GRASP THE FOOD AND DRINK OPPORTUNITY How to create the right on-the-go o ering that works in your store P23

NATIONAL LOTTERY

Allwyn unveils new and improved terminals expected to land in trial stores soon

GRASP THE FOOD AND DRINK OPPORTUNITY How to create the right on-the-go o ering that works in your store P23

Allwyn unveils new and improved terminals expected to land in trial stores soon

• Residents in Devon town hit by water contamination ‘nightmare’ rely on local shops to keep them safe

• MPs praise independents for ‘going above and beyond’ for their communities

Suppliers get ready to phase out disposable vapes ahead of the ban on 1 April 2025

Spar releases three new wines to its own-label collection to help boost sales

Megan Humphrey, editor

Megan Humphrey, editor

THIS issue marks a bittersweet moment for me. A er six years at Newtrade Media, I’m o cially standing down as editor of Retail Express.

There’s not enough words to express my gratitude to everyone who’s supported me, and taken time out of their day to speak with me.

When I rst took on the role, I was keen to stand up for independent retailers, try to hold those who were mistreating them to account and play a part in giving them the recognition they deserve.

There have been some standout moments. One in particular was getting Evri UK, formerly myHermes, to pay out thousands of pounds in missing parcel commission to stores, following our ongoing pressure.

Putting a spotlight on the need to better protect independents from crime has always remained a priority, and speaking at a parliamentary meeting to stress the need for funding to help shops invest in security was a privilege.

Reporting on how the sector was fairing during the Covid-19 pandemic was challenging, but one which showed the lifeline local shops became for their communities, when no one else stepped up.

Before I go, I want to say thank you once again. I truly mean it when I say the people working in this industry are some of the kindest there are – it’s been such a pleasure.

I truly wish you all the best, and I hope your businesses continue to prosper. I will most de nitely pop in and say hello if I nd myself near some of your fantastic shops.

editor Alex Yau @AlexYau_ 020 7689 3358

NATIONAL Lottery operator

Allwyn has already selected several independent retailers to trial its new ‘Wave 8’ terminal, boasting faster and easier transactions.

Leaked documents marked ‘internal use only’, seen by Retail Express, revealed the terminal, produced by Scienti�ic Games, will be one of at least

three models to be rolled out to more than 40,000 sites towards the end of the year.

The ‘Wave 8’ will allow for faster transactions, with its high-speed processor, and includes an ‘enhanced win sound’, a 15.6-inch LDC HD widescreen, tilt adjustable screen, 1D barcode and 2D code scanner.

The terminal requires two power sockets – one for the

terminal and one for the router. Julia Bywater, from Bywater News in Dudley, West Midlands is one of the �irst retailers selected to have the terminal added to her store.

“So far, we’ve just had the modem �itted through a BT line,” she said.

Sunder Sandher, owner of S&S One Stop in Leamington Spa, Warwickshire, added that he was left “shocked when

a rep came in and left a brochure for the new terminal”. A spokesperson for Allwyn con�irmed: “As part of this large-scale rollout, we’ve selected a number of retailers to take part in a trial to evaluate the deployment and setup of the new network and terminals, as well as the technology itself.”

Vennells spoke out publicly for the �irst time in nearly a decade last week in the in-

Bread Spread is under investigation after listeria was found it is chilled and readyto-eat products.

with an apology, warning her answers would be “dif�icult to listen to”.

She denied attempts to cover-up faults, and claimed she wasn’t kept informed about how many complaints subpostmasters were making about the system.

East Council has been working with the Food Standards Agency (FSA) after a recall was made. The affected products are sold under brand names Bread Spread, Orbital Foods and Perfect Bite, and include sandwiches, wraps, baguettes, twists, French sticks and torpedoes.

JUST East hasn’t ruled out the possibility of making scratchcard and lottery products available through its partnered stores.

A spokesperson told Retail Express “every decision we’re making as part of our convenience strategy is led by evidence”, and “our data tells us which food items customers are already searching for on our platform”. They went on to add: “We maintain an open dialogue with retailers on our platform and continue to update stock lists.”

THE recently announced General Election means that plans to increase the smoking age, restrict vapes and create new laws to protect shop workers may be scrapped. The election cuts short the time remaining to discuss legislation, resulting in the government needing to push weeks’ worth of complex legislation through.

Action on Smoking and Health chief executive Deborah Arnott said the laws are a “victim of the snap election”.

LOCAL shops in Brixham, Devon, are helping to keep customers safe as the town’s tap water remains contaminated and undrinkable.

Over two weeks ago, around 16,000 residents and businesses were warned to boil tap water before consumption by South West Water (SWW), after a parasite had been identi�ied in the water supply.

Independent retailers told Retail Express that as soon as the news broke, demand for bottled water grew “exponentially”, and many acted quickly to protect supply and prioritise deliveries to the vulnerable.

Speaking at the time, Charry Kaye, at Costcutter Pillar Avenue in Brixham, said: “We sold out of all forms of bottled water straight away. We are doing all we can to keep it in stock for customers. We’ve been looking around in other shops and the Sainsbury’s in town is completely sold out.”

Kathy Voisey, of Smardons Newsagents, added: “The community is looking after each other. We went to Booker to stock up, but it is beginning to quieten down.

Water deliveries from SWW have also gone out.”

Store owners praised SWW for its rapid response in delivering water to the vulnerable “every 24 hours”, and setting up collection points.

Despite the water supplier working to eradicate the problem, it issued an update last week, con�irming a notice remained in place for around 2,500 properties in Hillhead, upper parts of Brixham and Kingswear, where drinking water remains unsafe.

Lisa Hallett, an employee at Londis Cambridge Road, said “the whole community is working together to support one another”. She explained: “We sold out completely, but we had a lot of elderly customers calling us asking for us to keep some for them. We made the

deliveries as soon as we got the stock.

“Local shops have been speaking to one another to help as much as they can. When I needed bottled water for my pregnant daughter who fell ill, the Spar close to where I live had supply and they were very helpful. It has been a nightmare, especially as we don’t know when it’s going to get properly sorted.”

Conversative MP Anthony Mangnall, whose Totness constituency covers Brixham, praised the response of independent retailers and said they “adapted quickly

and this unforeseen event has shown the character of the community”.

He added: “Over the past few weeks I have seen extraordinary community spirit in which neighbours and businesses helped one another. It is moments like these that de�ine a community, and Brixham once again showed itself to be a kind, compassionate and welcoming place, even in the face of illness and anger.”

Mangnall described businesses as “resilient”, but added it had been “staggering how quiet Brixham has felt”. SWW incident director

David Harris con�irmed bottled water would continue to be delivered to properties every day, and water stations would remain open between 7am and 9pm.

He also announced a further increase to compensation for those affected by cryptosporidium, up to £265 from £115.

The UK Health Security Agency con�irmed that at least 70 people had been diagnosed with cryptosporidium, a diarrhoea-type illness.

The illness has an incubation period of up to 10 days, meaning more cases are expected.

“WE set quarterly targets for our managers. If they are met, they receive a bonus derived from a percentage of their salary. It helps to keep them driven. The targets aren’t just store performance and turnover, it’s about standards. It’s about ensuring our planograms are being followed and met. It means I don’t have to go to every store every week.”

Rishi Patel, multi-site Spar and Budgens owner, Hampshire

“YOU have to look after your online reputation, so I set my sta the target of having to get at least one Google review from a customer each shift. If they don’t do it, I hold them accountable, but if they get ve or six, I reward them. I hold competitions and if they get 10 in a row, they get a £10 voucher and I make a big deal about it and show them to the team. Since doing this, our Google reviews have gone from 43 to more than 2,300.” Dipesh Modha, Edgware Road Post O ce, London

“WE set quarterly targets, but also focus ahead to enable managers to adapt their approaches. We review targets every six months. We talk quarterly, so we’ll look at this quarter and the next one. The targets shift from store to store and year to year because things change. In departments where sales are dipping but margins are too high, you might need to make changes.”

Terry Mulkerns, Mulkerns Eurospar, Newry, County Armagh

PRICING: The rising cost of groceries has slowed to 2.4% year on year, raising retailer hopes that the trend of frequent shelf price increases may be coming to an end. The latest gures from Kantar said the drop below 3% should see shopper habits begin to revert to trading up to branded and more premium products.

