SOFT DRINKS TRENDS Get ahead of the biggest trends driving sales before summer arrives CATEGORY ADVICE SOFT DRINKS TRENDS 14 2023 betterretailing.com ACCORDING to suppliers, Drinks. “With unprecedented recorded summer, sales bigger ing and inflation last year, with numbers mindful of the they spend,” feeling they’re going their softdrink, wellbepremium. same time, SUMMER SALES IN A COST-OF-LIVING CRISIS YOUR COMPLETE GUIDE TO SOFT DRINKS TOM GOCKELEN-KOZLOWSKI finds out what trends are driving soft drinks – the biggest category in convenience stores – and how retailers can get ahead of them this summer P14 channel, the important profi in any store. school approaching and warm weather here, look monthsofpeak key period drinksopportunity for tobuild of last year,” Adrian Troy, director in soft and the biggest During the additional soft course, one major – and challenge – facing the the pastyear been the cost-of-living crisis. feeling the risParker, commercial Britvic. to make stretch these pressured pers are expected totransactions smallerpack also says well-managed drinks can appeal customers ‘affordable also seeing effect’ where are switching expensive to themselves with treatsand continue, important for offer choice shoppers who affected differently – ts-all adds. 27 JUNE-10 JULY 2023 STRICTLY FOR TRADEUSERSONLY • Retail Express uncovers the hardest-hit areas for theft in small shops, as incidents boom • Industry bosses explain why demand is fuelling crime, and what retailers can do about it P3 IS YOUR SHOP AN EASY TARGET? VAPE THEFT: NATIONAL LOT TERY P2 BACK PAGE Three retailers discuss how they implemented their best business decision P4 DEPOSIT RETURN SCHEME Firm appointed to lead scheme announces collapse following multiple delays STORE ADVICE Upcoming operator reveals plans to offer three different terminal models

Humphrey, editor

THE number of homophobic hate crime reports in the UK has doubled in the past year, with the number of transphobic hate crime reports tripling over the past five years.

The figures come from Vice World, which submitted a freedom of information request to every single police force in the UK.

Being aware of the challenges faced by the queer community is essential as a business owner, but none more so than during Pride month – an opportunity to stand shoulder to shoulder with staff, shoppers and your community.

Looking inward, charity Stonewall states that one in five LGBTQ+ people were the target of negative comments at work, more than a third feel they need to hide who they are at work, and one in five believe being LGBTQ+ limits their job opportunities.

As a business owner, its important to take note of these statistics and think about how you are working to ensure your employees feel valued and equal, regardless of sexuality.

If maintaining a safe and inclusive workplace isn’t a priority, then that needs to change.

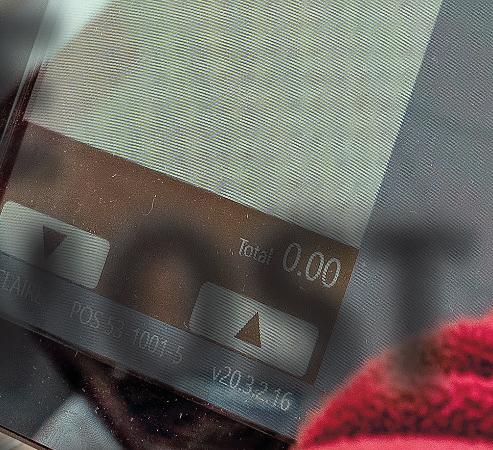

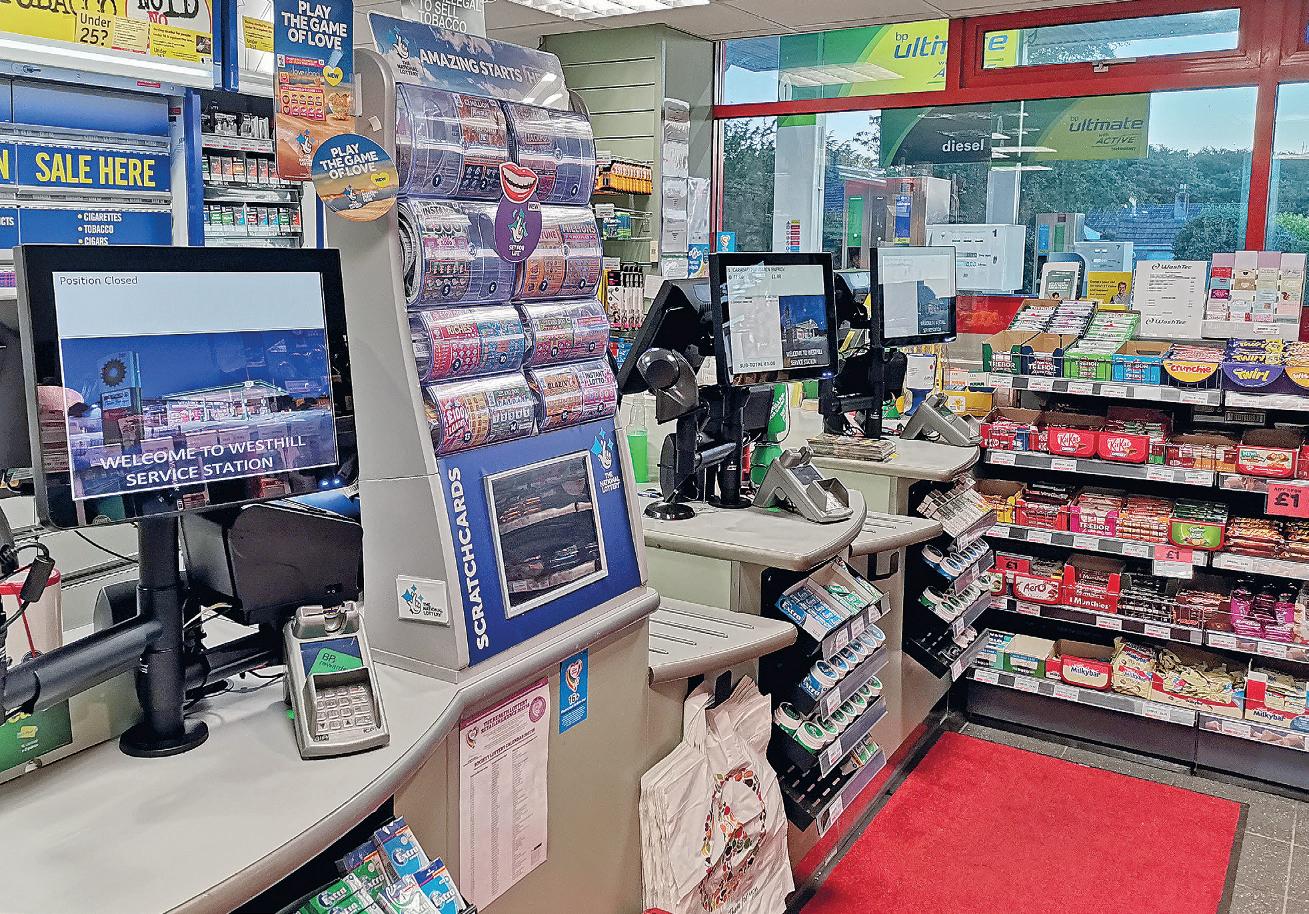

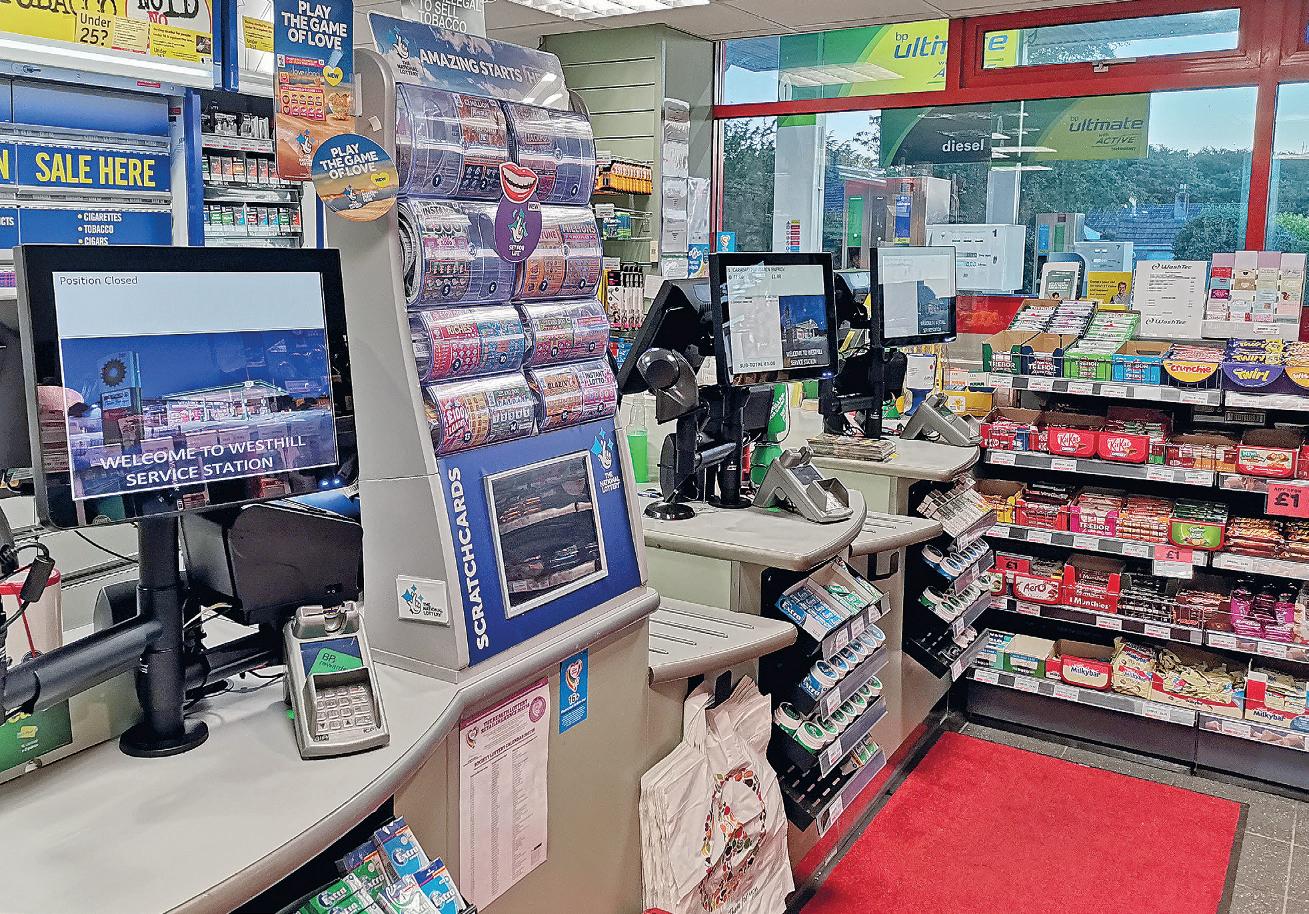

New Lottery operator to deploy three new terminals

UPCOMING National Lottery operator Allwyn has revealed it will be deploying three new terminals to stores.

