8

Bad Driving, Inflation Among Factors Pushing Increase in Auto Loss Ratios

NCCI: Almost One Quarter of COVID Claimants Suffer Prolonged Symptoms

As Homeowners Rebuild After Ian, a Cooling New Housing Market Drops Material Costs

Court Dismisses 32 COVID-19 Business Insurance Cases Against Erie Insurance

Closer Look: Top 50 Commercial Lines Leaders

BRONZE Best Agency to Work For – East: USI Insurance Services

BRONZE Best Agency to Work For – Midwest: Ansay & Associates

BRONZE Best Agency to Work For – South Central: Glenn Harris and Associates

BRONZE Best Agency to Work For – Southeast: Robins Insurance

BRONZE Best Agency to Work For – West: LP Insurance Services

Special Report: On the Road: Tough Trucking Market Brings Challenges, Opportunities

Spotlight: Agency E&O Survey

Closer Look: 4 mportant Aspects of Agency E&O Coverage

2022 Premium Finance Directory

Minding Your Business: M&A Deals Makers & Deal Breakers

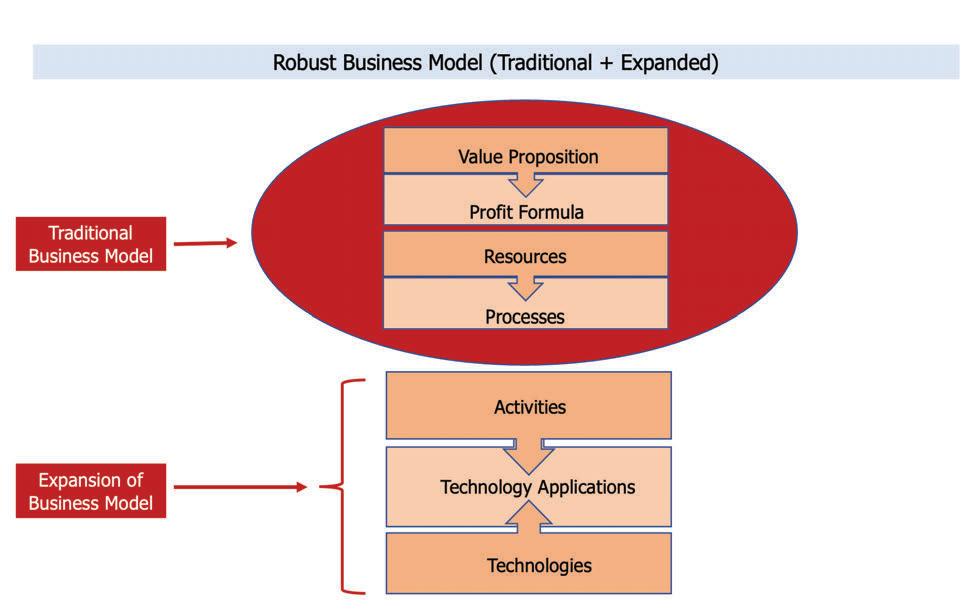

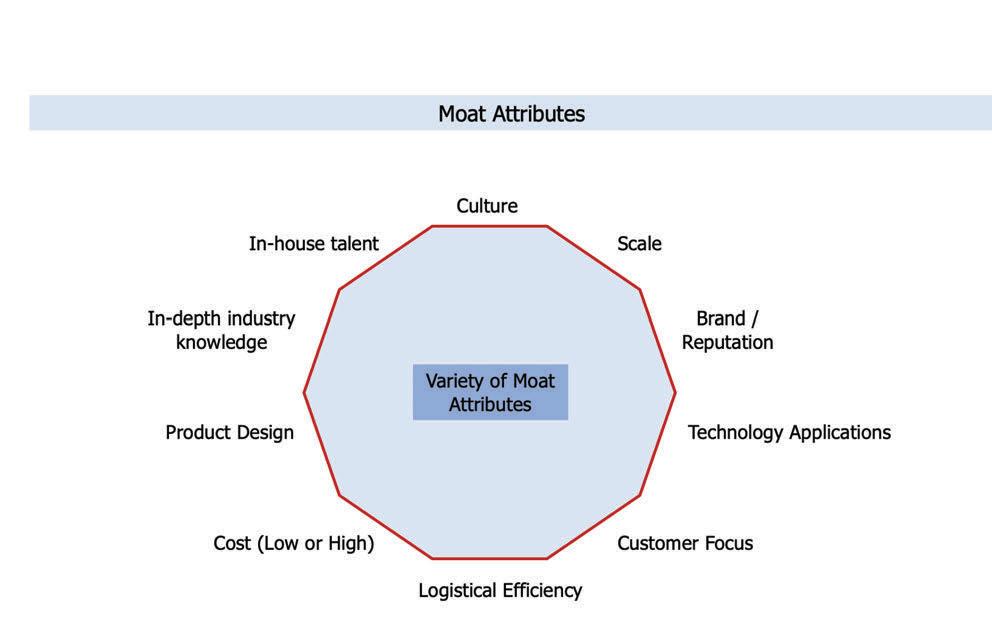

Models, Moats and Moat Mortality

48

Ask the Insurance Recruiter: 9 Talent Acquisition Goals for Insurance Organizations in 2023

Closing Quote: It’s Time for the Industry to Get on the Same Page About MFA

Conventional to complicated. Traditional to atypical. No matter the complexity, we’ve got you covered.

BTC. THC. OSB.

of it gets our TLC.

Chairman of the Board Mark Wells | mwells@wellsmedia.com

Chief Executive Officer Joshua Carlson | jcarlson@insurancejournal.com

ADMINISTRATION / CIRCULATION

Chief Financial Officer Mark Wooster | mwooster@wellsmedia.com

Circulation Manager Elizabeth Duffy | eduffy@wellsmedia.com

are leaving top roles in U.S. firms at higher rates than ever before. Women leaders are switching jobs at higher rates than men in leadership, too, according to “Women in the Workplace 2022, ” the largest study on the state of women in corporate America by McKinsey & Co. and LeanIn.org. The organizations, which analyzed data from 12 million employees at more than 330 companies, have been tracking the state of female workers since 2015, with the findings published in an annual report.

The study says this trend could have serious implications for companies going forward.

“Women are already significantly underrepresented in leadership,” the study said. “For years, fewer women have risen through the ranks because of the ‘broken rung’ at the first step up to manager. Now, companies are struggling to hold on to the relatively few women leaders they have. And all of these dynamics are even more pronounced for women of color.”

This trend in no way shows that women leaders are less ambitious than their male coun terparts. However, the study reveals that woman leaders face obstacles their male leader peers do not.

“Women leaders are just as ambitious as men, but at many companies they face head winds that make it harder to advance,” the study said. “They’re more likely to experience belittling microaggressions, such as having their judgment questioned or being mistaken for someone more junior.”

For example, they are far more likely than men leaders to have colleagues question their judgment or imply that they aren’t qualified for their jobs. Women leaders are also more likely to report that personal characteristics, such as their gender or being a parent, have played a role in them being denied or passed over for a raise, promotion, or chance to get ahead.

Also, the study’s authors pointed out that it’s increasingly important to women leaders that they work for companies that prioritize flexibility, employee well-being, and diversity, equity, and inclusion.

“If companies don’t take action, they won’t just lose their women leaders; they risk losing the next generation of women leaders, too,” the study said.

Although women are broadly underrepresented in corporate America, the talent pipeline varies by industry. Some industries struggle to attract entry-level women (e.g., Technology: Hardware; IT and Telecom; Engineering and Industrial Manufacturing), while others fail to advance women into middle management (Energy, Utilities, and Basic Materials) or senior leadership (Oil and Gas).

The good news: The study found that women in insurance industry leadership roles fared pretty well in representation compared to other sectors. For insurance, women leaders held manager roles at 53%, senior managers at 40%, vice presidents at 40%, senior vice presidents at 35% and C-suite at 31%.

