Don’t be afraid to share ideas with other retailers

LAST week, I had the honour of attending and chairing a masterclass and workshop at the Better Retailing Festival. The event had more than 200 attendees, consisting of the UK’s top retailers and senior industry gures from wholesalers and suppliers.

They had the opportunity to attend sessions hosted by several leading suppliers, providing useful advice on how to improve ranging, work with the community and back the right innovation, among other topics.

I facilitated Allwyn’s Responsible Retailing in the Current Climate masterclass, where the new National Lottery operator gave updates on upcoming campaigns and the rollout of its new terminals.

The masterclass also highlighted how retailers can overcome the consumer spending pressures a ecting footfall into their stores, which certainly prompted plenty of interaction from the audience.

Later, I hosted a more conversational workshop where alcohol supplier BrewDog advised retailers on how to get the best out of their store’s range and promotion, despite customer income being more squeezed.

Although the masterclass and workshop were held by di erent suppliers, similar challenges and opportunities were highlighted in both.

RETAILERS

It was also clear that retailers have the tools and ideas to help make next year more optimistic.

Full coverage of the event will be featured in the next issue of Retail Express.

@retailexpress betterretailing.com facebook.com/betterretailing

Editor Alex Yau

@AlexYau_ 020 7689 3358

Production editor

Ryan Cooper

020 7689 3354

Sub editors Jim Findlay 020 7689 3373

Robin Jarossi

Head of design

Anne-Claire Pickard

020 7689 3391

Senior designer

Jody Cooke

020 7689 3380

Junior designer Lauren Jackson

Production coordinator

Chris Gardner 020 7689 3368

Editor – news Jack Courtez @JackCourtez 020 7689 3371

Features editor Charles Whitting @CharlieWhittin1 020 7689 3350

Features and advertorial writer

Priya Khaira 020 7689 3379

Head of marketing

Kate Daw 020 7689 3363

Head of commercial

Natalie Reeve 07856 475 788

Associate director Charlotte Jesson 07807 287 607

Commercial project manager I y Afzal 07538 299 205

Account director

Lindsay Hudson 07749 416 544

Editor in chief Louise Banham @LouiseBanham

Features writer Jasper Hart

@JasperAHHart 020 7689 3384

Stronach 020 7689 3375

Account managers Megan Byrne 07530 834 009

Lisa Martin 07951 461 146

Finance manager (maternity cover) Isuri Abeykoon 020 7689 3383

Managing director Parin Gohil 020 7689 3388

Head of digital

Luthfa Begum 07909 254 949

ALEX YAU

MORE than 40 illicit tobacco and vape products were bought from dodgy stores during a test-purchasing sting between Retail Express and JTI.

The 24 September issue of Retail Express outlined details of covert visits to illegal sellers in Leeds, named

one of the UK’s illicit-tobacco capitals by the undercover investigators.

The stock purchased was sent to labs for testing, and Retail Express can now reveal the �indings.

Forty-three illicit vape and tobacco products were bought in 18 stores – 12 of them based in chancellor Rachel Reeve’s constituency of

BOOKER is set to launch its own home delivery service, recent trademark �ilings have suggested.

In September, the company submitted trademarks under the names of ‘Swoop’, ‘Nippy’, ‘Deliverease’ and ‘Scoot’.

Leeds West and Pudsey. The stock included 12 packs of cigarettes priced between £4 and £7, and 23 50g packs of rolling tobacco priced between £3.50 and £21. The most-common price for this illicit stock was £5.

A cigarette brand called Oscar, bought during the test purchases, had not been seen by the investigators before.

Eight vapes were also identi�ied as illegal, with some holding the largest capacity tank of 15,000 puffs. The stores visited included independent sites and some owned by major convenience brands in council estates and high-street locations.

The �indings of the investigation were made available by JTI to trading standards.

Online ordering and delivery of goods was listed under its lists of goods and services.

One source said: “It’s been an open secret that Booker has been building its own since the beginning of this year.”

A PROLIFIC shoplifter with 171 convictions has been allowed to roam free after escaping a prison sentence.

Tanya Liddle, 43, was handed a ban from visiting shops across north-east England last month following a hearing at Newcastle Civil Court.

Liddle, who has been arrested 400 times, will only be allowed to go to a pharmacy, a supermarket and a clothing retailer in the area.

Most of Liddle’s 171 convictions were for shoplifting.

RETAILERS have accused Dojo of ripping them off after the card merchant secretly added a £5 “optional” charge without their permission.

Messages to stores, seen by Retail Express, labelled the fee as a “Hardware Care” service, that enabled stores to replace damaged devices without additional cost.

A Dojo spokesperson said options for retailers to opt out were highlighted in an email or by calling customer service.

DIGITAL age veri�ication has become more accessible and affordable for retailers as part of Privately SA’s latest recruitment drive for small shops.

The company’s recently launched Age AI app costs £50 per month and can be downloaded onto a smartphone or tablet.

Certi�ied for European data protection laws, it uses arti�icial intelligence with the device’s camera to estimate someone’s age when they buy an age-restricted product.

RETAILERS �ighting for Post Of�ice (PO) directorships have promised to improve the �irm’s tarnished reputation, as outgoing chief executive Nick Read gave damning new evidence on the Horizon scandal.

Two out of the six candidates will be chosen as nonexecutive directors (NED), working closely with PO on addressing issues with the wider network over a threeyear term. The candidates were subpostmasters Brian Smith, Ruth Mander, Vince Malone, Sara Barlow, Ying Shi and Rizwan Salahuddin.

The appointed NEDs will replace Saf Ismail and Elliot Jacobs.

Voting closed on 16 October as Retail Express went to print, with the successful candidates expected to be announced in the following weeks.

Smith, of Free�ield PO in Lerwick, Shetland, said he wanted to use his 20 years of experience with the company to challenge decisions on the board.

The Horizon victim, who had £20,000 in shortfalls, added: “The experiences faced by the last NEDs [was that] PO did not take their advice seriously and they were not welcomed on the board.

“Those involved in prosecuting postmasters for the Horizon scandal are still in the role. PO needs its slate

wiped clean. How can we trust the company that still employs people who have done so much harm to so many postmasters?

“One of the things I’d like to see happen with Horizon is for it to be �inished – with those affected properly compensated.”

Speaking on a hustings hosted by the Communication Workers Union on 10 October, Smith described the culture at PO’s board as “toxic”.

Malone, of Tenby Stores & Post Of�ice in Pembrokeshire, agreed that changes must be made to �ix the relationship between the postmasters and PO.

He said: “Convictions were going to have a detrimental impact on postmasters and their view of PO. Morale drops and ability to serve customers drops. It has got to be put to bed in a way that is satisfactory for those impacted.”

Meanwhile, Mander, of Marcham Post Of�ice & Stores in Oxfordshire, said the publication of the public inquiry on the scandal would lead to “heartbreak”.

She added: “I’d like to see an effective and ef�icient resolution to all the IT-related matters. We want the new IT system to be truly ready, with appropriate training support.”

Mander also voiced support for a pay review of remuneration, promising to assess the number of service contracts available.

“WE were recently shortlisted for Convenience Drinks Retailer of the Year at the Drinks Retailing Awards. They said we’re outside of the areas they traditionally include, but we were selected because of our work with a local brewery to create our own branded craft beer range. The awards will also be a good way of networking with those we wouldn’t have traditionally met with at a convenience-focused event.”

Kaual Patel, Nisa Torridon Convenience, London

Barlow, of Rainhill Post Of�ice in Liverpool, pledged to put a pay review “front and centre”, and added: “I was speaking to a postmaster who was using a food bank and working 40 hours a week.”

Caterham-based subpostmaster Ying Shi said �ighting for a 30% increase in remuneration was a “top priority” alongside the creation of a “business school” for PO retailers.

Rizwan Salahuddin, of Wood Green Post Of�ice in London, similarly echoed that current rates of “salary is not good enough at all”.

He said: “Receiving remu-

neration after paying all the bills, wages and expenses – sometimes we are out of pocket. We don’t have even enough money to afford our own family things.”

The pledges come as outgoing PO chief executive Nick Read spent three days giving evidence to the Horizon inquiry between 9 and 11 October.

Claims were heard that PO’s top lawyer told Read not to “dig into” the past when he joined in 2019. Read also apologised over claims he was “frustrated” with not being given a pay rise, admitting how “poor” it looked given so many

victims are still waiting for compensation.

A “handful” of investigators working at the height of the Horizon scandal were also revealed to be still employed by PO, but in different roles. Read estimated Horizon shortfalls between 1999 and 2015 to be around £36m.

Speaking to Sky News before the inquiry, the PO boss claimed he did not need to clear his name following criticism over his handling of the scandal.

Read had previously met personally with victims of the Horizon scandal to hear the impact it had on them.

INPOST: The locker rm has gained full control of Menzies’ newstrade and parcel divisions following a £60.4m purchase. Several senior gures said it would be a “good deal” for retailers, ensuring the sustainability of newspaper and magazine deliveries. Menzies Distribution Services will be responsible for delivering papers to wholesale depots.

