Challenges? Sure. But Twin Cities industrial market still holding its own

By Dan Rafter, Editor

It’s true: These are challenging times for all commercial real estate sectors, including that long-time darling of investors, industrial. High interest rates, an uncertain economy rocked by the failures of four large banks and continued supply chain delays have made selling and building industrial properties more difficult.

But industrial remains one of the strongest commercial real estate sectors even with these challenges. And the industrial sector is still healthy in the Twin Cities region, thanks to demand that outpaces the supply of industrial space.

And the best news? Two local industrial experts told Minnesota Real Estate Journal that they expect the industrial market to weather the challenges of higher rates and economic certainty. That bodes well for the sector.

INDUSTRIAL (continued on page 7)

A time of change: Healthcare providers still working hard to meet their patients’ changing demands

Medical providers today are firmly in expansion mode, looking for new outposts to set up freestanding medical clinics, ambulatory surgery centers and specialty practices far from their main hospital campuses.

At the same time, they are struggling to rebuild their cash flows after the challenges of the COVID-19 pandemic. Many face a labor shortage as the country deals with a shortage of nurses and doctors. And the competition for patient dollars is only increasing.

By Dan Rafter, Editor

It all adds up to interesting, and challenging, times for the real estate companies that help these providers find and sell their medical space.

HEALTHCARE (continued on page 8)

©2023

Estate

May

Real

Publishing Corporation

2023 • VOL. 39 NO. 2

2023 Minnesota

Real Estate Journal Awards Section Pg. 11

Welcome to Greater Mankato.

Invest with Confidence

HIGHLY RATED

We’re #1 in manufacturing within Greater Minnesota, #13 of top small cities for business in the U.S. , and the best college town to live in after graduation, just to name a few.

CURRENT INVESTMENT

Our marketplace has been noticed and continues to be seen as a solid investment , with over 1.5 billion dollars in capital investment in the last 10 years.

“Greater Mankato Growth staff are among my hardest working partners. They are dedicated advocates for the Greater Mankato region. They are responsive to requests and work diligently to provide and update information as it is requested by the businesses I work with. They make projects a reality!” – Lisa Hughes, Department of Employment and Economic Development

GreaterMankato.com

10 11

CHALLENGES? SURE. BUT TWIN CITIES INDUSTRIAL MARKET STILL HOLDING ITS OWN: It’s true that these are challenging times for all commercial real estate sectors, including that long-time darling of investors, industrial. High interest rates, an uncertain economy rocked by the failures of four large banks and continued supply chain delays have made selling and building industrial properties more difficult.

A TIME OF CHANGE FOR HEALTHCARE PROVIDERS: Medical providers today are firmly in expansion mode, looking for new outposts to set up freestanding medical clinics, ambulatory surgery centers and specialty practices far from their main hospital campuses.

UNCERTAIN ECONOMY DOESN’T SLOW RYAN COMPANIES’ PLANS FOR BROOKLYN PARK BUSINESS PARK: Worries about an uncertain economy? Concerns that higher interest rates might cause companies to pause their expansion plans? Neither of those headwinds have stopped Minneapolis-based commercial real estate firm Ryan Companies from pushing ahead with its latest project.

MINNESOTA BECOMING A HOTSPOT FOR SENIORS COOPERATIVE HOUSING: Demand continues to rise across the United States for seniors housing, with the National Investment Center for Seniors Housing & Care’s most recent MAP Market Fundamentals Data report showing that the occupancy rate for seniors housing rose 0.9 percentage points from the third quarter to the fourth quarter of last year.

INSTANT MARKET REPORTS? NO MORE FUSSING OVER EMAILS? THAT’S JUST THE START OF HOW CHATGPT IS CHANGING THE WORLD OF COMMERCIAL REAL ESTATE: Commercial real estate brokers might be expert salespeople. They might have mastered the art of marketing. And when it comes to finding the right tenants and investors for the right properties? They shine.

O U ' R E I N V I T E D

C o l l a g e A r c h i t e c t s

F i r s t N a t i o n a l B a n k o f O m a h a H a l l S w e e n e y P r o p e r t i e s

Y e l l o w T r e e

F r a n a C o m p a n i e s

o n s o r s h i p i n f o r m a t i o n a t onevillagepartners.org/2023realestate.

H i g h l a n d B a n k L a t h r o p G P M S h e r m a n A s s o c i a t e s W i n t h r o p & W e i n s t i n e A c k e r b e r g G r o u p A x i a l R e a l E s t a t e A d v i s o r s B a r n a , G u z y & S t e f f e n B r a u n I n t e r t e c B r i d g e w a t e r B a n k C i v i l S i t e G r o u p C o m m o n L i v i n g D o r s e y & W h i t n e y L L P F i r s t A m e r i c a n T i t l e I n s u r a n c e G u a r a n t y C o m m e r c i a l T i t l e H u n t i n g t o n B a n k K i m l e y - H o r n K r a u s - A n d e r s o n L e J e u n e S t e e l C o m p a n y M i c h e l C o m m e r c i a l R e a l E s t a t e P A K P r o p e r t i e s U S I E S G A r c h i t e c t u r e & D e s i g n S t e v e n s C o n s t r u c t i o n C o r p H a l v e r s o n a n d B l a i s e r G r o u p W a l l C o m p a n i e s H o p e L a w W a r n e r s ' S t e l l i a n A p p l i a n c e L a r k i n H o f f m a n

3 MAY 2023 MINNESOTA REAL ESTATE JOURNAL

Minnesota Real Estate Journal (ISSN 08932255) Copyright © 2023 by the Minnesota Real Estate Journal is published bi-monthly for $85 a year by Jeff Johnson, 7767 Elm Creek Boulevard, Suite 210, Maple Grove, MN 55369. Monthly Business and Editorial Offices: 7767 Elm Creek Boulevard, Suite 210, Maple Grove, MN 55369 Accounting and Circulation Offices: Jeff Johnson, 7767 Elm Creek Boulevard, Suite 210, Maple Grove, MN 55369. Call 952-885-0815 to subscribe. For more information call: 952-885-0815. Periodical postage paid at Maple Grove and additional mailing offices. POSTMASTER: Send address changes to Minnesota Real Estate Journal, 7767 Elm Creek Boulevard, Suite 210, Maple Grove, MN 55369 Estate Publishing Corporation. No part of this publication may be reproduced without the written permission of the publisher.

CONTENTS 1 1 T H A N N U A L R E A L E S T A T E E V E N T 11:00 a.m. - Food & Networking 12:00 - 12:30 p.m. - Program The Market at Malcolm Yards 501 30th Ave SE, Minneapolis R e g i s t e r a n d f i n d s p

2023 MINNESOTA REAL ESTATE JOURNAL AWARDS SECTION

1 1 4 6

MAY 2023 MINNESOTA REAL ESTATE JOURNAL

T H A N K Y O U T O O U R 2 0 2 2 S P O N S O R S ! P R E S E N T I N G S I L V E R B R O N Z E C O M M U N I T Y

e a n e v e n t s p o n s o r !

your company while supporting OneVillage Partners! Your sponsorship is an investment in people who are working to improve the lives of their families and communities.

B

Promote

4

April 19, 2023 Y

President | Publisher Jeff Johnson jeff.johnson@rejournals.com

Managing Editor Dan Rafter drafter@rejournals.com

Senior Vice President Jay Kodytek jay.kodytek@rejournals.com

Chief Financial Officer Todd Phillips todd.phillips@rejournals.com

Minnesota Event Coordinator

Kaitlyn LaCroix kaitlyn.lacroix@rejournals.com

Art Director | Graphic Designer Alan Davis alan.davis@rejournals.com

Managing Director

National Events & Marketing

Alyssa Gawlinski agawlinski@rejournals.com

7767 Elm Creek Boulevard, Suite 210 Maple Grove, MN 55369

For information call 952-885-0815

EDITORIAL ADVISORY BOARD

JOHN ALLEN

JEFF EATON

MARK EVENSON

PATRICIA GNETZ

TOM GUMP

CHAD JOHNSON

BILL WARDWELL

JEFFREY LAFAVRE

WADE LAU

JIM LOCKHART

DUANE LUND

CLINT MILLER

WHITNEY PEYTON

MIKE SALMEN

Uncertain economy doesn’t slow Ryan Companies’ plans for Brooklyn Park business park

By Dan Rafter, Editor

Worries about an uncertain economy? Concerns that higher interest rates might cause companies to pause their expansion plans? Neither of those headwinds have stopped Minneapolis-based commercial real estate firm Ryan Companies from pushing ahead with its latest project, a pair of speculative industrial buildings in the 610 Zane Business Park in Brooklyn Park, Minnesota.

Construction started on the pair of industrial facilities in early April, with an expected completion date in October or November of this year. The two buildings will bring a total of 325,000 square feet of new industrial space to the Twin Cities market.