WellsStaff Accountant Sarah Kersbergen | skersbergen@wellsmedia.com

EDITORIAL V.P. of Content Andrea Wells | awells@insurancejournal.com

Executive Editor Emeritus Andrew Simpson | asimpson@wellsmedia.com

National Editor Chad Hemenway | chemenway@insurancejournal.com

Southeast Editor William Rabb | wrabb@insurancejournal.com

South Central Editor/Midwest Editor Ezra Amacher | eamacher@insurancejournal.com

West Editor Don Jergler | djergler@insurancejournal.com

International Editor L.S. Howard | lhoward@insurancejournal.com

Assistant Editor Jahna Jacobson | jjacobson@insurancejournal.com

Content Editor Allen Laman | alaman@wellsmedia.com

Columnists & Contributors

Contributors: Jim Sams, Keith Savino

Columnists: Catherine Oak, Barry Rabkin, Mary Newgard

SALES / MARKETING

Chief Marketing Officer Julie Tinney | jtinney@insurancejournal.com

West Sales Dena Kaplan | dkaplan@insurancejournal.com Romeo Valdez | rvaldez@insurancejournal.com Kelly DeLaMora | kdelamora@wellsmedia.com

South Central Sales Mindy Trammell | mtrammell@insurancejournal.com

Southeast and East Sales (except for NY, PA, CT) Howard Simkin | hsimkin@insurancejournal.com

Midwest Sales Lisa Whalen | (800) 897-9965 x180

East Sales (NY, PA and CT only) Dave Molchan | (800) 897-9965 x145

Advertising Coordinator Erin Burns | eburns@insurancejournal.com

Insurance Markets Manager Kristine Honey | khoney@insurancejournal.com

Sr. Sales & Marketing Coordinator Laura Roy | lroy@insurancejournal.com

Marketing Administrator Alberto Vazquez | avazquez@insurancejournal.com

Marketing Director Derence Walk | dwalk@insurancejournal.com

DESIGN / WEB / VIDEO

V.P. of Design Guy Boccia | gboccia@insurancejournal.com

Web Team Lead Josh Whitlow | jwhitlow@insurancejournal.com

Ad Ops Specialist Jeff Cardrant | jcardrant@insurancejournal.com

Web Developer Terrance Woest | twoest@wellsmedia.com

Web Developer Jason Chipp | jchipp@wellsmedia.com

V.P. of New Media Bobbie Dodge | bdodge@insurancejournal.com

Videographer/Editor Ashley Waldrop | awaldrop@insurancejournal.com

ACADEMY OF INSURANCE

Director Patrick Wraight | pwraight@ijacademy.com

Online Training Coordinator George Jack | gjack@ijacademy.com

Contact (800) 897-9965

‘Women are already significantly underrepresented in leadership.’

auto insurers are coping with the largest direct loss ratio in 20 years because of factors that include historic inflation, a deterioration in driving behavior and sky-high jury awards, the American Property and Casualty Insurance Association says in a new report.

APCIA said the direct loss ratio for auto physical damage reached 77.1% in the third quarter of 2021 — after reaching an historic low of 45.2% during COVID-19 business shutdowns in the second quarter of 2020.

The report says traffic levels regained as pandemic restrictions eased and were within 1% of pre-pandemic levels in the first half of this year. Along with the return to the roads came a 10% increase in the fatal accident rate from 2020 to 2021, the largest percentage increase in history. U.S. private passenger auto losses jumped 25% from 2020 to 2021.

“One of the things we ask in the report is, is this the new normal?” said Robert Passmore, the APCIA’s vice president for personal lines. “What is the new normal?

Normal is definitely more expensive. The report noted the inflation rate peaked above 9% in July, before dipping to 8.3% in August. But U.S. auto insurers are facing a variety of additional factors that are expected to continue pushing claims costs up into 2023 or longer.

The report includes several statistics that illustrate this trend:

Private passenger collision claim severity reached a record $5,743 in the first quarter of 2022, up 36.5% since the same period in 2020. Average bodily injury claim severity is up 24.2%.

Personal auto loss ratios climbed to 78.4% in the second quarter of 2022, compared to a quarterly average of 65% from 2016 to 2020.

The number of miles traveled on U.S. highways increased to 1.305 billion in the first five months of 2022, up from 1.119 billion during the same period of 2020, according to the Federal Highway Administration. The latest number is only slightly below the pre-pandemic level, which was 1.316 billion miles in the first

five months of 2019.

The traffic fatality rate reached 1.33 per 100 million vehicle miles traveled in 2021, up from 1.1 per 100 million in 2011, accord ing to data from the National Highway Traffic Safety Administration.

The average verdict for a lawsuit with more than $1 million awarded increased nearly tenfold from 2010 to 2018, rising to $22.3 million from $2.3 million, according to the American Transportation Research Institute. Personal injury judgments increased 320% in 10 years, to $125,366 in 2020 from $39,300 in 2010, according to data from Current Award Trends in Personal Injury.

The number of auto thefts jumped 25% from 2019 to the first half of 2022, reaching nearly 500,000 vehicles stolen with losses amounting to $4.5 billion.

The report says auto insurance rates have not increased enough to keep up with increasing costs. Direct written premiums for personal auto increased just 4.6% since last year, far below the rate of escalating losses.

Nearlya quarter of workers’ compensation claimants who were treated for COVID-19 experienced persistent symptoms or a relapse months later, according to a new study by the National Council on Compensation Insurance.

The researchers found workers who were hospitalized for COVID-19 were more likely to suffer “long-COVID” — 47% com pared to 20% of COVID patients who were not hospitalized. Overall, 24% of claimants suffered long-haul symptoms within 270 days of receiving acute care.

Claims costs were also much higher for claimants who experienced prolonged symptoms, especially if they were treated at a hospital. The report says treatment for long-COVID patients who were hospital ized cost an average of $216,000 per claim, compared to $40,000 for long-COVID claimants who were not hospitalized and $7,000 for claimants who were not hospitalized and did not suffer long-term effects.

Dr. Michael Choo, chief medical officer for Paradigm, worked with NCCI research ers on the report. The team studied 7,651 COVID-19 claims with accident dates from March 1, 2020 through June 30, 2021.

The researchers identified patients as having long-COVID if medical treatment for symptoms of the disease was reported more than 30 days after hospital discharge or the reported accident date, but no longer than 270 days after. That effectively gave each claim an eight-month observa tion window.

NCCI spokeswoman Christine Pike said the 270-day window was chosen so researchers could observe claims over a specific period with the most recently reported medical treatment data available.

The researchers found that females were more likely to report long-COVID, outnumbering males nearly four to one. However, females also make up greater

percentage of the workforce in the health care occupations that were most likely to contract the disease.

Long-COVID sufferers reported a variety of symptoms, most of which impacted the pulmonary and cardiovascular systems, the report says. Some experienced per sistent debilitating symptoms while others experienced a relapse.

The report says 1% of COVID claimants died from the disease, but 12% of those who were hospitalized did.

Claimants who were hospitalized and suffered long-COVID had longer duration claims. Medical treatment lasted 159 days on average for hospitalized COVID claim ants, with 89 days of that on temporary disability for the long-COVID patients. For long-COVID claimants who were not hospi talized, the duration of medical treatment was 93 days and temporary disability was 64 days.

Medical treatment for COVID claimants who were hospitalized but did not experience long-term symptoms lasted 26

days, with 35 days of indemnity benefits. For claimants who were not hospitalized and did not have long-COVID, medical treatment averaged 11 days and indemnity payments 19 days.

The data indicates that COVID-19 patients become less likely to exhibit long-term symptoms over time. While 47% of hospitalized COVID claimants reported long-COVID within the 270-day post-treat ment window, only 14% of those claimants reported symptoms after 240 days. For the 20% of non-hospitalized COVID claimants who reported long-COVID symptoms, only 4% did after 240 days.

The report states that because data was collected only through the first quarter of 2022, the impact of more infectious Omnicron COVID variant on long-COVID is unknown.

“However, we feel encouraged and reas sured by the progress that has been made toward prevention and more effective treatments for COVID-19 infections,” the report concludes.

AND THAT’S A WIN!

The California surplus lines stamping fee will decrease from .25% to .18% effective January 1, 2023.

The Surplus Line Association of California is committed to fostering a healthy, fair and competitive marketplace. Our board of directors, under the leadership of Janet Beaver, unanimously decided to lower California’s stamping fee from .25% to .18%.

Faced with historic inflation, concerns of recession, global political unrest, and emerging from Covid-19, the Surplus Line Association of California continues to grow its services for stakeholders while reducing cost. And that’s a win!

slacal.com/stampingfee

slacal.com sla_cal

Special thank you to the SLA’s own Iona Vinson for starring in this public service ad.

The amount University of Iowa Hospitals & Clinics will pay employees who filed a class-action lawsuit alleging overtime and other payments were improperly paid. The plaintiffs, including about 11,000 workers, argued that managers didn’t pay overtime, bonuses, or accrued leave as quickly as state and federal laws require. The six employees who led the lawsuit will each receive $10,000. The other workers will each receive a share of the remaining $11.6 million. The lawyers will take home $3.4 million.

The amount a New Orleans Saints player was sued for in connection with an assault in Las Vegas during Pro Bowl weekend. Saints running back Alvin Kamara already faces a felony battery charge in the alleged assault of Darnell Greene Jr., who was leaving a club at a hotel and casino at about 6:30 a.m. Feb. 5. The lawsuit, which was filed in Civil District Court of Orleans, includes stills from surveillance footage at the hotel and casino, as well as a photo of the alleged victim after the beating and details from the police report.