For the full story, go to betterretailing.com and search ‘Menzies’

SCOTTISH GROCERS’ FEDERATION: The trade body’s new national executive board president, Graham Watson, has pledged to help retailers tackle “challenges on the horizon”. The recently appointed independent retailer added: “Just like running a local shop, SGF is a team e ort and I’m very much looking forward to working more closely with everyone here.”

JISP: The loyalty rm’s longstanding managing director, Ilan Hepworth, has left the business, following a “strategic change in direction”. Jisp said the change would “ensure it was best placed to continue to grow in today’s competitive business environment”. The company’s sales director, Mike Baillie, also left to join the FWD earlier this month.

For the full story, go to betterretailing.com and search ‘Jisp’

BITCOIN ATM: Illegal Bitcoin ATMs are still being hosted by some stores, with investigations leading to prosecutions on retailers and network operators. So far, operators of the machines haven’t registered with the Financial Conduct Authority.

For the full story, go to betterretailing.com and search ‘Bitcoin’ express yourself the column where you

“WE’RE a former WHSmith Local franchisee, but there’s still a major focus on stationery and cards in our store. It’s what helps set us apart from competing stores nearby. I make an e ort to attend major stationery and card conferences around the country. The London Stationery Show is an example. We’re able to nd out about what the latest products are, and any exciting new services we can add to the store.”

Paul Patel, Dibden Purlieu News, Southampton

“THIS month, I was absolutely thrilled to have won the Best Consumer Business at the Best Business Women Awards. I was nominated by a friend and it was the rst time I had been entered into an awards focusing on the achievement of women. I was shortlisted with six other amazing women. It was a fantastic night that provided a great opportunity to speak to and share ideas with other businesses.”

ALICE BROOKER

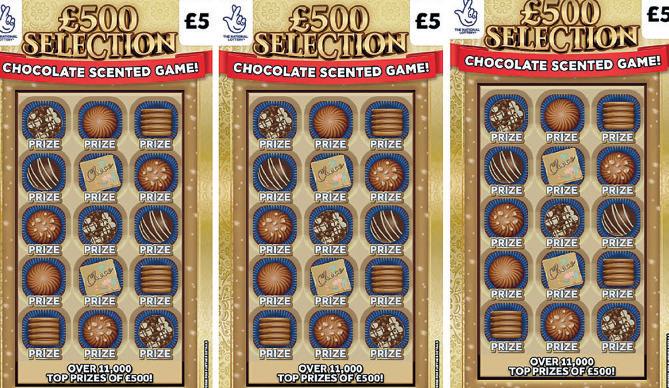

RETAILERS have hit back at Allwyn’s new chocolatescented scratch-and-sniff cards over fears they will encourage irresponsible gambling.

The £5 scratchcards offer £500 prizes and have been launched in 12,000 stores, with an eventual target of 30,000 outlets.

However, Susan Connolly,

of Connolly Spar Pewsey in Tidworth, Wiltshire, said the move was “utterly irresponsible retailing”, and will lead to an increase in underage gambling. “Cadbury and Mars don’t advertise for children, and now the gambling sector is,” she said.

“The new cards are selling, and you only know they smell of chocolate once you’ve bought them. Once that person has taken it home and a

child smells it, it’s a way of enticing them.”

Anita Nye, of Premier Eldred Drive Stores in Orpington, south-east London, is also selling the cards, but said she will “not draw attention to the fact they smell like chocolate”.

“The whole thing is contradictory,” she said. “They’re saying you’ve got that responsibility to watch people’s gambling and have implemented a 10-card purchase limit, but

they’re also trying to encourage people to buy scratchcards, which, in turn, could start a gambling addiction.

“We’ve been backed into a corner because we’ll be charged for them either way –so we have to sell them, rightly or wrongly.”

An Allwyn spokesperson said rigorous controls in place mean “the risk of problem play associated with National Lottery games is very low”.

For the

story, go to betterretailing.com and search ‘Allwyn’

NISA has delisted more than 130 core chilled lines, affecting partnered stores across Northern Ireland.

The wholesaler removed products from Müller, Grenade, Frijj and Arla, among others, blaming the Windsor Framework for its decision.

Neil Bell, of Nisa Summerhill Road in Belfast, said: “The number of delists is massive and we’ll start potentially looking at other suppliers to help fill the gaps.

“These lines always sell well, and there will be a financial impact.”

For the full response from Nisa and suppliers, go to betterretailing.com and search ‘Nisa’

BESTWAY’S shares in Sainsbury’s have crept over the 5% mark for the first time.

A notice published on 2 August showed the wholesaler purchased a holding of 5.01%, following several increases from 3.45% since January 2023.

Bestway remains Sainsbury’s fifth-largest shareholder with the increase.

When Bestway had first

For the full story, go to betterretailing.com and search ‘Bestway’ acquired shares in Sainsbury’s, the supermarket said it was “not considering an offer for the company”.

THE previous Conservative government failed to provide a promised £30m into funding illicit vape enforcement, the UK Vaping Industry Association (UKVIA) has alleged.

The trade body analysed 15 major city and London borough councils in England, alleging none received funding or indication of how much they would receive. UKVIA director general John Dunne said: “This is just another promise that has gone unfulfilled.”

Card reader takings in your account the next day* means less ‘oh no’ and more ‘ooh la la’.

Because when you’re not worried about cash flow, and there aren’t any hidden fees, you can turn your attention to more pressing matters – like saving your apprentice from another fringe accident.

What’s good for small business is good for everyone.

HANCOCKS has unveiled its festive confectionery range for Christmas, featuring lines from Bonds of London and Candy Realms.

Bonds has expanded its Candy Cup range with the launch of a Snow�lakes variety, while Hancocks has further enhanced its Candy Realms range.

Candy Realms now offers a Merry Mix Candy Cup, �illed with Christmas Tree Mallows, Candy Stars, and red and green sugared candy canes, all retailing for under £2.

Candy Realms is also launching Festive Stackers and Festive Mallow Pops, both strawberry-�lavoured

and sugar-coated marshmallow treats. The range also includes Festive Friends Dip n Lick lollipops, available in strawberry, apple and blue raspberry �lavours, complete with a dipping sherbet.

Hancocks has also added new products to its World of Sweets range from Elves Behavin’ Badly, including the Naughty Elf Mix, Giant Gummy El�ie and El�ie Tongue Painters Bag.

The Naughty Elf Mix comes in a candy cup �illed with sugar-coated strawberryvanilla and apple-vanilla mallows, fruit-�lavoured liquorice, crème candy canes, caramel and vanilla gummy elves, and fruit-�lavoured jelly candy canes.

PUKKA has launched a World Flavours parcel range, offering grab-and-go options inspired by a selection of global cuisines.

The range includes Jamaican Jerk Chicken, Mexican Beef and Indian Spiced Vegetable parcels.

Priced at £1.50 each, the new products aim to modernise the savoury pastry category by introducing internationally inspired �lavours to appeal to younger and wider customer bases.

The launch will be supported by a marketing campaign featuring PR, digital promotions and a TV advert.

Initially rolling out in Morrisons, the range will

be available to convenience and wholesale channels in November.

GLEBE Farm Foods’ 100% pure, British-grown oats are now included in Pip & Nut’s new range of Peanut Butter Stuffed Oat Bars.

FREJA Foods has introduced new Instant Bone Broth sachets in Beef and Chicken �lavours, providing a natural alternative to traditional stock cubes.

The sachets can also be mixed with hot water for a quick, nutritious broth drink.

Freja aims to offer a healthier option for consumers seeking to replace ultra-processed stocks with

CARLING has relaunched its limited-edition FA Cupthemed cans to celebrate its ongoing partnership with the iconic football tournament.

The cans, featuring artwork of the FA Cup trophy and the Wembley arch, are now available in single and multipack formats. Molson Coors Beverage Company, Carling’s parent company, is supporting the promotion through social media activity and sponsorship of Talksport’s FA Cup and UEFA Nations League coverage.

Lee Willett, Carling brand director at Molson Coors, highlighted that Carling is the lager brand most commonly

associated with football, thanks to its long-standing support for the sport.

Designed for on-the-go snacking, these bars are aimed at consumers seeking balanced breakfasts or energising treats.

COCA-COLA Europaci�ic Partners (CCEP) has launched a Halloween campaign for Fanta, continuing its collaboration with the �ilm Beetlejuice.

As a certi�ied B-Corp, Pip & Nut sources its oats from local farmers within a 70mile radius and mills them on site.

Phil Rayner, managing director of Glebe Farm Foods, said: “We saw a clear need for a high-quality, plantbased alternative that could enhance the tea-drinking experience.”

RRP: £2.09

The campaign features advertisements across outof-home, digital, social media and cinema, inviting consumers to engage with an interactive game by scanning QR codes via the Coca-Cola app.

Additionally, Fanta is hosting a Beetlejuice-themed Afterlife Train pop-up at West�ield Stratford City in London until 2 November. The pop-up will allow visitors to experience the Afterlife Train from the �ilm, which has grossed £375m worldwide.

more-natural alternatives in their cooking.