It’s not surprising that Ryan Companies is bullish on spec industrial space. The industrial vacancy rate for the Twin Cities market stood at 2.6% in the first quarter of this year. That’s a sign that demand for industrial space remains high.

Dan Mueller, vice president of real estate development with Ryan Companies, said that the spec industrial buildings are just the latest additions to the mixed-use 610 Zane Business Park that the company started developing several years ago.

The first addition to the park was a HyVee grocery store that opened in 2016. To bring this project to fruition, Ryan worked with the city of Brooklyn Park to rezone a

portion of the site. The 100,000-squarefoot flagship store features a full grocery, Market Grille restaurant, pharmacy, wine

and spirts store and convenience store with a drive-through Starbucks.

4 MAY 2023 MINNESOTA REAL ESTATE JOURNAL

www.rejournals.com

A rendering of one of the industrial buildings being built in the 610 Zane Business Park in Brooklyn Park, Minnesota.

“The Hy-Vee is a nice anchor to the development. It’s a nice amenities hub for the business park’s tenants.

We have sidewalks that connect all the tenants to the Hy-Vee and the ancillary retail that has been developed around it.”

That first addition to the park was key, Mueller said.

“The Hy-Vee is a nice anchor to the development,” he said. “It’s a nice amenities hub for the business park’s tenants. We have sidewalks that connect all the tenants to the Hy-Vee and the ancillary retail that has been developed around it.”

Today, the Hy-Vee portion of the development features retailers such as Chipotle, Jersey Mike’s and a Taco Bell, which give the business park’s tenants easy access to a quick lunch.

The business park also features a single-tenant build-to-suit space for Star Exhibits, a marketing company; the corporate headquarters building of water-treatment company Kurita America; and a medical office development anchored by PrairieCare.

Mueller said that the addition of the two spec industrial buildings will continue the momentum that Ryan has seen at this business park. And he’s not worried about filling the space once it hits the market.

“There is always concern when you are building on a spec basis,” Mueller said. “But we felt confident in the strength of the industrial market in this area. That was the main driver for this project: We

are bullish on the strength of the Northwest submarket of the Twin Cities region.”

Why is demand so strong for industrial product in the Twin Cities region and especially in the Northwest submarket? And what makes the 610 Zane Business Park such an attractive location for tenants, a park in such demand that Ryan was willing to take on the risk of building two spec industrial facilities here?

Mueller doesn’t hesitate to point out the positives of the 610 Zane Business Park.

The park boasts plenty of access to transportation. The buildings in the park are functional, modern and laid out well.

Then there are those retail amenities, including the Hy-Vee grocery store. These retail offerings are a short, sidewalk-connected, walk from the land that will house the two new speculative industrial buildings.

“Outside of the typical locational items that make for a good business park, we have those additional amenities that are

unique,” Mueller said. “Industrial employers are fighting the battle for talent like everyone else. If you have something unique to offer employees, such as a good quality building and some convenience or other amenities, that helps attract and retain talent.”

The new industrial buildings will feature 32-foot clear heights, ample truck loading areas and plenty of car parking. Ryan is willing to subdivide the space so that tenants of all sizes can move in.

“We want to cast a wide net to tenants,” Mueller said. “These buildings could work with anything from manufacturing to light industrial tenants. Anything that is warehouse-related would be set up nice here.”

Mueller said that he expects the new industrial buildings to attract plenty of attention from possible tenants.

“The demand for industrial space here is still extremely strong,” Mueller said. “Depending on which brokerage company you talk to, there are 10 million to 13 million square feet of total active tenants seeking space. Vacancy is still incredibly low, 2% to 3%. Those are all very good signs of a market with healthy demand.”

5 MAY 2023 MINNESOTA REAL ESTATE JOURNAL

WITH DEDICATED OWNERSHIP AMENITY RICH OFFICES Brent Karkula +1 612 217 5153 brent.karkula@jll.com Andrea Leon +1 612 217 5142 andrea.leon@jll.com Laura Farrell +1 612 217 6744 laura.farrell@jll.com Teig Hutchison +1 612 217 5157 teig.hutchison@jll.com SCHEDULE A TOUR www.touredina100.com www.theinternationalplaza.com

On the cutting edge of a growing trend: Minnesota becoming a hotspot for seniors cooperative housing

By Dan Rafter, Editor

Demand continues to rise across the United States for seniors housing, with the National Investment Center for Seniors Housing & Care’s most recent MAP Market Fundamentals Data report showing that the occupancy rate for seniors housing rose 0.9 percentage points from the third quarter to the fourth quarter of last year.

The occupancy rate jumped from 82.1% to 83%, up 5.2 percentage points from a low of 77.8% in the second quarter of 2021.

In response to this demand, seniors cooperative housing communities are emerging as a new option for those looking for an affordable approach to retirement living.

Seniors cooperative housing is a type of housing in which residents collectively own and manage the property, sharing in the responsibility of maintaining the community. Residents of seniors cooperatives typically purchase a share of the property and pay monthly fees that cover the costs of operating and maintaining the community.

The cooperative community owns the land, buildings and common areas in cooperative living communities. A member-elected board of directors makes decisions regarding the upkeep of the community and any improvements that need to be made. Professional management teams work with these boards to maintain the communities.

The Minneapolis-St. Paul market is becoming a hotspot for these types of seniors housing developments, thanks in part to Artessa Development.

Minneapolis-based Artessa is building a new suite of co-op communities in the Twin Cities metropolitan area. Construction will soon start on Artessa Mound Harbor, which overlooks Lake Minnetonka; Artessa Golden Valley, which is nestled alongside Golden Valley Country Club in Golden Valley, Minnesota; and Artessa Canterbury

Crossing, in the Canterbury Park area of Shakopee, Minnesota.

These new boutique co-ops will soon be joined by others being planned by Artessa.

Dena Meyer, president of Lifestyle Communities and Artessa Development, says that cooperatives offer seniors a new choice when planning their retirement years. Artessa’s cooperatives are open to seniors 62 and older.

“This is an alternative to single-family homes or owning a townhome,” Meyer said. “It’s ideal for people who want more of a connection with like-minded individuals.”

Seniors cooperatives, though, differ from assisted-living or independent-living seniors facilities. Cooperatives do not feature housekeeping services or meals. Instead, cooperatives are amenity-rich housing for those who are retired but still able to live independently.

For instance, amenities at Artessa cooperatives include outdoor living areas that feature pickleball courts, entertainment areas with grilling stations and fire pits and walking trails. Members of the cooperatives can also personalize their homes by selecting finishes that fit their own styles.

Artessa’s cooperatives also feature plenty of amenities inside their buildings. This includes a maker’s space; fitness studios with yoga and meditation areas; entertainment suites with a residential-type kitchen; underground parking; car wash bays; and pet wash areas.

Seniors cooperatives are unique in that members are buying a share to live in these developments. This means, as Meyer says, that they are stepping into a residence that is already pre-financed. Seniors don’t have to apply for individual financing for their own residences.

This means that cooperatives remain affordable for seniors, Meyer said.

“It’s about people wanting to do more of the things they want and less of the things they have to do,” Meyer said. “Anyone looking for a maintenance-free lifestyle and an abundance of amenities will do well at a cooperative.”

Artessa carefully plans in which communities to build its cooperatives, too, Meyer said. The key is to build these developments in walkable neighborhoods, so that cooperative members can walk to local shops, restaurants and golf courses. Artessa places many of its cooperatives near lakes and trail systems, too.

Each cooperative includes from 45 units to 78 units, Meyer said.

“We are trying to keep the boutique nature of these cooperatives,” she said. “We want our members to get to know their neighbors and not feel like they are living in a big apartment or a high-rise condominium.”

Meyer said that the average member of Artessa’s cooperatives is in his or her late 60s. That bodes well for the demand for this type of alternative seniors housing. Meyer points to statistics showing that by 2050, there will

be nearly 90 million people in the United States who will be 65 and older.

There are a growing number of options for these older Americans. Seniors can choose from market-rate housing with no age restrictions, rental communities set aside for residents who are 55 and older, assisted-living facilities, memory care facilities and, of course, seniors cooperatives.

Meyer says that she expects Minnesota to remain an active area for seniors cooperatives. Artessa has been involved in more than 42 cooperatives that are now operating in Minnesota, either on the development or finance side, she said. And Artessa plans to expand outside the state, moving into the southwest areas of the country.

Artessa is also looking at expanding throughout Minnesota, Meyer said, and into another Midwest state that the company will announce later this year.

“Cooperative living is a great option,” Meyer said. “It provides maximum affordability and provides members with financial predictability.”

