Shops share the simple tweaks that deliver the

Shops share the simple tweaks that deliver the

• ACS warns some legitimate shops could be banned from selling vapes under licensing scheme

Compare

• Retailers claim a licence refusal would destroy their stores while dodgy sellers are untouched

I’VE just returned from Hong Kong, where one of the dominant convenience chains is 7-Eleven.

Much has already been reported about the global rm’s most recent U-turn from the UK convenience sector. However, it’s clear why 7-Eleven has managed to remain one of Hong Kong’s biggest brands.

Unlike the UK, where the convenience sector is heavily saturated, 7-Eleven Hong Kong only faces competition from one major group – Cirkle K.

The culture is also heavily food-centric, with familyowned cafés, chains and larger restaurants on every street. The mindset is very much focused on a ordable items, with a ‘fast in, fast out’ ethos.

7-Eleven Hong Kong has spotted an opportunity with this culture, with a prominent feature of each store focusing on quick and easy self-serve food to go. Think microwaveable dumplings, ready-to-eat chicken legs and noodle pots.

It would be unrealistic to suggest UK retailers follow this model entirely, but there are some elements you can use, like breakfast deals or your own takes on regional classics.

You could even prepare food for customers from core convenience products already available in your store.

Growing up, I remember my neighbourhood retailer spotting such an opportunity, by o ering Pot Noodles prepared on site during the lunchtime school rush. Hot food to go doesn’t have to be high cost, it just has to match your shopper’s needs.

@retailexpress betterretailing.com facebook.com/betterretailing

ALICE BROOKER

TIKTOK failed to take action over accounts selling illegal tobacco on its platform, Retail Express can reveal.

An investigation by Retail Express, involving reporting 15 videos under �ive TikTok accounts selling illicit tobacco for UK buyers, found the videos were still available on the social media site more than a

week later.

The posts advertised deals including Amber Leaf 30g for £9 with free next-day delivery via Royal Mail.

Only after Retail Express contacted TikTok for comment were the illegal posts �inally removed and the accounts banned for violating guidelines.

According to the company, its community guidelines are

Editor Alex Yau

News editor

Ciarán Donnelly

@CiaranDNewtrade 07743 936703

News reporter

Alice Brooker

@alice_brooker 07597 588955

editor

Whitting @CharlieWhittin1 020 7689 3350 Production editor

Cooper 020 7689 3354

Findlay 020 7689 3373

Robin Jarossi Head of design

Pickard 020 7689 3391

Senior designer Jody Cooke 020 7689 3380

Junior designer

Production coordinator Chris Gardner 020 7689 3368

Head of marketing Kate Daw 020 7689 3363

Head of commercial Natalie Reeve 07856 475 788

Associate director Charlotte Jesson 07807 287 607

Commercial project manager I y Afzal 07538 299 205 Account

Hudson 07749 416 544

3384

Stronach 020 7689 3375

Account managers Megan Byrne 07530 834 009 Lisa Martin 07951 461 146 Finance manager (maternity cover) Isuri Abeykoon 020 7689 3383

Managing director Parin Gohil 020 7689 3388

of

41,116

clear that the trade of tobacco products is not allowed on the platform, and between April and June 2024, of the videos removed for violating its policies on the trade of regulated goods, 97% were removed before they were reported.

However, at the time of writing, variations of these accounts are still publishing videos selling counterfeit and smuggled tobacco.

THE Post Of�ice con�irmed that MoneyGram will not return to branches, ending a 28year partnership. It blamed poor pay, security and a lack of other bene�its for Post Of�ice retailers. Branches that relied on

MoneyGram will receive compensation until April 2025, and those with Western Union will also have enhanced pay rates.

Branches may independently partner with MoneyGram outside the PO network.

MORRISONS has introduced its More loyalty scheme to its Daily convenience stores. The rollout is expected in 600 franchise stores next year after being trialled in around 1,000 company-owned stores this year.

Amy Sohal, owner of Premier – Ken’s Convenience Store in Winsford, Cheshire, said “people don’t seem bothered” about taking social media posts down that advertise illicit tobacco, “or they do, and the next day they’re up again”.

“People can go on holiday and bring back cheap tobacco, then �log it on TikTok and other sites,” she said. “People keep getting away with it.”

LOCAL shops face greater price pressure as Sainsbury’s Local stores price-match against Aldi.

Retail expert Ananda Roy warned that supermarkets are becoming “increasingly aggressive” in the convenience market, as Sainsbury’s announced plans to boost footfall in its smaller stores with the programme. Sainsbury’s price-match is being extended to 200 products in all its Local convenience stores.

Some shops are already matching promotions available in larger Morrisons stores. Morrisons said all Daily customers “will bene�it from lower prices and being able to earn points” through the More scheme.

SYMBOLS and independents saw sales suffer year on year for the seventh consecutive month, according to Kantar.

Symbols and indies saw a 1.3% fall year on year in the four weeks to 3 November. Co-op also experienced a drop of 2.1% in sales. Yet sales across all grocers increased by 2.3% compared with last month, making it the “busiest month for supermarkets since March 2020”.

LEGITIMATE shops could be denied licences to sell vapes due to their proximity to other sellers, the ACS has warned.

The move could potentially kill vape sales for some law-abiding shops, and, in turn, shut down stores that rely on the category to keep them alive.

The latest version of the Tobacco and Vapes Bill, which, when passed, will require shops to have a licence to sell any variety of vape, gives councils powers to deny licences, probably in densely populated areas with many sellers present.

Any shops denied the ability to sell vapes legitimately face a catastrophic loss of sales and pro�it, shop owners told Retail Express.

“Margins of vapes have been keeping some shops going over the course of the past couple of years, as they’ve been 40%-60%,” said Aman Uppal, of One Stop Mount Nod, Coventry.

“We’re going to see stores closing more frequently because vapes are keeping some shops alive,” agreed Bay Bashir, of Belle Vue Convenience in Middlesborough.

The potential for legitimate traders being denied licences is the latest in a string of legislation affecting vape sales, including a ban on disposable vapes beginning in June 2025 and a tax on vape �luid set for

October 2026.

While retailers have largely called for a licensing scheme to combat the illicit trade, the bill allows for a “provision limiting the number of licensed premises within an area”. What constitutes such an area is as-yet unde�ined in the bill, but it will fall to local authorities to determine which shops could be denied.

“I sympathise with retailers who may be banned from selling just because of where they are. The licence was supposed to help shopkeepers,” said Arif Ahmed, of Ahmed Newsagent in Coventry. “I support the licence because the illicit trade must be stopped, but if the government had put its house in order earlier, we wouldn’t be here.”

In potential cases of densely populated areas containing many vape sellers, it is unclear how councils will determine which shops are denied licences.

In such cases, Uppal said: “They have to give the priority to the retailer there who’s been long standing, the one who’s probably a fully �ledged convenience store,” adding that he predicts under the licensing system there is “probably going to be a new load of applications” from specialist and non-convenience stores.

ACS chief executive James Lowman said: “A licensing scheme has the potential

to help tackle the illicit market and punish those who sell to children, but unless properly structured, it could also prevent legitimate traders from operating based on the presence of other outlets in the area, or the speci�ics of where that store is located.”

Chris Noice, communications director of the ACS, told Retail Express the speci�ics of councils’ powers to deny licences “is all to come in the detail as the bill goes through amendments, but as of right now, we don’t

“RETAILERS are never consulted on these schemes and the question I have with any licensing scheme is: who will police it? There are regular law-abiding community retailers like myself who will sign up to it and comply, but I don’t think it will stop the illegal vape traders. Trading standards are working with fewer resources. Illegal traders aren’t even hidden any more.” Narinder Randhawa, Great Haywood Spar, Stoke-on-Trent

know exactly”, calling the current wording of the bill “quite vague”.