The company is understood to have visited the �irst thousand stores as part of its estate-wide store review, helping them decide which size terminal will be needed.

DISPLAY A ZEROTOLERANCE POLICY ON ANTILGBTQ+ ABUSE

As a start, I recommend displaying a zero-tolerance policy on anti-LGBTQ+ abuse and language; making sure staff understand the legal duty to treat LGBTQ+ customers fairly as part of their induction training; talking to local LGBTQ+ groups to ensure customers don’t face barriers accessing your business; supporting Pride by displaying posters to show your customers that you support equality; and be sure to let other business owners know if you witness a hate crime.

Trust me on this, you’ll be making a huge difference.

Retail Express spoke to several retailers that have held meetings with senior �igures from Allwyn in recent weeks, to learn more about their plans for retail.

One said: “It’s a good thing. They spoke about the history of the lottery, explained the licensing changes will last for 10 years, and they have a number of metrics to tick for the Gambling Commission.”

Multibuy delay

THE promotional restrictions on high fat, sugar and salt (HFSS) products that were due to come into force in October have been delayed until 2025.

Specialist reporter

Dia Stronach 020 7689 3375

The restrictions will affect convenience store owners with more than 50 employees.

Promotions include multibuy, ‘buy one, get one free’ and the promotion of HFSS products alongside non-food products.

Experts have predicted the move represents a lost opportunity for stores that would not have had to comply with the restrictions.

Energy contracts

MORE energy suppliers are allowing businesses stuck on high tariffs to amend their energy contracts. Reports are growing of stores exploiting loopholes to escape their contracts.

Stores will also be asked to sign transfer agreements in October, with the documents re�lecting the switch from Camelot to Allwyn. Retailers will be noti�ied of how this process will work by the end of the summer.

A spokesperson for the company explained: “Allwyn’s plans for the licence handover in February 2024 are progressing well.

“The site surveys are underway, and we will be working closely with retailers in the coming months to transfer their Retailer Agreement.

“For the time being, retailers don’t need to do anything until contacted.

“Our plan is to grow the National Lottery responsibly, making it bigger, better and safer for all, with retail at the heart of that ambition.”

Fwip redundancies

FROZEN ice cream supplier

Fwip announced major redundancies in the UK earlier this month.

Thirteen employees are affected by the move, with six of those responsible for the UK.

The company told staff

that its main investor, Havella Capital, had pulled funding, and the redundancy procedure would leave it operating with a “skeleton staff”.

Fwip con�irmed it would continue to operate its machines as it seeks new streams of funding.

Vaping crackdown

Businesses revealed EDF has joined British Gas, Engie and Drax in the group’s ‘Blend & Extend’ initiative, allowing small businesses on high rates to lengthen their contracts to spread the costs over a longer period. .

IMPERIAL Tobacco has called for a licensing system to restrict which shops can sell vaping products, in order to tackle access for children.

The comments come after the Of�ice for Health Improvement and Disparities (OHID)

announced a call for evidence.

The tobacco company also requested a review into �lavour-naming conventions, the strengthening of regulations for advertising and promotion and a raise in the product quality and safety standards.

For the full story,

go to betterretailing.com and search ‘energy’

ALEX YAU

@retailexpress betterretailing.com facebook.com/betterretailing

The

biggest stories this fortnight 01 02 03 04 05

five

Editor Megan Humphrey @MeganHumphrey 020 7689 3357 Editor – news Jack Courtez @JackCourtez 020 7689 3371 Editor in chief Louise Banham @LouiseBanham Senior features writer Priyanka Jethwa @PriyankaJethwa_ 020 7689 3355 Features editor Charles Whitting @CharlieWhittin1 020 7689 3350 Production editor Ryan Cooper 020 7689 3354 Sub editor Jim Findlay 020 7689 3373 Sub editor Robin Jarossi Head of design Anne-Claire Pickard 020 7689 3391 Senior designer Jody Cooke 020 7689 3380 Junior designer Lauren Jackson Production coordinator Chris Gardner 020 7689 3368 Head of marketing Kate Daw 020 7689 3363 Head of commercial Natalie Reeve 020 7689 3367 Senior account director Charlotte Jesson 020 7689 3389 Commercial project manager Iffy Afzal 020 7689 3382 Account director Lindsay Hudson 020 7689 3366 Account managers Marie Dickens 020 7689 3372 Megan Byrne 020 7689 3364 Management accountant Abigayle Sylvane 020 7689 3383 Managing director Parin Gohil 020 7689 3388 Head of digital Luthfa Begum 07909 254 949 our say Creating

and inclusive workplace

a safe

Features writer Jasper Hart 020 7689 3384 @JasperAHHart 41,206 Audit Bureau of Circulations July 2021 to June 2022 average net circulation per issue Retail Express is printed and distributed by News UK at Broxbourne and delivered to news retailers free by their newspaper wholesaler. Published by: Newtrade Media Limited, 11 Angel Gate, City Road, London, EC1V 2SD; Phone: 020 7689 0600 Reproduction or transmission in part or whole of any item from Retail Express may only be undertaken with the prior written agreement of the Editor. Contributions are welcome and are included in part or whole at the sole discretion of the editor. Newtrade Media Limited accepts no responsibility for submitted material. Every possible care is taken to ensure the accuracy of information. No warranty for goods or services described is implied. Subscribe online at newtrade.co.uk/our-products/ print/retail-express. 1 year subscription: UK £65; overseas (EU) £75; overseas (non-EU) £85 Retail Express’ publisher, Newtrade Media, cares about the environment. Megan

The Federation of Small News editor Alex Yau @AlexYau_ 020 7689 3358

Cover image: Getty Images / Yaroslav Litun

For the full story, go to betterretailing.com and search ‘Fwip’

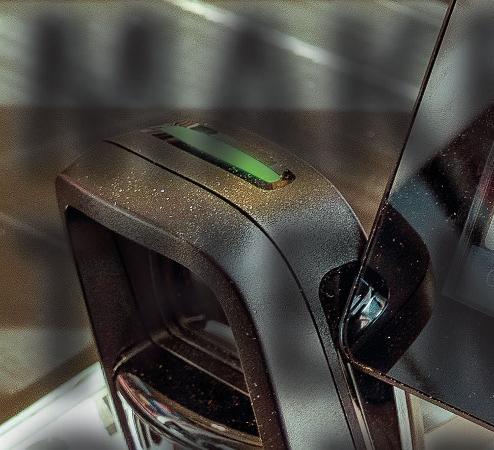

Demand for vapes sparks boom in local shop thefts

ALEX YAU

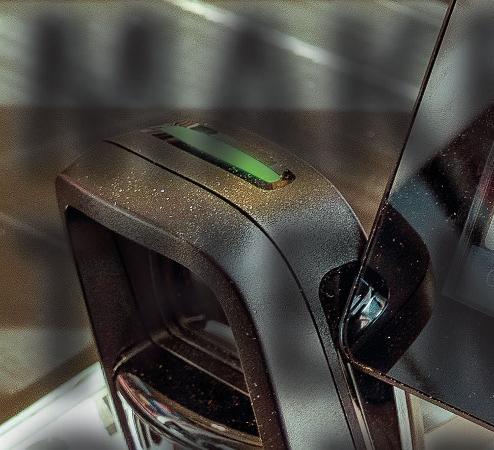

SMALL shops have been described as an “easy target” for vape thefts, as crime linked to the category in convenience have risen year on year.

The increase, which includes independents and supermarkets, was revealed in Freedom of Information (FOI) requests submitted by Retail Express, comparing vaping-related crimes for January to April 2022 and 2023.

Responses sent back by 19 out of 45 police forces across the UK also showed an annual decrease in reported general crime on independent retailers (36 to 28) and supermarkets (115 to 108) across the period.

Although there was an overall decline for supermarkets and independent retailers, vaping crimes across the grocery sector made up a third of total crimes across both years.

The bulk of reported vaping-related crimes were linked to theft, but some businesses were victims of more severe offences such as assault, sexual assault and racial abuse.

Out of those incidents recorded at independent convenience stores, Leicestershire encountered the highest number overall, followed by Hertfordshire, Lancashire, North Wales, Cleveland, Gwent and Northamptonshire. Devon & Cornwall recorded the

lowest number of incidents.

Several independent retailers attributed recent crimes on their stores to the rise in demand for vaping.

One store owner said they had two break-in attempts on their store this year as burglars tried to steal vapes – the �irst in decades.

Amit Puntambekar, of Ash’s Shop in Fenstanton, Cambridgeshire, criticised the lack of action from police after teenagers had stolen around £400-worth of vapes from his shop.

He told Retail Express: “It was really frustrating as the local college wouldn’t do anything when I told them. The police basically gave them a telling off and said they couldn’t do anything else as they were underage.

“I’ve certainly noticed an increase in thefts for agerestricted items recently. I always advise staff to make sure they ask for ID when a customer purchases vapes or other age-restricted products. If teenagers are loitering around vaping products, staff are told to be in the area and keep a close eye on them.”

When presented with the �igures from Retail Express’ FOI requests, John Dunne, director general of the UK Vaping Industry Association trade body, warned that convenience stores had become “easy targets” for vaping thefts.

