SMART PROPTECH THAT WON’T BREAK THE BANK

DECARBONIZING SMEs

SPECIAL FOCUS ON STRESS AND THE WORKPLACE

SMART PROPTECH THAT WON’T BREAK THE BANK

DECARBONIZING SMEs

SPECIAL FOCUS ON STRESS AND THE WORKPLACE

Zetlin & De Chiara LLP, one of the country’s leading law frms, has built a reputation on counseling clients through complex issues. Whether negotiating a contract, resolving a dispute, or providing guidance to navigate the construction process, Zetlin & De Chiara is recognized as a “go-to frm for construction.”

We’ve done hard things before, we do them all the time.

For most cancer patients, the usual options are surgery, chemotherapy, or radiation. So we’re working on ways to get the immune system to deploy billions of cancer-killing cells and help more patients survive.

When some people experienced mysterious COVID symptoms and had nowhere to go, our team created the first Center for Post-COVID Care.

It wasn’t that long ago we had to open up your whole chest for heart surgery. Now we’re pioneering a bypass that goes through a few tiny incisions. With this surgery, we can get you back on your feet in weeks instead of months.

So if anyone ever tells you there’s no other way—don’t listen.

We didn’t listen.

From coworking memberships to turnkey o ces, WeWork gives you more flexibility with your workspace. Discover solutions that make hybrid work for you.

Meridian’s national dominance in multifamily financing gives us a unique vantage point from which to approach markets on our clients’ behalf. By leveraging our 30+ year relationships and depth of experience, we are able to see what others can’t and produce exceptional outcomes — especially in turbulent markets. Remain informed and be agile with Meridian.

TODAY’S MARKETS MOVE MORE QUICKLY THAN EVER.

President & CEO

Jeff Mann

editorial Editor

Debra Hazel

Associate Editors

Alexandra Baumbusch

Laurie Melchionne

Copy Editor

Geraldine Melchionne

Director of Communications and Marketing

Penelope Herrera

Director of Newsletter

Division

Cheri Phillips

Director of Special Events

Mirusha Damiani

art

Art Director

Krystal Peguero

Graphic Designer

Serena Bhullar

Ran Jing

Cover Photography

Ed Lederman

contributors

Sean Burke

Frank DeLucia

Elaine Haney

Sabhya Katia

Merilee Kern

Kris Kiser

Steven Kratchman

Ira Meister

Myles Mellor

Marcus Moufarrige

Peter Provost

Robin Rivaton

Carol A. Sigmond

Kyle Spencer

Brian Zrimsek

business

Technology Consultant

Joshua Fried

Distribution

Mitchell’s Delivery Service

digital media

Editors

Alexandra Baumbusch

Debra Hazel

Penelope Herrera

Laurie Melchionne

Cheri Phillips

Web Developer

CS DesignWorks

East Coast Office 450 7th Ave., Suite 2306 New York, NY 10123 212-840-MANN (6266)

West Coast Ofice 110 E. 9th Street CMC, Suite A1169 Los Angeles, CA 90079 866-306-MANN (6266)

The opinions expressed by our columnists are not refective of the views and opinions of the publisher or editorial staff of Mann Report. Publication of such views and opinions does not constitute endorsement by Mann Report. Any reproduction, including but not limited to internet usage, is prohibited without the express written permission of the publisher. mannpublications.com

In the real estate business, especially the New York real estate business, we see a lot of legacy companies, with the third or sometimes even the fourth generation of a family running the firm and continuing a legacy of excellence. The Dermot Company, on the other hand, is in its fourth decade, and after being acquired by its current leadership, is growing rapidly here and in Florida.

I was excited to learn more about how Dermot’s leaders are continuing to take the company forward by focusing on their people: treating them with respect, o ering them opportunities to grow and remembering that real estate is a team sport.

Speaking of sports, there’s still time to sign up for the National

Realty Club Foundation’s annual Golf Outing, being held on October 2 at the Fresh Meadow Country Club and honoring Michael Kerr and Zach Kerr, chairman and president, respectively, of M&R Management Co.

I’m grateful to our co-chair and my dear friend Robert Romano of Absolute Electric and our Golf Committee for organizing what will be a fun day of golf and a spectacular cocktail hour and dinner after. The National Realty Club Foundation was founded to help support organizations that are supporting New York City and New Yorkers, and I’m excited to see how it has grown in the past couple of years.

See you next month!

”There are many roads to success, but only one sure road to failure; and that is to try to please everyone else.

– Benjamin Franklin

Rainier

Segment Leader Sr. Managing Director O ce: 212.661.0790

Cell: 908.720.4223 rguanlao@websterbank.com

Anna FusGorniak Managing Director, Relationship Manager O ce: 212.661.0236

Cell: 917.231.6758 afusgorniak@websterbank.com

John Kowalski Managing Director, Relationship Manager O ce: 212.661.2307

Cell: 646.629.9586

jkowalski@websterbank.com

Mark Reid Managing Director, Relationship Manager O ce: 215.900.1874 mreid@websterbank.com

Trevor Hintzen Director, Relationship Manager O ce: 212.661.0739 Cell: 917.727.5272 thintzen@websterbank.com

Robert Mallimo Director, Relationship Manager O ce: 212.661.0943 Cell: 631.620.4444 rmallimo@websterbank.com

Welcome to our annual Proptech issue, where we focus on some of the newest technologies and ways to use them to improve entrances and exits, decarbonize our propertes, integrate AI and more.

But even as we focus on the technical, we’re also shining a light on the very human needs surrounding the real estate industry. The last few years have been a challenge, at best, and it’s way past tme to discuss their efect on the mental health of all in the business. Thanks to Brian Zrimsek for his piece on the importance of alleviatng stress for property managers, Merilee Kern for her observatons on listening and for Sebasten de Ghellinck, Brendan Lofus and Elizabeth Crowley for speaking with me about their work to reduce the number of suicides taking place among constructon professionals.

Proptech can help real estate builders, agents, developers and consultants do their jobs beter, more efciently and more afordably. But it can’t replace interpersonal interacton or tell another human being going through a tough tme that he or she isn’t alone.

September is Natonal Suicide Preventon Month. Whether you need help or want to give it, reach out.

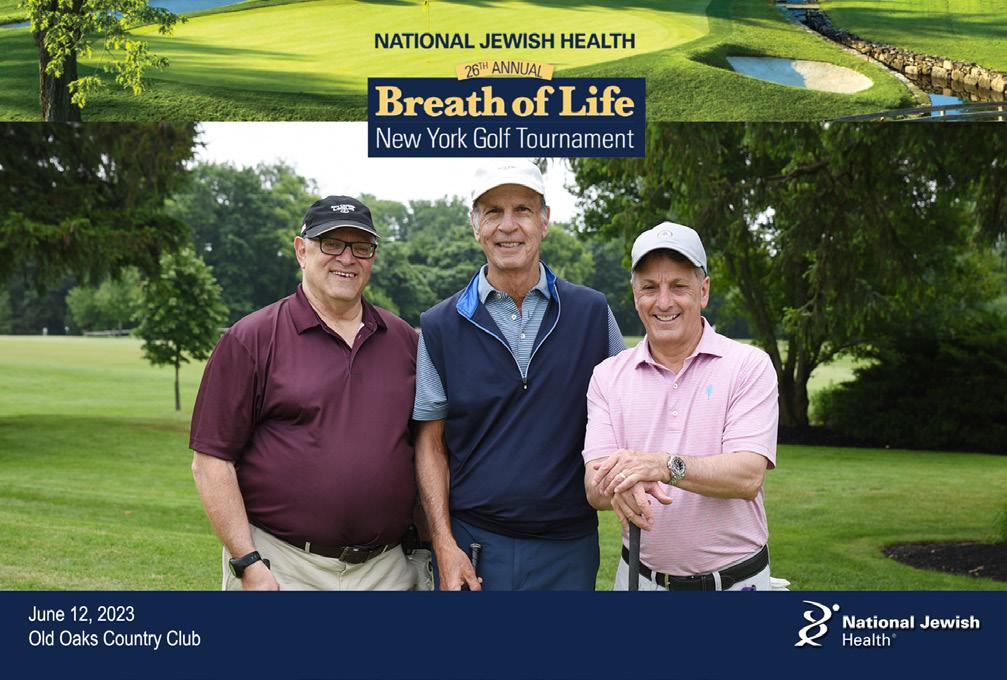

The 26th Annual Breath of Life New York Golf Tournament took place at Old Oaks Country Club in Purchase, New York, where more than 100 friends gathered to enjoy a day of golf benefting National Jewish Health, a leading respiratory hospital.

