NOVEMBER 2022 VOL 1022 ISSUE 9 portstrategy.com Green Corridors | Oz: Maritime Logistics Scrutinised | Lines and Terminals: Another Twist? BELT AND ROAD – QUO VADIS? CONGESTION: Lessons Learnt WEST MED’ TRANSSHIPMENT CALLAO GEARS UP

The tipping moment has arrived and we are said by many to be on the way back to normal. Signs are, however, this will be a new normal with some significant challenges but on the upside with the chance to take the best from recent experience as well as capitalise on opportunities that may result from the changed trading environment

VIEWPOINT

MIKE MUNDY

Beyond the tipping point, what next?

So, the tipping point has arrived, and a de-escalation is underway of container freight rates and of severe container congestion. Seemingly, we are on the road back to normality, if indeed anyone can remember what that was prior to the advent of COVID-19!

This is not to say its all over, done and dusted so to speak – lockdowns continue in China, industrial action is a new widespread brake on a return to a less volatile operating environment and behind these operational aspects is a world dogged by rising inflation and the prospect of economic recession plus of course the madness Vladamir Putin has unleashed on the world. There is no doubt that he will secure his place in history but almost certainly not in the way he intended – more in the hall of infamy than the hall of fame!

The big question is will there be a soft landing or a crash? The jury is still out on this but in our industry, with a few notable exceptions such as the gas sector, there are some disturbing signs. One big barometer is China and in our article on p26, which looks at China’s Belt and Road Investments (BRI) in the port sector, we detect clear signs of frailties in the Chinese economy with these, in turn, amplifying the inherent flaws of the BRI programme. The Belt and Road Initiative is slowing – indeed it seems to have metamorphosed from a tool for investment and strategic advice to a growing source of problems.

It is natural that the post-Covid era brings with it a lot of scrutiny as to what happened and what lessons can be learnt as well as some speculation about what next?

We address key takeaways that can be identified in our article Congestion: Lessons Learnt. While we recognise that there are some big policy issues that need attention and some heavy industry investments that are required, we also identify some low hanging fruit, particularly at an organisational level, that with the right treatment can realise significant ongoing benefits. Yes, positive takeaways. This thinking is also mirrored in the Strategist column which highlights IAPH’s interesting new Closing the Gaps report.

When it comes to speculation, look no further than the final page of this issue – what we call the PS Page. It tackles the interesting question of what happens next with liner investment in terminals? History has a view of this which suggests any downturn in the fortunes of lines will bring a reduction in this activity and ultimately divestment. Does this mean opportunities for independent terminal operators around the corner?

Plenty of food for thought, enjoy the read.

PORTSTRATEGY

FOR

The international magazine for senior port & terminal executives

EDITORIAL & CONTENT

Editorial Director: Mike Mundy mmundy@portstrategy.com

Features Editor: A J Keyes keyesj186@gmail.com

Consultant Editor: AndrewPenfold andypenfold@yahoo.com

Regular Correspondents:

Felicity Landon; Stevie Knight; John Bensalhia; Ben Hackett; Peter de Langen; Barry Parker; Charles Haine; AJ Keyes; Andrew Penfold; Oleksandr Gavrylyuk Johan-Paul Verschuure; Phoebe Davison

Production David Blake, Paul Dunnington production@mercatormedia.com

SALES & MARKETING

t +44 1329 825335 f +44 1329 550192

Media Sales Manager: Arrate Landera alandera@mercatormedia.com

Sales Executive: Rhys Lawton rlawton@mercatormedia.com

Marketing marketing@mercatormedia.com

Chief Executive: Andrew Webster awebster@mercatormedia.com

PS magazine is published monthly by Mercator Media Limited, Spinnaker House, Waterside Gardens, Fareham, Hants PO16 8SD UK t +44 1329 825335 f +44 1329 550192 info@mercatormedia.com www.mercatormedia.com

Subscriptions

subscriptions@portstrategy.com or subscribe online at www.portstrategy.com

Also, sign up to the weekly PS E-Newsletter.

1 year’s magazine subscription

Digital Edition: £GBP189.00

©Mercator Media Limited 2022. ISSN 2633-4232 (online). Port Strategy is a trade mark of Mercator Media Ltd. All rights reserved. No part of this magazine can be reproduced without the written consent of Mercator Media Ltd. Registered in England Company Number 2427909. Registered office: c/o Spinnaker House, Waterside Gardens, Fareham, Hampshire, PO16 8SD, UK.