The number of lawsuits over COVID-19 business interruption insurance claims against Erie Insurance that were dismissed in October by U.S. District Judge Mark R. Hornak in Western Pennsylvania. Hornak concluded the claimants failed to “plausibly plead” that they are entitled to coverage under their Erie policies.

The additional amount in coverage Harvard University is seeking from insurers for its defense of its affirmative action admissions program. The university has already exhausted $25 million in insurance coverage defending its program and wants its $15 million excess policy issued by Zurich Insurance to cover costs above that amount. Zurich maintains Harvard missed the dead line for notifying it of its claim. Students for Fair Admissions filed suit in 2014 over Harvard’s program and a Department of Justice investigation launched in 2017.

— Said Ashley Bernaugh, president of the parent-teacher association at a suburban St. Louis, Missouri, school that has significant radioactive con tamination. A Chemical Data Corp. report confirmed fears about contamination at Jana Elementary School in the Hazelwood School District in Florissant raised by a previous Army Corps of Engineers study. The school sits in the flood plain of Coldwater Creek, which was contaminated by nuclear waste from weapons production during World War II. Inhaling or ingesting these radioactive materials can cause significant injury, the report said.

“This landmark project represents largescale, real-world progress on the journey to decarbonize the global economy.”

— Dan Ammann, president of ExxonMobil Low Carbon Solutions, said about an agreement with EnLink Midstream to reduce industrial carbon dioxide emissions in Louisiana. Captured emissions from the CF Industries ammonia production plant in Donaldsonville — the top greenhouse gas industrial emitter in the state, based on Louisiana’s 2021 Greenhouse Gas Inventory report — will be trans ported through EnLink’s existing pipeline network and “injected into deep, underground geologic forma tions” on ExxonMobil property in Vermillion Parish. Officials estimate the startup date to be in 2025.

“We have bad public adjusters swarming impacted areas, soliciting, and trying to make a quick buck. Not only do individu als need more time to get out of a public adjuster contract during a state of emer gency, we need to reduce the percentage a public adjuster is entitled to immediately following a storm, ensuring their motives are aligned with helping Floridians get back on their feet.”

— Florida’s chief financial officer, Jimmy Patronis, said on Oct. 19, three weeks after Hurricane Ian made landfall and damaged thousands of properties in southwest Florida. The area has seen a large increase in adjusters, plaintiffs’ attorney adver tisements, and contractors hoping to benefit from insurance claims, according to various reports.

“Insurance is the Achilles heel of the fossil fuel industry and has the power to accelerate the transition to clean energy.”

— Peter Bosshard, author of a recent report by Insure Our Future, an alliance of groups that track insurers’ policies on fossil fuel industries, said regarding the report’s finding that 62% of reinsurance companies — which help other insurers spread their risks — have plans to stop covering coal projects, while 38% are now excluding some oil and natural gas projects. Insure Our Future said its annual scorecard of 30 companies ranked Allianz, AXA and Axis Capital best for their coal exit policies, while Aviva, Hannover Re and Munich Re came out on top for oil and natural gas.

— Drew Michanowicz, co-author of a new study that shows gas stoves in California homes are leaking cancer-causing benzene.

— Connecticut Gov. Ned Lamont said after the state’s insurance department approved an average decrease of 3% to workers’ compensation pure premium loss costs in the voluntary market. This marks the ninth consecutive year rate have declined, with premiums cut by $300 million over this span, reflecting decreases in the number of workplace injuries and claims filed, according to the state. The rate decrease is effective Jan. 1, 2023.

“This decline in workers’ compensation insurance premiums is good news for Connecticut businesses. … Additionally, it is good news for workers as it signifies the fact that workplaces are getting safer and safer.”

“It sounds so cliche, but it takes your breath from you.”

“What our science shows is that people in California are exposed to potentially hazardous levels of benzene from the gas that is piped into their homes.”

quartered in Iselin, New Jersey. Since its founding in 2011, World Insurance has completed 160 acquisitions and serves its customers from more than 250 offices across the country.

Arthur J. Gallagher & Co., Cason, Huff & Schlueter Insurance

Arthur J. Gallagher & Co. acquired Quincy, Illinois-based Cason, Huff & Schlueter Insurance.

Oliver Wyman has entered into an agree ment to acquire Avascent, an aerospace and defense management consulting firm focused on the corporate and private equity sectors.

The deal is expected to close before the end of the year.

The global management consulting firm and subsidiary of Marsh McLennan said Avascent complements Oliver Wyman’s strong position and reputation across the aviation, aerospace and defense industry globally.

For more than 15 years, Avascent has been a specialist management consulting firm serving clients across aerospace, defense and government sectors. Avascent is also a boutique private equity and M&A advisor in the A&D space and the combi nation of Avascent and Oliver Wyman will create a team with experience in deal and post-transaction work.

Avascent is based in the U.S., Canada, UK and France, with an extended network of clients and senior advisors around the world.

A team of approximately 130 profession als, including 10 partners, will join Oliver Wyman and will be integrated into Oliver Wyman’s Transportation & Services and Private Capital practices.

Warren Buffett’s Berkshire Hathaway Inc. and Alleghany Corp. announced

that all regulatory approvals relating to the proposed $11.6 billion acquisition of Alleghany by Berkshire Hathaway have been received.

The deal was first announced in March 2022.

At a special meeting held on June 9, 2022, the stockholders of Alleghany voted to approve and adopt the agreement and plan of merger.

World Insurance

Insurance brokerage World Insurance Associates reported that it recently closed on purchasing three insurance agencies in the Northeast.

World Insurance acquired Michael F. Iacangelo & Co. of Belleville, New Jersey, on Sept. 1, 2022.

Iacangelo, founded in 1957, sells person al lines coverages.

Also on Sept. 1, World Insurance acquired Cotten Coverage Insurance Agency of Farmingville, New York.

The Cotten Coverage agency provides property/casualty personal lines and com mercial lines on Long Island. The agency was founded in 1991 by Bob Cotten and his wife, Karen.

On Aug. 1, World Insurance Associates acquired O’Brien and Gibbons Insurance Agency of Worcester, Massachusetts.

Founded in 1961, O’Brien and Gibbons is retail personal and commercial lines agency.

World Insurance Associates is head

Terms of the transaction were not disclosed.

Founded in 1923, Cason, Huff & Schlueter is a retail insurance agency specializing in personal and commercial insurance as well as life, health and disability insurance to clients in Illinois and Missouri.

Mike McCaughey, Patty McCaughey, Bryan Feldner, Eric Frese, Mary Kinscherf and their associates will remain in their current location under the direction of Ryan Isaacs, head of Gallagher’s Midwest region retail property/casualty brokerage operations.

Inszone Insurance Services, Proctor Insurance

Inszone Insurance Services acquired Proctor Insurance, its fifth acquisition in the state of Texas.

Based in Houston, Proctor offers busi ness and personal lines, and specializes in hotels and motels. The agency was founded by Jeff Proctor in 1988.

Arthur J. Gallagher & Co.’s wholesale brokerage, binding authority and programs division known as Risk Placement Services acquired Florida-based SeaCoast Underwriters.

The terms were not disclosed.

Founded in 1996, SeaCoast is a whole sale specialist, a managing general agency with binding authority, and a surplus lines broker for admitted and non-admitted insurers. Headquartered in Lake Mary, Florida, SeaCoast specializes in commer cial property/casualty, flood and excess flood, personal lines, and transportation and garage risks in Florida and 13 other states.

Davies, Insurance Risk Services

Davies, a professional services and technology company serving the insurance market, has agreed to purchase Insurance Risk Services, a Florida-based firm that provides inspections for underwriting.

Insurance Risk Services, or IRS, is based in Lake Mary, Florida. It specializes in residential and some commercial inspec tions, telephone audits and drone roof inspections.

Choice Financial, Georgia Pines

Choice Financial Group, a regional insur ance agency based in Virginia Beach, has acquired Georgia Pines Agency, expanding its footprint into Georgia, Florida and California.

GPA, headquartered in Kennesaw, Georgia, is a full-service agency with 12 offices and 65 employees. Co-founders Michael Heidelberger and Steven Roy will continue to oversee operations.

Bob Hilb, founder and former CEO of the Hilb Group, a major insurance broker, is CEO of Choice Financial.

The acquisition is the 10th for Choice since it obtained capital support from Northlane Capital Partners, the company said. Choice now has offices in 11 states.

Hilb Group acquired Allegacy Benefit Solutions, a credit union service organization based in Winston-Salem, North Carolina. The move means that Allegacy Federal Credit Union is getting out of the employee benefits business, according to news reports. The unit has about 20 employees and most of those will transition to Hilb.

Hilb Group is a national property/casu alty and benefits brokerage that has grown

nationwide through multiple acquisitions in recent years.

Hotaling Insurance Services, a brokerage and risk management team, has merged with Akumen Insurance Advisors of South Florida.

