The export of Polish food products is an important element of the country’s economy and plays an increasingly important role in the international arena. Poland is one of the main food producers in Europe and its products are becoming more and more popular on world markets.

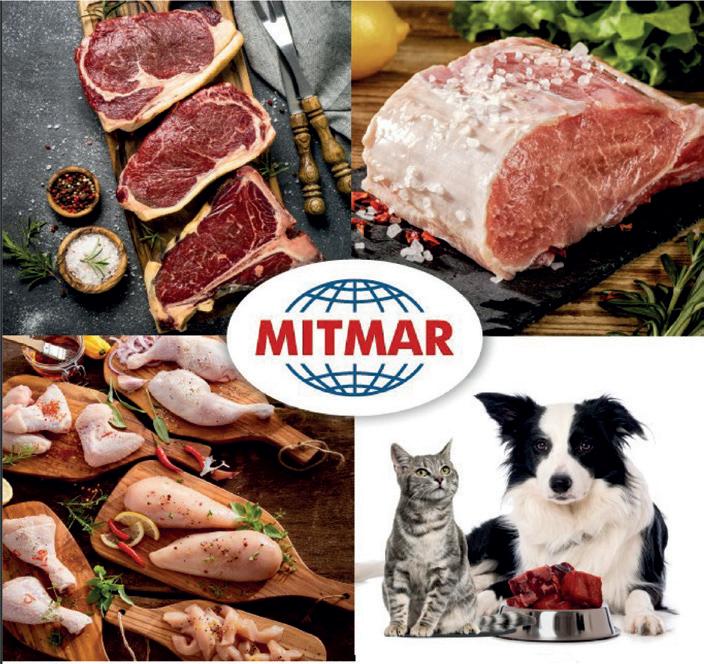

Polish producers offer a wide range of food products, including: meat, dairy products, cereals, fruit and vegetables, as well as processed food, cold cuts, cheese and many more. These products are characterized by high quality, they are manufactured with diligence, and have competitive prices which makes them more and more desirable on foreign markets.

Our food products reach consumers’ tables in Europe, North America, Asia and other parts of the world. Poland is famous for the production of pork and poultry, but it is also noted for the quality of its milk and cheese. These products are exported to many countries where they are appreciated for their taste and nutritional value.

The export of Polish food products not only contributes to the growth of the economy but also promotes Polish cuisine and culture abroad. Our food is

becoming more and more recognized and appreciated by consumers worldwide.

It is worth mentioning that the quality and tradition of Polish food products are chief assets that attract attention on foreign markets. Poland is famous for its long history of food production closely related to tradition, and for its concern for high quality and taste. It is these qualities that allow Polish products to gain recognition among consumers all over the world.

In 2022, the value of sales of agri-food products abroad reached a record level of EUR 47.6 billion (PLN 223 billion), 26.7% higher than a year earlier. Germany remained Poland’s main trading partner. Export to this country in 2022 amounted to EUR 11.9 billion and it was 25% higher than last year. The Netherlands, France, Italy and the Czech Republic were also important recipients of Polish agri-food products in EU countries. Among non-EU countries, the largest recipients of Polish agri-food products were Great Britain, Ukraine, the United States, Saudi Arabia and Israel.

Enjoy your reading.

28 Małgorzata Cebelińska, Vice President of the Management Board of SM Mlekpol

32 Bogdan Łukasik, President of the Management Board, Modern Expo

36 Jakub Kępka, Key Account Manager at Transad

44 Karol Pilaciński, Export Director and Edyta Pleban, Export Manager at Bogutti

50 Hubert Owczarek, Export Director at Cedrob Foods

54 Dariusz Goszczyński, the President of the National Poultry Council – Chamber of Commerce (KRD – IG)

58 Grzegorz Remigiusz Jekel,Chief Operating Officer, Wielkopolski Indyk and Chief Executive Officer, Grupa Producentów Drobiu

61 Franciszek Siegień, Owner of ELENA

64 Agnieszka Makaruk, President of the Management Board, Hela

92 Wojciech Ryttel, Member of the Board at MAXPOL

102 LIST

111

Editor-In-Chief Tomasz Pańczyk t.panczyk@foodfrompoland.pl Managing Editor Monika Górka m.gorka@foodfrompoland.plAdvertisement Office Phone: +48 22 847 93 67

Editorial Office Bagno Street 2/218 00-112 Warsaw, Poland Phone: +48 22 828 93 66 redakcja@foodfrompoland.pl www.foodfrompoland.pl

Fischer Trading Group Ltd.

CEO: Tomasz Pańczyk

t.panczyk@ftgroup.pl

Poland is the leading EU producer of many agrifood products, including poultry, pork and beef, dairy products, apples, soft fruits, sweets, cereal products, alcohol and fish products.

Currently, Polish agriculture and the agri-food industry face numerous challenges on foreign markets. On the one hand, we can observe an increase in competition caused by the ongoing processes of globalization and liberalization, on the other hand, agricultural markets have been experiencing significant disruptions in recent years, first caused by the COVID-19 pandemic and now by the armed conflict in Ukraine.

Military operations conducted in Ukraine caused disruptions in supply chains on an unprecedented scale. Before the outbreak of the war, Ukraine, due to its location, climatic and soil conditions, was the world’s leading producer and exporter of grain. The blockade of the Black Sea, which has prevented the transport of grain and other agricultural products, is causing not only disruptions in supply chains but also the risk of famine in African countries.

The opening of the EU market for goods from Ukraine resulted in uncontrolled imports of Ukrainian agricultural products, including those belonging to the so-called sensitive products, largely subject to quota imports until 2022. Agri-food imports from Ukraine to Poland increased threefold from the value of EUR 945 million in 2021 to the value of EUR 2.741 billion in 2022. This caused significant disruptions on agricultural markets, especially in the cereal and soft fruit sector, and the need to support domestic producers and search for new sales markets.

The war crisis in Ukraine is also a huge challenge for Polish agri-food exports where Ukraine is one of the main non-EU destinations. Polish entrepreneurs had to face sales and transport in war conditions.

Trade relations with Belarus constitute an additional difficulty. Belarus, still in 2021, was one of the

main Eastern European sales markets for Polish agrifood products and a leading recipient of Polish apples.

As of the 1st of January 2022, on the Belarusian market, there is a ban on the import of agri-food products from a number of countries, including Poland, as regards fruit and vegetables, meat products, dairy products and sweets.

There were also – fortunately, temporary – problems with the sale of Polish apples to Egypt, one of the main recipients of these fruits, which, because of the country’s difficult financial situation, introduced a number of obstacles in foreign trade.

Despite these difficulties, the results of Polish agrifood exports are very good, and last year was another record year for the industry. The value of Polish agrifood exports in 2022 amounted to 47.6 billion.

This is over 27% more than in 2021 and a 9-fold increase compared to 2004. An increase in the value of export was recorded in virtually all commodity groups of agricultural and food products. According to the latest results, the upward trend continues to strengthen.

In the first half of 2023, another increase in the value of exports was recorded, by approximately 16%, compared to the first half of the previous year. This proves the development of the Polish agri-food sector and the strengthening of its role in the Polish and global economy.

Polish food brands are becoming recognizable and known in the world, not only in nearby European markets. Sales markets in the Middle East have got great potential (including Saudi Arabia, Israel, United Arab Emirates) and in Asia (Japan, South Korea, Singapore and Vietnam), as well as in Africa (including Algeria).

Let me give you some examples: Polish apples are sought-after on markets such as India and Egypt. As regards beef, Israel and Japan are important destinations for Poland, and as far as pork is concerned - the USA and Vietnam. Polish dairy products sell well in Algeria, the United Arab Emirates, India and China. Polish beer, however, finds enthusiasts in Asian coun-

tries such as South Korea and China.