Roger Silverstein, executive vice president of Silverstein Properties Inc., is a National Jewish Health trustee and the tournament’s new chair. Chairs Emeriti of the event included Bob Helpern of Tannenbaum Helpern Syracuse & Hirschtritt LLP,

“Bob, Sandy and Steve have built this into a superb event,” said Silverstein. “I also give a special thanks to Nancy and James Berry Hill

and Marjorie and Stephen Raphael who founded it.”

Tournament sponsors included: CBRE Inc., Greenberg Traurig, Abby and Andrew May, Marjorie and Stephen Raphael, Silverstein Properties Inc., Wilk

PHOTOS BY ON THE SPOT PHOTOS Sandy Lewis of SBL Property Consultants LLC and Steve Siegel of CBRE.Auslander LLP, Marsha and Richard Goldberg, Jacqueline and Bob Helpern, Kambos Realty Corp., Sheila and Sandy Lewis, Diane and Darryl Mallah, Red Apple Group, Empire Automotive Group, Ornella and Robert Morrow, Harriet

and Eric Rothfeld, Jill and Sandy Sirulnick, Systems 2000 Plumbing, Sheryl and Arnie Winick, Ambassador Construction Company Inc., Felice and Jay Seeman, Joanne and Jeff Liebenstein, Kanaris Contracting and Shelley and Jeffrey Parker.

1. Roger Silverstein, Sandy Lewis, Bob Helpern and Marc Steron

2. Doug Donaldson, Roger Silverstein and Joe Scharf

3. Barry Horowitz, John Khani, Sandy Lewis and Gerald Yellin

4. Richard Adelman, Bob Helpern and Marc Steron

5. Bryan Rubin, Michael Helpern and Adam Haber

6. Joe Artusa, Lou D’Avanzo, Christine Colley and Kyle Young

7. Andrew Kaskel, Adam Lewis, Zach Winick and Andrew Schwartz

8. Elise Udolf, Audrey Horowitz, Nancy Gilbert and Sheila Lewis

9. Andrew Goldberg, David Maurer-Hollaender, Steve Siegel and Brett Shannon

The CoreNet Global New York City Chapter (CoreNet NYC) hosted its highly anticipated Annual Golf Outing at the prestigious Century Country Club and Old Oaks Country Club in Purchase, New York. The event brought together key industry leaders, executives and professionals for a day of networking, friendly competition and collaboration in a picturesque setting. The outing surpassed all expectations, cementing its reputation as a premier event in the commercial real estate community.

The CoreNet NYC Annual Golf Outing served as a platform for participants to connect, foster new relationships and exchange valuable insights in an informal and relaxed environment. The event attracted a diverse group of attendees, including corporate real estate executives,

service providers, developers, brokers and professionals from various sectors of the industry. The highly anticipated event was attended by over 300 leading professionals in the real estate and construction industry as well as CoreNet NYC members and leadership, making it one of the largest industry golf outings.

“The CoreNet NYC Annual Golf Outing continues to be a fantastic occasion for golf enthusiasts and professionals to connect,” said Alyson Blewett, president at Alyson Blewett Corporate Consulting LLC and Annual Golf Outing Committee co-chair, CoreNet NYC. “It brings us immense joy to organize and witness the event's overwhelming success. We extend our appreciation to all the participants for their unwavering support.”

Christian Bryan, Larry Charlip, CoreNet Guest and Tommy O Halloran

Christine Chaves and Alison Eagle

CoreNet Guest, Debra Cole, Linda Foggie and CoreNet Guest

CoreNet Guest, Morgan Gorospe and Cesar Robles

Dale Schalather, CoreNet Guest and Linda Foggie

Dan Johnson, Cesar Robles and Rose Arias

Elizabeth Beyer and Ariel Zurad

Elyse Santic, Michele Mann and CoreNet Guests

Jamie Fuertes, Lou D'Avanzo and James Love

Paul Darrah, Gina Rizzo and Dale Schlather

Christine Chaves and Alison Eagle

CoreNet Guest, Debra Cole, Linda Foggie and CoreNet Guest

CoreNet Guest, Morgan Gorospe and Cesar Robles

Dale Schalather, CoreNet Guest and Linda Foggie

Dan Johnson, Cesar Robles and Rose Arias

Elizabeth Beyer and Ariel Zurad

Elyse Santic, Michele Mann and CoreNet Guests

Jamie Fuertes, Lou D'Avanzo and James Love

Paul Darrah, Gina Rizzo and Dale Schlather

Financial technology and management consultancy Capco has signed a lease for a 26,620-square-foot, full-foor space at the Empire State Building (ESB) on the 68th foor, announced building owner Empire State Realty Trust (ESRT).

ESB features than 65,000 square

Supermarket fans, the wait is almost over. Wegmans will make its previously announced Manhattan debut at 770 Broadway on October 18.

The 87,500-square-foot store replaces the Astor Place Kmart (the Wanamaker Building). The Astor Place store will be the second in

feet of amenities that include a tenant-only ftness center.

Jared Horowitz and Jason Perla of Newmark represented Capco in the negotiations, and Shanae Ursini and Jordan Berger of ESRT and Scott Klau and Neil Rubin of Newmark represented the property owner.

New York City.

An extensive restaurant foods selection will be prepared by Executive Chef David Lopatynski and his culinary staff. The onsite dining room, featuring a Sushi Bar and Champagne-Oyster Bar at Astor Place, will open in the frst half of 2024.

PUBLIC STORAGE TO ACQUIRE SIMPLY SELF STORAGE FOR $2.2B

Public Storage has agreed to acquire Simply Self Storage from Blackstone Real Estate Income Trust Inc for $2.2 billion. The acquisition is expected to close in the third quarter of 2023.

The portfolio comprises 127 wholly owned properties and nine million net rentable square feet located across

18 states in markets with high population growth. Approximately 65% of the properties are in Sunbelt markets. Public Storage will integrate 25 more properties into its third-party management platform.

Eastdil Secured served as fnancial advisor to Public Storage, and Wachtell,

Lipton, Rosen & Katz and Hogan

Lovells US LLP acted as legal advisors. Wells Fargo and Newmark Group, Inc. served as lead fnancial advisors to BREIT, and BMO Capital Markets and Sumitomo Mitsui Banking Corporation

(SMBC) also served as fnancial advisors. Simpson Thacher & Bartlett LLP acted as BREIT’s legal advisor.

George Comfort & Sons, on behalf of the 44 Wall St. ownership, has signed lease agreements totaling 18,600 square feet with both existing and new tenants at the boutique Downtown Manhattan tower.

Cities for Financial Empowerment Fund has signed a 10-year lease for

12,000 square feet on the 10th foor. It is relocating within the building from its current 5,600 square feet. Street Smarts VR, formerly a subtenant, is moving to 3,300 square feet on the seventh foor. Also on the seventh foor, new tenant GovExec fnalized a deal for 3,300 square feet, relocating from 61 Broadway.

Multifamily investment management and development frm Cityview has completed Jasper, a 296-unit opportunity zone project adjacent to the University of Southern California.

The highly amenitized, mixed-use community is now open for leasing and offers a variety of studio,

one and two-bedroom foor plans, including 25 units designated very low affordable and three designated moderate income affordable.

Located at 2528 South Grand Ave., Jasper is situated at the nexus of Downtown Los Angeles and University Park East.

Fast casual Mexican restaurant

Qdoba announced plans to double in size over the next decade, opening 40 stores this year, followed by 60 in 2024 and 80-plus annually beginning in 2025. The company currently has 750 restaurants in 45 states.

Qdoba sold 77 company-owned

restaurants to existing franchisee, North Fork Fresh Mex, which now operates 97 Qdoba restaurants in Missouri, Illinois, Indiana, Kentucky and Virginia. North Fork has also committed to build 73 new restaurants over the next seven years. Qdoba is currently 80% franchised with 85 franchise partners in the U.S.

