Retailers

Buckinghamshire

12-25 MARCH 2024 STRICTLY FORTRADEUSERSONLY P3 • New vape duty to wipe out sales and margins, while gov’t stays silent on retailer calls for support • Inside: National Insurance cuts, alcohol- and fuel-duty freezes, and more… SPRING BUDGET: BANNED, TAXED AND IGNORED

P2 P26 Educate your sta and customers on alternatives ahead of disposables ban P4

PARCEL FIRM FRUSTRATION

RETAIL CRIME

retailer le hospitalised a er brutal axe attack in their shop VAPE LEGISLATION

er

contracts

accuse Evri of ‘leaving them high and dry’ a

ending

Have you been affected by the recent Floods? Are you struggling to stay warm and cover your heating bills during the colder weather? For more information visit www.newstraid.org.uk call us FREE on 0800 917 8616 or email mail@newstraid.org.uk NewstrAid is here to help and can provide FINANCIAL, EMOTIONAL and PRACTICAL support to retailers and their staff this winter.

CATEGORY ADVICE CRISPS & SNACKS 20 MARCH betterretailing.com CRISPS AND SNACKS OPPORTUNITIES SNAP UP CRISPS AND SNACKS PRIYA KHAIRA nds out what opportunities exist in the crisps and snacks category and what the top-performing lines are Walkers new flavours range: Mature Chilli Chutney and Salt Black varieties have £2.50. Nakd is expanding portfolio healthier the addition Fibre bars, available Cinnamon and Raspberry flavours Pringles replacing Sizzl’N range with Kickin’ Sour Cream Chilli flavours are available independents at Fridge Raiders Poppers range CATEGORY NEWS New products 12-25 MARCH 2024 STRICTLY FORTRADEUSERSONLY • New vape duty to wipe out sales and margins, while gov’t stays silent on retailer calls for support • Inside: National Insurance cuts,alcohol- and fuel-duty freezes, and more… PARCEL FIRM FRUSTRATION P2 P26 Educate your sta and customers on alternatives ahead of disposables ban P4 RETAIL CRIME Buckinghamshire retailer le hospitalised a er brutal axe attack in their shop VAPE LEGISLATION Retailers accuse Evri of ‘leaving them high and dry’ a er ending contracts P3 SPRING BUDGET: BANNED, TAXED AND IGNORED CRISPS & SNACKS Snap up the bestperforming lines and see your sales crunch all the way to the top P20

OUR last cover story has generated interest since it landed. We reported on the concerns from retailers about security company Verisure.

This included allegations of pressure selling, system failures, misleading information and insurance risks. A er publication, we heard from more independent retailers with speci c examples of how the system had failed them during attacks on their stores.

I want to reassure you how seriously we take claims like this, especially at a time when the lives of retailers are under extreme threat.

According to the ACS’ latest crime report, published last week, the number of violent incidents in shops has nearly doubled in the last year, jumping from 41,000 to 76,000.

We knew things were bad, but this reinforces the terrifying reality faced by shop owners up and down the UK. On top of this, retailers recorded more than 600 incidents of the an hour over the past year, with 87% of colleagues facing verbal abuse.

MORE THAN 600 INCIDENTS OF THEFT AN HOUR

The ACS is calling on the government to deliver justice for shopworkers and e ective sanctions for o enders; focus additional police resources on neighborhood policing; and support further investment in technology to deter and detect criminals.

Retail Express stands with the rest of the industry, and shall play its part in lobbying for better protections where possible.

Enough is enough. Retailers deserve so much more.

News reporter Alice Brooker

@alice_brooker 07597 588955

Specialist reporter Dia Stronach 020 7689 3375

Evri criticised for culling shops over low parcel volumes

RETAILERS have accused Evri of “leaving them out to dry” after being issued contract-termination letters, claiming they aren’t meeting parcel volume requirements.

Retail Express understands the company has been issuing notices since the start of last year. In communication sent to stores, Evri claims

those affected are not meeting suf�icient parcel volumes, and have been serving three months’ notice as a result.

Gajanthan Jegatheesan, owner of Stop N Go in Helpringham, Sleaford, had his equipment taken six months ago after receiving a letter.

“I’ve been so frustrated by the whole process,” he said. “We were making between £250-£300 in commission per month and apparently

it’s not enough. I also asked for more of an explanation, but no one got back to me. Instead, a rep just turned up six months later and took everything.”

A spokesperson for Evri said routine reviews are required “to ensure ef�iciency, including gaps for new locations, and reviewing ex-

isting locations that may no longer be viable for a number of reasons.”

They explained: “We work with retailers over a year-long process, providing support and allowing time for increases in volume.

“Less than 1% of Evri’s outof-home locations were decommissioned last year.”

03

PayPoint Royal Mail PO allegations

Post Of�ice (PO) in 2020. It’s understood the rollout will begin this month and all 5,000 Collect+ sites will be live by the summer.

However, the move is likely to further damage parcel remuneration payments and footfall for PO retailers.

04

FORMER Post Of�ice (PO) chairman Henry Staunton has claimed the company’s chief executive, Nick Read, was set to leave over a pay dispute.

Staunton made the claim at a hearing on compensation payouts to Horizon scan-

dal victims on 27 February. In response, PO acknowledged that there were complaints against Read alongside other members of staff in a note to all PO colleagues, and the boss “never tendered his resignation”.

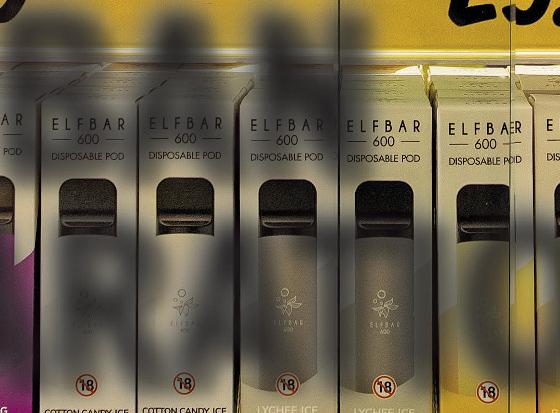

05 Scottish vape ban

RETAILERS in Scotland could be banned from selling single-use disposable vapes from 1 April 2025, following new proposals from the government.

The move mirrors the same ban announced in England

and Wales earlier this year.

The Scottish government will also bring forward UKwide plans to increase the age for purchasing tobacco, making it illegal for anyone born after 1 January 2009 to buy the product.

MEGAN HUMPHREY

MEGAN HUMPHREY

@retailexpress betterretailing.com facebook.com/betterretailing

The

stories

fortnight

ve biggest

this

01

02

FIVE thousand PayPoint Collect+ sites are to provide Royal Mail parcel pick-up and drop-off services under a new deal.

Royal

retail network partnership since

exclusivity with

The agreement marks

Mail’s �irst new

it moved away from

the

Editor Megan Humphrey @MeganHumphrey 020 7689 3357 Editor – news Jack Courtez @JackCourtez 020 7689 3371 Editor in chief Louise Banham @LouiseBanham Features editor Charles Whitting @CharlieWhittin1 020 7689 3350 Production editor Ryan Cooper 020 7689 3354 Sub editors Jim Findlay 020 7689 3373 Robin Jarossi Head of design Anne-Claire Pickard 020 7689 3391 Senior designer Jody Cooke 020 7689 3380 Junior designer Lauren Jackson Production coordinator Chris Gardner 020 7689 3368 Head of marketing Kate Daw 020 7689 3363 Head of commercial Natalie Reeve 07856 475 788 Associate director Charlotte Jesson 07807 287 607 Commercial project manager I y Afzal 07538 299 205 Account director Lindsay Hudson 07749 416 544 Account managers Megan Byrne 07530 834 009 Lisa Martin 07951 461 146 Management accountant (maternity cover) Michael Stack 020 7689 3383 Managing director Parin Gohil 020 7689 3388 Head of digital Luthfa Begum 07909 254 949 our say Retailers deserve better Wild Bean Cafe BP has developed a version of its popular Wild Bean Cafe concession speci�ically for independents. The new ‘micro market’ concept has grown coffee sales in stores by more than 60% and was created as a modular system, allowing retailers to expand or reduce the types of products they serve under the Wild Bean brand. At 90cm wide, the main coffee unit is around the same size as a standard Costa Coffee machine. Features writer Jasper Hart @JasperAHHart 020 7689 3384 40,152 Audit Bureau of Circulations July 2022 to June 2023 average net circulation per issue Retail Express is printed and distributed by News UK at Broxbourne and delivered to news retailers free by their newspaper wholesaler. Published by: Newtrade Media Limited, 11 Angel Gate, City Road, London, EC1V 2SD; Phone: 020 7689 0600 Reproduction or transmission in part or whole of any item from Retail Express may only be undertaken with the prior written agreement of the Editor. Contributions are welcome and are included in part or whole at the sole discretion of the editor. Newtrade Media Limited accepts no responsibility for submitted material. Every possible care is taken to ensure the accuracy of information. No warranty for goods or services described is implied. Subscribe online at newtrade.co.uk/our-products/ print/retail-express. 1 year subscription: UK £65; overseas (EU) £75; overseas (non-EU) £85 Retail Express’ publisher, Newtrade Media, cares about the environment. Megan Humphrey, editor News editor Alex Yau @AlexYau_

020 7689 3358

For the full story, go to betterretailing.com and search ‘Wild Bean’ For the full story, go to betterretailing.com and search ‘vapes’ For the full story, go to betterretailing.com and search ‘PayPoint’ For the full story, go to betterretailing.com and search ‘Nick Read’

Cover image: Getty Images/Stocknshares/Vidka/ Yosuke Hasegawa

12-25

Gov’t to impose vape duty in a bid to tackle youth vaping

A NEW tax on vaping products is set to slash sales and margins for independent retailers, as the government cracks down even further on youth vaping.

