A home with a BUILT TO SAVE® certificate allows homeowners to relax without worrying about high energy bills, unverified construction, and poor indoor comfort. A BUILT TO SAVE® certificate gives homeowners (1) the confidence in knowing their home was inspected, tested, and verified by an independent licensed home energy Rater, and (2) the happiness in knowing their home is “above code” and of superior energy efficiency and high-performance construction.

Don’t take anyone’s word that your new home is of superior energy efficiency. Ask to see the BUILT TO SAVE® certificate!

• Lower Utility Bills

• Increased Home Comfort

• Better Indoor Air Quality

• Tighter Construction

• Less Maintenance

• Higher Market Value

• Third-Party Inspections & Testing

• Compliance with Current Energy Codes

• “Above-Code” Compliance

• More Durability

• BUILT TO SAVE® Certificate

• LastingPeaceofMind

Guide to Building a Custom Home

See essential steps to building a home, from inception to completion, to make your home dream come true with meticulous and thoughful planning.

10 Questions to Ask Your Builder

Selecting the right builder for your custom home is crucial; asking the right questions is key and can make the difference between a good or bad decision.

A Borrower’s Checklist

To secure a home loan successfully, stay wellprepared with this comprehensive checklist outlining the essential elements needed for your application.

Power

Your FICO score, a powerful key factor in home buying or construction, reflects your credit risk, determines your interest rate, and influences the amount of credit lenders can offer based on your bill payment history and outstanding debts.

COVER FEATURE

LTR CONSTRUCTION WON THE TOP AWARDS IN THE RIO GRANDE VALLEY BUILDERS ASSOCIATION’S 2023 PARADE OF HOMES (PG 6) . SEE MATERIALES

EL VALLE’S SPECIAL FEATURE ON LTR CONSTRUCTION (PG 16).

Aug / Sept / Oct’23

Volume 31 Issue 3

PUBLISHER

Across Media Marketing, LLC

EDITOR-IN-CHIEF

Jose Vielma

SENIOR EDITOR

Barbara Zapffe

SALES MANAGER

Jose R. Vielma

CREATIVE DIRECTOR

Bobo Wenadan

ADVERTISING SALES

Ken Sabe

IT SPECIALIST

Nadine Sabe

DISTRIBUTION MANAGER

Ken Sabe, Jr.

SPECIAL FEATURE

2023 RGVBA Parade of Homes Winners

See the award-winning builders from the Rio Grande Valley Builders Association’s annual Parade of Homes.

BUILT TO SAVE® Builder Members

The builders listed here are active members of the BUILT TO SAVE® High-Performance Home Program and use licensed third-party independent home energy Raters to verify their home’s energy efficiency.

RGVBA 2023 Fishing Tournament

The RGVBA hosted its 2023 Fishing Tournament at Jim’s Pier in South Padre Island, featuring two divisions for members and non-members, with cash prizes for various fishing categories.

NEW HOME COMMUNITIES

New Home Community Map

Color-coded maps with the most up-to-date listings of new home communities in the area. Communities with one or more Parade entries are marked with a gold star for easy reference.

New Home Communities

At-a-glance information on everything you need to know about some of the finest new home communities in the Rio Grande Valley. Go online to rgvNewHomesGuide.com to download lot sheets and brochures or to contact the developer or builder.

THE RIO GRANDE VALLEY AREA NEW HOMES GUIDE (NHG) is a quarterly publication of Across Media Marketing, LLC. Unless otherwise noted, all photography, artwork, and editorial content printed in NHG are copyrighted material and may not be duplicated or reprinted without express written permission. NHG and Across Media Marketing, LLC. are not responsible for typographical or production errors, or for the accuracy of information provided by the advertisers. Opinions expressed by writers and contributors do not necessarily represent the opinions of the publisher. NHG reserves the right to cancel or refuse any advertising which we deem unsuitable for our publication, conflicts with other existing agreements, or if advertiser is not in good standing.

EQUAL HOUSING OPPORTUNITY

All real estate advertising in this magazine is subject to the Federal Fair Housing Act of 1968 and the Amendments Act of 1988 which makes it illegal to advertise “any preference, limitation or discrimination based on race, color, religion, sex, handicap, familial status, or national origin, or an intention to make any such preference, limitation or discrimination.”

This magazine will not knowingly accept any advertising for real estate which is in violation of the law. Our readers are hereby informed that all dwellings advertised in this magazine are available on an equal opportunity basis. To complain of discrimination, call HUD tollfree at 1-800-669-9777 or contact HUD’s regional office in Ft. Worth, Texas at (817) 885-5521. The telephone number for the hearing impaired is 1-800-927-9275.

The Rio Grande Valley New Homes Guide is published quarterly by:

Across Media Marketing, LLC

Mailing Address:

3000 Melinda Drive, Edinburg, Tx 78539

EXPERIENCE AWE-INSPIRING EXTERIORS WITH STUNNING STONE ACCENTS AND CAPTIVATING INTERIORS HARMONIZING MATERIALS, COLORS, AND DESIGNS. At Waldo Homes, we specialize in crafting unique, superior custom homes that perfectly match your vision of beauty, comfort, and energy efficiency. We are known for building one-of-a-kind homes tailored to each homebuyer.

