Bullish on ICEs: Accelleron’s Rofka On boarding CCS: Wärtsilä’s de Gruyter

Nanotech coatings: FuelSave’s EGR advance

MEPC80 preview: CII rules and CCS

Bullish on ICEs: Accelleron’s Rofka On boarding CCS: Wärtsilä’s de Gruyter

Nanotech coatings: FuelSave’s EGR advance

MEPC80 preview: CII rules and CCS

Combustion Engine Technology for Ship Propulsion | Power Generation | Rail Traction

Technical Programme

Over 200 lectures, interesting panels and keynotes

Exhibition

New technologies and products

New Formats

Pitch Stage, World Café and other new session formats

Technical Tours

Visits to local industry

Networking & Social Events

Welcome Reception and Gala Dinner, over 800 international experts

Intelligent Power Systems

Digitalization & Connectivity, System Integration & Hybridization

Zero Emissions

Alternative fuels of the future, Emissions reduction technologies

Traditional Topics

New engine developments & other new concepts

And many more

Basic research, advanced engineering, Operators/ End-users experience www.cimaccongress.com

Christoph Rofka, Accelleron’s president

14 Pitch perfect

A new propeller design series tailored to the needs of cruise vessels is being developed under a Dutch-led joint industry project (JIP).

17 Wärtsilä

Wärtsilä is increasing the power output from its 31 medium-speed engine to 650 kW, an increase of 6% in power per cylinder.

16 Accelleron launch

Accelleron is on track to unveil a new approach to low-speed turbocharging for the maritime sector at the CIMAC Congress in June in Busan.

10

Leader Briefing Tamara de Gruyter of Wärtsilä discusses the challenges of balancing footprint, solvent and energy requirements when marinising carbon capture and storage (CCS) technology.

12

Will IMO acknowledge carbon capture’s potential in reducing a ship’s carbon intensity when the topic is discussed at MEPC80? Paul Gunton reports.

FuelSave is patenting an innovative new development for EGR solutions that promises to not only reduce NOX emissions but also reduce CO2 emissions in an after treatment process.

Medium & Low Speed products discusses changes that are affecting the wider maritime propulsion market, and Accelleron’s response in an exclusive interview.

New advanced combustion technology designed to reduce methane slip is being developed for Wärtsilä’s large bore engine platform after earlier success with smaller engines.

30

Kongsberg Maritime’s Rune Garen poses some difficult questions of Paul Gunton, and sees opportunities to learn from nature.

MAN Energy Solutions’ Two-Stroke Business has seen the scope of EGR solutions expand since research began in 2004, as it has become a cornerstone in modern engine design and optimisation.

The tanker industry is monitoring the development of regulations produced by the California Air Resources Board (CARB) that will affect the segment from 2025.

The Motorship’s Propulsion and Future Fuels Conference will take place this year in Hamburg, Germany. Stay in touch at propulsionconference.com

The dust has barely settled on the draft agreement of the EU’s FuelEU Maritime legislation, which has seen difficult issues surrounding the admissibility of carbon-based fuels, the range of renewable fuels of non biological origin (RFNBO), certification and the allocation of funding resolved.

The rules themselves are likely to achieve their primary objective of encouraging the early adoption of sustainable alternative marine fuels into the market, which is intended to support the development of the EU’s domestic alternative fuels infrastructure.

The introduction of the multiplier mechanism to drive early adoption demand for alternative fuels represents an elegant solution to the challenge of creating demand, which in turn incentivise the production and hence the availability of e-fuels.

Subsequently, the rules are expected to expect to foster the development of equivalent to 2% of fuel consumption by 2035, at which point the reduction targets for the greenhouse gas intensity of energy used on board by ships will be raised.

The maritime sector is being asked to play a major role in the introduction of alternative fuels into Europe’s supply chain, acting as some of the first stable sources of demand, which will give European fuel suppliers the certainty to develop supply.

The creation of stable reliable demand will then allow alternative fuel suppliers to overcome the myriad technical and economic challenges that introducing alternative fuel supplies will entail – and Say’s Law will then begin to apply as expanding supply begins to create its own demand. Or to put it another way, the chicken and the egg problem is skirted by funding a poultry farm.

For operators in Europe’s short-sea sector who do not have the appetite or means to invest in offtake agreements with green methanol suppliers, the shortage of commercially available methanol for bunkering remains a key constraint to investment decisions, as Pat Wheater hears in this month’s issue.

Wider issues around the emergence of low-cost sources of renewable e-fuel supply in the US incentivised by provisions of President Biden’s blockbusting Inflation Reduction Act mean that European subsidies to operators to expand alternative fuel consumption may end up funding the most competitive renewable fuel plants on the cost curve. In other words, the supply that may be created may be located in Texas or even in Oman and Saudi Arabia. Investments of close to USD30bn into export-oriented green ammonia plants in the latter two have been announced within the last two months.

Nor is the only area where US regulations are likely to have a wider impact on the market. We note that the California Air Resources Board (CARB) proposal has completed consultation on the introduction of OPS requirements for terminals serving the oil tanker segment between 2025 and 2027.

I hope that you find something to interest you in this month’s issue, which also looks ahead to upcoming discussions about the inclusion of carbon capture technology into CII rules, and includes a interesting article on a potential nanotechnology advance that will improve the efficiency of reduction in EGR units.

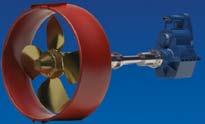

A new propeller design series tailored to the needs of cruise vessels is being developed under a Dutch-led joint industry project(JIP), writes David Tinsley.

Initiated by research body MARIN, the Wageningen FC research endeavour is the follow-up to the F-Series JIP, which realised a systematic range of 150 fixed-pitch propellers for merchant vessels using the latest technological tools. The R&D work showed that the geometric characteristics of propellers for cruise ships and other vessels such as large motor yachts, which impose especially high demands as to onboard comfort levels, differ from the requirements of the gamut of mercantile traders covered by the F-Series.

The objective of the collaboration partners in the Wageningen FC-series project is thereby to design and test 18 additional, fixed-pitch propellers to suit those applications where passenger comfort is of the highest order, married with exacting energy saving criteria. Only five- and six-bladed screws with a pitch ratio equal to, or higher than, 1.0 are being considered.

The F-series programme, which involved a multiplicity of companies and institutes, had followed successive JIPs realising the Wageningen CD-series open and ducted controllable pitch propellers, and Wageningen TT controllable and

fixed pitch tunnel thruster propellers, including rim-driven units. The latest initiative underscores the fact that propeller design has become a continuous drive for refinement and advance, to achieve the best balance between propulsive efficiency, hull vibration levels, and onboard and radiated underwater noise levels.

The FC project is undertaken through recourse to multiobjective optimisation tools, in combination with both boundary element methods(BEM) and Reynolds-averaged NavierStokes(RANS) CFD techniques at the design stage.

All propeller models will be manufactured on a new, five-axis milling machine, and tested in open water conditions using the quasi-steady measurement technique, which was deployed for the earlier CD-series propellers. The dataset of the FCseries will be included in the software of the F-Series JIP as a subset, so as to enable comparison of results.

At its outset, the budget for the FC programme was estimated at EUR280,000($299,500), and it was envisaged that some EUR 190,000($200,500) would be covered by the study partners.

Wärtsilä is increasing the power output from its highly efficient 31 medium-speed engine, the technology company has announced.

Wärtsilä has increased the power output of its highly efficient Wärtsilä 31 diesel engine to deliver increased power density within the same physical footprint. This upgraded engine will increase its power per cylinder to 650 kW, an increase of 6% in power per cylinder.

The Wärtsilä 31 will have the highest power per cylinder of any engine of its bore size. The upgrade will extend the output range of the 31 to a range of 5.2 to 10.4 MW. The increase in power, compared with the current 31-series engines, means the same power demand can be met with fewer cylinders. This will give significantly lower maintenance costs and will offer space advantages where engine room space is at a premium.

