FOOD from

Poland is a significant European food producer and the turnover of the Polish agri-food trade has been achieving record-breaking results for many years.

In 2021, the value of Polish food exports was higher by 9.6% in comparison with the previous year, reaching the level of EUR 37.6 billion. The first half of this year has grown as well in terms of the sales level in relation to the analogous period the year before – in this case, it was as much as 24%.

The increase of the turnover, as well as a higher growth rate, confirm that Polish entrepreneurs from the agri-food sector are doing well on the international market. The agrifood exports enable utilization of excess food produced in Poland, comprising an important source of revenue for the Polish agri-food industry, and indirectly affects the econo my of the entire country.

Unfortunately, the war in Ukraine, ongoing since Feb ruary 2022, is having a perceivable impact on the economic

and food situation, both in Poland and in the entire Euro pean Union. Due to limitations in availability of energy raw materials, such as petroleum, coal, or gas, as well as certain agricultural goods, we are experiencing a non-stan dard increase of prices, which simultaneously causes in flationary pressure. However, it should be kept in mind that Poland is a serious food producer, currently upholding Europe’s food safety.

However, experts assure that in no way is the food safety of Poland threatened; nevertheless, the developing situation beyond our eastern border should be observed with due attention. The months to come will be crucial, especially in view of growing prices of gas necessary for the production process of food and fertilizers. Currently, we are facing one of the greatest challenges of our generation, yet we can sleep well, as Poland has always closely kept an eye on the things happening around us and has perfectly prepared itself for problem-solving.

foreign

Editor-In-Chief Tomasz Pańczyk t.panczyk@foodfrompoland.pl

Managing Editor Monika Górka m.gorka@foodfrompoland.pl

Arkadiusz Majchrzak, Export Manager at Terravita

Krzysztof Stojanowski, Chairman of the Board at Profi

Marietta Stefaniak, Board Member for Strategy and Development at ZM Silesia

Olgar Suner, Deputy General Manager at Turka Invest

Marcin Zieliński, Business Development

at Makarony Polskie

Zbigniew Grycan, the creator and owner of

“Grycan – Lody od Pokoleń” brand

Editorial Office Bagno Street 2/218 00-112 Warsaw, Poland

redakcja@foodfrompoland.pl www.foodfrompoland.pl

Fischer Trading Group Ltd. CEO: Tomasz Pańczyk t.panczyk@ftgroup.pl

The manufacturer of Dorato has revealed its results. AMBRA Group has published its finan cial results for the financial year of 2021/2022. Poland’s largest wine manufacturer, importer and distributor has experienced record-breaking sales growth during that period.

Still wines, comprising the largest share of the Group’s rev enues, grew by 8.2%, definitely above the market growth rate of this segment. The sales on the Polish market, which is the most important for the Group, increased by 12%, and the most frequently purchased products – apart from sparkling wines – included WINIARNIA ZAMOJSKA as well as PORTADA and CONO SUR wines.

„We will invest in further development of our business: we modernize our production plants and make them even more environmentally-friendly,” says Robert Ogór, the Presi dent of the AMBRA Group. He adds that in the year that has just ended, the company has cut its carbon dioxide emissions by 20%.

Żabka is opening a laboratory of ecologic innovations enriched by smart solutions. Żabka Eko Smart features one of the world’s first perovskite installations –this groundbreaking technolo gy has been used to make price tags and window blinds with perovskite solar cells. The store is equipped with remote lighting management systems and Smart Shop Control devices located in side, whereas tiles made of coffee grounds and husks are laid next to the coffee machine stand. Clo sed refrigerators, insulated with mats of true hemp, allow for substantial energy savings, as do glycol-filled shelves in the freezing cabinet. Soon, Żabka intends to launch three more shops of such kind in different parts of the country.

The new store fits in with the Żabka Group Strategy of Responsibility, the main areas of which include concern for the natural environment, including achievement of climate neu trality by the end of 2025 and reduction of the emission intensity in stores by 70% by the end of 2026, as well as increase the level of satisfaction of franchisees with their cooperation with the chain.

The market is still growing. Germany, France and Poland – this is the European top three in terms of the number of post lockers. Additionally, Poland is the leader with regard to the number of parcel lockers (almost 11,500).

Parcel machines are a concept enjoying particular popularity in Poland; they have been used by as much as 97% of participants of a survey conducted by Colliers in late 2021.

Furthermore, among all countries in the world, it is Poland that has the most parcel machines per 100,000 inhabitants – in total, there were about 18,000 of them by the end of 2021, and estimates say that the number will exceed 25,000 by the end of 2022.

Mlekovita, a company with many years of tradition and a po sition well established on both the Polish and foreign market, is cel ebrating 30 years of its brand in 2022. The development of the company and the business partnership were the subject of the 1st All-Pol ish Forum of Business Partners, organized by the Mlekovita Group on 15 July 2022.

Mlekovita is the largest dairy group, not just in Poland but in all of Central-East ern Europe. It is already comprised by 22 production plants, 34 own distribution centres, 147 Mlekovitka stores, and the mlekovitka.pl online store.

In September, the Tarczyński brand has officially launched its first multi-channel campaign in Lithuania. The goal is to promote kabanosy dry sausages from the Tar czyński Exclusive line. Nationwide actions include key TV channels, online ads, as well as exposure at points of sales (POSs). The Lithuanian market has not been chosen at random. The company has been present there for several years and is currently a leader in the sales of meat snacks from the premium category.

Tarczyński is a brand currently present in nearly 30 countries of the world, on 3 continents. For several years, the brand’s flagship products, i.e. the Exclusive kabanosy, have also been available in Lithuania where they have quickly gained the appreciation of consumers.

The Krajowa Grupa Spożywcza (National Food Group) company is launching its sugar campaign for 2022/2023. During a celebration at the Kruszwica Sugar Plant, the President of the Group announced record-breaking production.

„This year, we intend to break our hitherto record of sugar pro duction. The yields seem more promising than in the previous year, the beet polarization level is higher as well, reaching the amount of 17%,” – Jan Wernicki, the President of Krajowa Grupa Spożywcza, announced on 9 September.

Predictions say that during the 2022/2023 campaign, sugar refi neries owned by the Group are to process approx. 6.2 million tons of raw material. The estimated highest sugar production may exceed 930,000 tons. The estimated highest sugar beet purchase this year will be conducted by Kruszwica Sugar Plant, amounting to almost 1.4 mil lion tons.

The generation 2.0 Fibre Bottle is a pioneering packaging solution comprised by an inter nal coating of PEF plant-based polymer and an external wood fibre casing. Both materials are of natural origin and make the bottle fully “bio” (excluding the bottle cap).

The Fibre Bottle will not be available for sale, but Polish consumers can win one of 570 innovative, 100% organic Fibre Bottle packages as part of joint opera tions between the Carlsberg brand and the Żabka chain. This is part of a consumer test conducted by the Carlsberg Group in eight countries of the EU, intended to collect information on the consumer experien ces with the Fibre Bottle.

A machine for filling Lubella pasta into packages is a brand new, innovative project Maspex Group is testing jointly with the Carrefour chain and the Swapp! company. The first such device has just appeared at a Warsaw hypermarket.

As a part of implementing the objectives announced in the “Hummingbird Effect” Sustainable Development Strategy, Maspex Group aims at limiting plastic use and food waste. One solution to bring the company closer to the achievement of its objectives is the Pasta Station – a refilling machine for purchase of Lubella pasta in paper bags, reusable bags, or own packages. The program is currently in the pilot stage.

Customers of Carrefour Arkadia will be able to buy four flagship types of Lubella pasta: fusilli, conchiglie, penne, and farfalle, each of them in three capacities: 150, 250, and 350 grams.

On the basis of the pilot programme, the company will decide what to develop, both in the context of the customer experience and the software of the Pasta Station. Consequently, the final form of the device may still change.

Renata Juszkiewicz

Renata Juszkiewicz

In view of the post-pandemic and geopolitical situation, the Polish trade struggles against many crucial challenges. The war in Ukraine has brought about a collapse of imports of fuels and raw materials from Russia and Ukraine. A strategic challenge for the sector is currently the stability of fuel supply and uninterrupted access to energy. Any interfe rences in this area may cause production downtimes and disruption of cold chains, both at the stage of production and trade. In order to main tain the continuity of supplies, the sector has repeatedly appealed to the government to treat the trade sector as critical infrastructure, i.e. one protected against potential electric power and gas supply interruptions.

