Times change. In the past, customers were grateful to be able to buy their food from their baker, butcher or farmer right next door, and conversely, farmers, butchers and bakers were satisfied if they were able to fulfil their customers' wishes. But the distance has increased both literally and figuratively. Insight and knowledge have been lost. Every small mistake becomes a scandal. Mistrust has spread, sometimes justified, but mostly unfounded.

Bread is no longer bread alone. It is only a good bread if it has been produced ecologically clean, baked with regional ingredients and – if ingredients from distant countries have been used – these have been harvested and processed under the best social and ecological conditions. The customer wants to have access to all the information, so it has to be provided.

Cumbersome? Maybe. Is that bad? No. The customer has always been King and he will remain King. Social media and various transparency requirements are his modern assistants. Influencers and even Greta Thunberg from Sweden are doing their job.

It would be unwise to try to resist this. The Generation Y, the digital natives, are changing society and thus the food industry. It sound’s a little silly that we are arguing about analogue data declaration (esp. nutri score) in the digital age. It will not be possible to keep it that way.

Only the readiness for transparency concerning raw materials, production and labelling will help food producers, bakers, butchers and farmers, and it will avoid further alienation between them and consumers.

We bake high quality bread for 500 million people in the EU every day. Vegan, vegetarian, regional, organic, with little salt, even without flour, or simply traditional. We are the experts! We can put the cards on the table!

Ours knows a good deal. Industry-specific processes, integration of machines and systems, monitoring and reporting, traceability, quality management and much more.

The CSB-System is the business software for the bread and bakery goods industry. The end-to-end solution encompasses ERP, FACTORY ERP and MES. And best-practice standards come as part of the package.

Would you like to know exactly why industry leaders count on CSB?

PUBLISHING COMPANY

f2m food multimedia gmbh Ehrenbergstr. 33

22767 Hamburg, Germany

+49 40 39 90 12 27 www.foodmultimedia.de

PUBLISHER

Hildegard M. Keil

+49 40 380 94 82 keil@foodmultimedia.de

EDITOR-IN-CHIEF

Bastian Borchfeld

+49 40 39 90 12 28 borchfeld@foodmultimedia.de

EDITORIAL STAFF

Helga Baumfalk +49 40 39 60 30 61 baumfalk@foodmultimedia.de

Katrina Finley finley@foodmultimedia.de

ADVERTISING DEPT.

International sales director

Dirk Dixon +44 14 35 87 20 09 dixon@foodmultimedia.de

Advertisement administration

Wilfried Krause +49 40 38 61 67 94 krause@foodmultimedia.de

DISTRIBUTION

+49 40 39 90 12 27 vertrieb@foodmultimedia.de

TRANSLATION

Skript Fachübersetzungen Gerd Röser info@skript-translations.de

TYPESETTING

LANDMAGD in der Heide Linda Langhagen; design@landmagd.de

PRINTED BY

Leinebergland Druck GmbH & Co. KG Industriestr. 2a, 31061 Alfeld (Leine), Germany

BAKING+BISCUIT INTERNATIONAL is published six times a year. Single copies may be purchased for EUR 15.– per copy. Subscription rates are EUR 75.– for one year. Students (with valid certification of student status) will pay EUR 40.– (all rates including postage and handling, but without VAT).

Cancellation of subscription must be presented three month prior to the end of the subscription period in writing to the publishing company. Address subscriptions to the above stated distribution department. No claims will be accepted for not received or lost copies due to reasons being outside the responsibility of the publishing company. This magazine, including all articles and illustrations, is copyright protected. Any utilization beyond the tight limit set by the copyright act is subject to the publisher’s approval.

Online dispute resolution in accordance with Article 14 Para. 1 of the ODR-VO (European Online Dispute Resolution Regulation): The European Commission provides a platform for Online Dispute Resolution (OS), which you can find at http://ec.europa.eu/consumers/odr

Valid advertising price list: 2019

In the past, artisan and industrial operators in the Slovakian bakery sector were organized into four different associations. On the initiative of a few major companies, all have now combined to form a single federation. We talked to Ing. Vladislav

Slovakia, who helped initiate this development.

+bbi: Mr. Baričák, as CEO of Penam Slovakia, you manage one of the biggest bakery companies in the Republic of Slovakia where, on your initiative in particular, you have just combined four previous associations into a single federation. There are between 450 and 500 bakery businesses in the Slovakian Republic, so why were there four associations in the first place, and what were the differences between them?

+ Baričák: The origin must be sought in history when there was even more bakery in Slovakia than it is today. The bakers were also joined by confectioners and pasta producers, or bakeries were also focused at the same time on confectionery production. Consequently, companies were more associated with the region, as they "had the closest to each other". That is why, for example, the Guild of Bakers and Confectioners of Eastern Slovakia and the Guild of Bakers and Confectioners of Western Slovakia were established in Slovakia. The youngest organization that was established in 2015 is the Union of Industrial Bakers of the Slovak Republic, which aimed to bring together the largest industrial bakeries in Slovakia. However, the oldest association on our territory was and still is the Slovak Union of Bakers, Confectioners and pasta producers. The fragmentation of bakers in different organizations was probably also related to the fact that we ceased to be aware of coherence and did not think that a unified organization could solve the problems of our sector comprehensively – ie. solve the problems of small, medium and large bakers. But over time, history has been right and if we are united, we can do more together. That is why we have begun to fight for a really strong organization to represent the vast majority of bakers in Slovakia. We started a recruitment campaign in the oldest association – the Slovak Association of Bakers, Confectioners and Pasta producers, and it was successful. In the past and this year, the vast majority of bakers who have been working in other professional organizations, or none at all, have become members of the association. While, for example, in 2018 the Slovak Union defended the interests of bakery companies with 5,000 employees, this year it will be 2,000 more people. This means that the unified organization of the Slovak Association of Bakers, Confectioners and pasta producers will represent 7,000 employees in the sector out of a total of 11,000. The remaining 3 professional organizations have also joined the Slovak Association of Bakers, Confectioners and pasta producers as collective members.

+ bbi: To allow the situation regarding baked products manufacturers in Slovakia to be put into perspective – could

, CEO of

you please give us a brief overview of how many companies produce on an industrial scale and how many large and small artisan businesses there are, and what proportion of the sale of baked goods in Slovakia is in the hands of the food retail?

+ Baričák: As the Statistical Office of the Slovak Republic does not have all the operations in the bakery and confectionery sector, the data on the number of companies are only a professional estimate. There are approximately 500 bakery and confectionery production facilities in Slovakia. Large industrial bakeries are about 30, while these supply about 60% of the market. The remaining 40% of the market is supplied by large and small craft businesses, but they also have machinery technology to increase production process automation. At the same time, the share of these domestic producers in the grocery stores is estimated at 60%, while the remaining 40% is imported from neighboring countries, and this negative trend continues and is increasing. To

The core of the problem in the Slovakian baked products market is the market power of foreign retail groups like Tesco, Lidl, Billa and Kaufland, whose combined market share and thus purchasing power is estimated to be 45%, whereas smaller domestic retail groups with considerably more locations amount to a total of 30%, and artisans and regional chain stores account for the remaining 25% share of the baked goods market.

Like in Austria, many artisans and chain store operators also supply the retail at the same time. Price-sensitive key articles on the baked products shelf, like a 1 kg mixed

illustrate: 10 years ago, about 90% of domestic bakery and pastry products were on Slovak bars and 10% were imported.

+ bbi: What are the most important problems facing baked products manufacturers, what aims is the new federation pursuing, how does it plan to achieve these aims?

