HHI-EMD announced plans to bring market its methane oxidation catalyst (oxicat) technology to market in 2023

MAN ES is preparing to introduce a new IO module for its Triton ECS in 2023, capable of handling 3rd party sensor inputs.

DNV is participating in a study project with MSC and WinGD to examine the possibility of converting the main engine of a container vessel to a methanol-fuelled dual-fuel engine.

Despite financial woes and public contract issues in India’s varied shipbuilding industry, pockets of private sector expertise indicate its capabilities and potential, writes David Tinsley.

8

The future is about pairing the right power solution to the application, says Eddie Brown, Director of Business Development, Global Marine at Cummins.

A high-speed electric ferry is now set to show her mettle and act as a technology demonstrator in west Norwegian local service, writes David Tinsley.

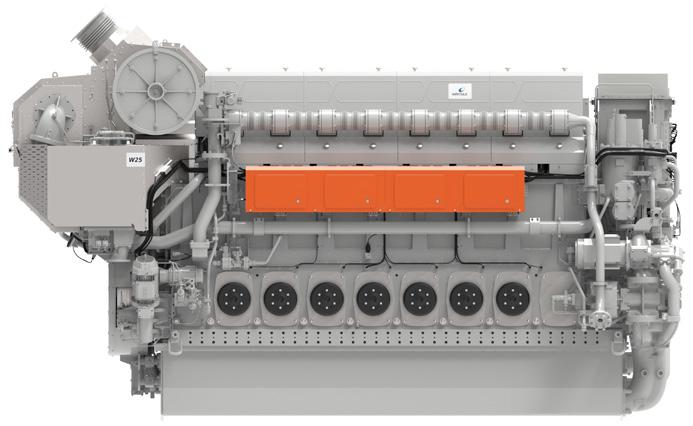

Stefan Nysjö, Vice President Marine Power at Wärtsilä discusses how the new 25-bore engine platform leverages digitalisation tools to deliver improved reliability and performance.

Finn Fjeldhøj, Head of Engineering, MAN Energy Solutions - Small Bore wants to bring its biofuels combustion expertise to the maritime market.

Wayne Jones OBE, Chief Sales Officer at MAN Energy Solutions calls for the industry to take action to prevent an emissions overshoot, and for regulators to deliver certainty to encourage investment.

Accelleron is piloting a new service model, Turbo SmartCare, in which it will provide potentially lifelong warranties to customers based on detailed data monitoring of their turbocharger.

WinGD is seeing increasing interest in its methanol and ammonia engine solutions, Volkmar Galke, Global Sales Director tells The Motorship.

Weekly

Sign

at:

The Motorship’s Propulsion & Future Fuels Conference will take place on 17-19 November 2020 in Hamburg, Germany.

The Motorship’s Propulsion and Future Fuels Conference will take place this year in Hamburg, Germany.

Stay in touch at propulsionconference.com

Stay in touch at propulsionconference.com

While it was a pleasure to meet old friends and contacts again at SMM in Hamburg last month, the greatest pleasure was the sense of a welcome return to normality – with busy stands and a constant stream of well-received market moving announcements.

MAN Energy Solutions’ launched a new 4-stroke engine, the xx/xx, which is intended to act as the basis for future engine developments. The 4-stroke engine includes a digital engine control system, which the engine designer plans to combine with an ABB energy storage system and DC grid in a potential electric dual-fuel LNG carrier design project.

Wartsila, Rolls-Royce Power Systems and ABC Engines also launched new 4-stroke engines at the event, as the pace of technological progress among engine designers continues to accelerate.

Outside events conspired to intrude on the event, as the ongoing conflict in Ukraine continues to disrupt international commodity markets. The LNG market is suffering from near-term disruptions as skyrocketing spot prices coincide with fundamental realignments in long term supply and demand dynamics. The latter is likely to be more significant over the long term, as the EU will emerge as a more and more important importer of seaborne LNG after spot LNG prices ease later this year.

The long-term effects of digitalisation have not yet begun to transform the shipping market – although the Accelleron’s plans to expand the scope of its Power-as-a-Service maintenance contracts for customers in the 4-stroke market is an interesting harbinger of future changes to business models to come. Sometimes the technological and business model advances go hand in hand – as Lubmarine’s new digital lube analysis platform.

A separate area of interest is the blurring of previous distinctions between traditional areas of focus for OEMs. Alfa Laval is increasingly interested in modelling the distribution of energy consumers aboard large vessels, while we have previously reported on engine designers’ increasing interest in modelling electrical supply issues on board vessels.

The pace of technological change – and the slow introduction of electrification onto larger vessels – has shown little sign of relenting since SMM, with engine designers increasingly focusing on the future requirements when developing new engines. We expect to see more announcements in the 4-stroke space, as development programmes accelerate.

Whether it is the impending introduction of fuel cell technology into the market or the potential advance of autonomous shipping programmes, we fully expect the possibilities of electrification to pick up. Alfa Laval is planning to begin testing ammonia-fuelled Solid Oxide Fuel Cells at its Aalborg facility.

Such new technologies offer potential solutions to volumetric storage and transportation issues connected with hydrogen. The Alfa Laval development relies on a technology to convert the ammonia into hydrogen for consumption at the individual fuel cell level, for instance.

MAN has unveiled a new dual-fuel engine that will act as a platform for mediumspeed engines that sets new benchmark in terms of fuel efficiency within four-stroke engines – both in gas and diesel modes – and therefore minimises fuel costs.

MAN Energy Solutions’ new MAN 49/60DF engine type was launched at the SMM trade fair in Hamburg on 6 September.

The new engines are claimed to offer a 13% increase in power per cylinder, while offering a 3% reduction in fuel consumption in gas mode compared with existing engines in the range.

This allows the engine to achieve “best in class” efficiency, with SFC in gas mode of 6,990 kJ/kWh. The engine was also able to achieve SFOC of 171g/ kWh.

The 49/60 platform will consist of 6, 7, 8, 9, and uniquely a 10-cylinder in-line variant spanning a power range from 7,800kW to 13,000KW. A range of 12 and 14-cylinder v-engine are also being introduced. The engines are said to be suited to numerous types including cruise vessels, ro-ros and ro-pax vessels.

The engine also features two-stroke turbocharging supplied by MAN’s turbocharging subsidiary. The use of two-stage turbocharging has contributed to the improvement in the engine’s performance, allowing the use of Miller Timing, and higher pressure ratios.

Marita Krems, Head of Four-Stroke Marine & License, MAN Energy Solutions told The

Motorship that the improvement in efficiency also reflected the use of MAN’s next generation Adaptive Combustion Control ACC 2.0, which automatically sets combustion to optimum levels, as well as success in lightweighting components within the design.

The engine also featured the first use of a new 2.2 Common Rail System, as well as an upgraded version of MAN’s SaCoS5000 automation system.

As a result, the engine will allow a 40% reduction in methane emissions, when operating in gas mode, compared with existing engines in the range. The benefits were not limited to operations in gas mode: a “significant” improvement in fuel consumption in diesel mode has also been achieved.

The increase in power means the same power demand can be met with fewer cylinders. This will offer opex cost advantages, Krems noted.

The engine also retains existing MAN technologies such as the gas-injection system, pilot-fuel-oil system and MAN SCR (Selective Catalytic Reduction) system.

The new dual-fuel engine is capable of running on LNG, diesel and HFO as well as a number of more sustainable fuels including biofuel blends and synthetic natural gas.

The 49/60DF is already available for order, with the first type approval test expected to occur in March 2023, Krems noted.

For the latest news and analysis go to

8 The MAN 49/60DF engine introduced at SMM Source: MAN EnergyTwo European exponents of heavy-lift and project cargo transport have jointly initiated a newbuild programme in China.

Two of four vessels ordered from Wuhu Shipyard by Hamburg-based SAL Heavy Lift will be operated under long-term charter to Siemens Gamesa Renewable Energy, while the second pair will be deployed in SAL’s partnership venture with Dutch specialist Jumbo Shipping.

Designated the Orca class, and developed by SAL in conjunction with Jumbo, the 150m vessels will each have two 800t Liebherr cranes for a tandem lift capacity of 1,600t. Deliveries of the first two newbuilds are scheduled during the second half of 2024, while the pair for the Jumbo-SALAlliance are expected within the opening half of 2025. SAL’s contract with Wuhu includes options on fifth and sixth vessels.