For the latest news and analysis go to www.portstrategy.com NOVEMBER 2022 | 3

INSIGHT

PORT EXECUTIVES

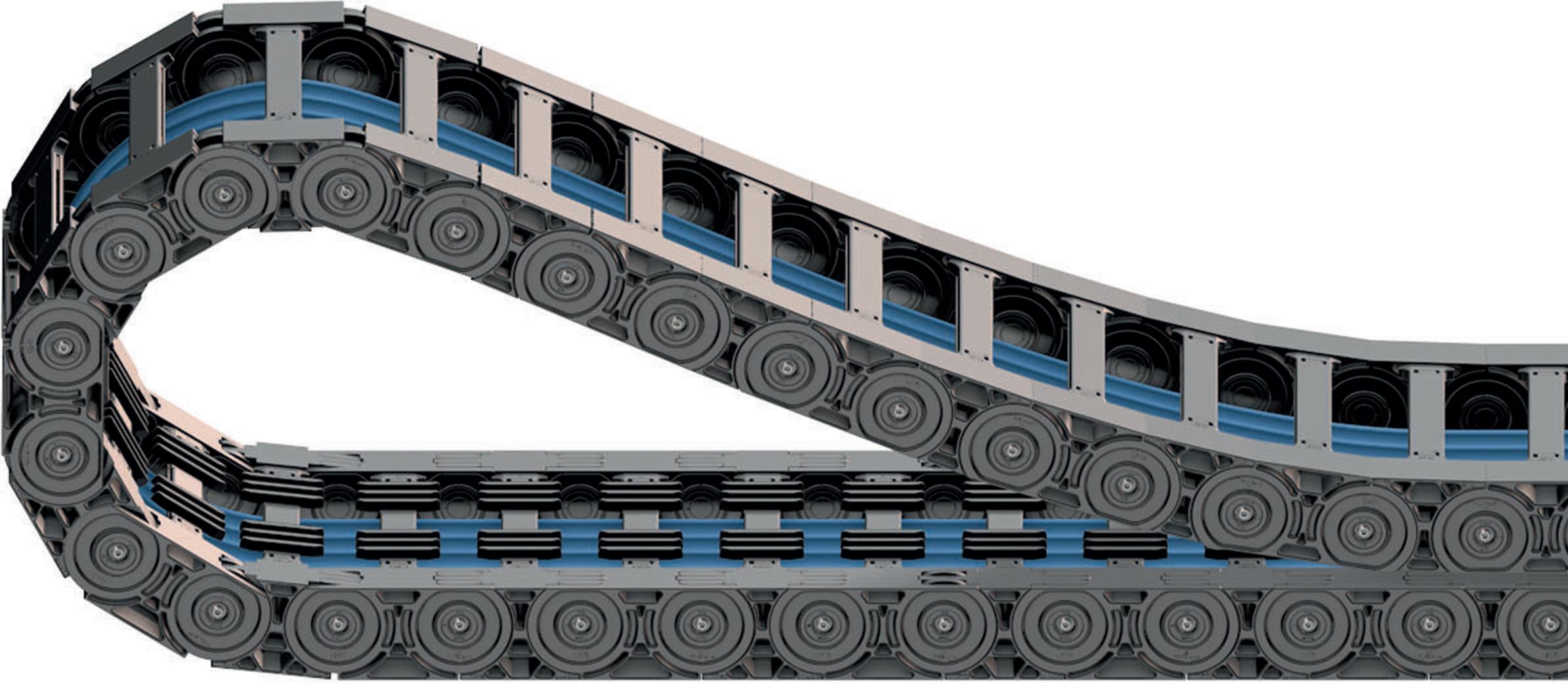

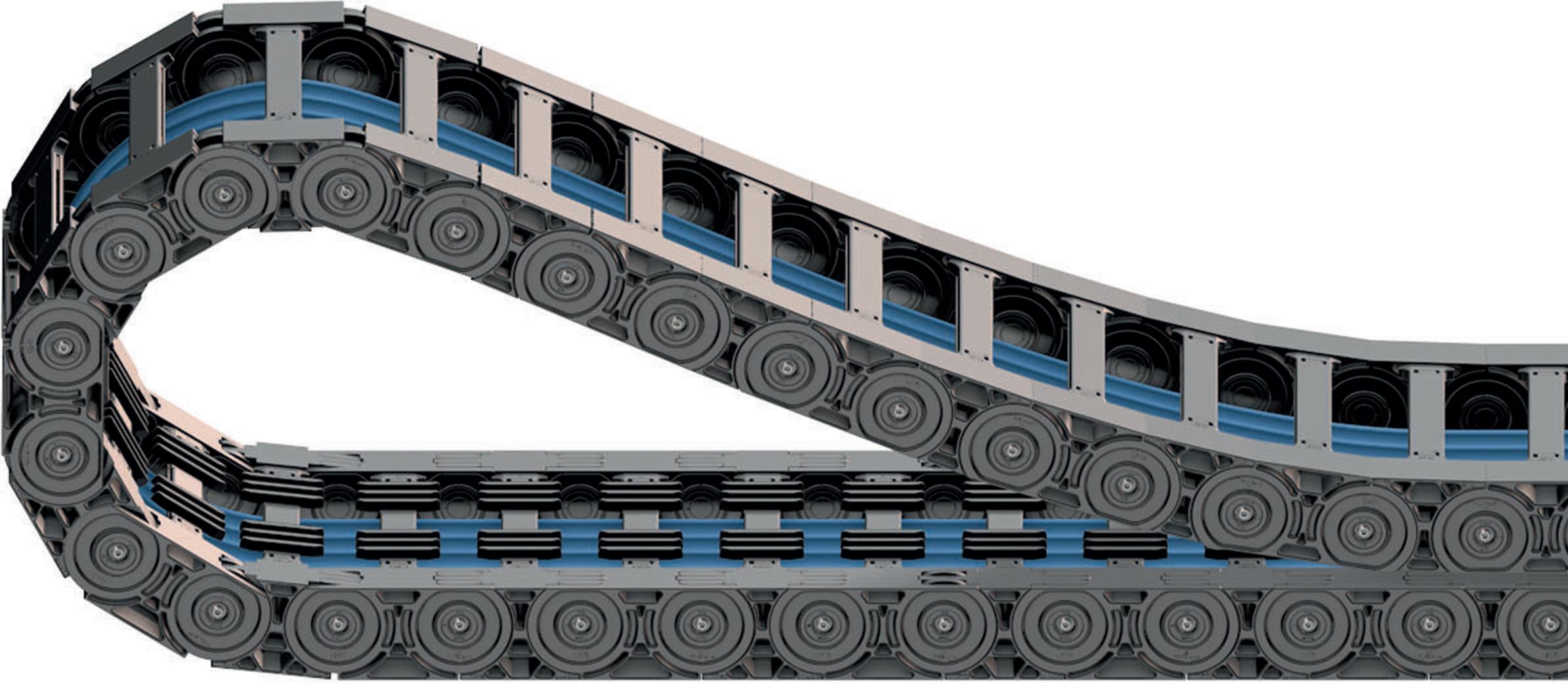

Maximum service life with optimised design Heavy duty rol e-chain® P4HD.56R for the next generations of container cranes 50% longer service life compared to proven P4.1 series Low maintenance due to lubrication-free tribo-polymer plain bearings Optimised design of rolling elements, side bands and joining links Secure guidance thanks to comb-like autoglide crossbars Optional: Integration of smart sensors for condition monitoring and predictive maintenance ... prepared for longer travels, higher speeds, short stress cycles and Industry 4.0 The terms "igus, e-chain, motion plastics" are legally protected trademarks in the Federal Republic of Germany and, where applicable, in some foreign countries. igus® GmbH Tel. +49-2203-9649-800 info@igus.eu motion plastics® /cranes

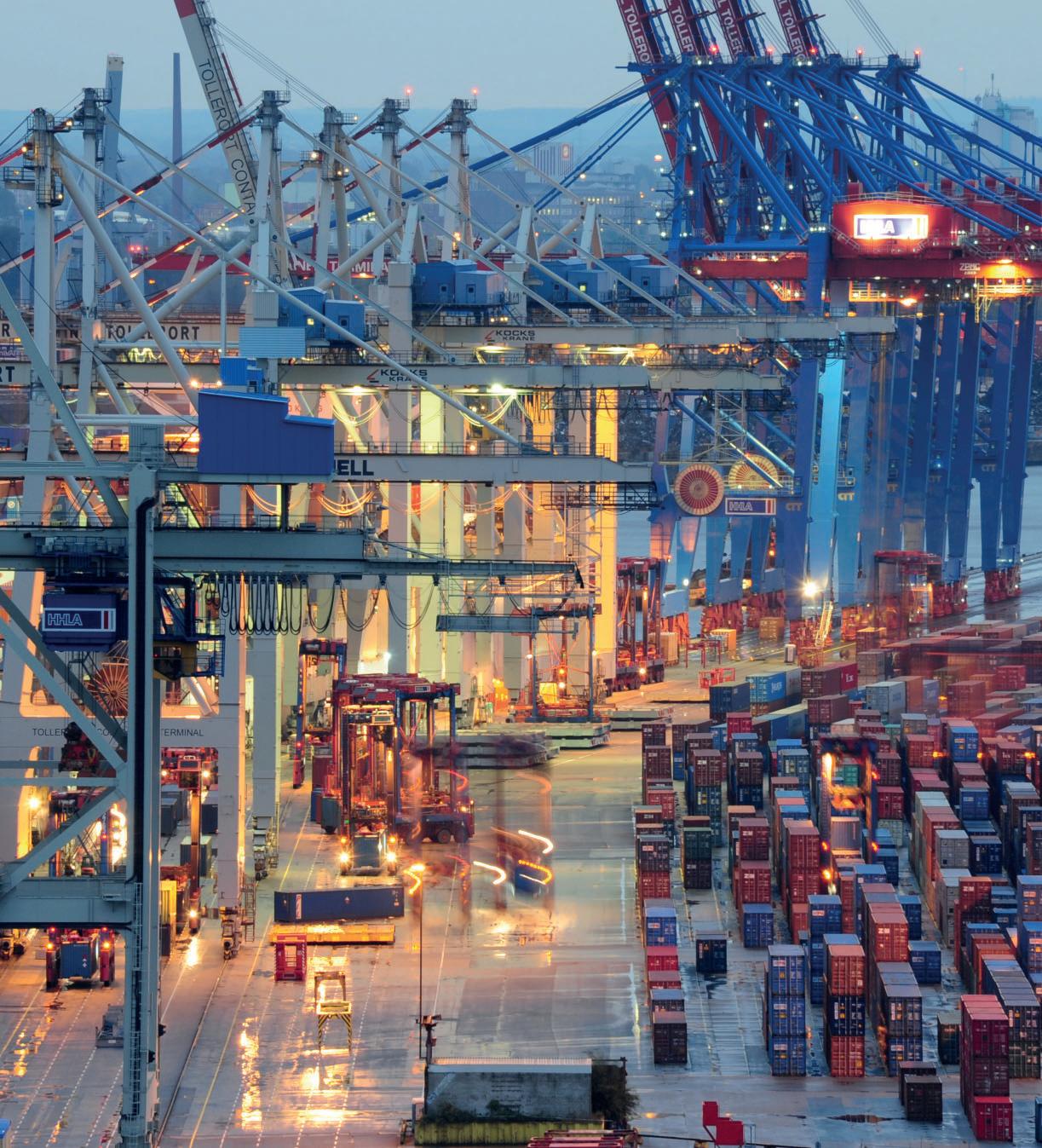

On the cover

The Port of Hamburg is one of many ports worldwide that have been challenged by Covid-19 and the resulting disruption to supply chains. It has faced severe congestion but like many of its peers it is able to take some positives away from this hardearnt experience

magazine is a business

resource on how best to

the environmental and CSR demands in marine ports and terminals. Sign up at greenport.com

require to

and

in touch at greenport.com

For the latest news and analysis go to www.portstrategy.com NOVEMBER 2022 | 5 Weekly E-News Sign up for FREEat: www.portstrategy.com/enews CONTENTS NOVEMBER 2022 is a proud support of Greenport and GreenPort Congress GreenPort

information

meet

The Congress is a meeting point that provides senior executives with the solutions they

meet regulatory

operational environmental challenges. Stay

Online portstrategy.com 5 Latest news 5 Comment & analysis 5 Industry database 5 Events Social Media links LinkedIn PortStrategy portstrategy YouTube

NEWS FEATURE ARTICLES REGULARS 21 The Environmentalist Thumbs up to Green Corridors 22 The New Yorker Measure and manage 22 The Analyst Port ecosystem development 23 The Economist Zombie politics chaos 23 The Strategist IAPH: Closing the Gaps 24 Congestion Lessons Simple fixes 26 Belt & RoadQuo Vadis? Belt and Road Realities 28 Oz: Logistics Scrutinised Port productivity goals 30 Signs of an Uplift Short Sea prospects 32 Pillars of Hercules Liner transshipment strategies 36 Mix & Match Strategy Algeciras and Tanger-Med’s roles 39 Callao Gears Up Expansion underway and planned 43 Smart Ports Doctrine Latest initiatives and news 47 Spreader Refinement Market and technical trends 54 Postscript Change in liner investment and new opportunities emerging? NOVEMBER 2022 VOL 1022 ISSUE 9 portstrategy.com Green Corridors Oz: Maritime Logistics Scrutinised Lines and Terminals: Another Twist? BELT AND ROAD – QUO VADIS? CONGESTION: Lessons Learnt WEST MED’ TRANSSHIPMENT CALLAO GEARS UP 16 Two Green, One Red Diering port expansion plans 16 SAAM Bought Hapag Lloyd Americas expansion 19 Adani Progress… …but challenges persist 19 Jeddah Target Receiving the big ships 11 Mega Shanghai Terminal… …and Nansha new berth 11 Deeper Paranagua Facilitating more grain exports 13 New CMA CGM Initiatives Optimizing India operations 15 AI Enhances Simulation Training & development 15 Robotic Folding Pins HHLA research project 17 Valencia Solar Initiative Taking up the solar option 19 Mobile Power Solution Option for small ports

BRIEFS

More Private Brazil

More port privatisations are expected in Brazil. Earlier this year the Brazilian government held an auction for the concession of Espírito Santo state port authority Codesa as well as made a commitment to offer a 35-year deal for the country’s biggest port, Santos, in São Paulo state, by the end of 2022. Now, both Rio de Janeiro’s port authority Companhia Docas do Rio de Janeiro (CDRJ) and Pará state port authority Companhia Docas do Pará (CDP) are also being made available.