A new hazard has appeared recently, in the form of nitrogen plants suspending their production of carbon dioxide and dry ice, necessary for food production. Due to the market deficit of such raw materials as sunflower oil, linseed, rapeseed, or soy, trade is facing a potential risk of the occurrence of shortages of certain food items. The industry is also concerned with speculation of food prices in global and local exchanges. This phenomenon adversely impacts the supply of pro ducts in stores and their prices, as we could observe with the example of sugar. A hazard for provision of uninterrupted food supplies to sales outlets is also posed by personnel shortages in logistics, especially in the positions of drivers or distribution centre employees, caused by citizens of Ukraine leaving Poland.

The aftermath of the pandemic is runaway inflation, loss in pur chasing power of the Polish people, and the deepening pauperization of the society. Among the lowest-income people, as much as 66% save money on food. The overarching priority for the industry is to miti gate the inflation shock and to stabilize the prices, to make all Polish families capable of obtaining food and necessary products. Another significant challenge to trade is posed by growing store supply costs. Skyrocketing energy prices have translated into an increase in food production costs, which, in turn, has caused a strong increase in pur chase prices of goods from their manufacturers.

To keep the prices for customers as low as possible, trade chains try to balance out the manufacturers’ price increases, often at the expense of their own margins. This is a colossal effort for the industry, con sidering the high business costs to be incurred by the stores, such as costs of transportation, maintenance of commercial facilities, or labo ur. The inflation acts as an additional sectoral tax, and let us recall that trade is currently facing an accumulation of almost 20 fiscal burdens, such as the trade tax, minimum income tax, or mall tax. The uncer tainty among the members of the industry is also caused by new legi slative changes, such as the final form of the projected deposit system and the implementation costs thereof, estimated at billions of zlotys.

This June, as shown by the latest survey by NielsenIQ, the share of private labels in the market has been the largest ever, comprising 21.1%. According to the survey, 23% of consumers treat private labels as a way to limit their expenses. The growing trend is also confirmed by the sales results of E.Leclerc.

An increase in value by 18% and in quantity by more than 6% – this is the private label sales dynamic E.Leclerc Polska may boast of. As noted by Jacek Stachoń from E.Leclerc Polska, „the sales are still growing”. This applies specifically to the Wiodąca Marka (Leading Brand) – an E.Leclerc brand currently offering nearly 3,000 products.

The growing share of private labels in the entire FMCG market is additionally evidenced by the latest data of NielsenIQ, showing the largest share ever of such products. As the analysis shows, price still remains of primary importance to customers. 7 out of 10 buyers dec lare their knowledge of food item prices, while 8 out of 10 look for promotions while shopping.

Maciej Ptaszyński Deputy President of the Board Polish Chamber of Commerce

Maciej Ptaszyński Deputy President of the Board Polish Chamber of Commerce

In 2021 and 2022, consumers have appreciated small grocery stores. Before that, they were often largely unaware how much such stores offer. The pandemic has made the Polish people notice how strategically important and how necessary small neighbourhood shops are. The shopping habits have changed. The customers also see that large outlets cannot handle everything, the smaller ones also have a broader assortment. A discount store may have approx. 3,000 items, whereas at a small store, one can find between 5,000 and 6,000 of them, and sometimes even between 9,000 and 10,000 items, plus local brands that cannot be found in discount stores.

As for the most important changes and trends to come, the Polish Chamber of Commerce points out that the package deposit system that is to come into effect should not include disposable glass packa ging and metal cans.

Another important part of the retail trade market landscape is the issue of Sunday trade limitation.

Since February, an amendment of the Sunday Trade Limitation Act has come into force. As a rule, the Sunday trade limit has proven favourable to a vast majority of small and medium trade enterprises.

Both the COVID-19 pandemic and the war in Ukraine have si gnificantly affected the processes in the global economy. As a result of pandemic restrictions and the limitation of demand, industrial enterprises were often forced to cease production. The increase in energy raw material prices and component supply shortages have been particularly painful to the automotive sector. Therefore, some European economies are still unable to catch their breath after the pandemic. Poland stands among the countries that have managed to recover from the “coronacrisis”. This February, the domestic industrial production has increased by almost 25% y/y. At the same time, the production in the Eurozone has dropped, while in the entire EU, it has only recorded a slight increase.

Additionally, Europe has found itself in a difficult situation after the Russian aggression on Ukraine, since most countries of the Old

The Sunday trade limitation situation would have been simpler and more orderly if, during the latest amendment of the Sunday Trade Limitation Act, the legislator had acceded to the postulates advanced. Among others, by the Polish Chamber of Commerce, allowing for broadening of the definition of family members who may assist the entrepreneur standing in person behind the counter in accordance with the one already existing in the legal order and letting micro-en trepreneurs use the assistance of students and pensioners on Sundays. One might say such a solution would be simple, compliant with the expectations of the public, and supportive to entrepreneurs. Here, we reach the conclusion that, for the law to be made well and in accor dance with the needs of entrepreneurs, public consultations need to be real consultations and the voice of entrepreneurs should be taken into consideration during the legislative process.

Continent had been dependent on imports of goods from the East until then. Although Poland has not been affected to such a large extent, our economy is feeling the effects of the war just as other eco nomies do. The most severe effect that Polish entrepreneurs mention frequently is the increase in business costs. Disruptions in the func tioning of supply chains come second, and employment problems occupy the third position. However, Polish companies are flexible and quickly adapt to new conditions. This is evident from the results of Polish exports. In the first half of this year, the sales of Polish goods, expressed in euros, were 19.1% higher than the year before. Signifi cant increases in export value were recorded by such industries as door and window joinery or the food sector. It is predicted that the collapse of trade with Russia and Ukraine will limit the growth of the trade volume, yet overall, Polish exports may grow by more than a dozen per cent y/y.

A phenomenon that alters the face of international trade is near shoring, involving the shortening of supply chains through regiona lization of processes and relocation thereof closer to main offices of companies. How can Polish businesses benefit from this? From Po land, one can deliver goods to most European cities within 24 hours, and to the entire continent – within 48 hours. This is a great opportu nity for our entrepreneurs, including small and medium ones.

In 2021, we observed a continued upward trend in the export of Agri-food products from Poland; since 2004 its value has increased more than seven fold. In 2021, the export of Agri-food products reached a record level of EUR 37.4 billion, i.e. it was 9% higher than a year earlier.

The increase in exports was a result of con tinued demand for Polish products, which, de spite rising prices in the second half of 2021, were competitive on the international market. Exports of Polish Agri-food products were supported by the zloty exchange rate against the euro, which was favourable for domestic businesses, and also by the progressive diversi fication of export directions. Also the growing economic activity of Polish entrepreneurs, the proper preparation of domestic companies to operate in the pandemic conditions, and ad justment of the assortment offer to suit foreign consumers with diverse preferences resulted in very good export figures.

The results of foreign sales achieved by domestic exporters in 2021 were also influ enced by high food prices on the world mar ket reflected in the growing value of the FAO monthly food price index. In 2021, the aver age index value increased from 113.5 points in January 2021 to 134.1 points in Decem ber 2021, i.e. an increase by 20.6 percentage points. The prices of vegetable oils (rose by 39.6 pp), sugar (by 22.3 pp), dairy products (by 17.7 pp), meat products (by 16.4 pp) and cereals (by 15.5 pp).

At the same time, the value of imports of Agri-food products amounted to EUR 24.7 billion and it was 8.6% higher than in the previous year. The positive trade balance in creased by 9.7% compared to 2020, reaching EUR 12.7 billion (of which EUR 7.7 billion in trade with the EU-27 countries and EUR 5.0 billion with non-EU countries).

Geographical structure of Polish exports of Agri-food products in 2021

France 6%Netherlands

Other countries

Italy

Germany

EU-27

Czech Republic

Spain

Romania

Belgium

Hungary

Slovakia

EU countries

In 2021, Polish Agri-food products were delivered to customers in 198 countries on all continents. A big diversification of export directions made it possible to compensate for the decline in the value of exports to Great Britain, after the UK left the EU customs union.