Meyer understands, though, why there aren’t even more senior cooperatives in the state and across the country. Building cooperatives requires a significant upfront cost, one that includes the expenses of marketing the communities. Meyer said that Artessa requires that its seniors cooperatives are 60% presold before the company begins construction.

“We have not had a problem reaching that 60% mark,” Meyer said. “We have a proven track record so that people know our projects will become a reality. It does require a lot of patience, education and advocacy on explaining the benefits of the cooperative model and lifestyle. The majority of our members? Once they move in, they wish they would have done this sooner.”

6 MAY 2023 MINNESOTA REAL ESTATE JOURNAL

Artessa’s Canterbury Crossing

Artessa Mound Harbor

Dena Meyer

“The rapid rise in interest rates over the last half of 2022 and into 2023 has had a dramatic effect on real estate investors and their appetite to develop new speculative buildings or buy existing buildings,” said Paul Hyde, co-founder of Minneapolis-based Hyde Development.

This shouldn’t be a surprise. As Hyde says, the cost to borrow money to buy or develop industrial space has risen, with interest rates jumping from 3.5% to about 7%. Because of this, the owners of industrial space have to increase rental rates for tenants to make up for their higher mortgage payments.

“That has had a chilling effect on new developments,” Hyde said.

The higher rates have also slowed the sales of industrial buildings. But Hyde said that this isn’t an entirely negative development.

Hyde said that the industrial market, though not a bubble, was overheated before interest rates began rising. As he says, investors were buying new buildings that were empty just so they could find a place in which to invest their money. They weren’t concerned that there weren’t tenants in the space yet to pay rent.

“That is not healthy in the long-term,” Hyde said. “There were prices being paid for existing building that were higher than we’d ever seen. I think this slowdown in sales is setting our market up for a strong and sustainable next cycle.”

What the higher rates haven’t impacted yet, Hyde said, is leasing activity. It seems logical that higher rates would have already slowed the appetites of tenants to grow or expand their industrial footprint. But that hasn’t happened yet.

The demand among tenants for industrial space remains high, Hyde said. Owners with vacancies in existing buildings or those building new industrial space will find plenty of tenants to fill those empty slots.

Why? Consumers still want the products that they order to show up on their doorsteps quickly. Companies, then, need to populate warehouse and distribution space that allows them to ship their products across the country in less time.

“It’s not just Amazon, either. Everything is now being held to that overnight delivery model,” Hyde said. “That consumer and business demand is driving the need for more industrial product. That’s one of the reasons why there hasn’t been a slowdown in industrial product. It’s one of the reasons why there hasn’t been a slowdown in demand.”

Mark Kolsrud, vice chair with the St. Louis Park, Minnesota, office of Colliers, said that the steady demand from tenants has been encouraging.

But Kolsrud did say that the amount of new industrial construction has slowed in the Twin Cities market.

“Speculative development has largely come to a stop,” Kolsrud said. “Now it is better to have a tenant in tow. With that, we are also seeing fewer industrial sales.”

At the same time, industrial rents throughout the Minneapolis-St. Paul market have grown during the last five years, Kolsrud said. This has helped keep vacancy rates low in industrial space throughout the region, he said.

Industrial landlords want to earn market-rate rents. When it is time for their tenants to renew, they propose a higher rent. Tenants then explore the market to see if they can find the same quality of industrial space at a lower cost.

The challenge? Industrial rents have risen throughout the market, Kolsrud said.

“Tenants often find that they can’t save any money even if they move,” he said.

“So they negotiate a renewal at their current locations. The rent growth in some ways is keeping tenants in their current locations for a longer time.”

Looking for certainty

While tenant demand remains high, the rising interest rates have made investors skittish, even it comes to the hot industrial sector.

As Hyde says, investors hate uncertainty. And there is nothing certain about today’s economy. Throw in the four bank failures earlier this year, and it’s little wonder that investors are cautious today.

“Investors are desperate to know where the market is,” Hyde said. “There isn’t a lot of data on where the market is for

new construction pricing or for buying existing buildings. That uncertainty causes investors to wait.”

Kolsrud said that this is still a good time for investors to buy industrial product in the Minneapolis-St. Paul market. But obtaining financing for all commercial real estate deals has become more difficult and expensive, he said.

At the same time, sellers are holding onto their industrial assets, waiting for the right sales price before closing deals.

“There are more investors out there than sellers,” Kolsrud said. “The sellers remember what prices they could get in the market 18 months ago. They don’t want to sell at today’s new market price. The sellers are hopeful that the market will improve and go back to where it was. I don’t know if that will happen. But sellers today are waiting to see what happens.”

But if investors see that the increase in interest rates is slowing or that the Federal Reserve Board might be ready to stop boosting its benchmark interest rate? The certainty that comes with that will increase investor activity.

Investors don’t even need to see rates fall back to the historic lows they recently enjoyed. As Hyde says, that’s unrealistic. Investors just need to know where rates will settle, he said.

“I’ve done this for 25 years and have never seen rates that low in my career,” Hyde said. “I think it’s likely that we might never see those rates again. That was the result of the pandemic and economic policy that was focused on recovering from COVID. We might get back to the interest rates we saw in the mid-2000s when we were borrowing at 4.5%. That is reasonable. And that would be perfectly fine.”

A focus on green

Hyde said that Hyde Development today is working to add solar to all its industrial projects. This is a smart move, he said: Industrial buildings feature large roofs. They can generate plenty of energy from solar panels.

“If I talked to tenants about this five years ago, they would have rolled their eyes at me. They wouldn’t have been interested,” Hyde said. “Now they are excited about this. Every single one of our tenants talks about this. They are either trying to meet corporate efficiency goals or they like the idea of the certainty of costs that we can provide with solar power.”

Hyde Development will also continue to focus on infill sites when developing new industrial projects, Hyde said.

“The last-mile space is important,” Hyde said. “Speed and service is a huge part of what tenants are looking for. If you can provide that, it can be a real difference maker. The challenge is that it is harder to find these sites. And when you find one, you’ll pay more. We have seen this in Denver, and we are seeing it now in Minneapolis.”

Kolsrud describes today’s industrial market as being in a “quiet period.” As he says, there is little product for sale, estimating that there is only 1/10th of what was on the market just two years ago.

But Kolsrud said that there are signs that buyers and sellers are getting closer to transacting again in the industrial space.

“Right now, investors want to be rewarded for the changes in the economy and the higher interest rates,” Kolsrud said. “The sellers haven’t been willing to adjust their pricing expectations. There hasn’t been an equilibrium yet. But we are getting closer all the time.”

7 MAY 2023 MINNESOTA REAL ESTATE JOURNAL

INDUSTRIAL (continued from page 1)

Hyde Development’s Northern Stacks Project in Fridley, Minnesota.

We recently spoke to two top healthcare real estate professionals serving the Twin Cities market about the demand for medical office and healthcare space, the challenges that providers are facing and the outlook for the rest of the year.

Here is what they had to say.

Jon Lewin Chief Financial Officer MedCraft Healthcare Real Estate Minneapolis

How strong is the demand for healthcare real estate, even with the uncertainty in the economy today?

Jon Lewin: We continue to be active on the leasing side of things. But that doesn’t mean there aren’t challenges. Health systems are struggling with cash flows. They are still recovering from the pandemic. The pandemic really did impact their cash flows.

I do think that healthcare systems are starting to get a little healthier again, though. Some have announced mergers to help improve their financial health. We’ve seen that Sanford Health and Fairview Health Services have agreed to a merger, though the closing date of that merger has been pushed back. That merger will have a long-lasting effect on the local healthcare real estate market. We are watching that merger closely and trying to understand what their overall strategy is.

Do you expect the financial challenges that some healthcare systems are seeing today to result in a higher vacancy rate in this sector?

Lewin: Physicians, once they establish their practices, don’t like a lot of disturbances. I don’t think that a bunch of vacancies will pop up in medical office building space. I think we’ll see more disruption in the administrative end of the sector than we will see in the physician practice space. That will be something that we will watch closely.

Can you talk a bit about how the trend to outpatient services is impacting healthcare real estate?

Lewin: The movement to outpatient care, which has been a rend for 15 to 20 years, continues to pick up steam. More procedures are able to be done with outpatient surgeries. It’s not just GI and emergency medical services. Cardiology is looking into outpatient surgery on certain procedures. The ambulatory surgery center market that has been so hot will continue to be very, very active.

Those ambulatory surgery centers provide good incentives for health systems and physicians to come together. They are lucrative deals. And they provide the communities that they are in with great access to healthcare.

Hospitals don’t want patients taking beds for any longer than they have to. Once you have a patient that has gone through a surgery, a procedure that hospitals can bill at a higher rate, hospitals want them out and back home fast. If those patients remain in the hospital for two, three or four days, or longer than that, the hospital views them as taking up a bed. The hospital is not getting the reimbursement rates that cover the expenses of maintaining that patient in that bed.

