Your guide to adding hot-selling, highmargin doughnuts to your store RETAIL NEWS THAT MATTERS ● betterretailing.com ● 14.06.2024 THE LEADING TITLE FOR NEWS AND CONVENIENCE RETAILERS Page 28 » GO RELOAD 1000 NEW **Up to 1000 puffs per pod. Based on laboratory testing of newly manufactured pods in a Vuse Go Reload 1000 (including recharging) at a puff duration of one second and may vary depending on individuals’ usage behaviour. For further information see: www.vuse.com/gb/en/puffcount. For trade use only. Not to be left in sight of consumers. These products contain nicotine and are addictive. DRIVE YOUR ROI WITH VUSE * VISIT VAPERMARKET.CO.UK To discuss, contact your local BAT Representative *Limited availability while stocks last UP TO 1000 PUFFS** EXTRA INTENSE FLAVOURS 24 Vol 135 No 24 £2.99 FOR TRADE USE ONLY FIRM SALE

Connecting, supporting and empowering women working in independent convenience retail The Studio, Birmingham Leading your Business to Success 26 June 2024 10.45am onwards Understand and develop your own personal leadership style Learn practical ways to empower your team and manage performance Share experiences and build a network of like-minded retailers Secure your FREE place today

by scanning the QR code

contacting Kate Daw:

07886 784465

at bit.ly/WiC2024,

or by

kate.daw@newtrade.co.uk //

Your guide to adding hot-selling, highmargin doughnuts to your store l Meet the retailers making 60% profit with simple thawand-serve products l All the suppliers and advice you need to copy their success Page 28 » RETAIL NEWS THAT MATTERS l betterretailing.com l 14.06.2024 THE LEADING TITLE FOR NEWS AND CONVENIENCE RETAILERS Make £250k in three years New automated launderette firm promises store owners rapid returns OPPORTUNITY Page 4 » INDUSTRY NEWS Post Office Horizon delays Scandal-hit till system gets life extension as replacement kit falls further behind Page 3 » CATEGORY ADVICE Boost your sports drinks Everything you need to grow your sales, plus six unique brands for your chiller IMPROVE YOUR STORE Get more from your EPoS Retailers reveal the tools that cut costs and improve sales in local shops Page 18 »

Editor

Jack Courtez

@JackCourtez

07592 880864

News editor

Alex Yau

@@AlexYau_ 020 7689 3358

Features editor

Charles Whitting

@CharlieWhittin1 020 7689 3350

News reporter

Alice Brooker 07597 588955

Head of design

Anne-Claire Pickard

Senior designer

Jody Cooke

Junior designer

Lauren Jackson

Production editor

Ryan Cooper

Sub editors

Jim Findlay, Robin Jarossi

Production coordinator

Bod Adegboyega 020 7689 3368

Editor in chief

Louise Banham

@LouiseBanham

Deputy insight & advertorial editor

Jasper Hart

@JasperAHHart 07597 588975

Specialist reporter

WELCOME

@ThisisRN

Dia Stronach 020 7689 3375

Features writer

Priya Khaira 020 7689 3379

Editor

Editor

Jack Courtez

@JackCourtez

020 7689 3371

Head of commercial

Natalie Reeve 07856 475788

Associate director

Charlotte Jesson 07807 287607

Account director

Lindsay Hudson 07749 416544

Account managers

Megan Byrne 07530 834009

Lisa Martin 07951 461146

Managing director

Parin Gohil 020 7689 3363

Five years ago, Tesco introduced Clubcard prices, a scheme so successful it forced nearly all of its rivals to follow suit. At the time, independent convenience stores took £1.70 in every £100 spent on groceries in the UK. That has now decreased to £1.40. That 30p difference is equivalent to around £36m less in the tills of local shops each month – around £1,000 extra in sales for every store like yours.

It’s dangerous to conflate causation and correlation, and there’s a roster of reasons for this dip, but the rise in supermarket loyalty schemes is certainly part of it. I’ve watched this monumental shift happen while the independent sector mostly stood still.

Symbol groups understand customer rewards – they spend endless hours tinkering with rebate schemes designed to buy your loyalty. Through many of their supermarket owners, they even have an insider’s view on how shopper reward schemes works.

However, when we asked different groups about their plans for a loyalty scheme, we rarely got a clear answer. Instead, I hunted out the alternative options for stores – companies you can partner with to bring member prices, points and offers to your customers. RN ran the first-ever industry interviews with companies such as Noumi and MyDD Points, and regularly covered Jisp.

There are signs symbol groups are waking up to the need for a loyalty scheme. Noumi and MyDD Points are exploring trials with some symbol groups and at the end of 2023, Nisa said it would “accelerate” the rollout of Jisp. The biggest and best news, however, is Booker’s trial of Premier-, Londis- and Budgens-branded reward schemes, launched towards the end of last month, featuring the Holy Grail of member-only pricing. The fact some participating stores reported such intense levels of shopper interest that they ran out of rewards cards to give out shows how much demand there is and the opportunities it presents.

For symbol groups, there are major benefits – it makes it harder for a retailer to switch fascias when all of their customers are tied in to one group’s rewards. It also boosts their sales to you and provides more data on how their promotions are performing. For everyone with an interest in local shops, more shoppers visiting more frequently and spending more per trip is the dream, and reward schemes are how we get there.

HEADLINES

3 INDUSTRY NEWS

Post Office Horizon to remain as replacement hit by more delays

Speed Queen on the hunt for retailers to add launderettes

5 SYMBOLS & WHOLESALE

New company’s plan to get unique lines into cash and carries

6 N EWS & MAGS

Stores put at risk by potentially illegal magazine cover

7 FED NEWS

Incoming president to make stores simpler and more profitable

8 YOUR VIEWS

‘We’re killing retail crime with kindness’

9 EXPERT OPINION

Neville Rhodes on why publishers and wholesalers should embrace sub-retailing

10 PRODUCT NEWS

CCEP on-pack promotion for Euros 2024

12 PRICEWATCH

Make more dough from bread

14 WHOLESALE PRICEWATCH

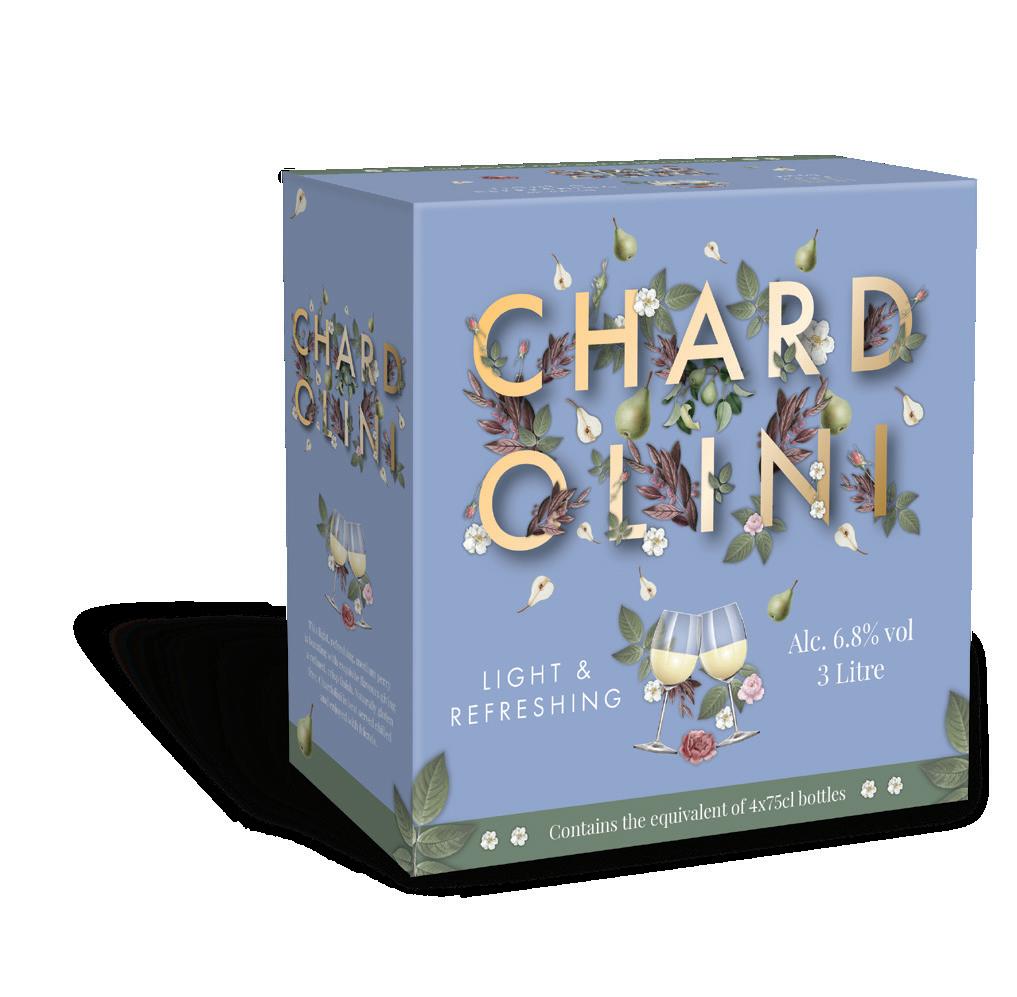

Compare wholesale prices on pre-mixed alcohol lines

15 STORE ADVICE

Retailers’ top tips for reviewing your ranges for greater sales

18 GETTING MORE FROM YOUR EPoS

The little-known features that create better- performing stores

21 SPORTS DRINKS

Your guide to selling more this summer

25 SUMMER BARBECUE

Capitalise on big at-home summer events

28 DOUGHNUT OPPORTUNITIES

Maximise margins with doughnuts

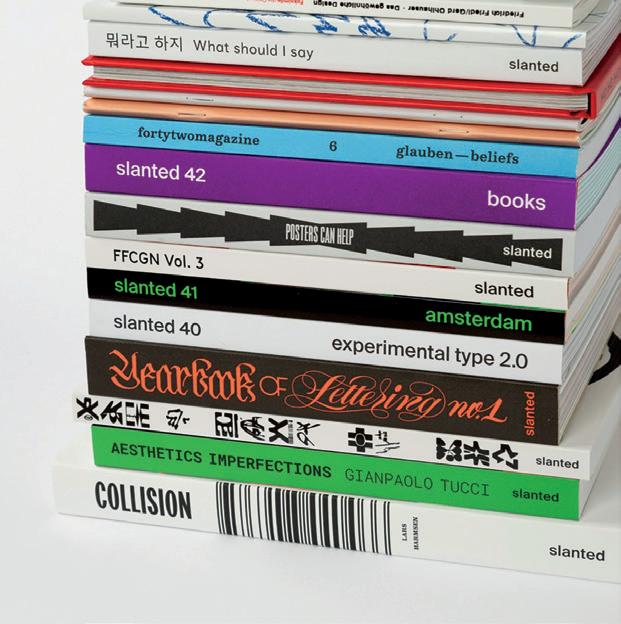

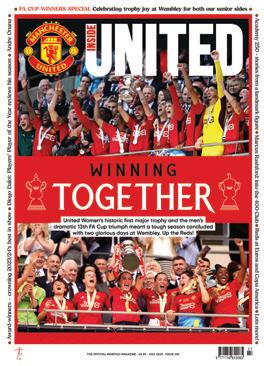

31 THIS WEEK IN MAGAZINES

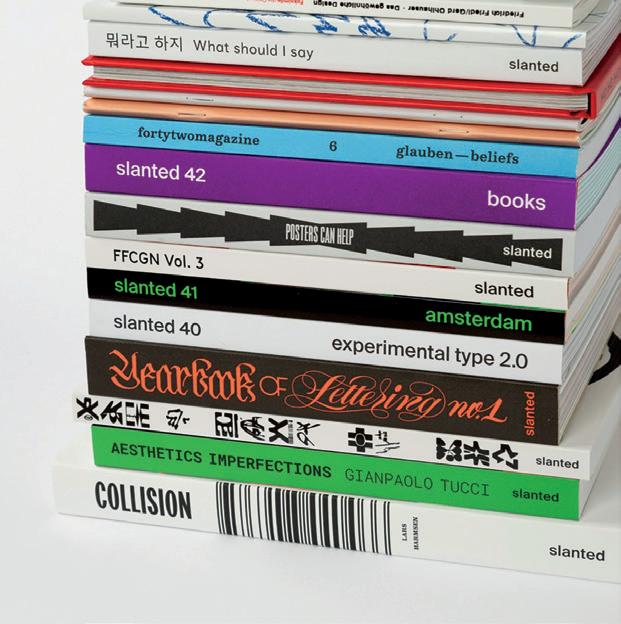

Typography title Slanted is on the hunt for more stockists

2 betterretailing.com // 14 June 2024 RN Newtrade Media Limited, 11

Tel

RN is published by Newtrade Media Limited, which is wholly owned by NFRN Holdings Ltd, which is wholly owned by the Benefits Fund of the National Federation of Retail Newsagents. RN is editorially independent of the NFRN and opinions, comments and reviews included are not necessarily those of the Federation and no warranty for goods or services described is implied. Reproduction or transmission in part or whole of any item from RN may only be undertaken with the prior written agreement of the Editor. Contributions are welcomed and are included in part or whole at the sole discretion of the editor. Newtrade Media Limited accepts no responsibility for submitted material. Every possible care is taken to ensure the accuracy of information. For trade use only Annual Subscription UK 1 year £165 Europe £332 2 years £297 Rest of world £389

years £396 To subscribe contact 020

6490 Printed by Warners Midlands plc Distributor Seymour Distribution, 2 East Poultry Avenue, London, EC1A 9PT Audit Bureau of Circulations July 2022 to June 2023 average net circulation per issue 8,063 RN’s publisher Newtrade Media cares about the environment.