Our family-owned company takes immense pride in creating standout homes that shine in competitions. Throughout the Rio Grande Valley, we have earned a solid reputation for our honest and personalized service, crafting some of the region’s most exceptional custom homes. We are proud to have been consistently acknowledged with awards for construction excellence in every RGVBA Parade of Homes competition we’ve participated in--and setting a record for winning the highest number of awards in the competition’s history. Our proudest achievement, however, is winning the hearts of our customers since 2004.

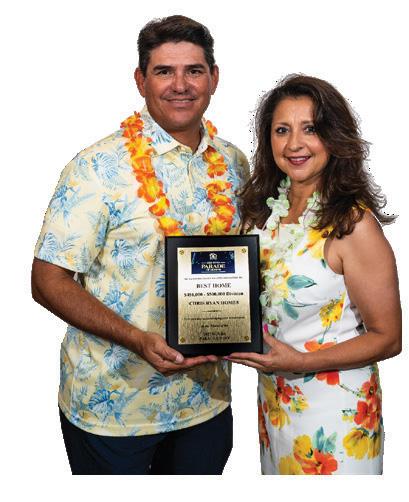

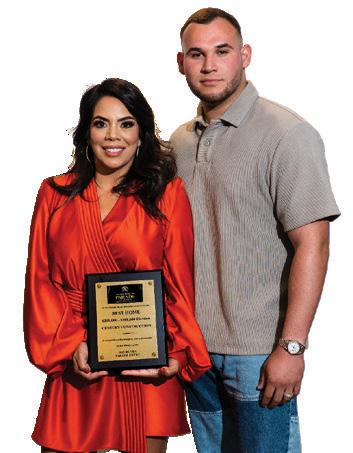

The Rio Grande Valley Builders Association (RGVBA) proudly presents the 2023 Parade of Homes winners. The Parade took place during the weekends of June 3-4 & 10-11 and featured 21 homes in new home communities in McAllen, Mission, Alton, Edinburg, and Progreso from some of the finest builders in the Rio Grande Valley of South Texas.

This year, the Parade awards winners were determined by the people who visited the homes and submitted their ratings. Awards were presented to builders in various price categories, with additional awards presented for People’s Choice, Best Architectural Design, Best Kitchen, Best Master Bed & Bath, and Best Curb Appeal. Visit www.rgvba.org for more information on the 2023 RGVBA Parade winners.

Esperanza Homes www.esperanzahomes.com Cell: 956-450-8035

Esperanza Homes www.esperanzahomes.com Cell: 956-450-8035

($251,000 - $300,000)

BEST HOME 251k - 300k 2023 RGVBA PARADE of HOMES AWARD

(956) 212-3859 / 566-0280

(L-R) Lisa Cordova; Victor Campos

WestWind 7405 N. 54th / Mission, TX 2709 W. Cambridge / Edinburg, TX

www.WestWindhomes.com 956-558-9535 / 558-9532 BEST HOME 401k - 450k 2023 RGVBA PARADE of HOMES AWARD EB Luxury

Homes

www.EBluxuryliving.com (956) 429-1069

(L-R) Jesus Espino; Griselda Espino; Jesus Espino, Jr.

$500,000)

(Over $551,000)

2023 RGVBA PARADE GOLD SPONSORS:

2023 RGVBA PARADE SILVER SPONSORS:

Sierra Title Company

2023 RGVBA PARADE GOLD SPONSORS:

2023 RGVBA PARADE SILVER SPONSORS:

Sierra Title Company

Being told that your home is energy efficient is not the same as getting written verification from a home energy Rater licensed by the Residential Energy Services Network (RESNET). Home Energy Raters are trained home energy inspectors who use specialized equipment and software to inspect, test, and verify that a home has met the requirements of high-performance home programs like BUILT TO SAVE®.

ASK YOUR BUILDER IF YOUR NEW HOME HAS BEEN VERIFIED

Carroll’s Inspection Services

Chris Carroll (956) 455-7779 chris@carrollsinspectors.com www.carrollsinspectors.com

Certifications: Home Energy Rater; ENERGY STAR® and BUILT TO SAVE® Certifications; ICC Energy Code Ambassador; EPA Indoor airPLUS; Level 2 Thermographer; TREC Property Inspector; RESNET Member; RESNET Green Rater; Building America Partner, DOE Zero Ready Verifier, Fortified Evaluator, Mold Assessment Consultant, & Insured/ Qualified 45L Tax Credit Certifier.

TREC license #7061 | RESNET license #0003953

TDRL license #MAC1689 | ICC #8194682

Luis Barrera Cell (956) 645-1213 homeenergyratingservice@gmail.com

Certifications: Home Energy Rater; ENERGY STAR® and BUILT TO SAVE® Certifications; HERS Rating for City Code Testing: Blower Door & Duct Leakage; Certificate of Occupancy (C of O); Energy Efficiency Mortgage Certification (EEM); HVAC Heat Load Calculations for Manual J, D, & F; Valley-wide Service.

