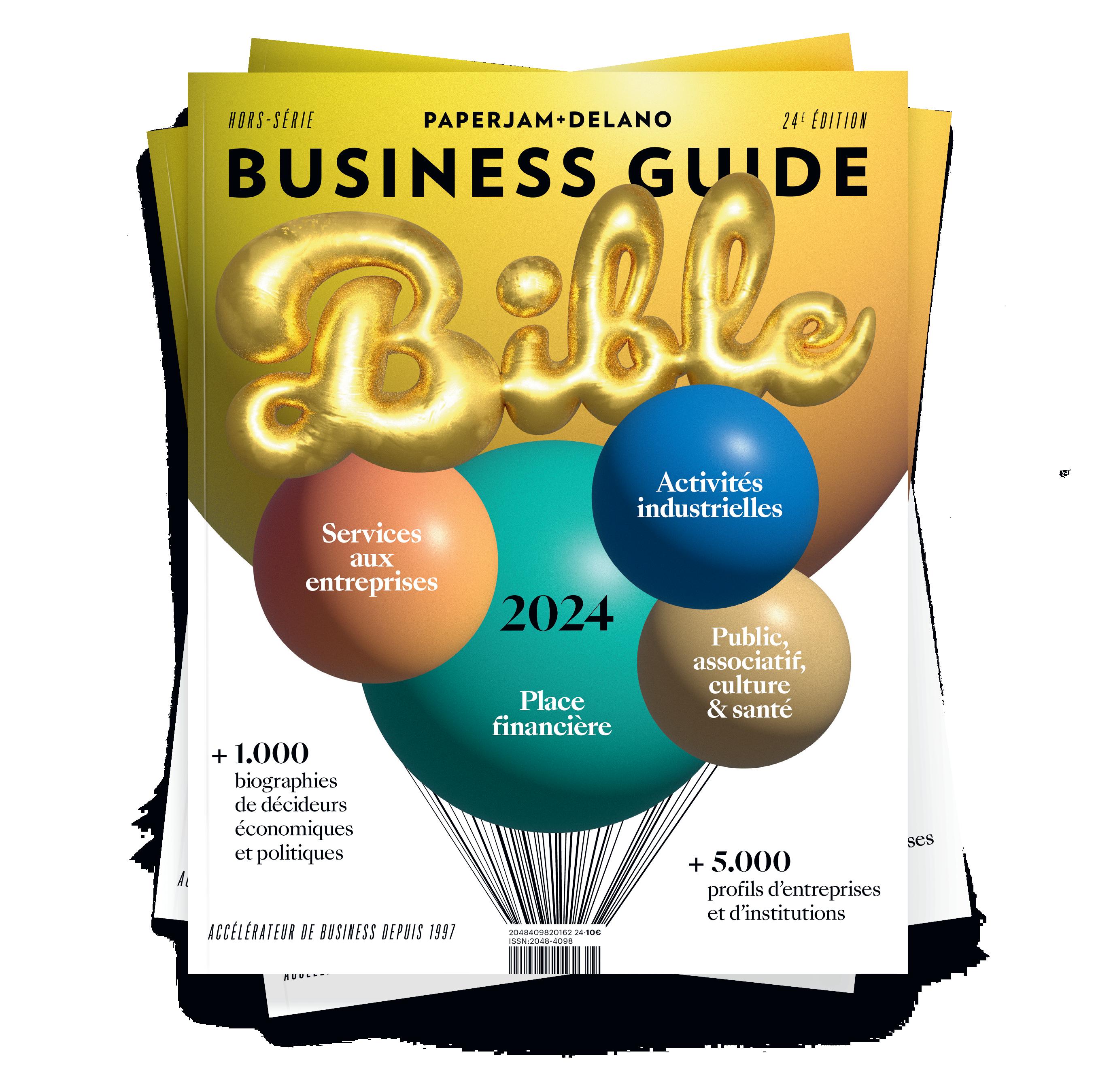

Luxembourg’s financial and expat communities

Luxembourg’s financial and expat communities

Three economic issues have been on my mind lately. First, indexation. Bosses don’t like the system where employees automatically get a 2.5% salary hike to match inflation. Corporate HQs located outside Luxembourg have no sympathy, putting local budgets under pressure. Not to mention the actual cost, which can put margins under severe pressure.

TUESDAY 18 JUNE

Then there’s the question of fairness. Is it fair that high earners get the same 2.5% raise as those on the minimum wage? That’s highly debatable. But when everyone benefits, everyone backs the system, which concentrates support for Luxembourg’s wider social contract. And there’s no doubt that low-income workers, hardest hit by rising consumer prices, rightly benefit from indexation. Perhaps the index could be introduced in tranches, based on gross salary. Surely there’s a compromise to be found.

Financial sector bosses complain of gold-plated regulation in the grand duchy. That means that the highest conceivable interpretations are applied locally to EU and international regulations. That gives other jurisdictions, which apply a more literal standard, a competitive advantage. I am all for less red tape and more simplification.

But while some may think Luxembourg has shaken off its reputation as a tax haven, the reality is that for many the grand duchy still evokes the image of Belgian dentists hauling suitcases up to boulevard Royal (or worse). Perhaps the sector should embrace high standards as a PR advantage. At the same time, maybe some of the box-ticking exercises can be downgraded to silver-plating.

Then there’s housing. It represents a huge part of the economy and a huge part of most people’s personal financial picture. Costs keep rising and supply keeps tightening. Little has improved after years of (probably too unambitious) initiatives. Housing is already a recruitment and retention challenge. When will it reach breaking point?

Au cœur de la Ville de Luxembourg

À 600 mètres de la Place de l’Étoile

Du studio au penthouse

LIVRAISON 2026

3 maisons unifamiliales et 3 résidences

Architecture contemporaine

À seulement 10 km de Luxembourg-ville

LIVRAISON 2026

LIVRAISON 2024

Appartements de 1 à 3 chambres

Situation calme à 6 km de la Ville de Luxembourg

À proximité de l’école Européenne et du Lycée Josy Barthel

LIVRAISON 2026

Résidence de 6 appartements

Vue extraordinaire sur les prés

À 8 minutes de la Ville de Luxembourg

08 YVES STEIN

“A banking sector our children aspire to work in”

12 FLORIAN DUMAS

Fintech startup founder says Excel is his biggest competitor

14 DIANA SENANAYAKE How fund services provider IQ-EQ has managed its growing pains

72 EU TAX RULES

Dac8 brings crypto assets into tax information exchange system

BUSINESS

10 BJORN TREMMERIE

“The best way to foresee the future is to invent it”

68 HUMAN RESOURCES What exactly is ‘workplace flexibility’?

80 PORTFOLIO Meet 9 European Parliament candidates

90 ANALYSIS Why the housing market will remain subdued in 2024

20 Investors guide Planning for the future

24 “Millennials would like to have a human interaction”

30 How one private banker approaches the role

34 Why “not taking enough risk” is a risk in retirement planning

38 Financial wellness for professional services partners

44 Major pressure points for investors in 2024

48 How to sift through the sustainable investing noise

52 How art is both an emotional and financial investment

56 How to start investing if you don’t know anything about investing

58 Jargon busters: get past the lingo

60 Quick guide to private market investment platforms

62 Outlook: 9 financial professionals on digitalisation & investing

66 My first investment: Emanuele Vignoli

76 Valérie Tollet

Meet the new deputy CEO of the Luxembourg insurers association Aca

78 Behind the stats Why and how wage indexation is calculated

92 10 things to do

The Luxembourg Bankers’ Association (ABBL) is turning 85 this year. Yves Stein, veteran of the country’s finance industry and newly named (in April 2024) chair of the association, reflects on this long history.

The ABBL is turning 85 this year. What can you tell us about its origin story?

In 1939, ten banks came together and decided to establish an association to better represent their common interests. No doubt a legitimate approach for any industry.

It should also be noted that the law on associations had just been passed a few years earlier in 1928.

Although we had already had a stock exchange since 1929 and some banks already had cross-border activities, it would have been premature to speak of a ‘Luxembourg financial centre’ as such back in 1939. The evolution from what was initially a banking centre into a fully-fledged financial centre only properly began in 1963 with the arrival of Eurobonds. Back in 1939, however, the Luxembourg economy was still predominantly characterised by steel and agriculture. And yet, bankers’ willingness to join forces and set up the ABBL suggests that the seeds of today’s financial centre were already being planted 85 years ago.

