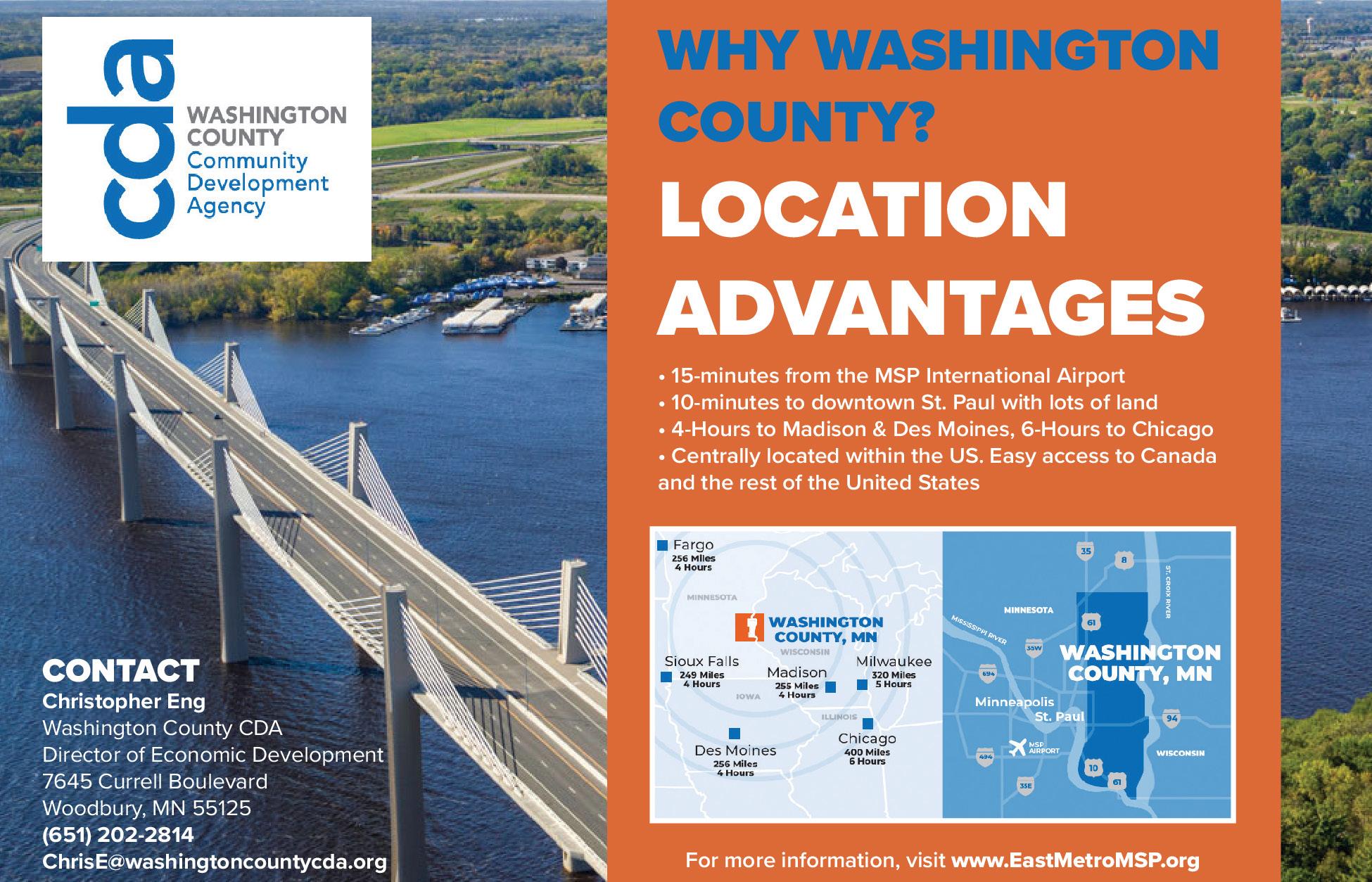

Cross Ocean Partners, Neuberger Berman and Onward Investors Purchase Minneapolis’ Wells Fargo Center

By Dan Rafter, Editor

A joint venture between Cross Ocean Partners, Neuberger Berman Special Situations client funds and Onward Investors acquired the iconic 57-story Wells Fargo Center in the heart of Minneapolis’ downtown commercial district.

The landmark property, Minneapolis’ third-tallest building and a mainstay of the city’s skyline, opened in 1987 as the headquarters of Norwest Corporation (which since merged with Wells Fargo) and was designed by internationally acclaimed architect César Pelli in art deco style.