RESNET license #2431025

Jorge Maldonado (956) 271-2322 jm-92@outlook.com

Certifications: Home Energy Rater; ENERGY STAR® and BUILT TO SAVE® New Home Certifications, IECC Energy Code Building Inspections; Blower Door & AC Duct Testing; Weatherization Inspections. BSI # 5298930

The Blower Door Test and the Duct Blaster Test are used to calculate a home’s Energy Rating Index (ERI—also referred to as the HERS score). Like miles per gallon (MPG) which measure the fuel efficiency of a car, an ERI (or HERS) score is an excellent predictor of a home’s energy efficiency—the lower the score, the higher the efficiency

BLOWER DOOR TESTS measure the leakiness of the home’s envelope— how much air comes in and goes out through the roof, windows, doors, and other openings in the home.

Required by code after Sept. 1, 2016.

DUCT BLASTER TESTS measure leaks in the joints and seams of the ductwork in the heating, ventilation, and air-conditioning (HVAC) system.

Required by code after Sept. 1, 2016 unless in conditioned space.

Building a custom home is a dream come true for many, offering the opportunity to create a living space tailored to individual preferences and needs. However, embarking on this journey requires meticulous planning, thoughtful financing, and a seamless closing process. In this article, we will outline the essential steps involved in building a custom home, from inception to completion.

GET PRE-QUALIFIED: Find out what size / price of home you are eligible for based on your financial qualifications. Most mortgage lenders offer free pre-qualification, and knowing what you can afford will serve as a basis for the size and price of a home you can build.

CHOOSE YOUR HOMESITE: Choose the lot and/or neighborhood

where you wish to live and that is within your price range. Make sure the lot you have selected meets all your requirements, such as square footage of your homeplans, and your budget.

CHOOSE YOUR BUILDER: This is probably the most important step and one that will determine the quality of your custom home. Do your homework. Look for a builder with a good reputation and the experience of building homes like the one you want. Most builders only build to minimum code standards. Find one that builds verified high-performance homes that are superior to minimum code-built homes. Look for builders who are members of the ENERGY STAR®, BUILT TO SAVE®, or AEP Texas HighPerformance home programs.

AND

The first step in building a custom home is to conceptualize the design and layout. Engage with architects and designers to transform your ideas into tangible plans. Most builders offer this as an in-house service. Consider factors such as the size, style, and specific features you want to incorporate. A deposit will be required by the builder (amount will vary) to start working on the home’s design and the elevations.

BUDGETING AND FINANCING:

Once the design is finalized, it’s crucial to determine a realistic budget for the project. Apart from construction costs, factor in other expenses like permits, taxes, and utility connections. Financing options may include a construction

When you’ve made the decision to build your own custom home, what comes next may seem intimidating. But if you follow the twelve steps listed and explained here, you will be one step ahead of the game!

loan (interim financing) that will convert to a permanent loan once the home is built. You may also consider the one-time close loan which is a construction loan and a permanent loan with one closing to fund the project. Talk to your mortgage lender to find out which financing option is best for you.

Ensure you or your builder obtains all necessary permits and clearances from local authorities. Compliance with zoning regulations and building codes is critical to avoid delays and legal issues during and after the construction process. Ask if your home will be built in compliance with the State’s energy code (2021 IECC). Not all builders comply with the State’s energy code. The best way to be sure is to ask that your home be verified as a highperformance home in the ENERGY STAR®, BUILT TO SAVE®, or AEP Texas High-Performance home programs.

Throughout the construction process, local building inspectors will conduct regular inspections to ensure that the work complies with safety and quality standards. Addressing any issues flagged during inspections is essential to maintain the project’s momentum. Homes in high-performance homes programs require a thermal bypass inspection after the home is insulated but before the drywall is put in. These programs also require home energy efficiency testing once the home is completed to determine if it qualifies for the high-performance home certification.

As the construction

progresses, you’ll have the opportunity to select finishes, fixtures, and other personalized elements for your custom home. From flooring and paint colors to cabinetry and lighting, these choices will contribute to the uniqueness of your new home. Selections for the home are done according to your budget or builder allowances.

INTERIM CLOSING: You will be notified when closing documents are available for your signature on the interim/construction loan. Once documents are signed, construction can start and can take from 3 to 6 months to complete for final Closing, depending on the size and/or details of the home.

FINALIZING FINANCING: As construction nears completion, it’s time to transition from the construction loan to a traditional mortgage, known as the end loan unless you opted for the one-time loan financing option. At 3-4 weeks prior to finishing construction, you need to collect updated information such as pay stubs, bank statements, tax returns/w2’s, and other documents required by the mortgage

lender to do a final close on your mortgage. The permanent loan pays off the remaining construction loan balance and becomes the long-term financing for your custom home.

PRE-CLOSING WALKTHROUGH: Before closing on the property, you will conduct a thorough walkthrough with your contractor to identify any remaining issues or discrepancies that need attention.

CLOSING AND MOVING IN: At the closing stage, you’ll sign the necessary paperwork and officially take ownership of your custom-built home. You finally get to celebrate this exciting milestone and begin the process of moving into your dream home!

In conclusion, building a custom home involves careful planning, securing financing, and meticulous attention to detail throughout the construction process. While it may require time and effort, the result is a home that perfectly aligns with your vision and lifestyle. With proper planning and execution, building a custom home can be an immensely memorable, happy, and rewarding experience.

