Alex Yau, editor

Avoid being caught out by upcoming disposables ban

LAST month, JTI invited me to an event in Parliament, highlighting the issue of illicit tobacco to independent retailers, MPs and other industry experts.

The a ernoon provided an opportunity to see the scale of test-purchasing conducted across England by the supplier, with seized products from di erent regions on display.

However, one area that surprised me was the way illicit sellers had manufactured vapes to appeal to children. One device had a screen and a control pad, allowing users to play retro-style video games on it.

Another device was designed to look like a miniaturised milkshake. One vape was also integrated into a dget spinner, a toy that some of you will remember as a popular seller in your own stores years ago.

All of this reminded me of a store I had seen earlier this year, where the shopfront displayed children’s toys and colourful vapes together. I doubt this was accidental.

These issues are some of the factors that have contributed to the government’s decision to ban disposable vapes from stores next year (p3), alongside a likely range of merchandising and packaging restrictions on rechargeable and re llable devices.

The June ban on disposables is seven months away, but it’s wise to prepare now if your sales are likely to be affected. Start looking at alternative products to ll the space and ways you can educate customers about the restrictions to avoid being caught out.

ALEX YAU

WAGE increases, duty rises and funding to tackle shoplifting were among the major announcements to impact retailers made in the Autumn Budget.

Chancellor Rachel Reeves’s Budget on 30 October revealed the hourly national living wage for those aged

21 and over will rise from £11.44 to £12.21 from 1 April. Rates for 18- to 20-year-olds will also increase from £8.60 to £10 an hour.

There will be no increases to employee National Insurance (NI), VAT or income tax, while the threshold that businesses start paying NI will be lowered from £9,100 to £5,000 per worker. The

rate employers pay NI will increase from 13.8% to 15%.

As expected, several core convenience products will face duty increase. From 1 October 2026, vaping products will be taxed at £2.20 per 10ml of e-liquid, while a oneoff tobacco duty rise will be implemented to incentivise the public to “choose re�illable vaping over smoking”.

Duty on hand-rolled tobacco will face a 10% increase.

The soft drinks sugar levy will also rise in line with the consumer price index each year.

Issues of retail crime were addressed, with Reeves announcing more funding to tackle shoplifting. Post Of�ice Horizon victims will also receive £1.8bn in compensation. @retailexpress

3350

7689 3373

7689 3391

7689 3380

020 7689 3368

Head of marketing

Kate Daw 020 7689 3363

Head of commercial

Natalie Reeve 07856 475 788

Associate director Charlotte Jesson 07807 287 607

Commercial project manager I y Afzal 07538 299 205

Features writer Jasper Hart @JasperAHHart 020 7689 3384

Stronach 020 7689 3375

Account director Lindsay Hudson 07749 416 544 Account managers

Byrne 07530 834 009

Martin 07951 461 146

Abeykoon 020 7689 3383

7689 3388

949

TOUGHER police action and harsher punishments on shop criminals have been demanded by most independent retailers, according to a recent Fed survey.

The survey revealed that 91% of 651 respondents called for more police patrols. Fed national president Mo Razzaq said: “Inadequate responses from the police mean that offenders are becoming more aggressive and brazen.”

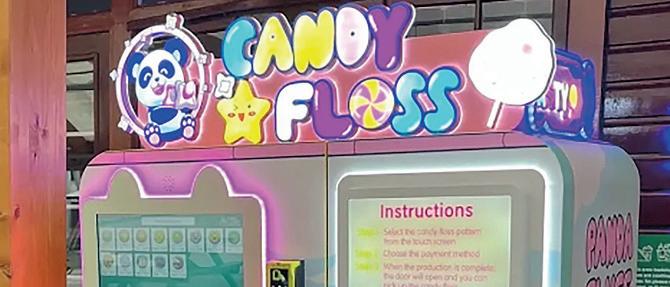

CANDY �loss machine manufacturer Panda Fluff claims stores stocking its unit can make at least £1,300 gross pro�it per month.

Founder Kelly Poon told Retail Express that sweet shops in Haven Holiday Parks already

stocking the machines are averaging 350 sales per month, with a £5.50 RRP charged per serving. She added: “It’s in tune with the whole slush-machine trend. Candy �loss will take off like a storm.”

THE National Federation of Subpostmasters (NFSP) has called for “an urgent review of ongoing injustices relating to the treatment of postmasters”.

The trade body’s CEO, Calum Greenhow, demanded a review of the Network Transformation scheme in a letter to the government. Greenhow alleged the scheme running between 2012 and 2018 “detrimentally affected” the income of postmasters.

5-18

STORES across the UK will be outlawed from selling disposable vapes from 1 June 2025, with retailers and industry �igures warning of the “devastating” impact on sales.

The government ban was announced last month, with a disposable vape de�ined as a device that is not re�illable or rechargeable. Re�illable tank and replaceable-pod devices will still be legal, however. These are expected to receive restrictions on in-store display, packaging, �lavours and marketing.

While Scotland had scheduled its own ban to begin on 1 April, sources told RN this is likely to move to be aligned with the rest of the UK.

Shital Patel, of Jimmy’s Store in Northampton, told Retail Express she is set to lose several thousand pounds in sales, with her monthly disposable takings amounting to £8,000. She added: “There’s a lot of change coming. I’m not sure how sell-through will go, but we are selling a lot of disposable vapes at the moment. Something else will replace it. That’s always the case when the government bans something.”

Ron Patel, of Ron’s News in Droitwich, Worcestershire, is one of many retailers who have begun transitioning customers onto re�illables ahead of the disposable ban. He said: “The

biggest issue, which has gone unnoticed, is the illegal vape market. It’s quite worrying that all the trade is disappearing to there, and we’ll see that worsen when the ban goes ahead.

“After the ban, some will transfer to re�illable devices, but not all. Quite a lot will move to the illicit market, and the cost of this is a big issue, because everyone is looking in their pocket.

“Also, the pro�it margin of disposable vapes is about 10 times that of a packet of cigarettes. Make as many bans and laws as you want, people will always �ind a way around it.”

Several trade bodies echoed Ron’s concerns and stressed the ban would fuel the illicit trade further. Fed

national president Mo Razzaq warned: “Those selling illicit stock, which is widespread, will be completely unfazed by the ban. If anything, it’s an advantage for them at the expense of all those that follow the law.

“A lot of retailers are struggling right now. It was a weak summer combined with the cost of living affecting spending, the cost of business affecting overheads and major increases to staff wages and business rates on the way.

“Many stores are still paying back the Covid-19 bounce-back loans.

“Disposable vapes have been a really important category for sales, footfall and pro�it. I’m really trying to be positive but unless some-

thing is done, many stores will close. The government needs to look at the effect of these policies cumulatively and consider a support package for small stores.”

John Dunne, director general of the UK Vaping Industry Association, added the restriction could have a “devastating effect” on independent stores. He told Retail Express: “Disposable vapes kept lots of independent stores from going under.

“I don’t know where this revenue of the black market will go; it could be an issue. Most retailers follow rules, but a few in the convenience sector don’t.

“We don’t know where illicit trade will �ilter through to, it could be sold via WhatsApp, at market stalls, or

“MY fellow independent retailers will relate to the video podcasts I’ve been making for YouTube. Our customers have become our friends. This is the advantage we have over the multiples. This podcast is bringing their stories to the community. This is done from the stock room. The latest episode is of a local hero who has fostered more than 17 children. The story is just amazing.” Ken Singh, BB Nevison Superstore, Pontefract, West Yorkshire

“WE’VE had an initiative called the Baillieston Community Walk that has been running since the pandemic. Businesses in our town join forces to display cut-out ghosts known as Boos in their windows. Children get a map listing all participants to count the Boos. They hand in their completed map at the end to enter for prizes. The businesses participating can hand out sweets to the trick-or-treaters.” Natalie Lightfoot, Londis Solo Convenience, Glasgow

online for home delivery. Is everyone in the sector squeaky clean? No.”