The 31 engine is said to have become increasingly popular for installation on a range of vessel types, including among others, cruise ships, ferries, cable layers, ice breakers and fishing vessels.

“With this power upgrade we are delivering significant added value to our customers,” explained Lars Anderson, Director of Product Management at Wärtsilä. “The Wärtsilä 31 is already the best engine in its class, and this development widens its market advantage even further. By extending its performance, we are making a real contribution to

greater sustainability and supporting our commitment to a decarbonised future.”

The first deliveries of the upgraded engine are taking place during the first half of 2023.

8 The Wärtsilä 31 engine upgrade will increase its power output.

Already, seven higher power output Wärtsilä 31 engines have been contracted.

Ronald Ervik, Managing Director of Herøyhav, a Norwegian fishing company and one of the first recipients of the upgraded engine said: “For our new vessel we opted for the Wärtsilä 31 engine because it is the most modern and most efficient mediumspeed marine diesel engine on the market. Not only will it give us the power we need and with dimensions that fit our engine room design, but it will also lower fuel consumption.”

The conceptual design of a carbon capture system onboard an oil tanker has received approval in principle from ABS. The design forms part of a pilot project to demonstrate end-to-end shipboard carbon capture at scale.

The REMARCCABLE project was initiated in 2022. In addition to Deltamarin, the project’s seven-member consortium includes the Global Centre for Maritime Decarbonization (GCMD) in Singapore, the Oil and Gas Climate Initiative (OGCI), ABS, Stena Bulk, Alfa Laval and the Netherlands Organization for Applied Scientific Research (TNO).

The first phase of the project involved conceptual design and a

front-end engineering design study of the carbon capture system. Following the approval in principle, the consortium’s members will decide whether to advance the project to the next stage.

The second phase would include engineering, procurement, and construction of a prototype shipboard carbon capture system and onshore commissioning.

Phase three would focus on integrating the carbon capture system with the MR tanker and conducting sea trials. Following a full engineering study, the carbon capture system will be built and tested prior to integration onboard a Stena Bulk medium range (MR) tanker for sea trials.

The global shipping industry is

looking at a range of solutions, including low-carbon fuels and onboard carbon capture, to help achieve a target to halve its greenhouse gas emissions by 2050 from a baseline of 2008.

The consortium’s members believe the onboard carbon capture system could help accelerate commercial deployment of shipboard carbon capture technology within the next five years.

The GCMD plans to launch a study on offloading the liquid carbon dioxide (CO2) to resolve potential challenges and inform the third phase of the project.

Hyundai Heavy Industries Engine & Machinery (HHIEMD) marked the renewal of its licensing agreement with Japan Engine Corporation (J-ENG) to build UE low-speed engines with a ceremony in mid March. The scope of the agreement extends from engine development to design, manufacturing, sales, and after-sales service. HHI-EMD is one of the market leaders in the manufacture of low speed 2-stroke main engines.

ClassNK has issued a statement of compliance (SoC) to a second ship recycling facility in Bangladesh, verifying that the facility is in line with the Hong Kong Convention (HKC). Although the convention is yet to be ratified, responsible ship recycling yard operators have begun undertaking voluntary certification so as to ensure rigorous safety standards and support ongoing calls for ESG reporting across maritime.

Samskip has awarded Cochin Shipyard a contract for 2+2 container feeder vessels. The container feeders will be equipped with a dieselelectric propulsion system, but are intended to be primarily powered by H2fuelled fuel cells. The vessels are scheduled for delivery in Q3 2025. The vessels will be equipped with onshore power supply connections. The vessel design was produced by Naval Dynamics AS.

NEOM Green Hydrogen Company has entered into an agreement to develop an export-oriented green ammonia production facility with an annual capacity of 1.2 million tonnes. NEOM aims to start the first green ammonia exports in 2026. Construction of the USD8.5bn export-oriented mega-project is expected to begin after it signed financing agreements with a number of financial institutions on 1 March.

Ports must be able to check the background of all vessels and show bodies such as OFAC that they have the technology to screen ships for suspected sanctionsSource: Wärtsilä Corporation

Although the much-vaunted scheme to realise at least 30 domestically-produced, zero-emission ships by 2030 under the Maritime Master Plan has yet to be endorsed by government, Dutch shipbuilders continue to show resilience and business verve, writes

8 New breed: diesel-electric coasters for Vertom at Thecla Bodewes’ Kampen yard

While Royal IHC is the subject of a further rescue plan due to a dearth of new contracts for larger, complex vessels in its target sectors, orderbooks among many of the industry’s key players have seen some strengthening over the past 12 months. Positive influences are an expansion-minded and innovative domestic shipowning and shipmanagement community, with recourse to an extensive supply chain and network of knowledge centres, underpinned by a Dutch propensity for cost-minded, technologically-pragmatic solutions.

Exemplifying the well-proven practice of many Dutch shipbuilders to assign the bulk of newbuild steel fabrication to yards in lower-cost countries, the Polish-built hull of a roro heavy-load carrier recently arrived at Urk, on the IJsselmeer, for completion by main contractor Hartman Marine. The latest project adheres to the production pattern adopted by the Hartman group for successive stages of its in-house fleet development programme.

The 108m Southern Rock is the third in a series of four vessels of the R3 Carrier-type ordered by Hartman Seatrade. With Partner Shipyard in Szczecin, Poland, having built the bare hull and superstructure, Hartman Marine has put in hand the high added-value phase entailing the fitting of the main engine, generators, compressors, separators, pumps, ballast system, navigation and electronic devices, hatch covers and hatch crane, together with interior outfitting, at its Urk premises.

The 3,500dwt R3 Carrier design is a lengthened version of the R2 Carrier type, a derivation of the M2 Runner multipurpose/project cargo vessel class. Shared key features of the ro-ro and general cargo designs include the proportionally large extent of deck space, provision for sailing in open-top condition, dangerous goods certification, and cost competitiveness. With full-width stern ramp access, the adoption of the ro-ro mode is considered a safer, more cost-

effective and less time consuming cargo working method compared to conventional lo-lo, for the target business involved.

The R3 Carrier is 13m longer than its R2 antecedent, allowing an increase in hold length of some 5m to 74m. Both ro-ro versions can accept rolling loads up to 80t per axle, and the ship’s removable tweendecks can take 5t/m2 up to a total 350t per tweendeck.

The continuity and commonality expressed in the Hartman programme yield important benefits as regards production flow and equipment purchasing. While the seminal M2 Runner series made its debut in 2012 via the 93m Oceanic, the initial ro-ro variant first came into being by way of the R2 Carrier Baltic in 2017, followed in the consecutive years by the Western Rock and Eastern Rock.

The R3 Carrier iteration assumed first form in the December 2021-delivered Celtic, and second-of-class Adriatic was commissioned last October. With outfitting of Southern Rock now in hand at Urk, fabrication of the fourth vessel, Rock Carrier, is under way in Poland before transfer to the Netherlands and scheduled handover to the operator during December 2023.

Inland from the IJsselmeer, on the lower reaches of the River IJssel, the town of Kampen has received a boost to shipbuilding activity through what has become an eight-ship series entrusted to Thecla Bodewes by the Vertom Group.

The 7,000dwt dry cargo carrier generation, designated the LABRAX-type, has been developed in association with Groot Ship Design and features diesel-electric propulsion and CFD(computational fluid dynamics) optimisation of the hull form for efficiency across the power and speed profile. The two holds are completely box-shaped, maximising loading flexibility and cargo intake.

David TinsleyCredit: Vertom

The modular propulsion concept employed is intended to allow the vessel to be readily adapted to future carbon emission-reducing solutions. The system distributes the energy load in efficient manner by using smaller engine prime movers for optimised combustion and fuel usage. The arrangements are also designed to facilitate any future switch to methanol-electric or hydrogen-electric propulsion.

