Retailers desperately plead for help to battle crime epidemic as shopli ers target one store every two seconds

Retailers desperately plead for help to battle crime epidemic as shopli ers target one store every two seconds

STRUCTURE COLLAPSE

STORE ADVICE

Three retailers share the best lessons from their biggest mistakes

19 SEPTEMBER-2 OCTOBER 2023 STRICTLY FORTRADEUSERSONLY

CHRISTMAS SOFT DRINKS

A look at the products you should be stocking to boost your festive sales

Retailers desperately plead for help to battle crime epidemic as shopli ers target one store every two seconds

P3

VAPE BAN

Indies hit back at Scottish plans to consult on the sale of disposables

STRUCTURE COLLAPSE

Shopworkers pulled from the rubble of a Spar site in Wales

STORE ADVICE

Three retailers share the best lessons from their biggest mistakes

BACK PAGE

IT’S nice to be back a er six weeks. I want to thank Alex for doing an outstanding job in my absence. I hope you all had a prosperous summer trading season.

I had really hoped to have come back on a more positive note, but I can’t ignore how saddened I was to hear the news that yet another independent retailer lost his life following an alleged shopli ing incident last month.

Unfortunately, this isn’t anything new, but matters seem to have worsened. I heard an ex-Met Police boss say that the o cer that claimed the police wouldn’t investigate a the of less than £250 may as well have shaken hands with shopli ers, giving them the green light to steal.

It sent the wrong message then, and, unfortunately, a lack of e ort from other police forces to rectify this narrative, and hold thieves accountable, has propelled the nation into chaos.

Luckily, trade bodies such as the Fed and ACS are doing what they can to highlight the true impact of shopli ing on small business owners. But in truth, it doesn’t seem to be working. How many more casualties do there need to be until someone stands up and says enough is enough?

MEGAN HUMPHREY

INDEPENDENT retailers have hit back at newly announced plans by Scotland to consult on banning disposable single-use vapes.

First minister Humza Yousef con�irmed a consultation would launch next year, when outlining his wider programme for government ear-

HOW MANY MORE CASUALTIES DO THERE NEED TO BE?

Over on page three, you can read about the desperate attempts by retailers to protect themselves. Some are working, and some are not, but again, all are having to be funded out of their own pocket. Although, that’s a debate I’ll save for another time.

lier this month.

In doing so, he warned the products were a threat to both public health and the environment. “We know that the bright colour and sweet �lavour catch the eye of children and young people in particular,” he said.

However, the Fed’s Scotland district president, Hussan Lal, warned an outright ban

would “simply expand an already booming illicit market”.

“Vapes help many give up smoking and are part of life now,” he said. “I am con�ident the black market will become even more active. Rather than looking to ban single-use vapes, the government should be looking at responsible ways of recycling them and more educa-

tional campaigns.”

Anti-smoking campaign group Action on Smoking and Health also shared fears that a ban would increase the sale of illicit vapes. The move by Scotland doesn’t come long after French prime minister Élizabeth Borne suggested she would impose an outright ban on the sale of disposable e-cigarettes.

OVER three-quarters (78%) of retailers said they ‘know the relevant practices to prevent discrimination in the workplace’.

Specialist reporter

Dia Stronach 020 7689 3375

The �igures come from Newtrade Media’s latest Insight report, entitled ‘Diversity, Equity & Inclusion: chal-

lenges and opportunities for convenience stores’.

Out of a survey of 200 retailers from across the UK in the second quarter of 2023, 74.5% also said they believe there are enough resources available to them, with only 16.5% saying there aren’t.

RETAILERS caught selling nitrous oxide could face up to 14 years in prison, as the government is to class the substance as a class C illegal drug by the end of the year.

Under the Misuse of Drugs Act, production of the sub-

stance, also known as laughing gas, will also be prohibited. There will be exemptions for legitimate uses of it, such as for use as a medicine or for catering.

The substance is commonly used by teenagers.

Aslam has become the �irst independent retailer to operate a Pizza Hut franchise alongside a convenience store, with potentially more sites to come.

The Nisa retailer and managing director of Greens Re-

tail parent company Glenshire Group revealed the news this month

Aslam told Retail Express conversations with Pizza Hut began a couple of years ago, with further sites to potentially open either inside or next to his other stores.

THE National Association of Cider Makers (NACM) has urged the government to freeze excise duty.

Speaking during an AllParty Parliamentary Cider Group reception last week, the group’s new chair, David

Sheppy, criticised excise duty increases in August for “penalising” the cider industry. He said: “[There are also] complicated systems that have been rushed through [and] increasing levels of red tape for both cider makers and farmers.”

MEGAN HUMPHREY

INDEPENDENT retailers are fearing for their safety and livelihoods more than ever, after new data has revealed that thieves are targeting stores once every two seconds.

The rising number of shoplifting incidents hit national headlines last week, sparking the Mail to launch its own campaign to crackdown on crime, by calling for the police, crown prosecution service and courts to be tougher with offenders.

Eugene Diamond, owner of Diamonds Newsagents in Ballymena, County Antrim, told Retail Express this is “vital” in slowing down this new wave of crime.

In February, Diamond was the victim of an attempted theft, which the defendant was charged with at the time. However, last week, the town’s Magistrates’ Court withdrew the charge in replacement for a caution.

“This hasn’t instilled faith in the court system,” he said. “I honestly can’t believe this is the outcome of an incident that was so scary, and closed my store for a prolonged period of time for an investigation.”

The ACS’ latest crime report estimates that there were more than 1.1 million incidents of theft reported last year. Due to a concerning spike in incidents, Asda’s chairman, Lord Stuart Rose, blamed a lack of po-

lice action for “decriminalising” shoplifting.

Speaking to LBC Radio, he said: “It’s actually just not seen as a crime anymore. We’ve become risk adverse. The police have got lots of other things to do, although Suella Braverman now says that all crime will be investigated, so let’s see what happens.”

In the same week, Tesco’s chief executive, Ken Murphy, con�irmed frontline workers will now be offered body cameras, due to an “unacceptable” rise in physical attacks.

However, despite supermarket bosses weighing in on the issue, ACS chief executive James Lowman said that independent retailers need more speci�ic support as their budgets don’t stretch as far as those of supermarkets.

Writing in The Sun, he said: “Theft is not a victimless crime, it takes an enormous �inancial and personal toll on the retailers trying to run a small business in their communities.

“While retail giants like Tesco have the budgets and the staff to tackle crime and �it their security teams with state-of-the-art body cameras, small shops can’t afford that and it’s costing them a fortune in their hard-won earnings.

“More than half (53%) of thieves are repeat offenders – usually well known in the area – banking on the fact they won’t be challenged.

Convenience retailers are most concerned about the sanctions being issued to offenders, the time taken for police to respond to incidents and a lack of visible police presence in the community.”

In response, the Fed has launched a petition to the home of�ice, asking for speci�ic grants for small businesses to be issued.

Now live, the pledge reads: “On average, it costs over £4,500 to install security measures such as CCTV, panic buttons and security alarms in a store.

“Independent retailers struggle to pay this due to being hard-pressed �inancially with rising costs and reduced margins.”

Hazel Ridge, of Bassett’s Londis in Weymouth, re-

“WE try to recruit from friends, family and regular customers. This way it means that we know them, and we can consider them properly. And if something happens, you know who to talk to and they respect that. It has worked very well for us. We also work to retain our sta by giving out nancial rewards, but they are considered to be part of the family.”

Milan Vakhania, Heathcote Express & Post O ce, East Grinstead, West Sussex

“I RECOMMEND work permits. It’s not a hard process. Each business can apply for di erent licences based on their requirements – they can hire from the local area or foreign countries, and they can choose the level of experience they’re looking for. Once someone has applied for the visa, you can hire them straight away and they have to work with the same employer within that visa.”