+ Baričák: There are several problems. The key is that the traditional bakery is gradually losing its value, and that is why many bakeries disappear. It is also related to the fact that the economic power of a nation is not strong enough and, as a result, local patriotism is not developed in Slovaks, such as in Germans or Austrians. Still the main factor in our choice remains the price, and foreign trade chains have built their policy, not just in our country. In the last ten years, when the chains were very strong in our country, bakers have begun to lose a lot of money. The dominant strength of foreign merchants caused them to have the power to push suppliers, in our case of bakers, at such low economic prices, which in many cases do not even cover production costs. And bakers often attempted to save and maintain large volumes of sales. This led us to significant economic difficulties, when several bakeries were forced to close, some bakeries were sold, others ended up in red. The aim of the association of companies in the Slovak Association of Bakers, Confectioners and Pasta producers is to be a joint effort to correct the covered market or to fight for better and enforceable legislative conditions contained in the laws. Recently, we have succeeded in changing the law on the law on prices (it should apply from the beginning of May 2019) or inadequate business conditions to help foreign networks not apply their predatory pricing

+ bbi: The Slovakian government has just adopted a legislative package designed to limit the market power of the big trading groups. In your opinion, which aspects of this package are likely to have positive effects for baked goods producers?

+ Baričák: I have to say that bakers appreciate the amendment of two key laws - the Unfair Commercial Terms and Prices Act. While the first one sets a number of positive changes, such as shortening the maturity of 15 days invoices, eliminating hidden fees, which often reduce the profits of bakers, tightening

wheat bread (70:30) or the the typical rolls rožky (in Czech language rohlíky), are frequently sold as customer magnets for 1 Euro and less than 5 Euro cents respectively. Persistent overcapacity is another of the reasons. Insiders estimate an overcapacity of 40% for rožky (rohlíky) alone.

The Slovakian government introduced a series of legislative initiatives in late 2018 and early 2019, partly already implemented and partly got underway. The aim is to reduce the dominance of big retail groups, mostly foreign, on the Slovakian food market, and to open up more opportunities for other players in the market.

controls on vendors, whether the customer can request a reduction in the purchase price from the supplier only if goods are actually sold to consumers in the stock price. Of course, the most positive in it is the sale ban below economically justifiable costs (production costs), ie. the customer will not be able to demand the sale of the products below the cost of production of the supplier, which is a common practice in business relations in the long term. On the contrary, the second amendment to the Act – the Act on Prices – stipulates that the determination of economically justifiable costs will be the responsibility of the Ministry of Agriculture and Rural Development of the Slovak Republic as an independent body, while the law requires regular updating of economically justifiable costs for the current situation.

+ bbi: Mass market products such as wheat mixed bread or rožky (rohlíky) are a serious problem in the Slovakian baked goods industry. The food retail offers them as loss leaders at extremely low prices. According to our information, a law is being prepared to limit the retail trade’s margin and to ban purchases below production costs. Do you hope this will ease the price pressure on manufacturers in the mass market products business?

+ Baričák: We believe in it. The price of a traditional white roll has not changed in Slovakia for years, the price of a classic 1-kilo bread has even dropped, but there is no economic reason for it. The price of raw materials and the price of labor for the last grew rapidly. For comparison only, the price of flour increased by 20-30% in the last year, the price of poppy increased by 102%, potato flour by 34%, salt by 64%, greaves by 101%, energy by 20%, but also the price of fuel substances. However, the largest item was fast-growing salaries, where average wages climbed by almost 10 percent.

+ bbi: A few weeks ago, the government significantly increased extra pay for night-time and public holiday working. However, bread factories cannot operate without night-time and public holiday working. How will the wage increases affect you?

+ Baričák: Significantly. According to statistics, up to 80% of the working time of bakers is burdened with extra charges

for weekend work, public holidays, and night work, known as the government's social package, and the Slovak bakers are most likely to pay for it. The first wave of social package started in May 2018, the second wave of the social package will start this May, which means that surcharges will increase again from last year's wages and will be deducted from the minimum wage. It has also increased since the new year (from EUR 480 in 2018 to EUR 520 in 2019). Wages currently account for an average of up to 38% of total production costs. While in 2017 the average monthly wage was 677 euros, in 2018 it was 731 euros, an increase of almost 10%. In May of this year, the second wave of the social package, which will represent a further rise in labor costs, will come into force, with wages exceeding 40% of total production costs.

+ bbi: The association’s tasks also include targeted public relations work in the country. What exactly do you do, and what effect do you hope you will have?

+ Baričák: Yes. In March of this year, the Slovak Association of Bakers, Confectioners and Pasta producers distributed the Fair Trade Award. It was acquired by those traders who adhere to fair trade relations and do not push suppliers to disproportionately low prices, which are predominantly focused on selling Slovak products or those who do not work with hidden fees, often at the expense of suppliers. This year, Labaš, p. r. o., MILK-AGRO, s.r.o., CBA Slovakia Lučenec, a.s., Makos, a.s., DEKORT, s.r.o., COOP Jednota Slovakia and CBA Slovakia, a.s. The award was given to the companies by the Deputy Prime Minister and Minister of Agriculture and Rural Development of the Slovak Republic, Gabriela Matečná, at the historically largest General Assembly of the Slovak Association of Bakers, Confectioners and pasta producers. We want to pass this award every year, and we want to show it to consumers and educate them a bit about how Slovak food goes to the shop shelves and what process it is. At the same time, the Fair Trade initiative aims to show the public who is fair to their suppliers and is willing to bear the risks stemming from the rise in raw material prices and other inputs, on the basis of which bakers objectively ask for higher sales prices. In addition to this initiative, we have been intensively communicating our visions, problems and the state of the sector for three years, as well as plans for the future for the media. Through them we try to move our link to lay and professional

public, what we are doing. At the same time, we organized a joint exhibition – Bakery Court – at the biggest gastronomic event for the general and professional public Danubius Gastro, where visitors could learn about products based on Slovak bakeries and news that they are just preparing (eg. Loin bread).

+ bbi: Have the country’s politicians already responded to the new federation?

+ Baričák: Certainly resonated. In the media, we regularly communicate the steps of the government that we do not like, as well as those for which we are grateful to help us. We are certainly also more active in communication with the agricultural sector or the Slovak Government and have a stronger voice, thanks to the wide representation of bakers in the association.

At the same time, the agricultural sector has begun to notice our struggle to save the industry and stand by us eg. at the Fair Trade Initiative. We again have to admit that we appreciate the ministry's activities in fighting for domestic products and promoting local patriotism.

+ bbi: Will this new federation collaborate with other national associations at a European level, or does such collaboration already exist?

+ Baričák: European bakers' cooperation has already begun last year. In the summer of 2018, we signed a Memorandum of Fair Trade on the Slovak level with representatives of the Trade Union of the Slovak Republic (which brings together Slovak retailers), on the basis of which the Fair Trade initiative was created. In autumn 2018, we also signed a Memorandum of Cooperation in the Bakery Industry in Munich together with other bakery organizations from the Czech Republic, Hungary, Poland and Romania. Our common goal is to fight for better conditions for bakers in the market, to fight against predatory pricing of foreign chains and to exchange information on steps that have a positive or negative impact on the bakery sector. This memorandum was signed in the presence of Antonio Aries from Mexico, President of the World Union of Bakers and Confectioners UIBC (International Union of Bakers and Confectioners) and Fernandez Villaverde of Spain, General Secretary of UIBC.

+ bbi: Mr. Baričák, thank you for the discussion. +++

with this master baker mindset, like our modular AMF Den Boer Tunnel Ovens, which allow us to engineer the most optimal baking solutions for today while preparing your bakery for future growth.

G et in touch with the industry ’s only tr uly g lobal complete system supplier for the best unit equipment and integ rated solutions for your operation. Booth 5436/5420

+T he Lesaffre yeast group has established a Baking Center in the Vienna-Neudorf industrial zone on the southern outskirts of the Austrian capital city. The bakery, laboratory and training facilities complex covering more than 600 m2 is aimed primarily at industrial and major artisan customers in western and eastern Europe. In addition to mixers and a sourdough preparation unit available for trials and product development, there is also a selection comprising a Rondo dough sheeting line, a König line for bread rolls, buns and donuts, and a Rheon stress-free V4. Proofing, baking and freezing take place in a Miwe plant combination. In addition there is a Rheon Cornucopia, and a Riehle fat-frying line stands ready for tests with fat-fried products. A small laboratory is also available for raw materials and quality investigations.