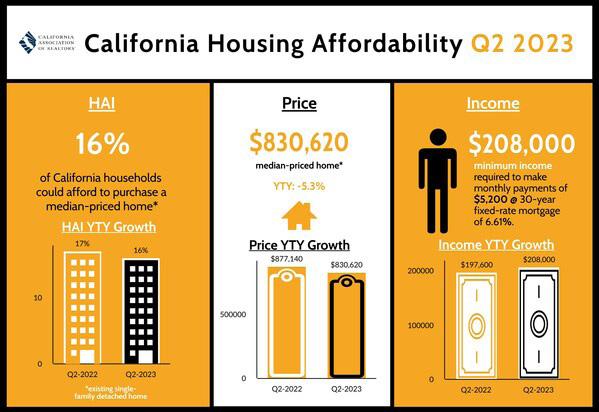

Housing affordability in California during the second quarter of 2023 slid to the lowest level in nearly 16 years as interest rates stayed above 6% for the third straight quarter and home prices remained elevated by a shortage of homes on the market, reported the California Association of Realtors (CAR).

Fewer than one in fve (16%) home buyers could afford to purchase a median-priced, existing single-family home in California in second-quarter 2023, down from 19% in the frst quarter of 2023 and down from 17% in the second quarter of 2022, according to CAR’s Traditional Housing Affordability Index (HAI).

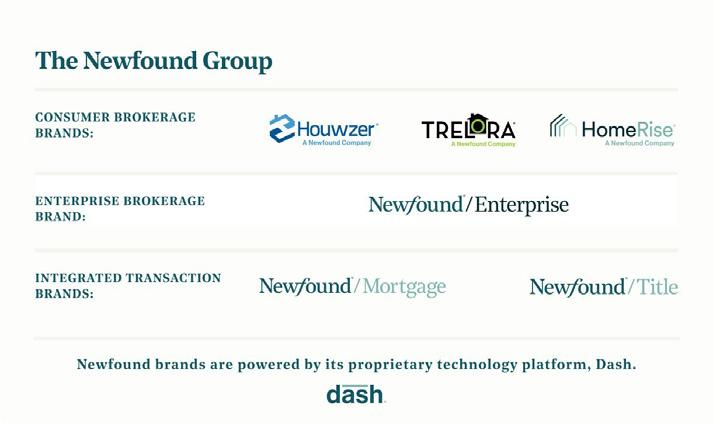

One-stop-shop real estate brokerage Houwzer announces the creation of its parent company, Newfound, which will leverage Houwzer and Trelora’s national network of salaried agents and its full-service, 1% listing model that it said has saved thousands of customers hundreds of millions in commissions.

The company is launching a suite of product lines designed to address the needs of a rapidly evolving real estate market. Among Newfound's introductions are HomeRise, a national, 'fat-fee DIY' listing platform and Dash, a transaction management platform that streamlines transactions for all parties.

The Loren Group, a hotel and residences brand, offcially broke ground

The Loren at Turtle Cove, continuing its international expansion in Turks & Caicos. The location is situated in a private cove on Grace Bay, a refection of the brand's growing demand for residences and hotel projects with naturally inspiring surroundings.

Berkshire Hathaway HomeServices (BHHS) EWM Realty has been appointed the exclusive sales team of 7918 West Dr. in Miami’s North Bay Village, developed by Malaysia-based Pacifc & Orient Properties LLC. Mirna Zarate, Zenaida Figueroa and Gasper Mavric are the exclusive sales agents.

The 21-story condominium, which broke ground in February and is slated for completion in the frst half of 2025, comprises 54 generously sized residences on the Intracoastal Waterway, marked by unobstructed vistas of Biscayne Bay and the surrounding city. Pricing currently starts at $2.2 million.

Following recent expansions in Italy, Greece, Portugal and Mexico, luxury brokerage Nest Seekers International has expanded to Spain with an offce in Mallorca. The new Spanish hub will broaden its reach to include some of the region's most desired destinations, including Menorca, Ibiza and Formentera.

Nest Seekers’ expansion into the Spanish market is driven by the surge in American interest in the country's real estate. Fueled by the strength of the dollar, increased direct fights and beautiful properties, American sales have soared with growing interest in Andalusia, including Marbella, Málaga and Seville.

The Westchester County Industrial Development Agency (IDA) voted fnal and preliminary approvals of fnancial incentives for two residential developments in White Plains — Armory Plaza and Modera White Plains. The two projects together represent a total private investment of $121.5 million.

The IDA voted fnal approval of fnancial incentives for a $32.3 million renovation of Armory Plaza. Project developer The Related Companies is seeking to redevelop the 52-unit senior apartment complex which is located 35 South Broadway. Built in 1909, the four-story castle-like property is 100% affordable.

Leap Analytics Inc., a fntech real estate investment frm, has launched educational training sessions for commercial realtors on how to utilize Home Equity Agreements (HEAs) to activate capital locked in commercial real estate investments.

Leap now provides online, on-de-

mand and in-person training for commercial agents on how small business owners and homeowners can leverage the equity in their existing properties for growth. It will educate and train commercial agents on its Leap Revive product, an HEA designed to support the capital needs of small businesses.

HOME FRANCHISE CONCEPTS INTRODUCES LIGHTSPEED RESTORATION

Home Franchise Concepts, a platform of franchise brands in the home services sector, is launching Lightspeed Renovation, the latest entrant in the $210 billion restoration market. Lightspeed Restoration provides 24/7 service from highly trained technicians to address water and fre damage restoration as well

as indoor air quality (IAQ) improvements for residential and commercial properties.

Lightspeed Restoration is making its debut in Lexington, Kentucky, Mobile, Alabama and Covington, Louisiana. Plans call for rapid expansion, with territories available across the U.S.

NYCHA, NYSERDA AND NYPA TEAM FOR THE INDUCTION STOVE CHALLENGE

The New York City Housing Authority (NYCHA) — with the New York State Energy Research and Development Authority (NYSERDA) and the New York Power Authority (NYPA) — signed an agreement for the Induction Stove Challenge. The program, expected to launch this fall, will be supported by NYSERDA and NYCHA as a competi-

tive challenge that calls on appliance manufacturers to design and produce energy-effcient, electric cooking systems to replace existing fossil fuel stoves while avoiding costly electrical upgrades in NYCHA buildings.

NYCHA, NYSERDA and NYPA will establish performance criteria and

product specifcations for the stoves. NYPA is expected to issue a Request for Proposal (RFP) later this year to select one or more manufacturers and will support the design and testing of the new stoves. Once proposals are selected for awards, NYSERDA will support the purchase, installation and testing of 100 stoves as a pilot.

Fitwel announced the latest cohort of companies to join its global community of Champions, Providers and Partners.

MetLife Investment Management, Manulife Investment Management and The Green Cities Company have signed on as dedicated Fitwel

Champions. Joining current Fitwel Providers Brightworks Sustainability, and JLL, among others, are CD Sonter Ltd., BranchPattern and Sustainable Investment Group.

HXE Partners (a Morrow Sodali Company) and Trane Technologies renewed commitments as Partners.

Turnbridge Equities (Turnbridge) and affliates of Dune Real Estate Partners LP (Dune) announced that their Bronx Logistics Center project has received a formal Precertifcation Letter from the U.S. Green Building Council (USGBC) designating the project with a LEED v4 Platinum rating, the highest LEED certifcation

currently available.

The designation makes Bronx Logistics Center the East Coast’s frst distribution warehouse with a LEED Platinum rating, with only nine other distribution buildings throughout the entire United States achieving the USGBC’s highest rating.

Erlanger Health Inc. has partnered with Realty Trust Group (RTG), a full-service healthcare real estate advisory and services frm, to manage its 1.6-million-square-foot real estate portfolio.

Based in Chattanooga, Tennessee, Erlanger is a six-hospital system that

treats more than 600,000 people annually, with facilities spanning East Tennessee, North Georgia and Western North Carolina.

Erlanger selected RTG to provide comprehensive real estate portfolio management, including property management, strategic planning support, lease

administration, fnancial management and maintenance support services.

With the addition of Erlanger, RTG has expanded its portfolio management platform to nine health system client relationships, totaling over 19 million square feet of healthcare facilities managed.

JLL has launched JLL GPT, the frst large language model purpose-built for the commercial real estate (CRE) industry. Developed by JLL Technologies (JLLT), the technology division of JLL, the bespoke generative artifcial intelligence (AI) model will be used by JLL's 103,000-plus workforce to provide CRE insights to clients in

RentSpree, a rental management software provider, has partnered with OneKey MLS, the largest multiple listing service in New York, to bring its services to the organization’s more than 50,000 members.

RentSpree’s full integration on the OneKey MLS platform will facilitate

a whole new way. JLL's extensive in-house data will be supplemented with external CRE sources, and the company plans to offer made-to-order solutions to clients later this year.