PD Ports Sale?

Unsubstantiated press reports in the UK have suggested that Australian investment company Macquarie is considering a £1 billion ($1.13 billion) bid to acquire PD Ports. This news follows the current owner of the UK asset, Canadian private equity firm Brookfi eld, cancelling a previous sale process in November 2021 over possible concerns from South Tees Development Corporation (STDC), the owner of land surrounding Teesport.

CTA Hydrogen Hub

The desire of the climate neutral HHLA Container Terminal Altenwerder in the port of Hamburg to become a hydrogen hub has moved a step closer to fruition following the arrival of a first test delivery of hydrogen and its derivatives. In March 2022, HHLA signed an agreement with Abu Dhabi National Oil Company (ADNOC) to test the transport chain for hydrogen from the UAE to Germany, following the launch in 2020 of the HHLA Hydrogen Network. HHLA is one of a number of North European port operators pursing the objective of establishing a hydrogen hub.

TWO GREEN LIGHTS, ONE RED LIGHT

Two new largescale container terminal projects have been announced at key North European ports, but APM Terminals has decided against expanding one of its regional facilities.

Antwerp: The Port of AntwerpBruges and PSA Antwerp has confirmed the renewal of the quayside and terminal at the Europa Terminal in a project that will consist of three phases across nine years

Cameron Thorpe, CEO of PSA Belgium, explains: “At PSA Belgium, we are delighted that construction works on the quayside are underway. This will allow us to start the transformation process of Europa Terminal with a highly sustainable investment while increasing capacity by more than

700,000TEU annually.”

The €335 million (US$328 million) investment will enable this terminal to receive the latest generation container vessels, with water depth at the 1200m berthing line being deepened from 13.5m to 16m.

London Gateway: DP World UK has confirmed that construction work on the fourth berth at its London Gateway terminal has commenced.

The £350 million (US$385 million) investment is expected to increase capacity by over 30 per cent, while also making the operation fully electric when completed in approximately five years’ time.

This project is part of planned spending of around £1 billion (US$1.1 billion) in the UK by DP World.

APMT Maasvlakte: However, the position is different in Rotterdam, where reports continue to circulate that APM Terminals (APMT) has decided not to pursue its Maasvlakte II expansion project, as the decision to confirm the project was originally due in June 2022.

APMT has been operating the facility since 2015 and in 2021 it contracted Ballast Nedam, Hochtief and Van Oord to undertake the construction that will double capacity from 2.7 million TEU to 5.4 million TEU by 2026. The project also planned to create additional berthing space for Ultra Large Container Vessels (ULCVs).

However, rising construction costs, especially for steel, looks like the project will be cancelled, potentially resulting in a squeeze on available capacity at the port according to informed sources.

HAPAG LLOYD ACQUIRES SAAM TERMINALS

In a surprise move, Hapag Lloyd, the Germany-based shipping line, has announced the acquisition of the terminal business of SM SAAM S.A.

This portfolio represents one of the few remaining independent terminal groups and will see Hapag Lloyd AG take a 100 per cent shareholding in 10 facilities across six different countries throughout the Americas, thereby offering the German shipping line a stronger presence in the region.

In an announcement from both contracting parties, it has been disclosed that Hapag Lloyd is acquiring full shares of SAAM Ports S.A. and SAAM Logistics S.A. for a price of approximately US$1 billion. Real estate assets connected to the logistics business are included but SM SAAM’s tugboat services and airport logistics services businesses are not part of the transaction.

Chilean-based SM SAAM was founded in 1960 and had been listed on the Santiago Stock Exchange (SSE) since 2012, when the terminal and logistics business was spun-off from Chilean shipping operator,

Compania Sud Americana de Vapores (CSAV), as part of its economic recovery strategy.

The terminal business being acquired by Hapag Lloyd comprises a mix of terminals, with notable container and cargohandling operations in Latin America at San Antonio, San Vicente, Iquique, and Guayaquil. Additional facilities are also in Caldara (Costa Rico) Mazatlan (Mexico) and Port Everglades (FL).

SM SAAM confirmed it had around 4000 current employees.

In 2021 the portfolio handled an estimated 3.3 million TEU, with a total capacity of 5.6 million TEU per annum available.

SM SAAM is controlled by major Chilean conglomerate Quiñenco (part of the Luksic Group) with a 52.2 per cent ownership stake. It is also a major shareholder in CSAV.

the latest news and analysis go to www.portstrategy.com

PORT & TERMINAL NEWS

6 | NOVEMBER 2022For

8 Hapag Lloyd has boosted its terminal and logistics coverage in the Americas with the US$1 billion acquisition of Chilean-based SM SAAM group businesses

Carry your terminal towards a more eco-efficient FUTURE

Kalmar Hybrid Straddle Carriers can cut your fuel consumption and emissions by up to 40% as they use an eco-efficient regenerative energy system. This system captures the energy produced through deceleration and spreader lowering and stores the energy in Li-ion batteries, which work in tandem with an efficient and compact diesel unit to power your crane. Kalmar Hybrid Straddle Carriers are eco-efficient and ready for an automated future. Kalmar, making your every move count.

kalmarglobal.com

With Kalmar Hybrid Straddle Carriers.

MOVING MORE PORT MACHINERY FROM SANY www.sanyeurope.com SANY PORT MACHINERY –FIRST-CLASS PERFORMANCE, EFFICIENCY AND DURABILITY + More than 5,000 port machines sold in 12 years + Innovative manufacturing processes incorporating trusted European components + Continuously development of alternative drive systems to reduce fuel consumption + Intuitive and comfortable to operate, enhanced concentration for more safety REACH STACKER FUEL-SAVING AND STABLE MATERIAL HANDLER STRONG AND EFFICIENT HEAVY DUTY FORKLIFT ROBUST AND DURABLE EMPTY CONTAINER HANDLER FAST AND COMFORTABLE HARBOUR CRANE CUSTOMIZED AND AUTOMATICE VISIT US AT INTERMODAL EUROPE RAI AMSTERDAM BOOTH C40 08. - 10.11. 2022

ADANI ENTERS BENGAL AND CLOSES GANGAVARAM…

Jeddah Targets top-of-the-range Containerships

Mawani, the Saudi Ports Authority, has confirmed it is targeting 24,000TEU container ships at Jeddah Islamic Port (JIP) and is making the necessary investments to facilitate achieving this goal.

Adani Ports and Special Economic Zone (APSEZ) has signed a 30-year concession agreement with Syamam Prasad Mookerjee Port in Calcutta for a bulk terminal at the Haldia Dock Complex.

This facility has an annual capacity of almost 3.75 million tonnes per annum and joins the company’s existing 13 port concessions on both coasts of India.

At the same time, APSEZ is also waiting to learn if a proposed project involving the port of Tapout, located to the south of Haldia, is going ahead.

One investment that is moving forward for APSEZ involves acquisition of the remaining 58.1 per cent in Gangavaram Port Ltd (GPL).

After receiving approvals from NCLT Ahmedabad and NCLT Hyderabad, GPL becomes a 100 per cent subsidy of APSEZ, with the acquisition price quoted at Rs6,200 crore (US$753.7 million).

Karan Adani, CEO and Whole-time Director, APSEZ, notes: “Acquisition of GPL is a key milestone in consolidating our position as India’s largest transport utility and in achieving East Coast & West Coast parity.

8 Adani Ports continues to push ahead with portfolio expansion in India

Gangavaram Port has excellent rail and road network connectivity and is the business gateway to a hinterland spread over eight states.”

Located in North Andhra Pradesh, adjacent to Vizag Port, Gangavaram Port is the third largest non-major port in the region, with the ability to handle fully laden super cape size ships up to 200,000DWT. In FY 2022 it handled 30 million metric tonnes of dry and bulk commodities across its nine berths.

…BUT VIZHINJAM CHALLENGES CONTINUE

The desire of APSEZ to develop the planned transshipment Vizhinjam Port in Kerala State continues to face challenges and disruption.

A large number of local inhabitants have been staging protests at the entrance of the port area to stop the construction work

APMT Deepens

APM Terminals Gothenburg has confirmed it is to deepen the port’s shipping channel so that the largest container ships in service, of 24,000TEU capacity, can call at Sweden’s principal port. Completion of the project is slated for 2026. The AP Moller Maersk company states that the project is needed because, “volumes passing through APM Terminals Gothenburg are steadily increasing, a trend that has been further accelerated by supply chain disruptions.”

and demand a coastal impact study is completed. Key concerns from the protesters state that the construction process is increasing coastal erosion.

However, the Kerala High Court has ruled that any obstructions impacting construction traffic must be removed, although APSEZ

Height Fatalities

UK-based insurer, the TT Club, has issued a seven-step checklist to combat height fatalities at ports, stressing that awareness of the issue and causation is a critical initial approach to resolving the issue. The seven steps are: conduct a working at height risk assessment; implement working at height training, invest in PPE, complete safety equipment maintenance, implement a personal safety system, update and review all procedures and record everything.

maintains that Issues still remain in this respect.

Kerala Chief Minister, Pinarayi Vijayan, has confirmed that the local government was considering providing rented accommodation to any displaced residents and addressing any rental issues.

Wilmington Terminal Port of Wilmington (DE) operator GT USA, part of the Gulftainer group, has confirmed it is committed to plans to develop a new US$410m container terminal near the existing port. This is despite changes to senior leadership and announcing in August 2022 that it had to bear “significant legacy costs.” GT USA states it is “resolutely committed to Delaware,” and wants to develop a new terminal at DuPont’s former Edgemoor site.