Lesaffre produces not only yeast for the baking sector but also sourdough, baking agents and premixes. Mixes and premixes, e.g. a protein bread mix, are marketed under the Inventis brand. The Group sells a full range of baking agents under the Magimix name for both fresh and frozen products, wheat and rye doughs, and aimed at specific dough problems. The third brand name in this product range is Levendo. Behind this lie sourdoughs arranged according to flavor profiles, including a liquid sourdough with live microorganisms that promises a “French flavor note” in the finished baked product. +++

For SIL (Société Industrielle Lesaffre), the Vienna site is centrally important to the European business. In 1996 the French took over the yeast business from Mautner-Markhof, the Austrian yeast mogul at that time, which not only dominated the Austrian market but had also bought up yeast factories in the former k.u.k. (Austro-Hungarian Imperial) countries immediately after German reunification. Lesaffre has operated the world’s biggest yeast factory at the company’s headquarters in Marcq-en-Barœul since 1968. The Budapest yeast factory from the M(autner)-M(arkhof) empire has grown into an important supplier to European markets. Yeast is also produced in Poland, Croatia, Romania and the Czech Republic, and at three locations in Russia. The Group owns the Asmussen GmbH production facility in Elmshorn in Germany.

Lesaffre Germany serves the German market through Fala GmbH based in Kehl am Rhein. Lesaffre Austria currently has 45 employees on its payroll, whose responsibilities include domestic business and the baking agent division’s exports. Yeast is marketed in Austria mainly through Bäko.

According to CEO Antoine Baule, the yeast market is growing worldwide. He says this is currently especially noticeable in Asian, Latin-American and African markets. A middle class with an increasing demand for bread and thus a need for yeast is coming into existence in these countries. In Europa, according to Baule, demand growth is mainly in sales of liquid yeast, whose metering can be integrated into automated processes. Lesaffre offers it in various types of package, starting with a bag-in-box system and mobile containers for artisan bakeries, and extending to large containers or tanker trucks for major consumers. +++

The Lesaffre Group is the world’s biggest yeast supplier. The company’s headquarters is in Marcq-enBarœul, a small town in the northeast of France close to the Belgian border. The Group, which originates from an alcohol distillery founded in 1853, has a current worldwide turnover of more than EUR 2 billion, 70% of it through business with baked products manufacturers in the form of yeast, sourdough, mixes and baking agents. The remaining 30% is contributed by three business divisions, all more or less based on fermentation technology. HealthCare focuses on healthpromoting products for use in the care of people, animals and plants (companies: LHC, Phileo and Agrauine). Antoine Baule, CEO of the Lesaffre Gruppe, says: “We don’t want to leave this area to the pharmaceutical industry.” A second division is devoted to industrial biotechnology, including for bioethanol and animal feed manufacture (companies: Leaf and Procelys). The LIS company, which also belongs to this Division, specializes in spray-drying as a service. A division known collectively as “Food Taste and Pleasure” deals with fermentation products that improve the flavors of wine and beer (Fermentis), food flavorings such as vanillin (Ennolys) or yeast extracts and natural flavorings that allow salt and sugar contents to be reduced (Biospringer).

The company operates 60 production facilities in more than 50 countries worldwide, whose products in turn go to customers in 185 countries. The total worldwide workforce is around 10,500 employees. Applications research for the various business areas takes place in 56 subsi-diaries. Baking Centers are located at 44 sites, including Vienna, where demonstrations to customers, tests and product development for baking sector customers can take place. +++

The Menes dough sheeting line can process up to 5,000 kg of dough. The line can be adapted to your needs with its elaborate modular design and is also available in hygienic design „H“ as wash-down version. The Menes line combines high weight accuracy with perfect handicraft quality.

DESIGN “H”

We set our focus on your product!ROTARY MOULDER

Spooner Vicars (part of the Middleby Group) has launched a new rotary moulder. The APEX Sport can handle a wide range of doughs, from detailed surface designs to deep-moulded shortcakes with fruit inclusions. The newest design focuses primarily on hygienic design.

+The company eliminated machine threads wherever possible and gave ample clearance under the machine for cleaning. Using direct drive motors allows the removal of many guards, as there are no transmission pieces such as chains and belt, thus allowing easy access for cleaning. The machine has three drive motors, allowing individual adjustment for the feed roll, die roll and belt.

+ Powered Feed roll: this allows the roll to be speeded up or slowed down, allowing precise filling of the die cavity

+ Powered die roller: this will be set to match the linear speed of the oven belt

+ Powered product belt. Dan Christie, Sales Manager Spooner Vicars, explains: “With many rotary moulders, the product belt is clutch-driven between the die roller and rubber roller. This is fine until the belt slips and then you apply more rubber roll pressure which creates product tails. When it is on its own drive, you can back off the rubber roll pressure and still drive the belt.”

According to the company, the die drive does not require a gear, which brings the total cost of buying dies down and

makes product changes fast. Dan Christie: “The machine comes with a belt tracker as standard, whereas with many manufacturers this is an option.” The feed roll has an adjustable gap for different dough viscosities. This gap is the distance between the feed and die rolls. The gap adjustment along with the knife adjustment can be manual or motor driven for settable recipe control, as the machine also comes with PLC controls.

Dough is put into the machine hopper, which sits on the top over the feed and die roller. The die roller rotates clockwise and the feed roller counterclockwise, allowing product to be pushed into the die engravings (cookie shapes). A knife which runs along the entire width of the die scrapes off any excess dough. At this point the belt contacts the surface of the die and the rubber roll slightly presses the dough (cookies) unto the belt surface. The belt then pulls the product out of the die roller and transfers it to an oven belt for baking. +++

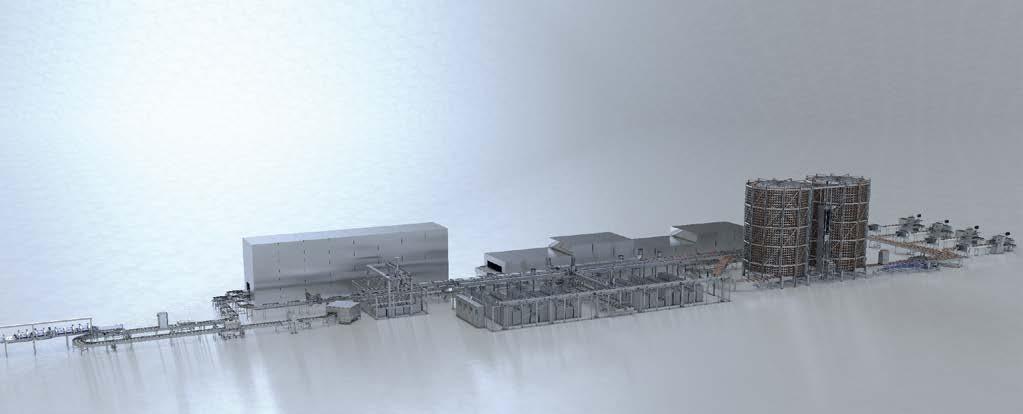

The Italian baked products manufacturer Galbusera’s new production facility is taking the first steps towards Industry 4.0. Oripan, an IT company partly owned by Sancassiano, is also involved.

+A 16,000 m 2 production area south of Milan came into operation last fall. It was planned and implemented by the Italian baked products manufacturer Galbusera, which moved in the new site its production of cakes and seasonal products like panettone and Easter dove cakes from the previous site in downtown Milan. The line for panettone and dove cakes is entirely new, and the cakes line is also new, except for the oven. A third new line for a novel product is just entering the production phase, and a fourth for crackers is currently being built.

Enterprise Resource Planning (ERP)

However, the reason for the new production center was not only to increase production through more capacity and new production lines, but also the decision to take a clear step towards automation and digitization. Support for the project came from the new state funding program for Industry 4.0. The old factory already had a raw materials traceability system. According to Dante Gelmini, Head of IT, the aim here was and still is to gain more information about the detailed status of the process chain, thus raising efficiency. As an example, he illustrated some details of line Line 1, which

This controls and administers operational resources, e.g. capital, personnel or means of production, in the best possible way based on a standardized data base, and the system usually comprises materials management, sales and marketing, finance and accountancy, controlling, human resources, the management of product data, historical files, documents and an interface to production and production planning.

