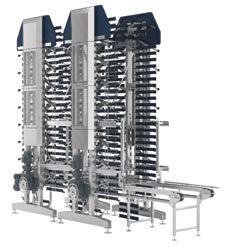

You get more space and more safe. We like to call it the best combo in baking. Together, the 909A/910A create the closing line of the future for bakeries, with tamper evidence, additional safety features and a space saving compact design. Partner our updated 910A high-throughput closure machine with our 10-inch “laser stitch” 909A to ensure your product stays tamper resistant, your team stays safer, and your

Learn more at kwiklok.com

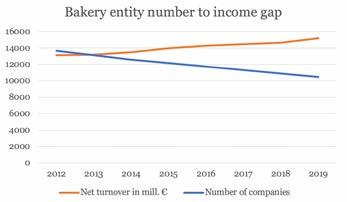

Someone once said that digging into published financial data was akin to archaeology because the data, once revealed, was already outdated. That certainly seems intuitively correct and is underscored anyway this year with the onset of the Corona pandemic. Irrespective of intuition, a detailed study of the financial statements of around 100 bakeries in Germany on the basis of their latest financial reports for fiscal year 2018 shows that taking a closer look at audited numbers is often more reliable than just going by hearsay, no matter how well that information has been gathered. A brief summary of the interesting results of that research is available in “The economic state of German artisan bakeries –Where less and less becomes more and more”

(See page 44).

At the same time, it is also important to keep abreast of the effects the present crisis is having on bakeries. The new Gira report, “COVID -19 Crises – Impact on European Bakery Markets” (see page 20) gives a good overview of what is actually happening at the moment. The report states that the pandemic and the measures implemented to contain it have led to widespread disruption and fear, leaving bakeries with the challenge of rebuilding a fragile consumer market. What is expected is a change in consumption habits in the long term, to the extent that existing trends will be accelerated, with consumers now showing greater concerns about food safety and hygiene.

In comparison to its European neighbors, Germany fared well during the first wave in March and April. Nevertheless, a recent survey carried out by the German Bakers’ Confederation, which collected information from over a 1,000 bakeries throughout the country, shows that turnover dropped by 13 percent between March and September, which will will lead to an anticipated loss of one billion euros. Most hit are bakery restaurants and cafés owing to reduced customer frequency. As pointed out in the report on the economic state of German artisan bakeries, quick-service restaurants and cafés have been installed virtually everywhere so as to take advantage of the growing trend towards out-of-home consumption, thus leaving bakers in a better position to attract customers away from cheaper selections of bakery products on sale at grocery retail stores. Not having that option for a prolonged period of time could certainly make life more difficult for bakeries.

Nobody will know the answer to this until 2022. That is when German bakeries generally expect COVID -19 to be history. It will then be worthwhile taking a closer look at their audited statements for 2020.

How much does your software know about bread?

Ours knows a good deal.

Industry-specific processes, integration of machines and systems, monitoring and reporting, traceability, quality management and much more.

The CSB-System is the business software for the bread and bakery goods industry. The end-to-end solution encompasses ERP, FACTORY ERP and MES. And best-practice standards come as part of the package.

Would you like to know exactly why industry leaders count on CSB?

Prof. Dr. James Bruton

PUBLISHING HOUSE

Food2Multimedia GmbH

Schoolkoppel 27

21449 Radbruch, Germany

+49 4178 244 9797

www.foodmultimedia.de

PUBLISHER; EDITOR-IN-CHIEF

James Dirk Dixon dixon@foodmultimedia.de

EDITORIAL

Helga Baumfalk baumfalk@foodmultimedia.de

COPY EDITOR

Annie Dixon annie.dixon@foodmultimedia.de

SUBSCRIPTIONS

Viktoria Usanova usanova@foodmultimedia.de

DISTRIBUTION

vertrieb@foodmultimedia.de

ADVERTISING info@foodmultimedia.de

LAYOUT/GRAPHIC DESIGN

LANDMAGD Design aus der Heide Linda Langhagen, design@landmagd.de

Leinebergland Druck GmbH & Co. KG Industriestr. 2a, 31061 Alfeld (Leine), Germany

IT

IT Consulting BRUNK Felix Brunk, felix-brunk-net.de

BAKING+BISCUIT INTERNATIONAL is published six times a year. Single copies may be purchased for EUR 15. Subscription rates are EUR 75. per annum. Students (with valid certification of student status) EUR 40. (All rates include postage and handling, but not VAT).

Cancellation of subscription must be presented three months prior to the end of the subscription period in writing to the publishing company. Address subscriptions to the above stated distribution department. Claims will not be accepted for any copies not received or lost copies due to reasons being outside the responsibility of the publishing company. This magazine, including all articles and illustrations, is copyright protected. Any utilization beyond the tight limit set by the copyright act is subject to the publisher’s approval.

Online dispute resolution in accordance with Article 14 Para. 1 of the ODR-VO (European Online Dispute Resolution Regulation): The European Commission provides a platform for Online Dispute Resolution (OS), which you can find at http://ec.europa.eu/consumers/odr

Valid advertising price list: 2020

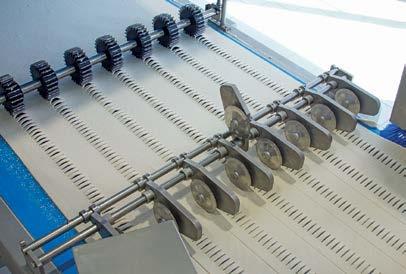

Customers demand the highest quality bakery products delivered on time and at the right price. Rademaker understands these challenges. We provide efficient bakery equipment for every possible production environment, based on your specific dough processes and product requirements. Resulting in the lowest cost of ownership in the market yielding maximal results in terms of product quality and return on investment.

We offer equipment for the production of:

• Dough bread / roll lines for bread rolls, Mediterranean breads and flatbreads.

• Dough strip toaster for premium quality toast and sandwich loaves.

• Laminating and processing lines for puff pastry and croissants.

• Dough roll-out lines for yeast doughs, shortcrust pastry, cake, Berliner and donuts.

• Pressing and punching machines for cakes, pies, quiches and tortelettes.

• Pizza bottom and topping machines, application specific dispensers and strewing.

Specialists in food processing equipment

Specialists in food processing equipment

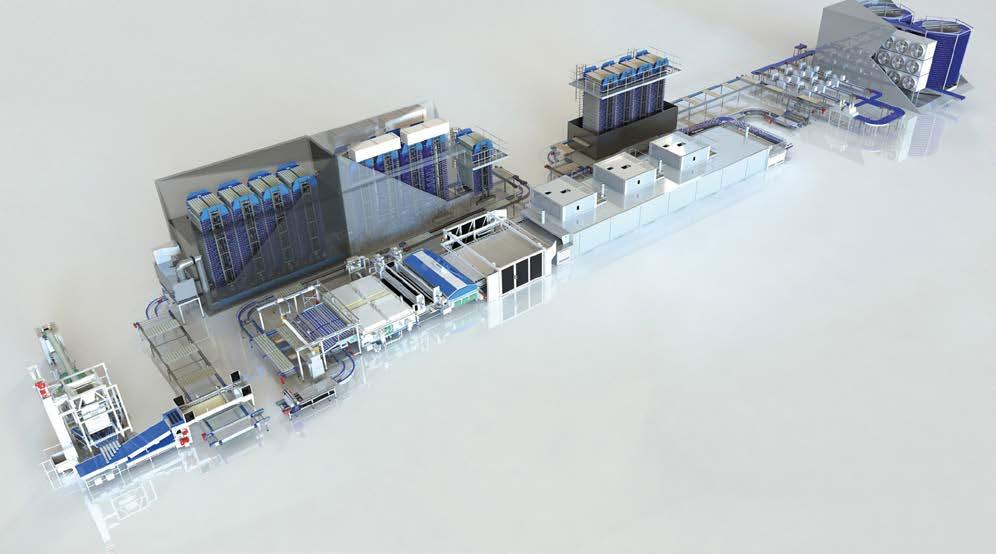

Mecatherm, French manufacturer of industrial ovens and production lines, has signed a partnership with American ABI LTD, a specialist in bagel makeup equipment. Together they are planning to market an industrial bagel line. baking+biscuit international investigates further.

+Worldwide, there is a growing market for bagels as a sandwich variant in the fast food industry and this forms the background to the collaboration, which was initially limited to the offer of industrial bagel lines. The dough for the ring-shaped yeast bread roll can be varied with any sweet or savory ingredients and due to the compact structure of the dough, it retains stability until the very last bite.