In recent years, Poland has become one of the main suppliers of eggs to the Singapore market. This is an important achievement proving very high quality of Polish food. Singapore is a country that, despite being virtually completely dependent on external food supplies, is one of the most stringent importers in terms of veterinary and phytosanitary requirements.

I would like to emphasize that the development of Polish agri-food exports is also influenced by institutional activities supporting the development of trade exchange. These activities are carried out by the National Agricultural Support Centre (KOWR).

KOWR activities focus in particular on organizing national stands at the most important global agri-food fairs held in Europe, Asia, the Middle East and Africa, where Polish companies present their offer. The promotion of Polish food on foreign markets is carried out under the slogan “Poland tastes good”.

KOWR also organizes trade missions during which entrepreneurs can learn about the conditions existing on a given market and take part in B2B talks.

Entrepreneurs can also take part in information webinars on foreign markets. KOWR also organizes inbound missions for foreign entrepreneurs during which they visit the most important Polish agri-food fairs, go to processing plants and participate in business meetings.

The numerous and diverse activities of KOWR have a positive effect. Polish food is becoming more and more recognizable on foreign markets, and its high quality and taste are appreciated. Trade relations between Polish and foreign entrepreneurs are also strengthened, which contributes to positive results of Polish foreign trade, even in the current difficult geopolitical situation.

Poland is the sixth food producer on the EU market. Food product manufacturing in Poland accounts for approximately 6% of the production value in the EU.

Brand Distribution Group, has been successful in the global distribution market for the last 30 years. The Polish company is an international importer and distributor of FMCG products. It supplies partners with renowned and popular brands. However, it is its ability to discover unique assortments in remote corners of the world that clearly sets it apart from other distribution companies.

Understanding consumers is the key to building an offer that accurately meets the needs of a particular market. The distributor constantly monitors buyer behaviour and current market trends. Every year, it participates in the most important trade fairs, such as Anuga in Cologne, SIAL in Paris, Gulfood in Dubai, Foodex in Tokyo, and the Fancy Food Show in New York. This gives the company an insight into the dynamic market situation.

The analysis covers key product categories, both in Poland and internationally. Consumer expectations, point-of-sale behaviour, financial capabilities, and sensitivity to marketing activities are taken into account. With this unique, continuously updated knowledge, Brand Distribution skilfully translates it into an offer optimally

suited to the market – which often is unique and very demanding.

The company is quick to spot trends that overlap across different regions of the world. Its sensitivity, and its ability to keep its finger on the pulse, allows it to offer contractors products that are yet to become popular. This, in turn, enables them to be the first one who markets such goods. In this way, Brand Distribution Group helps to build a competitive advantage for the businesses working with the organisation.

The company currently offers tens of thousands of products from all over the world and is constantly looking for new ones. This task is carried out by a 200-strong team of specialists,

speaking 16 languages, employed in branches located in Europe, Asia and the USA. The company operates in 100 markets and supplies products from all over the world. In virtually every country, the distributor has established contacts and, if this is not the case, it can build them quickly and efficiently.

The Brand Distribution Group’s product range includes brands in exclusive distribution for specific markets (including Huggies, Kotex, Dalli, Dash, Ambi Pur, Ariel, Dreft, Itsu, Vitamizu, Triumf and Voll), as well as world-renowned A-brands in both the food and non-food categories, and products from the rapidly growing pet accessories and food segment. This is a major convenience for business partners, who can complete even the most complex order in one place.

Wiktor Sawosz, Founder and President of the Management Board Armen Papazjan, Vice President and CEO

Wiktor Sawosz, Founder and President of the Management Board Armen Papazjan, Vice President and CEO

Wiktor Sawosz built the business by starting out by selling sweets. “I will never forget the shelves in our warehouse, which literally exploded with a fever of colours. A nice change after years of ubiquitous greyness. Then we expanded the range to include cleaning products. Then cosmetics,” he recalls. The founder of the Brand Distribution Group understood that providing the market with interesting novelties – products different from what consumers had been used to for many years – gave him great satisfaction. It is the driving force behind the business. This feeling has survived and accompanies the company and its employees to this day.

The owner’s mindset has naturally turned out to be the company’s differentiator, which is the ability to discover unique assortments in remote corners of the world. To maintain a competitive edge, the distributor invites people with the so-called “explorer gene” into its ranks, those who will not stop until they have found the products that meet the customer’s needs in a particular market. This is why the offer of the distributor is always full of novelties and products not commonly known, such as Chupa Chups drinks, Prime Hydration drinks, San Pellegrino flavoured waters, unusual flavours of popular brands, such as Fanta or Coca Cola, as well as Takis, Celsius and Chipoys products. American sweets, ITSU ready meals, and unique cosmetics generate huge demand among the distributor’s business customers.

This year, Brand Distribution is making its offer more attractive and expands into the alcohol category. It is analysing how markets and consumption are changing. For this purpose, it has attracted producers and suppliers from different regions of the world.

The company’s strategy for the next year is to strengthen its presence in the UK, Spain, Italy, China, and India in order to offer further new and surprising product categories. “We have been maintaining a good growth rate for several years now and we want to fully exploit our commercial potential,” comments Armen Papazjan, Vice President and CEO of Brand Distribution. “We are an increasingly flexible company that responds extremely quickly not only to dynamic changes in the global economy, but also to changing consumer needs and consump-

tion styles. We are extremely proud of this ability. For us, strengthening our presence in a particular market means being able to better identify needs, to diversify our offer, and to provide services to specific local expectations. It is also an opportunity to deepen relationships with our partners, based on trust and common interests to benefit both parties.”

The company operates globally and is therefore able to source the expected products at an attractive price in markets that offer the same product at a lower cost. Volume is also important. The more a distributor buys, the more attractive the price it can offer. Price plays an extremely important role, especially today, when it is becoming a major factor affecting purchasing decisions of consumers.

Moreover, Brand Distribution Group offers a whole set of support services that are essential in the FMCG business: product marketing, customs documentation, logistics, or after-sales service. By taking advantage of the full service in one place, customers can significantly reduce transaction costs and save time, thus being able to focus on other key aspects of their business development.

As a family-owned company, Brand Distribution Group is focused on long-term operations. It is much more concerned with maintaining quality, a higher level of credibility, and building long-term business relationships. This model worked well during the pandemic. It works in the current political and economic situation in Eastern Europe. “It is very important for us that our partners feel that we are on the same team, that our values, as well as the team definition go well beyond the internal structures

of the organisation. Reid Hoffman said: ‘No matter how brilliant your thinking or strategy is, if you play solo, you will always lose to the team.’ I agree with him 100%. Hence our presence at this year’s Anuga. We want to show current and prospective clients that they can gain even more business by working with us and by taking advantage of the opportunities we have to offer,” Armen Papazjan adds.

This year marks the company’s 30th anniversary and is in many ways a milestone year for the company. Brand Distribution is investing in more trade destinations and the offer is constantly being expanded based on the organisation’s unique knowledge of the needs of markets and customers. The company is refining its processes to be even more flexible in its operations. This is required in the current global situation and, consequently, expected by business partners. Brand Distribution has had a reorganisation process that has improved operational efficiency in a short period of time. The structure of the sales departments has been reorganised, the model for working with customers has been amended, and order picking and shipment times have been significantly reduced. We did not have to wait long for the results of the strategic changes. The company has recently seen a significant increase in sales by opening cooperation with new key customers, which is confirmation of the right direction of the organisation’s development and of a thorough understanding of the needs of business partners. “I am convinced that new clients will appreciate our way of working, which is focused on business development and tangible benefits for both parties,” Wiktor Sawosz concludes.

The right choice of business partner is one of the key elements for achieving success in the FMCG industry. We talk to Armen Papazjan, Vice President and CEO of the organisation, and to Wiktor Sawosz, Founder and President of the Management Board, about the competitive advantages that have allowed the company to win international contracts and build a stable global position, as well as about the benefits of cooperation with Brand Distribution Group.