Manufacturing Execution System (MES)

A multi-layer fabrication management system that thinks in process chains and translates production requirements from the ERP system into the most efficient possible production planning, collects and records production, machine and operating data, and enables real-time fabrication control.

Oripan Factory System (OFS)

Undertakes communications and creates the instructions to tell machines what is to be produced, in which amounts, when and in which process chain. The starting point for the OFS is the number of SKUs (stock-keeping units = distinctly identifiable articles; article variants have different SKUs) that are to be produced. It then decides the number of batches and calculates the time up to the packaging stage.

Maschinen (PLC)

Controlling individual machines and plants.

produces panettone from September to December and Easter dove cakes from January to May: Breaking the production program down by process parameters and recipes, 20 different varieties and 300 different SKUs (Stock-Keeping Units) must flow through the production line efficiently and trouble-free 24/7 during this period.

As the digitization partner, Gelmini brought on board Oripan, an IT company in Tione di Trento in which the mixer manufacturer Sancassiano in Roddi holds shares. The Piedmontese company brought in many years of process and machine knowledge, and its supervisor is responsible for the central dough preparation plant that supplies dough to all the lines. The line consists of two linear Robomixers together with metering stations for automatic loading and manual addition. There are integrated dough resting stations in which panettone doughs, for example, rest twice for up to 7.5 hours before going onto the line after a final kneading. With few exceptions, all the other plants are from Italian machine builders, and many production steps such as surface scoring, stacking flat baked products or packaging are carried out by robots. A total of 130 employees now work in the factory, 100 of them in a three-shift production operation.

Production planning starts with the Manufacturing Execution System (MES), which translates the production requirements from the ERP system into the most efficient possible

Italy has launched a program to promote investments that enable or speed up the automation and digitization of production processes. The national plan, “Industria 4.0”, was presented in 2016 and has provision for massive tax concessions together with numerous measures such as investments in education and training. In addition, each region is implementing its own individual broad program of incentive measures. This program has not only resulted in a considerable increase in the number of startups. In the first half of 2017, investments in machinery rose by 11.5%, in electronics by 10.7% and in research & development by 15%. In addition, Italy reduced the corporation tax rate from 27.4% to 24% in 2016.

The tax law has numerous other motivations. For example, the return on investment for certain investments up to a maximum of EUR 150,000 can be made tax-exempt for five years. There are tax credits for R&D activities, special depreciations on patents, and income tax concessions for highly-qualified people to attract them into the country.

Something that will probably make life particularly easy for Italian companies is the Finance Ministry’s plan to structure its administration in such a way that companies will now have only one contact point for both their tax liability and the subsidies.

production planning. The MES in turn sends its requirements to the Oripan Factory System, OFS, which undertakes the detailed planning.

The starting point for the OFS is the number of SKUs (stock-keeping units = distinctly identifiable articles; article variants have different SKUs) that are to be produced. It then decides the number of batches and calculates the time up to the packaging stage. To avoid congestion on the line, the supervisor plans all the processes, calculating the start of each operation backwards from the packaging phase to the raw material metering and mixing time. The algorithm optimizes the size and sequence of batches and the overlaps that may occur between them such that no collisions arise upstream the oven entry, ensuring no idling on the other hand. To this end, the first step is to verify whether all the raw materials are available and the individual stations on the line are free at the required time. Furthermore, the supervisor also checks whether the time needed to heat up the oven, or to let it cool down when necessary, was included in the calculation.

OFS synchronizes each process step with the MES and feedbacks the material consumptions for traceability and reordering purposes. It also includes raw materials warehouse supervision. The OFS correlates raw material warehouse outflow with the perspective production batches.

If people intervene in the production flow, e.g. by manually adding raw materials or giving a signal, the OFS requires confirmation by scanning barcodes on the transport containers and addition point.

The purpose of what has been installed up to now is communication and information gathering to optimize production planning. Direct interventions in individual machine controllers are reserved for subsequent further developments of the system. As the next project, Gelmini initially plans to incorporate servicing and maintenance, including preventive actions, into the factory digitization. The aim of this is to allow the company’s own technicians to immerse themselves in virtual reality, thus enabling them to remedy malfunctions based on embedded handling instructions and/or with digital support from suppliers’ technicians. Gelmini says: “We hope that will result in significantly fewer downtimes on the lines.” +++

The Italian family business was founded by Ermete Galbusera in 1930 as a cookie manufacturer in Morbegno and built up to national importance by his sons Mario and Enea Galbusera. It produces wafers, cookies and crackers on eight lines at the company’s present headquarters in Cosio Valtellino under both the Galbusera and Tre Marie owned brands, including also several private labels. A production factory opened in Vellezzo Bellini last year, producing cakes, gateaux, panettone at Christmas and colombas (dove cakes) at Easter in many variations. www.galbusera.it

The Tre Marie is an historic and well-known brand in Italy, deeply rooted in the panettone and colombas markets. The previous owner, The Sammontana S.p.A., an ice cream and frozen products maker, expanded the product range to include frozen pastries such as filled croissants and cannoli. In 2013, Tre Marie was acquired by Galbusera, which carries the production of panettone, dove cakes, cookies and gateaux. Frozen pastries are yet produced by Sammontana, but the commercialization is still managed under the Tre Marie brand.

Oripan is an Italian IT company dealing with networking complex production processes in the food industry. By using OFS (Oripan Factory System), a manufacturing execution system to plan production and automate the flow of information along the production chain in real time, Oripan lays the foundation for the process prescribed by Industry 4.0. The business is a Microsoft Partner supplying software together with selected hardware, and supports applications in Europe, Asia and North America. Oripan is a 30 years experienced company in automation and digitalization of the industrial bakeries and in 2015 become part of Sancassiano group. Oripan’s headquarters and ICT division is in Tione di Trento. The Industrial Automation division works at Sancassiano’s corporate head office in Roddi. www.oripan.it

++ Every raw material is precisely encoded as received and after quality testing, thus enabling its quantity, storage and date/time to be accurately traced. When materials are withdrawn, the codes are scanned and linked to the code of the dough batch currently running, together with a record of the date/time, quantity and addition valve identification

What drives the Clean Label movement? How does this affect artisan bakers? We talked to Michel Suas , President and Founder of the San Francisco Baking Institute, about Clean Label in the USA.

+bbi: Recently, you gave a seminar on Clean Label artisan bread in Texas. Unfortunately, we were unable to attend, but we would like to learn more about the clean labeling presentation.

+ Suas: The seminar’s focus was on the baking movement over the past 30 years in the USA and other countries. The artisan bread movement started around 1986 and the trend hasn’t stopped and has become an art for the consumer, incorporating diet selection and quality bread without additives. Clean Label was already in place at that time for small and mid-size bakeries

+ bbi: What is a “Clean Label”?

+ Suas: Initially, Clean Label was only the ingredients used for the actual bread formula: flour, water, salt, commercial yeast, or wild yeast, and excluded emulsion components, shelf life extension, or stabilizers that most of the large bakeries were using to make bread with at that time.

+ bbi: What ingredients are considered Clean Label?

+ Suas: Clean Label is not organic; it just includes conventional ingredients with no chemicals added during bread production. Now Clean Label is all about what the baking industry as a whole has been doing over the past few years and also looking ahead, what it will be doing. All the additional ingredients added to the basic formula are made with natural components, with enzymes predominantly used for these purposes.

+ bbi: How does the “Clean Label” movement affect the baking industry?

+ Suas: Again, we are talking about the large-scale distribution for store chains, institutions, and hotels. The new approach to manufacturing bread or any mass-produced food with Clean Label starts with the consumer who is looking for better, healthier food. Consumers are starting to read the label more and more and are also exposed to smaller production bakeries. The customer is now educated about the taste difference. U.S. customers are now looking for better food, as part of their lifestyles, and even large chains such as McDonalds are trying to portray a different image to the public.

+ bbi: What do you think is driving the Clean Label movement?

+ Suas: The continued drive for Clean Label or better food is multi-area, where good food is promoted with things such as the Food Network, competition television shows, as well as the news media, which are all helping people connect better with food. Before In the past, Americans ate for survival, but now they are alive to enjoy all that good food has to offer. A bakery has now become a place where you meet friends and

family and treat yourself. Consumers now read labels even more, and even large supermarkets such as Costco want quality food. Young professionals are the ones who keep the movement going especially those with kids because they want the best food for their children.