Currently 62% leased with up to 110,000 square feet of contiguous availability, the 1.15 million square foot trophy office building has long been one of Minneapolis’ most desirable, averaging 95% occupancy since 1988. Previously sold in 2019, considerable renovations have since been made, and ownership intends to continue to strategically invest in the property. Pairing state-of-the-art amenities with timeless design,

the Wells Fargo Center is well-positioned to attract tenants seeking a premier building in a dynamic urban environment.

“This acquisition epitomizes our fundamental value investment strategy of opportunistically capitalizing upon market dislocation and demonstrates Onward Investors’ continued commitment to playing an active role in Minneapolis’ revitalization,” said Jon Lanners, Partner at Onward Investors, in a statement.

Wells Fargo Tower (Photo courtesy of Onward Investors.)

space in the middle of a building. How do you work with that?

We must answer these questions right away with architects and ownership to make these conversions successful.

Do owners understand the challenges that can come with these conversions, especially when it comes to engineering issues?

Nordstrom: It depends on the owner. If it’s a first project, the owners might have a dream. But reality isn’t always fun. Sometimes I have to be the bad engineer. I have to tell owners the reality of what they signed up for when they took on a project.

The other thing is that sometimes people buy a 25-year-old building and don’t expect to have to put money into its mechanical systems. How many people drive around a 20-year-old car? Very few, right? But they expect these older building systems to keep working without having to invest in them. I understand: It’s something they need, but it’s not a fun purchase. I’m often the one who tells them they need to invest in an upgrade.

Commercial buildings with more efficient and effective heating and cooling systems, upgraded electrical systems and efficient plumbing systems must be an easier sell for owners hoping to attract tenants, right?

Nordstrom: Class-A buildings with great amenity spaces are the ones still leasing up today. Everyone wants to live or work in a new, modern space. Spaces that are tired are not leasing up, unless they have a great location. If you spend money on amenities and to modernize your buildings to make them look aesthetically pleasing, you have a better chance of leasing those spaces.

I encourage people to update their building systems, too, when they can. You still need good, fresh air in your spaces. You won’t effective temperature controls. The lighting system needs to provide a healthy amount of light to a space. Tenants don’t necessarily see these systems. They work in the background. But they also make a building a more pleasant space, and that matters.

Are building owners often hesitant to invest in upgrading their properties’ electrical, plumbing and other systems?

Nordstrom: I always encourage building owners if they don’t have a lot of money to upgrade their systems to at least hire an engineering firm to do retro-commissioning. That’s where engineers evaluate a building’s systems and recommend steps for owners to take to improve its efficiency and lower its energy usage.

When we do retro-commissioning, we look at the whole building. Then we put together a list of steps

that the owners can take to realize the biggest potential efficiency increases. It might be something easy. You might have old boilers. Changing them can make a big difference in your property’s efficiency. You might upgrade lighting and controls. There are many things you can do to make your building more efficient. It’s about making sure a building is functioning the way it was intended to when it was built. It’s about making sure the building receives the proper amount of outdoor air, that it is cooling and heating correctly. Sometimes systems are not running as efficiently as possible. Outside air dampers might be too far open. Systems might be stuck on and running when they don’t need to be. It can be so many things.

Are building owners aware of how important it is to invest in their buildings’ mechanical systems? Nordstrom: They are aware. But dollars get pulled to other things. Owners might not think about their building systems as often as they should. That’s the hard part. You must prioritize it. But as long as it works, owners tend to forget about it.

I know that 2024 was a challenging year for most commercial real estate companies. What about 2025? Do you think your company will be busy in 2025 with commercial engineering projects?

Nordstrom: It will be interesting to see. Affordable housing is still a need. We should see plenty of those projects coming online next year. We have been doing a lot more work on student housing through developers here and at campuses across the country. That market has been solid. Developers are creating what feel like market-rate apartments but designed for student living. Colleges don’t want to build their own student housing. They have property, so they work with developers to develop it. A lot of that should be happening next year.

John Nordstrom (Photo courtesy of EmanuelsonPodas Consulting Engineers.)

Meanwhile, it’s the practical, accessible amenities that residents use day in and day out that build loyalty and make life better. Our latest survey highlights what truly resonates:

● Full-Service Fitness Centers: Convenience is everything. A well-equipped fitness center allows residents to work out on their own terms - no extra memberships, no added hassle. In today’s world, this isn’t just a perk; it’s an expectation.

● Coffee Bars: More than just a caffeine fix, a great coffee bar becomes a community cornerstone. Whether fueling a busy morning or serving as a gathering spot during the day, this amenity delivers daily value and fosters connection.

● Pools: Pools aren’t just about swimming - they’re community hubs. Residents use them to unwind, stay active and connect with neighbors. The best pools turn into spaces where relationships thrive.

● Technology-Enabled Amenities: From smart thermostats to community printers, these features don’t just simplify daily life—they empower residents.

It’s about giving people control and convenience, seamlessly.