Following sea trials conducted during December 2022, class leader Vertom Patty has been phased into trade, while the second ship in the series, Vertom Cyta, was side-launched at Kampen on February 23 this year with a view to April commissioning. Six more sisters are on order, Thecla Bodewes having been awarded the seventh and eighth units a couple of weeks before Vertom Cyta went down the ways, such that the production programme extends into the latter stages of 2025.

Vertom has also joined forces with Groot Ship Design in a project entailing a series of smaller vessels, of 5,600dwt, based on the same platform as the 7,000dwt type. A construction contract calling for six newbuilds to the 99m, diesel-electric design has been placed with Chowgule & Company in Goa, India.

Each of the 5,600dwt multi-purpose cargo ships has been specified with four main generators of approximately 400kW apiece, feeding two 650kW propulsion motors and a 400kW bow thruster. At ‘economical’ speed settings, achieving around 10 knots at design draught, operation will be on three generators.

The company has gone ahead with further investments in wind-assisted propulsion systems by specifying VentoFoil retrofit installations for two of its existing short-sea cargo vessel fleet, the 2009-built, 118m sisters Progress and Perfect.

VentoFoil is the latest version of the VentiFoil solution, and is a wing-shaped element harnessing innovation in aerodynamics to create a high propelling force relative to its size. Vertom had been studying the wind-assist technology in more detail since signing a contract for two VentiFoil units to be retrofitted to the 2008-built, 90m cargo ship Anna in June last year.

Conoship International’s current work on new designs for the short-sea sector shows a predilection towards dieselelectric main power. Electric motors favour the use of a larger-diameter propeller in combination with an optimised aftship form, as encapsulated by the ConoDuctTail arrangement. This allows for very high propulsive efficiency and comparatively modest power in the electric propulsion motors. The large, fixed-pitch propeller is capable of handling wide torque fluctuations.

Drawing on extensive market research, Conoship has formulated a new CIP series of diesel-electric general cargo vessels suited to operations into small ports and river terminals throughout north and west Europe. Contracts were awarded to Holland Shipyards at the end of December last, spanning a total of five singledeckers. Two 88m cargo vessels will be built for De Bock Maritiem of Alkmaar in accordance with Conoship’s CIP 3600 blueprints, while three examples of the CIP 3800-designated 89.4m version have been ordered by Hartel Shipping & Chartering.

In all cases, the frequency-controlled diesel-electric power train, based on a pair of 374kW electro motors, will regulate the speed of the screw according to variables such as load factor, water level and navigation route. Fuel savings as great as 30-35% are anticipated.

The three diesel generators are to be sited on the upper deck, facilitating access for future adaptation of the prime movers for alternative fuels and the requisite fuel storage. The electric propulsion train would remain unchanged in such a conversion. Moreover, the CIP series has been prepared to facilitate the adoption, either at the newbuild

stage or through subsequent retrofit, of wind-assisted propulsion using Econowind’s VentiFoil sails. Hartel has committed to VentiFoils for the first of its newbuilds, and expects to thereby realise an additional gain in fuel efficiency in the order of 8-12%.

Conoship plans to augment the CIP offering with a 5,800dwt variant, currently under development. Whereas the 3600 and 3800 designs provide for the fitting of twin VentiFoils forward, at the fo’c’sle, the 5800 type is proposed with provision for three such sails along the port side.

A northern research consortium coordinated by Conoship International has examined the feasibility of a shared centre for robotised shipbuilding production. The completed report under the SHARED FACILITY initiative was handed over to the Groningen provincial authority in January 2023, and demonstrated that an automated, micro panel line would be technically, financially and organisationally feasible given sustained cooperation.

Conoship was partnered in the investigative project by the Groninger Maritime Board(GMB) Foundation, technology industry association FME and over 30 companies from the northern Netherlands’ maritime sector, including shipyards and equipment suppliers, plus specialists in automation and digitalisation. Consideration is now being given to a follow-up project, entailing the setting up of a pilot plant or Fieldlab, where companies and knowledge institutions could develop related production techniques for shipbuilding.

The Damen Shipyards Group has implemented a major new phase of business development focused on the offshore energy market. Part-and-parcel of the strategy, the design offering was recently augmented by the FLOW-SV vessel concept, addressing the challenging task of supplying and installing ground tackles for floating wind turbines and prepared for future operation on methanol. Indicative of its resources, Damen is currently undertaking the structural fabrication and outfitting of two high-voltage directcurrent(HVDC) offshore transmission topsides at its Mangalia yard in Romania.

A major investment is taking place at MARIN’s Wageningen establishment, by way of the construction of the new Seven Oceans Simulator centre(SOSc). Expected to be operational by 2024, SOSc will contribute to maritime safety and technology through realistically simulate the behaviour and interaction of ships and crews in challenging conditions and situations at sea.

Besides research into shipping safety, the virtual test facility will enable users to experience and validate the behaviour of newbuilds during the ship design phase, providing insights into the fundamental role of the crew and onboard cooperation. The centre will contribute to the development of innovative vessels offering the highest safety level in adverse sea conditions.

SOSc will feature spherical simulators giving wrap-around, upward and downward projection, with a moving bridge, and a laboratory incorporating VR/AR(virtual/augmented reality) technologies, plus human factor management and observation techniques.

Vertom has also joined forces with Groot Ship Design in a project entailing a series of smaller vessels, of 5,600dwt, based on the same platform as the 7,000dwt type

Tamara de Gruyter of Wärtsilä discusses the challenges of balancing footprint, solvent and energy requirements when marinising carbon capture and storage (CCS) technology for onboard CCS systems, and calls for regulators to bear CCS technology in mind during MEPC80 discussions

Thank you for agreeing to the interview. Looking at the wider regulatory context for carbon capture and storage (CCS), could you discuss the importance of establishing a clear regulatory framework?

If you look at the regulatory context, a lot of things are moving in the right direction. We have had carbon compliance indicators, such as CII, EEXI, and the emissions trading system (ETS) in the EU, as well as fiscal regulation.

These are starting to impact our customers’ operations … driving us all towards a greener world. One element of a greener world for us is also CCS. And I think while the IMO is maybe a bit slower, they acknowledge the potential, but I think then really getting regulations for maritime that are global, that's not really there yet.

But the regulatory environment is important, because it also sends a clear message to the industry, about the kind of technology they should invest in. And carbon capture is definitely one of the many technologies that can help customers.

One of the interesting aspects of CCS that has yet to be defined is how credits for CCS should be structured. Do you think the scheme should ascribe credit if the CO2 is reused?

I think it would be a good thing. When you look a bit more medium or long term, probably it's going to be a licence to operate. It’s going to be part of your operational costs there because that's the only way to incentivise people to bring down the CO2 footprint of the ship by whatever means. I also think, when considering what to do with all this captured CO2, that early movers will have the opportunity to sell the CO2 capture.

Over the medium to long term, we will be capturing way more CO2 compared to other industries. There's likely to be a transition when you're not going to get paid for the CO2 you are able to deliver, but you have to pay to dispose of it. At some point there will be too much and then it will have to be sequestered somewhere. And that probably has a price. I think this will also be a journey for the CO2 industry that will develop after the CO2 is captured.

Which leads into some wider questions about the emergence of supply chains for renewable or green ammonia, green methanol or other e-fuels. Do you think that might also emerge as an end use market for some of the captured CO2 without having to look into underground sequestration?

Of course, green fuels also form part of the potential end-use markets [alongside carbonated drinks and greenhouses]. While we would like to see all the steps in the process ready, I think… you also have to accept that certain things will play out over time.