“The existing scheme in terms of licensing to use as a reference point is probably on alcohol, but for alcohol there’s typically a presumption in favour of granting a licence, so it’s dif�icult because we don’t really have a precedent,” he added.

Other measures in the bill include a ban on vape advertising and sponsorship, as well as powers to restrict the �lavours, display and packaging of all types of

vapes, as well as other nicotine products.

A ban on the sale and manufacturing of snus has also been levied.

A �ine of £200 is also to be introduced as a deterrent for retailers selling products to underage customers, yet the ACS expressed concern “there is not enough enforcement right now to deal with the rogue operators in the market”.

The bill, which is backed by both major parliamentary parties, is likely to pass with minimal opposition.

“I HAVE no problem with a licensing scheme if it comes at no cost to the retailer. The problem is that no one will police it or implement it. Track and Trace was introduced, but it hasn’t made any di erence to the illicit tobacco trade. It’s a waste of millions of pounds and the illicit trade is still costing the government billions. If they are going to do it, it has to be done properly and be fully monitored.”

Hitesh Pandya, Toni’s News, Ramsgate, Kent

ELONEX: The advertising giant is looking to pay at least 1,000 shops for hosting digital media screens as part of a new venture. The ceiling-mounted screens are already live in 40 stores and are predicted to bring in £1,000 per year in pro t per participating store, based on a share of all adverts displayed. Stores can email editorial@newtrade.co.uk for more information.

NATIONAL LOTTERY: Celebrating 30 years since its launch in 1994, operator Allwyn has now paid out £8bn in commission to retailers. Allwyn hopes to double the money raised for good causes per week, a move requiring a similar increase in sales in stores. The company’s interim retail director, James Dunbar, said new games to be released in 2025 and beyond would be a key part of this plan, alongside the rollout of new tills and other technology.

PAYPOINT: Despite promising that stores could make £1,000 pro t per year from its Park Christmas Savings scheme, a dozen stores taking part conrmed they were nowhere near this target as the rst full year of savings via PayPoint stores concludes. The company o ered retailers struggling to hit the target free training on how to win over more savers.

WHOLESALER DELIVERIES: Retailers supplied by both Booker and Nisa are su ering from an absence of live delivery tracking data, causing issues in stores. Notices sent by both wholesalers con rmed their tools were down, probably linked to a cyberattack on fleet-tracking company Microlise. The issues began at the end of October, with e orts underway at Microlise to bring its services back online. Microlise promised retailers’ data had not been leaked.

“A REGISTRATION scheme that is free to use could be a good thing. Less so any scheme that charges overheads on top of already increased costs for retailers. I don’t think it will be enough of a deterrent to stop the illicit trade. Like so many community retailers, we will always do the right thing for our industry. We don’t sell to under-18s, but the government needs to stop focusing on us and tackle the criminals selling illegally.”

ALICE BROOKER

A LORDS Select Committee has called out the government for not “effectively” tackling shop theft.

In a letter to the Home Office, the House of Lords Justice and Home Affairs Committee has published a list of recommendations in order to reduce incidents of theft. These include phasing out

“trivialises the severity of the offence”, repealing the “lowvalue shoplifting” definition where theft of a value below £200 avoids court proceedings, and the creation of a standalone offence of assaulting a retail worker.

Lord Foster of Bath, chair of the House of Lords Justice and Home Affairs Committee, said the scale of shop theft is “totally unacceptable” and ac

The letter included estimates that theft is costing the retail sector almost £2bn last year – a “lucrative profitmaking opportunity” being exploited by criminal gangs.

The Committee also said shop theft is not treated seriously by the police, and there is a need for a quicker reporting system, better data collection and intelligence sharing between police forces.

Business Crime Reduction Partnerships, the letter explained, are welcome, but should all be part of the National Standards Accreditation Scheme.

The ACS said it is looking to work with the Home Office and police and crime commissioners on the report recommendations, and to “close the gap” between reported incidents and the true number

STORE owners with Fed membership can now access hundreds of consumer discounts through the newly launched FedPlus tool.

The benefit includes preferential rates on cinema visits, restaurants, flights, hotels and at other shops, plus guarantees of the best price around at many partnered businesses. FedPlus, available on the Fed’s website, will also be made available to staff working in members’ stores next year, helping retailers to find and retain employees.

SYMBOL group Select & Save has launched rebates of up to 5.5% and free holiday cover for shop owners as part of a refresh.

Chief executive Kam Sanghera accused rivals of “serving their own interests”, “dictating terms” and being “increasingly bland”. He said Select & Save will invest in local shops and protect retailers’ independence to win

SHOPPERS reported a “middle-class disaster” as Waitrose axed its free newspaper offer for its members.

The change on 29 October received an angry response from shoppers. Previously, myWaitrose members spending £10 in store could receive a free paper. While a blow for news publishers, the move could support sales in local shops closer to where the affected customers live. Waitrose said only a “small number” of its nine million members were using the offer.

PRIYA KHAIRA

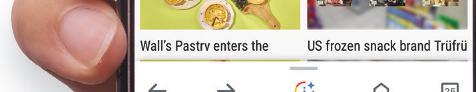

WKD X, the caffeinated alcoholic beverage range from SHS Drinks, has introduced two new �lavours – Citrus Ice and Purple Grape – both with an ABV of 7%.

Priced at £2.99 in pricemarked packs, these additions join the existing WKD X lineup of Blue Raspberry, Mango Passion and Dark Berry. They are available now.

To support the launch, WKD X has rolled out its �irst dedicated media campaign, featuring a three-week poster display across 1,200 UK locations.

The WKD X range has

grown signi�icantly in 2024, with volumes up 88% year on year and 106% in the past quarter. SHS Drinks anticipates further expansion next year.

Alison Gray, head of brand for WKD, said WKD X resonates with 18-to 24-yearolds seeking convenient caffeinated alcoholic options.

“The further expansion of WKD X emphasises conclusively our commitment to the range and consumers’ overwhelmingly positive reaction to developments so far,” she added.

COCA-COLA’S Christmas Truck Tour has returned to the UK.

For every visitor to the Truck Tour, Coca-Cola will donate the equivalent of a meal through hunger and food-waste charity FareShare, targeting up to one million meals this festive season.

A new on-pack promotion offers shoppers a chance to win a £50 shopping voucher by scanning QR codes on Coca-Cola cans and bottles.

Limited-edition festive designs featuring Father Christmas will be available until 2 January.

SCANDINAVIAN Tobacco Group UK (STG UK) has released a limited-edition ‘Gentleman’ pack for its Henri Wintermans Half Corona cigars.

PEPSI Max has teamed up with EA Sports FC for a second consecutive year, launching an on-pack promotion across all Pepsi 500ml packs and 330ml cans.

Last year’s campaign resulted in more than 530,000 promotional codes being redeemed by members of the public

Shoppers can enter by purchasing a promotional Pepsi product, scanning the QR code and entering their details online.

Prizes include 60 game consoles, 3,000 EA Sports FC25 game copies, and guaranteed in-game rewards. Entries close 30 December.

GORDON’S has introduced its ‘Mix It Up’ campaign, featuring Gordon’s Pink and Gordon’s Pink 0.0% for the �irst time.

non-alcoholic lines. The initiative taps into consumer trends, with 36% of drinkers pacing themselves with soft drinks.

Designed with a pinstripesuit-inspired look, the pack aims to highlight the brand’s premium appeal.

The Truck Tour schedule and updates can be followed on Instagram and Twitter.