The takeaway? Focus on what your residents value in their everyday lives. These are the amenities that create not just a place to live, but a community to love.

The End of One-Size-Fits-All

The days of cookie-cutter amenities are over. Today’s residents expect tailored experiences, and they want a say in shaping them. WithMe’s high survey response rates show just how eager people are to contribute to the design of their communities.

Creating feedback loops is essential. Regular surveys, focus groups and one-on-one check-ins ensure that amenities evolve alongside residents’ needs. It’s a win-win: residents feel heard, and properties avoid wasting resources on features that don’t deliver value.

This approach also strengthens satisfaction and retention. When residents see their preferences reflected in their living spaces, they’re more likely to stay. And in multifamily, resident retention isn’t

just good business - it’s the foundation of a thriving community.

2025 and Beyond: The Practicality Revolution Looking ahead, one thing is clear: the future of multifamily living is about thoughtful functionality over fleeting trends. The communities that thrive won’t be defined by aesthetics alone, but by spaces that make daily life better, easier and more connected.

At the heart of this practicality revolution is a simple truth: listening is your most powerful tool. Industry trends may inspire, but the voices of your residents will always guide you to what truly matters.

The best communities aren’t built on assumptions - they’re shaped by the people who call them home. As we step into 2025, let’s keep asking the question that drives meaningful change: “What do you value most?”

Jonathan Treble is founder and chief executive officer of amenities provider WithMe, Inc.

Photo courtesy of Kaboompics.com.

Keys from page 8

sign and construction happening concurrently saves owners money and allows projects to be completed faster.

While the amount of time in the pre-construction phase varies, a large multifamily high-rise usually requires approximately one year of planning and estimating before the project breaks ground. During this phase, we work with the owner/developer and design team to establish budgets and the scope of work. Putting in this time upfront maximizes time and cost efficiencies over the course of the project.

Making Informed Material Choices Through 3D Modeling

One way we make the design-build process better is through advanced modeling. Our first step is to turn conceptual sketches or 2D drawings from the architect or client into 3D models. From these 3D models, we can establish budgets and clearly define our scope of work. The models help us determine not only the amount of building material we will need, but also the types of structural, mechanical, electrical and plumbing systems required for the project. It also helps us determine if there are cost savings to be found as we’re able to show owners what an alternative material – that achieves the same aesthetic – will look like on the 3D model.

The models also give a developer or owner who isn’t as well versed in reading blueprints a better idea of how one slight change can create a major impact on the building’s budget and look. This can be especially relevant when tweaking a building’s exterior, which can be an expensive component of any budget. We can plug in alternative slab edge covers, window walls, balcony doors or metal panels and see new models reflecting those changes in only a matter of minutes.

Maximizing Structural, MEP Efficiencies

While a project’s structural system and its mechanical, electrical and plumbing (MEP) system aren’t usually part of a property tour – as would-be residents are much more interested in interior finishes and amenities – these two systems do comprise between 50% to 70% of a project’s entire budget. So, to say they are an important part of the design-build process is an understatement.

At McHugh, we’ve realized over the years that the best cost-savings in this part of the process can be obtained by working with the project’s structural engineer to optimize the placement of columns, core and shear walls and floor slabs, and by using our sister company McHugh Concrete to pour the concrete for the structure. We also work with the structural engineer on drift and deflection issues to ensure the build-

ing’s strength to support lateral and vertical loads. We can shave it down to a system that’s very cost efficient and yet performs to the requirements of the project. Based on our extensive experience, developers/ owners are most likely to hit their project budget and schedule goals by engaging their general contractor as early as possible, and McHugh Construction will no doubt be leading the charge in these better building practices.

Steve Wiley is senior vice president, pre-construction services with Chicago-based McHugh Construction.

Office

from page 1

“When we started in the office space in 2017, we believed that we were going to see a shift in office-space-using tenants moving from urban areas to urbanized suburban areas, walkable suburban areas that have plenty of restaurants, shops and entertainment options that you can walk to,” Webb told Minnesota Real Estate Journal in a January interview.

“We focus on well-located properties that serve that walkable multi-use suburban area. We find buildings in those locations that are currently underperforming that we can convert to best accommodate the needs of today’s tenants,” Webb said.

As Webb told us, the office is not a space in which employees need to sit five days a week doing busy work. Webb said that office space should be used for more important activities such as brainstorming, collaborating and mentoring.

And companies should use their office spaces as a way to attract the best pool of talent. How to do that?

Provide an office space with amenities such as meeting spaces, on-site healthy eating options, exercise facilities, plenty of natural light and outdoor walking paths.

“We focus on unique amenities that can be attractive to new tenants,” Webb said. “We might not decide to go with a traditional fitness center. Maybe instead we’ll offer a Peloton studio tied into a bike-share program. We also try to bring as much outdoor space programming as we can. We want to build an entire structure that can allow people to meet and collaborate in different parts of the building, not just in their own individual office spaces.”