As in previous years, Agri-food products were exported from Poland mainly to the EU market. In 2021, deliveries to the EU-

27 countries generated EUR 27.1 billion (an increase of 11%), which accounted for 73% of revenues attained from the total export of Agri-food products.

Polish Agri-food exports to the EU mar ket were characterized by a significant geo graphical concentration. Germany remained Poland’s main trading partner. Exports to this country in 2021 amounted to EUR 9.4 bil lion and was 9% higher than in the previous year (exports mainly of cigarettes, fish prod ucts, poultry meat, bakery products, animal feed and chocolate products). Significant im porters of Polish Agri-food products includ ed also: the Netherlands (EUR 2.2 billion,

In total 34 309 904 37 392

EU-27 24 380 597 27 116 678 11% 71% 73%

Outside EU 9 929 308 10 276 136 3% 29% 27%

Germany 8 622 826 9 388 423 9% 25% 25%

Great Britain 3 103 907 2 972 703 -4% 9% 8%

Netherlands 1 929 233 2 240 166 16% 6% 6%

France 1 850 883 2 148 501 16% 5% 6%

Italy 1 727 116 1 903 061 10% 5% 5%

Czech Republic 1 512 038 1 592 362 5% 4% 4%

Spain 882 656 1 100 485 25% 3% 3%

increase by 16%; exports mainly of poultry meat, cigarettes, corn grains, fruit and veg etable juices, chocolate products and beef), France (EUR 2.1 billion, increase by 16%; exports mainly of poultry meat, meat prod ucts, chocolate products, animal feed, bakery products and beef), Italy (EUR 1.9 billion, an increase by 10%; exports of cigarettes, beef, fish products and animal feed which ac

counted for nearly 50% of the export value) and the Czech Republic (EUR 1.6 billion, an increase by 5%; exports mainly of poul try meat, bakery products as well as cheese and cottage cheese). In total, exports to the markets of the five above mentioned coun tries generated a revenue of nearly EUR 17.3 billion, which accounted for approximately 64% of the export value to the EU-27.

In 2021, Agri-food products with a to tal value of EUR 10.3 billion were exported from Poland to non-EU countries, 3% more than in the previous year.

• Non-EU countries (excluding the CIS)

In 2021, exports to non-EU countries (excluding the CIS countries) increased by 2%, to EUR 8.4 billion. Outside the Europe an Union, the United Kingdom maintained the position of the largest importer of Polish Agri-food products (with revenues of EUR 3.0 billion, a decrease by 4%; exports mainly of meat products, poultry meat and chocolate and bakery products). Taking into account the changes in market conditions after the coming into force of the trade and coopera tion agreement between the European Union and Great Britain, a relatively small decrease in export revenues should be considered as confirmation that trade contacts have been maintained by domestic entrepreneurs. The factor supporting the competitiveness of Pol ish Agri-food products exported to the Brit ish market was a strong appreciation of the pound sterling against the domestic currency.

Significant importers of domestic Agrifood products, as in previous years, were also: The United States (EUR 612 million, increase by 14%; exports mainly of chocolate products, pork, fish products, alcohol and processed meats), Saudi Arabia (revenues of EUR 510 million, decrease by 26%; exports mainly of cigarettes and wheat) and Algeria

total

meat, meat products and livestock

cereal grains and products

tobacco and tobacco products

sugar and confectionery

dairy products

fish and fish products

vegetables and products

and products

oilseeds and plant fats

coffee and cocoa

300

(EUR 418 million, an increase by 66%; ex ports mainly of wheat grains – 55% of the export value, concentrated and powdered milk – 25%, and tobacco – 16%), followed by: Israel (EUR 293 million, increase by 19%; exports mainly of beef and sugar), Norway (EUR 270 million, increase by 15%; exports mainly of cigarettes, fruit preserves, animal feed and wheat), China ( EUR 190 million, decrease by 7%; exports mainly of liquid milk as well as cream and whey – in total 57% of the export value) and Switzer land (EUR 188 million, increase by 10%; exports mainly of alcohol, animal feed, water and bakery products).

In 2021, exports to the countries of the Commonwealth of Independent States amounted to EUR 1.9 billion, and it was

10% higher than in the previous year. Among the CIS countries, the highest value was achieved by exports to Ukraine - EUR 811 million (increase by 7%; exports mainly of cheese and cottage cheese, animal feed, choc olate products, coffee and bakery products), then to the Russian Federation - EUR 676 million (increase by 19%; exports mainly of bakery and chocolate products and vegetable preserves) and to Belarus - EUR 249 million (decrease by 1%; exports mainly of fresh ap ples and pears, seedlings and cut flowers, fruit and vegetable preserves).

In 2021, the following goods dominated in the commodity structure of revenues ob tained from the export of Agri-food products: meat, meat products and livestock, cereal grains and products, tobacco and tobac

co products, sugar and confectionery, dairy products, as well as fish and fish products. The export of the above mentioned groups of goods generated a total of 63% of the revenue obtained from all exports of Agri-food prod ucts from Poland.

In 2021, there was a decrease in the share of revenue generated from the ex port of Agri-food products in Polish total exports, which amounted to 13.1% com pared to 14.3% in 2020.

The National Support Centre for Agriculture establishes and develops contacts with entities interested in cooperation with the Polish agri-food sector and development of trade.

Contact us under the address: eksporter@kowr.gov.pl

information: www.polandtastesgood.pl/en/

Among the CIS countries, the highest value was achieved by exports to Ukraine –EUR 811 million.

How has the logistics market changed over the recent years? What has become the priority in the services of this segment?

The logistics market is one of the most actively developing sectors of the economy. One can easily see new warehouses sprouting around the largest agglomerations. In view of opening up to new product searches, the demand for innovative logistics and transport solutions has increased. Currently, of great importance is flexibility in relation to customers – services provided on the highest level, as well as con sulting in the area of proper storage, warehousing, and transporta tion. A major role is played here by partnership in relations between partners – highlighting potential problems which might be encoun tered, as well as presenting ways to solve them. Appropriate personnel, numerous training, experience amassed over the years, all become an invaluable source to overcome difficulties posed by the requirements of a market expecting professional and reliable service.

Is a logistics partner able to affect savings, or even increase profits, of manufacturers in the FMCG sector?

The term “logistics partner” may denote companies specializing in a given branch for many years – no company specializes in all branches of the sector of logistic services – which know all inner workings of the given area inside out. Learning, many times, from their own experiences and errors, they are able to nullify and prevent any future problems which might arise in cooperation with a new contractor and a long-time partner alike. Additionally, what matters is reliable and transparent cooperation, as well as explanation of cost-related details: what they result from and what consequences they entail.

The logistics market is one of the most actively developing sectors of the economy. On challanges, savings, geopolitical situation and innovations we talk with Sebastian Romaniak, Transad Owner.

Analysis of the given needs and expectations will minimize the risk of, first of all, failure, and secondly, potential losses due to inexperience and wrong decisions. There are tools allowing one to minimize the costs; it is a matter of finding them, implementing them and using them correct ly, as well as conversations with experienced people willing to share their knowledge and expertise.

What kind of services are your specialty? What makes your offer stand out?

The leitmotiv of our company is refrigerated transport – products that need to be carried under a controlled temperature; from foods to com ponents to medical products. It is due to customers to whom we have been providing services for years that we are developing, expanding and improving our fleet every year. Currently, we own every semitrailer type available on the global market, as far as refrigerating equipment is con cerned. Our fleet includes standard semitrailers, as well as double-floored ones, floral refrigerators, multi-chamber ones with partition walls to trans port goods at different temperatures; some of them have lifts. Most of our units are semitrailers with room for 33/66 pallets, but we also have small er ones, accommodating between 1 and 18 pallets, which allows us to distribute even to very hard-to-reach places. Additionally, apart from our vehicle fleet, we have a cadre of perfectly trained personnel fully involved in customer assistance and consulting. They oversee the entire process of transportation from point A to point B. This process is more than just pulling up to be loaded and reaching the unloading site; there is a whole range of relations to be fulfilled if the entire operation is to have a happy ending. Through commitment and passion, they prove their dedication to the company which is not just corporation but also the very friendly rela tions we have here. Everyone is involved in the works and development of the company, as evidenced by the expanding fleet and the new challenges posed by cooperating companies, which is proof of their confidence in us.