For the full story, go to betterretailing.com and search ‘grocery’

BLEED KITS: Local shops are being encouraged to add bleed kits to their stores, with support from the Daniel Baird Foundation and the Fed. Trudy Davies, owner of Woosnam & Davies News in Powys, raised funds in her store for public-access bleed kits two years ago, and has recently added one to her store as well. 4-17

VAPING: Regulatory consultancy Inter Scienti c, which is responsible for testing the legality of vaping products, has said trading standards requires more funding and sta for the disposable-vape ban to be e ective. Customer solutions advisor Tom Coleman said: “The disposable-vape ban can’t really make the state of the market much worse than it is already.”

For the full story, go to betterretailing.com and search ‘vape’

MORRISONS: Sta at two Morrisons warehouses took part in a strike last week, a ecting supply to the supermarket’s Daily franchisees and wholesale customers. Nearly 1,000 employees working across the depots in Cheshire and Wake eld voted in favour of strike action. Trade union Unite the said the most recent dispute was over pension changes and stricter targets for picking.

SUPPLIERS are getting ready to phase out disposable vapes from as early as the end of the year, ahead of the ban on 1 April 2025.

A representative of distributor Flavour Warehouse told Retail Express “compliant products are now launching every week”, and confirmed it is “forecasting that Christmas will be the last push for dis-

posables – after that it’s about running down stock and supplying alternatives”.

The firm is also making extra preparations in the event of a complete display ban and confirmed its gantries could be “retrofitted”.

In response to speculation, Navarra Retail Solutions has launched a combined tobacco-and-vape gantry, featuring shelving on the front for displaying vapes or other

products.

Chief executive Eamon De Valera said its EPoS-linked system can quickly find lines in the event of plain packaging or a display ban. He warned tobacco-company gantry contracts could leave stores stuck for space if a full vape display ban is introduced.

“A large proportion of the space has to go to the tobacco company’s vapes, which are often slower selling, with

lower margins,” he said. “They will not have space for many of their bestsellers.”

Government ministers have been vowing to close “loopholes” around vape designs post-disposable ban. However, all planned restrictions for 1 April, except the disposable vape ban, have been thrown into question by the General Election, with the legislation required failing to pass before Parliament broke up.

TANGO Ice Blast manufacturer Frozen Brothers has unveiled a slush machine it claims can detect and diagnose faults faster than previous units.

The firm said its new G3.5 power unit “features advanced software for quicker

fault detection and diagnosis, ensuring a longer lifespan, faster fixes, less downtime and increased profits”.

Retailers have previously slammed Frozen Brothers for multiple breakdowns of its Tango Ice Blast machines, which led to lost sales.

its

battery-powered locker

increasing the number of stores eligible for installation.

firm now has more than

locker units across the UK, giving sites the opportunity to earn commission as shoppers collect, send and return parcels free of charge.

Chief executive Neil Kuschel said despite “demand outstripping capability”, the firm

SNAPPY Shopper has teamed up with courier platform Stuart to enable deliveries in at least an hour.

Using bicycles, mopeds, and cards, Stuart’s couriers operate from 9am to 11pm, offering real-time tracking and order confirmation at the doorstep. Live tracking is provided through SMS and email.

Stuart’s UK general manager, John Gillian, said the move will “enable grocers to streamline deliveries”.

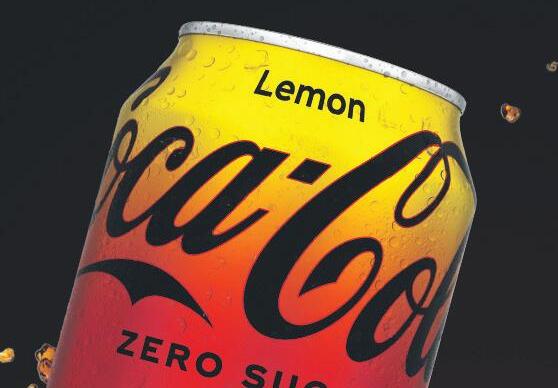

COCA-COLA Europaci�ic

Partners (CCEP) is supporting its recently launched Absolut Vodka & Sprite ready-to-drink (RTD) can with a new campaign ‘Planned for the Unplanned’.

Live now until August, the digitally-led campaign includes social media and in�luencer activity, and is expected to reach 70% of 18-to-34year-olds, the brand’s target audience.

It highlights the drink’s suitability for unplanned occasions at home or outdoors with friends and family, tapping into summer events and festivals.

Convenience retailers can

capitalise on the campaign with branded PoS and digital assets from My.CCEP.com. PoS includes chiller shelf trays and clip strips.

Absolut Vodka & Sprite is also an of�icial bar partner of this year’s Brighton Pride, alongside Jack Daniel’s & Coca-Cola’s full-sugar and sugar-free varieties.

The full range will be available to purchase across 10 different on-site bars, reaching up to 80,000 festival goers.

Elaine Maher, associate director of RTD alcohol at CCEP GB, said: “Seventy per cent of alcohol RTD options are consumed within two hours of purchase.

“We are con�ident that

THATCHERS Cider has launched a new round of adverts made by animation studio Aardman, running alongside summer sport events.

A new football-themed series of adverts debuted on 18 May, during the �inal weekend of the Premier League season.

They also ran across the FA Cup �inal, and will run during UEFA Euro 2024 and the women’s UEFA Euro 2025 quali�iers. Cricket-themed adverts also aired alongside Vitality Blast matches from the end of May and will continue during the international cricket season this summer.

Like the initial advert made

tapping into the idea of ‘unplanned’ moments will resonate with shoppers.

“We therefore recommend that retailers ensure their

with Aardman that aired last summer, they feature fourthgeneration cider maker Martin Thatcher and family dog Myrtle, at the supplier’s Myrtle Farm cider farm.

The adverts will be supported by outdoor and social media advertising this summer.

INNOCENT Drinks has added a Blueberry Focus Super Smoothie to its functional drinks range. The new variety is available in 300ml and 750ml varieties, with RRPs of £2.50 and £4.50. It joins the brand’s existing Energise and Invigorate lines.

It contains a blend of crushed blueberries, strawberries, apples, rhubarb, spirulina and added vitamins.

Its launch comes as functional smoothies are the fastest-growing segment within the smoothies category in the UK, according to Nielsen.

“With a growing demand for food and drink products that support cognitive health, new Blueberry Focus has added vitamin B5, which

helps with focus and mental clarity, as well as vitamin C, which contributes to the reduction of tiredness and fatigue,” said Innocent’s nutritionist, Louisa Handley.

RTD alcohol is stocked up in the chiller ready for consumption – after all, ‘cold is sold’ when it comes to this category.”

PERFETTI Van Melle has launched 10 months of promotional activity building on last year’s ‘Yes to Fresh’ campaign in support of Mentos.

Representing a total investment of £2.5m, the campaign spans out-of-home advertising, social media, in�luencer partnerships, in-store PoS and a partnership with radio station Kiss.

The partnership with Kiss sees Mentos sponsor Kiss Fresh, which has an estimated 620,000 monthly listeners, and the Kiss Hype Chart.

It will also include the ‘Corner Shop Drop’ social content

series. Across �ive episodes, the series will look at upand-coming music artists as they explore their local corner shops, which will feature as �ilming locations and as examples of community hubs.

ALPEN has launched an onpack promotion in partnership with BBC Gardeners’ World, offering one shopper the chance to win a £25,000 garden makeover.

OVER the past year, Heineken UK has launched a range of innovative products and campaigns, with the latest activity shining a light on Sevillian lager brand Cruzcampo.

Cruzcampo, Spain’s number-one draught lager1, was launched into the o -trade in response to the increased demand for Spanish lager. It was the o -trade’s numberone innovation in the beer, wine and spirits category during the 12-week Christmas period in 20232, and is the biggest brand launch in value in over a decade in the beer, wine and spirits category3.

With signi cant investment set to ramp up demand, ‘Choose to Cruz’ will further emphasise the brand’s Spanish heritage and comes at the time when more consumers are looking for new styles of beer to try, especially continental lagers with a Mediterranean twist, appealing to those seeking an authentic experience at an accessible price point.

Having a fully stocked display with a good mix of core brands, such as Heineken, immersed with trending lines like Cruzcampo, is the best way retailers can retain loyal customers, alongside attracting new shoppers to explore the beer category for the rst time.

To nd out more, head to Heineken UK’s Star Retailer platform at linktr.ee/starretailer

The supplier hopes the promotion and accompanying £300,000 campaign will reach 7.3 million UK adults, particularly among the brand’s target market, aged 45-plus.

