Griff

Jermaine

June 30, 2024

The ongoing mission of the City Government of Leavenworth, Kansas is to protect and maintain the health, safety, and general welfare of the Leavenworth community. All representatives of the Leavenworth city government will carry out this mission on a daily basis within the parameters of all fiscal resources available and in a fair and equitable manner for all individuals who live in, work in, conduct commerce in, and visit the City of Leavenworth.

June 28, 2024

Mayor and City Commission

City of Leavenworth

Leavenworth, Kansas

Dear Mayor and Commissioners:

The City of Leavenworth Management Team is pleased to present the 2025 Operating Budget and the 2025-2029 Capital Improvement Program (CIP). The two budgets are presented together to provide a comprehensive view of all planned City financial activity. The budget connects community needs and priorities with available resources and is one of the most important documents the City prepares in a given year. Efforts have been made to produce a document that is an effective communications tool, policy document, historical record, financial plan, and operations guide for the City.

The 2025 Operating Budget is balanced, as required by law, and builds on the City's goal to provide highquality services while maintaining a sound financial standing. The budget contains revenue and expenses for all City funds and includes a "pass-through" levy as mandated by the Library Ordinance.

The 2025 Operating Budget reflects the City's healthy and stable financial position using three key revenue strategies:

• Careful and conservative approaches to estimating future revenues,

• Maintaining a practical level of reserves, and

• Avoidance of using temporary revenues for ongoing needs.

The City's administrative functions, Police and Fire Departments, Parks and Recreation Department, and scheduled capital improvement projects are highly dependent on sales tax. Sales tax is a volatile revenue source that is dependent on consumer spending within the City and County of Leavenworth. The City saw unprecedented growth in sales tax collections in 2020, 2021, and 2022, due to pandemic related federal stimulus payments. 2023 saw a pull-back from this growth and for the first few months of 2024 sales tax collections were below 2023 sales tax collections. For this reason, the 2025 budget includes conservative sales tax projections, reflecting a sales tax growth rate similar to that of the pre-pandemic years. In addition, the budget does not include reliance on one-time revenues such as federal or state grants to fund operations.

Unlike recent years when City budgets were developed with expectations of continued economic growth, the 2025 budget takes into account signals of slowing economic momentum from various factors including higher interest rates, higher housing costs, increased cost of goods, and a tight, more expensive labor market. Therefore, in addition to conservative revenue projections, the City is preparing for continued inflationary pressure on the cost of goods, construction projects, and wages.

Inadditiontorevenueandexpenseforecastingandmanagement,theManagementTeamcontinuestopay closeattentiontoStateLegislature-generatedbudgetmeasuresthat,ifpassedintolaw,wouldrequirea fundamentalshiftinCitybudgeting.Inrecentlegislativesessionsthereweretwomeasuresthatwere consideredbutdidnotpassthatwillreducelocaltaxcollectionsiftheypassinfuturelegislativesessions. Thefirstisaneliminationoflocalsalestaxongroceryitemsandthesecondisapropertytaxabatement forcertainindustrieswithinCitylimits.Ifthesemeasurespassinfutureyears,theinitialestimatein lossofsalesandpropertytaxrevenueis$1.5-2.0million,whichisequivalentto5-6millsofproperty taxes.

Thelast-minutenatureofStatetaxlegislationresultsinunpredictabilityforlocalgovernments.The LeavenworthCityCommissionistheappropriatebodytomaketaxingdecisionsfortheresidentswho, everytwoyears,selectitscompositionandforthebusinessestheCityCommissionrepresents.

The2025OperatingBudgetisarepresentativeexampleofthemeasurestakenbythecurrentandpast CityCommissionsinfinancialmanagementandprudenttaxationtodeliverservicesatthelocallevel. Carefulconsiderationofexpensesandadiligentbuildingofappropriatereservelevels,alongwithefforts tobringaboutgrowth,haveresultedinthepresented2025OperatingBudgetthat:

•Providesforthethirdyearofapay-as-you-gopavementmanagementprogram:Thisprogram hasbrokenthecycleofborrowingmoney-withtheinterestandissuancecoststhatentails-for thisannualprogram.Overtime,thiseffortwillresultinmorefundinggoingtowardroad improvementsandmaintenanceandlessfundinggoingtowardstheservicingofdebt.

•InvestsinInformationTechnology:In2023and2024severalKansasCityMetroAreaand KansasMunicipalitiesweretargetsofcyber-attacksthatcrippledorshutdownmunicipal functionsforextendedperiodsoftime,makingitclearthatallmunicipalitiesintheregionneedto makeITsecurityatopissue.Inpreviousyears,theCityinvestedinITinfrastructurethat providesefficiencyofoperationsandahighlevelofservicetoCityresidents.Beginningin2024, theCityshifteditsInformationTechnologyinvestmentstocyber-security.Thisinvestment continueswiththe2025budgetwhichincludesthecreationofaDepartmentDirectorof InformationTechnology,theadditionofafull-timesystemsadministrator,andthepurchaseofIT equipmentandsoftwarethatwillenhancetheCity'sITsecurityposition.

•InvestsinsalaryincreasesconsistentwiththeConsumerPriceIndex(CPI):Forthe2024 OperatingBudget,theCommissionallocatedfundingtoimplementaslidingscalepayincrease throughouttheCity.Thelaborclassandentry-levelpositionswiththelowestpayrangesreceived 15%payrateincreases.Positionswiththehighestpayrangesreceivedthelowestpayincreasesof 5%.Allotherpositionsreceivedanincreasebetween15%and5%,withtheincreasegetting smalleraspayrangesgothigher.The2025OperatingBudgetincludesa3.5%payincreasefor allemployees,whichslightlyexceedsthe2023andyear-to-date2024CPisof3.4%and3.3%, respectively.

•Ensuringastablereserveposition:TheCity'sreservepositioniskeytomaintaininganAa2 bondratingandprovidestheCitywithstabilityduringperiodsoftemporaryrevenuedecline.Due tothe2025OperatingBudget'sconservativerevenueforecastandtheanticipatedinflationary impactonexpenditures,includingwages,the2025budgetallocatesaportionoftheCity's reservestoallowforexpendituresinexcessofrevenue,shouldthatbenecessary.Inspiteofthe budgetedspendingdeficit,the2025OperatingBudgetstillmaintainsadequateandresponsible reservestobeusedasconditionsdictate.

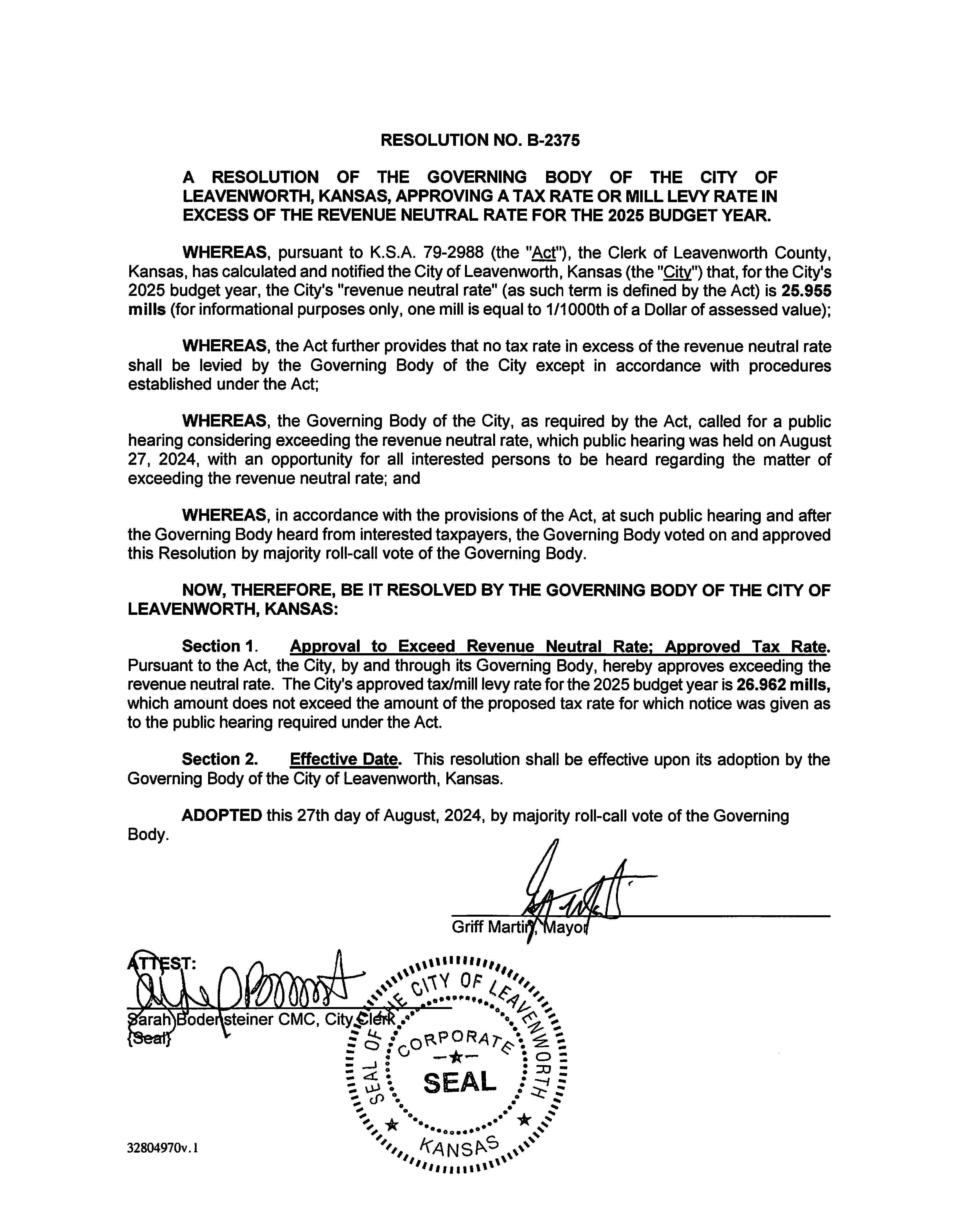

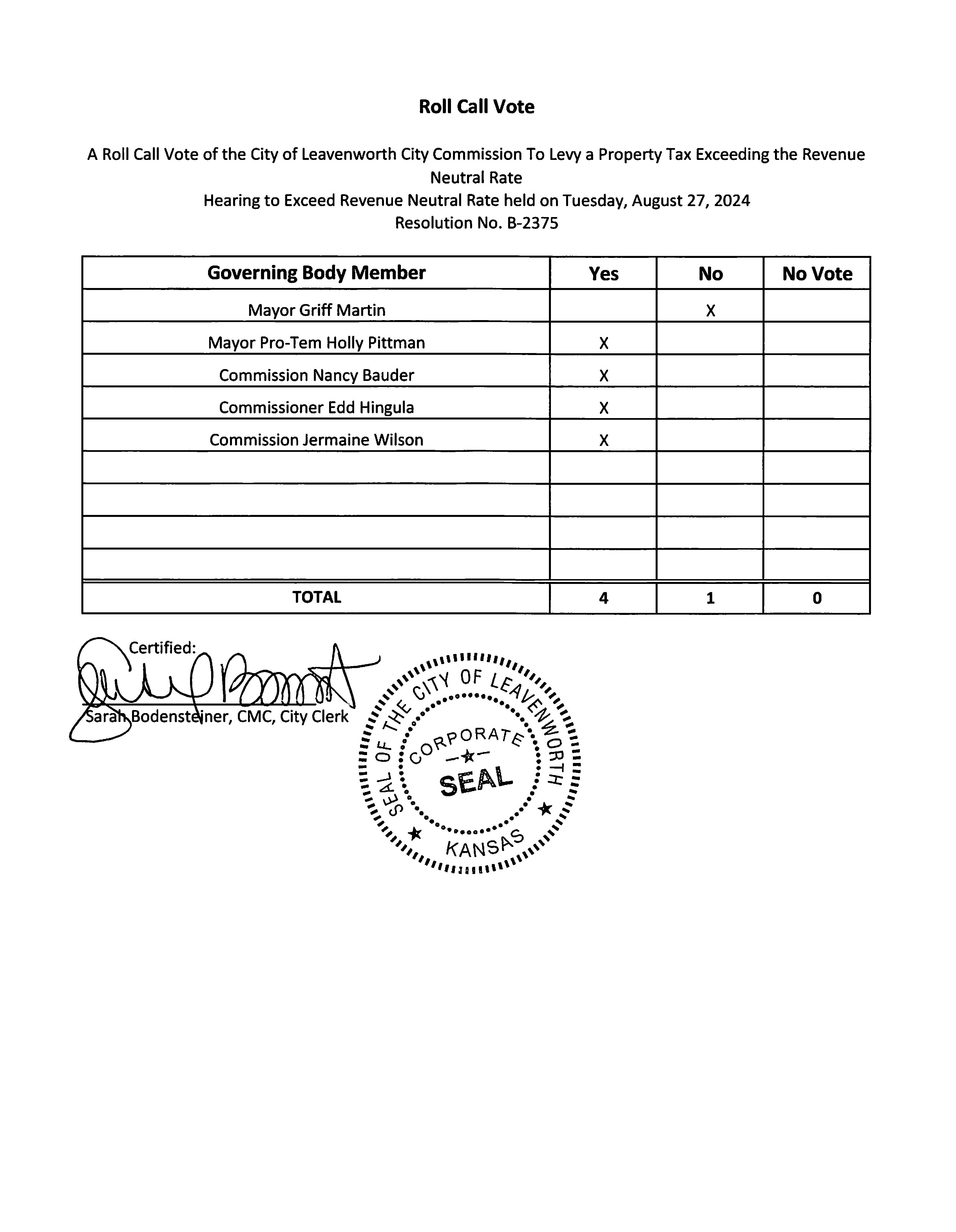

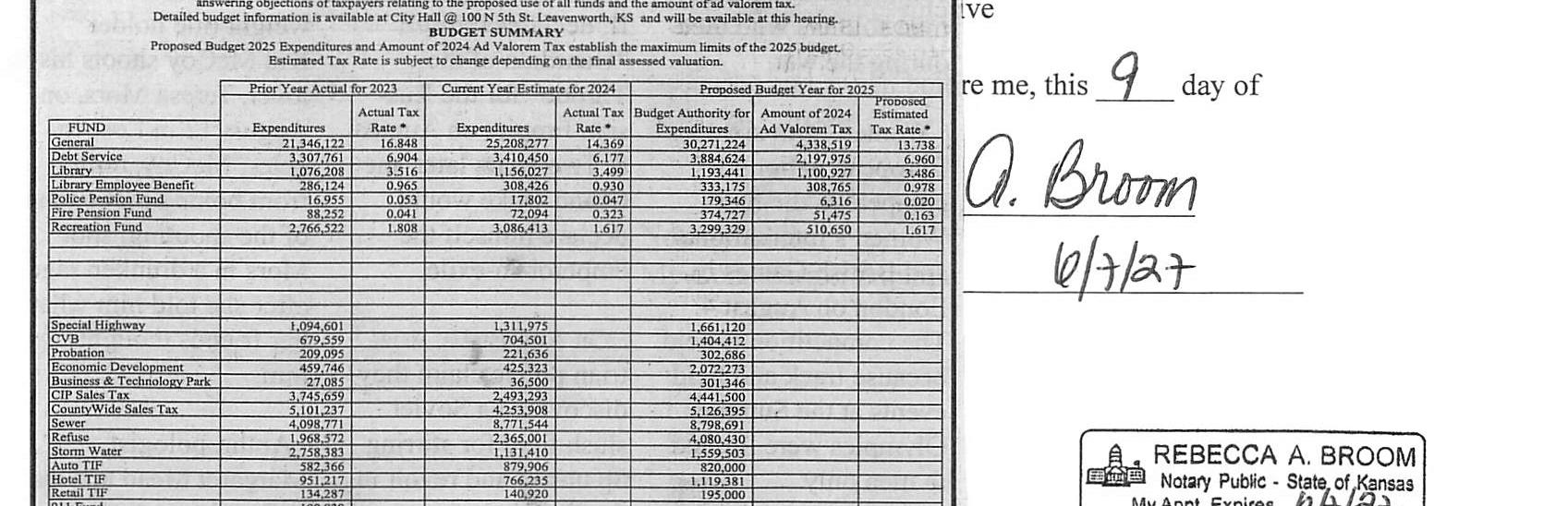

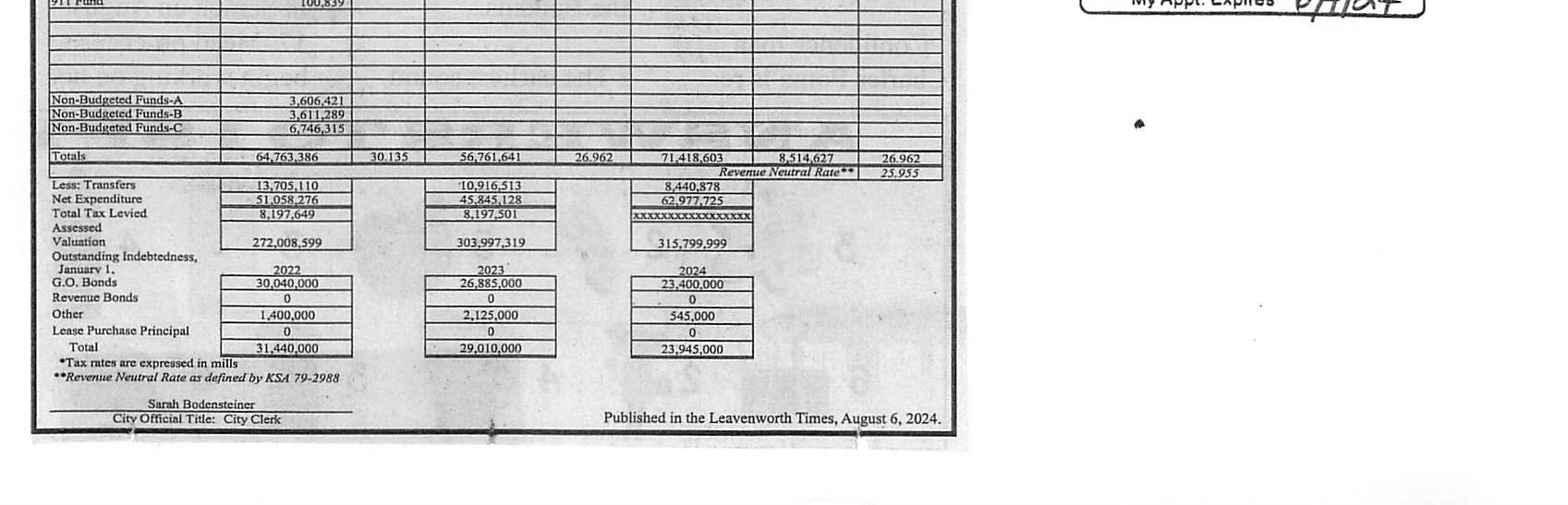

Based on Commission direction and action related to controlling expenses and preserving appropriate reserve levels, while also focusing on service delivery and investing in employees, the 2025 Operating Budget proposes a flat mill levy for the City and Library, combined, of 26.962 mills. The City-supportedmill levy will decrease by 0.0349 mills from 22.533 to 22.498 and the Library's mill levy will increase by 0.0349 mills from 4.429 to 4.464. Assessed values for the 2025 Operating Budget increased by $11,802,680, or 3.9%. Of this amount, $8,152,171 of the increase in assessed value was caused by improvements, remodeling, and changed use. Therefore, existing properties that were not significantly improved in 2023 saw an assessed value increase of only 1.2%. The 0.0349 mill decrease for the Citysupported-mill levy will generate $254,941 in additional revenue for the City, most of which will be paid by property owners with new or significantly improved properties.

Looking forward, the Management Team remains concerned that an increasing reliance, as a portion of general fund revenue, on sales tax makes the City more vulnerable to national economic conditions. In its most recent update on the City of Leavenworth's credit analysis, Moody's Investor Service cautions, "The city's reliance on economicallysensitive sales tax revenue is a credit challenge."

In general, sales tax is far more volatile than property tax. In addition, a portion of the growth in sales tax is tied to a 1 percent countywide sales tax that sunsets in 2035. The countywide sales tax allocation formula includes a property tax component. As the City reduces the percentage of property tax it collects, as compared to other Leavenworth County municipalities, the percentage of countywide sales tax the City receives will decrease.

The 2025 Operating Budget is impacted by the decrease in sales tax collections in 2023 and year-to-date 2024. While the Management Team feels confident that local and countywide sales tax revenue will grow at the average pre-pandemic levels of 2.8% per year, that growth, combined with the budgeted increase in property tax collections, does not make up for the deficit between the budgeted and actual sales tax collections in 2023 and 2024. If sales tax growth continues to be sluggish and the City continues to hold its mill levy flat, the trend of decreasing revenue may lead to the reduction of City services in future years. The Management Team is cautiously optimistic that the revenue trend can be reversed with new residential, commercial, and industrial development; which would provide property tax increases without an additional tax burden to existing homeowners and businesses.

The sluggish sales tax growth also impacts the 2025 Capital Improvement Projects (CIP) Budget. Therefore, the 2025 CIP Budget is focused on IT equipment improvements, necessary equipment replacements for the Police, Fire, Engineering, Public Works, and Parks departments, and park maintenance projects.

In constructing the 2025 Operating Budget, the Management Team evaluated economic trends and forecasts, pricing trends, City Commission priorities and adopted goals, public feedback, and staff recommendations. The following issues, in context of their relation to available resources, were discussed at length in development of the 2025 budget:

• Sales tax revenue leveled offin 2023 and decreased during the first few months of 2024.

• Prices increased across the board for everything from contractual services, to mechanical equipment, fuel, chemicals, and road materials.

•ContinuedconservativebudgetingandspendingpracticesasdirectedbytheCommissionto maintainbudgetreservegoalsthatenabletheCitytomaintainoperationsthroughpotential economicchallenges.

•MaintenanceofanemployeecompensationplandesignedtomaketheCitycompetitivein recruitingandretainingemployeesatalllevelsoftheorganization.

•Ensureadequatecoverageofemployeehealthandwelfareandretirementexpenses.

•Accountforpotentialchangesineconomicconditionsandtrendsafterthebudgetisadopted.