JLL GPT allows the company to extend its technology strategy into the generative AI era.

the instant creation of an ApplyLink for rental listings, which supports members in generating more leads, cutting down transaction time and increasing returns. The new integration makes it easy by allowing OneKey members to command the entire rental process easily and effciently.

Zillow Group's new-construction listings will soon be automatically syndicated to Redfn, connecting home builders with motivated buyers on both platforms. The strategic partnership will dramatically expand the reach of home builder listings on Zillow and allow Redfn customers to explore a broader range of new-con-

struction homes for sale.

Home builders will also market their new-construction communities to Redfn’s customer base of 50 million monthly visitors. Builders partnering with Zillow will begin to see their listings and communities syndicated to Redfn in the fourth quarter of 2023.

Mount Sinai New York–Concierge Care is a membershipbased medical practice that has brought the worldrenowned care of the Mount Sinai Health System in New York City, here to you in The Palm Beaches.

Our new concierge program o ers an outstanding patient experience and access around the clock. Our members receive comprehensive primary care, cardiac and dermatology assessments, and nutritional counseling, as well as amenities you would not find in a typical medical practice, such as home visits, urgent care, coordination of specialist care, travel medicine, and much more. Members will also have access to Mount Sinai’s Hudson Yards concierge practice in New York.

Most importantly, you gain access to the full resources of the Mount Sinai Health System, for all of your health care needs. This is the health care experience you have been looking for.

Learn more at mountsinaiconciergecare.org

To inquire about membership, please call 561-328-7112.

Plentifc, the fully integrated, real-time property operations platform for multifamily property repairs, has added a comprehensive Compliance Management Solution.

The Compliance Management Solution is customizable to help property management teams securely track

all local, state and federal requirements in a single platform. Designed to reduce the risk of citations, litigation violations and fnes while ensuring resident safety, the system encompasses all inspections, license renewals, renovation and rehab projects and administrative requirements in an online system.

Restb.ai, a provider of artifcial intelligence (AI) and computer vision solutions for the real estate industry, announced a strategic partnership with Bradford Technologies, a provider of solutions for valuation professionals. Restb.ai's advanced computer vision and machine learning technology will be integrated into

Bradford Technologies' report quality control processes.

Integrating Restb.ai's AI technology with Bradford's solutions aims to automate and bolster quality control processes, including detecting image issues such as out-of-focus images and other problematic content.

PLUNK UNVEILS AI - POWERED HOME ANALYSIS FOR REAL ESTATE INVESTORS

Artifcial intelligence (AI)-powered home analytics platform Plunk has launched Plunk Pro for real estate investors, advisors and analysts. Plunk tracks over 104 million homes nationwide to give users the comprehensive home valuation data in real time, in addition to predictive home investment analysis and risk assessment.

Designed for individual users and small teams, Plunk Pro provides real-time access to: Plunk Home Value, a proprietary, dynamic valuation model, updated in real time; Plunk Refned Value, a user-generated valuation; Home Compare, which evaluates how a home compares to others in the neighborhood; Plunk Remodel Val-

ue, the future fully remodeled value of a home; market insights including real-time market access to data including median days on market, price per square foot and more and project recommendations on improvements.

Plunk’s home analytics are also available for enterprise customers via API.

HUDSON

Counsel to Related Companies and Oxford Properties Group in connection with the development of and all leasing activities at the 26-acre Hudson Yards on the West Side, the largest private development in Manhattan since Rockefeller Center.

Counsel to Google in connection with its US$2.4 billion acquisition of Chelsea Market in New York City.

Counsel to BlackRock in its 850,000square-foot lease for its planned headquarters relocation to 50 Hudson Yards.

Counsel to Brookfield Property Partners on all aspects of the development of Manhattan West in the Hudson Yards District, including its recent lease to the National Hockey League.

Counsel to Vornado Realty Trust and Related Companies on the redevelopment of Penn Station, including the redevelopment of the James A. Farley building and construction of Moynihan Train Hall.

Counsel to J.P. Morgan, as lead lender, in its US$900 million construction loan syndication to Extell Development for the development of Central Park Tower.

Counsel to SL Green Realty Corp., including all zoning approvals, in connection with the development and leasing of One Vanderbilt Avenue, an iconic 1,401-foot tall, 1.7 million square foot office tower being constructed on the full block to the west of Grand Central Terminal.

Counsel to Maefield Development in its approximately US$1.5 billion acquisition of the EDITION hotel, retail, and signage project known as 20 Times Square.

Counsel to JP Morgan Chase in connection with various aspects of its planned 2.5-million-square-foot headquarters redevelopment at its 270 Park Avenue location.

“An extremely talented real estate group with an impressively deep bench: the team is ideal for handling the most complex matters.”

— Chambers USA

Arc'teryx, a Canadian outdoor apparel and equipment chain, has opened a new location at The Gate at Manhasset in Manhasset, New York. The Arc’teryx store occupies a 3,900-square-foot space.

The new store at The Gate represents the company’s ffth retail

location in New York state, as the brand continues to expand globally.

Positioned at the focal point of Manhasset’s Miracle Mile, The Gate at Manhasset is located just 1.5 miles north of Interstate 495, near the corner of Northern Boulevard and Searingtown Road.

Green Street, a provider of actionable commercial real estate intelligence and analytics, has partnered with Snowfake to engage with its Data Cloud to deliver real-time U.S. and pan-European commercial real estate intelligence in an easily accessible format.

“Green Street is committed to deliver-

ing seamlessly connected commercial real estate data, analytics, research and news on both the public and private real estate markets in various formats,” said John Guilfoy, chief product offcer for Green Street. “This collaboration gives clients yet another means to easily extract extensive time series data and predictive analytics –

such as cap rates, market grades, and forecasts — and seamlessly integrate them into their own company models, internal systems and daily workfows.”

Some key Snowfake capabilities include real-time updates and integrations with BI/dashboarding tools, internal databases and more.

MRA Group, a privately held real estate development and client services frm, has secured $63 million in additional debt for the ongoing redevelopment of Chestnut Run Innovation & Science Park (CRISP), the 164-acre, 14-building applied sciences hub in Northern Delaware. Fulton Bank in conjunction with Nu-

veen Green Capital through C-Pace fnanced $50 million, while the remaining $13 million was provided by WSFS Bank.

The utilization of C-Pace fnancing via Nuveen is a frst for MRA, which will use the funds for the continued redevelopment efforts at CRISP.

Understanding tax planning can be a taxing experience. It requires a dynamic knowledge of everchanging codes and regulations, plus a deep understanding of your individual needs and goals.

That’s where Janover comes in. We get to know both you AND your business. We then leverage our knowledge of the system to tailor a detailed tax plan that is unique to your specific needs.

At Janover, our greatest value is the ability to help you look at the whole picture - numbers, family, business. You’ve worked hard to have it all... wouldn’t you like to keep it?

Newmark Group Inc. has expanded its Capital Markets services with the launch of the Data Center and Digital Infrastructure practice group, further expanding its expertise in alternative assets. Newmark has hired Brent Mayo as executive managing director to anchor the practice group.

Mayo, based in Newmark's New York City headquarters, specializes in capital formation, fnancings, asset sales and platform advisory. He will work with Newmark’s Capital Markets advisors on capital formation, fnancing and asset and portfolio sales and alongside the frm’s Data Center Consulting Group advisors.

OneKey® MLS is the one source real estate marketplace for monthly statistics for residential real estate transactions from Montauk to Manhattan, north through the Hudson Valley and the Catskill Mountains.

The Greater New York region saw the number of residential sales

Curbio, the pre-sale contractor solution for realtors and their listing clients, announced its expansion into Sarasota, Florida. With this expansion, Curbio will begin helping Sarasota-area real estate agents and their clients get all their listings ready for market reliably and sold for top dollar amid an increasingly

slow, but prices rise in July, according to OneKey MLS. The New York regional closed median sale price of $633,000, was a 3.40% increase compared to June 2023. Year-overyear, the closed median sale price rose slightly as well, increasing 2.10% from the $620,000 reported in July 2022.

competitive housing market.

Curbio partners with real estate agents to complete pre-listing home improvements. Curbio works with agents to determine what updates will generate the highest ROI for sellers, and then acts as the licensed and insured contractor.

We get down to banking, so you can get down to business. Commerical Banking with TD Bank.

