Top retailers share how they encourage customers to spend more in store

Alex Yau, editor

Alex Yau, editor

THIS issue marks my rst as Retail Express’s editor, and my goal is to carry on the fantastic work my predecessor, Megan Humphrey, did during her six years at the helm.

Many of you will know that although this is my rst time overseeing Retail Express properly, I’ve spent many years ghting on the behalf of independent retailers in various roles. I’ll ensure I use my new position to make this happen with even more momentum.

One area I want to highlight more is the emotional and physical impact serious issues have on independent retailers and their communities. Our cover story this week is an example of this, putting the spotlight on a topic not covered as widely before in the Horizon scandal.

We spoke to several subpostmasters wanting to leave their businesses a er su ering from the Horizon scandal. However, a lack of interest from buyers put o by these historic injustices and poor remuneration meant these retailers had been trapped by the very businesses that harmed them.

The Horizon scandal isn’t the only area I want to focus on, though, as I know retail crime, tough legislation and rising costs are where you’re also facing problems. We’ve got a number of stories and campaigns planned, highlighting these issues, and holding companies and organisations to account.

Please don’t hesitate to get in contact with me should you be facing any of these issues. I’m always here to listen and will do my best to ght your corner.

INDEPENDENTconvenience stores will go out of business if the upcoming government ignores challenges faced by small shops, the Scottish Grocers’ Federation has warned.

Speaking at its Mini Summit in Edinburgh last week, the trade body’s chief executive, Pete Cheema, high-

lighted issues of rising costs, retail crime and strict legislation, among others affecting independent retailers.

He said: “The convenience sector cannot absorb any more costs, which creates a perfect storm where any loss in income must either be absorbed by the supply chain or passed onto customers.

“This in turn fuels a costof-living crisis and in�lation.

Retail crime, national living wage increases, reduced business rates relief and a torrent of restrictions across products could spell the end for many vital community services.

“SGF has raised these concerns to Edinburgh and Westminster. We will not allow them to lose sight that convenience stores are hubs which ensure custom-

ers can access essential groceries and key services around the clock. They also provide jobs for local people, thereby providing an economic bene�it. Where would we be without convenience stores?

“SGF will continue to lobby the UK and Scottish governments to ensure their interests and key priorities are protected.”

INPOST has revealed it wants to help its retail partners capitalise on the demand for its lockers after hitting 7,000 locations in the UK.

Neil Kuschel, UK CEO at InPost, said: “Our aim is that InPost is ubiquitous and that every store has an InPost locker, and every UK consumer uses our lockers.” The company revealed it is exploring smaller lockers designed for smaller stores. News reporter Alice Brooker @alice_brooker 07597 588955

Specialist reporter Dia Stronach 020 7689 3375

of marketing

Daw 020 7689 3363

being £100,000. Allwyn director of channel operations Alex Green said: “The arrival of the scratchcard in National Lottery retailers will also be an attractive proposition for players, with dual bene�its of either playing or gifting this card.”

The company reported a 40% increase in locations since March of last year, with ambitions to expand further.

THE ACS is

Adegboyega

7689 3368

AUTOMATED launderette provider Speed Queen is seeking expansion in convenience stores, claiming to generate partners £250,000 of pro�it in their �irst three years.

The �irm, which has already partnered with Tesco in Ireland, is launching in the UK for the �irst time and the automated service runs on card payments.

Existing sites have attracted 60 customers on peak days, with average spend around £15.

VICTIMS of the Post Of�ice (PO) Horizon scandal have been trapped by the very business that harmed their lives, after the injustice has prevented them from selling their branches.

Retail Express spoke to several subpostmasters looking to sell their PO sites, but claimed growing awareness of the historic injustices had scared away potential buyers.

Graham Livesey, of the Beehive in Stavely, Cumbria, said his PO branch had been on the market since 2015 with no viewings. He stated the “main reason” the branch hadn’t sold is that “no one wants to run a post of�ice any more, with the Horizon scandal having taken the money”.

Livesey added: “I can’t run a post of�ice any more after what PO did. I know three branches in South Cumbria that recorded shortfalls, and a lot of little village branches have shut down and not successfully relocated.

“I had shortfalls. I declared and paid them back. I was hit by one massive shortfall, which I reported. PO told me I was the only one. Watching the recent ITV drama, you know what was going on behind the scenes.

“The business is marketed at a realistic price, and I haven’t even put the asking price up. PO is a toxic attachment.”

Rosalind Cobb, who con�irmed she and her husband had put in a claim for historic shortfalls from the Horizon scandal, will retire after failing to sell the branch over the past two years.

The owner of the branch in Llangefni, Anglesey, said: “We don’t think we had a buyer of our post of�ice because of the Horizon scandal. PO isn’t very trustworthy any more. They’ve still got the Horizon system.

“We’re sad to leave after 35 years. We were the only post of�ice in the village, and there aren’t many in the larger area.”

Christopher Dubery, of Dulverton Post Of�ice in Somerset, had also shelled out his own money to make up for previous shortfalls in his Horizon system. He will leave the branch in September, after having it on the market for a year.

He added: “We’re partly not getting interest because of the scandal, but also because of remuneration being rubbish. The money just isn’t there. Across west Somerset and north Devon, more than 14 branches have closed over the past 15 months. They’ve had enough.

“If I was looking to buy a post of�ice now, that would put me off, irrespective of how much income I’d get.”

For anyone to take on an existing or new branch, any potential buyer must go through a rigorous approval process with PO. The challenges these subpost-

“IT’S about being visible to as many customers as possible. Certain people are programmed to do what they normally do. We feature all the big home delivery platforms such as Deliveroo, Uber Eats, Just Eat and Snappy Shopper. If a customer is used to using Deliveroo, they will use it, and it’s the same for Uber Eats. At 1am, when all the takeaways are shut, we come up on the sites.” Kesser Mahmood, Da Shop, Stockport, Cheshire.

masters have faced in �inding a buyer means their local communities risk losing their only PO branch.

Manish Jadav, owner of shop brokerage �irm Trinity Retail Sales, told Retail Express that post of�ices that have been on the market for more than a year need to “look at their price” to sell.

He added: “It’s about generating viewings through social media and marketing. I’d highlight the fact that banks are closing, and footfall will be coming to a post of�ice. Some agents will just take it

on and put on high prices.”

Asked to comment on the challenges in �inding a buyer, a PO spokesperson told Retail Express: “We’re saddened to hear that there are current postmasters who no longer want to operate a post of�ice.

“We �irmly believe customers recognise their value and are continuing to distinguish between PO’s appalling past behaviour in the Horizon scandal, and today’s postmasters, who are the lifeblood of their communities and provide

essential services.”

The challenges come as PO minister Kevin Hollinrake called for a “frank and open discussion” on shrinking the size of the PO network, having stressed the desire to drive down costs and maximise revenues for branches at a conference in mid-May.

According to Computer Weekly, PO branches could also have the Horizon system until March 2030, following delays with the rollout of the replacement NBIT system.

MEDIA SCREENS: Digital convenience network Hi Street Digital aims to expand to 500 screens by the end of 2025, after it installed its 300th high-de nition advertising screen at a Morrisons Daily in Horsham, West Sussex. The company, which aims to boost sales through screens, currently reaches around 148,812 shoppers daily.

For the full story, go to betterretailing.com and search ‘Hi Street’

PARFETTS: The wholesaler is now delivering to stores in southwest England for the rst time. Parfetts’ head of retail, Steve Moore, said: “Extending our reach to the south-west brings strong promotions.”