A muted but still strong industrial market

Also in our first issue of 2024, we spoke with Dan Larew, executive vice president of the Minneapolis industrial and tenant representation team with JLL, about the state of the industrial market.

Larew said that while industrial sales and development activity had slowed by this time, that leasing activity still remained strong. He also said that the Minneapolis-St. Paul industrial sector was a resilient one, even when facing high interest rates and construction costs.

“Even with tenant demand for industrial space dropping, we are still tracking tenants in our market who are looking for about 10 million square feet of industrial space,” Larew said “That is still higher than pre-pandemic levels. That is a healthy level of demand. A vacancy rate of 5% to 6% is still a healthy market. Because of that, occupiers aren’t landing any great deals on industrial space here.”

Larew added that he doesn’t expect to see a return to the type of industrial demand that the market saw during the height of the COVID pandemic.

“I’m not sure we will ever see a flurry of demand like what we saw in late 2021 and early 2022,” Larew said. “We are talking about a hopefully once-in-a-generation event like COVID. That climbed on top of the demands that were already trending, such as the rise of ecommerce.”

Office sales are still happening

A bit of good news in early 2024? We reported on several office sales that took place despite the challenges that continue to face this sector.

That included the sale of 13305 12th Ave. N. in Plymouth, Minnesota, a deal brokered by Colliers in late 2023.

The building itself wasn’t overly large, just 31,780 square feet. But this property was a good example of the type of office property that can sell today, even with the problems facing this asset class.

The property boasted several of the amenities that office tenants desire. That made it an attractive office property to own. Its new owners knew that because the building is modern and featured strong amenities, they could lease space in it.

13305 12th Ave. N. was named Building of the Year by the NAIOP in 2016 and boasts an extensive glass line, LED lighting and a high-tech audio/visual system. The property also features an inviting outdoor space with a patio and a deck on its second floor.

Nick Leviton, a senior vice president with Colliers, and one of the brokers who represented the building’s seller, said that this property is an example of the type of office space designed to flourish today: modern, bright, new and amenitized.

The property was also the right size. Leviton said that it’s easier today to sell office buildings that are under 40,000 square feet. These properties attract more buyers. Leviton said that three potential buyers bid on the Plymouth office property.

“No expenses were spared on this building,” Leviton told us early in 2024. “An owner-occupier built it as a showpiece, something that would show well for a long period of time. The audio-visual equipment, the finishes, the amenities, everything is top end. That helped attract buyers.”

Laura Moore, vice president of Colliers’ Minneapolis-St. Paul, also represented the seller in this deal. Jason Sell of Cushman & Wakefield represented the buyer.

Leviton said that the sale is evidence that the office market, while struggling, is far from dead. The right properties in the right locations will still sell, he said.

Meeting the challenges in healthcare real estate

The healthcare real estate market faced several challenges last year, too, something we explored when interviewing healthcare real estate specialists in the Twin Cities area for our April issue.

But Ann Duginske Cibulka, vice president of real estate development for healthcare at Minneapolis-based Ryan Companies, told us that the local healthcare real estate market remained resilient in these earlier months of 2024.

She said that demand for healthcare space remained strong throughout the Twin Cities market.

“The constant shift of patient care to outpatient services is a big reason for the steady demand for healthcare space,” Cibulka said. “As care comes out of the hospital and into more convenient outpatient centers in the community, we are seeing more demand for space throughout the market.”

At the same time, physician groups and healthcare providers are embracing new technology to assist them in treating their patients. Many occupiers, then, are searching for new, modern space that they can more easily equip with this tech, Cibulka said.

Then there’s the population growth in the Twin Cities suburbs. As more households form in these communities, medical providers are scrambling to fill the spaces that get them closer to these potential patients.

Interest rates, of course, remained a key challenge for health systems looking to expand by either purchasing or building new real estate in 2024. These challenges remained even after the Federal Reserve Board did cut its benchmark interest rate.

Steve Miller, vice president of development and acquisitions for Richfield, Minnesota-based MSP Commercial, said that he doesn’t expect investment sales activity to pick up until interest rates begin to fall by an even greater amount.

Miller told us that buyers are more selective today and are scrutinizing potential deals more carefully. He doesn’t expect this trend to change anytime soon.

While costs have risen, the revenues of healthcare providers have been reduced, too. COVID, of course, played havoc with the revenue streams of providers. Medical providers also face rising nursing and staffing costs. The cost of supplies has risen, too.

The combination of falling revenues and increasing costs is making it more challenging for healthcare systems and physician groups to build stronger bottom lines.