Uthay Soundararajan, Costcutter Inverleith Row, Edinburghvealed that installing facialrecognition technology Facewatch into the store has cut incidents considerably. “We were seeing at least two incidents per day, but we’ve seen that known perpetrators aren’t coming into the store any more,” she said. “Every shop should have it. I haven’t experienced any backlash from customers for using it.”

CHILLERS: Coca-Cola Europaci c Partners (CCEP) is distributing more Monster Energy-branded chillers to independent stores. A spokesperson told Retail Express: “Convenience retailers can enquire about a Monster chiller by talking to their local Monster or CCEP rep, or by visiting our trade website, my.ccep. com.” Stores reported receiving upright chillers, which have ve shelves, from the company over the past month.

NATIONAL LOTTERY: Allwyn has hinted at taking a “fresh look” at the service when it replaces Camelot as operator in February next year. Speaking to the PA news agency, Allwyn chief executive Robert Chvátal claimed the UK was the slowest-growing division within the group. “This is an opportunity to have a fresh look at how we can do it for the next 10 years,” he said.

BOTTLE RETURNS: Supermarket bosses have reportedly pushed the government to consider postponing the deposit return scheme (DRS) until at least 2026. The o cial start date is currently October 2025, but The Grocer reported earlier this month that government o cials and the industry agreed the current start date was “a non-starter”.

For the full story, go to betterretailing.com and search ‘DRS’

AMAZON: Several Post O ce (PO) retailers failed to receive remuneration for Amazon parcels last month. In a message sent to postmasters, and seen by Retail Express, PO said the error was caused by “an issue with the data feeds it receives from Amazon”. It added it was working with branches to resolve the issue, and assured those a ected that “missing payments will be made good at the earliest opportunity”.

“FACEBOOK is very generic; we just tell people we’re hiring without too much detail. It’s about making contact. It gets good traction locally because it won’t just be people applying for the job who see it. Indeed.com is the next most successful route. We get a 50% dropout at every stage. It’s important they understand what the job entails. It’s not just standing behind a till while the store miraculously runs itself.”

Julian Taylor-Green, Spar Lindford, Hampshire

Julian Taylor-Green, Spar Lindford, Hampshire

Do you have an issue to discuss with other retailers? Call 020 7689 3357 or email megan.humphrey@newtrade.co.uk

TWO shop workers and a member of the public were dragged from the rubble of a collapsed companyowned Spar store earlier this month.

Emergency services were called to the store, previously a converted chapel on Plas yn Dref Street in Dolgellau town centre, following reports of a collapsed roof. Retail Express

understands the road near to the site will remain closed while an investigation is underway as to what caused the accident.

A spokesperson for the wholesaler and supplier of the store, AF Blakemore, said: “Our customers and colleagues’ health and safety is paramount in all that we do.

“We are working with Gwynedd Council to establish the cause of the internal struc-

ture collapse. Structural engineers have been on site alongside council building control as we continue to investigate further. We are providing ongoing support to those who have been affected.”

Gwynedd Council stressed “the responsibility for ensuring that a building is safe and does not pose a risk to the public rests with the owners of the property”.

They told Retail Express:

“Cyngor Gwynedd Building Control Service – like any other local authority – has statutory enforcement powers to take action against the owner of a dangerous structure under Section 78 of the Building Act 1984.

“In addition, the cost of any emergency remedial works carried out by the Council to ensure public safety will also be recovered from the owner of the property.”

PARCEL company UPS has warned retailers to stay vigilant after an “unauthorised driver” was spotted stealing parcels from one of its sites.

In a message sent to stores earlier this month, seen by Retail Express, the company

con�irmed “a person pretending to be a UPS driver had attended an Access Point and cleared out all UPS packages”.

In response, a spokesperson said: “The safety and security of our network is our priority. These incidents are rare.”

RETAILERS have less than a month to prepare for an extension to the single-use plastics ban.

From October, businesses in England will be prohibited from selling or supplying single-use plastic plates, trays, bowls, balloon sticks, and polystyrene cups and containers.

A survey of retailers across England by Retail Express

For the full story, go to betterretailing.com and search ‘plastic’

found that 20% of store owners were unprepared, while 30% were unaware of the restrictions.

THE world’s �irst fully autonomous click & collect convenience store that requires no staff has opened in Salford.

Called In:Five, customers order in advance from an app and collect their grocer-

ies from a locker on site. More than 300 products are currently available, and are picked by robotic arms. The store has room for up to 1,200 lines. It has opened on the ground �loor of an £80m apartment complex.

AMERICAN non-alcoholic drinks brand Liquid Death has secured listings with Nisa and Co-op, marking its �irst UK brick-and-mortar availability.

The brand, which has become popular in the US thanks to its subversive branding and in�luencer marketing, is available in Mountain Water, Sparkling Water, Mango Chainsaw and Severed Lime varieties.

Mountain Water is sourced from a spring in the Austrian Alps and contains natural electrolytes, while Sparkling Water is carbonated at the same level as beer, which the supplier says makes it softer

than other sparkling waters.

Each variety is available in a 500ml can, and a portion of the brand’s sales go towards non-pro�it organisations �ighting plastic pollution. The Mountain Water and Sparking Water ranges are available at promotional prices of £1.50, while Mango Chainsaw and Severed Lime carry a £2 promotional price.

Post-promotion, the regular RRPs will be £1.99 for Mountain Water and Sparkling Water, and £2.49 for the �lavoured varieties.

Liquid Death launched via Amazon in April this year and has been available this summer at various Live Nation music events and festivals.

“Liquid Death is one of

CAPTAIN Morgan is set to enter the non-alcoholic segment with the launch of Spiced Gold 0.0%.

The new variety is available now in a 75cl bottle with an RRP of £15.

Samori Gambrah, global brand director at Captain Morgan, said: “With a resurgence of rum as a drink of choice, and 47% of UK adults switching between alcohol and low- and alcohol-free drinks, Captain Morgan 0.0% is perfectly placed to not only meet growing demand, but also give those looking to moderate their consumption a new alternative.”

Captain Morgan Spiced Gold 0.0% is the latest nonalcoholic entry from supplier

Diageo, following launches from Guinness, Tanqueray and Gordon’s in recent years.

the top three most-followed beverage brands on social media worldwide, and because of that we get daily messages from fans asking

when they can buy Liquid Death in their home countries,” said Mike Cessario, co-founder and CEO at Liquid Death.

MARS Chocolate Drinks & Treats (MCD&T) is expanding its range of protein products with Snickers Hi Protein Low Sugar and Snickers Hi Protein Low Sugar White bars. Both varieties are available now in convenience with RRPs of £2.79. Each bar contains 20g of protein and 2g of sugar.

Currently, the protein bar market is worth £151.7m in the UK, with value and unit sales increasing by 14% and 9%, respectively. The supplier hopes the Snickers brand can drive category penetration, as it is the second-bestselling single chocolate bar in

AUSTRALIAN Vintage has expanded its McGuigan wine brand with the launch of the premium Gold Label range.

The supplier says the new range combines accessibility and premium quality for shoppers looking to trade up for at-home consumption.

It is available in Shiraz and Sauvignon Blanc varieties, launching initially in Sainsbury’s each at an RRP of £10. The supplier said it is planning to list the range with wholesalers and symbol groups.

According to research from Wine Intelligence, the share of spend of premium wines priced from £8 to £10 is growing among 35-to-55-year-olds.

BRITVIC has launched a Mango variety of its Pepsi Max brand. The new �lavour is available across 500ml (plain RRP £1.45 and £1.25 price-marked), 1.25l, 1.5l and 2l bottles (RRPs £1.25, £1.45, £1.85) and multipacks of eight and 24 330ml cans (RRPs £3.85, £13.89).

The supplier says the new �lavour is aimed at helping retailers continue to attract new customers to the soft drinks category while keeping existing soft drinks shoppers engaged.