You’ve mentioned rehab hospitals. How does this play into today’s model of healthcare?

Lewin: The rest of the country has rehab hospitals. These are hospitals where people recovering from injuries or illnesses go to receive specialized treatment. They are sometimes called inpatient rehabilitation facilities. This gets patients out of the large hospitals while still providing them with the type of nursing care and other medical treatments that they can’t get at home. Minnesota has never had these. Here, if you were a patient who needed additional monitoring or care, you might move into, say, a senior living facility, a high-acuity senior facility. But the rehab hospitals are coming. And they can change the way patients receive care.

How busy is your business today?

Lewin: We continue to see a lot of activity. We still have a lot of physician practices

and specialty groups looking for healthcare real estate throughout the Twin Cities market, whether they are growing or looking for new space. We have done a lot of leasing at the Fairview Southdale facility in Edina. We’ve seen a lot of leasing activity at WestHealth, an Allina Health facility in Plymouth.

There are a lot of complementary practices that want to co-locate next to each other. That way, patients can go in and get an MRI and see their physicians. Once they have surgery, they can do their physical therapy in the same building or the same area.

We are not Chicago. We don’t have the elaborate El and subway system. People are used to getting in their cars. If you are elderly or you have elderly loved ones whom you are taking care of, drive-time is a big deal. If you live in South Minneapolis, you don’t want to drive to Eden Prairie for a follow-up. So medical providers want to open more locations throughout the area to better serve their patients.

What about rents? Are rents rising throughout this sector?

Lewin: The costs of developing new facilities have gone up since 2018 thanks to the pandemic and supply chain shortages. Say we build a new facility in town. To get the returns we need to get on those buildings, you are probably looking at $28 to $32 a square foot in rent. The market in the Twin Cities was more like $22 to $24 a square

foot pre-pandemic. The days of getting $16 tripe-net rents for a B-plus or A building are probably over. There is continued pressure on the rent side of this sector.

We work with our clients to make sure their facilities and spaces are programmed appropriately. The rents are what they are. If they are used to paying $20 a square foot on 5,000-square-foot space, maybe there is an opportunity to take less space by being more effective and efficient. They can create centralized workstations and remove physician offices. The operating rooms can be more efficient if you use the latest technology. In every space we work on now, we take into consideration what the tele-health situation might be.

Are investors still interested in healthcare real estate?

Lewin: There is still an extreme amount of interest in this space. But investment activity has almost come to a screeching halt. That is 100% driven by the Fed and the rise in interest rates. It has really caused a pause in the market.

Transactions are still taking place, but at a far slower pace. At some point, sellers will have to sell. Health systems are still looking for ways to generate cash. Health systems are still recovering from the pandemic and labor shortages. They are still struggling with how to get physicians and nurses happy again. One of the fastest ways to generate cash is to sell some of their as-

8 MAY 2023 MINNESOTA REAL ESTATE JOURNAL

HEALTHCARE (continued from page 1) Fairview Ridges Campus in Burnsville, Minnesota, developed by MedCraft.

Jon Lewin

“The movement to outpatient care, which has been a rend for 15 to 20 years, continues to pick up steam. More procedures are able to be done with outpatient surgeries.”

sets. I think that in the second half of this year, we will see more transactions happen because these health systems do need cash.

Jill Rasmussen Principal Davis Minneapolis

Can we start by talking about some of the changes that COVID brought to the way healthcare providers serve their patients?

Jill Rasmussen: There have certainly been a lot of changes that came into play with COVID. But these changes were already taking place. The pandemic mostly accelerated them. Healthcare systems and clinics are all trying to deliver more convenient and cost-effective care. That typically means care that takes place away from a hospital campus.

It’s just more convenient to offer care in outpatient facilities. It’s more convenient for patients to access these facilities. Outpatient facilities typically have strong visibility from major roads. They are cheaper to build. It makes sense for providers to shift more care to the outpatient setting.

Are there any interesting trends that you are seeing with these outpatient facilities?

Rasmussen: They are often a little larger than they had been in the past. That has been the trend for a while. With the growth

of ambulatory surgery centers, healthcare providers don’t have to perform as many procedures in the hospitals themselves. They are finding that outpatient facilities offer a better patient experience and outcomes. It is more convenient and cost-effective. Because the model works so well, the buildings themselves are getting a bit bigger. You might have a surgery center, some primary care, specialty care, imaging and a pharmacy all in the same freestanding center.

Healthcare providers are also expanding into growing markets, into second-tier market areas. They are opening in places like Blaine, Lakeville or Woodbury, communities where you are seeing a lot of growth. People want convenience and care closer to home. That was a trend that certainly started before COVID. People are not excited to go to a hospital or a big medical campus just for well-care. Hospitals have become a place for acute care. Everything else is being pushed off campus.

This approach also allows for better design and more efficient layouts. You can design around the care-delivery model. Healthcare providers can set up their system or independent clinics according to how they want to deliver that care.

What about telehealth and virtual doctor visits? Those were popular during COVID. Will they have any impact on the amount of space healthcare providers need?

Rasmussen: Everyone thought that everything would go virtual. But the reality is, virtual visits don’t work with every type of care. They might work with behavioral health. But for most everything else, people want to see a doctor in person. Telehealth and virtual medical visits, then, didn’t make as big of an impact as people thought they might. Is there going to be a need for less healthcare space because more care will be done virtually? We haven’t seen that play out yet.

How busy is the healthcare real estate market in Minnesota?

Rasmussen: The demand for space is still high. We are seeing a lot of leasing activity in existing buildings. A lot of leases and expansions are happening. The bigger independent clinics are taking a close look at their own expansion strategies. They are finishing their market coverage plans.

We just finished two projects for MNGI Digestive Health. The provider opened a new facility in Maple Grove and expanded in Woodbury. The principals of MNGI knew that they needed to get into those markets with newly designed and efficient facilities if they wanted to provide full market coverage. This is what a lot of medical groups are looking at today.

From the new development standpoint, everyone is still dealing with supply problems. Our hope is that things work their way through sooner rather than later. We

are building a 100,000-square-foot building in Lakeville for Allina Health, a specialty care surgery center. MNGI is coming in, too, and taking a floor in the building. Lakeville is a huge growth market. A lot of groups are looking to get into or expand their presence in Lakeville.

Are you seeing any signs of relief when it comes to supply chain issues?

Rasmussen: The supply chain is getting better. We had been seeing delays with steel for a while. That has gotten better. Now it is switchgear and elevators. There are some delays with doors and frames. When the lead time for some of these materials is longer than the time it would take you to develop a building, that is challenging. Our hope is that it gets back to a reasonable timeframe soon. There is not a lot of other office development demand right now, so hopefully that frees up some of the materials. Even industrial development, which had been so busy the last several years, is slowing a bit. So maybe it will get easier to get some of these materials delivered in a shorter time.

Can you talk about the aging of the country, too, and how that is impacting healthcare real estate?

Rasmussen: Healthcare providers do have to consider how old the country is getting. Maybe there will be a better coupling of memory care, assisted living, seniors housing, medical office buildings, surgery facilities, pharmacy and imaging all coming together as one project. That might be a better approach than having all these different practices with different owners and developers spread out across a market. You are starting to see this coupling happen in other markets. They create a little healthcare community. You have seniors housing and healthcare facilities in the same development or nearby.

How about the retailization of healthcare? Will we continue to see medical providers moving into locations in retail strip centers?

Rasmussen: Those retail sites are often in great locations. They have good visibility and good parking. It can be challenging, too. Retail sites have a different lease structure. They usually have shorter-term leases. It can be a little challenging for clinics to move into that retail environment. We just put a medical group in Savage in a retail center. The group went through some issues, but at the end of the day it ended up in a space with great big signage and in a location where their patient base is traveling regularly. Their patients go to the grocery store and Target and then to their appointment.

We put a provider in a former Old Country Buffet a few years ago. Some providers have gone into old Blockbuster stores. It can be a good fit. You get that big parking lot and good signage.

9 MAY 2023 MINNESOTA REAL ESTATE JOURNAL

Xchange Medical in St. Louis Park, Minnesota, designed by Davis.

Jill Rasmussen

“The demand for space is still high. We are seeing a lot of leasing activity in existing buildings. A lot of leases and expansions are happening.”

Instant market reports? No more fussing over emails? That’s just the start of how ChatGPT is changing the world of commercial real estate

Commercial real estate brokers might be expert salespeople. They might have mastered the art of marketing. And when it comes to finding the right tenants and investors for the right properties? They shine.

But not all commercial real estate professionals enjoy writing. Many would rather hammer out the details of a transaction during a face-to-face meeting than spend even 20 minutes fussing over the body of an email message.