Developed at the Bureau of Analyses and Strategies of the National Support Centre for Agriculture.

2022, in spite of difficult conditions on the international market, saw a further growth in the value of Polish food exports. In 2022, the value of foreign sales of agri-food products reached a record-breaking level of EUR 47.6 billion (PLN 223 billion), 26.7% higher than the year before.

Simultaneously, the agri-food imports had a value of EUR 32.1 billion (PLN 150 billion) and were 28.6% higher than the year before. The positive balance of trade developed to the level of EUR 15.5 billion (PLN 73 billion), higher by 23% than in 2021.

The revenues from foreign sales by domestic exporters were impacted by growing transaction prices of agri-food products on the international market, recorded upon the outbreak of the armed conflict in Ukraine. At the same time, trends of depreciation of the zloty in relation to the EU currency were a factor favourable to the price competitiveness of Polish agri-food products, since more than 80% of the receipts from food exports to the EU were generated by sales to the Eurozone countries.

The process of revival of the HoReCa sector’s activity in the EU after the pandemic, which took place in the first half of 2022, as well as growing food prices in EU countries, generated increased demand for Polish foods competitive in terms of prices and quality. Simultaneously, the good results achieved in exports were a consequence of the activity of domestic entrepreneurs towards diversification of business relations on markets of the EU and third countries, due to the ability to adapt the assortment offer to diverse preferences of foreign consumers.

As in the previous years, agri-food products were predominantly exported from Poland to

223 bn)

EUR 32.1 bn (PLN 150 bn)

Source: Elaboration of the Analysis and Strategy Office, the National Support Centre for Agriculture.

EUR 15.5 bn (PLN 73 bn)

Source: Elaboration of the Analysis and Strategy Office, the National Support Centre for Agriculture.

the market of the European Union. In 2022, supplies to EU-27 countries generated EUR 35.3 billion (an increase by 29%), comprising more than 74% of revenues from total agrifood exports.

The main products sold to EU countries

included: poultry meat (EUR 3.3 billion), cigarettes (EUR 2.9 billion), dairy products (EUR 2.6 billion), beef (EUR 1.8 billion), bread and bakery products (EUR 1.8 billion), animal feed (EUR 1.6 billion), as well as chocolate products (EUR 1.5 billion).

Agri-food products from Poland were predominantly exported to the market of the European Union.

Polish agri-food exports to the EU market are characterized by significant geographic concentration.

Germany remained the main trade partner of Poland. Exports to this country in 2022 amounted to EUR 11.9 billion and were 25% higher than the year before. The main products exported to Germany included cigarettes, poultry meat, fish preparations, animal feed, bread and bakery products, maize grain, as well as chocolate and chocolate products.

Other important recipients of Polish agrifood products included the Netherlands, France, Italy and the Czech Republic. Total exports to the markets of the five countries mentioned above (Germany, the Netherlands, France, Italy, and the Czech Republic) generated EUR 22.4 billion, comprising more than 63% of the value of exports to the EU-27 countries.

Non-EU countries in 2022 were reached by Polish agri-food products worth EUR 12.3 billion, higher by 20% than in 2021. The main products exported from Poland to nonEU countries included: dairy products (EUR 1.0 billion), poultry meat (EUR 990 million), wheat (EUR 776 million), chocolate and chocolate products (EUR 733 million), bread and bakery products (EUR 731 million), as well as cigarettes (EUR 612 million). The most significant non-EU recipients of Polish agri-food products, as in the previous years, included:

- United Kingdom (revenue of EUR 3.7 billion, a 25% increase in value, the exported goods were predominantly poultry meat, meat preparations, chocolate and chocolate products, as well as bread and bakery products);

- Ukraine (EUR 945 million, an increase

by 16%; the exported goods were predominantly cheese and curd, animal feed, coffee, chocolate and chocolate products, water, bread and bakery products, as well as pork);

- United States (EUR 770 million, an increase by 26%; the goods exported to the USA were predominantly chocolate and chocolate products, fish and fish preparations, pork, and meat preparations);

- Saudi Arabia (EUR 521 million, an increase by 2%; the exported goods were predominantly cigarettes, bread and bakery products, wheat, as well as cheese and curd);

- Israel (EUR 439 million, an increase by 50%; the exported goods were predominantly beef, wheat and sugar);

- Norway (EUR 296 million, an increase by 10%; the exported goods were predominantly cigarettes, maize grain, animal feed, and fruit preparations);

- Algeria (EUR 242 million, a drop by 42%; the exported goods were predominantly condensed and powdered milk – 66% of the exports value, as well as tobacco – 26%).

The commodity structure of agri-food exports from Poland was dominated by meat and meat preparations. In 2022, the revenues from foreign sales within this commodity group were higher by 37% than the year before, amounting to EUR 9.6 billion which comprised 20% of the total value of Polish agri-food exports. The largest share in the exports of meat and meat preparations was comprised by: poultry meat (44% – EUR 4.3 billion), meat preparations

(23% – EUR 2.2 billion), beef (22% – EUR 2.1 billion), and pork (8% – EUR 812 million). Export of live animals and other meats was relatively low, comprising a 2% and 1% share, respectively in the revenue from exports of meat products from Poland.

The commodity structure of agri-food exports from Poland was dominated by meat and meat preparations. In 2022, the revenues from foreign sales within this commodity group were higher by 37% than the year before, amounting to EUR 9.6 billion which comprised 20% of the total value of Polish agri-food exports.

The second most valuable position, with a 14% share in the agri-food exports from Poland, was occupied by cereal grains and their preparations, with their total value growing by 40%, to EUR 6.6 billion, in comparison with 2021.

The increased value of exports was recorded in virtually all commodity groups of agri-food products, i.e. tobacco and tobacco products (by 4%, to EUR 4.3 billion), dairy products (by 37%, to EUR 3.6 billion), sugar and confectionery products (by 14%, to EUR 3.2 billion), fish and their preparations (by 14%, to EUR 2.8 billion), as well as vegetables and their preparations (by 21%, to EUR 2.3 billion) and fruit with their preparations (by 6%, to EUR 1.8 billion). Furthermore, there was an increase in the export value of such goods as oilseeds and vegetable fats –by 80% (EUR 1.6 billion), coffee, tea and cocoa – by 28% (EUR 1.1 billion), fruit and vegetable juices – by 27% (EUR 0.9 billion), and alcohol – by 20% (EUR 0.8 billion).

The second most valuable position, with a 14% share in the agri-food exports from Poland, was occupied by cereal grains and their preparations, with their total value growing by 40%, to EUR 6.6 billion, in comparison with 2021.

As PILOT International approaches its 25th anniversary, Paweł Kubiak, President of the Management Board sheds light on Poland’s transformative role in global commerce, the fast-paced world of FMCG, and how PILOT International has continually innovated to stay ahead.

Is foreign trade an area exclusive to experienced Polish players? How to conquer foreign markets?

In the last two decades, we have witnessed significant changes in foreign markets and international trade. Globalization, ease of communication, as well as broad government support and funding have opened the doors of this field to many small and medium-sized entrepreneurs. Polish companies have begun to actively participate in international trade fairs and trade missions, thereby strengthening their position on the international stage. Polish products are becoming increasingly popular and are eagerly chosen by consumers worldwide. Nevertheless, for many entering foreign markets is still a significant challenge. The range of restrictions, complicated administrative and customs procedures constitute a significant barrier. The unstable political situation and changes in financial markets mean that many Polish companies still lack the courage and capital to effectively implement export activities. It must be acknowledged that the beginnings are very challenging and acquiring clients and maintaining high-quality service is a process that requires continuous improvement and hard work.