Last week, chancellor of the exchequer Jeremy Hunt outlined a series of measures impacting small shops in his latest Spring Budget.

Hunt con�irmed an excise duty would be placed on vaping products, set to be introduced in October 2026.

The rates, subject to consultation, will be £1 per 10ml for nicotine-free liquids, £2 per 10ml on liquids that contain 0.1-10.9mg nicotine per ml, and £3 per 10ml on liquids that contain 11g or more per ml. The measure would double the price of many top-selling lines in local shops.

The government will also introduce a one-off tobacco duty increase of £2 per 100 cigarettes or 50 grams of tobacco. Hunt said this was needed to “ensure vaping remains a more affordable option” over smoking.

The move comes two months after the government con�irmed plans to ban single-use disposable vapes, expected to leave stores thousands of pounds out of pocket.

Prime minister Rishi Sunak con�irmed the news, alongside a wider package of measures, including restrictions on vape �lavours

“WE’VE

that are speci�ically marketed towards children; plainer packaging across all vape products; and changes to the way vapes are sold seeing them be moved “out of sight of children and away from products that appeal to them, like sweets”.

ACS chief executive James Lowman said: “Retailers are trying to prepare for multiple changes to the regulation and taxation of the vaping category: a ban on disposables expected to come into effect in April 2025, a variety of as-yet-undrafted regulations on the siting and marketing of products, and now the introduction of duty on vape sales from 2026.

“We will work with the government to try and make these various meas-

ures coherent and effective, but retailers will be feeling confused about the purpose and implementation of these regulations. Responsible retailers will also be concerned at the advantage given to illicit importers and sellers of vapes who will not pay excise duty, over legitimate businesses who will apply this tax to the price of vapes.”

In an open letter addressed to Hunt, the UK Vaping Industry Association’s general director, John Dunne, warned that a vape tax would fuel sales on the black market.

“A rise in the cost of compliant vaping products will only incentivise consumers to turn to the black market – which will be even more

prevalent post a disposables vape ban – for more affordable and higher-risk alternatives,” he said.

“According to the Chartered Trading Standards Institute, one in three vaping products in the UK is already non-compliant.”

Hunt went on to announce a 2p cut to employees’ National Insurance contributions, which is expected to help the average earner save £450 a year. In addition, the main rate of Class 1 Employee National Insurance Contributions is to be cut 8% from 6 April 2024.

Alcohol duty has also been frozen once again until February 2025, after it was due to rise by 3% from August. In addition, fuel duty has been frozen at its current level for

another year, as expected. The levy should rise in line with in�lation, but this has not happened since 2011.

A 5p cut to fuel duty, which was introduced in 2022 and due to run out this month, has been extended.

Hunt went on to reveal that in�lation is expected to fall below the government’s 2% target in “just a few months’ time”, down from 4% in January. “Nearly a whole year earlier than forecast in the Autumn Statement,” he said.

Ahead of the Budget, the rest of the independent sector urged the government to address rising costs in business rates, employment and the cost of providing access to cash, all of which were ignored.

Nishi

Bexley Park, Dartford, Kent

“WE regularly change our till xtures to coincide with any upcoming seasonal event. We made a 40-50% margin on Valentine’s Day stock this year, which was mainly due to our till- xture range. We are usually conscious of the price of the products that we put there. However, this year, we placed pricier chocolate boxes and flowers there and saw the majority of customers buying these items on impulse.”

Vas Vekaria, Kegs N Blades, Warrington, Cheshire

“I RECOMMEND utilising EPoS data to monitor margins, sales and basket spend. This allows you to set weekly goals that contribute to annual targets. I’d also o er sta bonuses or rewards to those who meet weekly upselling targets to boost participation among sta . However, it’s important to keep these incentives and recommendations concise to avoid overwhelming customers.”

Raaj Chandarana, Tara’s Londis, High Wycombe, Buckinghamshire

DOUGHNUTS: Food-to-go wholesaler Country Choice has begun trials of a part-baked doughnut service in a number of stores. Retail Express understands the products are delivered to stores frozen, then defrosted by the retailer and dipped into a choice of toppings. This marks the rst time the rm doughnuts have been made available as a customisable product.

For the full story, go to betterretailing.com and search ‘Country Choice’

INFLATION: Grocery inflation has fallen to its lowest rate in two years, suggesting the cost-ofliving crisis could be easing. Data published last month by Kantar recorded a drop in inflation to 5.3%, the lowest since March 2022. Strategic insight director Tom Steel said it shows “things [were] looking up”. However, symbol groups and independents saw a slight decline in their market share of 1.4%, down by 0.1% in December 2023.

GOOD WEEK BAD WEEK

HFSS: Scotland’s proposed restrictions on lines high in fat, sugar, or salt (HFSS) are stricter than England’s. Measures include, but are not limited to, restrictions on meal deals, such as a sandwich, drink and snack, which are exempt from restrictions in England.

For the full story, go to betterretailing.com and search ‘HFSS’

BOTTLE RETURNS: Reports suggest that the UK’s upcoming deposit return scheme is set to be delayed once again until 2028. The i newspaper reported that ofcials have “halted” work on the scheme. No o cial announcement has yet been made.

For the full story, go to betterretailing.com and search ‘DRS’

03 betterretailing.com

MARCH 2024

express yourself the column where you can make your voice heard Do you have an issue to discuss with other retailers? Call 020 7689 3357 or email megan.humphrey@newtrade.co.uk

have you successfully increased basket

your store?

How

spend in

diversi ed our checkout area to include more premium and luxury items. We keep a collection of perfumes, aftershave and home fragrances, and it has been a signi cant driver of impulse purchases and additional margin. The cheaper range of products is around £24.99-£25.99, and the more premium ones are around £40. We o er a promotion that gives customers £10 o if they spend more than £35.”

Patel, Londis

MEGAN HUMPHREY

@retailexpress facebook.com/betterretailing megan.humphrey@newtrade.co.uk 07597 588972

Retailers are told to prepare for a new tax on vaping products from October 2026

Retailer hospitalised in axe attack

ALICE BROOKER

A BUCKINGHAMSHIRE retailer was the victim of an axe attack in his store last month, as thieves caused £2,000-worth of damage.

Harpal Singh, of Chesham Bois Store, was left with a blow to the head and hospitalised, after a group of thieves broke into his store at 5.30pm on 22 February, stealing cash, vapes and whisky.

Commenting on the attack, shop manager Marcus Green told Retail Express: “Two people entered the shop and asked Harpal to empty the till.

“They pushed him away and within a second of asking him, they struck him on the head with the back end of an axe.

“It’s a sickening act, just for a few hundred pounds. Total losses, including damages, amounted to £2,000.”

Singh was released from hospital on 26 February after being admitted for four days, due to sustained injuries from the attack.

The community responded by raising more than £6,000 via a JustGiving page, pledging their support for their local store. “We’re deeply humbled,” said Green.

The incident followed a knife robbery that took place 24 hours before on Ivy Stores

in Amersham on 21 February.

Thames Valley Police told Retail Express the investigation is ongoing.

A spokesperson said: “We urge anybody who recognises the individuals in the images, or who witnessed this incident, to get in touch with Thames Valley Police by calling 101, quoting reference 43240085255 or, alternatively, Crimestoppers anonymously on 0800 555 111.”

Glycerol slush

TANGO Ice Blast manufacturer Frozen Brothers (FB) has told stores to display age warnings for its products.

In notes sent last month, FB quality director Josie Patrick warned all slush containing glycerol (most FB lines) must state: “Product

contains glycerol. Not recommended for children four years of age and under.”

FB states this should be shown at tills, whereas a retailer claimed they were told to put it on the machine by an environmental health officer earlier this year.

RETAILERS mistakenly believe they no longer need to offer electrical recycling when the disposable-vape ban comes into force.

A senior industry source explained: “Stores think they will be exempt. This is the not the case, as any electrical is included in legislation.”

Retailers who sell more than £100,000 of electrical a year must offer customers

a process to take back electrical equipment or face the potential of unlimited fines.