In view of the drastically growing prices or the unstable geo political situation, it is a challenge nowadays to maintain the continuity of business. How do you provide your contractors with a stable supply chain?

The lack of stability in the world, with regard to both prices and geo political problems, affects us all, and entrepreneurs indeed bear the brunt of it. However, this affects not just the logistics sector but all areas of the economy. First of all, the situation impacts the first link of the chain; an increase in transportation costs affects the increase of prices in the final effect. However, many conversations with our contractors allowed us to realize the problems we are all facing, hence full comprehension thereof and the will to cooperate further. Nowadays, as I have already mentioned, it is not only price that matters but flexibility, the will to cooperate, ac tions based on the “win to win” principle, consulting, availability, timeli ness, as well as openness in solving problems and searching for solutions. Also with price increases, especially of fuel, our partners fully understand the lack of stability and our models of cooperation are elaborated in such a way as to avoid any disruptions to the supply chain at any moment.

How do you adapt your offer to the individual needs of contractors from different countries? Are you able to react to all variables?

The answer is in the question – this is individual. It is the basis of ac tion in the current times and situation, not just on the market of logistics services but mainly based on the best possible relations with partners. We cooperate differently with each one of them, as each customer is different, with individual needs, requirements, standards, or norms. However, since we know our partners and constantly remain in touch with them, we can respond on an ongoing basis and monitor all variables appearing during the implementation of individual tasks, virtually in real time.

As I have said before, we own every semitrailer type currently available on the market. We put much emphasis on proper servicing, appropriate equipment, regular maintenance, and systematic inspection of the correct ness of operation of individual components. Of tremendous importance to us is the proper operation of our equipment, worth several hundred thousand euros and often used to transport goods exceeding its value; si multaneously, we are able to ensure the safety of the property entrusted to us and, above all, to the drivers. Additionally, our semitrailers are equipped with many more options of cargo securing than in other companies of a similar nature have. Our stock is no older than 3 years, we systematically replace it with newer equipment, allowing no shortcomings on our part. We use all innovative solutions available on the market, and we search for them ourselves, to strengthen our position even more, expand the offer, and increase our competitiveness.

Innovativeness is a key area of operation on many markets, in lo gistics as well. What technologies and innovative solutions do you use?

We are able to find a solution for virtually every customer. It is not a problem for us to carry both frozen and fresh goods at the same time; whether it is 2 pallets of frozen fish or a whole truckload of fruit, we can

deliver on time. Each time, we approach every order individually, adapt ing to the needs required by the contractor. An extensive fleet, storage facilities – it is mainly due to this that we can store, repackage and reload goods as well, while preserving the cold chain all the time. Our employees take care to satisfy the customer to the full extent and also to make prop er use of our fleet and capabilities, such as double-chamber refrigerators enabling simultaneous transportation of fresh and frozen goods, or dou ble-floored refrigerators for transportation of increased batches of goods, e.g. 66 pallets. The only limit is our imagination.

How do the forwarding services you offer optimize the transport processes?

Above all, through using our own fleet, we know the real costs borne by transport companies, especially by forwarding ones. Based on our own example, we have experienced what most service-selling companies have only read about in industry magazines; we now have real costs we are able to document and present to our contractors. In addition to the numbers, immediately visible when the concept of optimization is concerned, one should not forget timeliness. Aware of the transported cargo, especially foods, we allow no delays. We adapt our cadre of drivers to perform the entire operation flawlessly. We know that the cargo loses quality with each delay, and thus the quality is reduced when it reaches the end recipient –and, in fact, we are such recipients too every day.

Our greatest benefit is customer satisfaction and orders for new trans ports, as well as new challenges being posed to us. This motivates us to act and develop even more dynamically.

What goals do you set for yourself for the years to come?

Development, development, development, and more development. Of course, as every entrepreneur, we have assumed a certain business plan we are implementing step by step. We are unable to foresee the geopolit ical situation and the extent to which it would impact us, but we surely intend to significantly increase our vehicle fleet, to develop even more with regard to less-than-truckload transportation, as well as to expand the scope of storage services. We can see potential in each of these areas. Few companies are willing and able to develop in all of the mentioned areas, while we can see a future in them. We will surely be able to repeatedly prove our experience to the customers who work and will work with us.

Thank you.

SM Mlekpol has been operating in the Polish market for more than 40 years. Over this period, it has taken over other cooperatives with diverse production profiles, reinforcing its position in Poland and abroad. Today, the Cooperative makes dairy products at 13 highly specialized and stateof-the-art production plants. The dairy raw material used for production comes from domestic farms located around the plants in the regions of Podlasie, Warmia and Masuria, as well as Kujawy. Each day, the Cooper ative processes more than 5.5 million litres of milk into products under brands so familiar to the consumers: Łaciate, Zambrowskie, Białe, Milko, Maślanka Mrągowska, or Rolmlecz.

Mlekpol, as the dairy cooperative with Poland’s largest own raw ma terial resources, i.e. processing 17% of all milk produced by Polish farms, exports almost 30% of its entire production. Mlekpol products are avail able in more than 100 countries worldwide, and Łaciate, the most popular Polish milk brand, reaches as many as 6 continents. Despite the difficult and unpredictable situation in the world, the company’s turnover between January and July 2021/2022 has grown significantly.

The most strategic directions for Mlekpol are European countries, such as the Baltic states, Slovakia, the Czech Republic, Bulgaria, Romania, Greece, Italy, and Germany. This is due to their European Union mem bership, guaranteeing freedom of trade, and the capability of using road transport to ensure short delivery times. Moreover, we focus on countries with insufficient dairy production of their own, which need to import various dairy products. These include China, Indonesia, the Philippines, Vietnam, South Korea, Israel, Mexico, Chile, the Dominican Republic, India, Iraq, Moldova, or Serbia. The range of products exported in these directions is very wide, starting from those intended for the B2B market, such as skimmed milk, whole milk and powdered whey products (in cluding WPC 85), to the ones aimed at distributors and retail customers. These include cheeses, butter, UHT milk and cream, yoghurt, etc. The Cooperative’s export capabilities are large enough to respond to the de mands of new customers in other markets of the world.

We talk with Małgorzata Cebelińska, Trade Director at SM Mlekpol – the dairy cooperative with Poland’s largest own raw material resources and the producer of finest Polish dairy products.

What are the hazards and opportunities for export today?

There was the corona virus pandemic that has proven food to be a strategic issue for every well-functioning state. Interrupted supply chains and other problems we had been experiencing then caused state governments to take action via local importers towards greater diversification of suppliers, including suppliers of dairy products. Mlekpol, a well-known and reputable manufacturer, is still gaining new customers on new markets. Unquestionably, export activities are threatened by the current geopolitical events, adversely affecting the continuity of cooperation and the supply of goods between indi vidual countries. Another problem is posed by economic issues, such as inflation and the related growth of prices of raw materials and key production materials. They cause higher business financing costs and a decrease in the customers’ purchasing capabilities. Purchases made by importers are thus more cautious, and the stocks they build last for a shorter time.

What are the consumer requirements worldwide and how does Mlekpol respond to them? Is it easy to match the expectations of con sumers from different countries?

Participation in fairs in different countries and different continents allows us to meet consumers and distributors from many countries and to learn their particular needs and inclinations. Consequently, Mlek pol implements many dedicated projects taking into account such spe cial preferences. Moreover, the Cooperative has created international brands, such as Milcasa or Happy Barn, already familiar to consumers in different countries worldwide. Due to the deep-sea transport and distribution capabilities of importers, Mlekpol primarily focuses on products with long shelf lives. High specialization of production and modern technologies implemented in production plants create greater flexibility and possibilities for the implementation of dairy production dedicated to customer needs. With our experience and cooperation with a specially established Institute of Dairy Industry Innovation based in Mrągowo, Mlekpol is open to every cooperation and eager to take new challenges.

Thank you.

100 active markets on five continents, millions of products delivered – nothing is impossible for the Brand Distribution Group.

For more than 30 years, they have been supplying thousands of products to cus tomers around the world: food, household chemicals, and cosmetics. The success of the Brand Distribution Group is based on experi ence, international relationships, and knowl edge of markets, products, and consumers. The Brand Distribution Group owes its suc cess to... people.