Each of the series has been specified with dual-fuel propulsion machinery capable of running on methanol, and complemented by a dieselelectric booster function.

At a service speed of 15 knots in diesel mode, consumption is anticipated to be significantly less than 20t of fuel oil per day, similar to smaller capacity, geared multipurpose tonnage. Alternatively, the vessels can be traded at an ultra-efficient speed of 10 knots, burning just 6t of fuel per day, while the installation as a whole provides for a maximum 18.5 knots, in the event of urgently needed shipments or schedule recovery. It is

Hyundai Merchant Marine (HMM) has signed a Memorandum of Understanding (MoU) with Panasia to collaborate on onboard carbon capture systems. Under the terms of MoU, HMM and Panasia will perform a feasibility study, economic analysis and risk assessment. In addition, the handling of captured CO2 will also be studied. HMM is expected to install the carbon capture system and perform an operational test on its vessels.

contended that, compared to other heavy-lift vessel designs, the hybrid setup of the Orca type features an especially wide range of economic speed settings and redundancy.

Funding from the German Federal Government under the NaMKu (“Sustainable Modernisation of Coastal Vessels”) programme allowed SAL to utilise what it describes as pioneering technology in the innovative power train of the Orca class, targeting high efficiency and substantial emissions reduction. The nominated arrangements promise a 10% lowering in NOx emissions below the IMO Tier III level, and a 21% undercutting of EEDI phase 3 limits for CO2.

Hull form and propulsion system were developed and optimised by SAL in cooperation with the Naval Architecture faculty at the Hamburg University of Technology (TUHH).

The bridge and accommodation structure is positioned forward, and the 149.9m x 27.2m hull envelope encapsulates a single, boxshaped hold with the largest dimensions in its class, plumbed by the two cranes mounted on high pedestals along the starboard side. The hatch covers can accept a loading of 10t/m2 and the ships will be certificated for sailing in open-top configuration so as to accommodate over-height cargo in the hold.

Jörg Stratmann will take over as CEO of Rolls-Royce business unit Rolls-Royce Power Systems on 15 November 2022. He is expected to leverage his experience of developing commercial solutions to meet opportunities within the energy transition at Rolls-Royce Power Systems. Dr Stratmann was previously CEO of Mahle AG, the automotive supplier. At Mahle GmbH, Dr Stratmann diversified the business beyond a focus on combustion engines towards customised solutions for e-mobility.

Hyundai Heavy Industries Engine & Machinery Division (HHI-EMD) held a webinar on 28 September 2022 discussing its after-treatment research for LNG and ammonia, saying it plans to market its methane oxidation catalyst (oxicat) technology in 2023.

Speaking at the First mover in De-carbonization prepared by HHI-EMD webinar, senior engineer Minjin Kim, noted that orders for dual-fuel LNG newbuildings received by HHI have increased from 6% (10 vessels) in 2018 to 59% (127 vessels) in 2021.

The group envisages increasing demand for both LNG and ammonia as decarbonization fuels, however both need after-treatment systems. For LNG, these systems will reduce methane slip, especially for 4-stroke Otto cycle engines.

Northern Xplorer and West Sea have signed a Letter of Intent for the construction of the cruise company’s maiden vessel. The zero-emission, 250-passenger vessel is expected to be delivered at the start of the 2025/2026 cruise season. The vessel’s design features a full-electric propulsion system, including ABB battery and hydrogen fuel cell technology.

HHI has various solutions for methane slip including incylinder technology that can reduce emissions by up to 50%, exhaust gas recirculation systems that can reduce emissions by over 40% and oxicats that can reduce emissions by up to 90%. The company envisages its new high performance oxicats will be combined with exhaust gas recirculation systems in a hybrid configuration in 2024 for specific engine models, with the oxicat solution itself expected in 2023.

The CMA CGM Group is creating a Special Fund for Energies, backed by a five-year, USD1.5 billion budget, to accelerate its energy transition. The Fund promote the development of industrial-scale production facilities for biofuels, biomethane, e-methane, carbon-free methanol, and other alternative fuels. It will also secure volumes in line with the CMA CGM Group’s needs.

8 Rendering of the Orca class.Against the backcloth of a raft of bankruptcies and closures within the private sector in recent years, and the continuing monopoly of government contracts by publicly-owned yards, elements of India’s shipbuilding industry indicate its capabilities and potential, writes David Tinsley

Shipbuilding has a long tradition in Goa, and the past 15 years or so has seen the local industry consistently raise its profile on the international stage. Having broken into the export market with a 12-ship coaster deal from north European owners in 2005, the shipbuilding division of the mining and industrial group Chowgule has continued to raise its game through a diversified output, combining domestically-honed craft skills and foreign design input.

A further stage of business development has recently been denoted by the extension of a newbuild deal with Swedish interests, entailing an innovative class of dieselelectric hybrid cargo vessels. Having booked six such 90m newbuilds of 5,350dwt from Chowgule & Company in September 2021, the Swedish company AtoB@C Shipping subsequently added a seventh vessel to the programme in June this year before going on to exercise options on five more ships during August, taking the series to 12.

AtoB@C is a subsidiary of Finnish dry bulk specialist ESL Shipping. In conjunction with institutional and private investors, which will own six of the new vessels, ESL will establish a pooling structure within which the class will be deployed. The GreenCoaster pool will be specific to vessels of the energy-efficient, environmentally-considerate standard set by the electrically-driven, nascent generation. It is claimed that the newbuild type’s overall greenhouse gas emissions, including CO2 per cargo unit, will be almost 50% less than existing ships of similar size.

From an Indian shipbuilding perspective, the project award is significant not only in its aggregate value(estimated at around $140m) and scale of serial production, but also as to the technical level involved. Chowgule’s successful execution of the project in line with the stipulations and expectations of Nordic players will undoubtedly strengthen the Indian company’s standing at a time when the global shipping industry is focusing increasingly on decarbonisation pathways and solutions.

The first of the 12 newbuilds is due to be completed during the third quarter of 2023, and the final ship is expected within the second quarter of 2026. Specified to 1A ice class, the design and model testing has been undertaken in conjunction with northern Netherlands-based SMB Naval Architects & Consultants. Bridge and accommodation are arranged forward, leaving an obstruction-free weatherdeck and flush hatch covers accessing a box-shaped hold of 7,650m3 capacity.

An energy storage system and electric drive configuration will enable the ships to enter and leave port solely on battery power, saving fuel and obviating both pollutant emissions and noise. Provision has been made for electrical power to be drawn from ashore when alongside.

The sixth and last of a series of 4,200dwt multi-purpose cargo vessels, Lady Hannah, was handed over by Chowgule

to Dutch owner Wijnne Barends in December. The sextet of 98m singledeckers was constructed at the Loutolim yard, where deliveries began in June 2019. Lady Hannah was the 32nd newbuild completed for a European client, and the design featured hull reinforcement to Swedish/Finnish 1A ice class and Wartsila medium-speed propulsion machinery certified to IMO Tier III NOx emission standard.

Chowgule first made its mark in the north European coastal and short-sea community 17 years ago by landing a 12-ship programme involving 4,450dwt cargo vessels for operators in the Netherlands and Germany. The series opened with the Damsterdijk in 2007, and the Indian builder went on to win contracts for 20 more newbuilds in the 4,2005,650dwt range for Dutch, German and British clients before attracting the initial tranche of orders in the current production run for AtoB@C Shipping.

The shipbuilding activities vested in Chowgule & Company encompass the Loutolim and Rassaim shipyards in Goa, some 7km apart, plus the plate preparation and pipe bending plant at Gadegally. The largest site, Loutolim, features a 220m slipway and two construction berths of 130m and 90m, with supporting equipment including 60t Goliath cranes, 70t overhead crane, 50t transporter and hull block and hatch cover fabrication workshops. Rassaim’s 123m side-launch facility is served by a parallel assembly area extending back for 27m.

The builder has a long track record in the production of vessels for the inland waterway network, not least orecarrying barges, grab and suction dredgers, tugs and various types of workcraft, plus trawlers, small naval vessels and Coast Guard units.