Self-serve protein

ONE Stop retailer Dee Sedani has become the first independent retailer to install a self-serve protein machine in his store.

The tabletop machines from Protein Life Express combine whey, a powdered form of protein, with water,

producing shakes of either chocolate, vanilla, banana, strawberry or chocolate bueno flavours, available in 350ml and 450ml cups.

The supplier confirmed plans to expand into convenience with a potential rollout scheduled for May.

NEWS 04 12-25 MARCH 2024 betterretailing.com

ELECTRICAL VAPE MISCONCEPTION For the full story, go to betterretailing.com and search ‘crime’ For the full story, go to betterretailing.com and search ‘protein’ Join in GroceryAid Day and help us tell as many colleagues as possible about the free and confidential support they can access. Free and Confidential Support Call the Helpline on 08088 021122 or visit groceryaid.org.uk SAVE THE DATE Add to Calendar RN Full page ad.indd 1 13/12/2023 10:33

Is your store at the heart of your community?

If the answer is YES, enter the Better Retailing Community Hero Award and gain the recognition you, your store and your team deserve.

Not sure about Community Hero?

We have seven other exciting categories to enter, from Merchandising & In-store Display to Team Development, and everything in between. Find the full list at betterretailing.com/ Awards-2024 or scan below:

COMMUNITY HERO AWARD

Sponsored by Suntory Beverage & Food GB&I

From fundraising and supporting local causes to helping vulnerable customers and offering vital services, being a community hero is about the positive impact your store has on your local area. NEED SOME HELP? Contact: marketing@newtrade.co.uk or call Kate Daw on 07886 784465

2024!FOR

NEWBRAND

AWARDS PARTNERS

PRODUCTS

The Big Win-Win returns

PRIYA KHAIRA

MONDELEZ has launched a new campaign, giving customers a chance to win cash prizes for themselves and for their local store.

‘The Big Win-Win’ campaign is an on- and off-pack promotion running until mid-May.

To enter, customers must purchase a participating Cadbury product and enter their details on the competition website. If they are a winner, they will be asked to nominate a local store to win as well.

The promotion is running across Cadbury’s full singles and duos range, including both PMP and non-PMP

formats. Participating brands include Twirl, Wispa, Boost and Cadbury Dairy Milk.

There are 70 prizes of £1,000 and another 60 prizes of £500 available to shoppers, and 130 retailers can win those prizes alongside their shoppers.

The competition will be supported in store with PoS materials and will be promoted to consumers through PR, radio, digital, outdoor advertising and social media activity to drive visibility.

It will also be pushed through personalised proximity advertising close to independent stores. Retailers will also feature in the digital materials.

Sarah Walker, brand

New Twix Secret Centre Biscuits

MARS Chocolate Drinks & Treats has announced the launch of Twix Secret Centre Biscuits.

Twix Secret Centre Biscuits have an RRP of £1.69, rolling out across wholesale and convenience channels this month.

Each 132g pack contains eight biscuits.

Special Treats are growing by 16% year on year and contribute £233m to

sponsored

manager for Cadbury at Mondelez International, said: “Last year’s winning retailers shared that they were delighted and were able to

the overall Sweet Biscuit category, which is worth £2.86bn.

Michelle Frost, general manager at Mars Chocolate Drinks & Treats said: “Our Secret Centre Biscuits range which includes Mars and Bounty varieties have added more than £680,000 to the category.

“We expect the new Twix Secret Centre Biscuits to accelerate this growth.”

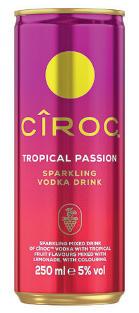

Win two cases of Cîroc’s new RTDs

TO celebrate the launch of its �irst-ever ready-to-drink (RTD) variants – Cîroc Summer Citrus and Cîroc Tropical Passion (both 5% ABV) – the brand has partnered with Retail Express to offer �ive retailers the chance to win £50-worth of stock.

The new sparkling vodka drinks are available at an RRP of £2.85 in 250ml cans, helping retailers offer their customers affordable indulgence in a convenient format.

“The move into RTDs feels like a natural progression, giving our customers across the grocery, wholesale and convenience channels the opportunity

to excite and intrigue their shoppers with brand-new, super-premium RTD options,” said Conor Brown, Cîroc brand manager at Diageo GB.

To enter, head to betterretailing.com/ competitions

use their winnings for well-deserved days off, holidays and even team outings to celebrate after a challenging year.”

Rockstar Energy gets rocking refresh

BRITVIC has unveiled a rebrand across its Rockstar Energy range. The rebrand includes updated packaging to highlight zero-sugar options and an integrated marketing campaign.

platforms, outdoor media, digital advertising, in�luencer partnerships and sampling events.

Birra Moretti unveils un ltered lager

HEINEKEN UK has launched Birra Moretti Sale di Mare, an un�iltered version of its lager.

Sale di Mare (4.8% ABV) is available in multipacks of 4x330ml and single 660ml bottles. It is a medium-bodied lager that contains hints of sea salt.

Heineken will support the launch with a multimillionpound marketing campaign launching on TV in April as well as a glassware gift to accompany purchases of the multipack format.

The packaging will also include a game accessible via a QR code to offer consumers a chance to win prizes.

Alexander Wilson, category & commercial strategy director at Heineken UK,

said: “With demand rising for continental lagers in the UK, Birra Moretti Sale di Mare is positioned to help retailers make the most of this trend.”

Extra’s newest fruity Sugarfree flavour

MARS Wrigley has released Extra Sugarfree Watermelon gum nationwide following its Tesco launch last year.

Extra Sugarfree Watermelon is available in 65p single packs and £2.75 tubs.

The launch comes as fruity gum is the fastest-growing gum segment, displaying a 25% increased rate of sale. Furthermore, a third of fruity gum shoppers only buy fruity gum, and 70% of fruity gum growth has been incremental to the gum category.

Mars Wrigley is supporting the rollout with a £2.1m

media spend supporting its total fruit range, including Refreshers.

Lucy Sherlock, senior brand manager at Extra, said that the new �lavour is arriving at a time when consumer demand for fruit�lavoured gum is enjoying a growth period.

The new can design features simpli�ied branding and enhanced graphics on zero-sugar varieties to cater to consumer preferences for sugar-free soft drinks.

The stimulants market is now worth £1.5bn. Low-sugar varieties are growing by 29.7% compared to standard stimulants, which are growing by 14.7%.

The marketing campaign will span across social media

The new packaging features QR codes, giving consumers a chance to win free tickets to over 20 O2 Academy venues through a weekly draw.

Corona enters no- and low- alcohol market

BUDWEISER Brewing Group has expanded its Corona portfolio with the introduction of Corona Ligera. It is now available to retailers from Booker.

Corona Ligera has an ABV of 3.2%, catering to consumers looking for lighter alcohol options, particularly consumers from the 18-34 age group. Research indicates that this age group has expressed a preference for high-quality, lower-alcohol beverages.

Kantar data shows that Corona is the number-one beer of choice for women. The new launch is therefore a further opportunity to recruit women to the low- and no-alcohol category.

Mark Wing�ield Digby, offtrade director at Budweiser Brewing Group, said: “With a steady increase in popularity with lower-alcohol options, we want to offer premium products that will help those who want to moderate their drinking.”

Rowntree’s to sweeten sales

NESTLÉ Confectionery has unveiled its Rowntree’s Rowntree’s Randoms Fizzy Cactuz sweets.

The item is now rolling out to convenience stores and supermarkets after an initial release in Asda and Morrisons.

The 130g sharing bag has an RRP of £1.75, containing raspberry, kiwi, passionfruit and lime �lavours. The sweets come in two textures, one gummy and the other with a juicy fruit �illing.

Fizzy Cactuz has joined the Randoms range that is currently made up of Original Randoms and Randoms Juicers.

Hayley Nixon, senior brand manager for Rowntree’s,

said: “We are thrilled to introduce Rowntree’s Fizzy Cactuz to our fans. Fizzy Cactuz represents our dedication to creating joyful and unexpected experiences.”

06

Pringles turns up the heat with new Hot range

PRINGLES has replaced its Sizzl’N range with its latest spicy line.

The new range contains �ive �lavours: Flamin’ Cheese, Mexican Chilli & Lime, Smokin’ BBQ Ribs, Kickin’ Sour Cream and Sweet Chilli.

Four of these �lavours are non-HFSS, with the exception of Sweet Chilli.

Kickin’ Sour Cream and Sweet Chilli varieties are available to independents in £2.75 price-marked packs. Beth Johnson, senior

brand manager for Kellog’s UK&I said: “We know our shoppers love spicy �lavours, as we saw with our

Sizzl’N range. Pringles Hot allows retailers to capitalise on the demand for more spicy offerings.”

Jacob’s Mini Cheddars line gets extra cheesy

PLADIS has released a limited-edition range of Jacob’s Mini Cheddars brand: Jacob’s Cheesy Specials.