The Second World War interrupted the initial impetus of this group, which then reorganised itself to gradually become the voice of the sector. At the end of 1947, the association's activities focused on organising--with the support of the Chamber of Commerce--the first training courses for banking staff and, from the 1960s onwards, on negotiating collective agreements with union representatives.

The increasing internationalisation of the financial centre gradually transformed this association, which initially focused on purely Luxembourg issues, into a group defending the interests of the financial centre both at home and abroad.

What’s something about the ABBL’s history that few people know?

I think that our name, Association des Banques et des Banquiers, hides a little the place we occupy within the ecosystem of the financial centre and does not sufficiently convey the diversity of the professions we represent. Today, the ABBL represents banking services in the broadest sense, i.e. not only banks, but also payment services, investment firms, fintechs, consultancy and audit firms, law firms, etc. As of 2023, more than 50% of our 280 members and associate members are no longer banks.

What’s the biggest mistake that the ABBL has ever made?

I would not so much talk of a mistake than of a regret. I regret our inability to instil in our fellow citizens the same pride for the financial centre that they once held for the steel industry, despite its remarkable international success. We haven’t effectively been able to convey either the nobility of our profession or its usefulness to society.

VOICE FOR THE BANKING SECTOR

Born and raised in Luxembourg, Yves Stein is the chair of the ABBL as well as the CEO of Edmond de Rothschild (Europe).

That’s why one of the first objectives I set the ABBL team when I took office was to strive for a banking sector our children aspire to work in.

Interview JEFF PALMS Photo GUY WOLFFUnderstanding the EU better changes everything.

Explore this new interactive space from 9 May free of charge. Europa Experience Luxembourg

17, Avenue John F. Kennedy

Adenauer Building, Luxembourg - Kirchberg

Tram stop: Parlement européen

“The

The European Investment Fund is celebrating its 30th anniversary in June 2024. Bjorn Tremmerie told Delano about the EIF’s contribution to the success of the European startup scene.

Do you feel frustrated investing in funds whereas you invested directly in companies when you started your career?

At the beginning, yes, before joining the EIF. However, I thought it would be a nice place to spend some time until the dust settled down. A world has opened unexpectedly in front of me. I met highly motivated entrepreneurs, not in firms directly, but with people raising capital for their fund. Nowadays, I could not return into the business of investing directly in companies because it is not my expertise anymore.

Celebrating 30 years, how have investments in technologies evolved over those years?

At the beginning of the 2000s, the [European] venture capital fund market was embryonic, whereas the market existed since the 1970s in the US with Sequoia founded in 1972. The early excitement gave way to a never again attitude on the back of the bursting of the internet bubble. Several entrepreneurs even wondered why they had tried this kamikaze mission instead of listening to their parents who suggested [that they] start their career in consulting or a bank and enjoy their pension 30 to 40 years later.

With a mission to promote entrepreneurship, innovation and technology, the EIF continued its march against all odds, supporting the VC funds, being almost the only player in the market along with CDC/BPI in France, CDP in Italy and Vækstfonden, the Danish Growth Fund. Contrary to the EIF and the European Investment Bank at the time, these national promotional institutes were also investing directly in the underlying firms. Step by step, returns became attractive and appetite to become an entrepreneur grew again as a result of available public funds but also on the back of some spectacular successes such as Kelkoo, the French price comparison service company sold to Yahoo for €500m in 2004. It was

followed by Skype, sold to Ebay for €2bn, a poster child for Mangrove in Luxembourg and Lovefilm in the UK [acquired by Amazon in 2011]. A feeling of amazement started to build in the sector.

When the EIF says that it is going where European investors have not gone before, is AI one of those sectors?

AI is not a good example because everyone is talking about AI nowadays. There are new funds being launched with a single sector focus, whereas the generalists will go where the wind is blowing. There is interest in cleantech, deep tech, which is not looking for better ways to sell shoes on the internet but rather for solutions to cure cancer which is real deep tech.

VC BACKGROUND

Bjorn Tremmerie, 50, head of technology investments, joined the European Investment Fund in 2002 after working for a Belgian venture capital firm that fell victim to the internet bubble at the turn of the century.

We need to be present and competitive in large language models. We are almost there. ChatGPT got $10bn from Microsoft, France’s Mistral just raised €500m. The latter is the second most performing large language chatbot ranked ahead of Anthropic from Google. The EIF has a view but it is also dependent on the mission assigned to it by the European Commission and the European Investment Bank. There is a focus on agtech, climate tech, quantum, cybersecurity with an increased attention to defence. If you want peace, prepare for war.

Interview SYLVAIN BARRETTE Photo MARIE RUSSILLO

U-Reg, a regtech firm based in Singapore, was awarded first prize of the Catapult Fundtech 360 competition at Alfi’s Global Asset Management conference in March. Delano sat down with founder Florian Dumas to hear more about the programme, his firm’s collaborative platform and their plans for Europe.

Words LYDIA LINNAOrganised by the Association of the Luxembourg Fund Industry (Alfi), the Luxembourg House of Financial Technology and venture capital firm Middlegame Ventures, the Catapult Fundtech 360 programme was designed to tackle “critical needs and pain points” faced by the funds industry.

Sixty-three startups--including U-Reg--applied for the programme last year, with the regtech firm announced as the winner of the fundtech competition during Alfi’s asset management conference in late March.

For founder and executive director Florian Dumas, the prize is more than the win itself. “We were obviously very happy that we have won, but that’s positive collateral damage.” The programme itself--which brought a better understanding of the Luxembourg ecosystem, problems faced by the industry, the solutions that are needed and networking opportunities--was the most important thing.

So what are the main challenges facing the fund industry? “The biggest problem is that the requirements from the regulators or the compliance requirements are extensive,” he argued. Processes are tedious, manual, costly and time-consuming, even though “the technology exists to solve these processes.”

But people are still using Excel, said Dumas, and they’re using it for the wrong reasons. Asked at a conference as to who U-Reg’s biggest competitor was, his reply was: Excel. “People use

Excel to manage data models. Excel is not built to manage data models. Emails are not created to validate workflows or tasks. It’s the biggest problem in the industry.”

“Input once, report to many” That’s where U-Reg comes in. Founded four years ago, the Singapore-based regtech firm provides regulatory and compliance solutions. “We solve the problem of manual processes, repetitive input and

FLORIAN DUMAS Founder & executive director U-Reg

FLORIAN DUMAS Founder & executive director U-Reg

“ The requirements from regulators or the compliance requirements are extensive”

inefficient workflows or processes in regulatory and compliance. The processes we help automate and digitise are onboarding, KYC, regulatory reporting, due diligence of service providers, staff compliance, ESG reporting. We’re an automation and collaboration platform that helps solve a global problem.”

What makes U-Reg special is how they built the platform, Dumas argued. With their “input once, report to many” principle, “once data is in the system and validated, you can use it, re-use it, distribute it across a number of processes.”

Internal and external collaboration is also possible. Documents and data can be collected and shared even if a person is not registered on the platform.

Third, “we made a choice--which is more difficult in terms of development and building a platform--to be very horizontal, which means that we provide an end-to-end platform where you can start a process and go all the way to the end.”

The fintech’s headquarters are in Singapore, but it does have clients in Europe, and participating in the Fundtech programme has helped to build relationships, said Dumas. “When we go to Europe in a more meaningful way, Luxembourg will be one of the destinations of choice.”

And it “will remain an important axis of development. The question is: how do we do it?… We’re actually open to having discussion with people who might be interested in partnerships.”

“It’s really

Diana Senanayake, Luxembourg managing director and Continental Europe CEO at IQ-EQ, talks about the fast-growing fund service provider’s challenges integrating some 30 acquisitions and what is worrying her about the future of the country’s financial sector.

Diana Senanayake spoke to Delano in late April 2024

Diana Senanayake spoke to Delano in late April 2024

How would you describe IQ-EQ’s growth trajectory?

“We have just celebrated, last year, our 70th anniversary here in Luxembourg,” IQ-EQ’s Diana Senanayake told Delano. “So that probably shows you our history. But I would say that we have grown quite tremendously since 2016,” when it was acquired by the private equity firm Astorg. The company rebranded from SGG to IQ-EQ in 2019.