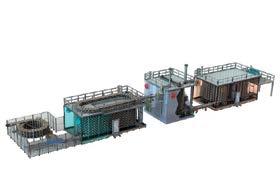

The joint offer from Mecatherm and ABI bears the symbolic name MECABAGEL, with the stations forming, cooking, seeding and drying from ABI, and fermentation, baking, cooling and freezing from Mecatherm.

The bagel in its original form comes from the Jewish communities in Eastern Europe. Emigrants brought it with them to the USA, where it developed from coast to coast into a standard bread roll that needs to be present on every supermarket shelf. Special feature: a real bagel is passed through boiling water before baking, so that the surface closes up and the finished bagel has a dense dough structure.

ABI has developed a very special solution for the cooking process. The technology used to cook bagels is what is referred to as “waterfall” style boiling. This method incorporates a boiling-hot waterbed, which generates an abundance of steam in the boiling chamber as well as when in contact with the bottoms of the bagels. In addition, the bagels travel through a series of hot water “curtains”, which coats the upper three quarters of the bagels as they pass through the curtains. This combination ensures an even, constant exposure to the

boiling water and steam. Belt speed adjustments are used to achieve the desired cooking time. Waterfall technology consumes less water, as the heated water of the bed is pulled through a filter and drawn up to the waterfalls.

Mecatherm does not use the traditional spiral solution for cooling, but the modular M-UB solution that improves hygiene and changeover management, as well as packaging stops. The new solution involves an independent cooling circuit, using cooling trays on a dedicated conveying loop and a modular M-UB cooler. François Retailleau, Production lines manager at Mecatherm, explains why.

“The Mecabagel cooling circuit provides the producers with tools to improve their hygiene control:

+ An independent cooling circuit limits contamination risks, which are further controlled when enclosed into a “clean room” area.

+ Dedicated cooling trays are easy to wash down. This is usually a tricky operation because every connection between links is a potential retention area where bacteria can grow.

+ Moreover M-UB technology has no top pusher, this makes for a smooth friction-free avoiding all kind of pollution risk.

As this solution uses pans, it is also possible to add a buffer in the cooler, thus allowing packaging stops to be managed (e.g. due to changeovers) without stopping the rest of the line upstream. This functionality – which is not available

1 Dough cutting and shaping (by ABI)

++ After leaving the kneader, the dough passes through the divider to obtain dough pieces, which are then shaped and rolled around a shaft to give the bagels their characteristic ring shape

2 Fermentation: Proofing and retarding (by MECATHERM)

++ Placed on fermentation trays called peel boards the dough pieces enter the fermentation stage. Bagels generally require two-phase fermentation: parboiling at very high temperatures, followed by "retarding" in a cold atmosphere, to stop fermentation and to firm up the product by creating a thin superficial skin

3 Boiling, seeding, drying (by ABI)

The bagels are now taken from the trays in the direction of the boiler. For this stage, a very original spray treatment has been developed by ABI that replaces standard immersion. The boiling stage is completed by seeding to decorate and personalize the product.

4 Baking (by Mecatherm)

The bagels move on to the oven where they will be traditionally baked on the floor or hearth of the oven. Depending on market expectations, the hearth of the oven is available with or without marks. For a bagel with a smooth underside, FTP technology with metal bands is recommended; and for hearth marking, the M-TA oven technology is used.

5 Cooling and freezing (optional) (by MECATHERM)

6 Production line mechanization (by MECATHERM)

++ For proofing, retarding or cooling, the assembly line is equipped with M-UB universal handling systems, which combine aspects of “paternoster” and “swing” type mechanizations

7 Smart-management tools (by MECATHERM)

++ The MECABAGEL line is equipped with digital user support solutions

+ An instinctive and user-friendly interface that facilitates operation, production monitoring and traceability on the line.

+ A preventive maintenance module that alerts the operator if inspection or maintenance of equipment is required, and provides maintenance recommendations. +++

Technical characteristics of the MECABAGEL line

+ Floor area: 1,800m² (excluding packaging) – 90 m x 20 m

+ Reference production capacity: 28,000 bagels per hour

+ Reference rate of production: 320 peelboards per hour

+ Dimensions of fermentation and cooling trays: 2,000mm x 800 mm

with continuous systems such as spirals – plays a key role in improving the overall line performance.”

Mecatherm and ABI report that customers in the respective markets will be referred to qualified providers for dough production if required. “The main challenge to mix bagel dough – characterized generally as being very stiff – is for the mixer to deliver a high level of power; therefore, horizontal mixers or spiral mixers (single or double) are the technologies that are generally used.”

Baking the bagel requires a lot of energy from the start of cooking, to ensure its development and prevent sticking. The dough has been made very sticky in the boiling process. It also requires mastery of baking parameters and especially control of the humidity of the oven. Depending on market expectations, the hearth of the oven is available with or without marks. For a bagel with a smooth underside, FTP technology with metal bands is recommended; and if a hearth marking is acceptable, M-TA oven technology can be used.

Maintenance and repair are according to the recommendations of each manufacturer. It is essential that the customer has a smooth transition period, and so once the contract

ABI is based in Toronto, Canada, and is one of the leading designers and manufacturers of bagel makeup equipment. The company, headed by founder and CEO Alex Kuperman, employs over 75 people across its engineering, production, service, sales, and admin functions.

has been signed, a single contact point will be defined for project management, as well as for servicing and maintenance once the line has been installed.

Each manufacturer has their own dedicated control system to maintain control of their own pieces of equipment. Integration is carried out by establishing communications between the systems, which allows each system to provide the relevant information to the next one. The French mechanical engineering company offers smart management tools as an instinctive and user-friendly interface that facilitates operation, production monitoring and traceability on the line. A preventive maintenance module is also supplied that alerts the operator if the equipment needs to be inspected or maintenance is required; maintenance recommendations are also provided. At present, this transatlantic cooperation includes bagel lines for Europe, Asia, Australia, Mexico, South America, the Middle East and Africa.

Founded in 1964, MECATHERM is a French manufacturer of industrial ovens and production lines. The company has two production sites in France and worldwide three sales offices in France, Mexico and Malaysia as well as a subsidiary in Atlanta, Georgia (USA). The company, headed by its President Olivier Sergent, employs more than 400 staff.

The 2 partners add: “We want to first of all develop it in the countries where we can find new opportunities and where ABI LTD does not have a market. Our future collaboration could be extended to other projects.” +++

The FRITSCH Academy was launched this summer at the bakery systems manufacturer FRITSCH. The new learning academy offers training tailored to the needs of customers and employees. All courses can be held at the customer's location, at FRITSCH's “World of Bakery”, or online. Stefan Schmitt, who has been with the company for over 30 years, manages the FRITSCH Academy. He is supported by Elke Döpfner.

The FRITSCH Technology Center (FTC) has been renamed “World of Bakery”. The new name is intended to make it clear that the company covers the entire spectrum. On the one hand, the facilities are geared to the trade and to industry, and on the other hand, the company sees itself as a partner when it comes to producing and developing baked goods or optimizing processes. Michael Gier heads the “World of Bakery” team. He is a trained baker and food technician and has been with the company since 2006.

FRITSCH has established a separate division for the sale of used machines: “Young Classics”. It includes used machines from the FRITSCH portfolio that have been returned from bakeries due to new acquisitions or business closures, as well as demonstration machines from trade fairs or from the

World of Bakery. All machines are subjected to a general overhaul before they are placed on the market. Stefan Schmitt heads the new division. +++

++ Digital expo: Fi Europe CONNECT 2020

Fi Europe co-located with Hi Europe has announced they are postponing the live event to 2021 and are transitioning to virtual for their 2020 event: Fi Europe CONNECT 2020 is a virtual event designed to give the F&B community access to the global F&B ingredients industry, tools and collaboration opportunities they require to meet their business objectives. Fi Europe CONNECT 2020 will take place from 23 November – 4 December 2020. +++

++ Cooperate: Nestlé and Dawn Foods

Nestlé Professional ® and Dawn Foods have agreed on co-branding in Europe, the Middle East and North Africa. Both see the partnership as a perfect opportunity to combine Nestlé's confectionery with Dawn Foods' bakery ingredients, according to a press release. The first product soon to be launched will be a muffin with the taste of KITKAT ® ingredients. +++

November 22-26, 2020

Gent/Belgian

HORECA EXPO 2020

www.horecaexpo.be/en/

November 25-28, 2020

Seoul/South Korea

Coex Food Week 2020

http://coexfoodweek.com

December 8-10, 2020

Casablanca/Morocco

Morocco FoodExpo 2020 www.moroccofoodexpo.com/

January 16-20, 2021

Rimini/Italy

SIGEP – International Trade Show of Artisan Gelato, Pastry, Bakery and the Coffee World https://en.sigep.it