“Healthcare systems have faced major headwinds. Reimbursements are not keeping pace with where the costs of delivering care have gone,” Miller said. “Labor costs have gone up. The cost of supplies has gone up. Everything has become more expensive. That makes it tough for these systems and has slowed growth and the flow of capital that would otherwise be used for relocations and expansions across the Twin Cities.”

Jon Lewin, principal and chief financial officer with Minneapolis’ MedCraft Healthcare Real Estate, said that the demand among tenants for healthcare space Office to page 24

North Loop Green celebrated its opening this summer in downtown Minneapolis. (Image courtesy of Marquee Development.)

still outpaced the supply available in 2024, both in the Twin Cities market and across the Midwest.

Lewin said that most of MedCraft’s healthcare real estate portfolio is leased up, with the exception being some space in older facilities built in the early 2000s.

This doesn’t mean, though, that leasing activity was brisk. Lewin said that while demand for healthcare space is high, medical providers and physician groups are actually moving slowly when making leasing decisions today.

That’s partly because the healthcare industry continues to see big changes in how patients want to access healthcare services. Medical groups are also struggling with lower profits today and higher costs, all of which means that they are carefully weighing their options before making a move today.

“The last four years, starting with the pandemic, have been a whirlwind,” Lewin said. “Some healthcare groups are expanding by buying independent practices. Some independent practices have spun back out of larger groups. Other medical groups are partnering with smaller physician groups. We have seen a flurry of new ambulatory surgery centers. There have just been a lot of factors in play.”

Industrial’ s new normal

We spoke with Joseph Mahoney, senior director with Opus Development Company, about the new normal faced by the industrial market in the Twin Cities region.

Mahoney told us that there was still demand from both investors and tenants for industrial space here. That demand, though, had cooled to pre-2020 levels.

“From a sales perspective, there is not much on the market in Minneapolis today,” Mahoney said. “But I can say that there has been good reception for the few projects that are on the market. The biggest shock that came with the higher interest rates has subsided. There is more confidence among investors in the lending environment today than what we saw in 2023.”

Mahoney said, too, that the pace of speculative industrial construction had slowed dramatically ths year both across the country and in the Twin Cities market. Mahoney predicted that few new spec industrial developments would get off the ground in 2024 in the Minneapolis-St. Paul market.

“For a true spec project? There’ll be between zero and two of those this year in our market,” Mahoney said. “We will have to wait and see if that prediction comes to fruition.”

What is still solid is the demand from tenants looking for industrial space. Mahoney said that when he speaks to brokerage company officials, they tell him

that there is anywhere from 10 million to 13 million square feet of active users hunting down industrial space now in the Twin Cities market.

That is just slightly less than what the market saw two years ago, Mahoney said.

What has changed is the size of industrial properties that users are seeking. Mahoney said that users looking for 300,000 square feet of space or more are not as active today. More users are instead searching for industrial property in the 30,000-square-foot range, he said.

The completion of North Loop Green

North Loop Green, which officially opened in the summer, ranked as one of the biggest new developments in the Twin Cities, bringing a 1-acre activated green space, dubbed The Green, to an area of downtown Minneapolis between the Cedar Lake Trail and Target Field, home of the Minnesota Twins.

The goal is for this area to serve as a town square for Minneapolis’ North Loop section of downtown, and to give fans attending Twins games, and nearby residents, a wider range of activities to enjoy in the neighborhood.

North Loop Green also includes 350,000 square feet of office space, 350 residential units, 100 hospitality units and 15,000 square feet of premier food and beverage offerings.

Global real estate firm Hines collaborated with partners Marquee Development and the AFL-CIO Build Investment Trust on the construction and opening of North Loop Green. JLL is serving as the leasing agent for the office component of the development. The architect of record for the project is ESG Architecture and Design, while Kraus-Anderson served as North Loop Green’s general contractor.

Eric Nordness spoke with us in the spring of this year about how important North Loop Green will be for the Twin Cities. He’s managing principal for Marquee Development, which has worked extensively on additions to Chicago’s Wrigleyville neighborhood.

He said that North Loop Green will bring new activity to Minneapolis’ North Loop neighborhood, even when the Twins aren’t playing.

“North Loop Green is an amazing location,” Nordness told us. “It’s a vibrant neighborhood. It has that live/work/play environment that everyone wants. There isn’t a lot of open space there. But there was this left-behind space because of the urban constraints of rail and highway. It left us with a pretty cool way to create a green space and invite the neighborhood to use it as its park.”

Nordness sees the green space portion of North Loop Green as a place for urban residents to decompress during an otherwise busy day. They can sit on a bench, read a book or sprawl out on the grass.

On other days, the park space will be programmed with music nights, farmers markets, craft fairs or other events.

“Whatever the neighborhood wants, that’s what that space can provide them,” Nordness said. “It will evolve and respond to what the neighbors and fans want to see and use. We will be pivoting and growing. But the idea was to start with this great space that invites everyone to come over 365 days a year.”