As Retail Express went to press, BAT and United Wholesale Scotland were the only suppliers to con�irm they were developing and operating a vape-takeback scheme to help stores with any leftover stock.

An El�bar spokesperson told Retail Express: “El�bar is committed to working closely with its manufacturer and retail partners on compliance with potential upcoming regulations and guidelines as issued by the government. We will keep monitoring the situation and provide guidance and support to our retailers in line with the evolving requirements.”

FLASH DELIVERY: The home delivery provider has claimed partnered stores can take £2,000 to £3,000 in extra sales during their rst year. The platform, founded by Premier store owner Justin Whittaker, has surpassed the 50-partnered store milestone after launching last year. The average basket spend on the platform is £24.

For the full story, go to betterretailing.com and search ‘Flash Delivery’

MORRISONS DAILY: The supermarket is making its More loyalty scheme available within its convenience format for the rst time. Several sources told Retail Express the scheme was introduced as a trial into company-owned stores at the start of November, with franchisees likely to receive it next year.

For the full story, go to betterretailing.com and search ‘Morrisons’

VAPING: Disposable vape-takeback schemes have failed to tackle vaping litter. The claim was made by environmental experts and retailers during a webinar held by the UK Vaping Industry Association last month. Dan Marchant, co-owner of Vape Club said: “Most vapers are exsmokers, and you have to train customers out of that smoker mentality [of throwing used items on the street].”

F’REAL: The self-serve milkshake supplier has stopped accepting any applications for its “free on loan” model until next year. A source con rmed the company is focused on sales through existing machines with new applications only being considered in 2025. In 2022, the company faced criticism from retailers for removing machines if they failed to meet a minimum target of 10 cups a day.

“FOR us, home news delivery is more than putting a stack of papers in a customer’s post box. We treat it like a friendly neighbour and our service doesn’t stop at delivering newspapers. It’s like an early warning system to provide support. Whether it’s a weather alert or a heads-up about that strange noise your car is making, we like to make sure we’ve got our customers’ backs.”

ALICE BROOKER

THE number of shoplifting offences across the UK have risen by 29% annually, marking a record high for incidents.

According to new figures for the year ending June 2024 from the Office for National Statistics, the spike represents an increase from 365,173 in the previous year.

lifting rate of eight incidents per 1,000 people in the most recent recordings.

Data from ACS’ Voice of Local Shops Survey, which tracks levels of theft in the convenience sector, has shown that theft has been increasing every quarter since mid-2021, reaching new record highs toward the end of 2023 and then breaking that record in the first half of 2024.

Lowman said: “We are hearing the right messages from government about reporting and investigating crime, and applying effective penalties.

“Sadly this is entirely at odds with our members’ experiences of policing in communities up and down the country.

“Local shop owners and their colleagues are becoming quite sick of assurances from politicians, they want a

at risk and for criminals to be apprehended and sanctioned effectively.

“These figures should prompt a redoubling of efforts from everyone involved in tackling shop theft: retailers reporting crime every time, the police investigating every offence and identifying prolific repeat offenders, and the courts system applying effective penalties that aim to break

ONE Stop has been examining the launch of a loyalty scheme into stores.

Several sources close to the company confirmed it had been discussing the introduction to franchisees at a recent conference.

One said: “It does tie in with Tesco own label because it’s going to be the same barcodes used. I think it will be based on points, where purchases add to your spend and redeem vouchers. Something will happen. It’s inevitable.”

BOOKER has claimed to have saved shops in its Energy Buying Club more than £1m since launching last year.

The service in partnership with Saffron Business Solutions negotiates cheaper rates through the combined buying power of members.

David Haworth, Saffron Business Solutions director, said: “Grouping retailers together has allowed us to of-

£5,000 (20%) per annum, per retailer.”

BESTWAY has appointed three senior hires from rivals to boost store support.

Nick Russell, formerly head of independent franchise and new business at Morrisons Daily, has taken up head of symbol. Rodney Tucker has moved from Appleby Westward to become head of new business and acquisition.

Parfetts retail director Steve Moore will join in January to lead Bestway’s Midlands and South Wales team.

ABSOLUT FLAVOURS BRINGS IN £20.6M WORTH OF VALUE SALES TO THE OFF TRADE

ENJOY RESPONSIBLY

PRIYA KHAIRA

FOX’S Burton’s Companies (FBC) has revealed its Christmas 2024 biscuit range, featuring launches from Maryland and Fox’s.

The new additions include Merryland White Chocolate Chip Minis and Fox’s Fabulous Half Coated Winter Spiced Cookies.

Merryland White Chocolate Chip Minis, available in a 150g sharing carton with an RRP of £1.75, come after a 111% annual growth in the white chocolate �lavour.

Meanwhile, Fox’s Fabulous Half Coated Winter Spiced Cookies, offered in a 250g pack with an RRP of £2.50, are designed to capture the

seasonal �lavour trend.

Colin Taylor, trade marketing director at FBC UK, noted the importance of biscuits to Christmas sales, citing last year’s success. “Sweet biscuits saw the highest uplift of any seasonal category, with 16% growth in December, compared to 7% across total seasonal products,” he said.

Alongside the launches, FBC’s returning range includes Fox’s Classic 550g Assortment, Fox’s Assortment Tins, Fox’s Snowman Tin, Fox’s Snowman Gingerbread Minis and Paterson’s.

UFIT has launched pricemarked packs (PMPs) for its ready-to-drink (RTD) protein range, now available in core �lavours with a �ixed price of £1.79.

These packs will replace the existing duo impulse packs and initially be rolled out in Spar, Nisa and Filshill, with wider distribution

planned for January 2025. The launch will be supported by a Spar TV campaign, in-store ads and digital promotions in January 2025.

FUNKIN Cocktails has teamed up with Irn-Bru to launch a limited-edition Vodka Martini RTD in celebration of Funkin’s 25th anniversary.

The 5% ABV cocktail is available to independent retailers through Booker and Bestway at an RRP of £2.19.

This collaboration aims to tap into popular cocktail trends, with vodka featuring in half of all cocktails and the martini format accounting for a �ifth of serves.

The release also aligns with the growing demand for bitter orange �lavours, similar to Aperol Spritz.

A marketing campaign will support the launch, spanning social media, digital and instore promotions.

PARFETTS has expanded its Go Local own-label brand with a new cooking sauce range, offering retailers a 33% margin.

The range includes Jalfrezi, Tikka Masala, Tomato & Basil and Tomato & Chilli, all available in 350g jars priced at £1.49.

Retailers can purchase the sauces in cases of six for £5.99, available both indepot and online.

This launch is part of Parfetts’ goal to grow the Go Local range to over 200 products by the end of 2024.

BIONA has announced the launch of two new organic quick-cook risotto �lavours, available now.

The new options include a rich Porcini Mushroom risotto, priced at £3.99, and a seasonal Pumpkin risotto, priced at £3.69.

Both risottos are vegan, organic and ready to eat in just 15 minutes.

Carmen Ferguson, brand manager at Windmill Organics, highlighted the growing demand for organic food and ready-to-cook meals, with 90% of shoppers incorporating these into their diets.

Data shows that 70% of shoppers are willing to pay more for sustainable grocery items.

BOOST Drinks has expanded its Energy range with the introduction of 500ml cans, now available in Original, Sugar-Free Original and Red Berry varieties.

Each carries a £1 pricemark, meeting consumer demand for larger, value-driven options in convenience.

Adrian Hipkiss, commercial director at Boost Drinks, noted that the move responds to rising demand for bigger, on-the-go formats. “We’ve identi�ied the trend for 500ml cans, which are showing huge growth,” he said.

The 500ml energy drinks market is growing 13% year-

on-year, valued at £745m, while sugar-free options are rising rapidly, up 23%.