The deal becomes effective Jan. 1. Terms were not disclosed.

Akumen CEO Vince Castro will become regional president of Hotaling Insurance, and the Akumen brand will be known as Hotaling Insurance Services Doral.

Hotaling opened a Miami office in 2018.

Both firms have offered commercial and personal lines of insurance.

Risk Strategies, Relation Education Solutions

Risk Strategies has acquired Relation

Education Solutions from Relation Insurance Services.

The deal adds key capabilities to Risk Strategies’ national education practice.

A division of California-based Relation Insurance Services, Relation Education Solutions' offerings complement existing Risk Strategies' education practice capa bilities, including student health plans, international benefits, faculty and staff benefits, and cultural exchange health plans, while expanding the existing portfolio in areas such as student athletics, amateur sports, and recreational programs.

Relation Education Solutions provides insurance brokerage and program adminis tration services for more than 950 colleges and universities across the country.

Risk Strategies is a specialty national insurance brokerage and risk management firm offering risk management advice and insurance and reinsurance placement for property/casualty, employee benefits and private client services risks.

You’ve known us as AFS/IBEX — now we’re Pathward. Our new name represents the path forward in our purpose to power financial inclusion. We’re turning obstacles into opportunities; helping businesses gain access to the funds they need to reach their full potential.

As Pathward, we remain committed to our agents, brokers, and insured clients in creating forward thinking solutions to meet your insurance premium finance needs.

Visit pathward.com/premiumfinance to learn more.

QBE International Markets appointed Sean Dollahon, vice president, U.S. marine manager, and Katie McCord, vice president, senior marine underwriter.

With nearly 20 years of industry experience, most recently as Inland Marine Manager at AIG and prior to that as vice president, South Region Ocean Marine at Liberty Mutual Insurance, Dollahon brings a wealth of expertise on the intricacies and challenges of the market.

McCord brings more than 15 years of industry experience in both the U.S. and London marine markets to her new role at QBE. Prior to joining, she served as national marine prac tice leader, at IMA Financial, and underwriting officer, marine, at Liberty Mutual Insurance.

Insurance broker Lockton added Deborah Hirschorn as managing director, U.S. cyber and technol ogy claims leader.

Hirschorn is based in New York, New York, and joins Lockton from Berkshire Hathaway Specialty Insurance.

AXA XL Insurance promoted Michael McKinley to lead its Construction Primary Casualty Insurance business in North

America.

Based in Atlanta, McKinley has more than 25 years of insur ance industry experience, including six years spent on Zurich Insurance’s Construction team.

Embroker named David Derigiotis as chief insurance officer.

Derigiotis previously served as cor porate senior vice president and national professional liability practice group leader for Burns & Wilcox, an international wholesale broker and MGA. He has 20 years of experience in the insurance industry.

Plymouth Rock Assurance Corp. appointed Paul Measley as chief claims officer.

Measley joins Boston, Massachusetts-based Plymouth Rock from GEICO. He spent nearly 30 years at GEICO in various roles, most recently developing aspects of GEICO’s corporate claims strategy, including digital claims, systems, first notice of loss, personal injury protection, subrogation, training and auditing.

Burns & Wilcox, a global wholesale insurance brokerage headquar tered in Farmington Hills, Michigan, added Carrie Chappie to its

Pittsburgh management team as associate managing director.

Chappie will oversee the Pittsburgh office’s day-to-day operations and growth strategy. With over 30 years in the industry, she most recently worked at Conway E&S, where she served as president of wholesale.

Ryan Specialty, headquar tered in Chicago, Illinois, announced promotions to key new roles within the under writing managers specialty.

Tom Curran has been appointed chief wholesale distribution officer.

Curran has over 25 years’ experience in the industry and most recently served as chief marketing officer for WKFC Underwriting Managers and its subsidiaries, CorRisk Solutions and AgRisk Underwriters, all Ryan Specialty managing general underwriters.

James Shaffer has been appointed chief retail distribu tion.

Shaffer has served as executive vice president, sales and marketing for SUITELIFE Underwriting Managers for the past three years. Prior to Ryan Specialty’s acquisition of the SUITELIFE business from Venture Programs Inc. in 2019, Shaffer served as executive vice president of that organization.

Valley Insurance Agency Alliance (VIAA), a network of nearly 150 independent insurance agencies in Missouri and Illinois, promoted Linsey Morris to commercial lines coach.

Her responsi

bilities include working with the company’s development team to assist its Independent Strategic Member (ISM) alliance with attaining technology and revenue goals. Morris will pro vide commercial technology assistance that specifically focuses on risk management, marketing, and prospecting.

Prior to joining VIAA, Morris worked for sister company Powers Insurance & Risk Management as a commercial account manager. She has more than 15 years of personal lines insurance industry experience.

Iroquois named Jo Gonzalez as a regional manager for Texas, where she will fur ther expand Iroquois’ presence by partnering with independent insurance agencies and select carriers.

Gonzalez most recently served as a director of sales for an independent adjusting firm building relationships with commercial carriers across the south central U.S. She has also held sales leadership roles at Encompass and Kemper where she established a virtual sales team and partnered with agents across Texas and the United States.

Iroquois Texas is part of Allegany, New York-based Iroquois Group.

Platinum Specialty Underwriters, based in Connecticut, promoted Jeri Lucas to managing director for Platinum Construction, a program Lucas created. This exclusive program focuses on

small to mid-size artisan con tractors and local contractors working with select individual wholesale producers.

Lucas, based in Texas, has led multiple MGAs, managing profitable books of business for construction and general P/C. She and her team have extensive knowledge of writing difficult classes.

Distinguished Programs, a national insurance program manager, named Beth Fulton as regional sales executive covering South Central states, including Arkansas, Louisiana, Oklahoma and Texas.

Joining Distinguished Programs from her recent position as the director of marketing for Zenith Insurance Company’s central region, Fulton brings over 18 years of insurance experience.

She is based in Austin, Texas.

Wholesale insurance brokerage firm Brown & Riding named Justin Peterson and Brenda Roberson to its national casualty practice, focusing on Florida.

As casualty brokers, Peterson and Roberson will specialize in complex casualty risks and new residential construction in Florida.

Brown & Riding, headquar tered in California, has 18 offices across the country.

Columbia Insurance Group made Michael Portanka regional vice president for the Southeast United States. Based in Atlanta, he will have responsibility for success fully growing the commercial lines business in the five-state region.

Headquartered in Columbia,

Missouri, Columbia Insurance Group provides comprehensive property/casualty insurance to policyholders in 14 states.

McGriff, a commercial insur ance broker and subsidiary of Truist Insurance Holdings, named Lanette Norgan vice president of its energy practice, based in Birmingham, Alabama.

Norgan, who has experience in employee benefits and property/ casualty insurance in the energy sector, will also serve as account executive.

Willis Towers Watson, a global advisory and broking company, named Samuel Stern director of financial, executive and professional risks (FINEX) for the Southeast.

He will be responsible for client retention and building the FINEX market in the South.

Shonda Manigault has been promoted to associate director for the Southeast FINEX commercial team to work with Stern in developing strategy.

Manigault has been the lead broker on some of the largest accounts within the region.

Georgia-based Southern Insurance Underwriters named David Green practice leader for professional lines.

Green, who previously was the new business manager for real estate errors and omissions at NormanSpencer Agency, will focus on

E&O, directors and officers and miscellaneous professional coverages.

Jacksonville-based One Call, a care management firm for the workers’ compensation industry, named Juan Perez chief financial officer.

Perez was previously CFO at WellPath, a health care company based in Tennessee. Perez is a certified public accountant who has led accounting and finance departments for other compa nies before joining WellPath.

California Insurance Commissioner Ricardo Lara made appointments to the California Automobile Assigned Risk Plan Advisory Committee, the Curriculum Board, and the Workers’ Compensation Insurance Rating Bureau Governing Committee.

These statewide programs are based in Sacramento.

The terms for the new CAARP Advisory Committee appointments end on Nov. 10, 2023.

Doug Heller has been reappointed to public member representative seat. He is the director of insurance for the Consumer Federation of America. Previously, he served as the executive director of Consumer Watchdog. He is also an appointee to the Federal Advisory Committee on Insurance.

Cynthia Strathmann has been reappointed to public member representative seat.

Strathmann is executive director for Strategic Actions

for a Just Economy, a non-profit economic justice organization that advocates for tenant rights, healthy housing, and equitable development in Los Angeles. Formerly, Strathmann was a research and policy analyst for the Los Angeles Alliance for a New Economy and a research assis tant professor at the University of Southern California.

Bernardo de la Torre joins the committee as a public member representative.

He is the owner of Law Offices of Bernardo de la Torre in La Mirada, a law firm spe cializing in the representation of injured workers founded in 1985.