The campaign, led by a video-on-demand advert, shows drinkers pacing their consumption by alternating between the alcoholic and

Featuring TV presenter Maya Jama, the campaign empowers consumers to moderate their consumption in a way that works for them.

KP SNACKS has introduced a new addition to its £1.25 PMP range with Space Raiders Saucy BBQ.

Joining the Beef and Pickled Onion �lavours, the Saucy BBQ variety aims to tap into the rising demand for barbecue �lavours in savoury snacks.

KP’s £1.25 PMP range is currently outperforming the overall PMP segment, growing by 5.2% versus 4.2%.

Stuart Graham, head of convenience and impulse at KP Snacks, noted that the launch aligned with the brand’s commitment to offering formats and �lavours that are known to help boost impulse sales in the convenience sector.

Henri Wintermans Half Corona ranks as the topselling medium/large cigar in the UK, with annual sales valued at £16.3m.

STG UK’s head of marketing, Prianka Jhingan, advised retailers to stock up, as larger cigar sales traditionally increase in the lead-up to Christmas when consumers seek celebratory options.

tion entries.

RIZLA has launched limitededition packaging for its King Size Super Thin Silver rolling papers, featuring three collectable designs.

When placed together, the packs form a complete image inspired by Michelangelo’s David, selected from more than 580 Instagram competi-

Yawer Rasool, consumer marketing director at Imperial Brands, said the designs align with Rizla’s brand image and appeal to its customer base.

“We asked customers to come up with a design. The Instagram competition was popular, meaning our judges had a tough time picking a winner,” he said.

HANCOCKS and World of Sweets have introduced sour treats to their confectionery lineups, featuring products from Zed Candy and Warheads.

Hancocks now offers Souracha Candy Sauce from Zed Candy Screamers, a novelty liquid candy inspired by sriracha sauce bottles, priced at £1.29. The sauce can be enjoyed on its own or added to other snacks.

World of Sweets has also expanded its Warheads range with Sour Popping

Candy, available in Sour Watermelon, Green Apple and Raspberry �lavours. Sold in 12-pouch displays and threepacks, this addition taps into the rising demand for US and sour candy.

PRIYA KHAIRA

IMPERIAL Brands has expanded its Golden Virginia Original range with a 40g hand-rolling tobacco pouch, now available alongside the existing 30g and 50g sizes.

The 40g pouch, which has an RRP of £33.70, is intended to provide an option for smokers facing increasing financial pressures.

The cost-of-living crisis and price inflation have already seen the introduction of other 40g pouches across the category.

According to Yawer Rasool, consumer marketing director UK & Ireland at Imperial Brands, the move reflects

the brand’s commitment to meeting customer demand for quality and value.

“The 40g pouch size has been introduced to provide increased options for Golden Virginia customers to enjoy the rolling tobacco at a more affordable cost, without compromising on quality,” he said.

First introduced in 1877, Golden Virginia combines 20 different tobacco grades sourced from four continents.

The 40g pouch includes rolling papers, as with all Golden Virginia pack sizes.

HANCOCKS has introduced Pick ‘N’ Mix Station, a new brand offering 1kg bulk bags of themed pick-and-mix treats, priced at £9.99.

The range includes varieties such as Space Bag, Blue Mix Bag and Choco Mix Bag, with options featuring fizzy, gummy, jelly and chocolate sweets.

The launch taps into social media trends, with Hancocks encouraging retailers to stock the bags for pick-and-mix stations or as pre-packaged options. “These bulk bags are perfect

for parties or filling jars,” said Kathryn Hague, head of marketing at Hancocks.

GNAW, the artisanal chocolate brand, has launched a new brand identity alongside an array of festive chocolate bars.

The rebranding introduces bright splashes of colour, aimed at capturing adultoriented nostalgia for comforting flavours.

New seasonal flavours include New York Cheesecake, Raspberry Mojito, Seville Orange, Popcorn & Peanut, Espresso Martini, Honeycomb & Caramel, Peppermint and Sticky Toffee Pudding.

Gnaw uses ethical Colombian cacao, compostable packaging and solarpowered production.

Mike Navarro, managing director of Gnaw, said

ELFBAR has introduced its first 4-in-1 pod kit, designed with four interchangeable 2ml pods and dual vaping modes.

Available now, the rechargeable device allows users to switch between Normal mode (up to 2,400 puffs) and Economy mode (up to 3,200 puffs) with a simple button press.

It features a 1,500mAh battery with a power display and Type-C USB charging.

The kit comes in 16 ‘editions’, including popular mixed and single flavours

such as Blueberry Sour Raspberry and Pineapple Ice.

COUNTRY Choice has introduced a new Christmas range featuring five festive items for holiday shoppers.

Leading the lineup are two savoury options: the Savour It Brie & Cranberry Ciabatta (£5.25), filled with creamy Brie and port-infused cranberry sauce, and the Brie, Port & Cranberry Turnover

(£2.45) in a flaky puff pastry. For sweet treats, the range includes a Mince Pie Cookie (£1.45), Chocolate Orange Cupcake (£1.75) and an Iced Ginger Mini Loaf Cake (£1.75), each dressed in seasonal packaging to add a festive touch.

MONDELEZ International has announced that Cadbury’s core sharing bars in the UK and Ireland will fully transition to 80% recycled plastic packaging by early next year.

The recycled plastic, sourced through advanced recycling technology, is set to launch at the start of next

year. Consumers can learn more about this sustainable shift via a QR code on the packaging, leading to resources on recycling and Cadbury’s sustainable packaging journey.

Mondelez aims to cover around 300 million Cadbury

Gnaw’s aim was to create nostalgic flavours that resonate with childhood memories and comfort-food cravings.

HOVIS is offering customers a chance to win a family holiday to Lapland with a new competition on its Best of Both loaves.

In collaboration with Locksmith Animation, Hovis has released limitededition packaging tied to the upcoming Netflix animated film That Christmas, set to premiere globally on

4 December.

The special packs, featuring characters from the film, are available nationwide on 4.3 million loaves.

Hovis will promote the competition on social media and share themed recipes following the film’s release.

REESE’S has kicked off its Christmas campaign with the launch of a new DJ Santa Advent Calendar (RRP £6.50).

From 1-24 December, each day of the calendar offers a mini Peanut Butter Cup and a QR code that leads to an interactive game with DJ Santa.

Independent and convenience retailers can stock the DJ Santa Advent Calendar through suppliers such as Hancocks Confectionery, Wholesale Sweets and Risus Wholesale, as well as local cash-and-carry outlets.

The calendar is part of a broader seasonal lineup that includes Reese’s Peanut Butter Trees (£3) and DJ Santa’s Disco Lights (£1.15).

The ultimate stocking guide for independent news and convenience retailers!

What to Stock takes an in-depth look at the sales and profit opportunities for stores like yours, alongside category data and trends across convenience retail’s 35 core categories

On sale now! Only £4.99

INCLUDING:

Distribution and profit opportunities

The rapidly climbing products in ‘Ones to Watch’

Weekly sales and profit data

The top profit drivers in each category

EPoS data from 3,918 independent retailers analysed

PRIYA KHAIRA

MÜLLER Yogurt & Desserts has converted its Corner yoghurt pots from white to clear plastic as part of its goal to halve its packaging impact by 2030.

Most Müller Corner and Bliss Corner pots are already in clear plastic, with full conversion expected by the end of this year.

The recyclable clear pots support a closed-loop system, potentially adding more than 3,000 tonnes of rPET to the UK market annually.

Sales of Müller Corner are growing by 11% year on year, with data showing that 78% of shoppers prefer a clear Müller Corner pot to a white pot.

Müller’s packaging shift responds to growing consumer demand for sustainable packaging practices.