Michel Suas began baking at the age of 14. In his home country of France, he trained under several renowned chefs before moving to the United States in 1986. Suas is internationally recognized as an industry expert and is a strong advocate of using education to advance the appreciation and craft of artisan baking. The Bread Bakers' Guild of America awarded Suas the Golden Baguette in recognition of his contribution to the Guild and the artisan baking industry. The Bread Project named Suas an honorary life member in recognition of his guidance and support. “Advanced Bread and Pastry: A Professional Approach”, was written by Michel Suas and is a comprehensive guide to bread and pastry, designed as a resource for colleges and universities, private culinary schools, professionals, and dedicated enthusiasts. +++

The San Francisco Baking Institute (SFBI) was founded in 1996 by Michel Suas. SFBI is one of the leaders in artisan bread and pastry education. Their mission is to elevate the craft and appreciation of artisan baking. SFBI is the only school dedicated to artisan baking in the United States. SFBI is now even hosting a French Diploma IV Program, which is at a higher level than is required in France for a baker to open up their own bakery. In addition to educational programs, SFBI also consults with bakeries around the world. These services have helped many of the world's best-known bakeries develop operational efficiency and quality production. In San Francisco, CA, SFBI runs an artisan bakery called Thorough Bread and Pastry. +++ Website SFBI: www.sfbi.com

+ bbi: How does it affect artisan bakers?

+ Suas: Right now, the emphasis in bakeries is on better nutrition, flavor, and lower protein (gluten) flour in order to respond to people with gluten intolerance or discomfort. Also, the introduction of ancient grains and cereals to baking ingredients will become more widespread including signature grains that are milled at the bakery to make whole wheat bread with fresh flour. Local small retail bakeries are coming back to downtown, and large cities have a more modern approach including a coffee culture where people can treat themselves or have a treat with family and friends. We see this as a modern trend viewed as a bar during the day with sugar replacing alcohol.

+ bbi: How can bakers keep up with this trend? Do you have any tips for formulation and/or processing?

+ Suas: You should take note; Clean Label is not a trend but an evolution of what the baking movement started 30 years ago. The artisan baker began to, and still continues to improve by adding ancient grains and recently the larger bakeries began changing due to demand.

+ bbi: Do you have any tips for bakers wanting to reformulate or develop new products to meet this demand for Clean Labels?

+ Suas: A good baker should be able to reformulate any product, but it’s important not to over complicate the process. Find a good source for ingredients, especially flour, but don’t over price your food costs by using ingredients that are way too expensive. Long fermentation and adding preferment dough will replace any chemicals that potentially might have been used, resulting in great flavor and health benefits.

+ bbi: Can you tell us a little bit more about SFBI?

+ Suas: The SFBI (San Francisco Baking Institute) always works to promote and support better quality baking. We were able to offer products made with ancient grain about 15 years ago when these were expensive and hard to get, but now larger distribution systems are in place at a more affordable price.

+ bbi: What do you think the future trends will be?

+ Suas: Besides ancient grains, the big movement is towards whole wheat, and fresh milled bread Viennoiserie is the big winner when it comes to new trends. I hope that gives you an idea of what is happening in the US bread market, but you should also note that there are movements in South and Central America towards better quality and healthy bake products.

+ bbi: Mr. Suas, thank you for the interview. +++

According to the trade fair, the visitors included food retail purchasers, importers, wholesalers and representatives from the food service sector. Around 2,500 exhibitors from 40 countries provided them with information about their products.

+The 7th TUTTOFOOD B2B trade fair took place in Milan, Italy, from 6th to 9th May 2019. This food fair attracted chiefly Italian visitors. However, the trade fair company’s primary aim is to make the exhibition better known, mainly abroad. The fair is on the right road in this respect: 82,551 visitors from all over the world made the journey to the trade fair grounds in Milan. According to the organizer’s report, a total of 21% of the visitors were from abroad, most of them from the USA, Spain, France, Germany, England, China, Canada, the Benelux countries and Japan, as well as from Russia.

The halls are divided into various areas such as kosher, halal, wines, oils, fish, meat, cheese, pasta, frozen products and baked goods. However, exhibitors from the “bakery” area are distributed among various halls. This leads to a mix of various different food producers, so potentially interested buyers needed to work through the various halls, for example they had to look for dough piece suppliers in the frozen foods hall. On the other hand, cookie and panettone manufacturers, for example, were all together in the “Sweet” area. A great diversity of panettone manufacturers showed a wide variety of creations of this specialty Milan cake on their trade fair stands. In addition to classic baked goods made with candied fruits and raisins, panettone producers show these wheat baked products in a variety of sizes (from 100 g to 1 kg) and with various fillings, e.g. with zabaglione, pistachio or grappa crème.

Visitors were able to find frozen baked product manufacturers, e.g. Wolf ButterBack, in the other halls. Beldessert from Belgium, a private label producer of muffins, cheesecake and other desserts, was also represented. The Italian producer Unigel was noticed in the frozen area with schiocco, a combination of a croissant and a bread roll. This baked product is said to promise the enjoyment of a cake and the calories of a roll. A schiocco has

a crisp crust and a soft crumb. The schiocco has already been produced and marketed in Italy since 2011, and demand is growing. Unigel now wants to increase exports of this frozen baked product, which is why the bakery participated as an exhibitor at the TUTTOFOOD trade fair. The pastries are offered in various sizes (35, 65 or 100 g) and with different flavors, e.g. with olives, garlic or rosemary.

The Bäckerei Lemayr bakery from South Tyrol was represented. A group of experts is available here to develop individually customized solutions for major customers. The bakery exhibited various pizza snacks, small frozen baked products and breads.

In the fine pastries area, RICOCREM COZZO s.r.l. offered frozen goat’s cream cheese to fill cannoli. This ricotta is already prepacked (1 kg) in a disposable piping bag, but the filling is also available in packages holding between 1 kg and 21 kg in pistachio, chocolate and natural flavors, and with chocolate pieces.

Cupiello, a producer of frozen baked goods in Naples, focuses on “vegan” and “organic” trends. Its trade fair presentation centers on various croissants and cakes.

The trade fair is suitable for buyers and product developers in the baked goods sector, and due to its international orientation could also be a springboard for suppliers of dough pieces, for

example. However, the majority of both visitors and exhibitors are from Italy. Visitors will gain an insight into the Italian food producers’ market. It was also slightly difficult for visitors to the trade fair to converse with exhibitors from Italy, since many of the catalogues were not translated, and none of the staff spoke sufficient English.

Baking sector exhibitors are also scattered across the entire trade fair grounds, which means long walking distances. This can mean that one is more likely to “stumble” on an interesting manufacturer at random. Altogether a B2B event with an international flair. The eighth TUTTOFOOD event will take place from 17th to 20th May 2021. +++

++ Unigel, a producer of frozen baked goods, wants to make its schiocco (Italian flaky bun) better known. The pastries are offered in various sizes (35, 65 or 100 g) and with different flavors, e.g. with olives, garlic or rosemary

Mecatherm has developed a new dough divider, the M-NS, presented for the first time at the 2018 iba trade fair.

+Mecatherm’s new Type M-NS dough divider model operates volumetrically. The plant is compact and can divide and mold even doughs with a high dough yield and long dough rest times and can deposit them, e.g. into pans or pan clusters. Dough pieces can weigh 100 to 900 g and the plant achieves an hourly output capacity of up to 2.5 tons of dough. According to the manufacturer, the divided dough pieces are not subject to any stress. Mecatherm says the combination of stress-free dough pieces and subsequent molding ensures that the end-product shows improved oven spring and develops a thin, non-dry crust together with a light, fluffy crumb, just as a French baguette should be.

The M-NS dough divider needs no molding machine, laminating roll or multi-roll. The division process starts once the dough is centered. After being divided, the individual dough pieces are separated and their weight checked. If the latter

does not agree with the target weight that was set, the dough piece is rejected. The density of the dough is also calculated. The manufacturer promises that the weight of the dough pieces always remains identical, irrespective of dough density. It also says the system responds automatically to dough density changes, e.g. in the event of a production interruption.

