The National Living wage increase in 2023 and low unemployment rates are causing difficulties for store owners in finding, training and retaining strong teams. This edition of The Retail Success Handbook examines recruitment strategies in a competitive job market, maximising efficiencies and retaining employees. We also explore ways to improve employee skills and loyalty, while maintaining profitability, including:

Best practice for recruiting and onboarding staff

Creating value through staff incentives and staff welfare

Exploring effective options to train and boost productivity

Smarter ways to promote products and interact with customers more effectively

Retailers are now facing fines of up to £5,000 if they fail to provide a take-back service for used vaping products.

You can read all about what this means for you on this page’s lead story, but I want to use this space to expose tobacco firms for not helping retailers comply.

Local shops have a long list of legislation they must comply with, and in almost every single case, they are required to foot the bill. This includes preparations for the deposit return scheme and promotional restrictions of foods high in fat, sugar and salt, just to name a few.

What’s interesting is that suppliers, in most cases, turn a blind eye. Recognising this, the Fed began urging vaping manufacturers to help finance take-back schemes in stores last month, but no one has really reacted.

In my opinion, just because an independent retailer chooses to sell a specific product, it doesn’t mean they should bear the responsibility of paying any relative compliancy costs.

However, this doesn’t seem to be the mindset of everyone. Major tobacco companies that produce vaping products confirmed to me last week that they are not actively helping independent retailers to provide a take-back service.

MEGAN HUMPHREY

TOBACCO companiesare failing to support independent retailers in providing a take-back service for used vaping products.

Most dodged the question, and instead took the opportunity to tell me how they are helping consumers return vapes. To me, this doesn’t cut it. Why are they not helping their retailers, who are liable to stay on the right side of the law? I would urge them to shift their focus, and provide retailers with urgent support to prevent them from being stung at an extremely challenging time.

Changes to Waste Electrical and Electronic Equipment (WEEE) recycling laws mean retailers selling electrical items must offer a recycling service. It was con�irmed earlier this year that the Of�ice for Product Safety

and Standards will be carrying out enforcement activity on retailers who are not compliant from the end of March.

Retail Express approached Philip Morris Limited (PML), British American Tobacco and Imperial Tobacco, asking how they were helping retailers. All of which did not speci�ically answer.

Imperial’s head of corporate and legal affairs UK, Lindsay Mennell Keating, said

the company communicates “responsible disposal guidance to both consumers and retailers”, and con�irmed it offers a scheme for its consumers to safely dispose of its Blu devices.

A PML spokesperson explained it also operates a recycling programme for its Veeba disposable e-vapour device, but for adult consumers only rather than retailers. “We are also working with selective retail partners to test the vi-

ability of other programmes that enable adult consumers to responsibly return their Veeba devices with ease and convenience,” they said.

A JTI representative added the �irm does not manufacture or sell single-use disposable vapes, but “under WEEE regulations, JTI contributes to waste-management levies which local authorities use to manage the collection and disposal of electronics and batteries”.

Scottish retailer Mo Razzaq introduced a vape disposable bin to comply with regulations

THOUSANDS of convenience stores are now at risk of closure as government support to battle energy costs comes to an end.

Last September, the government, under the Energy Bill Relief Scheme, �ixed gas and electricity prices from 1 Octo-

ber 2022 to 31 March 2023. However, they were later told this would be scaled back after the end date. ACS chief executive James Lowman said: “We have repeatedly warned the government that there are many convenience stores that cannot afford the increases.”

go to betterRetailing.com and search ‘energy’

PRIME Hydration energy chillers are set to be rolled out in stores “to cover the UK and beyond”, according to Congo Brands’ UK representative, Daniel Hoare.

Images shared by the �irm last month show full-height

branded chillers. “This is just a small taste of the fridges that will cover the UK and beyond,” said Hoare.

The �irst store chain to get the new chiller units is Euro Garages, according to the UK representative.

CAMELOT has told stores the quality of the service they receive will not drop in the run-up to Allwyn’s takeover of the Fourth National Lottery in February 2024.

The operator invited retailers to a conference on 22 March, asking them for feed-

back on issues.

Vince Malone, of Premier Tenby Stores & Post Of�ice in Pembrokeshire, was in attendance. “We used the conference to provide details about issues such as cost of living and rising utility prices affecting us,” he said. For the full story, go to betterRetailing.com and search ‘Camelot’

THE delivery platform will create a “squad” of independents operating in one area.

Newly appointed vice-president of groups and business development Greg Deacon revealed: “The idea is to get lots of stores in the same area

singing from the same hymn sheet. This will then start to encroach on shoppers within that vicinity.”

Deacon also con�irmed “we are open for business” when it comes to tying up with EPoS companies.

RETAILERS have stressed “enough is enough” after being slapped with commission cuts from parcel providers Evri and DPD.

Letters were sent to stores by both companies within the space of four days, alerting them to the changes.

On 20 March, Evri claimed its payment structure was “too dif�icult to follow, with many different payments for different parcel types”, and con�irmed a “new simpli�ied payment structure, which now includes an additional weekly volume bonus” will be implemented.

However, it failed to explain that the changes would result in retailers getting 12p less in commission, earning 20p, down from 32p, equating to a 37.5% drop.

One retailer, who processes 1,550 parcels a month, told Retail Express they expect to lose £131 a month under the new structure, totalling a loss of £1,656 a year.

Atul Sodha, owner of Londis Hare�ield in west London, described the move as “shocking”. He added: “It already feels like we are being shafted at a time when costs are going up.

“These companies are just trying to �ind ways to squeeze retailers even more. We don’t have a choice.”

Maqsood Akhtar, owner of ambassador store Blackthorn Newsagents in Rotherham, told Retail Express he has sent an open letter to Evri, outlining his frustration and the impact the cuts will have on his business.

“The problem is, there isn’t anything we can do,” he said. “There are a lot of us who want to take action and stop operating the service, but we have to think about it carefully due to the �inancial situation.

“Evri generates around £4,000 annually for my business and I’m not sure I can part with that right now.”

In its letter, Evri con�irmed it has “continued to see an increase in volume as more people continue to choose to shop online”, and that stores are set to bene�it from “additional customer footfall”.

In response, Akhtar said: “I’ve never fully agreed with the footfall defence. Just because someone brings in a parcel, it doesn’t automatically turn into extra sales. It’s certainly not a good enough reason for them to cut how much we get paid for using it.”

Hardik Patel, owner of Svarn News & Off Licence in Staffordshire, added: “A lot of us retailers are angry about this. Small retailers play a vital role in delivering the parcel service at a local level. We need to rally together, as we have a big-

ger voice that way, rather than individually.”

A few days later, DPDpartnered stores were informed they would earn 45p per parcel, down from 60p, equating to a 25% overall reduction, following a “market review”, yet reinforced its “rate continues to be one of the best in the world”.

Like Evri, the company claimed it has seen a “twofold increase” in the number of parcels being collected and delivered, and that retailers should “prepare for the continued increase in footfall in their shops”, which will also result in “increased spend”.

Graeme Pentland, owner

of Ashburton Village Store in Newcastle upon Tyne, said: “The claim is absolute rubbish, as I haven’t seen any. I’m doing worse than before because they’ve increased the number of outlets that operate the service, so it’s harder to compete.”

A day after it sent its original letter, Evri announced

customers using online marketplace Vinted would now be able to use its ‘print in store’ facility for labels.

When made aware of the news, Akhtar said: “Arguably, it’s like they are telling us to work more for less, which isn’t great.” Evri and DPD failed to respond by the time Retail Express went to press.

“We were having to increase staff to manage deliveries. We’ve reorganised a lot of them so that we don’t need to employ extra staff to manage multiple deliveries. We have managed to switch our deliveries with East-n-West Wholesale, which supplies us with a lot of ethnic food, and BMJ, which delivers spirits. If we can receive one delivery at a time, then that’s something our team can handle.”

Kay Patel, multi-site Best-one retailer, east London

“Retaining current employees is absolutely vital, especially in the current economic climate. If you have someone working for you, train and support them to ensure they stay with your business. If you have no one, then you don’t really have a business. We use training – such as the material provided by Nisa – to develop them. That includes modules on food safety, managing stock and customer service.”

Rav Garcha, multi-site Nisa retailer, Midlands

“We have fixed jobs built into Retail Guardian, and the rota has morning tasks and evening tasks. The staff on shift know they’ve got those tasks to complete, whether they’re till serving, cleaning or date rotating. Knowing they have these tasks means the staff feel as though they’re working independently, and are using their initiative to balance these tasks with the day-to-day eventualities that occur in convenience.”