For the full story, go to betterretailing.com and search ‘Parfetts’

“WE’VE seen a 20% uplift in grocery sales because of our home delivery service. We’ve got a Morrisons supermarket a stone’s throw from us and a Lidl behind it, but when we started delivery, people would spend £40£50 without thinking. There are a lot of flats nearby, so people do not want to carry multipacks up the stairs – they’re happy to get it delivered for a charge, if it’s more convenient.”

Nathalie Fullerton, One Stop, Partick, Glasgow

“WE’VE found that having promotions on home delivery can lead to additional basket spend. We’ve been building our delivery arm by incorporating loss leaders. For example, we’ve been o ering a 10-pack of Irn-Bru for 99p for the past 10 days. We’ve technically lost £1.25 every time we’ve sold one, but we can a ord that when customers are willing to pay a premium and make a £30 basket spend.”

Martin

Londis Solo Convenience, Glasgow.

ADMINISTRATION: Abra Wholesale owed more than £6.1m to 195 creditors. The struggling wholesaler went into administration last month but has since been bought by rival operator Leo Worldwide Supply’s (LWS) for £360,000. Abra owed nearly £2m to HSBC, alongside debts owed to four major tobacco companies.

For the full story, go to betterretailing.com and search ‘Abra’

NEW YORKER: The 20 May edition featured convicted killer Lucy Letby, potentially putting retailers at risk of contempt of court. A retrial meant the cover risks swaying the jury. The New Yorker blocked the UK online piece, but Condé Nast and distributor Seymour sent the edition to stockists.

For the full story, go to betterretailing.com and search ‘The New Yorker’

RETAILERS are being warned to check the credentials of freeze-dried sweet manufacturers and suppliers as more tap into the social-media fuelled trend.

The craze, promoted on TikTok, has seen some retailers generate more than £2,500 in sales a month.

Freeze-dried sweets are

made by removing moisture from products while preserving taste and nutritional value.

However, there are warnings urging retailers to check whether businesses selling the products are fully compliant. The warning comes following several reports of rogue companies selling online.

One source told Retail Express: “Retailers need to be

careful who they buy from. Make sure they are fully food registered and trading as an actual business.”

Amrit Singh Pahal, of H & Jodie’s Nisa Local in Walsall, has spent several months developing his own product range and says there are “hoops to go through” to make sure the product is safe.

He said: “Lots of people are jumping the gun on this craze and it’s a ticking time

bomb. What happens if a child chokes on one of these sweets?

“People can’t just buy a drying machine, package up sweets and sell them. There has to be full certification that complies with food hygiene and trading standards. I have a long list provided by my local council.”

Suresh Patel, of Premier Upholland near Liverpool, said he began selling the

sweets two weeks ago and has since reordered.

He said: “As a retailer, what I can do is make sure the item

has a barcode, ingredients and full allergen information, and that I’ve ordered it from a reputable wholesaler.”

A NEW loyalty card scheme is being trialled in 20 Premier, Londis and Budgens stores.

During the 12-week trial, customers who sign up receive physical cards to access discounts on household staples, such as bread and soft drinks. Loyalty card members also receive a 1p reward for every £1 spent.

Jaz Ali, of Jaz’s Premier in Falkirk, said: “We had 500 sign-ups within the first few days and customers are visiting more.”

or 5% for those trading under their own name.

FOOD waste app Gander has partnered with convenience experts C-Store Collective to promote discounted food to shoppers in a bid to cut food waste. The app helps shops sell a higher volume of discounted food at a faster rate. Jonathan Rons, co-founder of C-Store Collective, said: “Gander’s solution drives sustainability and reduces food waste by enabling retailers to sell more reduced food.” NISA has launched a longawaited rebate tracker so retailers can follow weekly progress to ensure the greatest possible quarterly payout. Now, Nisa’s Order Capture System (OCS) will provide updates on the symbol group’s Fresh Rewards rebate scheme, showing figures on both previous and current financial quarters. The maximum rebate rate is

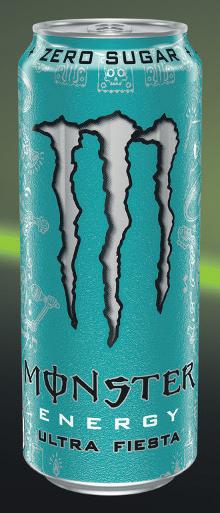

BRITVIC’S Soft Drinks Review 2024 has identi�ied a plethora of soft drinks opportunities for retailers.

The review found that more shoppers are turning to convenience stores for take-home soft drinks purchases, with nearly twothirds of customers now using them. It stated that the category is demonstrating strong signs of growth.

The report also indicated that changes to consumer shopping habits and commercial climates are presenting new opportunities for convenience retailers.

It showed that soft drinks are now the most bought

impulse category in convenience, present in just over one in four baskets.

The stimulant energy segment delivered growth worth £181.5m last year. It was the second fastestgrowing sub-sector at 23.7% behind sports drinks, which grew by 64.6%, taking �ifth place in the list of bestselling soft drinks sub-categories in convenience.

Stimulant energy drinks remain number one in the category.

Sugar-free energy drinks have also demonstrated a rise in popularity, the report found that effective merchandising and advertising on social media is a key way to engage with shoppers of

this segment.

While soft drinks are identi�ied as the most bought impulse category in

the channel, the report also identi�ied that stores could be doing more to tap into ‘meal for tonight’ occasions.

CHUPA Chups has stepped into the jellies market with the launch of a new Belts and Laces range.

The range consists of Belts in Sour Mixed, Sour Apple and Sour Strawberry varieties, and Strawberry Laces.

The whole range is available to the convenience channel this month.

The range taps into growing demand for sour and exotic confectionery �lavours.

Confectionery is worth £5.5bn to the UK’s overall treat and snack market, with 75% of sales coming from confectionery.

Data also suggests that more consumers are looking

FUNKIN Cocktails is celebrating its 25th anniversary with an on-pack promotion offering cash prizes.

The promotion, which is the brand’s largest yet, is offering retailers cash prizes of up to £25,000.

Available until August, it is available on its 700ml Bartender Edition Bottles and Nitro Can Cocktail Mixed Party Packs.

The promotion builds on the brand’s ‘Shake it Lucky’ campaign, which launched last year.

Shoppers can enter by scanning the QR code available on each participating pack.

Winners can also secure a trip for two to

Barcelona, a Polaroid Now Gen Camera, a mini fridge stacked with Funkin Cocktails or a £100 supermarket voucher.

The ready-to-drink segment has reached doubledigit growth, and Funkin Cocktails has grown by 12% over the past year. Live until: August

SPECIALITY food importer and distributor Empire Bespoke Foods has added American breakfast cereal Marshmallow Mateys to its range and is rolling it out through Empire Bespoke Foods

The frosted wholegrain oat cereal contains marshmallow chunks. It is available directly to independents from Empire and through wholesalers including Glencrest, Dhamecha, Bestway and others. According to Empire, at-home breakfasts are at an all-time high, with 93% of people eating breakfast at home.

Additionally, research shows that 88% of cereal

IMPERIAL Brands has expanded its Golden Virginia tobacco range for the �irst time in 15 years with the launch of an Amber Blend.

It is available in a 30g pouch with a £21.35 RRP.

The supplier says it has a “smooth, rich and aromatic” �lavour pro�ile, with lower moisture content from sundried leaf.

It is the brand’s �irst launch since Golden Virginia Yellow in 2009.