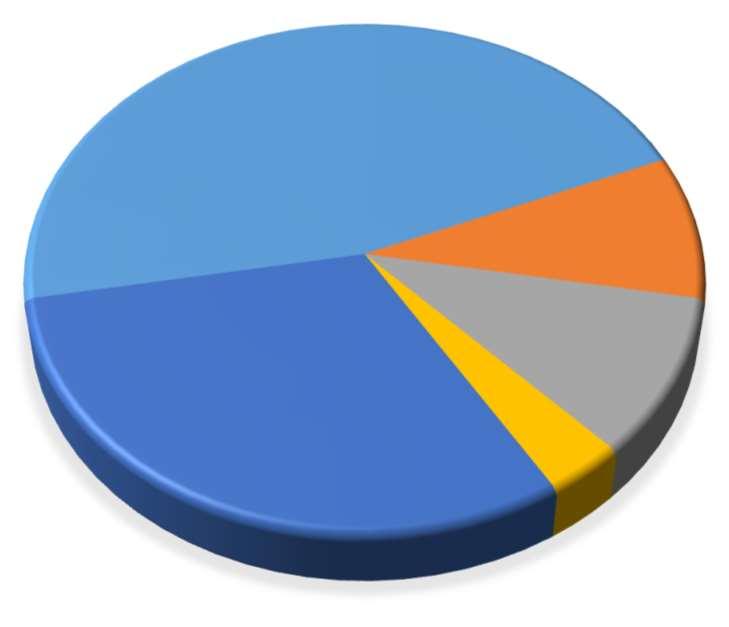

TheCity'sGeneralFundaccountsforcoremunicipalfunctionsandservicessuchasPolice,Fire,Public Works,andPlanningandAdministration.Thisisanoperatingbudgetfocusedprimarilyonrevenues comingandgoinginaparticularfiscalyear.TheprimaryrevenuestreamsthatsupporttheGeneralFund budgetare:1)SalesandUseTaxes;2)PropertyTaxes;3)ChargesforServices;4)FinesandForfeitures; and5)FranchiseFees.FluctuationsintheserevenuestreamsaffecthowtheCityisabletopayforand maintaincoreservices.

•TheCityexperiencedanincreaseininitialassessedvaluationfrom$303,997,319in2023to $315,799,999in2024-anincreaseof3.9%.Attheproposedloweredmillrateof22.498forthe City,theincreasedassessedvaluationwillgenerate$254,941moreinrevenuethanitgenerated in2024.Inspiteofthatincrease,theGeneralFundwillreceive$11,954lessthanitdidin2024, becausetheGeneralFund'sportionofthemilllevywilldecreasesothattheDebtServiceFund's milllevycanincreasetocoverthefirstyearofdebtserviceforthenewFireStation's2024 $5,000,000bondissuance.

•Totalsalestaxrevenues,whichincludelocalandcounty-widesalestaxandlocalandcountywidecompensatingusetax,arebudgetedtobe4.46%higherthanactual2023salestax revenues,generatinganadditional$754,174 (note that this includes two years ofgrowth, 2024 actuals and 2025 budgeted). Thesix-yeartrendhasbeenanannualincreaseof4.63%,andthe four-yearpre-pandemicannualincreasewas2.8%;therefore,a4.46%increaseovertwoyears(or approximately2.23%annually)isareasonableestimate.Theincreaseinsalestaxrevenuewillbe allocatedasfollows:approximately$515,367totheGeneralFund,$23,882totheEconomic DevelopmentFund,and$214,925toCapitalImprovementProjectsFunds.

•Franchiserevenuesarebudgetedtobeequalto2023actualrevenues.

•Cityfeesforpermitsandinspectionsandcourtfinesandfeesarebudgetedtoremainrelatively flat,at2024budgetedlevels.

TheGeneralFundincludesabudgetedreserveof$5,275,549whichisavailabletosupport unanticipatedexpensesorunderperformingrevenues.The2025budgetedreserverepresents21.15% oftheGeneralFund's2025budgetedoperatingexpenses,whichisbetweentheCity'sreserve minimumof16%andthetargetreservelevelof30%.TheendingreservepositiononDec.31,2023, was45.42%,aportionofwhichwasbudgetedin2024tocreateaGrantMatchingCapitalFundand provideresourcestoorderanew$1.3millionfireapparatus.The2024projectionincludesan operatingreserveof32%,whichtheManagementTeamhasworkedtokeepstablethroughperiodsof economicuncertainties.MaintainingastableandhealthyreserveiscriticaltomaintaintheCity'sAa2 bondrating.

• Utilities are budgeted to decrease 2.59%, across all City operations. The City continues to experience lower utility rates since the peaks in 2021 and 2022.

• The increase in information technology (IT) and connectivity expenses including telephone, internet, IT services, computer back-up fees, IT maintenance and repairs, and software continue to outpace inflation. IT expenses are budgeted to increase 32%, or $172,000, over budgeted 2024 IT expenses. This increase in spending is a result of the City's commitment to improving cybersecurity including adding a director level position to the IT Department, hiring a full-time systems administrator and investing in new hardware and software.

• City contributions to the Police and Fire KP&F State Pension system and the KPERS State Pension system for all City employees is budgeted to increase by $245,000 over the 2024 budget due to increases in the KP&F and KPERS contribution rates, salary increases, and budgeting for full employment.

• The 2024 employee compensation plan recommends a 3.5% across the board increase. Total salaries are budgeted to increase 4.28% due to the 3.5% increase and the changes in staffing in the IT Department. When combined with high-quality medical benefits, the City remains competitive in the region for employee recruitment and retention.

Other budgets included

It is useful to consider the 2025 budget document as consisting of four separate budgets: Library Funds, Federal Grant Funds, Non-Tax Funds and Tax Funds.

The Library Ordinance establishes a mill rate not to exceed 3.75 mills to support Libraiy operations. For 2025, the Libraiy's submitted budget includes 3.486 mills for operations, and 0.978 mills for the Libraiy Employee Benefits Fund. The total Library levy will generate approximately $1,409,687 for the 2025 budget.

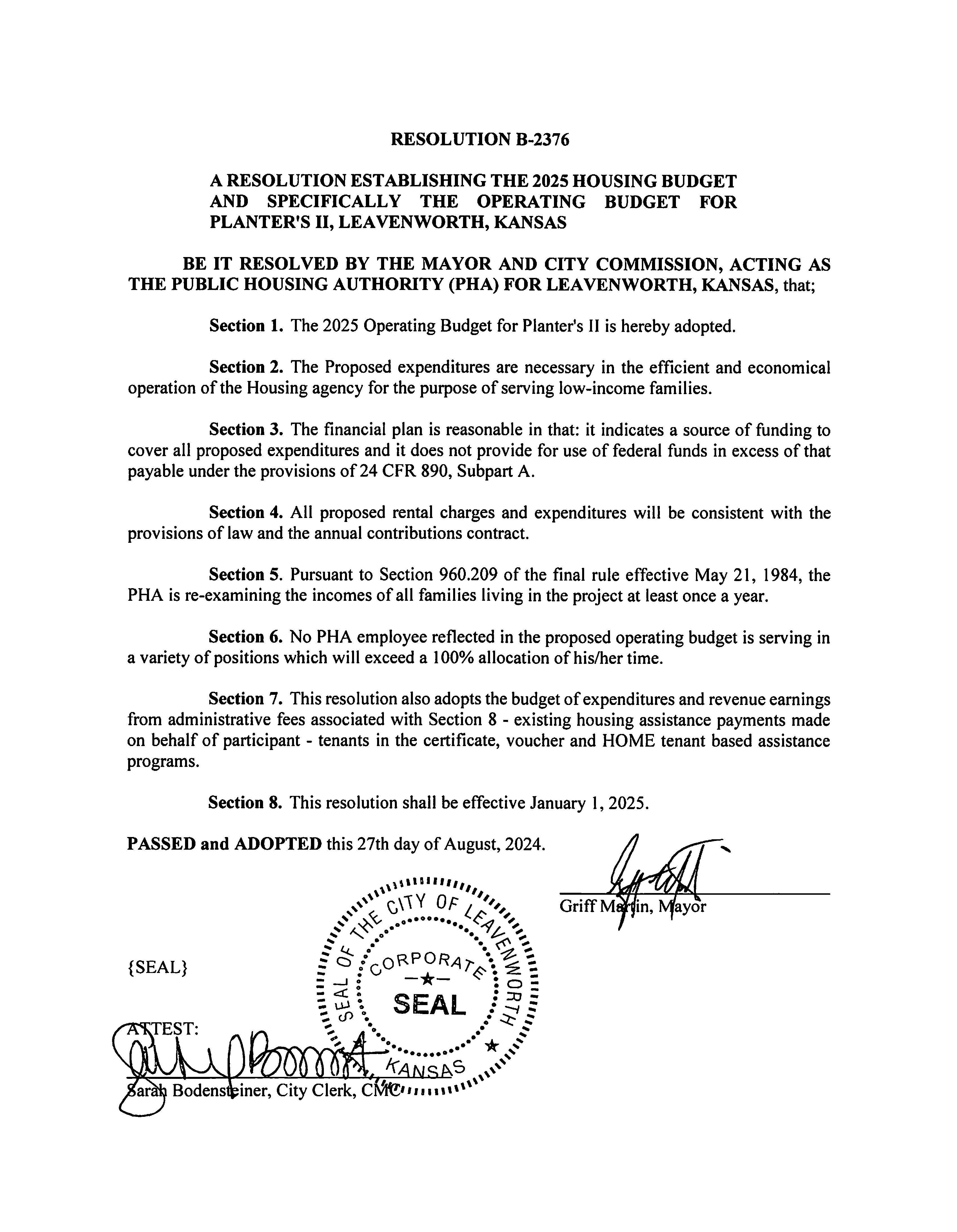

The City receives grants each year for Planters II, Section 8, Community Development, and Comprehensive Improvements Assistance Program (CIAP) activities.

The 2025 Planters II expense budget decreased by $90,000 (-6.4%). The decrease was caused by a $140,000 decrease in capital outlay and a $42,000 decrease in budgeted reserves, offset by an $8,600 increase in personnel expenses and an $84,000 increase in contractual services and commodities, combined. The financial condition of the fund is stable.

The 2025 Voucher Choice Fund expense budget increased by $432,000. This increase is due to a 260,000 increase in voucher choice payment and a $172,944 increase in budgeted reserves. The voucher payments increase based on the level of federal funding the program receives each year. The financial condition of the Voucher Choice Fund is stable.

The 2025 Community Development Block Grant Fund is estimated to increase $7,000 to $347,000. Of that total budget,approximately $69,000 may be used for administrative purposes; the balance, or $278,000, is used for a variety of community projects in accordance with CDBG guidelines.

Non-taxfundsderivetheirfinancialsupportfromsourcesotherthanadvaloremtaxes.Expensebudget levelsforthesefundsaregenerallydependentupontheavailabilityofrevenuegeneratedthroughthe collectionofsalestaxandthepursuitofthefund'sactivity.Forexample,theSewerFundexpensebudget isdependentuponfundsgeneratedfromthesaleofsewerservices.

The2025expensebasebudgetforthisgroupofFundsdecreasesby$16,092,394or30%,to $38,178,119.Thissignificantdecreaseinthenon-taxfundsbudgetsislargelyattributedtoa$15.1 milliondecreaseinthecombinedCapitalProjectFunds.

TheConventionandVisitor'sBureauFundwasestablishedin2014toaccountforthereceiptoftransient guesttaxrevenuethathadpreviouslybeenaccountedforintheGeneralFund.Transientguesttax revenueisprojectedtoremainflatwithactual2023revenueat$700,000.Thisis$50,000morethan 2024budgetedrevenuebecauseoccupancyratesintheCity'shotelsincreasedin2023over2022. Personnelexpensesarebudgetedtoincreaseby$16,000(6.8%),contractualservicesarebudgetedto increaseby$19,450(4.2%)andtheCityFestivalexpensesarebudgetedtoincreaseby$13,000(5.6%). 2025budgetedreservesincreaseby$27,000over2024budgetedreserves.

TheProbationFundisbudgetedtodecreaseby$43,572(-12.6%)ascomparedto2024.The2024budget includedprovidingservicestoLansingandTonganoxieandthe2025budgetincludesprovidingservices toonlyTonganoxie.Thebudgeteddecreaseisreflectiveofthedecreaseinservicesbeingprovided.

TheStreetsFundisbudgetedtoincreaseby16.4%($234,425)becauseaSidewalkandCurbsDivision wasaddedtotheStreetsDepartmentin2025.TheSidewalkandCurbsDivisionwillemploytwo equipmentoperatorswhowillfocusonsidewalkandcurbimprovementandreplacement.Thenew divisionisfundedbyatransferfromtheCountyWideSalesTaxFundasapartoftheCity's$416,000 annualSidewalkandCurbProgram.

TheEconomicDevelopmentFundbudgetincreasesby8.4%or$161,375.Thisisprimarilyduetoa $141,598increaseinthebudgetedreserves,whicharebudgetedtobe$1,616,578attheendof2025.

TheCIPSalesTaxandtheCountywideSalesTaxFundsaresetuptocollectlocalandcountywidesales andusetaxanddisbursethosefundstovariousfundsbasedonpreviouslyestablishedCityordinances andthe2025operatingandcapitalimprovementbudgets.Theprimaryrecipientsoflocalandcountywide salestaxaretheRecreationFund,theDebtServiceFund,TheCapitalProjectsFund,andtheStreets CapitalProjectsFund.Localsalestaxinthesefundsisbudgetedtoincrease2.79%($79,591)over2023 actualsandcountywidesalestaxisbudgetedtoincrease2.72%($82,688).ThetransfertotheRecreation Fundisbudgetedtobe$2,077,894,whichisanincreaseof$309,000overthe2024budget.Thetransfer totheBondFundisbudgetedtobe$1,259,066whichisadecreaseof$141,000(-10%)fromthe2024 budgetbecauseofadecreaseinprincipalandinterestpaymentsintheBondFundforCIPprojects.The transfertotheCapitalProjectsFundisbudgetedtodecreaseby$635,578(-19.8%)becausefewercapital projectsarescheduledfor2025.ThetransfertotheStreetsCapitalProjectsFundisbudgetedtodecrease by1,613,108(-51.8%)overthe2024budget,becausetheDowntown4thStreetProjectwasbudgetedtobe completedin2024.

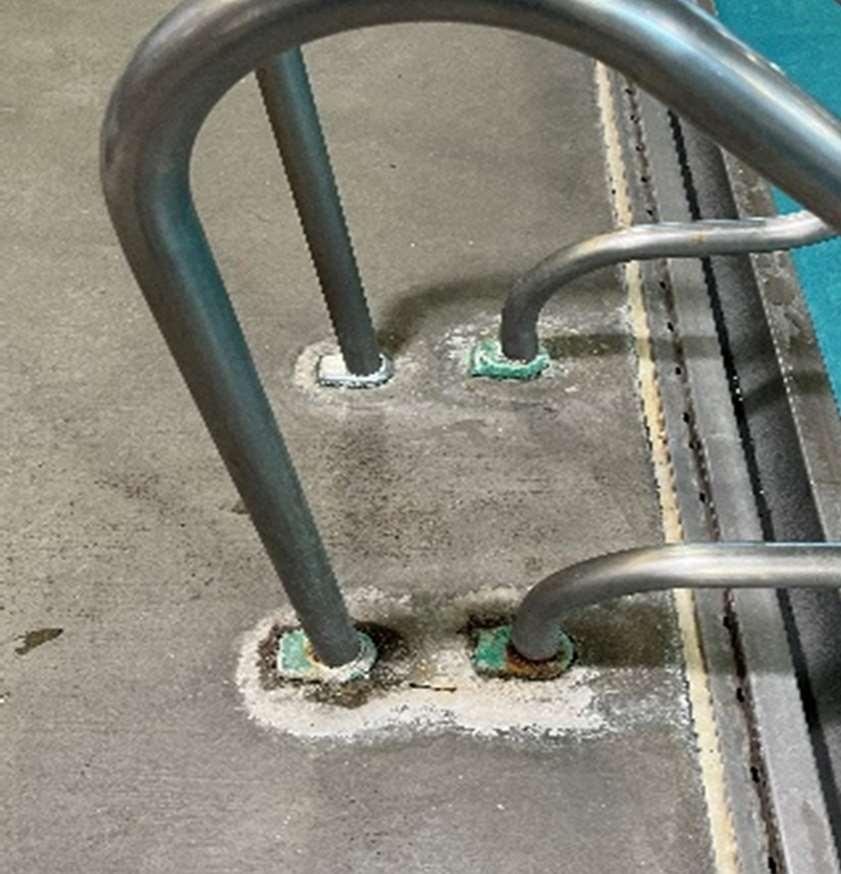

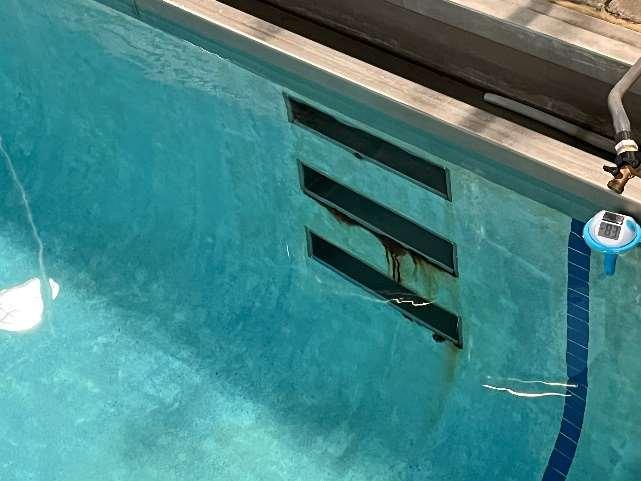

TheCapitalProjectsFundisbudgetedtodecreaseby$7,315,546(-74%)to$2,569,871.Theattached 2025-2029CIPBudgetprovidesalistingoftheprojectsthatarescheduledtobecompletedin2025.The highlightsinclude$111,000fornecessaryroofandexteriorrepairstothelibrary;$345,000forthe replacementofalloftheself-contained-breathing-apparatusfortheFireDepartment,$89,000forthe purchaseofacompacttrackloaderfortheStreetsDepartment,$334,000forupdatestotheRiverfront CommunityCenter,$222,000forparksprojects,and$138,000formaintenancetotheCity'stwopools.

TheStreetsCapitalProjectsFundisbudgetedtodecreaseby$6,094,981(72.4%)to$2,319,750.The decreaseinspendingisprimarilyattributabletothe$5.2millionthatwasbudgetedforthe4thStreet betweenChoctawandSenecaprojectin2024.Reservesarebudgetedtodecreaseby$790,000(100%) becausestartingwiththe2025budget,reserveswillbeheldintheCountyWideSalesTaxFunduntil theyneedtobetransferredtotheStreetsCapitalProjectsFundforaspecificproject.

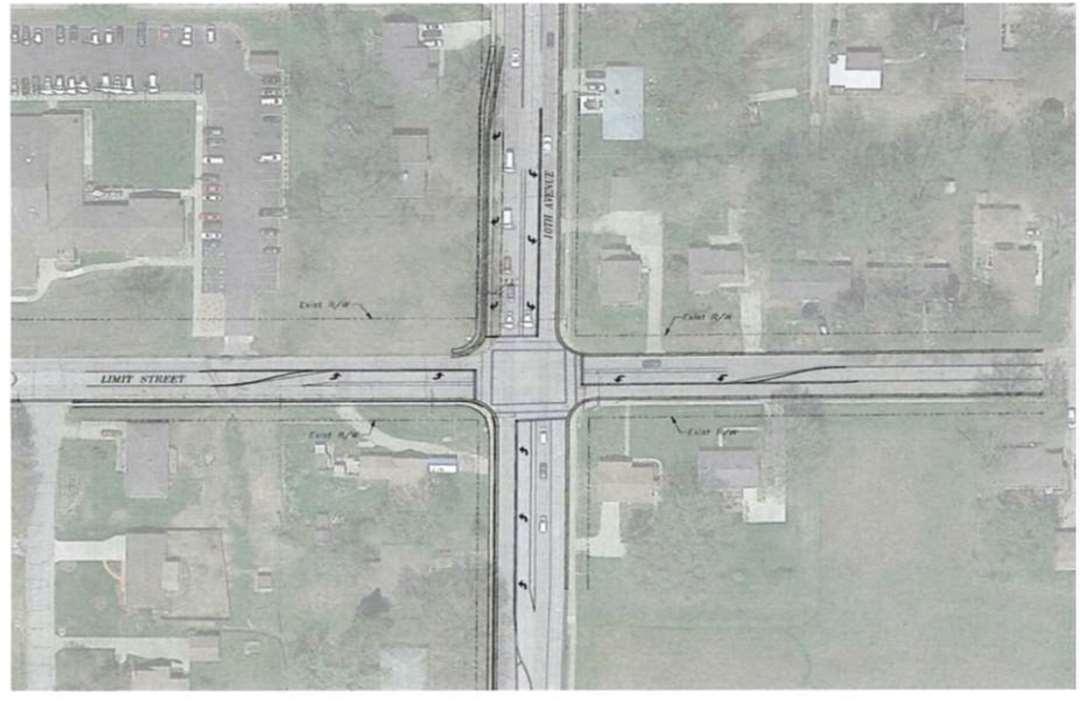

TheGrantMatchingCapitalProjectsFundisbudgetedtodecreaseby$1,726,326(54%).2024wasthe inauguralyearforthisfundandincludedthe$1,979,000VilasStreetProjectanda$1,000,000budgeted reserve.The2025budgetincludesaK-7/USHighway73surfacepreservationprojectbetweenReesand PoplarStreets(totalcost$594,000,City'scost$194,000),aDowntownsidewalkintersectionimprovement toADAstandardsproject(totalcost$475,000,City'scost$95,000),and$326,228inbudgetedreserves.

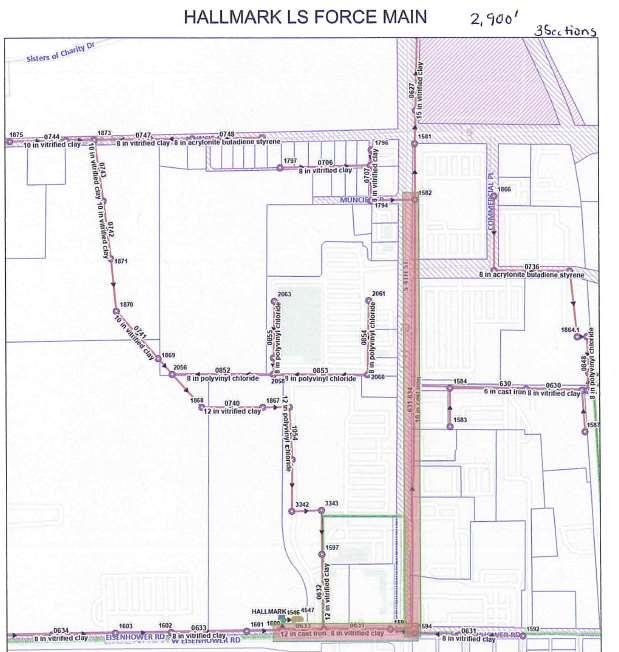

The2025SewerFundbudgetis$44,711(0.5%)higherthan2024.Operatingexpensesarebudgetedto increasebyapproximately$195,000andbudgetedreservesdecreaseby$150,823.The2025proposed budgetincludesa3%increaseinutilityfees.

The2025RefuseFundbudgetis$364,986(21.3%)higherthan2024.The2025RefuseFundbudget,as presented,ispredicateduponaprospectiveprojectthatmayallowtheCitytohaulitsrefusetoalocal transferstationratherthantheJohnsonCountyLandfill.Iftheprojectcomestofruition,someexpenses willincreasewhileothersdecrease,withthenetimpactonexpensesbeingrelativelyneutral.The proposed2025RefuseFundbudgetincludespersonnelexpensesthatincreaseby$70,637(7.4%)and contractualexpensesthatincreaseby$184,130(19.0%).Theincreasedcostofcontractualexpensesis dueprimarilytoincreasedlandfillfees.Commoditiesarebudgetedtodecreaseby$56,250primarilydue toadecreaseindieselfuel,whichwillresultfromhaulingrefusetoalocaltransferstationratherthan theJohnsonCountyLandfill.TheRefuseFundisbudgetedtofinish2025witha90-dayoperating reserveof$624,977andacapitalreserveof$920,822.TheRefuseFund'scapitalreservesareusedto

replacetheoldestgarbagetruckinthefleetwithanewgarbagetruckeveryotheryear(approximately $245,000/each)andotherheavyequipmentneededtoproviderefusecollectionanddisposalservices.The 2025proposedbudgetincludesa3%increaseinutilityfees.