Angel Gate, City Road, London EC1V 2SD

020 7689 0600 email letters@newtrade.co.uk

3

3871

Cover image credits: Getty Images/S-S-S/sweetlova

facebook.com/ThisisRN have your say on the latest news Follow

Facebook f

INSIGHT

CONTENTS

on

grow

sales

the website betterretailing.com extensive galleries and news

for expert advice to help you

your

Follow RN on X Visit

NEWS

Five-year hold-up to get rid of Horizon IT in POs

by Alex Yau alex.yau@newtrade.co.uk

Post Offices (POs) are to be stuck with the scandal-hit Horizon IT system for another five years, following delays to the rollout of its replacement New Branch IT (NBIT) kit.

According to Computer Weekly, issues with cost, quality and lack of staff have delayed the release of the new system scheduled for March 2025. As a result, Horizon manufacturer Fujitsu could receive an additional £180m from taxpayers to support an extension of its existing contract to 2030.

Fujitsu warned it would not continue to support Horizon unless PO had a “credible plan” to exit the contract, meaning PO would have to find another supplier or bring the management in-house.

PO said these alternatives would not be “economically viable”.

PO confirmed to RN it had recently completed demonstrating the NBIT software to postmasters in South Wales and the west of England, with another pilot in the works.

In April, the company announced a £75m tender for a manufacturer of

kit that would house the NBIT software, with the contract expected to start in August.

Participating postmasters were shown functions for the sale of first- and second-class stamps, the sending of Royal Mail postal items and the acceptance of pre-paid items.

PO has been taking on feedback during the demos and will also be demonstrating NBIT at its upcoming conference on 18 June.

One subpostmaster involved in the recent NBIT pilot, who asked not to be named, told RN:

“We’ve had sight of it, as PO has been bringing it to selected stores as part of 30-minute demos.

“We’ve only seen a few functions so far, which are the main ones to process PO services. It does what it says on the tin, really. It’s a much simpler system and it’s more intuitive.

“One of the issues of Horizon was that it tried to do way more than it could handle, which was one of the reasons for the glitches. The new kit is trying to address this.

“The new system we saw is around the same size as the current Horizon equipment, but it’s

also more modular, meaning there’s some flexibility in its design. We can customise it to some degree to fit the space requirements of our counter.”

A PO spokesperson told RN: “We are acutely aware that we will be introducing a new system across the biggest retail network in Europe and ensuring postmasters are kept fully informed is crucial.

“We have around 250 postmasters in our working group, which has helped inform our initial design of the new IT system, and we’re showing the system directly to postmasters.”

Freeze-dried sweets safety warning

Retailers are being urged to be vigilant about the “ticking time bomb” of freeze-dried sweets and ensure they are buying from reputable suppliers.

Several store owners warned of a rise in rogue suppliers trying to take advantage of the craze.

Amrit Singh Pahal, of H & Jodie's Nisa Local in Walsall, has spent several months developing his

own product range and says there are “hoops to go through” to make sure the products are safe.

He said: “Lots of people are jumping the gun on this craze, and it’s a ticking time bomb.

“What happens if a child chokes on one of these sweets? People can’t just buy a drying machine, package sweets and sell them.

“There has to be full certification that complies with food hygiene and trading standards. I have a long list provided by my local council.”

One reputable supplier, who asked not to be named, added: “Retailers need to be careful who they buy from. Make sure they are fully food registered and trading as a business.”

Allwyn’s direct payouts

Store owners can now get their National Lottery rewards payments paid directly into their bank accounts, with more changes on the way, according to Allwyn.

Responding to letters sent out to stores, an Allwyn spokesperson told RN: “We've improved the way we pay National Lottery retailers their hard-earned rewards with a faster payment method.

“With our new payment partner HSBC, retailers are now able to transfer rewards directly into a bank account when they’re ready to be redeemed from the TNL Retailer Hub.

“This new payment method replaces the old one whereby retailers loaded their rewards onto a Mastercard to spend.

“We're also working on a number of new ways to reward National Lottery retailers for their hard work.”

Nisa tracker launched

Suresh Patel of Premier Upholland, Lancashire, said he began selling the sweets two weeks ago and has since reordered.

He said: “Several wholesalers are selling freezedried sweets. As a retailer, what I can do is make sure the item has a barcode, ingredients and full allergen information and that I’ve ordered it from a reputable wholesaler.”

Nisa’s long-awaited rebate tracker launched on 3 June, enabling retailers to follow their weekly progress and ensure the best possible quarterly payout. Messages to stores seen by RN stated that Nisa’s Order Capture System (OCS) will provide updates on the symbol group’s Fresh Rewards rebate scheme, showing figures on previous and current financial quarters.

Nisa stated: “You will now be able to track your weekly spend against the Fresh Reward rebate targets to ensure the maximum percentage rebate can be achieved.”

3 RN 14 June 2024 // betterretailing.com

NEWS

SGF launches manifesto

The Scottish Grocers Federation (SGF) has called on election candidates to back local shops on five points impacting profitability.

In its own manifesto ahead of the 4 July General Election, the trade group pushed for candidates to agree to a UK-wide depositreturn scheme with clear dates and terms; to take “a balanced approach” to proposed tobacco and vaping restrictions; to protect free access to cash and ATMs; to base minimum wage increases on “economic conditions”; and to recognise the overall legislative burden that stores face.

The document claimed: “The cost of doing business is severely threatening the viability of many Scottish independent convenience stores.”

SGF chief executive Pete Cheema added: “We are asking the new government, whatever their [party], to take a serious look at how overregulation is impacting small business.”

Tobacco Club ups profits

Booker has claimed its new Tobacco Club for retailers using its Shop Locally promotions scheme can give stores an extra £1,000 annual profit.

Like its tobacco clubs for symbol stores, the scheme will give participants lower prices, but only if shops promise to sell them at recommended retail prices.

The 10 products included are Chesterfield Red, Mayfair SK Gold and Silver and Mayfair KS Gold and Silver, Malboro Gold RYO 30g, and B&H Blue RYO 30g. Scotland-only lines are Kensitas Club SK, KS, and RYO.

Speed Queen laundries seek retail partners

by Jack Courtez jack.courtez@newtrade.co.uk

New automated-laundry format Speed Queen has landed in the UK, and its owners are looking for retailers to take on the concept in their areas.

Speaking exclusively to RN, the licence holder for the brand in the UK and Ireland, Patrick Brennan of DNL Collective, explained how the units are proven to deliver around £250,000 of profit in their first three years; why they are a perfect match for convenience stores and forecourts, and how demand for laundry services is higher than most people realise.

In partnership with Tesco in Ireland, Brennan has already launched and tested 22 sites on the supermarket’s forecourts. “We’re not just here to sell stores, we’re going to invest and open them as well,” he explained.

The concept’s first UK backers are the “exceptional” Scottish forecourt owners RaceTrack, with a Speed Queen concession at its new Wishaw site near Glasgow already trading.

A Speed Queen is automated, running on card payments with live sales and CCTV tracking to make operating costs near non-existent.

The opportunity

“It’s a turnkey solution – they hand us the keys and when they come back, their store is ready to trade,” Brennan stated. Each site requires an investment of around £250,000 from the retailer, with the founder adding: “Our data proves a three-year return on investment, which is pretty much unseen across most

sectors.”

Nearly £200,000 of the £250,000 is spent on equipment. Brennan said: “Financing has not been an issue because it’s going into assets with serial numbers. We have real live data and financial models that have been given to banks and they’ve been happy to accept.”

In return for the investment, Brennan’s average site in Ireland is delivering 60 customers on peak days, and 30 customers on quieter days such as Tuesdays and Wednesdays.

The average spend per customer is £15. The sites operate without staff except for cleaning. “To own and operate a Speed Queen in an adjacent premises takes one hour to 90 minutes of staff time per day from an existing employee, so zero labour cost pretty much,” he said.

The opportunity to leverage existing staff to operate the site is what makes existing store owners a core part of Speed Queen’s UK expansion plans. The four models suggested for retailers are: converting an existing store; adding a Speed Queen to a store; adding one to an adjacent unit; or using its prefabricated

units to place one on a car park or forecourt.

Other benefits include the opportunity to crosssell to customers. Brennan said the average laundry-service user has a one-hour dwell time, with 60% of users in his Ireland Tesco sites also visiting the supermarket while they wait. Of these “over 50%” took a trolley for a larger shop.

Challenged on the reputation of launderettes for being a declining market, Brennan admitted the number of sites had fallen from 12,000 in the 1970s to “fewer than 3,000”, but said the decline was driven by poor locations, labour-intensive models and service standards, not a lack of demand.

He explained: “I’ve got stores where people have said, ‘It won’t work there, everyone is driving a BMW’. We do it, and it works. Everybody uses a launderette, from 16-to-96-year-olds, male and female, bank managers, tradespeople, every demographic. Our advertising educates people on why to use a launderette, even if you have a washer dryer at home. There’s things you can’t do in that machine or are much

easier with us. Think of a family returning from holiday. That’s three days of laundry at home or an hour with us. Bedding is difficult to do at home. For elderly people, it’s simpler to do at a launderette without worrying about drying clothes at home in bad weather.”

The right sites and retailers

The major factor in the success of the site is the number of homes nearby. Brennan commented: “You’re looking ideally for 5,000 chimney pots. In rural areas, that radius can be six to seven miles – they’re used to commuting into the town.

“In more built-up areas, we believe we can put a store for every 5,00010,000 chimney pots at a two-mile radius.”

The format “ideally” requires 750sq ft, but sizes either in development or up and running range from 500sq ft to 2,000sq ft. Brennan said he is looking for partners to open multiple sites to limit the number of operators and ensure each gets a high level of support.

He added he would also consider giving operators territorial exclusivity.

4 betterretailing.com // 14 June 2024 RN

EXCLUSIVE

Patrick Brennan of DNL Collective

New firm brings new brands to wholesale SYMBOL NEWS Parfetts adds new cereal

by Alex Yau alex.yau@newtrade.co.uk

A new food-and-drink consultancy is bringing more challenger brands into cash and carries for retailers, with each product generating average margins of 30% for stores.

Retail Distribution Management was set up Shane Nimmo, who has previously held senior roles at Halewood Wines & Spirits, InterContinental Brands and Biotiful Gut Health.

Explaining the decision behind company’s establishment, Nimmo said: “Retail Distribution Management was born out of the frustration of seeing good brands fail to treat wholesale and convenience as something other than an afterthought.

“We work closely with key retailers and wholesalers to offer strategies to grow brands in a manageable way, which means no more dusty cases and bottles on a wholesaler’s shelf.”