Bob Pfefferle, managing director at Hines, agreed that the park serves as the centerpiece of the North Loop Green development.

“North Loop Green will be an exciting and dynamic destination for businesses and residents,” Pfefferle said in a statement. “North Loop Green will add significant dining, recreational and family-friendly entertainment options in the rapidly growing North Loop submarket.”

The affordable-housing gap

The United States doesn’t have enough housing. And it certainly doesn’t boast enough affordable housing. Not surprisingly, the same can be said of the Minneapolis-St. Paul market and its suburbs.

Renters and buyers alike are struggling today to find affordable housing in their communities.

Blame it on the high prices for single-family homes. The higher mortgage interest rates aren’t helping, either. Both are preventing many renters from making the leap to homeownership. This only increases the demand and need for more multifamily housing.

But when this housing is built? It’s often targeted to wealthier renters. That’s because it’s so difficult for developers to recoup their money on affordable housing. They simply can’t charge high enough rents to offset their construction and operational costs.

What are the solutions? Minnesota Real Estate Journal spoke this summer with two affordable-housing advocates about the challenges in this arena and about what can be done to increase the supply of affordable multifamily units in the Twin Cities market.

Dayton Parkway Business Center rendering. (Image courtesy of The Opus Group.)

Sound on 76 in Edina. (Photo courtesy of Aeon.)

Anne Mavity, executive director of the St. Paul-based Minnesota Housing Partnership, said that high housing prices are making life more challenging for a growing number of Minneapolis-St. Paul residents.

“Overpaying for housing is a big issue in the Twin Cities,” Mavity told us. “It doesn’t just stress a family’s budget. It stresses our larger community, too. When people are spending too much on housing, they don’t have enough money for transportation and healthcare. That makes it hard for kids to thrive in schools. It makes it hard to develop a good workforce.”

Part of the issue? Mavity pointed to the slowdown in the building of housing from 2006 through 2008. The country is still trying to add enough housing supply to meet demand.

Eric Anthony Johnson, president and chief executive officer of Minneapolis’ Aeon, pointed to NIMBYism as another reason why there aren’t enough affordable-housing units in the Twin Cities area. Too many communities quickly reject affordable-housing projects without learning what these projects entail, he told us.

“Part of the problem is that everyone treats this as a zero-sum game,” Johnson said during an interview in August of this year. “It’s a fight, with developers vs. the community and the community vs. the government. We need to reset how we engage with each other to find solutions to this housing challenge.”

to develop apartment projects, despite the higher interest rates and construction costs.

“If you had told me a year ago that we’d still be seeing the demand for apartment space that we are seeing now despite the influx of new product that we’ve seen, I don’t know that I would have believed it,” Wilcox said. “It’s a testament to the strength of the suburban multifamily market.”

Why is the demand for multifamily space so high in the Twin Cities market? Wilcox points to the area’s growing population. At the same time, it’s become more expensive to buy a single-family home.

And even those who can afford to buy a single-family home are struggling to move from apartment units. That’s because the supply of single-family homes for sale remains low. Many existing homeowners aren’t selling because they don’t want to trade their existing mortgages with interest rates in the 3% range for a new loan with a rate closer to 6.5%. Because construction costs remain high, homebuilders aren’t building as many new residences.

These factors have led to a healthy absorption rate in the multifamily sector despite the new product that has been delivered, Wilcox said.

“Then there is a general societal shift of people staying in apartments longer, choosing to rent because they want the flexibility and the amenities,” Wilcox said. “They are staying as renters longer before they settle down. That is playing a role, too.”

The enduring strength of suburban multifamily

Also in the summer, we spoke with John Wilcox, president of development, finance and investment with St. Louis Park-based Enclave about the state of the multifamily market in the Twin Cities region.

He told us that demand for multifamily properties in the area was not about to slow down. Turns out, he was right: Renters continue to seek out apartment living in the Twin Cities market. And there isn’t enough multifamily housing to keep up with this demand.

Wilcox said that demand for apartments in the suburbs was especially strong.

“In the suburbs, we are still seeing healthy demand for all the projects that we are delivering now,” Wilcox said for our August issue. “There is a slight uptick in some incentives that might be required to keep up the leasing velocity. That is driven by all the new supply that was delivered during the last six months. But there is still healthy demand and leasing velocity. Our market is very healthy in the grand scheme of the national picture and other markets.”

Wilcox said that Enclave is so confident in the Minneapolis-St. Paul multifamily market that it continues

Bucking the spec industrial trend in Dayton

The Opus Group made news last year by beginning construction in July on a spec industrial project in Minneapolis northwest market.

Opus took this move during a time in which high interest rates and construction costs mostly throttled speculative industrial building.