January 31 – February 3, 2021

Cologne/Germany

ProSweets Cologne 2021 www.prosweets.com

February 20-23, 2021

Madrid/Spain InterSICOP

www.ifema.es/en/intersicop

February 25 – March 3, 2021

Düsseldorf/Germany

interpack – Processing & Packaging www.interpack.com

April 13-15, 2020

Nanjing/China

International Bake & Shop Expo

www.bakeandshopexpo.com

October 24-28, 2021

Munich/Germany

iba 2021 www.iba.de/en

+Officially she is a lawyer, but in fact Beth George has been working as a bagel consultant since 2013, worldwide. From her base in Fair Lawn, New Jersey, USA (about 20 minutes from New York City), under the name BYOB Bagels – which stands for “Be Your Own Boss” as well as “Build Your Own Business” – she has advised beginners and professionals alike on the opening of some 50 bagel shops. Prospective bagel bakers hire her to teach or adjust recipes, to guide their business plans, and to help set up production. As part of the consultation, B eth George offers follow-up coaching after the hands-on training. Due to travel limitations as a result of the COVID Pandemic, BYOB BAGELS has developed effective methods to train remotely, including real time conferences and training through Zoom, Google Meet and other online platforms, as well as providing detailed materials and training videos.

Many of her clients are newcomers: architects, lawyers, engineers, accountants, teachers, graphic designers and business people. Some, reports The New York Times, are tempted by the adaptability of bagels and believe bagels are easy to make. “It was so much harder than I thought”, said Elizabeth Rubin, an expat from Manhattan, who opened Jimmy & Joan’s New

York, two years ago in Gothenburg, Sweden. “There’s the baking itself: days or weeks of trial and error, with different flours and enzymes, to replicate a New York bagel’s distinctive chewiness and crust; adapting the recipe to the local humidity and temperature; and adjusting the amount of time bagels need to “nap,” or “proof.”

While most of Beth George’s clients seek to conjure what she calls “the authentic New York (bagel) experience,” many aim to — or need to — incorporate local influences: a labneh yogurt spread instead of cream cheese in the Middle East, and bagels with Emmental cheese in France. In Paris and Brisbane, Australia, where crowds lean more towards lunch than breakfast, bagel sandwiches feature pastrami or grilled halloumi. Website: https://byobbagels.com +++

Dr. August Oetker Nahrungsmittel KG has increased its minority shareholding (49 percent) in InterNestor GmbH, the European market leader for customizable photo-cakes, to 100 percent. The remaining shares in the company were taken over from the founders. It was agreed not to disclose the purchase price. The Cologne-based company operates online stores in five countries (Germany: deineTorte.de, France: votreGateau.fr, Netherlands: jeEigenTaart.nl, Poland: twojTort.pl and Sweden: dinTårta.se) and employs more than 80 people. The company produces several thousand cakes per week. InterNestor was founded by Alexander and Henrik Svensson. +++

Corona effects have led to a split business situation among the member groups of the Association of German Industrial Bakeries. This was reported by the Association's President Prof. Dr. Ulrike Detmers at the Association's annual press conference. On the one hand, the services of the delivery wholesale bakeries are in great demand, because security of supply and stockpiling at home have become extremely important since the lockdown. On the other hand, according to her, the group of branch wholesale bakeries has suffered a drop in sales and turnover as a result of the lockdown. Customer frequency has fallen, in some cases sharply. The demand for snacks has collapsed.

The members and their workforces are routinely prepared for a second wave of corona, which will hopefully not happen. The association's president: “The first corona wave was accomplished with extra shifts, overtime, new staff and teamwork in the smart bottleneck management of the baking processes due to increased volume production.”

What post-corona effects does the association see? Prof. Dr. Ulrike Detmers: “The demand for bread and baked goods with longer freshness times is increasing. Packaged baked goods such as toast breads, toast rolls, wraps and seed breads also benefit from this.” With regard to further economic development, the President of the Association forecasts: “The market share of large delivery bakeries and branch bakeries amounting to 70% of the industry's turnover, which in 2018 was estimated at around 21 billion euros per year, will remain stable or grow slightly.” +++

At its last meeting, the Presidium of AIBI, International Association of Plant Bakeries, appointed Didier Jans as new Managing Director. Jans is Belgian and a well-connected business and association consultant in Brussels, according to AIBI. He succeeds Susanne Döring, who is resigning from the management of the association at her own request as of 31 December 2020.

It was also decided to postpone the European Congress in Ljubljana, planned for 2021, until 2022. The term of office of the acting President Janez Bojc from Slovenia as President and of the Vice-President Georg Heberer was unanimously extended accordingly for both. In 2022, Georg Heberer will run for the office of President of AIBI. Armin Juncker, General Manager of the Association of German Industrial Bakeries, also remains in office as Treasurer. +++

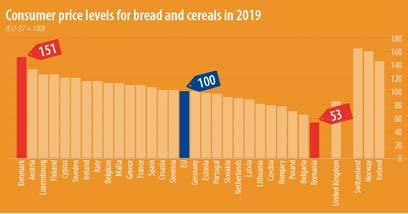

In 2019, the price of bread and cereals across the EU was around three times higher in the most expensive Member State than in the cheapest one.

When comparing price levels in countries with the EU average price level index of 100, the results show that in 2019, the price of bread and cereals was highest in Denmark (with a price level index of 151), followed by Austria (133), Luxembourg and Finland (both 125).

In contrast, the price levels for bread and cereals in 2019 were lowest in Romania (with a price level index of 53), followed by Bulgaria (65) and Poland (70).

Eurostat, the statistical office of the European Union (EU), published the figures in August 2020. +++

Although eating habits are tending to be more similar throughout the world, differences, originating in local traditions, still remain from one continent to the next. In the world of bread and baking, this is also the same.

Finished products such as sandwich bread, croissants and other types of Viennese pastries can be found in abundance on the shelves, alongside more and more diverse baked goods such as biscuits, filled pastries and sponge cakes.

These are very diversified products in terms of texture that require specific attention in the mixing process. It goes without saying that dough that contains fat, and dough that doesn’t, is not mixed in the same way, and the same is true when the dough contains inclusions (chocolate chips, blueberries, etc.), which are more difficult to mix. VMI has adapted and developed a “snacking” version of its vertical double tool mixer, the KNEADSTER, that fully meets these requirements. With its specific tooling and its reverse rotation, all types of dough and meats/vegetables can be mixed.

At the heart of VMI’s machine development is a desire to be even more cost-effective and environmentally responsible, and so an added feature on the KNEADSTER mixer is the ability to store the energy produced by the rotation of the bowl and reinject this energy back into the tools' driving system,

thus significantly reducing energy consumption (up to a saving of 15%). VMI has vast experience in designing planetary mixers and dough or batter-mixing systems for the snacking, pastry and confectionery industries. To date, about 30,000 planetary machines in total have been manufactured and installed worldwide by VMI.

There is a wide variety of planetary machines including lines for both small and medium-sized companies, as well as fully automatic solutions designed for wholesale baking and food industries.

The range of small planetary machines has capacities of 20, 40, 60 and 80 liters. All are equipped with a choice of 5 speeds, inverters, recipe programming, and 3 different attachments. (Please see photographs on Page 15) The speed of rotation of the kneading tool and the planetary mechanism can be adjusted. Up to 20 different phases can be programmed for each recipe, all designed for better consistency in mixing.

VMI is part of the LINXIS GROUP, which brings together leading companies in the food and baking industry. Before mixing, Shick Esteve offers automated ingredient management solutions. Downstream, the machines of the Canadian company Unifiller make it possible to dose, fill or decorate the snacking products mixed by VMI equipment.

++ The Ultimix is available in sizes from 200 to 900 liters bowl capacity

The design of the mixers is such that they are easy to clean. The area in contact with the product is almost completely devoid of seams and joints where the product could accumulate, creating a negative microbiological background. The working area is illuminated and equipped with a safety grid with a transparent, easily removable screen and a closing chute for loading the ingredients during mixing. The area of the flat planetary mechanism is easily and quickly cleaned. The

whisk has removable rods, which are easily replaced in case of breakage and give the best product volume. The carriage stroke allows the replacement of tools without removing the bowl. Removable scrapers for the bowl are available as an option.