Currently, �lavoured cola is growing three times faster than un�lavoured cola. Pepsi Max’s �lavoured colas grew by £6.3m (+16.9%) in 2022, which delivered more growth

for retailers than all other �lavoured sugar-free colas combined, according to IRI �igures.

Additionally, new �lavours are a top in�luence of Gen-Z shoppers’ purchase decisions.

“We are seeing a growing trend for premium wines, particularly trade-ups with brands consumers trust,” said Oliver Hoey, brand manager at McGuigan Wines.

CONVENIENCE retailers have the chance to win a £250 cash prize every month thanks to an exclusive competition from Rockstar Energy Drink.

Four retailers can win the cash prize every month until the end of 2023 through Britvic’s At Your Convenience site.

From now until the end of 2023, four retailers every month will be selected to win the cash prize.

To enter, retailers must visit Britvic’s At Your Convenience website as registered members and �ill out the form.

The deadline for the next draw is 11 October.

the UK, according to Nielsen �igures.

Michelle Frost, general manager at MCD&T, said: “We believe that with our trusted Snickers brand, coupled with 20g protein and only 2g sugar, we have the potential to signi�icantly drive category penetration across both major multiples and impulse channels.”

FOOD-TO-GO brand Urban Eat has expanded its core range with 10 new sandwiches, wraps and hot eats.

The expansion of its core range caters to ‘breakfastin-a-rush mornings’ with a Sausage & Egg sandwich and an All Day Breakfast Triple sandwich.

The range also includes lunchtime options with the addition of a Chicken & Stuf�ing sandwich, alongside Sweet Chilli Chicken and Chicken & Bacon Wraps.

There is also a new Chicken & Bacon panini and Chicken & Bacon Toastie, alongside a Ham & Cheese and Cheese & Tomato Toastie.

For vegetarian customers,

Urban Eat has launched a Cheddar Ploughman’s Sub Roll.

The new range is being supported with marketing activity across Urban Eat’s social media channels.

DELICE de France has partnered with oat drink Oddlygood to help its retail and foodservice customers drive sales of dairy milk alternatives, which are growing in popularity among consumers.

Oddlygood’s leading line, Barista Oat Drink, has a 12-month shelf life and comes in cases of six 1l cartons, making it appropriate for retail or use in coffee to go.

Oddlygood is also set to expand its range, with a Cinnamon Roll Barista Oat Drink and Pumpkin Spice Barista Oat Drink set to launch this autumn.

Retailers are encouraged to get in touch with Delice

de France to bene�it from instore promotions and Oddlygood’s ‘free coffee days’ promotional programme.

ELFBAR's classic hit ELFBAR 600 has been upgraded with a new metallic look and upgraded taste powered by QUAQ Tech, giving you the best vaping experience.

Smooth Touch with Premium Metal Body

Industry's 1st Modularized Battery Solution, increasing recycling efficiency and battery reusability.

Apple Peach Banana Ice

Blue Razz Lemonade

Blueberry

Blueberry Raspberry

Blueberry Sour Raspberry

Cherry

Cherry Cola

Cola

P&B Cloudd

Elfturbo Ice

Grape

Kiwi Passion Fruit Guava

Mad Blue

Pink Grapefruit

Pink Lemonade

Strawberry Ice

Strawberry Kiwi

Strawberry Raspberry Cherry Ice

Watermelon

Apple Watermelon

Banana Mango

Blueberry kiwi

Grape Raspberry

Golden Kiwi

Lemon Lime

Mojito

Rinbo Cloudd

Watermelon BG

BOBBY’S Foods has launched a courier delivery service for its retail customers, which it says offers them a wider range of products, deals and promotions.

The supplier said its van sales were restricting the breadth of its offering to retailers, who can now bene�it from a wider range, enhanced stock levels and improved availability.

The Delivered by Courier range also has exclusive deals and promotions, giving retailers more chances to drive pro�its. One of these, the ‘Sweet deal’ promotion, gives retailers £10 off their

invoice when purchasing any 10 products from the kids confectionery range, excluding bagged sweets, Bonds or van products.

To open an account, retailers can contact their Bobby’s rep or their local depot.

Bobby’s has also expanded its footprint with the launch of a depot in Crumlin, west of Belfast, its 12th in the UK. The supplier hopes to build on the 500 retailers in Northern Ireland it already serves.

At the opening of the depot, John Lucas, national sales manager at Bobby’s, said: “Thanks to the commitment and hard work of Bobby’s sales team in Northern Ireland, we now provide our exclusive prod-

4

BUDWEISER Brewing Group

UK&I (BBG UK&I) is capitalising on the growth of fourpacks in the beer category with the launch of Corona 4x440ml in convenience and wholesale.

The supplier said the launch responds to a growth in consumer demand for the four-pack format, which is the fastest-growing pack format in impulse, and for world beer, which is the fastest-growing segment in the off-trade.

Since 2019, consumers have purchased 5% more world beer in comparison to standard lager, and BBG UK&I forecasts a further 8% increase in sales by 2030.

Corona’s sales have also

grown by 38.1% since 2019 and, according to Nielsen �igures, it is now the numberone world lager.

ucts to 500 retailers in the convenience trade. Our ambition for 2023 is to further

increase this number and continue serving our valued retailers.”

KINGSLAND Drinks has expanded its range of Andrew Peace Australian wines with six new additions across two ranges.

The launches come under Black Label and White Label ranges. Black Label consists of Shiraz and Chardonnay varieties in 75cl bottle and 2.25l bag-in-box formats. Meanwhile, White Label includes Shiraz and Chardonnay lines in 75cl bottle and 1.5l bag-in-box formats.

The 75cl bottles carry a

GREEK dairy company Dodoni has made its range of feta- and halloumi-based Cheese Thins available to UK convenience retailers through Cotswold Fayre.

The expansion follows the brand’s listings with Marks & Spencer and Ocado. It is available in Feta Tomato & Oregano, Feta Jalapeno Chilli

MONDELEZ International has expanded its Belvita breakfast biscuit brand with the launch of three non-HFSS lines.

The supplier is set to launch Belvita Fruit Crunch in Raisin & Currant and Apple & Pear varieties this month. Each Fruit Crunch bar contains fewer than 100 calories. It has also expanded the

Belvita Soft Bakes range with a Apricot Filled variety. All of the new launches have an RRP of £2.99.

Amy Lucas, brand manager for Belvita at Mondelez, said: “These latest tasty additions to the growing Belvita range are set to offer shoppers exciting, healthier options for their morning snack.”

£6.50 RRP, while the 1.5l and 2.25l bag-in-box formats have respective RRPs of £12 and £17.

The supplier wants to offer wines that tap into the trend of consumers seeking lower alcohol content, while addressing recent duty changes.

Throughout autumn, the Andrew Peace range will be supported by an advertising campaign including social media activity and in�luencer marketing.

IMPORTER and distributor Empire Bespoke Foods has launched Spanish �lavoured milk brand Cacaolat into UK convenience stores.

Cacaolat, which is available in 25 countries, is the number-two cocoa milk brand in Spain, and number-one in Catalonia, the Spanish province where it originates from.

It is made with Rainforest Alliance-certi�ied cocoa plants from Africa and locally sourced milk in Spain.

It is available in Original, No Added Sugar and Mocca varieties, in 200ml recyclable bottles with a paper straw, at RRPs of £1.50 (Original and No Added Sugar) and £1.65 (Mocca).

and Halloumi Caramelised Onion varieties. Each variety comes in a 22g grab bag with an RRP of £1.75.

The snacks are made with Greek Feta PDO and Cypriot halloumi and are baked, rather than fried, lowering their calorie count. They are also gluten-free.

CHUPA Chups has collaborated with online game platform Roblox for a new game, Chupa Chups: Shake & Create.

The lollipop brand looks to build cultural relevance among younger, growing audiences. Research around Gen-Z enabled Chupa Chups to establish the game mission and concept of ‘creative empowerment’.