(956) 800-8889 | rosendo@villanuevahomes.com

www.VillanuevaHomes.com

Villanueva Construction, founded in 1985 by Martin Villanueva, has almost four decades of excellent home-building experience. Since joining the BUILT TO SAVE® high-performance home program in 2016, the company has been at the forefront of building energyefficient homes. For the sixth year in a row, Villanueva Construction was honored with the Outstanding Achievement Award: “Most Homes Certified in the BUILT TO SAVE® Program.”

Divine Custom Homes

(956) 467-1111 | olga@divinecustomhomes.com

www.DivineCustomHomes.net

DIVINE Custom Homes is supremely committed to energy efficiency. Founder Olga Treviño offers homebuyers high-performance homes that provide comfort, safety, and healthy indoor air. DIVINE Custom Homes is the only builder in the Valley whose homes qualify for the EPA Indoor airPLUS program. All homes Olga Treviño builds qualify for the ENERGY STAR® program, and she adds BUILT TO SAVE® certifications in Magic Valley Energy Cooperative communities. The company can build in any price range and in any architectural style, anywhere in the Valley.

(956) 687-6263 | info@ahsti.org

www.ahsti.org

For decades, Affordable Homes of South Texas, Inc. (AHSTI) has provided affordable, energy-efficient homes to the low-income residents of the Rio Grande Valley. 100% of AHSTI’s homes comply with the requirements of ENERGY STAR®, and in Magic Valley Electric Cooperative communities are also certified as BUILT TO SAVE®. By building energy-saving high-performance homes, AHSTI makes maintaining homeownership truly more affordable for their homebuyers.

(956) 222-0721 | bellissimobuilders@gmail.com

www.BellissimoBuilders.com

Clemente Gonzalez and Rick Garza of Bellissimo Builders are innovative, quality-focused custom builders that embrace the core principles of the BUILT TO SAVE® high-performance home program. The two partners construct homes that are notable for their attention to detail—especially when it comes to energy efficiency, durable construction, and overall comfort. The company has earned a reputation for excellence in every aspect of the construction process.

LTR Construction

(956) 453-6689 | ltrperez956@gmail.com www.LTRrgv.com

LTR Construction is devoted to satisfying clients with beautiful, master-crafted homes. The company was recognized with multiple awards including the Most Energy-Efficient Home, Best Home in the $251,000 to $300,000 Division, and Best Master Bed & Bath in the 2022 Rio Grande Valley Builders Association (RGVBA) Parade of Homes. Owner and builder Roy Perez is passionate about providing individually focused, one-onone service. LTR Construction’s culture reflects Roy’s desire to be the best at everything he does.

Monarch Custom Homes

(956) 250-7737 | info@monarchhomesrgv.com www.MonarchHomesRGV.com

Monarch Custom Homes has earned a reputation for excellence in customer satisfaction by building verified energy-efficient homes individualized to each homebuyer’s vision. Founder Gustavo Garcia and his daughters, D’Ann and Melinda, create timeless architectural designs and elegant finishing details that set the standard for ultimate sophistication in construction. Monarch Custom Homes makes building beautiful high-quality BUILT TO SAVE® homes an easy, enjoyable, and memorable experience for their clients.

These builders represent a small, select group of professionals leading today’s energy-efficient construction by building high-performance homes in the BUILT TO SAVE® and other high-performance home programs. Learn more about BUILT TO SAVE® at www.BuiltToSave.org.

The process of obtaining a home loan can be both exciting and daunting. As a potential borrower, being well-prepared is key to a smooth and successful application process. To help you navigate through this journey, here’s a comprehensive checklist outlining the essential elements needed for a home loan application:

1 2

The first step in applying for a home loan is having a sales contract for the property you wish to purchase. This contract should include all relevant details such as the property’s address, purchase price, and the names of all parties involved. The lender will require this information to initiate the loan process.

Your personal details are fundamental to the loan application. Prepare the following documents which you will need for your mortgage lender.

■ Identification: a copy of your valid government-issued ID, such as a passport or driver’s license

■ The name and address of current landlord/mortgage holder (if applicable)

■ Social Security information which will be used to verify your identity and credit history

■ A dollar amount for what you pay now for housing

Lenders want to ensure that you have a stable income to support mortgage repayments.

If you are employed by someone else, you may be asked for:

■ Proof of Income: recent pay-stubs signed by a company rep. You many need a month’s worth of pay-stubs

■ A minimum two years of employment history and contact information for those employers

■ W-2 forms, or tax returns for the last two to three years (especially for commission income and/or unreimbursed expenses)

■ Employment History: provide a record of your employment history, including any job changes. If you were unemployed during the last two years (or employed less than two years), provide a letter that explains this gap

If you are self-employed, you will be asked to show:

■ That your business is profitable

■ That your business is well-managed (you will need to show that revenue has increased and/or costs have decreased)

■ Your company Balance Sheet (Profit & Loss statement)

■ Personal tax return for two years

■ Corporate tax returns if applicable

Alternate income you may be asked to prove:

■ Pension income

■ Social security income

■ Other form of income not generated through employment such as trust funds, etc.

Your financial standing plays a significant role in determining your loan eligibility. Prepare the following:

■ Assets: Documentation of your assets, including bank statements, investment accounts, retirement funds, and details of any real estate you own.

