Exploring 4 phases of the electrification journey & efficiency for the future

MAY/JUNE 2024 oemoffhighway.com

OPTIMIZATION FOR

HYDRAULIC

ELECTRIC MACHINES

PAGE 26 + Improving Grease Performance Amid Thickener Supply Squeeze

STEP INTO THE FUTURE OF MINING.

done.

business

Register

Only MINExpo INTERNATIONAL 2024® connects you with the innovations that will transform the way your work gets

With a focus on mining (and only mining), you’ll find the products, solutions and connections to future-proof your

at the world’s largest global mining event.

Now at MINExpo.com

Behind the brand's 40th anniversary & what's still to come in 2024

5 NEWS BRIEF

3 leadership changes taking place at Red Dot, Scania & moveero

6 EQUIPMENT MARKET OUTLOOK

Construction equipment orders show mild uptick amid slow growth rates

33 NEW PRODUCTS

4 innovative new releases hitting the OEM market now

35 OFF-HIGHWAY HEROES

Power prospects, sales strategies & expenses surrounding Stroud Road Machinery Company’s 1930s graders

Video Network

oemoffhighway.com/videos

OEM Industry Update

oemoffhighway.com/podcasts

Premium Content

oemoffhighway.com/premium-content

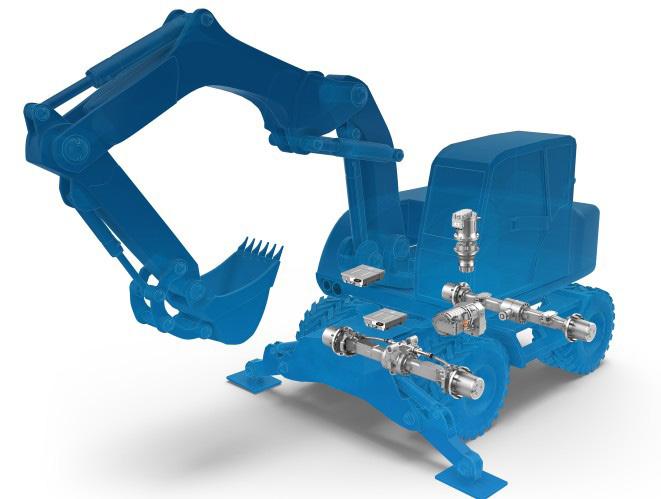

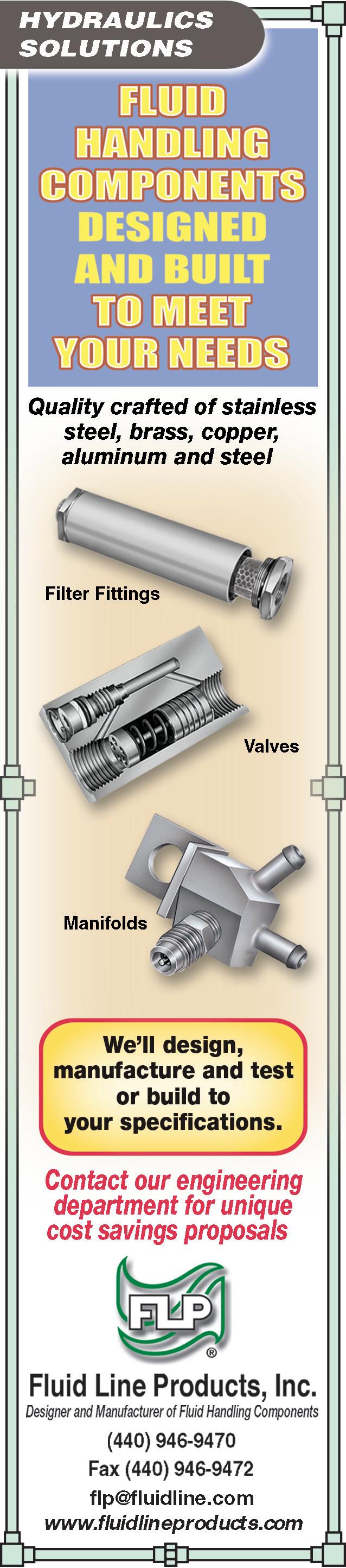

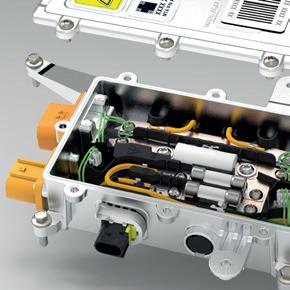

FEATURE SERIES: FLUID POWER 18 Hydraulic Optimization for Electric Machines

Exploring key parts of the electrification journey & levers for efficiency improvements in open-circuit hydraulic systems 22 Automation Expectations

Bosch Rexroth’s Mauro Silva on the trends leading today’s fluid power market & improving tomorrow’s equipment efficiency

CONSULTANT CORNER

10 Building an Electrified Future for Commercial Vehicles

Understanding the infrastructure challenges when migrating fleets to BEVs

12 Leveraging Advanced Charging Technologies for Electrification

How to optimize performance, flexibility & reliability, & enhance long-term impact on business & sustainability initiatives

SECTION 16 OEM Off-Highway Celebrates 40 Years of Innovation

Uncover the brand’s origins & the driving factors that have steered its success for four decades

ENGINEERING & MANUFACTURING

24 3 Ways to Increase Throughput & Decrease Costs

Strategic methods for lowering the total cost of your paint line while maintaining operational standards

GREASES & LUBRICATION

26 Improving Grease Performance Amid Thickener Supply Squeeze

Evaluating alternatives as market forces spur industrial grease makers to shift from lithium as thickener of choice

HYDROGEN 101

28 Charting a Green Future With Hydrogen

Solutions that reliably, safely & efficiently control hydrogen are critical for the scale-up required to meet demand today & tomorrow

3 OEM Off-Highway | MAY/JUNE 2024 CONTENTS VOLUME 42, NO. 03 | MAY/JUNE 2024 12 10 24 18 4 EDITOR'S NOTE

WEB EXCLUSIVES

TECH & IOT

SPECIAL

33

This year marks OEM OffHighway’s 40th

anniversary. For the past four decades, this brand and its media products have been dedicated to delivering to readers the important, breaking news and trend-setting design developments happening throughout the on- and off-highway mobile equipment industry. To learn more about our legacy, major milestones and insider insights, turn to page 16, then check out our extended coverage at oemoh.co/OOH40. Whether you’re a longtime reader of the print magazine or a new subscriber or follower, we appreciate your support and hope to continue to serve you and your needs well into the next decade and beyond.

As OEM Off-Highway celebrates 40 years in the on- and off-highway mobile equipment industry, we’re exploring industry progress. Share your thoughts on the past and predictions for the future at oemoh.co/industryprogress.

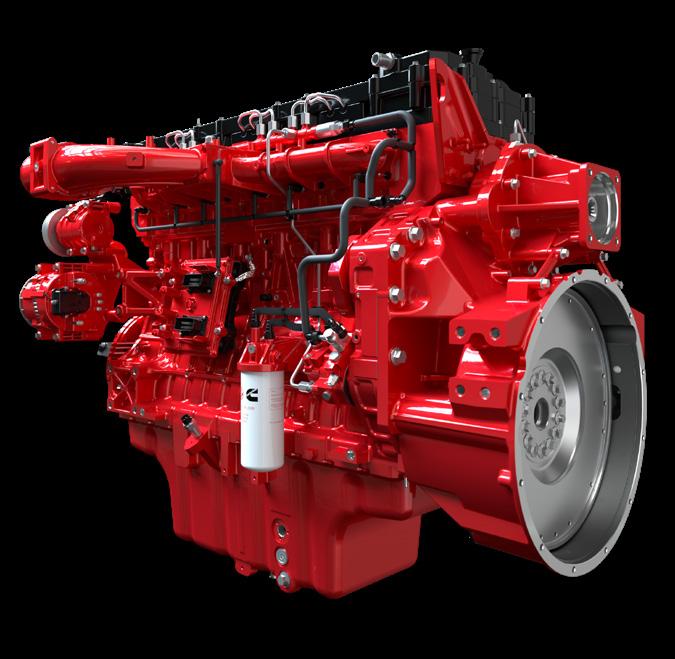

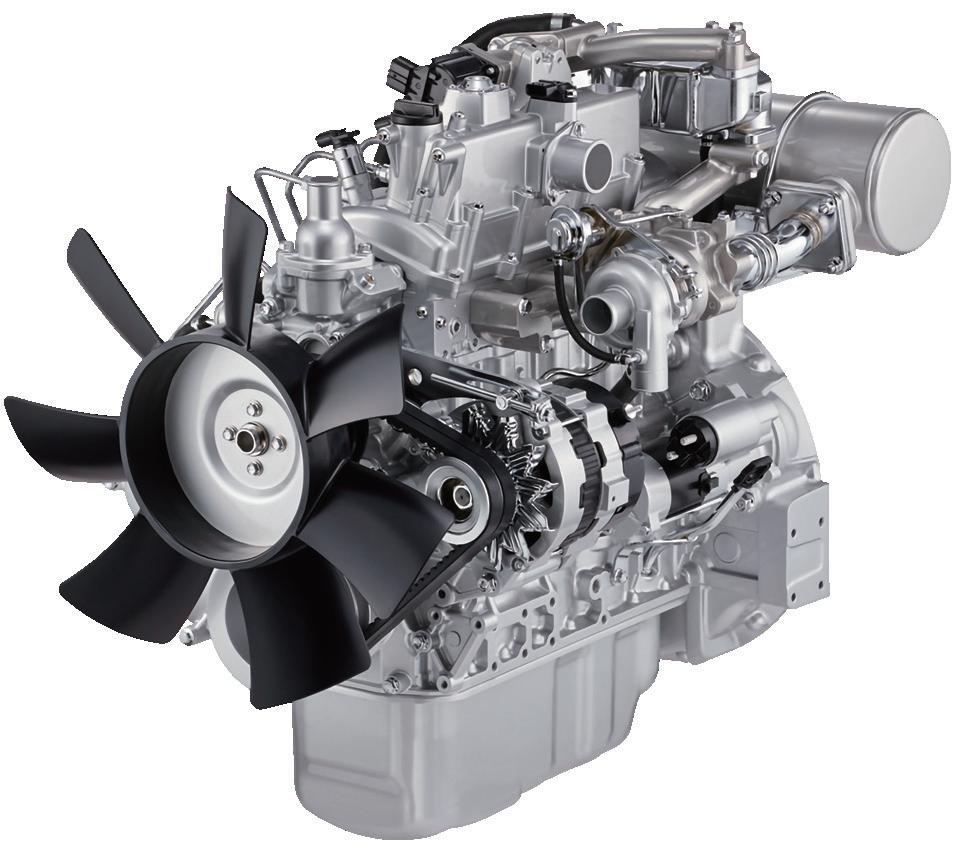

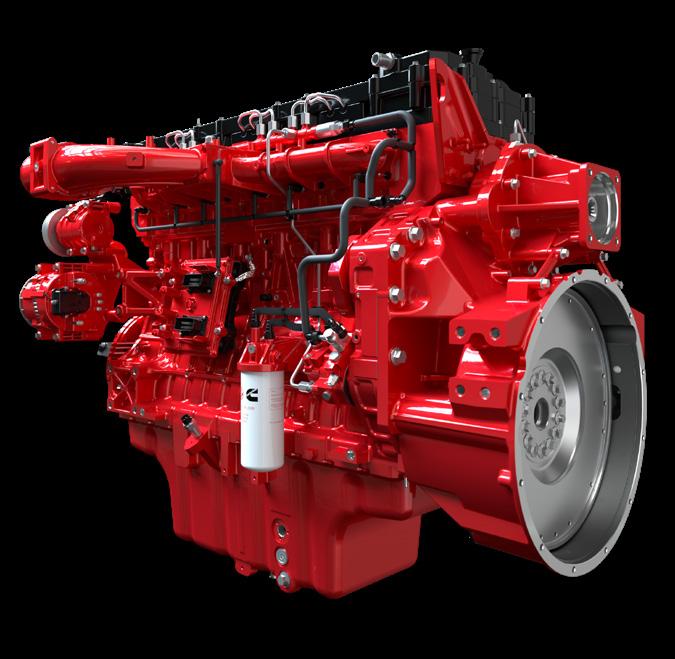

Alongside this month’s issue is a staple of the brand, the OEM Off-Highway Engine Spec Guide. Published annually, this special supplement provides engineers with the specs of hundreds of gas and diesel engine systems in the on- and off-highway markets. We’ve not only packed our 2024 print installment to the brim, but we’ve also stacked our website with hundreds of additional specs to ensure a comprehensive view of options from more than 25 major engine manufacturers. For free, online access to the full volume of specs, visit oemoh.co/specguide — and be sure to bookmark this resource as a reference for use in your work throughout the year.

As we continue to navigate a changing equipment landscape, OEM Off-Highway is proud to deliver another industry resource that has been pillar of the publication since its inception in 1984. In our next issue, we’ll welcome a new crop of cutting-edge products to OEM Off-Highway’s Annual Product Showcase and provide a concentrated focus on many of the components, solutions and services available to product development teams today. I invite you to browse the latest in our upcoming July/August 2024 issue. Take care,

EDITORIAL ADVISORY BOARD

Craig Callewaert, PE, Chief Project Manager, Volvo Construction Equipment

Roy Chidgey, Business Segment Head, Minerals Projects and Global Mobile Mining, Siemens Large Drives US

Andrew Halonen , President, Mayflower Consulting, LLC

Terry Hershberger, Director, Sales Product Management, Mobile Hydraulics, Bosch Rexroth Corp.

Steven Nendick, Marketing Communications Director, Cummins Inc.

John Madsen, Director Engineering & Product Management, GKN Wheels & Structures

Doug Meyer, Global Director of Construction Engineering, John Deere

Andy Noble, Head of Heavy Duty Engines, Ricardo

Daniel Reibscheid, Business Development Manager, MNP Corporation

Matt Rushing, Vice President, Product Line, Global Crop Care, AGCO Corp.

Allen Schaeffer, Executive Director, Diesel Technology Forum

Keith T. Simons, President – Controls Products, OEM Controls, Inc.

Alexandra Nolde , Senior Communication & Media Specialist, Liebherr-Components AG

Bob Straka, General Manager, Transportation SBU, Southco, Inc.