The brand aims to expand upon the Roblox partnership with in-person events, seasonal content, outdoor campaigns and in-store PoS.

Kim McMahon, brand manager for Chupa Chups at Perfetti Van Melle, said: “Gaming is an area we’ve had our eyes on for a while and

are excited to now be playing a part in. We know it’s a rich territory to connect with younger audiences.”

GINSTERS is set to launch three new pastry products this month inspired by growing interest in Mexican and modern British cuisines.

The trio consists of a BBQ Hunters Chicken Slice, at an RRP of £1.95; a Smoky Beef Chilli Pasty, at an RRP of £1.95; and a vegetarian Mexican Bean Bake, at an RRP of £1.50.

The BBQ Hunters Chicken Slice and Smoky Beef Chilli Pasty launch on 25 September, while the Mexican Bean Bake is available now.

The launches come from research indicating a growing interest in Mexican and Modern British �lavour pro�iles.

Sam Mitchell, Ginsters

managing director, said: “We want to create excitement for the Ginsters brand as well as for the category as a whole.”

PRIYA KHAIRA

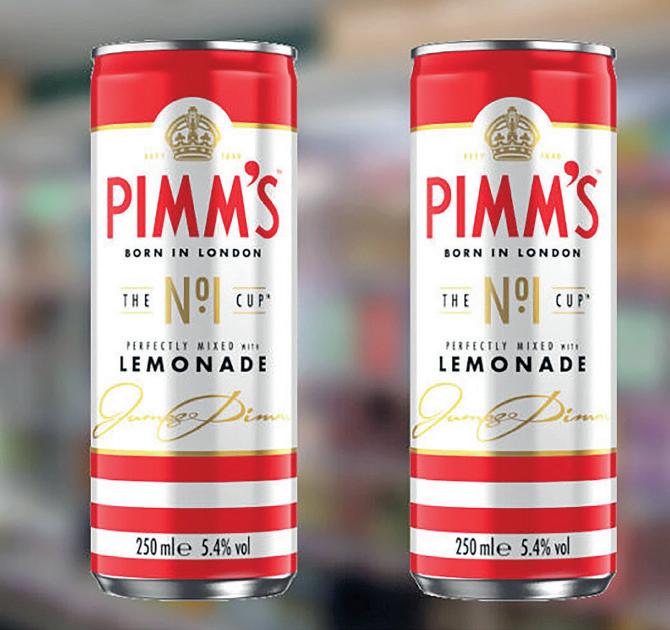

PIMM’S is encouraging convenience retailers to seize the opportunity presented by alcoholic ready-to-drink (RTD) options.

The category, growing by £2m year on year, is worth £283m in the off-trade, with £94m of this coming from the convenience channel.

One of the key drivers of RTD sales is convenience, with 67% of occasions taking place at home or at a friend’s house. The supplier said this made the category ideal for adding to retailers’ bottom lines, as shoppers can pick RTDs up on their way to a range of occasions, including barbecues, picnics, garden

parties and nights in.

Additionally, according to Pimm’s brand owner Diageo, �lavour, cocktails and moderation are key trends driving alcohol sales, which RTDs are well positioned to respond to as shoppers look to celebrate the end of summer.

Pimm’s own No.1 RTD mixed with lemonade (5.4% ABV) is available in a single 250ml can (RRP £2.19) and a 10-can multipack. It is currently worth £3m in the offtrade and has grown by 1.6% year on year this summer.

It recommends retailers implement multibuy offers and promotions with ample signposting in store and on social media.

BELVITA has launched its ‘Give a smile’ initiative with FareShare as part of its mission to help �ight food insecurity.

Through the partnership, Belvita will donate up to 100,000 meals to help make a difference to those in need.

The ‘Give a smile’ campaign aims to start conversations and inspire action to address food poverty.

Anna Lucas, brand manager for Belvita at Mondelez International, said: “Retailers can get involved by stocking up on the full Belvita product range to drive awareness of ‘Give a Smile’ and by encouraging shoppers to head to the

Belvita ‘Give a Smile’ website or look out for the billboards near stores to help �ight food poverty.”

AS part of Activia’s new ‘A-Z’ campaign, Activia has teamed up with S Club member Rachel Stevens.

Research from Activia found that 37% of Brits want to get into better routines to improve their overall well-being. The campaign aims to inspire consumers to use Activia to look after their gut health.

Stevens said: “What many people don’t know is that the gut can affect so much. Exercise, such as dancing and going to the gym, managing stress levels and eating a balanced diet are my go-tos in supporting my gut health, especially with our upcoming S Club tour.”

GIN brand Tipplemill Distillery is launching its �irst London Dry Gin into the UK market.

Based in South Lincolnshire, the product is the UKs only windmill-made gin.

Lily Craven, founder of Tipplemill Distillery, said: “I am extremely proud to be launching Tipplemill to the market, the result of a twoyear journey.

“I set out to create the best possible gin using wheat grown in harmony with nature on our family farm, taking inspiration from our milling heritage and all that the British countryside has to offer.

“Dedicated to quality, sustainability and traceability,

MCGUIGAN Wines is launching a mid-strength wine, McGuigan Mid, that aims to cater to consumers conscious of their alcohol intake

The range comes in Shiraz, Sauvignon Blanc and Rosé varieties, and contains less than 75 calories per can with an ABV of 7%.

Oliver Hoey, senior brand manager at McGuigan Wines, said: “We are delighted to launch McGuigan Mid to the market. As consumers become increasingly healthconscious, we understand the need for an alternative that aligns with their goals of moderation without compromising on taste.”

Recent global qualitative research by Australian Vintage found 92% of respondents would consider buying a lower-ABV wine.

Alana Jackson, head of marketing at McGuigan Wines, said: “There is a trend towards living ‘lighter’, where consumers are seeking moderation or lighter drinking experiences.”

LUCOZADE Energy is rolling out a marketing campaign to encourage trial and awareness of its Orange and Original �lavours. This will also follow with a fresh pack design.

The campaign includes outdoor advertising comprising billboard and bus-side ads, in-store shopper activations and social media activity.

Lucozade Energy will be launching a national consumer sampling campaign aiming to reach more than 1.5 million consumers across the UK.

Zoe Trimble, head of Lucozade Energy at Suntory Beverage & Food GB&I, said: “We are excited to be

this meant starting at the very beginning with the core ingredient, the base alcohol spirit.”

Tipplemill is available online with an RRP of £44.

INSTANT coffee brand L’Or has launched a limited-edition design of its stopper jar.

Featuring three new looks, the jars, with resealable lids, have been created to drive collectability and reusability among consumers, which the supplier says are growing shopper trends.

Available now, the designs have been inspired by coffee �lowers and plants from

around the world. These designs will feature across six varieties, including Classique, Intense and Decafeine in 100g and 150g formats.

Roberto De Felice, marketing director UK&I at Jacobs Douwe Egberts, said: “With 81% of in-home coffee cups being made using soluble products, there is still a demand for exciting launches within our core range.”

launching this campaign to bring our Core Brand Innovation programme to life and introduce our Orange and Original �lavours to even more shoppers.” The campaign launches this month.

HARIBO is expanding its gifting range with the launch of Box of Happy treats.

Available in 120g packs, each box is packed with jelly and foam gummies in a variety of �lavours. The supplier recommends retailers stock the Box of Happy as a yearround gifting item.

Peter Robinson, marketing manager at Haribo, said: “We’re excited to be launching Box of Happy. Our latest piece of innovation will allow our fans to share their love of Haribo.

“By creating a gift that can be shared all year round, consumers no longer need to wait to have an excuse to share the happy and put a smile on someone’s face.”

RETAIL EXPRESS joins ASHLEY HARWOOD from RED BULL to help two retailers improve their merchandising to capitalise on the growth of the soft drinks category

RETAILERS might think the soft drinks category sells itself to shoppers, but there’s plenty they can do to maximise turnover. Red Bull visited Shelley & Anu Goel and Ankur Patel at their stores to make their ranges stand out to enhance sales.

