2025 Opera ng and 2025 – 2029 CIP Budget TABLE OF CONTENTS Introduc on and Table of Contents Page Table of Contents 1 Transmi al Le er 5 Elected and Appointed Officials 16 Budget Management Team 17 Mission Statement 18 Organiza on Chart 19 Community Profile 20 Budget Presenta on Page 8:30 2025 – 2029 Capital Improvements Program CIP Summary: Overview and Funding Sources 30 9:00 Public Works Engineering Overview 43 o Engineering 44 o Buildings & Grounds 47 o Inspec ons 48 o Street Ligh ng 51 o Airport 52 o Library Maintenance 53 9:15 MSC Overview 54 o Garage 55 o Service Center 58 9:30 Streets Fund Overview 61 o Streets & Alley Maintenance 62 o Traffic 65 o Sidewalks & Curbs 68 9:45 Sewer Fund Overview 70 o Sewer Plant 71 o Sewer Collec on 75 o Storm Sewers 78 o Sewer Capital Projects 81 10:15 Refuse Fund Overview 82 o Refuse Collec ons 83 o Refuse Disposal 87 o Refuse Restricted 90 10:30 Storm Water Capital Projects Fund Overview 91 o Storm Water Capital Projects 92 11:00 Human Resources Human Resources Overview 95 o Human Resources Department 96 Page 1

City of Leavenworth

Budget Presenta on

Con nued Page 11:15 City Clerk’s Office City Clerk’s Office Overview 98 o City Clerk’s Department 99 11:30 Informa on Technology IT Division Overview 102 o IT Division 103 11:45 Planning, Community Development, and Housing Planning & Community Development Overview 106 o Planning & Zoning Division 107 o Code Enforcement 109 o Rental Coordinator 112 Community Development Fund Overview 114 o CDBG Administra on Division 115 o Community Development Block Grant Program 117 Planters II Fund Overview 119 o Planters II Administra on Division 120 o Planters II Program Division 122 o Planters II CFP Division 126 Voucher Choice Program Overview 127 o Voucher Choice Administra on Division 128 o Voucher Choice Program Division 131 12:00 Lunch Break

Budget Presenta on Page 1:00 LCDC 132 1:15 Main Street 136 1:30 Library 140 1:45 Conven on and Visitors Bureau CVB Fund Overview 147 o CVB Division 148 o City Fes val Division 152 2:00 Fire Department 154 Fire Department Overview o Fire Department Administra on Division 155 o Fire Suppression Division 158 o Fire Preven on Division 161 2:30 Parks & Recrea on Fund Recrea on Fund – Revenue Overview 163 Recrea on Fund Overview 164 o Recrea on Division 165 o Aqua cs Division 168 o Performing Arts (PAC) Division 171 o Community Center Division 172 o RFCC Facility Maintenance Division 175 Page 2

-

Resume

Budget Presenta on – Con nued

Page o Riverfront Park Division 177 o Parks Division 179 Special Parks Gi s Fund Overview 183 o Special Parks Gi s Fund 184 3:00 City Administra on City Commission Overview 185 o City Commission Division 186 City Administra on Division 188 o City Manager’s Office 189 o Legal Division 192 o Municipal Court Division 194 o Con ngency Division 197 o Civil Defense Division 198 Proba on Overview 199 o Proba on Fund 200 Economic Development Overview 203 o Economic Development Fund 204 Business & Technology Park Overview 207 o Business & Technology Park Fund 208 3:30 Police Department 209 Police Department Overview o Police Department Administra on Division 210 o Dispatch Division 213 o Police Opera ons Division 215 o Animal Control Division 219 o Parking Division 222 Police Grants Overview 223 o Police Grants Fund 224 Police Seizure Overview 225 o Police Seizure Fund 226 4:00 Finance Finance Department Overview 227 o Finance Department Division 228 o General Revenue Division 231 o City Wide Division 233 Bond & Interest Fund Overview 235 o Bond & Interest Fund 236 ARPA Fund Overview 237 o ARPA Fund 238 Police & Fire Pension Funds 239 Sales Tax Funds Overview 242 o CIP (Local) Sales Tax Fund 243 o County Wide Sales Tax Fund 244 Page 3

Con nued Page Project Funds Overview 245 o Capital Projects Fund 246 o Streets Capital Projects Fund 248 o Grant Matching Capital Projects Fund 249 Auto TIF Overview 250 o Luxury & Import CID 251 o Zeck CID 252 o Zeck Sales Tax 253 o Zeck Property Tax 254 Hotel TIF Overview 255 o Downtown 256 o Downtown CID 257 o North Gateway CID 258 o 612 Metro Redevelopment 259 o 4th & Metropolitan 260 Retail Tif Overview 261 o Price Chopper 262 o MAPS 263 4:15 Wrap Up General Fund Overview 264 Appendices Appendix A – Summary of Financial Policies 265 Appendix B – Glossary of Terms 268 Appendix C – Glossary of Acronyms 278 Page 4

Budget Presenta on -

June 28, 2024

Mayor and City Commission

City of Leavenworth

Leavenworth, Kansas

Dear Mayor and Commissioners:

The City of Leavenworth Management Team is pleased to present the 2025 Operating Budget and the 2025-2029 Capital Improvement Program (CIP). The two budgets are presented together to provide a comprehensive view of all planned City financial activity. The budget connects community needs and priorities with available resources and is one of the most important documents the City prepares in a given year. Efforts have been made to produce a document that is an effective communications tool, policy document, historical record, financial plan, and operations guide for the City.

I. BUDGET OVERVIEW

The 2025 Operating Budget is balanced, as required by law, and builds on the City's goal to provide highquality services while maintaining a sound financial standing. The budget contains revenue and expenses for all City funds and includes a "pass-through" levy as mandated by the Library Ordinance.

The 2025 Operating Budget reflects the City's healthy and stable financial position using three key revenue strategies:

• Careful and conservative approaches to estimating future revenues,

• Maintaining a practical level of reserves, and

• Avoidance of using temporary revenues for ongoing needs.

The City's administrative functions, Police and Fire Departments, Parks and Recreation Department, and scheduled capital improvement projects are highly dependent on sales tax. Sales tax is a volatile revenue source that is dependent on consumer spending within the City and County of Leavenworth. The City saw unprecedented growth in sales tax collections in 2020, 2021, and 2022, due to pandemic related federal stimulus payments. 2023 saw a pull-back from this growth and for the first few months of 2024 sales tax collections were below 2023 sales tax collections. For this reason, the 2025 budget includes conservative sales tax projections, reflecting a sales tax growth rate similar to that of the pre-pandemic years. In addition, the budget does not include reliance on one-time revenues such as federal or state grants to fund operations.

Unlike recent years when City budgets were developed with expectations of continued economic growth, the 2025 budget takes into account signals of slowing economic momentum from various factors including higher interest rates, higher housing costs, increased cost of goods, and a tight, more expensive labor market. Therefore, in addition to conservative revenue projections, the City is preparing for continued inflationary pressure on the cost of goods, construction projects, and wages.

Page 5

Inadditiontorevenueandexpenseforecastingandmanagement,theManagementTeamcontinuestopay closeattentiontoStateLegislature-generatedbudgetmeasuresthat,ifpassedintolaw,wouldrequirea fundamentalshiftinCitybudgeting.Inrecentlegislativesessionsthereweretwomeasuresthatwere consideredbutdidnotpassthatwillreducelocaltaxcollectionsiftheypassinfuturelegislativesessions. Thefirstisaneliminationoflocalsalestaxongroceryitemsandthesecondisapropertytaxabatement forcertainindustrieswithinCitylimits.Ifthesemeasurespassinfutureyears,theinitialestimatein lossofsalesandpropertytaxrevenueis$1.5-2.0million,whichisequivalentto5-6millsofproperty taxes.

Thelast-minutenatureofStatetaxlegislationresultsinunpredictabilityforlocalgovernments.The LeavenworthCityCommissionistheappropriatebodytomaketaxingdecisionsfortheresidentswho, everytwoyears,selectitscompositionandforthebusinessestheCityCommissionrepresents.

The2025OperatingBudgetisarepresentativeexampleofthemeasurestakenbythecurrentandpast CityCommissionsinfinancialmanagementandprudenttaxationtodeliverservicesatthelocallevel. Carefulconsiderationofexpensesandadiligentbuildingofappropriatereservelevels,alongwithefforts tobringaboutgrowth,haveresultedinthepresented2025OperatingBudgetthat:

•Providesforthethirdyearofapay-as-you-gopavementmanagementprogram:Thisprogram hasbrokenthecycleofborrowingmoney-withtheinterestandissuancecoststhatentails-for thisannualprogram.Overtime,thiseffortwillresultinmorefundinggoingtowardroad improvementsandmaintenanceandlessfundinggoingtowardstheservicingofdebt.

•InvestsinInformationTechnology:In2023and2024severalKansasCityMetroAreaand KansasMunicipalitiesweretargetsofcyber-attacksthatcrippledorshutdownmunicipal functionsforextendedperiodsoftime,makingitclearthatallmunicipalitiesintheregionneedto makeITsecurityatopissue.Inpreviousyears,theCityinvestedinITinfrastructurethat providesefficiencyofoperationsandahighlevelofservicetoCityresidents.Beginningin2024, theCityshifteditsInformationTechnologyinvestmentstocyber-security.Thisinvestment continueswiththe2025budgetwhichincludesthecreationofaDepartmentDirectorof InformationTechnology,theadditionofafull-timesystemsadministrator,andthepurchaseofIT equipmentandsoftwarethatwillenhancetheCity'sITsecurityposition.

•InvestsinsalaryincreasesconsistentwiththeConsumerPriceIndex(CPI):Forthe2024 OperatingBudget,theCommissionallocatedfundingtoimplementaslidingscalepayincrease throughouttheCity.Thelaborclassandentry-levelpositionswiththelowestpayrangesreceived 15%payrateincreases.Positionswiththehighestpayrangesreceivedthelowestpayincreasesof 5%.Allotherpositionsreceivedanincreasebetween15%and5%,withtheincreasegetting smalleraspayrangesgothigher.The2025OperatingBudgetincludesa3.5%payincreasefor allemployees,whichslightlyexceedsthe2023andyear-to-date2024CPisof3.4%and3.3%, respectively.

•Ensuringastablereserveposition:TheCity'sreservepositioniskeytomaintaininganAa2 bondratingandprovidestheCitywithstabilityduringperiodsoftemporaryrevenuedecline.Due tothe2025OperatingBudget'sconservativerevenueforecastandtheanticipatedinflationary impactonexpenditures,includingwages,the2025budgetallocatesaportionoftheCity's reservestoallowforexpendituresinexcessofrevenue,shouldthatbenecessary.Inspiteofthe budgetedspendingdeficit,the2025OperatingBudgetstillmaintainsadequateandresponsible reservestobeusedasconditionsdictate.

ii Page 6

Based on Commission direction and action related to controlling expenses and preserving appropriate reserve levels, while also focusing on service delivery and investing in employees, the 2025 Operating Budget proposes a flat mill levy for the City and Library, combined, of 26.962 mills. The City-supportedmill levy will decrease by 0.0349 mills from 22.533 to 22.498 and the Library's mill levy will increase by 0.0349 mills from 4.429 to 4.464. Assessed values for the 2025 Operating Budget increased by $11,802,680, or 3.9%. Of this amount, $8,152,171 of the increase in assessed value was caused by improvements, remodeling, and changed use. Therefore, existing properties that were not significantly improved in 2023 saw an assessed value increase of only 1.2%. The 0.0349 mill decrease for the Citysupported-mill levy will generate $254,941 in additional revenue for the City, most of which will be paid by property owners with new or significantly improved properties.