The machine is operated via a display, where the operator simply enters two values: target weight and deviation tolerance. The dough divider does everything else automatically, and even independently resets itself if deviations occur. Its good accessibility and easy cleanability are also beneficial. The new dough divider is EHEDG-certified (EHEDG: European Hygienic Engineering and Design Group), so it conforms to the hygiene criteria specified by the EHEDG. Moreover, it is said that the dough divider can also be integrated into existing production lines. +++

UrkornCakeMix combines modern baking technology with the age-old knowledge of traditional grains. Successful baking of timeless classics, like sheet and shaped cakes, or trendy American Cookies has never been easier. www.backaldrin.com

New digital technology provides a better way to measure humidity in proofers, oven, dryers and cooling tunnels.

+The new Reading SCORPION ® 2 Digital Humidity Sensor is designed to measure the absolute moisture content, of the thermal environment, in both heating and cooling processes. It is applicable to proofers, ovens, dryers and cooling tunnels. Mechanically the Digital Humidity Sensor is comprised of a Bulk Air (dry bulb) temperature sensor, two inputs for Product Core Temperature Measurement and a proprietary humidity sampling system to measure Dew Point Temperature, Absolute Humidity and Relative Humidity. The sampling system contains patent pending Anti-Saturation Technology™ allowing measurements in very high dew point environments such as steam injection. The Digital Humidity Sensor is engineered to be compatible with direct gas fired (DGF) ovens. Unlike oxygen sensor technology, which can be off by as much as 25% due to combustion gases in DGF ovens, the accuracy of the digital humidity sensor remains the same regardless of the oven platform. The Humidity Sensor travels through the process with the product, yielding a precise profile of moisture experienced by the product.

In high temperature applications above 100°C (212°F), absolute humidity is displayed. The user can choose between % Moisture by Volume or Humidity Mass Ratio (kg water/kg dry air or lb water/lb dry air). In low temperature applications below 100°C (212°F), % Relative Humidity is displayed. In both high and low temperature applications, the dew point temperature and dry bulb air temperature is displayed. Humidity in ovens is generally controlled by extraction

Humidity in a thermal process interacts with the product. The moisture in the environment often comes from the product itself and represents a delicate balance affecting finished product quality in many ways. For example:

+ The amount of moisture left in a product can determine its shelf life.

+ Reduced evaporation can keep the surface of a product moist, allowing it to stretch, preventing cracks.

+ Low humidity in a cracker oven can cause blisters leading to undesirable dark spots and excessive breakage.

+ The lack of humidity in a cookie oven can cause case hardening preventing internal moisture from escaping leading to checking (the spontaneous cracking of the cookie after baking).

+ High humidity in bread ovens produces the desirable glossy crust seen on many bread products. For this reason steam injection is often used.

+ High humidity will assist with the killing of pathogens, like salmonella, potentially found in surface toppings.

Product throughput kg/hr (lb/hr) can also be affected by when and how much moisture builds in a process. Moisture laden environments reduce baking efficiency, thereby reducing product throughput. +++

fans and dampers. Here the sensor is used to display the shape of the humidity profile as well as the peak moisture value obtained and where. In proofers it is used to document the temperature and relative humidity of the proof cycle.

In cooling tunnels it is used to monitor dew point temperature, preventing condensation on the product surface which causes blooming.

Technical Summary:

+ Number of sensor elements: 2

+ Product Probe Inputs: 2

+ Data available for display

- Dry bulb air temperature (°F or °C)

- Dew point temperature (°F or °C)

- % Moisture by volume

- Humidity mass ratio (lb water/lb dry air or kg water/kg dry air)

- % Relative humidity atmosphere

+ Sensor type: Capacitive humidity chip and type T thermocouples

+ Operating Temperature Range: 32°F (0°C) to 662°F (350°C)

+ Accuracy: ±5% of full scale for Humidity and Dew Point

+ Response Time: t60 = 3sec in air at 200 ft/min (1m/sec)

+ Dew Point range: 32°F (0°C) to 212°F (100°C)

+ Relative Humidity Range: 0 to 100% RH Atm

+ Absolute Humidity range: 0 to 100% Moisture by volume

+ Dwell Time: See Digital Humidity Sensor Dwell Time Graph

+ Battery running time: 4+ hrs. +++

Humidity Sensor: NEW Digital vs. OLD Analog

Plant engineering redesigned: We offer you the choice rather than ready-made kits – because we integrate processes, not just parts – for more efficiency, flexibility and security. Innovative plant designs from the plant architects. For a perfect dough all along the line.

Staff in the American supply chain centers of Domino’s Pizza produce dough for franchise outlets, among others. This also guarantees the quality of the pizzas.

+Das D omino’s Pizza, an American listed company, specializes in producing and supplying pizza. The company operates mainly in North America, Europe and Japan. Domino’s in the USA and Canada relies on supply chain

centers to produce pizza dough for the branches, among other things. There are 18 of these distribution centers in North America alone. They vary in size, the smallest serving around 125 branches and the biggest approx. 650 branches. There are also supply chain centers in Alaska, on Hawaii and five more in Canada. On the one hand, the task of these supply chain centers is to check raw materials quality, and on the other they guarantee that each pizza in every outlet has the same flavor.

One of these North American distribution centers is at Hartford, Connecticut, in the USA. It consists of a building with an area of approx. 3,715 m 2 that serves about 400 branches in New England, upstate New York, Buffalo, Rochester and New York City. The respective franchise branches in this arrangement have a supply plan that provides for one or three deliveries per week. Branches can submit their orders up to midday each day. These orders are collected and pooled. Production in the distribution centers is then planned, and transports are organized in such a way that they can be optimally used. This involves trucks starting deliveries on the same evening. A delivery to the Bronx, New York, for example, needs about a three-hour drive, but it can still be received before midnight on the same day if the branch orders by midday. Half of these deliveries take place overnight when no-one is in the branch. The drivers open the branches, deliver their goods,

and lock up afterwards. It’s the best and quickest way to deliver in big towns with a lot of traffic.

Staff in Hartford load goods into around 20 transporters every night. These leave the center from 20:00 hrs. onwards. Each truck supplies 10 to 12 branches, starting with the branches that are furthest away. The branch furthest from the distribution center in Connecticut is in Maine, which needs an eleven-hour journey. As well as delivering pizza dough, the distribution center acts as a redistribution point for all the items needed to operate a branch of Domino’s, including cheese, salad, paprika, desserts and even serviettes etc. For this, the distribution center carries up to 200 article items. This process guarantees that branches don’t need to worry about running out of a particular ingredient or article; they must just look after the order and receiving the incoming delivery.

The Connecticut supply chain center produces around 140,000 fresh pizza dough balls per day on six days a week. Each dough ball is made from six basic ingredients: water, flour, salt, oil and yeast, together with sugar. A special “Domino’s ingredient” – the so-called “secret ingredient” – is also added to turn the dough into Domino’s dough. The company was unwilling to give away anything more.

Dough production in Connecticut starts at 3:00 a.m. and continues until all the orders from the branches have been worked through. The center has two flour silos holding approx. 31 tons of flour per silo. Between 10 and 14 trucks deliver wheat flour to the center every week. Dough preparation starts with batches weighing approx. 230 kg. A total of three Diosna wendel mixers are in operation in Connecticut, so production can continue even if one mixer breaks down.

After all the ingredients have been put into the mixing bowl, the bowl is rolled into the Diosna mixer by hand. The ingredients are mixed and kneaded for about five minutes, after which a sample is taken from each batch to check its temperature and dough elasticity. After mixing, a bowl tipper is used to transfer the dough to an AMF dough divider. Knives cut the dough to the correct size and/or weight. This is followed by round-molding.