CADBURY is offering retailers the chance to win one of �ive Sky Glass TVs and a 12-month Sky TV subscription as part of its ‘Win a Day to Remember’ promotion.

Retailers can enter by completing the entry form on snackdisplay.co.uk before 30 November 2024.

There are �ive Sky Glass TVs and subscription pack-

of sale.

ages up for grabs. The supplier launched the ‘Win a Day to Remember’ promotion to mark its 200th anniversary, offering more than 200,000 prizes to shoppers to help drive rate of sale.

NEW CAMPAIGN

STRONG Roots has launched a new Air Bites range designed speci�ically for air fryers. These vegan-friendly, crispy bites are ready in just 10-12 minutes and come in three �lavours: Crispy SpinStrong Roots’ airfryer-friendly

ach & Carrot, Crispy Pea & Lemon and Crispy Veg, with an RRP of £2.95.

The range is designed for snacks, quick lunches or party platters, tapping into the growing trend for air fryer cooking and plantbased foods. It is available to independent retailers through wholesalers like Direct Wholesale Foods, Stratford and CLF.

PRIYA KHAIRA

TENZING has launched the UK’s �irst natural energy drink designed speci�ically for the winter.

The new Super Natural Fiery Mango blend is designed to boost energy, mood and immunity during the colder winter months, featuring a combination of natural ingredients including vitamin D, magnesium, lion’s mane mushrooms and vitamin C.

The drink contains 160mg of natural caffeine sourced from green coffee and 250mg of ginger, providing a strong energy boost and kick.

Originally launched as a limited edition, the Super

Natural Fiery Mango blend is now a permanent part of Tenzing’s range. It is available via wholesale channels including Unnu and Muscle Finesse as well as the Tenzing website.

Huib van Bockel, founder of Tenzing, said: “We are all about providing natural energy harnessed from plants.

Our vitamin D is sourced from pine trees, while lion’s mane is claimed to naturally lift mood and energy.

“We have spent years crafting a drink that provides the functionality to boost the UK through the dark winter months, a time when energy and mood tends to be at its lowest.”

RRP: £2.25

YOUNG’S Seafood has relaunched its scampi range, featuring recipe improvements and new packaging.

The updated products, including Popcorn Scampi Bites, Gastro Wholetail Scampi, Gastro Wholetail Jumbo Scampi and Golden Scampi, boast a coarser crumb ideal for air fryers and a better �ish-to-crumb ratio.

Independent tests show nearly 75% of consumers preferred the new recipe.

The relaunch aims to grow scampi sales and tap into the frozen seafood category.

The campaign will highlight scampi’s versatility for family meals and convenient

treats, supported by social media, in�luencer marketing and in-store promotions.

RETAILERS can get their hands on a case of Peroni Nastro Azurro 0.0% 4x440ml, the fastest-growing brand in the alcohol-free beer category*, as Asahi UK is distributing free stock to 250 convenience retailers.

Each case contains six packs, which have an RRP of £5.19. “Alcohol-free is a key growth area for independent convenience stores, yet distribution is much lower in this channel than in grocery,” said Rob Hobart, Asahi UK marketing director.

“We hope this campaign helps to drive distribution by giving more retailers the chance to see the bene�it

of stocking these lines for themselves. Asahi Europe & International’s ambition is for 20% of our core product portfolio to offer alcoholfree products by 2030, so we will continue to invest heavily in this category in years to come.”

PUKKA has launched ‘The Big One’ range, featuring larger versions of its popular All Steak and Chicken & Mushroom pies.

Targeting families and couples, these bigger 500g pies are designed for sharing, catering to the growing demand for larger pie formats, which have added £8m to the category.

Pukka aims to drive further growth in pie sales, especially during the autumn and winter seasons.

The range has an RRP of £4.

Pukka currently holds a 21.1% share of the overall pie category.

V RUM has launched V Spiced, a new spiced rum crafted at its sustainable distillery on the south coast of England.

With notes of tropical citrus, pineapple, banana and sweet spices, the 37.5% ABV rum is designed for cocktails or sipping neat.

In line with its sustainability efforts, V Spiced Rum features an eco-friendly label made from sugar cane waste, hemp and linen.

The distillery produces its range using 100% renewable electricity and locally sourced molasses.

V Spiced Rum is available online for £27.99, joining the brand’s Premium and Overproof White Rums.

LEE Kum Kee has launched its latest advertising campaign, ‘Chiu Chow Chilli Any Chow’, aimed at showcasing the versatility of its popular Chiu Chow Chilli Oil.

Running until 24 November, the campaign spans out-of-home and digital platforms across three European markets, including the UK.

Designed to tap into growing global trends for chilli

products, the six-week campaign encourages consumers to incorporate chilli oil into a variety of dishes beyond traditional Asian cuisine. It includes video, TV, YouTube and out-of-home activations.

BIONA has expanded its bakery range with three new additions: Rustic Seeded Sourdough Baguettes (twin pack), Oat Topped Wholemeal Rolls (four pack) and Power Protein Bread.

The baguettes and rolls are priced at £3.79, while the Power Protein Bread is £3.99.

All three products are organic, vegan, high in �ibre and each one is made with sourdough.

Biona’s bakery category saw a 183% sales growth between 2023-2024. The supplier expects these new launches to build on this success.

HIGGIDY is adding a festive touch to some of its range with new Christmas-themed packaging.

The special-edition design, featuring baubles, gold accents and festive �lorals, will be displayed on a selection of Higgidy’s bestselling

items, including Beechwood Smoked Bacon & Mature Cheddar Quiche, SlowRoasted Tomato & Cheddar Mini Muf�ins and Ham Hock & Mature Cheddar Sausage Rolls.

The new packaging will be available from 11 November.

PRIYA KHAIRA

CONFECTIONERY brand

Bebeto has released a new range of freeze-dried sweets, tapping into the growing popularity of these products online.

The Freeze Crunchy range comes in Peach Rings, Watermelon and Marshmallow Twist varieties. All are halal-certi�ied, with the Peach Rings and Watermelon varieties free from arti�icial colours.

The sweets are available in resealable 35g pouches, with an RRP of £2.

Bebeto is distributing the range through Spar, Co-op Scotland and Parfetts.

Bebeto is the �irst major

UK confectionery brand to produce freeze-dried sweets in-house, controlling the entire production process. The range comes after freeze-dried sweets have surged in popularity on TikTok. The trend has translated into strong sales for

DROGA5 UK has launched a campaign for Suntory’s latest vodka-based RTD beverage, -196, which features a mad scientist and a giant lemon character.

The ad highlights the drink’s unusual production process, which involves freezing the whole fruit using liquid nitrogen at -196°C, then crushing the frozen zest, pulp and juice into a powder before infusing it with vodka.

Pauline Varga, chief category expansion of�icer at Suntory Beverage & Food International, praised Droga5

for its playful, scienceinspired approach that celebrates Japan’s innovation and creativity.

convenience retailers.

For example, Sophie Williams, of Premier Broadway Convenience in Edinburgh, reported a 50% margin on freeze-dried sweets, selling out her range just two days after stocking it.

Phil Hulme, commer-

cial director at Kervan Gida UK said: “The trend started on social media, but we’ve elevated it by taking control of the freeze-drying process.”

KIKKOMAN has released a limited-edition design of its 150ml dispenser bottle.

Only 200,000 of these bottles will be available in supermarkets and independent stores across the UK.

CZECH lager brand Budweiser Budvar has rolled out a UK-wide marketing campaign designed to raise awareness of its authentic Czech roots and clear up any confusion with its US namesake.

The campaign, launched across out-of-home activations, emphasises what makes Budvar unique, from its use of premium local ingredients such as Saaz hops and Moravian malt to its traditional brewing methods.

The ‘Unmistakably US (Not U.S.)’ campaign highlights the brand’s heritage and features social media activations enabling users to engage in quizzes and interactive content.