We are focusing on the onboard carbon capture, but the maritime industry is not the only hard-to-abate industry that is looking at CCS. So, I think we will also benefit in the marine

industry from the infrastructure that will also be built for land based carbon that is [going to be] captured. We are playing a central role in LINCCS (linking carbon capture and storage) for the CCS value chain, which is a collaborative cooperation between many companies.

Since we spoke in Vaasa in 2022, the CCS market has been transformed with a large number of technology developers seeking to develop marinised solutions.

Yes, it does seem to be evolving very quickly. It has definitely become an active space. Within Wärtsilä, we have a saying that “green is not black and white”. Unlike in previous transitions, we think that there will be a multitude of solutions, reflecting local technology and fuel availability.

Looking further ahead, we should recognise that we are likely to be working with fossil fuels for quite a long time. Because, as our experience with LNG has shown, it's not so easy to really transform our whole industry rapidly, and partly because some of the green fuels under consideration, such as methanol or some biofuels, might not be fully carbon neutral unless you combine them with carbon capture.

Before we look at the technology itself, do you think that there could be a role for some sort of certification to ensure the CO2 has been captured and safely disposed of?

I think it's a good question. When I look at it more from a ship perspective, I think it's how are you as a ship owner going to prove that you are capturing the carbon? I think that's the first step, you're capturing it from your fuel. So I think that that is something that probably will be regulated or tested, I can also imagine that you probably have to do a test on board of the vessel to prove that the system is working.

I think that is a separate issue to your wider question, which is how to certify that the whole CO2 sequestration chain has been followed.

A related question is the extent to which you see the introduction of CCS as dependent upon the introduction of a carbon price?

I think that regulation has been one way of forcing the industry to take steps, and the social licence to operate is another strong driver.

We recognise that financial incentives are also required to ensure a common playing field and to reward market participants who have invested in decarbonisation technologies such as this one.

But returning to the first question, do you think that the upcoming meeting of the MEPC committee at the IMO in June needs to add carbon capture into the list of recognised technologies for CII and EEXI purposes?

I would like to see a bit more speed and also recognition of CCS as a technology. I also hope that we realise that

there's not enough carbon or carbon free fuels, that because you will then have to make them maybe with fossil fuels. So, we also have to have enough realism not to rule out certain solutions, because we feel they are maybe not green enough.

Turning to some of the shoreside infrastructure issues, would you like to address any of the concerns about the handling of captured carbon, given the toxicity of pure CO2, as well as moisture constraints.

CCS has been used for many years, so it's not exactly new technology. While I don’t think there has been much incentive to use it in a very wide scale, you could say some land-based projects have definitely proven its technical, but also commercial viability.

At Wärtsilä, we are focusing on onboard carbon capture for maritime, and there is a lot of knowledge in the world by other parties, and at some point would have to buy the shore side infrastructure. There are already some projects, especially in North Europe, ongoing that have started to work on this.

The fact that CCS solutions are actually already in the market, means that the infrastructure to discharge CO2 shouldn’t be a barrier to wider adoption, I guess. Which is a key difference compared with some other breakthrough technologies, like hydrogen.

I think the main challenge that we have is that if you want to marinise this technology, it needs to fit on a ship. And in a lot of cases, it might have to fit on an existing ship where [no] space was [originally allocated] in the first place.

It is very important to show how to make CCS neat and small, but also how to make it durable to be able to use onboard a ship, which is very different from stationary landbased uses. So the challenge is how to use that technology and put it in reliable, sturdy, small footprint, concepts that we can use onboard ships.

And that leads us really neatly on to where you're spending a lot of your time, which is exactly looking at those looking at those challenges.

Yes, exactly. I think the other thing we shouldn't underestimate is that you don’t only have to make it in a size that fits in a weight, but that [you have to manage] the energy consumption. You cannot put a second main engine on the ship just to run the carbon capture plant.

I think that that is an extremely important element. If I can share a story from the market, I remember talking to a ship owner in Asia who was proudly telling me that they had taken part in a carbon capture pilot project. But he also admitted that the vessel couldn't leave the port because the whole engine power was running the carbon capture plant.

He said that as a proof of concept, it worked. But it's not something we can use. The challenge of how to make CCS

There are several regulatory initiatives to promote the use of fuels made with recycled carbon.

These include the EU’s Renewable Energy Directive (RED II), which promotes the use of “recycled carbon fuels” as long as they generate emission savings of at least 70%

possible in reality on board a ship is one we're working on with our R&D team..

And one of the areas of research is around solvent consumption. Is the development of solvents a space that you’re actively looking at, or are looking at mature solvents as a first phase?

Of course, we are testing a lot of different solvents to make sure that we pick the right one. But I think you also need to have [solvent] availability and reusability. I also believe that as this industry grows not only in marine, but also on land, of course, the solvent space will divide.

But I think that solvent selection is definitely one of the key things in order to make CCS a financially viable concept, alongside energy consumption and reusability.

Do you see there being a kind of minimum threshold in terms of energy consumption? Or do you anticipate there may be progressive reductions as the technology matures? Or perhaps both?

I think it's a very good point. Because I think first of all, you need to come with a solution. But solvent selection is a key. It's a key critical factor, because the solvent, of course, also has an impact on the energy needs on board.

Can you give us an update on how things are going with your own developments?

But we are currently doing testing, and testing actually takes quite a long time. We are iterating, we are doing the testing. In addition, we are planning to schedule the next big test within the next 12 months on board a vessel. I'm quite sure that this continue to productise the technology.

within the next 12 months on board a vessel. Im quite at first pilot will also give us a lot more input to e the

And you're looking at developing your onboard CCS solutions for both the 2-stroke and 4-stroke market? Do you think that it will, will be particularly interesting for vessels for operators looking for retro existing assets?

nd finally, you mentioned that ou're your d e and 4-stroke hat it will, will be ting for g retrofit solutions for their g assets?

eah, I think I think it will raise a lot of terest fits because it could er a financial incentive, or how to tions, fits, because for the nt ecially some ybe ithin the that ed to be

Yeah, I think I think it will raise a lot of interest for retro be either a comply with the CII indicator. According to our calculations, I believe that there is a large market for retro merchant segment, it's not so easy to especially with some ships that are maybe a bit older, to still keep them within the eight things that they need to be.

relative to their fossil counterparts.

In the State of California in the United States, a Low Carbon Fuel Standard provides credits for fuels with a lower carbon intensity than petrol, with credits trading at USD 90/ ton of CO2. This measure can be combined with the US 45Q tax credit, which has

recently been increased through the Inflation Reduction Act to USD 60 per ton of CO2 used, providing emission reductions are verified.

The IEA notes that national requirements for low-carbon fuels in aviation fuel have been introduced in France, Norway and Sweden and France.

At first sight, carbon capture and storage (CCS) seems an obvious factor to take into account when calculating a ship’s Carbon Intensity Indicator (CII): it reduces a ship’s carbon emissions and thus its carbon intensity. But it is not currently included in the calculation, although momentum is building for that to be reviewed and IMO’s Marine Environment Protection Committee has it on its agenda..

CII came into effect on 1 January 2023 to provide a measure of a ship’s efficiency in terms of its emitted CO2 per cargocarrying mile, using fuel consumption as the main parameter for calculating how much CO2 is emitted. The notion that there could be a technology that retains some – perhaps most – of those emissions onboard, was not taken into account.

One company that makes such equipment is Wärtsilä and a comment to The Motorship by its director of exhaust treatment, Sigurd Jenssen, gives a clue about its omission. The company looked at CCS a decade ago and “didn’t really think this was doable. But we’ve changed our minds”, he said.

He believes that legislators have been on the same journey as they developed greenhouse gas (GHG) strategies. They began with energy efficiency, voyage optimisation and lowcarbon fuels, but their views have matured to take a more holistic view, he said. “Then, carbon capture easily comes into the picture.”