For the past eight years, IQ-EQ has had “a very strong focus on growth, growth coming organically, but also externally. From 2016 till last year--because this year, we still haven’t gone through any acquisitions--we’ve had a bit shy of 30 acquisitions. So you can count the number of” transactions to manage each year. “That was a very strong growth trajectory. And that also means that we now have a presence across three main regions. So, the US, Europe--and in Europe, it’s Ireland, the UK, crown dependencies, continental Europe and Middle East--and in Asia. We have offices in 25 locations and we are a little bit more than 5,500 employees worldwide.”

What markets do you serve?

“We are very, very keen in maintaining what we call our three segments strategy. Our segments are funds and asset managers that we call FAM. Then we have our private institution and asset owners segment. And then we have our corporate and DCM segment,” which stands for debt and capital markets. “We feel that it’s quite important to continue to develop our threesegment strategy because we want to remain diversified. Also, we do see, I would say, bridges between the three segments. So when we talk about funds, for example, funds don’t only concern asset managers. We see more and more [links] on the private side, on family offices, multifamily offices and even corporates. So really what we’re trying to do is support and service the three segments, whilst also identify synergies across segments.”

What have been some of the growth challenges?

“What came the last two to three years is a recognition that with growth comes the need to integrate the businesses that we

have acquired over the years. And that’s the reason why you would have noticed probably the number of hires at a very senior level that has happened for the last two or three years, across the board, not only in Luxembourg, of course, but at a group level.”

“Why is that? Simply because when you want to integrate businesses and make sure that we become a true global organisation, we probably need to change the mindset a little bit . So, moving from a startup or a small size company to become more global, whilst maintaining a very strong entrepreneur mindset. That’s where the challenge is... to make sure that you strike that right balance between continuing to bring new products, continue to maintain that entrepreneur mindset, whilst we integrate the business, while we create a real global platform across all the regions, across the segments.”

Can you give me an example of one of those challenges changing your mindset from being kind of startupish to being a real global player?

“The first area I would highlight is the change of the organisation structure, the way we are organised and operating today, versus how we were operating a few years back.” Previously, operations were run “very much country-by-country. Why? Because the various acquisitions happen country by country, and acquisitions really related to that specific market, or that specific segment.”

In recent years, Mark Pesco, the group CEO and board of directors determined that “to put in place a global organisation, you need to put in place a global structure. So, there are global functions that have been put in place, and also the creation of regions. And there’s the reason why I’m here, by the way. So when I talk about global functions, you have, of course, functions like HR, risk and compliance, technology, commercial operations. Those global functions did not necessarily exist in the past, simply because there was probably no need [when the firm] was much smaller.”

Today, Senanayake stated, the group is organised around four operational regions: the Americas, Europe, Middle East and Asia. While regional leaders “will be

Diana Senanayake was named regional CEO for Continental Europe and managing director for Luxembourg at the fund services provider IQ-EQ in August 2022.

She joined IQ-EQ after four years as CEO for Southeast Asia at BNP Paribas Securities Services. Prior to that, she spent 13 years at RBC Investor & Treasury Services, holding a number of management posts in Luxembourg, Malaysia and Singapore. She previously worked at Deloitte, Arthur Andersen and Clearstream.

Senanayake earned a bachelor’s degree at the London School of Economics, an executive leadership certificate at London Business School and an independent directorship certificate at Insead business school.

running the business that is within the region, we will link up with the global functions just to make sure that there is an alignment from a strategy perspective, from a function perspective.”

And on a client perspective, because you could support a client across more than one of your regions, right?

“Absolutely. It’s a very good question, because with the globalisation comes, of course, a very different set of clients that we are now working with, and that we are targeting as well.” Earlier in the firm’s history, offices in each jurisdiction “were servicing a number of domestic clients, small- to medium-sized clients. Today, we are moving more and more towards what you call the tier one, the more strategic names. And those clients, as you can imagine, need a wider suite of services, more complex type of services, but also the ability to service them in multiple locations. And that’s why as regional CEOs, and together with the functions, we would make sure that we are all linked up, so that we provide the same look and feel to those clients who are being supported in multiple jurisdictions.”

If you’re going more and more for the tier one, the big names, are you planning additional acquisitions or focussing more on organic growth?

“We do continue to grow organically. I mean, we had a great year in ’23 and we will continue” to post strong growth in 2024. “Organic growth is absolutely key. I mean, I won’t hide from you that growth the last few years has come from the funds side and will continue to drive growth. We will, of course, continue our three-segments strategy.”

“But we will also continue to look at external growth. We might be a little bit more selective, if I can say so, in terms of our external growth. The reason why we can be more selective is because we’ve set up quite a clear strategy on how we want to move forward. We’ve just come to a stage where we are now closing the loop on our 2024 strategy, and we are now embarking on a ’24-’28 strategy,” which is currently being finalised and will be presented later this year. Under IQ-EQ’s

IQ-EQ employees in the grand duchy, as of April 2024

Source IQ-EQIQ-EQ, as of April 2024

IQ-EQ worldwide staff, as of April 2024

2024-2028 strategy, the firm will “be more selective in the way we are going to be identifying future companies for external growth.”

What are you looking for in terms of external companies? Is it expertise?

Or is it geographic reach?

“Well, it could be different things, right? I mean, number one, we continuously look for complementary services. One area where we’ve been acquiring a number of companies in other regions--especially in the US, and in ’23 a lot in Asia--is on the reg compliance side. We feel that’s an area that is growing. There’s quite an increasing demand from our clients. And it’s quite complementary to the suite of services that we have. So it could be a complementary service.”

“It could be, as you mentioned, more a geographic footprint, in countries where we are not yet present.”

“It could be a reinforcement of our existing product. It could be, for example, on the AIFM side, if you talk about Europe, we’ve already got a very strong footprint in Luxembourg that we continue to grow.” The firm also has an AIFM presence in France and Ireland that hypothetically could be “reinforced”.

“But once again, we’d do that in a selective manner, as we wouldn’t want to be distracted by acquiring companies that wouldn’t necessarily fit into our strategy.”

Has integration of acquired companies been the biggest challenge that you’ve had to tackle since you joined IQ-EQ in 2022?

“It’s probably one of the challenges I had to tackle, but not the only challenge. But it is an important challenge. There are a few reasons to that. It is critical that we integrate the business. We are ‘one IQ-EQ’ and it’s very hard to be seen [that way] by the market, by our clients, if you have an integrated business. I’m speaking about integrating businesses within a country, because in each country, there has been multiple acquisitions. But also integrating the businesses across the region. So creating regional platforms, before we move into global platforms. That has been quite critical.”

“But also we are a people business. We should never forget, we’re not manufacturing cars, we’re not on a production line. We are in a service industry, when you’re talking about services,” then you’re talking “about our people. The various acquisitions, which we’ve done over the years, have been not only [about] acquiring expertise, adding services, but people.”

“It’s really changing the mindset of the teams. I do feel--even though it’s been less than two years I’ve been now here--that there’s a very strong buy-in by the teams, because I think people do see where we are going. People understand where they were coming from. They’ve been part of the transformation journey and they have bought into the vision. I think you can’t change, transform, drive business growth, if you don’t bring people along.”

Are you happy with the retention rate at acquired companies?

“Absolutely, absolutely.” Retention involves keeping “the teams that have been working for those companies. That could be the second, third generation... I think it’s helping people understand that they are moving to a new organisation, a bigger organisation, a global organisation. And with that, there are changes. And people understand that. And people who are probably wanting to stay in a smaller kind of firm probably decided to leave the firm because that’s not what they joined 10, 20 years ago. You know what, that’s fine as well.”

Looking out more broadly, what are some of the challenges Luxembourg market--you, your competitors and your partners--have to face in the coming years?

“Luxembourg has continued to grow and remained a very strong financial centre, and I’m very pleased with that.” Senanayake first came to the grand duchy in 1996 and “I’m quite amazed to see how much Luxembourg has continued to grow and to remain very relevant to the financial sector, not only in Europe, but globally. The challenges that Luxembourg will face--including IQ-EQ, by the way, because we are part of the whole ecosystem here in Luxembourg--is the competitive environment that we are in, probably

the macroeconomics as well, that is heavily impacting the marketplace.”