The latest design features a motif inspired by osechiryori, a traditional array of colourful dishes enjoyed in Japan during the new-year celebrations.

Kikkoman’s soy sauce, which is brewed according to a 300-year-old Japanese recipe, holds a 30.9% value share in the UK’s soy-sauce category. Its 150ml dispenser bottle, which accounts for 13% of all soy-sauce sales, had a 12.4% growth in the past three months.

LUXURY dark chocolate brand

Cox & Co has introduced a range of hot chocolate spoons, crafted from singleorigin Colombian cacao in time for winter.

The spoons come in Miso & Caramel, Mint and Single Origin (Plain Chocolate) �lavours, all of which are made with 60% cacao.

The range has an RRP of £12 for a 135g pack of three spoons and is available via the Cox & Co website. It is also vegan friendly and features eco-friendly packaging, including vegetable ink and biodegradable card.

IVG’s new Nicotine Pouches offer a tobacco-free, smokeless alternative for adult smokers.

The pouches have been designed to deliver a 45-minute nicotine experience with high-grade nicotine and plant-based ingredients.

Available in Mango, Strawberry, Spearmint, Ice Mint, Cola and Blue �lavours, IVG Nicotine Pouches come in both 15mg and 20mg strength options.

The nicotine pouch category is rapidly growing in the UK, now worth £3.8m per month, with 45% of sales coming through convenience and independent retailers.

The category saw a 92% growth rate last year.

WATER Almighty, an ecofunctional drinks brand, has launched two new bottled waters, Mighty Pure and Mighty Minerals, in aluminium packaging.

The 500ml bottles have an RRP of £2 and are fully recyclable and resealable.

Water Almighty’s products cater to health-conscious and eco-driven consumers, offering a signi�icant environmental advantage over plastic.

Mighty Pure is triplepuri�ied, pH-balanced water enhanced with electrolytes, while Mighty Minerals is packed with seven essential minerals and provides 20% of the daily recommended intake per bottle.

BAKERS is to become the �irst global pet-food brand to incorporate NaviLens technology into its packaging.

Launching in early 2025 across all of the Purina brands’ main meals, NaviLens will make it easier for visually impaired dog owners to access product information when picking up the pack.

NaviLens, which is a scannable technology similar to QR codes, enables users to detect packaging codes from up to three metres away, enabling easier navigation in stores.

The NaviLens app enables users to hear information about ingredients and feeding guidelines.

LACTALIS UK & Ireland has introduced more sustainable packaging for Président Crème, reducing the spray cream’s environmental footprint.

The new packaging is now 10g lighter, and its steel/ tinplate component has been removed from the aerosol can body.

This change makes the can fully recyclable, with 17% recycled material incorporated.

The supplier has supported the launch with social media activations.

Président Crème is available via wholesale suppliers including Booker and AF Blakemore.

FAIRY Non-Bio has teamed up with Paddington to celebrate the release of the Paddington in Peru movie.

The partnership promotes Fairy Non-Bio’s #LoadsOfKindness campaign, encouraging people across the UK to pledge small acts of kindness.

UK consumers can share

their pledges of kindness via social media.

Special edition Fairy Non-Bio packs featuring Paddington are now available to buy both in stores and online.

SWIZZELS has revealed its �irst Christmas-themed Squashies, the Naughty & Nice range, in time for the festive season.

The limited-edition treat features two festive �lavours, Strawberry Ice Cream and Apple Pie.

The bags feature two elves, one on the ‘naughty’ list and one on the ‘nice’ list.

The sugar confectionery market in convenience is currently valued at over £1.4bn.

Share bags and seasonal packaging play a key role in driving sales.

RETAILER OPINION ON THIS FORTNIGHT’S HOT TOPICS

What do you think? Call Retail Express on 020 7689 3357 for the chance to be featured

SCRATCHCARDS: Did you used to sell over the now-banned 10-card limits?

“SOME customers would buy more than 10 to give away at Christmas. Others get them for corporate events to give out at a dinner or to colleagues to thank them for their work. It would be a fun activity to do, and I wouldn’t say gambling addictions were behind any of this.”

Kaual Patel, Nisa Torridon, London

“I DON’T feel my staff should get abuse for the sake of refusing sales for 10 scratchcards. I think it should be the value that should have limits rather than quantity. Someone came in for their 21st birthday party and wanted to buy a £1 scratchcard per guest. I couldn’t sell them.”

Customers would get them as presents

SUSTAINABILITY: How are you being more environmentally friendly?

“WE have added smart plugs that we can monitor via an app, fridge sensors and even solar panels. These things have had a positive impact on our energy bills. By monitoring, we’re saving about £5 a day, which doesn’t seem like much, but over a year, it’s around £1,500-£2,000.”

Ken Singh, BB Nevison Superstore, Pontefract

SOCIAL MEDIA: What are you doing to promote your store?

“ SIMPLE things like sharing memes can engage customers and make them feel connected to your store. When customers feel that connection, they’re more likely to stay loyal, to engage with your posts, and to return to your store time and again.”

Umar Majid, Baba’s Kitchen, Lanarkshire

“WE we hired a company to handle all of our store’s social media for us. Doing so helps take something off our plate and gives it to someone who knows what they’re doing. We’ve noticed engagements on our social media have gone up.”

Chris Tomes from Costcutter & The Food Shop in Swanage

“FOR the �irst time, we’ve put our slush machine away for the winter. The sales don’t justify the cost and energy it was using. I’ve also reduced the amount of lea�lets I distribute and have launched a WhatsApp channel instead. We have about 60 people signed up.”

Andrew Newton, Nisa Local Colley Gate, Halesowen

We hired a company to handle it all

FOOD TO GO: What new investments have you made?

“MY food to go is busy in the morning, with sandwich meal deals, pasties and Rustlers. I also sell samosas from a company called Gazebo Cuisine, and customers prefer these to those I supply from a local vendor, because they are sealed, so they can take them for later consumption.”

Neil Godhania, Neil’s Premier, Peterborough

“AT one of my store’s, we get a lot of students, so Rollover and Country Choice Bake and Bite are important. We do about 200 sausage rolls a day. At my Brentwood store, we have a serve-over counter where you can pick a roll and we �ill it. We sell about 250 rolls a day there. ” Peter Patel, Costcutter Meopham, Kent

Why did you contact NewstrAid for help?

“When I confronted a shopli er in my store, I was subjected to a torrent of verbal abuse and I was violently punched by the shopli er as they made their getaway. The whole experience was very frightening and had a huge impact on my con dence and mental health as well as a ecting the sta who were present during the attack.”

How did NewstrAid help you?

“NewstrAid was fantastic and immediately gave me the free emotional support helpline number, which allowed me to talk to a trained counsellor about the traumatic experience, which really helped. In addition, my sta and I registered on the Wellbeing Website and were able to access a wide range of free emotional support resources.”

What advice would you give to other retailers who have experienced retail crime?

“Retail crime is sadly on the rise, and NewstrAid o ers help and resources to support anyone from our sector who has been a victim of crime. Anyone struggling with their mental health or struggling to pay household bills as a result of crime should contact them for help.”

I HAD an issue with my parcel company recently, but the rep was helpful in trying to resolve the issue.

One day, I saw that I was unable to process parcel returns through a major retailer in my store.

It was strange, as I’ve never had an issue before over the years. It was also a

very popular retailer used by many of my customers for collections and returns. This was concerning, especially running up to the peak seasonal period, when parcel transactions hit a yearly high.

As expected, it’s the Christmas period in which I make the most commission,

and any major loss would have had a signi�icant impact on my business. I would have been set to lose several hundreds of pounds if the issue hadn’t been resolved quickly enough.

I contacted my rep to see what the issue was, as other retailers had reported they had not experienced the

same problem with their parcel services.