Co-founder Ed Armitage said: “High in protein and packed with collagen, our Instant Bone Broth is nutrientrich and ideal for cooking. It’s a clean-label option that adds 11g of protein per serving and collagen to any meal.”

RRP: £5.99

ABBOT Ale has launched a consumer giveaway aimed at enhancing relaxation at home.

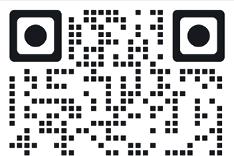

Customers purchasing selected packs of the premium ale – available in four- and 10-packs – can enter to win various prizes by scanning a QR code on the packaging.

Prizes include Kindle e-readers, Sony noise-can-

celling headphones, a home gadget pack featuring a TV and sound bar, and annual subscriptions for Audible and Paramount Plus.

The competition runs until 30 November. The initiative aims to drive repeat purchases during the colder months.

LUSCOMBE Drinks has introduced its latest non-alcoholic offering, the Mulled Winter Warmer, available now.

Offered in 27cl (RRP £2.75) and 74cl bottles (RRP £4), the drink blends organic cherry juice, hibiscus and traditional mulling spices such as cinnamon, cloves, and nutmeg.

The beverage can be en-

joyed hot or cold, catering to festive celebrations.

Gluten-free and veganfriendly, it joins Luscombe’s range of soft drinks, including Damascene Rose Bubbly and Hot Ginger Beer. Available from: luscombe.co.uk

MARS Chocolate Drinks & Treats (MCD&T) has added Milky Way Milk to its range of canned milk drinks, in a 250ml format.

The move is part of the supplier’s commitment to more sustainable packaging. The cans are available in cases of 12 and can be stored ambient.

Last year, MCD&T launched the can range with Mars and Galaxy milk drink varieties. Currently, the �lavoured milk drinks category is growing by 11.9% year

on year, with Mars’ milk drinks seeing annual sales of £18.5m.

RRP: £1.25

SPAR stores across the north of England can now stock Hawkstone beer and cider from Jeremy Clarkson’s farm thanks to a new partnership with James Hall & Co.

Hawkstone Lager and

bottles for £2.99. This is designed to to more easily introduce customers to the product.

Rob Midgley, head of trading for licensed products at James

THE Scottish Professional Football League (SPFL) has partnered with Molson Coors Beverage Company, naming Carling as the of�icial beer of the SPFL in a deal set to run until the end of the 2026/27 season.

As part of the agreement, Carling will feature prominently at league matches and across the Premier Sports Cup.

This partnership aims to engage football fans through initiatives such as the Grassroots Goals programme.

CONFECTIONERY brand Reese’s has expanded its UK portfolio with the launch of the Fast Break bar, a nougat-�illed treat featuring the brand’s signature peanut butter.

Available at all major wholesalers, the Fast Break bar is priced at £1.15.

The Hershey Company, the brand’s supplier, has introduced the bar following

a successful year of growth, with Reese’s seeing a 25% increase in sales among symbol groups and independent retailers, indicating rising

consumer demand for the brand’s peanut butter and chocolate combinations.

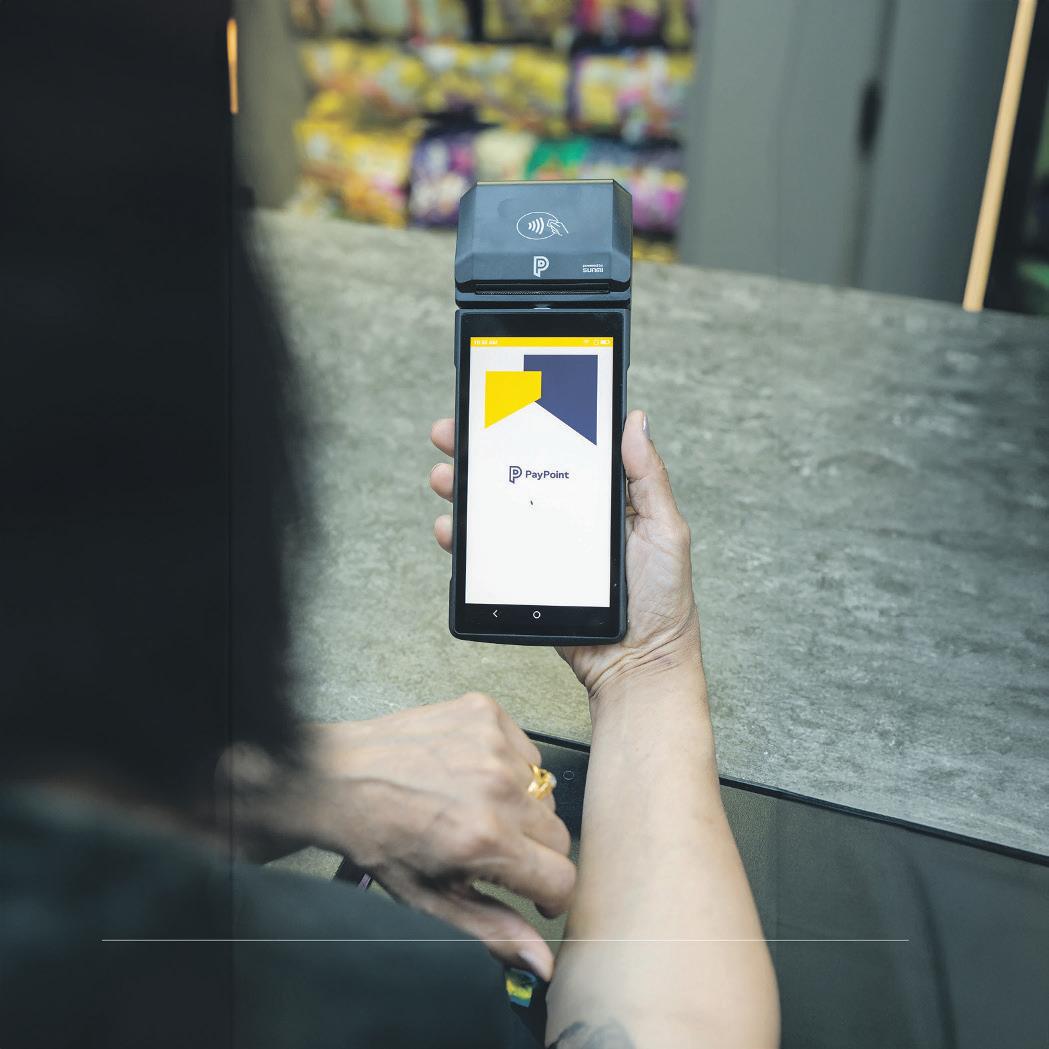

The PayPoint Mini is an all-in-one, handheld solution that offers seamless PayPoint transactions, card payments, and parcel services. It’s effortless to use, takes up minimal counter space and brings the most up-to-date technology to your store - how does that sound!

(80g) packs.

KP SNACKS has unveiled a collaboration between Butterkist and the upcoming Wicked movie.

The promotion, which runs until 31 December, offers consumers a chance to win a ‘Thrillifying Adventure to London’, with �ive prizes up for grabs, including a luxury hotel stay, a potion-making experience, a makeover, a £200 shopping spree and a wizard-themed afternoon tea.

It will run across Butterkist’s £1.25 price-marked range, including Sweet, Salted, Toffee and Sweet & Salty varieties, as well as its standard Sweet (100g), Sweet & Salty (110g) and Salted

Butterkist is also launching a limited-edition 180g Sweet popcorn sharing pack, featuring Wicked-themed packaging.

Additionally, between now and 1 December, retailers will automatically be entered into a prize draw to win one of 35 TV tech bundles when they buy cases of all four Butterkist £1.25 PMPs featuring the on-pack promotion.

The campaign will be backed by digital media, outdoor advertising, in�luencer content and sampling events.

ROBINSONS has teamed up with Universal Pictures to celebrate the release of the upcoming Wicked movie

The partnership includes an on-pack promotion across Robinsons’ Double Concentrate and Ready to Drink Raspberry & Apple ranges, available now.

As part of the promotion, Robinsons is introducing two

new �lavours in its Double Concentrate range: Amazafying Citrus Twist and Outstandiful Berry.

The promotion, with the tagline ‘Witch Will You Win?’, offers consumers a chance to win exclusive Wicked merchandise and a trip to New York.

LEEDS-BASED bakery

Love Handmade Cakes has launched a selection of spooky bakery treats in time for Halloween.

The collection includes Caramel Ghost Shortbread, Ginger & Treacle Traybake, Parkin Traybake – all of which have 15 portions per traybake – Skeleton and Mummy Gingerbread, Spider Cookies, and Cream Gateau, which offers 14 portions.

The Halloween treats are now available to wholesalers and independent outlets.

This Halloween collection aims to tap into seasonal demands for Halloween innovations while providing both classic and novelty options for customers.

INVENTURE has expanded its breakfast offering with the introduction of a new onthe-go cereal cup range.