The company has confirmed that two contracts have been signed, to deepen and construct new berths at JIP, with PC Marine Services and Modern Building Leaders (MBL), with the latter part of a consortium with HutaHegerfeld Saudi Ltd.

The project represents a US$170 million investment and will see new berths, 26 to 31, each with a 16m water depth alongside and together totalling 1100m in length constructed.

The location of JIP in the Red Sea represents no deviation from the main East-West shipping routes for vessels sailing between Asia and North Europe/ Mediterranean via the Suez Canal, so the facilities represent an optimal location for the largest ships in service making calls with no deviation.

Mawani is also expecting JIP to commence receiving larger bulk grain ships in the light of the desire of Saudi Arabia to secure and maintain higher grain reserves. This follows on from the recent volatility of grain supply caused by the Russia – Ukraine conflict.

BRIEFS

COSCO Pauses

COSCO Shipping Ports (CSP) is delaying the completion of the acquisition of a 35 per cent stake in Hamburger Hafen und Lagerhausgesellschaft’s (HHLA) Tollerort facility at the Port of Hamburg. Despite both HHLA and the Mayor of Hamburg already approving the deal, the Federal Ministry of Economics and Technology voiced concerns about COSCO’s entrance. Berlin must approve the deal, and now an investment review procedure is underway.

For the latest news and analysis go to www.portstrategy.com NOVEMBER 2022 | 9 PORT & TERMINAL NEWS

MEGA SHANGHAI TERMINAL DEVELOPMENT INITIATED…

Paranagua Anticipates More Grain Throughput After Deepening

As a result of the main access channel at the Port of Paranagua, Brazil being deepened, higher volumes of grain throughput are expected.

According to the port authority, Portos do Parana, the route into the port and mooring berths at its Eastern Export Corridor are now 12.8m deep up from the previous depth of 12.5m, based on the lowest point of a ship’s keel and the waterline.

A new 11.6 million TEU capacity container facility has been confirmed north of Yangshan in China.

The US$7.8 billion project is being undertaken by Shanghai International Port Group (SIPG) and is expected to deliver an additional 5500m of container berthing space.

Initial construction works commenced in early October 2022, with a projected completion

date of the end of 2030.

SIPG states that the new facilities will help improve service levels for the Yangshan deep-water area while enhancing river-to-sea combined transportation in the Yangtze river delta.

Shanghai remains the world’s largest volume container port, based on volume throughput. In the January to end of August 2022 period the port handled

8 With almost 12 million TEU of extra capacity due in the north of Yangshan, no let-up in throughput is expected by Chinese authorities

31.02 million TEU, reflecting a drop of just 0.2 per cent on the comparable eight months of 2021, which was achieved despite a two-month lockdown earlier in 2022 due to Beijing’s continuing zero-tolerance COVID-19 strategy.

…AND NEW NANSHA BERTH PLANNED

A reported US$1 billion is being invested at Nansha Port by Guangzhou Port Group (GPG) to help keep pace with demand.

Currently, the annual capacity of Guangzhou Port is more than 23 million TEU per annum, but for 2021 the facility recorded almost

Klaipeda Wind Hub

Klaipeda is planning to establish a regional hub supporting offshore wind activities. Lithuania has already announced a 700-MW wind park off of its coast in a plan that could eventually provide 25 per cent of the total power demand for the country. A tender process will commence in early 2023.

Another project is being considered off the coast of Poland which will power more than 1.5m homes from 2026.

24.2 million TEU and for the year-to-date as of end of August 2022 the Ministry of Transport in China reports that the port handled 16 million TEU, reflecting a small rise of 0.8 per cent over the comparable 2021 period.

GPG confirmed in a filing to the

VW Selects New Hub

Port Freeport (TX) has been chosen as the new major US Gulf Coast hub for the future logistics operations supporting

Volkswagen Group of America, Inc. (VWGoA). A 20-year lease has been signed and VWGoA plans to serve 300 vehicle dealers in the US from this location once the new port facilities are operational in Q1 2024. Up to 140,000 vehicles per year will be imported from production factories in Europe and Mexico.

Shanghai Stock Exchange that the investment “intends to better serve the economic and social development of the hinterlands and speed up cargo processing.”

A new subsidiary, with paid-up capital of US$210m will own and operate the new facility.

Suez Zone Projects

The Suez Canal Economic Zone has approved major new expansion projects in SCZone-affiliated ports. These include a US$10 million, grain production and manufacturing activity in the East Port Said zone, a US$500 million, 955m berth expansion and accompanying yard at Suez Canal Container Terminal and launching construction of the new CMA CGM, COSCO and Hutchison Ports terminal facility at Sokhna.

As a result, the port is now preparing to load an additional 2100 tonnes of grain per ship calling and an annual total of near 600,000 tonnes, based on 285 vessels calling over the course of a 12-month period.

Further water depth is also being targeted initially of 13.5m, followed by more sediment dredging to reach a depth of 15.5m. In addition, the work will also enable bulk carriers up to 245m LOA to call.

The port houses a public silo and nine terminals, with three facilities designated for simultaneous bulk operations.

Paranagua has a key strategic role to play in the state of Parana, with its current volumes accounting for almost 30 per cent of all cargo throughout, which amounted to 57.5 million tonnes in 2021.

BRIEFS

Ethiopia Dry Port

A new consolidation centre at Modjo Dry Port in Ethiopia has opened. It is a joint venture of Maersk and its in-country partner, Freights International (PABOMI). According to the Danish carrier, the new facility is going to help “simplify and optimise” the supply chains of customers in the apparel and lifestyle industries by offering cost savings and optimising the speed of access to end-user markets based on using one centralised facility.

For the latest news and analysis go to www.portstrategy.com NOVEMBER 2022 | 11 PORT & TERMINAL NEWS

CMA CGM LAUNCHES DIGITAL AND IT INITIATIVES

CMA CGM companies in India are launching a range of digital and IT initiatives to improve supplychain activities for shippers and customers in this country’s hinterlands.

Effective from October 3, 2022, CMA CGM Agencies India confirms that it has introduced four different inland container depots (ICDs) in North India (at Ludhiana, Jodhpur, Kanpur and Jaipur) to its digital forwarding system, which was originally piloted at two other northern India locations in April 2022.

This process involves introducing the implementation of the digital forwarding note or Form-11 via the ODex platform in the ICDs. From the end of October 2022, CMA CGM will move on to only accepting digital forwarding information, although

for the immediate future all reefer shipments will remain part of the manual processing system. This initiative is part of the French carrier’s desire to introduce more paperless transactions to significantly speed up the flow of cargo via rail, especially as greater use of block train activities is forming a larger part of multi-modal

8 CMA CGM is implementing new digital initiatives in India to deliver greater supply-chain e

ciency

contract arrangements.

At the same time, CMA CGM (India) has announced it is using the MatchBox Exchange, a technology platform that provides empty container exchange solutions. This allows

NEW INTEGRATED PLATFORM IN RIGA

Freeport of Riga Authority has released a new integrated shared platform to provide multimodal cargo services for sea and land freight. As a result, this port is targeting the digitalisation of cargo documents and data circulation, along with electronic data exchange, with existing information systems throughout Latvia.

The Authority contends that by implementing the project it will be able to “significantly” improve the speed of cargo circulation while also reducing the administrative burden and impact on the environment.

Viesturs Zeps, Chairman,

Advancing PMIS

Development of an advanced and innovative analytics dashboard to enhance digital Port Management Information Systems (PMIS) is the target of a new strategic partnership formed between Innovez One and specialist maritime IT company, Aventra Group. A joint platform, dubbed Port Management Insights, will use historical and real-time data sourced to sensor-based IoT technology) to optimise port, towage and pilotage.

For

stakeholders to better optimise landside logistics operations and save on costs by eliminating unnecessary container trips to empty storage yards.

The latest developments from CMA CGM come at a time when Indian authorities are encouraging their transport, logistics and shipping stakeholder partners to move away from paper-based documents to digital solutions.

Indeed, a new National Logistics Policy (NLP) in India reiterates the need for standardisation of documentation processes and a move to single-window systems within a Unified Logistics Interface Platform (ULIP).

Freeport of Riga Board, notes:

“We are aiming to become a leader in the implementation of digital technologies throughout the Baltic region. We are working on the digital transformation of port processes in order to introduce the principles of the smart port into everyday life by integrating several information systems that make the port a multimodal transport hub and allow information to move faster than actual cargo carriers.

Digitalisation of the port not only facilitates the port’s and the port companies’ cluster operation, promoting their role among the logistics players of the region, but

Namsung Takes OPUS

Namsung Shipping has confirmed that it has implemented CyberLogitec’s OPUS Stowage Prime, a planning solution for automated vessel stowage activities.

The South Korean marine transportation services company has been utilising OPUS Stowage to assist its vessel loading and unloading plans since 2012, but has now chosen to upgrade to the new, next generation automated intelligent algorithm system.

go to www.portstrategy.com

also provides data for new solutions aimed for linking the city, the city transport and other solutions.”

This project is classified as “Digital transformation of port management, improving the processing and analysis of transport and logistics data” and the project implementation financing of €3.2 million (US$3 million) is part of the “Digital transformation” of the European Union Recovery and Resilience plan within the framework of the reform and investment direction 2.1 “Digital transformation of public administration, including local governments”.