He said: “The reason why convenience stores are seen as easy targets is because

express yourself

“WE sell a lot of gifts and souvenirs, which give us margins of between 40% and 45%. We do offer expensive gifts, but we don’t sell a lot of them because people see it as too high a price. I can’t really charge over £15 for a product because that also brings out a high incidence of shoplifting. It’s about finding the right niche. We sell a lot of different things – magnets, spoons, key rings and other novelties.”

Dee Goberdhan, Albany Road Post Office, Cardiff

the column where you can make your voice heard

they don’t often have the same level of security as a supermarket.

“There is usually only one or two members of staff in the shop at any one time, so criminals look to take advantage of this.”

Unitas Wholesale managing director John Kinney added that the rise in thefts related to vaping products was a “clear threat to independent retailers”. He added: “It is vitally important retailers report every crime to the police, as this highlights the scale of the problem and encourages more support from local and national authorities.

“We know retail crime is not seen as a priority by local police forces, but crime is increasing, and retailers

need the support of the police as a deterrent and not just to investigate crime after the event, which can be a challenge.

“We would urge retailers to do whatever they can to reduce their risk through methods such as installing CCTV and store alarms, as well as investigate other alternatives, such as bodycams. Being an active member of the local community and supporting their local Neighbourhood Watch group can go a long way to reducing crime.”

Parfetts head of retail Steve Moore warned that criminals were targeting high-value items, such as vaping products, in the current economic climate.

He advised: “Don’t have

excessive amounts of stock on display.

“Potential thieves will be deterred if there is not a lot to take. Make sure you use posters to let customers know that if the product isn’t visible, they can ask a member of staff.”

A Nisa spokesperson added: “We understand that the retail theft of vape products is becoming increasingly common and encourage all retailers to take the appropriate measures to protect themselves and their products.

“We are always looking for ways to help retailers minimalise risk of theft and will continue to provide retailers with advice and guidance on improving security measures.”

How does selling high-margin gifts help grow your sales?

“A LOT of our gift sales come from premium food options that customers wouldn’t normally pay for if they were buying for themselves. We have a couple of things to tick off before we’ll take something on – it should be Fairtrade or have a uniqueness to it, or it could be local. I recommend buying something when it becomes available at the right price, buying lots and then bringing it out at the right moment.”

Christine Hope, Hopes of Longtown, Herefordshire

GOOD WEEK

SUBPOSTMASTERS: The Communication Worker’s Union has appointed a new branch secretary. Sean Hudson, co-owner of West-Bolden Post Office, has previously received the accolade of ‘Post Office Retailer of the Year Award’, and said pushing the Post Office to address challenges, such as low remuneration, was his top priority. Hudson replaces retiring Mark Baker.

PAYZONE: Jisp has revealed plans to roll out its Scan & Save app to the entire Payzone estate. Following a first phase implementation last year, the app will now be automatically added to the Payzone Plus device to around 4,000 stores, with a third push later in the summer. The technology allows shoppers to scan barcodes and receive money off selected lines.

For the full story, go to betterretailing.com and search ‘Payzone’

BAD WEEK

BREAD: Retailers faced disruption to their bread supply earlier this month after a fire broke out at Roberts Bakery’s Northwich production site. The blaze on 5 June is thought to have impacted the production of branded and non-branded lines. The cause of the fire is under investigation, but the firm said its two other sites in Northwich and another in Derbyshire were still operational.

MEDICINES: Wholesalers are reporting more medicine shortages after suppliers fail to meet demand from hayfever sufferers. In messages sent to stores, and seen by Retail Express this month, Nisa told retailers temperatures exceeding 24°C meant they would be unable to deliver medicines to stores from 10-14 June. One retailer said: “It’s frustrating, because my cash and carry has no availability, but the nearest Asda has lots of medicinal products.”

“WE focus on upcoming events and change a gondola with relevant gifts. For example, we thought people would come in and just buy flags for the coronation, but they were buying pin badges and pens as gifts for relations as well. There’s always a gifting opportunity. We up the ante for Christmas and Easter, but there are always local events to capitalise on as well.”

Trudy Davies, Woosnam & Davies News, Llanidloes, Powys

Do you have an issue to discuss with other retailers? Call 020 7689 3357 or email megan.humphrey@newtrade.co.uk

03 betterretailing.com @retailexpress facebook.com/betterretailing megan.humphrey@newtrade.co.uk 07597 588972

27 JUNE-10 JULY 2023

Trudy Davies

Firm leading Scottish DRS collapses

MEGAN HUMPHREY

CIRCULARITY Scotland Limited (CSL), the company appointed to manage Scotland’s upcoming deposit return scheme (DRS), has gone into administration.

Circular economy minister

Lorna Slater told members of Scottish Parliament the collapse was a “disaster” for CSL’s 60 workers.

She blamed the news on re-

cent conditions imposed by the UK government, including the exclusion of glass.

“This is an unforgiveable consequence of the UK government’s 11th-hour intervention, which undermined our DRS, made progress impossible and is now resulting in these jobs being lost,” said Slater.

“We set out what we were going to do; the UK government changed its mind at the last minute.”

DRS is now set to go live in Scotland in October 2025, aligning itself with the UK’s wider rollout.

It is also understood the Fed is in talks with the Scottish government to achieve a financial “compromise” for retailers left out of pocket over the delay.

Earlier this month, Scottish first minister Humza Yousef claimed there was “no case” for compensation for store owners who had already

made changes to their shop to accommodate DRS, either by installing reverse-vending machines or by accepting returned bottles manually.

However, the Fed’s DRS lead and national vice-president, Mo Razzaq, said “more information” on a potential alternative solution had been put forward by the trade body. “We have come up with a solution, and are confident this can work,” he said.

PayPoint Engage

PAYPOINT-PARTNERED stores can now expect more customers visiting with money-off vouchers through the launch of PayPoint Engage.

The service allows brands to push out digital vouchers that can then be scanned when the

relevant line is purchased. PayPoint said it trialled the service in late 2022 “to help retailers increase footfall in the cost-of-living crisis”. Leading drinks and snack suppliers are already signed up.

SEVERAL of Weetabix’s On The Go breakfast drink lines are to disappear from shelves, as the supplier blamed a “Europe-wide capacity shortfall” on flavoured milks.

The move means pricemarked (PMP) varieties are to be temporarily dropped, but online searches show many cash and carries as only stocking the soon-to-be-discontinued PMP range.

A widespread absence from shelves would cost stores an estimated £825,000 per month in sales.

Local shop ‘rip-off’

TWO-THIRDS of consumers feel they are being “ripped off” by convenience store prices, according to a recent Which? survey.

Three-quarters of UK adults also went on to reveal they find the price of conven-

ience store food expensive, compared to supermarkets, with nearly half claiming to struggle to find affordable food in convenience stores.

However, 57% agreed that more budget ranges would help them afford more.

NEWS 04 27 JUNE-10 JULY 2023 betterretailing.com

the full story, go to betterretailing.com and search ‘PayPoint’ T IM E FOR A PROP E R BR EA K H AR D WORK T HE Y For Tobacco Traders Only. *Based on ITUK RRPs as at April 2023. For the avoidance of doubt retailers are free at all times to determine the selling price of their products Give them exceptional value at our lowest price*

WEETABIX DRINKS CUT For

NOW 1 entry per outlet only by 5pm 31st July 2023. You must live in the UK and be 18+ to enter. The prize is as described with no alternative. Winners will be chosen by Buzzballz Cocktails and by entering you accept these terms and agree to be contacted directly. We reserve the right to remove entries believed fraudulent or invalid. For more information visit https://www.betterretailing.com/competitions/ The BuzzBallz Bundle. Includes £500 cash, over £500 of BuzzBallz Cocktails, plus a floor and counter top display. To enter visit : www.betterretailing.com/competitions/ www.betterretailing.com/competitions/ NOW!! For info scan QR code or call 01565 872 872 America’sbestselling si ve co c k at i l v Win a BuzzBallz£1,000Bundle!!

PRODUCTS

Win cash with Crumpton Oaks

JASPER HART

ASTON Manor is offering retailers and wholesalers the chance to win a £1,000 cash prize to mark the return of its ‘Straight outta Crumpton’ advertising campaign, following a successful inaugural year in 2022.

To enter, retailers and wholesalers have until 31 August 2023 to buy any case of Crumpton Oaks cider and scan the QR code.

They can then upload a picture of their invoice to enter. There are no limits on entries, with one invoice per entry permitted.

The advert – a play on the N.W.A song Straight Outta

Compton – began airing across Channel 4, Channel 4 Music, Gold, Dave and various Sky channels on 1 June as part of a wider marketing push.

It is also appearing alongside this year’s Ashes cricket tournament on Sky Sports Cricket and Sky Sports Main Event, as well as on-demand platforms ITVX, All4 and Sky Media, outdoor and social media.

The competition and campaign come as Crumpton Oaks is now the number-one value cider brand in impulse, according to Katie Walker, brand manager at Aston Manor Cider, who cited Nielsen �igures.

“Following on from the

Skittles launch targets desserts

MARS Wrigley has launched a new variety of Skittles, Desserts, to tap into the growing confectionery-asdessert occasion.

Skittles desserts is available in a 152g bag at an RRP of £1. Each pack contains �ive �lavours: Cherry Cheesecake, Strawberry Ice Cream, Choco-Orange Cake, Lemon Pie and Blueberry Tart.

The new launch comes as the number of under35-year-olds consuming fruity confectionery as a dessert has risen by 42.5% by 2020, according to the supplier.

Additionally, 37% of the UK are revisiting nostalgic childhood dishes, which informed the �inal �lavour

selections.

Skittles senior brand manager, Ryan Pardo Roques, said the new launch could attract new shoppers and drive relevance among Gen Z shoppers in particular.

Cash prizes to mark Benson’s birthday

JTI UK is marking 150 years of its Benson & Hedges tobacco brand with a ‘Great £150 giveaway’, offering 50 retailers the chance to win £150 each.

To enter, retailers need to log onto JTI Advance to enter a new dedicated Benson & Hedges trade microsite, which contains details on how to enter the prize draw with full terms and conditions.

Winners will be picked every fortnight from 30 June until 11 August. Non-winning entries will be placed into the next draw.