And that’s where ChatGPT comes in. Since OpenAI launched this Artificial Intelligence-powered chatbot in November of last year, real estate professionals have turned to it for help with drafting marketing materials, emails, letters of intent, right of first contracts and property descriptions.

This, though, might just be the beginning of what ChatGPT can do for commercial real estate professionals.

Damodaram Bashyam, executive vice president and chief information and innovation officer with Berkadia, said this chatbot, especially as it evolves, can help commercial real estate professionals eliminate the most repetitive and time-consuming parts of the job of selling real estate, freeing them to spend more time on marketing properties, finding clients, networking and closing sales.

“During the past few years, we have seen the evolution of AI in general,” Bashyam said. “Many companies have already been using AI-enabled chatbots to answer the questions of customers who log onto their sites. But what ChatGPT is doing is a more transformational change. There are more opportunities for commercial real estate professionals to leverage this technology and become even more efficient.”

As Bashyam says, commercial real estate brokers can use ChatGPT to develop pitch decks, create the copy for marketing materials and craft market analyses for clients.

Consider the potential the chatbot holds for creating an analysis of a market. Brokers can simply enter the demographics and economic stats of a region and then ask ChatGPT to create a report highlighting the benefits of buying a property or bringing a business to the area. If brokers enter the right prompts, ChatGPT can create a compelling market analysis in minutes.

Without the help of ChatGPT? That job could take an entire day.

Another example of how ChatGPT can help CRE professionals? Brokers need to constantly stay in touch with their clients, something that often involves sending regular email messages. Bashyam says that CRE professionals can use ChatGPT to draft email messages that contain the latest trends and information and then send these messages to their clients.

“It is up to real estate providers to keep their clients informed on the latest trends in commercial real estate,” Bashyam said. “This job can be much easier with ChatGPT.”

Reasons for concern

This doesn’t mean, though, that ChatGPT is foolproof or that the human touch isn’t

By Dan Rafter, Editor

needed to create market analyses or marketing materials.

Bashyam points out that ChatGPT does not have the most up-to-date information, having little knowledge of anything that has taken place across the globe after 2021.

It’s why real estate professionals will need to tinker with any copy that ChatGPT produces.

“It’s not wise to just use whatever ChatGPT produces as is,” Bashyam said. “You need to have people look at what it writes. You have to be sure the information is accurate. Most of the companies in the commercial real estate industry will want to leverage the tool in a cautious manner. They will need to implement this in a more controlled way, enacting some guidelines for people to follow.”

This is especially important with ChatGPT because real estate professionals are adopting it more quickly than they typically do with most forms of new technology. That’s largely because ChatGPT allows CRE pros to immediately do their jobs more efficiently. It can be tempting, then, for brokers to use the AI software to create reports, emails and marketing materials without taking the time to review the materials that it creates.

ChatGPT is also more powerful when companies and individuals fuel it with their own data and information. That way, the software will create marketing materials and reports that contain information that is useful to clients.

“Because it is seeing such a fast adoption and because it has such a wide variety of applications, you have to make sure that you follow data privacy and security practices to protect a company’s data,” Bashyam said. “This is one of the best tools to improve productivity and efficiency. But it comes back to how you use it. You need to leverage the tool with your own real-time data. That is more powerful. It’s about integrating ChatGPT with your company’s own data. That helps you provide more insights and current information versus broader and more general information.”

The challenge with commercial real estate is that it is a high-touch and relationship-driven business. Bashyam says that the key to using ChatGPT effectively in this industry is to marry the efficiency boost that the AI program can provide with the need to build relationships with clients.

Again, that’s where using ChatGPT to create emails with current market information or to draft market analyses comes in. Brokers can create these reports quickly, fine-tune them and then send them to their clients, usually completing these tasks in under an hour. That’s an efficient way to keep in contact with key clients.

“Real estate is always going to be a business that is driven by long-standing relationships,” Bashyam said. “ChatGPT won’t change that. But ChatGPT can make it easier for brokers to maintain those relationships and keep their clients informed. We are still at the beginning stages of this technology. But we can already see the efficiencies that it can bring.”

10 MAY 2023 MINNESOTA REAL ESTATE JOURNAL

Damodaram Bashyam

April 20, 2023

Over 900 Professionals gathered to celebrate the achievements of 2023

Thank you to all that attended!

12 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS #mrejawards | #rejournals | Find Us On re_jounrals REjournals @REjournals THANK YOU Visit the 2023 Awards Company Profile Page