■ Liabilities and debts: Lenders want to know how much you owe and how well you pay back loans. Your credit history will show this information. If you have past issues with bad credit, you will need to provide a written explanation about what happened. If you have had any bankruptcies in the past seven years, you’ll need to provide documentation that fully details it, as well as legal proof of discharge of the bankruptcy from your credit history and verification that you have satisfied the waiting period to apply for a mortgage. If you own other land or have other mortgages, you will need to provide tax and insurance documentation for them, as well.

Compile a list of all outstanding debts such as student loans, credit card balances, and car loans.

a.) Credit Score: Check your credit score beforehand, as this greatly impacts your loan terms. A higher credit score generally results in better interest rates and loan options.

b.) Down Payment: Be prepared to provide the down payment, which is typically a percentage of the home’s purchase price.

c.) Loan Options: Research and understand the various loan programs available. Compare interest rates, terms, and conditions to choose the one that best suits your financial situation.

d.) Paperwork: Keep all documents organized and readily accessible to speed up the application process.

e.) Pre-approval: Consider getting pre-approved for a loan to strengthen your negotiating position with sellers.

By preparing this comprehensive checklist, you’ll streamline the home loan application process and increase the likelihood of securing your dream home. Remember, each lender may have specific requirements, so it’s essential to communicate with them directly to ensure you meet all their criteria. Happy house hunting!

At the top of the list of reasons for Materiales El Valle’s popularity is its millions of square feet of product inventory and thousands of square feet of showroom space with beautiful fullsized displays and samples of products including brick, ceramic tile, glass mosaic tile, handmade Saltillo tile, roof tile, porcelain, marble, Travertine, Cantera, engineered stone, and wood flooring. If a product makes your home stand out from the ordinary, the company almost certainly has it in stock—and in large supply.

And what could go better with the largest inventory? How about the best prices! The company’s longstanding history with name-brand manufacturers is a major part of its success. Because of those relationships, Materiales El Valle is able to not only offer lower prices; more importantly, the company is able to introduce the latest trending products, which may explain why so many builders win awards for homes that use materials that are often new to the market.

No matter how good products are and how inexpensive they may be, shoppers, however, tend to place greater value on how they are treated and whether they can rely on their vendor to be there for them. And that’s where the company excels—customer service. Combined with their many years of knowledge and experience, Materiales El Valle’s staff provides a friendly, personal service that makes buyers feel like family…because in the company’s eyes, they are. And that keeps customers coming back.

BUILDERS: We’d love to see your creativity using Materiales El Valle products. Tag @MaterialesElValleInc

on

LTR Construction is deeply grateful for the unwavering support of Materiales El Valle, whose exceptional selection of materials elevates homes to unparalleled heights, setting them apart from the rest. Winning all of the awards in the major categories in the 2023 Parade of Homes is a testament to the impressive and captivating elegance that Materiales El Valle’s products bring to LTR’s projects. We are happy to share our success with the leading supplier of tile and natural stone products in the Valley—Materiales El Valle.

CUSTOM HOMES www.DivineCustomHomes.net

(956) 467-1111 olga@divinecustomhomes.net

MONARCH HOMES ............................................. www.monarchhomesrgv.com m (956) 566-2838 ................................................ info@monarchhomesrgv.com

BELLISSIMO BUILDERS www.bellissimobuilders.com m (956) 222-0721 bellissimobuilders@gmail.com

LTR CONSTRUCTION ........................................... www.ltrrgv.com m (956) 453-6689 ltrperez956@gmail.com

EB LUXURY HOMES www.ebluxuryliving.com m (956) 429-1069 ebconstructionllc@yahoo.com

RAMITA HOMES m (956) 537-7360 lunatvnews@gmail.com

BRITO CONSTRUCTION ...................................... www.britoconstruction.com m (956) 540-5557 ................................................ info@britoconstruction.com

TREASURE BUILDERS .......................................... www.treasurebuildersllc.com m (956) 874-3686 treasurebuilders@att.net

RANMAR CONSTRUCTION (956) 451-7289

(956) 648-4637

VILLA HOMES (956) 257-9508

WALDO HOMES

(956) 466-8590

In the process of purchasing or constructing a new home, one crucial aspect you’ll inevitably discuss with your lenders is your credit score. The FICO score, developed by the Fair Isaac Corporation, serves as the primary tool lenders use to assess credit risk and determine whether to extend credit. Notably, it also influences your interest rate and the amount of credit they can safely provide. Your FICO score essentially reflects your bill payment history and outstanding debts each month. To comprehend why your FICO score matters, let’s delve into some fundamental points.

The FICO score scale ranges from 300 to 850, and the higher your score, the better. A good score signifies that you consistently pay your bills on time and manage your debts responsibly. A score above 740 is considered very good.

Your FICO credit report includes details of any loans you’ve had, be it a car loan, student loan, or credit card. This report reveals the outstanding balance on each loan and whether you’ve paid it off. Additionally, it shows your monthly payment history and whether you make payments on time. Late payments, high debt

levels, and defaults negatively impact your credit reputation.

If you plan to buy a house soon, it’s essential to review your credit report and score before applying. Lenders assess various factors in your application, such as current monthly debts, income, employment history, loan request size, and down payment affordability. Among these factors, your FICO score carries significant weight.