Yawer Rasool, consumer marketing director UK & Ireland at Imperial Brands, said: “With many consumers looking to save money, we’ve seen roll-your-own (RYO) product sales within the value price sector in-

consumers eat cereal at least once per week, with 50% consuming cereal up to four times a week.

RRP: £3.75 (320g)

Available: Now

Fox’s Burton’s Companies UK (FBC UK) has expanded its Jammie Dodgers biscuit range with the launch of a Giant edition.

The launch is available to independent retailers from Bidfood, Brakes, CJ Lang, Appleby Westward and AF Blakemore.

Sales of Jammie Dodgers rose by £32.5m last year and grew in volume by 18% year on year.

The Giant single serve Jammie Dodger is FBC UK’s third biscuit format, alongside the traditional biscuits and preportioned mini biscuits.

The 50g biscuits come in a shelf-ready case of 20 in a Raspberry �lavour. Available: Now

crease by 8% year on year, making it the fastest-growing segment.”

RRP: £21.35 (30g)

for fruity �lavours.

Chupa Chups is currently worth £17.7m and is growing by 5%. The launch is being supported with a social media campaign.

RRP: £1.25

SPANISH lager brand Estrella Galicia has committed £10m in marketing spend to drive awareness of the brand in the UK.

The investment includes further exposure for the brand’s campaign ‘Spanish not Span-ish’ and sports sponsorships with McLaren and MotoGP.

The campaign consists of a comedy skit highlighting Estrella’s origins in the Galicia region of Spain across TV and social media, as well as out-of-home adverts.

Aitor Artaza, managing director at Estrella Galicia International, said: “The UK is an important market for us as people here embrace authenticity and heritage of brands.

“That’s why we have put a multimillion-pound investment behind the brand to ensure that people are aware of it and its genuine Spanish provenance.”

PLADIS is expanding its McVitie’s Jaffa Cakes range beyond fruit �lavours with the launch of a limited-edition Cola Bottle Flavour.

The new �lavour will be available across Jaffa Cakes biscuits and Jaffa Cakes Bars range.

Jaffa Cakes Cola Bottle biscuits will be rolling out widely from the end of July, with a £1.25 RRP. This will be accompanied by a £1.25 PMP version exclusive to convenience and wholesale being released at the same time. The Cola Bottle Cake Bars will be released in a £1.80 non-PMP variant in mid-August.

The supplier will be supporting the launch with

outdoor advertising, social and in�luencer content and in-store activations.

Adam Woolf, marketing director – McVitie’s at Pladis UK&I, said: “Inspired by the enduring popularity of both McVitie’s Jaffa Cakes and Cola Bottle sweets, McVitie’s Jaffa Cakes Cola Bottle Flavour is tailor-made for those who’ve got the bottle to branch out.”

COCA-COLA is offering football-themed prizes across its Zero Sugar formats as part of its partnership with UEFA Euro 2024.

The on-pack promotion runs for �ive weeks from 10 June across 2l, 1.25l and 500ml PET bottles, 330ml cans, 24x330ml multipacks and 330ml glass bottles of Coca-Cola Zero Sugar.

Shoppers can scan QR codes on limited-edition packs to go to the Coke App and enter a prize draw.

Prizes include Adidas training tops and Coca-Colabranded footballs and cups.

Every entrant will also be added to a draw for a VIP

�inal experience at Boxpark.

Convenience retailers can support the promotion with PoS from My.CCEP.com.

During the 2018 World Cup, the last summer football tournament unaffected by the Covid-19 pandemic, cola varieties contributed more value to the growth of the soft drinks category than any other segment, driven mainly by Coca-Cola.

Rob Yeomans, vice-president, commercial development at Coca-Cola Europaci�ic Partners (CCEP) GB, said: “International tournaments attract mainstream viewers in a way that club football doesn’t.

“In fact, football is a key passion point for consumers,

THATCHERS Cider has given its Cloudy Lemon variety a refreshed look to align with the rest of its range.

The new look for the fourpack, which rolled out at the start of the month, follows news that Thatchers Cloudy Lemon four-pack grew by 9.2% in the past 52 weeks.

Additionally, Thatchers Apple & Blackcurrant became the fastest-growing new product launch in the cider

with the UEFA Euro 2020 �inal drawing more than 29 million UK viewers.

“Within retail, our large PET bottles and multipacks

of cans are a must-stock to cater for increased at-home social occasions, during the tournament and throughout the summer.”

category since the launch of Thatchers Blood Orange.

Yvonne Flannery, head of brands at Thatchers, said:

“This new design adds a sense of depth and location to the branding, with zesty colours and a warm Mediterranean vibe.

“It now sits clearly in our family of fruit ciders, alongside our Blood Orange and Apple & Blackcurrant innovations.”

CLEANING products brand

Flash has launched its �irst kitchen roll product.

Flash All-Purpose Roll is available to independent retailers through wholesalers and cash and carry operators including Dhamecha, Regal, Lioncroft and Rayburn Trading.

The three-ply roll is available in two sizes. One slightly

smaller for quicker jobs and XL sheets for bigger jobs.

Graham Cox, chief operating of�icer of Accrol, said:

“Using FSC-sourced material, as is standard at Accrol, Flash Kitchen Roll is engineered to deliver superior absorbency and strength to help consumers achieve a hygienic clean with minimal effort.”

RRP: £3.50

DIAGEO has collaborated with The Flava People on the launch of a non-alcoholic Baileys Caramel Sauce.

The sauce is available to wholesalers from The Flava People in a 500ml squeezy ambient bottle.

It can be used across a variety of items, including desserts, hot drinks, ice cream and alcoholic drinks.

Scott Dixon, managing director at The Flava People, said: “We know Baileys licensed products perform well, especially at Christmas.

HEINEKEN UK has added a Strawberry variety to its Strongbow �lavoured cider range, available exclusively through Booker and One Stop.

The new variety comes in a 4x440ml can and 500ml bottle formats to drive summer sales.

Following the launch of Strongbow Zest, the strawberry �lavour comes as Strongbow is the number one cider brand in volume and value sales, with more than 20% share of the total cider category.

The supplier is looking to capitalise on the growth of premium berry �lavours within cider by offering one at a more accessible

price point. Strongbow Strawberry is also free from arti�icial �lavours, sweeteners, colours and gluten and is vegan.

RRP: £5 (promo), £5.50 (off promo); 500ml: £2.35, three for £6

“Drawing on our expertise from working closely with the foodservice industry for decades, and the insight

from the Baileys team, we believe we have a truly unique product.”

GOLDEN Acre foods has hopped on the protein trend with the launch of premium meat snack range Hungry Boar.

The range includes Chicken, Pork, Flamin’ Peri Peri and Flamin’ Jalapeno varieties.

Branded meat snacking products account for 90% of the total meat snacking category, but are in 2.6% decline.

The launch aims to attract new shoppers to the category. It is targeting picnic and at-home occasions, as well as on-the-go snack missions.

It is also aimed at young, male shoppers prioritising their protein intake.

Hungry Boar is being sup-

STARBUCKS has unveiled a new protein drink, as part of its ready-to-drink range, with Starbucks Protein Drink with Coffee. Starbucks Protein Drink with Coffee is available in Caffe Latte, Chocolate Mocha �lavour, and Caramel Hazelnut varieties.

Each 330ml bottle contains 20g of protein per bottle, low-fat milk and no added sugar.

The launch comes as research suggests that younger demographics are prioritising protein intake. Iced coffee sales across this demographic are also on the rise.