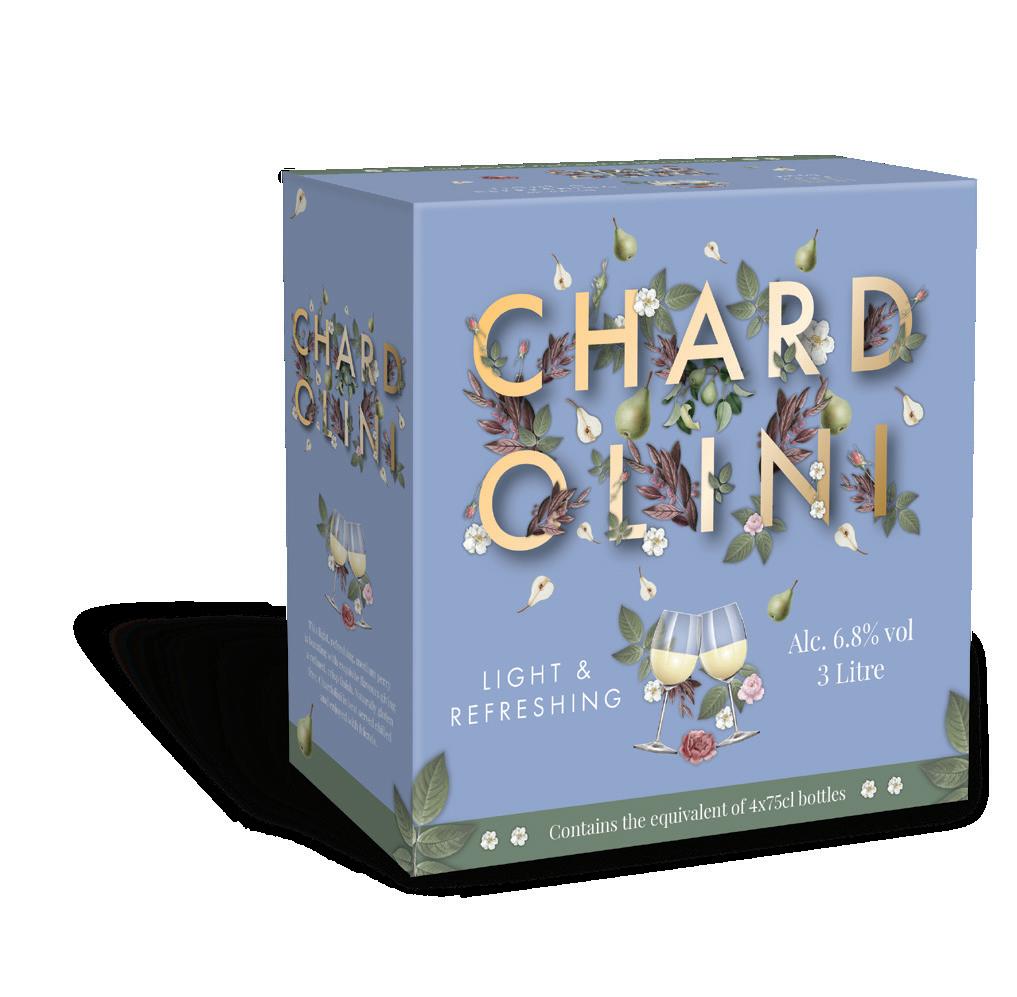

The company is currently working with four alcohol brands for distribution into wholesale and convenience, including

Mahiki Rum, Wrexham Lager and Panther Milk. Nimmo added the company is also in discussions to add soft drink and dairy suppliers to its list of partners.

Nimmo told RN: “Having previously worked with big and small suppliers, there’s a mindset that everyone wants to be in big supermarkets such as Tesco, Sainsbury’s and Waitrose, but there’s a big disconnect with the 40,000 convenience stores in the UK that sell alcohol and dairy.

“Retail Distribution Management is about creating this education piece that wholesalers

have reach and distribution into retail stores.

“It’s easy for a supplier just to chuck pallets of products into a wholesaler and hope for the best, but it doesn’t work this way.”

Retail Distribution Management has also held talks with major Fed retailers for feedback on products, which are available through Unitas Wholesale’s central distribution network.

Nimmo explained: “It’s about getting the education piece for brands and getting feedback from retailers. For example,

“I was recently on a call with 20 of the Fed’s most

influential retailers and they provided feedback on the design of a particular product.

“We went through several rounds. It’s about creating a hybrid plan for these brands from both wholesalers and retailers.

“What makes customers come back and continue to purchase products? Just because a retailer purchases a product doesn’t mean their customers will.”

“We aim to give retailers an average of 30% margin on the products distributed into wholesale. If a product can work in 50 stores, there’s no reason it can’t work in 5,000 stores.”

Spar increases Philpotts food to go

A Spar has begun rolling out more Philpotts food-to-go concessions in its stores, following the latest addition in Llandaff in Cardiff.

The standalone food-togo service, which offers premium fresh sandwiches, salads and coffees, was added as part of a £500,000 refurbishment.

As part of the refit, a County Bridge Kitchen site was also installed,

specialising in evening meals.

Ian Lewis, of Spar Minster Lovell in Oxfordshire, visited the site last month. He told RN: “It was impressive and has made me think about how I’m approaching food to go in my store. I was particularly impressed by the fresh sandwiches and wraps.

“I’m also looking at whether I stick with Costa Coffee or go for a more

local offer. It’s potentially a difficult choice as Costa is a big name. I need to determine whether customers actually get coffee from my shop because of the brand. It seems Spar is looking at extending Philpotts further, but only if the conditions and site is right.”

Last year, Spar hinted at potential rollouts of the Philpotts chain, after buying it out of administra-

tion in 2019.

Speaking to RN last year following a number of Philpotts trials, Blakemore commercial director Louis Drake said: “The results so far are pretty positive. It’s the sort of thing you’re always looking to innovate, do something different and bring new things to market. If we own our foodservice brand, why wouldn’t we try to use it?”

Parfetts has added four new cereals to its Go Local own-label range, with more understood be joining the lineup soon.

The company made 320g packs of Cookies and Cream Hoops, Choco Puff Rice, Honey Hoops and Cornflakes available to stores last month. Each product is price-marked at £1.99.

Commenting on the new range, Sasi Patel, of Go Local Extra in Rochdale, told RN: “Taste-wise they’re good and offer a 30% saving to customers when compared with similar brands.

“The packaging is smaller as well, meaning I can get five boxes on the shelf. I can only get four boxes on display with other brands.”

Reuben Singh Mander, of The Three Singhs in Selby, added: “Parfetts’s Go Local own-label range is going from strength to strength.”

Thames C&C collapse

Thames Cash and Carry in Harrow has filed for administration.

The London-based food, alcohol and tobacco wholesaler, which is a separate business to Thames Cash and Carry in Croydon, appointed administrators on 30 May. Despite the administration, latest accounts for the year ending 31 March 2022 claimed it was “experiencing good levels of sales growth and profitability”.

Thames Cash and Carry is the latest regional wholesaler to experience financial difficulties, following Abra Wholesale.

5 RN 14 June 2024 // betterretailing.com

EXCLUSIVE

HND Month opens

NEWS & MAGS Publisher put stores at risk of legal action

Retailers can now sign up to benefit from this October’s Home News Delivery (HND) Month campaign.

Registrations have opened for the second instalment of the initiative, designed to bag retailers more delivered and subscriber newspaper customers.

Stores that sign up are likely to receive point-ofsale material and leaflets for doordrops, alongside advice on offering HND.

HND Month organiser Paul Bacon told RN: “We’ll be releasing guides with subjects as diverse as ‘How to canvass effectively’, ‘HND admin’ and ‘How to tie up returns parcels’.

“Our intention is that everyone will find tips or initiatives to make managing the category easier and more profitable.”

l Retailers can take part by visiting HNDMonth.co.uk

PDRP supports

retailers

The Press Distribution Review Panel (PDRP) is continuing efforts to support retailers in complaints against wholesalers and publishers.

Postcards are being sent out to retailers reminding them how to make complaints or demand restitution for repeated issues.

This comes after the PDRP conducted a survey that was reissued earlier this year seeking to assess how satisfied retailers are with their wholesalers’ level of service.

However, so few retailers responded it was impossible to reach accurate conclusions.