The range features four American-themed �lavours: Marshmallow Cookie O’s, Peanut Butter Puffs, S’mores and Flumps.

Each 40g cup is available at a £1 RRP, and provides a convenient, portable option for busy consumers.

Retailers can access the range directly from Inventure or through wholesalers such as Distinctive Retail Group.

Designed with convenience in mind, the cereal cups are suitable for school or work environments, or as a snack option.

WHITE Claw has launched a new limited-edition seasonal �lavour, Blackberry, to tap into autumnal �lavours.

Following the success of its summer Watermelon �lavour, the new release marks White Claw’s ambition to offer two seasonal �lavours each year.

The Blackberry variety is made from natural �lavourings, triple-distilled spirit and sparkling water.

It is vegan, gluten-free and contains 95 calories per can. It also contains an ABV of 4.5%.

White Claw is currently growing by 27% year on year, compared to the category’s 6%.

RRP: £2.25

PORK Farms has introduced a new meat snacking brand, Meateors, which features ready-to-eat pork meatballs.

The launch aims to cater to the growing demand for high-protein, on-the-go snacks and offers an alternative to the chicken-based snacks that currently dominate the market.

The Meateors range includes three varieties: Spicy Fajita, Italian Style Herb and Sweet BBQ. Each option is made from 100% pork and comes in a 50g pack.

consumers looking for

Meateors is set to expand Pork Farms’ presence in the growing meat snacking sector, appealing to health-

limited-edition pack for the women’s Rugby World Cup England 2025.

WORLD Rugby and Asahi Super Dry have extended their partnership, with the Japanese beer brand continuing as the Principal Partner for both men’s and women’s Rugby World Cup tournaments through 2029.

This long-term agreement includes sponsorship of the Women’s Rugby World Cup in England 2025, the Men’s Rugby World Cup in Australia 2027 and the Women’s Rugby World Cup in Australia 2029.

Asahi Super Dry will build on the momentum from its successful debut at the Rugby World Cup France 2023, launching multi-channel marketing campaigns for each event, including a

MAGNUM has introduced its �irst-ever bite-sized product, Bon Bon, as it responds to the growing popularity of smaller ice cream formats.

Bon Bons come in 12-piece tubs designed for sharing and snacking. It is available in three �lavours – White Chocolate & Cookies, Gold Caramel Billionaire and Salted Caramel & Almond.

Magnum’s entry into the bite-sized category follows similar launches from Ben & Jerry’s and Yasso. The rise of micro-formats in ice cream re�lects broader consumer trends, with onethird of UK ice cream consumers expressing interest in trying smaller portions.

THE fast-growing nicotine pouch category provides another choice for adult tobacco consumers.

Introducing on!PLUS, an innovative tobacco-free nicotine pouch, o ered in a variety of flavours and nicotine strengths, and containing 20 pouches per can. Each on!PLUS flavour contains a special blend of ingredients that gives a fullbodied taste.

Switching to on! Nicotine

Pouches allows adult consumers to experience discreet nicotine satisfaction in any moment throughout their day, such as working, shopping, travelling and socialising, without smoke or odour.

HELIX SWEDEN is a wholly owned subsidiary of Altria Group, Inc. and supports its aspiration of ‘Moving Beyond Smoking’ and the international expansion of on! Nicotine Pouches, which are available to retailers now

For on!PLUS, your store is the most important place to connect with adult tobacco consumers. It o ers breadth and flexibility in sales solutions, displays and CTUs, aimed at maximising returns.

on!PLUS nicotine pouches are a pioneer for next-generation alternatives. The brand strives to stay relevant and innovative, o ering products that meet the evolving needs of consumers.

The combination of quality, wide range of flavours and functional packaging is making on!PLUS one of the quickest-growing nicotine pouch brands in terms of popularity1.

Priyesh Vekaria, One Stop Carlton Convenience, Manchester

39%

The global nicotine pouches market is expected to grow at a compound annual growth rate (CAGR) of 39% from 2024 to 20301

The on!PLUS range o ers a slim pouch with ‘Flex Tech’, an exclusive flexible pouch technology for a seamless experience, which means they t neatly out of sight under the upper lip.

Mint Strong on!PLUS Mint with a cooling and refreshing mint flavour.

RRP: £6.49

Smooth Mint Strong on!PLUS Smooth Mint with a balanced mint flavour.

RRP: £6.49

“ON! Nicotine Pouches, especially the latest on!PLUS range, have impressed me. Since introducing them, we have received overwhelmingly positive feedback. Consumers have appreciated the competitive pricing, delightful taste and the satisfying sensation experienced. I highly recommend on! Nicotine Pouches, particularly the on!PLUS range, to anyone looking for a top-tier product that excels in quality and innovation.”

Berry Strong on!PLUS Berry with a taste of red berries combined with a subtle hint of currant and forest berries.

RRP: £6.49

Citrus Strong on!PLUS Citrus with a refreshing taste of grapefruit, lime and citrus.

RRP: £6.49

Premier Broadway, Edinburgh, and Women in Convenience ambassador Sophie Williams

THERE are several things you can do if you receive online negativity through social media – everyone has experienced this, and it’s best to know about it and be prepared for it.

Something you can do if you get a negative experience or trolls is use the block button. If you create an online space that you feel comfortable in and give out positive vibes, that’s what you’ll attract back – what goes around comes around.

If your output is more opinionated or negative, you’re more likely to attract that energy back. Try to focus on creating a happy online environment.

You can also attract online negativity without meaning to, and it can just be best to take the post down. We recently had a shopli ing incident involving suspects in balaclavas.

We then put posted a video advising people to take down their hoods because it’s easier for us to identify them, and it created a really negative discourse in the comments about racism. We didn’t engage with it and took the post down. It’s not worth it.

Another tip is to use lters. For example, on TikTok you can lter out certain words – if I wanted to block the word ‘hate’, that means nobody can comment that on my posts. It’s useful, and allows you to continue to create your positive space online.

PRIYA KHAIRA

JASON’S Sourdough is entering the food-to-go category with a new range of premium toasties and hot rolls, made in partnership with food-to-go manufacturer Around Noon.

The new Toastie range has four �lavours, including Ham Hock & Mature Cornish Cheddar, Nduja & Mature Cornish Cheddar, Kimchi & Mature Cornish Cheddar and Three Cheese & Onion. The range of toasties is priced between £3.50 and £6.

Jason’s new Hot Rolls, which are also priced between £3.50 and £6, feature favourites including Thick Cut Bacon with Posh Tomato

Ketchup, Hog Roast with Sage & Onion Stuf�ing and Chunky Apple Sauce, and Roast Chicken with Sage & Onion Stuf�ing.

Jason Geary, master baker at Jason’s Sourdough, said: “Our sourdough’s unique texture and �lavour make it ideal for toasties, and this new range is a way to bring Jason’s signature range to the food-to-go category.”

The launch aims to

CITIZENS of Soil has partnered with Notpla to launch single-serve extra-virginolive-oil pipettes.

Packaged in Notpla’s plastic-free, biodegradable, and edible seaweed-based material, the pipettes have been created to offer a sustainable alternative to traditional packaging.

The pipettes have been designed for convenience, allowing a controlled release of olive oil, making them suited for drizzling on salads, pizzas or smoothies.

strengthen Jason’s position in the bread and food-to-go markets.

This collaboration aims to reduce the impact of single-use plastic packaging while providing consumers with an eco-friendly and functional product.

DEL Monte has teamed up with TV presenter Fern Britton to revive its ‘Man from Del Monte’ campaign with a twist, ahead of National Baking Week.

The new ‘Nans from Del Monte’ campaign is a nationwide search to �ind grandmothers who excel in

traditional baking and want to share their recipes.

The public is invited to nominate their grandmothers, with �ive ‘Nans from Del Monte’ being selected as ambassadors to inspire the next generation of bakers.

THE Scottish Bee Company has introduced a new chocolate spread, which is made with a combination of Fairtrade chocolate, Scottish milk and butter, and homegrown Scottish Blossom honey.

The chocolate spread offers an ethically sourced blend of ingredients.

Founder

highlighted the use of smallbatch, locally sourced

which includes manganese and vitamins B and C. The chocolate spread has an RRP of £8.

PRINGLES has reintroduced its QR code design for a limited-edition run of Movemberthemed tubes.

The moustache of Mr. P now functions as a QR code that directs users to Movember’s Conversations tool, offering resources and guidance about mental health and well-being. It is available on Salt & Vinegar and Texas BBQ 185g �lavours.

Since partnering with Movember in 2020, Pringles has raised more than £1m to support mental-health initiatives.

In partnership with

Demand for out-of-home (OOH) delivery has skyrocketed, and INPOST delivery lockers are revolutionising the way people send and receive parcels, creating opportunities for retailers to capitalise on this trend

SHOPPERS crave convenience and having a parcel nicked from your doorstep or missing a delivery is anything but.