Running until 31 October, the promotion will be highlighted on packs of Alpen’s Original and No Added Sugar 550g varieties.

The packs also offer a three-month trial subscription to gardenersworld.com.

Alpen will also sponsor the magazine’s Garden of the Year contest this year.

AS retailers, it’s so important we look a er ourselves. We spend so much time listening to everyone else oload, and work hard to make so many people happy. I wanted to ensure Mental Health Week (13-19 May) was prioritised across our business. I allocated one of our sta members to be available to chat to customers between 10am to 12pm each day throughout the week. They were o ered cups of tea or co ee; it’s important for everyone to take time out.

Retailers must also ensure they are taking time to network with each other, as sometimes it can feel like you are stuck in a rut, and sharing your problems with people who are going through the same thing can be so bene cial.

I’d like to see more being done to support those working in independent retail. Perhaps the government could provide a step-by-step guide, recommending ve things to that can improve health and well-being, such as drinking plenty of water, taking exercise and speaking to people.

I try to take a break at Christmas and a few weekends here and there to focus on myself. In my experience, retailers can work so hard that they don’t take enough holidays, or even the occasional long weekend.

It’s so important. I feel women in particular have a lot to balance – we tend to take more on, whether it’s caring for children or our families.

Try to nd other female retailers in the same area as you, and perhaps do something together, like a book club or swimming. It’s good to do an activity that takes your mind o the everyday.

SPAR UK has introduced three new wines to its ownlabel collection.

Available in participating licensed Spar stores, the new Red, White and Rosé varieties have been developed by Philippa Carr, master of wine, who said: “I selected the new Spar own-label wine collection to provide wine lovers with exceptional value, making them the perfect choice for everyday enjoyment.”

Each wine contains different notes and �lavours. They are also designed to be paired with separate meals.

The value range is being launched with three characters featured on the bottles

including Reginald the Dog (red), Croxanne the Crocodile (white) and Phil-Mingo the Flamingo (rosé).

The characters have been designed to engage with shoppers. QR codes are also incorporated on the bottles.

The QR codes will direct shoppers to a dedicated ageveri�ication website and will provide more information about the wines.

Each wine in the collection has an RRP of £4.99. The launch will be supported in store with PoS and responsible age-veri�ied social media and digital activity.

Amrit Rebello, Spar brand controller, said: “We are delighted to launch our new value wines specially curated

PURITY Soft Drinks has announced the launch of Juice Burst’s biggest marketing campaign to date. Its ‘Punchy to the Core’ campaign showcases Juice Burst’s Apple variety. It aims to highlight the drink as a refreshing beverage choice that contains no added sugar, arti�icial �lavours or sweeteners.

for our Spar stores. They are not only competitively priced, but they are also designed to be an attractive option for

shoppers looking for affordable yet �lavourful choices.” The own-label value wine collection is vegan-friendly.

The drink-now category is growing at 13%, with apple �lavours performing ahead of the total category at 18.2%.

The advert is set to reach more than 30 million UK adults. Consumer research conducted by the brand found that 92% of adults liked it.

The campaign is being supported with social media and out-of-home ads.

Sometimes, it’s about nding something outside of your day-to-day routine to get a sense of escapism –doing so can really bene t your mental health. Collaborators Headline partner Supporting partners

BESTWAY Wholesale has begun rolling out its new Bestin own-label range, which promises retailers margins between 30% and 75%.

The range consists of more than 160 products across key impulse and grocery categories. It contains a mixture of new lines and reformulated and repackaged existing Bestone lines.

Most of the products are price-marked, with a few exceptions in categories that have been subject to heavily increasing prices, such as sun�lower oil and cat litter.

Bestway also claims to be the only supplier offering convenience retailers ownbrand washing powder.

The range is available to every Bestway customer.

MOO Free’s Rocky Jumble share bag is now available to convenience stores.

Rocky Jumble share bags contain a mix of free-from vegan chocolate-covered raisins and vegan honeycomb and gluten-free rice balls.

Each Rocky Jumble share bag has an RRP of £3 and is wrapped in fully recyclable packaging.

The sharing bags are available from the Moo Free wholesale website.

Andrea Jessop, chief executive of Moo Free, said: “The free-from market has seen signi�icant growth in the past 15 years and is now a recognised core grocery category. Treating and snacking continues to be high priority

for thousands of consumers, and we hope that with the new Rocky Jumble share bags, people with allergies or following a vegan diet don’t have to miss out.”

WORLD of Sweets’ �ield sales team has made a range of healthier products available to customers through its app.

The app has been updated with healthier products, such as Clif bars. A current deal offers free Clif stock worth £54 when buying any eight snacks in the healthier range.

Retailers can also get free Sneak Energy stock worth £59.67 when they buy any

eight drinks in the healthier range.

Gemma Allanson, national �ield sales manager at World of Sweets, said: “Lots of convenience retailers have expanded their in-store ranges recently, with a big emphasis being put on healthier ranges. Bars, functional energy drinks and healthy snacks offer a huge market for retailers to tap into.”

IMPERIAL BRANDS is taking its popular Blu Bar range to the next level with the launch of its new Blu Bar 1000 device to help retailers grow their vape sales

IN the UK alone, the vape category is forecast to almost triple in value from £930m in 2019 to £3bn in 20252. Many retailers have seized the opportunity to tap into this flourishing category and with the number of vapers continuing to grow, there’s further sales

successes on o er for retailers who can get their range right. To tap into this booming category and boost customer loyalty, retailers must keep an eye on any of the latest trends – for example, the rising demand for disposables. By ensuring they’re stocking

products that respond to these key trends, retailers can meet the ever-evolving needs of shoppers. Thanks to the latest launch from Imperial’s popular Blu brand, there’s an exciting new product well placed to help them do just that.

ONE area experiencing signi cant growth is the disposables category, accounting for an impressive 88% of all vape sales3. With demand for these products continuing to rise, Imperial has launched its new and improved Blu Bar 1000 device to help retailers grow their vape sales even further. The new range, which is available for an RRP of £5.99*, o ers up to 1,000 pu s1 per device and features Blu Flavour Tech mesh coil technology to deliver strong bursts of flavour. The redesigned casing on the device also means that the liquid level is visible through the translucent mouthpiece, making it easier to see when the liquid is running low. Blu Bar 1000 also has a removable battery that us-

ers can now twist, pop and release, making it easy to safely dispose of the used battery at a local collection point, while a new security lock feature allows users to lock their device when it is not in use.

To learn more about Blu Bar 1000, retailers should visit the new dedicated trade microsite, blubarhub.co.uk, which provides everything they need to know about the range

Yawer Rasool, consumer marketing director UK & Ireland, Imperial Brands

11 flavours, at an MRRP of £5.99* per device

“THE vaping category has expanded signi cantly and one of the leading trends is the sizeable shi towards disposables, which have gained popularity thanks to their simple, easy-to-use design.

“Although the disposable vapes ban announcement may have brought concern for retailers, it’s important to note that if the dra regulations pass through parliament, the ban is not set to come into force until 1 April 2025, meaning it’s business as usual for now.

“Despite the announcement, it’s unlikely that the demand for disposable vapes will slow down any time soon, so retailers should continue to stock a range of leading disposables, like our new Blu Bar 1000, which is the perfect solution for retailers looking to capitalise on this growing sector.”

IMPERIAL Brands has relaunched its Embassy Signature Silver Edition cigarettes for a limited time, with an updated packaging design.

The limited-edition updated Signature Silver variety now has a diamondshaped bore �ilter, to offer a unique smoking experience.

This is alongside reducedsmoke-smell paper and resealable foil packaging.

The relaunched cigarette carries a £12.75 RRP for a pack of 20.

Yawer Rasool, consumer marketing Director UK & Ireland at Imperial Brands, said: “As consum-

ers continue to seek out the greatest value for money possible, many adult smokers are increasingly buying tobacco products in the lowest price tiers.

“In fact, over a quarter of tobacco sales are now within the low-price tier and this is also the largest sector in growth. However, while shoppers are looking for value, many don’t want to comprise on quality.

“Through the launch of our Embassy Signature Silver Edition, we’re directly addressing both of these consumer needs with a completely unique product that offers exceptional quality and premium features from the well-known Embassy

CEREAL bar brand Nakd has partnered with �itness memberships provider ClassPass for an on-pack promotion offering shoppers the opportunity to win �itness memberships and thousands of gym classes and spa sessions via the ClassPass app.