All the balls of dough then pass through a metal detector before being loaded into blue crates by hand. Each plastic box holds an average of seven dough balls, although this can vary depending on their size. The crates are then immediately taken into a cold store where the dough is cooled down from 26.7°C to 4.4°C. This must happen quickly so the dough does not already develop in the supply chain, but only when it is in the branch. The specification is that the dough must be brought from the mixing bowl into the cooler within 15 minutes. Staff stack the crates crisscross in the cold store to ensure efficient removal of heat and moisture from the dough balls. After cooling, the boxes are then stacked one on top of another

before being transported to the branches. The dough must now always be stored at a temperature between 0.5°C and 3.3°C. In this respect, maintenance of the cooling chain is what decides the dough’s quality.

Domino’s has numerous recipes for its own branches. However, it also produces dough balls for school meals programs in the USA. In this case, the recipe must conform to government school meals specifications. However, these rules applicable to pizza can vary from one school district to another. Pizzas supplied to cater for children in schools are then baked in Domino’s branches.

We have a closure for every production need and labels that drive sales.

Labels get you noticed

• Eye-catching on the shelf

• Drives incremental display

• Instant brand recognition

• Wide variety of label options to meet your needs

Labels drive sales

• Increase sales up to 15%

• Use a promotional hook to gain shelf space

• Connect o ers to your other products for co-purchase

• Use Kwik Lok labels to amplify your marketing message

• Link digital content and social media via Quick Response (QR) codes

• Use labels for Immediate Redemption (IRC) and bounce-back coupons

• Cross promote with other products

• Create brand and occasion o ers that drive loyalty and transactions

All the dough used in branches of Domino’s is fresh, and is never frozen. However, the fresh dough is not yet ready for use when it is delivered, and must be chilled for one or two days before being used in the branches. The dough should then be processed in less than one week.

There are around 175,000 blue crates in the Hartford, Connecticut, center to transport dough balls. After a delivery has taken place, the driver takes the empty crates from the branch back to be cleaned and refilled in the distribution center. The distribution center has a crate washing plant. The boxes are washed, disinfected and stored until they are refilled with fresh dough. The entire washing process takes approx. 20 minutes.

After being loaded with dough, the edge of the box is labelled using washable food-safe ink, stating the production date and time of day, together with the size and type of dough. This allows employees to determine the dough’s proofing time and shelf life. The fresher the dough, the longer it must proof in the branch before being used. The longer the transport time to the branch, the sooner the dough becomes ready for use.

The crates are not all the same color. A few of the boxes are dark blue, meaning that one crate must remain empty and must be put at the bottom of a stack. There are even a couple of red crates, although these come from distribution centers in North Carolina or Georgia. If the plastic boxes are damaged, show cracks or are discolored, they are recycled.

Domino’s operates worldwide and employs more than 14,000 staff who generate an annual turnover of around USD 2.4 billion. Around 150 staff work in the Connecticut supply chain center.

Domino’s was founded in December of 1960 by Tom Monaghan and his brother James. They got their start in Ypsilanti, Michigan originally purchasing a pizza store being called “DomiNicks”. One year later, James traded his half of the business for a Volkswagen Beetle. You can still see the VW Beetle that Tom used to buy his brother out from the business at their current headquarters in Ann Arbor, MI.

Domino’s began franchising with three flagship stores. The first franchised store outside of Michigan was in 1967 located in Burlington, Vermont, and is still there to this day. The Domino’s logo has three dots on a domino piece, each do representing one of these original stores. Originally, they planned to put one dot per store on the logo, but now with over 15,000 stores worldwide, that logo would look like one large dot.

Larry Manning, Supply Chain Customer Service Director, says “It’s a company in which you can grow old.” Manning began his career as a customer service employee in this distribution center about 30 years ago. According to Manning: “Everyone knows their job; the job is to sell more pizza and to have more fun.” That makes the manager proud of the centralized production of pizza dough. +++

To allow the franchise stores to focus on making pizza, Domino’s began controlling the supply chain process in 1972. The goal was to create a one-stop shop for all the operating needs of all franchises. This strategy would allow each store to make one phone call to order all its ingredients, which would save the stores a lot of time and money. This strategy would also help ensure quality and consistency of ingredients, as well as create one brand for one global organization whose clear goal was to sell pizzas all around the world. Domino’s stores are now located in over 85 countries worldwide.

Domino’s Supply Chain Centers keep tight control over the quality and pricing of ingredients to offer a competitive advantage. All ingredients are controlled to ensure every pizza in every store has the same taste. After 47 years, there are now 18 distribution facilities in North America alone. These vary in size with the smallest servicing approximately 125 stores and the largest serving about 650 stores. Additionally, there is one in Alaska, one in Hawaii as well as five more in Canada.

Bundy Baking Solutions announced the launch of a new business, Synova LLC, to manufacture and distribute baking release agents. The new business, located in Westerville, Ohio/USA, will offer release agents for baked goods including bread and cakes, as well as food-grade release agents for troughs and other bakery equipment. The 70,000 square foot facility has been fitted with new, state-of-the-art equipment with automated manufacturing systems to meet the highest sanitation, reliability, quality and sustainability standards. Synova will employ up to 20 people including a team of experienced R&D scientists for product formulation and new product development. “We are very excited to add high-quality release agents to our product offering,” said Gilbert Bundy, Bundy Baking Solutions CEO. “The new release agents combined with our pans, pan coatings, pan refurbishment services and experienced sales force gives us the ability to provide comprehensive service to our customers to ensure they get the longest, most productive life out of their baking pans.” +++

FRITSCH GmbH has filed an application for the opening of insolvency proceedings for itself and the companies FRITSCH Holding AG, FRITSCH Vertriebsgesellschaft GmbH, FRITSCH Bakery Systems GmbH, all from Markt Einersheim, and FRITSCH Service GmbH from Heilbad Heiligenstadt – with the district court in Würzburg in charge due to imminent insolvency.

The Local Court will now appoint a provisional insolvency administrator who will, together with the Management Board examine restructuring options and the restructuring measures already initiated, with the aim of continuing the business operations of the companies.

The group of companies wants to preserve the best possible opportunity to sustainably restructure itself through insolvency proceedings. Alexander Schmitz, who has been CEO of FRITSCH Holding AG for three months, sees a good chance that this can be successful: "FRITSCH has a very good reputation in the market, the products are of high quality and in demand, despite intensified competition and structural changes in the baking industry," says Schmitz. +++

After a construction period of 20 months and an investment of about CHF 50 million, Bühler Group has officially opened its CUBIC innovation campus with eight Application Centers. “We are with this driving forward our strategy of innovation, training, and development,” says Stefan Scheiber, CEO of Bühler Group. The new innovation campus is integrated into the Bühler site in Uzwil as the bridge that links the development, engineering, and design teams with the modernized Application Centers and the factory. This enables Bühler to develop solutions together with customers, start-ups, and industry and research partners up to the point of market maturity with much higher speed and efficiency. “The CUBIC campus will become the epicenter of our collaborative ecosystem,” says CTO Ian Roberts. +++

In its centennial year, MIWE Michael Wenz GmbH has expanded its international presence at a strategically important location in the Middle East and Africa by opening a new subsidiary in Dubai, United Arab Emirates. The ninth subsidiary of the German bakery systems manufacturer based in the Dubai Silicon Oasis free trade zone started operations. It will serve the United Arab Emirates (UAE) alongside other countries in the Gulf Cooperation Council (GCC), including Saudi Arabia, Kuwait, Oman, Qatar and Bahrain, as well as sub-Saharan Africa and Pakistan.

Pizza is one of the most popular foods worldwide, and various plant constructors offer industrial pizza lines. Here is a small overview of the manufacturers and methods.

P izza can be produced to a customer’s specification to comply with almost all personal preferences and dietary or religious restrictions. A pizza can also be adapted to a series of regional preferences. In addition there are variations of pizzas and pizza-like snacks. Industrial pizza line manufacturers offer a very wide variety of solutions and processes. Here is a small, albeit incomplete, overview of plant constructors and processes.

According to the manufacturer, FRITSCH pizza lines start with a dough sheeting line operating according to the

FRITSCH SoftProcessing © method to carefully shape the dough into a dough sheet while retaining the structure of soft doughs. For this, the SoftProcessing © method uses a satellite head. The satellite head has eight rollers with a non-stick coating, and moves in the same direction as the dough sheet. Each of the eight rollers moves in the opposite direction to the dough sheet. After the dough has been reduced to the required dough sheet thickness, and depending on the process, the dough can go into the proofer, for example. To create a slightly irregular shape, a poking roller can be used to poke the dough after proofing, thus simulating manual make-up. A FRITSCH IMPRESSA pizza line can be used to produce Italian pizza, American pizza, calzones and flatbreads.