TheStormWaterCapitalProjectsFundisbudgetedtodecreaseby$905,999(-36.7%)In2024a $1,000,000transfertotheStreetsCapitalProjectFundwasbudgetedforthestormsewerportionofthe 4th StreetbetweenSenecaandChoctawproject.Thereisnotransferbudgetedfor2025.Capitaloutlayis scheduledtoincreaseby$601,200(92.8%)becausealloftheStormWaterAssessmentFeescollectedin 2025arebudgetedtobespentonemergencyrepairs.Thisexpenditurewillresultinadecreaseof $448,846(-100%)inbudgetedreserves.

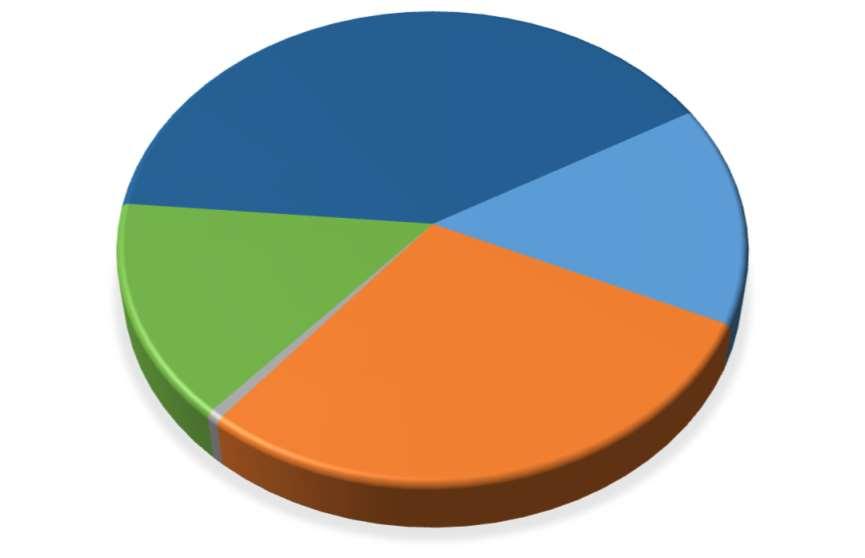

TheRecreationFundissupportedbythefollowingrevenuesources,withtheapproximate2025proposed budgetamountsappearinginparentheses:propertytax($554,103);localsalestaxwhichistransferred fromtheCIPSalesTaxFund($2,077,895);one-thirdoftheCity'sliquortax($94,700);andchargesfor servicessuchasroomrentalsatRiverfrontCommunityCenter(RFCC),parkshelterrentals,gym memberships,andentrancefeesforRFCCandWollmanPool($492,500).Comparedtothe2024budget, the2025proposedbudgetmilllevyisflat,thereisa$309,007(17.47%)increaseinthetransferfromthe CIPSalesTaxFund,a$44,600(-8.30%)decreaseinchargesforservices,anda$64,235projectedcarry forwardbalance.The2025RecreationFundexpendituresarebudgetedtoincreaseby$167,877(5.4%)to $3,300,033.Sixty-eightpercent(55%)oftheincreaseintheRecreationFundexpendituresisattributedto a$91,752(4.52%)increaseinpersonnelexpenses.Thebalanceoftheincreaseisattributedtoa$54,600 (9.23%)increaseincontractualservicesanda$9,300(4.08%)increaseincommodities.

The2025BondandInterestFundbudgetincreasedby$297,115(8.22%).Theincreasehastwo components.Thefirstisa$221,775decreaseindebtservicefordebtthatexistedasofDecember31, 2023.Secondisa$606,191increaseindebtserviceforthe$5,000,000G.O.bondissuedin2024forthe constructionofanewfirestation.Ofthe$606,191indebtserviceforthefirestation,$350,000isfora principalpaymentandtheremaining$256,191isinterestexpense.Theinterestexpenseonthisbond willdecreaseto$181,400in2026.Interestexpensein2025ishighbecauseitincludes2024accrued interestaswellas2025interestexpense.TheBondandInterestFundisbudgetedtofinishtheyearwith a$112,220reservewhichis$92,301(-45.13%)lowerthanthe2024budget.

In2021theCitywasawarded$8,549,064inAmericanRescuePlanAct(ARPA)fundsfromthefederal government.TheARPAFundwascreatedtoaccountfortherevenueandexpendituresassociatedwith thisgrant.AsofDecember31,2024,allARPAfundswillhavebeenexpendedorencumbered.Theonly encumbranceremainingasofDecember31,2024,willbe$832,479forafireapparatusthatisexpected tobedeliveredin2025.TheremainingbalanceintheARPAFundasofDecember31,2025isbudgeted tobe$0.

BaseduponinformationrecentlyreceivedfromtheCountyClerk,theCityofLeavenworthexperiencedan increaseinassessedvaluationfrom$303,997,319in2023to$315,799,999in2024.Thisisa3.88% increaseinassessedvaluation.Taxabatedproperties,suchastheNRA,increasedfrom$3,896,476to $3,971,027,increasingthenetincreaseinassessedvalue,notincludingtaxabatedpropertiesto3.91%.

PersonalProperty

StateAssessedUtilities

Thefollowingtableillustratesthe2025advaloremtaxlevy(priortothedelinquencyratecalculation) requiredbyeachCityFund.

Thetablebelowillustratesthe2024milllevyrateforeachCityFundrequiringadvaloremtaxsupport giventheassessedvaluationdataprovidedbytheCountyClerk.

The Capital Improvements Plan is a comprehensive investment of $38 million over 5 years to improve and expand the City's full spectrum of services including utilities, buildings, roadways, recreation facilities, and technology.The 2025 CIP Budget includes revenue from three sources: 1) ¼ of the City's local sales tax, 2) 85% of the City's portion of the countywide sales and use tax, and 3) state and federal grants.The CIP also includes information for enterprise funds (Sewer, Refuse, and Storm Water), which are funded by user fees and a stormwater impact fee. Based on current and forecasted conditions, as well as work over the past few years to establish industry standard reserve positions, the ManagementTeam is proposing a 3% increase in refuse and sanitary sewer rates.

The CIP budget is allocated across a number of pay-as-you-go projects including upgrades to existing City buildings, the construction of new buildings, equipment purchases, operating transfers, and infrastructure projects. Projects included in the CIP are prioritized by direction from the Commission and staffs evaluation on how operations will be impacted by the condition of the City's equipment, buildings, and infrastructure. Although the CIP represents a five-year-look-ahead, the program is evaluated on a yearly basis to offer the most flexibility to the Commission and the community.The goal of the 20252029 CIP is to align the City's resources with the highest priority needs while offering transparency and accountability to the taxpayers.

Due primarily to conservative capital budgeting over the past two years, the funds carried forward for CIP projects from the 2024 budget are projected to be approximately $3,500,000.These funds, along with sales tax collected in 2025 will allow the 2025-2029 CIP budget to continue to make investments in identified projects, while reducing the City's reliance on debt financing.

• Continued debt service on a number of City facilities, projects and equipment, including:

o The Leavenworth Business andTechnology Park - $357,390

o The reconstruction ofThomton Street - $473,388

o The purchase of an aerial ladder fire apparatus - $149,163

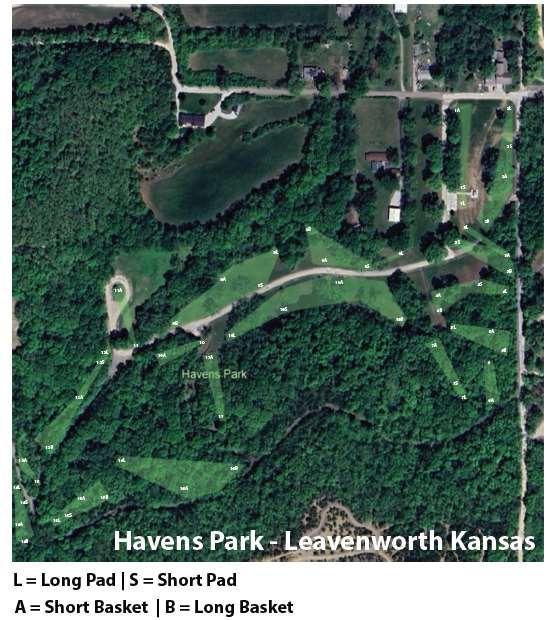

o The final temporary-note payment for park improvements including the Havens Park restroom, the Stubby Park restroom and shelter, and the splash pad - $279,125

• Multiple information technology upgrade projects at a cost of $152,000.

• The replacement of thirty-two (32) self-contained breathing apparatus for the Fire Department$345,000

• Purchase of street equipment - $105,000

• Improvements to the Riverfront Community Center - $333,928

• Purchase of parks equipment - $74,302

• Trails, parks, and pools maintenance and improvements -$359,641

• 2025 Pavement Management Program - $2,100,000

• Three (3) projects partially funded by grants - total project cost $1,145,780; City's cost $296,678

o K-7/US Hichway surface preservation from Rees to Poplar Streets

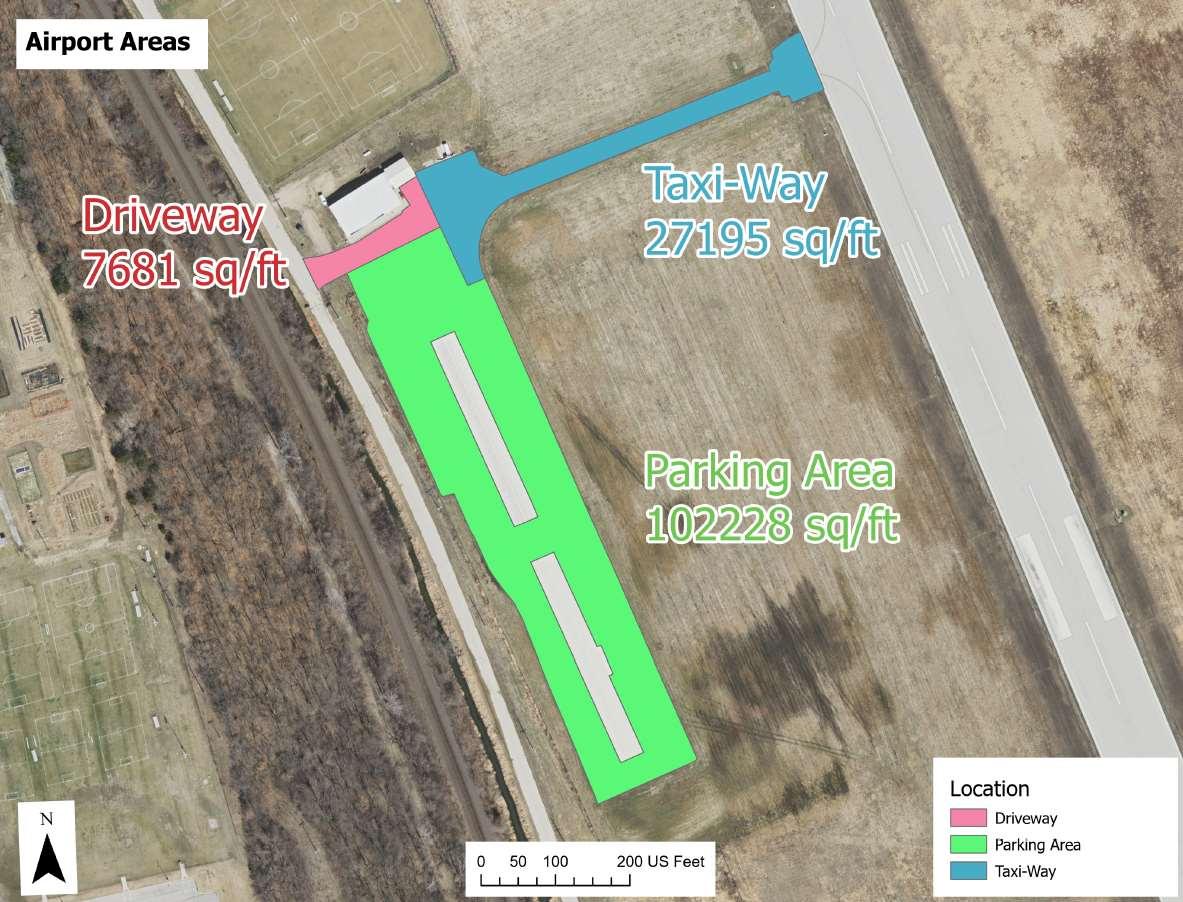

o Airport taxi-way and apron pavement seal

o Upgrade downtown sidewalk intersections to current ADA standards

• WastewaterTreatment Plant equipment replacement - $1,970,000

• Refuse Fund replacement of front loader tractor - $214,000

• Completion of seven (7) Storm Water Capital repair and/or replacement projects - $1,249,177 X

The recommended 2025 Operating Budget and 2025-2029 Capital Improvement Program (CIP) reflect a conservative approach to the fluctuations in the local, state and federal economies. The recommended budget makes responsible use of reserve levels and reduces the City-supported mill levy by 0.15 percent. The reduction in the City's mill levy is offset by an increase in the Library's mill levy by the same amount, so the City's overall mill levy remains flat in 2025. The 2025 proposed mill levy is based solely on current and 2025 forecasted conditions, and is an issue that should be analyzed each year based on new information and data. As mentioned above, local governments are subject to mandates from other levels of government that can dramatically impact the shape and composition of budgeting and tax structures without regard for local governments' ability to provide service at levels expected by residents and businesses.

The recommended budget proposes to maintain City services and offerings at current levels while providing funding for necessary maintenance, repair, and improvement projects. The 2025 budget maintains these services and offerings while holding the mill rate flat. The budget includes a 3% increase in sewer and refuse rates and makes no increase in stormwater impact fees. General Fund reserves are budgeted to decrease to approximately 21% of General Fund expenditures, which is above the established minimum reserve position of 16%, and the City, as a whole, remains in sounds financial condition.

As with any budget process, certain areas were selected for enhancements, while others remained unchanged. We hope the proposed budget matches the goals and expectations of the residents of Leavenworth and the City Commission.

The City's budget process is a year-round team effort that includes the entire management team and staff at all levels throughout the City. We appreciate the support of the staff in the preparation and presentation of the Interim City Manager's recommended 2025 Operating Budget and 2025-2029 CIP and we look forward to reviewing its contents with the City Commission.

Patrick Kitchens Interim City Manager

Roberta Beier Finance Director

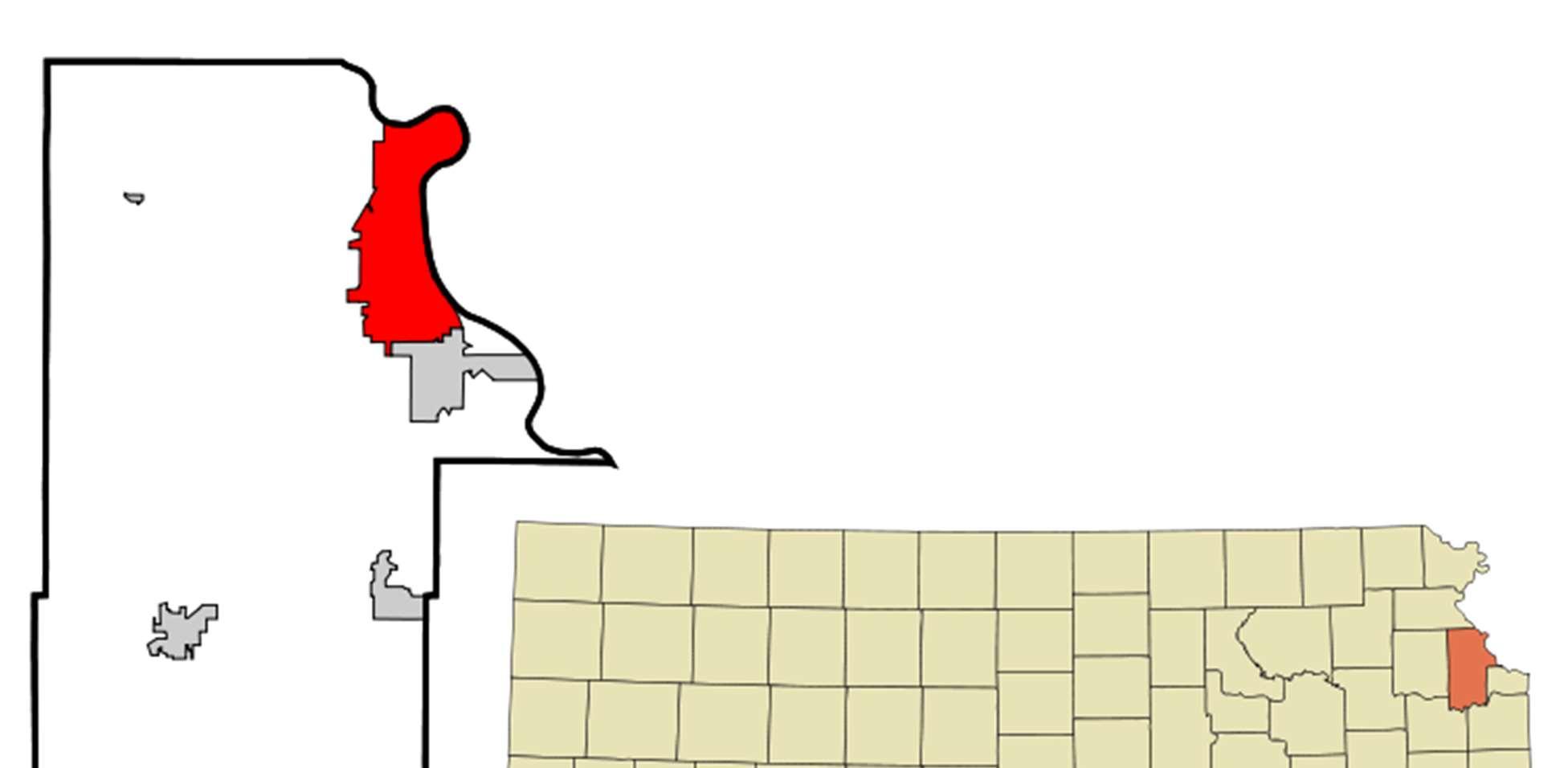

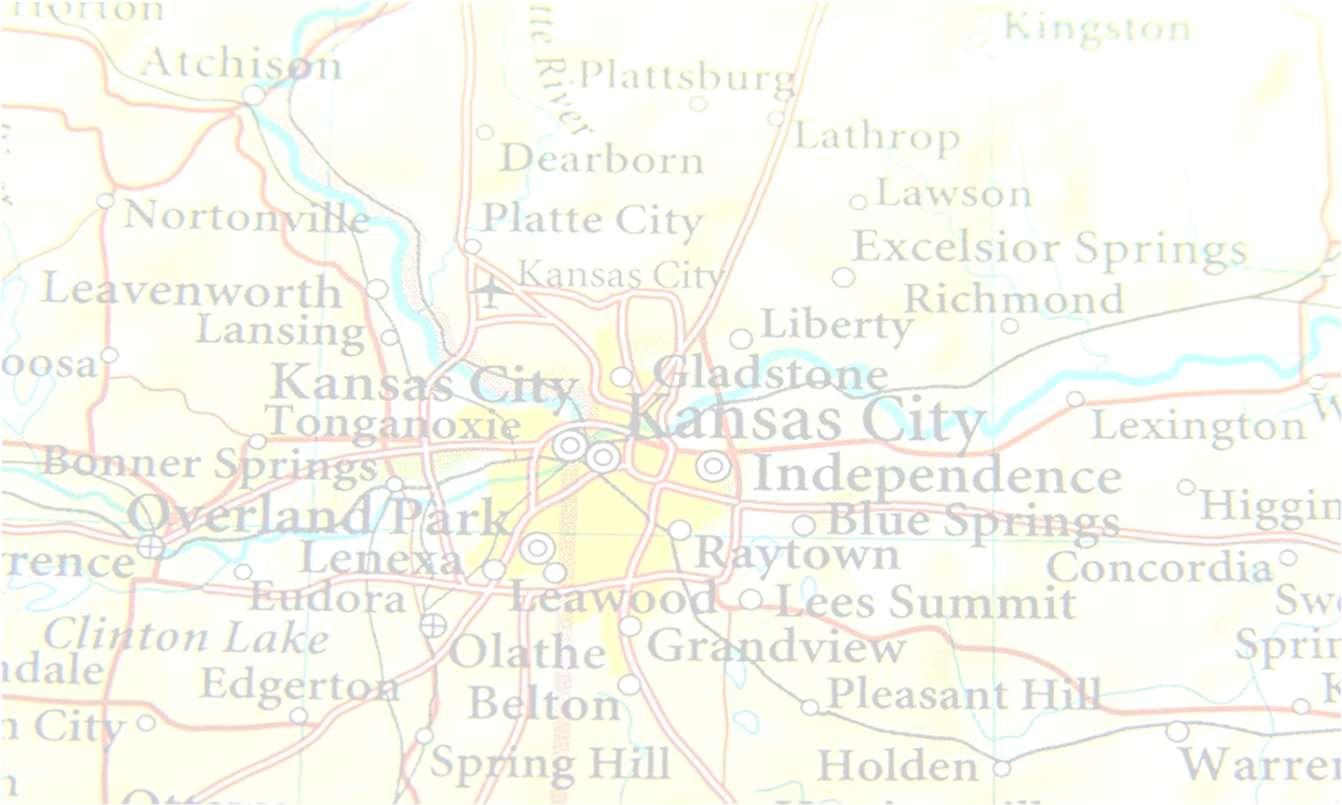

The City of Leavenworth, Kansas is located on the west bank of the Missouri River in the Dissected Till Plains region of North America’s Central Lowlands on land that was originally inhabited by the tribes of the Delaware, Kansa, and Osage peoples. Four small tributaries of the Missouri River flow eastward through the city, Quarry Creek, Corral Creek, Three Mile Creek, and Five Mile Creek. The City’s water source comes from the Missouri River.

Leavenworth is 28 miles northwest of Kansas City, Missouri, 45 miles northeast of Topeka, Kansas, 145 miles south-southeast of Omaha, Nebraska, and 165 miles northeast of Wichita, Kansas, at the intersection of US Route 73 and Kansas Highway 92. The City has a population of 37,176 and covers an area of approximately 24.7 square miles.

Fort Leavenworth, built in 1827, was originally named Cantonment Leavenworth by Colonel Henry Leavenworth. For several decades, the fort played an important role in keeping the peace between the various Native tribes and the settlers moving west. Many Leavenworth city streets are named after local Native tribes.

While Fort Leavenworth was separate from the city until annexation in 1977, the two are interdependent on each other and their histories are inextricably intertwined. The City provides additional housing, shopping, recreational, and cultural amenities that are not available on post. In addition to the military personnel, the Fort provides employment for over 4,500 civilian employees and contractors.