1 Merchandise by segment – group colas together and sports drinks together.

2 Keep beacon brands at eye-level to draw shoppers to the fixture quickly.

EXPERT ADVICE

ASHLEY HARWOOD

FOCUS ON SHELLEY & ANU GOEL

One Stop Gospel Lane, Solihull

80% of sports and energy drinks sales come from 40 SKUs2

Category Lead, Red Bull 80% of growth comes from three brands. Red Bull drives 46% of this growth3

“WE’VE had our store since 2013 and are always looking to improve. There are so many new products coming out and we only have a small chiller for them all, so it can be difficult to know what to stock. The project will give us a new way of looking at how to range the category.”

“Shelley and Anu’s challenge was about having the right products and making them visible. To make the fixture as shoppable as possible, we looked at how to segment it, put similar products together and signpost beacon brands. This makes it easy for shoppers to get in and get the products they want.”

“I DECIDED to take part in this project to increase footfall and sales, by improving my knowledge of the products and how best to display them, so they’re easier to pick up for shoppers. There are many new launches in the market, so it’s good for us to know what works best.”

“Ninety-nine per cent of people shop the soft drinks category4 and, as an impulse category, it can increase basket spend. Ankur’s challenge was confusion in such a big fixture. I’ve merchandised by segment and led with beacon brands so shoppers can quickly get to the right section and find the product they want.”

1

2

3 Facings: Give bestselling products extra facings, as that’s better than having an unknown line that is unlikely to sell.

Over a six-week trial period, Shelley & Anu and Ankur followed Ashley’s expert advice, and we tracked the sales data.

To find out how they got on, keep a look out for Retail Express on 3 OCTOBER

3 Give top brands adequate space instead of products with lower rates of sale. GET

For more advice, and to see more of Shelley & Anu and Ankur’s stores, go to betterretailing.com/ energise-softdrinks-sales

What do you think? Call Retail Express on 020 7689 3357 for the chance to be featured

PEAKING INTEREST: What are you doing to help get your store famous?

“WE don’t want it to seem like we are constantly selling things to customers, so instead we focus on building relationships, by posting more whimsical photographs. We sell ice cream, so we have posts of dogs eating it.”

“MAKE sure you’re up to date on Google and your business page. There are more and more people on there giving me a rating than I’ve seen before. Always be positive about bad reviews and flag incorrect ones with Google.”

Pricewatch: see what other retailers are

charging for confectionery tablets and boost your own

We

PROMOTIONS: How are you using merchandising to generate interest?

“YOU should make a conscious effort to make your store look good. If you wouldn’t go in there and buy something, why will your customers? People say it’s all about price, but presentation and cleanliness go a long way.”

“GIVEN that most other retailers in your area will have access to supplier-made PoS, there is scope to make your own. It’s not as fabulous as the things we get sent, but it has our own company logo on it and things like that. ”

BEING UNIQUE: What services do you offer to stand out from competition?

“WE have a printing service and it’s a real revenue driver. There’s nowhere else locally that does it, so it already gives us an edge over anyone else. A lot of people don’t tend to have a printer at home anymore, so it means we are catering to a niche.”

“WE have integrated a keycutting service in store. There is still good demand, and it brings in a decent profit. It doesn’t take up much space, it’s down one side of the store, and I can do it all myself. We keep clear signage outside the store about it, as advertising these services is essential.”

Kana Kukan, Yaxley Convenience Store, Lincolnshire

There is scope to make your own

GROCERY: How are you maximising sales of this category?

“WE always keep ours looking optimum – it has a halo effect, customers know they can get their full basket here. We see margins of 25%-to-30% on fresh produce, but the real value of stocking the category is that is encourages crosssales of higher-value items, such as meat.”

“WE train staff that if they wouldn’t buy it themselves, it shouldn’t be left on display. We saw extra demand due to availability issues earlier this year, and I made it a priority to get up early and get to the cash and carry. Any gaps are filled with other produce, so customers don’t get alarmed.”

We always keep ours looking optimum

Enya McAteer, Mulkerns Spar, Jonesborough, County Armagh

Samantha Coldbeck, Wharfedale Premier, Hull

THIS is the time of year when people have had their summer holidays and the weather is starting to draw in, although we’ve enjoyed an unexpected late splurge of hot weather recently.

The sunny spell has seen us bask a little longer in the highmargin footfall drivers of food and drink that go with summer.

BRITVIC is currently running a voucher promotion until October, where customers can claim a free bottle of Pepsi Max from Booker symbol and One Stop stores.

However, we stopped accepting these promotions ages ago and the only vouchers we accept are for newspapers. The issue is that retailers are still required to pay

postage to get the value of the product back when they send these vouchers off.

In reality, you don’t actually get the full value back.

It requires time from members of staff to sort the vouchers, put them in an envelope and take them to the nearest post box or post of�ice.

You also have to wait for a period of time before the money gets returned to you.

All this combined means

the retailer loses out.

It’s �ine for supermarkets as they have their own processes in place, and they can easily subsidise the time and cost.

Paper-voucher redemptions for products are generally quite outdated nowadays, anyway, and I don’t know of many customers who actually use them that much.

Anonymous retailer

A Britvic spokesperson commented: “We value every single customer and invite the retailer to get in touch with us directly so we can assist them. Once we have all the information from the retailer, we will of course investigate thoroughly and work with them on an appropriate solution. We value feedback from all our retailers and will continue to take it on board as we build new sampling plans”

“ANY company can sign up to Re ll Water so people can ll up their water bottle for free. It doesn’t cost anything. I’ve been doing this for about ve years. It’s great because people will invariably pick up a KitKat or a protein bar. I nd it worthwhile; they won’t go to another shop to buy their [snacks]. Half the battle of anything is getting [customers] into your store – they just need a reason. It makes your store their go-to shop. We have schoolchildren, walkers, local workers – it’s all been [about] building a rapport with your customers.”

“DURING Covid-19, we created a group [of retailers] that agreed to allocate products to food banks, shelters, charities and hospitals. In 2021, I was given the number of Midland Langar Seva Society. There’s so much overwhelming emotion when you do the feed. There’s pasta, pizza, tea, co ee, fruits. You can see you’re doing a good thing, but then you’re angry at how people can be in such a situation. You get to know the people. There’s a ne line – any one of us could, due to circumstances, go onto the other side of the line.”

Each issue, one of seven top retailers shares advice to make your store magni cent

It’s important not to forget that a er this good weather, minds will turn to Halloween and Christmas, and you need to be thinking about how you’re going to prime customers for the festive season and let them know what you’ve got.

We took advantage of the Londis presell for Christmas. We make sure to get the stock for any seasonal events at the rst available opportunity because it gives us the chance to make customers aware in advance. We don’t keep it in the storeroom, it goes straight onto the shelves because that’s where it sells and makes money.

Take sharing tubs of chocolate, for example. Customers will buy them in advance, stocking up for Christmas, but the majority will consume those before Christmas anyway and come back for more. And we mustn’t forget that Christmas isn’t the only gi ing opportunity in the year. There are still birthdays and family visits that require gi s, which means these are good items to have in your store year-round.

With chocolate, we focus on advent calendars and gi ing, making sure customers know what we’ve got. We’ve got Christmas cards and tissue wrapping paper out as well. It means customers know we’ve got them and will remember where they saw them. If you’re in a hurry, you’ll get what you can from where you know you can get it.

None of this is in a prominent position in the store yet; they’re all merchandised within their categories –Christmas cards in our greetings cards section and tubs of Christmas chocolate in with the rest of the confectionery. But we’ve made space for our next big sell at the end of September.