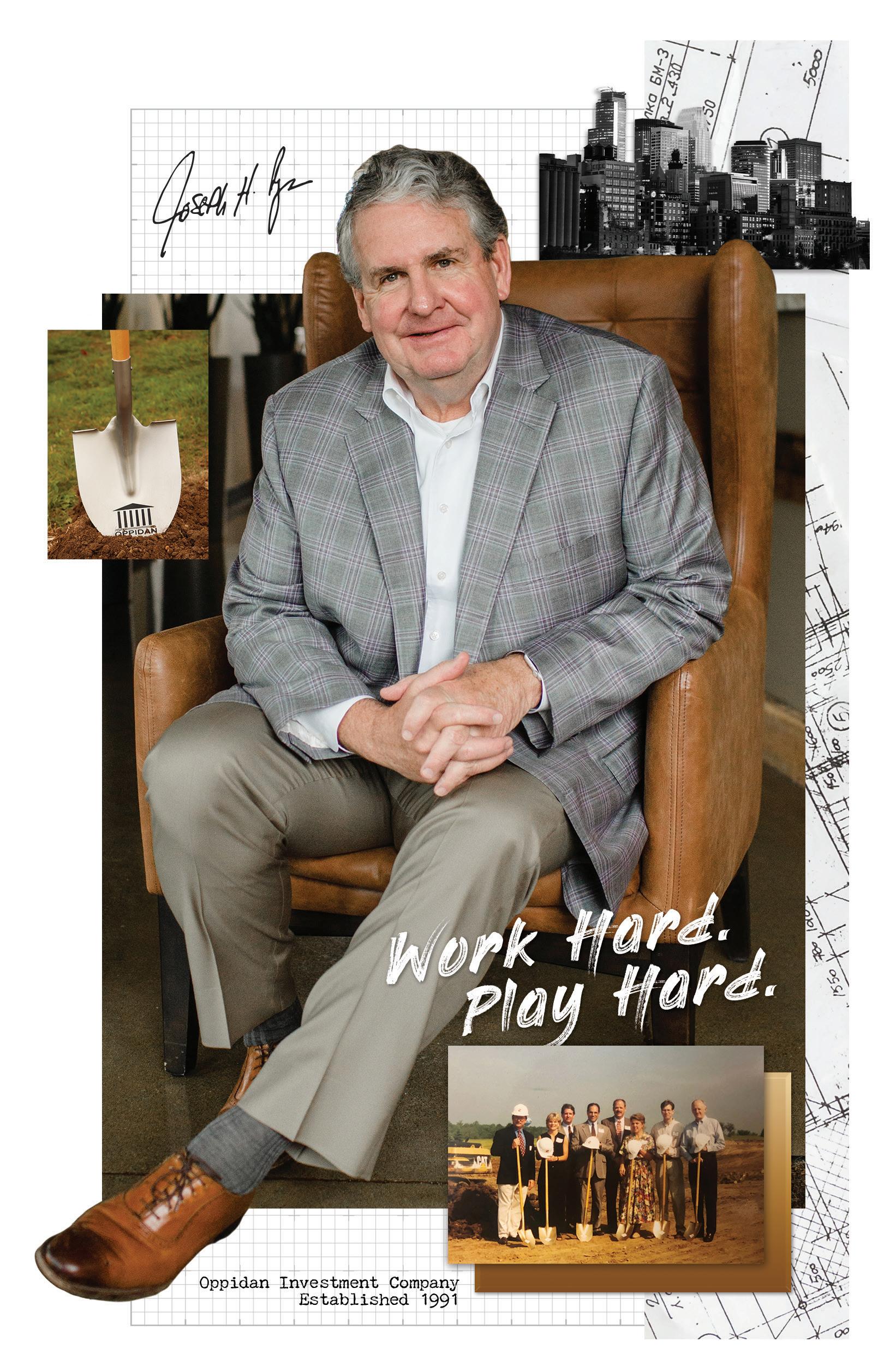

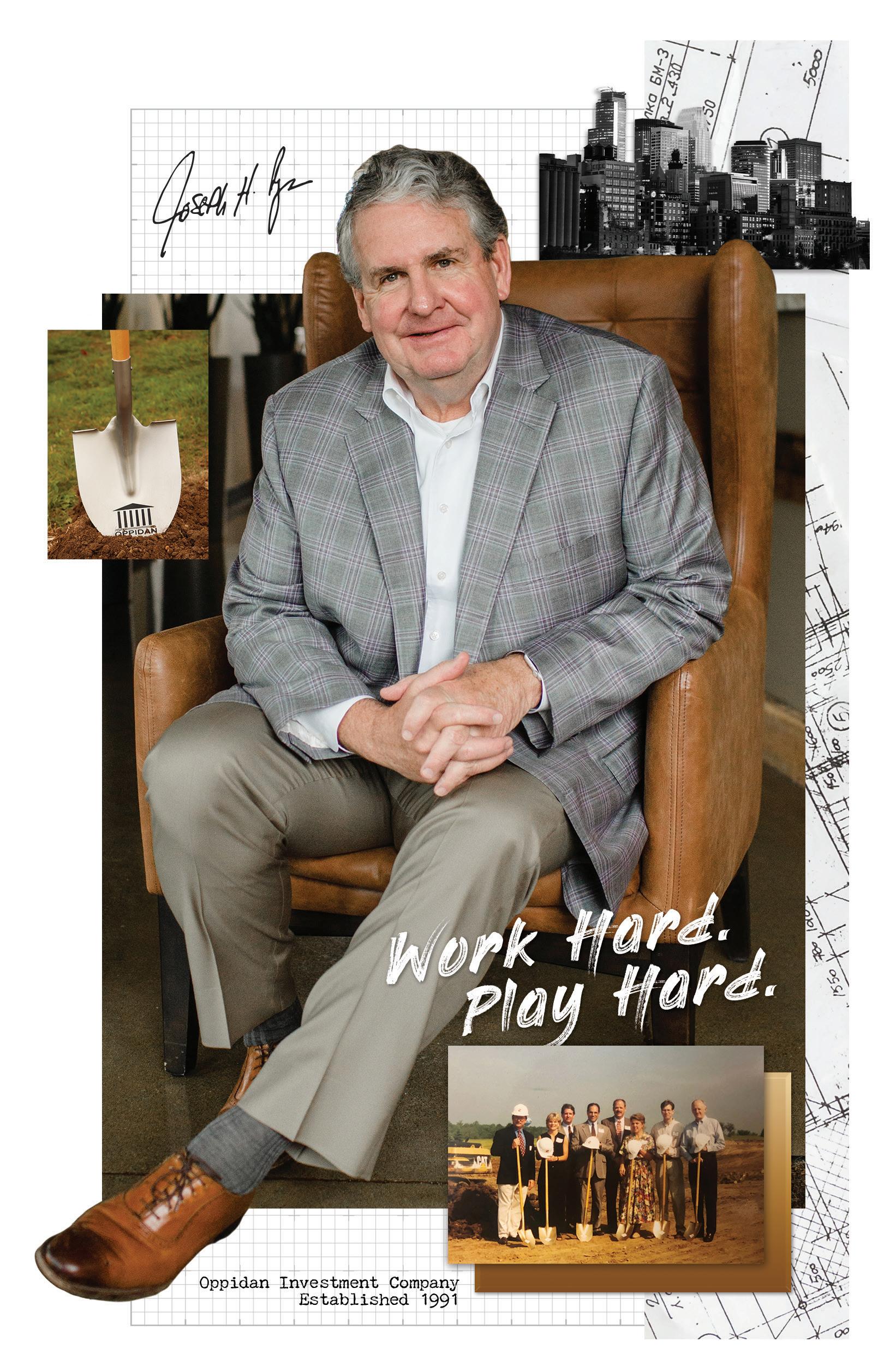

LIFETIME ACHIEVEMENT

JOE RYAN

Joe Ryan’s personal philosophy of always “delivering value” was instrumental in the creation of Oppidan Investment Company in 1991. Oppidan is the Latin word for investing in your city, and that’s exactly what Joe strives to achieve each and every day. Oppidan is the result of years of hard work, recalibration and creativity, all of which makes it unique and dynamic. There is no other company quite like Oppidan and for the past 32 years, “delivering value” has been the key to transforming Oppidan into a national real estate development leader.

Joe built a team steeped with experience in development, capital markets, project management, construction management and senior housing operations. Oppidan quickly became the leader you can trust, with the reputation to prove it. Relationships matter to Joe, which is why every Oppidan client has become a repeat client.

Oppidan has made its mark in all facets of the commercial development industry, from development to project management. Joe has kept the company laser-focused on key developments, such as Senior Housing, Industrial, Data Centers, Market Rate Apartments, Mixed Use, Affordable Housing and Retail. Its national presence continues to grow with offices in San Jose, CA, and Raleigh, NC.

Joe’s leadership is apparent through Oppidan’s success. Joe has led his team in the development of more than 580 projects valued at over $4 billion and spanning 25 millionsquare feet throughout 41 states and parts of Canada. Oppidan’s impressive client list includes, US Franciscans, Christian Brothers, Oblates Priests and Brothers, Ebenezer, Watermark Retirement Communities, Duluth Trading Company, Northern Tool, Cub Foods, Hornbachers, Coborns, Camping World, Target, Sprouts, GE Oil & Gas, Goodwill, Caliber Collision and multiple global industrial and mission critical clients.

Oppidan has evolved and created many institutional and private joint venture partnerships with the nation’s top financial institutions, including Harrison Street and Kayne Anderson, as well as asset managers like Bailard and Goldman Sachs Asset Management. Joe

also co-founded Oppidan’s sister company, Water Street Partners, in 2017 which invests in real estate opportunities on behalf of its private real estate funds.

Joe has been recognized by his peers with an impressive list of awards including GlobeSt. Best Boss, Minneapolis/St. Paul Magazine Most Admired CEO, Finance & Commerce Power 30, Twin Cities Business Family Business Award and Twin Cities Business 100 People to Watch.

13 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS 54 2023 Minnesota Real Estate Journal | Commercial Real Estate Awards | REjournals.com

14 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS PCL.COM

IN HEALTHCARE

Southdale Medical Center

YOUR LOCAL EXPERTS

CONSTRUCTION

Clinic University of North Dakota School of Medicine & Health Sciences

CCRM Fertility

PROJECT AWARDS

Affordable Housing - Suburban

Sonder Point Apartments 50+ Community

Axle Apartments

WINNER! PARKWAY FLATS

Aster House

Affordable Housing - Urban

BEAM

The Hollows

WINNER! MORROW

Endeavors

The Hillock

Education & Daycare - Suburban

Prairie View Middle School

John Glenn Middle School

Lakeville Area Schools Blanchard Aquatic

Center

New Creations Valley View Daycare

WINNER! CARVER ELEMENTARY SCHOOL

Education & Daycare - Urban

WINNER! UNIVERSITY OF MINNESOTA

CAMPBELL HALL / INSTITUTE OF CHILD DEVELOPMENT

Minnesota Transitional Charter School - k-12

Saint Paul City School

Hotel / Hospitality

WINNER! FOUR SEASONS - MINNEAPOLIS

Tru & Home2 Suites by Hilton Minneapolis

Downtown

Courtyard by Marriott Owatonna Downtown

15 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS

INVEST IN BUILDINGS THAT ARE INVESTED IN PEOPLE

Our collective insight, paired with cutting-edge technology, defines a clear path forward for our clients.

Industrial / Manufacturing / Science - SE

Magnum Trucking LTL

WINNER! METRO SALES, INC. HQ

InverPoint Business Park, Building #2

Industrial / Manufacturing / Science - SW

WINNER! CHASKA CREEK INDUSTRIAL I

Miromatrix

ONTO Innovation Cleanroom

Interior Design - 50 Plus/Senior Living

Round Lake Senior Living

Sonder Point Apartments 50+ Community

WINNER! VIEW 44

Interior Design - Healthcare

Wayzata Specialty Center

Community Dental Care

WINNER! ASSOCIATED SKIN CARE

SPECIALISTS

Retina Consultants of Minnesota

Interior Design - Hospitality

WINNER! FOUR SEASONS - MINNEAPOLIS

Cafesjian Art Trust

Interior Design - Suburban Apartment

Rya at RF 64 Granite Works

The Morrison

Risor Apple Valley

WINNER! LANDSBY ON PENN

Axle Apartments

Interior Design - Suburban Office

Metro Sales, Inc. HQ

Miromatrix

Thermo King East Office (Phase 3B) Big Bridge Holdings, Inc.

WINNER! DAVIS & ASSOCIATES

Ralco Agriculture Headquarters

Louisiana Crossing Lifeworks Main Office

Interior Design - Urban Multifamily

BEAM

WINNER! ELEVEN

The Scenic

The Mason

Interior Design - Urban Office

Riverplace Office Complex Renovation

WINNER! JLL

Hyde Development Office

Court International Atrium Remodel

RBC Wealth Management - U.S. HQ

Medical Property

Wayzata Specialty Center

610 Medical

WINNER! HUDSON MEDICAL CENTER

MNGI Digestive Health

North Memorial Health Clinic

16 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS | www.a-p.com

LIFETIME ACHIEVEMENT AWARD-WINNER, JOE RYAN

Congratulations to Joe Ryan on his Lifetime Achievement Award from the RE Journals! Joe founded Oppidan in 1991 with the personal philosophy of always “delivering value.” For 32 years, “delivering value” has been the key to transforming Oppidan into a national real estate development leader.