Miami Digital Cranes

PACECO MOMENTUM has been appointed by PortMiami Crane Management, Inc. (PMCM) to install its specialist digitalisation tool, PACECO SPYDER, on three of its container cranes. The system was installed on six similar units in 2020. Two more cranes will get the system at a later date. PortMiami has already reported an increase in both “data awareness” and an improvement in both the quality and scope of data.

Shashi Kiran Shetty, Founder and Chairman of Mumbai-based Allcargo Group explains the value of this digital move. “The launch of NLP is a visionary move by the government which will bring transparency through digital integration in addition to boosting speed and efficiency. It will enable fast-paced logistics infrastructure development, better coordination among multiple stakeholders, simplify processes and documentation and boost last-mile connectivity.”

India represents a major market to CMA CGM, with the French shipping line and logistics service provider serving over 50 inland locations from its network of deepsea and feeder port calls throughout the country.

BRIEFS

NYK Integrates IMOS

The Veson IMOS Platform (IMOS) is being integrated and deployed as a platform supporting the shipping businesses of Nippon Yusen Kabushiki Kaisha (NYK) and NYK Bulk & Projects Carriers Ltd. IMOS is a shipmanagement platform that has been developed by Veson Nautical that has the capability to support ship operations including fuel management. NYK plans to link the platform to its financial system.

the latest news and analysis

NOVEMBER 2022 | 13 DIGITAL NEWS

ffi

RESEARCH PROJECT TARGETS ENHANCED SIMULATOR ACTIVITIES

BRIEFS

Blue Visby for MOL

A greater use of simulation continues to gather momentum across the maritime industry, with the introduction of Artificial Intelligence supporting training and development needs. From a shipping perspective many functions on modern vessels have been automated but a ship is still, to a great extent, a human controlled system.

A new €3.3 million research project, funded by Horizon Europe, is targeting the improvement of the effectiveness and accessibility of simulatorbased education, safety, security, and the performance of maritime operations.

This innovative initiative is called Integrating Adaptive Learning in Maritime SimulatorBased Education and Training

with Intelligent Learning System (i-MASTER). The approach has a primary objective to develop an Intelligent Learning System (ILS) with maritime learning analytics and adaptive learning function for students engaged in both remote and on-site maritime simulatorbased education and training.

The i-MASTER Intelligent Learning System comprises three specific innovations:

1) Digitalised navigational performance assessment

2) AI-enabled intelligent learning for remote (desktop) ship bridge simulator training

3) AI-enabled intelligent learning for on-site full mission ship bridge simulator training

The Finnish-German/ German-Finnish Fraunhofer Innovation Platform for Smart

8 Shipping remains largely a human-controlled process, but AI is getting involved with simulation

Shipping at Novia University of Applied Sciences (FIP-S2@Novia) is one of the core partners in i-MASTER, with responsibility for the maritime learning analytics development and the implementation and testing phase, thus digitising maritime education.

Mira Salokorpi, Director, FIP-S2@Novia, explains more about the project: “It brings together technological, educational, psychological, and economical expertise with experience in shipping, while also representing the first joint EU project in the framework of the FIP cooperation.”

HHLA’S ROBOTIC FOLDING PINS

Hamburger Hafen und Logistik AG (HHLA) and a number of fellow German partners are developing a research project that demonstrates the handling of folding pins on container wagons using an autonomous mobile robotics system.

The initiative is part of the IHATEC “Pin handling mR” project in which HHLA and the Fraunhofer Centre for Maritime Logistics and Service (CML) are researching the automation of pin handling in rail processing, with support from the German Federal Ministry of Transport and Digital

Infrastructure (BMDV), which is part of work focused on innovative port technologies (IHATEC).

The existing process involves the pins that secure containers to train wagons having to be manually fastened before trains are loaded, with the installation of the pin amended by the size of the container. This is clearly a time-consuming process but can be replaced by a mobile robot that can operate the pins using a gripper arm.

HHLA notes that the specific software supporting the robotics activity is connected via an

interface, which is expected to be developed “within two and a half years” and this will then ensure that the control centre can monitor and manage all pin handling activities.

HHLA is taking responsibility as overall coordinator for the project and will support it with its subsidiaries Container Terminal

Altenwerder (CTA), HHLA Sky, Hamburg Port Consulting (HPC), Metrans and Service Centre

Altenwerder (SCA). Partner in the project, Fraunhofer CML, is leading the development and procurement of robotics hardware and software.

Major Japanese shipping line, Mitsui OSK Lines (MOL) has confirmed that it has joined the Blue Visby Consortium. This group of companies is led by Finnish maritime software company NAPA, and UKbased law firm Stephenson Harwood and consists of over 15 organisations from across industry, government and academia, with the set objective of reducing greenhouse gas (GHG) emissions from ocean vessels through the development and implementation of digitalbased platform technology.

Galileo Projections

A new tool has been launched to accurately predict the arrival time of ships in the Port of Montreal up to 21 days in advance.

Dubbed project Galileo and developed by the Maritime Employers Association (MEA), in conjunction with Airudi and Scale AI, the new artificial intelligence tool is targeting improved dispatch of the port’s workforce. Galileo takes into account port traffic, weather and quantity and type of merchandise, according to MEA.

Zencargo in Real Time

Specialist digital freight forwarder, Zencargo, is to provide real-time tracking and visibility improvements for freight cargo across the logistics supply chain through a partnership with Tive.

Zencargo states that its customers will have an exact knowledge of a shipment’s location through its real-time collaborative platform. The company’s platform connects all stakeholders, while Tive will bring critical shipment data via its real-time sensors.

For the latest news and analysis go to www.portstrategy.com NOVEMBER 2022 | 15 DIGITAL NEWS

Rope-, Motor-, Hydraulic-Grabs OUR EXPERIENCE –YOUR ADVANTAGE The perfect grabs with unbeatable reliability, leading in efficiency and quality, expedient and economical. MRS GREIFER GmbH Talweg 15-17 • 74921 Helmstadt • Germany Tel: +49 7263 912 90 • Fax: +49 7263 912 912 export@mrs-greifer.de • www.mrs-greifer.de

VALENCIA SETS UP SOLAR OPTION

The port of Valencia, Spain is installing two solar plants so that 14 per cent of its total electrical energy can be self-generated.

The Board of Directors of the Port Authority of Valencia (PAV) has confirmed approval of a second, large, project that will see a total of 11 per cent of the port’s electrical power generated from the installation of photovoltaic plant on the roof of the Valencia Terminal Europa vehicle storage unit, located at the east dock of the port.

This solar facility will see a surface area of 27,700m2 constructed on the roof of the terminal, which is operated by the Grimaldi Group. Although no timescales have been released for the project, a tender is due for release “in the near future”

and will come with a budget of €17 million.

The infrastructure is equivalent to the size of four football fields and will comprise 10,773

photovoltaic modules installed on a metal-framed structure, inclined at four degrees, and facing in a southerly direction. There will be four transformers,

HOUSTON HYBRID ORDER

A total of 14 hybrid Rubber-Tyred Gantries (RTGs) are for use at the Barbours Cut Container Terminal, with an additional 12 hybrid RTG units selected for the Bayport Container Terminal.

The US Gulf Port of Houston has placed an order for 26 new hybrid RTGs from Konecranes as part of preparing for larger vessels and to keep pace with growth in demand.

These new RTGs, from Konecranes, have a lifting capacity of 50 tons while stacking containers up to 1-over-5 high across six container rows as well as providing coverage of the

Generation 6

The Port of Genoa will soon be receiving its first Generation 6 mobile harbour crane (MHC) from Konecranes. The Gottwald MHC has been ordered by Gruppo Spinelli, to support its growing container handling business and will provide additional capacity as volumes surpass 500,000 TEU per annum, while also delivering both operating and overall energy efficiencies. Delivery of the new generation unit is due in December 2022.

truck lane. Key design features include Li-ion battery technology and a battery management system that monitors the charge level and overall health of the batteries, although the hybrid power system is retrofittable and also comes with eco-efficient Tier 4f diesel engines that charge the batteries, as needed.

Each unit is configured with the Active Load Control system, which eliminates container sway, plus includes Auto-steering, Stack Collision Prevention and Truck Lift Prevention smart features.

Konecranes has confirmed the

Upgrades at VSC

Vostochnaya Stevedoring Company (VSC) has boosted its equipment fleet with 10 additional Kalmar terminal tractors and a further 10 Seacom semitrailers. In addition, the operator, Global Ports, has also confirmed plans to transfer three additional RTGs and eight more Kalmar straddle carriers to this facility as part of expanding the terminal’s equipment fleet by 20 per cent during 2023. VSC handle a mixed cargo base.

to

8 With its latest two projects, Valencia is targeting 14 per cent of its total electrical energy needs to be generated from solar power

with two units of 1250 kilovoltamperes (kVA) each and another two of 1,600 kVA, thereby generating around 8,380 MWh/ year, which equals approximately 11 per cent of the port’s total electrical energy consumption.

The remaining three per cent of electrical power will be generated from the first project of this nature in Valencia, which involves development of a photovoltaic energy plant at the Príncipe Felipe dock area. Here the solar energy panels are occupying a surface area of 6420m2 and will generate 2353 MWh/year. This component has a budget of just over €3 million.

ability to monitor the status of the equipment via its TRUCONNECT remote link.