Curriculum Board appointee Michael Lujan is the principal consultant of Michael Lujan Consulting Group LLC.

Previously, Lujan was the inaugural director of sales for Covered California. He created the curriculum required to cer tify licensed agents to enroll in the program and successfully trained, certified and appointed more than 14,000 agents in the first year.

Lujan joins the life agent trade association representa tive seat with a term ending on Oct. 14, 2025.

WCIRB Governing Committee appointee Lynne Davidson is president of Tito’s Tacos Mexican Restaurant.

Davidson has been a board member of the California Restaurant Association for the past 28 years and is a past board chair of the Los Angeles chapter of the California Restaurant Association.

Davidson has been reappointed to the insured employer representative seat, with a term ending on Oct. 14, 2024.

About the Commercial Lines Leaders: The 2022 Commercial Lines Leaders in this special feature are taken from Insurance Journal’s Top 100 Property/Casualty Independent Agencies as reported in August. This list utilizes only the 2021 commercial lines property/casualty revenue numbers of the independent agencies and brokerages that submitted data to the Top 100 agencies report. For more information on Insurance Journal’s Top 100 Property/Casualty Independent Agencies list, contact awells@insurancejournal.com.

1 Acrisure $1,756,372,897 $16,221,866,751 $2,347,119,636 12,793 Grand Rapids, Michigan

2 Lockton $1,629,139,000 $20,521,888,069 $1,755,563,000 9,328 Kansas City, Missouri

3 Alliant Insurance Services Inc. $1,585,547,796 $10,065,628,814 $1,943,452,876 9,529 Irvine, California

4 HUB International Ltd. $1,522,975,317 $12,000,000,000 $2,017,825,215 15,081 Chicago, Illinois

5 AssuredPartners Inc. $1,303,699,241 $8,000,000,000 $1,507,408,268 8,279 Lake Mary, Florida

6 USI Insurance Services $1,192,945,494 $9,260,000,000 $1,304,201,153 8,661 Valhalla, New York

7 BroadStreet Partners Inc. $712,880,000 $5,629,000,000 $921,760,000 5,360 Columbus, Ohio

8 EPIC Insurance Brokers & Consultant $603,450,800 $4,220,000,000 $678,511,800 2,830 San Francisco, California

9 NFP $559,385,531 $4,080,390,000 $632,589,166 6,849 New York, New York

10 Alera Group $435,000,000 $480,000,000 3,500 Deerfield, Illinois

11 RSC Insurance Brokerage Inc. (DBA Risk Strategies Co.) $380,173,642 $2,933,561,615 $442,820,067 3,271 Boston, Massachusetts

12 IMA Financial Group $342,992,241 $6,122,497,000 $450,130,337 1,707 Denver, Colorado

13 PCF Insurance Services $340,000,000 $2,600,000,000 $470,000,000 2,492 Lehi, Utah

14 Baldwin Risk Partners $265,514,985 $2,900,000,000 $487,768,057 3,300 Tampa, Florida

15 Woodruff Sawyer $233,000,000 $2,694,300,000 $235,600,000 566 San Francisco, California

16 Higginbotham $212,684,000 $1,900,000,000 $239,303,000 2,000 Fort Worth, Texas

17 Insurance Office of America Inc. $208,078,674 $2,067,052,014 $223,186,545 1,364 Longwood, Florida

18 Hilb Group $208,043,498 $284,433,293 1,958 Richmond, Virginia

19 Leavitt Group $197,974,548 $1,315,969,278 $261,716,764 2,224 Cedar City, Utah

20 Cross Insurance $131,166,000 $1,958,923,400 $207,942,000 1,093 Bangor, Maine

21 Cobbs Allen/CAC Specialty $129,161,761 $1,186,250,000 $145,021,560 326 Denver, Colorado

22 High Street Insurance Partners $119,000,000 $224,000,000 1,800 Traverse City, Michigan

23 Heffernan Insurance Brokers $109,043,216 $735,261,295 $150,716,937 581 Walnut Creek, California

24 Hylant $102,865,658 $877,603,303 $111,703,038 851 Toledo, Ohio

25 INSURICA Inc. $100,062,144 $784,901,467 $120,574,551 663 Oklahoma City, Oklahoma

26 BXS Insurance** $100,000,000 $828,000,000 $110,000,000 782 Gulfport, Mississippi

27 World Insurance Associates LLC $98,673,447 $1,114,288,512 $154,346,670 1,479 Iselin, New Jersey

28 TrueNorth $73,078,370 $570,000,000 $108,200,000 488 Cedar Rapids, Iowa

29 The Liberty Company Insurance Brokers $71,400,000 $571,200,000 $92,400,000 647 Gainesville, Florida

30 Sunstar Insurance Group $58,500,000 $585,000,000 $90,000,000 550 Memphis, Tennessee

31 Graham Company $56,506,382 $413,701,571 $68,258,577 210 Philadelphia, Pennsylvania

32 Houchens Insurance Group Inc. $54,349,853 $394,360,608 $58,723,870 345 Bowling Green, Kentucky

33 Patriot Growth Insurance Services LLC $53,350,000 $372,800,000 $104,450,000 1,175 Fort Washington, Pennsylvania

34 Marshall & Sterling Enterprises Inc. $52,710,603 $390,797,463 $77,110,179 531 Poughkeepsie, New York

35 Sterling Seacrest Pritchard $47,987,427 $421,391,467 $53,822,577 299 Atlanta, Georgia

36 Towne Insurance** $47,930,124 $325,048,695 $65,832,414 422 Norfolk, Virginia

37 Horton Group $46,130,000 $356,935,000 $53,318,000 400 Orland Park, Illinois

38 Starkweather & Shepley Insurance Brokerage Inc. $44,851,384 $326,135,435 $67,640,828 266 East Providence, Rhode Island

39 Lawley LLC $43,532,579 $357,630,835 $57,230,801 424 Buffalo, New York

40 Eastern Insurance Group LLC** $43,526,136 $320,524,689 $76,071,244 404 Natick, Massachusetts

41 Shepherd Insurance $43,270,860 $332,015,517 $58,008,213 431 Carmel, Indiana

42 ALKEME $42,766,000 $285,000,000 $61,034,000 300 Ladera Ranch, California

43 Bowen, Miclette & Britt Insurance Agency LLC $41,168,190 $288,485,652 $46,224,997 210 Houston, Texas

44 Robertson Ryan & Associates $38,261,373 $307,000,000 $57,931,594 419 Milwaukee, Wisconsin

45 Professional Insurance Associates $35,000,000 $275,000,000 $60,000,000 75 San Carlos, California

46 Moreton & Company $34,999,520 $230,000,000 $39,523,484 240 Salt Lake City, Utah

47 Huntington Insurance** $34,563,000 $165,000,000 $40,563,000 353 Columbus, Ohio

48 The Mahoney Group $33,442,342 $271,578,655 $49,130,885 190 Mesa, Arizona

49 The Buckner Company Inc. $33,026,066 $234,273,777 $34,427,893 202 Salt Lake City, Utah

50 Inszone Insurance Services LLC $32,001,854 $213,345,694 $45,787,268 218 Rancho Cordova, California

IfHurricane Ian would have made landfall in Florida, say, six months ago, the costs of reconstruction could have been even higher than the already staggering estimates now coming from the Sunshine State.

Inflation is indeed set to bump up rebuilding price tags. But one insurance expert told Insurance Journal how a softening in the new home construction market has contributed to the unkinking of supply chains and reductions in the prices of many types of building materials.

“Inflation will exacerbate repair and rebuilding costs from Ian above and beyond the effect we would ordinarily see from demand surge,” said Bob Hartwig, an industry veteran who currently works as a professor of finance at the University of South Carolina’s Darla Moore School of Business and serves as director of the school’s Center for Risk and Uncertainty Management.

“There is a small silver lining in this, in that as it turns out, because the Federal Reserve has been raising interest rates for the past several months, this has cooled the housing market, and it’s been cooling the new home market,” Hartwig added. “The headline rate of inflation, which is about 8.5% today, is somewhat lower for

building materials.”

An Oct. 14 blog post from the National Association of Home Builders (NAHB) shared that the prices of building materials decreased 0.3% in September (not sea sonally adjusted) according to the latest Producer Price Index report. The post also shared that PPI for goods inputs to residential construction, including energy, declined for the third consecutive month in September (-0.1%).

“Prices have fallen 2.3% since June, the largest three-month drop since April 2020,” reported NAHB. “However, these modest price declines have occurred when material prices were already at extremely elevated rates.”