A new showcase for Indian shipbuilding is the Vikrant, the country’s first aircraft carrier to have been designed and constructed indigenously, previous vessels having been either of British or Russian origin. Completed by Cochin

8 Chowgule’s Loutolim shipyard, birthplace of multiple European short-sea cargo vessels since 2007 Credit: Chowgule & CompanyShipyard(CSL) towards the end of July 2022, followed by induction into Indian Navy service during August, Vikrant is testament to high-end technical capabilities within the industry.

The basic design was drawn up by the Indian Navy and the detailed engineering, construction and system integration was undertaken by the Cochin yard, the publicly-owned enterprise located on the south west coast in Kerala State. The project took the application of comprehensive 3D modelling, and extraction of production drawings from the 3D model, to a new scale in India. With a displacement of some 45,000t, the Vikrant is the largest warship ever built in India, and is powered by four gas turbines in a COGAG(combined gas and gas) propulsion configuration.

Fincantieri, which built two fleet replenishment tankers for the Indian Navy in 2011, forged collaboration with India back in 2004 when contracts were signed relating to engine system design, technology transfer and provision of complementary services for the Indigenous Aircraft Carrier project, realised as the Vikrant.

The Italian international group deepened its commitment to the Indian market in 2020 by signing an understanding for cooperation with CSL in various fields, including design, procurement and local construction of new vessels for the Indian defence sector, and local production and marketing of mechanical equipment such as propellers, shaftlines, stabilisers, steering systems and thrusters, naval automation development and training of Indian personnel.

The Cochin yard is currently building eight anti-submarine warfare, shallow-water craft for the Indian Navy, and recently secured an order for six next-generation missile vessels. Centrepiece of development plans is a new dry dock sized for larger ships than hitherto, including a future, further aircraft carrier.

Recourse by Scandinavian principals to the Indian subcontinent for short-sea tonnage of advanced type is also presently illustrated in the production programme at Sri Lanka’s Colombo Dockyard(CDL). The soon-to-be-delivered, 90m Misje Vita is the first in a series of 5,000dwt dry cargo vessels booked by Kare Misje of Norway and is notable for a hybrid propulsion arrangement and provision for future, zero-emission operation.

CDL’s contract entails six such newbuilds for the shipping group’s Bergen-based division Misje Eco Bulk, which holds options on a further four vessels. The concept and basic design has been prepared by the Norwegian arm of Wartsila Ship Design. A Wartsila 20-type medium-speed engine is complemented by an electric hybrid solution delivering power through a 1,000kWh bank of batteries.

The singledeckers will cater to the range of bulk commodities, including timber and steel products, and will meet IMO Tier III standards through the adoption of selective catalytic reduction(SCR) technology. As well as 100% NOx abatement, it is claimed that the class offers a 47% reduction in both SOx and CO2 emissions relative to comparable, existing tonnage. The energy storage system promises emission-free port entry and departure, while the shore power connection will also reduce environmental impact when alongside and handling cargo.

One strand of CDL’s business strategy has been to target the European market, with particular reference to demand for smaller classes of vessels incorporating greater technical sophistication, such as the minibulkers for Norway, plus cable-laying and cable repair ships, and service operation vessels for the offshore energy sector. The Colombo yard showed its mettle in 2019 through the delivery of its longest ship and most valuable contract hitherto, the 113m Japanese

ocean cable-layer KDDI Cable Infinity. This accomplishment was followed in 2020 by another export deal calling for a 100m cable-laying and repair ship for Orange Marine of France, to be completed during 2023.

While CDL’s majority shareholder and technical collaborator is Onomichi Dockyard of Japan, Sri Lanka’s Government retains a vested interest through a 35% stake.

The yard has, however, suffered a setback through the cancellation in July this year of contracts with Edda Wind for two commissioning service operation vessels(CSOVs). The Norwegian company attributes the annulment to the detrimental effects of the Sri Lanka’s national economic crisis, which has apparently impinged on the yard’s ability to fulfil the project.

The commanding feature of Pakistan shipbuilding is naval work to domestic account, participation in the international commercial market being negligible. Technical progression in combination with a reliance on technology transfer from overseas specialists is expressed in the current workload at Karachi Shipyard & Engineering Works(KS&EW), which launched a Milgem-class corvette in May this year, part of a $1.5bn deal Pakistan signed with Turkey in 2018. Turkish defence company ASFAT is acting as the main contractor for the four-ship programme, with two vessels being constructed in Istanbul and two by KS&EW.

The Karachi yard is also looking to an extensive Pakistan Navy submarine programme, whereby a total of eight boats are envisaged under a deal with China. Four of the dieselelectric submarines will come from China, and four are to be constructed by KS&EW.

Bangladesh is a longstanding recipient of Dutch knowhow in waterway maintenance and dredge technology, and this connection has found new expression in the latest contract award to Royal IHC. Four cutter suction dredgers to be constructed by Karnafuly Ship Builders for the Bangladesh Inland Water Transport Authority(BIWTA) will embody design, engineering and hardware input from the Dutch group. Furthermore, Royal IHC will provide yard assistance for the installation, testing and commissioning of the equipment and the vessels.

Two of the newbuilds will be of 74m and the other pair will be of 54m, and the vessels’ maintenance dredging function will serve both the country’s constant battle against flooding and the need to keep waterways navigable during the dry season.

Royal IHC has supplied numerous Beaver-type, standard modular dredgers and workcraft to the country’s public and private sectors over the past five decades, while a deal completed six years ago saw the delivery of design, engineering and component ‘packages’ plus shipbuilding back-up for the construction of 10 cutter suction dredgers.

8 High-end production: the 113m KDDI Cable Infinity, built in Colombo for JapanThe future is about pairing the right power solution to the application, says Eddie Brown, Director of Business Development, Global Marine at Cummins.

There will no longer be one design that generally fits all. It’s a dynamic environment with evolving infrastructure, regulations, policies, incentives, applications, and more. We are working with customers, partners, and policy makers to help define the path forward.

In the marine division, we are able to leverage Cummins’ investments, identifying the best of power solutions and technology in automotive, industrial and power generation spaces, and bringing them forward into the maritime space. We recently did just that with our X15 engine, which has more than two million engines installed in other markets.

Now we are taking this to the next level with our Destination Zero and Planet 2050 initiatives and looking at how we can scale new technologies and fuels in a way that is feasible to bring them to the marine market.

There is not one-fuel-fits-all solution to replace diesel but rather fuel choice will be highly dependent on the application. For example, the majority of discussions regarding LNG and ammonia are in the large ship applications. For smaller ships HVO, hydrogen, and methanol as a carrier for hydrogen are at the forefront.

There will be trade offs with all the potential fuels as they compare to diesel, and it comes down to what are the acceptable trade offs for our customers. We are working with them to learn what matters to them and what will meet there needs versus designing a single solution and then trying to fit it into the different applications. To help our customers on their journey to zero emissions, we are studying the viability of the different fuels – in both single and dual fuel arrangements. Most immediately besides hydrogen fuel cells, Cummins is approving HVO as a fuel.

Our hydrogen-fuelled engine development program is one of our latest steps to advance zero-carbon technology. In marine, we have several projects in development, including Sea Change in the U.S. and Sealink in Australia that are utilizing hydrogen fuel cells as their main power source. The next evolution that Cummins has focused on related to hydrogen is its use in combustion engines.

Hydrogen, at this stage, is most feasible for a vessel with a dedicated application and set route and use, such as the ferry projects we are working on. These boats are able to access hydrogen as needed, whether refuelling or exchanging tanks while at the dock. The ability for long range vessels to use hydrogen is limited due to needing to store hydrogen in tanks and the volume needed

due to its low energy density, but there is potential to use hydrogen to power harbor gensets, replacing existing ones with a zero-emissions solution for use in port.

Hydrogen has many benefits, but it comes with challenges as well. We will be taking our early learnings on hydrogen engines and applying those to the next generation of engines we develop.

Even as new fuels are being studied for their viability within the marine industry, we are continuing to optimise our existing products and developing new products that rely on diesel. For example, we recently released a 3,000hp intermittent rating on our QSK60 engine. There was a gap in power for harbor and escort tugs in the 70T bollard pull range, and through some engineering and development on the air handling, turbos, and some other areas, we were able to produce a product specifically designed for this market. The biggest opportunity for Cummins during this transition is delivering the best solutions for each application within the maritime industry, regardless of which fuel powers it. As older fleets are revitalized, sometimes driven by a desire for more efficient operations and at other times driven by regulations, we are seeing incremental steps being taken, such as upgrading from a mechanical engine to a cleaner electronic engine, and in some cases implementing hybrid solutions in place of straight diesel.