Luka Korzeniowski, Global Market Segment Leader, Mobile Hydraulics, MTS Sensors

Chris Williamson, PhD, Senior Systems Engineer Global Research & Development, Danfoss Power Solutions Company

EDITORIAL

Editor Kathy Wells kwells@iron.markets

AUDIENCE

Audience Development Manager Angela Franks

PRODUCTION

Senior Production Manager Cindy Rusch crusch@iron.markets

Art Director Kimberly Fleming kfleming@iron.markets

ADVERTISING/SALES

Brand Director Sean Dunphy sdunphy@iron.markets

Brand Manager, OEM & Construction Nikki Lawson nlawson@iron.markets

Sales Representative Kris Flitcroft kflitcroft@iron.markets

Sales Representative Craig Rohde crohde@iron.markets

IRONMARKETS

Chief Executive Officer Ron Spink

Chief Revenue Officer Amy Schwandt VP, Finance Greta Teter VP, Audience Development Ronda Hughes VP, Operations & IT Nick Raether VP, Demand Generation & Education Jim Bagan

Corporate Director of Sales Jason DeSarle

Brand Director, Construction, OEM & IRONPROS Sean Dunphy

Content Director Marina Mayer

Director, Online & Marketing Services Bethany Chambers

Director, Event Content & Programming Jess Lombardo CIRCULATION & SUBSCRIPTIONS

PO Box 3605 Northbrook, IL 60065-3605, Phone: 877-201-3915 Fax: 847-291-4816 circ.oemoff-highway@omeda.com

LIST RENTAL

Sr. Account Manager Bart Piccirillo, Data Axle 402-836-2768 | bart.piccirillo@data-axle.com

REPRINTS & LICENSING

Brand Manager, OEM & Construction Nikki Lawson 920-542-1239 | nlawson@iron.markets

Published and copyrighted 2024 by IRONMARKETS. All rights reserved. No part of this publication shall be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording or any information storage or retrieval system, without written permission from the publisher.

SUBSCRIPTION POLICY: Individual print subscriptions are available without charge in the United States to original equipment manufacturers. Digital subscriptions are available without charge to all geographic locations. Publisher reserves the right to reject nonqualified subscribers. Subscription Prices: U.S. $35 One Year, $70 Two Years; Canada and Mexico $60 One Year, $105 Two Years; all other countries, payable in U.S. funds, drawn on U.S. bank, $85 One Year, $160 Two Years. OEMOff-Highway (USPS 752-770, ISSN 1048-3039 (print); ISSN 2158-7094 (online) is published 6 times a year: January/February, March/April, May/ June, July/August, September/October and November/December by IRONMARKETS, 201 N. Main Street, 3rd Fl., Fort Atkinson, WI 53538. Periodicals Postage paid at Fort Atkinson, WI and additional entry offices. POSTMASTER:

@oemoffhighway @oemoffhighway @oem-off-highway @oemoffhighway

Published by IRONMARKETS

201 N. Main Street, Fort Atkinson, WI 53538 800-538-5544 iron.markets oemoffhighway.com ironpros.com

Send address changes to: OEMOff-Highway, PO Box 3605 Northbrook, IL 60065-3605. Printed in the U.S.A. EDITOR’S NOTE MAY/JUNE 2024 | OEM Off-Highway

4

Red Dot Names John Beering CEO

Beering aims to work with Red Dot’s board, executives and team members to drive the company’s strategic vision.

Beering has more than 30 years of experience as a leader across a range of industries, including commercial vehicle development, energy storage solutions and mobility equipment sales. Beering aims to drive the strategic vision for the company, including optimizing Red Dot’s operations and manufacturing capabilities, generating momentum across each facility and cultivating relationships. He has held leadership roles across the manufacturing and transportation verticals. He holds a bachelor’s degree in industrial engineering and a master’s degree in management from Purdue University.

Read More oemoh.co/93ggjmej

Scania Appoints Sara Forsberg to EVP, CTO & Head of Brand Identity Dev

Forsberg joins Scania’s Executive Board and reports to Christian Levin, president and CEO Scania and

TRATON GROUP

Since joining Scania in 2001, Forsberg has held several positions within R&D, including head of truck chassis development. She took up her current position as acting manager for vehicle development in Södertälje in 2023. Forsberg has extensive experience in vehicle development, modularization and validation, and will now take on the task of implementing and leading Scania’s Brand Identity Development (BID) organization. Together with her team, she will drive the development of Scania’s product roadmap. Forsberg holds a master’s degree in ergonomic design and production from Luleå University of Technology.

Read More

oemoh.co/rjyiyg7f

Moveero Announces

David Geraghty as New CEO

Geraghty takes the helm to lead the company’s next stages of growth across

the U.S. and worldwide.

Geraghty has over 25 years of experience in senior roles with multinational, multibilliondollar organizations to the business, including his most recent position as president of Yokohama Off Highway Tires, America, where he was responsible for aftermarket and OE operations. Geraghty has worked across a number of industry sectors, including heavy truck, mining, construction and agricultural equipment, aftermarket parts and service, primarily in the diesel engine and tire spaces. With an MBA in strategy, marketing and operations, Geraghty will be based at moveero’s global headquarters in Armstrong, Iowa, and will work with the company’s teams across its global locations.

Read More oemoh.co/9vekav1p

With over 80 years of expertise, ZF has become a full-range system supplier, offering tailormade technology for all applications and customer needs. Our extensive product portfolio is contributing to efficient, emission-free and safe farming.

ZF.com/agriculture

5 OEM Off-Highway | MAY/JUNE 2024 NEWS BRIEF

Future

The

of Farming

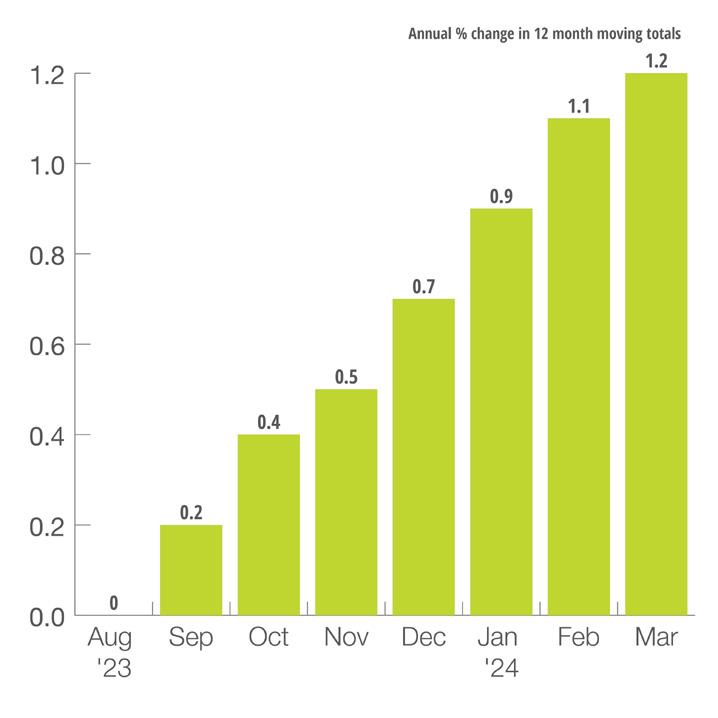

CONSTRUCTION EQUIPMENT ORDERS SHOW MILD UPTICK AMID SLOW GROWTH RATES

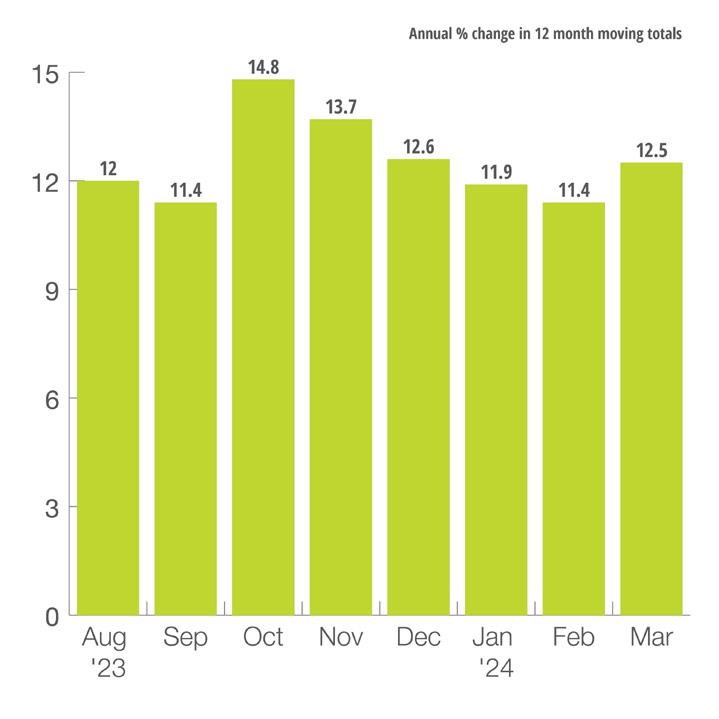

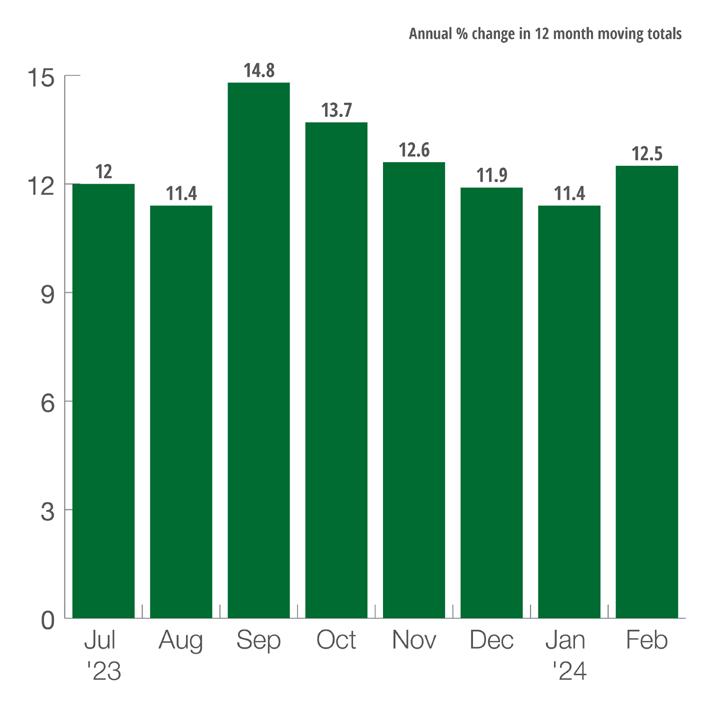

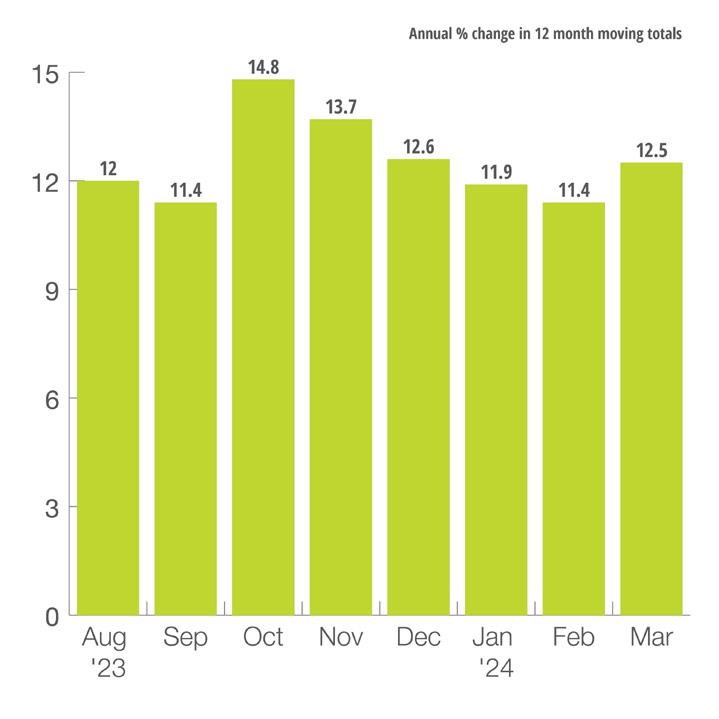

Industry-leading economic firm ITR Economics provides heavy-duty equipment market trends to help OEMs stay up to date on top industry information and insights, which can help them make better decisions in 2024. In our continued analysis, U.S. construction machinery new orders showed a mild uptick in growth, coming in 12.5% above the year-ago level.

Visit oemoffhighway.com to sign up for our monthly ECONOMIC NEWSLETTER!

The growth rate has been oscillating in the low doubledigits for more than a year. However, tight borrowing conditions suggest further downside pressure on machinery demand. The following provides a summary of key observations across 13 indicators and areas of industry that contribute to today’s global economic conditions.

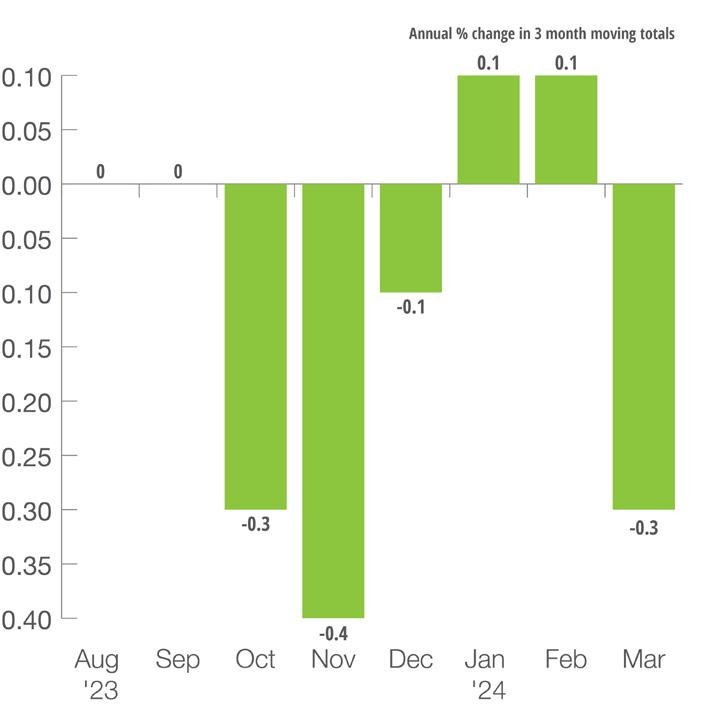

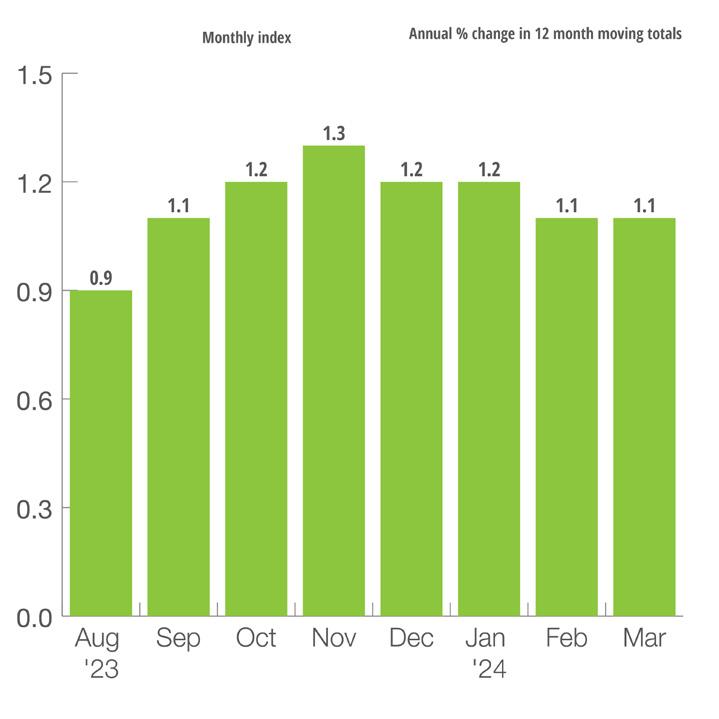

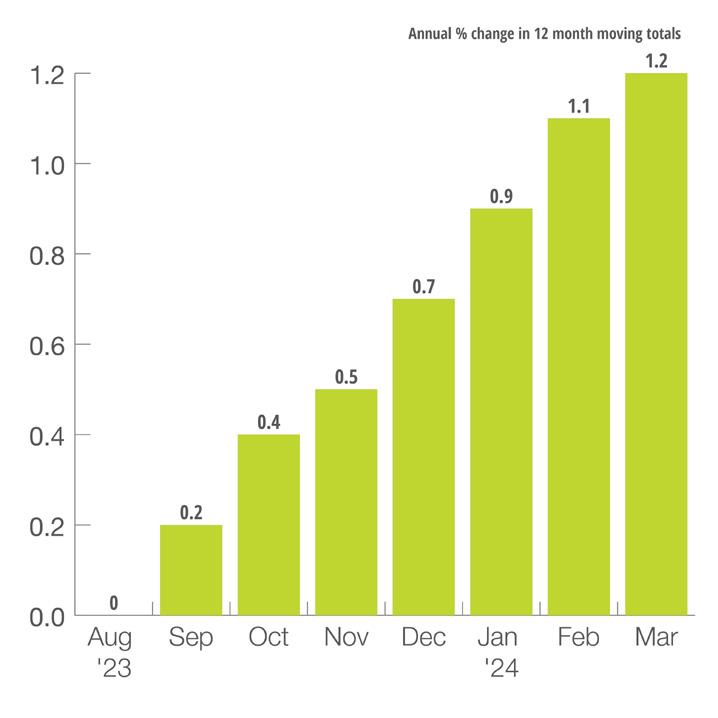

US Leading Indicator

• The monthly rate-of-change for the U.S. OECD Leading Indicator rose mildly in March.

