ICONS OF INDUSTRY Q&A: FINANCE LEADER JAMES OHRN REFLECTS ON CAREER, CONTRIBUTIONS

SPECIAL SECTION:

MBA RECOGNIZES RECENT TRAINING GRADUATES

BANKING LEADER CELEBRATES 160 YEARS OF PEOPLE-DRIVEN SUCCESS

Keep moving toward your goals with HUB.

When you partner with us, you’re at the center of a vast network of experts dedicated to advising you on how to prepare for the unexpected with:

o Employee benefits that help you navigate change, and support and engage your people

• Specialized self-funding proficiency

• Call center solutions

• Benefit administration systems

• Self-funded dental and vision plans and a variety of Consumer Directed Healthcare Plans (HRA’s, FSA’s) and COBRA through BAI

o Business insurance and risk services to help protect your organization, brand and assets

• Development and management of captive insurance programs

• Certified Safety Professional engagement

o Retirement and private wealth management to help you and your employees pursue personal financial goals with confidence

Let’s protect what matters most to you. hubinternational.com

Nathan Burtt SVP, Erie Office Leader (814) 897-6857 nate.burtt@hubinternational.com 1250 Tower Lane Erie, PA 16505

BUSINESS BUZZ WHAT’S NEW

See exclusive photo coverage of the MBA’s latest events and happenings.

Executive Editor

Karen Torres ktorres@mbausa.org

Contributing Writers

Tracy Daggett

Carrie DelRosso

Kim Figurski

Milton Koch

Rachel Loper

Feature Photography R. Frank Media PNC

Additional Photography iStockPhoto.com

Design, Production & Printing Printing Concepts Inc. info@printingconceptsonline.com

READ ON THE GO!

For the most current Business Magazine updates, visit mbabizmag.com

Advertising Sales Shawn Netkowicz snetkowicz@mbausa.org

Judy Rosatti jrosatti@mbausa.org

Patty Welther pwelther@mbausa.org

On the Cover: The PNC management team for northwest Pennsylvania is shown at the bank offices in downtown Erie. From left are: Todd P. Swanson, senior vice president and senior investment manager; Ashley Ross, vice president and director of Client and Community Relations; Stephen Ventrello, CFA, senior vice president of PNC Private Bank and investment market manager; Chris Bernatowicz, senior vice president and regional manager of Retail Banking; Jim Stevenson, regional president; Kalpesh Shah, senior vice president and regional sales manager of PNC Investments; Allison Kaverman, senior vice president of PNC Private Bank and banking market manager; and Jeff Szumigale, senior vice president and managing director of PNC Private Bank. PNC prides itself on its leadership in helping grow PNC and the regional business community. For full story, see page 4.

Mission Statement: “We are dedicated to creating and delivering services and expertise that help businesses solve problems and succeed.” – Board of Governors

Manufacturer & Business Association

Headquarters: 2171 West 38th Street, Erie, PA 16508 Pittsburgh: 850 Cranberry Woods Drive, Suite 2224 Cranberry Township, PA 16066 814/833-3200 | 800/815-2660 | mbausa.org

WHAT’S INSIDE | FEATURED STORY

3 BANKING AND BENEFITS

Comprehensive resources can be critical to achieving organizational goals and objectives.

COVER STORY | LOCAL PROFILE

4 PNC FINANCIAL SERVICES GROUP, INC.

With roots dating back to 1865, PNC Financial Services Group, Inc. is marking 160 years as a banking leader and peopledriven success.

ICONS OF INDUSTRY | Q & A

8

Longtime finance leader James (“Jim”) Ohrn reflects on his leadership journey and key business roles.

LEGAL BRIEF | LOANS

11 The role of UCC-1 financing statements in Pennsylvania commercial lending: What borrowers need to know. Rachel Loper ON THE HILL | TRADE

15

Let’s talk tariffs! Carrie DelRosso and Milton Koch

TRAINING | RECOGNITION

23

See the graduates of The MBA’s recent computer and professional development training classes.

Employers are often searching for ways to streamline operations, manage finances efficiently and remain competitive. In fact, robust banking and employee benefits solutions can be crucial for long-term success by providing essential support in managing daily operations, improving employee satisfaction and driving overall business growth.

According to a 2024 report by PYMNTS.com, 60 percent of small and medium-sized businesses (SMBs) struggle with cash flow management. Similarly, a 2024 article in Forbes shows that over 80 percent of businesses fail due to cash flow issues, underscoring the importance of having a robust cash management system.

Comprehensive banking solutions, such as business loans, favorable interest rates, and efficient payment systems, can alleviate these pressures and enable businesses to focus on growth while ensuring financial stability.

Likewise, employee benefits are often viewed as a valuable investment when it comes to a company’s financial health as they directly influence employee retention, productivity and overall cost management. Research from the Employee Benefit Research Institute (EBRI) reveals that employees who are satisfied with their benefits are more likely to stay with their employer, reducing the costly turnover associated with recruitment and training.

In many ways, banking and employee benefits solutions provide businesses with the stability needed to plan for the

future. Reliable financial services enable companies to secure the necessary funding for growth initiatives and navigate economic fluctuations. Similarly, offering comprehensive benefits ensures that employees are supported, which leads to higher productivity and a stronger organizational culture.

Today, another growing factor for employers to consider is the role of artificial intelligence (AI). AI is significantly transforming how employers streamline financial and benefits solutions. According to a 2024 report by McKinsey, AI adoption in finance has led to a 30-percent reduction in administrative costs and a 20-percent increase in forecasting accuracy. AI also is enhancing the area of benefits solutions by analyzing employee preferences, allowing employers to tailor offerings more effectively.

In this issue of The MBA Business Magazine, we’ll explore the banking and benefits solutions that are available to employers in our membership region.

We’ll highlight financial institutions like PNC, which is marking its 160th year of operation. We’ll also hear from James (“Jim”) Ohrn, a financial leader in the northwest Pennsylvania business community and one of The MBA’s Icons of Industry, about his professional journey.

In addition, check out our special section recognizing our recent computer and professional development training graduates.

Plus, be sure to register for the MBA’s third annual Leadership Summit: The Future of AI in Business on April 29 in Erie as we explore how to leverage AI to streamline your business with strategic insights and practical applications.

For more information about the Summit, see page 24 or visit mbausa.org.

Banking is more than just numbers and transactions. Behind every business loan and savings account is a team of professionals dedicated to helping customers achieve their financial goals.

At PNC Financial Services Group, Inc. (PNC), it’s this people-driven success that has made it a leader in the banking industry for 160 years and counting.