Samantha Coldbeck, Wharfedale Premier, Hullto discuss with other retailers? Call 020 7689 3357 or email megan.humphrey@newtrade.co.uk

RATES: The Scottish Grocer’s Federation has launched an online resource to help convenience retailers calculate their business rates relief and transitional relief for 2023/24. From April, support provided by the government’s small business bonus scheme will be tapered, according to rateable value (RV), reducing the amount of relief small businesses will receive. Support will now be on a sliding scale, from 100% for properties with an RV up to £12,000, down to 0% for properties with a RV over £20,000. Previously, the threshold for 100% relief was set at £15,000.

WASTE: Retailers using food waste app Too Good To Go have helped save 200 million meals from landfill. In the past 18 months, the firm has increased its registered users by 50% and had a 30% uplift in business partners, including Booker and Spar. Chief executive Metter Lykke said the company “is helping thousands of companies have a positive impact on the planet”.

ASDA: The Competition and Markets Authority has raised concerns over 13 sites that form part of the 132 being acquired by Asda from The Co-op Group. The deal was investigated after concerns were raised over consumers and businesses in certain areas facing higher prices or lower-quality services when shopping or purchasing fuel.

UBER EATS: The delivery platform is putting independent retailers at a disadvantage by offering cheaper in-store pricing from supermarkets. The news comes after it offered the promotion last month via Co-op, Morrisons Daily, Iceland and McColl’s. However, independents had to add a premium to make a profit due to being charged a 33% fee per transaction.

A NOTTINGHAMSHIRE retailer has praised his local police force for successfully intercepting a cash machine theft at one of his stores last month.

Tristan King told Retail Express the police were called to Spar Wesley Road in Retford on 14 March at 3:30am after neighbours spotted heavy machinery ramming the ATM.

“The police were absolutely fantastic,” he said. “They arrived so quickly to the scene that they were able to stop the criminals from taking the ATM out of the wall. We lost a day’s trade and are looking at £30,000-worth of damage.”

King stressed he had wanted to remove the ATM for a while due to a drop in usage since a transaction charge was added, and it is emptied at the end of each day.

“I would urge retailers to consider whether it is worth having an ATM if it isn’t being used, because they are a huge risk for ram raids, which are usually premeditated,” he said.

The store was closed for 24 hours, and King praised his symbol partner, AF Blakemore, for their support during the process.

“Something like this does have an impact on you not

just business wise, but mentally,” he said. “We were thinking of doing a re�it, but will now have to bring this forward after what’s happened.”

Two men, aged 41 and 49, were detained shortly after the incident on suspicion of commercial burglary. The 41-year-old was further arrested on suspicion of assaulting an emergency worker after an of�icer was grabbed by the neck during the arrest.

COCACOLA Europaci�ic Partners (CCEP) is currently trialling “Woolworths-like”

150ml can pick ’n’ mix dispensing stands with One Stop. The units offer �ivefor-£2 on Fanta, Appletiser,

Sprite, Coca-Cola and Dr Pepper 150ml cans. CCEP con�irmed ongoing trials and an ambition to “make similar units more widely available”, including in independent shops.

BESTWAY is considering legal action against customers reselling its own-label products on Amazon. This comes after Retail Express found more than 50 Best-one items listed at nearly four times the price-mark. They were priced higher than the PMP on single-unit costs.

A Bestway Wholesale spokesperson said: “It’s a growing area of concern, and

we are currently discussing how we can manage this situation with our legal team.”

NITROUS oxide is to be banned under government plans to crackdown on antisocial behaviour.

The move goes further than recommendations of a review commissioned by the Home Of�ice. Nitrous oxide, known as laughing gas, is the second-

most-commonly-used drug among 16-to-24-year-olds in England after cannabis.

In January, the police issued letters to independent stores warning them it was a criminal offence to sell nitrous oxide for anything other than its intended use.

HEINEKEN UK is rolling out a new pack design across the Strongbow cider range alongside the launch of a new Tropical variety.

The new design abandons the brand’s traditional black and gold colour palette for the �irst time since it was created in 1960.

It is a more stripped-back design with the brand’s signature archer at the front and centre.

Rachel Holms, Heineken UK cider brand director, said: “This is a huge milestone in the 63 years of Strongbow. It’s a new design that not only resonates and engages our loyal consumer

base, but something that also appeals to new cider and Strongbow drinkers, and the start of a new chapter for us. And it’s only just the beginning. Setting the pace for what’s to come, we’re excited to show people what else we have in store for our summer of cider.”

Rolling out this month, the redesign has been created to attract new customers and help launch new �lavours, including Tropical.

Tropical (ABV 4%), which is a blend of mango and pineapple, is available in 500ml bottles and 4x440ml can multipacks.

It contains no arti�icial �lavours, sweeteners or colours.

JIM Beam‘s latest variety, Jim Beam Orange, will be available to convenience and wholesale from May.

The new �lavour (ABV 37.5%) launched exclusively in Asda in February in a 70cl bottle with an RRP of £18.

It joins the brand’s growing �lavoured whiskey range, which already includes Peach, Apple and Honey varieties.

The supplier says it hopes to recruit new consumers into the brand with the launch, which has been developed with summer cocktails in mind.

Sarah Isaac, head of UK brand marketing at Beam Suntory, said: “After the successful launch of Jim

Beam Peach in 2021, we are looking forward to the launch of Jim Beam Orange, to encourage new occasions and recruit new consumers to taste the spirit.”

Holms added: “The launch of Strongbow Tropical Cider will further encourage new drinkers into the cider cate-

gory, providing experimental consumers with an exciting new �lavour to try whatever the occasion.”

WALKERS has launched a BBQ Sauce variety of its Quavers brand alongside a new pack design.

The new variety has launched in Asda and convenience in multipack and £1.25 price-marked pack formats. A grab-bag format will be available in Tesco and Morrisons from 10 April, before further expansion from May.

The launch comes as par-

DORITOS has partnered with fast-food chain Burger King to launch a Flame-grilled Whopper variety, based on the popular burger.

The non-HFSS tortilla chip �lavour is said to taste like the real burger, including its onions, tomatoes and pickles. Unlike the burger, however, it is suitable for vegetarians.

It is available now in a 180g sharing bag (RRP £2.25) and a 70g bag (RRP £1.25).

The supplier is supporting the launch with an on-pack promotion offering consumers a chance to get a free Whopper meal when they buy a selected meal at Burger

King. The promotion runs across 180g, 230g and 70g Doritos formats until 30 October.

Additionally, a multimedia campaign with accompanying in-store activity will take place in April and May.

THE �irst-ever British Cider Week is set to take place this month, giving suppliers, retailers and shoppers the chance to celebrate the diversity of British cider.

The campaign, which runs from 14 April to 23 April, will see suppliers of various sizes across the country organise events and activities such as tours, tastings and

competitions.

Participating producers include: Pilton Cider, Sheppy’s Cider, Westons Cider, Thatchers Cider, Thistly Cross Cider and Ross Cider, among others.

Martin Berkeley, founder of Pilton Cider, said: “This is a great opportunity for retailers and distributors to show their cider ranges.”

ent company PepsiCo has invested £24m into production capacity at Quavers’ Lincoln factory.

It comes in the wake of the relaunch of retro �lavours including Prawn Cocktail and Salt & Vinegar in 2021, which the supplier says have reinvigorated the brand.

The launch and rebrand will be supported by outdoor, in-store and social media marketing.

COCA-COLA Europaci�ic Partners (CCEP) has launched the ‘Win what you love’ Diet Coke promotion, continuing its collaboration with creative director Kate Moss.

Consumers have until 2 May to scan QR codes on promotional packs of Diet Coke illustrated with Moss’ portrait for the chance to instantly win prizes and enter weekly prize draws.

Prizes include an exclusive trip away to one of Moss’ favourite countryside retreats, hundreds of cosmetic products from her Cosmoss wellness brand, and retail vouchers.

The promotion will run across the core Diet Coke range and Diet Coke No

SWIZZELS has launched a campaign to drive sales of its Marvellous Mallows line.

The #Marvellousormadness social media campaign, which started on 1 April, will run until the end of May.

It will invite consumers from the UK to share the “weird and wonderful” ways in which they enjoy eating their mallows in return for prizes.

The supplier has launched the campaign as the mallows category has grown in convenience by 22.3% in the past year to be worth £24.4m.

Additionally, Swizzels Marvellous Mallows are maintaining their £1 price on-pack, amid rising price-

marked pack (PMP) RRPs across snacking and confectionery.

Caffeine varieties, including take-home bottles and multipack cans.