As a result, InPost is seeing huge demand for its lockers –one of the quickest, cheapest and most convenient forms of OOH delivery. With their self-service convenience, parcels can be collected by consumers 24/7. Over half of UK consumers have used them for online purchases, rising to 71% for Gen Zs and 68% for Millennials1, with convenience the top reason for choosing a locker1.

These convenience-loving locker users are a more a luent demographic1, so they can spend more and shop more, making them a valuable audience to attract.

WHILE convenience is key, the demand being seen for lockers is also driven by shopper concerns around sustainability.

Shoppers are keen to do their bit for the environment and here, lockers present an ideal solution. Delivering to a locker means fewer deliveries, which means fewer vans on the road – and 84% of shoppers believe they o er a greener solution1. Consumer demand for lockers is already huge, but they also provide many bene ts for retailers. O ering InPost Lockers increases footfall and drives incremental sales, as customers using them often make additional purchases when visiting a store2 Not to mention the guaranteed rent InPost pays landlords, providing retailers with an additional income stream. With installation costs covered and minimal space requirements, hosting an InPost Locker is a strategic move that can really set a business apart from the competition – it’s a no-brainer.

To capitalise on the rising demand for lockers, get in touch with InPost at info.inpost.co.uk/host-a-locker-retailexpress to nd out more

Key stats

84.2% of shoppers believe lockers present a greener solution1 5 2 3 4 1

Convenience (36%), cost (19%) and speed (17%) are the top three reasons for choosing lockers1

71% of locker users are Gen Zs and 68% are Millennials1

31% of locker users have an income over £50,0001

64% of consumers who shop online once per week or more have used lockers1

Mike Fearn, head of network sales, InPost UK SUPPLIER VIEW

“INPOST is well-positioned to help retailers tap into this demand. Through our InPost parcel lockers, we o er a low-cost way for consumers to collect, send and return parcels quickly and with ease. We have the largest locker network in the UK, with more than 8,000 parcel lockers nationwide3. Thanks to our rapidly growing network of parcel lockers and Pick Up/Drop O (PUDO) points, millions of consumers can now choose anytime, anywhere delivery options.

“The locker market remains extremely strong, and we have aggressive growth plans in place to help more retailers capitalise on this demand and allow every UK consumer to use InPost Lockers as part of their journey. As pioneers, we are revolutionising parcel delivery by making lockers an a ordable, convenient and quick option.”

RETAILER OPINION ON THIS FORTNIGHT’S HOT TOPICS What do you think? Call Retail Express on 020 7689 3357 for the chance to be featured

better to put the time and e ort in elsewhere

VIRAL PRODUCTS: Which lines have you begun stocking?

“I’VE been working with a wholesaler to add South-East Asian versions of popular soft drinks. I don’t think I’ll be stocking them for long, as they’re the kind of products customers will only buy once because they’ve seen them on social media.”

“I’VE been stocking Warhammer �igurines since the pandemic and they are still doing well. They’ve got regular customers, and we’ve got a WhatsApp group that says when new models come in. It’s mainly older men and children who buy the �igurines.”

Judith Mercer, Hamilton News, Belfast

WORLD FOODS: What sorts of products are you stocking?

“WE stock noodle pots that are selling well on Instagram. The European and Asian categories are doing well. We’ve seen a 30% increase over the past six months and we’ve increased our range as a result. We also use a wholesaler called Dimark for European crisps and snacks.”

Max Amin, One Stop Canterbury, Kent

“I HAVE two full bays dedicated to Italian, Indian, Chinese, Pan-Asian and US foods. The whole category has gone beyond standard Italian, Indian and Mexican lines. People are more adventurous with the food they’re willing to try and there are a lot more cuisines out there.”

We stock noodle pots that are selling really well

STORE REVIEW: Are you making any changes to services?

“WE’VE closed our restaurant and expanded our convenience side. We’re looking to complete the expansion around November and add some new food-to-go ideas. It was a hard decision, but the convenience side of the business has been bursting at the seams.”

James Brundle, Spar Eat 17, Walthamstow, east London

“OUR Facebook page has often featured meal recipes. We’ve been doing it for a few years, but we’re thinking of stopping them entirely and replacing them because they haven’t been getting much attention lately. It would be better to put the time and effort in elsewhere.”

Alan Mannings, Shop on the Green, Chartham, Kent

TESCO: Will its own label going into One Stop stores be significant?

“IT could be a game-changer as the only real credible convenience own label on the market is Co-op. As another multiple-operated convenience chain, One Stop was likely feeling pressure from Co-op and Nisa and had to up its game. I’m sure Nisa and Co-op will be keeping a close eye on how this develops.”

Anonymous retailer

“IT’S a very positive move and marks another stage in the blurring of the lines between supermarkets and independent convenience. Tesco and Co-op are the two most-credible own-label ranges. I know a lot of Booker retailers have raised issues about stocking more Tesco own label, and this may enable that.”

Anonymous retailer

‘I’m

up in my store’

WHEN the National Lottery moved to Allwyn, we told them we wanted to continue providing the service. The lottery terminals went off in our eight shops with the switchover. Nothing happened with the machines for several weeks, but this was eventually sorted, except in one store.

Allwyn said the store was

registered under a name different to our own. They said they would register us as a new partner, but eventually stated there was something wrong with the application and asked us to reapply. The application was processed, but I didn’t hear anything for several weeks. I phoned up and Allwyn said they’d need a £5,000 bond.

They were supposed to return a £5,000 bond under a previous account.

Zain Ali, Budgens Shield Row, County Durham

An Allwyn spokesperson said: “The transfer of retailer agreement wasn’t successfully completed ahead of February and so a new application

had to be completed for the remaining store.

“We sent a cheque refunding the previous £5,000 bond. Unfortunately, the cheque wasn’t received due to the retailer no longer living at the supplied address.

“We will be returning the bond under this new retailer ID, which we’ve set up for the new store application.”

Find your point of di erence

THE convenience market has taken a downturn, according to recent reports, with visits remaining stable but overall spend dropping. People are worried about what the market is going to do as well, with interest rates still relatively high and people having less and less disposable income.

But retailers can’t a ord to sit still and worry about this. They have to work out how they’re going to drive footfall and make people want to come to their store. I’ve been very against bringing a post o ce into my store for a long time. I thought it was a lot of work for not much money, but what it does do is drive customers into your store. It’s o en more lucrative than PayPoint. We’re looking at potentially installing one in March next year. What you’ve got to do as a retailer now is make your store a destination and give it a point of di erence so that people not only want to come to you, but want to spend more with you.

I know a retailer who’s in a fairly a luent area and he’s installing four Cook freezers in his store. Then, on top of that, they’ve improved the section further by investing in some premium wines as well, which is what the average Cook customer is looking for. You’re making them want to spend their money with you instead of elsewhere. For stores in less a luent areas, it’s got to be about driving value. Price-marked packs give people con dence in the price points and let them know they don’t have to shop anywhere else. Parcel collections and other instore services can be a great way to make your store a destination.

‘I’ve sponsored my life-long football club’

“I AM a now a super-proud sponsor of a football club. Being a life-long fan of Charlton Athletic, whose ground isn’t too far away from the shop, I was so proud as a small business to have my board up around the grounds of Charlton’s stadium ready for the new season, which started recently.

“I would like to take this chance to say thank you to the many people who have helped to make this sponsorship possible. I am forever thankful to them for making this happen.” COMMUNITY RETAILER OF THE WEEK

“MYSELF, alongside fellow retailers Atul Sodha, Natalie Lightfoot and Sophie Towers, are launching a safe space by retailers, for retailers. Our aim is to create support speci cally for retailers in the convenience industry as human beings and individuals.

“We all work for ourselves, not for a giant corporation, and from time to time it’s challenging, hard and incredibly lonely. There is no judgement, because life happens, and as retailers, no one understands what we face more than other retailers.”

Right now, you’ve got to hit Halloween hard and o er consumers some value, and then keep that range very tight and value-led all the way to Christmas. Use your symbol if you can. If you can’t, shop around. We’ve used the multiples to cherry pick some deals that we can shout about in our store.

Don’t be afraid to beat the drum, wherever you are. And don’t forget that even in a luent areas, people still want value for money.

Be proactive instead of reactive. Look at what you’re doing right and what you’re not, and think about driving that footfall. It’s the key to survival. Each

PRIYA KHAIRA explores key snack trends, insight and strategies to boost sales and meet consumer demand

THE snack market in the UK is thriving, with data showing that approximately £4.15bn snacks are being sold annually across convenience channels.

Value packs and pricemarked packs (PMPs) are leading snack sales for retailers.

James Brown, of Nisa Local Beech Stores in Heysham, Lancashire, emphasises the importance of value to his customers.

“Own-label savoury snacks

and biscuits are a popular impulse purchase,” he says. “The majority of our biscuit range is own label and we run promotions across our confectionery and snack ranges frequently.”

This strategy not only provides customers with a ordable options, but also enhances the store’s appeal as a coste ective shopping destination. Clear communication of discounts and value o ers is essential. Retailers should

consider e ective signage that highlights promotions, making it easy for customers to identify value options.