• Rise in the Indicator is a positive sign, but monetary policy suggests further downside pressure.

Editor’s Note: Please note that this chart has been modified on the Y-axis to show the trend more easily. All data for charts are supplied by ITR Economics. ITR Economics is an independent economic research and consulting firm with 75+ years of experience. MAY/JUNE 2024 | OEM Off-Highway oemoffhighway.com/economics EQUIPMENT MARKET OUTLOOK Sponsored by Eberspächer 6

ABCDSTOCK – STOCK.ADOBE.COM

to show the trend more easily.

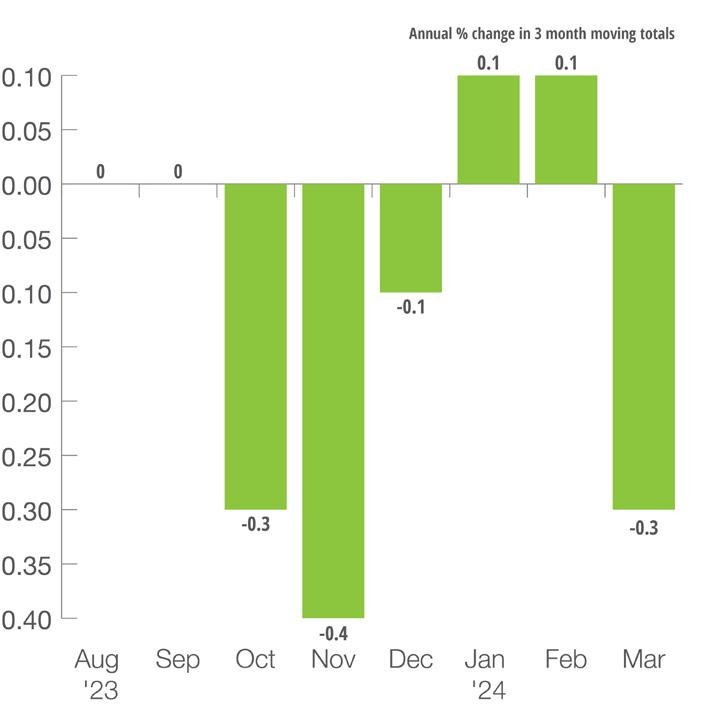

Editor’s Note: Please note that this chart has been modified on the Y-axis

• U.S. Industrial Production in the three months through March was 0.3% below the same period one year ago.

• While the US industrial sector is contending with elevated interest rates and a slowdown in manufacturing, decline will likely be mild in the near term as there are upside pressures from onshoring, government spending and the high-tech sector.

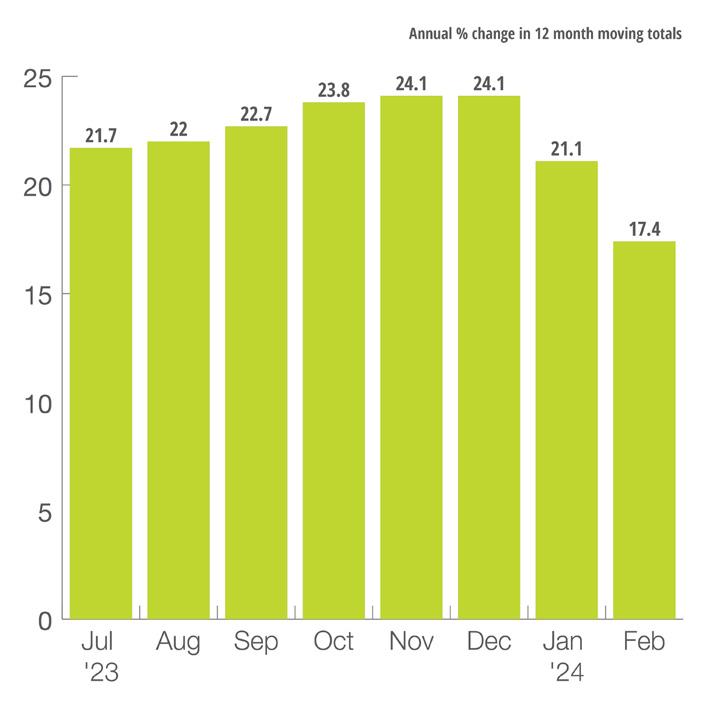

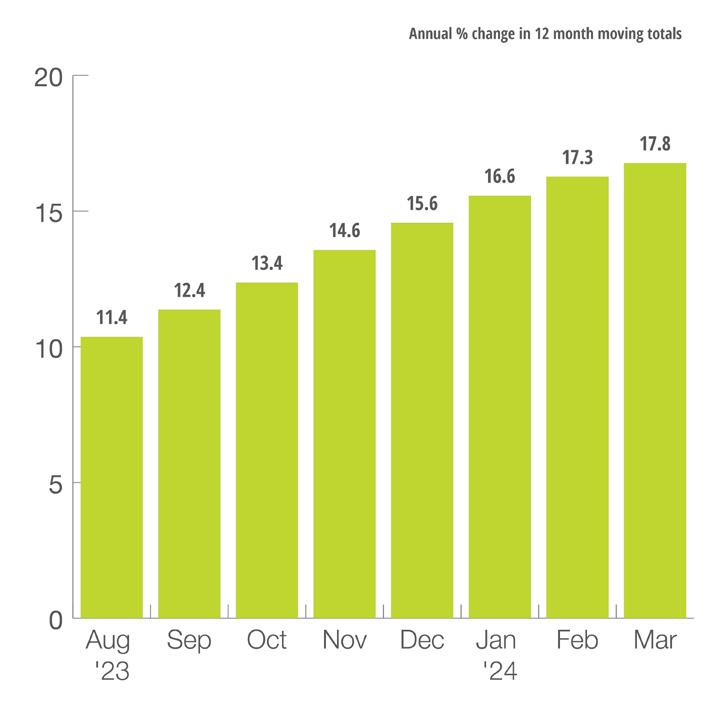

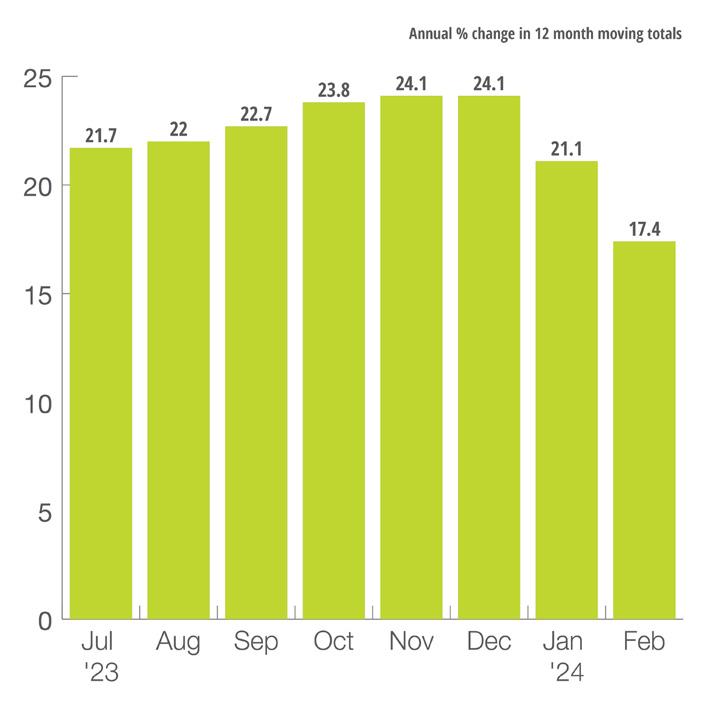

• U.S. Private Nonresidential Construction in the three months through February was 17.4% higher than in the same period one year prior.

• Nonresidential construction is generally slowing in growth partly from business hesitancy and elevated interest rates. Certain segments, such as Manufacturing Construction, are outperforming the overall market due in part to government spending.

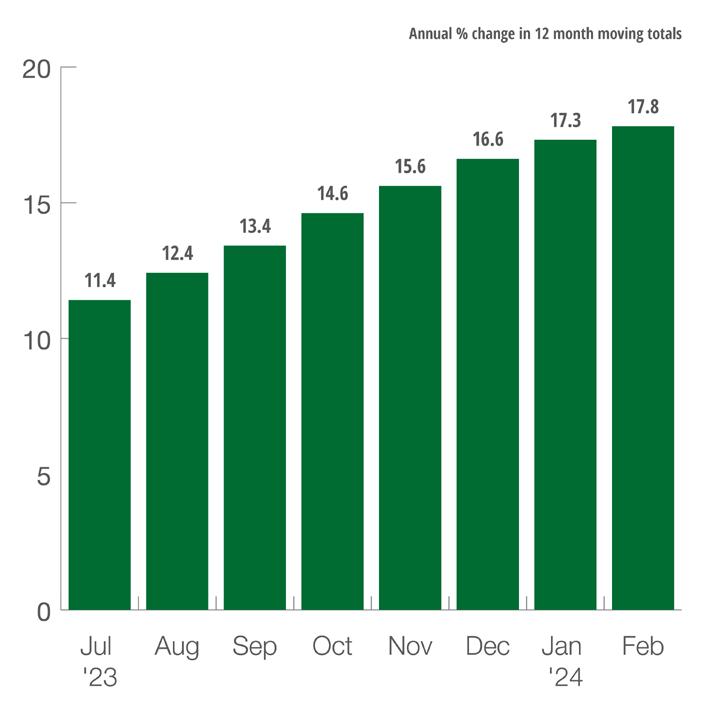

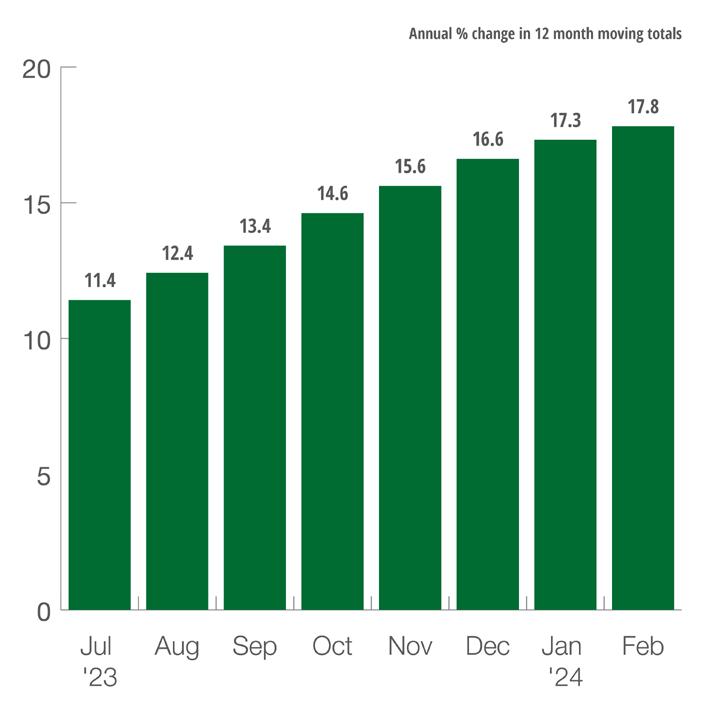

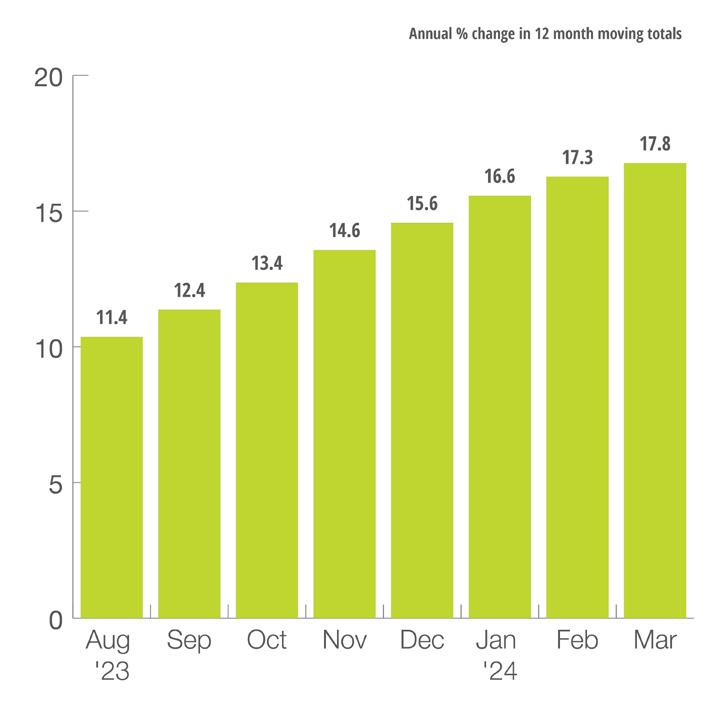

• U.S. Total Public Construction in the 12 months through February totaled $449.1 billion, 17.8% above the year-ago level. Growth may soon begin to decelerate.

• While both are at record-high annual levels, U.S. State and Local Infrastructure Construction is accelerating in growth while U.S. Federal Infrastructure Construction is slowing in growth.

OEM Off-Highway | MAY/JUNE 2024 7

US Industrial Production US Private Nonresidential New Construction US Total Public New Construction A WORLD OF COMFORT Customized A/C Systems for Every Application

presents an extensive range of solutions that caters to every facet of optimal thermal management for your off-highway and special-purpose vehicles. Our offerings include integrated split climate control systems

tailor-made special designs.

us to assist you in discovering the ideal solution

your specific application.