Stonybrook Capital, a strategic advisory and investment banking firm, reported that Hurricane Ian will result in the largest ever insured loss event in nominal dollars at an estimated price tag of more than $75 billion. Catastrophe modeler RMS said a “sizable portion” of losses from the hurricane will be from “post-event loss amplification and inflationary trends,” when it released an initial best estimate of $67 billion in insured losses from Ian. Modeler Karen Clark & Co. similarly worked in these factors when coming up with an insured loss estimate for Ian of $63 billion. [Updated estimated loss predic tions have declined from initial figures.]

Temporary surges in inflation aren’t unusual following natural disasters that leave a large footprint of destruction. Demand surges commonly follow catastro phes like Ian, driving up the prices of basic commodities related to homebuilding and construction — such as plywood, lumber, concrete and other materials.

Those costs are built into insurance policy rates. What isn’t factored in, however, is the country’s accelerated national underlying annual inflationary trend, which was reported as being north of 8% in September. This underlying inflation is “definitely a problem,” Hartwig said, “but less of a problem than it would have been six months or a year ago, and that’s because of the cooling of new home construction, which is leading to greater availability for building materials and even labor.”

On the provider end, he explained that insurers will look to build that inflationary trend into 2023 rates and beyond. When this happens, Hartwig estimated hundreds of thousands of Floridians will experience dramatic increases in premiums. Others may be dropped from their providers entirely.

“Double-digit percent increases in virtually every case,” he said. “And many others are going to find that their insurer is potentially going to non-renew them. Others are going to be in a situation where their insurer went under, and so they will be seeking coverage elsewhere.”

The road to rebuilding could be a long one. With inflation at a four-decade high and labor and materials still high in demand, CoreLogic, a data and analytics services provider, anticipates recovery will be slow and difficult.

Still, while labor markets — including construction — are tight, they aren’t quite as tight as they would have been back in April or last fall. Typically, following an event like Ian, many contractors will descend on the impacted area simply because much work is needed, Hartwig said.

that was either the Ultrapack Plus Policy or the UltraFlex Policy.

judge has dismissed 32 lawsuits over COVID-19 business interruption insurance claims against Erie Insurance, concluding the claimants failed to “plausibly plead” that they are entitled to coverage under their Erie policies.

The ruling by U.S. District Judge Mark R. Hornak in Western Pennsylvania reflects the opinions of other courts that have rejected allegations that COVID-19 viruses and government shutdowns cause direct physical damage and loss that triggers business interruption coverage. The opinion also reflects the analysis the same judge gave in dismissing similar claims against Cincinnati Insurance, Travelers Insurance and Hartford Financial Services.

Plaintiffs in this multidistrict litigation included retail stores, restaurants, car deal erships, hair salons, and dental practices located in the District of Columbia, Illinois, Maryland, New York, Ohio, Pennsylvania, Tennessee, Virginia, and West Virginia.

Each plaintiff had an “all risk” commer cial property insurance policy with Erie

While their businesses may be different, their legal claims were similar to those asserted by business owners in a multitude of similar cases nationwide. The Erie cases were consolidated under Judge Hornak in January 2021.

Plaintiffs in this multidistrict litigation included retail stores, restaurants, car dealerships, hair salons, and dental practices located in the District of Columbia, Illinois, Maryland, New York, Ohio, Pennsylvania, Tennessee, Virginia, and West Virginia.

Both Erie policies cover direct physical loss or damage to covered property resulting from an insured peril. Both policies contain a “law or ordinance” exclusion. The UltraFlex also contains a virus exclusion.

After Erie denied their claims, the plain tiffs filed suits alleging that Erie wrongfully denied them coverage under the income protection, extra expense, civil authority, dependent property, and/or sue and labor coverage provisions. They asserted two covered causes of direct physical loss or damage: the COVID-19 virus itself and the mandated shutdown rules issued by gov ernments to mitigate the virus’s spread.

The parties’ primary dispute, as in many other cases, was whether those events caused “direct physical loss of or damage to” covered property.

Erie argued that “direct physical loss of or damage to” property unambiguously “requires a tangible, concrete physical harm” to the property, which “cannot be plausibly alleged” by the plaintiffs. The judge agreed.

The district court considered the laws and rulings from the various plaintiffs’ states where similar cases have been decided, noting that while no high court in those states has yet ruled, other courts have and the “near-uniform dismissal” of claims like plaintiffs’ applying the law of the jurisdictions involved in this MDL

presented an “uphill precedential path” for the claimants. Hornak said the central question was whether those decisions were “correct predictions of how the involved jurisdiction’s highest court would decide claims” that mirror those of plaintiffs.

The court said that there is “not a persua sive basis” to conclude that these cases were not soundly decided and are not reliable indicators of the path the federal court should follow.

The court rejected the claimants’ allega tions that the virus particles can become affixed to and remain stable on surfaces for hours or from one to 14 days, and in that way “change” the surfaces. “[T]he natural plausible inference from those allegations

is that the virus particles dissipate on their own, after those numbers of hours or days have passed, without any human intervention. Based on those allegations, the impact that COVID-19 virus particles have on property on which it is present is wholly unlike the impact that, say, a fire that burns all or part of a structure has on property where a fire has occurred,” the

opinion states. The court also rejected the argument that the absence of a virus exclusion in some policies means coverage should be provided under those policies.

The court additionally denied the plea that Pennsylvania’s reasonable expecta tions doctrine in insurance law entitles a policyholder to coverage based on the pol icyholder’s reasonable expectations even if the terms of the insurance contract clearly and unambiguously preclude coverage.

The court concluded: “[I]t is self-evident that the COVID-19 pandemic has had detrimental consequences to people all over the world that cannot be overstated.

However, it can also be accurate that the Erie Policies to which the Plaintiffs in this MDL were parties do not provide coverage for the additional consequences that Plaintiffs assert that they as property and business owners suffered as a result of the pandemic and the associated government orders limiting how the properties could be used.”

By Jahna Jacobson

By Jahna Jacobson

It takes a lot of skill, orga nization and compassion to make more than 9,000 people feel like a family. But the leadership and team at USI Insurance Services are up to the challenge.

Valhalla, New Yorkheadquartered USI has 9,379 employees and an annual revenue of over $2 billion. Its size and national presence could make employees feel lost in the crowd, but instead, USI team members feel seen and heard. The responses submitted by USI employees to Insurance Journal’s 2022 Best Agencies To Work For survey reflect the pride they have in their com pany, which has been selected as the Bronze award winner for IJ’s East region.

“USI is a progressive com pany and has a good balance of the national footprint with regional offices,” one nominating employee said. “I feel respected and that my contributions matter.”

“USI promotes leaders and

employees to take ownership in their individual and team performance,” an employee said. “The communication, systems and processes around performance are consistent and valuable to all employees at any level.”

Senior Vice President and Chief Human Resources Officer Kim Van Orman said it’s all about building a culture that goes above and beyond when it comes to employees, in and out of the workplace.

“It’s critical that employees feel a strong sense of support and belonging when they show up for work each day,” Van Orman said. “I am a firm believer that prioritizing ongo ing investments in DE&I, career development, and reward and recognition programs will continue to drive higher levels of employee engagement and workplace satisfaction among all organizations.”

The efforts help grow an even stronger team.

“USI strives to engage me as an employee,” one nominating employee said. “USI ensures its

performance engagement and salary are tops to attract and retain top talent. Also, USI’s dedication to career pathing to invest in the advancement of the employees is top in the industry.”

Another employee said, “USI does an incredible job providing clear, transparent, and obtainable career advancement opportunities. I started 3+ years ago at USI and was promoted multiple times because I was able to hit the performance metrics that were clearly stated at the beginning of my career. USI leadership is very supportive and has an interest in seeing new employ ees succeed.”

Many employees mentioned the company’s amazing benefits, excellent salaries and performance-based bonuses.

“I have worked several places in my career, and USI, by far, is the most employ ee-driven company,” one nominator said. “From senior management down, everyone is approachable, takes the time to know you, and you feel that they want you to enjoy working there.”

USI recognizes and rewards employees for exceptional performance and dedi cation each year through its national

Summit Awards program. Summit honorees receive company-wide recognition, additional bonuses, and the opportunity to participate in a bucket list experience custom-tailored to them.

This year the company expanded the prize to make 200 employees USI shareholders in 2022. The move establishes a path for all employees to have an ownership opportunity in the company and build long-term wealth, Van Orman said.

And the care doesn’t stop when employees walk out the door. USI Cares helps associates and their families in times of need or crisis.

“Our employees have a vari ety of needs and face unique challenges in their personal and professional lives, which is why we help them access financial, medical, housing, social, and emotional support through our employee assistance program,” Van Orman said.

“We have an unmatched depth of leadership throughout the organization from the corporate level to the local office,” Van Orman said.

“USI has built a culture of respect, fairness, profession alism, cutting edge client solutions (and more), which is nothing short of remarkable,” he added.