Fort Leavenworth is home to the United States Army Combined Arms Center; the U.S. Army Command and General Staff College; National Simulation Center and the Army Corrections Complex. Leavenworth is home to the University of Saint Mary, the Dwight D. Eisenhower Veterans Affairs Medical Center, and the Leavenworth Federal Penitentiary.

Leavenworth has a small town, historic atmosphere with access to the amenities of a larger city. In addition to the large federal presence and large private employers, such as Hallmark Cards, the Leavenworth community is home to many smaller, family-owned businesses. The 28-blocks of downtown Historic Leavenworth still contains many of the buildings that were present in the early 1900's. Vintage homes are scattered throughout the community.

The City, which grew south of and in support of the fort, was established in 1854 and was incorporated by the first Kansas territorial legislature in 1855. The City was the first city incorporated in the Kansas Territory, hence its motto: “First City of Kansas.” American history identifies Leavenworth for its key role as a supply base for settlers going west. The City was home to freight companies, meat packers, provisioners, stove makers, and furniture manufacturers. As the city grew, factories and businesses flourished and stately homes were built to house the families whose wealth grew as the city grew. Leavenworth was the industrial center of Kansas and of the west. The city has a historic wayside walking and driving tour commemorating the notable events and locations in the community.

Leavenworth also became known as a refuge for African-American slaves fleeing the slave state of Missouri, with the help of Abolitionists. In the years preceding the Civil War, Leavenworth frequently had physical confrontations between anti- and pro-slavery factions.

In April 1858, the Leavenworth Constitution was adopted for the State of Kansas in Leavenworth. The constitution was never officially recognized by the federal government, but was considered the most radical constitution drafted for the new western territories because it included freed African-Americans as citizens.

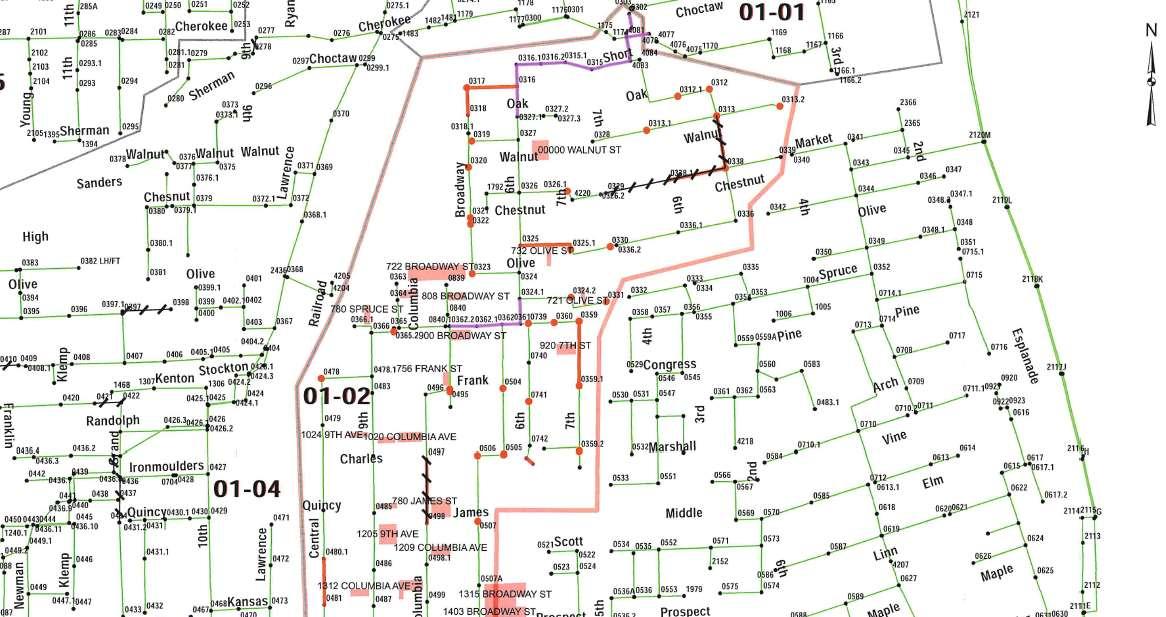

The following map shows the Location of Leavenworth County in Kansas and the City of Leavenworth within Leavenworth County.

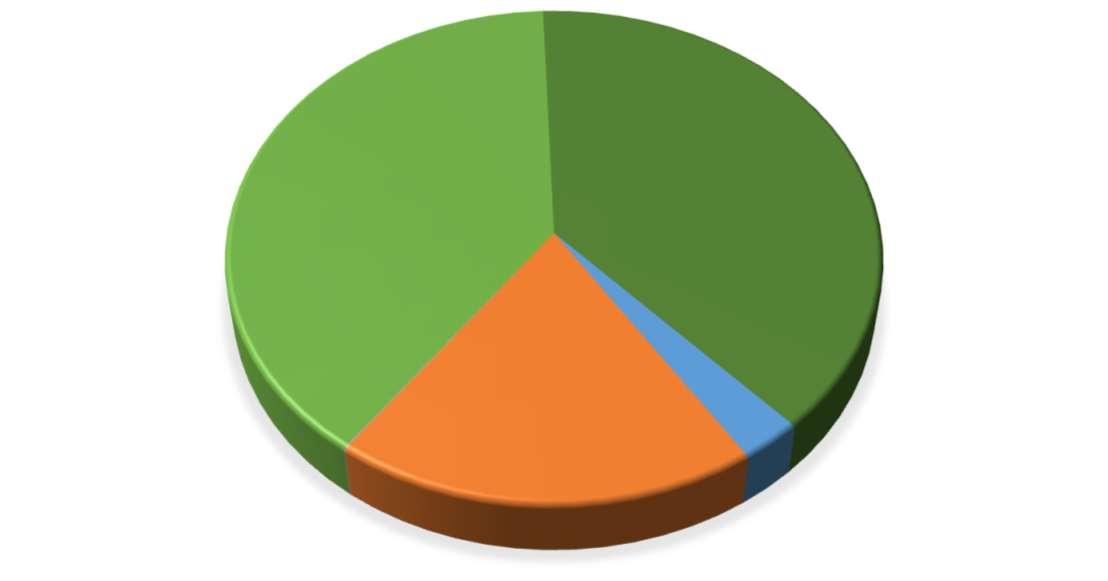

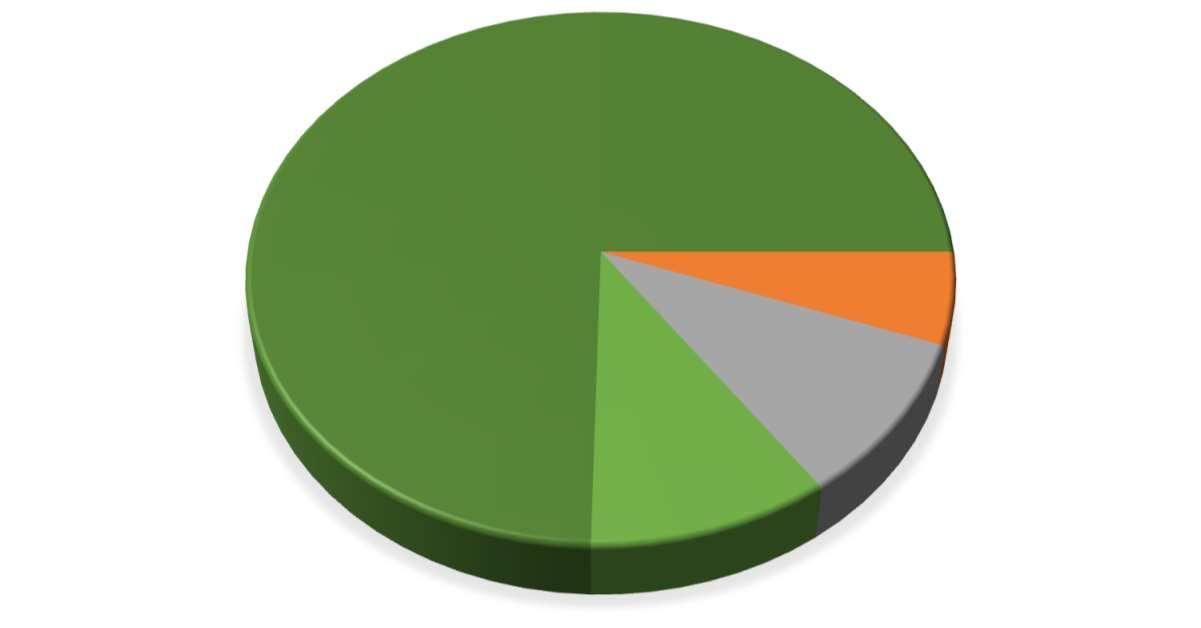

The City of Leavenworth is made up of 15 zoning districts. These zoning districts can be divided into three groups: residential, commercial, and industrial. The residential group is made up of all parcels zoned for the intent of use for habitable dwellings. The commercial group is all parcels zoned with the intent to operate a business for profit. An industrial group is a group made up of zoned areas for industrial uses. Land use in Leavenworth is 76.6% residential, 6.9% commercial, and 9.29% industrial. Leavenworth has several federal and state entities that make up a portion of the land within city limits; these entities are not included in any of the three groups since they are considered government properties and are therefore tax-exempt.

As mentioned earlier, the City has a strong federal presence, which includes Fort Leavenworth, home to the U.S. Army Combined Arms Center and the U.S. Army Command and General Staff College, School of Military Studies, the Center for Army Leadership, the Combat Studies Institute, the Combined Arms Directorate, the Center for Army Lessons Learned (CALL), and the Mission Command Center of Excellence (MCCoE).

The Fort has been continuously occupied by the U.S. Army since its inception in 1827. The original purpose of the fort was to protect settlers on the Santa Fe Trail. The fort also played a key role in both the Mexican and Civil Wars. In 1854, it was the temporary capital of the Kansas Territory. There are two national cemeteries located in Leavenworth. One of these, the Fort Leavenworth National Cemetery, is located on the Fort. Today, Fort Leavenworth is a major economic driver of the community. Providing roughly 15,000 military, civilian, and Department of Defense jobs, an average daily post population of 21,420, and an estimated $1.5 billion economic impact to the city and the region.

In addition to Fort Leavenworth, the U.S. Department of Veteran’s affairs operates the Dwight D. Eisenhower Veterans Affairs Medical Center. The other national cemetery, the Leavenworth National Cemetery, is located on these grounds behind the Veteran’s Affairs Medical Center.

There are several prisons located in Leavenworth and the immediate surrounding area. The United States Federal Penitentiary was built in 1903, along with its satellite prison camp, and the Federal Bureau of Prisons operates both. The Federal Bureau of Prisons has renamed the former United States Penitentiary and is currently constructing a new $461 million Federal Correctional Institution in Leavenworth. The United States Disciplinary Barracks, which is located on the fort and is the military’s only maximum-security facility, and the Midwest Joint Regional Correctional Facility are both military facilities. The Kansas Department of Corrections operates the Lansing Correctional Facility located in Lansing, Kansas, a neighboring city.

These facilities provide strong financial stability to the City.

Three public school districts provide educational services to local citizens. Unified School District (USD) 207 is on Fort Leavenworth and has three elementary schools and one junior high school. The USD 207 high school students attend USD 453, the City of Leavenworth’s school district. USD 453 operates four elementary schools, one intermediate school, one middle school, Leavenworth Virtual School (LVS), an Educational Center, and Leavenworth High School. Leavenworth High School boasts the very first Junior Reserve Officer Training Corps (JROTC) in the country. Leavenworth Virtual School is an internet-based school for kindergarten through eighth grade students. Children living in the City’s southernmost areas are included in the Lansing USD 469 School District.

There are also two private schools in Leavenworth, Xavier Elementary school for students in pre-kindergarten through eighth grade and St. Paul Lutheran School for students in pre-kindergarten through eighth grade.

The University of Saint Mary is a four-year private Catholic university located in Leavenworth. Other higher education opportunities in Leavenworth include a Kansas City Kansas Community College satellite campus and a University of Kansas satellite campus.

(Ages 25 and over)

Bureau

Leavenworth is a prime middle-class community with a sound business base in the Kansas City Metropolitan area. The cost of living in Leavenworth is 83.1% of the national average (or 16.9% lower than the national average).

Economic activity in Leavenworth during the past year included:

Construction began on a new, $461 million federal prison to replace the 126 year-old facility; the new facility will be state of the art, offer increased security and services for physical and mental wellbeing for prisoners

Site visits from businesses interested in the shovel-ready, 82-acre Business and Technology Park

Two growing subdivisions had several new houses built in the City’s southeast corner

City celebrated one year of partnership with RideLV, the on-demand micro transit system providing public transportation within City limits

Distribution of dozens of Small Business Economic Development Grants to new and existing businesses to make building and façade improvements

Expanded participation in the City-hosted Annual Business Symposium to connect current and future business owners with the resources to help them succeed and grow.

Continued outreach regarding the City’s Neighborhood Revitalization Area (NRA) tax rebate program to stimulate investment into properties within the NRA boundaries

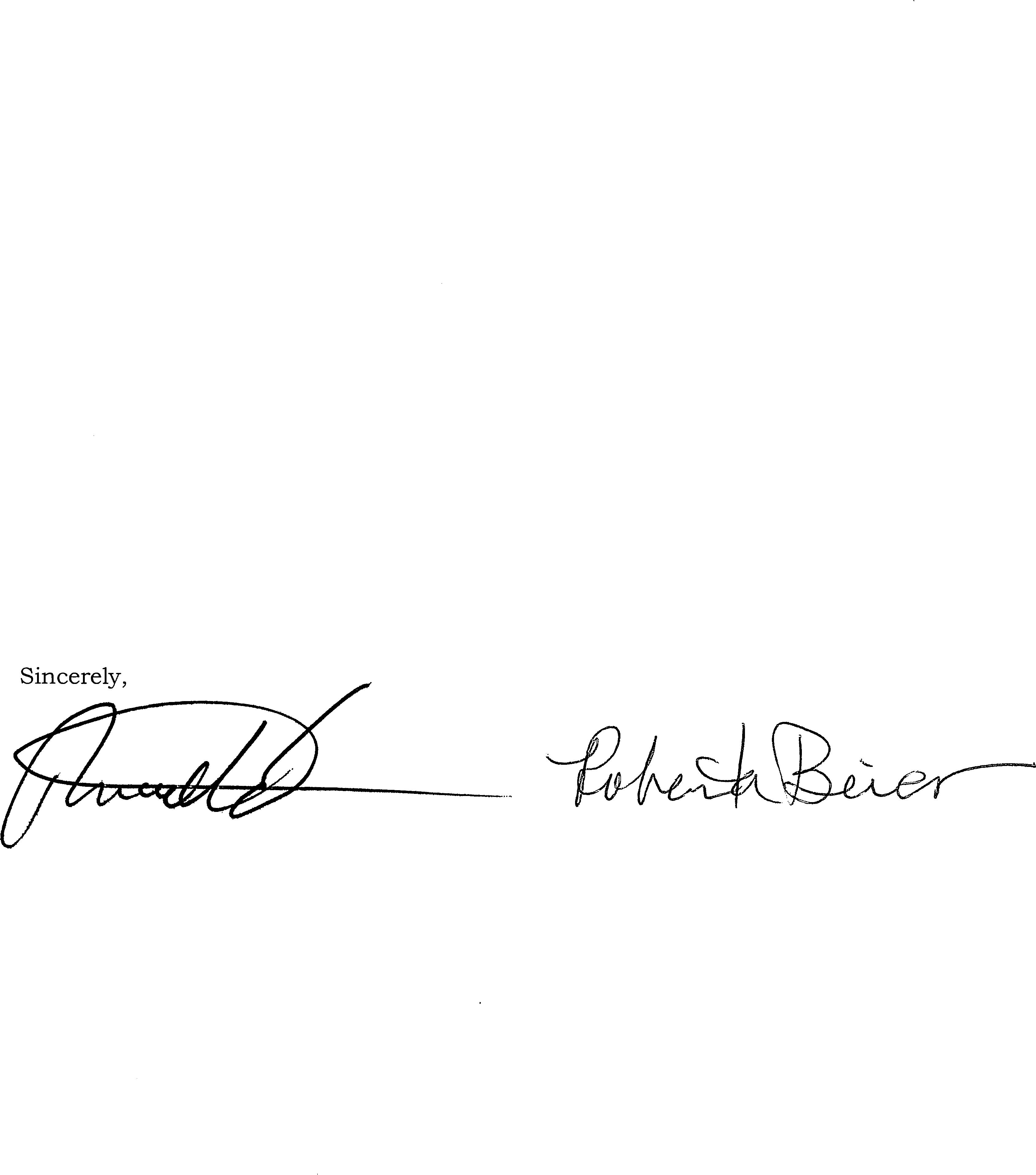

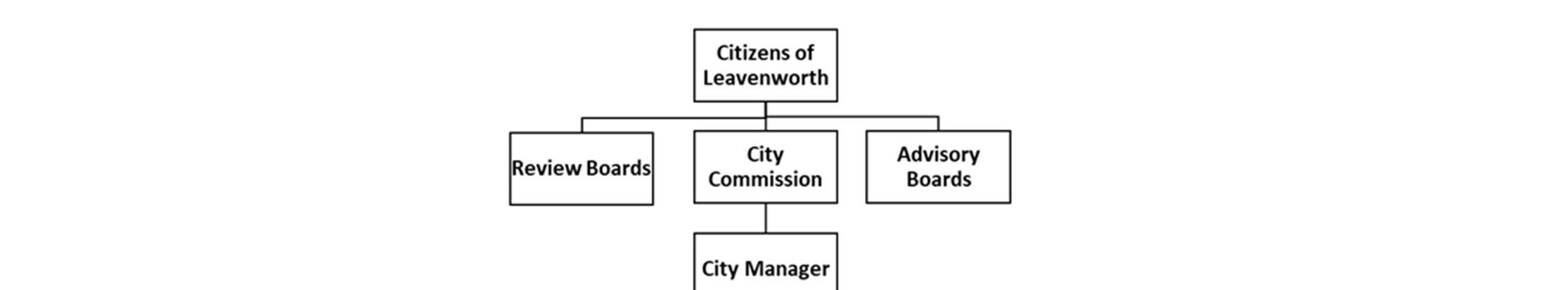

Leavenworth is a legally constituted city of the First Class and the county seat of Leavenworth County.

The City is empowered to levy a property tax on both real and personal properties located within its boundaries. It is also empowered by state statute to extend its corporate limits by annexation, which occurs periodically when deemed appropriate by the governing body.

Since 1969 the City has operated under the commission-manager form of government. Policymaking and legislative authority are vested in the City Commission, which consists of five commissioners elected at large on a non-partisan basis by the general population. The commission elections are held every two years. Three of the commissioners are elected at each election. The two highest vote totals receive a four-year term and the third highest vote total receives a two-year term. Each year the Commission selects the Mayor from amongst themselves based on the number of votes in the most recent election.

In comparison to the federal government, the City Commission performs the legislative function; the Municipal Court performs the judicial function; and the City Manager and city staff perform the executive function.

The Commission is responsible for passing ordinances, adopting the annual budget and capital improvement program, appointing committees, and hiring the City Manager. The City Manager is responsible for carrying out the policies and ordinances of the City Commission, overseeing the day-to-day operations of the City, and appointing the heads of the City’s departments.

The City’s financial reporting entity includes all the funds of the primary government (the City of Leavenworth) and of its component unit - the Public Library. A component unit is a legally separate entity for which the primary government is financially accountable.

The City provides a full range of services, including:

Public safety: police and fire protection, animal control, and parking enforcement.

Public Works: sewer, refuse, storm water management, building inspection, airport, and the construction and maintenance of streets, storm water, bridges, and other infrastructure.

Housing and urban development: code enforcement, rental coordinator, and a range of housing and community development programs supported by federal grants.

Culture and recreation: parks, recreation, library, community center, aquatic center, farmers market, and performing arts.

Community and economic development: planning and zoning and economic development activities.

General government: Commission, City Manager, Legal, Municipal Court, Contingency, Airport, Civil Defense, City Clerk, Human Resources, Finance, General Revenue (Gen Gov’t), and Information Technology

Spectrum TV Channel 2 is the channel the City uses to broadcast live Commission meetings and other City related public announcements from other governmental agencies and school districts.

The Leavenworth Times is the city’s daily newspaper and is published by Cherry Road Media. Fort Leavenworth publishes a weekly newspaper through the U.S. Army that covers local military and community news.

In addition to print and broadcast media, the City publishes news and updates through their webpage (https://www.leavenworthks.org) and social media sites.

Area medical facilities provide a full range of services including general health care, preventive health care, dental and vision care, behavioral and counseling services, dialysis, long-term care facilities, hospice care, rehabilitative care, and surgical care. These facilities provide in excess of 1,260 jobs.

In addition to medical facilities for the civilian population, the Dwight D. Eisenhower Veteran’s Affairs Medical Center is located in Leavenworth City limits. There is also a medical care facility located on the Fort.

Currently, there are seven banks in Leavenworth with thirteen locations. The following summary of deposit report is as of June 2024, the most recent data available (in Thousands):

Source: FDIC Bank Ratings

Leavenworth’s location in the Kansas City metropolitan area is advantageous for commercial transportation. A massive logistics hub, the intermodal park in Edgerton, Kansas, (just south of Kansas City) connects railway shipments, trucking shipments, and inland port access to ocean shipping.

The Kansas City International (KCI) airport is located twenty minutes from Leavenworth, and as of April 2023, boasts a brand-new terminal with increased services and amenities. In addition, the City of Leavenworth has

a joint-use agreement with the Department of the Army for the use of Sherman Army Airfield located on post. The airfield is approximately one-mile north of the city and, while it is a military airfield, civilian access is unlimited.

Located at the intersection of U.S. Highway 73, Kansas Highway 92, and Kansas Highway 7, Leavenworth is within easy access to U.S. Interstates 70, 435, and 35. Interstate highway 29 and State highway 45 are within a few minutes of the City on the Missouri side of the river.

In conjunction with the Guidance Center and the Kansas City Area Transit Authority (KCATA), the City began an app-based transportation system that allows residents to get to medical offices, grocery stores, and places of work within City limits. RideLV MicroTransit, began in April 2023 and provides on-demand transportation upon request for a flat, affordable $2 rate.

Culture and Recreation

The City of Leavenworth enjoys a multi-cultural and religious diversity due to its military and international military heritage.

The Leavenworth Parks and Recreation Department maintains a system of more than twenty-five parks, an aquatic center, and the Riverfront Community Center. The community center offers an indoor cardio facility, an indoor pool, a gymnasium, and an excellent event venue. New in 2023 is a popular Splash Pad with water features located at Hawthorn Park.

The LeavenworthPublic Library offers many programs suchas meeting rooms, technology services, elementary and teen gaming, and interlibrary loan programs, in addition to specialty programs for children, teens, adults, and seniors.

The River City Community Players provides year-round plays and musicals at the Performing Arts Center.

Camp Leavenworth is the City’s annual festival held in September and attended by up to 10,000 residents and guests. The two-day event features live music, local craft vendors, food vendors, and family-friendly activities.

The City is home to several museums such as:

The Richard Allen Cultural Center featuring items and artifacts from African-American pioneers and members of the military and collections of 1870-1920 photos from the Mary Everhard Collection.

C.W. Parker Carousel Museum offers three complete carousels that can be ridden and unique carousel horses.