According to the National Retail Federation’s Global Port Tracker, volume imports to the end of July 2022 at Houston were up by 21 per cent. The August 2022 total box volume of 382,842TEU represents a 20 per cent increase over August 2021 and comprises the port’s best ever month. Year-to-date volumes of 2.6 million TEU are 17 per cent up on 2021, which itself was a record. The ever-increasing demand is seeing dwell times increasing though.

Green Altenwerder

HHLA Container Terminal Altenwerder (CTA) has confirmed an order for seven battery-powered tractor units. CTA states that the new electrified equipment will save around 3000 tonnes of CO2, if compared with the existing diesel machines in use. The new units will support the ship-to-shore container gantry cranes and rail-mounted gantry cranes in the storage and rail areas which are already electrically powered.

Aurelio Martínez, President, PAV, highlights “Valenciaport’s commitment to the fight against climate change with specific projects underway to become an emission neutral port by 2030 and contribute to the environmental sustainability of our surroundings. Making sustainability and growth compatible is an essential objective in our present and future strategy”.

Both projects are being financed by the Next Generation funds of the European Union and the Spanish Government’s Recovery, Transformation, and Resilience Plan.

BRIEFS

Amazon Expanding

Amazon has confirmed that it now has a fleet of 5000 x 53ft domestic containers for the US market and is also now offering space on its intermodal services to third-party shippers. The company has openly pledged to compete with existing intermodal service providers on the basis of ‘cost, speed, capacity and performance.’ Although only offering a small fleet, the company is selling services based on its fulfilment centres located near US rail terminals.

For the latest news and analysis go

www.portstrategy.com NOVEMBER 2022 | 17 EQUIPMENT NEWS

The new LHM

Designed for the future of maritime cargo handling. www.liebherr.com

Mobile harbour crane

Mobile harbour crane

Discover

STUDY SEES MOBILE POWER SOLUTION FOR SMALL PORTS

BRIEFS

New Noatum MHCs

Small ports should target provision of shore-side power from mobile units, according to a new study from specialist consultancies, Hanseatic Transport Consultancy and MKO Marine Consulting.

The study, entitled ‘Mobile shore power – technological possibilities and prerequisites,‘ evaluates the use of mobile shore power solutions in German ports and concludes that the use of mobile power units can aid ports in switching to this climate-

friendly technology option.

The switch to shore-based power systems offers welldocumented benefits, including emission-free electricity on a noiseless basis, although it remains subject to sufficient shored-based power being accessible.

The Study confirms, mobile shore power systems offer greater flexibility than fixed shore-based power options and represent a good option over the more expensive, stationary

8 Smaller ports in Germany can benefit from mobile shore-power units, according to a new study

infrastructure, especially for smaller ports that generally have smaller vessels calling that require less power, often under 1.5MW, which can be provided by mobile shore power equipment.

The challenge for ports in Germany, and the industry overall, is that workable mobile units remain a new option, with many solutions still being tested or needing further development.

Noatum’s terminal operations at the Spanish ports of Castellon, Sagunto and Tarragona are each receiving a new Liebherr mobile harbour crane. The new units offer an effective option for reduced energy consumption while maintaining efficient cargo handling productivity. This is primarily due to Liebherr’s proprietary hydrostatic drive that uses closed hydraulic loops for all lifting and turning activities to provide the crane operator with very precise control of all movements.

Fenders for Maio, Cape Verde

The small but strategically located Port of Maio in Cape Verde has received a new set of fenders from ShibataFenderTeam (SFT). This facility is part of a strategic transport corridor involving Africa in which infrastructure spending is co-financed by a combination of the African Development Bank, European Union, and local authorities. A total of 46 fender systems and 31 bollards were provided.

Maersk & Volvo Link-Up

8 In August 2022, the inland shipping container vessel ‘FPS Maas’ made its final journey on an internal combustion engine powered by diesel from Belgium to Rotterdam. During Q4 2022, the diesel propulsion is being replaced with hydrogen technology, entailing removing both the main engine and gearbox, and installing a new modular propulsion system of electric motors, hydrogen tanks, a fuel cell system and an EST-Floattech battery system with a capacity of 504 kWh. EST-Floattech’s reliable and DNV-certified Green Orca system will be used for peak shaving, secondary and bridging power as well as to ensure software failsafes are implemented to achieve safe and long-time operation of the batteries.

Maersk Performance Team is deploying its first battery-electric trucks in Southern California. In a new arrangement with Volvo Trucks North America, 30 units were operational in October 2022, with the aim of deploying 126 vehicles by Q3 2023. Each Volvo truck has a range of 275 miles on a single charge, with the aim of undertaking local and regional distribution activities throughout this US state.

For the latest news and analysis go to www.portstrategy.com NOVEMBER 2022 | 19 EQUIPMENT NEWS

Credit:

EST-Floattech Intelligent Energy Storage Solutions

THEENVIRONMENTALIST

CHARLES HAINE

Maritime news pages are awash with talk of ‘green corridors’. It Is a great move to set them up now because zero-emissions’ ships won’t enter the market until 2030. Under the guise “if you build it, they will come,” there’s time to get organised on transforming these key arteries between specific hubs, to embrace new technologies and clean fuels. But there are also huge challenges.

The annual festival of climate compromise is almost upon us: on 6 November, COP27 starts in Egypt. A long year ago, in Glasgow, shipping rose to prominence. The Clydebank Declaration, signed by 22 countries, called for six green shipping corridors (GSC) by 2025. Proponents were charged with ‘facilitating partnerships’ and ‘taking steps’ to decarbonise routes between at least two ports in signatory countries.

What else makes a GSC, and what does green – in this seagoing context – look like?

Bearing in mind there are no zero-emission vessels in play at commercial scale, the emphasis is going to be on modifying places and building networks that offer key services (e.g., alternative fuels, plug-in charging) for the next-gen’ of cargo vessel.

The Energy Transition Commission for the Getting-toZero Coalition points out the required factors for success: getting the right stakeholders into collaboration mood; bunkering infrastructure; customer demand; and new policy, including incentives.

Maritime safety has to be embedded too, so there’s no time to delay. However, this is not easy when government policies aren’t clear (or available), cross-industry partners need to be aligned (which takes time), and investors need to know returns will be adequate while completing meaningful diligence before imparting millions. Remember that net-zero is a decades long journey rather than a near-term outcome. To be realistic, transition fuels and tech are going to be a bridge in all this,

THUMBS UP TO GREEN CORRIDORS BUT BIG CHALLENGES LIE AHEAD

on the bill, yet biodiversity is barely mentioned in the grand announcements and plans for new green shipping routes.

REALITY OR SPIN?

and that can water down the green credentials.

They’re not holding back though, citing two major opportunities: the Asia-Europe (Singapore-Rotterdam) container route and the Australia-Japan iron ore route.

The latter might in fact be called “the irony route,” on the basis that steelmaking generates around eight per cent of global CO2 emissions, over shipping’s three per cent. Yes, it’s a good idea to try and decarbonise an energy intensive sector but are we looking at real change and innovation or simply enhancing the ‘business-as-usual’ situation?

‘Green’ evokes images of clean air and healthy lifestyles, no or low impact (e.g., from noise, lighting) on receptors, and the proliferation of nature. Surely marine biology deserves a place

From the outset, the use of the word green in this context smacks of marketing and spin, a type of greenwash, or green ship-wash if you like! Some reputations in oil & gas and banking through to aviation and retail are being hammered at the moment for false claims on sustainability benefits.

In reality, progress is being made with more pace in local and regional settings. Nearshore/ coastal routes and inland navigation networks have shorter distances and proven connectivity, so are well-placed to adopt step-change. Strides towards the provision of smart energy networks and electrification have been made in some key river networks of Europe.

In these settings, it is also easier to measure positive impact, evidenced in improved

local air quality (and thus human health), avoiding damage to marine life, while delivering cleaner and efficient cargo and passenger transfer.

The supply-chain understanding and actionoriented mindset of ports will help deliver successful, lower impact, corridors. In January, the C40 Cities group announced a trans-Pacific GSC between the proactive ports of Los Angeles and Shanghai with shipping lines and cargo owners partnering. The Port of Dover intends to become the world’s first high volume GSC.

COLLABORATION KEY

Collaboration with a wide range of stakeholders is key to creating mutual benefits and investment.

A good example is National Maritime’s (UK) Blue Space Advanced Port, Energy & Logistics Centre concept. This can support ambitious strategic plans by connecting-in spin-off businesses and entrepreneurial start-ups. By stimulating green economy employment and creating new streams of economic value in port areas, and in locations where renewable sources of energy are available, we will truly be starting to anchor greener corridors and logistics into the lower-carbon future.

For the latest news and analysis go to www.portstrategy.com NOVEMBER 2022 | 21

The supply-chain understanding and action-oriented mindset of ports will help deliver successful, lower impact, corridors

‘‘

8 As part of comprehensive plans to decarbonise, the Port of Dover has set the goal of establishing the UK’s first high volume green shipping corridor with a focus on select cross channel operations

THENEWYORKER

BARRY PARKER

TIME TO MEASURE IT AND MANAGE IT

The supply chains are constrained- that is something that all the panelists agreed on during a presentation at Capital Link’s 2022 Maritime Forum in New York. Though they could not agree on the right analogy (one speaker from a carrier talked about a narrowing highway, while a top port executive on the panel referred to a plumbing situation of smaller and smaller pipes), a very clear consensus came through that the present system in the States is broken.

One of the panelists, also a top port manager, said that we need to be changing operations to a 21st century mindset- which includes getting to a 24 x 7 mode of working well beyond the load and discharge of vessels. The

plumbing analogy rang true here, as the talks described “an increasing lack of fluidity” in the movements of cargo (a pipe rather than a chain, but readers should get the idea). Farther away from the cranes on the wharves, the likelihood of slowdowns grows.