At Cummins, our role is to improve the efficiency of converting energy to power, to continue to offer a broad portfolio of power solutions including electrolysers for hydrogen production and supporting our customers wherever they are in their journey.

8 Eddie Brown, Director of Business Development, Global Marine at CumminsThe potential for digitalisation tools to play a significant role in improving the performance of combustion technology has been a recurring theme in Mr. Nysjö’s interviews with The Motorship. Speaking on the sidelines of the launch of Wärtsilä’s 25 engine platform at SMM in Hamburg in September, Mr. Nysjö returned to the theme.

“The engine [has been designed] with the needs of more complex hybrid systems, which require more sophisticated engine control systems,” Mr Nysjö began. The engine platform had also been developed with the intention of forming a platform for future alternative fuel developments, such as methanol or ammonia multi-fuel variants, which will sit alongside the dual-fuel version, which is available with two-stroke turbocharging.

The engine also sets new standards in terms of its environmental performance. The improvement of the dualfuel engine’s combustion performance has lowered the greenhouse gas emissions produced by the engine to the same level as a pure gas engine.

Mr. Nysjö noted that in common with Wärtsilä’s recent 31 and 46 engine launches, the 25 engine had been developed to be a fuel agnostic, and fuel flexible engine platform.

Wärtsilä remained committed to the launch of alternative fuel versions of the engine, with an technology concept capable of operating on ammonia expected to be unveiled in 2023. The ammonia-burning product is expected to be launched shortly thereafter.

“When it comes to ammonia, it is a fuel which will most likely benefit more than methanol from the modern technology [in the 25 platform].”

While the development of the 25 engine had taken three years of testing, the development of alternative fuel engines was likely to be much shorter, as it will be more like a product industrialization. “The development cycle for an ammonia-burning 25 engine will not be as long as the platform is there, particularly as we are doing the technology development related to ammonia on the side”.

“But the advantages of digitalisation also benefit the maintenance side of the engine’s operations. It allows us to enable our Wärtsilä Expert Insight services, and also helps support our maintenance agreements.”

Mr. Nysjö noted that the step change in engine efficiency achieved in the 25 platform was not solely

Wärtsilä has developed the 25 engine with an eye on the operational requirements of the short-sea market, where the engine’s compact footprint, modular design and ease of upgrading is meet specific customer requirements. While the coastal tanker market, general merchant vessels and even certain ferry niches were potential markets, the engine was also well suited for auxiliary engine applications on board larger vessels.

Broader market trends were also “playing into the hands” of the 25 engine, which was likely to benefit from a trend towards specifying smaller engines in response to decarbonisation regulations. In addition, there was fewer in-line engine in the small-bore segment, which was likely to benefit the platform.

8 Stefan Nysjö, Vice President Power Supply – Marine Power at WärtsiläStefan Nysjö, Vice President Power Supply – Marine Power at Wärtsilä discusses how the new 25-bore engine platform leverages digitalisation tools to deliver improved reliability and performance.

The Motorship notes that Wärtsilä shared some details of its focus on lightweighting research during a recent visit to Vaasa, in which research engineers discussed the use of additive manufacturing and the substitution of traditional components with lighter more durable materials.

However, Mr. Nysjö noted that the use of data tools such as Expert Insight had made a major contribution to the step change in reliability achieved by the new platform.

“We have extended the TBO [time between overhaul] by

When operating with natural gas the engine is IMO Tier III compliant, as it also is with diesel when integrated with a Wärtsilä NOx Reducer (NOR) emissions abatement system. Furthermore, it enables economically viable compliance with regulations such as the IMO’s CII and EEXI protocols that enter into force in 2023.

The Wärtsilä 25 is designed for long periods of maintenance-free operation and it supports drydocking schedules with a TBO of up to 32,000 hours. Data-driven dynamic maintenance planning and predictive maintenance services can extend the TBO even further.

The engine features a robust and highly efficient turbocharging system with a high pressure ratio. It is now available in 6L, 7L, 8L and 9L cylinder configurations, while the dual-fuel (DF) version has a power output ranging from 1.9 to 3.1 MW, and the diesel version from 2.0 to 3.4 MW. The common-rail high pressure fuel injection technology optimises combustion and the fuel-injection settings at all loads. This in turn promotes smoke-free operation.

Other features include a self-learning proportional, integral, derivative (PID) control to reduce calibration needs, and the gathering of critical engine data for predictive maintenance, reporting and analysis purposes via Wärtsilä’s Expert Insight service. The modules can be replaced ‘on the fly’, which eliminates the need for separate software downloads. Optional and easy-to-apply adjustments for arctic or tropical conditions and for reducing emissions to the level of a pure gas engine are also available.

Bore, mm 250 250 Stroke, mm 340 340

Engine speed rpm 900/1 000 900/1,000 Piston speed, 900/1,000 10.2/11.3 10 2/11 3

Rated output, 6L @ 900 2,040 1,890

Rated output, 9L @1000 3,375 3,105

BSEC, kJ/kWh 7,560 7,560 SFOC, kJ/kWh 184 184

Main engine dimensions, 9L25 6,200 (L) x 2,400 (W) x 3,600 (H) 6,300 (L) x 2,200 (W) x 3,700 (H)

Main genset dimensions, 9L25 9,950 (L) x 2,720 (W) x 3,860 (H) 9,900 (L) x 2,720 (W) x 3,960 (H)

utilising the data tools to the maximum. By applying tools like Expert Insight, we have been able to apply dynamic maintenance, which also allows operators to flex their TBOs.”

Adopting a dynamic approach to scheduled maintenance relies on Wärtsilä having a deeper insight into the way the engine is run and the wider operating environment.

“For assets operating in really harsh conditions, it might not be advisable to look to run the 32,000 hours, it might be more economical to do the overhaul at 30,000. By contrast, for assets in less challenging conditions, it should be risk free to run up to the full 32,000 hours.”

The greater operational advantage of flexing TBO intervals is the ability to synchronise the major overhauls with scheduled maintenance on the engine turbocharger and other assets. This is likely to create greater overall savings over the course of a four or five year period between dry docks. “We expect that this will result in greater asset availability by saving downtime, with a direct impact on the bottom line,” Mr. Nysjö said.

This was a practical example of how Wärtsilä’s services can create additional value for customers, Mr. Nysjö said. This is one of the businesses expansion focuses, along with decarbonisation.

FOUR-STROKE ENGINES 10 | OCTOBER 2022 For the latest news and analysis go to www.motorship.com 8 The Wärtsilä 25DF utilises advanced combustion technology to lower GHG emissions to the same level as a pure gas engine.

Main Particulars – Wärtsilä 25 engine

Main Particulars – Wärtsilä 25 engine

The industry is still undecided about what will be the future fuel for shipping, and indeed if there will just be one. What may seem to be a good fuel today may be thrown out and another taking its place tomorrow. However, MTU Rolls-Royce are taking the bull by the horns and are looking to set a direction for the maritime industry, writes Samantha Fisk.

Following the recent decision to extend the ISO 8217 standard for fuel requirements in the marine industry from HVO and 7% FAME blends to other types of biofuel, MAN Energy Solutions expects the market for biofuels to expand rapidly.

Rolls-Royce business unit Power Systems wants to lead the way as a pioneer in the marine industry when it comes to climate friendly power and propulsion solutions. The new development of a mtu methanol engines is an important part of this strategy, the company highlights.

With this in mind Rolls-Royce have started developments on a new engine last year, based on the mobile gas engine of the mtu Series 4000. Rolls-Royce will launch its methanol engines on the market from 2026 and has already found a first partner and customer for the engines.

“Rolls-Royce and Italian yacht builder Sanlorenzo plan to develop and build a large motor yacht with a methanol engine propulsion system able to run carbon-neutrally on ‘green’ methanol. The two companies announced an exclusive memorandum of understanding to this effect for yachts between 40 and 70 meters at the 2022 Cannes Yachting Festival,” says Rolf Behrens, Spokesman Mobile Solutions, Rolls Royce.

The yachts will be powered by two mtu methanol engines based on the Series 4000. The Sanlorenzo yacht is expected to undertake her maiden voyage in 2026.