What challenges does the FMCG market face?

Globalization, and as a result, easier access to foreign products, means that audiences/consumers are saturated with the number of offers, and end consumers are overstimulated by new products heavily promoted on social media. The biggest challenge is keeping up with market trends, meeting consumer expectations and creating new sales strategies. One must constantly follow the fast-paced trends and changing consumer needs to avoid falling behind.

What does your offer look like? Can you tailor the offer to individual clients?

PILOT International offers a wide range of FMCG products, primarily from international well-known manufacturers such as Nestle, Mars, Ferrero, Coca Cola, Unilever, Procter & Gamble, Mondelez and many others. In our offer you will find products from the following categories: beverages, coffees and teas, confectionery, hygiene products, cosmetics as well as frozen products and toys. Furthermore, we regularly expand our portfolio with new items based on client needs. We scour markets

around the world, selecting offers from manufacturers in many countries to source new products. We constantly monitor trends on TikTok, Instagram, and YouTube. As a result, our offers continue to surprise. We are not afraid of challenges and boldly enter new markets. In addition, we always strive to provide a comprehensive service to the client and listen to their needs. We offer commercial and logistics consultancy for new clients, who are starting their export journey. Our team does everything that’s possible to make our clients feel comfortable in their dealings with us and we ensure that the transaction is secure - our most frequently chosen service is ‘door to door’.

How do you ensure competitive prices? What sets you apart from other companies?

The prices of our products are very attractive, however, this is not the only important component of our commercial offer. We place a great deal of importance on optimising additional costs and providing comprehensive service to our clients. Price is the first value that a potential client sees. The price, however, can sometimes be accompanied by additional costs and transactional risks. The PILOT Team keeps the client informed about what is included in the price of the product and, above all, we guarantee order fulfillment regardless of market price fluctuations. We often bear the risk of exchange rate differences, manufacturer price increases, delivery delays, and so on. We do not make empty promises but present our offer in a clear and accessible manner. Currently, the biggest challenge is not the price of a product, but ensuring availability and timely delivery.

Efficient logistics and a reliable warehouse base are essential requirements for an export operator. How does your experience and established position help meet these requirements?

We provide access to our warehouse stock, continually replenishing it with the fastest-moving products. Clients receive offers for products available in our warehouse and can place orders on the same day. The stock value at PILOT INTERNATIONAL is constantly maintained at a high level – and we stock the most popular products. We have invested in an innovative system dedicated to our company that controls product best-before dates and location, enabling us to swiftly prepare the order for loading and also to accurately inform clients about the unique characteristics of the products. We have an experienced warehouse team trained for all types of loadings. We offer labelling and repackaging services, carefully securing shipments to ensure that the goods reach clients undamaged.

The FMCG industry is very susceptible to any turbulence in the world. It is like a living organism that reacts very quickly to changes. The closure of one factory or sudden congestion can trigger a “domino effect” in international markets. Minimal shortages or price hikes by manufacturers create chaos and uncertainity. We stay up to date and absorb information from around the world to react as quickly as possible to any situation.

Does the increasingly modern, digital world still need physical meetings at trade fairs? What importance does participation in such events have for your company?

“Covid” has opened up the digital world of meetings and human relationships. We are aware that a new generation is entering the job market for whom conveying essential information via text and virtual meetings are an everyday occurrence. Personally, I still prefer “face-to-face” meetings – nothing can replace the handshake of business partners, the smile of satisfaction from a transaction, the exchange of views and human emotions. PILOT INTERNATIONAL participates in almost all significant trade fairs – both existing and potential clients can approach us, get to know us personally, exchange views and opinions, not only on business matters. A long-term friendly business relationship is in our view the best and guarantees cooperation for years.

In what direction is the food market developing? Have new trends, geopolitical situations, and crises changed the way the FMCG industry operates?

The FMCG industry is very susceptible to any turbulence in the world. It is like a living organism that reacts very quickly to changes. The closure of one factory or sudden congestion can trigger a “domino effect” in international markets. Minimal shortages or price hikes by manufacturers create chaos and uncertainity. We stay up to date and absorb information from around the world to react as quickly as possible to any situation.

How is Pilot International changing? What goals do you set for yourselves in the coming years?

Pilot International will soon celebrate its 25th anniversary. We continually work on improving our services. We want the PILOT brand to be associated with high-quality services, transaction security and good interpersonal relationships. Business and pleasure – we believe that working in the FMCG industry, despite its fast pace, can be enjoyable and not a constant battle over prices and products. We look forward to meeting our friends and business partners at the Anuga trade fair to sit down together and seek solutions for the development of our businesses. You are welcome to visit our booth D 024 in hall 2.1.

Thank you

Tomasz Pańczyk, Editor-in-Chief

Currently, the Mokate Group consists of several enterprises operating in Poland, the Czech Republic, Slovakia, Hungary, the UK, South Africa, and Dubai, exporting their products to almost all countries of the world. The company owns three production plants: in Ustroń, Żory, and Votice, Czech Republic.

Mokate’s annual revenues approach PLN 1.5 billion, 80% of which come from foreign markets. “We like challenges that require bold and visionary action. With our experience and perseverance, we manage to overcome these challenges and expand successfully on international markets. Our export activities account for more than 70% of the Group’s revenues. Its further development is possible because of our focus on innovation and the quality of our offer,” stresses Dr. Adam Mokrysz, the CEO of the Mokate Group.

The company employs more than 1,500 people worldwide. The Mokate Group is dynamically increasing its exports, implementing innovative products, and contending successfully for global consumers. The best-known Mokate brands include: LOYD, Mokate, NYCoffee, Minutka, Marila, Marizzi, Alpino, Babcia Jagoda.

“Since the beginning of our operations, the company has been a family enterprise, which is an enormous value for the entire brand. Staying true to the tradition and to family values has been the basis for the development of the Mokate business so far. The family nature of the company is manifested, above all, in the relations there, since Mokate employs entire families, including multigenerational ones,” says Dr. Katarzyna Mokrysz, the General Director of the Mokate Group.

Since the beginning of its operations, Mokate has been a family company. As the fourth generation in charge, Dr. Adam Mokrysz and his wife, Dr. Katarzyna Mokrysz, work together for the success of the Mokate Group. For many years, their goal has been the creation of a brand-name international enterprise based on family values.

The success of the Mokate Group is all the more satisfying that the company engages in activities in the area of corporate social responsibility. The Mokate Group builds its CSR, among other things, on the basis of the popularization of chess. This game is a tradition of the Mokrysz family. On the initiative of the company’s founders, chess clubs have been established, and the Mokate Chess Academy was created several years ago.

Mokate is known and appreciated in Poland and beyond. What has contributed to the successful expansion of the Mokate Group to foreign markets?

Adam Mokrysz: At Mokate, we try to act and build our growth on the basis of 3 pillars: vision, courage, and action. We face challenges with courage, we focus on teamwork and cooperation with experts, we set ourselves ambitious goals and we pursue them step by step with wonderful people. Most of all, we like working and we work with great passion.

Katarzyna Mokrysz: Mokate is a flexible company, able to skillfully adapt to changing consumer needs and market conditions. We present an agile approach, our offer often includes innovations and new products. We explore and look for new, attractive markets, we cooperate with reliable business partners. Investment in new technologies and in our plants is a priority to us. Teamwork, perseverance and consistency of the decisions made, as well as the ability to calculate well, are important elements allowing us to develop dynamically.

What challenges are faced today when managing such an enterprise as Mokate? How do you combine your family tradition with the global scale of business?

Adam Mokrysz: Indeed, I think the greatest challenge is to reconcile the local, family level with international development and the scale of the company’s operations. The foundations of our identity, our DNA, are based on family tradition, human beings, but also on Polishness. We are proud of it and we have turned those features into our competitive advantage.