The rep was very good at listening to the issue and promptly investigated the problem. It turned out the issue was a system glitch, and the rep worked quickly to get it resolved.

Anonymous retailer

WE’RE always working on our promotions because they add a huge amount of value to our business. They drive footfall and help you compete with the multiples. You’ve got to look at them year-round, but especially now with Christmas on the way. That’s a great time to be doing promotions.

Any time there’s a big event on – like the Euros this summer – you’ve got to be competing, and you’ll get le behind if you don’t have the right promotions. You might be sacri cing margins, but without the o ers, people won’t visit and business will deteriorate. With promotions, it’s all about footfall and volume, and then trying to sell additional items alongside it. PoS and branding are essential to successful promotions. You could have the best deals in the world, but they’ll be worth nothing without the right displays. People have to know you’ve got promotions on. It doesn’t have to be the biggest poster, but it has to be vibrant and eye-catching. We get some from suppliers, but we also have a guy who makes bespoke PoS for our shop so it’s the right size and quantity for our stores.

You also can’t leave your promotions and PoS up for too long because otherwise it starts to look just like another part of the furniture and people just get used to it. Four weeks is about right, six weeks is way too long. You’ve got mix it up and change things regularly.

Having that stand-out deal that o ers something di erent from your competitors and the multiples is the key. You might get less margin on that item, but it brings people in and then it’s your job to make sure they pick up a few more items along the way.

Check your EPoS data to see that it’s working. Find out if people are just buying what’s on promotion or if they’re also buying extra things on top. If the promotion isn’t having the desired e ect, change it.

Don’t be afraid to try something. If it doesn’t work, you can always change it. We don’t have the same promotions in all our stores because no store is the same. A promotion might work in one store, but not in another.

PRIYA KHAIRA explores how retailers can unlock the full potential of their stores with the right EPoS system

AS technology evolves, electronic point-of-sale (EPoS) systems have become indispensable tools.

Modern EPoS systems o er powerful features that streamline store operations, making ordering, stock management, and sales analysis faster and more e cient.

Ramesh Kurup, of Morrisons Daily in Fraserburgh, Aberdeenshire, recently adopted Henderson Technology’s EDGEPoS, which includes manned and self-service tills.

He says: “Having a good EPoS system is one of the most crucial parts of any convenience or forecourt business. It works end to end from when the customer walks in to when they walk out.”

One of the most valuable features of modern EPoS systems is their ability to streamline stock ordering. For many retailers, especially those using cash and carry for their stock, this has meant cutting down on the time spent manually managing stock levels.

Instead, the EPoS system provides real-time data on sales trends, stock levels, and seasonal shifts, ensuring retailers can place orders based on accurate, up-to-date information.

“I just generate the report, and it gives me suggested items I should be ordering based on sales, stock levels, and other data,” explains Faraz Iqbal, from Premier Linktown Local in Kirkcaldy, Fife.

“It’s a really simple integration to use that can help

speed up processes once you get used to it,” he adds.

While automated ordering features can be incredibly useful, many retailers still prefer to have control over their stock levels, particularly when relying on cash-and-carry trips.

However, EPoS systems simplify the process by providing retailers with accurate data to guide their decisions, ensuring they can order what’s needed without overstocking or running out of key products.

BEYOND faster ordering, EPoS systems o er powerful tools for analysing sales data, enabling retailers to make more informed decisions about product ranges, promotions, and seasonal trends.

The systems can also enable retailers to generate detailed reports that compare weekly, monthly, or yearly sales.

Susan Connolly, who runs Spar Pennings Road in Tid-

worth, Wiltshire, noted that her team’s performance increased by 15% once she started using EPoS data to monitor sales trends and set sta targets.

For retailers like Connolly, being able to track these metrics closely helps them plan more e ectively around peak trading periods, identify which products to focus on during these periods, and ensure sales targets are met.

UPGRADING to an entry-level EPoS system is an a ordable but e ective way for small retailers to track inventory, sales trends and customer preferences in real time.

Cloud-based products like Vend or iZettle o er flexible, subscription-based pricing for those without the budget for a fully integrated EPoS system.

They don’t require extensive on-site infrastructure and can be easily set up using tablets or smartphones, mak-

ing them suited to smaller retailers with limited space.

The ability to monitor and operate stores remotely has been a game-changing feature for retailers.

Cloud-based systems mean retailers can access their data from anywhere, enabling them to stay in control even when they’re not on site.

This feature has proved especially useful during promotional periods or when introducing new lines, ensuring that retailers can stay on top

ONE of the most frustrating aspects when it comes to stock management is dealing with slow-moving lines.

Not only do they take up valuable shelf space, but they also tie up capital that could be used to invest in better-selling products.

EPoS systems provide retailers with real-time data on which products are underperforming.

Imtiyaz Mamode, from Wych Lane Premier in Gosport, Hampshire, uses his

EPoS data to keep track of any fast- and slow-selling lines. He notes that through analysing EPoS data, he realised his international and US lines were generating significant sales for his store every single month, leading him to expand on these lines and become a destination store for the category.

These products are more premium than their domestic versions, netting him higher baskets and bigger cash margins.

of changes without needing to manually adjust each product’s information.

With the ability to make changes remotely, retailers can adapt quickly to market shifts.

Supplier

What features are included in the base package, and are there additional costs for upgrades or extra features?

Ensure you know what’s included in the price and if you’ll need to pay more for things like advanced reporting, cloud access, or supplier integrations.

How easy is it to train sta on the system?

Find out if the system requires complex training or if it’s intuitive enough for your team to use with minimal onboarding.

What level of customer support is available, and during what hours?

Check if support is available 24/7 or only during speci c hours, and whether it’s via phone, email or live chat.

Is the system scalable if I decide to open more stores or expand?

Ask if the EPoS system can grow with your business, especially if you plan to add more locations or expand your product o ering.

Can the system integrate with my suppliers for automatic updates and stock management?

Ensure it can streamline stock ordering and updates with your primary suppliers to save time on manual processes.

What kind of reporting does the system o er?

Find out how detailed the sales reports are and whether you can customise them to suit your store’s needs (for example, daily versus monthly reports and category breakdowns).

Is remote access included, and is it cloud-based? If you want to manage your store from anywhere, ask about cloud-based features and how easily you can access real-time data.

Does the system support loyalty programs or promotions?

If customer rewards are important to your business, make sure the EPoS can handle loyalty schemes and promotional campaigns.

What hardware is needed, and is it included in the package?

Clarify whether you need to purchase additional hardware (for example, tills, receipt printers and scanners) or if it’s included with the system.

How often does the provider update the system to keep up with industry changes?

Make sure your EPoS provider o ers regular updates to stay compliant with regulations and retail trends, keeping your system current.

PAYPOINT Mini and Connect: the next-generation technology integrating with EPoS partners ShopMate to bring you a complete point-of-sale system

How easy was it to install the PayPoint Mini?

“I was a bit anxious about the installation and training process for the PayPoint Mini, but the team made everything incredibly smooth and straightforward. They took the time to explain each step and ensured I was comfortable with all the features before leaving. The training was hands-on and very intuitive, which I really appreciated.”

What do you love most about the PayPoint Mini?

“How user-friendly it is. The interface is clean and simple, so even my sta , who aren’t tech-savvy, nd it easy to navigate. The compact size is a huge bonus for us because it doesn’t take up much counter space. This means we can keep our workspace clutter-free, which is really important in our busy store.”

What is your advice to other retailers considering the PayPoint Mini?

“My advice to other retailers considering the PayPoint Mini is to go for it. The ease of use, space-saving design and the time you’ll save on transactions make it a worthwhile investment. Overall, it’s been a gamechanger for our store.”

Local stores should prepare for Christmas biscuitand-cake opportunities, and think about building year-round sales, writes CHARLES SMITH

EVERY day brings opportunities to build your biscuitsand-cakes sales. Seasonal ranges generate excitement, peaking in the Christmas build-up, and biscuits are the biggest festive season segment after confectionery and alcohol.