Convenience retailers can request PoS materials from my.ccep.com to support the promotion.

BIRRA Moretti is encouraging shoppers to ‘Live Italian’ with the launch of limitededition collectable glassware. Available in four designs to convenience and wholesale from this month, the glassware is available as a gift with a purchase of a Birra Moretti pack.

Each glassware box and selected PoS feature a QR code. Shoppers can scan the code for an immersive augmentedreality experience.

This experience allows shoppers to play games and discover food recipes from Positano, Rome, Tuscany and Siena, as well as win prizes.

The launch of the glassware coincides with Birra Moretti’s multimillion-pound

campaign, which includes a three-part series airing on Amazon Prime Video later this month.

The series features comedian Jack Whitehall, former rugby player Lawrence Dallaglio and presenter Maya Jama as they explore Italian culture.

‘Win what you love’

Convenience retailers could increase sales of noand low-alcohol beer by £660 on average this year, according to Asahi UK.

The supplier says the category is under-indexing in convenience, where it accounts for 0.7% of beer sales. By comparison, it makes up 2.9% of beer sales in multiples.

Steve Young, sales director at Asahi UK, said: “The category is underdeveloped in convenience stores, but retailers can �ix this by stocking just four key products to create a credible range.

“Retailers should offer Peroni Nastro Azzurro 0.0%

4x330ml as it is the top alcohol-free beer by rate of sale in impulse. Seventy per cent of no- and low-alcohol beer sold in impulse stores is in four-packs, with this format growing at 30%.

“Single bottle is the second-biggest segment, with 6% of sales, but this area is declining at -7%.”

Raising no- and lowalcohol sales to the same level as in the multiples would generate £32m in sales in convenience, or £660 per store.

Additionally, this January was the most successful January on record for noand low-alcohol products

No- and low-alcohol beer was 4.6% of the beer market

NESTLÉ Cereals has unveiled KitKat Cereal, a new breakfast option which brings the taste of the chocolate bar to consumers’ cereal bowls.

KitKat Cereal will be available from mid-April. It is made with a milk chocolate�lavoured coating to help recreate the KitKat bar’s taste of chocolate and wafer.

The supplier says it is a source of �ive vitamins, calcium and iron.

Sarah Fordy, head of marketing at Cereal Partners UK & Ireland, said: “This exciting new cereal delivers a delicious taste of KitKat and has been developed to cater to consumers who are looking for an occasional,

indulgent breakfast option, that can be enjoyed as part of a balanced diet.”

in multiples, up from 4% in January 2022. In the 12 weeks to 28 January, no- and

low-alcohol beer grew by 13.7%, while total beer grew by 0.6%.

NICHOLS PLC is bringing Slush Puppie into the �lavoured carbonates category with Slush Puppie Fizzie.

The new range is rolling out in Blue Raspberrie and Strawberrie varieties in 2l and 500ml price-marked bottles with respective RRPs of £1.49 and £1. The 2l bottle is also available in a plain-pack format.

It contains only natural �lavours and no added sugar, and is non-HFSS.

The supplier hopes to use the recognisable brand to drive interest in �lavoured carbonates, which are experiencing 13% growth.

Jenny Powell, marketing

SUNTORY Beverage & food GB&I (SBF GB&I) has launched the Lucozade Sport Zero Sugar range.

The range is launching in Orange & Peach and Raspberry & Passion Fruit varieties. Each is available in 500ml bottles and 4x500ml multipacks with respective RRPs of £1.39 and £3.50.

Its launch comes as the low- and no-sugar soft drinks segment is growing by 22% annually, accounting for nearly half of total soft drinks sales.

SBF’s Lucozade Zero range has grown by 58.5% in the same period. Additionally, the sports drink market’s sales are up 29.3% year on year, with Lucozade Sport

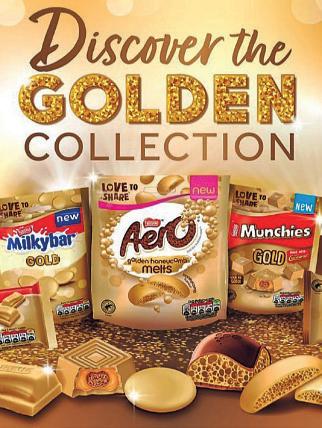

NESTLÉ Confectionery has launched the Golden Collection, which includes four of its most popular brands, reimagined with a golden touch.

Leading the line-up is Aero with two new products: Aero Golden Honeycomb Melts sharing bag (RRP £1.75) and Aero Golden Honeycomb Block (RRP £1.25).

The Munchies Gold sharing bag (RRP £1.75) sees the brand’s traditional centre of soft caramel and crispy biscuit shelled with Caramac, creating a strong �lavour combination aimed to be popular with consumers.

Smarties Gold Buttons are also made with Caramac in a sharing bag variety (RRP

£1.75), mixed with colourful Smarties.

Finally, Milkybar Gold Buttons sharing bag (RRP £1.75) and Milkybar Gold block (RRP £1.25) also join the range.

seeing 26.2% growth in convenience.

The supplier will support the launch with a marketing campaign from April, including digital and social media advertising.

BRITVIC is rolling out a rebrand across its Robinsons brand, including core squash, Fruit & Barley, Bene�its and Minis ranges.

The rebranded packs feature a simpli�ied design with bold colours and sliced fruit, which the supplier says champions the “real fruit joy” and natural ingredients found in every bottle.

These help reinforce the inclusion of real fruit and refreshment in each bottle, according to the supplier.

The rebrand comes as Robinsons is the UK’s number-one squash brand, according to Nielsen �igures.

It currently has a retail sales value of nearly £200m, and is bought by nearly half of all UK households.

manager at Nichols PLC, said: “The new Slush Puppie Fizzie range will allow consumers to extend those special moments of enjoyment by delivering the retro, nostalgic taste of Slush Puppie that they know and love in an exciting new format.”

ASAHI UK has extended its Peroni Nastro Azzurro range with a Stile Capri variety, launching in Spar, Nisa, Bestway, Parfetts and Co-op.

Peroni Nastro Azzurro Stile Capri has a lower ABV (4.2%) than the brand’s core lager product (5.1%) and is aimed at younger adult consumers searching for great refreshment.

The line will be available in 3x330ml and 10x330ml bottle packs and will be supported by a £3m integrated campaign to drive awareness.

Steve Young, sales director at Asahi UK, said: “Launching under the instantly recognisable and much-loved Peroni Nastro Azzurro masterbrand range, this new launch is a

strong proposition for all operators and retailers to gain value from the highpotential and lucrative sunshine beer category.”

WEETABIX is expanding its Weetos cereal brand with a Caramel variety of its Chocolatey Hoops.

The new, non-HFSS �lavour will be available in 420g packs. It will launch initially in Asda in April with an RRP of £3.29 before nationwide expansion.

It contains vitamin D, vitamin B12 and iron. Its launch comes as caramel �lavours are in growth, with 86% of people �inding them an appealing taste.

Charlie Boland, Weetos brand manager, said: “With its delicious, chocolatey taste, Weetos already ranks at number seven in the total tasty cereal category. Weetos Chocolatey Hoops Caramel

�lavour delivered strong results during taste testing that saw 85% of parents prepared to buy the product for their children and 78% of children asking their parents to buy the product.”

JASPER HART

MONDELEZ International is tapping into the popularity of caramel �lavours with the launch of a Cadbury Dairy Milk Salted Caramel range.

The range is available now in tablet, Nibbles and Cadbury Fingers formats. It comes in the wake of the launch of Cadbury Wispa Gold Salted Caramel last year.

Dairy Milk Salted Caramel tablets (120g) have an RRP of £1.49, while Salted Caramel Nibbles (120g) and Fingers (114g) have respective RRPs of £1.50 and £1.85.

A Salted Caramel Nibbles £1.20 price-marked pack will also be available.

Caramel is currently the most-popular �lavour addition in standard chocolate, while salted caramel is the fourth-most-popular new chocolate �lavour.

Products containing salted caramel have seen 17% growth in the past two years, helping to deliver £36m in retail sales.

Christina Bland, brand manager for Cadbury at Mondelez, said: “Salted caramel is popular with shoppers, and as a �lavour is second only to orange in terms of growth over the past two years.

“The three product innovations in the range are ideal for consumers looking for sweet products for big nights

NATURAL Balance Foods is expanding its healthy snack bar brand, Nakd, with the addition of Protein Bars and Big Bars.

Nakd Protein Bars are the only raw protein bars in the segment, according to the supplier. They are available in single and three-pack formats with respective RRPs of £1.25 and £3.