The two new varieties are Smoked Cheddar and Cheddar & Roasted Tomato.

Smoked Cheddar is available to independent retailers in a 90g £1.25 price-marked pack. Both varieties will be launched more widely across convenience and wholesale

from April after an initial launch in Tesco in 6x23g multipacks with an RRP of £1.75. The launch aims to attract younger shoppers and tap into lunchtime and snacking occasions. The brand’s limited-edition launches have so far generated an additional £13.1m over the past three years. The Red Leicester variety, for instance, became a permanent addition to

Carte D’Or expands Deluxe dessert o ering

CARTE D’Or has added a mini pots range and has expanded its Carte D’Or Deluxe range.

The mini pot range is made up of Carte D’Or Mini Indulgence Vanilla Caramel Pecan, Carte D’Or Mini Indulgence Eton Mess and Carte D’Or Mini Indulgence Chocolate Cookie in 200ml tubs, while Carte D’Or Tiramisu and Carte D’Or New York Cheesecake varieties have been added to the Deluxe range.

The 200ml mini pots have

an RRP of £1.99 while the 850ml containers of the Deluxe range additions have an RRP of £4.50.

The launch will be supported by shopper, digital

the Jacob’s Mini Cheddars core range after a successful limited-edition launch.

and experiential activations along with a media investment of £1.6m.

The launch aims to tap into at-home occasions and snack missions.

Irn-Bru adds limited-edition Xtra lines for summer

IRN-BRU Xtra is rolling out two limited-edition �lavours. Irn-Blue Extra Raspberry Ripple and Wild Berry Slush are going to be available from 18 March. The berry-themed launches will have an RRP of 75p and will be made available in 330ml plain and price-marked cans along with a 8x330ml plain can multipack.

Last year’s Irn Bru’s Xtra limited-editions generated £29m for the category as well as a 30% uplift to the core Irn-Bru Xtra range. The launch hopes to drive demand ahead of summer.

The release is going to be supported by a media investment spanning social media, outdoor posters and in�luencer activity. The media plan is set to reach

93% of 16-to-24-year-old consumers at least 11 times throughout the campaign.

The cat

in

07 12-25 MARCH 2024 betterretailing.com

†50% off card reader rental fees until 31 December 2024 on selected products only. Apply by 30 April 2024. The approval of your application depends on financial services and borrowing history. *Settlement terms may vary. T&Cs apply. Barclaycard is a trading name of Barclays Bank PLC. Barclays Bank PLC is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (Financial Services Register number: 122702). Registered in England No. 1026167. Registered Office: 1 Churchill Place, London E14 5HP.

Because with a card reader that stays connected and gets you paid the next day,* the time you used to spend pacing is now spent giving chin scratches. And with half your card reader rental fees covered†, your resident feline got a new scratching post. your bookshop adores Barclaycard Payments. What’s good for small business is good for everyone.

PRODUCTS

Coca-Cola Lemon hits shelves

PRIYA KHAIRA

COCA-COLA has launched a Lemon �lavour in Original Taste and Zero Sugar varieties. Both are available in 330ml cans and 500ml rPET bottles for on-the-go occasions in both plain and price-marked packaging, along with 2l Zero Sugar and 1.75l Original Taste rPET bottles for home consumption.

The launch joins CocaCola’s existing �lavoured cola range, which is worth £118m. Presently, CocaCola's �lavoured colas lineup includes Coca-Cola Original Taste Cherry, Coca-Cola Zero Sugar Cherry and Coca-Cola Zero Sugar Vanilla.

Coca-Cola Europaci�ic Partners (CCEP) is supporting the launch of Original Taste Lemon and Zero Sugar Lemon with a marketing campaign, comprising sampling, out-of-home advertising, experiential, social media content and in-store activations.

Convenience and independent retailers can also access PoS materials from the CCEP website.

Coca-Cola Lemon was sold in the UK until being discontinued in 2006.

Rob Yeomans, vicepresident of commercial development at CCEP, said the reintroduction of the variety comes as �lavoured colas grow ahead of the total

cola segment. “Consumers are looking for new twists on their favourite drinks, which we’ve seen through the popularity of our Cherry varieties and other limited-editions,” he added.

“The sub-segment presents a real opportunity for retailers with �lavoured colas growing ahead of the total cola segment. So, we will be investing in our range of �lavours throughout 2024.”

Epicurium secures new listings

EPICURIUM has secured a listing of Tony’s Chocolonely’s Everything Bar and has expanded its range with Huel’s A-Z Vitamin Drinks.

Nakd adds functional Fruit & Fibre duo to range

NAKD has extended its portfolio of healthier snacks with the addition of Fruit & Fibre bars.

The new bars are available in Apple & Cinnamon and Strawberry & Raspberry �lavours, containing nuts, seeds, grains, spices and 6g of �ibre each.

Its launch will be supported by a digital plan spanning in�luencer gifting, social media activations and sampling.

They are both available in single (RRP £1.25)

and multipacks of 3x44g (RRP £3).

Jo Agnew, marketing director at Natural Balance Foods said: “Having successfully entered the ‘bars with bene�its’ category in 2023 with

the launch of our protein bars and delivering £2.3m in just eight months, we are well placed to help retailers meet needs for healthy and functional snack bars.”

It is Fair Trade-certi�ied, plastic and palm oil free, containing caramel and pretzel pieces, nougat, almonds and sea salt. It is also made with recycled FSC-certi�ied paper and 100% recyclable packaging.

The wholesaler has added Huel Daily A-Z Vitamin Drinks in Cherry & Raspberry, Pineapple & Mango and Watermelon to its range.

Each item has an RRP of £1.99, containing 30 calories per can, 925mg of electrolytes and 100mg of natural caffeine. It is also low in sugar and gluten-free.

Tony’s Chocolonely Everything Bar is available to retailers in cases of 15 with an RRP of £4.05.

08

Funkin adds funky martini flavour

Lyle’s gets its rst-ever packaging update

LYLE'S Golden Syrup has undergone its �irst rebrand since �irst launching in 1883.

The brand is the Guinness World Records holder for the world’s oldest logo. However, the company has now redesigned its packaging on certain lines.

The update won’t remove its central feature, the lion, and it will also keep its key colours – green and gold.

James Whiteley, brand director for Lyle’s Golden Syrup,

said: “We’re excited to unveil a fresh redesign for the Lyle’s Golden Syrup brand.

“While we’ll continue to honour our original branding with the heritage tin, consumers need to see brands moving with the times.”

Glen’s ‘Golden goal’ promo

Seabrook’s Smoky Bacon relaunch

SEABROOK has relaunched its Smoky Bacon variety for a limited time.

The crinkle-cut crisps are gluten-free and vegetarian, and are available in single 25g and 6x25g multipack formats (RRP £1.25).

According to marketing director for Calbee UK Claire Hooper, customers displayed a huge demand for the �lavour’s return.

“We have been inundated with requests for our Smoky

Bacon �lavour to return. Our shoppers know that they can rely on Seabrook for affordable crisps and snacks.

“Combine this with the appeal of a limited-edition �lavour, Seabrook Smoky Bacon becomes a must-stock for retailers.”

The brand has con�irmed that consumers can expect to see other classic �lavours make a comeback. Last year, the brand brought back its Lamb & Mint �lavour crisps.

Discover Mentos’

latest launch

PERFETTI Van Melle has launched Mentos Discovery. It contains 14 different fruit�lavoured sweets in one roll, which the supplier calls a category �irst.

Its launch comes as Funkin’s Nitro Can RTD range saw 12% growth in 2023, to be valued at more than £24m.

GLEN’S Vodka has released its ‘Golden goal’ promotion in partnership with the Scottish Professional Football League.

The on-pack promotion gives customers a chance to win cash prizes.

FUNKIN Cocktails has unveiled its Blue Raspberry Martini, the newest addition to its ready-to-drink (RTD) cocktail range. The variety contains an ABV of 5% and is available in a 200ml can with an RRP of £2.20. It is now available to independent retailers after an initial launch in Tesco.

The supplier said Blue Raspberry Martini is aimed at Gen Z consumers, as customers from this demographic are displaying a preference for blue raspberry �lavours.

To take part, shoppers can scan the QR code on participating packs to be in with a chance of winning.

Cash prizes range from £10 to £1,000. The promotion runs until 6 May nationwide.

Loch Lomond Group, which

blueberry, blackcurrant, lime, strawberry, raspberry, orange, lemon, watermelon, banana, grape, cherry and pineapple.

Mentos Discovery will be available to convenience retailers from the end of April in a single roll in plain and price-marked formats (65p RRP) as well as a three-roll multipack (£1.25 RRP).

Its 14 �lavours include: passion fruit, lychee,

owns Glen’s Vodka, is supporting the promotion with outdoor and digital marketing worth £500,000. The promotion comes after a good year for Glen’s, which the supplier said added more value to the UK off-trade in the past 12 months than other spirits brands.