“First and foremost, our people differentiate us,” explains Jim Stevenson, regional president of PNC. “Starting with our local leaders in northwest Pennsylvania (NWPA), we are blessed to have some of the best bankers in the region. Our local leadership team is comprised of individuals who have lived and worked in the communities across the NWPA region, some their whole lives.”

Stevenson has been a part of the PNC team for the past 36 years. Since 2016, he has served as the Bank’s regional president and manger of Corporate and Commercial Banking in Northwestern Pa. He has also overseen Corporate and Commercial

Banking activities in Western New York since 2009. He is supported by a strong senior leadership team that includes Chris Bernatowicz, the local leader for PNC’s Retail business, who has been with PNC for 37 years; Todd Swanson, the local market leader for Institutional Asset Management, who has also been with PNC for 37 years; and, Jeff Szumigale, the local market leader for PNC Private Bank, who has been with the Company for 40 years. A new face to PNC, but an experienced member of the senior leadership is Ashley Ross, a Meadville native and former banker, who joined the PNC team as vice president and director of Client and Community Relations in 2024 from a local health-care company.

“Our senior leadership team would be the first to recognize that PNC’s success in NWPA

reflects the outstanding teams that we are fortunate to lead,” says Stevenson. “Without them and their ongoing commitment to our clients, none of this is possible.”

As the one of the largest banks in the country with large-scale capabilities, PNC recognizes the importance of local leadership. The Bank’s local leadership has autonomy to make decisions that are in the best interest of clients and communities throughout the NWPA region.

According to Stevenson, PNC’s scale and capital position benefit clients because they know that they can depend on the bank whether times are good or, perhaps more importantly, challenging. The strength of PNC’s balance sheet enables the bank to extend credit to its clients throughout the economic cycle.

“This issue really came into play during a recent tumultuous period in the banking industry,” explains Stevenson. “This resulted in rising industry funding costs and related margin pressures as well as deteriorating capital positions.”

As Stevenson points out, banks that maintained disproportionate exposure to commercial real estate, particularly in the office-space segment, experienced further pressure on their balance sheets. This “perfect storm” resulted in the sector dislocation during that three-year period, which resulted in several high-profile bank closures and related acquisitions.

“Fortunately, PNC, though not immune to industry challenges, weathered that storm very well relative to the broader banking segment, which positioned us to continue to provide credit in a consistent and predictable manner,” says Stevenson.

Today’s bank customers seek critical banking resources that offer financial security, easy access to credit, and digital convenience to manage their money efficiently. They also prioritize personalized financial advice, competitive interest rates and strong fraud protection to support both their personal and business financial goals.

For many businesses across NWPA, PNC’s treasury management offerings are a major consideration.PNC’s platform offers organizations of all sizes the products, solutions and advice they need to streamline processes, solve problems, maximize capital and drive their businesses forward. PNC’s technology tools, such as PNC PINACLE Connect ®, can seamlessly integrate with

PNC Financial Services Group, Inc. (NYSE: PNC) is one of the largest diversified financial services institutions in the United States, with assets of $560 billion as of December 31, 2024. PNC is a coast-to-coast franchise with an extensive retail branch network and a presence in all of the country’s 30 largest markets. PNC also has strategic international offices in four countries outside the United States. With roots dating back to 1865, PNC provides retail banking, including residential mortgage, corporate and institutional banking, and asset management to individuals, institutions and businesses of all sizes.

a company’s existing treasury platform without disrupting its current banking relationship.

PNC’s payment and receivables functions can improve working capital cycles to help a given company operate more efficiently and to offset higher costs in other parts of its business.

“In addition, we know that across NWPA, there is a preponderance of companies whose annual sales range up to $100 million,” notes Stevenson. “As such, with estimates that a significant percentage of companies in that segment nationwide are likely to have an ownership change in the next five years, PNC is well-positioned to further serve and advise our clients in this regard.”

PNC’s local Private Banking team, led by Szumigale, provides a full-service suite of solutions ranging from estate, investment and tax planning to advise a business owner who may be considering a sale of his or her business.

At PNC, businesses of all sizes have access to resources tailored to their specific needs.

“We take a segmented approach, so we have a team that is dedicated to working with smaller companies, one that primarily supports mid-size businesses and another team that supports large corporates,” says Stevenson.

PNC also employs industry experts who can help any size business integrate industry best practices, whether they’re in food and beverage, chemicals and plastics, or energy, metals and mining, to name a few.

While the needs for each size company may be different, even the smallest companies can benefit from PNC’s broad scale and expertise. “Every business owner wants to operate more efficiently, and we have access to advanced technological tools that can make operations more efficient,” notes Stevenson

PNC monitors emerging trends in commercial banking to help its clients stay competitive, resilient and financially secure.

One trend that has persisted since the COVID pandemic has been the focus on technology improvements that drive efficiency and productivity through automation.

“As this trend is only accelerating, it benefits businesses to work with a bank that is technologically advanced,” explains Stevenson. “The fact is costs of necessary technology and cybersecurity investments remain disproportionately high for smaller banks compared to the largest banks — which are able to realize economies of scale across their vast customer bases.”

The takeaway: scale and density in banking matter. According to Stevenson, as one of the largest banks in the country, PNC has made large investments to build out its technology to help customers drive business and to help protect them from cybersecurity threats.

Stevenson points out that size and stability are also critical trends in commercial banking, influencing how banks support businesses and manage risk.

“During the banking challenges in the spring 2023, many companies were worried about their respective bank’s condition. PNC customers did not have to worry about that,” assures Stevenson. “As consolidation is inevitable in the banking industry, more and more clients are telling us PNC’s stability is an important deciding factor in choosing to bank with us.”

In the area of risk management and financial planning, “PNC’s credit box is consistent and predictable, which helps our clients plan ahead,” Stevenson adds. “There can always be variations based on where we are in the cycle, but generally clients understand our appetite for risk, which helps them as they’re making business decisions.”

Stevenson believes PNC’s flagship products and services — such as its bestin-class treasury management tools and capital markets solutions set, which includes rate risk management hedging and foreign exchange risk management — are in high demand among clients because they offer trusted, high-value solutions that address key financial needs. These offerings help businesses and individuals manage cash flow, reduce risk and grow strategically. “PNC’s consistency and predictability regarding a business’s access to credit are incredibly important as well,” adds Stevenson.