The basis of success in distribution is a true passion, thirst for knowledge, open communication, and multitasking. Experi enced sales representatives say that it is the ability to do several transactions at once that attracts more business partners. This is more so because they perfectly understand the needs of their customers – retailers, whole salers, merchants of large retail chains, and, above all, the target consumers.

– There’s a lot going on at the same time. There is no boredom, there are tasks. What about the goal? To understand the needs of a business partner – says Wiktoria Karpiel, who coordinates the work of the sales team in the Spanish-speaking markets daily.

Other experts at the Brand Distribution Group share similar considerations. Not a day goes by that their teams don’t ship hundreds of thousands of products to customers around the world. The expedition of quickly tradable products is their element. They have been working for the company for years – it’s a busi ness where relationships and mutual trust mat ter above all. And these take time. Especially because we are talking about relationships be tween different cultures, races, religions, cus toms, behaviors, and languages.

Sales representatives speak fluent English and the languages of their business partners’ countries of origin. They are all university graduates and have many years of industry experience. They love what they do and con stantly deepen their knowledge of the mar kets, local trends, applicable laws, customs regulations, and much more.

One-man band? In the Brand Distribu tion Group, yes. – Expert, connoisseur, advi sor. From product search to negotiation and delivery to the point of sale. Logistics? Right away! Flexible approach to order processing? Of course! – says Katarzyna Bruczko, busi ness unit leader, which serves clients from North America. She added that the current macroeconomic situation was an addition al obstacle. – Higher costs, poorer access to resources, disruptions in supply chains, ex change rate fluctuations, and inflation. An obstacle is a challenge, so the Polish trait comes in handy – the ability to adapt to the most difficult situations”, explains Bruczko.

The Brand Distribution Group offers a service that starts with the search for goods at a reasonable price, logistics, and the prepa ration of all necessary customs documents and transport. It is a close collaboration of many de partments of the company: Trade, Purchasing, Finance, Controlling, Logistics, Marketing, and Customs Agency. – It is no wonder that the company’s purchasing department is a team of scouts trained in international search – empha sizes Malgorzata Lukaszuk. – Do you find a product on another continent and bring it to

Poland, for example? For us, it’s a piece of cake! When consumers reach for a product on the shelf, they don’t realize how much effort and work goes into getting the East Asian delica cy on the shelf in a shop on the other side of the world. We take care of the formalities be cause our business partners don’t have time for them. Their goal, and our mission, is to deliver a product that allows them to reach their profit margin”, adds Lukaszuk.

What is allowed in one market can be banned in another, so the attempt to market such products is a recipe for financial and reputational disaster. – We know how local law regulates the composition of the product, the descriptions on the labels, and even the tools of marketing communication, explains Katarzyna Bruczko. For example, the usual gelatin for Americans or Italians, often mixed with sweets, disqualifies the product in the markets of Islamic countries. Because the in dustrial source of gelatin is pork. Therefore, expert knowledge is required in product sales teams in different markets.

Product data sheets, studies, certificates, la beling – sales representatives need to know ex actly what they are selling. Edyta Owsiejczuk, business unit leader of the export team for Central Europe and the Balkans, confirms the words of her colleague. – Knowledge of the lo cal market is the guarantee of the success of my business partner. I need to know which brand of washing powder is most appreciated by con sumers and why. And I must find a replace ment if I need one. We cannot afford to lose trust, she explains. For this reason, the Brand

Distribution Group offers thousands of prod ucts. – We need to be sure that the product thrives on the market and that the customer has a sense of security, adds Wiktoria Karpiel.

Pandemic, commodity, energetical cri ses, broken supply chains, inflation, and skyrocketing price increases. For others, it’s a problem, for Brand Distribution Group it’s an opportunity to show how much they can support their business customers even in turbulence.

Some products can be replaced by oth ers, less popular, but often with potential for iconic brands. – Our new destinations are not self-evident, but we don’t think it makes sense for a global business to stick to old patterns. For this reason, we have decided to look at customers from other, even a little exotic, markets. It has been shown that con sumers from countries such as Uzbekistan, Mongolia, Armenia, and Georgia are much more open to new products than before”, ex plains Anna Muszynska, business unit leader of the Eastern Markets Team.

Although prices continue to be the most important determinant of consumer choices, other motivations and trends come into play. An example of this is the growing demand for superfoods and functional foods. Knowledge from other, already mature markets is very useful in opening new markets. For example, from an already very diversified superfood market in Poland, says Klaudia Ejsmont, who works in French-speaking countries (France, Belgium, etc.). – Many superfoods or func tional foods come from Poland. So, we have our share in the promotion of domestic pro ducers in other market, she says.

The company’s business sense is also re flected in its approach to the organization of deliveries. Mixed deliveries are the perfect an swer to the crisis. The ability to mix goods in transport, i.e., to ship mixed categories, is a clear advantage of the Brand Distribution Group. It is a win-win for both parties – retailers and pur chasers. – Transport costs are increasing, so it is our aim to organize delivery in such a way as to maximize space and capacity. The custom er receives from us a product volume that is so loaded that the proportion of transport costs relative to the value of these products is as low as possible – says Anna Muszynska.

All employees of the company agree that sales work is based on constant change and adrenaline. They are not complaining be cause, as they say, the number of customers returning to the Brand Distribution Group is increasing. It is a sign of the quality of their work. They also appreciate the opportunity to get in touch with people from all over the world. Here, working in an international environment is not a slogan from a corpo rate recruitment advertisement. It is not just about markets, but above all, about cultures. This can be seen, for example, in the man

ner of business communication. – In Europe, e-mail business contacts dominate, but Bra zilians or Uzbeks prefer to make calls. For the people of the Balkans, it is completely natural to combine business topics with pri vate ones, and everything at dinner – this is what charmed Edyta Owsiejczuk, who works with clients from the Balkans and appreciates openness in contact with her business part ner. – The customer is our focus – adds Anna Muszynska. – His trust, relationships, and sense of professional and safe service are the basis of our work.

For over 30 years we are one of the leaders of Polish export ers. As a part of Ewa Bis Group, we have been supplying top quality Polish food to over 70 countries around the world.

We sell our products across the EU, Africa, Asia and North America. We have been cooperating with large interna tional manufacturers, distributors, retail chains, and smaller local stores and wholesalers. Our main purpose is to satisfy the needs, requirements and expectations of our customers

quality and food safety of offered products.

In the period from January to May 2022, the sales value of agri-food goods abroad reached € 17.9 billion (PLN 82 billion), 21.9% higher than in the comparable period a year earlier.

The increase in revenue generated from foreign sales in the period from January to May 2022, as well as the higher growth rate in 2021, confirm that domestic agri-food entrepreneurs are doing well in the interna tional market. The export of agri-food prod ucts makes it possible to manage the surplus of food produced in Poland, which is an important source of revenue for the Polish agri-food industry and indirectly affects the economy of the country as a whole.

The increase in the value of exports was largely contributed to by the favorable ex change rate of the zloty against euro, which favored the price competitiveness of Polish agri-food products on the international mar ket. The good results obtained in the export of agri-food goods testify to the growing activity of domestic entrepreneurs to diversify business relations in third-country markets and the high quality of the products offered. Thanks to the adaptation of the assortment offer by our domestic entrepreneurs to the diverse pref erences of foreign consumers, the demand for Polish products on the international market is maintained. In addition, the relatively small, nearly 4% share of CIS countries in food ex port revenues has limited the negative impact of the armed conflict in Ukraine on total agrifood export performance.

The revenue generated from foreign sales by domestic exporters was also affected by high food prices on the world market, due to global inflationary factors, among other fac tors. This situation was reflected in the rising value of FAO’s monthly food price index. In the period from January to May 2022, the average value of the index increased from

Geographical

Other

Other

France

135.6 points in January 2022 to 157.9 points in May 2022, i.e. by 22.3 points. In partic ular, the prices of vegetable oils (up by 43.3 points), as well as cereals (32.9 points) and dairy products (11.2 points) showed signifi cant growth dynamics.

At the same time, imports of agri-food products amounted to EUR 12.5 billion (PLN 57 billion), 27.7% higher than a year ago. The positive balance of trade stood at EUR 5.3 billion (PLN 25 billion), 10.2% higher than in the period from January to May 2021.