Oppidan.com

952.294.0353

Excelsior, Minnesota

17 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS

Mixed-Use Property - Minneapolis

The Salvation Army Adult Rehabilitation Center

Doyle Apartments

WINNER! RBC GATEWAY TOWER

Mixed-Use Property - St. Paul

WINNER! THE COLLECTION AT HIGHLAND BRIDGE

Morrow

International Institute of Minnesota Office

WINNER! LIFELONG WEALTH ADVISORS

401 Lake Street East

Louisiana Crossing

Redevelopment / Reuse / HistoricSuburban

WINNER! LOUISIANA CROSSING

Amber Union Apartments

Crest Ridge Building Reposition

Redevelopment / Reuse / HistoricUrban

WINNER! STEELMAN EXCHANGE

724 Lofts

The Abbey Duffey Lofts

Leijona

Retail / Restaurant

WINNER! MARA RESTAURANT

MSP Airport - Concourse G Concessions

Redevelopment

North American Banking Company Orchard Place

Karl’s Fishing & Outdoors Store

Hazelwood

Senior Housing

Round Lake Senior Living

WINNER! AMIRA BLOOMINGTON

Risor of Apple Valley Flagstone

Willows Bend Senior Living

Marvella

Suburban Multifamily - NE

WINNER! RATIO

Lexington Lofts

Axle Apartments

Suburban Multifamily - NW

Granite Works

The Bowline at Mississippi Crossings

WINNER! FREDRIK APARTMENTS

The Reeve

Suburban Multifamily - SE

Rya at RF 64

The Morrison Riley

Risor of Apple Valley

WINNER! CANVAS AT WOODBURY

The Overlook at Crystal Lake

Suburban Multifamily - SW

Villages of Island Park

WINNER! PARKWAY PLACE

Shakopee Flats

The Bower

OPPIDAN FOUNDER/CEO

JOE RYAN CONGRATULATIONS

for earning Minnesota Real Estate Journal’s Lifetime Achievement Award

18 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS ALERUS.COM/BUSINESS Member FDIC

CSM Corporation develops, owns, and manages a wide range of properties including hotels, office, retail, industrial and residential communities.

We’re committed to delivering exceptional business results for our guests, tenants and residents, while making a positive difference for our employees — and the communities where we live and work.

COMMERCIAL & RETAIL

CSM Commercial develops, owns and manages office, industrial, and retail real estate nationwide. In its 40+ years of operation, CSM has built, acquired or redeveloped 140 commercial properties coast to coast, including more than 15 million square feet of space. Our unique approach to design and development results in construction that is well-built, easily maintained and flexible for future use. CSM’s in-house resources provide unparalleled expertise and cohesive solutions for clients.

LODGING

CSM Lodging has been one of the top 50 hotel management companies in the US with a proven track record of success. Some of our accolades include; Marriott Developer of the Year, Marriott Classic Premium Hotel of the Year and Best Conversation Hotel of the Year. CSM has built and managed nearly 50 hotels for some of the nation’s most prestigious brands, including Marriott, Hilton and Hyatt. We develop, design and operate hotels from coast to coast with unique and comprehensive experience.

RESIDENTIAL

With more than 7,800 residential units developed, managed and owned nationwide, CSM Residential is a highly respected residential property management company nationwide. We understand that communities are more than just a building, they are our residents home. Ultimately, our goal is to drive value for our residential investments to be; more competitive in the market, more profitable and more attractive to residents over the long-term.

19 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS

CSMCorp.net | 612.395.7000

CSM Corporation and Gary Holmes Congratulate JOE RYAN

- 2023 Minnesota Real Estate Journal Lifetime Achievement Award -

Urban Multifamily - Minneapolis

WINNER! FOUR SEASONS PRIVATE RESIDENCES

Doyle Apartments

The Duffey

Wakpada Apartments

Urban Multifamily - St. Paul

The Scenic

Waterford Bay Apartments

The Mason

WINNER! MODA ON RAYMOND

COMPANY AWARDS

Developer of the Year

Capital Partners

Davis Development Team

United Properties

Solhem Development

JO Companies, LLC

Hyde Development Enclave

WINNER! ROERS COMPANIES

Hall Sweeney Properties

Senior Housing Partners

Real Estate Equities

Oppidan

General Contractor of the Year

RJM Construction

WINNER! DORAN COMPANIES

Ironmark Building Company

PCL Construction, Inc.

Bauer Design Build

Owner / Landlord

WINNER! CAPITAL PARTNERS

MANAGEMENT

Hempel Real Estate

United Properties

Soderberg Apartment Specialist

Professional Service Company of the Year

Sambatek, LLC

Forte Real Estate Partners

WINNER! CARLSON PARTNERS

Insight Restoration

Property Management Company of the Year

Capital Partners Management

Davis Property Management

WINNER! RYAN COMPANIES

Zeller

Frauenshuh, Inc.

Suntide

20 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS Accurate Transparent Instinctive Trusted Traditional Likeable Proven Knowledgeable Collaborative Reliable Tangible Unmatched Network. Operational Excellence. Incredible Investor Return. capitalpartnersmn.com Industrial Real Estate Owner & Operator

21 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS #mrejawards | #rejournals | Find Us On re_jounrals REjournals @REjournals THANK YOU Visit the 2023 Awards Company Profile Page

Property Management Company of the Year - Housing

WINNER! EBENEZER MANAGEMENT SERVICES

Renters Warehouse

Solhem

Real Estate Equities

PEOPLE AWARDS

Architect / Engineer of the Year

WINNER! ANTHONY ADAMS, RYAN COMPANIES

Broker of the Year

Judd Welliver, CBRE

Ra’eesa Motala, Roko Advisors

Dave Berglund, JLL

Colin Ryan, JLL

WINNER! MARC NANNE, JLL

Jim Rock, Avison Young

Ross Hedlund, CCIM, RPA, Frauenshuh

Jaclyn May, Cushman & Wakefield

Emerging Leader of the Year

John Nordstrom, PE, Emanuelson-Podas

Christian Osmundson, Alatus

Austin Lovin, CBRE

Anne Madyun, Davis WINNER! SAMI COWGER, CARLSON PARTNERS

Tim Tysk, Carlson Partners

John McKenna, Cushman & Wakefield

Executive of the Year

Ted Carlson, SIOR, CCIM, Carlson Partners

Raphael Golberstein, PACE Loan Group WINNER! JOHN CURRY, KNUTSON CONSTRUCTION

Tim Elam, Scannell Properties

Barb Schuba, Suntide Commercial Realty

Mortgage Broker / Banker of the Year

Jon Tollefson, Bridgewater Bank

Jeff Lepley, JLL WINNER! MARSHA GOFF, MERCHANTS CAPITAL

CONGRATULATIONS NOMINEES!