As one of the largest financial institutions in NWPA, PNC plays a crucial role in regional economic development by providing

Tyler Majewski, vice president and relationship manager for PNC Corporate & Institutional Banking, meets with (from left) Erika Puda, CFP, assistant vice president of PNC Private Bank and investment advisor; Jim Kubaney, senior vice president of PNC Private Bank and senior investment advisor; Melissa Morris, vice president and business banker; and, Melissa Grucza, vice president of Institutional Asset Management and senior investment advisor.

“Since acquiring National City Bank in 2009, PNC has served as Acutec’s strategic capital financing and billing partner, demonstrating a deep understanding of the manufacturing industry’s unique capital-intensive demands. This long-term relationship, with the consistency of leadership and financial expertise of Jim Stevenson and his team, and his predecessor Marlene Mosco, has allowed Acutec to navigate industry fluctuations and make strategic, long-term investments through changing economic conditions and inflationary environments. PNC has supported Acutec through major business evolutions, offering insights into succession planning, ESOPs, employee benefits, and fintech innovations that has afforded us the operational flexibility and resources needed as a growing private company to remain globally competitive in the Aerospace and Defense sectors through our stages of growth. We thank PNC for their continued support, without which we would not be where we are today.”

— Elisabeth Smith, President & CEO Acutec Precision Aerospace, Inc.

PNC is actively involved in giving back to

are

financial resources, fostering business growth and supporting community initiatives.

Stevenson is very proud of what PNC does to give back to the communities in the Bank’s 13-county footprint, one of the most notable being PNC’s longtime commitment to early childhood education.

“For 20 years, PNC Grow Up Great ® has helped children from birth to age 5 discover their love of learning,” says Stevenson. “By supporting and delivering engaging programs, experiences and resources in this region, we’re helping to create a world of opportunities for the next generation of community leaders.”

Adding to this local impact, PNC has supported other initiatives, including Operation Warm Coats. In 16 years, PNC has donated more than 17,000 warm winter coats to preschool children throughout Northwestern Pennsylvania.

Recently, PNC was proud to lead the formation of local bank coalition through United Way to adopt an Erie City public elementary school.

“PNC is committed to investing in and supporting the Northwestern PA community that has given us so much over our 100-plusyear history here,” Stevenson says.

For business customers in NWPA, PNC’s greatest strengths are predictability, longevity and its commitment to its customers and the broader community.

It was only three years ago, as Stevenson recalls, that the banking industry faced significant headwinds arising from the Fed’s strategic response to the 40-year high in inflation.

Today, the industry is much better positioned given the repositioning of balance sheets and the Fed’s easing policy in the second half of 2024. According to Stevenson, the latter has favorably impacted bank funding costs and, coupled with the repositioning of balance sheets, has driven margin improvement in the sector.

“In my 36 years at the Bank, I have never been more excited about PNC’s future,” says Stevenson. “It’s no secret PNC is looking to grow both organically and by acquisition. Our multi-year investments in our branch system across the entire PNC footprint is a clear demonstration of our commitment to this segment.”

Stevenson believes that industry consolidation may very well accelerate over the next few years due to a more favorable regulatory environment and, perhaps more importantly, the ongoing costs associated with technology investment requirements.

“We appreciate PNC Bank’s expertise in structuring finance deals that are both effective and easy to manage. This is complemented by their attentive service, where they prioritize understanding and addressing our specific requirements.

Additionally, they provide a robust treasury management system. This platform empowers our accounting team to take on expanded responsibilities, streamlining financial operations and enhancing overall efficiency.”

— Bradley Conquer, VP of Finance and Administration

To remain competitive with cutting-edge solutions, banks must invest as there is no alternative.

“PNC is committed to and has positioned itself to be a long-term player in the industry via our size, our strength and our capabilities,” says Stevenson.

“All that having been said,” he adds, “it only works if we continue to perform at a high level by supporting our clients and our communities.”

Fortunately, PNC has a track record — 160 years of people-driven success — of doing just that.

“If we continue to do so,” Stevenson says, “I have no doubt 2025 and beyond will be successful for PNC not just in NWPA but across our entire nationwide footprint.”

For more information, visit pnc.com. PNC is a registered mark of The PNC Financial Services Group, Inc. (“PNC”) ©2025 The PNC Financial Services Group, Inc. All rights reserved

their financial goals.

In celebration of the MBA’s 120th year, the Association is recognizing Icons of Industry for their many contributions to the MBA and business community. James (“Jim”) Ohrn has been a highly respected finance professional for more than 30 years, working behind the scenes and at the forefront of industry. He is currently a Board member and secretary-treasurer for Custom Group Industries — including Custom Engineering, Venango Machine and Lamjen. He is an active Board member and former chairman for Americans for the Competitive Enterprise System (ACES), a longtime judge for the MBA’s Patrick R. Locco Scholarship Awards, and also has served as the financial administrator for the City of Erie School District during its state-mandated financial improvement plan after being appointed by then-Governor Tom Wolf. Here, Ohrn reflects on his leadership journey and key business roles.

Although you retired as a VP and CFO from Custom Group Industries after nearly three decades, you are still an active Board member. Tell us what inspired you to be a