“Luxembourg, if you think of the funds industry, has moved from a mainstream, traditional Ucits” mutual fund-oriented centre to increasingly spotlighting alternative or private market funds, “which is really what we are focussing on. But today, the market environment is undergoing a number of challenges--a slowdown. In Europe, in general, we are seeing quite a strong showdown in the private markets. Real estate, with the interest rate that we saw the last few years, has not been very helpful either. So I would say, Luxembourg will need to continue to remain relevant, knowing that there are these external factors that is impacting” the country’s financial sector.

What can the industry or the government or both do to counterbalance market conditions?

“I think diversification is critical. That’s what we continuously try to do. That’s why I talked to you about the three-segments strategy. That’s why I talked to you about the different kind of products that we have, so that we can make sure that when there is some slowdown in some areas, you still have other areas you can work on.”

the success of Luxembourg’s financial sector, are “coming to a kind of an age where they have to allow the second generation take over. But the ‘hunger’ that was there at the time might not be the same today. And from my perspective, it would be really important that it continues.”

How do you pass on that hunger then?

“We have a number of committees in Luxembourg,” for example, the Association of the Luxembourg Fund Industry. Luxembourg’s financial supervisor, the CSSF, “is very strong as a regulator... very close to the industry. The new regulations that come up can be seen as an additional

“It’s a continuous combat to remain relevant”

requirement. However, it could be seen as an opportunity. The [European Long-Term Investment Fund] 2.0 is a good example of how we could leverage” changes in regulation to the sector’s advantage.

“More specifically,” think about how Luxembourg will “continue to maintain its strong ecosystem. And I’m saying this because I think it has been one of the key elements that has helped Luxembourg become so successful, compared to many other financial centres. Luxembourg has managed to create an ecosystem.”

“When I talk about ecosystem, it’s the regulators, the [industry] associations, the law firms, the audit firms, the consulting [firms and] today, all the startups, the digital firms. It has really managed to work as one. But I’m a little bit doubtful that that joint effort, that collaboration that has made Luxembourg so successful over the last 30 years” will be able to be maintained. “ We need to make sure the second generation, the third generation, continue to focus on that.”

“I see now more and more people who have created Luxemburg, the fathers of”

“I think making sure that all the associations work as one. So the people who are on the boards of those associations, rather than creating more and more associations maybe try to unite more.”

“I think the biggest threat for Luxembourg is to think that” the financial sector’s success “could be maintained on its own. It will not. It’s a continuous combat to remain relevant. That’s my personal view.”

One point of this interview is to get your perspective.

“Personally, I spent nearly 10 years outside Luxembourg. I was in Asia for many, many years before I joined IQ-EQ, and coming back to Luxembourg, I’m very happy to be back in Luxembourg, to see that it has continued to flourish. But it is my fear--for the next 30 years.”

We understand the different sides of your wealth.

Delano’s investors guide provides tips and advice for investors with different levels of financial savviness. For true beginners, we have recommendations on how to start investing from scratch and jargon busters to help break down some of the lingo. Nearly everyone should be thinking about retirement, market risks and how to sift through the noise around sustainable investing. The most sophisticated investors will want to read how one private banker sees his role and check out our look at art investing and private market platforms.

But the section kicks off with perspective on what younger investors are seeking, seen through the eyes of one of Luxembourg’s top fund lawyers.

European households have kept well over a third of their non-property savings and investments in bank deposits and a relatively low level in investment funds and securities, a trendline which has not shown much sign of changing.

Net asset acquisition, €bn

Having an appetite for risk taking but with a distrust of public markets have contributed to a generational shift whereby millennials are keen investors in sustainable and impactful private equity and credit assets, according to Veronica Aroutiunian at Loyens & Loeff.

Veronica Aroutiunian structures alternative investment funds

Veronica Aroutiunian structures alternative investment funds

Percentage of clients looking for more advice in investment services and client satisfaction rate for each investment services product

Why do you think you’re well placed to discuss what is of interest in terms of financial products for young investors?

“My job is to be aware of any new trends and understand the needs of my clients, my clients being asset managers. They need to understand the needs of the investors to be successful.”

Veronica Aroutiunian, a partner at Loyens & Loeff, believes that the democratisation of private assets is usually not analysed “under the right angle.” She thinks that one of the main reasons of the trend towards democratisation is not related to economics but rather more to a “shift in generations.”

She argued that the topic has been extensively covered in recent studies conducted in the US but also elsewhere. “What is happening right now, is that you have a new generation of investors arriving in the market with generational and cultural differences.”

She noted that her generation, the millennials--born between 1981 and

2000--is “the fastest growing generation of investors right now and is the richest generation ever seen in history.” She admitted a huge part of their current or upcoming wealth is coming from the inheritance of their parents, the baby boomer generation. “They don’t need to buy a house right now because we will get it from the parents.”

“I am in the middle of the whole thing. I was in the first year of university when the first financial crisis hit [2008-09] and we saw those people losing their job. We had 2012 [the European sovereign debt crisis], Brexit and covid.”

“To be honest, there is a mistrust of the markets and the stock exchanges because every time something happens, the markets collapse… yet the weird thing with this generation is that there is a risk appetite.” She believes that the confluence of financial crisis, lack of trust and a risk propensity means that the product of choice for her generation--alternative investments--are burgeoning. She added:

“That’s how the whole thing came together.”

Aroutiunian considers millennials as an “ESG sustainability and meaning in life driven” generation. They want to “do something meaningful with their money” and they are “driven to private equity and private credit” investments for their impact on society while offering a diversified portfolio. Besides, she thinks that they care about developing sustainable economies and they encourage diversity.

Aroutiunian added: “you have a bigger impact when you go into private assets because as an investor, you have no influence whatsoever on the company that is traded on the stock exchange.” She argued that millenniums think that “the only purpose of investing on stock exchanges is getting rich.”

What is your source of information to educate asset managers about your perspective on their clients?

Aroutiunian explained that she reviews “financial research and market research

that is used by our clients.” She added: “I am a lawyer; obviously, reading through Morgan Stanley market overview reports is not something natural.”

She manages to extract added value from these readings coupled with her knowledge of the regulators’ actions. “If politics meets reality, then it’s a new product that comes into play.”

Why are you so interested in what young investors want?

Aroutiunian explained that she initially struggled to understand the underlying reasons toward democratisation of private assets. As she started working with Ucits and later moved to alternatives, she said: “I woke up one day, and I saw the shift whereby the two worlds started to meet each other.” That has led her to conclude that it was due to a generational shift.

Are millennials more educated than previous generations about financial investments?

“When the previous generation had a question about the markets, or what to do with their money, they tended to address the question to a financial advisor, and they would physically go to a bank.”

“Are they [millennials] more aware? Are they smarter? They’re not but when they arrive to the advisor, they are.” She noted that millennials will do their due diligence by looking on the internet, ask more questions and “second guess or challenge the advisor” compared to the “other generations which would just trust the advisor.” Yet she admitted that they need the support of a wealth manager given their lack of experience.

What is the perception of younger generations about the current interactive apps or other technologies when investing?

“The millennials would like to have a human interaction.” Yet Aroutiunian commented that they expect the wealth manager to explain their “stand on technology.” Being “very cost sensitive,” millennials want to know whether their advisors are investing in innovation to ensure that their “processes are simpler, easier and cheaper.”

As “millennials are obsessed about being screwed,” technologies enable more transparency so that they can investigate hidden costs. Aroutiunian noted that legislators are precisely looking into the matter as the issue preoccupies investors.

Aroutiunian reported that Generation Z, also known as the Zoomers--born between 1997 and 2012--are all on Tiktok. She explained that wealth managers are in direct competition with “finfluencers” who are grabbing more attention when it comes to investing.

Some in a survey commented that they would rather trust “the guy” on Tiktok then the marketing material of wealth managers.

In a recent report, State Street claimed that young investors have a greater interest in ETFs over mutual funds. Why is that?

Contrary to the “millennials, who are currently obsessed about alternative [investments],” Gen Z is looking into ETFs on the back of their “close link with cryptocurrencies.”

Should Gen Z invest directly into the underlying crypto instead of an ETF? “They know a lot of things, but they have little experience… and they need help.” She thinks that they would rather trust someone else to select the assets and manage the funds. The newest generation will reflect and tell itself: “let’s be prudent, I’m not the smartest guy on earth.” She also noted that asset managers are also advertising their crypto ETFs on Tiktok.