Retailers are allowed one entry and prize only. All winners will be selected and contacted by 8 September.

success of our Straight Outta Crumpton campaign last summer, we have decided to

rerun it on a greater scale to further target 25-to-35-yearolds,” she said.

Wrigley expands Extra Refreshers

MARS Wrigley has added to its Extra gum range with the launch of sugar-free Extra Refreshers Strawberry Lemon.

The supplier has launched the new �lavour off the back of research showing that strawberry is the most popular �lavour within fruity confectionery, accounting for four in �ive fruit new launches.

Strawberry �lavours are also responsible for the most category-wide repeat purchases, while lemon is the number-two �lavour for consumer loyalty.

Extra Refreshers Strawberry Lemon will be available

New Hooch fl avour to lift the Blues

HOOCH has expanded with the launch of a new Blue Hooch variety and the expansion of Orange Hooch into 440ml cans.

According to supplier Global Brands, Blue Hooch (4% ABV) is a tropicalthemed drink that retains Hooch’s citrus �lavour, making it ideal for summer social occasions.

It has begun appearing in 8x440ml mixed packs in Tesco alongside Hooch Lemon Brew, Pink and Orange. It is rolling out to convenience retailers in individual 440ml cans alongside Hooch Orange 440ml to JW Filshill and United Wholesale, while the mixed packs are also available through United

Wholesale. Blue Hooch is also available in a 24-pack from online retailer Good Time in for £39.50.

New frozen lines from Chupa Chups

ROSE Marketing has partnered with Perfetti Van Melle to launch a range of Chupa Chups frozen products.

Chupa Chups Squeezee

Freeze Pops comes in Cola, Apple, Strawberry and Orange �lavours, available in mixed packs of 12 at an RRP of £1.50 from Booker Wholesale or Rose Marketing directly.

They are vegan, halal and gluten-free and are made with real fruit juice.

Meanwhile, Strawberry Chupa Chups Eezy Freezzy Triangles are available in packs of eight at an RRP of £2 from Nisa and Rose Marketing. They are also vegan.

Both launches can be stocked ambiently for shoppers to freeze at home.

from “early summer” with an RRP of 65p for a single pack and £2.75 for a bottle.

According to Hannah Lee, senior brand manager at Extra, new shoppers account for more than 80% of sales of fruit gum, which is currently growing faster than mint gum.

Aluminium bottled soft drinks

ETHICAL soft drinks brand

Gunna Drinks has launched what it claims is the UK’s �irst range of aluminium bottled soft drinks, hoping the move is a catalyst for change in the soft drinks sector.

The supplier has launched Tropical Lemonade, Raspberry Lemonade and Twisted Lemonade varieties in 500ml, resealable bottles, each at an RRP of £1.99. They are also available in 300ml cans at an RRP of £1.10.

Aside from the bottles’ environmental credentials, they are also intended to cater to consumers looking for healthier and more functional soft drinks. They provide immune-boosting bene�its and are free from arti�icial

additives.

Retailers interested in stocking Gunna Drinks are encouraged to visit gunnadrinks.com.

Bebeto builds out 150g bag range

BEBETO has added two vegan lines, Fizzy Vegan Peach Hearts and Fizzy Vegan Ring Mix, to its core 150g bag range.

The Peach Hearts are soft heart-shaped sweets with a �izzy coating, while Ring Mix are chewy, gummy ringshaped sweets with a �izzy coating in strawberry, apple and raspberry �lavours. Both varieties are also halal.

The supplier says the new launches are ideal for a range of occasions, such as being on the go, at picnics, festivals or at home.

They join Bebeto’s existing range of 150g bags, alongside Big Mix, Strawberries, Big Fizzy Mix, Watermelons and Just Bears.

06

Rekorderlig urges shoppers to ‘Be a little fruktig’

MOLSON Coors Beverage Company has launched a ‘Be a little fruktig’ campaign for its Rekorderlig fruit cider brand.

The campaign encourages people to be more ‘fruktig’, which is Swedish for ‘fruity’. It will run throughout summer across social media, outdoor advertising, YouTube and video-on-demand, reaching an estimated 42

million UK adults.

Rekorderlig will also be supporting retailers with outdoor content in proximity to stores, and in-store PoS with the tagline ‘Discover your �lavour’ to encourage purchase.

According to the supplier, premium fruit cider sales returned to pre-pandemic levels in 2022, fuelled by a strong summer performance.

Copella refreshes packaging

JUICE brand Copella has unveiled a new look to appeal to a younger audience and improve on-shelf impact.

The brand update is part of the brand’s wider strategy to maintain market share and focuses on Copella’s apple ingredients, highlighting its quality.

Copella currently has a 14% share of the chilled juices category and has seen a 5% growth year-to-date in 2023.

Jessica Perry, senior brand manager at Copella, said: “While we know consumers are watching what they spend, they still enjoy choosing brands made from highquality ingredients that have been expertly crafted.

“This new look focuses on the green apple icon putting our expertise and quality ingredients at the core of what we do: tasting good, doing good and making you feel good.”

Guylian goes dark with new launch

PREMIUM chocolate brand Guylian has launched Dark Praliné Seashells as it looks to expand its dark chocolate offering.

The new variety is available at an RRP of £6. It is coated in 72% Belgian dark chocolate made from 100% Fairtrade cocoa.

Tom Snick, chief executive of�icer at Guylian, said: “The growing demand for dark

chocolate has encouraged us to expand our range. Dark is no longer a trend but fully established in the chocolate industry and is the logical next step for Guylian.

“Thanks to the balanced composition between the different ingredients, the Dark Praliné Seashells are a must-try.”

Win music prizes with Coca-Cola

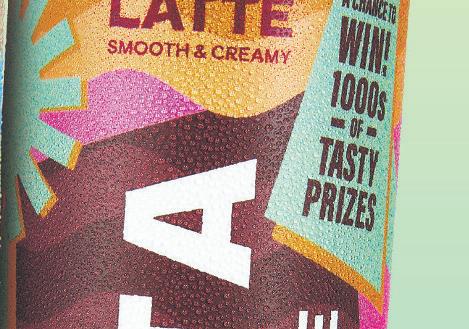

COCA-COLA has launched an on-pack promotion offering customers the chance to win summer music prizes.

Packs of Coca-Cola Original Taste, Zero Sugar and Zero Sugar Cherry will have QR codes which shoppers can scan to go to the CocaCola app, where they have a chance to win festival tickets and music merchandise.

The promotion is part of Coca-Cola’s program of music experiences across the UK and Europe and new artist collaborations via its Coke Studio platform.

Javier Meza, marketing senior vice president at Coca-Cola in Europe, said: “What makes Coke Studio so

special, is how it offers such a variety of touchpoints and ways to engage on- and of�line.”

27 JUNE-10 JULY 2023 07 betterretailing.com

Rizla Trade Ad 2023_27% more revenue_(172x240).indd 1 07/06/2023 09:16

PRODUCTS

Thatchers makes 330ml debut

JASPER HART

THATCHERS Cider has unveiled a 10x330ml can multipack format of its Blood Orange variety, a �irst for the brand.

The new pack will be available to convenience retailers from the beginning of July, after a grocery launch on 14 June and joins the variety’s existing 500ml bottle and 4x440ml can packs.

It is intended to drive further sales for Blood Orange, which attracted more shoppers than any other innovation within beer, cider, wine and spirits, making it the category’s most successful launch last year.

According to IRI, it added

more value to the cider category than all other new cider launches combined.

Jonathan Nixon, commercial director at Thatchers, said: “We know the smaller 330ml can appeals to those younger 18-to-30-year-old shoppers who opt for fruit cider. And it’s this same audi-

Bring bubble tea home with new kits

BUBBLE tea brand Bubbleology is expanding beyond its UK-wide store estate with a range of make-at-home bubble tea kits for retail, made in partnership with manufacturer Aimia Foods.

The range is available in two mixology kits and two single-serve packs. One kit contains Passion Fruit and Raspberry fruit teas with popping boba pearls, while the other contains Taro and Bown Sugar milk teas with caramelised tapioca pearls.

Each kit also contains jumbo straws and a QR code which, when scanned, leads to a video with instructions on how to make the teas.

Bubbleology has con�irmed a listing with Asda

and plans to launch the range in convenience in mid-September. The mixology kits each have an £8.50 RRP and the single serves will retail at £2.29.

ence who seek out the provenance and sustainability that Thatchers is committed to. Fruit �lavours with their premium positioning create a buzz that keeps consumers engaged with this exciting category.

“Due to the success of Blood Orange, we’ve been

Ukrainian vodka brand set for UK

inundated with requests for a mid-pack. This is a format rapidly gaining momentum in the market, as we have seen with our Gold and Haze 10-packs.”

Thatchers is supporting Blood Orange this summer with a sampling campaign across major festivals.

‘Pukka for the people’ celebrates success

PUKKA has launched a summer campaign, ‘Pukka for the people’, in an attempt to build on its strong sales success.

According to the supplier, the campaign is intended as a thank-you to the British people for supporting the brand.

It comes as Pukka has solidi�ied its position as the number-one pie brand across the UK’s chilled and

Rustlers campaign pushes wider sales

KEPAK is aiming to drive sales for Rustlers as well as additional basket spend with the ‘Boost your burger’ campaign.

The campaign, which runs throughout the summer, intends to help shoppers tap into the ‘fakeaway’ trend by making their at-home consumption more exciting. It encourages shoppers to buy additional ingredients alongside Rustlers burgers

such as onions, tomatoes, lettuce and avocados.

Retailers will have access to ‘Boost your burger’ PoS including shelf talkers, digital screen graphics, chiller vinyl and aisle �ins.

Additionally, more than 500 independent retailers can bene�it from tear-off shelf talkers from Kepak’s team of Rustlers sales reps, which feature recipe recommendations.

frozen aisles, as well as in chip shops.

It has also become the number-two brand in total savoury pastry, contributing to more than half of the category’s growth.

The campaign will air across TV and radio until September with seven adverts featuring everyday British people enjoying Pukka products under a range of circumstances.

UKRAINIAN premium vodka maker Nemiroff has announced a strategic partnership with Whyte & Mackay to grow its footprint in the UK and Ireland.