Looking forward, the Management Team remains concerned that an increasing reliance, as a portion of general fund revenue, on sales tax makes the City more vulnerable to national economic conditions. In its most recent update on the City of Leavenworth's credit analysis, Moody's Investor Service cautions, "The city's reliance on economicallysensitive sales tax revenue is a credit challenge."

In general, sales tax is far more volatile than property tax. In addition, a portion of the growth in sales tax is tied to a 1 percent countywide sales tax that sunsets in 2035. The countywide sales tax allocation formula includes a property tax component. As the City reduces the percentage of property tax it collects, as compared to other Leavenworth County municipalities, the percentage of countywide sales tax the City receives will decrease.

The 2025 Operating Budget is impacted by the decrease in sales tax collections in 2023 and year-to-date 2024. While the Management Team feels confident that local and countywide sales tax revenue will grow at the average pre-pandemic levels of 2.8% per year, that growth, combined with the budgeted increase in property tax collections, does not make up for the deficit between the budgeted and actual sales tax collections in 2023 and 2024. If sales tax growth continues to be sluggish and the City continues to hold its mill levy flat, the trend of decreasing revenue may lead to the reduction of City services in future years. The Management Team is cautiously optimistic that the revenue trend can be reversed with new residential, commercial, and industrial development; which would provide property tax increases without an additional tax burden to existing homeowners and businesses.

The sluggish sales tax growth also impacts the 2025 Capital Improvement Projects (CIP) Budget. Therefore, the 2025 CIP Budget is focused on IT equipment improvements, necessary equipment replacements for the Police, Fire, Engineering, Public Works, and Parks departments, and park maintenance projects.

II. OPERATING BUDGET

In constructing the 2025 Operating Budget, the Management Team evaluated economic trends and forecasts, pricing trends, City Commission priorities and adopted goals, public feedback, and staff recommendations. The following issues, in context of their relation to available resources, were discussed at length in development of the 2025 budget:

• Sales tax revenue leveled offin 2023 and decreased during the first few months of 2024.

• Prices increased across the board for everything from contractual services, to mechanical equipment, fuel, chemicals, and road materials.

iii Page 7

•ContinuedconservativebudgetingandspendingpracticesasdirectedbytheCommissionto maintainbudgetreservegoalsthatenabletheCitytomaintainoperationsthroughpotential economicchallenges.

•MaintenanceofanemployeecompensationplandesignedtomaketheCitycompetitivein recruitingandretainingemployeesatalllevelsoftheorganization.

•Ensureadequatecoverageofemployeehealthandwelfareandretirementexpenses.

•Accountforpotentialchangesineconomicconditionsandtrendsafterthebudgetisadopted.

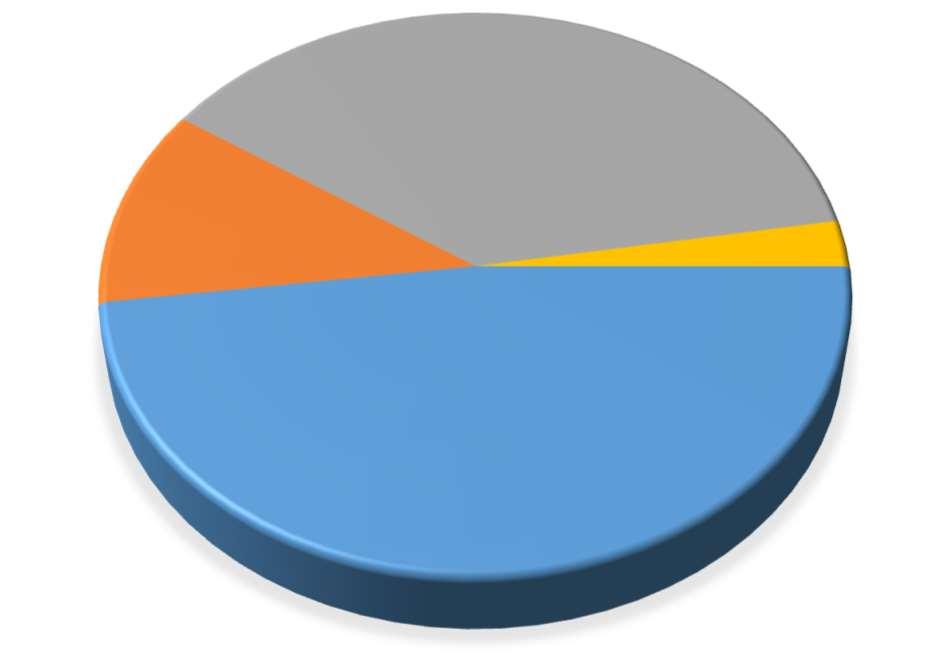

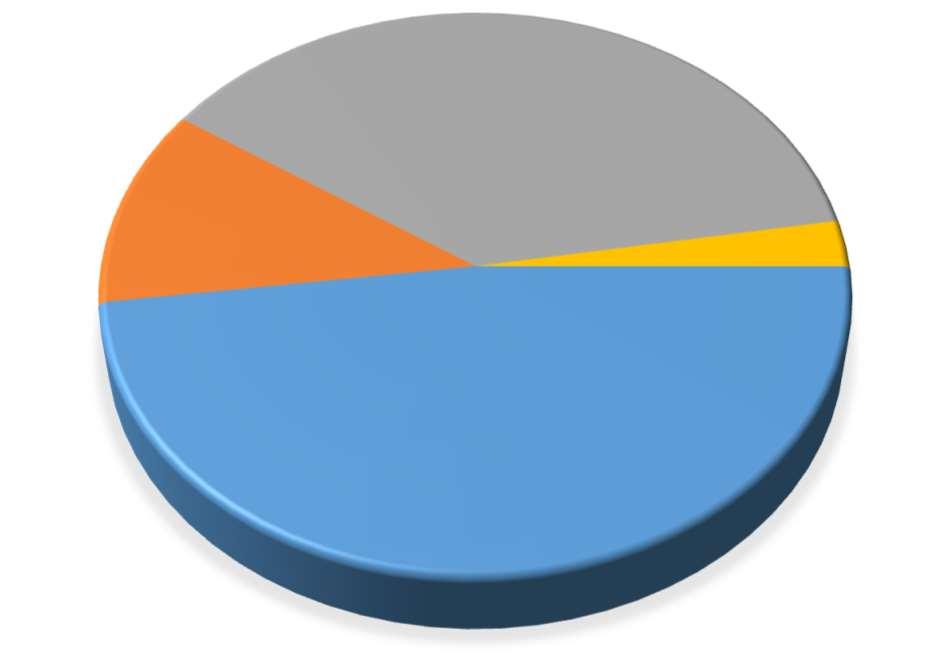

GeneralFund

TheCity'sGeneralFundaccountsforcoremunicipalfunctionsandservicessuchasPolice,Fire,Public Works,andPlanningandAdministration.Thisisanoperatingbudgetfocusedprimarilyonrevenues comingandgoinginaparticularfiscalyear.TheprimaryrevenuestreamsthatsupporttheGeneralFund budgetare:1)SalesandUseTaxes;2)PropertyTaxes;3)ChargesforServices;4)FinesandForfeitures; and5)FranchiseFees.FluctuationsintheserevenuestreamsaffecthowtheCityisabletopayforand maintaincoreservices.

RevenueHighlights

•TheCityexperiencedanincreaseininitialassessedvaluationfrom$303,997,319in2023to $315,799,999in2024-anincreaseof3.9%.Attheproposedloweredmillrateof22.498forthe City,theincreasedassessedvaluationwillgenerate$254,941moreinrevenuethanitgenerated in2024.Inspiteofthatincrease,theGeneralFundwillreceive$11,954lessthanitdidin2024, becausetheGeneralFund'sportionofthemilllevywilldecreasesothattheDebtServiceFund's milllevycanincreasetocoverthefirstyearofdebtserviceforthenewFireStation's2024 $5,000,000bondissuance.

•Totalsalestaxrevenues,whichincludelocalandcounty-widesalestaxandlocalandcountywidecompensatingusetax,arebudgetedtobe4.46%higherthanactual2023salestax revenues,generatinganadditional$754,174 (note that this includes two years ofgrowth, 2024 actuals and 2025 budgeted). Thesix-yeartrendhasbeenanannualincreaseof4.63%,andthe four-yearpre-pandemicannualincreasewas2.8%;therefore,a4.46%increaseovertwoyears(or approximately2.23%annually)isareasonableestimate.Theincreaseinsalestaxrevenuewillbe allocatedasfollows:approximately$515,367totheGeneralFund,$23,882totheEconomic DevelopmentFund,and$214,925toCapitalImprovementProjectsFunds.

•Franchiserevenuesarebudgetedtobeequalto2023actualrevenues.

•Cityfeesforpermitsandinspectionsandcourtfinesandfeesarebudgetedtoremainrelatively flat,at2024budgetedlevels.

TheGeneralFundincludesabudgetedreserveof$5,275,549whichisavailabletosupport unanticipatedexpensesorunderperformingrevenues.The2025budgetedreserverepresents21.15% oftheGeneralFund's2025budgetedoperatingexpenses,whichisbetweentheCity'sreserve minimumof16%andthetargetreservelevelof30%.TheendingreservepositiononDec.31,2023, was45.42%,aportionofwhichwasbudgetedin2024tocreateaGrantMatchingCapitalFundand provideresourcestoorderanew$1.3millionfireapparatus.The2024projectionincludesan operatingreserveof32%,whichtheManagementTeamhasworkedtokeepstablethroughperiodsof economicuncertainties.MaintainingastableandhealthyreserveiscriticaltomaintaintheCity'sAa2 bondrating.

iv Page 8

Expense Highlights

• Utilities are budgeted to decrease 2.59%, across all City operations. The City continues to experience lower utility rates since the peaks in 2021 and 2022.

• The increase in information technology (IT) and connectivity expenses including telephone, internet, IT services, computer back-up fees, IT maintenance and repairs, and software continue to outpace inflation. IT expenses are budgeted to increase 32%, or $172,000, over budgeted 2024 IT expenses. This increase in spending is a result of the City's commitment to improving cybersecurity including adding a director level position to the IT Department, hiring a full-time systems administrator and investing in new hardware and software.