Eberspächer

and

Allow

for

| MORE AT EBERSPAECHER-OFF-HIGHWAY.COM

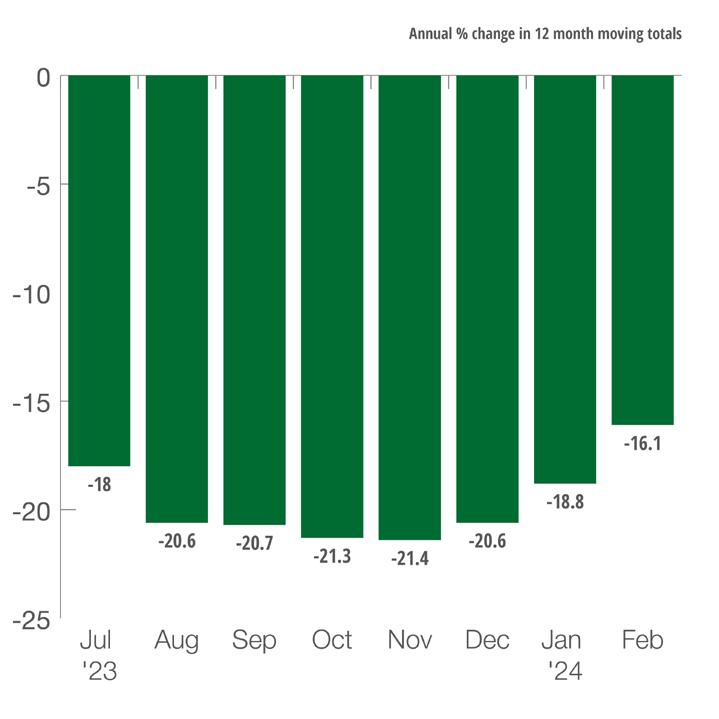

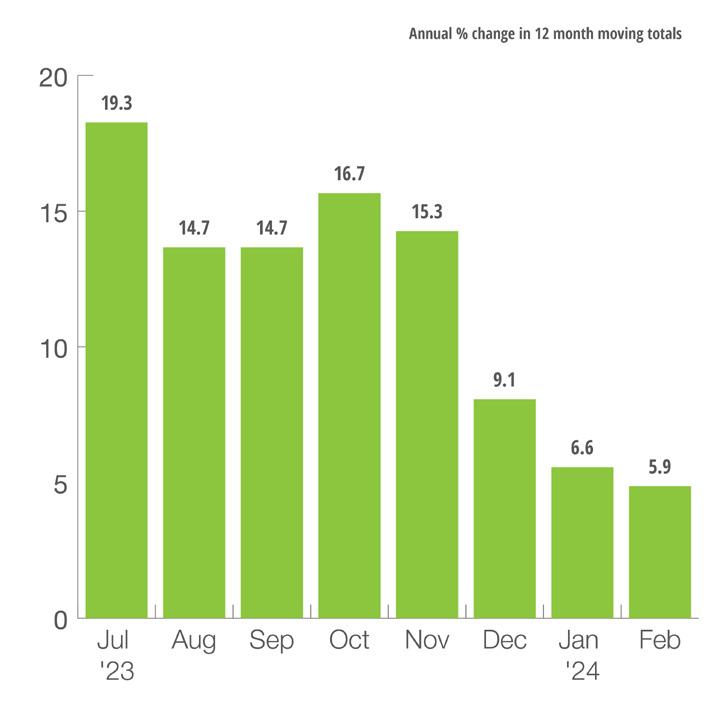

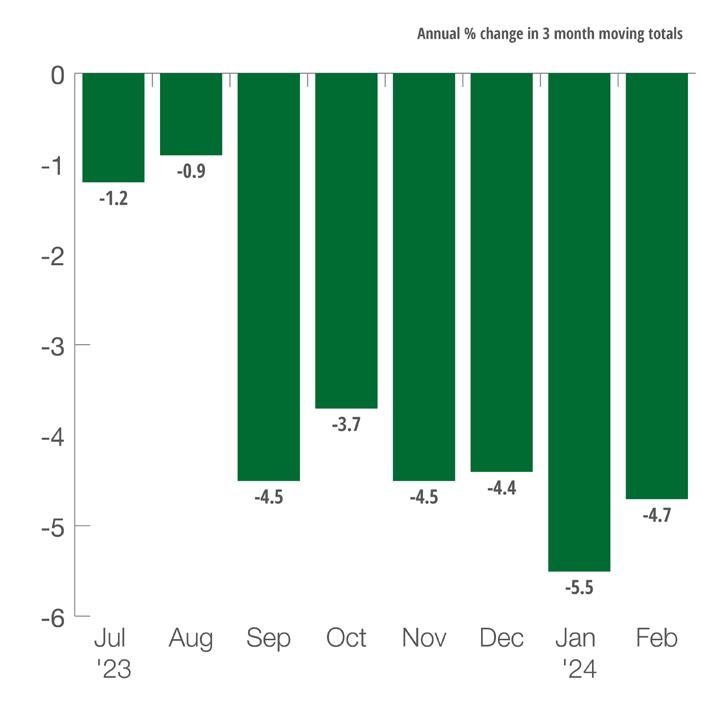

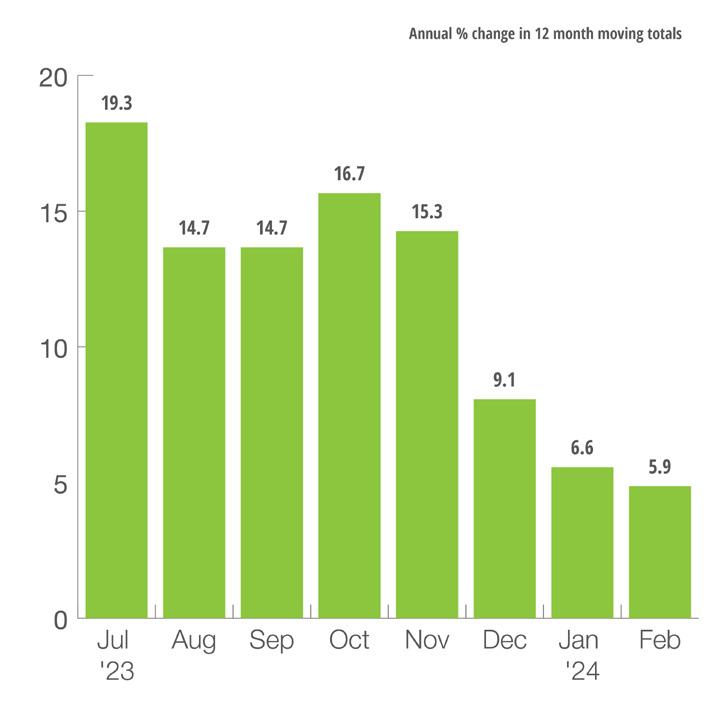

US Farm Machinery Production

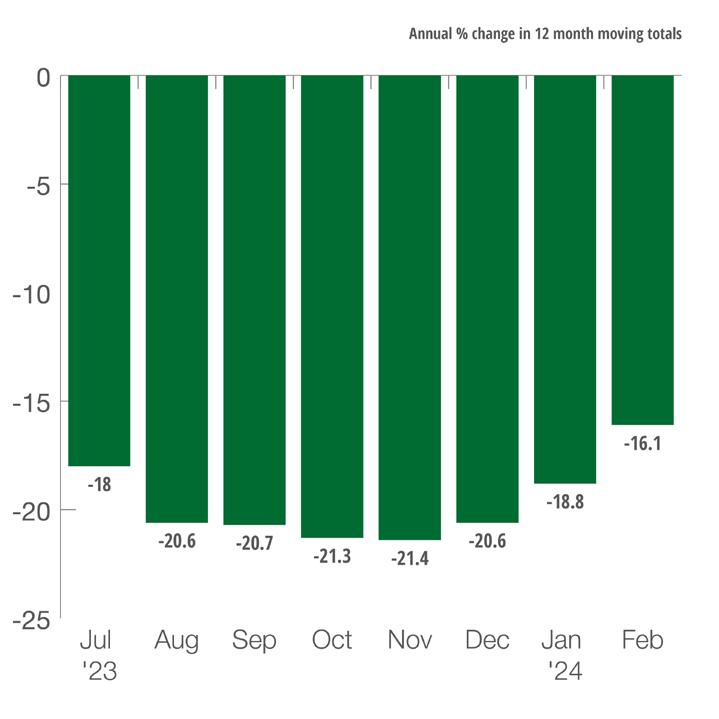

• U.S. Farm Machinery Shipments in the 12 months through February were 16.1% below the year-ago level.

• The annual rate-of-change, while still negative, is rising; further rise is likely in at least the near term.

US HeavyDuty Truck Production

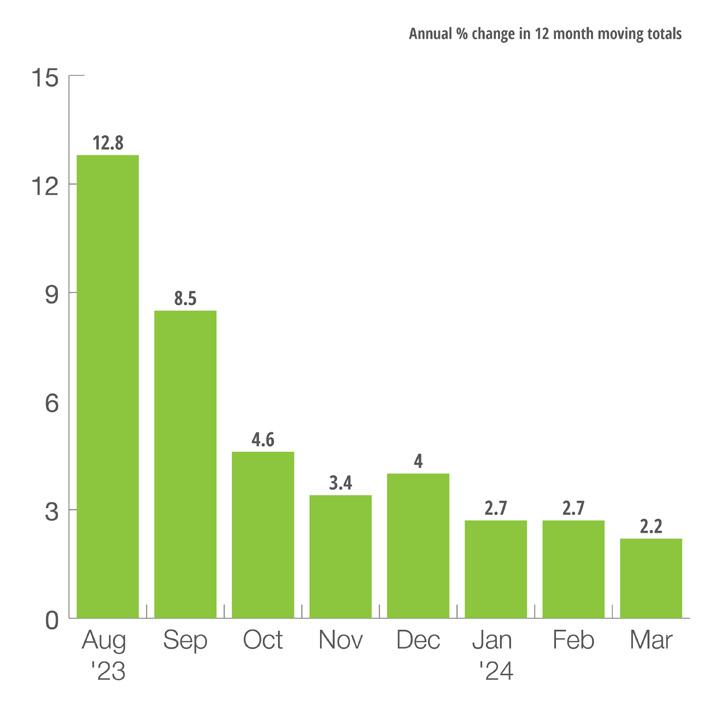

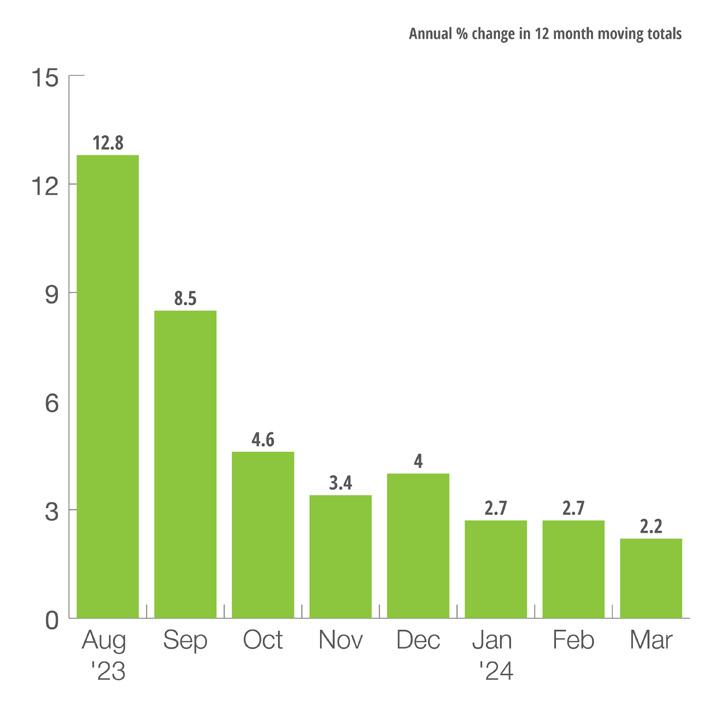

• Annual U.S. Heavy-Duty Truck Production in the 12 months through March was 2.2% above the year-ago level, but evidence suggests mild contraction ahead.

• Downward pressures on Heavy-Duty Truck Production stem, in part, from a weak freight market and slowing growth in consumer and business-to-business spending.

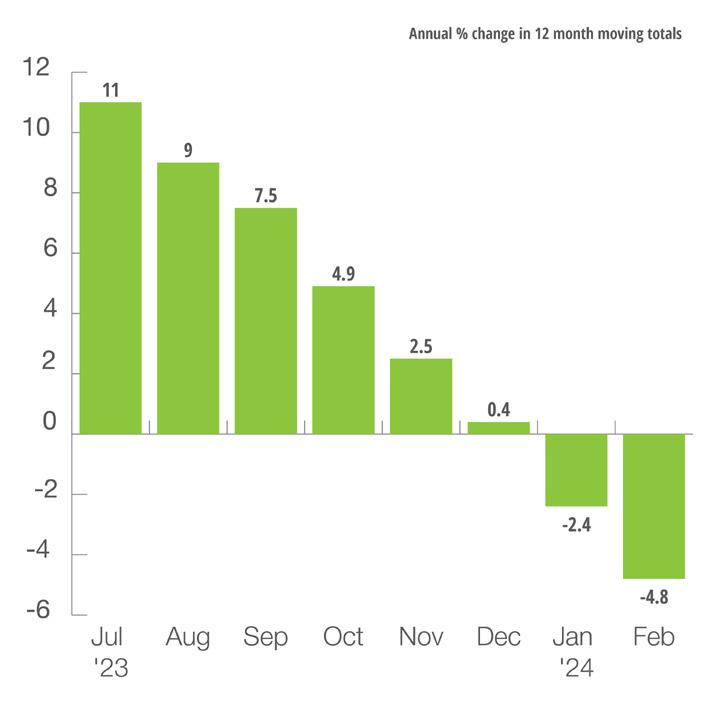

Europe Ag & Forestry Machinery Production

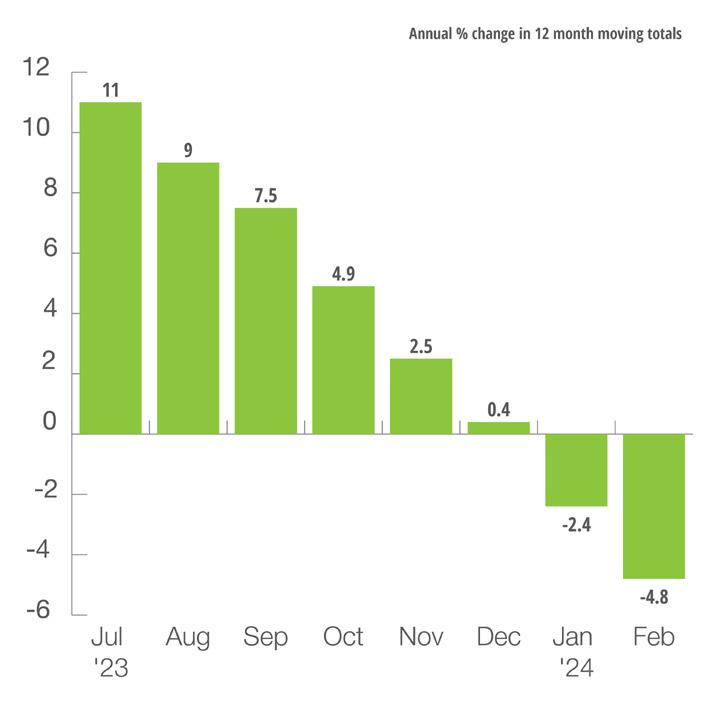

• Annual Europe Agricultural and Forestry Machinery Production in February was 4.8% below the year-ago level.