The kneading bowl on the line of industrial planetary machines is normally lifted hydraulically. These machines have 80, 100and 150-liter bowls. The machine is designed for a long working life even in the most extreme conditions. 5 attachment points fix the bowl with the frame being pressure welded and mounted on stainless steel supports. The attachment of the tool shaft to the shaft is equipped with an anti-blocking system. It is possible for the machines to be made partly or completely from stainless steel. The programming of recipes and control management help to achieve productivity and consistency goals.

The ULTIMIX planetary mixer is entirely made of stainless steel (304L / 316L). The flat cover is designed without dead zones, which makes cleaning this part of the machine much easier. The bowl lifting mechanism is almost completely hidden in the columns, and the slider guides of the bowl trolley are covered on the outside with shifting straps, which prevents dirt from getting inside the mechanism. The ULTIMIX line uses a patented ultra-flat gearbox, which significantly reduces the height of the machines. Built-in devices for connecting positive pressure/ vacuum supply devices, as well as vertical feed lines for ingredients also reduce the size of machines.

VMI offers a wide range of tools adapted to different viscosities and products, from whipping for sponge cakes to incorporation and homogenization of butter and microingredients for brownies. The ability to interchange tools very easily makes VMI's latest planetary bridge mixer, the ULTIMIX, a particularly flexible and adaptable machine. The design of the tools is very important for the efficiency of any mix. For some products, the bowl profile can also be adapted to improve performance.

The VMI ULTIMIX mixer can operate 24 hours a day and can include the automatic integration of ingredients, and in some cases can further optimize the diversity of recipes, while limiting downtime in production. It is an industrial machine that can integrate automatic mixing cycles and be integrated into an automated bowl transport system. Adjusting the ratio of the speed of rotation of the tool around its axis and the movement of the planetary

mechanism makes it possible to expose the optimal trajectory of movement of the tool inside the bowl. The control system allows variation in energy consumption. A scraper carfully processes the entire inner surface of the bowl, and at the same time contributes to a better homogenization of the mixture. The scraper and kneading mixing tools are installed on the machine with the help of special devices for quick installation and removal of tools. Several sets of tools are offered as standard.

At the request of the customer, machines can be equipped with a variety of options: supply of pressure over 0.5 bar; ratio variation between speeds of tool rotation and planetary revolution speed; bowl with thermal insulation and the ability to control the temperature; automatic setting of the required temperature with visual display of the process on a dashboard; wireless temperature sensors; a set of pumps with nozzles for the automatic washing device; special drain valve in the bowl for manual or automatic emptying; devices for quick connection of the bowl with heating or cooling fluid supply systems; inspection hatches, vertical supply pipes for ingredients, etc. The machines are supplied with bowl sizes of 200 - 300 - 450 - 600900 liters. At the request of the customer it is possible to create automatic lines based on this line of machines.

Pastry and biscuit batter or dough, can also be produced on kneading machines equipped with a quick tool release system and exchangeable tools of various configurations.

A feature of the snacking version of the vertical mixer SPI AV is both direct and reverse rotation of the kneading tools. An important role in the kneading process is played by the scraper. The machine can prepare both liquid (muffins) and very solid types of dough without any non-mixed parts and dead zones. It easily mixes 10-kilogram blocks of butter or margarine. At the same time, thanks to the special form of the kneading tools, the incorporation of various fragile components into the dough, such as chocolate drops, for example, occurs very carefully, without smearing. The machine is made of stainless steel. All options, except automatic dosing connections are included in the basic package.

Deep-fried biscuits have long since ceased to be a seasonal product, as – freshly prepared – they are a customer magnet. Opelka is presenting a combination of the individual production steps that provide flexibility and make savings on personnel and floor space.

The EcoLine is suitable for the production of all kinds of deep-fried pastries, such as Berlin pancakes and donuts made of yeast dough, as well as for doughnuts, curd cheese balls or salty variants made of choux pastry, such as the increasingly popular churros and croquettes. The baking station is made up of Opelka MB 48 or MB 60 series deepfrying units and, depending on the baking time, has a capacity of up to 800 Berlin pancakes per hour (with MB 48-based station) or 1,000 Berlin pancakes per hour (MB 60). According to the manufacturer, its space requirement is only 6 m 2

Together with an independently operating, dockable filling station, the two or more deep-frying units become the EcoLine, which can be operated by just one person.

The Berlin pancakes are filled automatically, right up to refilling the jams. In the double filling function, two filling points can be set per Berlin pancake, either with the same mass or with two different masses. The newly developed eccentric screw filler can be completely dismantled and –like the entire station – is easy to clean. All components are mobile and can either be pushed into a cleaning cell or cleaned on-site.

As an option, a sugar roundel or a station can be docked to the EcoLine, which makes all-round sugaring possible; in the case of curd cheese balls, for example, this would be flow-through sugaring.

The COVID-19 crisis, the lockdown period and all the measures taken to limit the spread of the virus have led to considerable disruption and fear, touching every aspect of business and social life.

The food industries are facing challenges of an unimaginable scale. There are lessons to be learned, challenges to be shared, and a process of trying to understand how the global industry and markets are reacting. At a professional level we are all facing similar challenges, and the industry must go through a series of steps: Breakdown " Handling the direct impact " Rebuilding in a fragile consumer market.

In this crisis analysis, Gira has put the first markers down, looked for the early lessons and built a base of insight for us all to move forward from.

We thought we had returned to a certain “New Normal” this summer, but now things are accelerating again. What has been the impact of this crisis for the food industry, and what will be the consequences in the months to come?

The objective of this new Gira report “COVID-19 CRISIS –IMPACT ON EUROPEAN BAKERY MARKETS” is to provide clear insight into the impact of the global COVID-19 crisis on the European bakery markets, while updating the last Gira figures and forecasts published end-December 2019 in the “BAKE-OFF BAKERY MARKETS IN EUROPE” report. This report lays out, at European level and for the 14 main European countries:

+ The evolving situation in Europe: the impact of the COVID-19 crisis at each level of the bakery chain:

• Consumer purchasing behaviour: from fresh to packaged bakery products, from indulgence to staple products, coming back to home-baking

• Shopping habit changes and consequences for the different channels

• Foodservice downturn impact on the consumption of bakery products

• Switch in supply method strategies for fresh bakery products

• The consequences of all these changes for the fresh and bake-off bakery markets, at each level of the bakery chain

+ Implications for the future: given a recovery process and the possible scenarios for the evolution of the pandemic, what will the consequences be for fresh, packaged and bake-off bakery products’ consumption, distribution and production.

European bakery product consumption down by 7% in 2020. The assessment of consumption trends by 2020 quarters shows a 14% decrease in the overall bakery product consumption in Europe in the 2nd quarter of 2020 compared to the same 2019 period, -7% over the 3rd quarter. Developments are contrasted however, depending on the type of product, the technology, or the country. For example in 2Q 2020:

+ Savory snack products suffered the most with -25% in Q2 2020 compared to 2019 – followed by viennoiseries (-22%) and patisseries (-17%). Bread has been less affected, and consumption only fell by -12% over the same period

+ However, in Q2 2020, fresh bakery product consumption fell by -23%. In the same period, ambient packaged products (long shelf life) saw an increase of +10%; and packaged products to bake at home +8%.

+ Spain and Italy experienced the biggest drops in consumption in Q2 2020 (beyond -20%), while consumption of bakery products stagnated or even increased in the United Kingdom and Sweden, due to the importance of packaged products in these countries.

Overall, Gira anticipates an overall -7% to -8% drop in European bakery consumption over the year 2020 compared to 2019. Packaged products should experience over +6% growth in 2020 compared to 2019, while the consumption of fresh products could decrease by -11%, or even more depending on the magnitude of the second COVID-19 wave.

Packaged long-life ambient products are therefore the big winners of the COVID-19 pandemic, especially packaged bread, which has seen double digit growth during lockdown. Protective packaging has given consumers great reassurance, and this is a trend that should continue in the long term. In many countries, packaged bakery products have also been favored by supermarkets, as fresh bakery counter staff have often been assigned to other departments and many in-store laboratories have closed, at least temporarily. Packaged products to be baked at home have indirectly benefited from the renewed interest in home cooking.

During lockdown, consumers favored fresh bakery products allowing better conservation (large formats of bread, sourdough breads, special breads), and core product lines (croissants, chocolate breads, to the detriment of donuts). Snacks

and festive products have almost disappeared from the shelves.

It is not expected that the COVID-19 crisis will change consumption habits in the long term. However, it will accelerate the existing trends: demand for healthier products, functional food, continued support for local purchase and local production, search for clean label, organic products etc. One of the main impacts of the COVID-19 crisis will be increasing concerns about food safety and hygiene – and this will require more protective packaging. This will obviously have an impact on fresh bakery products in the medium term.