The promotion runs until the end of July across 13 of Nakd’s bestselling multipacks, including its Protein range.

It coincides with a digitalled campaign running across Instagram, Facebook, TikTok and YouTube, which focuses on Nakd’s latest launch, Fruit & Fibre.

Jo Agnew, Nakd’s marketing director, said: “As the number-six brand in cereal

bars, and with 56% of cereal bar consumption occasions being around exercise, there is no doubt that this partnership will resonate with current Nakd fans and new consumers alike.”

BEAR has launched an onpack promotion with swimming school Water Babies to offer shoppers the chance to win free lessons for their children.

The promotion runs until September and is the �irst to launch across the snack brand’s Little Paws and Fruit Treasures ranges, which are aimed at children aged between two and �ive. It offers shoppers the chance to win eight free swimming lessons. It comes as Bear claims top spot for market share in the kids fruit snacking category, with a 39.4% value share and a 33.2% volume share, up by 6.2% annually.

The supplier and Water Babies are supporting the

brand, all at a great value price point.

promotion with social media activity and in�luencer marketing.

“The new packs will only be available for a limited time, so we’d recommend

that retailers stock up now to take advantage of the summer sales on offer while they can.”

SUPPLIER Gold Standard Nutrition (GSN) has expanded its frozen offering with the launch of Panko Breaded Chicken Bites.

The new variety is available in a 1kg bag with a £15 RRP and is undergoing trials in Spar and Co-op sites.

It is targeted at shoppers looking for frozen options that are higher in protein and low in sugar and salt.

Craig Allen, founder of GSN said: “Initially, our Panko Chicken gained a cult following on account of its starring role within our top-selling Chicken Katsu curry pot.

“Brand die-hards were forever telling us that it would make a welcome standalone addition to our Chicken Bites

range, so we �inally heeded their advice and took a leap of faith.”

QUORN has launched a summer snacking campaign.

The meat-free brand is running it until July, spanning TV, video, social media and out-of-home activations.

The TV advert sees a character named Perry T Pigg showing an audience of meat eaters the meat-free snacks.

The campaign comes after the brand recently

relaunched its Cocktail Sausages range with a new recipe.

Gill Riley, consumer director at Quorn Foods, said: “Quorn is the number-one brand in meat-free snacks where we are outperforming the category itself, and we’re on a mission to drive even more growth in this key recruitment sector.”

ONE STOP has launched 16 new bakery items.

The launch includes new bakery, bread and cake lines including Simply Doughnuts Mini Ring Bites, Cinnamon Buns, Tesco Raspberry Sponge and Chocolate Tray Bake.

Customers can purchase two items for £4 on a selection of items including

The symbol is also bringing in a range of protein bakery products, including Warburtons Protein Thin Bagels and Warburtons Protein Power. It is also partnering with local bakeries on new localised products.

FROZEN snacking brand Pukpip has launched Real Banana Bites, a range of frozen banana slices dipped in chocolate in sharing bags.

The vegan range has launched in Dark Chocolate, Peanut Butter and Milk Chocolate varieties, each at an RRP of £4.

Dark Chocolate and Peanut Butter are currently available to independent retailers through CLF Distribution, with the supplier saying it is looking to secure further listings for all three varieties.

Zara Godfrey, founder and managing director of Pukpip, said: “Our Real Banana Bites deliver on convenience as well as permissible indulgence, allowing more

consumers to treat themselves and their families, while getting more fruit into their diet.”

GRAZE has added two new products – the Snack Pack Crunch multipack and Honeycomb Oat Boosts �lapjack – to its healthier snacking range. The Snack Pack Crunch multipack is available in Smoky Barbecue and Marmite varieties, and contains �ive individual packs with an RRP of £3.

Meanwhile, the nonHFSS Honeycomb Oat Boosts �lapjack is now available to retailers, having become the number-one SKU on Graze’s online shop.

With an RRP of £1.20, it contains 50% less sugar than the average cereal bar and is high in �ibre.

Joanna Allen, Graze CEO,

said: “We want to ensure that our customers have suitable purchase options available, displayed in convenient and attractive places within stores, that appeal to their desire for high-quality produce, healthy ingredients and delicious �lavours.”

In partnership with

Mark McGuinness, marketing director at JTI UK, discusses how retailers can boost their tobacco sales this year through the Bestway Tobacco Club, and how suppliers can bene t from being a part of it

WITH the cost-of-living crisis continuing to put pressure on consumer spending, consumers are seeking value more than ever. Therefore, it is key for retailers to have a strong pricing strategy, particularly as 53% of tobacco shoppers say price is an important factor when purchasing in store1. Through the Tobacco Club, retailers supplied by Best-

way get access to the best deals and excellent promotional support from leading manufacturers such as JTI. By selling tobacco at or below MRRP*, retailers can o er customers competitive prices and consistent value, driving footfall and, as a result, maximising the fantastic pro t opportunity available to them.

WE know tobacco shoppers are loyal to convenience retailers, particularly if they can o er consistently low and competitive prices. Shoppers, on average, visit stores 3.7 times a week, and 2.9 of those times are to buy tobacco products2.

With seven in 10 existing adult smokers saying brand is the most important factor when purchasing tobacco products2, stocking wellknown brands has never been more important.

JTI remains the numberone tobacco manufacturer in the UK, and being a part of the Bestway Tobacco Club gives retailers access to wellknown brands, including Benson & Hedges and Mayfair, at

1 2

Growing tobacco sales by pricing competitively

“Everyone is looking for value at the moment, so by offering well-known brands, at a competitive price point, we’ve seen a positive increase in our tobacco sales. It enables us to keep customers satis ed and stand out from our competitors.”

Impact on overall shopfloor sales

“If shoppers know a store for stocking products that o er more value for money, they aren’t going to go to one store to buy tobacco and another for a pint of milk. Being able to o er consistently low prices has resulted in a positive impact not only in our tobacco sales, but our overall shopfloor sales, too.”

3

Driving repeat purchases

“As shoppers now recognise us as a place that has competitive prices, we have been able to build a really strong customer base, with loyal customers who regularly come back to the store.”

even better value, o ering a signi cant opportunity to maximise sales.

Richard Booth, director of trading at Bestway, explains the club’s objective is to get retailers access to the best deals to drive consumer footfall into their stores. “It’s great to have the support from JTI, a leading manufacturer in the industry,” he says.

“Within the current challenging market, there has never been a better time for retailers to change the way they trade. Being able to capitalise on these propositions by leveraging brand heritage with a competitive on-shelf price point enables brands to help retailers make the most of this category.”

SIGN UP

For further information on the Bestway Tobacco Club and how to maximise pro ts, retailers can contact their local Bestway depot manager

ENERGY drinks brand

Sneak Energy is launching a major out-of-home campaign this summer backed by an investment of more than £500,000.

The campaign includes outdoor advertising across the north-west, East Midlands and Scotland, as well as the brand’s �irst TV advert on Sky.

There will also be appearances at music, gaming and pop culture events throughout this summer, as well as sampling to university students throughout freshers’ week this September.

The brand expects to reach more than six million con-

sumers and offer more than 100,000 samples.

Chris Smith, partner brand manager at Sneak’s distribu-

tor World of Sweets, said: “[The campaign] is a positive way to communicate with existing customers and reach

those potential shoppers who enjoy energy drinks and are looking to try something new.”

SUDOCREM has unveiled its ‘Not Just for Babies, for Everybody’ campaign.

The campaign sees the brand expand its positioning from exclusively being a nappy rash treatment.

tial and cherished brand in households around the world.

PORK Farms has added a four-pack Mini Ploughman’s Pork Pies with Cheese & Pickle to its range.

The four-pack is an expansion of Pork Farms’ successful Four Mini Pork Pie range.

In the advert, adults use the cream to soothe cuts, grazes, eczema and acne spots.

The campaign is being rolled out in more than 15 international markets, including the UK and across Europe.

It marks the �irst time the brand has aimed to target a wide range of consumers other than parents.

Nicholas Lang, director of global OTC marketing at Teva Pharmaceuticals, said: “Sudocrem has �irmly established itself as a versatile, essen-

“While our messaging has historically focused on its soothing treatment of nappy rash, it’s about time we recognised the many different people who swear by our product.”