Adam Hacking, head of beverages at Arla, said: “By

appealing to existing protein drinkers as a trade-up opportunity and by tapping into the penetration opportunity for new shoppers, Starbucks Protein Drink with Coffee will continue to drive growth in the milk-based beverage category.”

RRP: £2.75

INDEPENDENT Kerry-born distillery, Dingle, distributed by Paragon Brands, has announced the launch of Cónocht an Earraigh Single Malt, a new limited-edition single malt whiskey.

contains notes of red fruit, spice and gingerbread. Along with hints of roasted almond and sugar.

Available this month, the whiskey is the sixth release in Dingle’s Celtic Wheel of the Year series, a limited edition run of whiskeys, which pay homage to Ireland’s cultural heritage of equinoxes and solstices.

Following the launch of Grianstad an Gheimhrid in November, Cónocht an Earraigh will be the rarest release in the Dingle Wheel series with 5,500 bottles available worldwide.

“The Wheel Series is a testament to Dingle’s deeprooted connection to its cultural heritage, celebrating the ever-changing seasons,” said Chris Jones, managing director of Paragon Brands.

RRP: £73.53

It has an ABV of 50.5% and

FOOD and beverage manufacturer Danone UK & Ireland has released an online platform designed to provide retailers with category insights, updates and advice.

Danone-The-Go combines key category trends, downloadable planograms, range recommendations, merchandising advice and top tips tailored to independent stores.

Users can access expert advice on ways to grow sales across soft drinks, yoghurts, desserts, plant-based drinks and baby feeding categories.

The platform will be updated monthly, featuring new trends and topics that can

help retailers drive sales.

The website allows independent owners to be able contact Danone to organise face-to-face merchandising visits to drive interactions and enhance in-store displays.

It is free to access and can be found via danone.co.uk/ danone-the-go.html.

Charlotte Andrassy, head of category development for beverages and impulse at Danone, said: “The new website will give our retail partners an improved understanding of the different categories, while providing an increased knowledge of all our Danone brands.

“This launch allows us to provide customers with the

MEXICAN food brand Old El Paso has released street food-inspired soft taco kits, sauces and spice mixes.

The ‘Street Vibes’ range includes two soft taco meal kits, available in Barbacoa and Al Pastor �lavours.

The sauces are available in Smoky Barbacoa and Sweet Chilli & Lime to complement the bold �lavours of the kits.

Tacos are one of the Mexican food category’s leading

segments, growing by 8% year on year.

The launch aims to target younger demographics, looking for a quick and easy mid-week meal or takeaway alternative. It is designed to serve two people, taking 20 minutes to prepare.

It is being supported by a campaign, which spans TV, out-of-home and social media activations.

best tools to positively help grow their businesses.

“As a business, we’re also

on a mission to bring health through food and drink to as many people as possible.”

PREMIUM beer and cider company King�isher Drinks has announced that it is the of�icial sponsor of the Royal Parks Half Marathon in London this year.

As part of the partnership, King�isher Zero will be available for runners to enjoy during the event in October.

Data shows that 50% of adults purchased from the no- or low-alcohol category in the past year.

The sponsorship aims to capitalise on this growth and raise the brand’s awareness among demographics of health-conscious adults.

Andy Sunnucks, senior brand manager at King�isher

SAUSAGE roll brand Wall’s is targeting breakfast sales with the launch of an All Day Breakfast Scotch Egg, All Day Breakfast Jumbo Roll and an All Day Breakfast Slice.

The trio has been designed to meet the increased demand for quick and convenient breakfast options, with more than half of consumers reportedly eating breakfast on the move.

Jason Manley, brand director at Wall’s Pastry, said: “Demand for quick, easy but tasty on-the-go breakfast solutions is on the rise, and our range offers shoppers a new way to enjoy the Wall’s brand.”

RRP: £1.50 (Scotch Egg), £1.20 (Jumbo Roll), £1.85 (Breakfast Slice)

All three items are available to convenience and wholesale channels.

The launch comes as part of the brand’s wider strategy to introduce more formats and cater for a wider range of eating occasions, having recently entered the quiche category.

TO celebrate Peroni Nastro Azzurro Stile Capri hitting one year in market, Asahi UK is giving away a case each to 200 lucky convenience retailers. The brand is currently growing by 38% versus its launch period last year1, indicating that its marketing campaigns are driving traction. As Stile Capri is a premium upsell in the ‘sunshine beer’ category, Asahi UK believes retailers should consider it for their core ranges.

“We believe Peroni Nastro Azzurro is the right brand to help retailers grow their sales of premium beer,

which is the fastest-growing area of the market,” said Rob Hobart, Asahi UK marketing director. “Peroni Nastro Azzurro Stile Capri’s unique position enables stores to drive incremental sales and drive their beer pro�its.”

CARIBBEAN food and drinks supplier Grace Foods has launched price-marked packs (PMP) for its Mighty Malt drink.

The launch follows the success of a PMP range for another one of its brands, Say Aloe, earlier this year.

agree that PMPs are

now more than ever.

The Mighty Malt drinks are available now to the convenience channel in 99p PMPs for 330ml bottles.

The launch aims to attract the increasing number of consumers looking for value options, especially in convenience stores.

Research found that 76% of convenience retailers are more likely to stock PMPs over non-price-marked formats and that 57% of

THREE Robins has extended its smoothie range with the launch of two oat milk-based smoothies.

The new additions come in 100g pouches in Super Berry and Totally Tropical �lavours. They are produced for three-to-12-year-olds and are designed to be a lunchbox sweet snack or an on-the-go treat for healthconscious parents looking for plant-based alternative snacks.

The smoothies also target parents wanting to give their children snacks that are not high in arti�icial sweeteners and sugar.

The pouches contain vitamins, folic acid and hidden vegetables, and are avail-

able from the Three Robins website. There is 4.5% vegetable content in Super Berry and 25% vegetable content in Totally Tropical. RRP: £1.89 (100g)

MENTOS has launched a £1.5m campaign this summer to promote its gum after a consumer taste test found that Mentos is ‘unbeaten on taste and �lavour’.

Live now until September, the campaign will cover out of home, shopper, radio and in�luencer activities, with an expected reach of more than 51 million adults across the UK.

The campaign will focus on Mentos’ paper bottle Pure Fresh Gum range, including menthol and fruit �lavours. Mentos aims

Drinks, said: “This partnership with the Royal Half Parks Marathon will further raise the pro�ile of King�isher Zero and really underscores the growing appetite for noand low-alcohol brands.” to capitalise on the growth of both of these categories, with fruit sales growing by 13.4% and mint growing by 12.5% year on year. Outdoor ads have been targetting almost 430 sites, including key university towns to reach Generation Z shoppers.

BESTWAY RETAIL is celebrating the success of this year’s Retail Showcase on 15 May at the Coventry Building Society Arena, which helped retailers and suppliers to collaborate and grow each other’s businesses

MORE than 800 retailers attended Bestway Wholesale’s 2024 Retail Showcase at the Coventry Building Society Arena on 15 May. Retail customers from Costcutter, Best-one, Bargain Booze and Xtra Local symbols, as well as prospective retailers considering joining the Bestway Retail family.

These retailers got to bene t from the presence of more than 150 partner suppliers across a range of categories. They also had the chance to win £1,000

in Bestway credit, with two runner-up prizes of £500 also up for grabs. Suppliers also o ered exclusive on-the-day deals for retailers to take advantage of.

“It was a nice event and the suppliers went the extra mile,” said an attending retailer.

“This year felt very energetic and engaging. I

Retailers who attended this year’s Showcase give their views on the day: RETAILER FEEDBACK

“It was great to catch up with other retailers and suppliers.”