by Dia Stronach dia.stronach@newtrade.co.uk

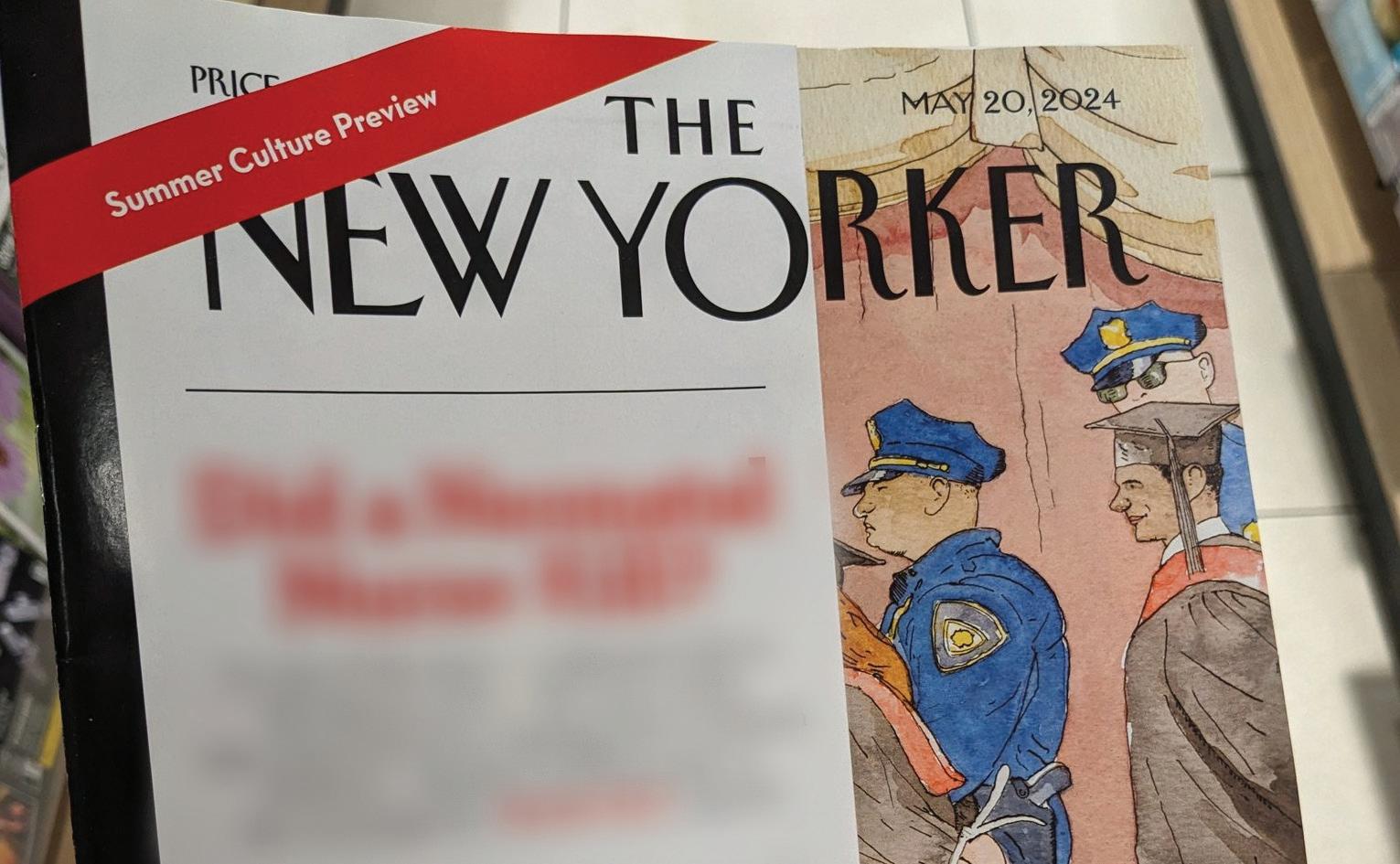

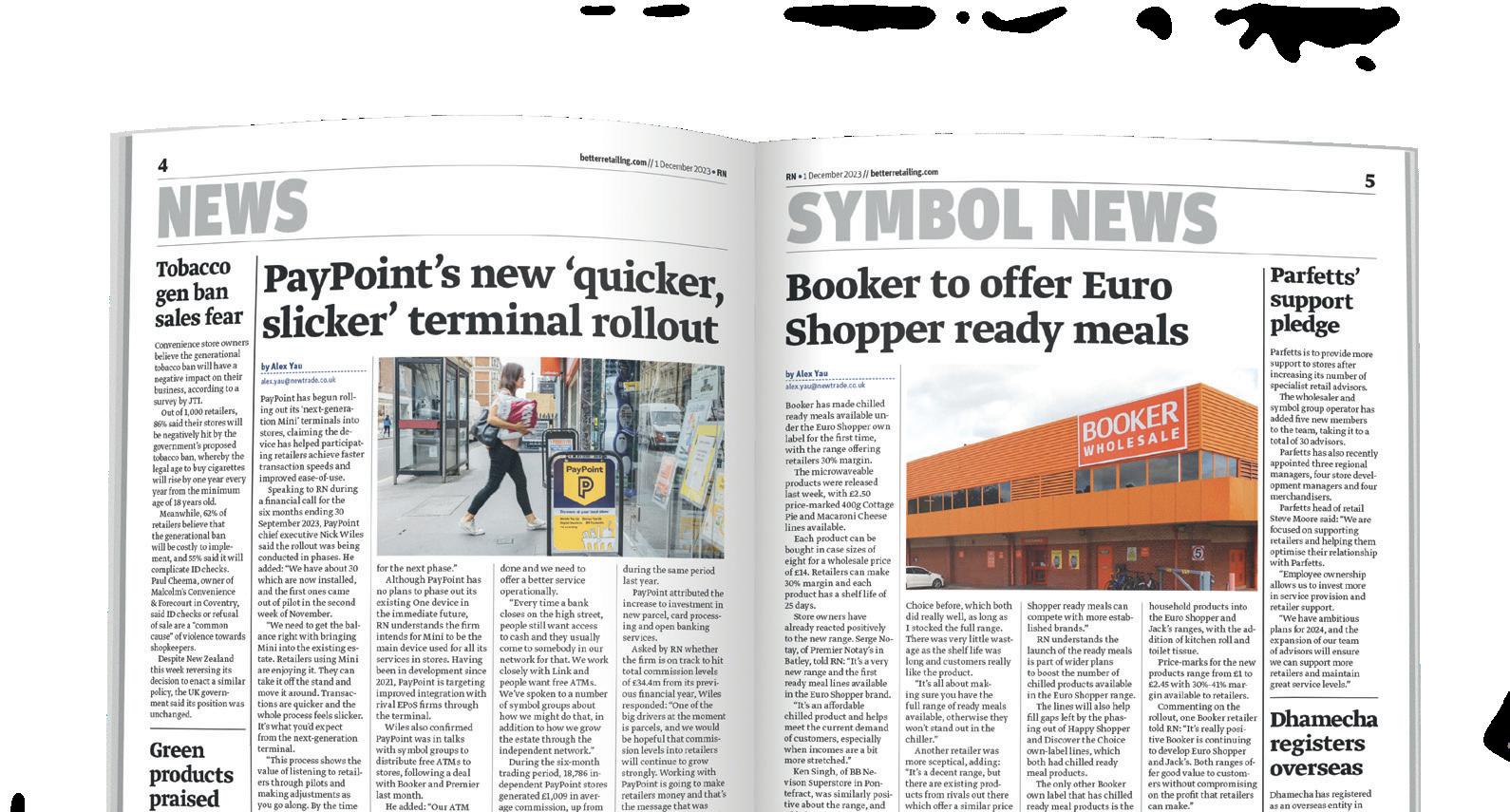

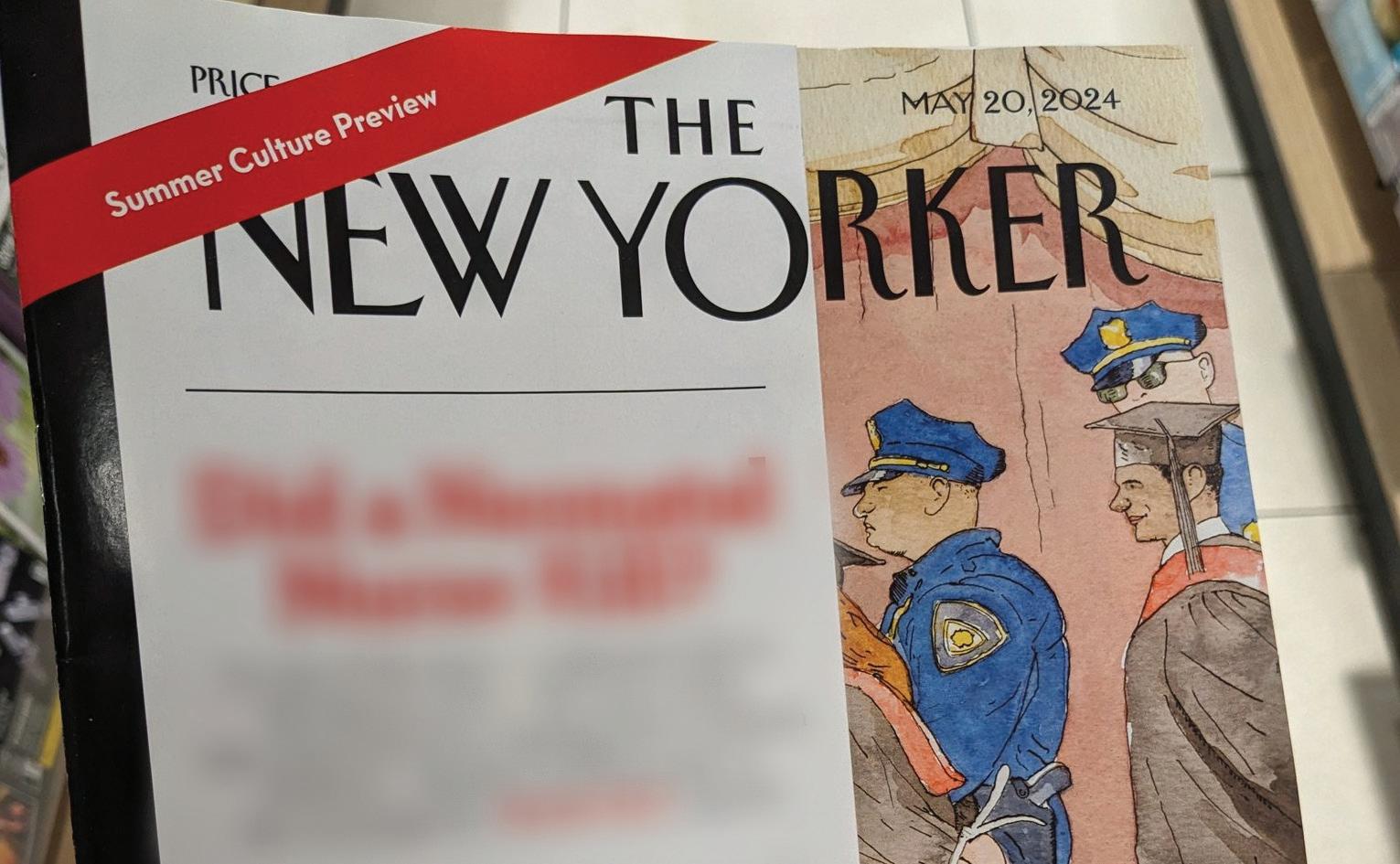

Shop owners were put at risk of prosecution last month after a potentially illegal magazine was distributed to them to display on shelves, despite the publisher being aware of the issue.

The cover of the 20 May edition of the New Yorker focused on Lucy Letby, a nurse convicted of killing seven infants and attempting to kill six more.

Letby is facing a retrial this month, meaning doing anything that could sway the jury is a criminal offence (contempt of court) carrying a maximum sentence of up two years.

While the New Yorker had blocked the online article from being visible in the UK due to the legal issues, publisher Condé Nast, aided by distributor Seymour, allowed the contentious print edition to be sent to stockists in the UK, including numerous newsagents and major chains such as Sainsbury’s, WHSmith Travel and M&S.

Press Gazette challenged the publisher on the decision, with Condé Nast seeming to back down. Sanjay Shah of May-

hews News in Belgravia, London, said: “We had a warning about a particular issue about three weeks ago. They asked us to remove it from sale and just send all copies back with our returns. It was the issue with the nurse.”

However, wholesaler communications to stores from Smiths News for the period did not show any early recall notice had been issued by Seymour or Condé Nast, and some stockists claimed they were not warned to remove it from sale.

Vinay Patel of Jeffrey’s News in Battersea, London, told RN: “We stock the New Yorker, but we

haven’t heard anything about it in the past month. We haven’t had notices.”

University of Leeds professor of media law Paul Wragg told RN the situation created a risk of stockists ending up in court. He said: “What I’m about to say is not legal advice and is not to be construed as legal advice. This is merely a comment by a professor of media law,” before continuing: “Distributors have to be very careful on the issue of whether to stock the New Yorker. The safest avenue is not to stock it.”

Wragg explained that he had not read the article, but based on coverage, he

believes contempt of court “could arise” as the article “could create a substantial risk of prejudice to the outcome of the trial”.

Asked whether it could land stockists in legal trouble, he said: “Strictly, yes, there is a risk. Is it a high risk? Who knows?”

Describing the supply chain’s failure to warn all stockists, the Fed’s head of news, Brian Murphy, said: “The Fed is aghast this took place. Members have legal support through the Fed membership.

“It’s important that there should be protections against a problem like this happening again in the future.”

News UK and DMG finish merger

NewCo, created through the merging of Daily Mail Group and News UK’s printers, is now fully operational, with those involved claiming it will support retailers.

Under the plan, DMG’s Thurrock (Essex) and Dinnington (South Yorkshire) sites were closed, with News UK’s Broxbourne (Hertfordshire), Knowsley

(Merseyside) and Eurocentral (Glasgow) now serving both publishers.

A News UK spokeperson told RN: “As print volumes decline, the cost to serve increases, making this initial step crucial for the continued production of our titles.

“It’s essential to safeguard the entire supply chain and support retail

to maintain engagement with the category. This is a fundamental step of that journey.”

Richard Johnstone, chief of staff at News UK’s former print arm Newsprinters, said production and distribution timings since the changes had “largely met our planning expectations”, adding: “We will continue to

work with our wholesale partners to resolve the isolated territory issues and will continue to refine our service levels to ensure we enhance overall supply chain performance.

“Our ultimate aim remains to keep printed newspapers in the hands of their readers at the time they want.”

6 betterretailing.com // 14 June 2024 RN

An edition of the potentially illegal issue found in WHSmith

In partnership with

Head Office

Head Office

Razzaq vows to make running stores simpler for members

by Jack Courtez jack.courtez@newtrade.co.uk

Mo Razzaq has pledged the Fed will create new tools and benefits designed to make it simpler and more profitable to run a store during his time at the head of the trade group.

The award-winning owner of Premier Mo’s in Blantyre and local councillor will take over as Fed national president at the end of the group’s annual conference on 18 and 19 June.

In an interview with RN, he explained his plan for the year ahead.

“We need to be a members’ organisation that deals with members’ issues. Yes, we need to support them in the medium- and long-term, but it’s also about what’s going on in their stores today,” he explained.

The Fed today Razzaq described the Fed as being “in transition” as a group, explaining: “Originally, it was a retail newsagents’ federation, so news was front and centre, and everything else was by the wayside. News is no longer as important to retailers as other things, and retailers are branching out to other sections.

“We want to continue to prioritise newspapers and magazines but we’ll also be looking at other sectors to help people adapt and to be fair to all members.”

Razzaq will oversee what is expected to be a turbulent year for independent retailers.

A recent survey of 150 shop owners by RN found a majority were less confi-

dent about the future than this time last year.

With newstrade decline, tobacco and vape restrictions and increasing wages, the survey found a majority were looking to make major changes to protect their sales and profit.

It’s a journey Razzaq knows well – he was one of the first to introduce grocery delivery services and complex food-to-go elements, including a dessert bar and Subway.

Supporting members

Asked about how the Fed will support members to improve their stores during his time at the helm, he said: “First, our store in Blantyre; the thing we never had was much money. Sourcing funding is very difficult – we know we need to look at that.

“The second thing is knowing the right things to invest in. A lot of the time, members know they want to make changes, but don’t know what or how. We’re not going to tell them what to do because we’re not experts. What we will do is share what other members are doing successfully, and how that can be replicated.”