COFFEE roaster Lost Sheep Coffee is moving into the ready-to-drink (RTD) category with the launch of Iced Latte and Iced Mocha varieties.

Both varieties are made with the supplier’s Get To The Hopper coffee, a blend of Brazilian and Colombian beans. They are also made with skimmed milk and are under 85 calories a can.

Independent retailers can

stock the range from Amazon, Lansdell Soft Drinks and Chapple & Jenkins.

Stuart Wilson, founder of Lost Sheep Coffee, said: “With Gen Z consumers more likely to drink RTD coffee than hot coffee, the category is buzzing, yet right now there isn’t another brand using ‘farm-to-can’ traceable, specialty grade beans in an RTD milk-based coffee format.”

The ingredient combination of cheese and pickle has been developed because of its association with pork pie eating occasions.

It aims to tap into summer snacking occasions such as picnics or at home parties.

Nick Partridge, marketing manager at Pork Farms, said: “We look forward to encouraging people to see the pork pie as more than a monthly treat, but as a regular snack or part of a light meal they can enjoy.”

CADBURY has partnered with Alzheimer’s Research UK to create memory bar boxes.

The boxes have been created in response to requests for old Cadbury packaging to help stimulate conversation and support memory activities for people living with dementia and their loved ones.

The launch forms part of the brand’s partnership with Alzheimer’s Research UK to support the charity’s mission in accelerating progress towards a cure for dementia.

Three thousand boxes will be distributed to care homes and Alzheimer’s Research UK supporters throughout Dementia Action Week, with 1,000 available for those caring for loved ones at home.

There are almost one million people living with dementia in the UK today and analysis from Alzheimer’s Research UK con�irms it to be the UK’s biggest killer.

FRUBES’ Freeze ’Em campaign is back for 2024.

The campaign encourages consumers to try freezing their Frubes and is supported with its biggest-ever investment, which includes three limited-edition packs, sampling, social media and PR activations.

The launch supports its three Frubes limited-edition Try Me Frozen packs, which are available now, each containing calcium and vitamin D. A new online game has also been released to further engage customers.

Ewa Moxham, head of marketing at Yoplait UK, said:

“Last year’s Freeze ’Em campaign was hugely successful. We saw 34% more consumers purchasing Frubes during the campaign period, and this year we are making the activation even bigger.”

WILKINSON Sword has unveiled new branding and packaging to promote its Hydro range.

Hoping to overcome the decline of the razors and blades category, Wilkinson Sword is aiming to recruit more men and encourage them to shave more often.

‘The Blade Master’ will be introduced for the �irst time this summer in a new advertising campaign, which aims to inject fun into the category.

In store, Wilkinson Sword will be transforming the men’s shaving �ixture with new packaging to focus on the blade.

Euan Condron, brand manager at Wilkinson Sword said: “Men’s shaving needs a rethink and the category is never going to grow if we maintain the status quo. This rebrand is the most signi�icant in our 250-year history.”

CHEWITS has shaken up its confectionery offering with Chewits Jewels, which is its biggest launch yet. Available in both Fruity and Xtreme Sour varieties, Chewits Jewels are the brand’s �irst pyramid-shaped soft gummies.

The launch is being supported by a campaign that aims to target a wider range

MILKSHAKE brand Shaken

Udder has launched a new marketing campaign that showcases the brand’s core range of on-the-go 330ml milkshakes.

The milkshakes come in seven different �lavours including Chocolush, Vanillalicious and Strawberry Dream.

The TV advert shows the brand’s use of real ingredients in its milkshakes by using images of real Belgian chocolate and real fruit.

The multimillion-pound media campaign includes four weeks of out-of-home advertising and is predicted to reach 35 million adults.

It also spans digital, social

media, in�luencer, sampling and retailer activations.

Jo Abram, marketing director at Shaken Udder, said: “Our adult lives are packed full of ‘grown-up-isms’ that can make life feel quite heavy. We want to sprinkle a bit of positivity and playfulness into grown-ups’ everyday lives through a light-hearted advertising campaign.”

BEBETO is tapping into the super sour trend with the launch of Fizzy Whizzy Weenie Worms.

The sour sweets are available in 150g sharing bags in three �lavours, including Apple & Lemon, Strawberry & Orange and Blackcurrant & Raspberry.

Made with real fruit juice and natural colours, the halal-certi�ied sweets come in plain and £1 pricemarked packs.

The product is stocked at Bestway, Dhamecha, A G Parfett & Sons Ltd and James Hall & Company Limited.

The launch aims to tap into sharing occasions. It comes as confectionery sharing bags are in growth.

of audiences through incorporating nods to the Chewits ads of the ’70s and ’80s.

The campaign spans social media, in�luencer and out-ofhome activations, along with its �irst TV advert in more than 14 years.

The supplier noted that Chewits Jewels will be made available to more retailers throughout the year.

MOLSON Coors Beverage Company has launched a new ‘Paint your Pint’ campaign, offering fans of Madrí Excepcional the chance to win exclusive prizes, including a trip to Madrid.

The campaign celebrates the launch of the beer brand’s new limited-edition glass, designed by renowned Madrid street artist Sokram, famed for his colourful and multidimensional art that stands out from its surroundings.

Live now until September, customers that buy promotional packs of Madrí Excepcional at selected convenience stores across the UK will receive one of the limitededition glasses as a gift. The promotion accompa-

nies the brand’s return to TV screens this summer, with a campaign spanning social media and in�luencer events.

RETAILER OPINION ON THIS FORTNIGHT’S HOT TOPICS

What do you think? Call Retail Express on 020 7689 3357 for the chance to be featured

Pricewatch: see what other retailers are charging for biscuits and cakes, and

SHOPPERS: How are you avoiding pricing errors on shelf?

“WE changed the size of the labels on our shelves, and this has reduced issues. I’ve made the pricing labels on shelves 30-40% bigger, and I get my staff to double-check everything once a price �ile has come through from my EPoS company or when we receive a delivery.”

Amy Sohal, Premier Ken’s Convenience, Winsford, Cheshire

“WE’VE had customers discover an error at the till. The best thing to do is to apologise and honour the pricing. It’s vital we check pricing once a week. I get staff to check when tickets have exceeded a certain date. We also look at speci�ic sections each week.”

I get my sta to doublecheck everything

RISING COSTS: What impact are they having on news & mags buying habits?

“WE have noticed a rise in customers phoning up to change their delivered orders due to rising prices. It’s been happening regularly for the past two or three months. Mostly, I have seen people switching to the Daily Mail, away from other papers.”

Hemel Patel, Tring News, Hertfordshire

“THE i approached us about their free copy giveaway campaign. We’ve got 50 copies a day for a week, and we’re in the process of making sure we target customers who left our home news delivery rounds because the prices were too expensive, but also brand-new customers.”

Vince Malone, Tenby Stores & Post Of�ice, Pembrokeshire

REFRESH: How are you revamping your store without breaking the bank?

“WE grew sales by 20% after improving the layout. We added a chiller of lunch and snacking lines adjacent to our hot food to go, alongside expanding our soft drinks. We also rearranged our fresh ranges and thought about what placements make sense.”

Nishi Patel, Londis Bexley Park, Dartford, Kent

“WE reduced our red wine and ale offering after noticing the margins weren’t performing well according to our EPoS data. We invested in 150 vape lines and expanded our nextgen nicotine range with heated tobacco.”

Vinal Patel, Jimmy’s Store, Northampton

EXTERNAL: How are you generating profit from outside your shop?

“IN the summer, we sell plants outside, which brings in around £100 every week. I can get them for £2 and I’m selling them for £5.99, so the margins are good. It depends where you are, but it’s possible to get plants very cheaply from local suppliers.”

Milan Vahanaha, Heathcote Express & Post Of�ice, East Grinstead, West Sussex

“WE sell three types of compost, cages of Calor Gas bottles and lots of plants. Between 25-30% of our sales come from outdoor plants. We also have three free clothing banks, which helps us raise money for the Making a Difference Locally charity.”