The supplier said it is targeting younger confectionery consumers who are looking for new and “exotic” �lavours.

Perfetti Van Melle will support the launch with a £1m marketing campaign spanning radio, in�luencer marketing, YouTube and video-on-demand adverts.

09 12-25 MARCH 2024 betterretailing.com

C M Y CM MY CY CMY K ai169747038525_RN16Oct- Fed SSSAdvert print.pdf 1 16/10/2023 16:33 Untitled-17 1 18/10/2023 10:03

PRODUCTS

Biona unveils natural range

PRIYA KHAIRA

ORGANIC food supplier

Biona has launched a new range of cooking pastes in Garlic, Garlic & Ginger and Organic Ginger varieties.

All products across this line have an RRP of £3.19 for a 130g jar. The items aim to target consumers looking for quality ingredients for immediate use, the supplier said.

The brand is also launching three natural maple syrups. The new range consists of a 330ml bottle of Amber syrup and a 330ml bottle of Dark syrup, both with an RRP of £6.79, as well as a 1l bottle of the Amber, with an RRP of £23.29.

This range is vegan and is made from Canadian Maple sourced from the Bas-StLaurent region of Quebec, intended to appeal to consumers looking for natural syrups and sweeteners.

Presently, the UK’s organic food and drink market is worth £3.1bn in annual sales, having grown by 1.6% in 2022.

Despite challenging conditions, the market has grown for 11 consecutive years, displaying existing and potentially fresh appetites for new varieties.

Founder and director of Biona’s parent company Windmill Organic, Noel McDonald, said: “Our brand ethos is built on an unwaver-

Country Choice launches Easter lines

COUNTRY Choice has announced its 2024 Easter lineup.

The collection includes Hot Cross Buns, sweetly spiced buns �illed with sultanas, raisins and mixed peel.

There’s a Corn�lake Cake with Chocolate Eggs, a combination of cripsy corn�lake cake and a chocolate coating.

Giant Lemon & Chocolate Bakewell-Style Tarts have a lemon-�lavoured frangipane in a pastry shell topped with lemon fondant and a chocolate sponge.

Gingerbread Bear is a bear-shaped ginger biscuit decorated with sugar beans.

The Easter Cupcakes in Lemon and Chocolate �lavours are topped with white

chocolate shavings.

Then there is a Easter Chocolate Cake with vanilla�lavoured cream cheese icing.

Finally, the Mini Loaf Cakes include Carrot, Double Chocolate and Lemon Meringue �lavours.

Retailers can place orders for these items online via the Country Choice website.

Ice cream-inspired launch from Nestlé

NESTLÉ Confectionery has released its sharing bag selection, inspired by icecream �lavours.

The range includes Neapolitan �lavour Aero Melts, Munchies Cookie Dough Ice Cream �lavour, Raspberry Ripple �lavour Milkybar Buttons and Ice Cream shaped Rowntree’s Randoms Foamies.

The Ice Cream Sharing Bag range has taken inspiration from classic frozen �lavours, the supplier said.

The range is now available for independents to order from Hancocks. Each sharing bag is £1.75 and comes in £8.49 packs of 8x97g.

To celebrate the launch, Nestlé has partnered with

ing commitment to 100% organic, ethically and sustainably sourced food and we’re

con�ident these ranges will be well received by retailers and consumers alike.”

GrowUp Farms secures Spar listing

GROWUP Farms has partnered with Spar by securing a listing for its Fresh Leaf Co bagged salad.

Fresh Leaf Co Red & Green Baby Leaf Salad is now available to purchase in over 400 Spar stores nationwide.

Fresh Leaf Co was launched in Iceland stores last year. However, its new partnership with Spar aims to attract a new demographic of shoppers, the supplier said.

Kate Hofman, founder of GrowUp Farms, said: “Convenience stores in general can struggle to offer a prepared salad mix, given the challenges of its traditional short shelf life.

“Our longer shelf life

allows stores to stock our salad and provide their shoppers with more healthy meal options, which won’t break the bank.”

CHRIS SMITH

Partner brand manager, World of Sweets

Why freezables could boost sales

FREEZABLES are a category with a retail sales value of around £21m* and the potential to carry on increasing in popularity.

Low-cost ice poles to freeze at home or be sold as singles can bene t retailers looking to capitalise on impulse purchases and be well stocked ahead of the warmer weather.

Here at World of Sweets we’ve seen sales of these treats grow by 79% through o ering retailers big-name brands that are developing flavours with mass appeal.

Barratts, Warheads, Jolly Rancher and PAW Patrol are among the new brands o ering consumers a low-cost freezable treat.

The nostalgic flavours of Barratt, including Fruit Salad, Wham, Refreshers and Dip Dab, are aimed at families including children and adults who enjoy the nonpolarising fruity flavours.

dancer and Kiss FM host Jordan Banjo to release two ice-cream jingles.

LINDT has added Lindor Dark 70% to its Lindor range. The premium chocolate has an RRP of £6.30 per 200g box.

Lindt Lindor Dark 70% is available to supermarkets and independents across the UK as well as Lindt Chocolate Shops and the Lindt online website.

The new release taps into treat and gift occasions ahead of Mother’s Day and Easter. Other seasonal varieties are available to the wholesale channel.

It is made up of a 70% cocoa chocolate shell, containing a melting dark chocolate �illing. It is also the newest addition to the Lindt Lindor collection, comprised

Lindt reveals Lindor Dark 70% line

of Salted Caramel, Double Chocolate, White, Dark and Blood Orange variants, among many others.

The sour flavours of Warheads will appeal to millennials who are now introducing their children to the brand, and Gen Z. Mintel research shows 40% of sweet enthusiasts among 16-to-34-year-olds are drawn to sour flavours.

US brand Jolly Rancher will sit alongside US ranges in store with the fruity flavours appealing to US candy lovers and younger customers.

In contrast, PAW Patrol is targeted at children between the ages of two and six, with smaller portion sizes and fruity flavours. The popular cartoon is watched by more than 350 million households across 170 territories.

For retailers, stocking a combination of these freezables will show there’s a low-cost freezable flavour to suit everyone.

To nd out more, email sales@worldofsweets.co.uk, call 0330 202 0903 or visit worldofsweets.co.uk

11 12-25 MARCH 2024 betterretailing.com

Paid feature

*Figure from 2022

SUPERHERO YOUR CSN SALES

RETAIL EXPRESS checks in with London retailer Harveen Kapoor to see how PEPSICO’s advice helped give his savoury snacking sales a boost in appearance and sales

THE total salty snack category is one of the most important in independent convenience retail, with total salty snacks in independents and symbols growing at 18%1. In November, Mike Chapman, from PepsiCo, visited Harveen Kapoor in south-west London to help him optimise his salty snack display. We nd out what e ect it had on his sales.

FOCUS ON HARVEEN KAPOOR

Surbiton Road Stores, Kingston upon Thames

MY CHALLENGE

HARVEEN’S shop is near a university, so he gets a lot of student customers, and he also bene ts from nearby building works that bring in tradespeople through his doors. With so much potential for CSN sales from these demographics, he wants to maximise the snacking opportunity to drive increased interest in the segment.

CHANGES TO DRIVE SALES

Optimise bestsellers: Bestsellers were stocked on the main xture at eye level and on secondary displays as well.

Increase PMPs and drive excitement: The amount of PMPs was increased, and launches from Wotsits and Walkers Max were stocked.

Rearrange xtures: A new xture was put by the till and a slim xture was placed in an impulsive, high-footfall area of the store.

BEFORE HARVEEN SAYS

“WORKING with PepsiCo has helped me increase my CSN sales signi cantly. Having dual sitings for its products, a good selection of PMPs and its Hero 25 range has really made a di erence to the products my customers are choosing to buy. It also widened my range with Walkers Max’s new non-HFSS collaboration with Pizza Hut.”

The projected increase in annual revenue by following PepsiCo’s advice3

1 Fourteen of the top 25 bestselling CSN products are from Walkers, so it’s essential to stock as many of these as possible2

2 PMPs equated to 23% of total CSN sales during the trial, which annualised equals £6,667.77

3

AFTER THE RESULT £8,395

SUPPLIER ADVICE 12

in

revenue3

such as the

by the soft drinks

can help boost impulsive spend.

LESSONS

YOUR STORE

Secondary siting in high-footfall areas

till or

xture

KEY

FOR

GET INVOLVED

you want to grow

snacking

If

your savoury

sales, visit shopt.digital/ gb/pepsico

1

2

“WE’VE learned a lot from Harveen about his challenges. He’s had some good CSN sales, but there were some great opportunities for further growth. We were really con dent with the advice we gave him to prioritise the bestsellers – and he has reaped the rewards, with new products adding £13.50 to average daily CSN sales, which could add £4,927.50 annually in revenue3.” For more

of

store, scan

QR code or go to betterretailing.