Protein varieties added

£25m to the UK snack bar market in 2022. The segment is predicted to grow by 6.2% by 2028.

Meanwhile, Nakd Big Bars are 45g, 10g more than the standard Nakd bar size.

They are available in Cocoa Orange and Blueberry Muf�in varieties, at an RRP of £1.25. The supplier said the larger format works well for inclusion in meal deals.

THATCHERS Cider has launched a £5.49 pricemarked pack (PMP) for its Thatchers Gold Cider 4x500ml pack, available exclusively to independents.

The supplier said the move comes as PMPs continue to be popular with shoppers, as they communicate con�idence in value for money.

Jonathan Nixon, commercial director at Thatchers Cider, said: “This new pack for Thatchers Gold – our most popular cider, which attracts more shoppers than any other apple cider –means we’re able to further support retailers and help boost sales by adding an extra incentive for shoppers

in, which are a continually growing opportunity at a time when people are looking to be careful with money but still wanting to enjoy a treat,” she added.

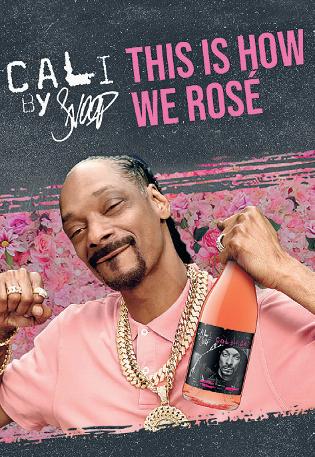

TREASURY Wine Estates (TWE) is continuing its collaboration with rapper Snoop Dogg with the launch of Cali Rosé.

Cali Rosé is the second wine in the range, following the launch of Cali Red last year. The supplier says it is “fruit forward”, with raspberry, strawberry and cherry �lavours.

It is aimed at attracting younger adult drinkers who do not usually drink wine.

Available now at an RRP of £11, the new variety aims to drive standout on-shelf by featuring Snoop Dogg’s pro�ile on the bottle.

Additionally, an on-pack

AMERICAN rolled tortilla chip brand Chipoys is set to launch in the UK this month through imported goods supplier Envis Snacks.

Chipoys will be available in Fire Red Hot and Chilli & Lime varieties in cases of eight 113.4g bags.

Andy Brown, managing director at Envis Snacks, said: “Chipoys is a genuine and established challenger brand to the ever-popular market leaders, amassing a huge following which looks set to continue into the UK.

“Chipoys has a huge following in the US, and with demand for new, innovative products and strong, exciting �lavours on the rise, we know UK consumers are going to

love them.”

Retailers are encouraged to contact sales@envissnacks.com to order stock.

to purchase.

“We’re committed to supporting our customers with this growth opportunity across the convenience channel.”

KEPAK is expanding its Rustlers brand with the launch of a Marinara Meatball Sub Sandwich, launching exclusively in convenience.

The sub is available at an RRP of £2.30. Elaine Rothballer, head of marketing consumer brands at Kepak, said the launch coincided with the rise of the ‘fakeaway’ trend.

“Rustlers Meatball Sub taps into this opportunity as it allows shoppers to recreate a much-loved quickservice restaurant favourite at a great price,” she said.

“The top foods we consume for lunch remain sandwiches, soup and toastbased meals. However, more �illing and �lavour-packed

lunches, such as Italian food, are seeing the fastest growth. This highlights the opportunity for a hot lunch option beyond the mediocre that delivers against convenience, enjoyment and value for money.”

QR code invites consumers to ‘ask the Doggfather’, where the rapper will respond to their questions.

THE Dole Sunshine Company has launched a Fruit & Cream dessert range, combining fruit with plantbased cream.

The range is available in Apple & Cinnamon and Peach & Vanilla varieties. Each comes in a pack of four at an RRP of £2.49.

It is also gluten-free, halal, vegan and counts as one of your �ive a day.

According to the supplier, shoppers are looking for indulgent, healthier desserts that are affordable.

“As part of our transition to a nutrition-and-wellness brand, we are expanding our offering using our expertise and strong product credentials, with the launch of Dole Fruit & Cream,” said Andrew Bradshaw, UK Sales Director at Dole.

HALEWOOD Artisanal Spirits has launched a limited-edition bottle of its Whitley Neill Connoisseur’s Cut London Dry Gin to commemorate the coronation of King Charles III.

Available now at an RRP of £30, the bottle replaces its usual blue colouring for a white, red and blue combination. It also features the of�icial coronation emblem on the seal of the lid and the coronation’s 6 May date.

Connoisseur’s Cut has a 47% ABV, with notes of juniper and citrus. It is made at The City of London Distillery’s Elizabeth still, named for the late queen in 2022 to mark her diamond jubilee. The supplier has also created a range of themed serves.

CARLSBERG Marston’s Brewing Company (CMBC) has launched alcohol-free Carlsberg 0.0. Available in a 4x330ml bottle format, Carlsberg 0.0 has launched in Tesco ahead of a wider rollout planned for later this year.

The supplier said it has “ambitious plans” for the beer’s wider distribution.

Carlsberg 0.0 contains 63 calories per bottle and tested well among current UK alcohol-free buyers. According to the supplier, 64% expressed intent to purchase the new variety.

The launch comes as alcohol-free lagers have grown 6% in off-trade value sales in the past 12 weeks,

compared to the same period last year, according to Nielsen �igures. CMBC will support the launch with a nationwide outdoor and social media advertising campaign.

BARR Soft Drinks has expanded its Rubicon brand with the launch of a Sparkling Rose Lemonade variety, exclusive to convenience retailers.

It is available in a 79p price-marked 330ml can and a £1 price-marked 500ml bottle.

The launch comes as Rubicon has grown by 89% in the past two years.

“Rubicon continues to go from strength to strength in convenience, offering retailers something different in the �ixture that their shoppers love,” said Adrian Troy, marketing director at Barr.

“We know unique �lavours in convenient packaging formats appeal to shop-

pers. With Rose Lemonade launching in PMP in the most popular pack sizes, we’re con�ident this latest addition will quickly become a popular addition to the �ixture.”

FINE foods supplier Cypressa has undergone a rebrand to re�lect its heritage and align with its ‘Foods of the sun’ slogan.

The rebrand consists of a contemporary new look featuring illustrations inspired by the Mediterranean and Middle Eastern sources of Cypressa’s products.

These include landscapes of Ethiopia and Sudan for jars of Tahini, Mediterranean shores and skies for antipasti, and Greek olive groves and farms for olives and olive oils.

Harry Constantinou, commercial controller at Cypressa,

said: “We used to have about 15 different designs across our product lines. Now we have a more consistent look that customers can immediately perceive as Cypressa, with its vibrant and colourful illustrations that encapsulate what our brand and the products themselves stand for.”

SHS DRINKS is launching can formats of its WKD ready-todrink (RTD) alcopop brand.

The aluminium cans are available this month in Blue four-packs and 10-packs, and variety 10-packs.

Research from SHS Drinks found that cans are popular among its target consumers, although it is maintaining its range of 700ml glass bottles.

With WKD the UK’s number-one RTD brand, according to Nielsen �igures,

The Independent Achievers Academy (IAA) joined this year’s Brand Ambassador, AMAN UPPAL , of One Stop Mount Nod in Coventry, West Midlands, to understand how he’s keeping his store profitable while dealing with this month’s minimum wage increase

COCA-COLA Europaci�ic Partners (CCEP) is giving independent retailers the chance to win a meal at home to mark Iftar, the meal eaten after sunset during Ramadan to break the fast.

The ‘Win Iftar on us’ promotion is currently live on the supplier’s trade website, my.ccep.com. Retailers must be registered to enter.

It is offering £4,000-worth of meal delivery vouchers, with 10 randomly selected winners collecting a £100 voucher across each of the four prize draws.

The winners of the �irst prize draw were drawn on Friday 31 March, and other winners will be drawn every Friday until 21 April. They will be noti�ied the Monday after each draw.

the supplier said shoppers expect to see it represented in a popular format.

The cans are lighter than glass and help offset packaging industry price rises. Currently, WKD sales are at a 10-year high. Alison Gray, head of brand for WKD at SHS Drinks, said: “The move plays to a real increase in consumer appetite for cans, which are now seen as a leading format in the RTD category.”

IRISH food company Ballymaloe Foods has secured a listing in Booker for its bestselling relish.

The wholesaler will now stock 3kg pots of Ballymaloe Original Relish across 70% of its sites.

According to the supplier, Ballymaloe Original Relish is its best-known product. Gluten-free and made with natural ingredients, it is produced in Cork.