The partnership is part of Nemiroff’s ambitions to become a top-�ive premium vodka producer.

Commenting on the partnership, Mike Greggs, Whyte & Mackay managing director for Europe and global travel retail, said: “In our experience, the UK and Ireland markets are rich with opportunity for a premium brand that speaks to provenance and to quality.

“The team and I are look-

ing forward to present Nemiroff as part of our brilliant brand portfolio alongside Jura, Tamnavulin, Whyte and Mackay, Flor De Cana, Fundador and Harveys to our retail partners soon.”

Weetabix launches

Disney-fied packs

WEETABIX has partnered with Disney on an on-pack makeover across various lines to mark the �ilm studio’s 100th anniversary.

The partnership sees a series of Disney and Marvelinspired packs hit shelves, starting with a ‘100 years of wonder’ Multigrain Hoops pack.

The supplier hopes to help create in-store theatre with branded pallet drops, PoS and gondola ends to make shoppers’ breakfast shopping experience more exciting.

Al Porter, marketing controller at The Weetabix Food Company, said: “The coming together of these two iconic family brands is a landmark moment for the breakfast

New novelty lines from World of Sweets

WORLD of Sweets has revealed new summer confectionery lines from partner brands including Warheads, Tootsie and Pez.

Part of the new launches are Warheads Candy Pops, which feature a sour lollipop in novelty packaging. They are available in cases of 12, with an individual RRP of £1.29. The Warheads brand has seen 60% annual growth in the UK.

Retailers can also stock Charms Fluffy Stuff cotton candy, which is available at an RRP of £2.29. It comes in a variety of �lavours, including strawberry, lemon, raspberry and lime and a Rainbow Sherbet version with strawberry, orange,

lemon and lime �lavours.

World of Sweets is also stocking Pez’ new Playmobil range of dispensers in Police Of�icer, Fire�ighter, Princess and Knight varieties, each at an RRP of £2 in cases of 12.

sector. Working closely with Disney, we’re excited to be inspiring children’s imaginations right from the very start of the day.”

Ribena brings back berries to TV

RIBENA is bringing its bouncing berry mascots back to TV for the �irst time since 2014 as part of a broader ‘Summer of fun’ marketing campaign.

The ad will run throughout summer across UK TV and on-demand services. The supplier anticipates it will reach almost 40 million people, who will see it 10 times on average between

June and August. It highlights the use of British blackcurrants in the drink, as well as its high vitamin C content. Further marketing will take place across brand partnerships and events. The campaign comes as Ribena is a top-100 UK grocery brand, worth nearly £120m, and growing by 5.3% annually.

08

PepsiCo ups Walkers investment

PEPSICO has announced a £58m investment in its Walkers Leicester production site, its largest investment in the UK in the past 25 years.

The investment in the factory, which marks its 75th anniversary this year, is meant to improve ef�iciency and sustainability.

According to the supplier, a new production line will increase the production of snack lines including Wotsits and Monster Munch, which have grown in popularity recently.

It will also enable the production of Wotsits Giants and Monster Munch Giants by 2024, reducing transport-

Body Fuel launches Swizzels collab

related emissions as these lines are currently made in Europe.

The factory will also change from gas-�ired ovens to electric ones, which the supplier says will cut 1,000 tonnes of greenhouse gas emissions annually.

WKD continues Love Island promo

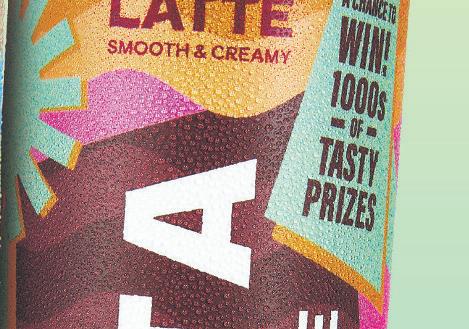

WKD has launched a lineup of limited-edition pack formats with an on-pack promotion to mark its continuing of�icial alcohol partnership status with reality TV series Love Island.

A limited-edition Orange & Passionfruit variety is available in a 700ml glass bottle and a 250ml slimline can as part of WKD variety 10-packs.

Additionally, an on-pack promotion is running across WKD Blue 4x250ml £5.49 price-marked packs and WKD Blue and variety 10x250ml multipacks.

It offers �ive holidays for two people to either Ibiza or Mallorca, as well as thousands of other prizes includ-

ing co-branded WKD and Love Island merchandise and money-off-next-purchase vouchers.

SPORTS nutrition brand Applied Nutrition has launched a Drumstick Original Raspberry variety of its Body Fuel vitamin water in collaboration with Swizzels.

The launch is the �irst of two collaborations between the brands set to launch this summer. It comes as Liverpool-based Body Fuel, which launched in December 2022, has sold more than six million units since launch.

Swizzels Drumstick Original Raspberry Body Fuel is available in a 500ml bottle with an RRP of £1.75. It is available from United

Walkers launches top fl avour combos

Wholesale and was available through Spar Scotland in a ‘when it’s gone it’s gone’ run, which the supplier said it sold through.

The supplier told Retail Express it is also in discussions with Booker and Bestway over potential listings.

Rubicon aims for summer sales splash

BARR Soft Drinks is bringing back its ‘Made of different stuff’ campaign to help drive sales of Rubicon.

The campaign runs until the end of August across outdoor advertising, TV during shows including Love Island, and experiential activations at festivals. Retailers and wholesalers also have access to bespoke PoS and display units, which they can order by emailing trademarketing@agbarr.co.uk.

Rubicon is currently worth £74m and is growing by 18% annually. Additionally, during the summer, almost twice as many shoppers as the monthly average search for “exotic” drinks.

Adrian Troy, marketing

Quorn campaign for Deli range

QUORN has relaunched its ‘So tasty! Why choose the alternative?’ campaign to help push its vegan Deli range. The campaign runs across radio, on-demand, digital and social media.

According to the supplier, after last year’s version of the campaign, Quorn recorded its highest level of brand awareness for the year and chilled Quorn Deli

sales were up by 7.7%.

Within six months of its launch last year, Quorn Deli exceeded £1m in retail sales value. Gill Riley, marketing director at Quorn Foods UK, said: “The nation spends around £8bn on sandwiches each year, so there is a huge opportunity to encourage shoppers into making more sustainable choices around these occasions.”

director at Barr, said last year’s iteration of the campaign drove a 21% increase in Rubicon shoppers.

Fresh lettuce for James Hall stores

SPAR stores supplied by James Hall & Co now have increased access to Romaine lettuces as part of the symbol’s own-brand offering thanks to a collaboration between the wholesaler and supplier Gore Hall Produce.

The lettuces are hand-cut and packaged just after picking at Gore Hall’s site near Southport, and are in James Hall & Co’s distribution centre in Preston the same day, ready to be delivered to Spar stores the following day. They have an RRP of 89p.

Richard Cropper, commercial director at Gore Hall, said: “I think the Romaine salad is having a comeback which is fantastic to see after the Iceberg became the

WALKERS has launched a range of crisps that combines three of its most popular brand �lavours with the Walkers crisp base.

Wotsits Really Cheesy, Monster Munch Pickled Onion and Doritos Chilli Heatwave varieties are available for a limited time while stocks last.

a growth in popularity, to the extent that PepsiCo has invested in an improved production line at Walkers’ Leicester site to improve production of the brand.

go-to option for many years. Personally, I think it is a tastier product with a better lifespan.”

The non-HFSS crisps are available to convenience retailers in 5x24g multipacks (RRP £1.65) and a 65g single bag (£1.65 PMP).

(RRP £1.65) and a 65g single

Currently, Doritos is the UK’s largest tortilla chip brand, while Wotsits saw more than £130m in value sales in 2022. Monster Munch has also seen

‘Love the taste’ of Horlicks

HORLICKS has launched a ‘Love the taste’ campaign, which features an on-pack money-back guarantee for consumers.

The campaign is running across Horlicks’ Original Instant and Chocolate 400g packs, with the aim of driving trial of the range among shoppers who are new to the brand.

It is being supported by digital, outdoor and in-store PoS advertising and follows the brand’s ‘Find your happy place’ campaign, which launched this spring.

Michelle Younger, marketing director at Horlicks manufacturer Aimia Foods, said: “We are now looking forward to reviewing the

impact of this latest activation, as we drive purchase amongst non-users, encouraging them to sample, perhaps for the �irst time, our signature �lavour.”

Find Nurishment with new range

NUTRITIONAL milk drink brand Nurishment has launched a range of noadded-sugar drinks with two additional varieties.

The launch features the brand’s four original varieties – Strawberry, Chocolate, Vanilla and Banana – alongside new �lavours Hazelnut and Coffee.

Dorota Dziedzic, brand manager for Nurishment, said: “We have polled our Nurishment fans and they said they were looking for more ‘modern’ �lavours that suited more sophisticated palates, which has led to the launch of the Hazelnut and Coffee �lavours. Coffee is one of the most widely consumed drinks in the UK, so we

thought it was about time we got in on the act.”

Like the original Nurishment range, the no-addedsugar formats contain 17.8g of protein per portion.

09 27 JUNE-10 JULY 2023 betterretailing.com

COMING UP IN THE 30 JUNE ISSUE OF RN

RETAILER OPINION ON THIS FORTNIGHT’S HOT TOPICS

What do you think? Call Retail Express on 020 7689 3357 for the chance to be featured

POST OFFICE: Is the DVLA contract extension good for branches?

“WE don’t offer these services, but I am surprised they actually listened to postmasters. The DVLA could say after the contract ends that they haven’t sorted their system yet, so want to extend it for another year. It is important to stay hopeful.”

Guarave Sood, Neelam Post Office & Convenience, Uxbridge, west London

VAPING: What role can shops play in helping crack down on youth sales?

“WE enforce the Challenge 25 policy, so anyone we suspect is under that age, we ask for ID before they can buy vapes. We had an issue with doctored IDs on phones that can be Photoshopped, so refused them. All shops should do the same.”

Stores, Aberdeen

It’s important to stay hopeful

“UNFORTUNATELY, it’s only temporary. Lots of our customers say they wouldn’t be able to do it online, so we are concerned for them. The Post Office is government funded, so it’s weird that a government-funded body wouldn’t want to use it.”