The development of the engine has come about through studies that Rolls-Royce has carried out on environmentally friendly fuels, which have also included pure electric and hydrogen. Behrens comments that: “There is no silver bullet for environmentally friendly marine propulsion systems of the future, there will not be a one-technology-fits-all solution given the wide variety of requirements and missions of marine customers and vessels. Rolls-Royce business unit Power Systems is developing a range of future technologies for its marine customers, including hybrid propulsion and fuel cell systems.” He adds that it expected that from 2023, mtu marine engines can be used with sustainable fuels such as HVO or renewable diesel, immediately cutting CO2 emissions by 90 percent.

With this development Rolls-Royce are putting its flag in the ground about the direction that it sees the development of fuels in the future going. The reason that Rolls-Royce is placing its bets on methanol is that it sees that methanol has the potential to shape the energy transition in marine propulsion systems, for example for tugs, yachts, fast ferries

and coastal shipping.

“The market now seems ripe for alternative fuels”, says Behrens, “There’s an increasing demand from the user side and growing willingness to allow their use from authorities. It has been clear for some time that methanol (MeOH) has great potential in terms of CO2 reduction. Now we see a concrete market trend towards methanol. Interest in, demand for and readiness for MeOH projects are growing.” Rolls-Royce is continuing its development of the methanol engine technology, partly funded by the German Federal Ministry of Economics and Climate Protection’s "MeOHmare" project.

Behrens adds whys methanol is attractive for smaller commercial vessels in that: “We expect its production to be economically competitive and advantageous over other e-fuels in the future. Methanol as a common chemical product is traded and transported worldwide and is, in principle, globally available, for example at more than 100 of the world’s most important ports. The required modifications to existing infrastructure are less than for other alternative gaseous fuels. E-methanol may play a role in other applications in the future beyond the new mtu methanol engine. The fuel can also be used in combustion engines using the diesel principle, or with the help of a reformer to produce electrical energy in fuel cells. These points give e-methanol an edge over pure electric propulsion and hydrogen-fuelled energy converters in a number of marine applications, as well as over solutions using other e-fuels.”

The company also adds about the fuel that Compared to other climate neutral “e-fuels” (H2, methane, ammonia) methanol (MeOH) has the highest energy density, logistics and handling are much less complicated, as MeOH is a liquid fuel under normal boundary conditions (no pressure tanks and no cryogenics are required) and the existing diesel infrastructure can be used. Methanol engines will most likely not need exhaust gas aftertreatment making propulsion solutions more compact.

The trend towards ‘green’ or e versions of fuels are starting to come apparent on the market, as it isn’t just the carbon neutrality of the fuel it’s self but also how the fuel is produced where its environmental efficiency is also being measured.

The company also highlights that its assessment is that e-methanol is the CO₂-neutral fuel which is best suitable for a range of marine applications. It meets the requirements of an e-fuel because it is produced from hydrogen and CO2 with the aid of wind or solar energy. For on-board storage, it requires significantly less space than would be needed for hydrogen in fuel cell drives or for batteries with the same range. In addition, methanol is less toxic than other e-fuels, such as ammonia. Production costs are also expected to fall faster than those of e-diesel due to economies of scale.

In general, Rolls-Royce believes methanol is suitable for all marine applications. When comparing MeOH and H2/ batteries, MeOH generally lends itself as a fuel for:

8 Ships that require a long range

8 Vessels that have a high weight sensitivity

8 Ships with little internal available space

8 Ships requiring a low downtime/little time for bunkering

However, the company also still believes that there will not be one propulsion solution in the future, different forms of energy sources will be developed and used in parallel.

So, with this in mind Rolls-Royce is looking to help guide the future market for smaller commercial vessels towards methanol, as it sees that it will have benefits and offers the best fuel for this market in years to come.

For the latest news and analysis go to

MAN Energy Solutions plans to leverage its expertise in the combustion of biofuels in stationary applications in the maritime market, Finn Fjeldhøj, Head of Engineering, MAN Energy SolutionsSmall Bore at Holeby tells The Motorship.

Following the recent decision to extend the ISO 8217 standard for fuel requirements in the marine industry from HVO and 7% FAME blends to other types of biofuel, MAN Energy Solutions expects the market for biofuels to expand rapidly.

In response, MAN Energy Solutions has recently distributed a new set of Guidelines for the Use of Biofuels to its existing customers, outlining operational advice for the use of biofuel with its two-stroke main movers. The engine designer and builder’s guidance also addresses the introduction of biofuels into the large-bore 4-stroke market.

“We think the market for biofuels will take off,” Fjeldhøj says simply.

However, the likely increase in demand for operating large-bore 4-stroke engines or 2-stroke engines on biofuel blends is also likely to lead to increase in demand for gensets that can operate on the same fuel mixture.

Fjeldhøj told The Motorship in an exclusive interview in late September that MAN Energy Solutions has an extensive history in assessing biofuel blends before their introduction into the market. The Small Bore team in Holeby also had an established business supplying gensets to the stationary market for operation on a variety of different fuels.

“Depending on the fuel type and blend, we can offer a range of services including engine component upgrades, injection timing modifications, and even turbocharger upgrades, to ensure that the engine can operate successfully on the fuel.”

However, owing to the current lack of standardisation in the biofuel market, there is no single retrofit service package for the different fuels. “We are currently taking everything on a case by case basis.”

MAN Energy Solutions has been participating in trials to evaluate the performance of biofuel and VLSFO blends at concentrations of up to 50% biofuel, Kjell Aabo told The Motorship.

One of the trials has been carried out with a Western European biofuel supplier using a 16/24 MAN test engine.

“The trial covered six different biofuel blends at concentrations of up to 50%, and included emission measurements of different greenhouse gases, including NO, NOx, SOx, particulates, and black carbon.

The tests threw up a number of interesting results, including that overall NOx emissions did not increase after biofuel was added to the VLSFO. The mixture of biofuel in the VLSFO made the blend more stable.”

MAN Energy Solutions has acquired a significant amount of operational experience running stationary engines on a range of biofuels since 1994, Fjeldhøj told The Motorship.

Although it was regarded as a niche solution with the Small Bore Genset business, stationary gensets had run on crude palm oil (CPO), FAME, HVO, palm oil, stearin, tallow (animal fat), and used cooking oil.

While most of the installations were smaller than 3,800kW, a Belgian customer had operated an 8x14V52/55 installation on vegetable oil, with an output of 85,000kW. A different Belgian customer had operated several facilities on tallow with output of up to 17,500kW.

One of the most intriguing options currently under consideration is waste fish oil. The waste fish oil is being assessed in response to a request by a Norwegian fishing vessel operator. The trial is expected to examine the performance of fish oil and VLSFO blends at concentrations of between 25% and 30% fish oil, or B20 and B30, Fjeldhøj noted.

The initial results of the trial should be available by Summer 2023, Fjeldhøj noted. The solution is expected to attract significant interest from larger European trawler operators, The Motorship notes. The potential of recycling waste fish oil generated from processing operations on board a factory vessel would lower operating costs and reduce waste disposal requirements.

Diesel Fish Oil FOME

Density at 15 C, kg/m³ 850 923 873

Kinematic viscosity at 40C. (mm²/s) 2 5 29 59 6.10

Specific gravity (gm/cm³) 0.83 0 93 0.873

Higher heating value (MJ/kg) 43 39 01 41.60

Flash point (C) 56 165 110

Source: MAN Energy Solutions

latest news and analysis

A separate fuel that is being assessed is lignin and pyrolysis fuel based on waste feedstock. Unlike some of the firstgeneration vegetable based fuels that MAN Energy Solutions assessed in the 1990s, suppliers are focusing on second -generation plant based fuels to ensure that potential food is not being diverted from human or animal food chains. “Ensuring supply chain transparency to guarantee that they are not diverting food away from human populations will be needed, particularly for extended international supply chains,” Fjeldhøj noted, adding that a variety of potential technological solutions existed.

When considering a new fuel, such as lignin-based biofuels, Fjeldhøj noted that the properties of the ligninbased fuel itself need to be carefully evaluated, including the ash, volatile matter and the carbon content in the fuel.

After theoretical studies, Fjeldhøj noted that a practical evaluation needs to be carried out to ascertain how the fuel will affect the engine’s performance, the wear and the emissions profile.

These tests are typically carried out on MAN Energy Solutions’ L21/31 test engine at Frederikshavn. Aside from the environmental emissions measurements, the tests examine optimal blending ratios and also the impact of the fuel on components.