As in previous years, agri-food products were exported from Poland primarily to the European Union market. In the period from January to May 2022, deliveries to the EU-27

generated more than EUR 13.3 billion (a 27% increase), which accounted for 75% of the rev enue generated from total agri-food exports.

The main products sold to EU coun tries were: poultry meat (EUR 1.2 billion), cigarettes (EUR 1.1 billion), dairy products (EUR 0.9 billion), beef (EUR 0.7 billion), bread and bakery products as well as animal feed (EUR 0.6 billion each), and chocolate products (EUR 0.5 billion).

Polish agri-food exports to the EU mar ket are characterized by significant geo graphic concentration. Germany remained Poland’s main trading partner. Exports to this country in January-May 2022 amount ed to EUR 4.5 billion and were 26% higher than a year ago. Important recipients of Pol ish agri-food products were also: The Neth erlands (EUR 1.2 billion, up 39%), France (EUR 1.1 billion, up 28%), Italy (EUR 874

million, up 9%) and the Czech Republic (EUR 805 million, up 31%). In total, ex ports to the markets of the aforementioned five countries generated EUR 8.5 billion, which accounted for about 64% of the value of exports to the EU-27.

Agri-food products worth more than EUR 4.5 billion were exported from Poland to non-EU countries in the period from Jan uary to May 2022, 8% more than in the first five months of 2021.

Exports to non-EU (non-CIS) countries increased by 12%, to €3.8 billion. The main exports from Poland to non-EU (non-CIS) countries were dairy products (EUR 343 mil lion), poultry meat (EUR 340 million), ciga rettes (EUR 235 million), chocolate products (EUR 233 million), bread and bakery prod ucts (EUR 215 million) and meat products (EUR 207 million).

Significant buyers of domestic agri-food products, as in previous years, were primari ly: Great Britain (revenues of €1.5 billion, up 33%), the United States (€295 million, up 27%) and Saudi Arabia (€177 million, down 41%), followed by: Israel (€155 million, up 45%), Norway (€114 million, up 16%), and Algeria (€103 million, down 52%).

In the period from January to May 2022, exports to CIS countries stood at EUR 694 million, 7% lower than in the compara ble period a year earlier. Poland’s exports to CIS countries were mainly bread and bakery products (EUR 44 million), fresh apples and pears (EUR 41 million), chocolate products as well as cheese and cottage cheese (EUR 36

million each), animal feed (EUR 35 million) and coffee (EUR 25 million).

The commodity structure of Polish ex ports of agri-food products was dominat ed by meat and meat products. In Janu ary-May 2022, revenues generated from foreign sales within this commodity group were 37% higher than a year earlier and amounted to EUR 3.7 billion, accounting for 20% of the value of all Polish agri-food exports. Poultry meat (43% - EUR 1.6 bil lion), beef (23% – EUR 842 million) meat preparations (23% – EUR 834 million) and pork (9% – EUR 317 million) ac counted for the largest share of the export value. Exports of live animals and other meat species were relatively small and each accounted for about 1% of Poland’s meat product export revenue.

The second position in terms of value, with a 13% share of Poland’s agri-food ex ports, was occupied by cereal grains and processed goods. Their total sales, compared to January-May 2021, increased by 20%, to EUR 2.3 billion.

In the commodity group analyzed, ex port revenue from cereal grains amounted to nearly EUR 1.0 billion. In the structure of the export volume of 3 million tons of grain, corn accounted for 54% (1.6 million tons), wheat 29% (885,000 tons), and rye and barley 6% each (135,000 tons and 121,000 tons, respectively).

Domestic exporters sent grain primarily to the EU market (2.4 million tons, 79% of exported grain). In January-May 2022, corn grain was exported mainly to Germany (853 thousand tons, 53% of grain exports), the Netherlands (215 thousand tons, 13%) and the UK (133 thousand tons, 8%).

Wheat was mainly exported to Germa ny (384 thousand tons, 43% of the exports of this grain), Nigeria (99 thousand tons, 11%) and South Africa (93 thousand tons, 11%). The main direction of rye exports from Poland was Germany (123 thousand tons, 91% of the exports of this grain), and barley – Germany (56 thousand tons, 46% of exports of this grain) and Algeria (31 thousand tons, 25%).

Increases in the value of exports were recorded for tobacco and tobacco products (up 2%, to €1.7 billion), dairy products (up 39%, to €1.5 billion), sugar and confec tionery (up 17%, to €1.2 billion), as well as vegetables and processed foods (up 15%, to €0.8 billion) and fruits including preserves (up 12%, to €0.7 billion). There was also a higher value of exports of, among others: oilseeds and vegetable fats, up 83% (€0.5 billion); coffee, tea and cocoa, up 16% (€0.4 billion); alcohol, up 18% (€0.3 billion); and fruit and vegetable juices, up 35% (€0.3 bil lion). In contrast, receipts from foreign sales of fish and processed foods decreased (by 2%, to EUR 1.0 billion).

Prepared in the Office of Analysis and Strategy at the National Center for Agricul tural Support.

Arkadiusz Majchrzak, Export Manager at Terravita talks about current international food market situation, Terravita’s export activities, offer and products’ innovations.

What export results can Terravita boast? Is the slowdown of growth caused by the pandemic returning to its original pace?

It is for several years that we have been recording double-digit growth in export sales each year. The growth dynamics of export sales had slightly slowed down in the second quarter of 2020, i.e. in the first months of the pandemic, however, since the end of the third quarter, the export sales have accelerated. The year of 2021 and the very be ginning of 2022, despite the ongoing pandemic, saw further growth of export sales. It was only the events from late February 2022, i.e. the outbreak of the war in Ukraine, almost two years after the start of the pandemic, that have slowed down the growth of export sales again, especially that the Ukrainian market used to be one of our key outlets. That situation continued until early July, i.e. the moment when the Cabinet Ministers of Ukraine decided to abolish the list of critical import goods, including chocolate products since 24 February.

Which foreign markets have the most strategic significance for Terravita and why?

Our goal is to develop our sales on all possible foreign markets. We realize that reaching certain markets is hindered for different reasons; therefore, we predominantly focus our activities on markets which we find most attractive from the viewpoint of logistics, i.e. the markets of Central, Eastern and Southern Europe, as well as Asian ones.

What challenges has 2022 brought to export activities?

Since the beginning of 2022, apart from the slowdown of the growth of export sales, caused by the outbreak of the war in Ukraine, we have also been facing a serious problem resulting from increases in prices of raw materials, packaging, energy, gas or costs of transport, directly affecting the manufacturing cost of our products.

Our goal is to develop our sales on all possible foreign markets. We realize that reaching certain markets is hindered for different reasons; therefore, we predominantly focus our activities on markets which we find most attractive from the viewpoint of logistics.

What is the export offer? What makes these products stand out against your competitors in global markets?

Our export offer may be divided into two categories: regular prod ucts, on sale for 12 months per year, and seasonal products with spe cial holiday graphic designs, sold in the months preceding Christmas and Easter. Speaking of regular products, the overwhelming majority consists of chocolate bars under the TERRAVITA, COCOACARA, and ALPINELLA brands, in different formats. Our year-round offer is supplemented by TERRAVITA spreads. The essential distinguishing feature of our products is their quality, as well as interesting taste com binations, such as refreshing peppermint and lime in milk chocolate.

How do you adapt your offer to consumer requirements world wide? What innovations have been introduced to the offer?

Our offer is based, first of all, on the diversity of chocolate tastes, attractive packages, and competitive prices. Additionally, the basic line of TERRAVITA classic 100g chocolates, due to our concern for the natural environment, is entirely manufactured in 100%-recyclable pa per packages.

Thank you

On strong brands such as Profi, JemyJemy, and Manor Style Paté, export directions and nearest expansion plans we talk with Krzysztof Stojanowski, Chairman of the Board at Profi.

What share of your production is comprised by exports? What is the company’s strategy in production for both the Polish and for eign markets?