• City contributions to the Police and Fire KP&F State Pension system and the KPERS State Pension system for all City employees is budgeted to increase by $245,000 over the 2024 budget due to increases in the KP&F and KPERS contribution rates, salary increases, and budgeting for full employment.

• The 2024 employee compensation plan recommends a 3.5% across the board increase. Total salaries are budgeted to increase 4.28% due to the 3.5% increase and the changes in staffing in the IT Department. When combined with high-quality medical benefits, the City remains competitive in the region for employee recruitment and retention.

Other budgets included

It is useful to consider the 2025 budget document as consisting of four separate budgets: Library Funds, Federal Grant Funds, Non-Tax Funds and Tax Funds.

Library

The Library Ordinance establishes a mill rate not to exceed 3.75 mills to support Libraiy operations. For 2025, the Libraiy's submitted budget includes 3.486 mills for operations, and 0.978 mills for the Libraiy Employee Benefits Fund. The total Library levy will generate approximately $1,409,687 for the 2025 budget.

Federal Grant Funds

The City receives grants each year for Planters II, Section 8, Community Development, and Comprehensive Improvements Assistance Program (CIAP) activities.

The 2025 Planters II expense budget decreased by $90,000 (-6.4%). The decrease was caused by a $140,000 decrease in capital outlay and a $42,000 decrease in budgeted reserves, offset by an $8,600 increase in personnel expenses and an $84,000 increase in contractual services and commodities, combined. The financial condition of the fund is stable.

The 2025 Voucher Choice Fund expense budget increased by $432,000. This increase is due to a 260,000 increase in voucher choice payment and a $172,944 increase in budgeted reserves. The voucher payments increase based on the level of federal funding the program receives each year. The financial condition of the Voucher Choice Fund is stable.

The 2025 Community Development Block Grant Fund is estimated to increase $7,000 to $347,000. Of that total budget,approximately $69,000 may be used for administrative purposes; the balance, or $278,000, is used for a variety of community projects in accordance with CDBG guidelines.

V Page 9

Non-Tax Funds

Non-taxfundsderivetheirfinancialsupportfromsourcesotherthanadvaloremtaxes.Expensebudget levelsforthesefundsaregenerallydependentupontheavailabilityofrevenuegeneratedthroughthe collectionofsalestaxandthepursuitofthefund'sactivity.Forexample,theSewerFundexpensebudget isdependentuponfundsgeneratedfromthesaleofsewerservices.

The2025expensebasebudgetforthisgroupofFundsdecreasesby$16,092,394or30%,to $38,178,119.Thissignificantdecreaseinthenon-taxfundsbudgetsislargelyattributedtoa$15.1 milliondecreaseinthecombinedCapitalProjectFunds.

TheConventionandVisitor'sBureauFundwasestablishedin2014toaccountforthereceiptoftransient guesttaxrevenuethathadpreviouslybeenaccountedforintheGeneralFund.Transientguesttax revenueisprojectedtoremainflatwithactual2023revenueat$700,000.Thisis$50,000morethan 2024budgetedrevenuebecauseoccupancyratesintheCity'shotelsincreasedin2023over2022. Personnelexpensesarebudgetedtoincreaseby$16,000(6.8%),contractualservicesarebudgetedto increaseby$19,450(4.2%)andtheCityFestivalexpensesarebudgetedtoincreaseby$13,000(5.6%). 2025budgetedreservesincreaseby$27,000over2024budgetedreserves.

TheProbationFundisbudgetedtodecreaseby$43,572(-12.6%)ascomparedto2024.The2024budget includedprovidingservicestoLansingandTonganoxieandthe2025budgetincludesprovidingservices toonlyTonganoxie.Thebudgeteddecreaseisreflectiveofthedecreaseinservicesbeingprovided.

TheStreetsFundisbudgetedtoincreaseby16.4%($234,425)becauseaSidewalkandCurbsDivision wasaddedtotheStreetsDepartmentin2025.TheSidewalkandCurbsDivisionwillemploytwo equipmentoperatorswhowillfocusonsidewalkandcurbimprovementandreplacement.Thenew divisionisfundedbyatransferfromtheCountyWideSalesTaxFundasapartoftheCity's$416,000 annualSidewalkandCurbProgram.

TheEconomicDevelopmentFundbudgetincreasesby8.4%or$161,375.Thisisprimarilyduetoa $141,598increaseinthebudgetedreserves,whicharebudgetedtobe$1,616,578attheendof2025.

2024 2025 CVBFund 1,573,9081,649,512 ProbationFund 346,258302,686 StreetsFund 1,426,694

Economic

1,910,899

CIP

Countywide

Fund 5,906,502

Capital

9,885,417

Streets

8,414,731

Grant

Sewer

8,753,980

Refuse

StormWaterCapitalProjectsFund 2,465,5021,559,503 AutoTIFFund 879,906820,000 HotelTIFFund 1,131,0161,119,381 RetailTIFFund 144,124195,000 Total 54,270,513 38,178,119

1,661,119

DevelopmentFund

2,072,274

SalesTaxFund 4,517,7984,431,500

SalesTax

5,126,395

ProjectsFund

2,569,871

CapitalProjectsFund

2,319,749

MatchingCapitalProjectsFund3,198,3341,472,008

Fund

8,798,691

Fund 3,715,4444,080,430

vi Page 10

TheCIPSalesTaxandtheCountywideSalesTaxFundsaresetuptocollectlocalandcountywidesales andusetaxanddisbursethosefundstovariousfundsbasedonpreviouslyestablishedCityordinances andthe2025operatingandcapitalimprovementbudgets.Theprimaryrecipientsoflocalandcountywide salestaxaretheRecreationFund,theDebtServiceFund,TheCapitalProjectsFund,andtheStreets CapitalProjectsFund.Localsalestaxinthesefundsisbudgetedtoincrease2.79%($79,591)over2023 actualsandcountywidesalestaxisbudgetedtoincrease2.72%($82,688).ThetransfertotheRecreation Fundisbudgetedtobe$2,077,894,whichisanincreaseof$309,000overthe2024budget.Thetransfer totheBondFundisbudgetedtobe$1,259,066whichisadecreaseof$141,000(-10%)fromthe2024 budgetbecauseofadecreaseinprincipalandinterestpaymentsintheBondFundforCIPprojects.The transfertotheCapitalProjectsFundisbudgetedtodecreaseby$635,578(-19.8%)becausefewercapital projectsarescheduledfor2025.ThetransfertotheStreetsCapitalProjectsFundisbudgetedtodecrease by1,613,108(-51.8%)overthe2024budget,becausetheDowntown4thStreetProjectwasbudgetedtobe completedin2024.

TheCapitalProjectsFundisbudgetedtodecreaseby$7,315,546(-74%)to$2,569,871.Theattached 2025-2029CIPBudgetprovidesalistingoftheprojectsthatarescheduledtobecompletedin2025.The highlightsinclude$111,000fornecessaryroofandexteriorrepairstothelibrary;$345,000forthe replacementofalloftheself-contained-breathing-apparatusfortheFireDepartment,$89,000forthe purchaseofacompacttrackloaderfortheStreetsDepartment,$334,000forupdatestotheRiverfront CommunityCenter,$222,000forparksprojects,and$138,000formaintenancetotheCity'stwopools.

TheStreetsCapitalProjectsFundisbudgetedtodecreaseby$6,094,981(72.4%)to$2,319,750.The decreaseinspendingisprimarilyattributabletothe$5.2millionthatwasbudgetedforthe4thStreet betweenChoctawandSenecaprojectin2024.Reservesarebudgetedtodecreaseby$790,000(100%) becausestartingwiththe2025budget,reserveswillbeheldintheCountyWideSalesTaxFunduntil theyneedtobetransferredtotheStreetsCapitalProjectsFundforaspecificproject.

TheGrantMatchingCapitalProjectsFundisbudgetedtodecreaseby$1,726,326(54%).2024wasthe inauguralyearforthisfundandincludedthe$1,979,000VilasStreetProjectanda$1,000,000budgeted reserve.The2025budgetincludesaK-7/USHighway73surfacepreservationprojectbetweenReesand PoplarStreets(totalcost$594,000,City'scost$194,000),aDowntownsidewalkintersectionimprovement toADAstandardsproject(totalcost$475,000,City'scost$95,000),and$326,228inbudgetedreserves.

The2025SewerFundbudgetis$44,711(0.5%)higherthan2024.Operatingexpensesarebudgetedto increasebyapproximately$195,000andbudgetedreservesdecreaseby$150,823.The2025proposed budgetincludesa3%increaseinutilityfees.

The2025RefuseFundbudgetis$364,986(21.3%)higherthan2024.The2025RefuseFundbudget,as presented,ispredicateduponaprospectiveprojectthatmayallowtheCitytohaulitsrefusetoalocal transferstationratherthantheJohnsonCountyLandfill.Iftheprojectcomestofruition,someexpenses willincreasewhileothersdecrease,withthenetimpactonexpensesbeingrelativelyneutral.The proposed2025RefuseFundbudgetincludespersonnelexpensesthatincreaseby$70,637(7.4%)and contractualexpensesthatincreaseby$184,130(19.0%).Theincreasedcostofcontractualexpensesis dueprimarilytoincreasedlandfillfees.Commoditiesarebudgetedtodecreaseby$56,250primarilydue toadecreaseindieselfuel,whichwillresultfromhaulingrefusetoalocaltransferstationratherthan theJohnsonCountyLandfill.TheRefuseFundisbudgetedtofinish2025witha90-dayoperating reserveof$624,977andacapitalreserveof$920,822.TheRefuseFund'scapitalreservesareusedto

vii Page 11

replacetheoldestgarbagetruckinthefleetwithanewgarbagetruckeveryotheryear(approximately $245,000/each)andotherheavyequipmentneededtoproviderefusecollectionanddisposalservices.The 2025proposedbudgetincludesa3%increaseinutilityfees.

TheStormWaterCapitalProjectsFundisbudgetedtodecreaseby$905,999(-36.7%)In2024a $1,000,000transfertotheStreetsCapitalProjectFundwasbudgetedforthestormsewerportionofthe 4th StreetbetweenSenecaandChoctawproject.Thereisnotransferbudgetedfor2025.Capitaloutlayis scheduledtoincreaseby$601,200(92.8%)becausealloftheStormWaterAssessmentFeescollectedin 2025arebudgetedtobespentonemergencyrepairs.Thisexpenditurewillresultinadecreaseof $448,846(-100%)inbudgetedreserves.