Susan Nash, trade communications manager at Mondelez, says: “As we face trying times, shoppers view their favourite snacks as a ordable and necessary indulgences.”

Despite this, retailers with the right demographics are noticing growing consumer interest in locally sourced snacks.

The trend toward local sourcing can be used to provide you with a point of di erence. “Local produce is what sets us apart from other stores,” says Andy Miles, from Dike & Sons in Stalbridge, Dorset.

“Engaging with customers to share stories about local suppliers and the bene ts of supporting local products can promote sales, as well as clearly signposting where di erent snacks are from.”

Stay updated on trends

Regularly monitor social media for trending snacks and new launches. Engage with platforms such as TikTok to spot emerging flavours and products that resonate with consumers.

Diversify your product range

O er a mix of traditional snacks alongside innovative and healthier options. This approach caters to various consumer preferences and maximises potential sales.

Highlight promotions

Use in-store displays and signage to promote trending snacks, particularly those that are HFSS-compliant or have gone viral. This can enhance visibility and encourage impulse purchases.

Engage with customers

Create opportunities for feedback from shoppers regarding snack preferences. This can inform future product selections and enhance customer loyalty.

AS consumers become more adventurous in their snacking habits, demand is rising for international flavours that provide unique snacking experiences.

Ruban Jeyaruban, from Londis Fairfax in Kidlington, Oxfordshire, has successfully tapped into this trend by emphasising his US snack o ering. “Our US section down the middle of the confectionery aisle always attracts attention,” he notes.

Jeyaruban notes that snacks are bringing in £400 per day in his store, with sales being driven by on-trend US

brands. “I’m amazed by the success of our US lines,” Jeyaruban says. Similarly, Nishi Patel, of Londis Bexley Park in Dartford, Kent, has successfully di erentiated his o erings by focusing on unique products and creating a designated US snacks area in his store. Patel has seen 15% growth in confectionery sales after prioritising trendy, social media-driven products. “If a product is circulating on social media, we will ensure we include it on till xtures or by the front of the store,” he says.

Product

Dubai Chocolate

Pickle in a Pouch

Oreo Chocolate Peanut Butter Pie

American Bakery Cookies

Gold sh Crackers

Chips Ahoy

RRP

Where to buy

£6.99 Candy Mail UK, Cocoa Cabana, Snack Plug UK, American Candy Stores

£1.50 JDM Distributors, American Grocer, Wholesale Sweets, Hancocks

£7.45 Central Sweet Supply, American Fizz, JDM Distributors, King’s Candy

£2The Kandy King, Candy Mail UK, Candy Cargo, King’s Candy

£3.99American Grocer, JDM Distributors, American Fizz, Candy Mail UK

£6.99 JDM, SoSweet Shop, American Candy UK, Wholesome Goodies LTD, Candy Mail UK, Crazy Candy Co

Jimmy’s Nachos and Sauces£2.80Jimmy’s Popcorn

Becky Allan, marketing manager for Takis, Grupo Bimbo

“WHEN it comes to shopper attitudes to snacking, bold and strong flavours are dominating purchase decisions. While planned purchases lend themselves to milder flavours, impulse purchase is where intense flavours, such as chilli and paprika, have their moment to shine.

“In fact, snacks are growing at a rate of 13.9% value sales year on year, and Takis sales overindex on distribution. The ‘need for heat’ is not showing any signs of stopping, as 33% of snackers are looking to explore intense flavours in the category, suggesting a continued interest in spicy flavours.”

Takis Intense Nacho and Buckin Ranch£3.99American Food Mart, Candy Mail UK, American Fizz

Nic Storey, senior sales director, impulse & eld sales, PepsiCo

“A KEY trend we have seen within the savoury snacks category this year is the increased demand for spicier snacks. Fi y-one per cent of consumers say they love spicy food1, and the UK’s desire for spice ranks as the second highest in Europe1. This has led to the hot and spicy flavour segment growing at 8.9% year on year2, and we believe this trend will continue.

“To help retailers tap into this, we launched our Extra Flamin’ Hot range into the UK. Spanning some of the nation’s most-loved brands – Doritos, Walkers Max and Wotsits Crunchy – the range is available in both sharing and PMP formats. Through this, retailers can leverage the trend and boost sales by o ering spicy snacks in formats suitable for multiple needstates and occasions.”

AS consumers increasingly seek novel and exciting snacks, the impact of social media trends on purchasing behaviour cannot be overlooked.

To engage e ectively with the demand for international flavours, retailers should consider stocking a variety of products from around the world, especially those trending on social media.

Products like freeze-dried sweets, Takis and Dubai Chocolate have gained popularity among UK consumers, particularly as they align with social media trends.

Imtiyaz Mamode, of Wych Lane Premier in Gosport, Hampshire, notes that US, East Asian, Turkish and Mexican snacks are all popular. He has a designated area in his store for

international products, stocking more than 400 lines of US snacks.

Patel says that if a certain product circulates on social media, he displays it prominently at the front of the store or near the checkout. This strategic placement, along with other layout changes, has resulted in a 20% increase in overall store turnover.

Retailers must adopt a proactive approach to stocking trending snacks. Regularly reviewing product ranges to include innovation enables retailers to remain relevant in a fast-changing market. As consumer interests shift, being able to adapt quickly can make all the di erence to attracting foot tra c and boosting sales.

Butterkist

KP Snacks has announced a partnership between Butterkist and musical lm Wicked. An on-pack promotion is running across Butterkist’s £1.25 PMP range of Sweet, Salted, To ee and Sweet & Salty varieties, as well as Sweet (100g), Sweet & Salty (110g) and Salted (80g), o ering customers a trip to London.

Ritz

Cracker brand Ritz has launched an on-pack promotion o ering one shopper a chance to win £100,000 ahead of Christmas. The supplier notes that Ritz sales increase during the festive season.

Bobby’s

Bobby’s Foods has added a trio of lines to its bagged sweets range: Blue Razz Dreams, Fruit Fools and Vimto Fried Eggs (RRP £1.25).

World of Sweets

World of Sweets has launched the Sweet Vibes confectionery brand, with the Freakshake range available in cups and bags in Banana, Strawberry and Choc-a-Lot varieties.

Mars Wrigley

Mars Wrigley has launched M&M’s Crispy Milk Chocolate Santa Treat (65p) and Twix & Friends Medium Selection Box (£2.75) for Christmas.

IMPULSE buying is a signicant driver of snack sales, so retailers shouldn’t underestimate how important it is to site snacks in the right places.

Retailers must create a shopping atmosphere that encourages spontaneous purchases to make the most of the category.

Becky Allan, marketing manager for Takis at Grupo Bimbo, notes that 57% of shoppers buy bagged snacks at least once per week.

“The crisps and bagged snacks market is a huge pro t driver for retailers, operating in a value category that is outperforming the wider grocery o ering,” she says.

To enhance impulse buying, retailers should consider strategic product placement, ensuring that popular snacks are located near high-tra c areas such as the checkout.

Positioning eye-catching and trendy snacks in these locations can entice consumers to add them to their baskets, boosting overall sales. When snacks are easily accessible and visually appealing, consumers are more inclined to add them to their baskets. This is particularly true for products that feature eye-catching packaging or current trending flavours, which can attract attention and stimulate spontaneous purchasing behaviours. O ering limited-time discounts or bundle deals can create a sense of urgency that encourages shoppers to make quick purchasing decisions. Additionally, in-store sampling of new or trending snacks can provide consumers with immediate gratication, increasing the opportunity to buy products on impulse.

CONSUMER interest in health and wellness is another signi cant trend influencing the snack market. The demand for healthy low-calorie snacks has been steadily increasing, reflecting a broader trend towards health consciousness among consumers.

Mondelez International’s Susan Nash says: “Snacks continue to be important to shoppers as they view their favourite snacks as a ordable

and necessary indulgences.

“The healthier biscuit category is in growth and generates the highest value per tonne of all the category subsegments.”

Miles keeps a selection of gluten-free, vegan snacks such as Naturally Delicious Brown Bag Crisps and Delicious Cashews’ range, which he says sell well despite there being an own-label selection of similar products available as well.

Shumaila Malik, from Costcutter Heathside Road in Manchester, also notes that healthy snacks are growing in prevalence among younger demographics.

“We see lots of protein infused bars, shakes, crisps and snacks selling quickly among these age groups as well as low-fat alternatives,” she notes.

For convenience retailers, stocking a diverse range of

low-calorie snacks is essential to capture the health-conscious market segment.

By emphasising products that are nutritious and satisfying, retailers can attract customers who might otherwise opt for traditional, higher-calorie snacks.

Creating a dedicated section for healthy snacks can enhance visibility and encourage shoppers to explore these options.

Health-conscious choices

There is increasing demand for low-calorie, low-sugar and HFSS-compliant snacks as consumers prioritise nutrition.

International flavours

Consumers are seeking novel taste experiences, driving interest in bold and exotic flavours from around the world.

Local sourcing

There is a growing consumer preference for unique, community-based snacks sourced from local producers.