• The quarterly rate-of-change, at -15.7%, suggests that decline will persist in at least the near term.

US Mining Production

• Annual U.S. Mining Production through February was 2.5% above the year-ago level. Annual Production has plateaued with a slight downward bias.

• Coal Mining and Nonmetallic Mining are in decline. There is further downward pressure from China as they contend with their challenged property sector, which in turn negatively impacts U.S. iron mining demand.

Europe Leading Indicator

• The Four Big European Nations Leading Indicator monthly rate-of-change held steady in March.

• While the EU’s industrial sector is contracting overall, there is tentative accelerating growth in the industrial sector for the UK.

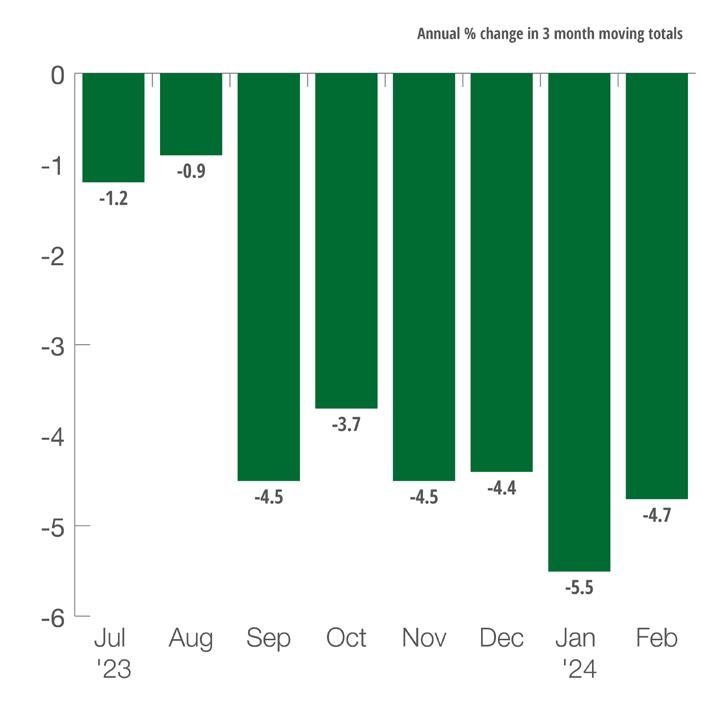

Germany Industrial Production

• Germany Industrial Production in the three months through February was 4.7% below the year-ago level.

• Further decline is likely in the near term as Germany grapples with high interest rates and a plateau in exports. Germany is also still struggling to get energy costs under control.

MAY/JUNE 2024 | OEM Off-Highway 8 oemoffhighway.com/economics EQUIPMENT MARKET OUTLOOK Sponsored by Eberspächer

Editor’s Note: Please note that this chart has been modified on the Y-axis to show the trend more easily.

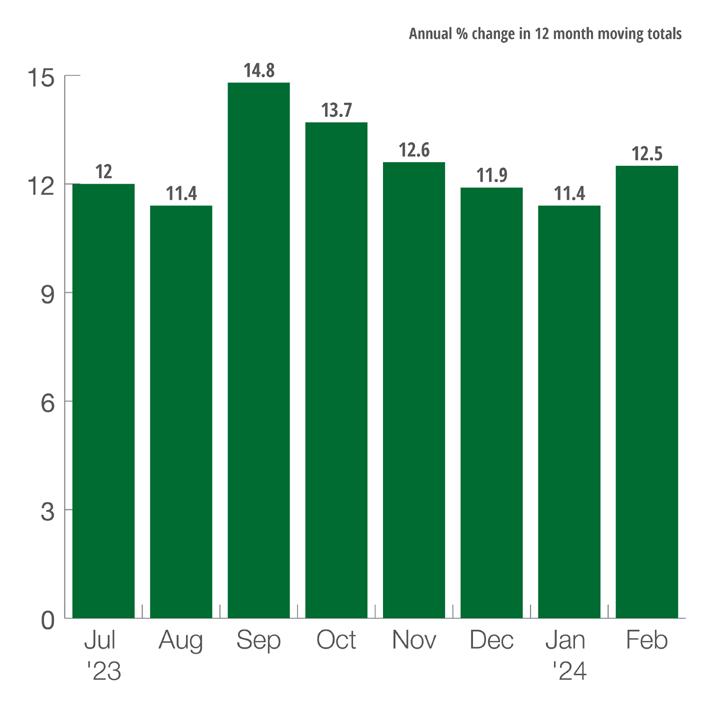

US Construction Machinery New Orders

• U.S. Construction Machinery New Orders in the 12 months through February had a mild uptick in growth, coming in 12.5% above the year-ago level. The growth rate has been oscillating in the low double-digits for more than a year.

• Lagging nonresidential construction is slowing in growth while single-unit residential construction is accelerating. Tight borrowing conditions suggest further downside pressure on machinery demand.

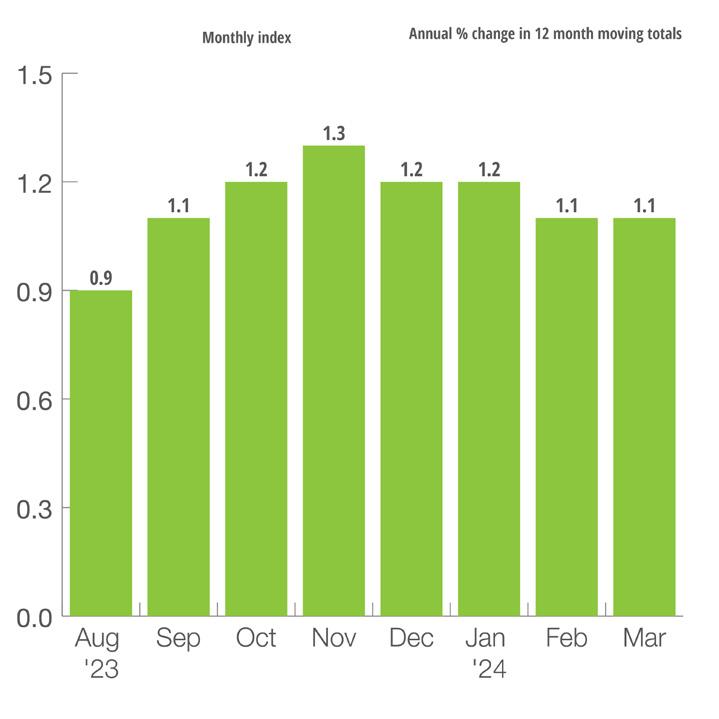

US Mining & Oil Field Machinery Production Index US Defense Industry, New Orders

• Mining and Oil Field Machinery Production in the 12 months through March was 0.5% below the year-ago level.

• While extraction of oil and gas remains relatively strong, especially given various global tensions that are amplifying energy demand from domestic sources, businesses are not likely to invest in Machinery Production in the near term due in part to high interest rates and regulatory hurdles.

• U.S. Defense Capital Goods New Orders in the 12 months through February totaled $163.9 billion. Annual New Orders have been moving lower in recent months.

• The U.S. Congress recently passed a $95 billion foreign aid package for Ukraine, Israel and Taiwan; this will likely present an upside opportunity for New Orders.

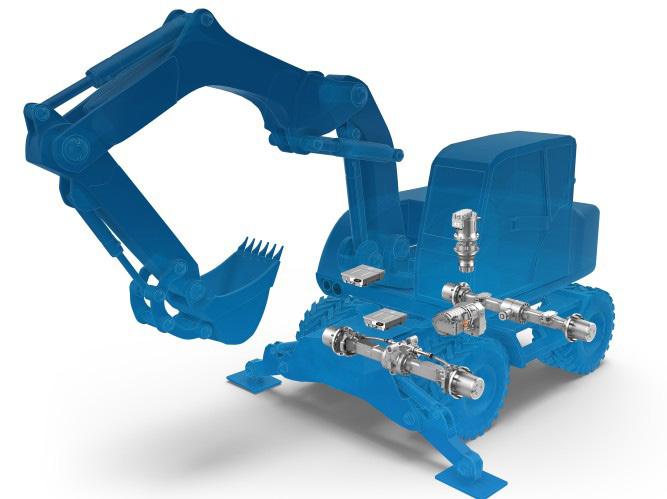

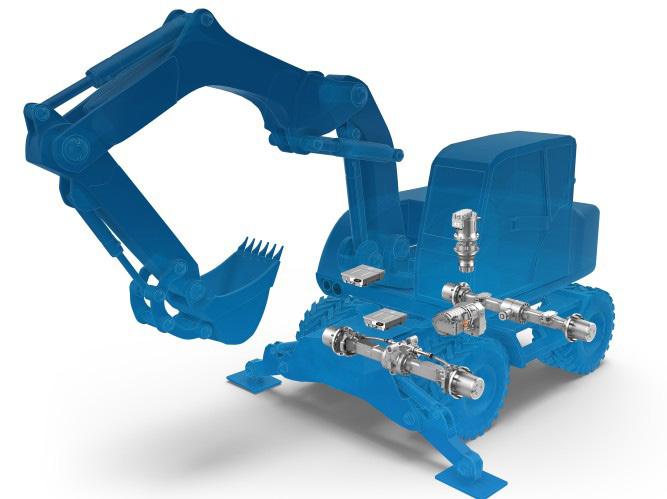

Parker enables its partners in the off-road machinery industry access to unsurpassed people, technology and expertise that work together to develop electrification solutions with maximized system efficiency in work and traction applications for a quieter, cleaner tomorrow. parker.com/electrification

OEM Off-Highway | MAY/JUNE 2024 9

Maximizing Machine Efficiency Integrating Electric and Hydraulics Connecting Off-Road Machinery Smart Electrification

Building an ELECTRIFIED FUTURE for Commercial Vehicles

Understanding the infrastructure challenges when migrating fleets to BEVs

by Wilfried Aulbur, Giovanni Schelfi & Walter Rentzsch

Our planet is facing a climate change crisis, and we have a responsibility to reduce greenhouse gas (GHG) emissions and abate the destructive effect rising temperatures have on the earth and the global economy. Almost one-third (29%) of U.S. GHG emissions are generated by transportation, and medium-duty (MD) and heavy-duty (HD) vehicles make up almost a quarter (23%) of the transportation sector. With this in mind, the commercial vehicle (CV) industry must be on the front line of decarbonization.

Electric vehicle (EV) innovations are making batteries more affordable, extending vehicle range and producing more purpose-built platforms — all within in a relatively short time span. Consider the fact that diesel engine development has spanned 130 years, while development of battery electric vehicles (BEVs) at scale has been an automotive focus for less than a decade.

Even with this progress, however, as we look to the future of EVs in the logistics industry, we are starting to see some long-term challenges, especially when compared to diesel vehicles:

• The cost of electric vehicles and the supporting infrastructure are substantial, straining the financial viability of fleets, especially smaller operators with fewer vehicles.

• EV usage is currently limited by the number of routes that will accommodate electric CVs, and the volume of load an EV can transport.

• Prolonged charging time reduces asset productivity and is problematic for conventional driver compensation. Ultimately, fleet operating models will have to be revised to address EVs.

• Lack of parking and charging station availability impedes electrification.

• Working with utilities is difficult and lead times for EV infrastructure deployments outpace normal lead times for asset purchases.

All of these impediments, combined with negative public debate about EVs, increase the perceived risk as fleets migrate from diesel to electric vehicles.

In particular, fleets are becoming less concerned about EV availability and more concerned about the capacity of the charging infrastructure and electric grid to handle electrification of MD and HD vehicles.

Modeling a Complete Transition to BEVs

To delve deeper into this topic, Roland Berger modeled a 100% build out case for electrification of all U.S. Class 3-8 commercial vehicles. The objective was to ascertain the total investment required for the infrastructure build

out for vehicle charging — as well as electricity distribution, generation and transmission — to support a complete transition of U.S. Class 3-8 commercial vehicles to BEVs.

This study was not intended to project how BEV adoption would grow, but rather to determine the cost to convert the entire U.S. fleet from diesel to electric vehicles based on plausible, conservative expectations.

The Roland Berger model considered three basic charging locations:

• On-site charging — Privately owned chargers at the fleet’s locations, as well as shared charging hubs with dedicated availability for commercial vehicles, providing a mix of L2, L3 and, in limited cases, DCFC chargers.

• Local on-route charging — Highmileage local applications offering public access to DCFC chargers.

• On-route highway charging — DCFC chargers as well as L2 and L3 chargers used for charging long-haul vehicles overnight.

For the local charging network simulation, we used fleet telematics data from NREL to analyze Class 3-8 vehicle operation during the day, excluding long-haul trucks. We used the mileage distribution and duty cycle to determine the charging resources required across overnight depot and on-route “top-up”

CONSULTANT CORNER 10 MAY/JUNE 2024 | OEM Off-Highway

charging. Aggregating average load curves per vehicle class, combined with the regional allocation of vehicles per weight class, allowed us to simulate charging infrastructure and load curves at the county level.

For the on-route highway charging network simulation, we evaluated the existing distribution of refueling stations throughout the U.S. highway network. We also used route-specific truck traffic data to calculate how many long-haul vehicles would be recharging at each location, differentiating between top-up and overnight charging. Based on this data, we determined the investment required to deploy vehicle charging infrastructure at each station. Again, this allowed us to simulate charging infrastructure and load curves at the county level.

Calculating the Cost

Estimating a usable range for Class 6-8 trucks at 250 miles and DCFC chargers of 500 kW for local on-route charging and 1 MW for highway charging, the Roland Berger model calculated that a total investment of $620 billion will be required for chargers, site infrastructure and utility services. On-site charging with L2 and L3 chargers constitutes the majority of the cost at roughly $500 billion. On-route charging investments are almost equally divided between local 500 kW chargers (USD 69 bn) and on-highway 1 MW chargers (57 bn).

The cost of local charging is driven mostly by HD vehicles that need L3 or even DCFC charging at their depot. The charging infrastructure is three times as expensive on a per vehicle level for HDs (approximately $145,000) then for MDs (approximately $54,000).

In addition, distribution grid upgrades and new builds are expected to cost

utilities about $370 billion to meet the local charging demand from MDHD vehicles. More regulatory support and practical grid planning will be necessary to avoid bottlenecks and delays. Since utilities tend to keep rates low and ensure affordability for customers, funding for these upgrades will also be an issue.

The investment required for energy production and distribution will cost an additional $44 billion, per the Roland Berger model. However, this investment is already factored into the utilities’ longterm roadmap.

The overall price tag of almost $1 trillion demonstrates the imposing challenge the logistics industry will face when advancing from internal combustion engines (ICE) to BEV. In addition, the high BEV prices and operational issues will impact the total cost of maintaining a fleet of BEV trucks even more.

Taking on the Challenges

How can the logistics industry address the challenges revealed by the Roland Berger study?