Premium assortments drive Christmas sweet biscuit sales, but savoury options are important for snacking and eating with cheese.

That said, a core 7% of biscuits generate 80% of sales, so highlight seasonal o erings, but build yearround sales by prioritising bestsellers.

Biscuits and cakes is one of the biggest a ordable-treat categories; Mintel says consumers enjoy biscuits three or more times a week.

Shoppers happily pay extra for their favourites. In betterretailing.com’s Pricewatch analysis, 59% of retailers charge above £1.18, the mostcommon price for Cadbury Mini Rolls Milk Chocolate, with some hitting £2.55. It comes down to keeping customers happy, for smaller

stores like Ravi Raveendran’s Colombo Food & Wine in Hounslow, west London, and larger ones like Jeet Bansi’s Londis Meon Vale in Stratfordupon-Avon, Warwickshire.

Raveendran’s biscuit-andcake sales are geared to locals shopping after work.

“The xture is 20 steps from the till, with brands on top, then children’s, adult biscuits, and cakes on the bottom,” he says.

While some retailers do well with imported US biscuits, Raveendran’s strong sellers are short-life Italian and Polish cakes. “Our customer base is European, and many go home for Christmas, then it’s quiet,” he says.

“Our Christmas sales are geared more to alcohol, but seasonal biscuits and cakes sell well at Easter.”

Meanwhile, Bansi aims for double- gure uplifts on all seasonal ranges, but says the Christmas uplift is much greater. “We put Christmas stock out in September, after Londis’ pre-sell, and go through to the last delivery, so no-one’s left out,” he says.

BOUGHT every week by more than 99% of households, biscuits are the biggest everyday snacking category after confectionery.

With more than 22% of sweet-biscuit sales going through convenience stores, variety is crucial.

“You need a core range that covers all bases for your demographic,” says Bansi.

Single-serve packs of sweet and savoury address impulse treats and food-to-go snacks; products that promote healthy ingredients and dietary re-

quirements draw health-conscious shoppers.

Shoppers being careful in the current climate go for sharing packs and assortments for big nights in, and seasonal ranges and assortments are calendar xtures.

Bansi’s top-selling biscuits are McVitie’s core sweet lines, snack bars Club, Mint and Gold, and Wagon Wheels.

Pladis UK & Ireland’s chief marketing o cer, Aslı Özen Turhan, says £1 in £4 spent on sweet biscuits is on a top 10 brand, so retailers should

identify their top sellers and to give them as much attention as possible.

With Mondelez International and Lotus Bakeries’ recently announced strategic partnership likely to produce product innovation in cookies and chocolate, 2025 looks like another exciting year for the category.

In savoury biscuits, demand is growing for healthier and tastier options. Challenger brand Good Guys’ recently launched Bakehouse’s Cheddar Biscuit Melts, which have

a higher cheese content than standard snacks, is seeing strong growth.

Shoppers view biscuits as everyday treats, while cakes are regarded as more special. Cake sales grew strongly in 2023, says Mintel, driven by people wanting treats.

Packaged cakes sell steadily, but a strong freshly made cakes selection can impress shoppers. Given fresh cakes’ short shelf life, the trick is, as Bansi says, to “order little and often – just enough to keep them available”.

MAKING xtures easier to shop encourages return visits. Bansi says: “People expect to nd what they’re looking for, but you can create news by changing things round and taking things out, then bringing them back.”

Retailers can use launches and limited editions to generate excitement, giving promotions multiple facings and using PoS to build big, bold displays.

PMPs on gondola ends grab shoppers and con rm they’re getting value for money.

It’s important to play to peak buying periods. Raveendran’s shoppers like treats after work, whereas Bansi’s customers’ sweet spots are weekends and Monday morn-

ings. O er a choice of ‘good, better and best’. Push premium o ers and value lines for di erent occasions.

Pricing and margin for these products is whatever works in your store.

“Our typical margin on biscuits and packaged cakes is 15%-20%, and 25%-30% on fresh cakes, but it’s not worth putting shoppers o ,” says Bansi.

Raveendran says: “With fresh cakes on sale or return, the margin’s only 20%, so it’s best to control stock through rotation.”

Where space allows, drive impulse purchases with offers by the till. Bansi usually has small packs of Oreos and other small biscuits there, and

brownies and cookies in food to go. Around Christmas, he puts single slices of Christmas cake and mince pies on the till, and double slices of Christmascake in food to go.

After Christmas, o er healthier biscuits alongside bottled water for shoppers getting into shape. Cross-merchandise healthier biscuits and singles with hot drinks and sandwiches, and include them in meal deals.

Finally, keep your customers happy all year round by highlighting the latest launches and limited editions in store. Stock the new products and promotions featured in wholesalers’ pre-sells and allocations.

Biscuits

• Block-merchandise biscuits by brand, type and pack size.

• Put bestsellers at eye level and allocate space in line with sales performance. Give seasonal products a third of xture space, with secondary displays around the store.

• Cross-merchandise premium biscuits with speciality teas and premium co ees. Group chocolate biscuits to drive sales.

• Healthier biscuits have the largest share of onthe-go biscuit singles, so include them in food-togo sections.

Cakes

• In packaged cakes, place launches next to bestsellers, to capitalise on brands’ strength. Put limited editions and seasonal options alongside core ranges.

• Position small cakes at eye level to boost impulse sales. Large cake purchases are usually planned, so place them at the bottom of xtures.

• Pies and tarts are more popular with older shoppers. Putting them together makes selection easier.

• Secondary-site cakes near custard, cream and ice cream to inspire purchases as desserts.

Seasonal merchandising

• Put hard-to-resist products out early. Include vegan and free-from options.

• Use novelty products to add sparkle, focusing on items from known brands.

• Highlight seasonal ranges with secondary sitings.

• Make prices and promotions highly visible.

Retailers talk to TAMARA BIRCH about their thoughts on price-marked packs, the bene ts they’ve seen and how they manage inflexible margins

THERE has long been questions around whether it’s a good idea for convenience retailers to stock price-marked packs (PMPs). This has been especially true in recent years, when retailers have reported bigger drops in margin, making it harder than ever for PMPs to be pro table.

However, the general consensus is that PMPs can be a great idea for retailers, as they reas-

sures shoppers they’re not being overcharged, and puts their trust in PMP labels.

Nic Storey, senior sales director, impulse & eld sales at PepsiCo, says: “PMPs reassure consumers of value and help retailers o er an accessible price that builds trust with shoppers.

“PMPs cater to multiple occasions and missions, so it’s important retailers are stock-

ing the right mix of flavours and brands.”

Retailers agree with Storey and say PMPs can be a great addition. “The rate of sale and customer con dence make PMPs worth it for us,” says Andrew Newton, owner of Nisa Local Colley Gate in Halesowen, West Midlands.

“It helps them come through the door. I’ve tried my store with and without PMPs,

and regularly go through periods of doing one or the other, and right now, PMPs are working best.”

Ken Singh, owner of Boghar Bros in Pontefract, West Yorkshire, adds: “PMPs are essential if you want to o er a competitive edge for your customers and assure them you’re not overpricing products, especially with the costof-living crisis.”

MARGINS on PMPs are the biggest challenge for retailers, with the majority often lower than their non-PMP counterparts.

The way to counter this narrative, according to retailers, is to shop around and buy key lines when they are on o er.

“We visit a couple of wholesalers and check beforehand what they have on o er,” Newton says.

“We’ll stock up on any PMP products that are on o er, giving us a stronger margin and helping us get through that inflexibility.”

Singh has a similar strat-

Steve Moore, head of retail, Parfetts

egy, but says suppliers have a role to play within the margins o ered on PMPs, and that retailers should try to collaborate with them on getting the best solution where possible.