Fjeldhøj noted that the impact of the fuel on components in general, and the fuel injection nozzles in particular, varied according to the different fuel feedstock.

The increased acidity of the biofuel blends typically had an impact on the engine components, although different fuels had different impacts.

“The interesting thing about operating the engines on tallow was that it actually extended the time between

Second-generation biofuels are made on the basis of lignocelluloses, wood biomass, agricultural residues, waste vegetable oil, and public waste. Third-generation biofuels are derived from microalgae cultivation; however, most efforts to produce fuel from algae have been abandoned.

overhauls (TBO) to 24,000”, Fjeldhøj noted.

Fjeldhøj also identified the lack of a standard specification for biofuels as a particular challenge for shipowners.

This meant that both the fuel and the engine set up would need to be tested whenever a shipowner wanted to introduce a new fuel into the market.

“We expect new standard specifications to the introduced as biofuels are progressively introduced into the market, such as Shell’s new biorefinery in the Netherlands, although smaller fuel supplier and start ups are likely to continue to need help.”

Fjeldhøj noted that aside from issues around the consistency of individual biofuels, there are wider questions around how fuel blends will perform when combined.

“We have first hand experience of seeing just how biofuel blends can interact against each other to create foaming issues, causing

significant damage to a test engine’s fuel pumps. The day before, they had performed perfectly well when blended together.”

Fjeldhøj stressed that there was likely to be a greater requirement for fuel analysis services in the future. While shipowners have dominated MAN ES’ biofuels consultancy requirements, the upcoming introduction of a greater range of fuels was likely to increase demand.

In particular, the introduction of new small scale fuels from small suppliers was likely to require verification.

While the cost of introducing new fuels into the maritime market was likely to be prohibitive for very small volume suppliers of niche fuels, owing to the involvement of class societies and regulatory bodies, there was little doubt that the number and range of biofuels reaching the market was set to increase rapidly. This was particularly the case because of the wider range of second-generation biofuels that are under investigation. “We are currently looking at testing fuels based on waste nutshells, for example,” Fjeldhøj said.

“We don’t think that pyrolysis fuels based on recycled tyres are going to gain a significant market share, but looking further ahead there are possibilities for other pyrolysis fuels, such as bagasse, palm kernel cake (PKC) and nutshells pyrolysis bio oil, to enter the marine biofuel supply chain.”

While the introduction of biofuel blending requirements for marine fuels under the EU’s upcoming FuelEUMaritime proposals was likely to create significant demand, The Motorship notes, there was little prospect of biofuels becoming a regional market.

8 Finn Fjeldhøj, Head of Engineering, MAN Energy Solutions - Small Bore at Holeby

Hosted by:

Hosted by:

Anglo Belgian Corporation (ABC) has launched its second EVOLVE engine, the 20-cylinder medium speed 20EV23.

Like the first engine in the series, the 4-cylinder 4EL23 launched last year, the 20EV23 has cylinder heads adaptive to multifuel solutions. The engine allows for a choice between liquid, dual fuel and gas combustion: including a highly efficient Common Rail or pump-line-nozzle (PLN) fuel injection system for liquid fuels, a micro pilot liquid fuel injection combined with gas injection system for dual-fuel operation, and a spark ignited gas system.

This facilitates financially viable conversion or retrofit to new fuel types, such as diesel, biodiesel, MDO, HFO, methanol, LNG, CNG and hydrogen, using the same engine. The engine is IMO TIER II and IMO TIER III certified and EU stage V compliant.

The company claims the engine displays impressive response times at heavy load pick up, combining extreme reliability and distinctive speed with the best power-toweight ratio. It offers 20 x 360kW of acceleration (7.2MW) and two-stage turbocharging which increases load pick-up and improves shock load acceptance. Higher power is available in special applications.

The 230mm bore, 310mm stroke 20EL23 engine features speeds from 400 to 1,200 rpm (400 rpm idling), and a nominal power range of 3,960-7,200kW. ABC claims best-in-class fuel and lube oil consumption due to the optimised throttle air

and fuel volumes in its injection technology and the twostage turbocharging.

In recent years, ABC has invested heavily in the development of environmentally friendly power systems. Last year, ABC was the first in the world to receive the official EU Stage V certificate for its DZC engines which limit the emission of NOx and soot particles to very low values. Before that, together with CMB, it launched BeHydro, a marine dual fuel hydrogen engine range that reduces CO2 emissions by 85%.

ABC’s DZC engine is already hydrogen-ready in a dual fuel version (DZD - 85% hydrogen gas and 15% liquid fuel). This hydrogen engine is available with 6, 8, 12 or 16 cylinders and has a power output from 1,000 up to 2,670kW. The DZD hydrogen engine can be combined with an after-treatment system in which the smaller proportion of diesel that is burned can be filtered through a particle filter for the soot particles and a catalytic converter for the NOx emissions.

The 20EV23 is 100% manufactured in ABC’s production facility in Ghent. All components are produced within the EU. No conflict or rare materials are used during the manufacturing process.

In a plain speaking interview at SMM, Wayne Jones OBE, Chief Sales Officer at MAN Energy Solutions calls for the industry to take action, and for regulators to deliver certainty to encourage investment

What do you think the overshoot that MAN ES expects to see in shipping emissions will mean for the industry?

Wayne Jones: Well, we do have some possibilities to arrive at the [IMO] goal. It depends on the ambitions that are put into the regulatory framework. But we also need intermediate targets to push down the overshoot.

In practical terms, I think we can encourage the retrofitting of the existing fleet. Another way to do it is to accelerate the uptake of new fuels. So there are various levers to pull on the new or general direction.

But the development of supply chains for alternative fuels is going to be a challenge. So we need other industries, and companies to be first movers as well. And I think there's lots of ways to encourage that. One of the things we wanted to achieve with the paper was to show that we can actually reduce the severity of the forecast overshoot if we begin to act now. That's the biggest challenge.

Do you feel that the industry should expect renewed pressure for the imposition of market-based measures, such as a carbon levy, in the short term?

Wayne Jones: Something like a carbon levy has to be high on the agenda [at the IMO], because nothing will happen unless we introduce regulation. When I say nothing, not to the level we need to keep to the Paris Agreement. So regulation, whether we like it or we don't, is going to part of the puzzle. And this is something we have to drive… We shouldn’t forget that there are other industries that don’t have the same institutions [as the IMO] to regulate on such a global scale.

But more widely, we see greater regulatory certainty as an important condition to encourage investment. We also want to let the market function properly, using market mechanisms. As a technology developer, we can see how regulation has encouraged the takeup of other technologies in other areas.

Are you concerned that some of the proposed solutions under develo-pment by regulators appear to be excessively focused on shortsea routes, or the demands of smaller vessel types?

Well, there are a range of alternative energy efficiency solutions under development.

And there is a role for batteries to improve the operation of our 4-stroke engines, for instance. We have experience delivering these solutions. However, if we are looking at deep sea shipping, which accounts for around 70% of overall emissions, alternative fuels are the main solution. Electrification isn’t really a solution for our largest 2-stroke engines, which have maximum power output of weigh in at up to 2MW more than 80 M.W

QSince we spoke last year, cost differentials between LNG and conventional fuels have become even more volatile. How do you see such price pressures affecting the development of LNG and alternative fuels more widely?

AWayne Jones: I think that that’s where the advantages of dual fuel options reveal themselves. The clever thing is that you can still run on traditional fuels. While people do take a longer-term view when they're making these investment decisions, because the capex investment is significant… there has to be commercial viability to [LNG and alternative fuel pricing] as well.

8 “I think we’re past the point of discussion and should be really looking at acting now”: Wayne Jones, Chief Sales Officer at MAN Energy Solutions

Looking ahead, one of the advantages is that ship owners will have the flexibility to operate on other fuels, such as biodiesel, if there are supply or availability issues. We expect that the traditional laws of supply and demand will expand the supply of alternative fuels in the future, with suppliers moving to fill local supply gaps.

QDo you feel that there is a risk that ship owners and operators will delay investment decisions until there is greater regulatory clarity before deciding on retrofits, for example?

Wayne Jones: I think shipping really should take care of its own business… If you wait around for legislation to become as you want to, if you wait around for governments to do, then you'll be waiting a long time.