Maxine Hyde, general manager at Ballymaloe Relish, said: “This is a signi�icant milestone for us as a brand and provides greater access to foodservice providers across the UK, a crucial market for our business. We look forward to

1

A lot has changed in the past 12 months. Aman is focused on looking at his costs to ensure his business stays profitable. Aman analyses everything – not just categories, but utilities, wages and when he’s buying.

2 3

Aman’s time is precious, but he feels it’s important to find time to go to events, such as the upcoming IAA Learning & Development Festival on 3 July, where he gets advice and new ideas to make his store more profitable.

Aman believes that meeting and engaging with fellow retailers, suppliers and industry experts is a key part of keeping his business successful. It helps him to keep on top of industry developments and to stay ahead.

continuing our growth and providing customers with our delicious relishes.”

Ballymaloe Foods also produces pasta sauces, beetroot, meat sauces and salad dressings.

“You think you know your business, but you don’t. When you go through all your EPoS data, you find things you thought were selling well perhaps aren’t, or they aren’t as profitable.”

HOT TOPICS

What do you think? Call Retail Express on 020 7689 3358 for the chance to be featured

VAPES: How are you complying with eco-laws with a take-back service?

“ WE introduced a disposable bin 10 days ago, and now are discussing how to promote it. We are speaking to customers who come in to let them know that we have one. We’ve put it in a prominent place so it can’t be missed. The early days are always the hardest to get traction. We are also collecting batteries.”

Vince Malone, Tenby Stores & Post Office, Pembrokeshire

BUDGET: How have the latest announcements impacted your store?

“WE are going to save £19,000 from the new full expensing policy, with corporation tax deducted for every £1 spent on IT equipment, commercial vehicles and office equipment until March 2026. We are looking to refit one of our stores over the next year.”

retailer

“FUEL duty is going to remain frozen for a 13th consecutive year, at 57.95p per litre. The current 5p cut and freeze for a further 12 months have been frozen, also until March 2024. We do two-to-three cash-and-carry runs a week, about five miles away.”

Ken Singh, Boghar Brothers, Pontefract, West Yorkshire

“ WE’VE introduced a 20p cashback incentive, which is self-funded. For every used disposable that’s returned to us, we give the customer 20p off their next purchase. A litter group said they found lots of them on the streets. Doing this means we help the environment and stay on the right side of the law.”

We’ve introduced a 20p cashback initiative

ENERGY: How are you going to tackle rising prices when support ends?

“I’M panicking. Our contract ends in June, and after that we’ll be on a much higher rate. The government needs to help us more. We need to get some relief every month for our bills. We just can’t compete with supermarkets.”

Amy Sohal, Premier – Ken’s Convenience Store, Winsford, Cheshire

“OUR prices have nearly doubled. I’m still looking for a better price, and things are looking bad. We are thinking about closing the shop when it’s less busy to cut costs. We aren’t focusing on profitability, but rather survivability.”

Aman Uppal, One Stop Mount Nod, Coventry

We are going to save £19,000

EQUALITY: How should suppliers recognise gender inequality?

“REGARDLESS of gender, sometimes there are dates we can’t attend. But it would be great to be given more flexibility and choice when it comes to potential meetings and events. This makes us feel valued, but equally like we have a say in the matters.”

Nathalie Fullerton, One Stop Partick, Glasgow

“ THINGS have improved. Before, reps would go to the man, but now they come to women, too. I am speaking from my own experience. Sometimes women are scared to speak up because in the past we were told to not speak, but change has to come from within first.”

Suki Khunkun, One Stop Woodcross, Wolverhampton

Our prices have nearly doubled

It would be great to be given more flexibilityMo Razzaq, Premier Mo’s, Blantyre, South Lanarkshire

Given

Afzalur Rahman, B2B Manager (UK)

The leading learning, development and recognition programme helping retailers grow profitable sales

The chance of being recognised for your

An invitation to the IAA Learning & Development Festival on 3 July

The IAA is supported by leading industry brands who recognise that retailers want free support to increase profits Headline partners Supporting partner

I AM still owed an outdated payment from Evri. Since the last letter, which ran in Retail Express (21 March), someone got in touch claiming that I’m not owed payment for 250 parcels, and instead it’s just three. I keep my own records of the number of parcels I process due to Evri miscounting and owing retailers

thousands of pounds a few years back. They told me that the payment would be made by 17 March. Even though their claim is incorrect, I am still yet to receive the money.

I responded contesting their �inding, and requested the number of parcels their system says were processed daily between 29 January and 25 February. I was told

they couldn’t contractually share this information, but they could provide a monthly self-billed invoice. In addition, they said if I had a further dispute, they would happily investigate it, but I would need to provide my daily or weekly numbers. I then provided them with this, and no one has yet got back to me and

PRICE increases used to happen once a year, but recently they have been happening every few weeks.

it’s been eight days. It’s just ridiculous that this is continuing, and no one is treating it with any urgency.

Hardik Patel, Svarn News & Off Licence, Staffordshire, West Midlands

Evri failed to respond by the time Retail Express went to print.

RED Bull has partnered with Retail Express to offer five retailers the chance to win £50-worth of Juneberry, its latest Summer Edition variety. Red Bull Juneberry has a flavour reminiscent of dark cherries and mild blueberries, and is available in 250ml plain and £1.45 price-marked packs. It is also available in a Sugarfree version in 355ml single cans and 250ml can four-packs.

TO ENTER

Fill in your details at: betterRetailing.com/competitions

This competition closes on 2 May. Editor’s decision is final.

“WE celebrated our store’s 40th birthday last week. We held a special event every single day of the week and promoted everything on Facebook, including daily 40p deals, free hot drinks, £40-worth of shopping for free and a trolley dash. It’s a huge milestone, and is special because my grandparents initially had the store.

“We have great relationships with Irn-Bru, Walkers, Heineken, Pringles and Kellogg’s, and they issued us banners and flyers to market the week. Without customers and community, we wouldn’t be here – they are our extended family.”

The increases are big, as well. We’re not talking about 2% increases here, we’re talking about 20% increases. Last year, we were selling bread at £1, now it needs to be £1.45 if I’m to keep the same margin. Milk was £1 last year, but now we’re selling it at £1.70, and that’s cheap from us. Last Christmas, a pricemarked bottle of Smirnoff was £14.79. Now it’s £16.29. It’s gone up three times to get to that price, which means you might not notice each one.

Each issue, one of seven top retailers shares advice to make your store magnificent

I’ve been going through all my prices today, making sure they’re right because prices are fluctuating so often and so much at the cash and carry that if I don’t keep up with it, then we’ll be underselling a lot of our products.

If you’re not checking up on your own prices on a weekly or fortnightly basis, then you could be selling something at a loss. So, we’re doing a full overhaul, category by category. It’s quite labour-intensive, but it’s a massive thing for us to get in order. Luckily we can do it centrally from one store’s back office, but it’s then about making sure all the shops have the right prices and are in the correct order.

We used to check the prices every time the Budget came around, and when we did that this year, we could see that the increases from wholesalers was crazy. If you’re not checking it regularly, it can be easy to miss. We’ve got Retail Data Partnership tills, but I don’t want them to change the prices for me according to RRPs. I want to change them myself when I see the need.

The trick to raising prices is to get those price bands right so people don’t feel like you’re overcharging them, but you’re still getting the right margin. I try to fair and honest with customers and people are accepting it, but it’s a big increase. A 20% increase in one item is one thing, but when you multiply that by 100 items, that’s a huge increase in your weekly basket spend.

For us, the key is to ensure that we’ve always good availability, no matter what, on our 100 bestselling lines. We might not be the cheapest, but people know that we’re fair on price and that we don’t ever run out of stock. If a store can’t stock even one of those lines, I want to know about it and I want to know why.

‘Our

its 40th birthday’

INDEPENDENT retailers have had a tough three years, from Covid-19 and each subsequent lockdown to navigating rising wages, energy bills and the cost-ofliving crisis that is reducing the spending capacity of their customers.

Additionally, customers are looking for more from their local convenience store than ever before. Examples include quick and ef�icient service, strong availability and access to the latest products.

This is where the help of a partnering with a fas-

cia group comes in. Fascia groups can help with ranging, merchandising and new technological advancements, like self-checkouts and home delivery.

Over the next �ive pages, �ive different fascia groups –AG Parfetts, Bestway Retail on behalf of Costcutter, Welcome in partnership with Southern Co-op, Spar and Nisa – explain what’s new for their fascia group in 2023 to help retailers meet the needs of their customers.