Recreation Fund

TheRecreationFundissupportedbythefollowingrevenuesources,withtheapproximate2025proposed budgetamountsappearinginparentheses:propertytax($554,103);localsalestaxwhichistransferred fromtheCIPSalesTaxFund($2,077,895);one-thirdoftheCity'sliquortax($94,700);andchargesfor servicessuchasroomrentalsatRiverfrontCommunityCenter(RFCC),parkshelterrentals,gym memberships,andentrancefeesforRFCCandWollmanPool($492,500).Comparedtothe2024budget, the2025proposedbudgetmilllevyisflat,thereisa$309,007(17.47%)increaseinthetransferfromthe CIPSalesTaxFund,a$44,600(-8.30%)decreaseinchargesforservices,anda$64,235projectedcarry forwardbalance.The2025RecreationFundexpendituresarebudgetedtoincreaseby$167,877(5.4%)to $3,300,033.Sixty-eightpercent(55%)oftheincreaseintheRecreationFundexpendituresisattributedto a$91,752(4.52%)increaseinpersonnelexpenses.Thebalanceoftheincreaseisattributedtoa$54,600 (9.23%)increaseincontractualservicesanda$9,300(4.08%)increaseincommodities.

Bond and Interest Fund

The2025BondandInterestFundbudgetincreasedby$297,115(8.22%).Theincreasehastwo components.Thefirstisa$221,775decreaseindebtservicefordebtthatexistedasofDecember31, 2023.Secondisa$606,191increaseindebtserviceforthe$5,000,000G.O.bondissuedin2024forthe constructionofanewfirestation.Ofthe$606,191indebtserviceforthefirestation,$350,000isfora principalpaymentandtheremaining$256,191isinterestexpense.Theinterestexpenseonthisbond willdecreaseto$181,400in2026.Interestexpensein2025ishighbecauseitincludes2024accrued interestaswellas2025interestexpense.TheBondandInterestFundisbudgetedtofinishtheyearwith a$112,220reservewhichis$92,301(-45.13%)lowerthanthe2024budget.

ARPA Fund

In2021theCitywasawarded$8,549,064inAmericanRescuePlanAct(ARPA)fundsfromthefederal government.TheARPAFundwascreatedtoaccountfortherevenueandexpendituresassociatedwith thisgrant.AsofDecember31,2024,allARPAfundswillhavebeenexpendedorencumbered.Theonly encumbranceremainingasofDecember31,2024,willbe$832,479forafireapparatusthatisexpected tobedeliveredin2025.TheremainingbalanceintheARPAFundasofDecember31,2025isbudgeted tobe$0.

viii Page 12

Assessed Valuation

BaseduponinformationrecentlyreceivedfromtheCountyClerk,theCityofLeavenworthexperiencedan increaseinassessedvaluationfrom$303,997,319in2023to$315,799,999in2024.Thisisa3.88% increaseinassessedvaluation.Taxabatedproperties,suchastheNRA,increasedfrom$3,896,476to $3,971,027,increasingthenetincreaseinassessedvalue,notincludingtaxabatedpropertiesto3.91%.

Ad Valorem Taxes

Thefollowingtableillustratesthe2025advaloremtaxlevy(priortothedelinquencyratecalculation) requiredbyeachCityFund.

Mill Levies

Thetablebelowillustratesthe2024milllevyrateforeachCityFundrequiringadvaloremtaxsupport giventheassessedvaluationdataprovidedbytheCountyClerk.

Total

RealProperty PersonalProperty StateAssessedUtilities

2024 Budget $288,063,525 2,646,929 13,286,865

2025 % Budget Variance $299,151,561$11,088,036 2,789,998 142,569 13,858,940 572,075 $315,799,999

$303,997,319

$11,082,680

2024 2025 % Fund Budget Budget Variance GeneralFund $4,368,138$4,338,505 -0.68% Recreation 491,564 510,649 3.88% Bond&Interest 1,877,791 2,197,968 17.05% FirePension 98,191 51,475 -47.58% PolicePension 14,288 6,316 -55.79% Subtotal - City 6,849,972 7,104,913 3.72% LibraryFund 1,063,687 1,100,923 3.5% LibraryEmployeeBenefits 282,717 308,764 9.21% Subtotal - Library 1,346,404 1,409,687 4.70% Total $8,196,376 $8,514,600 3.88%

2024 2025 Mill % Fund Budget Budget Variance Variance GeneralFund 14.369 13.738 -0.631 -4.39 Recreation 1.617 1.617 0.0 0% Bond&Interest 6.177 6.960 0.78312.68% FirePension 0.323 0.163 -0.160-49.54% PolicePension 0.047 0.020-0.0.27-57.45% Subtotal - City 22.533 22.498 -0.0349 -0.16% LibraryFund 3.499 3.486 -0.37% LibraryEmployeeBenefits 0.930 0.978 5.16% Subtotal - Library 4.429 4.464 -0.013 0.048 0.0349 0.79% Total 26.962 26.962 0% ix Page 13

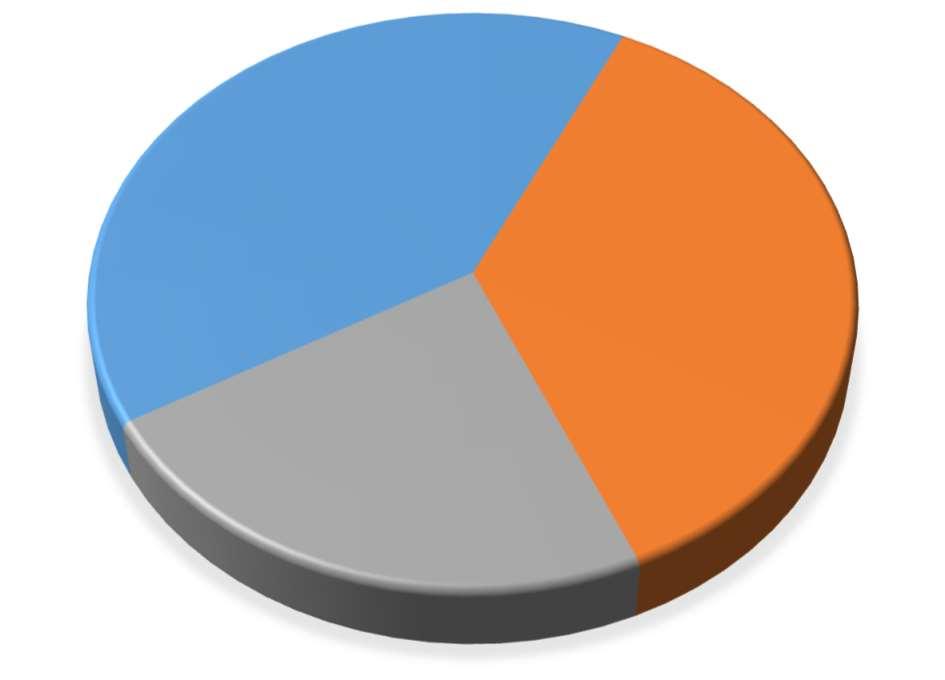

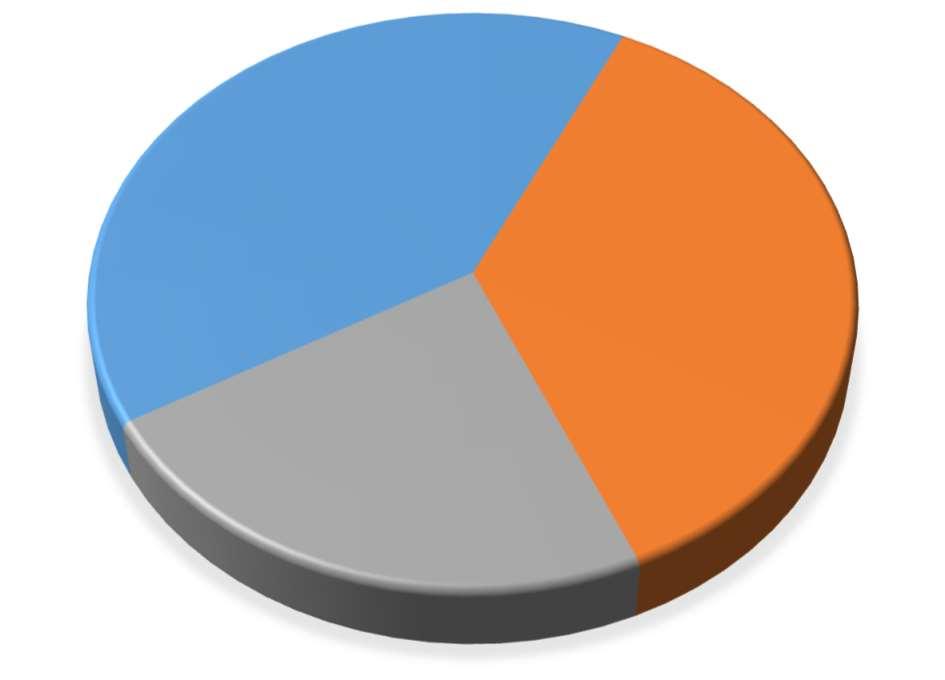

III. CAPITAL IMPROVEMENTS PLAN (CIP) BUDGET

The Capital Improvements Plan is a comprehensive investment of $38 million over 5 years to improve and expand the City's full spectrum of services including utilities, buildings, roadways, recreation facilities, and technology.The 2025 CIP Budget includes revenue from three sources: 1) ¼ of the City's local sales tax, 2) 85% of the City's portion of the countywide sales and use tax, and 3) state and federal grants.The CIP also includes information for enterprise funds (Sewer, Refuse, and Storm Water), which are funded by user fees and a stormwater impact fee. Based on current and forecasted conditions, as well as work over the past few years to establish industry standard reserve positions, the ManagementTeam is proposing a 3% increase in refuse and sanitary sewer rates.

The CIP budget is allocated across a number of pay-as-you-go projects including upgrades to existing City buildings, the construction of new buildings, equipment purchases, operating transfers, and infrastructure projects. Projects included in the CIP are prioritized by direction from the Commission and staffs evaluation on how operations will be impacted by the condition of the City's equipment, buildings, and infrastructure. Although the CIP represents a five-year-look-ahead, the program is evaluated on a yearly basis to offer the most flexibility to the Commission and the community.The goal of the 20252029 CIP is to align the City's resources with the highest priority needs while offering transparency and accountability to the taxpayers.

Approach and Goals

Due primarily to conservative capital budgeting over the past two years, the funds carried forward for CIP projects from the 2024 budget are projected to be approximately $3,500,000.These funds, along with sales tax collected in 2025 will allow the 2025-2029 CIP budget to continue to make investments in identified projects, while reducing the City's reliance on debt financing.

2025 CIP Highlights Include

• Continued debt service on a number of City facilities, projects and equipment, including:

o The Leavenworth Business andTechnology Park - $357,390

o The reconstruction ofThomton Street - $473,388

o The purchase of an aerial ladder fire apparatus - $149,163

o The final temporary-note payment for park improvements including the Havens Park restroom, the Stubby Park restroom and shelter, and the splash pad - $279,125

• Multiple information technology upgrade projects at a cost of $152,000.