Katarzyna Mokrysz: Work in an international environment means a great diversity of cultures that broaden our horizons, stimulate creativity and allow for exchange of experience. We observe different trends and flexibly adapt to the circumstances. This is how creative ideas, new product concepts, or even investments are born. The knowledge and knowhow of our teams is invaluable; as a family compa-

ny, we know this well and we can take advantage of this like no one else. Of course, there are many more challenges – of a different nature: formal and legal, technological, logistic. But we handle them excellently, thanks to the teams of people on whom we base our business.

Thank you

Tomasz Pańczyk, Editor-in-Chief The production plant in Żory

As one of Poland’s dairy titans, Mlekpol’s reach spans over 100 countries worldwide. We talk with Małgorzata Cebelińska, Vice President of the Management Board of SM Mlekpol about export to dynamic markets of Asia and Africa, unique strategies, and unwavering commitment to quality that define Polish dairy manufacturer.

SM Mlekpol in Grajewo is one of the main dairy producers in Poland. However, 30% of your output reaches foreign markets. In which countries can your products be found?

The products of SM Mlekpol reach more than 100 countries of the world, and our main recipients are the European Union states. Our highest turnover today is achieved with Germany, the Netherlands, Lithuania, Latvia, Bulgaria, Italy, and Greece. The scale of production and broadness of our offer allow Mlekpol to develop exports also to the countries of Africa and the Far East. Our products are present in such countries as Libya, Morocco, China, Vietnam, Japan, South Korea, Cambodia, Indonesia, Malaysia, and the Philippines. Another important direction of export is the Middle East – Israel, Iraq, Saudi Arabia, the United Arab Emirates, and Qatar.

Due to the distance and common legal conditions, the European Union countries are the natural recipients of Mlekpol’s products. The cooperative collaborates, to a varied extent, with almost all states of the Community. The most intense trade exchange is conducted with such countries as Lithuania, Latvia, Estonia, Bulgaria, Greece, Romania, Germany, and Italy. Recently, an increasing amount of the Cooperative’s goods reaches Balkan countries, such as Serbia, Croatia, or Bosnia and Herzegovina. Countries whose own milk production is insufficient are another major direction of exports. Therefore, Mlekpol continues to develop its exports to the countries of Africa, Middle East, South-East Asia, as well as Latin America, mainly Mexico, Chile, and the Dominican Republic.

What makes your export offer stand out? Does it differ depending on the country?

Mlekpol’s export offer means, above all, products with long shelf lives, appreciated by foreign clients and consumers for their high and repeatable quality as well as Polish origin. They include cheese, butter, UHT milk, cream cheese and processed cheese. To meet the expectations of foreign partners, Mlekpol has created new UHT milk brands (Milcasa and Happy Barn), standing out with their image and communication on store shelves in various countries around the world. Products intended for the B2B sector are powdered goods, such as skimmed and whole milk, whey, WPC, MPC, permeate, as well as fat-filled milk and whey. Construction of a modern Powder Production Plant in Mrągowo, equipped with 3 drying towers, has broadened the offer of such products, most of which reach foreign recipients. With its production scale and experience, Mlekpol adapts efficiently to specific requirements of individual countries. This often entails the creation of a completely new product marked in the recipient’s language.

Which products are currently trending? How have the customer preferences changed in the dairy category? How does the consumption of milk and dairy products look like in Poland, and how does it look like in the countries to which you export?

The most popular product has always been liquid milk as well as fresh dairy goods, consumed every day by billions of people worldwide. The annual per capita consumption of milk and dairy products is higher in developed countries than in developing ones, yet this gap is narrowing year

by year. Due to population growth, increasing consumption is recorded in African countries, in India, as well as in East and South-East Asia, particularly in China, Indonesia and Vietnam. In Poland, an upward trend in consumption of milk and dairy products has been maintained, yet its intensity is getting weaker. The consumption is higher in comparison with such countries as Slovakia, Hungary, Bulgaria, but still much lower than in the Netherlands, Germany, Finland, Sweden, or the UK. A product gaining popularity in almost all countries of the world is Mozzarella cheese, used, among other things, to produce, loved by everyone, pizza. Most fermented products, such as yoghurt, are sold in the drinking form, in practical and convenient “on the go” packages.

Quality plays a special role in the dairy product segment. How do you care about the safety and quality of your products? How do you verify your suppliers?

Mlekpol’s products are made exclusively of milk from our own suppliers who are members of the Cooperative. This allows Mlekpol to establish and enforce strict raw material quality standards, often more stringent than the requirements provided for in the regulations of the EU law. The quality of the received raw material is verified through testing of more than a dozen parameters, performed by internal as well as external and independent laboratories. Furthermore, the Cooperative meets international standards, such as the International Food Standard (IFS), HACCP in accordance with the Codex Alimentarius, or those resulting from evaluation systems, including Ecovadis, Sedex, and the SMETA social standard. Besides, Mlekpol offers its customers selected products compliant with the requirements of Islamic diet (halal) and with the rules of the Jewish law (kosher).

The high standard is also ensured by the technologies applied in production. How does the Mlekpol production line look like in this regard?

Mlekpol is comprised by 14 highly specialized processing plants operating several hundred production lines. Every year sees investments connected with machinery modernization as well as digitization and automation of processes. They are intended to increase the efficiency and effectiveness of production, to reduce the work inconvenience, and to cut the costs. Individual plants are characterized by narrow specialization in production of specific goods. The production in Grajewo, the main seat of Mlekpol, includes UHT milk, butter, curd, cottage cheese, and powdered milk. Mrągowo, on the other hand, has the largest cheesemaking line in Poland, with a daily capacity of 150 tons. Next to the cheesemaking plant, a modern Powdered Dairy Goods Production Plant has been built as one of Europe’s largest establishments of such type, processing 3 million litres of raw material (milk, whey) per day.

Sustainable development is a major aspect of operation on which producers on the FMCG market are focused. How do you care for the environment and the future of our planet?

Mlekpol has always aimed to care for the environment and natural resources. Therefore, the Cooperative has developed a strategy efficiently restricting the company’s negative climate impact. First, the use of bitu-

minous coal was eliminated in favour of natural gas or LNG. Secondly, Mlekpol produces its own electric power from low-emission fuels, increasing its energy security and independence. Between 2020 and 2022, two cogeneration heat and power plants were launched at the Mrągowo and Zambrów plants and are currently Europe’s most modern energy centres of industrial plants. The third area of the Cooperative’s energy policy is the production of electric power from renewable sources. This year, construction of the first biogas plant will be finished as part of modernization of the factory sewage treatment facility in Grajewo. Another aspect is the implementation of technologies that enable saving and recovery of energy from processes. Of course, the Cooperative also focuses on other aspects in the area of sustainable development, e.g. through introducing more ecological product packages to the market. These include tethered-cap cartons of UHT products.

Care for health and good mental wellbeing is a strong trend among consumers and it is still developing. People are increasing their awareness and are paying attention to the composition and origin of products. This is a very positive phenomenon, since Mlekpol’s mission has always been production of natural and safe dairy products representing high quality. Interestingly, there is a growing interest among consumers in products made with respect to tradition, so called comfort food, but also satisfying modern needs and functionality, such as the so called immuno-food (with vitamin or probiotic additives). Furthermore, different snack and dessert products, such as yoghurts, desserts and puddings, are trending now. Responding to this trend, Mlekpol has introduced an innovative dessert with buttermilk in three original flavours, as well as crème fraiche cream dips inspired by French cuisine. Over the recent years, being the centre of attention has become a characteristic phenomenon, especially with the young generation. Consumers wish to stand out and emphasize their individuality, including through things they eat on an everyday basis. Mlekpol keeps meeting such needs, caring not only for quality and innovativeness but also for the exceptional taste of our products.