In terms of the Fed becoming a hub for shop opportunities, Razzaq suggested a Fed programme of workshops, more trade events and visits to other stores would be key.

As well as sharing opportunities, the incoming president said the Fed would create benefits that make it simpler to run a shop. He pitched a fleet of online training and guides for owners and their teams

on ensuring compliance with all the different pieces of legislation stores have to follow. “We need to be the go-to-people to make a business fully legally compliant. If we offer that, we offer something vital to members’ shops,” he said.

While vowing to continue in sourcing Fed-backed supplier deals for members, Razzaq described the pressure to achieve these as “problematic”, and said focusing on unique opportunities and the measures described above would be a greater focus, alongside perks from beyond the industry to make members’ lives better, such as holiday discounts.

Razzaq said the range of benefits provided by the Fed was “incredible”, and the problem lay with members and potential members not being aware of what’s on offer. “We just need to reach out to them,” he said.

Communication and the relationship with members was a key overall theme in the Scottish retailer’s list of desired changes.

He stated: “I want there to be a new structure at the Fed that will get rid of the divide between top table and the membership. There can be a communication gap.”

Changes agreed include a new committee featuring senior Fed staff and members that’s designed to challenge and support head office in representing all members.

Representing members

Better representation also extends to Razzaq’s plan to get more members’ views in front of politicians.

He said: “I want a committee for political engagement for every part of the UK and Ireland. Each nation has different laws, different parliaments, different challenges and may require a different approach.

“We need different representatives for each, with a better understanding of local issues. A political engagement consultant will support them.”

Listing retail crime, tobacco, vaping, deposit return schemes, wage increases and changes to em-

ployment law as the big areas to focus on this year, he added: “We’re about to have a political upheaval and that will have an impact on retailers.

“The change in government we expect is going to happen comes with a change in government priorities.

“At every turn, they need to understand the impact of their decisions on our members.”

As well as governments, the Fed is responsible for representing retailers’ interests with news wholesalers and publishers. In the past, this has, at times, been combative, at others collaborative.

Asked about his strategy, he told RN: “It’s a balance, we’re dealing with an industry that’s declining, so they have to make tough decisions, but I feel some are hindering the category.

“We don’t always agree with what they’ve said and done, but we still need to work with them because there are areas in which collaboration will make a difference.

“We can’t just spit the dummy out because we don’t agree with everything.”

7 RN 14 June 2024 // betterretailing.com

FED NEWS

Contact Jack Courtez with your trade news on 07592 880864, jack.courtez@newtrade.co.uk or @JackCourtez on

Mo Razzaq

YOUR VIEWS

We tackle shop crime with a smile

I’ve started trying to tackle retail crime with a smile. It’s all about education, and trying to be a pillar in the community.

I’ve started focusing on creating a stance whereby people do not want to steal from me.

Customers will always receive a smile, a please and a thank-you.

Of course, there will always be prolific offenders who require sterner approaches – you can’t

educate everyone.

With the cost-of-living crisis and shrinking disposable incomes, it’s all very real. We’re doing our best to provide brand names at value prices and keep these ahead of supermarket pricing.

We ensure our product range caters to impulse purchases and focus on multipacks where there is real value for customers.

This feeds back to providing the best customer service and giving more for less money.

I’ve trained my staff to provide the best possible customer service, and it

ACS IS LOBBYING MPS AND MINISTERS ON YOUR BEHALF

James Lowman, chief executive, ACS

The election campaign is underway, and the candidates are seeking your vote.

Just as they vie for your attention, groups like ACS try to engage with the MPs and ministers explaining why our sector matters and what they can do to help us.

Where do local shops sit in the view of politicians? They like the community role we play, they don’t always like what we sell.

This gives us two overarching points. Firstly, that community role isn’t just about the charitable and local engagement we initiate; the local shop is often the only service available to that community and it is very likely to be the only place where a post office, parceldelivery point, prescription-collection counter, recycling return point or access to cash can sit.

The convenience store is crucial to the

sometimes leads to people simply not wanting to steal from here .

Also, sometimes community service isn’t carried out in a big showy way. It can simply be allowing those customers that can’t afford to pay to take the product, and we’ll write it off.

It’s a way of giving back to the community on a needs basis.

We try to ensure needs are met from all perspectives, and this drives revenue in the longer term.

Priyesh Vekaria

VIEW FROM THE COUNTER with Serge Notay

We’ve been enjoying the weather lately, which has really been helping sales. People are buying a lot of cold drinks, snacks, and a lot of people buying barbecue bits.

We’re getting ready for the Euros. Our décor isn’t up quite yet, but Coca-Cola sent us wall charts with the games on, and we’re handing these out to customers. I’ve also bought England shirts for my dad and I so we can serve with them on –we’ve got our names on the back, so that should bring a bit of banter.

There’s a lot of chat going on in store at the moment because I’ve got this cardboard cut out of me at the front. Snappy Shopper came up with the idea – it’s your full body holding blank piece of A4 paper – a 6ft 2in cutout of me.

We can put promos on it; it’s a write-on and wipe-off model, and it’s a really good way to encourage sales. People ask if I’m famous, so I say yes, and tell them to follow me on TikTok.

WHAT I’VE LEARNED THIS WEEK

A couple of weeks ago, Booker lost our delivery, so we were potentially a delivery down. It actually worked out really well, and turned out to be a blessing in disguise, as it helped us clear some leftover stock we had in the back. Plus, we were thankful we had enough stock to last the weekend.

health and vitality of more places than any other sector in the UK.

Secondly, it’s the breadth of products and services that we offer that makes us so resilient.

Some politicians don’t like tobacco, vapes, even alcohol and increasingly sugary products, but they should welcome the fact that the range of products in a local shop is the site’s contribution to increased social and health value in an area.

Some products should

be regulated, and when policy-makers think about how to do that, they should put legitimate, community-based businesses at the centre of their thinking.

I want to share my reflections on the campaign as it progresses, but I hope that provides a framework for how candidates might think about our sector, and how we can make our pitch for their support. We should be very proud of what we do.

Are many Lucozade lines out of stock in your store?

Which political party is better for local shops?

8 betterretailing.com // 14 June 2024 RN

Get in touch letters@newtrade.co.uk 020 7689 3357 YOUR SAY

NEXT WEEK’S QUESTION

Vote now @ThisIsRN

Yes 36% No 64%

One Stop, Grecian Street, Salford, Greater Manchester

How to make papers pay Neville Rhodes COLUMNIST

Credit vouchers, margins and carriage charges are set to be debated at the Fed’s conference next week

As members of the Fed gather in Birmingham for its annual conference next week, they will find only two motions on the agenda about the newstrade.

O ne calls on the wholesalers to credit vouchers in a “prompt and reasonable time”.

The other, from Chesterfield and Sheffield branch, instructs the Fed’s e xecutive council to raise the issue of margins and carriage charges with publishers and wholesalers.

These are, the branch says, “determined unilaterally and levied on retailers reducing or wiping out any financial return”.

The Fed has been fighting publishers’ margin reductions and wholesalers’ carriage charges for the past 50 years or more, so it won’t give up now.

It can also point to some recent successes. In March last year, the Mail increased retailers’ margins on home news delivery (HND) copies, and Smiths News’ 2023 carriage-charge review changed the gearing of

its charging template to help retailers with small newsbills –and there are thousands of them.

The average number of national newspapers sold over the course of a week i n each of the UK’s 42,000 newspaper outlets is around 420 copies, or 60 copies a day (this figure is based on the April 2024 ABC figures, with trade estimates for titles that keep their figures private).

Using the national newspapers’ weighted average cover price of £1.71 and their weighted average retail discount of 20.1%, and applying 70% of the weekly carriage charge, shows a gross profit for the average outlet of £114 per week.

This average covers all wholesaler-supplied outlets, including roundsmen, supermarkets, travel points, high-street stores, and local shops, and assumes they all pay standard carriage charges.

For an outlet with half the average sales – 30 copies a day – the weekly gross profit based on the same formula is £45.

* HND Month gears up

+ BY STARTING THE publicity for October’s National Home News Delivery Month in May, much earlier than last year, it will be talked about at newstrade events during the summer, and hopefully attract more HND retailers to take part. The advance publicity will be a series of guides and videos highlighting best practices for HND. The first guide, out now on the promotion’s website (hndmonth.co.uk), is a double-sided A4 leaflet downloadable in PDF format explaining how to get the most out of the campaign’s promotional pack. Watch the website for the release dates of other guides and videos.

The Fed has been fighting margin reductions and carriage charges for the past 50 years or more, so it won’t give up now

The paucity of profit shown in these figures suggests that the national newspapers and their wholesalers will lose many more full-service outlets if sales continue to fall, and that urgent action is needed to limit the damage.

S ub-retailing is a cheaper alternative supply system. It has a long track record, and although it has limitations, it enables limited availability at the outlet to be maintained.

Sub-retailers will have to accept reduced margins – likely to be about half the usual discount – but will avoid the checking, chasing, hassle and carriage charges involved with wholesale accounts.

The supplying retailer, sometimes called a sub-wholesaler, is usually an H ND operator that includes the deliveries to the sub-retailer in one of its rounds, and uses the delivery system software for billing, minimising additional costs.

Neither wholesalers nor publishers would want to see retailers switching from wholesale supply to sub-retail, but it is not in their interests to stop it.

K eeping the selling point open for a few regular and casual sales is preferable to losing the outlet completely.

P erhaps one of the industry leaders scheduled to address the conference will have something to say about this

Neville Rhodes is a freelance journalist and former retailer providing his views on the major topics affecting news sellers

9 RN 14 June 2024 // betterretailing.com

PRODUCT NEWS

TREND TRACKER

Proper Whiskey Apple Whiskey

Recommended by: Amit Patel, Go Local Sandiacre, Nottinghamshire

Who buys it:

It tends to be an older demographic RRP: £29.95

Why it’s important:

It is a good way to appeal to customers looking for fruity flavoured spirits

How to range it:

Inside alcohol fixtures

Where to buy it: Secret Bottle Shop, House of Malt, Distillers Direct, Bestway Wholesale

New tool to order Danone rep visits

by Priya Khaira priya.khaira@newtrade.co.uk

Food and beverage manufacturer Danone UK & Ireland has unveiled an online website that provides independent retailers with category insights, updates and advice.

The launch comes as Danone data suggests that convenience stores are one of the biggest drivers of growth for their brand categories, including soft drinks.

Danone-The-Go combines key category trends, downloadable planograms, range recommendations, merchandising advice and tips tailored to independent stores.

Users can access expert advice on ways to grow

sales across soft drinks, yoghurt, desserts, plantbased drinks and babyfeeding categories.

The platform is free to use and will be updated monthly, featuring trends and topics to help shops.

Users can contact Danone representatives via the website to organise face-to-face merchandising visits to drive interactions and enhance in-store displays.

Charlotte Andrassy, head of category development at Beverages & Impulse at Danone, said: “The new website will give our retail partners an improved understanding of the different categories, while providing an increased knowledge of all our Danone brands.

“This launch allows us to provide customers with the best tools to help support their businesses.”

Coca-Cola UEFA Euro 2024 prizes to boost store sales

To celebrate its status as the official partner of UEFA Euro 2024, CocaCola has unveiled an onpack promotion offering football-themed prizes.

It is running for five weeks from 10 June, across Coca-Cola Zero Sugar 2l, 1.25l and 500ml pet bottles, 330ml cans, 24x330ml multipacks and 330ml glass bottles.

Shoppers can scan QR codes on limited-edition packs that are present on participating brands. This will allow them to go to the Coke App and enter a prize draw. Prizes include Adidas training tops and Coca-Colabranded footballs and cups.

Every entrant will also

be added to a draw for a VIP final experience at Boxpark.

Convenience retailers can support the promotion with in-store theatre and PoS from the ‘My CCEP’ website.

Coca-Cola contributed more value to the growth of the soft drinks category than any other segment during the 2018 World Cup.

Rob Yeomans, vice-

president, commercial development at CocaCola Europacific Partners (CCEP) GB, said: “The games encourage gettogethers for a barbecue or drinks at home or down the pub.

“Within retail, our large PET bottles and multipacks are a muststock to cater to these at-home occasions, during the tournament and throughout the summer.”