That is when the weather is really starting to draw in. Cross-merchandising is useful then. We merchandise our gi wrap, which doesn’t get a great margin, with gi tags and Sellotape, which does. That makes us a one-stop shop.

My advice to retailers is: take advantage of the presells and get in as early as possible with them.

Jet Sunner, Michaels Supermarket Nisa, Birmingham

‘We work with the disadvantaged’Trudy Davies, Woosnam & Davies News, Llanidloes, Powys –@trudydavies1964

‘We o er a free bottle re ll service’Sarah Davies advertising the free-to-use service

AS people gear up for o ce parties and gatherings with family and friends, the Christmas period generally sees a surge in demand for all types of alcohol.

Jo Taylorson, head of marketing and product management at Kingsland Drinks, tells retailers to expect a bumper Christmas 2023 with plenty of opportunities around wine, ready-to-drinks (RTDs) and cocktails. Products like Advocaat and Baileys come

into their own during the festive period, so retailers should make sure they have a strong supply of festive liquors and spirits.

“Forti ed Baileys and other liquors might not sell through the year, but are guaranteed to sell at Christmas,” says Gaurave Sood, of Neelam Post O ce & Convenience Store in Uxbridge, west London.

While Serge Khunkhun, owner of One Stop Woodcross in the West Midlands, says the

numerous promotions o ered by wholesalers on beer make them a popular product.

Natalie Lightfoot, of Londis Solo Convenience Store in Glasgow, sees a big demand for Buckfast Tonic Wine.

“We put Buckfast in a gift set and that sells very well,” she says. “I advise retailers to get in several gift sets, as you can still sell them over the rest of the year, like at Valentine’s. It doesn’t have to look like a Christmas gift set.”

RETAILERS are noticing a change in the pattern of Christmas purchasing, with more people leaving shopping until the last minute.

“About 15 years ago, Christmas was a week-long a air, but now it tends to be Christmas Eve and that’s about it,” says Khunkhun.

“We hold a high level of stock in December and in the last week ramp things up, but most sales happen over two or three days.”

Sood starts to organise stock in November. “By midDecember, we are pretty much ready,” he says.

“As we get nearer to Christmas, there are more special o ers available from wholesalers, so we wait a week or two before Christmas to pick up the last bits.”

Lightfoot says it is important to get festive launches in early, adding that RTDs are important throughout December as people are celebrating

o ce parties. “We ramp up the spirits and RTD options,” she says.

“We make sure gift sets and personalised hampers are available ahead of time so people can start to order in, and we can advertise on social media.”

The Cocktail Co is introducing Christmas crackers containing a surprise, alongside its Christmas gift boxes. This is the sort of product retailers can bring in early.

From personalised hampers to beer promotions, there are many ways retailers can boost their alcohol sales over Christmas, despite the costof-living crisis, as JO TILLEY discovers

ABSOLUT FLAVOURS BRINGS IN £25.3M WORTH OF VALUE SALES TO THE OFF TRADE*

Sto CK UP noW

WITH the cost of food and drink hitting the public hard, there will undoubtedly be more people looking for budget products over the festive period, with 72% of UK households now a ected by rising costs of food and drink.

Prices will have more of an impact on what consumers are willing to treat themselves

to, according to Tom Smith, marketing director at Accolate Wines, Europe. However, he adds that the £6-£9 range for wine remains particularly important for impulse buying.

Having a deal with a discount company like Jisp is another way for retailers to attract shoppers and encourages return visits.

“WE sell hampers all year round, but these are especially popular at Christmas. Customers pay a deposit and can come in store and cherry-pick what they want, or give me a budget to choose.

“We also make these available on our Snappy Shopper online service. They might tell me they want to spend £40, and their partner likes whisky, prosecco or chocolate. It is nice to make something personalised for someone.

“It is important to get the o er up in November, prepare items and make sure you have space for the hampers and an organised schedule of when they are being collected.

“Another great thing about doing this is we can take pictures of the hampers and use them on social media, so we then appeal to even more people. We make £2,000-£3,000 from hampers over this period.”

“It would be tough to operate without Jisp, as it’s hard to promote higher-priced items,” says Andrew Newton, owner of Nisa Local Colley Gate. “Our shipping container makes it easier for us to store Jisp products during Christmas, and ensures we can buy them in bulk and provide a ordability for customers.”

OBVIOUSLY, it is ideal to have a selection of formats over Christmas, but large formats are particularly in demand. Selling large beer pack formats at a discount rate is a hit with customers, with Khunkhun having 10-, 12- and 18-packs available on a range of brands.

“Multipacks are a popular choice over Christmas because drinking occasions are in groups,” says Giles Mountford, Badger Beers drinks marketing manager. “Drinkers who might ordinarily buy one or two bottles of their favourite beer will now buy one or two multipacks to cater for guests, or

to take to friends or family.”

to take to friends or family.”

Christmas also prompts the return of the retro bagin-the-box format.

to this must recyclability,

“Consumers are switching on to wines in this format, so we must embrace what they o er: recyclability, affordability and longer-lasting wine,” says Kingsland Drinks’ Jo Taylorson. “Bagin-box wines stay fresh for six weeks, so can cover the whole festive period.”

Alcohol-free formats should also be considered by retailers as this is a growing area across the board, according to Paul Callow, senior category and insights manager at Thatchers Cider.

SHELF ends and other highly visible areas are ideal to push sales of alcohol and alcohol gift sets.

“We put the funky stu at the front and also use window displays to present larger pack formats, which is useful as we don’t have that much space for

stock,” says Khunkhun. “It is nice to streamline the display and add a bit of in-store theatre, as it’s the time of year to make a special e ort.”

Many suppliers have special PoS materials available and if there are certain products that lend themselves to colourful

and exciting PoS, like strawberry and blackberry gins, then retailers should lean into it.

“All retailers are di erent and so are their customers, so we don’t have a one-size- tsall policy,” says Isabela Lluch, global innovation director at Puerto de Indias. “Some of

them need glassware, others need sta training and support while many retailers are looking for creative Christmas gifting products. My advice is to give us a call, get in touch and let us talk to you about the various bespoke ways we can help you this Christmas.”

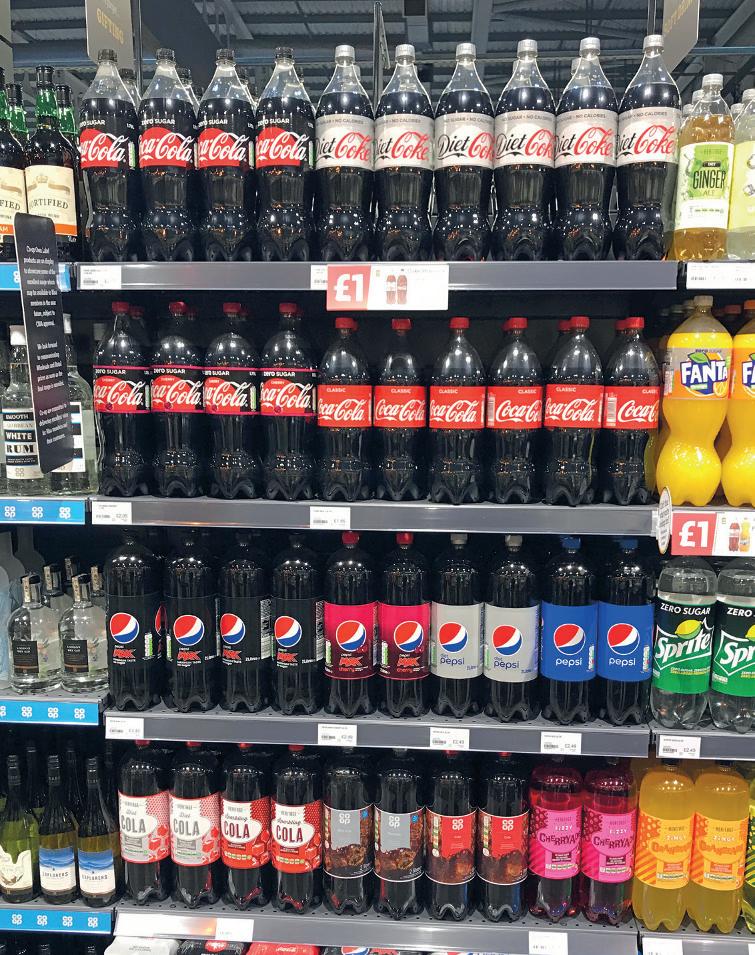

THE Christmas soft drinks opportunity covers everything from carbonates to energy drinks, from low-sugar options to mixers for spirits to adult soft drinks for alcohol avoiders.