How do Mlekpol’s plans for the upcoming years look like?

The Cooperative’s continued objective is to care for its resource pool and to develop it. Currently, Mlekpol is processing 17% of Polish milk, Poland still has huge potential in this regard, and it is worth taking advantage of it. The company still intends to develop its product portfolio and to diversify the sales directions. This regards modernization of production lines, automation and implementation of modern technologies, as well as optimization of production processes. For instance, we are now carrying out two innovative projects: one is connected with the production of long-life UHT milk, similar to fresh milk in terms of organoleptic properties, and the other is related to butter with improved nutritional characteristics and health-promoting values (vitamins D3, K2, MFGM). This is a response to the changing consumer needs we included in our long-term development plans.

Thank you

Tomasz Pańczyk, Editor-in-Chief

Above all, Modern Expo means store equipment supplied to shops in several dozen countries. Besides, you focus on generating value for customers of a completely different nature. Please tell us about your offer.

Thank you very much for starting our conversation from this very question. Indeed, we have been consistently building our position as a leading shopfitter for many years. Beginning from shelf systems, in which we have reached the level of perfection, through cooling solutions, to cash register counters, our offer is dedicated to all key segments of the market. However, we are a company that listens closely to its customers on the one hand, but not afraid to experiment and enter completely new areas of operation on the other hand. An excellent example of such a quick process was our introduction of parcel lockers. But the key, as you have said, is the issue of value generation. Value comes into life in very diverse dimensions. Over the last decade, we have created a group including, among other entities, companies involved in software and smart solutions for trade chains or retail space design, and we achieve excellent results. Lately, we have been increasingly developing our service potential. We have obviously noticed that the current situation in the retail sector is forcing chains to compete vigorously and to vie for the consumers’ loyalty and shopping basket. This makes them focus less on the operating part of the business. Therefore, we have proposed an offer we call “Peace of Mind”, a set of services relieving our customers from such activities as everyday quality maintenance of retail space, renovation of store equipment, or technical support. Thus, we are slowly closing the circle of value for trade chains.

To shed some light on the scope of your operations, please tell us which of your latest projects, both on the domestic market and abroad, have been the most interesting?

That is a big question. The period of the last few years has brought

us many projects of unique nature. In their original version, the parcel lockers I have already mentioned were a product created for Allegro; an enormous project encompassing not only supply of several thousand devices but their installation and software. The process was so complex that we created a separate organizational unit for the purpose of managing it. Besides, the success in this area has given us clear evidence that we have much to offer in the field of services. As of today, we have already produced approx. 15,000 machines for the Ukrainian Nova Post company. We are active on the Balkan market where we are a supplier for eMAG (an online store) operating in Bulgaria, Romania and Hungary. For the Castorama chain, we have created the first DIY-oriented machine of such a type. Within a short time, we have become a European leader in this segment.

For several years, we have been actively participating in the dynamic development of the Żabka chain, serving as a supplier of key items of equipment to new stores. This project strongly impacts the development of Modern Expo as well. Today, I can boldly say that the Convenience format is no secret to us. On the other hand, we very recently remodelled the Auchan hypermarket in Piaseczno, creating an excellent and eye-pleasing harmony of shelves, decorations and visual communication. Unique examples are legion. I think the most important fact is that our experiences and credentials are so diverse, and they always have a positive impact on the development of Modern Expo as an organization.

Many countries are currently facing growing costs, and savings are becoming crucial. In what areas can one generate savings at a trade outlet?

Let’s start from revitalization. The pressure of inflation and energy source costs are a great burden to the operation of stores. Chains have to look for optimization on the side of expenses. Today, we are able to

From shelves to smart solutions: Bogdan Łukasik, President of the Management Board reveals how MODERN EXPO is reshaping the global retail landscape and defining new standards.

remove old equipment from a store, refurbish it fully and deliver it back. Thus, you can realistically lower the investment costs by 30-40%. An obvious aspect is the broadly understood servicing of devices. This is a natural direction of development of services, ensuring certain savings. Another one is recycling of equipment that has ceased to fulfil its essential functions. We can also see fantastic potential in maintenance of the appropriate functioning of entire sales outlets, including monitoring of key performance indicators, as well as outsourcing of merchandising and coordination of promotional processes – an immensely interesting subject. And this is just a fraction of the services we can provide to our customers. We are open to the development of this business. We have performed market analyses in search for new business models and initiated this idea several years ago. We were inspired by similar companies from the US market where optimizing processes are immensely developed.

What are the global trends on the market of refrigerating appliances? How do Modern Expo devices fit in with those trends?

Before I move on to the trends, I would like to perform a brief positioning of our refrigerating assortment. From the viewpoint of store equipment, we started out with shelves. It was much later that refrigerating solutions appeared in our offer. Therefore, we are not among the pioneers of these products. Many of our competitors have been present on the market for as long as several decades. They have a well-established position and take advantage of the experience curve. What strategy have we taken to get a share of that pie? An excellent illustration of our approach is the global rivalry on the car rental market between Hertz and Avis. The former had always been a definite leader. In the 1960s, however, Avis made up for almost 20% of shares in relation to its rival over a relatively short time. All due to a famous campaign utilizing the slogan “When you’re only number 2, you try harder”. This is the best illustration of our idea. Entering the category with a product on a level similar to those offered by old players would be pointless. This is why we have focused outright on high-quality workmanship, use of state-of-the-art technologies and full compliance with trends. We try harder than others. This is true for energy efficiency, adaptation to shrinking retail spaces, ecology, or the option of smart control.

What energy consumption savings may exactly be achieved when implementing solutions from the Modern Expo offer?

If you need examples, here you are – Cooles SlimDeck PRO operates in the A class of energy efficiency, consuming 65% less energy than a classic refrigerated cabinet and as much as 85% less than an open one. Moreover, it uses propane (R290) as a refrigerant, which is not only efficient but friendly to the planet. Another example is the Quadros line of refrigerated counters. In this case, high energy efficiency is also combined with an ecologic refrigerant.

Energy saving – is there still any room for development? Can you, as Modern Expo, see more future opportunities for savings? Or maybe you have already been working on new solutions?

This is a complex issue, but I will try to shed some light. Innovation and quick improvements in technology are largely connected today with liquid compression systems and ammonia absorption systems. Manufac-

turers focus on R&D activities in order to improve the design and control the temperature of their products to gain competitive advantage. The growing need of control and monitoring of the environment is expected to provide the participants of the industry with broad possibilities for development in the foreseeable future. On the other hand, climate concerns related to high-GWP refrigerants, such as global warming and ozone depletion, encourage the invention of alternatives. The growing demand for technologies to handle the emissions of hazardous gases is prompting fitting products with advanced magnetic refrigeration systems. Such systems also improve the energy efficiency of refrigerating devices, thus minimizing the operating expenses. The systems are highly energy-efficient and may help save energy by as much as 30%. We, Modern Expo, keep our finger on the pulse. At our labs, works are going on in a direction perfectly in line with the worldwide trends.

On what markets does Modern Expo operate? Do you intend to expand to new areas?

So far, we have been present in 65 countries. On our home markets of Poland and Ukraine, we have a dominating position. On many others, just like the Balkan region, our role is very significant. Soon we will surely want to strengthen in Western Europe. We have been present there for several years and we have spectacular implementations behind us in Germany, France, or the UK, but appetite grows with eating. Besides, we try to develop in a sustainable way, so this is definitely a natural direction. Nevertheless, I will reveal some of my personal dreams revolving around the US market. It is not just about the size of that market but, above all, about the challenges it poses. Yes, being the main supplier and partner for Walmart is a grand goal.

What strategy of development does Modern Expo follow? Will you focus even more on services, or rather on new devices? What is Modern Expo’s key to success?