According to the Gira 2019 study on European fresh and bake-off bakery markets, it was expected leading up to 2023 that the foodservice sectors would be the winners in fresh bakery distribution, especially commercial foodservice and bakery chains. But those channels have suffered the most from lockdown, with a drop of -60% in fresh bakery product distribution for commercial foodservice, in Q2 2020. The social foodservice sector (-45%) and bakery chains (-36%) were also largely affected in Q2 2020. Retail stores also saw their sales of fresh bakery products falling over the same period, but less dramatically than foodservice sectors: supermarkets benefited from stockpiling purchases early on in lockdown while artisans and small retail stores were favored by consumers due to their proximity, small store size and being local. However, many stores have reduced their opening hours and limited their offers to core lines.

Nevertheless, at European level Gira anticipates a drop of -6% to -7% in fresh bakery retail sales in 2020, and beyond -25% for the foodservice sectors. The development of click & collect, online shopping and home deliveries will continue in the near future, including for fresh bakery products, which until then had been little concerned by digitalisation.

The COVID-19 crisis has also had an impact on fresh bakery product supply strategies. In most European countries, the use of bake-off increased to the detriment of scratch baking on the premises, which faced problems of labor shortages and new sanitary constraints.

However, even in bake-off stations, habits have been changed: more baking batches throughout the day to reassure consumers about product freshness and, to reduce wastage, systematic packaging of fresh products after baking. Alternatively, the delivery of fresh bakery products (for resale) has decreased during lockdown, due to the difficulties of ensuring a daily service. There were a few exceptions however:

+ In Eastern countries, where large fresh industrial bakeries are very competitive in price compared to bake-off products

+ In some Nordic countries, where dynamic artisans and bakery chains have developed direct deliveries to supermarkets, arguing the local manufacturing of their products

+ Finally, some modern retailers relied more on their own central fresh baking units.

At European level, Gira forecasts for 2020 indicate a -15% decrease of artisanal fresh bakery product production (artisans bakers, in-store bakeries and restaurants), whereas industrial production (packaged, fresh and bake-off products) could only see a -5% reduction.

The sharpest fall in industrial bakery production could be seen in Spain, Italy and Germany (-8% down to -10% in 2020 vs 2019). Alternatively, Sweden, the United Kingdom and Poland may experience an increase in industrial production (+1% up to +3% in 2020 vs 2019).

Will these trends continue over the medium term? What would be the consequences for bake-off manufacturers?

According to Gira interviews, on the one hand, many channels are determined to resume with their initial pre-crisis supply methods with the “new normal” situation. On the other hand, channels who started using bake-off during the crisis are likely to continue to use those types of products, at least for part of their supplies.

While retailers and caterers have expressed their gratitude towards suppliers who have managed to maintain deliveries during lockdown despite difficult conditions, some additional requirements could however remain: increased demand for more regional supplies, greater transparency and monitoring of the supply chain, more packaging for fresh products to avoid contamination. Bake-off manufacturers will now have to take these requirements into account.

The potential development of own central manufacturing plants by modern retailers or bakery chains (supplying fresh bakery products to owned stores) should be closely followed by bake-off suppliers: these potential competitors should not be minimized.

European bake-off manufacturers were not spared by the pandemic. Bake-off is the most promising sector (growing by more than + 3% per year before the pandemic) in a steady European bakery market, but it should also see a drop in volumes in 2020. Companies most affected were those manufacturers specializing in foodservice channels or in sweet or savory products.

In the future, the winning manufacturers will be those who will be able to decrease their level of exposure to a specific channel (e.g. foodservice), their degree of product specialization, and who will have the ability to switch from one technology to another. (fresh vs. packaged, or different bake-off technologies). +++

Contact:

Anne Fremaux, Director Bakery Girag & Associates, 13, chemin du Levant, F-01210 Ferney-Voltaire, www.girafood.com+Fedima hosts panel discussion with industry stakeholders on the impact of COVID-19 on the sector on 24th September, as part of its first virtual Annual General Assembly.

The COVID-19 panel discussion followed the General Assembly, and gathered experts from across the industry, including Blaga Papova from the European Commission, Robb MacKie, President and CEO of the American Bakers Association, and Els Bedert from EuroCommerce, as well as Steve Gillman, reporter at IHS Markit. Speakers discussed the challenges raised by the pandemic, the trends that have been established, and the opportunities facing the sector.

“COVID-19 has accelerated the speed of change, and we will have to be even more adaptable if we are to see a strong recovery of the sector and the economy as a whole.

Stimulating consumption will be crucial for retailers and producers, as will gaining a deep understanding of swiftly changing consumer behaviours. Adaptability across the supply chain and the distribution channels of bakery products will be the best way of ensuring that the sector will be able to respond to consumer demands more effectively,” stated Els Bedert from EuroCommerce.

“At EU policy level, we have established a set of measures supporting the EU economy, including of course the food sector, in facing the pandemic. We are working on policies to relaunch the European agri-food ecosystem geared towards a green recovery and new digital opportunities. In the past months marked by the pandemic, we have worked even more closely with EU Member States, to secure the integrity and proper functioning of our Single Market which is our best anti-crisis weapon,” stated Blaga Popova from the European Commission.

Robb MacKie, President and CEO of the American Bakers Association, noted, “From the perspective of the United States of America, we have noted clear trends in terms of packaging and food safety, and consumer trust. Indeed, it is essential that as an industry we build upon the momentum of the past months of renewed connection with consumers. This crisis is accelerating many processes and innovation trends in the sector, which is vital for maintaining the agility the sector has demonstrated during this pandemic.”

“We are delighted to have welcomed such an exciting list of panellists to discuss the impacts of COVID-19 on our sector, providing a platform for fruitful debate on the challenges facing the industry and the multifaceted response that is necessary. Fedima will continue in its aim to support members on how best to grow in a sustainable manner, to inform consumers on the safety of bakery products, and to enable the sector to be resilient and innovative. Fedima looks forward to playing an important role in supporting and informing its members, the industry, and policy makers on these issues going forward,” concluded Johan Sanders, President of Fedima. +++

Fedima is the Federation of European Manufacturers and Suppliers of Ingredients to the Bakery, Confectionery and Patisserie Industries from across Europe, and is composed of national associations from 13 countries.

The Fedima has rolled out a campaign to promote sourdough. The campaign launch is marked by the release of a video on sourdough, the first in a series of videos and other informative materials.

“In 2019, we conducted a study to gain insights into how European consumers perceive sourdough, and we found that 58% do not fully understand what sourdough is. As such, this campaign will focus on informing consumers about sourdough in an engaging manner, providing details into many interesting characteristics of this ingredient. Our intention is to open up debate and encourage curiosity around sourdough throughout the coming months and years,” stated Johan Sanders, President of Fedima. Fedima’s sourdough campaign, to take place over several weeks, is based on the results of the survey carried out in nine European countries involving 5,000 people. The campaign aims to educate consumers on sourdough, providing information on how it is formed, its taste and history, and its value in baking traditions across Europe.

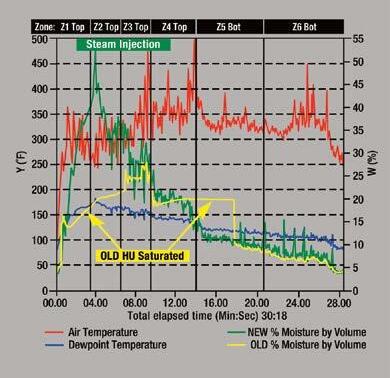

The new SCORPION® 2 Digital Humidity Sensor is designed to measure the absolute moisture content of the thermal environment in both heating and cooling processes. It is applicable to ovens, proofers, dryers and cooling tunnels and is unaffected by combustion gases. Moisture laden environments reduce baking efficiency and product quality. Understanding and controlling humidity greatly improves product consistency and throughput.

Mechanically, the Digital Humidity Sensor is comprised of a Bulk Air (dry bulb) temperature sensor, two inputs for Product Core Temperature Measurement and a proprietary humidity sampling system to measure Dew Point Temperature, Absolute Humidity and Relative Humidity. The sampling system contains patented Anti-Saturation Technology™ allowing measurements in very high dew point environments such as steam injection.

The Digital Humidity Sensor is engineered to be compatible with all types of ovens, including direct gas fired (DGF) ovens. Unlike oxygen sensor technology, which can be off by as much as 25% due to combustion gases in DGF ovens, the accuracy of the digital humidity sensor remains the same regardless of the oven platform. The Humidity Sensor travels through the process with the product, yielding a precise profile of moisture experienced by the product.