Social media influence

Snack trends are heavily influenced by platforms such as TikTok, where viral products can rapidly gain popularity.

Sustainable choices

There is rising demand for snacks that minimise environmental impact and use sustainable packaging.

Impulsive behaviours

Shoppers are more inclined to pick up sweet and savoury snacks on impulse. Bundle deals, PMPs and e ective merchandising can help retailers capitalise on this shopping behaviour.

TAMARA BIRCH looks at the sports and energy drinks retailers should stock, and the trends they need to cater to

WHAT’S THE DIFFERENCE?

WHILE they are often lumped together in the same category, sports and energy drinks satisfy di erent missions.

Vince Malone, co-owner of Tenby Stores & Post O ce in Pembrokeshire, de nes the two as follows: “Sports drinks tend to be non- zzy and the cap is a bit of a giveaway. In terms of brands, Lucozade Sport, Boost Sport and other isotonic drinks belong in this sub-category.

“Energy drinks are associated with Red Bull, Monster and Euro Shopper. Older shoppers will probably shop our sports drinks range, whereas late-teens or early-20s will

buy energy drinks.”

Trudy Davies, owner of Woosnam & Davies News in Llanidloes, Powys, echoes this de nition, but adds:

“Sports drinks tend to be for hydration and o er long-term energy bene ts, whereas energy drinks are more for quick bursts of energy, thanks to their higher ca eine content.”

From a tness perspective, the UK Coaching association says sports drinks are purposely formulated to help replace fluids and electrolytes lost in sweat and replace sugar used during intense activity. Energy drinks are not designed for hydration.

FUNCTIONAL energy drinks, or drinks with added bene ts, are growing in popularity, according to suppliers.

“We are seeing a lot healthier, vitamin-based and supple-

ment drinks entering the market and starting to grow, while attracting new customers,” explains Gurms Athwal, trading director at Parfetts.

Coca-Cola Europaci c Partners’ (CCEP) Reign Total Body Fuel is one of many functional energy drinks in the market. “[Reign Total Body Fuel] contains 200mg of naturally sourced ca eine and is enriched with branched-chain amino acids (BCAAs) and vitamins B3, B6 and B12, which may contribute to the reduction of tiredness and fatigue to a normal energy-yielding metabolism,” explains Amy Burgess, senior trade communications manager at CCEP.

Knowledge is key within functional energy drinks, so if you’re unsure of ingredients, be sure to do some research in case a customer asks. BCAAs –similar to protein – for example, play an important role in the building and repairing of

muscles and there are three to note: Luecine, Valine and Isoleucine.

Flavours also continue to play an important role in sports and energy drinks, so retailers should keep their range fresh. “Flavoured energy drinks act as entry points for consumers, selling, on average, 38% more units per store versus two years ago,” says a Red Bull spokesperson.

“With 83% of energy drink consumers wanting to buy across a variety of flavours, the category has been tapping into this demand with new and exciting options.”

Retailers, however, say core brands are what’s driving sales. “Monster, Red Bull and Euro Shopper have stood the test of time,” says Malone. “New products enter the market all the time, but most of the time, people gravitate back towards their preferred products.”

Adrian Hipkiss, commercial director, Boost Drinks

“THE total UK so drinks market continues to grow, and is now worth £12.3bn, maintaining its spot as a top-three category in convenience. Within so drinks, sports and energy accounts for £1bn.

“When taking a closer look into the energy sub-categories, energy-stimulation drinks are a signi cant contributor to the value growth of the so drinks category, growing 21% year on year, and accounting for 28% of all so drinks value sales.”

THE biggest challenge within sports and energy drinks, according to Malone and Davies, is that the market is swiftly becoming saturated.

“It keeps the category fresh, but it is very crowded,” Malone says. “Monster brings out new flavours regularly, and new brands have entered the market, such as Hell. Retailers have to reflect

these changes, while also keeping the core range our customers want.”

New products are vital to boosting retailers’ sales, but a core range will help maintain sales in the long term. If a retailer’s range is full and they want to change it, they should use EPoS data to determine which lines need to be delisted.

MERCHANDISING e ectively can help customers shop the category. Athwal recommends block-zoning drinks by subcategory, such as hydration, functional and sport.

“Block by brand to ensure the relevant products and brands are in the correct sub-category because there can be di erent shopper missions,” he says. “Also, any extra space that can be given for branded fridges and chillers for fast sellers, such as Red Bull and Monster, helps to block ranges together with

PoS and create the main chiller space for the rest of the range.”

Malone follows this theory in store and has a Red Bull chiller bin near the entrance and a Monster-branded chiller from CCEP.

“The Red Bull chiller looks like a can. We chose to put it by the front door to increase impulse buys, and it reduces the amount of facings we have in our main display,” Malone says.

Gurms Athwal, trading director, Parfetts

“SPORTS and energy drinks are very important and currently represent more than 50% of the so drinks category sales within Parfetts. The category has grown massively over the past few years and most so drinks suppliers have some kind of representation within the category. It is becoming crowded, but there is still room for growth.

“Retailers need to ensure they carry the right range with relevant prices, and always ensure chilled availability. Constantly review the slow sellers and try something new as there is constant new products coming out within the category/extended category.”

ATHWAL says value makes up 50% of the category, so retailers need to make sure they are catering to this demand from customers, whether through own-label products, price-marked packs (PMPs) or multipacks, where the bulk purchase gives more bang for the buck. Brand also remains a core driver, the Red Bull spokesperson says, but price is number two in importance.

Monster Call of Duty promotion

CCEP has announced the return of Monster Energy’s promotion in partnership with the popular Call of Duty videogame series. Live now until the end of the year, the promotion enables fans of the game to scan unique QR codes or enter codes found under ringpulls to nd exclusive content in its latest instalment, Call of Duty: Black Ops 6.

Monster Ultra Strawberry Dream CCEP’s Monster Ultra Strawberry Dream is available in the UK following its US launch in 2023. The flavour comes in 500ml plain and price-marked single cans and plain four-packs. Retailers can request themed PoS and digital assets to accompany the launch from my.ccep.com.

Monster Cosmic Peach Nitro

CCEP has added Monster Nitro Cosmic Peach to its range, available in 500ml cans price-marked at £1.49. The cans feature a design with a brightorange background and the Monster claw logo. It aims to build on the success of Monster Nitro Super Dry, which has generated £6.4m in sales since its launch in May 2021.

Red Bull Winter Edition Iced Vanilla Berry

Red Bull’s second Winter Edition, Iced Vanilla Berry, has o cially hit shelves. The new variety has blueberry, vanilla, candy floss and eucalyptus flavours, and is available in 250ml plain and £1.55 pricemarked cans, a sugar-free 355ml can with a £1.95 RRP, and a sugar-free 4x250ml multipack at £5.

Warrior Protein Water

Warrior has launched Warrior Protein Water, which includes vitamins and electrolytes to help with hydration. It also contains 10g of Collagen Peptides to boost protein intake and nourish skin, hair and nails. It is sugar-free, contains 50 calories per bottle, and is available in Tropical and Berry flavours. It is suitable for vegetarians and vegans.

“PMPs can help drive rate of sale, with 75% of convenience shoppers more inclined to buy if in a PMP,” they say.

“This is even more relevant in times of nancial hardship, when shoppers are more careful about what they spend their money on.”

Retailers are largely focusing on PMPs within sports and energy, not only to show value, but reassure their customers they are pricing competitively.

“There’s not always a place for PMPs in my store, but we focus on PMPs in sports and energy,” explains Davies. “It gives shoppers con dence they aren’t being ripped o .

“However, I would like to see suppliers increase margins on PMPs as they do tend to be lower, which isn’t good for either of us.”

Lower-priced products aren’t the only way to showcase value. It’s typically about showing

shoppers they can get more for their money, like multipacks and larger formats.

“We are selling more fourpacks of Red Bull and Monster than we have in the past fourto- ve years and it’s become something we’ve regularly reorders. Customers are looking for them,” Malone says.

“In the summer, we’ll even chill them as groups will buy them on holiday, whereas they will be ambient in the winter.”

CHARLES WHITTING nds out what retailers and suppliers have been doing as the disposable-vape ban approaches

THE disposable-vape ban is set to come into force on 1 April 2025, meaning any single-use vape product will no longer be legal to sell in less than six months’ time.

Retailers know it’s best to start planning for Christmas in late summer, so they are getting themselves and their customers prepared for it now.

“We’re reducing the number of disposables in the store,” says Narayan Siddhu, from Wagon Convenience Store & Post O ce in Rotherham, South Yorkshire.

“We’ve kept the most popular ones – Elfbar and SKE Crystal – but sales are slowing down. Customers are moving onto the re llables already.”

Dilan Patel, from Hallcroft News in Retford, Nottinghamshire, still has a strong range of disposables, but he is ordering less than he used to.

“I used to just do it to order, and have them in the stock room, but I’m no longer doing that,” he says. “I don’t want to be caught out and get left with stu I can’t sell afterwards.