Generally speaking, there are two ways to produce pizza crusts, either from a doughball or by cutting out on a dough sheeting line.

FRITSCH specializes in dough make-up, while FRITSCH Bakery Systems also offers to plan entire pizza lines extending beyond the dough sheeter line. FRITSCH Bakery Systems acts as a single provider to plan the design concept and coordinate the suppliers of the ovens, freezers and packing plants to offer a turnkey solution for the whole pizza line.

The Kaak Group can also offer turnkey solutions to fabricate an industrial pizza line. Combining together various business divisions (DrieM, Daub, MCS, Benier and Kaak FPS) enables pooled expertise within the company to be utilized to create a design concept for a pizza line that can handle the variations

VMI offers state-of-the-art mixing technologies to meet the varied requirements of the baking industry

VMI is THE mixing company.

in pizza manufacture. These turnkey lines offer capacities of up to 6,000 pieces/hour for standard pizza (or 4,000 pieces/ hour for gluten-free products).

A Kaak integrated pizza production line offers all the various components needed to make pizza, including: metering, mixing, molding, proofing, baking, cooling, topping and freezing.

Mixing and make-up are provided by Benier, ovens by MCS, for example, spiral coolers by Kaak and conveyor belts by Multiparts. MCS also offers MDD mixing systems. There is also a pizza press from Italy. After the dough has been molded into balls, it is placed either on trays or onto a belt and sent to the MCS hot press. Dough balls deposited onto trays are first of all gently pressed onto the trays without any heat. The dough pieces are then put under a presser head that applies pressure and heat to press the dough up to the tray walls to create a rim on the crust. Without a tray, the dough can be pressed on a conveyor belt. Dough pieces arriving from the proofer are lined up in rows to be carried under the presser heads. Kaak goes on to say that this allows the traditional dough handling method. MCS also makes some proofer variants for these hot-pressed crusts. As well as plants to produce pizza crusts from dough balls, DrieM also makes a dough sheeter with which pizza bases are cut out by die-cutting.

The biggest pizza line fabricated by AMF Tromp was installed in the USA and produced 100,000 pizza crusts per hour. The Group supplies customized lines with which the customer can choose whether his pizza crust is to be produced either from a dough ball or from a dough sheet. For this, as the company explained, the Tromp dough sheeter line offers gentle dough handling that retains the dough’s structure, consistency and volume.

AMF Tromp uses a dough divider for crusts made from a dough ball. This offers high weight accuracy and a greater capacity than a dough sheeter plant.

Various topping and decorating systems are offered to apply ingredients such as cheese, meat and vegetables. Excess ingredients are recycled to the ingredients cone. AMF Tromp proofer systems are also tailor-made. The oven designs can be equally customer-specific. Thus AMF Tromp offers an integrated pizza solution through partnerships with AMF, AMF Den Boer and Reading Bakery Systems.

Rademaker offers a pizza line capable of producing pizzas in various shapes and sizes, as well as alternative products or variants such as pizza baguettes and pizza sticks. The Rademaker pizza line can process between 500 kg and 6,500 kg/hour of dough. In this respect the company specializes in dough sheeter technology. With a working width of 600 to 1,600 mm, the dough sheeter line provides the flexibility needed to manufacture a wide range of products and shapes. Capacities depend on the product and dough thickness. Proofer cabinets can be set up “in line” if necessary, to proof dough sheets before cutting out the product. Rademaker’s pizza topping solution is also said to be a modular system that guarantees the flexibility and quick changeover needed to produce a pizza topped with tomato sauce, vegetables, cheese, meat and other toppings. This allows the plant constructor to offer customized solutions for pizza production. +++

Some manufacturers believe a pizza doesn’t always need a wheat dough crust. Nowadays, for example, there are alternatives made from cauliflower, vegetables or even chicken meat.

+Traditional pizzas usually contain a crust made from six basic ingredients including: flour, sugar, water, salt, oil and yeast. The crust is the base used to deliver flavor through the sauce and toppings. Recently manufacturers have begun to differentiate themselves with unique offerings in the crust, such as various vegetable alternatives, seeds, flours, which offer different flavors and nutritional profiles.

According to Mintel’s latest U.S. pizza market report, three quarters of pizza consumers are willing to spend more on better quality frozen pizza. A new-comer in the US pizza market is Caulipower ® which started its first year with $2.1 million US sales. Caulipower® is a gluten free pizza crust that is made from cauliflower, brown rice flour, corn starch and tapioca as the base of the crust instead of wheat flour. The paleo version of the cauliflower crust is grain free with the main ingredients including cauliflower, almond flour, cassava flour, and tapioca flour.

In addition to ready-to-bake frozen cauliflower based pizzas, Cali’flour Foods offers frozen plain cauliflower pizza crusts and flatbreads that are ready to be topped with fresh ingredients at home. These crusts and flatbreads mix cauliflower with mozzarella cheese and egg whites to provide gluten, grain, and nut free pizza crust, ready to be topped. These crusts are a good source of protein and were formulated with the paleo and ketogenic diet in mind with 1 g of net carbs per serving. The flat breads are only 50 calories with 5 grams of protein and 3 grams of net carbs. Cali’flour Foods also offers a plantbased pizza crust that is vegan. This crust is made from cauliflower, sesame seed flour, sunflower seed flour, olive oil, psyillum husk and nutritional yeast. The vegan crusts are offered in three flavors: plain, spicy jalapeño, and Italian.

Realgood Pizza Co offers a unique pizza using chicken and cheese as the crust base for a high protein and low carb pizza that is gluten and grain free. In addition to the chicken crust pizza, Realgood also offers a cauliflower crust made from the base ingredients cauliflower, cheese, and egg. These crusts are providing more options for gluten-free diets.

Outside of the United States, Dr. Oetker’s “Yes It’s Pizza” is selling vegetable-based crusts with at least 38% vegetables in the crust and as a topping. These thin crispy crusts include varieties with beetroot, spinach, and cauliflower. The crust of the pizza is even the color of the vegetable, so the beetroot crust is pink and the spinach crust is green. While these pizza crusts still contain wheat flour, for the consumer looking to increase vegetable intake and try new flavors, this product is an interesting option.

Manufacturers are also offering consumer ways to increase creativity at home. Nestlé Wagner is offering ERNST WAGNER’s with three new types of fresh dough ready to be decorated and baked at home. The varieties of fresh dough include “Pizza” in a rectangular shape to fit in the baking pan, “Flammkuchen” being extra thin and crispy also the shape of a baking pan, “Pizza & Focaccia” for round and fluffier pizza.

Other things that are showing up are dough formulations, especially gluten-free products, which include ancient grains such as quinoa, sorghum, amaranth, teff, and buckwheat to provide variety in flavor and textures as well as health benefits while maintaining a clean label.

These new and interesting pizza crusts are pushing the boundaries on what can be used as a pizza crust. The thing these crusts have in common is targeting the trend towards healthier pizza, cleaner labels, and alternatives for all food products. +++

The Berlin-based Freiberger Group is one of the pizza market’s most important players. A 100% subsidiary of Südzucker AG, it produces frozen and chilled pizzas, frozen pasta dishes and snacks, and is clearly focused on the own-brand retail business. Freiberger says it makes around 700 million frozen and chilled pizzas per year. The Berliner Morgenpost (newspaper) reports that the group is one of the world’s biggest suppliers, with a 2018 turnover figure of almost EUR 1 billion. The company itself does not give any turnover information. According to Freiberger, the number of employees is around 3,500, of which just over 600 work at the Berlin head office.

In total, the Group has eleven locations in Europe and the USA. Products are marketed in 30 European countries and in the USA, Canada and South Africa. The Freiberger company’s web site says it is the market leader in frozen and chilled own-brand pizzas in eight countries that between them account for 80% of worldwide pizza sales.