It is easy to see why CCS might not seem an attractive route towards tackling emissions. The captured CO2 weighs about three times that of the fuel burned, which will have an impact on a ship’s displacement during a voyage; the collection machinery requires a significant amount of fuel (estimates vary, but 10-20% of installed power are typical figures); CAPEX and OPEX will increase; offloading and onshore storage complicate discharge calls; and monitoring and confirming that the CO2 is actually permanently locked away – or transferred to a re-use facility – will add regulatory burdens.

On the other hand, IMO’s Initial GHG strategy includes two related ambitions that share a 2050 goal: to cut annual GHG emissions from international shipping by at least half and to aim to reduce the carbon intensity of international shipping by 70%, both compared to 2008. With carbon capture, “you can essentially reach 2050 targets today”, Mr Jenssen said.

Not only that, but this delivers a much greater total emissions reduction between now and then that could be achieved by the 2-3% per year reduction envisaged by the current CII reduction curve. On that basis, CCS “would enable a much more aggressive reduction in emissions”, he added.

It was the Republic of Korea that first brought CCS to MEPC’s attention, in a paper submitted for MEPC 76 in June 2021, although scheduling pressures led to it being held over for a year, to MEPC 78, for discussion.

Korea’s paper made the same point as Mr Jenssen: “now is a timely stage for introducing measures for onboard CO2 capture so as to promote the adoption of innovative CO2 reduction technologies as well as provide the opportunity to

reduce CO2 emissions … to meet the goals set by the Initial Strategy at the earliest possible moment”, its paper argued. It also noted that EEDI/EEXI calculations should also take account of the impact of CCS.

Discussions at that meeting included views both in support and with concerns about the proposal and the committee asked for “further information and concrete proposals” to be submitted to future sessions.

The result was six submissions on the topic at MEPC 79 in December 2022, including one by Norway. It called on MEPC to set up a dedicated work stream to consider the use of CCS technology, with three terms of reference. First, it should review the status of technological development of onboard carbon capture applications; second it should identify possible options for the accounting, verification and certification of captured CO2; and consider how to incorporate onboard carbon capture into IMO’s regulatory framework.

Lloyd’s Register’s lead decarbonisation consultant, Brijesh Tewari, drew The Motorship’s attention to a particular section of that paper, which suggested that “for the calculation of the CII, the accounting might be easier as the actual mass of CO2 delivered to a certified transport network could be used … [and be] potentially subtracted when calculating the emissions of the ship.” The paper also suggested that “the same approach can be used in a market-based measure such as an emission trading scheme or a levy-based system if developed.”

In that section of the paper, Norway also identified “a need for stand-alone guidelines regarding the verification of systems relating to the performance, the characterisation of the carbon dioxide stream and possibly a recognised certification scheme for environmentally safe permanent storage.” This, it said, could require amendments to MARPOL Annex VI.

Korea also submitted a paper to MEPC 79, in which it noted that CII, EEDI and EEXI calculations are based on tank-to-wake (TtW) methodology, while IMO’s draft Lifecycle Assessment (LCA) guidelines apply a well-to-wake (WtW) approach. It pointed out this inconsistency and said that “onboard CO2

8 We’ve changed our minds” about carbon capture, says Sigurd Jenssen

capture can be included only in IMO GHG regulations based on WtW methodology.”

No decisions were taken on how to incorporate CCS into CII, EEDI or EEXI during MEPC 79, “owing to time constraints”, the meeting’s summary reported. Instead, MEPC agreed “to further consider proposals related to onboard CO2 capture” at MEPC 80, which will take place 3-7 July.

“This means that the documents already submitted are kept alive, which is important”, commented Eirik Nyhus, DNV’s environment director, in conversation with The Motorship. He is also a member of Norway’s IMO delegation and is concerned that there will be little time during that meeting to discuss it in depth, because that meeting will have a busy agenda. It is possible, he said, that the topic could be moved on to the next intersessional meeting or to MEPC 81, which will take place in 2024.

Even if it is discussed during MEPC 80, no firm decisions will be taken on how to apply CCS, Mr Nyhus believes. Not only does it present technical challenges, “but there’s also the issue of what happens with the CO2 once it gets delivered to shore”, he said. “We do not want to see it vented outside the port gates, so environmental integrity is a crucial point.”

Another potential destination for captured carbon could be to use it as a feedstock for making renewable methanol or ammonia, something that would also have to be considered in any WtW calculation and the LCA guidelines, he suggested, since “if you use recycled carbon, there is a potential that would reduce [those fuels’] production footprint.”

It is not only fuel production that would benefit from

captured CO2. A submission by Liberia and the International Chamber of Shipping included a list of industries that can use the gas, such as the fertiliser sector, which they say uses 130Mt per year. Oil and gas processors use 70-80Mt/year for enhanced oil recovery, the paper noted, while other commercial applications include food and beverage production, metal fabrication, cooling, fire suppression and stimulating plant growth in greenhouses.

Asked whether shipowners might gain some form of carbon credit for delivering CO2 for recycling, Mr Nyhus said that this had not been discussed and “it would be really horrendously complicated to make such a system work.” He did not rule out some kind of market-based measure including CCS eventually being developed, but “that is for the post-MEPC 80 era.” A more likely outcome, he suggested, would be that companies would reflect such actions as part of their voluntary Environmental, Social and Governance (ESG) policies.

CII is due to be reviewed in 2025, with adjustments made if necessary to keep the industry on track towards hitting the 2050 target of reducing GHG emissions by 70%. So any changes to its formulation to take account of CCS may not be introduced until then, Mr Nyhus believes. In the meantime, CCS may eventually be addressed through IMO’s LCA guideline. While the first version is expected to be approved at MEPC 80, incorporating CCS may have to wait until a later version he suggested.

That will not be the end of the debate, however. “We still need to have the political discussion at IMO about how, and to what extent, should that guideline be applied to existing and future regulations.” Resolving that could take until 2025, he said. “We are eating the elephant in very thin slices.”

While IMO grapples with the technical and regulatory aspects of adopting onboard carbon capture and storage (CCS), it remains to be seen whether shipowners will embrace the opportunity.

We are planning to, says gas tanker operator Solvang. No, we probably won’t, says car carrier specialist Wallenius Wilhelmsen.

Solvang is one of several shipowners working with Wärtsilä Exhaust Treatment to deploy CCS technology and intends to install a full-scale pilot retrofit on one of its ethylene carriers, the 21,000m3 Clipper Eos. Wärtsilä has already built a land-based 1MW test system at its Norwegian headquarters and plans to fit the ship’s system this year.

When the contract was announced in 2021, Solvang’s CEO Edvin Endresen said that CCS “could be an important key to decarbonise the world’s deep-sea fleet.” The vessel is time-chartered to Japan’s Marubeni Corp, which is “committed to cooperating with Solvang and Wärtsilä … in a mutual effort to drastically reduce the CO2 footprint of the vessel”, the 2021 statement said.

More recently, in November 2022, Wärtsilä secured its first order for CCS-ready 35MW open-loop scrubbers for four 8,200TEU container ships. Their owner and Asian yard have not been disclosed.

Wärtsilä’s head of exhaust treatment, Sigurd Jenssen, told The Motorship that interest in CCS “is massive. Every shipowner is keen to understand how this could be applied to their fleet.” It offers them a way of addressing emissions that is lessdisruptive than alternatives because of the amount of CO2 reductions that can be achieved, despite the cost and operational compromises required, he said.

For example, although additional tanks are required to store the CO2, the added volume is no worse than the additional volume required to store less energy-dense fuels such as LNG and methanol, and certainly better than storing ammonia or hydrogen, he said.

On the Solvang vessel, for example, two deck-mounted tanks will hold about 720m3 of CO2 that will be recovered by Wärtsilä’s carbon capture equipment, which will remove about 66% of the emitted gas. That is sufficient to support a transatlantic crossing and although the extra weight will affect cargo capacity, it is not enough to make the operation uneconomic, Mr Jenssen said.