10 betterretailing.com // 14 June 2024 RN

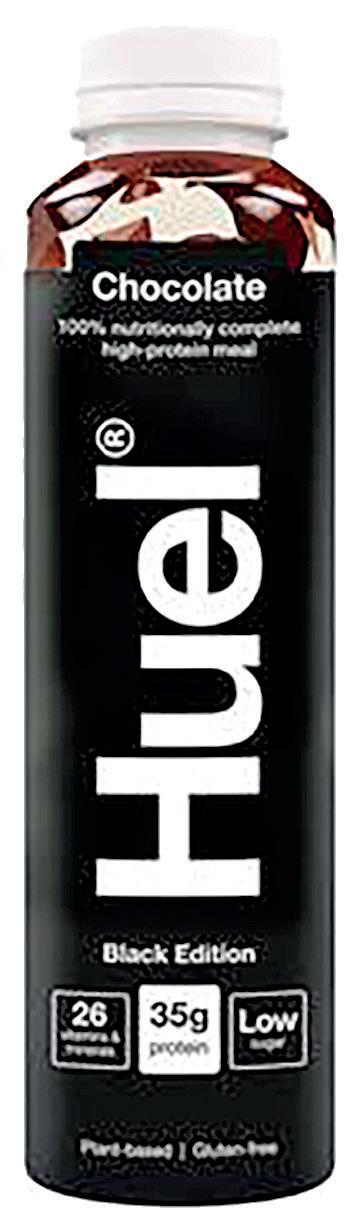

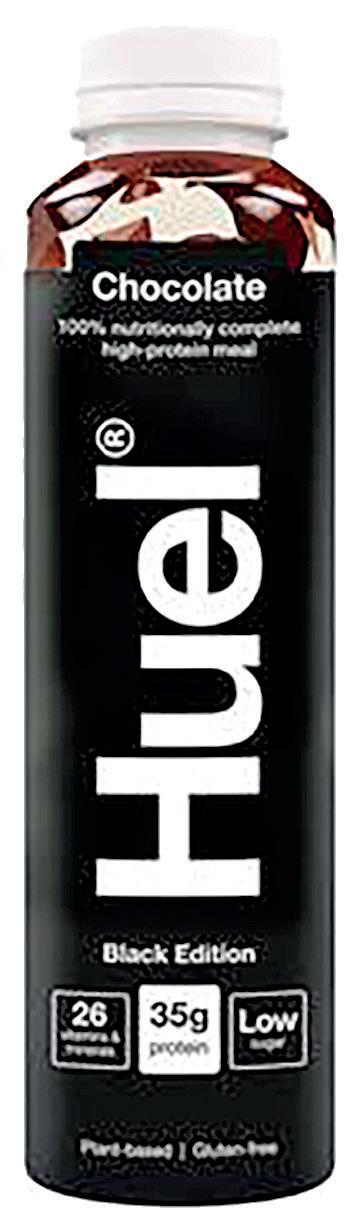

Starbucks Protein Drink with Coffee

Starbucks has launched a Protein Drink with Coffee range. In Chocolate Mocha, Caffe Latte and Caramel Hazelnut varieties, it is available now and contains 20g of protein per bottle, low-fat milk and no added sugar. The protein category grew in value from £46m in 2021 to £125m in 2023. Young adults are prioritising protein intake, and data suggests there will be an uplift in iced-coffee sales among this demographic.

RRP £2.75 (330ml)

Jammie Dodgers launches Giant variety

Fox’s Burton’s Companies UK (FBC UK) has expanded its Jammie Dodgers biscuit range with a new Giant Jammie Dodger. Jammie Dodgers Giant is available to independent retailers from Bidfood, Brakes and Spar wholesalers CJ Lang, Appleby Westward and AF Blakemore. It has launched in the brand’s traditional Raspberry flavour. The 50g biscuit comes in cases of 20. The brand demonstrates signs of growth year on year.

RRP £1.50 (each)

New Baileys Caramel Sauce

Diageo and The Flava People have partnered to launch a non-alcoholic Baileys Caramel Sauce. The sauce is available to wholesalers from The Flava People in a 500ml squeezy ambient bottle. It can be used across various treats, including desserts, hot drinks, ice cream and alcoholic drinks. The launch aims to tap into at-home occasions for the summer and festive seasons. Available Now

Strongbow adds Strawberry flavour

Heineken UK has added a Strawberry variety to its Strongbow flavoured cider range, available exclusively through Booker and One Stop. The new variety comes in 4x440ml can and 500ml bottle formats. Strongbow Strawberry is free from artificial flavours, sweeteners, colours and gluten, and is vegan. It is being supported by a £10m marketing campaign. The brand holds a 20% share of the total cider category.

RRP £5 (promo), £5.50 (off promo), 500ml: £2.35, 3 for £6

Jaffa Cakes Cola Bottle

Pladis has expanded its McVitie’s Jaffa Cakes flavour range to include a Cola-Bottle variety. The new flavour will be available across Jaffa Cakes biscuits and Jaffa Cakes Bars. The biscuits will be available from the end of July while the Cakes will be made available from mid-August. The supplier will be supporting the launch with outdoor advertising, influencer content and in-store activations.

RRP £1.25 PMP (biscuits), £1.80 (cakes)

Marshmallow Mateys gets UK launch

Speciality food importer and distributor Empire Bespoke Foods has added American breakfast cereal Marshmallow Mateys to its range and is rolling it out through wholesale. It is available to independents from Empire and through wholesalers including Glencrest, Dhamecha and Bestway. Athome breakfasts are at an all-time high, with 93% of people eating breakfast at home.

RRP £3.75 (320g)

RN 14 June 2024 // betterretailing.com 11

Priya Khaira Features writer @priyakaurkhaira 020 7689 3379 priya.khaira@newtrade.co.uk

betterretailing.com/products

find out

product launches

Visit the website

to

more about

PRICEWATCH

Profit checker Bread and bakery

21.17% of transactions are processed at £1.69

Behind the numbers

This week’s data shows retailers are managing to increase margins on top-selling bread and bakery lines, with at least 40% charging above the most-common price on six examined here. The top-two-selling lines, Hovis Soft White Medium Sliced and Soft White Thick Sliced Loaves, are being sold for more than their

TOP PRODUCTS

most-common price of £1.49 by 52% and 54% of retailers, respectively, with both recording a highest price of £1.99. Brace’s Luxury Medium White Sliced Loaf is responsible for this week’s highest price of £2.20.

Forty-five per cent of retailers are exceeding its most-common price of £1.65. That 55p differ-

We tend to have lots of passing trade in the mornings from grocery top-up shoppers and commuters. So, we try and ensure that we have a selection of breakfast and bakery items available, including pre-packaged waffles, crumpets and muffins. We also keep lots of fresh bread and rolls. They’re in a fixture towards the back of the store. We also keep a range of grocery breakfast items like cereals nearby along with chillers with breakfast drinks to help encourage incremental purchases. We tend to make up to a 25-30% margin on this category.

ence is the largest this week.

Conversely, 86% are selling Kingsmill Soft White Medium Sliced Loaf at its most-common price of £1.79, although this is the joint-highest most-common price out of all lines examined. Similarly, 84% are pricing the same with Kingsmill Soft White Thick Sliced Loaf.

STORE MJ’s Premier

LOCATION Royton, Oldham

SIZE 1,300sq ft

TYPE Residential

We keep a selection of bakery items. A couple of years back, we tried to really focus on baked goods and, as part of our expansion, we created a dessert bar. This included a range of freshly baked goods, brownies, pastries and crêpes. However, we struggled to attract repeat customers. So, we have since cut down our bakery range. We keep a core range that includes bread, wraps, pitta breads and packaged cakes. It is still a category that attracts customers making impulse purchases or those looking for grocery top-ups.

12 betterretailing.com // 14 June 2024 RN

Justin Whittaker

Warburtons Half & Half

Warburtons Toastie Soft Thick White

Warburtons Crumpets 6pk TOP PRODUCTS

STORE Jimmy’s Store LOCATION Northampton SIZE 1,000sq ft TYPE Residential

Jimmy Patel

Warburtons Crumpets 6pk

Muffins 4pkl Warburtons Toastie Soft Thick White

Warburtons Toasting

WARBURTONS TOASTIE THICK WHITE SLICED LOAF 800G Price distribution % £1.39 £1.30 £1.45 £1.49 £1.50 £1.55 £1.59 £1.60 £1.65 £1.69 £1.70 £1.75 £1.79 £1.80 £1.85 £1.89 £1.90 £1.95 £1.99 30% 27% 24% 21% 18% 15% 12% 9% 6% 3% 0%

Datasuppliedby

Must-stock products

Price

Sliced Loaf 800g Hovis Soft White Medium Sliced Loaf 800g

Hovis Soft White Thick Sliced Loaf 800g

Kingsmill Soft White Medium Sliced Loaf 800g

Kingsmill Soft White Thick Sliced Loaf 800g

Mission Plain Tortilla Wraps 368g 6s

Roberts Medium Soft White Sliced Loaf 800g

Roberts Thick Soft White Sliced Loaf 800g

Warburtons Crumpets 330g 6s

Warburtons Soft White Medium Sliced Loaf 800g Warburtons Toastie Thick White Sliced Loaf 800g

13 RN 14 June 2024 // betterretailing.com 0 20 40 60 80 100 Below mostcommon price Most-common price Above mostcommon price

PRODUCT NAME LOWEST PRICE MOST-COMMON PRICE HIGHEST PRICE BRACE’S LUXURY MEDIUM WHITE SLICED LOAF 800G £1.39 £1.65 £2.20 BRACE’S LUXURY THICK WHITE SLICED LOAF 800G £1.39 £1.65 £2.09 HOVIS SOFT WHITE MEDIUM SLICED LOAF 800G £1.19 £1.49 £1.99 HOVIS SOFT WHITE THICK SLICED LOAF 800G £1.25 £1.49 £1.99 KINGSMILL SOFT WHITE MEDIUM SLICED LOAF 800G £1.19 £1.79 £2 KINGSMILL SOFT WHITE THICK SLICED LOAF 800G £1.19 £1.79 £2.05 MISSION PLAIN TORTILLA WRAPS 368G 6S £1.49 £1.75 £2.00 ROBERTS MEDIUM SOFT WHITE SLICED LOAF 800G £1.39 £1.79 £2.19 ROBERTS THICK SOFT WHITE SLICED LOAF 800G £1.39 £1.69 £2.09 WARBURTONS CRUMPETS 330G 6S 99p £1.10 £1.79 WARBURTONS SOFT WHITE MEDIUM SLICED LOAF 800G £1.29 £1.69 £1.99 WARBURTONS TOASTIE THICK WHITE SLICED LOAF 800G £1.30 £1.69 £1.99

Percentage of stores selling above, below and at the most-common retail price Jasper Hart Deputy insight & advertorial editor @JasperAHHart 07597 588978 jasper.hart@newtrade.co.uk Visit the website betterretailing.com/ pricewatch How to use this data 1 Use the price-checker table to see what the most-common prices are for a key line in the category. 2 Use the price distribution chart to see the range of prices being charged on 12 key lines. 3 Use the must-stock products table to see the percentage of retailers charging above, below and at the most-common price. RetailDataPartnershipisaspecialistdataandEPoS suppliercommittedtoservingtheindependentretail sector.Tofindouthowtheycanhelpyouimproveyour business,call01780480562

distribution chart

Brace’s Luxury Medium White

Thick

Sliced Loaf 800g Brace’s Luxury

White

Next

Tobacco accessories 51% 84% 20% 52% 62% 48% 36% 48% 75% 57% 45% 86% 54% 23% 13% 12% 41% 79% 70% 45% 54% 43% 29% 56%

week’s Pricewatch:

PRICEWATCH

Wholesale checker

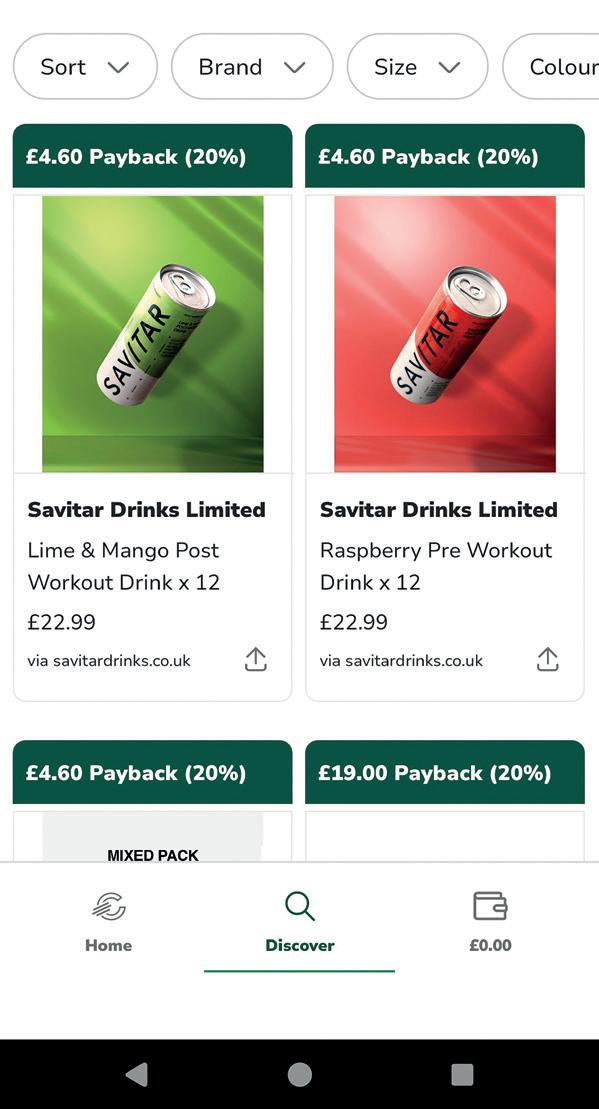

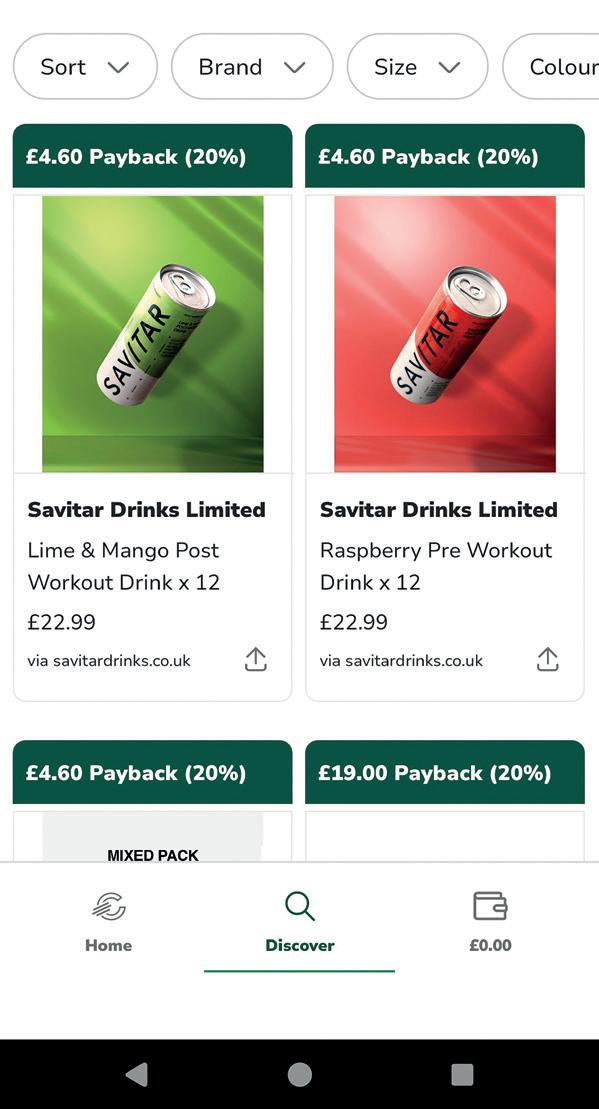

Ready-to-drink (RTD) alcohol beverages are worth £540m in the UK, which is the largest market for the segment in Europe. They are also currently the fastest-growing alcoholic segment in the UK, bolstered by several recent high-profile launches. To help retailers, we’ve compared the pricing of top lines across five major wholesalers

case size

Dead Man’s Fingers Passionfruit Rum & Lemonade

Comfort & Lemonade

Vodka & Sprite

Cîroc Summer Citrus 5% 250ml

We stock a large range of RTDs. They have grown massively over the past year and we are making margins of up to 35%. I make large orders twice a week from Parfetts. I go for items that are on promotion for the margins. The Absolut & Sprite RTD we brought in recently did really well. We try and keep on top of launches as they tend to be in demand.

&

is another one that does well.

14 betterretailing.com // 14 June 2024 RN

Jack

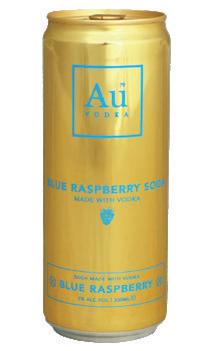

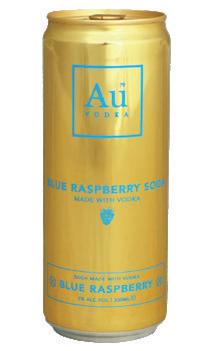

Jasper Hart Deputy insight & advertorial editor @JasperAHHart 07597 588978 jasper.hart@newtrade.co.uk DEAL OF THE WEEK PRODUCT Au Vodka Blue Raspberry Soda Made with Vodka 5% 330ml WHOLESALER Nisa SINGLE UNIT PRICE £1.51 MARGIN AT LOWEST RRP 47.64% TOP TIP Keep on top of innovations Jey Sivapalan STORE 1 Stop Convenience Go Local LOCATION Derby SIZE 1,300sq ft TYPE Residential WHOLESALER 1 WHOLESALER 2 WHOLESALER 3 WHOLESALER 4 WHOLESALER 5 DISCLAIMER: Prices accurate as of 6 June, prices may vary by region. Rebates, delivery costs and membership fees not included. All prices are inclusive of VAT. Minimum or maximum orders may apply. Booker Wholesale Abra Wholesale Bestway Wholesale Nisa Costcutter National delivered cash-and-carry wholesaler National delivered cash & carry wholesaler National delivered cash-and-carry wholesaler National delivered symbol group wholesaler National delivered symbol group wholesaler AVG – Average RRP N/A – Information not available PMP – Price-marked pack * – On promotion P – Different pack size C – Different

PRODUCT DESCRIPTION RRP WSP RRP WSP RRP WSP RRP WSP RRP WSP Jack Daniel’s Tennessee Whiskey & Coca-Cola 5% 330ml £2.85 £2 £2.49 £2 £2.89 £1.84* £1.92 £1.33* £2.99 £1.70* Au Vodka Blue Raspberry Soda Made with Vodka 5% 330ml £2.99 £1.95 n/a n/a n/a n/a £2.89 £1.51 £2.99 £2 Au

Made with Vodka 5% 330ml 2.99 £1.95 £3 £2.15 n/a n/a £2.89 £1.51 £2.99 £2 Dead

5% 330ml £2.19 £1.51 n/a n/a £2.59 £1.95 £1.90 £1.28* £2.29 £1.60* Malibu

5% 250ml £2.49 £1.55 £2.19 £1.65 £2.19 £1.45 £1.92 £1.25* £2.29 £1.60*

Daniel’s

Coca-Cola

Vodka Black Grape Soda

Man’s Fingers Spiced Rum & Cola

& Pineapple

330ml £2.19 £1.51 n/a n/a £2.59 £1.95 £1.90 £1.28* £2.29 £1.60*

330ml n/a n/a £2.49 £1.54 n/a n/a £1.92 £1.12* £2.29 £1.60* Malibu &

5% 250ml n/a n/a £2.19 £1.65 £2.19 £1.45* £2.45 £1.25* £2.29 £1.60

250ml £2.49 £1.99 n/a n/a £2.49 £1.50* £2.39 £1.44 £2.79 £2.10*

5%

Southern

5%

Cola

Absolut

5%

£2.99 £1.95 n/a n/a £2.49 £1.70 £3 £2.04 £2.99 £2.55

STORE ADVICE

Review your range

The RN team finds out how to optimise your offer to provide exactly what your customers want

Range reviews are part and parcel of running a convenience store. It’s so important to know what’s on your shelves, what’s selling and what’s isn’t across your store

It’s important not only to ensure you a re purchasing and storing the right amount of stock, but also constantly improv ing your offer as you remove things your customers don’t need, and provide them with more of the products they’re looking for.

“We do range reviews fairly regularly,” says Craig Warren, from The Corner Stores Costcutter in Bury St Edmunds, Suffolk.

“Often, you do it without even realising, just by taking out a specific

line to put something new in.”

Most retailers will say they can accurately assess what their customers are buying and what’s happening in their store just by looking at the shelves, but your experience, bias and prejudices can count against you, and it’s always worth backing up your personal insights with data.

“EPoS system will help you make those decisions,” says Warren. “A lways look at the average sales of something and work it out against the average of a similar product. I also go with my gut feeling.”

R ange reviews might not just be about what to take off the shelves, but might instead encourage you to

approach merchandising, promotion and ranging differently for a certain product or category.

Graeme Pentland, from Ashburton Village Store in Newcastle upon Tyne, deals with local suppliers, and before he delists a product, he’ll try moving it somewhere else “You’ve got move things around in the shop as well,” he says. “M&S is always moving stuff around, which can be frustrating, but it’s amazing how many times you move something, and someone says they didn’t know you sold it.”

To see what other stores are doing, go to

We used the range review to work out how to make that whole space work better

15 RN 14 June 2024 // betterretailing.com

JEET

BANSI

betterretailing.com/advice »

STORE ADVICE

Seasonal range reviews

While Craig Warren, from The Corner Stores Costcutter in Bury St Edmunds, Suffolk, holds range reviews regularly, it is those big four seasonal ones that have the biggest impact on what’s his stocking.

“At the moment, we’ve got the full barbecue range, with meat, coleslaw and similar products,” he says. “We removed the the autumnal swedes, sprouts and parsnips. We still have cabbage, broccoli and carrots, but warming stews and things have been removed completely and will come back in September.”

Warren also keeps on top of his bestselling categories, as these are where changes in purchasing behaviours can have the biggest impact.

“The vape market moves quickly and things that were big three months ago are slowly dying,” he says. “We did a review, and we’re taking out a number of Elfbars to introduce bigger reusable devices.”

Use range reviews to boost categories

Range reviews aren’t just useful for identifying lines that are performing badly or well. They can also be indicative of how well a category or kind of product is selling at that moment.

For Jeet Bansi, from Londis Meon Vale in Stratford-uponAvon, Warwickshire, analysing EPoS data helps him grow an entire range rather than just boosting a single line.

“We had some tinned cannellini beans that were selling well, but we noticed one of our suppliers also had a five-bean mix, so we brought that in as well and put them close by. It was the right product to add because now they’re both selling well,” he says. “We used the range review to work out how to make that whole space work better.”

Bansi downloads his EPoS data on a weekly basis but it’s something that is a daily topic of conversation and consideration with him and his team, especially when it comes to new products.

16 betterretailing.com // 14 June 2024 RN

Keep up with trends

Ushma Amin, from Londis North Cheam in Surrey, keeps a close eye on trade press to find out about launches and trends. When she finds something that will work for her, she tries to get it as quickly as she can, but her core range is where things start.

“You need to see what’s trending and what your fastest sellers are,” she says. “Start with the core range and then expand things based on what customers are asking for. When there’s demand for a line, you bring it in.”

She suggests that a range focused on its fastest sellers will do better than one focused on breadth of offer.

“If you have space then do double facings for the fastest and slowest sellers that you want to get rid of. Give double facings to new products as well,” she says. “Rather than having a range of five different colas, give three facings to the bestselling one, and have one or two different varieties.”

Give things a chance

Graeme Pentland, from Ashburton Village Store in Newcastle upon Tyne, has had a strong focus on local suppliers for the past seven years, which has improved the shop’s reputation and its profits. It also means he’s often got lots of new lines to try out, but by dealing with lots of individual suppliers, he has to be on top of range reviews all the more, finding slow sellers and their replacements fast.

“You get to know if a product isn’t going to last,” he says. “We tried a tea that just didn’t work. You’ve got to be wary of dates because you don’t want to put half of it in the bin, but you’ve got to give things a chance as well. Sometimes, we’ll run something at a loss for a few weeks because we have faith in it.”