Helen Eichler, Gwilliam’s of Edington, Bridgwater, Somerset

I HAD a cash machine with DC Payments, which was acquired by Cashzone. The machine was previously free, but Cashzone then began charging 95p a transaction, and then charging the retailer £1.95. I was promised a new, freeto-use machine if I signed a new contract. I did and the transaction fee stopped, but

I continued being billed by Cashzone. I was receiving bills for £250 a month, which has equated to more than £2,500 over time. When I enquired about it, I was told I didn’t need to pay for it, and it was just an ‘admin thing’. Naturally, this concerned me as I don’t like the thought of being charged, rightly or

COMMUNITY RETAILER OF THE WEEK

Trudy

‘I camped out for homeless veterans’

“IT’S not about money, it’s about highlighting certain things in our community that are o en hidden. A lot of homeless have been veterans. They were trained in forces to be self-su cient and can feel ashamed to ask for help. There’s so much out there for them. We slept out one night for Royal British Legion – my experience was nothing like what they must cope with, but it makes people aware. I’ve been member of the British Legion for 43 years – it’s one of my passions as well as retailing.”

wrongly, for so much money. I did get through to someone who sent me back my statements marked as ‘nil’. It seems as though this has been sorted, but no one will tell me where I am in my contract, or when it ends –so I’ve been left in the dark. I’m nervous that when my contract renews, I’m going to start seeing charges

on there again.

Jai Singh, MJ’s Go Local Extra, Shef�ield

A spokesperson for Cashzone responded: “We are unable to discuss individual contracts, but we will continue to communicate with our customer to identify a resolution.”

COMMUNITY RETAILER OF THE WEEK

‘I

repurpose plastic waste into pro t’

“I’VE partnered with Polythene UK, who come and pick up my recycling waste for free, and then deliver it back in the form of rubble bags. I then sell these onto customers. Sustainability wise, we’re doing our bit. We have around six deliveries a week. We buy the rolls of bags made from waste for £1.50 and then sell them to customers for £2.50. At the current rate, doing this could deliver £500 in additional annual pro t. The bags have high margins.”

RETAILING is a balancing act; you have to be able to have a solid core range of products, but also be flexible enough to keep your eye on what new products are trending and get them in store and available for your customers.

This leading retailer shares her thoughts on the challenges in the sector

Recently, I have been spending many hours scrolling on TikTok (it is so easy to lose an a ernoon to the For You page) to nd out what the Gen Z kids are going crazy for. We have found that people are willing to buy a trending product, regardless of price, just so they can tell their friends or post on their socials saying that they have it. In many cases, they don’t even like the taste of these products, but will still buy them so they can shout to the world that they are up to date with trends – it is madness. It’s all about that exclusivity, just like we saw with Prime.

Over the past few months we have brought in a range of products that have been trending online, such as Freeze Dried Sweets, Mogu Mogu, MrBeast Chocolate, Kimade –the list goes on. We have displayed these products on the end of our front bay so that customers see them as soon as they walk in the door.

These kinds of disruptions are fantastic for impulse buying, especially when you change the products on the front end quite o en to keep interest up. For example, one week we will have a range of cleaning products and toilet rolls on o er to attract a certain type of customer, then the next week our home-made hampers will be on display to again generate some more business in a di erent category.

This keeps our customers looking at that bay every time they come in the door to see what we have on o er this time. The more you can change up your mega deals, the better, because looking at the same display for weeks on end is just as boring for the customer as it is for you.

My advice to other retailers would be to get online and have a look at what your customers want. Ask them questions and try to link up with other local businesses to provide an even more unique range of local goods. This will make your customers feel pretty special.

The RETAILEXPRESS team nds out how to get your core ranges right with ve major suppliers

WHEN it comes to creating a successful independent convenience store, retailers will o en point to the categories that provide a unique point

of di erence. But these are categories that are standing on the shoulders of giants. There is unlikely to be a convenience store in the UK that doesn’t rely heavily on the biggest, key categories, such as tobacco, nextgen nicotine, snacks, confectionery and so drinks. But just because these are universally popular categories, it doesn’t mean that retailers can’t be doing more with them. Availability, variety and range building can all ensure

JTI UK will have plenty of advice on getting your tobacco ranges right for your customer base. When it comes to crisps, snacks and nuts, KP Snacks is on hand to provide insights on the latest trends, flavour preferences and advice for a successful summer and beyond. Sugar confectionery continues to be popular and to evolve in a variety of directions. The insights from Swizzels will help retailers navigate them to build a range that attracts attention. And nally, the huge so drinks opportunity will be explored by Coca-Cola Europaci c Partners. nicotine, confectionery and so But

that customers get what they want from your store. Using the right merchandising, promotional and advertising techniques can get these key products in front of more faces and increase return visits and basket spend. Over the next ve pages, Retail Express will be sharing some of the best advice on core categories from leading suppliers. With a disposables ban looming on the horizon, BAT UK will explore one of the alternatives that retailers can turn to – nicotine pouches – and how retailers can use them to replace disposables in time.

• Velo Strawberry Ice (Mellow 6mg & Original 10mg)

In partnership with

• Velo Tropical Ice (Mellow 6mg & Original 10mg)

• Velo Cherry Ice (Mellow 6mg & Original 10mg)

THE nicotine pouch category continues to see growth year on year, with a 50% rise in sales volume when looking at a year-to-date comparison from 2023 to 20241. With the popularity of nicotine pouches steadily increasing, it provides an opportunity for independent retailers to increase their sales within alternative nicotine products. Velo is for 18+ existing nicotine users only. It is totally tobacco-free with no smoke, no smell, no vapour2 and is available in various flavours. And the best part? Unlike vapes or cigarettes, nicotine pouches can be used anytime, anywhere, as Velo allows adult nicotine consumers to enjoy the product wherever they like – in cinemas, at gigs, in the o ce, on the train or a plane. Velo is also the number-one nicotine pouch brand in the UK3 .

VELO nicotine pouches come in all sorts of flavours and strengths. Adult nicotine consumers can choose from Crispy Peppermint, Bright Spearmint, Freezing Peppermint, Ruby Berry, Tropical Mango, Purple Grape and Creamy Latte varieties. The packs have been given a fresh new out t, so it’s even easier for adult nicotine consumers to spot them on your shelf. But as we all know, it’s what’s inside that counts, so rest assured that everything inside Velo nicotine pouches is as weirdly wonderful as always.

RETAILERS should get to know their customers’ flavour preferences, and their level of nicotine consumption. It’s important to stock a range that caters for all: new users would be suited to Mellow 1-2 dots (4-6mg), regular users Original 3-4 dots (6-11mg), and for the more experienced users, Intense 5-6 dots (8-17mg). Retailers should group brands together in order of flavour and strength, and have their display in a well-lit area, ideally behind the counter.

1Nielsen IQ total coverage sell out data, YTD W/E 20.04.2024, 2This product is not risk-free and contains nicotine, an addictive substance. For adult nicotine consumers only, 3Based on NielsenIQ RMS data for the Nicotine Pouches category for the 18-month period ending 30.12.2023 for the UK total retail market (Copyright © 2023, NielsenIQ)

* Based on NielsenIQ RMS data for the Nicotine Pouches category for the 18-month period ending 30/12/2023 for the UK total retail market (Copyright © 2023, NielsenIQ) **This product is not risk-free and contains nicotine, an addictive substance. For adult nicotine consumers only.

In partnership with WHAT ARE THE LATEST TRENDS WITHIN SOFT DRINKS?

SOFT drinks is the third-biggest category in convenience, worth nearly £3.4bn annually1, and a primary footfall driver for stores2. Merchandising food and drink together can double shopper engagement and increase sales by up to 32%3

Stocking sharing packs of so drinks alongside meals and snacks can help shoppers grab everything they need for a summer barbecue or meal for tonight, while displaying single cans and bottles in chillers next to sandwiches can drive incremental sales.

BIG brands remain key – and that includes Coca-Cola, the number-one so drinks brand in Britain1; Fanta and Dr Pepper, the number-one and number-two flavouredcarbonates brands1; Schweppes, the number-one mixers brand in convenience2; and Monster, which continues to deliver double-digit value and volume growth in Britain4

The ready-to-drink chilled co ee sector is up 9.4% in convenience5, with sales peaking during summer6. The nation’s favourite co ee shop brand, Costa Co ee7, o ers a range of Lattes, Flat Whites and Frappés. More than half of energy drinks are sold through convenience8, and last year Monster drove 59% of total energy-category growth9.

HOW CAN RETAILERS GET THE MOST FROM SOFT DRINKS?

GIVE major brands like Coca-Cola, Fanta and Monster enough space to avoid out-of-stocks while also making space for new launches.

Over 20% of so drink sales are colas in Britain10, so dedicate roughly a quarter of your chiller to cola –including zero-sugar options such as Coca-Cola Zero Sugar and flavoured colas such as Coca-Cola Lemon, with and without sugar.