But for Roger Strevens, vice-president of global sustainability at car carrier Wallenius Wilhelmsen, the 3:1 ratio between the weight of CO2 produced and fuel burned

is a significant concern. Then there is the space needed both for storage and for the capture equipment: “We are volume carriers, constantly squeezing the engine, machinery and fuel into the smallest possible spaces,” he said.

He is also worried about operational impacts. Matching CCS-equipped ships to ports with suitable reception facilities would limit their scheduling flexibility and he foresees practical difficulties in discharging the stored material. “Our preference is to have no obstructions whatsoever on the berth” and offloading “several thousand tonnes of frozen CO2 is going to occupy some space.” In short, as things currently stand, “we don’t see very good prospects for carbon capture onboard our vessels,” he said. But CCS could work for other operators. Those providing short haul services with regular calls at their home port, for example, may find CCS an interesting solution, he said.

An ABB study based on three years of operational ship data mounts the compelling case for integrating battery power onboard modern icebreakers, writes Samuli Hänninen, who specializes in icebreaking vessels at ABB Marine & Ports

The maritime industry is still at the formative stage of realizing the gains available from batteries, but the ability to scale up to megawatt-hour levels is not the only attraction for the zero-emission technology. Evidence newly disclosed by ABB suggests that the improvements made to power efficiency and responsiveness can make a decisive difference for the performance of icebreakers operating in extreme conditions.

Demanding high installed power, icebreakers should also be efficient across a wide variation in power needs, especially given that they operate in areas where emissions face particular scrutiny. However, conventionally the need for high dynamic loads is met by oversizing generators running on fossil fuel – a solution which is highly inefficient when engine loads are low.

Slow load ramping is also a common problem for diesel engines, while new generation LNG engines are even less responsive. At the propulsion controls, icebreaker operators are often ready to respond but left waiting for engines to ramp up. Time lags like this can encourage what some call a conservative approach to operations, and others call out as inefficient: if an engine takes 10 minutes to warm up to 100 percent power, crew operating at loads in the margin between two and three engines will prefer to run continuously on three.

Battery power integration by ferry and cruise ship owners offers strong guidance on the way instantly available stored energy can improve the performance of other ship power sources by assisting peak shaving or spinning reserve, as

well as providing a zero-emission power alternative. Understandably, newbuilds account for the vast majority of battery installations to date, but the number of cruise, ferry and cargo ship retrofit projects is growing.

As one of the leading companies driving sea-going battery power, ABB has evaluated the impact of installing an energy storage system (ESS) onboard icebreaker Polaris. Delivered in 2016 but still one of the most advanced icebreakers in the world, Polaris was the first ship in its class to run on liquefied natural gas (LNG), driving four Low Pressure Dual Fuel (LPDF) engine driven gensets. The vessel is owned and operated by the Finnish state-owned company and has combined electrical power plant output of 22.5 MW.

Like many icebreakers before it, Polaris features an Azipod® propulsion system from ABB – in this case two 6.5 MW stern units and one 6 MW bow unit from the Azipod® VI product family ranging from 6-17 MW, developed and tailored for icebreaking vessels. The high torque induction motors in the propulsors come with a simple and durable construction and can deliver up to 180 percent of over torque, ensuring that the propeller rotates even during the heaviest ice interactions.

Plug-in simulation

Using data drawn from three full winter seasons operating in the Bay of Bothnia, ABB’s Polaris study sets a new precedent in evaluating the impact of ESS technology on a new ship type.

8 ABB’s simulationbased study indicated that installing a battery can play a positive role in the power system of the Polaris

With an overall objective of simulating a battery system that could absorb large load variations, to improve fuel efficiency and ramping capability, ABB uploaded powerplant load profile data from real operations in ice to a MATLAB file. The model evaluated the impact of an ESS Installation on total greenhouse gas emissions, primarily CH₄, in addition to reducing fuel consumption and improving the dynamic performance of the system.

The model worked using a hybrid power system that was simplified in comparison to real operations onboard Polaris, to consist of four main generators (auxiliary generator was excluded), one 4.5MWh and one main system load, with the battery to be charged from the generators. The dual-fuel engines were simulated to operate in gas mode or in diesel mode, with experience-based assumptions made on reduced engine efficiency at lower loads. A linear correlation between load fluctuations, fuel efficiency and CH₄ emissions was also assumed.

Based on a profile that saw Polaris at sea for four consecutive weeks, around 4,000 hours of operations were modelled over a 28-month period.

In the anecdotal example given, a conventionally powered ship working in ice-infested waters and operating at loads at the margins between two and three engines was maintained on three engines, based on the precautionary principle. However, the instant availability of additional power from a 4.5MWh ESS implies room for maneuver. The ESS will provide immediate propulsion power to cover the time it takes for additional main engines to come online, for example.

In the scenario given, safe operations should be possible for more of the time with two engines online supplemented by peak load battery power. From the Polaris simulation, ABB suggests that the immediate availability of power as needed would reduce main engine usage hours by up to a very substantial 46 percent of online time, with consequent fuel and emissions savings, and other knock-on benefits for maintenance and through-life cost.

Together, the operating profile and expectations on environmental footprint make the vessel type the ideal candidate to exploit the peak loading, spinning reserve and

zero-emission power capabilities available through integrating batteries into propulsion. For LNG, ABB’s simulation suggests that including the ESS onboard Polaris would result in a 38 percent CH₄ reduction, 16 percent less fuel consumption (based on 46 percent reduction in engine hours); for diesel, the result is a 10 percent reduction in fuel consumption, 36 percent reduction of engine hours.

By being more responsive to power load needs, the addition of the ESS will also improve the icebreaker’s overall safety margin: an icebreaker engine working to overcome an ice ridge can be exposed to sudden over torque condition, for example; the power ramp with an onboard ESS-equipped vessel is no more than 10-12 seconds.

Despite the limitations of the model, ABB concludes that it is evident from the simulations that installing a battery can play a positive role in the power system of ships like Polaris. As well as reducing the number of engine running hours, the specific example highlights that the use of batteries would also lead to a reduction in the methane slip.

In addition, integrating battery power may be a route to broadening the safety envelope of icebreaking in a way that could allow for reduced installed power/number of main engines. It may be argued that, if most situations requiring full ahead power are relatively short in duration, it would be feasible to increase the capacity of the ESS and do away with one main engine. In some applications, ABB believes this is worthy of further study.

8 The Polaris, the world's first LNG-powered icebreaker, was delivered to the Finnish Transport Agency in 2016. The Polaris features a 6 MW Azipod unit at the bow and two 6.5 MW units at the stern

8 ABB has significant experience delivering electric propulsion systems to icebreakers or ice-going vessels. In 2019, the Azipod-propelled Norwegian coastguard vessel KV Svalbard visited the North Pole as part of an international research project

Christoph Rofka, Accelleron’s president Medium & Low Speed products and VP Communications at CIMAC, discusses changes that are affecting the wider maritime propulsion market, and Accelleron’s response in an exclusive interview with The Motorship

8 Christoph Rofka noted that techno-economic comparisons between CCGTs and ICEs for energy generation reserve capacity were changing as higher levels of renewable energy capacity entered regional and national grids

Before turning to Accelleron’s own activities, Rofka took stock of the intense pace of technological development taking place in the large bore engine market. The technical programme for the upcoming CIMAC congress in Busan in June 2023 revealed the range of areas in which industry participants have been working on solutions.

Rofka also agreed that the depth and breadth of the programme was a testament to the industry’s response to the IMO’s target of reducing greenhouse emissions by 50% by 2050, compared with 2018.

“The decarbonisation targets have transformed research, which [had been] dominated by traditional targets such as higher efficiency, higher power density, and new engine types… before the industry began to take the IMO targets seriously. But we’re seeing a completely different dynamic [and] a different level of spending by engine manufacturers and their partners on R&D.”