• The replacement of thirty-two (32) self-contained breathing apparatus for the Fire Department$345,000

• Purchase of street equipment - $105,000

• Improvements to the Riverfront Community Center - $333,928

• Purchase of parks equipment - $74,302

• Trails, parks, and pools maintenance and improvements -$359,641

• 2025 Pavement Management Program - $2,100,000

• Three (3) projects partially funded by grants - total project cost $1,145,780; City's cost $296,678

o K-7/US Hichway surface preservation from Rees to Poplar Streets

o Airport taxi-way and apron pavement seal

o Upgrade downtown sidewalk intersections to current ADA standards

• WastewaterTreatment Plant equipment replacement - $1,970,000

• Refuse Fund replacement of front loader tractor - $214,000

• Completion of seven (7) Storm Water Capital repair and/or replacement projects - $1,249,177 X

Page 14

IV. CONCLUSION

The recommended 2025 Operating Budget and 2025-2029 Capital Improvement Program (CIP) reflect a conservative approach to the fluctuations in the local, state and federal economies. The recommended budget makes responsible use of reserve levels and reduces the City-supported mill levy by 0.15 percent. The reduction in the City's mill levy is offset by an increase in the Library's mill levy by the same amount, so the City's overall mill levy remains flat in 2025. The 2025 proposed mill levy is based solely on current and 2025 forecasted conditions, and is an issue that should be analyzed each year based on new information and data. As mentioned above, local governments are subject to mandates from other levels of government that can dramatically impact the shape and composition of budgeting and tax structures without regard for local governments' ability to provide service at levels expected by residents and businesses.

The recommended budget proposes to maintain City services and offerings at current levels while providing funding for necessary maintenance, repair, and improvement projects. The 2025 budget maintains these services and offerings while holding the mill rate flat. The budget includes a 3% increase in sewer and refuse rates and makes no increase in stormwater impact fees. General Fund reserves are budgeted to decrease to approximately 21% of General Fund expenditures, which is above the established minimum reserve position of 16%, and the City, as a whole, remains in sounds financial condition.

As with any budget process, certain areas were selected for enhancements, while others remained unchanged. We hope the proposed budget matches the goals and expectations of the residents of Leavenworth and the City Commission.

The City's budget process is a year-round team effort that includes the entire management team and staff at all levels throughout the City. We appreciate the support of the staff in the preparation and presentation of the Interim City Manager's recommended 2025 Operating Budget and 2025-2029 CIP and we look forward to reviewing its contents with the City Commission.

Patrick Kitchens Interim City Manager

Roberta Beier Finance Director

xi Page 15

Griff

Jermaine

City of Leavenworth, Kansas

List of Elected and Appointed Officials

June 30, 2024

ElectedOfficials Position TermExpires

Martin Mayor 2025 Holly Pittman Mayor Pro Tem 2027 Nancy Bauder Commissioner 2027

Hingula Commissioner 2025

Ed

Wilson Commissioner 2025 AppointedOfficials Position LengthofService withCity Pat Kitchens Interim City Manager / Police Chief 34 years David Waters City Attorney 7 years Penny Holler Assistant City Manager 4 years Melissa Bower Public Information Officer 12 years Lona Lanter Human Resources Director 21 years Sarah Bodensteiner City Clerk 3 years Roberta Beier Finance Director 4 years Steve Grant Director of Parks & Community Activities 23 years Brian Faust Director of Public Works 4 years Dan Nicodemus Acting Police Chief 28 years Gary Birch Fire Chief 11 years Julie Hurley Director of Community Development 10 years Page 16

Staff Responsible for the 2025 Proposed Budget Include:

Sarah Bodensteiner, City Clerk

Pat Kitchens, Interim City Manager

Karen Parker, Senior Accountant

Penny Holler, Assistant City Manager

Roberta Beier, Finance Director

Melissa Bower, Public Information

Andrew See, Deputy Finance Director

Sarah Bodensteiner, City Clerk

Pat Kitchens, Interim City Manager

Karen Parker, Senior Accountant

Penny Holler, Assistant City Manager

Roberta Beier, Finance Director

Melissa Bower, Public Information

Andrew See, Deputy Finance Director

Page 17

Pam Cline, Accountant

Mission Statement

The ongoing mission of the City Government of Leavenworth, Kansas is to protect and maintain the health, safety, and general welfare of the Leavenworth community. All representatives of the Leavenworth city government will carry out this mission on a daily basis within the parameters of all fiscal resources available and in a fair and equitable manner for all individuals who live in, work in, conduct commerce in, and visit the City of Leavenworth.

Page 18

City of Leavenworth Organization Chart

Page 19

Community Profile

History, Size, and Location

The City of Leavenworth, Kansas is located on the west bank of the Missouri River in the Dissected Till Plains region of North America’s Central Lowlands on land that was originally inhabited by the tribes of the Delaware, Kansa, and Osage peoples. Four small tributaries of the Missouri River flow eastward through the city, Quarry Creek, Corral Creek, Three Mile Creek, and Five Mile Creek. The City’s water source comes from the Missouri River.

Leavenworth is 28 miles northwest of Kansas City, Missouri, 45 miles northeast of Topeka, Kansas, 145 miles south-southeast of Omaha, Nebraska, and 165 miles northeast of Wichita, Kansas, at the intersection of US Route 73 and Kansas Highway 92. The City has a population of 37,176 and covers an area of approximately 24.7 square miles.

Fort Leavenworth, built in 1827, was originally named Cantonment Leavenworth by Colonel Henry Leavenworth. For several decades, the fort played an important role in keeping the peace between the various Native tribes and the settlers moving west. Many Leavenworth city streets are named after local Native tribes.

While Fort Leavenworth was separate from the city until annexation in 1977, the two are interdependent on each other and their histories are inextricably intertwined. The City provides additional housing, shopping, recreational, and cultural amenities that are not available on post. In addition to the military personnel, the Fort provides employment for over 4,500 civilian employees and contractors.

Fort Leavenworth is home to the United States Army Combined Arms Center; the U.S. Army Command and General Staff College; National Simulation Center and the Army Corrections Complex. Leavenworth is home to the University of Saint Mary, the Dwight D. Eisenhower Veterans Affairs Medical Center, and the Leavenworth Federal Penitentiary.

Leavenworth has a small town, historic atmosphere with access to the amenities of a larger city. In addition to the large federal presence and large private employers, such as Hallmark Cards, the Leavenworth community is home to many smaller, family-owned businesses. The 28-blocks of downtown Historic Leavenworth still contains many of the buildings that were present in the early 1900's. Vintage homes are scattered throughout the community.

The City, which grew south of and in support of the fort, was established in 1854 and was incorporated by the first Kansas territorial legislature in 1855. The City was the first city incorporated in the Kansas Territory, hence its motto: “First City of Kansas.” American history identifies Leavenworth for its key role as a supply base for settlers going west. The City was home to freight companies, meat packers, provisioners, stove makers, and furniture manufacturers. As the city grew, factories and businesses flourished and stately homes were built to house the families whose wealth grew as the city grew. Leavenworth was the industrial center of Kansas and of the west. The city has a historic wayside walking and driving tour commemorating the notable events and locations in the community.

Page 20

Leavenworth also became known as a refuge for African-American slaves fleeing the slave state of Missouri, with the help of Abolitionists. In the years preceding the Civil War, Leavenworth frequently had physical confrontations between anti- and pro-slavery factions.

In April 1858, the Leavenworth Constitution was adopted for the State of Kansas in Leavenworth. The constitution was never officially recognized by the federal government, but was considered the most radical constitution drafted for the new western territories because it included freed African-Americans as citizens.

The following map shows the Location of Leavenworth County in Kansas and the City of Leavenworth within Leavenworth County.

Page 21

Land Use

The City of Leavenworth is made up of 15 zoning districts. These zoning districts can be divided into three groups: residential, commercial, and industrial. The residential group is made up of all parcels zoned for the intent of use for habitable dwellings. The commercial group is all parcels zoned with the intent to operate a business for profit. An industrial group is a group made up of zoned areas for industrial uses. Land use in Leavenworth is 76.6% residential, 6.9% commercial, and 9.29% industrial. Leavenworth has several federal and state entities that make up a portion of the land within city limits; these entities are not included in any of the three groups since they are considered government properties and are therefore tax-exempt.

Federal Presence

As mentioned earlier, the City has a strong federal presence, which includes Fort Leavenworth, home to the U.S. Army Combined Arms Center and the U.S. Army Command and General Staff College, School of Military Studies, the Center for Army Leadership, the Combat Studies Institute, the Combined Arms Directorate, the Center for Army Lessons Learned (CALL), and the Mission Command Center of Excellence (MCCoE).

The Fort has been continuously occupied by the U.S. Army since its inception in 1827. The original purpose of the fort was to protect settlers on the Santa Fe Trail. The fort also played a key role in both the Mexican and Civil Wars. In 1854, it was the temporary capital of the Kansas Territory. There are two national cemeteries located in Leavenworth. One of these, the Fort Leavenworth National Cemetery, is located on the Fort. Today, Fort Leavenworth is a major economic driver of the community. Providing roughly 15,000 military, civilian, and Department of Defense jobs, an average daily post population of 21,420, and an estimated $1.5 billion economic impact to the city and the region.

In addition to Fort Leavenworth, the U.S. Department of Veteran’s affairs operates the Dwight D. Eisenhower Veterans Affairs Medical Center. The other national cemetery, the Leavenworth National Cemetery, is located on these grounds behind the Veteran’s Affairs Medical Center.

There are several prisons located in Leavenworth and the immediate surrounding area. The United States Federal Penitentiary was built in 1903, along with its satellite prison camp, and the Federal Bureau of Prisons operates both. The Federal Bureau of Prisons has renamed the former United States Penitentiary and is currently constructing a new $461 million Federal Correctional Institution in Leavenworth. The United States Disciplinary Barracks, which is located on the fort and is the military’s only maximum-security facility, and the Midwest Joint Regional Correctional Facility are both military facilities. The Kansas Department of Corrections operates the Lansing Correctional Facility located in Lansing, Kansas, a neighboring city.

These facilities provide strong financial stability to the City.

Page 22

Education

Primary and secondary

Three public school districts provide educational services to local citizens. Unified School District (USD) 207 is on Fort Leavenworth and has three elementary schools and one junior high school. The USD 207 high school students attend USD 453, the City of Leavenworth’s school district. USD 453 operates four elementary schools, one intermediate school, one middle school, Leavenworth Virtual School (LVS), an Educational Center, and Leavenworth High School. Leavenworth High School boasts the very first Junior Reserve Officer Training Corps (JROTC) in the country. Leavenworth Virtual School is an internet-based school for kindergarten through eighth grade students. Children living in the City’s southernmost areas are included in the Lansing USD 469 School District.

There are also two private schools in Leavenworth, Xavier Elementary school for students in pre-kindergarten through eighth grade and St. Paul Lutheran School for students in pre-kindergarten through eighth grade.

Colleges and Universities

The University of Saint Mary is a four-year private Catholic university located in Leavenworth. Other higher education opportunities in Leavenworth include a Kansas City Kansas Community College satellite campus and a University of Kansas satellite campus.

(Ages 25 and over)

Bureau

Economy and Growth

Leavenworth is a prime middle-class community with a sound business base in the Kansas City Metropolitan area. The cost of living in Leavenworth is 83.1% of the national average (or 16.9% lower than the national average).