• Swizzels Squashies

Original

£1.15 PMP

• Swizzels Squashies Sour Cherry & Apple

£1.15 PMP

• Swizzels Scrumptious Sweets

£1.25 PMP

SUGAR confectionery is worth £1.6bn, growing by 16.2%1, and the category has long since had a reputation for being one of the best performing, as customers are likely to make impulse sweet purchases. Research indicates an increased desire for new, innovative flavours, but also an increase in consumers choosing nostalgic products. Swizzels’ incredibly well-received new Squashes Strawberry & Cream variety has also highlighted that consumers are still keen fans of traditional flavours.

There is also a growing demand for vegan confectionery correlating with the rise of plant-based diets. Swizzels has ensured that the majority of its product range is vegan, so its sweet treats can be enjoyed by a broad demographic.

SWIZZELS products are worth £96.6m in the market, growing by 5.2% over the past year1, with £27m of this value coming from symbols and independents. Figures like this highlight just how popular Swizzels products continue to be, and how they have become an integral part of any retailer’s range.

With Squashies being the number-one sugar hanging bag brand in the market1, it’s important that retailers stock a full range, or if space is limited in store, ensure that the Squashies Original 120g is a key line to ensure that consumers’ needs are being met.

Taking the opportunity to stock other lines, such as Scrumptious Sweets, Luscious Lollies and Curious Chews, also means retailers will bene t from having a vegan range.

RETAILERS can maximise sales by having plentiful stock of their listed products. They should also focus on adding confectionery lines to locations where related items are stocked, such as drinks and crisps, to increase the chance of impulse purchases. Ensuring sweets are a key focus during seasonal changes is also key – warm weather o en steers consumers away from chocolate and into products which won’t melt, such as sweets.

AS shopper demand for value tobacco continues to gain momentum because of the cost-of-living crisis, the value and ultra-value price sectors continue to grow1 as shoppers seek out lower prices.

With the ultra-value category currently boasting the fastest share growth1 and 60% of all sales volumes of tobacco in this sector2, the category o ers a signi cant opportunity for retailers to maximise sales. With existing adult smokers increasingly looking for premium quality at an ultra-value or value price point, brands must continue to innovate to meet demand and help drive sales.

RESPONDING to the demand for value with well-known brands like Benson & Hedges, Sovereign and Mayfair all at ultra-value price points, JTI remains the numberone tobacco manufacturer in the UK, holding a leading combined market share of 44.3%3

Building on this success, last year JTI launched Mayfair Gold to o er existing adult smokers even more value for money.

At an RRP of £12.75*, Mayfair Gold and Mayfair Silver are now among JTI’s lowest-priced cigarette brands. Mayfair Gold has had a hugely successful introduction, selling 1.5 million packs since launch4

CAN RETAILERS GET THE MOST FROM TOBACCO?

BY stocking a full range and maintaining good availability of products, retailers can provide a successful o ering to their customers. Having up-to-date knowledge on tobacco trends enables retailers to provide a good level of customer service. Reach out to JTI’s business advisers, who can help identify opportunities and o er advice. Retailers can nd their local JTI business adviser by calling JTI’s customer care line on 0800 163 503.

1Circana Market Place, Volume Share, Total Tobacco Category, Total UK, over the past 12 months to Dec 2023 (based on slope calculation), 2Circana Market Place, Volume Share, Total RMC Value & Ultra Value and Total RYO/MYO Combined, Total UK, Dec 2023, 3Circana Market Place, Volume Share, Total Tobacco Category, Total UK, Dec 2023, 4Circana Market Place, Unit Sales, Mayfair Gold, Total UK, September 2023 to January 2024 *RRP as of April 2024, retailers are free to sell JTI products at whatever price they choose

CHARLES WHITTING nds out how to make food to go work, no matter the size of your store

THE FOOD-TO-GO OPPORTUNITY

FOOD and drink to go as a convenience-store concept is growing like never before. Hybrid working has resulted in people being on the move in more areas than pre-pandemic and the cost-of-living crisis has seen people avoiding the on-trade when eating out of home. With summer here and more options available each week, that opportunity is getting bigger.

“Brits are rmly on the move again and they are looking for snacks to enjoy,” says Nic Storey, senior sales director for impulse and eld sales at PepsiCo. “Out-of-home snacking makes up 19% of all snacking occasions. There

is a signi cant opportunity for retailers to capitalise on on-the-go occasions and encourage spend – particularly through meal deals, which can o er value and convenience to shoppers.”

There are food-to-go o ers for retailers of all sizes, but the more you invest, the better the potential for driving footfall and growing margins.

“Food to go is a really important category and a lot of retailers aren’t doing it yet,” says Sunder Sandher, from S&S One Stop, Leamington Spa, Warwickshire. “It’s got very high margins Now is the time to start small and work your way up.”

Andrew Robinson, Summer Lane Stores, Wombwell, South Yorkshire

“WE do all sorts of food to go. We make our own sandwiches, pre-pack them and put them in the deli. We’ve got paninis, bacon and sausage baps, jacket potatoes and pies. And we also source other sandwiches, cream cakes and cheese cakes externally. We get pork pies from a local butcher.

“When you make your own sandwiches, you’re looking at 25-40% margin, but you’re always going to get some wastage. We reduce prices depending on how far we are from the best-before date, because I’d rather reduce it and give someone a bargain than just get rid of it. We have all our labels done by a printer with all the allergens and ingredients on them.

“Food to go is important. People might come in at lunch for a sandwich and a Mars bar and that will prompt them to come back that evening for a case of beers.”

FOOD and drink to go covers a wide array of options and every shop can o er it to some degree. Ultimately, a single chocolate bar and a can of pop represents food and drink on the go. This means that, while

not every retailer can install a fully fledged kitchen or hotfood-and-drinks machines, they can o er food to go.

“How extensive a retailer’s food-to-go option can be will depend on the space they have

available,” says Phil Carratt, head of marketing and strategy at Country Choice.

“Stores that are tight for space should consider combined display units that can accommodate hot and ambient

products. Countertop hot-hold units are also good for smaller stores. If space is not an issue, and the footfall justi es it, then separate full-sized hot and chilled cabinets should be considered.”

BEYOND single packs of snacks, confectionery and soft drinks, retailers can extend their o er to include something approaching more of a meal.

Sandwiches are a lunchtime staple in the UK, and there are lots of options for how retailers can build a sandwich o er to complement their food-to-go options.

“We have a one-metre fridge at the front of the store which is lled with sandwiches and snacks on the go,” says Reuben Singh Mander, from the Three Singh’s in Halifax, West Yorkshire.

“We don’t currently have any hot food, but we want to introduce a meal deal. We’re just working out the maths on it to see if we can make it worthwhile. It’s a good entrylevel way of getting into it.”

Singh Mander uses Eden Farms through Parfetts and

gets his sandwiches prepacked on a sale-or-return basis. This means that, in exchange for slightly lower margins, he can order one of each, and there is no wastage concern.

In a cost-of-living crisis, meal deals can serve to boost basket spend for retailers while also providing good value to customers.

specialists, instead looking

“Latest research tells us that shoppers buying lunch are looking to save money,” says Oliver Richmond, senior brand manager for snacks and spreads at Bel UK. “People are shunning foodservice specialists, instead looking to convenience stores for their midday meals.

“This makes it more important than ever for convenience stores to o er a broad selection of food to go that meets the various need-states of shoppers.”

WHEN it comes to food to go, most people are in a hurry and looking for something simple. They don’t want to have to wander the aisles looking for their lunch. Keeping products close together, highly visible and, ideally, close to the shop front will help to entice customers in and encourage a big-

ger basket spend.

“Ensure products are blocked by soft drinks category and merchandise products by pack size to limit any confusion,” says Adrian Hipkiss, commercial director at Boost Drinks. “Ensure bestsellers are at eyeline in the chiller. Retailers can also maximise

space by increasing vertical facings as well as horizontal and maximise space in the chiller by placing large packs in ambient space.”

Singh Mander recommends positioning food to go prominently at the front of the store to help customers get in and out more easily, but also to put

the o er in their mind.

“If the fridge is in a highfootfall area or near the front of the store, then they’ll probably see it,” he says.

“They know you have that option available. Even if you don’t get the sale that time, it’s building that pro le to that customer.”