A low FICO score could limit the amount of money you’re

eligible to borrow or even result in a rejection of your application. Additionally, it may lead to higher interest rates. Furthermore, the type of loan you qualify for can be influenced by your FICO score; for instance, an FHA loan tends to have more lenient credit requirements compared to a conventional loan.

Obtaining your credit score is relatively simple. You can request a credit report from any of the three national credit bureaus, each of which provides a separate FICO score based on the information they collect about your debt and

bill payment history. Although there is usually a fee to access your credit report, federal law permits consumers to receive a free report once a year from each of the major credit bureaus through annualcreditreport.com.

The contact information for the bureaus is as follows:

• Experian: 1-888-397-3742, www.experian.com

• Equifax: 1-800-685-1111, www.equifax.com

• TransUnion: 1-800-916-8800, www.transunion.com

The good news is that you can improve your FICO score over time by taking specific actions. Here are three basic tips to boost your credit score:

• Pay your bills on time: timely bill payments are crucial for maintaining a high score.

• Maintain a reasonable debtto-income ratio: too many cards with high balances can lower your score.

• Avoid excessive loan or credit card applications: multiple inquiries on your credit report

When it comes to securing a mortgage, it’s essential to be aware that each type of loan has specific credit score requirements for approval. Here’s a breakdown of the minimum FICO scores needed for various loan types:

• FHA Loans: These loans are backed by the government, offering a more accessible path to homeownership. To qualify for an FHA loan with a 3.5% down payment, you’ll need a minimum FICO score of 580. However, if your credit score falls below 580, a higher down payment of 10% will be required.

• Conventional Loans: Considered more challenging to qualify for, conventional mortgages have higher credit score requirements. The minimum FICO score needed is typically 620. It’s worth noting that conventional loans may also come with higher interest rates compared to government-backed options.

• VA Loans: If you’re a veteran, you might be eligible for a VA loan, which often offers very competitive interest rates. While specific requirements can vary, the average minimum FICO score needed for VA loans is around 620.

It’s important to keep in mind that the presented rates, down payments, and credit score requirements are intended as general information and are subject to change. When exploring mortgage options, it’s best to consult with your lender to get accurate and up-to-date details tailored to your unique financial situation. Being well-informed will help you make the right decisions on your journey to homeownership.

can raise concerns for lenders. Moreover, canceling old credit card accounts can negatively affect your score by increasing your credit utilization rate –the amount of credit you’re using compared to the credit available to you.

In conclusion, if you want to assess your eligibility for a mortgage and understand potential costs, consider using an online home affordability calculator. Websites

like www.nerdwallet.com offer valuable advice and tips. While online resources are convenient, if you prefer personalized guidance, consult with local lenders for expert advice on your homebuying journey.

For comprehensive insights into credit reports and scores, visit www.truecredit.com and explore their “Credit Education” section, which provides highly beneficial information.

THE RIO GRANDE VALLEY BUILDERS ASSOCIATION (RGVBA) hosted its 2023 Fishing Tournament on a sunny Saturday, June 24, at the popular Jim’s Pier in South Padre Island. The event was a perfect combination of camaraderie, competition, and relaxation, bringing together family, friends, and fishing enthusiasts.

This year’s tournament featured two exciting divisions: the Member Division exclusively for RGVBA members and a new Open Division welcoming non-members to join in on the action, providing an excellent opportunity for networking and forging new connections within the industry.

Early in the day, 4-person boats set sail, each crew eager to prove their angling prowess, vying for top cash prizes and the highly coveted bragging rights that come with victory in this prestigious event.

The RGVBA fishing tournament has become an annual tradition, strategically planned after the Association’s bustling Parade of Homes event. This timing allows RGVBA members and their families to unwind and recharge after the arduous but rewarding efforts that go into organizing the successful Parade of Homes event.

Participants used their fishing skills (and luck) to compete for cash prizes in various fishing categories according to legal sizes, such as the heaviest

redfish, heaviest trout, and heaviest flounder. Additional cash prizes included a Grand Slam prize, awarded to the team with the highest combined weight of one redfish, one flounder, and one trout, and a “fun” cash prize awarded for the redfish with the most spots.

The RGVBA extends its gratitude to all of the participants, and to Paco Vielma and Michael Ramirez, co-chairs of the Fishing Tournament Committee, and to the member companies listed here who made this event possible with their generous sponsorships.

LUMBER SPONSORS:

• McCoy’s Building Supply

• San Jacinto Title

GOLD SPONSORS:

• Builders FirstSource

• MVEC

• Matt’s Building Materials

• Texas National Bank Mortgage

CAPTAIN’S PARTY SPONSORS

• Encore Title

• WestWind Homes

BEVERAGE SPONSOR

• Encore Title

FOOD SPONSORS:

• McCoy’s Building Supply

• Sierra Title Company

With funding provided by the State Energy Conservation Office (SECO), is pleased to announce that it will be providing the following trainings that will cover the changes from the 2018 to the 2021 IECC Energy Code

The training is designed to educate and train Texas builders, building officials, architects, and engineers who are already knowledgeable of building designs and practices, but who may not have a thorough understanding of the updated International Energy Conservation Code (IECC) and International Residential Code (IRC).

• Introduction of the basic concepts and principles of the Code

• Discussion of the major differences between the previous editions of the Code and the 2021 Code

• Discussion of the alternate compliance path components of the Code, and

• An overview of the importance of compliance with the Code.