Economic activity in Leavenworth during the past year included:

Construction began on a new, $461 million federal prison to replace the 126 year-old facility; the new facility will be state of the art, offer increased security and services for physical and mental wellbeing for prisoners

Site visits from businesses interested in the shovel-ready, 82-acre Business and Technology Park

Two growing subdivisions had several new houses built in the City’s southeast corner

City celebrated one year of partnership with RideLV, the on-demand micro transit system providing public transportation within City limits

Distribution of dozens of Small Business Economic Development Grants to new and existing businesses to make building and façade improvements

Expanded participation in the City-hosted Annual Business Symposium to connect current and future business owners with the resources to help them succeed and grow.

Educational Attainment

High School or higher 92.2% Bachelor’s degree or higher 33.8% U.S. Census

Page 23

Continued outreach regarding the City’s Neighborhood Revitalization Area (NRA) tax rebate program to stimulate investment into properties within the NRA boundaries

Governmental Structure

Leavenworth is a legally constituted city of the First Class and the county seat of Leavenworth County.

The City is empowered to levy a property tax on both real and personal properties located within its boundaries. It is also empowered by state statute to extend its corporate limits by annexation, which occurs periodically when deemed appropriate by the governing body.

Since 1969 the City has operated under the commission-manager form of government. Policymaking and legislative authority are vested in the City Commission, which consists of five commissioners elected at large on a non-partisan basis by the general population. The commission elections are held every two years. Three of the commissioners are elected at each election. The two highest vote totals receive a four-year term and the third highest vote total receives a two-year term. Each year the Commission selects the Mayor from amongst themselves based on the number of votes in the most recent election.

In comparison to the federal government, the City Commission performs the legislative function; the Municipal Court performs the judicial function; and the City Manager and city staff perform the executive function.

The Commission is responsible for passing ordinances, adopting the annual budget and capital improvement program, appointing committees, and hiring the City Manager. The City Manager is responsible for carrying out the policies and ordinances of the City Commission, overseeing the day-to-day operations of the City, and appointing the heads of the City’s departments.

The City’s financial reporting entity includes all the funds of the primary government (the City of Leavenworth) and of its component unit - the Public Library. A component unit is a legally separate entity for which the primary government is financially accountable.

The City provides a full range of services, including:

Public safety: police and fire protection, animal control, and parking enforcement.

Public Works: sewer, refuse, storm water management, building inspection, airport, and the construction and maintenance of streets, storm water, bridges, and other infrastructure.

Housing and urban development: code enforcement, rental coordinator, and a range of housing and community development programs supported by federal grants.

Culture and recreation: parks, recreation, library, community center, aquatic center, farmers market, and performing arts.

Community and economic development: planning and zoning and economic development activities.

General government: Commission, City Manager, Legal, Municipal Court, Contingency, Airport, Civil Defense, City Clerk, Human Resources, Finance, General Revenue (Gen Gov’t), and Information Technology

Page 24

Media

Spectrum TV Channel 2 is the channel the City uses to broadcast live Commission meetings and other City related public announcements from other governmental agencies and school districts.

The Leavenworth Times is the city’s daily newspaper and is published by Cherry Road Media. Fort Leavenworth publishes a weekly newspaper through the U.S. Army that covers local military and community news.

In addition to print and broadcast media, the City publishes news and updates through their webpage (https://www.leavenworthks.org) and social media sites.

Medical and Health Facilities

Area medical facilities provide a full range of services including general health care, preventive health care, dental and vision care, behavioral and counseling services, dialysis, long-term care facilities, hospice care, rehabilitative care, and surgical care. These facilities provide in excess of 1,260 jobs.

In addition to medical facilities for the civilian population, the Dwight D. Eisenhower Veteran’s Affairs Medical Center is located in Leavenworth City limits. There is also a medical care facility located on the Fort.

Financial and Banking Institutions

Currently, there are seven banks in Leavenworth with thirteen locations. The following summary of deposit report is as of June 2024, the most recent data available (in Thousands):

Source: FDIC Bank Ratings

Transportation Facilities

Leavenworth’s location in the Kansas City metropolitan area is advantageous for commercial transportation. A massive logistics hub, the intermodal park in Edgerton, Kansas, (just south of Kansas City) connects railway shipments, trucking shipments, and inland port access to ocean shipping.

The Kansas City International (KCI) airport is located twenty minutes from Leavenworth, and as of April 2023, boasts a brand-new terminal with increased services and amenities. In addition, the City of Leavenworth has

Institution Deposits Armed Forces Bank $1,173,909 Citizen’s Federal Savings Bank $138,970 Commerce Bank $24,744,749 Country Club Bank $1,672,002 Exchange Bank & Trust $497,638 Mutual Savings Association $245,297 The Citizens National Bank $206,548

Page 25

a joint-use agreement with the Department of the Army for the use of Sherman Army Airfield located on post. The airfield is approximately one-mile north of the city and, while it is a military airfield, civilian access is unlimited.

Located at the intersection of U.S. Highway 73, Kansas Highway 92, and Kansas Highway 7, Leavenworth is within easy access to U.S. Interstates 70, 435, and 35. Interstate highway 29 and State highway 45 are within a few minutes of the City on the Missouri side of the river.

In conjunction with the Guidance Center and the Kansas City Area Transit Authority (KCATA), the City began an app-based transportation system that allows residents to get to medical offices, grocery stores, and places of work within City limits. RideLV MicroTransit, began in April 2023 and provides on-demand transportation upon request for a flat, affordable $2 rate.

Distance to Major Cities

Culture and Recreation

The City of Leavenworth enjoys a multi-cultural and religious diversity due to its military and international military heritage.

The Leavenworth Parks and Recreation Department maintains a system of more than twenty-five parks, an aquatic center, and the Riverfront Community Center. The community center offers an indoor cardio facility, an indoor pool, a gymnasium, and an excellent event venue. New in 2023 is a popular Splash Pad with water features located at Hawthorn Park.

The LeavenworthPublic Library offers many programs suchas meeting rooms, technology services, elementary and teen gaming, and interlibrary loan programs, in addition to specialty programs for children, teens, adults, and seniors.

The River City Community Players provides year-round plays and musicals at the Performing Arts Center.

Driving Distance (in Miles) Chicago 525 Dallas 554 Des Moines 209 Kansas City 28 Little Rock 454 Minneapolis 452 Oklahoma City 351 Omaha 174 St. Louis 281 Topeka 63 Tulsa 253 Wichita 201

City

Page 26

Camp Leavenworth is the City’s annual festival held in September and attended by up to 10,000 residents and guests. The two-day event features live music, local craft vendors, food vendors, and family-friendly activities.

The City is home to several museums such as:

The Richard Allen Cultural Center featuring items and artifacts from African-American pioneers and members of the military and collections of 1870-1920 photos from the Mary Everhard Collection.

C.W. Parker Carousel Museum offers three complete carousels that can be ridden and unique carousel horses.

National Fred Harvey Museum which is dedicated to the famous American entrepreneur credited with creating the world’s first chain of restaurants and hotels in association with the Atchison, Topeka, & Santa Fe railroad.

First City Museum showcases many different collections and displays of Leavenworth history.

The Carroll Mansion Museum is an 1880’s Victorian house featuring elaborate handcrafted woodwork, stained glass, and antiques from the early 20th century.

Fort Leavenworth Frontier Army Museum boasts a large collection of 19th century military artifacts.

Leavenworth has an historic shopping district that includes artisan shops, antique shops, art galleries, bakeries, book stores, pottery shops, restaurants, a farmers’ market, and many other points of interest. There is a variety of international cuisine offered in local restaurants.

In addition to the many cultural and recreational opportunities in Leavenworth, its proximity to the Kansas City metropolitan area enhances the City’s quality of life. There are many professional sports venues, such as baseball, football, soccer, hockey, and racing. Kansas City also boasts several museums, art galleries, performing arts venues, restaurants, shopping, farmers market, micro-breweries, and of course, the zoo.

Demographics

Census Population Percent Change 1860 7,4291870 17,873 140.6% 1880 16,546 -7.4% 1890 19,768 19.5% 1900 20,735 4.9% 1910 19,363 -6.6% 1920 16,912 -12.7% 1930 17,466 3.3% 1940 19,220 10.0% 1950 20,579 7.1% 1960 22,052 7.2% 1970 25,147 14.0% Page 27

U.S. Decennial Census and worldpopulationreview.com

U.S. Census

and elevation.maplogs.com

1980 33,656 33.8% 1990 38,495 14.4% 2000 35,420 -8.0% 2010 35,251 -0.5% 2020 37,351 5.9% 2023 37,034 -0.8%

Population by Gender Percent of Population Male 54.8% Female 45.2%

Bureau Ethnic Composition Percent of Population White 75.3% Black or African American 11.2% Hispanic or Latino 8.0% Two or More Races 8.8% Asian 1.6% American Indian and Alaska Native 0.5% Native Hawaiian or Other Pacific islander 0.1% U.S. Census Bureau Age Composition Percent of Population Persons under 5 years 7.5% Persons under 18 years 23.2% Persons 65 years and over 13.4% Median Age 36.4 years U.S. Census Bureau Average Climate Conditions Percent of Population January - Average High and Low Temperatures 39°F high/22°F low July - Average High and Low Temperatures 89°F high/70°F low Average Annual Rainfall 26.39 inches Average Annual Snowfall 7.12 inches Average Number of Days with Some Rain 131 Average Number of Days with Some Snow 17.5 Elevation 935 feet Weather-us.com

Page 28

Household Data Number of Households 13,285 Average Household Size 2.49 Persons living in the same house 1 year ago 69.4% Language other than English spoken at home 6.5% U.S. Census Bureau Crime Indices Per 1,000 Violent Crime 6.2 Non-violent Crime 31.6 Total Crime Index 32.5 Kansas Bureau of Investigation 2020 annual report Income Median Household Income $67,360 Per Capital Income $32,849 Individuals below poverty level 14.6% Children below poverty level 19.2% U.S. Census Bureau Homeownership Median Housing Price $163,800 Home Ownership Rate 50.0% U.S. Census Bureau Unemployment Comparison City of Leavenworth 3.0% State of Kansas 2.8% United States of America 4.0% June 2021 U.S. Bureau of Labor Statistics and May 2021 Kansas Department of Labor Page 29