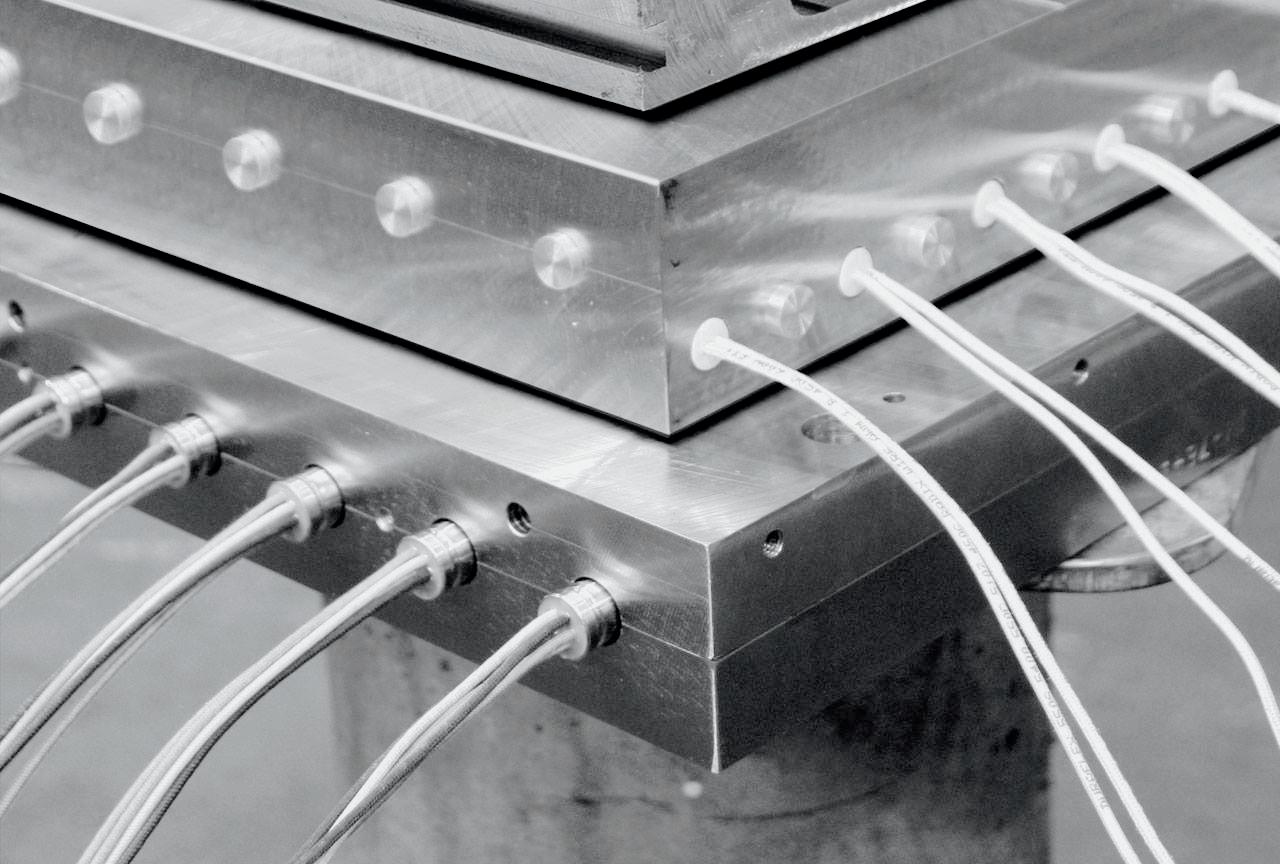

CFO, the importance of the CFO role and your continued involvement. My first job after graduate school and military service was at a regional public accounting firm, Main Lafrentz and Company, located in downtown Erie. As I conducted financial audits of many local companies, both service and manufacturing, I was most attracted to the process of producing a product — the unique discipline of taking various raw materials, adding technical skills and utilizing machinery and equipment to produce an item that satisfied public demand. Friendships and acquaintances established during these audit engagements resulted in job opportunities for me as a plant accountant and controller in manufacturing firms in Millcreek and North East, PA. It was these experiences that prepared me for the chief financial officer (CFO) position at Custom Engineering Company starting in 1997. In 1999 and 2000, Venango Machine Co. and Lamjen, Inc. were added and the companies were known as Custom Group Industries.

In a smaller company such as Custom Engineering Company, the CFO role takes on various tasks in addition to financial and accounting oversight. During my tenure at Custom, I also was responsible for risk management, human resources, information systems and procurement. This broad spectrum of responsibilities was both challenging and rewarding as I had the opportunity to learn and experience these important functions while working with the talented staff assigned in those departments. My successor, Dan Cullen, also possesses a wide range of financial and operational experiences, which positions him well. I have been fortunate to be asked to remain on the Custom Group Industries Board of Directors where I also serve as the secretary-treasurer.

In your experience, what role does financial leadership play in fostering a company culture that values both growth and fiscal responsibility?

Financial stewardship in any organization is so important. It is a key discipline needed to ensure the viability, stability and sustainability of an

organization. Senior management cannot make the best decisions on operational matters without accurate, timely and relevant financial information. In addition, employees also need reliable financial input in the areas of compensation, benefits and retirement planning, etc.

Given your extensive experience in finance, what have been some of the biggest challenges you’ve faced in your career and how did you overcome them?

The two biggest challenges that I faced have to be the recession of 2007–2009 and the COVID-19 pandemic of 2020–2022. These were two unexpected situations that rattled the markets, our customer base, our employees and vendors. It was so difficult to right-size our business based on realities in the marketplace during these two unfortunate events while ensuring that our lenders and customers were satisfied that we could persevere despite the many challenges, many of which were out of our control. Ongoing meetings with employees, customers, vendors and lenders assured them that we were taking the necessary steps to ensure good financial stewardship and operational efficiency to navigate through these uncharted waters.

Tell us about the importance of such involvement from a leadership perspective. What have you learned from these diverse roles?

I believe in the importance of giving back to the community that has supported my family and me over the years. Philanthropy is a big part of this response, but so is actual hands-on involvement with nonprofit organizations that serve the community in so many important ways. Over the years, I have been asked to serve on boards of nonprofit organizations which serve youth, seniors, hospice patients, public education and economic development. All are an essential part of the fabric of a vital community. Selfishly, I have learned so much from the wise men and women who compose these nonprofit boards. Most are intelligent,

passionate and dedicated to the mission of the respective organization. They have instilled in me an appreciation for the needs of those in our community who are at risk, and we have worked tirelessly to overcome the challenges faced.

As someone deeply involved in both financial leadership and community service, how do you personally balance these responsibilities, and how do they influence each other in terms of your approach to leadership?

Accepting positions on various boards and committees occurred gradually over time, which enabled me to handle the responsibilities in an orderly fashion. I usually start out focusing on financial matters in an organization, and, as I become more familiar with the mission and vision of the organization, I can be of more assistance beyond the numbers. The other board members of these nonprofit organizations contribute greatly to the cause and enabled me to benefit from their wisdom and insight which, in turn, grew my leadership skills.

What has been the greatest lesson you’ve learned during your professional career?

To always put others first and treat them with dignity and respect. Also, not to hesitate to ask a question to make sure the task at hand is well understood.

Throughout your career, what has MBA membershipmeant to you and the organizations you serve?

We have relied on The MBA over the years for its great supervisor training programs as well as the human resources and legal assistance expertise. In addition, we appreciate that The MBA recognizes the great importance of manufacturing in this region with the focus on Manufacturing Day (MFG Day) each October. Finally, the Patrick R. Locco Scholarship Awards, which I have helped judge for more than 10 years, motivate young men and women who are focusing on technical skills — these are the future employees that we will depend on.

What is your fondest memory of working with the MBA?