National Fred Harvey Museum which is dedicated to the famous American entrepreneur credited with creating the world’s first chain of restaurants and hotels in association with the Atchison, Topeka, & Santa Fe railroad.

First City Museum showcases many different collections and displays of Leavenworth history.

The Carroll Mansion Museum is an 1880’s Victorian house featuring elaborate handcrafted woodwork, stained glass, and antiques from the early 20th century.

Fort Leavenworth Frontier Army Museum boasts a large collection of 19th century military artifacts.

Leavenworth has an historic shopping district that includes artisan shops, antique shops, art galleries, bakeries, book stores, pottery shops, restaurants, a farmers’ market, and many other points of interest. There is a variety of international cuisine offered in local restaurants.

In addition to the many cultural and recreational opportunities in Leavenworth, its proximity to the Kansas City metropolitan area enhances the City’s quality of life. There are many professional sports venues, such as baseball, football, soccer, hockey, and racing. Kansas City also boasts several museums, art galleries, performing arts venues, restaurants, shopping, farmers market, micro-breweries, and of course, the zoo.

U.S. Decennial Census and worldpopulationreview.com

U.S. Census

and elevation.maplogs.com

City of Leavenworth, Kansas

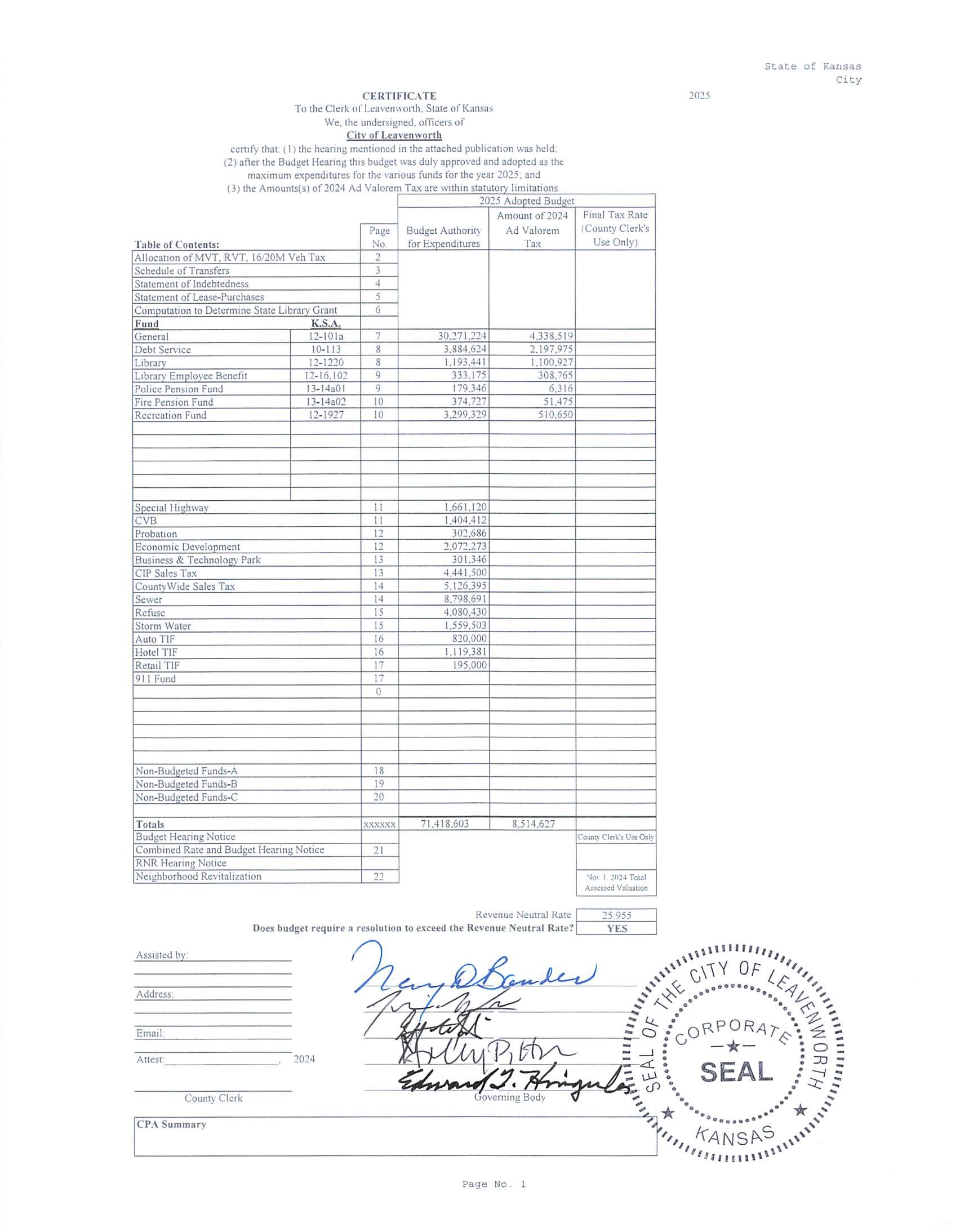

The City of Leavenworth abides by Kansas budget law which requires municipali es to prepare an annual budget form that includes the informa on required by Kansas budget law and discloses complete informa on as to the financial condi on of the municipality. The state provides budget workbooks that must be completed by all municipali es over a certain size. The City’s 2024 Kansas Budget Workbook is included in Appendix D.

The Governmental Accoun ng Standards Board (GASB) establishes the accoun ng rules that municipali es must follow. These rules require the City to use a fund accoun ng system. Fund accoun ng systems establish separate funds, each with its own budget, that accounts for financial ac vity by revenue source and/or purpose. The City has several different types of funds including General, Debt Service, Special Revenue, Capital Project, Enterprise, Pension and Custodial Funds. A municipality can have only one General Fund, but may have mul ple funds of the other types. The following are brief descrip ons of each type of fund.

General Fund: Main opera ng fund used to account for and report all financial resources and expenditures not accounted for and reported in another fund.

Special revenue funds: Used to account for and report the proceeds of specific revenue sources that are restricted or commi ed to expenditures for specified purposes other than debt service or capital projects.

Capital projects funds: Used to account for and report financial resources that are restricted, commi ed, or assigned to expenditures for capital outlays, including the acquisi on or construc on of facili es, construc on of infrastructure, and acquisi on of equipment.

Debt service funds: Used to account for and report financial resources that are restricted, commi ed or assigned to expenditures for principal and interest.

Enterprise funds: Used to report any ac vity for which the fee that is charged to external users covers the cost for goods and services provided by that fund.

Fiduciary funds: Fiduciary funds account for revenues that are collected and held on behalf of others and are not available for use in support of the City’s ac vi es. The City budgets for the following types of fiduciary funds:

Pension funds: The City has a Fire Pension Fund and a Police Pension Fund that hold resources in trust for members and their dependents.

Agency funds: Used to report resources held by the City in a custodial capacity. The City Budgets for the following agency funds:

o Leavenworth Public Library (Library Fund)

o Library Employee Benefit Fund

o Tax Increments Funds (Auto TIF Fund, Hotel TIF Fund, and Retail TIF Fund)

The Kansas Budget Form is divided into three sec ons: budgeted funds that include an ad valorem tax levy, budgeted funds that do not include an ad valorem tax levy, and unbudgeted funds. While Kansas

budget law includes several statutes that specify types of funds that are not required to be budgeted, the City budgets all funds for planning and internal control purposes.

The following City of Leavenworth 2025 Adopted Budget discussion follows the sequence of the 2025 Kansas Budget Form. The next page is an overview of Leavenworth’s City-wide 2025 budget, by fund. Following the City-wide 2025 Budget overview, there is a sec on for each fund. Those sec ons include a brief descrip on, including purpose, of each fund and the budget for each fund, broken down by division.

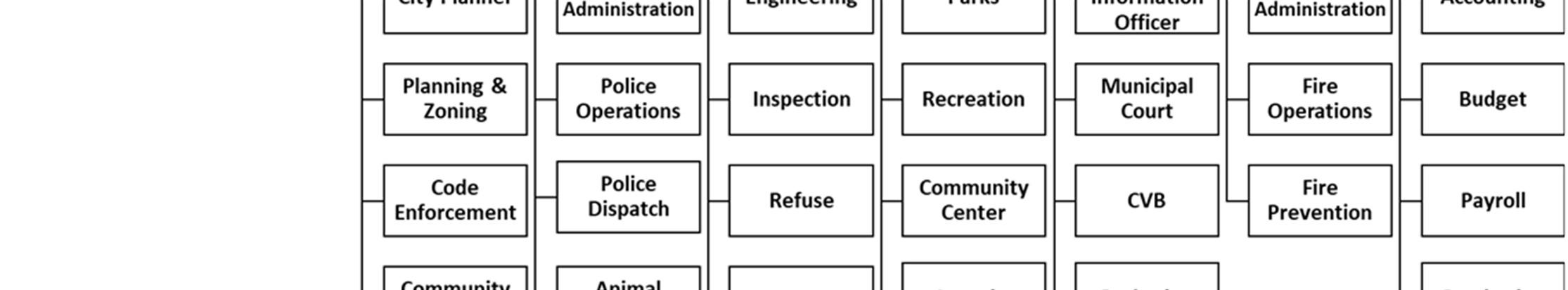

Description:TheGeneralFundistheCity'smainoperatingfund.MostoftheCity'smainfunctionsareintheGeneralFundincludingPublicSafety(Police andFireDepartments),PublicWorks(Permitting,Engineering,andInspections),andtheCity'sAdministrativeFunctions(CityCommission,CityManager's Office,CityClerk'sOffice,MunicipalCourt,HR,Finance,CodesEnforcement,Planning,andInformationTechnology).

Note:TheCashBalanceCarryForwardof$7,318,199representsthe estimatedGeneralReservesintheGeneralFundasof12/31/2024.TheCity hasaBudgetaryReservePolicywiththepurposeofestablishingaframework toprovidequalityserviceswhilemaintainingfinancialstability.The BudgetaryReservePolicyrequiresminimumGeneralReservesequalto16% ofannualexpendituresandatargetedGeneralReservesequalto30%of annualexpenditures.TheCashBalanceCarryForwardfor2025is29.29%of 2025budgetedGeneralFundexpenditures.

Note:TheGeneralRevenueDivisionexpendituresof$5,288,966 include$5,279,216inGeneralReserveswhichis21.13%of2025 budgetedGeneralFundexpenditures.

ThetabletotheleftprovidesanoverviewoftheGeneralFundrevenuesandexpendituresfor2023Actual, 2024AdoptedBudget,2024Projection,and2025ProposedBudget.

Thetablebelowbreaksoutthe2025GeneralFundProposedBudgetbyFunction.Severalofthebelow functionsarecomprisedofmorethanonedepartmentordivisionasfollows:

CityCommission:CityCommission

CityAdmin:CityManager'sOffice,Legal,MunicipalCourt,Contingency,CivilDefense InformationTechnology:InformationTechnology

CityClerk:CityClerk'sOffice HumanResources:HumanResourcesDepartment Finance:FinanceDepartment,GeneralRevenueDivision,CityWideDivision Police:PoliceAdmin,Dispatch,PoliceOperations,AnimalControl,Parking Fire:FireAdmin,FireSuppression,FirePrevention Engineering:Engineering,Buildings&Ground,Inspections,StreetLighting,Airport,LibraryMaintenance MunicipalServiceCenter:ServiceCenter,Garage Planning&CommunityDevelopment:Planning&Zoning,CodeEnforcement,RentalCoordinator

City of Leavenworth, Kansas

2025ProposedBudget-GeneralFund:CityCommissionDivision

Description:TheCityCommissionisthegoverningbodyfortheCityofLeavenworth.Itiscomprisedoffive(5)commissioners,electedatlarge.TheMayorandMayorProTemarecommissionersthatareselectedtoserveinthese positionsbecausetheyreceivedthehighestnumberofvotesinthepreviouselectioncycle.

Mission:ThemissionoftheCityCommissionisto,throughitpoliciesanddecisions,improvethequalityoflifeforresidentsoftheCityandtobetterpositiontheCityforeconomicdevelopment.

(paid$5,200 in

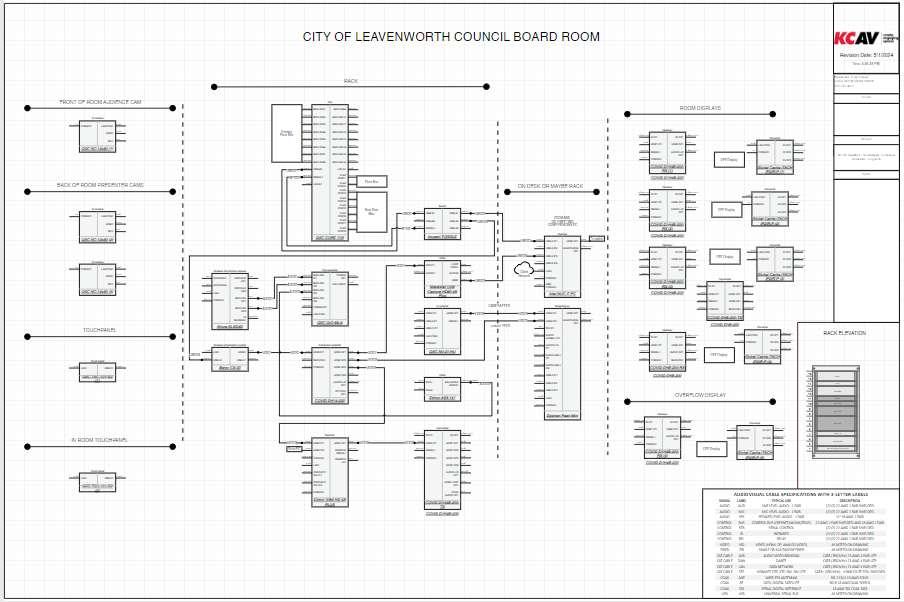

technicalsupportcontractforbroadcastingsupport/troubleshooting ($5,250 in2021wasgood for3 years).

City of Leavenworth, Kansas

City of Leavenworth, Kansas

General Fund Adopted Budget January 1, 2024 - December 31, 2024

Description:TheCityManagerisappointedbyandservesatthepleasureoftheCityCommission.AstheCity’schiefexecutiveofficer,theCityManagerandtheirstaffareresponsibleforthedaytodayadministrationoftheCity. TheCityManagerisresponsibleforthecreationandsubmissionoftheannualbudget.

Mission:ThemissionoftheCityManager’sOfficeistosupporttheCityCommissioninformulatingandimplementingpoliciesthatprovideresponsive,effectiveandfiscallyresponsibleservicesforresidentsofLeavenworth.

$850monthlySpectrumChannel2(digitalupgradeprojectbegan2020withsigned contract,completedfall2022)

Assoc.ofDefenseCommunities $600,KAPIOConference$150,ICMARegistration $1500,KU/KCCMPublicMgmt.Conference$300,LeagueKSMuniConf./Training $350,KACMConf.$200,MainStreetAnnualMeeting$50,ChamberofCommerce AnnualMeeting$90(annual$3,000pre-COVID)

ChamberofCommerce$1,200,LVTimes $150,KCStar$275,KAPIO$35,ICMA CM/ACMDues $2,000,Association ofDefenseCommunities $240,KACM Membership$100

$7,115CitywebsiteMunicodeannualfee,GoToMeetingsoftware$400,ASCAP AnnualLicense$434,SESACMusicPerformanceLicense$1,159,Staffphotosfor website,misc.professionalservices(rangeof$5kto$12kbetween2019through 2022),$30,000executiverecruitmentservicesincludedin2024Projection.

KeyWestChannel2software$360,SurveyMonkeysoftware$470(Websitecoded herein2023,budgetedin6699)

City of Leavenworth, Kansas

2025ProposedBudget-GeneralFund:CityAdministration/CityManager'sOffice

General Fund Adopted Budget

January 1, 2024 - December 31, 2024

City Manager Division

CITY ADMIN

Description:TheCityManagerisappointedbyandservesatthepleasureoftheCityCommission.AstheCity’schiefexecutiveofficer,theCityManagerandtheirstaffareresponsibleforthedaytodayadministrationoftheCity. TheCityManagerisresponsibleforthecreationandsubmissionoftheannualbudget. Mission:ThemissionoftheCityManager’sOfficeistosupporttheCityCommissioninformulatingandimplementingpoliciesthatprovideresponsive,effectiveandfiscallyresponsibleservicesforresidentsofLeavenworth.

City Manager's Office

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2023 Actual, 2024 Adopted Budget, 2024 Projection, and 2025 Adopted Budget

Notes:TheAssistantManager(ACM)isallocatedbetweenthefollowingdivisions:CityManager(40%),EconomicDevelopment(40%),andCVB(20%).The CityManagerpositionisprojectedtobevacantfor4monthsin2024.TheExecutiveAdminAssistantPositionisprojectedtobevacantforallof2024.

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2023 Actual, 2024 Adopted Budget, 2024 Projection, and 2025 Adopted Budget

Notes:TheCityAttorneyisacontractposition,whichispaidbasedonservicesprovided.Theonlypersonnelrelatedexpenseforthispositionsisworkers compensationinsurance.

Actualsfor2021and2022were$483,000. Revenues havedecreased yearlysince 2017.Factors includenumberof citationswritten duetounderstaffed trafficunitand unpaid fees/fines.

Courtfunds6FTEs: Judge,Prosecutor,2part-timepublicdefenders (1FTE),1Court Supervisor,and2CourtClerks

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2023 Actual, 2024 Adopted Budget, 2024 Projection, and 2025 Adopted Budget

City of Leavenworth, Kansas

Includes three(3)full-timeemployees:

2025),&(1)ITSpecialistI. ITDirectoralsooversees(1)ITSupervisorand(1)IT SpecialistwhichareincludedinthePoliceAdminbudget.

Cable&Internet.Increasedamountduetoincreasedinternetspeed workatCityHall andJusticeCenterwhichcosts$200additionalpermonth.

NetworkConnectivity-LAN&WAN. Increasedamountduetoadditional$1,100per monthtoincreasenetworkspeed at10LocationsincludingCityHall,FireStation, WSC,Housing,etc.2.5xspeed increasetosupportcloudbasedsoftware.

ITbudgetincludes$7,000forallCitystafftohaveanonlinetrainingportal(Skillsets). ITstafftrainingandconferencesalsocovered inthisline.

Internetstipend,andcontractedhigh-levelVendorNetworkSupportduringIT Directortransition.Addedin2025are: managedpenetration securitytestingand SEIMlogging(securityeventinformationmanagement).

2025ProposedBudget-GeneralFund:InformationTechnology(IT)Department

Description:TheITDepartmentmonitors,maintains,andenhancestheCity’stechnologynetwork;testsnewequipment,applications,andsystemspriortoimplementation;andmanagesandupgradesallcommunicationssystems. InadditiontothreeemployeesintheITDivision,theITDirectoroverseestwoITemployeesincludedinthePoliceDepartmentAdministrativeDivision'sbudget.

Budgetassumes 3%annualincreaseinsoftwarerenewalfees for35different licensedprograms.Alsoincludesnewsoftware: Lansweeper ($4,000-network managementtoolthatprovidesinventoriesofallhardware&software)and KnowBe4 ($4,000securitytrainingsoftware). VMWare (virtualserversoftware)is projectedtoincreaseby300%,2024costwas $15,000. Addedannualsubscriptions for M365forGovernment and Adobe (approximately$100,000/year).

Replacementbatteries,computermice,webcams,smallUPS's

Usedmainlyfordeskphonereplacements. Fluctuatesannuallybasedonneeded replacements

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2023 Actual, 2024 Adopted Budget, 2024 Projection, and 2025 Adopted Budget

City of Leavenworth, Kansas

2025ProposedBudget-GeneralFund:CityClerk'sOffice

Description:TheOfficeoftheCityClerkisdedicatedtoprovidingtimely,accurateinformationandexcellentservicetothepublic,Citystaff,andtheCityCommissionwhilemaintainingfullcompliancewithlocalandstatelaws.The CityClerk'sstaffisresponsibleforefficientrecordkeepinginaccordancewithlocalandstatelawsandinamannerthatfosterspublictrustandaccountability.TheCityClerk'sofficemonitorsandissuesCitylicensesandpermits. TheCityClerk'sofficeisalsoresponsibleforpreparinganddistributingtheagendasandminutesforCityCommissionstudysessions,worksessions,andCityCommissionmeetings.

City Clerk's Office

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2023 Actual, 2024 Adopted Budget, 2024 Projection, and 2025 Adopted Budget

Notes:The2025BudgetincludestheOfficeClerkpositionbeingtransitionedfromafull-timepositiontoapart-timeposition.The2024Projectionincludes vacancies.

City of Leavenworth, Kansas

City of Leavenworth, Kansas

General Fund

2025 Adopted Budget

Description:TheCityofLeavenworthiscommittedtotheprudentuseofpublicmoney.TheFinanceDepartment'sprimaryresponsibilityisfulfillingthiscommitment.TheemployeesoftheFinanceDepartmentareaccountablefor allaspectsoftheCity'sfinancialmanagementwiththeexceptionofpropertytaxadministration,whichisconductedthroughthecollaborativeeffortsofthecountyappraiser,countyclerk,andcountytreasurer.Inadditiontothe FinanceDepartment,theFinanceDirectorhasdirectoversightovertheGeneralRevenueandCity-WideDivisions,whicharebothaccountedforwithintheGeneralFund.TheFinanceDirectorhasoversightoveradditionaldivisions thatarenotpartoftheGeneralFund,whichwillbediscussedlaterinthispresentation.

2025ProposedBudget-GeneralFund:FinanceDepartment

Description:TheCityofLeavenworthiscommittedtotheprudentuseofpublicmoney.TheFinanceDepartment'sprimaryresponsibilityisfulfillingthiscommitment.TheemployeesoftheFinanceDepartmentareaccountablefor allaspectsoftheCity'sfinancialmanagementwiththeexceptionofpropertytaxadministration,whichisconductedthroughthecollaborativeeffortsofthecountyappraiser,countyclerk,andcountytreasurer.Inadditiontothe FinanceDepartment,theFinanceDirectorhasdirectoversightovertheGeneralRevenueandCity-WideDivisions,whicharebothaccountedforwithintheGeneralFund.TheFinanceDirectorhasoversightoveradditionaldivisions thatarenotpartoftheGeneralFund,whichwillbediscussedlaterinthispresentation.

Commodities 110101110OfficeSupplies

2025milllevyisflat. GeneralFundmilllevydecreasedtooffsetincreasedmilllevy needed forthe2025FireStationbondpayment.

+4%,2025budgetedsalestax+3% over2023,Cityusetax+7%over2024

Retainingall StormWaterassessmentfeesinStormWaterCapitalFundforessential infrastructurerepairs.

Interestratesexpectedtodecline,investmentswillbelowerastheCityspendsARPA Fundsandcompleteslargeprojectssuchasthe4thStreetProject.

TransfertoStreetsFundin2024willnotbenecessary becauseStreetsFundhad a BalanceForwardthatwassufficienttocover2024budgeteddeficit.

FireApparatustobeorderedin2024willnotbedelivered until2027,transferto CapitalProjectsfundwillcoverpurchaseorderplacedin2024.