By Allen Laman

By Allen Laman

Take five-star customer service, add in a fourstep strategic process — and what do you get? An award-winning organization. That organization, Ansay & Associates, an independent insurance agency based in Port Washington, Wisconsin, has built success by identifying needs and exposures, develop ing strategies, and implement ing and monitoring programs. Creating value for customers is key. Treating employees right is part of the winning equation, too.

A&A has received Insurance Journal’s 2022 Best Agencies To Work For Bronze award for the Midwest region based on employee responses to IJ's annual “Best Agencies” survey.

A&A is family owned and was founded in 1946. Today, the organization has locations scattered throughout the Badger State.

Per the Ansay website, the company’s plan for the future remains the same as it was in the beginning: Utilize relation ships and a solutions-based approach to help people and businesses reach their goals.

“I feel honored and proud of the culture that my father helped build,” Mike Ansay, chairman and CEO of Ansay & Associates, wrote in an email. “His legacy was built around the phrase: ‘You have to give to get.’ It’s a motto I fully embrace and fulfill daily.”

The IJ survey respondents clearly appreciate that legacy. They praised the company’s positive culture, strong empha sis on community involvement and effective leaders. Many responses pointed to the importance placed on employ ee care.

“We are a communi ty-focused organization, offering many opportunities for employees to get involved with local organizations and individuals in need of support,”

wrote one employee. “Our benefits package and employer contribution is above average in the market, we offer flexibil ity in working environments, and there is plenty of room for advancement. Continued education goals are strongly supported as is the advance ment of technology resources and tools we use to increase efficiencies.”

They added: “I cannot imagine working anywhere else!”

One respondent commended A&A for not only caring about the wellness of employees, “but also the needs for individ uals and businesses.” Another response noted how leadership “is open and transparent and listens to individuals, and makes them feel valued.”

“Ansay is a family-owned business that brings all of its associates together and works well as a team,” another survey respondent noted.

Still another said: “The leaders of the agency see me

as a person, not a number. My efforts are seen and appreciat ed.”

One employee praised the work of the agency’s leadership, stating: “The owner truly cares about his employees from a personal standpoint and a business standpoint. He understands how important his producers are. He keeps all of us informed on company and industry changes and is on the forefront of the industry. He is seen every day and leads the business by example.”

Another said: “Ansay & Associates is a great company to work for. Ansay prides them selves on their commitment to clients and employees as well as community involvement. We have a great group of employees including manage ment who are always looking towards the future.”

For his part, Mike Ansay praised the positive contribu tions to the agency brought by the people who work there.

“Our people make all the difference,” he wrote. “We are focused not only on growing our client base but also giving our current clients the best possible customer experience. Our agency continues to evolve and improve, finding ways to innovate and be leaders within the industry.”

AtGlenn Harris and Associates, the whole company is a team, and the team is family. That includes three tail-wagging “Directors of Morale” — com pany dogs Smoky, Mocha and Chief.

The overwhelming sense of camaraderie is just one of the reasons Glenn Harris employ ees responded en masse to Insurance Journal’s 2022 Best Agencies to Work For survey, making the agency IJ’s Bronze winner for the South Central region.

Of course, accolades are nothing new to Glenn Harris, which has also been voted Best Local Insurance Agent by The Oklahoman’s Reader’s Choice Awards five years in a row, including in 2022.

“Insurance market condi tions change regularly, and, as an independent agent, we can select from a variety of carriers and programs,” a nominating employee said. “This makes me very proud to represent an agency so strong in Oklahoma City.”

Founded in 1987, the firm currently has 34 employees and 10 producers, with annual revenue between $11 million and $25 million. The team serves the Oklahoma City area and clients through out Oklahoma.

“I’ve worked at three insurance agencies in my career and have never found a more welcoming, growing,

and full of opportunities than Glenn Harris & Associates,” said one nominating employee. “We have a great team with a purpose!”

“We are a family,” said another nominating employee. “We have a great team and really back each other up for work and personal stuff.”

The teamwork extends across departments and throughout the agency, employees said.

“I’m in the commercial department, and should one of the account managers be out for any length of time, we work together to assist with work flow so the work is not doubled up on one person,” said one employee. “We have meetings to check up on how everyone is doing and if one of the account managers needs extra help.”

“GHA is a fun but profes sional place to work,” said an employee. “Mr. Harris treats his employees well, from celebrating birthdays to being

understanding. The office is … comfortable to be in but also half the team gets to work from home.”

Offering remote work options has helped the compa ny retain staff and secure top talent from other locations.

“Since Covid, several employees are able to work from home 100 percent of the time, which has increased pro ductivity, saving on expense commuting to and from work,” a nominating employee said.

On top of their competitive salaries and remote work options, Glenn Harris offers employees health, dental, vision, 401(k), pension, monthly luncheons, birthday recognitions, an annual bonus, holiday pay and a legendary holiday party.

“Knowing that our employees are happy and feel appreciated are the most important factors in a continued, successful, and growing agency,” a nominating employee said.

The family atmo sphere and confidence in the team frees the employees to work toward their common and ultimate goal.

“We make a day go by fast with a smile, a laugh and hard work,” said Tonda Walters, personal lines team lead. “We diligently provide our clients with the best coverage and rates available from one of our many preferred carriers.”

So how does Glenn Harris make it work across depart ments and remote employees?

“Create an exciting, energetic and enjoyable place to work! Ensure you acknowledge, promote, and supply your staff with the needed avenues to advance themselves in their career,” said Chloey Benson, who works in accounting.

The learning and growing begin the day you walk in the door and never stop, said another nominating employee.

“I am proud to be a part of the GHA family because that is what this agency is,” the employee said. “We have team leads who welcome and train newcomers; we have an accounting team who does any and everything for the office and its needs.”

“We have an absolutely amazing office manager/HR who keeps the office aligned as well as alive, and account managers continuously make the world go round while smiling,” they added. “And to put a cherry on top, we have three extraordinary morale-supporting pups.”

‘We make a day go by fast with a smile, a laugh and hard work.’Glenn Harris and Associates Oklahoma City, Oklahoma Glenn Harris and Family

Southeast

Theteam credits amazing leadership. Leadership gives all the kudos to an incomparable team.

That mutual admiration, trust and respect has led Robins Insurance in Nashville, Tennessee, to be selected as Insurance Journal’s 2022 Best Agencies to Work For Bronze award winner for the Southeast region.

“They are respectful, have a good, laid back and non-micro management style that trusts their employees and provides much respect and flexibility,” one nominating employee said.

“The core values of the agency are at the center for what they do and how they treat their clients,” said another nominating employee. “While growth is the goal, the top of management truly cares about his employees and wants the best for them always.”

CEO Van Robins says that while any agency can invest in a management system or office space, or develop great processes, it’s the talent that makes it work.

“Top-level talent is hard to come by,” he said. “I believe it’s the only durable differentiator for independent insurance agencies. … Top talent — the best subject matter experts available, delivering custom ized insurance solutions and excellent client care — is not easy to replicate.”

Providing great service grows from the positive atmo

sphere, employees said. One cited benefits like flexible work schedules, new challenges and a fun workplace, and added, “I love the feeling of helping people feel comfortable and complete with their insurance needs.”

The employees are also engaged in how the agency is run day-to-day.

“Robins focuses on employ ee involvement and opinions to create policies and procedures,” an employee said. “It is a collaborative environment where employees’ opinions and knowledge are appreciated and acknowledged.”

One thing several employees said helps the agency shine is specializing in insuring niche risks, such as entertainment, hospitality, education, nonprof its, churches and real estate.

“(We have) specialized departments with their own specialties,” an employee said. “(We’re) focused on that specif ic risk. Very knowledgeable in each area.”

“The producers have the highest of standards and presentation I have ever seen; this is why the commercial department is such a success,” said another survey respon dent. “The positive manner in which they interact with the account managers is refreshing and respectful.”

Employees have a custom ized talent development plan with training and educational opportunities focused on the agency’s niche clientele.

“We have a ‘work where you’re weak’ philosophy to training and development,” CEO Robins said. “The idea is

to create the strongest, most well-rounded team members possible. We try to recruit people who value that kind of talent development.”

If you want happy employ ees that create satisfied clients, you’ve got to start from within, he said.

“Be intentional about creating a corporate culture and identity — and be able to articulate it. Use that culture to recruit top talent,” he said. “The best account managers will attract the best producers and vice versa, which creates a virtuous cycle of growth and development.”

Ofcourse, LP Insurance Services protects and defends clients when things go wrong.

But those who work for the Reno, Nevada-headquartered company see themselves as more than guardians. They see how their work removes stress from business owners and empowers them to go beyond. They see themselves as enablers of dreams.

“By protecting, we also enable (them) to go deeper,” explained Brian Cushard, LP’s president, in a phone interview. “To stretch a little farther.”