First, fleet operation must be continuously optimized. While this study-based BEV fleet operation on the same model used for conventional trucks, BEV fleets must actually improve operations by leveraging route planning and managed charging to counteract the limitations of BEVs. OEMs, fleets, utilities and regulators must collaborate to find appropriate use cases and expedite build out of the necessary infrastructure. Escalated improvement of technical performance would also help reduce costs.

Second, roll out of electrification in MDHD must be in phases. The initial focus should be on use cases that

minimize operational costs. In Roland Berger’s view, there are MD use cases and HD use cases along specific highway corridors that are candidates for early adoption.

Third, we must use a technologyagnostic approach to find cost-effective solutions. Other decarbonization options are available. For example, certain use cases or routes may be more cost-effectively served by alternatives such as renewable diesel.

And finally, we cannot expect this transformation to be financed by transport operators, since the U.S. logistics industry has annual revenues of about $800 billion with minimal profits. Private capital may be the ideal method to finance the charging infrastructure, but government support — such as targeted incentives and regulation — is presumably needed until BEV technology and business model improvements deliver a cost advantage over ICE vehicles.

The logistics industry strives to maintain safe, economical and sustainable transportation of cargo. Electrification can help fleet operators meet this commitment, and BEVs are ideally positioned for widespread adoption across commercial vehicle fleets. As we set expectations, make decisions and implement policies to guide the transition from BEV to ICE, we must consider the challenges faced by fleets and other industry stakeholders while establishing ambitious yet achievable goals and timelines.

At international management consultancy firm Roland Berger, Wilfried Aulbur is a senior partner, Giovanni Schelfi is a partner, and Walter Rentzsch is a director. Visit rolandberger.com.

11 OEM Off-Highway | MAY/JUNE 2024

ADOBE STOCK | VIT

Leveraging ADVANCED CHARGING TECHNOLOGIES for Off-Highway Vehicle Electrification

How to optimize performance, flexibility & reliability, & enhance long-term impact on business & sustainability initiatives

by Mourad Chergui

As we stand at the threshold of a new era in vehicular technology, the off-highway sector, comprising heavy-duty machinery used in material handling, construction, agriculture, mining and more, is experiencing a paradigm shift toward electrification.

This transition toward electric powertrains is catalyzed by various factors, from meeting decarbonization and sustainability goals to improving vehicle performance.

Yet, despite electrification’s many benefits, adoption rates vary greatly among off-highway vehicles and trail well behind passenger EVs.

Projections estimate the passenger EV market size to exceed $1 trillion in 2030, whereas off-highway electric vehicles (OHEVs) will linger at $37.5 billion.

To OEMs in the off-highway space, this disparity between segments is nothing new. Logistical challenges abound — from high-demand duty cycles that drain batteries to zero mid-shift to the losses accrued from extensive downtime while charging.

But what if opportunistic, fast or wireless charging solutions overcame those challenges and made it easier for OHEVs to maintain uptime comparable to diesel-powered counterparts? This would certainly pave the way for broader acceptance and implementation across off-highway applications.

Opportunity Charging

For decades, EVs have been forced to conform to stationary, external charging station designs, with charging logistics continually posing the most significant hurdle to OHEV adoption. Opportunity charging technology now takes advantage of brief downtime during the workday to recharge the vehicle’s battery and strategically maximize OHEV operation time.

This type of charger is well-suited to OHEVs with sporadic usage patterns. Idle moments, such as operator shift changes, lunch breaks and loading or unloading times, can be transformed into charging opportunities.

Consider the following benefits of opportunity charging:

• Improves vehicle utilization and

productivity per duty cycle

• Frequent recharging allows for smaller, lighter battery packs

• Enables multishift operations via opportunistic top-ups

• Eliminates the need for manual battery swapping

Since opportunity chargers cut off at 80% charge, they may serve as a viable option for extending the work life of aging batteries that can no longer reach full charge.

In general, opportunity charging is best suited for lithium-ion batteries, which have an inherently faster charging potential. Li-ion also emerges as the ideal choice for opportunity charging thanks to resilience against stress caused by increased charging rates and the resulting battery life reductions it causes. Conversely, lead-acid battery packs are particularly susceptible to the effects of this stress as they require a fully saturated charge to keep them in good condition.

In either case, all batteries charged this way still require a standard full charge at least once a week to equalize and maintain battery health.

|

MAY/JUNE 2024 | OEM Off-Highway 12 TECH & IoT

\DOBE STOCK

JIJOMATHAI

Fast Charging Solutions

At its core, fast charging relies on higher power levels to achieve quicker energy transfer compared to standard charging methods.

While a typical Level 2 charger might deliver power at rates up to 19 kilowatts (kW), fast chargers utilize direct current (DC) to provide power from 50 kW to over 350 kW, depending on the charger and vehicle capabilities. This substantial power increase allows the vehicle’s battery to be charged in a fraction of the time it would take with traditional chargers.

This increased charging speed offers several benefits:

• Drastically reduces charge time from 4 to 10 hours down to 20 to 60 minutes, on average

• Reduces charging downtime that translates to increased operating time

• Eliminates the need for dedicated battery charging rooms

• Improves return on investment by freeing up time and on-site space for revenue-generating operations

Fast charging admittedly brings its own logistical challenges. OEMs must consider the charging infrastructure of intended application zones, and DC charging places increased demand on the electrical grid.

However, governments worldwide help address this challenge via massive investments in public charging infrastructure, such as the $7.5 billion the U.S. is dedicating toward adding more than 500,000 chargers. Greater public charging availability helps create economies of scale, driving down costs for private fleet charging infrastructure. Private implementation of chargers can be accompanied by energy generation and storage infrastructure like rooftop solar panels for additional cost savings and greater resilience against price fluctuations.

The equipment itself also must support fast charging, often requiring larger, costlier chargers and cabling. However, these components can be used to achieve cost reductions and additional value for OEMs, owners and operators. For example, improving energy transfer and storage efficiency to support fast charging also helps reduce battery sizes (reclaiming onboard space for auxiliary systems) and the amount of thermal regulation equipment required.

Onboard Charging

Central to the broader landscape of off-highway electrification, onboard charging systems outfit the vehicle with convenience. With an onboard charger, OEMs can leverage the existing electrical grid from anywhere at any time.

Modern onboard chargers from reputable companies are characterized by compactness, robustness and a rugged design built to withstand harsh conditions across industrial applications, such as vibration, extreme temperatures, moisture and dust.

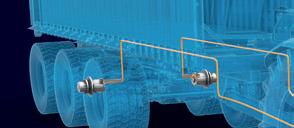

CAN Bus Splitters by Trombetta

Make long, confusing harnesses a thing of the past.

Trombetta CAN Bus splitters collectively power your devices and clean up your system wiring, easing the troubleshooting of your harnesses. Featuring a compact efficient design, these splitters reduce cost by eliminating Y adapters and extra harnesses typically used to provide additional connections to the bus.

For stocking information visit www.waytekwire.com/TromCanBus

13 OEM Off-Highway | MAY/JUNE 2024

Consider just a few additional benefits of utilizing onboard chargers:

• Convenient and cost-efficient, eliminating the need for costly external charging systems

• Efficient charging fine-tuned for the vehicle’s specific battery

• Built-in safety measures to prevent overcharging or electrical hazards

• Versatility to charge anywhere an electrical outlet is present

These benefits are especially profound when working with highpower equipment or in remote settings where access to specialized charging infrastructure may be limited or nonexistent. Of course, with such conveniences come practical considerations. Integrating charging systems into the vehicle itself increases design and validation complexities. This includes space and

weight considerations, which may be particularly impactful for ultra-compact OHEVs. Lastly, the compact and rugged design often cannot offer the same power output as external chargers purpose-built for rapid charging.

Yet these considerations may merely require other engineering adjustments. For example, switching from passive, air-cooled heatsinks to an electrical fan or liquid cooling system improves performance while eliminating configuration concerns. As system configurations become less impactful on performance, they can be optimized for space and weight savings rather than the necessary airflow.

Wireless Charging

Sometimes referred to as inductive charging, wireless charging operates on the principle of electromagnetic induction, where an electric current

generates a magnetic field in a transmitter coil that, in turn, induces a voltage in a receiver coil located within the vehicle.

The basic setup of a wireless charging system for OHEVs includes a ground or wall pad that houses the transmitter coil that is connected to the electricity supply, as well as a vehicle pad (the receiver coil) installed on the vehicle. When the vehicle is positioned over the ground pad, the charging process begins automatically, guided by alignment systems or magnetic resonance coupling that allows for a small degree of misalignment.

Previously seen as something with only niche applications, wireless charging does offer potential benefits:

• Eliminates the need for manual plugins, paving the way for automated vehicle applications

• Allows for charging outdoors or in

14 TECH & IoT MAY/JUNE 2024 | OEM Off-Highway

challenging environments such as mines or construction sites

• Heightened safety due to the absence of exposed, potentially live cables and wiring

Despite its promising advantages, wireless charging technology faces several limitations that currently inhibit its widespread adoption. One of the primary challenges is the relatively lower efficiency compared to wired charging. Energy losses occur during the transfer between the ground pad and the vehicle pad, which can mean that more electricity is required to achieve the same level of charge, potentially resulting in higher operational costs. Moreover, energy loss from inefficient transfer results in excess heat that risks damaging batteries. These losses further compound unless near-perfect alignment (less than 2 inches) between

vehicle and pad is achieved. Lastly, wireless charging solutions are much more costly compared to conductive systems at the same power level.

Ultimately, the trade-offs brought by wireless charging must be evaluated with appropriate partners according to their importance for a given application to ensure these decisions result in net performance and total cost of ownership improvements. If wireless charging provides enough utility — as in environments with hazardous chemicals — or overall cost reductions to owners and operators, navigating these complexities offers a competitive advantage.

Diverse Charging Methods

Today, off-highway equipment OEMs have access to a diverse range of battery charging methods, architectures and technologies that support full fleet

electrification. The benefits of doing so are immense: zero emissions, reduced noise, enhanced operator comfort, improved safety and lower cost of operation and ownership.

As battery charging systems continue their ascent from basic designs to cutting-edge innovations, the gap between commercial EVs and their off-highway counterparts will undoubtedly shrink. By leveraging the most appropriate charging solutions for their specific applications, OEMs of off-highway vehicles can optimize the performance, flexibility, and reliability of their electrified fleets — enhancing the long-term impact on business and sustainability initiatives.

Mourad Chergui is senior product manager at Delta-Q Technologies, a ZAPI GROUP company. Visit delta-q.com.

NOKIAN TYRES TRI 2

Nokian Tyres TRI 2 excels in a wide variety of tasks from job sites to highways, from snowy winters to hot tarmac. Its durability, economy and comfortable driving response make it a reliable choice for versatile contracting work.

VERSATILE PROFESSIONAL CONTRACTING TIRE FOR YEAR-ROUND USE

nokiantyres.com/heavy

15 OEM Off-Highway | MAY/JUNE 2024

OEM Off-Highway Celebrates 40 Years of Innovation

Uncover the brand’s origins & the driving factors that have steered its success for four decades

by Kathy Wells

This year, OEM Off-Highway celebrates its 40th anniversary. For the past four decades, this brand and its media products have been dedicated to delivering to readers the important, breaking news and trend-setting design developments happening throughout the on- and offhighway mobile equipment industry.

What was initially established as an agricultural supplement has today become a multifaceted brand comprised of industry-leading digital properties, magazines, e-newsletters, videos, webinars, podcasts, whitepapers, social media platforms and more, accessed daily by thousands of engineers and designers around the world.

Cut from the same cloth as its former sister publication, Farm Equipment magazine, Johnson Hill Press (JHP) founded the brand we know today as OEM Off-Highway in 1984. Originally recognized as Farm Equipment - OEM, it first served only readers within the agricultural equipment sector. By 1987, the brand was simply known as OEM, which opened its readership to design engineers and purchasing agents at agricultural, construction and light industrial manufacturing facilities throughout North America. Willie Vogt was named editor of the brand in 1985 and began to shape content and help to form the OEM Off-Highway brand you know today.

According to the brand’s early literature, “Farm Equipment - OEM began

as a publication presenting readers with information about dozens of new products each issue. In 1985, OEM took the next step, providing not only new and innovative products for the ag manufacturer, but also insights into how other design engineers, purchasing personnel and corporate decision makers were finding solutions to the day’s most current challenges. Our aim is to do more than just provide interesting reading. It is to help our readers make better decisions in their companies by expanding their body of knowledge.”

This original brand vision still stands strong today as OEM Off-Highway’s indepth reporting on trends, technology developments, engineering innovations and new product releases keep its readers informed of the latest information, products and data in a dynamic and rapidly changing global industry.

Vogt recalls fine-tuning the publication’s focus in the early ‘80s: “The manufacturing landscape was changing and there was a growing need for information to help companies explore new approaches or take on innovations in manufacturing,” said Vogt.

According to Vogt, readers wanted not only to know what was new on the market, but also learn more about the forces impacting manufacturing and hear how companies were achieving success in new areas of interest. “Those early new stories dug into ergonomics, expanded equipment testing and more,” said Vogt. “Across the off-highway industry,

companies were tightening their belts while working to maintain equipment quality. It wasn’t easy, but new approaches were coming from robotic welding to enhanced parts management.”

As equipment technology developed and innovation brought forth new efficiencies, OEM Off-Highway stepped up to cover the importance of these topics. “Add in the new tech tools to speed product development,” said Vogt. “Finite element analysis alone changed the way engineers viewed the materials needed for equipment. They could design a machine using thinner steel, or even advanced plastics, in some areas to cut weight and cost while still maintaining equipment durability and quality,” said Vogt.

As manufacturing trends continued to drive change throughout the ‘80s and into the ‘90s, manufacturers called on OEM Off-Highway as a resource. Curt Bennink, who joined the team in 1992 and became editor in 1997, recalls a significant shift in the streamlining of manufacturing strategies. “The offroad machinery manufacturing sector continually evolves as manufacturers chase the next competitive edge that elevates customer expectations,” said Bennink. “The pace of that change kicked into high gear as the industry moved into an era where computers, data and the emergence of sophisticated electronics transformed the off-highway manufacturing landscape. With each passing year the pace of change picks

16 MAY/JUNE 2024 | OEM Off-Highway SPECIAL SECTION: 40TH ANNIVERSARY

up momentum, making it more challenging for OEMs to stay abreast of these developments.”

This decade brought on a transformation of the production and assembly processes, with a rise in interest of robotic welding and a push for factory automation.

“As the production line transformation progressed, there was a renewed focus on defining manufacturing processes,” said Bennink. “ISO 9001:2000 quality management emerged as a way manufacturers could demonstrate their ability to produce consistent product quality. Many manufacturers began to pursue certification to this international standard. Processes were painstakingly documented to ensure repeatable results.”

At the same time, the publishing world was also changing. OEM Off-Highway’s original publisher, JHP, would eventually become Cygnus Business Media in 1997. And for the next 17 years under its stewardship, OEM Off-Highway would herald both on- and off-highway OEMs through a time of great regulatory transition.

Throughout the ‘90s, the emergence of diesel emissions standards played a critical role in product development and manufacturing. “[This] changed the product development cycle for dieselpowered equipment, which continues to reverberate through the industry until this day,” said Bennink.