“I’ve heard nothing from my suppliers about a take-back scheme, so I’m taking it upon myself.

“We’re slowly introducing re llables, but we’ll stock disposables right to the end because I don’t want to be turning customers down and have them walking out of the store without vapes.”

Disposables drive footfall, sales and margins. When they’re gone, retailers are concerned the shortfall won’t be entirely met by the re llable options, which are, by their nature, more a ordable and purchased less regularly.

Retailers will need to consider how much space they want to dedicate to re llable options

next year.

“When it was booming, I gave vapes a prime location and lots of shelving,” says Siddhu. “I reduced my spirits range to accommodate them.

“I might think about reintroducing some spirits and other things at some point next year, because my vape range simply won’t be the same size.”

WHILE the disposables ban has been looming large for the convenience sector since January, there’s no guarantee that everyday customers are as aware of what’s happening within the category.

This means retailers need to be educating and informing them as much as possible, not only to introduce them to the alternatives now, but also to establish them-

selves as specialist stores that customers can trust further down the line.

“Mostly, we do have to explain things to customers,” says Siddhu.

“The more we explain, the happier they are to buy the oils and the pods, but there are still so many di erent types and some have been struggling with the coils that burn, for example.”

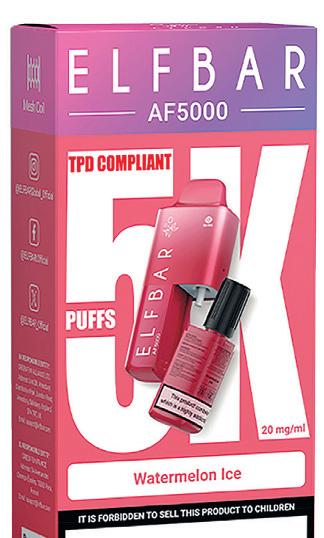

Elfbar

Elfbar has launched the AF5000 pre lled pod kit, while its sister brand, Lost Mary, recently launched the BM6000, o ering up to 6,000 pu s. Elfbar has also released the Elfbar 1200, a pre lled pod system that features dual pods, allowing adults to switch between flavours. On top of this, Elfbar has unveiled the rst product in its Elfx series. This is a rechargeable device that enables adults to add the e-liquid flavour of their choice and features adjustable settings.

Philip Morris

Philip Morris has expanded the flavour range for Iqos Iluma to 13 with the launch of Terea Pearls. The range features capsule technology, enabling users to switch from a traditional tobacco blend to a unique flavour with a single click. New flavours include Abora Pearl and Amelia Pearl.

Imperial Imperial recently launched the Blu bar kit , a device that o ers the easy use of a disposable device, while a rechargeable battery and USB-C charging port enables repeated use. It has launched with four flavours, including Cherry and Pineapple, and features Blu Flavour Tech mesh coil technology to deliver strong bursts of flavour. E-liquid level visibility on the kit means users can monitor when their pods need replacing.

Andrew Cruden

Market Square News, Northampton

“SALES are still quite static, really, but we’ve started selling the bigger re llables now. We’ve got some pods in and the IVG brand is selling really well. You have to educate people because not all of them know about the ban.

“We haven’t got a massive display – it’s 1.5 metres in total – but we’ll keep the disposable vapes for the time being. We’ll end up moving more into re llable units and pods. It amazes me how big disposables got with young adults when most of them are so environmentally conscious.

“We also sell nicotine pouches from Velo, Klint and Nordic Spirit, and they’re gradually growing. And then we do heated tobacco from Ploom and Iqos. We’ve really pushed the Iqos devices and we’re now a platinum store. Philip Morris put its advertising up on our shelves and we get a bonus from it for selling more devices. We sell about 10-15 devices a month and we recently received a £9,500 bonus, so it’s well worth pushing them. Retailers are scared of heated tobacco, but it’s going to be the future because it’s similar to smoking.”

ONCE disposables are o the table, retailers and customers will need to purchase alternatives, but they should already be looking into these now.

Retailers should test certain products and brands, and talk to their customer base about what they’d like to see.

Even now, disposable sales are growing and account for 88% of all vape sales, according to Andrew Malm, UK market manager at Imperial Brands.

But new pod systems need to be introduced and trialled in store.

“Pod systems that o er the

same flavour range and experience of disposables are gaining traction and are expected to grow in terms of market share, with the current sales value of the new flavour pod market valued at £64m and expected to grow exponentially to £404m in the next nancial year,” says Malm.

On top of pods and other re llable vapes, there are two other growing players within next-gen nicotine, each o ering di erent reasons for choosing them, whether it’s nicotine pouches that can be used indoors or heated tobacco that most closely resembles the

smoking experience.

“Nicotine pouch sales are really gathering pace in the UK, with our latest data showing the category is now worth just over £110m in annual retail sales and this gure doesn’t include sales taking place online,” says Prianka Jhingan, head of marketing at Scandinavian Tobacco Group UK.

“This reflects year-on-year growth of 88% in volume terms.

“We’d advise retailers to talk to their regular customers to let them know what their options are. Do your research, talk to your reps and make sure

you educate yourself on what the best options are.”

John Rennie, director of commercial operations at Philip Morris Limited in the UK and Ireland, says Iqos heated tobacco has surpassed Marlboro in global net revenues, becoming Philip Morris’ number-one international nicotine brand.

“Nationally, the percentage of convenience retailers now selling our Terea and Heets tobacco sticks has risen by 42% in two years,” he adds.

“The demand for heated tobacco products will continue to grow as more adult smokers seek better alternatives.”

Andrew Malm,

UK market manager, Imperial Brands

“WE’D recommend having a strong visual display of next-gen products, positioned away from the main gantry where possible, with clear information on pricing to enable customers to browse at their leisure without the need to handle and inspect products. If you only have limited space, a small countertop unit can help achieve this, especially if it is organised and fully stocked. Positioning the unit in a well-lit part of the counter will also help increase the visibility of the products.

“Retailers can display, advertise and promote vaping products in and around the store, so using eye-catching countertop display units can really help grab the attention of shoppers as soon as they walk through the door.”

Establish clear product visibility

Give the category a clear ‘home’ by displaying nicotine pouches on a back wall with heated tobacco and vaping devices so customers have a visible choice of nicotine products based on their preferences.

Ensure consistent product availability

As well as stocking a full range of products, it is important for retailers to maintain good stock levels. Retailers should also observe seasonal trends and busy periods. For example, they should keep their nicotine-pouch ranges particularly strong in the summer months when demand is highest.

Stay ahead with category education

Consumers will require guidance, so ensure sta are category experts by working with JTI’s local business advisers to make the most of all opportunities.

THERE are concerns that the disposable-vape ban will drive the trade underground, resulting in even greater advances in illicit trade.

Baroness Merron recently said the government was considering a vape licensing scheme to clamp down on rogue retailers and reduce underage sales.

“We have been calling for a

robust vape-licensing scheme – backed up by nes of at least £10,000 for those who sell to children – for years,” says John Dunne, director general of the UKVIA.

“Such a scheme could generate upwards of £50m per year to fund a much-needed national trading-standardsenforcement programme at no cost to the Treasury.”

The RETAIL EXPRESS team nds out what products are contributing to a higher overall margin for retailers

Sonni Saini, Barnes Pantry, west London

“OUR store is quite niche and there’s not much here that you can get from Tesco or Marks & Spencer. We’re a small store with smaller suppliers – that makes the margin better. We have an overall margin of 40%, but it will depend on demographics as to whether that could work for other retailers. You don’t have to be very expensive for it to work – with a few niche suppliers you’ve got a useful point of difference compared to Sainsbury’s. We have small suppliers for things like salami, cheese and �ish, but I think dairy is the best one. If you order it properly, the wastage is very low and the margins are very good.

“We go to all the organic shows, such as the Speciality & Food Fair and the Food & Drink show at The O2, to �ind our niche suppliers. You pick up a lot of ideas and contacts at these events and then I read about what’s trending in the market via the trade press. Smaller suppliers will often send you samples.”

Pinal Amin, Nisa Local Preston Street, Faversham, Kent

Kopi Kalanathan, Costcutter Kirk Sandall, South Yorkshire

“FOR us, vapes are the biggest and most obvious one. We do really well with them and we’re getting 40-45% margins. And because we offer them at good value, we’re selling good volume as well.

“But on top of that, we’ve introduced a kidzone into the store. It’s full of sweets that we source from Hancocks and various cash and carries. They’re affordable – we’re selling lollies for 20p-40p – but the margins are 40% on them. We don’t do pick ’n’ mix because then you’ve got to get tongs and bags, which can complicate things too much, particularly post-Covid. So, instead what we do is we make up our own bags with the sweets in them, whichthe kids pick up for 50p or £1.

“We’ve also got toys and other types of sweets. And right opposite that aisle is a fridge full of soft drinks, which the kids will pick up as well.”

“FOOD to go is a big margin driver for us. It might not work in all our sites in the same way. We do selective food to go in each of our store locations. We haven’t got the same concept in all the stores. But we’re making more than 50% margin on food to go.