SONDER POINT APARTMENTS

AFFORDABLE HOUSING - SUBURBAN INTERIOR DESIGN - 50+/SENIOR LIVING

ASTER HOUSE

AFFORDABLE HOUSING - SUBURBAN

Jeffrey Haug, Great Southern Bank

WINNER! TONY CARLSON, COLLIERS

MORTGAGE

Project Manager of the Year

Luke Capistrant, Loeffler Construction

Ken Kraft, AIA, CHC, LEED AP, Frauenshuh

Brock Norman, Ryan Companies

Cameron Dahlin, Loeffler Construction

Steve Nornes, Senior Housing Partners

WINNER! JILL NOKLEBY KAISER, EBENEZER

Property Manager of the Year - Female

Kellee Vinge, Capital Partners

Melissa Gomes, Davis

Tami Shroyer, RPA, Frauenshuh

WINNER! CRYSTAL PINGEL, FRAUENSHUH

CELEBRATING 10 YEARS IN THE MIDWEST

22 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS

CONSTRUCTION

LYNN,

BIG-D

KRIS

BUSINESS DEVELOPMENT DIRECTOR P: 612-469-5760 MIDWEST.BIG-D.COM

Property Manager of the Year - Male

Tom Gergen, Blackbridge Property Management

Matthew Swanson, CBRE

Mitch Robertson, Suntide

Xue Yang, Zeller

WINNER! DENNIS MEADOWS, CUSHMAN & WAKEFIELD

Jason Van De Wiele, Oppidan

Real Estate Lawyer of the Year

Alan Van Dellen, Stinson LLP

Thomas L. Bray, Taft

David Krco, Best & Flanagan

WINNER! CHRISTINA RIECK LOUKAS, WINTHROP & WEINSTINE

Kyle Willems, Bassford Remele

Woman of the YearDevelopment & Construction

Robin Mooney, DJR Architecture

Calleigh Kennedy, Big-D Construction

WINNER! MEGHAN ELLIOTT, NEW HISTORY

Kate Hamerly Spooner, Roers Companies

Kristyn Secaur, Suntide Commercial Realty

Woman of the YearReal Estate Services

WINNER! JILL RASMUSSEN, DAVIS

Joyce Stupnik, BDH

Sami Cowger, Carlson Partners

Genevieve Liesener, Cushman & Wakefield

Woman of the Year - Senior Housing

WINNER! SUSAN FARR, EBENEZER

Pam Belz, Senior Housing Partners

Lisa Albain, Marvella

TRANSACTION / CITY / COUNTY AWARDS

Most Significant Lease Transaction in 2022

WINNER! PIPER SANDLER LEASE - NORTH LOOP GREEN

State of MN - Disability Determination Services

Most Significant Investment Sale Transaction in 2022

WINNER! 10 WEST END

The Shops at West End

Minneapolis Core Logistics Portfolio

The Berkman

Asia Mall / Pacifica Square in Burnsville

City / County / Municipality of the Year

WINNER! CITY OF APPLE VALLEY

City of Elk River

City of Lakeville

City of Forest Lake

DEVELOP DESIGN BUILD MANAGE dorancompanies.com

23 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS

A HISTORY OF SUCCESS: OUR KEY TO THE FUTURE.

For over 100 years, Ebenezer Senior Living has been Minnesota’s most trusted senior housing provider. We are driven to heal, discover and educate for longer, healthier, meaningful lives.

Today, we celebrate each person, community and partner who shares in fulfilling our mission, along with those who are finalists in REjournal’s 2023 Minnesota Commercial Real Estate Awards.

Willows Bend Senior Living | SENIOR HOUSING

Ebenezer Management Services | PROPERTY MANAGEMENT COMPANY OF THE YEAR

Jill Nokleby Kaiser | PROJECT MANAGER OF THE YEAR

Susan Farr | WOMAN OF THE YEAR

Congratulations to our development partner; Joe Ryan, Oppidan | 2023 LIFETIME ACHIEVEMENT AWARD

SENIOR LIVING & SERVICES | PROPERTY MANAGEMENT & CONSULTING | E benezerCares.org

©2023 Fairview Health Services 10033

24 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS w w w e b e r t c o m p a n i e s c o m G E N E R A L C O N T R A C T I N G & R E A L E S T A T E D E V E L O P M E N T C o n g r a t u l a t i o n s t o G r a n i t e W o r k s , D e l a n o o n t h e i r n o m i n a t i o n s !

AIR POWER LIGHT WATER

Smarter design of your mechanical and electrical systems will dramatically impact your ability to achieve your project goals and maximize your investment. We work closely with developers, owners, architects, and construction professionals to intelligently bring air, power, light, and water to the places that matter.

Let’s connect and do great things.

25 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS

epinc.com

26 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS Thank you, Joe and all the finalists for the experience and expertise you bring to the Minnesota real estate industry. We’re proud to help play a part in this thriving community and are with you in our commitment to its success. EDINA & ROSEVILLE | 800.843.1552 | WWW.BANKEASY.COM CONGRATULATIONS, JOE RYAN! Minnesota Real Estate Journal Lifetime Achievement Award Winner Marissa Ulstad Operations Director 612.305.2008 mulstad@firstam.com First American Title National Commercial Services 121 South 8th Street, Suite 1250 Minneapolis, MN 55402 Industry-leading products, services and commercial expertise you need to close your transactions efficiently – regardless of size, scope or complexity. First American Title Insurance Company, and the operating divisions thereof, make no express or implied warranty respecting the information presented and assume no responsibility for errors or omissions. First American, the eagle logo, First American Title, and firstam.com are registered trademarks or trademarks of First American Financial Corporation and/or its affiliates. ©2023 First American Financial Corporation and/or its affiliates. All rights reserved. NYSE: FAF

Marsha Goff

Merchants Capital is proud to support the 2023 Minnesota Real Estate Journal Awards and congratulates on her nomination for Mortgage Banker/Broker of the Year!

Merchants Capital is ranked the Affordable Housing Lender nationwide.*

27 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS

* A f f o r d a b l e H o u s i n g F i n a n c e 2 0 2 2 T o p 2 5 A f f o r d a b l e H o u s i n g L e n d e r s r a n k i n g

#2

28 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS Custom designed innovative technology solutions for commercial and industrial properties. InFocusSystems.com 952.929.0000 Two locations: St. Louis Park & St. Paul AUDIO/VISUAL ACCESS CONTROL DATA CAMERAS SECURITY VOICE WI-FI

29 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS

Larkin Hoffman is delighted to congratulate Joe Ryan, CEO and Owner of Oppidan Investment Company , for receiving the Minnesota Real Estate Journal Lifetime Achievement Award. www.larkinhoffman.com Congratulations! Joe Ryan REJ_JoeRyan_Ad.indd 1 3/31/23 3:55 PM ON BEING NAMED FINALISTS FOR THE 2023 MREJ AWARDS UNIVERSITY OF MINNESOTA, CAMPBELL HALL / INSTITUTE OF CHILD DEVELOPMENT (ICD) Education + Daycare, Urban ROCHESTER PUBLIC SCHOOLS Greater Minnesota JOHN CURRY Executive of the Year

University of Minnesota, Campbell Hall / Institute of Child Development (ICD); Minneapolis, MN

31 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS As the most active C-PACE lender in Minnesota we’re proud to be part of the toolkit that makes development happen. PACE Loan Group is proud to support the nominees of the 2023 Minnesota REJournal Real Estate Awards. www.goplg.com

The Grove Ryan Companies

Crosstown Core Hempel Real Estate

Four Seasons at RBC Gateway United Properties

The Deco First & First

Accelerate your future success by removing all obstacles. We manage your Risk Management Program. So you can focus on your business. Our offerings include Business Insurance, Employee Health & Benefits, Private Client Services & Retirement Services. Your future is limitless. Find out how we can take you there. MarshMMA.com | 763.203.2069

Mankato Heights Plaza Solar Tailwind Group

32 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS driven by your vision Construction management expertise to bring your vision to life RJMConstruction.com

33 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS Congratulations

Congratulations to all the FINALISTS and to JOE RYAN on the Lifetime Achievement Award!

JOE RYAN

34 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS STAHLCONSTRUCTION COM 861 E Hennepin Ave , Suite 200 Minneapolis, MN 55414 BUILDING SOLUTIONS THAT MATTER For solutions that meet your needs, contact us at scannellproperties.com

35 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS

UNITED PROPERTIES

Creating Deep Roots for Over 100 Years

36 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS

37 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS Congratulations to Tony Carlson Colliers Mortgage congratulates Tony Carlson as a 2023 Mortgage Broker/Banker of the Year winner! We are beyond thrilled to have you as part of our team! colliers.com Congratulations to Susan Farr Colliers Mortgage and Colliers Securities congratulate Susan Farr on her well-deserved Woman of the Year - Senior Housing Award! Congratulations to Christina Rieck Loukas on your recognition and achievements. We applaud your dedication, and thank you for your leadership in the profession and in the community.

CHRISTINA RIECK LOUKAS

FINALIST, REAL ESTATE LAWYER OF THE YEAR

Colliers

Joe Ryan on his well-deserved Lifetime Achievement Award!

We are honored to support Joe and Oppidan as a long-time finance partner! colliers.com

38 APRIL/MAY 2023 2023 MINNESOTA REAL ESTATE AWARDS Congratulations

to Joe Ryan

Mortgage congratulates

On April 6 at the St. Paul Event Center, Minnesota Brownfields and members of Minnesota’s redevelopment community will gather to celebrate finalist projects demonstrating innovation, collaboration, and exemplary results in revitalizing formerly contaminated land. The program will feature five project awards and student brownfield scholarship recipients.

Thank You Sponsors!

Gold Sponsors: $5,000

Mac Hyde Scholarship Sponsors: $3,500

Silver Sponsors: $2,500

Table Sponsors: $1,000

Bay West LLC

Bolander

Braun Intertec

Frattalone Companies

Frauenshuh, Inc.

GZA GeoEnvironmental Inc.

Kandiyohi County and City of Willmar (EDC)

Landmark Environmental

Minnwest Bank

Saint Paul Port Authority

Terracon Consultants, Inc

The Opus Group

WSB

WSP USA

Custom designed innovative technology solutions for commercial and industrial properties. InFocusSystems.com 952.929.0000 Two locations: St. Louis Park & St. Paul AUDIO/VISUAL ACCESS CONTROL DATA CAMERAS SECURITY VOICE WI-FI