The presentations, held during New York’s “Climate Week” at the United Nations in late September, attracted a coterie of high-level executives from the shipowner community. Though many of those attending the Forum came from the bulk cargo side of the business, there were a fair number of delegates from tonnage providers (who charter vessels out), the actual carriers (who charter vessels in), and even a few from the cargo side.

THEANALYST

PETER DE LANGEN

This conference was not aimed at attendees from the port side; other than the panelists- representing large ports on the East and the West coasts, I did not see many stakeholders from local or other ports. Nevertheless, many port planners are no doubt aware of the issues that came up (and might even have some different analogies to describe the blockages and constraints that they’ve experienced), and might possibly have seen similar presentations.

If there is a take-away for readers here, it is a reminder to look at the operations of terminals and transport providers serving the ports- links in the chain farther inland from the wharves.

One entity alone will not solve the problems, but groups of ports (working ad hoc or may be through established trade organisations) might be able to develop strategies for unclogging the pipes (or unjamming the highways) and share their findings with legislators and policy makers. The aphorism “If you can’t measure it, you can’t manage it,” also applies here as the ports work towards moving the mindset forward. It’s important for the port community to be able to quantify the costs of narrowed pipes father away from the docks.

The folks in state capitals and on Capitol Hill will take notice more quickly if presented with actual data on real costs and opportunity costs.

CONDITIONS FOR PORT BUSINESS ECOSYSTEM DEVELOPMENT

DP World, the developer of London Gateway, made two recent announcements, signaling the steady development of the London Gateway port business ecosystem. First, it will invest around £350 million in a fourth berth project, which will increase London Gateway’s capacity by a third.

This will enable London Gateway to continue increasing volumes and expanding its share of the UK market. Second, DPW announced that work has begun on a new speculative 119,000 ft2 green warehouse at London Gateway’s port-centric Logistics Park. DPW stated that demand for premium warehousing space in the South East of England reached ‘unprecedented’ levels in 2022 and various new tenants have taken leases at London Gateway’s Logistics Park.

These announcements are relevant for a couple of reasons. First, they show that

DPW really is developing a ‘port business ecosystem’ not just a container terminal. The development of the logistics park of around 400 hectares, is an important mechanism to capture the value that is created through the investment in the container terminal.

Second, they show that developing such an ecosystem is a long-term endeavour. The building permission for London Gateway was granted in 2007, building started in 2010 and the

first ship was handled in 2013. The fourth berth will become operational in 2024, and after that there is still room for expanding the terminal with two more berths. The logistics park is currently around 50 per cent utilised.

Third, this case shows that in specific instances, if the conditions are right, a commercial developer (albeit a state owned one) is willing to

take the risks associated with building a port business ecosystem from scratch, even in a fairly mature market like the UK. Other countries may be interested in replicating this approach.

However, this success case may be fairly unique in the sense that the development took place in a privileged location (which became available after the closing down of a refinery) in a competitive market. This aspect is critical from the perspective of a policy maker, as a private initiative port development is an especially attractive policy option if the market is sufficiently competitive (else there is a huge risk of rent seeking and unattractive service and price levels). These conditions for private port development (an attractive location and sufficiently high competition levels) may not be met in most markets where there is space for a new port business ecosystems.

For the latest news and analysis go to www.portstrategy.com

22 | NOVEMBER 2022

8 London Gateway: ecosystem focus

BEN HACKETT THEECONOMIST

ECONOMIC CHAOS CAUSED BY ZOMBIE POLICIES

Misguided policies are causing an unprecedented collapse in global economic confidence leading to further inflation and rising costs of living and a global recession. Did someone forget to read “the basic rules of economics”?

The war in Ukraine has caused global energy and food prices to rise causing widespread inflation putting pressures on the cost of living in the West. In China the Covid Zero policy has damaged the economy to such an extent that economic growth is stuttering just as exports growth is slowing forcing the government to pump financial aid and stimulus into the economy. The impact on shipping and ports became evident from July onward as overcapacity appeared on the Transpacific and European trades, crashing freight rates whilst tankers, particularly LNG vessels boomed. Overall,

consumer demand became more discretionary, and consumption is beginning to slow.

And then came along a new government in the United Kingdom promising tax cuts and economic growth based on the theory of “trickle down economics” which supposes that investments and a greater money supply will lead to growth at the lower end of the income spectrum. This has never been substantiated and the last person that tried this, Ronald Reagan, ended up with a sharp recession.

MIKE MUNDY THESTRATEGIST

In short, the UK Government’s misguided economic policy, and that is being polite, has resulted in economic chaos and for the need for massive borrowing at home that has spread uncertainty across the major industrial world with hits on stock markets and rising interest rates to follow.

The UK Pound sterling collapsed, and interest rates are rising quickly, both leading

to further pressures on the cost of living with absolutely no gain to the economy. The UK is now in a state of potential economic collapse only salvageable by a U-turn, but national and international trust is gone. The IMF has sharply criticized the policy as have most economists.

The impact of these events will lead to a global recession with the UK and Germany already sliding in that direction. The only issue now is whether it will be a short one, “V” shaped with a strong recovery, or a long one “L” shaped with no recovery in sight, particularly as Russia is threatening a nuclear war.

Six months ago there was no container space available for shippers, today the excess supply is staring the industry in the face as demand is crumbling. Ports will begin to see declining volumes as well.

IAPH FOCUS: CLOSING THE GAPS

Against a background of port systems and supply chains under immense pressure during the onslaught of COVID-19, the International Association of Ports & Harbors (IAPH) has recently released a new report, Closing the Gaps, which highlights actions that should be considered in conjunction with the key themes of resilience, digitalisation and decarbonisation as a path to curing system inefficiencies and delivering a stronger and generally more efficient port system and supply chain.

The 80+pp report finds its origins in IAPH’s 2021 Conference and its conclusions represent the output of eight regional workshops held early in 2022, attended by diverse players in the supply chain right through from bankers and academics operating in support functions to front-line entities such as

shipping agencies and terminal operators. The report was prepared in collaboration with the World Bank and as it states in its foreword it is designed to act as an action plan via which key problem areas can be resolved and a more resilient supply chain overall brought into play.

The character of the Closing the Gaps report is that it is essentially big picture and big issue focused, albeit that its recommendations come out of the regional meetings that undoubtedly went into some detail from the standpoint of key industry participants. In this context, actions to “close the gap” are identified together with the strategic objective of working in partnership with the IMO, UN agencies, other industry bodies, port agencies and its own membership to bring about positive change.

Under the heading of Resilience,

the port identifies key challenges that emerged in the full-blooded Covid era: lack of adequate infrastructure, poor intermodal connectivity, the need to accelerate cargo shift from road to rail or waterway and so on. The solutions presented to these and other problems are comprehensive, stretching from improved transparency with data and the revision by ports of their land investment portfolios to accommodate greater partnership opportunities with the private sector through to the improved synchronisation of activities between industry players and a change of mindset to think more in a supply chain context.

In the area of digitalisation Closing the Gaps notes the challenge that some parties face in reaching the first stage of the digitalisation of ship-to-shore FAL requirements and to get onboard with port community

processes. Equally, there are issues around applying the same data standards and lack of cooperation. Solutions to these and other common problems are set out over four detailed pages.

The section of the report on decarbonisation follows a similar path – detailed identification of key problems and immediately following these discussion of workable solutions – regretfully there is not sufficient space to go into detail regarding this subject area.

The report, Closing the Gaps, is undoubtedly a well thought out and useful document in the context of both shaping policy and implementing practical measures. It is not an exaggeration to say it offers something to everyone involved in ports and logistics – in itself it goes a long way towards closing an long-standing information gap, realising another important goal.

For the latest news and analysis go to www.portstrategy.com NOVEMBER 2022 | 23

8 Did someone forget to read the basic rules of economics? Zombie politics appear to be the order of the day

CONGESTION: LESSONS LEARNT

Congestion has rained pain on port and supply chain operations but as Mike Mundy discusses it has also delivered some valuable lessons, including simple fixes, that can promote resilience and efficiency going forward

As of the beginning of October the maritime consultancy Sea Intelligence reported that 50 per cent of congestion had been resolved. As of November, it will doubtless be the case that the situation has further improved. The backdrop to this, though, the trade picture is by no means healthy –in October consultants Drewry lowered its demand outlook for 2022 to 1.5 per cent and to 1.9 per cent for 2023 on the back of heavily downgraded GDP predictions.

Without doubt the “feast” is over and much leaner times are in prospect.

There are still problems – lockdowns in China persist and industrial action are both ongoing causes of supply chain disruption - but in the main it seems fair to say the worst is over.

Indeed, another big indicator of this is that the “postmortem” has begun – what lessons have we learnt from COVID-19 and the resulting supply chain chaos and what needs to be addressed to make supply chains and port operations in particular more resilient?

A new report from IAPH entitled Closing the Gaps makes a very useful contribution in this respect with insight into its content provided in the Strategist column on p23.

Closing the Gaps, along with many other sources, rightly highlights the deficiencies in infrastructure provision that served to intensify the congestion problems. As Closing the Gaps puts it: “The congestion in key global port hubs and the reduced efficiency in hinterland connectivity for inbound and outbound cargo resulting in consumer and industrial supply shortages has exposed the lack of long-term investment in port infrastructure.”