The brand has established environmental targets across its entire range, aligning with wider industry initiatives to reduce plastic waste. This change further supports the UK’s recycling and packaging goals as Müller adapts its packaging to address environmental concerns within the dairy sector.

Müller has announced that it is committed to using fully recyclable materials by 2025 and aims to include 30% recycled content across its portfolio by early next year.

NOMADIC has introduced Power Pot, a high-protein snack aimed at busy, healthconscious consumers.

Available in Chocolate Brownie and Smooth Caramel �lavours, each pot combines vanilla yoghurt, granola and toppings, delivering 20g of protein, 100% of daily vitamin D, and gutfriendly cultures to support immunity.

The 190g pots (RRP

£1.99) mirror the format of Nomadic’s popular Yogurt & Oat Clusters and include a wooden spoon for on-the-go enjoyment.

Data shows that the protein category is experiencing rapid growth, with growing demand for protein-enriched snacks.

SOFT drinks brand Trip has launched Magnesium Gummies as part of its wellnessfocused lineup.

Following the success of its Mindful Blend drinks, Trip’s new gummies offer a convenient way for consumers to enjoy the bene�its of magnesium.

Vegan-friendly and sugar-free, the Wild Berry�lavoured gummies are available on Trip’s website for £19.60, with plans for Amazon availability and broader retail distribution.

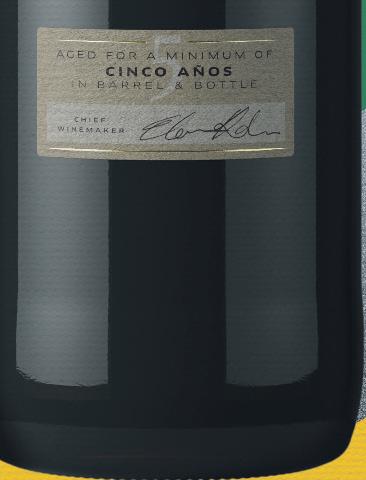

KINGFISHER Drinks has introduced King�isher Ultra, a super-premium beer with a 5% ABV, to the UK market. Brewed with hand-picked malts, King�isher Ultra undergoes a six-step �iltration process and contains no additives.

Already popular in India, where it launched 15 years ago and grew by 20% annually from 2021 to 2023, Ultra appeals to consumers seeking premium beer.

It has recently sponsored the Indian Derby and Sunburn Festival in Goa, as well as fashion shows.

The launch adds to King�isher’s UK portfolio, which includes King�isher Premium and King�isher Zero.

Magnesium is known to support muscle function, energy levels and provide stress relief. The launch aligns with Trip’s focus on accessible wellness.

CATHEDRAL City has reintroduced its 200g pricemarked packs (PMPs) of Mature and Extra Mature cheeses into the convenience channel.

Priced at £2.59, the relaunch aims to provide value-conscious consumers with a premium cheese option.

Recent insights indicate that 78% of consumers are prioritising value, and 66% actively seek ways to reduce grocery costs as they continue to be impacted by the cost-of-living crisis. Data shows that sales of PMPs are growing in the convenience sector especially.According to Kantar, PMP sales in the

chilled foods category have increased as shoppers look for ways to save.

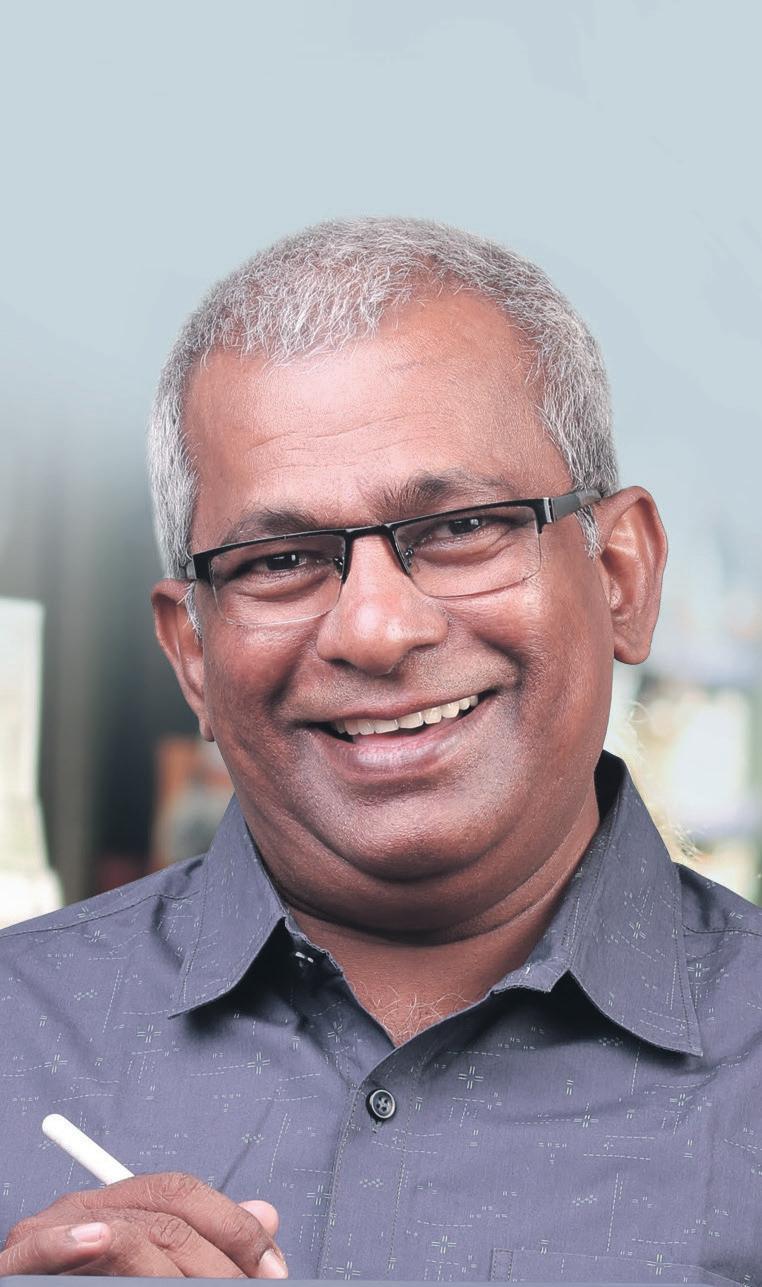

GETTING a good work-life balance is about time management, and not saying yes to everything –prioritise yourself for a cup of tea or a walk with a friend. You should have time to yourself each day. Going to events can be a big part of getting a worklife balance. Lately, the more events I go to, the more I realise that people are getting better at socialising. There’s a lot of positivity in the room. Being a part of groups like Women in Convenience (WiC) or the ACS’s women’s group is a big help. Going to these events is a mix of work and life, because you’re all networking together and learning more, but also getting to relax and feel supported. There’s even a new joiner to WiC who is keen to get into running, and that’s a big part of my life outside of work. So, I’ve got a small retail group together and we’re going to nd a running event between us all. The lines of work and life can begin to blur in this industry, and that’s a good thing at times. It’s also important to not jump in the deep end at work and in your personal life. Seek support if work is overwhelming, or if you want to try a new hobby, like running. Start small and slow – start with a 5k walk. That way, everything can feel more manageable and it’s easier to make progress. Image

RETAILER OPINION ON THIS FORTNIGHT’S HOT TOPICS

What do you think? Call Retail Express on 020 7689 3357 for the chance to be featured

CHRISTMAS SALES: Are you preparing for the festive season?