These include helping retailers tackle energy costs

to having ongoing support, such as merchandising and range advice, from in-house teams or business development managers. Each fascia group also explains how they help their retailers drive seasonal sales, such as having the right products or building a marketing plan to encourage customers in store.

Retail Express has also spoken to retailers about working within each fascia group to get an understanding of the support they offer through the year and how they continue that support in 2023.

Independent retailers have been hit hard by the cost-of-living crisis with sky-rocketing operating costs being customers’ number-one concern. New Nisa managing director Peter Batt has committed to investing where it matters most. At the start of 2023, Nisa invested £6m into the wholesale selling price (WSP) on more than 1,000 popular branded products.

Nisa offers its customers a fantastic quality Co-op own-brand range of over 2,200 products that also delivers great value to shoppers. In February,

Nisa Blidworth Post Office, Mansfield

I’ve developed a really good working relationship with Nisa

SUNNY has been a Nisa customer for more than eight years. He opened his second Nisa Local store in Mansfield in December 2022. His original store was an independent in Blidworth, with its own fascia.

“Staying with Nisa was a no-brainer for me. I’ve de-

SEASONAL events provide a fantastic opportunity for retailers to drive incremental sales and grow their business, with seasonal space complimenting a core range of everyday convenience essentials. Nisa provides PoS to drive engagement and create theatre around seasonal events, supported by implementation guides for executing the PoS effectively in store.

At Nisa, customers benefit from the best of both, with the Co-op core essentials range developed to meet the

Average store size: 2,000sq ft

Number of stores: 4,000

Membership cost: £860+VAT

needs of all core customer missions through a greatquality, great-value range of products.

Tailored seasonal ranges and promotions support retailers to drive trade across the key seasonal events throughout the year, including ‘Big deal’ promotions, such as two Co-op pizzas and a pack of four beers for just £6.

With specific store planograms, ensuring customers get the maximum return from their prime retail space, seasonal PoS designed to drive

Telephone: 0800 542 7490

Website: nisalocally.co.uk

Email: customer.services @nisaretail.com

engagement and drive basket spend, the leaflet and social media assets, both Nisa retailers and shoppers will be all set to make the most of summer this year.

Nisa helped customers combat energy prices through energy-saving packs and advice. This support will continue throughout 2023.

For customers looking to expand their business or refit their store, Nisa offers the retail expertise to support the process. Through the replanning of store space including the expansion of fresh, ranging advice and the introduction of Co-op own-brand products, retailers such as Sunny Mann have driven store turnover and increased basket spend.

veloped a good working relationship with the retail managers who couldn’t do enough for us. I know where I am with Nisa and I’m impressed with the offering it can provide to me, so I’d recommend it to anyone.”

BESTWAY RETAIL explains what’s new in

stores this year and how it’s supporting retailers drive seasonal sales

Bestway Retail has invested in new Costcutter store openings and refits. It has focused on the new hybrid ‘store within a store’ concept and has targeted 300 stores over a 12-month period.

Bestway Retail has launched a new KeyNest Smart Key Exchange partnership where Costcutter stores can hold Airbnb keys, helping to drive footfall.

Costcutter retailers can benefit from Bestway Retail’s IT investment, including the rollout of CPoS, its inhouse EPoS system. It has also invested in next-gen self-checkout units and is carrying out further trials of age-verification technology.

Bestway Retail has also launched The Bestway Retail Showcase. It gives exclusive retailer opportunity to access insights, advice, category information and discounts to drive growth and meet customer needs. The event also allows retailers to enter the Bestway Retail Development Awards, designed to ‘connect-learngrow’ and give recognition to best practice.

BESTWAY Retail believes it all starts with the customer journey, which begins with wholesale. Bestway Retail will be building on its innovative approach to present the key seasonal products in its depots, supported by strong promotions giving retailers the opportunity to buy ahead and maximise profits. The journey continues across the digital platforms, enabling retailers to access leading insights and the same experience and tools to leverage best practice, such as leading category advice. Bestway Retail builds focused comms plans with

Average store size: 700sq ft to 7,000sq ft

Number of stores: 1,260

Membership cost: Free

the key messages to drive footfall.

For stores, Bestway Retail will be providing retailers with seasonal and compelling PoS, merchandising tips, alongside planograms. Working with key suppliers, they leverage unprecedented category advice for stores. For example, in 2022, the summer campaigns delivered 24% sales versus the previous year.

At Christmas, Bestway Retail plans ahead and uses its buying power to negotiate deep deals across key seasonal lines. Stores ben-

The support we receive from BDMs has been second to none

“I REJOINED Costcutter four years ago, but I initially joined them 25 years ago. I rejoined when Costcutter partnered with Nisa and gave retailers access to their Co-op products, which have been great for us and incredibly beneficial. Bestway Retail gives us access

to different suppliers and the support we receive from business development managers have been second to none. They also have strong prices and good special offers. During each seasonal period, they give us coverings for our gondola bays to help boost vis-

Telephone: 020 8453 1234

Website: bestwayretail.co.uk

LinkedIn: linkedin.com/company/ bestway-retail

efit from these deals, giving them enhanced profit margins, which they can pass onto shoppers.

ibility and drive sales. They also do this for the little seasonal occasions, such as Valentine’s Day and Mother’s Day.”

bestwayretail.co.uk 020 8453 1234

Average store size: 1,600-3,000sq ft

WELCOME IN PARTNERSHIP WITH SOUTHERN CO-OP explains how it is supporting its franchisees this year and what retailers can expect when they join

In 2022, a number of Southern Co-op’s Welcome stores underwent several changes to enhance the shopping experience for its customers.

With franchisees being able to choose the right approach for them, franchisee Kash Jaffar decided to carry out a new refit to his Welcome – Bromham store, covering 6,000sq ft with a modern and inviting design.

Welcome franchisees can access a range of support and expertise from

We’ve just installed ESELs, which we had great support for

“I’VE been with Southern Co-op for two years. We joined because I knew it was time for a refit and I wanted to maximise sales and keep most of our success we obtained during the pandemic. Southern Co-op is helping us with profitability, especially as we’re being

Number of members: 28 franchisees

Average store turnover: £31,000 (excludes VAT, fuel and services)

Telephone: 023 9222 2677

Website: southern.coop/ what-we-do/ welcome

Email: welcomefranchise@southerncoops.co.uk

WELCOME’S tailored planograms play a crucial role in driving seasonal sales in Welcome stores. The specialist team at Southern Co-op creates customised planograms based on a store’s size and layout.

The planograms help to optimise the store’s layout and merchandise display, making it easy for customers to find what they’re looking for.

By placing seasonal items in prominent areas, it increases visibility and drives sales, while being mindful of HFSS display regulations.

Southern Co-op’s in-house teams, including the results of innovative trials – for example, electronic shelfedge labels (ESELs). Seven Welcome franchise stores now feature ESELs, providing real-time product information to customers, with more stores to follow.

Franchisees have also created more in-store theatre by installing media screens above food-to-go areas, alongside new slush machines offering a variety of new fl avours.

Success is also driven by guidance and regular visits from Welcome’s operations managers, who help to ensure that franchisees are consistently meeting seasonal sales goals. They ensure that each store has the necessary information to drive sales by evaluating each store’s performance, providing feedback and support.

Franchisees are also encouraged to add their own individual ideas with complimentary ranges, such as local products.

Seasonal display materials are also provided to

Welcome stores, as part of the franchise package. This includes signage, window displays, posters and banners that help to highlight seasonal items and create a festive shopping experience. By creating a visually appealing and cohesive store environment, the Welcome team succeeds in engaging customers and driving sales.

southern.coop/what-we-do/welcome

stretched across the board with labour costs increasing, as well as electricity. We’ve just installed ESELs, which we had great support for. It was all done by them and behind the scenes, and completed in 24 hours.”

PARFETTS explains how it’s supporting retailers in 2023, from having the right technology to maintaining profits amid the cost-of-living crisis

Parfetts’ Go Local symbol group now offers a range of fascia options to suit every store format and size. Go Local is designed to support convenience retail businesses and help them grow – with support from a 25-strong and growing team of retail development advisors.

Parfetts’ employee ownership model enables the wholesaler to invest more in margins and service as it doesn’t have shareholders to pay. “Our customers understand the benefits of our employee ownership model and how Parfetts is uniquely placed in the market to support their businesses,” says Jamie Ferguson, head of marketing at Parfetts.

Parfetts is expanding into the Midlands with a new state-of-the-art depot opening in Birmingham early this year. “Retailers across the Midlands and beyond are set to benefit as we launch our eighth depot in Birmingham,” says Ferguson. “It will offer access to industry-leading margins, an incredible range and our famous levels of service.”