“The first Tier 1 diesel emission standard was published in 1991 and took effect in 1996. It set limits on NOx emissions on engines over 50 hp,” said Bennink. “This was followed by a series of increasingly stringent regulations in the form of Tier 2, Tier 3, Tier 4 interim and Tier 4 final. Each stage included tighter emissions limits for NOx and Particulate Matter (PM) broken out by engine horsepower.”

According to Bennink, this major

challenge was faced by both engine suppliers and OEMs, who were expected to increasingly invest in R&D to modify machines at each Tier. “At each Tier of emissions, the OEM R&D departments were challenged to maintain fuel efficiency and increase performance to help offset the mandatory increase in complexity and cost,” said Bennink. “For instance, mechanical engines transitioned to electronically controlled engines. This opened a whole realm of new possibilities for many OEMs.”

As the World Wide Web and internet access reached the public and met more mainstream use throughout the late ‘90s and into the early 2000s, equipment OEMs began to integrate more emerging electronics and equipment technologies, including smart systems, GPS technologies and telematics capabilities, Wi-Fi and mobile connectivity and more, embracing a new era in equipment technology across multiple sectors. This shift in data-driven equipment brought landmark improvements to machine precision, accuracy and efficiency.

Following the boom and bust of The Great Recession in the late 2000s, OEMs

This 1986 rate card details the advertising opportunity to participate in the brand’s showcase issue, a special issue of OEM Off-Highway’s print magazine that is still in production today.

would also face the challenge of phasing in new emissions standards throughout the 2010s. In 2014, Tier 4 was nearing full implementation as OEM Off-Highway was changing ownership one final time.

AC Business Media, now known as IRONMARKETS, acquired OEM OffHighway in 2014 and continues to support and elevate the brand’s original vision: helping readers to make better decisions and expand their body of knowledge. With IRONMARKETS backing the brand, OEM Off-Highway has continued to grow alongside its readers’ thirst for knowledge, introducing the OEM Industry Update podcast in 2020 and the OEM Industry Summit in 2022.

Forty years strong and looking forward, OEM Off-Highway remains more engrained than ever in the future of the mobile equipment industry and those who lead its designs and developments.

To learn more about OEM OffHighway’s legacy, major milestones and insider insights, look for extended coverage at oemoh.co/OOH40

Kathy Wells is editor of OEM Off-Highway.

LESSITER MEDIA

17 OEM Off-Highway | MAY/JUNE 2024

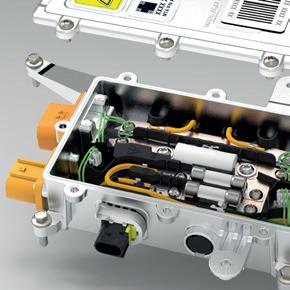

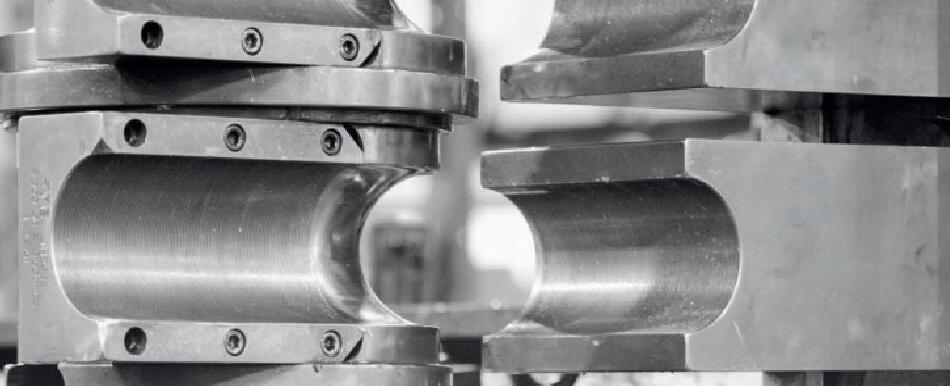

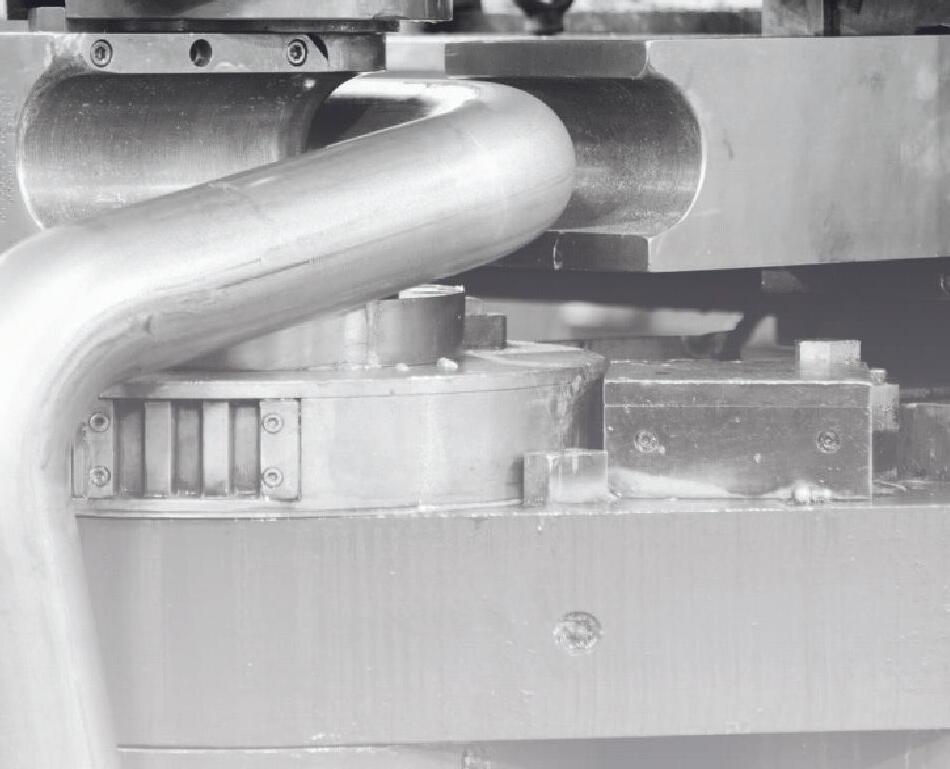

Hydraulic Optimization for Electric Machines

Exploring key parts of the electrification journey & levers for efficiency improvements in open-circuit hydraulic systems

by Chad Larish

While the increasing frequency of electric machine launches might lead some to think the electrified off-highway machine industry is mature, the reality is many OEMs are only in the first phase of the journey. This article explores the phases of the electrification journey, why hydraulic optimization is a key part of the journey, and levers for efficiency improvements in open-circuit hydraulic systems.

The Electrification Journey Machine electrification is a complex journey that can be simplified into four

phases. Advancing from one phase to the next increases machine efficiency, but also complexity, cost and risk.

PHASE 1: IT’S ELECTRIC

Most OEMs start the electrification journey by replacing the internal combustion engine with an electric motor and batteries. Coupled to that motor is a hydraulic pump with fixed or variable pump control. There’s little change to the system hydraulics and control algorithms. This low-risk method enables OEMs to dip their toes into electrification and understand the associated complexities and challenges.

For the end user, there’s not a significant number of changes, which can be both an advantage and a disadvantage. The major downside is that these machines today are not very efficient, hydraulically speaking, so runtime is often inadequate. Cost is another downside: they can be double the price of diesel equivalents. As with many things surrounding electrification, runtime and cost comparisons are application specific. Take a mini excavator, for example. With no changes to the hydraulics, current runtimes are about 3 to 4 hours. OEMs want 6 to 8 hours, but they don’t want to add more batteries,

MAY/JUNE 2024 | OEM Off-Highway 18 FLUID POWER

which is the major cost driver. Some customers can justify the 2x cost based on total-cost-of-ownership calculations, but they won’t pay much more. Aerial work platforms, on the other hand, have a much smaller cost difference between conventional and electric — so much so that in some countries, a significant majority of new machines are electric.

PHASE 2: OPTIMIZE HYDRAULICS

An OEM could stop at phase 1 and wait for the price of batteries to come down — and that might make sense for lower-cost platforms. While battery costs are declining, pricing is still multiples of on-highway battery costs, driven by the packaging and ruggedness required for off-highway use. Another option is to optimize the system hydraulics to improve machine runtime without increasing battery costs. This is Phase 2 of the electrification journey. Optimization levers include

changes to the hydraulic architecture and technologies such as gravity lowering, independent metering, and zonal systems, which focus on driving out the inefficiencies of hydraulics. OEMs are generally open to spending more on the hydraulics to save on the batteries, but there’s a delicate balance of upfront cost versus total cost of ownership many suppliers are trying to understand and, conversely, demonstrate to OEMs. The technologies necessary for optimization are more than just metal bits — it’s software, sensors, and associated costs, such as homologating the software to be functionally safe.

PHASE 3: LET’S RECOVER

In Phase 3 of the electrification journey, we introduce energy recuperation, which captures and stores recoverable energy to further increase machine runtime. This phase can be a step change in complexity, depending on the

application. Energy recovery is easiest in machines that often operate with one function at a time, such as boom lifts. In machines doing multifunction operation — think telehandlers, wheel loaders and excavators — the complexity of capturing energy while making the process smooth and imperceptible for the operator is much greater.

PHASE 4: FULLY ELECTRIC

The fourth phase of the electrification journey transitions into fully electric systems, meaning no or substantially reduced hydraulic systems. The benefit of fully electric machines is maximum efficiency, quieter operation, fewer components and less maintenance. This phase of electrification is currently feasible and makes sense for more compact, lighter duty applications requiring lower actuation power. The feasibility of this phase for larger, higherpower machinery is currently limited,

OEM Off-Highway | MAY/JUNE 2024 19

with power-dense hydraulics often the best solution. The electrification journey is not universal; it’s highly dependent on application and OEM. Certain platforms will stop at Phase 2 or 3, while others are more conducive to Phase 4 electrification. The industry as a whole is still very much in Phase 1. Even the leading OEMs in machine electrification are just starting to look at Phase 2, but this will quickly accelerate.

Why Hydraulics Are Inefficient

Hydraulic systems today work well. However, efficiency has often not been a priority for OEMs. The typical hydraulic excavator wastes up to 70% of the useful power delivered by the engine. In a conventional architecture, a single pump delivers flow to a control valve, which meters that flow to different services on the machine. While this architecture works well and provides good machine feel, it’s inherently inefficient because the pump supplies all the services at the same pressure demanded by the highest-pressure service. When digging, an excavator arm might require 250 bar of pressure, while the boom requires 140 bar, and the bucket requires only 100 bar. The pump supplies all the services at 250 bar, and the valve meters that pressure down for the boom and bucket, which burns energy across the spools and generates heat. This is known as a meterin or flow-sharing loss.

Additional losses in the system include meter-out losses, used to control overrunning or lowering functions on a machine. There are also pumping losses, which are associated with converting prime mover power to hydraulic fluid flow. Valve inefficiencies increase pressure upstream, which drives greater losses throughout the hydraulic system. By making the valve more efficient, it’s possible to make the whole system — including the pump — more efficient. This is the focus of Phase 2, and it’s a critical step to increase the feasibility of large machine electrification.

How to Improve Efficiency

The first requirement to improve efficiency is a change in mindset. Most

of today’s machine control systems are linear in nature, meaning they are reactive to inputs and operational conditions. The operator moves the joystick, sending a signal to the controller. The controller commands the valve, the valve sends a message to the pump, and the pump demands a torque from the engine. This can lead to siloed component selection with limited focus on function and performance synergies.

Electrification and trends such as autonomy and intelligent controls demand more integrated solutions. To act efficiently, more intelligence and communication between components is required, which makes it critical to select components that work well together. Integrated systems that combine valves, pumps and electric motors can maximize performance and efficiency. Suppliers know where their products run most efficiently and can generate control algorithms to operate at those peak points. Ultimately, many efficiency optimizations involve much more than swapping out a component.

REGENERATION & GRAVITY LOWERING

The first area for optimization is regeneration, which means reusing flow and pressure that’s already in the system. Boom gravity lowering is the prime example. Platforms such as telehandlers today require pump flow to the rod side of cylinder to open a counterbalance valve to lower the boom. Electronic load-lowering valves provide direct lowering control and the ability to recycle head side flow back to the rod side, requiring no additional pump flow. This saves energy, mitigates many stability challenges with traditional counterbalance valves, and meets load control requirements.

INDEPENDENT METERING

With conventional metering valves, a single joystick/spool controls acceleration and braking of a function simultaneously. In a car, this would be akin to braking while still applying the throttle when going downhill, then applying more throttle but still braking while climbing a hill. For independent

metering valves, each work port can operate independent of the other, enabling more efficient and better control of services that transition between passive and overrunning states. Returning to our car analogy, independent metering valves operate more like a traditional car, only braking or accelerating when needed. This increases energy efficiency and frees horsepower to do other functions.

VARIABLE MARGIN CONTROL

Additional pump pressure, typically called margin pressure, is required to push flow through the valves and hoses out to the various machine functions. In conventional systems, this margin pressure is fixed. However, the actual pressure required to achieve the desired flow is variable based on flow demand and other factors. If a pump is providing 20 bar margin pressure when only 11 bar is needed to achieve the desired flow, this wastes energy. Electronic load sensing or variable margin control enable the pump to dynamically adjust how much margin pressure is provided. These technologies tailor the pump pressure to the flow demand in the circuit. While this might only be a reduction of 5 to 9 bar here and there, it adds up in efficiency when managing large flows over a long day.

ENERGY RECUPERATION

Energy recovery, or recuperation, means using existing overrunning energy in the system to back drive an electric motor for battery charging. This is Phase 3, but it’s important to distinguish between regeneration and recuperation. It’s possible today to recover energy quite easily on singlemotor/single-actuator applications. In fact, scissor lifts have demonstrated significant energy savings by using such technology. For multifunction machines, recuperation is more challenging. While it is possible, there are not many examples of implementation because of the complexity, cost, and potential impact on operational feel. For these reasons, many OEMs see bigger benefits in and are currently more focused on regeneration.

20 MAY/JUNE 2024 | OEM Off-Highway FLUID POWER

ALTERNATIVE ARCHITECTURES

Much higher efficiency improvements are possible with alternative architectures, such as distributed, multi-pump, and flow summation systems. In both distributed and multi-pump systems, the central control valve is often eliminated in favor of distributed controls (i.e., a valve applied to each actuator). This offers improved control, more efficient regeneration/ recuperation, and provides load holding/hose burst mitigation without the traditional counterbalance inefficiencies. Additionally, the distributed valve arrangement reduces the number of fluid conveyance lines to just two: a pump supply and a tank rail. This enables the use of larger hoses, which improves efficiency by reducing hose friction losses.

Distributed architectures often have a single motor and pump, while multi-pump architectures feature a pump and motor per service. A multi-pump architecture can further reduce meter-in losses from a single pump flow sharing between services and enables energy recuperation without impacting other services. The trade-off is the power cannot be shared between services and each pump/motor must be sized for full function performance. This will increase system hardware capability, cost, and size.

Finally, flow summation is a variation on the multi-pump architecture that maintains the central control valve to provide selectable flow sharing. This enables many of the benefits of the multi-pump architecture and the ability to combine flow when using higher flow/power functions. It could support multiple motors and pumps, or a digital displacement pump with independently controllable outlets.