(FTEs

City of Leavenworth, Kansas General

2025 Adopted Budget

2025ProposedBudget-GeneralFund:PoliceDepartment/AdministrativeDivision

Description:ThePoliceDepartmentischargedwithupholdingthelawsoftheCityofLeavenworthandtheStateofKansas,andthetenetsoftheConstitutionandwilldosowithintegrityandhonesty.EveryonethePolice Departmentcomesincontactwithwillbetreatedwithcompassionandrespectwithoutbias.ThePoliceDepartmentwillbeaccountableforitsactionsandacknowledgeitsmistakes.ThePoliceDepartmentiscomprisedofthe followingdivisions:PoliceAdministration,Dispatch,PoliceOperations,AnimalControl,andParking.TheAdministrativeDivisionincludesthePoliceChiefandhisstaff,includingtheDeputyPoliceChief,aLieutenant,aSergeant, administrativestaff,anEvidenceCustodian,aRecordsSupervisorandClerk,andtwoITSpecialists.

13full-timeemployees: PoliceChief(1),DeputyPoliceChief(1),Lieutenant(1), Sergeant(1),Secretary(1),AdminSpecialist(1),EvidenceCustodian(1),Records Supervisor(1),RecordsClerk(3),ITSpecialist(2)

Description:ThePoliceDepartmentischargedwithupholdingthelawsoftheCityofLeavenworthandtheStateofKansas,andthetenetsoftheConstitutionandwilldosowithintegrityandhonesty.EveryonethePolice Departmentcomesincontactwithwillbetreatedwithcompassionandrespectwithoutbias.ThePoliceDepartmentwillbeaccountableforitsactionsandacknowledgeitsmistakes.ThePoliceDepartmentiscomprisedofthe followingdivisions:PoliceAdministration,Dispatch,PoliceOperations,AnimalControl,andParking.TheAdministrativeDivisionincludesthePoliceChiefandhisstaff,includingtheDeputyPoliceChief,aLieutenant,aSergeant, administrativestaff,anEvidenceCustodian,aRecordsSupervisorandClerk,andtwoITSpecialists.

Police Department - Administration

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2023 Actual, 2024 Adopted Budget, 2024 Projection, and 2025 Adopted Budget

Description:ThePoliceDepartment'sDispatchCallCenterisinasharedfacilitywithLeavenworthCounty'sDispatchCallCenter,locatedintheLeavenworthCountyJusticeCenter.TheCityhasten(10)fulltimeTelecomSpecialists. TheCityreceivesfundsfromtheKansas911CoordinatingCouncilwhichtheCitytransferstotheCountytohelpsupportthesharedDispatchCallCenter.

Countyexceed 911 Fees(revenue)becausethe911 Feesareinsufficienttocover DispatchCenterexpenditures.

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2023 Actual, 2024 Adopted Budget, 2024 Projection, and 2025 Adopted Budget

Notes:The2023actualsincludedanequivalentofonevacancy.The2024and2025budgetsincludeten(10)Dispatcherpositionsfilledfortheentireyear.

(8),PoliceOfficers(32)

Description:

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2023 Actual, 2024 Adopted Budget, 2024 Projection, and 2025 Adopted Budget

2025Proposed-GeneralFund:PoliceDepartment/AnimalControlDivision

Description:AnimalControlisresponsibleforenforcingcityordinancesregardinganimalsincludingtheleashlaw,vaccinationandlicensingrequirements,andcheckingonneglectedorabusedanimals.AnimalControlOfficerscan issuecitationsforviolationsinthesecases.Theyalsopickuplooseanimalsandinjuredanimalswithnoidentifiableowner.LeavenworthAnimalControlfacilitatestheadoptionofunclaimedanimalsfromtheAnimalControlShelter. LeavenworthAnimalControlstronglyurgespetownerstospayorneutertheirpets.AnimalControlpromotesresponsiblepetownershipthrougheducationeffortsandadvocacy.

Police Department - Animal Control

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2023 Actual, 2024 Adopted Budget, 2024 Projection, and 2025 Adopted Budget

Notes:IncreaseinTaxes&Benefitsfor2024Projectionand2025ProposedBudgetisduetoall6FTemployeesoptingintohealthinsuranceplan.Inprevious years,1or2AnimalShelteremployeesdeclinedhealthinsurancecoverage.Overtimewasunderbudgetedinthe2024AdoptedBudget.

City of Leavenworth, Kansas

2025 Adopted Budget

2025ProposedBudget-GeneralFund:FireDepartment/FireAdministrationDivision Description:TheFireDepartmentprovidesfirepreventiontraining,firesuppressionandfireprotectionservices,searchandrescueoperations,medicalservices,andinspectionprograms.TheFireDepartmentalsorespondsto environmentalemergenciesandotherthreatstohealth,safety,life,andproperty.TheFireDepartmentiscomprisedofthefollowingdivisions:FireAdministration,FireSuppression,andFirePrevention.TheFireAdministration Divisionhasthreefulltimeemployees:TheFireChief,DeputyFireChief,andFireSecretary.TheLeavenworthFireDepartmenthasthreefirestations.TheFireAdministrativeDivisionislocatedinFireStation#1.

Fire Department - Administration

2025ProposedBudget-GeneralFund:FireDepartment/FireAdministrationDivision

Description:TheFireDepartmentprovidesfirepreventiontraining,firesuppressionandfireprotectionservices,searchandrescueoperations,medicalservices,andinspectionprograms.TheFireDepartmentalsorespondsto environmentalemergenciesandotherthreatstohealth,safety,life,andproperty.TheFireDepartmentiscomprisedofthefollowingdivisions:FireAdministration,FireSuppression,andFirePrevention.TheFireAdministration

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2023 Actual, 2024 Adopted Budget, 2024 Projection, and 2025 Adopted Budget

49full-timeemployees: BattalionChiefs(3),FireCaptains(12),FireDriver/Operators (12),Firefighters(22)

2025

Description:ThePublicWorksDepartmentistheadministrativeentitythatcoordinatesthedeliveryofinfrastructureservicestothecitizensofLeavenworth.Thedepartmentprovidesanarrayofcityservicesincluding:

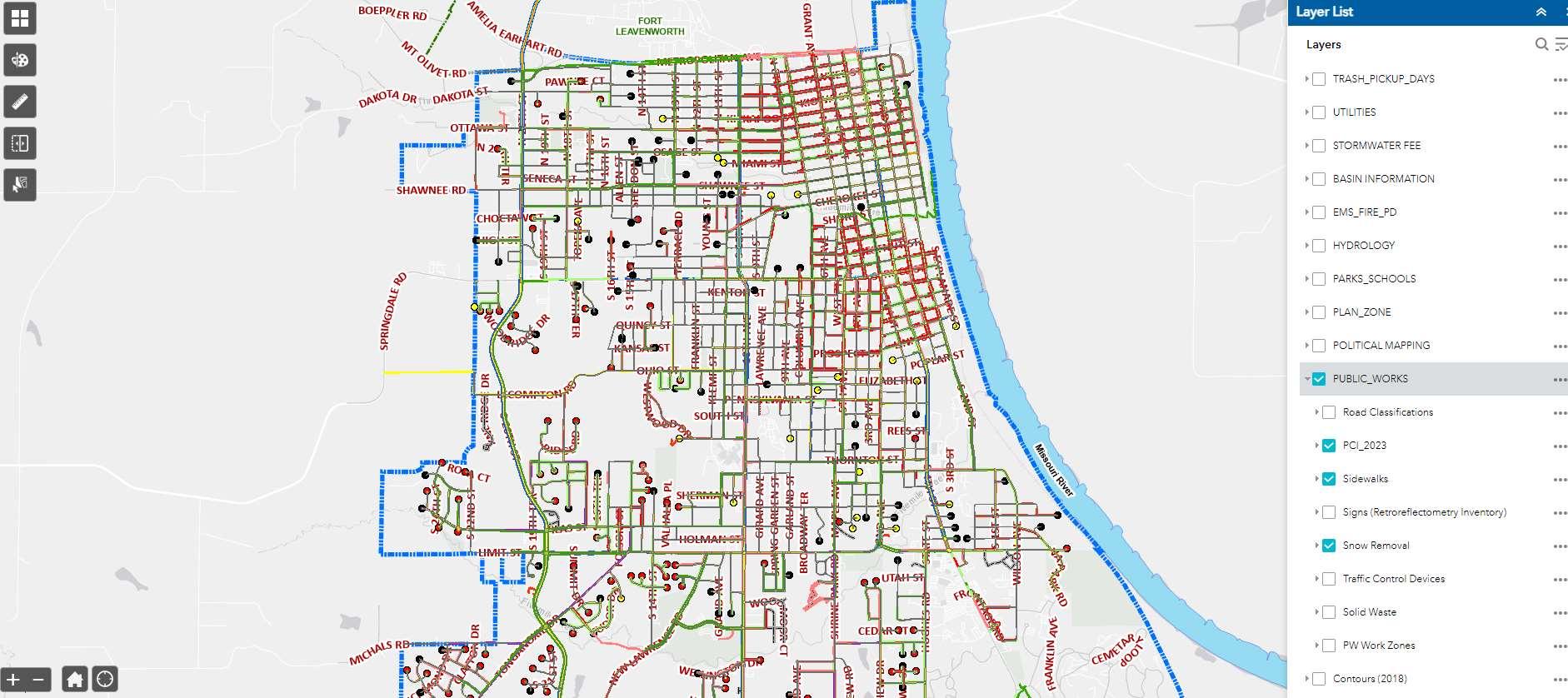

EngineeringDivision:TheEngineeringDivisionprovidesoversightofthedivisionswithinPublicWorks.ThisdivisionalsoprovidesalloftheCity'sin-houseengineering,design,andmappingservices.

2025ProposedBudget-GeneralFund:PublicWorks

Description:ThePublicWorksDepartmentistheadministrativeentitythatcoordinatesthedeliveryofinfrastructureservicestothecitizensofLeavenworth.Thedepartmentprovidesanarrayofcityservicesincluding: engineering,building&groundsmaintenance,buildinginspections,streetmaintenanceandrepair,stormsewers,trashcollectionandrecycling,sewersandwaterpollutioncontrol,andmapping.

EngineeringDivision:TheEngineeringDivisionprovidesoversightofthedivisionswithinPublicWorks.ThisdivisionalsoprovidesalloftheCity'sin-houseengineering,design,andmappingservices.

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2023 Actual, 2024 Adopted Budget, 2024 Projection, and 2025 Adopted Budget

Description:

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2023 Actual, 2024 Adopted Budget, 2024 Projection, and 2025 Adopted Budget

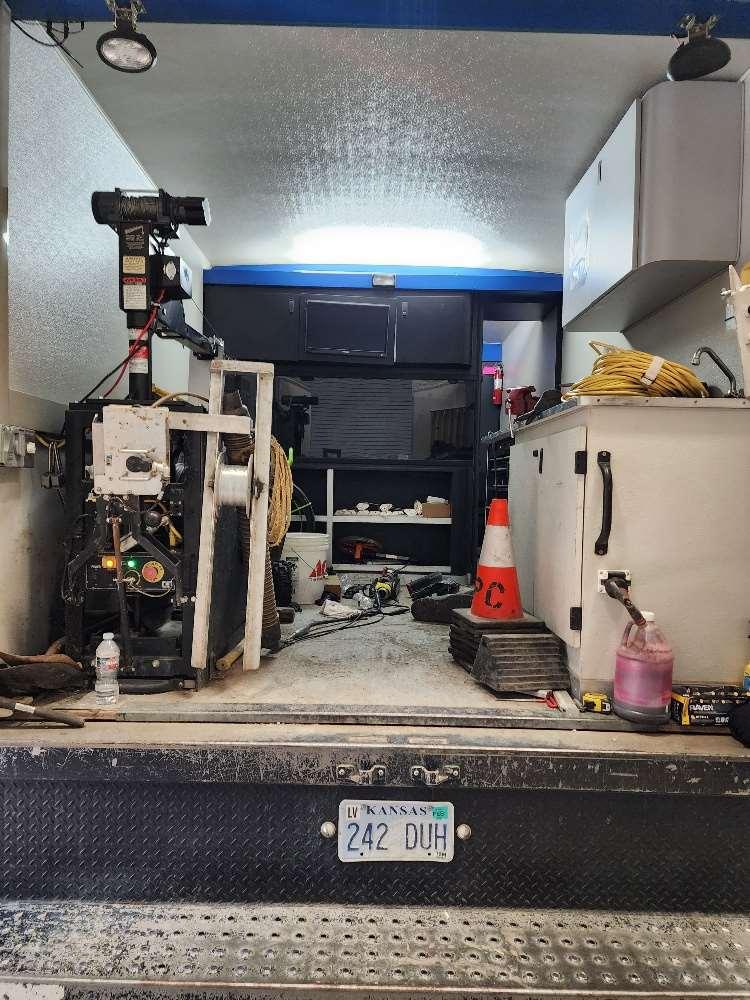

2025ProposedBudget-GeneralFund:PublicWorksDepartment/AirportDivision

Description:TheCityofLeavenworthhasajoint-useagreementwiththeDepartmentoftheArmyfortheuseofShermanArmyAirfieldatFortLeavenworth.Althoughthisisamilitaryairfield,civilianaccessisunlimited.The airportisstaffedwithafixedbaseoperatorthatoffersavarietyofaviationservicesincludingaircraftfueling,catering,tiedown/hangarspace,rentalcars,computerizedflightplanning,aircraftrepairandparts.Theairporthasdaily

KSAssoc. of Airportsdues (moved fromCityManager'sbudget),contracted minormaintenance

City of Leavenworth, Kansas

Description:TheCity'sGarageDivision,Streets&AlleyMaintenanceDivisions,andRefuseDivisionsarehousedintheMunicipalServiceCenter(MSC)building.TheMunicipalServiceCenterbudgetaccountsfortheGarageDivision andthemaintenanceoftheServiceCenterfacility.TheStreets&AlleyMaintenanceDivisionandRefuseDivisionsarenotintheGeneralFund,thereforetheyarepresentedelsewhereinthebudget.

GarageDivision

Description:ThebudgetfortheGarageincludesthesalaryandbenefitsforthemechanicsthatserviceandrepairCityownedequipmentandvehicles.TheGaragebudgetalsoaccountsfortheparts,equipment,andother expendituresrelatedtothoseservices.

TheGaragebillsotherCitydepartmentsforrepairstheGaragemechanicsperform onotherDepartments' vehicles.

TheGaragepurchasesfuel(gasolineanddiesel)inbulk. OtherCitydepartmentsfuel theirvehiclesattheGarage. TheGaragebillsthosedepartmentsfortheuseoffuel.

2.25full-timeemployees:OperationsSuperintendent(0.25),MasterMechanic(1), Mechanic(1). 2023includedavacancyformostoftheyear.

Description:TheCity'sGarageDivision,Streets&AlleyMaintenanceDivisions,andRefuseDivisionsarehousedintheMunicipalServiceCenter(MSC)building.TheMunicipalServiceCenterbudgetaccountsfortheGarageDivision andthemaintenanceoftheServiceCenterfacility.TheStreets&AlleyMaintenanceDivisionandRefuseDivisionsarenotintheGeneralFund,thereforetheyarepresentedelsewhereinthebudget.

GarageDivision

Description:ThebudgetfortheGarageincludesthesalaryandbenefitsforthemechanicsthatserviceandrepairCityownedequipmentandvehicles.TheGaragebudgetalsoaccountsfortheparts,equipment,andother expendituresrelatedtothoseservices.

Thesecostsarereducedduetonew vehicles

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2023 Actual, 2024 Adopted Budget, 2024 Projection, and 2025 Adopted Budget

City of Leavenworth, Kansas

Description:

3.4full-timeemployees:Planning&CommunityDevelopmentDirector(0.80),City Planner(1),Admin Assistant(1),Clerk/Typist(0.60)

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2023 Actual, 2024 Adopted Budget, 2024 Projection, and 2025 Adopted Budget

2025ProposedBudget-GeneralFund:CommunityDevelopment/CodeEnforcementDivision

Description:TheCodeEnforcementdivisionprovidesinterpretationandenforcementofadoptedcodes,rules,andregulationsrelatedtoplanningandzoning.Enforcementactivitiesincludepropertymaintenanceissuessuchas junk,nuisances,grass&weeds,andinoperablevehicles,aswellaszoningissuessuchasuses,signs,andfences.

CodeEnforcementmowing,currentlyin2yearcontract,willneed toreneworrebid for2025

actuallydemolished,amountavailable throughCDBG,andcostsfordemolitioncontractors.

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2023 Actual, 2024 Adopted Budget, 2024 Projection, and 2025 Adopted Budget

City of Leavenworth, Kansas

Description:TheBond&InterestFundprovidesfortheretirementofgeneralobligationbonds.Eachyear,thecityleviestaxesthat,togetherwithotherrevenuescreditedtothefund,aresufficienttopaytheprincipalandinterest paymentsduethroughouttheyear.TheCityDebtPolicyestablishesguidelinespertainingtotheCity'suseofdebt.Theobjectivesofthepolicyareto:a)ensurefinancingisobtainedonlywhennecessary,b)ensurethattheprocess foridentifyingthetimingandamountofdebtorotherfinancingisasefficientaspossible,c)ensurethatthemostfavorableinterestratesandotherrelatedcostsareobtained,andd)ensurefuturefinancialflexibilityismaintained. TheBondFunddoesnothaveanyemployees.

Description:TheLeavenworthPublicLibraryisacomponentunitoftheCityofLeavenworth.Asacomponentunit,thelibraryisalegallyseparateentitywithitsowngoverningboardandbudget.TheCitymaintainstheLibrary Fundtoaccountforthelevying,collection,anddisbursementofadvalorempropertytaxesinsupportoftheLeavenworthPublicLibrary'soperatingactivities.TheLibraryFundisanagencyfund,thereforetheresourcesinthe LibraryFundarenotavailableforCityoperations.CurrentCityordinanceslimittheadvaloremtaxlevyfortheLibraryFundto3.75mills.

Description:Thisfundaccountsforthelevying,collection,anddisbursementofadvalorempropertytaxesrelatedtothepaymentofemployeebenefitssuchasKansasPublicEmployeeRetirementSystem(KPERS)andhealth insuranceinsupportoftheLeavenworthPublicLibraryemployees.Therearenoconstraintsuponlevyingthenecessarymillagetosupportthelibraryemployeebenefits.Theresourcesinthisfundcanonlybeusedtopayfor employmentrelatedbenefitsfortheLibrary'semployees.

The Leavenworth Public Library is a gathering place for everyone that stimulates discovery, understanding and enjoyment

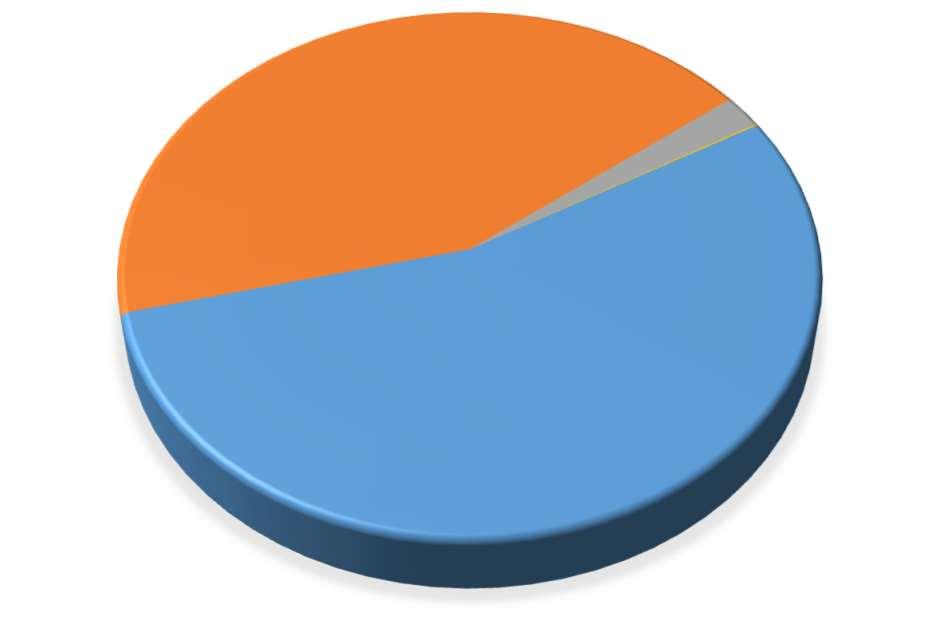

Budgets approved by the Leavenworth Library Board of Trustees Library are built using a thorough, informed process based on real data. Expenditures and balances for every line item have been tracked for 15 years and are used to allocate funds appropriately. Public service statistics indicate changing community demand. Needs expressed by the community during strategic planning conducted in 2015, 2018 and 2022 are also important factors. The FY2025 budget is built around those needs and the maintenance of ongoing services in the face of inflationary trends. City property taxes generate 81% of all Library funding. No other source of City revenue is received. A share of Motor Vehicle taxes is received and that amount will decrease in FY2025. Grants, donations and in-house sources account for the rest. The Northeast Kansas Regional System (NEKLS) has ceased direct support for the Hoopla digital collection but increased the Library’s Development Grant. The Library Board has committed $94,374 in reserves to balance FY2025 General Fund expenditures.

The Library’s collection is the fundamental form of service. This is reflected in public comments made during the planning process. 153 survey respondents identified collections as their “Favorite Thing”, books were the top response for “What to Keep No Matter What”, 56 respondents would improve collections if they could “Wave a Magic Wand.” Grow collections was the second “Best Opportunity.” Meeting this significant demand requires a steady investment in materials, particularly digital content. Materials expenses must represent a minimum of 12% of total expenses in order to qualify for the highest level of NEKLS Development Grant funding. The FY2025 Materials budget represents 14% of all expenses.

13 out of 40 Service and Supply line items are unchanged from FY2024 and 5 were cut. Increases are required in tech support, janitorial services, a new state elevator inspection requirement, newsletter printing and mailing, Quick Books fee increases, insurance and training/travel. The total dollar increase for the remaining 22 line items is $19,249.

The Employee Benefit Fund (EBF) budget includes increases for KPERS, Medicare and Social Security partially driven by increased pay. Carefully re-calculated projections of EBF expenses for FY2024 anticipate a surplus of approximately $20,000; this will absorb part of the anticipated benefit cost increase in FY2025.

FY2024 EMPLOYEE BENEFIT FUND $308,396

• 2.83 full time positions have been cut in the last 5 years

• The total dollar increase over FY2023 is $21,051

• A surplus of $26,277 allowed a decrease in the FY2023 EBF budget

• In 2022, the Library Board approved a new pay scale in order to attract and retain quality employees

• The Library’s established pay scale provides 3% increases between years, the City is planning 515% increases in 2024

Description:TheCityprovidedandadministeredasingle-employerdefinedpensionfundforpoliceofficersandfirefighters.Theplanwasestablishedbyordinancein1945.In1971,theCityaffiliatedwiththeKansasPoliceand Firemen'sRetirementSystem(KP&F).Atthattime,theCitypensionplanbecameclosedtonewentrants.AllmembersalreadyenrolledintheCity'ssingle-employerdefinedpensionplanweregiventheoptionofjoiningKP&For remainingwiththeCityPlan.AsofDecember31,2023,theplanconsistedofthree(3)beneficiaries,two(2)beneficiariesareintheFirePensionFundandone(1)beneficiaryisinthePolicePensionFund.Bothfundsaresupported byadvalorempropertytaxes.TheGeneralFundabsorbsalloftheadministrativecostsofmaintainingthefunds.