Let’s not make the perfect the enemy of the good, or progress… let's at least retrofit what we've got, let's at least go to LNG, today. It's a fossil-based fuel, but it still gives us 20% improvement on CO2 emissions. I think we’re past the point of discussion and should be really look at acting now.

One of the reasons that I'm trying to preach this all the time is that I believe agility is going to be the new corporate currency.

QWe recently interviewed your colleague Dorthe Jacobsen about the progress of the ammonia engine research project. It looks like you are on track to bring the first commercial 2-stroke ammonia engine to market in 2024. From a commercial perspective, would it be possible to discuss how clients are responding to the new ammonia engine?

AWayne Jones: We’re making good progress with the ammonia engine and we're testing the one cylinder, literally, as we speak, we're going to launch it 2024. And, of course, our launch customer is the biggest ammonia carrier in the world.

For ammonia carriers, it is a very sensible decision to use the cargo to power the engine, in the same way that LNG carriers [benefit from running on their cargo]. I hear from companies looking at ammonia supply chains that they believe that ammonia will play a huge role in the future across various industries.

But there are other sections of the market that are waiting to see our first engines launched and the first year of production. I remember people saying the same thing about methanol engines three years ago – we’re probably at a similar stage of development. And then after the first year, people start to say, “actually, yes”.

8 According to MAN ES analysis, shipping’s greenhouse gas emissions are likely to rise by 10% over the coming decade as the global fleet expands.

QQuestion: How do you see the introduction of methanol engines proceeding?

AThe introduction of methanol has been very successful.

We have 70 engines on order, and people can see for themselves that it works. There are no major technological technology challenges, and we’re getting to the stage where we can call it a proven technology.

The customer reaction to methanol has been pleasantly surprising, with particularly strong interest from some of the larger vessel segments, such as the container market, driven by major customers who are now looking at it.

Shortly before speaking to The Motorship at SMM, Wayne Jones, MAN Energy Solutions’ Chief Sales Officer, warned that without urgent action to encourage a faster adoption of synthetic fuels, global shipping might “significantly overshoot” the targets set by the Paris Agreement to limit temperature increase.

The analysis is based upon a 60% increase in the global fleet, which would contribute to an overall increase in shipping’s greenhouse gas emissions of 10% (measured on a well-to-wake basis) over the coming

decade, despite an improvement in the efficiency of individual assets.

In order to prevent an overshoot in greenhouse gas emissions which would lead to shipping failing to meet its targets to comply with the Paris Agreement, Jones called for urgent action for the industry to meet its targets.

The proposals included regulatory levers, such as accelerating the pace of CO2 regulation alongside the potential introduction of carbon pricing.

Jones also specifically identified the issue

8 Conventional engines will account for over 50% of installed engine capacity on newbuildings until 2040.

of incentivising ship owners to retrofit vessels to operate on alternative fuels as an area of focus.

Lastly, and most ambitiously, Jones called for the industry to do more to attract outside investment into green energy production earmarked for the use of the shipping industry.

This was particularly pressing as MAN ES’s analysis had indicated that fuel availability was likely to act as a potential constraint on the adoption of alternative fuels, such as methanol and ammonia, after the end of the current decade.

The propulsion market sees further developments as regulation and digitalisation push the shipping industry further, writes Samantha Fisk.

The race is still on for the propulsion market to develop products that will meet with needs of tomorrow’s vessels. The need to develop smarter and more efficient systems, whilst still in the fog of working out what the fuel of choice will be in the future, has meant that system will need to be adaptable.

We have been used to the ‘big names’ in the industry leading the way in developments coming on to the market, but today we are now seeing more collaboration starting to happen, and as some might say needed to happen for the industry to meet with the future challenges of regulations.

Earlier in September MAN Energy Solutions announced that it had signed an agreement with ABB to co-operate on the development of a dual fuel propulsion concept for LNG carriers. The development will see the next-generation ‘DFE+’ decarbonisation solutions based on new MAN 49/60DF engine and ABB’s Dynamic AC power distribution and control system

The DFE+ concept will feature the MAN 49/60DF engine which was also launched earlier in September, and ABB’s Dynamic AC (DAC) technology. The company highlights that the concept aims to deliver the operational flexibility shipowners need to cut carbon footprints as well as fuel bills for liquefied natural gas carriers. The scope of the collaboration covers a joint concept study between the partners sharing technical data, and discussing interfaces and system integration.

Elvis Ettenhofer, Head of Marine Four-Stroke – Region Asia Pacific, MAN Energy Solutions, said: “This cooperation with ABB will deliver the technology necessary to provide a new propulsion concept. In turn, this will help our customers to reduce their CO2 footprint and fuel costs, and will provide the flexibility, for example, in operation for different trades or retrofits from an LNG carrier to floating storage units or floating storage regasification units. This concept can reduce methane slip and fuel costs compared to conventional diesel electric propulsion systems. ABB’s DAC and global presence are an ideal match for our new four-stroke engine.”

The conventional DFDE concept is characterised by constant-speed operating engines (gensets) over the entire engine load, optimised for high load, for example, the 85% load point in part- and low-load have high methane slip and less efficiency. The latest MAN/ABB DFE+ concept will feature variable-speed operating engines (gensets) over the entire

engine load and better efficiency with significant reduction of methane slip over the entire engine map.

ABB’s Dynamic AC technology will enable the operation of propulsion systems above 10 mWe at variable speed with all the accompanying benefits. The company notes that variable-speed applications have been established for liquid-fuel systems up to 10mWe, torque requirements and the low efficiency of first-generation dual-fuel engines, including limitations in the e-systems design for dieselelectric propulsion systems over 10 mWe badly impacted variable speed for propulsion systems over 10mWe.

In combination with the second-generation, high-efficiency MAN 49/60DF engine (with ALSi – Air Lubrication System interface, as an add-on), this DFE+ concept is expected to provide customers with better efficiency and flexibility.

Picking up on the lubrication topic, Thordon Bearings has been conducting studies in to the hydrodynamic lubrication efficiency of a ship’s propeller shaft bearing has found that the use of seawater-lubricated elastomeric polymer bearings reduces fuel consumption.

Lubrication is coming into the spotlight in the maritime industry particularly for propulsion and the effects that it can make on an engine and towards potential fuel savings. Thordon Bearing says that through its study the environmental and financial benefits of adopting a seawaterlubricated propeller shaft system are well documented, but this is the first indication that the arrangement reduces hydrodynamic resistance enough to improve fuel consumption, compared to a conventional oillubricated bearing arrangement.

The research that has been carried out is based on new methodology for calculating the performance of seawater-lubricated bearings, which, until now, has been based on theory developed for oil-lubricated propeller shaft bearings.

“Classic rigid surface bearing theory is valid and commonly used for oillubricated metal bearings. However, two major factors of seawaterlubricated bearings, namely low lubricant viscosity and deformability [of the polymer bearing surface], make the

application of rigid surface bearing calculations susceptible,” Thordon Bearings’ Chief Research Engineer, Dr. Gary Ren, says in his peer-reviewed paper published in the July edition of the Elsevier journal Tribology International.

“We believe Dr Ren’s method is more accurate, because it takes into account the characteristics of seawater as a lubricant, the polymer materials used, bearing pressures, viscosity, friction and so on,” said Elena Corin, Senior Manager, Special Marine Projects, Thordon Bearings. “This is the first time anyone has investigated whether there are differences in friction coefficient between the two types of bearings. And there are!”

Corin furthered that the new methodology provides “strong evidence” to quantitatively support the benefits of a Thordon COMPAC system.

Thordon Bearings used the methodology to compare the fuel consumption of a Panamax containership and an Aframax tanker operating a 640mm (25.2in) diameter oillubricated propeller shaft bearing versus the same ships operating an open COMPAC seawater-lubricated bearing system. Each vessel was assumed to run on VLSFO (very low sulphur fuel oil) at a global average price of US$890/mt, operating for 70% of the time.

“By applying the results, we were able to determine the minimum required shaft speed for hydrodynamic lubrication efficiency, the coefficient of friction as well as the water film thickness at any given load and shaft speed,” Corin highlights.

“Test results confirmed that fuel losses due to the friction coefficient [hydrodynamic resistance] of an oil-lubricated propeller shaft bearing system can be reduced by as much as 85% by using seawater-lubricated polymer bearings.” In turn it is expected that this will have an impact on fuel costs with an estimate annual savings of at least US$10,000 per vessel.