Matt Collins, sales director, KP Snacks

“WEEKDAY lunchtimes are the most popular time for eating on the go, with 62% of consumers saying they enjoy picking meal-deal combos. Retailers should look to create value by understanding customer expectations, whether through premium or value o erings. Fi y-three per cent of shoppers look for meal deals when buying food to go and 34% of shoppers say they would pay more than £5 for meal deals if the products were high quality.

“Many o ce workers have not gone back to the o ce full-time. Hybrid workers may view food to go as more of a treat if purchasing less frequently and will likely be willing to spend more, meaning there is opportunity to create premium lunch deals catered to part-time o ce workers.

“‘Tide me over’ is an increasingly important on-thego snacking opportunity. Whether during the school run, evening commute or the lunchtime zoom call, 64% of consumers eat snacks to keep their energy up throughout the day, and 53% eat snacks to satisfy hunger between meals.”

Suppliers share their advice for top food-to-go performance

Snacking

“With the typical customer pushed for time and not wanting to spend ages looking for what they want, retailers can capitalise on impulse purchases by making sure pot snacks are highly visible and located in high-tra c areas,” says Lucy Richardson, Unilever UK category manager.

Biscuits

“Your main biscuit bay will ideally be near complementary categories like hot drinks and savoury snacks,” says Colin Taylor, trade marketing director at Fox’s Burton’s Companies UK. “Event zones can help shoppers see how di erent products connect – for example, try shelving Fox’s Fabulous Chocolatey Rounds with hot chocolate.”

Hygiene and allergens

“The preparation, safety, quality and merchandising of food to go is vital, as is attention to all relevant legislation, such as that relating to Natasha’s Law,” says Phil Carratt, head of marketing and strategy at Country Choice. “We have just appointed an allergen ambassador and part of their role is to ensure that our sales team is fully trained on potential allergen risks when preparing food in store so that they are able to share this knowledge with our customers.”

Healthier options

“The healthier snacking market has risen signicantly over the past year with a 15% increase in market growth and an estimated overall worth of £148m,” says Kathryn Hague, head of marketing at Hancocks. “Retailers need to keep on top of this growing trend to ensure they have the right products available for the growing health-conscious audience.”

BEYOND pre-made sandwiches and chocolate bars lie the opportunities from machines from the likes of Costa Co ee and F’real, or hot and cold food stations from Fri-Jado where frozen pasties and pastries can be defrosted and displayed. Beyond that, there is scope to take things even further with food to go.

“I’ve been to some food

shows and gathered information,” says Uthay Soundararajan, from Costcutter Inverleith in Edinburgh.

“Going forward, the café is coming into the convenience store. There are funds there from the Post O ce. We use locally produced meat to cook in the ovens and we’re getting a Go Local grant which funds half the money and reduces food

miles. I’ve applied for that and I’m going to get the funding to get the machine. I would like to do food to go in this shop. It has big potential.”

Jack Cross, manager of Warner’s in Upton-upon-Severn, has hot and cold holding display units and a small grab & go unit from Fri-Jado, allowing him to o er a wide range of food-to-go options through-

out the day. He is also taking things a step further.

“We recently appointed a chef, who works in store to produce delicious meals throughout the day,” he says. “We see a real opportunity with the 4pm-6pm period, where freshly prepared, seasonal meals to go, or even doing themed evenings, such as pizza pop-up nights, is doable.”

WITH most of us eating three meals a day, there are three key selling opportunities for retailers when it comes to food to go, and to grasp them most e ectively, they will need to adapt their ranges as the day progresses.

In the morning, a hot-andcold-co ee o er supported by a range of pastries, cereal bars and hot sandwiches like bacon baps can drive sales from hurrying commuters on their way

to work.

Sandwiches, soft drinks, confectionery and a host of other hot and cold food options can turn your store into a lunchtime destination for customers.

Having a good range of small evening meals and snacks alongside ready-to-drink (RTD) alcoholic options can o er an extra boost to sales at the end of the day.

“Canned RTDs have been

met with an explosion of popularity and this is set to grow even further as we head into the summer season,” says Jo Taylorson, head of marketing at Kingsland Drinks.

“The beauty of these products is that the single-serve measures encourage trial and experimentation. It is an extremely cost-e ective way for consumers to try new flavours, products and brands, plus they’re portable.”

Schulstad Bakery Solutions has added a new Fruit Danish Selection of on-the-go pastries.

The range includes Morello Cherry & Almond Bakewell, which is topped with toasted almonds and a drizzle of icing; Apple & Cinnamon Custard, which is topped with a caramelised biscuit crumb; and Rhubarb, Madagascan Vanilla Custard & Meringue, which is topped with sweet crunchy pieces of meringue.

Crisps

Walkers’ premium crisp range Sensations has launched two new flavours – Mature Cheddar & Chilli Chutney and Crushed Sea Salt & Black Peppercorn. Mature Cheddar & Chilli Chutney will roll out in 150g (RRP £2.50) and 40g (RRP £1) bags; and Crushed Sea Salt & Black Peppercorn will roll out in 150g (RRP £2.50), 65g PMP (RRP £1.25) and 40g (RRP £1) bags.

Snacks

PepsiCo has launched its new Extra Flamin’ Hot platform. The three-strong range covers Doritos, Walkers Max and Wotsits Crunchy. The UK’s desire for spice ranks as the second-highest in Europe, with 51% saying they love spicy food. Extra Flamin’ Hot is available in sharing bags and PMPs. The sharing bags have a RRP of £2.50, and the PMPs have an RRP of £1.25.

The existing Flamin’ Hot range across Monster Munch and Cheetos has been rebranded as Sweet & Spicy Flamin’ Hot.

Energy drinks

Coca-Cola Europaci c Partners is adding a Fruit Punch variety to its Relentless energy drinks range. The new tropical flavour has been launched to help drive summer sales of Relentless, in plain packs and £1 price-marked packs.

Chocolate

Nestlé has announced the return of its KitKat Chunky White with Lotus Bisco alongside new KitKat White four- nger and Chunky variants. KitKat Chunky White with Lotus Bisco has an RRP of 75p.

RIO is a refreshing, delicious blend of ve tropical flavours, inspired by the fruits of the South American rainforest. This fruit carbonate capitalises on the rising demand for drinks that incorporate provenance and nutritional bene ts, as consumers increasingly look for added health bene ts from the products they choose1.

With its 11% real fruit juice content and source of vitamin C, Rio is a top- ve-ranked product in fruit carbonates and is in the top three rate of sale of all fruit carbonates2. Data shows ‘tropical’ is the secondfastest-growing fruit flavour in the category, while Rio, which contains exotic guava and passion fruit, is growing by 3% year on year3

Add a tropical twist to your fruit carbonates selection with RIO, and see how its fruity flavours, reduced-sugar product and multiple formats can help boost pro ts

Tina Patel, East Ham Newsagents, east London

Tina Patel, East Ham Newsagents, east London

Rio o ers exciting growth opportunities for retailers. Its range of products includes Rio Tropical (330ml can, 500ml bottle and 1.5l bottle) and Rio Tropical Light (330ml can), all of which o er options to suit varying consumer needs.

“RIO and its tropical flavours are a huge hit with our customers, and the 330ml Rio Tropical can is one of our biggest sellers when it comes to carbonated so drinks. Despite typically coming across as a summer drink, we’ve seen that Rio maintains a strong rate of sale even through the colder months and is o en grabbed as an impulse purchase by customers as they walk past the fridge on their way to the till. I admit, Rio is also one of my personal favourite drinks.”

ANNE BRUCE nds out where pro ts can be driven through babycare and how retailers can grow basket spend

BABYCARE items are often distress purchases in convenience stores, where the parent or carer needs baby wipes to mop up for a spillage or a new dummy as one has fallen on the way to the park.

Swarti Rabadia, from One Stop Rabadia Convenience in Leigh, Greater Manchester, says formula milk, wipes and nappies are her must-stocks. For nappies, Pampers is the only nappy brand on sale, due to space constraints.

Baby wipes are the key line in babycare, according to Suki Athwal, of Shop Around the Clock in Tenterden, Kent. He has three varieties, including Pampers and Co-op own label.

Baby soothers and bottles also sell well. He also stocks a variety of formula milks, and 10 types of food pouches, two of which are organic.

Although babycare in general may not be the fastestmoving category in store, it is a necessary one to keep well-

stocked with a good crosssection of everything that a customer might need in an emergency.