He recently introduced products from a local bakery that brought £200 a week at first. “It brings people in, it makes the shop smell nice and we got up to £700 last week,” he says. l

17 RN 14 June 2024 // betterretailing.com

EPoS SYSTEMS

Get the most out of your EPoS systems

Charles Whitting finds out the myriad ways you can make your EPoS do more for your store

Most retailers admit they are not using their EPoS systems to their full potential, with one telling RN they were using theirs at about 25% of its capacity and another saying 95% of retailers aren’t getting the most out of their software and hardware.

An EPoS system is more than just electronic equipment that scans customers’ purchases at the till.

It can help retailers to better understand their business at a micro and macro level, while also providing the tools to run that business more efficiently and effectively.

It comes down to effective training, which retailers should demand from their EPoS suppliers if they are to get the maximum benefit from a system they are paying for.

“Training is compulsory for retail-

ers who take our system,” says Romesh Perera, a former retailer who created his own EPoS system, MSP Systems. “It’s a free 14-day training period, and we don’t provide the equipment if they don’t attend the training session.

“It also takes time and hard work to set these things up, but once you get there, you never go back to the chaotic way of doing things the way you did before.”

ORDERING MORE EFFECTIVELY

Managing stock, especially in a cost-of-living crisis when prices are changing on a daily basis, is absolutely critical to maintaining the bottom line. Many retailers will use their EPoS system to simply order deliveries from the wholesalers to their stores, but they can do much more than this.

Retailers should demand effective training from EPoS suppliers

Paul Gardner, from Budgens of Islington in London, uses PointFour EPoS for ordering, and while he finds it harder to get things right with bigger wholesalers –which change prices and promotions – he has used suggested delivery to simplify discussions with his 60 direct suppliers.

“It looks at your sales over the previous four weeks and what you’ve got in stock,” he says. “And I can ask it to get me enough stock to last me two or 10 weeks and it will work out how much I need to avoid over- or under-stocking.

“Then it sends an email to the supplier and orders it automatically. Before, I was dealing with all the suppliers myself, it would take me at least an entire day.”

EPoS systems are in constant contact with suppliers, receiving information daily about price fluctuations and availability.

That means that retailers who are communicating with their EPoS can find out more about what they’re ordering faster.

“Rather than waiting until your delivery has arrived to find out what your margins will look like, you can use your EPoS to work them out via the supplier download,” says Perera. “You’re playing the game ahead of the situation rather than when it’s too late to do anything about it.”

Sid Ali, from Morrisons Mintlaw in Aberdeenshire, has worked with three EPoS companies and, for reduced prices, did testing with them as well to iron out issues with the system.

He believes a good EPoS system

18 betterretailing.com // 14 June 2024 RN

is worth 1.5-2% of a store’s overall margin if it’s used correctly.

“Take a product such as Lurpak,” he says. “My EPoS can tell me I can get a case from Morrisons for £52 and from Nisa for £41, but Nisa is only selling it in 12s and Morrisons is selling it in 16s.

“Which one do I go for? With my EPoS, I can look at the margin on each individual pack and see that Morrison gives me 23% and Nisa 18%. That’s a 4% difference in margin on one product at the click of a button.”

RUNNING THE STORE

EPoS systems enable retailers to access their data remotely with phones and tablets, and update it wherever they are in the world. It’s important to select who in your team is able to access the information and make changes to avoid any potential confusion.

Ali uses his EPoS systems to update prices in his store faster and more efficiently. He cites SignWriter, an older piece of software that allows

him to design templates for labels, which can then be filled in by the EPoS as it pulls pricing information from the store’s database.

“You could have large labels where you’d scan half a dozen things and it would print everything you needed for a store-wide promotion without you having to scan everything individually,” he says.

“If you have a clearance line, you can just put in a dump bin, print ‘label 23’ and it will print a big £1 label.

“We also got paper that was yellow on one side where we’d print the promo price and white on the other where we’d print the regular price.”

EPoS should provide accurate data not just on what’s selling and at what price, but also at what time of day. Getting into the nitty-gritty details of transactions across a period of time allows retailers to make far betterinformed decisions.

“You can look at takings per hour when looking to find out when you need additional staff,” says Ali. “But you should also compare it with how

SUPPLIER VIEWPOINT

Brian

EagleBrown Managing director, ShopMate

When it comes to selecting the right stock for the store, without reports you’re operating blind and you have to rely on hunches. You don’t see supermarkets operate that way – they understand that data is crucial for evidence-based decision making.

Having a price file that is regularly updated helps you keep on top of margins and if the prices change it helps you stay competitive. Accurate pricing is crucial for keeping customers. It helps build trust.

A good EPoS system will help with automated pricing and promotions (including integrations with home delivery and shelf-edge labelling), price analysis reports, product reviews such as slow sellers and key selling lines, stock-holding reports, suggested ordering, queue busting with self-serve, and fully managed PoS media screens for advertisements with till roll.

RN 14 June 2024 // betterretailing.com 19

»

EPoS SYSTEMS

FUNCTIONS YOUR EPoS SYSTEM CAN DO FOR YOU

PROFIT CALCULATION: “Our EPoS system tells us how much profit we’ve made on each item per week,” says Ali. “I can look at an individual item and work out the margins and prices that are working for me that week.”

SUGGESTED ORDERING: “We do lots of suggested ordering now, especially on things like tobacco, which aren’t seasonal and have no promotions,” says Gardner.

EXAMINE YOUR BESTSELLERS: “We look through the 10 bestsellers in each department and each sub department,” says Gardner. “And we ask, ‘Are we price-marking them or not? What margin are we getting? What would we get if we went non-price-marked? What’s the difference?’”

PRICE COMPARISON: “We can compare the prices of different wholesalers – as long as the price files are in the right format,” says Gardner. “It will upload the prices and tell you which supplier is offering each product at the best price so you can adjust your order accordingly. That’s some margin enhancement right there.”

REMOTE ACCESS: “Everything is backed up, so we have easy access no matter where we are in the world,” says Bobby Singh, from BB Nevison Superstore in Pontefract, West Yorkshire. “We can keep tabs on how our businesses are doing and what we’re up to.”

RETAILER VIEWPOINT

Sid Ali Morrisons Mintlaw, Aberdeenshire

EPoS gives you the power of the big multiples but on a cost-effective basis. Most of them can link with electronic shelf-edge labels (ESL), which open a whole new world in terms of what you can do. You can make a meal deal promotion that flashes to let people know they’re in the meal deal. Or you can increase the prices of certain products for just one day and have them revert back, all at the click of a button instead of going round and changing all the prices twice.

We developed the Optimiser with our EPoS provider. It links to several suppliers and when you create an order for your shop, you can press a single button and it will put the cheapest item from each supplier into the basket. That can save me £1,000 an order. It will even adjust to find the next best price or I can rejig it to split between fewer suppliers.

We can run multibuys in one shop and none in another. We can have the same product with three different prices across three different shops depending on the local competition.

many transactions per hour because you might have 200 customers coming in at lunchtime spending £3, which is a different shopping experience but provides the same takings as 10 people coming in and spending £60 each.”

You can look at takings per hour to manage staff

While analysing sales data is something retailers should be doing on a regular basis, all of it is not always relevant to what you might be working on at that time or for every single store in an estate.

Being able to select which sections of data you wish to analyse without non-relevant or unhelpful seasonal anomalies muddying the water can

enable you to make far better longterm decisions.

“Take Prime, for example,” Ali says. “When we added it to one shop’s delivery, the EPoS added it automatically to the other five shops, the same way the multiples work. It wasn’t selling at one of my stores, so I set it up so it didn’t appear in that store’s data. It’s active in some stores and inactive in others.

“You can do the same for seasonal products, putting your Halloween EPoS data on ‘snooze’ for most of the year so it’s not affecting your annual data and then make it active again in October.” l

20 betterretailing.com // 14 June 2024 RN

SPORTS DRINKS

Capitalising on sports and functional drinks

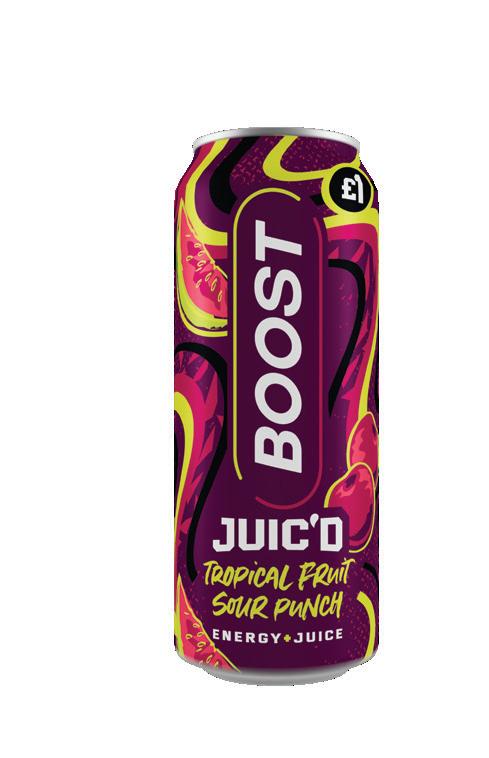

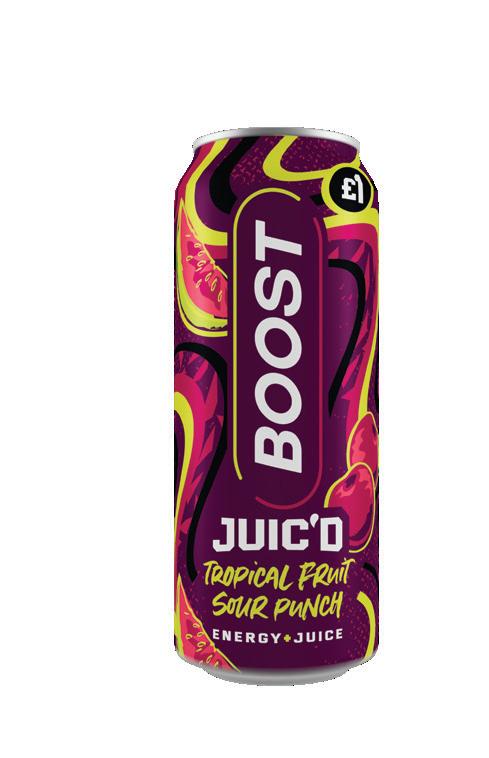

Sports and functional drinks are increasing in popularity as alternatives to energy beverages. Tamara Birch explores how you can benefit from the opportunity

Wh ile 11 mil lion Gen Z and millennials regularly buy energy drinks, five million of those buy ‘functional drinks’, which advertise themselves as cleaner and benefit-driven.

“ With more consumers demanding function when it comes to their drinks choices, the growth of sports and func tional drinks has exploded over the past few years,” says Pip Brook, co-founder UK/head of brand at Fhirst Living Soda.

“For retailers, these brands are offering a trade-up from tradi tional soft drinks. They’re bring ing choice into the category, as well as bringing in incremental shoppers who perhaps wouldn’t ordinarily have looked at the soft-drink aisle.”

The key difference between sports and functional drinks compared to energy is the added ingredients they offer.

One of the original func tional drinks is Britvic’s Pur dey’s Natural Energy drink, which contains natural sug ars and vitamins B and C. Retailers also capitalise on the popularity of Lucozade Sport and Boost Isotonic Sports Drinks.

Data to the end of January 2024 has shown that sports drinks have become the second-fastestgrowing category within soft drinks, with 57% value growth year on year,” Adrian Hipkiss, commercial director at Boost

obby Singh, of BB Nevison Stores & Post Office in Pontefract, West Yorkshire, has noticed a growing demand for functional drinks, which has come down to consumer educa-

Once upon a time, it was about consumers having five fruits and vegetables a day. While that’s still important, shoppers want convenience,” he says.

“People have been looking into preservatives and the vitamins they need, and then finding drinks that provide them all in

WHAT’S

TRENDING IN SPORTS AND FUNCTIONAL DRINKS?

“Flavours and new products play a crucial role,” says Mark Langohr, category controller at Unitas Wholesale. “While tra-

In partnership with

Ben Parker

Ben Parker

Retail commercial director, Britvic

THE POWER OF STOCKING THE RIGHT RANGE

Earlier this year we shone a light on how retailers could power up so drink sales. We o ered ve retailers a bespoke planogram and £1,000 each towards their energy bills. Now, we want to inspire more retailers with top tips to help them maximise the potential of the so drink category.