In late 1998, I was serving as chairman of the Americans for the Competitive Enterprise System (ACES) Board of Directors and, along with the ACES staff, had the privilege to work with Ralph Pontillo and John Krahe when ACES was offered the opportunity to assume responsibility for the successful Pennsylvania Business Week (PBW) program. These discussions were both professional and productive and 25-plus years later, PBW continues to thrive conducting programs at 10 high schools in the region. Also, the ACES organization is so appreciative of The MBA’s financial support over the years.

Is there anything you’d like to add?

Sincere congratulations to The MBA, now under the wise leadership of Lori Joint, as you celebrate your 120th year serving all companies in the region, especially the all-important manufacturing base. Thank you for this great honor.

Before it was The MBA, then-MAE President Howard Kelly’s arrival in 1952 changed the face of the Association. Under the direction of the Board of Governors and Kelly’s management, the organization focused more on health and safety issues, and for the first time offered insurance programs to its membership, which had grown to 150 companies. The programs would help employers find the best benefits, thus making health care a focal point of the organization for years to come.

“We became the biggest client or policyholder of Blue Cross of Western Pa.,” stated Ray Weber, who became executive director in 1971.

As the head of the Association, Weber’s first formal duty was to keep members up to date on the wage and price controls issued by President Richard Nixon to combat inflation. ”I think that was really the thing that got me very quickly acquainted with many of our members,” he said. “We built up quite a library on price controls, and this was before computers.”

Rachel Loper is an associate at MacDonald Illig Attorneys and her practice focuses on Banking & Finance, Real Estate, and Business Transactions.

Commercial lending is an essential component of Pennsylvania’s business landscape, by providing businesses with the financial resources needed to grow, innovate and thrive. Whether in support of a startup looking to expand, a manufacturer needing to upgrade equipment or an established business seeking working capital, commercial loans offer solutions for a wide range of financing needs. When a business seeks a commercial loan, one critical aspect that often comes into play is the Uniform Commercial Code (UCC) financing statement. While this document might seem complex, it is essential for borrowers to understand the implications as the UCC directly affects the borrower’s business assets and operational flexibility.

What is a UCC-1 Financing Statement?

A UCC-1 financing statement is a legal document filed under the Uniform

Commercial Code (UCC), which is a set of laws governing commercial transactions across the United States. In the context of commercial lending, a UCC-1 is filed by a lender to establish their legal claim to a borrower’s business assets, as collateral. By filing this public statement, the lender creates a security interest in the borrower’s property — such as equipment, inventory, accounts receivable or intellectual property — making it easier for the lender to execute on (collect against) those assets if the borrower defaults on the loan.

For lenders, the primary purpose of filing a UCC-1 financing statement is to protect their investment. By securing the loan with the borrower’s assets, the lender ensures that it will have a legal claim to those assets if the borrower defaults. Additionally, filing a UCC-1 establishes the priority of the lender’s claim. If a borrower defaults on multiple loans, the lender who files the UCC-1 first generally has the first right to claim the collateral. This can be particularly important if the borrower has multiple outstanding debts.

How Does the UCC-1 Impact Borrowers?

As a borrower, it is essential to understand both the benefits and the obligations that come with the filing of a UCC-1 financing

statement. This understanding will better enable a business owner to prepare for the future and create necessary cash flow and flexibility in operations.

To start, a UCC-1 financing statement allows businesses to access capital by using their assets as collateral. If the business’s cash flow and operations do not generate sufficient revenue sufficient to fund the business, ongoing operations or capital needs, the business can offer collateral — such as equipment or inventory — to obtain a loan. In this way, the assets secured by the UCC-1 enable the borrower to secure the funds needed to grow and operate its business. However, it is important to note, if the borrower defaults on the loan, the lender can seize the collateral assets listed in the UCC-1 filing to recover the outstanding debt. Moreover, when a UCC-1 is publicly filed, the specific assets identified as collateral to secure the loan are clearly outlined. As a borrower, this clarity is crucial for knowing the collateral will be at risk in the event of default and the collateral that the lender will not have a lien against, creating possible future borrowing opportunities for the business. However, the UCC-1 is a public document, meaning that anyone — including potential creditors, partners and competitors — can view it, and this may influence how others perceive the business’s financial health or credit worthiness.

A UCC-1 financing statement is an important part of the commercial lending process, providing both borrowers and lenders with a clear legal framework for securing loans. For borrowers, understanding the implications of a UCC-1 filing is essential for making informed decisions about cash flow and operational freedom. By carefully considering the terms of the loan, the collateral involved and the risks associated with default, borrowers can make informed, strategic choices that protect both their business and their financial future.

For more information about MacDonald Illig Attorneys, visit macdonaldillig.com or call 814/870-7600.

F.N.B. Corporation (NYSE: FNB), the holding company for First National Bank, recently welcomed civic and community leaders to its new $300 million headquarters, FNB Financial Center, to celebrate the building’s grand opening.

FNB Chairman, President and Chief Executive Officer Vincent J. Delie, Jr. provided remarks before a ceremonial ribbon-cutting at the February 18 event in the lobby of the new building in Pittsburgh’s Lower Hill District neighborhood. The occasion formally commemorated the success of a transformational venture that was a decade in the making, announced at the end of 2019 and completed despite the significant challengespresented by the COVID-19 pandemic.

“It is extremely rewarding to have played a role in bringing hundreds of high-quality jobs to Pittsburgh, and also to have realized the vision for this building for our employees and the community,” said Delie. “Growing up on Pittsburgh’s North Side with views of the city, I was inspired by our skyline and its beauty, and now FNB is part of it — and we are here because of our determination and what we have achieved as a Company.”

The newest addition to the Pittsburgh skyline, and one of the few multi-tenant towers constructed in the central business district during the past four decades, FNB Financial Center adds new, modern workspace and amenities to the downtown marketplace. FNB owns and occupies the majority of the building, bringing employees together in new, state-of-theart space that is designed to encourage communication and collaboration between lines of business.

For more information, visit fnb-online.com.

PARTNERSHIP WITH SCHAFFNER, KNIGHT, MINNAUGH & CO., P.C.

One-Up Financial, a registered fiduciary advisory firm in Erie, recently announced its partnership with Schaffner, Knight, Minnaugh & Co., P.C. (SKM), a fullservice accounting and advisory firm headquartered in Erie with additional locations in Pennsylvania and New York.

Founded in 2020 by Eric Presogna, CPA, CFP©, One-Up Financial is affiliated with Charles Schwab, the largest custodian for independent registered investment advisors. Presogna has more than 18 years of tax and investment management experience including working for a Fortune 500 wealth management firm. One-Up Financial provides investment management, financial planning and tax planning services to individuals and businesses looking to maximize their income, reduce their taxes and invest smarter.