AmountReq. 2025-202920252026202720282029 Total Unscheduled 3% 3% 3% 3% 3% 3,391,774 $ 3,493,528 $ 3,598,333 $ 3,706,283 $ 3,817,472 $ 18,007,391 $ (473,388) (477,438) (476,038) (474,338) (472,338) (2,373,538) $ (357,390) (360,693) (363,343) (365,438) (371,958) (1,818,820) $ (196,251) (190,000) (200,000) (200,000) (200,000) (986,251) $ (103,749) (110,000) (100,000) (100,000) (100,000) (513,749) $ (116,000) (116,000) (116,000) (116,000) (116,000) (580,000) $ (1,283,143) (1,695,750) (1,780,588) (1,869,652) (1,974,408) (8,603,540) $ 861,854 $ 543,648 $ 562,366 $ 580,857 $ 582,769 $ 3,131,493 $ 2,732,632 $ 2,814,611 $ 2,899,049 $ 2,986,021 $ 3,075,601 $ 14,507,915 $ 6,124,406 $ (2,077,894) (2,119,452) (1,465,472) (1,222,937) (1,016,111) (7,901,867) $ (149,163) (150,413) (151,513) (152,463) (148,263) (751,813) $ (279,125) - - - - (279,125) $ (63,847) (68,892) (70,958) (73,087) (75,280) (352,064) $ 162,603 $ 475,855 $ 1,211,106 $ 1,537,534 $ 1,835,948 $ 5,223,046 $ 1,024,458 $ 1,019,502 $ 1,773,472 $ 2,118,390 $ 2,418,716 $ 8,354,539 $ 375,000 $ 75,000 $ 75,000 $ 75,000 $ 75,000 $ 75,000 $ 375,000 $20,000 10,000 10,000 - - - 20,000 $310,200 75,000 235,200 - - - 310,200 $100,000 100,000 - - - - 100,000 $11,000 11,000 - - - - 11,000 $816,200 $ 271,000 $ 320,200 $ 75,000 $ 75,000 $ 75,000 $ 816,200 $ -$ 2,250,000 $ 450,000 $ 450,000 $ 450,000 $ 450,000 $ 450,000 $ 2,250,000 $2,250,000 $ 450,000 $ 450,000 $ 450,000 $ 450,000 $ 450,000 $ 2,250,000 $ -$ CapitalImprovementsProgram 2025-2029Program ScheduleofCapitalExpendituresbyFundingSource CapitalProjectsFund(fundingsourcesare25%ofLocalSalesTaxand85%ofCountywideSalesand UseTax) Estimated countywide sales & use tax revenue Less transfer to Debt Fund for Thornton Street Less transfer to Debt Fund for Business & Tech Park bonds Less transfer to Street Projects Fund for sidewalk program Less transfer to Streets Fund for sidewalks & curbs Less transfer to Street Projects Fund for curb program Estimated local sales tax revenue Less transfer to Recreation Fund for annual operations Less transfer to Debt Fund for aerial ladder Less transfer to Debt Fund for 2022 parks temp note Less transfer to TIF Funds NetlocalsalestaxrevenueavailabletofundCIPaftertransfers Less transfer to Street Projects Fund for pavement management program NetcountywidesalestaxrevenueavailabletofundCIPaftertransfers EstimatedsalestaxavailabletofundCIPprojects ProposedCIPprojectsfortheCapitalProjectsFund Buildings&grounds City Hall annual maintenance LED lighting upgrades in multiple buildings (except City Hall) City Hall HVAC upgrades & safety enhancements Library maintenance - roof urethane coating Library maintenance - west wall panel attachment Totalbuildings&grounds Vehiclereplacementprogram(EnterpriseLeaseProgram) Police SUVs, pick-up trucks, animal control van, & other city vehicles (estimated annual lease payments net of vehicle sales) Totalvehiclereplacementprogram Page 30

Informationtechnology

Annual allocation for computer equipment

Hand-held radio replacement (managed by P.D. for Parks, Streets, & other departments)

Replace desktop phones (moved from 2024)

Edge switches

Core switches: City Hall, Justice Center, & Fire Station #2

UPS (Uninterruptable Power Supply) City Hall, Justice Center, & Fire Station #2

Firewalls

Routers - current phone and network traffic

Replace the Nimble storage system

Meraki Z3 - wireless system

Upgrade audio/visual in City Commission room

7th Street Corridor Study

MARCs funding for 7th street corridor

ScheduleofCapitalExpendituresbyFundingSource

Total Unscheduled

AmountReq. 2025-202920252026202720282029

CapitalImprovementsProgram 2025-2029Program

CapitalProjectsFund(fundingsourcesare25%ofLocalSalesTaxand85%ofCountywideSalesand 280,000 $ 56,000 $ 56,000 $ 56,000 $ 56,000 $ 56,000 $ 280,000 $ -$ 30,000 30,000 - - - - 30,000 $36,000 36,000 - - - - 36,000 $160,000 30,000 - - - 130,000 160,000 $90,000 - - 90,000 - - 90,000 $25,000 - - 25,000 - - 25,000 $70,000 - - 70,000 - - 70,000 $60,000 - - - 60,000 60,000 $500,000 - - - - 500,000 500,000 $25,000 - - - - 25,000 25,000 $67,000 - - - - 67,000 67,000 $1,343,000 $ 152,000 $ 56,000 $ 241,000 $ 116,000 $ 778,000 $ 1,343,000 $ -$ 130,000 $ 130,000 $ -$ -$ -$ -$ 130,000 $ -$ (65,000) (65,000) - - - - (65,000) $65,000 $ 65,000 $ -$ -$ -$ -$ 65,000 $ -$

Totalinformationtechnology Planning&communitydevelopment

Totalplanning&communitydevelopment Page 31

New officer safety equipment - Narcotics Analyzer

Possible availability of opioid settlement funds

Updated technology and replacement: SWAT Team integrated hearing protection and communications devices

Replace 20-year-old equipment (broken): "Throw Phone" for Police Department Crisis Negotiations Unit

Police patrol equipment for new leased vehicles. Sedans are being replaced with SUVs, therefore old equipment will not fit new vehicles.

Replace 2004 SWAT vehicle: Lenco Bearcat armored SWAT vehicle

Possible MARC grant

Bomb suit

Bryne Grant - timing may change

Totalpolice

Fire

Overhead door openers for Fire Station 2 (final 4 of 16 units)

Replace 32 2014 Self Contained Breathing Apparatus and 10 masks

Portable radio maintenance - batteries, microphones, etc.

Concrete driveway replacement

Fire Station #2 locker replacement

Security cameras for stations 1 & 2

Replace 2017 Pumper Unit E1, delivery est. 2032

Replace 2017 Pumper Unit E2, delivery est. 2032

Approve resolution for bonds for 3 fire trucks in 2029.

Replace 2017 Pumper Unit E3, delivery est. 2032

Approve resolution for bonds for 3 fire trucks in 2029.

Replace 2007 Pumper Unit E4, delivery est. 2032

Approve resolution for bonds for 3 fire trucks in 2029.

Totalfire

ScheduleofCapitalExpendituresbyFundingSource

AmountReq. 2025-202920252026202720282029

Total Unscheduled

CapitalImprovementsProgram 2025-2029Program

CapitalProjectsFund(fundingsourcesare25%ofLocalSalesTaxand85%ofCountywideSalesand 35,000 $ 35,000 $ 35,000 $ -$ - $25,000 25,000 25,000 $37,000 37,000 37,000 $350,000 110,000 120,000 40,000 40,000 40,000 350,000 $400,000 400,000 400,000 $(200,000) (200,000) (200,000) $50,000 - - 50,000 - - 50,000 $(50,000) - (50,000) (50,000) $647,000 $ 207,000 $ 320,000 $ 40,000 $ 40,000 $ 40,000 $ 647,000 $ -$ 16,000 16,000 - - - - 16,000 $ -$ 345,000 345,000 - - - - 345,000 $16,000 16,000 - - - - 16,000 $70,000 - - 70,000 - - 70,000 $16,000 - - - 16,000 - 16,000 $56,000 - - - 56,000 - 56,000 $1,000,000 - - - - 1,000,000 1,000,000 $1,000,000 - - - - 1,000,000 1,000,000 $(1,000,000) (1,000,000) $ 1,000,000 1,000,000 - - - - 1,000,000 1,000,000 $(1,000,000) (1,000,000) $ 1,000,000 1,000,000 - - - - 1,000,000 1,000,000 $(1,000,000) (1,000,000) $ 1,000,000 4,519,000 $ 377,000 $ -$ 70,000 $ 72,000 $ 1,000,000 $ 1,519,000 $ 3,000,000 $

Police

Page 32

ScheduleofCapitalExpendituresbyFundingSource

Engineering

Replacement & upgrade of GPS unit for GIS Department

2023 and 2025 biannual bridge inspection

Plotter replacement

Street Eq. - 1635 gallon brine sprayer with boom

Street Eq. - replace 2008 compact track loader

Street Eq. - replace 2011 International dump truck (asset #3324)

Street Eq. - replace 2010 Freightliner dump truck (asset #3326)

Street Eq. - replace 2017 Doosan rubber tire loader (asset #102)

Street Eq. - replace 2017 Atlas CC1300 roller (asset #164)

Street Eq. - replace 2015 Freightliner dump truck (asset #3331)

Street Eq. - replace 2017 Ford F550 1 ton single axle dump truck (asset #3323)

Street Eq. - replace 2014 International 108sd single axle dump truck (asset 3328)

Street Eq. - replace 2015 Ford F550 1 ton single axle dump truck (asset #3321)

Street Eq. - replace 2009 Elgin street sweeper

Street Eq. - garage - new service truck

MSC - EV charging stations

Totalpublicworks

Total Unscheduled CapitalImprovementsProgram

AmountReq. 2025-202920252026202720282029

2025-2029Program

CapitalProjectsFund(fundingsourcesare25%ofLocalSalesTaxand85%ofCountywideSalesand 20,000 $ 20,000 $ -$ -$ -$ -$ 20,000 $ -$ 135,000 45,000 - 45,000 - 45,000 135,000 $15,000 15,000 - - - - 15,000 $170,000 $ 80,000 $ -$ 45,000 $ -$ 45,000 $ 170,000 $ -$ 16,000 $ 16,000 $ -$ -$ -$ -$ 16,000 $ -$ 89,000 89,000 - - - - 89,000 $200,000 - 200,000 - - - 200,000 $200,000 - - 200,000 - - 200,000 $275,000 - - 275,000 - - 275,000 $40,000 - - 40,000 - - 40,000 $225,000 - - - 225,000 - 225,000 $100,000 - - - 100,000 - 100,000 $225,000 - - - 225,000 - 225,000 $100,000 - - - - 100,000 100,000 $295,000 - - - - - $ 295,000 150,000 - - - - - - $ 150,000 39,000 - - - - 39,000 39,000 $1,954,000 $ 105,000 $ 200,000 $ 515,000 $ 550,000 $ 139,000 $ 1,509,000 $ 445,000 $

Totalengineering Publicworks

Page 33

- scheduled equipment replacement RFCC - Pool area painting (ceiling, walls, railings of pool area to include RFCCbalcony)