In partnership with AFTER betterretailing.com 12-25 MARCH 2024 Promotional feature 13

more

com/superhero-your-csn-sales GET INVOLVED PEPSICO’S TOP TIPS

advice and tips, and to see

Harveen’s

the

Shoppers’ top snacking priority is taste4, so it’s vital to sell bestsellers and new lines that deliver on flavour.

PMPs continue to be the growth engine for crisps and savoury snacks as they reassure consumers of value.

Eighty-four per cent of big-night-in occasions include cold drinks5, so cross-merchandise them with big bag crisps. EXPERT ADVICE MIKE CHAPMAN Head of wholesale, PepsiCo 1NielsenIQ, Independents & Symbols, MAT 20.01.24, 2Nielsen Total Coverage GB, 52wk MAT 02.09.23, 3Based on in-store project trial period November 2023-January 2024, 4Bolt Snacking Tracking Q2 2022 MAT, change vs Bolt Main Study 2020-2022, 5Bolt Tracking MAT Q3’22 (Q4’21 – Q3’22) data

3

OPINION

RETAILER OPINION ON THIS FORTNIGHT’S HOT TOPICS

What do you think? Call Retail Express on 020 7689 3357 for the chance to be featured

You need something di erent and bespoke

PRODUCTS: What viral crazes are proving most profitable for you?

“WE

“I NOTICED that American snacks and drinks are on trend on social media, and I have brought more into the store. I utilise social media, especially TikTok. Last year, we saw pickle kits and Prime gain popularity online.”

Lewis Woodward, Nisa Local Colley Gate, Halesowen, West Midlands

We created a Monster slushie station

ROTAS: How will staff making flexible requests from day one impact you?

“THE upcoming changes in April will make it more dif�icult for stores to manage their teams and it’s important to have an external HR service you can depend on. I know a lot of shop owners are really scared of getting things like this wrong.”

Anonymous retailer

“BOTH us and our teams bene�it from �lexibility, but only if it’s agreed. The changes will create challenges in making sure the business’s needs, as well as the team members’, are balanced, but hopefully it will improve reliability.”

Anonymous retailer

The changes will create challenges

BRAND BUILDING: What are you doing to help put your store on the map?

“THE reputation of our name was important. Our shop�itter redesigned it to what we have today, and we’ve carried that forward. It’s on the exteriors, on the windows, the signage inside and the staff uniforms. It’s advertising who we are, whether it’s on a �lyer or a Facebook page.”

Dean Holborn, multi-site owner, Surrey

“YOU need something different and bespoke. We work with local suppliers to get specialty products and homemade goods. There needs to be something different between us and the next store. It’s important to promote what you are doing on social media, radio and lea�lets.”

Andy Miles, Dike & Sons, Stalbridge, Dorset

I could stock it two days before the supermarkets

SOFT DRINKS: What’s performing well and how are you capitalising on it?

“WE have seen a rise in demand for sugar-free soft drinks. We are making 23% margin on Coca-Cola Original Taste and a 31% margin on Coca-Cola Zero Sugar. Even with energy drinks, customers are opting for sugar-free varieties like Monster Zero Sugar.”

Natalie Lightfoot, Londis Solo Convenience, Baillieston, Glasgow

“THERE are many different demographics that are keeping an eye out on social media for new �lavours or developments, especially in energy drinks. Monster is a top seller for us, so we created a Monster slushie station to take our offering to the next level.”

Amit Patel, Go Local Town Street Sandiacre, Nottinghamshire

14

120 bottles of Prime Hydration Cherry Freeze in one day. Time, price and promotion are the objectives to make a new craze successful. One Stop had the �lavour in on its launch week, meaning I could stock it two days before the supermarkets.” Aman Uppal, One Stop Mount Nod, Coventry, Warwickshire COMING UP IN THE 15 MARCH ISSUE OF RN Pricewatch: see what other retailers are charging for chilled snacks, and boost your own profits How to build a refill range that drives loyal footfall Maximise your store’s potential to become a one-stop shop for household goods + STAY INFORMED AND GET AHEAD WITH RN betterretailing.com/subscribe To ADVERTISE IN RN please contact Natalie Reeve on 07824 058172 3,451 retailers’ sales data analysed for every issue 69+ unique retailers spoken to every month 71% of RN’s news stories are exclusive At RN, our content is data-led and informed by those on the shop floor ORDER YOUR COPY from your magazine wholesaler today or contact Kate Daw on 020 7689 3363

sold

MAYFAIR GOING FOR GOLD WITH

RETAIL EXPRESS partnered with JTI to o er ve retailers a £1,000 cash prize each to celebrate the launch of the supplier’s Mayfair Gold cigarettes

THE MAYFAIR OPPORTUNITY

IN October 2023, JTI expanded its ultra-value cigarette range with the launch of Mayfair Gold.

Launching in King Size and Superkings 20s formats, the new variety o ers a premiumquality Virginia blend at an a ordable RRP of £12.75. Retailers have said its price has helped drive sales among their cigarette customers.

“Some customers will always buy the same product and move with the prices, but others have to change because of the increases,” says Natalie Lightfoot, of Londis Solo Convenience in Glasgow. “Mayfair Gold has enabled them to stay brand loyal.”

Alongside the premium blend, Mayfair Gold packs also have rounded corners and modernised outer packaging, which JTI also extended to packs of Mayfair Silver. Stocking both variants ensures retailers maximise their potential pro ts by o ering a wide range of choice to existing adult smokers.

To mark the launch of Mayfair Gold, JTI o ered ve retailers the chance to win a £1,000 cash prize through betterretailing.com. Retail Express spoke to the ve winners about the need to continue o ering value cigarette options and how they planned to spend the winnings.

SUPPLIER VIEW

Mark McGuinness, marketing director, JTI UK

“PRICE remains a key consideration for existing adult smokers when making a purchasing decision. By stocking iconic brands, like Mayfair, at ultra-low prices, retailers can capitalise on the sales opportunity.

“The ultra-value sector remains a key priority for us, as the fastest-growing segment in both RMC and roll-yourown tobacco. With existing adult smokers increasingly looking for products that o er premium quality at an ultra-value or value price point, we have continued to innovate our value product o ering. The launch of Mayfair Gold now o ers existing adult smokers greater variety.

“Mayfair Gold o ers the same premium-quality Virginia blend that is synonymous with the Mayfair brand and has already reached 0.83% market share since launch1.”

For more information, retailers should speak to their local JTI business advisers, call the help desk on 0800 163503 or visit jtiadvance.co.uk

the winners

Aruna Patel, Rons News, Droitwich Spa, Worcestershire

Aruna Patel, Rons News, Droitwich Spa, Worcestershire

“ WE nd product launches are helpful for our business across all categories, even in tobacco, where customers are more brand loyal. Mayfair is a popular brand and we’d recommend Mayfair Gold to other retailers, as price is the main factor for our cigarette customers. The prize was a nice surprise as my birthday was in January, so I’m going to spend it on a late present and enjoying myself with my family.”

Dave Hiscutt,

Londis Westham

Road, Weymouth, Dorset

“ WE’VE been doing a lot of activity in store with Mayfair Gold. It launched at a price point which has helped drive loyalty with customers and we’ve been putting it at the top of our cigarettes page on Snappy Shopper. We’re about to deploy electronic shelf-edge labels, so this prize can help contribute to the expenditure. They’re a time-saving measure, but they can also help us get more data out of our EPoS.”

Karen Mackay, Spar & PO Stores, Rogart, Sutherland

“MAYFAIR has traditionally been a popular brand in our store and we still have our regular customers. It’s a good brand for us to have as a lot of our cigarette and tobacco sales are down to pricing. With the prize money, I intend to spend some of it on a wee something for my sta as a gift, as they’ve been working very hard. I’m going to treat my family with the rest, perhaps with a weekend away.”

Natalie Lightfoot, Londis Solo Convenience, Baillieston, Glasgow

“MAYFAIR is a popular brand and we’ve been stocking Gold in King Size and Superkings. It’s been a good addition to the range for our more price-conscious cigarette shoppers. It’s a good reason to stick with a brand they like at a favourable price, and we’ve recommended it to other retailers. We’ll probably spend the prize money on a family holiday, as it’s been a long few years without one.”

Sukhwinder Samra, Lawnside Stores, Nailsworth, Gloucestershire

“PRODUCT launches are important for us, we look out for new products across di erent categories. I have regular Mayfair customers and they have started trying Mayfair Gold. I’d like to put the money towards a bike, just to take out for a ride on Sunday afternoons. It’s good for your health to get out from behind the counter and get some fresh air, which gives you time to think about things.”

15 12-25 MARCH 2024 betterretailing.com

In partnership with PAID FEATURE MAYFAIR GOLD GIVEAWAY

1Circana Market Place, Mayfair Gold Volume Share, Total RMC, Total UK, W/E 07.01.24

‘No Lottery scratchcard deliveries for a month’

OUR scratchcard availability has been very poor as of late. We hadn’t had a delivery for about a month.