The Christmas sales period extends from the start of the party season in early December

through to the days between Christmas and New Year, when people get active again, and gettogethers on New Year’s Eve and New Year’s Day. Retailers are con dent their soft drinks sales will be good this Christmas.

Christmas so drinks are a massive pro t opportunity, writes CHARLES SMITH. The secret is having the right range, highlighting it and staying in stock GET YOUR FREE POS KIT AT WWW.ATYOURCONVENIENCE.COM AVAILABLE IN PMP STOCK UP TODAY Visual Purposes only. Subject to availability. Max 1 kit per outlet. NPN. Registration & email address required. Visit atyourconvenience.com for Terms and Details. Promoter: Britvic Soft Drinks AVAILABLE FROM OCT 23 WITH EVERY 500ml BOTTLE EA SPORTS FC™ 24 IN-GAME REWARDS FREE

Ben Parker, Britvic GB’s retail commercial director, says take-

home soft drinks sales over social occasions like Christmas were worth £2.6bn annually to the end of November 2022, showing the opportunity particularly for large formats and multipacks across the key categories.

a time when people go out celebrating,” says Parker, “but in the current climate, many will be opting for cosy nights in with friends and family to save money. Consumers have been feeling the pinch this year, with consumer con dence the lowest on record.”

THE cost-of-living crisis is affecting the majority of households. With that in mind, shopping purchasing habits may di er this Christmas compared to previous years, with an emphasis either on buying in bulk to make greater savings or, as Britvic’s Ben Parker says, moving towards smaller transactions and smaller pack sizes.

“Value scrutiny has become more important than ever, and retailers should highlight their larger-format range, and how

they provide greater value for social gatherings,” he says.

However, Imtiyaz Mamode, at Wych Lane Premier in Gosport, Hampshire, has yet to see an impact on sales of soft drinks because of the costof-living crisis, and has high hopes for strong sales this Christmas, including imported soft drinks from countries such as the US, which are often bought as festive gifts because of their higher price tag.

“We’re always busy on soft

drinks. We’ve not really seen any cost-of-living impact, our business is much the same,” he says. “Prices have gone up, but customers are still buying the same amount, or more.”

In contrast, Paresh Vyas, from Limehurst Mini Market in Ashton-Under-Lyne, Greater Manchester, believes that customers are always looking for value when it comes to festive soft drinks, so o ering price promotions is something his store has always

focused on.

“During Christmas, all our soft drinks are on promotion. The local supermarkets o er 3l bottles for £1.50, but those don’t work here because our shoppers don’t want to carry heavy bottles back home,” he says.

“Over Christmas, we usually sell out of 2l and smaller sizes, and need to restock. It’s all about heavy promotion and price-marks – and without them, you might struggle.”

WHEN it comes to preparation for Christmas, retailers need to consider three different things: when to order the stock, when to put it on the shelves and when to start those promotional festive drives.

“We start getting ready for Christmas in October,” says Mamode. “It’s all about getting help from your wholesaler’s regional development manager (RDM). The RDMs work with many stores and they’re right most of the time, so listen to what they say.”

Vyas is more relaxed about timing, changing his soft drinks ranges to festive options at the end of Novem-

ber, as he follows Premier’s Christmas planograms. No matter when your soft drinks start appearing on shelves, however, it is crucial to get the word out to your customers about your o ers. Placing them in prominent places and – crucially – next to other complementary products can help to drive awareness and sales.

“Social media is the key to selling Christmas soft drinks – it’s about customer relationships. In store, it all depends on the planogram, how it’s displayed and where. If people can’t nd what they’re looking for, it a ects the basket spend,” says Mamode.

What to Stock – think big, health and flavours

Stock favourites

Shoppers see more value in familiar brands. Those with less disposable income are defaulting to trusted brands.

Think big

For consumers’ at-home gatherings, larger formats, such as 2l sharing bottles and six-can multipacks of carbonated soft drinks such as Pepsi Max, Tango and 7Up Free, are important.

Think health

Health is important in low-calorie soft drinks’ success. Tango’s sugar-free launches have helped make it the number-three flavoured fruit carbonates range.

Think flavours

Cola is now the second-biggest mixer with spirits, and flavours are driving the growth. Over half (56%) of Pepsi Max’s additional sales are flavours.

CHRISTMAS is a time when customers will look to treat themselves, as well as friends and family, with something a bit unusual, so this is when suppliers and retailers alike should be looking at limitededition and special seasonal options on their shelves.

According to Red Bull, three out of four consumers say they would buy a festive-flavoured energy drink, which explains October’s launch of the rstever UK Red Bull Winter Edition, Spiced Pear.

Mamode’s bestselling energy drink used to be Monster, which he stocks in eight fla-

vours, including Co ee, Salted Caramel and Swiss Chocolate, but now it’s the American brand G Fuel Zero sugar.

“We’ve got nearly 20 different ones. They sell all year round, including at Christmas,” he says.

Customers come from miles away and often spend several hundred pounds a time on imported soft drinks and American sweets as gifts for friends and family at Mamode’s store.

He promotes his premium soft drinks on social media, along with his imported confectionery.

“People compare the cost of travelling here with buying on eBay or Amazon, and it’s worth it,” he says. “Our biggest Christmas seller was Fanta Strawberry & Grape and Fruit Twist, now it’s Mexican Coca-Cola.

“We also do well with Dr Pepper Strawberries & Cream and Cherry Vanilla, and another hard-to-get bestseller, Mountain Dew.

“We sell 12 330ml cans for £17.95. We’ve not really seen any cost-of-living impact. Prices have gone up, but customers are still buying the same amount, or more.”

Paresh Vyas, Limehurst Mini Market, Ashton-under-Lyne, Greater Manchester

“PEOPLE are going for cheaper brands and extravolume packs generally, but they go for brands at Christmas, because they don’t want to look like cheapskates. You don’t see own-label sparkling wine in people’s houses, unless it’s M&S.

“Maximising Christmas so drinks sales comes down to following wholesalers’ promotions, changing products’ positions so they’re more visible, and putting additional displays by the till and in other places around the store. We have four Coca-Cola stands as well as our usual xtures and chillers, and put whatever we can t on them.

“To really push basket spend, you also need front-of-store gondolas with so drinks and snacks multipacks together in link-save deals. Parfetts, our wholesaler, gives us linked promotions on these two categories over Christmas, and run retail club promotions with di erent levels of o ers.”

Tell the story

Use the right range and display it to highlight what’s available.

O er value

Special deals are a key sales driver, placed next to regularly priced soft drinks to give a clear choice.

Be visible

Placing impactful PoS in store and posting on social media helps increase basket spend. Use gondola ends for large-format take-home soft drinks. Ensure display ranges work within HFSS legislation. Create displays alongside complementary categories such as snacks. Keep aware

Stay prepared with enough stock to keep up with demand during key dates over the Christmas period.

Talk to the experts

Check suppliers’ trade websites for practical recommendations and tested tips to engage shoppers.

ANOTHER factor to consider at Christmas is the increasing number of adults changing their drinking habits, whether that’s avoiding alcohol or reducing their sugar and calorie intake, even at Christmas.