Rofka was keen to stress that the current momentum was not restricted to the marine industry, and that a number of promising developments are emerging in the energy market.

Looking ahead, Rofka noted that the International Maritime

Organisation (IMO) was expected to discuss proposals to introduce more ambitious greenhouse gas (GHG) emission reduction targets at the MEPC80 meeting in June.

“Regardless of whether the IMO strengthens its efficiency goals, it is clear that the maritime industry will need to embrace alternative so-called Net Zero Carbon fuels. For ocean going vessels, this will mean that the current propulsion system, with a low-speed main engine directly coupled to the propeller, is here to stay. So the challenge is that this technology has to be ready and available to burn future fuels. And this is where, of course, all the key technology providers, including us at Accelleron, have to play their part.”

Rofka noted that in addition to LNG, the current range of alternative fuels for the marine market include methanol, while the first green ammonia projects are expected to be delivered after 2025.

The emergence of the first large-scale green ammonia export projects, such as the 1.2 million tonnes per year NEOM green ammonia project in Saudi Arabia which was approved a few days before the interview on 1 March, were expected to

be positive in terms of creating demand for carriers, which in turn would create demand for dual fuel engines capable of running on the alternative fuel as fuel.

“It is important for our industry to move forward with confidence, because this is no time for placing bets on something exotic. Given the tight timeframe, you have to get it right from the beginning. And there's not too much time for, let's say, trying out fundamentally different routes that potentially lead to nowhere.”

From the perspective of a technology supplier, Rofka noted that the development of technology solutions for alternative fuels was an interesting challenge. The Motorship notes that this is particularly the case for ammonia, where the first full scale engine tests have yet to be undertaken.

The uptake of dual-fuel ammonia engines is likely to be running ahead of the establishment of ammonia bunkering availability. This early ramp up period was likely to see vessels continue to operate on diesel-like secondary fuels. As a result, the engine concepts are initially expected to remain close to those currently used. From a turbocharging perspective, the difference is that the expected rise in fuel prices is likely to drive a focus on efficiency and specific fuel consumption.

However, if fuel availability ceases to represent a key constraint on specifying alternative fuel engines in the future, we will expect to see an increasing number of pure-ammonia engines. Rofka noted that while hydrogen was not currently expected to play a significant role in deep-sea shipping, it had quite distinct combustion characteristics.

Rofka noted that one unexpected consequence of decarbonisation requirements was that it mightn reveal new opportunities for ICE installations in stationary markets.

The rapid rise in renewable energy generation that is being seen in many parts of the world is creating additional demand for power generation capacity with very high response rates to stabilise the grid. The need for accompanying investments in load balancing capacity becomes increasingly important once the proportion of renewable power generation from solar power or wind powered sources exceeds a certain threshold for a variety of technical reasons, including the possibility of natural

The emergence of monofuel engines operating on ammonia or hydrogen would be likely to see engine specifications change “quite a bit” from today’s requirements. This would pose some challenges as monofuel NH3 or monofuel H2 engines were likely to evolve in completely opposite directions. Engineers would be likely to rely on richer burning strategies to overcome ammonia’s recognised weak flammability and poor ignitability characteristics.

The high flame speed and highly ignitable nature of hydrogen combustion means that engineers would increase air to fuel ratios combustion, which would lead to higher pressure operations on the turbocharger compared to current solutions.

This means that Accelleron is swiftly preparing for the emergence of demand for new turbocharger solutions within highly compressed timeframes. Rofka noted that Accelleron already commenced by simplifying its portfolio and by fundamentally altering its product development model.

Rofka explained in an interview with The Motorship in May 2022 that Accelleron was seeking to introduce a modular design approach towards technology development, in which

fl

uctuations in wind and solar generation, as well as the inertia certain types of power plant provide the grid.

Combined cycle gas turbines have come to replace internal combustion engines for power generation purposes, as their responsiveness and the low cost of natural gas have made them attractive solutions to meet peaks of energy supply alongside base load generation.

However, Rofka noted that the introduction of renewable energy generation at high levels into some local and national grids was creating different loading patterns, with reserve power generation sometimes standing idle for extended periods of time, which was changing the economics of CCGT

comparisons against ICEs.

CCGTs tend to suffer from low cycle fatigue when started up irregularly to a greater extent than ICEs, while ICEs also tend to have a higher efficiency over a wider load range than CCGTs, which are typically ‘tuned’ for an optimal load.

Rofka noted that while batteries can meet short-lived spikes in demand, ICE based capacity might be able to meet longer-term fluctuations in demand.

“We are seeing projects from US, Italy, the UK and in Ireland,” Rofka said.

This opportunity in the power market was quite distinct from existing demand for ICEs for base load power generation in geographically remote areas , islands or an urgent need for capacity build-up.

It's completely different [now]. We are going forward, and we learn as we go forward. And then we have to adapt fast. So that's a completely different philosophy, and then we have to adapt our processes accordingly

component level advances (in the turbine or compressor stages) could be introduced into the turbocharger design platform as advances occur. In parallel, Accelleron was examining the possibility of introducing a design platform specifically designed to allow the core of the unit to be replaced during port stays.

Earlier engagement with industry partners was likely to offer advantages in contributing to the capture of requirements earlier in the product development cycle. This was also a logical response to a fast-evolving market where the future demands for turbocharger solutions and the pathway of development is no longer predictable for the next five years or more.

“It's completely different [now]. We are going forward, and we learn as we go forward. And then we have to adapt fast. So that's a completely different philosophy, and then we have to adapt our processes accordingly.”

“For us it is strategically key that we position ourselves on the most relevant future fuel engine platform developments. So it's not only then to provide hardware for testing, that that feels best and but also to support with engine performance simulation.”

The modular design strategy, collaborative working approach with engine builders, and integrated digital and physical asset approach outlined by Rofka are expected to form part of Accelleron’s upcoming low-speed turbocharging solution launch.

The approach to low-speed turbocharging is still on track to be unveiled at the CIMAC Congress in June in Busan. Accelleron still plans to bring the new concept to market by the end of 2024.

But the concept is expected to go beyond the simple introduction of alternative turbocharger configurations into the low-speed maritime market.

Development tests conducted in 2023 had confirmed that the solution would make a significant improvement in efficiency levels. “Our ambition remains that we want to be the turbocharger maker with the highest efficiency levels and that will not change,” Rofka said firmly.

But Rofka stressed that the modular design was also expected to act as an enabler for quite advanced future service concepts that cannot be implemented today from a design perspective.

The solution was also expected to integrate digital elements into Accelleron’s service offerings. “So the new hardware together with digital and our service capabilities amount to a service offering that is a step change, if not an evolutionary leap.”

While the development of solutions for alternative fuel powered engines is a major focus for Accelleron at present, Rofka did note that the company was studying nascent technologies, like fuel cells, for potential product niches. There were certain prerequisites for such technologies to attract Accelleron’s interest, including a close relationship with the internal combustion engine. In addition, they were expected to include a strong service element to be compatible with its existing product portfolio.

One such opportunity might exist in the application of turbocharger technology to fuel cells, where the technology can be used to increase the output and efficiency of fuel cells. Fuel cell technology still needs to overcome some technical and commercial hurdles and is unlikely to become commercially viable in the short term. Rofka was at pains to

note that despite a flurry of small-scale pilot projects, there was little prospect of fuel cells entering into the marine market before the end of the current decade.

Off-highway expansion plans

Christophe Rofka also noted that as an independent company, Accelleron was free to pursue commercial opportunities in other segments of the market.

The company has begun Intensify its activities in the high speed diesel engine market, and has already launched its first dedicated products.

Rofka noted that the off-highway Market, which is currently below Accelleron’s product coverage in term of engine power and served by turbocharger makers from the automotive industry, provides interesting opportunities.