“IT feels like Christmas isn’t as big as it used to be. We’ve given up doing the presales six months in advance, because the margins are horrendous. However, we will be offering our gift baskets, and will make sure we have enough groceries and spirits.” Kay Patel, Best-one, Wanstead, east London

“WE start thinking about store activations from 1 December. I’m not expecting big sales as it’s been a hard year and people are nervous. We will make sure we have availability for the last few days of the season, that’s when we get sales.”

Jimmy Patel, Premier Jimmy’s Store, Northampton

AUTUMN BUDGET: What changes will you be making in your store?

“WE’LL be increasing our prices. With the minimum wage increase, it’s become costly to have our staff, so we’ll have to pass the cost on to shoppers. We won’t be making any more changes for now. We’re going to wait and see what happens.”

Lakshman Thirunavukkarsu, Sam Convenience Store, Ferndown, Dorset

“I’LL be putting cigarette prices up, but I’ve given up explaining to shoppers why I keep doing this. Customers are so unhappy. Tobacco sales are already declining, and while the price increase is good for health, I can’t afford to lose more sales.”

I can’t afford to lose more sales

TOBACCO & VAPES BILL: How do you feel about a licensing scheme?

“IT may be an extra cost to retailers. It feels like responsible retailers are being punished. We might have to meet certain criteria, then pay a price for it. It’s great if it’s a case of fulfilling the criteria and being given it, or even paying a one-off small price.”

Maqsood Akhtar, Blackthorn Newsagents, Rotherham, South Yorkshire

“WE should get the licence scheme for free for five years. Independents need someone lobbying the government to support small shops, the big shops make more than us. We’re providing a lot for local communities. We deserve the scheme for free or at a reduced rate.”

Julie Kaur, Jules Convenience, Telford, Shropshire

COMMUNITY WORK: How are you helping your local area?

“WE offer selection boxes to primary schools every Christmas, so we’re gearing up for that. We make sure every child gets one. It’s great for getting to know the community because the kids will come in with their parents to say thanks. The goodwill is unbelievable.”

Bay Bashir, Belle Vue Convenience, Middlesborough

“DURING the last week of December, we donate towards our local Christmas festival, which we also get involved in. We’ll help fund the decorations and keep the shop open past its usual hours. We make sure our shop looks festive and welcoming for the community.”

Ira Parikh, Top Shop, Frodsham, Cheshire

INCH’S CIDER has partnered with Nisa’s Making a Di erence Locally charity for the second year in a row to create vibrant Green Storefronts outside ve convenience stores. RETAIL EXPRESS nds out more

HEINEKEN UK has extended its partnership with Nisa’s Making a Di erence Locally (MADL) charity, awarding ve convenience retailers with Green Storefront installations outside their stores.

By partnering with the charity for the second year in a row, which was set up to help independent stores add value to and further their position within their local communities, Inch’s Cider is recognising and rewarding the hardworking retailers with Green Storefronts.

Building on the success of last year, the promotion is designed to make green spaces more accessible for convenience retailers and their local communities.

Through enhancing the area outside their shop fronts with décor, including Inch’s Cider-branded benches, planters and trellises, the brand aims to add value and encourage consumers to spend more time in store.

Cra ed in Hereford, Inch’s Cider is made with a blend of 100% British apples, creating a perfectly balanced and refreshing cider which is not too sweet, and not too dry.

The brand remains proud of its British heritage and its commitment to sourcing locally, with apples being sourced within 40 miles of its Hereford mill, and all apple waste being turned into renewable energy.

Amrit Singh Pahal, H & Jodie’s Nisa Local, Walsall, West Midlands

“WE’RE excited to be working with Inch’s Cider and Nisa’s MADL charity on the Green Storefront project. Cider is a huge category for us, and by working with bestselling brands like Inch’s Cider, we’re able to ensure awareness remains high throughout the summer and beyond into the festive season. Paired with the vibrant installations, we hope to bring some greenery to our local customers and inspire them to take a moment to enjoy the displays.”

‘One4all has le us with none at all to sell’

WE can’t get through to One4all to get more gift cards, and it’s really strange. I’ve sent a customer email to customer services and had no joy. We do really well with sales of its cards, and I’m guessing the post of�ice receives them a different way, as they tend to have a fairly large selection there.

A rep came last year and left a load of cards, and now those have gone. I’ve come to the end of the road – I don’t know who to talk to. Whenever I try to resolve this issue and get more in

stock, I keep getting passed to different people.

I’m not getting the result I want. I don’t know the best way forward.

I tried ringing Payzone, as we top the cards up through Payzone, but I can’t get through to them, either. I’m so busy, I can’t be sitting on the phone. We sell about 12 cards on average a week, ranging between topups of £15 and £30. In total, this means we’re probably losing about £200 a week in sales. I’ve sent emails and made phone calls, and I am at a loss.

COMMUNITY RETAILER OF THE WEEK

Lorna Maclennan, Taynuilt Newsagency & Post O ce, Argyll and Bute

‘Cards can support

“FOR the past few years, we’ve been selling Christmas cards to raise funds for Scotland’s Charity Air Ambulance. We do a lot for charities throughout the year, but this cause gets the most support from us. Our store is in a rural area and the air ambulance is a really vital service for our community. Our support for them started a er a local man required their services. It’s going incredibly well. We’re barely in November, and have already sold 24 packs of the cards at £4.50 each. I’ll be getting more in today.”

Reeta Dulay, Nisa Local, Warley, Oldbury, West Midlands

A spokesperson for One4all responded:

“Thanks for contacting us. We have been reviewing internally to see how we could best help. In the absence of the Nisa retailer’s email address, we were unable to locate their customer service communication to review their case. The Nisa network of stores is not one of our distribution partners. However, we wanted to come back with a solution for the Nisa retailer who contacted you so they could

continue to order One4all gift cards via Payzone, especially ahead of the busy Christmas period. Having investigated further, our sales team have con�irmed that our distribution partner, Payzone, has a till system called Frontline, on which it is possible for Payzone branches to request stock, and this is its current process for ordering One4all gift cards to sell in branches. Blackhawk network, the parent company for the One4all brand, will also be carrying out its annual merchandising visits to Payzone outlets, ahead of Christmas.”

‘Shoppers helped

“LAST year, I volunteered for a school in Uganda. Before I went, we raised £2,200 through Halloween ra les and donations. It’s been a bit last-minute this year, but in just four weeks my mum, Mandy, and I have raised another £1,200. We did hampers, ra les and a ‘guess the number of sweets’ contest. The community’s support has been amazing. We’ve been with our shop here for 40 years, and some customers donated £100, while others contributed children’s clothing. Every penny will go towards upkeeping the school.”

You need to look for savings wherever you can

IN the wake of the Autumn Budget, the need to lower our costs across the board has become even greater.

Reducing sta members or sta hours aren’t options for us because we’d end up losing too much money, so we’re looking at every other aspect of the business. It’s about looking closely at costs and where I can save any amount of money.

The wasterecycling people we use at the moment

take our cardboard for free, but their fee has just gone up by 7.5%, so I’m shopping around for another option, which is something we’d never thought about doing before. Even if I have to pay for cardboard with another supplier, it could work out cheaper.

We’ll look at internet providers and energy suppliers as well because every little thing can make a di erence. Look at getting your newspaper credits. I’m using Go Audit to help my sta work smarter rather than harder, so they’re doing what they want to do and are good at.

Range reviews are also a good way to reduce costs, because if you can identify those lines that aren’t making you money and get rid of them fast, you can replace them with a really bold o er. We’re looking at things like the ‘middle of Lidl’ – getting an aisle full of products that will create a bit of theatre and drive incremental sales.

Social media is free marketing, so I’m going to get even more proactive with that. I am planning time out of my week to schedule posts and messages that will reach our customers for no cost.