Do you think they’re losing faith in SFDR article 8 or 9 funds? Do they know what they are?

Aroutiunian reported the outcome of a survey by Morgan Stanley which stated that 75% of young investors want to invest into ethical financial vehicles while having no idea of the ESG meaning.

“I don’t believe for a second that there is a disinterest or mistrust towards ESG driven funds, but I do believe that the way those funds are structured and sold… we’re not there yet.” She thinks that the asset managers and the young investors are not speaking the same language.

Veronica Aroutiunian, a partner at Loyens & Loeff, is a member of the law firm’s investment management practice. She specialises in the structuring of alternative investment funds but could also cope with the “structuring of any investment funds.”

Background

She studied law at the Sorbonne in Paris and is now a Luxembourg qualified lawyer. She started her career at Arendt & Medernach in 2013 working in “everything related to Ucits and ETFs.”

Ideal but illiquid Eltifs “I think that the Eltif has everything from a legal perspective to be the right product… for the long-term investment.” Yet during a recent LPEA conference in Paris, she reported that a speaker at an alternative investment firm conveyed his concerns about contingent mis-selling legal liabilities related to the lack of liquidity of Eltifs and has expressed the firm’s intention not to interact “directly with investors but go via private advisors. They are very well aware of this risk. They don’t want to take it because they don’t want to be the banks of tomorrow.”

The non-profit organisation, Digital Inclusion focuses on a 100% local and publicly accessible distribution model to address disparities in access to computer hardware.

THANK YOU for the 600 laptops!

Access to information technology is a major challenge for society in a constantly evolving world. Yet, some do not have the privilege of owning computer equipment, including in Luxembourg. “A large majority of the population has very good access to these technologies and many households are well equipped, but there are still some who do not have a computer at home and who are therefore poorly connected. This divide grew even wider during the pandemic ,” according to Patrick de la Hamette, Director of Digital inclusion.

Founded in 2016, Digital Inclusion works to bridge this gap by making information technology accessible to all in Luxembourg. One of the non-profit association’s main missions is to collect and distribute computer equipment throughout Luxembourg. “As official Partner for the government’s IT recycling policy, we operate a circular economy model which aims to offer low-income residents and refugees the equipment required to attain digital independence.”

Digital Inclusion targets the country’s local businesses by offering to come and collect their outdated laptops and smartphones for reuse in the framework of a social project. Through this initiative, businesses, organisations, and individuals can promote their charitable and environmentally responsible actions. Offering their devices a second lease of life ensures that these can be used for as long as possible and at the same time maximises their own impact. “Additionally, Digital Inclusion promotes each donation through social media campaigns to showcase the donor’s ecological awareness and social commitment to Luxembourg. The number of laptops donated is also indicated.”

AN INCLUSIVE AND PARTICIPATIVE APPROACH

The organisation refurbishes each device, including damaged laptops and smart -

phones, at its participative computer workshop accessible to all. Digital Inclusion runs the workshop, teaches computer maintenance skills to out-of-work individuals and volunteers, and certifies their skills. It also distributes these devices promptly and free of charge to people in need throughout Luxembourg via a fair and public waiting list opened in 2016. To register, candidates must meet certain criteria: benefit from the cost-of-living allowance granted by the government or be a refugee in Luxembourg.

“ Since 2017, recipients of laptops have also been able to follow free computer classes in ten languages and three levels, from digital literacy to digital citizenship. Unlike our free laptop distribution activities, these classes are open to everyone and offer participants the chance to improve their general digital skills.”

AND CASH-FREE DISTRIBUTION

Digital Inclusion differs greatly from other laptop collection initiatives. “ We are committed to distributing 100% of the value collected through our social, cash-free, transparent, and entirely local distribution model. We guarantee that the laptops will only be given to families in need and refugees in Luxembourg.”

With consistently high demand for devices, the non-profit organisation offers an alternative to traditional laptop and smartphone donations. Businesses can opt for sponsorship models in which devices are sourced from second-hand suppliers.

The non-profit organisation takes steps to ensure that donated devices remain within Luxembourg and are reused solely for social purposes during their lifespan. To that end, all devices are engraved with a serial number and issued with a free replacement guarantee in case of obsolescence. Once the devices reach the end of their lifespan, they are handed to the local recycling centre. Digital Inclusion was officially granted the social

SINCE 2016, DISTRIBUTION OF:

+ 7,000 free computers, mainly laptops + 1,000 free smartphones

reuse mandate in 2022 under a Luxembourg government agreement, namely for the Ministry of Family Affairs, guaranteeing fair and transparent practices. The association not only complies with environmental regulations and authorisations, but thanks to its partnership with the Ministry of Family Affairs since 2022, it also ensures the very highest transparency, fairness, and GDPR standards. Digital Inclusion provides every available solution to protect data, including the possibility of donating laptops without a hard drive or by offering a certified data erasure service. “ We provide donors with donation and data erasure certificates” In addition to a full range of data security options, Digital Inclusion also offers complete logistical support for donations of unused devices, for example, ensuring their transportation.

With the increasing digitalisation of society and rising inflation exacerbating the challenges faced by those in need, the demand for Digital Inclusion’s services has never been higher and every laptop counts. “ In 2022, for example, in response to the war in Ukraine and the large numbers of additional refugees arriving in Luxembourg, we launched a call to action. This led to the collection, refurbishment, and distribution of more than 2,000 second-hand computers and 270 smartphones.” Digital Inclusion has been recognised for its work by the IMS Sustainability Awards.

TO FIND OUT MORE about Digital Inclusion or make a donation, contact info@digital-inclusion.lu

Private banking is about managing a network of reliable and trusted experts. After gaining a broad experience in banking, Bojan Kulisic nurtured his reputation by offering his most valuable assets: deep knowledge of the local market and personal attention.

Bojan Kulisic serves clients with an institutional offering at Quintet Private Bank

Bojan Kulisic serves clients with an institutional offering at Quintet Private Bank

“I help private banking clients that have become too complex for traditional private banking with more complex needs to gain access to our institutional services,” said Bojan Kulisic, executive director, head of private label solutions asset servicing & financial intermediaries at Quintet Private Bank.

He noted that most of their institutional services and products such as dedicated funds, holding companies, SPVs, trusts, partnerships and foundations have become “acceptable or mainstream also for the wealthy family, individuals or even small investor clubs.”

Kulisic commented that his clients have selected Luxembourg on the back of recommendations from their legal and tax advisors. Besides, the country is perceived as a “fully transparent onshore financial centre” that is known for its creativity and innovation. He thinks that “the place” is particularly attractive for “family or institutional investors looking to offer services to other friends and family members or other investors.”

Kulisic differentiates himself by being “the trusted person on the ground locally,” through personal contacts and his knowledge of the Luxembourg ecosystem. “I always commit with my own name first to you as a client or a potential client, and then Quintet.” Given that all banks are offering “more of less the same services… [as we have] the same rules at the European level,” he thinks that the key question for the client is his availability, when needed. “Being the concierge for the client” is how Kulisic perceives his role. “It’s really about listening to clients’ needs, then come with solutions. Always listen first,” said Kulisic. As his clients may come from outside Luxembourg or even outside of Europe, he explained that his role is to guide them and reach out to the local expert to respond to their needs.

Kulisic explained that Quintet has decided to focus on its core private banking expertise and leave the fund administration business and is out of the “thirdparty management company” business.

As such, Kulisic thinks that the key strengths of the bank are its long experi-

ence in the domestic market (75 years), its “huge” business partners network, the inhouse operations and decision making, the “very low and stable” staff turnover and the fact that senior managers are members of “big local organisations.” Through that membership, Quintet contributes to the development of new rules in the local financial industry.