We wish to be a company that impacts retail on the market, or maybe shape it to an extent. We surely want to use it to help those who cooperate with us, to take advantage of opportunities presenting themselves. Our transformation for over 15 years has been enormous. We started out as a small trade company, then the production phase came and we learned it from scratch. Subsequent years brought us a complete store equipment offer, and ultimately, time came for parcel lockers. Today, we are developing our services very strongly, each of those steps came naturally and smoothly, in response to market expectations. In general, we are open, we test a lot, i.e. we invest a lot of resources into being ready for another opportunity to appear. We are waiting for the market to say this is the moment when it is ready to invest in artificial intelligence. We are capable of relatively quick diagnosis of trends and changes incoming on the market. The most important of all is our ability of quick transition into the implementation phase. Internally, we devote much time simultaneously to develop the competences of our teams. We implement new tools to support our everyday operating activities. The strength of Modern Expo is people and this gives me comfort when looking into the future. To sum up, and to refer once again to your first question, we base our strategy on maximizing the value for the customer.

Thank you

Monika Górka

Innovativeness is a key area of operation on many markets, in logistics as well. What technologies and innovative solutions do you use?

We are able to find a solution for virtually every customer. It is not a problem for us to carry both frozen and fresh goods at the same time; whether it is 2 pallets of frozen fish or a whole truckload of fruit, we can deliver on time. Each time, we approach every order individually, adapting to the needs required by the contractor. An extensive fleet, storage facilities – it is mainly due to this that we can store, repackage and reload goods as well, while preserving the cold chain all the time. Our employees take care to satisfy the customer to the full extent and also to make proper use of our fleet and capabilities, such as double-chamber refrigerators enabling simultaneous transportation of fresh and frozen goods, or double-floored refrigerators for transportation of increased batches of goods, e.g. 66 pallets. The only limit is our imagination.

Logistic of the future - how has the logistics market changed over the recent years? What has become the priority in the services of this segment?

The logistics market is one of the most actively developing sectors of the economy. One can easily see new warehouses sprouting around the largest agglomerations. In view of opening up to new product searches, the demand for innovative logistics and transport solutions has increased. Currently, of great importance is flexibility in relation

to customers – services provided on the highest level, as well as consulting in the area of proper storage, warehousing, and transportation. A major role is played here by partnership in relations between partners – highlighting potential problems which might be encountered, as well as presenting ways to solve them. Appropriate personnel, numerous training, experience amassed over the years, all become an invaluable source to overcome difficulties posed by the requirements of a market expecting professional and reliable service.

What kind of services are your specialty? What makes your offer stand out?

The leitmotiv of our company is refrigerated transport – products that need to be carried under a controlled temperature; from foods to components to medical products. It is due to customers to whom we have been providing services for years that we are developing, expanding and improving our fleet every year. Currently, we own every semitrailer type available on the global market, as far as refrigerating equipment is concerned. Our fleet includes standard semitrailers, as well as double-floored ones, floral refrigerators, multi-chamber ones with partition walls to transport goods at different temperatures; some of them have lifts. Most of our units are semitrailers with room for 33/66 pallets, but we also have smaller ones, accommodating between 1 and 18 pallets, which allows us to distribute even to very hard-toreach places. Additionally, apart from our vehicle fleet, we have a cadre of perfectly trained personnel fully involved in customer assistance

and consulting. They oversee the entire process of transportation from point A to point B. This process is more than just pulling up to be loaded and reaching the unloading site; there is a whole range of relations to be fulfilled if the entire operation is to have a happy ending. Through commitment and passion, they prove their dedication to the company which is not just corporation but also the very friendly relations we have here. Everyone is involved in the works and development of the company, as evidenced by the expanding fleet and the new challenges posed by cooperating companies, which is proof of their confidence in us.

Is a logistics partner able to affect savings, or even increase profits, of manufacturers in the FMCG sector?

The term “logistics partner” may denote companies specializing in a given branch for many years – no company specializes in all branches of the sector of logistic services – which know all inner workings of the given area inside out. Learning, many times, from their own experiences and errors, they are able to nullify and prevent any future problems which might arise in cooperation with a new contractor and a long-time partner alike. Additionally, what matters is reliable and transparent cooperation, as well as explanation of cost-related details: what they result from and what consequences they entail.

Analysis of the given needs and expectations will minimize the risk of, first of all, failure, and secondly, potential losses due to inexperience and wrong decisions. There are tools allowing one to minimize the costs; it is a matter of finding them, implementing them and using them correctly, as well as conversations with experienced people willing to share their knowledge and expertise.

In view of the drastically growing prices or the unstable geopolitical situation, it is a challenge nowadays to maintain the continuity of business. How do you provide your contractors with a stable supply chain?

The lack of stability in the world, with regard to both prices and geopolitical problems, affects us all, and entrepreneurs indeed bear the brunt of it. However, this affects not just the logistics sector but all areas of the economy. First of all, the situation impacts the first link of the chain; an increase in transportation costs affects the increase of prices in the final effect. However, many conversations with our contractors allowed us to realize the problems we are all facing, hence full comprehension thereof and the will to cooperate further. Nowadays, as I have already mentioned, it is not only price that matters but flexibility, the will to cooperate, actions based on the “win to win” principle, consulting, availability, timeliness, as well as openness in solving problems and searching for solutions. Also with price increases, especially of fuel, our partners fully understand the lack of stability and our models of cooperation are elaborated in such a way as to avoid any disruptions to the supply chain at any moment.

How do you adapt your offer to the individual needs of contractors from different countries? Are you able to react to all variables? What stands out in your fleet ?

The answer is in the question – this is individual. It is the basis of action in the current times and situation, not just on the market of

logistics services but mainly based on the best possible relations with partners. We cooperate differently with each one of them, as each customer is different, with individual needs, requirements, standards, or norms. However, since we know our partners and constantly remain in touch with them, we can respond on an ongoing basis and monitor all variables appearing during the implementation of individual tasks, virtually in real time. As I have said before, we own every semitrailer type currently available on the market. We put much emphasis on proper servicing, appropriate equipment, regular maintenance, and systematic inspection of the correctness of operation of individual components. Of tremendous importance to us is the proper operation of our equipment, worth several hundred thousand euros and often used to transport goods exceeding its value; simultaneously, we are able to ensure the safety of the property entrusted to us and, above all, to the drivers. Additionally, our semitrailers are equipped with many more options of cargo securing than in other companies of a similar nature have. Our stock is no older than 3 years, we systematically replace it with newer equipment, allowing no shortcomings on our part. We use all innovative solutions available on the market, and we search for them ourselves, to strengthen our position even more, expand the offer, and increase our competitiveness.

How do the forwarding services you offer optimize the transport processes?

Above all, through using our own fleet, we know the real costs borne by transport companies, especially by forwarding ones. Based on our own example, we have experienced what most service-selling companies have only read about in industry magazines; we now have real costs we are able to document and present to our contractors. In addition to the numbers, immediately visible when the concept of optimization is concerned, one should not forget timeliness. Aware of the transported cargo, especially foods, we allow no delays. We adapt our cadre of drivers to perform the entire operation flawlessly. We know that the cargo loses quality with each delay, and thus the quality is reduced when it reaches the end recipient – and, in fact, we are such recipients too every day.

Our greatest benefit is customer satisfaction and orders for new transports, as well as new challenges being posed to us. This motivates us to act and develop even more dynamically.

What goals do you set for yourself for the years to come?

Development, development, development, and more development. Of course, as every entrepreneur, we have assumed a certain business plan we are implementing step by step. We are unable to foresee the geopolitical situation and the extent to which it would impact us, but we surely intend to significantly increase our vehicle fleet, to develop even more with regard to less-than-truckload transportation, as well as to expand the scope of storage services. We can see potential in each of these areas. Few companies are willing and able to develop in all of the mentioned areas, while we can see a future in them. We will surely be able to repeatedly prove our experience to the customers who work and will work with us.