In 30 years since inception, SKM has grown into the largest locally owned CPA firm with more than 50 professional staff who hold a wide range of designations including CPA, PFS, CVA and CFE. SKM’s team is uniquely qualified to deliver world-class accounting, tax and advisory services that meet the specific needs of clients.

“We’re excited to bring this unique business model to our area,” says Presogna. “Taxes and investments have always been inextricably linked, yet most professional advisors are only equipped to offer tax or investment advice but not both. With this partnership, we’ll do both, allowing our clients to benefit from tax-efficient investment and financial planning strategies that come from our comprehensive approach to wealth management.”

For more information, visit oneupfinancial.com.

TURK NAMED CHIEF GROWTH OFFICER OF FERN ROCK INSURANCE AGENCY

Matt Turk has been named chief growth officer of the Fern Rock Insurance Agency in Western Pennsylvania. In this role, Turk will focus on driving business development strategies, spearheading market expansion efforts and enhancing the agency’s product offerings to meet the evolving needs of clients.

According to the firm, Turk’s expertise will be instrumental in fostering sustainable growth and securing Fern Rock’s position as a leader in the industry.

Born and raised in Franklin, Pennsylvania, Turk is a graduate of Gannon University and has served in a senior vice president leadership role for over 20 years.

Fern Rock Risk Partners, under the leadership of Bryan Wright and Marty Muchnok, announced the official launch of the Fern Rock Insurance Agency on October 31, 2024.

As a holding company, Fern Rock’s broader strategy is to partner with independent agencies that are growth-oriented and have a strong local influence, especially those with 20 or fewer employees in regions like Pennsylvania, Ohio and Maryland. This strategy aims to expand Fern Rock’s reach across the eastern half of the United States, while retaining a significant degree of autonomy for the acquired agencies, including allowing them to keep a percentage of ownership.

Fern Rock Risk Partners had its first major acquisition with the purchase of Jack L. Bonus Insurance Agency located in Zelienople, Pennsylvania. “The decision to acquire Jack L. Bonus Insurance was strategic, leveraging a long-standing customer relationship of over 30 years, which ensured a good cultural and operational fit,” the firm stated in a press release.

GANNON UNIVERSITY APPOINTS VP FOR MARKETING AND ENROLLMENT

Gannon University recently announced the appointment of Randyll Bowen, Ed.D , as the university’s new vice president for Marketing and Enrollment. Bowen, who was selected after a national search, has more than 27 years of leadership

experience in higher education. He has had a distinguished career spanning enrollment management, student life, institutional advancement, information technology, workforce and community development.

Bowen recently served as the vice president for enrollment management at Buffalo State University, where he was a member of the president’s cabinet. Bowen, a graduate of Buffalo State University, has played a pivotal role in shaping policies and practices to promote equity and access for students aspiring to earn a college degree.

Prior to his role at Buffalo State, Bowen served as vice president for enrollment management at Hilbert College, overseeing graduate and undergraduate admissions, financial aid, registration, marketing and college communications. His leadership was instrumental in launching Hilbert College Global to expand student enrollment. He has also held senior leadership roles at D’Youville University and Niagara County Community College, where he contributed to student life, institutional advancement, and workforce development initiatives.

“We are thrilled to welcome Dr. Bowen to Gannon University,” said Gannon University President Walter Iwanenko, Ph.D. “His extensive experience, innovative approach and dedication to student success will be invaluable as we continue to advance our mission and grow our enrollment across our soon-to-be three campuses in three states.”

Bowen earned his Doctorate in Education in organizational leadership with an emphasis in higher education leadership from Grand Canyon University. He also holds a Master of Science in student personnel administration from Buffalo State University and a Bachelor of Science in communications from SUNY Brockport with a minor in criminal justice.

Bowen was to officially begin his role as vice president for Marketing and Enrollment on March 10. Bowen comes to Gannon following the retirement of William Edmondson, who served as vice president for enrollment for 15 years. Edmondson retired from Gannon on January 3.

Gannon University is a Catholic, diocesan university with campuses in Erie, Pennsylvania and Ruskin, Florida, offering online and traditional associate, bachelor’s, master’s and doctoral programs to more than 4,700 students.

PLASTEK GROUP CEO NAMED PENN STATE ALUMNI FELLOW

Dennis J. Prischak , president and CEO of the Plastek Group, an Erie-based manufacturer of plastics packaging for the personal care, pharmaceutical, and food and beverage industries, has been named a Penn State Alumni Fellow.

The lifelong title of Alumni Fellow is the highest award given by the Penn State Alumni Association. The award, which originated in 1973, is given to a select group of alumni who are leaders in their professional fields.

Prischak earned an MBA from Penn State Behrend in 1992. He serves on the college’s Council of Fellows and is a Laurel Circle member of the Mount Nittany Society.

At Plastek, he has continued the legacy of his father, the late Joseph Prischak, who founded the company in 1971. He and his brothers — Daniel, Douglas and Donald Prischak — run the company, which operates manufacturing sites in the United States, the United Kingdom, Brazil and Mexico.

Dennis Prischak joined Plastek as a toolmaker in 1983, shortly after earning a bachelor’s degree in mechanical engineering. He worked as a process engineer, process engineering manager and as general manager of the company’s spectrum molding division. He served as global vice president of tooling and engineering and then, in 2002, following the retirement of his father, became president and CEO.

In 2022, the Plastek Group and the Prischak family named the Prischak Robotics and Automation Lab at Penn State Behrend. The $1.2 million facility is equipped with robots, sensors, vision systems and manufacturing control systems. The lab is open to industry, including Erie’s plastics companies, which can test new ideas and processes without interrupting their production work.

“Dennis has supported Penn State Behrend in many ways over many years,” Chancellor Ralph Ford said, in a press release. “His family’s support of the college, and their commitment to building and keeping a business in Erie, has had tremendous impact in the local business community.”

Prischak’s nonprofit service includes work with the Erie Downtown Development Corporation, the ExpERIEnce Children’s Museum and Africa 6000 International, which works to provide fresh water to communities in Africa.

Alumni are nominated for the Fellows award by Penn State colleges and campuses and accept an invitation from University President Neeli Bendapudi to return to their home college or campus to share their experience with students, faculty and administrators.

Since 2010, Marquette’s Business Banking group has enjoyed continued growth year over year, and our relationship-focused commitment to our clients has been a major reason for that growth.