DRS: What impact does the Scottish delay until October 2025 have on you?

“IT gives us time to process everything and means we are moving forward with the UK, not just as Scotland. We are often guinea pigs for everything. We’re tackling it as one and learning as we go. Retailers can share experiences and move forward together.”

Sophie Williams, Broadway Convenience Store, Edinburgh

“IT is not affecting us directly as we haven’t invested in preparing for it yet, but I’m aware other retailers paid out to accommodate space, create floor plans and layouts, and even enquired about vending machines. The biggest problem is glass being excluded now.”

Faisal Naseem, multi-site retailer, Arbroath, Angus

“EVERYONE should enforce Challenge 25. It also comes down to trading standards punishing sellers. One of our fascias with vapes on the shop floor is near a school. It circulated that they were easy to steal, so we moved them behind the counter.”

Harj Dhasee, Mickleton Village Stores, Gloucestershire

We are also mindful of expiry dates

It also comes down to trading standards

FOOD WASTE: How are you working to reduce your store’s waste?

“WE use Too Good To Go, and I’ve nearly hit 1,000 meals in the past six months. We wanted to use it to help the community cut down on their food waste, too. Just because it has a day until it expires doesn’t mean food can’t be consumed, and customers are aware of that.”

Asad Hashmi, Hashmees Convenience Store, Sutton, Surrey

“WE keep on top of food waste by doing various small things like putting special offers on products to entice customers to buy them before they expire. We are also mindful of expiry dates, so that we can keep items on our shelves for as long as possible.”

Serdar Akbay, Hoddesdon Food & Wine, Hertfordshire

10

27 JUNE-10 JULY 2023 betterretailing.com

OPINION

us time to process everything

It gives

Fiona Malone, Tenby Stores and Post Office, Tenby, Pembrokeshire

Chris Cobb, Cult

Pricewatch: see what other retailers are charging for tobacco accessories and boost your own profits Working with the right suppliers: how you can get the best arrangements with wholesalers, symbols and local providers Sugar confectionery: an overview of the state of this conveniencestore staple + STAY INFORMED AND GET AHEAD WITH RN betterretailing.com/subscribe To ADVERTISE IN RN please contact Natalie Reeve on 07824 058172 3,451 retailers’ sales data analysed for every issue 69+ unique retailers spoken to every month 71% of RN’s news stories are exclusive At RN, our content is data-led and informed by those on the shop floor ORDER YOUR COPY from your magazine wholesaler today or contact Kate Daw on 020 7689 3363

Top

There’s always something new to learn. Take inspiration from other retailers and keep up with the latest advances to continue evolving your business. Gemma

To find out more, visit betterretailing.com/IAAfest or contact the team on iaa@newtrade.co.uk // 020 7689 0500 Join the Independent Achievers Academy today and take advantage of: A free, comprehensive health check for your store The chance of being recognised for your efforts A network of success-driven retailers An invitation to the IAA Learning & Development Festival on 3 July

Marris, Sales Capability Manager

The leading learning, development and recognition programme helping retailers grow profitable sales

tip

UK

profits #ALWAYSIMPROVING #IAA23 Headline partners Focus group partners Networking partners

from JTI

The IAA is supported by leading industry brands who recognise that retailers want free support to increase

Show your community that you’re there for them

I’VE just recently finished hosting a charity golf day fundraiser in honour of my late husband, Raj, where we raised more than £30,000 for two local hospital charities – Leicester Children’s Hospital and Sheffield Sanctuary Garden.

‘I’m not happy with DeliveryDrop service’

DELIVERYDROP has promised a lot to us, but delivered nothing.

They said that they would take over our Facebook page to promote the service to customers, but I feel like all they did was spam it and put customers off. So much so, that we had people tell us to stop and they unliked our page. We didn’t get any interaction from their posts, and it didn’t gain any traction.

There are also secret costs involved.

I don’t want to up my prices in order to cover commission, I want to remain competitive. This wasn’t revealed to me until I paid £600

to sign up. I tried to cancel the service, but I never heard anything back. They eventually said they would stop my subscription, but continued taking money out of my account. The bank did cover these costs, but I’ve had to go to extreme lengths to stop using this service.

Nathalie Fullerton, One Stop Partick, Glasgow

DeliveryDrop’s sales manager, Callen Deighan, responded: “Each retailer signs up after being given a Zoom presentation of the entire system, including pricing. It is the customer decision to sign up

WIN £50-worth of KP Snacks stock

to the agreed fees. One of the key parts of the service we offer is help/support with their social media to post offers of products in store, this further supports their online presence. It is the only way stores can build their online gateway in local communities and we have found this a great success, as many store owners simply don’t have the time to continually post. We can only post if the store owner gives us permission as some may opt to do themselves.

“Mail marketing is only done to customers who have signed up for the service. Customers have an option to opt out. These customers have

downloaded the DeliveryDrop app, so, effectively, customers of the app have the option to opt out of any marketing.

“The contract any businesses sign up to is clearly provided to the customer on email. Upon reading, they will digitally sign and return. We have two charges, which are the sign-up fee, paid by the customer on acceptance, and their direct debit, which they opt for the amount they wish to pay. Again, this is clearly stated in the contract and discussed with their sales executive. We have no other hidden charges and all contracts are stated at 12 months from sign-up.”

WIN £50-worth of

Choc Mint stock

KP SNACKS is proud to be the official team partner of The Hundred for the third year running. The action-packed, 100-ball cricket competition captured a broadcast audience of 14 million last year. KP Snacks has partnered with Retail Express to give five lucky retailers the chance to win £50-worth of mixed price-marked pack (PMP) stock which features on The Hundred team shirts.

YAZOO has partnered with Retail Express to offer five lucky retailers the chance to win £50-worth of Yazoo Choc Mint. As Yazoo is bringing a burst of refreshment to UK screens on 3 July with a new TV ad campaign, brand awareness will be at an all-time high, so there’s never been a better time to have a Yazoo on the shelf.

Each issue, one of seven top retailers shares advice to make your store magnificent

It started off a couple of years ago when Raj passed away. I wanted retailers to be recognised as key workers and, as my husband had been donating drinks to the local hospitals, we started a project in his name. We asked retailers and suppliers for their support and, so far, we have managed to raise just under £107,000 for two hospitals.

None of what we have done with Do As Raj Would Do would have been possible without the support of friends, family and the retailer community.

The charity golf day is something we started last year, and it’s an opportunity for people to get together to socialise and network, but it’s also a day to recognise Raj and all of the good deeds he did. We also hold a wine tasting with Concha y Toro, and a spa day for the non-golfers.

We get a lot of retailers involved, around 80 during the day and about 200 people at the evening event. Last year, it was held at The Belfry Hotel and Resort in Sutton Coldfield, and this year it was at The Forest of Arden Marriott Hotel and Country Club in Birmingham.

It was very easy to set things up with the hospital and we’ve been giving back to our community, schools and clubs for a long time. Raj also used to do things with the local police and fire brigade. It’s all about showing the community that we’re there for them.

I think there are lots of retailers who are doing similar things to this already and almost see it as part of their everyday job, but because they don’t shout about it, I think we’ve been undervalued. The retailers don’t want to seem like they’re preaching about it, but it would be so much better for the communities to know more about what we do. As retailers, we play a big role in our communities and we should be recognised for the things we do.

12 LETTERS Letters may be edited betterretailing.com 27 JUNE-10 JULY 2023

Get in touch @retailexpress betterretailing.com facebook.com/betterretailing megan.humphrey@newtrade.co.uk 07597 588972 Sunita Aggarwal Spar Hackenthorpe, Sheffield

ENTER

TO

Fill in your details at: betterretailing.com/competitions This competition closes on 25 July. Editor’s decision is final.

ENTER

TO

Fill in your details at: betterretailing.com/competitions This competition closes on 25 July. Editor’s decision is final.

Yazoo

A MUST-READ FOR PROFIT-DRIVEN INDEPENDENT RETAILERS Find out top sellers, highest margins and biggest profit drivers in stores like yours 30+ CRUCIAL CONVENIENCE CATEGORIES ANALYSED WHAT TO STOCK 2023 INALSOTHIS ISSUE A MUST-READ FOR PROFIT-DRIVEN INDEPENDENT RETAILERS Find out top sellers, highest margins and biggest profit drivers in stores like yours June 2023 CONVENIENCE CATEGORIES ALSO IN THIS ISSUE CRUCIAL ANALYSED A MUST-READ FOR PROFIT-DRIVEN INDEPENDENT RETAILERS Find out top sellers, highest margins and biggest profit drivers in stores like yours June 2023 30+ CRUCIAL CONVENIENCE CATEGORIES ANALYSED WHAT TO STOCK 2023 ALSO IN THIS ISSUE Exclusive data on the top sellers and profit drivers over the past 12 months Detailed sales data on more than 800 product lines across 31 core convenience categories Spotlight on key growth areas and up-and-coming trends, including value, premium and free-from Supplier viewpoints and insight to help you stock a more profitable range INCLUDING: Order your copy from your magazine wholesaler today or contact us on 020 3871 6490 On sale now! Only £5.50 EPoS data from 3,705 independent retailers analysed The ultimate stocking guide for independent news and convenience retailers! What to Stock will help you find new opportunities for your store and plan the core product lines that you need to add to your shelves Maximise your profits with What to Stock!

YOUR COMPLETE GUIDE TO SOFT DRINKS

TOM GOCKELEN-KOZLOWSKI finds out what trends are driving soft drinks – the biggest category in convenience stores – and how retailers can get ahead of them this summer

SUMMER SALES IN A COST-OF-LIVING CRISIS

ACCORDING to suppliers, the soft drinks market is worth £2.7bn to the convenience channel, making it one of the most important profit drivers in any store. And, with school holidays approaching and the warm weather already here, retailers can look forward to months of peak sales ahead.

“Summer is the key period for soft drinks sales and there is a huge opportunity for retailers to build on the success of last year,” says Adrian Troy, marketing director at Barr Soft

Drinks. “With unprecedented temperatures recorded last summer, sales were bigger than ever before in soft drinks, with flavoured carbonates and water seeing the biggest uplifts. During the peak of the heatwave, an additional £75m in soft drinks sales were recorded in one week.”

