to have a consistent experience and accumulation within the products.

INN: How do you see custom indices evolving in the years ahead?

Politzer: Athene is a company that strives to stay ahead of the latest innovations, and I can tell you that custom indices are only going to get better in the years ahead. We’ve already seen exciting developments, like more sophisticated versions of volatility control and the use of AI to pick better stock portfolios and macro investment strategies for indices. And I’m confident these trends will continue, leading to even more effective and efficient index solutions for our clients.

But it’s not just about the latest technology; diversification will also remain crucial. By offering a wide range of custom indices that can help provide that diversification, we can help our clients navigate whatever comes their way.

INN: What advice would you offer financial professionals who are considering using custom indices, and what resources would you recommend to help them explain the value to their clients?

remains the same, but with the addition of volatility control, we can offer clients greater growth potential with a smoother-performing index.

INN: What would you suggest a financial professional and their client consider when comparing one custom index to another?

Politzer: When comparing custom indices, it’s crucial for financial professionals and their clients to weigh the client’s goals and need for diversification.

Additionally, it’s important to consider that participation rate multiplied by index performance is what determines the index return. So, to make an apples-to-apples comparison, you need to understand the participation rate relative to the index return.

For example, a 10% return with a 50% participation rate would result in a 5% interest credit, while a 5% return with a 200% participation rate would result in a 10% interest credit. Ultimately, it’s not just about the pure index return, but also the strategy performance over time.

INN: What do clients expect from an index and how are Athene’s custom indices designed to meet and exceed these expectations?

Politzer: Athene’s custom indices are designed with diversification in mind to help ensure they perform well in

Politzer: We recognize the importance of simplifying custom indices and making them easily accessible for financial professionals and their clients. That’s why we’ve invested significant time and resources into quarterly webinars with our partners and creating dedicated webpages, providing a comprehensive library of materials.

These resources range from beginner-level content to more sophisticated information on how custom indices work and improve financial outcomes to point-of-sale collateral. Our content is designed to be easily digestible, providing small, bite-sized chunks of information that can be shared with clients. In addition, we offer simple recommendations on how to build a properly diversified portfolio with our indices.

Athene.com/INN-IndexInsight.

To learn more about the value of custom indices, visit

As more complex indices enter the market, it’s important to ensure they’re built on sound financial principles and not just designed to perform well in a historical backtest.

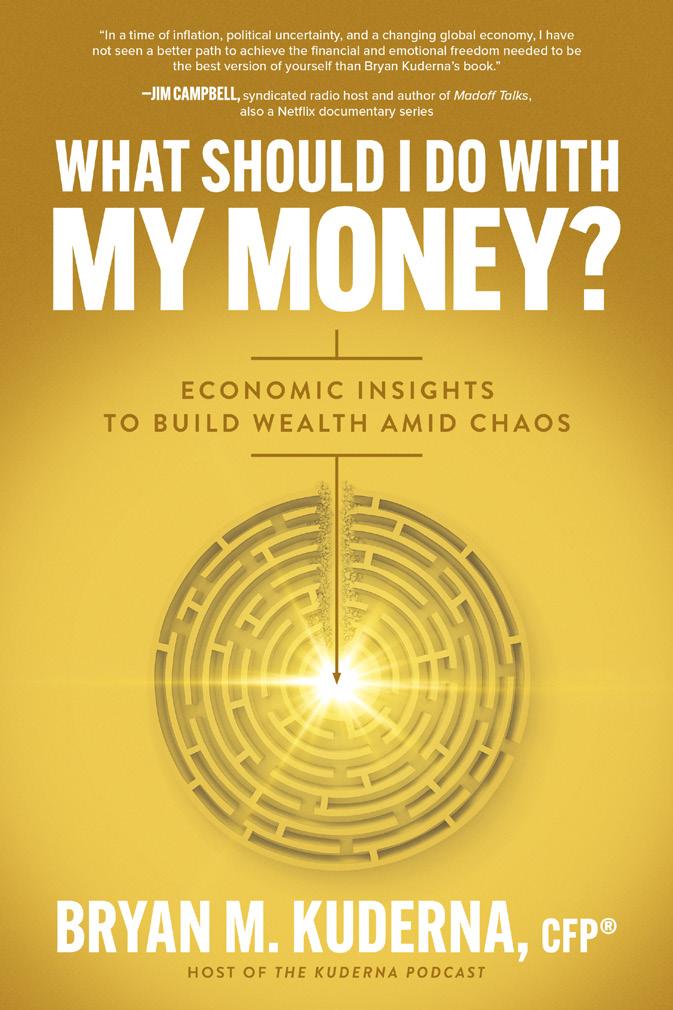

Bryan Kuderna was in college and trying to make up his mind about his future. Should he continue as a marketing major? Pursue a career with the federal Drug Enforcement Administration? Switch majors to something more “practical,” such as accounting or finance? Then there was his love of writing — maybe declare a minor in journalism?

Kuderna opted to change his major to finance and accepted an internship in a small financial services firm affiliated with Guardian. And he never looked back.

Today, Kuderna is founder of Kuderna Financial Team in Shrewsbury, N.J., and he is still a part of the financial services firm in which he started his career as a junior at the College of New Jersey. His love of writing inspired him to pen two books about wealth management as well as a fantasy novel and a long-running blog, Weekly Wealth Wisdom.