Bill Hagan, technical sales manager for AB Mauri North America, has been profiling ovens, proofers and coolers using the SCORPION®2 Digital Humidity Sensor. Mr. Hagan said that being able to measure humidity throughout the entire baking process, particularly in the oven, allows him to give bakers information that was previously not possible. He further incorporated AB Mauri's knowledge base to assist and utilize the sensor for use in bread and roll production.

“Data from oven profiling provides absolute humidity measurements verifying steam applications and proper oven exhaust settings. Analysis of proofer data indicates relative humidity throughout the process, allowing the proper settings for optimal proof which yields the desired dough piece texture entering the oven,” Hagan said. “Profiling air-conditioned bread and bun coolers displays relative humidity through the cooler. This data can indicate too much evaporation during the cooling process, thereby drying out finished product prior to being packaged.”

Mr. Hagan recommends the SCORPION®2 Digital Humidity Sensor as an extremely versatile instrument used to document, troubleshoot and improve quality of the complete baking process.

For details, e-mail us at info@readingthermal.com or call 610-678-5890 ext. 2.

At the Extraordinary General Shareholders’ Meeting on August 28, 2020, the shareholders elected Stefan Scheiber (54) unanimously as a new member of the Board of Directors of Bühler Holding AG with immediate effect. Ruth MetzlerArnold announced she will resign from her assignments as a Member of the Board of Directors and Chairwoman of the Audit Committee of Bühler Group with effect by the ordinary general shareholders’ meeting on February 11, 2021. She has been a Member of the Board of Directors of Bühler since 2011 and Chairwoman of the Audit Committee for the last six and a half years. Rainer E. Schulz, Member of the Board of Directors, shall succeed Ruth Metzler-Arnold as the new Chairman of the Audit Committee. +++

Hiestand CEO Urs Jordi as the new Chairman of the Board of Directors. Also appointed to the Board were former Hiestand Manager Armin Bieri and Heiner Kamps, founder of the Kamps bakery. Aryzta CEO Kevin Toland was elected. Andreas Schmid, who was nominated by the company as Chairman of the Board of Directors, had withdrawn his candidacy the day before. Urs Jordi commented on the shareholders' decision: "The vote is an overwhelming vote for change and a strong vote of confidence for the bakery experience, which is urgently needed for the reconstruction of Aryzta. Our task is clear and urgent action is required to use this new experience in the bakery to bring about change and improvement throughout the company in order to regain the trust of all stakeholders". +++

++ Dr. Michael P. Witzak strengthens the GBT management Dr.-Ing. Michael Paul Witzak becomes the second Managing Director of GBT Bäckerei Technologie, based in Villingen-Schwenningen and Lünen, alongside Wolfgang Fuhst. Dr. Witzak and will take over sales and service. In addition to expansion in Europe, a particular focus will be the development of new markets. After studying electrical engineering and completing his doctorate in the field of machine tools, Dr. Witzak worked in various management positions at well-known mechanical and plant engineering companies in the bakery industry. +++

++ Marko Bergholm appointed MD of Fazer Bakery Finland

Marko Bergholm has been appointed Managing Director of Fazer Bakery Finland and a member of the Fazer Group Management Team. For the past three years, he has worked as the Head of Finance of Fazer Confectionery.

Marko Bergholm is an appreciated leader with extensive experience in Fazer’s businesses and has a demonstrated track record in successfully leading teams and in driving performance. Bergholm joined Fazer in 2012. For the past three years, he has worked as the Head of Finance of Fazer Confectionery. In 2018, he worked simultaneously also as the interim Managing Director of the Fazer Confectionery Business Area. Prior to his current role, Bergholm was the Head of Finance of Fazer Bakery. +++

The Swiss-Irish bakery products group Aryzta has a new board of directors. At an Extraordinary General Meeting on Wednesday (September 16), the shareholders elected former

Dr. Thomas Beer will retire on 31 October 2020 after more than 34 years with the Oetker Group. Previously know as the 'Executive Board' it was renamed 'Management Board' of the Martin Braun Group as of September 1, 2020 and will work with a different structure. In addition, there will be expansion combined with a corresponding division of responsibilities within the Executive Board. This change is necessary because the Group has grown enormously over the last 15 years and the markets have also changed considerably:

Dr. Detlev Krüger, previously Spokesman of the Executive Board, has been appointed Chairman and Chief Executive Officer (CEO) of the Martin Braun Group's Executive Board. As before, he will be responsible for Marketing & Sales Strategy, Strategic Corporate Development including Merger & Acquisition and DTO as well as Corporate Communications and Compliance. In addition, he will in future be responsible for Human Resources & Organization at Group level. In addition, Dr. Krüger will remain Chairman of the Board of Poland Gida, the Martin Braun Group's joint venture in Turkey, and will continue to be responsible for the Asia-Pacific region across all product lines. In the role of Chairman, Dr. Krüger will steer the Board and coordinate its work.

Franky De Grave, previously Co-CEO of the Frozen Bakery Division of the Martin Braun Group, has been appointed to the Martin Braun Group's management board and becomes Chief Financial Officer (CFO). In this role, he will succeed Dr. Beer in his current professional responsibilities: Finance & Controlling, IT, Quality Management, Production & Logistics and Purchasing. De Grave brings many years of

extensive expertise from his previous positions in various industries. He is already largely responsible for these specialist areas within the Frozen unit of the Martin Braun Group and can therefore draw on his broad experience for his new responsibilities.

Reto Huber and Christian Tomasch were also appointed to the management of the Martin Braun Group. Huber takes over as Chief Operating Officer (COO) Bakery Ingredients Division with Tomasch taking on the role of Chief Operating Officer (COO) Frozen Bakery Division.

Both have been working successfully for the Group for many years and are already well established in their future areas of responsibility.

In this division, all four will in future be jointly responsible for the Martin Braun Group business. +++

Johan Nilsson is a new member of the Syntegon Technology’s Management Board having joined at the beginning of September 2020.

As Managing Director he is responsible for the newly founded Service & Digital Solutions division.

Nilsson was most recently Head of Service & Industry 4.0 Solutions at Tetra Pak. +++

CSM Bakery Solutions intends to concentrate exclusively on the frozen bakery products business in the future. The group, which has been owned by the Rhone Capital investment fund since 2013, has announced its intention to sell its bakery ingredients business to the Investindustrial investment group by the end of March 2021. The name CSM Bakery Solutions will also be sold. The label under which the telecommunications business will operate in future has not yet been published. The

only exception to the sale of baking ingredients is the US subsidiary Brill Inc. which sells toppings, fillings and ready-to-use mixes in the USA. Most of the US baking ingredients business was sold in 2018 to a private equity group, Pamplona Capital. +++

Josephine Coombe, Managing Director of Nulogy in Europe, has been appointed to the board of the European Co-Packers Association (ECPA). The move comes as the ECPA sees increased demand for contract packing and contract manufacturing services from brands across Europe. Josephine Coombe joins the four existing board members of the ECPA and will help provide an international perspective on enhancing agility through innovation in the external supply chain. With over 20 years' experience serving global FMCG and retail brands in North America and Europe, Josephine Coombe is a senior leader focused on the digital transformation of supply chains worldwide. +++

Diana Food, a division of Symrise, has received Fair for Life (FFL) certification and has expanded its range to include an acerola powder with organic and fair trade certification. According to the company, the product has a high antioxidant content and is made from dried acai fibers. +++

Wood-baked bread is right on trend – particularly for Coop customers in Switzerland.

+In order to meet the continually increasing demand for rustic, strongly baked breads with their unique taste, the Swiss cooperative is investing in the modernization and expansion of its bakery locations. Werner & Pfleiderer Lebensmitteltechnik was awarded the contract to build a fully automatic direct-fired oven system which included overcoming the special challenges presented by the structural conditions at the Coop site in Castione in Ticino, southern Switzerland.

In its own bakeries, Coop combines high craftsmanship in baking with state-of-the-art baking technology to produce a wide range of high-quality baked goods. When the retailer reorganized its production, it also set high quality standards for the technical equipment and assigned Werner & Pfleiderer Lebensmitteltechnik to plan, build and commission a fully automatic direct-fired oven system. This consists of 18 floor decks of the WP PELLADOR series including the necessary loading and transport technology. It is the second plant owned by Coop and the largest of its kind that WP has ever built. The plant manufacturer from Dinkelsbühl in Central Franconia specializes in oven technology for the baking industry.