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2023 Actual, 2024 Adopted Budget, 2024 Projection, and 2025 Adopted Budget

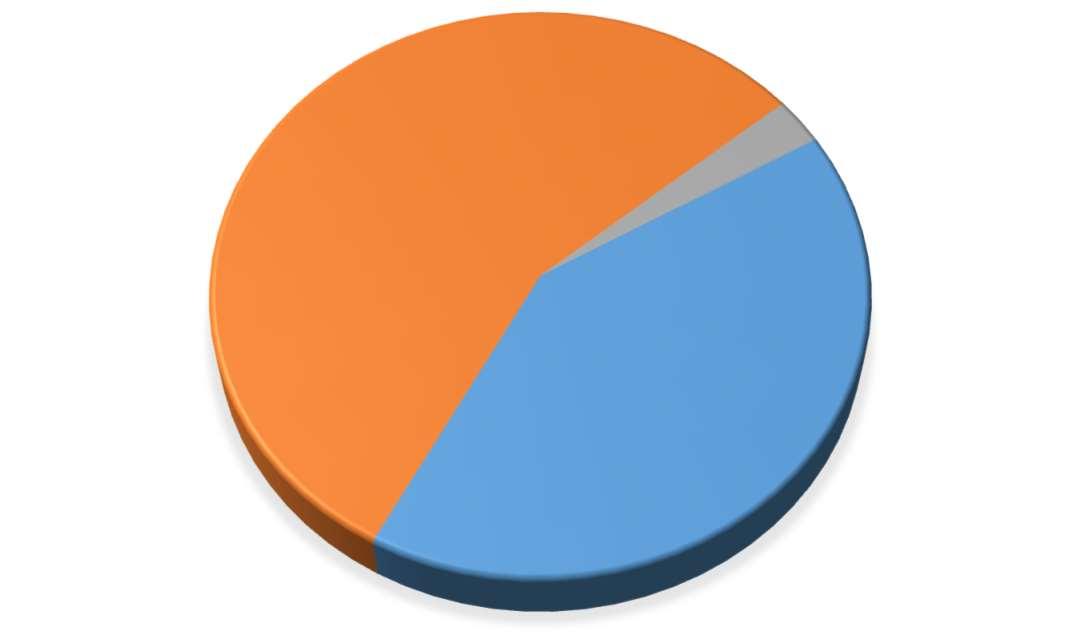

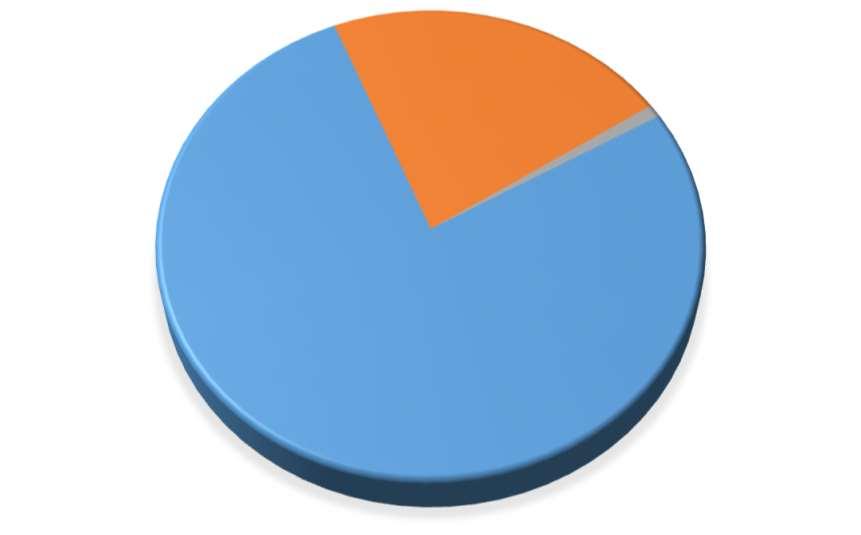

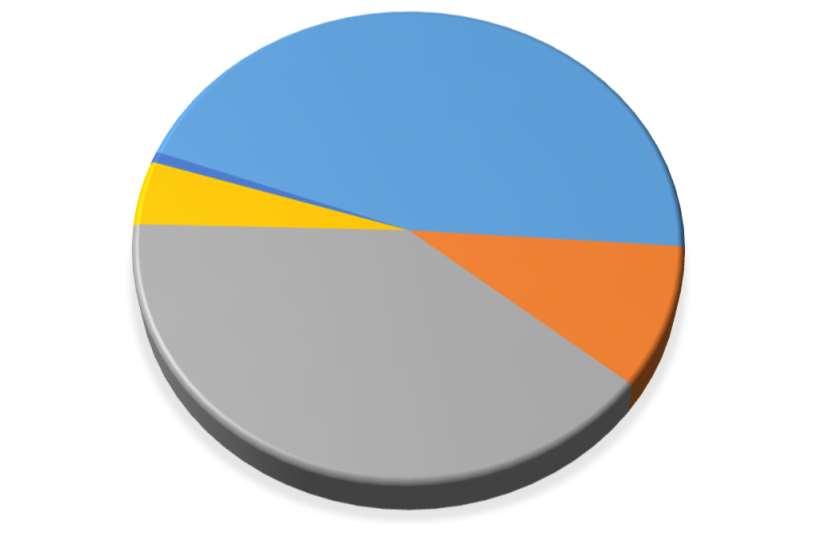

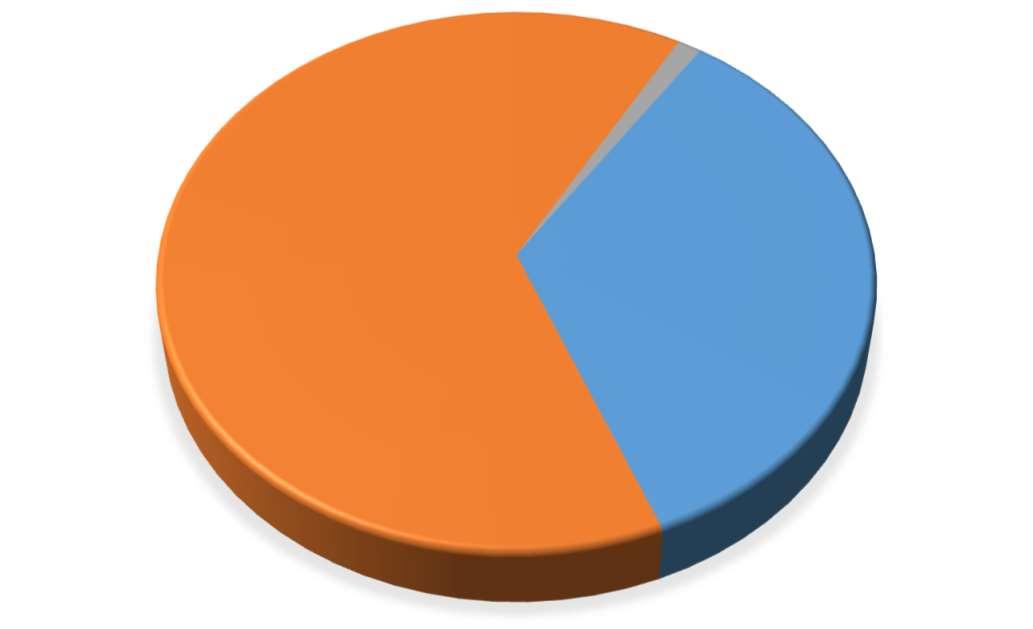

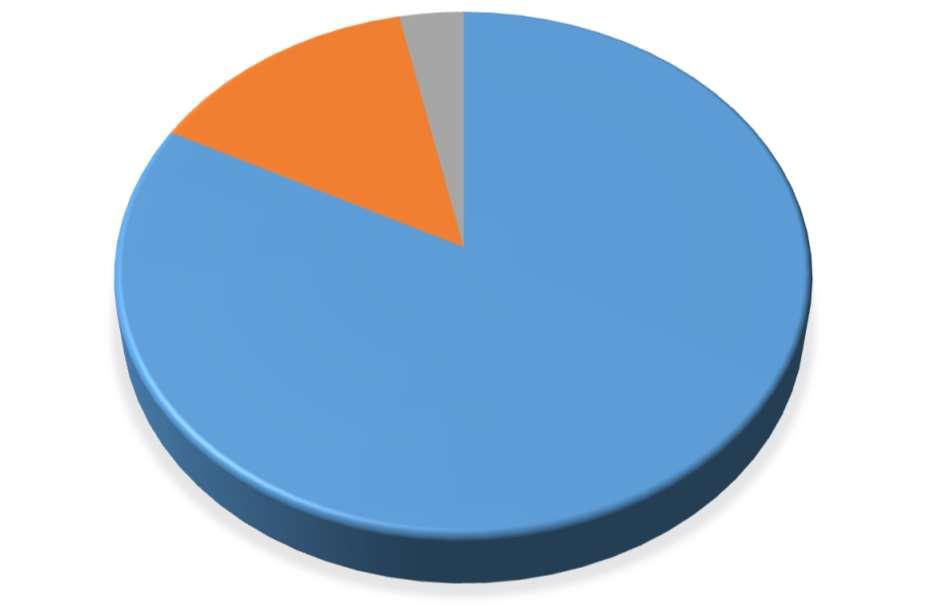

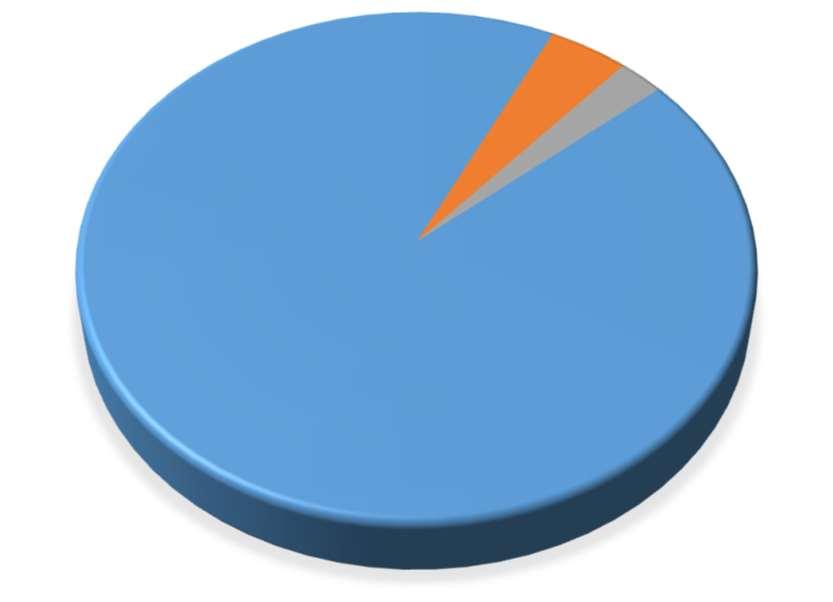

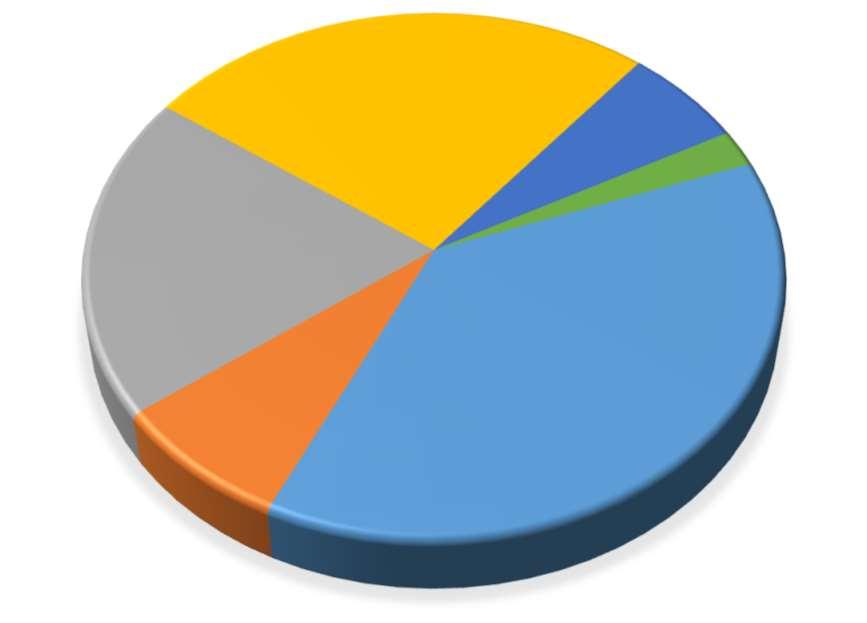

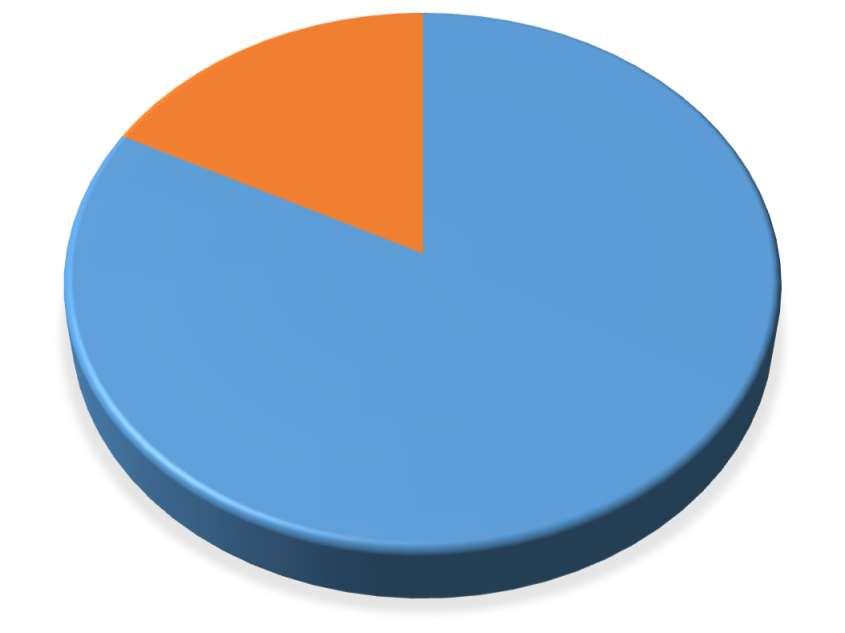

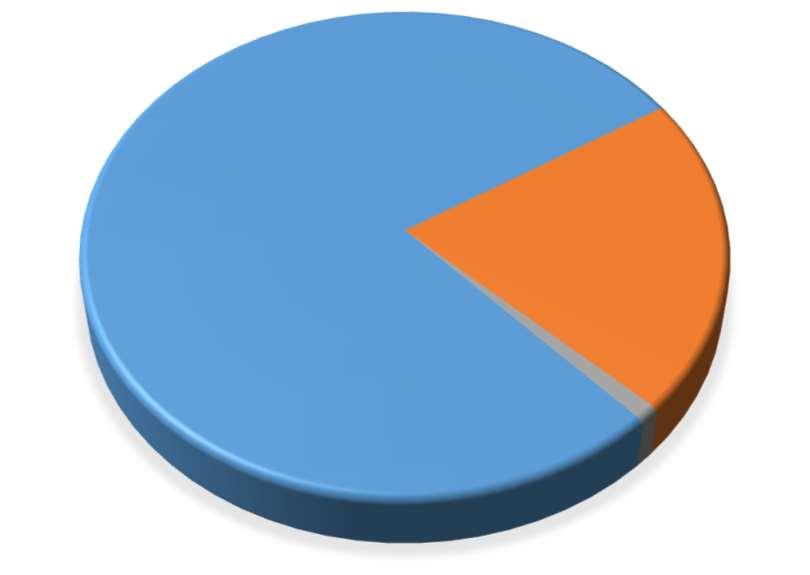

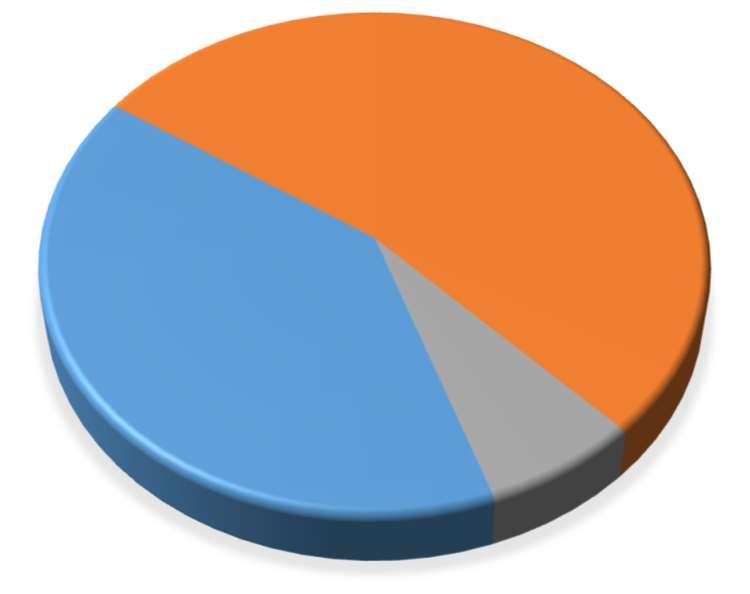

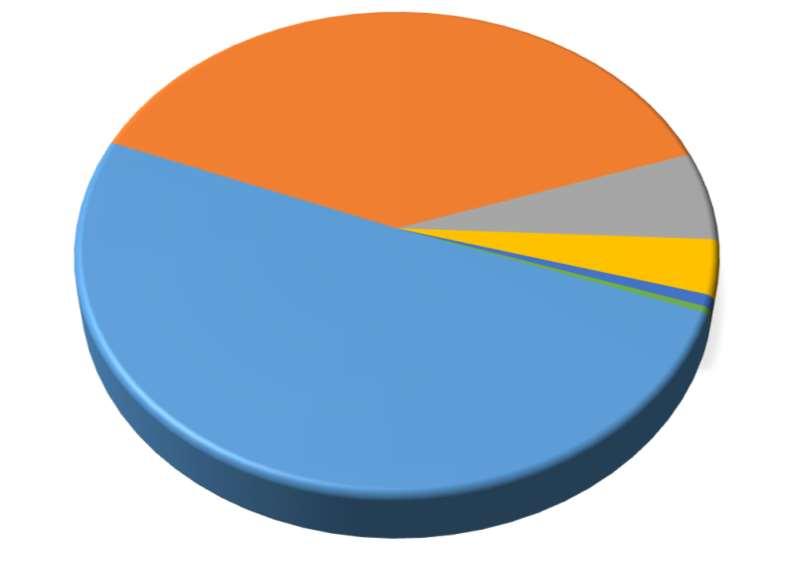

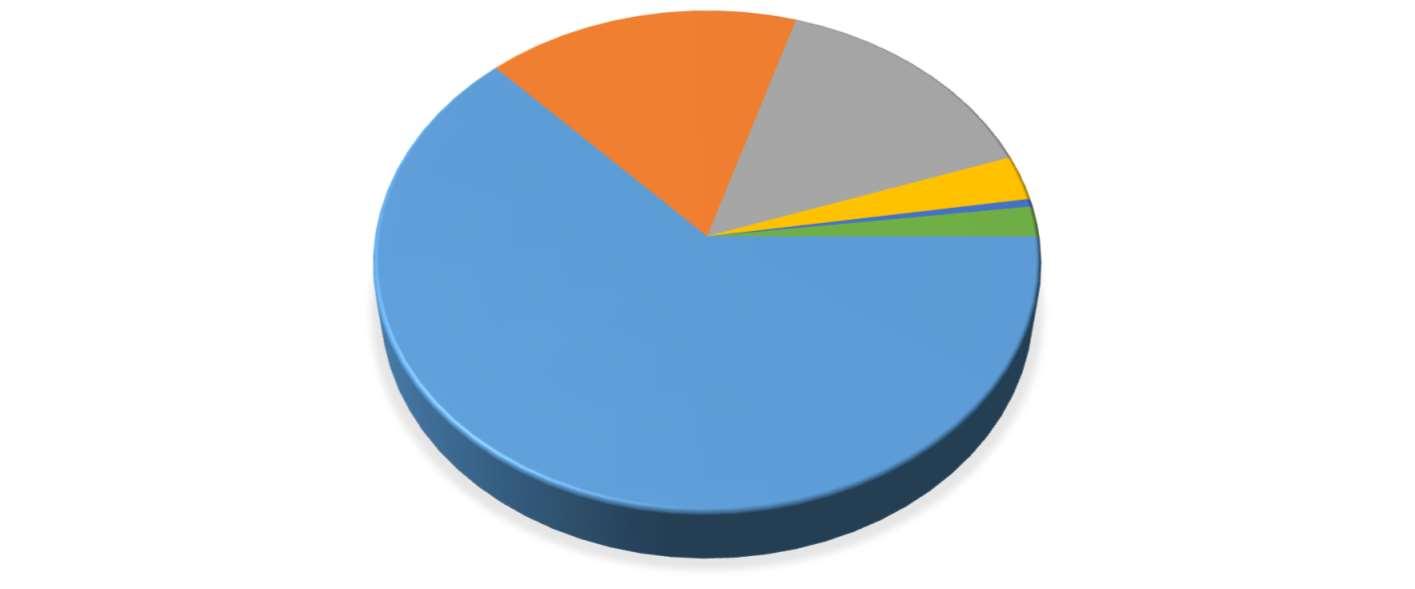

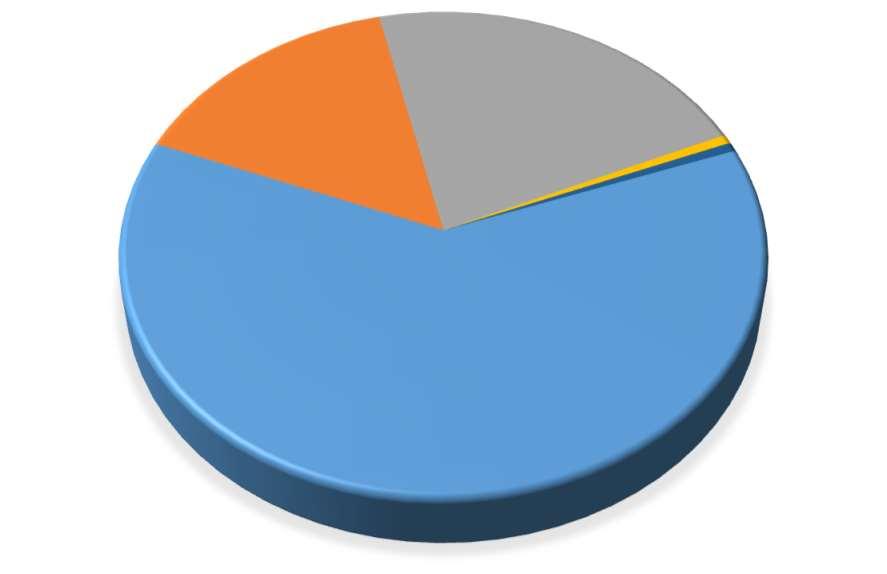

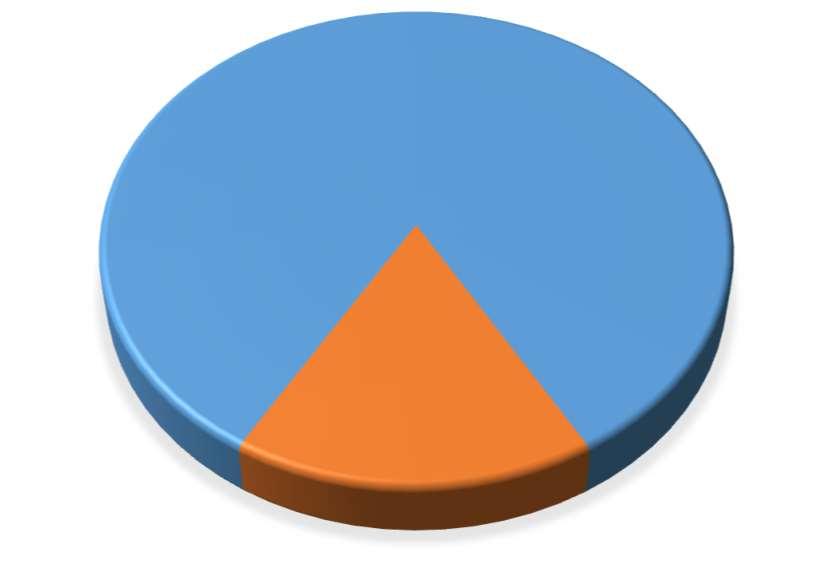

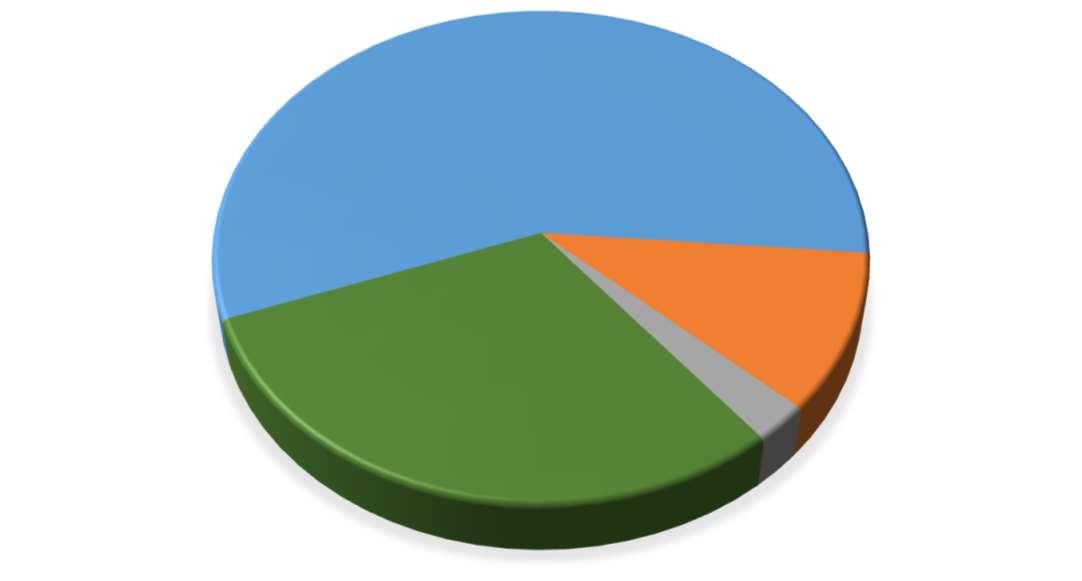

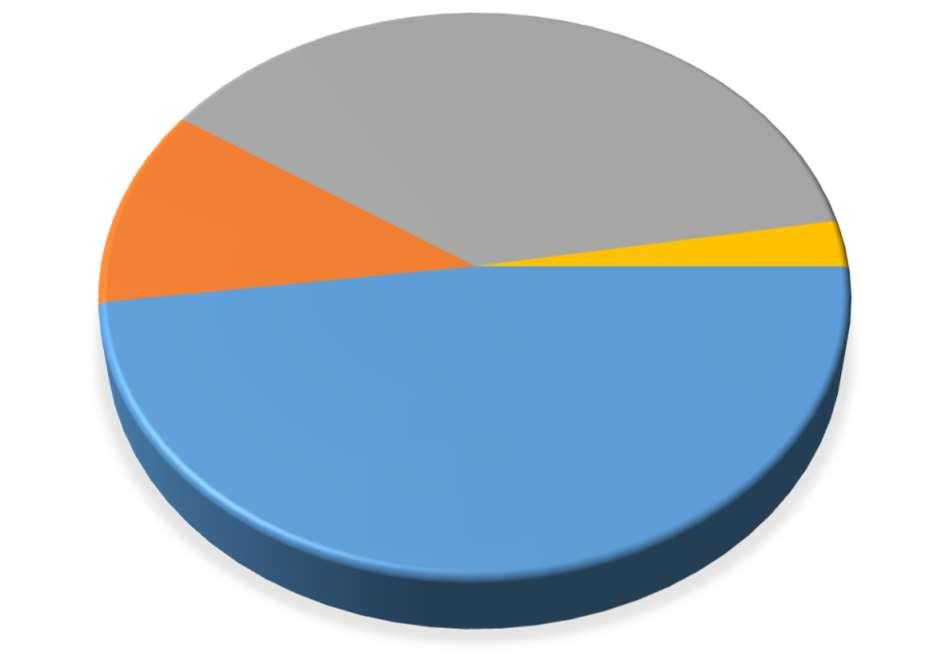