Although we received them last week, we had three of our 12-point display slots missing for that entire time. I appreciate there have probably been some teething issues since Allwyn took over as operator, but it would’ve been good for someone to have told us what the problem was. We are an independent, and

there is a Co-op and Spar only down the road from us. One customer came in and when he saw we didn’t have the ones he wanted, he left. It’s clear someone else is getting that custom.

It’s all just been a bit stressful, and we don’t expect to be left this long with no availability on certain scratchcards. It doesn’t bode well when they’ve just taken over.

Anonymous retailer

A spokesperson for Allwyn responded: “As you may know, one of the key changes we made on 1 February was moving the entire distribution operation for all our scratchcard and consumable deliveries to a new eco-friendly warehouse in Warrington. This new arrangement will help us achieve the ambitious plans we have for retail over the next 10 years, but, as a result of the complexity of this change, we have been experiencing some short-term

scratchcard replenishment challenges that we’re working through.

“We’re really sorry for any delays to deliveries that retailers may be experiencing, and we’re emailing them directly to reassure them that we’re doing everything we can to resolve this as quickly as possible. In the meantime, we’ll also be prioritising affected stores with a call from our team to clarify their stock requirements in order to make any necessary adjustments.”

COMMUNITY RETAILER OF THE WEEK

Vas Vekaria, Kegs N Blades, Bolton

‘We held a charity supermarket sweep’

“LAST month I ran a ra le for a supermarket sweep in the shop. It’s the second one I’ve done and the money I made was donated to local charities. It gained a lot of attention on social media and the two winners were children. They were given 60 seconds to grab what they wanted from the store within reason for free, and they had a lot of fun doing the sweep. It’s important that we support the local community in any way we can. We also sponsor a darts team and donate regularly to several organisations.”

Are you ready for summer?

SPRING is already upon us, so we’ve started our preparations for the warmer seasons.

First things rst, we’ve got our fridges serviced. You should be getting them serviced every year.

Each issue, one of seven top retailers shares advice to make your store magni cent

It might seem like a needless expense, but it works out cheaper to get them serviced now when things are quiet. It will cost you a bomb to get an emergency callout in the middle of summer if they break down when the store is full of people wanting cold drinks. We also make sure to de-ice them and deep clean them so they’re ready to go for the summer. It’s about reducing costs and reducing risks.

It’s also important to get your planograms sorted for the summer as well. In the winter, we’re stocking lots of stews and root vegetables, dumplings and gravy, but in summer it’s picnic and barbecue time, so you want to be stocking up on lighter eating lines, alcohol and barbecue food. We get lots of cider drinkers in the summer because it’s so cool and fruity.

Beyond your core summer ranging, you also want to drive those additional sales. You can put out clip strips with skewers for the barbecue, for example. And it’s even better if you can cross-merchandise as well. We’ll be putting out straws with our so drinks, and marinades and seasonings with our barbecue meats. These will grab those extra sales.

The big event this summer is the Euros, so you want to think about what pre-deals you can buy beforehand and stock up. We’re going to put up bunting with the flags of all the di erent countries taking part in the competition. It’s important to think about what displays you can put up in store to create a bit of atmosphere and that will drive footfall.

Footfall is so important, and in a cost-of-living crisis it’s o en driven by price, so if you see a really good deal, buy it and, if you can, store it. It’s about being savvy with your buying and keeping an eye on trends as they come out.

16 LETTERS Letters may be edited

Get in touch @retailexpress betterretailing.com facebook.com/betterretailing megan.humphrey@newtrade.co.uk 07597 588972 SUSAN COnNOLLY Spar Tidworth, Wiltshire TO ENTER SUNTORY Beverage & Food GB&I has partnered with Retail Express to o er 10 retailers the chance to win two cases of each of its three brand-new Blucozade drinks – Lucozade Sport Blue Force, Lucozade Energy Blue Burst and Lucozade Alert Blue Rush. Available now, it is the rst time all three Lucozade sub-brands will appear side by side in a single launch, adding a splash of colour to chillers and creating real excitement for shoppers. WIN two cases of the new Blucozade range Fill in your details at: betterretailing.com/competitions This competition closes on 9 April. Editor’s decision is nal.

GROW THOSE SWEET SALES

CHARLES WHITTING nds out where sales and pro ts can be increased within sugar confectionery

TOP TRENDS IN THE CATEGORY

THE sugar confectionery category isn’t one that stands still, although there are rm favourites that retailers agree will always generate sales.

Customer purchasing behaviour has also shifted, with HFSS legislation having indirect impacts on retailers and customers alike.

However, the cost-of-living crisis appears to have had little impact on the way people think about treating themselves, with more than twofths of UK consumers saying sweets are a low-cost way to boost their mood, according to Mintel 2023.

Yogesh Darji, from Baddesly Store & Post O ce in Atherstone, Warwickshire, nds that what’s popular doesn’t change. “Haribo is the most popular,” he says.

“We have them in £1.25 price-marked packs (PMPs).” He also says anything new on his shelves will fly o them, and there is no shortage of product launches in the category.

Some of the launches are following recent trends, such as a desire for new flavours or reduced sugar.

“Research shows that 19% of adults are interested in

products with di erent flavour options, and, as a result, retailers should look to stock a wide choice,” says Elizabeth Hughes-Gapper, Jakemans senior brand manager.

Clare Newton, trade marketing manager at Swizzels, adds: “With the rise of plant-based diets, there has been a growing demand for plant-based and vegan confectionery options.

“Innovation within the vegan sugar confectionery category is a strong driver to entice consumers to try vegan products and ensure repeat custom.”

17 12-25 MARCH 2024 betterretailing.com cider CATEGORY ADVICE SUGAR CONFECTIONERY

CATEGORY ADVICE SUGAR CONFECTIONERY

STOCK SOMETHING NEW

SUGAR confectionery is generally a playful category, so it lends itself well to new and wacky product launches semiregularly. Retailers looking to carve out a point of di erence for their o ering need to be at the cutting edge of the market to nd out what’s trending, and then they need to source the appropriate products for

their stores. This can either be new flavour launches from established brands or some of the bigger viral trends that sweep social media.

“Research shows younger audiences are more experimental and seek innovative flavours,” says Sarah du Plessis, brand manager of Mentos.

“Mixed-fruit flavours domi-

US CONFECTIONERY

PERHAPS the biggest headline-stealer when it comes to novelty and new products within sugar confectionery is the huge growth of global confectionery, especially from the US.

Minesh Keshwala has only been at Spar Ash Close in Barlborough, Derbyshire, for a few weeks, but has already made sure to introduce a onemetre bay of US candy, something his local competitors aren’t o ering.

“It’s selling well and we’re getting more than 30% margins on it,” he says. “We get it through American Assets, but we’ve got another contact in She eld we’re in talks with as well because they’ve got a bigger range in.

“We used to have an end

bay dedicated to US sweets, but we’ve moved it because it’s harder to get hold of stock these days.

“The MrBeast confectionery is still selling well simply because of the brand around the person who owns it.”

If you can’t get hold of certain products from your existing wholesalers, then it’s worth shopping around because these can be huge footfall drivers if you can keep the range up to date and fresh.

“You’ve got to get that newest range in because people like to try di erent things,” says Keshwala. “They won’t keep buying the same stu . We’re looking into introducing US drinks and crisps now o the success of the confectionery.”

nate the ‘hard chews sweets’ category, with recent research proving there is a burgeoning appetite for exotic flavours.”

As an example, Swizzels is set to launch Mallows countlines in April and Strawberry & Cream Squashies in May, so it’s important to keep on top of what’s on the horizon and stock up accordingly.

Mentos

Fruittella

product launches

Perfetti Van Melle has unveiled Mentos Discovery, which o ers a category- rst 14 di erent flavour sweets in one roll. The 14 flavours include passion fruit, lychee, blueberry, blackcurrant, lime, strawberry, raspberry, orange, lemon, watermelon, banana, grape, cherry and pineapple.

Perfetti Van Melle has introduced a sharing-bag format for its Fruitella Strawberry chew brand. “The new sharing-bag format is ideal for making quality time with friends and family even sweeter,” says Lauren Potter, senior brand manager at Fruittella.

Hancocks

Hancocks has introduced new pick ‘n’ mix lines to its Kingsway range of confectionery. Additions include Kingsway Pint Pots, non-alcoholic sweets with a beer flavour, and Cherry Scandi Fish. Giant Cola Bottles, Heart Throbs, Fizzy Rings and Filled Whale are also set to be launched.

World of Sweets

World of Sweets is adding to its kids novelty range. Launches for this year include products from Crazy Candy Factory, Warheads, Buildable Surprise, Pez, Sweet Bandit and Kidsmania.

18

THE TILL AND BEYOND

MOST retailers agree that the till is the best place to drive impulse sales of confectionery, with its high visibility and ease of purchase.

It is also important to put sugar confectionery in other places around the store, including gondola ends, near sandwiches for meal-deal inspiration and a dedicated section of shelving.