In addition to the enormous capacity of the plant, which has a baking area of 65 m 2, the design engineers at WP faced a

special challenge: the structural conditions. The bakery is located on the first floor of the production hall and the existing structural analysis was not designed for the weight of the massive ovens. A new extension on the ground floor was the solution, but it had to be implemented to the highest standards. The baking technology in the new building had to be connected to the dough preparation with a mobile loading system over two floors with a total height of nine meters, which is also separated by a fire protection wall. This was made possible by a special design of the WP OBER Pro deck oven loader, which has been on the worldwide market since 1992.

“We had a clear idea of the capacity, the limited space requirements and the special specification of the wood-fired oven baking system which would be required for more than 20 specialties such as organic wholemeal bread and the organic butter plait. The WP team, consisting of engineers, automation technicians and master bakers in the factory and on-site, supported us at all times with advice and practical assistance. As a result, we received a plant that exactly met our requirements, which went into operation on schedule in February 2020 and has been running to our complete satisfaction ever since,” concludes Simon Oeschger, head of the technical department and responsible for project coordination at Coop.

Fully automatic system saves operators’ time

WP has further developed the principle of the traditional wood-fired oven, in which the baking chamber is directly fired with wooden pellets, into an ultra-modern system with wood pellet burners, which enables CO 2-neutral firing and rational processes in the bakeries. “The Wood Baking WP PELLADOR production deck ovens are fired with modern, energy-saving industrial burners, each floor being equipped with two PLC-controlled pellet burners. The combustion of the pellets is largely residue-free and any combustion residues – the ashes – are also removed by a special suction device before each charging process. Baking is done in the classic way with falling temperature, whereby the individual recipe and product management and the oven and loader control is carried out via the integrated SIEMENS S7 overall system control,” explains Dr. Christoph Adams, Technical Director at WP. The system knows the status of each product in the baking process, including the baking time, and controls all processes fully automatically. This means that the operator only needs to monitor the system creating time for other tasks.

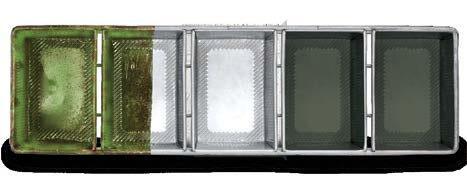

The system is fed with proofed dough pieces, which are placed on plastic peel boards in rack trolleys. At present, almost 100 peel boards are used per hour, which are loaded with up to twelve dough pieces depending on the product. In an automatic transfer system, they are “scrabbled off” from the peel boards in one go and fed to the deck oven loading system. In terms of weight, the system also allows conventional manual loading for special products such as the 3 kg butter plait. At the end of the baking time, the loader system moves to the corresponding deck for baking, unloads the baking chamber and transports the finished baked products to the downstream cooling system.

Baking in a wood-fired oven is a traditional technique. So what exactly is meant by the term, a wood-fired oven? The “Guidelines for Bread and Small Baked Goods of the German Food Book” from Jan 1994 describes it as being where,

“wood-fired bread is pushed free and produced in directly fired ovens, with the baking chambers made of stone or a stone-like material. The heating material is located in the baking chamber. Only natural wood is used as heating material”. The WP PELLADOR meets all of these requirements.

The combustion of wood, regardless of whether its as a piece of wood, pellets or as wood chips, always follows the same physical and chemical principles of wood combustion. First of all, the wood is heated up, whereby the residual water content still present in the wood evaporates. This is followed by the pyrolytic (thermal) decomposition of approx. 85% of the wood into gaseous and combustible products. The remaining charcoal is then burned almost completely and is residue-free due to the sufficient addition of oxygen (oxidation).

In the WP PELLADOR the volatile components escape from the inside of the combustible material during the combustion mechanisms, ignite and burn completely outside the fuel at a temperature above 800°C – usually between 1000 - 1200°C. The thermal energy produced in this process is fed to the thermal storage mass fireclay, which is characterized by a high energy storage capacity (heat capacity). This enables the baking process to start with the necessary temperatures directly after the end of the combustion process. The actual baking process takes place gently in a heat radiation envelope, which emanates from the fireclay bricks, in the baking chamber of the WP PELLADOR, with the influence of the highly volatile aroma substances. This gives the baked goods their typical wood-oven aroma – an unmistakable taste that inspires many customers. +++

Author Dipl.-Wirtschaftsingenieur (Industrial Engineer) Jörg A. Lauer , Manager Project Sales Werner & Pfleiderer Lebensmitteltechnik (WP-L), Dinkelsbühl, GermanySmall baked goods production: Innovative dough dividing, forming and depositing in a single step with the FS 520 forming system.

Handtmann offers an application solution for the production of rustic and gluten-free small baked goods that is capable of dividing, forming and depositing soft and pre-proofed dough in a single process step. The term “free forming” means that a variety of product shapes such as round (Vinschgauer, gluten-free soft buns), longish (rye rolls, gluten-free baguette rolls) and more can be created. Soft, pre-proofed dough such as rye rolls with a rye content of up to 100 % can be deposited directly into baguette trays or onto trays/peel boards after dividing and forming.

The fully automatic production of bread, rustic small baked goods and modern trend products, such as gluten-free soft buns is all made possible with the Handtmann system solution, comprising a VF 800 dough divider and the FS 520 forming system including servo-driven flow divider. Production has a high degree of flexibility and can be expanded up to 8 lanes. The dough pieces can be deposited onto trays, into baguette trays or directly onto the conveyor belt. Different types of dough can be processed and with free and gentle forming there is ample scope for a variety of product ideas as well as gluten-free or vegan small baked goods.

The control system of the VF 800 allows for easy visualization of the product shape and calculation of the process parameters via the display. In a fully automatic production process, the

dough is fed by the VF 800 to the flow divider in the FS 520 forming system. A precise volume flow is guaranteed due to the flow divider with servo drive, which is a prerequisite for precise-to-the-gram final weights of the individual dough pieces.

The dough reaches the forming module on multiple lanes via the flow divider. A rotating hole plate system then forms the product. It is possible to alter the shape quickly and easily by changing just a few mould components. Alongside the main advantage of automated portioning, forming and depositing of the dough pieces onto baked goods carriers in a single step, there is the added advantage of exceptionally high weight accuracy and the cost reduction associated with this. The completely oil-free and flour-free dough dividing and forming principle allows for further cost savings as well as the significant improvement of process hygiene.

Rye small baked goods with a rye content of up to 100 % into baguette trays can be produced with this innovative forming system from Handtmann. This process solution can also be supplemented with a flour duster for the dusting of portioned dough pieces. In this case, the production parameters are: Bulk fermentation 30 minutes, dough yield 186, scaling weight 150 g, cycle rate 45 cycles per minute (corresponds to a capacity of 16,200 pieces/hour) with deposit of 6 x 5 pieces/ tray and a tray size of 580 x 980 mm. Visit the Handtmann website for more product examples and details of system solutions for small baked goods. +++

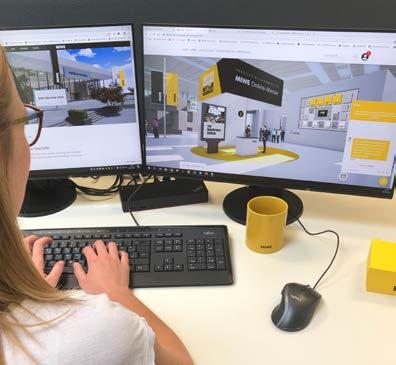

+The German bakery equipment manufacturer MIWE invites customers and interested parties to an international online exhibition, for the very first time, on 1 December 2020 (kick-off 0:00 UTC). The trade fair will run as a live event 24 hours a day, worldwide, across all time zones. Registrations are now possible and free of charge.

The company aims to offer what a classic trade fair is all about in this innovative format: an inspirational event where contacts can be made. MIWE has been working for some time now to make contact with customers and interested parties on its new digital channels in addition to the classic “analogue” channels. Communication is possible via the website, YouTube channel, miwe.tv and through social media channels including Instagram and LinkedIn.

The digitalization of the trade fair is a logical step, explains Marketing Manager Eike Zuckschwerdt. The corona pandemic has merely accelerated this move. “Direct discussions with groups of experts, exchange of ideas in a hospitable environment, and close contact with experts and products is what our customers expect at trade fairs. Currently, we can only do this to a very limited extent and in some cases not at all”. For this reason, after the first German-language online trade fair

Event date: 1 December 2020

Registration at: www.miwe.com/online-exhibition

(You will also find the complete lecture program there)

in July and August, the company has worked flat out to transfer the new form of presentation to an international format.