Growing up, Kuderna said, he was interested in law enforcement. But he also was interested in becoming a business owner. “I loved the idea of controlling your own destiny and being an entrepreneur,” he said. He also managed his college newspaper and found his passion for writing.

But it was an interview with the DEA that solidified his path to a financial services career.

“They asked me if I had a pilot’s license, and I did not,” he said. “Then they asked me if I spoke a second language other than Spanish, and I did not. They asked me what my major was, and I said it was marketing. They said, ‘Everything that we do is about following money. So if you want to even try and have a shot at the job with us, you need to change majors to either finance or accounting.’”

Instead of further pursuing a DEA career, he changed his major to finance

and began the internship that launched his career.

But starting out in the industry wasn’t easy for someone who hadn’t even graduated from college yet.

“It was very much go try and find your natural market or draw up your list of your target 200, things like that. And I was like, ‘Well, I’m 20 years old. There’s not really a natural market here.’”

Without a natural market to help him get started, Kuderna began cold-calling business owners to discuss employee health benefits to help get a foot in the door with that population. He also coldcalled CPAs “just to get in the know with some folks in the community.” But he didn’t have much luck in cold-calling with either group.

But he did begin to find success from attending networking events in his area — and he attended a lot of them.

“I did a ton of networking events, probably a couple of them a day — usually one for lunch, and then I’d go to a happy hour or something in the evening,” he said. “And I started to meet a lot of people in the area. It was a slow start those first couple of years. I was hardly staying afloat. I was living at home after I graduated from college.”

Those rough early years eventually passed when Kuderna discovered he had a talent and a passion for discussing financial literacy with the public.

“Where I really kind of hit the ground running was in putting together financial literacy talks — in particular, doing them at hospitals,” he said. “I created these financial education curricula to present to all the residents and fellows at teaching hospitals in the area, and that’s where my career really started to jump.”

Kuderna realized that newly minted medical professionals have a particular set of financial and insurance needs, and because he was about the same age as they were, he could position himself as a trusted source of advice.

“I was able to get in with them and kind of coach them,” he said. “I was right around their age, in my mid-20s, late 20s. I talked with them about their student loan concerns, kind of put them at ease there; talked a lot about disability insurance, which became a huge part of my practice.

I began to grow with them as they moved out of their residencies and began practicing and making money. Then I got licensed nationwide, and I expanded with them as they scattered all around the country.”

Kuderna continued to discuss financial issues in more hospitals. He earned his Certified Financial Planner designation in 2013, and he described that achievement as “giving me some credibility.”

Today, about 80% of Kuderna’s clients are dentists or physicians. He finds that one of their biggest issues is managing the massive student loan debt they carry after graduation.

“They come into the early years of their career feeling a sense of guilt that they’re

He described the book as “kind of a crash course on finance for the young professional.”

“It was part memoir, and a lot of it was based on the conversations I have with young professionals,” he said. “I was able to blend my old passion of writing with my new passion of financial education and what I do as my day job. The good part about writing the book is that it was supposed to help my clients and it also got my name out there.”

Kuderna switched gears during the COVID-19 lockdown to write a fantasy novel, Anoroc, which is “corona” spelled backward. The book is a coming-of-age novel that tells the story of a young boy living in a world where people compete for scarce resources.

“During quarantine, I was able to free up so much of my schedule because I was doing all Zoom calls instead of traveling,” he said. “I thought, now I actually can write something that’s a total escape from constantly talking about COVID-19 and finance and all the stuff that was going on.”

Kuderna said that after his second book was published, people asked him whether he planned to write a sequel to Millennial Millionaire. “Certainly there were a lot of things that happened in the economy since I wrote my first book in 2016,” he said. The result was his newest book, What Should I Do With My Money? Economic Insights to Build Wealth Amid Chaos, which was published in February.

not planning for retirement,” he said. “What I try to do is draw up a game plan with their student loans and get them to calm down. We come up with a strategy on how to deal with them. It’s not different from if you got a $600,000 mortgage. It’s not like your whole life stops; it’s just that you continue living now with that monthly payment. When they become attending physicians and their incomes start to rise, that’s when we’re able to help them start investing in their retirement plans.”

By 2016, Kuderna decided to indulge his passion for writing and merge it with his interest in educating people about money. He wrote his first book,

He said that the book begins with the original meaning of the word “wealth,” which comes from an Old English word, “weal,” which means “well-being.”

“I write about wealth in the context of well-being, not just in a monetary sense. I think that guides all economic decisions and all financial decisions. Every person is trying to make decisions for their own well-being.”

Going back to the days when he considered working for the DEA, Kuderna said he read a book on the Central Intelligence Agency that said that when they train their spies, they tell them to “look for the MICE.”

“MICE stands for money, ideology, compromise and ego,” he said. “Those four motivators make human

decision-making what it is. In my book, I took some of the most pressing issues today — from entitlements to education, environment, big tech, economic philosophies — and looked at them through the context of MICE. It’s not just money —

podcast,” he said. “Sometimes we address the podcast interviews or topics and elaborate on them.”

Kuderna ran his first marathon race in 2015, then followed it up by entering an Ironman competition in Quebec as a fundraiser for his local YMCA. Six years ago, he began practicing Brazilian jiujitsu. “It’s a good outlet not just for exercise but for learning a new skill that’s very complicated,” he said. “I made a lot of friends through it, and it became a kind of balance to my everyday workplace and family life.”

He plans to continue educating people about financial literacy.