“New products should be visible from the moment a customer enters the store, whether it’s the items themselves or signage pointing to where they are on display,” says Chris Smith, partner brand manager at World of Sweets.

“This will help instantly guide them to where they can browse and eventually purchase.”

RETAILER

VIEW

Umar Majid, Baba’s Kitchen, Glasgow

This will allow retailers to expand and diversify the range further, give it some grounding in people’s minds and help to build a reputation for confectionery.

A dedicated US confectionery section or a pick ’n’ mix area can both provide a point of di erence for a store.

secured in aisles and smaller, more a ordable, on-the-go options located wherever the footfall is highest.

As it doesn’t melt like chocolate, sugar confectionery should be the category retailers focus on as we move into spring and summer.

“Demand for convenient, on-the-go sweets will increase as the weather warms and consumers look to venture outdoors, providing an opportunity for retailers to maximise sales,” says Jakemans’ Hughes-Gapper.

mainly cheaper, Spar-branded

“The Haribo bags – including Starmix and Tangfastics – sell well, along with Maoam and Mentos,” says Keshwala. “They’re mostly on hooks with other bagged sweets. We have sweet bays at the promotional ends of aisles, but those are mainly cheaper, Spar-branded products.”

Where they are placed will often be determined by the pack formats and price, with larger, value options better

“IT’S all about new products, especially for impulse purchases. There’s always a new Jolly Rancher or a new Haribo coming in. And you can get them in, we do it all the time.

“If it’s a new product, it always tends to sell out rst time around. Then, on the second round, sales will slow down, and, if that happens, then we’ll get rid of it. Sometimes, it will sell well and we’ll keep it. People are more loyal when it comes to chocolate. New chocolates don’t sell as well as new sugar confectionery.

“I’ve reduced the amount of products at the till and now it’s only new lines that get up there. I tell the sta to do more upselling. If they’re only upselling one product and it’s a new product, then it sells well. It might only be 10p, but if you sell 15 of them, that’s £1.50 a day and that works out at more than £500 over a year. If there’s good uptake, I’ll put them in the main confectionery section, and if it doesn’t sell well, it goes in the promotional bin.”

Pez

Candy Pops

World of Sweets launches

World of Sweets has launched a new Pez Star Wars Mandalorian 1+2 Impulse packs. With an RRP of £2, each pack comes with one dispenser and two candies. Customers can choose from four characters from the franchise including Yoda, R2-D2, Stormtrooper or The Mandalorian.

World of Sweets is also set to introduce a range of strawberry-flavoured lollipops with di erent themes. The Teenage Mutant Ninja Turtles Push N Twist Candy Pops have a novelty push-up level to reveal the sweet treat. Customers will be able to choose from Donatello, Michaelangelo, Raphael, or Leonardo. There is also a PAW Patrol version, where customers can choose between Rubble, Chase, Skye and Marshall.

Dino Dip

Candy Realms Dino Dips are a range of lollipops and popping candy. The sugary treat contains a lollipop, a popping candy sachet and a sticker at 50p per packet. It is available in blueberry, cola and strawberry flavours.

Zed Candy

The Zed Candy Jawbreaker USA Bag has an RRP of £1.29 and features a tough exterior with a bubblegum centre. It will be available in three flavours: cherry, grape and watermelon.

Barratt Wham Flash and Dip Pop

These light-up lollipops come with sour raspberry taste and super sour green crystals. These 25g lollipops have an RRP of £1.29.

19 12-25 MARCH 2024

CATEGORY ADVICE CRISPS & SNACKS

SNAP UP CRISPS AND SNACKS

PRIYA KHAIRA nds out what opportunities exist in the crisps and snacks category and what the top-performing lines are

CRISPS AND SNACKS OPPORTUNITIES

RETAILERS faced many challenges with the crisps and snacks category in the past year, with HFSS restrictions limiting product visibility and the cost-of-living crisis impacting consumer spending habits.

However, research indicates that the category is now growing in independents by 19.5% annually.

In fact, recent Mintel research shows the category is witnessing an uplift in sales as 70% of consumers are purchasing crisps and savoury snacks for at-home treats and big nights in.

For Enya McAteer, of Mul-

kerns Spar in Jonesborough, County Armagh, the category is a key sales driver. McAteer runs deals each weekend on her crisps and snacks range to encourage bigand quiet-night-in purchases.

“We have a clearly signposted xture at the front of our store dedicated to crisps and savoury snacks,” she says, “We keep the area full of our crisp multipacks, large snack bags and soft drinks multipacks to encourage incremental sales.”

McAteer notes that she tries to keep on top of any seasonal events that are taking place

throughout the year that might prompt a spike in demand.

Kenton Burchell, group trading director at Bestway Wholesale, says curating a selection of popular, trending snacks can encourage big-night-in sales.

“This category is key for big nights in as many enjoy indulging in a variety of crisps and snacks while watching a lm, sporting events or spending a relaxed evening at home,” he says.

Burchell says retailers can promote these occasions further on their social media accounts. In store, they can be creative with the help of PoS.

On-the-go and top-up missions are also key opportunities across the category.

According to Mike Chapman, head of wholesale at PepsiCo, data shows that 35% of savoury snacks are picked up by consumers at tills, indicating these items are often purchased on impulse. “Retailers should stock products that cover these di erent shopper missions through merchandising to encourage incremental sales,” he says. “For instance, customers are four times as likely to purchase crisps and snacks if they see them in a secondary location.”

Walkers

CATEGORY NEWS

New products

Walkers has added two new flavours to its Sensations range: Mature Cheddar & Chilli Chutney and Crushed Sea Salt & Black Peppercorn. Both varieties have an RRP of £2.50.

Nakd

Nakd is expanding its portfolio of healthier snacks with the addition of its Fruit & Fibre bars, available in Apple & Cinnamon and Strawberry & Raspberry flavours

Pringles

Pringles is replacing its Sizzl’N range with its Hot range. Kickin’ Sour Cream and Sweet Chilli flavours are available to independents at an RRP of £2.25.

Fridge Raiders

Fridge Raiders is launching its Poppers range in a Cheesy Nacho flavour this April.

KP Snacks

KP Snacks has expanded its Nik Naks range with the launch of its Rib ‘N’ Saucy variety in a 45g Grab Bag. The item has an RRP of £1.

Kurkure

Kurkure has launched a new Chilli Chatka flavour. The variety is available in 80g pricemarked packs for an RRP of £1.25 and 100g plain packs.

McCoy’s

McCoy’s Epic Eats Chip Shop Curry Sauce and Bangin BBQ varieties are available in PMP formats at an RRP of £1.25.

20 12-25 MARCH 2024 betterretailing.com

KELL_05_606 Pop Tarts Smores Trade Comms Retail Express 260x339mm Feb 24 HIGH RES.pdf 1 20/02/2024 17:31

NewstrAid’s Wellbeing Suite

Supported by Hearst UK in memory of Terry Mansfield

Calling all newspaper and magazine retailers…

Give your employees all the benefits of a workplace wellbeing programme with absolutely no cost to your business.

Industry charity NewstrAid has teamed up with wellbeing experts Spectrum.Life to offer independent retailers access to a FREE Wellbeing Helpline and Website.

24/7 Wellbeing Helpline

Confidential ‘in the moment’ help and advice from clinically trained counsellors.

FREEPHONE 0808 196 2016

Text/WhatsApp ‘Hi’ to 00353 87369 0010

Wellbeing Website and App

Hours of industry leading health & wellbeing content supporting mind, body and life including:

• Mental health & lifestyle guides (wellbeing)

• Wellbeing podcasts (soundspace)

• Self-guided meditation (be calm)

• Eating plans & video recipes (nutrition)

• Exercise programmes & tracking (fitness)

• Exclusive benefits & savings (discounts)

https://newstraid.spectrum.life

Download the Spectrum.Life app from your app store.

Sign Up Today! https://newstraid.spectrum.life Using Organisation Code: news2021

PMPS

DATA gathered by pricecomparison tool Pricewatch shows that price-marked packs (PMPs) are driving category growth.

McAteer says the category is promotion-led, with many customers gravitating towards multipack and larger formats only when on promotion. “Customers are gravitating towards well-known brands like O’Donnells, Doritos, Kettle Chips, Tayto, Walkers, Quavers and Monster Munch,” she adds.

“However, sales are much stronger when these lines are on promotion, so value for money is really important to customers in this category.”

Matt Smith, marketing director for Tayto Group, explains that value for money is now the third-most-important reason for snack purchases after flavour and quality.

“PMPs give them the condence that they are not being ripped o , which is why PMPs have increased to 77% of snack sales,” he says.

Chapman predicts that PMPs will be at the forefront of crisp-and-snack sales this year. “PMPs cater to multiple occasions, which is signi cant for retailers looking to drive incremental sales due to the importance of catering to all shopper missions,” he adds.

Chapman says it’s important retailers stock the right mixes of flavours and brands in PMP formats to maximise sales opportunities across various shopper missions.

Sharing bags