Of course, one major trend – and challenge – facing the category over the past year has been the cost-of-living crisis.

“Consumers have been feeling the pinch from ris-

ing living costs and inflation this last year, with increasing numbers being mindful of the amount they spend,” says Ben Parker, GB retail commercial director at Britvic. “In a bid to make their money stretch further, these pressured shoppers are expected to move toward smaller transactions and smaller pack sizes.”

Yet, Parker also says that a well-managed soft drinks category can appeal to customers looking for ‘affordable luxury’, with

customers feeling that if they’re going to spend their money on a soft drink, it might as well be premium.

“At the same time, we’re also seeing a ‘lipstick effect’ where shoppers are switching from expensive purchases to treating themselves with smaller treats and indulgences.

As inflation is set to continue, it’s important for retailers to offer choice to shoppers who will all be affected differently – there’s no one-size-fits-all solution,” he adds.

CATEGORY ADVICE SOFT DRINKS TRENDS 14 27 JUNE-10 JULY 2023 betterretailing.com

Get summer ready with our £90M+* must-stock range £90M+ must-stock

These 10 key must-stock bestsellers from SBF GB&I are worth more than £91.7M to convenience stores across the UK*. Make sure you have them on shelf to secure your share of summer sales.

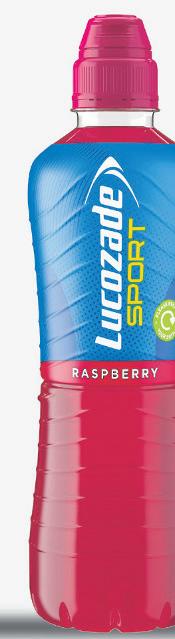

*Nielsen Independent & Symbol, Total Coverage GB, MAT w/e 01.04.23 RIBENA, LUCOZADE, LUCOZADE ENERGY, LUCOZADE ALERT, LUCOZADE ZERO, LUCOZADE SPORT and the Arc Device are registered trade marks of Lucozade Ribena Suntory Ltd. © Lucozade Ribena Suntory Ltd. All rights reserved.

CATEGORY ADVICE SOFT DRINKS TRENDS

THE IMPORTANCE OF BRANDS FOR ENERGY DRINKS

ACCORDING to a spokesperson for Red Bull, consumers are proving to be particularly loyal to the energy drinks category in tough times.

“Despite the current challenges on shoppers’ household income, soft drinks performance remains resilient, growing faster than other key FMCG categories,” the spokesperson says.

So, while shoppers are getting used to switching away from familiar brands across a host of other categories, big brands in energy drinks remain important.

“Switching to own label is a key savings strategy, which is amplified as shoppers spend more at the discounters. As a result, own-label is outperforming brands across most categories, although soft drinks the exception.

“Soft drinks branded spend is in fact 36% higher than own-label, suggesting that shoppers prefer to stay brand loyal and are willing to spend more, rather than revert to own label to save money as they do in other categories,” the spokesperson says.

Another energy brand that has continued to grow despite competition from own label alternatives is Boost. The company recently invested in the fast-growing energy stimulation range (up 15% year on year), with the arrival of Boost Lemon & Lime Energy.

“Looking at the growing success of our 250ml Energy Stimulation range, we spotted a great opportunity to launch Lemon & Lime. The drink adds another flavour

variant to our existing range, and provides a point of difference to the usual singleflavour lines available on the market,” says Adrian Hipkiss, marketing director at Boost Drinks.

For retailers, energy drinks continue to be a priority when ranging their soft drinks display. Jason Birks, who owns Mosci’s Convenience Store in Horden, County Durham, has added six metres of shelf space, which has allowed him to increase his facings of this category as well as having more space for new or limitededition flavours.

“We sell all the major energy drinks brands and we find that customers will have a favourite brand and they’ll always stick to that. It means that, despite the cost of living going up, our customers are very brand loyal,” he says.

Within the energy segment, retailers should also consider

the benefits of a strong sports & functional range, aimed at people looking for a boost without caffeine and, instead with other benefits.

With the weather improving and sporting events taking centre stage, now is the time to be leaning into this category.

“Spikes in sports drinks sales not only correlate with temperature increases, but also from national and international events taking place throughout the year.

“In fact, during the 2022 World Cup, the sports drinks category experienced incredible value growth of 40% and almost 11% volume growth compared with the same period in 2021,” says Matt Gouldsmith, channel director for wholesale at Suntory Beverages & Food GB&I (SBF).

“During this time, Lucozade Sport also saw almost 13% year-on-year volume growth.”

16

17 27 JUNE-10 JULY 2023 betterretailing.com

THE UK’S

NO.1 CHILLED COFFEE*

CATEGORY ADVICE SOFT DRINKS TRENDS 18 *Nielsen 22/04/23

ADAPTING TO HFSS

IT could be argued that the high in fat, salt and sugar (HFSS) regulations did not have a significant effect on the soft drinks category, as it had already been evolving to deal with the earlier sugar tax.

“The long-term trend towards drinks with lower sugar shows no sign of stopping, with consumers becoming much more aware of their health and well-being. The diet segment continues to outperform the regular segment and currently accounts for just under 67% of the volume share of the total soft drinks market,” says SBF’s Matt Gouldsmith.

“As a category we were well prepared ahead of the legislation, following the introduction of the Soft Drinks Industry Levy, which came into effect in 2018,” adds Ben

which has seen demand for noand low-sugar options grow across soft drink categories. Demand for lower-sugar options is on the rise, with retailers citing the larger share of sales enjoyed by Diet Coke, Pepsi Max and Coke Zero these days.

“The long-term trend towards drinks with lower sugar shows no sign of stopping, with consumers becoming much more aware of their health and wellbeing. The diet segment continues to outperform the regular segment and currently accounts for just under 67% of the volume share of the total soft drinks market,” says Gouldsmith.

As with other drinks manufacturers, innovation and investment in low- and no-sugar reformulations has resulted in much of Britvic’s portfolio – 90% in Britvic’s or “196 liquids” – already being HFSScompliant. This includes the recent launch of Tango Apple

Sugar Free and 7Up Free Cherry.

“Last year, we also reduced the sugar content across our Rockstar core range of energy drinks, making the brand’s six bestselling flavours HFSScompliant,” Parker says.

Another major soft drinks brand to adapt its range to HFSS regulations is Oasis. Worth £94m to the category, Coca-Cola Europacific Partners (CCEP) says Oasis has sold 39 million litres in the past year. In April, the company launched its HFSS-compliant Oasis Zero Exotic Fruits.

“We’re confident the launch – and summer marketing campaign – will help keep the brand front of mind with consumers on their lunchtime shopping mission, giving them more choice alongside our popular Summer Fruits, Citrus Punch and Blackcurrant Apple

19 27 JUNE-10 JULY 2023 betterretailing.com

THE RISE OF FLAVOURED WATER

ONE sector that has benefited from the category’s adaptation to consumers’ demand for healthier options is flavoured water, particularly in the summer months when the need for hydration meets the desire for the taste of something interesting.

“Post-pandemic, health continues to be an important factor influencing purchasing decisions. We’re still seeing increased demand for lower calorie products and a significant reduction in alcohol consumption,” Adrian Troy at Barr Soft Drinks.

“Flavoured water is

growing in popularity as a result, with flavoured sparkling water sales up 10% year on year. Offer a good choice of low-calorie products that don’t compromise on flavour, taste or value, such as Rubicon Spring, to tap into incremental sales,” he adds.

A partnership between Unitas, Valeo Snackfoods and Whatever Brands, meanwhile, has brought a new range of flavoured waters and carbonated drinks inspired by classic Barratt sweet flavours.

Barratt Fruit Salad Spring Water and Wham Spring are HFSS-compliant, while the carbonates range includes

Barratt Fruit Salad, Wham, Flump and Dip Dab, which come in 555ml PET bottles, RRP £1, and an 850ml format (RRP £1.29). The range is available exclusively in the independent wholesale channel.

“This is an opportunity to partner exclusively with Barratt on a range of exciting new products,” says Cheryl Hope, Unitas trading director. “The big brand flavours and pack formats available in this exclusive to Unitas range will prove to be a huge hit with our wholesale members across retail and out of home, and their customers.”

RETAILER VIEW

“AS soon as the hot weather arrives, the challenge is to keep our shelves full. We’re lucky to have a chilled store room so products can go from one cold place to another and be ready for sale.

“Water sales increase, but what I’ve noticed is that when the weather is warmer, these customers will go from buying the smaller bottles to the larger 1.5l bottles. We also see an increase in sports drinks like Lucozade Sport. The only sector which dips a little in sales is milkshakes because a lot of people don’t want to drink milk on a hot day.

“The cost-of-living crisis is obviously having a huge effect on our business but – when it comes to soft drinks – people want the brands they know. It has to be CocaCola or Pepsi, for example.”

CATEGORY

SOFT DRINKS TRENDS 20 27 JUNE-10 JULY 2023 betterretailing.com

ADVICE

Anita Nye, Premier Eldred Drive Stores, Orpington, Kent

© 2013-2023 Costa Limited. All rights reserved. COSTA, COSTA COFFEE and the 3 Bean Logo are registered trade marks of Costa Limited. Source: 1. AC Nielsen, Total GB value sales MAT vs YAG 25.03.2023. 2. AC Nielsen, Total GB, % value sales growth of Costa vs Starbucks, Jimmys, Artic, Emmi, MAT vs YAG 25.03.2023. 3. Kantar, Take Home Purchasing, Data to Feb 2023, RTD Coffee, Gains Loss 52we vs YA. To find out more email connect@ccep.com, call 0808 1 000 000 or visit my.ccep.com Scan to visit My.CCEP.com Give your summer a sales lift £7.5k WORTH OF GIVEAWAYS FOR YOU AND YOUR COMMUNITY! TO HEAR MORE VISIT MY.CCEP.COM Costa Coffee shoppers are 73% incremental to Chilled Coffee spend3 Costa Coffee is the fastest growing major Chilled Coffee brand2 Costa Coffee is growing over 3.5x faster than the total Chilled Coffee sector1 COC1654_Costa_Summer RTD_RE_AW3.indd 1 21/06/2023 09:23

THE RISE OF COFFEE

THE ready-to-drink (RTD) coffee sector has grown substantially and become a “key driver within soft drinks” according to Amy Burgess, senior trade communications manager at CCEP.