The MIWE online exhibition does indeed resemble a real trade fair. Visitors can move around freely in the various exhibition halls organized according to areas and can target individual stands on specific topics and products, just as they are used to doing at visits to conventional trade fairs. All that is needed is a PC or laptop with an Internet connection – even mobile devices can be used.

However, the density of information at the online trade fair is much higher and above all more individual. Visitors decide what they want to learn and the level of detail and take a closer look. The information required can be compiled from a large number of images, texts, videos and documents (also for download), from simple technical data to explanatory application videos. The expert chat function also provides the opportunity of contacting a MIWE specialist directly.

It was precisely this opportunity for dialogue that was particularly important to the organizers: "A trade fair is a lot more than a trade fair stand – it thrives on direct exchange, on discussions," stresses Zuckschwerdt. The MIWE online exhibition offers all this. Apart from being convenient, it is also extremely cost-effective for visitors.

The MIWE online exhibition also includes a comprehensive program of lectures on current topics from the international world of baking. These lectures, which require prior registration, will be held – just like in real life – at fixed times around the globe and will each end with a round of questions. The topics are wide-ranging and cover, amongst other things, the production steps of certain products (e.g. Boost your business with real German Pretzels and French style Baguettes – freshly baked in your convection oven) and organizational issues (Remove night shifts and, deck or rack oven – how to get the perfect bake). +++

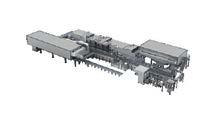

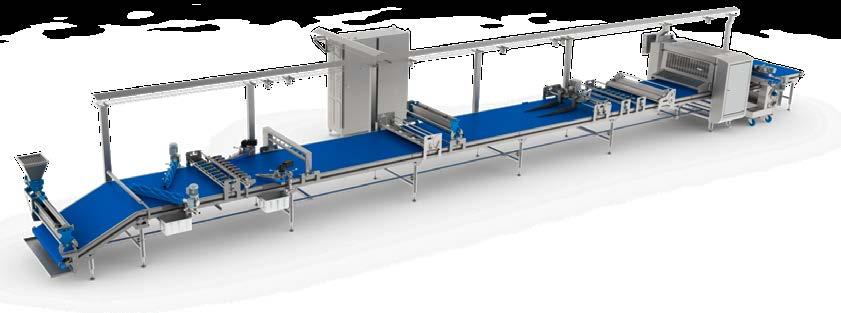

A pain au chocolat at breakfast, a Danish pastry with coffee, a pasty for lunch – indulgent moments that everyone loves. For over twenty years, Rademaker's Universal Make up line ranging from a laminator or bread line has made the production of a wide range of dough products possible to tickle the taste buds.

+A comprehensive update of the line is aimed at making production even more efficient and the name is changing as well to Universal Pastry Line. Rademaker reports that operation is easier and more intuitive, fewer ingredients are wasted, the machine line requires less maintenance and meets the highest hygiene and safety standards. Rademaker’s System Architect, Jan de Kroon, and Senior Bakery Technologist, Richard van Dooren, were intensively involved in developing the new generation of the Universal Pastry Line. Here’s what they had to say about it.

Rademaker has been making pastry production lines for over forty years. Over the past twenty years, the Universal Make-up line has been at the forefront of production. This line has now been developed and updated using information from the market.

‘Before we embarked on the development process, we asked our worldwide sales team to analyze the needs and wishes of their customers in relation to the development of the Universal Make-up line. Lots of information was gathered, which eventually led to a project assignment,’ says De Kroon. After an initial prototype and the beta version, it is now time to launch the Universal Pastry Line: The Next Generation.

The key principal to this project was 'boosting the efficiency of the Universal Pastry Line'. In order to approach the

project in a targeted way, a design philosophy (see box) was developed. ‘This was based on five main requirements from the market with additional emphasis on the issues of safety and hygiene. Everything we did with respect to the redesign needed to make the operation simpler and enable multiple deployability and simple tool changes, otherwise you could say, we were just tweaking things,’ De Kroon explains.

The Rademaker Technology Centre (RTC) has acquired a great deal of knowledge of dough processing and other processes over the years. The RTC therefore played an important role in developing the Universal Pastry Line. ‘What was once carried out by the baker is now done on a conveyor belt. In

Requirements from the market:

+ Fast and error-free adjustment of the machine to make different products

+ Reduction of spillages and wasted ingredients

+ Improved cleanability

+ Simplified operation and better ergonomics

+ Reduced maintenance

Comply with regulations in the fields of:

+ Safety

+ Hygiene

the first instance, the new line needed to operate well from a technical perspective, and that was down to the engineers at Rademaker. It was then important that the line worked as efficiently as possible and yet still achieved high product quality. It cannot be forgotten that dough is a living material and therefore the various processes can easily damage the structure. Rademaker over the years has developed dough processing technology that handles the delicate dough very carefully, from the start of the production process to the final product,’ says Van Dooren. All the modifications were therefore extensively tested in the Rademaker Research and Development Centre and the RTC.

The basis of the existing production line fulfilled the needs, so no fundamentally new choices were required. De Kroon: ‘With efficiency improvement being our starting point, we looked at all the eighty units that can make up the line and made improvements. These were not necessarily big or complicated changes but always useful. These varied from small modifications such as indicating the direction of the dough so that the unit is always placed correctly, an innovative lift system for the conveyor belt so that it dries faster after wet cleaning and the introduction of the Tool Assistant, which makes a big contribution to the fast and error-free changing of the line. The result is a machine that every user can operate, even someone without a bakery background.’ Van Dooren adds: ‘The set of Allen keys, a thirteen mm spanner and the familiar notebook with settings that each

operator used to carry are now no longer needed due to the Tool Assistant.’

Rademaker believes that the updated line fits in with developments in the industry. Van Dooren: ‘Baking is a craft, but unfortunately there is less and less interest in this remarkable profession. To us, it seems that knowledge of the bakery sector is disappearing, particularly in industrial bakeries. More and more operators do not have a bakery background or training. Due to lack of knowledge and organization, a lot of things go wrong in the dough processing and the production processes. That costs time and money. We believe that The Universal Pastry Line is a machine that allows the processes to be well organized and the Tool Assistant makes it easy to operate, which also ensures more uniform work between the different bakery employees, and tools are no longer necessary. The Rademaker Technology Centre is used to show the advantages of the latest generation of the Universal Pastry Line, explain how the line works and how quickly it can be set up and used.’

The flexible, modular design of the Universal Pastry Line makes it possible to produce nearly all the various types of viennoiserie and laminated products in many shapes and sizes, filled or unfilled. Rademaker is increasingly moving from being a machine supplier to a system supplier in

conjunction with the customer and suppliers of kneaders, proofing cabinets and ingredients. Van Dooren says, ‘Because of this development, the relationship that Rademaker has with customers is changing. We are becoming more of a sparring partner. The process is now also more frequently reversed. While Rademaker merely used to deliver the machine so that the customers could make their product, customers are now asking what they could produce. They are looking for new and different forms. Traditional patisseries and bakers still make a lot of their products by hand. The next step is that experienced technologists increasingly translate this into an industrial process.

It seems that the continuous improvement of machine performance and finding innovative production and end-product

solutions will not stop with the launch of the latest generation of the Universal Pastry Line. ‘We have learned a lot from updating this machine line and we will certainly apply that knowledge to other lines. And we will obviously continue listening to customer needs. We enjoy sharing ideas so that they can make high-quality products,’ say De Kroon and Van Dooren. +++

Authors

Jan de Kroon is System Architect at Rademaker and in this capacity monitors the content of projects.

Richard van Dooren is Senior Bakery Technologist in the Rademaker Technology Centre in Culemborg. As a very experienced baker and technological expert in different line concepts, he is an important source of support for the engineers.

+ Fast and error-free adjustment of the machine

• Settings can be saved digitally per recipe.

• Indication of the direction of the dough on all changeable parts.

• A Tool Assistant makes the operation and adjustment even easier because line configurations and part information can be saved. Information can be exported to the control panel, a tablet or a printer. Pop-up screens explain the settings.

+ Reduction of spillages and wasted ingredients

• The conveyor belts are fifty millimetres wider.

• Because of the previously saved information, non-professional alignment and adjustment of settings are prevented.

+ Improved cleanability

• The new machine meets the highest industrial requirements for hygiene according to the GMA (Grocery Manufacturers Association) standard and EHEDG (European Hygienic Engineering and Design Group) recommendations.

• The conveyor belt can be raised during cleaning so that it dries faster.

• Frames are rounded off.

+ Simplified operation and better ergonomics

• The units are smaller and lighter.