Profi, JemyJemy, and Manor Style Paté are all very strong brands on the Polish market and are leaders of their categories (pâtés, ambi ent soups, and premium pâtés, respectively). We have been continually working towards our position and the consumers’ loyalty since 1993, and we will soon celebrate our 30th anniversary of operation. Aim ing for top quality, excellent taste and constant development, we have amassed a huge capital of confidence, allowing our products to reach outside the borders of Poland. Currently, between several per cent and more than a dozen per cent of our production is allocated for exports. We are present on many markets, predominantly in ethnic environ ments, but also more extensively in selected chains, such as Morrisons or ASDA in the British Isles. Our strategy is very consistent – we place our bets on high quality and taste, both of which are guaranteed by a strong brand. We focus on building our brands, providing consumers with new product proposals, and active response to the changing needs. This does not mean we are closing up to any Private Label actions. For instance, we cooperate with a global customer to whom we are the main supplier of soups and sauces, for both the Asian and European market.

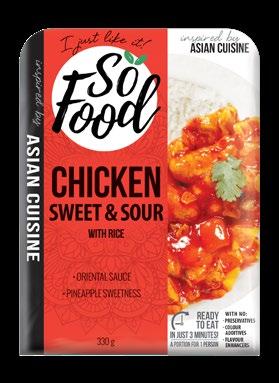

Three of our brands are present on foreign markets: Profi and Man or Style Paté pâtés, and JemyJemy ambient soups. We are particularly proud of the latter. The JemyJemy brand appeared on the local market at the end of the past year and was received fantastically by the consumers. Its advantage, obviously apart from its high quality and diverse compo sition inspired by traditional tastes from around the world (e.g. Asian and Indian cuisine, or European cuisines such as Hungarian or Italian ones) is a very convenient doypack packaging. Few manufacturers offer this kind of packaging, which gives us an unquestionable advantage in this category. It makes the JemyJemy soups excellently fit in with the quick lifestyle of consumers and with the ongoing trends: zero waste, plant-based food, or convenience food. Moreover, they are gluten-free, which makes them perfectly suit the needs of another customer group. JemyJemy soups need no refrigerator storage, have long shelf lives, and are easy to transport. To put it shortly, they fulfill many criteria guaran teeing success in sales.

We can see vast potential in the “ready-to-eat” ambient foods (soups, sauces, quick dishes ready to eat upon heating) and in this regard, we would like to develop on foreign markets as well. Our offer is wide, and our production capacities enable much elasticity in order implementa tion. We can supply dedicated products – with a specific composition, weight or in indicated packages, according to the customer’s preferences. Going further, we have the resources and capacities to manufacture the dedicated assortment in accordance with a provided external recipe.

The Profi pâté is number one on the Polish market. Is it wellliked abroad as well?

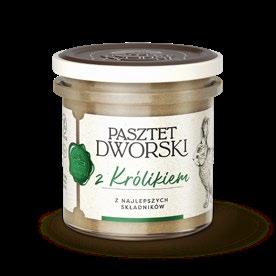

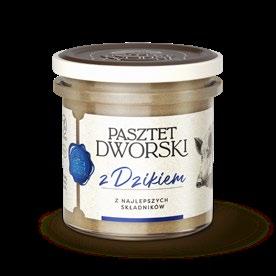

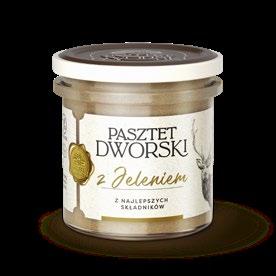

The Profi pâté enjoys huge popularity, it is a widely available product addressed to mainstream customers. It fits in perfectly with the consum er needs, as confirmed by its position as category leader on the Polish market, held for many years. For more demanding users, our offer also includes a premium brand – Manor Style Paté, a line of pâtés with an addition of noble meats: boar, deer, rabbit, and duck. A perfect taste, 100% natural recipes, premium craft packages – all of this makes the product highly appreciated by customers from around the world and distinguishes Profi among other suppliers.

Which foreign markets are of strategic significance for the sales of Profi products?

We mainly focus our attention on European and South American markets, but we cooperate with the Asian one as well. For a considerable time, our products have been present in Ukraine, enjoying much popu larity. We will unquestionably be active in this area.

What are the export plans of Profi for the time to come? Will your products appear on new foreign markets?

We can see much potential in the category of ambient soups and sauces, we wish to develop it to the level currently achieved by pâtés from our portfolio. We also strongly believe in the potential of the Man or Style Paté brand. Above all, our aspiration is to increase the scale on all markets – both at home and in exports.

Thank you.

PROFI Pâté is the undisputed leader in the category of pâtés in Poland. Valued for its high quality and excellent taste, it continues to be trusted by loyal consumers and distributors for almost 30 years. Available in a wide selection of flavors and different weights (50 g, 131 g, 160 g, 250 g) and in two types of packaging – an aluminum mold and a convenient metal tin. Shelf life is 24 months.

Manor Style Paté is a premium brand of pâtés with the addition of precious boar, deer, rabbit and duck meat. Its excellent taste, 100% natural recipes and premium craft packaging make it highly appreciated by recipients from all over the world. Products available in 130 g glass jars. Shelf life is 24 months.

The brand of JemyJemy ambient soups is inspired by traditional flavors from around the world (including Asian, Indian, European or American cuisine) which is why it offers both Traditional soups (11 flavors, including classic Polish red borscht); vegetable, gluten-free Cream soups (4 flavors) and Soups of the world (4 flavors).

*

2-3 min.

They are distinguished by very high quality, excellent flavors and convenient one-portion doypack packaging with a weight of 375–450 g*. JemyJemy soups fit perfectly into the fast lifestyle of consumers and current trends: zero waste, plantbased food and convenience food. What’s more, they do not require refrigeration and have a long shelf life of 12 months. Just pour them into a dish and heat them up to get a wholesome, nutritious meal.

borscht is the only one available in a 1 liter carton.

min.

Many factors influence purchasing de cisions. The first associations certainly in clude price, quality, and the brand. How ever, an equally important element is the origin – of both products and raw mate rials, as well as capital. The family nature of the business and its multi-generational tradition are also important.

The origin of products and Polish roots of the business are of great importance to cus tomers. Not only because of the so-called con sumer patriotism. There are many reasons. The belief that these products are of better quality and manufactured with greater care is one of the most often mentioned reasons presented in studies on this subject. Another reason is the awareness that by investing in domestic products we support the domestic economy because the funds ’do not go’ abroad.

The SW Research Institute1 conducted a research that confirmed the Polish brand as being extremely important in terms of pur chasing choices. As many as 76% of respon dents indicated that it was important for them that the food products they buy came from Poland. And 25.1% of them considered it to be a very important factor, and 50.9% as rath er important. Whether a given product came from Poland was not considered important by

Polish family businesses have reasons to be proud –many of them have grown into huge enterprises with an international reputation. However, any business that is based on traditional values has lots of enthusiasts attracted by the quality and trust in the brand.

16.2% of the respondents (of which 12.9% considered this issue rather unimportant, and 3.3% as definitely unimportant).

The Family Business Institute, whose mis sion is to support businesses with such tradi tions, conducted research which showed that ca. 92% of enterprises run in Poland remained in the hands of their founders. This shows how valuable they are for the national econo my. However, the other side of the coin is that only 36% of them identify themselves as fam ily businesses. The Institute also reports that only 30% of such businesses can pass from the first to the second generation, and only 8% of the successors are willing to take over the busi ness from their parents. In turn, the Family Firms Foundation, referring to Eurostat data, states that in Poland only 40% of companies experience their fifth year of operation. How ever, the organization points out that there are many companies with traditions because as many as 59% of those established in 1989 have survived.

Entrepreneurs rely on similar research and willingly confirm Polish origin by placing spe cial marks on their products. Some such labels are approved by government departments, other marks are based on affiliation to industry organi zations, still others rely on producer declarations.

One cannot ignore the fact that, in reality, when some products or companies are boycot

ted precisely because of their origin, empha sizing Polishness has a particularly significant meaning. Supporting domestic production may also prove invaluable in attempts to save the economy in the face of high inflation and rising prices.

The aforementioned marks or labels confirming the origin have been func tioning in the market space for years. It is impossible to list all those used by Polish producers that is why we present only few subjectively selected ones.