In fact, CCEP data shows the sector is now worth more than £268m and up by nearly one quarter (24.4%) in value over the past 12 months.

“This success can be put down to the widespread popularity of Costa Coffee, the nation’s favourite coffee shop for the last 12 years, and the quality of what’s inside the can,” Burgess adds. “Costa’s RTD range taps into the Chill Break

and Energising Break growth drivers in our Refresh Tomorrow soft drinks category vision, which identifies opportunities for further sales growth over the next three years.”

The Costa Coffee range includes Lattes, Flat Whites and Frappés, all of which provide various levels of caffeine, coffee flavour and sweetness.

While the summer months see RTD coffee enjoy a spike in sales, it is becoming an allyear seller.

Another major coffee shop brand to find success in the RTD market is Starbucks.

Adam Hacking, head of beverages at Starbucks RTD

brand owner Arla, says new flavours and formats are one of the ways manufacturers continue to deliver growth in convenience.

“The release of limitededition products allows consumers to keep up with ever-changing consumer wants and stay on top of flavour trends. Bringing variety to the soft drinks category via limited edition products promotes the exploration of sub-categories such as chilled coffee. As 80% of RTD coffee is bought on impulse, capturing shoppers’ attention with innovative lines is key to profiting from this lucrative sector,” he says.

CHOOSE BOLD OVER THE SAME OLD THIS SUMMER

CATEGORY ADVICE SOFT DRINKS TRENDS 22

ROBINSONS

Robinsons Ready to Drink has teamed up with The Hundred cricket tournament once again for an on-pack promotion to drive summer sales, giving away tickets as part of its three-year partnership. RETAIL EXPRESS finds out more

Robinsons: what’s new?

ROBINSONS Ready to Drink is helping retailers get set for summer by bringing back its on-pack promotion to give 200 consumers the chance to win tickets to The Hundred every two weeks, as well as £20 via bank transfer to spend on food and drink on the day. As the fastest-growing fruit drink in the category1, the range is ideally placed to support retailers in increasing summer soft drinks sales.

Robinsons Ready to Drink will be supporting The Hundred partnership through disruptive PoS, digital and in-store activations. It will also include in-ground advertising –alongside other branded partners –during the tournament. The on-pack promotion and in-store activations will support retailers in driving sales this summer, particularly in and around sporting events. The Hundred tournament runs from 1 to 27 August.

Three bestsellers

Blackberry & Blueberry 500ml RRP: £1.09

events, bank holidays and seasonal occasions. Ensure you are prepared with the right range and enough stock to keep up with demand.

Ensure juice drinks are located near to flavoured carbonate drinks, as the ‘still’ equivalent to those flavours, but also adjacent to water products, for those consumers seeking fullerflavoured hydration.

Create displays in the build-up to key sporting events such as The Hundred to drive excitement and attract attention. Site picnic items such as drinks, snacks and sandwiches to drive on-the-go purchases.

ROBINSONS Ready to Drink is also offering four retailers the chance to win four tickets each to The Hundred cricket tournament, with eight tickets to give away to The Hundred at Edgbaston on 5 August, and another eight tickets to give away for Lords on 8 August. The competition runs until 23 July and is available to all retailers who claim a free case of Robinsons Ready to Drink Raspberry & Apple, and free PoS materials through atyourconvenience.com/Robs100. To enter the competition, retailers simply need to take the best photo possible of their Robinsons Ready to Drink PoS and submit to yourpos@britvic.com.

Raspberry & Apple 500ml

RRP: £1.09

Peach & Mango 500ml

RRP: £1.09

In partnership with RETAIL PAID FEATURE BRAND SPOTLIGHT 27 JUNE-10 JULY 2023 betterretailing.com 23

Find out more at atyourconvenience.com/working-with-britvic/brands/robinsons, offering 24/7 advice for all outlets and the latest trends and insights Make sure you are aware of upcoming events, including key sports

In action

FOCUS ON: 1 NielsenIQ RMS, Single Serve Drinks, Britvic Defi ned, Value Sales 52w/e 25.03.23, *GB only. Promotional period: 00:01 12.06.2023 until 23:59 23.07.2023. First come fi rst served. NPN. Visit the At Your Convenience website to claim your free competition POS kit and Free Case of 500ml PET. 500 POS kits available, max 1 per outlet. Once set up, submit a photo to yourpos@britvic.com of your PoS kit set up to enter the competition to win one of 4 x 4 tickets to a ‘The Hundred’ game (either Edgebaston 5 Aug (2 x 4 tickets) or Lords 8 Aug (2 x 4 tickets)). Four prizes in total. Draw date: 27.07.2023. Registration & a valid email address are required. Travel, food and accommodation not included. Visit atyourconvenience.com for full terms and details. Promoter: Britvic Soft Drinks.

OFFERING SOMETHING DIFFERENT

THE resilience of the soft drinks market means it can be the ideal category to offer consumers something new –whether it is a new, innovative format or a premium option to encourage shoppers to trade up.

Shaken Udder is a premium milkshake brand that, the company hopes, will allow retailers to do just this. Last year, the company launched an ambient range, offering a longer shelf-life and removing the need for chilled storage. The range includes Chocolush 330ml and Vanillalicious 330ml with more flavours planned.

“As we move into summer, Shaken Udder typically sees an increase of around 50-100 in sales of our 330ml on-the-go milkshake range,

which are easier to carry and consume while out and about. Our fruity, refreshing ‘Strawberry Dream’ milkshake flavour is particularly popular in the summer months while our ‘Chocolush’ flavour remains our bestselling flavour all year round,” says Shaken Udder co-founder Jodie Howie. Premium cordials brand Bottlegreen is planning to capitalise on the summer soft drinks sales boom with the launch of an outdoor, radio and in-store marketing campaign. The “Add a Dash of Extraordinary” message will include the idea or adding the “Pro into Prosecco” by pairing a cordial with the sparkling wine to enhance its flavour.

“The ‘Add a Dash of Extraordinary’ campaign highlights

to consumers how simple it is to enhance their favourite drinks and make them that little bit more special,” says Sarah Lawson, head of marketing for soft drinks at SHS Drinks.

Retailers, too, are on the search for ways to offer consumers something different from their soft drinks range.

“We stock as big a range of American soft drinks as we can,” says Kopi Kalanathan at Freshgo Budgens Carcroft in South Yorkshire. “The latest range we’ve started to stock is energy drinks brand G Fuel. These products provide 40 to 50% margins compared to tradition soft drinks and the only real challenge for us is ensuring availability – that’s why we work with a number of different suppliers.”

CATEGORY ADVICE SOFT DRINKS TRENDS 24 27 JUNE-10 JULY 2023 betterretailing.com

SIGN TODAY!UP Free POS Kits Free Product Trials Exclusive O ers See website for full Terms and Conditions. To get started and claim your free case, scan the QR or visit atyourconvenience.com Increase your shop’s sales and grow your business

new 1.5L *Source IRI Total Market Carbonated 52we 19th Feb 2023 **Source VYPR 09/02/23 ***Source IRI GB Symbols & Indies 52we 19th Feb 2023 Search Rio Soft Drink

Home Drink

are still in huge growth

YoY* Rio is the fastest growing Carbonates brand +29%

of Fruit Carbonate

Take

Formats

+13.5%

YoY*** 40%

shoppers buy 1.5Ltr/ 2Ltr bottleS once a week or more**

new products

Ribena’s berries back on the screens

As part of Ribena’s Summer Of Fun to celebrate its 85th birthday in 2023, the brand’s bouncing berries are back on TV this month for the first time since 2014. The ad will run throughout the summer season across TV, video-on-demand and catch-up TV. It is expected to reach almost 40 million people.

Starbucks Frappuccino Salted Caramel Brownie Arla has brought this latest limited-edition drink –alongside Starbucks Chilled Classics Dark Chocolate Mocha to shelves in time for this summer.

Lucozade Sport Zero Sugar

Lucozade Sport has launched Lucozade Sport Zero Sugar, a move from the brand into the low- and-nosugar segment. Available in Orange & Peach and Raspberry & Passion Fruit flavours, Lucozade Sport

Zero Sugar is designed specifically for those taking part in sporting activities. It contains sodium and Vitamin B3 to help reduce tiredness and is available in 500ml bottles and 4x500ml multipack formats.

Barratt Fruit Salad Spring Water

Two confectionery-flavoured waters have been launched by a new partnership with Unitas. Barratt Fruit Salad Spring Water and Wham Spring Water are available in 500ml PET bottles, both with an RRP of 69p.

Oasis Zero Exotic Fruit

Like the rest of the Oasis range, this HFSS-compliant mango and passion fruit flavour contains no calories and no sugar and was launched earlier this year in time for the summer.

Boost Lemon & Lime Energy

Available in 75p PMPs, this new flavour “enables retailers to communicate great value amidst increased consumer price-consciousness”, according to the company.

Robinsons Blackberry & Blueberry

Launched last year, sales of this new flavour – the third in the Robinsons RTD range – have already grown by more than 26%. Britvic says it is helping retailers further drive on-the-go sales.

26

ADVICE SOFT DRINKS TRENDS

CATEGORY

GROW SALES WITH FLAVOURED ENERGY

WHAT’S THE OPPORTUNITY?

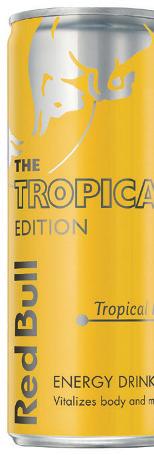

CONTINUING its mission to offer ‘Flavours for all tastes’, and ‘Wiings for your summer’, Red Bull recently launched its latest Summer Edition, with the taste of Juneberry.

The new Red Bull Summer Edition has a flavour reminiscent of dark cherries or raisins, and slightly mild blueberries, and aims to create excitement and drive trial. It performed particularly well in multiple consumer taste

SUPPLIER VIEW