“A focused choice of suppliers geared towards helping retailers grow pro ts.”

“Great networking opportunities at the afterparty.”

“Lots of chances to meet new suppliers and start a relationship.”

In partnership with

NOW in its second year, the Showcase featured a brandnew Innovation Zone, aimed at helping retailers improve their sales and margins. It included a virtual-reality walk-around of the supplier’s “best-inclass” stores, including its new Costcutter and Wine Rack hybrid, as well as the latest developments under its Bestone and Bargain Booze fascias. Also on display was a popup shop designed to minimise store closures during re ts, which retailers could visit. On the trade show floor, retailers

enjoyed interactive events, live demos, experiential zones and tasting sessions. As Bestway is the only wholesaler in the industry with a symbol or store format for all retailer types and customer demographics, the Retail Showcase is arguably the largest show of its kind.

Additionally, retailers got a rst look at the new Best-in own-label range. It consists of more than 160 products across key impulse and grocery categories, and promises retailers margins ranging from 30% to

75%, with the majority of lines being price-marked to give shoppers more con dence. The launch of Best-in underpins Bestway’s commitment to offering its retailers solutions that can help them save their customers money while continuing to o er the retailer a strong margin.

“The Showcase is a useful exercise to either nd something di erent or new that you possibly haven’t heard about, or to con rm that you’re on the right track with what you’re currently doing,” said one re-

tailer who attended. “The best part of the day was speaking to suppliers both new and existing and seeing what they have coming up. Having face-to-face time with them is great, and we found some new brands that we are in stocking – we would de nitely come back next year.”

After the Showcase ended, attendees were treated to a festival-themed afterparty, with food, drinks and entertainment as well as a retailer ra le and further opportunities to network.

“THIS year’s Showcase has exceeded our expectations.

To have our retailers engaged alongside our supplier partners and industry colleagues was hugely valuable for all parties,” said Bestway Wholesale’s managing director, Dawood Pervez.

“It’s often hard for retailers to nd time to discover the latest trends and insights to support their business but the Showcase enables them

to do this and make the time really count.

“This year’s Showcase was all about innovation and progression. We wanted to help retailers look ahead and identify great new products and services, whilst sharing ideas with like-minded business owners, who inevitably face the same challenges.

“It’s not just about new products, it’s also about creating a leading edge for our

retailers. As digital platforms grow in importance, we were keen to showcase the latest equipment and technology to help stores reduce energy, environmental and labour costs, as well as highlight the latest security technology.

“It was an immensely exciting and stimulating day, and I would like to extend a sincere thank-you to our retailers and supply partners who helped make it such a huge success.”

Pricewatch: see what other retailers are charging for tobacco accessories, and

HFSS: How will regulations in Scotland impact you?

“WHILE we back the desire for healthy eating, incomes drive the meals families can afford. Instead of implementing health education campaigns, the Scottish government is intent on making small businesses bear the brunt of lazy legislation, putting retailers in the front line of enforcement.”

Mo Razzaq, Premier Mo’s, Blantyre , South Lanarkshire

UPGRADES: Which of your store improvements have paid off?

“WHEN we opened our second store, we decided to have a beer cave. It was so popular that, when we extended our �irst store, we had to put it in. We saw an upturn in off-licence sales of about 20% and our £30,000 investment was paid off within two years.”

Paul Thomas, One Stop Main Avenue, Bridgend

“I INVESTED in my frozen section. It used to have a three-door freezer, but now we’ve got a three-door and a four-door freezer. We’ve spent £25,000 on it and sales have doubled. Frozen-pizza sales are great and there are kebab ranges in the freezer.”

Kopi Kalanathan, Costcutter, Kirk Sandall, Yorkshire

to be featured Who is going to police this?

“THERE are pros and cons. Healthy eating is a good message, but education must start at school. However, knowing this is coming, we got ahead of the game and moved confectionery from the till area. But as with all of these regulations, I ask, who is going to police this?”

OLYMPICS: Will you benefit from the event?

“I’LL be doing a couple of little on-the-spot prizes and draws on a regular basis –things like the 50th customer of the day. It doesn’t have to be expensive, just a goodie bag with a drink and some sweets. If you have smaller prizes you can affect more people.”

Trudy Davies, Woosnam & Davies News, Llanidloes, Powys

“WE’RE putting in new machines in our three shops that do protein shakes. Shake Shop does an all-in-one machine that doesn’t take up much space. I found it at the National Convenience Show. The growth in healthy products could dovetail really nicely with the Olympics.”

Peter Patel, Costcutter, Brockley, London

We spent £25,000 and sales have doubled

FOOD TO GO: How are you boosting sales in your store?

“CUSTOMERS use QR codes when they order meals in store. You can work out what the most popular products are, but you can also use it as an opportunity to ask if they’d like to sign up to a monthly newsletter. We’re not perfect at this, but we’re trying our best when we do it.”

James Brundle, Eat 17, Bishop’s Stortford , Herts

“I VISITED one of the latest Spar Philpotts’ concessions in Cardiff and was impressed by the premium sandwich and food-to-go range. It’s made me reassess how I approach food to go. I’m looking at whether I stick with my current coffee machine or go for one with more local branding.”

Ian Lewis, Spar Minster Lovell, Oxon

I RECENTLY went through several weeks of putting up with having to buy short-dated bread whenever I went to my Booker cash and carry.

Hovis loaves that should have had a seven-day shelflife were on sale, but with a three- or four-day shelf-life. This was frustrating because in the �irst week I needed to

throw out 10 loaves. Other retailers spoke to me about this problem and it begs the question: how much bread was wasted elsewhere?

I don’t receive deliveries from Booker, but instead go to the cash and carry myself. This problem of short-dated stock meant that I ended up having to buy less and go more often, which obviously

COMMUNITY RETAILER OF THE WEEK

Deep Patel, Meet & Deep News, Twickenham, London

‘We o er home remedies for animals’

“WE pride ourselves on being a good karma shop, so we o er free home remedies for animal welfare. It’s part of Hinduism, be kind to all living beings – from ants to humans. If people come in looking for pest killer, we o er non-lethal ways to get rid of pests to show compassion, and we put posters up outside the store and o er pamphlets with remedies in there. Mice slowly die from mice killer, which can be consumed by other animals that then can die from poison, so we’ve been making sure we educate our customers on the impact these things can have on wildlife.”

added time and excess cost to my days.

I can only think that Hovis were delivering late to Booker and that’s why the bread was short-dated. However, in situations where core products like bread are delivered late from a supplier to a wholesaler, shouldn’t there be more communication? Hovis and Booker need to be

talking to one another and, of course, someone should better inform retailers. As ever, it seems we are the last to know.

Alan Mannings, Shop on the Green, Chartham, Canterbury Booker and Hovis failed to comment as Retail Express went to print

COMMUNITY RETAILER OF THE WEEK

‘We o er food to our community’

“WE’RE providing homemade food to the local community, and seen our food-to-go sales rocket because of it. The takings from the category have even surpassed cigarettes and alcohol on some days. A er having a re t, we have more space to o er food, and we extended our food-to-go operating times to 6pm – it was 3pm before. We’ve got curry, jacket potatoes and roast dinners. It doesn’t have to be as expensive as restaurant food. People love it, and we use what we can to be sustainable. It’s increased the margin of the shop to 29%, while before we were at 25-26%.”

IT’S so important to look at your sales and what’s selling best. You have to look at pro tability, especially with costs going up.