The automotive market was highly competitive, and faced longer term challenges as electrification and the introduction of hybridisation were likely to reduce the importance of the internal combustion engine in the segment over the medium term. As a result, some suppliers were choosing to exit the market.

However, the challenges facing competitors in the automotive space were likely to create opportunities for established OEMs like Accelleron in the off-highway market. Rofka noted that the off-highway market was unlikely to electrify to a similar extent as on-highway, owing to wellknown challenges with power densities, which would create a demand for solutions capable of handling engines operating on alternative fuel. “But then they won't have the technology supply from the automotive sector. While we believe that that offers a potential entry for us to extend our portfolio towards the [high-speed] end, it's a long journey.”

8 Accelleron is planning to introduce a novel approach to low-speed turbocharging at the CIMAC Congress in June in Busan, South Korea

For us it is strategically key that we position ourselves on the most relevant future fuel engine platform developments. So it's not only then to provide hardware for testing, that that feels best and but also to support with engine performance simulation

Keynote panel topic: The cost of decarbonisation & who is going to pay?

Some of the topics you can expect to discuss with the keynote panel will include carbon levy funding, funding for investment, national incentives, funding for new technology & hypothecation.

Sponsored by:

Book your place now and save 20%

Secure your place at the 44th Propulsion & Future Fuels Conference, the leading technical conference that provides:

A meeting space for the latest innovation in transoceanic zero-carbon shipping Technical solutions for decarbonising the shipping sector of 5,100 ships Multiple networking opportunities.

Supported by:

THE Media partner:

MOTOR

Meet and network with 200 CEOs and technical directors from ship owning, operating and management policy makers, shipbuilding, fuel, equipment and technology suppliers. Visit: motorship.com/PFFBOOK

Media supporters:

Contact: +44 1329 825335

Email: conferences@propulsionconference.com

Swiss-based WinGD is upping its offerings to the market with its latest development for conditionbased maintenance in its WIDE suite that is currently undergoing trails, writes Samantha

Fisk

Fisk

8 WinGD expects Enhanced WiDE to simplify engine maintenance for crew and fleet managers

WinGD in partnership with Bernhard Schulte Shipmanagment (BSM) are currently carrying out a pilot project for its latest development in condition-based maintenance module for its WiDE suite that the company says will reduce costs associated with maintenance of engine components. It is expected that with this development it will enable predictive maintenance for two-stroke engines in the long term.

The pilot project will monitor five of the engine components onboard the LNG carrier that are crucial for reliable engine operation, which will include cylinder liners, piston rings, exhaust valves, fuel pumps and fuel injectors. The monitoring will recommend condition-based maintenance intervals by using algorithms to estimate their remaining useful life.

The trial vessel is a BSM-managed LNG gas carrier with two five-cylinder WinGD X72DF engines. The crew on the vessel, using the WiDE engine diagnostic system, will be provided with the possible causes to diagnose faults and prompted to add relevant maintenance tasks. The scheduling of the tasks will be calculated based on the predicted remaining useful life for the components affected.

The WiDE remote support team will validate and improve the system throughout the project, which is expected to last for 14 months.

The pilot project is also being run in collaboration with Propulsion Analytics, the software company that assisted in the development of WiDE, with verification provided by classification society Lloyd’s Register. The lass society has developed a special notification for condition-based monitoring systems, adding emphasis on the importance of this technology for the industry.

Rudolf Holtbecker, Operations Director, WinGD highlights

the need in the industry for condition-based and predictive maintenance that: “many operators are seeking to adopt this maintenance concept to reduce maintenance costs, but they need a robust system approved by class societies.” The shipping industry is being pushed by environmentally regulations to adopt more efficient technologies, requiring continuous learning and increasing monitoring and maintenance demands.

However, one of the advantages that condition-based monitoring will have for the future is that it will help “relieve the crew” of unplanned maintenance, notes Holtbecker. Better planning will also make it easier for crew to ensure that parts are available when needed.

mponents need

e new to the WiDE suite anges upgrade mes with the engine”, comments

Condition-based maintenance will give more insight into the condition of engine components and when they need renewal, moving two-stroke engines a step closer to predictive maintenance. The new upgrade to the WiDE suite will not need any systems changes needed, “just an upgrade of the WIDE software that comes with the engine”, comments Holtbecker.

of its

t is offering ext step in WiDE suite

ntenance, the

Through the pilot project and upgrading of the WiDE suite WinGD is expanding its digitalization services that it is o customers. As part of its next step in development of the WiDE suite condition-based monitoring is expected to take maintenance intervals from fixed time-based maintenance intervals to true condition-based maintenance and further predictive maintenance, the company has explained.

JUNE 2023 Southampton United Kingdom 13 15 TO

For more information visit: seawork.com contact: +44 1329 825 335 or email: info@seawork.com

The 24th edition of Europe’s largest commercial marine and workboat exhibition, is a proven platform to build business networks.

Seawork delivers an international audience of visitors supported by our trusted partners.

Seawork is the meeting place for the commercial marine and workboat sector.

12,000m2 of undercover halls feature 500 and equipment on the quayside and pontoons.

Speed@Seawork on Monday 12 June at the Royal event for fast vessels operating at high speed for security interventions and Search & Rescue.

Speed@Seawork Sea Trials & Conference

The European Commercial Marine Awards (ECMAs) and Innovations Showcase.

experts, helps visitors to keep up to date with the latest challenges and emerging opportunities.

The Careers & Training Day on Thursday 15 June 2023 delivers a programme focused on careers in the commercial marine industry.

New advanced combustion technology designed to reduce methane slip is being developed for Wärtsilä’s large bore engine platform after earlier success with smaller engines

The EU-funded Green Ray project is developing onengine technologies for low-pressure dual-fuel engines – both 2- and 4-stroke – as well as a novel aftertreatment concept. These solutions will be advanced to a high state of technology readiness, including demonstrators installed on two newbuildings and one retrofitted to an existing vessel.

As part of the project, Wärtsilä is developing technology specifically for low pressure 4-stroke dual fuel engines that enables methane slip reduction, increased efficiency and lower operational costs at all engine loads. The project is in line with Wärtsilä’s aim is to demonstrate slip rates of one gram per kWh, a significant reduction compared to existing performance.

“This research will allow us to build on the continuous improvements made in reducing methane slip from gas engines over the past 20 years,” said Sebastiaan Bleuanus, General Manager, Research Coordination & Funding, Wärtsilä Marine Power. “Taking these solutions for newbuilds and retrofits to near commercial readiness will be an important step for the long-term viability of LNG as a marine fuel.”

The technology development for the project targets the largest four-stroke engines on the market as widely used by cruise ships, ferries and gas carriers. It follows and expands on the developments achieved as part of the EU-funded SeaTech project which began in 2019 and included also the development of sophisticated control and combustion systems for Wärtsilä dual-fuel 31 engines. The resulting optimisation could only be achieved by using the advanced engine concepts Wärtsilä already employs.

Another facet of the work undertaken by the Green Ray project will be to measure methane slip on existing modern engines, to update public domain data that can be as much as a decade behind current technology. “This is a key collaboration we are seeing in the Green Ray project,” says Bleuanus. “Industry and academia are pulling together not only to solve the problem of methane slip, but to also make insightful progress on current emission levels.”

Wärtsilä will also develop an on-engine technology for 2-stroke engines around a patented LNG injection system to reduce methane slip from tankers, container ships, etc.

Additionally, Shell has developed a proprietary methane abatement catalyst system that has been lab tested and scaled up to a field demonstration, where it was proven to be effective not only in significantly reducing methane slip (over 90%), but also in handling typical compounds that can degrade the catalyst, via the inclusion of a guard bed. It can be used as a stand-alone solution or combined with either the 2- or 4-stroke engine developments to further reduce methane slip.