Thank you

Monika GórkaThe TRANSAD company was established in 2006; ever since, we have met the requirements of our Customers to the greatest care and extent possible. With the experience we have gained over all those years in the TSL industry, we can say with full responsibility that we focus on quality and professionalism. For many years, we have worked for the effects that are now plain to see.

Currently, we are able to adapt to almost every Customer, offering top-quality services and an individual approach to needs and requirements.

We care for our fleet to be state-of-the-art all the time and to meet the highest standards. We complement and improve our team on an ongoing basis so they can always be fully flexible and self-contained in the fulfillment of the tasks they have been entrusted with. We can offer top-level cooling transport, adapting to individual requirements. Our offer includes specialist types of cooling semi-trailers, from standard ones to multi-temperature or double-floor semitrailers.

Since the inception of our operations, we have been setting new goals for ourselves, setting the bar higher and higher, to motivate ourselves for constant development and search

for new solutions. Closely watching the market and the realities set for us by our customers, we have started dynamic development of one of the transportation branches, namely, groupage transport. There are just a handful of companies which take on the challenge of organizing such special kinds of shipments, especially as far as part of the load at a controlled temperature are concerned.

Facing the prospects of a new challenge, we have decided to improve the tools we have been working with so far. At a very quick rate, we have adapted storage areas for handling and confectioning of products, with simultaneous continued preservation of the cold chain that will in no way affect the product quality. Watching the world, our competitors, and the experience of our employees, we have balanced the entire system to adapt and select the best

options to fully satisfy the expectations of our customers. A modern warehouse furnished with ramps, insulated sleeves, specialist loading equipment for all kinds of goods, as well as different forms of cargo protection – from standard locking rods to anti-slip mats to heatshrink films, edge protectors, protective liners. Each time when a new way to secure transported materials appears, we strive to test it with our own fleet in order to introduce it into a wider circulation and to propose additional solutions to our customers.

Although we set the bars high for ourselves with regard to development, our contractors motivate us additionally, by searching for solutions together and with their trust in a company providing the highest value available on the market. We never shy away from problems or challenges; quite the opposite, we always

strive to seek solutions together. Conducting a “win-win” corporate policy from the very beginning, we have never been oriented exclusively to our own good or the satisfaction of our needs. It is worth bending your everyday principles in order to work for the sake of common satisfaction. With our search for solutions, we broaden our knowledge and experience, to share with our customers and to be even more competitive.

Today, it is not hard to buy a car, to hire a driver, to take up an order and to drive ahead; yet there are few “ambitious” companies, setting themselves new challenges and willing to continue their development. In our small employee team, there is surely no lack of commitment or desire for development, both personal and of the entire company. We are aware that we act for the sake of a common future. Both in contact with customers and between each other, we focus on friendly, almost family-like relations. Time spent together, not only within the limits of professional contact, helps us strengthen the ties, consolidate the attachment, stability and conviction, and boost the confidence that nothing is impossible and the sky is the limit.

We do not give in to principles prevailing at corporations where every person becomes a robot, ceasing to be a human being, empathic and helpful. With our openness, devotion and intentions, we largely focus on relations. The relations with our customers have been developed for years; at some point, the business vs. business limits blur and we transcend to the level of friends, which helps us deepen the mutual trust. When we are able to count

on each other in every situation, the customer is certain we will always provide advice and a common solution to a problem. We also often participate in problems as consultants, even if we have not been involved in any of the logistic components. Such joint action strengthens the ties even tighter and allows us to spread our wings.

We can boast a list of customers who have cooperated with us for many years, have never been disappointed with us and wish to continue the cooperation, involving us in new projects and recommending our services to their own contractors. We are surely open to new experiences and further development in the transport and logistic industry.

A Polish family company on foreign markets – what is the key to success?

KP: A family company is characterized by a lack of a formal structure, enabling a flexible approach to the customer and quick action. We are able to adapt to the individual expectations of our partners. The decision-making process is brief and simple.

High-quality products, a wide offer and a search for new options are the essential assumptions of our company. They serve as the foundation for further development. The Bogutti offer contains crunchy cookies, cookies with cream or natural fruit filling, sugar-free cookies, cookies with sugar-free chocolate, without palm oil, as well as fudge in many flavours, from milk, butter and cocoa to more elaborate ones, such as coffee, honey, strawberry, spice, peppermint, lavender. We are open to new products.

KP: Confectionery is a very large category generating an enormous turnover. Customers are fond of confectionery and it will surely find its way to shopping carts. It is consumed on a mass scale by all groups of people – children, youth and adults. This is surely not a product group which consumers will easily give up. Some savings are possible, as are changes of habits, but not resignation.

KP: Krówka fudge is a typical Polish product and it is recognized as such by customers worldwide. A very strong association between the product and country of origin has been built. Fudge from other countries is present on the market but does not comprise a large share in the market. Customers look for “Made in Poland” products. Being very sweet, fudge does not spark an interest everywhere. There are regions, particularly the Middle Eastern countries, where this Polish delicacy enjoys enormous popularity and customers cannot imagine functioning without traditional Polish milk fudge.

An interview with Karol Pilaciński – Export Director, and Edyta Pleban – Export Manager at Bogutti.EP: There are as many tastes as people – this is the simplest way to describe the development of the cookies category. The domestic market is largely comprised by our traditional tastes and cookie types, such as homemade cookies or cookies with fruit filling. Nevertheless, Poland is a market affected by Western trends as well. Several years ago, the American-type cookie with pieces of chocolate appeared on our market and has been enjoying much popularity until the present day. Of course, it has undergone many innovations: from an ordinary cookie with chocolate, we have arrived at sugar-free cookies with pieces of fruit or with nuts. This is exactly what product development is about. Foreign trends and expectations depend on the region. A trend for single-packed cookies is clearly noticeable in the Far East, while, on the other hand, family packages of 400-600 g are popular in the Middle East and in Eastern Europe. The market situation impacts consumer preferences.

KP: Bogutti has been present on the market for more than 10 years and since the beginning, it has focused on the development of export sales. Every year has brought new success – opening of new markets to our products, as well as increased turnover. Today, our products can be found in approx. 50 countries in all continents – from Chile to Japan.

Please tell our readers about your export offer. What makes your products stand out from their competition on global markets?

KP: Development of export sales has been the assumption of the company owners. The Bogutti offer was not directed to a Polish customer but to foreign consumers. Everything started from Italian-style filled cookies under the La Gustosa brand. Currently, our offer includes differ-

In our offer, we strive to combine high product quality with an afford able price, allowing us to reach a broad group of consumers.

Do the consumers on the confectionery market look for innovation, new products, interesting taste sensations, or do they stay with classics?

KP: Currently, we can see both trends intermingle. There are more and more products compliant with the latest nutrition or lifestyle trends. Popular are sugar-free products, protein products, those without palm oil or different additives. On the other hand, traditional brands and tastes are holding fast. Such products have an established market position and a broad group of consumers. These are „must have” products with which no producer can afford to resign.

How do you assess your participation in international fairs and where can you be met in the future?

EP: Fairs give an opportunity to meet in an international environment. This means an enormous diversity of cultures and tastes which broaden our horizons, allowing us to exchange experiences. International fairs provide an opportunity to meet customers and to learn about new trends. They also allow us to watch our competitors, thus letting us adapt flexibly to the market’s requirements and expectations. This is how creative ideas, new product concepts and new investments are born.

In 2023/2024, we will participate in the Anuga and ISM fairs in Cologne, ISM Middle East and Gulfood in Dubai, Food Expo in Greece, Anufood in India, as well as PLMA in Amsterdam and SIAL in Paris.

Thank you

Monika Górka

FMCG

FMCG