It’s important to look at your EPoS for your pro t margins, your cashflow and bestsellers, but it’s also about going back to the shop floor. They go hand in hand. We do a range review every week. It’s important to see what the trade and current climate is doing and react accordingly ahead of time.

We’ve got some fridges at the front of the shop that we use as a seasonal impulse area, with changing promotions as an opportunity to push things. When the weather was good we bought £700-worth of barbecue products and sold the lot. People coming into buy kebabs also bought buns and condiments with all the cross merchandising.

When you’re doing a range review, it should be a daily or twice-daily topic of conversation. Ask what’s selling and what’s selling quickly, especially for new products. It’s something we’re talking about on the shop floor. We know what customers are buying and asking for. So it’s about talking to sta so they can talk to customers con dently and know when products are coming in. It’s just a conversation on the shop floor.

If something’s selling quickly, you need to think about whether you can increase facings or even bring in more products that are similar. Timing, positioning and range all work together. With the Euros upon us, we’ve already got the beers in because we don’t want to be caught out. We’re ahead of it and priming the customer that, when the football’s on or the weather’s good, they know where they’ve seen the products they need.

We’re always looking at the EPoS data to see if we can delist something to make room for something new and interesting. But you need to look at your year-on-year sales in context. Your ice cream sales might be down one week this year compared to last, but have you checked what the weather was like that week compared to this year?

Use your EPoS and your own knowledge of the shelves, and talk to your sta and you customers about what’s selling and what products are coming in. Each issue, one of seven top retailers shares advice to make your store magni cent

It’s

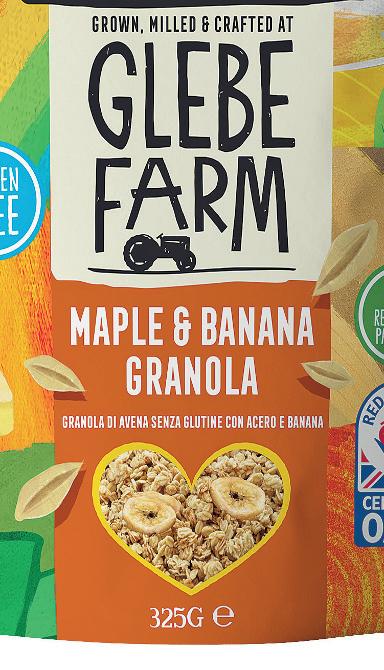

the most important meal of the day. But what are the key trends in breakfast cereals, and how does starting the morning the right way help retailers? TIM MURRAY investigates

BREAKFAST, as parents often maintain, is the most important meal of the day. And it’s also a lucrative area for retailers, as long as they get it right and stock the correct range.

As Glebe Farm chief operating o cer Tony Holmes notes: “Breakfast being the most important meal of the day is certainly true for most adults in Great Britain, with 62% making time for the occasion ve days or more a week.

“Research shows that starting the day feeling nourished and ready for action is what people look for most from their breakfast. Simplicity as well as nutrition is also key, with more and more people choosing dishes with three or fewer components.”

It is also increasingly complex, with new products being launched in a category where famous brands and long-time familiar xtures on the shelves

can still dominate and keep cheaper own-brand options out of the frame, even during a cost-of-living crisis.

“It’s di cult,” says Daniall Nadeem, of Spar Motherwell Road in Bellshill, Scotland. “Consumers aren’t really willing to experiment when it comes to breakfast cereals. If you buy one – even on promotion – when it launches and you don’t like it, then you’ve got another 370g to get

through before you can get another pack.”

Space is at a premium in convenience stores so retailers don’t want to have big boxes of product hanging around on the shelves.

“Our cereal section isn’t that big and we can’t a ord to have anything sitting around, especially if it’s a bigger box, taking up space,” says Simon Dixon, of Premier Lower Darwen, in Darwen, Lancashire.

NEW cereal products are a regular occurrence, but the new items added don’t always stick.

Retailers will take a punt when the stock is being actively promoted and pushed in their stores, but are consumers won over by flavour or by price? It may initially seem that customers are wooed by new variants, but once the promoted price disappears and full pric-

ing starts, they sometimes seem less enthusiastic.

“Whenever a cereal is on TV, people go with it,” says Dixon. “If a new product comes along, and we get help with it, then we might take it. Price and offers are the best way to launch something. Then the customers will tell you if they like it or not. I’m open to anything if it’s free and people are pushing it.”

“If we go back and look at when Oreos O’s launched, we couldn’t get enough of them,” says Nadeem. “We were burning through them, It was the same with Kellogg’s Chocolate Corn Flakes and Salted Caramel Crunchy Nut Corn Flakes. Product launches on promotion always do well, such as the Weetabix Marvel cereals, which came out on promotion and went well, but as soon as

they went up to full price, consumers decided they didn’t like them that much.

“Customers might think they’re in love with a new cereal, but they’re probably in love with the price. As soon as they go to full price, sales start to fall o . We normally give them 13 weeks – we’ll give it a quarter to see if it picks up. If they do, that’s good. But they do tend to be discontinued.”

OWN brands are not necessarily the breakfast of champions. But while recognised brands still dominate the proceedings at the breakfast table, a selection of own-brand products provide an alternative to the cereal giants and familiar names.

Consumers are willing to pay more for branded names when it comes to breakfast.

products are not a mere substitute for higher ticket cereals. “We carry at least three metres’ worth of cereals,” he explains. “And where we really excel is with own-brand. It really is a bene t of being with Spar, they have won Great Taste Awards for their cereals.

As Glebe Farm’s Tony Holmes says: “Amid inflation, 77% of consumers still think cereal is good value for breakfast, and are willing to pay extra for branded products, either as a treat or for a specialist diet, such as gluten-free.”

And for Nadeem, own-label

“We don’t have a massive range of own-brands, customers will often opt for the household name and they’re very loyal to Kellogg’s and Nestlé. We have the two main key players and we look at own-brand alternatives. There’s not a great deal of range, but own-brand is important.”

CEREAL bars are now an accepted part of any good convenience store o ering, having made their mark in recent years.

While they’re an essential part of the mix, siting is not always standard for retailers. Some put cereal bars as part of a healthy food o ering, others with food to go or other takeaway options. Most retailers still tend to keep them away from cereals, however.

Nadeem puts his cereal bars alongside his on-the-go drinks o er. “Our cereal bars sit next to the co ee machine,”

he says. “We’re targeting the morning customers who will pick one up with a co ee.”

Dixon, meanwhile, has trimmed down what used to be a wider health bar area and now uses it to focus entirely on cereal bars.

“About ve years ago, we introduced a health bar when we had a re t,” he says. “We were doing protein shakes and other things. It’s zzled down a bit and now it’s used for health bars. We’ve got it in the food-to-go area and we stock everything from Kellogg’s Rice Krispies Squares to

protein bars and other on-thego products. We put them all together. It’s not a huge area, but it does well. For us it’s like chewing gum, it’s there, people pick it up.”

The gamut of cereal bars runs from traditional names through to protein bars and other health and tness-related products.

“We go for a simple range,” says Nadeem. “It’s a range that doesn’t really change and a lot of it is price-marked. It includes the likes of Kellogg’s, Nutella, Nutrigrain, Ready Brek and so on.”

PRIYA KHAIRA reports on the opportunities available to retailers in the so drinks category

THE soft drink category is worth £3.3bn annually to convenience retailers, making it one of the strongest categories for independents.