There’s also the new waste legislation in March 2025. This will mean that businesses will be legally required to separate dry recycling and food waste from general waste. It means I need to look at how I can use my wasted food more productively. Can I use it in the kitchen, or give it to charities? All these small things will add up to make big di erences.

RETAIL EXPRESS looks at what these symbol groups have been doing for their retailers over the past year and what their plans are for the next 12 months

IN the midst of a change of government, a cost-of-living crisis, and growing concern about theft and store security, retailers have rarely needed the support of their symbol groups more.

Retailers are trying to �ind ways to boost their sales, footfall and margin while looking after their customers who now have less money in their back pockets.

As a result, this fascia guide has a strong focus on what symbol groups have been do-

ing to help their retailers �ind ways to maintain and grow their basket spend without sacri�icing their margins.

The online world features heavily from One Stop, which has put a lot of emphasis on delivery platforms in 2024, while prices and product range have been the major talking points from Parfetts.

The piece will also look ahead to 2025 to �ind out what plans symbol groups have for the year ahead when it comes to supporting their

retailers. These include promotions, the expansion of own-label ranges, improved data harvesting and analysis for retailers looking to understand their business better, and the reduction of wastage. As ever, the fascia guide for Retail Express also features commentary from retailers working with these symbol groups, talking about their experiences, their reasons for joining or staying with their particular fascias and their hopes for the year ahead.

“Co-op fresh products have completely changed our business. Customers come to us now over the supermarket and we’ve doubled our basket spend.”

Sunny Mann, Nisa Local Mansfield

ONE Stop’s strategy to provide an all-in-one delivery platform leveraging the scale of its business to negotiate lower charges is keeping partners profitable. Online opportunities are immense and One Stop’s platform is so simple to use, it does all of the work for you. Franchisees are fully supported selling online for the rst time, with one terminal connecting Deliveroo, Just Eat and Uber Eats as well as Snappy Shopper.

Shopping data highlighted the success of lowering prices as customers continue to look for value for their grocery shop. One Stop launched a £1m ‘Price Drop’ campaign, allowing customers to shop a wide range of everyday essentials and fresh products at cheaper prices.

Long-term price reductions were highlighted in an eight-week marketing campaign, focusing on singleprice items, end-of-basket value and meal bundles, providing options for every customer. The campaign included meeting demand for healthier food.

ONLINE is a huge part of One Stop’s business. There are more than 165 franchise stores currently o ering an online proposition to customers, and this is rapidly increasing.

One Stop’s online platform features more than 3,000 lines across the big three aggregators, together with Snappy Shopper trials for even greater reach.

Regular online promotions continue to help retailers entice more customers, drive loyalty and increase sales.

The marketplace remains competitive as a result

of cost-conscious consumers.

One Stop bene ts from seeing sales data from all of its stores to make informed decisions on what consumers want. Promotions are and will continue to be a key strength for One Stop, and it has a threestage split promotion plan that keeps o ers fresh.

Average store size: 1,000-3,000sq

Number of members: 350+ franchise stores

Cost of joining: £115 weekly fee

Moving into 2025, market-leading deals will continue, such as the ‘any three for £6’ on beer, lager and cider, and cocktail and ready-to-drink cans, while the £4 lunchtime meal deal is one of the strongest meal deals in the marketplace. One Stop has brought in food-waste bins in Wales and plans to roll these out across its England stores next year.

One Stop – Basainty Stores, Clase, Swansea

“ANY stores I open in the future will be One Stop stores because of how easy it is to run with it.

“The systems it provides give us the controls needed for our day-to-day running of the store and the processes help our store team deliver great operations.

“Launching online delivery with One Stop has worked really well.

“We attract shoppers from outside the catchment area.

With One Stop’s technology, everything is accounted for. It’s designed to help reduce waste as you know what’s selling and what isn’t.

“All stock is planogrammed to your store layout so you know where everything goes.

“Our BDM visits us every four weeks and pushes us to be better, so we can bene t from increased sales and pro t.

“We have group chats with all the other retailers talking about what’s going on – if anyone’s got an issue, we help each other out.

“Every six months, our franchise director visits us and we all come together for a meal.”

How PARFETTS supports its members and how it plans to build on this support in 2025

PARFETTS’ employee-ownership model means it can invest more back into price, promotion and customers’ stores. With a growing network of depots, totalling eight currently, Parfetts o ers a wider geographical reach for its delivered business and is investing heavily in its order app and website to ensure it continues to provide a hassle-free and feature-packed experience – all of which attract customers to the symbol group.

Currently, the Go Local network has

Mohammed ‘Naz’ Nazir

Go Local Extra Shard End, Birmingham

“I REOPENED my second store under the Go Local Extra fascia this May, having become the rst store to do so last year with my Coventry Road site.

“Shard End has reopened to the same standard – the pricing and o ers are a lot better than my former fascia’s, especially the chiller and freezer o ering, which has boosted our sales.

Looking ahead to 2025

PARFETTS is focused on maximising retailers’ margins. A key part of this approach is expanding the Go Local own-label range, which will expand to 200 lines in 2025.

Parfetts retailers say they like the products’ excellent quality and substantial margins. It now covers various impulse categories, including wine, snacks, energy drinks, so drinks and pet food, which have already seen successful debuts.

The Go Local range is seeing phenomenal growth, and Parfetts is making every e ort to maintain this

1,300 locations in the Midlands and the North, and it is rapidly growing farther south. The company has broadened its reach by extending an awardwinning delivery service that serves shops from Gloucestershire to the Scottish border, and it has now opened a second depot in Birmingham.

Parfetts treats every retailer as an individual, which means bespoke store design and range advice. There are no ‘o the shelf’ formats because each business is di erent.

“I’m getting weekly retail development adviser visits, and the Birmingham depot is matching the price of any stock we can’t order online.

trajectory by introducing new products and improving the selection.

With the help of suppliers, the Parfetts team creates a busy promotional calendar that ensures there’s always a deal at the depot or online.

The scale and frequency of the promotions have increased in the past 12 months, and this will continue to be a focus.

Parfetts is also investing in continually improving its digital platforms to ensure that retailers can bene t from real-time data and or-

der around the clock for free next-day delivery.

The Parfetts app and website are invaluable for ensuring e cient operations and making the most of the promotions on o er.

“The shop layout hasn’t changed much, apart from the fascia and tidying up the inside, because it’s an old building and it would be costly to do big changes like taking out walls.

“However, we’ve added all of Parfetts’ own-label

range; with the cost of living how it is, people are more eager to buy pricemarked products and own label is cheaper than branded. There have also been changes to my chiller and freezer ranges thanks to some exciting new partnerships Parfetts has made.”

“We worked closely with the Go Local store development team when we moved to Go Local Extra, totally replanning the store to meet our customers’ needs – leading to a 10% turnover increase straight away.”

CHARLES WHITTING nds out how retailers can introduce low- and no-alcohol products to an increasingly interested customer base

LOW- and no-alcohol (low & no) products are growing more popular with every passing year, as people’s drinking habits change – both in general and around certain times of year.

For producers and retailers, this has meant products they previously didn’t give too much thought to have become an essential, if not necessarily hugely lucrative, part of their businesses.

“We’ve seen a growth in demand and we’ve increased the range,” says Amandeep Singh, from Singh’s Convenience Store in Barnsley, South Yorkshire

“For us, it’s working people

who want a cider or a beer after work during the week, but don’t want to have alcohol.”

John Price, head of marketing at King sher Drinks, notes the low- and no-alcohol segment is most popular with younger customers. “Nearly half (44%) of 18-to-24-year-olds surveyed consider themselves either an occasional or regular drinker of alcohol alternatives, compared with 31% in 2022,” he says.