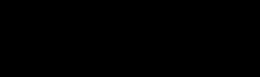

The Opus Group on July 8 began construction on a distribution and light manufacturing facility in Dayton, Minnesota, about 30 miles from the Twin Cities. The 132,200-square-foot speculative facility is rising at 17600 Territorial Road in Dayton, a 10-acre site easily accessible from the new Dayton Parkway Interchange and Interstate 94.

And further bucking the slowdown trend, the new facility has already landed a major tenant. TurbinePROs, a leading North American provider of field services for rotating equipment manufacturers, has signed a lease for more than 87,000 square feet at the facility. This leaves about 44,000 square feet available for lease.

Joe Mahoney, senior director of real estate with Opus Development Company, told us that Opus long had confidence in the site’s location. The opening of

the Dayton Parkway Interchange, though, only enhanced the location.

As Mahoney said, Rogers and Maple Grove both already had their own interchanges. It was time, too, for Dayton to get its access point.

“For a long time, Dayton tended to get skipped over when new development was being planned for the area,” Mahoney said. “Having this interchange has helped unlock this area for industrial projects. That interchange is key to unlocking the available parcels in Dayton for future development.”

The Dayton Parkway Business Center will offer tenants 19 dock doors, expandable to 34; four drive-in doors; a clear height of 28 feet; 136 vehicle parking stalls, expandable to 177; and 14 trailer parking stalls. Additional amenities include natural lighting, motion-activated occupancy sensors and a solar-friendly roof.

TurbinePROs needed a space near the interstate, a need that the Dayton Parkway Business Center met. Because the company signed up for the development so early, Opus was able to construct the property around its needs.

“They were in Rogers a bit further from the interstate. Now they are closer to the interstate, and they were able to customize their space,” Mahoney said. “Their business is growing, and they were able to find a solution to help them advance their business.”

Beating the office sector blues

The office sector continues to struggle across the country, with owners dealing with sometimes record-high vacancy rates. The Minneapolis-St. Paul market isn’t immune, especially in the market’s downtown cores.

We spoke with Ryan Pires, vice president for asset management at KBS, about the challenges that the office sector faces in Minneapolis.

“Post-pandemic leasing continues to be a struggle in downtown Minneapolis and across the metro,” Pires told us. “While companies are reevaluating their space requirements, most are prioritizing flexibility, and, more importantly, amenities that help draw employees into the office.”

Pires said that while leasing in the suburbs has not yet reached pre-pandemic levels, the activity there is considerably higher than in downtown. Bloomington continues to be an attractive submarket, according to Pires, thanks to its prime location and abundance of shopping, dining, hotel and entertainment options.

Pires pointed to KBS’ Northland Center is an example of how owners can boost leasing and retention rates by approving capital improvements to its properties each year.

At the time we spoke with Pires, KBS had recently completed nearly $1 million in renovations at Northland Center, further enhancing its appeal to companies seeking top-tier space in the Bloomington area. These renovations included refreshing the lobbies of both buildings and the addition of 25,000 square feet of spec suite space.

“We strive to create a welcoming, hospitality-inspired environment at each property that will positively impact occupancy, and the renovation helped us do that,” Pires said. “In fact, we signed over 145,000 square feet in new and renewal leases at the 492,514-square-foot office park last year.”

60 South Sixth in downtown Minneapolis underwent an extensive renovation project that has resulted in stronger occupancy levels. (Photo courtesy of KBS.)

Farmington

from page 1

Kuennen said. “That’s the intangible. That’s what makes Farmington special.”

That left Kuennen and city staffers with another challenge: New development and growth are coming to Farmington. How can the city steer this development so that it provides residents with the businesses, restaurants and services they want without erasing the charm, somewhat-rural atmosphere and neighborly feel that Farmington has long boasted?

To Kuennen, it’s about balance.

“How do we balance our tax base without putting all the burden on residential?” Kuennen asked. “We must create business growth. But how do we do that while preserving the special thing that is Farmington?”

This is a challenge not unique to Farmington. Economic development organizations must juggle the need for growth with the desire to avoid sprawl, traffic jams and characterless retail or office developments.

As Kuennen says, economic development is about the intangibles, such as creating a sense of place. It’s about connecting the community and preserving what makes an area a good place to live.

In the summer of 2023, the city of Farmington asked its community members a series of questions when creating its most recent comprehensive plan. This included asking residents what they loved about Farmington.

Not surprisingly, residents said that they enjoyed the parks and trails dotting the city. Many also said that

they wanted the various neighborhoods of Farmington to connect with walking or bike trails.

“There is something unique about Farmington,” Kuennen said. “We are faced with growth pressures. We have Lakeville to our west, which is growing. Rosemont, which is exploding, is just to the north. Those growth pressures will impact us. How do we drive it ourselves? How do we move to a proactive versus a reactive community perspective?”