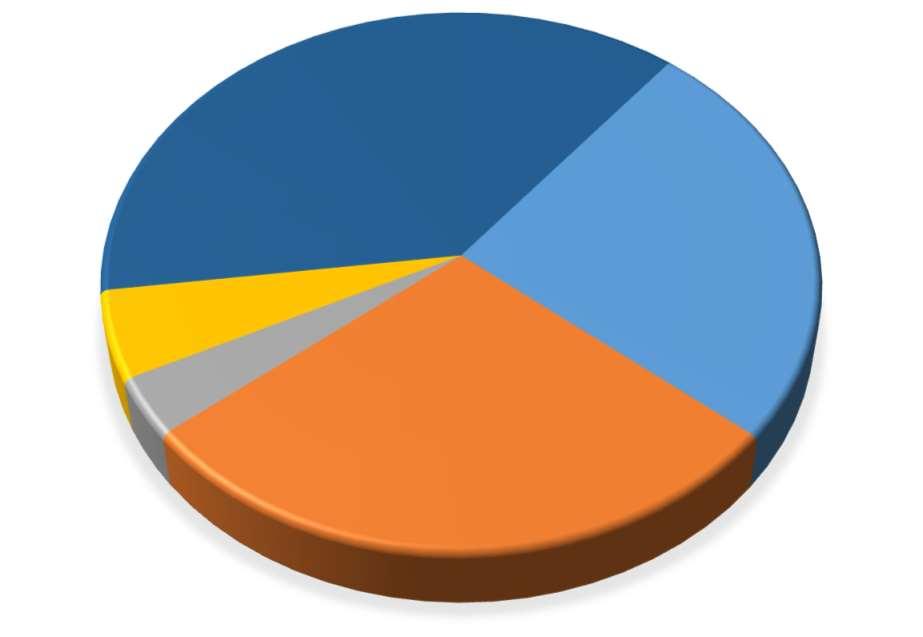

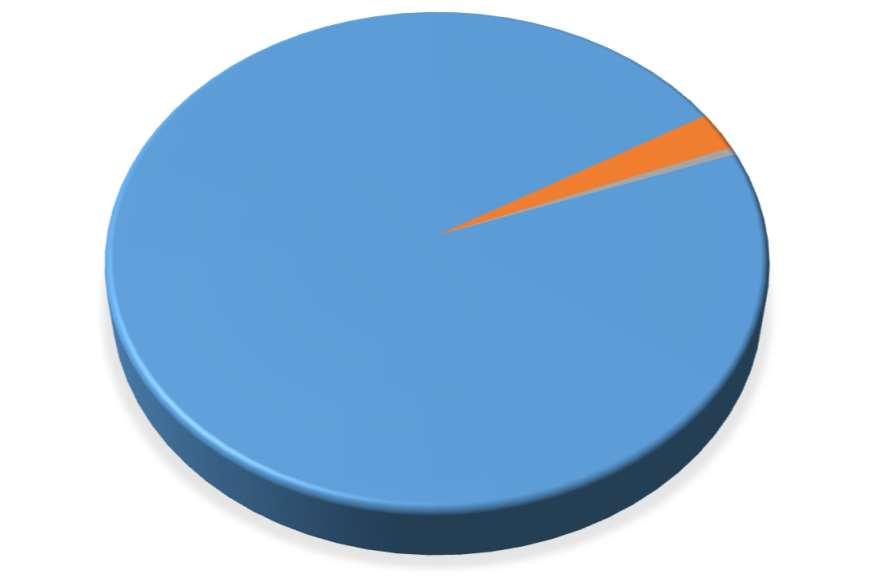

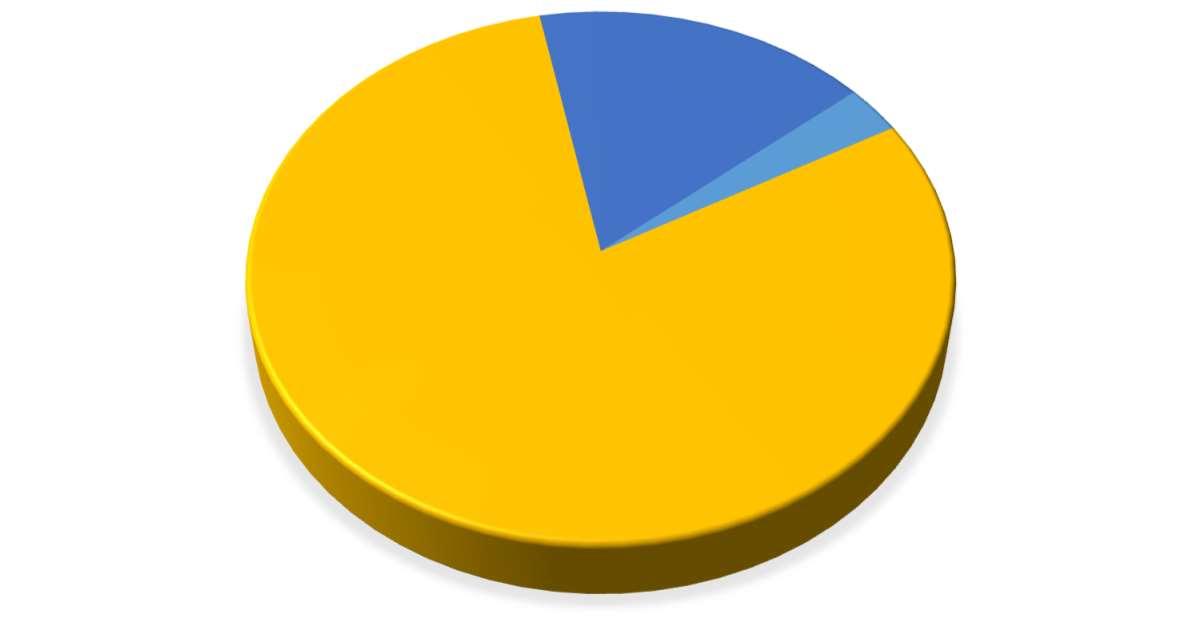

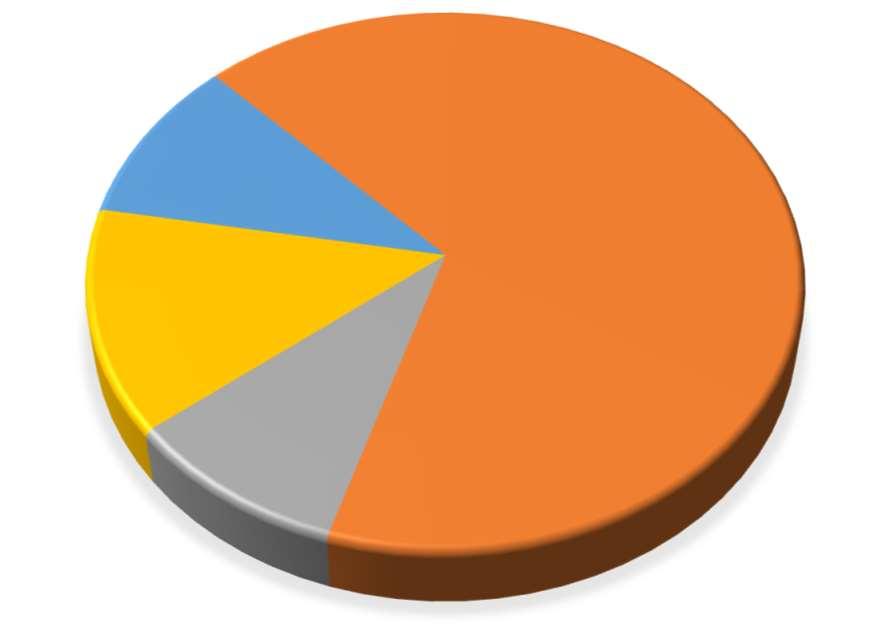

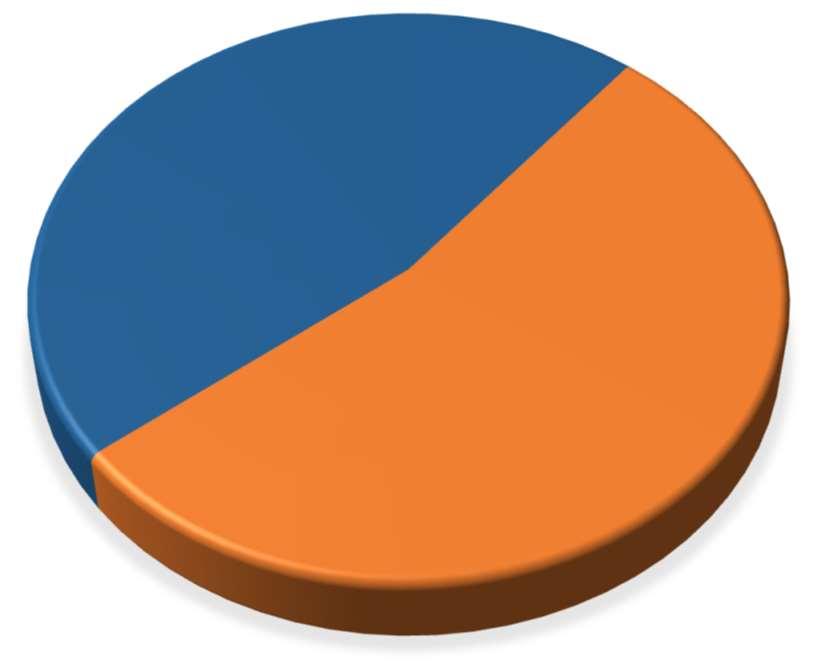

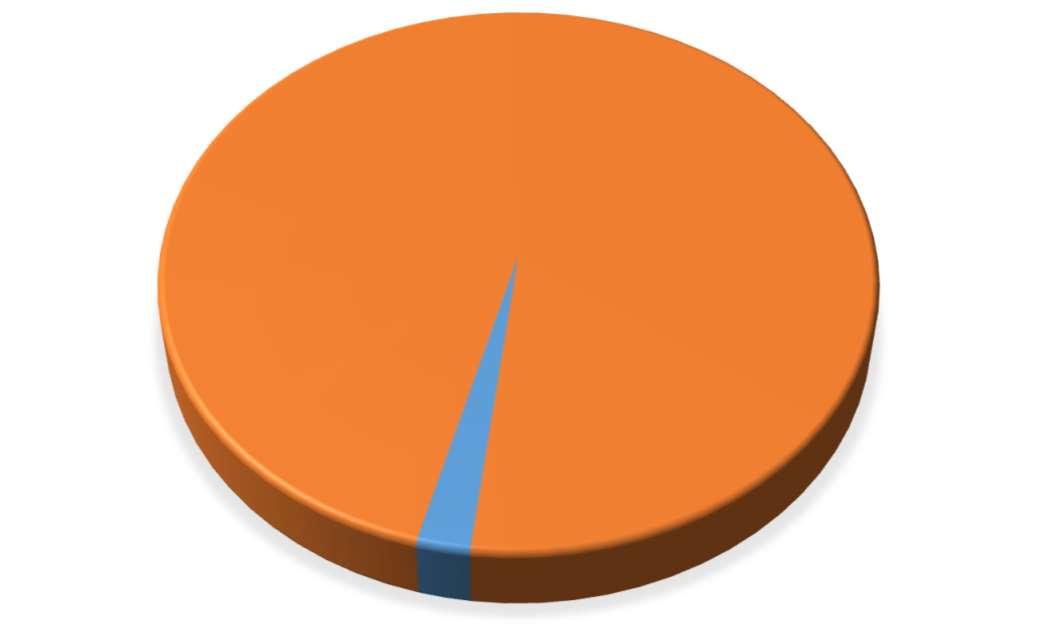

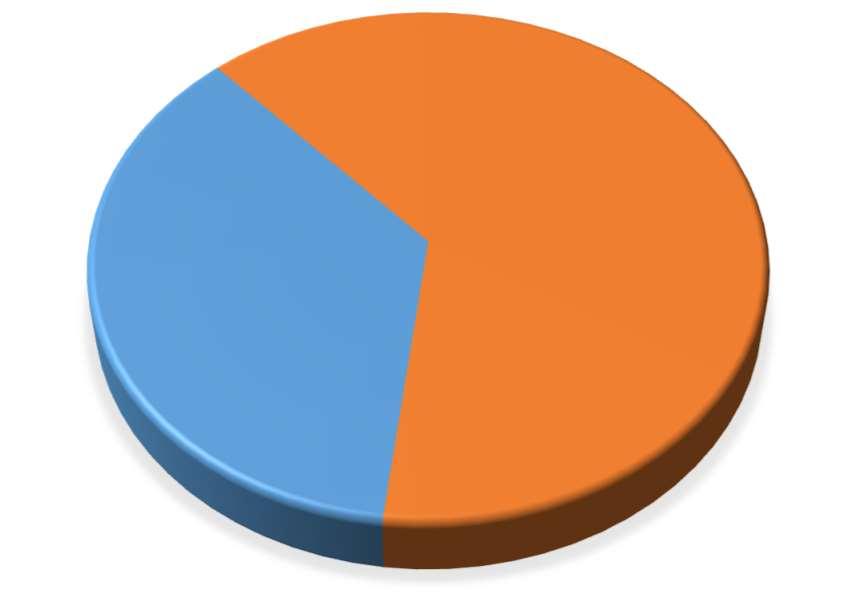

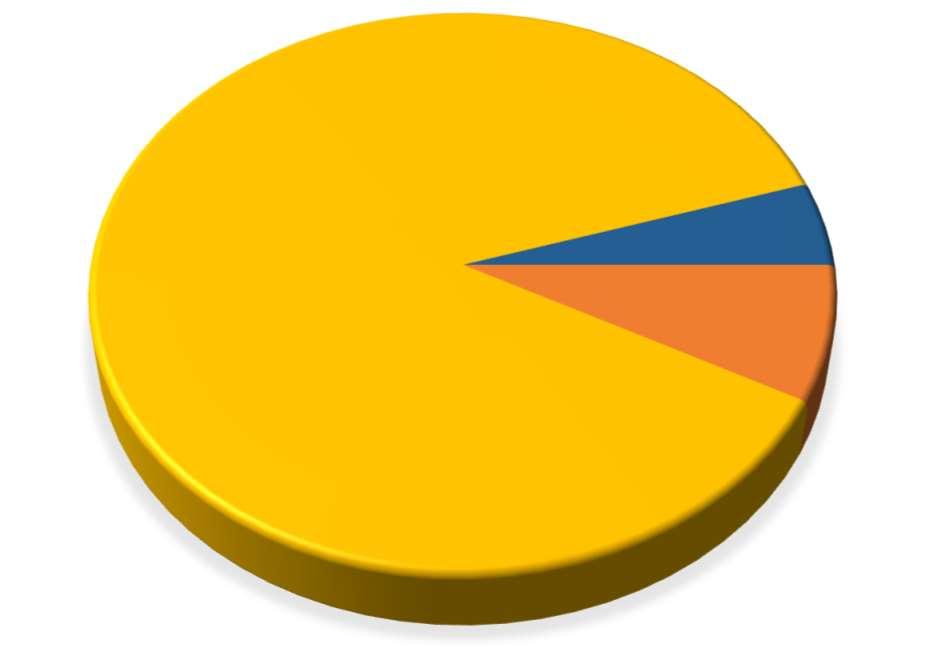

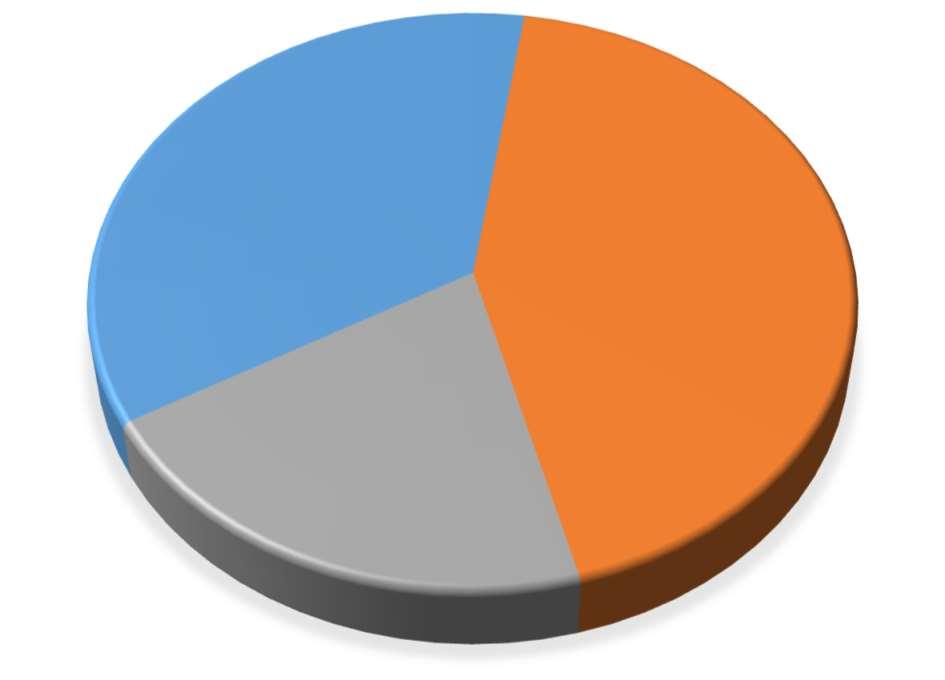

Description:TheRecreationFundisusedtoaccountfortheculturalandrecreationalactivitiesoftheCity.Itsresourcesaregeneratedfromadvalorem propertytaxes,salestaxes,anduserfees,asillustratedinthebelowpiechart.Thetablebelow,right,liststhedivisionsthatthe$3,299,329inrevenue supports.Theindividual2025budgetsforeachdivisionareshownonthefollowingpages. 2025RECREATIONFUNDREVENUEBYSOURCE

City of Leavenworth, Kansas

2025 Adopted Budget