An ecosystem referencing each other

As a private bank, Quintet will not deliver legal advice or structured tax planning. As part of the value chain, Kulisic will redirect his clients to the relevant and competent companies where he expects “a match on culture, asset type and market experience.” He added: “If you have the best competence coming from each of the pieces of the value chain in each of the links, the client gets the best service and the best value for the money.” Despite being “a medium size player… I would say that we are competing with more or less everybody on the market on fair conditions and there is mutual respect.” He suggested the competition is based “on pricing on service level, on structuring possibilities and the flexibility of the organisation.”

its

“There are no easy structures to set up but nothing is complex“

At the global level, Quintet does not target one market specifically, but the bank is sensitive to anyone or anything that is sanctioned or blacklisted. “In principle, everything which is clean and acceptable from the regulatory point of view, and where we can deliver the service--not overselling or over committing--we will look into the case,” stated Kulisic.

Besides, Kulisic does not see how “unclean assets” in fully regulated structures could find its way through the Luxembourg financial market nowadays.

Bojan Kulisic acts as a “bridge between our two pillars… which is classical private banking with its advisory services and the institutional [business], which we call asset servicing and financial intermediaries.”

Kulisic has worked in the banking sector for about 22 years, starting his career in Sweden in a small savings bank before switching to Swedbank in Stockholm and then moving to Luxembourg to work in private banking and funds. He worked for Nordea Asset Management and UBS before heading to Quintet in 2021. The bank is 99.99% owned by a Qatari private investor.

A Swedish national with a Serbian ethnic background, Kulisic grew up in Sweden where he trained as an economist.

Luxembourg is undergoing a process of continuous transformation as an international financial centre. By 2035, Luxembourg’s economic landscape will have evolved considerably, driven by technological innovation, evolving customer expectations and shifting global trends. What will our financial marketplace look like in a decade’s time? Ten experts offer their views on the future of finance in Luxembourg.

With the participation of Professor Gilbert Fridgen (SnT), Ala Presenti (Moniflo), Candi Carrera (36 Square Capital, Spain), Stéphanie Delperdange (Independent Director), Simon Schwall (OKO), Emilie Allaert (Digital Minds Sàrl), Markus Sauerland (NowCM Luxembourg), Claude Marx (CSSF) and Isabelle Delas (LuxFLAG).

“ Not taking enough risk”: a risk in itself

When planning for retirement, it’s important to consider the risk of not taking enough risk in terms of investments, says Jeremy Lauret, who shares his top tips with Delano. Having more savings and investments means that people have more options when it comes to spending their most valuable resource: time.

Jeremy Lauret is head of direct investing at Swissquote Bank Europe

Jeremy Lauret is head of direct investing at Swissquote Bank Europe

As Europe’s population ages, retirement-and funding pensions--are topics that are becoming more important. Why is it crucial to invest for retirement?

“Relying solely on the public pension system will not allow people to maintain the lifestyle that they would like to keep in retirement--and even less so than one that they might be aspiring to,” said Jeremy Lauret, head of direct investing at Swissquote Bank Europe, an online bank and brokerage. State pensions must be supplemented.

What many don’t consider--especially when they’re young--is that later in life, they may want to work on a personal project, volunteer or work part-time, which “can be incompatible with retiring with a full state pension.” So “the more people have in terms of personal savings and investments, the more high-quality options they have in terms of how they spend what is actually their most valuable resource.”

This resource? “It’s not money. It’s their time.”

Higher level of risk aversion in Europe

In Europe, people “tend to be more risk adverse” than in other developed economies. That translates into an aversion for risky assets--such as equities--and more savings in cash deposits.

Cash deposits are useful, he added, like when it comes to facing emergencies or unexpected expenses. But because cash also struggles to keep up with inflation, savings may not actually be growing.

“People need to think about not taking enough risk--and therefore earning a low return on their investments--as being a risk in itself, because then they might not be growing their nest egg sufficiently.”

vs capital market investments

In some European countries--including Luxembourg and France--“there’s really a strong tendency to invest in property, and that is at the expense of investments in capital markets.”

Property can be part of a diversified portfolio, “but people tend to not take into account some of the risks with property investments.” They may focus on gross rental income gains, but underesti-

mate the costs that come with owning and managing a property, such as maintenance, renovations, property management, insurance or transfer taxes.

On the other hand, capital market investments tend to be highly liquid, more diversified, have lower transaction and holding costs compared to property, and have “relatively straightforward” taxation rules. “They’re also easy to manage or transfer to another country,” which is a positive aspect given the “mobile lifestyles” many people lead today.

Risks should be respected, not feared

But when it comes to their retirement, people may be afraid to invest and potentially lose money after an unsuccessful investment. Are these fears unfounded?

“Risks must be respected, and not necessarily feared.” Stocks can be volatile--the S&P500, for instance, lost one-third of its value at the start of the pandemic in early 2020. Conventional advice “is to not invest in the stock market any money that people need to access in the short term or in the near future, or any money that they can actually not afford to lose.”

The “flip side” is that if people are investing for the long term, for a retirement that is over a decade away, “and they’re not overextending themselves by borrowing money to invest, for example,” then there’s no reason to fear market corrections. “Over long periods of time, stocks outperform other asset classes.”

“The risk of investing in one bad company is easy to mitigate. Just make sure that your portfolio is diversified across many industrial sectors and geographies--and you’ve taken care of that risk.”

Focus on what can be controlled

People have to focus on what they can control, said Lauret. Timing the market or picking the best-performing stocks is very difficult, but investors control how much they decide to set aside, as well as the discipline to invest regularly. “It’s that discipline that ultimately is going to ensure that wealth can build up over a long period of time--and that includes when stock markets are fearful and depressed.”

1. Think about how much income you need in your retirement to fund the lifestyle you want, then work back from there and see how much money needs to be set aside every month, quarter or year. Compounding has a strong impact on how quickly savings grow, “and the most important factor in succeeding is how early in their lives they start investing.” Setting aside money to invest may mean making lifestyle compromises today in order to improve your life tomorrow.

2. People need to ask themselves: what is likely to drive their happiness and well-being in the long run? Is it growing an investment portfolio that will pay back with more time and freedom in the future, or spending more money today? “The answer to this is as unique as each individual,” and everybody has “to find that balance that is right for them.”

3. Consider where you intend to retire. Think about the type of currencies, geographies and asset classes you’re exposed to. Rental and dividend income may be taxed differently depending on the country in which you live.

4. Pay attention to annual costs and portfolio fees

Freitage / vendredi 19. MAI

14.00: Blasorchester / Fanfare MELICK

12.00-12.30 : Blasorchester / Fanfare MELICK

16.00: Blasorchester / Fanfare GOORSEL

durch die Fussgängerzone/à travers la zone piétonne

14.00: Blasorchester / Fanfare MELICK

Samstag / samedi 20. MAI

16.00: Blasorchester / Fanfare GOORSEL

Saturday & Sunday 18. & 19.05

14.00 : Blasorchester / Fanfare OPMAAT

Samstag / samedi 20. MAI

14.00 : Blasorchester / Fanfare OPMAAT

16.00 : Blasorchester / Fanfare BARNEVELD

16.00 : Blasorchester / Fanfare BARNEVELD FREEEntry

The castle’s museums are open from 10.00 am to 6.00 pm and a varied programme awaits you.

www.paperjam.lu

Votre newsletter biquotidienne à 31.000 abonnés fortement engagés. Un moment de lecture incontournable pour la communauté des affaires.

And in the town centre, the ‘Provençal Village’ with 40 exhibitors welcome you by selling products typical of the Provence, from 10am to 9pm.

sur go.maisonmoderne.com/bienvenue

Partners at asset managers, consultancies and law firms have a lot in common when it comes to personal finance. Naz Vahid at Citi told Delano about the banking giant’s specialty service for these types of professionals and why it recently relocated its European hub from London to Luxembourg.

Words AARON GRUNWALD Photo GUY WOLFF

“ People who are in private equity, tend to know private equity “

“It started with the idea of lawyers are people who know wealthy people, so we called on them,” said Naz Vahid, managing director and global head of the Citi Global Wealth at Work division at Citigroup. This was on Wall Street, 54 years ago. Originally, Citi bankers “thought they could get introductions to their clients... and soon enough, they realised that, wait a minute, they actually are wealthy people, they own their own businesses, they have really solid businesses. And it went from just calling on them [for client leads] to banking their partners to then being a part of the bigger business.”

Today, Citi Global Wealth at Work has “close to 49,000 clients; about 42,000 of them are with the law firm group,” although the business has since expanded into other professional services, such as accounting, consulting and headhunting. Such firms, Vahid said, are “very much structured like law firms,” often as nonlisted partnerships, so from the bank’s perspective they were grouped together. So were asset managers.