“This presents a huge opportunity to increase sales by stocking an enticing range of soft drinks,” says Sarah Baldwin, CEO at Purity Soft Drinks. “This is especially true during the summer months, when more customers are seeking on-the-go thirst-quenchers.”

For Justin Whittaker, of MJ’s Premier Store in Royton, Greater Manchester, soft drinks is one of the most pro table ‘everyday’ categories. “We’re making steady margins of up to 30% on most soft drink lines. We are seeing an uplift in sport and energy segments,” he says. “Over the past year or two, I would say that sales have really increased, and demand is growing.”

According to the most recent

Britvic Soft Drinks Review, more shoppers are turning to convenience stores for takehome soft drink purchases. It shows that soft drinks are the most bought impulse category in convenience, present in one in four baskets.

Tapping into new product developments on the market is a guaranteed way to drive sales and attract new shoppers. Adam Hacking, head of beverages at Arla, notes that

signi cant growth in the sector is driven by innovative product launches.

Retail Data Partnership statistics, for instance, show new releases including Tango Raspberry Blast, Tango Cherry Blast, Red Bull Pink Edition and Boost Sport Watermelon & Lime were four of the top performing products in convenience stores last month.

THE Britvic Soft Drinks Review identi ed that the stimulant energy is the second fastest growing sub-sector growing at a rate of 23.7% behind sports drinks, which grew by 64.6% last year.

Street Sandiacre in Nottinghamshire, who makes up to a 60% margin on his soft drink o er, says there has been a clear increase in demand for energy drinks from consumers over the past year.

turn to convenience stores to nd them.”

Adrian Hipkiss, commercial director at Boost Drinks, says: “It’s essential that retailers stock a sports drink o ering that takes the ‘taste’ and ‘value’ drivers into account to e ectively maximise sales from impulse shoppers. This also o ers retailers a chance to connect with their core audiences, thereby enhancing sales rates to their maximum potential.”

Amit Patel, of Go Local Town

Patel keeps track of energy drink launches and makes sure to be one of the rst stores in his area to bring them in. As a result, soft drinks account for 45% of Patel’s store’s overall sales.

“The category is predominantly trend driven, so it is important that we remain aware of what customers are looking for,” he says. “New energy drinks are always going viral online and lots of customers

There is also room for sales opportunities within sugarfree soft drinks. This area has witnessed notable growth across various segments within the category. According to Patel, demand for sugar-free has risen over the past year and he has made sure that half of his soft drink o ering is sugar-free.

“We keep four one-metre rows dedicated to zero-sugar drinks,” he says, “We’re seeing preferences for sugar-free soft drinks like Coca-Cola but also on energy drinks, such as Monster Zero Sugar and Red Bull Zero Energy.”

Coca-Cola

Red Bull

Coca-Cola Zero Sugar is giving shoppers a chance to win football prizes in the ve weeks leading up to the UEFA Euro 2024 tournament, running across two-litre, 1.25l and 500ml PET bottles, 330ml cans and 24-can multipacks, plus 330ml glass bottles of Coca-Cola Zero Sugar.

Red Bull aims to tap into the take-home occasion with the launch of a new multipack, including Original, Tropical and Blue editions. The multipack has an RRP of £5.25.

Innocent Drinks

Innocent Drinks has announced the launch of Blueberry Focus Super Smoothie as part of its functional smoothie range. Its 300ml format is £2.50 and the larger 750ml format has an RRP of £4.50.

Boost Energy

Boost Energy has introduced Tropical Blitz and Apple & Raspberry Sugar-Free Energy along with a new limited-edition Watermelon & Lime Sport to the brand’s portfolio.

LOCATION:

AS we step into the summer, retailers can expect a multitude of opportunities from the category. Whittaker notes that despite soft drinks delivering strong sales all-year round, he is increasing his multipack offerings across his soft drinks range for the summer. With sporting events such as the Olympics, Cricket T20 World Cup and Euros taking place this summer, retailers can expect to see a rise in demand for multipacks or take-home formats. To cash in on these at-home occasions,

retailers should consider running bundle deals or promotions across their soft drink and snack o erings.

A spokesperson for Red Bull comments: “More consumers are trading up into multipacks. This year, energy drink multipacks saw impressive growth of 14% in value sales, with more than half of take-home energy shoppers purchasing a multipack.”

Additionally, Lumina data shows that 77% of shoppers have a value-led attitude when it comes to making impulse

purchases. Retailers can optimise their range using sales data to highlight bestselling lines across each segment and price-marked packs (PMPs) to help encourage impulse purchases on single formats.

Hipkiss says: “Clear pricing eliminates the need for customers to inquire about prices, streamlining the decision process.” He adds that leading soft drinks should be kept in vertical facings as well as horizontal ones and that larger or multipacks should be kept in ambient spacing.

The cost of living continues to influence shopper behaviour, with 71% stating that the overall price is more important to them now compared to six months ago.

PMPs provide reassurance around pricing for shoppers. They make up two-thirds of soft drink sales in symbol and independents, and add £1.3bn to the category.

During nancial hardship, shoppers are choosing budget-friendly indulgences in the impulse categories.

Sales of low- and no-sugar soft drinks have grown by 12.9% yearly, with 42% of shoppers having very health-conscious behaviours and attitudes. Retailers should ensure they stock a range of functional soft drinks to accommodate.

More than two-thirds of shoppers consider themselves very sustainability-conscious and say they are willing to pay more for sustainable products. Retailers should use branded PoS to highlight these products in store.

Low and no

Provide an appealing range of low- and no-sugar drinks to meet the needs of shoppers looking for healthier options and ensure they are easy to nd when shoppers are browsing the category.

Merchandising

Group similar products together to help the shopper nd and position top-selling segments at eye level for ease of shop.

Carbonates

Lead in with carbonates in your chiller as these act as a category signpost to attract impulse shoppers.

Multipacks

Drink-later formats such as multipacks and large serve bottles do not need to be chilled, so retailers should stock these in an ambient section.

In today’s competitive retail landscape, it can be challenging to find the right strategy to boost sales. Yet, Suntory Beverage & Food GB&I (SBF GB&I) has identified a lever of growth, demonstrating through in-store trials that strategic changes in how beverages are displayed can significantly elevate sales and consumer engagement in convenience stores.

With ten years of soft drinks category data at their disposal, SBF GB&I has uncovered the untapped potential in beverage sales, driven by the consumer shifts due to the pandemic. Economic strains have pushed customers toward value—but not at the cost of enjoyment, as seen in the 4.7% increase in ‘treat for today’ purchases. This trend highlights the important role of convenient, appealing drink options placed right where customers want them. Shopper desire for low- and no-sugar soft drinks has shown no sign of slowing, which means communicating no or low sugar drinks in store is key.

PRACTICAL STEPS TO AMPLIFY YOUR SALES

BEACON BRANDS: USE BEST-SELLING BRANDS TO GUIDE CUSTOMERS THROUGH YOUR STORE.

COLOUR BLOCKS: MAKE SECTIONS EASY TO SPOTAND ATTRACTIVE.

Drawing on deep data insights, SBF GB&I crafted a category vision focused on maximising retailer revenue across five key store areas. This vision was put to the test with three convenience stores. The collaboration with retailers like Fiona Malone, Serge Notay, and Sue Nithyanandan has proven that attention to detail in drink placement and selection isn't just about aesthetics—it's about connecting with the shopper’s desire for convenience, quality, and value. Implementing these principles led to:

RANGE RATIONALISATION: FOCUS ON HIGH PERFORMERS AND CUT THE UNDERPERFORMERS.

Easier navigation and better shopping experiences.

Enhanced visibility of healthier and premium options.