He adds: “We recently had Sharwood’s in store, and did an activation where the sauces were reduced from £2.99 PMP to £1.99 PMP.

“Our volume sales increased as a result, and so has our overall store margin.”

Retailers can maintain healthy margins on PMPs by carefully managing their product range and selecting PMP lines that strike a good

balance by o ering value and sustainable pro t margins

Clare Newton, trade marketing manager at Swizzels, says: “It’s essential to strike a balance that is well-suited to the store’s competitive prices and stocking PMP products that are well-suited to the store’s customer base.”

This is echoed by Steve Moore, head of retail at Parfetts, who adds: “Balancing margins with footfall requires retailers to o er enough PMPs to attract value-conscious shoppers while maintaining some flexibility in non-PMP products.”

“PMPs have become a signi cant and growing part of convenience retail. This is largely due to the transparency and value PMPs o er to consumers, particularly in the current cost-of-living crisis. PMPs help consumers manage their budgets and boost con dence that they are getting value for money, which has made them an essential part of many stores’ strategies.

“Phasing PMPs can be an e ective strategy. Retailers should align PMP o erings with peak shopping periods or seasonal demand to maximise their impact. For example, impulse purchases could be promoted more heavily during certain times of the year, and seasonal PMPs can attract attention.”

Ben

Parker, GB retail commercial director, Britvic

“AS the cost-of-living crisis continues, PMPs continue to play an important role in communicating value, reassuring shoppers, and creating con dence in local retailers. For example, while purchasing PMPs, 51% of shoppers feel reassured they are not being overcharged.

“Stocking PMPs can signal to shoppers that retailers understand the current market challenges and are providing a ordable options for consumers. In turn, this is a great way to drive further sales opportunities in the so drinks category, given the current landscape.”

Tango Mango 500ml PMP

This year, Britvic launched Tango Mango in a 500ml PMP format for shoppers on the go, while providing a value option. It combines an indemand flavour with Tango’s recognisable pack, which is designed to create standout on shelves and in chillers.

Butterkist’s PMP Wicked promo

KP Snacks has announced a partnership between Butterkist and upcoming musical lm Wicked that will include an on-pack promotion. To mark the movie’s release on 22 November, Butterkist will drive visibility with a limited-edition 180g Sweet pack, with Wicked-themed packaging highlighting the promotion. The promotion will also run across Butterkist’s £1.25 PMP range of Sweet, Salted, To ee and Sweet & Salty varieties. It o ers shoppers the chance to win a “thrillifying adventure to London”, with ve prizes up for grabs. These include a stay in a luxury London hotel, a potion-making experience, a makeover, a shopping spree worth £200 and a wizard-themed afternoon tea.

Boost launches 500ml £1 PMP for Energy range

Boost Drinks has expanded its o ering with the launch of a 500ml format for its Energy range, initially available in Original, Sugar Free Original and Red Berry varieties. The range is available now, with each variety carrying a £1 price-mark.

Captain Morgan Original Spiced Gold & Pepsi Max Diageo has launched a new ready-to-drink (RTD) beverage from Captain Morgan, in partnership with Pepsi Max. Exclusive to Great Britain, it is available in 250ml slimline PMP cans (£2.19). According to the supplier, 81% of consumers agree they are more likely to purchase an RTD mixed with a branded mixer. Captain Morgan is currently Britain’s number-one rum brand, while Pepsi Max is the top-selling zero-sugar cola, according to Nielsen gures.

Bobby’s trio bagged sweets

In September, Bobby’s Foods added a trio of £1.25 PMP lines to its bagged sweets range: Blue Razz Dreams, Fruit Fools and Vimto Fried Eggs. Blue Razz Dreams are a blue raspberry variety of the brand’s popular Strawberry Dreams Line, while Fruit Fools consists of di erently shaped fruitflavour sweets.

WKD reduces 700ml PMP

In September, WKD announced it had reduced the RRP of its 700ml PMP from £3.79 to £3.29, a decrease of more than 13%. The permanent change will see no changes to trade case sizes, and aims to drive rate of sale for independent retailers, for which the 700ml bottles are exclusively available.

THE reality is there are some categories that don’t require PMPs, as shoppers will trade up, treat themselves or budget accordingly for these products. These categories will depend on your customer base, but for some retailers, categories that are non-PMP include alcohol and food to go.

But there are some categories where PMPs are the only option. “Soft drinks work so much better as a PMP,” Newton says. “I don’t know many

that don’t, it helps bring shoppers through the door. Biscuits and hot beverages work better if there’s a PMP option, too.”

According to suppliers, though, impulse-driven categories can be popular with a PMP options. “In the confectionery sector, smaller formats, such as single bars, sharing bags, and multipacks are ideal for PMPs, as these products are often bought on impulse and bene t from the clear value proposition PMPs

Nic

o er,” Newton adds.

“£1.25 PMPs are a key format for independent and symbol stores to focus on, accounting for 50% of crisps, snacks, nuts and popcorn sales,” says Matt Collins, sales director at KP Snacks.

“These PMPs are worth £322.7m within the crisps, snacks & nuts (CSN) category and are growing in value by 6.1%, and 18 of the top 20 bestselling lines are £1.25 PMPs.”

Storey,

senior sales director, impulse & eld sales, PepsiCo

“PMPs continue to be crucial to the savoury snacks category, remaining a signi cant source of growth. The format reassures shoppers of value, whilst helping retailers to o er an accessible price point that builds trust. To support retailers in tapping into this opportunity, we recently teamed up with fellow British icon Heinz to launch three limited-edition Walkers Lunch sandwich-inspired flavours, all available in a 70g PMP format.

“Aimed at sprucing up snacking aisles and helping to boost lunchtime sales, our Walkers Sausage Sarnie with Heinz Tomato Ketchup, Cheese Toastie with Heinz Baked Beanz and Roast Chicken with Heinz Mayonnaise flavours have supported retailers in catering to shopper demands for bold flavour variations of their favourite snacks, helping to drive their overall PMP crisps and snacks sales.”

“FIRST, focus on valueconscious shoppers and adjust your PMP strategy accordingly,” explains Parfetts’ Steve Moore.

“Second, PMPs should be used for impulse items and value-driven categories, but keep flexibility for premium products.

conditions and adjust the use of PMPs based on economic conditions, increasing them during tougher times and reducing them in more premium environments.”

Finally, monitor market

Within soft drinks, Ben Parker, GB retail commercial director at Britvic says to offer a choice of PMPs, including di erent flavours and formats, as well as well established brands.

“Brand is the most important factor when choosing a soft drink,” he says. “This also anchors a consumer’s eye and is the key to successful navigation. Consider stocking well-known brands in PMP formats to maximise this opportunity.”

The inaugural Better Retailing Festival provided retailers with top advice on how to improve their businesses. ALEX YAU outlines the main takeaways

SHOP crime was a major topic at the festival, with retailers highlighting the ongoing impact on their stores. Explaining how she tackles the issue in an a ordable manner, Fiona Malone, of Tenby Stores & Post O ce in Pembrokeshire, said: “Lay your store out in a way where it makes it di cult for shoplifters to navigate. We

get our sta to greet everyone who comes in.” Central Co-op chief executive Debbie Robinson added: “Theft is a massive issue. My colleagues go into schools to talk about violent attacks and the impact it has on them. Not just in the moment, but also on their lives and their families. It has to stop.

“Incidents are increasing in our stores and my worry is that colleagues will go to work and not return home safely. Everybody has the right to return home safely. I write to the home secretary, the prime minister and every MP in a particular area when there is an incident. I share the graphic detail of what’s happened.”

IN Mars Wrigley’s ‘How to Do a Great Range Review’ masterclass, the supplier’s wholesale category development lead, Fiona Martin, said retailers had an opportunity to boost impulse sales in the current climate. She said: “Just looking at the current market, the past couple of years have been

tough, and continue to be tough, but we are seeing reduced pressure on household spending. That’s great news within this sector. People are going out to shops more frequently. Convenience can really drive this part of the segment.