Like other professional service firm partners, asset managers are “very, very busy individuals, who have no time to spend on their own financial matters. Like most of us, they work tremendous hours,

they pay attention to themselves at midnight. And they tend to be great clients, if you build relationships with them early. They will stay with you as well, into their retirement if you serve them. And if you do well by them, [they are] a great source of referrals.”

The unit focusses on personal finances and is “not looking to serve the business”. The needs of the firm itself are “managed out of our commercial bank, which is part of our corporate bank. But we serve all the wealth needs of the individuals that [are part of] these firms.” She described the approach as “financial wellness”.

That includes asking clients: “Do you have the right allocation on the wealth side to the types of investments that you need to have? Are you keeping too much cash? Are you keeping too little cash? Are you putting your retirement assets in the right place? Do you have too much real estate or you don’t have enough real estate? All the way to liabilities: Have you borrowed sufficiently? Are you paying extremely high rates for what you could do differently? Is it money you need to borrow to put capital into your law firm, into your consulting firm, even funding

Starting salary ranges for lawyers working at law firms in Luxembourg, by specialty, according to research published by the recruitment firm Kingsley in February 2024

when private equity firms want their partners to buy into co-investments?”

But surely investment fund professionals don’t need much finance advice, right? “Yeah, it’s interesting, originally when we were doing research on the asset manager segment, the comment people came back to us was ‘really, asset managers, why would they give you a shot at their investments?’ What we have learned is people who are in private equity, tend to know private equity. But, actually, because they’re so invested in private equity,” an advisor could potentially “say to them, you should be looking at fixed income on the other side of it, just to balance what you have.”

Specialisation in a certain class “will give you a lot of deep investment personally into that segment” while possibly leaving blind spots, stated Vahid. “Let’s not generalise. It’s not everyone, but it’s a good enough number that they want us to come in and do a checkup on the health of their financial wellness.”

Often fund professionals are not aware of or don’t fully understand all the options. “These are very successful individuals... they’re also embarrassed to tell people they don’t understand what is in front of them. So a lot of times the

relationship with a banker is an easy way to get those answers.”

The team also works with pre-IPO entrepreneurs. “Think about it. They’re worth a lot of money, but in paper form, not in real form. So how could we help them figure out a way to plan for the moment they have the wealth, right? It’s really more important to plan before you have the wealth. Because once you have it, the liquidity event has happened, your tax situation has changed. And it’s almost too late to go back” and consult financial planners.

According to Vahid, Citi faces little competition in the segment, aside from a few smaller local banks in specific markets. Private banks “are set to go after ultra high net worth individuals” while rival full service banks typically have dipped their toes in the market only briefly. “I would say the biggest reason [we] have grown as much as we have in the law firm group is our staying power, that we haven’t gone in and out of that market where other banks have.”

Citi Global Wealth at Work has 14 offices in the US, a centre in London and its European hub in Luxembourg. Its

European Economic Area business used to be run out of London but was shifted to the grand duchy in October 2022. There was an extended training and ramp-up period, and Vahid said the bank has “just finished” moving “existing clients that should be served out of the EEA into the Luxembourg office.”

The grand duchy was selected because of the density of law firms and because “all of the major consulting and accounting arms are here, all of the big asset managers are here.” The Luxembourg team is currently made up of four people, although the number could rise as the business grows. They coach and support local bankers, who maintain their direct relationships with clients.

“I think we’re at the tip of the iceberg,” Andrew James, head of Citi Global Wealth at Work EMEA, said during the interview. “Luxembourg is absolutely core to our growth plans. This is really our first full year of being up and running, and having done a significant amount of migration as a result of Brexit. We are seeing very substantial interest in the offering and that’s been reflected in both revenue and AUM growth. And I think Luxembourg is a very exciting place to be, in terms of acting as a hub for the wider EEA.”

Nexus2050,

Nexus2050

Global Senior Business Executive

ANDREZ Forbes Books & Amazon Bestselling Author, President EmeritusEuropean Business Angel Network (EBAN) Samsung Electronics

CASTEGNARO Lawyer, Author, Teacher and Conference Speaker, CASTEGNARO - Ius Laboris Luxembourg

CLAUSEN DG GROW - Director for Investment, European Commission

and

GILLES ROTH Minister of Finance, The Government of Luxembourg

PAULO

Benelux

LEX DELLES Minister of Economy, The Government of Luxembourg

GUY

MERETE

GILLES ROTH Minister of Finance, The Government of Luxembourg

PAULO

Benelux

LEX DELLES Minister of Economy, The Government of Luxembourg

GUY

MERETE

PETER KERSTENS Advisor for Technological Innovation, Digital Transformation and Cybersecurity, European Commission

ERYKA LEHR Chief of Staff in Global Affairs, Google

Ella Media AG

EDOUARD LEONET Head of Partnerships, Asia-Pacific Region, Acclime

GUY-PHILIPPE GOLDSTEIN Strategic Advisor, Consultant,

ADINA GRIGORIU CEO and Founder, Active Asset Allocation Founder and CEO, Epieos

MARJORIE HAMELIN Founder & CEO, US Outreach CEO, Redbridge

CEO,

THIERRY LANGRENEY President and Founder, Les Ateliers du Futur

TOSHIHIKO OTSUKA Chief Executive Officer, Rakuten Europe Bank S.A.

YANNICK OSWALD Partner, Mangrove Capital Partners

JOCHEN PAPENBROCK Head of Fiancial Tech, EMEA NVIDIA Tech Law Advisor, SCHILTZ & SCHILTZ Partner, Entrepreneur and Innovator, Tenzing Partners

Vuillermoz Capital

JESSICA HOLZBACH CEO, Pile Capital

ILANA IVANOVA Commissioner for Innovation, Research, Culture, Education, and Youth, European Commission

GUY-PHILIPPE GOLDSTEIN Strategic Advisor, Consultant,

ADINA GRIGORIU CEO and Founder, Active Asset Allocation Founder and CEO, Epieos

MARJORIE HAMELIN Founder & CEO, US Outreach CEO, Redbridge

CEO,

THIERRY LANGRENEY President and Founder, Les Ateliers du Futur

TOSHIHIKO OTSUKA Chief Executive Officer, Rakuten Europe Bank S.A.

YANNICK OSWALD Partner, Mangrove Capital Partners

JOCHEN PAPENBROCK Head of Fiancial Tech, EMEA NVIDIA Tech Law Advisor, SCHILTZ & SCHILTZ Partner, Entrepreneur and Innovator, Tenzing Partners

Vuillermoz Capital

JESSICA HOLZBACH CEO, Pile Capital

ILANA IVANOVA Commissioner for Innovation, Research, Culture, Education, and Youth, European Commission

Lionel De Broux, chief investment officer at Banque Internationale à Luxembourg, is confident that the US economy will “not land,” while Europe is staving off a recession. Climate risks are undervalued by the markets and demand immediate attention. Yet financial resources directed to Ukraine will delay green investments.

Words SYLVAIN BARRETTEDespite a first quarter growth rate of 1.6%, much lower than anticipated by the market (2.5%), on the back of weak inventories and exports, Lionel De Broux, chief investment officer at Banque Internationale à Luxembourg, is confident that a US recession is not in the cards. He sees the economy as relatively robust and supported by the all too important and “resilient US consumers, the engine of the US economy.”

A distant possibility, he thinks that we may see one “marginally negative quarter,” but overall, De Broux expects a relatively good performance for the year as a whole.

US Fed rates to go up or down?

“When the economy runs smoothly with an inflation not yet under control, there is no urgency for a central bank to cut rates,” commented De Broux during an interview in late April. Despite being on the right path, he considers that the last mile in taming inflation toward the 2% target as the most difficult. He thinks that the upcoming inflation figures will determine whether the current one-cut expectation by the market will hold for early autumn (September).

“There are no rationale today justifying a rate hike… unless the economy strongly rebounds toward 5%,” said De Broux. He is not aware of any broker-dealers or asset managers expecting a hike by the Fed.

LIONELDE BROUX Chief investment officer

“The true risk for the US economy lies more in addressing the large deficit which may negatively affect the economy and the capital markets.“

Consequently, a rate hike nowadays would be a “major shock for the world markets.”