PARFETTS is focused on helping retailers maintain margins in the current economy. It has increased the number of promotions it has throughout the year and is working closely with suppliers. At key trading times, such as Easter, back to school, Halloween and Christmas, plus events such as the World Cup, Jubilees and Coronations, trade week deals will help to maximise margins across the key lines and categories.

“Our store development team offers a full range of services to ensure that stores operate efficiently

Average store size: 1,500sq ft

Number of members: 1,100+

Telephone: 0161 429 0429

and meet local market needs,” says Ferguson. “Advice is based on local and national data to help retailers stock the right range and merchandise it correctly to maximise sales and margin. A full merchandising service helps stores present products to increase sales.”

Parfetts offers threeweekly promotions, twiceweekly one-day specials and a range of other promotions to further drive sales and enhance margins, alongside a full PoS suite to support promotions,

Simon Mahal

Go Local Extra Hucknall, Nottingham

Parfetts provides us with posters and tags around the store

“WE’VE been with Parfetts for eight years, but we adopted the Go Local Extra fascia a few months ago. We joined so it would match my first store, but also because we knew how they ran and their promotions are strong.

“We have support from our depot manager and Par-

fetts provides us with posters and shelf talkers around the store, too.

“Parfetts is helping us currently with our new store we are due to open in the next few months, and is helping us with the store layout and our range.”

digital and social media campaigns, plus leaflet print and distribution – all free of charge.

“ Parfetts provide me with the right products at the right price and have always given the highest levels of service. They have taken the time to understand my business and provide help and advice that has increased sales and margin. Being part of the Go Local symbol group also means I have access to a level of support I couldn’t get anywhere else.”Kalbinder Singh Gill :: Go Local Extra Tipton

SPAR explains the importance of stocking own-label lines, as well as how it’s supporting its retailers manage their businesses amid rising costs

Spar’s plans include delivering across the board on value, key marketing initiatives and customer mission-based formats that drive sales and profitability for Spar retailers to help combat rising costs.

Spar is continuing its passion for local suppliers and products. Over 75% of fresh food in Spar stores in Northern Ireland is sourced locally and Spar Scotland is highlighting the provenance of its local suppliers with in-store barkers and digital communications.

Spar Minster Lovell, Witney, Oxfordshire

Spar helps us to convey value by always looking at price-marked packs

“WE founded the store in 1937 and joined Spar in 1991. Joining Spar was the next step for us in becoming a bit bigger than a village shop.

“We enjoy being with Spar because AF Blakemore is a family-run business and they look after us – and we

REGIONALLY, a network of dedicated business development managers provides crucial frontline support to Spar retailers. They cover in-store operations and standards compliance, along with developing sales, margins and business management.

Spar retailers benefit from an extensive marketing and selling programme, which has digital support – further enhanced at a regional RDC level, all supported by excellent service and product availability.

When an independent

Average store size: 1,700sq ft

Number of members: 2,600

Average store turnover: £22,000 (excluding

retailer joins Spar, they have access to a multimillion-pound marketing programme, with threeweekly and weekly promotions and competitive deals, designed to drive footfall and sales.

Spar also has a low-price programme providing ongoing value and price promises on essentials and fresh produce. Retailers can also benefit from in-store theatre, online marketing materials, such as seasonal PoS, and easy-to-use in-store promotional print solutions.

Spar drives footfall

020 8426 3700

Spar is also focusing on how small projects can be undertaken in its convenience formats, through macro and micro space changes that make a difference to the bottom line. These include making the store easier to shop with missionbased layouts, key foodservice offers and changing the range to meet customer demand.

Spar retailers also have access to a Deliveroo partnership, opening up the ecommerce channel for them, delivering incremental sales.

services and fuel)

Telephone: 020 8426 3700

Website: spar.co.uk/owna-store

Twitter: @SPARintheUK

throughout the year by delivering value on customers’ doorsteps with a national low prices everyday campaign, an annual programme of market-leading pre-sold deals and through use of digital technology to drive footfall into stores.

All five Spar wholesalers also offer category management services to all retail members.

spar.co.uk/own-a-store

have no intention of leaving. A year ago, we converted to a Spar Market, a new idea that focuses on fresh food and loose fruit and veg. It is also helping us to convey value by always looking at pricemarked packs.”

BEER and cider continues to be an important category for retailers to stock. Although sales are down due partly to price increases and inflation, it bears reminding that the category is also coming off the back of an unprecedented twoand-a-half years where the off-trade faced either no or highly limited competition from hospitality.

“As price increases and inflation take effect, total beer is down in value annually, as stretched shoppers make more considered choices about

where to spend their money,” says Miriam Thompson, offtrade category development manager at BrewDog. “This is also rolling off the back of a strong Christmas in 2021 due to the closure of the on-trade.”

Now, even though society is fully open, the average cost of a pub pint continues to rise, meaning retailers can stand to gain from offering the right ranges to people. “Sales are good. If anything, the cost of living has increased sales of the category,” says Peter Patel, who counts the

UK’s first Costcutter-Bargain Booze hybrid in Meopham, Kent, among his store estate. “Because it’s going to be cheaper to go to an off-licence and sit at home.”

According to Mike Lewis, wholesale category controller at Nisa, beer and cider sales in convenience totalled £1.85bn, 28% of the category’s total trade. With summer approaching and events such as bank holidays and the coronation of Charles III on the horizon, chances abound to help raise that figure this year.

• Tackling illicit vapes: how to protect your vape sales by staying clear of non-compliant stock

• Nicotine pouches: an update on the most popular lines, and how retailers are managing the segment

• Regional trends: The bestselling 10ml e-liquids and short fills in convenience

All the latest product launches, and… Quick guide: understanding how coils can affect your customers’ vape experience Gantries and displays: a guide on how to take your vape display to the next level in 2023

DESPITE many people feeling more pressure on their finances, growth in beer and cider is coming from premium lines and the craft segment. Due to reduced on-trade activity, customers have more money

to spend on alcohol in the home, and want it to be a worthwhile investment. Budweiser forecasts that by 2025, 70% of total beer consumption will be of premium or superpremium brands.

“Nisa has noticed consumers are still purchasing beer and cider, although at a less frequent rate,” says Lewis.

“Consumers are still drawn to premium products – the main reason being that shoppers want to experience quality beer at home without spending as much money.”

According to Thomp-

THE rise of premium lines also goes hand in hand with the athome evening meal occasion.

“A trend that has been growing in traction over recent years is consumers developing a new love for cooking and eating at home, with 2.2 million households claiming to do more at-home entertaining than before the pandemic,” says Sunny Mirpuri, director for wholesale and convenience at Budweiser Brewing Group UK&I. “Mealtimes now account for 43% of all drinking occasions in the home, which represents a great opportunity for cross-merchandising the categories to boost basket spend.”

As world lagers heavily promote their overseas origins, retailers can use

this as an opportunity to site them alongside corresponding foods or themed meals in their stores. “With an increasing number of consumers making fewer visits to pubs, bars and restaurants due to ongoing financial pressures, this almost certainly means more eating and drinking at home, where they will still want to make home meals as authentic as possible, which means matching their beer choice to cuisine,” says KBE’s Price.

“So, for example, if they are eating Indian food, then pairing it with Kingfisher is a great idea, or perhaps if they are eating a Nando’s-inspired meal, then pairing it with an authentic Portuguese lager such as Sagres.”

son, craft beer declined at a slower rate (-10%) than total beer (-12.3%), enabling it to slightly grow its market share. Meanwhile, world beers continue to provide an appealing and accessible premium option. “It [the cost-of-living crisis] doesn’t seem to have impacted on consumers’ choices, with our latest data showing

standard lager sales in the offtrade down by 17%, whereas world lager sales are only down by 5%,” says John Price, head of marketing at distributor KBE Drinks.

“The ‘drinking less but better’ trend is therefore still very much prevalent, which has seen consumers increasingly willing to spend more to treat

themselves to premium and super-premium lager brands, which is, in turn, driving increased value in store.”

Price adds that retailers can charge up to 30% more for these brands compared to more mainstream options, and will have the chance to do so as customers continue to stay at home.

“WE work with a couple of local beer breweries. They have a core range then do a rotating specialist range, which works pretty well.

“Non-alcoholic lines are growing, but aren’t off the scale yet. I would say our sales generally are on and off. For instance, at the minute we’ve got people on Guinness 0.0 – we can’t buy enough to meet demand. Heineken 0.0 did really well for a couple of months, then it flips into something else.