EACH DAY WILL HAVE THESE SESSIONS:

Commercial Training - Morning Sessions - 8am to 12pm:

• Updates (2018 -> 2021) to the Commercial section of the IECC energy code

Residential Training - Afternoon Sessions - 1pm to 5pm:

• Updates (2018 -> 2021) to the Residential section of the IECC energy code, including the Energy Efficiency chapter of the IRC

RESIDENTIAL - SECO Energy Code Training: 2021 IECC

Registration Link: www.bit.ly/RES-SECO

COMMERCIAL - SECO Energy Code Training: 2021 IECC

Registration Link: www.bit.ly/COM-SECO

For more information, email: Angela Rowell

arowell@tamu.edu

Earn Continuing Education Credits

LOCATION:

6601 N. 10th / Ste. A McAllen, TX

Next to The Boot Jack on N.10th St.

The only thing that should be MINIMUM in your new home is your energy cost. Choose a builder committed to building high-performance homes verified by an independent third-party home energy Rater.

You’ll enjoy more energy savings on utilities, better indoor air quality, and more comfort than a similar home built to minimum code.

Choose a BUILT TO SAVE® builder member.

See pages 20-21 for a list of participating builders.

When you’ve made the decision to build your own custom home, one of the most crucial tasks ahead is selecting the right builder. Making the wrong choice can lead to ongoing problems as well as maintenance issues in your home. To help ensure you’re making the best decision, here are some key questions you should ask the builder:

Seek Knowledge:

Don’t hesitate to ask questions, even if you’re unfamiliar with construction matters. Remember, you’re not expected to be an expert in building homes— that’s the builder’s domain.

Do Your Research: Take advantage of online resources to gather information about the builder. Check if there are any complaints reported by the Better Business Bureau. Talk to mortgage companies, vendors, and other new home buyers who have already done their research. Assess the professionalism of the company’s website, as it often reflects the company’s values.

where you’re evaluating them. Observe how they respond to questions, even the seemingly silly ones. Look for transparency and compatibility since you’re seeking a reliable partner for the project.

Energy Conservation: Ask if the builder adheres to the state’s mandated 2021 International Energy Conservation Code (IECC). Knowing this will help ensure your home meets energy efficiency standards.

will be performing the actual work. Understand who will be on-site during construction and who will be your contact throughout the process.

Trustworthiness: The trustworthiness of the builder is paramount. Look for a history of honesty and integrity. Small dishonesties may be indicative of larger issues. Pay attention to their ethical conduct, even in smaller matters.

Inquire about the builder’s experience and how long they have been in the industry. A wellestablished history can be an indicator of reliability, but don’t discount newer companies that might be highly motivated to build a solid reputation.

Treat your initial meeting with the builder as a job interview

HERS Score: Inquire about the average HERS (Home Energy Rating System) score of the homes they build. This score indicates the energy efficiency of the property and is a valuable indicator of their commitment to building sustainable homes.

Learn about the builder’s architectural styles and the typical price ranges they work in. Ensure their expertise aligns with the type of home you desire.

1 5 9 10 6 7 8

Inspection: Inquire if the builder is open to having your new home inspected by a third-party property inspector upon completion. A builder who is confident in their work will welcome such inspections, ensuring the quality of your home.

Contractor

Qualifications: Assess the qualifications of the contractors who

2 3 4 Aug / Sept / Oct 2023 31

is committed to reducing energy usage and utility costs to ensure reliable and affordable electricity for its member-owners. It strives to improve the quality of life for residents of the Rio Grande Valley by providing incentives and marketing assistance to builders and developers selling homes or lots in MVEC new home communities. Take advantage of these effective and beneficial marketing opportunities.

As sponsors of BUILT TO SAVE®, a regional high-performance home program, MVEC has helped to improve the quality of new home construction with its rebate program for builders who build verified energy-efficient homes.

The BUILT TO SAVE® program for new home builders is a voluntary program that awards “high-performance” certificates to new homes built to energy-saving standards that are above the minimum building code standards required by law. MVEC provides a variety of monetary incentives paid directly to builders of BUILT TO SAVE® verified homes based on the energy efficiency HERS rating of their homes. Each BUILT TO SAVE® home is inspected during construction and tested upon completion by an independent RESNET licensed Home Energy Rater to verify that the home meets the strict requirements of the program in order to qualify for the BUILT TO SAVE® certificate. For more information, email: info@builttosave.org.

RGV New Homes Guide, a quarterly printed and digital magazine in the Rio Grande Valley, provides marketing opportunities for developers of new home communities in MVEC’s territory.

Developers with a community located in MVEC’s territory qualify for a rebate of $75 on their community ad in the RGV New Homes Guide. Community ads are ¼-page horizontal ads that provide an “at a glance” look at all of a community’s important information and provide traffic and sales leads.

To qualify for all of the offers shown here, builders and developers must be building or developing in a MVEC community. All offers are on a “funds available” basis and require pre-approval. See below for additional conditions.

BUILT TO SAVE® REBATES – The BUILT TO SAVE® program is responsible for determining the eligibility of builder rebates. The rebate amounts are determined by the home’s HERS score as documented and verified by the builder’s third-party Home Energy Rater.