“Those 18-to-24-year-old consumers who are purchasing more no & low now are more likely to convert to lifelong fans of the brand they choose, whether it is alcoholic or low & no.”

Low & no can be divided

up in similar fashion to the alcohol segment in general, with beers and ciders perhaps the most well known, followed by a growing market for nonalcoholic gin and other white spirits, as well as wines.

Judging how much to delve into each will require a bit of trial and error, along with customer conversations.

“Beer remains the dominant category, but spirits have shown the most rapid growth in recent years, with increasing innovation and consumer interest across all segments,” says Gurms Athwal, head of trading at Parfetts. “Alcoholfree gin has experienced huge growth.”

David Sheppy, managing director, Sheppy’s Cider

“MERCHANDISING low- and no-alcohol options during ‘sober months’ like Sober October and Dry January is highly e ective. During these periods, consumers are seeking enjoyable low-alcohol alternatives, creating a prime opportunity to introduce them to new products

“O ering a variety of low & no gives retailers the opportunity to cater to di erent preferences. A diverse selection ensures appeal to a wider audience and encourages exploration.

“Promoting low & no options as cocktail ingredients can boost sales by showcasing their versatility and therefore appeal to a broader audience. This approach encourages customers to view these products not just as standalone beverages, but as a base for creative, alcohol-free cocktails.”

•

…BRINGING SHOP OWNERS TOGETHER …COVERING THE RETAIL NEWS THAT MATTERS …HIGHLIGHTING NEW OPPORTUNITIES …STANDING UP FOR LOCAL SHOPS …CONNECTING RETAILERS AND SUPPLIERS

And helping independent retailers know more, sell more and make more-informed business decisions.

FIND OUT HOW RN CAN HELP YOU RUN A BETTER STORE AT BIT.LY/RNMAGAZINE

NOT every shop is going to see increased demand for low & no products, but that doesn’t mean these stores shouldn’t have them on their shelves.

Singh’s other store is down the road, and there are not as many customers asking for non-alcoholic options. “It’s area- and demand-dependent,” he says. “Retailers shouldn’t lock up precious alcohol space with products that will sell slowly. Look at your square footage

Amandeep Singh

Singh’s Convenience Store, Barnsley, South Yorkshire

and make the most of it. I sell eight non-alcoholic items a day at one shop, and one a day in the other shop. It’s a big di erence.

“I don’t think you should treat them too di erently from alcoholic versions – if there’s demand, make more space and go for it. If not, then don’t.” Singh’s range is therefore reduced, but it’s still there. Charik Patel, from Bickley Food and Wine in Bromley, south-east London, also

“IN the ciders, we’ve got two non-alcoholic Kopparbergs: Strawberry & Lime and Mixed Fruit. In non-alcoholic beer, we’ve got Heineken, San Miguel and Stella Artois. We’ve got a non-alcoholic wine brand called Eisberg as well. In the spirits, we’ve got the big names like Gordon’s, but no one really buys the low- and no-alcohol spirits. It’s the ciders and the beers that have the most demand.

“We stock our low & no products together with the alcoholic versions, whether it’s beer, cider or wine. They are positioned prominently in their own minisection at the front. That means people can clearly identify them and they won’t get mixed up with the alcoholic versions.

doesn’t have much demand for low & no, but he still stocks Heineken, Guinness, Peroni and Gordon’s.

“If there is demand, we’ll expand it, but it’s not there right now,” he says. “We carry it because then it shows people we have it and we’re thinking about it, and that means that they’ll feel empowered to ask us about it and ask us if we’ll take a chance on stocking something they might want. That’s hugely important.”

ONE of the major questions around low & no is where to position it in store for the greatest impact. Do you put them immediately next to their alcoholic counterparts to give customers a clear alternative, or do you position them in a completely separate area to avoid customers accidently picking up a non-alcoholic option that they didn’t want?

Parfetts’ Gurms Athwal recommends placing them among their alcoholic equivalents to make it “easier for customers who are familiar with alcohol brands to nd alternatives”. But Alexander Wilson, category and commercial strategy director at Heineken UK, disagrees.

“Our best advice is to consider merchandising and

“As demand has increased, our range has grown. We used to just have one beer and one cider. We’ve also increased facings to two each so it’s more visible because more people want it. If more than two or three people ask for another brand, we’ll get it in and try it out.”

Caitlin Brown, o -trade category development executive, BrewDog SUPPLIER VIEW

“PRICE is an important factor within the low & no category, with shoppers expecting a to pay a signi cantly lower price than the alcohol alternative. Ensuring your low & no options are set at a compelling price while still delivering margin will help drive rate of sale and create customer loyalty.

“Think about the primary tools you use to promote your alcohol range and include an alcohol-free option to provide shoppers with choice.

“For example, a meal deal with a pizza and a four-pack, or big-night-in displays with snacks and so drinks. By having alcohol-free options available and adapting the promotional price accordingly, shoppers will feel their demands are being met and will return.”

and

ranging no- and low-alcohol separately to its alcoholic counterparts,” he says.

“Having a separate display clearly signposts to consumers that they can rely on the store to provide them no- and lowalcohol products, and that the store owner has put e ort into curating the category, and therefore will have the latest products available.”

TOM GOCKELEN-KOZLOWSKI takes a tour of the world food opportunities within convenience retail and how stores can take better advantage

IF your store is operating under the assumption that world foods is an opportunity only available to businesses located in diverse neighbourhoods, or where shoppers are committed to trying new recipes and flavours, we have good news.

This pro t-driving category has gone mainstream.

“We’ve got two full bays for world food, which represents Italian, Indian, Chinese, PanAsian and Far East and American,” says Avtar Sidhu, who owns St John’s Budgens in Kenilworth, Warwickshire. “I think it’s de nitely been grow-

ing as a category since the pandemic. It’s getting more interest – and driving more spend – than it did before. Shopping habits have changed and people’s types of food consumption has changed.”

The world is getting smaller thanks to customers travelling further and interacting with di erent cultures on a more regular basis. One of the biggest impacts these interactions have is on cuisine.

This adventurousness is also caused by the cost-of-living crisis encouraging people to eat at home, rather than out of home.

“People are more adventurous with the food they’re willing to try,” says Sidhu. “They go abroad and want to relive that cuisine.

“Whereas before they’d have gone to restaurants and takeaways, more often now they’re consuming them at home, saving money.”

This shift in consumer behaviour is giving suppliers the con dence to launch a range of products catering to different cuisines. For example, this summer, Master Cook launched a Japanese foods range including four meal kits

(katsu curry, sesame teriyaki, curry udon and yaki soba), plus ramen, udon and soba dry noodles, soy sauces, ramen broth and classic kimchi.

“Created by chefs to blend authentic flavours with convenience for time-poor consumers keen to recreate their favourite dishes at home, each kit contains pre-measured ingredients to add to the consumer’s preferred protein or vegetables, to help create chef-crafted meals, at home, within 15 minutes,” says Upuli Ambawatta, brand manager at Empire Bespoke Foods.

WHILE the average consumer is still looking to create the world food recipes they know and love, other cuisines are also providing inspiration.

Retailers need to keep their nger on the pulse by talking to customers and monitoring social media to nd out where the next opportunity could be coming from.

“One of the big trends for me recently has been the rise of West African foods and recipes such as jollof rice,” says Abdul Arain, who runs the Al-Amin convenience store in

Cambridge. “This means we’re selling more scotch bonnet peppers, spices mixes and other ingredients needed to make these dishes.”

Abdul says this trend is currently in a sweet spot of helping his store grow sales and attract new shoppers while not being catered for by the big multiples.