We may be one of the 10 largest banks in the U.S., but we never lose sight of the individual. Our Relationship Managers personally get to know your business, taking the time to understand your unique needs before o ering their custom solutions. And with over 150 years of industry experience, you won’t just like working with us. You’ll love it.

tdbank.com/commercialbanking

Bonnie Heatzig is the Director of Luxury Sales for Douglas Elliman and rated nationally as the top 1% of real estate agents nationwide with over 1 Billion Dollars in sales. She ranks among the most elite agents in South Florida thanks to her unparalleled knowledge of the ultra-luxury real estate market, especially in Boca Raton.

What truly sets Bonnie apart is the fact that she is a licensed attorney, making her able to navigate even the most complex contracts with ease and finesse. Bonnie approaches every deal with a deep sense of empathy and a genuine desire to help her clients Her ability to build strong and lasting relationships is a testament to her exceptional interpersonal skills and her unwavering commitment to providing the most personalized, ultra-exclusive services

For over 30 years, The Dermot Company, a vertically integrated multifamily investor and operator, has grown to become a market leader, with a portfolio that includes over 6,000 apartments on the East Coast, from New York to Florida. With o ces in New York City and West Palm Beach,

Florida, Dermot owns and/or operates 21 luxury communities across New York City and Florida.

But what truly sets Dermot apart, the company said, is its “people-first” perspective that guides its company culture, investment portfolio, property management and commitment

to residents and dedication to excellence in every aspect of the business. The factors guiding the business, said CEO Stephen Benjamin, are investment standards, resiliency and sustainability.

“It is critical that we treat every dollar in our possession as our own,” said Benjamin.

“We take nothing more seriously than being a good steward of our investors’ capital as we identify opportunities to outperform the market and deliver superior investment returns for them.”

The company was founded outside San Diego, California in 1991 by William Dickey,

and named for Dickey’s father, Dermot. When Dickey and his wife moved back to their native New York a decade later, so did the company. Dickey sold the company to Benjamin and his two partners, Andrew Levison and Drew Spitler, in 2015 and is now happily retired. Meanwhile, Benjamin, Levison and Spitler, have built a leadership team to lead the company into the future.

“When we bought Dermot from Bill in 2015, it was just Steve, Drew and I and about 20 people across both the corporate o ce and the on-site teams,” recalled Levison, partner, chief operating o cer and managing director.

“We had five properties and assets under management (AUM) of approximately $1 billion. We had recently successfully sold o most of our portfolio as part of Bill’s retirement and

had shrunk to our smallest size in many years. From that base, we have grown the company over the past eight years to include nearly 100 people, 21 properties and AUM of about $4 billion. Our goal now is to double in size over the next five years.”

Levison, who joined Dermot in 2011, has played a pivotal role in transforming Dermot’s approach to acquisitions and asset management with a focus on acquiring and developing younger properties with a value-add component, as well as expanding its roster of investment partners. Dermot’s strength, he said, lies in a deep understanding of its specific submarkets.

“We look at everything that comes across our desk, but that doesn’t mean we’re interested in everything,” he

said, adding that the company’s belief that integrating ESG practices enhances resident experience and lowers operational costs for partners. “It has to be good for employees, good for residents and good for our investments simultaneously.”

A key di erentiator, said Luke Pierce, vice

president of investments, is Dermot’s thorough evaluation of potential investments, using a comprehensive approach that combines raw data and analytics on block-by-block geography, building condition, transportation accessibility and area demographics.

Another “lifer,” Partner and Managing Director Drew Spitler, joined the company following his 2002 graduation from the University of Arizona, and was integral to much of its development and investment activity in New York, even as he earned an MBA from New York University in 2008. In 2020, Spitler moved to South Florida to open Dermot’s o ce in West Palm Beach and expand the company’s

reach throughout the Southeast. Dermot has completed over $500 million in investments in both value-add acquisitions and the development market in Florida.

“We know we are ‘new’ to Florida and the Southeast and, despite our success to date, we still have a lot to learn. It’s essential to have

boots on the ground and actively manage our projects locally. We also believe that we bring a unique investment strategy and system informed by our experience in New York City, focusing on critical in-fill neighborhoods, high-quality assets and significant opportunity to add long-term value,” Spitler said.

The intense growth and transformation that is

occurring in Southeast Florida led Dermot to acquire three value-add properties, one each in Palm Beach, Broward and Dade Counties, including Seabourn Cove in Palm Beach County in late 2020. Located in a strong infill area adjacent to Delray Beach, Seabourn Cove’s townhome-style apartments met the renter demand for more space during the pandemic.

“Demographic trends, coupled with a strong pro-business environment in Florida, suggested that a dramatic spike in investment activity was forthcoming, so we acted early and eagerly,” said Spitler.

Dermot paused purchases in the

Southeast in 2022 as prices became too frothy and cap rates dipped below 3%. With the debt markets creating market uncertainty and pricing opportunities in late 2022, Dermot returned, recently acquring The Preserve at Deercreek, a 540-unit multifamily complex in Broward County.

“It’s important to not follow the herd. When the market heads in one direction, we don’t naturally follow. We ask why and then build our strategy around the void that is created,” Spitler said.

“There is an opportunity for us when property is for sale unrelated to the real estate fundamentals. We saw this as assets came to market due to redemption requests and/or a challenging

refinance market.”

The partners have invested heavily in building a high-quality, institutional platform with internal controls, processes and systems that would rival those of much larger money managers. Dermot has developed internal committees to vet and implement company changes that range from accounting procedures, hiring and software implementation to complex engineering feats such as installing a solar panel system on a parking garage roof at a Florida apartment complex.

As ESG (environmental, social and governance) considerations have gained prominence, Dermot

has been a leader in incorporating these factors into their business — at the Pension Real Estate Association’s (PREA) Spring 2023 conference, Dermot received the prestigious Emerging Manager ESG award.

Jane Cohen, who joined Dermot as an assistant property manager in 2010, and is now vice president of operations and leads the ESG program, stressed the importance of Dermot’s comprehensive approach to ESG, integrating it into every aspect of the company's operations rather than treating it as a checkbox.

To that end, Dermot has set forth a goal to reduce its portfolio’s emission load by 40%

THE SEABOURN IN BOYNTON BEACH, FLORIDA IS ONE OF FIVE MULTIFAMILY DEVELOPMENTS IN DERMOT’S GROWING SOUTH FLORIDA PORTFOLIO. (PHOTO BY LUXHUNTER PRODUCTIONS) GROUP PHOTO BY ED LEDERMANby 2030, implementing multiple initiatives within each of its buildings to achieve emissions reductions with the help of multiple partners.

“It’s not like you just install a more e cient boiler and everything's fine,” Benjamin said. “We have to attack the problem on all fronts to find winning solutions.”

Dermot also recognizes that it’s not only about what the company does.

“Our work includes resident responsibility, engaging residents for active management on their own utilities, because the residents are 60% or more of the usage,” Benjamin added.

Incorporating sustainable business practices is not only important for our collective future, but also good for his investors’ bottom line, Benjamin added.

“We are fortunate to have an amazing group of partners who have supported our work over the years because they see that we are committed to our mission and we are consistent.” Benjamin said. “Our primary focus is at the asset level. By building adaptability and sustainability into the company’s DNA, Dermot can seize opportunities that others miss, and navigate challenges with grace and e ciency. In an industry that is constantly facing new challenges, the ability to adapt, recover and thrive in the face of adversity is essential.”

Bringing older NYC properties up to ESG standards presents unique challenges. After acquiring 220 East 72nd St. from a prominent New York family who

had built and owned the asset for over 40 years, Dermot performed upgrades and renovations that increased rental rates and improved energy e ciency and resident comfort. By replacing single-pane windows with high-e ciency windows and transitioning from steam heating to more e cient electrical systems, Dermot reduced energy consumption and contributed to a statewide e ort to electrify heating systems. The company also uses its amenity club to engage with residents, providing information and educational programs on energy use, recycling and sustainability.

The Not-so-little Luxuries

The management platform has also been transformed as the needs of the renters in Dermot’s luxury buildings have evolved to prioritize amenities, said Alissa Hazan, director of portfolio operations and general counsel. These discerning residents appreciate the range of amenities o ered in Dermot properties, including gyms, children's rooms, rooftop spaces, screening rooms and even a golf simulator. Dermot’s programming, facilitated through its amenity club, helps residents form connections and build friendships through events.

At 250 East Houston, Dermot recently partnered with Decorazon Gallery to open a pop-up gallery and commissioned an intricate mural by Guillaume Cornet, where he immortalized five residents and their pets. At 101 West End, local band Fuey brought the house down on the building’s expansive rooftop. At 21 West End, residents sipped on cocktails while browsing a selection of handmade, sustainable jewelry

from a New York artisan, at a Dermot “Sip and Shop” event.