RGV NEW HOMES GUIDE ADS – Co-op marketing rebates for advertising in the New Homes Guide requires branding with the “Powered by MVEC” logo. Artwork fees are not included.

DRONE VIDEOS – This is a one-time offer for new home communities that are under development or newly developed and includes the cost of production. Drone videos are to be produced by Across Media Marketing, LLC and branded with the “Powered by MVEC” logo. Existing new home communities must have 80% of lots still available for construction to qualify.

Developers advertising their MVEC community may qualify for a $300 rebate on their display ad available in half-page and full-page sizes. Distribution includes a digital and printed magazine as well as social media promotions on Facebook, Pinterest, Instagram, and Twitter. Visit rgvNewHomesGuide.com /magazine for a look at the RGV New Homes Guide. Email: info@acrossmediamarketing.com for advertising information.

Drone videos will give potential buyers a bird’s eye view of a community and its surrounding area. These videos will capture the look and feel of a community, thus giving viewers a comprehensive view of the “lay of the land” and nearby attractions. MVEC will provide a complimentary drone video for qualifying communities located in MVEC’s territory.

A community sign will make it easier to find a community and will assist by providing a 24/7 sales tool offering sales and contact information. MVEC offers assistance in producing entrance signage for communities in MVEC’s territory. Call for details.

SIGNAGE – Artwork for community sign to be provided by MVEC in collaboration with Across Media Marketing, LLC. MVEC will provide a pre-determined amount based on the sign’s specifications to help cover the art fee. Installation of signage is the developer’s responsibility. Signage is required to be branded with the “Powered by MVEC” logo.

For more information about rebates, contact: Johnathan Sloss MVEC Business Development Representative (956) 289-4055 / email jsloss@magicvalley.coop

For more information on BUILT TO SAVE® contact: Jose Vielma / Program Director (956) 971-9700 / email info@BuiltToSave.org www.BuiltToSave.org

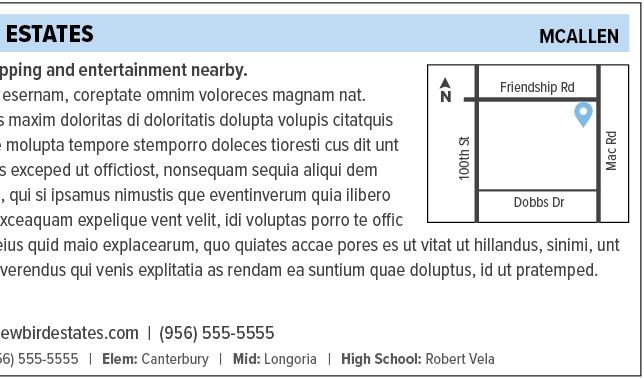

Get directions to a new home community at: www.rgvNewHomesGuide.com/All-Communities

To add a New Community on this map, call (956) 778-3590

MAP LISTING NUMBER

This number identifies the community on the locater maps.

PRICES & PROPERTIES FOR SALE

Prices or price ranges are shown for lots, homes, or a combination of both. Prices subject to change without notice. Call advertiser for more information.

CITY COLOR CODE

Cities are coded by color. Each color represents a different city.

QUICK LOCATOR MAP

See a simplified map with directions to the community showing minor and major roadways.

SCHOOL INFORMATION

Find Independent School District telephone numbers and names of related schools.

www.rgvNewHomesGuide.com/All-Communities

DOWNLOAD BROCHURES

www.rgvNewHomesGuide.com/All-Communities

VIEW OUR DIGITAL MAGAZINE

www.issuu.com/NewHomesSouthTX

If you like privacy and exclusive living but don’t want to live miles from everything you need, then Magnolia Park, a newly opened gated community in the heart of Mission’s Sharyland ISD, is for you. This new community offers a great location, excellent school district, super value per square foot, and best-in-class homes from Villa Homes: an awardwinning luxury home builder for over 20 years. Magnolia Park is just a short drive away—and an even shorter drive to your dream of a luxury home! Come see.

275-3271 | info@villahomesrgv.com

Homes

Welcome to Mayberry Ranch! This upcoming exclusive gated community in Palmhurst, Texas, located on Mayberry Rd just south of Mile 3 (Buddy Owens Blvd), will feature 21 spacious one-acre lots. The community, estimated to be completed in August/September of 2023, is conveniently located just minutes away from schools, restaurants, and grocery stores. Mayberry Ranch, since it is located in Palmhurst, Texas, will provide the added benefit of NO city taxes. You won’t want to miss out on this opportunity! Special pre-development prices are available for a limited time. Call now—ask about multiple-lot prices or to place your deposit today!!!

Discover Eldorado at Thousand Oaks, Villa Homes’ newest gated community, offering exclusive custom homes. Imagine living in a serene countryside setting in the master-planned community of Thousand Oaks in North McAllen, yet close to IDEA Academy, Texas A&M University, and minutes from the University of Texas RGV. Elevate your expectations with award-winning builder Villa Homes, and secure your “forever home” in this prime location today. Choose from a wide selection of available homesites. Download our brochure online and reserve your lot now.

Contact: Ricardo Rodriguez (956) 275-3271 | info@villahomesrgv.com Homes

ISD: Edinburg - (956) 289-2300 | Elem: Anne Magee | Mid: Elias Longoria | High School: Vela |