Optimised product assortments that meet consumer demands and preferences.

PRODUCT FLOW: ENCOURAGE CUSTOMERS TO TRADE UP WITH A 'GOOD, BETTER, BEST' ARRANGEMENT.

CLEAR SIGNAGE: ENSURE MEAL DEALS AND PROMOTIONS ARE VISIBLE AND APPEALING.

BLOCKS HEALTH: ATTRACT HEALTH-CONSCIOUS CONSUMERS BY BLOCKING LOW OR NOSUGAR OPTIONS UNDER EACH BRAND

COMPARED with cigarettes, which have the lion’s share of the tobacco market and vaping products, which continue to grow even in the face of the disposables ban, cigars and cigarillos might not seem an important pro t driver within the tobacco category.

However, this sub-category is seeing some growth in sales

and still has a lot to o er retailers if they invest in building the kind of range that fully considers their customers.

“Cigars remain an important category for convenience retailers to get right, not only for the revenue it brings into their till, but as a driver of footfall and repeat business from regular customers and the as-

sociated basket spend that goes with that,” says Priyanka Jhingan, marketing manager at Scandinavian Tobacco Group UK (STG UK).

“Our latest data shows the total UK cigar category to be worth £309m in annual sales, which is a value increase of just over 9% versus the same time last year.

Priyanka Jhingan, marketing manager, Scandinavian Tobacco Group UK

“RETAILERS will be well aware that cigar sales go up at Christmas as many adult smokers like to enjoy a large cigar as part of their festive celebrations. However, it’s not just Christmas time when retailers can enjoy a seasonal spike in sales.

“Cigarillos are now worth just over £124m in annual sales and are responsible for just over half of total cigar volume sales across the UK.

“The key thing cigars and cigarillos o er retailers that other forms of tobacco don’t is great pro t margins. On average, they are three times higher than cigarettes.”

“With summer here, some adult smokers may again start to think about trading up to larger format cigars to enjoy in the sunshine so ensure your sta are equipped with the knowledge to have those kinds of conversations.

“Finally, it’s worth reminding convenience retailers that as cigars are exempt from the plain packaging legislation, we recommend they stock them on the middle shelf of the gantry where they are visible, and more likely to be purchased by adult smokers who can see them.”

FOR some retailers, having a decent range of cigars and cigarillos is essential for holding onto customers who buy them.

This means the range itself is as much of a footfall driver as it is a pro t driver. But it also means retailers can be more precise with their ranging, stocking only what speci c customers are after.

“The key to good cigar sales is to follow trends and know which brands your regular customers want and always

keep those in stock,” says Jhingan.

“With cigars, it’s more important to stock the right range rather a big range, so we usually advise retailers to consider stocking the top two or three brands in each of the four main cigar segments, as the top 10 biggest sellers overall account for well over 90% of sales.”

It’s also important to recognise what appeals to customers when they purchase cigars

Dipak Shah H&R News, Camberley, Surrey

Dipak Shah H&R News, Camberley, Surrey

“WHEN it comes to cigarillos, we only stock Sterling. We have two varieties of 10-packs, but the standard flavour is the most popular. We also have a standard flavour 20-pack, but the 10s sell better. People want a quick smoke and they only cost £5 or £6. A 10-pack is also more appealing to people who are trying to give up smoking.

and cigarillos, and to make sure your range matches this, you’re keeping on top of availability and your sta are aware of how to talk about them to customers.

“Cigarillos tick over for us, and the selling point is that they come in 10s,” says Ronak Patel, who operates Budgens and Nisa stores in Cambridge.

“Cigars are for the older generations. Younger adults might dabble in it at the weekend and buy a single.”

“Cigarillos make for regular sales with customers. We have people who we know will always come in because they know we’ve got their brand available and it’s at a reasonable price.

“Cigar-wise, we have a bit more variety. We do a few of the big Cuban ones like Montecristo, but we also sell a lot of tins of Signature. Henri Wintermans are also quite popular.

“You should always have cigars and cigarillos available. The margins are better than with cigarettes and there’s steady demand. People always have a special occasion or just the desire to try them out. If you have regular customers, nd out what they like and get that in stock.”

AS far as Patel is concerned, for retailers to make a success with cigars they must dedicate themselves to the category.

“Some of my friends smoke cigars but they go to specialist stores in town and they receive specialist advice on what to buy,” he says. “To do premium

cigars right, you need to be a specialist and promote yourself as such.”

To become a specialist store, as some retailers have done, it requires a broader supply network, with Hunters & Frankau one of the prime importers of Cuban cigars into the UK. But it

also requires specialist knowledge, which means education and training for members of sta to ensure they’re making recommendations that will keep customers coming back.

“Sta training is also key, and when it comes to better understanding the category, nothing beats face-to-face communication, so rst and foremost, we have our growing eld sales force, which goes out and visits convenience retailers daily to share their knowledge and expertise on how to maximise sales from cigars,” says Jhingan.

The RETAIL EXPRESS team nds out how retailers are encouraging shoppers to buy more

Sue Nithyanandan, Costcutter Epsom, Surrey

Sue Nithyanandan, Costcutter Epsom, Surrey

“INCREASING basket spend is always about the impulse section. It’s about decisions being made quickly, so we’re doing deals with pizzas and beer or soft drinks. We also have the beer and pizzas right next to each other with the right PoS.

“Availability is the other big thing. You can’t run out and you have to be ahead of anything that’s happening. Ice is a big thing with all the parties happening at home. We noticed that when we had just a couple of days of sunshine, the barbecue meats, equipment and charcoal were �lying out. People were grabbing any opportunity to get out into the sun. We’re very much a weather-led business. The sun makes such a big difference. So if the weather’s going to be good, you need to have good availability of alcohol and soft drinks. RTDs are very much in vogue at the moment, because they’re so easy to carry and to drink.

Customers often value their time more than their money.”

2

Peter Patel, Costcutter Brockley, south London

Joshua James, Fresh and Proper, Fordham, Cambridgeshire 3

“WE always �ind we can increase basket spend by disrupting the shopper journey. We use dump bins and put them where you wouldn’t expect them, rather than by the counter or the door. You can get impulse sales for products that are 50p or less at the counter, but people have largely done their shop and made their �inal purchase by the time they get to the till.

“We put the bins around the store so people can’t miss them. Anything that’s not too big – cereal isn’t impactful even if it’s a good deal, but biscuits do really well. When we put Jammy Dodgers in the dump bins we see a 700% increase in sales. Hot cross buns work as well, not just at Easter. We’ll sell 10 packs a week when they’re not in the dump bin, but we’ll sell 100 when they’re in there.

“We move the dump bins around and swap products from bin to bin, which sees an upturn in sales as well.”

“OUR fresh produce is a marketing tool in its own right and it’s really pushed our average basket spend up. When we launched the fresh produce, we saw a bit of a dip, but now it’s gone up from £10 to £14. The colours that people see when they walk in is like a promotional end. It’s full of colourful, fresh and quality produce staring right at you as you come in.

“Being able to see and feel the products – which are mostly loose – has a big impact on sales as well. And when they see the quality of our peppers, for example, it makes them think that the rest of the store’s products will also be that good. With that, though, availability is the big thing. We have deliveries of fresh produce six days a week, which is massive for us. It’s worked for us in a rural area. We had wastage at the start, but now we’ve got a better understanding of what our customers want and how we can cater to them.”

In the next issue, the Retail Express team nds out how retailers are using food and drink machines to grow sales. If you have any problems you’d like us to explore, email