“New York can be an anonymous place where people don’t get to know their neighbors,” said Hazan. “Our residents crave connection, and our unique programming helps facilitate that.”

Navigating the challenges posed by the COVID-19 pandemic was a significant test. Having joined the team in 2019, just before the onset of the pandemic, Hazan had to quickly adapt to both a new job and a new world.

“Many of the challenges were related to the unknown,” Hazan reflected, with teams working tirelessly to address resident concerns and rapidly changing government guidelines.

Frequent communication with residents, suspension of amenity fees and additional cleaning measures were some of the steps taken to support residents during this challenging period. The company also proactively lowered rents to stay competitive in a plummeting market, resulting in a 90% occupancy rate compared to industry averages of 70% or less.

That level of communication also extends to the team itself. Unlike larger corporations and familyowned firms, where individual voices can get lost, Dermot’s “people-first mindset” fosters a supportive and inclusive environment, where employees are recognized for their contributions and given opportunities to grow, the team said. Levison points to Dermot’s focus on talent development, entrepreneurial mindset and absence of typical

bureaucracy as reasons why he has dedicated his career to the company.

Cohen cites the company’s “family-like” atmosphere, where ownership is given to each person, and hard work is recognized and rewarded on an individual scale. The reciprocal relationship between employee and company creates an environment where individuals feel valued and motivated to contribute to Dermot's growth. Similar, she said, is Dermot’s commitment to its residents and the recognition that their homes are “not just business ventures, but personal spaces that require special care.”

Pierce praised the company’s culture, which fosters support, recognition and a sense of belonging, resulting in a high employee retention rate. While Dermot has experienced significant growth during his tenure, Pierce said he believes the company will maintain its supportive and collaborative environment as it continues to expand. Pierce has been at Dermot since the start of his career and doesn’t see himself going anywhere.

“Dermot was a great place when I joined the company, and it’s even better today,” he said.

As the company continues through its fourth decade, Dermot’s leaders recognize that its greatest asset is its team and the high level of service they provide to its residents. With a strong focus on talent development, a supportive company culture and a dedication to ESG, they say, Dermot is poised to continue its growth and deliver exceptional living experiences to residents for years to come.

The most recent IPCC report, entitled “AR6 Synthesis Report: Climate Change 2023,” warned that if the world continues to produce greenhouse gas at the current rate, limiting the global temperature increase to below 1.5°C, the goal set in the Paris Agreement in 2015, will be unachievable. As the World Green Building Council highlighted, buildings are to blame for 39% of global carbon output, with operational emissions making up a significant portion of this figure.

However, with Reuters reporting that 90%

of businesses across the world are small and mid-sized enterprises (SMEs), it’s time to address the lack of support for these organizations and their sustainability strategies to mitigate the e ects of climate change.

It has long been acknowledged that large corporations are responsible for the majority of greenhouse gas emissions. However, this recognition has led to a sector-wide failure to help SMEs improve their ESG credentials. Although SMEs are not at fault, they simply do not have the same access to resources and

education as their larger counterparts.

Sustainable investment in forward-facing solutions is crucial for corporations that need to reduce their carbon output. Asset managers are responsible for decarbonizing their assets under management. However, without the appropriate insights and tools, this becomes almost impossible. So, how can real estate decarbonize?

An Eco-Education

Information is power. A substantial hurdle

preventing smaller businesses from achieving sustainability goals is the lack of access to relevant support and resources.

In 2022, an Organization for Economic Co-operation and Development report titled “Financing SMEs for Sustainability” acknowledged that despite the “significant aggregate environmental footprint” of SMEs, the overwhelming upfront costs, lack of information and uncertain market conditions were key factors preventing action. Lack of access to “non-financial support in the form of training, tools, information, portals, etc.,” which should be a simple fix, is stopping corporations from decarbonizing.

A key hurdle for SMEs is a lack of guidance. Many understand the importance of sustainability, but they must receive practical advice on implementing it into their business plan.

Even ESG experts would struggle to create a successful long-term sustainability strategy without analyzing data from the relevant building or corporation.

There is a wide disparity between ESG data analysis at large companies and SMEs. Democratizing data is the only way for the built environment to move forward toward a more sustainable future. For example, a recent study titled “The

Disclosure

SMEs in Hong Kong” by Angus Yip and William Yu revealed that Hong Kong’s annual ESG reports from SMEs had a low general disclosure quality. They pointed out that, while larger corporations had been reporting their

ESG successes voluntarily for years, SMEs had less knowledge or skills to extract and analyze information.

Why does this matter? With less experience than larger corporations, the SMEs involved struggled to collect the exact information needed for their report. ESG data analysis is fundamental to building a long-term sustainability strategy. By recognizing anomalies and patterns in data, corporations can work out where they could be more e cient, saving money and reducing their carbon footprint simultaneously.

Despite expectations to monitor and report their sustainability statistics, the significant lack of guidance leaves smaller corporations confused about where to begin. In his article “Five Solutions to the ESG Data Gap for SMEs,” Experian’s Director of Strategy and Innovation Scott Harrison noted that only 3% to 7% of SMEs have measured their greenhouse gas emissions despite contributing 33% toward the UK’s carbon output. More needs to be done.

The Solution: Introducing Tech So why should SMEs turn to technology? Which technology will o er long-term success?

A clear example reflecting the benefits of proptech in this space is smart buildings., where sensors collecting data to guide their carbon reduction approach and improve sustainability credentials. According to Market. US’s “Global Smart Buildings Market” forecast for 2023 - 2032, the industry was worth $72.8 billion in 2022 and is projected to hit $304.3 billion in 2032. This projected increase reveals the

growing importance of proptech solutions that can collect and act on data findings, making it easier to create a long-term, data-based ESG strategy.

However, a significant factor preventing the deployment of such advancements is concern about the upfront cost. Research undertaken by Ipsos MORI suggested that 67% of SMEs believed that the “current economic climate” was a fundamental obstacle to lessening environmental impact. An inability to budget for ESG technology can result in a lack of access to the correct information, data and guidance required for decarbonization and adequate reporting.

Leaders of CRE organizations should encourage the use of informative platforms that connect

them to other occupiers, easyto-use ESG monitoring solutions, data analysis and sustainability resources. It is important to consider the money that will be saved with more data-driven ecient energy use. Flexibility is required to cater to smaller corporations, to ensure those seeking to reduce their carbon footprint can make sure their investment is worth the outcome.

Education and data-empowered insights are required to build a strong, long-term ESG strategy. Yet this has been largely unattainable for smaller businesses. Incorporating a platform that gives access to knowledge and insight that helps reduce their carbon footprint, is fundamental to building an eco-friendly future for the built environment.

Artificial intelligence (AI) has experienced a renaissance over the last year. With calls for more stringent regulations, concerns over security and fears over potential job loss, we are left wondering what the actual impact of automation will be.

Well, we already know many of the implications of AI because we have been surrounded by AI-integration for decades.

In commercial real estate (CRE), the benefits of automation are already clear. It has improved customer experience, provided previously inaccessible insights into operations and management and provided a bedrock for sustainability reporting and management in buildings.

This new era of automation was ushered in by the arrival of ChatGPT, as it utilizes a generative AI model. Generative AI models are designed to generate new insights gained from internal or inputted data. This enables predictions to be made based on inputted information.

The rapid advancements driven by the rise of ChatGPT and the integration we have seen across various industries have resulted in rising customer expectations. Those unwilling to try AI-driven solutions risk falling behind.

These models seek to learn the underlying patterns and relationships, using this knowledge to generate new data points. This means that the longer the system is in place, the less manual data entry is necessary. It improves accuracy while also saving time from repetitive data entry.

For CRE owners and operators, this has had a seismic impact on the level of e ciency when compiling insights and data points. At NextRivet, we are focused on digital innovation opportunities, and our expansive network of solutions has provided us a front-row seat to see just how automation has reoriented the CRE industry.

Changing Customer Expectations?

AI-powered services such as chatbots have made good customer service easy and

a ordable. The benefits are twofold. Customers have access to round-theclock support, and CRE owners have access to limitless amounts of data to make personalized marketing recommendations.

Virtual assistants and chatbots are affordable solutions for providing enhanced customer support. By implementing these services, CRE operators can make it easier for customers to access support wherever they are. Previously, you would have to phone into a help desk or find the physical location to have questions answered. Now, with increasingly advanced AI tools, customers can access support anytime and anywhere.