“Premium lines and craft beer seem to be leading sales. Lines such as BrewDog are really good. I think people drink less but are wanting more quality when it comes to what they are drinking. That kind of market is where we’ve seen sales perform instead of your everyday lines such as Stella, Carling and Budweiser.”

it comes to the right pack sizes, sticking to those that allow customers instant gratification is especially important as we head towards warmer temperatures that are suitable for outdoor consumption.

“The majority of sales are made to customers who purchase beverages for immediate consumption,” says

Nisa’s Lewis.

“In most cases, they are looking for chilled, small packs and singles. Small packs are the largest contributor to impulse beer, accounting for 53% of impulse beer value sales in the past year. Single packs at 43% and small packs at 40% were found to be the largest contributors to impulse cider value sales in 2022.”

Meanwhile, according to

THE low- and no-alcohol segment continues to attract more attention from suppliers, and this year has already seen two major launches. Carlsberg 0.0 is set to be available to convenience retailers later this year, after an initial Tesco launch last month, while Staropramen 0.0% is now available nationwide.

In launching the former, supplier Carlsberg Marston’s Brewing Company cited the fact that alcohol-free lagers had grown by 6% in off-trade value sales in the 12 weeks leading up to launch compared to the same period in 2022. Meanwhile, Molson Coors Beverage Company said that the Staropramen launch came as 41% of

UK adults have drunk low- or no-alcoholic drinks in the past three months.

The increase in non-alcoholic beer and cider sales isn’t necessarily due to a decline in desire to drink alcohol, says Peter Patel, although plenty of younger adult drinkers are turning away from it. “When I talk to customers, they say it

offers a similar taste, but lower calories compared to the real thing – they’re swapping for the health benefits,” he says. Suppliers are making strides in replicating the taste of alcohol – this has also contributed to the success of non-alcoholic ciders such as Kopparberg Zero in Sue Nithyanandan’s Costcutter Epsom in Surrey.

BrewDog’s Thompson, the four-can pack is the biggest craft beer format, with a 47.4% share. If retailers can strike a balance between the right formats and the right pricemarked packs (PMPs), this will help to optimise their category sales. Mirpuri says PMPs boost confidence in fair pricing, but also give 60% of consumers the impression that they are getting a special promotion.

Peroni Nastro Azzurro Stile Capri

Asahi has launched a lighter variety of its Peroni Nastro Azzurro brand in Spar, Nisa, Bestway, Parfetts and Co-op. It has a lower ABV (4.2%) and is targeting younger adult drinkers looking for a lighter option, similar to last year’s Heineken Silver and Strongbow Dark Fruit Ultra launches.

Sapporo

KBE Drinks is looking to capitalise on the rise of premium options with a three-year distribution with Japanese supplier Sapporo. Sales of Sapporo (ABV 5.0%), which is available in a 650ml can, have grown by 19% in the past year.

British Cider Week

Retailers have the chance to drive cider sales with the launch of the first British Cider Week, between 14 and 23 April. Suppliers including Thatchers and Westons are planning events to highlight the diversity and heritage of British cider.

Birra Moretti

Heineken has launched limited-edition Birra Morettibranded glassware, available as a gift alongside a purchase of the Italian beer. There is an accompanying campaign which includes a three-part Amazon Prime Video series starring Jack Whitehall, former rugby player Lawrence Dallaglio and presenter Maya Jama.

Thatchers PMP

Thatchers Cider has launched a £5.49 PMP for its Thatchers Gold 4x500ml, available exclusively to independent retailers. The supplier said it hoped to give independents good competition with the multiples, where Thatchers Gold 4x440ml is the top-selling branded apple cider four-pack.

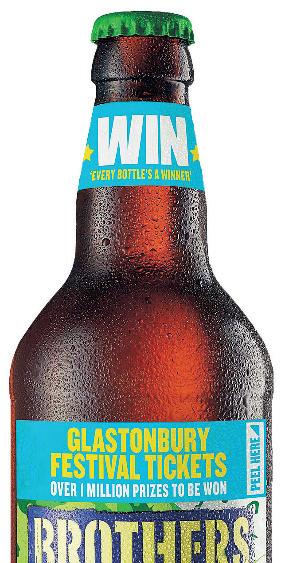

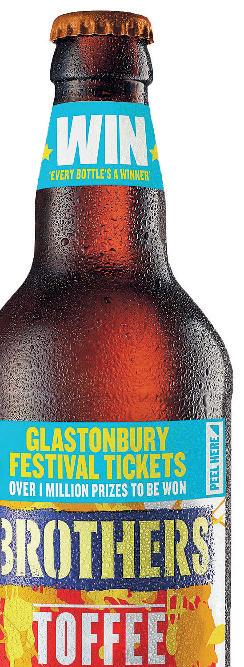

Brothers Cider

Brothers Cider is marking its partnership with Glastonbury Festival with an on-pack promotion offering more than a million prizes, including 10 pairs of tickets to the sold-out festival. It has also launched a new 500ml bottle format of its Toffee Apple Cider.

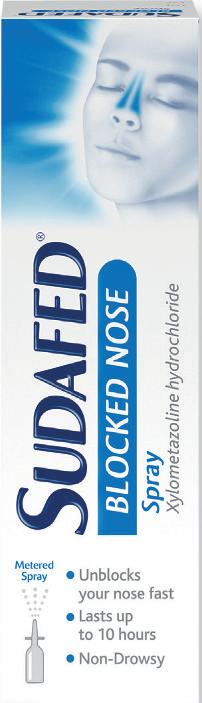

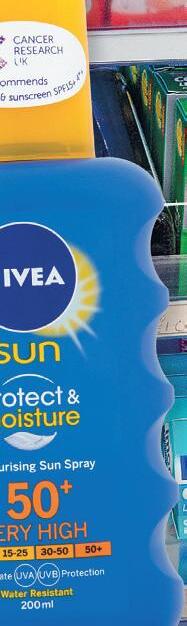

A CONVENIENCE store is limited compared to a pharmacy when it comes to the medications it can sell over the counter. But when summer rolls around, there are two key issues that customers can come to your store for.

Sunburn is the first thing to consider, with sales of suncream and aftersun soaring as the weather improves and people start spending their time working and relaxing outside in the sunshine. Whether it’s people stocking up as they go on holiday or grabbing something to take advantage of a sunny afternoon in their garden, demand grows in the summer.

“Sunscreens sell well in the summer,” says Vijay Aanasane, from Foxhole Store (Premier) in St Austell, Cornwall. “We’ve found that we sell

more suncream for children than for adults. We get them from Londis in the presell.”

As well as suncream, antihistamines will also be in demand during the summer months as high pollen counts send hay-fever symptoms skyrocketing. Having strong availability of antihistamine products is essential as people will often purchase these in an emergency and will remember times when a store has let them down.

“Mintel estimates almost half of all adults suffer from an allergy and, of that, the most common is hay fever, affecting approximately seven million each year,” says Claire Campbell, senior manager at Olbas. “A 2021 study from the University of Worcester, spanning Northwestern Europe, suggests that climate

change will increase the severity of hay fever season by up to 60% unless carbon emissions are reined in. And demand for allergy remedies will rise as pollen and pollution levels continue to increase.”

Hay fever symptoms can also be alleviated by other more traditional remedies for cold and flus, so retailers should consider winter remedies just as necessary once summer comes around.

“Cold and flu products, such as Olbas Nasal Spray and the Olbas Inhaler, can be used to help with hay fever relief,” says Campbell. “A simple nasal spray or decongestant can relieve a blocked nose and reduce the impact of headaches and sinus issues, leaving allergy sufferers feeling less sluggish.”

THE third summer remedy that retailers highlight as a key seller is actually something that’s in demand all year round – painkillers.

“Paracetamol and ibuprofen have to be fully stocked all year round,” says Shumaila Malik, from Costcutter Heathside Road in Manchester. “Children’s medicines, such as Calpol, can see people coming in at any time of day. If a child has a temperature or you’re feeling in pain, and the chemist isn’t open, painkillers are urgent, necessary things, and you shouldn’t be running out of stock with this. You don’t have to worry about brands for painkillers, but you have to be in stock.”

But on top of painkillers, retailers should consider stocking up on other products that might not have immediate associations with the summer, but which will still be in demand.

“Anti-diarrhoea remedies, such as Imodium, increase in summer as many Brits go abroad on holiday. The barbecue season drives an increase, too, with people eating and drinking a little too much. Indigestion remedies are important for these shoppers, too, so make sure you’re stocking Gaviscon and Rennie,” says Matt Stanton, head of insight at DCS Group. “Other adjacent cateogies grow significantly, too, such as insect killers.”