LP Insurance this year has earned Insurance Journal’s 2022 Best Agencies To Work For Bronze award for the West region. The independent brokerage firm won the award based on employee responses

to IJ's annual “Best Agencies” survey.

“It’s a great feeling,” Cushard shared in an email. “I believe one of the highest compliments in any professional arena is when a team willingly praises their workplace. I certainly think LP is an amazing compa ny as well as being a genuine part of the communities we serve. It seems our team feels the same way.”

According to the company’s website, LP is an established yet growing commercial and personal insurance brokerage firm. The organization spe cializes in property, casualty, surety, workers’ compensation, employee benefits and personal insurance solutions — with an emphasis on risk management services.

LP’s roots can be traced back to Granata/Lucini Insurance, which launched in Reno in

1927. Ninety-five years later, LP has grown into a leading regional brokerage with 226 employees and offices in Nevada, Arizona, California and New Mexico.

“We are committed to the strong relationships we’ve built with our clients, employees, partners and communities,” reads an excerpt from the company’s website. “It’s the LP Difference, and it’s what makes us, us. From commercial and personal insurance to an established and growing risk management arm, we offer our support because we’re focused on doing what’s right.”

IJ survey respondents praised the company’s positive work environment, strong community involvement and respected reputation. Others pointed to attainable growth opportunities. Many employ ees compared the bonds they share with colleagues to a family.

“LP Insurance Services is a fast growing agency but have maintained a commu nity within the agency,” one employee wrote. “The COO, president (and) CFO all are very approachable and engag ing individuals. They always make you feel like you are important to the growth of the company. I enjoy working for a company that appreciates its employees and does random gestures of appreciation. When a person does not dread coming to work it is a great place to work.”

Added another: “My agency

is large but it feels like family. Individuals are valued. The investment in training is extensive and those responsible for training are hardworking and determined.”

Cushard explained in his email that LP leaders “consis tently reiterate to our team that if something is important to them, it is important to us. And then we act on it.”

In an industry built on rela tionships, LP leaders “show our team that they are important,” Cushard wrote.

“Listen to your team and do your best to be genuinely connected to one another,” Cushing responded when asked for advice to other agencies striving to become a Best Place to Work. “Like any great relationship, it boils down to trust and communications. If the team knows why we are doing (or not doing) something because leadership has been openly communicative, then there’s mutual trust and understanding.”

that destroyed nearly 1,100 homes and businesses in suburban Denver last winter caused more than $2 billion in losses, making it by far the costliest in Colorado history, the state insurance commissioner said.

Commissioner Michael Conway provid ed the updated estimate during a meeting with residents who lost homes to the so-called Marshall Fire in Boulder County and other Colorado wildfires in recent years, The Denver Post reported.

The Boulder County fire broke out unusually late in December following months of drought and is blamed for at least one death. Official estimates released days after the fire put the losses at more than $500 million.

Experts say the winter grassland fire that blew up along Colorado’s Front Range was rare but that similar events will be more common in the coming years as climate change warms the planet, sucking the moisture out of plants, and as suburbs grow in fire-prone areas.

Conway said additional insurance claims and assessments of the scope of rebuilding from the wildfire prompted the new esti

mate. “We’re estimating now it will be $2 billion in claims if not more,” he told residents.

Investigators have yet to determine what caused the Dec. 30 fire, which was fed by winds up to 100 mph and raced from the Rocky Mountain foothills eastward through unincorporated Boulder County and into the cities of Superior and Louisville. Another 149 homes and 30 businesses were damaged.

According to the Rocky Mountain Insurance Association, the state’s costliest wildfire had been the 2020 East Troublesome Fire in Grand County, which destroyed 366 homes and caused $543 mil lion in property damage. The association also says the Marshall Fire ranks 10th on a list of costliest wildfires in the nation. That list is led by the 2018 Camp Fire in Northern California, which it says caused $10 billion in property losses.

The Camp Fire killed 85 people,

destroyed nearly 19,000 homes, businesses and other buildings and virtually razed the town of Paradise.

A Colorado Division of Insurance anal ysis found that 67% of homeowners who lost their homes in Boulder County didn’t have enough insurance to replace them, the newspaper reported.

Following the wildfire, lawmakers passed several bills boosting firefighting resources and mitigation planning for fires that, owing to climate change and the West’s megadrought, have become a year-round threat in Colorado.

Copyright 2022 Associated Press. All rights reserved.

judge has ruled in favor of a bakery owner who refused to make wedding cakes for a same-sex couple because it violated her Christian beliefs.

The state Department of Fair Housing and Employment had sued Tastries Bakery in Bakersfield, arguing owner Cathy Miller inten tionally discriminated against the couple in violation of California’s Unruh Civil Rights Act.

Miller’s attorneys argued her right to free speech and free expression of religion trumped the argument that she violated the anti-discrimination law. Kern County Superior Court Judge Eric Bradshaw ruled that Miller acted lawfully while upholding

her beliefs about what the Bible teaches regarding marriage.

The decision was welcomed as a First Amendment victory by Miller and her pro-bono attorneys with the conservative Thomas More Society.

“I’m hoping that in our com munity we can grow together,” Miller told the Bakersfield Californian after the ruling. “And we should understand that we shouldn’t push any agenda against anyone else.”

A spokesperson said the fair housing department was aware of the ruling but had not determined what to do next. The couple, Eileen and Mireya Rodriguez-Del

Rio, said they expect an appeal.

“Of course we’re disappointed, but not surprised,” Eileen told the newspaper. “We anticipate that our appeal will have a different result.”

An earlier decision in Kern County Superior Court also went Miller’s way, but it was later vacated by the 5th District Court of Appeal, which sent the lawsuit back to the county.

The decision comes as a Colorado baker is challenging a ruling he violated that state’s anti-discrimination law by refusing to make a cake celebrating a gender transition. That baker, Jack Phillips, separately won a partial U.S. Supreme Court victory after refusing on religious grounds to make a gay couple’s wedding cake a decade ago.

Copyright 2022 Associated Press. All rights reserved.

operator has agreed to pay $50 million to thousands of Southern California fishermen, tourism companies and property owners who sued after an offshore oil spill last year near Huntington Beach.

A proposed settlement between Amplify Energy Corp., which owns the pipeline that ruptured in October 2021 and spilled 25,000 gallons of crude oil into the Pacific Ocean, and the businesses and residents was filed in late October in federal court in Santa Ana, court documents show.

Under the proposal, the Houston-based energy company would pay $34 million to commercial fishermen and $9 million to coastal property owners. It also would pay $7 million to waterfront tourism operators, including businesses that provide surf lessons and leisure cruises and shops that sell swimwear and fishing bait.

A federal judge still needs to sign off on the proposal for it to take effect. A hearing is scheduled for Nov. 16.

“This is a really dramatic first step and a dramatic compensation for these victims of this terrible tragedy,” said Wylie Aitken, co-lead counsel for the plaintiffs, whom he estimated number more than 10,000. The proposal requires Amplify to install a leak detection system and provide spill

training to employees, steps that the company also agreed to in a plea deal with federal authorities. It also would require Amplify to increase staffing on an off shore oil platform, court papers show.

The leak occurred about 4 miles offshore and sent blobs of crude washing ashore in surf-friendly Huntington Beach and other coastal communities. While less severe than initially feared, the spill shuttered the beaches in the area for a week, fisheries for more than a month, oiled birds and threatened area wetlands.

Amplify had no comment and referred to a statement issued when the agreement was reached in August calling it a “reason able and fair resolution.” The company said it would continue to seek damages from shipping vessels accused of dragging anchor and damaging the pipeline months before the leak.

Amplify has $200 million in liability insurance coverage for spill-related claims and as of March the company had incurred costs of about $111 million, according to the court papers filed by the plaintiffs.

Earlier this year, Amplify reached a plea deal with federal authorities for negligently discharging crude oil. The company, which authorities said failed to respond to leak detection system alarms that should have alerted workers to the spill, agreed to pay a combined $13 mil lion in fines and expenses incurred by government agencies.

Amplify contends that two commercial shipping vessels damaged its pipeline when they dragged their anchors across it during a January 2021 storm. The proposed settlement doesn’t apply to the operators of those ships or to an organization that helps oversee marine traffic, which has also been brought into the litigation.

Copyright 2022 Associated Press. All rights reserved.

ordered Southern California’s Santa Monica-Malibu Unified School District to pay $45 million to the family of autistic twins who were physically abused and restrained by an aide at their elementary school.

The lawsuit filed in 2019 alleged a district employee, Galit Gottlieb, used corporal punishment including physical restraint and battery against the two special-needs students when they were in second grade at Juan Cabrillo Elementary in Malibu.

A Los Angeles Superior Court jury found in favor of the plaintiffs . After the verdict, district Superintendent Ben Drati issued a statement to the newspaper calling the decision “not justified by the evidence

presented.”