When thinking about a new banking relationship for your business, consider the top factors our clients say are the reasons they put their trust in Marquette:

With a streamlined loan approval process, decisions are made quickly. All underwriting, servicing and commercial loan applications are handled here locally.

All loan decisions are made here — at the only remaining bank headquartered in Erie and Crawford counties. Our decision-makers sit at the same table with you to discuss possibilities and to get you the answers you need.

We pride ourselves on being accessible. Whether it’s a quick call to discuss an initial idea, or an in-person sit-down to review long-term planning, we’re here for you every step of the way.

Marquette is committed to providing an array of cash management services and fraud protection programs designed specifically for business customers — helping your business run more efficiently.

From the Marquette Board of Trustees to our business bankers and support staff, you’re often dealing with professionals who have decades of experience in banking — and in business — and who are longtime, active members of our communities. 1 2 3 4 5

Talk with us at 814-455-4481 or visit MarquetteSavings.bank/business to learn more.

Matt Zonno Chief Lending Officer, Executive Vice President

Carrie DelRosso is a senior advisor of Government Relations for Buchanan Ingersoll & Rooney PC.

Milton Koch is an international trade advisor for Buchanan Ingersoll & Rooney PC.

The Trump administration has quickly made international trade a focus with its America First Trade Policy, including a series of executive orders and proclamations imposing tariffs to address a host of different issues. Three main executive actions have emerged in February 2025.

First, the Trump administration announced executive orders on China, Canada and Mexico imposing tariffs to address the flow of illicit drugs. After announcing tariffs on Canada and Mexico of 25 percent, the Trump administration paused the tariffs for 30 days to negotiate a deal. However, no deal was offered to China and the 10-percent tariff is already in effect. Many goods imported from China are already covered by the 2018 Section 301 25-percent tariffs for intellectual property theft, effectively making the tariff rate a combined 35 percent.

On February 13, 2025, the Trump administration announced United States Trade Representatives (USTR) will prepare a report for imposing reciprocal tariffs on a country-by-country basis to tackle known unfair trade practices such as other countries’ higher tariffs, taxes and other policies affecting trade. The report will include recommendations on next steps, including proposed tariffs rates for each country and their goods.

Similarly, on February 10 and 11, the Trump administration also issued two proclamations modifying the Section 232 national security tariffs on steel and aluminum. These executive actions aim “to protect America’s steel and aluminum industries, which have been harmed by unfair trade practices and global excess capacity.” Beginning March 12, 2025, the proclamations expand the steel and aluminum tariffs to 25 percent and nullifying exemptions to various countries and ends the exclusion process for goods which cannot be sourced domestically. However, given the increasing volumes of imports, the Trump administration is now ending the exclusion process and applying the Section 232 tariffs to all imports of steel and aluminum into the United States. Further, the proclamations amend the Section 232 duties to cover “derivative” steel and aluminum products, including downstream metal products such as I-beams, rebar and aluminum extrusions. While these 232 Tariffs establish a level playing field for U.S. steel and aluminum producers, it is important to note that this initial trade action also provides opportunity for producers to seek inclusion of additional

derivative steel and derivative aluminum articles. Within 90 days from the date of the proclamations, the U.S. Department of Commerce (Commerce) is required to establish a process for U.S. manufacturers to request the Section 232 25-percent duties apply to additional steel and aluminum products. Within 60 days of receiving a request, Commerce will rule on whether to apply the Section 232 25-percent tariff to the named products. This is an opportunity for Pennsylvania manufacturers of downstream steel and aluminum goods to benefit from the Section 232 tariffs and regain market share in the U.S. market from unfairly lowpriced imports.

Why is manufacturing so important?

Manufacturing in the United States plays a significant role in driving economic growth in the country. Manufacturing jobs provide good family sustaining wages that form the backbone of many communities. When manufacturers leave to other countries or are forced to shut down because unfair trade make it impossible to continue, it hurts the local economy. Manufacturing in our country ultimately improves the quality of life and enables communities to thrive by creating jobs where people live. U.S. manufacturers can protect their investments by working together and finding common ground to protect production and service.

To contact Carrie DelRosso or Milton Koch, visit bipc.com.

I know what my business needs. And so does my bank.

Comprehensive financing solutions. Local decisions. Let’s get started.

Having a financial partner who understands your business is important. Having one who is invested in your success is invaluable. With FNB, you’ll have access to a full range of financing solutions to meet your long- and short-term goals, from asset-based loans to flexible equipment leasing options. More importantly, you’ll have the support of a dedicated expert who understands your vision and can offer creative solutions to realize it. Find out how FNB can help your business grow at fnb-online.com/behindyourbusiness.

In today’s fast-paced business environment, it is crucial for non-financial managers to understand the basic principles of finance. While finance can seem like a specialized field, a solid understanding of key financial concepts empowers managers to make better decisions, manage budgets effectively and contribute to the overall success of their organizations. Here are the top three important takeaways from The MBA’s Finance for the Non-Financial Manager training programs:

1. Understanding Financial Statements

Non-financial managers need to be able to interpret basic financial statements such as the income statement, balance sheet, and cash flow statement. By understanding how these documents reflect the financial health of a business, managers can assess performance, identify potential risks and make more informed decisions.

2. Budgeting and Cost Management

A key skill for non-financial managers is the ability to manage budgets and control costs. This involves understanding the allocation of resources, identifying areas for cost reduction and ensuring that their department or team stays within budget.

Financial Decision-Making and KPIs Finance for non-financial managers emphasizes the importance of key performance indicators (KPIs) in evaluating business performance. Understanding how to use financial metrics like return on investment (ROI), gross profit margin and break-even analysis helps managers evaluate opportunities, manage risks and make decisions that align with the company’s financial objectives.

These foundational finance skills — understanding financial statements, managing budgets and making informed financial decisions — are essential for non-financial managers. They not only help improve individual performance but also foster a culture of financial awareness across the organization, ultimately contributing to sustainable business growth. Scan the QR code to get more information about financial management training at The MBA.

Tracy Daggett, PHR, is the director of Training and Development at The MBA. Contact him at 814/833-3200, 800/815-2660 or tdaggett@mbausa.org

SURVEY SAYS FINANCE LEADERS PLAN TO PRIORITIZE DIGITAL

Many chief financial officers (CFOs) are planning significant technology budget increases, viewing digital investments as crucial for growth and efficiency, according to Gartner, Inc.