Thordon Bearings is now carrying out research to assess the carbon emissions reduction attributes of vessels using a seawater-lubricated system to help shipowners meet CII (Carbon Intensity Indicator) requirements.

The market is also seeing further pick-up in orders for propulsion units. Rolls-Royce has announced that it has received an order from Turkish yacht builder Turquoise Yachts to supply an mtu Hybrid Propulsion Pack for a newbuilt 76m displacement mega yacht.

The yacht will be equipped with a Rolls-Royce integrated mtu hybrid propulsion system, comprising two mtu 12-cylinder Series 4000 M65L engines with SCR system, fulfilling the strict IMO III emissions directive. The system also includes two gearboxes, two e-motors and electric cooling systems, two variable speed gensets, a battery system and electrical power management system and the mtu NautIQ Blue Vision NG hybrid automation system which monitors and controls the hybrid propulsion system.

The mtu system allows for fully electric operation and is set to be delivered in 2023, the yacht is to be commissioned in 2025. Turquoise will also build a second yacht with a conventional mtu propulsion system.

Mehmet Karabeyoğlu, Partner of Turquoise Yachts, said: “With this new project we are setting new standards for comfort and environmental protection in a mega yacht. We are happy to have found Rolls-Royce as the right partner for this endeavour.”

Denise Kurtulus, Vice President Global Marine at RollsRoyce business unit Power Systems, said: “The cooperation with Turquoise is another fantastic milestone in our efforts to make shipping in general and also the yacht application greener and more climate-friendly with our mtu power

and propulsion solutions. We are proud to be pioneering hybrid solutions in the mega yacht segment together with Turquoise Yachts.”

Further in its developments Rolls-Royce’s sustainability programme “Net Zero at Power Systems”, Power Systems is taking steps towards climate-friendly and climate-neutral solutions in all applications. from 2023, the company is planning on releasing its mtu Series 2000 and 4000 engines for sustainable fuels such as e-diesel and HVO (renewable diesel), thus enabling climate-neutral mobility. In addition to the use of sustainable fuels, the company is building on new technologies such as methanol engines and CO2-free fuel cell systems, which could also be used in yachts.

Turkey once again appears in the spotlight as Steerprop have also announced that they have signed a contract with Turkish Med Marine shipyard to deliver the propulsion units for two RAscal 2100 harbour tugs designed by Robert Allan. The contract is the first for the new Steerprop T product line, especially designed for the stringent demands of tug operations.

The order includes equipment for two harbour tugs. The four SP 175 T propulsion units have 1.80 m propellers in nozzles and provide the power of 1080 kW per unit to deliver 35 TBP. The delivery is scheduled for January 2023.

The growth of global trade and marine transport has brought about larger vessels and a need of more powerful and manoeuvrable tugs, with increased bollard pull for ship assistance and harbour operations. In order to meet with these demands Steerprop has developed the Steerprop T azimuth propulsion product line. The latest evolution of propulsors as able to adapt to changing configurations and versatile operations with mechanical, hybrid or electrica prime movers.

8 Rolls-Royce Power Systems announced plans at SMM to launch the mtu Hybrid PropulsionPack for Series 2000 and 4000 engines from 2023RINA and Waygate Technologies are combining digitalisation and advanced non-destructive inspection technologies to make shipbuilding more efficient.

The companies have signed a global technology cooperation agreement that aims to digitalise welding inspections in shipyards and provide data analytics that will enable them to optimise workflows.

During the ship manufacturing process, many parts are welded together and then inspected for acceptance, usually by means of a visual inspection and non-destructive testing. Through the digitalisation development, shipyards will be able to detect welding defects immediately after welding is completed, reducing delays caused by repair or reprocessing, and thus decrease costs.

Shipyards can also use the solutions to generate statistics and insights from the inspection data collected, enabling them to identify critical points in the welding process and implement preventive corrective actions.

Waygate Technologies’ non-destructive testing expertise and the digital capabilities of the company’s software InspectionWorks enable artificial intelligence (AI) and machine learning assisted recognition of welding defects based on images captured in the field. InspectionWorks is an agnostic software platform that combines data from multiple non-destructive testing (NDT) tools, connects the entire inspection history of an asset and enables users to add inspection insights to a digital twin throughout its lifecycle. As part of a predictive maintenance strategy, NDT identify areas of concern before they lead to a failure.

“Our joint solution helps detect potential defects during and after welding, optimizing production processes, reducing the risk of rework and scrap and eventually improve the quality of welded joints”, said Alberto Cavaggioni, CEO at RINA Consulting.

Nicola Jannis, CEO at Waygate Technologies, added: “Jointly, we will create pioneering inspection solutions and consulting services for marine shipyards and related businesses. Our digital NDT solution helps leverage data to constantly improve production process quality as well as efficiency and drive innovation.”

During the pre-fabrication of blocks, images of welding are taken. These images are then processed with an assisted defect recognition tool based on AI algorithms and can highlight in real time potential defects. Images are then enriched with annotation and made available for analytic purposes. The application has been designed mainly for newbuildings, but may also be extended to repairs.

“The recognition system can be used immediately after the welding is completed,” says Leonardo Brunori, Executive Vice President Energy & Mobility at RINA. “Therefore, the feedback can be provided in real time and the defect corrected at a very early stage, thus avoiding repairs and reprocessing at a later stage. Analytics can be used to identify recurring defects and to undertake corrective actions at the manufacturing stage.”

The NDT and inspection solutions used have already proven to be very beneficial in the aviation and automotive sectors. “Now we are looking forward to applying them successfully in the marine and shipyard industry,” says Brunori.

“In the first proof of concept trials carried out we were very

happy with the consistency in detecting of defects, speed in providing results and good analytics enabling new workflows for the shipyards.”

As the tool is aimed at identifying welding defects at an early stage, it makes the class surveyor’s job more effective and efficient. Furthermore, the possible recurrent defects identified through the analysis of data may be used as an input in the continuous review of classification rules and training of surveyors, says Brunori. The tool can be used for welders’ training, as well.

Feedback from shipyards has been encouraging, and the first projects using the technology will get underway towards the end of this year.

Brunori says the development is part of the progressive digital transformation of the whole marine industry, where manual activities that, to remain competitive, are supported or sometimes replaced by digital tools.

Waygate Technologies, a Baker Hughes company, is building a range of industrial solutions including borescopes that can detect and measure micro cracks, ultrasound testing machines that can inspect entire rails and pipe sections, robots that can travel into cavernous tanks and CT machines that can inspect for inner microscopic pores in parts the size of a small car. Recently, its work has included inspecting hydrogen tanks and ensuring their integrity and functionality and assessing lithium-ion batteries to

8 Rina Waygate Technologies partnership marine shipyard 8 Rina Waygate Technologies partnership signing ceremonyDigitalisation is still keeping pace in the maritime industry as more solutions onboard look to become more connected through digitalisation, writes Samantha Fisk.

Digitalisation is affecting all sectors of the maritime industry and every part of the vessel is now being scrutinised as how it can be made more efficient, and if a sensor can be installed somewhere in order for data to be gleaned and feedback to the shipowner to understand how that vessel is performing.

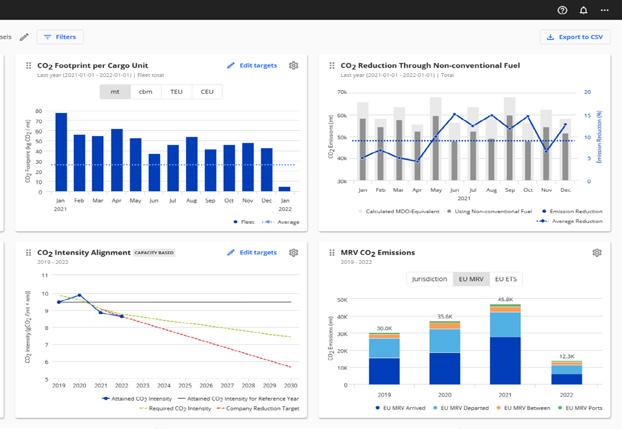

Today though it is not just about the vessel’s performance anymore. We now see that with the added pressure of regulations that will be hitting the market in the next few years that the data gleaned from these monitoring solutions will be valuable for the shipowner and operators trying to plot courses not just through seas but also through environmental legislation.