With increased support comes increased expectations. Advancements in AI have raised customer expectations as they allow CRE owners and operators to tailor the customer experience. Algorithms analyze customer data to provide personalized product recommendations, o ering more e ective returns on marketing investments. It also means increased customer satisfaction, as they are no longer bombarded with irrelevant information.

Considering the tailored response provided to consumers in venues improved by AI, those choosing not to integrate AI into their operations will find it di cult to remain competitive. As customers across a variety of industries become accustomed to the ease of chatbots powered by generative AI and personalized marketing recommendations, competitive advantage will come from your ability to capture, analyze and utilize personalized customer data at scale.

NextRivet is located in Silicon Valley. This has given us unique access to see the groundbreaking advancements coming out of technology companies, while also working with CRE clients who are integrating these solutions. For those companies unable to take advantage of these new

solutions, customer retention will be extremely di cult.

The Risks of Avoiding AI

Managing and operating commercial real estate is both time- and cost-intensive. And predicting customer requests and ensuring safety is di cult without the proper analytics infrastructure. AI enables you to make data-driven decisions that allow you to allocate resources based on previous reports and findings.

Customer analytics have become a key resource for better understanding tenant preferences, and in turn, their expectations. AI is vital to improving this aspect of operations. The data analyzed and processed by AI can come from a variety of sources, including cameras, Wi-Fi network logins and web forms. This helps owners and operators understand customer and tenant preferences, allowing them to optimize building layouts.

Another key feature of AI that can vastly improve the e ciency of operations and management is video analytics. We speak to many operators who are finding one of the core components of customer and tenant demands is optimized security and surveillance measures.

AI-powered video analytics ensure security, notifying operators of anomalies in activity. This provides enhanced safety to tenants and customers while improving the e ciency of management and operations. Automation also improves access control in buildings, a core way to ensure that only authorized people are able to enter certain areas of buildings.

AI-driven solutions o er key customer analytics, real-time monitoring and enhanced security. This enables the CRE industry to maintain operational e ciency and reduce risk.

Sustainability reporting has become a

requirement for those managing and operating real estate portfolios. AI integration can provide immense support both with reporting, as it gathers data, and with alerting owners to energy-intensive operations.

AI's predictive maintenance and energy management capabilities are remarkable. By monitoring data from HVAC systems, lighting and elevators, they empower owners to identify environmentally costly operations. Additionally, AI forecasts maintenance needs by analyzing historical data and usage patterns, optimizing resource e ciency.

With vast data generated by CRE properties, traditional reporting methods can be overwhelming. However, if we use AI adeptly, it can automatically collect, organize and interpret information. This enables the e ortless compilation of transparent reports on buildings' environmental impact.

The transformative potential of AI in greening CRE operations is profound. By aligning sustainability reporting and predictive energy management, AI empowers stakeholders to make informed, ecoconscious decisions. By adopting AI, you can become a leader in sustainable CRE management, redefining the standards of responsible real estate.

The integration of AI is a necessity for commercial real estate owners to remain competitive. AI-driven solutions have already demonstrated their transformative impact, from revolutionizing customer service with chatbots and personalized marketing to optimizing operational e ciency through data-driven decision-making.

As customers' expectations evolve with the adoption of AI-powered services, those who fail to integrate these solutions may struggle to retain their base.

In today's digital age, where visual content plays a vital role in engaging audiences and conveying messages e ectively, video production has become an indispensable tool for businesses. Recognizing this, companies are adopting content studios within their o ces. These facilities allow brands to create high-quality video content inhouse, enabling greater control, flexibility and cost e ciency.

Because content plays such a critical role in engaging audiences and driving business success, having a dedicated space for content creation allows organizations to stay competitive, build a strong brand presence and strengthen connections with their target markets.

Having an in-house studio provides immediate access to resources,

talent and equipment, eliminating the need for outsourcing and providing faster turnaround times. Companies can also maintain control over their content, which is crucial for protecting sensitive information and intellectual property. With the rise of video as a preferred medium for communication, these facilities enable companies to stay ahead of the curve and produce thoughtful

content that resonates with their target audiences.

Newsrooms have long been at the forefront of video production, and their influence on corporate studios is evident. Newsroom environments are characterized by fastpaced operations, collaborative workflows and the ability to adapt to rapidly evolving stories. These elements have translated well into

corporate studios. Newsroom practices, such as multi-camera setups, real-time editing and live broadcasting capabilities are now being integrated into corporate production facilities. This enhances the agility and responsiveness of companies in delivering video content that captures the attention of their internal and external audiences.

By having a studio within their offices, organizations can foster a culture of innovation and collaboration among their employees. The physical space itself, with its professional equipment and versatile sets, inspires creativity and empowers thinking outside the box. The studio environment encourages experimentation. With a dedicated content studio, businesses can unleash their creative potential and produce powerful material that sets them apart from competitors.

These spaces facilitate the production of internal communications, such as training videos, onboarding materials and executive messages. They also support external communication e orts by generating marketing videos, product demonstrations and customer testimonials. Additionally, live streaming and webcasting capabilities allow

companies to broadcast events, town halls and conferences to a wider audience. With virtual reality (VR) and augmented reality (AR), companies are even leveraging these studios to create immersive experiences and interactive content that captivates their stakeholders.

In today's fast-paced digital landscape, companies need a constant stream of content in order to keep their audience engaged. In-house studios enable companies to produce content quickly and consistently, allowing them to maintain a strong online presence, attract new customers and nurture existing relationships. The ability to generate high-quality content on demand ensures that companies remain relevant in their industry and seize opportunities in real time.

Content studios also facilitate multichannel distribution by producing material that’s tailored to di erent platforms such as YouTube, Instagram, Facebook and TikTok.

Brands today recognize the power of storytelling to connect with their audiences on an emotional level. By harnessing the facility's capabilities, businesses can create

clever narratives that showcase their values, culture and unique selling propositions. Through visually captivating content, brands can build awareness, foster loyalty and differentiate themselves.

With an in-house content studio, companies can maintain strict control over their brand image. External agencies may not fully capture the company's values, tone or visual style, leading to inconsistencies in the content produced. Companies can also respond swiftly to any changes in strategy.

Designers play a crucial role in incorporating video production studios seamlessly into corporate o ce plans. Studio design focuses on building a conducive environment for creativity, collaboration and productivity. This involves considering factors such as acoustic treatment, lighting control, versatile sets and ample space for equipment and personnel. Designers also ensure that the studio integrates harmoniously with the overall o ce layout. By designing studios that are functional, visually appealing and adaptable to evolving needs, designers facilitate the smooth operation of content studios within corporate o ces.

Outsourcing content production can be costly, with expenses such as hiring external agencies, renting equipment and covering travel expenses. However, by establishing an in-house production studio, companies can significantly reduce these costs. Initial investments in setup and equipment may be required, but in the long run, it’s invaluable.

External production arrangements also often come with limitations and rigid timelines. By having an in-house content studio, companies gain flexibility and agility in their content creation process. They can quickly adapt to changing requirements, adjust their strategies and respond promptly to market trends. The ability to control every aspect of the production process ensures that companies can iterate, experiment and refine their content within their own timelines.

Content studios within corporate o ces have emerged as game-changers in the modern business landscape. By creating diverse types of content, leveraging newsroom environments and incorporating e ective storytelling techniques, these facilities empower brands to engage audiences, strengthen internal communications and drive business growth.

Introduced in the early 1990s, smartphone technology steadily gained traction in the early 2000s and, consequently, our lives have become more integrated with this pocket-sized tech. According to a 2021 Pew report, 85% of American adults now have smartphones, with more devices in the hands of those who are younger. In fact, 95% of adults between 30 and 49 have smartphones, with that number reaching 96% for those aged 18 to 29. It’s not uncommon for even pre-teens to have some limited use of phones.

Most of us now never leave home without our smartphones, and this

Integrating smart property technology (proptech) into multifamily properties — including co-ops, condos and gated communities — doesn’t have to break the bank. Newer systems and technologies can consolidate and streamline services by using smartphones.

As technology transforms residential living, spending on smart tech — which eclipsed $79 billion in 2022 — is forecast by Grand View Research to reach nearly $540 billion by 2030. Younger residents now expect such services to be o ered in their buildings while older residents are more inclined than ever to request the conveniences.