Arguably, this was most notable on the US West Coast in the San Pedro Bay area where both major ports of Los Angeles and Long Beach were choked with monumental vessel queues waiting. For sure there were port capacity deficiencies but beyond this it was very apparent that the offtake infrastructure, rail and road, was a root cause of many problems. This is further underlined by the announcement at the beginning of July that the new California state fiscal year budget includes an unprecedented US$2.3 billion provision for port infrastructure improvements and upgrades, with US$1.2 billion of this set aside for projects that increase goods movement on rail and roads.

The inability of existing infrastructure to weather constant heavy utilisation or what some might define as moments of stress became very apparent in the congested Covid era in turn highlighting the need for more investment to be put in place the essential elements to confirm system resilience.

Clearly, this is an aspect when reviewing experience under Covid conditions that all involved government agencies should look at and, if necessary, make provision for.

DIGITALISATION

IAPH’s Closing the Gaps report focuses at some length on the benefits to be derived from digitalisation.

This report, which IAPH developed in conjunction with the World Bank, makes a number of interesting observations regarding digitalisation including:

5 “The incidence of a significant number of respondents yet to commence or reach the first stage in the implementation

For the latest news and analysis go to www.portstrategy.com

8 Container terminal operators identify relatively simple fixes that can play a part in keeping cargo moving

SUPPLY CHAIN OPERATIONS 24 | NOVEMBER 2022

Credit: HHLA

SUPPLY CHAIN OPERATIONS

of digitalisation of ship-shore FAL requirements and port community processes was confirmed…

5 “The overall absence in applying the same data standards, often within the same country between different ports is seen as a major obstacle to achieving improved port efficiency in a port call.

5 “The gap in governance and understanding on the definition and inclusion of stakeholders in a maritime single window system and port community system and their roles are an impediment to digitalisation, and

5 “The lack of cooperation between neighbouring and or competing ports makes data collaboration challenging.”

To solve these and other problems highlighted there is of course some requirement for investment but it is generally true to say that this requires a comparatively ‘light touch’ compared to the scale of investment required in conjunctionwith basic infrastructure.

The report makes good points when it identifies many problems in this arena as fixable through actions such as: greater collaboration between parties, establishing a realistic long-term digitalisation road-map and complementing this with a three stage plan which encompasses:

5 The optimisation of processes around trade to close the gaps between stakeholders.

5 The use of digitalisation elements to resolve specific supply chain and port issues – for example, the Internet of Things; Artificial Intelligence and 5G.

5 Digital transformation brought about by combining the preceding two elements. This, it is suggested, will, “provide the opportunity for ports to extend their activities and offer new solutions thereby improving their competitiveness.

Overall, however, what is interesting about the commentary on digitalisation is that it indicates that with understanding, organisation, standardisation and collaboration progressive benefits can be achieved with a relatively low level of investment.

Suggested actions in this area border upon relatively simple fixes – in itself an aspect that offers great potential to promote more resilience and efficiency, as is particularly noteworthy at the terminal operations level.

TERMINAL OPS: SIMPLE FIXES

Focusing on the specific area of container terminal operations it is very interesting indeed to obtain the feedback of diverse terminal operators pointing out relatively simple fixes that have been successfully implemented during the peak of the pandemic that provide a range of benefits including: maximising terminal resilience under stress conditions; raising efficiency levels and boosting capacity. Furthermore, the characterisation of these steps as “simple” basically means comparatively easy to implement and without big costs involved. Key examples are:

Capacity Initiatives

– Expanding the hours of terminal operation to match cargo volume flow

– Making use of bonded off-dock facilities/capacity to reposition containers for clearance

– Regulating truck flow through Vehicle Booking Systems

supported by disciplinary systems that maximise compliance – plus potential app usage.

– Encouraging optimising the truck capacity – e.g. carriage of 2 x 20ft and not just one whenever possible.

– Barges: encouraging consolidating different cargo loads on barges to reduce barge traffic overall

Administrative/Organisational

– Working with port management and other parties to maximise the uniformity of the working hours of warehouses and other cargo receiving parties with terminal operating hours

– Standardisation of data protocols/ensuring communications compatibility with interfacing customers and other parties – app for container tracking

– Implementation of robust cyber security measures

– Reducing inefficiencies caused by manual processes/ automating – for example gate operations

– Optimising compliance to safety to measures to avoid accidents and maintain efficient working

– Promotion of continuous improvement processes

– Fostering a collaborative approach with other parties along the supply chain

Human Resources

– Investing in human capital/training and development Bottom line, the message is that yes significant investment is required in certain areas – offtake infrastructure as noted earlier – but it is not the sole solution. Relatively simple fixes are available on diverse fronts to raise terminal performance with the ensuing benefits often feeding along the supply chain.

It has regularly been acknowledged in the past that the container terminal represents the major interface between transport modes. The importance of this role at a physical and online/communications level can be seen to have heightened during the pandemic with arguably a greater appreciation being fostered of the terminal’s role in the supply chain. This mind-set is to be welcomed as part of a collaborative effort to learn from recent events and build system efficiency overall on an ongoing basis.

8 The US state of California has allocated an unprecedented US$2.3 billion dollars for port infrastructure improvements but there are also simple fixes available

For the latest news and analysis go to www.portstrategy.com NOVEMBER 2022 | 25

Congestion has rained pain on port and supply chain operations but has also delivered some valuable lessons

‘‘

Credit: Port of Los Angeles

BELT AND ROAD – QUO VADIS?

China’s march into port investments around the globe is slowing. Andrew Penfold identifies the problems, fall-out and potential for others to step in

China’s overseas infrastructure investment programme – the ‘Belt and Road Initiative’ (BRI) – has been one of the major drivers of port investment since it was initiated in 2013. Various estimates place the commitments of the Chinese state to the BRI at up to USD1.5-2tn by 2021. The overall identified investments since 2013 are summarised in Figure 1. Given the role of the Chinese government it is not really possible to differentiate between BRI initiatives and more ‘commercial’ investments. Overall, the commitment is massive.

Today’s reality is, however, that the Chinese economy now looks much less impressive than it did as recently as two years ago, what does this mean for port investments? In addition, the attitude of many countries to inward Chinese investments is experiencing major change.

Within the total expenditure the primary focus has been on energy related projects, but the port sector has also been a major beneficiary of China’s largesse. To date, some 17 port projects have been reliant – to varying degrees – on Chinese financing to secure construction. In addition, the BRI has focused on major infrastructure investments that will support port developments such as rail links and economic development zones. These projects are summarised in Table 1.

The Belt and Road Initiative (BRI) has come in for additional severe criticism lately. AidData’s newly released report highlights a tranche of China’s overseas lending worth USD843bn with this including some USD385bn of ‘un- and under-reported debt’. This begs the question, can this be sustainable?

A CRISIS WAITING TO HAPPEN?

The massive expansion of the Chinese economy has permitted these huge overseas investments. Indeed, export volumes have held-up in the past year, with the problems basically domestically focused. The sheer level of funds flowing out from China has proved irresistible to many Developing World governments, but it hasn’t been plain sailing in most projects. Structural difficulties beset many of these investments.

Today, the situation in China is now looking much weaker and there is a real danger of a financial crisis based on a property Ponzi scheme and worsening political pressures –particularly sabre rattling over Taiwan – compounded by repeated unrealistic Covid responses. Furthermore, there are difficulties with a lack of transparency with regard to debt crossholdings. The opaque nature of these arrangements suggests the debt position could be much worse than admitted.

China was facing a much more uncertain economic outlook even ahead of high inflation and rising interest rates. There are mounting concerns of an impending crisis and it is difficult to see how the BRI can weather such difficulties should they worsen dramatically.

In the longer-term, China is under pressure from a declining and aging population and classic development difficulties as it tries to emerge from the ‘middle income trap’ that besets even much more open economies. How can China continue to fund BRI projects, when under these

pressures? How does this impact the BRI programme and –specifically – key port developments?

Already heavily indebted countries are struggling to meet loan repayments as many of the initiative’s high-profile projects have failed to yield commercial returns. If these projects are to mature and stand a chance of reaching genuine profitability, then China is on the hook for billions of dollars of rescue loans. The question is whether the Chinese economy will be able to make these commitments?

BRI – GOOD PROJECTS?

A brief look at the port projects that were at the centre of the Chinese funding initiatives confirm that only Piraeus and possibly elements of the purchase of Noatum Ports can be said to have been an unqualified success. In Piraeus, volumes have accelerated sharply with the port playing a central role in regional transshipment. Other projects such as Kumport and Haifa are in a much earlier stage of development and the position remains unclear, but the strategic initiative is apparent.

Elsewhere, the position has been much less positive. The focus of development has been on Asia and East Africa, with some investments aimed at securing raw material supply for China and others clearly focused on a more ‘strategic’ motivation. Some of these projects have been hawked to investors for a long time and have been found to be unbankable in straightforward commercial terms. The port of Gwadar in Pakistan is an example of this. The project was first brought forward for development in the late 1990s, as part of an initiative to boost Pakistan’s development and provide a gateway to the north. Although demand was identified it was clear that the scale of investment – both for the port and supporting hinterland links – together with political risk made the project unattractive. It is difficult to see how these concerns have changed, so investment here must be for other reasons.

It should also be noted that the attitude to Chinese

8 Hambantota port, Sri Lanka seen by many as a classic debt trap which ultimately provided China with a strategic Indian Ocean base

CHINA: PORT INVESTMENT 26 | NOVEMBER 2022 For the latest news and analysis go to www.portstrategy.com