Kuennen said that her mission now? It’s all about being bold and selling the spirit and feel of Farmington to potential new businesses and developers.

“We are unexpectedly bold,” Kuennen said. “We are changing the narrative. People are excited to look at Farmington. They are considering our city when maybe in the past they wouldn’t have. They are ready to invest in Farmington.”

An example? Developer Yellow Tree in August of this year broke ground on Farmington Apartments, a four-story, 168-unit multifamily building at 21401 Dushane Parkway in the city.

The apartment building will include a pool, dog spa, fitness center, work-from-home spaces, community lounge, game room and patio with a bocce ball court. Other amenities will include a pet run, indoor parking and indoor bike storage.

Kuennen says that city of Farmington officials attended a conference held by Minnesota Real Estate Journal and networked with developers and brokers.

Deanna Kuennen (Photo courtesy of City of Farmington.)

That included Yellow Tree. Kuennen says that if Farmington officials hadn’t attended that conference and promoted the virtues of the city there, the Farmington Apartments project would not have happened.

“By getting out there and talking about who we are, we have created more interest from other developers,” Kuennen said.

Another example of being bold? In early December, members of the Farmington City Council in a 4-1 vote approved a contract for the Farmington Technology Park, which will be built at the Fountain Valley Golf Club property at 2830 220th St.

Tract, a Denver-based development company, will build up to 12 data centers covering about 340 acres.

“Who would have thought just two years ago that a potential multi-billion-dollar investment, and that’s ‘billion’ with a ‘b,’ would be happening in Farmington?” Kuennen asked. “It really is about showing up and telling our story, making sure that people understand that there are opportunities here. We want to find those partners who can come to our community and appreciate the unique nature of it and want to be a part of it.”

Kuennen said that Farmington officials continue to reach out to developers looking to expand their offerings in the Twin Cities market. As she says, city officials know how valuable the land they can offer is to developers looking for more opportunities.

Developers are not just interested in Farmington because of the area’s intangibles and available land, Kuennen said. They also appreciate that Farmington city officials are reviewing the city’s comprehensive plan.

“This demonstrates that we recognize that we want to drive our own future and proactively pursue that vision,” Kuennen said.

Farmington city officials are identifying opportunity sites to help accomplish its future development goals. At the same time, Kuennen and other city staffers are actively and proactively reaching out to developers to see if they are interested in exploring what Farmington offers.

“What it boils down to is that we know what we have to offer and we are trying to find those developers who can see themselves becoming a part of our community,” Kuennen said.

Kuennen said that the city of Farmington is not overly incentivizing possible projects. They are, though, willing to use financial tools that they might have relied on in the past to attract new businesses and developers.

“We recognize that if we want to accomplish certain things, we have to do more than just talk about them,” Kuennen said. “We have to become a partner in this.”

As a sign of its commitment to bringing in new businesses and developments, the Farmington City Council approved a $100,000 increase in the Farmington Economic Development Authority levy. This will boost the levy to $250,000 and gives the develop-

ment authority more financial power to offer needed incentives to developers.

What types of new businesses would Kuennen like to see open in Farmington? At the top of the list is a grocery store. The City of Farmington, with a population of nearly 24,000 as of 2023, does not have a grocery store.

Kuennen said that she is meeting with grocery chains and developers that have connections with the chains in an effort to bring a grocery store to the city.

“We are not located on an interstate. We understand that,” Kuennen said. “But some businesses don’t need an interstate.”

A good example? Aerospace Fabrication & Materials, which is located at 5147 208th St. West in Farmington. This company designs, manufactures and installs multi-layer insulation blankets for aerospace and cryogenic applications. It did not need an interstate in its backyard and is thriving in Farmington.

These are the kind of success stories that the Farmington Economic Development Authority is emphasizing when it talks with other businesses and developers.

“We have an industrial park here. Every one of the businesses in it supports one another,” Kuennen said. “That is the kind of story we are sharing.”

The Emery, a new apartment community in Farmington. (Photo courtesy of the City of Farmington.)

T H A N K Y O U T O O U R S P O N S O R S :

P L A T I N U M

G O L D

S I L V E R

F r a s e r - M o r r i s E l e c t r i c C o ∘ D a v i s H e a l t h c a r e R e a l E s t a t e ∘ C S M C o r p o r a t i o n

P i e d m o n t O f f i c e R e a l t y T r u s t ∘ G a r d a W o r l d S e c u r i t y ∘ N E L S O N W o r l d w i d e

H i n e s M a n a g e m e n t ∘ S c h i n d l e r E l e v a t o r ∘ K r a u s - A n d e r s o n

∘ L V C C o m p a n i e s ∘ T h e R M R G r o u p ∘ J L L