A rapid rise of energy prices as seen during Russia’s invasion of Crimea in 2014-when Brent almost reached $120--on the back of exogenous factors may result in an “inflation shock.” Yet he believes central banks would hold rates steady as their currently elevated level, coupled with higher inflation, would put downward pressure on the economy. “The objective of raising rates is always, always, always to dampen an overheating economy.” Therefore, this condition would not be fulfilled.

ECB: Cut rates at your peril

“Rates have been higher for longer with the markets continuously pushing back the rate cuts for the last 12 months,” observed De Broux. Contrary to the US, the European economy is in worse shape. “ Not much is needed for it to fall in recession.” He thinks that we in Europe cannot afford to maintain elevated rates for too long.

De Broux admitted that nothing is easy, as a rate cut would increase the rate differential between the Fed and the ECB. The euro may then weaken, an adverse outcome on inflation as Europe is a net importer of energy, which is priced in dollars. The timing for rate cuts is therefore crucial.

The size and the speed of the rate cut(s) in Europe will depend on the com-

Photo Romain Gamba/Maison Moderne (archives) Banque Internationale à Luxembourg

ing moves from the Fed. “Our inflation outcome is not independent of what will decide the Fed.”

Asked about a tech bubble, De Broux replied: “Is it a bubble?” When comparing the internet bubble of the late 1990s to today, several factors make him believe that “we have not reached this [bubble state], at least for now.” The sector is rather “blooming but not bowing.”

First, he thinks that “the markets are quite discerning” by separating the wheat from the chaff in terms of financial profile. He commented that the market is serious about in-depth due diligence in the artificial intelligence sector, for instance.

Second, the current market does not display the turn of the century IPO madness when business plans were written on the back of an envelope. He noted that the number of IPOs so far this year has been very limited. De Broux could recall only one company in artificial intelligence, Databricks, planning an IPO in March which was postponed as the market was seen as “pretty shut” by its CEO.

De Broux also noted that differentiation also applies to the Magnificent Seven with Meta’s stock hit hard after it published its 1Q24 earnings. The market grew concerned about its ability to monetise the firm’s plans with AI. In short, the market does not appear ready to give a blank cheque to anyone, including Mark Zuckerberg, Meta’s CEO.

De Broux noted that AI is in an infrastructure building phase. That benefits Nvidia, which has very few competitors, enabling it to dictate prices. He thinks that the growth of the sector will depend on the economic cycle to evolve beyond Microsoft, Amazon and Meta.

Any concerns on major defaults or credit events?

“None in the short term.” De Broux noted that spreads have declined so much that the “cost of risk is near zero.” Therefore, the market signals little risk of default rates to climb despite the high refinancing cost for several companies in the current cycle and the expectation by the credit ratings agency Fitch that “default rates for

“It is highly difficult to foresee adverse climatic events, but we see a trend.” Yet Lionel De Broux at Banque Internationale à Luxembourg knows that there is a high risk that these events will impact some sectors more than others. Therefore, he explained that Bil is accounting for ESG factors in addition to financial projections when pricing financial assets.

“Some like to claim that the worst is in front of us. All the options are well known, the probabilities are just wrong.”

For instance, De Broux thinks that ESG factors considered in financial asset valuations are understated He believes that the performance of financial assets will take significant hits as the timeline of climate events will likely occur sooner than companies and society expect. Consequently, the repricing of financial assets will likely be violent if not gauged early enough.

European high-yield bonds and leveraged loans to rise to 4% in 2024 and 2025 from 2.5% and 3% respectively in 2023.”

Moreover, he thinks that the pressure on large debtors is limited as the demand for credit and debt products remains high.

“At this point in the cycle, whatever the rating of a debtor, the risk of default reflected by the spread is much lower than what has been observed historically.”

De Broux is concerned about the return of large pandemics given the high mobility of people. Whether it is about pandemics or geopolitics, he thinks that low probabilities should not prevent investing but rather prompt an investor to assess what should be their next action upon the occurrence of such events. Yet he does not think that an investor should mobilise capital to protect against an event with an unknown timing.

Trump: policies may be floppy

“The last time around was not that bad for investors… as Trump is perceived as business friendly,” stated De Broux. Besides, such a victory would not be such a surprise anymore.

He considers that a Trump administration will be negative for the export sector targeting Asia and Europe, in particular given the adverse consequences of raising tariffs to 10% across the board. Elsewhere, he thinks that the oil and gas sectors should be net beneficiaries whereas his policies will likely be negative for the cleantech industry “as observed in [his] first mandate.”

De Broux noted that the additional expenditures on defence may result in the making of new industrial champions in Europe. However, the redirection of expenses will most likely come at the cost of weaker economies, weaker budgetary positions, higher taxes and cutbacks on investment commitments to counter climate change effects. Not surprisingly, he is unclear on the extent and the timing of additional European expenses given the inherent war uncertainties.

There’s a lot of talk around green finance, ESG regulation and sustainability criteria when it comes to investing. But how can one sift through the noise?

Tiago Freire de Andrade, CEO and co-founder of LynxAI, and independent director Nathalie Dogniez sat down with Delano to discuss the topic.

NATHALIE DOGNIEZ Independent director

NATHALIE DOGNIEZ Independent director

“The challenge remains the availability, the comparability, the reliability and the cost of the data“

“There is an increasing understanding that sustainability is a journey,” thanks to increasing maturity amongst investors and market participants, independent director Nathalie Dogniez told Delano during an interview on trends around sustainable investing, challenges and more. Dogniez is also the chair of the Luxembourg Sustainable Finance Initiative’s ESG data working group and was recently appointed chair of Eurosif, a pan-European association that promotes sustainable finance at the European level.

“We are shifting away from looking at sustainability investing from the lens of compliance, or black-and-white approach, [comparing] investment into sustainable activities or sustainable companies [versus] non-sustainable companies, towards what I would call a true sustainability process and towards a transition concept.”

For Dogniez, the EU recommendation on facilitating transition finance is one of the most important publications that the EU put out in the past year. Published in June 2023, the EU’s sustainable finance package aims to support companies and the financial sector while encouraging private funding of transition projects and technologies. The driver behind this recommendation, said Dogniez, is the “huge need” for financing. “We would require an additional €700bn per year until 2030, just to finance the decarbonisation of the

economy and achieve the objective in terms of greenhouse gas emissions, which is reduction of 55% by 2030.”

Data a top challenge

Besides the need for funding, the field of sustainable finance is faced with challenges. “The lack of data is clearly the main challenge,” Tiago Freire de Andrade, CEO and co-founder of LynxAI, told Delano during a separate interview. LynxAI is a technology platform that aggregates ESG data and provides interactive dashboards to facilitate analysis, so it might seem like an easy answer for Freire de Andrade to say that data is a major challenge.

But the need for data was a challenge echoed by Dogniez. “To be able to determine that an investment is sustainable or that you’re financing the transition, you need to be able to measure the outcome. And for this, you need to have proper data from the underlying company, and today, the challenge remains the availability, the comparability, the reliability and the cost of the data.”

Challenges related to the standardisation of data were also mentioned by both Dogniez and Freire de Andrade.

“If you look at financial reporting, for instance, this has been defined, standardised over decades, and with proper audit-

THURSDAY, 11 JULY

start: 19:00

Proudly organized by www.luxembourgpriderun.lu

ing requirements,” said Dogniez. “For the non-financial data like ESG data, it remains today--to a large extent--voluntary reporting with no uniform standardised reporting standards, with no or limited auditing requirements. So, as a result, not all the ESG data that would be required to properly measure sustainability outcomes are always available.”

“In the absence of proper measurements, many of the data remain estimated data: data estimated by the company, by the data provider or by market participants. There is no requirement for these data to be audited, and as a part of that, the cost for acquiring and validating the data are quite significant,” added Dogniez. “Here, also very often, we talk about big data, because you have hundreds of KPI [key performance indicators] per company, which is adding cost in terms of technology to implement, I would say, data validation processes.”

In Europe, the Corporate Sustainability Reporting Directive (CSRD) will improve the situation, she said, “but it will take years because it’s only starting this year, and it’s a phased introduction.”

Taking a “wider perspective, the availability and comparability of ESG data will also improve on a worldwide basis because there is fortunately work that is conducted in terms of interoperability between” different countries and regions.