“It’s exactly these kinds of products that aren’t likely to be available in Sainsbury’s and that helps our store to stand out,” he says. “For this reason, we’re also able to earn a 40%

margin on these products, which is signi cantly more than you can get from a tin of baked beans that is available everywhere.”

To maximise pro ts in this emerging category, Arain believes shopping around at a range of wholesalers is the most e ective strategy.

“Availability isn’t an issue when it comes to world foods, but I recommend retailers shop around if they want to get the best price – and earn the biggest possible margin,” he says.

ANOTHER trend to emerge in the past year or two has been the rise of Korean foods, whether it’s ready meals, ingredients sourced from South Korea or products trending on social media.

“It was a trend I rst saw on Tiktok and has grown from there,” says Kay Patel who runs a number of Best-one stores in East London. “The customers coming in for this range are aged 16 to 24 and they’ve grown up listening to Korean music and watching Korean movies. A lot of K-Pop videos on YouTube will have adverts for these products, so that drives sales, too.”

Patel sells kimchi, gochujang paste, wet udon noodles and even soft drinks such as Jinro Soju.

at a trade show at the NEC where I met a number of suppliers. We also use our main ethnic foods wholesaler, but you can nd some of these products at Costco, too. It’s only a matter of time before Bestway and Booker start stocking them.”

When this range was introduced, Patel put products out on gondola ends. “A lot of these products have really bright, eye-catching packaging so we tried to take advantage of that.

“We’ve now put them further back with the rest of our Chinese and Asian foods. I thought there might be a drop o in sales, but they’ve held up really well.”

“We can sell these products at a premium, too,” says Patel. “A ve-pack of carbonara-flavour Buldak Ramen Noodles sells for £12 and we make 40% on that. I was rst introduced to the opportunity

Korean foods are a trend suppliers are also picking up on. Earlier this year, Mrs Elswood – more commonly associated with gherkins in the UK – launched a range of kimchis. Flavours include Classic, Turmeric and Beetroot.

IN addition to introducing consumers to new flavours, methods of cooking and other cultures, a less often recognised bene t of buying into the world foods category is enabling busy families to create healthier flavour-full dishes quickly and conveniently.

“There’s an element of health,” agrees Sidhu. “People are more conscious of what they’re consuming. Making it at home gives families

and there’s a lot of these businesses where we are.

“The whole category has gone beyond the standard Italian, Indian and Mexican. There are a lot more cuisines and people want to buy something di erent – so it’s great we can reflect this in store.”

It’s a shift in consumer be-

spend by o ering a complete one-stop-shop range within world foods.

and even something like Uncle Ben’s Mexican rice, which we have on at two for £2. So, one sale can actually turn into a whole basket.”

“People are de nitely looking to cook more meals at home to save money and be healthier. So, people are buying all the ingredients to make spaghetti bolognaise and picking up some garlic bread while they are here.

As shoppers have become more adventurous – both with their cooking and the cuisines they want to try – Kaur has noticed a growing demand for ingredients like fresh garlic and ginger.

haviour that has also been seen by Julie Kaur at her Jules’ Convenience Store in Telford, Shropshire, who is using this change in customer cooking habits to bolster her basket

Shropshire, who is using this control. Generally, if you get a takeaway, it’s often greasy

“At the same time, if someone comes in to buy tortilla wraps for a Mexican meal they are going to be buying sour cream and jalapenos, too –

“These products have a limited shelf life so we now stock frozen versions, which are popular with customers.”

KAUR’S experience of the world foods category does contain one salutary lesson.

“We have a large Polish and Romanian community near our store and to begin with we made sure we stocked a good range of foods these customers wanted.

so our sales went down and we cut back our range.”

It’s a great example of how important getting on to trends as soon as possible is – as well as maintaining a good understanding of the changing needs of your customer base.

“But quite quickly two specialist Polish foods stores opened in the neighbourhood,

Lee Kum Kee, the Asian sauce and condiments brand, has launched a multichannel advertising campaign, encouraging consumers to ‘Chiu Chow Chilli Any Chow’. Throughout a series of creatives, it hopes to motivate people to step outside the con nes of only using chilli oil within Asianinspired cooking.

Pot Noodle has released a new flavour in its Fusions range – Korean BBQ Beef – to tap into the fast-growing food trend of Korean street food. Pot Noodle Fusions Korean BBQ Beef is available now exclusively at Co-op, but will roll out to the wider grocery channel from January 2025.

Pasta Nostra has launched six healthy pasta pots, made in Italy. Made with natural ingredients, Pasta Nostra instant fusilli pasta pots are available in six flavours: Bolognese and Carbonara, which contain meat; three vegetarian options in Tomato & Mozzarella, Cheese & Pepper and Mushroom; and Arrabbiata, which is suitable for vegans. Each recipe provides a 250g serve, with calories for the di erent flavours ranging from 233-263 calories per pot. It has an RRP of £1.75 per pot.

work in terms of researching and sourcing products, but it could result in you broadening your customer base far further a eld as you become something of a destination.

It’s possible to dive more deeply into this category and become a specialist store yourself. This will require more

The world foods category offers a huge range of bene ts – from driving new customers into your store, boosting your margins and creating excitement about your range.

The RETAIL EXPRESS team nds out what minor changes have had a major e ect on sales and footfall in shops

Oliver Blake, Oasis Services, Long Riston, Hull, East Riding of Yorkshire

“WE had spent a few thousand pounds on a special stand for all the sweet treats that we make in our kitchen – doughnuts, croissants, cookies, mince pies and the like. We even had stuff on there from Dunkin’ Donuts, but they were placed near the rest of our food to go, so they weren’t generating any impulse sales for the store. As I walked around the store, I saw we had a beer stack on the way to the till.

“I asked myself ‘why do we have that there? Cases of beer aren’t bought on impulse’. We wanted to put something more impulsive there, so we put the sweet-treat stand there instead.

“We didn’t lose any sales from the beer stack after it was moved, but we saw a 40% increase in sales of sweet treats – we have to top it up several times a day. It started growing from day one and hasn’t stopped. I can’t recommend doing store walks enough. They help you make far better sense of your store.”

2

Dhaval Gosaliya, Barton Seagrave Post O ce, Northamptonshire

3

Ashish Pal, Mount Pellon Newsagent, Halifax, West Yorkshire

“WE’RE a post of�ice rather than a newsagent, but last year, we introduced a fridge so we could sell cold soft drinks. We invested in a new fridge in March 2023 and stocked it with soft drinks. It was slow at �irst, but people bought into it.

“We now get teenagers from the local secondary school coming into our shop all the time to buy our chilled soft drinks. They started asking if we sold sweets as well, so we brought in a small range that included Skittles and Maltesers, which �lew out, so we’re expanding it further now. It’s something small we can do over the counter to boost basket spend, but it’s also increased footfall to the shop.

“Adding just couple of in-demand products has had a big impact on our sales. Our bestselling soft drinks are currently Coca-Cola and Dr Pepper, while the energy drinks are also working very well.”

“WE’VE only been in the store since January 2024, but one of the small changes we made after we took it on was to introduce a wider range of children’s confectionery.

“We have started stocking a lot compared with the previous owner, and we’ve now got a strong selection, with the sweets ranging in price from 10p to £1.

“We’ve highlighted the prices with marketing materials. It means if children come into our shop they’re almost certain to buy something. Delving into this section and expanding it has had a big impact, and we’ve seen so many more kids coming into the shop as a result.

“It hasn’t required any extra space – we just adjusted our newspaper section and managed the space more effectively. We source all our confectionery from Bestway, Booker and Parfetts. I recommend retailers get involved in smaller sweets and confectionery.”

In the next issue, the Retail Express team nds out how retailers are improving impulse sales. If you have any problems you’d like us to explore, please email charles.whitting@newtrade.co.uk