A 2019 National Apartment Association (NAA) survey found 84% of respondents who did not yet have smart home technology said they would like to see some smart features implemented in their apartment communities. And tech usage is on the rise with an astounding 22 connected devices in the average household, according to Deloitte’s 2022 Connectivity and Mobile Trends Survey.

The rise of property technology has created an opportunity for owners and managers to research which services and systems would be welcomed by their residents while balancing costs and

what can integrate with legacy systems.

Proptech can positively impact the operations of multifamily properties by ensuring they are not left behind as competitors are digitized. But when prioritizing smart home tech solutions, property managers and boards should select options that will enhance the residents’ experience and support the retention of their tenants/owners.

Smart home solutions that leverage both existing systems and tools — like the ever-present smartphones already being used by residents — should be high on the list of must-haves.

now very powerful device has become the central hub for our daily lives. It makes sense to integrate the smartphone with multifamily properties so residents can take advantage of smart home living. Many residents and owners are using their smartphones to access their o ce buildings and hotel doors, amenities and elevators when traveling.

Forget key fobs — the newest entry systems let residents use their phones as a modern, keyless option for main entryways and shared spaces like gyms, pool gates and common areas. Residents no longer need juggle what they are already holding to find multiple keys.

Smart access control solutions also allow residents to both create and share either a one-time digital key for a friend or generate recurring digital keys for those who visit on a regular basis like dog walkers and cleaning professionals, while

also limiting the days and hours such remote “keys” will work.

Many new systems also put the residents in control over who has access to their private spaces and when — thus taking the property manager, super or doorman out of the equation and enabling the residents to manage their homes remotely. For shared spaces, boards and property managers should also consider systems that can be flexibly integrated with partner systems that enable residents to also digitize their individual door locks.

Putting the resident user’s experience first and foremost can enable boards, owners and managers to prioritize proptech needs and choose the tech that will have the most positive impact.

While weighing smart tech solutions, consider how each o ering can also

create property management eciencies by eliminating common and time-consuming tasks such as replicating and accounting for keys, storing and tracking packages or scheduling maintenance requests.

Enabling keyless entry using smartphones, for instance, means less time taking deposits for key fobs or cutting keys while allowing residents seamless access to their building. Any keyless entry system should also enhance security and eliminate site visits for lockouts.

For property owners with existing legacy technologies, the ability to integrate with and implement new tech could become a complete game changer at a nominal cost. It's important to consider both the platforms and tech that residents are already using to implement easy, cost-e ective solutions that can integrate with those devices easily.

The newest solutions like Nimbio are cellular-based, whereas older systems either require a less reliable and less secure Wi-Fi connection or costly direct wiring through phone lines or fiber optic lines.

In addition to dependability, multifamily owners, property managers and condo/co-op boards nationwide tout the safety of smartphone access and the significant enhancements that come with the elimination of community-wide access codes. Many have cited situations where security codes were discovered written directly on doors or gate entry/call boxes. Unique digital keys prevent unsafe sharing of codes and a 24/7 access log for each entryway is available.

The rapid rise of smart innovations can seem overwhelming, but if you ask the right questions, prioritize your residents’ requirements and work within your existing infrastructure, you can find a solution that can be integrated while future-proofing your facility for years to come.

Despite laws requiring regular inspections, falling debris from defective building façades continues to present hazards for pedestrians on the streets of New York City. Multiple cases of falling masonry have resulted in serious injuries and even deaths in recent years, and sidewalk sheds erected to protect those walking on the streets below are a common sight.

The New York City Department of Buildings (DOB) has responded by tightening its façade inspection rules. The Façade Inspection Safety Program (FISP), previously Local Law 11/98, requires façade inspections every five years for all buildings taller than six stories.

Inspecting and maintaining façades can be complex and costly for owners and managers of pre-War buildings. These buildings often have terra cotta or limestone architectural features that are over 100 years old – the normal lifespan

for materials that are naturally brittle and vulnerable to weathering and deterioration. Many of these decorative and functional elements are failing, resulting in buildings being classified as “Unsafe,” or “SWARMP” under FISP.

Steven Kratchman

Architect PC has been helping building owners repair and maintain historic façades and protecting those on the streets below. Our work has included FISP façade inspections and reports, such as for 480 Park and at 25 East 9th St., including handling DOB approvals for terra cotta restoration and composite replacements for projecting decorative railings.

Architects have been using terra cotta to beautify building exteriors for centuries. Its popularity in America grew in the late 1800s, and buildings with elaborate glazed terra cotta ornamentation became commonplace in Manhattan

neighborhoods.

Some of the tallest buildings were 10- to 30-story commercial structures that were later converted into residential or hotels. The Flatiron Building and the Woolworth Building are two well-known examples of large structures built in the city during terra cotta’s heyday, from the 1880s through the 1920s.

At the time, terra cotta’s

reputation as a waterproof, low-maintenance material sometimes led to faulty design and installation that allowed water to penetrate. The expansion and rusting of steel anchors caused terra cotta units to crack and chip, and serious waterrelated structural failures resulted from the deterioration of mortar and masonry backfill. By around 1930, faith in terra cotta’s durability — and its popularity — had waned.

The DOB estimates there are 14,500 buildings in the FISP “universe,” and terra cotta is one of the top three concerns when it comes to façade failures. Although regulations, improvement techniques and technology are all evolving, compliance is often challenging for building owners, engineers and architects. FISP requires building owners to keep up with required inspections and

STEVEN KRATCHMAN, FOUNDER AND OWNER OF STEVEN KRATCHMAN ARCHITECT, PCcover the cost of mandated repairs. However, the program’s complex details often result in missed inspections and expensive penalties for failing to correct issues.

Despite these challenges, building owners must focus on the benefits of façade maintenance and repair, often taking a building from being “Unsafe” (non-compliant) to “Safe.“

Buildings with landmark designations may encounter additional hurdles. For instance, the Landmark Preservation Commission has not approved the use of fiberglass, a lightweight material that is a great option for hard-to-getto locations. Prior to this ruling, our firm used fiberglass on the tenth story, and cast stone to replace façade sections of the Corn Exchange Bank Building at 140 Fifth Avenue. The landmark building had an “Unsafe” inspection report due to damaged terra cotta detailing. Selective fiberglass use helped us maintain the historical design aesthetics, which was paramount.

That said, when possible, original material should be replaced to keep the visual integrity, as was the case with our terra cotta and precast concrete repairs for the Harmonie Club, the city’s second-oldest social club. The extensive renovation of the landmark Beaux-Arts

building, designed by Stanford White in the early 1900s, included repointing and replacing damaged terra cotta units and cleaning and repairing the limestone base. The façade now showcases the classic design as it was originally envisioned.

Utilizing Technology Building inspection teams and façade experts are now embracing technology to develop new techniques for improving both the inspection and restoration process, including:

• Installation improvements, new anchoring and waterproofing construction methodologies and installation techniques that help prolong terra cotta’s lifespan.

• 3-D Mapping. We work with digital imaging companies to measure the architectural characteristics of a building, allowing us to cast replacement pieces that are 100% accurate.

• Drones aid human building inspectors by easily accessing hard-to-reach places where deterioration has taken place. New York City laws prohibit most drone flights, but the DOB is examining the use of drones for façade inspections.

With its diverse colors, textures and shapes, terra cotta is experiencing a global resurgence in contemporary applications ranging from cladding to rain screens. When our team designed a groundup, 24-story luxury residential building at 200 Eleventh Avenue

in Chelsea, terra cotta cladding was used to pay homage to the neighborhood’s industrial past. We found it critical to improve the anchoring and waterproofing systems to enhance durability for this ultra-modern building known for its “garages in the sky” — attached garages for each unit that

provide the ultimate in privacy for celebrity residents.

Advances in technology will continue to help architects and engineers create safer buildings, and they may be instrumental in helping the industry take a proactive role in preventing safety issues.

THE HARMONIE CLUB FAÇADE AFTER RESTORATION, MADE WITH TERRA COTTA AND PRECAST CONCRETE.Whether it is hybrid or full-time, employees are returning to the o ce and business owners are looking for ways to make that return more enticing.

In addition to improving facilities to be safer, healthier and more ecologically friendly with programs like LEED, Well and Well HealthSafety Rating certifications, building owners and operators are taking the opportunity to make their facilities more aesthetically pleasing.

One popular renovation project is updating lobbies of existing structures to bring in more natural light with the addition or replacement of windows. This one step can help modernize a building’s appearance and in general, make the o ce environment more