OPERATIONAL EFFICIENCY

Beyond hydraulic system efficiency, there are other ways to increase machine efficiency. General operational efficiency can be improved by automating certain functionalities. It can take operators several years to master the controls of a heavy machine. A new operator may hit the end stop more frequently, which dumps flow over a relief valve and generates heat. By giving operators automated functionality that enables them to leverage best practices right away, they not only become more productive, but the whole system becomes more efficient. Rather than watch a machine’s bucket come down to ensure it doesn’t hit the ground, the operator can press a button to bring that bucket down to the correct point every time. Meanwhile, the operator can focus on his or her surroundings.

Now, Next, Future

Hydraulic optimization for electric machines goes beyond selecting more efficient components. This is why there will be — and OEMs will gain more value from — validated system solutions for machine integration. The future of hydraulics is applicationspecific optimized solutions for each phase of the electrification journey.

Chad Larish is a principal subsystem engineer at Danfoss Power Solutions. Visit danfoss.com.

21 OEM Off-Highway | MAY/JUNE 2024 The power behind it all.™ WWW.ISUZUENGINES.COM * WARRANTY 1 4LE2 Engine2 2.2L | 40-66 HP (30–49 kW) LIMITED5-year / 5,000-hour is the standard limited warranty. 3C models and power unit components offer a 2-year / 2,000-hour limited warranty. Warranty is based on years or hours of service, whichever comes first. See your authorized Isuzu Distributor or dealer for warranty and other details. 4LE2 engine shown. See your authorized Isuzu representative for performance info and specifications. 1 2 GENUINE PARTS DIAGNOSTIC TOOLS TRAINING & SUPPORT DEDICATED SERVICE NETWORK INDUSTRY-LEADING WARRANTIES1

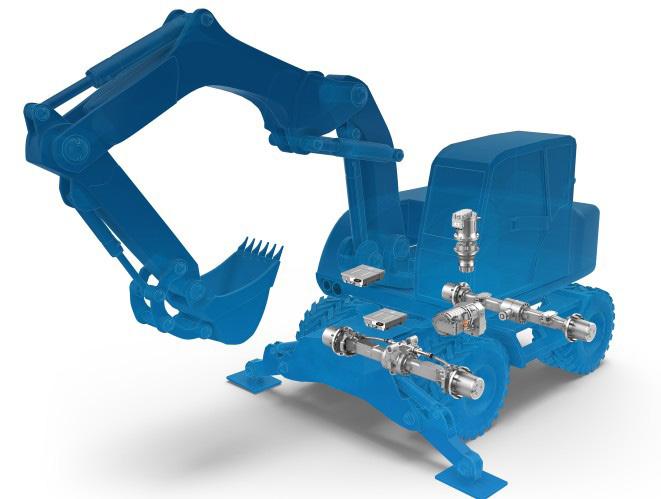

AUTOMATION EXPECTATIONS

Bosch

Rexroth’s Mauro Silva on the trends leading today’s fluid power market & improving tomorrow’s equipment efficiency

by Kathy Wells

With an increase in automation throughout the machinery sector, technological advancements continue to drive growth and innovation within the global mobile hydraulic market. For an update on the latest fluid power trends and solutions in the mobile equipment environment, OEM Off-Highway spoke with Mauro Silva, sales technical expert responsible for mobile electronics and electrics at Bosch Rexroth, where he focuses on the company’s electronic and electric products. Read on for Silva’s insights on the fluid power trends that are shaping the market today and where technology is leading the industry in the future.

What are the most in-demand mobile hydraulic components?

MS: First is automation. We see an increased demand from OEMs highlighting machine automation. This aspect of off-highway machines is increasingly used to differentiate various OEMs offerings and add value for the end-user, while increasing productivity and operator comfort. Second is power management. OEMs are ever more cautious about machines that are not as efficient as they could be, leading to bad ROI for their customers. Machine OEMs are demanding technologies and solutions for the most optimal hydraulics control. When adding electrified systems, it makes it even more critical to have efficient power management to thereby reduce battery cost and increase machine uptime.

What are the unique applications of automation within the mobile equipment industry?

MS: We have two examples that have been implemented in thousands of machines by now: compact track loaders and excavators. One of the primary uses for compact track loaders is for the bucket or attachment self-leveling function. In today’s systems, this function is performed by a dedicated hydraulic circuit in combination with the main control valve. Using an electronic solution, this leveling circuit can be eliminated and the self-leveling can be performed via reading the kinematic position of an implement using an MM7 inertial sensor. Besides a higher performance, accuracy and flexibility, this solution represents cost savings by eliminating hydraulic hardware and hoses.

Regarding excavators, grading with a bucket has a higher dynamic complexity as more than one endeffector is present. Moreover, the bucket can grade slopes at various angles and must produce very linear and repetitive results regardless of the machine positioning. The system is similar to compact track loaders, where MM7 inertial sensors are used as the primary form of feedback, and the software adjusts with the complexity.

These are only two examples, and the beauty of the off-highway market is that there are so many applications that these automation systems can be applied into, all of them with very interesting results.

How are these components offering OEMs an advantage?

MS: There are several, one of them is robustness and reliability. One way to see feedback in a machine’s joint angles is using angle sensors installed directly on the pins. This, however, results in radial or axial forces in the rotary sensor that can damage it. Using an inertia sensor completely avoids this failure mode as these sensors can be attached to the end-effector at any position along its body. One additional and very important advantage is productivity. Using these solutions results on the operator giving minimal commands for very repetitive movements, which results in less fatigue, improved comfort, and more importantly, very standardized, reproduceable results.

What challenges do OEMs face when it comes to fluid power?

MS: Every application and every sector in fluid power has varying challenges. Some of the common denominators are efficiency, controllability, safety, and sustainability. Regarding efficiency, our components’ latest generation for hydrostatic transmissions can achieve up to 8% improvement over the previous generation. Moreover, on the open circuit side, the ability of our A10VO eOC pump to lower margin levels and operate as multiple control types, all through software, addresses further efficiency improvement.

Regarding controllability, the electronic hardware that we supply can run very complex algorithms that

MAY/JUNE 2024 | OEM Off-Highway 22 FLUID POWER

have enabled Rexroth to move a lot of the mechanical complexity on our components to software. This in turn opens the door for very precise controls that brings best-in-class controllability and operability of off-highway machines. Regarding safety, all of our solutions are validated through the most rigorous functional safety standards. As a global supplier of systems and components, Rexroth has the application knowhow and regulation standards for every part of the world in mind during the development process. Therefore, we ensure that we can offer any performance level for all of our solutions per the OEM demand.

Finally, but not less important, sustainability. This topic is a growing aspect for us to become a supplier in many industries. In mobile applications, our hydrostatic components’ latest generation is up to 33% lighter, which means lower carbon footprint, and combined with the aforementioned improved efficiency improvements, they contribute highly to lower their carbon footprint over their product life cycle.

Fluid power trends: Where are we headed next?

MS: At the moment, the trending technologies around fluid power are electronic controls, automation, connectivity and electrification. And that’s a long way from where we came from. We came out of open center systems with gear pumps, and that open center culture evolved with

incremental improvements. We then migrated to load-sensing technology and flow sharing, which also evolved incrementally with electronic flow management. Now we’re reaching a point where we’re looking to electrify the machine and we are re-engineering the entire system to maximize efficiency. More and more we see that the electronic controls are being adopted in the machine. Even simple machines, like mowers, are being heavily automated and electrified.

How will hydraulics play a part in the equipment of the future with regard to electrification?

MS: Regarding electrification, we see the market increasing over the next decade. There are certain applications that might adopt it quick, as it has been done for compact equipment, while there are others where it might make less sense, or the adoption rate will be slower. We also see the hydraulic market plateauing and becoming stable over the next decade. Still, hydraulics will continue to play a crucial role in the off-highway market as a complimentary part to electrification. Our current strategy is to serve the high-power range machines and we have developed a full portfolio around this. We also see that this market is growing, specifically in ports and in large mining or recycling equipment.

Kathy Wells is editor of OEM Off-Highway.

OEM Off-Highway | MAY/JUNE 2024 23

ADOBE STOCK | KOSSSMOSSS

3 Ways to Increase Throughput & Decrease Costs in Your Finishing Line

Strategic methods for lowering the total cost of your paint line while maintaining operational standards

by Aaron Wagner

There are a lot of factors to consider when choosing a paint and coatings provider, and pricing is one of the big ones. Although, the paint itself is only a fraction of the total applied costs when compared to other elements of your finishing operation. So, how else can you find savings within your operation?

1. Identify Hidden Costs

Often, operational inefficiencies lead to costs not found on invoices or in traditional spending models. Sometimes, these hidden inefficiencies are normalized as limitations of the facility. Consider your finishing process. There are many steps, and each one takes time, labor and product. When building your paint line, put yourself in your employees’ shoes to make sure that each step is optimized for efficiency. Labor typically accounts for the largest portion of total finishing costs, so ensuring a smooth and timely finishing operation at every step is critical.

Even minor inconveniences can have a huge impact. Something as small as getting paint from the container to the spray equipment can slow employees down, increasing labor costs and decreasing throughput.

A smooth, continuous flow is what you’re aiming for. Are there times during the day when your line is shut down?

Even a short pause can cause a major disruption on the finishing line. Not only do you have a break in production but, depending on the pot life of the product you’re using, your lines may need to be flushed and product will be wasted.

Think about how to reconfigure your process to minimize disruptions. Instead of running your line at full speed then stopping production intermittently, you could employ an alternating schedule. Using a lighter crew to run the line at half speed during those pauses can keep things moving and prevent your lines from needing to be flushed. It can take a little bit of trial and error to figure out the best line speed and staffing needs but use your resources. A good coatings partner can be a valuable resource in helping you find the right balance to optimize efficiency. In fact, many complex businesses look for engineering and process improvement assistance from their coating supplier.

2. Think Farther

A lower unit price up front may end up costing more in the long run. Pay attention to the details of the product you’re purchasing. If the cost is lower because it has lower pigment concentration or lower solids, it’s going to need additional coats to achieve the right hide — meaning more labor and

more product than you would have needed with a higher quality coating.

A typical liquid coating has around 30% to 35% solid content. That means roughly 70% of each gallon is evaporating during curing and only a third of the product gets delivered to the part you’re painting. High solid coatings range from 50% to 60% solid content, which means less volatiles, more coverage and more hiding power, as well as less waste. Higher solids also tend to have better durability, with coverage lasting 5 to10 years instead of the traditional 3- to 5-year range, as well as decreased VOC emission. New developments with polyurea and polyaspartic formulas are also entering the market with ultra-high, or even 100% solid content. These formulas offer incredible hiding strength and cure quickly at room temperature, reducing energy costs while sometimes still offering a pot life that extends beyond an hour.

Higher solid formulas also provide sustainability advantages — another important element to factor into your long-term plan. Less solvents means lower VOCs and less waste accumulated. At the same time, your product life is extended. In the heavy equipment market, where assets are subject to harsh environment and working conditions daily, improved durability can be a game changer. Allowing

MAY/JUNE 2024 | OEM Off-Highway 24 ENGINEERING & MANUFACTURING

machines to get an extra two years in the field before needing to be stripped and recoated can lead to a significantly lower total cost of asset ownership over time. Your production settings can also impact costs. Obviously, you want to run your line as fast as possible, but that doesn’t mean you need the highest possible settings. Sometimes it’s necessary to dial things down to optimize speed and profitability in your transfer rate.

The tools you use make a difference here, too. Spray guns are not one size fits all, especially in a powder coating booth. The wrong particle size can cause a lot of wear and tear on a powder gun and can lead to impact fusion. Considering the nozzle size and configuration of equipment, it’s very easy for these machines to get clogged.

3. Explore New Technologies

Stay aware of market trends and innovations. Technology has greatly

advanced in the paint and coatings industry, and there are options that can work within your existing operations to streamline steps and improve cycle time.

New formulas in powder coating can eliminate steps by combining the topcoat and primer into one, increasing throughput by saving time, labor and energy. For the heavy equipment and transportation markets, these formulas can be combined with an epoxy or zinc primer to achieve optimal performance. If you’re considering a zinc coating, pay attention to content percentage. Some companies offer formulas as high as 65% zinc, which can put you on the next level when it comes to durability.

There are similar solutions in liquid coatings that support an advanced “wet-on-wet” application. New primers in the market require just a quick flash off period, allowing the topcoat to be applied almost immediately. Not only do these solutions make your line faster

and increase throughput, but they also reduce energy consumption and can help you manage labor needs.

When looking for cost savings in your finishing line, it’s important to remember that each facility is unique. What worked for one company may not work for you. Use your resources. Some coatings suppliers go beyond delivering products and act as an industrial finishing partner for your business. These companies have field support teams that go into your facility to help identify cost drivers and implement solutions to minimize them. These experts advise you on the latest technologies and what would work best for your operation.

Aaron Wagner is global segment director of Heavy Equipment at Sherwin-Williams General Industrial. Visit sherwin-williams.com.

HAS THE GUTS

When you’re racing against time and Mother Nature, the last thing you need is a pump that isn’t up to the job. That’s why it makes sense to put your trust in Ace Pro 5 Series pumps. Choose from Pro 5 FMCSC pumps with severe-duty silicon carbide seals, or Pro 5 FMCWS models with Ace Pump’s exclusive Oasis™ WetSeal Technology. All Pro 5 pumps feature larger bearings for longer pump life. E-coated castings for added corrosion resistance. Standardized components for simplified inventory and maintenance. And optional motors with integrated PWM control valves for precision application. To learn more, visit www.acepumps.com.

25 OEM Off-Highway | MAY/JUNE 2024 M A K E S U R E Y O U R P U M P

T O G O T H E D I S T A N C E

IMPROVING GREASE PERFORMANCE Amid Thickener Supply Squeeze

Evaluating alternatives as market forces spur industrial grease makers to shift from lithium as thickener of choice

by Gareth Fish

The industrial grease market is facing an urgent challenge.

Lithium soaps — a reliable, consistent and cost-effective thickening agent used by the industry for decades — have become increasingly costly and unavailable. There are a few contributing forces to the lithium supply crisis. First, the North American volume and market share of both conventional and complex lithium greases have fallen in recent years, compounded by the closure of a major grease-producing facility in 2021 that significantly impacted supplied volumes. Secondly, production has failed to meet demand, lithium has become increasingly scarce for grease applications, as lithium producers have shifted their focus to the exponentially growing market for battery applications in electric vehicles. This shift has driven unsustainable price volatility for lubricating grease applications. Finally, potential changes in classification and labelling pose an even greater threat. In 2021, the European Chemicals Agency published an opinion that lithium hydroxide was identified as a potential reproductive and lactation hazard. While a final classification will not be known until an ultimate ruling is made, if lithium hydroxide is classified as a reproductive toxic and a

substance of very high concern, it could have significant impact on the way lithium-containing greases are labeled and used. For the global off-highway equipment industry, OEMs would likely need to carefully consider their specified lubricating greases throughout Europe.

A reliable alternative is a necessity moving forward. The good news: Moving away from lithium may enable grease manufacturers to improve performance across a range of critical applications, and a number of candidates have demonstrated significant potential..

Anhydrous Calcium Soaps