Kenton Burchell, Bestway

Wholesale’s trading director, quotes drinks market analysts IWSR predicting this trend will continue, with projected no-alcohol volume growth of 10% between 2022 and 2026. Meanwhile, with suppliers reformulating ranges to meet

HFSS regulations, Burchell says consumers will be actively searching for new and exciting drinks this Christmas.

“Many brands are focusing on healthier o erings, including soft drinks with no sugar content, and sales are growing

for products such as Pepsi Max and Volvic Touch of Fruit Low Sugar Strawberry Natural Flavoured Water,” he says. A well-positioned healthy range could be a useful point of di erence for retailers with the right local demographic.

THE traditional tobacco industry has been facing a long decline in sales for some time.

According to the latest headline statistics for Tobacco Duty, total tobacco sales over the past year were just over £10bn, which is £274m (3%) lower than the previous nancial year.

Cigars currently account for

a small percentage of overall tobacco sales, but are also seeing a similar decline. Data gathered by Scandinavian Tobacco Group (STG) demonstrates the total cigar category is down slightly by 3.4% in value compared to last year, at £286.2m.

Traditional cigar segments

have taken a toll due to costof-living concerns and a switch up from many smokers who are moving to next-generation tobacco products such as nicotine pouches or heated tobacco.

However, cigarillos are bucking the downward trend, with sales continuing to grow (currently £102.8m, and up 3.9%

WITH a growing demand for next-generation tobacco, retailers can set themselves apart from competitors by stocking a varied range of cigars and cigarillos for those customers who are loyal to the products.

Christmas o ers an additional opportunity for cigar sales as people who might not normally purchase cigars start looking

for special gifts for friends and family. Having the right range and sta training for this will be key to success.

Many customers, particularly within the premium market, might purchase fewer cigars in total compared to other, next-generation tobacco users. However, they are likely to be willing to spend more money

on each purchase. For many of these customers, maximising indulgence and remaining loyal to their chosen cigar brand is important.

“We do stock cigars and cigarillos because there is a customer base for the products. But we don’t stock a massive range of products – instead, we keep the range small, and stock

on last year). According to the same data gathered by STG, the cigarillos market constitutes for 48% of sales within the cigar category and generates over £100m in value sales.

The cigarillos market constitutes a major opportunity for retailers and signals to potential growth for the category.

the products we know our customers will like,” says Pramit Patel, from Epping Stores in Essex. “This is because cigars don’t often sell as fast or as much compared to other tobacco products, but we still stock them for those customers who go for them.”

Nataly Scarpetta, marketing manager at STG, says: “To

boost cigar sales, it’s important retailers stock the right range rather than a big range, as the top 10 brands account for over 90% of sales, so don’t tie up your cashflow with slowmoving brands.

“I think customers who buy cigars and cigarillos are quite varied and are looking for different things. You’ll have adult

smokers who come in regularly for their usual pack. Retailers will also recognise that there will be customers who perhaps aren’t regular cigar smokers who come into the store intermittently, perhaps before Christmas, Easter or during the summer for a larger cigar, which they’ll enjoy as a bit of a treat or part of a celebration.”

WHILE consumers are likely to gravitate toward highquality products that will provide them with an enjoyable smoking experience, value for money is still a priority for many customers. Retailers should ensure they are o ering ultra-value tobacco brands as well as luxury ones, as more customers are looking for a ordable options within the market.

With cost-of-living concerns acting as a major constraint for consumer spending in the category, retailers should o er customers lowcost options that provide value for money, such as 10-pack cigarillos.

Cigarillos are generally cheaper than cigarettes from

the same brand. According to the National Institutes of Health, with rising cigarette taxes, consumers might feel inclined to switch to cigarillos instead of switching to another cigarette brand or reducing their consumption.

“I think there’s little doubt the cost-of-living crisis is highlighting the importance of value as a consumer trend at the moment,” says Scarpetta. “Many consumers are going to be increasingly price conscious, and this will a ect cigars and the wider tobacco category purchases just as much as any other category in store, so retailers should ensure they are highlighting their value brands to customers to help them save money.”

Flavoured cigars and cigarillos are steadily growing in popularity in the UK, along with menthol cigarillos. It is crucial for retailers to be aware of these growing trends and consumer preferences.

Royal Dutch is seeing continued growth in the sector. A spokesperson from Royal Dutch notes that the ltered range of Royal Dutch Double Filter, Royal Dutch Flame and the new Royal Dutch Filter 10s are seeing a growth in popularity and prevalence in the convenience sector.

STG’s Signature Red Filter Brand is currently the UKs top-selling aromatic lter cigar. This summer, the brand has recently launched a range of limited-edition packs. The brand has also recently announced that tins for Signature Blue 20s and Signature Original 20s are set to make a return.

JTI has also expanded its cigarillo portfolio with the launch of a Sterling Dual Double Capsule Leaf Wrapped cigarillo. The products are available in Peppermint and Berry Mint capsules at a RRP of £6 for a 10-pack.

Sta training

Sta training is essential for boosting cigar and cigarillos sales. With tobacco display bans a ecting the merchandising and visibility of tobacco products in-store, it can prove di cult for retailers to make sales if they lack knowledge of their products and customer base.

Communication is key

Talking to your customers is key, but particularly with your tobacco customers, who may well be the most loyal you have. Your tobacco customers’ associated basket spend can often be signi cant, too, so always keep their brands in stock. Many customers will be searching for value propositions, so let them know what products you can o er them to help them save money.

Seek supplier support

Many suppliers o er retailers support through tobacco training programs. Contact your cigar and cigarillos suppliers and ask them for in-store training to learn more about their speci c products and their consumer base.

Dan Brown, Lothian Stores, Musselburgh, East Lothian

Dan Brown, Lothian Stores, Musselburgh, East Lothian

“I THINK probably the biggest mistake I made was when I was starting out and I was trying to do too much myself and not delegating more tasks out to other people. There have been times in the past where I’ve not delegated enough and I’ve ended up burning myself out as a result.

“Since then, I’ve learned what I’m able to achieve myself and I’ve ultimately been able to get a lot more done by utilising the team around me. I now spend more time trying to develop the team and we delegate things a lot more. We now have different team members responsible for different areas of the store. And now they’re developing new people. There are people who are now in leadership positions and delegating themselves.

“It’s driven growth in sales and pro�its, and new concepts and projects have been developed. Everything runs a lot more ef�iciently now.”

“I LIKE experimenting and buying new things for the store. When the disposables craze started, there were so many varieties �looding the market. I used to get everything I could get my hands on, every brand that was out there. But I soon found that only certain products were actually selling and I was being left with a lot of unsold stock as interest in them fell away.

“So, now, I’m only stocking Lost Mary, El�bars and Blu from Imperial. I’ve seen a sales increase since and the customers are happier. If I’m buying paint and there are �ive different shades of white, I’m going to get confused, and it’s the same with vapes. It’s been very rare for someone to come in, ask for a brand we don’t have and then walk out. They’ll try what we have and come back again for it. Our range is still big, but it’s in terms of �lavours rather than brands. There are people offering sale or return, but it’s just such a headache.”

“FOR me, the big one is the need to evolve or die. I think there’s a constant fear of investment where you decide you’re not going to do something because you have this fear about the economy or your own personal circumstances. But then you have to deal with the consequences of falling behind.

“Every time we’ve gone to do something, we’ve had reasons not to do it and sometimes we haven’t. Now, I try to be less overly cautious because you need to make changes. Having said that, if I’d made the 120,000 investments I’d thought of, I might not have gotten all my returns back.

“The other mistake is making decisions on accountants and EPoS providers based on other people’s recommendations. They’re important, but not as important as actually focusing on what would be right for my business and the way I operate. It’s about looking at your own needs and wants as a business.”

In the next issue, the Retail Express team nds out who retailers turn to in their local communities. If you have any problems you’d like us to explore, please email charles.whitting@newtrade.co.uk