RFCC - Indoor track surface replacement

RFCC - gymnasium floor replacement

Equipment - snow removal equipment

Equipment - 2 column /post equipment lift

Equipment - replace parks service truck

Equipment - replace 16' self-propelled mower

Equipment - replace 11' self-propelled rotary mower

Parks - trails - annual allotment

Parks - asphalt seal coating for parking lots at 4 parks

Parks - Cody Park pickle ball court shade system

Parks - disc golf course @ Havens Park

Parks - Riverfront Park fence replacement

Parks - gazebo park development

Parks - overhead protection and shade at Sportsfield Park

Parks - Cody Park restroom/concession facility replacement

Pool & RFCC - Wollman and RFCC drive & parking lot repaving

Pool - Wollman roof replacement

Pool - WAC & RFCC indoor pool lane lines

Pool - training platforms at WAC & RFCC

Pool - WAC vault/pit doors

Pool - WAC deck caulking and repairs

Pool - WAC painting of locker room, restrooms, office and break room

Pool - Wollman slide restorations

Pool - Wollman Pool painting and caulking Totalparks

ScheduleofCapitalExpendituresbyFundingSource

Total Unscheduled

AmountReq. 2025-202920252026202720282029

CapitalImprovementsProgram 2025-2029Program

CapitalProjectsFund(fundingsourcesare25%ofLocalSalesTaxand85%ofCountywideSalesand 198,450 $ 198,450 $ -$ -$ -$ -$ 198,450 $ -$ 224,956 112,478 112,478 - - - 224,956 $127,091 23,000 24,150 25,358 26,626 27,957 127,091 $98,936 - 98,936 - - - 98,936 $84,000 - - 84,000 - - 84,000 $205,000 - - - - - - $ 205,000 56,370 56,370 - - - - 56,370 $17,932 17,932 - - - - 17,932 $98,768 - - 98,768 - - 98,768 $171,033 - - 171,033 - - 171,033 $127,000 - - - - 127,000 127,000 $225,000 45,000 45,000 45,000 45,000 45,000 225,000 $57,000 57,000 - - - - 57,000 $65,000 65,000 - - - - 65,000 $55,000 55,000 - - - - 55,000 $55,000 - - - - 55,000 55,000 $515,000 - - - - - - $ 515,000 260,000 - - - - - - $ 260,000 550,000 - - - - - - $ 550,000 82,552 82,552 - - - - 82,552 $30,800 30,800 - - - - 30,800 $5,663 5,663 - - - - 5,663 $8,626 8,626 - - - - 8,626 $10,000 10,000 - - - - 10,000 $20,000 - 20,000 - - - 20,000 $11,547 - 11,547 - - - 11,547 $56,685 - - 56,685 - - 56,685 $100,000 - - 100,000 - - 100,000 $3,517,409 $ 767,871 $ 312,111 $ 580,844 $ 71,626 $ 254,957 $ 1,987,409 $ 1,530,000 $ Parks RFCC

elevator modernization

indoor pool restorations

phases

-

RFCC -

- 2

RFCC

Page 34

2025-202920252026202720282029 Total Unscheduled CapitalImprovementsProgram 2025-2029Program

CapitalProjectsFund(fundingsourcesare25%ofLocalSalesTaxand85%ofCountywideSalesand Unscheduled 816,200 $ 271,000 $ 320,200 $ 75,000 $ 75,000 $ 75,000 $ 816,200 $ -$ 2,250,000 450,000 450,000 450,000 450,000 450,000 2,250,000 $1,343,000 152,000 56,000 241,000 116,000 778,000 1,343,000 $65,000 65,000 - - - - 65,000 $647,000 207,000 320,000 40,000 40,000 40,000 647,000 $4,519,000 377,000 - 70,000 72,000 1,000,000 1,519,000 $ 3,000,000 170,000 80,000 - 45,000 - 45,000 170,000 $1,954,000 105,000 200,000 515,000 550,000 139,000 1,509,000 $ 445,000 3,517,409 767,871 312,111 580,844 71,626 254,957 1,987,409 $ 1,530,000 15,281,609 $ 2,474,871 $ 1,658,311 $ 2,016,844 $ 1,374,626 $ 2,781,957 $ 10,306,609 $ 4,975,000 $ 861,854 543,648 562,366 580,857 582,769 162,603 475,855 1,211,106 1,537,534 1,835,948 (2,474,871) (1,658,311) (2,016,844) (1,374,626) (2,781,957) (1,450,413) $ (638,809) $ (243,372) $ 743,764 $ (363,241) $ 3,497,335 2,046,922 1,408,113 1,164,741 1,908,506 (1,450,413) (638,809) (243,372) 743,764 (363,241) 2,046,922 $ 1,408,113 $ 1,164,741 $ 1,908,506 $ 1,545,265 $ SummaryofprojectsfortheCapitalProjectsFund Buildings & grounds Vehicle lease program (net estimated lease payments) Information technology Planning & community development Police Fire Engineering Public works Parks Totalprojectsfundedbycountywideandlocalsalestax SalesTaxFunds-CashForecast Estimated countywide sales & use tax revenue Estimated local sales tax revenue Annual project costs - (Net of grants & bonds) Netrevenueinexcessof/(lessthan)annualprojectcost Sales tax funds estimated year-end fund balance from previous year Net revenue in excess of/(less than) annual project cost Projectedfundbalancetocarryforwardtonextyear Page 35

AmountReq.

ScheduleofCapitalExpendituresbyFundingSource

Pavement management program (5% increase per year)

Sidewalk program (Portion of $300,000 Sidewalk Project funding transferred to Streets Fund. Adding 2 FT Equipment Operators dedicated to sidewalks & curbs)

Curb program

Wilson Avenue improvements

Design expenditures already incurred

Funding allocated to Wilson Avenue Improvements

Waterworks portion of project costs

2025-202920252026202720282029 Total Unscheduled CapitalImprovementsProgram 2025-2029Program

CapitalProjectsFund(fundingsourcesare25%ofLocalSalesTaxand85%ofCountywideSalesand 103,749 $ 110,000 $ 100,000 $ 100,000 $ 100,000 $ 513,749 $ 116,000 116,000 116,000 116,000 116,000 580,000 $ 1,283,143 1,695,750 1,780,588 1,869,652 1,974,408 8,603,540 $ 485,000 509,250 534,713 561,448 578,292 2,668,702 $ 1,987,892 $ 2,431,000 $ 2,531,300 $ 2,647,100 $ 2,768,700 $ 12,365,992 $ Unscheduled 11,604,100 $ 2,100,000 $ 2,205,000 $ 2,315,300 $ 2,431,100 $ 2,552,700 $ 11,604,100 $ -$ 513,749 103,749 110,000 100,000 100,000 100,000 513,749 $580,000 116,000 116,000 116,000 116,000 116,000 580,000 $1,680,000 - - - - - $ 1,680,000 (114,000) - - - - - $ (114,000) (603,346) - - - - - $ (603,346) (147,000) - - $ (147,000) 13,513,503 $ 2,319,749 $ 2,431,000 $ 2,531,300 $ 2,647,100 $ 2,768,700 $ 12,697,849 $ 815,654 $ 1,987,892 2,431,000 2,531,300 2,647,100 2,768,700 (2,319,749) (2,431,000) (2,531,300) (2,647,100) (2,768,700) (331,857) $ -$ -$ 0 $ (0) $ 331,857 - - - 0 (331,857) - - 0 (0) - $ -$ -$ 0 0 $ StreetCapitalProjectsFund(fundingsourceisFFEfundsandtransfersfromsalestaxfunds) Transfer from countywide sales & use tax for sidewalks Transfer from countywide sales & use tax for curbs Transfer from countywide sales & use tax for pavement management program Estimated FFE reimbursements Totalannualrevenueforstreetcapitalprojects ProposedCIPProjectsfortheStreetsCapitalProjectsFund

AmountReq.

ScheduleofCapitalExpendituresbyFundingSource

Totalstreetsprojectcost Annual revenue available for street capital projects Annual project cost Netrevenueinexcessof/(lessthan)annualprojectcost,streets Estimated reserves as of 1/1/2025 Net revenue in excess of/(less than) annual project costs ProjectedfundsintheStreetsCapitalProjectsFundatyear-end Page 36

and apron pavement seal

KDOT Funding - 90%

Upgrade downtown sidewalks at intersections to current ADA Standards. (Design work is complete.)

KDOT Funding. Concept paper approved. Grant application will be submitted in May 2024, Intersection 10th & Limit (submitted for KDOT 90/10 funding. $207,600 design costs in 2024, bids open in 2026) KDOT/Federal funding for 10th & Limit intersection project

revenue available for Grant Funded Capital Projects

AmountReq. 2025-202920252026202720282029 Total Unscheduled CapitalImprovementsProgram 2025-2029Program ScheduleofCapitalExpendituresbyFundingSource CapitalProjectsFund(fundingsourcesare25%ofLocalSalesTaxand85%ofCountywideSalesand - $ 196,172 $ -$ -$ -$ 196,172 $ - $ 196,172 $ -$ -$ -$ 196,172 $ Unscheduled 594,000 594,000 - - - 594,000 $(400,000) (400,000) - - - (400,000) $76,780 76,780 - - - 76,780 $(69,102) (69,102) - - - (69,102) $475,000 475,000 - - - 475,000 $(380,000) (380,000) - - - (380,000) $1,522,400 $ - $ 1,522,400 $ -$ -$ 1,522,400 $ -$ (1,000,000) - (1,000,000) - - (1,000,000) $819,078 $ 296,678 $ 522,400 $ -$ -$ -$ 819,078 $ -$ - 196,172 - - - 196,172 (296,678) (522,400) - - - (819,078) (296,678) $ (326,228) $ -$ -$ -$ (622,906) $ 622,906 326,228 - -(296,678) (326,228) - -326,228 $ - $ - $ - $ - $ GrantMatchingFunds(fundingsourceisfederalandstategrantsplusGeneralFundmatchingdollars,asrequiredbygrant) Transfer from General Fund TotalannualrevenueforGrantMatchingFund GrantPlanningandProjectFund K-7/US Highway 73 surface preservation - Rees to Poplar Streets

KDOT Funding for Rees Street to Poplar Street Airport: taxi-way

TotalGrantPlanning&ProjectsFund

Annual project

Netrevenueinexcessof/(lessthan)annualprojectcost,streets Estimated reserves as

Net revenue in excess of/(less than) annual project cost, streets ProjectedunallocatedGrantPlanningandProjectsFundcashbalanceatyear-end Page 37

Annual

cost

of 1/1/2025

and sewer line repairs

WWTP - Asphalt resurfacing

WWTP - Air scrubber maint/repair, main building

WWTP - Hoffman blowers replacement

WWTP - Holding tank roof

WWTP - Switchgear replacement

WWTP - Press room water lines

WWTP - Air handler - main building

WWTP - Trickling filter #1

WWTP - Motor control center #4

WWTP - Motor control center #9

WWTP - Primary clarifiers

WWTP - Polymer room equipment

WWTP - Electrical transformers

WWTP - UV lamps for channel 1

WWTP - UV lamps for channel 2

WWTP - Hot water unit heaters filter building 20

WWTP - UV lamps for channel 3

WWTP - Duct work - filter building

Non-potable water system

Furniture & fixtures for admin building

Decommission of old admin bldg. - turn into storage

Hallmark force main

Lift station pumps

Trailer mounted jetter

Camera replacement

Flush truck (asset 3372) replacement

Manhole replacements along river