A Gartner survey of 301 CFOs and other senior finance leaders, conducted from September through October 2024, found that 77 percent of respondents plan to boost spending in the technology category with almost half (47 percent) of CFOs intending to increase spending by 10 percent or more in 2025 compared to last year. The results underscore the critical role of technology in driving profitable growth and efficiency across industries. Conversely, spending on staff compensation is trending downwards, with only 61 percent of CFOs planning to increase average employee compensation in 2025, compared to 71 percent in 2024 and 86 percent in 2023. The proportion of CFOs planning to boost average employee compensation by 10 percent or more fell from 16 percent in 2023 to 11 percent in 2025.

“The continued focus on technology aligns with developments in traditional and generative AI, which promise to drive new offerings, enhance decision-making, and boost productivity,” stated Randeep Rathindran, distinguished VP, Research in the Gartner Finance practice. “Although the cooling labor market gives organizations more negotiating power on compensation, CFOs should remain sensitized to the potential risks of attrition and low engagement as prices for household necessities remain stubbornly high.”

A recent survey from Grant Thornton, one of America’s largest brands of professional audit, assurance, tax and advisory services, revealed a dramatic surge in confidence and optimism from chief financial officers (CFOs).

Grant Thornton’s Q4 2024 CFO survey engaged more than 250 senior finance leaders and found the uncertainty associated with the presidential election in November has given way to unrestrained optimism about the U.S. economy and meeting business goals. In fact, that optimism rose to 68 percent — the highest mark since the third quarter of 2021. Compared with the previous quarter, the rises in optimism and some key confidence metrics are unmatched in the four years that this survey has been conducted. Respondents reported 13-quarter highs in their confidence in meeting growth projections (65 percent), increased demand (64 percent), cost control goals (62 percent) and labor needs (60 percent).

WHAT ARE SOME ‘TO DO’ ITEMS THAT WILL HELP WITH ENSURING WAGE AND HOUR COMPLIANCE?

1. Employers can prevent many common issues that lead to wage and hour claims by classifying employees properly, paying wages correctly and maintaining accurate records. Perform audits to ensure employee classifications are correct.

2. Regular training, clear policies and staying up to date on changes in the law are also successful strategies to ensure compliance and maintain a positive workplace.

3. Establishing best practices to reduce wage and hour claims can enable employers to foster a culture of compliance that can not only help organizations avoid potential liabilities but also build trust and morale among their workforce, contributing to a more productive and harmonious work environment.

HAVE AN HR OR EMPLOYMENT LAW QUESTION? GET ANSWERS!

The MBA HR/LEGAL Hotline provides members with FREE counsel on a broad range of workplace-related issues like:

• Hiring and firing practices

• Company policies

• Compensation and benefits

• Employment law

• Employment agreements

• Workers’ compensation

• Affirmative Action plans

• Unemployment compensation plans Employee handbook policies

• Sexual harassment

• OSHA compliance

• Family Medical Leave Act

• Americans with Disabilities Act

• COBRA

Contact us at 814/833-3200 or 800/815-2660.

Wage and hour claims are a common source of legal challenges for employers. With everevolving laws and regulations, employers must stay vigilant to ensure compliance with wage and hour laws. Even unintentional violations can lead to costly lawsuits, penalties, reputational damage and employee dissatisfaction.

The following are effective practices that can help employers manage wage and hour issues effectively and reduce potential claims and legal risks:

• Classifying employees correctly: One of the most widespread wage and hour issues stems from incorrect employee classification. Under the Fair Labor Standards Act (FLSA), employers typically encounter two main challenges when classifying employees. First, employers must avoid misclassifying employees as independent contractors. Second, certain employees may be exempt from the FLSA’s wage and hour provisions, including executive, administrative, professional and outside sales employees.

• Paying employees properly: The FLSA requires employers to pay their employees for all hours required or permitted to work. Failing to pay nonexempt employees at least the federal or state-mandated minimum wage, whichever is higher, for all hours worked and overtime pay — at a rate of 1.5 times the employee’s regular rate of pay — for every hour they work over 40 during a workweek is one of the most common sources of wage and hour violations.

• Developing clear and consistent workplace policies: By developing workplace policies that address common wage and hour violations, such as work hours, breaks and overtime, and consistently enforcing them, employers can help mitigate risks and potential violations.

• Conducting regular training: Many wage and hour violations are preventable. Effective training can improve an organization’s compliance efforts by ensuring managers and employees recognize applicable laws and regulations, identify compliance concerns and issues, and report compliance issues properly.

• Ensuring accurate recordkeeping: Proper recordkeeping is a critical component in reducing potential wage and hour claims. Under the FLSA, employers are legally required to maintain certain records for each nonexempt employee.

• Addressing employee complaints promptly: Taking employee wage and hour complaints seriously and resolving issues quickly can prevent internal complaints from becoming formal legal actions.

Kim Figurski, SPHR, is an HR consultant and trainer at The MBA. Contact her at 814/833-3200, 800/815-2660 or kfigurski@mbausa.org.

•

•

•

•

•

•

•

•

The Manufacturer & Business Association (MBA) recently recognized the graduates of its computer training and professional development training course series. To see exclusive photos from the events or to learn more about the MBA’s training courses, visit mbausa.org.

The MBA hosts a variety of informational briefings and networking opportunities to keep members informed of happenings in the region and beyond. For more information on upcoming member events, visit mbausa.org.

enjoyed the MBA’s new

Speaker Series –

Congratulations to MBA member Teresa’s Italian Deli, which celebrated its 75th anniversary in 2024. Teresa’s Italian Deli has been providing the Erie area with the same authentic recipes from when they opened their doors in 1949. Shown here is General Manager Nicole Swanson.

here is

Shown here (from left) are MBA Executive Speaker Series –Health-Care Leadership panelists: Christopher Clark, D.O., MHA, president of AHN Saint Vincent Hospital; Danielle Hansen, D.O., MS, MHSA, regional president of LECOM Health; and, Brian Durniok, president of UPMC Hamot. Their discussion focused on challenges and opportunities facing organizations in our community as well as leadership strategies for navigating change and driving success.

The MBA had the opportunity to attend the Mercy Center for Women’s open house recently. The Mercy Center for Women provides safe, supportive and empowering housing solutions (Including permanent supportive housing) for individuals and families in transition with a focus on those affected by domestic violence, addiction and mental health challenges.

MBA Events Coordinator Davina Pacley had the honor of speaking with 5th graders at Grover Cleveland Elementary during their Black History Month Snack and Chat event in Erie. She shared insights about her role at The MBA and led a meaningful discussion on self-love and confidence. The event was organized by the director of the United Way Community Schools.