Teraz Polska – a Polish promotional sign created in 1992 on the initiative of the Pol ish Promotional Emblem Foundation. The idea behind its creation was a strive to restore the prestige of the Polish brand. Standing out among other activities of this organization is the ‘Teraz Polska’ competition under the hon orary patronage of the President of the Repub lic of Poland. The poll aims to choose the best domestic products and services. The voting is carried out in 3 categories: for the best prod ucts and services, for municipalities and for innovative projects.

Produkt Polski [‘Polish product’] – is a le gally defined mark in the commercial quality Act of farm and food products. It is voluntary to mark products with this sign but in order to

use it one has to meet criteria clearly defined in the regulations. The rules stipulate that prod ucts must be made of raw materials produced in Poland, however, in processed products it is allowed to use imported ingredients (e.g. spic es, dried fruits) in the amount of up to 25% by weight, provided that such ingredients are not manufactured in Poland. Unprocessed products may be marked with the informa tion ‘Produkt polski’ [‘Polish product’] if the production, cultivation or breeding, including harvesting, milking in the case of cows, sheep and goats, took place on the territory of the Republic of Poland. In the case of meat, it is additionally required that it is obtained from animals born, raised and slaughtered in Po land, and in the case of products of animal origin other than meat, that they are obtained from animals reared in Poland.

In addition to official marks approved by regulations or organizations, producers may voluntarily mark products with graphics re ferring to their origin e.g. the map of Poland, flag, etc. The following inscriptions are also a popular means of identification: ‘I am from Poland’, ‘I come from Poland’ or ‘Made in Po land’. Of course, if it does not correspond to the actual production, the manufacturer must take into account legal consequences as adopt ing this practice can be considered as mislead ing the consumer.

The bar code on the packaging tells us a lot about the origin of the product. Goods distributed by a company which is registered in Poland, including goods manufactured by such a company in our country or abroad, are signed with a barcode, the beginning of which begins with the prefix 590.

On the other hand, e.g. for German compa nies, a sequence of numbers from 400 to 440 is reserved. In the case of Japanese goods it will be

45 and 49, and Chinese – from 690 to 695 and 699. However, if we care about the Polish ori gin of the raw material itself, the bar code will not be a sufficient source of information. As it has already been mentioned – the code specifies only the place of registration of the company.

Poland is a significant country in Europe and in the world. As it turns out – products marked as ‘made in Poland’ have positive asso ciations, and they are also valued.

SW Research conducted a survey2 in which one of the questions concerned associ ations with Poland. There are many product items listed in it. The first place was taken by John Paul II (57.8%), second by Robert Lewandowski (45.7%), and the podium was closed by Polish Vodka (27%). In addition to the aforementioned alcohol, the product indi cations also included pierogi (17.8%), bigos (10.8%), Polish sausage (8.8%) and sauer kraut or pickled cucumbers (7.1%).

In Poland, we have a lot of family business es that are proud of their origin. JBB Bałdyga is one example. The company is a Polish family business that has been operating on the market since 1992. It is one of the biggest meat pro cessing companies in Poland. They base their activity on proven recipes applying at the same time modern technologies.

The capital is 100% Polish, and over 200 products in the portfolio come from our country.

Another example is Mokate – a company that has been run from the very beginning by the Mokrysz family. Subsequent genera tions continue to develop the business and the strong position of products in their categories. The company has gained a reputation and rec ognition among domestic consumers and is successively taking over new markets.

BZK Alco is an alcohol producer which emphasizes Polishness even in the names of products. Their portfolio includes Wokulski, Sienkiewicz, Mickiewicz, Słowacki and Ka zimierz Wielki vodkas. These are just a few examples. The company is the author of alco holic products made from the best raw materi als; its products are of world-class quality. The company takes constant care about highlight ing its roots and origin.

Cukry Nyskie present over 70 years of Pol ish confectionery tradition. The history of the company dates back to 1949. The company operates in line with the slogan ‘Good, be cause Polish’, and its goal is to produce healthy products, and actively participate in environ mental protection. It is very important for the company to follow tradition and choose good and proven raw materials.

‘Tradition, simple recipes, no preser vatives and taste like in the good old days’ – these are our main advantages. If we add more than 70 years of experience in baking cookies and local patriotism, the whole pic ture will show a place manufacturing prod ucts which delight Poles with their taste as best as they can’ – indicates Andrzej Cho myszczak, President of the Management Board of Spółdzielnia Pracy ‘Cukry Nyskie’.

For Spółdzielnia Pracy ‘Cukry Nyskie’ this is very good news showing that thanks to the commitment of its employees, guarantee of the origin of raw materials, excellent quality, Petit Beurre biscuits – one of the company’s flagship products – are more and more often ‘landing’ in the shopping basket of Poles.

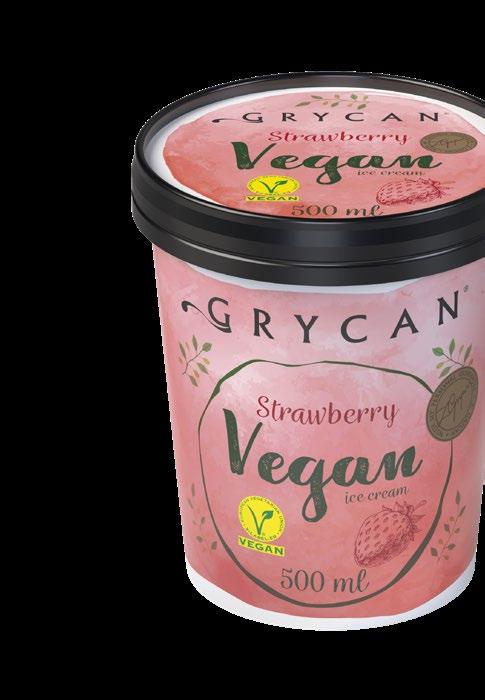

The Grycan company can also boast a sweet tradition. It started with a small ice cream shop and a passion for the product. In 2004, as the founders themselves say, their life’s work was created – the Grycan brand – Ice cream for generations. From the beginning of its oper ation the company has been using family rec ipes creating traditional ice cream, constantly relying on quality, experience and knowledge.

Family, tradition, brand – these slogans combine the history of many Polish com panies whose strength lies in their Polish roots. And consumers appreciate the enor mity of work that Polish companies put every day to provide us with the highest quality products signed with the Polish quality mark.

The recent research showed that ca. 92% of enterprises run in Poland remained in the hands of their founders (The Family Business Institute).

Within 32 years, the Mokate Group has become one of the largest coffee and tea producers in Central Europe, with more than a billion zlotys in revenue. It is also one of the leaders in the market for specialised ingredients for the food industry. Today, Mokate operates in more than 70 foreign markets and is one of the leaders in the market of milk-fat base powders, i.e. coffee creamers, foamers, topping bases and high-fat powders. Mokate products are widely used in the food industry around the world. The present image of the company includes more than 20 lines of coffee drinks (coffee mixes, cappuccino), coffee beans, as well as black, green, fruit and herbal teas. The range is complemented by own-produced wafers, biscuits and gingerbread.

Within 32 years, the Mokate Group has become one of the largest coffee and tea producers in Central Europe, with more than a billion zlotys in revenue. It is also one of the leaders in the market for specialised ingredients for the food industry. Today, Mokate operates in more than 70 foreign markets and is one of the leaders in the market of milk-fat base powders, i.e. coffee creamers, foamers, topping bases and high-fat powders. Mokate products are widely used in the food industry around the world. The present image of the company includes more than 20 lines of coffee drinks (coffee mixes, cappuccino), coffee beans, as well as black, green, fruit and herbal teas. The range is complemented by own-produced wafers, biscuits and gingerbread.

Mokate is a family-owned company. Being the fourth generation, Dr Adam Mokrysz and his wife, Dr Katarzyna Mokrysz, success fully manage the company. For many years, their goal has been to create a trademarked, international company. They want to build on Mokate’s solid foundations with values such as hard work, responsi bility, knowledge and competence, as well as openness, credibility and kindness. Mokate’s long-standing presence on international markets has earned it a group of loyal consumers for whom the company de velops its products, creates innovations, and also supports domestic brands with strategic marketing activities. Mokate’s most well-known brands include: Mokate, Loyd, Minutka, NYCoffee, Marilla, Marizzi, Mokate Ingredients, Alpino, Babcia Jagoda.