“We know there’s big demand for fresher and more

food-service-based products.”

In a separate masterclass, Suntory Beverage & Food GB&I national account manager Elliot Sleath advised retailers to look within their own circles for community engagement ideas. “Look at the relationships with your fellow retailers, as many are already doing amazing things,” he said.

Huge congratulations to Judith Smitham from The Old Dairy - Pydar Stores, Truro, winner of the Responsible Retailing Award!

From all of us at Allwyn Operator of The National Lottery

ATTENDEES were also given top advice on how to use social media to boost sales. For example, Natalie Lightfoot, of Londis Solo Convenience in Glasgow, focuses on trending products and uses social media platforms such as TikTok to create a buzz. This has helped Lightfoot tap into new customer bases and boost average basket spend.

She also makes it as simple as possible for customers to follow the store on social media. A Facebook poster features a QR code which customers can scan.

EPoS data has also been vital in Lightfoot’s social media strategy. She uses this data to decide when to introduce new products and maximise their potential. “While innovation

is important, knowing when and how to promote new products is key to success,” she explained.

According to an in-session survey during Coca-Cola Europaci c Partners’ ‘Backing the Right Innovation masterclass, new products and store services were among the top three areas of focus for retailers when it comes to innovation.

SUPPLIERS such as Allwyn highlighted the importance of collaboration, with the National Lottery operator revealing a number of new upcoming initiatives. The rm’s retail strategy manager, Guy Goodacre, told retailers in its ‘Responsible Retailing in the Current Climate’ masterclass about a new type of store visits separate from traditional mystery shops.

A member of the Allwyn team will visit a store and assess it on several areas. Rather than notify the retailer

that it has failed or passed on certain areas at a later date, Allwyn will work more collaboratively with the retailer afterwards to address how they can improve on certain areas.

Allwyn head of retail strategy and operations Julie Brian also revealed a number of upcoming products to help retailers take advantage of the seasonal gifting opportunity, such as scratchcards designed to be used as a tag on a Christmas present, as well as scratchcards that can be folded like Christmas cards.

DURING the ‘Making Vaping and Next-Gen Products Work

For You’ masterclass, BAT UK

B2B manager Hashim Tahir was asked how retailers can retain customers who might switch to specialist vape shops following the ban on disposable vapes in June 2025.

He advised: “The rst thing is obviously education, especially if you’ve got sta at the store making sure they educate the customer when they come in. We’re going to be launching a lot on our websites alongside training courses for retailers and sta members

so they can understand all the new products that are coming in.

“They can learn how to get customers through the transition away from disposable vapes as well. The key thing is becoming educated on all the di erent formats avail-

able because there will be people that will transition into smaller pod systems. There’ll be people who’ll want bigger devices.

“They will go to shops who have that knowledge, so it’s key for retailers to ensure they can provide that.”

double or triple face. What are your biggest sellers?”

Mondelez trade communications manager Susan Nash advised retailers to take a di erent perspective on their shop in her The Power of Display masterclass. She said:

STEFAN Appleby, head of retail engagement at Better Retailing’s parent company Newtrade Media, highlighted areas where retailers can oset sales losses. Referencing Newtrade’s sentiment tracker, he said: “The con dence retailers have in making profit is decreasing rapidly. How much does it cost to open your shop? It might not be a onesize- ts-all solution, but you should think about how much you make per metre. This calculation is a good way to think about what you should

“Watch your shoppers. Stand outside your store and count customers, and see where they go, as this will give you clues on what captures their eye. Look at other stores, as this will make you think differently. Think about what you don’t like.”

Some of independent convenience’s top retailers were celebrated at the BETTER RETAILING AWARDS last month. Here are their tips on how to stand out

“Make your store a destination by introducing specialised food-to-go areas, or food for speci�ic days of the week such as a Sunday roast.”

“Investing in your team’s training can help them recognise potential negative situations and defuse them through engagement and communication.”

Edinburgh

“Work with local foodbanks or companies such as Too Good to Go to support local residents facing hardship.”

Congratulations to the Community Hero winner Sophie Williams

Broadway Premier, Edinburgh

Natalie Lightfoot, Londis Solo Convenience, Glasgow

“Encourage your staff to speak to customers about what they would like, whether that’s a particular wine or chocolate.”

Judith Smitham, Pydar Stores – The Old Dairy, Cornwall

“Maintain good availability by having senior members of staff monitor stock levels daily, through product �iles and checking invoices.”

Shilen Madhani, Premier MBROS, Swindon, Wiltshire

“Place your bestselling and high-margin products in high-traf�ic areas, such as the store entrance, checkout and main aisles.”

Ashan Chaudry, Triple ‘a’ Foodhall, Nuneaton

“Become inspired to innovate by visiting other stores. For instance, we saw a 12,000sq ft store in Toronto and came away with so many ideas.”

Kaual Patel, Nisa Torridon Convenience, London

“Try to bring excitement into the store through theatre, by introducing special sections for individual categories.”

Judith Smitham, Pydar Stores – The Old Dairy, Cornwall

“Make disability access as easy as possible by ensuring aisles are kept clear and shelves aren’t stacked too high.”

Girish Jeeva, Girish’s Premier, Glasgow

“Instead of letting staff handle all elements of the shop, determine which components of the role they excel at.”

Proudly sponsored by

The RETAIL EXPRESS team nds out what technological gadgets are helping retailers run their businesses more e ectively

Peter Bhadal, Londis Woodhouse Street, Leeds 1

“I BOUGHT headsets for my team and me. I’ve bought four of them for both stores and they’ve been well received by my team. We got them in July and I wish I’d got them earlier. It’s been a game changer for us. In the �irst instance, it helps with things like customer abuse and handling shoplifters and opportunists who might want to take advantage of a single point cashier. Now we’ve got the headsets, they know they’ve got backup at the press of a button.

“It also means we’re not chasing each other around the store, trying to �ind people you need to help you with a job. I couldn’t put a �igure on how much it’s saved us, but when a customer needs help, there’s a team behind the staff member helping them. They weren’t cheap, so I only got four, but I never have more than �ive people working, so I’ll forego one person going without as long as there are four headsets running.”

2

Justin Whittaker, Premier MJ’s, Oldham, Greater Manchester

Jay Javed, Nisa Rutherglen, South Lanarkshire 3

“IT was a simple thing, but we got these little fridge alerts. When the temperature drops on a fridge or if the door hasn’t been closed properly, it just rings at you to let you know so you can sort it out. I got them cheap from a company called Fridge Alert, but they’ve already saved me a couple of times. There are more advanced gadgets out there that record the temperatures and email them to you, but when your fridge is beeping, you can’t ignore it.

“We don’t have them on all our fridges, just the freezers and the fresh and chilled – the ones where there’s a serious and genuine health risk around the products in them if the temperature gets too high. They’re not on the soft drinks fridges. Retailers should be investing in this. It’s good for peace of mind and it’s also good for reducing unnecessary food and energy wastage.”

In the next issue, the Retail Express team nds out retailers’

If you have problems you’d like us to explore, please

“WE opened a store in December last year and it was the �irst one we opened with electronic shelf-edge labels (ESLs). And now we’re going to put them into our other 11 stores. We invested almost £50,000 in the Nisa EPoS systems along with ESLs from Herbert Retail. But every single one is a game changer.

“The savings in labour costs are huge and there’s the transparency of pricing that you can provide customers. On top of that, we’re able to offer more promotions, so we’ve seen a sales uplift in the store that has them compared to the others. The information is never out of date. It’s a big commitment, but I reckon it’s saved us 15-20% in labour costs already.

“Before minimum unit pricing went up, we had to spend huge amounts of money getting all the prices changed, getting IT people to come up from Liverpool to check them – except in the ESL store, where we pressed a button and it was done.”